|

|

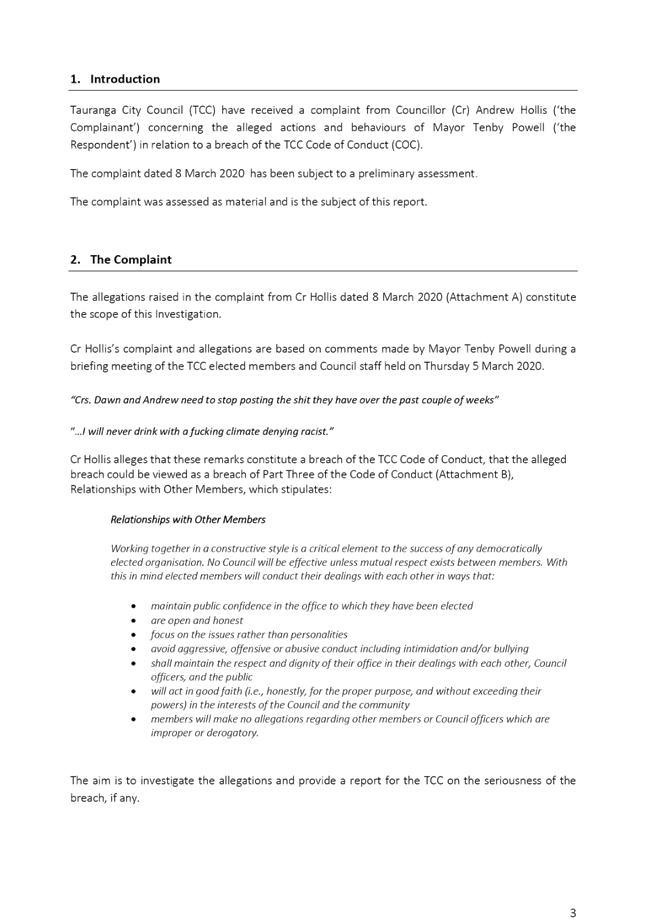

|

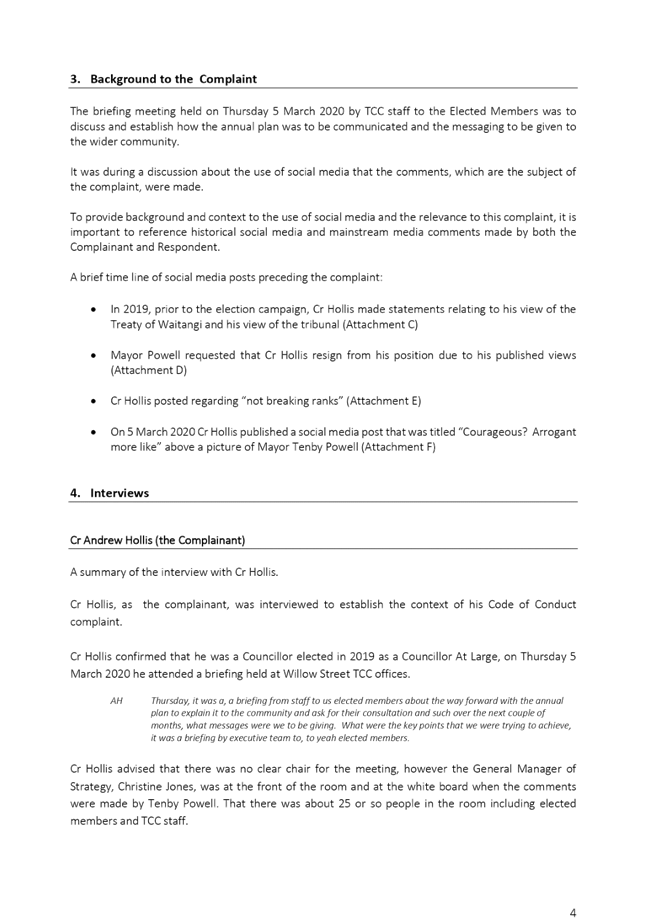

AGENDA

Ordinary Council Meeting

Tuesday, 24 March 2020

|

|

I hereby give notice that an Ordinary Meeting of

Council will be held on:

|

|

Date:

|

Tuesday, 24

March 2020

|

|

Time:

|

9am

|

|

Location:

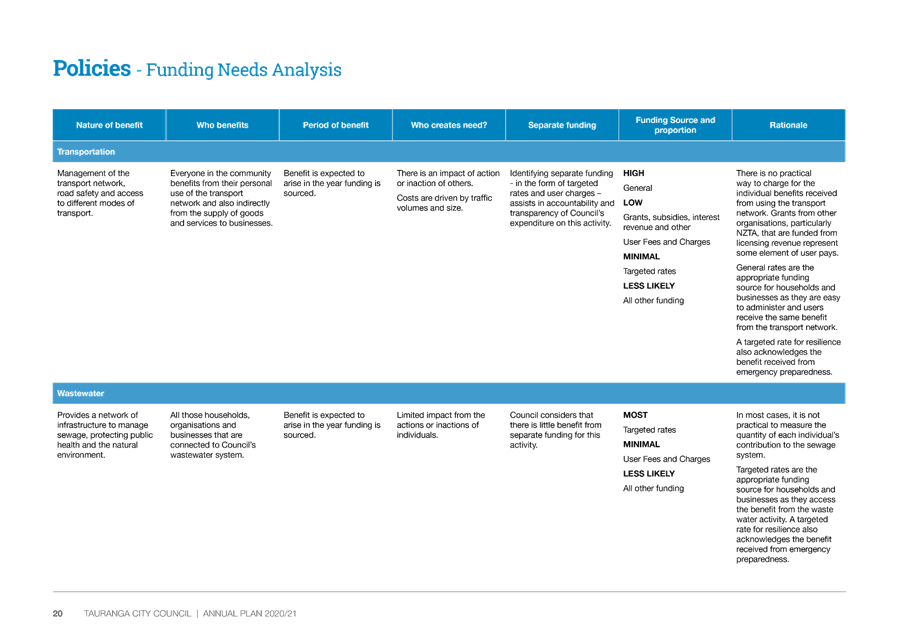

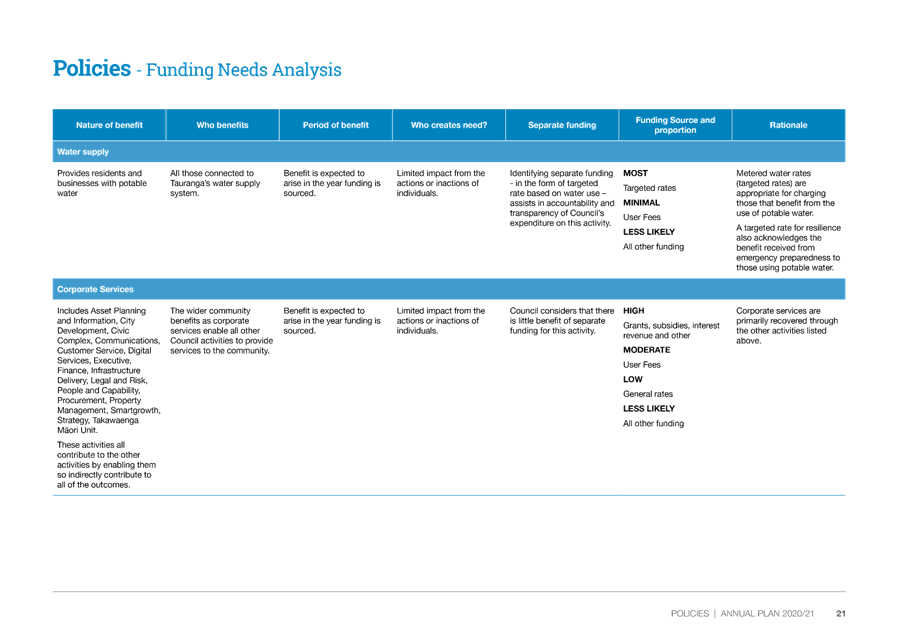

|

Tauranga City

Council

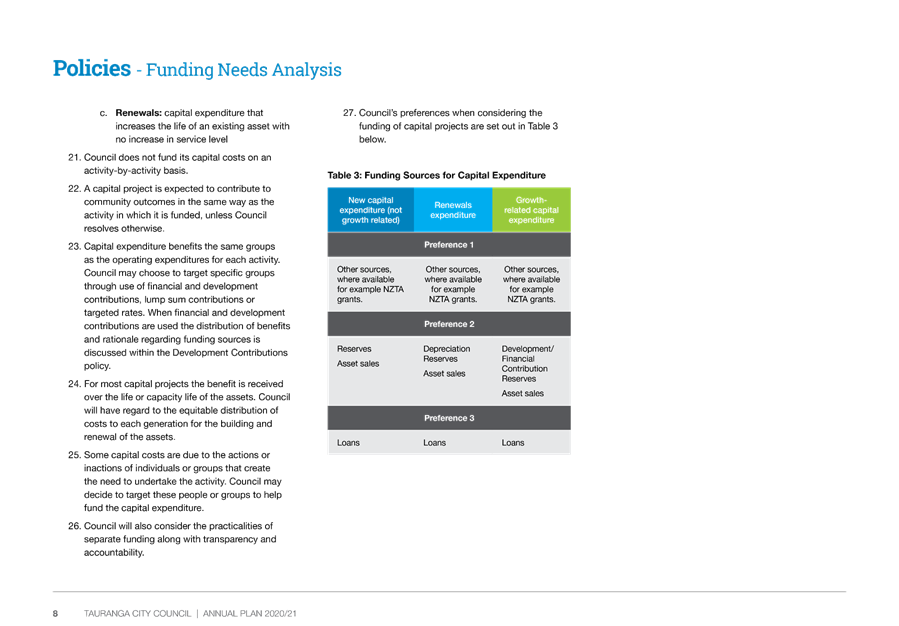

Council

Chambers

91 Willow Street

Tauranga

|

|

Please note that this meeting will be livestreamed and the

recording will be publicly available on Tauranga City Council's website: www.tauranga.govt.nz.

|

|

Marty Grenfell

Chief

Executive

|

10 Business

10.1 Adoption of draft Annual

Plan 2020/21

File Number: A11286937

Author: Ben Burnand, Corporate Planner

Authoriser: Paul Davidson, General Manager: Corporate Services

Purpose of the

Report

1. In

accordance with the Local Government Act 2002, Council is required to produce

and adopt an annual plan by 30 June 2020.

2. This

report seeks your approval of the draft Annual Plan 2020/21, the draft User

Fees and Charges 2020/21, and the updated draft Revenue and Financing Policy

prior to consultation.

|

Recommendations

That the Council:

(a) Adopts the

Annual Plan 2020/21 Consultation Document (CD) for public consultation from

25 March to 27 April 2020;

(b) Adopts the

draft Annual Plan 2020/21 supporting financial information;

(c) Adopts the

Statement of Proposal for the draft 2020/21 User Fees and Charges as the

basis for public consultation;

(d) Adopts the

Statement of Proposal for the draft Revenue and Financing Policy as the basis

for public consultation.

(e) Authorises

the Chief Executive to approve minor drafting, financial and presentation

amendments to the draft Annual Plan 2020/21 Consultation Document and

Statement of Proposals for User Fees and Charges and the Revenue and

Financing Policy prior to printing if necessary.

|

Executive Summary

3. The

early development of the Annual Plan 2020/21 was based on a Council endorsed

principle of a draft budget for

capital and operations within the envelope of an average residential rates

increase of no more than inflation plus 2%.

4. This

endorsed approach was reviewed following several matters including the

requirement for additional capital budgets, additional provisions for

weathertightness claims, and the deferral of the elder housing divestment

revenues. Following this review, the endorsed approach for the setting of the

2020/21 budget within the envelope of an average residential rates increase of

no more than inflation plus 2% was no longer financially sustainable or

prudent.

5. On

4 March 2020, Policy Committee considered various options to address the

current financial situation for 2020/21 and to ensure we are preparing for

future years as we develop the Long-term Plan 2021-31. Council resolved to

approve a draft 2020/21 capital programme of $244M and an associated rates

revenue increase of 12.6%. A further resolution was approved to amend the

rating structure by reducing the Uniform Annual General Charge (UAGC) to 10%

and increasing the Commercial differential to 1.3.

6. This

report presents the draft Annual Plan and Supporting Financial Information for

adoption for consultation following the decisions made at the Policy Committee

meeting on 4 March 2020. The proposed Consultation Document (CD) (Attachment

1) and Statement of Proposals for the User Fees and Charges, and for the

Revenue and Financing Policy require adoption in order to progress to public

consultation. A draft Annual Plan 2020/21 summary document (a shortened version

of the Consultation Document) will be tabled at this meeting and will be

accompany our consultation material.

7. In

addition, Report - Adoption of the Draft 2020/21 Development Contributions

Policy presented at this meeting contains the Draft Development Contributions

Policy as well as the Statement of Proposal for the Development Contributions

Policy which will require adoption in order to progress to public consultation.

Background

8. On 10 December 2019, Council considered the

indicative draft budget for the Annual Plan 2020/21. Council endorsed, in

principle, the Annual Plan draft budget for capital and operations within the

envelope of an average residential rates increase for 2020/21 of no more than

inflation plus 2%.

9. In addition, Council

(a) requested

options to achieve this rating level

(b) agreed to

continue with year three of the rating structure changes to reduce the UAGC to

15% and increase the commercial differential to 1.2%

(c) agreed to

assess contributions to the risk reserve at a later meeting.

10. Following December 2019, there were a number of

matters that affected Council’s financial outlook. The matters

included additional capital budgets, additional provisions for weathertightness

claims, and the deferral of elder housing divestment revenues. The cumulative

effect of these matters resulted in the draft Annual Plan that was endorsed by

Council in December 2019, no longer being financially sustainable or prudent.

11. On 4 March 2020, Council was presented with

several options to address Council’s current financial situation. Report

– Annual Plan 2020/21 – Draft 2020/21 Budget Options and

Implications was presented to Council with the following immediate actions for consideration:

(a) Prioritising

capital expenditure

(b) Increasing

revenue

(c) Paying down

debt

(d) Commencing

engagement with the community and with regional and national partners regarding

the city’s and Council’s ongoing fiscal challenges

(e) Commencing

development of a plan to investigate, execute and decide upon options for

medium-term solutions

12. Four specific

options were considered by Council relating to the budget for 2020/21. These

options had undergone a four-step process being:

(a) Determination

of what needs to be delivered in 2020/21 (predominantly capital projects since

they have a larger effect on the debt to revenue ratio)

(b) Determination

of the appropriate debt to revenue ratio (to demonstrate prudent financial

management and to ensure that Council’s financial positioning entering

the Long-term Plan process is acceptable)

(c) Determination

of operational areas of priority and assessment of increases and decreases

accordingly.

(d) Identification

of the level of revenue required and the split of revenue sources to deliver on

(a) to (c).

13. Council

considered these matters on 4 March 2020 and resolved to:

(a) Approve the

draft 2020/21 capital programme of $244M and associated rates revenue increase

of 12.6%.

(b) Recognise

that the rates increase of 12.6% is made up of:

(i) Business

as usual general rate 3.9%

(ii) Waters 2.1%

(iii) Growth

& transport planning 1.5%

(iv) Debt management 5%

(v) Other

operating expenditure 0.1%

(c) Approve a

further amendment to the rating structure by reducing the uniform annual

general charge to 10% (over and above the reduction to 15% approved by Council

in December 2019) and a further increase in the commercial differential to 1.3.

14. The draft

Annual Plan 2020/21 has been produced in line with the resolutions from 4 March

2020. A Consultation Document (CD) has been produced accordingly which aims to

consult with the community regarding Council’s preferred approach for

2020/21 and how we best position ourselves for future years.

15. It should be

noted that the Annual Plan direction from Elected Members was provided prior to

the COVID19 outbreak.

Supporting Financial Information

16. The attached

Supporting Financial Information (Attachment 2) provides the information

that is relied upon by the content of the proposed CD.

17. The

Supporting Financial Information sets out the updated financial reports and how

these compare to those presented in the 2018-28 Long Term Plan (LTP). The

proposed Annual Plan budget for 2020/21 is based on year three of the LTP.

18. Since the

development of the LTP, Council is experiencing significantly higher costs

relating to its capital programme. Council signalled in the 2019/20 budget that

this continues to put pressure on debt levels. For 2020/21, the risk of Council

exceeding its debt-to-revenue ratio limit either in-year or in the following

year, is much higher and necessitated reconsideration of the capital

expenditure programme (and therefore debt levels) and/or the level of revenue.

This was considered on 4 March 2020 with those resolutions providing the basis

for the Supporting Financial Information.

19. The

Supporting Financial Information will be made publicly available on our website

in order to provide the community access to the financial detail relied upon by

the CD.

CONSULTATION DOCUMENT

20. The purpose

and content of the Annual Plan CD is set out in section 95A of the Local

Government Act 2002. It must provide a basis for public participation in

decision-making, identifying significant or material differences between the

proposed Annual Plan and the content of the LTP for the relevant financial

year.

21. Given the

significance of both the short-term and long-term impact on debt, and proposed

rates increase, the Annual Plan 2020/21 will go through consultation to enable

Council to obtain feedback from the community regarding its preferred approach

for 2020/21 and the long-term financial sustainability issue.

22. The attached

Annual Plan 2020/21 CD (Attachment 1) has been drafted to seek community

feedback.

STATEMENTS OF PROPOSAL

23. The attached

Statement of Proposal – User Fees and Charges 2020/21 (Attachment 3)

presents the proposed changes to the User Fees and Charges for year

2020/21. These were approved as the basis for consultation by Council on

19 February 2020. These will be consulted on alongside the Annual Plan 2020/21

with a reference to these processes included in the CD.

(a) Since the

adoption of the draft User Fees and Charges schedule on 19 February 2020 the

following fee amendments are proposed and reflected in the attached Statement

of Proposal (Attachment 3):

(i) The

proposed fee for the water consumption charge per m3 has increased

from $2.22 (inclusive GST) to $2.32 (inclusive GST). The increase in this fee reflects increases in the costs of providing potable water and

includes the result of the 5% debt management decision approved by Council at

the Policy Committee on 4 March 2020. In the Water

activity, the increased income required to retire existing debt is reflected in

the volumetric charge.

(ii) New fees are

proposed in the Development Works, and Asset Protection Bond and Service

Connection areas, to recover actual costs incurred by Council. These fees

relate to streetlight relocations, a monthly charge for Development Works

Approval applications, and CCTV processing. In addition, it is proposed that

the administration fee for Incomplete Works and Landscaping Bonds is increased

to reflect actual costs. The fee changes are presented in the Statement of

Proposal (Attachment 3).

(b) Council

has requested a report that assesses the potential to provide a discounted dog

registration fee for residents aged over 65. This report is due to be presented

to Council on 21 April 2020 and may affect the user fees and charges for Animal

Services. The 21 April report will advise Council on whether further

consultation will be required if they decide to amend the draft user fees and

charges for Animal Services.

(c) On

19 February 2020, Council approved a small increase and removal of the early bird fee is to discourage long stay commuter

parking in favour of alternative transport modes and creating capacity for

short stay parking.

24. The attached

Statement of Proposal – Revenue and Financing Policy (Attachment 4)

presents the proposed changes to Council’s Revenue and Financing Policy.

This is required following the decision made on 4 March 2020 to further amend

the rating structure by reducing the UAGC to 10% (over and above the reduction

to 15% approved by Council in December 2019). The updated draft Revenue and

Financing Policy for consultation is attached (Attachment 5).

25. The Statement

of Proposal – Development Contributions Policy will also be considered by

Council for adoption at this meeting through Report – Adoption of the

Draft 2020/21 Development Contributions Policy.

Strategic / Statutory Context

26. The Local

Government Act 2002 (LGA) requires local authorities to prepare and adopt an

Annual Plan for each financial year. This report is in relation to the 2020/21

financial year, which is the third year of the LTP. Developing an Annual Plan

requires consultation on changes that are significantly or materially different

from the LTP. If there are no such changes, a local authority is not required

to consult.

Legal Implications / Risks

27. In accordance

with the LGA, Council must consult with the community if the annual plan

includes significant or material differences from the content of the LTP for

the financial year to which the proposed annual plan relates.

Consultation / Engagement

28. The Annual

Plan will go through consultation to enable Council to obtain feedback from the

community regarding its preferred approach for 2020/21 and the long-term

financial sustainability issue.

29. The proposed

updates to the User Fees and Charges, to the Revenue and Financing Policy, and

to the Development Contributions Policy require consultation under the LGA and

other Acts.

30. Consultation

will take place between 25 March 2020 and 27 April 2020. Consultation on the

Statement of Proposals for User Fees and Charges, the Revenue and Financing

Policy, and for the Development Contributions Policy will be held concurrently.

A formal submission process and hearings will be held in May 2020.

Significance

31. Tauranga’s

Significance and Engagement Policy determines whether a matter is significant.

In making the assessment against this policy, there is no intention to assess

the importance of this item to individuals, groups, or agencies within the

community and it is acknowledged that all reports have a high degree of

importance to those affected by Council decisions. Materiality is defined as

being something that would influence the decisions or assessments of those

reading or responding to the consultation document.

32. In terms of

the Significance and Engagement Policy the financial matters raised, and the

budget adjustments identified and recommended through previous reports that

have led to the draft Annual Plan are deemed to be significant. It is therefore

proposed that the Annual Plan is presented to the community for consultation.

Next Steps

33. Following

adoption of the Annual Plan 2020/21 documents, consultation will take place

between 25 March 2020 and 27 April 2020. This will be followed by hearings on

4-7 May 2020, deliberations on 25-28 May 2020 and final adoption in June 2020.

Attachments

1. TO

BE TABLED AT MEETING - Draft Annual Plan 2020-21 Consultation Document -

A11338220

2. TO

BE TABLED AT MEETING - Supporting Financial Information - A11342225

3. Statement

of Proposal for 2020-21 User Fees and Charges Consultation - A11283607 ⇩

4. Statement

of Proposal for 2020-21 Revenue and Financing Policy for Consultation -

A11315703 ⇩

5. Draft

Revenue and Financing Policy - AP2020-21 - A11331472 ⇩

|

Ordinary Council

Meeting Agenda

|

24 March 2020

|

|

Statement of Proposal

Proposed

2020/21

Tauranga

City Council Fees and Charges for Community Consultation

|

This Statement of Proposal includes:

· The proposed 2020/21 fees and charges that require

consultation

· The reasons for the proposal; and

· How people can present their views on the

proposal.

Proposed

2020/21 fees and charges

The Council’s fees and charges

are set under the Local Government Act 2002 (LGA), Resource Management Act 1991

(RMA), Food Act 2014 and other legislation. Under the Local Government Act 2002

(LGA) Council is required to consult on user fees and charges where there is a

significant or material difference to the budget in the Long-term Plan. Council

is also legislatively required to consult on a number of other fees. This

proposal sets out the fees and charges that meet this criterion (see table

below).

Council’s user fees and

charges are updated each year during the annual plan process. Updates reflect

changing circumstances, Consumer Price Index (CPI) adjustments, new or removed

fee requirements, or benchmarking with other Councils. The proposed fees and charges

reflect the outcome of this review process. The key changes and reasons for

these changes are outlined below.

|

Activity area

|

|

|

|

ANIMAL SERVICES

|

2020/21

Proposed fee

|

Current fee

|

|

Dog owner

classification

|

|

Normal fee

Discounted fee (if

paid before 1 August)

|

$138

$92

|

$130

$87

|

|

Dangerous dogs

(classified)

Discounted fee (if

paid before 1 August)

|

$207

$138

|

$196.50

$131

|

|

Service of

notices

|

|

Mileage

|

$0.79/km

|

$0.60/km

|

|

Reason for

proposal:

PLEASE NOTE – Animal Services

fees may be subject to change and will be dependent upon a Council report on

21 April 2020 to consider discounted dog registration fees for residents

over the age of 65.

Proposed increase

to dog registration fees to match the operational cost.

The mileage

reimbursement fee has increased to reflect the current rate.

|

|

ASSET PROTECTION BONDS & SERVICE CONNECTION FEES

|

2020/21

Proposed fee

|

Current fee

|

|

Service

connection fees

|

|

Service connection

application fee

|

$228

|

$92

|

|

Streetlight

relocation fee

|

$471

|

NEW

|

|

Reason for proposal:

The increase in

service connection application fees to reflect the actual cost processing

applications.

The new fee for

streetlight relocation to recover the actual cost of this service.

|

|

BAYCOURT

|

2020/21

Proposed fee

|

Current fee

|

|

COMMERCIAL VENUE RENTAL – proposed fees below or 10% box

office, whichever is greater after ticketing fees.

|

|

Complex

|

|

All day / Conference / Private functions

|

$3,943

|

$3,685

|

|

Performances

|

$3,814

|

$3,685

|

|

Exhibitions

|

$3,814

|

$3,685

|

|

Auditorium

|

|

All day / Conference / Private functions

|

$2,444

|

$2,280

|

|

Performances

|

$2,360

|

$2,280

|

|

Exhibitions

|

$2,360

|

$2,280

|

|

X Space

|

|

All day / Conference / Private functions

|

$878

|

$820

|

|

Performances

|

$861

|

$820

|

|

Exhibitions

|

$605

|

$585

|

|

Pre / Post show function

|

$308

|

$293

|

|

Terrace Room

|

|

All day / Conference / Private functions

|

$287

|

$268

|

|

Performances

|

$174

|

$168

|

|

Exhibitions

|

$303

|

$293

|

|

Pre / Post show function

|

$308

|

$293

|

|

Greenroom

|

|

All day / Conference / Private functions

|

$314

|

$268

|

|

Performances

|

$174

|

$168

|

|

Exhibitions

|

$303

|

$293

|

|

Pre / Post show function

|

$308

|

$293

|

|

COMMUNITY VENUE RENTAL – applies to performances and

exhibitions only

|

|

Complex

|

|

|

|

Performances

|

$1,907

|

$1,843

|

|

Exhibitions

|

$1,907

|

$1,843

|

|

Auditorium

|

|

|

|

Performances

|

$1,180

|

$1,140

|

|

Exhibitions

|

$1,180

|

$1,140

|

|

X Space

|

|

Performances

|

$430.50

|

$820

|

|

Exhibitions

|

$303

|

$585

|

|

Terrace Room

|

|

Performances

|

$87

|

$84

|

|

Exhibitions

|

$152

|

$146.50

|

|

Greenroom

|

|

Performances

|

$87

|

$84

|

|

Exhibitions

|

$152

|

$146.50

|

|

Reason for proposal:

For clarity, a community organisation fee and a separate

commercial fee are proposed to be in place as opposed to a general fee and

subsidised fee for community organisations.

|

|

BAY VENUES LIMITED (BVL)

|

2020/21

Proposed fee

|

Current fee

|

|

AQUATICS GENERAL ENTRY

|

|

Baywave

|

|

Adult

|

$8

|

$7.90

|

|

Child / Senior

|

$5.50

|

$5.20

|

|

Family

|

$22

|

$21

|

|

Spectator

|

$2

|

$1.50

|

|

Greerton

|

|

Adult

|

$6

|

$5

|

|

Child / Senior

|

$3.50

|

$2.50

|

|

Family

|

$15.50

|

$12

|

|

Spectator

|

$1

|

$0.60

|

|

Memorial / Otumoetai

|

|

Adult

|

$6

|

$4.80

|

|

Child / Senior

|

$3.50

|

$2.50

|

|

Family

|

$15.50

|

$11.70

|

|

Spectator

|

$1

|

$0.60

|

|

AQUATICS LANE HIRE

|

|

Standard Lane Hire – Peak

|

$12

|

$8.50

|

|

Standard Lane Hire – Off Peak

|

$12

|

$4

|

|

High User Lane Hire – Peak

|

$8.50

|

$8.50

|

|

High User Lane Hire – Off Peak

|

$8.50

|

$4

|

|

Schools (9am – 3pm)

|

$6

|

$4

|

|

Adult Squad Baywave – Peak

|

$4.50

|

$3.80

|

|

Adult Squad Baywave – Off Peak

|

$4.50

|

$3.80

|

|

Adult Squad Greerton / Memorial / Otumoetai – Peak

|

$3

|

$1.40

|

|

Adult Squad Greerton / Memorial / Otumoetai – Off Peak

|

$3

|

$1.40

|

|

Child Squad Baywave – Peak

|

$3

|

$3.80

|

|

Child Squad Baywave – Off Peak

|

$3

|

$3.80

|

|

Child Squad Greerton / Memorial / Otumoetai – Peak

|

$2

|

$1.40

|

|

Child Squad Greerton / Memorial / Otumoetai – Off Peak

|

$2

|

$1.40

|

|

AQUATICS MEMBERSHIPS

|

|

Adult – Baywave

|

$832

|

$418

|

|

Child / Senior – Baywave

|

$572

|

$418

|

|

Adult – Greerton / Memorial / Otumoetai

|

$624

|

$253

|

|

Child / Senior - Greerton / Memorial / Otumoetai

|

$364

|

$253

|

|

INDOOR SPORTS

|

|

Arena

|

|

Adult – Standard

|

$55

|

$46.20

|

|

Adult – Community

|

$46.50

|

$37

|

|

Youth / Senior – Standard

|

$37.50

|

$30

|

|

Youth / Senior – Community

|

$32.50

|

$24

|

|

Queen Elizabeth Youth Centre

|

|

Adult – Standard

|

$38.50

|

$32.40

|

|

Adult – Community

|

$33

|

$25.90

|

|

Youth / Senior – Standard

|

$27

|

$23

|

|

Youth / Senior – Community

|

$23

|

$18.40

|

|

Aquinas

|

|

Adult – Standard

|

$30.50

|

$32.40

|

|

Adult – Community

|

$25.50

|

$25.90

|

|

Youth / Senior – Standard

|

$20.50

|

$23

|

|

Youth / Senior – Community

|

$18

|

$18.40

|

|

Merivale Action Centre

|

|

|

|

Adult – Standard

|

$30.50

|

$24.80

|

|

Adult – Community

|

$25.50

|

$21.10

|

|

Youth / Senior – Standard

|

$20.50

|

$17

|

|

Youth / Senior – Community

|

$18

|

$14.80

|

|

Mount Sports Centre

|

|

Adult – Standard

|

$30.50

|

$23.40

|

|

Adult – Community

|

$25.50

|

$18.70

|

|

Youth / Senior – Standard

|

$20.50

|

$14.70

|

|

Youth / Senior – Community

|

$18

|

$11.80

|

|

COMMUNITY HALLS

|

|

Bethlehem

|

|

Adult – Standard

|

$26.50

|

$21.70

|

|

Adult – Community

|

$22.50

|

$17.40

|

|

Youth / Senior – Standard

|

$18.50

|

$17.30

|

|

Youth / Senior – Community

|

$15.50

|

$13.80

|

|

Cliff Road

|

|

Adult – Standard

|

$14.50

|

$10.90

|

|

Adult – Community

|

$12.50

|

$8.70

|

|

Youth / Senior – Standard

|

$10

|

$10.10

|

|

Youth / Senior – Community

|

$8.50

|

$8.10

|

|

Elizabeth Street

|

|

Adult – Standard

|

$14.50

|

$11.60

|

|

Adult – Community

|

$12.50

|

$9.30

|

|

Youth / Senior – Standard

|

$10

|

$8.20

|

|

Youth / Senior – Community

|

$8.50

|

$6.60

|

|

Greerton

|

|

Adult – Standard

|

$26.50

|

$23.40

|

|

Adult – Community

|

$22.50

|

$18.70

|

|

Youth / Senior – Standard

|

$18.50

|

$18.30

|

|

Youth / Senior – Community

|

$15.50

|

$14.60

|

|

Matua

|

|

Adult – Standard

|

$26.50

|

$22.40

|

|

Adult – Community

|

$22.50

|

$17.90

|

|

Youth / Senior – Standard

|

$18.50

|

$17.40

|

|

Youth / Senior – Community

|

$15.50

|

$13.90

|

|

Tauriko

|

|

Adult – Standard

|

$23

|

$20.60

|

|

Adult – Community

|

$19.50

|

$14

|

|

Youth / Senior – Standard

|

$16

|

$20.60

|

|

Youth / Senior – Community

|

$13.50

|

$14

|

|

Waipuna

|

|

Adult – Standard

|

$23

|

$17.70

|

|

Adult – Community

|

$19.50

|

$14.20

|

|

Youth / Senior – Standard

|

$16

|

$13.90

|

|

Youth / Senior – Community

|

$13.50

|

$11.10

|

|

Welcome Bay

|

|

Adult – Standard

|

$26.50

|

$23

|

|

Adult – Community

|

$22.50

|

$18.40

|

|

Youth / Senior – Standard

|

$18.50

|

$17.30

|

|

Youth / Senior – Community

|

$15.50

|

$13.80

|

|

COMMUNITY CENTRES

|

|

Arataki – XL Room (Heron & Dotterel)

|

|

Adult – Standard

|

$37.50

|

$29.10

|

|

Adult – Community

|

$32

|

$23.30

|

|

Youth / Senior – Standard

|

$26

|

$25.90

|

|

Youth / Senior – Community

|

$22

|

$20.70

|

|

Arataki – Large Room (Heron / Dotterel)

|

|

Adult – Standard

|

$29.50

|

$16.20

|

|

Adult – Community

|

$25

|

$12.90

|

|

Youth / Senior – Standard

|

$21

|

$13.90

|

|

Youth / Senior – Community

|

$18

|

$11.10

|

|

Arataki – Medium Room (Kingfisher / Penguin)

|

|

Adult – Standard

|

$23.50

|

$13.80

|

|

Adult – Community

|

$21.50

|

$11

|

|

Youth / Senior – Standard

|

$16

|

$12

|

|

Youth / Senior – Community

|

$14

|

$9.60

|

|

Arataki – Small Room (Sandpiper / Oyster Catcher)

|

|

Adult – Standard

|

$17.50

|

$10.60

|

|

Adult – Community

|

$15

|

$8.70

|

|

Youth / Senior – Standard

|

$12

|

$9.30

|

|

Youth / Senior – Community

|

$10

|

$7.60

|

|

Papamoa Community Centre – Large Room (Tohora / Aihe)

|

|

Adult – Standard

|

$29.50

|

$28.20

|

|

Adult – Community

|

$25

|

$22.60

|

|

Youth / Senior – Standard

|

$21

|

$28.20

|

|

Youth / Senior – Community

|

$18

|

$22.60

|

|

Papamoa Community Centre – Medium Room (Mako)

|

|

Adult – Standard

|

$23.50

|

$26.10

|

|

Adult – Community

|

$21.50

|

$19.30

|

|

Youth / Senior – Standard

|

$16

|

$26.10

|

|

Youth / Senior – Community

|

$14

|

$19.30

|

|

Papamoa Community Centre – Small Room (Tamure / Tarakihi /

Patiki / Atrium)

|

|

Adult – Standard

|

$17.50

|

$20.40

|

|

Adult – Community

|

$15

|

$13.70

|

|

Youth / Senior – Standard

|

$12

|

$20.40

|

|

Youth / Senior – Community

|

$10

|

$13.70

|

|

Papamoa Sport & Recreation Centre – XXL Room

(Surfbreaker & Dunes)

|

|

Adult – Standard

|

$45.50

|

$29.40

|

|

Adult – Community

|

$39

|

$23.50

|

|

Youth / Senior – Standard

|

$32

|

$29.40

|

|

Youth / Senior – Community

|

$27

|

$23.50

|

|

Papamoa Sport & Recreation Centre – XL Room

(Surfbreaker)

|

|

Adult – Standard

|

$37.50

|

$18.90

|

|

Adult – Community

|

$32

|

$15.10

|

|

Youth / Senior – Standard

|

$26

|

$14.50

|

|

Youth / Senior – Community

|

$22

|

$11.60

|

|

Papamoa Sport & Recreation Centre – Large Room (Dunes /

Beachside)

|

|

Adult – Standard

|

$29.50

|

$18.90

|

|

Adult – Community

|

$25

|

$15.10

|

|

Youth / Senior – Standard

|

$21

|

$14.50

|

|

Youth / Senior – Community

|

$18

|

$11.60

|

|

Papamoa Sport & Recreation Centre – Medium Room (Driftwood)

|

|

Adult – Standard

|

$23.50

|

$8.90

|

|

Adult – Community

|

$21.50

|

$7.10

|

|

Youth / Senior – Standard

|

$16

|

$6.80

|

|

Youth / Senior – Community

|

$14

|

$5.40

|

|

Papamoa Sport & Recreation Centre – Small Room (Seashell

/ Shoreline)

|

|

Adult – Standard

|

$17.50

|

$8.90

|

|

Adult – Community

|

$15

|

$7.10

|

|

Youth / Senior – Standard

|

$12

|

$6.80

|

|

Youth / Senior – Community

|

$10

|

$5.40

|

|

Reason for proposal:

An increase to the above user fees and charges (as well as to

rates-funded subsidy) is proposed to cover the cost of operation of these

facilities which has grown by 7% per year over the last 4 years on average. The

proposed approach has lower impact on users and a lower impact on rates. This

option also enables BVL to simplify and rationalise its user fees and charges

as entry prices across the network are currently overly complex are not

consistent between facilities.

|

|

BUILDING SERVICES

|

2020/21

Proposed fee

|

Current fee

|

|

Building Consent Fees – staff hourly rates

|

|

Administration

|

$147

|

$144

|

|

Team Leader

|

$270

|

$264

|

|

Manager / Project Manager / Legal Services

|

$279

|

$273

|

|

Compliance Officer Pool Fencing

|

$219

|

$213

|

|

Technical Specialist (Hazardous Substances and New Organisms)

|

$236

|

$231

|

|

Environmental Planning Processing

|

$231

|

$162

|

|

PIM fees

|

|

Solar Heater – Installation only

|

$442.50

|

$433

|

|

Amended Plans

|

|

On-site minor variation

|

$90

|

NEW

|

|

Building Consent Administration Charges & Levies

|

|

Building levy ($1.75 per $1,000 (or part there-after of building

works $20,000 or more). The BA04 requires Council to collect a levy to be

paid to MBIE.

|

$1.75 per $1,000

(or part there-after of building works $20,444 or more)

|

$2.01 per $1,000

(or part there-after of building works $20,444 or more)

|

|

Priority Code Compliance Certificate

|

|

Code Compliance Certificate (over 5 years old)

Drainage, Solid Fuel Heaters, Solar, Retaining Walls

(Non-refundable CCC fee, in addition to CCC project value fees,

plus hourly charge fees as applicable).

|

$383

|

NEW

|

|

Commercial Code Compliance Certificate (over 5 years old)

(Non- refundable CCC fee, in addition to CCC project value fees,

plus hourly charge fees as applicable).

|

$1,500

|

NEW

|

|

CCC Reactivation Fee

|

$180

|

NEW

|

|

Reason for proposal:

Proposed increases for staff hourly rates to reflect demand on

complexity of applications.

Proposed increase to solar heater installation only to reflect

actual cost.

New fees proposed for on-site minor

variations to Amended Plans, Code Compliance Certificate (over 5 years old),

and Code Compliance Certificate Reactivation Fee.

Correction to building levy fee paid to MBIE.

|

|

DEVELOPMENT WORKS

|

2020/21

Proposed fee

|

Current fee

|

|

Development Works Approvals, Observations / Testing / Reinspection

|

|

Minimum monthly charge for an active Development Works Approval

application

|

$195

|

NEW

|

|

CCTV Inspections of Gravity Drainage Lines

|

|

CCTV processing fee

|

$90

|

NEW

|

|

Incomplete Works and Landscaping Bonds

|

|

Administration Fee (non-refundable)

|

$505

|

$280

|

|

Reason for proposal:

Proposed increases to administration fee to reflect actual cost.

Proposed new fees for CCTV processing and a minimum monthly charge

for an active Development Works Approval application to cover actual cost to

Council for these services.

|

|

LABORATORY FEES

|

2020/21

Proposed fee

|

Current fee

|

|

IANZ Accredited Tests

|

|

pH

|

$18.50

|

$18

|

|

Turbidity

|

$18.50

|

$18

|

|

Free Available Chlorine

|

$26.25

|

$25

|

|

E.coli

|

$50

|

$47.50

|

|

Total Coliforms

|

$50

|

$47.50

|

|

E.coli and Total Coliforms

|

$50

|

$47.50

|

|

Enterococci

|

$50

|

$47.50

|

|

Non Accredited Tests

|

|

Colour

|

$22

|

$21

|

|

%T 254nm

|

$22

|

$21

|

|

Conductivity

|

$22

|

$21

|

|

Salinity

|

$13

|

$12

|

|

Alkalinity

|

$28.50

|

$27

|

|

Iodometric Chlorine

|

$28.50

|

$27

|

|

COD

|

$33

|

$31

|

|

Ammonia Nitrogen

|

$38

|

$36.50

|

|

Nitrate Nitrogen

|

$30

|

$28

|

|

Dry Solids

|

$29

|

$27.50

|

|

Settleable solids

|

$29

|

$27.50

|

|

Volatile solids

|

$29

|

$27.50

|

|

Heterophile Plate Count

|

$38.50

|

$37

|

|

Soil pH

|

$75

|

$70

|

|

Soil conductivity

|

$65

|

$60

|

|

Toxicity

Test

|

$160

|

$150

|

|

TKN

|

$47.50

|

$45

|

|

Dissolved

Reactive Phos

|

$30

|

$25

|

|

Oil

& Grease-SUB

|

$80

|

$76.50

|

|

Miscellaneous

Fees

|

|

Sub

sampling

|

$9

|

$8.50

|

|

Courier

|

$9

|

$8.50

|

|

Call

back rate; per hour or portion thereof

|

$80

|

$75

|

|

Microscopic

Exam

|

$85

|

$80

|

|

Reason for proposal:

Please

note - Laboratory fees are not an external fee available to the public.

The

proposed increase to the laboratory fees reflects new contract rates.

|

|

PARKING FEES

|

2020/21

Proposed fee

|

Current fee

|

|

Paid Parking Area

|

|

Paid Parking Area – Dive Crescent

|

$6 daily

|

$4 daily

|

|

Paid Parking Area – Cliff Road

|

$5 daily

|

$3 daily

|

|

Paid Parking Area (Off Street)

|

$10 daily

|

$8 daily

|

|

Paid Parking Area – per hour (on and off street)

|

$2.50/hr

|

$2/hr

|

|

Parking Buildings – Casual

|

|

2-3 hours

|

$5

|

$4

|

|

3-4 hours

|

$7

|

$6

|

|

4-5 hours

|

$9

|

$8

|

|

5-6 hours

|

$11

|

$10

|

|

6-7 hours

|

$12

|

$11

|

|

7-8 hours

|

$14

|

$12

|

|

Parking Buildings - Leased

|

|

Spring Street Lease – Covered (monthly)

|

$230

|

$200

|

|

Spring Street Lease – Uncovered (monthly)

|

$210

|

$180

|

|

Spring Street Lease – Basement (monthly)

|

$290

|

$250

|

|

Elizabeth Street Lease – Covered (monthly)

|

$230

|

$220

|

|

Elizabeth Street Lease – Uncovered (monthly)

|

$210

|

$200

|

|

Harington Street Lease – Covered (monthly)

|

$230

|

$220

|

|

Off-street leased carparks

|

|

TV 3 – Lease

|

$230

|

$220

|

|

Kingsview – Lease

|

$230

|

$220

|

|

Devonport – Lease

|

$210

|

$190

|

|

Dive Crescent – Lease

|

$128

|

$125

|

|

Reason for proposal:

Early bird (pre 9.30am) fees have been removed.

The proposed increases and removal of the early bird fee is to

discourage long stay commuter parking in favour of alternative transport

modes and creating capacity for short stay parking.

|

|

PARKS & RECREATION

|

2020/21

Proposed fee

|

Current fee

|

|

Events on Parks

|

|

Commercial, ticket price less than $50 – per day

|

$300

|

$230

|

|

Commercial, ticket price more than $50 – per day

|

$3,500

|

$3,022

|

|

Amenities charge – per site, weekdays, 9am to 5pm

|

$35

|

NEW

|

|

Amenities charge – per site, after hours, weekends and

public holidays

|

$70

|

NEW

|

|

Markets on public open space per market – commercial

operator

|

$250

|

NEW

|

|

Markets on public open space per market – not got profit

organisation

|

$100

|

NEW

|

|

McLaren Falls - Hire Charges – Group Bookings (per night 3pm

to 10am)

|

|

Hostel – sleeps 16

|

$200

|

$153

|

|

McLaren Falls - Hire Charges – Group Bookings (day fee 10am

to 3pm)

|

|

Hostel – sleeps 16

|

$70

|

$60

|

|

McLaren Falls – Camping (per person per night)

|

|

Adults

|

$15

|

$10.50

|

|

McLaren Falls – Events

|

|

Over 100 participants

|

$300

|

NEW

|

|

Reason for proposal:

Proposed increases to McLaren Falls hire charges adequately

reflect the service provided and are aligned with fees from comparable

regional parks. A new fee is proposed for McLaren Falls events with over 100

participants and new fees are proposed for amenities use for events on Parks.

New fees are also proposed for markets on public open space for commercial and

not for profit organisations.

|

|

PLANNING

|

2020/21 Proposed

fee

|

Current fee

|

|

Staff Hourly

Rates - Environmental Planning Staff

|

|

Environmental Planner

|

$234

|

$158

|

|

Senior Environmental Planner

|

$255

|

$193

|

|

Manager: Environmental Planning

|

$279

|

$222

|

|

Planning Technician

|

$147

|

$112

|

|

Intermediate Environmental Planner

|

$245

|

$173

|

|

Development Planner / Principal Planner

|

$270

|

$208

|

|

Team Leader: Environmental Planning

|

$270

|

$208

|

|

Staff Hourly Rates - Environmental Protection Staff

|

|

|

|

Team Leader: Environmental Monitoring

|

$270

|

$176

|

|

Environmental Monitoring Officer

|

$219

|

$151

|

|

Environmental Monitoring Technician

|

$147

|

NEW

|

|

Reason for proposal:

The proposed increase to planning and protection staff charge out

rates reflect the demand for services and their associated complexity.

A new fee is proposed for Environmental Monitoring Technician.

|

|

REGULATION MONITORING

|

2020/21 Proposed

fee

|

Current fee

|

|

Mobile Shops

|

|

Base Fee Marine Parade Tender sites per parking space (Christmas

Day to Waitangi Day)

|

$750 per parking space

|

$700 per parking space

|

|

Reason for proposal:

The base fee for Marine Parade has not been reviewed and updated.

This fee was last reviewed in 2015.

|

|

SUSTAINABILITY AND WASTE

|

2020/21 Proposed

fee

|

Current fee

|

|

|

Abandoned Cars

|

|

|

Storage fee (per day)

|

$20

|

$15

|

|

|

Reason for proposal:

The proposed

increase to the storage fee of abandoned cars reflects the increase in

contract rates. Public Events waste monitoring services are no longer

provided and have been removed from Council’s User fees and charges.

|

|

|

TAURANGA CEMETERY PARKS AND CREMATORIUM

|

2020/21 Proposed

fee

|

Current fee

|

|

Burial of Ashes

|

|

Ashes Plot Catholic and Presbyterian

|

$450

|

NEW

|

|

Burials

|

|

Late fee for burials and cremations

(Applies when services arrive later than time booked. See Cemetery

rules for grace periods that apply)

|

$250

|

$235

|

|

Additional

charges

|

|

Public Holiday Surcharge

|

$350

|

$315

|

|

Reason for proposal:

There are proposed increases

to the Burials late fee and public holiday surcharge. A new fee has been

introduced for a new area for the Burial of Ashes.

Some fees have been

removed from the Burial of Ashes section as these areas are no longer

available.

|

|

|

|

|

|

|

|

WATER SUPPLY

|

2020/21 Proposed

fee

|

Current fee

|

|

General

|

|

Consumption Charge per m3

|

$2.32

|

$2.14

|

|

Reason for proposal:

The increase in the

water consumption charge reflects increases in the costs of providing potable

water and includes the result from the 5% debt management decision approved

by Council at the Policy Committee on 4 March 2020. In the Water activity,

the increased income required to retire existing debt is reflected in the

volumetric charge.

|

How can I

make a submission?

The proposed 2020/21 Fees and Charges will be open for

public submissions alongside the Annual Plan 2020/21 consultation from 25 March

2020 until 5.00pm 25 April 2020.

Full copies of the proposed fees and charges document and

submission forms are available from Council’s Willow Street Customer

Service Centre, the Tauranga, Mount Maunganui, Greerton and Papamoa Libraries

and on Council’s website at www.tauranga.govt.nz/annualplan2020.

If you also wish to present your submission in person,

Council will hear verbal submissions on the 4 – 7 May 2020. You can

indicate if you wish to speak to your submission on the submission form.

|

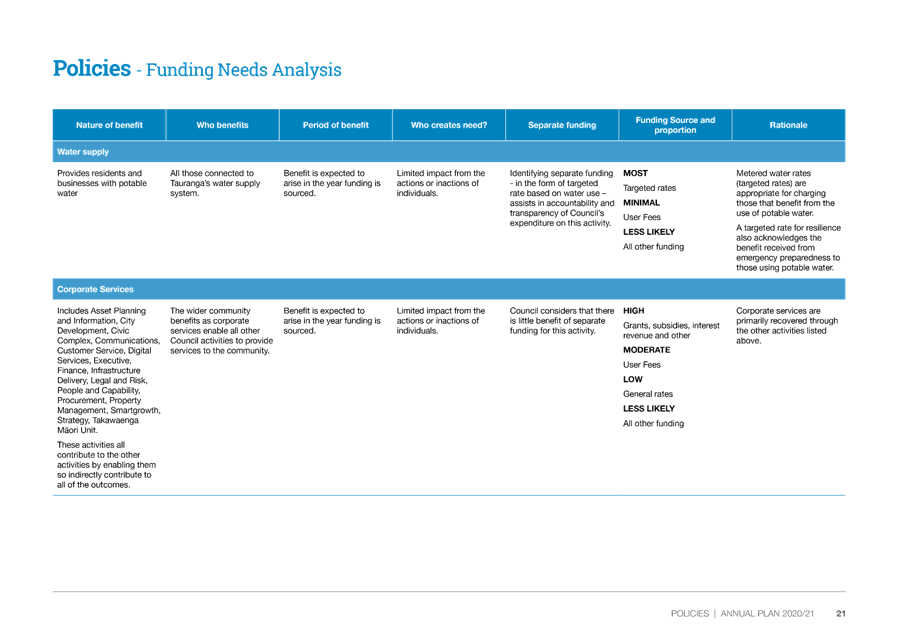

Ordinary Council Meeting Agenda

|

24 March 2020

|

|

Statement of Proposal

Proposed

Revenue and Financing Policy

|

Proposed

changes to the Revenue and Financing Policy

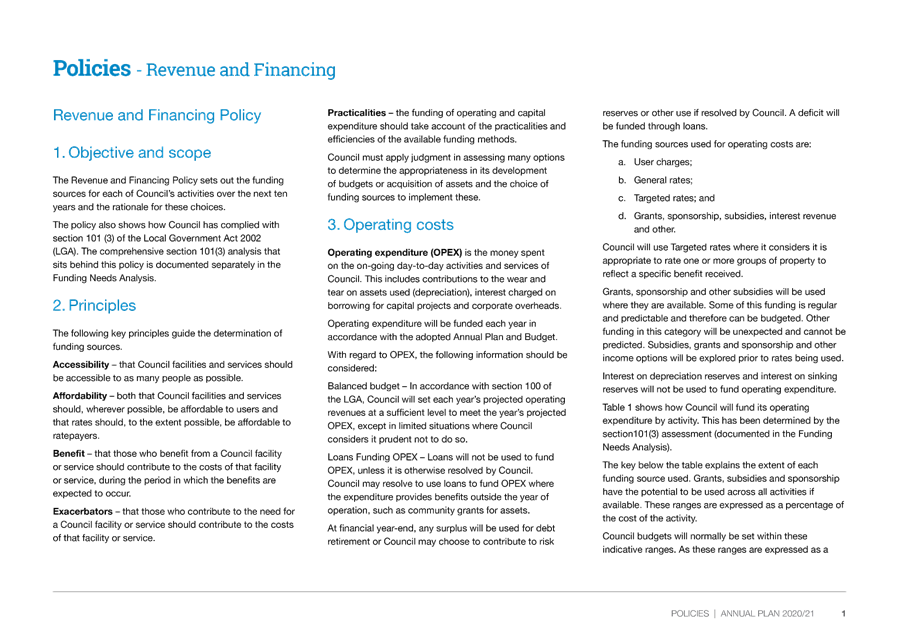

The Revenue and Financing Policy

sets out how Council will fund each of its activities over the next 10 years. Council normally reviews its Revenue and

Financing Policy every 3 years as part of the Long-term Plan process.

Due to the proposed rates increase

of 12.6% including 5% debt retirement, and the

proposed amendment to the rating structure in the draft Annual Plan for

2020/21, a change is required to the Revenue and Financing Policy.

Council’s

decision on 4 March 2020 to propose a rates increase of 12.6% including 5% debt

retirement, and to amend the rating structure requires a change to the Revenue

and Finance Policy. The proposed wording will be included in the draft

Revenue and Finance Policy for consultation:

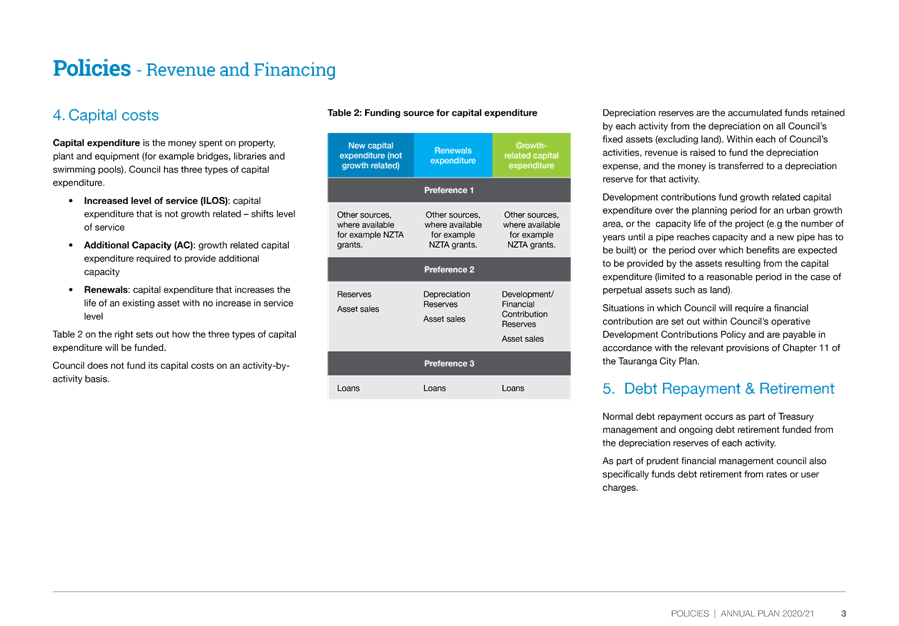

5. Debt Repayment &

Retirement

Normal debt repayment occurs as

part of Treasury management and ongoing debt retirement funded from the

depreciation reserves of each activity.

As part of prudent financial

management council also specifically funds debt retirement from rates or user

charges.

6. Overall funding

consideration

Council is required by section 101

(3)(b) of the LGA to consider the overall impact of the allocation of liability

for revenue needs on the current and future social, economic, environmental and

cultural well-being of the community. It allows Council, as a final measure, to

modify the overall mix of funding that would otherwise apply after the 101

(3)(a) analysis.

In considering the overall impact

Council will;

a. Lower the

Uniform Annual General Charge, and other targeted rates set on a uniform basis

from 30% to an indicative 10% of total rates revenue over a period of three

years.

b. Set

Differential General rates for residential and commercial categories, to be

phased in over three years to allow property owners to adjust to the

change.

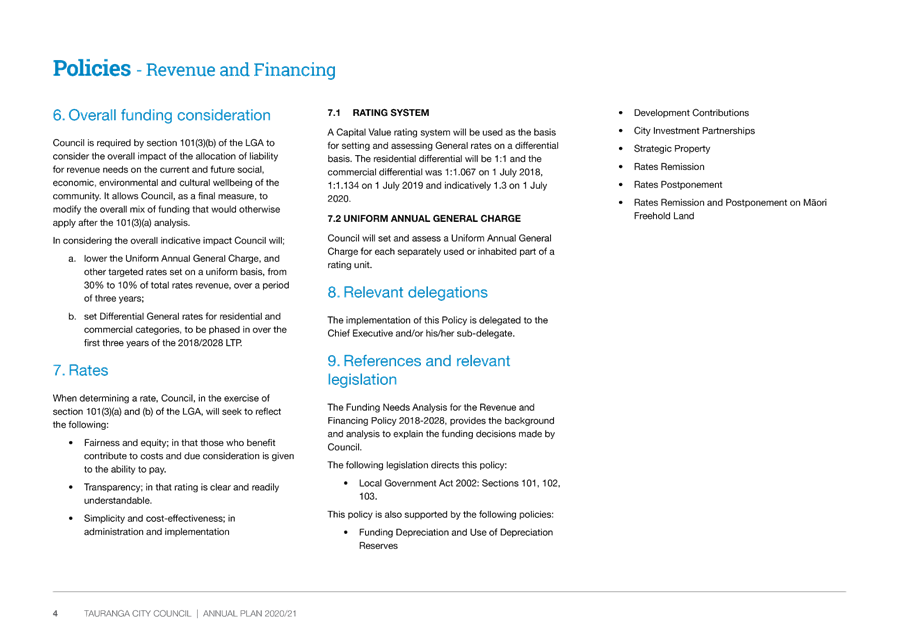

7.1 Rating System

A Capital Value rating system will

be used as the basis for setting and assessing General rates on a differential

basis. The residential will be 1:1 and the commercial differential was 1:1.067

on 1 July 2018, 1;1.134 on 1 July 2019 and indicatively 1.3 on 1 July

2020.

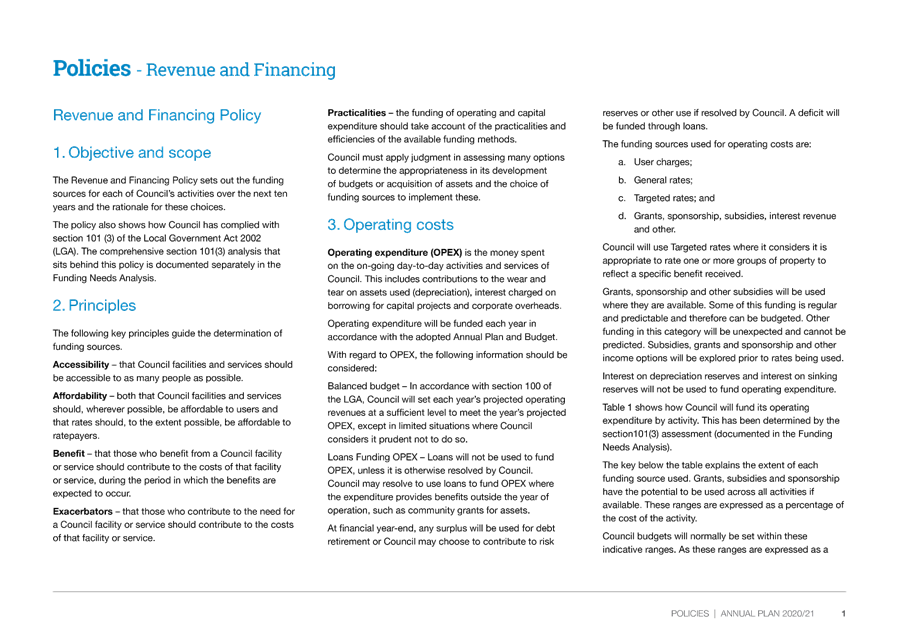

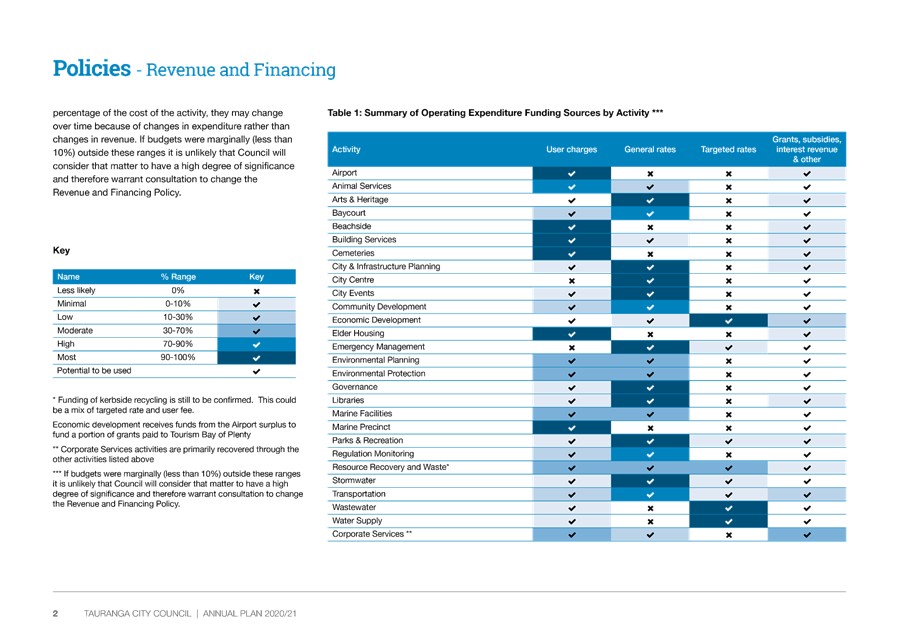

Recent organisational

restructures resulted in changes to the way some activities are funded.

During the draft Annual Plan process a review into the funding of all

activities was undertaken to ensure the policy remains up to date and the

activities are funded appropriately.

The majority of

activities remain consistent with the Revenue and Finance Policy from the

2018-28 Long-term Plan (LTP). Some activity funding splits have changed

slightly from the LTP but remain within the policy’s 10% margin.

The follow activities

have material changes:

City

Infrastructure & Planning

Addition of minimal

funding from grants and subsidies to reflect New Zealand Transport Agency

funding coming into the activity.

Council considered a

number of options ahead of their decision to propose amendments to the Uniform

Annual General Charge (UAGC), the commercial differential on the general rate

and to the capital budget for 2020/21. These included keeping to the limits

approved for year three of the 2018-20 Long-term Plan (LTP), reducing the UAGC

further than year three of the LTP and increasing the commercial differential,

and prioritising our capital budget with options for debt retirement. For

further information please see the impact on your rates for each of these

options under Options Analysis in our Supporting Financial Information on your

website www.tauranga.govt.nz/annualplan2020.

How can I

make a submission?

The proposed draft Revenue and Financing Policy will be

open for public submissions from 25 March 2020 to 27 April 2020.

Full copies of the proposed policy, this statement of

proposal and the submission form are available from Council’s Willow

Street Customer Service Centre, the Tauranga, Mount Maunganui, Greerton

and Papamoa Libraries and on Council’s website at

www.tauranga.govt.nz/annualplan2020.

If you also wish to present your submission in person,

Council will hear verbal submissions 4-7 May 2020. You can indicate if you wish

to speak to your submission on the submission form.

|

Ordinary Council Meeting Agenda

|

24 March 2020

|

10.2 Adoption

of the Draft 2020/21 Development Contributions Policy

File Number: A11284758

Author: Ana Blackwood, Development Contributions Policy Analyst

Authoriser: Christine Jones, General Manager: Strategy & Growth

Purpose of the

Report

1. The

purpose of this report is to adopt the Draft 2020/21 Development Contributions

Policy for public consultation.

|

Recommendations

That the Council:

(a) Adopts the

Draft 2020/21 Development Contributions Policy for public consultation

(b) Adopts the

Statement of Proposal for the Draft 2020/21 Development Contributions Policy

as the basis of public consultation;

(c) Authorises

the Chief Executive to approve minor drafting, financial and presentation

amendments to the Draft 2020/21 Development Contributions Policy prior to

printing if necessary

|

DISCUSSION

2. Council

reviews and updates its Development Contributions Policy on an annual basis.

The Local Government Act 2002 requires that Council undertake public

consultation prior to the adoption of the new Policy.

3. The

Draft 2020/21 Development Contributions Policy (2020/21 DC Policy) will be

consulted on in conjunction with the Annual Plan. For the purposes of this

consultation, staff have prepared the attached Statement of Proposal

(Attachment A). The Statement sets out the proposal to adopt the 2020/21 Development

Contributions Policy and includes:

(a) The reason

for the proposal;

(b) An analysis

of the reasonable practical options that Council could use to fund growth

related capital expenditure;

(c) A summary of

the proposed amendments to the 2020/21 Development Contributions Policy;

(d) A draft copy

of the 2020/21 Development Contributions Policy.

4. The

majority of the 2020/21 DC Policy remains unchanged compared to the operative

2019/20 DC Policy. Staff have made some relatively minor formatting and editing

changes to the document, but the only significant changes are updates to

capital expenditure budgets. These updates are required to ensure that the

budgets are based on the most up to date information and are in line with

budgets in the Annual Plan.

5. Updates

to capital expenditure budgets result in changes to development contribution

charges. The Statement of Proposal includes a table which sets out the proposed

new fees and the percentage change in fees compared to these in the operative

2019/20 Policy.

6. The

key drivers for the change are also discussed in the Statement of Proposal and

were presented to the Policy Committee on the meeting 19 February 2020.

7. The

only change since the Policy Committee meeting (19 February) is for development

contribution fees in Tauriko. These fees have increased as shown in the

table below:

|

|

Fees in Operative Policy

|

Fees shown in February report

|

Fees in the Draft 2021 DC Policy

|

|

$ per hectare of land

|

$359,759

|

$352,404

|

$378,911

|

8. This

increase is due to an update of some of the development contribution funded

wastewater infrastructure to service land in the southern portion of the

Tauriko Business Estate. This land includes the land on which the recently

announced Winstone Wallboards factory is proposed to be built. This update is

required as the previously planned wastewater projects to service the Tauriko

land are, for several reasons, no longer feasible.

9. The

new project shown in the 2020/21 Policy is the costs associated with delivery

of an Interim Stage (Stage 1A) of a larger wastewater scheme which will provide

for the future Western Corridor development. 39% of the costs associated with

Stage 1A ($8.1M) are to be funded from development contributions in Tauriko.

This funding proportion is based on the expected wastewater flows from Tauriko

compared to the wastewater flows from other areas of future development that

the works will also service.

10. Overall the

fees in the 2020/21 Policy for Tauriko are an increase of 6% (or approximately

$22,000 per hectare) compared to the fees in the operative Development

Contributions Policy. While this is a relatively significant increase if

we do not include the new costs in the Policy then Council cannot start

collecting development contributions towards the cost of this project.

Citywide

development contributions

11. The Citywide Development

Contribution (CDC) in the Draft 2020/21 Policy is $9,946 per household unit

equivalent (excluding GST). This is an increase of $1,408 or 16% compared to

what is in the operative policy. The causes of this increase are discussed in

the attached Statement of Proposal.

12. The CDC is

expected to increase by an even greater quantum in the next financial year when

Council starts collecting Development Contributions for the Waiāri Water

Supply Scheme. The exact quantum of the increase cannot be calculated until

project costs are finalised but is expected to be an increase of between $5,000

and $9,000 compared to the 2020/21 CDC. (i.e. this will be in addition to the

final adopted CDC for this financial year).

13. This increase

is signalled within the 2020/21 Policy and staff will be working to ensure that

this future increase is highlighted to the building community. While this is

not technically a change that impacts the 2020/21 Policy which is being

consulted on, it could be expected that Council may receive some feedback on

this matter via this year’s annual plan process.

Strategic / Statutory Context

14. The Local Government Act 2002 requires Council to have a Development

Contributions Policy. Development contributions are a significant and strategic

revenue source for the Council and are critical to funding capital expenditure

associated with providing for the growing city. Development contributions

enable infrastructure to be built to unlock additional development capacity.

Consultation / Engagement

15. One adopted

the Draft 2020/21 Development Contributions Policy and the Statement of

Proposal will be made publicly available and consulted on in conjunction with

Annual Plan proposals. The policy will be directly distributed to key

stakeholders in the development community who will have the opportunity to

submit to Council on the content of the Policy.

16. Staff are

planning to undertake additional engagement compared to previous years to

ensure that contacts within the building industry are provided with copies of

the policy and are made aware of the increases proposed in the Citywide

Development Contribution fee and of the anticipated future increase in the

Citywide Development Contributions.

Significance

17. Under the Significance and Engagement Policy 2014, this report has

high significance as the Development Contributions Policy and the fees that are

included within this policy can have a large impact on a wide range of people

and it is a highly difficult decision to reverse.

Attachments

1. Draft

2021 - Statement of Proposal - A11285507 ⇩

2. Attachment

B - Draft 2020/21 Development Contributions Policy - A11285589 (supplementary

document)

|

Ordinary Council

Meeting Agenda

|

24 March 2020

|

Statement of Proposal

2020/21 Development Contributions Policy

Under the Local Government Act 2002 Council may require development contributions.

Council has had a Development Contributions Policy in place since 1 July 2004.

This Policy has been reviewed annually in conjunction with the Council’s

Annual Plan or Long-Term Plan process, with an amended Policy becoming

operative on 1 July of each subsequent year.

The Draft 2020/21 Development Contributions Policy (2020/21 Policy)

forms part of this proposal and includes revised schedules of charges (Tables 1

– 3 in Section 1).

This Statement of Proposal sets out:

· The reasons for the proposal;

· An analysis of the reasonable practicable options;

· A summary of proposed policy amendments for the 2020/21 Policy;

· A summary of the differences in fees and charges from the 2019/20

Policy compared to those in the draft 2019/20 Development Contributions Policy;

and

· A copy of the Draft 2020/21 Policy.

Development contributions are an integral component in

Council’s funding strategy, specifically in regard to the funding of

growth-related capital expenditure. The proposed 2020/21 Development

Contributions Policy will allow Council to continue to collect Development

Contributions.

Reviewing, updating and amending the Development Contributions

Policy ensures that the charges are based on the best possible data available

to Council.

Any organisation, group or member of the public may make a

submission to Council in regard to the content of the Draft Development

Contributions Policy. The Draft Policy will be distributed after 24 March

2020 along with information regarding methods to submit.

Full copies of the Statement of Proposal, the Draft Policy document

and the submission forms are available from Council’s Willow Street

Customer Service Centre, the Tauranga, Mount Maunganui, Greerton and Papamoa

Libraries and on Council’s website at www.tauranga.govt.nz.

If you also wish to present your submission in person to the Mayor

and Councillors then please indicate this on your written submission and

Council staff will be in touch to advise you of dates for verbal submissions.

Analysis of Reasonably Practicable Options

The table below contains an analysis of the reasonable practicable

options for the funding of growth-related capital expenditure incurred by

Tauranga City Council. This includes the current proposal.

|

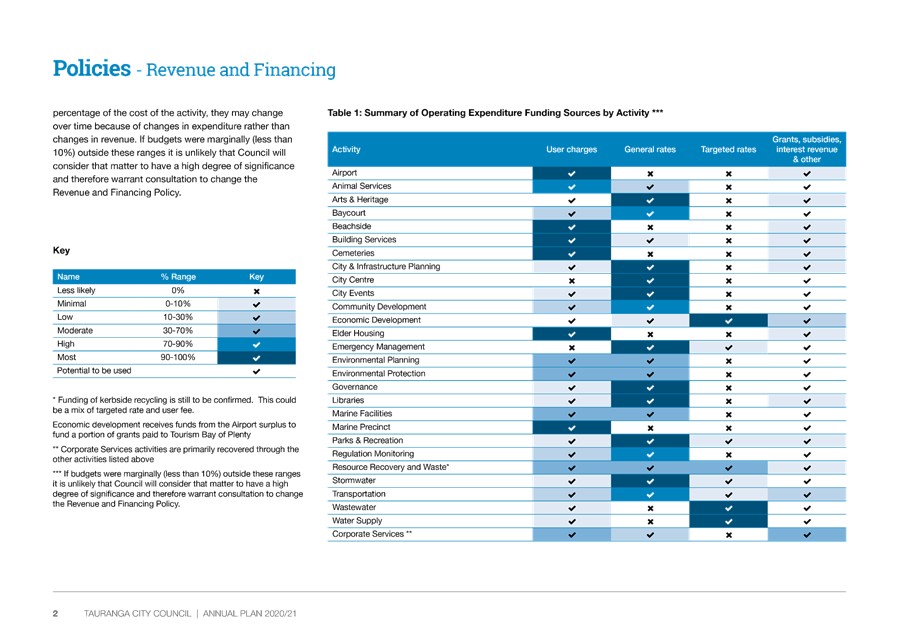

Option

|

Analysis

|

|

Charge

Development Contributions under the Local Government Act 2002

|

Population and urban growth of the

city is the reason much of Council’s capital expenditure needs to be

undertaken. As the cause of this expenditure, it is fair that a significant

portion of this cost is recovered directly from the development community

through the collection of development contributions. While this does create a

significant upfront cost for development, if these costs were not funded by

development, the main alternative would be to increase rates by a substantial

amount. Council’s view is that this would impose an unfair financial

burden on the ratepayers of the city.

|

|

Financial

contributions under the Resource Management Act 1991

|

Financial contributions are similar

to development contributions. The main differences are that:

· The implementation of a financial contribution system is open to

merits-based appeal through the Environment Court for each individual

development. This adds cost, time and uncertainty for Council.

· The adoption and subsequent review of financial contribution

systems is also open to merits-based appeal through the Environment Court.

This adds further cost, time and uncertainty for Council.

For these reasons, Council has, in

most cases, chosen to use development contributions rather than financial

contributions to fund growth-related capital expenditure. The limited

circumstances where Council has chosen to use financial contributions are:

· Where specific organisations are exempt from the payment of

development contributions but not financial contributions.

· To fund local reserve infrastructure within the Papamoa urban

growth area.

These provisions are summarised in

the Draft 2020/21Development Contributions Policy and are set out in detail

in Council’s City Plan..

|

|

Rates-funded loans

|

This would involve growth-related

capital expenditure being funded in the same manner as most of

Council’s other capital expenditure – through loans that are

repaid through the collection of rates. This would impose the cost of

growth-related capital expenditure on the whole community rather than

targeting the funding of these costs at the growth community which have

caused these costs to be incurred.

|

|

Targeted rates

|

This would be similar to development

or financial contributions in the sense that funding would still be targeted

at the growth community. The primary difference is that development

contributions are charged upfront whereas the targeted rate would recover the

costs over a period of time. This option would increase rates on new

properties by a significant amount for an extended period of time. For

example, it could potentially double rates for a period of 20 years. This is

unlikely to be popular and may cause Council difficulties in the future when

properties are sold to new owners. This has been Council’s experience

to date with a relatively modest targeted rate in The Lakes development. It

should also be noted that Council has not fully explored the details

associated with implementing this type of targeted rate under the Local

Government (Rating) Act 2002, and some legal impediments may exist.

|

Summary of proposed amendments to the 2019/20 Development

Contributions Policy

1. The

content of the 2020/21 Development Contributions Policy has not changed

materially compared to the Operative Policy. A version of the Draft Policy

showing tracked changes is available from Council upon request. Key changes

that have been made to the policy compared to the Operative Policy are

discussed below.

Updated Development Contribution Fees

2. Council

reviews and updates all planned capital expenditure works on an annual basis.

Changes to the development contribution funded works result in changes to

development contribution fees. The following table shows the fees that are

included in the Draft 2020/21 Development Contributions Policy and the

percentage change compared to the current 2019/20 Development Contributions

Policy.

|

Catchment

|

Charge basis

|

2019/20 DC Fees

|

Proposed 2021

DC Fees

|

Movement

|

Percentage

change

|

|

Citywide

|

Per household

|

$8,538

|

$9,946

|

$1,408

|

16%

|

|

Bethlehem

|

Per additional lot

|

$12,495

|

$ 12,516

|

$21

|

0.2%

|

|

Ohauiti

|

Per additional lot

|

$11,334

|

$11,272

|

($62)

|

-0.5%

|

|

Papamoa

|

Per additional lot

|

$8,673

|

$ 8,701

|

$28

|

0.3%

|

|

Pyes Pa

|

Per additional lot

|

$6,750

|

$ 6,802

|

$52

|

0.8%

|

|

Pyes Pa West

|

Per additional lot

|

$30,758

|

$ 29,752

|

($1,006)

|

-3.3%

|

|

Tauranga Infill

|

Per additional lot

|

$3,568

|

$ 3,614

|

$46

|

1.3%

|

|

Tauriko

|

Per hectare

|

$359,759

|

$ 378,911

|

$19,152

|

5.3%

|

|

Wairakei

|

|

|

|

|

|

|

Sub catchment A

|

Per hectare

|

$483,220

|

$517,527

|

$34,307

|

7.1%

|

|

Sub catchment B

|

Per hectare

|

$331,678

|

$367,250

|

$35,572

|

10.7%

|

|

Sub catchment C

|

Per hectare

|

$667,971

|

$685,456

|

$17,485

|

2.6%

|

|

Welcome Bay

|

Per additional lot

|

$8,457

|

$ 8,480

|

$ 23.00

|

0.3%

|

|

West Bethlehem

|

Per additional lot

|

$26,332

|

$ 27,621

|

$1,289

|

4.9%

|

3. Causes

for the changes in the development contribution fees are discussed on the

following page.

Citywide Fees

4. The

Citywide development contributions have increased from $8,538 per household to

$9,919 per household. This increase is driven by the cost to construct the Te

Maunga Wastewater Treatment Plant and by the increased cost to construct a large

Trunk Watermain project which is funded via citywide development contributions.

5. The

costs increase in the Te Maunga Treatment Plant are due to increased

preliminary and general costs and contractor margins. The national trend has

been going upward the last couple of years. There has also been an increase in

costs due to poor ground conditions and the requirement for additional subfloor

ground support for the bioreactor.

6. The

new costs for the Trunk Watermain project are based on costing knowledge of

similar projects which are already tendered and under construction as part of

the Waiari Water scheme. Cost increases are reflective of market costs and

include risk allowances.

Bethlehem, Ohauiti, Papamoa, Pyes Pa, Pyes Pa West, Tauranga Infill

and Welcome Bay

7. The

fluctuation in fees for development in these catchments are due to small

changes in a number of different aspects which influence the final fee. They

include small changes to project costs, changes in cost of capital and

inflation allowances (which are calculated based on the expected time of

constructing projects compared to expected timeframe of recovering the debt)

and changes in timing of delivery. Most of these catchments also include a

contribution towards the Southern Pipeline project which has also increased

minimally (increase of $46 per lot due to updates to cost of capital

calculations).

8. The

decrease in the charge per lot in Pyes Pa West is primarily related to funding

received from the New Zealand Transport Agency (NZTA) towards some of the

higher value projects in that catchment. When funds are received from NZTA this

decreases the portion of costs that are recovered as development contributions.

These funds were received retrospectively (i.e. after the funds were spent) and

so weren’t previously accounted for in the funding apportionments.

Wairakei

9. The

cost for development in the Wairakei catchments is increasing by approximately

$30,000 per hectare. These costs increases are primarily driven by increases

for several planned wastewater projects – more specifically the costs of

the Opal Drive and Wairakei Trunk networks.

10. These

project costs were revised based on needs identified in a review of the wider

wastewater networks needs for the eastern corridor area of Tauranga. The review

considered wastewater network constraints, future needs and the ground

conditions of the area to ensure that planned projects will provide adequately

for future populations and resilience. The review also identified a

number of new design requirements and provided a greater understanding of

constraints and risk to be manged throughout construction.

Tauriko

11. The

increase in development contribution costs for Tauriko primarily relates to the