|

|

|

AGENDA

Finance, Audit and Risk Committee Meeting

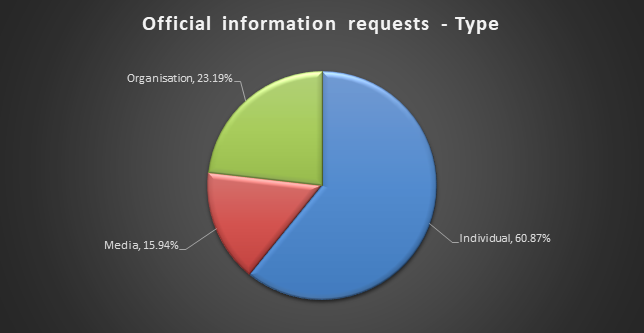

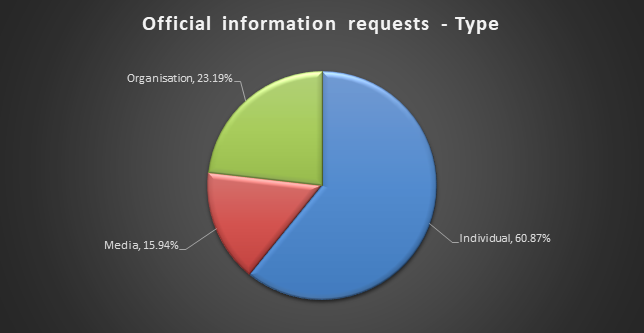

Tuesday, 25 February 2020

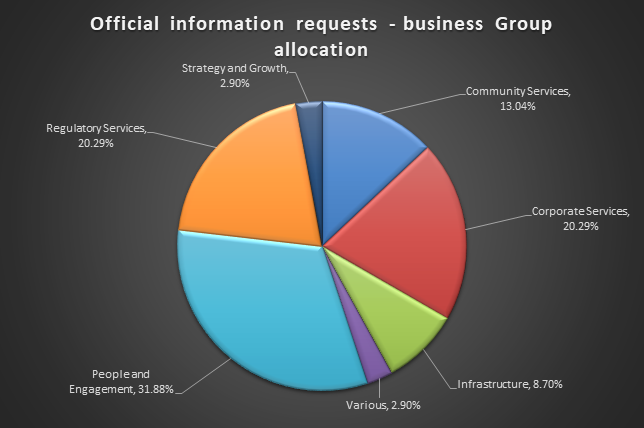

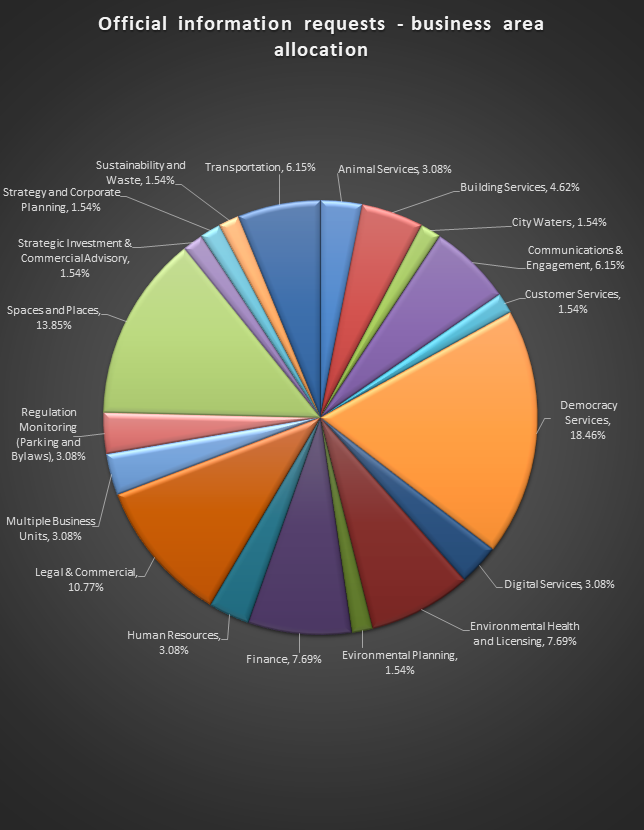

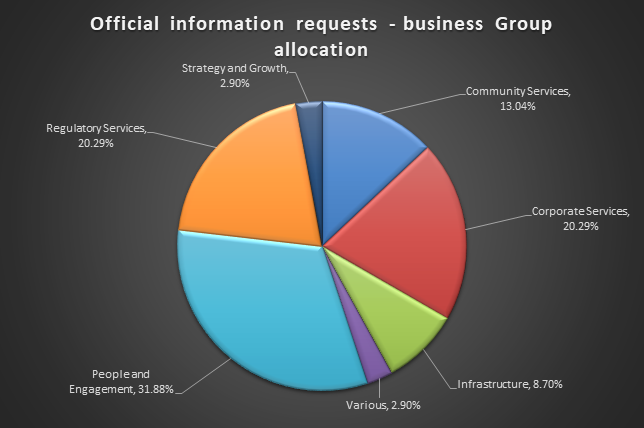

|

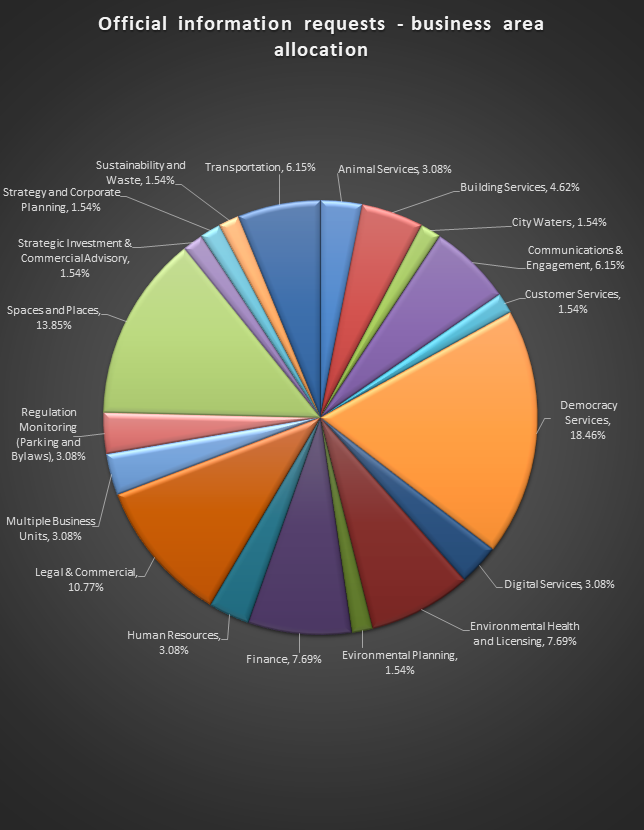

|

I hereby give notice that a Finance, Audit and Risk

Committee Meeting will be held on:

|

|

Date:

|

Tuesday, 25 February

2020

|

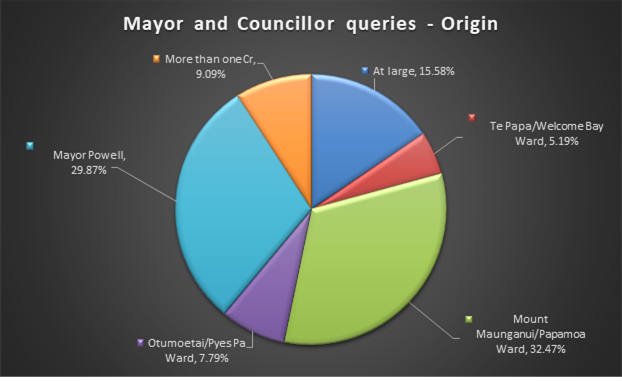

|

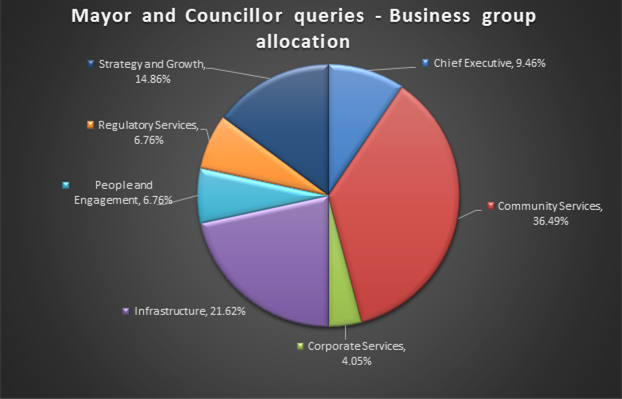

Time:

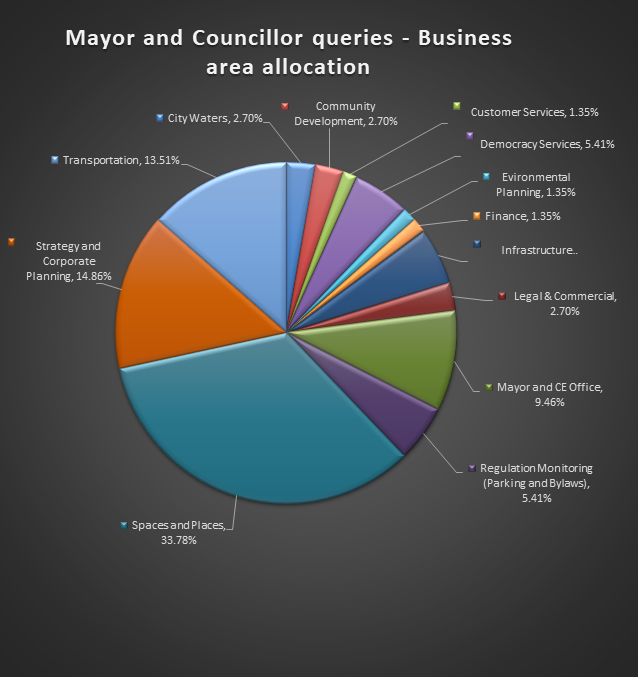

|

10am

|

|

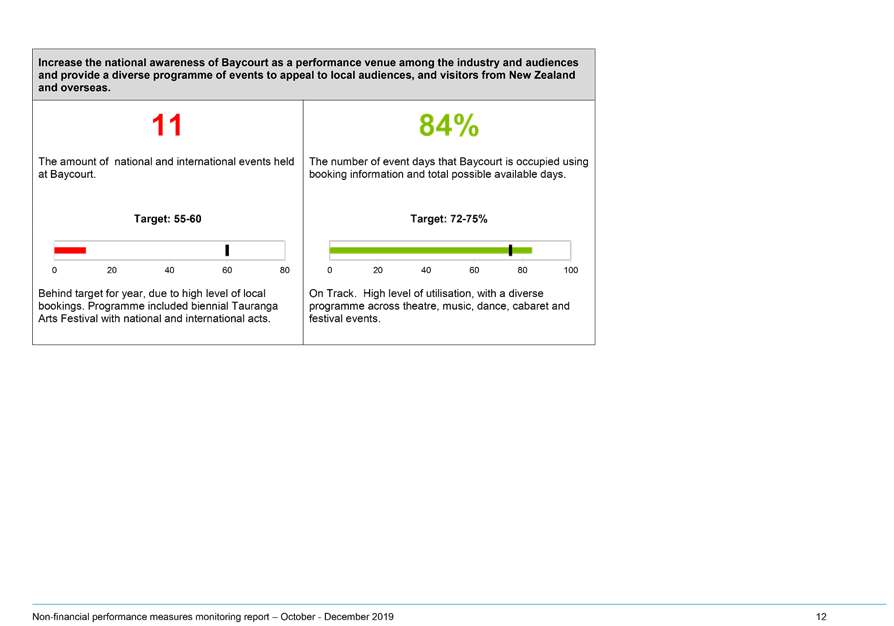

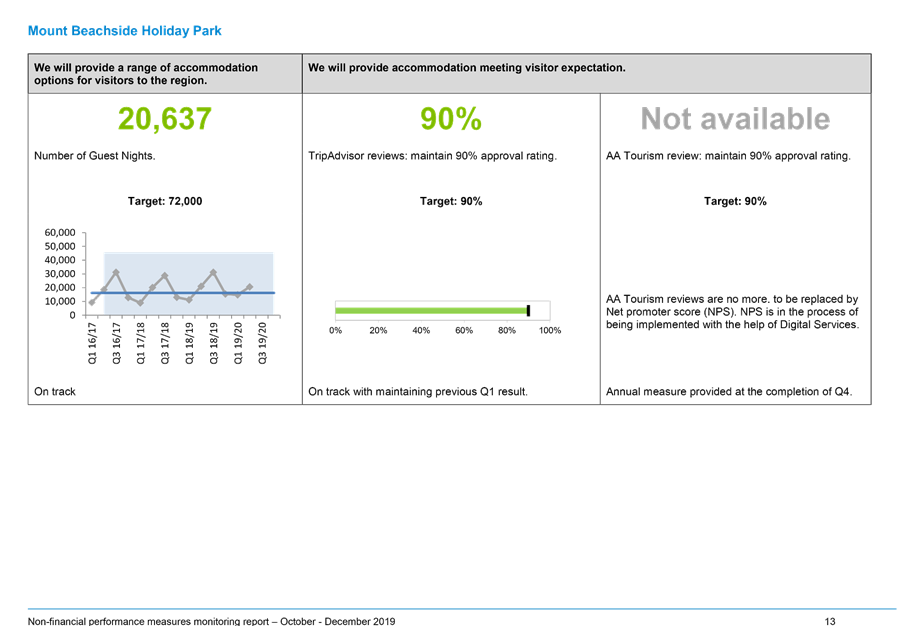

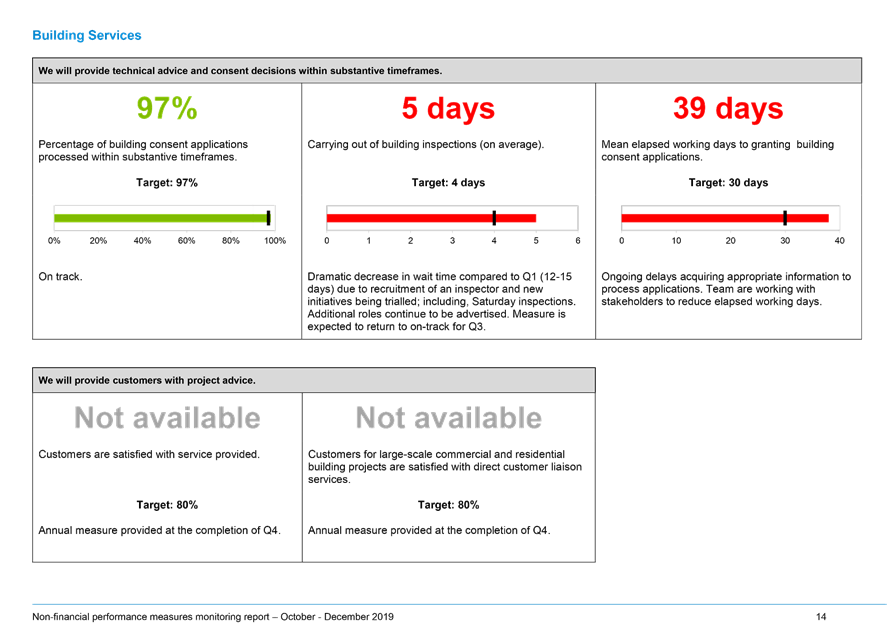

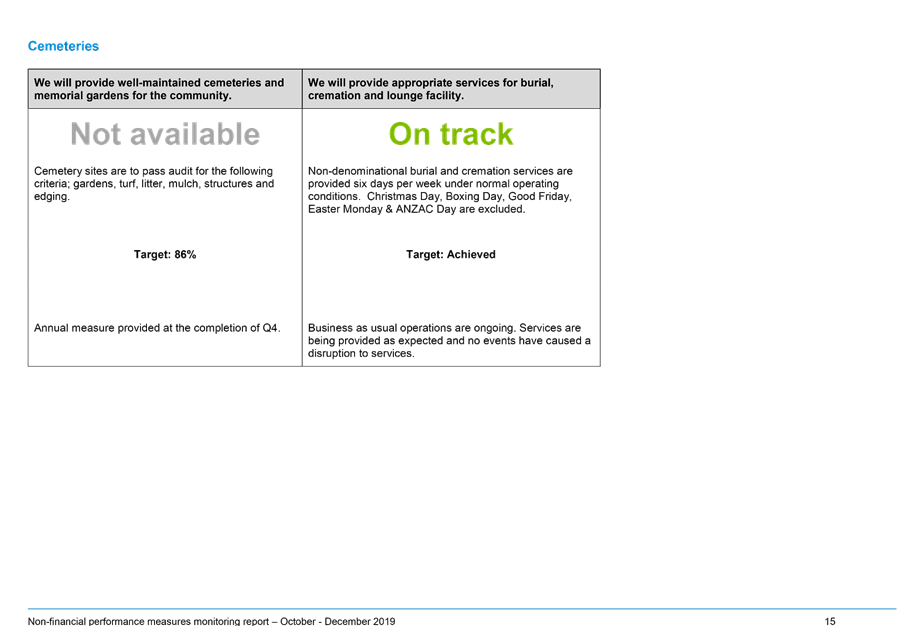

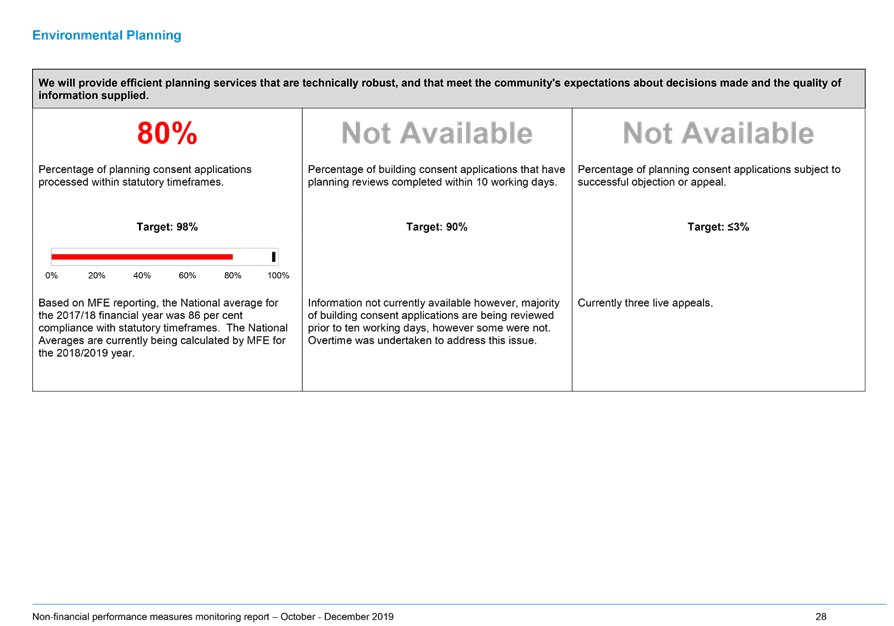

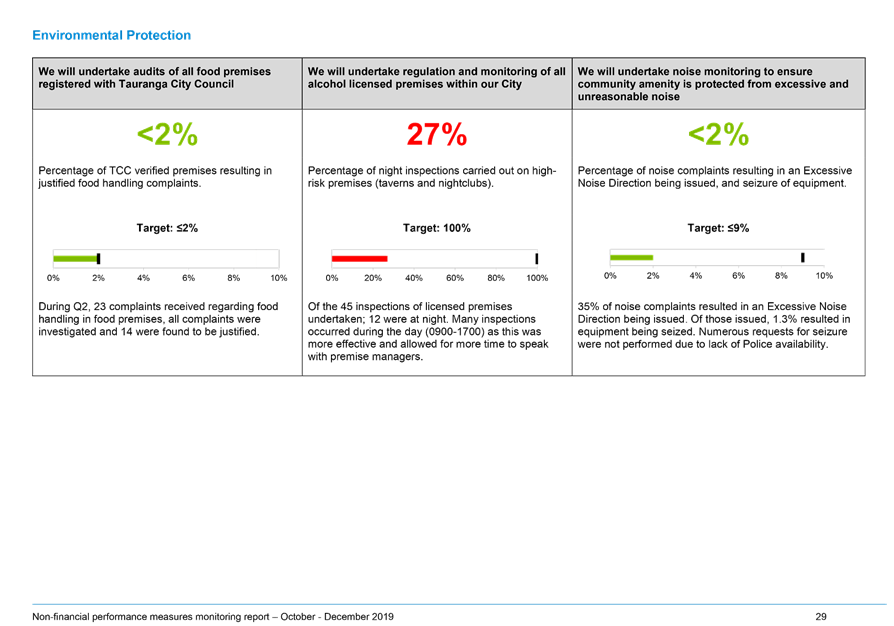

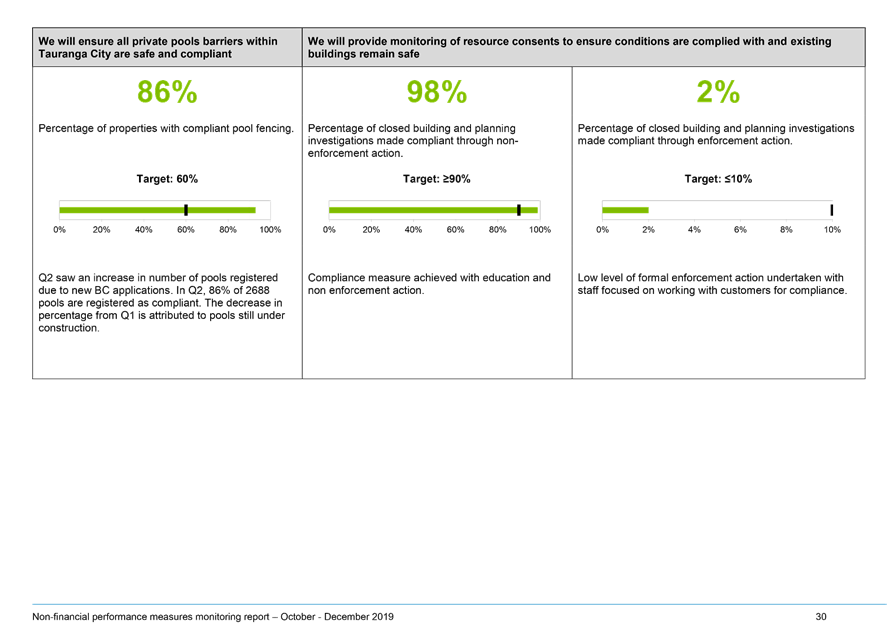

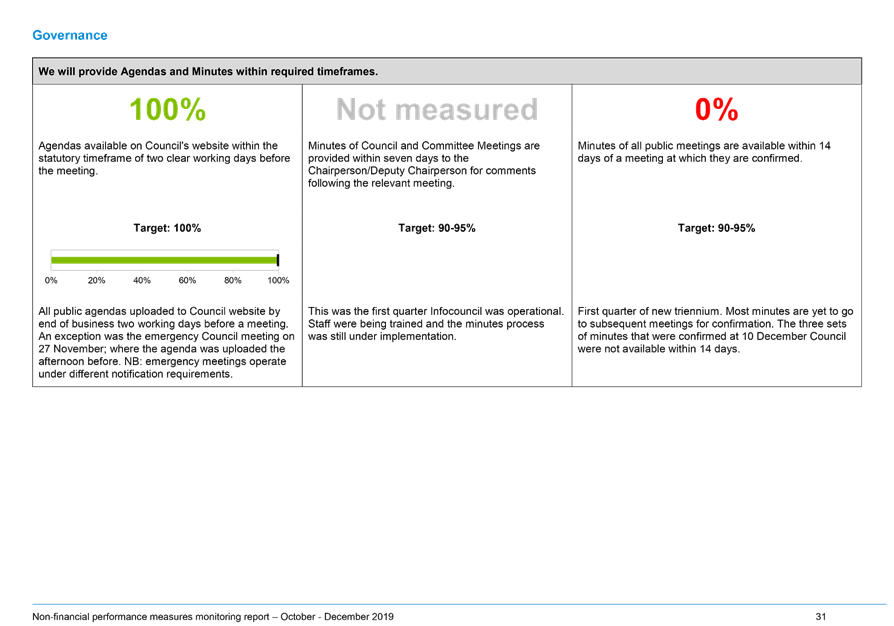

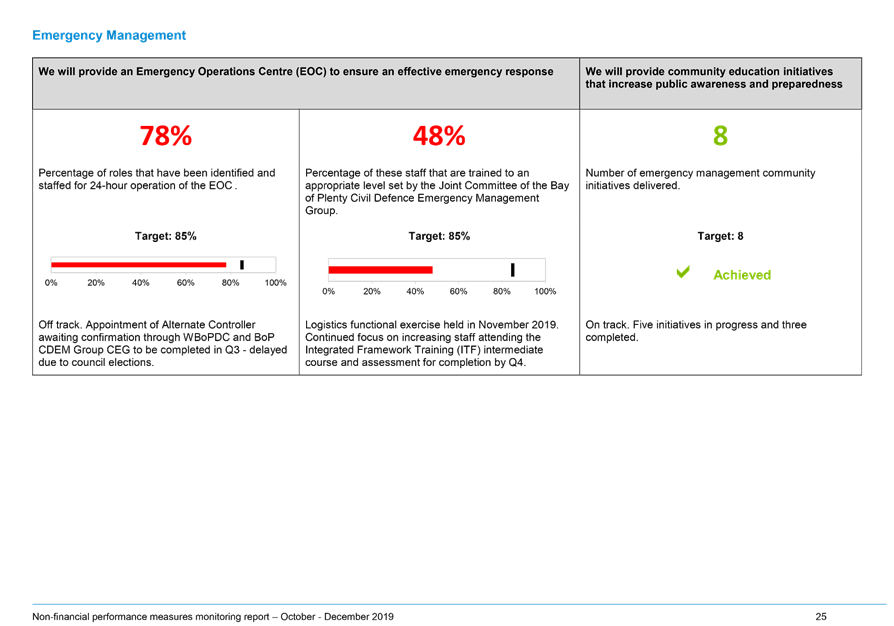

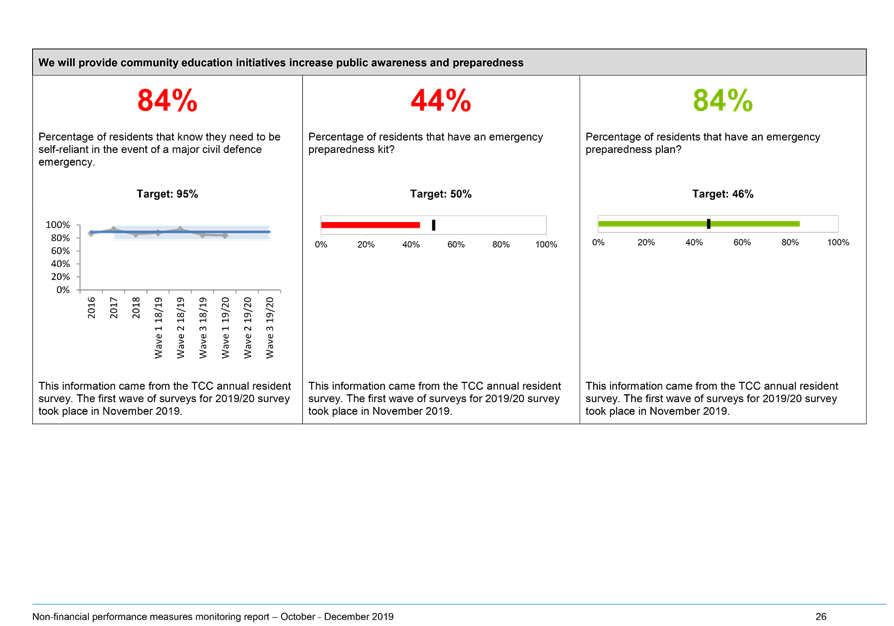

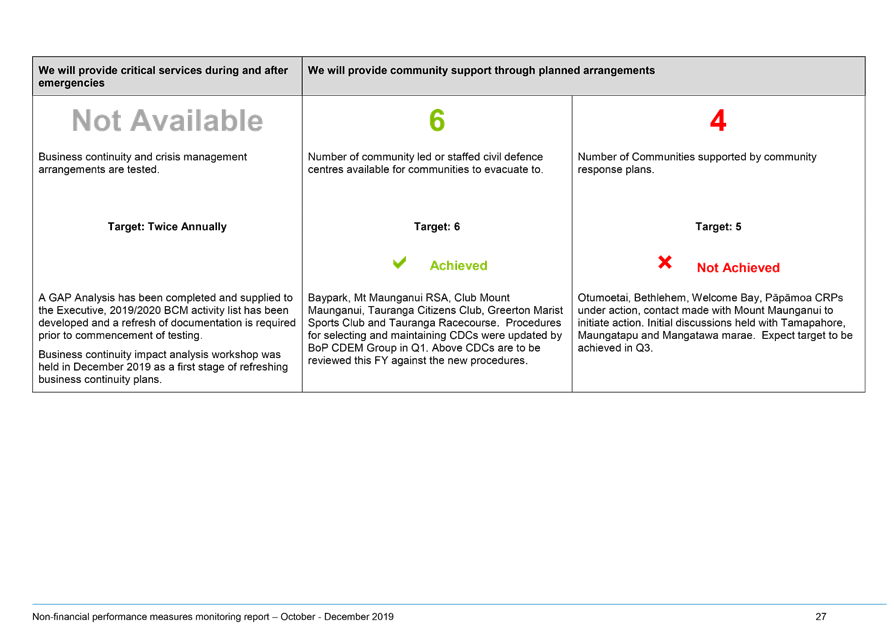

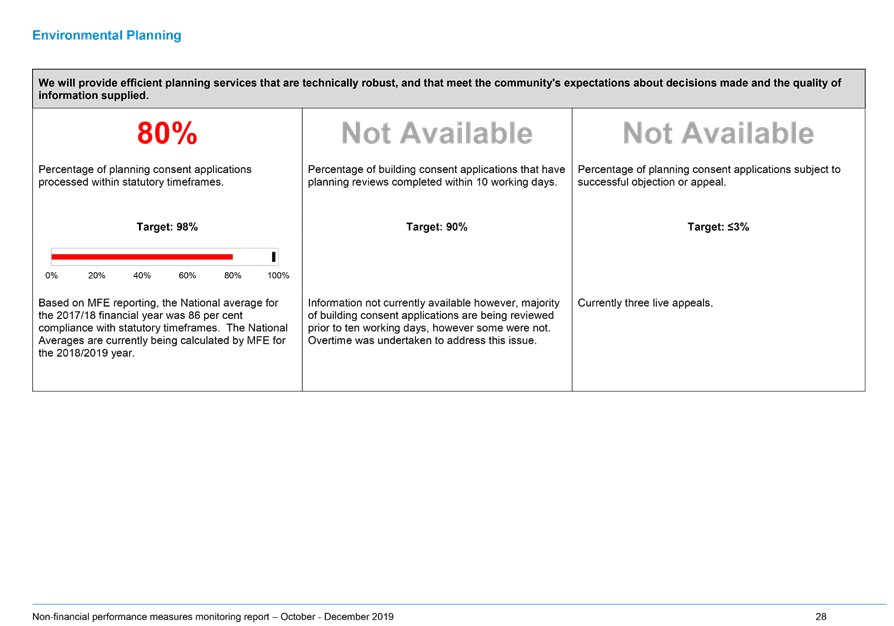

Location:

|

Tauranga City Council

Council Chambers

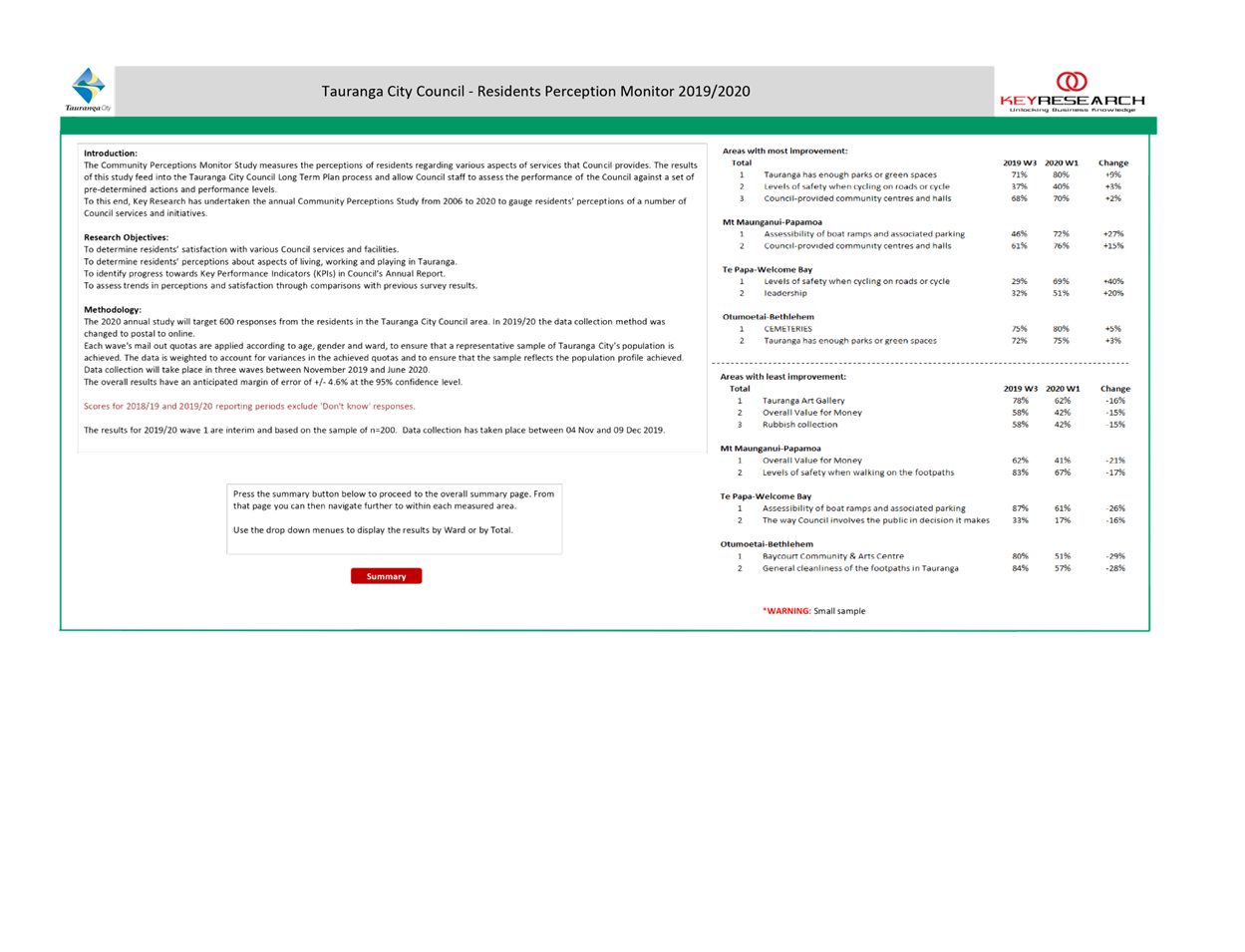

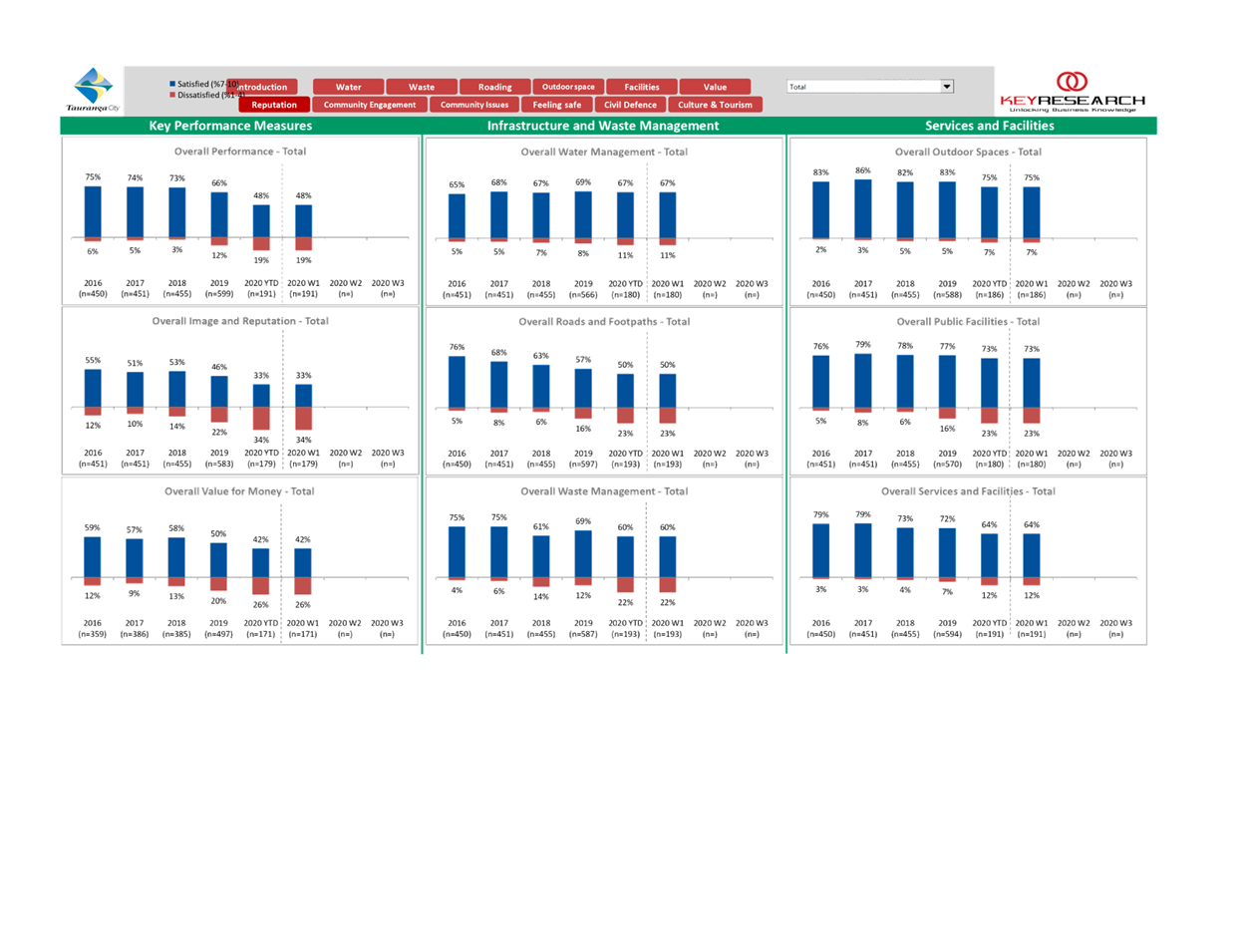

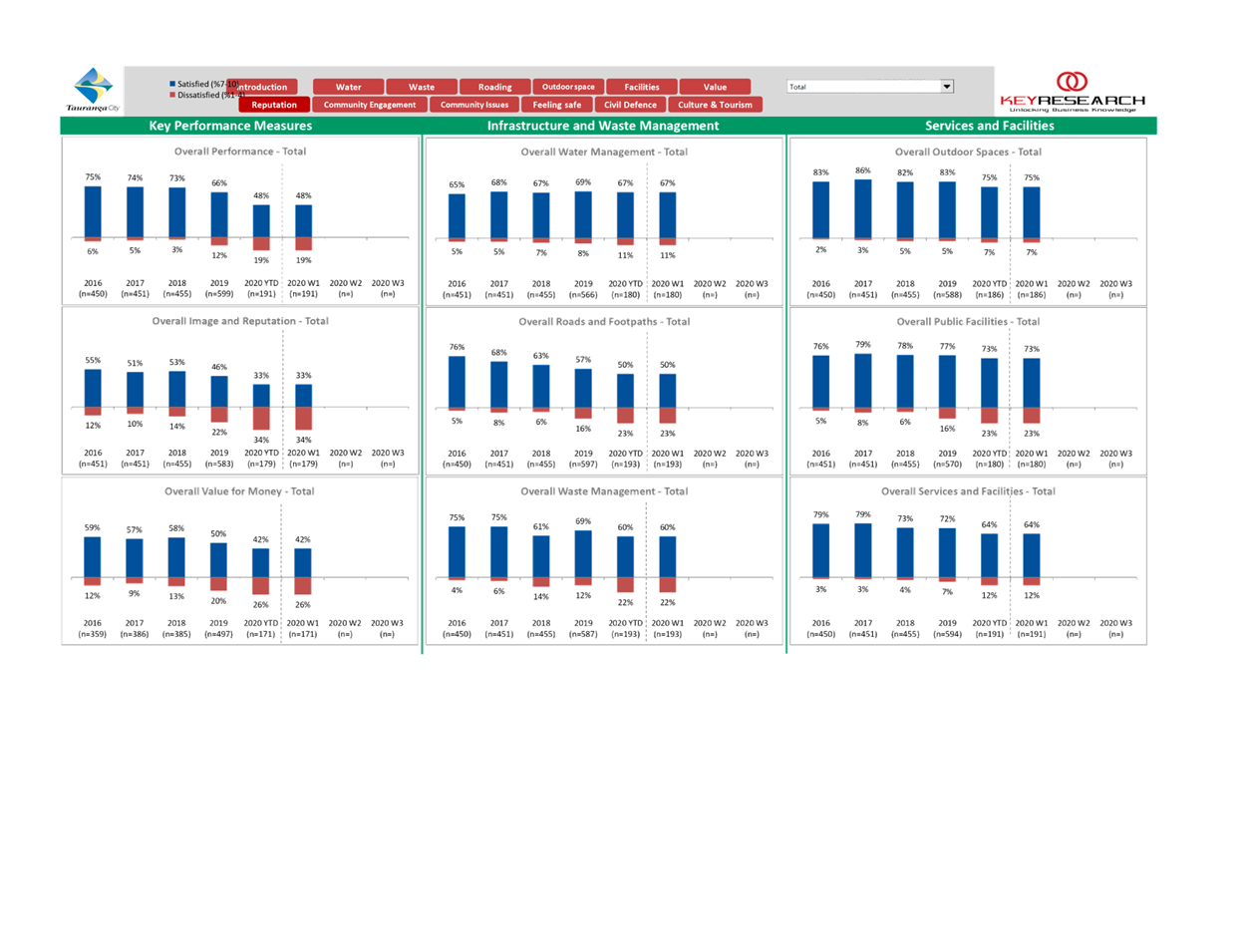

91 Willow Street

Tauranga

|

|

Please

note that this meeting will be livestreamed and the recording will be

publicly available on Tauranga City Council's website: www.tauranga.govt.nz.

|

|

Marty Grenfell

Chief Executive

|

7 Business

7.1 Mainstreet

Monitoring Report July to December 2019

File

Number: A11145224

Author: Michael

Vujnovich, Manager: Project Tauranga

Authoriser: Gareth

Wallis, General Manager: Community Services

Purpose of the Report

1. For Mainstreet

organisations to report to Council on their activities for the period July to

December 2019, to highlight issues, to provide a financial update, and to

provide plans for future activities.

Discussion

2. Mainstreet

organisations receive a targeted rate through Council.

3. As part of

Council’s agreement with Mainstreets, they must report every six months

on activities achieved, activities planned and any issues they want to bring to

the attention of Council. They are expected to provide a financial update at

end of each financial year, comment on tracking against budget in interim

reporting cycle and note any matters that Council needs to be made aware of.

4. This report

reflects the period 1 July 2019 to 31 December 2019.

5. All Mainstreet

organisations are in good financial health with all showing annual operating

surpluses and positive equity.

6. Activities

undertaken by all Mainstreet organisations appear to be having a positive

effect on the activation and economic vibrancy of their areas through events

and promotions.

7. Issues presented by

Mainstreets to Council – please see Appendix A for a summary of the

issues presented to Council. The following is in response to the issues

presented.

(a) Mount Mainstreet:

(i) Note name change to

“The Mount Business Association Incorporated”.

(ii) TCC’s Transportation

staff considered Mount Mainstreet’s proposal for signage directing people

from cruise ships and the beaches to the Mount shopping area. This was declined

by Transportation as this proposal did not meet the criteria for developing

such signage of being ‘for drivers’, easy to miss due to distance,

or affecting the safety of the traveller.

(iii) TCC Transportation staff are

working on a draft Parking Strategy. This document will outline key principles

on how parking supply and demand will be managed throughout the city. Should

Council adopt the strategy, staff will work with the Mainstreet organisations

to develop implementation plans for the key centres; City Centre, Mount

Maunganui and Greerton. Measures could include parking restrictions, time

restrictions and parking pricing.

(iv) TCC Transportation staff will

discuss the bus stop signs and route signage board with BoPRC who are

responsible for timetables and route maps.

(v) The sign for Te Papa o Nga

Manu Porotakataka is being refabricated due to errors in the first sign and is

expected to be installed shortly.

(vi) Working with TCC’s Urban Spaces,

Spaces & Places and Transportation teams to plan and resolve general street

appeal issues, including the lamp posts.

(b) Tauranga Mainstreet:

(i) Collaborating

with TCC’s Urban Spaces team to help resolve challenges and develop a

city centre strategy.

(ii) Traffic

counters have been established around the CBD. Tauranga Mainstreet and TCC are

sharing counter data.

(c) Greerton Village Mainstreet:

(i) Working with

Transportation regarding ongoing ‘tidy-up’ maintenance work.

(ii) Transportation are aware of

Greerton Village Mainstreet’s preference to engage in any consultation

for any further changes to the recent roadworks.

(iii) Greerton Village Mainstreet

note their preference to retain the begging bylaw.

(d) Papamoa Unlimited:

(i) No issues for Council

attention

Next Steps

8. Receive the report.

Attachments

1. Appendix A

Mainstreet Monitoring Report Summary July to December 2019 - A11163651 ⇩

2. Mount Mainstreet

Monitoring Report July-Dec 19 - A11259703 ⇩

3. Mount Mainstreet

Financials FY 2019 - A11264549 ⇩

4. Tauranga

Mainstreet Monitoring Report July - Dec 19 - A11163655 ⇩

5. Tauranga

Mainstreet Financials FY2019 - A11163656 ⇩

6. Greerton

Mainstreet Monitoring Report July - Dec 19 - A11163653 ⇩

7. Greerton

Mainstreet Financial report FY2019 - A11163652 ⇩

8. Papamoa Unlimited

monitoring report July - Dec19 - A11163659 ⇩

9. Papamoa Unlimited

YOY growth report 2020 - A11166716 ⇩

10. Promote Papamoa Inc.

Financials FY 2019 - A11163660 ⇩

|

Finance, Audit

and Risk Committee Meeting Agenda

|

25 February

2020

|

Appendix

A: Mainstreet Monitoring Report to Finance, Audit and Risk Committee, 25

February 2020

For period 1 July to 31 December 2019

|

Organisation

|

Issues for Council

attention

|

Summary of activities

|

Looking forward

|

|

Mount Mainstreet

|

· Car parking – seeking to

increase availability for visitors

· Bus-stop and signage outside Bayleys

· Signage for Te Papa o Nga Manu

Porotakataka

· General street appeal – palm

holder-boxes are messy

· Directional Signage to the shopping

centre from Pilot Bay and Marine Parade (note that Transportation has

previously provided Mount Mainstreet a reasoned decline to this proposition)

|

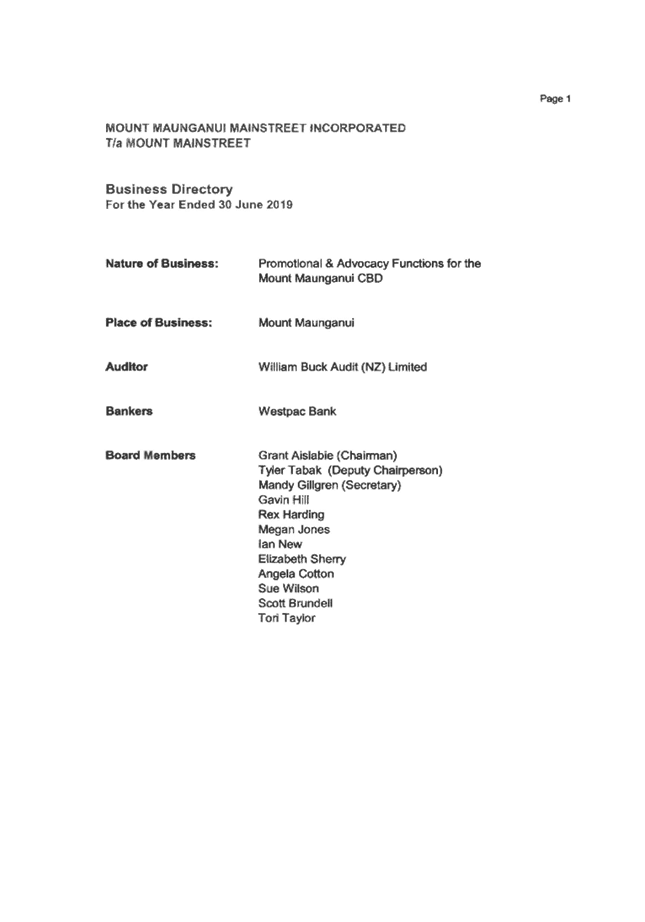

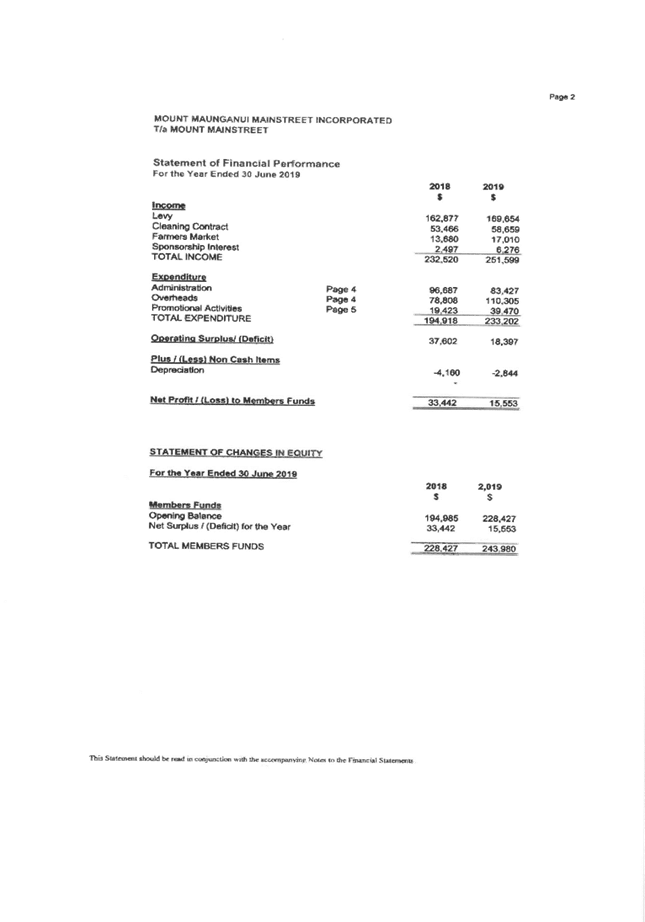

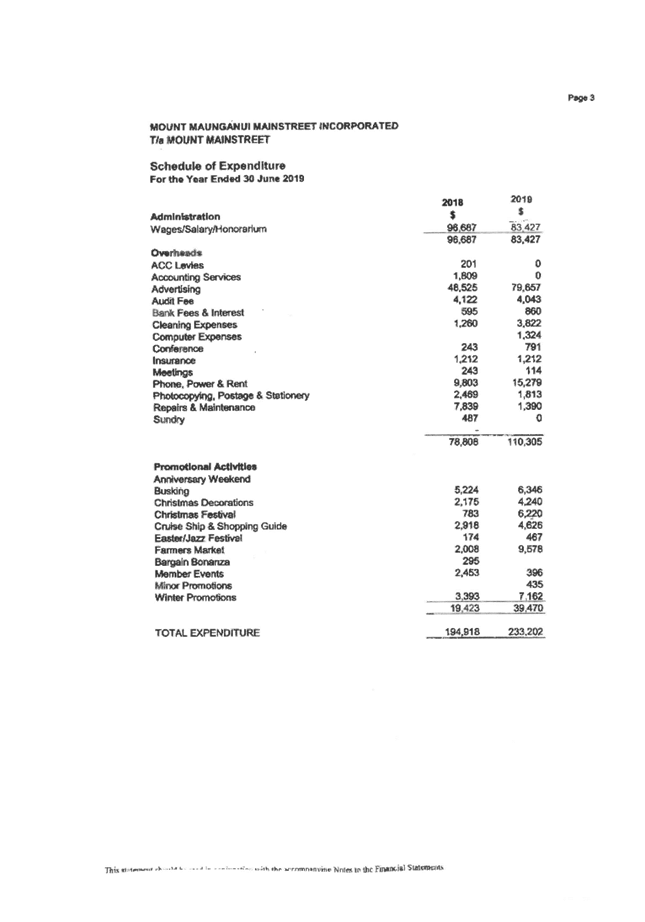

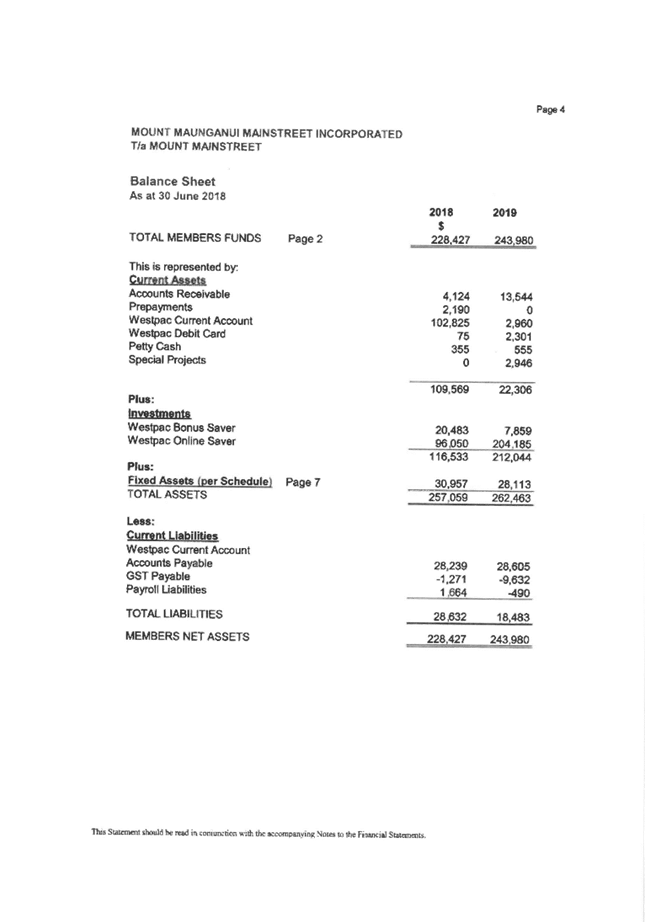

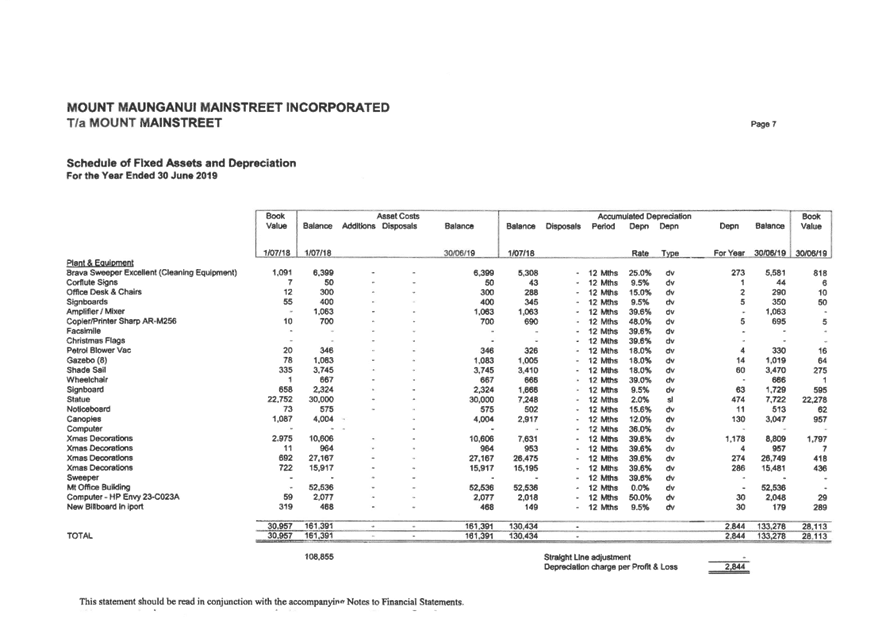

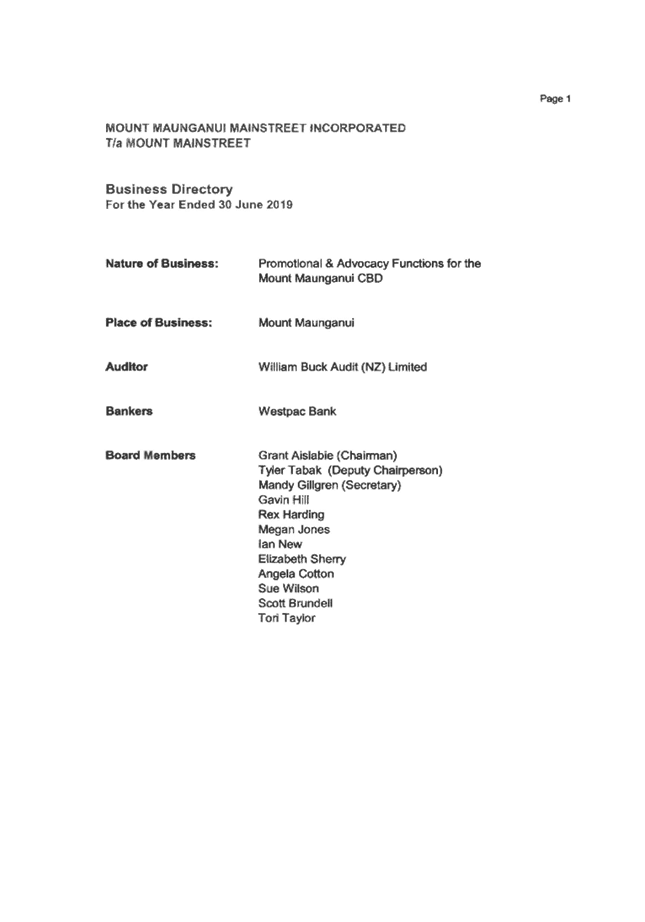

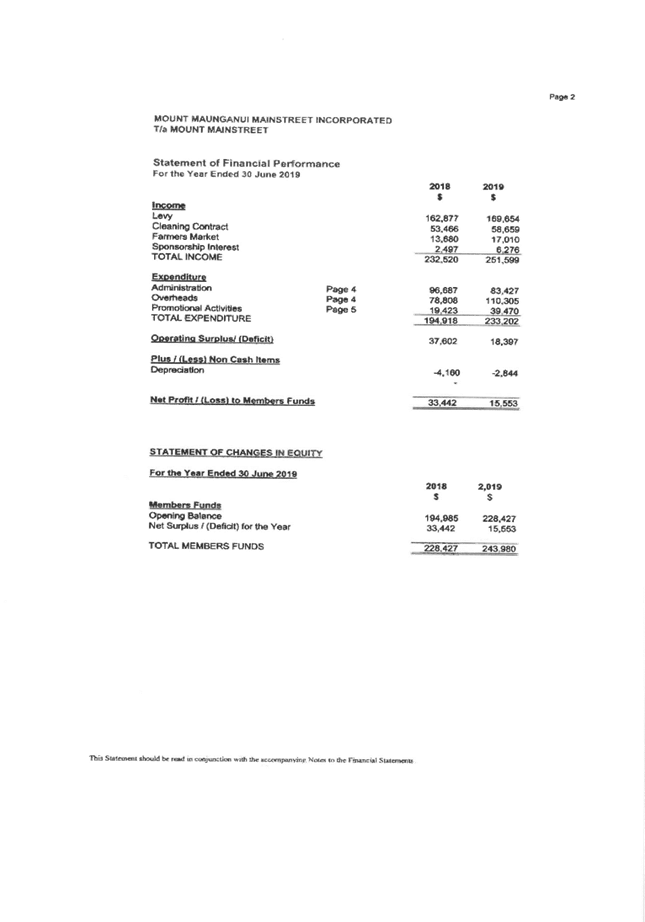

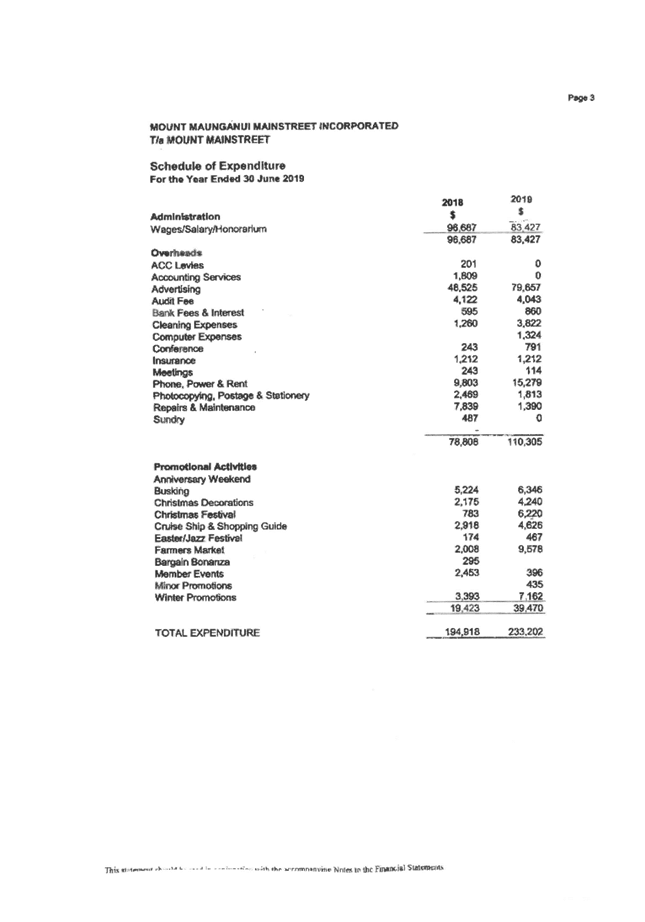

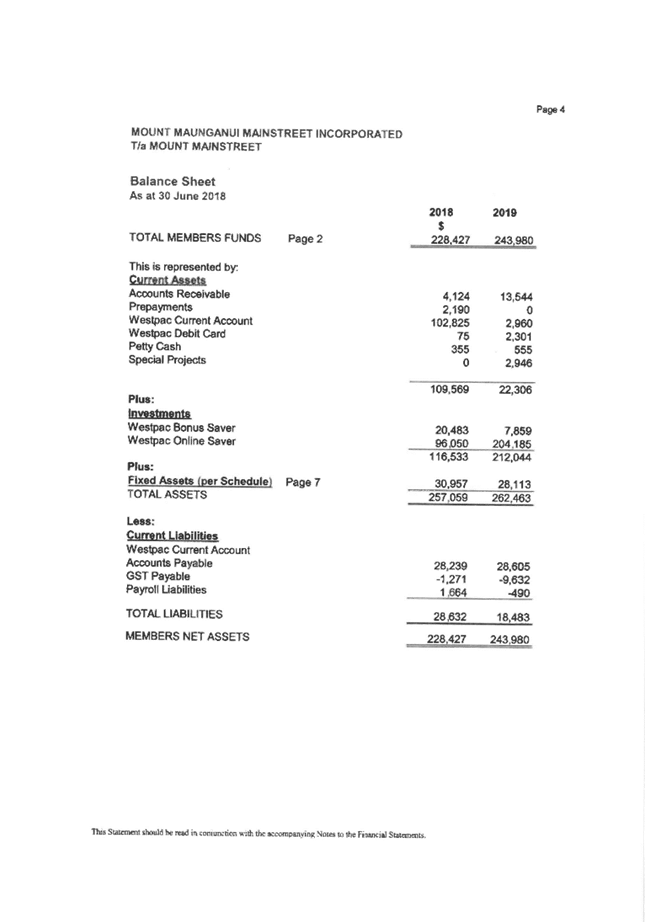

· Financials for FY2019 show an

operating surplus of $33,442 and positive equity of $228,427

· Rebranding for Mt Mainstreet

“Love the Mount”, collateral rebranding in progress

· Change of name from “Mount

Maunganui Mainstreet Incorporated” to “The Mount Business

Association Incorporated” to reflect and support a wider business

environment

· Business engagement –

competitions, surveys and emails

· Busking Festival in October 2019

· Friday night events in Te Papa o Nga

Manu Porotakataka

|

· Continuing with “Love the

Mount” brand engagement strategies

· Mount Pride

· Evening Light Art exhibition

· Friday night events in Te Papa o Nga

Manu Porotakataka

· ANZAC Day commemorations

· Valentine’s Day

· Partnerships with external events

|

|

Tauranga Mainstreet

|

· Disruption to city

centre from increasing construction activity, showing a significant decline

in foot traffic (Devonport Road counter). This is challenging for businesses.

Collaborating with TCC Urban Spaces team to develop a city centre strategy

|

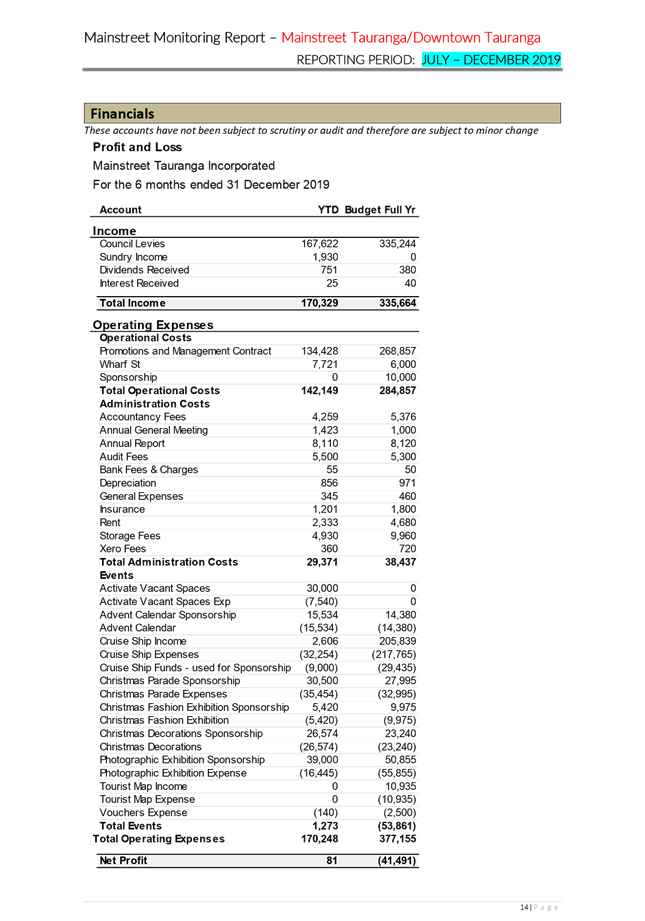

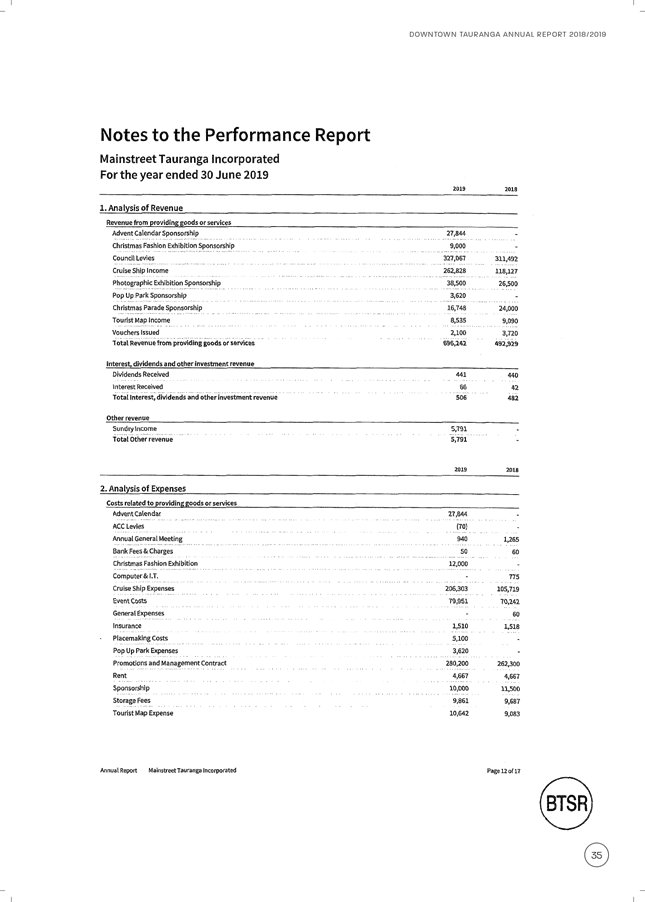

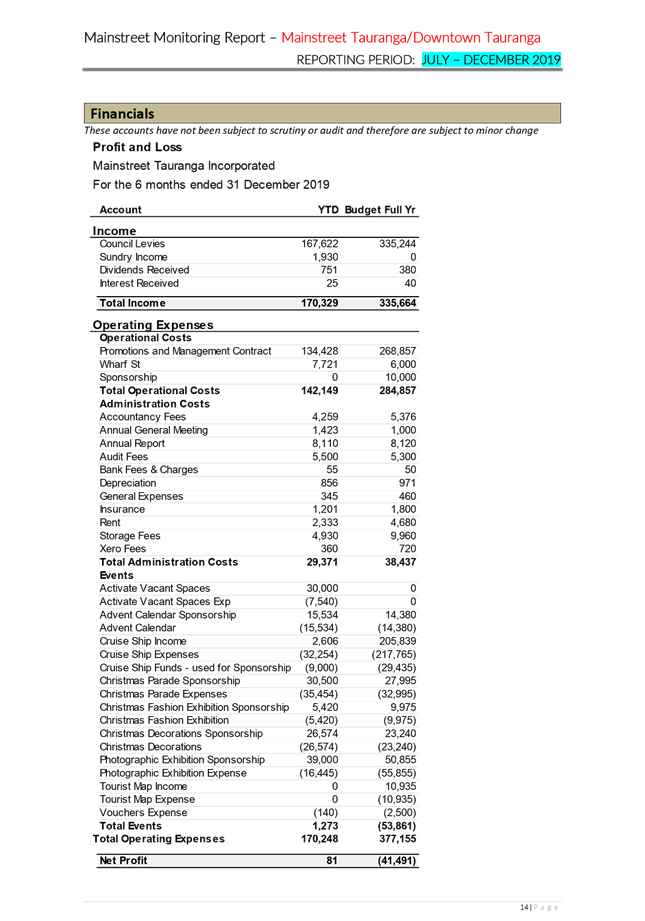

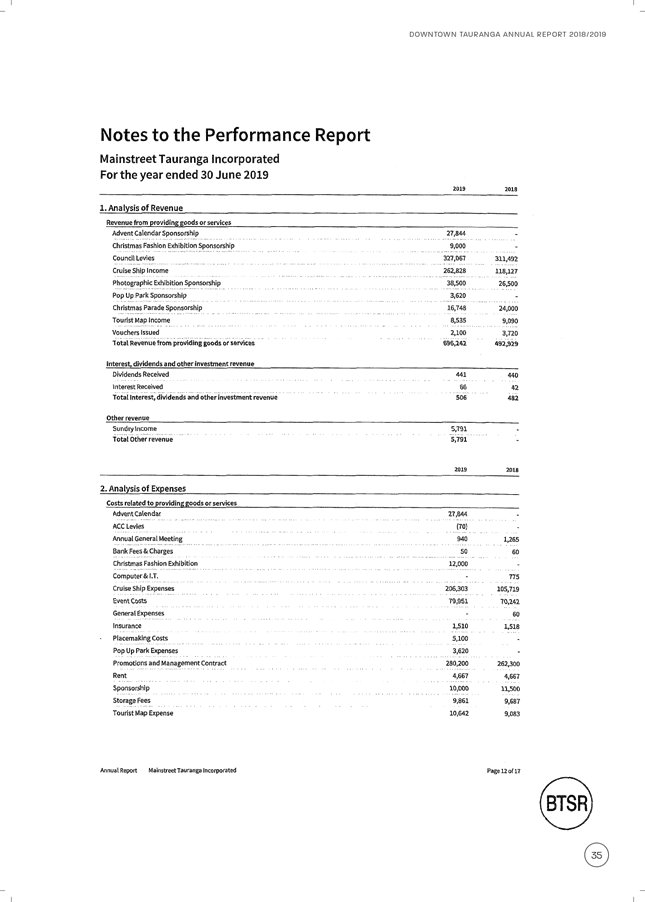

· Financials for FY2019 show an

operating surplus of $35,490 and positive equity of $118,479

· Taste Tauranga, 30+

events promoting dining

· Cruise Ship shuttle bus

service, challenges to sustain the service

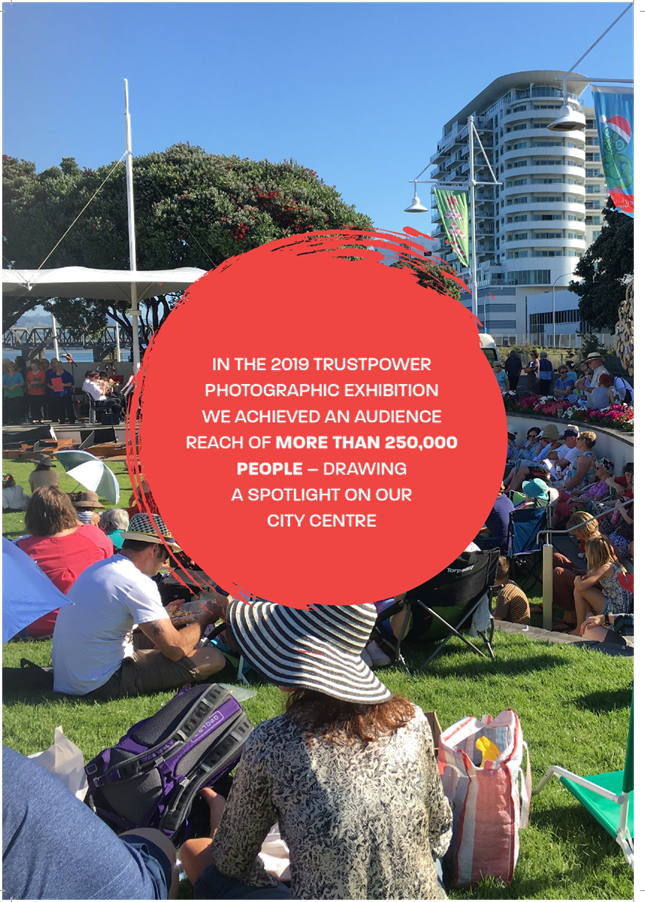

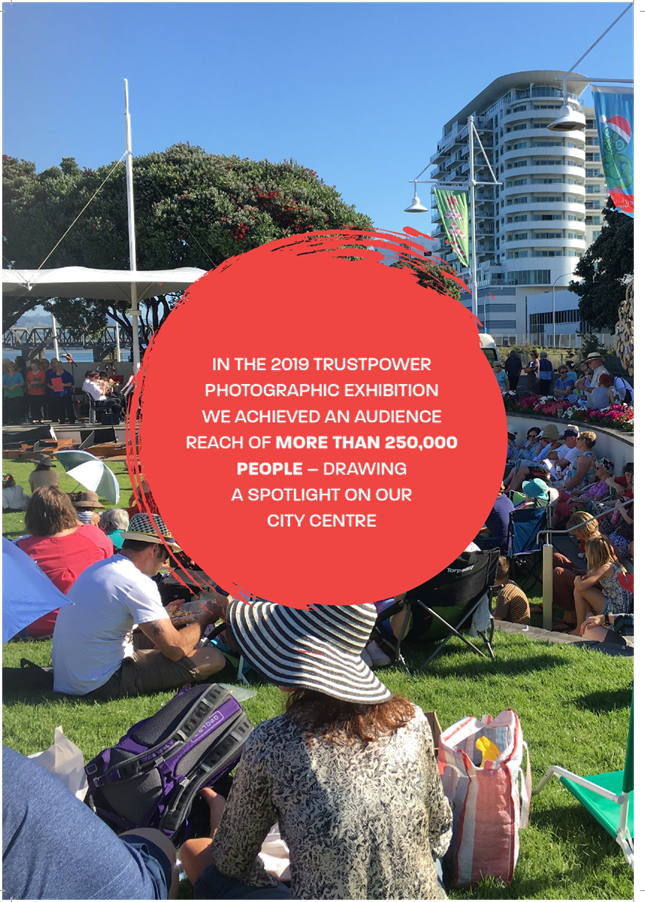

· Trustpower photographic exhibition,

a 10-week exhibition attracting people to the CBD

· Trustpower Christmas

Parade 70 floats with 780 participants, attracting 30,000+ people

· Christmas activations,

shopping spree promotion, Wearable art exhibition, advent calendar,

“Stuff the Bus” charitable donations collection, street

decorations, Carols on the waterfront

· Smart Digital Strategy

rollout to improve Downtown Tauranga brand, showing ongoing significant

increases in a variety of measures

· Tourist map refreshed

· Springfest – Labour

weekend promotion

· Marketing campaigns

including “more than meets the eye”, Hidden Gems, business

videos, and the Durham St promotion

· Downtown Tauranga

membership engagement activities

· Activation of vacant

spaces – aiming to increase vibrancy in CBD

|

· Implement Activate

Vacant Spaces strategy in CBD

· Trustpower photographic

exhibition January to April 2020

· Look Fashion Month

– May 2020

· Growth workshops via the

PoweringOn programme

· Ongoing marketing and

member engagement and advocacy

|

|

Greerton Village Mainstreet

|

· Greerton Village members are keen to

be involved in consultation with TCC – prior to any decisions or

further work undertaken

· Homelessness and begging is still

present but significantly improving, hope to see bylaw retained

· The tidying up of Greerton Village.

Some work completed but very keen to see remaining work completed

|

· Financials for FY 2018/19 show an

operating surplus of $5,498 and positive equity of $60,362

Highlights include:

· The biggest ever Cherry Blossom

Festival

· Kids Book Reading day celebrating

our Yarn Bombing installations

Marketing and promotional initiatives include:

· Yarn Bombing

· Mid-Winter Madness promotion

· Cherry Blossom Festival and Street Car Show

was held in September attracting a 5,500+ crowd

· Giant Christmas Hamper Promotion

· Christmas Carols around the Tree

Ongoing

· Greerton Village Website, Sun Media

Partnership and bi-monthly feature, NZME Radio, Media Works (The Breeze),

newly printed and revamped Greerton Village map distributed, Bay Waka, Town

signage, Social Media (up to 3200 likes for Facebook page), Random Acts of

Kindness, Greerton Village branded bags

|

· Ongoing programmes continue, such as

“Let’s Grow Greerton” which seeks to improve perception of

Greerton, e-newsletters, Greerton business closed Facebook page, BA5

meetings, and ongoing relationship building

· Yarn Bombing in June

· January – Random Acts of

Kindness

· February – Valentines

chocolates

· March - St Patrick’s Day

family events

· April – Easter Egg Hunt

· May and June – yet to be

decided after feedback from January to March events

|

|

Papamoa Unlimited

|

· No issues for Council attention

|

· Financials for FY 2019 show an

operating surplus of $8,727 and positive equity of $50,247

· 28 July – Polar Plunge, 500+

participants

· 29 September – Pedal Papamoa,

600+ participants

· 24 November – Santa Parade 36

floats, attended by 16,000+ people and was “the best Papamoa Santa

Parade ever”

|

· Reviewing all events to ensure

relevance to the local community

· Possibility of replacing Hunt for

Gold with “Papamoa’s Got Talent” event

|

|

Finance, Audit and Risk Committee

Meeting Agenda

|

25 February

2020

|

|

Finance, Audit and Risk Committee Meeting

Agenda

|

25 February

2020

|

|

Finance, Audit

and Risk Committee Meeting Agenda

|

25 February

2020

|

|

Finance, Audit and Risk Committee

Meeting Agenda

|

25 February

2020

|

|

Finance, Audit and Risk Committee

Meeting Agenda

|

25 February

2020

|

Vision: No

changes to this

Core Purpose

/ Focus areas of Mainstreet Business Plan: No change

Membership

overview: Approx. 120 Businesses

Summary of

highlights:

· Our biggest ever Cherry Blossom

Festival

· Kids Book Reading day celebrating our Yarn

Bombing installations

· The TCC vote to retain the Begging

Bylaw

· Gaining substantial support from our

members regarding the additional work conducted around addressing the begging

bylaw and associated issues

Key Activity and Achievements (previous

6 months):

|

Activity

Area: Events

|

|

Activity

|

Explanation

|

Results /

Status / Outcome

|

|

The Yarn

Bombed tree installations that ran from late June until end of August

|

Attracted

visitors from around the BOP and wider area. The standard of trees yarn bombed,

raised yet again this year

|

Impossible to

gauge visitor numbers for this activity however I am aware of coaches

travelling from Katikati, Matamata, Whakatane. The voting for trees and

Charites has proven popular with many locals and visitors and this year we

held both online voting on the dedicated YB face book page and manual voting

throughout 8 locations in the village. A total of $2000 was secured in

sponsorship and passed onto the local charities

|

|

Midwinter

Madness Promotion, July - Aug

|

Shop n Win

promo to encourage shoppers to spend in the village and be in to win one of 3

prizes of $2500, $1500 & $1000 Greerton dollars

|

51 Greerton

Village businesses participated, all paying $100 to be part of promotion

which then formed the prize pool of $5000. Aprox. Same amount of entries as

last year. It was a new initiative to split the prize 3 ways this year

instead of winner takes all – way more popular with the retailers and

other business owners

|

|

Annual Cherry

Blossom Festival and Street Car Show

September

|

Annual

Festival to celebrate our wonderful flowering Cherry Trees and bring the

whole community together for a fun, family day featuring a Car show, School

Fair, stalls and entertainment

|

This year our

biggest ever for car registrations – 126 – and crowd number

estimated at 5,500 plus during the day. The Greerton Village School Fair held

in conjunction as a fund raiser also the biggest ever with over $10,000

raised on the day

|

|

Giant

Christmas Hamper Promotion

|

Shop n Win

Christmas promotion

|

Now in its 4th

year this promotion remained popular by attracting just over half of total

businesses in Greerton Village. Again, split the prize 3 ways this time which

is clearly a good move and something we will try and retain with our promos

|

|

Christmas

Carols around the Tree

|

After last

year’s big show featuring the Topp Twins, this year we needed to revert

to a more local show – will look at celebrity show for 2020

|

A crowd of

around 400 gathered on a warm Summers evening to be entertained by Tauranga

Brass band, Inachord choral group, new choir Tauranga Everybody Sings and 2

sets performed by Green Park School students. In addition Santa was kept busy

all evening as was the face painting fairy and the whole show pulled together

by our local MC . Excellent response to this free event by the community

|

|

Activity

Area: Initiatives & Marketing

|

|

Activity

|

Purpose

|

Results /

Status / Outcome

|

|

Greerton

Village Website

|

Ongoing

regular updates. All new businesses added to the Business Directory. I

believe that less people are looking at web site and preferring face book

|

Reasonable

reaction to Events promoted on web site and receive enquiries re. Greerton

Village businesses via the Business Directory

|

|

Sun Media

Partnership, Bi Monthly feature + additional space for events and promotions

|

To engage

with the public regarding upcoming promotions and events

|

Continue to

receive very positive and regular feedback to our feature pages. Sun Media

continue to support us with addition videos of events and sponsorship of

Window Dressing competitions. In November we tried a new initiative with a

full page featuring 16 GV businesses, each with their own small adverts. This

proved successful for some and not so for others. Sufficient that we will run

again

|

|

NZME Radio

across 4 x local stations

|

Used to

promote events and promotions to the public

|

Hard to gauge

sometimes but do hear feedback from those who are regular radio listeners. In

addition to advertising campaigns, also receive plenty of additional liners

and mentions at no cost

|

|

Greerton

Village Map

|

The newly

printed map was distributed to local I Sites as well as sent to Matamata I

site who usually have 3 bundles a year sent to them – promoted heavily

there as a quirky village to visit from Op. Shops and Yarn Bombing

|

The new revamped

map has continued to be popular with retailers requesting more during the

year. Contains colourful images of Greerton Village and its events as well as

promoting businesses that have bought space. Real Creative sell and produce

the map for us

|

|

Town Signage

|

Utilised for

promotion of events and promotions

|

Always

receive feedback from public when the signs go up or are changed so has a

place in the marketing platforms

|

|

Social Media

|

GV Public

face book page used to promote all events and promotions in Greerton Village

as well as advise public of new Businesses and Retailers promotion

|

Page likes

increased slightly from 3.1k to 3.2K on public page.

This platform

is of course important however our members have made clear that they embrace

one on one contact with Mainstreet in preference to face book communications

|

|

Random Acts

of Kindness

|

This was an

initiative that was born out of the Lets Grow Greerton Group – reported

on later in this report. The idea is for one business each week throughout

the year, to get out in the street, offer members of the public either a free

gift or special prize of some sort, take a photo and post to our public page

|

We have

continued this promotion right up until Christmas 2019 and the face book

posts have created many positive comments. We will kick off again in February

2020

|

|

Greerton

Village Branded Bags

|

Designed to

promote Greerton with hessian bags – to alleviate the plastics issue

|

Most

retailers have chosen to use as promotional tools giving away with large

purchases and GVCA have used to promote #greertonhasheart by using a prizes

and random giveaways

|

|

Activity

Area: Member

Communication

|

|

Activity

|

Purpose

|

Results /

Status / Outcome

|

|

Lets Grow

Greerton

|

Initiated in

March 2019 to advise activities, meetings, items of importance, promotions

and events to our members only

|

Following on

from 2 meetings earlier in the year, we have continued with this initiative

via our closed Facebook page for GV businesses and personal contact from our

committee members and manager

|

|

GVCA

Mailchimp newsletters

|

Again, to

advise, inform, celebrate both to our members database and our public

database

|

As you would

expect, some newsletters generate more interest and comment than others but

certainly our best way of communication to all members

|

|

Greerton

Business Group Closed Face Book page

|

To inform and

communicate within our business community without external input from members

of the public

|

Membership of

this group has now grown to 52 – just under half of all businesses in Greerton

and is well used open and frank exchange of views and information. As well

this has provided a platform for retailers to support each other

|

|

BA5 Network

evenings

|

To encourage

Business owners to host and showcase their business to fellow business owners

in GV

|

The last two

BA5’s of the year held in November and December drew good numbers in

November, lower in December (many clashes same night) and we will be starting

again in February 2020

|

|

Personal

visits to business owners from Mainstreet Manager and Committee members

|

Mainly for

committee members to get out and meet and engage with business owners

|

Business

owners have appreciated being called on by committee members as a change form

always the Mainstreet Manager

|

|

Meeting with

GVCA Business owners and TCC Regarding Begging/Rough Sleeping Bylaw

|

To give an

opportunity for Business owners to attend a meeting, ask

questions and hear about possible solutions

|

Good

attendance for GV meeting. Most not that happy still but willing to hear of

possible outcomes

|

Key issues:

|

Issue

|

Explanation

|

Status

|

|

Greerton

Village Development work for safety in GV – carried over from last

report

|

We have

received no further advice from TCC around this issue so really not sure of

whats in the picture from last we heard was that TCC had tasked staff to look

at possible solutions

|

Since I have

received no complaints at all this 6 month period, I believe that the

majority of business owners have come to accept the situation as is (which is

what was predicted) and indeed would now be reluctant to have further

remedial work resulting in more upheaval – ie moving traffic signals

etc., temporary road closures and loss of parks. Indeed if TCC do have plans

in the pipeline for any changes to the current set up, we would really want

to have in-depth consultation with businesses prior to any decisions that

will further affect their livelihood

|

|

Rough

Sleeping and Begging Bylaw – carried over from numerous reports

|

Relates to

historical issue with people begging in Greerton Village and introduction of

Bylaw in April 2019

|

At the time

of preparing this report, we are once again holding our breath in Greerton

Village – very worried about the outcome of upcoming hearing on this

subject in January and deliberations in February. Having TCC vote in favour

of the bylaw remaining in August last year, only to have a new council vote

to go out for consultation again – to prevent a possible legal

challenge against the current wording and so it goes on. Since 1 April 2019

the presence of people begging in the street has dramatically reduced with

just the occasional one or two and Greerton Village has regained its friendly

vibe and shoppers have returned in numbers with no negative comments received

either in person or through social media. Long may it last is our view

– please consider the health and well being of the 100+ business owners

in Greerton Village – as well as the people begging

|

|

The tidying

up of Greerton Village

|

We were told

by TCC staff, that following the completion of the safety improvements in GV,

that a “spruce up” would be conducted

|

I will copy

and paste here the comments from our report from 30 June 2019

|

Following a walkabout with Callum and Richard from TCC – we

are waiting to see a schedule of works for the jobs that we identified. We

understand that some work will not take place until Spring – if it

involves paint, however we would really like to get the schedule and see

the timelines for removing the old bollards and poles where possible and

painting programme on those that have to stay. As the business owners are

making an effort it would be very helpful to be able to report back with

firm schedules

It is

disappointing that little of this work has been carried out – despite

Spring coming and going and already half way through Summer. To the best of

my knowledge work that was agreed to: Repainting the disabled car park

pavement sign next to Greerton Hall – completed. Painting white marks

on steps leading from hall to Cameron road shops – completed –

but already almost gone as needed 2 coats of paint. Straightening up of

various poles – completed.

Plastic

fence in Cameron Road removed – completed and car park painting

completed

The repair,

cleaning and revarnish (where required) of all seating in Greerton Village.

The 3 seats around the hall were cleaned – they come under reserves

– however the rest of the village seats remain very dirty, some

broken and all needing a good clean and many varnishing. We had requested

the very old damaged bollards and poles to be removed and told too

expensive to remove but a quote would be sought for repainting – all

in July last year, nothing seen since. Some poles removed, rest remain. I

have regularly requested updates and a contractors timeline (as promised)

to complete these works, but so far none received

|

|

Future

activities (coming 6 months):

Now that we

have that good vibe back – we feel ready and able to move forward with

new ideas and initiatives for the coming 6 months.

Out of our Lets

Grow Greerton meetings, although virtually all are in favour of retaining our

iconic events such as Cherry Blossom Festival and Yarn Bombing, there was a

strong call also for smaller initiatives more frequently and with that, the

following has been developed:

· January – Random Acts continue

with a Stilt Walkers in the village handing our lollies and branded

balloons

· February – hundreds of chocolate

hearts will be distributed by our Valentine entertainer and Greerton Lions

· March A fun day to celebrate St

Patrick’s Day. In the village square, Irish band to perform, scavenger

hunt, face painting, Circus in a Flash and games for the kids

· April – Easter Egg Hunt

· May and June – yet to be decided

after feedback from January to March events

Financials:

A copy of our

YTD Budget Vs Actual to 31 December 2019 and full financials for year end 30

June 2019 are attached with this report. We are tracking well with accounts of

$10,200 payable in January 2020.

|

Finance, Audit and Risk Committee

Meeting Agenda

|

25 February

2020

|

|

Finance, Audit and Risk Committee Meeting

Agenda

|

25 February

2020

|

This section will only need to be

updated when there are changes to report on

Vision:

Core Purpose

/ Focus areas of Mainstreet Business Plan:

Membership

overview:

Summary of

highlights:

Selecting 3

– 6 activities to highlight, also include anything else that should be

highlighted to Council

Key Activity

and Achievements (previous 6 months):

Additional

tables can be added if needed

|

Activity

Area: for example: events

|

|

Activity

|

Explanation

|

Results /

Status / Outcome

|

|

28 July

Polar Plunge

|

Community

engagement to celebrate mid winter in the sunshine capital!

|

Around 500

hardy souls braved the surf at Papamoa and enjoyed a warming meal at

retailers within Papamoa.

|

|

|

|

|

|

Activity

Area: for example: initiatives, marketing

|

|

Activity

|

Purpose

|

Results /

Status / Outcome

|

|

29

September Pedal Papamoa

|

Highlight

the beautiful waterways around Papamoa and encourage cyclists to get out and

about

|

Around 600

cyclists enjoyed a magnificent day out with refresher stops, quizzes and a

hearty breakfast along the waterways of Papamoa.

|

|

|

|

|

|

Activity

Area: for example: member communication

|

|

Activity

|

Purpose

|

Results /

Status / Outcome

|

|

24

November Santa Parade

|

Engage the

local Papamoa Community into a celebration of “Kiwiana” and all

thing “Papamoa”!

|

A record

36 floats took part and record crowds attended (approximately15,000) what was

acknowledged as the “best Papamoa Santa Parade ever”.

|

|

|

|

|

Key issues:

Are there

any particular current issues that need to be highlighted to Council? What is

happening to resolve these issues, if the issues relate to Council activity

what is the next step? On a rolling basis close issues that were raised in

previous reports.

|

Issue

|

Explanation

|

Status

|

|

Review all

events to ensure relevance to the local community.

|

Events

that do not change to meet local objectives need to be reviewed.

|

Currently

reviewing the “Hunt for Gold” activity from March 2019 and

looking to step it up with a “Has Papamoa got talent”

competition.

|

|

|

|

|

Future

activities (coming 6 months):

More

community engagement, roll out new activity and engage with stakeholders…

Financials:

On budget

and looking to maximise returns to stakeholders by delivering high

participation events.

|

Finance, Audit and Risk Committee

Meeting Agenda

|

25 February

2020

|

|

Finance, Audit

and Risk Committee Meeting Agenda

|

25 February

2020

|

7.2 Financial

and Non-Financial Monitoring Report: Period ended 31 December 2019

File Number: A11142830

Author: Kathryn

Sharplin, Manager: Finance

Authoriser: Christine Jones, General Manager: Strategy & Growth

Purpose of the

Report

1. The

purpose of this report is to inform Council and the public of our financial and

service level performance result for the first six months of the financial year

2019/20 and provide an overview of resident perceptions.

|

Recommendations

That the Finance, Audit and Risk

Committee:

(a) Receives

Report Financial and Non-Financial Monitoring Report: Period ended 31 December

2019.

(b) Approves an

overspend of $375,000 for the Durham Street Streetscape project

(c) Approves an

overspend of $194,000 for Te Papa o Ngā Manu Porotaktaka.

|

Executive

Summary

2. The

full year financial projection at this stage is for an operating result

slightly favourable to budget. Net debt at year end is projected to be close

to budget ($540m). The main risk to this projection is timing of capital spend

and timing of payments on weathertight claims.

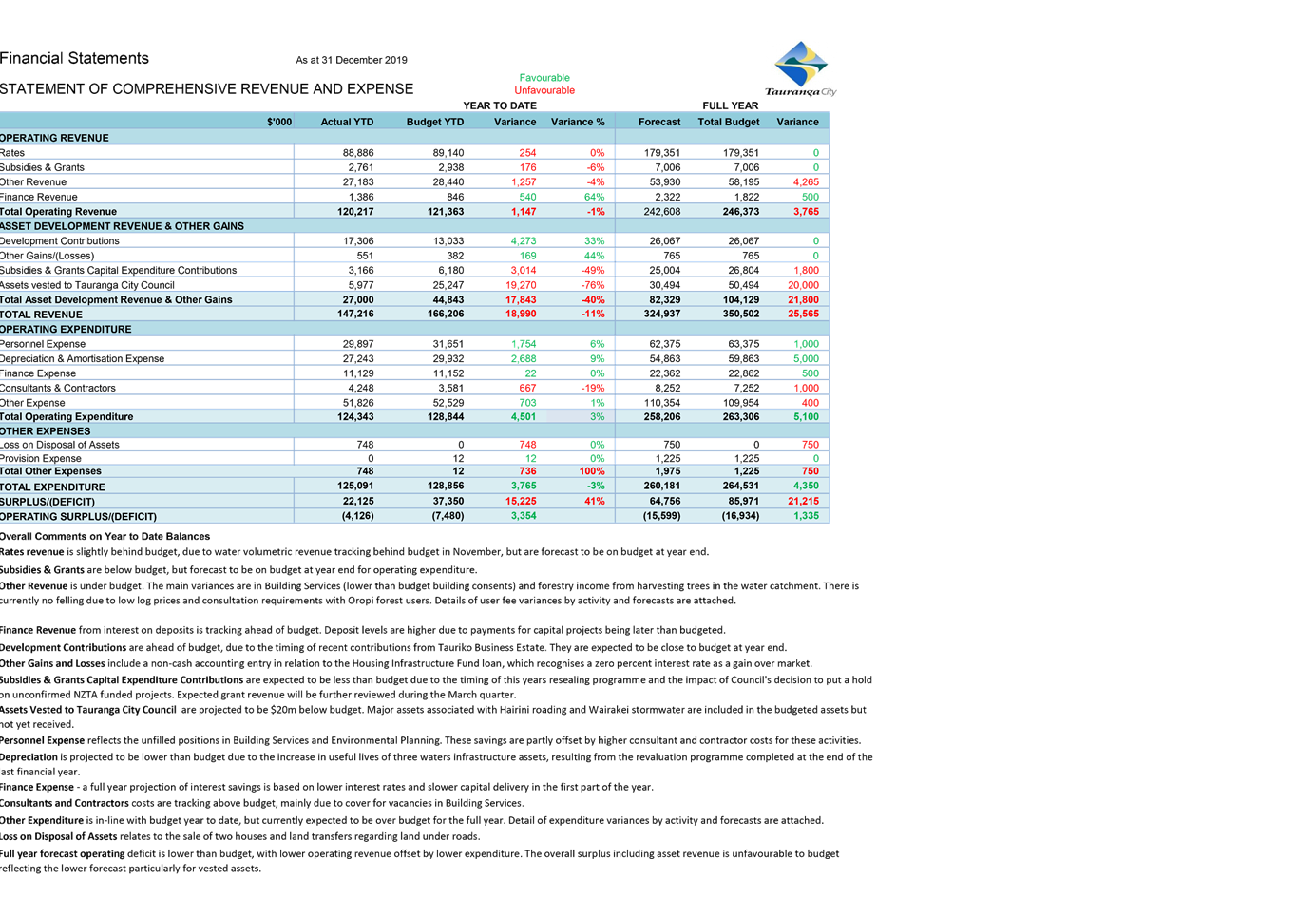

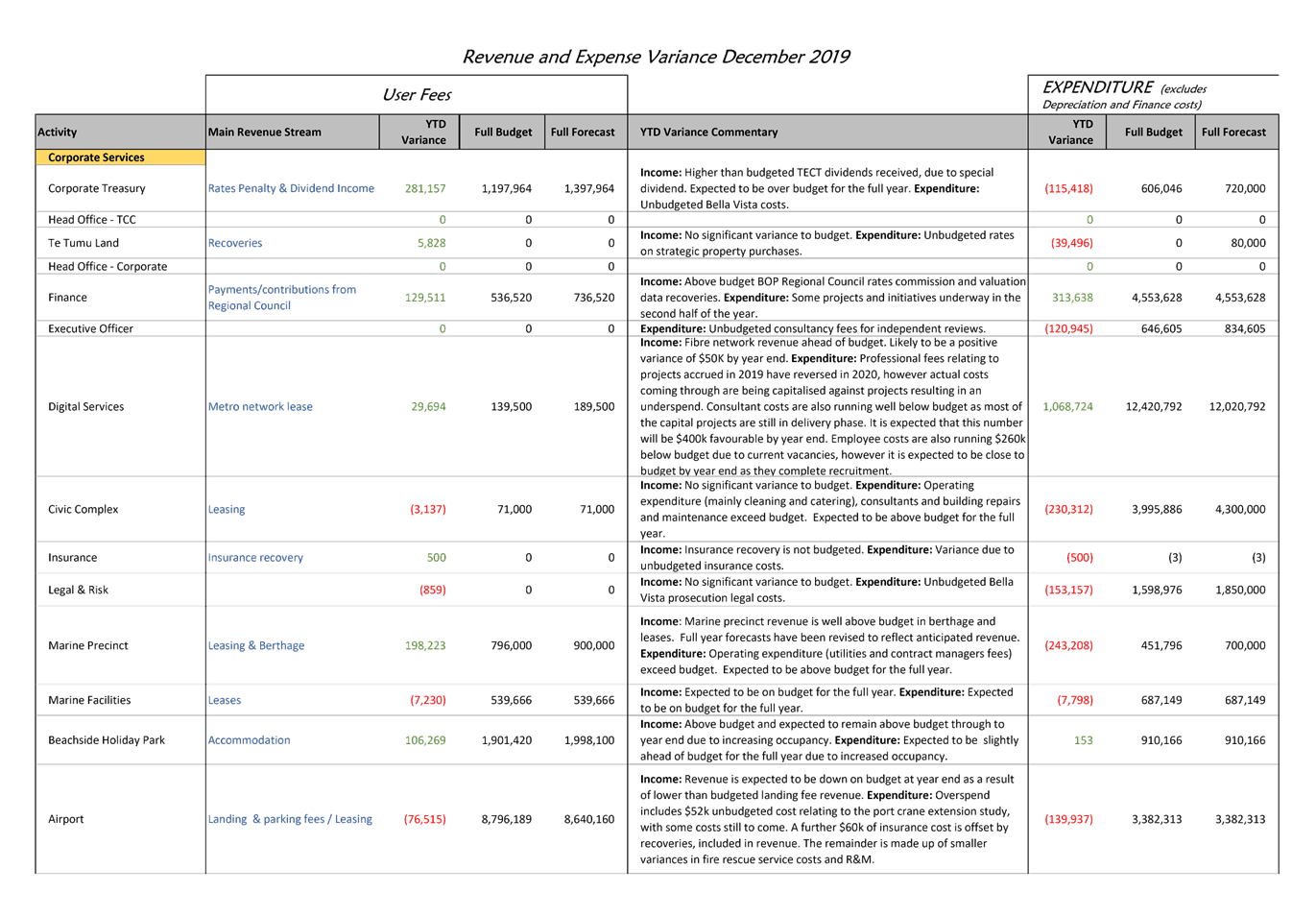

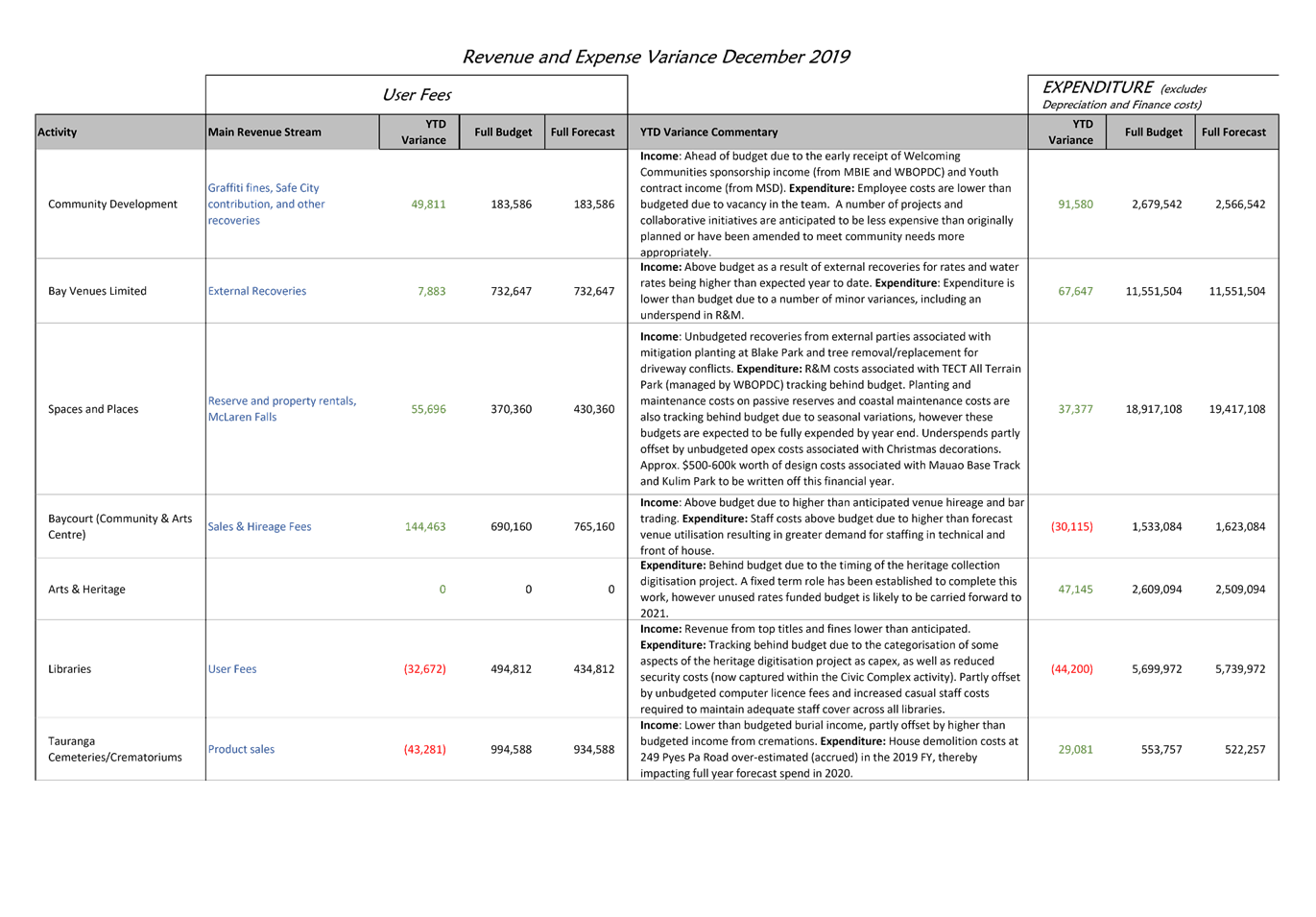

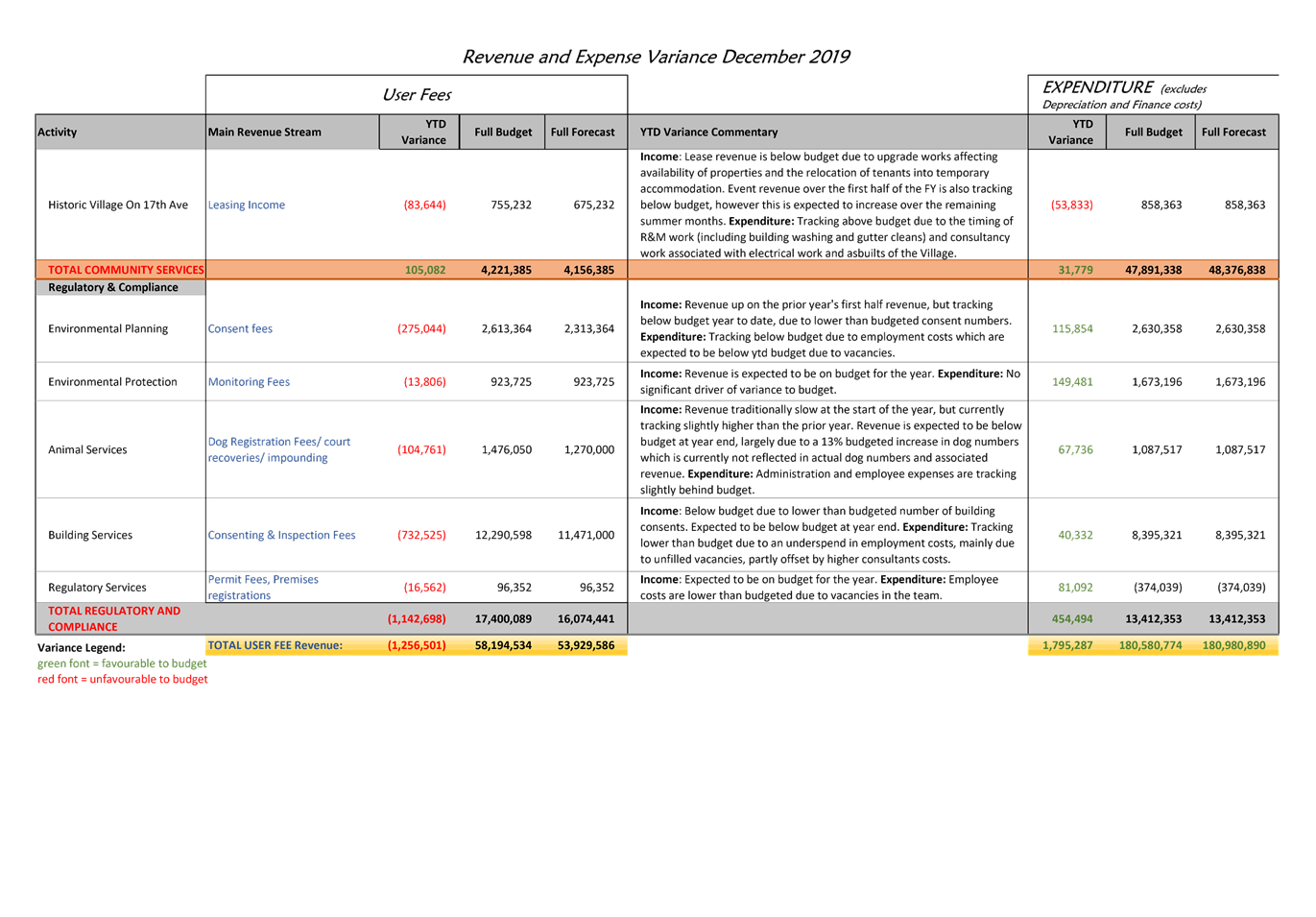

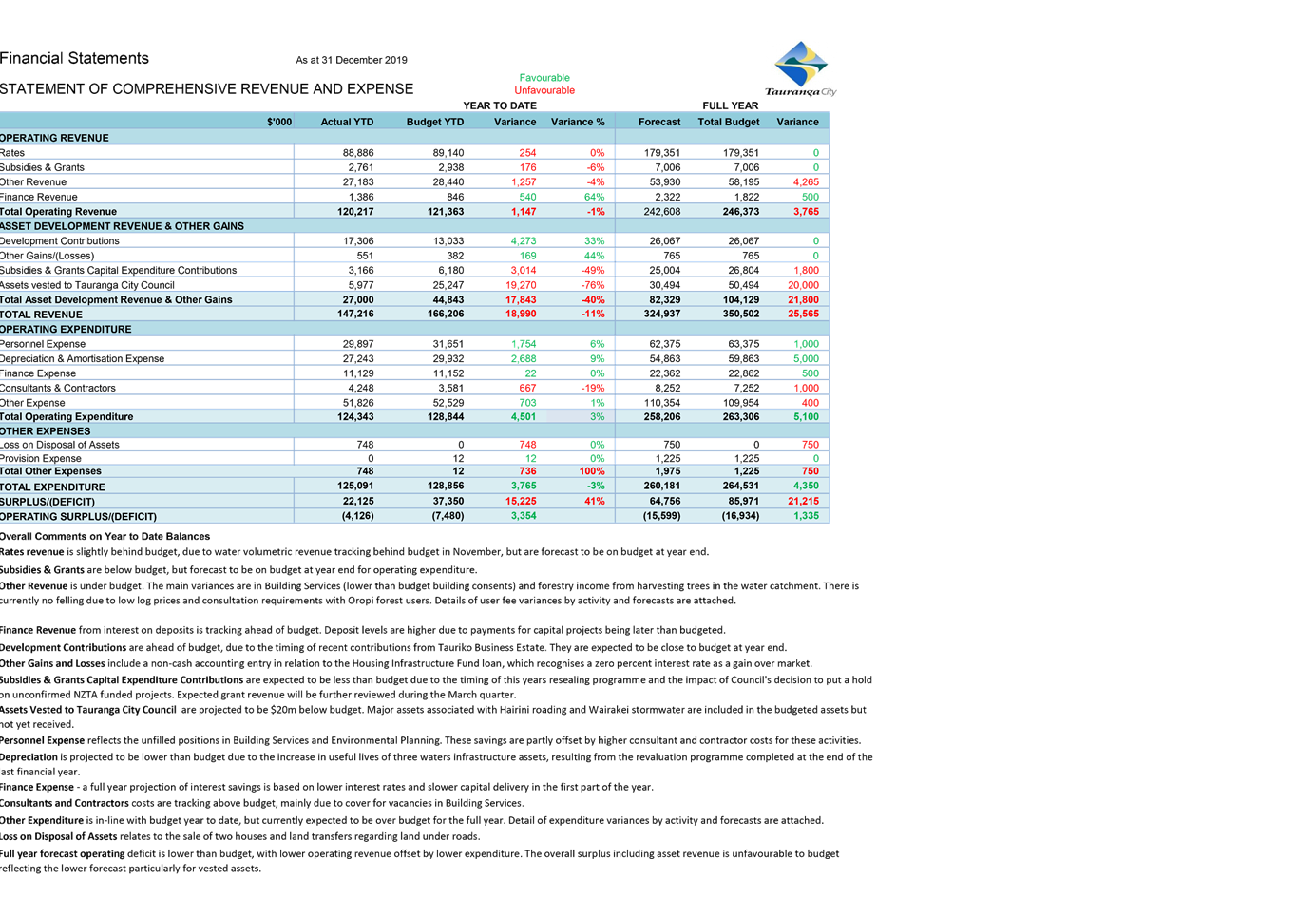

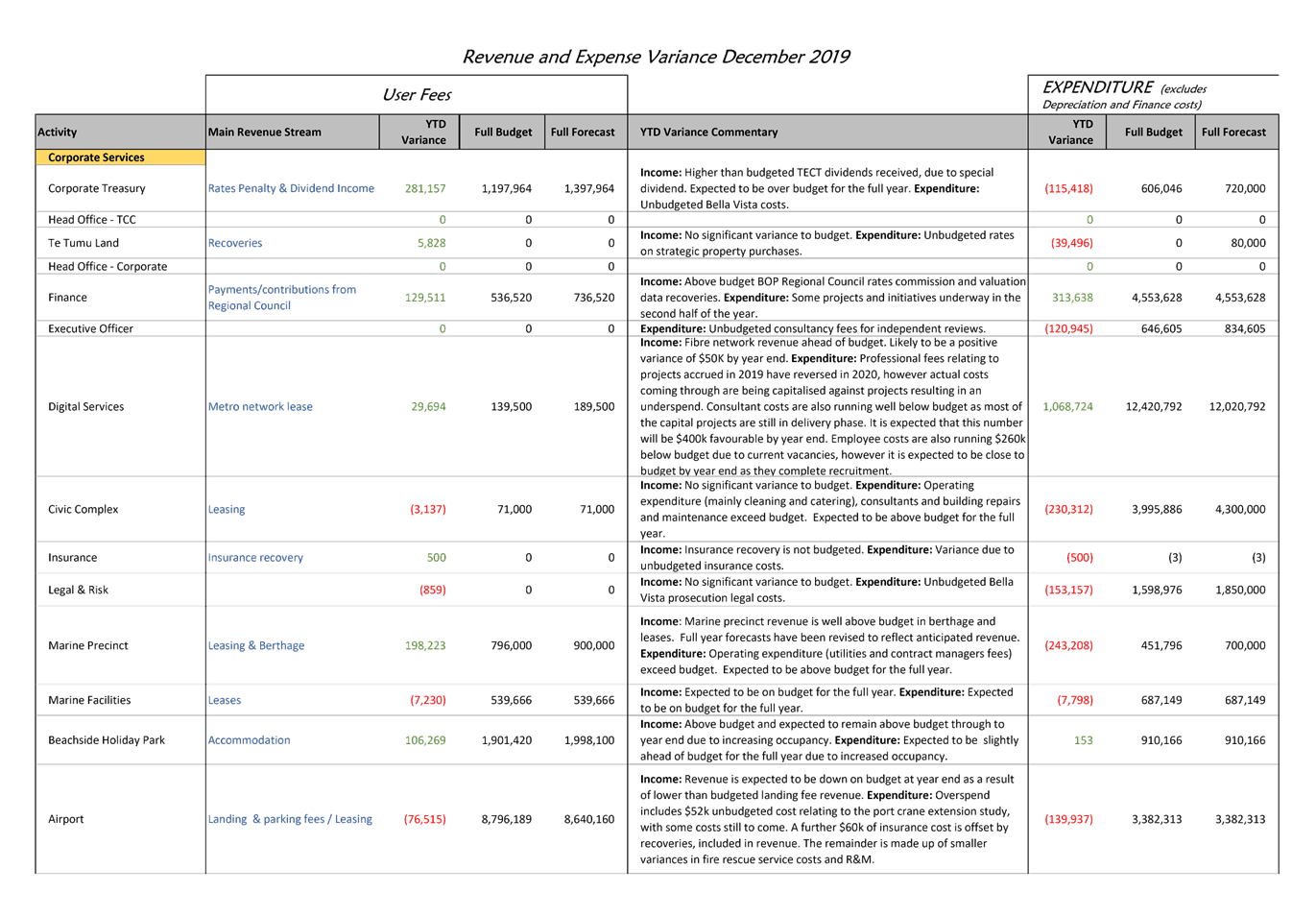

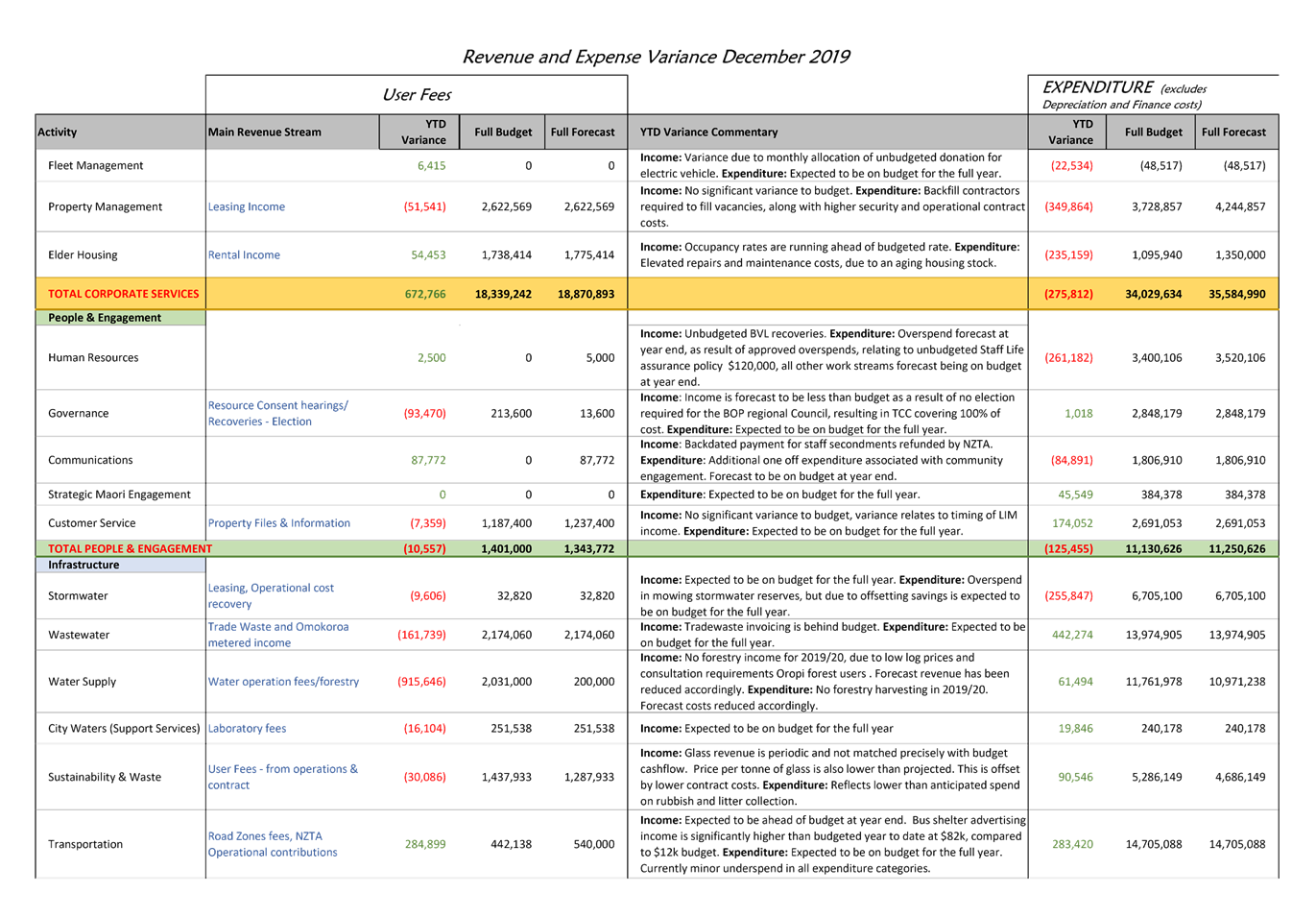

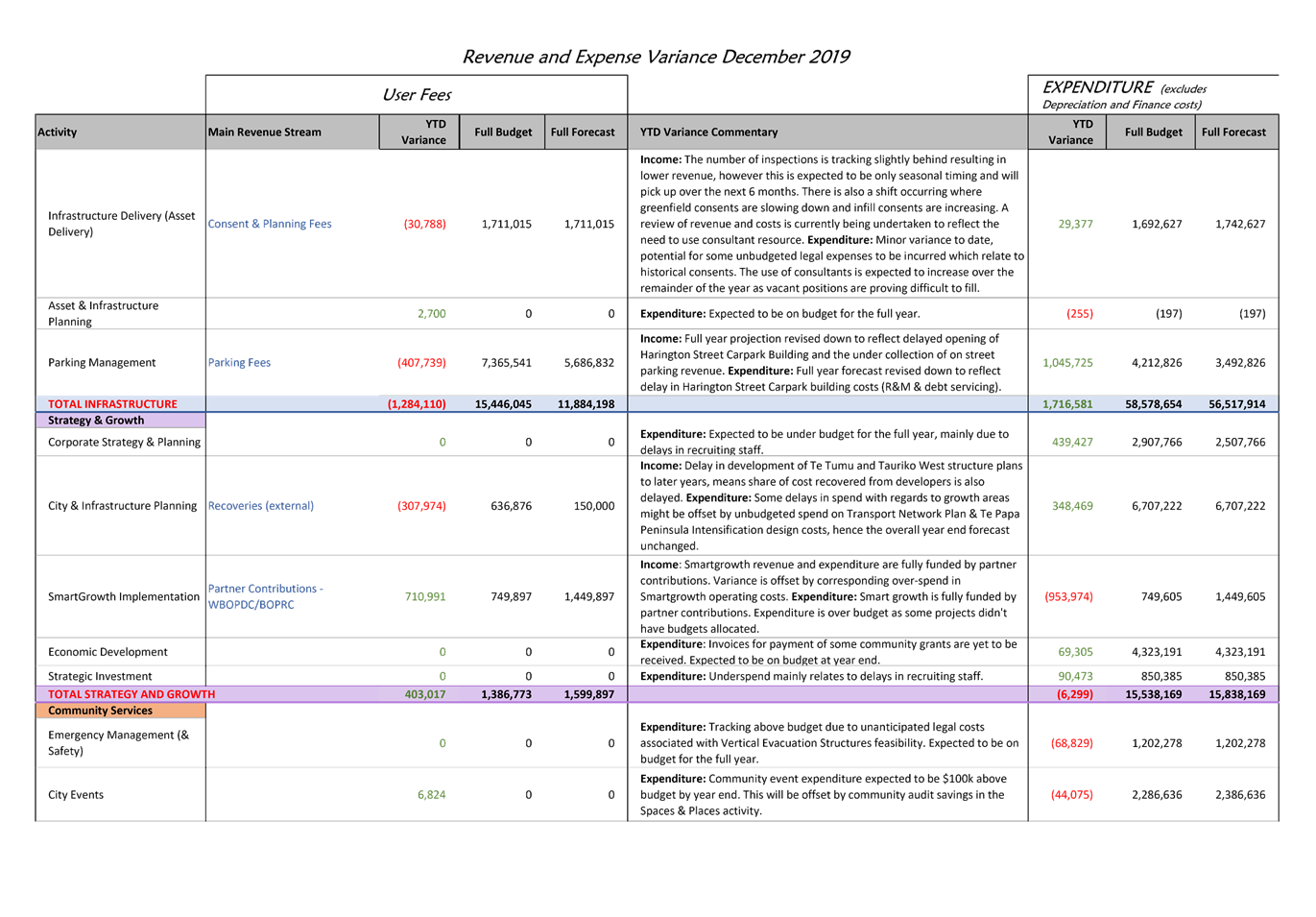

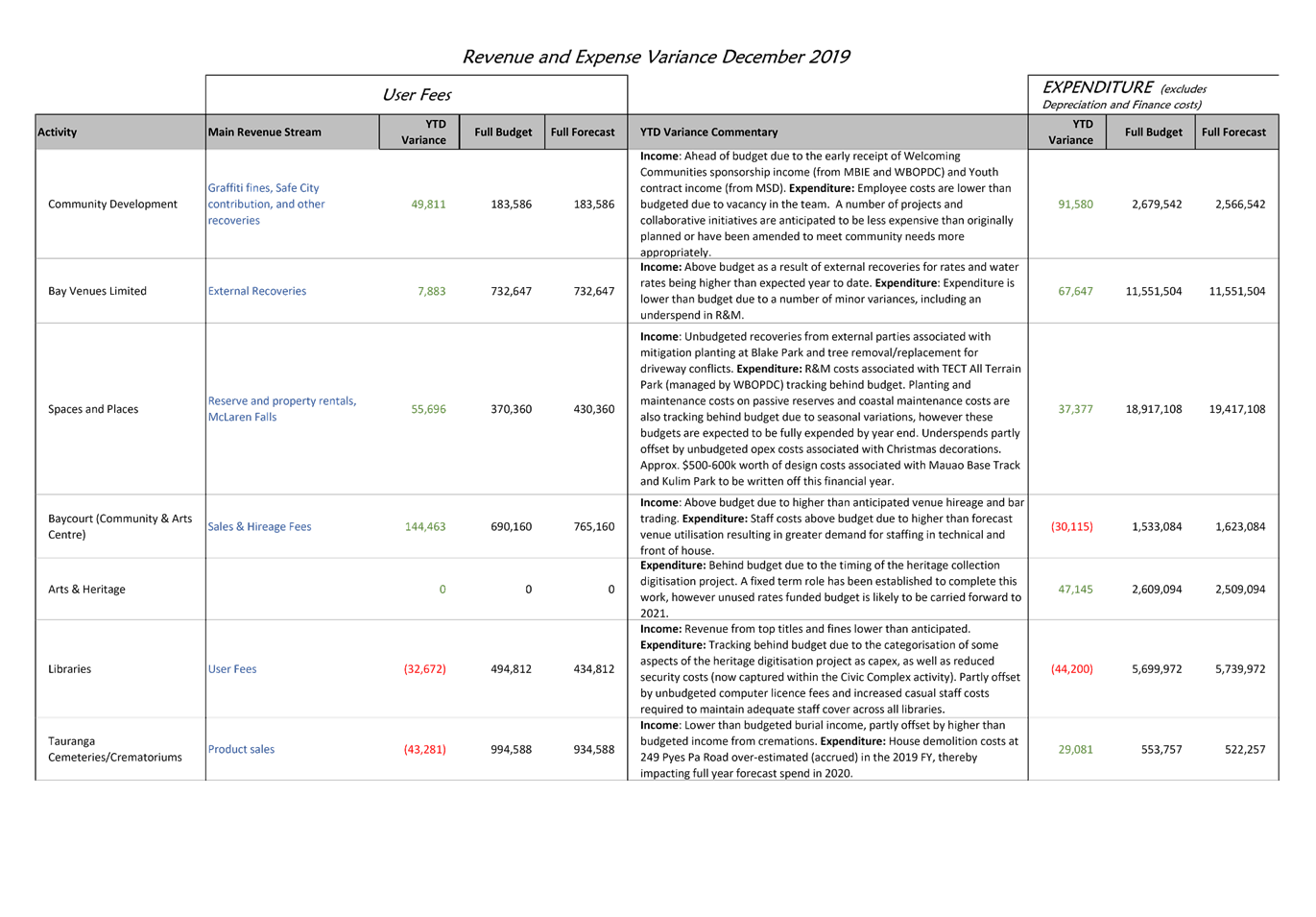

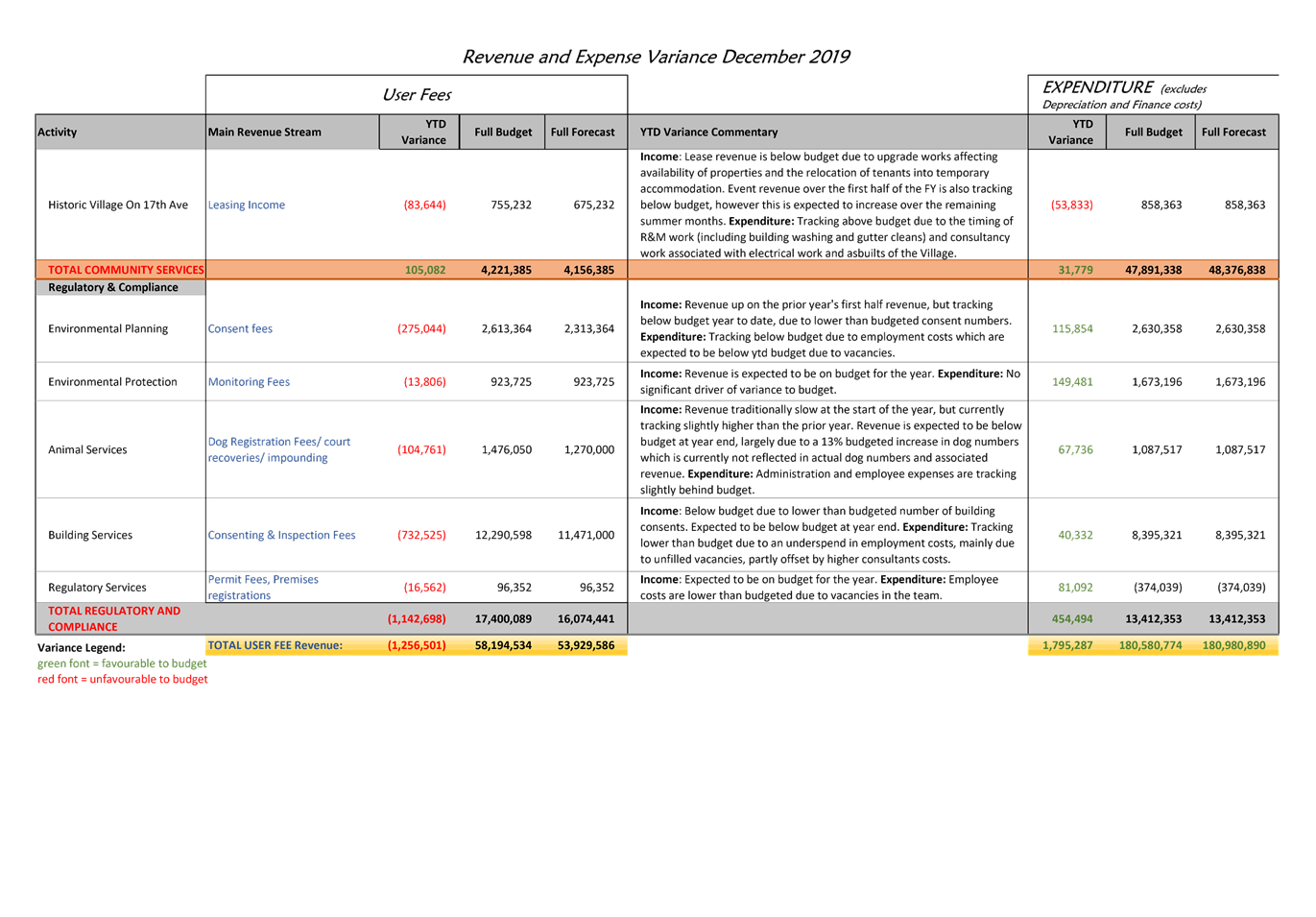

a) Summary Statement of Comprehensive Revenue and

Expense (Attachment 1) shows both operating expenditure and revenue behind

budget. Revised full year forecasts have been presented showing that the full

year forecast for net operating deficit is $15.6m, $1.3m favourable to budget

with interest rate savings accounting for $1m favourable result.

b) The Treasury Report (Attachment 1) shows total net debt to 31 December 2019 of $487m

with the full year forecast close to budget at $540m.

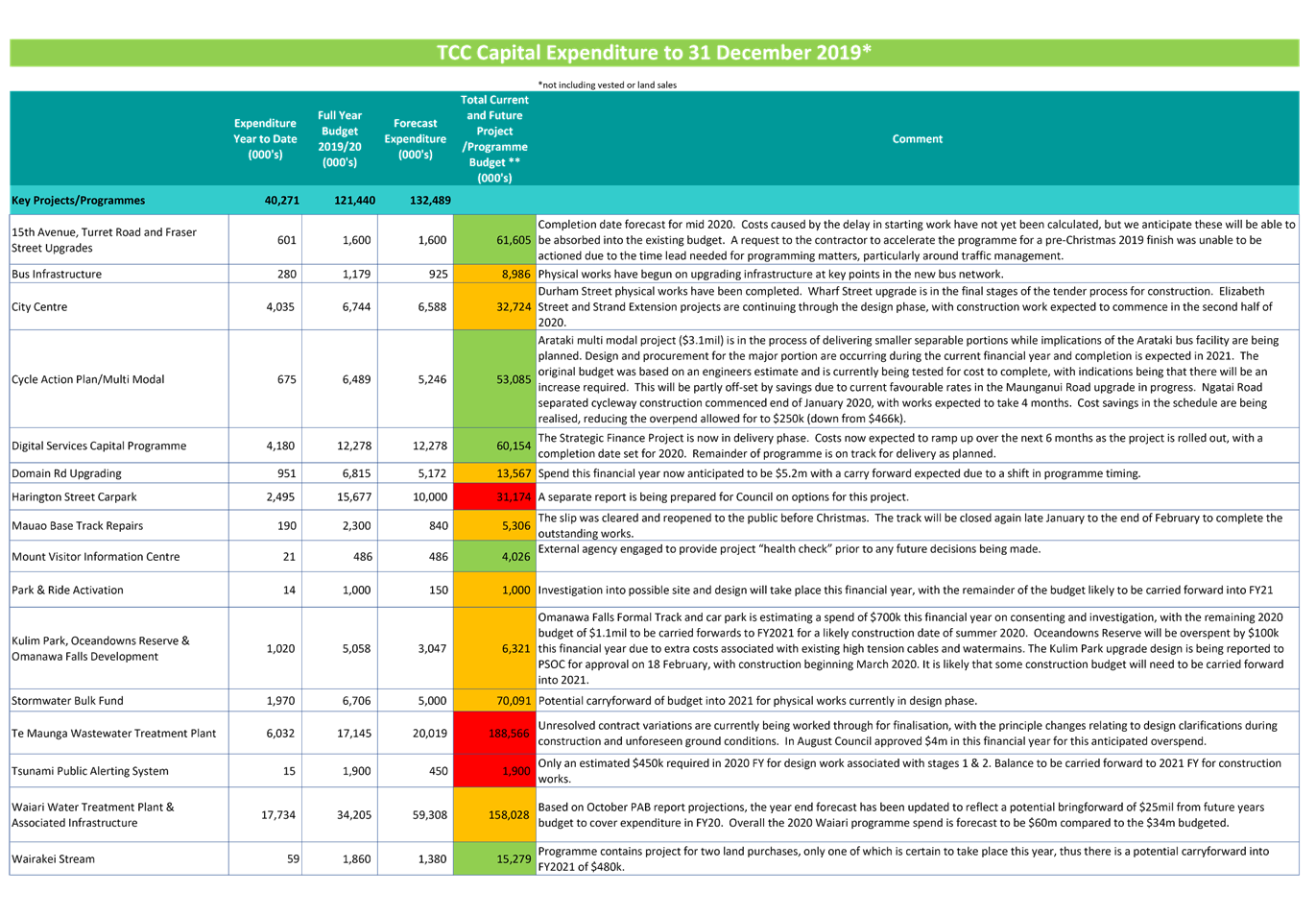

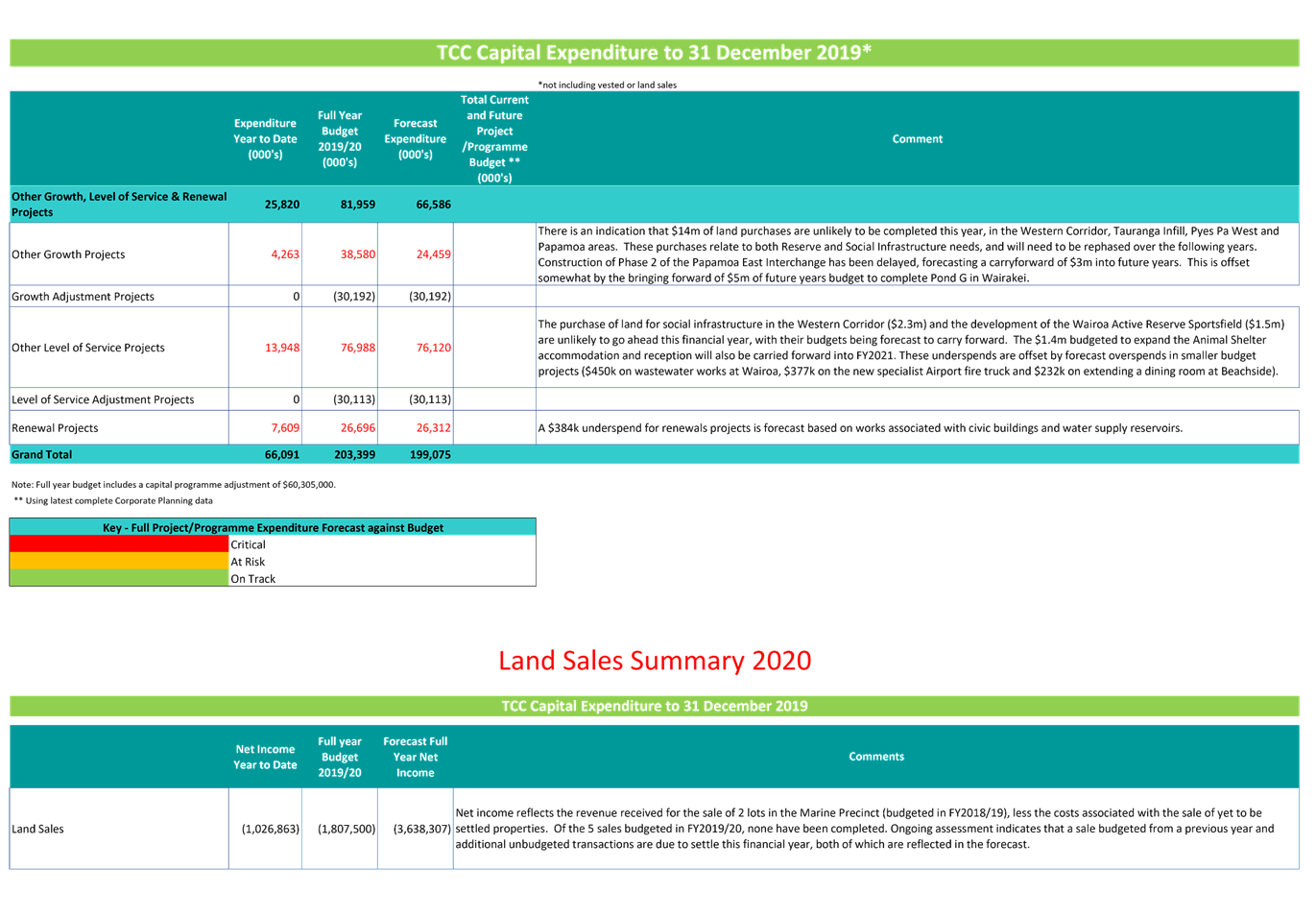

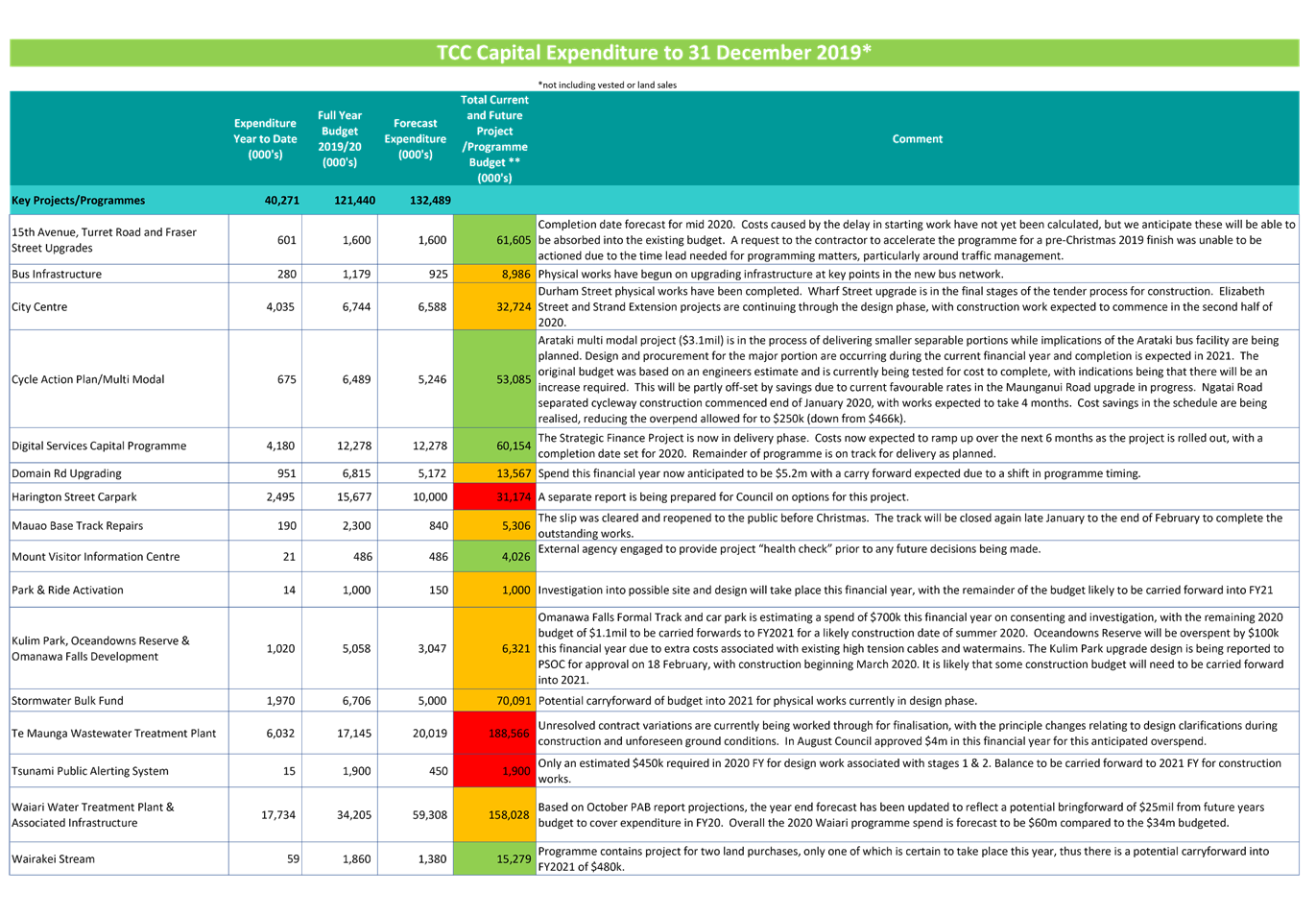

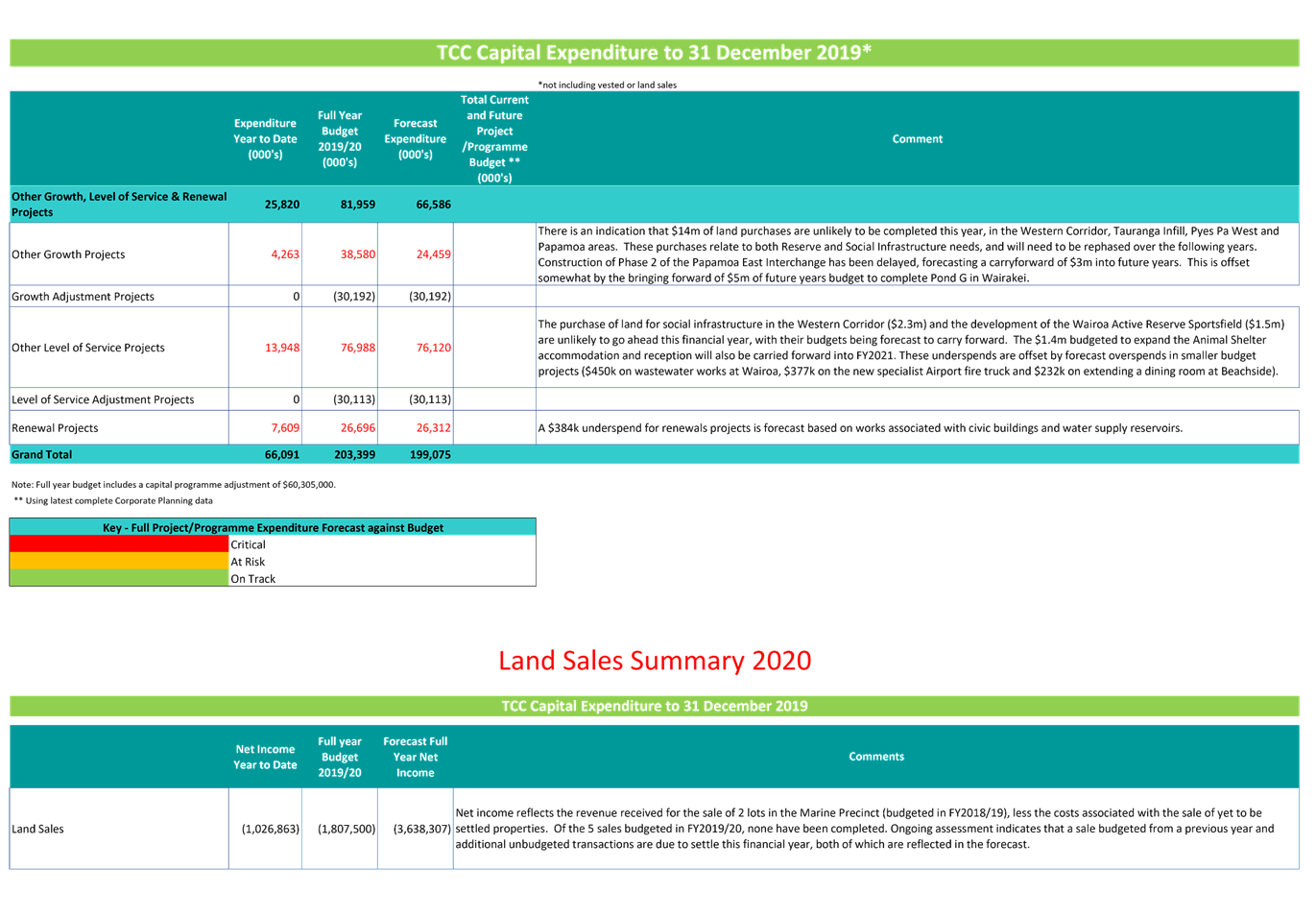

c) The TCC Capital expenditure table

(Attachment 2) identifies capital project budgets for the year by significant

projects and other categories of expenditure. At this stage we are projecting

capital delivery to be $4m below budget, noting that the budget includes an

adjustment for non- delivery of $60m.

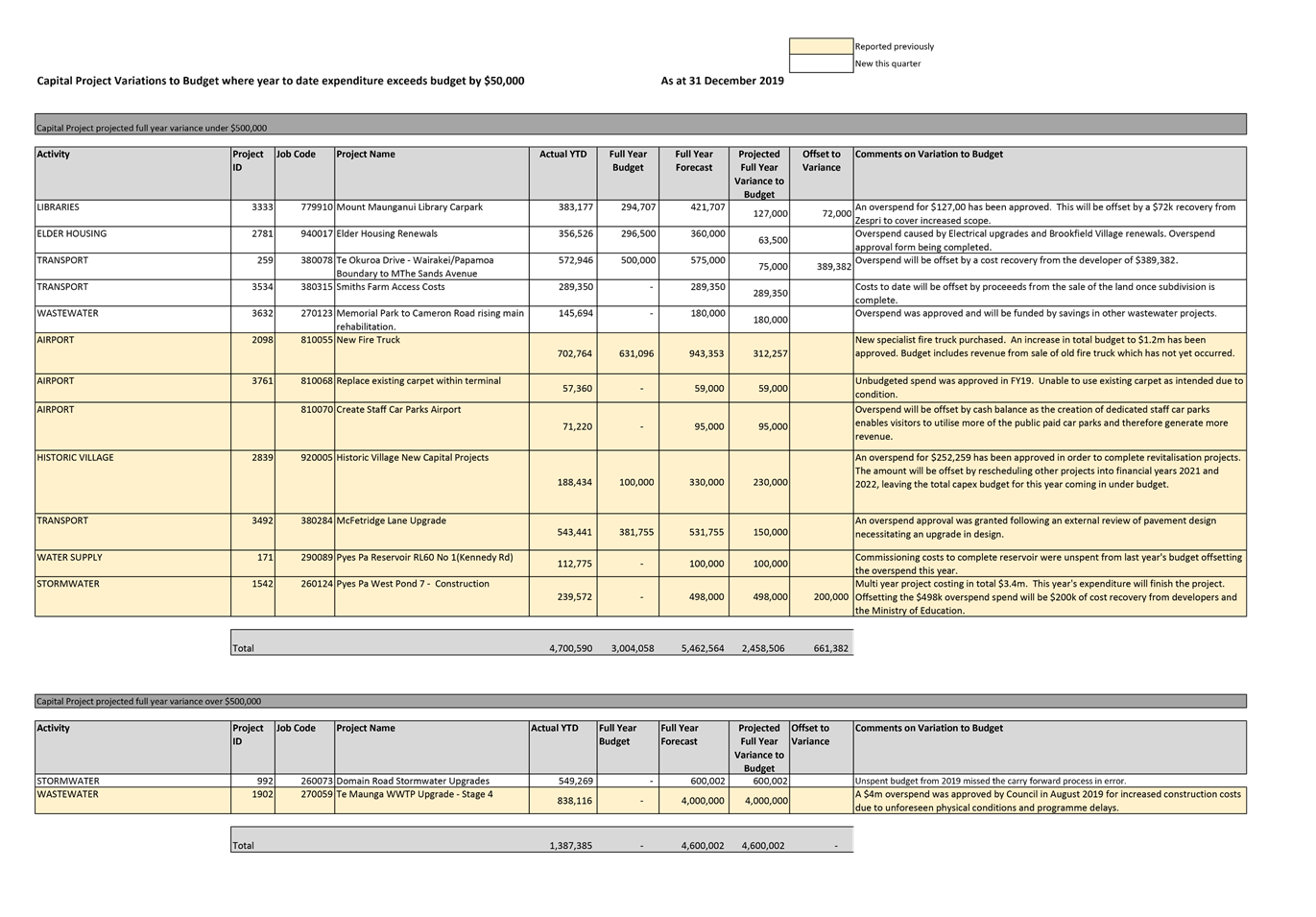

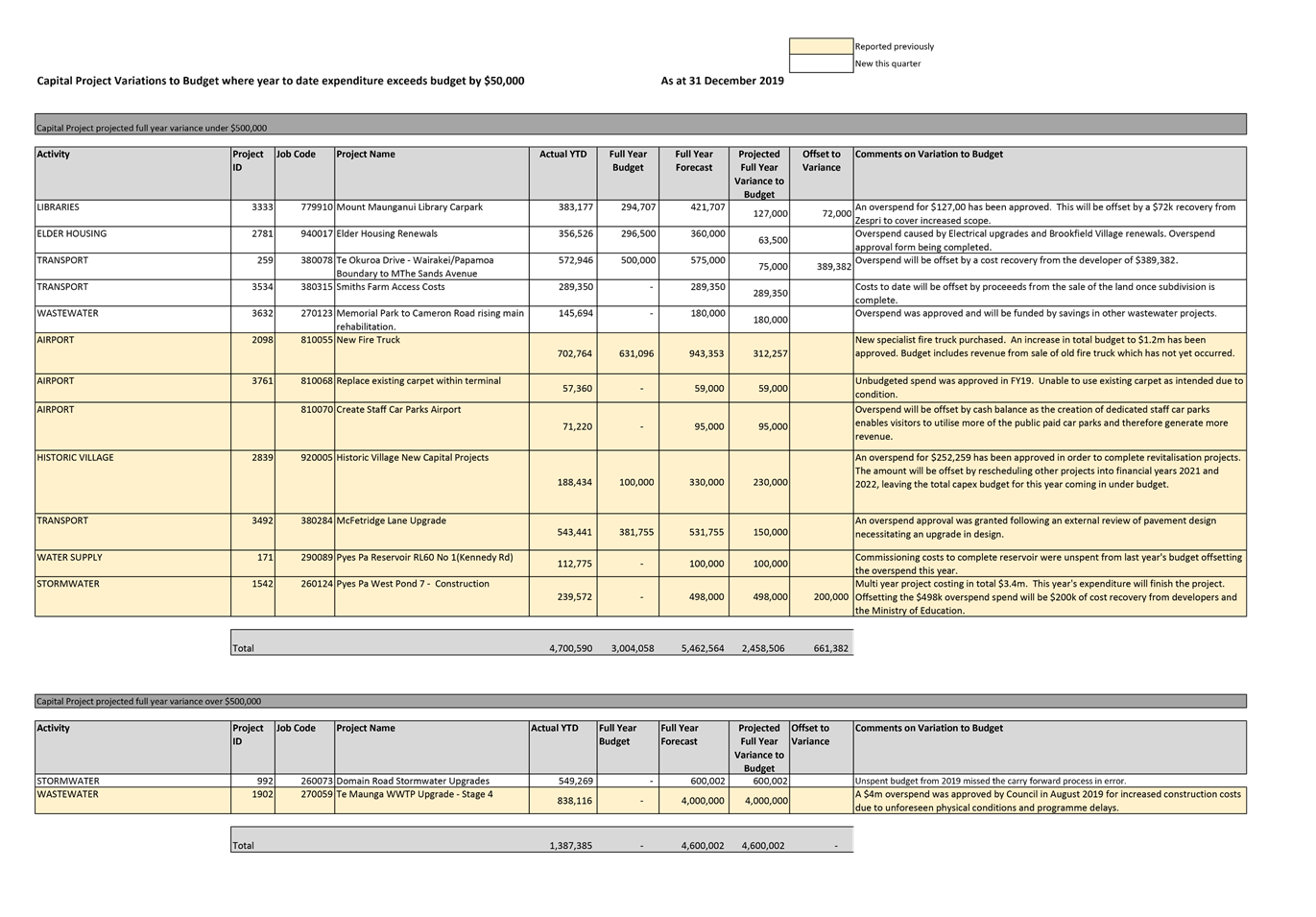

d) Financial Overspends table (Attachment 2)

shows the projects forecast to be overspent this financial year, which

currently total $7m. The main project overspend is the multi-year Te

Maunga wastewater plant upgrade, which has a projected overspend to budget for

the portion of work carried out this year of $4m. This overspend was approved

by Council in August 2019.

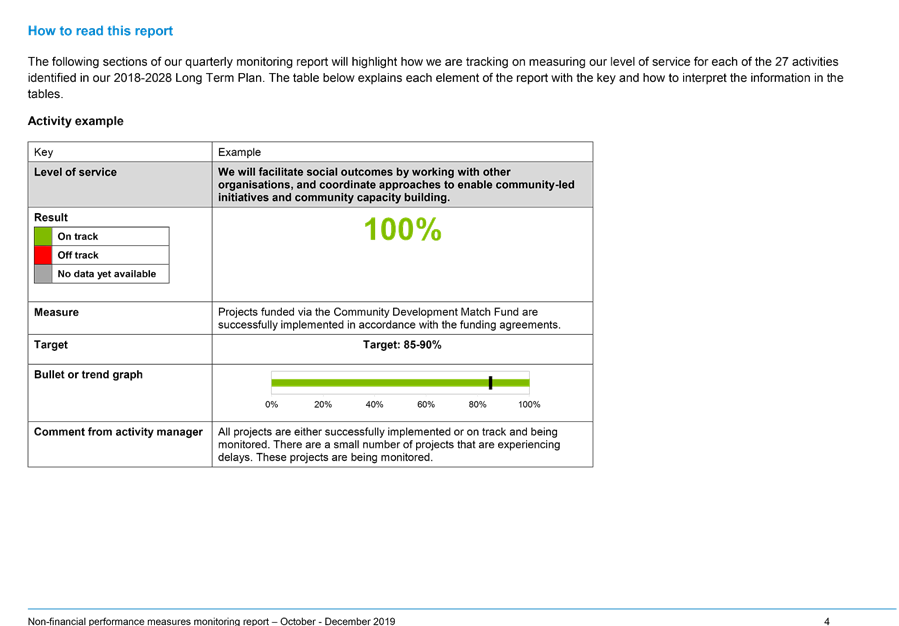

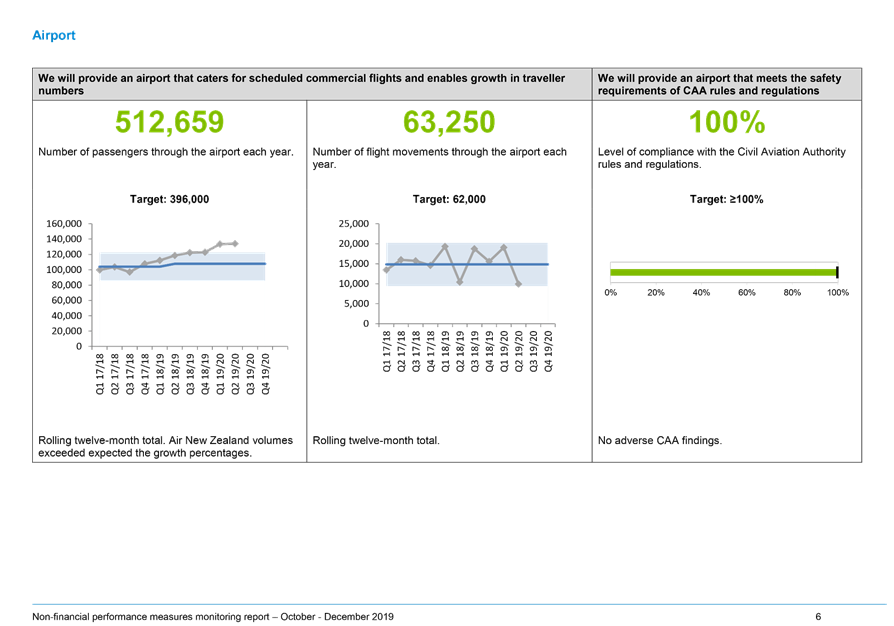

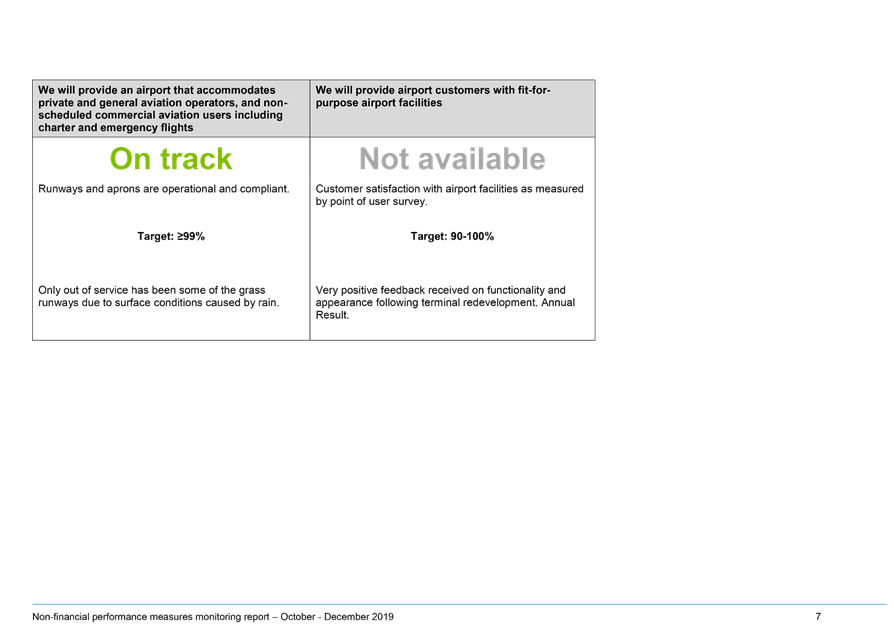

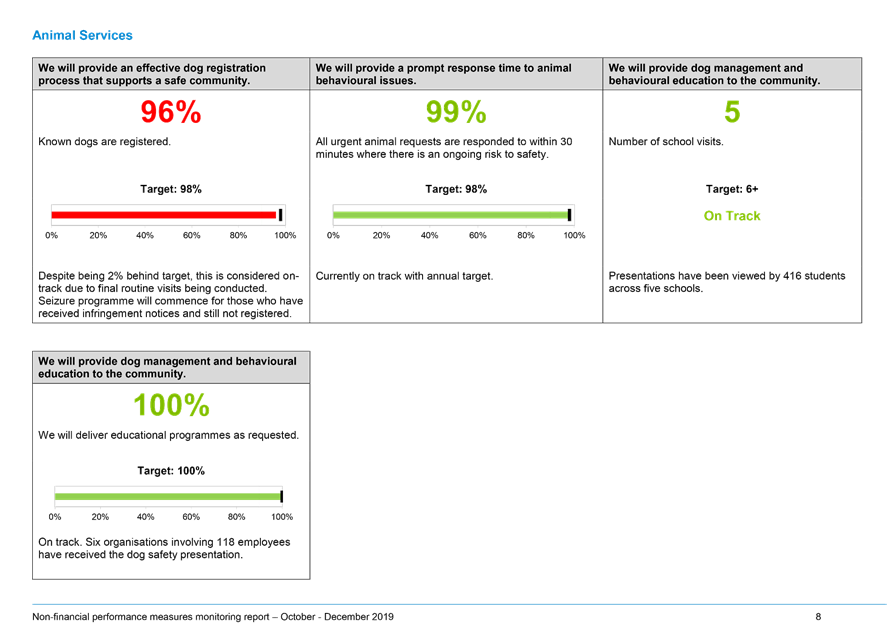

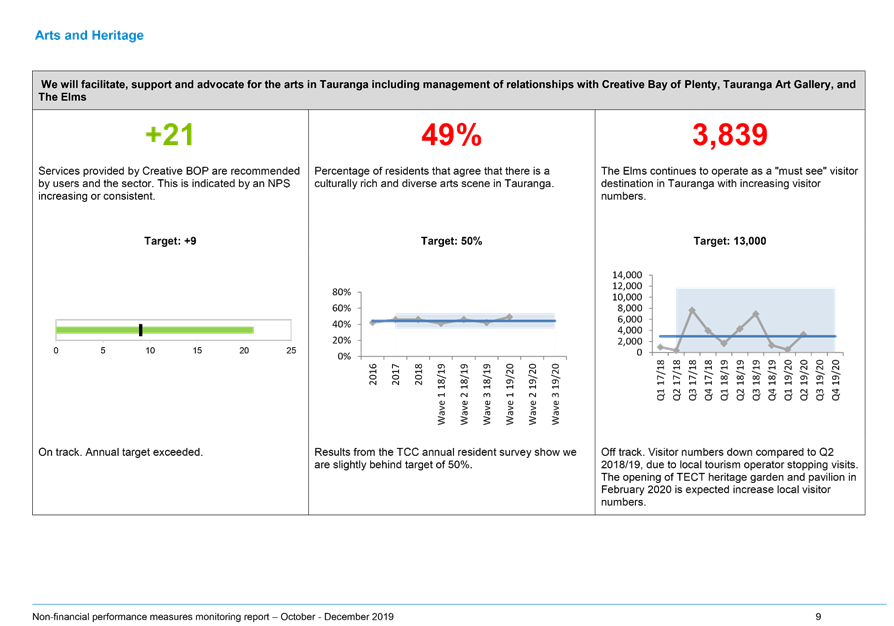

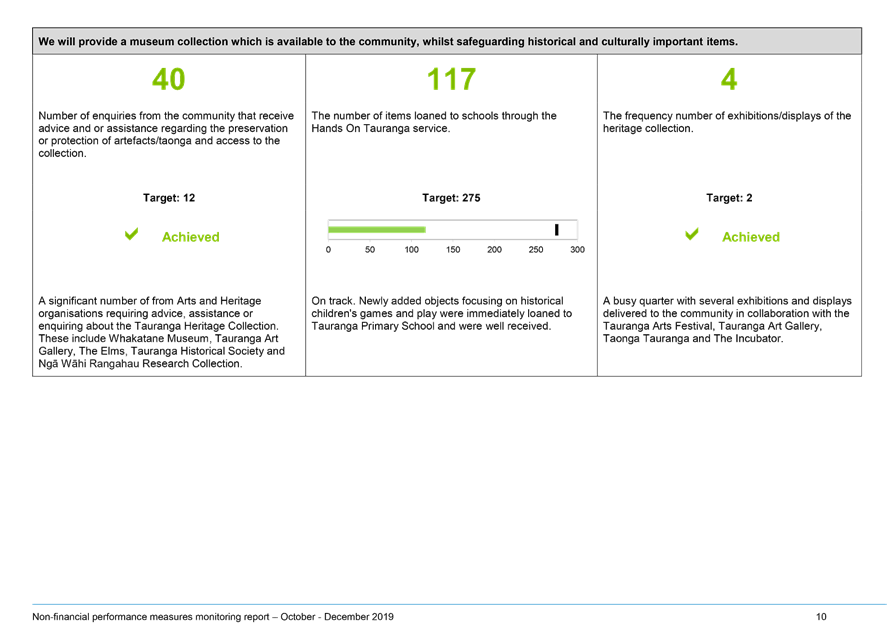

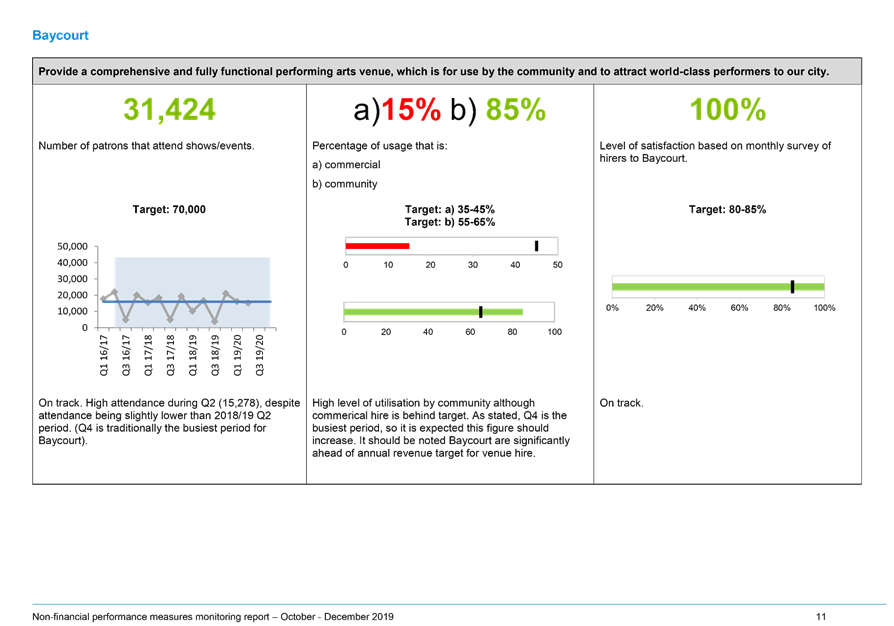

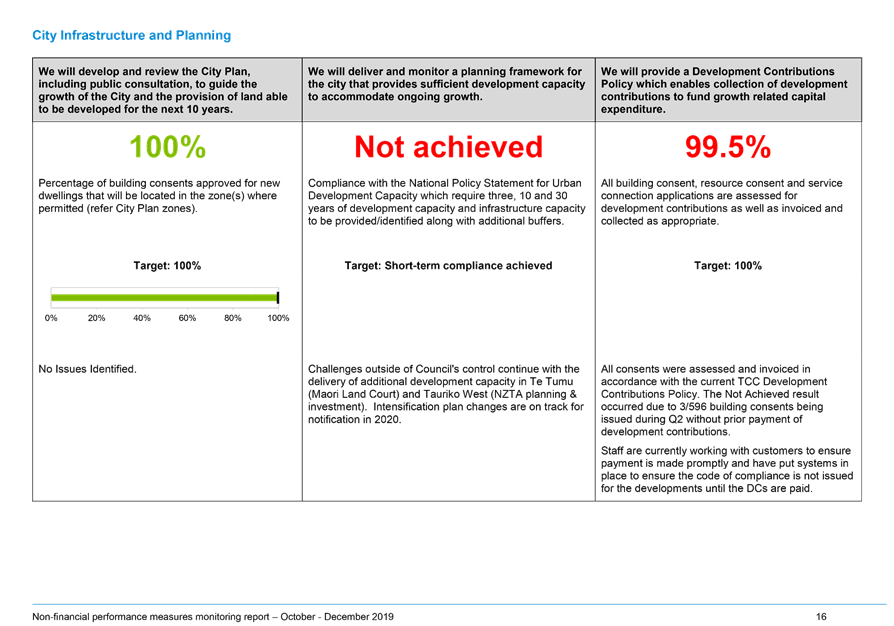

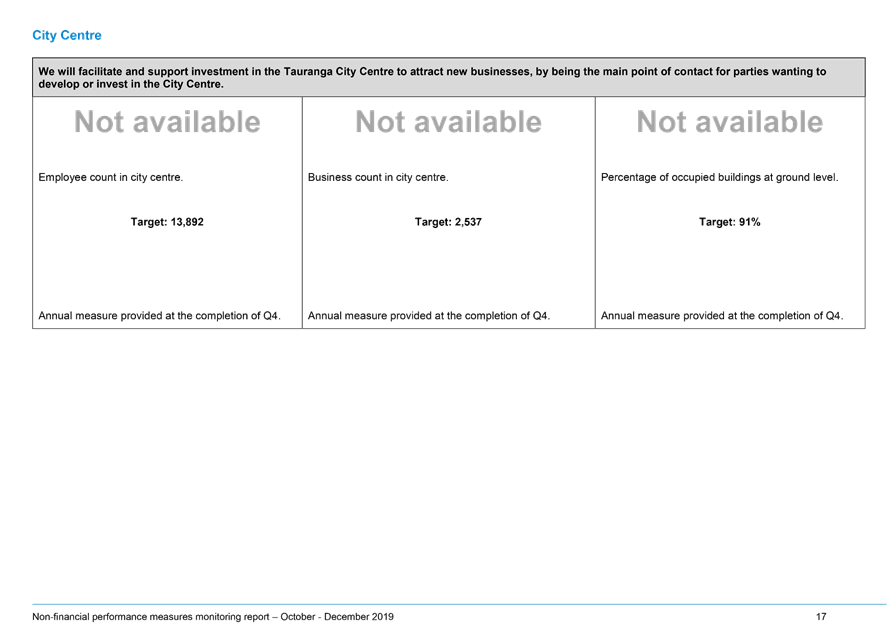

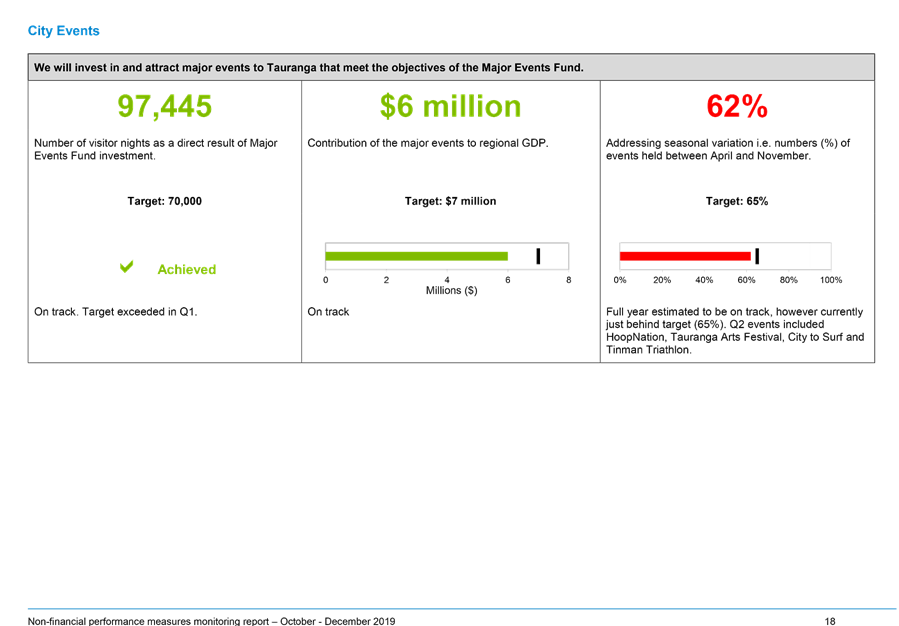

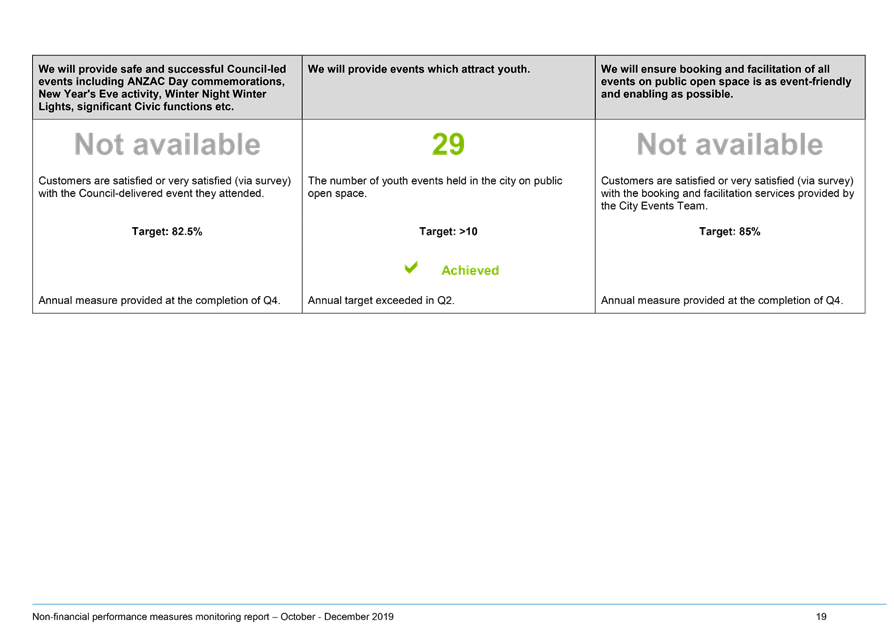

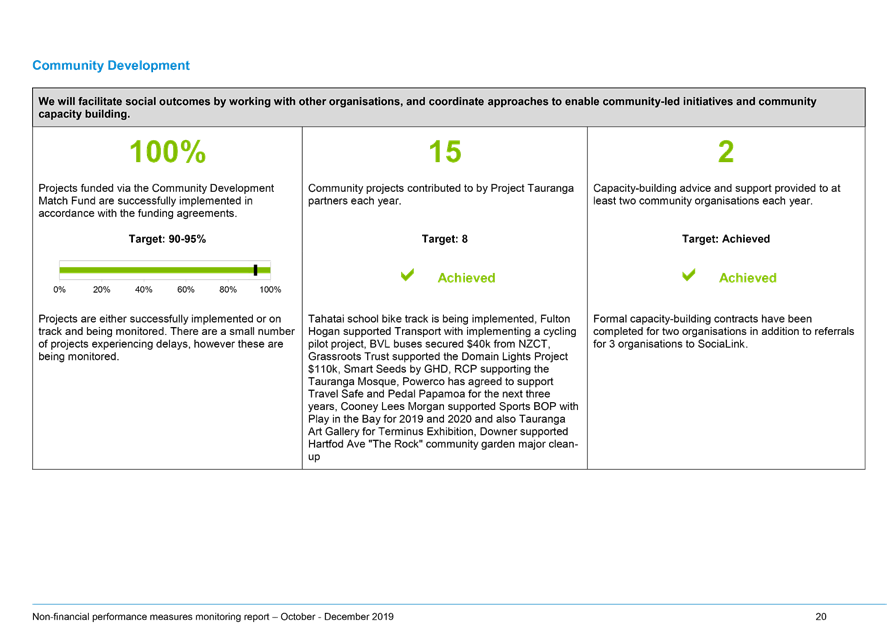

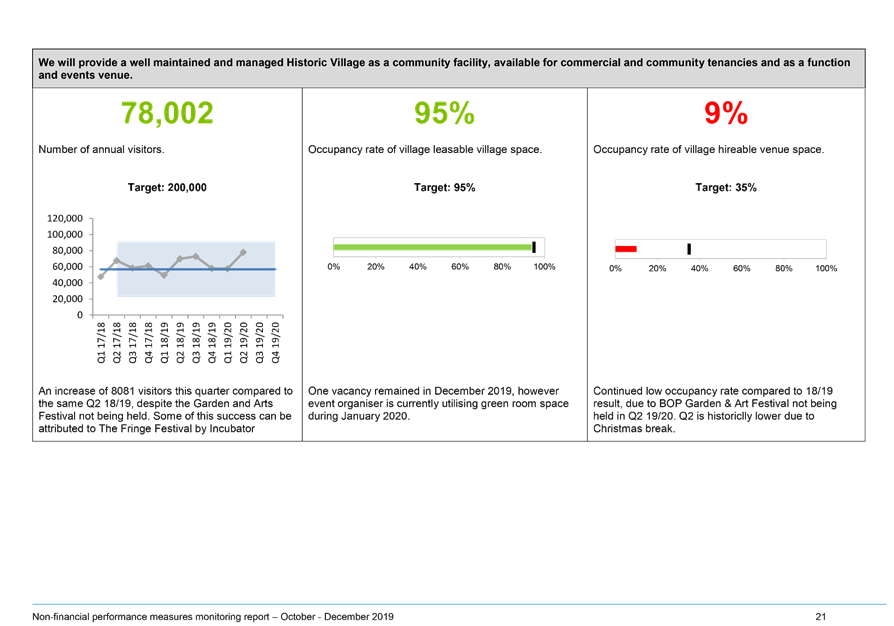

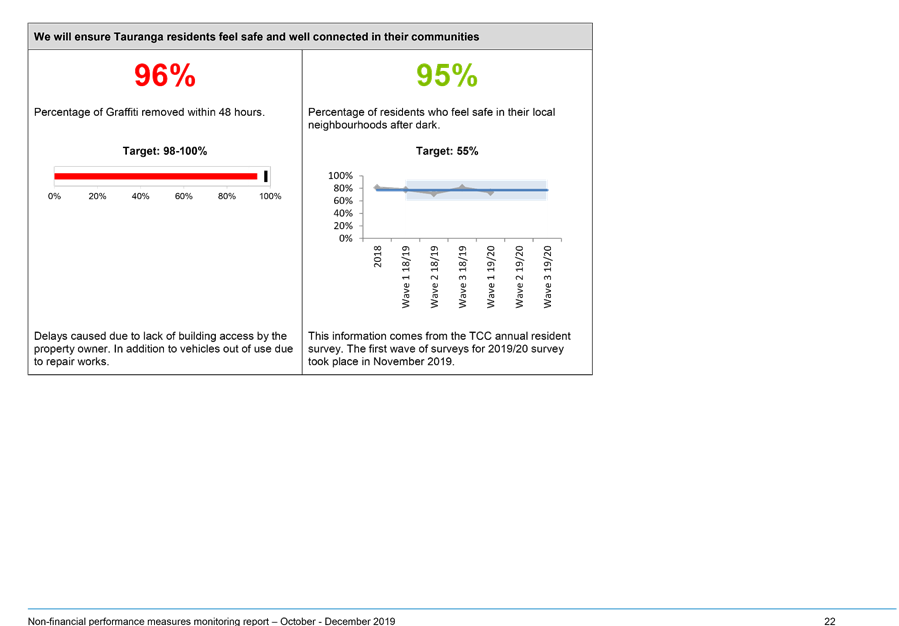

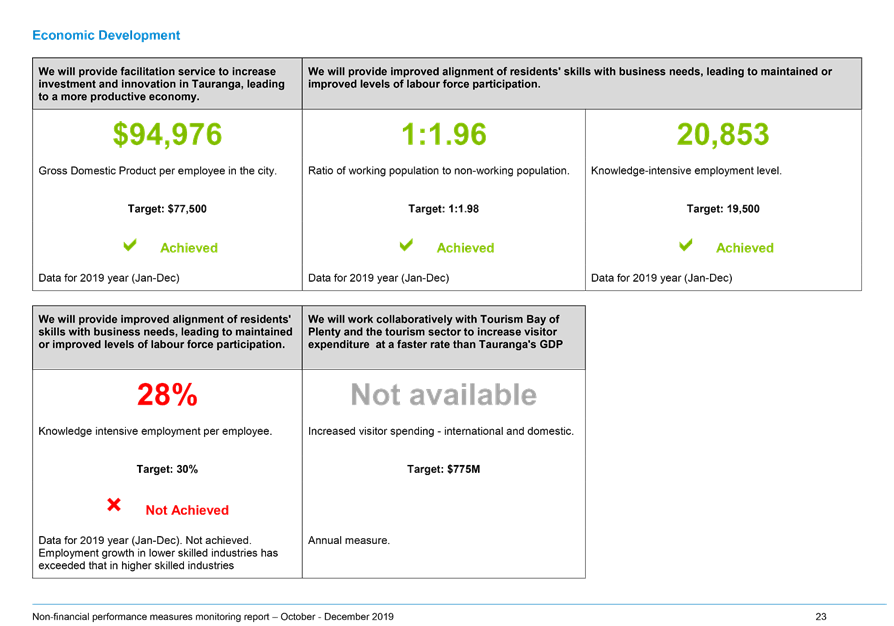

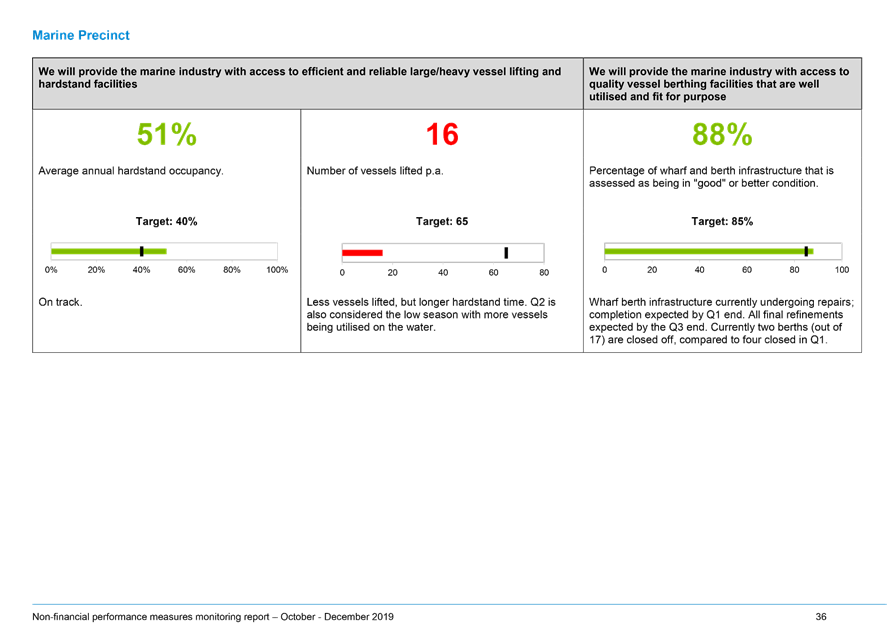

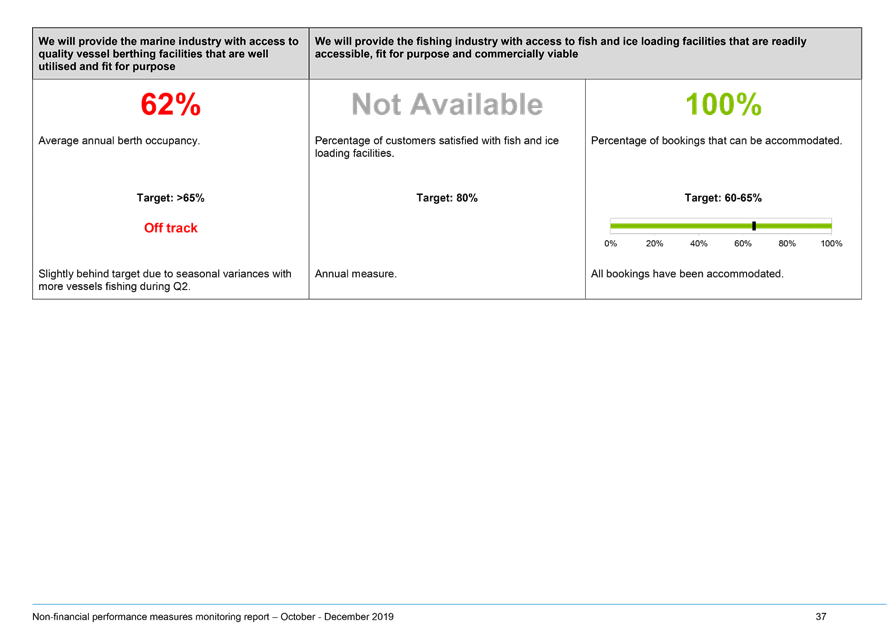

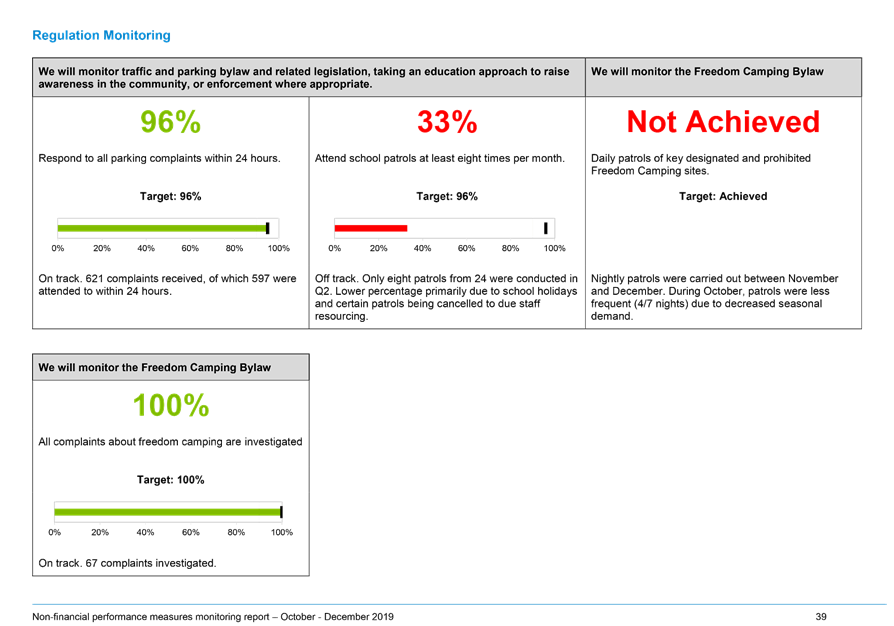

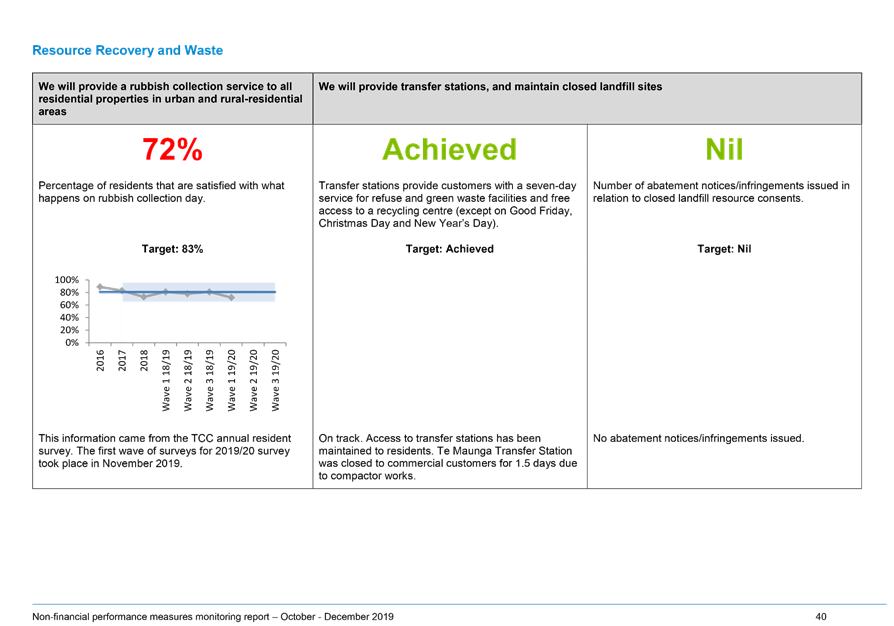

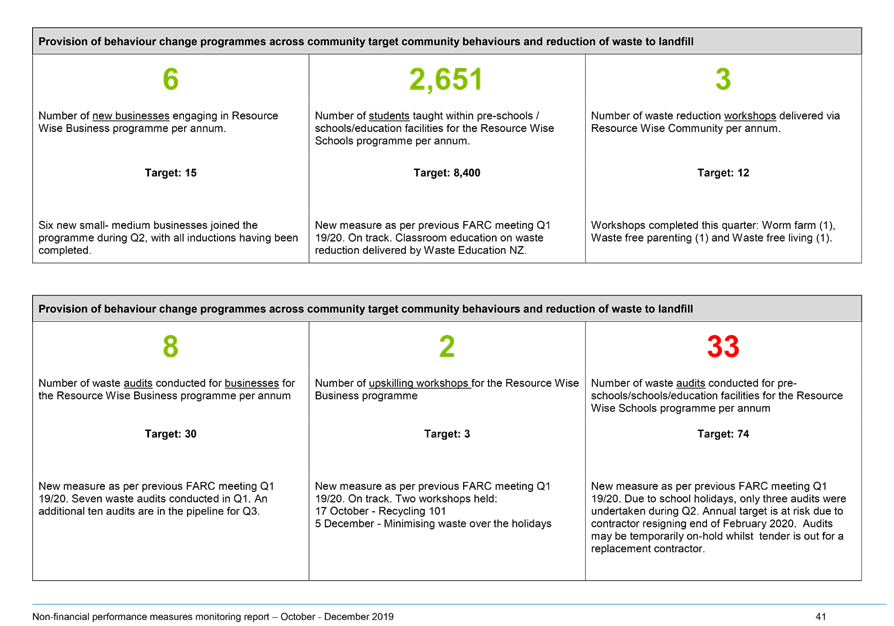

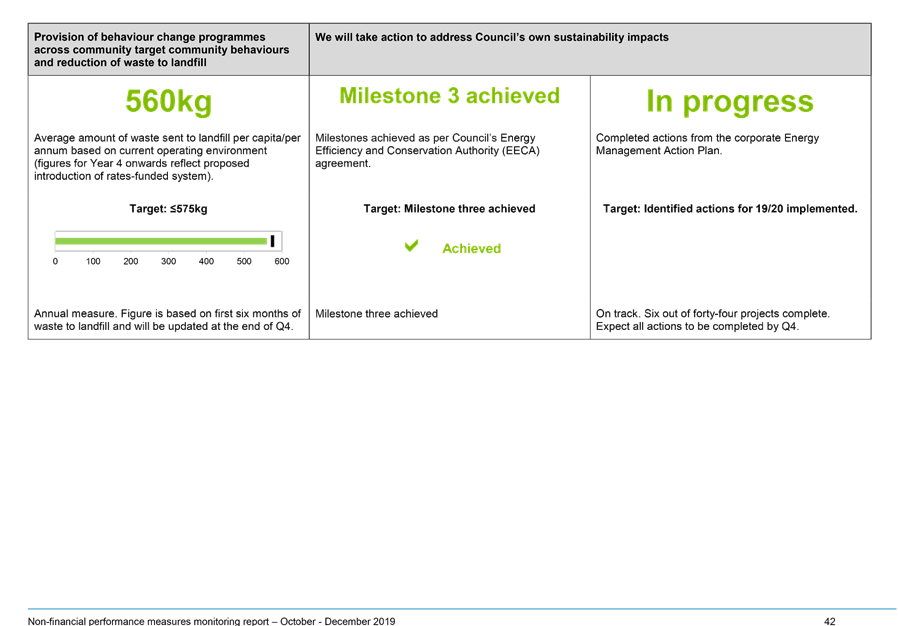

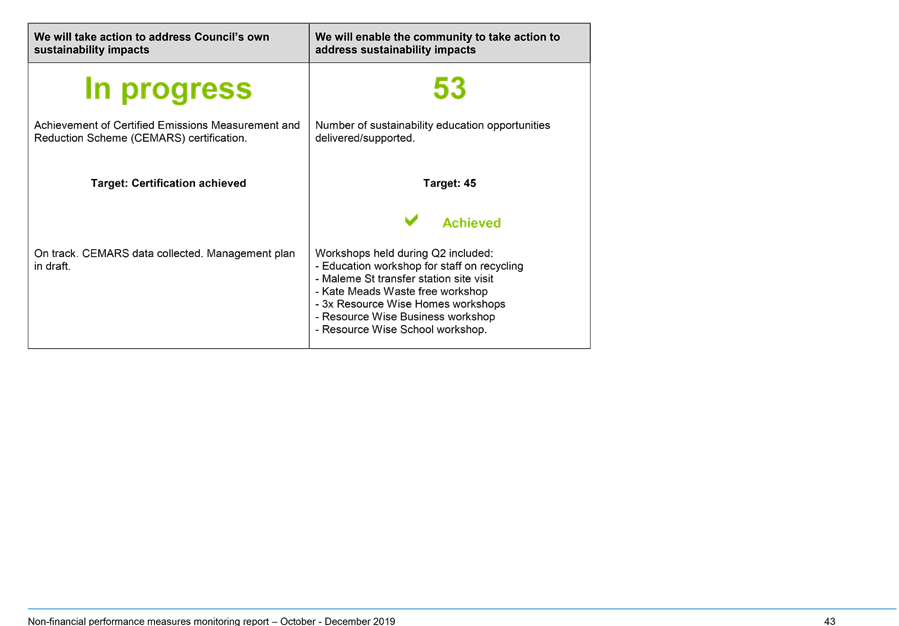

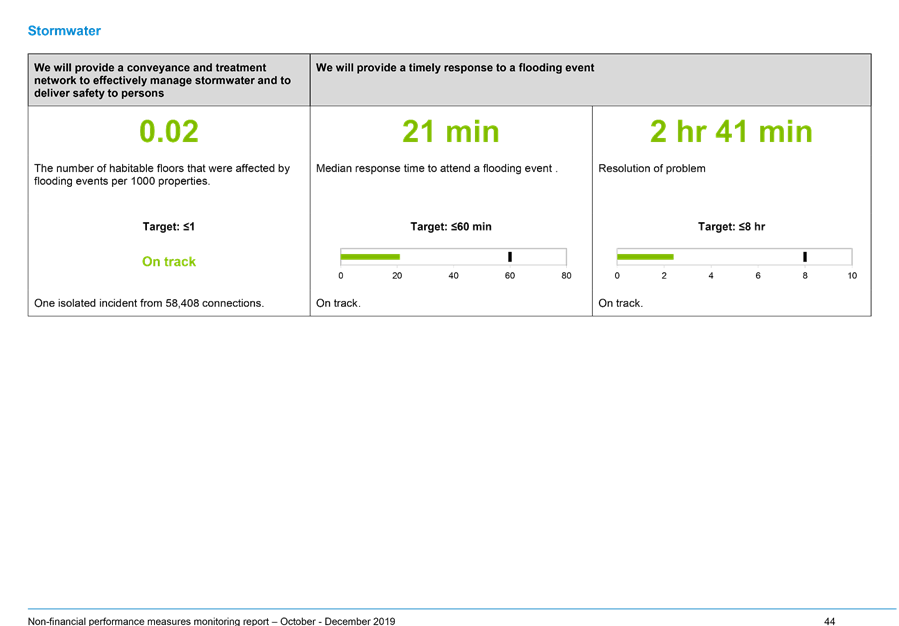

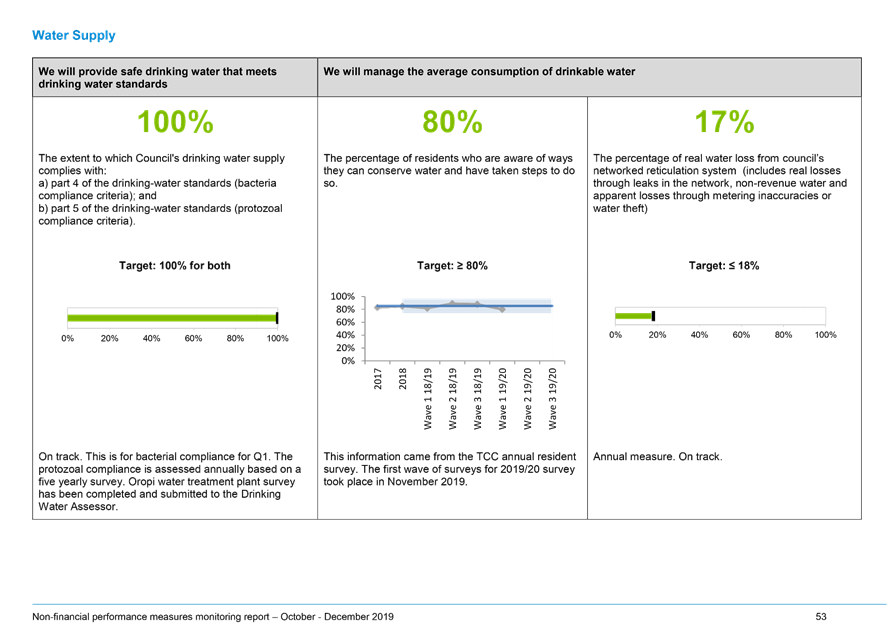

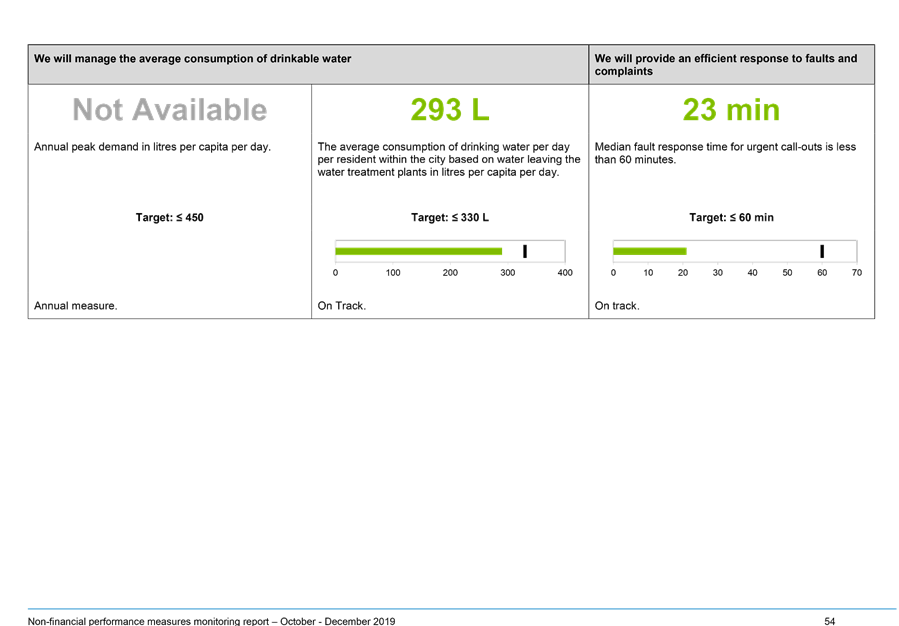

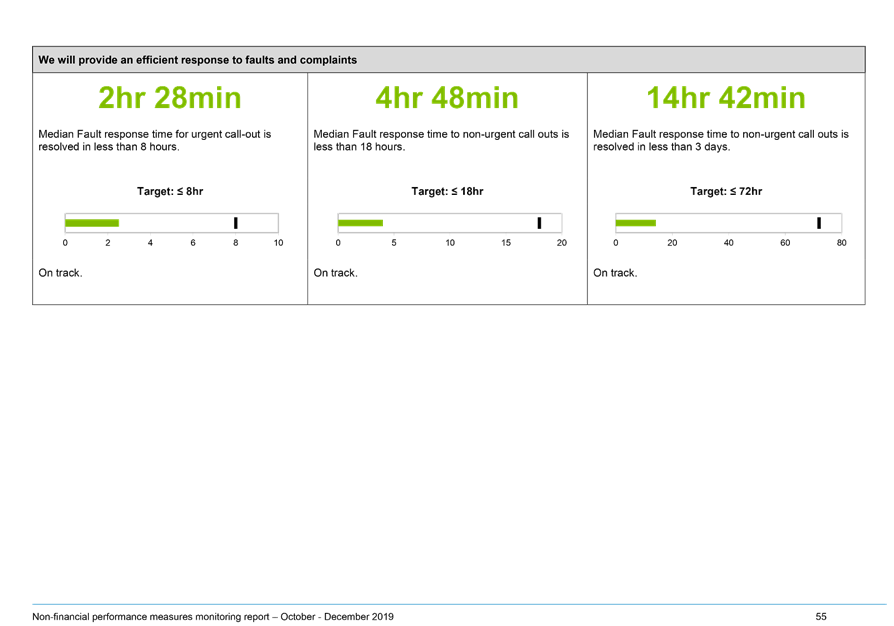

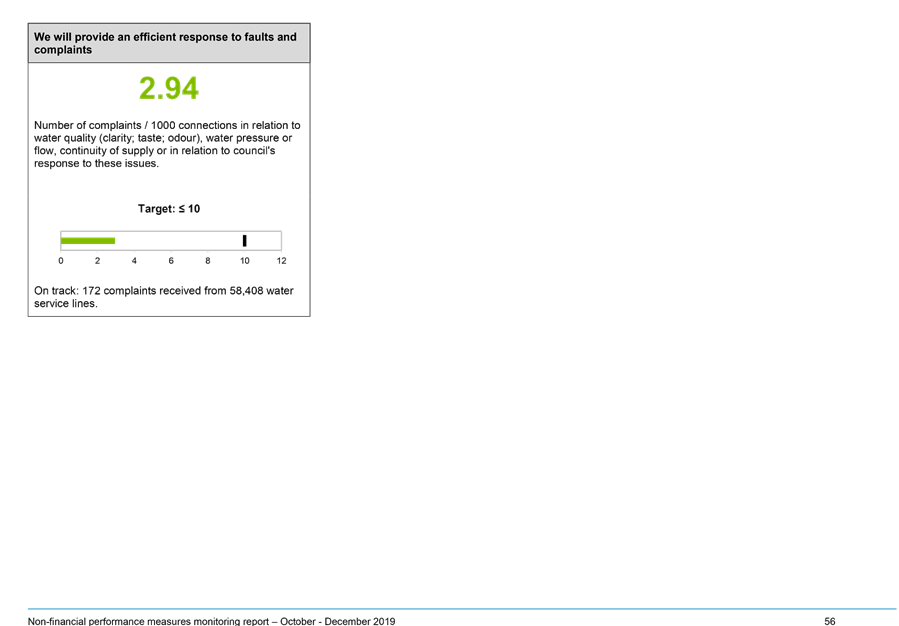

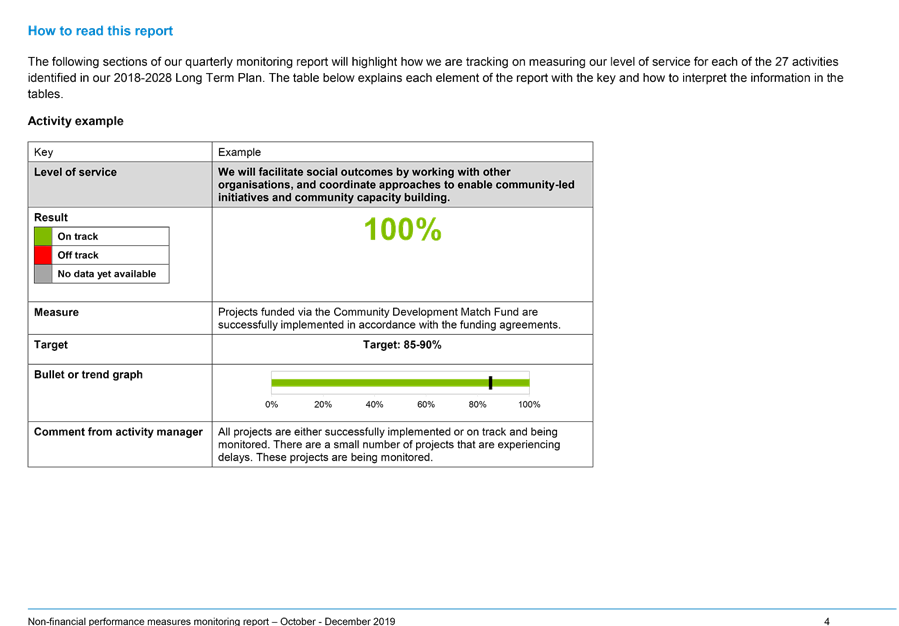

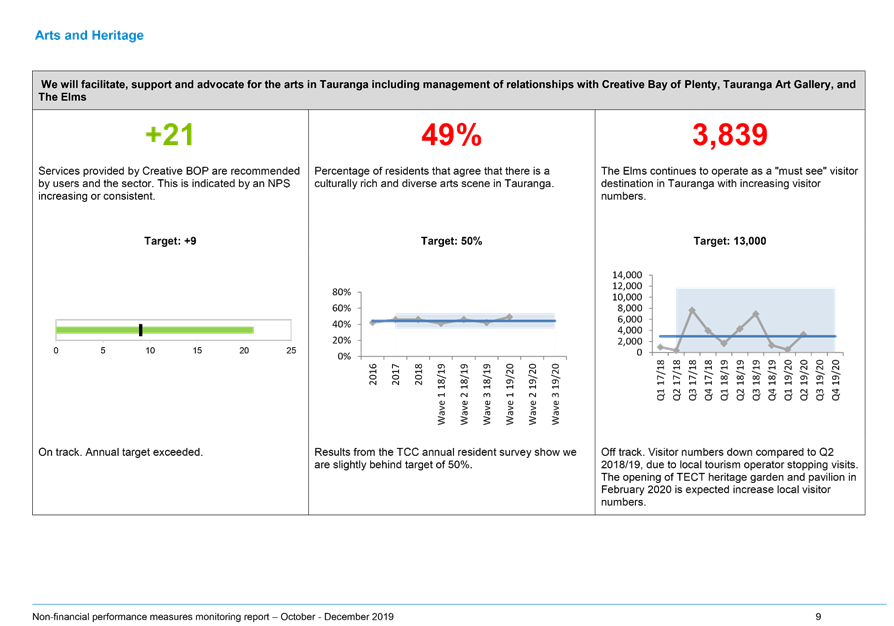

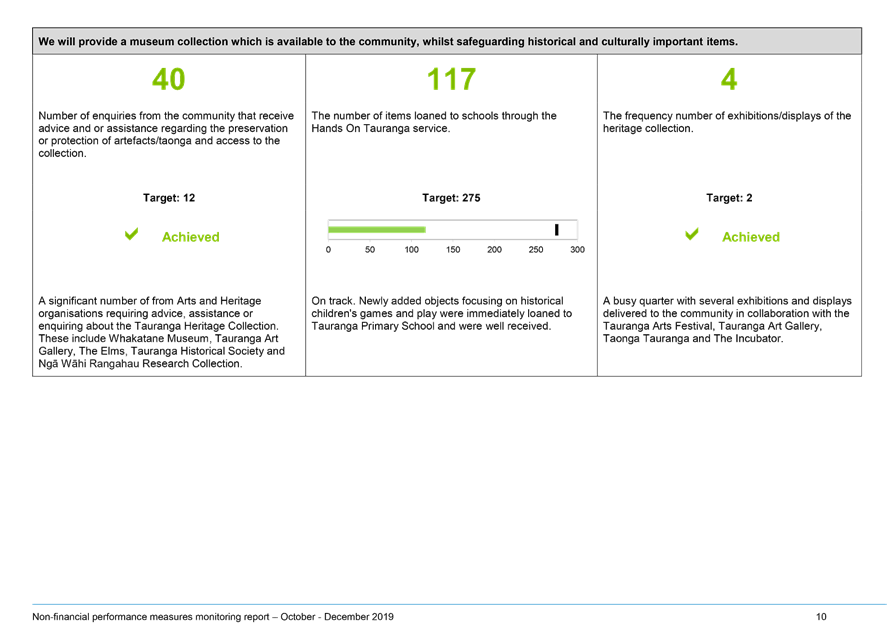

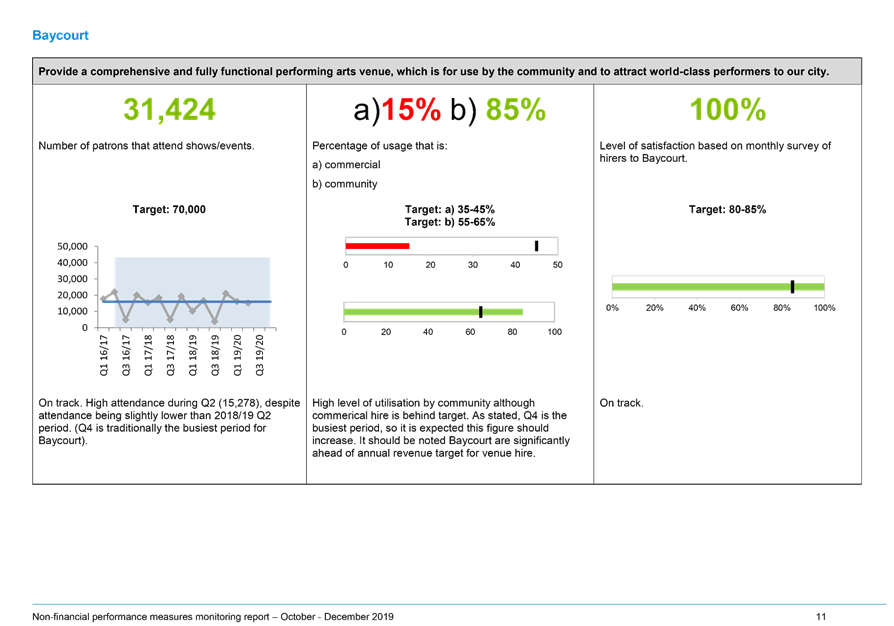

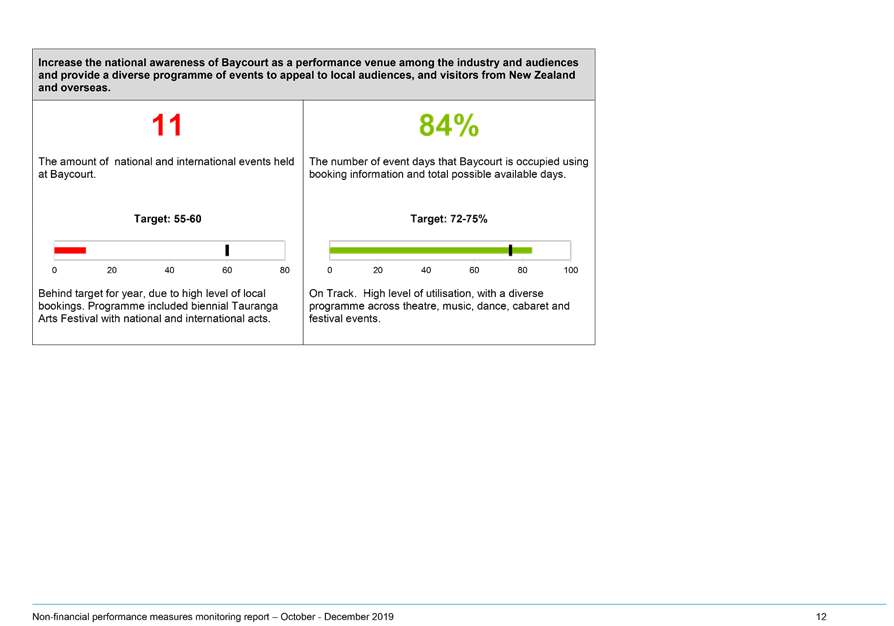

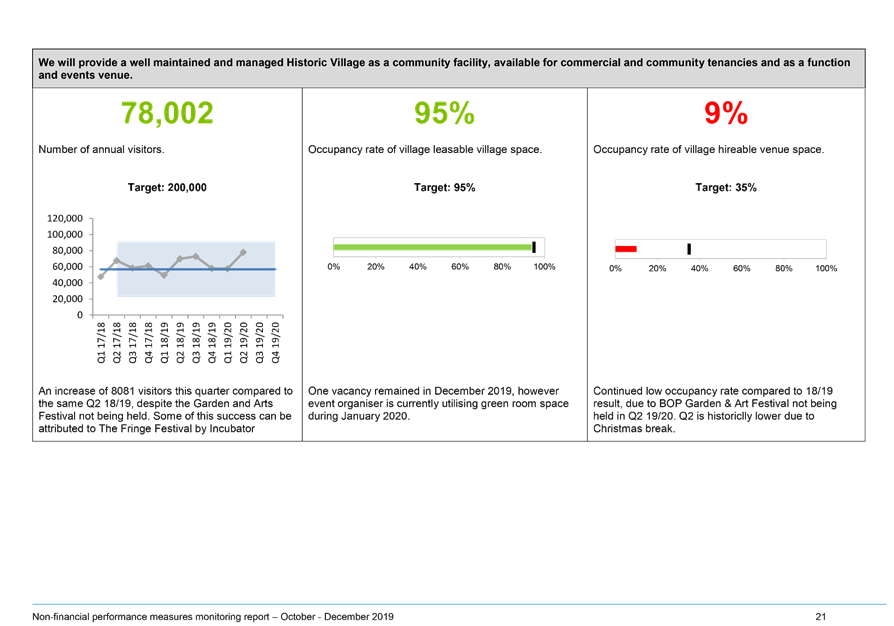

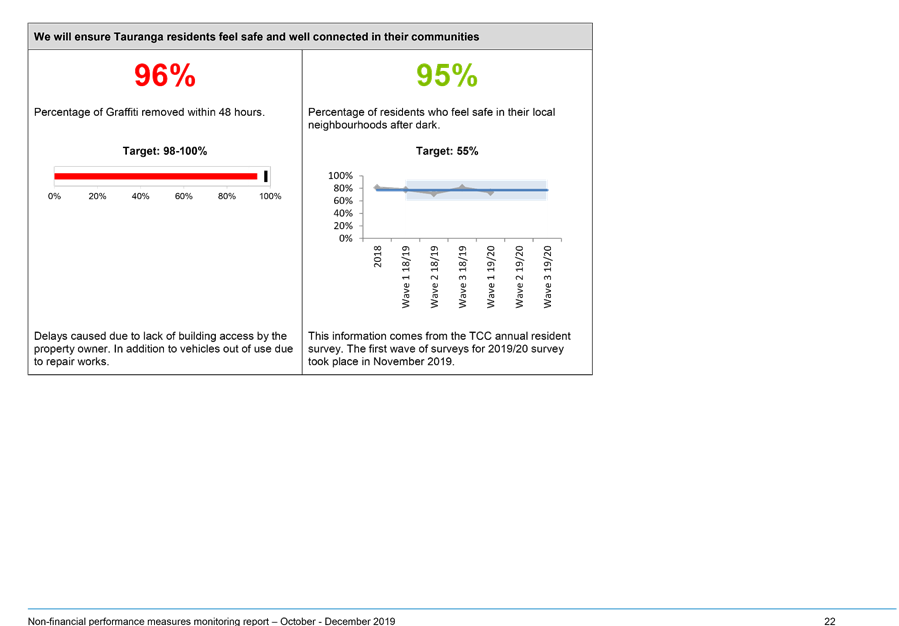

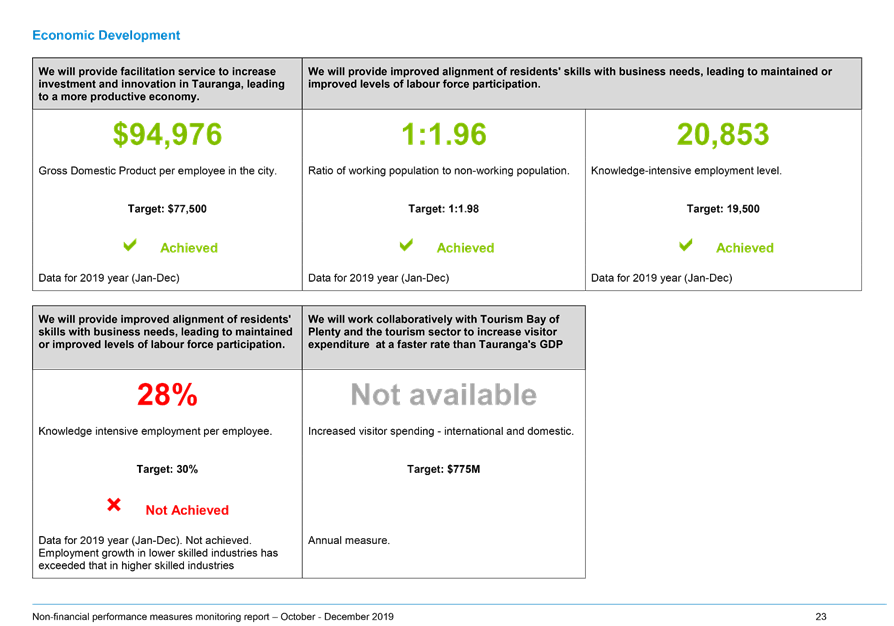

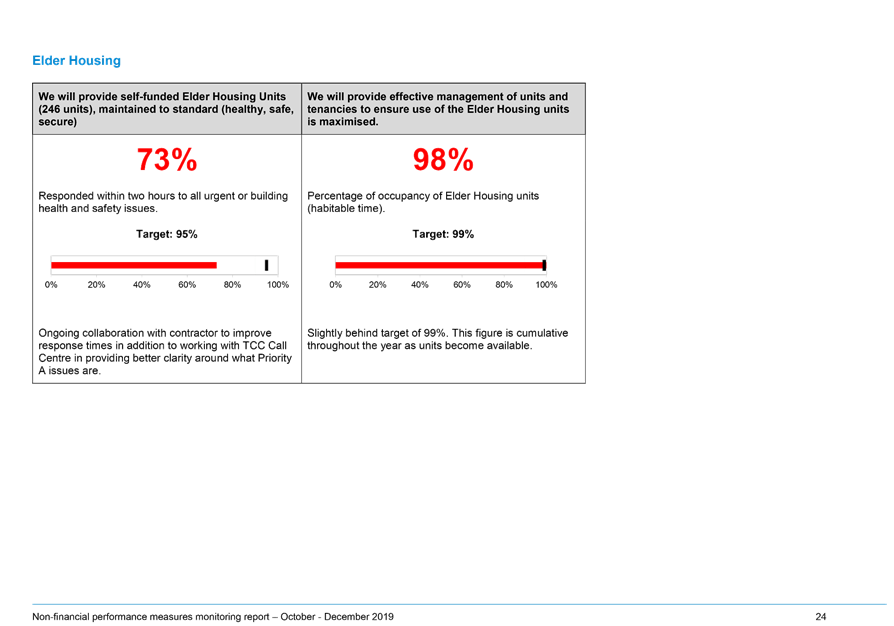

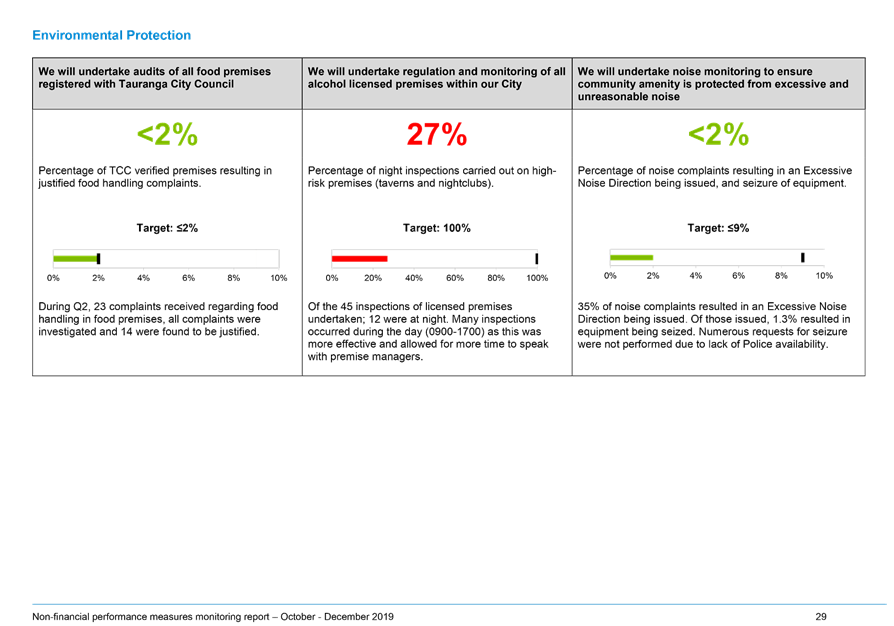

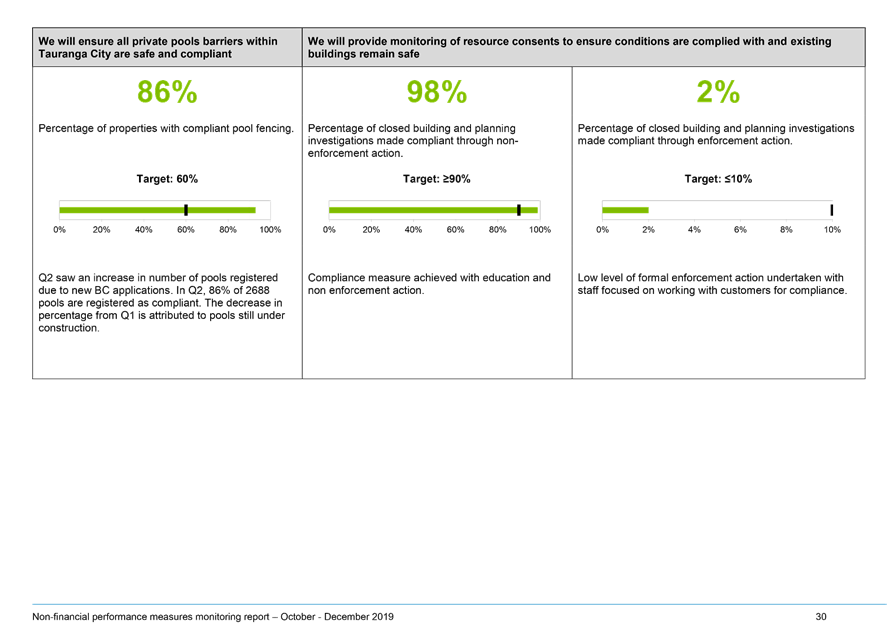

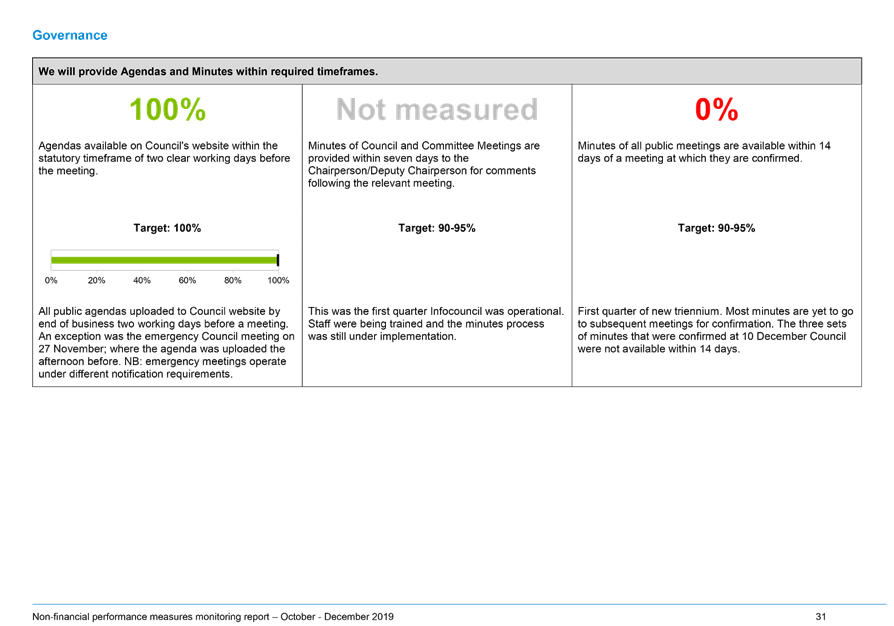

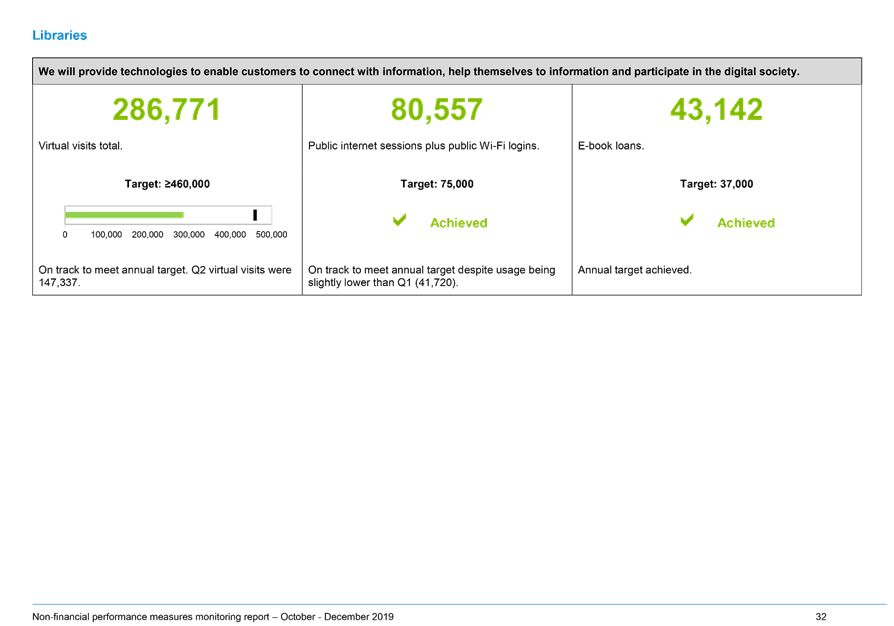

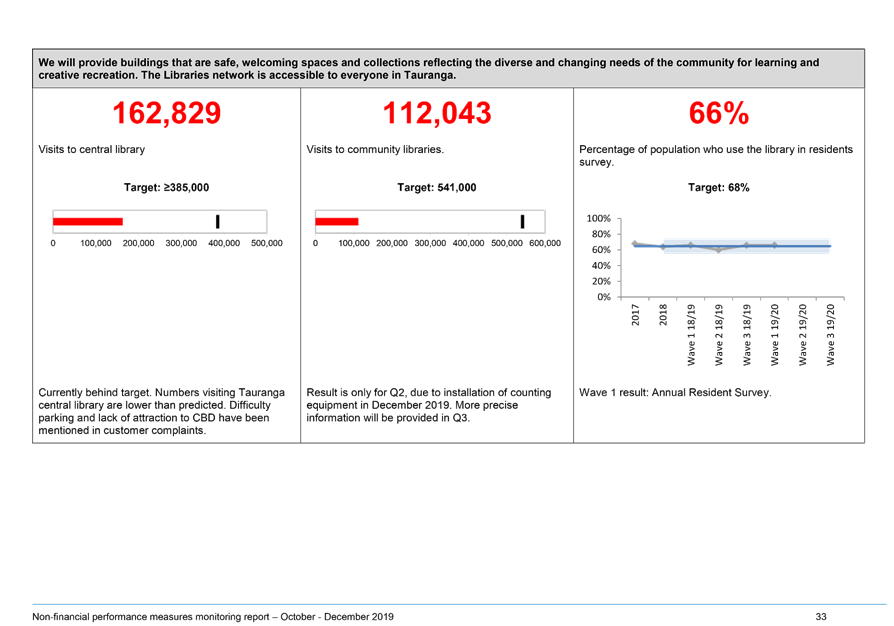

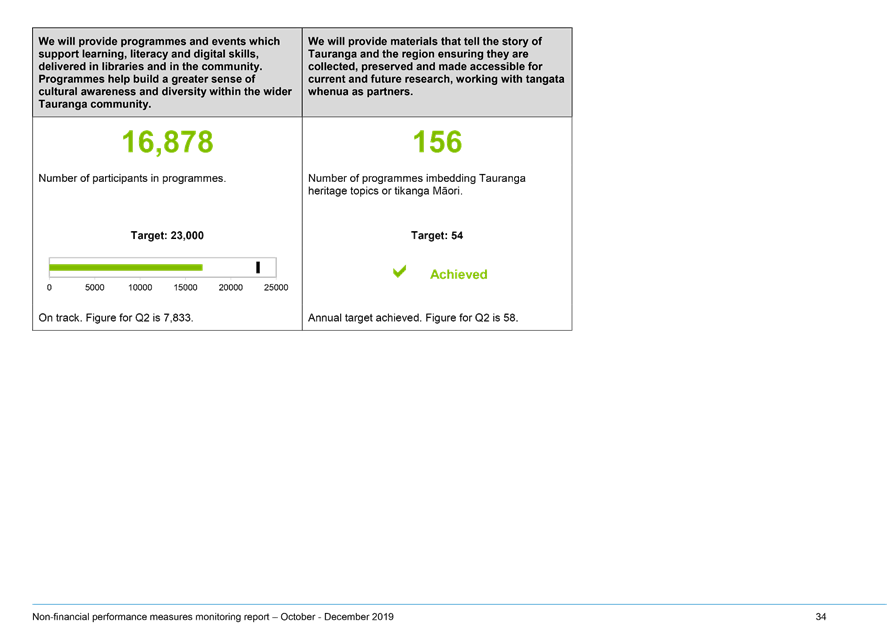

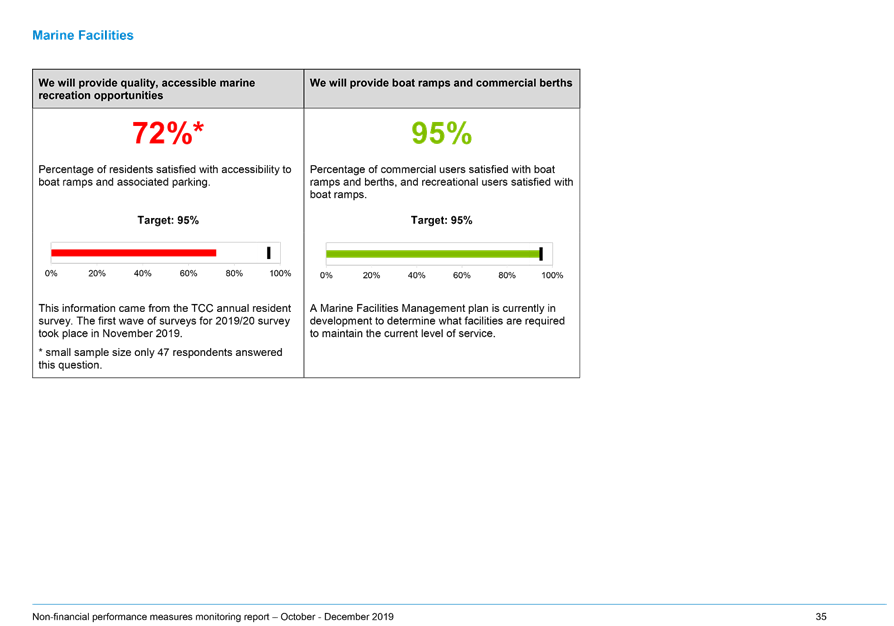

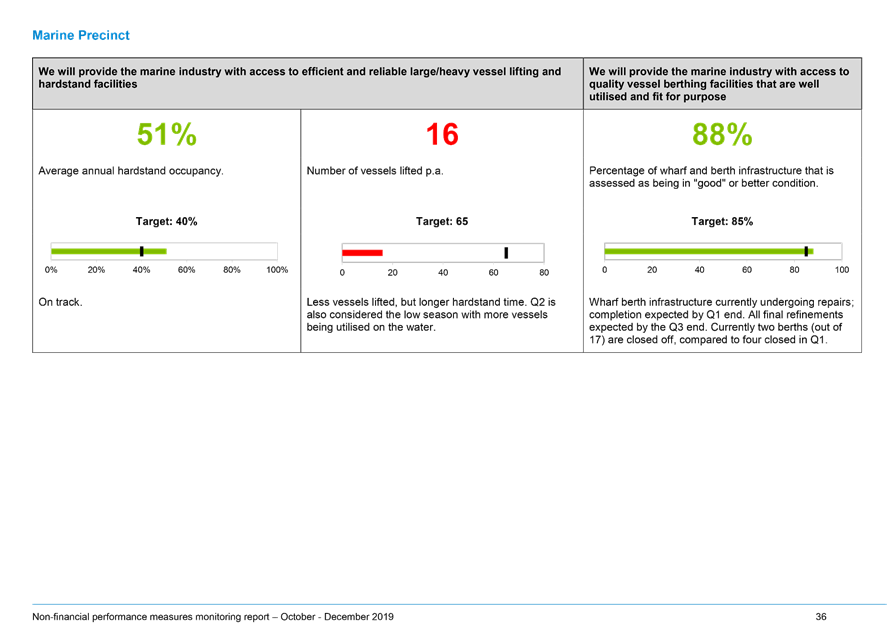

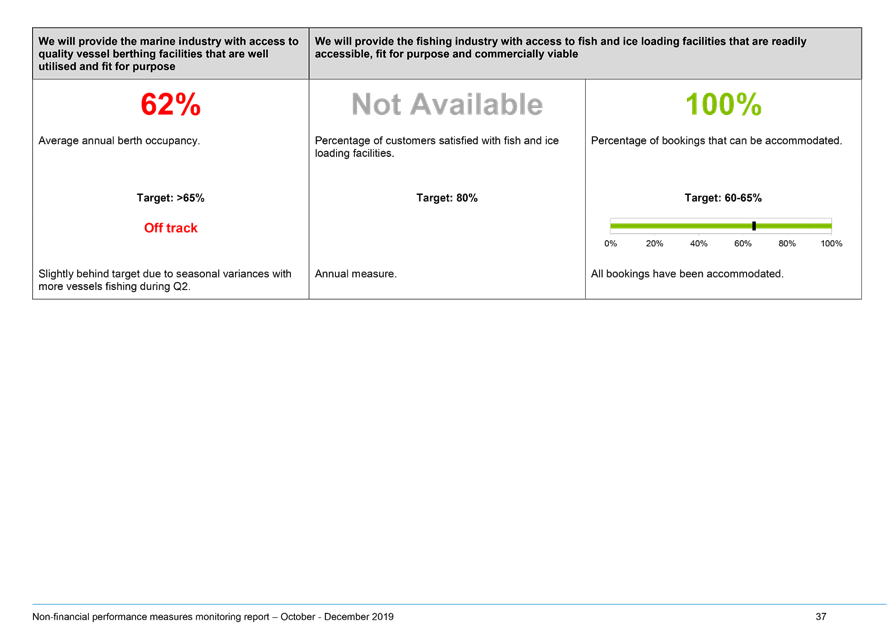

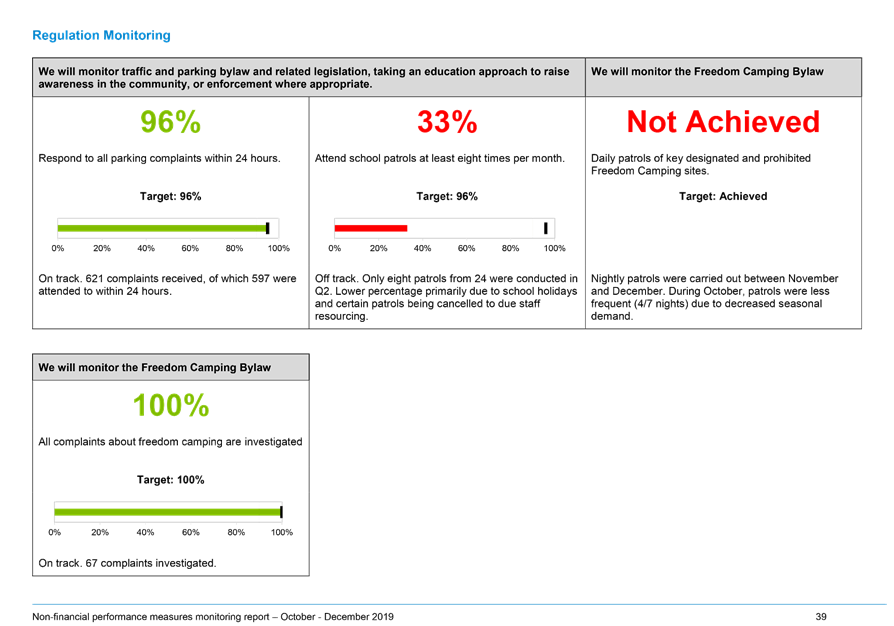

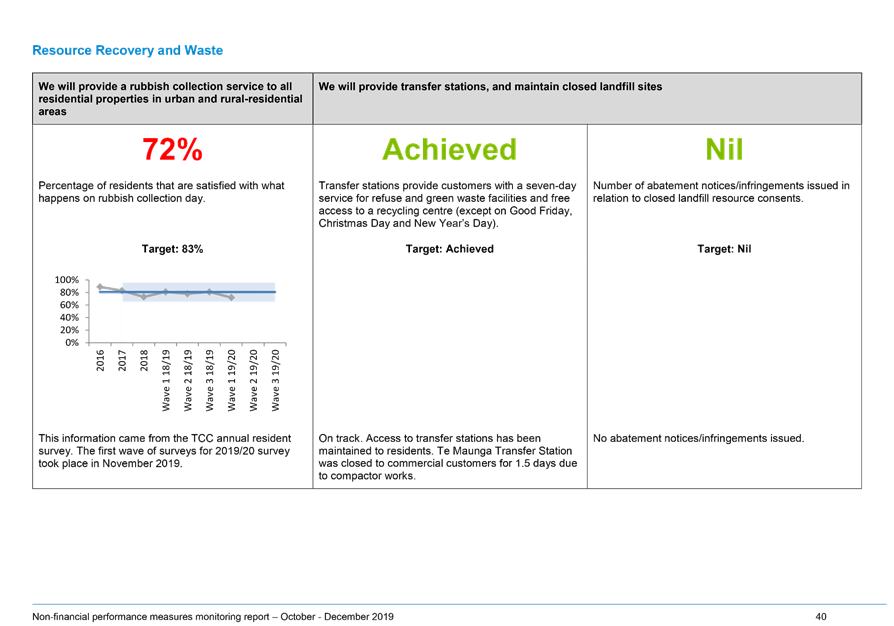

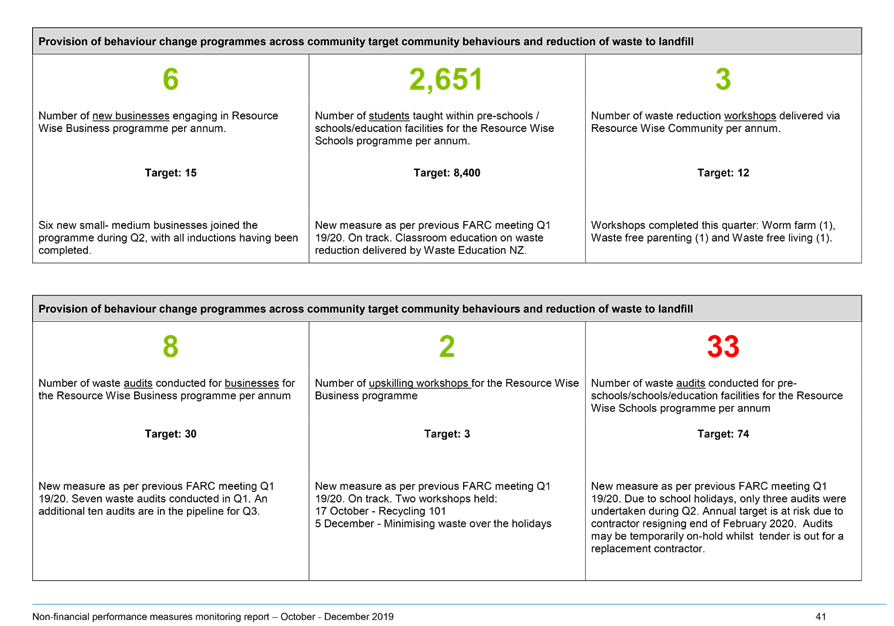

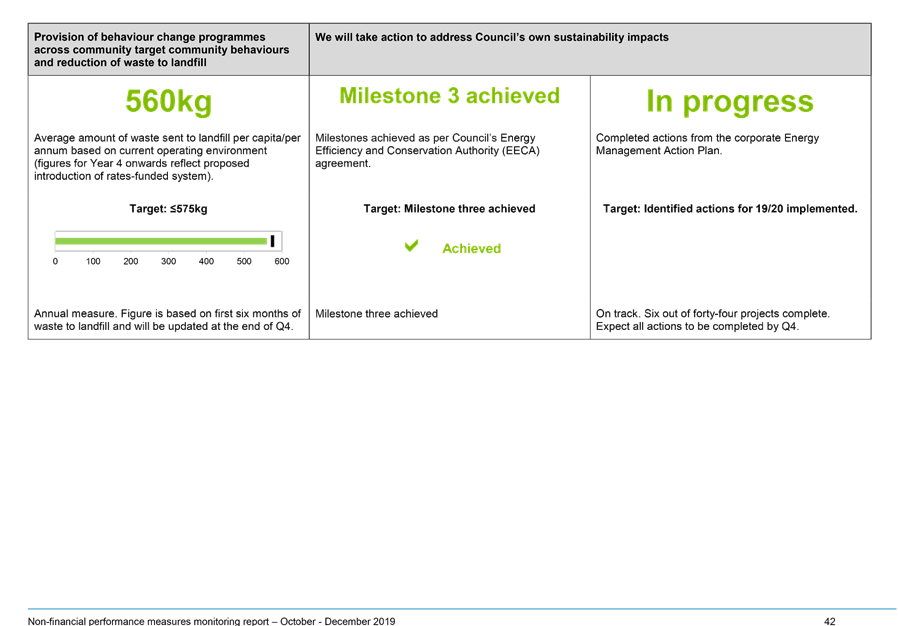

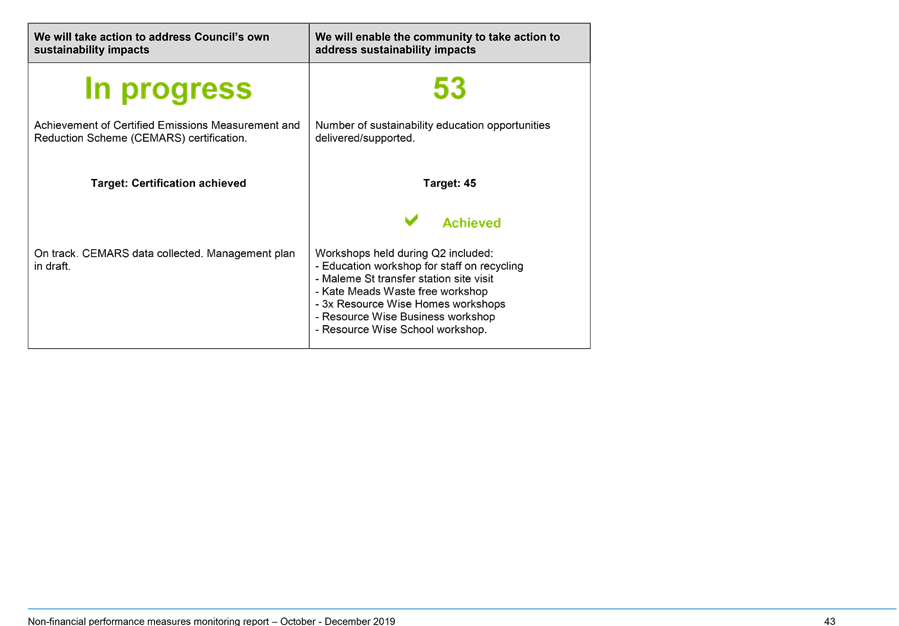

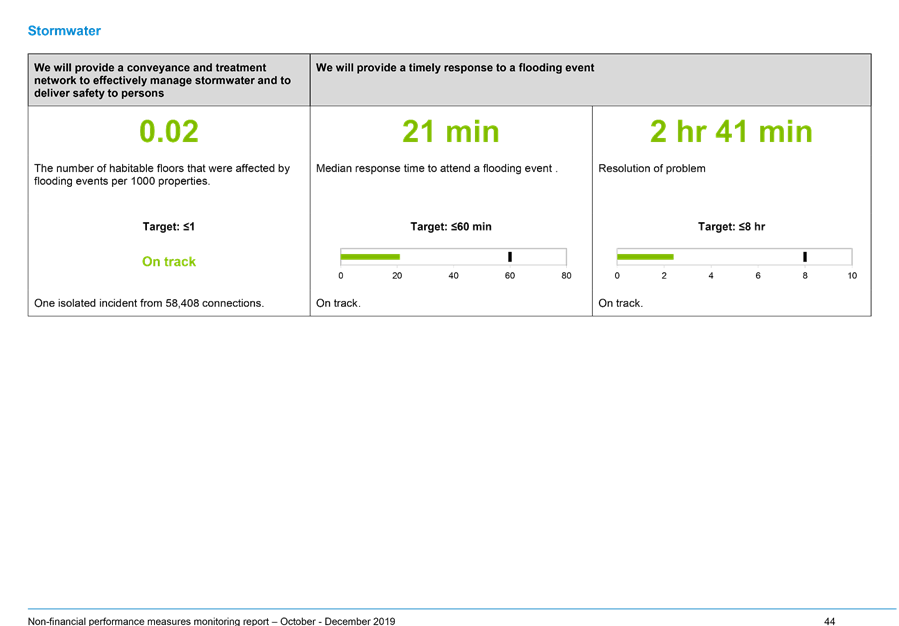

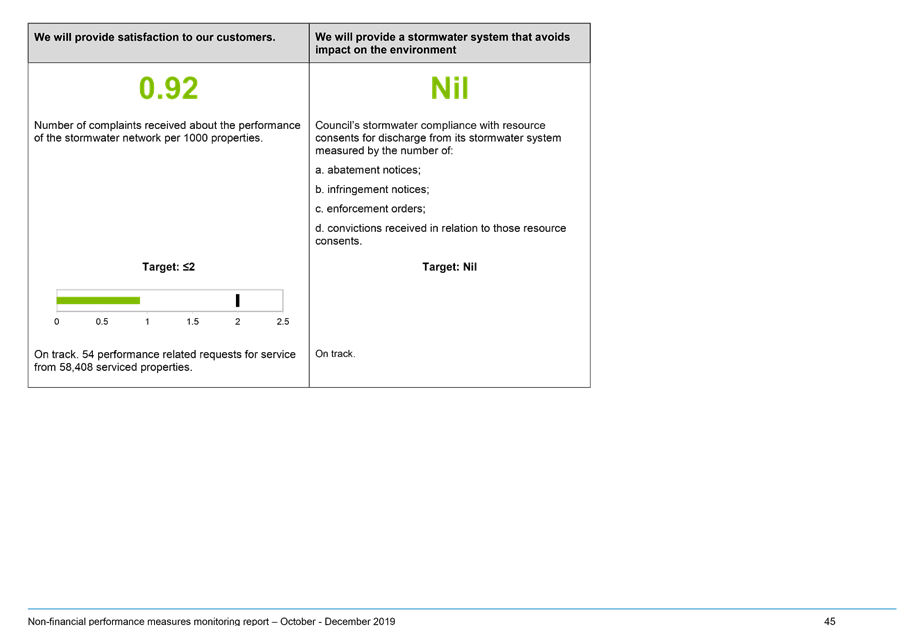

3. Attachment

3 presents how Council and the community are tracking towards achieving

Council’s non-financial performance measures and levels of service.

4. Of

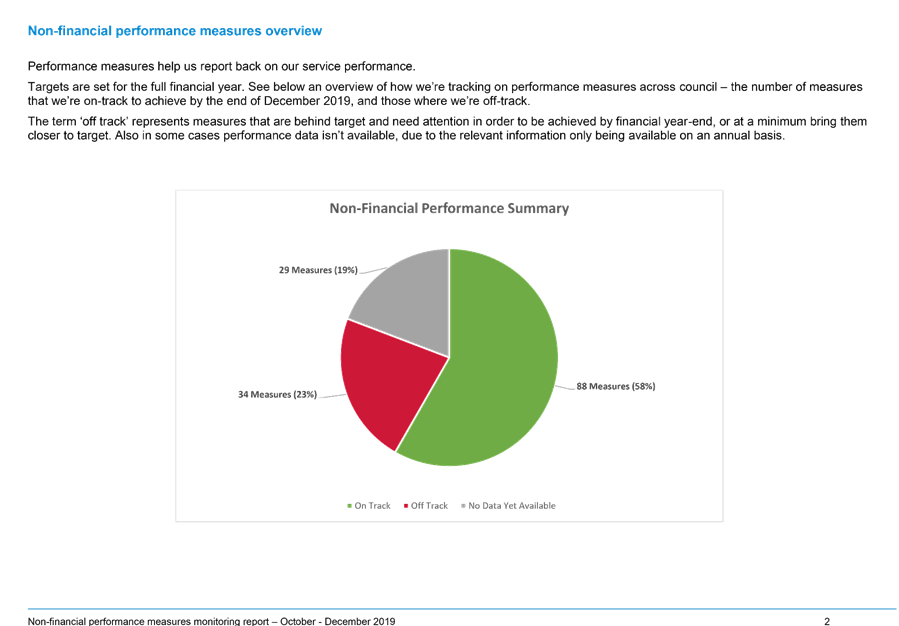

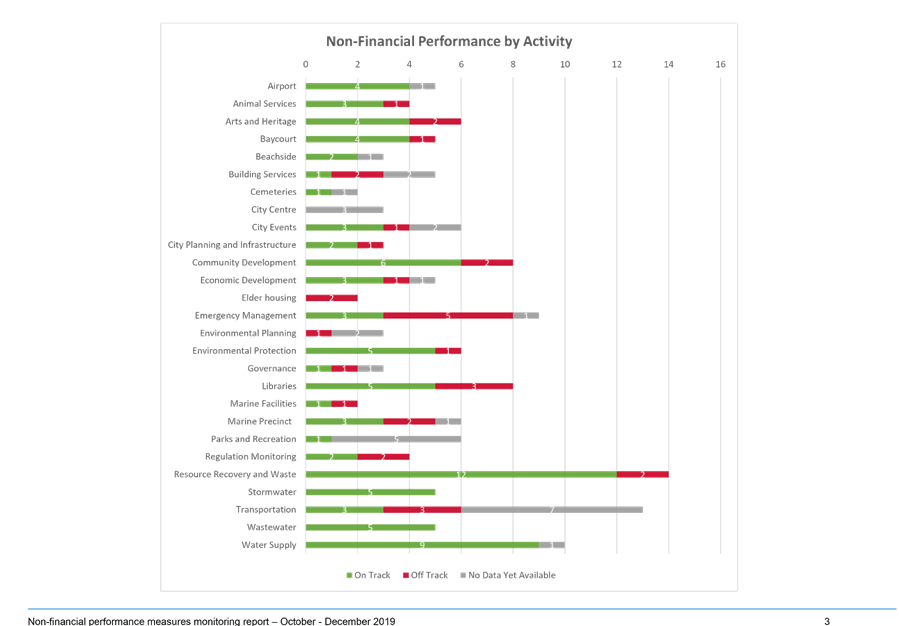

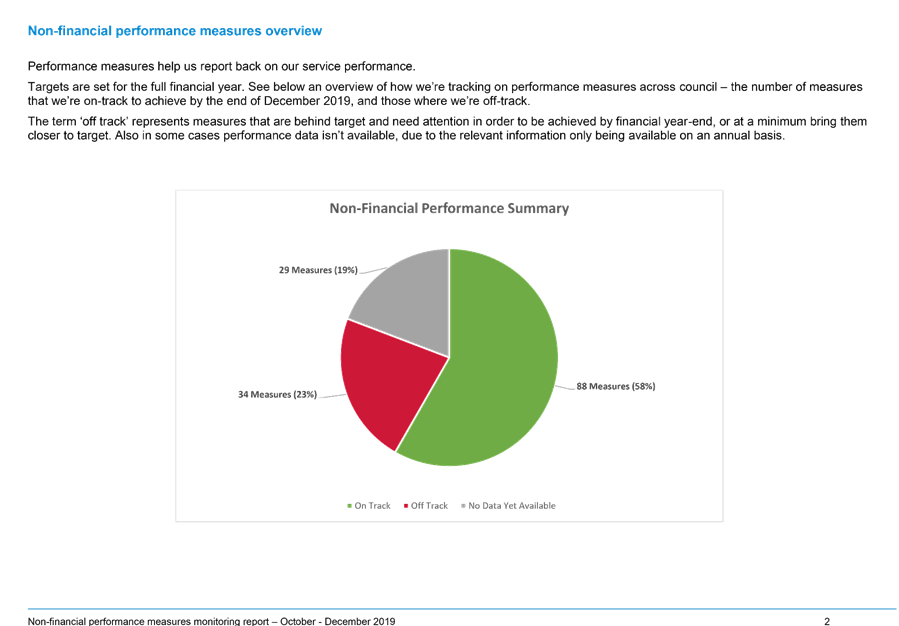

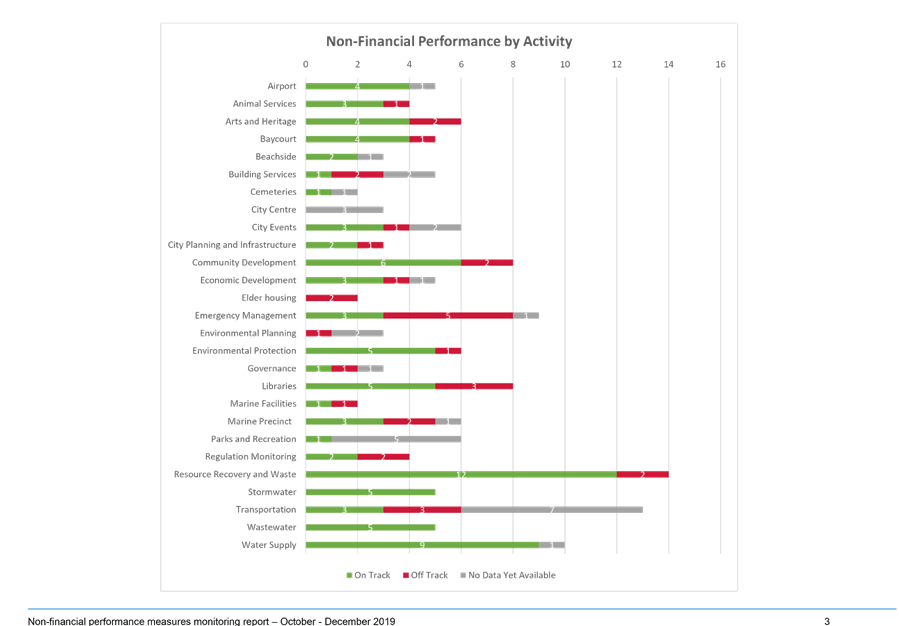

the 151 non-financial performance measures, 122 have been measured and reported

on. 88 measures (58%) are on track with 34 measures (23%) off track and 29 measures

(19%) yet to be measured.

Background

5. This

report is for monitoring and reporting purposes showing Council’s

financial and non-financial performance in delivering services to the community

6. In

a long-term plan (LTP), the level of service that the council will deliver is

agreed upon by the council in consultation with the public.

7. The

Local Government Act 2002 stipulates that local authorities are required to

report on how well they are performing in delivering these levels of service to

their communities as measured by the non-financial performance Indicators.

8. In

the 2018-28 Long-term Plan there were 148 KPIs that were agreed upon

(subsequent measures have also been added to increase total to 151 via this

committee, no levels of services have been changed), 23 of which are mandatory

measures as per section 261B of the Local Government Act.

9. The

budget to achieve the agreed level of service is set in the LTP. Rates

are set based on the agreed budget.

Strategic Context

10. Maintaining

expenditure within budget ensures delivery of services in a financially

sustainable way.

11. Monitoring

non-financial performance is a key function of the committee.

DISCUSSION

Part 1: Financial Performance

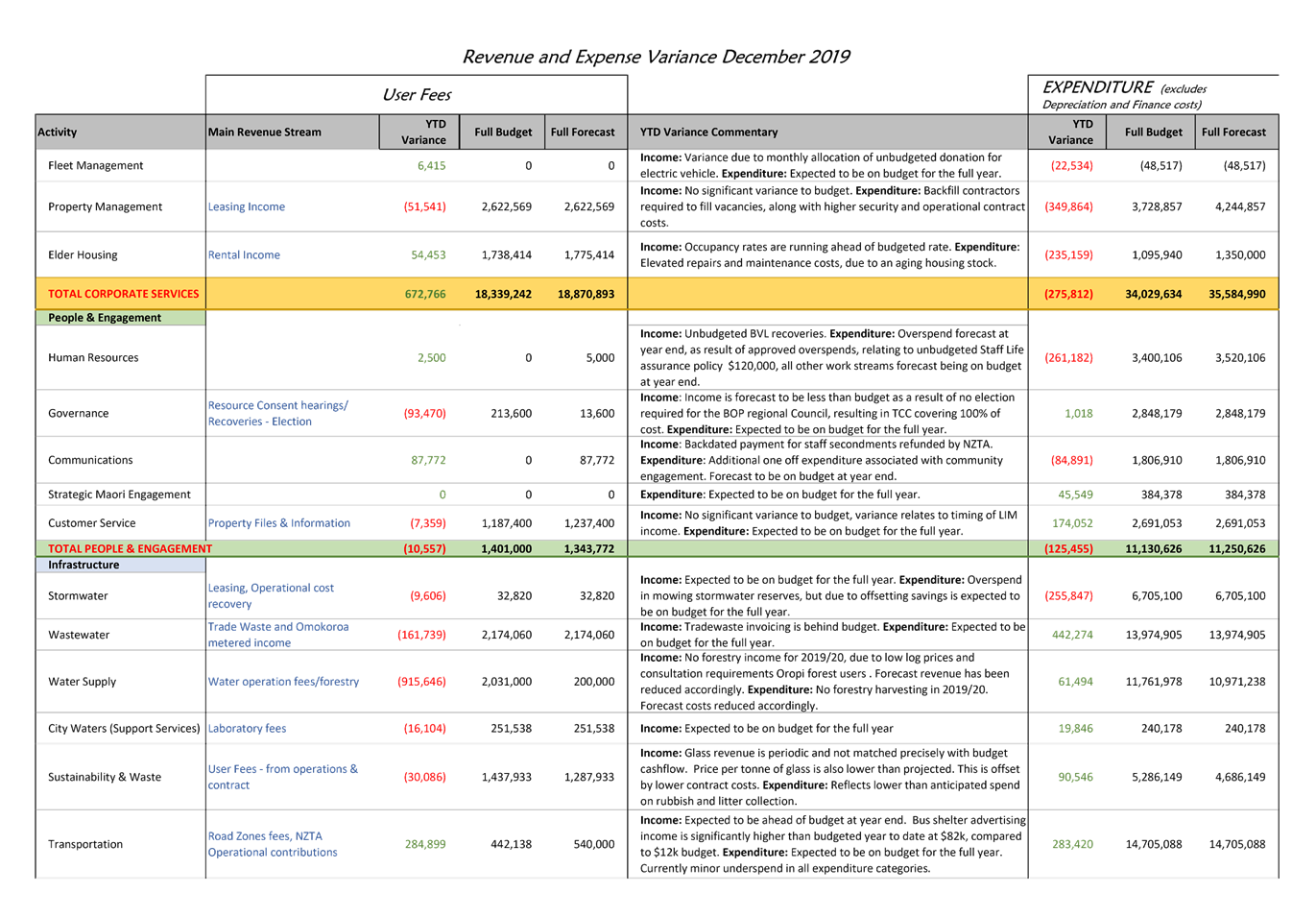

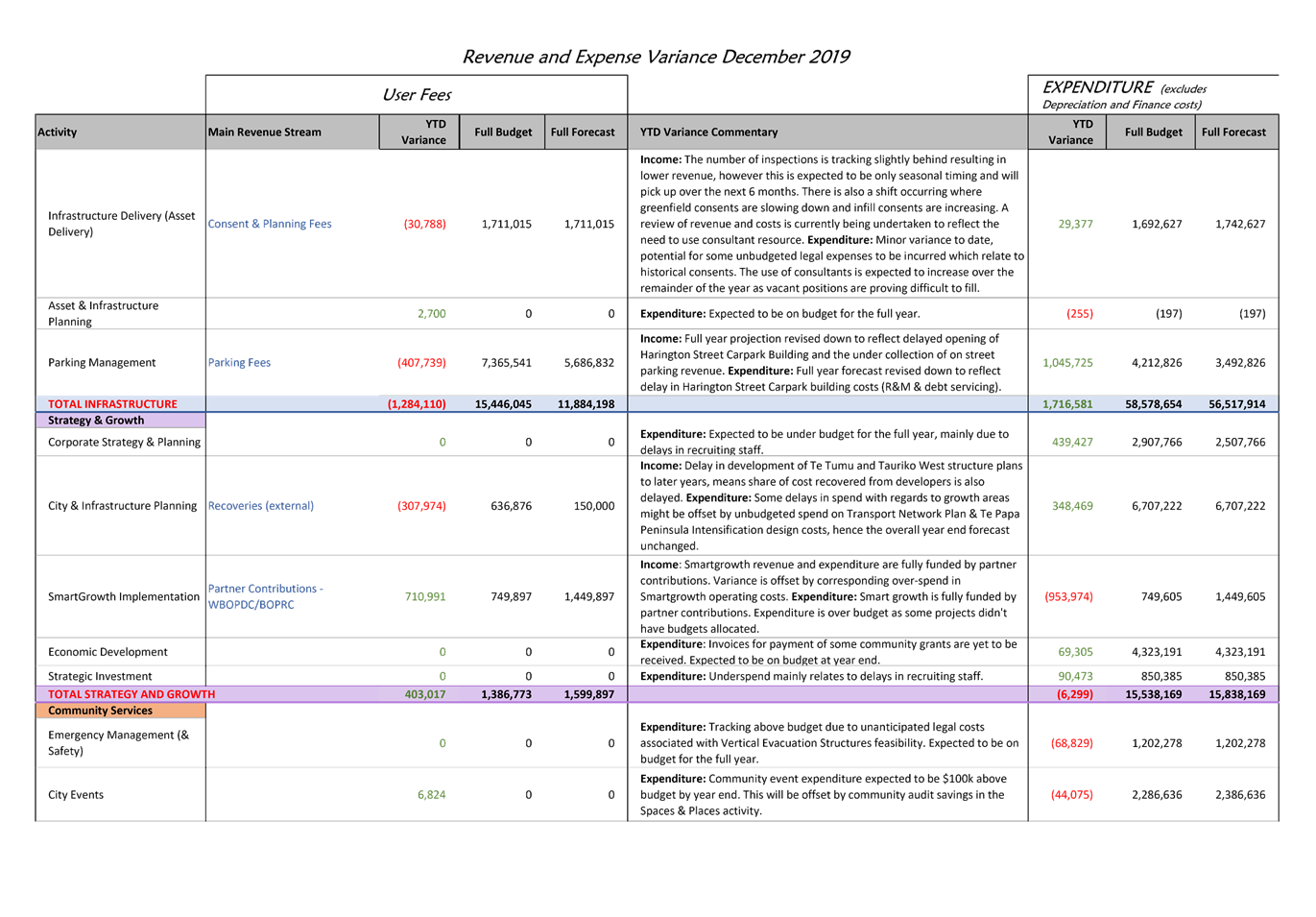

12. Attachments

to this report provide a summary of Council’s financial performance for

the year to date. The content of this report includes:

(a) A summary of

revenue and expenditure year to date with revised full year projections

presented as a Statement of Comprehensive Revenue and Expense (Attachment 1).

(b) The Treasury

report which shows borrowing year to date and full year projections, the

average cost of funds and money market investments benchmarked to average

return (Attachment 1).

(c) The Capital

Programme spend to date and full year projections, also identifying key

projects (Attachment 2).

13. The Statement

of Comprehensive Revenue and Expenditure shows the operating and capital

revenue and expenses in a format consistent with the Annual Report. It shows

the year to date results for revenue and expenditure and provides a full year

forecast.

14. Operating

revenue is projected to be unfavourable to budget for the year with building

services revenue tracking below budget due to lower building consent levels and

forestry harvesting revenue (from the Oropi water catchment) deferred due to

low prices and community consultation timeframes.

15. Operating

costs variances are favourable primarily due to lower depreciation on water

infrastructure arising from last year’s asset revaluation which extended

the useful life of some of our plant. Personnel expenses are $1.8m behind

budget reflecting vacant positions across the business including Building

Services and Environmental Planning. Due to these vacancies, contractor costs

are running over budget.

16. The forecast

for provisions expense is currently under review. Any update in the risk

associated with weathertight homes claims would be included in the March

quarter forecast.

17. The Treasury

Report (included as part of Attachment 1) shows total net debt to 31 December of

$488m with the full year forecast close to budget at $540m. The final

debt position will be influenced by the amount and timing of capital costs and

other payments and revenues such as development contributions.

18. TCC Capital

Expenditure (Attachment 2) summarises expenditure on the capital programme,

identifying significant capital projects. The capital programme is tracking

behind budget by $26m year to date which is 32% spent with 50% of the year

gone. Project delivery usually increases in later months so at this stage

our forecast debt position is based on expenditure to budget (Note the capital

budget at $203m includes a $60m underspend assumption).

19. The Capital

Overspends table (Attachment 2) identifies project overspends for the year

totalling $7m. The largest of these relates to Te Maunga Wastewater

Treatment plant. This $4m overspend was approved by Council in August

2019.

Part 2: Capital overspends for approval

20. Officers are

requesting overspend approval for two capital projects: Durham Street

Streetscape and Te Papa o

Ngā Manu Porotakataka.

21. An amount of $375,000

has been requested to fund additional works to complete the Durham Street

project, in addition to the overspend approved under DC64 in May 2019. These

additional works were as a result of additional unforeseen ground conditions,

service relocations, extensions of time for the contractor, consultancy

services and building consents. These items were highlighted in DC64

however the actual costs have exceeded the contingency estimated for that

report.

22. An amount of

$194,000 has been requested for Te Papa o Ngā Manu Porotakataka, in

addition to that approved under DC282. This overspend was driven by extra

professional services fees resulting from the necessity for consultants to

complete designs for the toilet block amendments as well as extra design work

around issues on site (both landscape and civil). In addition, in order to

complete the project before Christmas there was increased time on site required

from engineers on management, survey and quality assurance activities.

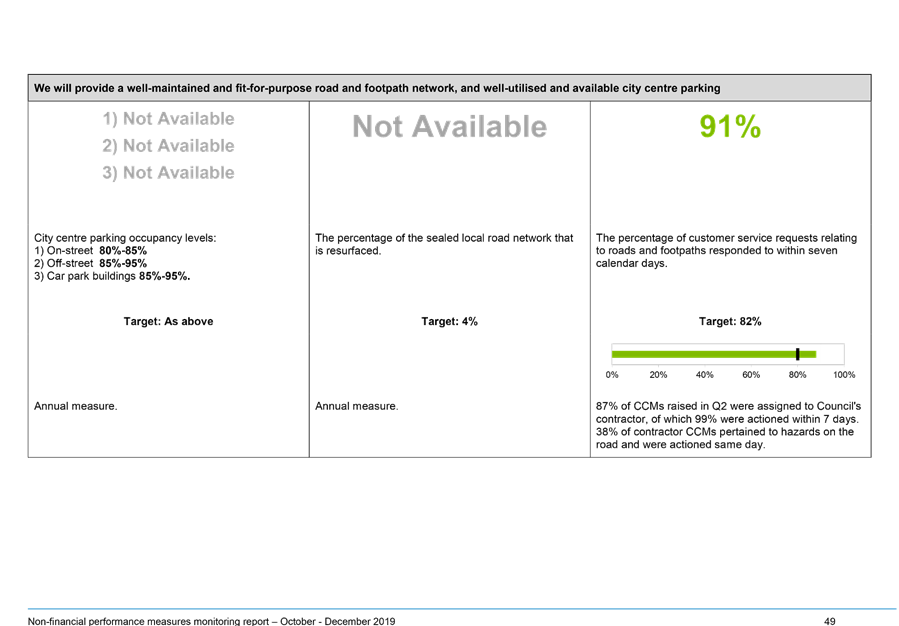

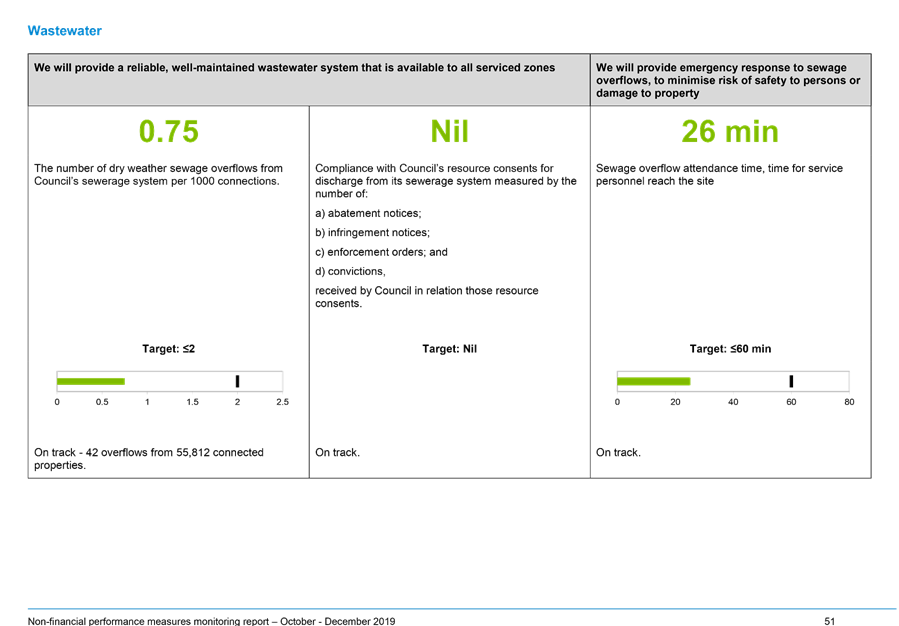

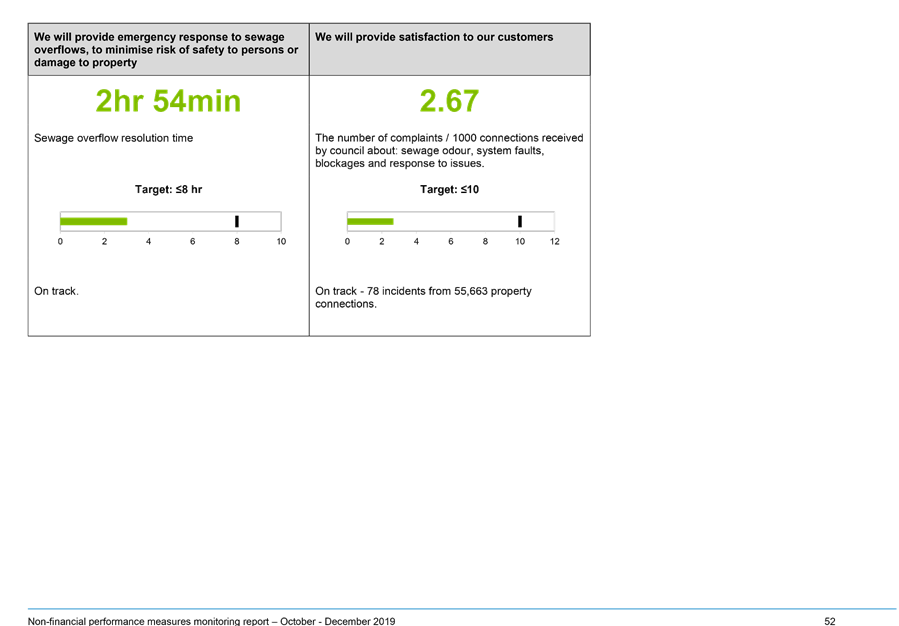

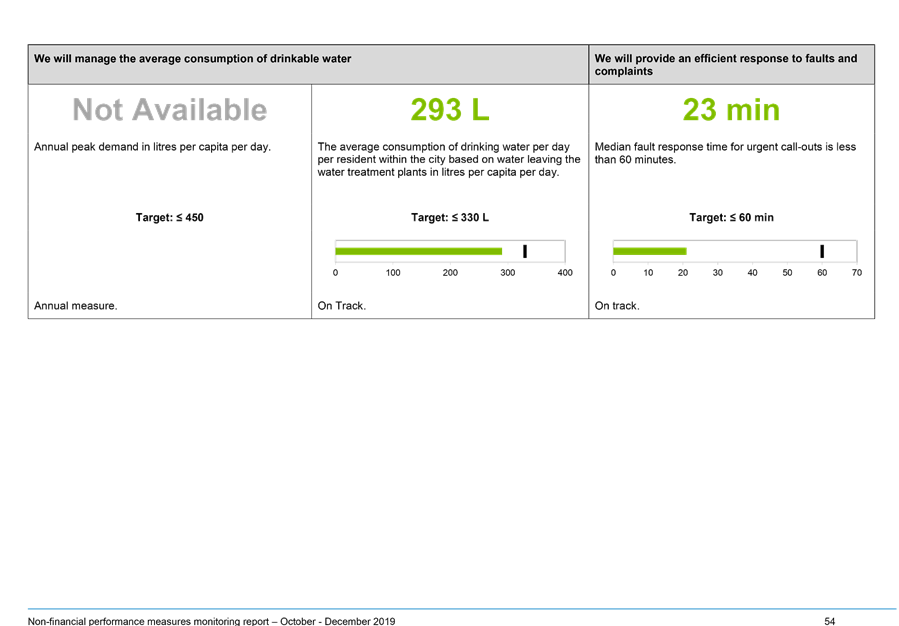

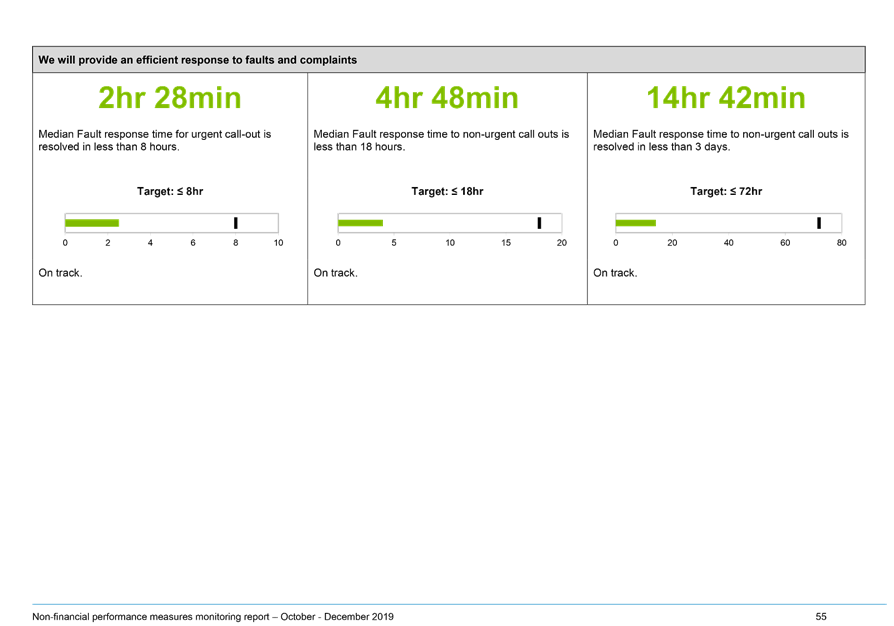

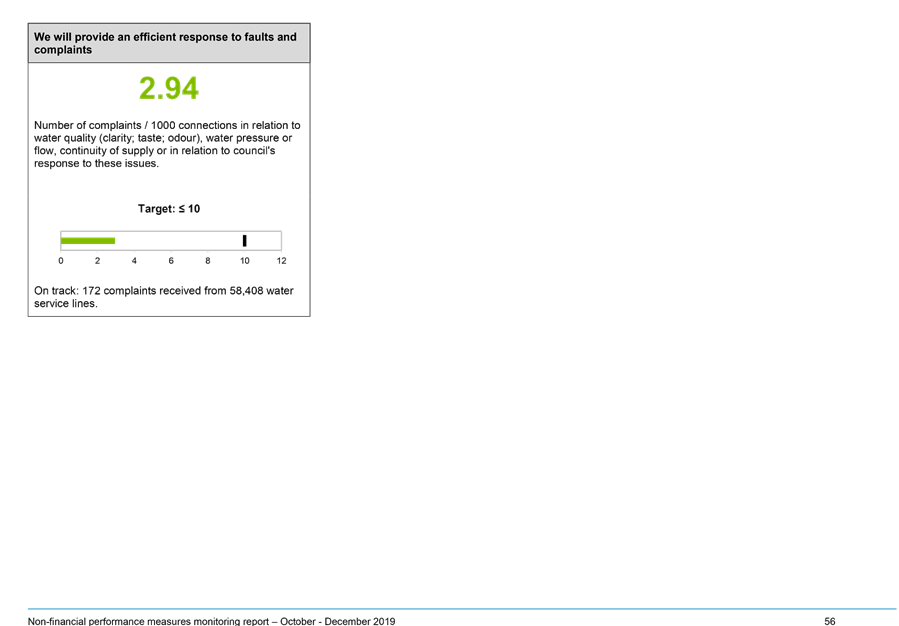

Part 3: Non-Financial Performance

Measures

23. Attachment 3

presents how Council and the community are tracking towards achieving

Council’s non-financial performance measures and levels of service.

24. Of the 151

non-financial performance measures (four measures were added in as part

of the recommendation when this was last reported in November 2019), 122 have been measured and reported on. Data is not yet available

for 29 measures.

25. Of those that

have been measured, 88 measures (58%) are on track with 34 measures (23%) off

track.

26. Where data is

not available, the majority relate to annual measures which are only surveyed

at one point through the year or to measures that have no current method of

assessment.

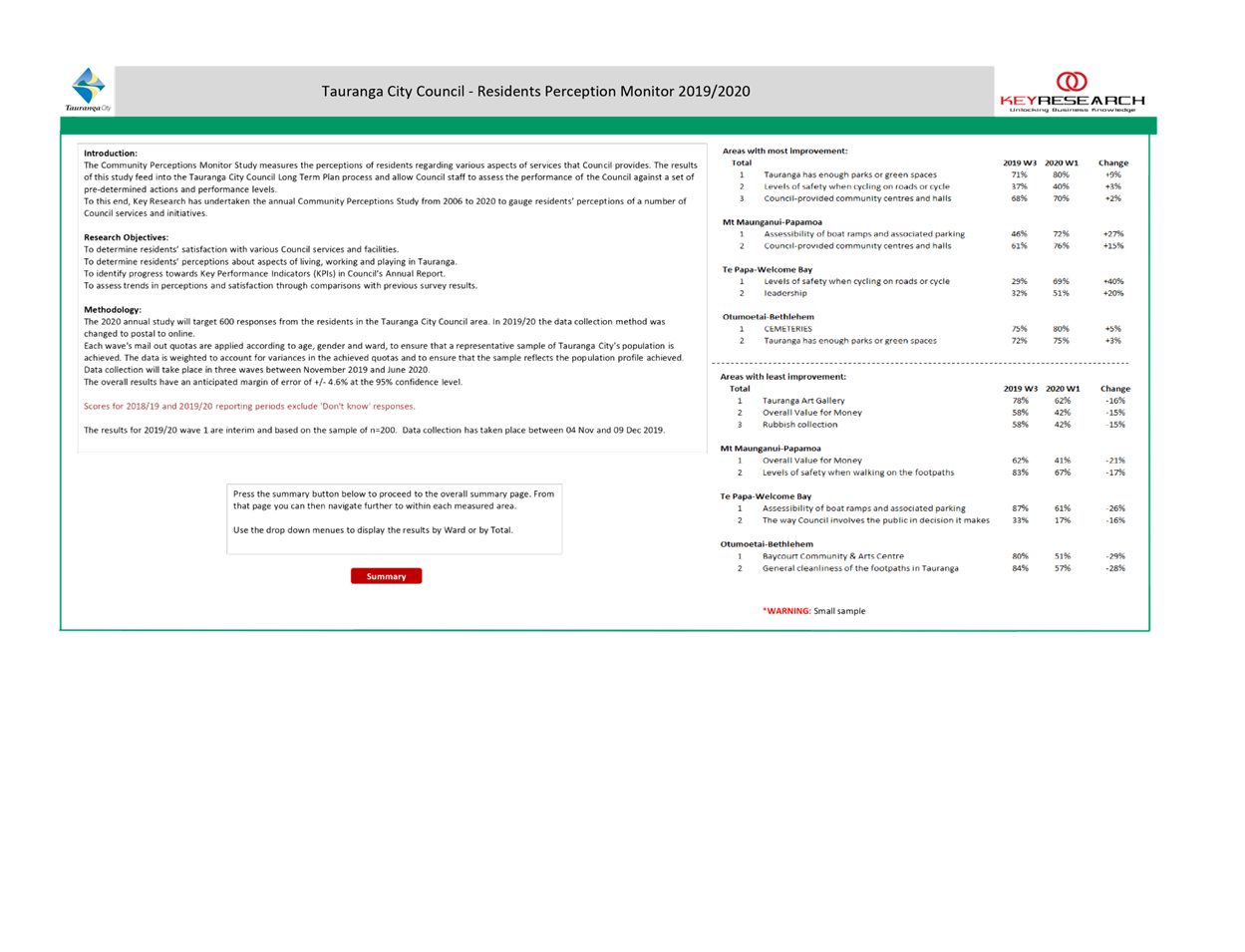

Perceptions Monitor

27. The Annual

Residents’ Survey supports non-financial reporting by measuring the perceptions

of residents regarding various aspects of services that Council provides.

28. Each wave's mail out quotas

are applied according to age, gender and ward, to ensure that a representative

sample of Tauranga City’s population is achieved. The data is weighted to

account for variances in the achieved quotas and to ensure that the sample

reflects the population profile achieved.

29. The overall results have an

anticipated margin of error of +/- 4.6% at the 95% confidence level. Scores for

2018/19 and 2019/20 reporting periods exclude 'Don't know' responses.

30. The results for 2019/20 wave 1

are interim and based on the sample of n=200. Data collection has taken place

between 04 Nov and 09 Dec 2019.

31. A summary of

the highlights of the first wave are attached at Attachment 4. The summary

helps provide an insight into how different elements of Council’s

core service deliverables, reputation and the perception of value for money

contribute to respondents’ perception of Council’s overall

performance.

32. The

level of satisfaction (reputation measure) with Tauranga City Council in

general has decreased from 66% in 2018/19 to 48% year-to-date. Reputation

measures the community’s perception of four key areas – leadership,

acting honesty/fairly, financial management and quality of services/facilities.

These results were captured during the period from mid-November to mid-December

2019. The timing suggests that there may have been uncertainty during this

post-election period which influenced results. Furthermore, it has historically

been common for the first wave of results to be lower than the subsequent waves

of results. There are three waves before we receive the final result, with wave

1 having a small sample size.

33. Perceptions

of each of the three drivers of overall performance have decreased:

a. The

perception of value for money, which is the major driver of the overall

perception score, has dropped from 50% to 42% year to date. This has been

driven by a decline in the perception that annual property rates are fair and

reasonable.

b. The

second biggest driver, overall service and facilities, decreased from 72% to

64% year-to-date.

c. Reputation

has dropped from 46% in 2018/19 to 33% year-to-date.

34. The next wave will be due to

be reported in May with the Q3 non-financial performance.

OPTIONS

35. There are no options associated with this report. The report is

provided as information only.

Significance

36. Under the

Significance and Engagement Policy 2014, the decision to receive this report is

of low significance. The decisions to approve the capital overspends are also

of low significance as the size of the overspends do not reach a higher

threshold.

Next Steps

37. This report

ensures monitoring of Council performance to ensure compliance with

Council’s budgets, policies and delegations.

Attachments

1. Statement

of Comprehensive Revenue and Expense - A11175587 ⇩

2. Capital

Programme - A11175570 ⇩

3. Non-Financial

Performance Measures - Q2 2019 - A11199173 ⇩

4. Tauranga

City Council Dashboard 2020 Wave 1 Summary - A11166820 ⇩

|

Finance, Audit

and Risk Committee Meeting Agenda

|

25 February

2020

|

|

Finance, Audit and Risk Committee

Meeting Agenda

|

25 February

2020

|

|

Finance, Audit and Risk Committee

Meeting Agenda

|

25 February

2020

|

|

Finance, Audit and Risk Committee

Meeting Agenda

|

25 February

2020

|

7.3 Quarter

2 - LGOIMA and Mayor & Councillor Requests

File

Number: A11208325

Author: Kath

Norris, Team Leader: Democracy Services

Authoriser: Susan

Jamieson, General Manager: People & Engagement

Purpose of the Report:

1. The purpose of the report is to update

the committee on Local Government Official Information and Meetings Act 1987

(LGOIMA) requests as well as the Mayor and councillor requests over the second

quarter (Quarter 2) from 1 September 2019 to 31 December 2019.

|

Recommendations

That the

Finance, Audit and Risk Committee receives the report Quarter 2 Local

Government Official Information and Meetings Act 1987 and Mayor and Councillors

requests.

|

LGOIMA Requests

2. A

total of 69 requests were received in Q2 (67 LGOIMA, one Privacy Act, one

both), compared with 101 information requests received in Q1. This is a

decrease of 32% from the previous quarter.

Q1 figures were higher due in part to multiple requests received for the

release of the Colgan Report.

3. There

are five requests still to be finalised for the quarter.

4. Seven

requests made in Q2 were partially withheld and six requests were refused. Two

requests were transferred to other government agencies.

5. Information

requests are broken down into the following types: individuals (61%),

organisations (23%) and the media (16%).

6. Top

three allocations per business group were People and Engagement (31.88%),

Corporate Services (20.29%) and Regulatory and Compliance (20.29%).

7. This

is further broken down to the business units: Democracy Services (18%), Spaces

and Places (14%) and Legal and Commercial (11%). The remaining requests were

allocated to other areas across the organisation.

8. Six

requesters made multiple requests (two or more), with two of these requesters

making three or more requests each. One requester made four requests, these

four were all Bella Vista related. Multiple requests comprised 22% of the total

requests made in Q2.

9. There

is one current complaint to the Office of the Privacy Commissioner lodged by an

ex staff member that is being investigated and responded to by Legal Services.

10. Only

one request in the quarter (LGOIMA) had the response time extended, compared

with seven extensions in Q1.

11. 99%

of Q2 requests were responded to within the statutory timeframes, compared with

97% in Q1. One response this quarter did not meet the deadline.

12. We

recorded an estimated total of 215 hours of staff time spent responding to information

requests that were due in Q2, which equates to $16,313.40.

13. The

Office of the Ombudsman has commenced its audit process with a number of

surveys for Mayor and Councillors, the public, and staff. An agency

questionnaire has been completed and we are now responding to follow up

questions. Staff from the Ombudsman’s Office will be on site at Willow St

from 17-21 February 2020 to conduct meetings with the staff they wish to meet

with. These meetings have been scheduled by the Office itself.

14. The

Office of the Ombudsman has provided their last six monthly report for the

period 1 July to 31 December 2019 on complaints completed in regards to the

Council’s LGOIMA responses. This information will be published on their

website 4 March 2020. They completed six complaints, two resolved

without investigation, two required no investigation, one investigation

discontinued, and one investigation finalised. Following the Ombudsman’s

initial inquiries, we amended two decisions and in one case rectified an

omission.

Mayor

and Councillor Queries Q2

15. Democracy

Services received 77 Mayor and Councillor queries. There are no outstanding Q2

queries.

16. This

process is improving each week as everyone becomes familiar with it and there

are less requests going directly to General Managers (GMs) or staff that are

not logged with the Democracy Services team first. GMs will follow up by

providing Democracy Services the final response for our records. Gentle

reminders are sent to those that do not use the democracy.services@tauranga.govt.nz

to log their request.

17. The

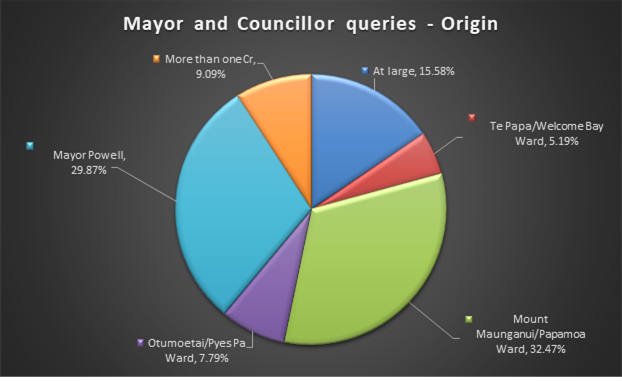

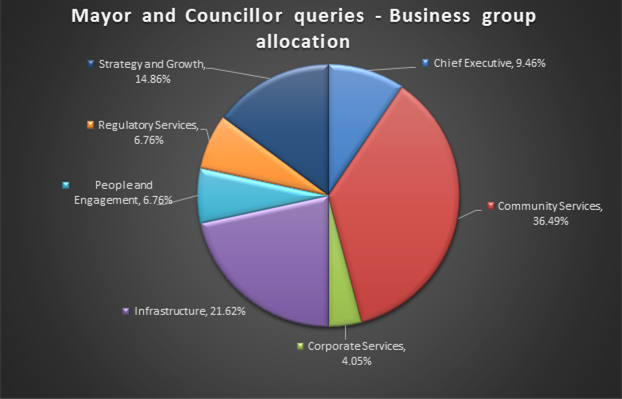

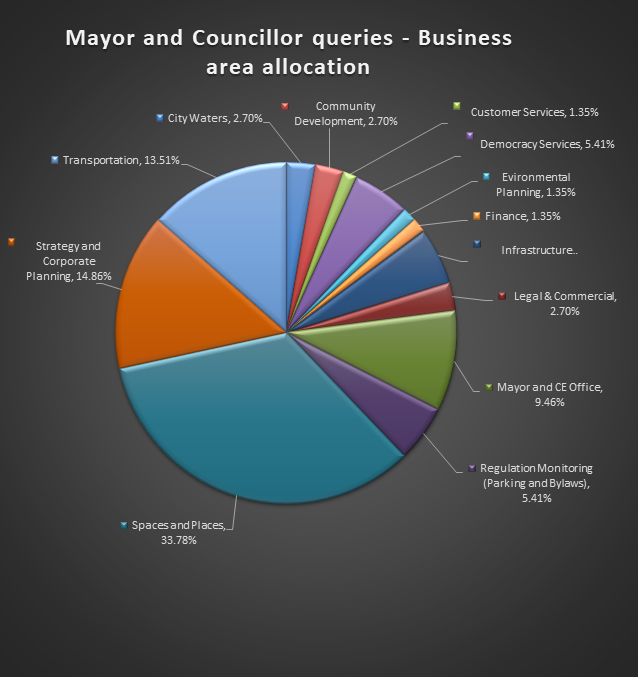

two most significant contributors were the Mayor (30%) and Cr. Morris (26%).

18. Community

Services (36%) received most queries, followed by Infrastructure at (22%) and

Strategy and Growth (15%), with the balance spread across the remaining

business groups.

19. This

is further broken down to the business units: Spaces and Places (34%), Strategy

and Corporate Planning (15%) and Transportation (14%). The remaining requests

were allocated to other areas across the organisation.

20. We

are continually reviewing and refining our processes and reporting. In the next

quarter we will focus on adding more to the reporting by capturing the key

themes.

Q2 Official information requests

(LGOIMA, Privacy Act requests) - Graphs

Q2 Mayor and Councillor query graphs

Attachments

Nil

9 Public

Excluded Session

RESOLUTION TO

EXCLUDE THE PUBLIC

|

Recommendations

That the public be excluded from the following parts of

the proceedings of this meeting.

The general subject matter of each matter to be considered

while the public is excluded, the reason for passing this resolution in

relation to each matter, and the specific grounds under section 48 of the

Local Government Official Information and Meetings Act 1987 for the passing

of this resolution are as follows:

|

General subject of each matter to be considered

|

Reason for passing this resolution in relation to

each matter

|

Ground(s) under section 48 for the passing of this

resolution

|

|

9.1 - Litigation Report

|

s7(2)(a) - the withholding of the information is

necessary to protect the privacy of natural persons, including that of

deceased natural persons

s7(2)(g) - the withholding of the information is

necessary to maintain legal professional privilege

s7(2)(i) - the withholding of the information is

necessary to enable Council to carry on, without prejudice or disadvantage,

negotiations (including commercial and industrial negotiations)

|

s48(1)(a)(i) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

9.2 - Bella Vista Update - Building

Matters

|

s7(2)(a) - the withholding of the information is

necessary to protect the privacy of natural persons, including that of

deceased natural persons

s7(2)(g) - the withholding of the information is

necessary to maintain legal professional privilege

|

s48(1)(a)(i) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

9.3 - Corporate Risk Register -

Quarterly Update

|

s7(2)(b)(i) - the withholding of the information

is necessary to protect information where the making available of the

information would disclose a trade secret

s7(2)(b)(ii) - the withholding of the information

is necessary to protect information where the making available of the

information would be likely unreasonably to prejudice the commercial

position of the person who supplied or who is the subject of the

information

s7(2)(h) - the withholding of the information is

necessary to enable Council to carry out, without prejudice or

disadvantage, commercial activities

s7(2)(i) - the withholding of the information is

necessary to enable Council to carry on, without prejudice or disadvantage,

negotiations (including commercial and industrial negotiations)

|

s48(1)(a)(i) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

9.4 - Internal Audit Programme for

2019/20 to 2020/21

|

s6(b) - the making available of the information

would be likely to endanger the safety of any person

s7(2)(a) - the withholding of the information is

necessary to protect the privacy of natural persons, including that of

deceased natural persons

s7(2)(b)(i) - the withholding of the information

is necessary to protect information where the making available of the

information would disclose a trade secret

s7(2)(d) - the withholding of the information is

necessary to avoid prejudice to measures protecting the health or safety of

members of the public

s7(2)(g) - the withholding of the information is

necessary to maintain legal professional privilege

s7(2)(j) - the withholding of the information is

necessary to prevent the disclosure or use of official information for

improper gain or improper advantage

|

s48(1)(a)(i) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

9.5 - Harington Street Transport Hub -

Project Update

|

s7(2)(b)(ii) - the withholding of the information

is necessary to protect information where the making available of the

information would be likely unreasonably to prejudice the commercial

position of the person who supplied or who is the subject of the

information

s7(2)(g) - the withholding of the information is

necessary to maintain legal professional privilege

s7(2)(h) - the withholding of the information is

necessary to enable Council to carry out, without prejudice or

disadvantage, commercial activities

|

s48(1)(a)(i) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|