|

|

|

AGENDA

Ordinary Council Meeting

Tuesday, 21 April 2020

|

|

I hereby give notice that an Ordinary Meeting of

Council will be held on:

|

|

Date:

|

Tuesday, 21 April 2020

|

|

Time:

|

1pm

|

|

Location:

|

Tauranga City Council

By video conference

|

|

Please

note that this meeting will be livestreamed if possible; a recording will be

publicly available on Tauranga City Council's website: www.tauranga.govt.nz.

|

|

Marty Grenfell

Chief Executive

|

Terms of reference – Council

Membership

|

Chairperson

|

Mayor Tenby Powell

|

|

Deputy chairperson

|

Cr Larry Baldock

|

|

Members

|

Cr Jako Abrie

Cr Kelvin Clout

Cr Bill Grainger

Cr Andrew Hollis

Cr Heidi Hughes

Cr Dawn Kiddie

Cr Steve Morris

|

|

Quorum

|

Half of the members physically present, where the

number of members (including vacancies) is even; and a majority

of the members physically present, where the number of members (including

vacancies) is odd.

|

|

Meeting

frequency

|

Six weekly or as required for Annual Plan, Long Term Plan

and other relevant legislative requirements.

|

Role

·

To ensure the effective and efficient

governance of the City

·

To enable leadership of the City

including advocacy and facilitation on behalf of the community.

Scope

·

Oversee the work of all

committees and subcommittees.

·

Exercise all non-delegable and

non-delegated functions and powers of the Council.

·

The powers Council is legally prohibited from delegating include:

o

Power to make a rate.

o

Power to make a bylaw.

o Power to borrow

money, or purchase or dispose of assets, other than in accordance with the

long-term plan.

o

Power to adopt a long-term plan, annual plan, or annual report

o

Power to appoint a chief executive.

o Power to adopt

policies required to be adopted and consulted on under the Local Government Act

2002 in association with the long-term plan or developed for the purpose of the

local governance statement.

o All final

decisions required to be made by resolution of the territorial

authority/Council pursuant to relevant legislation (for example: the approval

of the City Plan or City Plan changes as per section 34A Resource Management

Act 1991).

·

Council has chosen not to delegate the following:

o Power to

compulsorily acquire land under the Public Works Act 1981.

·

Make those decisions which are required by legislation to be made

by resolution of the local authority.

·

Authorise all expenditure not delegated to officers, Committees

or other subordinate decision-making bodies of Council.

·

Make appointments of members to the CCO Boards of

Directors/Trustees and representatives of Council to external organisations.

·

Consider any matters referred from any of the Standing or Special

Committees, Joint Committees, Chief Executive or General Managers.

Procedural matters

·

Delegation of Council powers to Council’s committees and

other subordinate decision-making bodies.

·

Adoption of Standing Orders.

·

Receipt of Joint Committee minutes.

·

Approval of Special Orders.

·

Employment of Chief Executive.

·

Other Delegations of Council’s powers, duties and

responsibilities.

Regulatory matters

Administration,

monitoring and enforcement of all regulatory matters that have not otherwise

been delegated or that are referred to Council for determination (by a

committee, subordinate decision-making body, Chief Executive or relevant

General Manager).

10 Business

10.1 Amendment

to emergency committee following law change

File

Number: A11372956

Author: Nick

Swallow, Manager: Legal & Commercial

Authoriser: Paul

Davidson, General Manager: Corporate Services

Purpose of the Report

1. This report is to amend

the resolutions passed on 24 March 2020 that were put in place to establish an

emergency committee and other measures necessary to enable Council to operate

under Covid-19.

|

Recommendations

That the Council:

(a) In order to enable

continuation of Council and Committee meetings under Covid-19 restrictions,

modifies resolution CO4/20/9 passed on 24 March 2020 by:

(i) Revoking the

suspension of all committees by amending resolution (e) as follows:

“(e) Activates

the Emergency Committee from 24 March 2020 to operate during Alert

Levels 3 and 4 of the COVID-19 Emergency and suspends all other Committees,

apart from the Civil Defence and Emergency Management Joint

Committee.”

(ii) Deletes resolution (f)

being the requirement for a quorum of two members to be physically present.

|

|

|

Executive Summary

2. A recent law change has

allowed for more flexibility for Council meetings in response to the Covid-19

lock-down requirements, enabling them to be held remotely and online.

This has necessitated two technical changes to the emergency measures put in

place by Council prior to this law change to enable continued operation of

Council meetings.

Background

3. In the week of 24 March

2020, the Government escalated measures to prevent the spread of Covid-19.

However, the legislation regulating how Council meetings were required to

operate were not affected by the response measures.

4. The continued operation

of regular Council and Committees meetings in the usual way would have risked a

breach of Government requirements to prevent the spread of the virus and generally

have been counter-productive to efforts to contain this. Of relevance for

this report, the attendance of all Councillors in person, and the continued

operation of all Council Committees, would have necessitated a lot of travel

and congregation.

5. It was not clear if

Parliament would pass legislation to amend existing laws regulating Council

meetings so that these aligned with the Covid-19 response measures. To

avoid this problem, emergency measures were considered and passed by Council on

24 March 2020 (report titled Emergency Provisions for COVID-19). A

copy of the resolution is set out below for ease of reference.

6. Again of relevance for

this report, these included the establishment of an Emergency Committee which

required a quorum of only two members to be physically present and also the

suspension of all Council Committees.

7. However, on 25 March 2020

the COVID-19 Response (Urgent Management Measures)

Legislation Act 2020 came into force (Covid legislation). This

amended legal requirement for Council meetings to enable, among other things,

meetings to be held without the public having to the right to attend

physically, and also without a physical presence of Councillors to establish a

quorum.

8. As such, it is now

necessary to revoke some of the resolutions made on 24 March 2020 CO4/20/9 in

order to allow Council and Committee meetings to be held under the new

requirements set out in the Covid legislation.

9. These changes are:

(a) Revoking the suspension of all

committees (resolution [e]). This is no longer needed since all

committees can now meet on-line.

(b) Revoking the requirement for a

quorum of two members to be physically present (resolution [f]). Again,

this is no longer needed since quorum can be achieved remotely online

10. It is prudent to retain the

remaining parts of resolution CO4/20/9 while the Covid-19 crisis continues.

Copy of

emergency powers resolutions as passed on 24 March 2020

That the Council:

(a) Receives the report

“Emergency Provisions for COVID-19”

(b) Establishes an Emergency

Committee with a membership of three consisting of the Mayor Tenby Powell as

the Chairperson, the Deputy Mayor Larry Baldock as the Deputy Chairperson and

one other elected member selected in the following order:

· Councillors Kelvin Clout

and Steve Morris (Standing Committee Chairpersons – with preference being

given with the Chairperson whose portfolio aligns with the matter of urgency

being considered)

· Councillors Tina

Salisbury, Jako Abrie, Dawn Kiddie and Heidi Hughes (Standing Committee Deputy

Chairpersons - with preference being given with the Deputy Chairperson whose

portfolio aligns with the matter of urgency being considered)

· Councillors John Robson,

Andrew Hollis and Bill Grainger

In the event that the Mayor

or Deputy Mayor are unavailable three elected members in the order as stated

above.

(c) Adopts the following Emergency

Committee’s Terms of Reference:

(i) To determine matters within

the authority of Tauranga City Council where the urgency of those matters

precludes a full meeting of the Council, or its committees, or emergency

legislation is enacted and the Council or its committees are unable to meet.

(ii) To exercise all Council

functions that cannot be exercised by the Council or its committees using its

standard processes and procedures due to a pandemic, other natural disaster or

state of emergency, except for those that:

· have been delegated to

staff; or

· cannot be delegated as set

out in Clause 32 of Schedule 7 of the Local Government Act 2002 which are:

(a)

the power to make a rate; or

(b)

the power to make a bylaw; or

(c)

the power to borrow money, or purchase or dispose of assets, other than in

accordance with the long-term plan; or

(d)

the power to adopt a long-term plan, annual plan, or annual report; or

(e)

the power to appoint a chief executive; or

(f)

the power to adopt policies required to be adopted and consulted on under this

Act in association with the long-term plan or developed for the purpose of the

local governance statement; or

(g)

[Repealed]

(h)

the power to adopt a remuneration and employment policy. or

· cannot be delegated by the

Council as set out in any other legislation.

(iii) The Emergency Committee can

only be activated by resolution of Council for specific emergency events, or

where resolution by Council is not possible, on the joint authority of the

Mayor and Deputy Mayor and the Chief Executive.

(iv) The Emergency Committee will report to

the Council (at the next available full meeting of Council) summarising the

Committee’s activities and any decisions made over the period.

(v) The quorum for the Emergency

Committee will be two members.

(vi) The Emergency Committee will meet as

required.

(vii) When an Emergency Committee meeting

has been called, Councillors will be notified details by email and agendas and

minutes will be circulated electronically. Public notice requirements as set

out in the Local Government Official Information and Meetings Act 1987 will

apply.

(d) Delegates to the Mayor, the

Deputy Mayor and the Chief Executive, the authority to activate the Emergency

Committee during the COVID-19 emergency when a resolution of Council is not

possible.

(e) Activates the Emergency Committee

from 24 March 2020 to operate during Alert Levels 3 and 4 of the COVID-19

Emergency and suspends all other Committees, apart from the Civil Defence and

Emergency Management Joint Committee.

(f) Establishes that the quorum

for the Council’s Standing Committees during the COVID-19 emergency will

be two members to be physically present.

(g) For the purposes of the COVID-19

emergency, delegates to the Chief Executive all the Council’s powers,

duties, and responsibilities that the Council can lawfully delegate to

officers, including the ability to enter into any contract and/or to authorise

any level of expenditure (“Emergency Delegation”). This

Emergency Delegation does not include (or limit) the powers, duties, and

responsibilities that the Council has already delegated to the Chief Executive

under delegations in force at this time, or any authority to make any Council

decisions under the Civil Defence Emergency Management Act 2002 (which shall be

dealt with in accordance with that Act). This Emergency Delegation is subject

to the following conditions:

(viii) It may

be exercised only in circumstances where the Council and its committees are

unable or unavailable to hold meetings that comply with the requirements of the

Local Government Act 2002 and the Local Government Official Information and

Meetings Act 1987;

(ix) The Chief Executive may only exercise

the Emergency Delegation in consultation with the Mayor (or if the Mayor is

unavailable, the Deputy Mayor, or if the Deputy Mayor is unavailable, the

Chairperson of the relevant committee, or if the Chairperson of the relevant

committee is unavailable, the Deputy Chairperson of the committee).

(x) Any decisions made and documents

executed in exercising the Emergency Delegation must be reported to the next

ordinary meeting of the Council.

(xi) This Emergency Delegation may be

revoked at any time by the Council.

(xii) In the event there is any

inconsistency between this Emergency Delegation and any other delegation made

by the Council, this Emergency Delegation takes precedence. For the

avoidance of doubt, this means that the contract value and other limits

specified in the Chief Executive’s delegations under clause 6 of

Council’s Procurement Policy (relating to approval of exemptions to open

procurement and contract variations) will not apply while this Emergency

Delegation is in effect, thus enabling the Chief Executive to approve these no

matter the contract value or contract variation parameters during the effective

period of this Emergency Delegation.

(h) Delegates the powers, duties and

responsibilities of the Chief Executive to Christine Jones, General Manager:

Strategy and Growth, as Acting Chief Executive in the event that the Chief

Executive is unable to fulfil his duties due to COVID-19; and

(i) Agrees that where the

Acting Chief Executive is unable to fulfil her duties due to COVID-19, the

Chief Executive’s delegated powers, duties and responsibilities will be

transferred to the next designated General Manager in the following order:

· Paul Davidson, General Manager:

Corporate Services

· Barbara Dempsey, General

Manager: Regulatory and Compliance

· Nic Johansson, General

Manager: Infrastructure

· Gareth Wallis, General

Manager: Community Services

· Susan Jamieson, General

Manager: People and Engagement

Strategic / Statutory Context

11. This concerns technical requirements

for Council meetings and is not of strategic significance. The statutory

context is noted above.

Consultation / Engagement

12. No consultation or engagement is

needed for this technical change.

Significance

13. This matter is of low significance.

Click here to

view the TCC

Significance and Engagement Policy

Next Steps

14. Council staff will monitor any

further changes to Government policy or legislative requirements which may have

a bearing on Council decision-making requirements.

Attachments

Nil

10.2 Draft

2020/21 Annual Plan - COVID19 update

File

Number: A11370384

Author: Jeremy

Boase, Manager: Strategy and Corporate Planning

Kathryn Sharplin, Manager:

Finance

Christine Jones, General Manager:

Strategy & Growth

Authoriser: Paul

Davidson, General Manager: Corporate Services

Purpose of the Report

1. To seek initial direction

on Council’s core principles to be built into planning for the final

2020/21 Annual Plan and to identify a process for considering potential changes

to levels of service and resource allocation in that Annual Plan.

|

Recommendations

That the Council:

(a) Recognises

that the impacts of the COVID-19 pandemic on the nation, the city, and the

council will require significant reconsideration of the draft 2020/21 Annual

Plan prior to adoption by 30 June 2020.

(b) Recognises that the direct

impact on Council of government stimulus package opportunities is currently

unknown and that, depending on the outcome of those opportunities, further

analysis and options beyond those covered by this report may need to be

considered by Council prior to the adoption of the 2020/21 Annual Plan.

(c) Requests the following

prioritisation of key principles be included into all further work on the

draft 2020/21 Annual Plan (“draft AP”)

(i) Provision of essential

council services – more focus than draft AP / same focus as draft AP /

less focus than draft AP (selection required)

(ii) Provision of Civil Defence

and Emergency Management capability and capacity – more focus than

draft AP / same focus as draft AP / less focus than draft AP

(iii) Council’s role in

promoting or protecting employment in the city – more focus than draft

AP / same focus as draft AP / less focus than draft AP

(iv) Council’s role in promoting

or protecting social wellbeing in the city – more focus than draft AP /

same focus as draft AP / less focus than draft AP

(v) Council’s role in

providing planning and infrastructure for current and future residential and employment

growth areas (including intensification) – more focus than draft AP /

same focus as draft AP / less focus than draft AP

(vi) Council’s financial and

project positioning for post-COVID operations – more focus than draft

AP / same focus as draft AP / less focus than draft AP

(vii) Other specific core principles

as identified by Council – with appropriate focus direction (to be

completed if necessary)

(d) Notes that staff will

conduct further work on planning scenarios relating to future disruption

assumptions to be brought to a subsequent Council or Committee meeting for

endorsement.

(e) Requests that level of

service options be prepared that are consistent with the above direction, for

consideration prior to deliberations on the draft 2020/21 Annual

Plan.

|

Executive Summary

2. To help address

medium-term issues with its debt-to-revenue ratios, Council initially prepared

a draft 2020/21 Annual Plan including a 12.6% rates revenue increase. In

response to the escalating COVID-19 crisis, Council eventually adopted its

draft Annual Plan with a 7.6% rates increase.

3. Since that adoption, the

impact of COVID-19 has become clearer. Among those impacts are financial

models that show a significant reduction in Council’s expected revenue in

2020/21. This reduction, coupled with maximum prudent debt-to-revenue

ratio levels, means that Council’s ability to deliver its expected

capital expenditure programme in 2020/21 is in serious doubt.

4. In addition, balanced

budget and financial prudence requirements in the Local Government Act 2002 mean

that a significant reduction in budgeted revenue may require a reconsideration

of plans for operating expenditure.

5. At the same time, central

government has announced plans for economic stimulus packages. Council

has made applications to various such initiatives but at the time of writing no

direct feedback has been received on those. It is not certain how much

clarity on such packages will be available before Council adopts its final

2020/21 Annual Plan.

6. All of this means that

Council will need to have a more fundamental review of its final Annual Plan

preparation than is normal in the period between the adoption of the draft

document and the adoption of the final document.

7. This report sets out a

staged process for Council to consider the various issues involved. That

staged process includes considering core principles, agreeing on assumptions,

and then considering the levels of service that different activities should be

aiming to deliver in the 2020/21 year.

Background

Annual Plan process to date

8. Planning work for the

draft 2020/21 Annual Plan commenced in the third quarter of 2019 and culminated

in a Council decision-making process on 10 December 2019.

9. In response to concerns

about the impact of that decision-making process on Council’s

debt-to-revenue ratios, both for 2020/21 and future years, a revised round of

decision-making occurred at the Policy Committee meeting of 4 March 2020.

That meeting agreed, by majority, a total rates revenue increase of 12.6% for

2020/21. At this stage, New Zealand had two COVID-19 cases

confirmed.

10. On 24 March, while adopting the

draft Annual Plan for the purposes of public consultation, Council responded to

the developing COVID-19 situation by unanimously agreeing to reduce the total proposed

rates revenue increase to 7.6% while looking to reduce the capital expenditure

budget prior to final adoption. At this stage, New Zealand had 155

confirmed and probable cases of COVID-19 and had announced, but had not yet

commenced, the Level 4 lockdown.

11. The draft Annual Plan consultation

document noted that, before the final Annual Plan is considered and adopted,

further work would be undertaken to understand the impact of COVID-19 and

Council’s appropriate response in that document.

12. Consultation on the draft Annual

Plan commenced on Friday 3 April and will close on Sunday 3 May. Hearings

and deliberations will follow, with adoption of the final Annual Plan scheduled

for 30 June.

This report

13. Since the adoption of the draft

Annual Plan, more information, analysis and opinions on the impact of COVID-19

on all aspects of society are being created and shared on a daily basis.

This includes work done by central government and outside agencies, as well as

work done within this organisation.

14. This report does not attempt to pull

together all of that work.

15. This report instead attempts to

identify the key issues that decision-makers will need to address as they

relate to the finalisation of the 2020/21 Annual Plan.

16. Note that this report will not

attempt to address or ‘solve’ those issues (though it does seek

direction on Council’s underlying core principles). Separate

processes will be put in place to enable discussion and decision-making on

those issues on a staged basis between now and the adoption of the final Annual

Plan. This report sets out initial ideas on a route map for those

discussions.

Council’s financial framing

17. As was outlined to Council in

late-2019 and through Annual Plan discussions in early 2020, Council’s

financial situation entering the COVID-19 crisis was challenged. This was

a direct result of carrying significant levels of debt to fund essential growth

infrastructure. Several other ‘growth councils’ are in a

similar situation.

18. The impact of COVID-19 has made that

financial situation significantly worse.

19. Revenue modelling undertaken by

staff indicates that the ongoing effects of the COVID-19 pandemic are likely to

have a severe impact on revenue, and potentially on Council’s ability to

carry-out vital infrastructure investment projects.

20. That modelling indicated potential

revenue between $40 million and $77 million less than budgeted in the draft

Annual Plan. With Council’s debt-to-revenue ratio capped by funding

agencies at 250%, such reductions in revenue lead directly to a need to reduce

debt and therefore to reduce the capital expenditure that creates that

debt. The impact of the modelled reduction in revenue is a capital

expenditure programme that is, at best, half that shown in the draft Annual

Plan and, at worst, less than $50m, and with a debt to revenue ratio moving

closer to the 250% limit than the 235% proposed in the annual plan. This

will clearly affect Council’s ability to renew existing infrastructure

and to invest in much-needed growth infrastructure.

21. That initial modelling was conducted

at a very high-level and was based on different scenarios based on broad

assumptions as to the length and depth of pandemic-related disruption.

Scenarios and associated assumptions covered:

(a) the extent of disruption (from

Alert Level 3 for 12 months as a worst case, down to Alert Level 2 or 3 for six

months and then relaxing for the second six months)

(b) the impact on rates revenue

(from the draft Annual Plan status quo as a best case, to reductions in the

rates strike and increases in non-payment as a worst case)

(c) the impact on water-by-meter

revenue, linked to estimates of reduced commercial use

(d) the impact on significant user

fees revenue streams, such as the airport (both lease revenue and

airport-related revenue), parking, building consenting, Baycourt, parks,

events, cemetery, etc

(e) the impact on capital revenues

(such as NZTA subsidies and development contributions) which are directly

linked to the assumed extent of capital investment by Council and the private

sector respectively

(f) the impact on Bay Venues

Limited’s revenue stream (based on the limited ability to open venues and

facilities during the modelled Alert Levels).

22. All scenarios also recognised the

likelihood of:

(a) a significant underlying

recession in the New Zealand economy

(b) New Zealand’s borders

essentially remaining closed

(c) Limited travel within New

Zealand

(d) High unemployment affecting

retail and entertainment activity and associated revenue streams for council

such as from use of central city parking and facilities such as Baycourt and

venues and events.

23. Further work will be conducted

across the organisation over coming weeks to refine this initial high-level

modelling. During that time, there may also be more clarity as to New

Zealand’s potential route out of Alert Level 4 which will also be

factored in.

24. While additional detail may be added

to the modelling, it is not expected that the underlying message will change

significantly. That is, the draft Annual Plan for 2020/21 will need

significant revision before it is adopted as a final document.

The role of the Annual Plan

25. The Annual Plan is Council’s

resource-allocation document for the year ahead.

26. Legally, the purpose of the Annual

Plan is set out in section 95(5) of the Local Government Act 2002 (“the

Act”) as being to:

(a) contain the proposed annual

budget and funding impact statement for the year to which the annual plan

relates; and

(b) identify any variation from

the financial statements and funding impact statement included in the local

authority’s long-term plan in respect of the year; and

(c) provide integrated decision

making and co-ordination of the resources of the local authority; and

(d) contribute to the

accountability of the local authority to the community.

27. The Act also requires, at section

95(6), that the Annual Plan be prepared in accordance with the principles and

procedures that apply to the 2018/28 Long-term Plan.

28. This legal framing, and the impact

of potentially significant changes from the Long-term Plan (and from the draft

Annual Plan) caused by the COVID-19 pandemic, are matters that are being

considered at a national sector level. Staff will update Council on the

impact of that consideration as appropriate.

Other relevant legislative context

29. There are two key elements of the

Act that need to be considered as Council prepares the final Annual Plan.

Prudent financial management

30. Section 101 of the Act addresses

financial management and, at sub-section (1) explicitly refers to prudent

financial management in relation to both the current and future communities.

‘A

local authority must manage its revenues, expenses, assets, liabilities,

investments, and general financial dealings prudently and in a manner that

promotes the current and future interests of the community.’

31. This means that Council needs to

find the balance between the short-term and long-term interests of its

community when managing its finances.

Balanced budget

32. Section 100 of the Act requires that

Council sets a balanced budget. This is explicitly stated in sub-section

(1) thus:

‘A

local authority must ensure that each year’s projected operating revenues

are set at a level sufficient to meet that year’s projected operating

expenses.’

33. Despite this requirement,

sub-section (2) provides for Council to set a budget where projected operating

revenues do not meet projected operating expenses if it considers it is

financially prudent to do so. In setting an ‘unbalanced

budget’ Council’s consideration of financial prudence needs to

address four matters listed in the act and paraphrased as:

(a) The costs of desired service

levels and of maintaining the capacity and integrity of assets throughout their

useful lives

(b) The revenues available to

maintain the capacity and integrity of assets throughout their useful lives

(c) Inter-generational equity

(d) Council’s own Revenue

& Financing Policy and other financial policies.

34. This means that Council needs to

give due consideration to the financial prudence of long-term cost and funding

issues before adopting an unbalanced budget in its Annual Plan.

Issues to address

35. This section of the report

identifies various issues that Council will need to address before the final

Annual Plan can be prepared and adopted.

36. Some of these issues may be able to

be addressed singly and once only, others will need to be addressed

collectively and iteratively. The changing nature of the information

available and forecasts about the future mean that some decisions may need to

be made very late in the Annual Plan’s finalisation process.

Core principles

37. Given the financial framing and the

high level of uncertainties the world, nation and city are experiencing,

Council will need to consider the core principles it wishes to pursue when

preparing the final Annual Plan.

38. These core principles will guide

Council’s resource allocation decision-making.

39. The discussion on core principles

will likely address Council’s role in its community in the 2020/21

year. Matters to be considered will include (but are not limited to):

· Council’s

‘essential services’ and which services those are

· Council’s

role in protecting or promoting employment in the city

· Council’s

role in protecting or promoting social wellbeing in the city

· Council’s

role in providing planning and infrastructure for current and future growth

areas (including intensification)

· Council’s

financial and project positioning for post-COVID operations.

40. The consideration of core principles

is urgent as it provides the foundation for many of the subsequent

discussions. As such, further discussion is covered in the

‘Options’ section of this report below.

Opportunities

41. As has been widely publicised, the

New Zealand government has initiated a number of workstreams intended to

protect jobs, stimulate the economy, provide for housing, and enable good

social and economic outcomes for all New Zealanders. These are in

addition to the immediate response actions, such as wage subsidies, that the

government implemented.

42. These workstreams provide

opportunities to leverage central government investment for the benefit of the

city while (potentially) not compromising Council’s financial

position. At the time of writing, the funding model for each of the

government’s initiatives was uncertain. As such, the impact of

these initiatives on Council’s financial position is equally

uncertain. However, the opportunity to leverage funding remains just

that, a great opportunity for the city.

43. There are several major initiatives that

the government has created. Those that Council has been involved in, and

the extent of that involvement, are listed below.

(a) Ministry of Housing and Urban

Development (“MHUD”): growth councils workstream

Council provided

initial information to MHUD on 20 March. Further updates provided 3

April, with the final information package submitted by the SmartGrowth

partnership on 6 April 2020.

(b) Crown Infrastructure Partners

(“CIP”): shovel-ready infrastructure projects

Council provided

applications of over $1 billion to CIP on 14 April under two broad headings:

· Creating

Communities and Housing for All

· Employing Our

People.

(c) Ministry of Business Industry

& Employment: local and state highway transport opportunities

Schedule of

projects submitted 23 March

(d) Ministry for the Environment:

identifying Resource Management Act and other constraints on opportunities

Submission on

Maori land and other RMA issues, including resilience, submitted 25 March.

44. The impact of these opportunities,

to the extent that those impacts are understood by June, will need to be

factored into the consideration of the final Annual Plan.

Assumptions regarding disruption and the ‘new

normal’

45. In preparing budgets and workplans

for 2020/21, assumptions will need to be made regarding the extent of COVID-19

restrictions during the coming year i.e. the extent to which Level 1, 2, 3, or

4 restrictions will be applied nationally or to any sub-national region that

includes Tauranga (i.e. North Island, upper North Island, Bay of Plenty,

western Bay of Plenty, or just city-wide).

46. If assumptions are made that at some

stage during 2020/21 there will be no COVID-19 restrictions in place (or only

Alert Level 1 restrictions), further assumptions will need to be made regarding

the impact of a ‘new normal’ on the community and Council’s

activities. For instance, what (if any) will be the propensity for people

to travel, or to gather indoors (or outdoors) even if there are no formal restrictions

on such activities?

47. These assumptions will invariably

prove to be wrong, but for planning purposes they need to be considered and

then applied consistently to all activities. These assumptions should

also be shared with Council’s council-controlled organisations

(“CCOs”) to ensure further consistency of approaches.

48. Advice will be sought from central

government regarding these assumptions, and it is likely that such advice may

evolve over the period between now and adoption of the final Annual Plan.

However, notwithstanding that evolving nature of that advice, early

consideration of such assumptions is necessary as the knock-on impacts on

activity-level (and CCO) planning are potentially significant.

49. Covid19 has impacted the economies

of countries around the world and a significant recession or even depression is

being talked about. The extent and duration of the economic recession is

as yet unclear. This economic impact influences a number of

assumptions for Council’s final Annual Plan, including demand for new

houses, use of infrastructure, revenue to the council and the level of rates

considered acceptable to Tauranga ratepayers – commercial and

residential.

50. In the meantime, staff planning will

continue to be based on a number of different potential scenarios.

Levels of service

51. As a consequence of discussions on

core principles and then assumptions regarding disruption, Council will need to

consider its desired levels of service for the 2020/21 year. These levels

of service will then drive resource allocation decisions.

52. Depending on the assumptions around

disruption there are a number of activities where anticipated levels of service

for 2020/21 may be significantly different from those assumed in the 2018/28

Long-term Plan.

53. For some activities this may result

in increased levels of service to address the impacts of the COVID-19

pandemic. For other activities it may result in a decrease in levels of

service due to either the impracticalities of delivering the originally

proposed level of service or the likely lack of customers to deliver that

service to. For yet others it may involve similar outcomes for the

community but delivered in a very different way to that originally planned.

54. There are a large number of

‘community facing’ activities where the impacts of the COVID-19

pandemic may give cause to reconsider Council’s intentions for the

activity in 2020/21. These include (but are not limited to):

· the airport

· Baycourt

· Bay Venues Limited

· Community

Development activities

· community

engagement activities

· the Historic

Village

· education

activities, particularly school-based education such as library programmes,

walking and cycling programmes, waste minimisation programmes, etc)

· events

· external agencies

such as Priority One, Chamber of Commerce, Sport Bay of Plenty, etc

· libraries

· mainstreet

organisations

· parking

· Places and Spaces

(parks, sportsgrounds, etc)

· Tauranga Art

Gallery

· Tourism Bay of

Plenty.

55. This list is for illustrative

purposes only, indicating the breadth of activities where service levels may or

may not be affected by the COVID-19 pandemic, at least over the next 12

months. It is not intended to be exhaustive nor to indicate any potential

changes in service levels in any or all activities.

56. Within the ‘essential

services’ there may be limited scope (or need) for significant level of

service discussions. However, given Council’s potential financial

positioning noted above, any process to review levels of service would need to

consider all services albeit potentially in different groupings commensurate

the potential scope of change.

57. A process will be designed to enable

Council to consider the potential impacts on service levels across all

activities. Work has already commenced with activity managers to help

facilitate this.

An example

58. The following is provided as an example

only. It is not to be intended to be used for direction-setting or

decision-making. Instead it is intended to allow Council to understand

the depth and breadth of discussion that is likely to be brought to future

Council meetings.

59. A level of service paper relating to

the libraries may, under an assumption of extended Alert Level 2 or 3

restrictions, cover matters such as whether the Annual Plan 2020/21 should

provide for:

· Full or partial

opening of the city centre library

o And if partial, which parts

and under what restrictions?

· Full or partial

opening of the branch libraries

· The operation of

the mobile library

· The operation of a

‘click and collect’ service for items issued from the lending

collection

· The operation of a

delivery service for items issued from the lending collections

· Education

programmes, whether delivered in the library or virtually through digital

delivery

· Access to the Nga

Wahi Rangahau collections (New Zealand Room) whether or not the rest of the

city centre library is open

· Whether fees

and/or fines should be in place for the 2020/21 year (or under various Alert

Level assumptions during the year).

60. Ideally, each of these discussions

(and any other level of service discussions considered relevant) would be

accompanied by full information on the advantages, disadvantages, cost and

risks of the various options under consideration. They will also be

informed by national and regional discussions and decision-making as

relevant. For example, and relevant to the libraries example above, there

are nation-wide discussions underway regarding what libraries can deliver under

various Alert Level scenarios and how those services could be delivered.

It is important that Council leverage off those wider conversations wherever

they are occurring.

61. The extent to which that analysis

will be possible (based on the disruption assumptions made) is likely to be

somewhat compromised by the circumstances, particularly the unique nature of

the post-COVID-19 world and the short timeframes to undertake the necessary

analysis.

Other issues to address

62. Together with substantive

discussions around principles, opportunities, disruption assumptions, and

levels of service, a number of individually more minor issues will need to be

addressed before the final Annual Plan is adopted.

63. These include:

(a) Population growth assumptions,

and whether these should remain as per the 2018/28 Long-term Plan or whether

they need to be amended to reflect the impacts of COVID-19 on construction

activity and migration to Tauranga

(b) Procurement approaches and

whether any changes to procurement policies may have a material impact on

project costs

(c) Potential impacts on project

costs of world-wide material supply and demand issues

(d) Rating policies, including

those relating to remission, postponement and penalties (this is in addition to

the identified consultation topics relating to the level of the uniform annual

general charge and the commercial differential). Some of these

discussions are referred to in a separate paper on this agenda.

options – core principles

64. A clear understanding of

Council’s guiding principles for the 2020/21 Annual Plan will help to

guide more detailed subsequent decision-making, for example around levels of

service for specific activities.

65. It is recognised that 2020/21 will

at best be focused on the city’s recovery from the COVID-19

pandemic. At worst, the nation and the city may be experiencing repeat

breakouts of infection clusters or widescale community infections.

66. It is unlikely in either scenario

that Council will be able to provide support for all sectors of the economy,

society and community that it would like to. Given Council’s

financial positioning, there is simply not sufficient resources to provide such

support. As such, direction is sought as to the core principles that

Council wishes to apply to its 2020/21 Annual Plan.

67. The following options are not

mutually exclusive in the traditional sense of considering different

options. Council may choose a graduated response to any or all of

them. What is important is that the direction provided is of sufficient

clarity to be meaningfully applied to the further work that staff will

undertake over the next two months on the 2020/21 Annual Plan. To aid

this, it is suggested that a scale of ‘more / same / less’ than the

focus in the draft Annual Plan is applied by Council to each potential focus or

‘core principle’.

68. For each option, narrative is

provided together with example of what Council’s support may look like if

this principle was prioritised. This information is by necessity vague at

this stage. The feedback is intended to direct future thinking and

modelling and is not intended to be conclusive. As noted earlier in this

report, considerations and decision-making is likely to be iterative with these

principles revisited as more detail is available regarding implications for

activities.

Potential principle 1 – Provision of Council’s

essential services

69. From the initial stages of the

COVID-19 pandemic there has been a significant focus on continuing to provide

Council’s essential services. This was supported by central

government planning and pronouncements relating to the pandemic.

70. Council’s essential services

during the COVID-19 pandemic have been:

· Water supply

services and operations

· Wastewater

services and operations

· Stormwater (urgent

maintenance and flood management)

· Tauranga transport

operations centre (TTOC)

· Transportation

– urgent maintenance

· Customer call

centre

· Digital services

· Communications

· Animal services

· Property services

– contractor management, security and access

· Community

development

· Cemeteries

· Tree maintenance

(road corridor)

· Finance –

transactional services

· Human resources

– transactional services and health & safety support

71. It is assumed that this will

continue to be a focus for the 2020/21 Annual Plan. Confirmation of that

is sought through this report.

Potential principle 2 – Provision of Civil

Defence and Emergency Management capability and capacity

72. It is a requirement of the Civil

Defence Emergency Management Act 2002 that Council ‘must ensure that it

is able to function to the fullest possible extent, even though this may be at

a reduced level, during and after an emergency’ (sec 64(2)).

Retaining a strong CDEM capability and capacity is critical to being able to

discharge this responsibility. To that end, the Emergency Operations

Centre has been operational for the Alert Level 4 lockdown.

73. Again, it is assumed that CDEM

capability and capacity will continue to be a priority in planning for the

2020/21 Annual Plan. Confirmation of that is sought through this report.

Potential principle 3 – Council’s role in

promoting or protecting employment in the city

74. That New Zealand, and the world, is

headed for an economic recession

is by now considered a truism. On 14 April 2020, Treasury released

modelling which showed the best case to be a fall in GDP of 13% in the year to

31 March 2021.

75. Central government’s initial

response to the COVID-19 pandemic has been to attempt to protect jobs by

injecting billions of dollars into the economy to subsidise wages and provide

other support to allow people to remain in employment.

76. The question now is to what extent

should Council’s own COVID-19 recovery efforts be focused on protecting

or promoting employment in the city? Council’s current direct

funding of economic development activities is approximately $5m per

annum. Activities are delivered through contracts with Priority One, Tourism

Bay of Plenty, the Chamber of Commerce, and the four mainstreet

organisations. These activities are currently funded by a targeted rate

on non-residential properties.

77. If, as a core principle, Council

were to prioritise the protection and promotion of employment in its 2020/21

Annual Plan then it would also need to consider whether that principle should

apply to employment in general or whether specific targeted support should be

provided to certain sectors or types of employment. For example, through

its various stimulus package initiatives central government has shown a clear

priority for the protection of construction industry capacity and

capability. Other sectors to receive significant attention through the

COVID-19 pandemic (though not necessarily directed funding) include tourism,

the retail and service sector, and media.

78. Council’s response to the CIP

‘shovel-ready projects’ opportunity identified above included a

tranche of projects under the priority heading of ‘employing our

people’.

79. If an approach of targeted

protection of employment is preferred, then clear direction on such specifics

would enable staff to prepare level of service options that meet that direction

for future Council consideration.

80. Note that Council is working with

Priority One and the Chamber of Commerce to prepare a comprehensive economic

response to COVID-19 and that any level of service options will draw on that

work. A separate report on this work is included on this

agenda.

81. Direction is sought as to the

relative priority that protecting or promoting employment should have in

planning for Council’s 2020/21 Annual Plan.

Potential principle 4 – Council’s role in

protecting or promoting social wellbeing in the city

82. The COVID-19 pandemic is having, and

will continue to have, significant negative social outcomes for people within

the city. These encompass but are broader than the employment-related

concerns covered in the item above.

83. Social wellbeing in a post-COVID-19

world may be difficult to define at this early juncture. However, as a

guide, the five priority areas in Council’s draft 2018-21 Community

Wellbeing Strategic Plan are illustrative:

· Social equity

– ensuring Tauranga is a fair and just society where everyone has

access to enough resources (including housing) to participate in their

community

· Community pride

and belonging – celebrating identity, heritage and cultural diversity,

and feeling a sense of belonging and inclusion

· Healthy and active

communities –

supporting healthy living and physical activity, and having access to

health services

· Safe and resilient

communities – people are safe and feel safe in their homes,

neighbourhoods and public places

· Engagement and

partnership – collaboration with partners, including tangata whenua,

and engaging in two-way conversations with our communities so we can better

understand their needs.

84. There are a number of Council

activities that contribute in different ways to the outcomes identified

above. These include Community Development, Places and Spaces,

Communication and Engagement, Bay Venues Limited, Libraries, Baycourt, Historic

Village, Tauranga Art Gallery and others.

85. Council’s response to the CIP ‘shovel-ready

projects’ opportunity identified above included a tranche of projects

under both the ‘Creating Communities and Housing for All’ heading

and under the ‘Employing Our People’ heading.

86. Direction is sought as to the

relative priority that protecting or promoting social wellbeing should have in

planning for Council’s 2020/21 Annual Plan.

Potential

principle 5 – Council’s role in providing planning and

infrastructure for current and future residential and employment growth areas

(including intensification)

87. For several years pre-COVID, the key

issues facing the city and Council have been related to responding to growth

pressures. This involves both the planning for and delivery of core

infrastructure to growth areas.

88. The 2018/28 Long-Term Plan

identified four ‘biggest challenges’ for the city, two of which

talk directly to the management of growth and the other two of which have

strong links. The four challenges were listed as:

· Moving around the

city

· Resilience

· Increased

environmental standards

· Land supply and

urban form.

89. As noted above, central government

has a significant focus on economic stimulus as part of the COVID recovery

approach. This council’s responses to these stimulus opportunities

have been strongly focused on responding to growth pressures.

90. Council has been at the forefront of

promoting the ‘growth councils’ case to central government for

several years. That approach has continued and intensified through the

COVID-19 pandemic and the emerging response to it.

91. Council’s response to the CIP ‘shovel-ready

projects’ opportunity identified above included a tranche of projects

under the priority heading of ‘Creating Communities and Housing for

All’. In addition, the ‘Growth Councils Workstream’

opportunity being promoted by MHUD (and also identified above) is totally

focused on projects that respond to growth pressures.

92. As such, Council’s positioning

with central government is that responding to growth pressures is a key focus

for this city. It would be expected that a degree of consistency of

messaging would be applied through Council’s own 2020/21 Annual Plan.

93. Direction is sought as to the

relative priority that providing planning and infrastructure for current and

future residential and employment growth areas (including intensification) should

have in planning for Council’s 2020/21 Annual Plan.

Potential principle 6 – Council’s financial and

project positioning for post-COVID operations

94. As described earlier in this report,

Council’s financial position, particularly its ability to remain within

its defined debt-to-ratio limits while delivering necessary services and

infrastructure, is not strong.

95. In considering its response to

post-COVID-19 recovery activities, Council clearly needs to have a focus on its

own financial capacity. This applies both in the short-term of the

2020/21 Annual Plan but also with regard to Council’s positioning for the

medium-term of the 2021/31 Long-Term Plan.

96. Given the importance of retaining a

stable financial base, it is recommended that this principle continue to be a

focus when considering the final 2020/21 Annual Plan.

Other potential principles

97. The list of potential core

principles listed above is not intended to be exhaustive. If there are

other core principles that Council wishes to be prioritised in the planning for

the 2020/21 Annual Plan, then they should be noted in the resolutions.

Significance

98. The matter of the 2020/21 Annual

Plan and Council’s planning and budgeting response to the COVID-19

pandemic is significant. Engagement has already commenced on the draft

Annual Plan and, depending on decisions to be made over the next two months,

further engagement may be required.

99. The decisions recommended in this

report are high-level and preparatory to more detailed decision-making to occur

later in the Annual Plan process. Engagement on these early decisions is

not anticipated.

Next Steps

100. Decisions made on this report will be

incorporated into further papers to be considered prior to the adoption of the

final 2020/21 Annual Plan. Among these will be a consideration of

planning scenarios regarding disruption assumptions.

101. Levels of service papers relating to specific

activities will be prepared for Council’s consideration during May and

alongside submissions to the draft Annual Plan during the ‘Annual Plan

deliberations’ meeting.

Attachments

Nil

10.3 Dog

Registration Fee Report

File

Number: A11337885

Author: Sam

Fellows, Manager: Environmental Regulation

Authoriser: Barbara

Dempsey, General Manager: Regulatory & Compliance

Purpose of the Report

1. To set dog registration

fees for 2020/2021.

|

Recommendations

That the Council:

(a) Receives the report; and

(b) Resolves to maintain Dog

registration at $87.00 per dog and $130.00 for Dangerous Dogs

|

Executive Summary

2. Council is required to

annually set dog registration fees resolution as outline in the Dog Control Act

1996 (the “Act”), in particular section 37 as stated below:

(a) The dog control fees payable to a territorial authority shall

be those reasonable fees prescribed by resolution of that authority for the

registration and control of dogs under this Act.

3. In setting fees, Council

may also make provision for the establishment of a penalty fee for those dogs

that are registered after the 31 July of each year, if that dog should have

been registered by 1 July.

4. This penalty is applied

at the beginning of August and must not exceed 50% of the standard fee. Council

has previously set the penalty fee at 50% of the standard fee, this is normal

practice for the majority of Councils.

5. A large portion of the

Animal Services revenue is sourced from dog registration with the balance

coming from fines and a rates subsidy which recognises the “public

good” of the service. Currently 20% of Animal Services revenue comes from

rates allocation.

6. Several Councillors have

requested options for setting fees based on age.

7. Any decrease in fees for

one sector would require an increase from the remaining dog owners or the rates

contribution.

8. Any change to the fee

structure, as outlined below, could likely require a compete change to the way

we charge currently. Given the short time period before these fees need to be

finalised, we propose setting out these types of options in a future paper for

the 2021/2022 financial year, if Council wishes.

9. It is appreciated that

given the current situation an increase in fees is likely to be seen as out of

touch and although the 2021 budget is based off an increased registration fee,

we recommend fees stay the same and staff will endeavour to work to reduce

costs.

Background

10. There are currently 13973 dogs on

the Tauranga City dog register. On Average approximately 8% of the dogs

recorded in the “Dog Register” have not contributed toward dog

registration fees for the current year. This is comprised of

(a) Disability assist dogs.

(b) Service dogs, such as Police.

(c) Dogs which have transferred to

Tauranga after paying registration in another district.

(d) Unregistered dogs.

11. Apart from the categories of dog

mentioned above all owners pay the same registration fee except those who own dogs

classified as dangerous, who pay more.

Strategic / Statutory Context

12. As noted above, s37 of the Act

requires Council to set dog registration fees. Section 37(2) states that in

setting fees Council may set:

(a) Lower fees for neutered dogs;

(b) Lower fees for working dogs;

(c) Different fees for various

classes of working dogs;

(d) Fees for dogs under 12 months

of age;

(e) Lower fees for an owner that

displays a specified level of competency for dog ownership (Selected owner);

(f) A penalty fee for late

registration of a dog; and

(g) A fee for a replacement

registration tag.

13. The Act is structured in such a way

that it requires all dog owners to be good owners and makes penalty provisions

for various offences including those that will not or do not register or

control their dogs. Central government sets infringement fees for owners that

do not comply with legislation or the Bylaw.

14. As mentioned above, Council has

worked on the principals of the Act that all dog owners are “good”

owners and if not, there are infringements for various offences. The

current fees are as follows;

(a) All Dogs $87.00

(b) Dangerous Dogs $130.00

There are

no reduced fees to encourage neutering of dogs, age of dogs or selected owners.

OPTIONS

FOR LOWER FEES BASED ON AGE OF THE DOG OWNER

15. While the Act does not specifically

allow for fees set based on the age of the owner a small number of Councils do

offer reduced fees for those over 65.

16. They do this by classifying those

over 65 as responsible dog owners (referred to as selected owners in the

legislation), due to the low rate of issues from owners in this demographic,

under s37(e).

17. These Councils also have a separate

responsible owner discounted fee, which Tauranga currently does not have. This

allows them to have over 65-year olds as a separate category of these

responsible owners.

18. Factors regarding whether someone is

a responsible owner include:

(a) Registering their dog on or

before 1 July each year;

(b) Microchipping their dog;

(c) Being offence-free (for both

owner and dog);

(d) Having their property

inspected to approve fencing, sleeping quarters and exercise space;

(e) Keeping their address current

to allow for an inspection of new property; and

(f) Passing a responsible

owner test.

19. In our communities those over 65 are

not the only ones who have well behaved dogs and/or are on fixed income.

There would be other groups that could put forward similar arguments that they

should pay a lower fee than others. The fees are structured in a way that

treats owners equally except for those who have dogs classified as dangerous.

It uses infringement fees and penalty fees against owners who do not control

their animals or comply with the legislation.

20. Any introduction of an over 65

responsible owner discounted fee would not be in line with the intent of the

Act and would likely require an implementation of a general responsible owner

discount including the costs associated with administering such a programme.

21. Based on current figures at 1 July

2020 (start of new registration year) we estimate there will be:

(a) 2000 owners who are 65 years

of age or older and they will own 2258 dogs.

(b) This 16% of owners.

(c) 246 of these owners have more

than one dog.

22. For every $10 reduction in dog

registration for dogs owned by those over 65 year an equivalent increase in

contribution from rates would be required or alternatively an increase of

approximately $2.00 per dog for those owners under 65.

23. It is not recommended that Council

adopt a lower fee based on age demographics at this stage.

24. It is recommended that if Council

wishes to have a different fee structure, staff look at different fee

structures based on a number of factors that can include neutering of dogs, age

of dogs or selected owners.

Options Analysis

Option 1:

Retain Current Dog Registration Fees at $87.00 for 2020/2021

25. The current registration fee is

$87.00 together with a penalty fee of $130.00 (total fee) for dogs registered

after 31 July. Maintaining this fee will increase a budget deficit and may

require a review of the level of service provided by Animal Services.

|

Advantages

|

Disadvantages

|

|

Little impact on

voluntary compliance in paying registration.

Will increase

budget deficit.

|

Will impact on

ability to maintain the current level of service without further rates

contribution.

|

26. Key risks:

(a) If we retain the current dog

registration fees at $87.00, we will need to increase the rates contribution to

off-set the reduction in income or alternatively reduce the level of service

from Animal Services

Option 2: Increase the Standard Dog Registration Fees

by $5.00 to $92.00 per dog for 2020/2021.

27. To meet current budget requirements

an increase in dog registration of $5 per dog is required. This would increase

the standard registration fee to $92.00, together with a penalty fee of 50% of

the standard fee for registration payments received after 31 July 2020.

|

Advantages

|

Disadvantages

|

|

Increased income to maintain budget.

Maintain current level of service.

|

Increased price

may create small reduction in voluntary compliance

|

28. Key risks:

(a) Any increase in dog

registration fee may create a negative response from dog owners. This may lead

to a small increase in non-compliance but is not expected to be significant.

(b) Failure to increase dog

registration will create a deficit in operation budget for Animal Services

unless the rates contribution is increased to cover this or alternatively, we

would need to consider a reduction in the level of service from Animal

Services.

29. An increase in fee had originally

been thought to be the best option to ensure that there was no budget deficit,

however, given the post COVID19 environment it is recommended that the current

fee remain.

Financial Considerations

30. Below is a table of dog registration

revenue budget vs actual. As you can see up until the current year we have been

generally achieving or exceeding our revenue targets, but there is a big jump

in the current year budget due to the budgeted amount incorrectly including GST

in the Long Term Plan.

31. The budget should have been $1,097,988.70

for the 2020 year and $950,280.00 for the 2019 year. Staff have ensured

expenditure meets the GST exclusive level and internal submissions on the

annual plan will look to rectify this. This would have meant the 2019 budget

was exceeded and the 2020 budget likely to be slightly missed.

|

Dog Registration Revenue

|

|

|

Budget

|

Actual

|

|

2015

|

$692,181

|

$836,142

|

|

2016

|

$703,256

|

$893,346

|

|

2017

|

$873,540

|

$849,664

|

|

2018

|

$908,303

|

$931,124

|

|

2019

|

$1,092,822

|

$1,030,782

|

|

2020

|

$1,262,687

|

$1,050,000 (projected)

|

32. The 2021 budgeted dog registration

revenue is $1,224,344.

33. As noted above maintaining current

dog registration fees will require additional rates revenue or a reduction in

current services. Given the current situation staff will work to ensure the

revenue deficit is as small as possible while trying to maintain services to

our community.

COMPARISON of Other Council Fees (2019/2020 including GST)

|

|

Tauranga

|

Western Bay

|

Hamilton

|

|

Registration

Fee

|

$87

|

$88 ($70

De-sexed)

|

$165 ($95

responsible owner)

|

|

Late

|

$130

|

$132 ($105

De-sexed)

|

$247.00 ($142

responsible owner)

|

|

Dangerous Dog

|

$131

|

$132 ($105

De-sexed)

|

$247.50 ($142.50

responsible owner)

|

|

Late

Dangerous

|

$196.50

|

$198 ($157.50

De-sexed)

|

$370.50 ($213

responsible owner)

|

Legal Implications / Risks

34. Risk of legal challenge if over 65

receive a responsible owner discount and there is not one for other owners.

Significance

35. Under the TCC

Significance and Engagement Policy the decision

to consider dog registration fees is of medium significance.

Attachments

Nil

10.4 New

Bus Shelter Sites Update

File Number: A11351894

Author: Philippa Browne, Traffic Safety & Planning Specialist

Authoriser: Nic Johansson, General Manager: Infrastructure

Purpose of the

Report

1. To

provide Council with a further update on the provision of new bus shelters across

the city.

|

Recommendations

That the Council:

(i) Receives

the report updating on progress of bus shelter installation and acknowledges

that installation will continue where no formal objections have been

received.

(ii) Approves

to proceed with arrangements for a public hearing to consider formal

objections to the installation of bus shelters, at an appropriate time with

regard to alert levels and Covid-19 restrictions.

|

Executive Summary

2. Public

transport, including appropriate infrastructure, better enables the young, old

and those with impaired mobility or for whom driving isn’t an option, to

use the public transport system.

3. Council

currently has 185 bus shelters installed across the city. Staff have

identified a number of new bus shelter locations which are identified in the

attachment to this report.

4. In

accordance with the Local Government Act 1974, Section 339, Council must

consult with the adjacent landowner and seek their consent to erect any

shelter. Council shall not proceed with the erection of a shelter until

after the expiration of the time

for objecting against the proposal or, in the event of an objection, until

after the objection has been determined. Council may either dismiss the

objection or decide not to proceed with the proposal to erect a bus shelter.

Background

5. Improving

the public transport experience for users of all ages requires creating

comfortable and safe public transport infrastructure, which includes the

provision of bus shelters.

6. Following

a report to Council on 10 December 2019 staff have contacted a number of

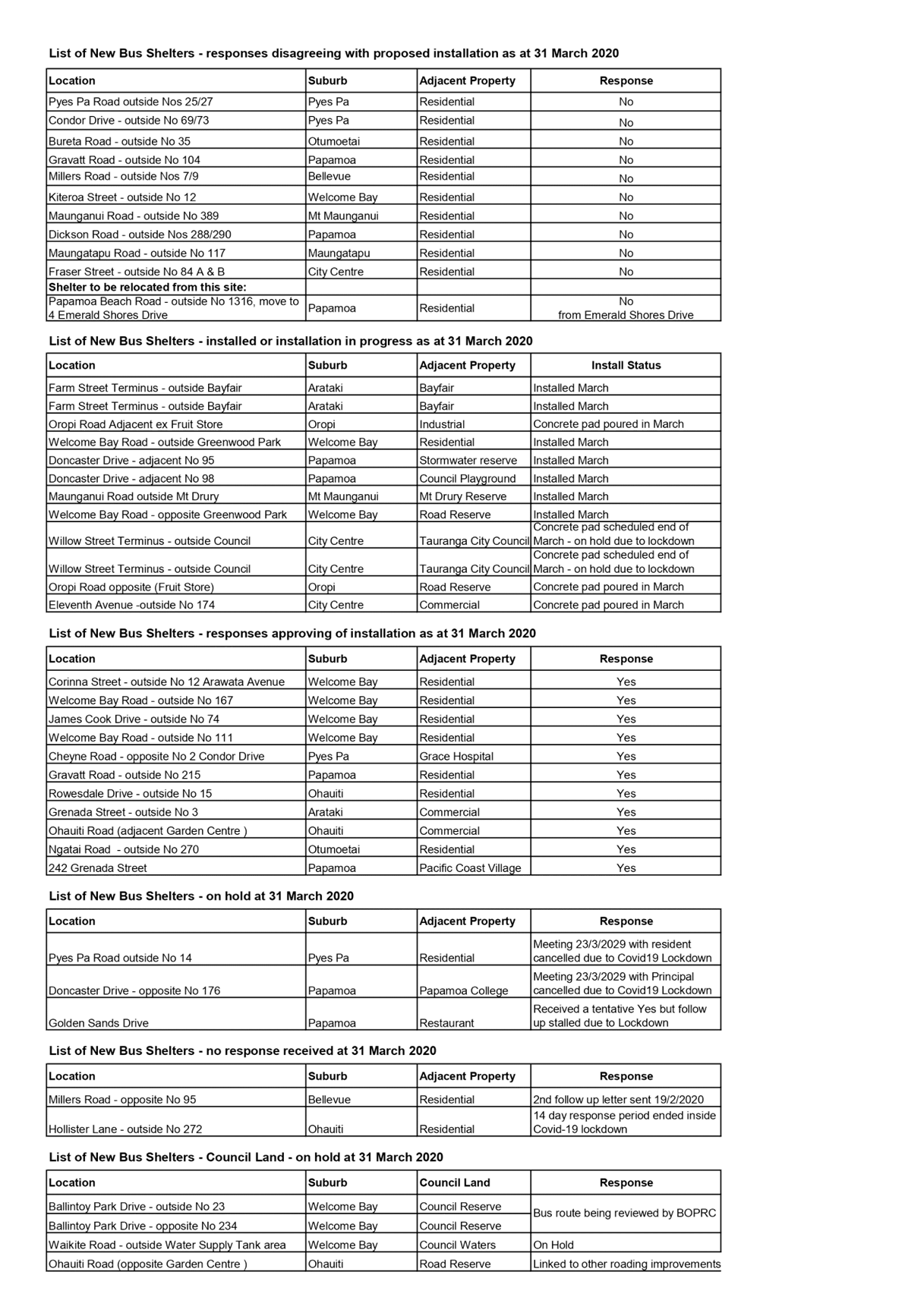

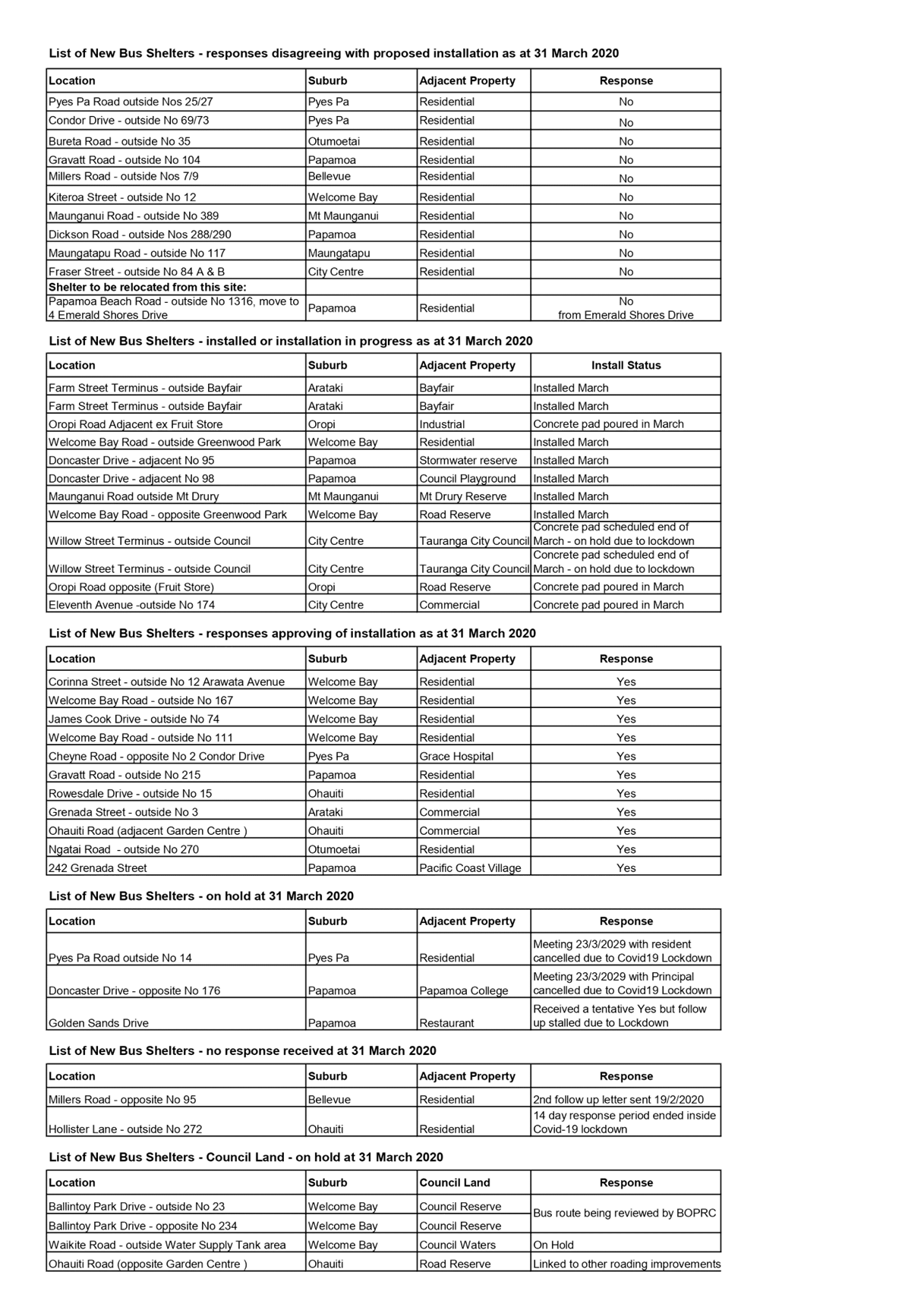

property owners setting out council’s intention to install bus shelters

adjacent to their properties. The response rate has been reasonable, with

a modest level of opposition from property owners (refer Attachment 1).

7. Since

the meeting on 10 December 2019, seven bus shelters were successfully

installed, and a further five are in progress but have been delayed, due to the

Covid-19 lockdown.

Financial Considerations

8. Council

has provided funding to deliver a number of new bus shelters per annum. These

are being delivered as part of various capital projects-- including:

· LIPS

2311 Bus shelter installation

· LIPS 2793 Upgrade bus infrastructure at public transport locations

· LIPS 2798 Peak hour traffic management and public transport priority

· LIPS 3528 Improved facilities for PT

Blueprint.

Consultation / Engagement

9. Installation

of bus shelters needs to balance the rights of individual property owners, who

have opposed the installation of bus shelters, with the greater good for the

wider community, specifically those who use the bus network.

10. The Local

Government Act 1974 states that where any person objects to the proposal in

accordance with Section 339 subsection (3), the council shall appoint a day for

considering the objection and shall give notice to the objector of the time

when and place where the objection is to be heard. Any such time shall be not

earlier than seven days after the date on which the notice of objection was

received at the office of the council.

11. We have attempted

to consult with all impacted property owners with regard to the provision of

bus shelters adjacent to their properties. The responses we have received

are detailed in Attachment 1. For those who have not responded a second

time, we have followed up with either a telephone call or a personal visit.

12. Owing to the

current situation around Covid-19 restrictions and alert levels, we will

organise for a public hearing to take place as soon as alert levels

allow.

Significance

13. Under the TCC Significance and Engagement Policy the decision with regard to provision of bus shelters is of low

significance as the impact on the wider community is considered minor.

Next Steps

14. We will continue

with installations at locations where bus shelters are supported, as per the

attached schedule.

15. We will arrange a

public hearing as soon as practicable to deal with the sites where formal

objections have been received and inform those residents of the date and time

of the hearing.

Attachments

1. New bus shelters - responses and

status as at 31 March 2020 - A11392201 ⇩

|

Ordinary Council

Meeting Agenda

|

21 April 2020

|

10.5 CCO

Half Yearly Reports, Draft Statements of Intent and Increase to BVL's Two Way

Loan Agreement

File

Number: A11362221

Author: Anne

Blakeway, Manager: CCO Relationships and Governance

Authoriser: Gareth

Wallis, General Manager: Community Services

Purpose of the Report

1. This

cover report brings together the executive summaries of three separate reports

(attached), and the resolutions required of Council, in relation to the

reporting and monitoring of its council controlled organisations (CCOs).

|

Recommendations

That the Council:

(a) Receives

the CCO half yearly reports, draft statements of intent and increase to

BVL’s two-way loan agreement cover report, noting that further

information is provided in the attached reports.

(b) Receives the half yearly

reports to 31 December 2019 report (Attachment 1):

(i) Receives

Bay Venues Limited’s report on its performance for the six months to 31

December 2019 as required by the 2019-2020 Statement of Intent.

(ii) Receives

Bay of Plenty Local Authority Shared Services Limited’s report on its

performance for the six months to 31 December 2019 as required by the

2019-2020 Statement of Intent.

(iii) Receives

Tauranga Art Gallery Trust’s report on its performance for the six

months to 31 December 2019 as required by the 2019-2020 Statement of Intent.

(iv) Receives

Tourism Bay of Plenty’s report on its performance for the six months to

31 December 2019 as required by the 2019-2020 Statement of Intent.

(v) Receives the Local

Government Funding Agency’s report on its performance for the six

months to 31 December 2019 as required by the 2019-2020 Statement of Intent.

(c) Receives the CCO Draft

Statements of Intent 2020/21 to 2022/23 report (Attachment 2):

(i) Receives

the draft Statements of Intent (SOIs) for Tauranga City Council’s CCOs;

Bay of Plenty Local Authority Shared Services Limited, Bay Venues Limited,

Tauranga Art Gallery Trust, Tourism Bay of Plenty, and the Local Government

Funding Agency for 2020/21 to 2022/23.

(ii) Approves

the shareholder comments on those draft SOIs, while expecting that it will be

necessary for the CCOs to revise their SOIs and financial and non-financial

targets prior to 30 June 2020, in response to the COVID-19 pandemic.

(iii) Notes that as joint shareholder

of TBOP, Western Bay of Plenty District Council (WBOPDC) will be asked at

their next Council meeting to approve the shareholder comments on the draft

Statement of Intent for TBOP.

(d) Approves an increase to

the Intra-Group Two-Way Loan Agreement between Tauranga City Council and Bay

Venues Limited, from $20.1 million to $25 million (Attachment 3):

(i) Noting that this is

subject to Bay Venues Limited continuing to work with council staff in

monitoring their cashflow position.

(ii) Delegates to Tauranga City