Terms of reference – Finance,

Audit & Risk Committee

Common responsibilities and delegations

The following common responsibilities and delegations apply

to all standing committees.

Responsibilities of standing committees

·

Establish priorities and guidance on programmes

relevant to the Role and Scope of the committee.

·

Provide guidance to staff on the development of

investment options to inform the Long Term Plan and Annual Plans.

·

Report to Council on matters of strategic

importance.

·

Recommend to Council investment priorities and

lead Council considerations of relevant strategic and high significance

decisions.

·

Provide guidance to staff on levels of service

relevant to the role and scope of the committee.

·

Establish and participate in relevant task

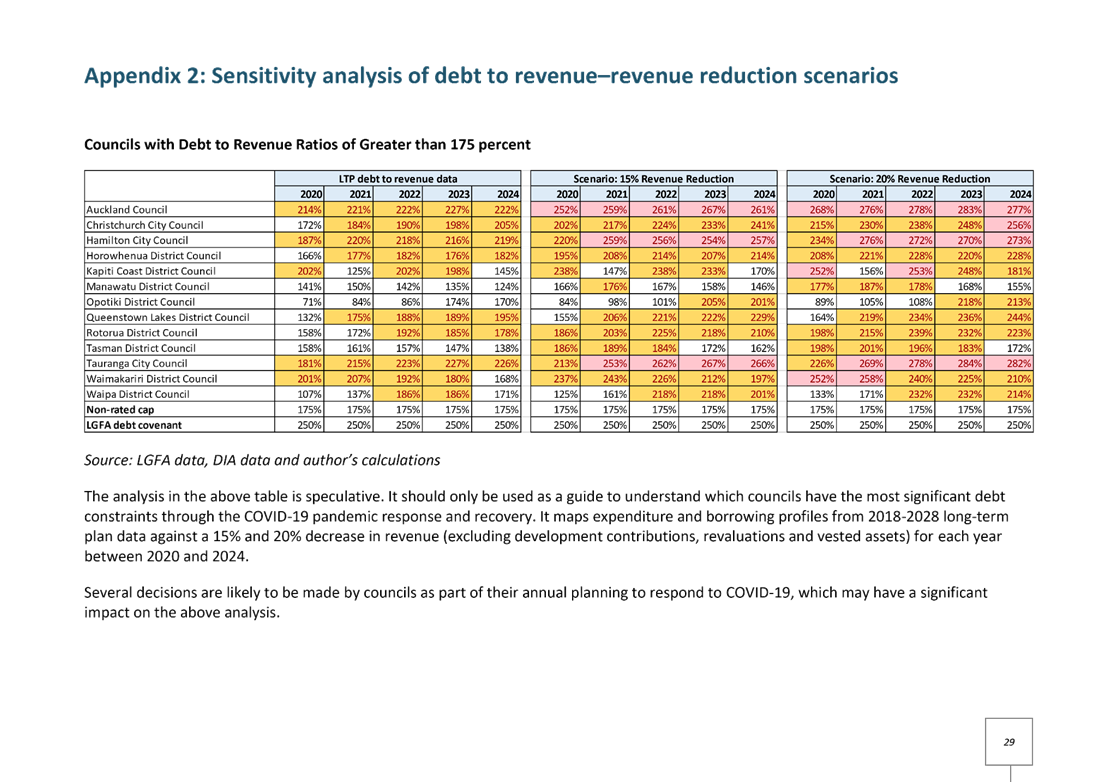

forces and working groups.

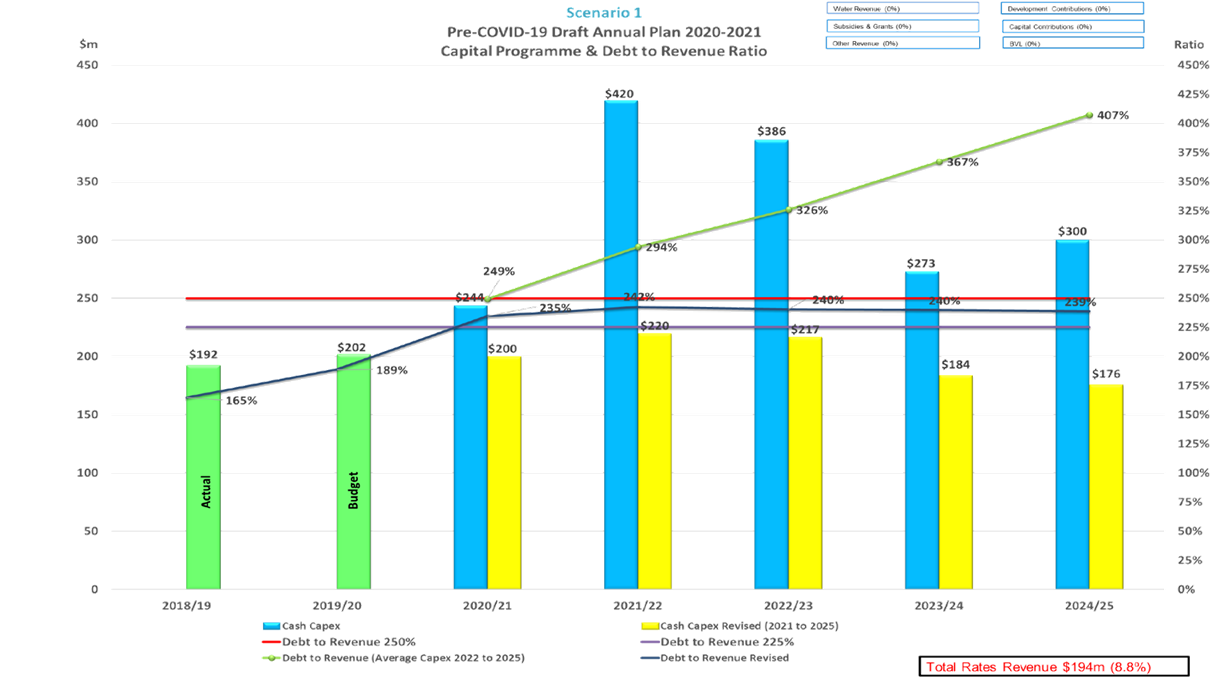

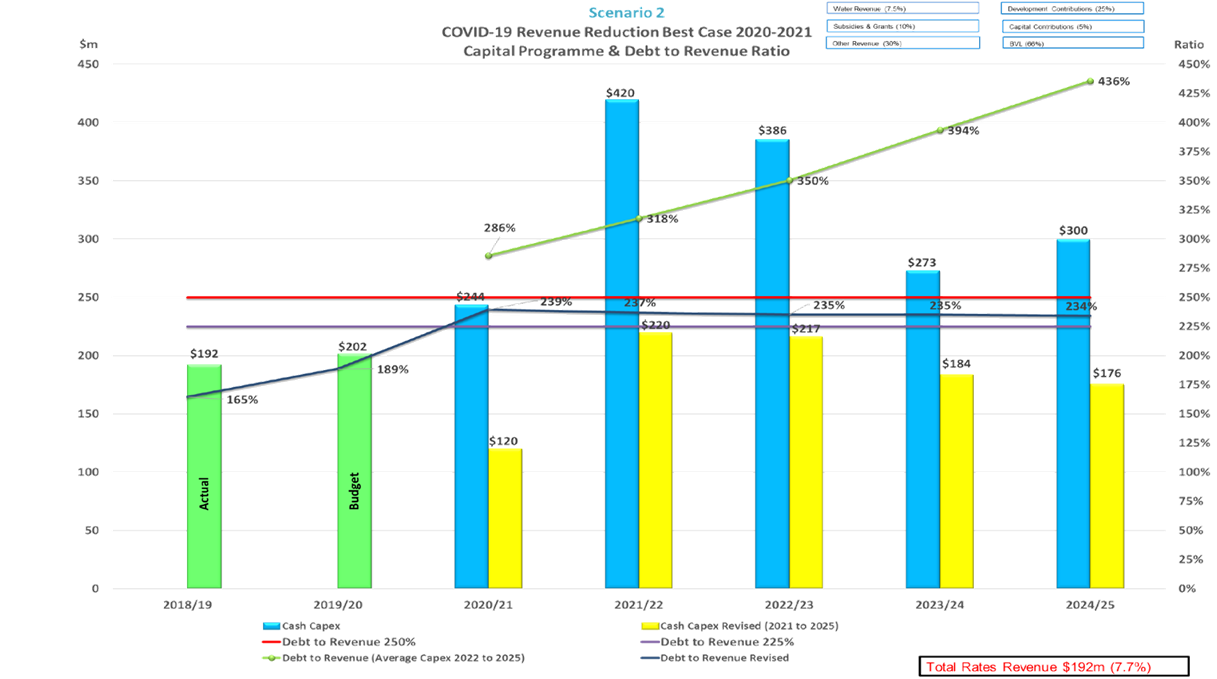

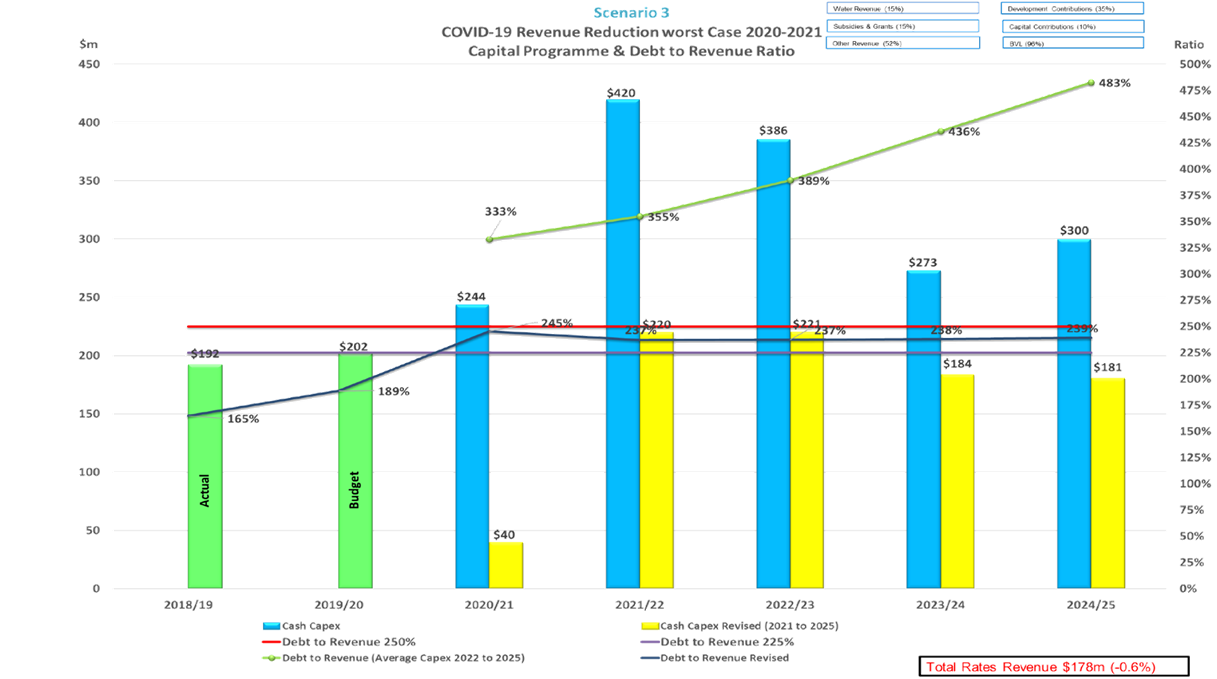

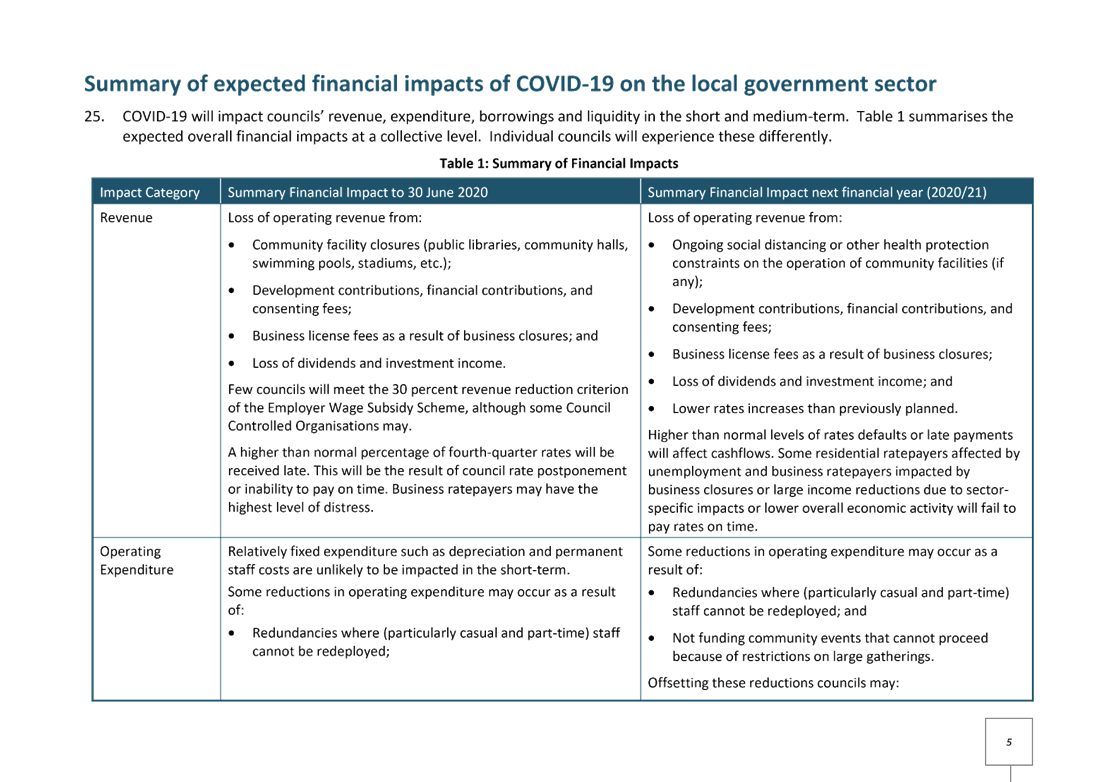

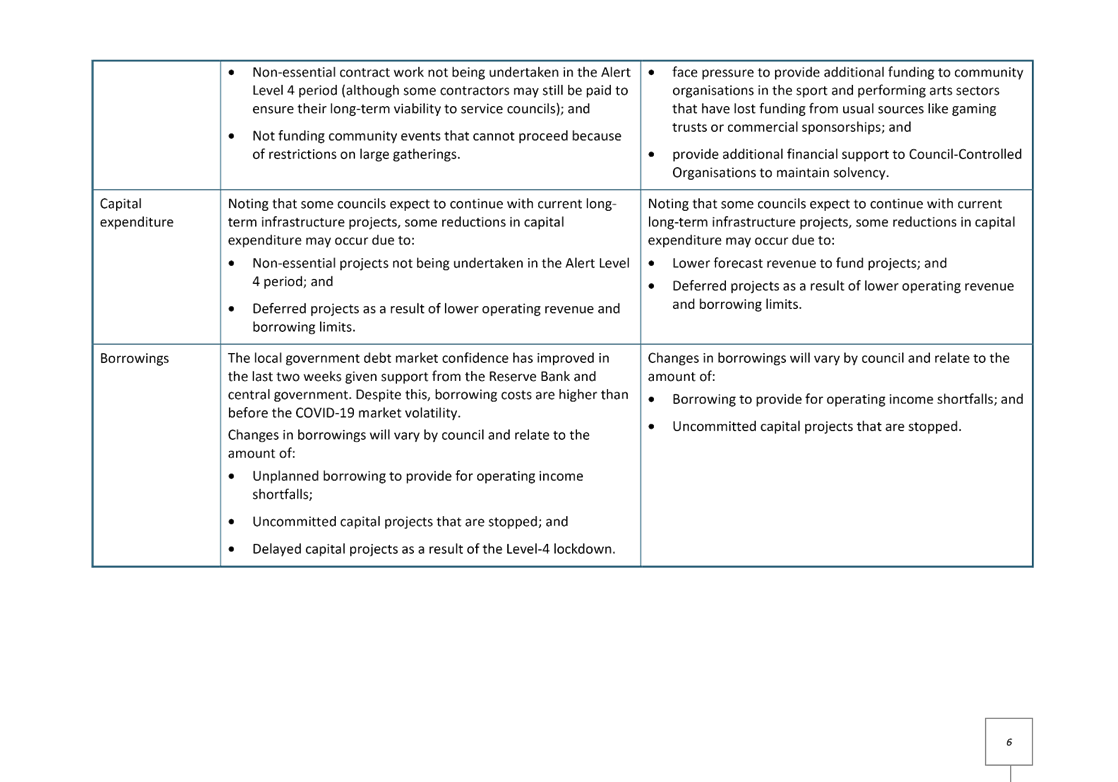

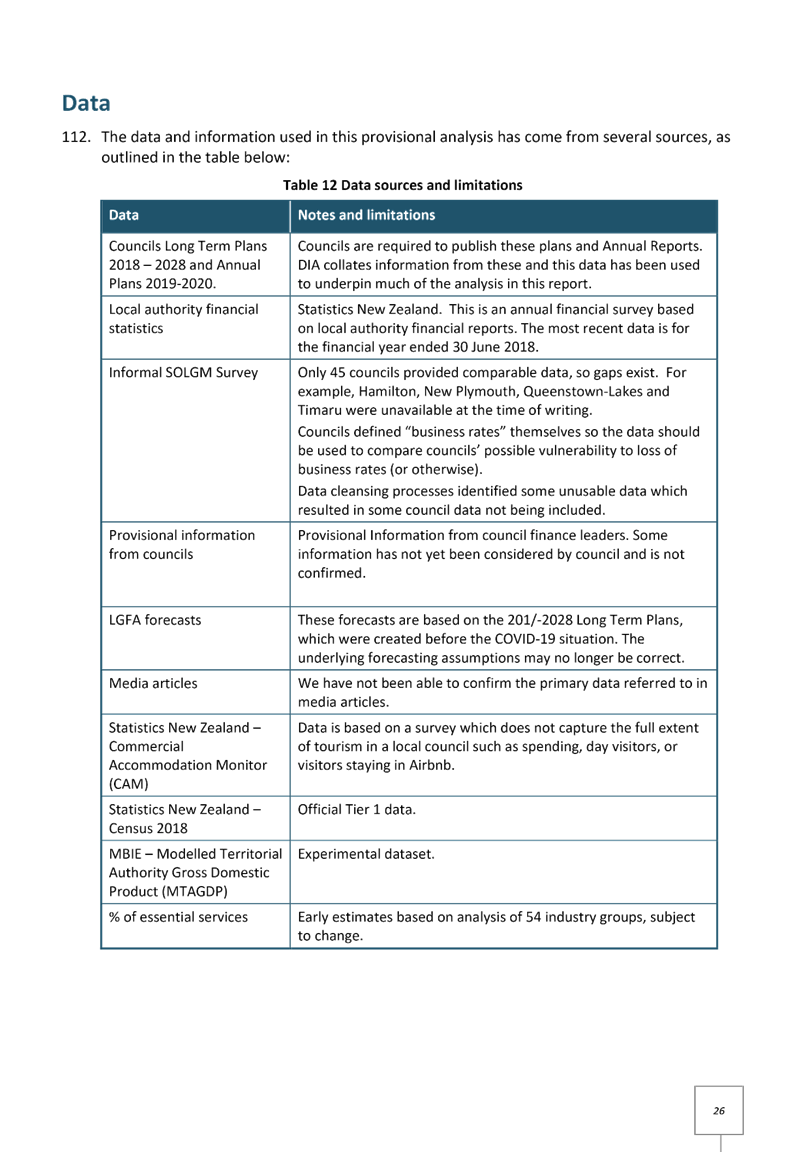

·

Engage in dialogue with strategic partners, such

as Smart Growth partners, to ensure alignment of objectives and implementation

of agreed actions.

- Confirmation of committee minutes.

Delegations to standing committees

·

To make recommendations to Council outside of the

delegated responsibility as agreed by Council relevant to the role and scope of

the Committee.

·

To make all decisions necessary to fulfil the

role and scope of the Committee subject to the delegations/limitations imposed.

·

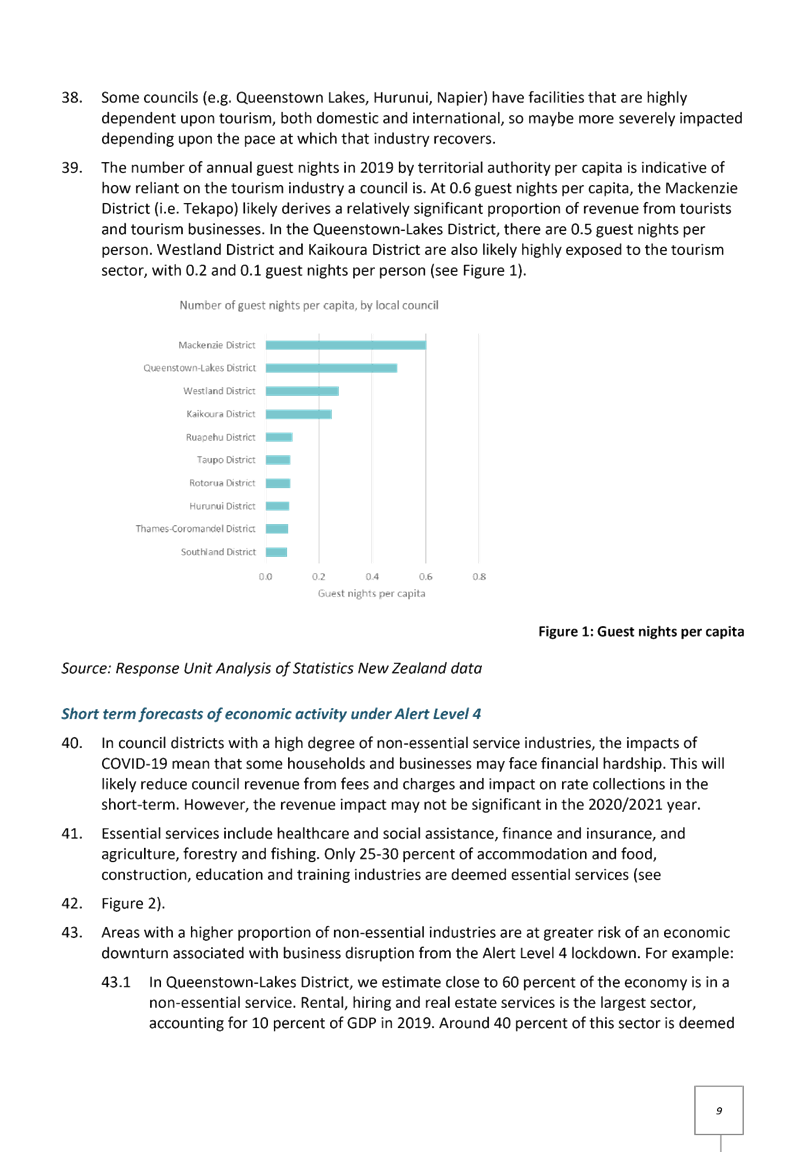

To develop and consider, receive submissions on

and adopt strategies, policies and plans relevant to the role and scope of the

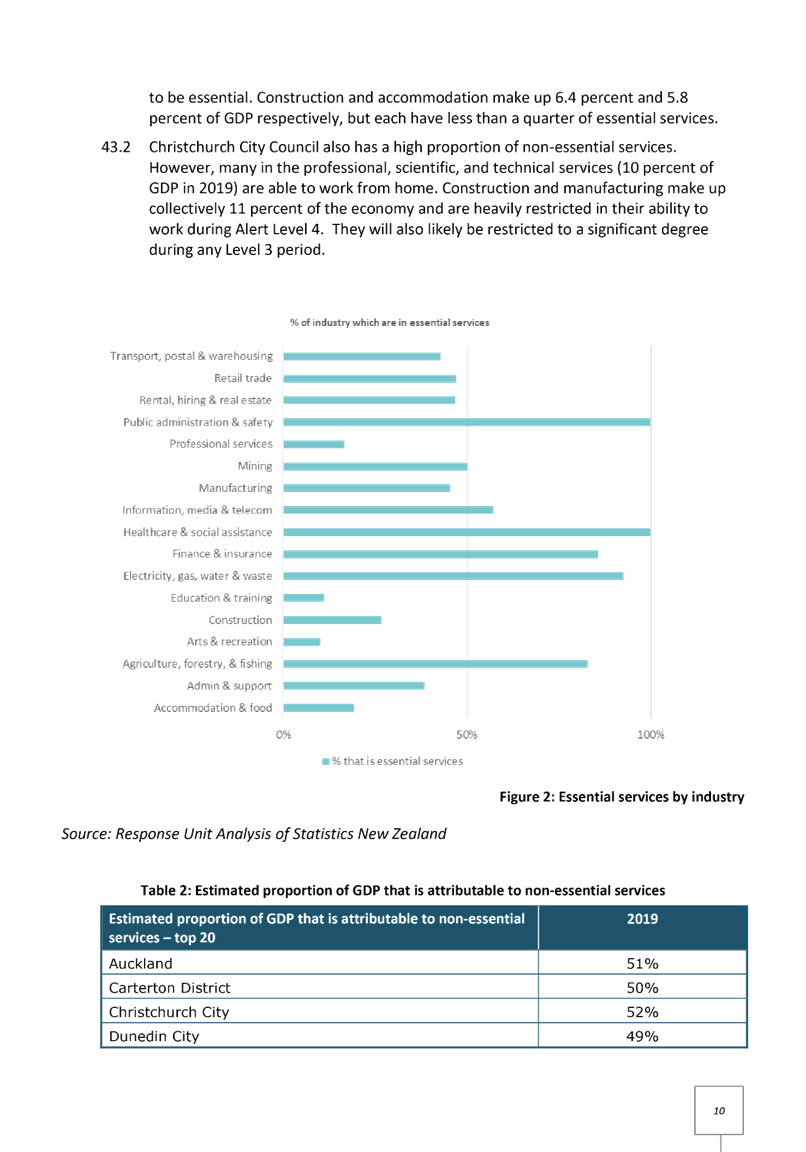

committee, except where these may only be legally adopted by Council.

·

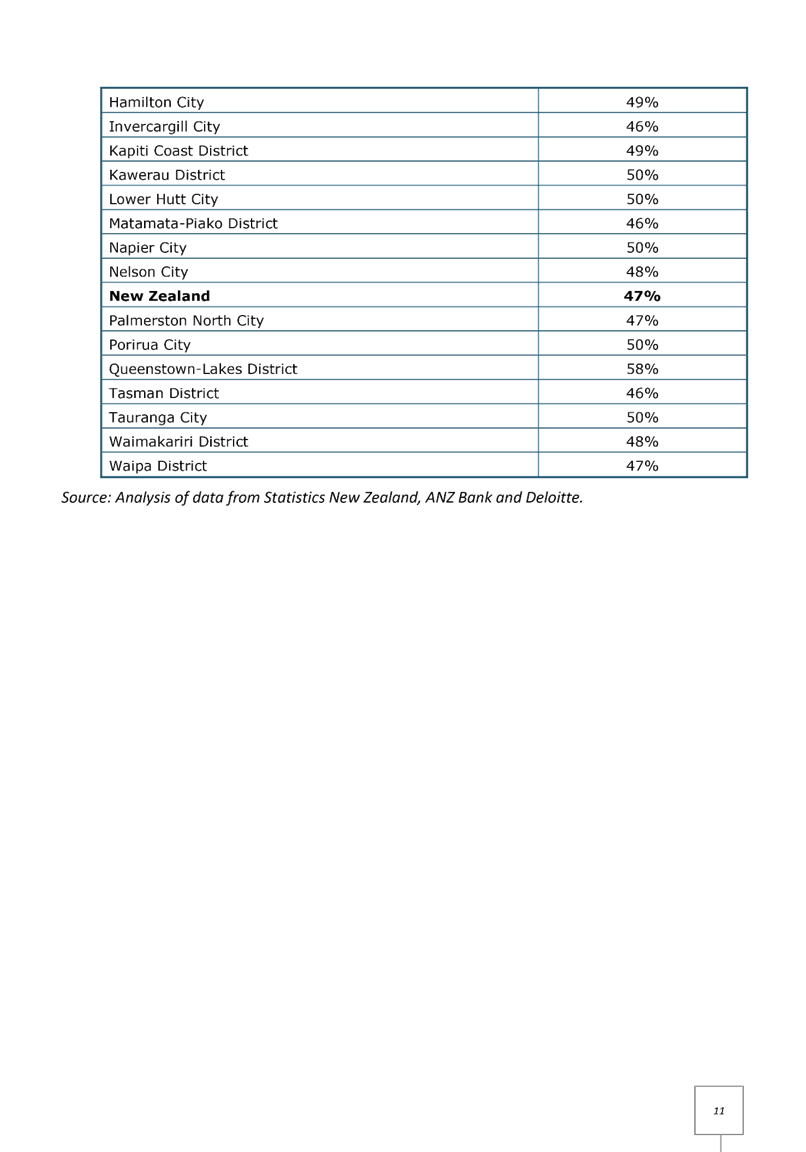

To consider, consult on, hear and make

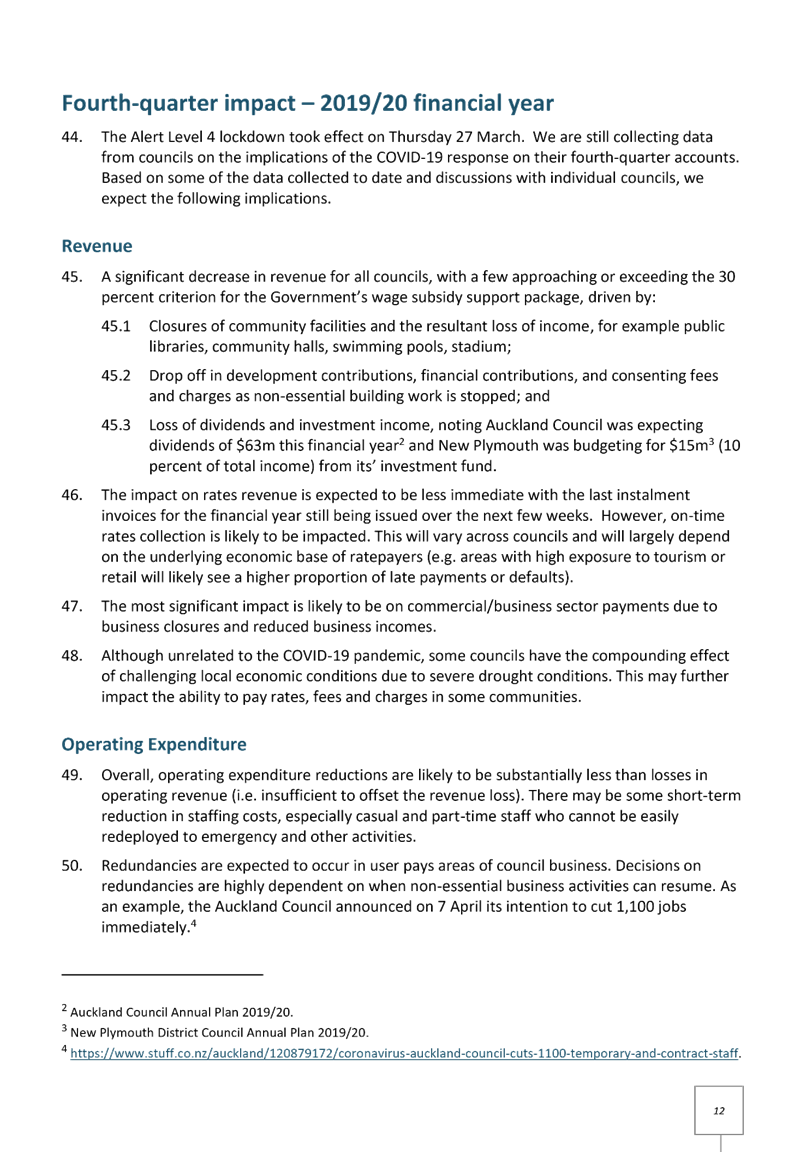

determinations on relevant strategies, policies and bylaws (including adoption

of drafts), making recommendations to Council on adoption, rescinding and

modification, where these must be legally adopted by Council,

·

To approve relevant submissions to central

government, its agencies and other bodies beyond any specific delegation to any

particular committee.

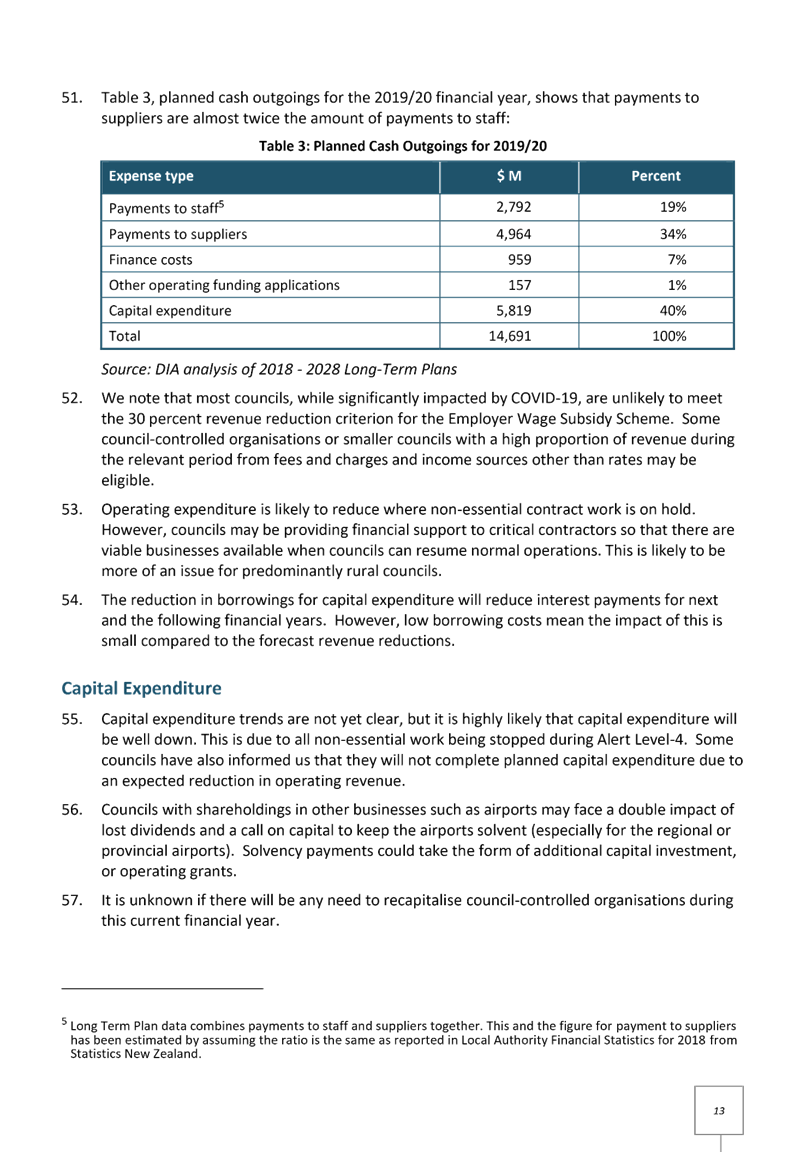

·

To appoint a non-voting Tangata Whenua

representative to the Committee.

·

Engage external parties as required.

Finance,

Audit & Risk Committee

Membership

|

Chairperson

|

Mr Bruce

Robertson

|

|

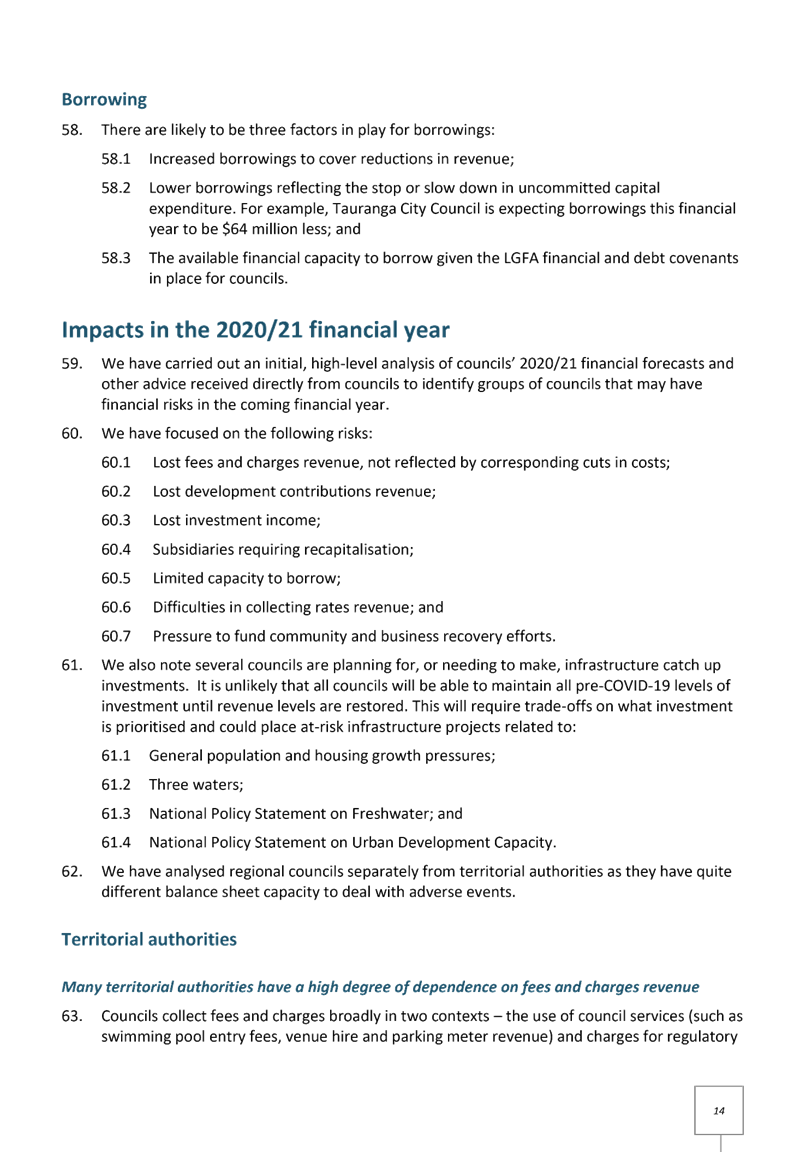

Deputy

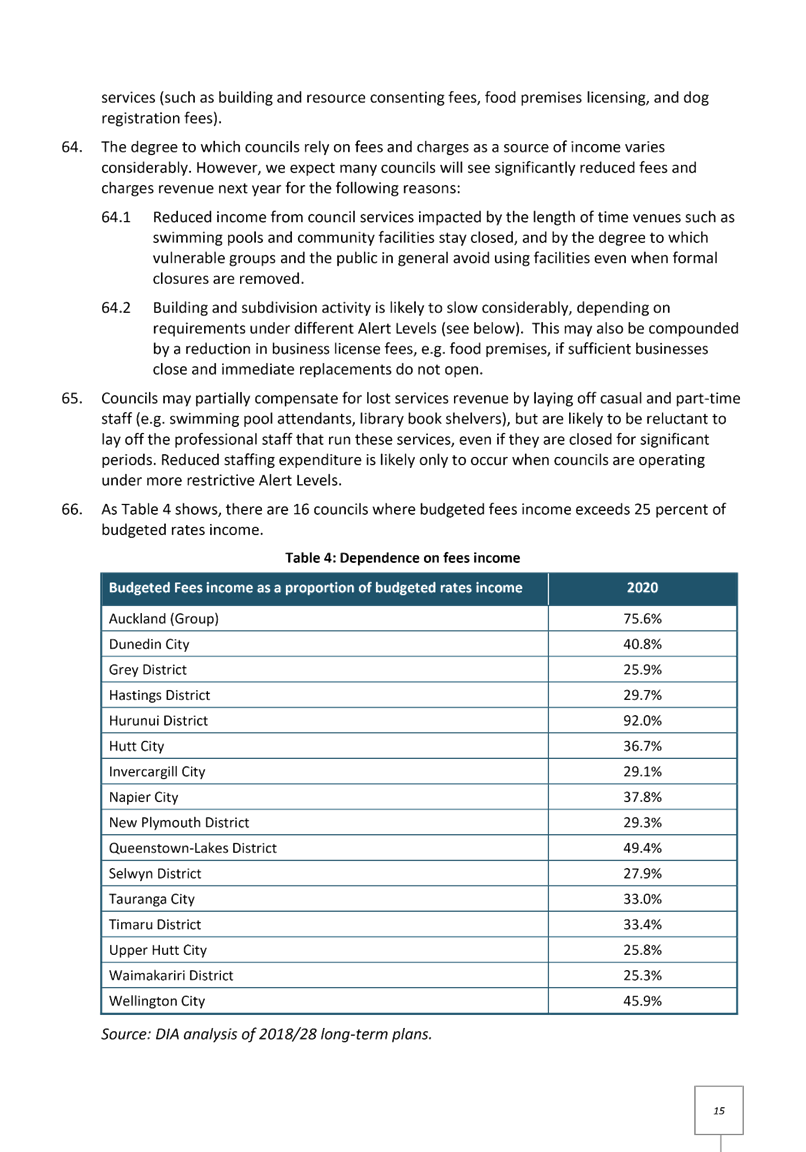

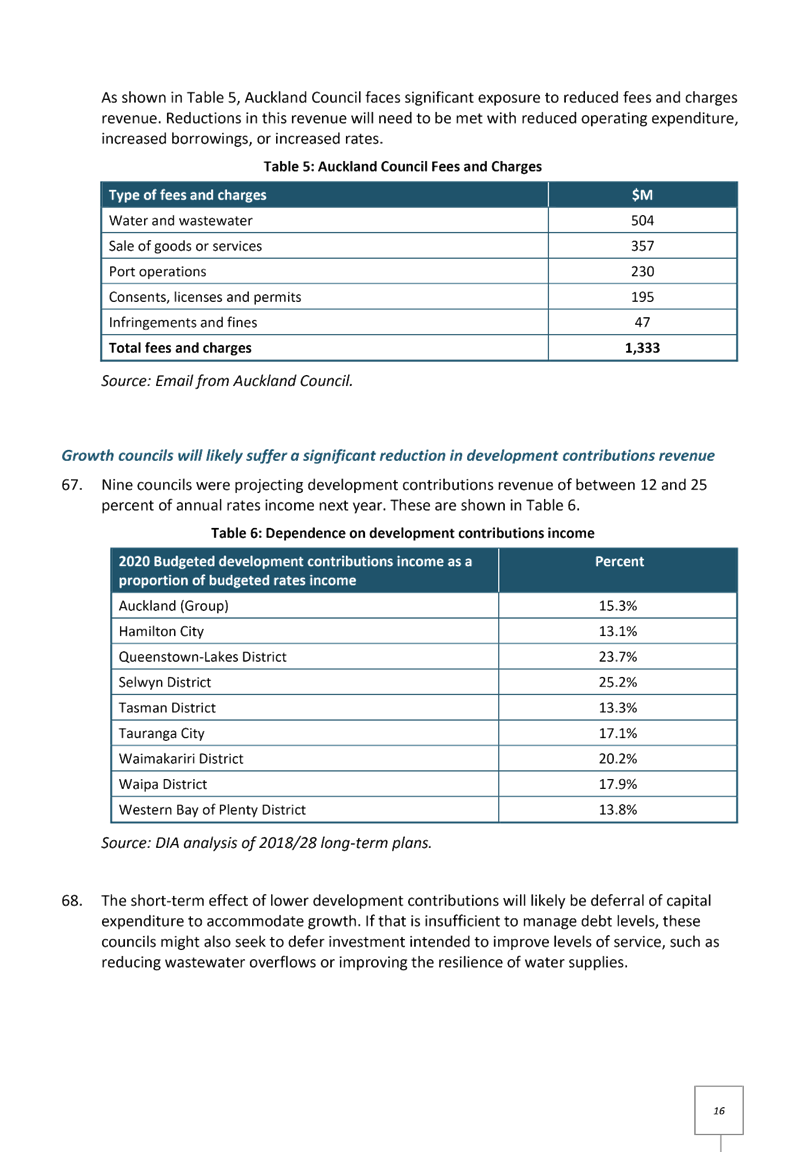

chairperson

|

Cr Tina

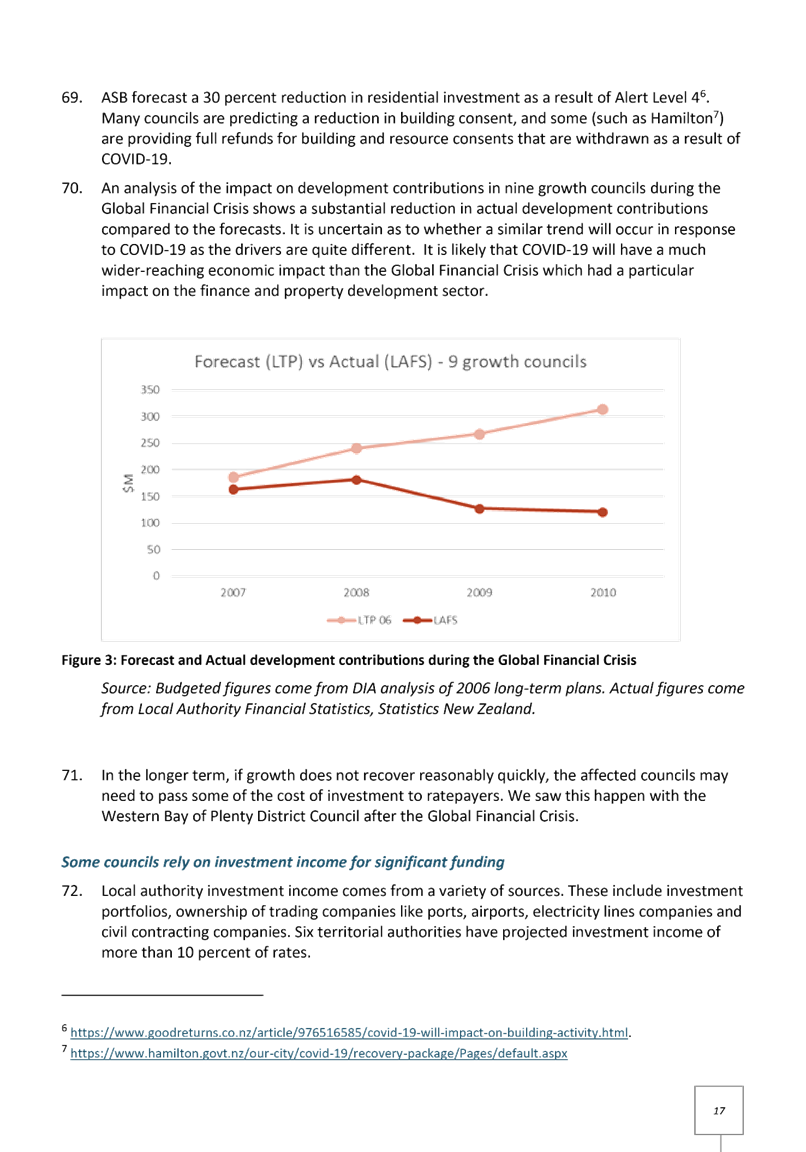

Salisbury

|

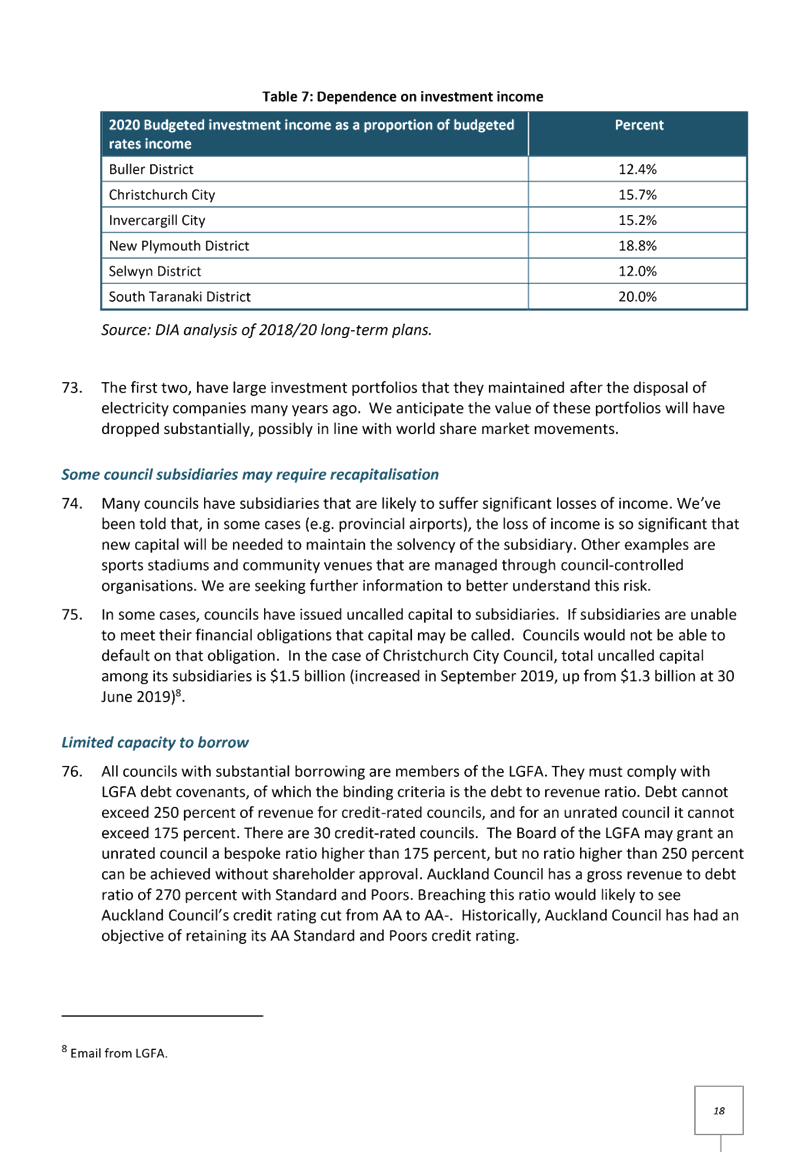

|

Members

|

Cr Jako

Abrie

Cr Larry

Baldock

Cr Kelvin

Clout

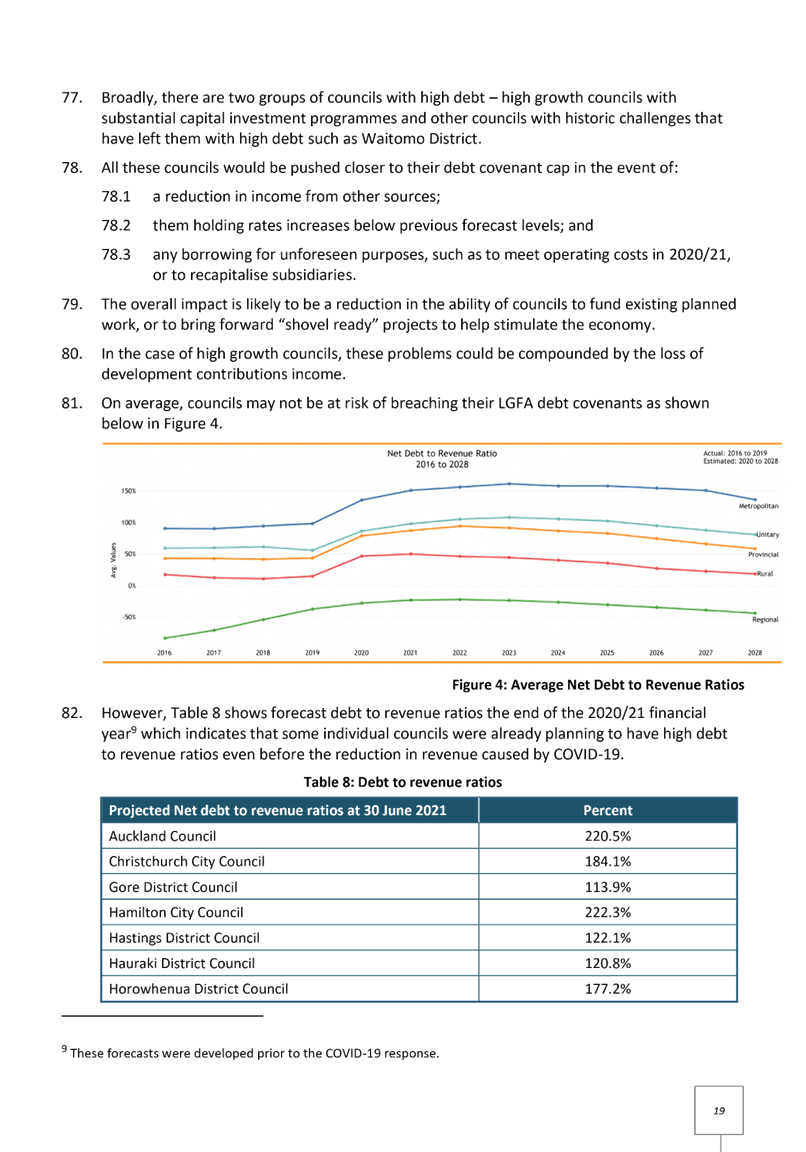

Cr Bill

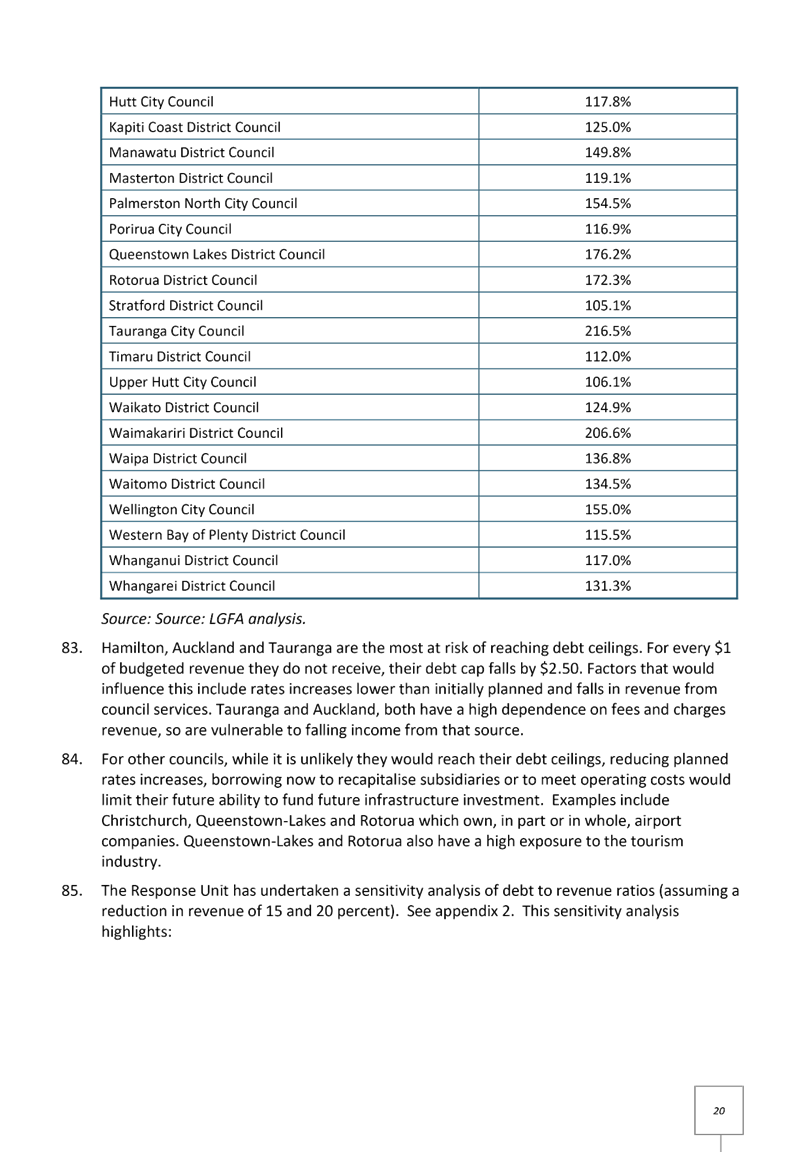

Grainger

Cr Andrew

Hollis

Cr Heidi

Hughes

Cr Dawn

Kiddie

Cr Steve

Morris

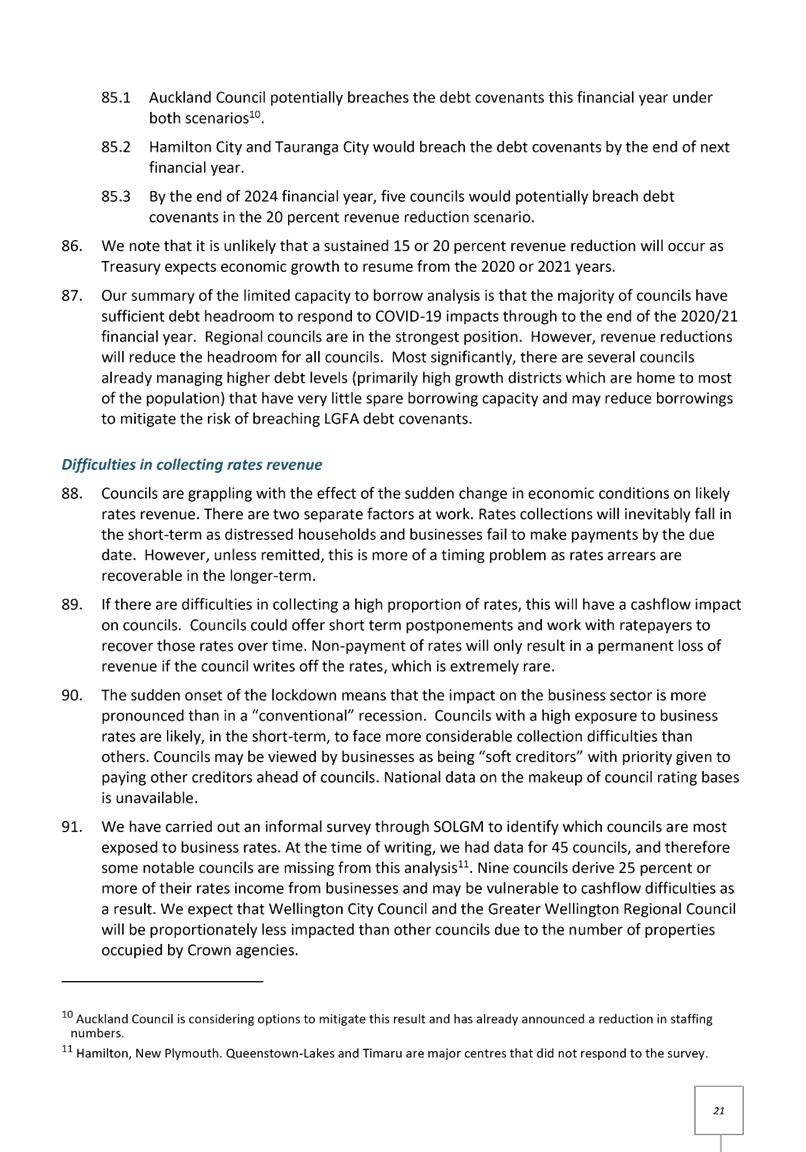

|

|

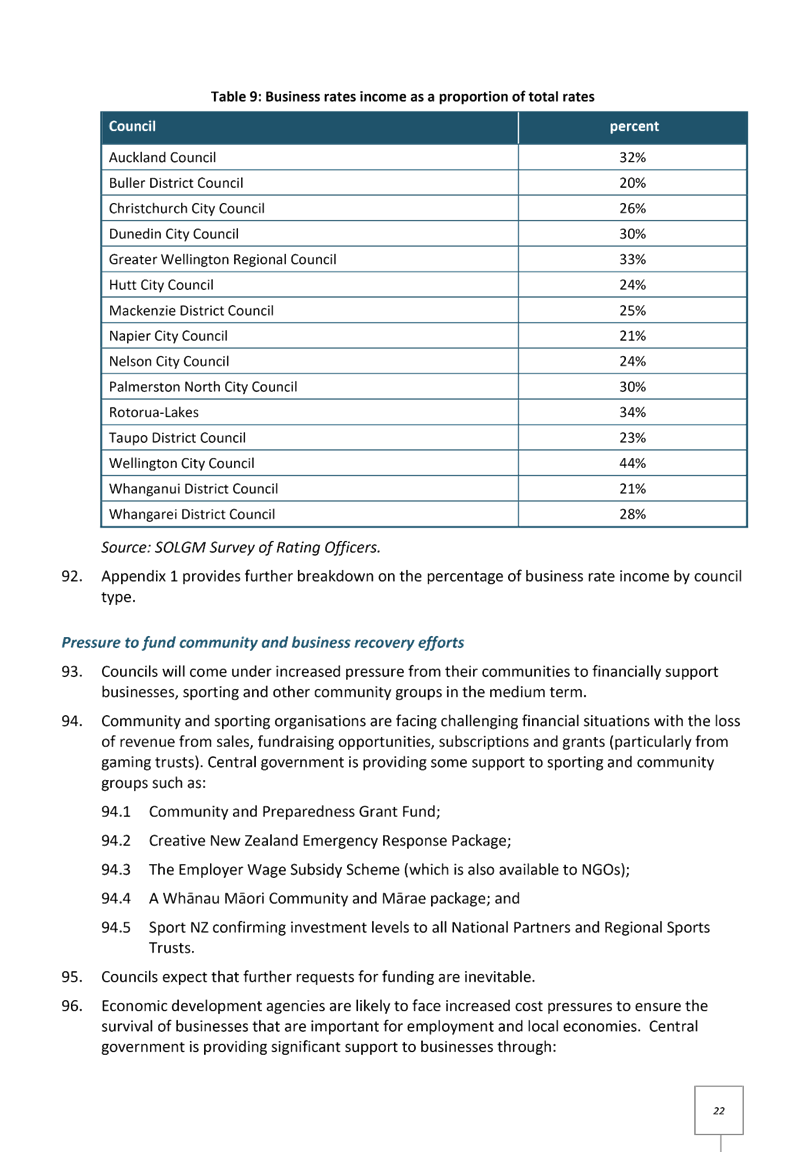

Non-voting

members

|

Tangata

Whenua representative (TBC)

A maximum

of two external appointments may be made by Council on recommendation from

the Committee

|

|

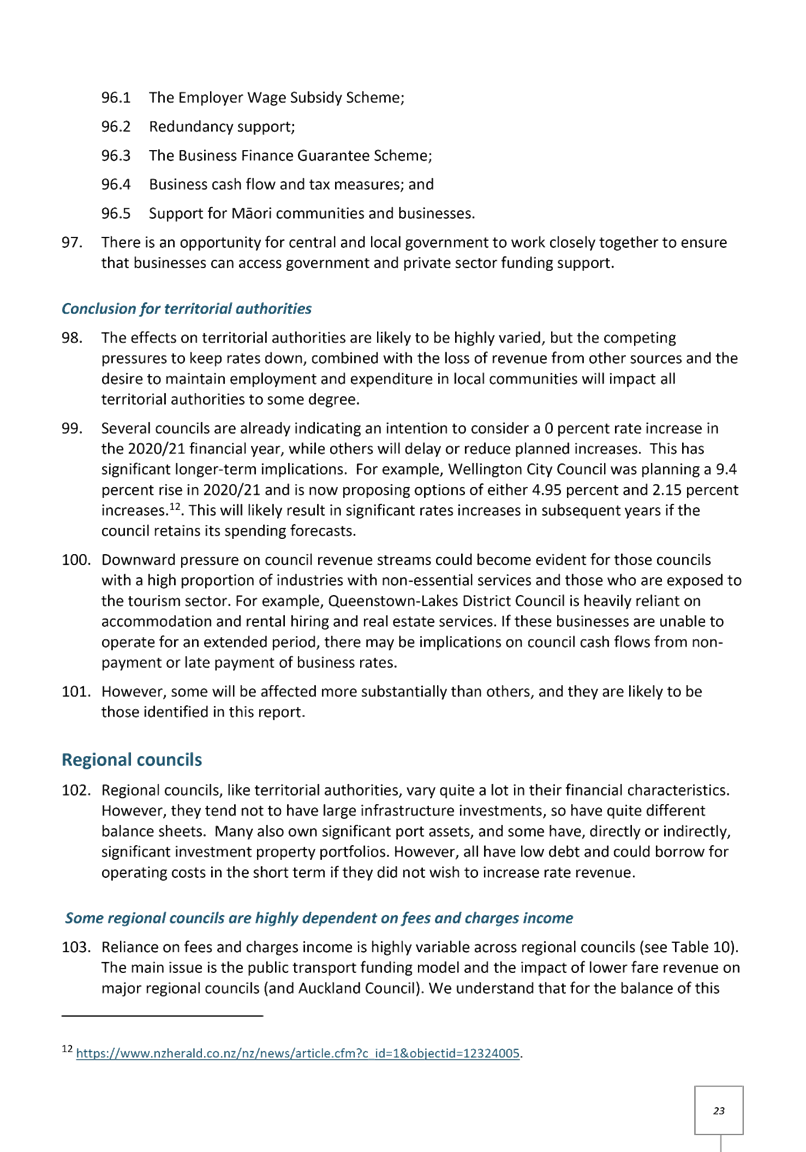

Quorum

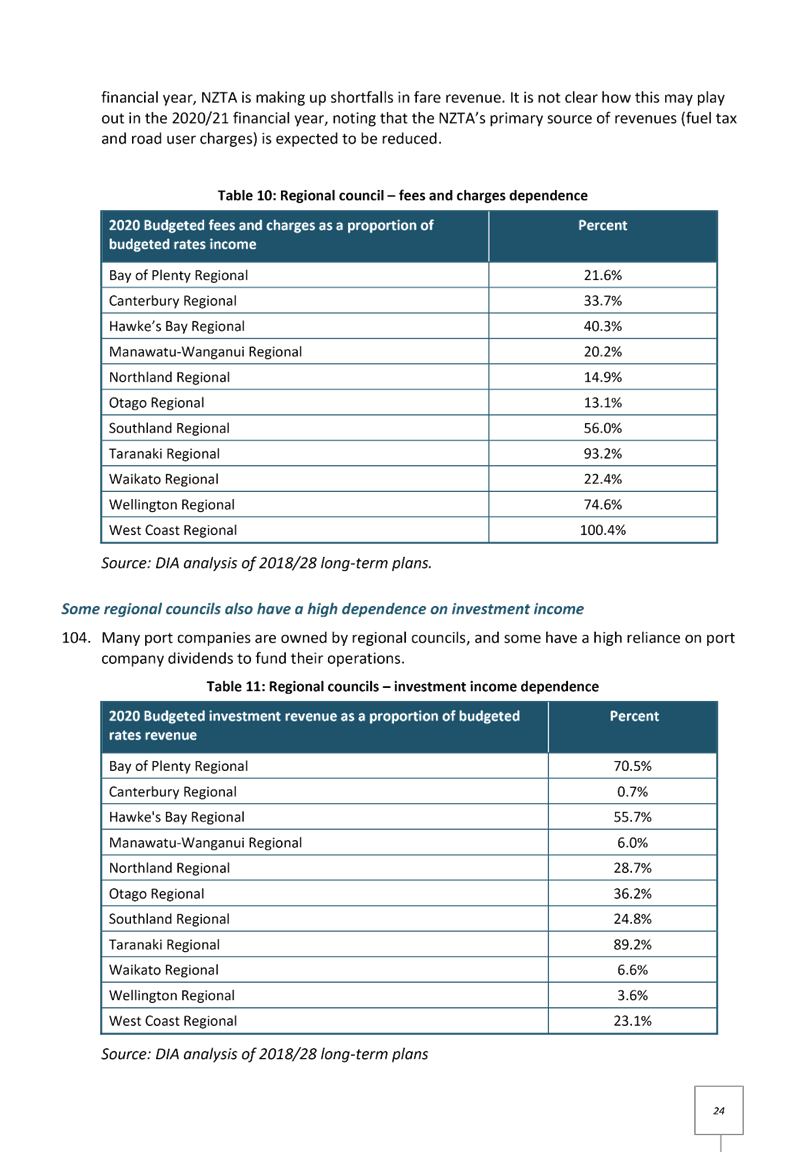

|

Half

of the members physically present, where the number of members (including

vacancies) is even; and a majority of the members physically

present, where the number of members (including vacancies) is odd.

|

|

Meeting

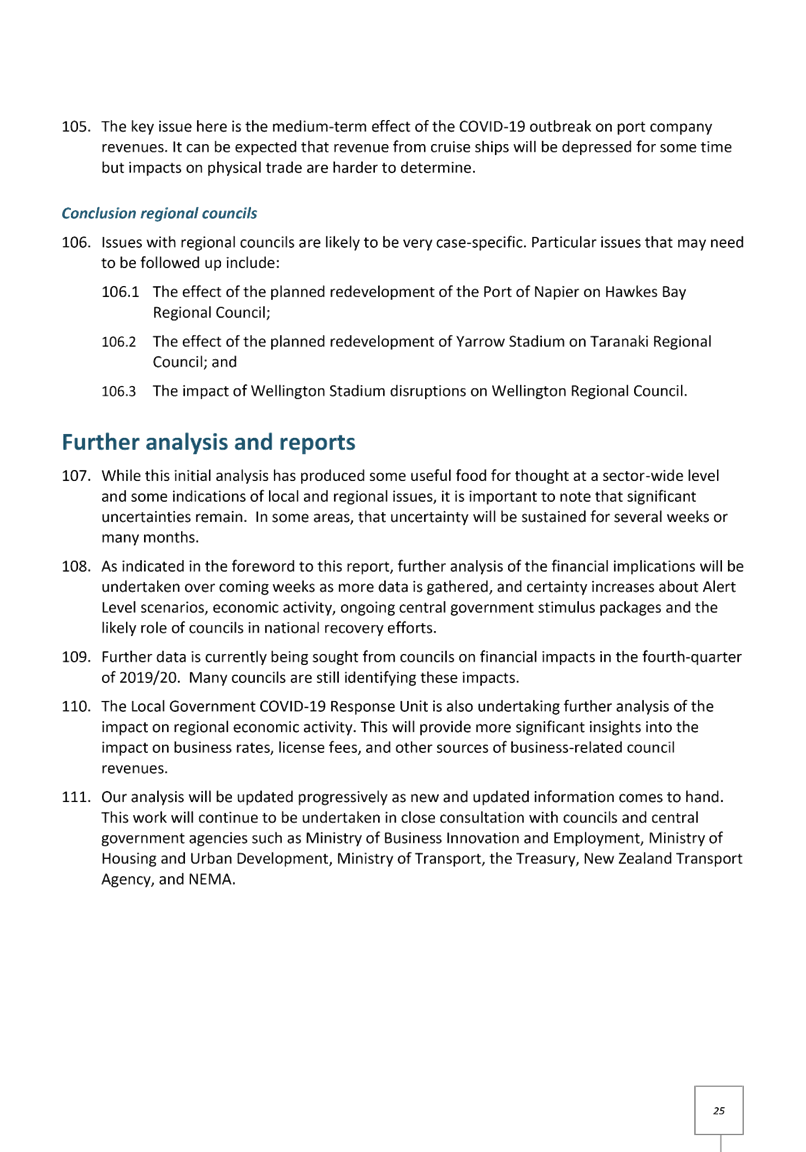

frequency

|

Six weekly

|

Role

·

To ensure that Council is delivering on agreed

outcomes.

·

To ensure that Council is managing its finances

in an appropriate manner.

·

To ensure that Council is managing risk in an

appropriate manner.

Scope

·

Monitor financial and non-financial performance

against the approved Long Term Plan and Annual Plan (Note:

Council cannot delegate to a Committee the adoption of the Long Term Plan and

Annual Plan).

·

Oversee the development of the council’s

Annual Report.

·

Oversee the development of financial and

treasury management strategies and policies.

·

Consider and approve external audit arrangements

and receiving Audit reports.

·

Consider the outcome of internal and external

audit reviews.

·

Advise Council on matters of finance and provide

objective advice and recommendations for its consideration.

·

Advise Council on matters of risk and provide

objective advice and recommendations for its consideration.

·

Consider matters which are related to quality

assurance and internal controls in council and ensure the financial management

practices and processes comply with the Local Government Act 2002, other

relevant legislation and Council’s own policies.

·

Consider, monitor and recommend (where

appropriate) in respect to Council’s financial interest in CCOs.

·

Consider all matters regarding the Local

Government Funding Agency (LGFA).

·

Monitor key activities, projects and services

(without operational interference in the services) in order to better inform

the members and the community about key Council activities and issues that

arise in the operational arm of the council.

Power to act

·

To make all decisions necessary to fulfil the

role and scope of the Committee subject to the limitations imposed.

·

To appoint a non-voting Tangata Whenua representative

to the Committee.

·

To establish working parties and forums as

required.

·

For the avoidance of doubt, this Committee has not

been delegated the power to:

o

make a rate;

o

borrow money, or purchase or dispose of assets, other than in

accordance with the Long Term Plan.

Power to recommend

·

To Council and/or any standing committee as it

deems appropriate.

7 Business

7.1 Financial

Update - COVID-19

File

Number: A11407268

Author: Kathryn

Sharplin, Manager: Finance

Mohan De Mel, Treasurer

Authoriser: Paul

Davidson, General Manager: Corporate Services

Purpose of the Report

The purpose of this report is to:

1. Set out the latest

understanding of the short-term financial impacts of COVID-19 through to June

30, 2020.

2. Update Council on

scenarios for the 2020-21 annual plan and any government actions or other

strategic responses that influence those scenarios and financials.

3. Identify and regularly monitor

key areas of financial risk and proposed mitigation over the next few months.

This report will

form the basis of regular updates to this committee on the financial situation

as a result of COVID-19 and any other significant funding and financing

outcomes.

|

Recommendations

That the Finance, Audit and Risk Committee:

(a) Receives Report COVID-19

Financial Update

(b) Recognises the need to

significantly recast capital and operational expenditure budgets in the

absence of financial support prior to the end of May 2020.

(c) Recognises the need to

reconsult with the community based on any significant changes to the annual

plan due to financial support being provided by government or in the absence

of such support.

|

Executive Summary

Financial

impacts for the 2019-20 year

4. COVID-19

has had a significant and immediate impact on the final quarter of the 2019-20.

Key points are as follows:

a. Council

has already collected 98% of its rates requirement for the year, so the

year-end result for rates and debt is expected to be close to budget

b. The

short-term impact of COVID-19, as a result of the lockdown and expected move to

Alert Level 3, has been a significant loss of user fee revenue for the last

three months of the year of $10m (including Bay Venues Limited (BVL))

c. Delayed

delivery of our capital programme for 2019-20 of $30-$50m unspent budget. This

capital expenditure is expected to be undertaken in 2020-21

d. The

lower expenditure on capital more than offsets lower revenue, including

operating and capital revenue, so the net debt at year end is expected to be

$525m which is less that the $544m budgeted in the annual plan

e. Our

forecast debt to revenue ratio at 30 June is 211% (199% including BVL).

For the

2020-21 Annual Plan Year

5. There

are a number of financial considerations that will form part of the annual plan

process:

a. A

range of COVID-19 based scenarios along with expectations of economic recession

will need to inform the 2020-21 annual plan with the final budget based around

an agreed set of assumptions that inform the most likely scenario.

b. Initial

high-level estimates of the impact of COVID-19 for the 2020-21 year were

undertaken in the first week of April. These estimates were based on

assumptions of border closure and significant operating constraints on

businesses. This led to estimates of revenue shortfall of $40-$77m below

budget for the group, (including BVL). Impacted revenue includes both operating

revenue (rates and user fees) and asset revenues (capital subsidies and

development contributions).

c. The

rates reduction assumed ranged from a figure close to the 2020-21 total revenue

adjusted for growth through to the 7.6% level already in the draft.

d. Work

is being undertaken over the next few weeks to refine expectations of service

delivery under various Alert Levels, which will provide a better indication of

expected revenue and costs for various activities over the next year.

e. In

the light of reduced revenue, Council would need to reduce both operational and

capital expenditure to remain financially sound and compliant with borrowing

covenants.

f. Council

is talking with Government about funding support for capital investment to bridge

the revenue gap and ensure that the planned level of capital investment can be

maintained along with additional expenditure that could further stimulate the

economy.

g. Without

Government funding, the extent of revenue loss estimated would reduce the capital

investment proposed in the annual plan from $244m to $40-$120m, while also

increasing the council’s debt to revenue ratio toward its limit of 250%.

h. Further

work will be undertaken during May to update annual plan budgets to reflect the

changes to services, capital prioritisation and Government funding support.

Financial

Risk

6. There

are a number of areas of uncertainty, business and economic trends which

increase the financial risk of council’s business over the next 12 to 18

months. These risks will continue to be monitored and assumptions updated as we

move though the annual plan process and the year ahead. Council will need

to agree amended assumptions for the annual plan as the revised budgets are

developed.

7. Key

areas of uncertainty and risk revolve around:

a. Planning

scenarios related to alert levels and business operations

b. The

impact on revenue and opportunities to reduce expenditure in the short term

c. Increasing

costs of delivering capital projects and prioritisation of available capital

funding

d. Council

ability to debt fund revenue shortfalls or unexpected events.

e. The

ongoing impact of cutting rates revenue in the short term on Council’s

long-term financial sustainability and ability to fund the ongoing capital

programme.

f. Economic

recession – its extent and duration and the impact on the city, council

services and residents’ ability to pay for council services.

g. Ability

of LGFA to raise finance over time to meet the demands of councils and in the

light of government stimulus packages.

h. Possible

credit rating downgrade due to a deteriorating financial position.

Risk Management

8. Staff

are working on a detailed COVID-19 risk register. This is built around

areas of social, economic, and built and natural environment. This will be

available for the next FARC committee meeting in a fortnight.

Background

Overall Change in Financials resulting from COVID-19

9. Prior

to COVID-19, council had already identified, and begun to address through the

draft annual plan, the worsening financial position as a result of:

a. ongoing

demands for new infrastructure to manage growth

b. the

increasing costs of that infrastructure,

c. the

cost of unplanned liability for weathertight building issues, and

d. lower

revenue including rates increases and user fee revenue than was budgeted in the

LTP.

10. Covid-19

response, including the closing of borders, the associated lockdown, and

ongoing Alert Level constraints on economic activity has led to a significant

worsening of our financial position, both for the remainder of 2019/20, but

more significantly into next financial year. Council’s initial

response in the draft annual plan was to reduce the proposed average rates

increase from 12.6%, (which included 5% for debt retirement) to 7.6%. The

proposed capital programme budget remained at $244m.

11. Subsequently

high-level modelling by the finance team was undertaken to ascertain the likely

impacts on TCC business next year from the business and wider economic impacts

of COVID-19 and associated Alert level

responses. The results showed potential revenue loss of $40-$77m

resulting in a reduced level of affordable capital investment of $40-$120m.

2019-20 Financials

12. Council’s

primary source of operating revenue is rates. Because Tauranga City

Council (TCC) operates a two-instalment rates collection process – in

August and February- most of the rates due for the year was collected by the

end of February (98% collection to date) prior to the impact of COVID-19. This

rates revenue enables council to continue to run its operations for the

remainder of the year without generating a significant rates deficit outside of

some specific activities. We note that the councils who provided rates

postponement in the 2020 year were those that operated 4 (or more) instalments.

13. The

two main impacts on the financial results through to year end in June 2020

relate to other revenue including user fees, development contributions and

government subsidy.

14. Operating

revenue for 2019-20 for the group (including BVL) is forecast to be $15m lower

than budget - $10m of this is due to COVID-19. Business areas

significantly affected by revenue loss include BVL, parking, property

management and the airport.

15. Asset

revenue which supports the capital expenditure programme is forecast to be $13m

lower, however, this is expected to be a timing difference.

16. For

the remainder of this financial year, Council has taken a number of actions to

respond to the impact on our community of COVID-19 including rent relief,

consideration of remitting rates penalties on a case by case basis and

establishment of a fund for user fees and charges relief. In total this

package of measures is estimated to cost up to $900,000, with $135,000 rates

funded in the 2019-20 year. In total these initiatives are reflected in

lower revenue estimates totalling $800,000 this financial year. These impacts

are included in the 2019-20 revenue forecasts.

17. Operating

expenditure largely continues as budgeted, with many of council’s

services identified as essential. Delays in some activities during lockdown are

expected to be offset by busy workload once services such as building services

inspections and plant and asset maintenance come back into operation.

Other council services that are expected to remain temporarily closed for a

period after lockdown include community services such as the library, Baycourt

and BVL facilities. While in the short term some of the operational costs of

these activities may be reduced, many of the costs are likely to remain.

Therefore, the rates collected to fund these activities are expected to

continue to be required, and some increase in loan is expected in user fee

funded activities to meet costs through to 30 June 2020.

18. The

BVL Board is considering service delivery options and associated financing as

part of finalising their Statement of Intent for 2020-21.

19. Cash

expenditure on capital is lower as a result of the lockdown when most sites

have remained closed. However, this is a timing difference only, so the

expenditure will occur during 2020-21. Furthermore, the contract costs

associated with delays in current projects, and potentially higher costs of

delivery under Alert Level 3, mean that over time capital expenditure is expected

to be higher to deliver the proposed programmes of work.

20. Because

the slow-down in capital expenditure more than offsets the revenue loss, the

net debt position for council at year end is expected to be $525m, which is

lower than the level budgeted of $544m.

21. There

is currently no difficulty in maintaining liquidity. LGFA, from whom we

source our new borrowings has successfully completed a syndicated borrowing of

$1 billion. The Crown has extended their support to LGFA in the capital

market by extending liquidity support on LGFA Bonds to provide confidence to

investors and rating agencies.

2020-21

Annual Plan Financials

22. As

was outlined to Council in late-2019 and through Annual Plan discussions in

early 2020, Council’s financial situation entering the COVID-19 crisis

was challenging. This was a direct result of carrying significant levels

of debt to fund essential growth infrastructure. The impact of COVID-19

has made that financial situation significantly worse.

23. Initial

high-level modelling of revenue in early April indicated that the ongoing

effects of the COVID-19 pandemic are likely to have a severe impact on revenue,

and because of our high debt levels directly impacts Council’s ability to

fund proposed infrastructure investment projects.

24. The

initial modelling indicated potential revenue loss between $40 million and $77

million below that budgeted in the draft Annual Plan. This revenue included

both operational and capital revenue. The reduction in revenue directly

affects ability to borrow to fund capital investment leading to a reduction in

the affordable capital programme for 2020-21 from the $244m budgeted to between

$40 -$120m.

25. The

changes in revenue and its relationship to our debt to revenue ratio and the

value of capital investment that can be undertaken is shown graphically in

Attachment 1. Three different revenue scenarios are included showing the

value of the capital programme and debt to revenue ratio under each scenario.

The basis of the existing draft annual plan as currently being consulted is

scenario one. While low and high revenue reduction assumptions are represented

in scenarios 2 and 3. These graphs are at a high level. They assume that lower

operating revenue is offset by lower operating expenditure. Where

expenditure reductions can’t be achieved debt levels will be higher.

26. The

impact of COVID-19 is expected to have a significant and ongoing impact on

Council’s ability to deliver its planned capital programme, even before

considering the Government’s desire to increase economic stimulus by

bringing projects forward. This is due to the impact of reduced revenue

on Council’s debt/ equity borrowing limits. This has been

externally recognised through a central Government paper. Attachment 2 of this

document is a key summary of their findings.

27. Key

assumptions for the initial modelling included ongoing border closure,

restriction on social activity and general economic recession. Revenue

impacts were therefore most severe in airport, recreational and parking

activities. Capital revenue was assumed to also be disrupted with capital

subsidies affected by delays in capital delivery, and a slow-down in

development contributions.

28. Council

has agreed to conduct further work on planning scenarios relating to future

disruption assumptions. These will inform the development of scenarios

for next year’s economic and business conditions which can then inform

revised annual plan budgets.

29. As

the impact of COVID19 on New Zealand and the world becomes clearer over the

coming weeks Council will be considering appropriate amendments to the 2020-21

annual plan. A range of potential scenarios and their budget implications

will be considered and refined.

30. Experience

from the Global Financial Crisis which impacted council for several years from

2008 was that it is important to continue to plan for growth even when

immediate demand is reduced due to recessionary impacts. This ensures

Council is in a position to respond as economic conditions improve. Council

also has a role in supporting Government economic stimulus through its capital

investment and operational expenditure. Initiatives to support the

community including relief from rates or user fees should be appropriately

targeted to ensure council maintains necessary revenue and remains within

required debt levels.

31. To

respond to the business conditions of various scenarios we will look at:

(a) both

revenue and expenditure settings across essential and non-essential services,

(b) priority

for capital expenditure,

(c) potential

of government funding support to bridge the revenue gap and achieve stimulatory

infrastructure investment (the outcome of this may lead to the need to

reconsult on our existing 2020-21 Annual Plan), and

(d) in

the event support is provided, a high-level analysis of the potential future

costs flowing from such investment.

Financial

Risks and Risk Management

32. There

are a number of areas of uncertainty and business and economic trends which

increase the financial risk of council’s business over the next 12 to 18

months. These risks will continue to be monitored and assumptions updated as we

move though the annual plan process and the year ahead. Council will need

to agree amended assumptions for the annual plan as the revised budgets are

developed.

33. The

identified financial risks are as follows:

a. Uncertainty

around the appropriate planning scenarios which reflect expectations of how

COVID-19 continues to affect our community and alert level requirements.

b. Uncertainty

around revenue including rates, user fees and asset revenue.

c. Constraints

on and implications of reducing costs in the short term in response to revenue

shortfalls, while enabling council to assist with economic recovery through

investment and to cost effectively restore level of service across its

activities once alert levels are lifted.

d. Increasing

costs of delivering capital projects including:

i. additional

costs of alert level requirements, in particular health and safety standards,

ii. financially

challenged construction sector,

iii. contractual

considerations including project risk and where it falls and

iv. the

pricing and delivery impacts of a large government stimulus package across New

Zealand.

e. Council

ability to debt fund revenue shortfalls or unexpected events.

f. Economic

recession – its extent and duration and the impact on the city, council

services and residents’ ability to pay for council services.

g. Ability

of LGFA to raise finance over time to meet the demands of councils and in the

light of government stimulus packages.

h. In

the event Council breached LGFA borrowing covenants, in particular the debt to revenue

ratio of 250%, this would trigger Council to refinance all debt funded by

LGFA. Re-financing in the current market would be very challenging and

likely to be at a significantly higher cost.

i. Possible

credit rating downgrade due to a deteriorating financial position.

j. The

ongoing impact of cutting rates revenue in the short term on Council’s

long-term financial sustainability and ability to fund the ongoing capital

programme.

34. Staff are continuing to work on a

detailed COVID-19 risk register. This is built around the areas of

social, economic, natural and built environments. At present this is a

detailed list of risks. In line with previous conversations around risk

governance, staff will now refine this detailed register to allow councillors

to focus on the key risks from a governance perspective. This will be

available for the next FARC committee meeting in a fortnight

Strategic / Statutory Context

35. COVID-19 represents a significant

challenge to the financial sustainability and effectiveness of Council.

Regular update of financial situation and risks enables Council to be informed

and to take these matters into account in its key decision making, particularly

in relation to the annual plan.

Options Analysis

36. There are no

options associated with this report. The report is provided as information only.

Significance

37. Under the

Significance and Engagement Policy 2014, the decision to receive this report is

of low significance.

Next Steps

38. This report is intended to regularly

update the FARC committee on Council’s financials and risks. This

information will also feed into the work on the annual plan 2020-21 that is

ongoing. More complete information on performance to date and forecasts to year

end by activity will be covered through the Quarterly Monitoring report to be

presented to FARC on 12 May.

Attachments

1. Graphical Analysis of

Revenue Scenarios and Capital Programme - A11406957 ⇩

2. Local Government Sector

COVID-19 Financial Implications Summary Report - A11406606 ⇩