|

|

|

AGENDA

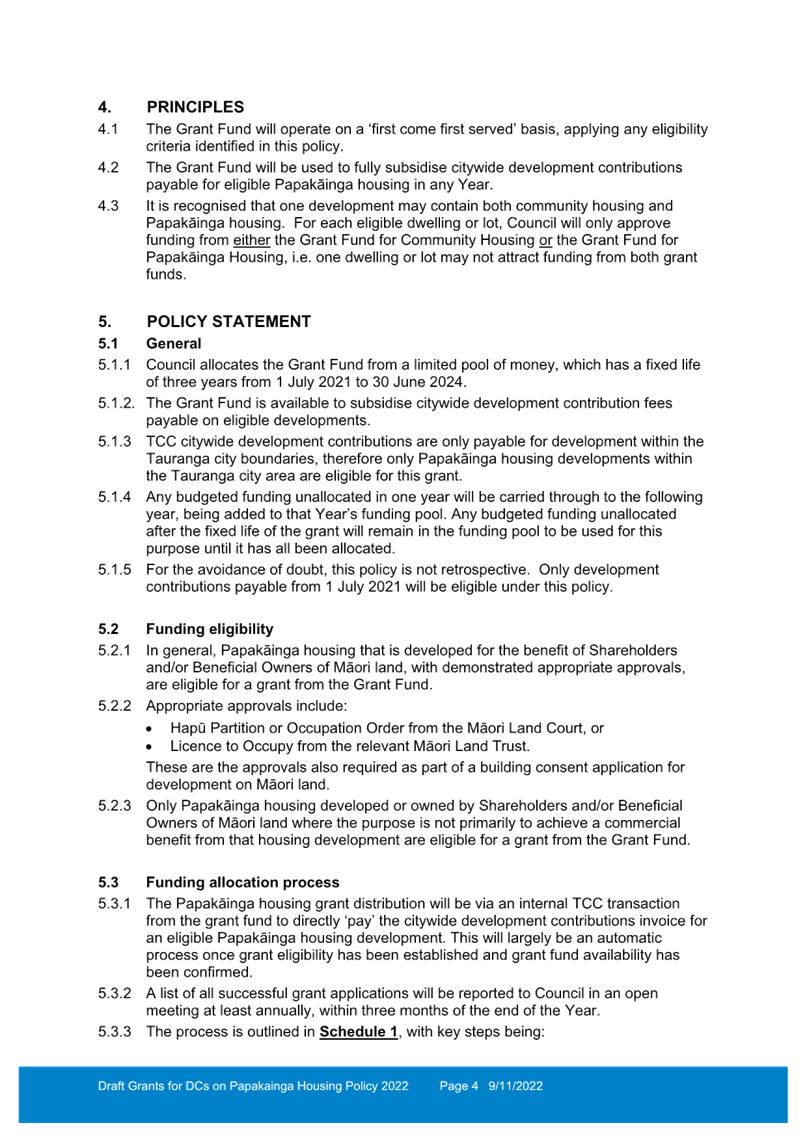

Strategy, Finance and Risk Committee meeting

Monday, 14 November 2022

|

|

I hereby give notice that a Strategy, Finance and

Risk Committee meeting will be held on:

|

|

Date:

|

Monday, 14 November 2022

|

|

Time:

|

9.30am

|

|

Location:

|

BoP Regional Council Chambers

Regional House

1 Elizabeth Street

Tauranga

|

|

Please note that this

meeting will be livestreamed and the recording will be publicly available on

Tauranga City Council's website: www.tauranga.govt.nz.

|

|

Marty Grenfell

Chief Executive

|

Terms of reference – Strategy,

Finance & Risk Committee

Membership

|

Chairperson

|

Commission Chair Anne Tolley

|

|

Deputy chairperson

|

Dr Wayne Beilby – Tangata

Whenua representative

|

|

Members

|

Commissioner Shadrach Rolleston

Commissioner Stephen Selwood

Commissioner Bill Wasley

|

|

|

Matire

Duncan, Te Rangapū Mana Whenua o Tauranga Moana Chairperson

Te Pio Kawe – Tangata

Whenua representative

Rohario Murray – Tangata

Whenua representative

Bruce

Robertson – External appointee with finance and risk

experience

|

|

Quorum

|

Five

(5) members must be physically present, and at least three (3) commissioners

and two (2) externally appointed members must be present.

|

|

Meeting frequency

|

Six weekly

|

Role

The role of the Strategy, Finance and Risk Committee (the

Committee) is:

·

to assist and advise the Council in discharging

its responsibility and ownership of health and safety, risk management,

internal control, financial management practices, frameworks and processes to

ensure these are robust and appropriate to safeguard the Council's staff and

its financial and non-financial assets;

·

to consider strategic issues facing the city and

develop a pathway for the future;

·

to monitor progress on achievement of desired

strategic outcomes;

·

to review and determine the policy and bylaw

framework that will assist in achieving the strategic priorities and outcomes

for the Tauranga City Council.

Membership

The Committee will consist of:

·

four commissioners with the Commission Chair

appointed as the Chairperson of the Committee

·

the Chairperson of Te

Rangapū Mana Whenua o Tauranga Moana

·

three tangata whenua representatives

(recommended by Te Rangapū Mana Whenua o Tauranga

Moana and appointed by Council)

·

an independent external person with finance and

risk experience appointed by the Council.

Voting

Rights

The tangata whenua representatives and the independent

external person have voting rights as do the Commissioners.

The Chairperson of Te Rangapu Mana Whenua o Tauranga Moana

is an advisory position, without voting rights, designed to ensure mana whenua

discussions are connected to the committee.

Committee's

Scope and Responsibilities

A. STRATEGIC ISSUES

The

Committee will consider strategic issues, options, community impact and explore

opportunities for achieving outcomes through a partnership approach.

A1 – Strategic Issues

The Committee's

responsibilities with regard to Strategic Issues are:

·

Adopt an annual work

programme of significant strategic issues and projects to be addressed. The

work programme will be reviewed on a six-monthly basis.

·

In respect of each

issue/project on the work programme, and any additional matters as determined

by the Committee:

1.

Consider existing

and future strategic context

2.

Consider

opportunities and possible options

3.

Determine preferred

direction and pathway forward and recommend to Council for inclusion into

strategies, statutory documents (including City Plan) and plans.

·

Consider and approve

changes to service delivery arrangements arising from the service delivery

reviews required under Local Government Act 2002 that are referred to the Committee

by the Chief Executive.

·

To take appropriate

account of the principles of the Treaty of Waitangi.

A2 – Policy and Bylaws

The Committee's

responsibilities with regard to Policy and Bylaws are:

·

Develop, review and

approve bylaws to be publicly consulted on, hear and deliberate on any

submissions and recommend to Council the adoption of the final bylaw. (The

Committee will recommend the adoption of a bylaw to the Council as the Council

cannot delegate to a Committee the adoption of a bylaw.)

·

Develop, review and

approve policies including the ability to publicly consult, hear and deliberate

on and adopt policies.

A3 – Monitoring of Strategic

Outcomes and Long Term Plan and Annual Plan

The Committee's

responsibilities with regard to monitoring of strategic outcomes and Long Term

Plan and Annual Plan are:

·

Reviewing and

reporting on outcomes and action progress against the approved strategic

direction. Determine any required review / refresh of strategic direction or

action pathway.

·

Reviewing and assessing

progress in each of the six (6) key investment proposal areas within the

2021-2031 Long Term Plan.

·

Reviewing the

achievement of financial and non-financial performance measures against the

approved Long Term Plan and Annual Plans.

B.

FINANCE AND RISK

The Committee will review the

effectiveness of the following to ensure these are robust and appropriate to

safeguard the Council's financial and non-financial assets:

4.

Health and safety.

5.

Risk management.

6.

Significant projects and programmes of work focussing

on the appropriate management of risk.

7.

Internal and external audit and assurance.

8.

Fraud, integrity and investigations.

9.

Monitoring of compliance with laws and regulations.

10.

Oversight of preparation of the Annual Report

and other external financial reports required by statute.

11.

Oversee the relationship with the

Council’s Investment Advisors and Fund Managers.

12.

Oversee the relationship between the Council and

its external auditor.

13.

Review the quarterly financial and non-financial

reports to the Council.

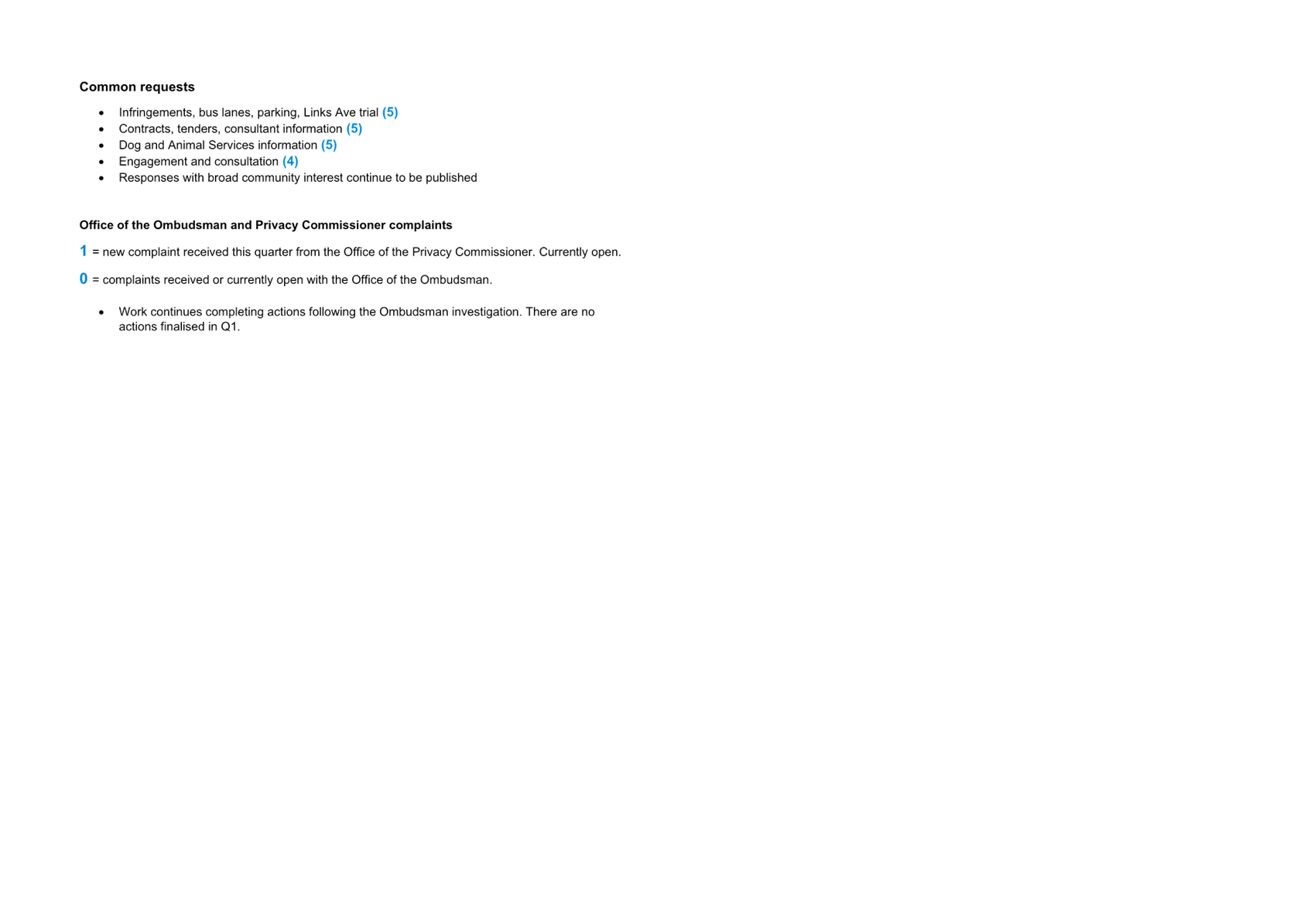

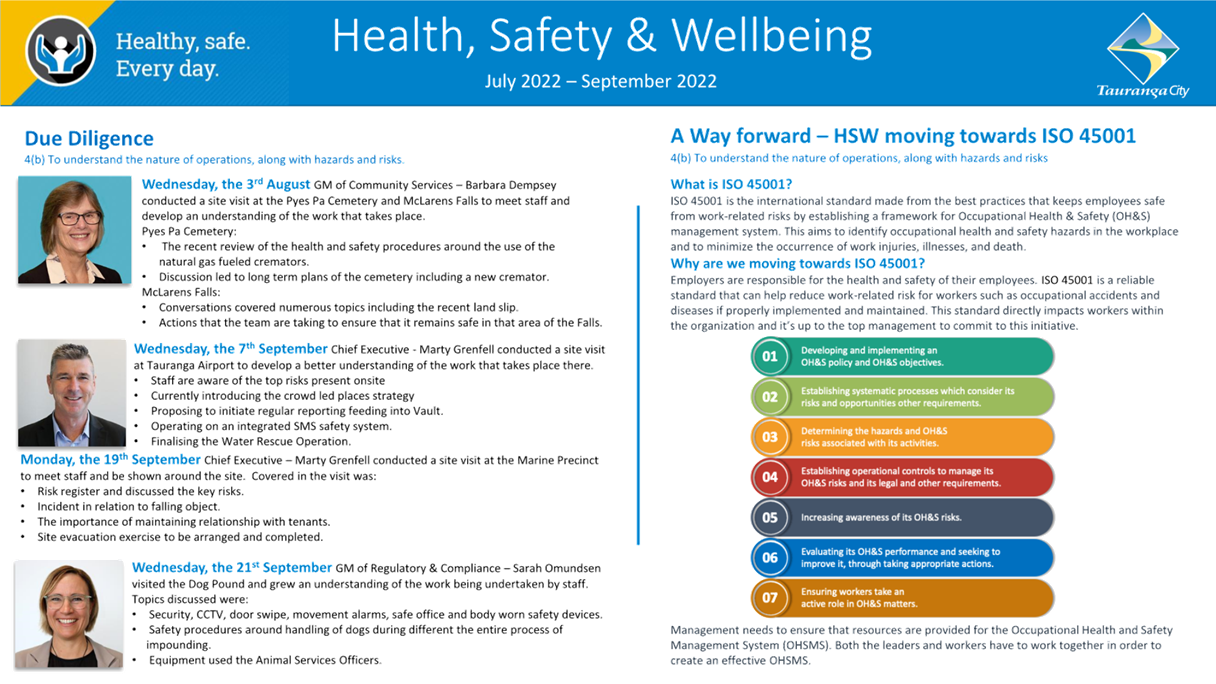

B1 - Health and Safety

The Committee’s responsibilities through regard to

health and safety are:

1.

Reviewing the effectiveness of the health and

safety policies and processes to ensure a healthy and safe workspace for

representatives, staff, contractors, visitors and the public.

2.

Assisting the Commissioners to discharge their

statutory roles as "Officers" in terms of the Health and Safety at

Work Act 2015.

B2 - Risk Management

The Committee's responsibilities with regard to risk

management are:

1.

Review, approve and monitor the implementation of the Risk Management

Policy, Framework and Strategy including the Corporate Risk Register.

2.

Review and approve the Council’s "risk appetite"

statement.

3.

Review the effectiveness of risk management and internal control systems

including all material financial, operational, compliance and other material

controls. This includes legislative compliance, significant projects and

programmes of work, and significant procurement.

4.

Review risk management reports identifying new and/or emerging risks and

any subsequent changes to the "Tier One" register.

B3

- Internal Audit

The Committee’s responsibilities with regard to the

Internal Audit are:

5.

Review and approve the Internal Audit Charter to confirm the authority,

independence and scope of the Internal Audit function. The Internal Audit

Charter may be reviewed at other times and as required.

6.

Review and approve annually and monitor the implementation of the

Internal Audit Plan.

7.

Review the co-ordination between the risk and internal audit functions,

including the integration of the Council's risk profile with the Internal Audit

programme. This includes assurance over all material financial, operational,

compliance and other material controls. This includes legislative compliance

(including Health and Safety), significant projects and programmes of work and

significant procurement.

8.

Review the reports of the Internal Audit functions dealing with

findings, conclusions and recommendations.

9.

Review and monitor management’s responsiveness to the findings and

recommendations and enquire into the reasons that any recommendation is not

acted upon.

B4

- External Audit

The Committee's responsibilities with regard to the

External Audit are:

10.

Review with the external auditor, before the audit commences, the areas

of audit focus and audit plan.

11.

Review with the external auditors, representations required by

commissioners and senior management, including representations as to the fraud

and integrity control environment.

12.

Recommend adoption of external accountability documents (LTP and annual

report) to the Council.

13.

Review the external auditors, management letter and management responses

and inquire into reasons for any recommendations not acted upon.

14.

Where required, the Chair may ask a senior representative of the Office

of the Auditor General (OAG) to attend the Committee meetings to discuss the

OAG's plans, findings and other matters of mutual interest.

15.

Recommend to the Office of the Auditor General the decision either to

publicly tender the external audit or to continue with the existing provider

for a further three-year term.

B5

- Fraud and Integrity

The Committee's responsibilities with regard to Fraud and

Integrity are:

16.

Review and provide advice on the Fraud Prevention and Management Policy.

17.

Review, adopt and monitor the Protected Disclosures Policy.

18.

Review and monitor policy and process to manage conflicts of interest

amongst commissioners, tangata whenua representatives, external

representatives appointed to council committees or advisory boards, management,

staff, consultants and contractors.

19.

Review reports from Internal Audit, external audit and management

related to protected disclosures, ethics, bribery and fraud related incidents.

20.

Review and monitor policy and processes to manage responsibilities under

the Local Government Official Information and Meetings Act 1987 and the Privacy

Act 2020 and any actions from the Office of the Ombudsman's report.

B6

- Statutory Reporting

The

Committee's responsibilities with regard to Statutory Reporting relate to

reviewing and monitoring the integrity of the Annual Report and recommending to

the Council for adoption the statutory financial statements and any other

formal announcements relating to the Council's financial performance, focusing

particularly on:

21.

Compliance with, and the appropriate application of, relevant accounting

policies, practices and accounting standards.

22.

Compliance with applicable legal requirements relevant to statutory reporting.

23.

The consistency of application of accounting policies, across reporting

periods.

24.

Changes to accounting policies and practices that may affect the way

that accounts are presented.

25.

Any decisions involving significant judgement, estimation or uncertainty.

26.

The extent to which financial statements are affected by any unusual

transactions and the manner in which they are disclosed.

27.

The disclosure of contingent liabilities and contingent assets.

28.

The basis for the adoption of the going concern assumption.

29.

Significant adjustments resulting from the audit.

Power

to Act

·

To make all

decisions necessary to fulfil the role, scope and responsibilities of the

Committee subject to the limitations imposed.

·

To establish

sub-committees, working parties and forums as required.

·

This Committee has not

been delegated any responsibilities, duties or powers that the Local Government

Act 2002, or any other Act, expressly provides the Council may not delegate.

For the avoidance of doubt, this Committee has not been delegated

the power to:

·

make a rate;

·

make a bylaw;

·

borrow money, or

purchase or dispose of assets, other than in accordance with the Long-Term Plan

(LTP);

·

adopt the LTP or

Annual Plan;

·

adopt the Annual

Report;

·

adopt any policies

required to be adopted and consulted on in association with the LTP or

developed for the purpose of the local governance statement;

·

adopt a remuneration

and employment policy;

·

appoint a chief

executive.

Power

to Recommend

To Council and/or any standing committee

as it deems appropriate.

|

Strategy,

Finance and Risk Committee meeting Agenda

|

14

November 2022

|

7 Confirmation

of minutes

7.1 Minutes

of the Strategy, Finance and Risk Committee meeting held on 3 October 2022

File

Number: A14194774

Author: Robyn

Garrett, Team Leader: Governance Services

Authoriser: Robyn

Garrett, Team Leader: Governance Services

|

Recommendations

That the Minutes of the Strategy, Finance and Risk Committee

meeting held on 3 October 2022 be confirmed as a true and correct record.

|

Attachments

1. Minutes

of the Strategy, Finance and Risk Committee meeting held on 3 October

2022

|

Strategy, Finance and Risk

Committee Meeting Minutes

|

3 October 2022

|

|

|

|

MINUTES

Strategy, Finance and Risk Committee

Meeting

Monday, 3 October 2022

|

Order of

Business

1 Opening karakia. 3

2 Apologies. 3

2.1 Apologies. 3

3 Public forum.. 3

4 Acceptance of late items. 3

5 Confidential business to be transferred into the open. 3

6 Change to order of business. 4

7 Confirmation of minutes. 5

7.1 Minutes of the Strategy, Finance and Risk Committee meeting held on

12 September 2022. 5

8 Declaration of conflicts of interest 6

9 Business. 6

9.1 Adoption of Ōtūmoetai Spatial Plan. 6

9.2 Transport Emissions Projection Tool 7

10 Discussion of late items. 9

MINUTES OF Tauranga City

Council

Strategy, Finance and Risk

Committee Meeting

HELD AT THE BoP Regional

Council Chambers, Regional House,

1 Elizabeth Street, Tauranga

ON Monday, 3 October 2022 AT

9.30am

PRESENT: Commission Chair Anne Tolley, Dr Wayne Beilby, Commissioner Shadrach

Rolleston, Commissioner Stephen Selwood, Commissioner Bill Wasley, Mr Te Pio

Kawe, Ms Rohario Murray, Mr Bruce Robertson

IN ATTENDANCE: Marty

Grenfell (Chief Executive), Paul Davidson (Chief Financial Officer), Barbara

Dempsey (General Manager: Community Services), Nic Johansson (General Manager:

Infrastructure), Christine Jones (General Manager: Strategy, Growth &

Governance), Alastair McNeill (General Manager: Corporate Services), Gareth

Wallis (General Manager: City Development & Partnerships), Sarah Omundsen

(General Manager: Regulatory and Compliance), Corinne Frischknecht (Senior

Urban Planner), Alistair Talbot, (Team Leader: Structure Planning &

Strategic Transport), Andrew Mead (Manager: City Planning & Growth),

Ceilidh Dunphy (Community Relations Manager), Coral Hair (Manager: Democracy

& Governance Services), Robyn Garrett (Team Leader: Governance Services),

Anahera Dinsdale (Governance Advisor), Janie Storey (Governance Advisor)

1 Opening

karakia

Te Pio Kawe opened the meeting with a karakia.

2 Apologies

|

2.1 Apologies

|

|

Committee Resolution SFR10/22/1

Moved: Commissioner Bill

Wasley

Seconded: Commissioner

Stephen Selwood

That the apology

for absence from Ms Matire Duncan be received.

Carried

|

3 Public

forum

Nil

4 Acceptance

of late items

Nil

5 Confidential

business to be transferred into the open

Nil

6 Change

to order of business

Nil

7 Confirmation

of minutes

8 Declaration

of conflicts of interest

Nil

9 Business

|

9.1 Adoption

of Ōtūmoetai Spatial Plan

|

|

Staff Christine

Jones, General Manager: Strategy, Growth and Governance

Corinne Frischknecht, Senior Urban

Planner

Carl Lucca, Team Leader: Urban

Communities

Key points

·

Sets out the vision for how and where growth

would occur between 2022 and 2050 in the Ōtūmoetai peninsula.

·

Inclusive process in partnership with mana

whenua and key stakeholders.

·

Two rounds of public consultation had been

held including a successful social media pinpoint active tool receiving 1,200

comments.

·

The second round of engagement included 60

projects, with respondents able to share and comment on those projects.

·

Three Pou established to recognise the

cultural significance through future growth - Mana Rangatiratanga, Mana

Taiao, Mana Tangata.

·

Four key strategic outcomes to achieve -

unique neighbourhoods, liveable neighbourhoods, connected neighbourhoods,

healthy neighbourhoods.

·

Key centre plans provided an overview of

expectations for planning and improvement with the key directions and actions

to be taken.

·

The action plan outlined how to deliver the

actions; some were funded, and others would need to be funded with project

partners and future Long-term Plans.

·

Partnership with mana whenua would be

essential.

·

Ongoing implementation would be tested through

modelling etc to ensure actions continued to meet the plan and outcomes.

In response

to questions

·

The overview should be changed to provide a

stronger emphasis on the well-being of the people that currently lived there.

·

It was agreed that the area was growing and

focus would be on it being a great place to live. Need to consider how

to support the wellbeing of the community now and into the future through

connected neighbourhoods, parks fit for purpose and used, safe ways to travel

etc.

·

Another stage to the project was to package

and prioritise actions with funding requirements and whether they included

external funding partners.

·

Adopting the plan did not commit the Council

to implementation, it provided a direction of travel to achieve the

plan’s outcomes. Staff were looking for guidance on what items

were considered priorities and would then look at the impact and could refine

or remove as required. The plan needed to be finalised for the works to flow

into the Long-term Plan (LTP).

·

Recommendation (c) was changed to - Endorses

in principle the intention and direction of the Ōtūmoetai Spatial

Plan.

·

The plan would need clear guidance and

framework and the three Pou were an important part of that. Prioritisation

would sit alongside other citywide discussions.

·

Consideration of the protection of marae with

the growth in the area was being addressed by working closely with Ngai

Tamarāwaho with the intensification around Brookfield. It would

include how initiatives could be provided around the marae to improve the

amenities and public transport links. It was noted that the ability for

dwellings to be able to be built up to three stories was out of

Council’s control but there were view shaft provisions which would

remain.

Discussion

points raised

·

More emphasis to be given to the community

already living in the area.

·

Looking into the future - with an anticipated

5,000 more people and 2,200 dwellings - funding required would be

substantial, with limited funding in the current LTP. Some of the

facilities serviced the city-wide area not just the local community and were

a destination for the city.

·

The meeting congratulated staff on the plan,

noting that the community consultation and engagement processes were

innovative and good.

·

The consideration of the Action and Investment

Plan would need to be extensively workshopped signalling what items would

need to be included into the LTP, the implications of ability to fund through

the LTP, which items were on a wish list to possibly be funded into the

future and where the accountability lay to measure achievement over a long

period of time.

·

There were items in the plan which could

result in tangible change benefits/quick wins within the community.

|

|

Committee Resolution SFR10/22/3

Moved: Commission Chair Anne

Tolley

Seconded: Commissioner

Bill Wasley

That

the Strategy, Finance and Risk Committee:

1.

Receives the ‘Ōtūmoetai

Spatial Plan’ report.

2.

Acknowledges the contribution from the

community through the engagement process and notes that this input has been

reflected within the Ōtūmoetai Spatial Plan presented for

consideration.

3.

Endorses in principle the intention and

direction of the Ōtūmoetai Spatial Plan.

4.

Notes that a further Strategy, Finance and

Risk Committee discussion is required to address the issue of prioritisation

and funding of actions within the proposed Plan.

Carried

|

|

9.2 Transport

Emissions Projection Tool

|

|

Staff Alistair

Talbot, Team Leader: Structure Planning & Strategic Transport

External Craig Richards and Rick Lomax - BECA

Key points

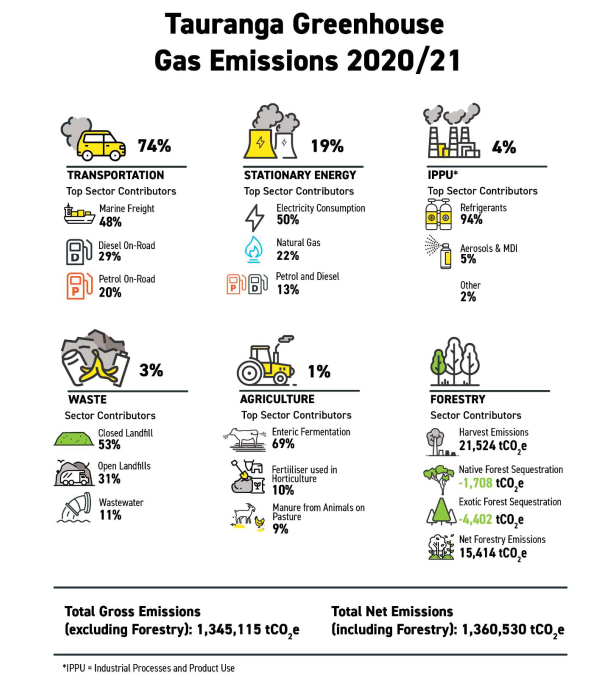

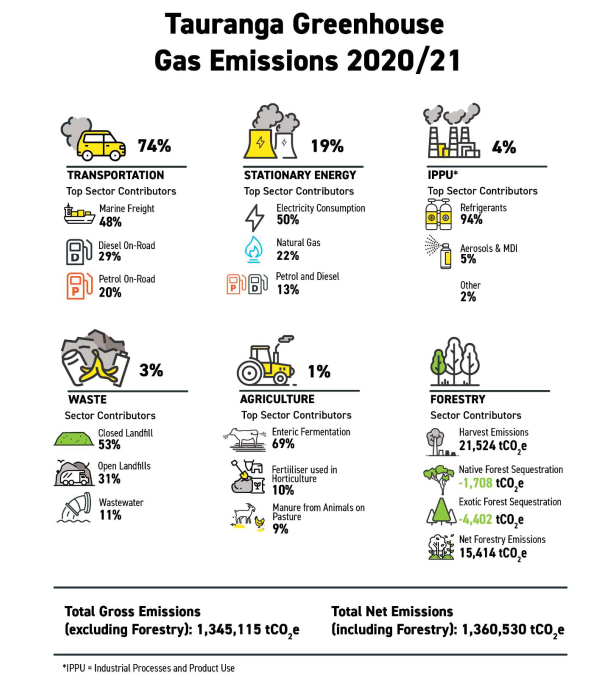

·

A power point presentation outlined the

purpose of the projection tool, which was to aid Council’s

understanding of potential for specific interventions or levers needed to

achieve emissions reduction targets.

·

National decarbonisation level to reduce 41%

by 2035 on the 2019 emissions level was set but how this would be achieved

was still being engaged on.

·

The Ministry of Transport had determined a

target for Tauranga City Council (TCC) of 21%.

·

Bay of Plenty Regional Council had provided a

community carbon footprint assessment setting out greenhouse gas levels for

TCC for three years – the assessment’s broader emissions included

marine and airport as well as land transport.

·

The projection tool developed covered all

different modes of road transport, how people and goods were carted around,

the type of vehicles and fuel used.

·

Model hierarchy noted the different variables included

kilometres travelled, travel avoidance measures, mode shift, fuels to give

outputs and changes in vehicle kms travelled 2035 and 2050 horizons.

·

Scenarios included working from home and the

limited impact this had on emissions.

·

Scenario C noted that improving the way

freight moved from road to rail with a greater shift to hybrid and electric

vehicles would have a considerable impact on emissions.

·

Council was able to influence some levers more

than others.

In response

to questions

·

Queried how significant behaviour change

proposed could be achieved without being given an understanding of why the

changes in behaviour were needed.

·

It was suggested it would be interesting to

compare the during and post Covid vehicle use with today’s vehicle use,

and whether there was an increase in people working from home, trips avoided,

percentage of car sharing etc.

·

The tool showed the size of the challenges

within a growing city that had a car dependency.

·

The government fundability was high on

aspiration and low on funding with a suggestion that the TCC share

would be around $15m. This was not considered anywhere near enough and

no rigour seemed to be given around the feasibility of that by the

government.

·

Ongoing conversations were being held with the

Ministry of Transport about confirming national targets and sharing the tool

with them. Engagement would continue with key partners.

·

Waka Kotahi was developing guidance which

would apply to a number of workstreams and business cases.

·

The Climate Change Action and Investment plan

visions were already set and were working towards 2050 emissions.

·

Nationally there was no agreement for who was

responsible for marine freight around the country, therefore there was

currently no requirement to include marine freight. This may need to be

integrated going forward.

·

The transference of mode from road to marine

transport had pros and cons, it included the amount of freight and how it

moved to and from the port. Air freight was more carbon intensive than

other forms. There were opportunities at a national level to consider

this.

·

Everyday use of vehicles was one of the areas

that could not easily be addressed. Different land use patterns

including intensification etc were not addressed. There may be other methods

outside of the tool to assist with those.

Discussion

points raised

·

Congratulations was passed on to the team for

developing the tool, it was leading edge, and it was noted that the Ministry

of Transport had expressed an interest in using the tool.

|

|

Committee Resolution SFR10/22/4

Moved: Commissioner Stephen

Selwood

Seconded: Mr

Bruce Robertson

That

the Strategy, Finance and Risk Committee:

· Receives

the report "Transport Emissions Projection Tool".

Carried

|

|

Attachments

1 Transport

Emissions Projection Tool Presentation PDF

|

10 Discussion

of late items

Nil

The

closing karakia would take place at the end of the Council meeting to follow

this meeting.

Resolutions transferred into the open section of the

meeting after discussion

Nil

The

meeting closed at 10.48 am.

The

minutes of this meeting were confirmed as a true and correct record at the

Strategy, Finance and Risk Committee meeting held on 14 November 2022.

...................................................

CHAIRPERSON

|

Strategy,

Finance and Risk Committee meeting Agenda

|

14

November 2022

|

9 Business

9.1 Priority

One - Annual Report 2021/22

File

Number: A13875256

Author: Lisa

Gilmour, City Partnership Specialist

Authoriser: Gareth

Wallis, General Manager: City Development & Partnerships

Purpose of the Report

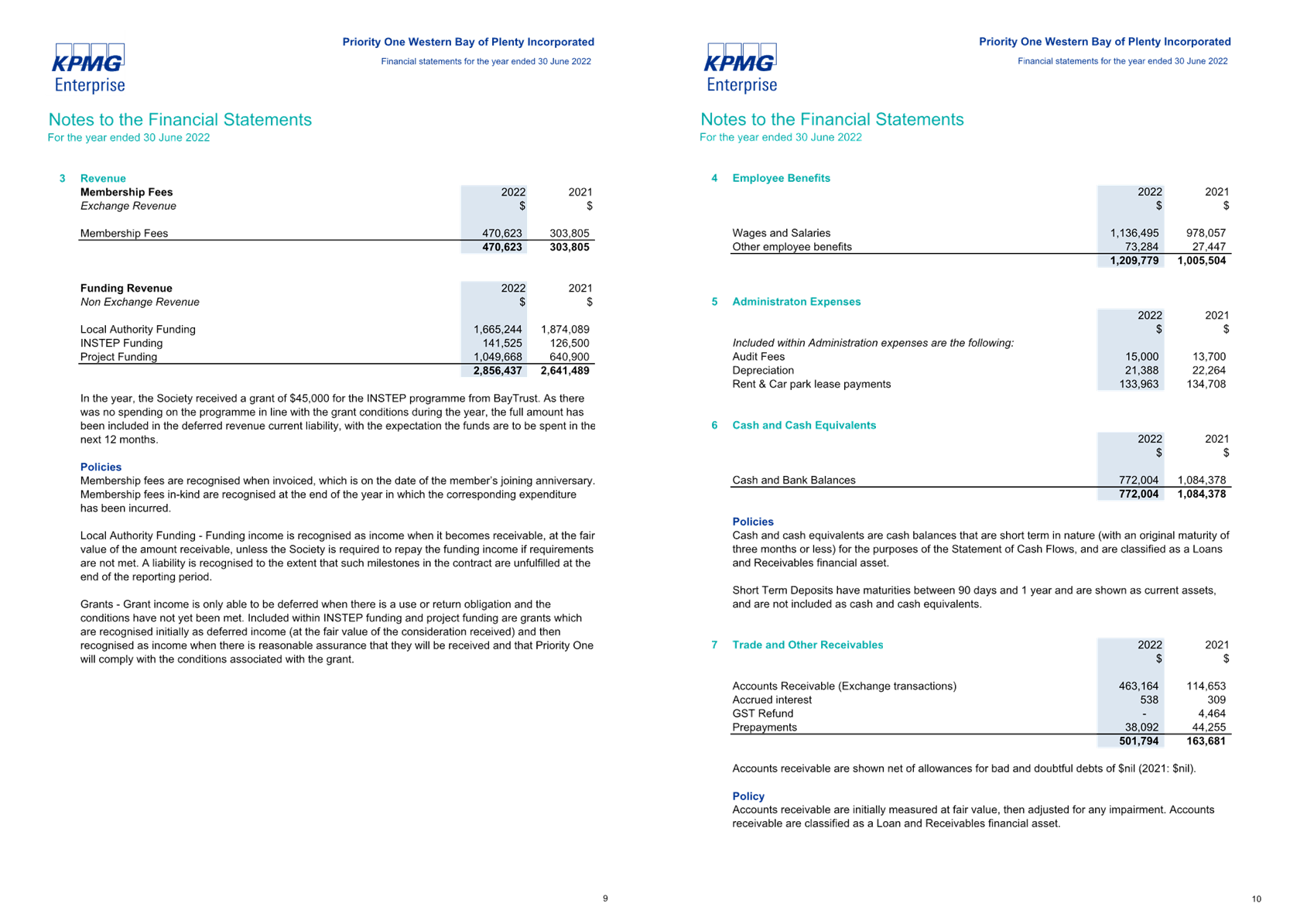

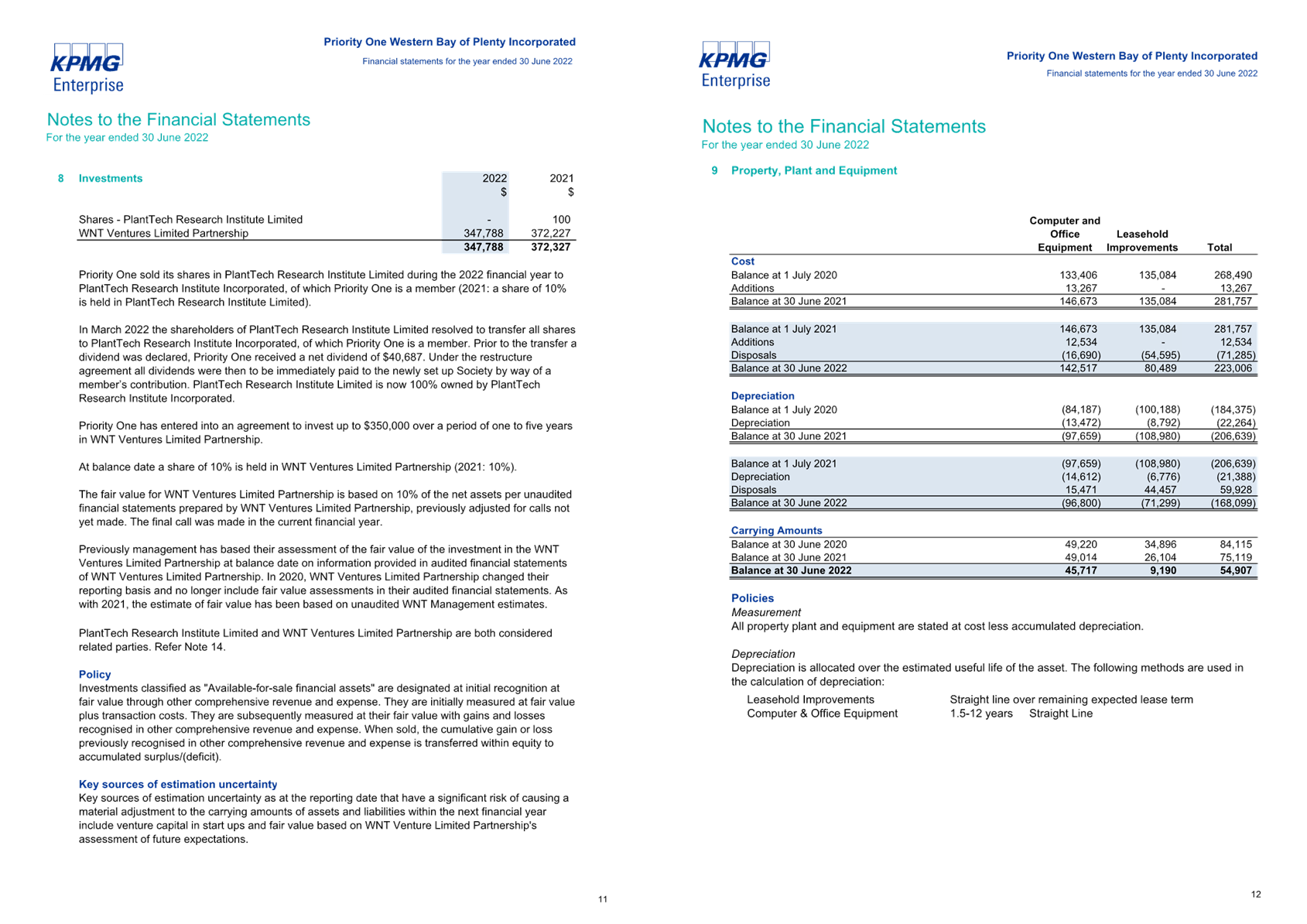

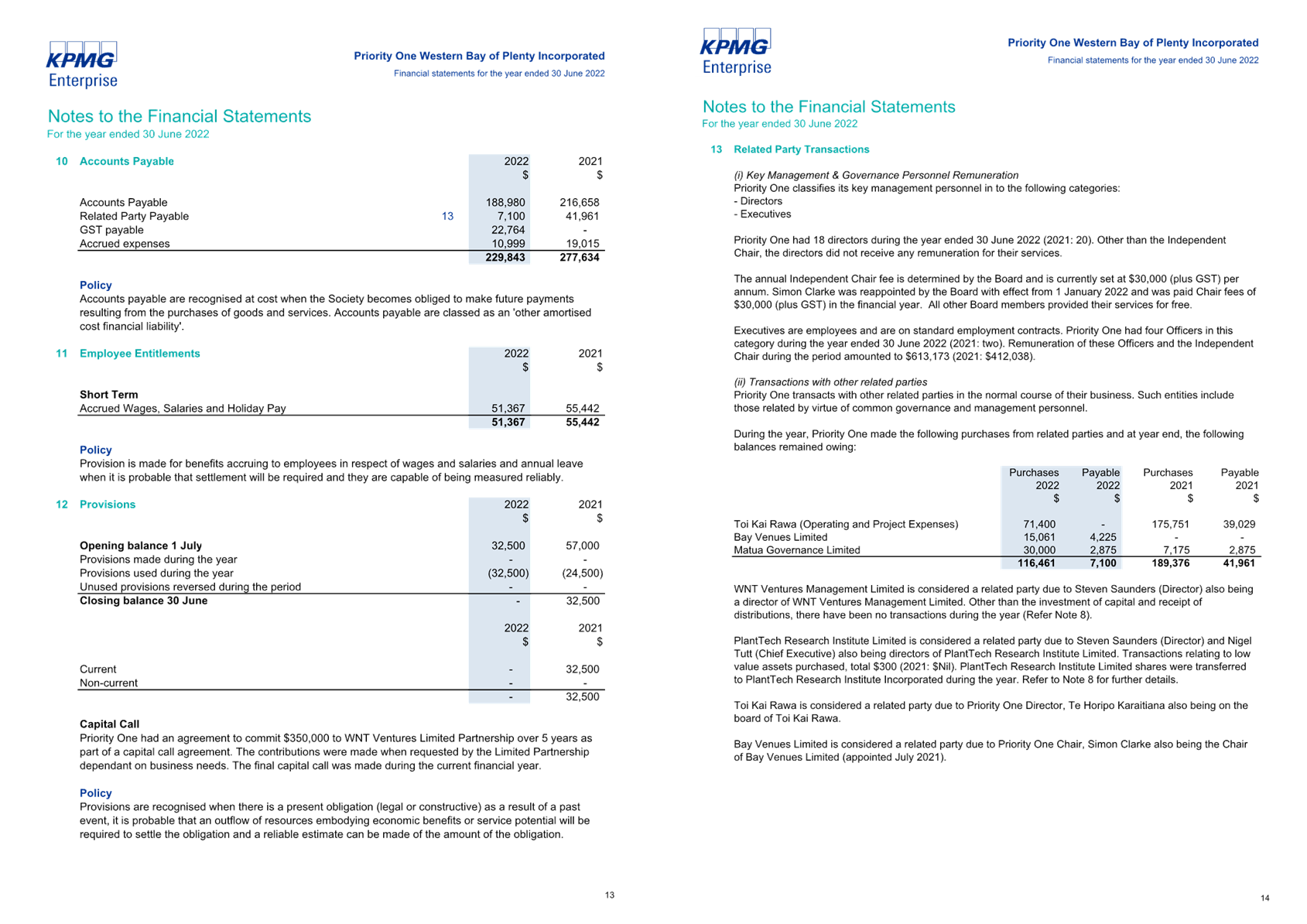

1. That Council receives

Priority One’s Annual Report for 2021/22, in accordance with the terms of

the joint service delivery contract between Priority One and the two councils.

|

Recommendations

That the Strategy,

Finance and Risk Committee:

(a) Receives the report

"Priority One - Annual Report 2021/22".

|

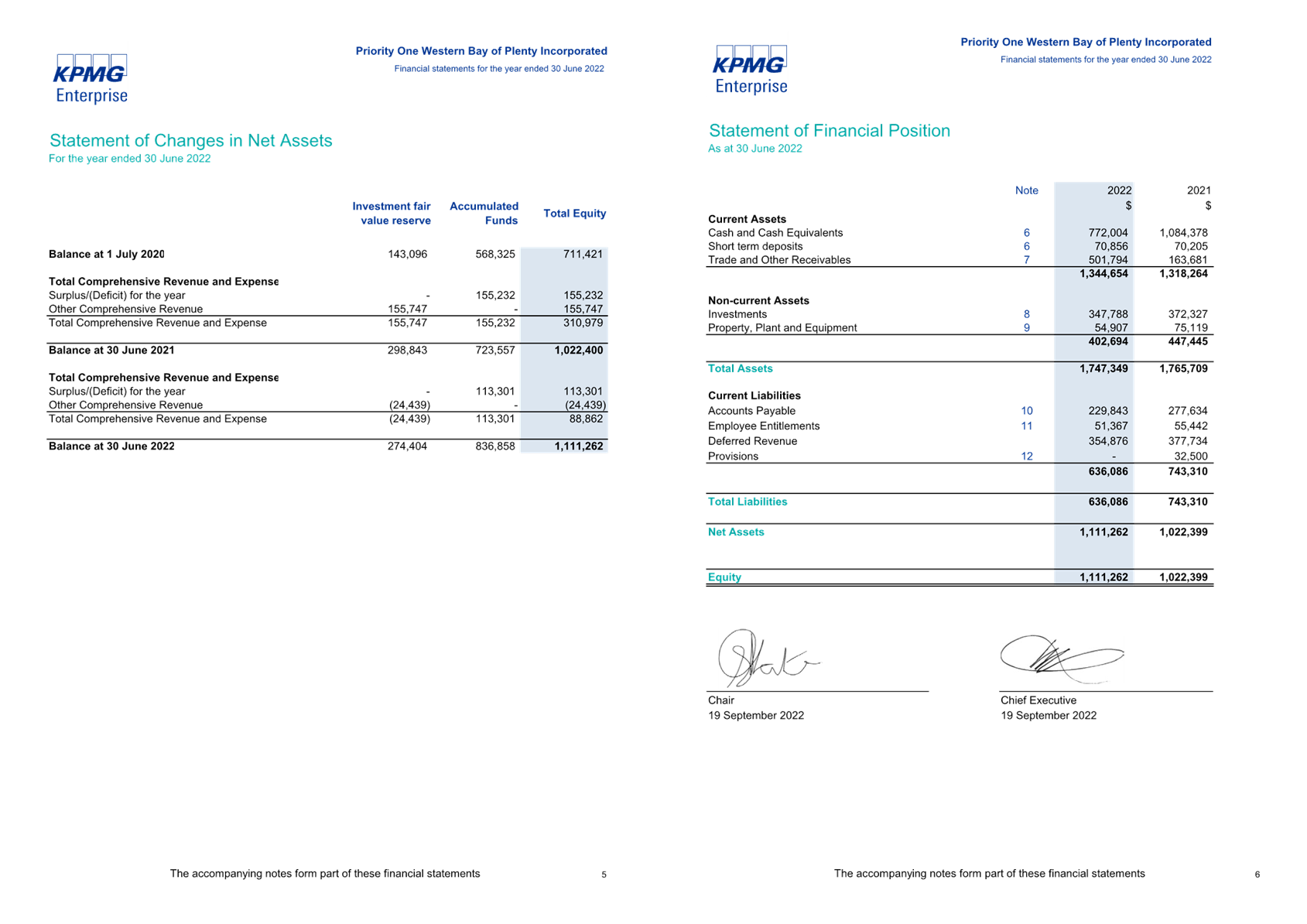

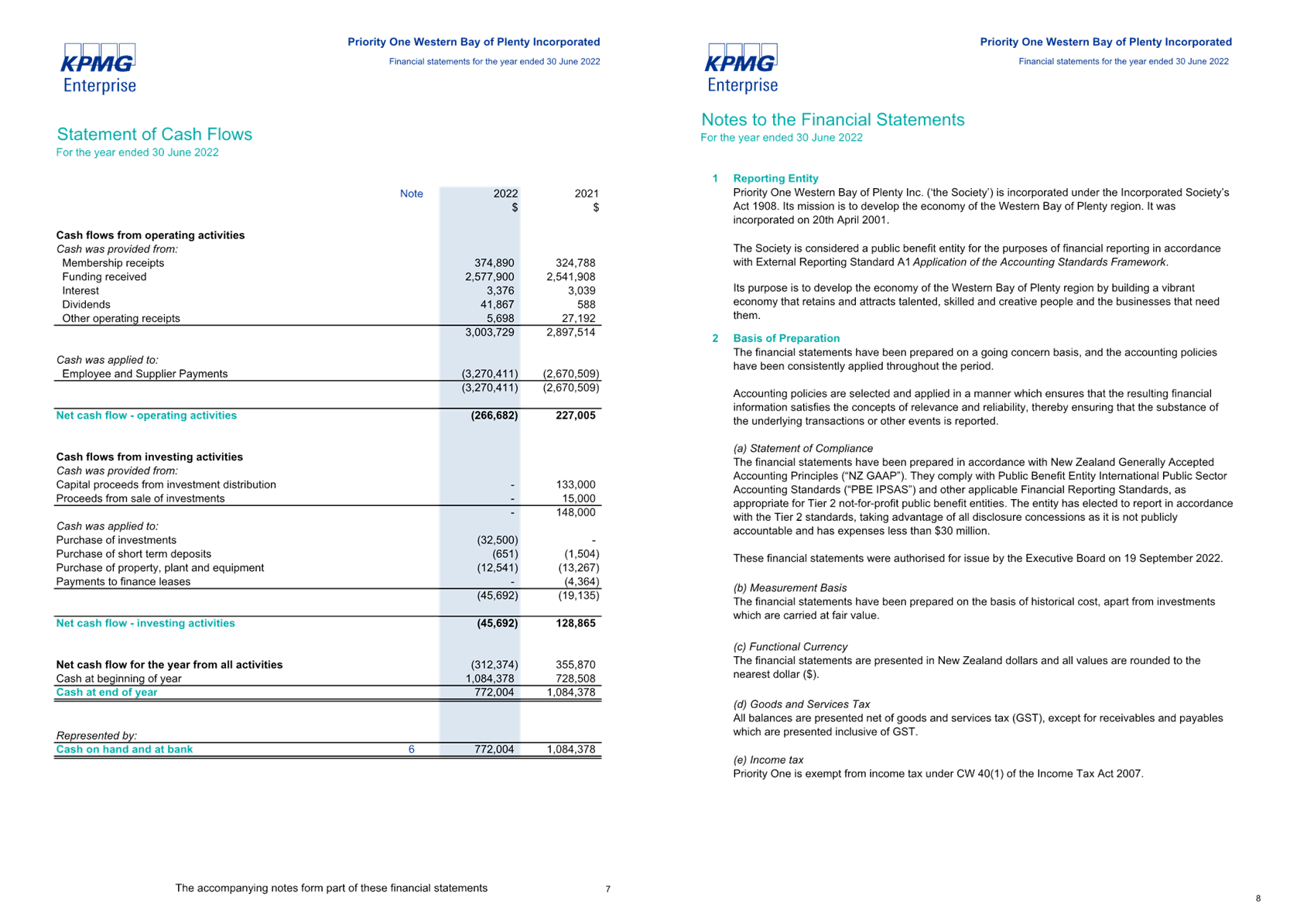

Executive Summary

1. Priority

One’s Annual Report for 2021/22 covers the key outputs of their work

during that period.

2. The

report, provided at Attachment 1, addresses the requirements under the

partnership agreement with Tauranga City Council and Western Bay of Plenty

District Council to report annually to Council on actions taken.

3. Priority

One align their agreed priorities set out in the partnership agreement with

those of their board and membership base through their strategic plan.

4. The

contract with Priority One is in accordance with the status and powers of local

government as set out in section 12 of the Local Government Act 2002.

Background

5. The

Annual Report is provided by the economic development agency to Council as part

of its role to ensure the organisation’s performance is consistent with

Council’s partnership agreement with them.

6. Priority

One is the Western Bay of Plenty’s economic development organisation,

established in 2001 by the business community in partnership with the

sub-region’s local authorities. Priority One’s role is to grow the

economy of the region. They work with local authorities to ensure local

government and business needs and aspirations are aligned.

7. Key

achievements outlined in the report include:

· Ara

Rau skills and employment hub have supported over 200 people into sustainable

employment or training to work pathways in 2021/22. In addition, Ara Rau and

Toi Kai Rawa (the region’s Māori economic development agency) have

worked actively to support Māori economic development and worked closely

with local iwi to support their training and employment initiatives.

· Priority

One, in collaboration with member businesses, held a Future of Work Forum with

Deputy Prime Minister, Grant Robertson, in February and are now developing a

series of activations supporting the development, retention, and attraction of

talent to the region.

· Priority

One have been collaborating closely with the University of Waikato to support

several initiatives to grow Tauranga’s reputation as a tertiary

destination, with the goal of attracting 5,000 students to study here.

· New

scholarships and degree offerings have been announced and the first R&D lab

has been opened specifically focussed on engineering and technology for primary

industries. The lab offers students the opportunity to work on projects

including automation, robotics, artificial intelligence, aquaculture, and

marine biotechnology. It is another step on our collaborative journey to

establish Tauranga as a global destination for innovation.

· Priority

One has led the development of Tauranga’s CBD Blueprint, which identifies

$1.5 billion in private sector investment into the city centre. This is the

result of fostering relationships with key developers and city stakeholders,

and promotes the reinstatement of Tauranga’s city centre as the civic,

commercial and cultural capital of the Bay of Plenty.

· A

group called Hydrogen X has been set up to find alternative ways to fuel

transport sectors across heavy machinery, port infrastructure, material

handling, freight, and public transport. One of the many initiatives includes

the establishment of Aotearoa New Zealand’s first hydrogen education and

training facility, through Te Pukenga – Toi Ohomai, and commencing late

2023.

· Priority

One have led the collaboration to undertake a feasibility study investigating a

community stadium. A business case is now being completed and due before the

end of 2022.

· The

Western Bay of Plenty Infrastructure Forum was established in early 2022 as a

platform to highlight the infrastructure needs of the region. The group exists

to actively discuss key challenges and advocate for the infrastructure needs

critical for business success.

Strategic / Statutory Context

8. Council’s

partnership with Priority One helps us deliver our community outcomes and

contribute to a city that is well planned, with a variety of successful and

thriving compact centres and resilient infrastructure.

9. A

successful economic development organisation plays a key role in making a

significant contribution to the social, economic, cultural, and environmental

well-being of the region.

10. Tauranga

is a city that attracts and supports a range of businesses and education

opportunities, creating jobs, and a skilled workforce.

Options Analysis

11. There

are no options as Council is only receiving Priority One’s Annual Report

for 2021/22.

Financial Considerations

12. The

financial considerations are outlined in the main body of the report.

Legal Implications / Risks

13. The

Annual Report meets the legislative requirements for the economic development

agency to provide Council with an overview of performance.

Consultation / Engagement

14. No

consultation or engagement is required or planned.

Significance

15. The

Local Government Act 2002 requires an assessment of the significance of

matters, issues, proposals and decisions in this report against Council’s

Significance and Engagement Policy. Council acknowledges that in some instances

a matter, issue, proposal or decision may have a high degree of importance to

individuals, groups, or agencies affected by the report.

16. In

making this assessment, consideration has been given to the likely impact, and

likely consequences for:

(a) the current

and future social, economic, environmental, or cultural well-being of the

district or region;

(b) any persons who are likely to be

particularly affected by, or interested in, the matter; and

(c) the capacity of the local authority to

perform its role, and the financial and other costs of doing so.

17. In

accordance with the considerations above, criteria and thresholds in the

policy, it is considered that the matter is of low significance.

ENGAGEMENT

18. Taking

into consideration the above assessment, that the matter is of low significance,

officers are of the opinion that no further engagement is required prior to

Council making a decision.

Next Steps

19. Priority

One will have an opportunity to present their Annual Report and answer any

questions during the Committee’s consideration of this paper on 14

November.

20. The

report will be published on Priority One’s website.

Attachments

1. Priority

One - Annual Report 2021/22 - A14141184 ⇩

|

Strategy,

Finance and Risk Committee meeting Agenda

|

14

November 2022

|

|

Strategy,

Finance and Risk Committee meeting Agenda

|

14

November 2022

|

9.2 Delivering

Better Outcomes - City Waters Enhanced Procurement

File

Number: A14113786

Author: Kelvin

Hill, Manager: Water Infrastructure Outcomes

Authoriser: Nic

Johansson, General Manager: Infrastructure

Purpose of the Report

1. To inform the Committee on

a new approach to enhance the procurement for City Waters; Planning, Design and

Physical Works of the capital programme.

|

Recommendations

That the Strategy,

Finance and Risk Committee:

(a) Receives the report "Delivering

Better Outcomes - City Waters Enhanced Procurement".

(b) Endorses two procurement

activities leading to new panels for:

(i) Detailed design

services for water supply and wastewater network

(ii) Construction services for

defined scope areas for City Waters.

|

Executive Summary

2. The City Waters team have

determined the preferred procurement approach for delivering the next five

years of the long-term plan which involves the establishment of two new panels.

3. This approach takes

consideration of feedback from the supply chain, current procurement

arrangements in place and the required design and construction activities over

the next five years.

4. An Integrated Programme

Approach is being developed in order to increase collaboration with the panel

members to assist in delivering on the 9 outcomes.

Background

5. Following a review of the

current state of procurement across Council last year, and the development of 9

benefits and outcomes that Council aim to achieve, Arup was engaged to assist

with the procurement strategy and executing delivery models for delivering the

Long-Term Plan.

6. Initially the intent had

been for one procurement strategy to cover the whole of the Long-Term Plan and

any procurement model(s) adopted to be suitable for all procurement streams.

7. Following internal

engagement, it was determined that City Waters should be the focus and that any

procurement models put in place could then be scalable for the other areas at a

later date.

8. As part of the engagement process

key stake holders across the consultant and construction fields have provided

feedback to Council on the potential benefits and outcomes a revised

procurement process could deliver. The last update to the sector was provided

at the yearly gathering of suppliers evening hosted by TCC in August 2022.

9. Following a detailed

review with the City Waters team to look at current panels in place, the next

five years of capital works required, works already contracted (or where no

procurement is required e.g. developer payments, land purchase etc) and the

forward spend profile, the procurement model outlined below was determined as

achieving a balance between achieving the 9 outcomes, making best use of

current panels and consideration for suitability for upcoming water reform. The

impact on organisational change was also a key consideration to continue to

allow the team to deliver the current annual spend targets.

10. Approximate spend per annum for the

next 5 years is $110M with an anticipated split of 90% construction, 5%

detailed design and 5% modelling, planning and studies.

11. In order to meet the pace of required

spend and delivery programme, early packages of works that could fall outside

of the scope of the procurement model are being considered in the shorter term.

However, the procurement model will be scalable to expand in the longer term

and be in place to provide continuity during the potential changes that

eventuate from water reform.

Strategic

/ Statutory Context

12. Three Waters Reform has been

considered in developing the procurement approach and the proposed panels

ensure that delivery of the capital programme can continue unhindered while any

transitions occur but will also be scalable to allow the addition of other

packages of work should this be required under Entity B.

Options

Analysis

13. Multiple options have been considered

taking into account the current panels in place and the upcoming program of

works for City Waters. These included models such as delivery partnership,

alliance, bundling packages of works, staged ‘traditional’ approach

and fixed price D&C. However, based on the level of expected spend and the

type of work required to be delivered over the next five years, each of these

options were not considered to best leverage off the existing models in place

and continue to enable the team to deliver good performance.

14. The City Waters team will create a

new detailed design panel through a single stage RFT process which will

consider financial and non-financial aspects. It is anticipated that there will

be 3 to 4 suppliers on this panel.

15. The length of the new detailed design

panel will align with the planning panels with a longer-term view that one

planning and design panel could be established in the future.

16. The City Waters team will create of a

new Construction panel through a 2-stage procurement process. The initial ROI

phase will be based on non-financial aspects only. The second stage RFT will

consider financial components through either example project pricing or rates

and margin assessment.

17. The construction panel members will

deliver allocated packages of work suited to their track record, capability and

capacity which would be established through the procurement process. The number

of panel members is still to be determined depending on how the packages are split

but it is expected to be around 5 or 6.

18. Methodology for agreeing the pricing

of the packages and ensuring value for money is still being finalised. This

will include an element of open book style approach and independent review of

the estimates.

19. The existing panels and new panels

will be brought together under an integrated programme approach which will see

improved collaboration between Council and the supply chain and this will

evolve over time as relationships develops and collective capability increase.

20. Performance measurements to stay on

the panel and keep delivering for TCC will be imbedded within the panel

delivery documentation.

Financial

Considerations

21. The proposed panels deliver for the

City Waters elements of the long term plan. There are no further financial

commitments required.

22. The proposed procurement models and

the way in which the work packages would be allocated is intended to deliver in

a more efficient manner.

Legal

Implications / Risks

23. As the panels are proposed for a

duration of five years there could be some dissatisfaction from the supply

chain that are not successful in securing a place on the new panels. Any risks

associated with this will be mitigated through a number of measures including

the engagement of a probity advisor, following the Council procurement rules

and having a clear and approved procurement plan and having legal review of the

contracts.

24. There will be consideration of the

appropriate terms and conditions for including in the contracts to allow for

the uncertainty of Three Waters Reform.

25. By grouping the works into packages

and having earlier engagement with the supplier chain should reduce the

delivery risk as any risks will be visible earlier and therefore allow time for

suitable changes to be made or mitigations to be put in place.

Consultation /

Engagement

26. There has been

extensive engagement with the supply chain not only to get their feedback on

the current procurement models but also ensuring they are aware of the status

and program for new procurement activities.

Significance

27. The Local Government Act 2002

requires an assessment of the significance of matters, issues, proposals and

decisions in this report against Council’s Significance and Engagement

Policy. Council acknowledges that in some instances a matter, issue,

proposal or decision may have a high degree of importance to individuals,

groups, or agencies affected by the report.

28. In making this assessment,

consideration has been given to the likely impact, and likely consequences for:

(a) the current and future social, economic,

environmental, or cultural well-being of the district or region

(b) any persons who are likely to be

particularly affected by, or interested in, the .

(c) the capacity of the local authority to

perform its role, and the financial and other costs of doing so.

29. In accordance with the considerations

above, criteria and thresholds in the policy, it is considered that the matter

is of medium significance.

ENGAGEMENT

30. Taking into consideration the above

assessment, that the matter is of medium significance, officers are of the

opinion that no further engagement is required prior to Council making a

decision.

Click here to view the TCC

Significance and Engagement Policy

Next

Steps

31. The procurement plan will be

finalised, and the procurement activities carried out as per our draft

programme.

· December 2022 Registration

of interest sent out

· February 2023 Submissions

received, and procurement process undertaken

· May 2023 Outcome

of Procurement process completed

Attachments

Nil

|

Strategy,

Finance and Risk Committee meeting Agenda

|

14

November 2022

|

9.3 Draft

Annual Plan 2023/24 - Approach and Key Financials

File

Number: A14091423

Author: Kathryn

Sharplin, Manager: Finance

Tracey Hughes,

Financial Insights & Reporting Manager

Authoriser: Paul

Davidson, Chief Financial Officer

Purpose of the Report

1. In accordance with the

Local Government Act 2002, Council is required to produce and adopt an annual

plan, by 30 June 2023.

2. The purpose of this report

is to discuss the high-level financials for the 2023-24 Annual Plan, outlining

some of the key risks and challenges and shows some early benchmarking of

operational expenditure.

|

Recommendations

That the Strategy,

Finance and Risk Committee:

(a) Receives the report

"Draft Annual Plan 2023/24 - Approach and Key Financials"

(b) Notes high-level initial

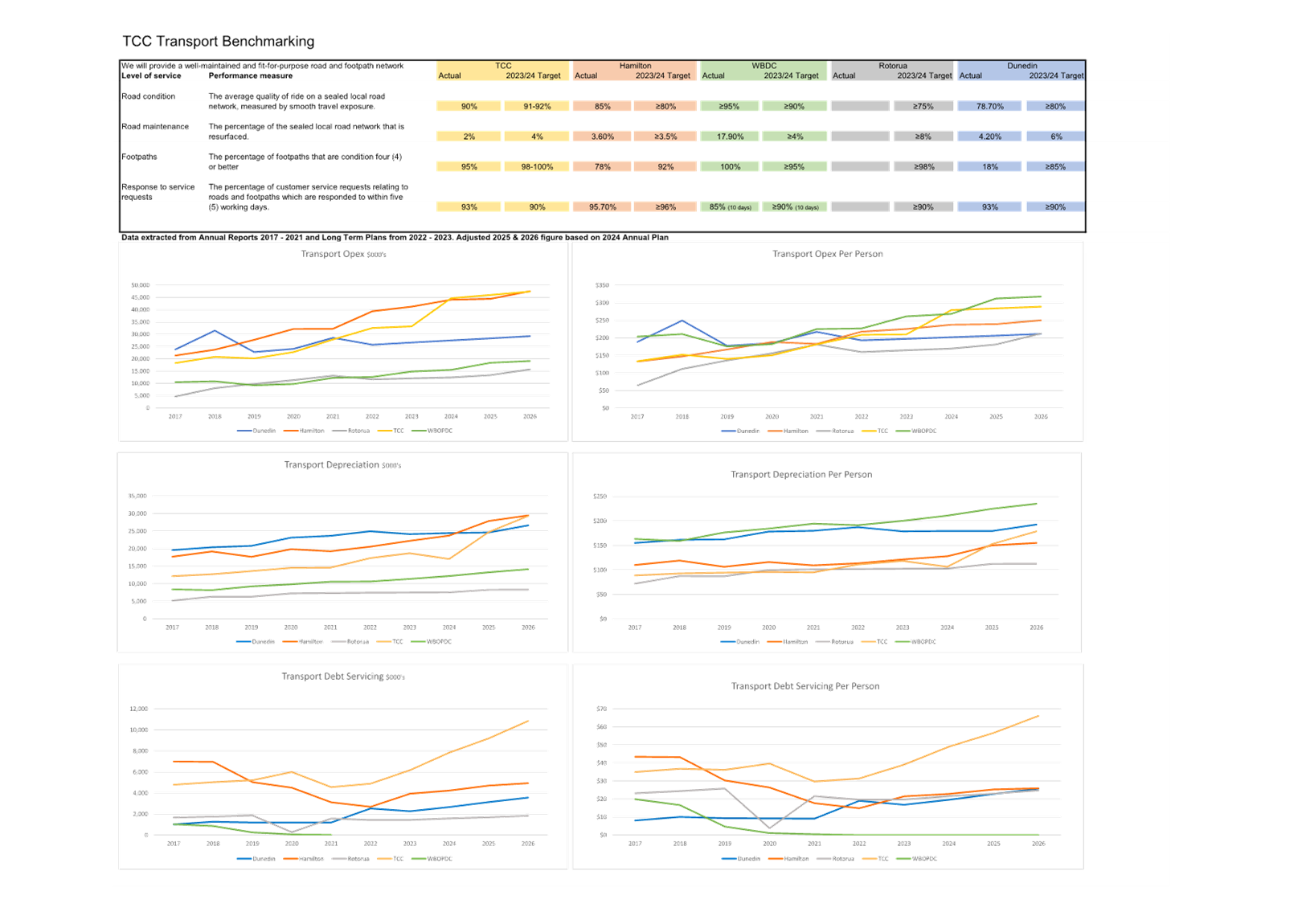

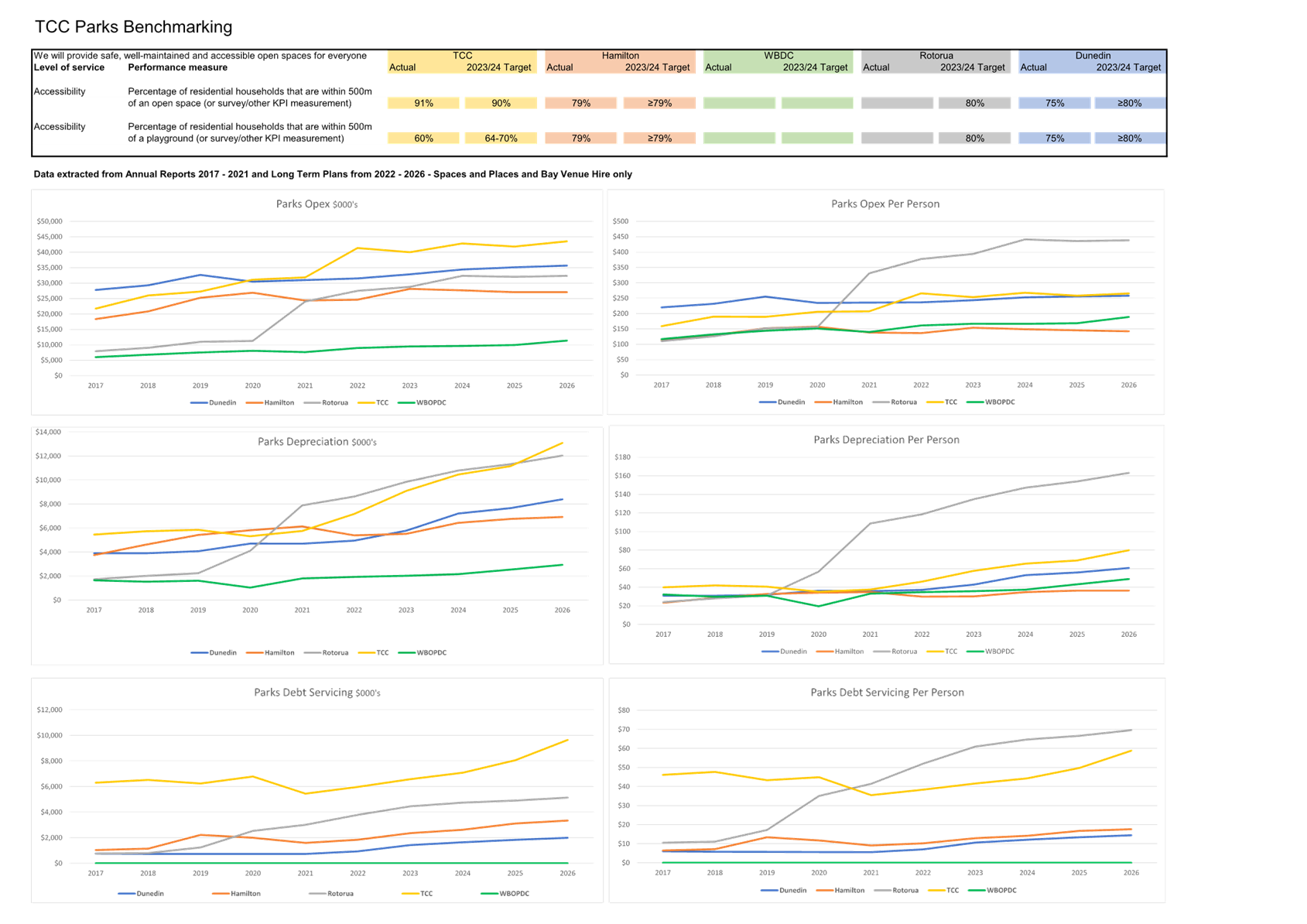

benchmarking data for transportation, three waters and spaces and places

against other councils

(c) Agrees the proposed approach

to budgeting for the 2023-24 Annual Plan targeting key financials of year 3

of the LTP, but noting inflationary and interest rate pressures

|

Executive Summary

3. The Annual Plan for

2023-24 continues the priority expenditure of the 2022-23 year and is broadly

consistent with the ten-year programme of work set out in the amended 2021-31

Long-term Plan (LTP). The 2023-24 Annual Plan is compared with year 3 of the

LTP.

4. The overall financials in

the draft annual plan remain broadly consistent with year three of the LTPA,

which is now the new LTP. There is an overall rates requirement increase

of approximately 7.5% after growth (estimated at 1.5%) and including water by

meter. However, excluding water by meter revenue which is declining, the rates

increase is 10%.

5. This has been achieved by

a number of measures to reduce the impacts of increasing costs which are being

experienced across the business. CPI has come in at about 5% above LTP

assumptions. Interest rates have also risen significantly above budgeted

levels. In addition, large cost increases have occurred across key

service delivery areas including transportation and aspects of parks

maintenance where budgets and contracts had been insufficient to meet service

level requirements. There have been a number of proposals to keep cost

increases and rates requirement down including greater use of debt, phasing in

some costs and initiatives e.g. fully funding depreciation from revaluations.

6. The capital programme

budget and work programme is proposed to remain close to the LTPA programme of

$434m for 2023/24 including vested assets. With rising costs of delivery this

does indicate a slower rate of delivery of projects, noting that there is

expected to be capital projects carried forward from 2022-23 to also be

completed later than budgeted.

7. Further consideration and

advice is being sought on requirements to consult on the annual plan, which

will be addressed in December reports to Council.

Background

8. The

Annual Plan for 2023-24 continues the priority expenditure of the 2022-23 year

and is broadly consistent with the ten-year programme of work set out in the

amended 2021-31 Long-term Plan (LTP). The required comparator for the Annual

Plan 2023/24 is the budgets for year three of the LTP. After considering

estimated population growth and higher than expected inflation levels the total

rates requirement is comparable to that in year 3 of the LTP.

9. The

expenditure on level of service and capital investment in the LTP, which is

reflected in the 2023-24 Annual Plan aims to improve outcomes across:

(a) transportation,

(b) housing

supply,

(c) civic

and community facilities,

(d) three

waters expenditure

(e) resilience

arising from climate change.

10. The

Long-term Plan was amended in 2022 to include:

(a) a

civic investment programme of $303m including library, museum exhibition centre

and community space, with $150m of this expenditure funded by asset sales or

grants. This investment is continuing as planned in 2023-24 subject to

external funding.

(b) alternative

funding for specific work programmes, including Infrastructure Funding and

Financing (IFF)) for the Transport System Plan (TSP) and Tauriko West. The

alternative IFF funding for TSP has remained in the draft 2023-24 annual plan

but the Tauriko West funding and capital has been amended to Waka Kotahi

delivery with payment of a share made by TCC, which is partially offset by

grant payments made by other entities, including developers and central

government.

11. After

allowing for much higher inflation than assumed in the LTP, the overall

financials in the draft annual plan remain broadly consistent with year three

of the LTPA, which is now the new LTP. There is an overall rates

requirement increase at 7.5% after growth and including water by meter.

Excluding water, the rates increase is 10%. This has been achieved by measures

to reduce the impacts of increasing costs which are being experienced across

the business. General price increases are about 5% above assumptions used

in the LTP (CPI 7.3% to end of June 2022) against the LTP assumptions of about

3% per annum. In addition, large cost increases have occurred across key

service delivery areas including transportation and aspects of parks

maintenance where budgets and contracts had been insufficient to meet service

level requirements. These additional pressures have meant we have had to

look at other ways to address budgets than simply increasing rates and user

fees. Proposals to keep cost increases down include:

(a) loan

funded opex across planning and design expenditure that has longer term benefit

e.g. intensification and growth area structure planning,

(b) phasing

in of rate funding of additional depreciation arising from asset revaluations

across transportation and buildings,

(c) application

of the rates surplus from 2022 to interest rate risk reserve to fund part of

the interest rate increases in 2023-24,

(d) reductions

across some areas of expenditure primarily achieved by not applying CPI to

costs,

(e) phasing

in more slowly some new initiatives and expenditure.

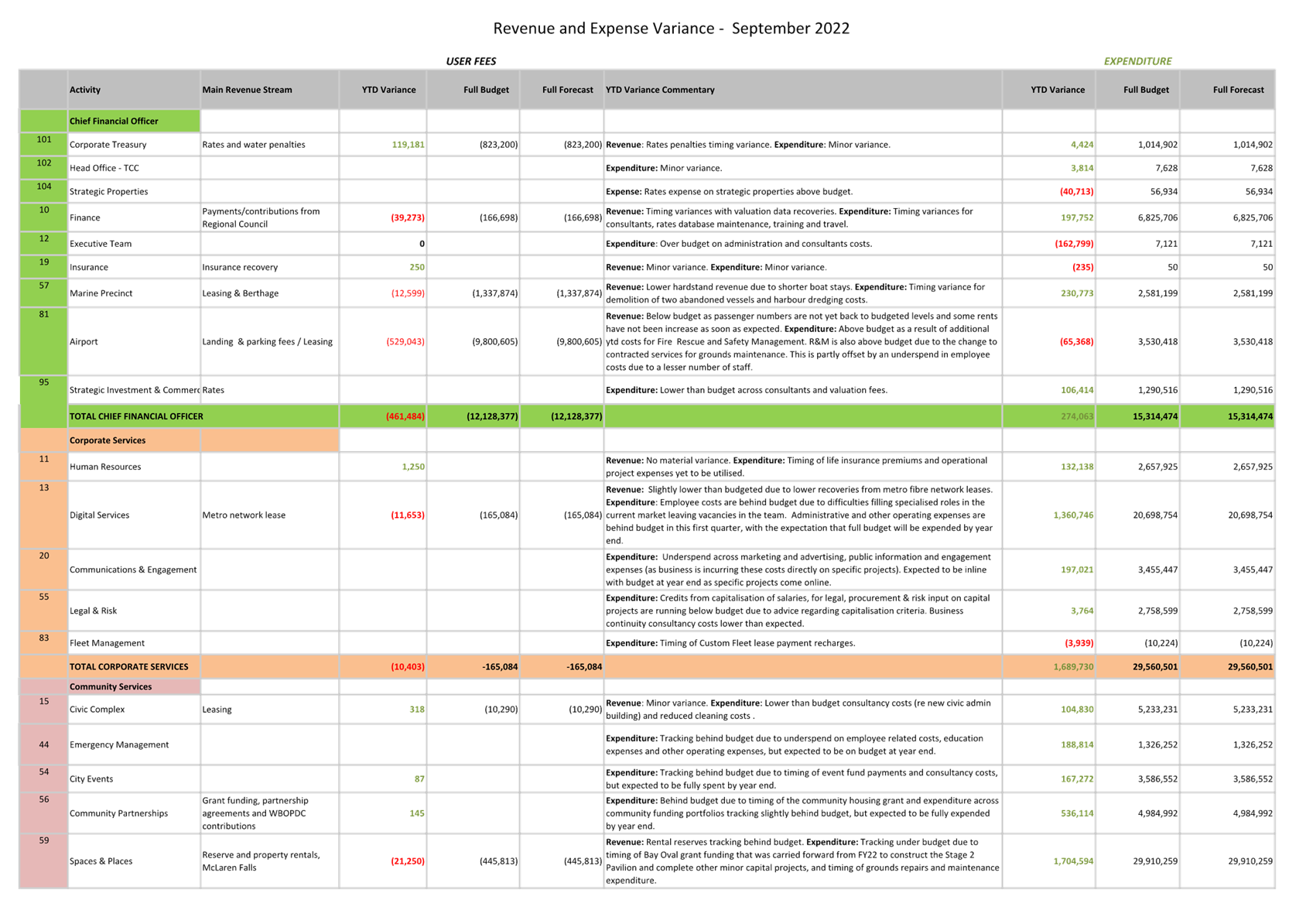

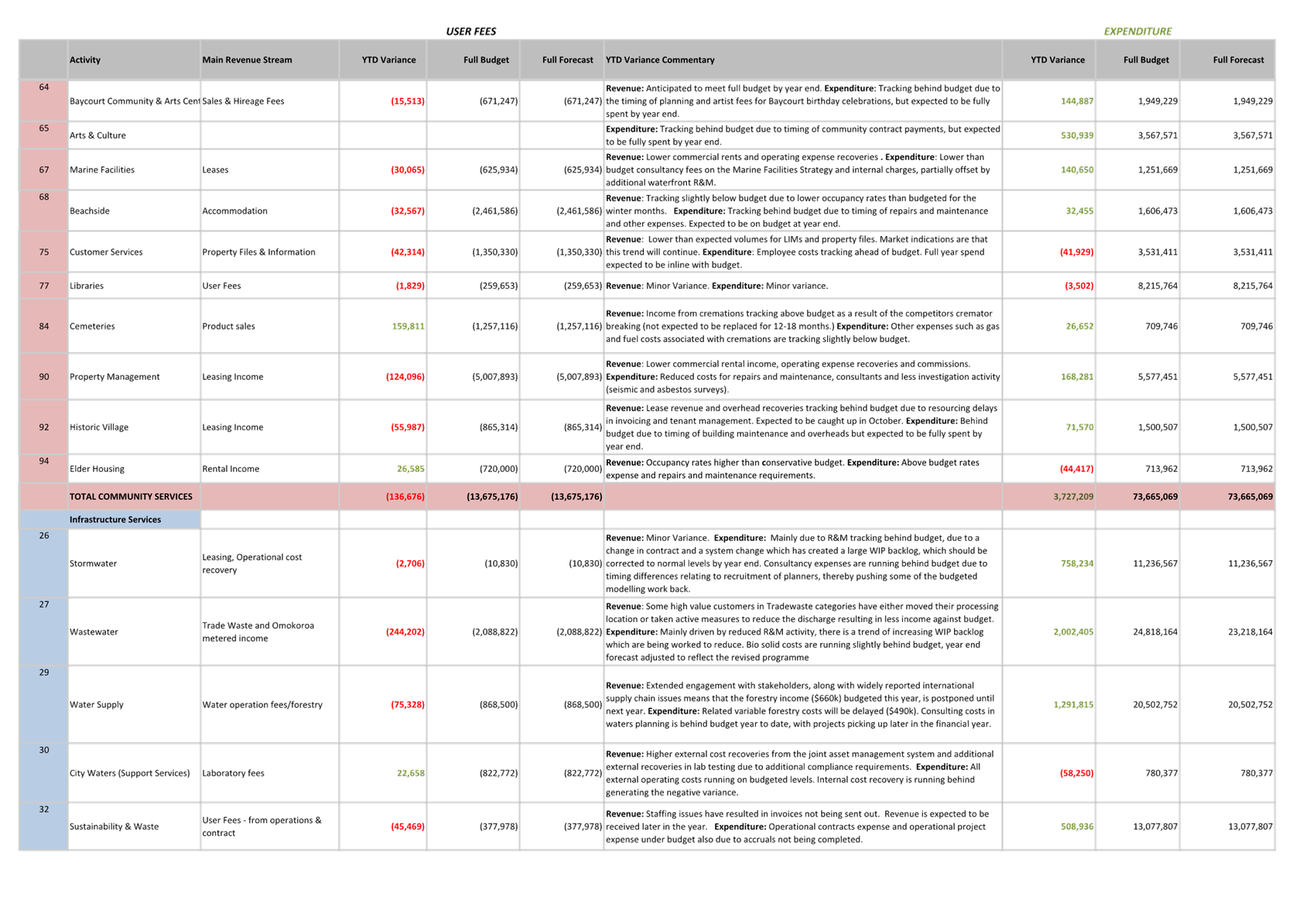

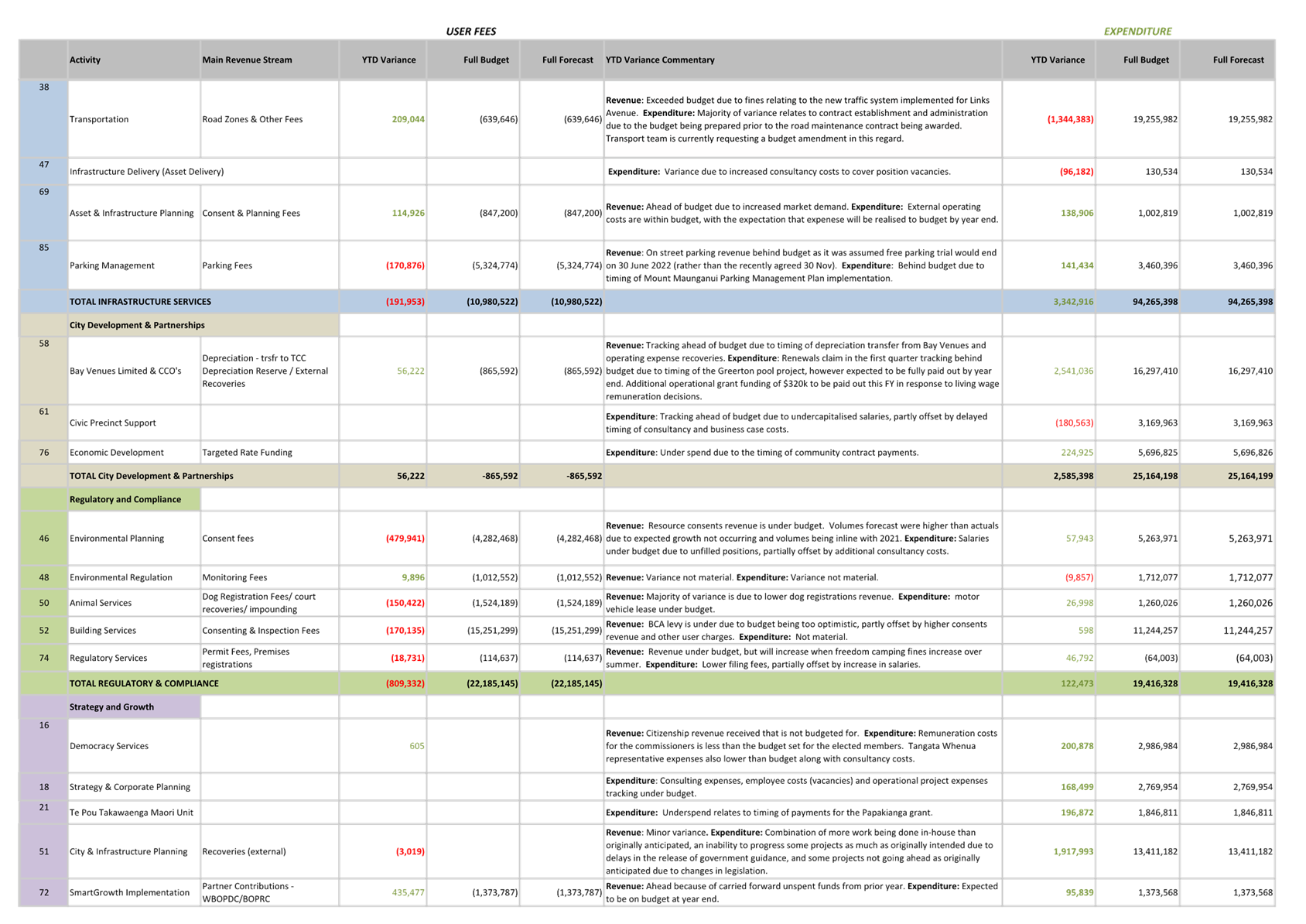

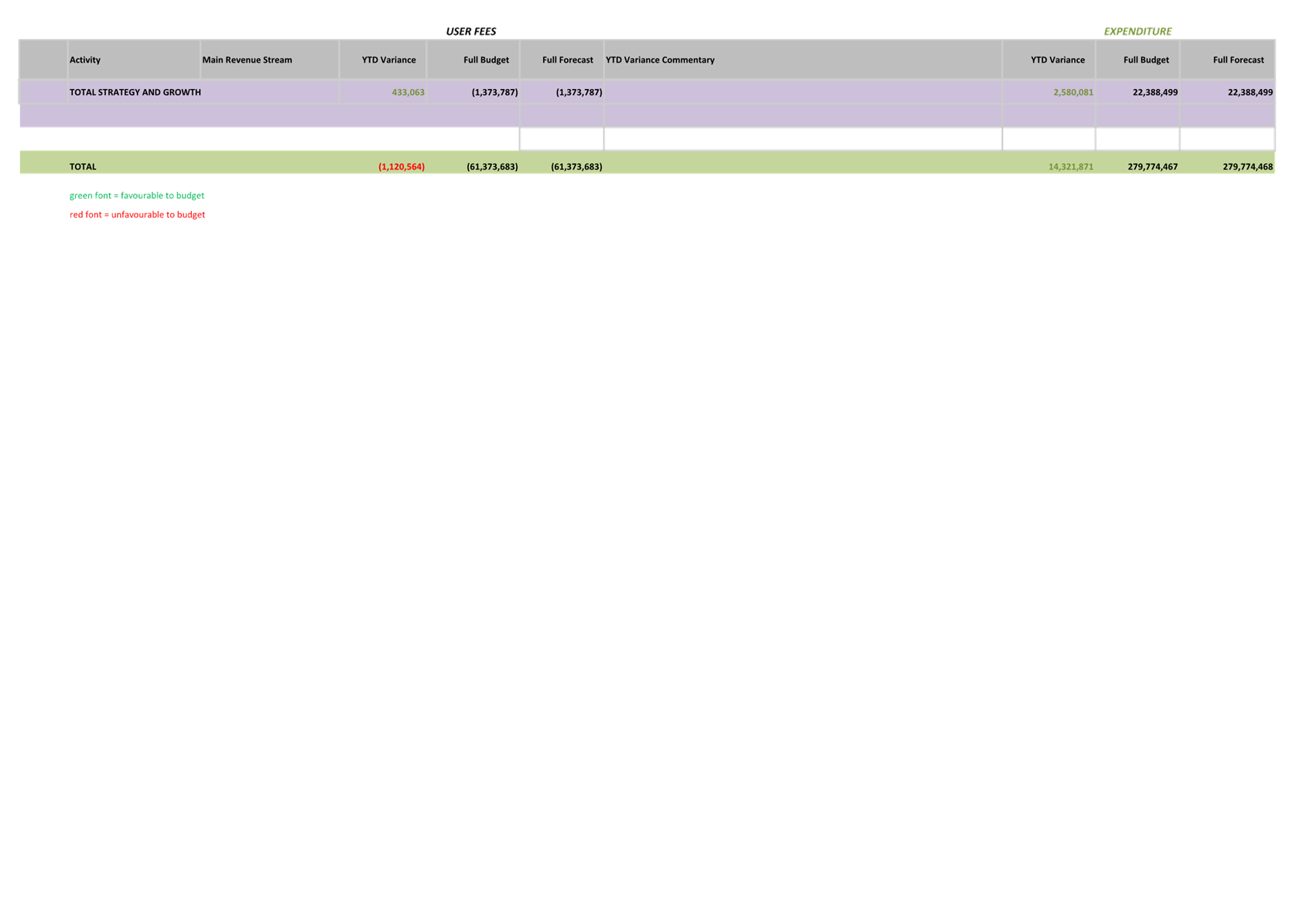

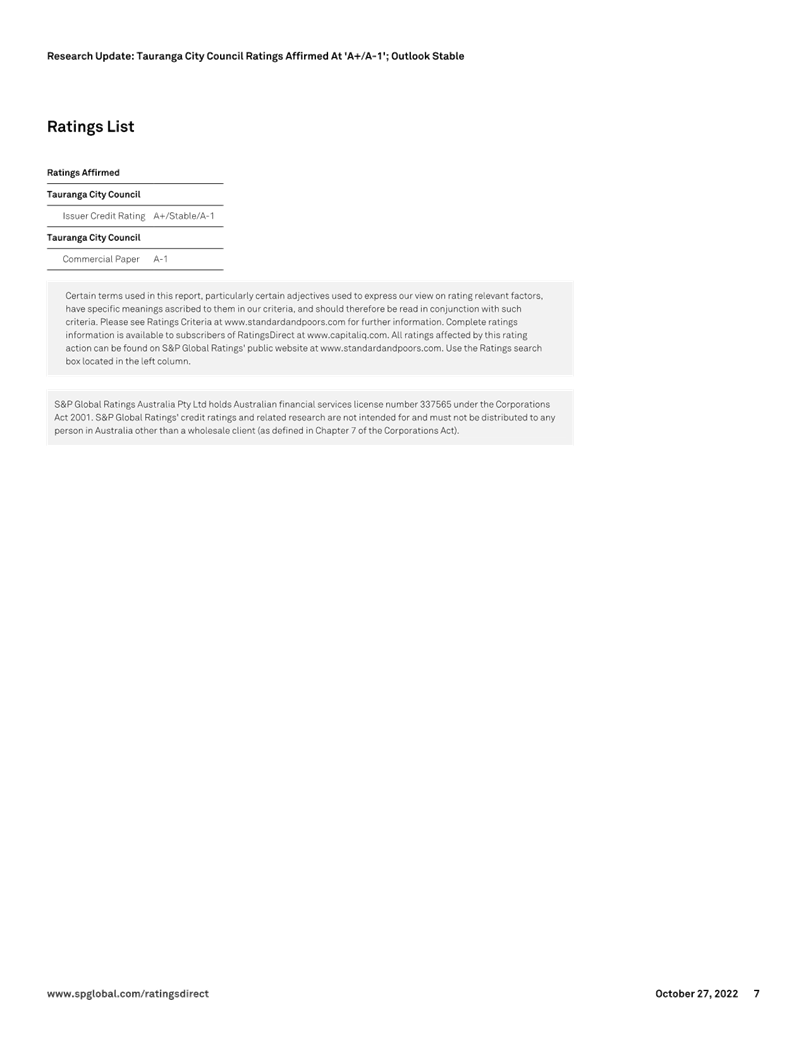

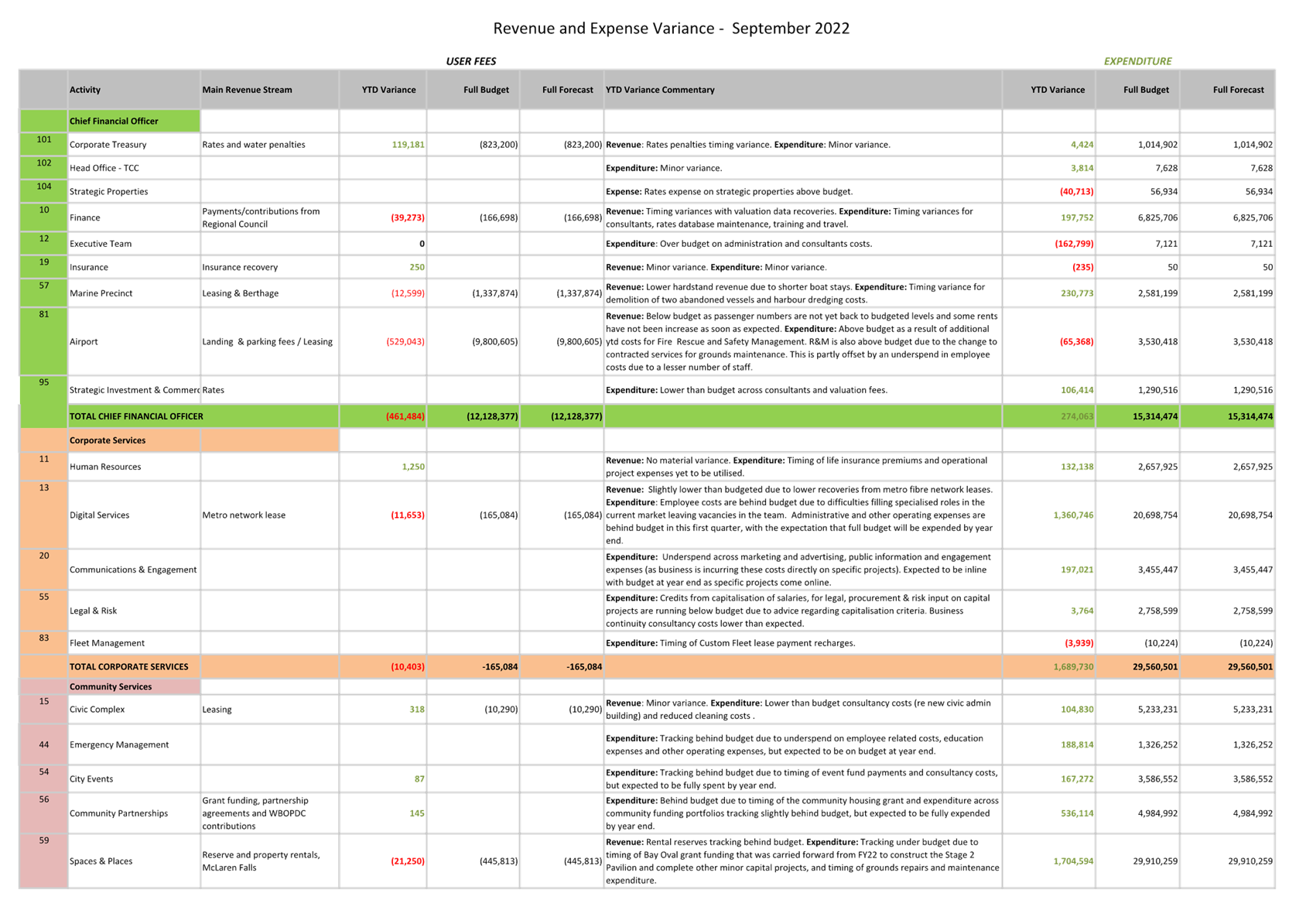

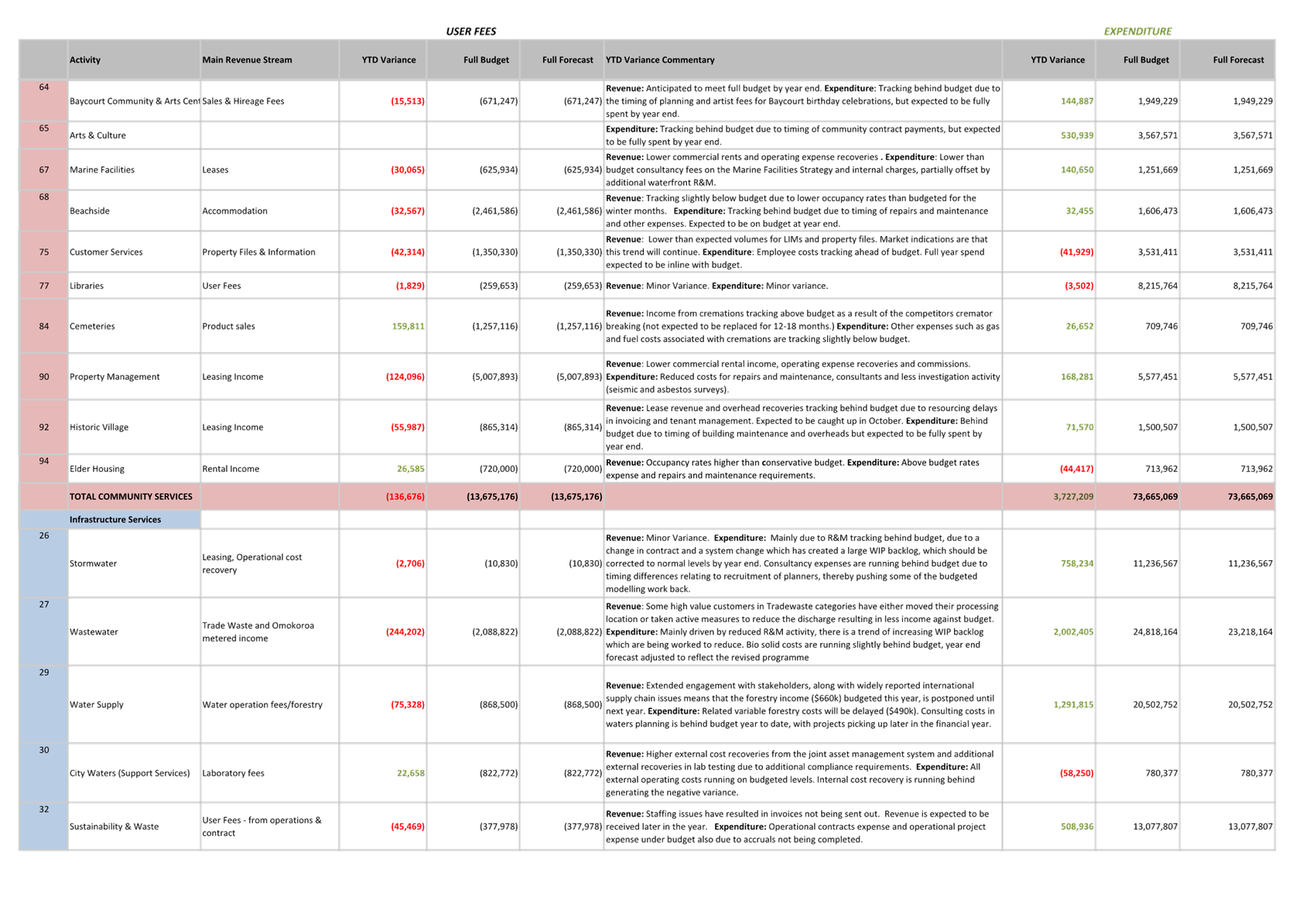

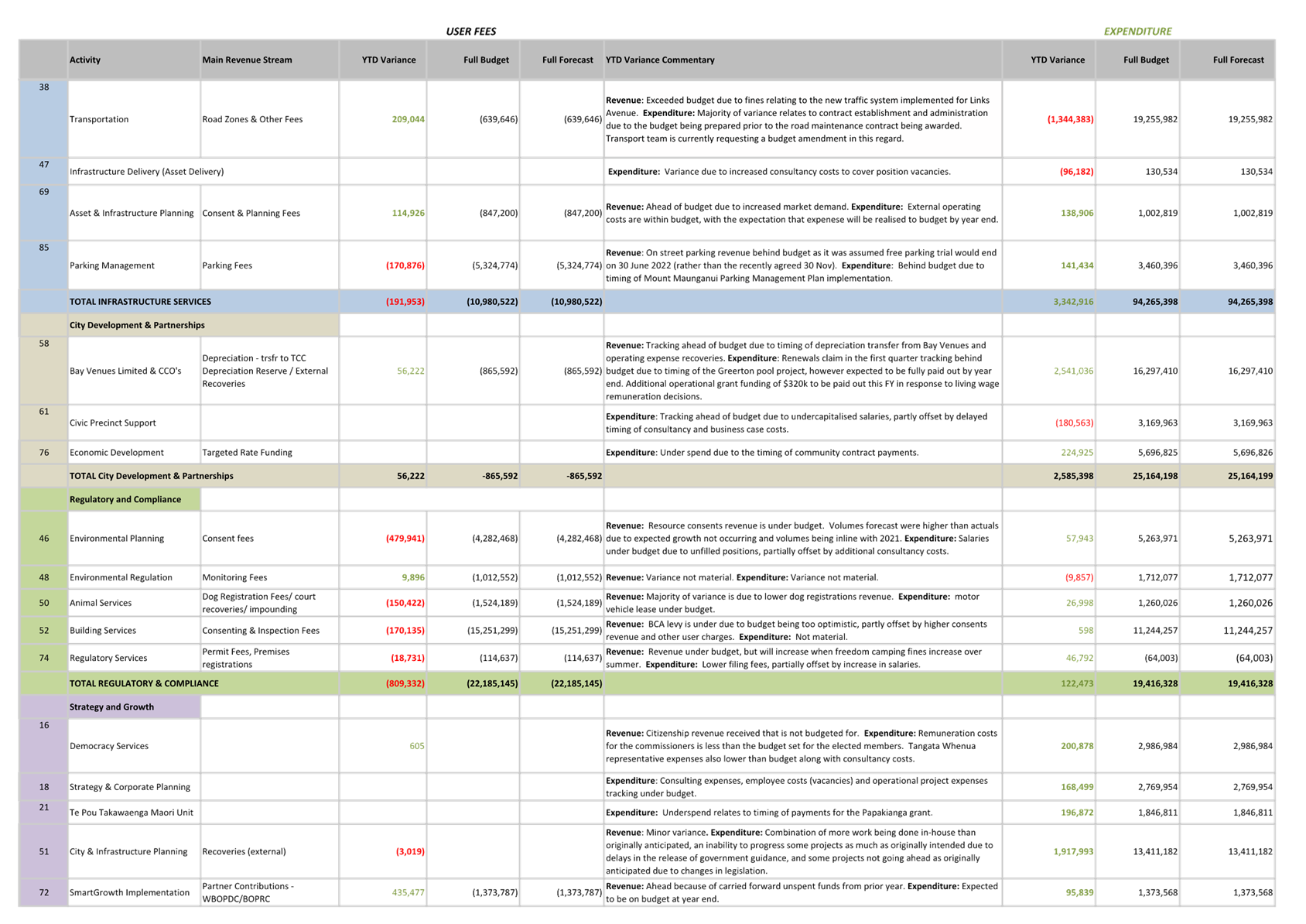

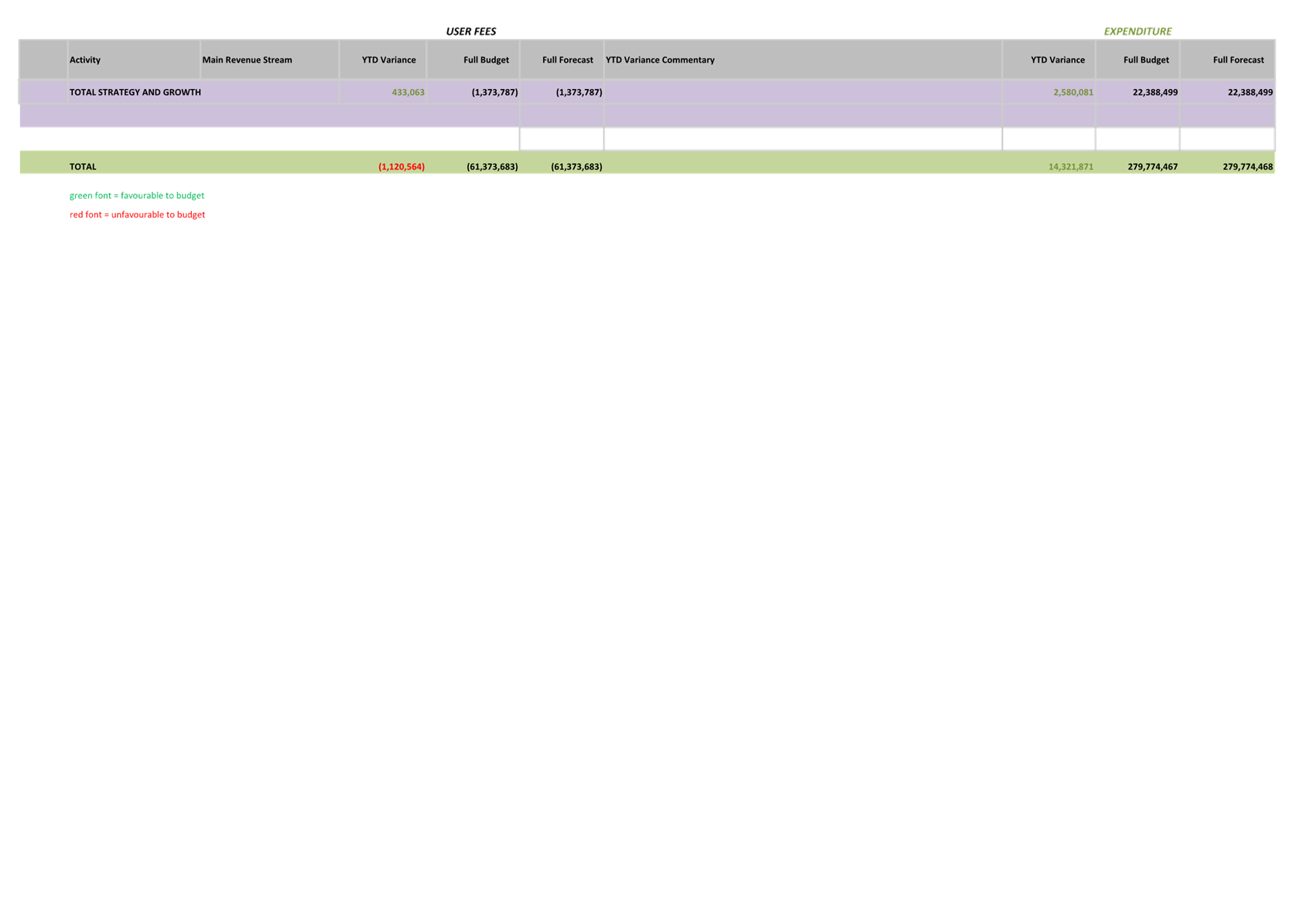

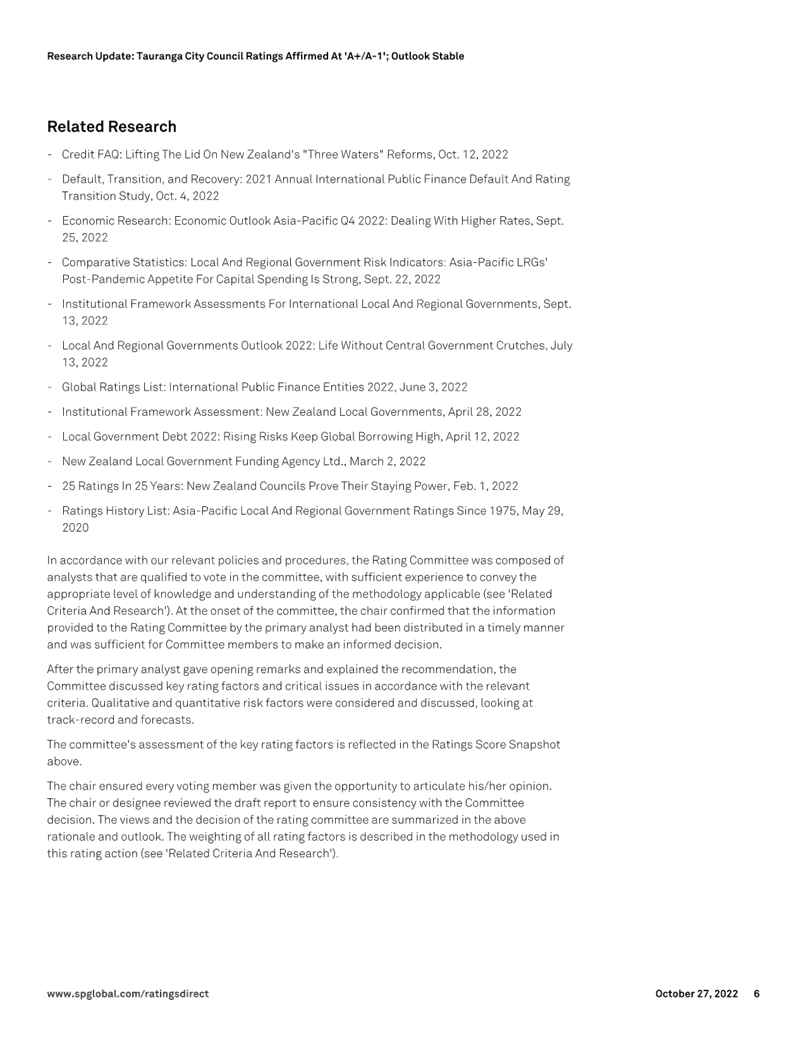

12. The following table shows the

comparison of key financials between the LTP and the annual plan 2024.

|

Key Financials

|

LTP 2023/24

|

Draft Annual Plan 2023/24

|

|

Total Rates Increase from 2023 including water by meter

|

6% after growth

|

Approx. 7.5% after estimated population growth of 1.5%

|

|

Rates excluding water by meter

|

6.5% after growth

|

Approx. 10% after estimated population growth, 8.4%

residential and 19% commercial

|

|

Target to achieve a further 2% reduction in residential

rates

|

|

Approx. $5m reduction in rates funded expenditure

|

|

Total Capex $m

|

434

|

400* (350 TCC delivered)

|

|

Total Debt $m

|

1,038

|

Approx. 1,100

|

*Capex

delivered by TCC plus vested and including Tauriko West now delivered by Waka

Kotahi, excluding carry forwards from 2022-23

Capital

13. Overall, the capital programme is not

significantly different to the LTP. The $434m LTP budget included vested

assets and $50m Tauriko West expenditure. Tauriko West is now being

delivered by Waka Kotahi with TCC’s share of expenditure now recognised

as operational costs and contributions from third parties are recognised as

grant revenue. The other key changes to capital reflect timing and cost

adjustments for projects. A capital delivery adjustment of $44m is also

included to give a total budget of $350m.

14. There is

additional funding proposed for strategic land purchase. To recognise the

increasing cost of land, the budget has been increased by 40% to $7.4m for the

year in 2024. Budgets will also be included in activities to purchase land

from the strategic acquisition fund and the funds made available to future

strategic land purchase.

Significant

operational Differences between Annual Plan and LTP

15. Some operational revenue and

expenditure has changed significantly from the LTP in key areas including:

(a) Interest

expense from rapidly increasing interest rates

(b) Transportation

costs from large maintenance contract budget adjustments

(c) Spaces

and Places more realistic cost of maintenance is now reflected in budgets

(d) Salary

costs have increased reflecting

(i) in-housing

of some spaces and places contracts with a redistribution of budget from other

operating costs

(ii) other

staffing requirements to achieve higher delivery across the capital programme

and other priority areas including transportation

(e) Civic

group with programme and delivery costs capitalised or proposed to be loan

funded as part of the wider programme

(f) Civic

governance changes proposed which may be delivered through a CCO subject to

consultation, with costs loan funded along with delivery costs of the civic

programme that are not capitalised. Approval for this will be sought

through the annual plan report to council in December.

(g) Depreciation

expense arising from substantial asset revaluations across buildings and infrastructure

(h) Volume

consumption of water has decreased relative to forecast level, generating a

reduction in water by meter revenue despite a 7% increase in the cubic metre

charge.

16. The interest-rate environment has

undergone a huge shock over the last 12 months. Budgeted interest is now $11m

higher than in the LTP for year 3.

17. During 2023 there has been a focus on

improving service delivery across the core areas of transportation and spaces

and places. In previous year’s budgets, and including year 3 of the

LTP, budgets were held artificially low by existing maintenance contracts that

under-priced the cost of maintenance and had resulted in inadequate service

delivery across TCC’s assets. In addressing these issues, the true

cost of adequate maintenance has been reflected in 2024 budgets leading to a

significant increase in cost compared with the LTP year 3 in both spaces and

places and transportation. Some of this increase has been offset by lower

cost increases across other areas of Council.

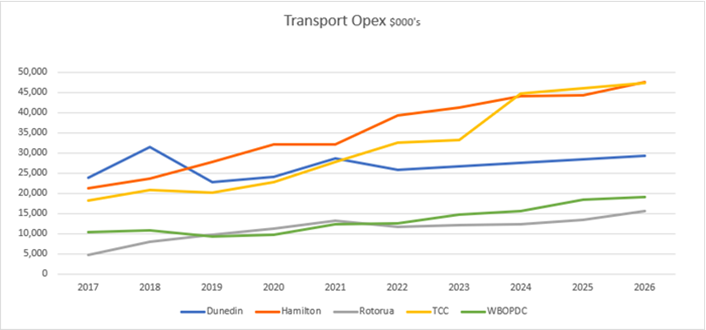

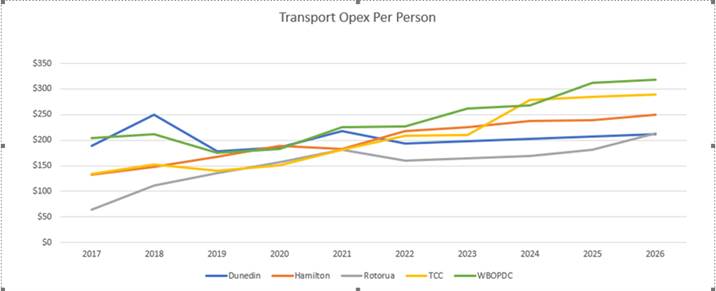

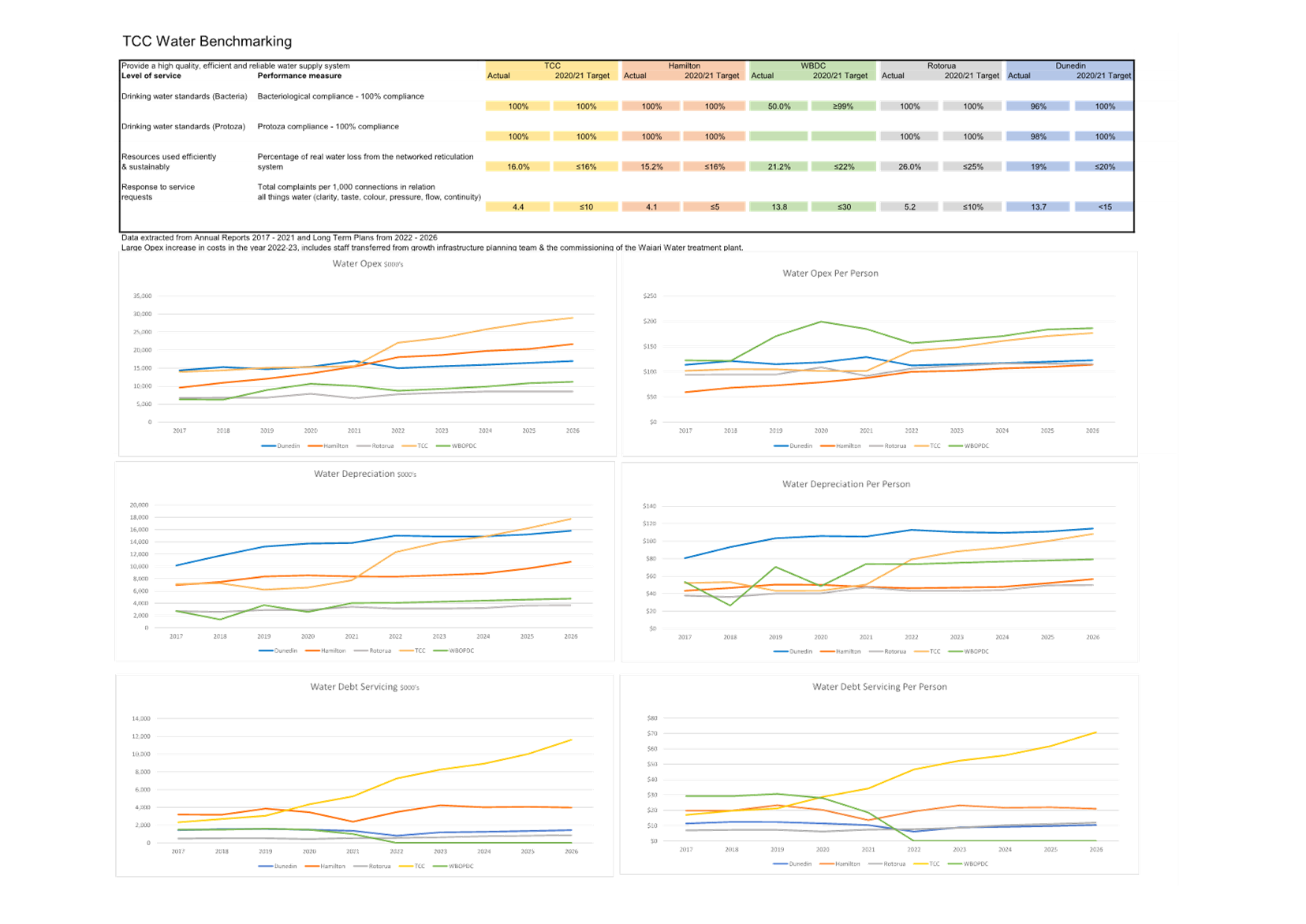

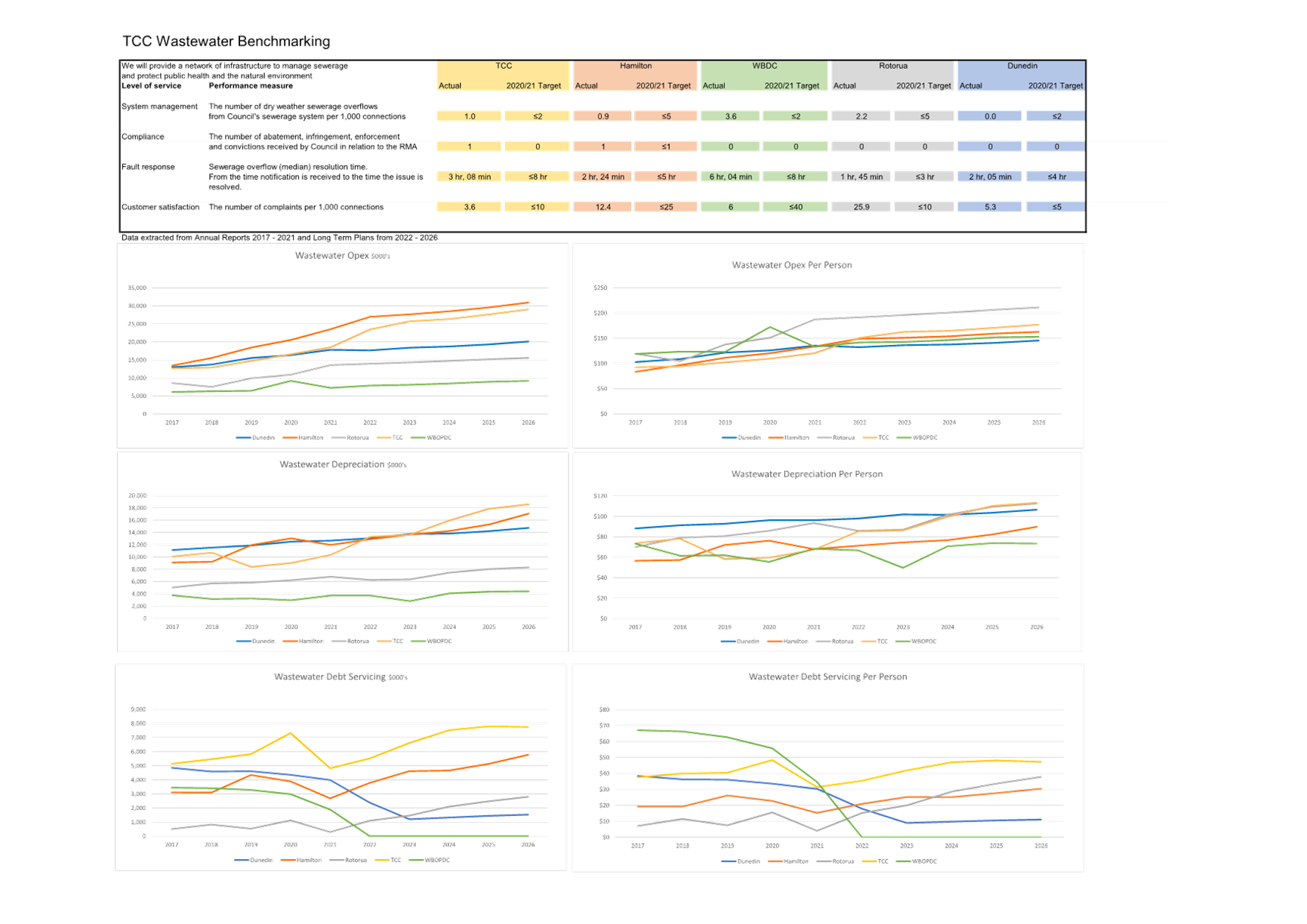

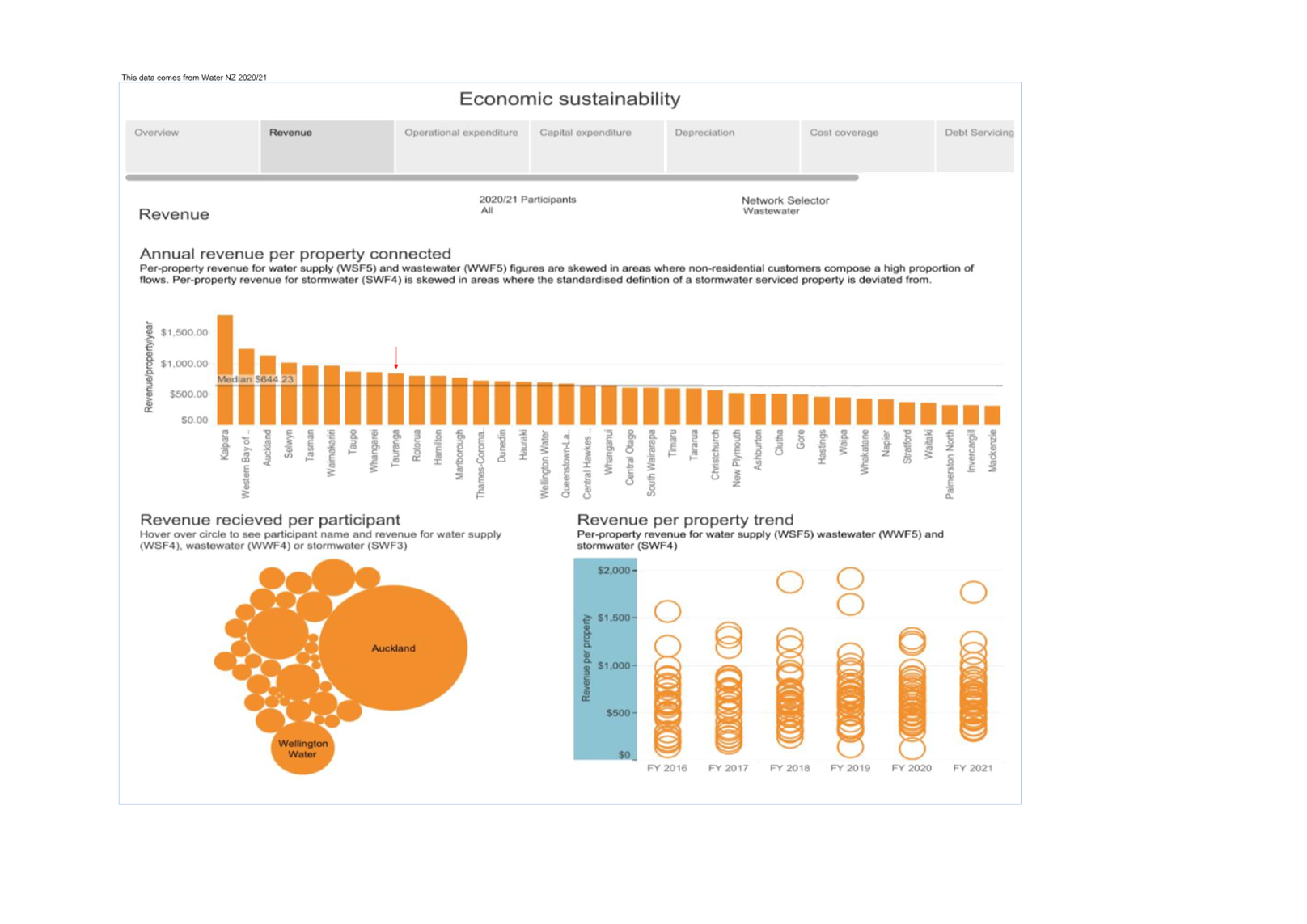

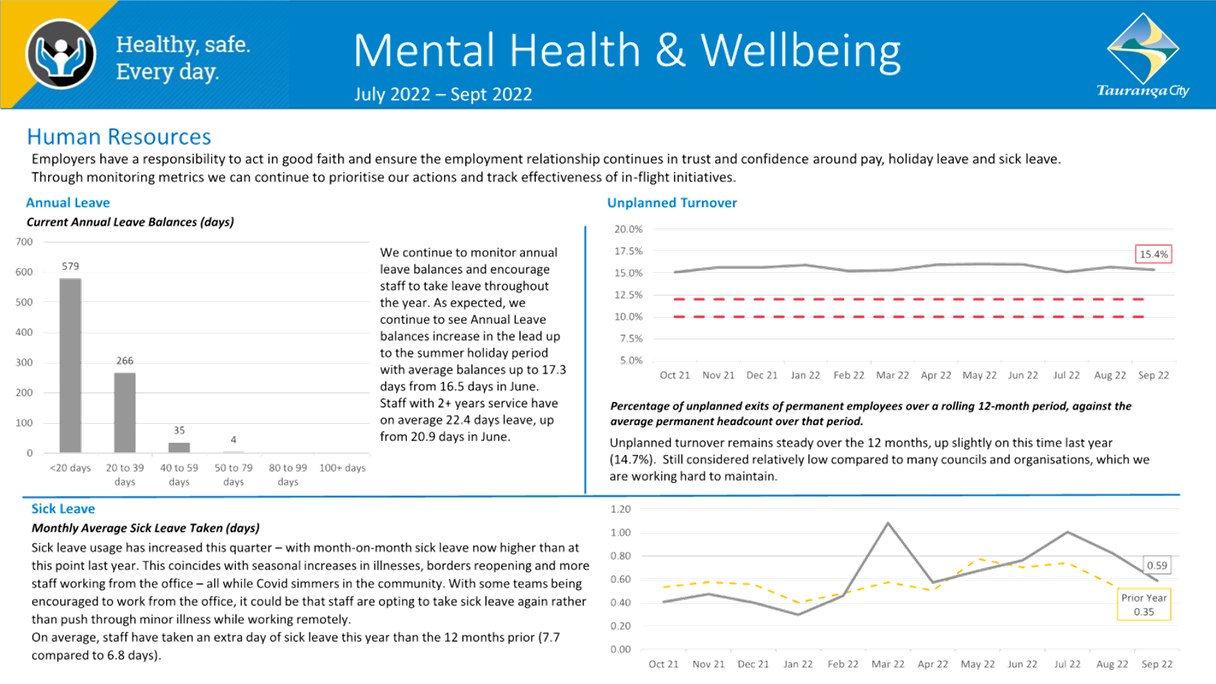

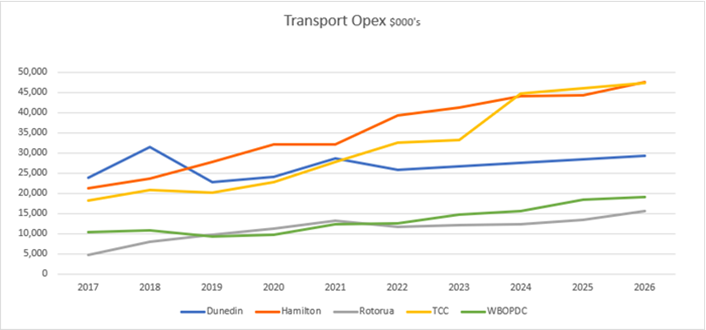

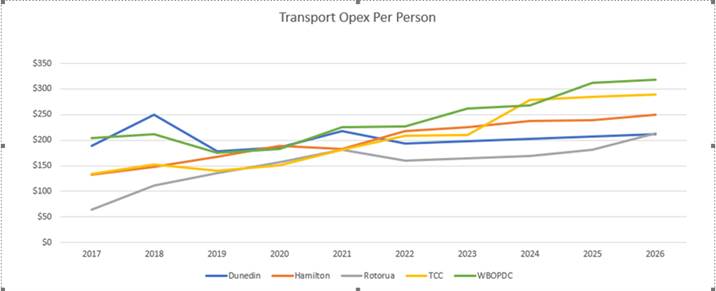

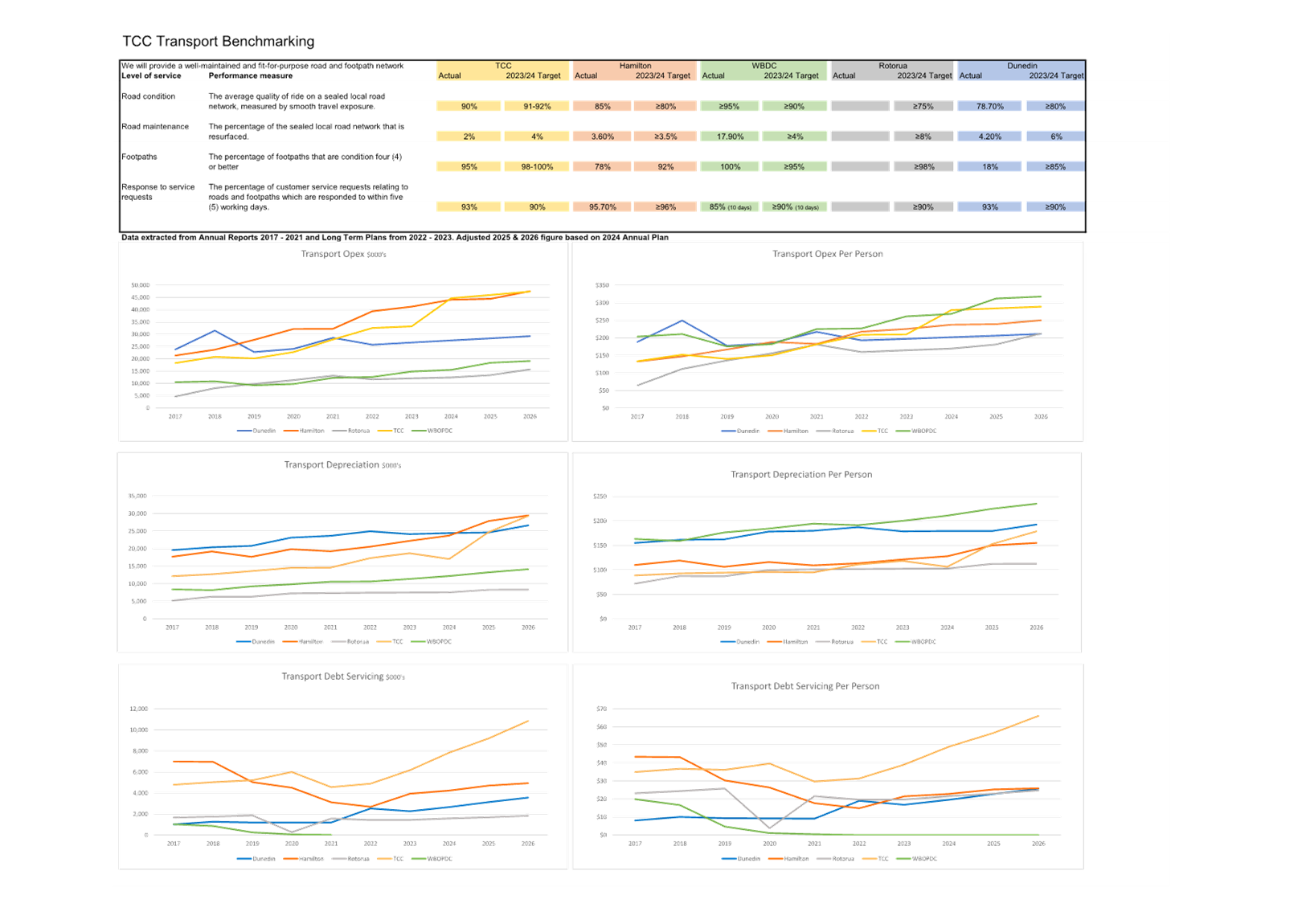

18. The following benchmarking charts

confirm that TCC has underfunded transportation maintenance relative to peer

councils such as Hamilton. Data has come from annual reports for the

years up to 2021 and the latest LTP for the years from 2022. For TCC only,

the LTP base for 2024 has been adjusted to reflect the draft annual plan budget

for 2023-24. Hamilton is considered the best comparator for transport

total costs given it is also an urban network and is a city of a similar size

to Tauranga. The expenditure per person opex result shows Tauranga at the

higher end of peers, noting that none of the comparative data has been adjusted

for higher costs since the LTP was set in 2021 where TCC was at the midpoint of

comparators.

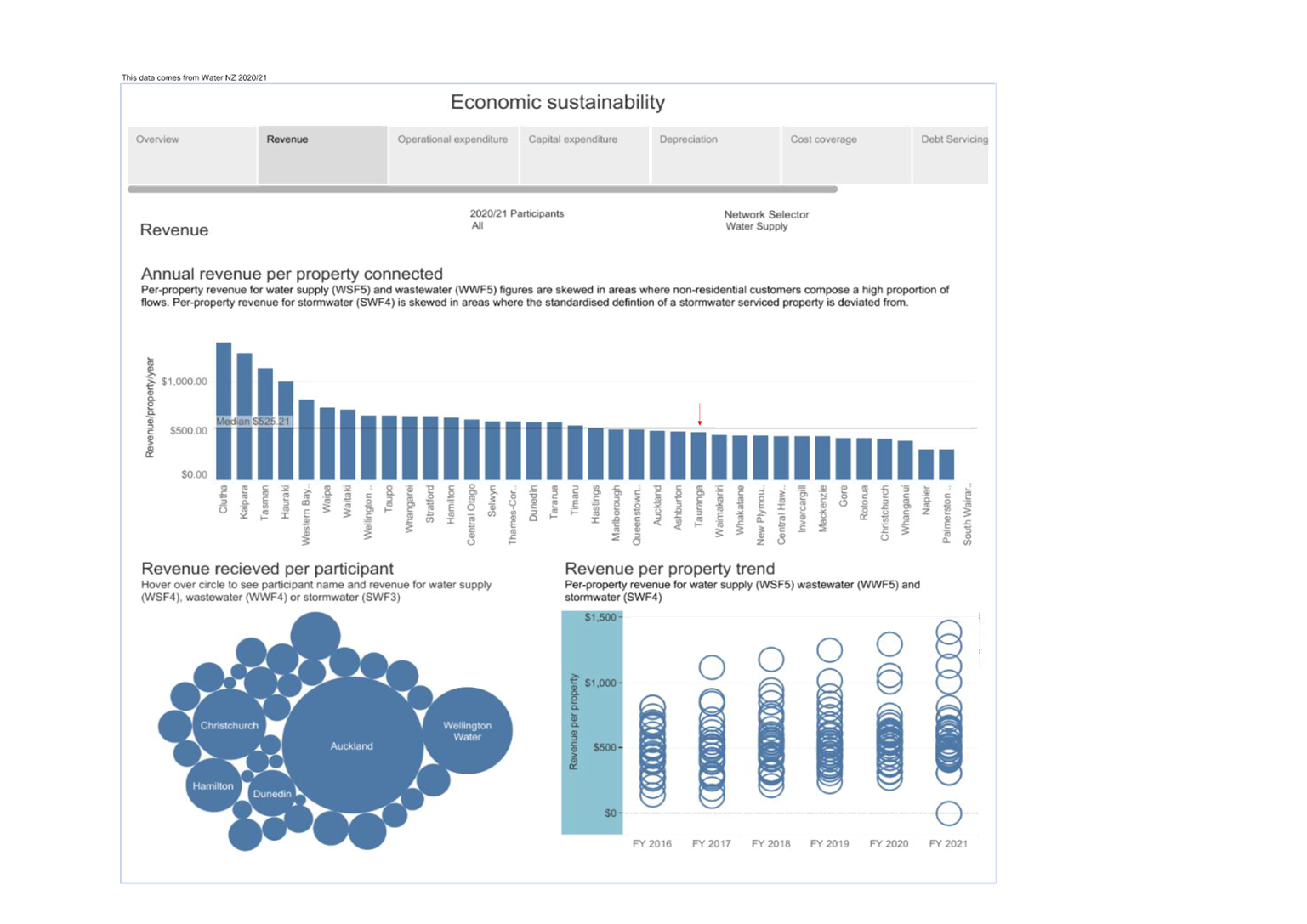

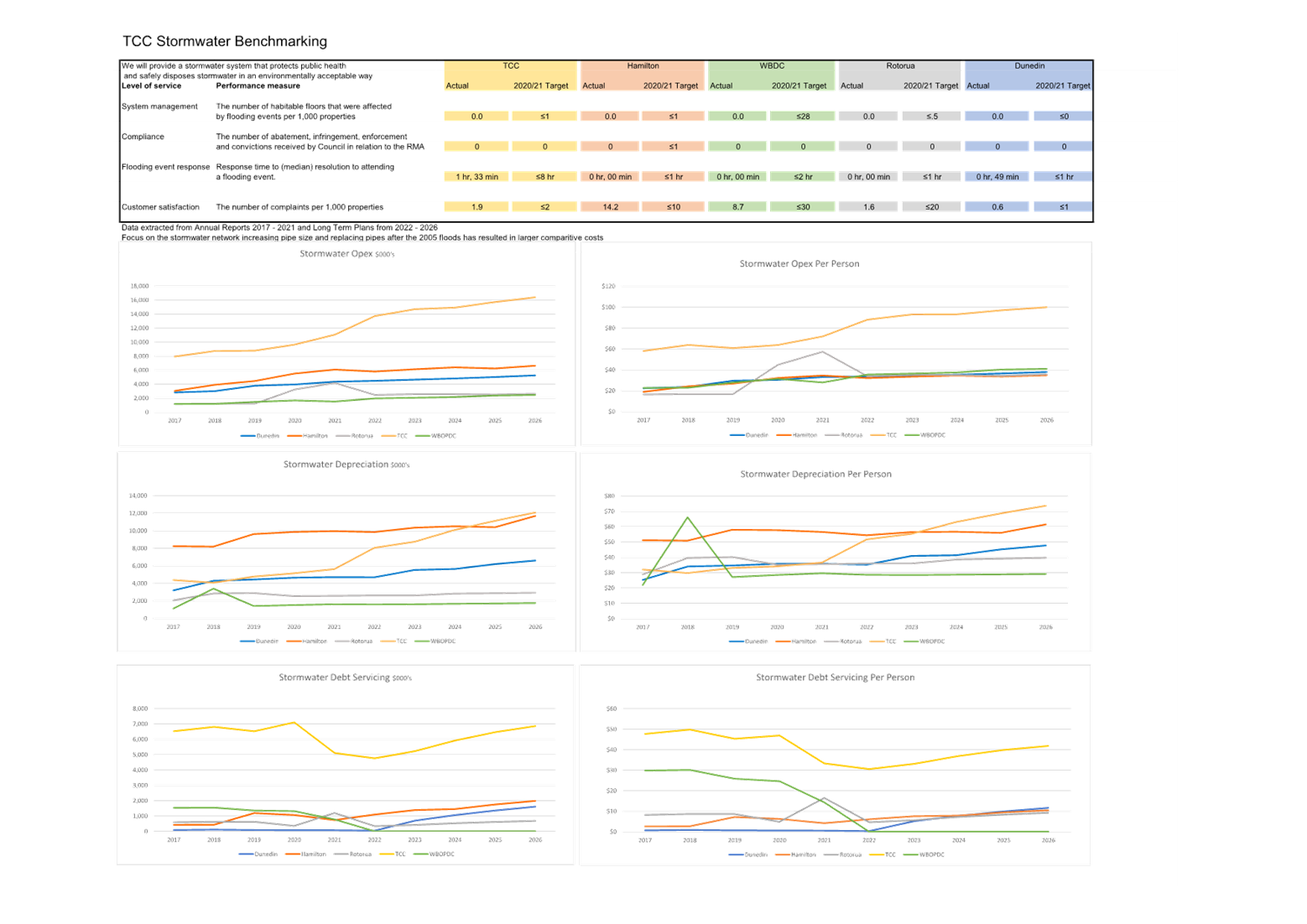

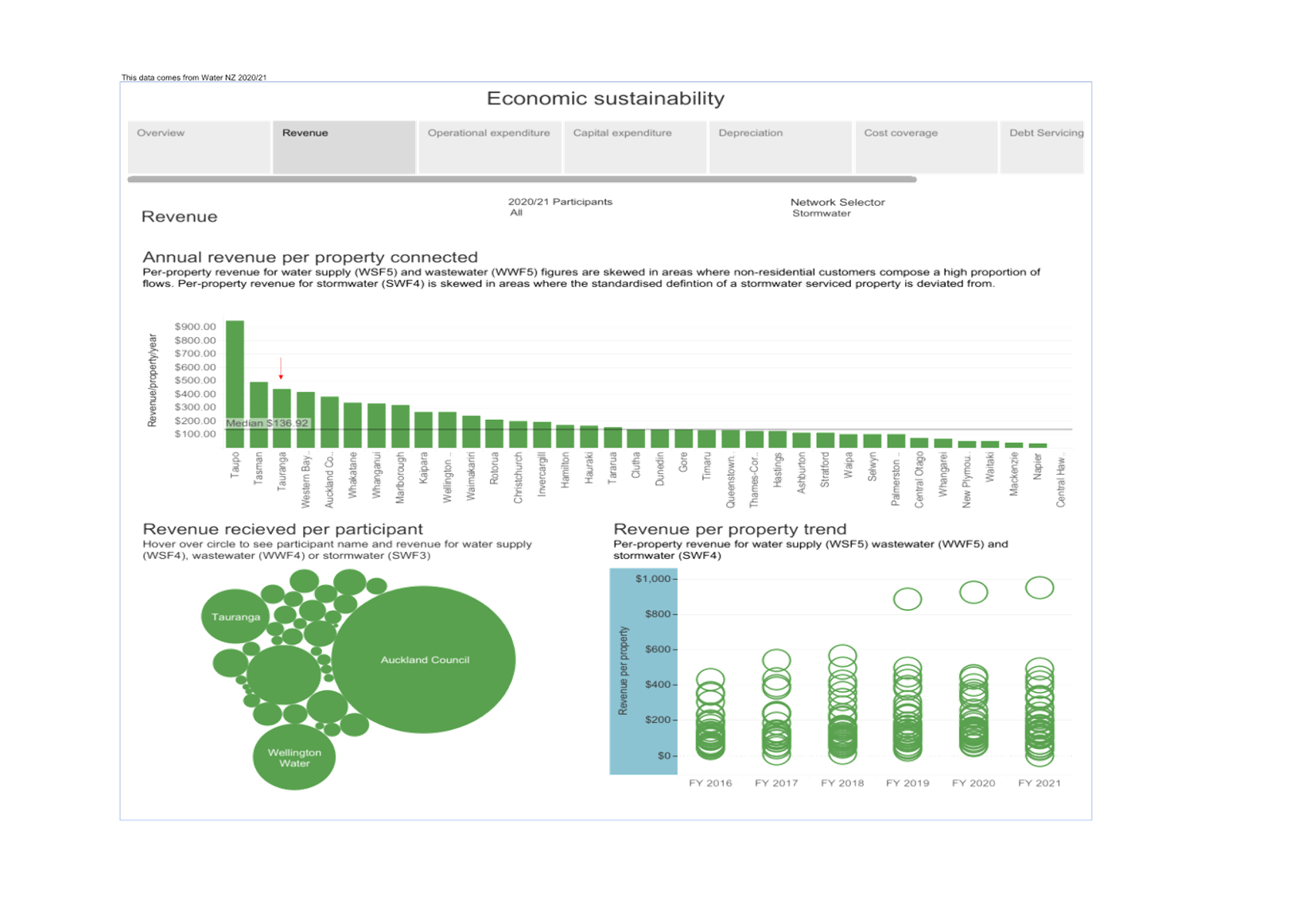

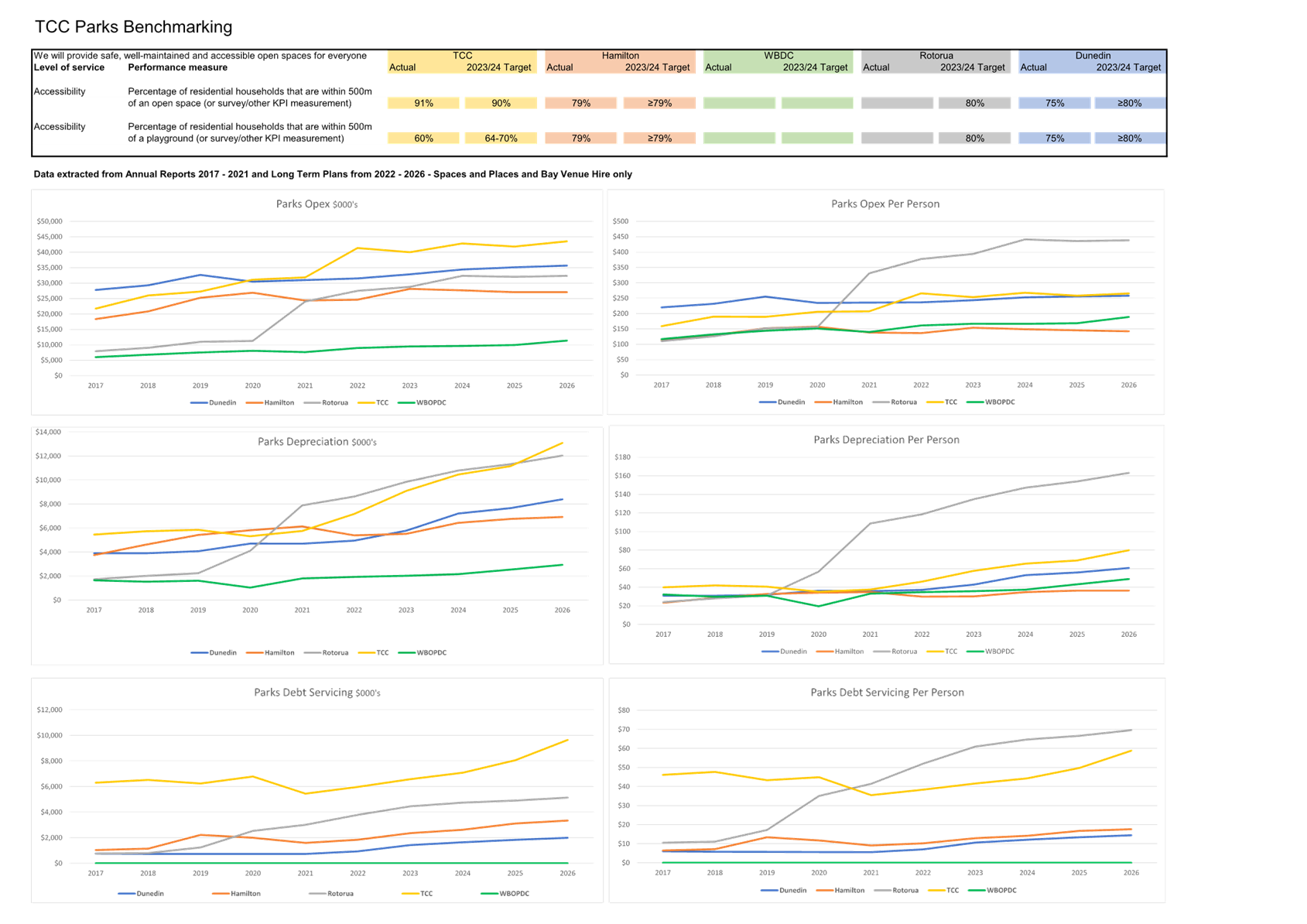

19. Attachment 2 includes benchmarking

data for transportation stormwater, wastewater, water supply (three waters) and

parks. The results for transportation and all three waters activities

show that TCC costs are generally favourable to peers. The parks data is

less complete with inconsistent measurement approaches and performance outcomes

across councils. Therefore, it is currently not possible to draw conclusions

around our cost and quality of parks delivery relative to our peers. Further

work is proposed in this area.

20. Changes to operating cost structures

have also been included in the 2024 annual plan to reflect the in-housing of a

number of maintenance contracts in order to better control quality of delivery.

Increases in employment costs will offset decreases in other operating

expenditure.

21. Staff resource required to support

the delivery of the work programme continues to be a challenge to both

anticipate and to recruit.

22. Asset revaluations for roading, land

and buildings in 2021/22 were significantly higher than that anticipated in the

LTP. This has in turn caused an increase to rates-funded depreciation that is

difficult to absorb in a single year (alongside other factors). Recent

forecasts indicate that current inflationary pressures will ease within the 2023/24

financial year and the core inflation for that year will be 4.2%.

However, base costs in the 2023 budget had been adjusted in the LTP by 3% but

actual inflation has been over 7%. The difference has required a catch up

in costs across capital and some operational expenditure.

Mitigations

23. Staff have identified areas where

expenditure can be minimised or delayed without significant impact on the work

programme. However, it is noted that where this uses debt to fund some

operational costs or phases in funding such as with depreciation there will be

ongoing pressure on rates increases into the future as this debt funding and

phasing unwinds.

24. Budgets have been set at a realistic

level, with a proposal to bring forward additional budget if delivery of

priority areas exceeds budget across both capital and operational projects and

service areas.

25. The broad mitigations to control cost

pressures include:

(a) Forecast

vacancy levels and the general difficulty recruiting in some areas has

justified an increase in temporary reductions of salary budgets for the year,

which would be removed in the following year as recruitment is phased in.

(b) Increasing

the capitalisation of staff time after a thorough review of how this is

calculated.

(c) Deferral

of some new FTE requested to be considered within the priority of the next

2024-34 LTP.

(d) Phasing

in of additional depreciation resulting from 2021/22 revaluation over the early

years of the 2024-34 LTP.

(e) Not

applying an inflation increase across the board (as would be normal practice),

recognising that there were notable operating underspends against budget in

2021/22. Expenditure in the current year is also being monitored with

slow expenditure in some areas informing adjustment to next year’s

budget.

(f) Reducing

the cash balances carried in some activities.

(g) Loan

funding operational expenditure (by resolution) where it is directly

attributable to a programme of capital works or offers longer term benefit

(e.g. structure planning for Keenan Road and transportation planning).

Items for loan funding will be specifically identified for Council approval

consistent with the revenue and financing policy.

(h) Reduction

in targeted rates for debt retirement in:

(i) community

infrastructure reflecting the slower delivery of capital

(ii) wastewater

to avoid increasing rates in these areas above LTP levels.

(i) Recognising

further revenue to offset or subsidise further expenditure where it is likely

this might eventuate.

(j) Defer

or phase in some new initiatives over the 2023-24 financial year and into late

2024.

Requirement for Consultation

26. Further

consideration is being given to whether and what consultation is required as

part of the Annual Plan. While the target budgets are close to LTP budgets and

therefore may not require consultation, there are issues that are included in

the annual plan that may require further consultation. The approach to

these items will be presented to a December Council meeting.

Proposed timeframe for the Annual

Plan

27. The

following table outlines the proposed timeline for the Annual plan 2023/24 from

now until adoption. A report will be presented to Council in December

updating this timeline based on a full assessment and programme of consultation

requirements:

|

Type

|

Date

|

|

Council meeting –

indicative draft annual plan

|

12 December 2022

|

|

Present

update collating any outstanding issues and options for Council

consideration.

|

7 February 2023

|

|

Consider Draft Annual

Plan for adoption or consultation if required

|

27 Feb 2023

|

|

Consideration

of consultation document, if required

|

20

March 2023

|

|

Consultation,

if required

|

23

March-26 April 2023

|

|

Hearings,

if required

|

8-11

May 2023

|

|

Deliberations,

if required

|

22-24

May 2023

|

|

Consideration

of Annual Plan for adoption, if required

|

26

June 2023

|

Strategic

/ Statutory Context

28. The

preparation of an annual plan is required under the Local Government Act 2002.

Where areas of expenditure and budgets are in line with year 3 of the LTP

consultation may not be required or could be limited to specific items of

difference.

Options

Analysis

29. This information presents broad areas

to address in order to stay close to LTP financial parameters. The committee

may provide feedback on various initiatives proposed to limit rates increases.

Financial

Considerations

30. This report covers the issues and

approach to developing the draft Annual Plan 2023/24. The initial

financials for the development of the draft annual plan will be presented to

the 12 December 2022 Council meeting.

Legal

Implications / Risks

31. The

process of preparing and adopting an Annual Plan is set out under the Local

Government Act 2002.

Consultation

/ Engagement

32. While there is no requirement to

consult on each Annual Plan where it is consistent with the operational

Long-term Plan, staff are doing further work to support consideration as to

whether consultation is appropriate.

Significance

33. The matter considered by this report,

the draft Annual Plan 2023/24, is considered of high significance in terms of

council’s Significance and Engagement Policy. This is because it

affects all residents, ratepayers and businesses in, and visitors to, the city,

and because it involves council’s resource allocation decisions and

rating decisions for the next year.

34. However,

the decisions to be made in response to this report are considered of low

significance as they are just one interim step in the process of developing the

draft annual plan.

ENGAGEMENT

35. Taking into consideration the above

assessment, that the decision in this report is of low significance, staff are

of the opinion that no further engagement is required prior to Council making a

decision.

Next

Steps

36. The indicative draft annual plan

financials will be reported to Council on 12 December 2022.

Attachments

1. Benchmarking

by activity for Annual Plan - A14178755 ⇩

|

Strategy,

Finance and Risk Committee meeting Agenda

|

14

November 2022

|

|

Strategy,

Finance and Risk Committee meeting Agenda

|

14

November 2022

|

9.4 Annual

Report - Update with Consolidation and Final Asset Revaluations

File Number: A13762389

Author: Sheree Covell, Treasury & Financial Compliance Manager

Kathryn

Sharplin, Manager: Finance

Jolene

Nelson, Team Leader: Corporate Planning

Authoriser: Paul Davidson, Chief Financial Officer

Purpose of the Report

1. The

purpose of this report is to provide the committee with an update of the

year-end financial and non-financial results of the annual report. This update

includes the consolidated financial accounts and amendments to the introductory

sections of the report as requested by Strategy Finance and Risk at the meeting

on 12 September 2022. It is noted that the report is still subject to final

audit changes so the final consolidated accounts are subject to final audit

adjustments.

2. The

secondary purpose of this report is to provide an update on the status of three

waters revaluation.

|

Recommendations

That

the Strategy, Finance and Risk Committee:

(a) Receives the

report - Tauranga City Council Draft Consolidated Annual Report 2021/22

(b) Agrees the

transfer of $1.5m from rates surplus to either

(i) the interest rate contingency reserve (or)

(ii) the risk reserve

|

Executive Summary

3. The annual

report is the key document for Tauranga City Council (TCC) to report back to

the community on its achievements for the year. The report provides

background information on the operations of council, its governance and the

year in review by major activity. It provides comparisons against its

non-financial performance targets and financial budgets as set out in year one

of the 2021-31 Long-term Plan.

4. The

consolidated annual report includes the results for TCC’s

council-controlled organisations Bay Venues Limited BVL, and Tauranga Art

Gallery Trust.

5. The

updated annual report reflects changes from the report presented on 12

September 2022, this included the draft financial statements and notes to

accounts which were not consolidated and did not include the revaluation of

land and buildings assets.

6. The

financial statements and notes are now progressing through to completion

including consolidated CCOs and are currently going through the audit

process.

7. A three

waters revaluation is being progressed with external valuers and will be

included in the 2022/23 Annual Report as an out of cycle revaluation.

This revaluation will form the basis for waters assets and depreciation in the

2024 -2034 Long Term Plan.

8. Non-financial

performance currently remains unchanged from those presented on 12 September,

however eight measures relating to Transportation, Building Services and Water

Supply are still being investigated by audit.

9. There are

currently two matters relating to drinking water and rainfall measurement that

audit have highlighted and staff are working to resolve. These are

outlined in detail in the non financial performance section of this

report. Staff have engaged external resource to investigate and

resolve. This will mean that the adoption of the annual report will

likely be delayed to mid December.

10. The draft result for

the full financial year is currently 60% achieved (60 measures), 37% not

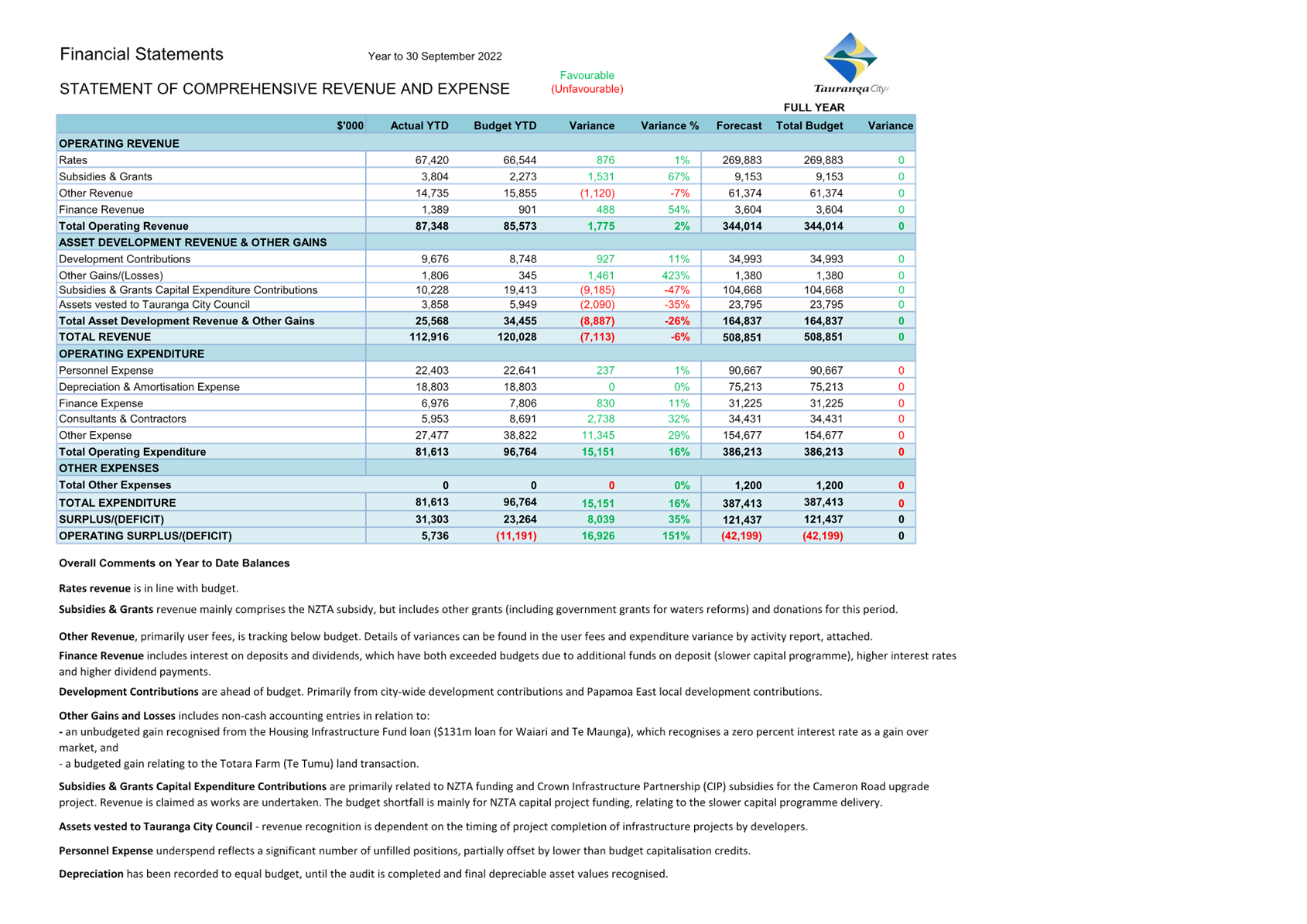

achieved (37 measures) and 3% not measured (3 measures).

Background

Financials

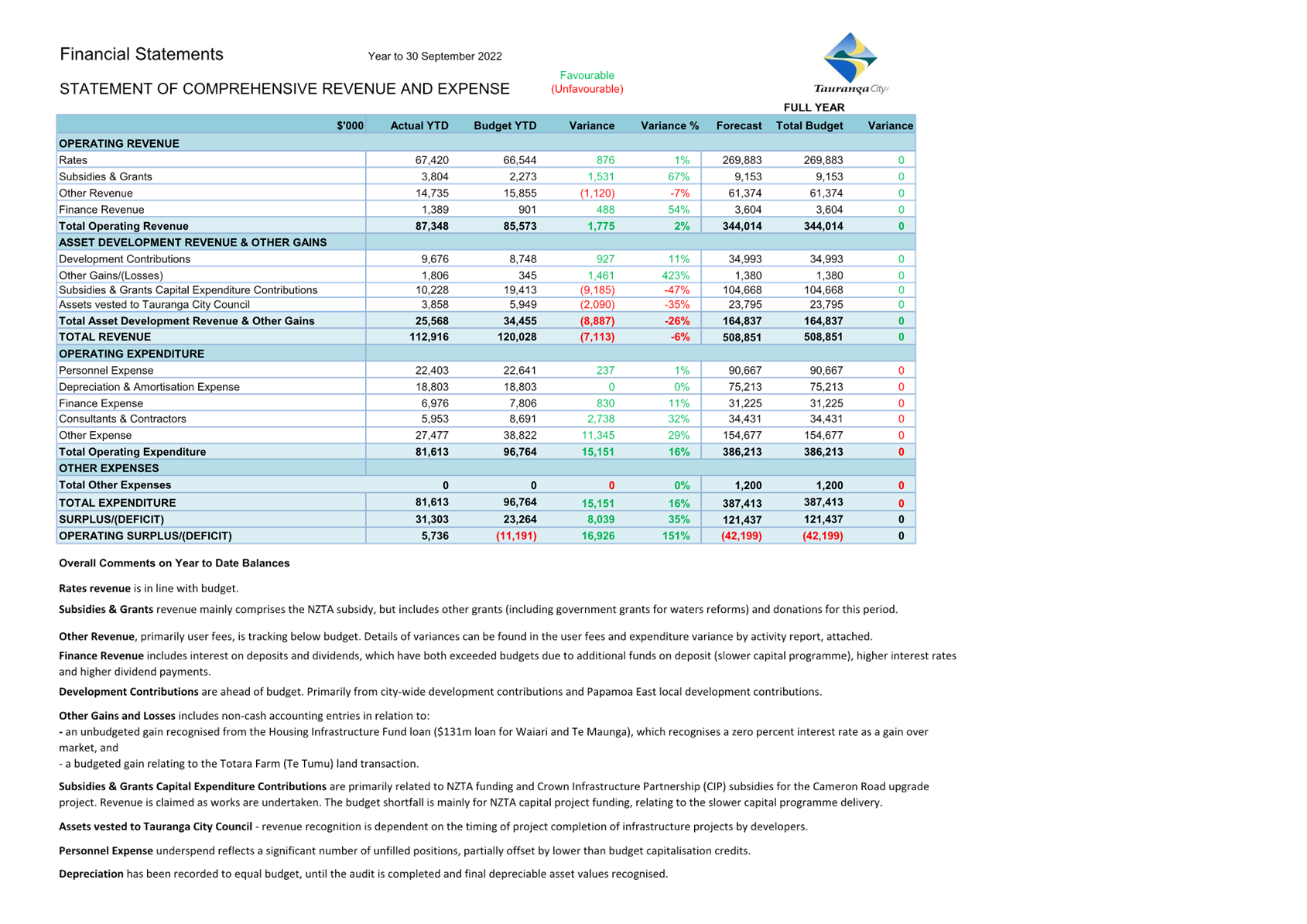

11. The key financial results for TCC

(unconsolidated are as follows)

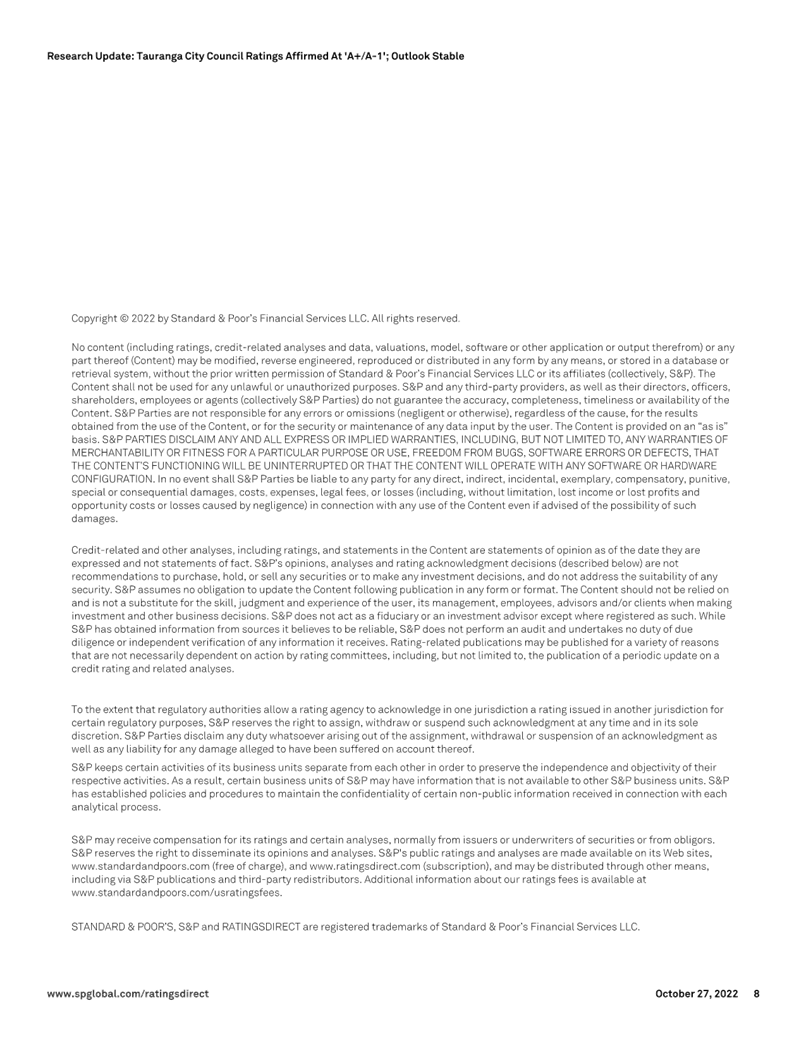

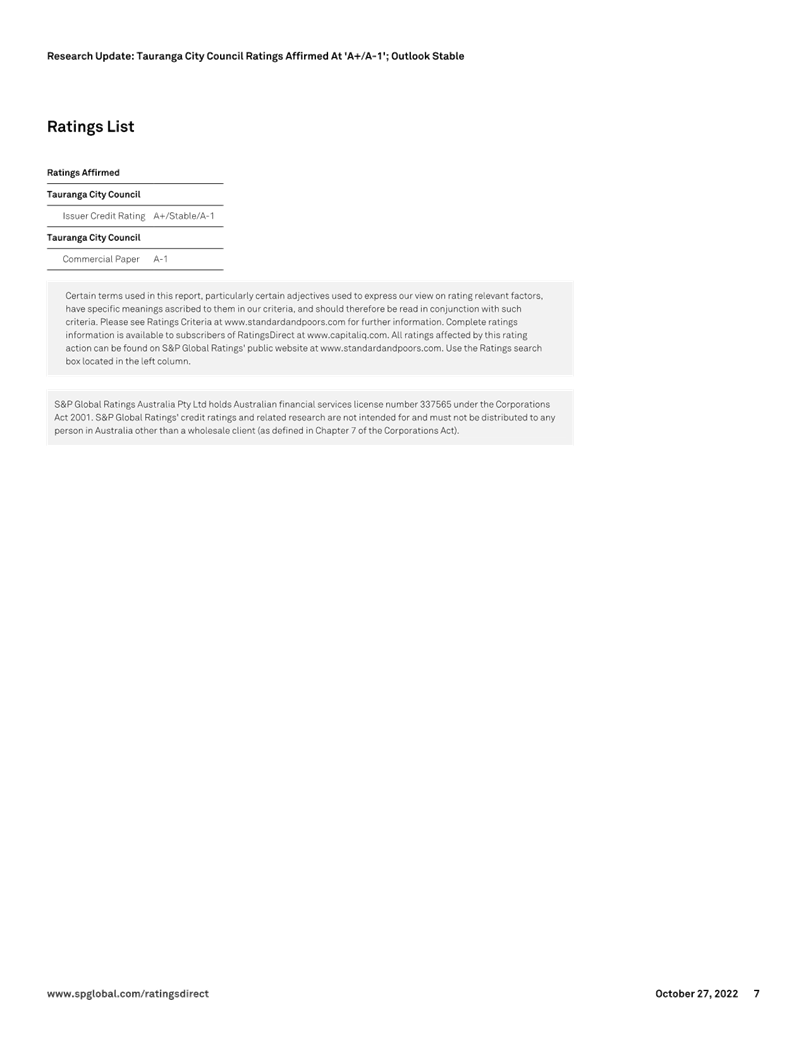

|

Key metric

|

12 September 2022

|

14 November 2022

|

|

Total operating revenue

|

$303m

|

$303m

|

|

Total operating expenditure

|

$306m

|

$308m

|

|

Capital & operating subsidies

|

$52m

|

$51m

|

|

Net debt

|

$701m

|

$701m

|

|

Capital Expenditure

|

$208m

|

$208m

|

|

Debt to revenue ratio

|

205%

|

204%

|

|

Total Assets

|

$6.0bn

|

$6.4bn

|

12. The noteworthy changes that have occurred

since the draft financial statements were presented in September 2022 are:

· Land

& Building revaluation is now included. This resulted is a $417m increase to assets

· Consolidation

of CCOs is now included. The CCO Annual Reports were presented to the

committee on 3 October and summaries of the year’s performance are

included in section 06.

13. The financial statements and notes to accounts

remain in draft form and could change as a result of final tax calculations and

final audit adjustments.

14. In this draft the rates surplus of $1.5m has

been transferred to the interest rate contingency reserve to minimise the

impact of increasing interest costs for the 2022/23 and 2023/24 financial year.

This is the recommended treatment for the surplus as it has the most beneficial

rates impact.

Revaluations

15. Council’s assets total $6.4bn of which

$5.9bn are Property Plant & Equipment which is subject to independent

revaluations of its major asset classes on a three-year rolling cycle.

16. The asset classes due for revaluation in the

2022 financial year are marine and roading. These revaluations have been

completed and resulted in a reduction in marine assets of $7m and an increase

in roading assets of $404m.

17. Due to the significant valuation increases in

the property market and cost escalation in the construction industry a fair

value assessment of waters, land and buildings assets was completed in order to

determine whether a formal revaluation would be required in order to report the

most accurate asset values and comply with appropriate accounting standards.

18. The fair value assessment of land and

buildings resulted in significant increases to asset values which required a

formal revaluation. This revaluation has been completed resulting in an

increase to land and building assets of $417m.

19. A fair value assessment was carried out on the

three waters asset by GHD which came back with a movement of 11% increase

overall. After discussions with Audit NZ this was considered not material

and the financial statements were not adjusted. An out of cycle

revaluation will be completed for the 2022/23 financial year.

Non- financial

20. Of the 100

non-financial performance measures, 97 have been measured during the financial

year.

21. The draft result is

currently 60% achieved (60 measures), 37% not achieved (37 measures) and 3% not

measured (3 measures).

22. Measures relating to

Transportation, Building Services and Water Supply are still being investigated

by audit.

23. Of the Water

measures, there are currently two matters highlighted by audit which staff are

working to resolve. The following two matters have meant that the final

adoption of the annual report will be delayed to mid December in order to

engage the appropriate expertise and allow time for audit to review:

(a) Independent review of TCC’s

drinking water testing. All councils have been requested to provide proof of

independent testing of their drinking water. TCC carry out their own testing

via their laboratory. From Audits perspective our laboratory is not deemed

independent. TCC has employed an independent water testing expert called Wai

Comply to carry out an independent assessment.

(b) Audit have identified from their testing

sample on the non financial measures for Wastewater that there is some

discrepancy in dry weather days recorded which will need to be investigated

further and if this is not resolved could result in a potential modified audit.

Further work will be carried out by staff to provide comfort to Audit that we

are carrying out the ground testing of rainfall correctly.

24. As a result of the feedback received at

Strategy Finance and Risk Committee on

12 September, the following changes were made to the presentation and content

of the front sections:

· Section

one

o infographics

have been updated to include iwi and hapū, marae and two universities.

· Section

two

o text for Cameron Road, Te Papa updated to include housing

choice.

o amended text

to Ātea-ā-Rangi to align with other sections.

· Section

three

o commissioners’ attendance at council and committee meetings

recalculated

o corrected

text to Public Transport Committee: Alternate: Commissioner Wasley.

· Section

five

o updates to whole of council funding impact statements.

o minor text updates

to non-financial performance measures commentary in accordance with audit

discussions.

· Section

6

o financial performance for CCOs updated

o performance

measure tables updated to include results that had not been entirely available

for the last Strategy, Finance and Risk Committee meeting.

Strategic / Statutory Context

25. The annual report is

prepared consistent with requirements of the Local Government Act 2022 and

International Public Sector Accounting Standards.

Options Analysis

26. The option of

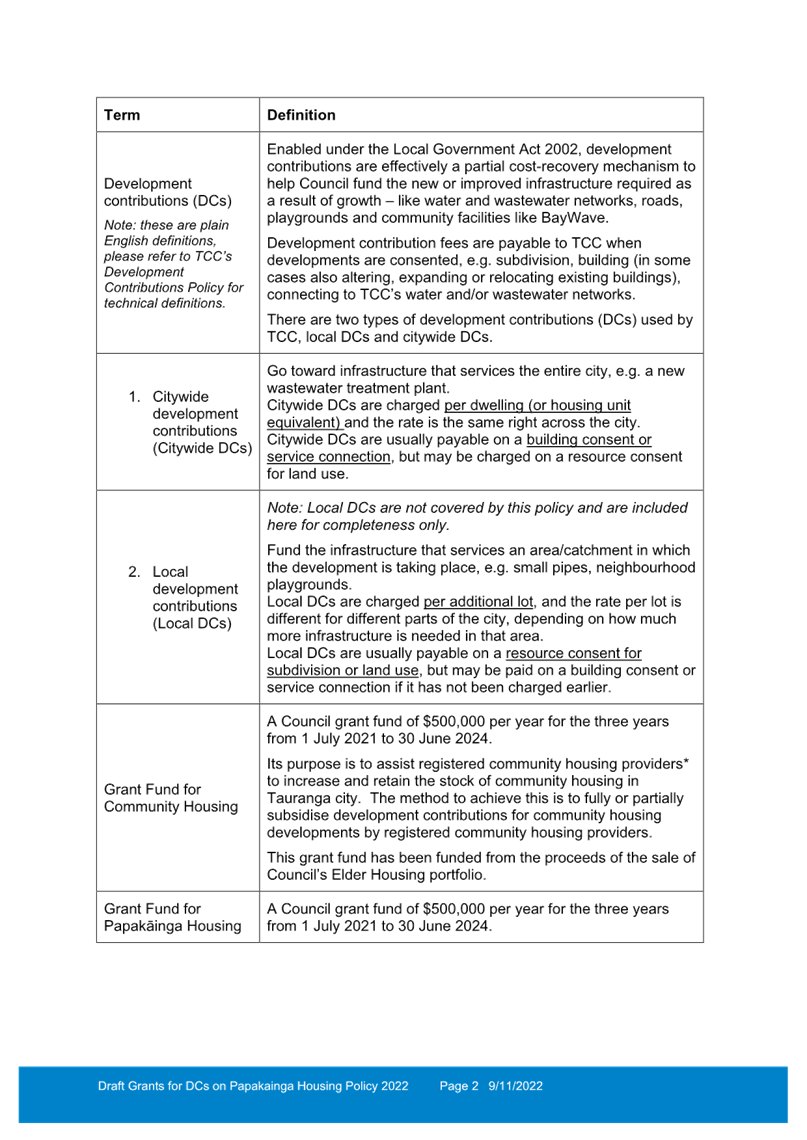

treatment of the $1.5m rating surplus is presented below:

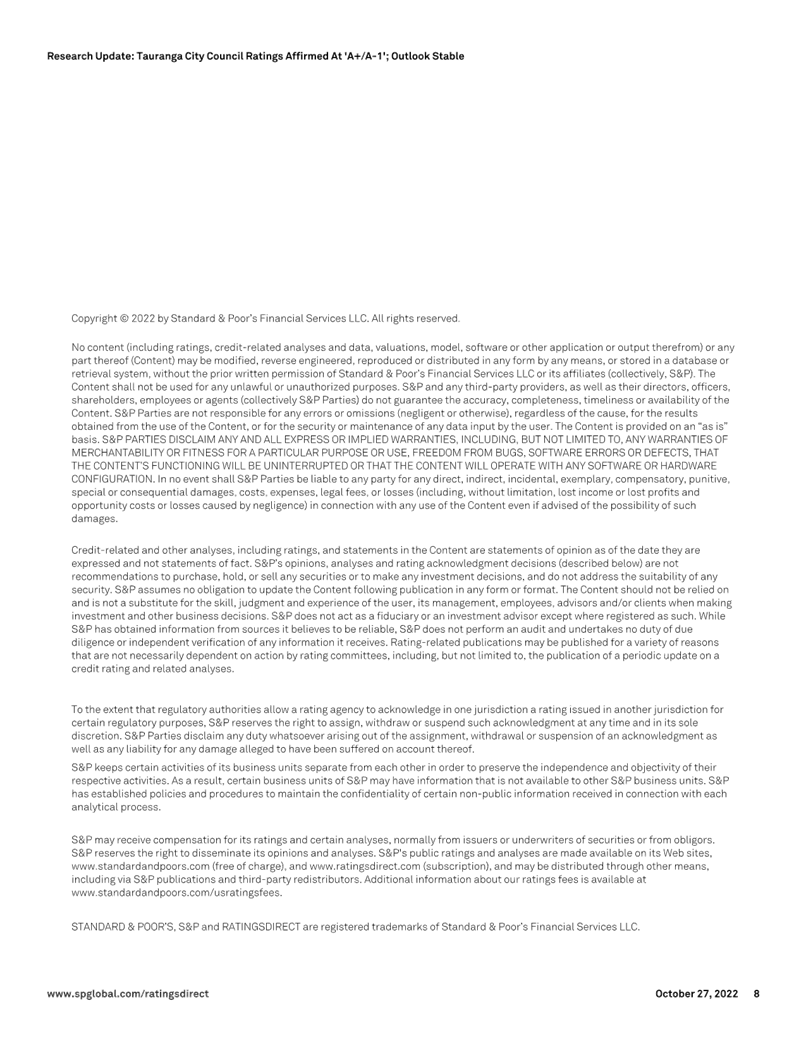

|

|

Option

|

Advantages

|

Disadvantages

|

|

1

|

Transfer rates surplus to the interest rate

contingency reserve

(Recommended)

|

· $1:$1 rating benefit

· Minimises impact of increasing interest costs

· Allows buffer for unplanned borrowing costs associated with

unbudgeted expenditure and cost escalation

|

· Risk reserve surplus remains low

· Can only be used to offset interest costs

|

|

2

|

Transfer rates to the general risk reserve

|

· Flexibility to be utilised for a range of matters

|

· Approx $1:$0.7 rating benefit

|

Financial Considerations

27. The financial

statements and information presented is for the financial year ended 30 June

2022. The presentation of the financials section is guided by the

requirements of the Local Government Act 2002, accounting standards

(International Public Sector Accounting Standards (IPSAS)) and generally agreed

accounting policies. It is audited by Audit New Zealand. The

financial statements and note to accounts are prepared on a going concern basis

and any incidence or allegations of fraud, non compliance or misstatement

should be disclosed.

Legal Implications / Risks

28. The Local Government

Act 2002 requires the annual report to be adopted within four months of balance