|

|

|

AGENDA

Emergency Council Meeting

Tuesday, 14 April 2020

|

|

I hereby give notice that an Emergency Meeting of

Council will be held on:

|

|

Date:

|

Tuesday, 14 April 2020

|

|

Time:

|

11.30am

|

|

Location:

|

Tauranga City Council

Council Chambers

91 Willow Street

Tauranga

|

|

Please

note that this meeting will be livestreamed and the recording will be

publicly available on Tauranga City Council's website: www.tauranga.govt.nz.

|

|

Marty Grenfell

Chief Executive

|

Terms of reference – Council

Membership

|

Chairperson

|

Mayor Tenby Powell

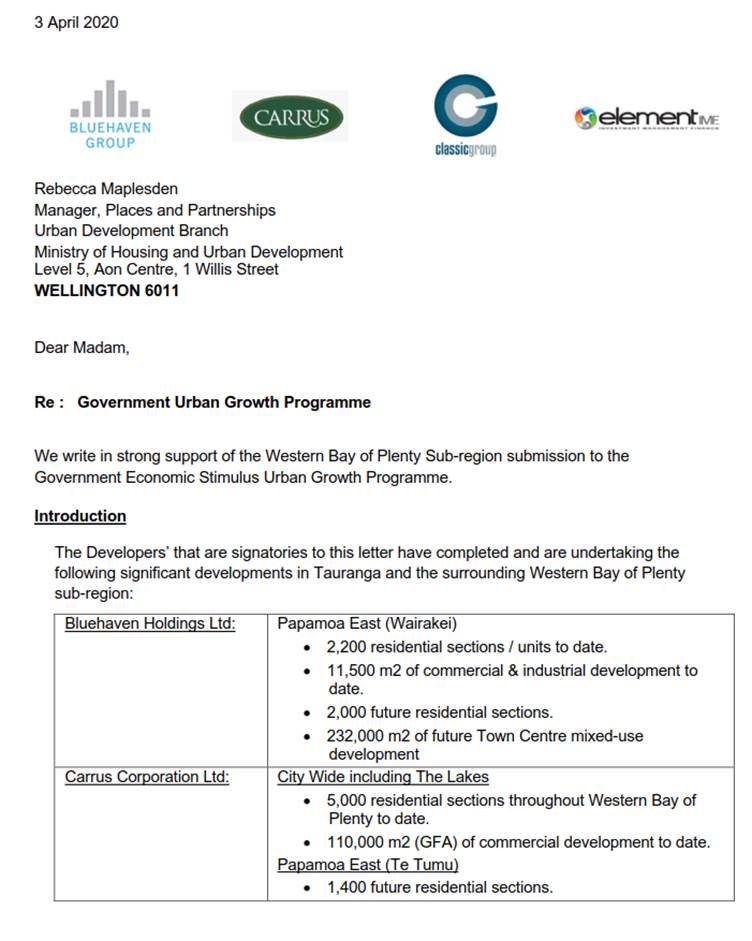

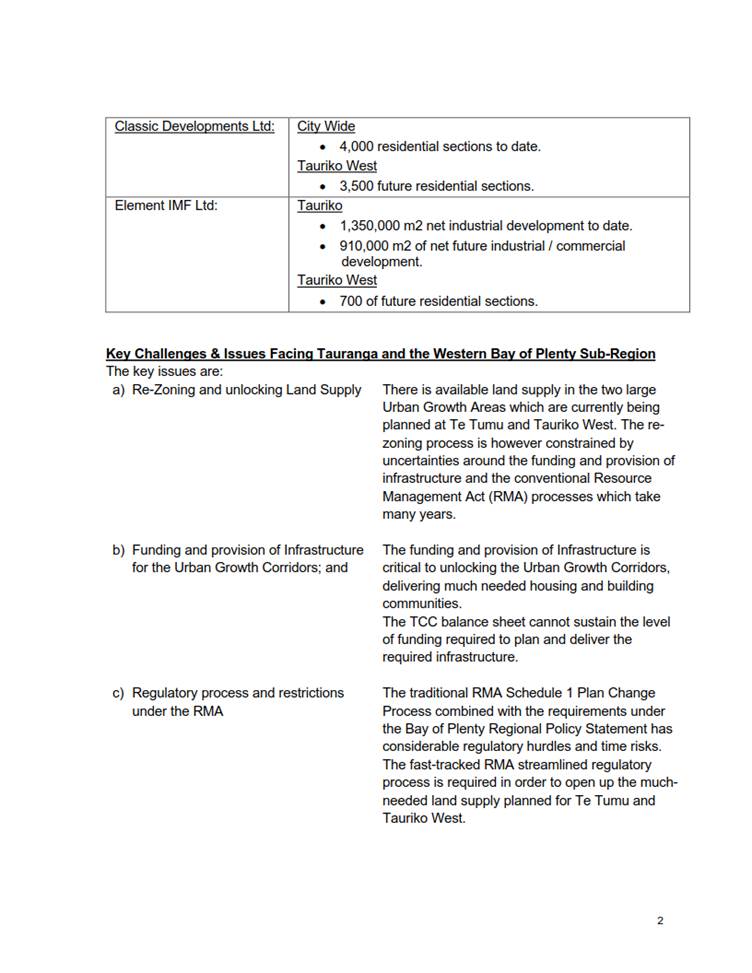

|

|

Deputy chairperson

|

Cr Larry Baldock

|

|

Members

|

Cr Jako Abrie

Cr Kelvin Clout

Cr Bill Grainger

Cr Andrew Hollis

Cr Heidi Hughes

Cr Dawn Kiddie

Cr Steve Morris

|

|

Quorum

|

Half of the members physically present, where the

number of members (including vacancies) is even; and a majority

of the members physically present, where the number of members (including

vacancies) is odd.

|

|

Meeting

frequency

|

Six weekly or as required for Annual Plan, Long Term Plan

and other relevant legislative requirements.

|

Role

·

To ensure the effective and efficient

governance of the City

·

To enable leadership of the City

including advocacy and facilitation on behalf of the community.

Scope

·

Oversee the work of all

committees and subcommittees.

·

Exercise all non-delegable and

non-delegated functions and powers of the Council.

·

The powers Council is legally prohibited from delegating include:

o

Power to make a rate.

o

Power to make a bylaw.

o Power to borrow

money, or purchase or dispose of assets, other than in accordance with the

long-term plan.

o

Power to adopt a long-term plan, annual plan, or annual report

o

Power to appoint a chief executive.

o Power to adopt

policies required to be adopted and consulted on under the Local Government Act

2002 in association with the long-term plan or developed for the purpose of the

local governance statement.

o All final

decisions required to be made by resolution of the territorial

authority/Council pursuant to relevant legislation (for example: the approval

of the City Plan or City Plan changes as per section 34A Resource Management

Act 1991).

·

Council has chosen not to delegate the following:

o Power to

compulsorily acquire land under the Public Works Act 1981.

·

Make those decisions which are required by legislation to be made

by resolution of the local authority.

·

Authorise all expenditure not delegated to officers, Committees

or other subordinate decision-making bodies of Council.

·

Make appointments of members to the CCO Boards of

Directors/Trustees and representatives of Council to external organisations.

·

Consider any matters referred from any of the Standing or Special

Committees, Joint Committees, Chief Executive or General Managers.

Procedural matters

·

Delegation of Council powers to Council’s committees and

other subordinate decision-making bodies.

·

Adoption of Standing Orders.

·

Receipt of Joint Committee minutes.

·

Approval of Special Orders.

·

Employment of Chief Executive.

·

Other Delegations of Council’s powers, duties and

responsibilities.

Regulatory matters

Administration,

monitoring and enforcement of all regulatory matters that have not otherwise

been delegated or that are referred to Council for determination (by a

committee, subordinate decision-making body, Chief Executive or relevant

General Manager).

3 Business

3.1 Crown Infrastructure

Partners COVID Economic Stimulus Package Application

File Number: A11376057

Author: Christine Jones, General Manager: Strategy & Growth

Authoriser: Christine Jones, General Manager: Strategy & Growth

Purpose of the

Report

1. This report

seeks Council approval of Tauranga City Council’s application to the

Crown Infrastructure Partners (CIP) Economic Stimulus process.

|

Recommendations

That the Council:

(a) Approves

the package of projects described in the “Overview Statement” for

submission to the Crown Infrastructure Partners Economic Stimulus Process; or

(b) Approves

the package of projects as described in the “Overview Statement”

for submission to the Crown Infrastructure Partners Economic Stimulus Process

with the following amendments:

|

Executive Summary

2. The

Government is seeking information on public infrastructure projects which could

provide economic stimulus when the COVID 19 Response Level enables activity to

recommence.

3. Tauranga

City Council is submitting an application into the process and Elected Member

approval for that application is sought.

Background

4. Crown Infrastructure Partners (CIP)

is supporting the Infrastructure Industry Reference Group (the Reference Group)

to provide Ministers with information on ‘shovel ready’

infrastructure projects that could be part of an economic stimulus

package. The information in the following paragraphs is sourced from the

CIP website.

5. Ministers have advised that they

wish to understand the availability, benefits, geographical spread and scale of

‘shovel ready’ projects in New Zealand. These projects will be

considered in the context of any potential Government response to support the

construction industry, and to provide certainty on a pipeline of projects to be

commenced or re-commenced, once the COVID 19 Response Level is suitable for

construction to proceed.

6. Applications will be assessed on

the following criteria:

· Construction Readiness - the extent to which the project is

construction-ready now or within a realistic 6 - 12 months;

· Public or Regional Benefit - the project must be of an

infrastructure nature, either horizontal or vertical, and must demonstrate

public or regional benefit infrastructure;

· Size and Material Employment Benefits;

· Overall Risks and Benefits of the Project.

7. Construction Readiness - projects

will be categorised into:

· Projects which currently are (or were) in the construction phase but

have been put on hold due to COVID 19 and are likely not to progress, or to

progress at a much slower rate or scale/scope, if not supported post COVID 19.

· Projects which have a high expectation of commencing the

construction phase within the next six months (by 31 October 2020), but are unlikely

to do so due to COVID 19.

· Projects which could have been expected to commence the construction

phase within the next 12 months (by 30 May 2021) but are unlikely to do so due

to COVID 19.

8. Specific information is required to

be provided on ‘Construction Readiness’ in terms of where the

project is currently in a procurement phase, including where a:

· suitable tender has been completed;

· Tender evaluation is in progress;

· Request for Tender is in the market; or

· the principal is about to put out a Request for Tender to the

market.

This may also

include maintenance and asset replacement projects which require little design

or consenting, such as local/regional roading and three waters projects.

9. Public or Regional Benefit - projects

will have two separate classifications:

· Infrastructure activity: being one or more of transport, three

waters, buildings and structures, or other infrastructure;

· Infrastructure purpose: being one or more of critical

infrastructure, new infrastructure, replacement/refurbished infrastructure, or

repurposed infrastructure.

10. Size and Employment Benefits - will include

consideration of whether the project is of a size and has material employment

benefits of $10m+. This can include programmes of work - for example a

series of road maintenance/resealing projects or a series of three-water pipe

renewals/replacements.

11. Overall Risks and Benefits - this will include

consideration of:

· Benefits:

o Economic/Social/Environmental

benefits; and

o Regional/Nationwide

benefits.

· Risks:

o Risk

of the project not commencing within the advised timescale;

o Risk

the project will not be completed on time, to cost or to specification; and

o Risk

the project will not obtain the benefits outlined in the Overall Benefits

section above.

Each risk is

required to be ranked as high, medium or low and include a short explanation

why it was given that risk rating.

12. Information also is required on the impacts

that COVID 19 has had on the project, including:

· Likelihood of the project recommencing once the COVID 19 Response

Level is suitable for construction to proceed, whether it would recommence but

required to be scaled down, or stopped indefinitely;

· An estimate of the financial implications of COVID 19 on the

project; and

· Confirmation whether the project has already benefitted, or is

likely to benefit, from already announced Government-led financial support for

businesses e.g. wage subsidy scheme, business finance guarantee scheme.

tauranga city council application

13. The proposed application from Tauranga City

Council to the CIP Economic Stimulus process is made up of the following:

· Overview Statement which provides a summary of the key issues for

the city;

· Package of projects focused on ‘Creating Communities and

Housing for All’;

· Package of projects focused on “Employing Our People”.

14. A copy of the Overview Statement, which

includes a summary of the package of projects, is included in the attachment to

this report for Council consideration and approval.

15. The application is required to be submitted by

5pm Tuesday 14 April 2020 (today).

16. The Bay of Plenty Mayoral Forum is meeting in

the afternoon of Tuesday 14 April with the view to considering and endorsing

the applications of each of the Councils. It is intended that a joint

letter signed by Chairman Leeder and all the Mayors in the region is submitted

in support of the applications of the Councils in the Bay of Plenty.

17. Some significant

projects were considered but not included in the application due to extent of

readiness or priority relative to other projects. These included the Mt

Visitor Centre and I-Port, central library, administration building.

Consultation / Engagement

18. The projects

included in the application are all at different stages of consultation with

the community. Most have been included in previous Annual Plan, Long Term

Plan, or urban growth planning consultation processes. Each of the

detailed application forms notes engagement issues where they are relevant to

the project. As has previously been advised to Elected Members,

engagement for some projects continues through COVID lockdown by a range of

mechanisms including online, radio etc.

Significance

19. Tauranga City

Council’s Significance and Engagement Policy determines whether a matter

is significant. In making the assessment against this policy, there is no

intention to assess the importance of this item to individuals, groups, or

agencies within the community and it is acknowledged that all reports have a

high degree of importance to those affected by Council decisions. Materiality

is defined as being something that would influence the decisions or assessments

of those reading or responding to the consultation document.

20. In terms of the

Significance and Engagement Policy the matters raised, and the budget

associated with the projects are deemed to be significant. The Draft Annual Plan which is currently out for public

consultation notes the financial issues Council is facing, and that the impact

of COVID 19 on Council continues to be assessed. The Draft Annual Plan

Consultation Document noted that Council would be engaging with Government on

opportunities for investment.

Next Steps

21. CIP may advise that

they seek additional clarification on the project information received, and

will require responses no later than 5 pm on Monday 27 April 2020.

22. CIP and the

Reference Group will provide information on the projects to Government. CIP

intends to contact all parties that provide project information once Government

has advised what the next steps are.

Attachments

1. CIP

Economic Stimulus Application - Tauranga City Council Overview Statement -

A11375882 ⇩

2. Letter

of Support Tauranga Business (Not fully signed yet) - A11376164 ⇩

|

Emergency

Council Meeting Agenda

|

14 April 2020

|

Executive Summary

1. Prior

to the COVID-19 event Tauranga City Council was facing significant challenges

especially in respect of:

· a

broad range of issues across the housing continuum (homelessness, affordable

housing, housing and land supply and transitioning to a more sustainable urban

form)

· delivering

a well-functioning transport network that can support urban growth, deliver better

multi-modal choices and support NZ’s economy by providing efficient

transport links to and from NZ’s largest port.

· significant

funding challenges to deliver the infrastructure required for a current and

growing city.

2. In

the face of COVID-19 these challenges are now all the greater and new

challenges will emerge, especially providing employment and supporting the

business sector. Tauranga City Council is well placed to positively

contribute to these challenges. We have a range of infrastructure projects

which are (or are nearly) ready to go. We applaud initiatives such as

CIP’s request for applications for large scale projects that support the

acceleration of much needed work to the benefit of ‘immediate

return’ employment and supporting capacity for future urban and economic

growth.

3. Tauranga

City Council’s CIP application is focussed on maintaining a viable

economy in Tauranga and the Western Bay region, and creating capacity for

future growth, by clear focus on two priority areas:

o Creating

Communities and Housing for All

o Employing Our People

4. Creating

Communities and Housing for All - $674.6 million. Investment required

to provide serviced land for residential, industrial and commercial

development. Creating complete and connected communities with multi-modal

transport options, community amenity, education and employment opportunities.

5. The

‘Creating Communities and Housing for All’ projects were also

included in the Urban Growth economic stimulus package submitted to MHUD by

SmartGrowth Partnership (Bay of Plenty Regional Council, Tauranga City Council,

Western Bay of Plenty District Council and Tangata Whenua) on 6 April

2020. The projects in this CIP application reflect those that can be

commenced within 6 to 12 months. The projects implement the urban

settlement pattern which has been agreed by the SmartGrowth partnership.

6. Employing

Our People – $396.89 million. Immediate investment in a wide

range of projects that will support our small and medium sized businesses,

particularly those involved directly and indirectly with the construction

industry. These projects aim to support individuals, families and

communities that need help the most.

7. There

is also genuine co-investment commitment by developers associated with the

major growth areas to invest in infrastructure and housing on their land

holdings if key public infrastructure to service those areas is provided.

This will provide a second wave of economic stimulus

8. Key

to this application is understanding that:

· The

construction sector represents 12% of total employment in Tauranga

· The

city has a shortage of readily available residential and business land supply

which is negatively impacting on median house prices and business activity.

· NZIER

estimates[1]

that the shortage of residential land supply will result in:

o Median

house price of $966,000 in five years (compared to current circa $710,000)

o Lower

direct residential construction employment of 196 – 290 workers in the

short term and 1,140 – 1,680 in the medium term

o Direct

impact of residential construction on GDP is reduction of $30 million in year

1, with a cumulative impact of $546 million by year 5 and $2.5 billion by year

10

· The

balance sheet of the City is severely constrained as Council is near to the

debt to revenue ratio ceiling of 250%. Prior to COVID-19 Council was

projecting a shortfall in financial capacity to deliver the required level of

infrastructure of between $0.5b to $1b over the next 5 to 10 years.

Revenue reductions due to COVID-19 mean severe reductions to the planned

capital programme will be required immediately to remain within prudent debt

levels.

· Due

to the forecast reductions in revenue and current debt levels the planned

capital programme of $244 million for 2020/21 will, in the best-case scenario,

need to be halved and, in a worst-case scenario, Council’s ability to

deliver capital in 2021 will be virtually non-existent. This reduction in

capital investment will significantly affect jobs and the local economy.

9. Given

the financial capacity constraints, which have been exacerbated by reduced

revenue forecasts, Council is unable to take on further debt without revenue

support. Revenue support should be considered as complimentary to direct

investment support to enable current planned investment to continue.

10. While additional

funding is essential to enable infrastructure projects and for the economy to

recover, this alone won’t be enough. As such we believe that in

order to maximise the effectiveness of the CIP stimulus programme it is

essential that the following matters are also addressed:

· streamlined processes for resource consents,

designations and other authorisations (e.g. Heritage NZ authorisations) for

infrastructure and urban development projects that better balance the benefits

and costs of projects and better provide opportunity to balance competing

priorities

· streamline processes to enable land the be zoned for

development (or to avoid the zoning process altogether and proceed directly to

resource consent)

· ability to fast track land acquisition and easements

for infrastructure projects

· more efficient and streamlined NZTA business case

approach

· better mechanisms and more financial support to

partner with Maori Land Trusts to enable development of their land in

accordance with their aspirations and enabling the delivery of essential

infrastructure through Maori Land to enable development of adjoining land.

· Off balance sheet debt arrangements to be repaid by

funding sources such as development contributions and road tolls.

introduction

11. The

Government is seeking to identify ‘shovel ready’ infrastructure

projects that have been impacted by COVID-19 and that could be reinvigorated

rapidly to mobilise the construction industry and stimulate the economy.

12. We

wholeheartedly endorse the objectives of the Industry Reference Group and those

outlined on 5th April by the Construction Sector Accord in its

Response Plan. A rapid, flexible and ongoing response will be needed to

re-establish not just the horizontal infrastructure industry but to maintain

those parts of our economy, our community and our environment on which it

relies.

13. Our

proposed programme is supported by Priority One - the Western Bay of Plenty

region's economic development organisation, key business leaders in the City

and major developers. It is also endorsed by the Bay of Plenty Mayoral

Forum, being made up of the Bay of Plenty Regional Council, and all the

Councils within the wider Bay of Plenty.

14. We

are submitting a suite of projects that meet the criteria and that will provide

much needed stimulus to the sector in Tauranga, with flow-on job retention and

creation in the wider Bay of Plenty and New Zealand economy.

Construction

industry is key to Tauranga employment and economy

15. Construction

industry leaders in the Bay of Plenty have made their position clear in the

last few days that the sector is experiencing significant challenges, but also

that it is well positioned to bounce-back as soon as level 4 restrictions are

removed. It is essential that it does as the sector provides almost 9,000 jobs

in Tauranga, 12% of our total employment and is integral to the ongoing social

and economic wellbeing of our city and region. The resilience of the Tauranga-Western

Bay economy in the face of COVID-19 and its readiness to respond to and

maximise the benefits of the CIP stimulus makes it a low risk, high return

location for investment.

16. Rebooting

infrastructure projects in Tauranga will also provide a major catalyst to the

wider New Zealand economy. Our rapid economic and population growth,

horticultural and manufacturing sectors and exports through the Port of

Tauranga rely on infrastructure capacity and on the availability of affordable

homes and commercial land. The quicker that capacity is in place, the quicker

those industries can create new jobs for those displaced from sectors that will

be slower to recover and the quicker export revenues and GST returns will be

generated, recycling the Government’s economic stimulus.

17. Tauranga

forms part of the Upper North Island ‘golden triangle’ and there is

critical economic infrastructure needed to support immediate and long-term

economic growth and wellbeing. That infrastructure is already constrained

and having negative impact on business expansion, attraction of skills, and

productivity.

18. Investment

is needed to support our economy. As an example, transport and three

waters infrastructure projects within our applications will enable 3,000 new

jobs within businesses that choose to locate in future stages of the Tauriko

Business Estate, including Winstone Wallboards (GIB) which has recently

announced $400m of investment to relocate its manufacturing and distributing

facilities from Auckland. The Tauriko Business Estate is the only

large-scale industrial area under development in the Bay of Plenty and the

release of future zoned stages and the planned future extension are essential

to deliver sufficient industrial sections to meet demand.

COVID-19 places

transformational growth at risk

19. Whilst

our proposed programme of works speaks to the urgency of the situation and to

the creation of jobs, it will also achieve longer-term, transformational

outcomes. The programme aligns to our sub-regional approach to urban

development which aims to overcome some of the challenges of a shortage of both

residential and commercial land. The Urban Form and Transport

Initiative sets out a development pathway for the creation of healthy,

connected and thriving communities, based on quality urban form with high

density urban centres and efficient, low carbon transport networks. Our

intention through this programme is to create physical capital that enables

improved environmental outcomes – cleaner water, low emissions transport

options and resilience to natural hazards as well as social wellbeing through

access to homes, employment, active living and community facilities and social

connectedness.

20. The

Capex programme of Tauranga City Council is the primary enabler of a high

growth city. It is integral to the wellbeing of the infrastructure sector

and the community, both through its own infrastructure projects and through the

flow-on construction opportunities those create. Housing, business land and

water shortages in Tauranga that are already an issue will become acute without

timely and sufficiently scaled delivery of key infrastructure projects.

Tauranga City

Council’s financial position and the impact of COVID-19

21. COVID

19 has, unfortunately, also hit our own balance sheet capacity hard with our

revenue now expected to be $53m - $77m less than forecast for the 2020-21

financial year. Due to our obligation to keep our debt to revenue ratio below

250%, this now puts in jeopardy our capital programme.

22. Before

COVID-19, the 2002-21 Capex programme of $244 million and emerging Long-Term

Plan (2021-31) capital needs were already placing significant pressure on our

borrowing covenants and our ability to borrow through the Local Government

Funding Agency. This has been acknowledged through on-going conversations

with Government Ministers on the need for new ways to fund and finance much

needed growth infrastructure. The balance sheet of the City is severely

constrained and therefore too is the ability of the Council to provide serviced

land for residential and commercial development. The pre-COVID assessment

was that Tauranga City Council has a shortfall in financial capacity to deliver

the required level of infrastructure of between $0.5b to $1b over the next 5 to

10 years. The Council had

initially proposed an Annual Plan rates rises of 12.6% to start to address the

City’s infrastructure needs but reduced this to 7.6% in its draft Annual

Plan (currently under community consultation) in recognition of the financial

stress Covid is having on our communities.

23. Over the last week, we have been

remodelling our forecasting assumptions and have developed various scenarios of

revenue stream impacts from COVID-19. High level estimates (subject to

further analysis) see revenue forecasts reduced between 13% to 27% for 2020-21

due to:

· User

fee revenue down by $20m- $34m (reduction 23% to 40%)

· Bay

Venues Limited (CCO operating swimming pools, indoor sports facilities and

community halls) external revenue down by $10m- $16m (reduction 66% to 96%)

· Development

contributions and other capital contributions down by $10m-$14m (reduction 19%

to 26%)

· Rates

being lower by up to $13m (reduction up to 8%).

24. The

extent of the loss in revenue will depend on the restrictions on activity that

may continue into next financial year depending on the alert level and the

extent to which housing construction and infrastructure capital investment can

continue. With our already constrained balance sheet, the impact of this

revenue loss would be a reduction of our capital programme by $90m to $200m in

the coming financial year. In a best-case scenario, our capital programme

would be approximately halved and in a worst-case scenario our ability to

deliver capital in the 2021 year would be virtually non-existent.

25. This

would mean that not only would Council be unable to deliver on key

infrastructure projects to allow growth and hence housing supply to the city,

it would also be unable to maintain its existing assets through its renewal

programme. Further projects required to build a community would not continue.

26. Due

to the severity of this financial position, we have now integrated and

prioritised many ‘shovel ready’ projects that are in our draft

2020/21 Annual Plan into this CIP application process. Top priority projects

and programmes of work reflect the key outcomes for the city as outlined in our

current Long-Term Plan and draft Annual Plan for 2020-21 – addressing

growth and transport challenges, environmental resilience and community wellbeing.

Opportunities for

Crown Infrastructure Partners consideration

27. TCC’s

CIP package is categorised into two key themes that together will support our

communities to recover from COVID-19 as quickly as possible. It will also

help create communities within the city that offer housing and employment for

all.

28. The

priorities for action are:

· Urban Growth - Creating Communities and Housing for

All

· Employing our people

29. It

should be noted that both priorities for action are of equal significance for

recovery from COVID-19. Many projects are interrelated and will deliver

different aspects of economic recovery as well as delivering across

Treasury’s Living Standard’s Framework and the four wellbeings of

the Local Government Act, 2002. Without both categories being progressed,

recovery from COVID-19 will be less effective and will have a detrimental

effect on both our communities and our infrastructure.

30. TCC

has prioritised projects within each theme. Projects have been prioritised as

either priority 1, 2 or 3. Prioritisation of projects has been based on

the community benefits that will be delivered, employment opportunities and

wider regional and national benefits demonstrated, as well as how ‘shovel

ready’ projects are. Prioritisation is also influenced by consideration

of the impact that failure to deliver would have on our community and our

infrastructure.

31. There

are very few projects categorised as low, these projects are ones which would

have minimal impact in terms of Council delivering on its infrastructure

priorities, but which still deliver value to the community and create jobs.

Urban Growth -

Creating Communities and Housing for All

32. Tauranga

is an attractive city, and people will continue to move here. Growth

creates many benefits. However, it also creates higher house prices, a lack of

rental options, increased congestion, and the need to invest in infrastructure,

community wellbeing and safer communities.

33. The

number of people living in Tauranga City has doubled in the past 30 years and

is expected to grow by at least 45,000 more in the next 30 years. We are short

of land for housing and expect a shortfall of 600 homes within 1-3 years and a

further 3,500 homes in 4-10 years.

34. If

we do not plan well, we will end up with fragmented suburbs and even more

pressure on our roads, water supply, wastewater systems and community

amenities. Failure to deliver the infrastructure needed for growth will make

homes more costly and is likely to drive more housing stress, rough sleeping

and homelessness. It will also hold back our economy, because workers and new

businesses will not be able to find affordable properties.

35. TCC

has been working on this problem with local and regional partners for years.

This has resulted in planning new greenfield growth areas at Te Tumu and

Tauriko West, while considering fresh approaches to housing more people within

our existing city footprint. The latter aspect is being explored through our Te

Papa Spatial Plan and Housing Choice city plan change projects which focus on

residential intensification.

36. New

land must be zoned and appropriately serviced with infrastructure before homes

can be built. Achieving this is difficult because of our city’s

topography, land ownership, and financial ability to fund the required

infrastructure as well as the challenges of RMA processes and reliance on third

party infrastructure providers, especially NZTA investment in the State Highway

system which is an integral component of the city’s local transport

network.

37. Further

progress depends on delivering more infrastructure that supports the creation

of communities to deliver the benefits so desperately needed, particularly

housing opportunities for all. The inability to invest in infrastructure

means that there is a shortage of land available for housing and as a result,

land prices continue to increase. This creates a huge challenge for building

the homes we need in fast growing areas like Tauranga.

38. NZIER

recent analysis (February 2020) identified that the projected shortfall in

housing supply in Tauranga would increase median house prices by $40,000 per

annum over each of the next three years and by year five the median house prices

would have increased from the current $710,000 to $966,000. NZIER

predicts an associated lower construction employment of 196 – 290 workers

in the short term and 1140 – 1680 less construction workers in the medium

term. The assessed impact on GDP is a reduction of $30 million in year 1,

and a cumulative impact of $546 million by year 5 and $2.5 billion by year 10.

39. As

such, significant infrastructure investment is required to unlock new

development opportunities to enable the labour intensive residential and

commercial construction sectors to thrive.

40. The

SmartGrowth Partnership (Tauranga City Council, Western Bay of Plenty Council,

Bay of Plenty Regional Council and Tangata Whenua) supported by Priority 1

(sub-regional economic development agency) submitted to MHUD (6 April 2020) a

package of Urban Growth-related investments to deliver both economic stimulus

and achieve strategic urban growth objectives. The projects in

‘Creating Communities and Housing for All’ represent those urban

growth projects Tauranga City Council can proceed within the next 6 to 12

months.

41. Capital

investment under ‘Creating Communities and Housing for All’ totals

$674.6M and includes planning and investing in core infrastructure needed in

the next few years to support the efficient functioning of our growing city and

to ensure the next growth areas are underway. This consists of a

mixture of greenfield and brownfield investments, along with an opportunity for

residential housing development on Council owned land (which could be completed

in conjunction with Kainga Ora).

42. The

prioritised projects for the ‘Creating Communities and Housing for

All’ theme are summarised in attachment 1.

43. Much

of the investment in ‘Creating Communities and Housing for All’ is

planned to be funded by way of Development Contributions. The lack of

Council balance sheet capacity is holding back delivery. If an

off-balance sheet arrangement could be implemented the debt could subsequently

be repaid by development contributions as the development occurs. Some

discussions on possible options have been held with central government

officials over the past few weeks on this matter.

44. Developers

with large land holdings in the main growth areas have provided a written

letter of support (attachment 3). They make the following key points:

· They are ready, willing and able to invest in the

Urban Growth areas identified in the TCC application, however they are unable

to do this without commitments by Councils and/or the Government to fund and

provide the key public infrastructure required to service the Urban Growth

Corridors.

· This group of experienced developers recognise that

whilst most developers are averse to land development during recessions, they

recognise the opportunities post COVID-19 to develop more cost effective and

efficient approaches by stripping out costs and streamlining what has become an

unnecessarily complex construction supply chain in NZ. It is historically

the best time to undertake land development so that when the market takes off

again no momentum is lost.

45. Key

Tauranga businesses including Port of Tauranga, Craigs Investment Partners,

Winston Wallboards, Trustpower, Balance, and Zespri have signed a letter of

unequivocal support for the package of investment proposals being submitted to

Crown Infrastructure Partners. They place particular emphasis on the

projects that deliver residential, commercial and industrial land and which

will deliver a more multi-modal transport system and intensified urban

design. (Refer attachment 4).

Employing Our

People

46. At

this point, the extent of the impact of COVID-19 on the local construction and

development industry is unclear. However New Zealand’s construction and

development industry is one of the key sectors identified as vulnerable to the

impacts of COVID-19.

47. Paul

Blair, Chief Executive of the sector’s main industry body Infrastructure

New Zealand, has indicated he believes that as many of 30% of the jobs in the

sector are at risk within the next three months (unless a staged return to work

can be arranged). That loss of nearly one-third of staff in three months refers

to contracting and construction companies, while firms providing advisory and

other support services could expect to be in the same critical position within

six months.

48. Additionally,

construction is one of Tauranga’s most significant sectors in terms of

employment. Approximately 12% of all of Tauranga’s employees are employed

by the construction sector, around 9,000 people (Infometrics).

49. Adequate

job opportunities for those that have lost jobs, or have faced significant

reduction in hours, is key to recovering as quickly as possible from

COVID-19. Job creation through this suite of projects is focussed

at high labour force numbers at the entry level of the job market, thereby

supporting those individuals and families that need it most.

50. Investment

in the ‘Employing Our People’ package ($396.89 million)

provides opportunity for immediate investment in a wide range of projects that

will support our small and medium sized businesses, particularly those involved

directly and indirectly with the construction industry. These projects

aim to support individuals, families and communities that need help the most.

51. To

further support local business, Council will also be considering the best way

to support local business through the procurement process.

52. In

these uncertain times, the creation of employment through these projects will

not only have a direct positive impact on individuals and families, but also

will indirectly benefit the economic and social fabric of the wider community.

There will be a cascade of benefits including induced employment creation,

regional spill-overs, induced economic multiplier effects (those which occur

outside the value chain of the enterprise concerned, for example, the newly

employed worker spends more in the local shops, creating multiplier effects) as

well as social and potential environmental benefits from projects being

delivered.

53. The

capital investment required to unlock the benefits through delivery of the

‘Employing Our People’ project suite are summarised in attachment

2. Investment in these categories involves several smaller projects

across a wide range of sectors which are likely to provide local employment and

economic stimulation for smaller infrastructure and construction firms and

parks service providers.

Attachments

1. Summary Project

Table; Urban Growth – Creating Communities and Housing for All

2. Summary Project

Table – Employing Our People

3. Developers

Letter of Support and Commitment

4. Economic

Development Agency and Key Business Letter of Support

5. Bay of Plenty

Regional Mayor Forum Letter of Endorsement

6. CIP

Applications

Urban Growth - Creating Communities and Housing

for All

Summary Table

|

Project

|

Benefits

|

Key components

|

$’s

|

|

Western Corridor, including Tauriko Business Estate and

Urban Growth Area

Infrastructure to enable significant

expansion of the Tauriko Business Estate of over 200ha’s.

Infrastructure supports delivery of a

new greenfield urban growth area of approximately 3,000 dwellings.

Priority: 1

Total

Investment $78.5M

Support

Required:

- Capital

investment

- Fast-tracked

processes: NZTA, consenting, land acquisition, procurement

|

Create jobs in construction and professional services

sectors, and for the housing and commercial development that will be enabled

as a result of the infrastructure.

This infrastructure provides the transport access and

water/wastewater connections to the growth areas. Developers have

committed to co-investment with developer funded infrastructure within the

growth areas. This provides further economic stimulus.

Enables around 3,000 long-term jobs in the Tauriko Business

Estate and essential to enable Winstone Wallboards (GIB) to relocate from

Auckland to Tauranga as recently announced. The GIB project alone is a

$400m investment.

Development will make significant contribution to addressing

current shortage in available residential and industrial land.

Estimated spend within 12 months $52.65 m (being $8.5m

professional services, $24.4m land and $20.1 physical construction).

Further flow on investment enabled in following years.

|

Transport - Roundabout SH29 and Redwood Lane

|

$14.5M

|

|

Transport Ring Road & Roundabout SH36

|

$28.5M

|

|

Wastewater Infrastructure

|

$26 M

|

|

Water Supply Infrastructure

|

$4M

|

|

Water Treatment Plant Upgrade

|

$3.5M

|

|

Public infrastructure constructed by Developer and

reimbursed.

|

$2 M

|

|

Te Papa Spatial Plan – Early

Transport Interventions

Multi-modal

transport projects enable intensification in Te Papa Peninsula.

Priority: 1

Total Investment $84.3M

Support

Required:

- Capital investment

- Fast tracked processes: NZTA,

procurement

|

Project

supports implementation of the spatial framework for Te Papa which will

provide more housing choice within walking distance of high quality,

efficient public transport, urban centres, open space and amenities. In order

to develop a transport network that encourages intensified development, a range

of projects have been identified for implementation in the short term.

Growth projections are for up to

29,000 additional residents, 19,000 additional homes, and a 15,000 (60%)

increase in employees throughout the peninsula. Considered to be a

nationally significant urban development and renewal project.

Provides key public transport link

to the Western Corridor and into City Centre (through Cameron Road).

Estimated spend

within 12 months $16.9 m (being $1.6m professional services and $15.3m

physical construction). Further flow on investment enabled in following

years.

|

Enabling & early works –

Cameron Road

|

$9.6M

|

|

Enabling & early works - Peninsula

|

$6.5M

|

|

Multi-modal, connectors, intersection & safety

improvements

|

$68.2M

|

|

Tauranga Eastern Corridor

Growth - Te Tumu Urban Growth Area & Wairakei Town Centre Infrastructure

Infrastructure delivery across

transport and 3 waters activities to enable development of Te Tumu, a new

urban growth area of approximately 7,700 dwellings, 60 hectares of employment

land with an adjoining zoned town centre located in the Wairakei Urban Growth

Area (including an additional 2,300 houses).

Priority: 1

Total

Investment $117.34M

Support Required:

- Capital

investment

- Accelerated

processes: Maori Land Court response, procurement

- Financial

and technical support for Maori Land Trust

|

This initiative will transform the shape of the city, and

the delivery of works, will provide employment for many professional

services, such as engineers, planners, surveyors and more. The construction

phase will employ large numbers also, ranging from entry level positions

through to skilled workers.

This infrastructure provides the transport access and

water/wastewater connections to the growth areas. Developers have

committed to co-investment with developer funded infrastructure within the

growth areas. This provides further economic stimulus.

These enabling works will allow for the

creation of new communities, unlocking severely needed housing opportunities

and increasing housing affordability. The new growth areas are designed

with strong multi-modal transport options, amenity, employment and recreation

opportunities.

Estimated spend within 12 months

$27.769 m (being $5.14m professional services and $22.54m physical

works). Further flow on investment enabled in following years

|

Transport

|

$89.25M

|

|

Wastewater

|

$23.1M

|

|

Water

|

$2.69M

|

|

Stormwater

|

$2.3M

|

|

Western Stormwater Growth Infrastructure

Stormwater infrastructure to service zoned land. Will

enable more than 500 dwellings to be constructed.

Priority:

1

Total

Investment $17.9M

Support Required:

- Capital

investment

- Accelerated consenting processes, acquisition processes

and fast tracked procurement.

|

A programme of projects

which will provide jobs, directly through the delivery of the projects, and

indirectly by enabling the delivery of housing by the construction

industry. Developers are ready to go in these areas to provide

developer funded infrastructure and build house. They are only waiting

for these enabling works to be carried out.

Community benefits

include addressing existing flooding issues and/or preventing future flooding

issues. These stormwater projects also improve water quality and enhance

stream health.

|

Programme includes Nanako Stream catchment, Kopurererua

Stream catchment and Bethlehem catchment.

|

$17.9M

|

|

Waiari Water Supply Scheme

Construction of a new water supply scheme that will service

both residential and employment areas of the growing sub-region.

Priority: 1

Total

Investment $117M

Support

Required:

- Capital investment

|

Expect construction will require 90 -

100 full time skilled and unskilled trades staff (for approximately 20

months) with additional economic and employment benefits flowing out of the

supply chain stimulation.

Project is a key enabler of growth in

the city. Construction of the water treatment plant construction is

programmed to commence July 2020. The scheme is required to be

commissioned by November 2022 to meet the forecast community and growth

demands.

There is a significant risk that the

currently in progress contracts will need to be paused to manage Councils

financial position. Pausing of these contracts will incur significant costs

and may result in affected contractors seeking termination of the contracts

to pursue other opportunities.

|

Water treatment plant and reservoir. (Tenders due to

close 11 May).

|

$58.4M

|

|

Construction of 22km of pipeline (underway)

|

$43.4M

|

|

Construction of a raw water intake works and pump station

(underway)

|

$15.2M

|

|

Wastewater Te Maunga Outfall Pipeline – Landward

Upgrade

Upgrade ocean outfall pipe currently in poor condition and

at risk of failure.

Priority: 1

Total Investment $25M

Support

Required:

- Capital

investment

- Fast

track procurement (ability to appoint current contractor)

|

Address current failure risk and

provide capacity for wastewater flows due to growth.

Construction programmed to commence

late 2020 – major stimulus of local market (both skilled and unskilled

labour) and supply chain within next 12 months.

|

Construction late 2020 to September 2022

|

$25M

|

|

|

|

|

|

|

|

Wastewater Growth Infrastructure – Te Maunga

Bioreactor

Wastewater bioreactor required for growing city.

Priority: 1

Total Investment $31.86M

Support

Required:

- Capital investment, fast track procurement

|

Second wastewater bioreactor required

to be operational by 2023 to provide sufficient capacity for projected

growth.

Construction programmed to commence

early 2021 - major stimulus of local market (both skilled and unskilled

labour) and supply chain within next 12 months, in addition to public health

and environmental outcomes.

|

Tender expected to market October 2020 and construction

commencing February 2021

|

$31.86M

|

|

Memorial Park Recreation and Leisure Hub

1. Aquatics and indoor facility

Priority: 2

Investment $75M

2. Visitor

leisure facilities

Priority: 3

Investment $23.7M

Support

Required:

Capital

investment

Accelerated

consenting

|

Will provide a sub-regional scale

aquatics and recreation facility in Tauranga city centre to meet current and

future need in the Te Papa peninsula, including indoor and outdoor aquatics

and play spaces rebuilt indoor courts and a Spa & Wellness Centre. The

project is split for consideration between the core community facilities and

the facilities which make a commercial return.

Provides amenity in residential

intensification area so strategic important

Direct job creation is calculated at

347.

NOTES: Application provided by Bay

Venues Limited (Council Controlled Organisation)

Memorial Park Aquatic and

Indoor is higher priority than Western Corridor below as per Needs Assessment

completed 2019)

|

1. Redevelopment and upgrade of Memorial

pool

Upgrade of indoor sports centre

2. Wellness and Fitness Centre, Spa &

hot pools.

|

$75M

$23.7M

|

|

Western Corridor – Community Facilities

Priority: 2

Total

Investment $49M

Support

Required:

- Capital

investment

- Accelerated consenting process

|

Creates jobs in construction and

professional services during design and construction phases. Will

create ongoing service sector jobs in the running of the facilities. Total

direct job creation estimated at over 100.

Provides essential community facilities

by way of a new aquatics centre and a library with community space in a key

growth corridor.

|

Aquatic Facility

Library

Community Space

|

$49M

|

|

Residential Development Opportunity

Priority: 3

Total Investment $55M

Support Required:

- Capital

investment

- Accelerated

consenting processes, acquisition processes and enabling of increased

density, in line with proposed City Plan change.

|

Opportunity to develop Council owned

sites for housing. (Details confidential – refer supporting

application form).

|

Development Site 1

|

$22.5M

|

|

Development Site 2

|

$32.5M

|

|

TOTAL

URBAN GROWTH – CREATING COMMUNITIES AND HOUSING FOR ALL

|

$674.6M

|

eMPLOYING OUR

PEOPLE – SUMMARY TABLE

|

Project

|

Benefits

|

Key components

|

$’s

|

|

Stormwater Super-package

Stormwater upgrades to deal with

safety, flooding and environmental issues.

Priority: 1

Total

Investment $24.6M

Support

Required:

- Capital

investment

- Fast

track consenting

|

Flexibility to undertake projects individually or as a

package.

Construction can commence on first project from September

2020. Immediate jobs for not only construction workers and professionals, but

also Mana Whenua, numerous consultant/designers and the complex supply chain

within next 12 months.

Outcome benefits include mitigation to address ‘safety

to person’ risk, flood protection of land and buildings, protection of

the environment and health & safety management.

|

Programme of 8 projects

|

$24.6M

|

|

Mt Maunganui & Arataki Multi Modal and Transport

Improvements

Improve safety and attractiveness of active modes (cycling,

walking and public transport) and access to the Port of Tauranga.

Priority: 1

Total Investment $19.59M

Support

Required:

- Capital

investment

- fast

track processes

|

Project will support employment of a

range of suppliers with a wide range of skills including roading contractors,

drainage contractors, streetlighting contractors and electricity, water and gas

utility providers.

Walking and cycling improvements in

high traffic area which is a key connection for students accessing

schools.

New connection to support freight

associated with Port and reduce impact of freight movements on local communities.

|

Programme of 3 projects

|

$19.59M

|

|

Long Term Plan Renewals Programme

Priority: 1

Total Investment $31.9M

Support

Required:

- Capital investment

- Fast

track procurement

|

The renewal projects are currently

included over the next three years of our Long-Term Plan but are at risk of

not being completed due to Covid-19 impacts on Tauranga City Council’s

ability to borrow money.

Projects will be delivered by various

consultants and contractors under current and future contracts over a 3-year

period similar to what was proposed before the Covid-19 lock-down period.

|

Water, wastewater and stormwater renewals

|

$8.7M

|

|

Transportation renewals

|

$12.4M

|

|

Parks, Property and other renewals

|

$10.8M

|

|

Totara Street Operational and Safety

Improvement Projects

Priority: 1

Total

Investment $10.9M

Support

Required:

- Capital

investment

- Fast

track processes

|

Supporting commercial traffic

operations in vicinity of Port of Tauranga and improved safety for people

walking and cycling.

Project will support employment of a

range of suppliers with a wide range of skills including roading contractors,

drainage contractors, streetlighting contractors and electricity, water and

gas utility providers.

|

Improved safety for active modes

Road rehabilitation

|

$10.9M

|

|

Wastewater Upgrades

Priority: 1

Total

Investment $22.8M

Support required:

- Capital

investment

- Fast

tracking of consent processes and procurement

|

A programme of works across the network

aimed at increasing pipe size to address capacity constraints. This will

deliver environmental and public health benefits and also remove current

restrictions on development proposals which have been stalled by lack of

network capacity.

|

A wide ranging programme of capacity upgrades across the

wastewater network.

|

$22.8M

|

|

City Footpath Renewal

Upgrades to around 8% of city footpaths which are in

substandard condition and not fit for purpose.

Priority: 2

Total

Investment $24.6M

Support Required:

- Capital

investment

- Fast

track procurement

|

Construction programme over 1-2 years.

Flexibility of delivery, with a preference being to carry out the bulk of the

work during the winter months where other civil construction work is more

restricted by inclement weather, and multiple contractors across multiple

sites.

Significant public health benefits,

with immediate focus on vulnerable users in vicinity of rest homes, schools,

hospitals and medical centres.

High labour content, estimated 300 FTEs

over 12 months - major stimulus of local market and supply chain within next

12 months.

|

Footpath renewals across City – procurement to

commence immediately when COVID level 4 lifted

|

$18M

|

|

Tauranga CBD Placemaking

Priority: 2

Total Investment $47M

Support required:

- Capital investment

|

Upgrades to four key streetscapes in

Tauranga city centre to create safer, walkable, high amenity spaces and to

catalyse private investment in housing and office space. Supports high

density, sustainable transport outcomes across Te Papa peninsula.

Programme supports linear and vertical

construction jobs across a range of sub-sectors and professional services.

Immediate start possible for two projects post Level-4.

|

Street upgrades, infrastructure works, planting

|

$47M

|

|

Safety and Speed Management Package

Programme of work contributing to the Road to Zero Strategy

- includes a range of improvements that enhance safety and liveability and

support transport choices.

Priority: 2

Total

Investment $18.5M

Support

Required:

- Capital

investment

- Fast

track processes

|

Major public health and safety

benefits.

Package of works which can be delivered

by numerous consultants and contractors, under current and future contracts.

Numerous projects ready for commencement in 2020 - major stimulus of local

market and supply chain within next 12 months (and for up to 3 years).

|

Category B Shovel Ready Projects (Safety and Access

improvements)

|

$7M

|

|

Category C Shovel Ready Projects (Safety and Access

improvements)

|

$11.5M

|

|

City Wide Open Spaces Programme

Package of works focussed on developing and enhancing green spaces

and creating a range of employment opportunities.

Priority: 2

Total

Investment $16.8M

Support

Required:

- Capital investment

- Fast track consents

|

Significant public health,

environmental and employment benefits, including numerous high labour low

skill opportunities available immediately.

Variety of works (for example landscape

planting) able to commence in 2020 – significant stimulus of local market

(skilled and unskilled) within next 12 months.

|

Part 1 – Annual Plan Capital Works Delivery (25

projects)

|

$2.5M

|

|

Part 2 – Kopurererua Valley development and

enhancement

|

$6.5M

|

|

Part 3 – Ohauiti Reserve Sportsfield Development

|

$6.8M

|

|

Part 4 – Mauao (Mount Maunganui) small improvement

projects

|

$1M

|

|

Connected City - Digital

Priority: 2

Total

Investment $80M

Support

Required:

- Capital investment

- Changes

to AoG agreements to enable Councils to act as a reseller, and/or provide

access to small business to advantages provided to central and local

government agencies

|

Opportunity to provide communications

infrastructure, education, compliance, & business support solutions that

will achieve real change for Tauranga. This will support small

businesses, community groups and those worse hit by COVID 19 enabling them to

recover and thrive.

|

Communications infrastructure, education, business support solutions

|

$80M

|

|

Waste Package

Priority: 2

Total

Investment $34.6M

Support required:

- Capital

investment

- Fast

tracking of building consent process

|

A package of projects that will move

Tauranga City towards a circular waste economy, benefiting the environment

and creating a significant number of permanent jobs. Many of these jobs would

be suitable for those with entry level skills and have the potential to offer

employment to people transitioning from other industries, due to job loss,

thereby supporting those individuals and families that need it most.

|

Transfer stations, kerbside collection, optical sorting

equipment, cleanfill and resource recovery park.

|

$34.6

|

|

Te Papa Community Facilities Projects

Package of works focussed on creating better facilities for

operators in the community, social, arts and cultural sectors

Priority: 3

Total

Investment: $13M

Support

Required:

- Funding

- Fast

track processes

|

Significant social and cultural

benefits – enhanced ability of social sector to deliver, and

opportunity for Mana Whenua to tell their stories through art and traditional

practices.

Numerous projects ready for

commencement within next 12 months – significant employment opportunities including for local iwi artists.

|

Merivale Community Centre (extension / redevelopment)

|

$5M

|

|

Historic Village Building Upgrades (39 projects)

|

$6M

|

|

Wharewaka structure/resource centre – CBD waterfront

|

$2M

|

|

Community Events Centre

(Bay Venues Limited)

Development of a multi-functional

events centre for the Bay of Plenty

Priority: 3

Total

Investment $26.4M

Support

Required:

- Capital

investment

- Protections

to encourage local procurement/supply chain

|

Purpose-built centre (expansion of

existing site) to cater to both community and commercial activities and

alleviate extreme pressure on existing indoor sporting facilities.

Significant social benefits, and

construction (to commence January 2020) estimated at providing approximately

250 FTEs - significant stimulus of local market and supply chain within next

12 months.

NOTE: application provided by Bay

Venues Limited (Council Controlled Organisation)

|

Community facilities – events centre

|

$26.4M

|

|

Blake Park Sporting Precinct

(Bay Venues Limited)

Package of works (four projects) to expand existing sporting

facilities at Blake Park, Tauranga.

Priority: 3

Total

Investment $26.2M

Support

Required:

- Capital

investment

|

Blake Park is a premier

sport and recreation park. Expanded facilities would cater for increased

demand and ensure fit for purpose facilities for multiple sporting codes at

all levels.

Significant social benefits plus

employment benefits - construction is estimated at providing approximately

300 FTEs. Work ready to commence in next 12 months, significant stimulus of

local market and supply chain.

NOTE: application provided by Bay

Venues Limited (Council Controlled Organisation)

|

1. Bay Oval pavilion and development project

|

$6M

|

|

2. Adams Centre for High Performance Expansion Project

|

$5.3M

|

|

3. Bay of Plenty Rugby Union Accommodation Facility

|

$7M

|

|

4. Tauranga Hockey Pavilion and Development Project

|

$7.9M

|

|

TOTAL

EMPLOYING OUR PEOPLE

|

$396.89M

|

Attachment 3 – Developers letter of

support and commitment

|

Emergency Council Meeting Agenda

|

14 April 2020

|

[Date]

Mr Mark

Binns

Chair

Crown

Infrastructure Partners

Address etc

Dear Mark

We the undersigned, representing some

of the most significant businesses in the Western Bay of Plenty (WBOP) region,

are writing to express our unequivocal support for the package of investment

proposals being submitted to Crown Infrastructure Partners by Tauranga City

Council, and the Urban Growth Transformation package submitted to MHUD through

the SmartGrowth regional partnership.

We understand that the SmartGrowth

package also has the support of Tauranga City Council, the Western Bay of

Plenty District Council and the Bay of Plenty Regional Council.

Our proposed approach draws on

thinking developed jointly with central Government, led by the New Zealand

Transport Agency, through the Urban Form and Transport Initiative (UFTI), which

seeks to guide our region towards a more multi-modal transport system and

intensified urban design.

The projects contained in our proposal

will provide enormous stimulus to the economy of the Bay of Plenty region and

beyond. Most are either shovel ready now or in the immediate future.

The counterfactual impact on

investment in our region is very serious. Modelling done by Tauranga City

Council indicates a revenue loss in 2021 resulting from the recession of

$53-77m effectively halving the city’s capital works programme due to

impacts on borrowing limits as well as direct revenue sources, with an

estimated direct impact of up to $200 million in 2020/21 alone, excluding

multipliers.

By addressing critical constraints in

transport, port access, three waters and other network infrastructure, our

programmes will release additional value and create multiplier effects that

will be even more important as the economy moves through recession and into

recovery. Examples include:

· The Eastern Corridor, including

interchanges off the Tauranga Eastern Link, Te Tumu infrastructure and Te Puke

development. This helps unlock industrial and residential land to the

east.

· The Hewletts / Totara / Hull corridor,

which would see major improvement to transport capacity in this area supporting

future growth of the Port of Tauranga, which handles 43% of New Zealand’s

exports, and surrounding businesses and exporters.

· The Western Corridor, with

reorganisation of roading to unlock residential and industrial land vital to

accommodate Tauranga’s rapid population growth, and to provide better

links to the strategic Upper North Island transport nexus.

· Intensification of the Te Papa

peninsular to provide better housing and transport outcomes, better enabling

affordability and access to work / key services.

Infrastructure

investment in these areas would have the following benefits for businesses and

the economy:

· Allowing commercial / industrial land

to be opened along key strategic corridors. This is needed to accommodate

growth in the eastern sectors of greater Tauranga, to support the forecast

expansion in horticulture and to leverage the Government’s strategic

investment in the Upper North island “golden triangle”.

· Improving business productivity

through expanding the flow of freight to / from the Port of Tauranga, creating

a multiplier effect.

· Enabling new residential development

to accommodate a massive housing shortfall and spiralling

unaffordability. Affordable housing is our key future constraint for

talent. As you may be aware, future housing developments are being

carefully managed to link to upgrades in public and multi-modal transport.

· Encouraging additional investment from

the private sector (please note the accompanying letter from developers).

· The inclusion of community facility

projects related to key growth sectors and development of education / skills in

our community is thoroughly endorsed and noted to be important in delivering

strong economic outcomes.

In summary,

our local government leaders are focused on the eastern and western corridors

together with intensification of existing areas, that will unlock thousands of

houses and jobs and enable the Western Bay of Plenty to flourish over the next

several decades. That will require investment in three waters infrastructure,

transport networks and community facilities, as well as the state highway and

rail routes to the port, which will be critical to New Zealand’s

recovery.

Mark, we know

that Crown Infrastructure Partners will have a range of proposals before it

from all regions of the country. This Western Bay of Plenty package

has the advantage of drawing upon extensive planning work already in motion, so

it is:

· At scale

· Shovel ready

· Well researched and documented

· Economically and strategically

significant.

This package

provides confidence to businesses and households, which is key to mitigating

secondary effects of the immediate Covid-19 crisis.

By addressing

key pre-existing infrastructure bottlenecks, it will better fit one of New

Zealand’s highest potential regions for a more productive

future.

As business

leaders in the Western Bay of Plenty region, we want you to be clear that these

Tauranga City Council and SmartGrowth proposals have our full support.

Thank you for

your consideration of this letter. We eagerly await your deliberations.

Yours

sincerely

_______________________

Signed on behalf of

Port of Tauranga

_______________________

Signed on

behalf of

Zespri International Ltd

_______________________

Signed on

behalf of

Trustpower Ltd

_______________________

Signed on

behalf of

Ballance Agri-Nutrients Ltd

_______________________

_______________________

Signed on

behalf of

Winstone Wallboards Ltd

_______________________

_______________________

Signed on

behalf of

The University of Waikato

_______________________

_______________________

Signed

on behalf of

Toi Ohomai Institute of Technology

3.2 Covid-19

- Short term business sector relief options

File

Number: A11376063

Author: Ross

Hudson, Strategic Advisor

Authoriser: Christine

Jones, General Manager: Strategy & Growth

Purpose of the Report

1. To

enable Council to consider options to support the community and the business

sector in the short-term in response to Covid-19.

|

Recommendations

That the Council:

(a) Requests that staff report

back to the next Council meeting on options for specific short-term community

and business support measures, as identified and agreed in this meeting;

(b) Commits to working with the

business community through Priority One and the Chamber of Commerce to

produce a comprehensive economic response to Covid-19.

|

Executive Summary

2. Covid-19

is having a significant negative impact on the Tauranga community and economy,

especially on smaller businesses. The Chamber of Commerce has requested that

Council give consideration to a set of measures that could provide financial

relief to businesses in the near-term, in particular where businesses are

incurring costs from Council itself.

3. This

report focuses on support for the business sector; however, council will

continue to look at options to support the wider community through the

development of its 2020/21 Annual Plan. A number of the options outlined in

this paper impact on both the business sector and the wider community.

4. Council

itself is experiencing significant revenue declines as a result of Covid-19.

The desire to support local businesses through short-term cost reduction

measures must be balanced against the importance of maintaining revenue streams

to enable Council to use its borrowing capacity to invest in job-creating

infrastructure projects.

5. Council

is putting together a set of significant funding requests to Government’s

Covid-19 support packages. These have the potential to create significant

economic stimulus in Tauranga.

Background

6. Council

has been considering its options to support the community and business sector

in response to Covid-19. A significant focus of this work has been on the

creation of investment stimulus packages to be presented to government. This is

essential to allow Tauranga and other areas of New Zealand to emerge quickly

from a Covid triggered recession.

7. Council

also has been considering further options noting its significant financial

issues and recently the Chamber of Commerce has informally requested that

Council consider a set of measures to provide short-term financial relief to

the business sector. The same set of requests has been passed to the Regional

and Western Bay councils. The Regional Council has responded informally to the

Chamber on those measures of relevance.

8. Table

1 below captures these measures and provides an initial staff view as to

whether each measure should be given further consideration or not.

|

|

Request

|

Initial View

|

|

1

|

NZTA to make the

region’s state highways toll free until 30 June 2021.

|

A matter for NZTA to

consider, however any reduction in revenue from NZTA needs to ensure there is

no reduction in NZTA funding for the region as a result.

This would not affect

Council revenue.

|

|

2

|

All councils to remove

user fees and charges for building and resource consent amendments,

extensions of time and cancellations until 30 June

2020.

|

There are policy

provisions in place to allow this.

Further loss of revenue

will inhibit the city’s ability to raise debt to deliver on the current

capital programme that is supporting the growth agenda.

|

|

3

|

Councils to remove user

fees and charges for retailers (including hairdressers) and hospitality

businesses until 30 June 2020. This includes registration fees, food safety

plans and licences to occupy footpaths.

|

Further loss of revenue

will inhibit the city’s ability to raise debt to deliver on the current

capital programme that is supporting the growth agenda.

Noting this, options

will be explored providing alternatives to deliver some support to these

industries.

In the short term, we

suggest we continue to work with retailers on a case by case basis in terms

of providing any assistance we can.

|

|

4

|