|

|

|

AGENDA

Policy Committee Meeting

Wednesday, 19 February 2020

|

|

I hereby give notice that a Policy Committee Meeting

will be held on:

|

|

Date:

|

Wednesday, 19 February

2020

|

|

Time:

|

2pm

|

|

Location:

|

Tauranga City Council

Council Chambers

91 Willow Street

Tauranga

|

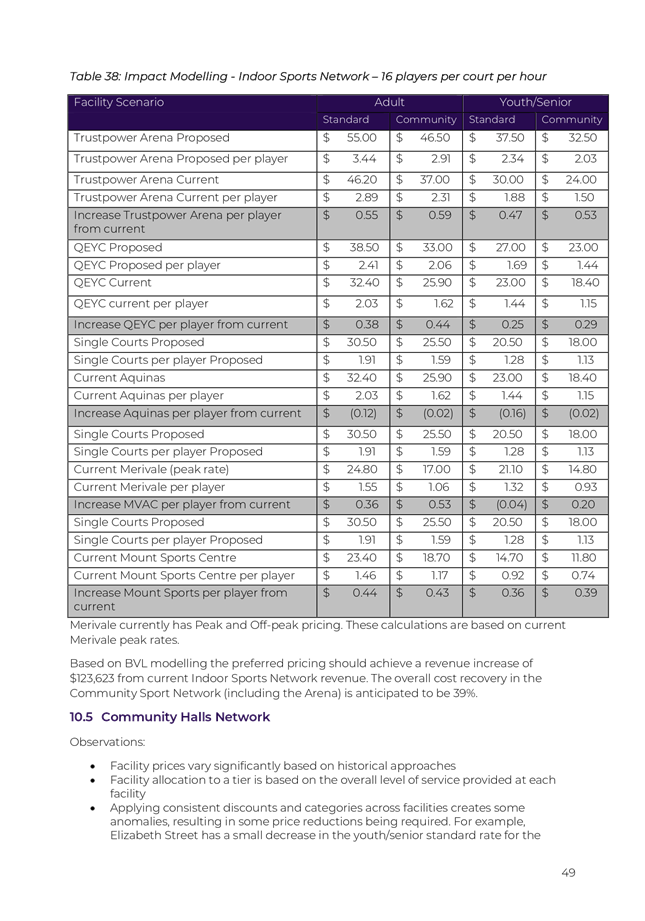

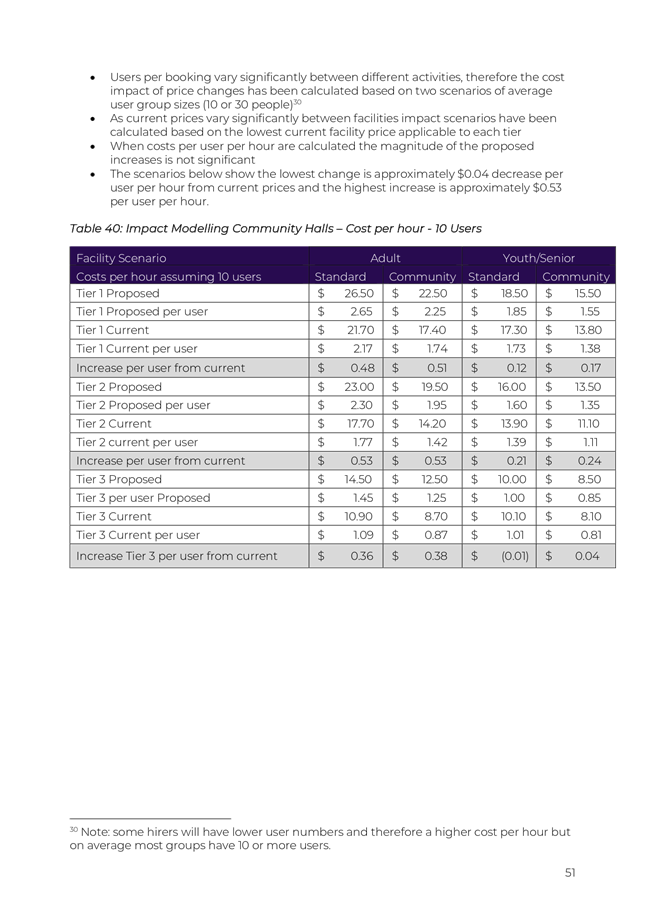

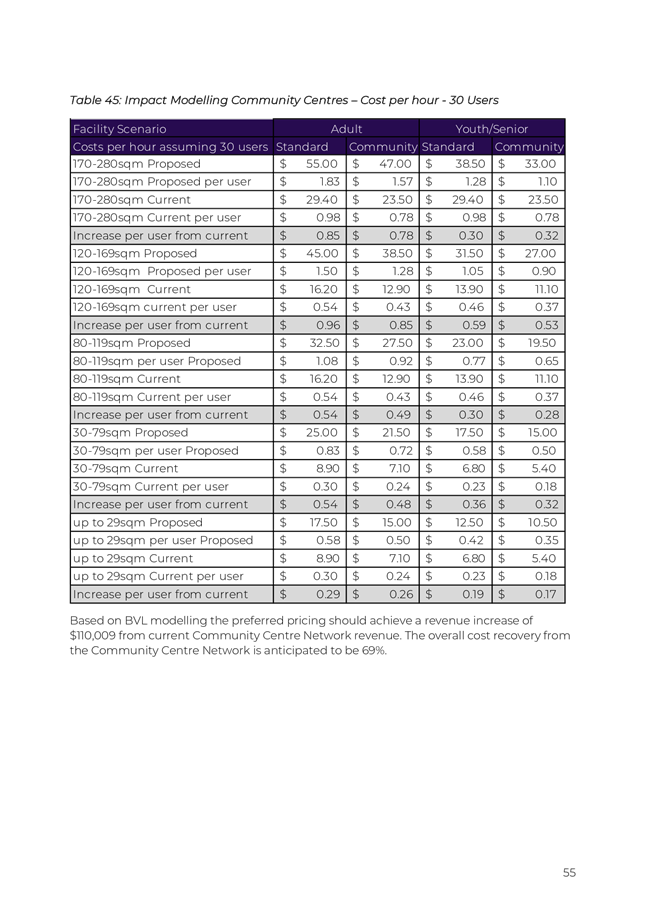

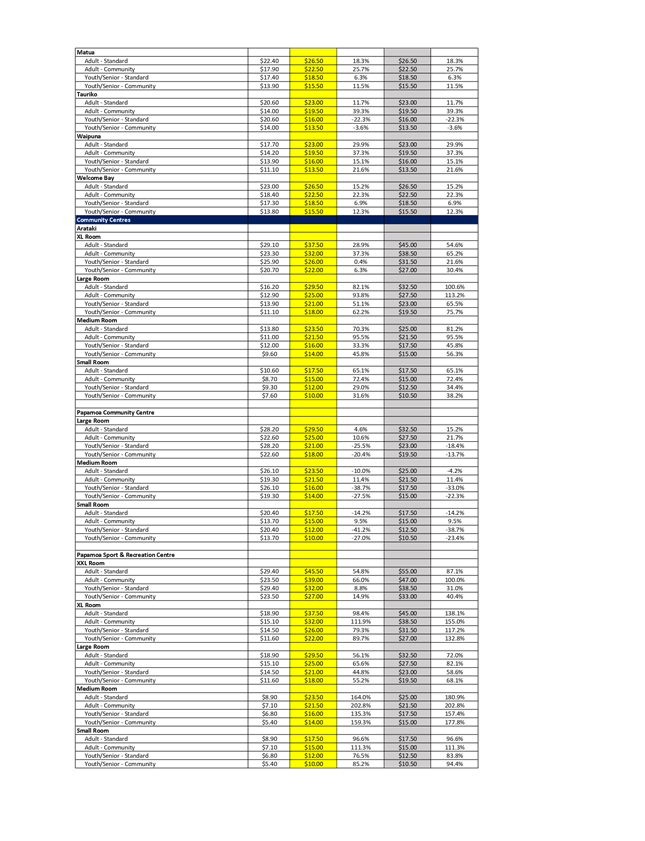

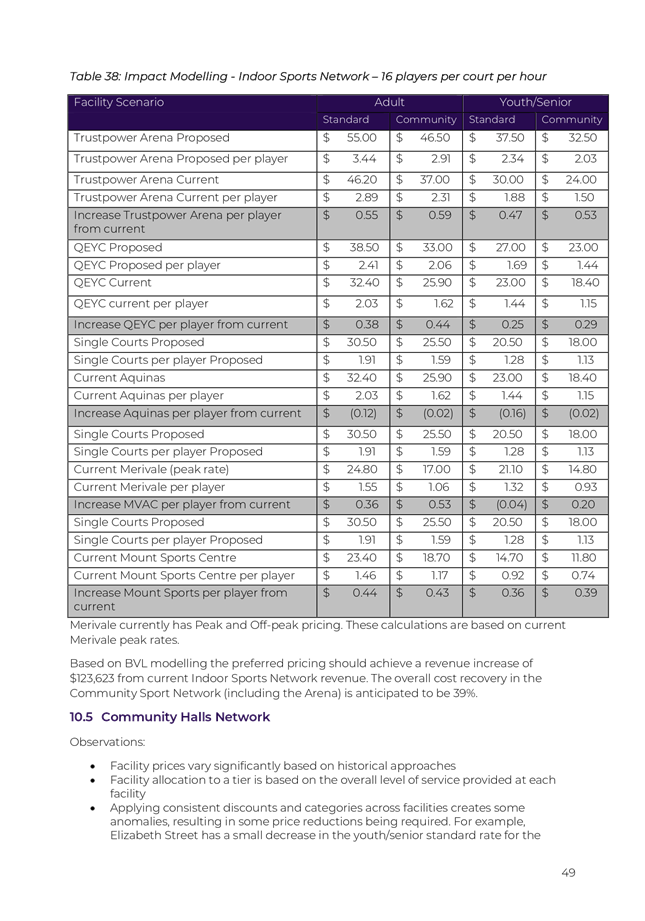

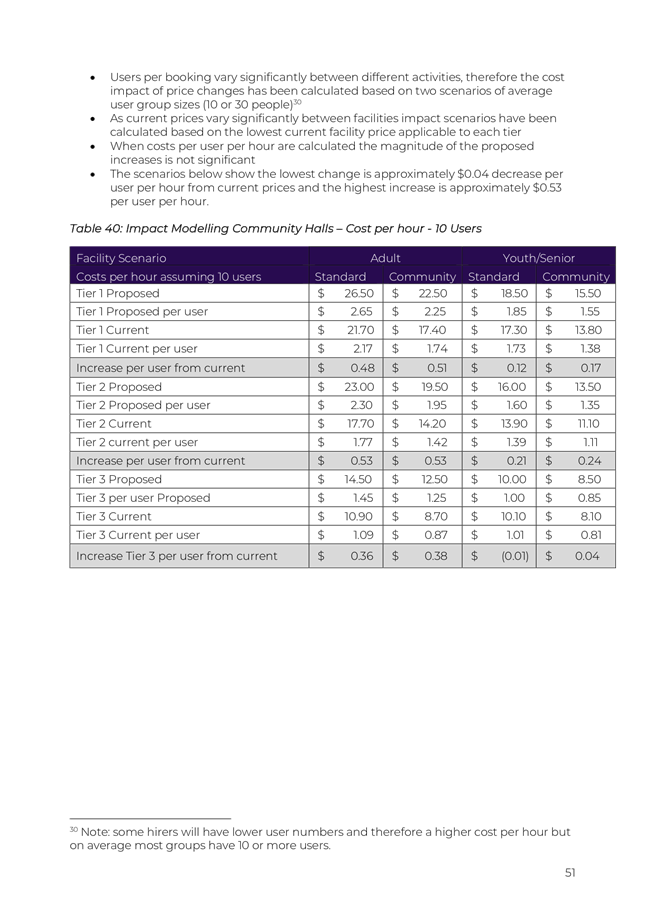

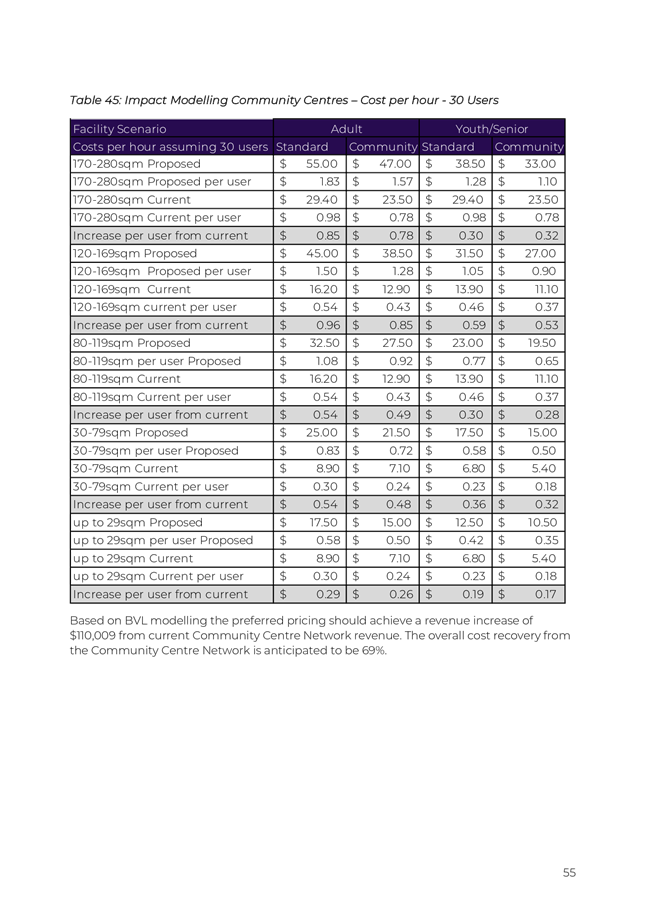

|

Please

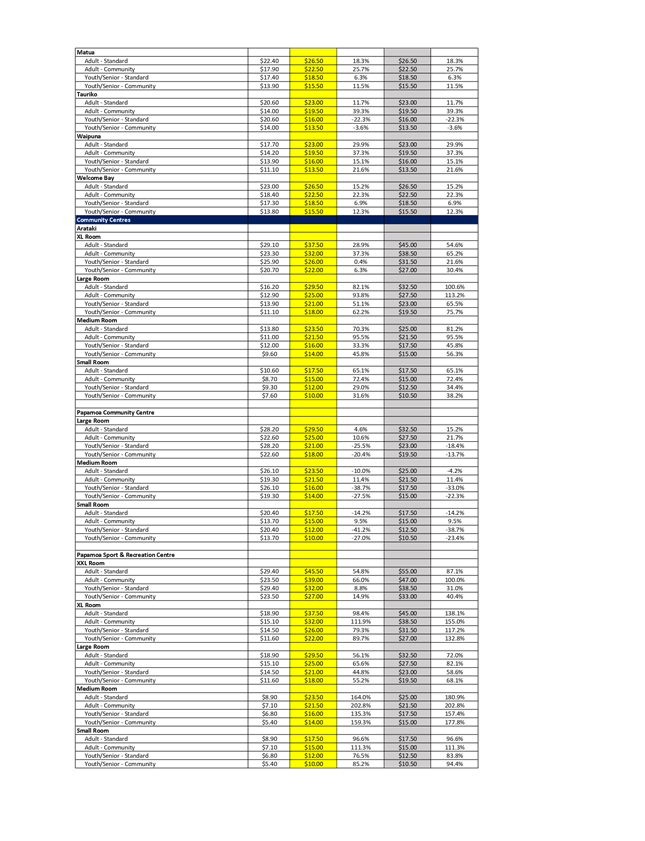

note that this meeting will be livestreamed and the recording will be

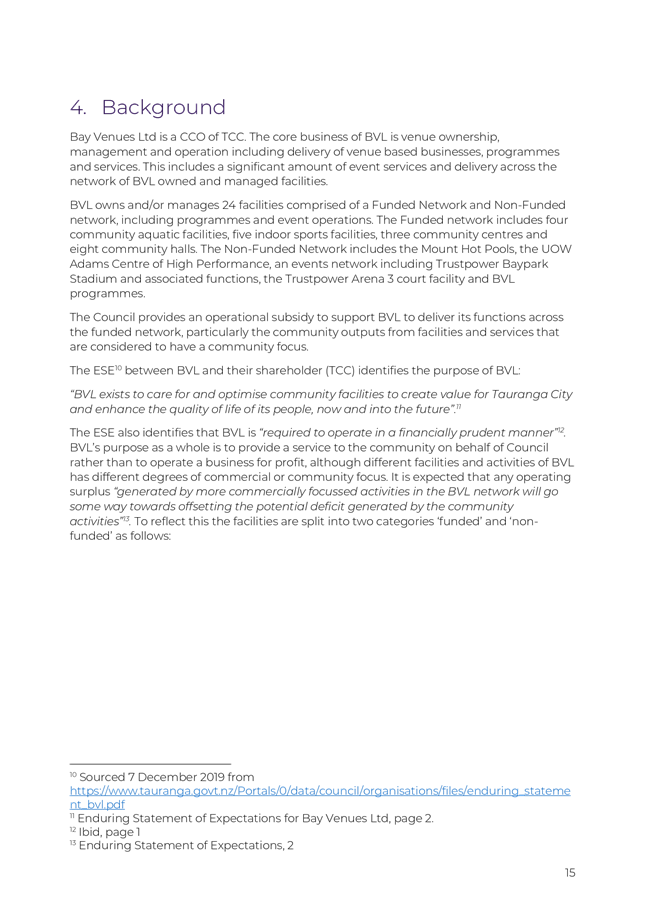

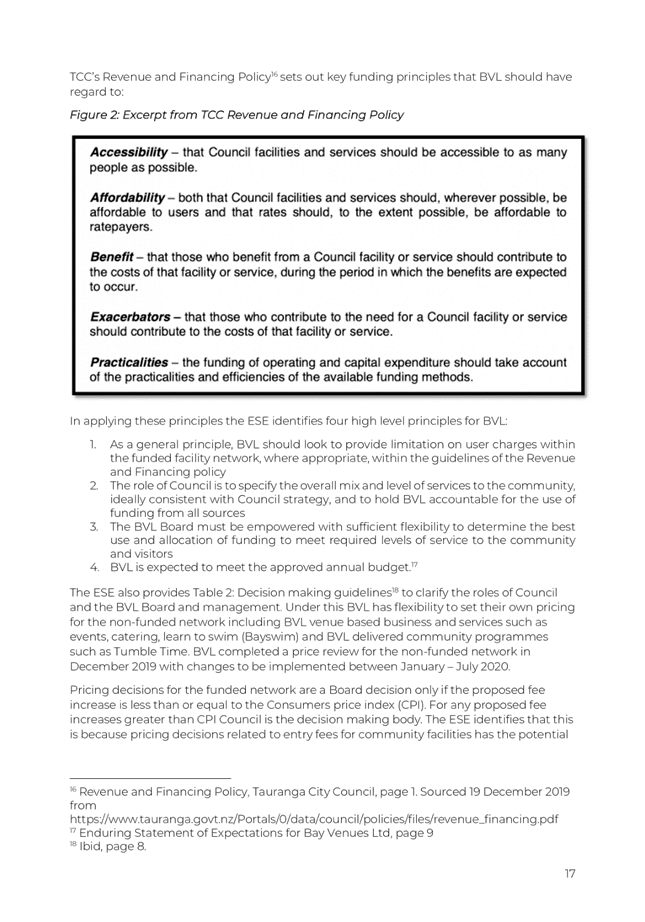

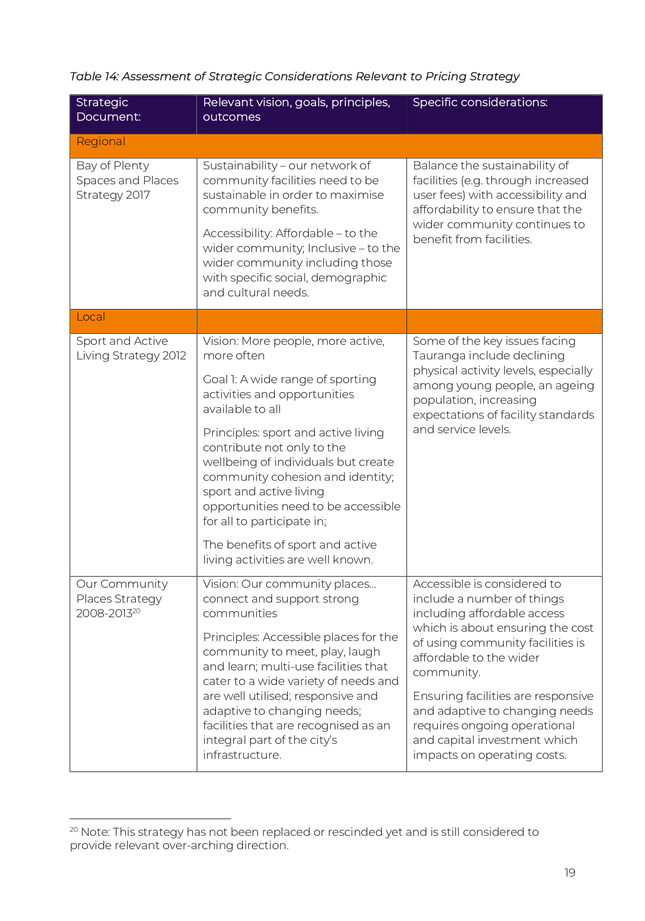

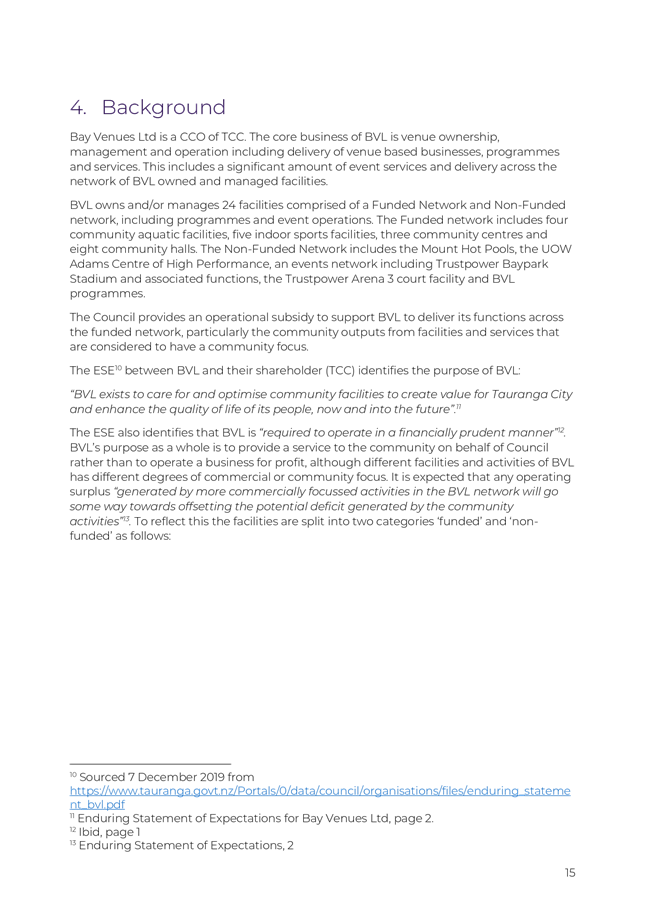

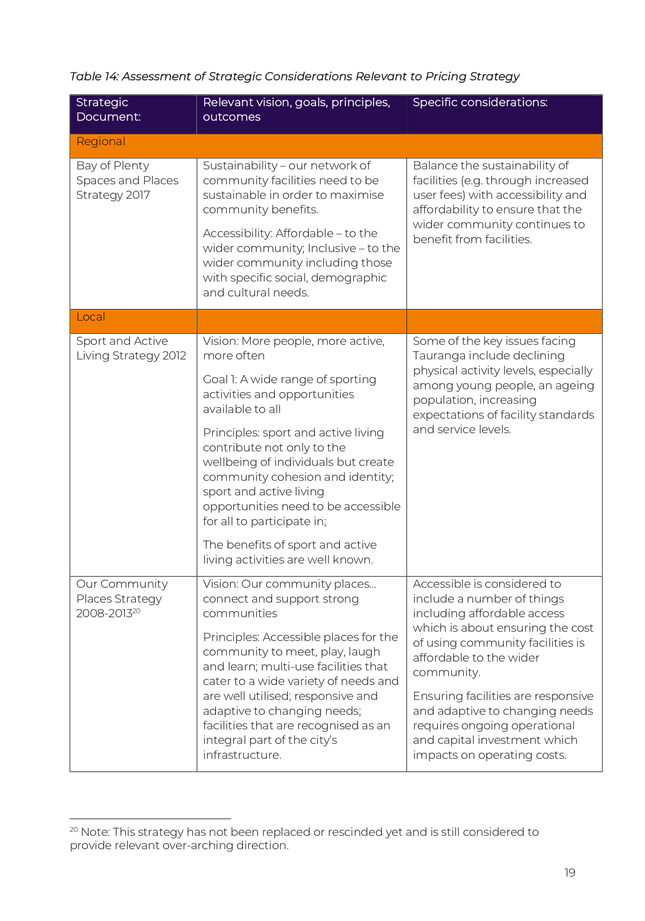

publicly available on Tauranga City Council's website: www.tauranga.govt.nz.

|

|

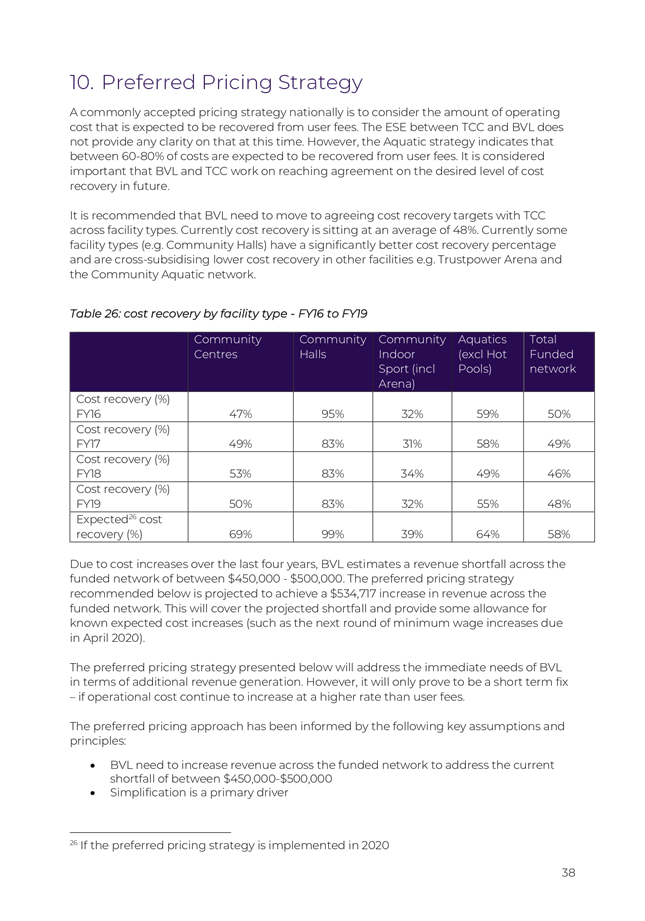

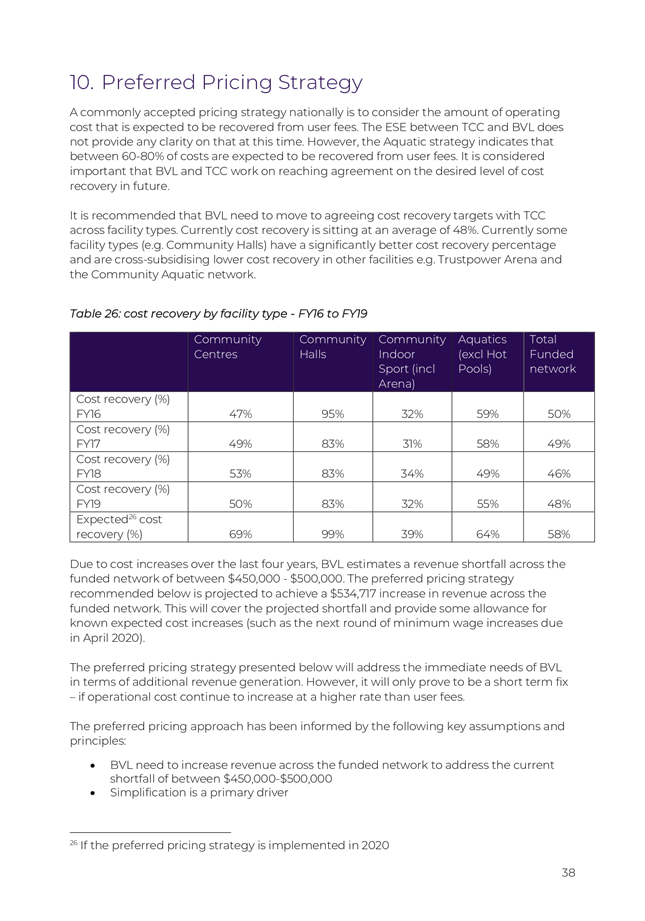

Marty Grenfell

Chief Executive

|

7 Business

7.1 Bay

Venues Limited - Capital and Renewals Expenditure and Pricing Review Proposals

for the Draft Annual Plan 2020/2021

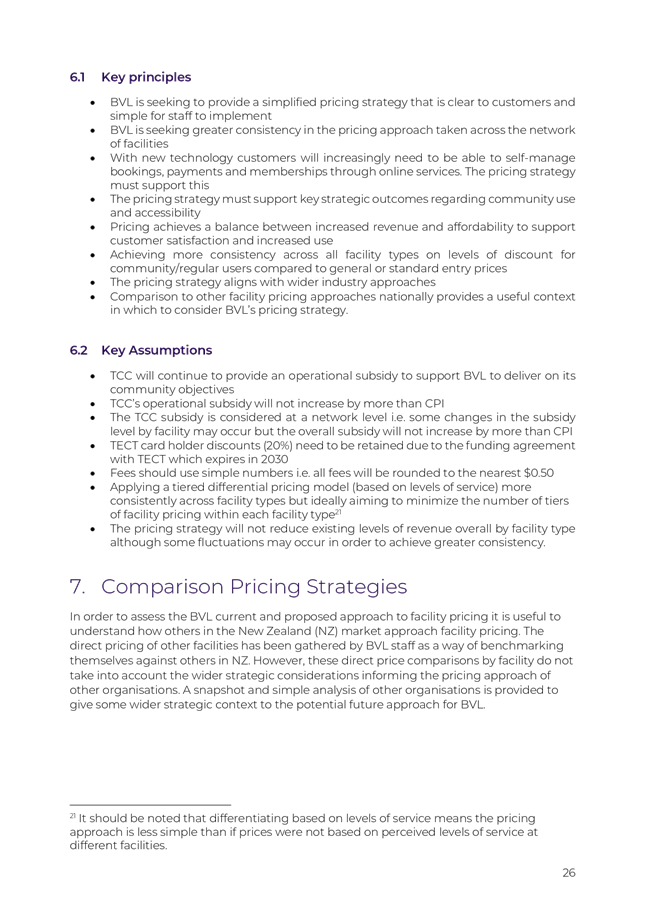

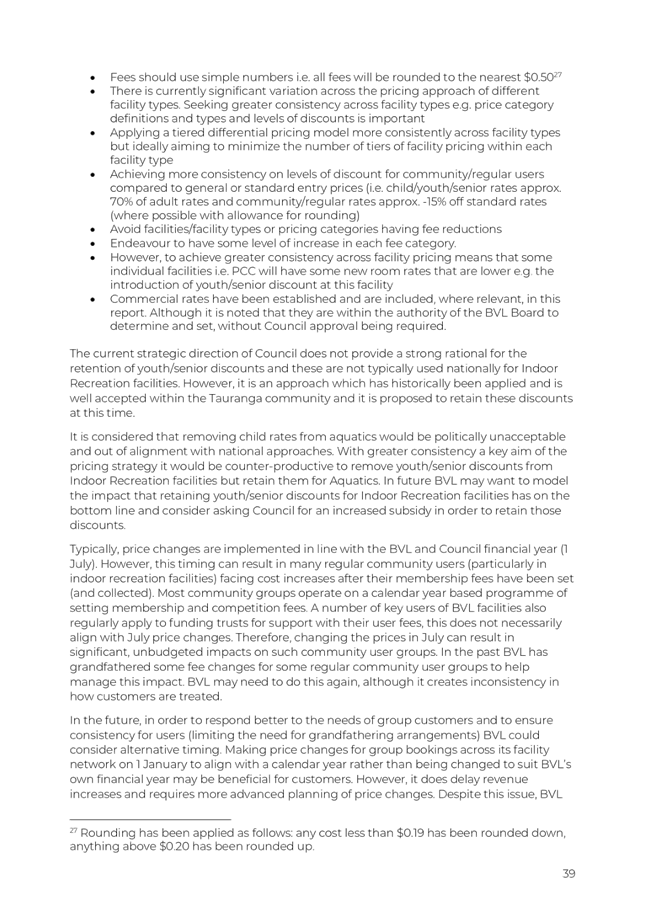

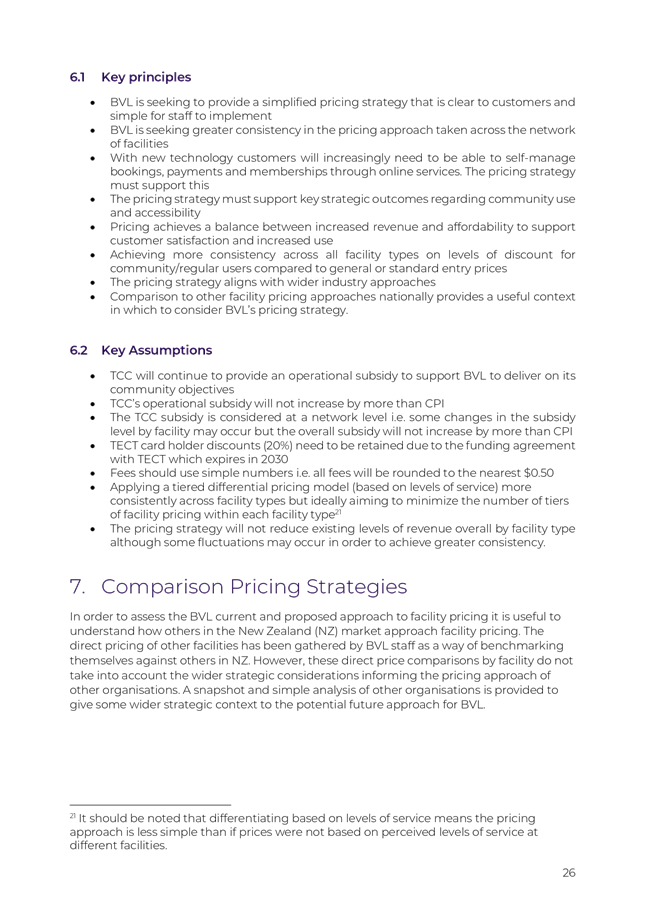

File

Number: A11167519

Author: Anne

Blakeway, Manager: CCO Relationships and Governance

Authoriser: Gareth

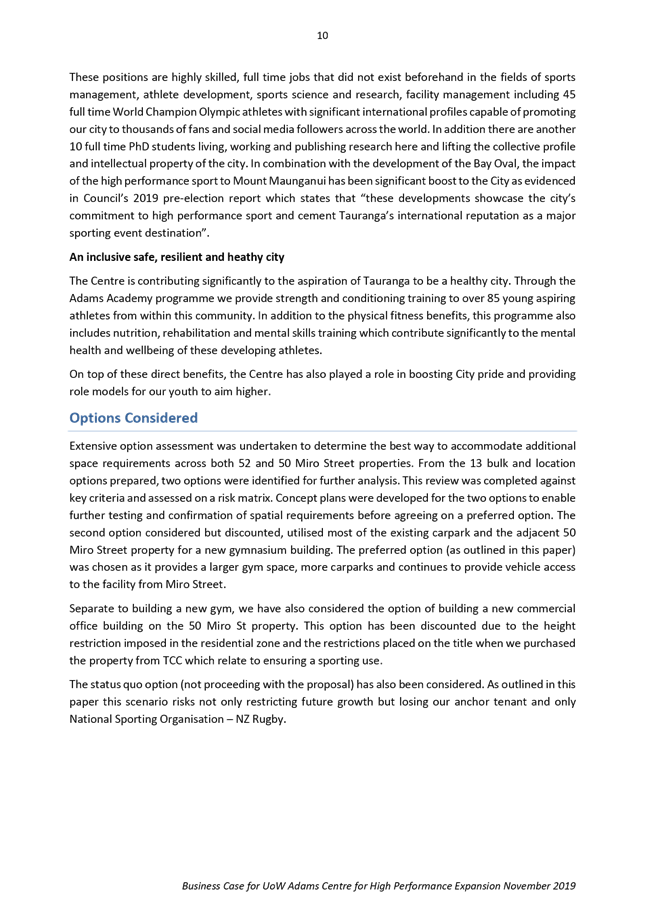

Wallis, General Manager: Community Services

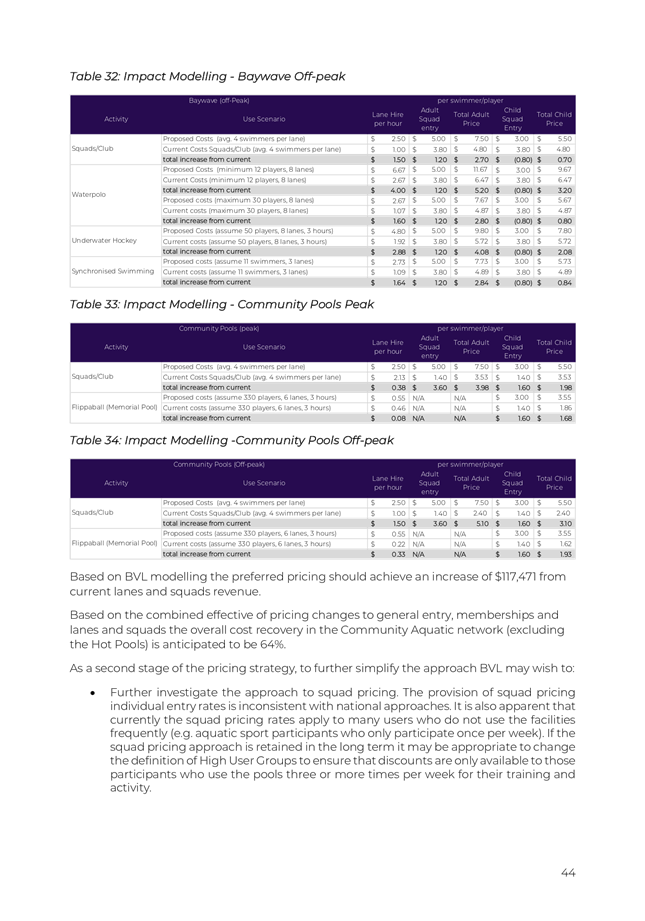

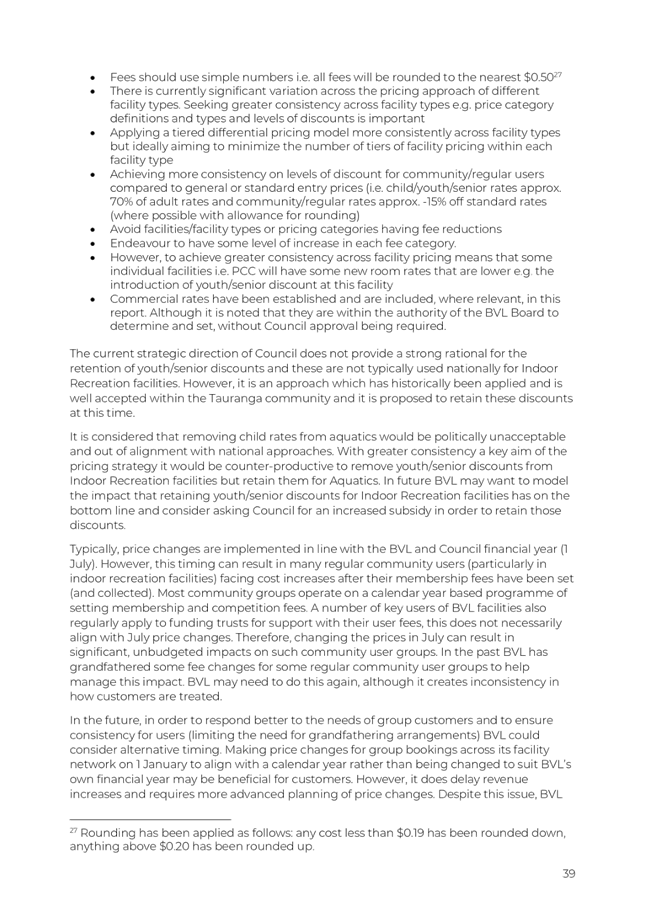

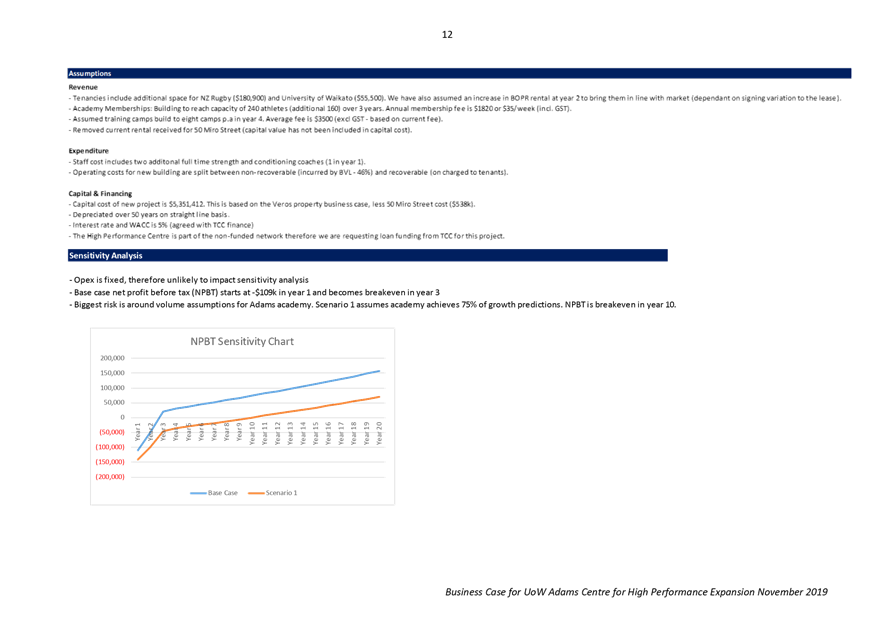

Purpose of the Report

1. The

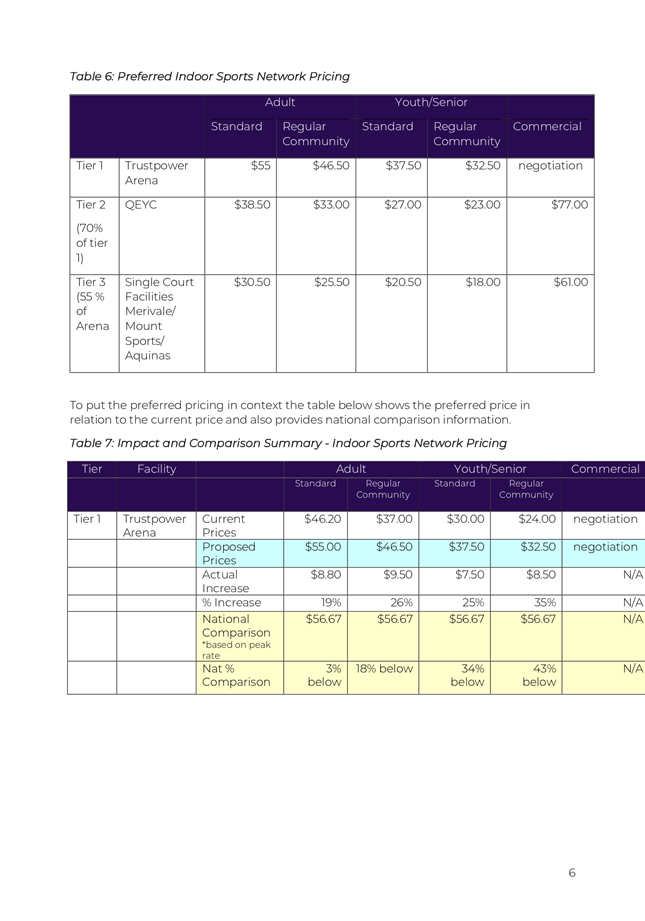

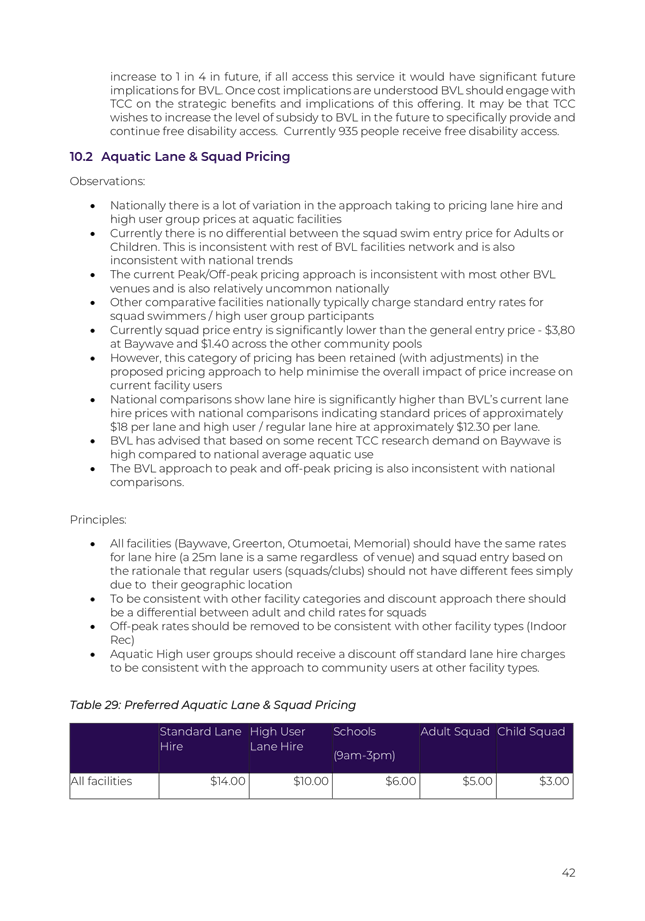

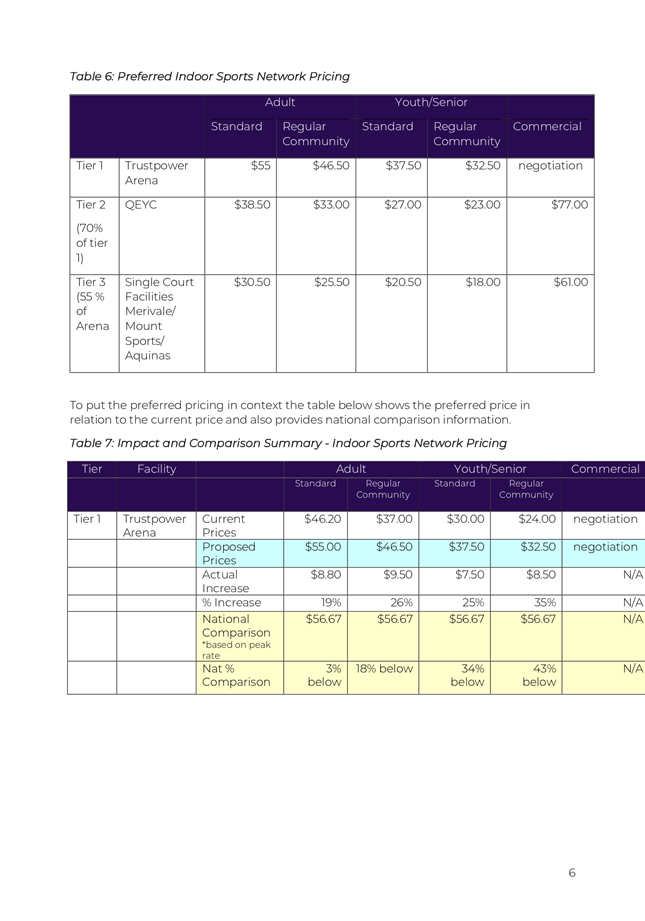

purpose of this report is to present Bay Venues Limited’s (BVL) proposed

capital and renewals expenditure and entry pricing for the Draft Annual Plan

2020/2021.

|

Recommendations

That the Policy Committee:

(a) Receives

Bay Venues Limited’s submission to the draft Annual Plan 2020/2021;

(b) Agrees

to incorporate Option 1b into the capital list for prioritisation in the

draft Annual Plan 2020/2021 going to Council in March, prior to community

consultation.

This option incorporates some

elements of Bay Venues Limited’s capital programme – in addition

to other minor new capital projects totalling $346,757 – and their

associated budgets, namely:

(i) the

Greerton rejuvenation project ($1,103,666); and / or

(ii) the

Adams Centre expansion project ($5,351,412).

(c) Defers

the following proposal for consideration in the Long Term Plan 2021-2031:

(i) Operations

Hub at Trustpower Baypark ($2,264,589)

(ii) Expansion

of Clubfit Baywave ($2,403,000); and

(iii) Baypark

Events Centre ($4,900,000).

(d) If

Council approves the capital funding for (b)(i) and/or (b)(ii) above,

delegate authority to the Chief Executive to approve an amendment of Bay

Venues Limited’s existing loan agreement to reflect the approved

capital budget;

(e) Approves

Bay Venues Limited’s total renewals budget of $5,822,826 into the draft

Annual Plan 2020/2021 and include for community consultation;

(f) In

relation to Bay Venues Limited’s operating revenue, agrees to

incorporate into the draft Annual Plan 2020/2021 and include for community

consultation:

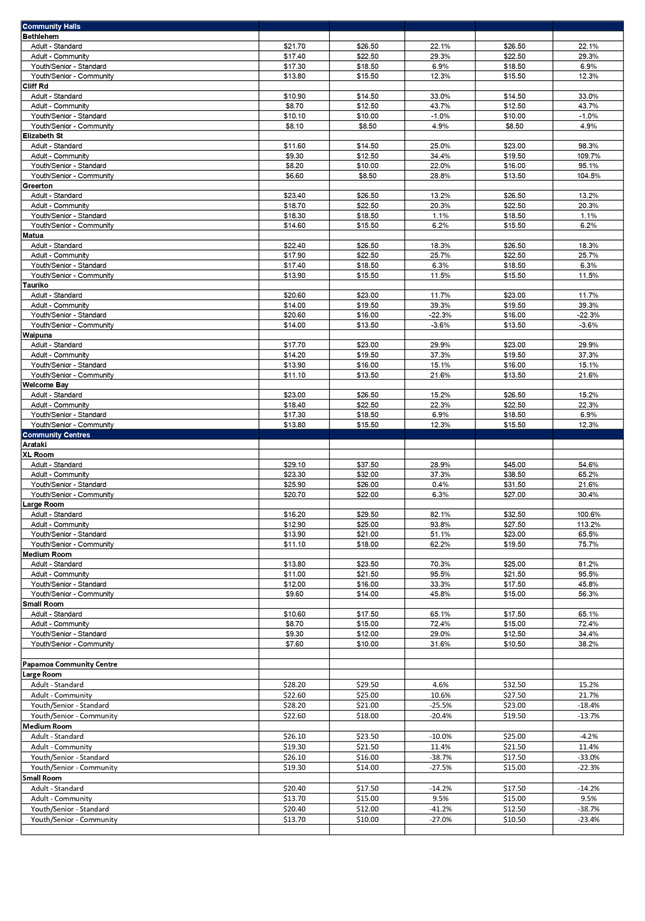

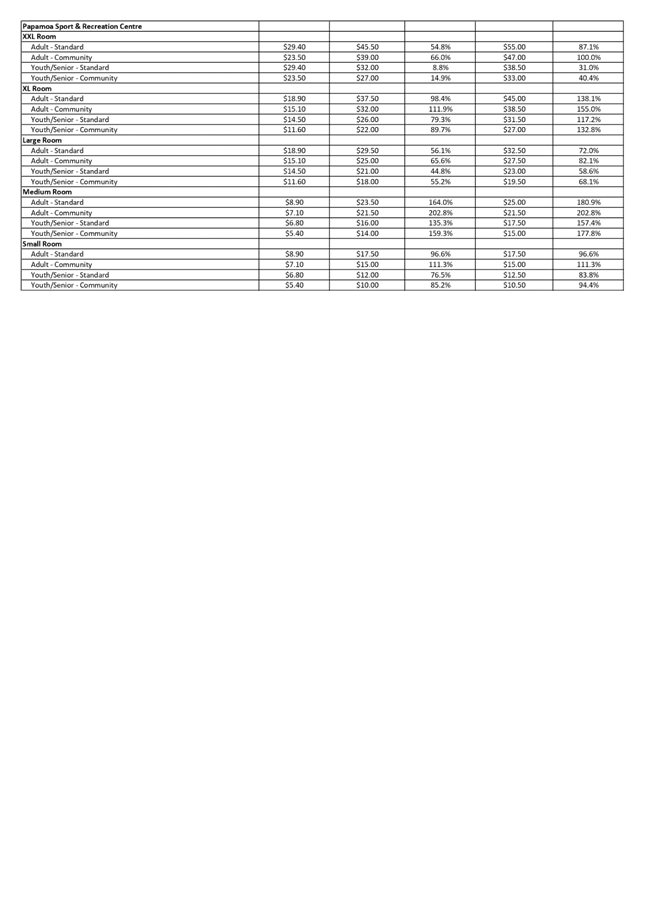

(i) Either

Option 2a – the pricing structure identified in the Recreation Sport

and Leisure Consultancy Ltd (RSL) pricing review report, along with

RSL’s pricing schedule included in Attachment 3.

(ii) Or

Option 2c – the hybrid model proposed by Bay Venues Limited (BVL),

along with BVL’s proposed pricing schedule included in Attachment 3.

This would enable some increase in user fees and charges ($400,000), with the

remainder of the shortfall to be provided through an increase to the rates-funded

operating subsidy ($150,000 plus CPI).

|

Executive Summary

2. BVL

has provided its submission to inform the development of the draft 2020/2021

Annual Plan, with a summary provided as Attachment 1. It provides information

that supports initiatives associated with capital projects, investment in

renewals and its operational budget.

3. The

submission includes a proposal for the inclusion of four major capital projects

– three of which are new projects and one, Greerton Aquatics and Leisure

Centre, was previously approved as part of the Long Term Plan (LTP) 2018-2028.

Together, these four projects represent an increase in new capital funding of

$5,370,724 from what was included in the LTP.

4. The

total renewals budget is $5,822,826, which is an increase of $1,312,375 on what

was approved as part of BVL’s submission to the LTP.

5. In

terms of operational funding, BVL has undertaken a comprehensive review of

profitability in the funded community network, which has indicated that a

revenue increase of approximately $550,000 is required to offset additional

operating costs incurred over recent years.

6. A

report (Attachment 2) from specialist leisure industry consultants, Recreation

Sport and Leisure Consultancy Limited (RSL), recommends price increases

throughout the funded network, which would simplify the complex pricing structure

and generate additional revenue of $534,717. RSL’s recommended pricing

schedule is included as Attachment 3.

7. As

an alternative to passing the full cost on to users, BVL has suggested a hybrid

model of cost recovery, which includes some increases to user fees and charges,

with the remainder of the shortfall provided through an increase to the

rates-funded operating subsidy of $150,000. BVL’s proposed price

increases are included as Attachment 3. They are less than those recommended by

the RSL Pricing Review, however they still require Council approval as they are

greater than CPI.

8. It

is noted that the operating subsidy provided to BVL in return for delivering

community outcomes has not increased above CPI since the inception of the

organisation, despite a significant increase in user numbers over this time.

9. BVL

are seeking Council approval for either the full RSL pricing schedule, or their

proposed hybrid model (Attachment 3) to be included for community consultation

through the 2020/2021 Annual Plan process.

BACKGROUND

10. BVL

has provided its submission to inform the development of the draft 2020/2021

Annual Plan (Attachment 1). It provides information that supports initiatives

associated with capital projects, investment in renewals and its operational

budget.

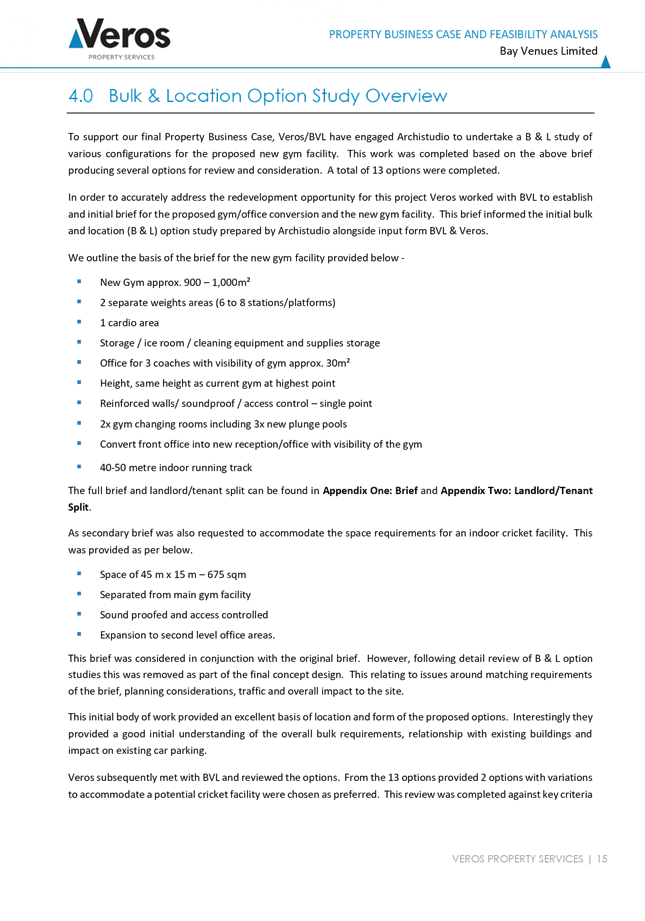

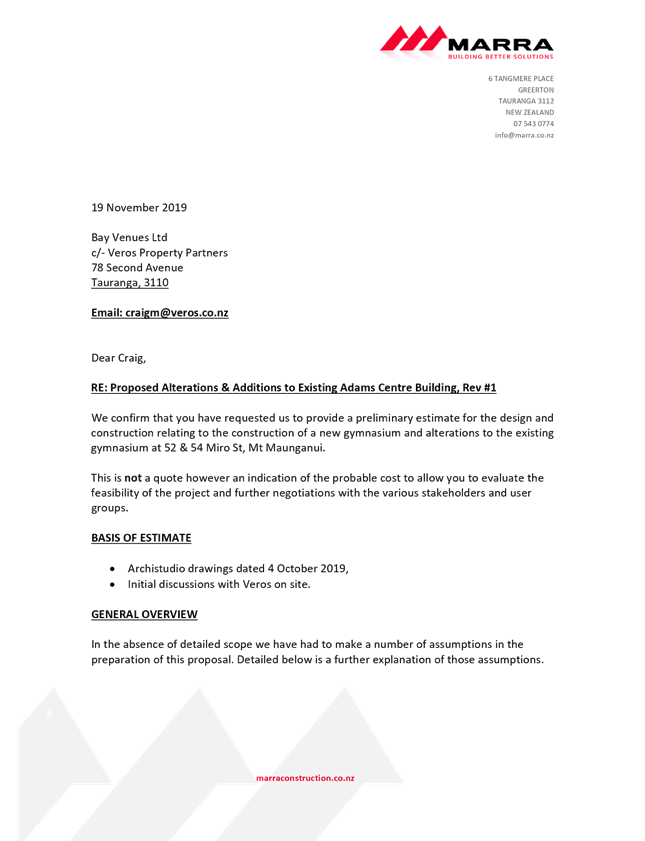

11. In addition,

each of the major new capital projects is supported by a detailed business

case, which has been approved by the BVL Board and submitted to Council staff

as per the requirements of the Enduring

Statement of Expectation. The detailed business cases are provided in Attachment

4.

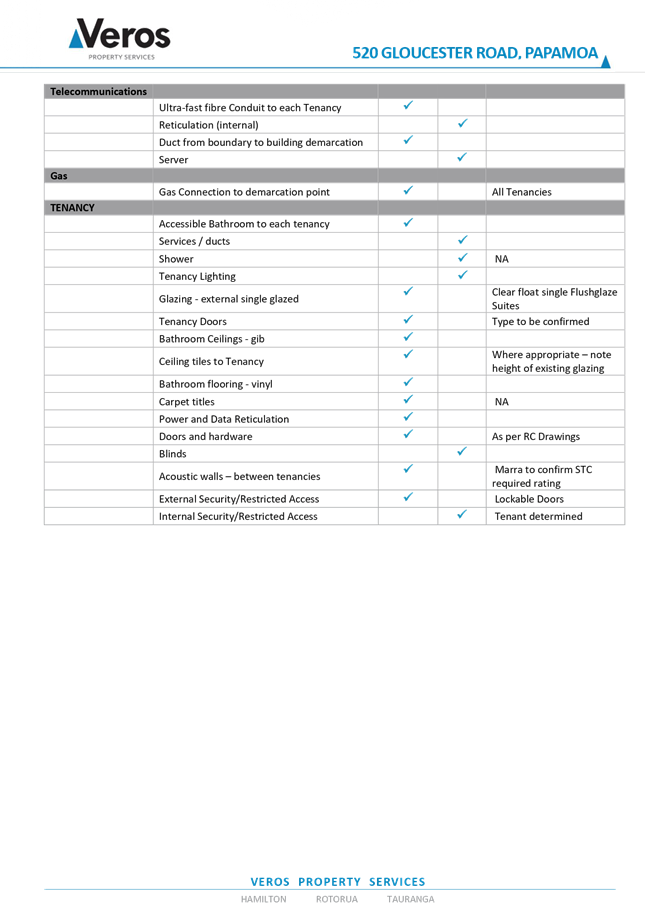

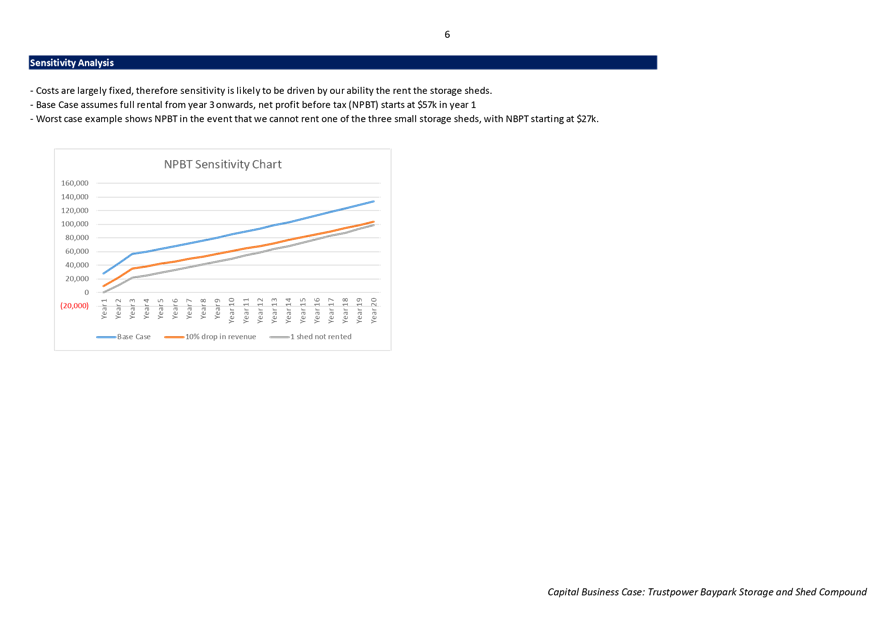

Significant capital projects requested

12. BVL’s

submission proposes inclusion into the Annual Plan 2020/2021 of four major

capital projects requiring Council approval as per the $200,000 threshold in

the Enduring Statement of Expectation.

13. Three

of the major capital projects are new projects and one, Greerton Aquatics and

Leisure Centre, was previously approved as part of the LTP.

14. Together

these four projects represent an increase in new capital funding of $5,370,724

from what is already in the LTP. Note: this figure includes the deferral of

another significant project currently in the LTP, the Baypark Events Centre,

with a detailed breakdown included in BVL’s submission (Attachment 1).

15. The

new capital projects are:

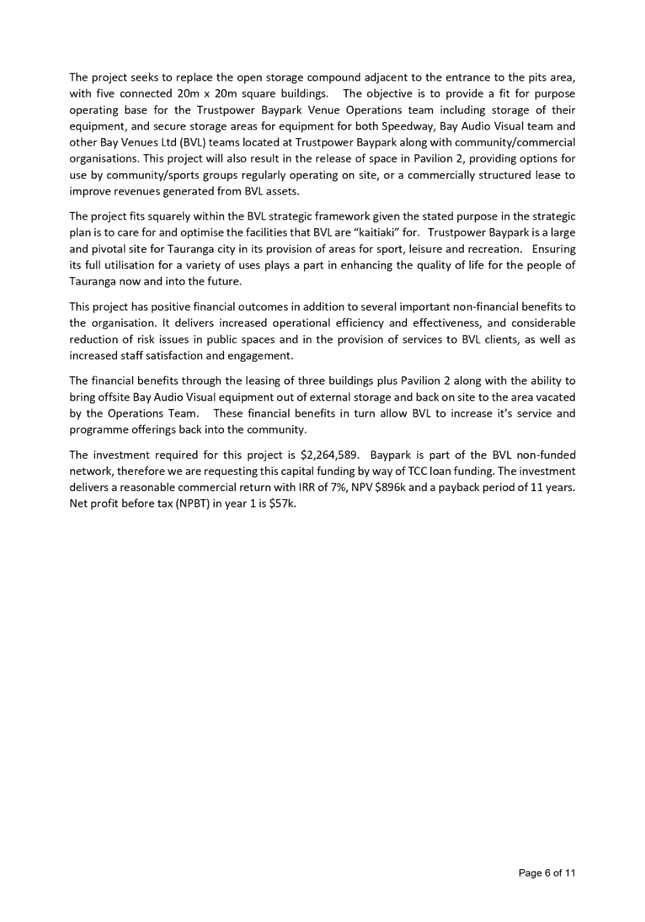

(a) Trustpower

Baypark Storage Compound and Operations Hub: $2,264,589

Construction of a multi-bay

storage compound, which will provide facilities for BVL Operations and

Maintenance staff and equipment. A component of the storage compound would also

be available for lease to generate revenue.

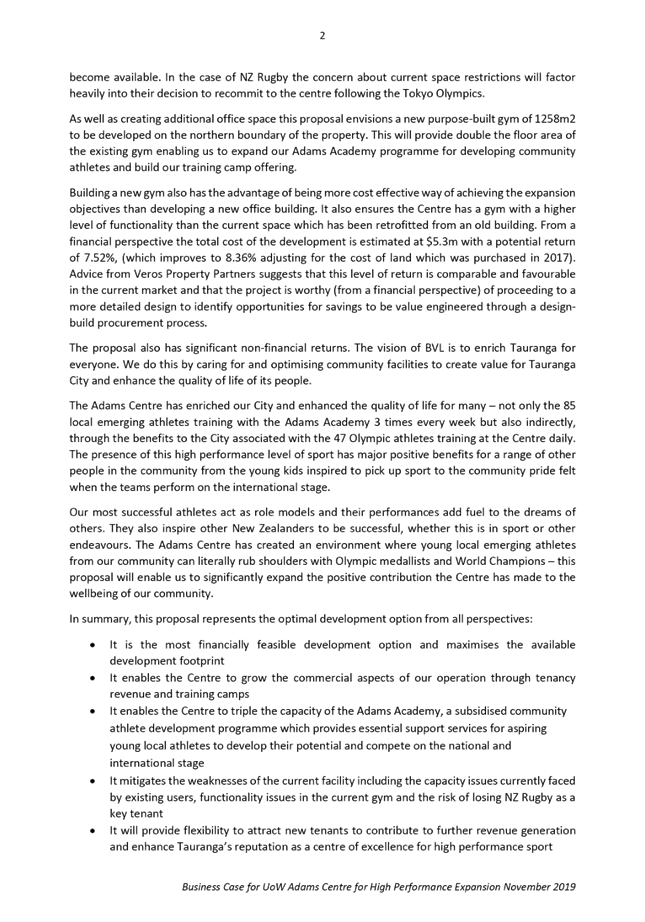

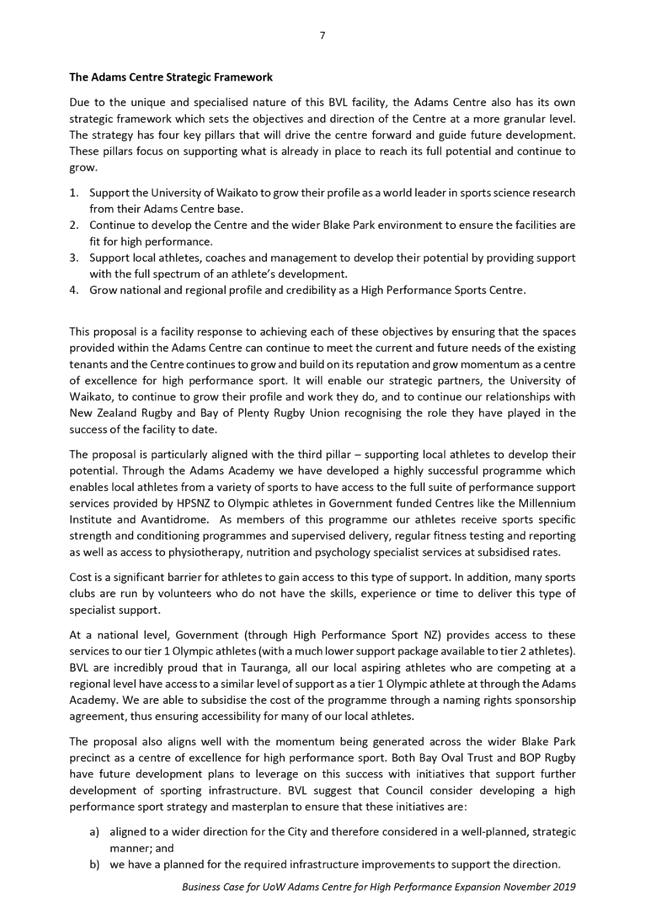

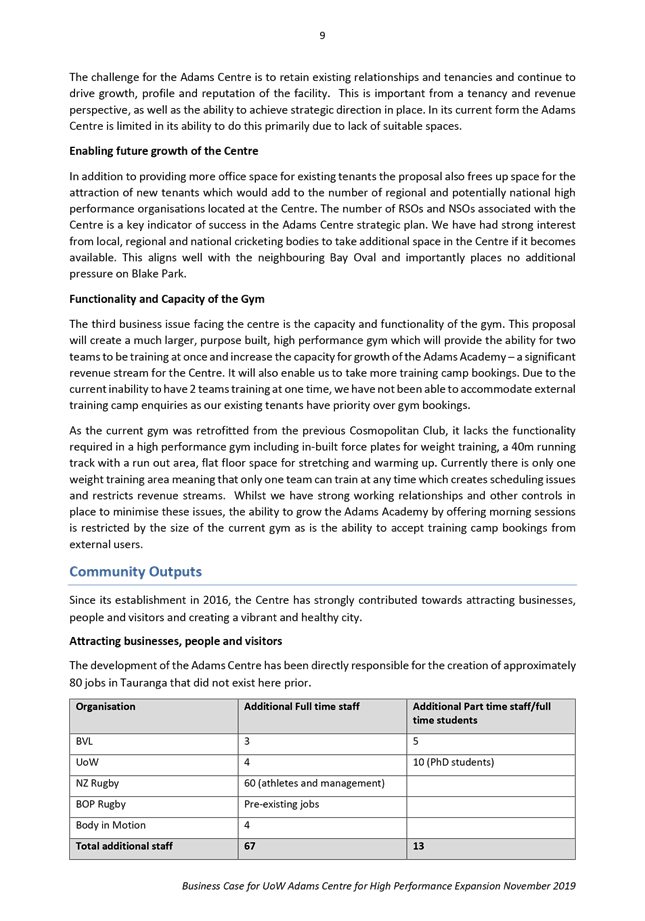

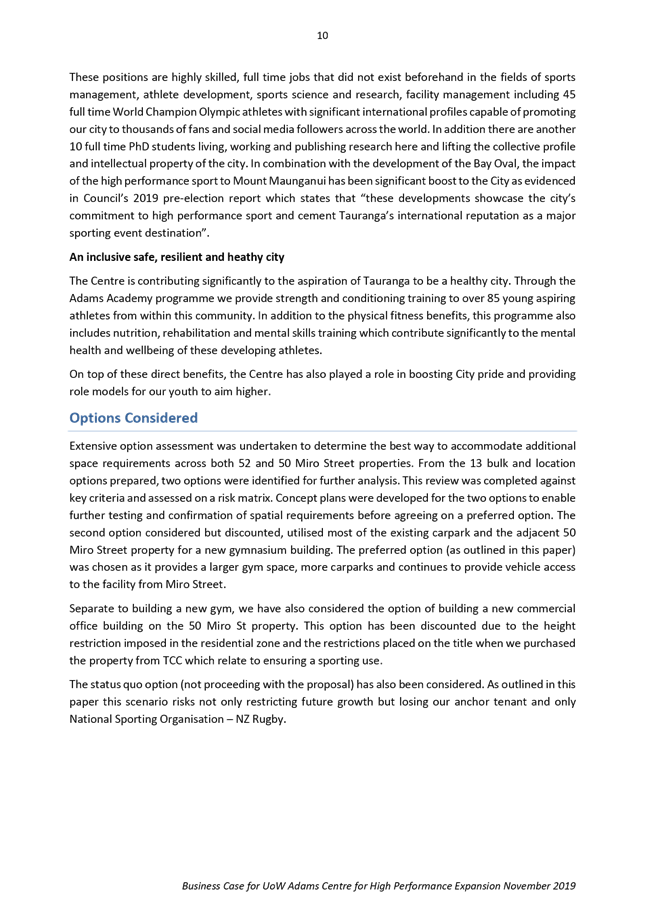

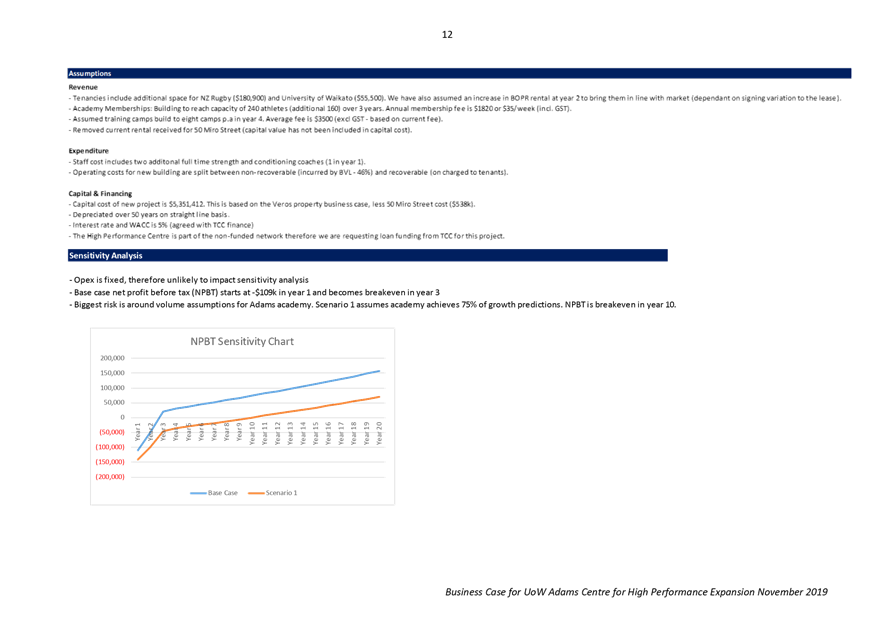

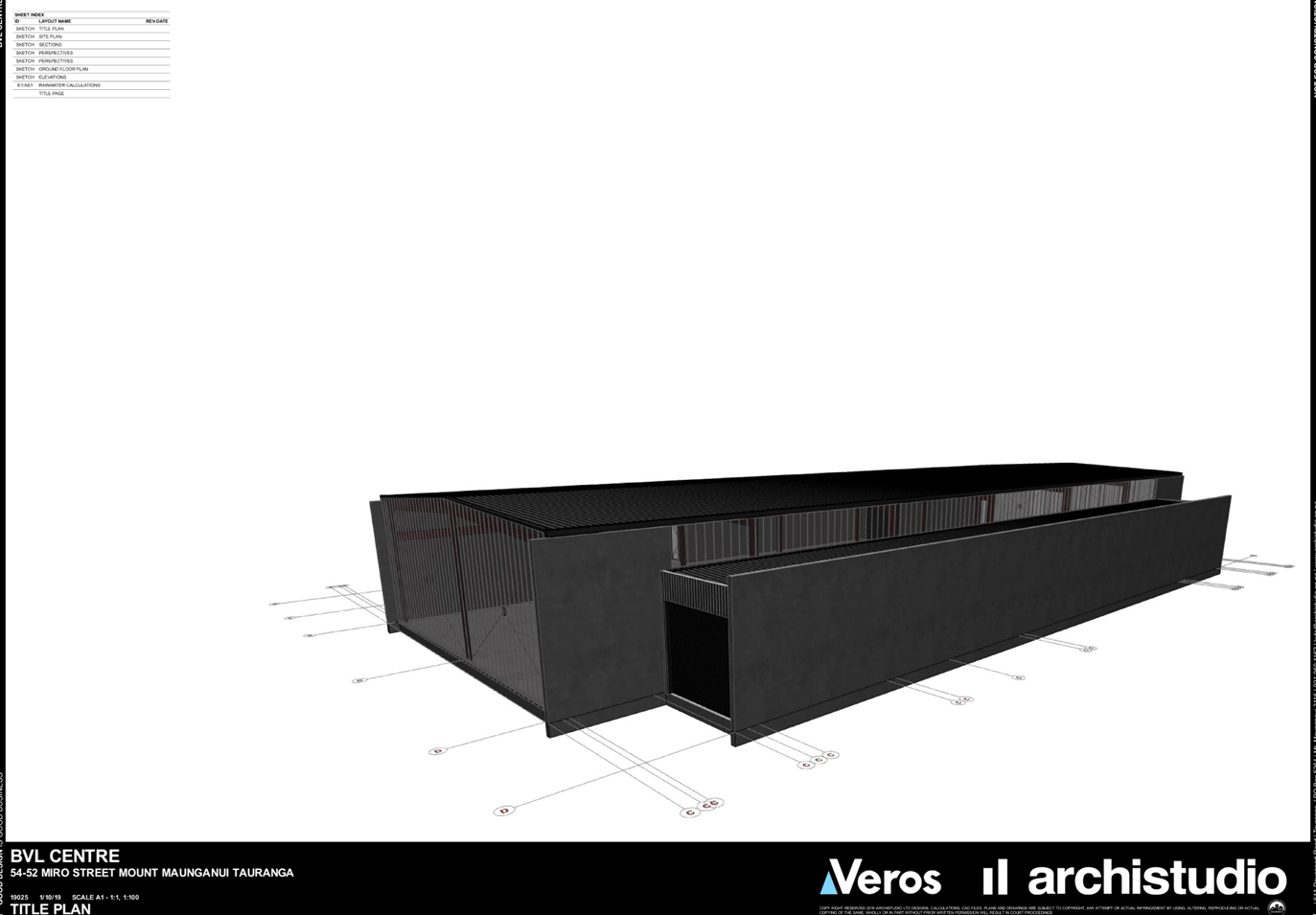

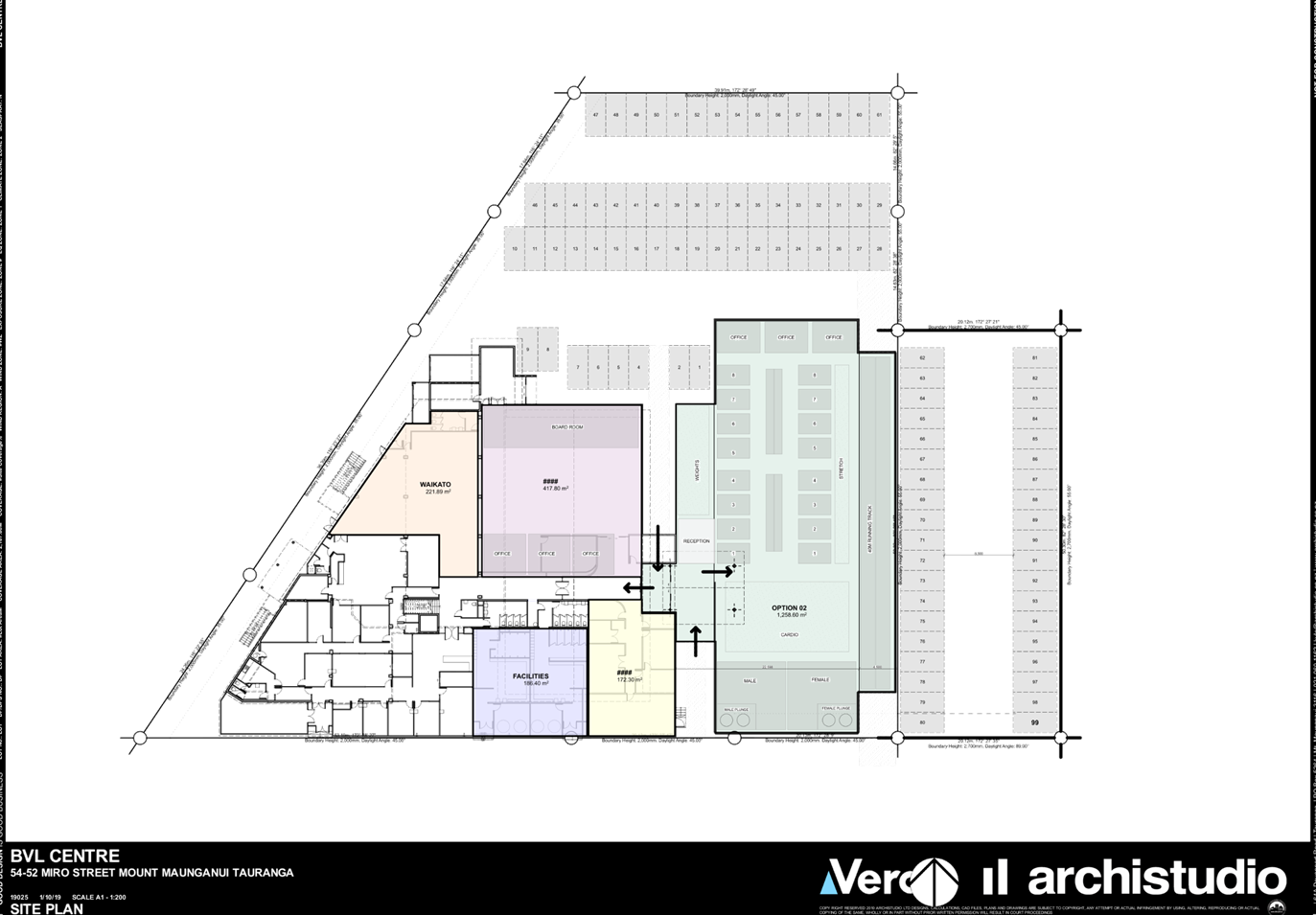

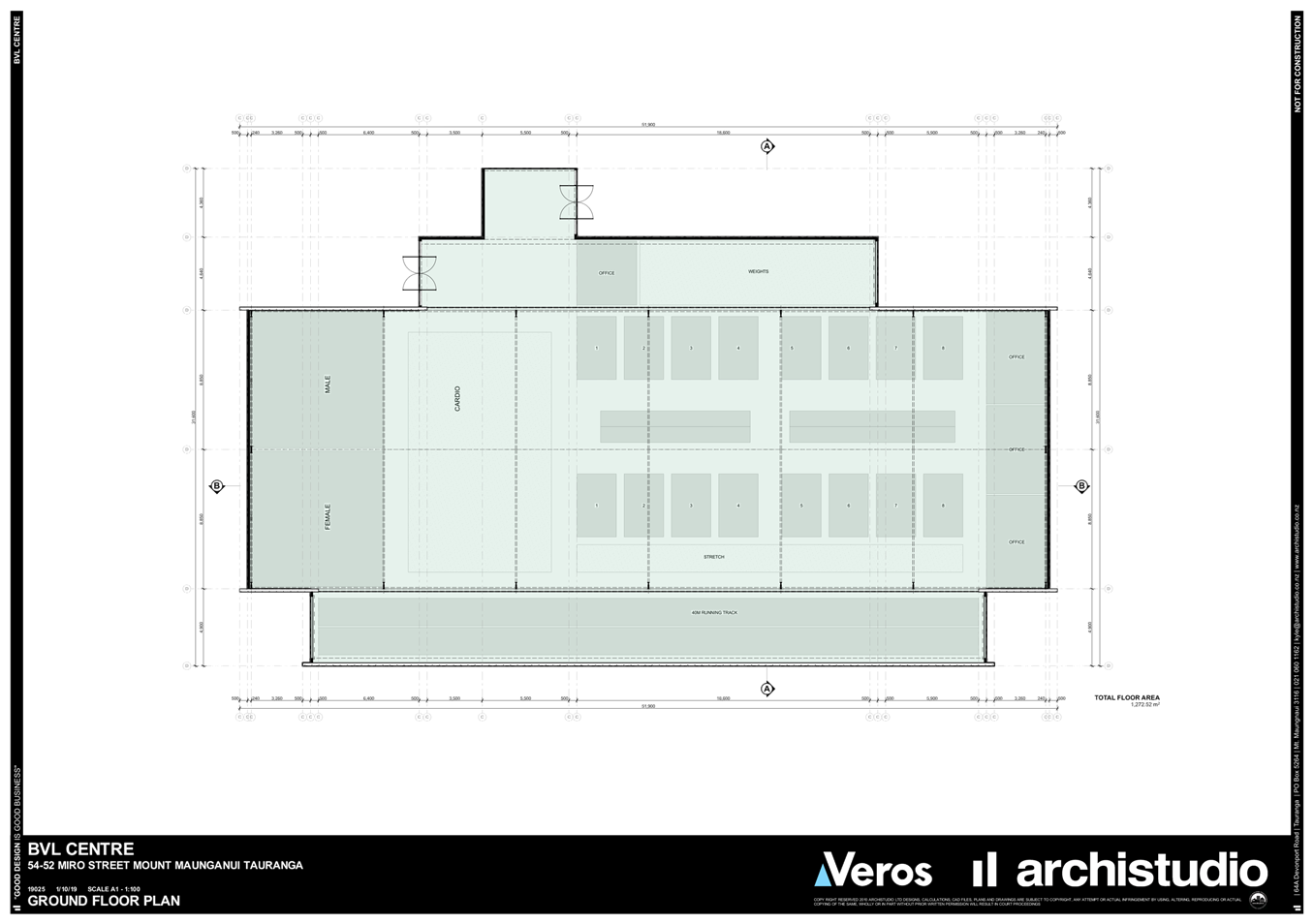

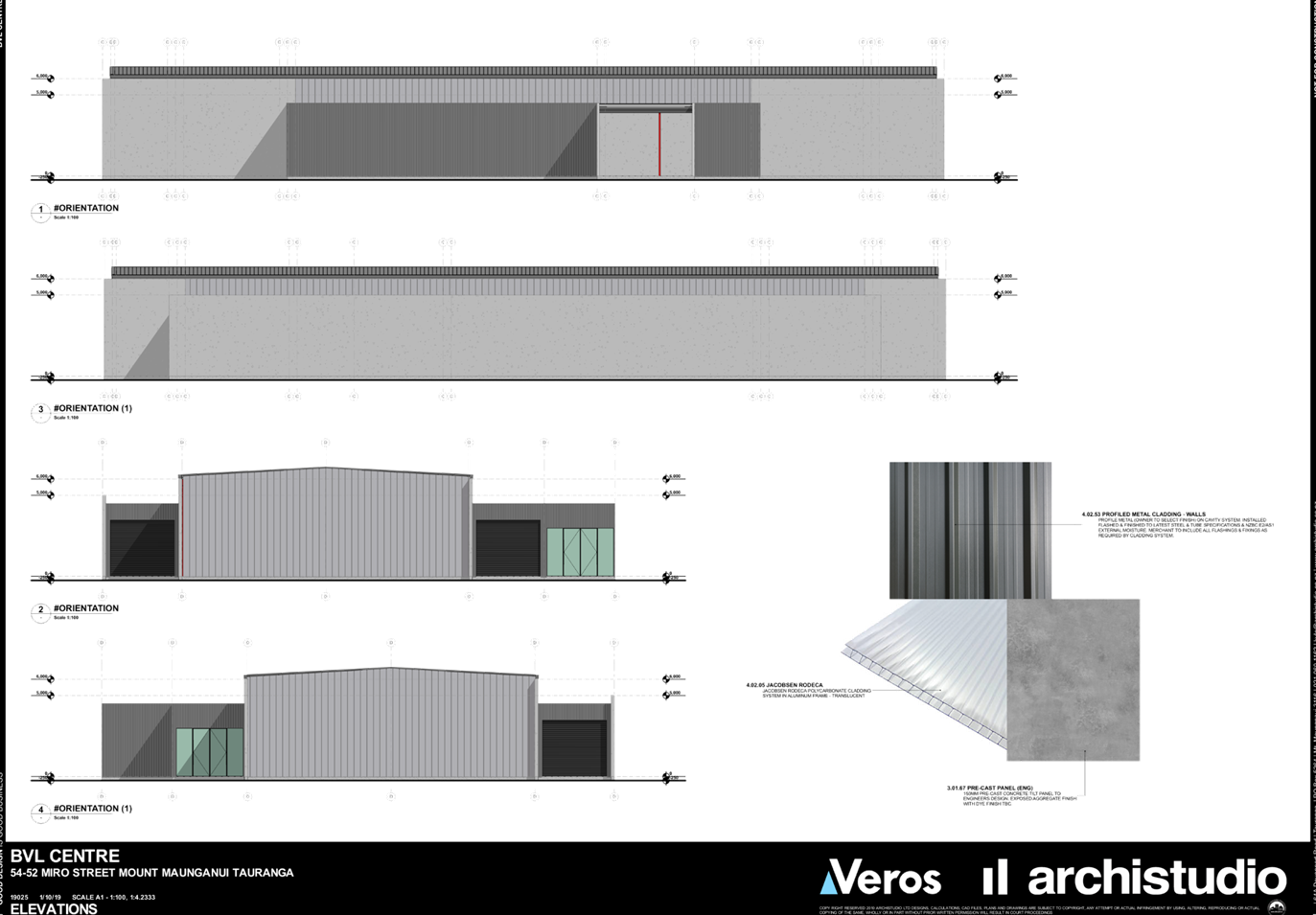

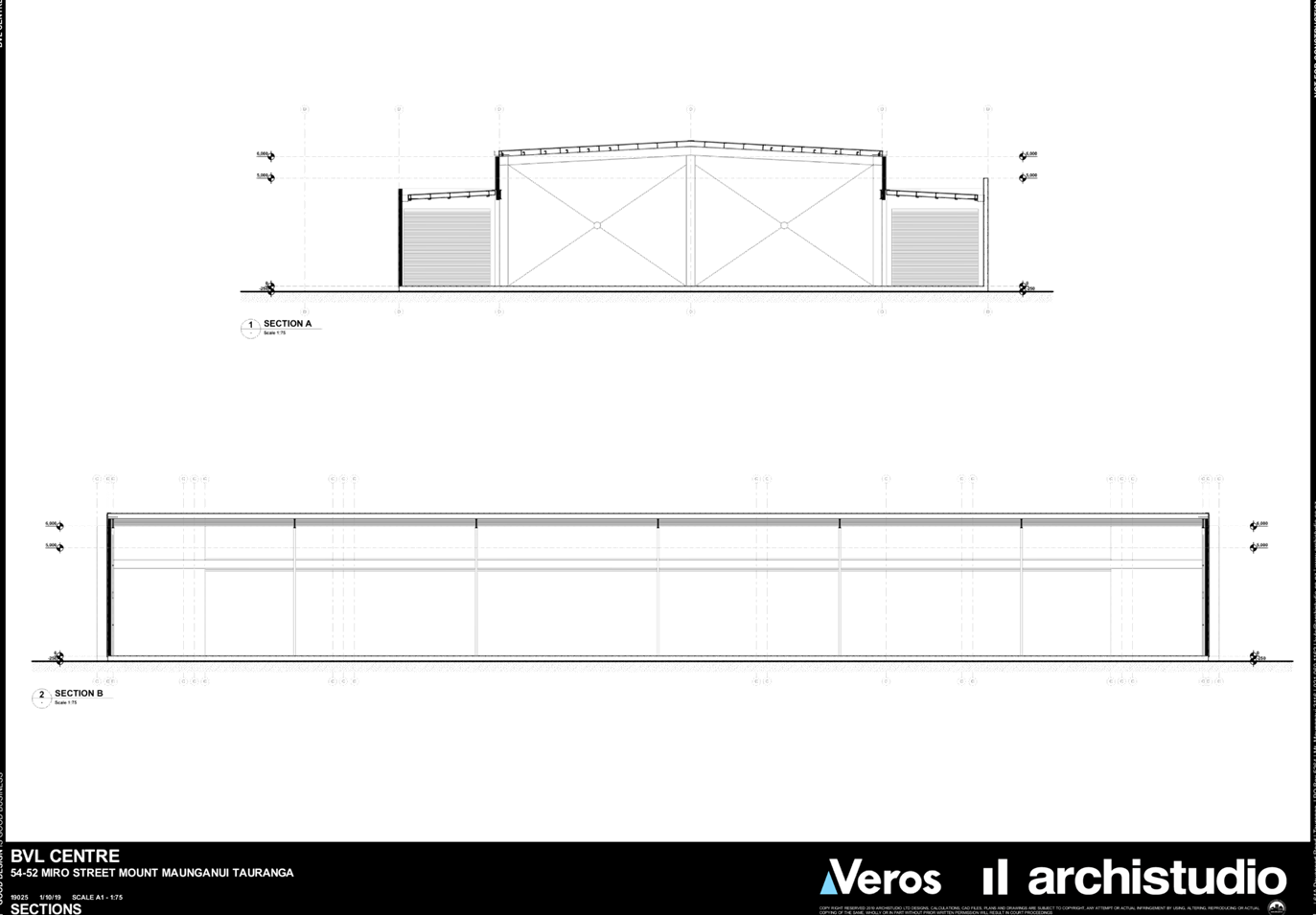

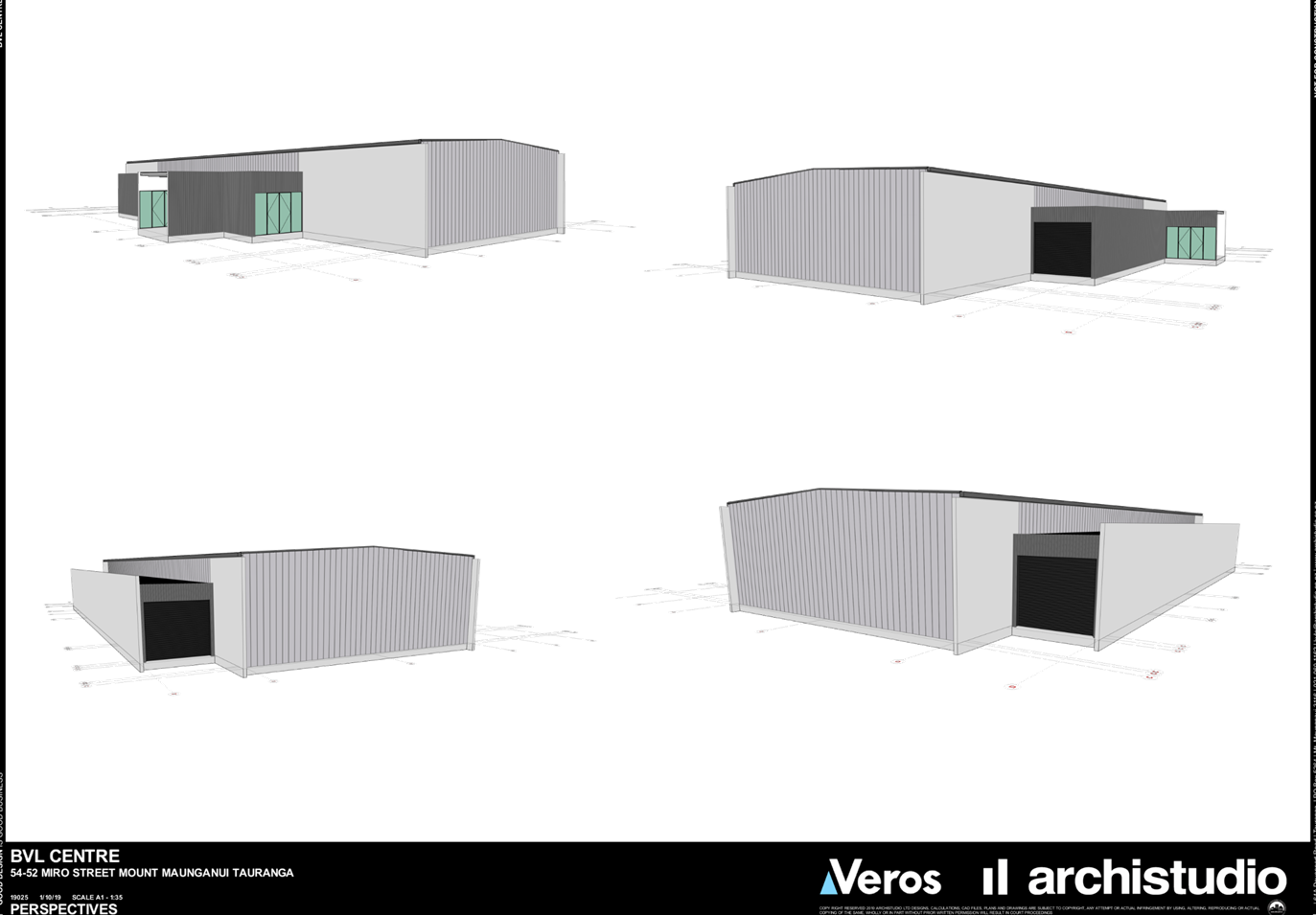

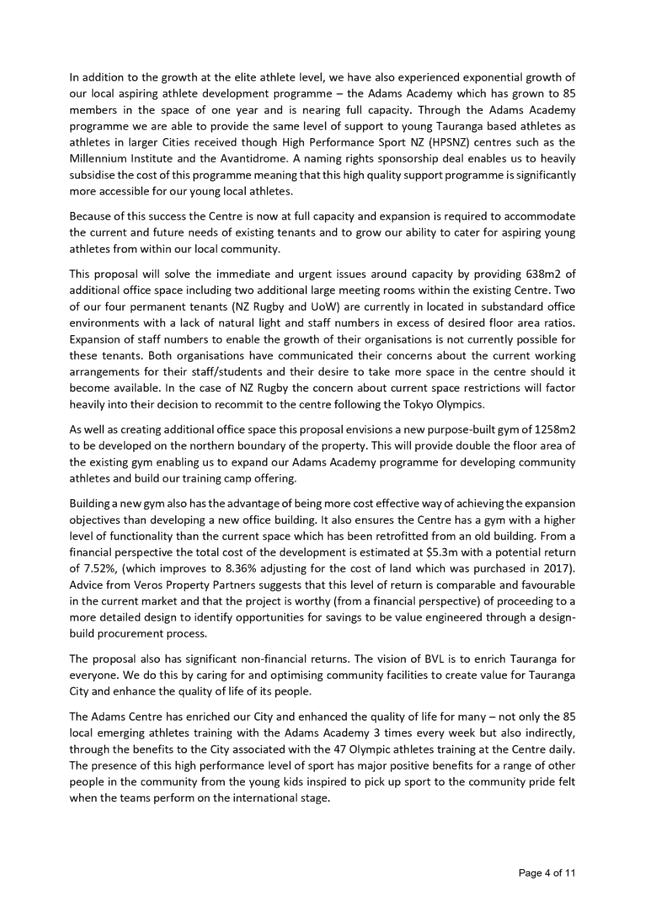

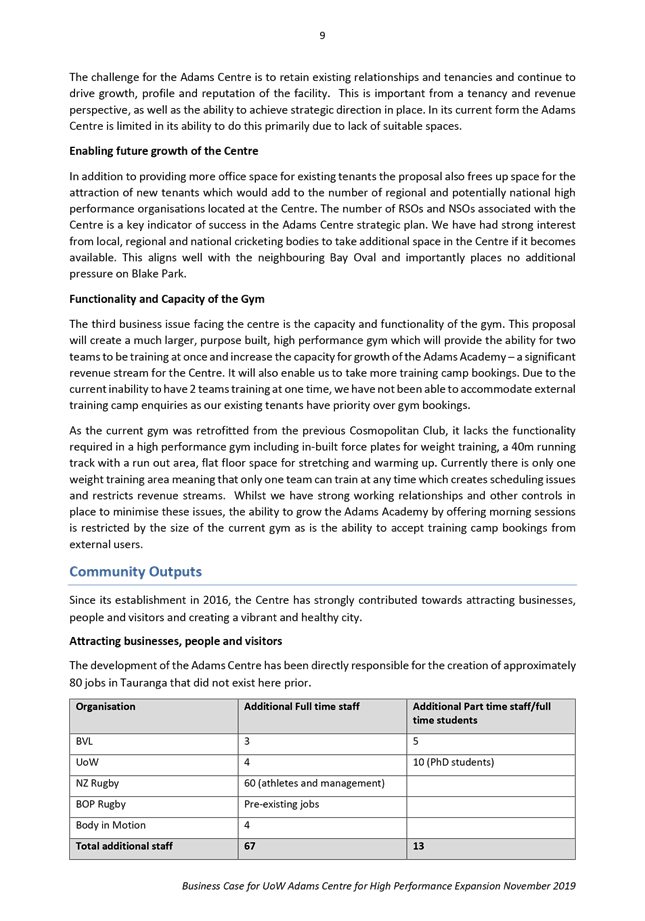

(b) UoW Adams

Centre High Performance Centre (Adams Centre): $5,351,412

Expansion of the University of

Waikato Adams Centre for High Performance by creating a new purpose-built gym

adjacent to the Centre, repurposing the existing gym into office space and

utilising the neighbouring BVL property at 50 Miro Street to provide the

required car parking.

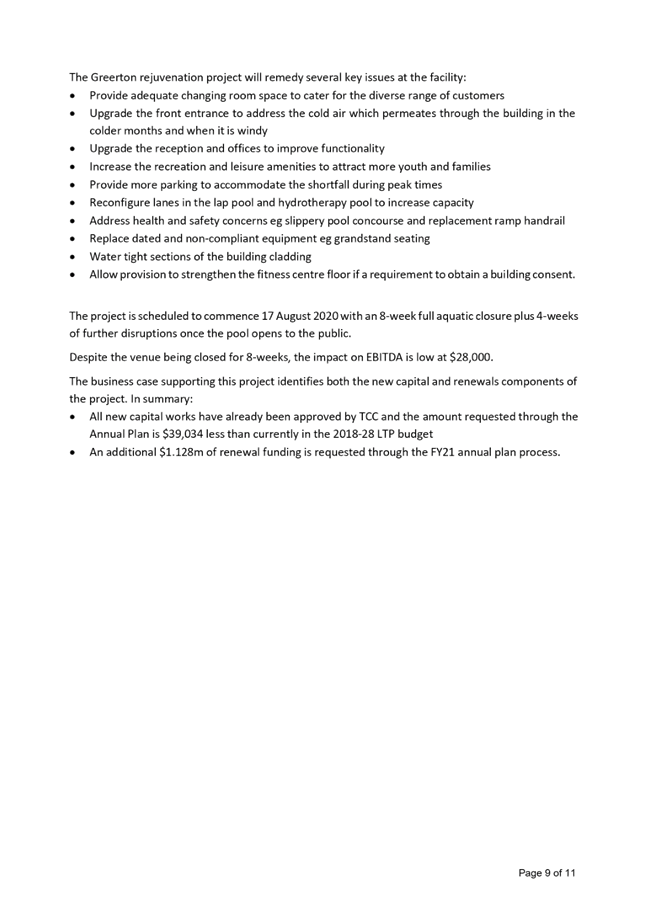

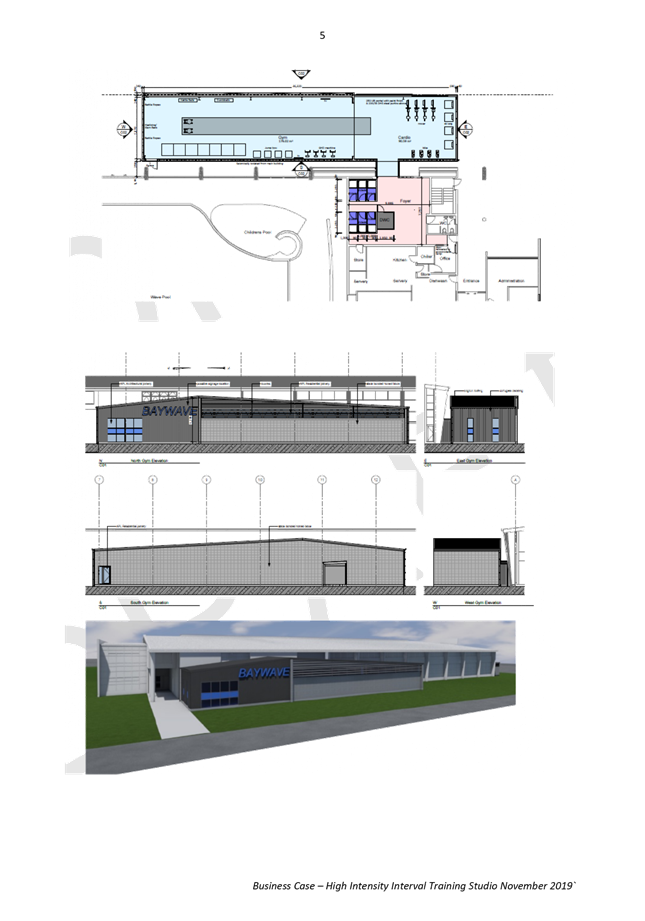

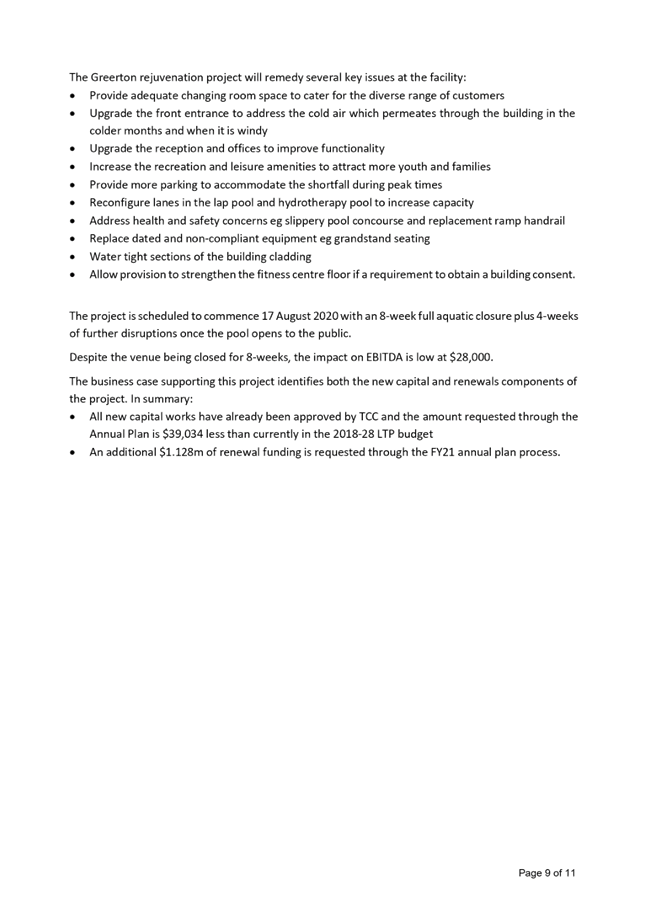

(c) High

Intensity Interval Training Studio (HIIT): $2,403,000

Construction of a 285m2 high

intensity fitness training studio at Clubfit Baywave to expand the product

offering and maximise utilisation and revenue returns.

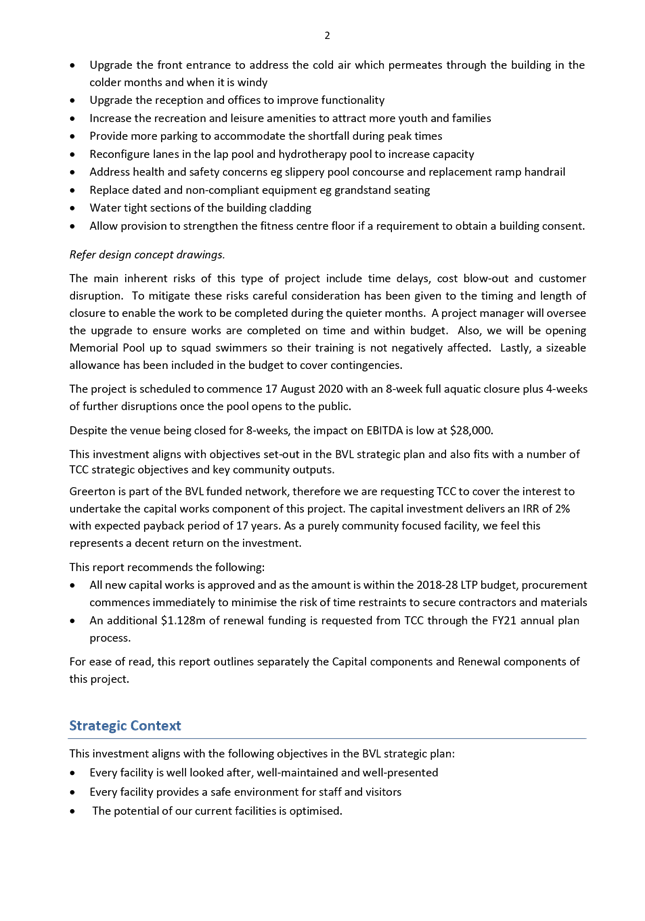

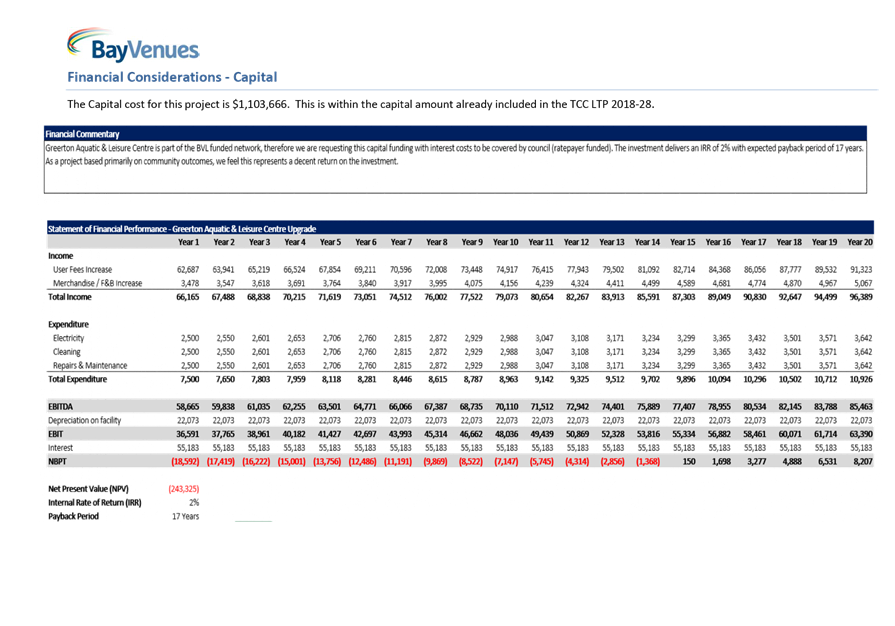

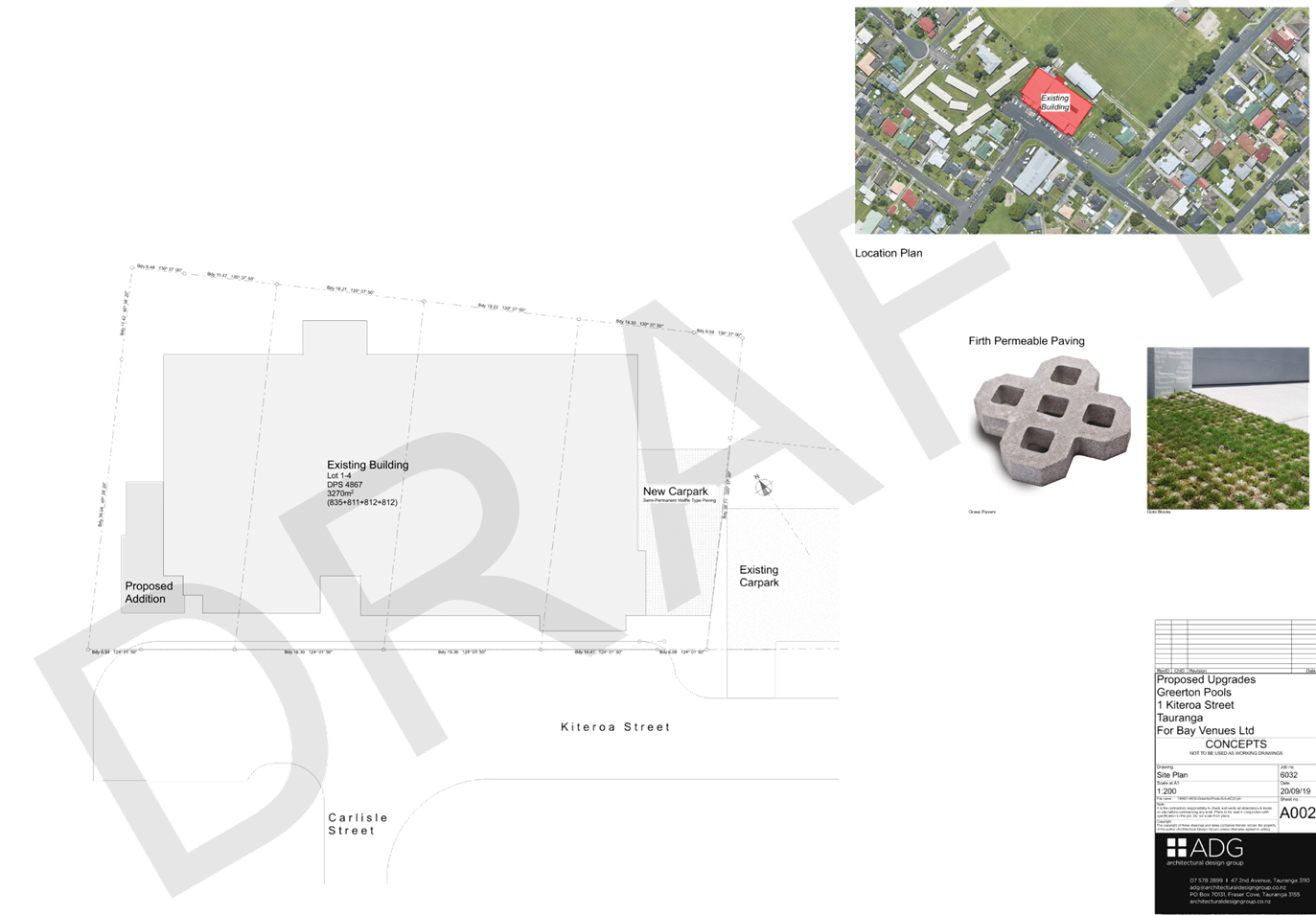

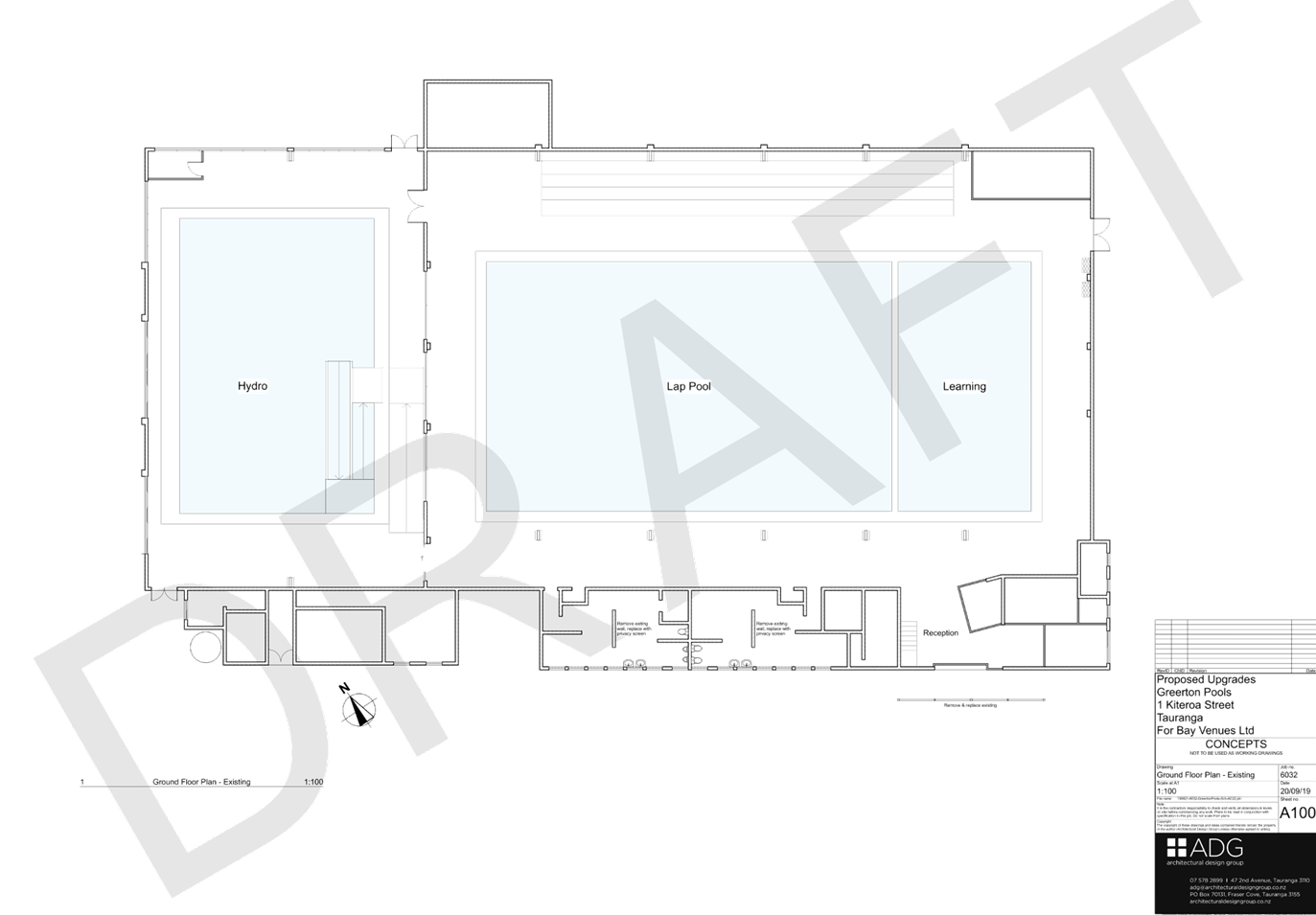

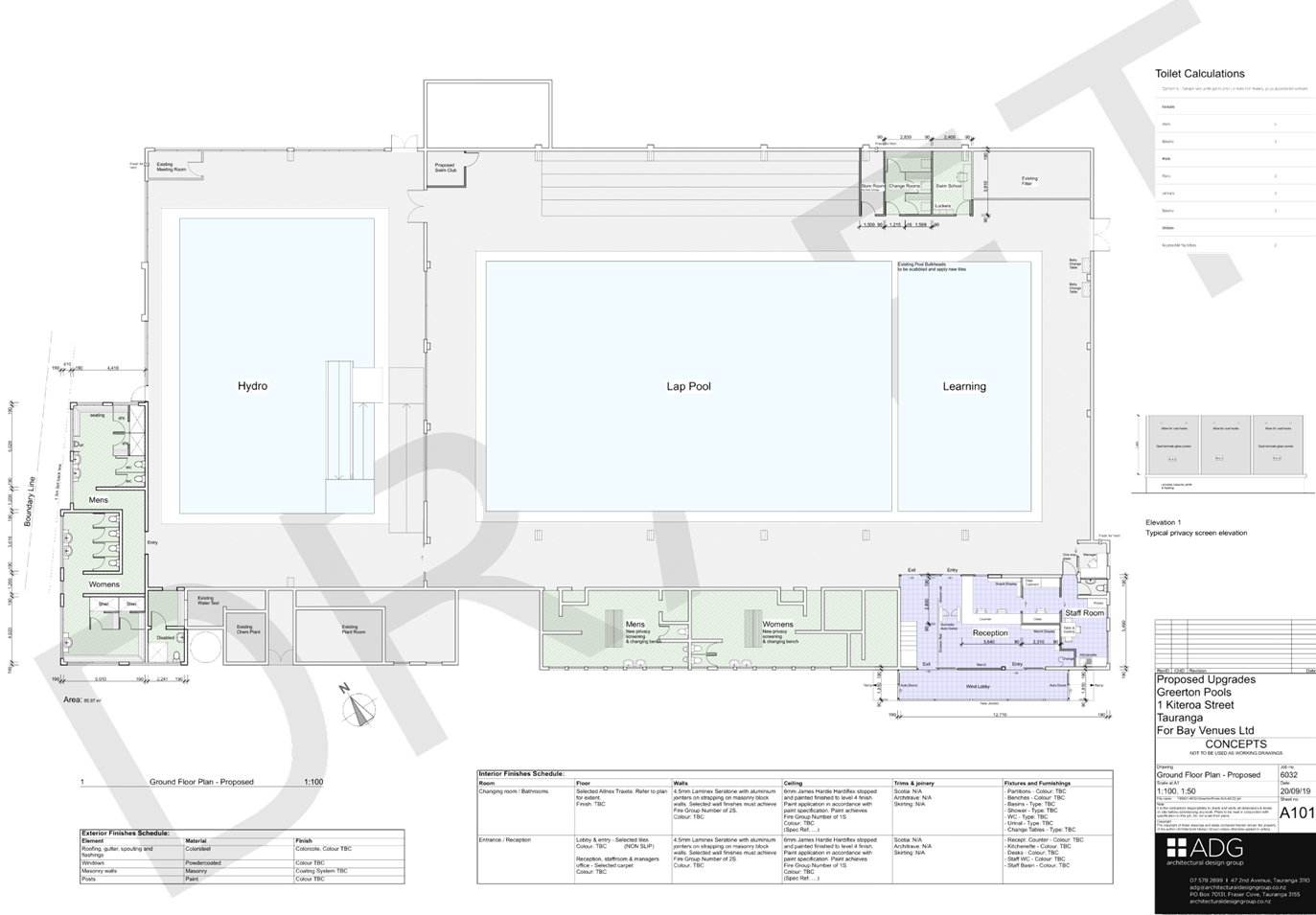

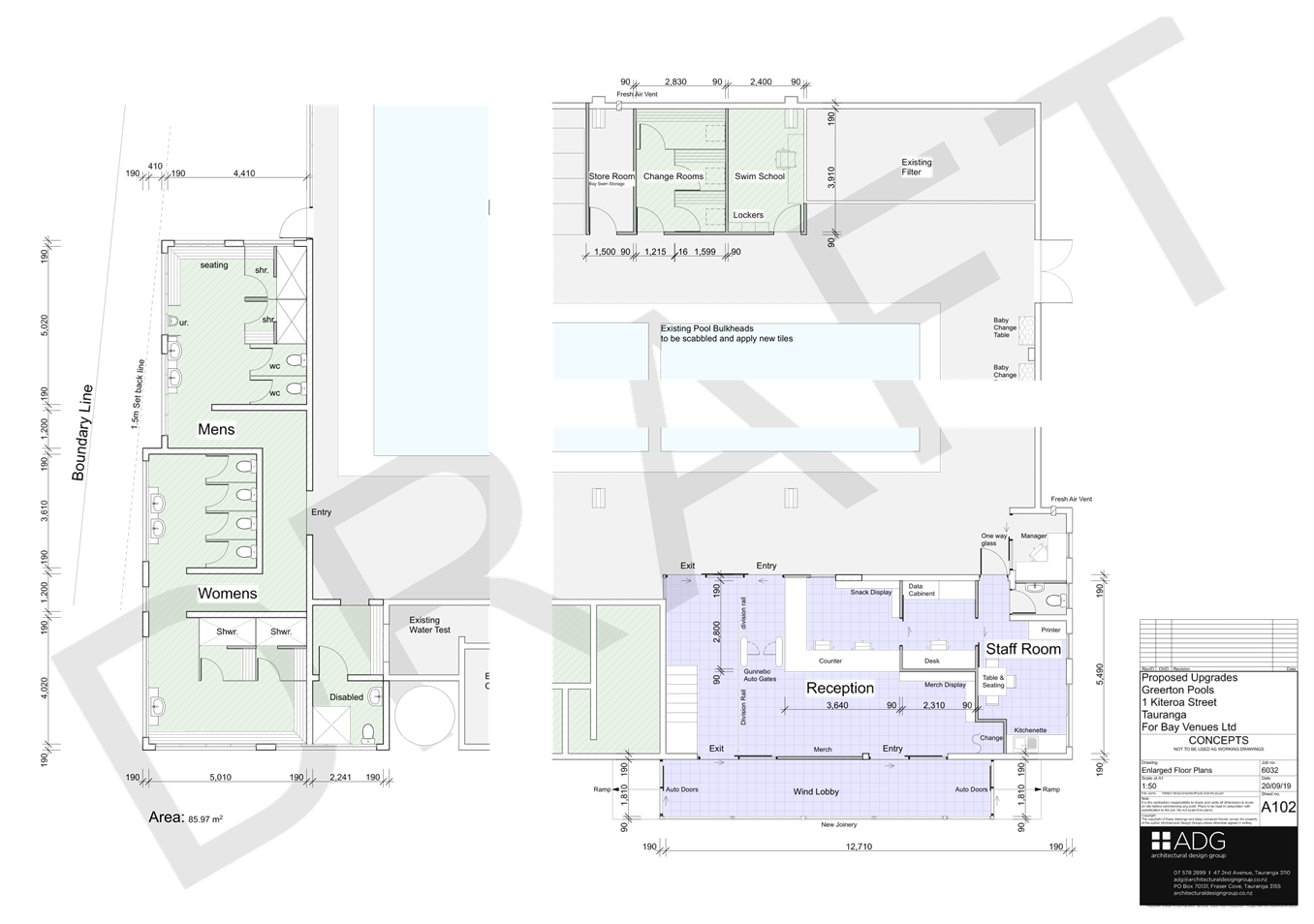

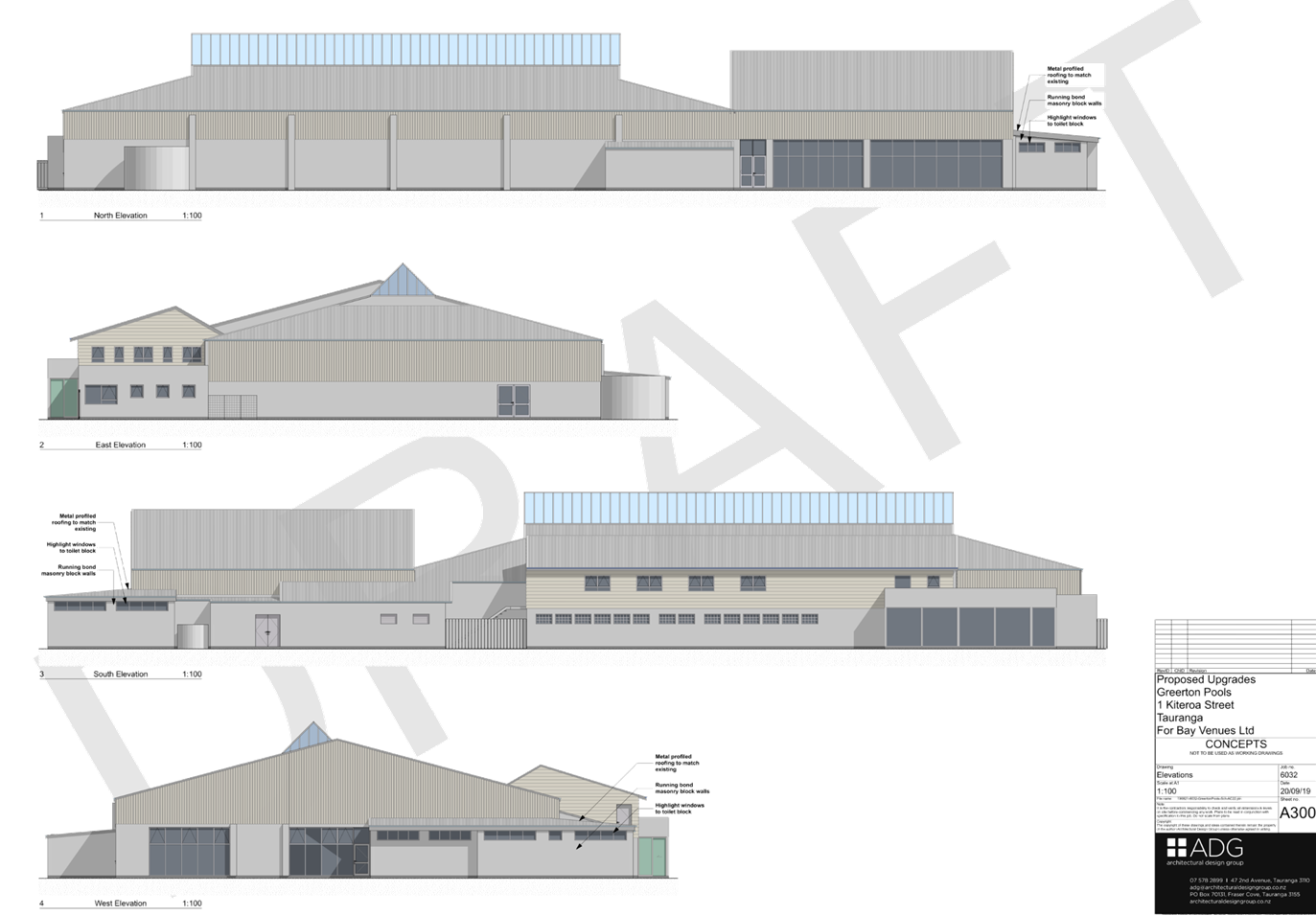

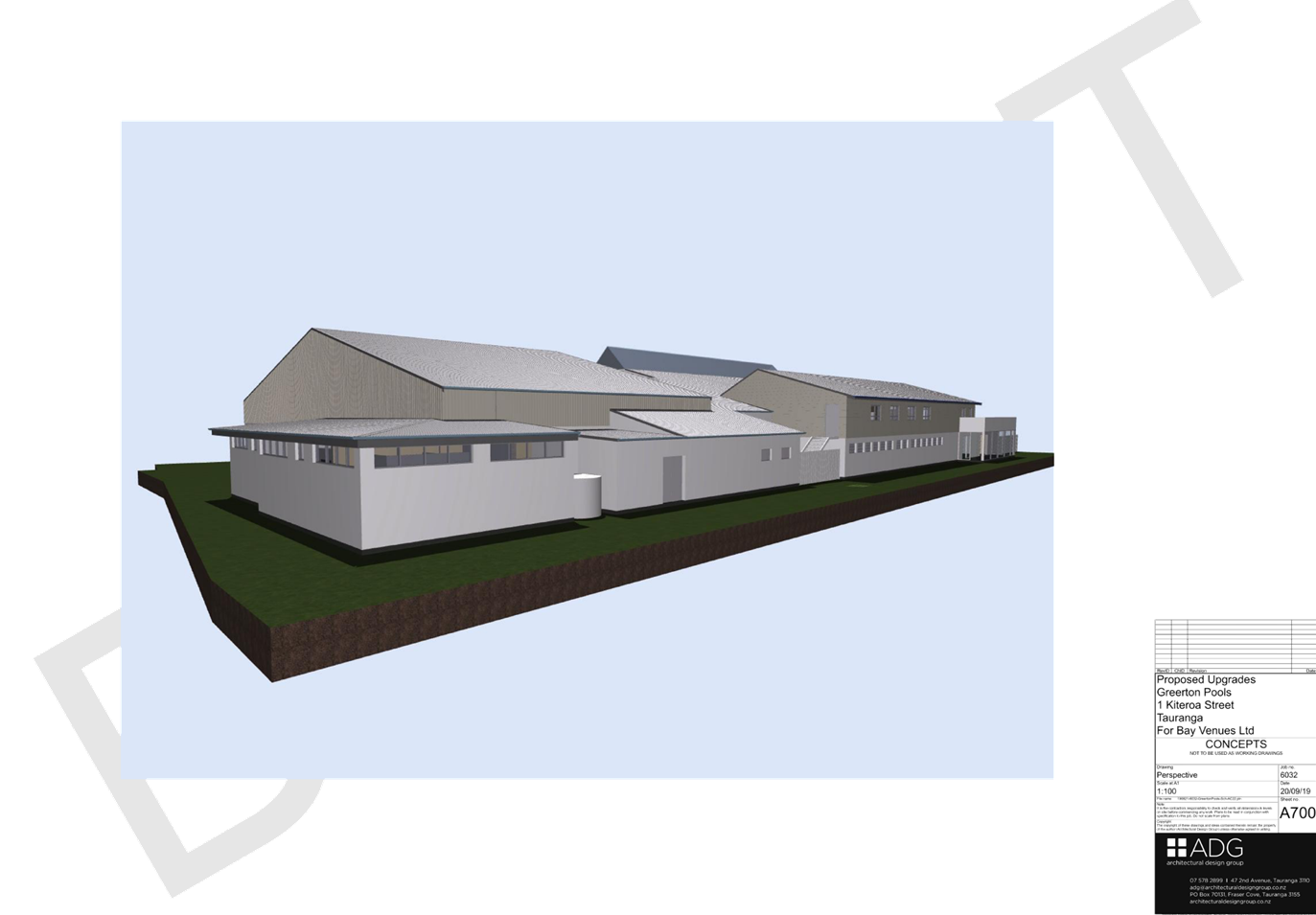

(d) Greerton

Aquatic & Leisure Centre (Greerton): $1,103,666

This project has both a new

capital and a renewals component. BVL have already had a business case approved

through the LTP for the capital works however these were delayed due to the

Baywave closure taking priority. In the interim, BVL have identified additional

renewals required, resulting in an additional $1.128m of renewal funding being

requested through the Annual Plan 2020/2021 process.

Options Analysis – CAPITAL

PROJECTS

Option 1a: Incorporate Bay Venues

Limited’s total capital programme and associated budgets into the draft

Annual Plan 2020/2021 for community consultation.

16. Agree

to support the capital programme outlined in Attachment 1, along with detailed

business cases (Attachment 4). Incorporate the capital funding into the draft

Annual Plan 2020/2021 for community consultation.

17. If

this option is approved, Council will need to amend BVL’s existing loan

agreement to reflect the approved capital funding. It is recommended that this

is delegated to the Chief Executive.

18. If the

projects were to go ahead, the BVL debt to equity ratio as stated in the

current ESE would need to be reviewed.

|

Advantages

|

Disadvantages

|

|

· Approving this submission

enables BVL to operate commercially, using community facilities to grow

financial and non-financial returns.

· Greerton –

improvements to an important but ageing aquatic facility to continue to meet

the needs of Tauranga’s growing community and remedy several negative

issues at the facility, including inadequate changing room space, carparking,

entranceway and health and safety concerns.

· Baypark

Operations Hub – increased operational efficiency and effectiveness,

reduction of Health and Safety risks. Financial benefits through rental of

storage units and Pavilion help subsidise the cost of providing community

outcomes across the wider network. Cost savings of no longer having to rent

external storage for Bay AV equipment.

· Adams Centre

– resolves immediate and urgent issues around capacity by providing

638m2 of additional office space. Enables growth of existing tenants who have

raised concerns about their ability to commit long-term in the absence of

growth potential. Expansion of Adams Academy programme for developing

community athletes.

· Clubfit

Baywave – opportunity to expand product offering and maximise

utilisation and revenue returns by increasing membership and relieving

capacity issues. Enables Clubfit to continue to play a significant role in

the BVL network, providing economic returns that help subsidise the cost of

providing community outcomes across the wider network.

|

· Further

increases to BVL’s capital funding will put pressure on TCC’s

debt limitations.

|

Option 1b: Incorporate some elements of Bay Venues

Limited’s proposed capital programme and associated budgets into the

capital list for prioritisation in the draft Annual Plan 2020/2021 going to

Council in March, prior to community consultation.

19. This

option incorporates some elements of Bay Venues Limited’s capital

programme outlined in Attachment 1, along with their detailed business cases

(Attachment 4) and associated budgets, into the capital list for prioritisation

in the draft Annual Plan 2020/2021 going to Council in March. This would

be in addition to other minor new capital projects totalling $346,757.

20. If

this option is approved, Council will need to amend BVL’s existing loan

agreement to reflect the approved capital funding. It is recommended that this

is delegated to the Chief Executive.

21. BVL

has indicated that the Greerton and Adams Centre projects have greater urgency

and that the Baypark Operations Hub and Clubfit HIIT studio could potentially

be deferred to the LTP.

22. The

advantages and disadvantages of Council approving both projects have been

analysed below.

|

Advantages

|

Disadvantages

|

|

· Reduces the

level of additional capital funding required for BVL by $4,667,589. The

capital budget would represent an increase of $703,135 over and above what is

already in the LTP budget for FY21.

· Enables the

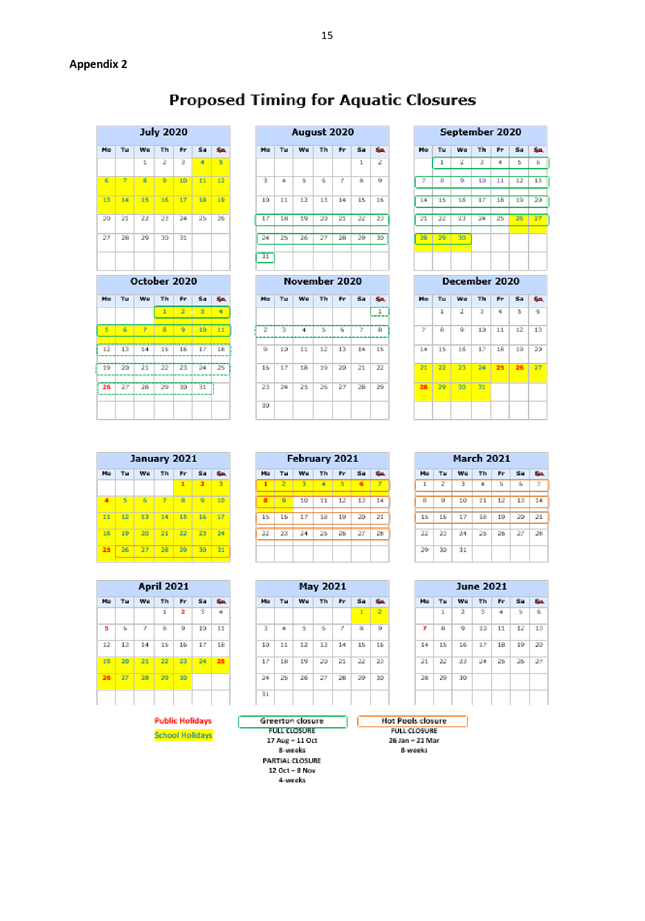

Greerton project capital works to be progressed in conjunction with the

scheduled maintenance shut-down period in August 2020, thus maximising

efficiencies and minimising customer inconvenience.

· Aligns

TCC’s recent review of community facilities, which found Greerton to be

a vitally important aquatic facility within the network and one which is

currently operating at capacity. Maintaining asset condition becomes critical

to de-risking the high level of reliance on this facility.

· Supports the

significant momentum and success of the Adams Centre since inception and

leverages the investment already made by the city into this facility.

· Triples the

capacity of the Adams Academy, a subsidised community athlete development

programme, which provides essential support services for aspiring young local

athletes to develop their potential and compete on the national/international

stage.

· Mitigates the

weaknesses of the current Centre, including the capacity issues currently

faced by existing users, functionality issues in the current gym and the risk

of losing NZ Rugby as a key tenant following the Tokyo Olympics.

· Provide

flexibility to attract new tenants to the Centre and contribute further

revenue generation, while enhancing Tauranga’s reputation as a centre

of excellence for high performance sport.

· Expanding the

capacity of the Adams Centre and upgrading Greerton to support higher

utilisation enables BVL to meet its strategic objectives around community

participation, health and wellbeing outcomes.

|

· Not

approving the Operations Hub will mean that BVL operations staff remain in

substandard working conditions and BVL continue to incur costs for offsite

storage of equipment.

· Not approving

the Clubfit HIIT Studio will restrict BVL’s ability to grow membership

and revenue. Risks Clubfit losing customers who are seeking small group

training opportunities – the leading industry trend.

|

Option 1c: Do not incorporate

any of Bay Venues Limited’s proposed capital programme and associated

budgets into the draft Annual Plan 2020/2021 for community consultation.

23. Do not agree

to support any of the proposals outlined in Attachment 1 of this report.

|

Advantages

|

Disadvantages

|

|

· This

will reduce the level of capital funding required for BVL by $11,122,667.

|

· BVL

may be unable to respond to increases in demand for its facilities and

therefore unable to meet its performance and strategic objectives.

· Not

supporting the Adams Centre expansion sends a negative message about the

support for Tauranga as a centre of excellence for high performance sport and

will risk NZ Rugby assessing alternative locations to base their programme

for the long-term.

· Not

approving the Greerton capital works will restrict improvements to the level

of service and utilisation at this facility (i.e. new aquaplay and leisure

equipment to cater for families). BVL will not be able to remedy existing

major issues with the facility (more changing rooms, additional parking,

upgrading the outdoor space).

· Deferring all

capital and renewals works at Greerton has been identified as a major risk in

the Community Facilities Needs Analysis which identifies that Greerton will

experience proportionally the greatest increase in demand along with Baywave,

due to the proximity to the growth areas. In order to keep pace with the

demand, investment to address the facility’s shortcomings is

required.

|

Renewals

24. BVL

has provided a total renewals budget of $5,822,826, which is an increase of

$1,312,375 on what is currently included in the draft Annual Plan 2020/2021

budget.

25. The

increase is made up of a number of variations (both up and down), due to a number of major renewals being rescheduled to reduce

facility closure times. Further detail has been provided in BVL’s

submission (Attachment 1).

26. BVL’s

renewals programme is prepared in conjunction with TCC staff using

Council’s Accela Asset Management System.

27. Renewals

capital is funded from the depreciation reserve, i.e. rates collected in the

past, and does not impact on the Annual Plan 2020/2021 rates.

Operational revenue

28. BVL’s

Enduring

Statement of Expectation requires that BVL seek Council approval for any

price increases in the funded community network that are greater than CPI.

29. CPI

increases in revenue over the 2016-2019 period have been insufficient to cover

operational expense growth.

30. A

comprehensive pricing review of BVL’s funded community network has been

undertaken with assistance from industry experts Recreation Sport and Leisure

Consultancy Limited (RSL) and is provided as Attachment 2.

31. The

objective of the pricing review is two-fold – firstly to enable BVL to

recover cost increases in the funded network over recent years, and secondly to

simplify and rationalise charges. Currently the charging structure and

resulting entry prices across the network are overly complex and include a

multitude of variations between facilities within the same network.

32. In

order to offset the increases in operational expenses and to simplify and

streamline the complex pricing structure across the funded network, BVL are

seeking Council approval of the one of the pricing schedule options outlined

below (and included in Attachment 3) for community consultation through the

2020/2021 Annual Plan process.

Strategic / Statutory Context

33. As

a council-controlled organisation (CCO), BVL operates under an Enduring

Statement of Expectation (ESE) with Council. The ESE identifies the purpose

of BVL as:

“BVL exists to care for

and optimise community facilities to create value for Tauranga City and enhance

the quality of life of its people, now and into the future”.

34. Whilst

BVL is required to operate in a financially prudent manner and has agreed

financial targets, it’s purpose as a whole is to provide a service to the

community on behalf of Council rather than to operate a business for profit.

The predominant strategic driver for BVL is “maintaining and enhancing

accessibility for all”.

35. There

is very little strategic direction associated with the level of cost recovery

BVL is required to recuperate through users fees and charges. While the CCO is

expected to be financially prudent and achieve agreed financial targets, it is

also expected to ensure accessibility and affordability and high levels of

utilisation and satisfaction from facilities, while also aligning with the TCC

Revenue and Financing policy.

36. Currently

there is significant variation in the cost recovery achieved across different

facilities and facility types as indicated in the table below:

|

Facility Type

|

Community Centres

|

Community Halls

|

Indoor Recreation Centres

|

Aquatic Centres

|

Total Funded Network

|

|

Cost recovery (%) FY19

|

50%

|

83%

|

32%

|

55%

|

48%

|

37. The

Tauranga Aquatic Strategy indicates that the appropriate level of cost recovery

from users is 60-80%. Whilst no such targets exist for indoor courts, community

halls or community centres, this figure can be used as guide for the entire

funded network.

38. Going forward,

Council and BVL need to reach agreement on the cost recovery/subsidy targets

that BVL is expected to achieve within each of the facility types. If Council

desires certain facilities or activities to attract higher subsidies for

strategic reasons that too needs to be clearly articulated, agreed and

appropriately funded.

The Funded Network

39. Different

facilities and activities of BVL has different degrees of commercial or

community focus. This pricing review relates only to the funded network, which

includes the facilities with more of a community focus and which receive the

benefit of the subsidy provided by TCC in order to enable a greater degree of

accessible to the community. The funded network includes:

|

Community Aquatic Network

|

Community Indoor Sports Network

|

Community Hall Network

|

Community Centre Network

|

|

Baywave

Greerton

Otumoetai

Memorial

|

Trustpower Baypark Arena 6 court

QEYC & Memorial Hall

Aquinas Action Centre

Merivale Action Centre

Mount Sport Centre

|

Greerton

Bethlehem

Tauriko

Welcome Bay

Matua

Waipuna Pavilion

Elizabeth Street

Cliff Road

|

Arataki Community Centre

Papamoa Community Centre

Papamoa Sport and Rec Centre

|

40. BVL is

limited in the strategies they can implement to improve their profitability by

the ESE and Letter of Expectations (LOE) between TCC and BVL. Within the funded

network, BVL is only able to make price increases that are less than or equal

to CPI; beyond that a Council decision is required.

41. The

ESE also dictates that levels of service within community facilities are

expected to remain the same (or increase) so reducing what is on offer (either

reduced hours or closing some facilities) is not an option.

42. This

means that BVL is limited in how it can respond to the operational cost

increases it has incurred in the funded network over recent years.

Key Drivers of Pricing Review

Simplification of the current pricing structure

43. The

current pricing approach is complicated, varies between facility types and has

inconsistencies between different facilities in the network. BVL is seeking to

provide a simplified pricing strategy that is clear to customers and simple for

staff to implement.

44. With

new technology, customers will increasingly need to be able to self-manage

bookings, payments and memberships through online services. The pricing

strategy must support this.

45. The last change

to the pricing strategy, undertaken in 2018 was only minor in nature and

simplified the pricing approach for some, but not all facilities (by removing

peak and off-peak pricing differentials in some areas). In some cases, the 2018

price simplification resulted in a decrease in charges, particularly for

regular users at some high demand facilities and times e.g. at Trustpower

Arena.

Operational expense growth

46. CPI

based price increases are not keeping pace with operational cost increases.

Over the last four years, BVL funded network revenue growth has been insufficient

to cover operational expense growth. Operational expense growth has primarily

been driven by the following factors:

· General

operational expenditure required to maintain quality facilities at a high level

of service (e.g. cleaning, repairs and maintenance).

· Increases

in BVL staff remuneration to align closer to market rates (including minimum

wage increases) from an historically low base.

· Additional

support costs associated with compliance requirements (e.g. Health & Safety

and HR).

Increases in the cost of depreciation and debt

servicing on new capital items to enhance levels of service

47. Under

the ESE, BVL are responsible for funding the cost of depreciation and debt

servicing on all new capital items incurred post the restructure of the BVL balance

sheet in 2013, in both the funded and non-funded network. This results in the

cost of financing new capital items that are required to increase the level of

service to the community but do not have a corresponding revenue flow (i.e. new

changing rooms).

48. The change in

the financial performance of BVL from financial year 2016 to financial year

2020 clearly demonstrates these issues.

Table 1: Funded Network Financial variations FY16 -

FY20

|

|

FY16

|

FY20

|

Variance

|

|

User Fees

|

$2.379m

|

$3.065m

|

$0.685m

|

|

Subsidy

|

$2.496m

|

$2.670m

|

$0.174m

|

|

Operating Expenses

|

$4.692m

|

$6.099m

|

$1.407m

|

|

Net Surplus

|

$0.184m

|

$(0.364)m

|

$(0.548)m

|

Options Analysis –

OPERATING REVENUE

49. Due

to cost increases over the last four years, BVL estimates a revenue shortfall

across the funded network of $550,000 in FY21.

50. There are three

options for achieving this revenue objective:

Option 2a: Approve the pricing structure identified in

the RSL pricing review report and include for community consultation through

the 2020/2021 Annual Plan process

51. Agree

to support the proposals outlined in the RSL report (Attachment 2) and

incorporate into the draft AP, along with the pricing schedule included in

Attachment 3.

52. Average

percentage price change across the network would be as follows:

|

Facility

|

Average % price

increase

|

|

Aquatic general entry

|

8.2%

|

|

Aquatic lane and squad

|

39.5%

|

|

Aquatics memberships

|

25.6%

|

|

Indoor court facilities

|

20.6%

|

|

Community halls

|

13.0%

|

|

Community centres

|

39%

|

|

Funded network total

|

18.9%

|

|

Advantages

|

Disadvantages

|

|

· The

growing cost to operate the funded network is offset by users who benefit

from the facilities.

· Ratepayer

subsidy remains status quo.

· BVL

financial sustainability is maintained, net loss does not increase.

· Complex

pricing structure is simplified.

· Easier

for the customer to understand.

· Lays

the platform for digital transformation to occur e.g. online bookings.

· Consistent

approach to pricing across facilities.

· Better

alignment with nationally comparative facility entry prices.

· Allows BVL to

maintain and/or increase levels of service.

|

· Percentage

increases to some users could result in negative feedback and impact

negatively on affordability and accessibility.

· Potential

decline in volumes and utilisation.

|

Option 2b: BVL increases entry

prices across the funded network by CPI and Council funds the remainder of the

shortfall by increasing the rates-funded operating subsidy by $500,000 above

CPI. Include for community consultation through the 2020/2021 Annual Plan

process.

53. The

operating subsidy provided to BVL in return for delivering community outcomes

has not increased above CPI since the inception of the organisation, despite a

significant increase in user numbers over this time.

|

Advantages

|

Disadvantages

|

|

· No

impact on current users.

· No

impact on utilisation rates.

· BVL

financial sustainability is maintained, net loss does not increase.

· Allows

BVL to maintain and/or increase levels of service.

|

· Ratepayer

subsidy will increase by $500,000 above status quo.

· General

entry prices for non-residents are subsidised by Tauranga ratepayers to some

facilities.

· Complex

pricing structure legacy issues remain in place.

· Minimal

alignment with comparative national facilities.

|

Option 2c: Approve a hybrid

model, which would enable some increase in user fees and charges ($400,000),

with the remainder of the shortfall to be provided through an increase to the

rates-funded operating subsidy ($150,000 plus CPI). Include for community

consultation through the 2020/2021 Annual Plan process.

54. BVL

prefers this option as it achieves both the revenue and simplification

objectives and minimises impact on users.

55. BVL is seeking

Council approval for the schedule of price increases associated with this

option. Average percentage price change across the network would be as follows:

|

Facility

|

Average % price increase

Option

2c

|

Average % price increase

Option 2a

|

|

Aquatic general entry

|

7.4%

|

8.2%

|

|

Aquatic lane and squad

|

17.6%

|

39.5%

|

|

Aquatics memberships

|

24.3%

|

25.6%

|

|

Indoor court facilities

|

19.6%

|

20.6%

|

|

Community halls

|

13.0%

|

13.0%

|

|

Community centres

|

26.4%

|

39%

|

|

Funded network total

|

14.6%

|

18.9%

|

|

Advantages

|

Disadvantages

|

|

· Lower

impact on current users than option 2a, particularly aquatic lane swimmers,

squad swimmers and community centre users.

· Impact

on rates funded subsidy is $350,000 lower than option 2b.

· The

growing cost to operate the funded network is partially offset by user fees

charged to those benefiting directly from the facilities.

· Closer

alignment with comparative national facilities.

· BVL’s

financial sustainability is maintained, net loss does not increase.

· Allows

BVL to maintain and/or increase levels of service.

· Complex pricing

structure legacy issues largely resolved.

|

· Ratepayer

subsidy will increase by $150,000 above status quo.

· Percentage

increases to some users could still result in negative feedback and impact

negatively on affordability and accessibility, albeit less than option 2a.

|

Financial Considerations

56. The

financial implications are outlined in the above report and attachments.

Legal Implications / Risks

57. There

are no legal implications.

Consultation / Engagement

58. This

proposal, if approved by Council, will be subject to community consultation in

March 2020 as part of the Annual Plan 2020/2021 process.

Significance

59. Under TCC’s

Significance and Engagement Policy,

this proposal is of medium significance as it represents a significant amount

of capital and operational expenditure by Tauranga City Council’s largest

and most visible CCO.

NEXT

STEPS

60. Council

staff will continue to work with BVL to incorporate the approved capital and

renewals expenditure and entry pricing for prioritisation into the draft Annual

Plan 2020/2021, for development and consultation before adoption of the final

Annual Plan.

61. The

budgets and projects incorporated into the draft Annual Plan will inform the

development of BVL’s 2020/2023 Statement of Intent with Council.

62. Council

staff will work with BVL on a number of other recommendations from RSL in

relation to pricing of facilities, including:

· Agree on the

desired level of cost recovery from the funded network of facilities and

investigate ways to respond to communities in need, where affordability is

having a detrimental effect on participation.

· As part of the

next review of BVL’s Enduring Statement of Expectation, consider an

amendment that enables BVL to increase prices in the funded network up to a

maximum of 5% percent per annum without Council approval. Any amendments to the

ESE would need Council approval.

Attachments

1. Annual Plan

2020/2021 - BVL submission summary - A11169638 ⇩

2. Annual Plan

2020/2021 - BVL pricing review report by RSL - A11179228 ⇩

3. Annual Plan

2020/2021 - BVL detailed price increase schedule - A11179227 ⇩

4. Annual Plan

2020/2021 - BVL detailed business cases for AP submission - A11179233 ⇩

|

Policy Committee

Meeting Agenda

|

19 February

2020

|

|

Policy Committee Meeting Agenda

|

19 February

2020

|

|

Policy Committee Meeting Agenda

|

19 February

2020

|

|

Policy Committee Meeting Agenda

|

19 February

2020

|

7.2 Annual

Plan 2020/21 Update

File Number: A11114461

Author: Joel Peters, Corporate Planner

Tracey

Hughes, Financial Insights & Reporting Manager

Authoriser: Paul Davidson, General Manager: Corporate Services

Purpose of the Report

1. To seek direction/approval of requests that

affect the Annual Plan 2020/21 draft budget and provide an update on the

development of the annual plan.

|

Recommendations

That the Policy

Committee:

(a) Receives the report.

(b) Approves the inclusion in the capital

programme prioritisation expenditure to:

(i) increase the capacity of the

Oropi water treatment plant ($2.6 million 2020/21 and $4.4 million 2021/22),

(ii) construct

an offloading wharf at the Marine Precinct ($1.4 million).

(c) Approves a continuation of funding for

Destination Management from the Airport Activity surplus.

(d) Notes additional requests for funding

are being prepared for:

(i) Tauranga Art Gallery

(ii) Future engagement costs

|

Executive Summary

2. In accordance with the Local Government Act

2002, Council is required to produce and adopt an annual plan, by 30 June 2020.

3. Since December several changes have meant

council is required to take on significantly more debt in 2020/21. This

has flow on effects to the capital programme. Essentially, council will

not be able to deliver all the 2020/21 capital programme and will need to

undertake some prioritisation.

4. Staff are working on these matters and will

bring a paper to the Policy Committee, for decision, in early March.

5. There are also

several items not currently confirmed/included in the annual plan budget

calculations for information/decision:

(a) additional funding to increase the

capacity of the Oropi water treatment plant

(b) additional funding to construct an

offloading wharf at the Marine Precinct.

(c) continuation of funding for Destination

Management from the Airport activity surplus

(d) additional funding for Tauranga Art

Gallery exhibitions

(e) additional funding for engagement

(f) Bay Venues Ltd funding request

(separate report on this agenda)

Background

6. On 10 December, staff presented the Annual Plan

2020/21 indicative budget for Council’s consideration. Staff recommended

that Council:

(a) Agrees to continue with year three of

the rating structure changes to reduce the UAGC to 15% and increase the

commercial differential to 1.2%.

(b) Endorses in principle the Annual Plan

draft budget for capital and operations as summarised in attachments 1, 2, and

3.

(c) In respect of the risk reserve:

(i) Notes that the draft annual plan

endorsed in resolution (b) above includes $1 million increase to the risk

reserve; or

(ii) Approves an increase to the

contribution to the risk reserve from $1 million to 4.4 million to begin to

address the current risk reserve deficit of $15 million and to recognise the

likely ongoing calls on the risk reserve.

(d) Notes that prior to finalising the draft

budget a further budget report will be provided to the Policy Committee in

February regarding:

(i) requests from Bay Venues Ltd; and

(ii) any budget updates that might arise

from work currently underway.

7. Council agreed to continue with rating

structure changes and amended recommendation (b). Council endorsed, in

principle, the Annual Plan draft budget for capital and

operations within the envelope of a mean residential rates increase for 2020/21

of no more than forecast inflation plus 2% (3.9%) and Council to be

provided with options to achieve this rating level, together with the pros and

cons of these options.

8. Council did not decide on the risk reserve and

noted the further requests and updates to come in February.

Strategic / Statutory

Context

9. In accordance with the Local Government Act

2002 (LGA), Council is required to produce and adopt an annual plan, by 30 June

2020. The purpose is to identify variations from the financial statements of

the third year of the current LTP.

10. Council must consult on changes that are significantly or

materially different from the LTP.

Current situation

11. Since the December Council meeting several updates have

occurred, which have implications for the 2020/21 budget, most significantly:

(a) The cost to deliver the Waiari water

supply project has increased impacting the 2020/21 budget.

(b) Weathertight claims have been reviewed

and have increased potential costs to council. Accordingly, staff are

recommending adding extra provision for claims in the 2020/21 budget.

12. A key financial limit for council is its debt to revenue

ratio. The limit through the LTP, and from the Local Government Funding Agency,

is a debt to revenue ratio of 250%.

13. The updates since December mean that the forecast debt

based on the current capital programme would be close to or exceed the 250%

limit. As a result, council will need to review operational and capital

budgets.

14. Staff are currently identifying what part of the capital

programme is committed in 2020/21 and what could be prioritised. A summary of

this work will be included in a report to this committee on 4 March.

15. The 4 March report will also include options and

implications for the 2020/21 budget including the option of a 3.9% mean

residential rates increase as requested in December.

16. There are also several items not currently

confirmed/included in the annual plan budget.

(a) There are four options presented for

your decision:

(i) funding to increase the capacity

of the Oropi water treatment plant

(ii) additional $1.4m to construct an

offloading wharf at the Marine Precinct.

(iii) funding Destination Management from

the Airport Activity surplus

(iv) Bay Venues Ltd funding request (separate

report on this agenda)

(b) There are also several costs/requests

that staff are aware of but require further information in advance of a

decision.

(i) Tauranga Art Gallery additional

exhibitions grant

(ii) future engagement costs

Options

Option 1: Approve funding to increase the

capacity of the Oropi water treatment plant for consideration in the capital

programme.

17. Council’s existing water treatment supply capacity

is being challenged as a result of several factors including:

(a) The Waiāri Water Treatment Plant

commissioning is likely to be delayed to the first half of 2022 therefore the

peak summer water demand for 2020/21 and 2021/22 will need to be met with

existing infrastructure.

(b) The current peak summer water demands

are higher than planning predictions and existing water treatment plants,

particularly Joyce Road, do not have the capacity to meet the future forecast

peak summer demands.

(c) The water network has pinch points and

is currently struggling to deliver the peak summer demands across the city

prior to the Waiāri being delivered.

(d) The current water demand from growth is

almost exclusively being applied to the Joyce Road plant.

18. Budgets of $2.6m in 2020/21 and $4.4m in 2021/22 are

requested for a project to increase water supply through the Oropi plant to

meet growth requirements.

19. This capital project will be considered alongside existing

capital projects for prioritisation on 4 March.

|

Advantages

|

Disadvantages

|

|

· This will provide for the peak summer demand of both 2020/21 and

2021/22.

· This option will improve the overall water supply into the City

prior to Waiāri water treatment plant coming on line.

· The increased capacity will service projected population growth in

advance of the Waiari project coming online.

· This option will also serve to provide water supply resilience

into the future.

|

· Staff and Council will need to prioritise the

capital programme, this adds to the projects in that process.

· Potential $2.6m impact on the 2020/21 capital

programme.

· If prioritised, an additional $4.4m in 2021/22 would

be required.

|

Option 2: Approve an additional $1.4m to

construct an offloading wharf at the Marine Precinct for consideration in the

capital programme.

20. $600,000 was included in the current financial year to

construct an offloading wharf for users of the marine facility. Through

engagement, users of the facility including the independent fishing fleet, have

identified the planned wharf will not be fit for purpose.

21. Staff are investigating a new concept which will provide

greater capacity for all users. Preliminary engagement with users and has been

received positively.

22. Whilst it is still in preliminary design, high level

estimates indicate that the facility would be costed at approximately $2m net

(private portions of the wharf would be paid for by those with exclusive

use).

23. This project would be undertaken in 2020/21, therefore the

budget to support this would be a $600,000 carry forward from 2019/20 and an

additional $1.4m not currently in the capital programme.

24. Detailed design and an updated business case will be

available prior to the adoption of the final annual plan in June.

25. This capital project would be considered alongside

existing capital projects for prioritisation.

|

Advantages

|

Disadvantages

|

|

· Increase the capacity of the fishing fleet in line with the

original intention of the project, to provide fit for purpose user

facilities.

· Better supports the objectives of the wharf users.

· No rating impact (subject to final business case)

|

· Staff and Council will need to prioritise the

capital programme, this adds to the projects in that process.

· Additional $1.4m debt required (non rate funded)

|

Option 3: Continue to fund Destination

Management from the Airport Activity surplus

26. Through the LTP, Council approved $621,000 of investment

per annuum to Tourism Bay of Plenty for destination management from the airport

activity. This funding was to revert to Economic Development targeted rate

funding from 2019/20 unless alternatives were found.

27. Through the Annual Plan 2019/20, Council endorsed that

Tourism Destination Management should continue to be funded through the airport

activity surplus to ensure no significant change to rating structures.

28. Staff recommend continuing to fund this investment into

destination management from the Airport activity in 2020/21.

29. Targeted rate funding or alternatives can be investigated

through the LTP process.

30. Note; Staff have already included this in the 2020/21

budget presented to you in December.

|

Advantages

|

Disadvantages

|

|

· This option will continue to support destination management.

· Funding through the airport will not have an impact on overall

rates.

|

· Debt will be higher by this amount

|

Upcoming Requests

Tauranga Art Gallery

31. The Tauranga Art Gallery is seeking funding for an

additional $259,000 grant for exhibitions which would go primarily towards

Tauranga Moana 2020.

32. A business case supporting this request will be presented

to you for consideration in March.

Future Engagement

Costs

33. Since the adoption of the LTP, Council has committed to

implementing consistent and fit for purpose engagement planning for all

projects.

34. At the time of this report a shortlist of more than 50

projects requiring engagement support over the next 12-24 months has been

developed for prioritisation with the responsible council activities.

35. The costs for engagement are likely to be highly variable

between projects and highly dependent on the level of service council seeks to

provide. These costs will be operational rather than capital.

36. As an indication, some of the potential largest engagement

projects are listed below.

· Cycle Plan

· Kerbside Collection Service Roll-out

· Long Term Plan

· Stormwater Improvements – flood hazard management

· Strategic Framework

· Transport Network Plan

· Transport Safety / Safer speeds and streets

· Te Maunga Wastewater Outfall

· Te Papa Peninsula Spatial Plan / City Plan Changes / Cameron Road

1. While many of these projects have their own

budget, a more ‘extensive’ engagement compared to the level currently

budgeted would likely incur significantly higher costs for the following

reasons:

· likely to run over a longer time period and include several phases

of engagement.

· Likely to involve a wider community decision-making approach.

· Incur more project manager time and administrative processes e.g.

collating and reporting outcomes data.

37. For example, the talking trash campaign was an extensive

city-wide campaign with an overall budget of approximately $135,000 (excluding

GST) for that distinct engagement period.

38. Staff are developing the level of service for engagement

and will be seeking guidance in March. Any increase in the level of service for

engagement will impact the 2020/21 budget.

Legal Implications /

Risks

39. In accordance with the LGA, council must consult with the

community if the annual plan includes significant or material differences from

the content of the LTP for the financial year to which the proposed annual plan

relates.

Consultation /

Engagement

40. Under the proposed approach, consultation on the annual

plan will occur in March and April 2020 alongside consultation on the draft

Development Contributions Policy (DC Policy) and draft Schedule of User Fees

and Charges.

41. The DC Policy and Schedule User Fees and Charges form part

of the annual plan. The draft documents have been presented to you as separate

reports on this agenda.

Significance

42. The annual plan is likely to be of medium to high

significance to communities.

43. The decision to accept this report and the recommendations

are of medium significance as they may affect a subgroup of the community.

Next Steps

44. Staff will incorporate the decisions from this Policy

Committee agenda into the 2020/21 budget.

45. Staff will bring a report to the 4 March Policy Committee

which will provide you with options and implications for the 2020/21 budget

including a 3.9% mean residential rates increase as resolved in December.

46. Staff will also present a consultation plan alongside the

updated budget.

Attachments

Nil

7.3 Draft

Fees for the 2020/21 Development Contributions Policy

File

Number: A11176342

Author: Ana

Blackwood, Development Contributions Policy Analyst

Authoriser: Christine

Jones, General Manager: Strategy & Growth

Purpose of the Report

1. The purpose of this

report is to provide an overview of the key changes that will be made to the

2020/21 Development Contributions Policy compared to the operative Development

Contributions Policy. A draft 2020/21 Development Contributions Policy will be

brought to Council to adopt for public consultation in March.

|

Recommendations

That the Policy Committee:

(a) Notes the contents of the

report and the expected changes to Development Contribution policy

which will be consulted on through the Draft 2020/21 Development Contribution

Policy

(b) Notes that staff will be

engaging with the building community with the purpose of providing early

notice of a signficant increase to the Citywide Development Contribution levy

in the 2021/22 financial year.

|

DISCUSSION

2. Tauranga City

Council has elected to use Development Contributions (“DCs”) as the

primary mechanism to fund growth related capital expenditure. The Development

Contributions Policy (“DC Policy”) is updated on an annual basis. The

new policy must be adopted by June to enable Council to continue collecting

Development Contributions in 2020/21.

3. The rationale

behind DCs is the growth pays for growth principle. The goal is to ascribe

costs of growth back to the development community to reduce the burden of these

costs on the existing rate payer community.

4. Use of DCs is

governed by legislation set out in the Local Government Act 2002 (LGA).

5. Sections 2-5 of the

DC Policy set out the rules for when a DC is charged, and the methodology used

by TCC for calculating development contributions. These sections are not

expected to change compared to the operative policy.

6. Section 1 contains

the fees applicable to development and these will be updated to reflect changes

made to capital expenditure budgets. Section 6 contains the Schedules of assets

(tables) which show detailed costing information for each asset for which

council collects development contributions. These tables have been updated to

reflect budgets set out in the annual plan documents.

7. Development

contribution fees are broken into two types, local development contributions

and citywide development contributions. These are discussed separately below.

Local

development contributions

8. Local development

contributions (“LDCs”) are usually payable when land development

occurs (i.e. subdivision). LDCs fund infrastructure within specific catchments

and the amount payable varies with location. The following table sets out the

LDCs that are expected to be included in the Draft 2020/21 DC Policy and comparisons

to fees in the operative policy.

|

Draft fees

|

|

Movement compared to

operative policy

|

|

Fee increases

|

|

West Bethlehem

|

$ 372,880

|

Per hectare

|

+

5.0%

|

+$17,400

|

|

Tauranga

|

$ 3,614

|

Per additional lot

|

+ 1.3

%

|

+ $46

|

|

Pyes Pa

|

$ 6,802

|

Per additional lot

|

+ 0.8

%

|

+ $ 51

|

|

Papamoa

|

$ 8,701

|

Per additional lot

|

+ 0.3

%

|

+ $ 27

|

|

Welcome Bay

|

$ 8,480

|

Per additional lot

|

+

0.3%

|

+ $ 23

|

|

Bethlehem

|

$ 12,516

|

Per additional lot

|

+ 0.2 %

|

+ $ 21

|

|

Fee decreases

|

|

Pyes Pa West

|

$ 29,752

|

Per additional lot

|

- 3.3 %

|

-$1,000

|

|

Wairakei

|

A: $480,124

B: $329,847

C: $648,053

|

Per hectare

|

- 0.6 %

- 0.6 %

- 3.0 %

|

-$3,096

-$1,830

-$19,917

|

|

Tauriko

|

$ 352,404

|

Per hectare

|

- 2.0 %

|

-$7,355

|

|

Ohauiti

|

$11,272

|

Per additional lot

|

- 0.5 %

|

-$61.46

|

9. As shown in the

above table, the fees for West Bethlehem will increase by 5%. This increase is

because LDCs in this catchment are subsidised by Council and the level of the

subsidy decreases each financial year. As the subsidy decreases the fees go up.

10. The West Bethlehem subsidy is

the result of previous Council decisions. Without the subsidy the LDC was so

high that it was inhibiting growth in the area and limiting TCC’s ability

to recover debt incurred in constructed infrastructure.

11. Other

fee increases are only minimal amounts and are the result of updated capital

expenditure budgets.

12. Fees for Wairakei, Tauriko,

Pyes Pa West and Ohauiti are decreasing. These decreases are because NZTA funds

have been apportioned towards specific projects in these catchments. Money received

from NZTA decreases the proportion that needs to be recovered as development

contributions.

13. While the charges for Wairakei

are decreasing overall it is important to note that there has been an increase

in the wastewater fees of approximately 111%, from $22,600 per hectare to

$48,000 per hectare.

14. The wastewater increases are

primarily driven by increased costs of the Opal Drive and Wairakei Trunk

networks. Budgets for these projects were reviewed to provide for needs

identified in the review of strategic wastewater projects in the eastern

corridor.

15. The review considered the

constraints, future needs, and ground conditions of the area to provide for

future populations and resilience. The review identified new design

requirements and provided a greater understanding of constraints and risk to be

managed throughout construction.

Citywide Fees

16. Citywide development

contributions (“CDCs”) are applied to building consents for growth

developments such as new houses or new commercial buildings. CDCs are due

payable immediately prior to the issue of the building consent.

|

|

Current 2019/20 Citywide

charge

|

Projected 2020/21 Citywide

charge

|

Movement

|

|

|

Charge per household

|

$ 8,530

|

$9,380

|

+10%

|

|

|

|

|

|

|

17. The CDC is currently just over

$8,500 per household. As shown in the above table, this is expected to increase

by 10% in 2021. This increase is driven by increased cost to construct the Te

Maunga Wastewater Treatment Plant. The two main reasons for this cost

escalation are:

(a) Increased preliminary &

general costs and contractor profit. The national trend has been going upward

the last couple of years.

(b) Large increase due to poor

ground conditions and requirement for additional subfloor ground support for

the bioreactor.

18. In the 2022 financial year the

CDC is expected to increase by an even greater margin. The exact increase

cannot be determined until project costs are finalised, but projections show it

is likely to be in the order of $5,000 - $9,000 more than the 2021 charge. This

means that the CDC could potentially double from $9,380 to $18,380 per

household.

19. The increase primarily relates

to the Waiari Water Supply Project which will be entirely funded by CDCs

collected from the 2022 year on. There are also some other smaller projects

which will be funded from 2022 year on that contribute to this increase.

20. There is already a brief

mention of this expected increase within the operative DC policy. Staff will

update and expand on this information in the 2021 DC Policy and are planning an

engagement strategy designed to highlight this information to the development

community to whom it will impact.

21. While this increase does not

technically impact the 2021 DC policy which is being consulted on in March, it

could be expected that Council may receive some feedback on this matter via

this year’s annual plan submission process.

Community

Infrastructure

22. The

review of the LGA in 2019 resulted in a broader definition

of the term ‘community infrastructure’ being adopted. Staff have identified

several community facilities projects planned in the western corridor and

Wairakei/Te Tumu catchments that were planned to be loan funded but, based on

the new definition of community infrastructure, could potentially be funded

using DCs.

23. In

order to calculate the proportion

of the projects which could be funded by DCs, we first need to

understand the rationale for the facilities, and the extent to which these

facilities benefit growth versus the benefit to existing populations. Work is

currently being undertaken on community facility needs (by Visitor Solutions)

which will help to inform this decision.

24. We cannot

start collecting DCs for any of these projects yet (as none are budgeted within

this planning period) and so staff have determined it is more appropriate to

make any updates to project funding through the LTP process when more detailed

information will be available.

25. A further report will be

brought to Council for consideration on this matter within the next few months.

Strategic / Statutory Context

26. The Local Government Act 2002

requires Council to have a Development Contributions Policy. Development

contributions are a significant and strategic revenue source for the Council

and are critical to funding capital expenditure associated with providing for

the growing city. Development contributions enable infrastructure to be

built to unlock additional development capacity.

Consultation / Engagement

27. In March 2020 a draft version

of the 2020/21 DC Policy will be brought to Council to adopt for public

consultation. This draft policy will be consulted on alongside the annual plan.

The policy will also be distributed directly to key stakeholders in the

development community.

28. Through this process the

community will have the opportunity to submit to Council on the key changes

proposed.

29. The draft policy will include

a discussion around the expected future increases to the Citywide Development

Contribution charges. Staff are also working on an engagement strategy that

will likely run in parallel to the annual plan consultation to ensure that this

future increase is highlighted to the building community whom will be impacted

by this increase.

30. While the increase is not

technically occurring in this financial year it is likely that Council will

receive feedback on this matter through the consultation process.

Significance

31. Under the Significance and Engagement Policy 2014,

this report is of low significance as it is asking Council to note the changes

that will be incorporated into the Draft 2020/21 Development Contributions Policy.

The adoption of the Draft policy itself will be of medium to high significance

and this policy will brought back to Council and will be consulted on in

accordance with requirements under the Local Government Act 2002.

Next Steps

32. Staff will finalise the

content of the Draft 2020/21 Development Contributions Policy and will bring

the Policy to Council to be adopted in March. Once adopted the Draft Policy

will be distributed for public consultation. Specific targeted consultation

will be undertaken with the development community and with the building

industry regarding the anticipated future increases to the Citywide Development

Contributions Fees.

Attachments

Nil

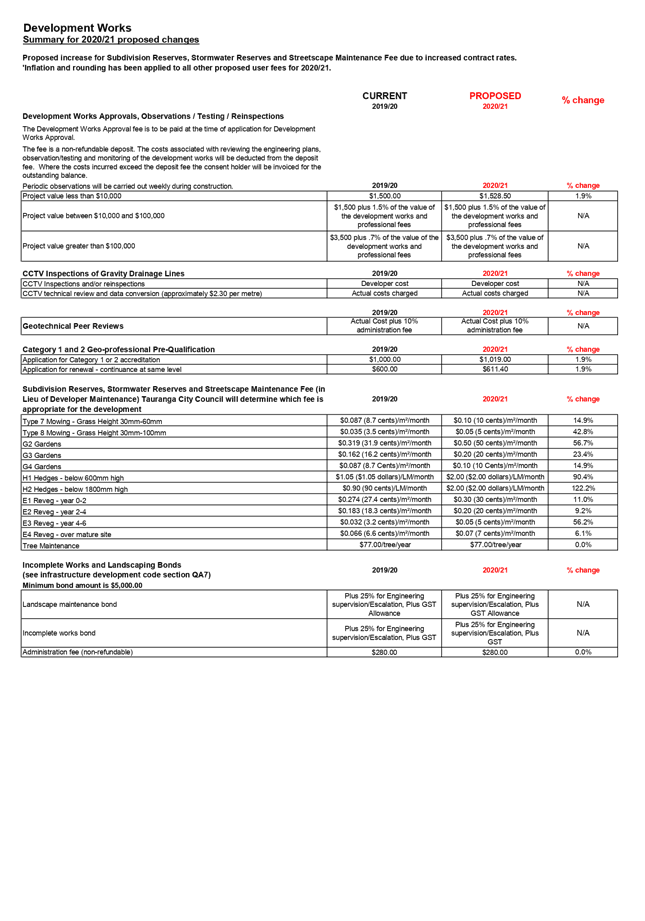

7.4 Draft

user fees and charges

File

Number: A11189535

Author: Tracey

Hughes, Financial Insights & Reporting Manager

Joel Peters, Corporate Planner

Kathryn Sharplin, Manager:

Finance

Authoriser: Paul

Davidson, General Manager: Corporate Services

Purpose of the Report

1. To seek your

approval of the proposed schedule of user fees and charges, for 2020/21, to be

consulted on alongside the annual plan.

|

Recommendations

That the Policy Committee:

(i) Approve

the proposed schedule of user fees and charges for 2020/21, outlined in Attachment

1, for future consultation with communities.

|

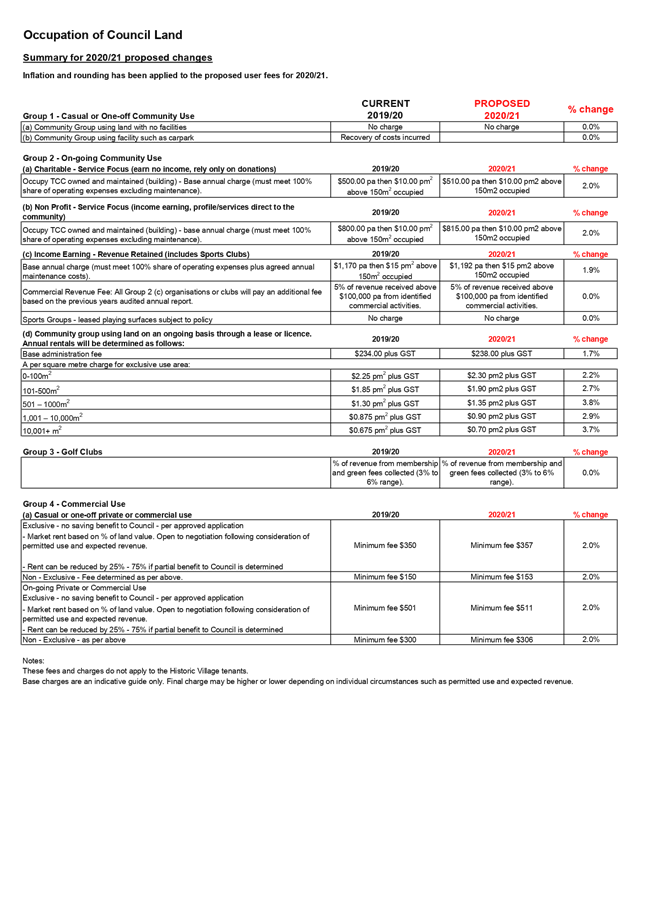

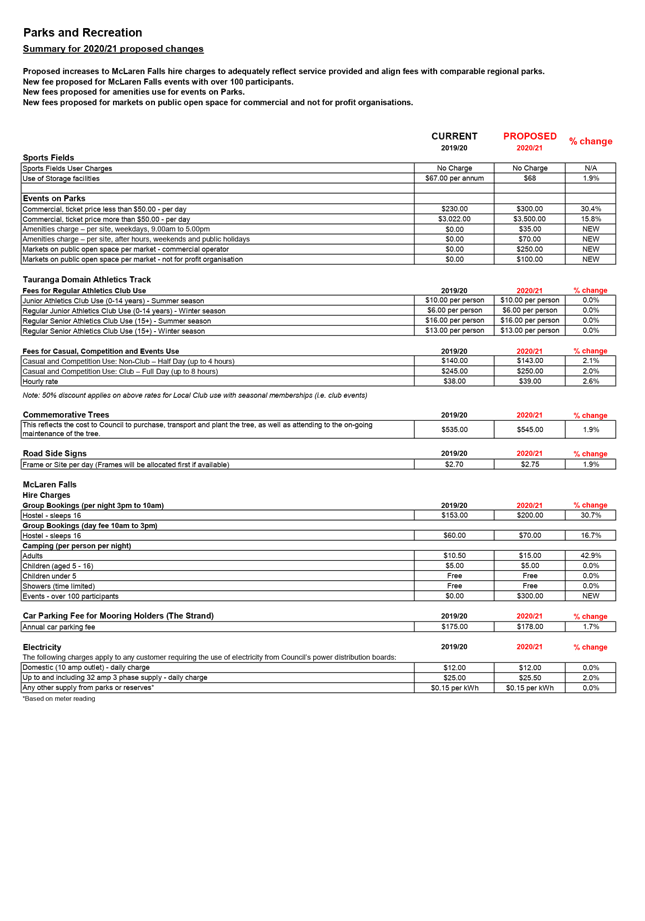

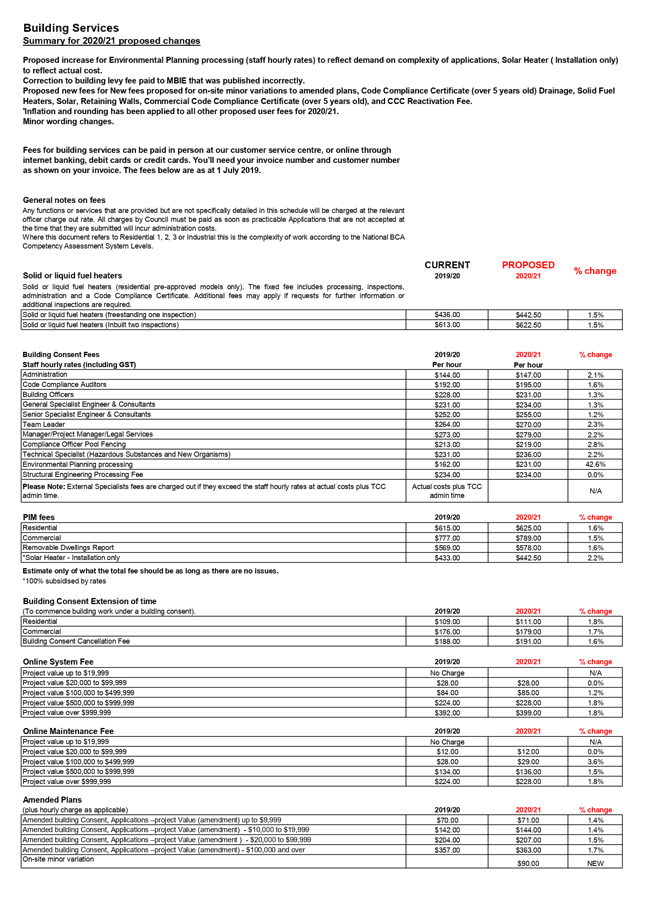

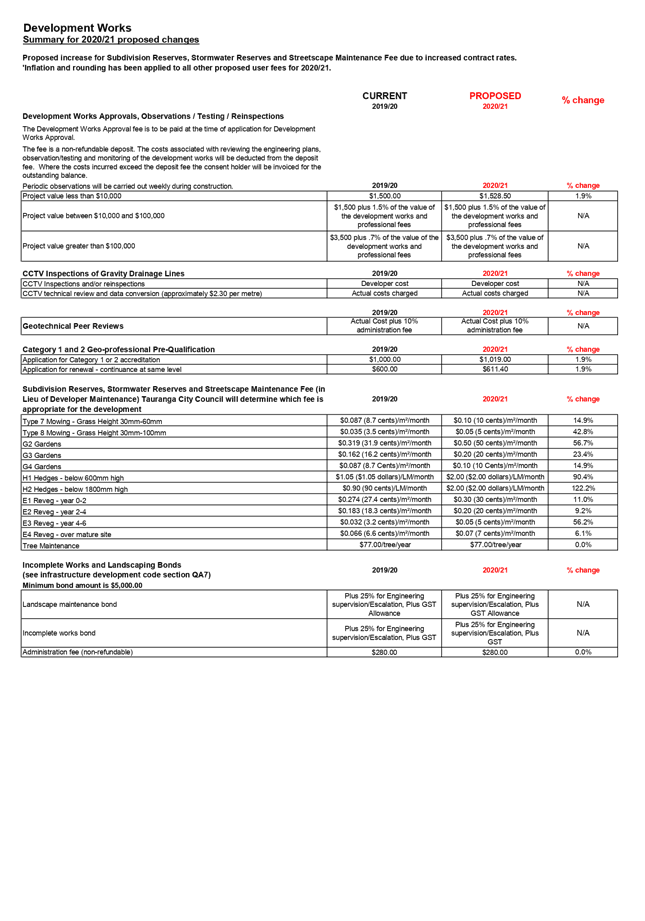

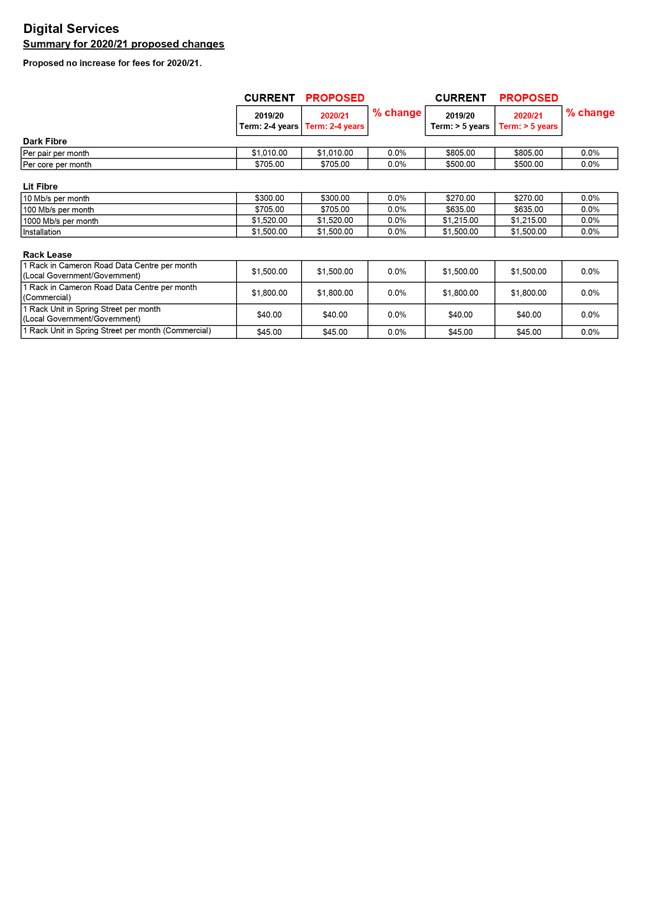

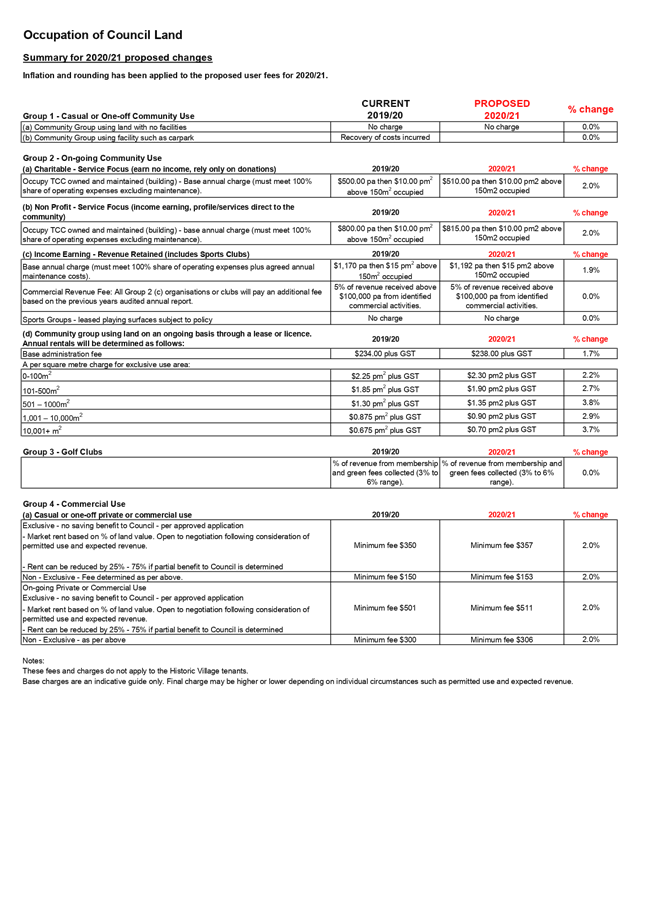

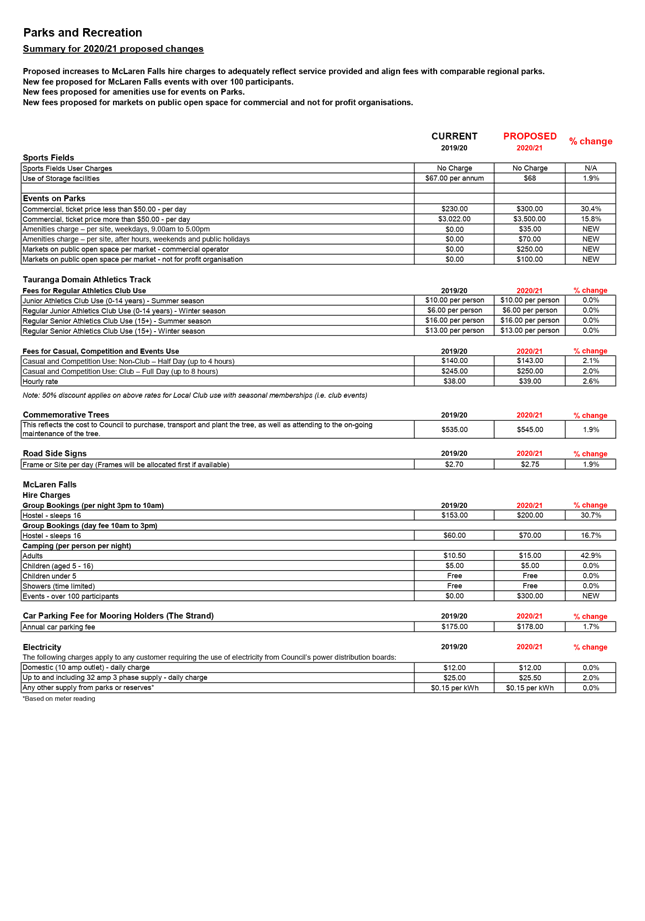

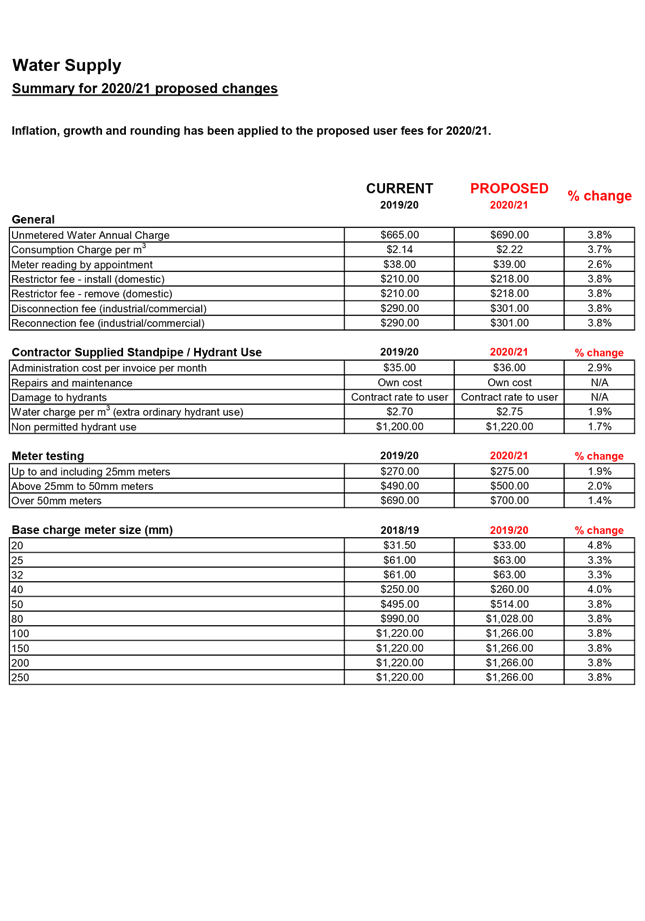

Discussion

2. User

fees and charges are one of our largest sources of revenue. They assist the

operation and maintenance of a variety of services provided to communities.

3. Each

year, we update user fees and charges to respond to economic and legislative

changes, and to ensure that charges do not become outdated.

4. We

produce and make a schedule of user fees and charges for communities to find

all fees and charges council is authorised to set under the various pieces of

legislation that we work under.

5. User

fees and charges and revenue projections have been reviewed and updated.

Updates reflect changing circumstances, amendment to descriptions to make the

document clearer for the community, Consumer Price Index (CPI) adjustments, new

or removed fee requirements, or benchmarking with other councils. Some user

fees and charges are set by government legislation.

6. Attachment

1 outlines the user fees and charges for each activity and are presented with a

comparison to the actual fees charged for the current financial year. A summary

is also included to discuss any proposed changes.

7. The

financial implications of proposed changes have been incorporated into the

draft Annual Plan 2020/21.

Summary of changes

8. Changes

to the CPI have been used as the basis for increases. Most fees and charges are

proposed to increase by 1.9% from 2019/20 (where more practical, values are

rounded).

No proposed increase

9. Some

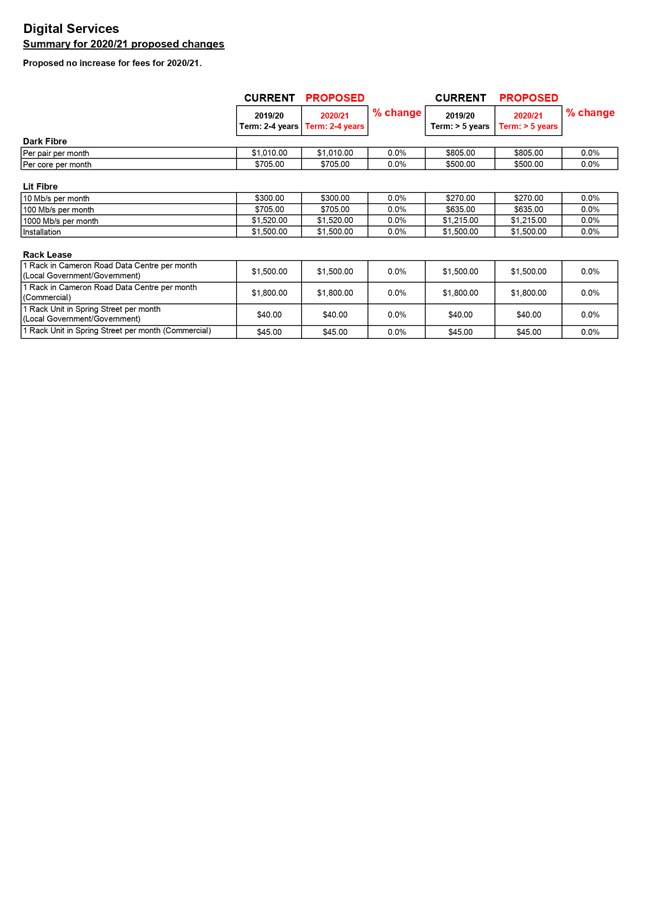

activities have proposed not to increase most of their fees and charges via

CPI. This is due to fees having undergone a significant increase last financial

year, and/or due to the current level being appropriate and in line with the

current market, or the fees are set by legislation. They include:

(a) Airport

(b) Digital

Services

(c) Land

information fees

(d) Libraries

(e) Mount

Maunganui Beachside Holiday Park

(f) Official

information requests

Proposed changes above

CPI

Explanations

have been provided in Attachment 1 for fee increases greater than CPI.

|

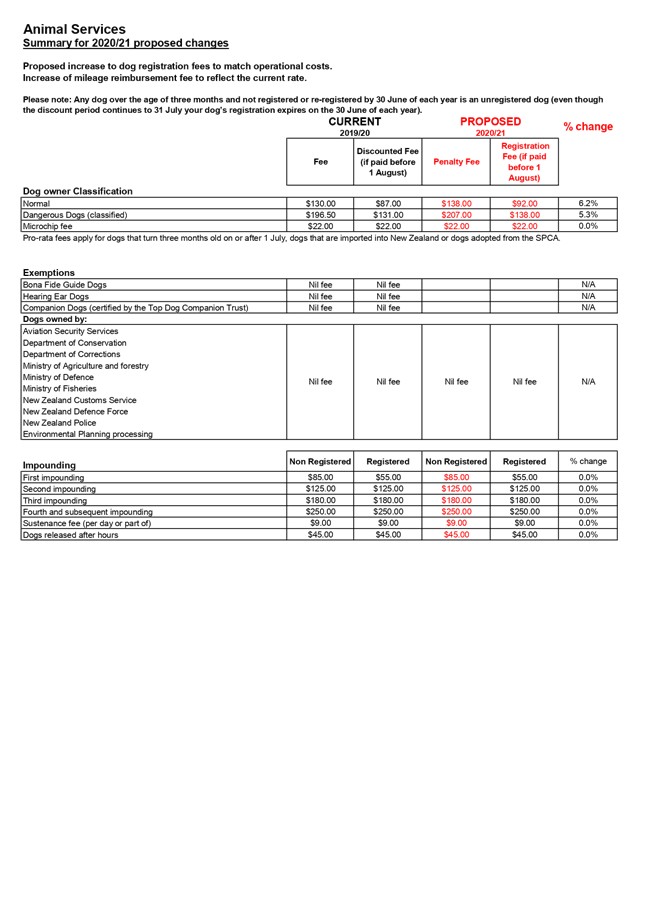

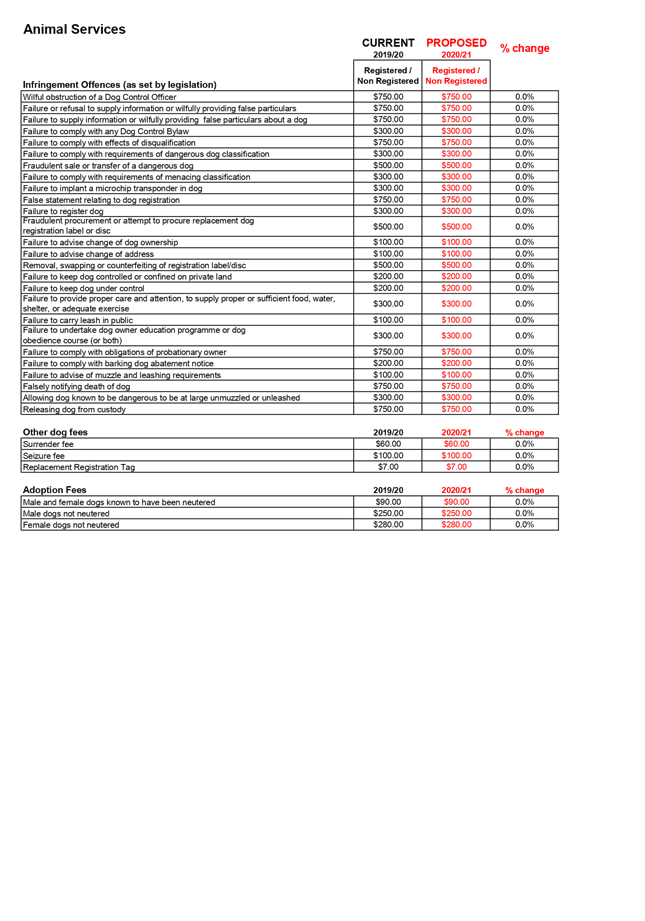

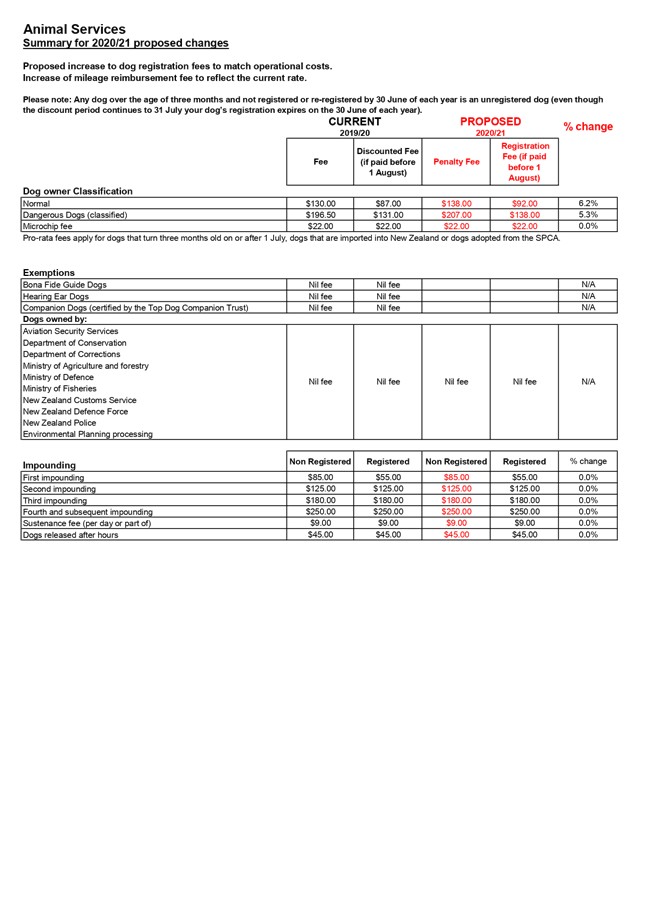

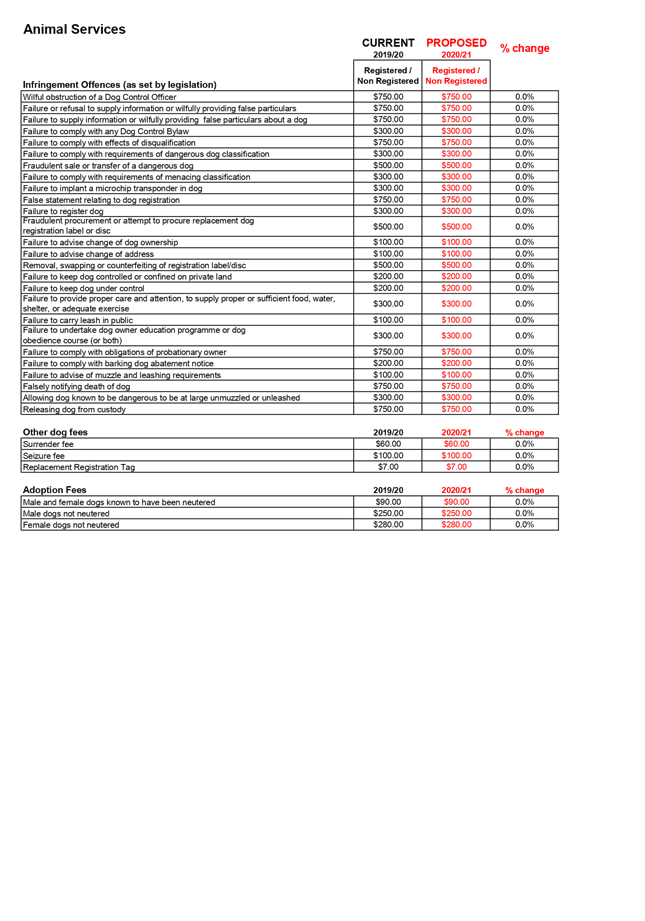

Animal

Services

|

Increase

of fees by 6% to match operational costs.

Increase

of mileage reimbursement fee to reflect the current rate.

|

|

Asset

Protection Bonds and service connection fees

|

Significant

increase in service connection application fees to reflect the actual cost

processing applications.

|

|

Bay

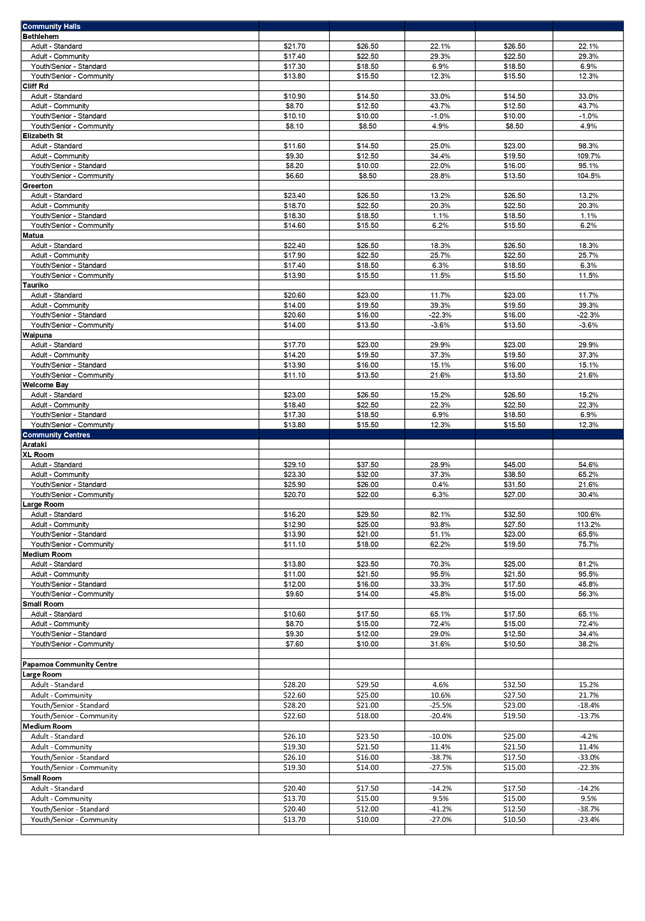

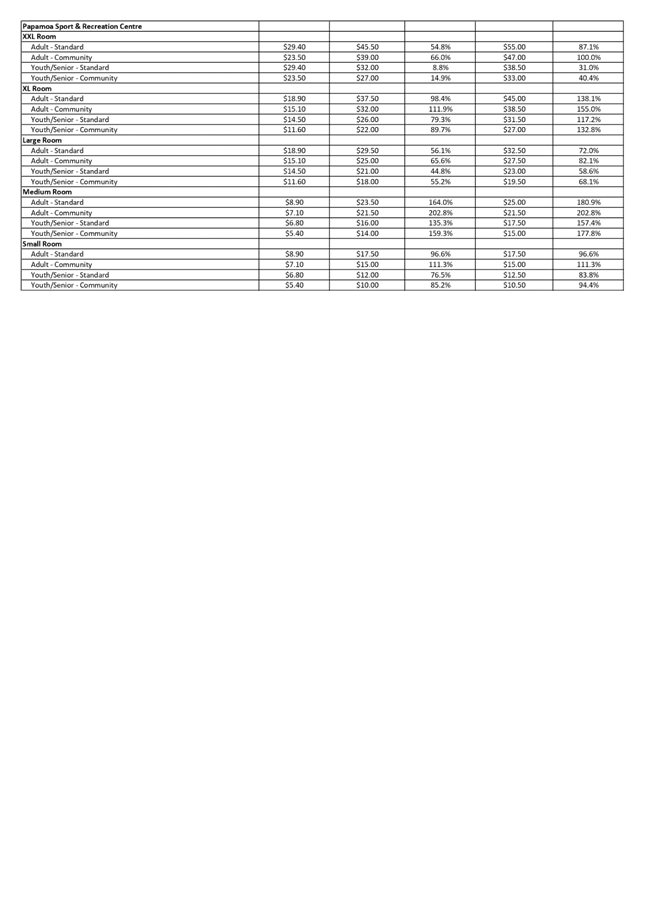

Venues

|

Increases

subject to Council/Policy Committee decisions. Note: this is the subject of a

report to the Policy Committee

|

|

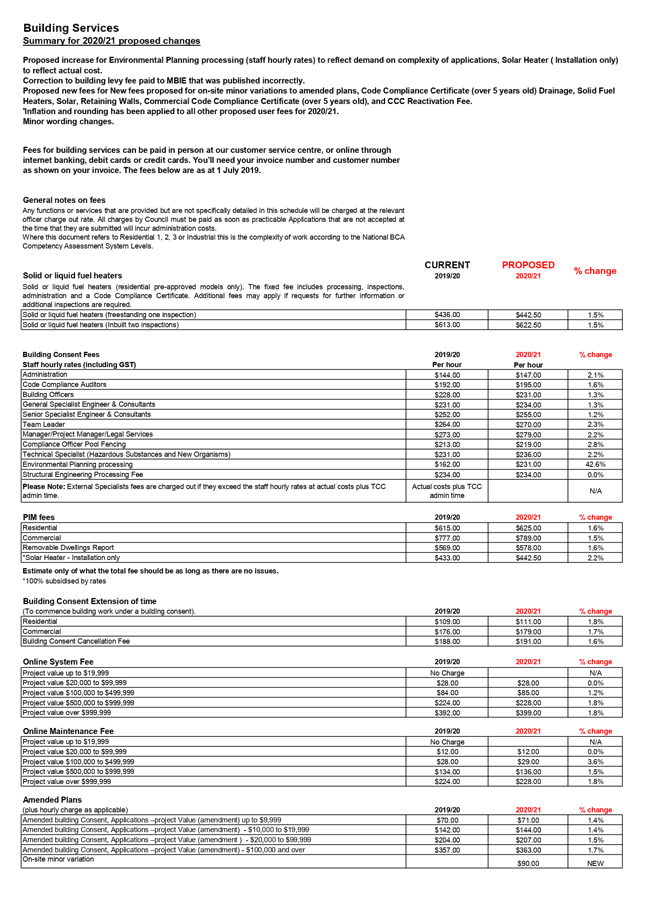

Building

services

|

Increase

to the solar installation fee to reflect an accurate cost and increase to the

environmental planning processing fee.

|

|

Laboratory

fees

|

Fees

updated to reflect new contract rates

|

|

Parking

|

Small

increase to off street parking fees which supports continued investment in

parking infrastructure and to encourage less dependency on private transport,

help manage congestion, and reduce carbon emissions. Remove early bird fees

from carpark buildings

|

|

Parks

& Recreation

|

Increase

in the fee to stay at McLaren Falls Reserve.

Increase

to the events on parks commercial fee.

|

|

Planning

|

Increase

to the hourly rate for some staff positions.

|

|

Regulation

Monitoring

|

Increase

to mobile shops fee for Marine Parade tender sites.

|

|

Sustainability

and Waste

|

Increase

in the abandoned car storage fee to reflect actual costs.

|

Proposed new fees

Some

activities have proposed new fees. They include:

|

Baycourt

|

For

clarity, a community organisation fee and a separate commercial fee are

proposed in place of a general fee and subsidised fee for community

organisations.

|

|

Building

Services

|

New fees proposed for on-site minor variations to amended plans,

Code Compliance Certificate (over 5 years old) Drainage, Solid Fuel Heaters,

Solar, Retaining Walls, Commercial Code Compliance Certificate (over 5 years

old), and CCC Reactivation Fee.

|

|

Parks

and Recreation

|

New fees

proposed for public amenities use for events on parks and to McLarens Falls

events with over 100 participants. Commercial and Not for Profit fees for

markets on public open space.

|

|

Planning

|

New fee

proposed for Environmental Monitoring Technician.

|

Next Steps

10. Should

you approve the proposed schedule of user fees and charges at Attachment 1, it

will become the basis of future consultation under a special consultative

procedure.

11. If

you propose amendments to the user fees and charges, this may result in changes

to required activity budgets.

12. We

will present a statement of proposal to the Policy Committee in March for

approval ahead of consultation.

Attachments

1. Draft

user fees and charges 2020-21 - A11189525 ⇩

|

Policy Committee

Meeting Agenda

|

19 February

2020

|