|

|

|

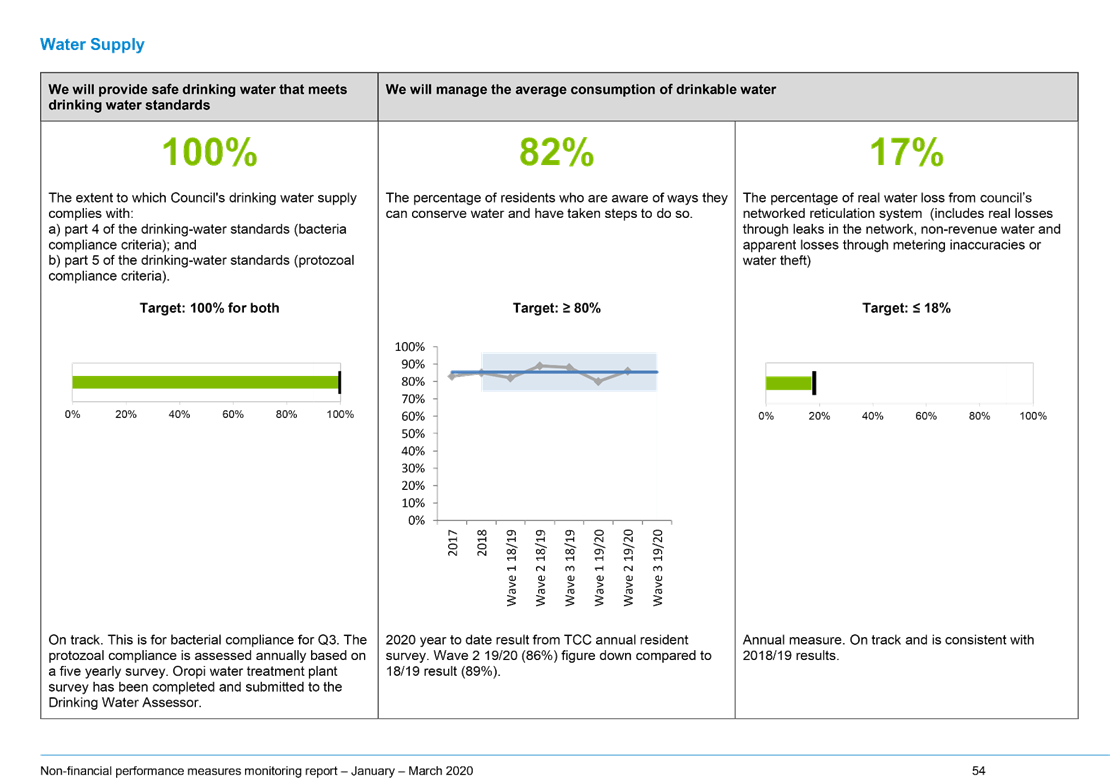

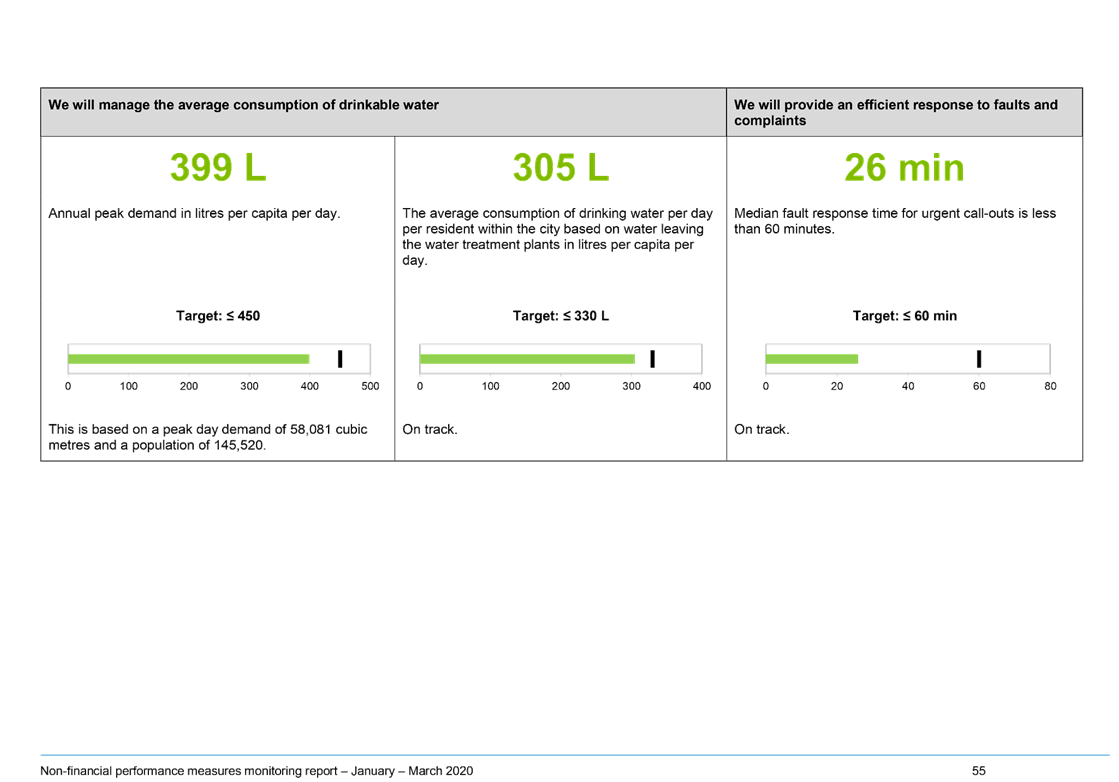

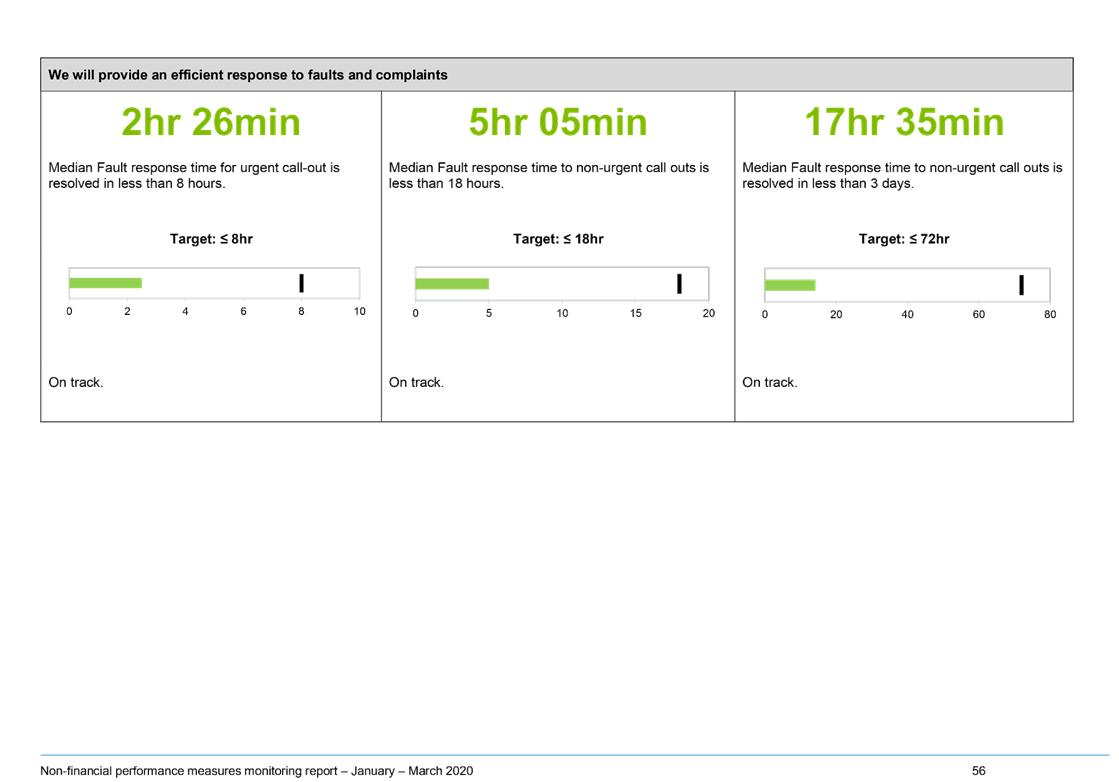

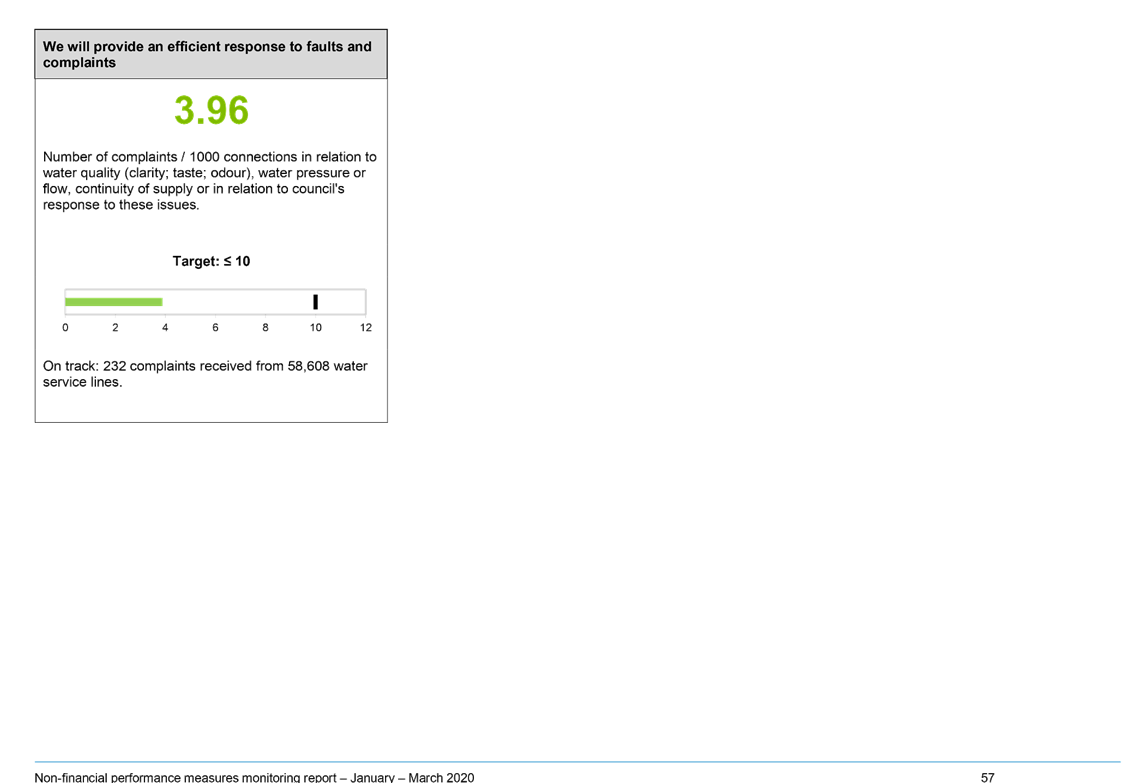

AGENDA

Finance, Audit and Risk Committee Meeting

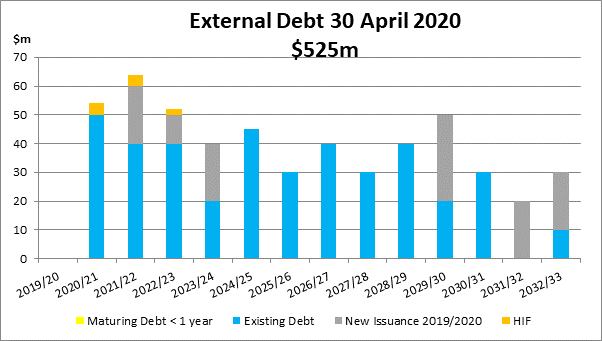

Tuesday, 12 May 2020

|

|

I hereby give notice that a Finance, Audit and Risk

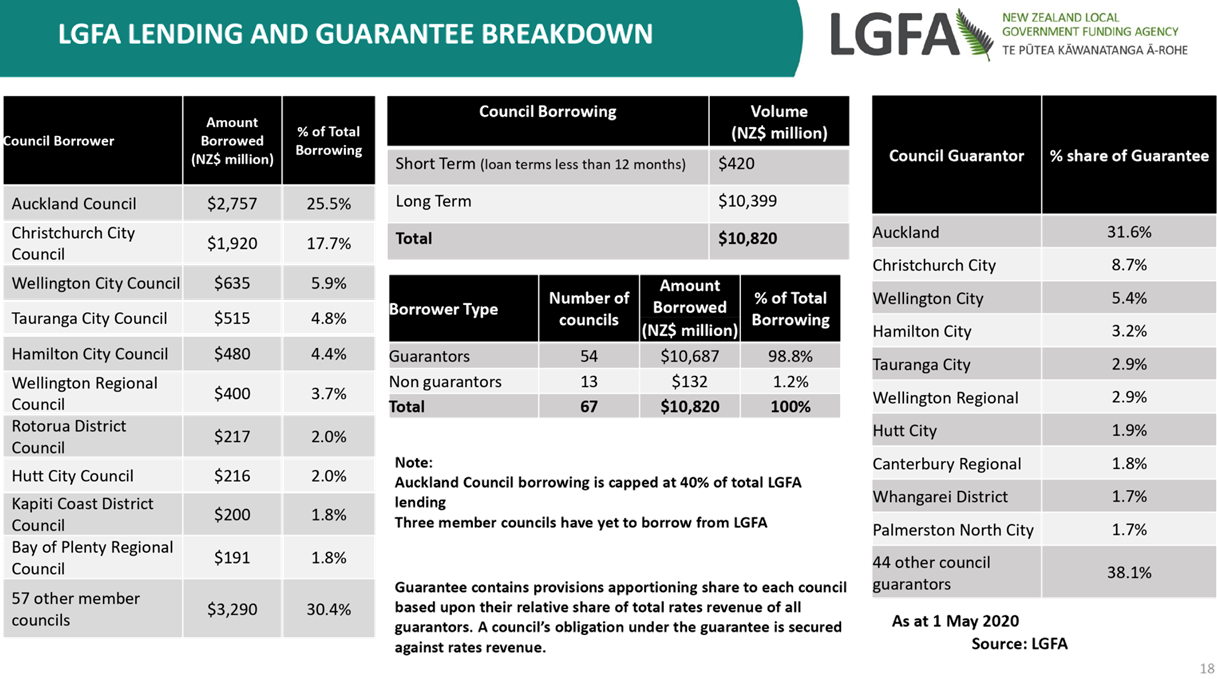

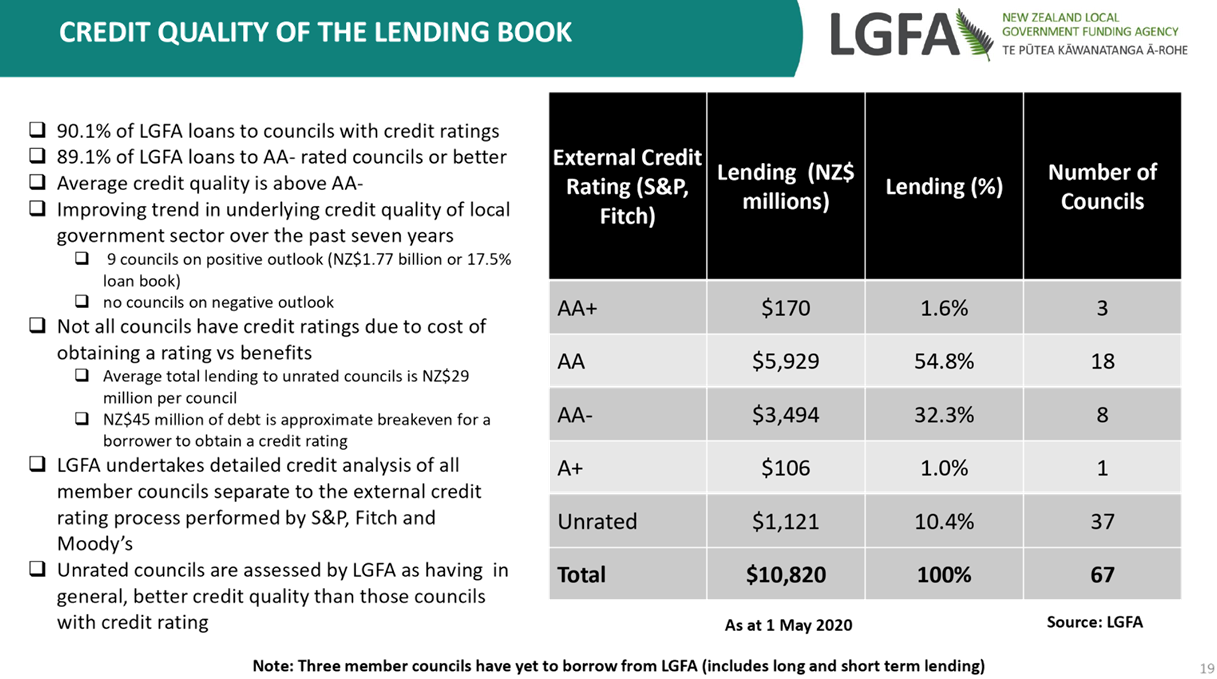

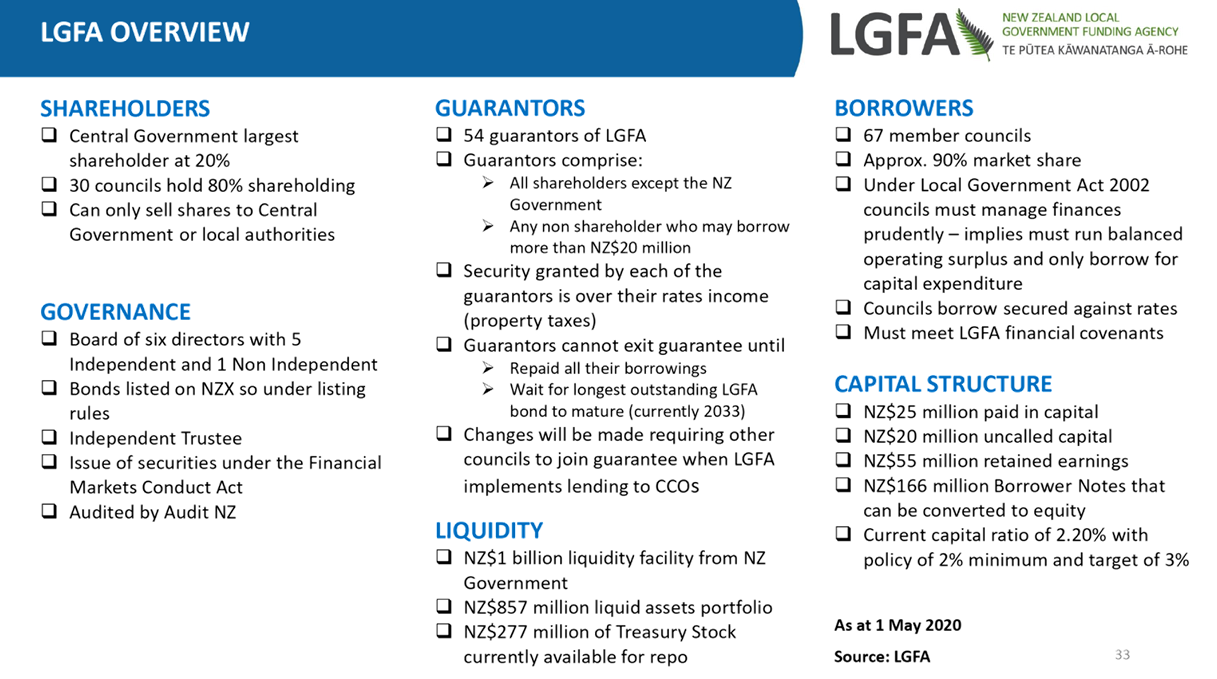

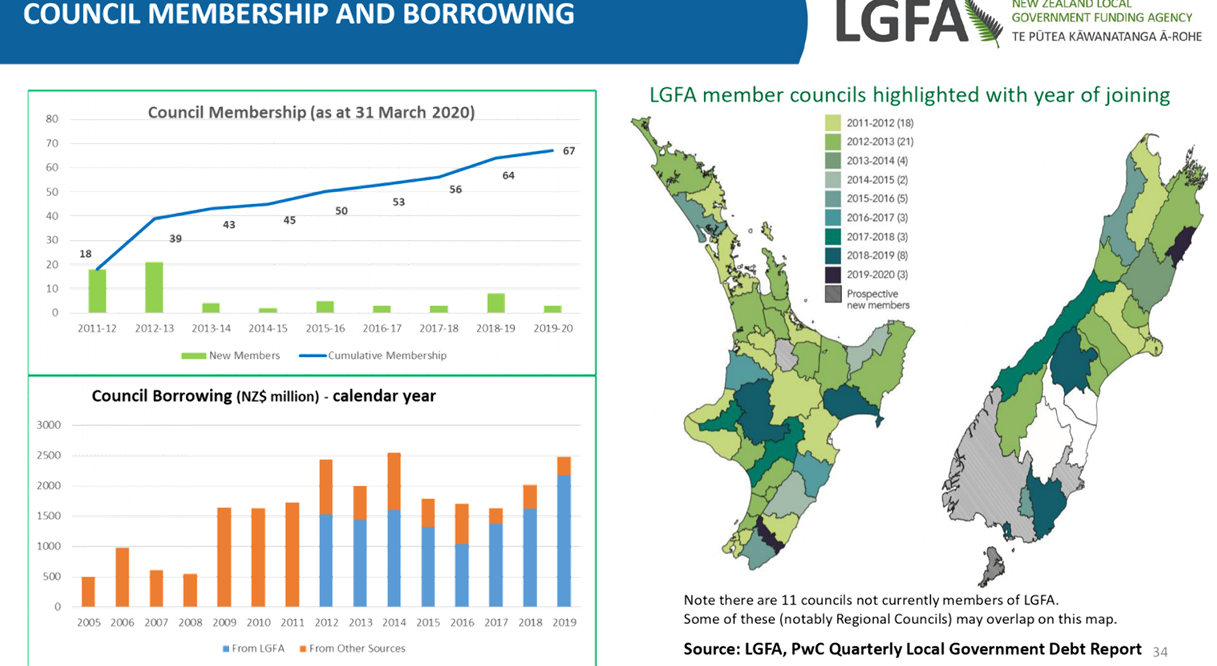

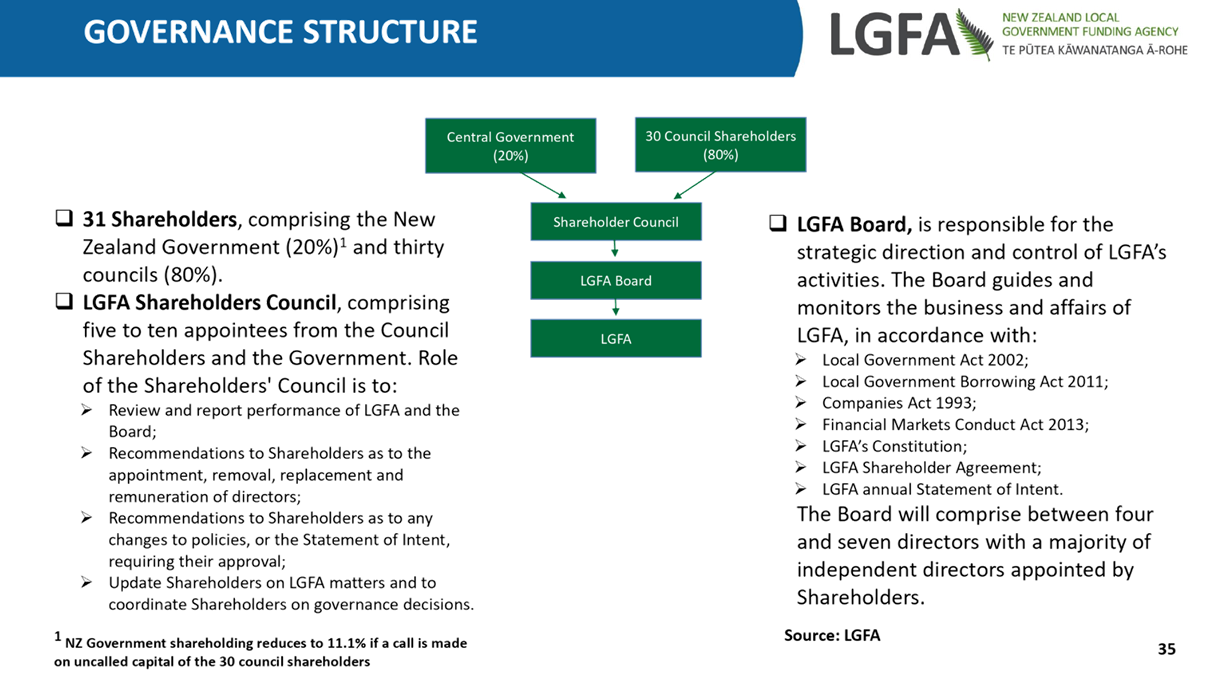

Committee Meeting will be held on:

|

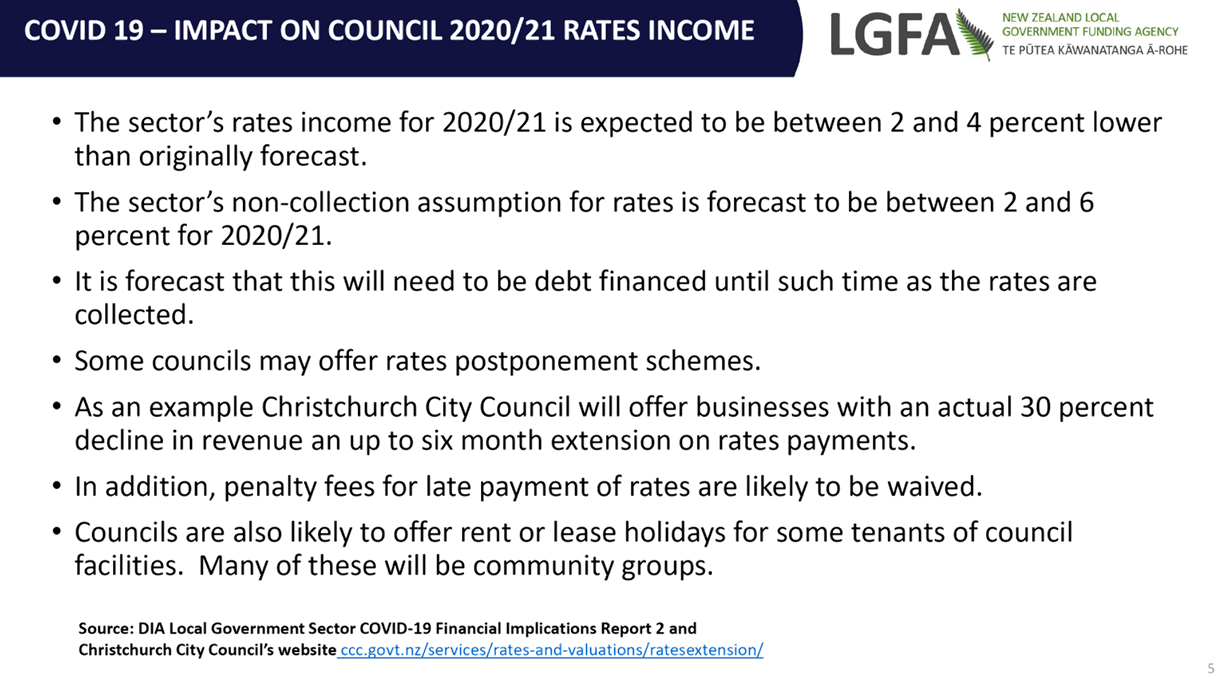

|

Date:

|

Tuesday, 12 May 2020

|

|

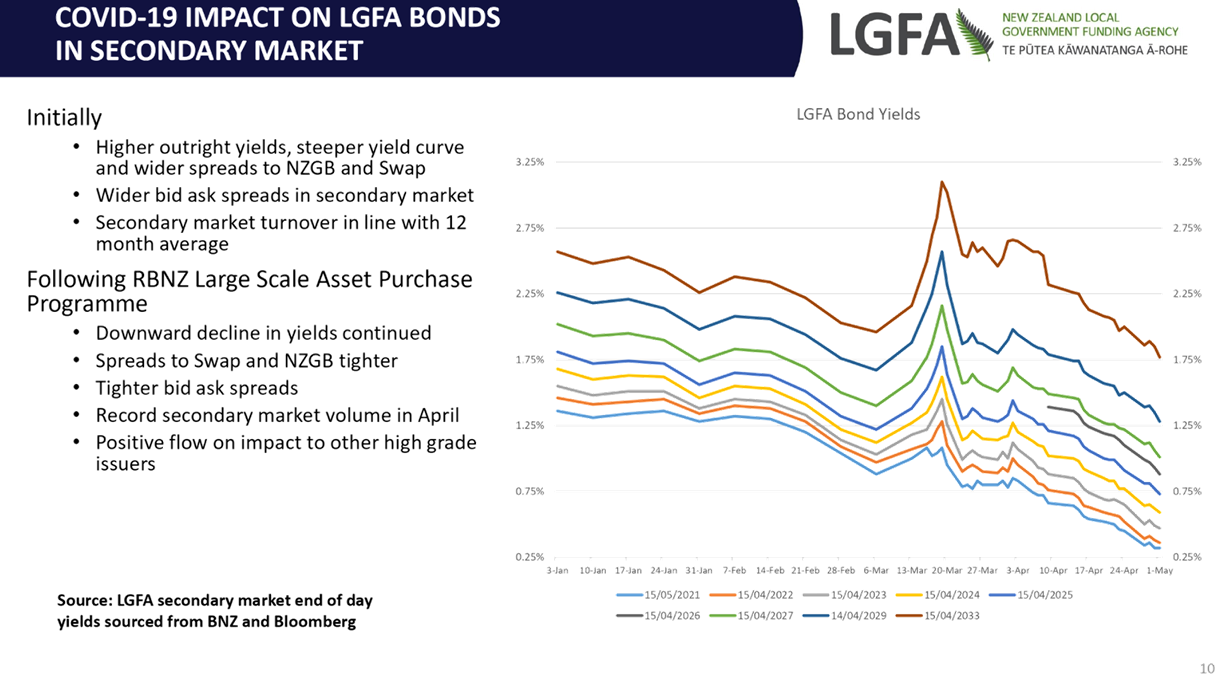

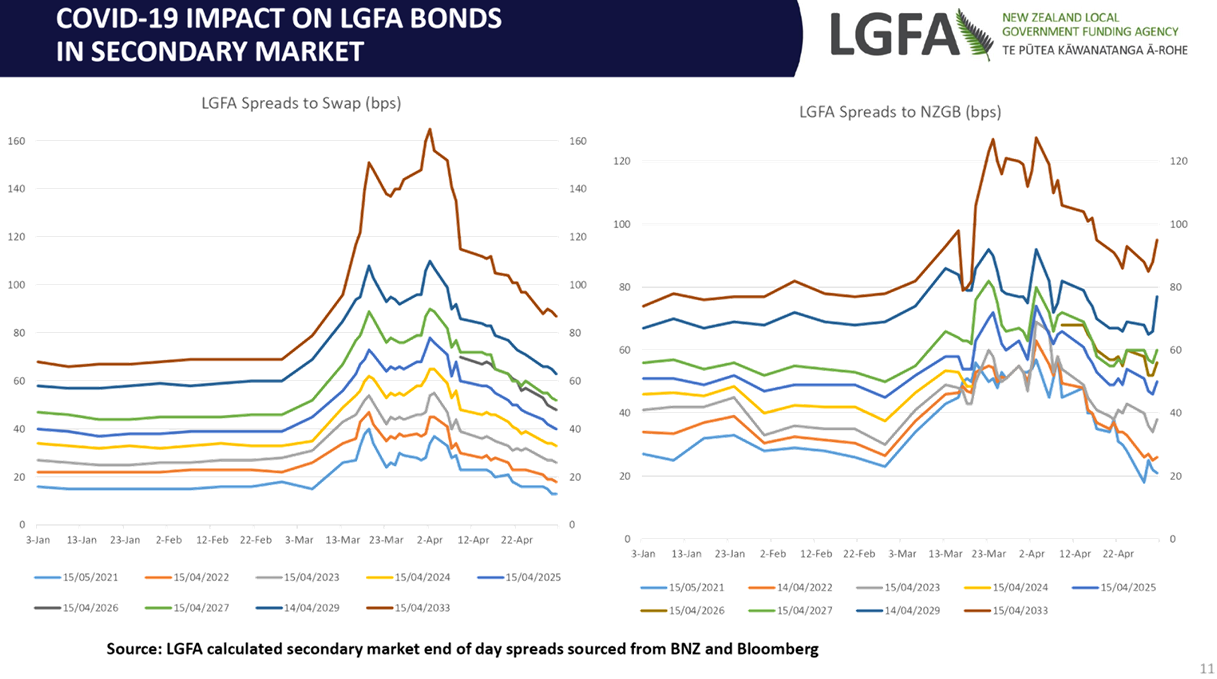

Time:

|

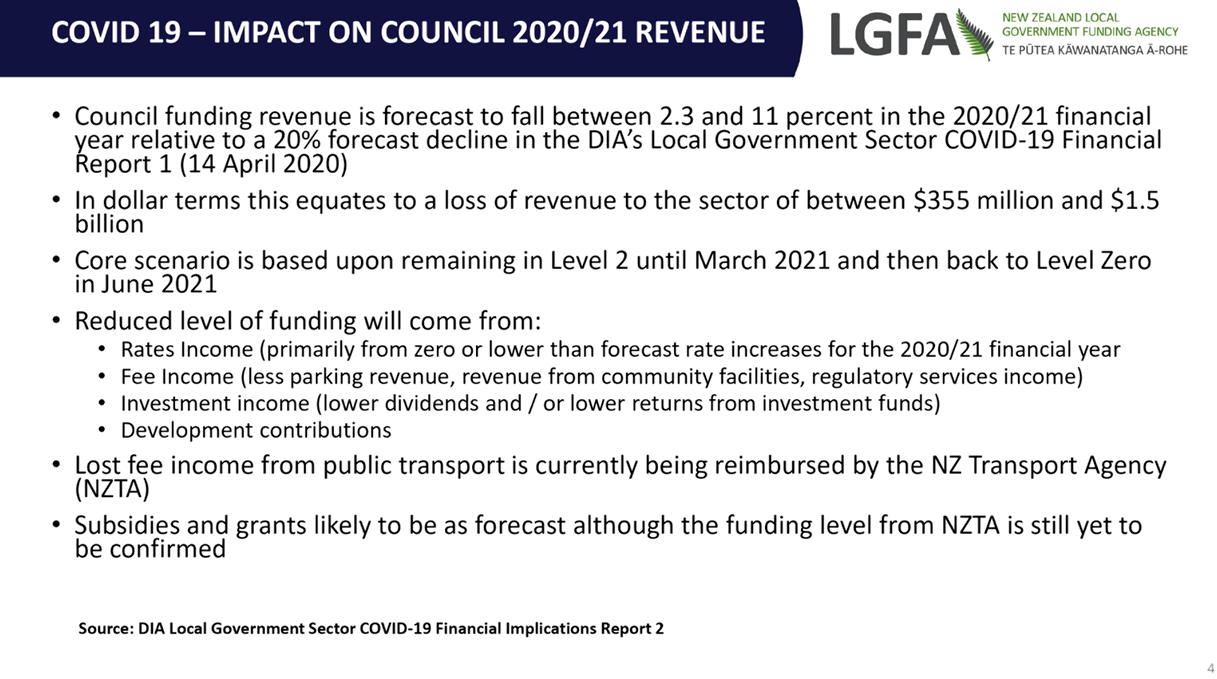

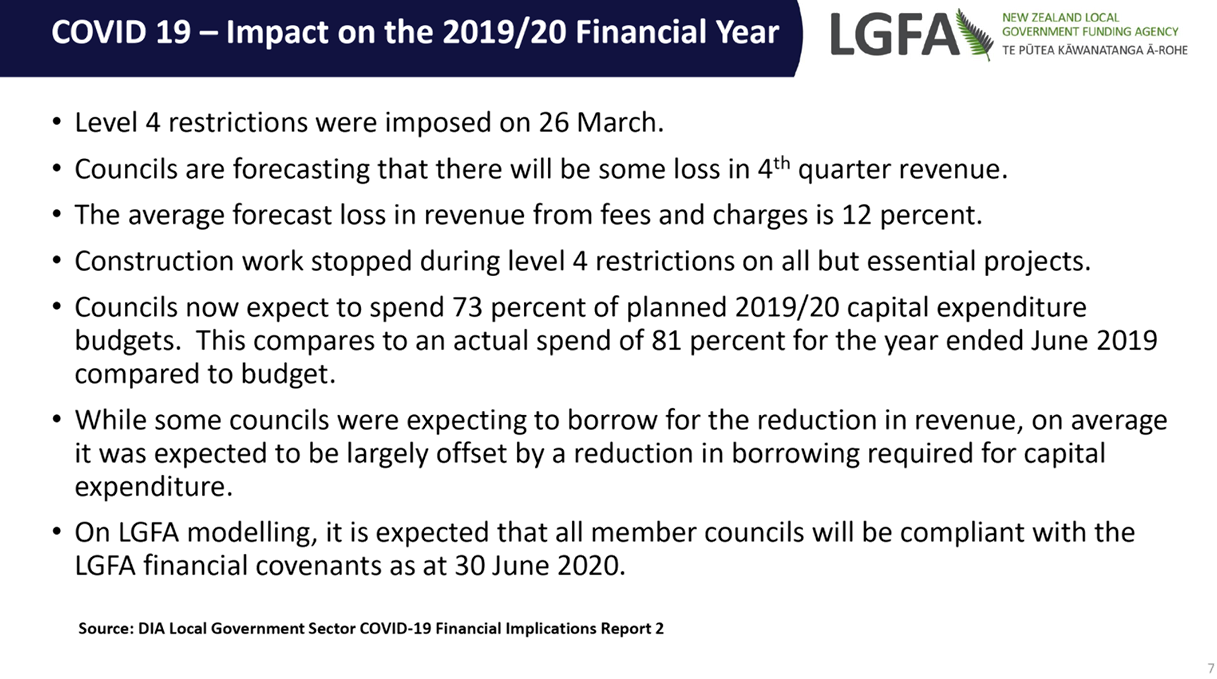

9am

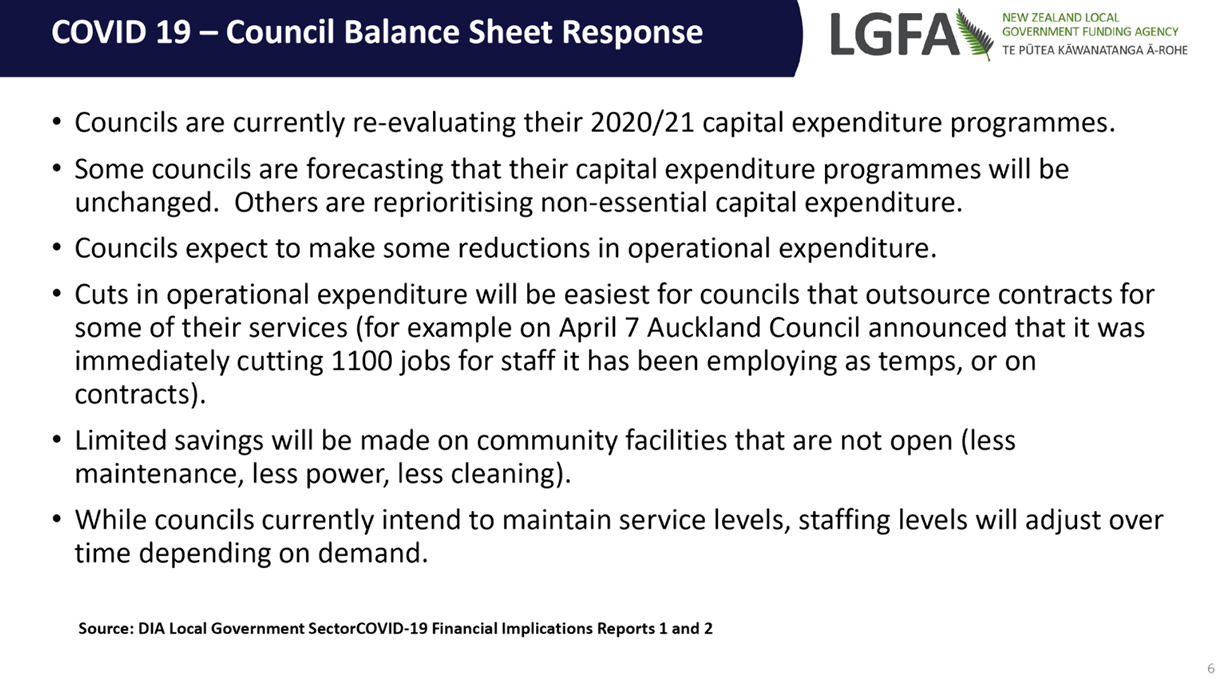

|

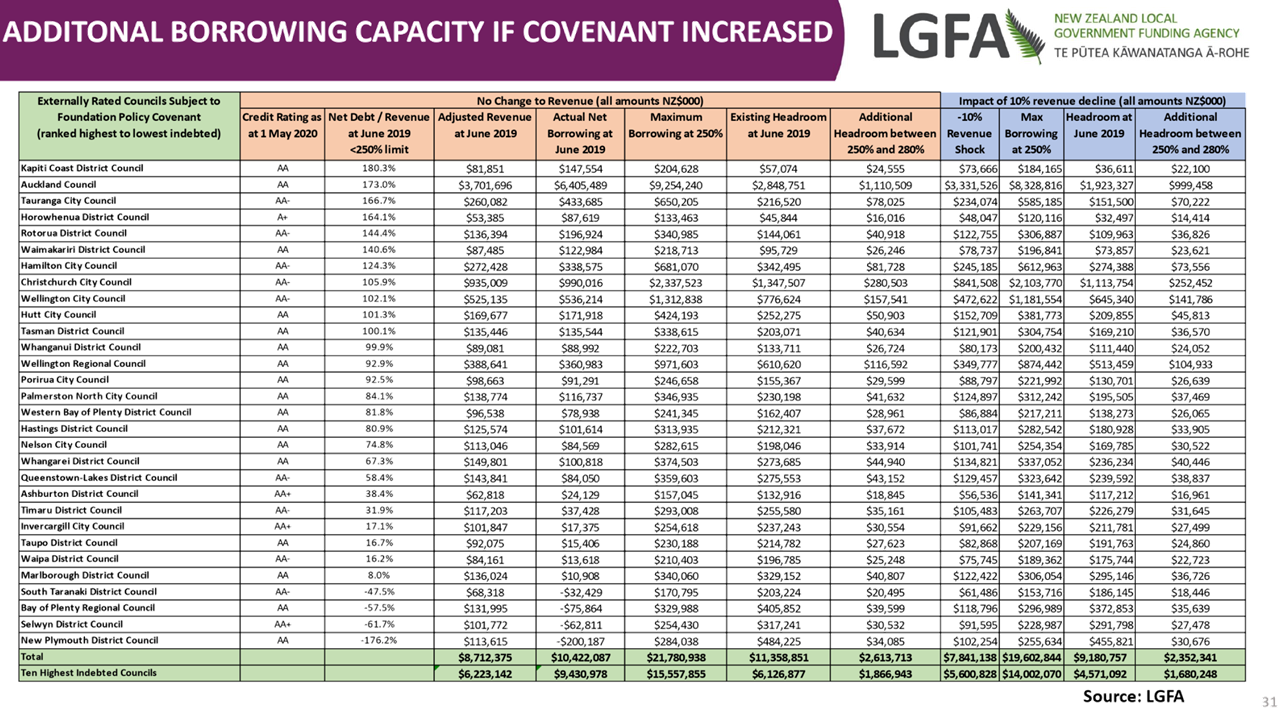

|

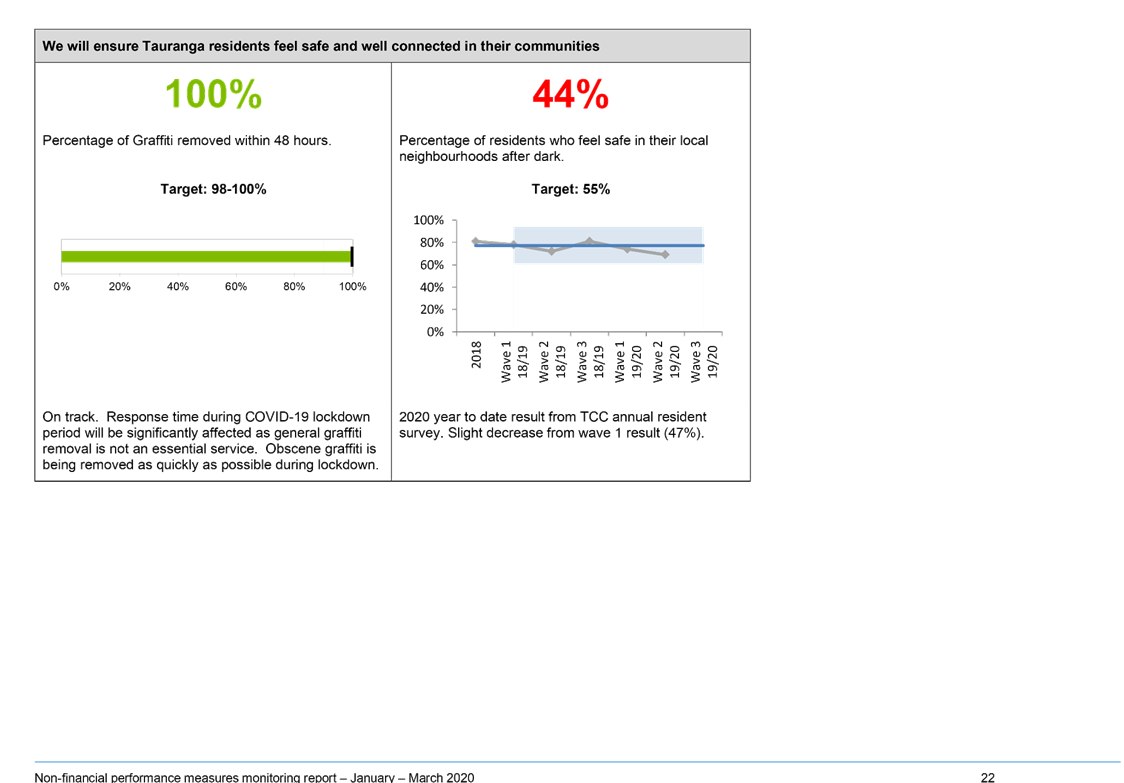

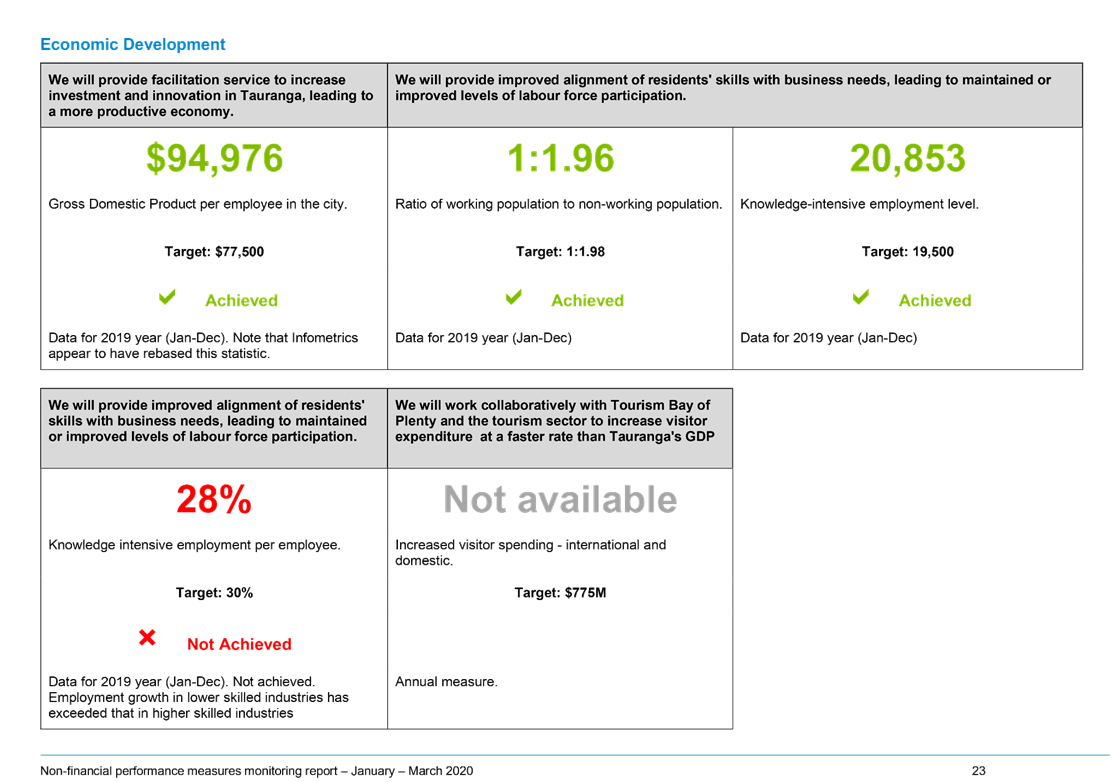

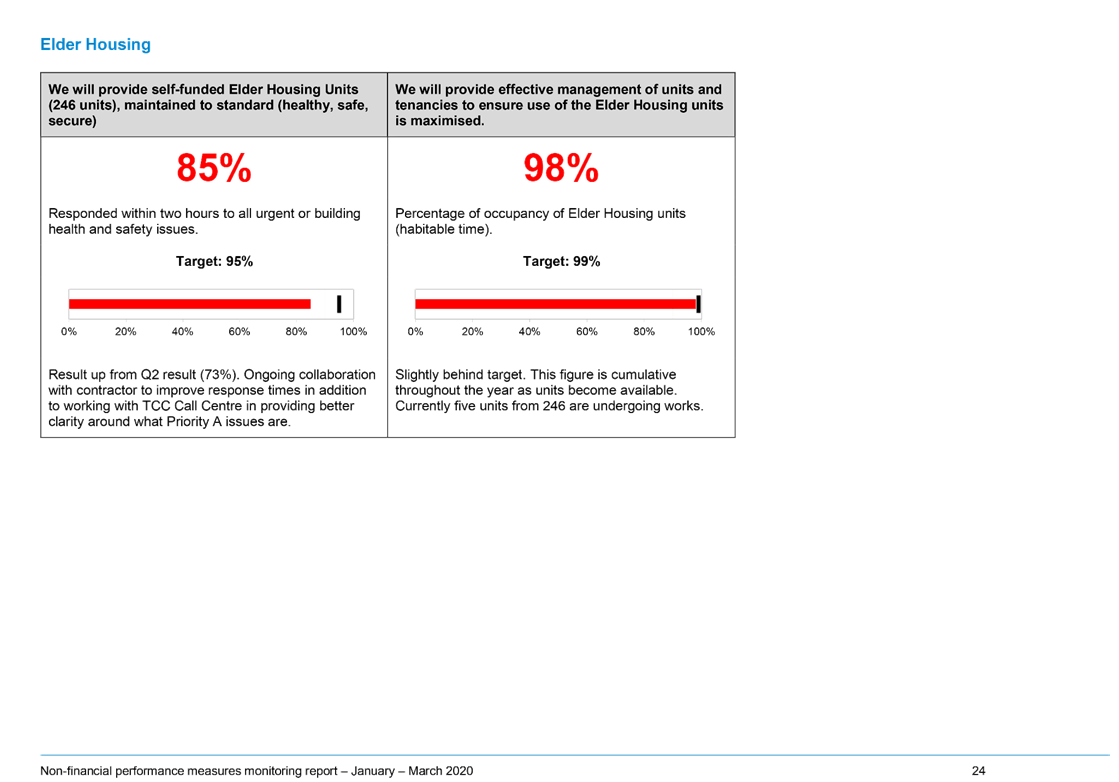

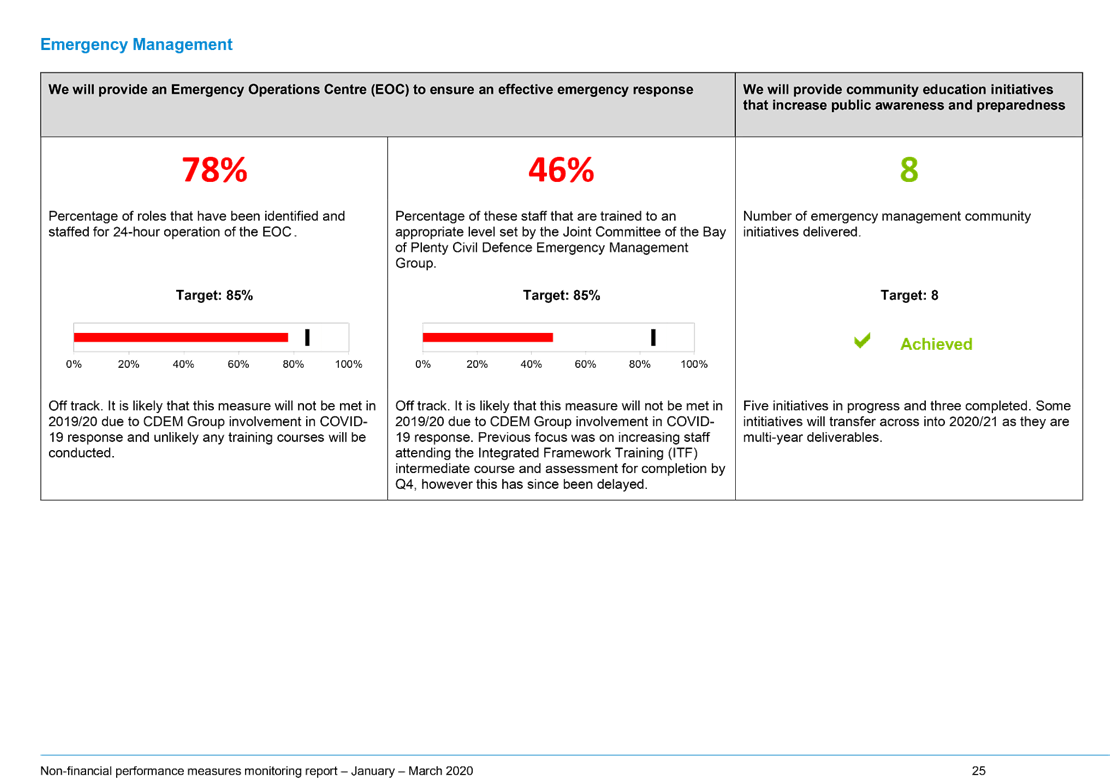

Location:

|

Tauranga City Council

By video conference

|

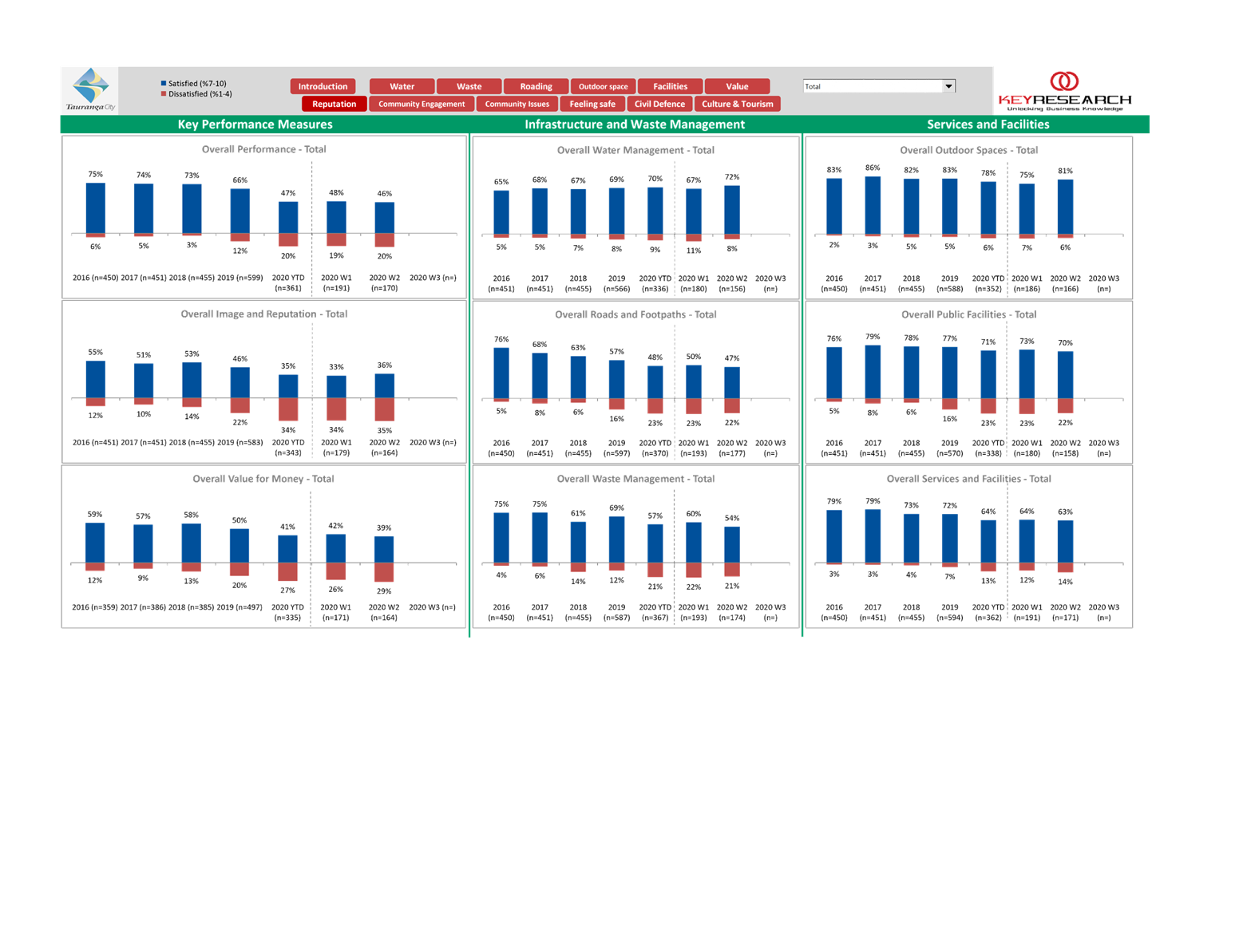

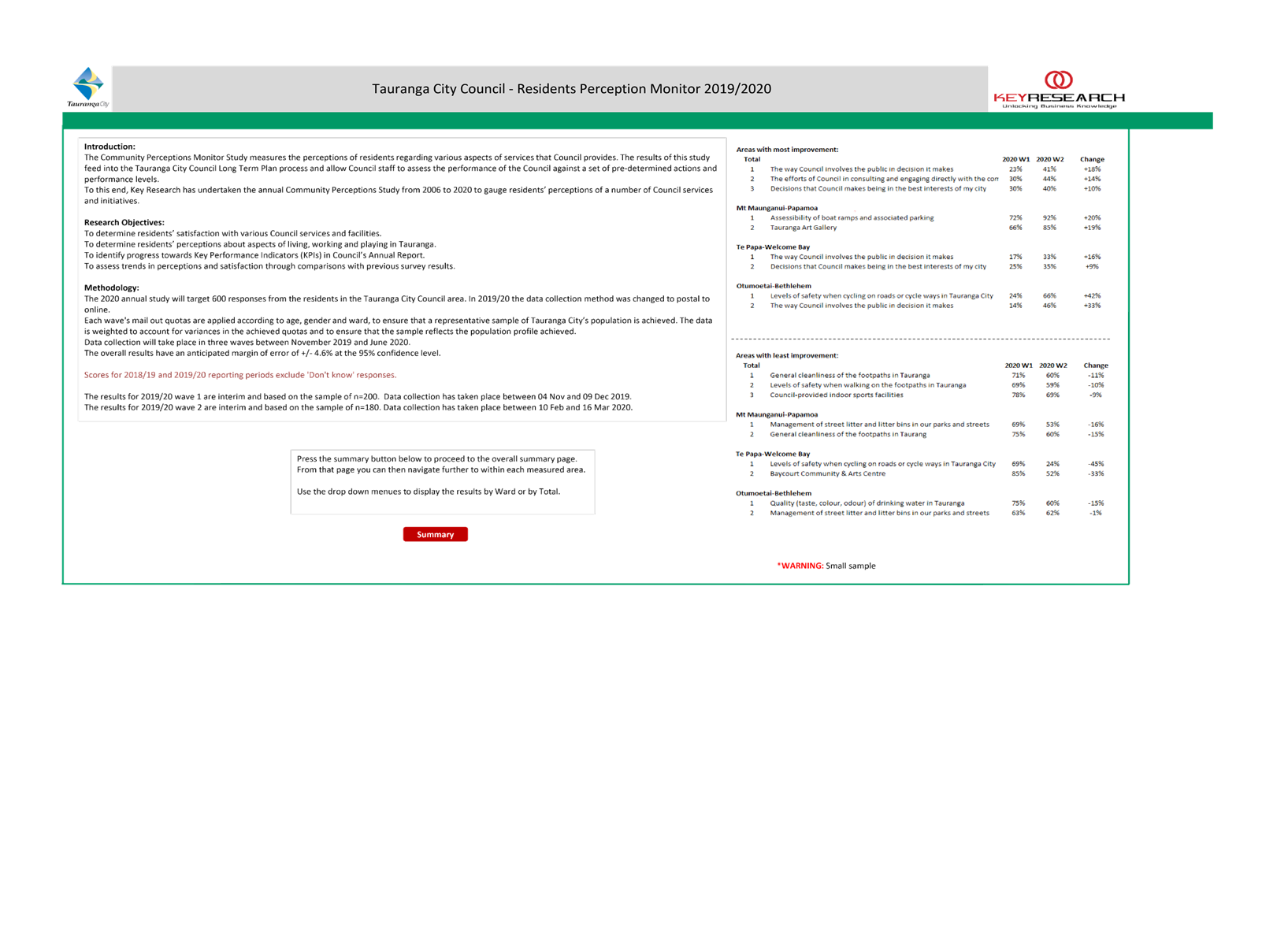

|

Please

note that this meeting will be livestreamed and the recording will be

publicly available on Tauranga City Council's website: www.tauranga.govt.nz.

|

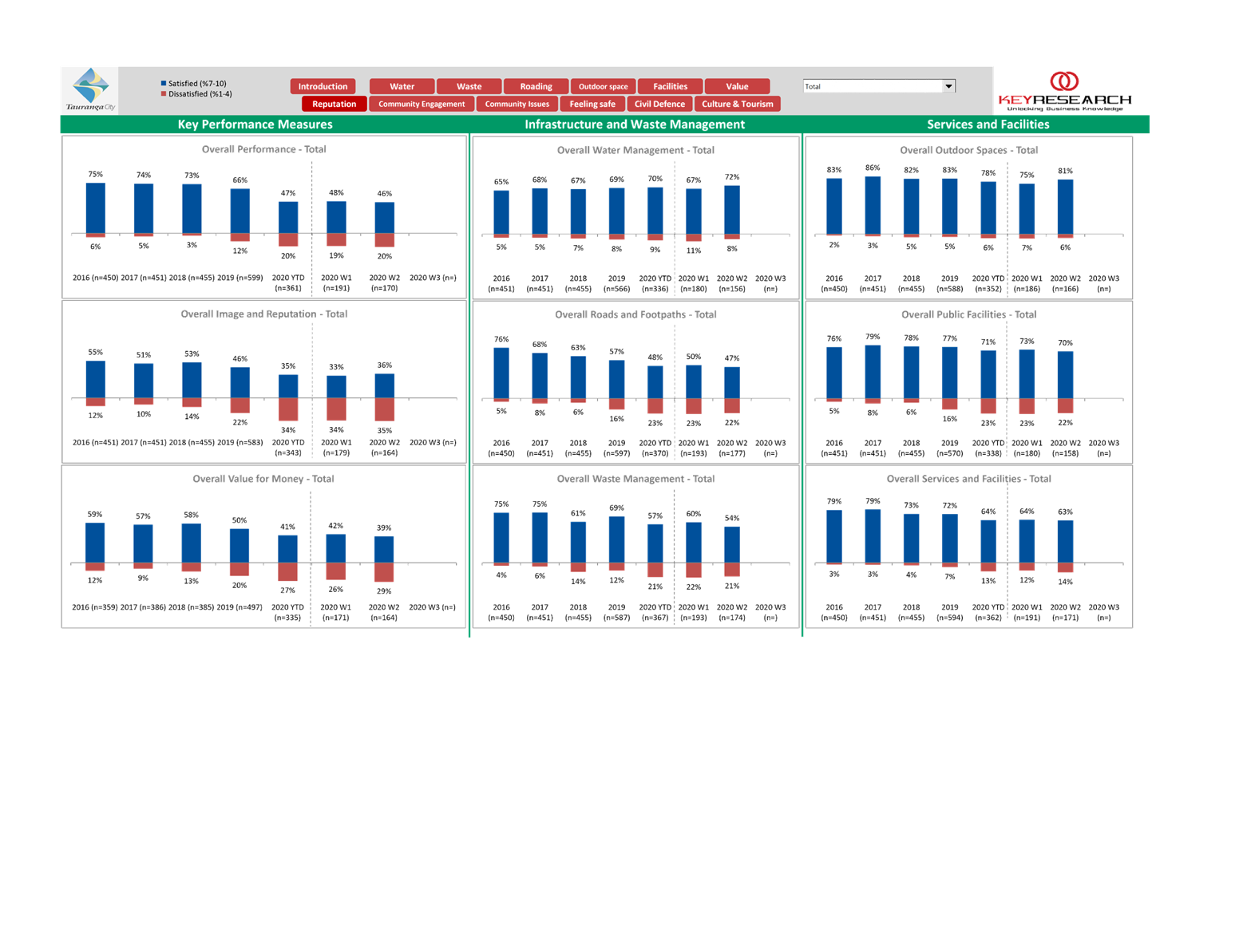

|

Marty Grenfell

Chief Executive

|

Terms of reference –

Finance, Audit & Risk Committee

Common

responsibilities and delegations

The following common responsibilities and delegations apply

to all standing committees.

Responsibilities of standing committees

·

Establish priorities and guidance on programmes

relevant to the Role and Scope of the committee.

·

Provide guidance to staff on the development of

investment options to inform the Long Term Plan and Annual Plans.

·

Report to Council on matters of strategic

importance.

·

Recommend to Council investment priorities and

lead Council considerations of relevant strategic and high significance

decisions.

·

Provide guidance to staff on levels of service

relevant to the role and scope of the committee.

·

Establish and participate in relevant task

forces and working groups.

·

Engage in dialogue with strategic partners, such

as Smart Growth partners, to ensure alignment of objectives and implementation

of agreed actions.

- Confirmation of committee minutes.

Delegations to standing committees

·

To make recommendations to Council outside of

the delegated responsibility as agreed by Council relevant to the role and

scope of the Committee.

·

To make all decisions necessary to fulfil the

role and scope of the Committee subject to the delegations/limitations imposed.

·

To develop and consider, receive submissions on

and adopt strategies, policies and plans relevant to the role and scope of the

committee, except where these may only be legally adopted by Council.

·

To consider, consult on, hear and make determinations

on relevant strategies, policies and bylaws (including adoption of drafts),

making recommendations to Council on adoption, rescinding and modification,

where these must be legally adopted by Council,

·

To approve relevant submissions to central government,

its agencies and other bodies beyond any specific delegation to any particular

committee.

·

To appoint a non-voting Tangata Whenua

representative to the Committee.

·

Engage external parties as required.

Terms of reference – Finance, Audit & Risk Committee

Membership

|

Chairperson

|

Mr Bruce

Robertson

|

|

Deputy

chairperson

|

Cr Tina

Salisbury

|

|

Members

|

Mayor

Tenby Powell

Cr Jako

Abrie

Cr Larry

Baldock

Cr Kelvin

Clout

Cr Bill

Grainger

Cr Andrew

Hollis

Cr Heidi

Hughes

Cr Dawn

Kiddie

Cr Steve Morris

|

|

Non-voting

members

|

Tangata

Whenua representative (TBC)

A maximum

of two external appointments may be made by Council on recommendation from

the Committee

|

|

Quorum

|

Half

of the members physically present, where the number of members (including

vacancies) is even; and a majority of the members physically

present, where the number of members (including vacancies) is odd.

|

|

Meeting

frequency

|

Six weekly

|

Role

·

To ensure that Council is delivering on agreed

outcomes.

·

To ensure that Council is managing its finances

in an appropriate manner.

·

To ensure that Council is managing risk in an

appropriate manner.

Scope

·

Monitor financial and non-financial performance

against the approved Long Term Plan and Annual Plan (Note:

Council cannot delegate to a Committee the adoption of the Long Term Plan and

Annual Plan).

·

Oversee the development of the council’s

Annual Report.

·

Oversee the development of financial and

treasury management strategies and policies.

·

Consider and approve external audit arrangements

and receiving Audit reports.

·

Consider the outcome of internal and external

audit reviews.

·

Advise Council on matters of finance and provide

objective advice and recommendations for its consideration.

·

Advise Council on matters of risk and provide

objective advice and recommendations for its consideration.

·

Consider matters which are related to quality

assurance and internal controls in council and ensure the financial management practices

and processes comply with the Local Government Act 2002, other relevant

legislation and Council’s own policies.

·

Consider, monitor and recommend (where

appropriate) in respect to Council’s financial interest in CCOs.

·

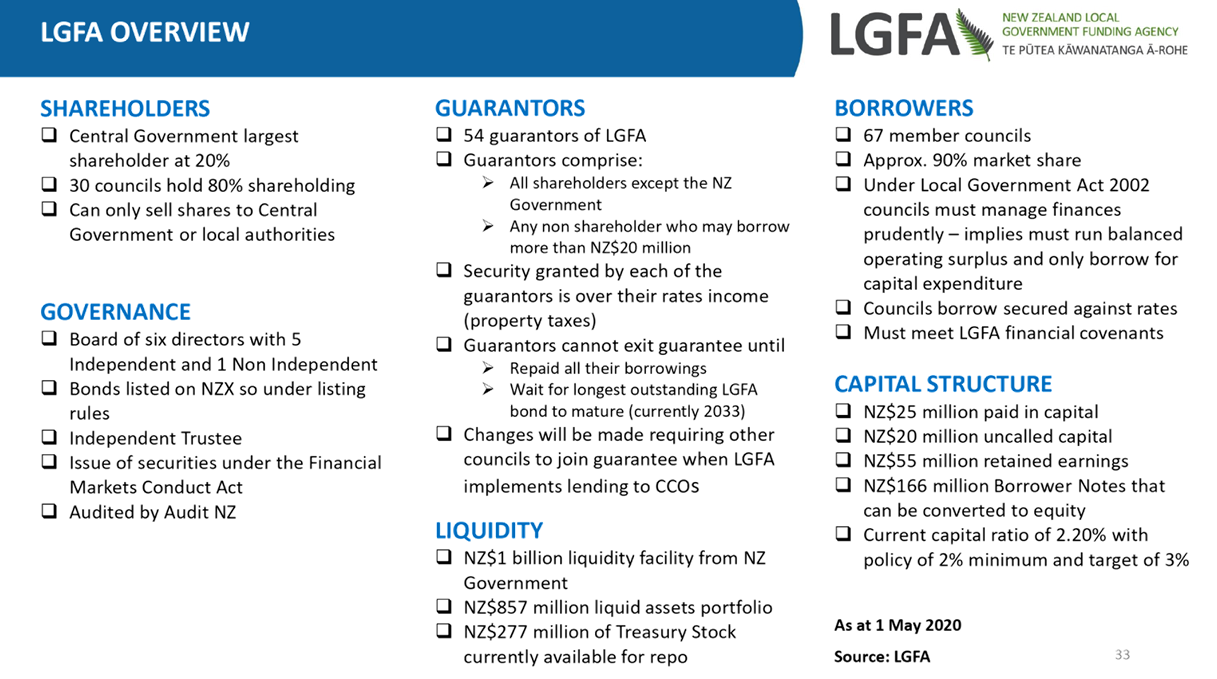

Consider all matters regarding the Local

Government Funding Agency (LGFA).

·

Monitor key activities, projects and services

(without operational interference in the services) in order to better inform

the members and the community about key Council activities and issues that

arise in the operational arm of the council.

Power to act

·

To make all decisions necessary to fulfil the

role and scope of the Committee subject to the limitations imposed.

·

To appoint a non-voting Tangata Whenua

representative to the Committee.

·

To establish working parties and forums as

required.

·

For the avoidance of doubt, this Committee has not

been delegated the power to:

o

make a rate;

o

borrow money, or purchase or dispose of assets, other than in

accordance with the Long Term Plan.

Power to recommend

·

To Council and/or any standing committee as it

deems appropriate.

7 Business

7.1 Financial and

Non-Financial Monitoring Report: Period ended 31 March 2020

File Number: A11391870

Author: Kathryn

Sharplin, Manager: Finance

Authoriser: Paul Davidson, General Manager: Corporate Services

Purpose of the Report

1. The purpose of this report is to

inform Council and the public of our financial and service level performance

result for the first nine months of the financial year 2019/20 and provide an

overview of resident perceptions.

|

Recommendations

That the Finance, Audit and Risk Committee:

(a) Receives Report Financial and

Non-Financial Monitoring Report: Period ended 31 March 2020.

|

Executive Summary

2. The full year financial projection

at this stage is for an operating result unfavourable to budget by $5.4m, after

initial analysis of the effect of the COVID-19 response. Net debt at year

end is projected to be $525m, less than the budget of $543m. The main risk to

this projection is timing of capital spend and timing of payments on

weathertight claims.

a) Summary Statement of Comprehensive Revenue and

Expense (Attachment 1) shows both operating expenditure and revenue behind

budget. Revised full year forecasts have been presented showing that the full

year forecast for net operating deficit is $22.4m, $5.4m unfavourable to budget

and $6.8m unfavourable to the deficit forecast at the end of quarter two.

b) The Treasury Report (Attachment 2) shows total net debt to 31 March 2020 of

$480m with the full year forecast of $525m.

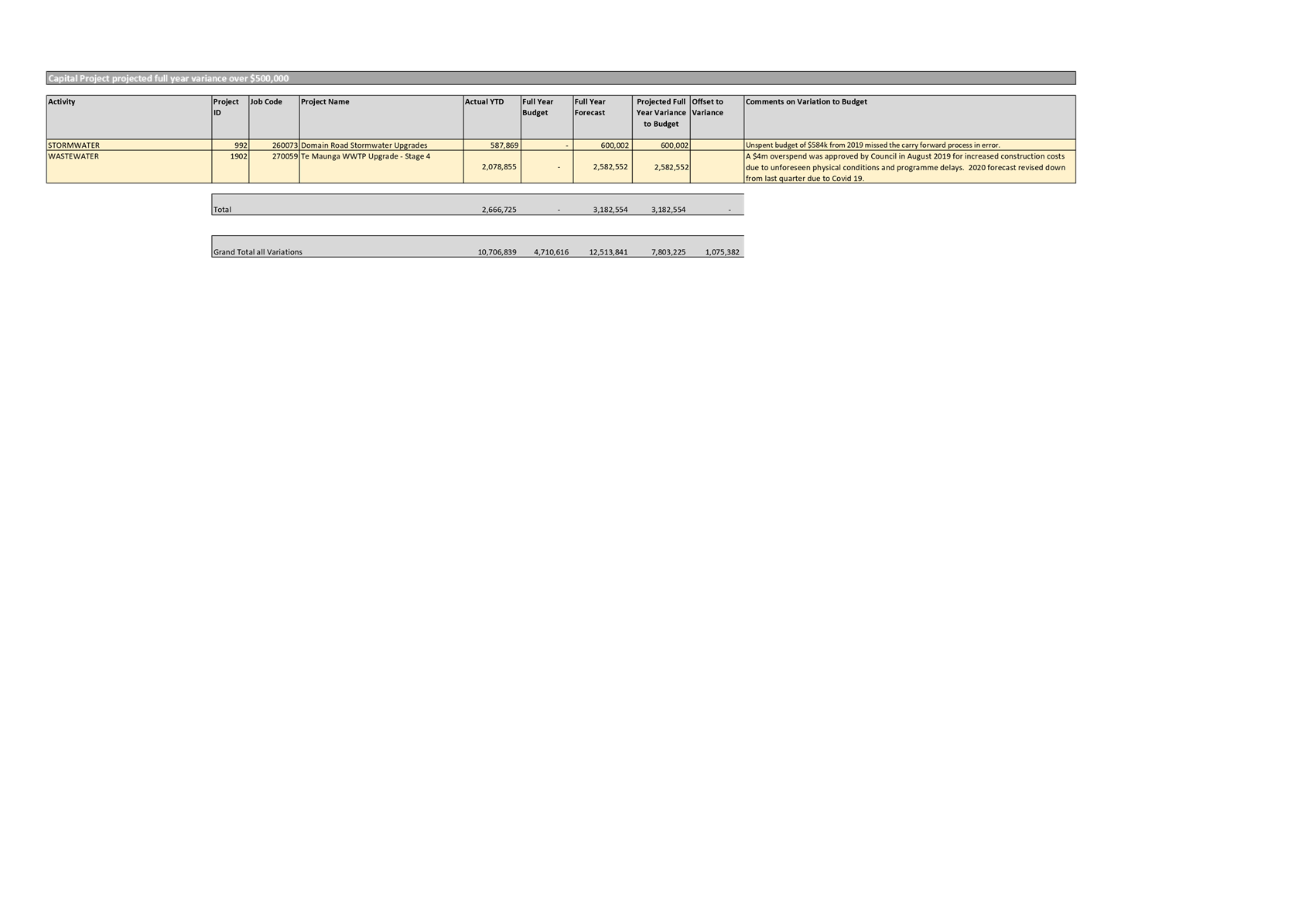

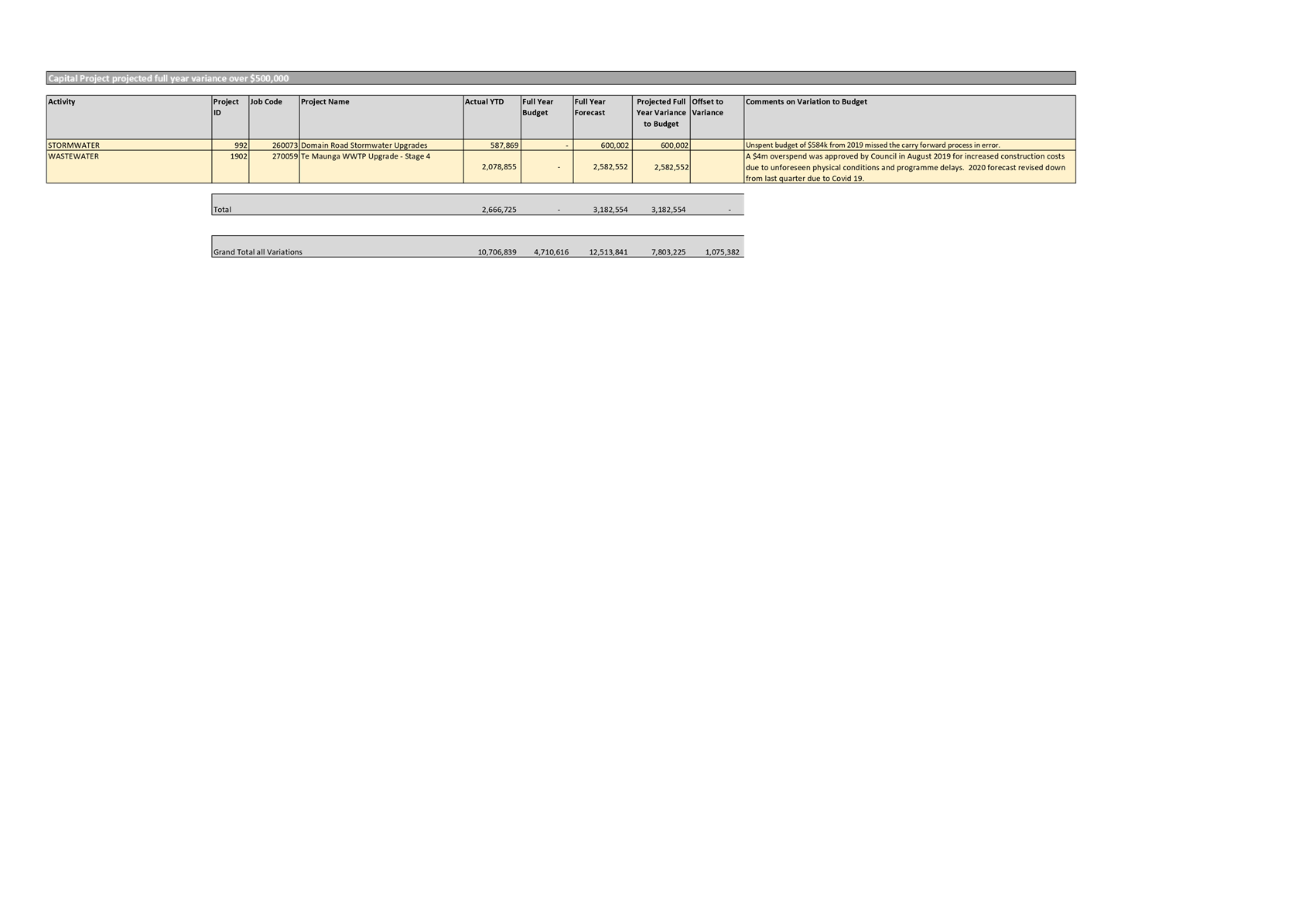

c) The TCC Capital expenditure table

(Attachment 3) identifies capital project budgets for the year by significant

projects and other categories of expenditure. At this stage we are projecting

capital delivery to be $48m below budget, noting that the budget includes an

adjustment for non- delivery of $60m.

d) Capital Overspends table (Attachment 3) shows

the projects forecast to be overspent this financial year, which currently

total $24m. $15.2m of this overspend is in relation to a timing

difference in the Waiari programme. A memo to bring forward budget from 2020/21

is in preparation.

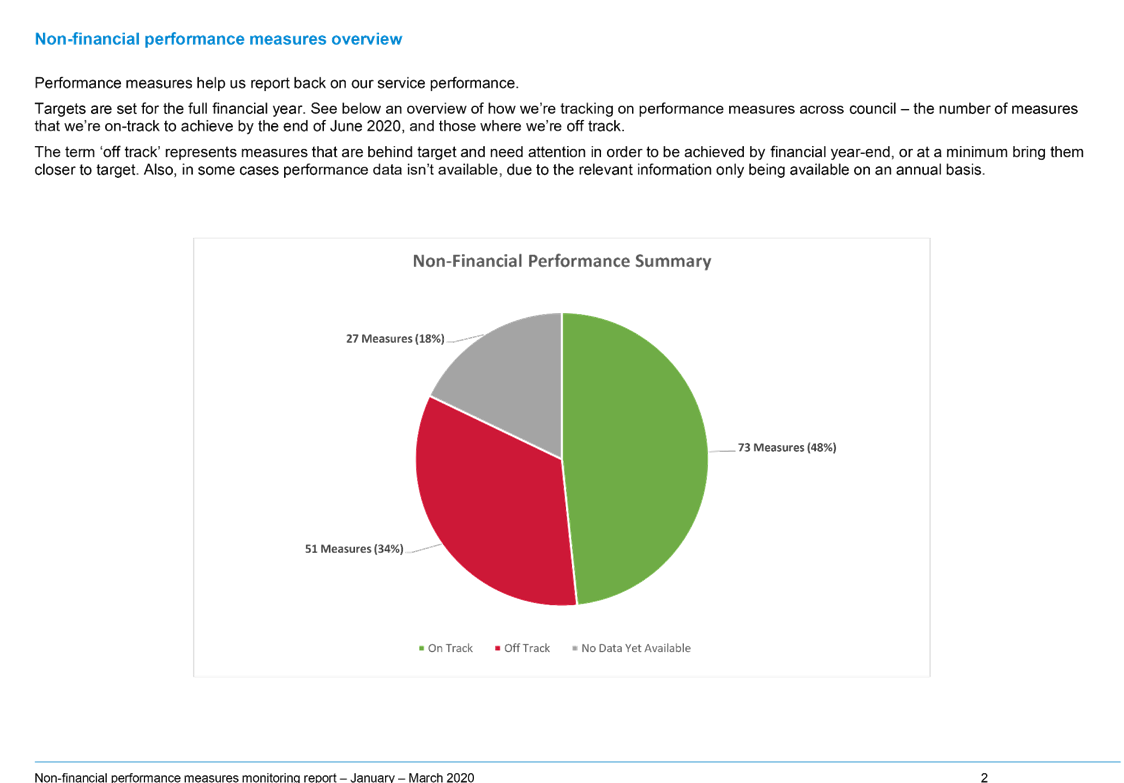

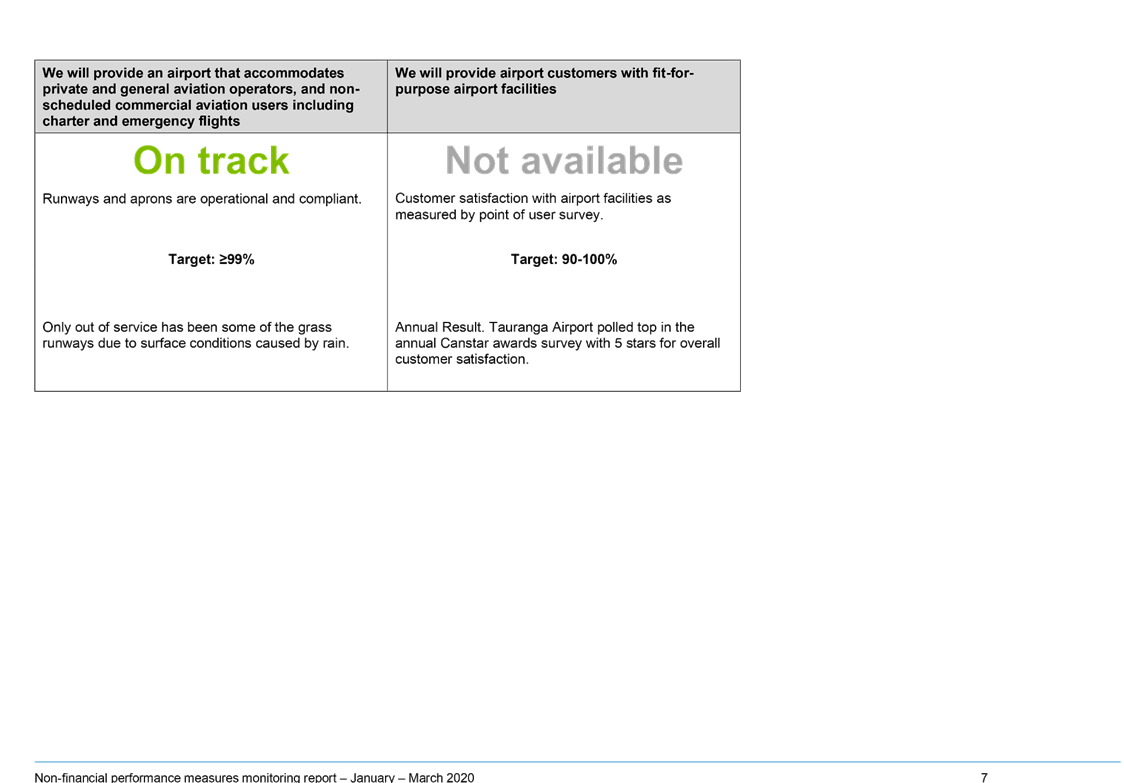

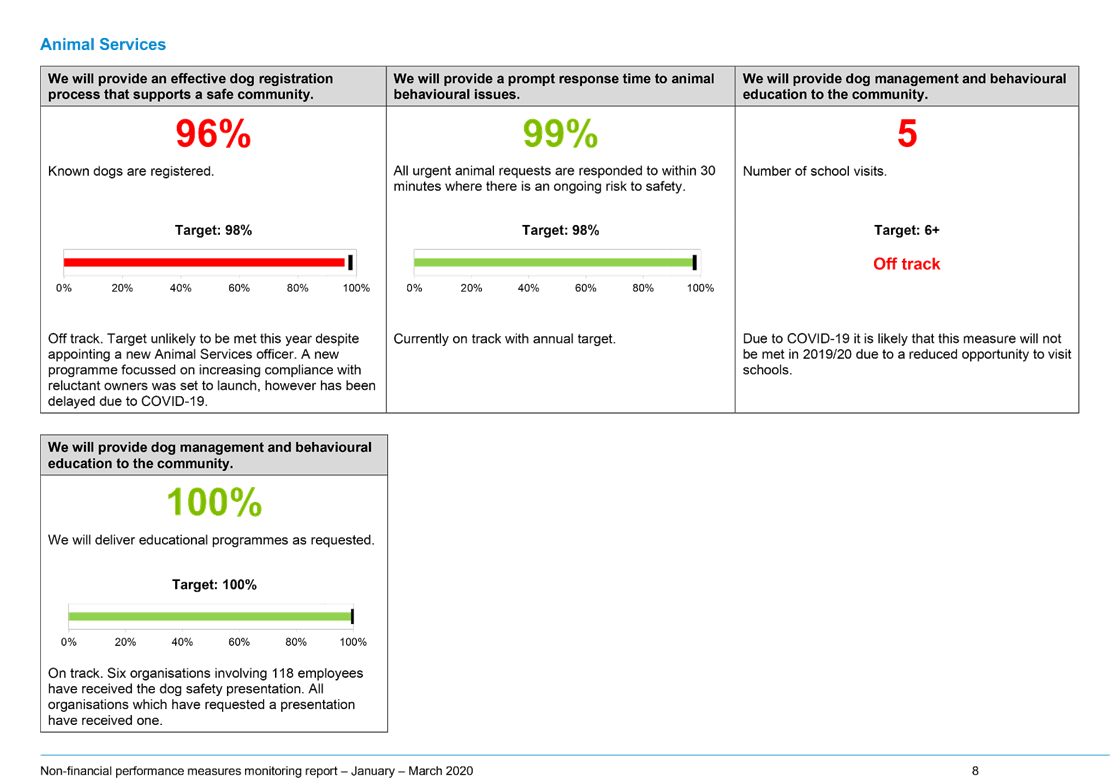

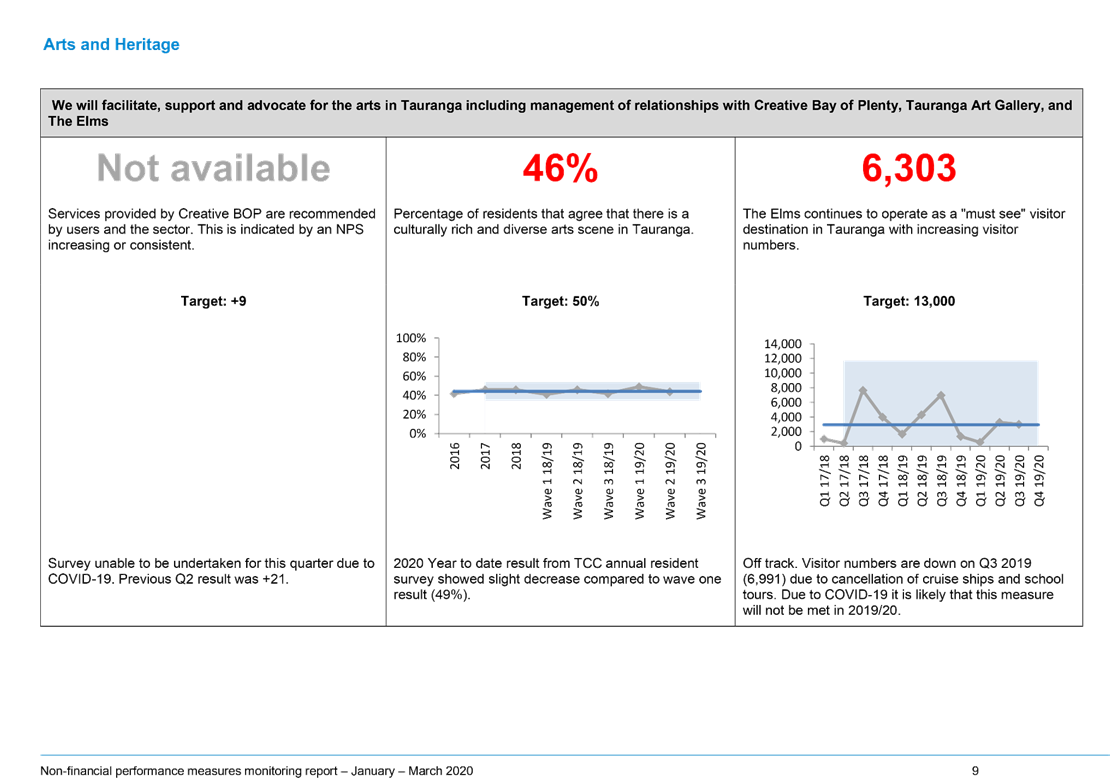

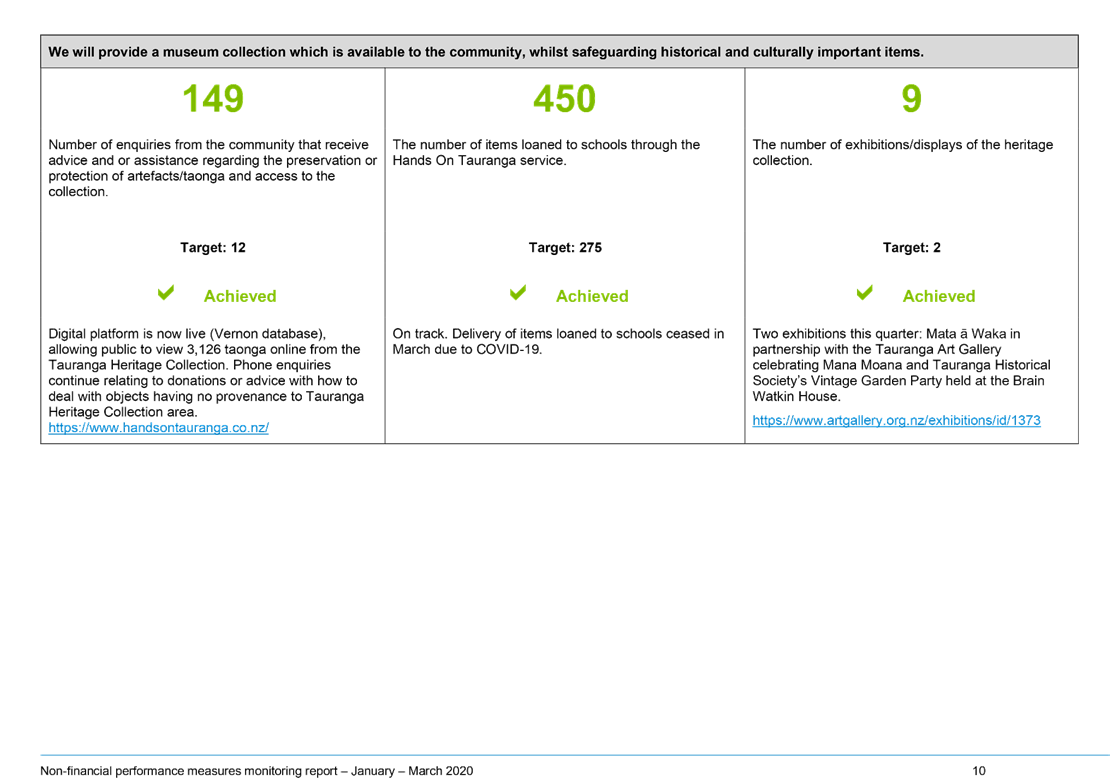

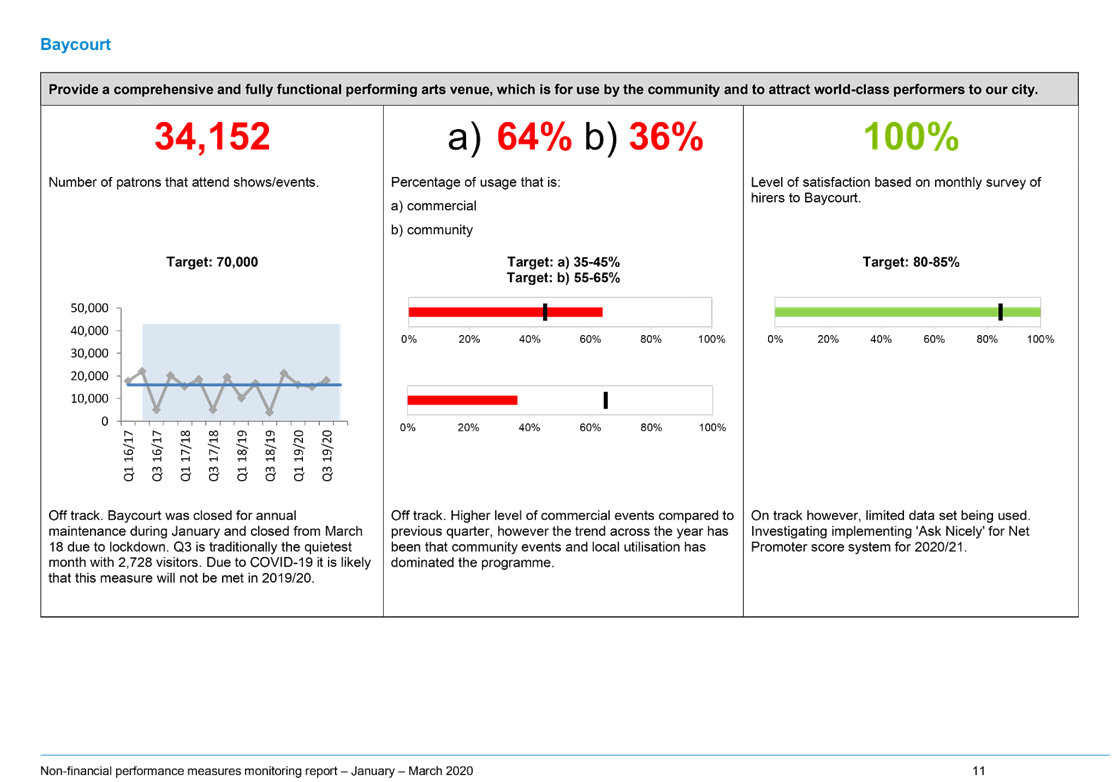

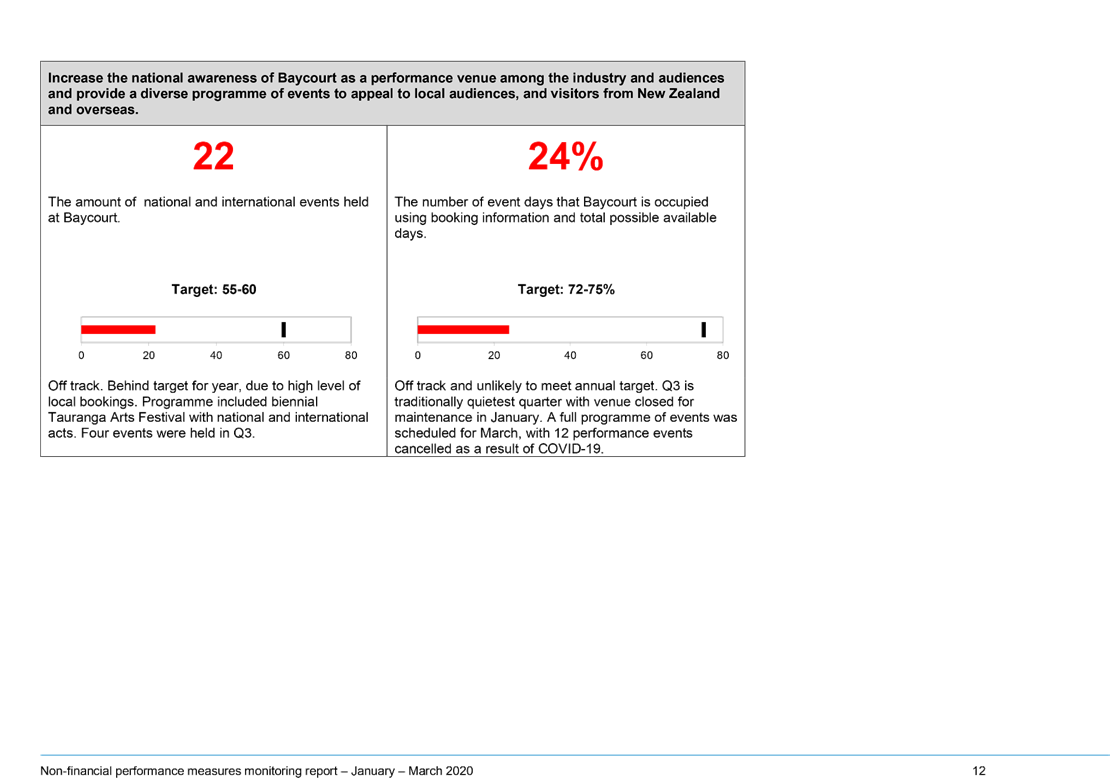

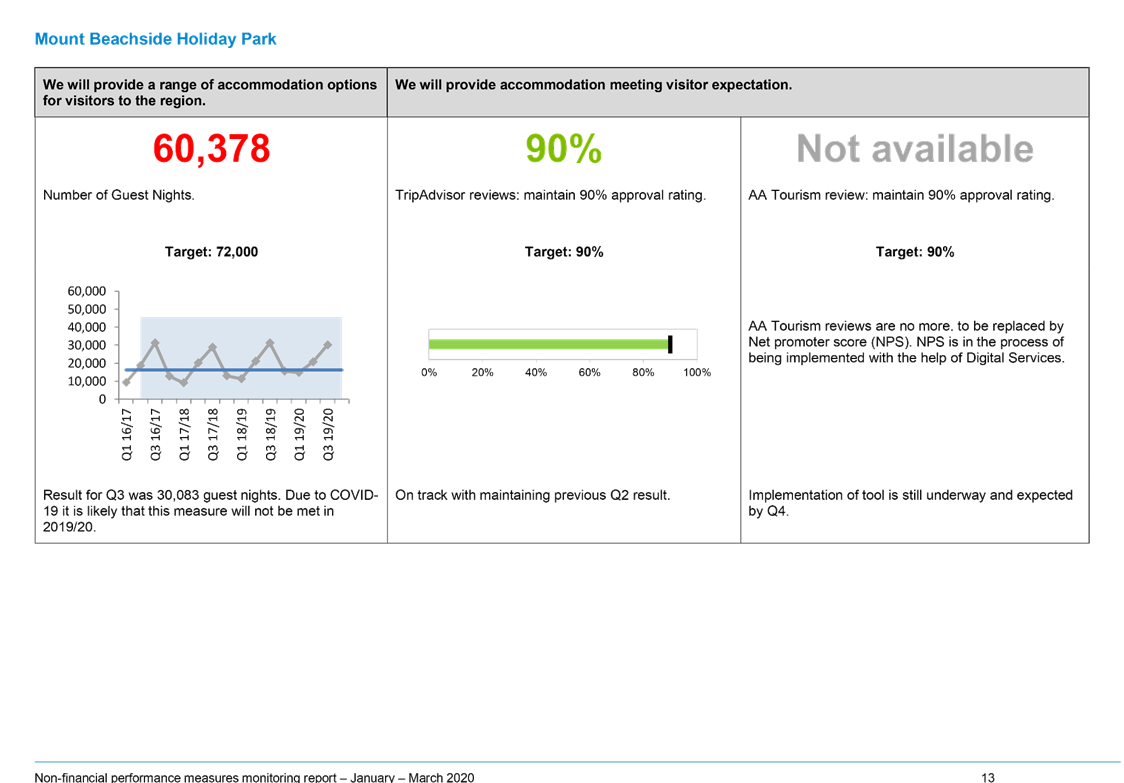

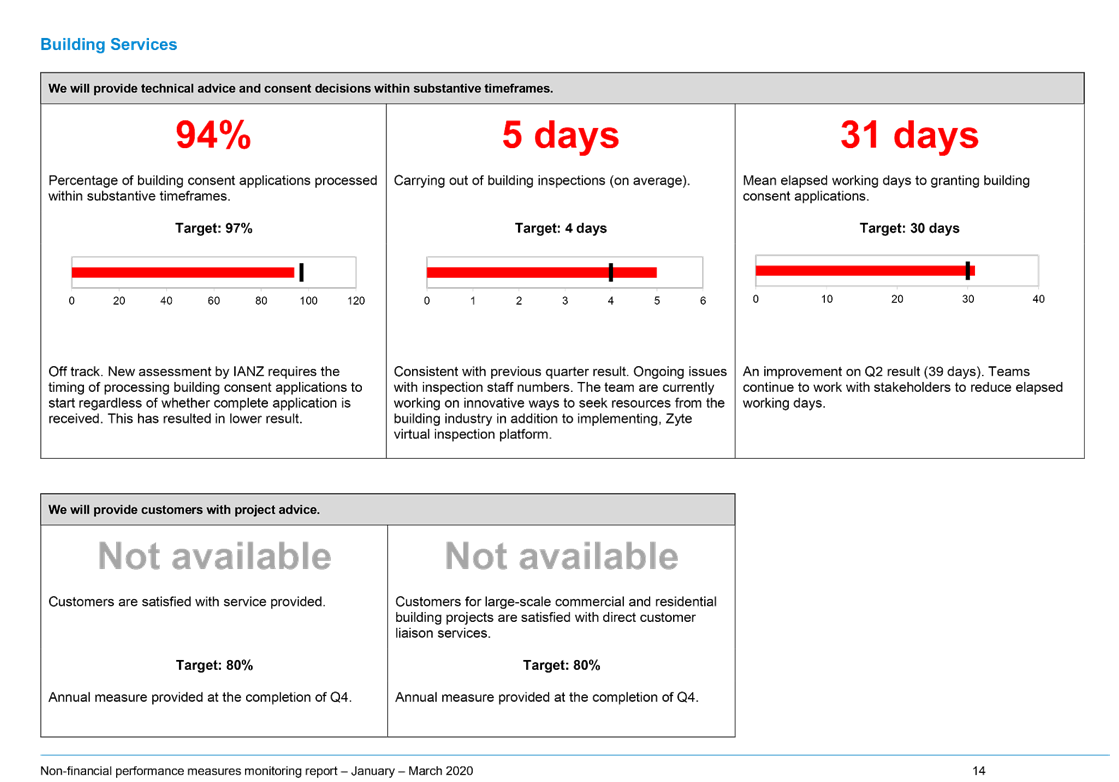

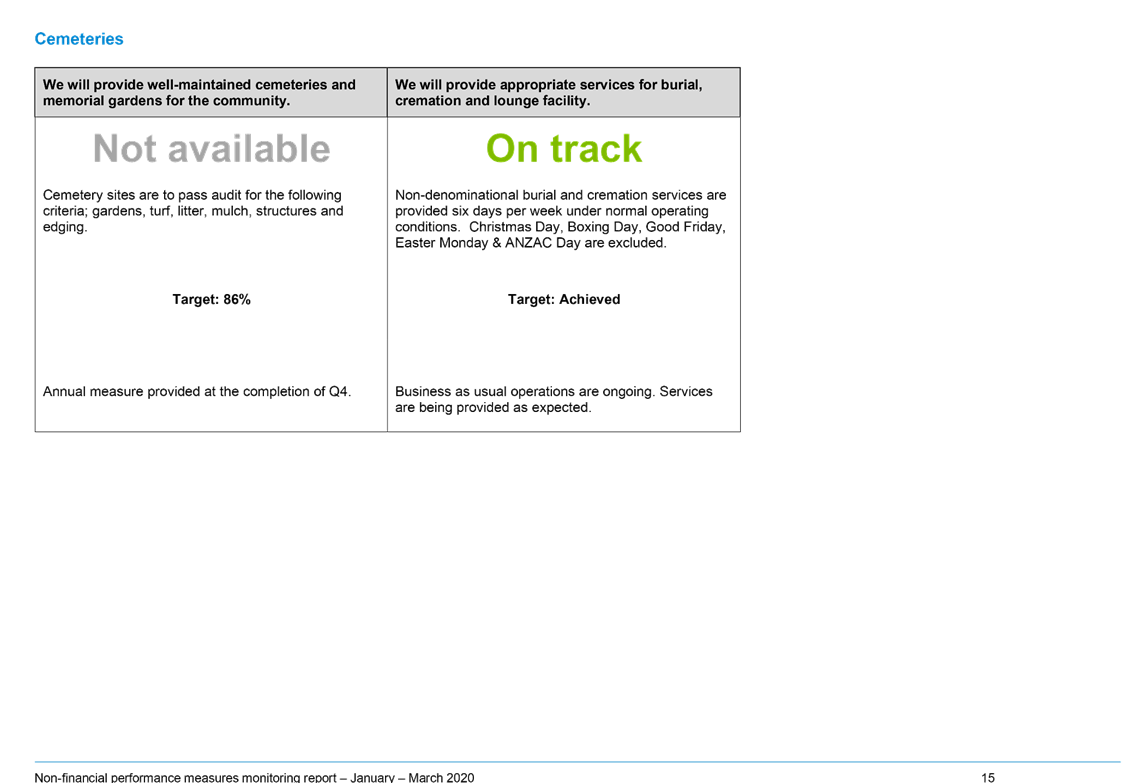

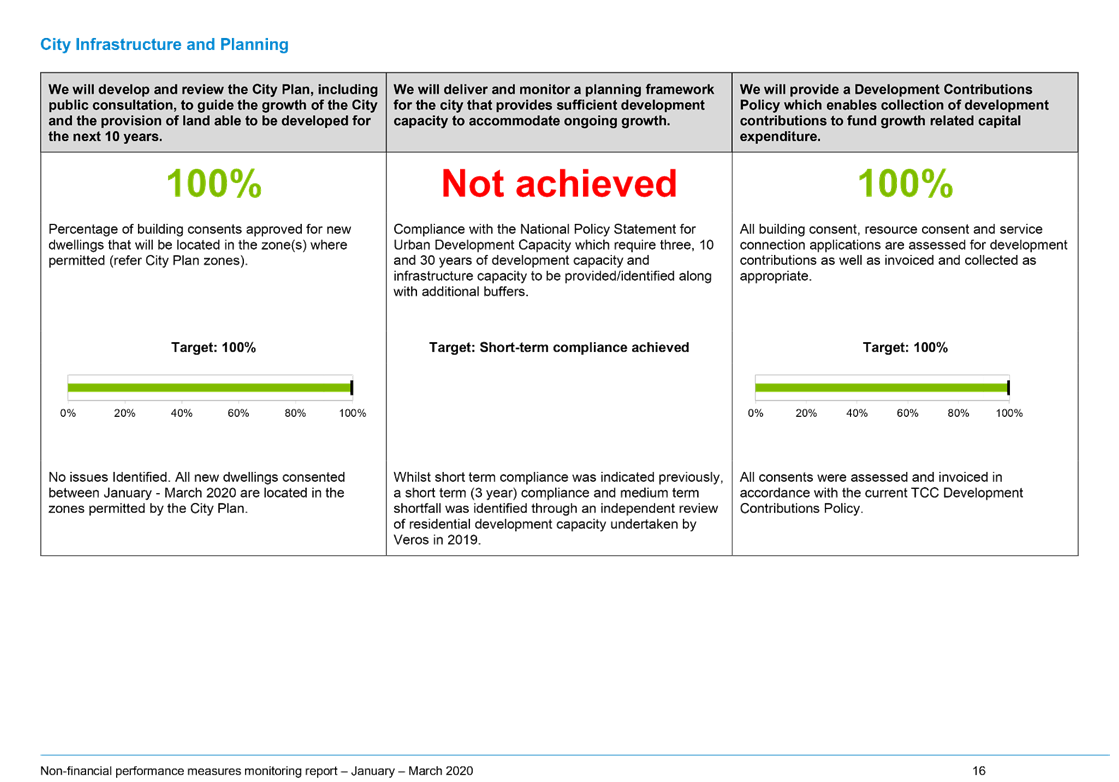

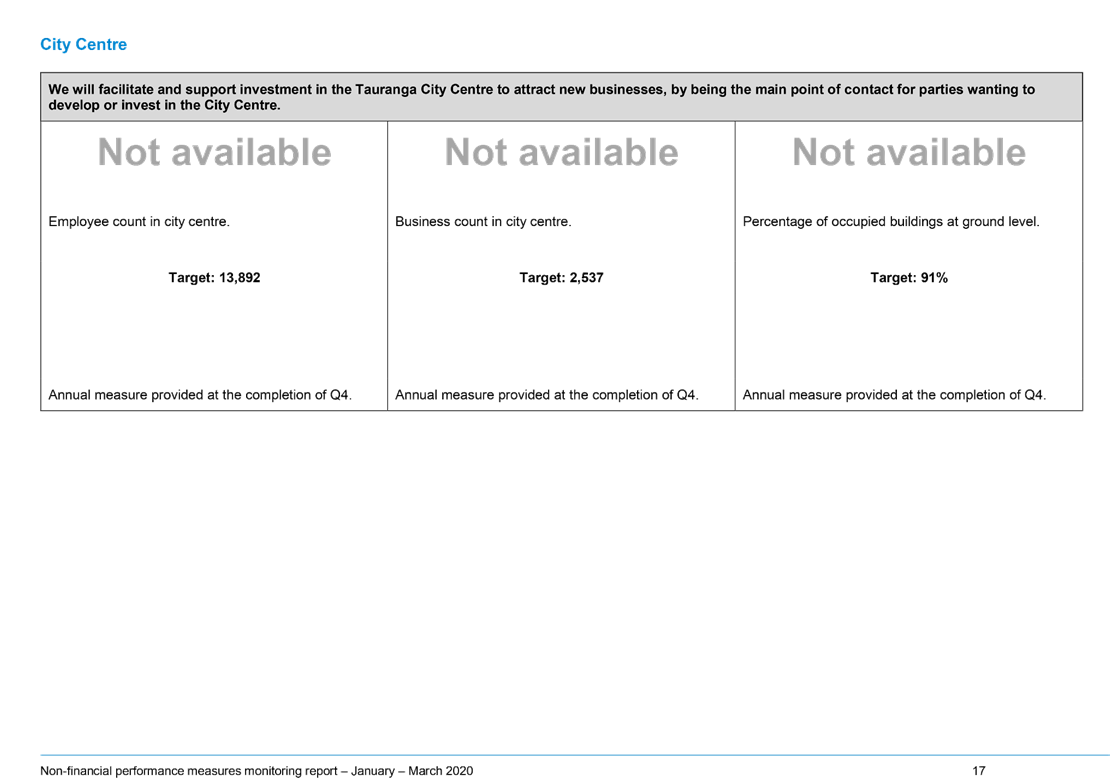

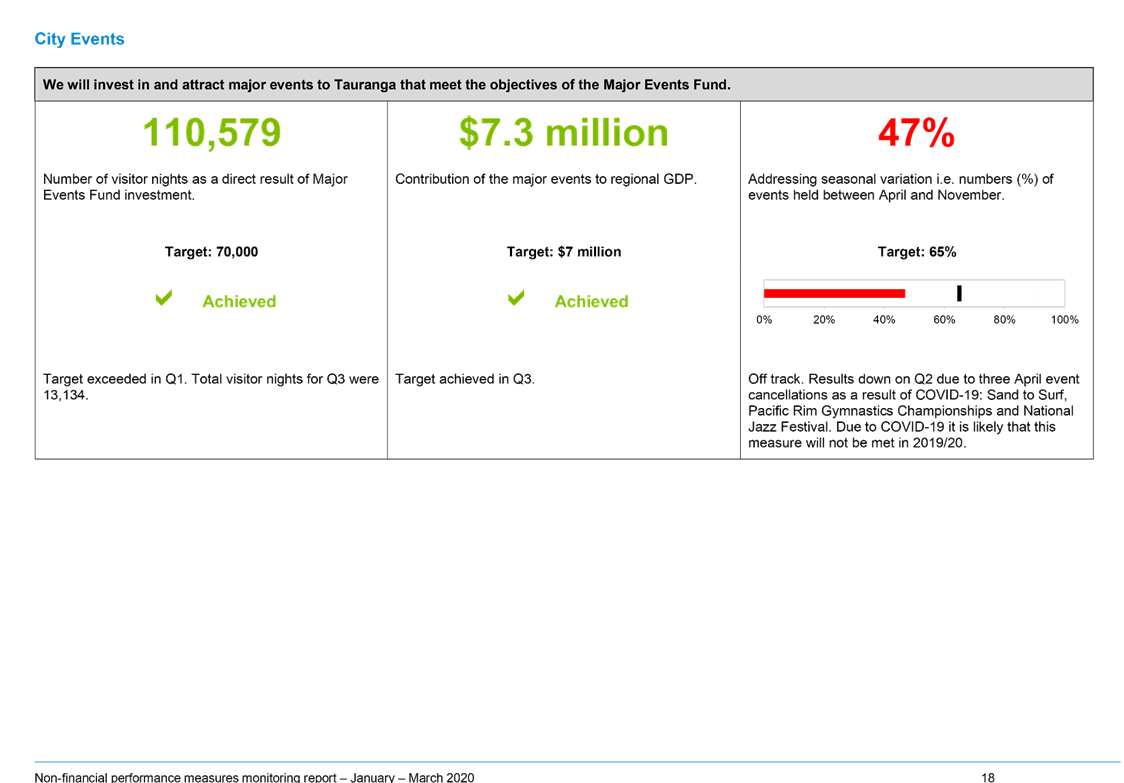

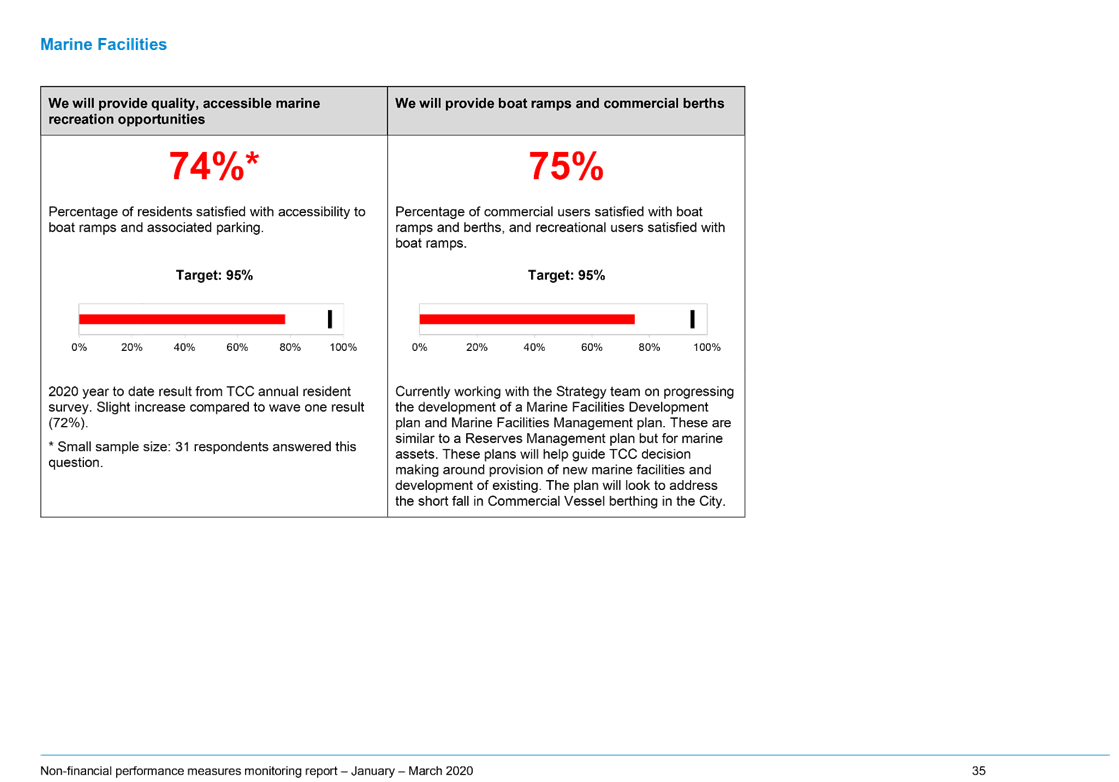

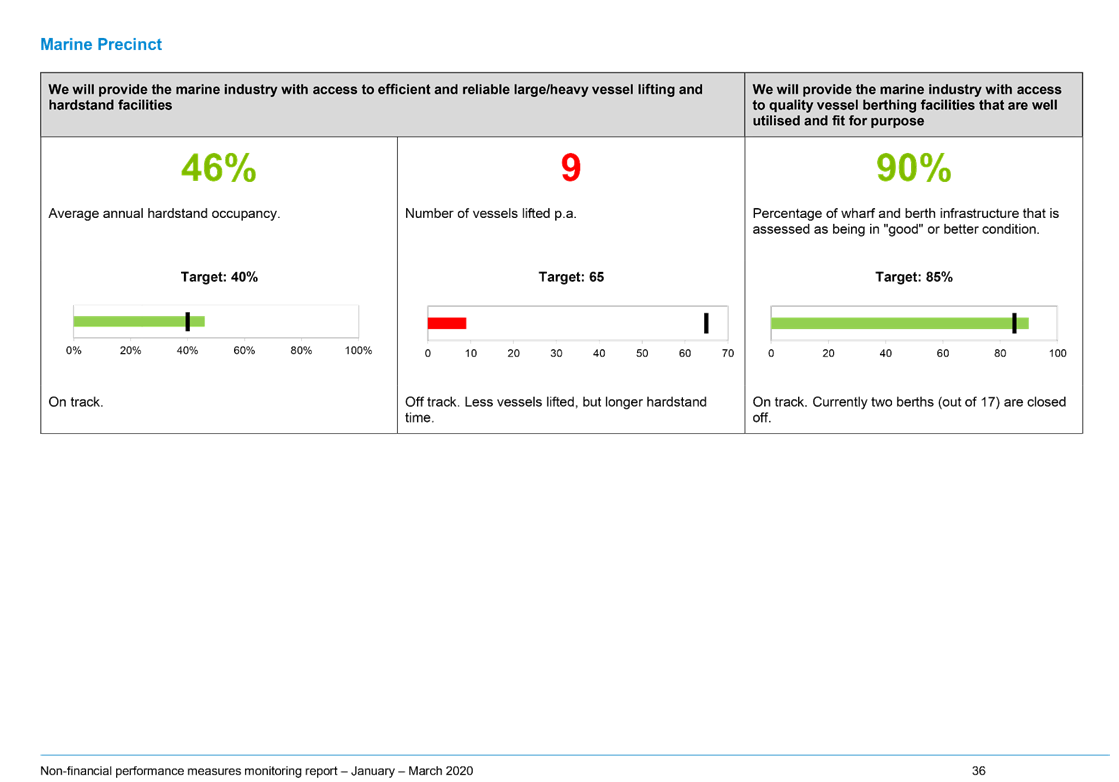

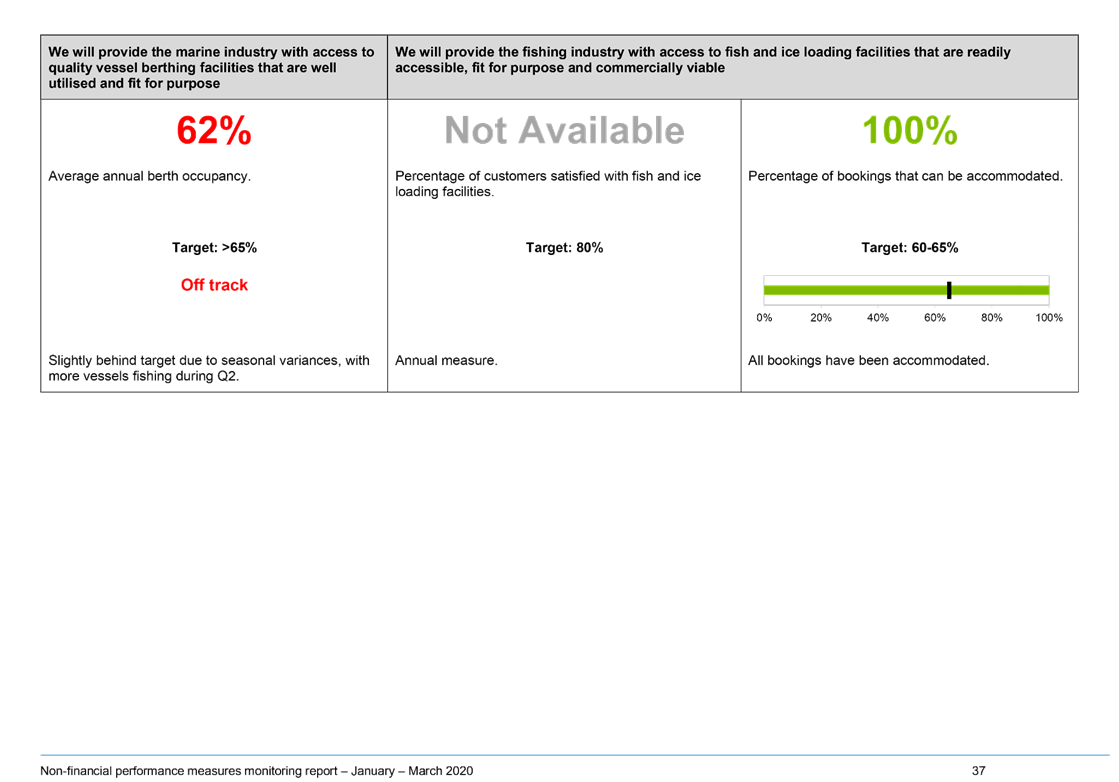

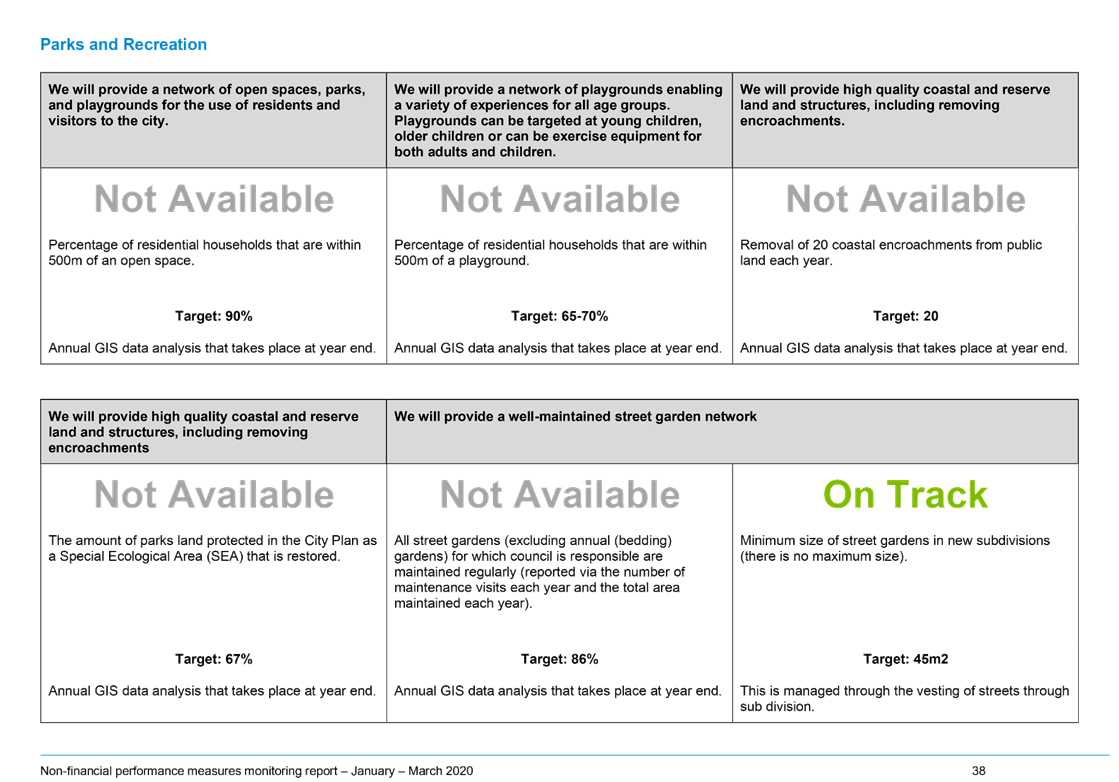

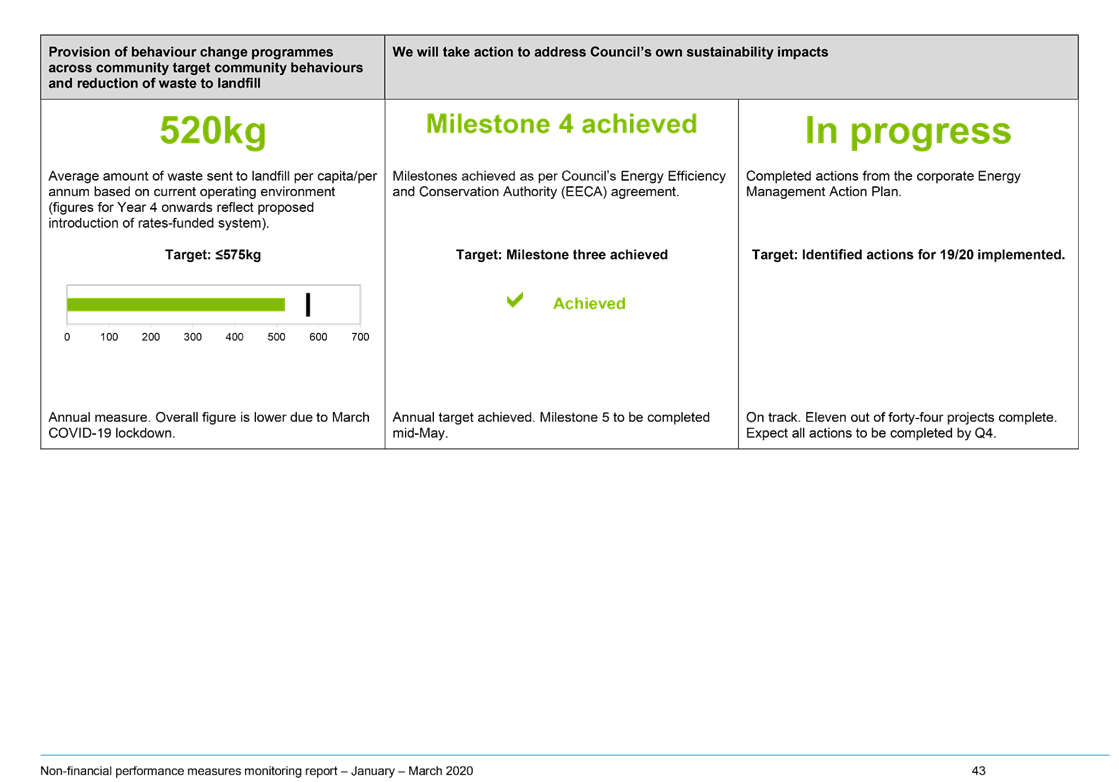

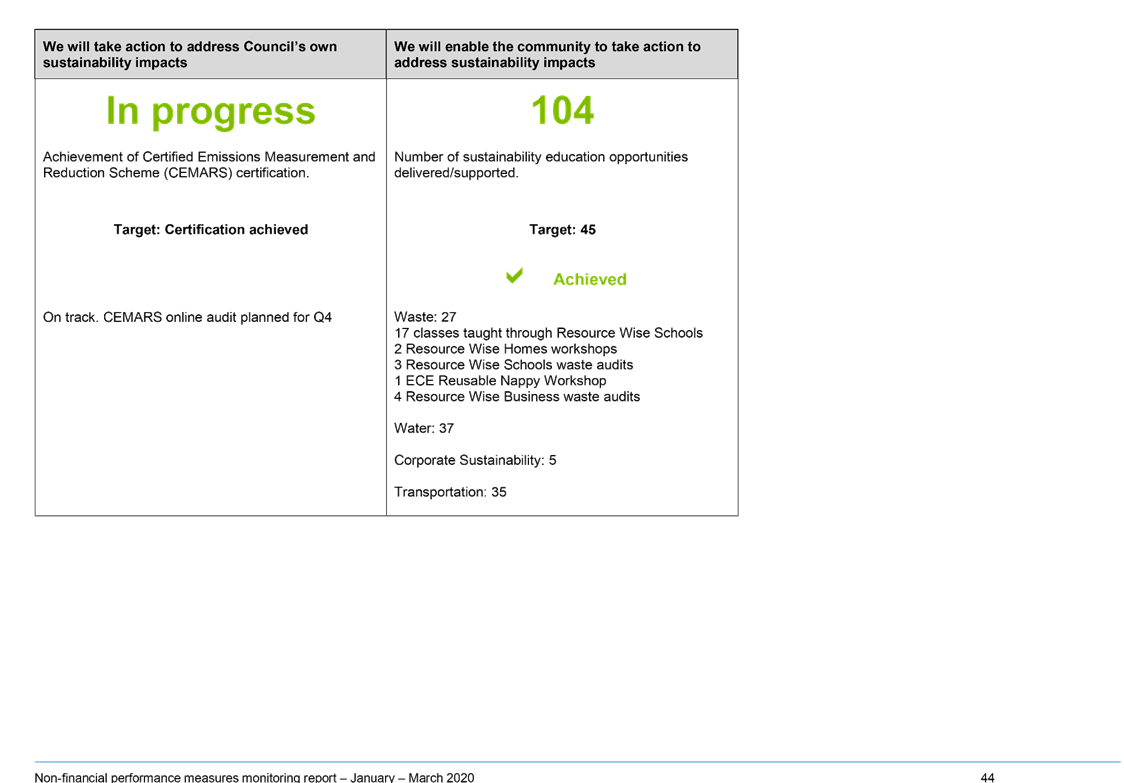

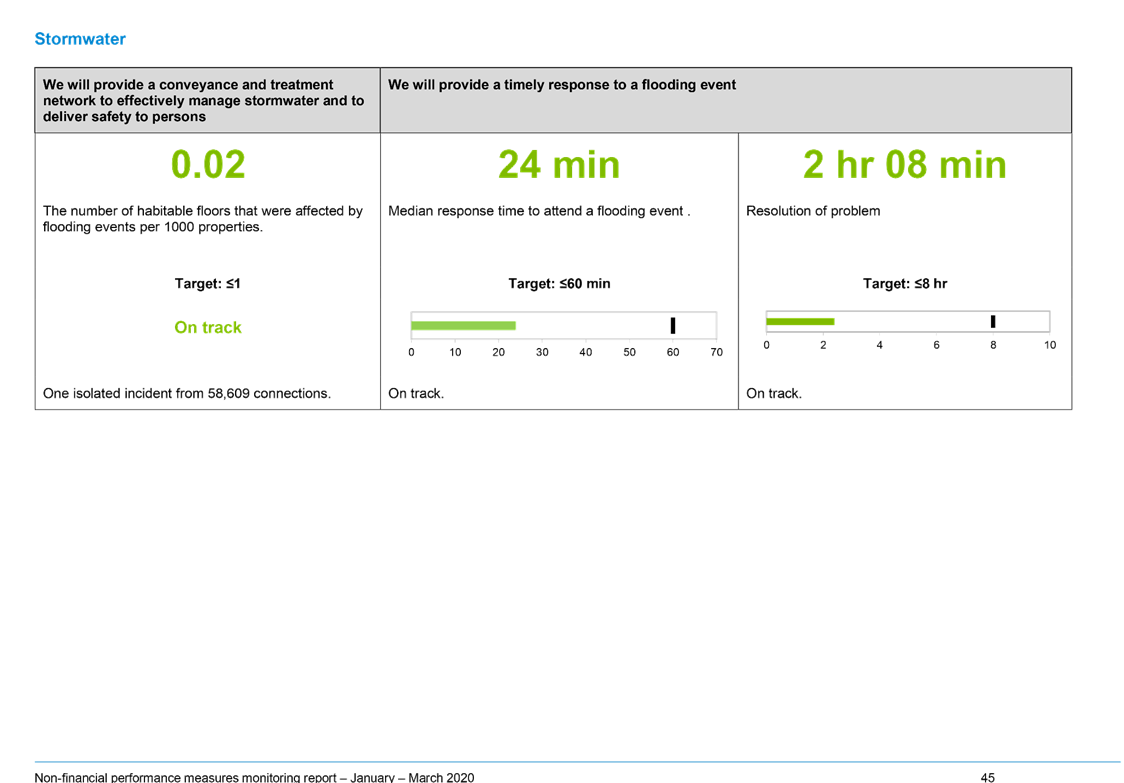

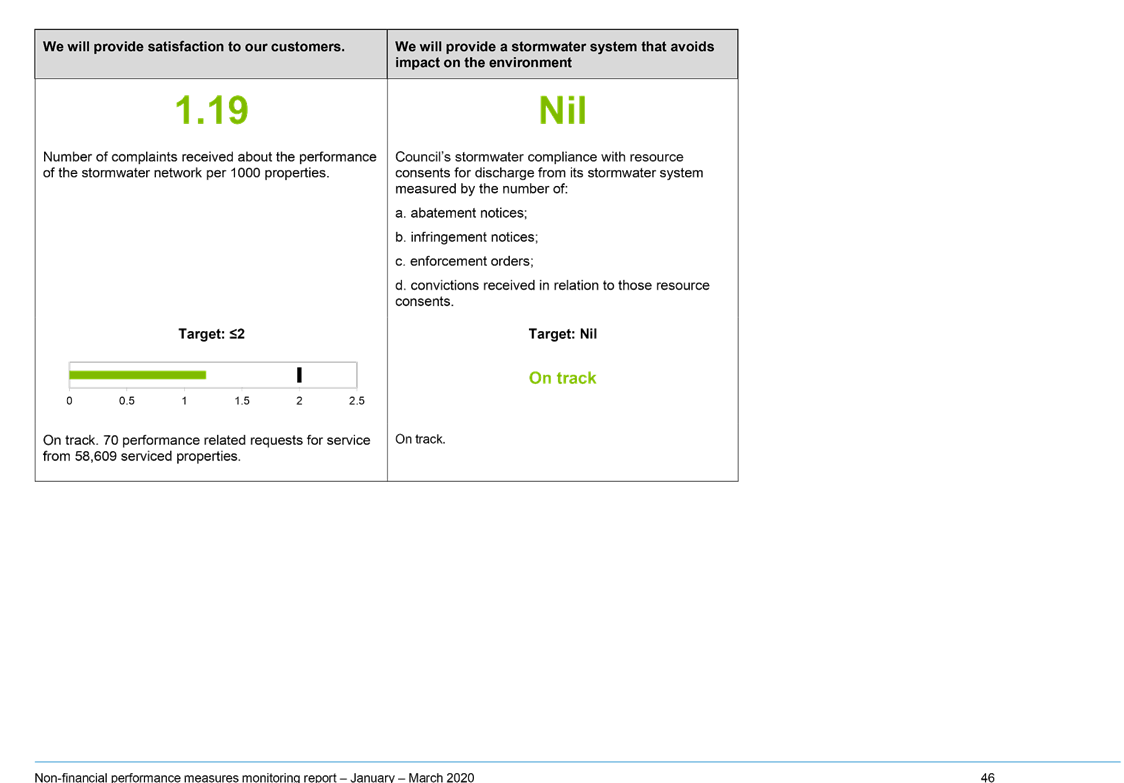

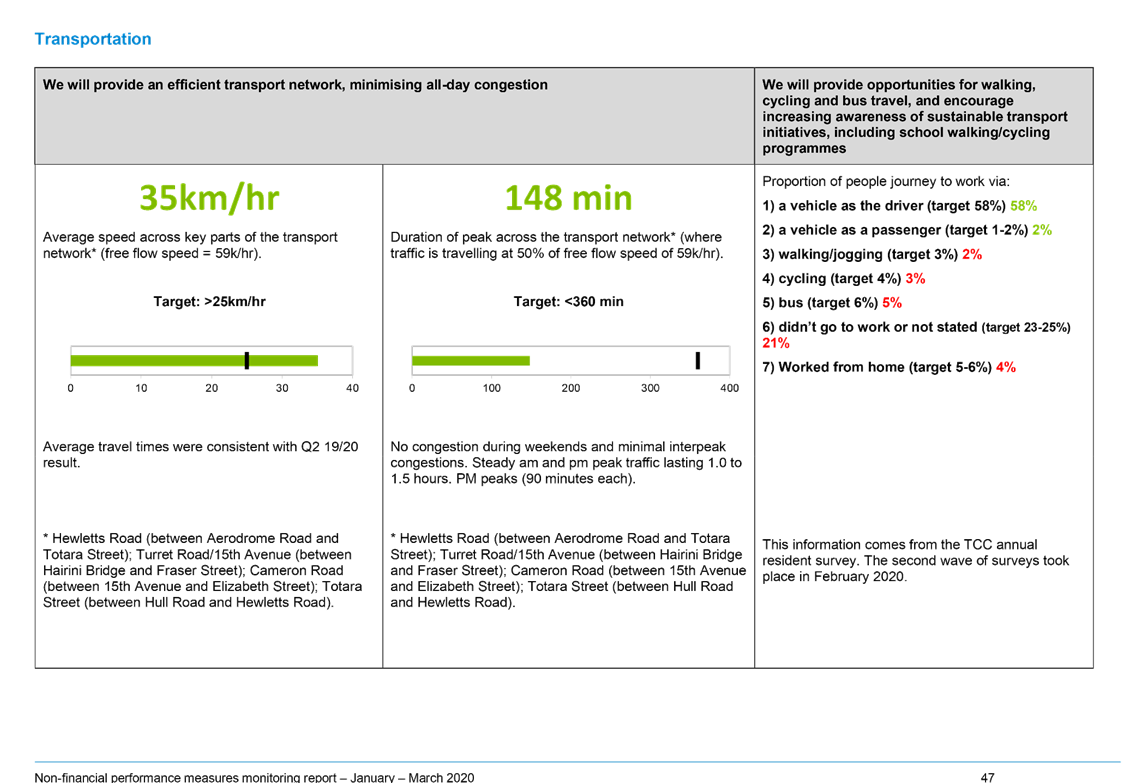

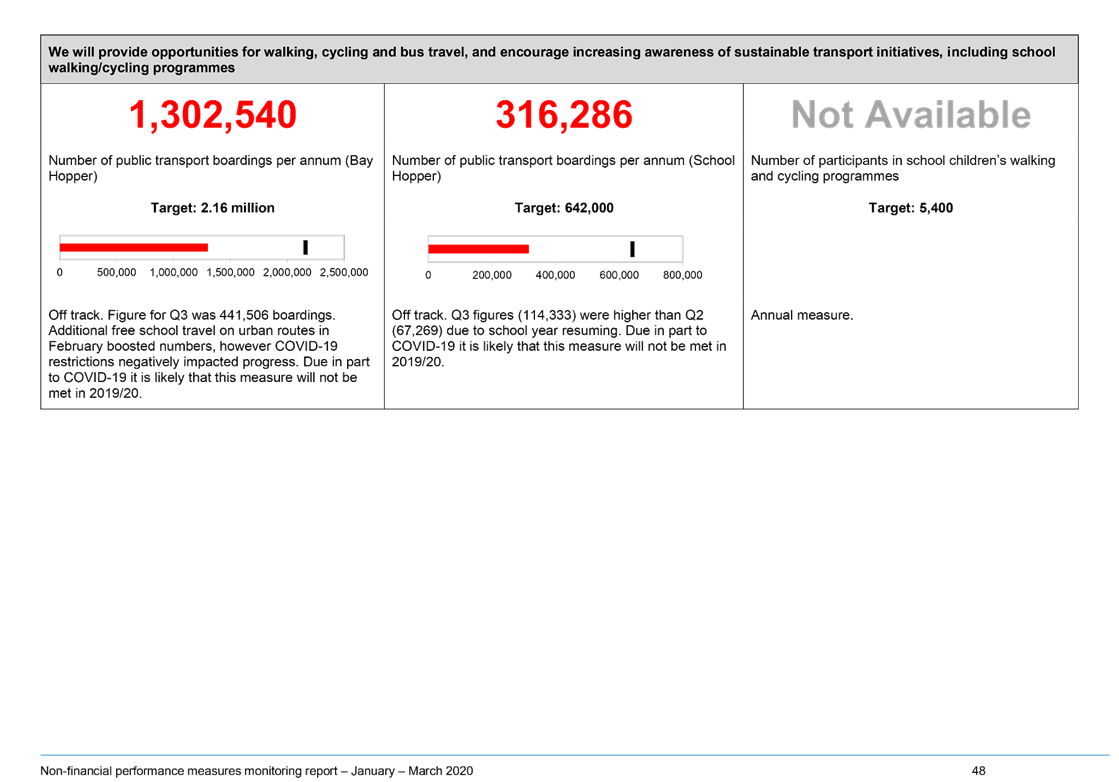

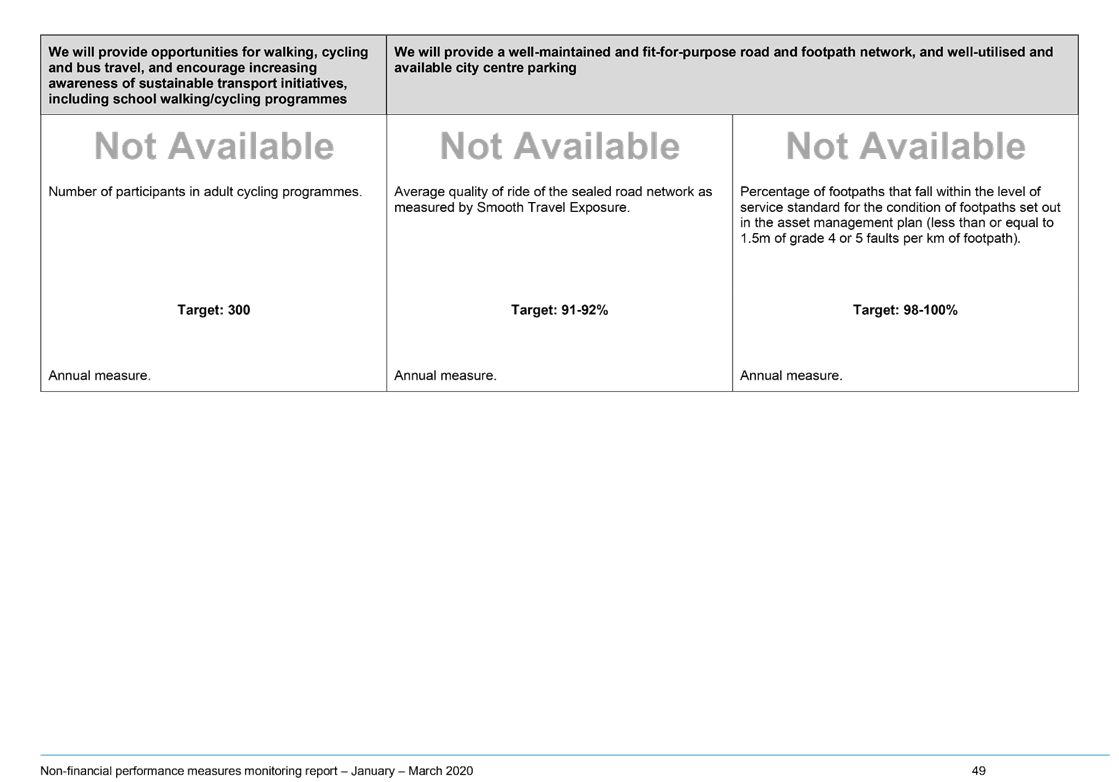

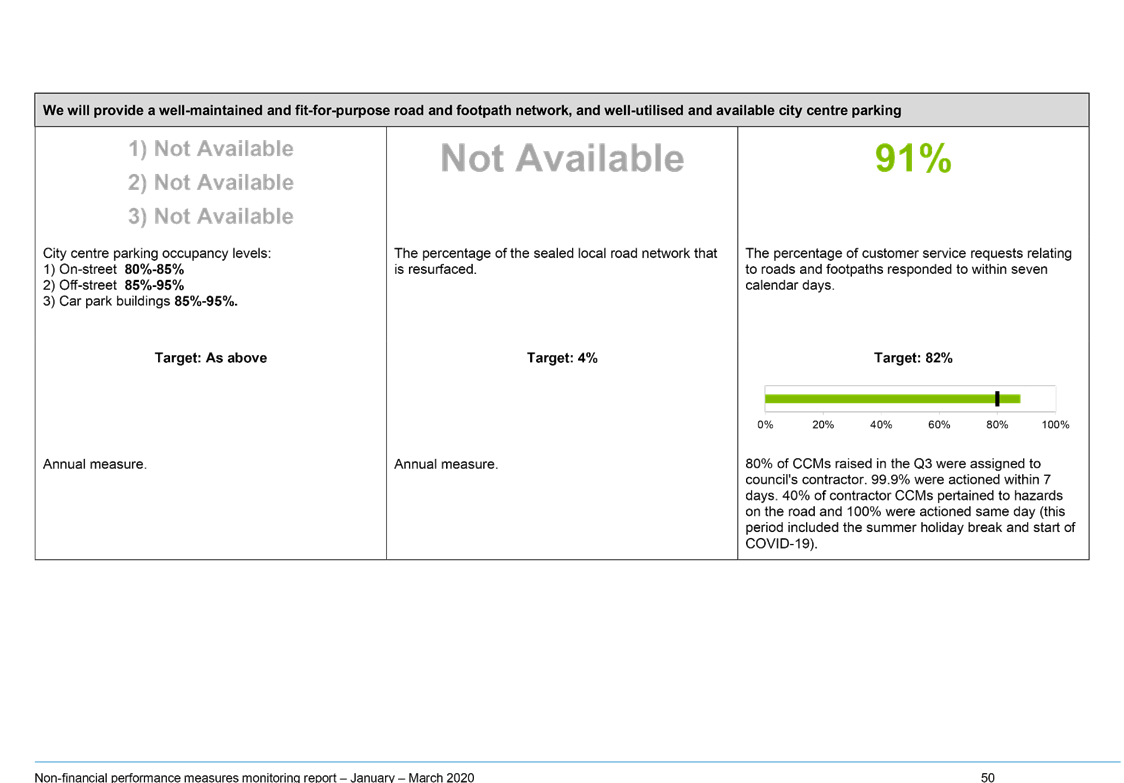

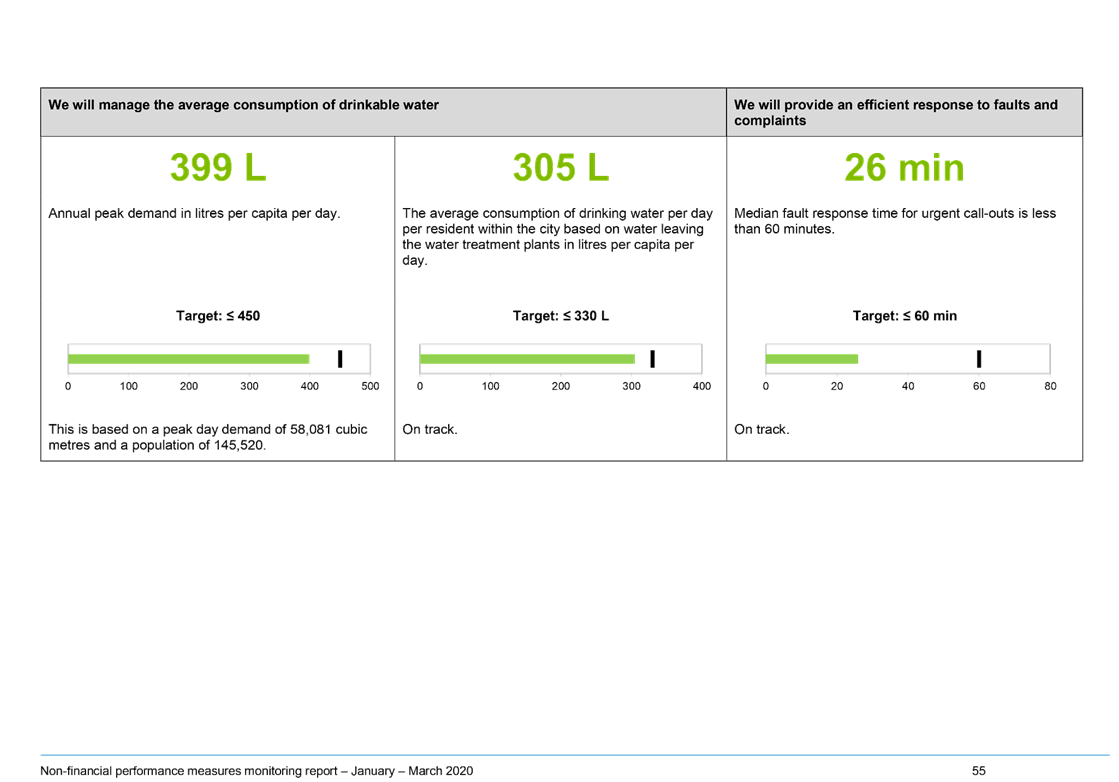

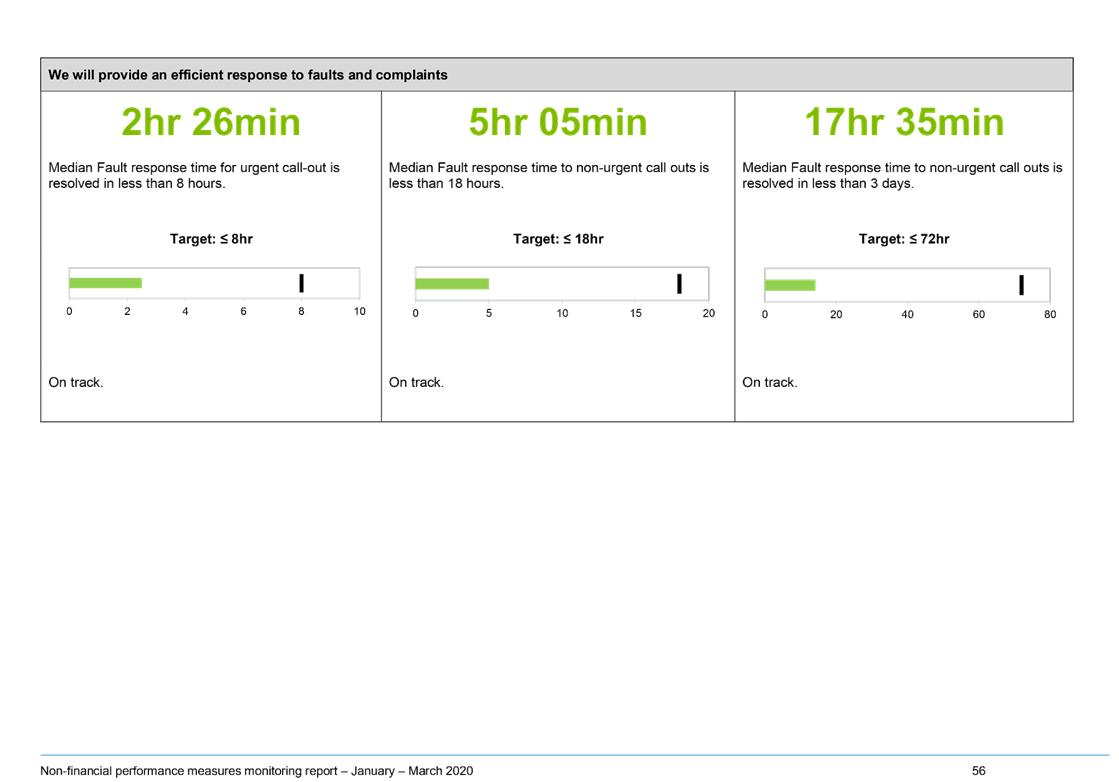

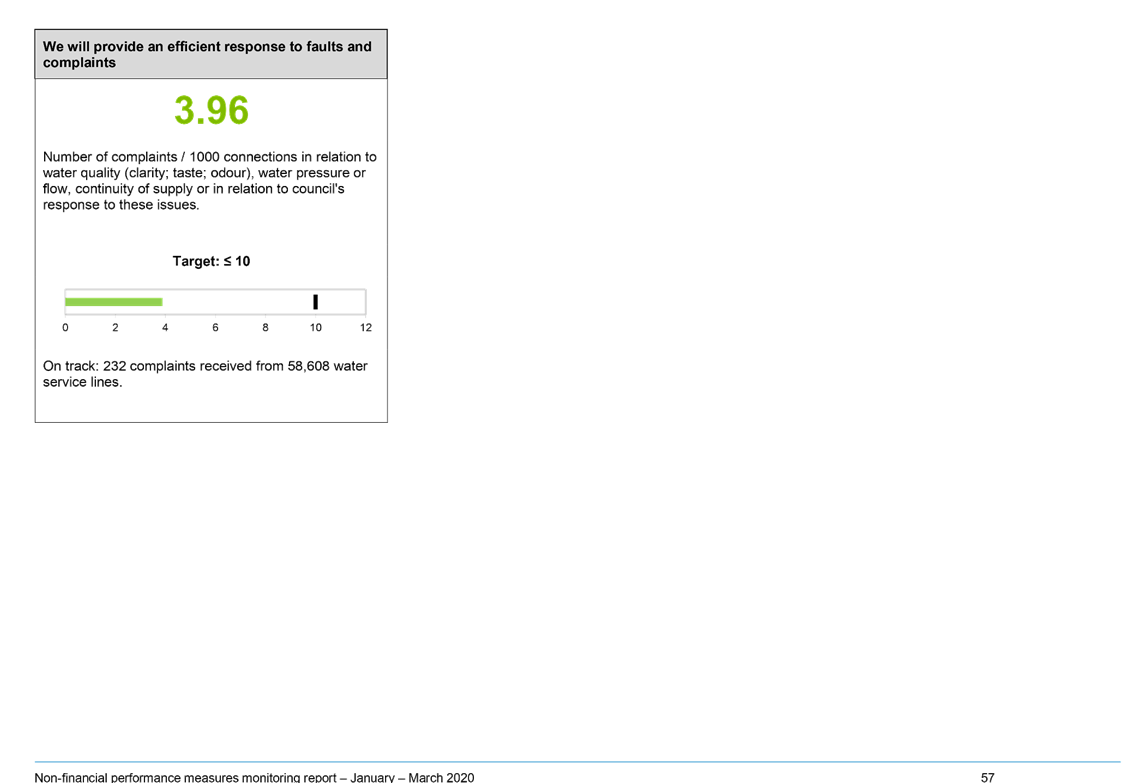

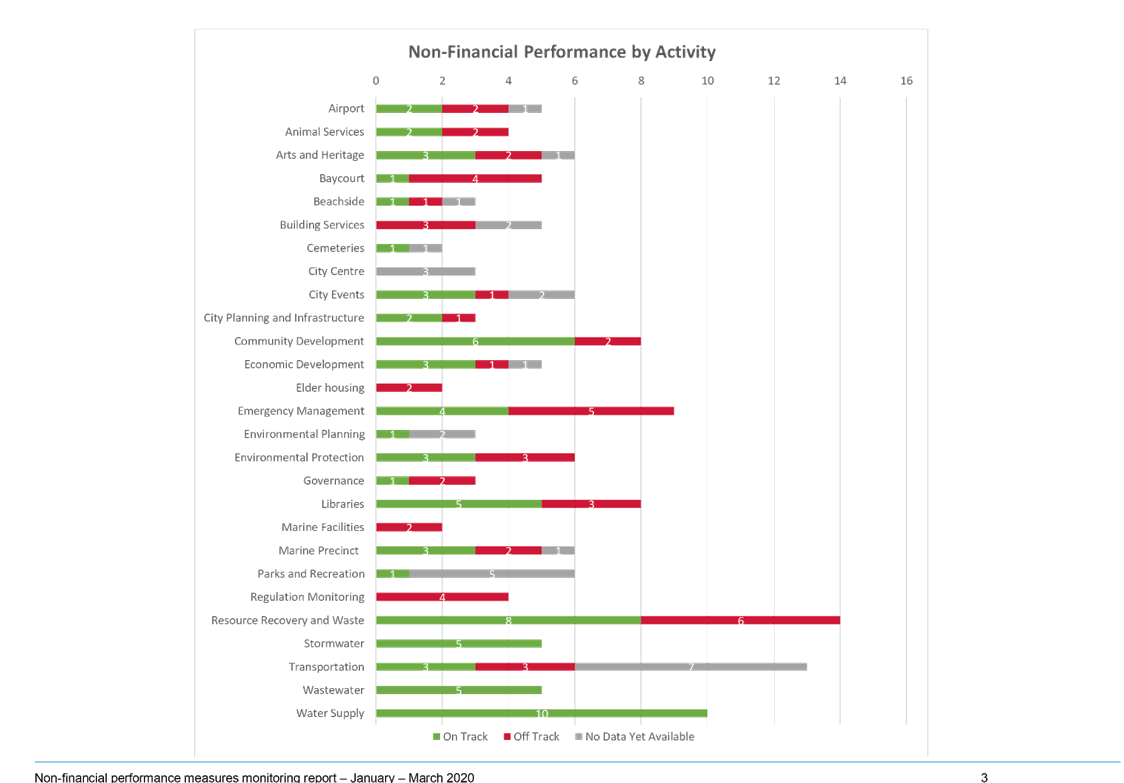

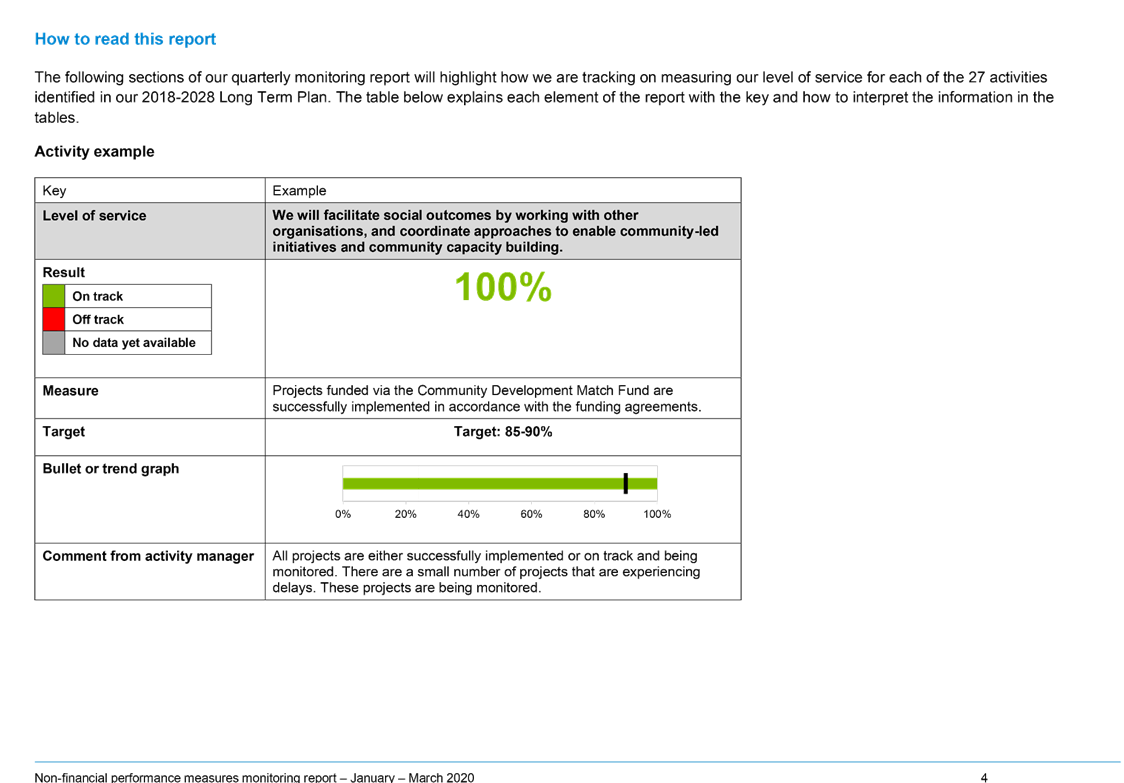

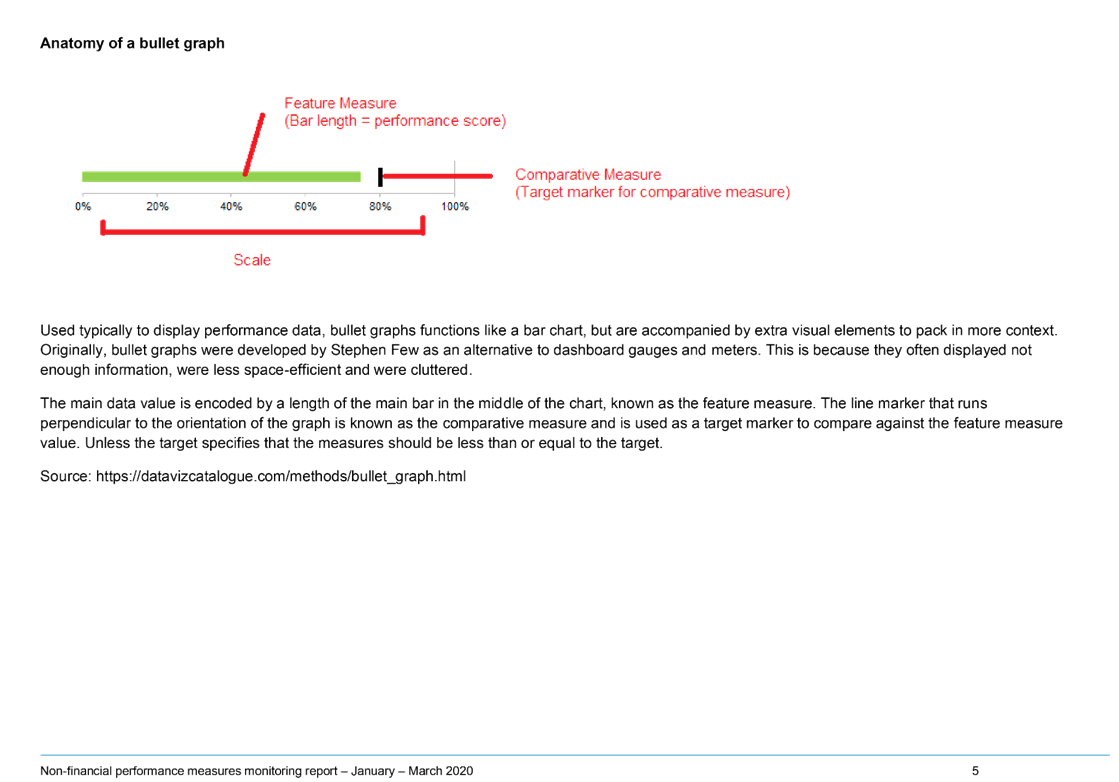

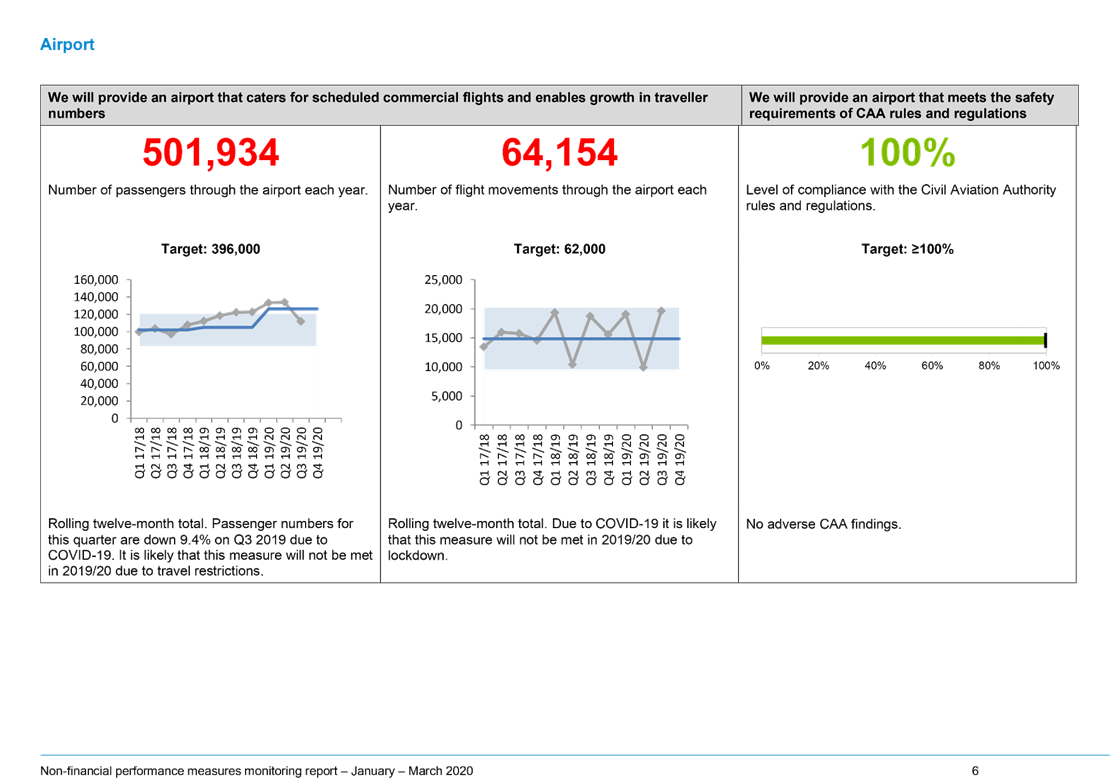

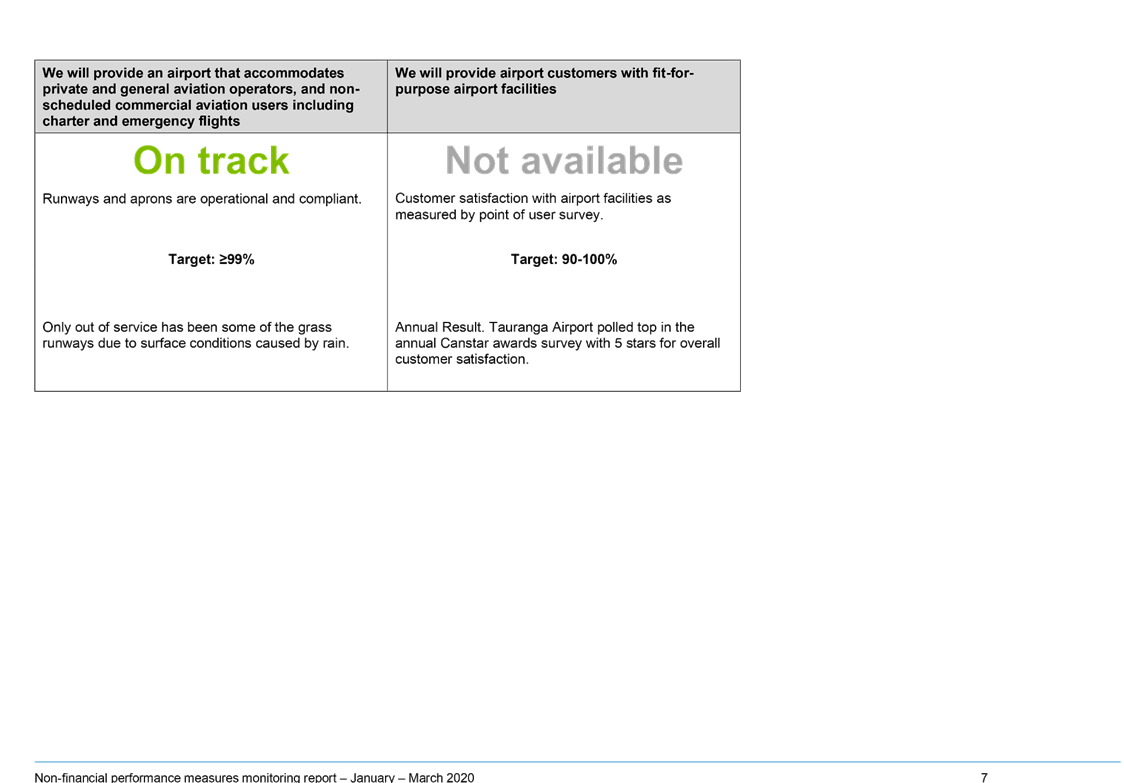

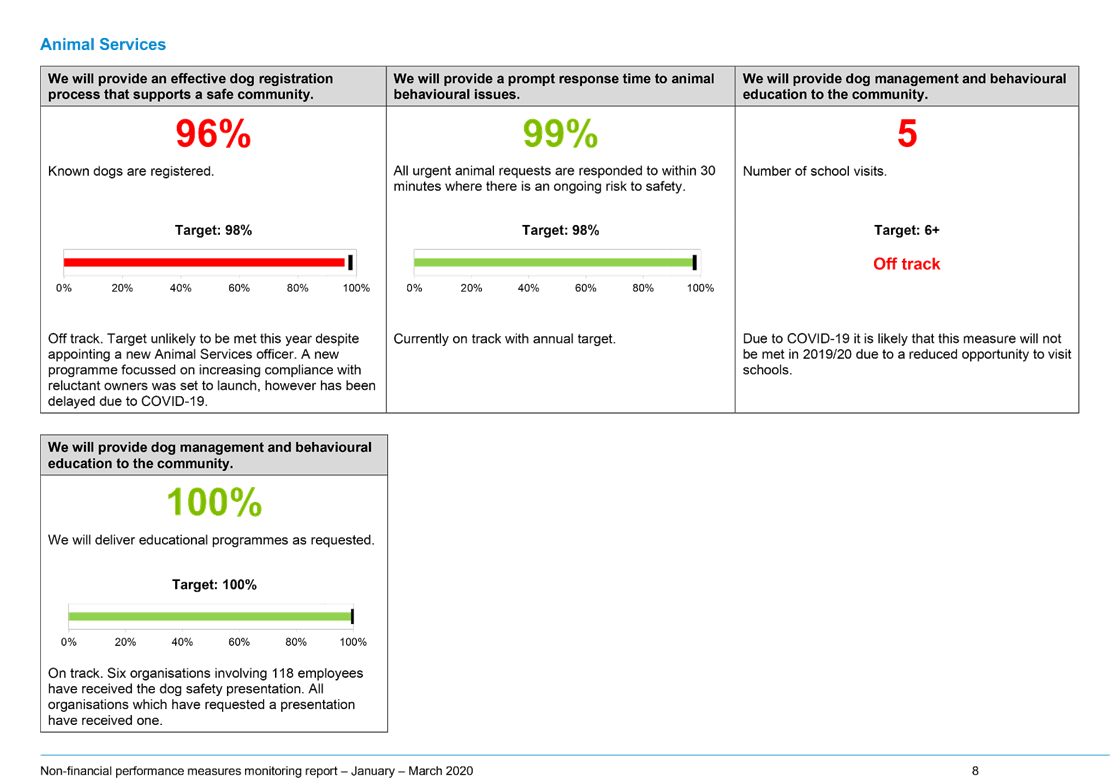

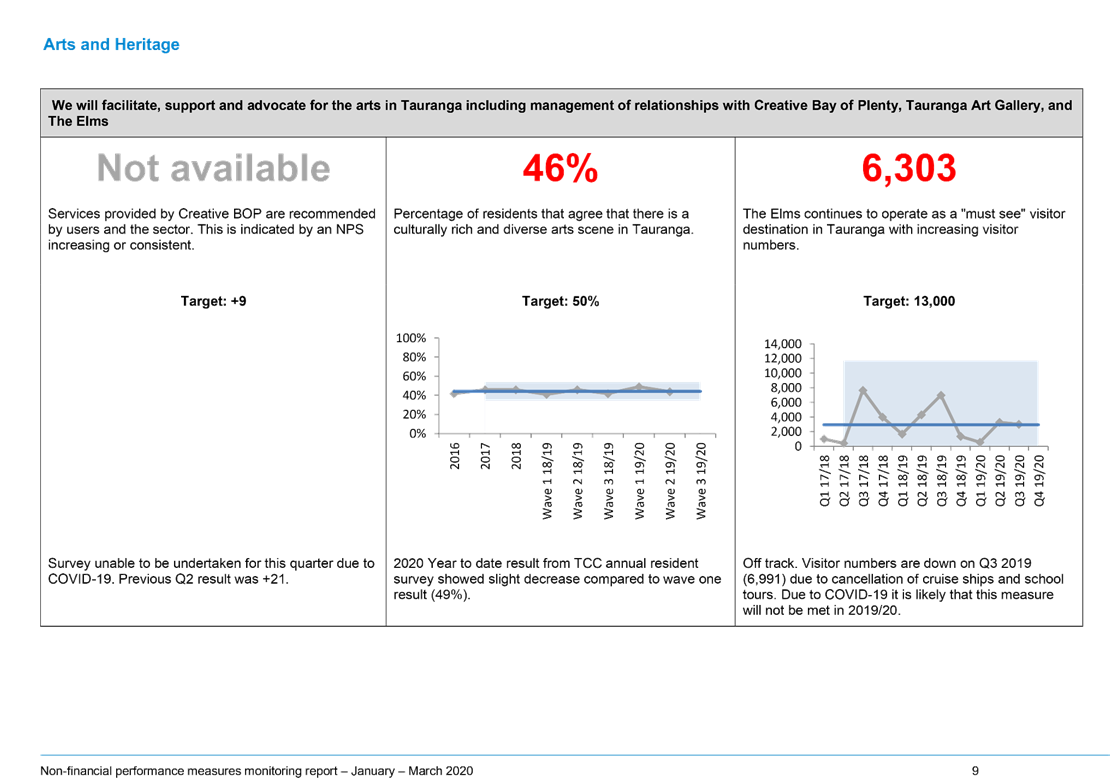

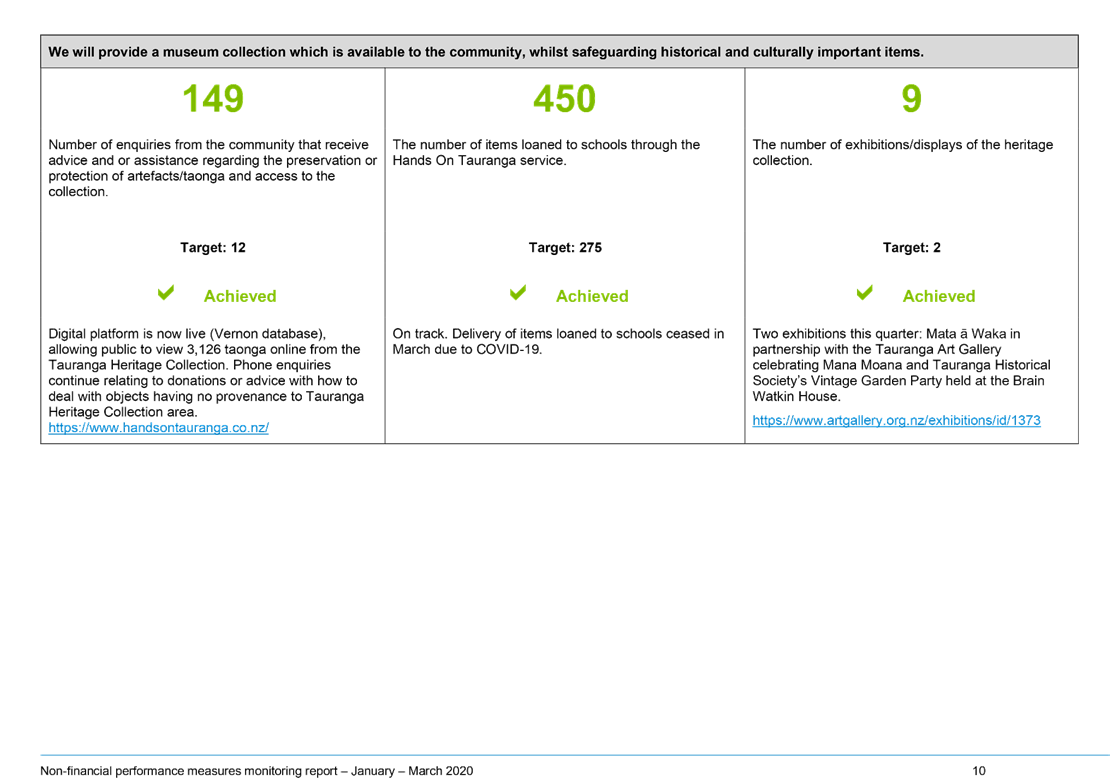

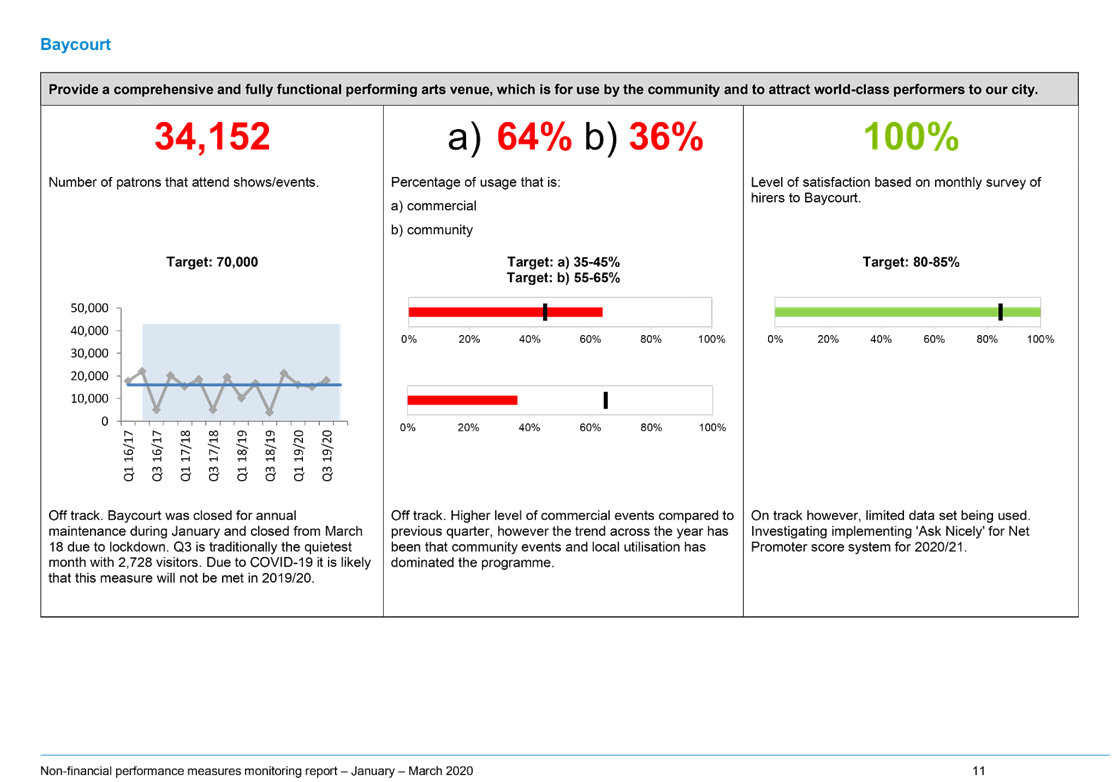

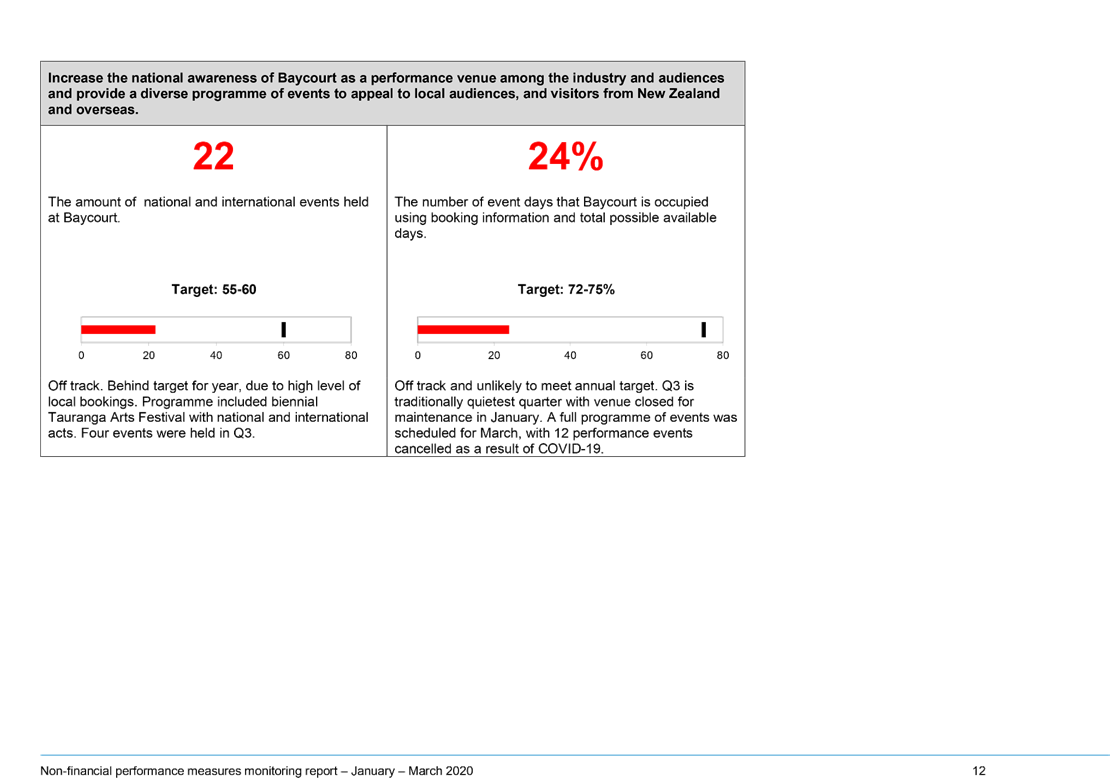

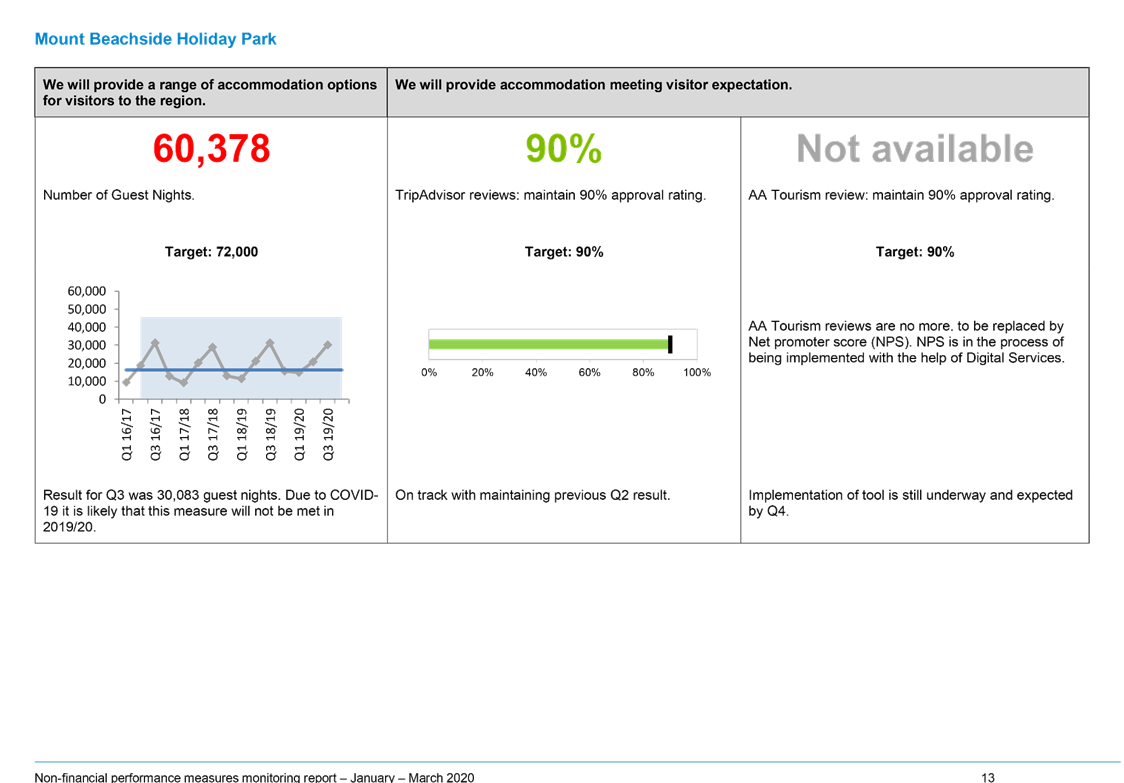

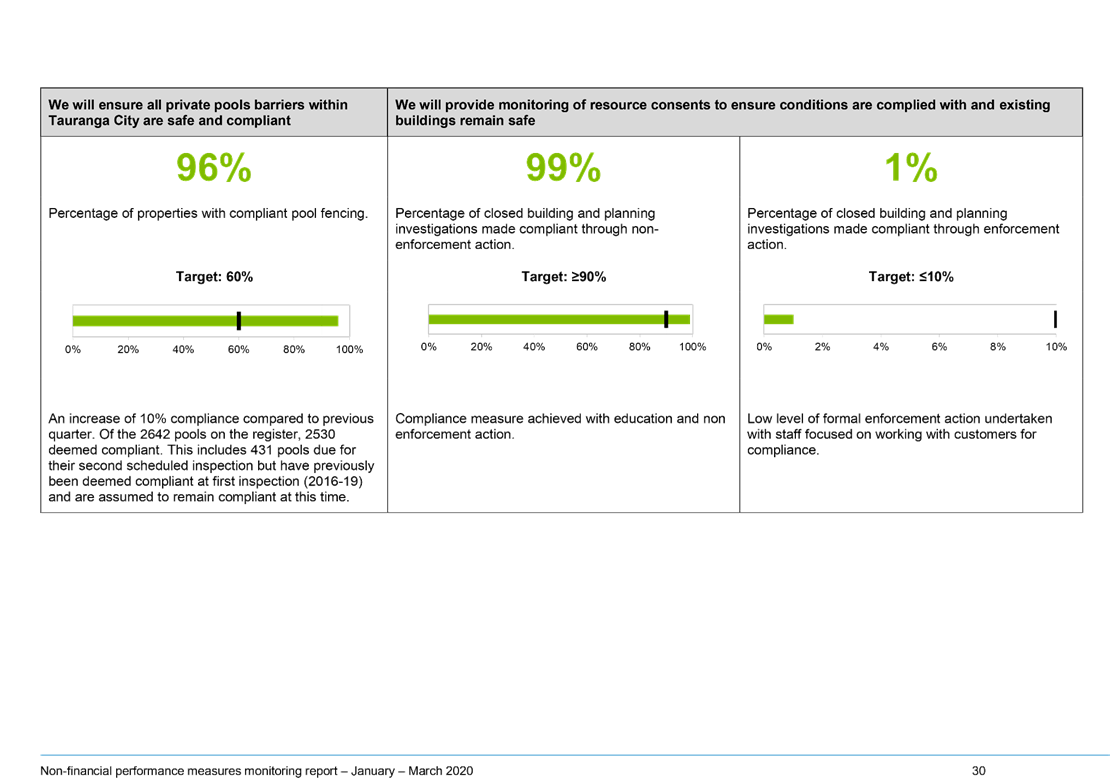

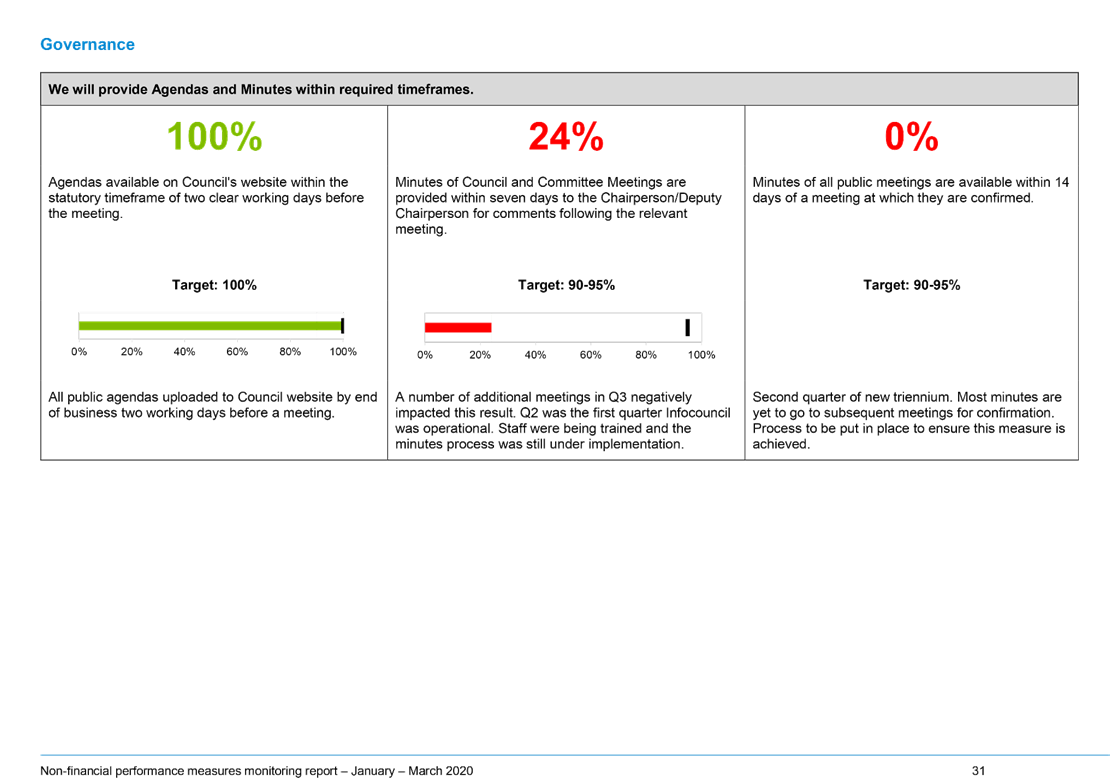

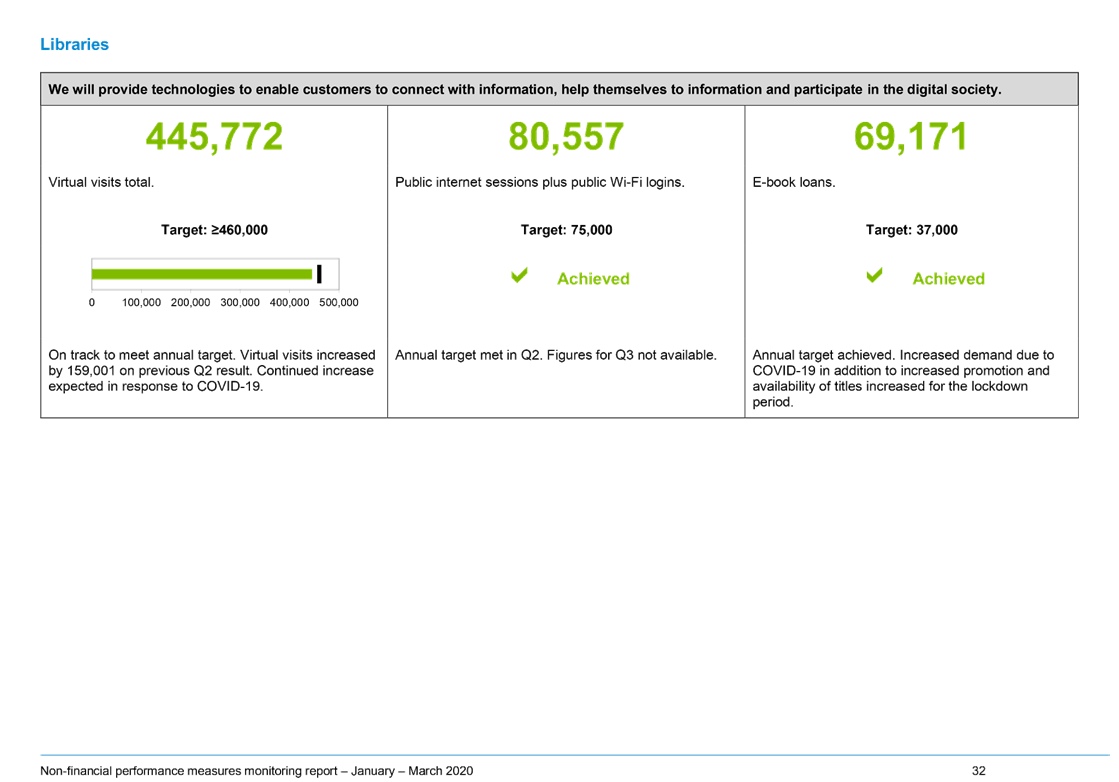

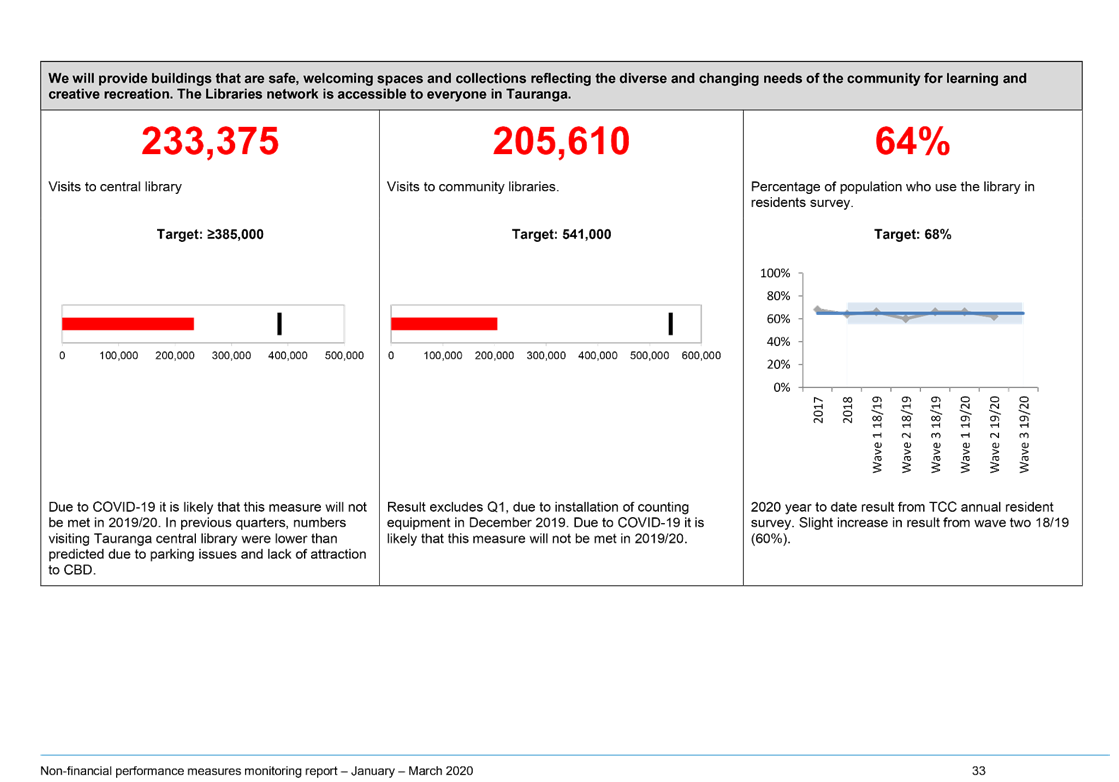

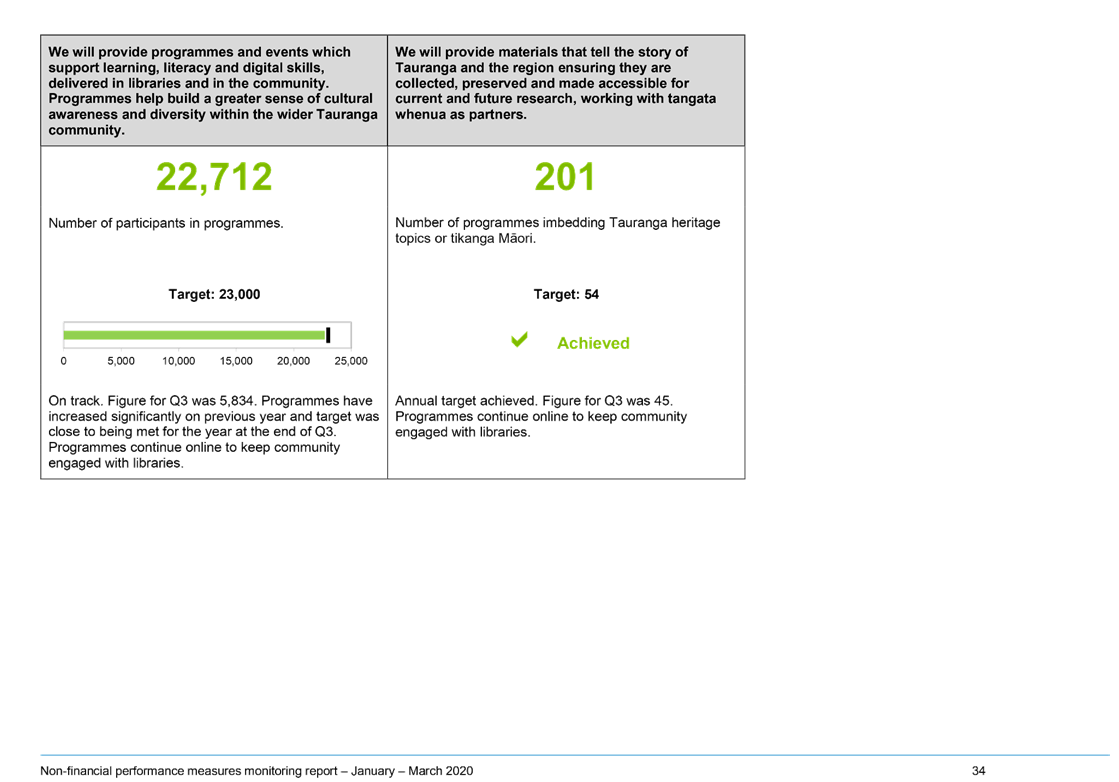

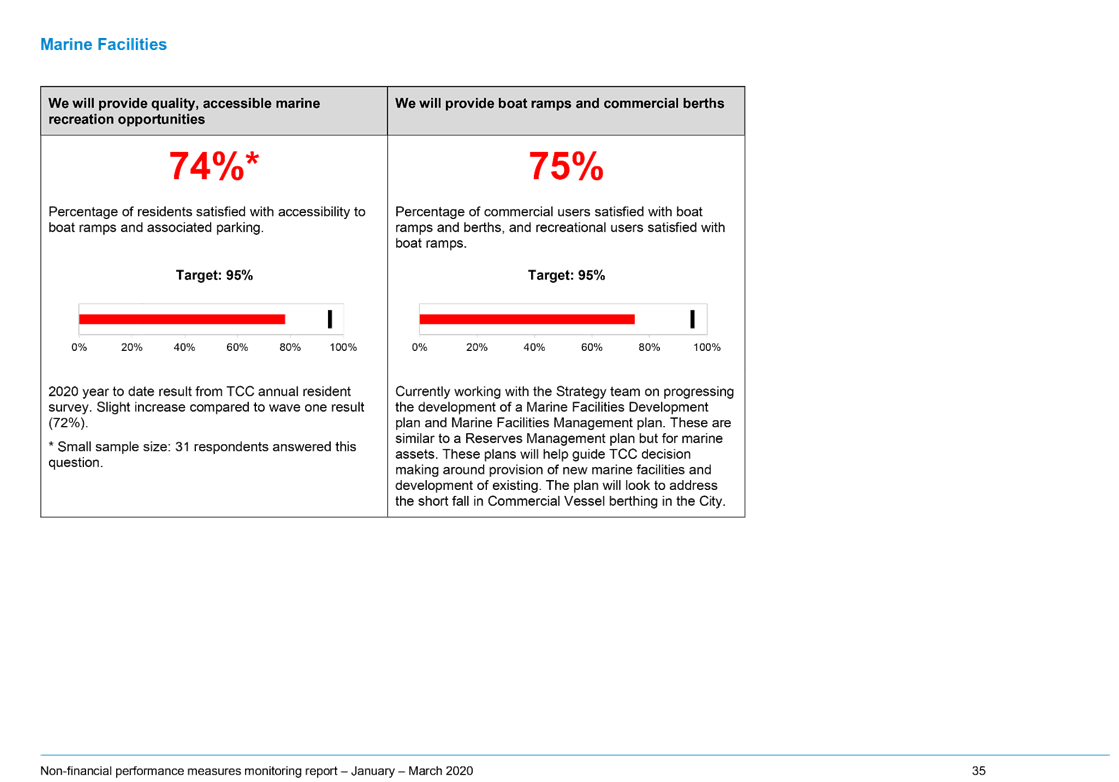

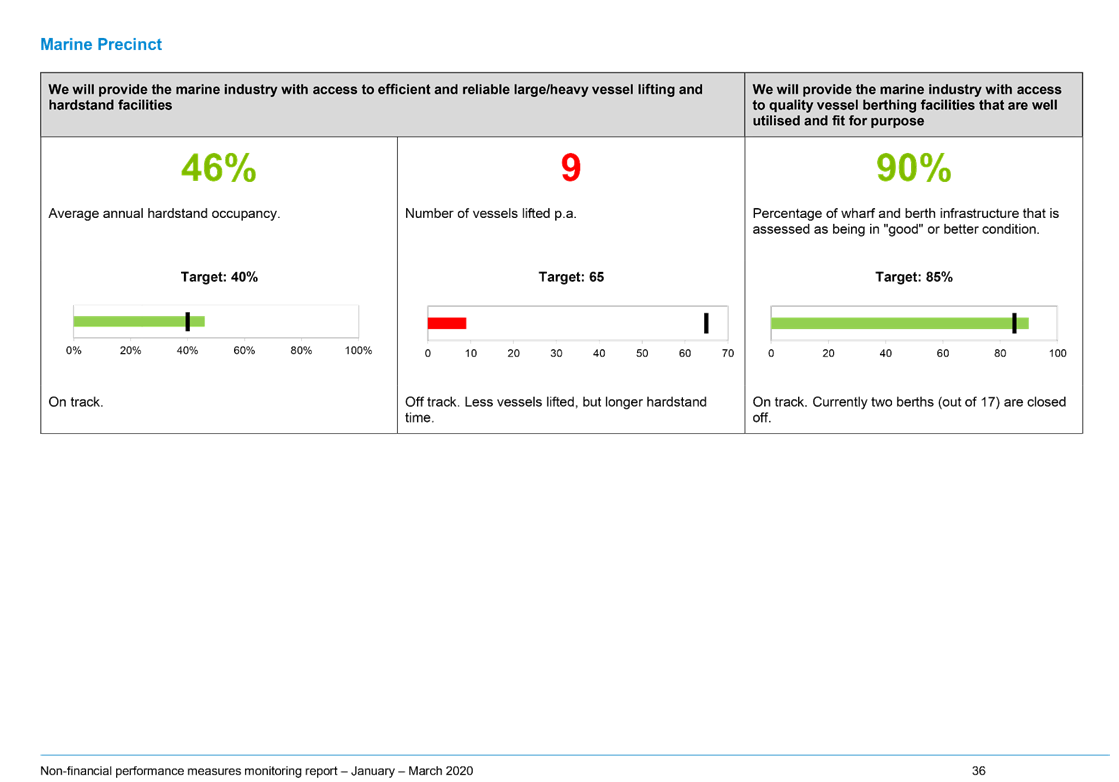

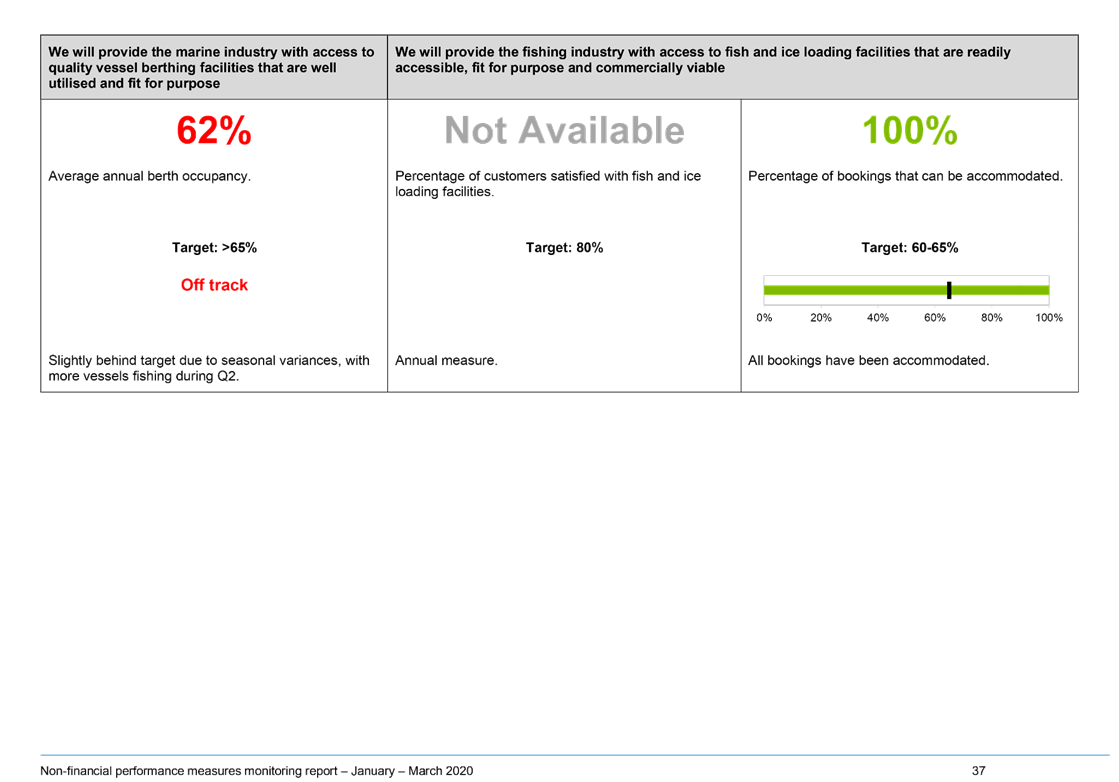

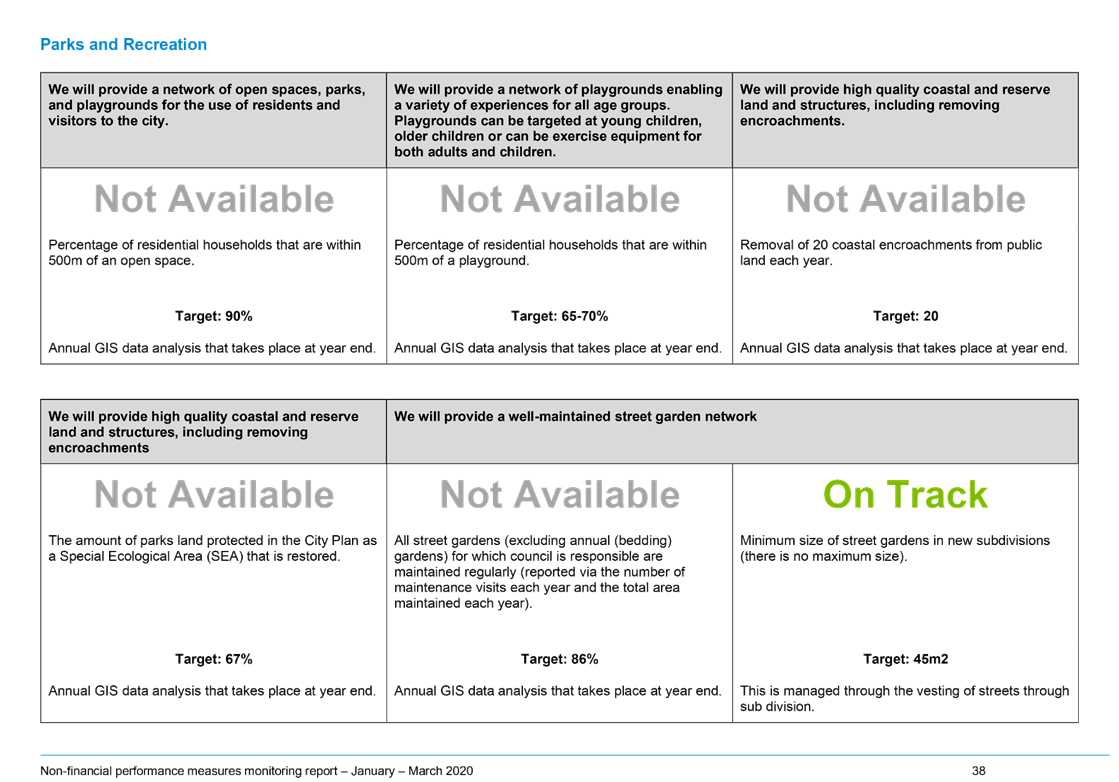

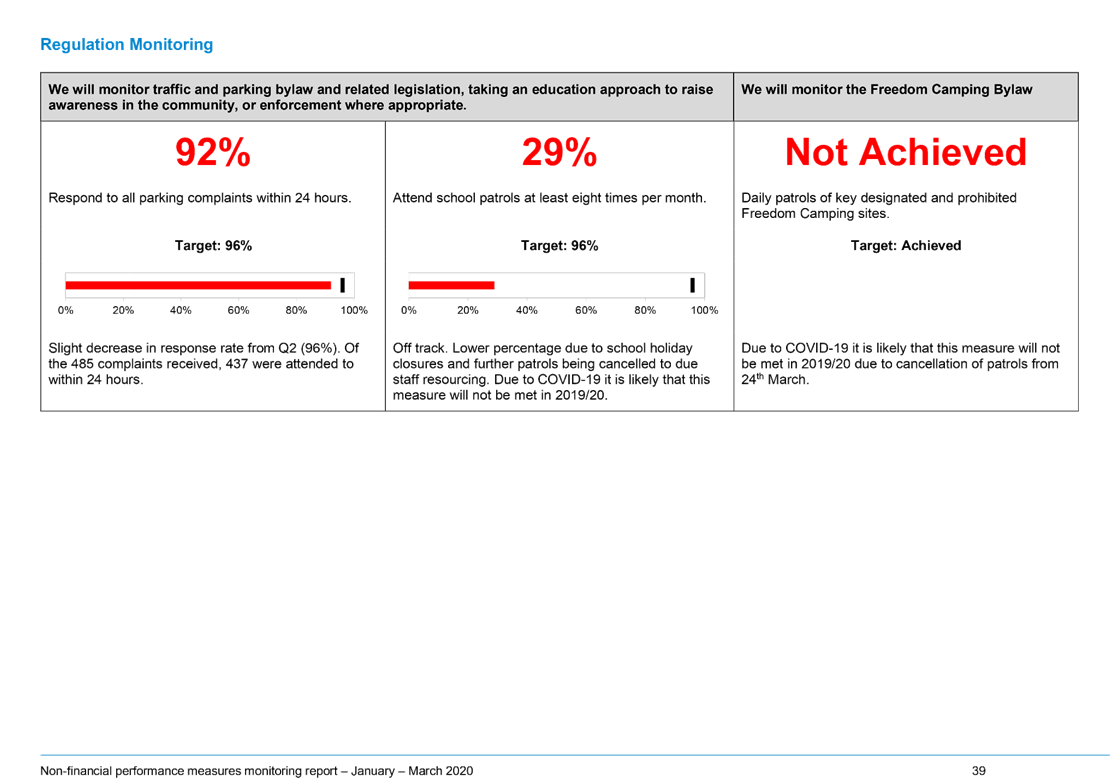

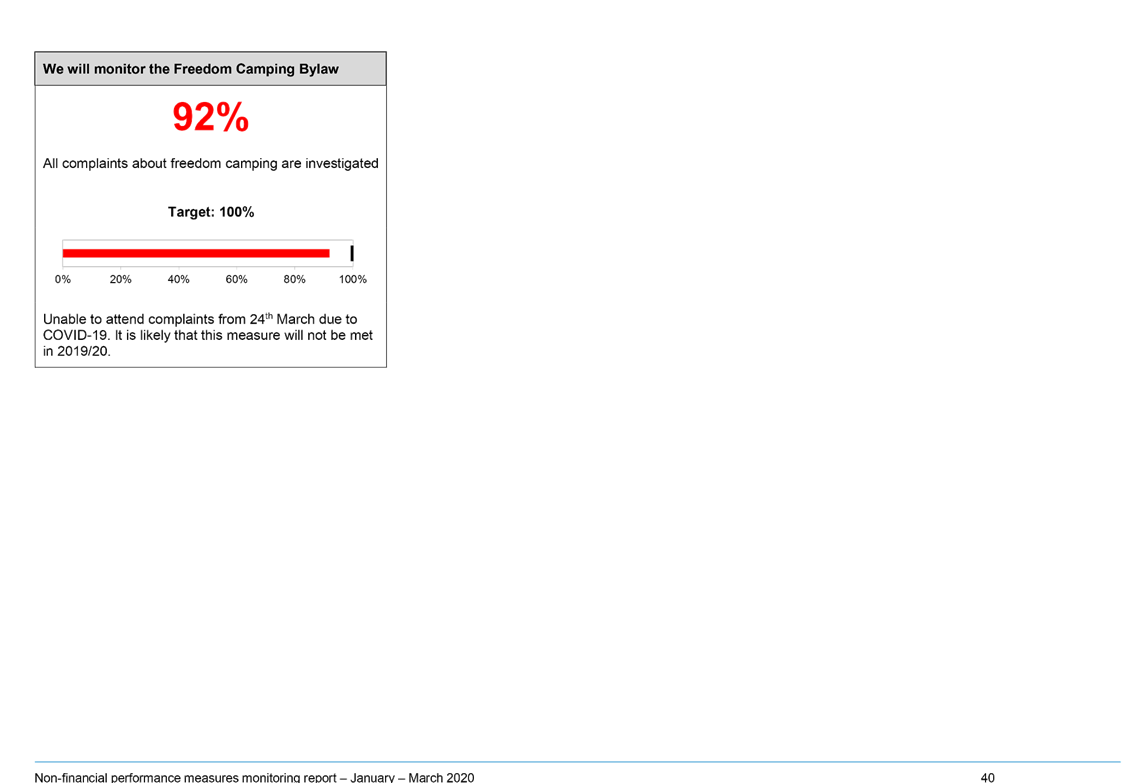

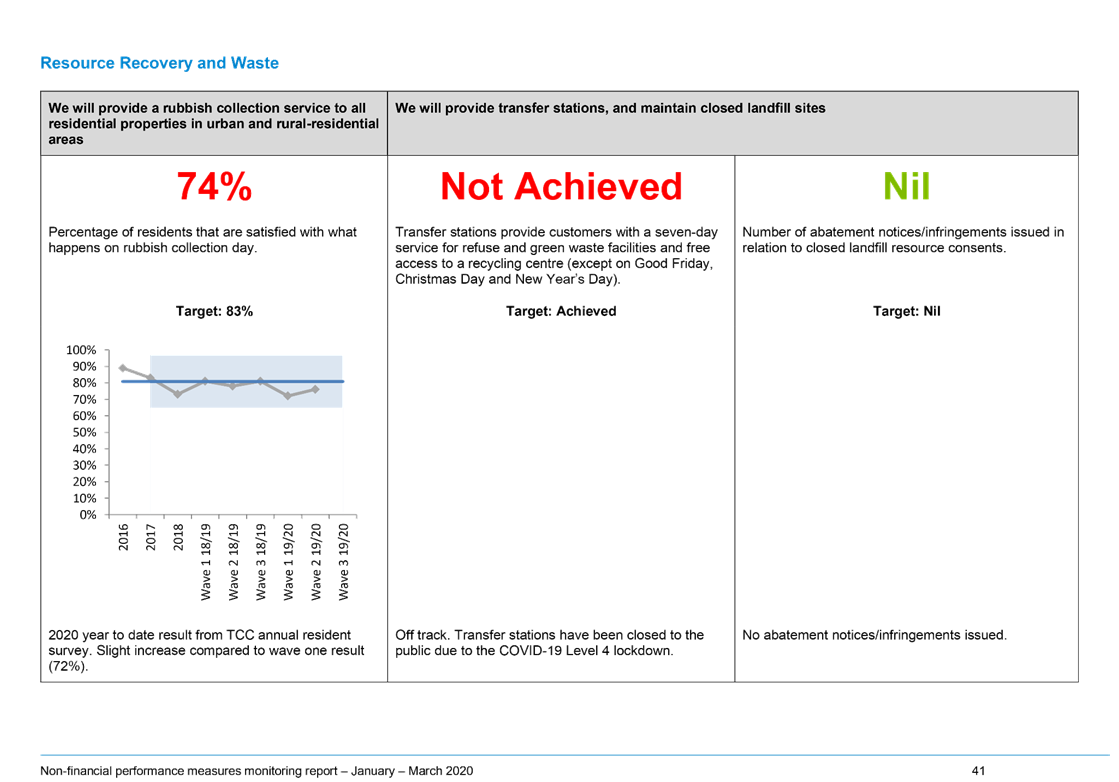

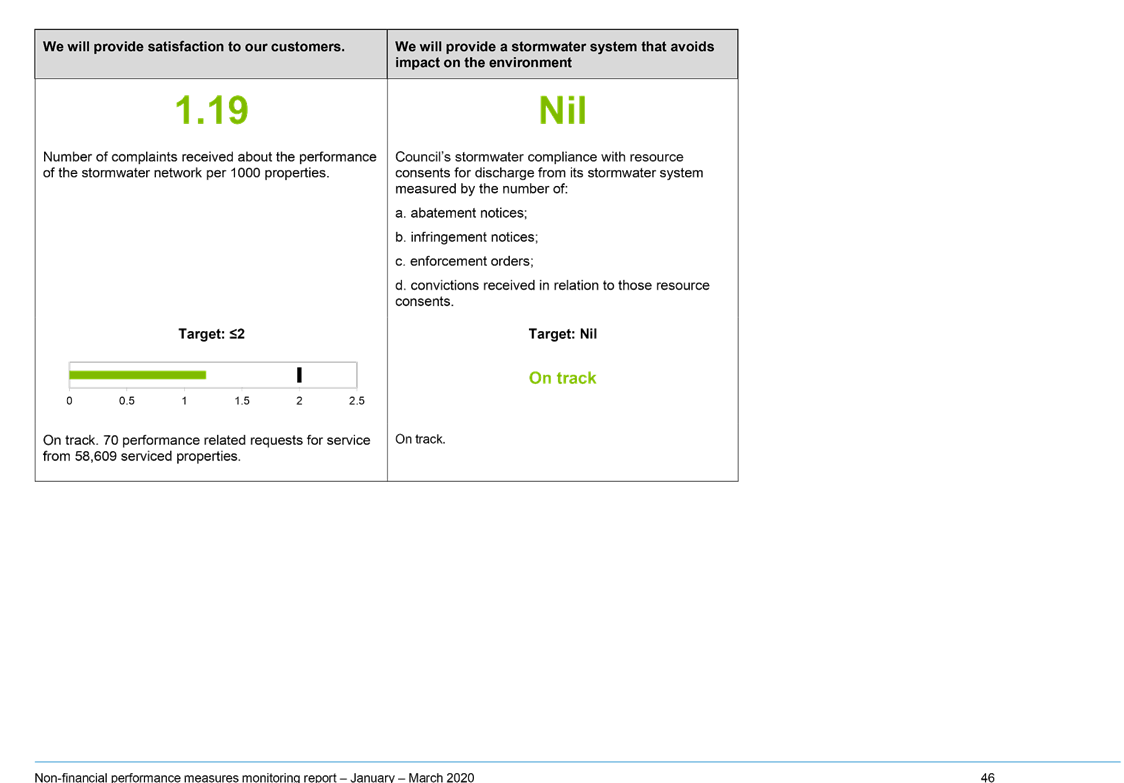

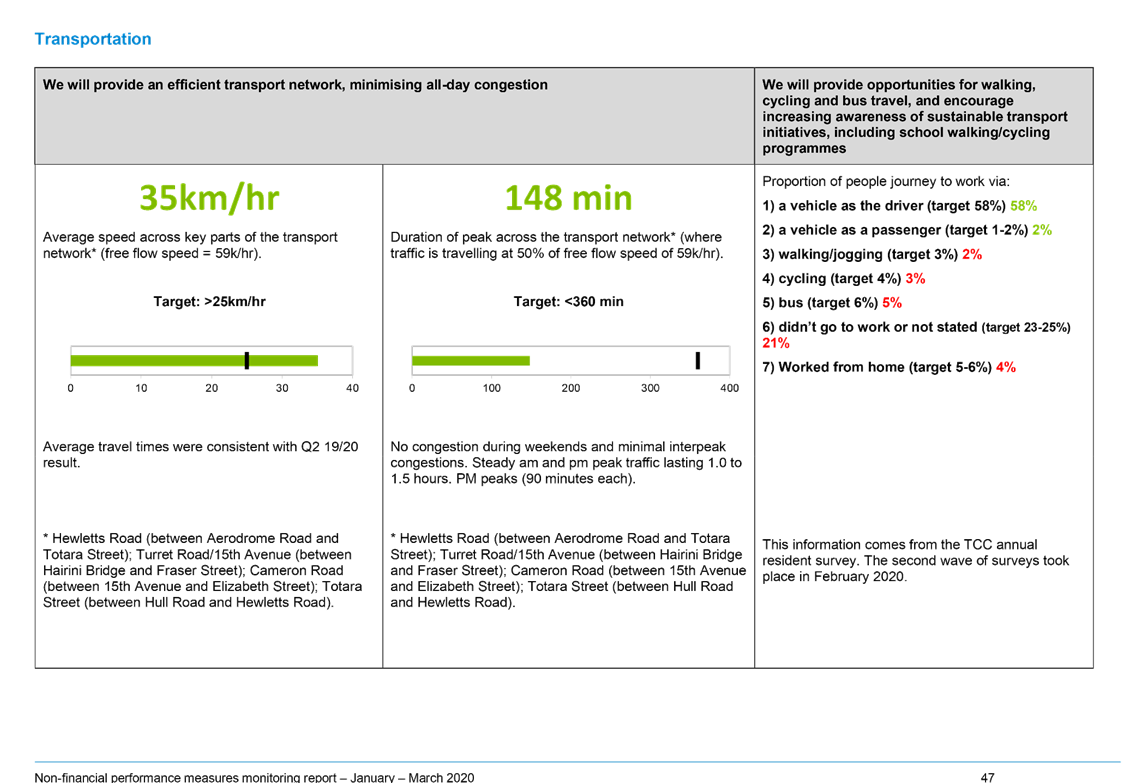

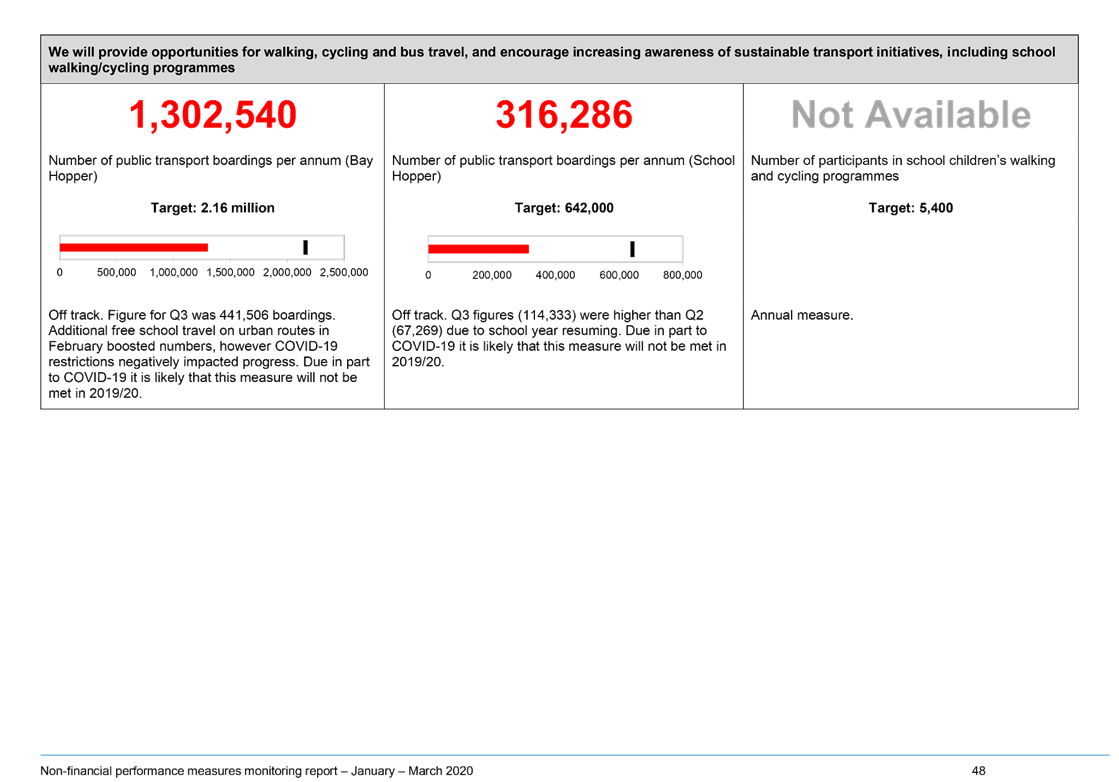

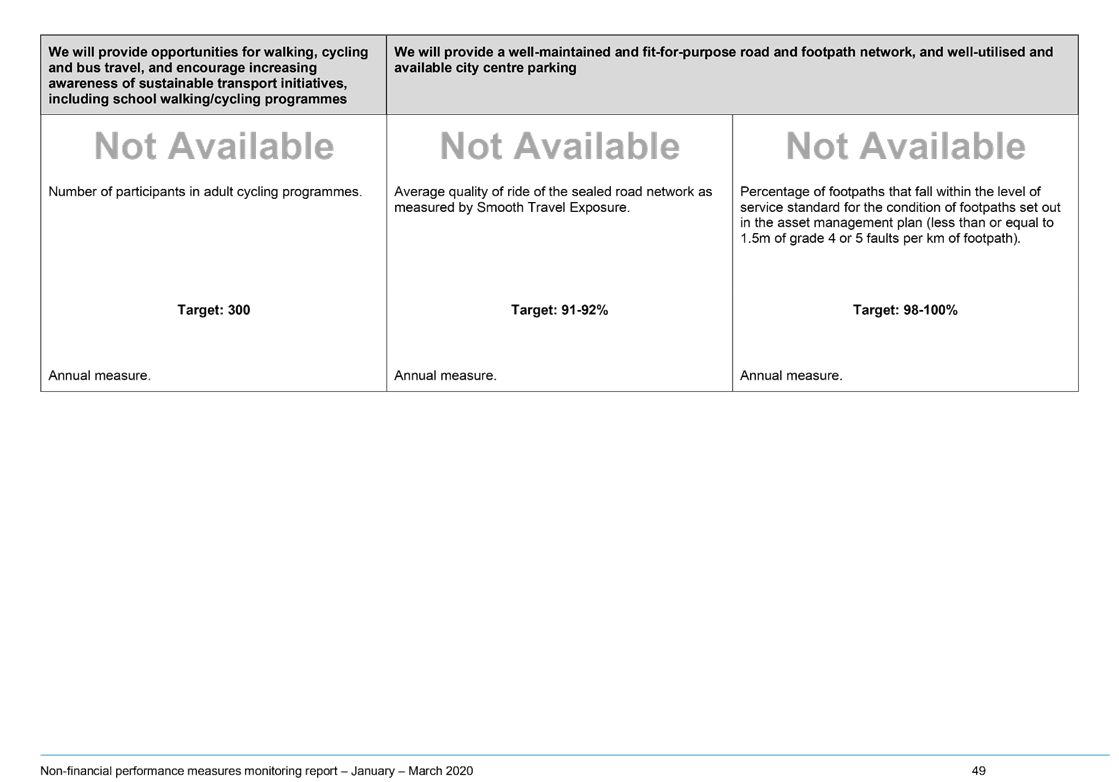

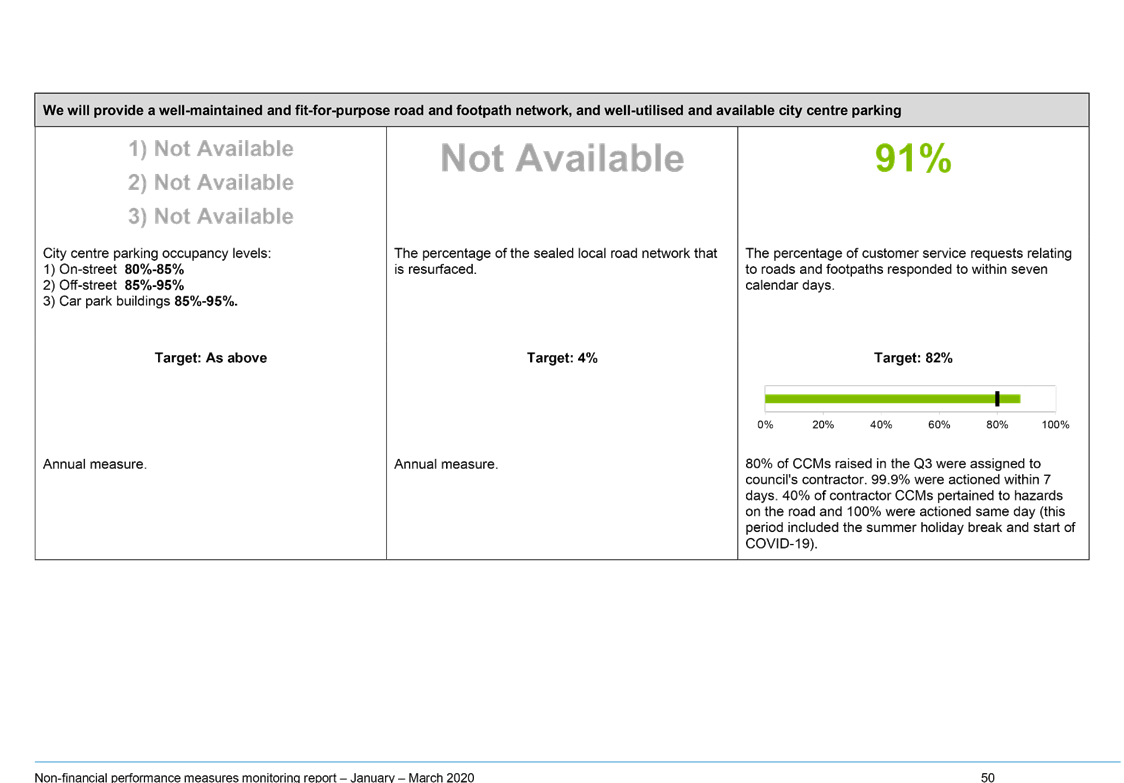

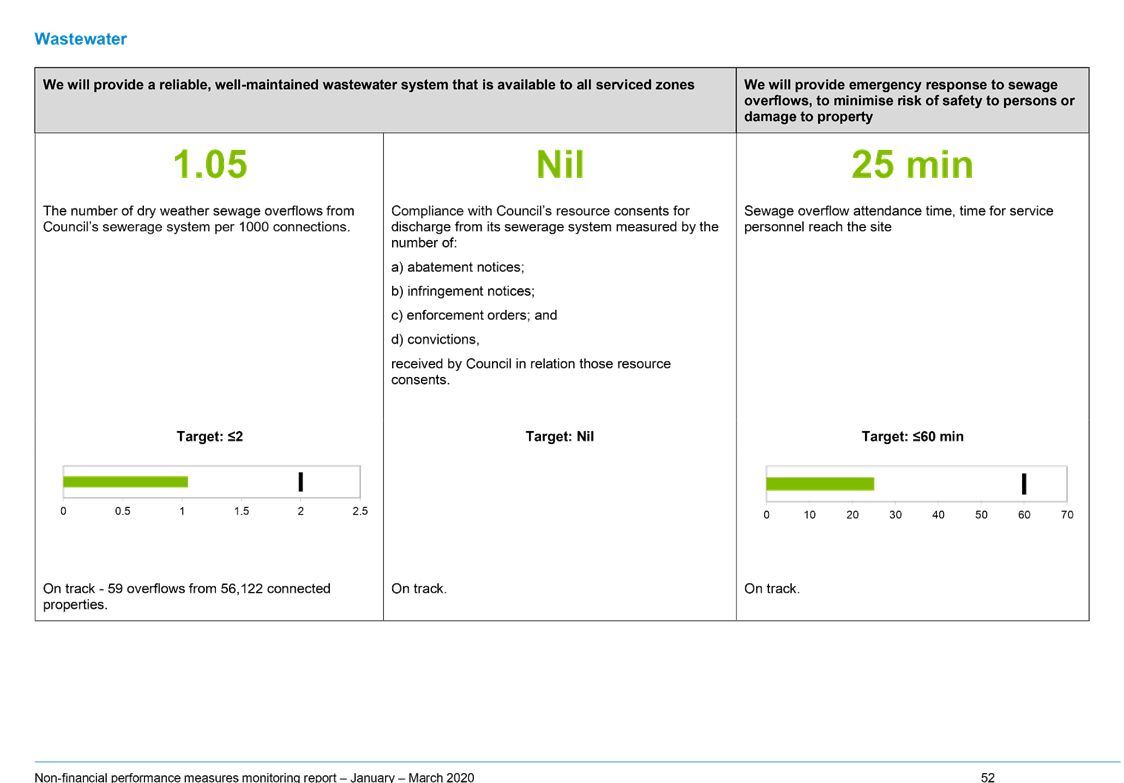

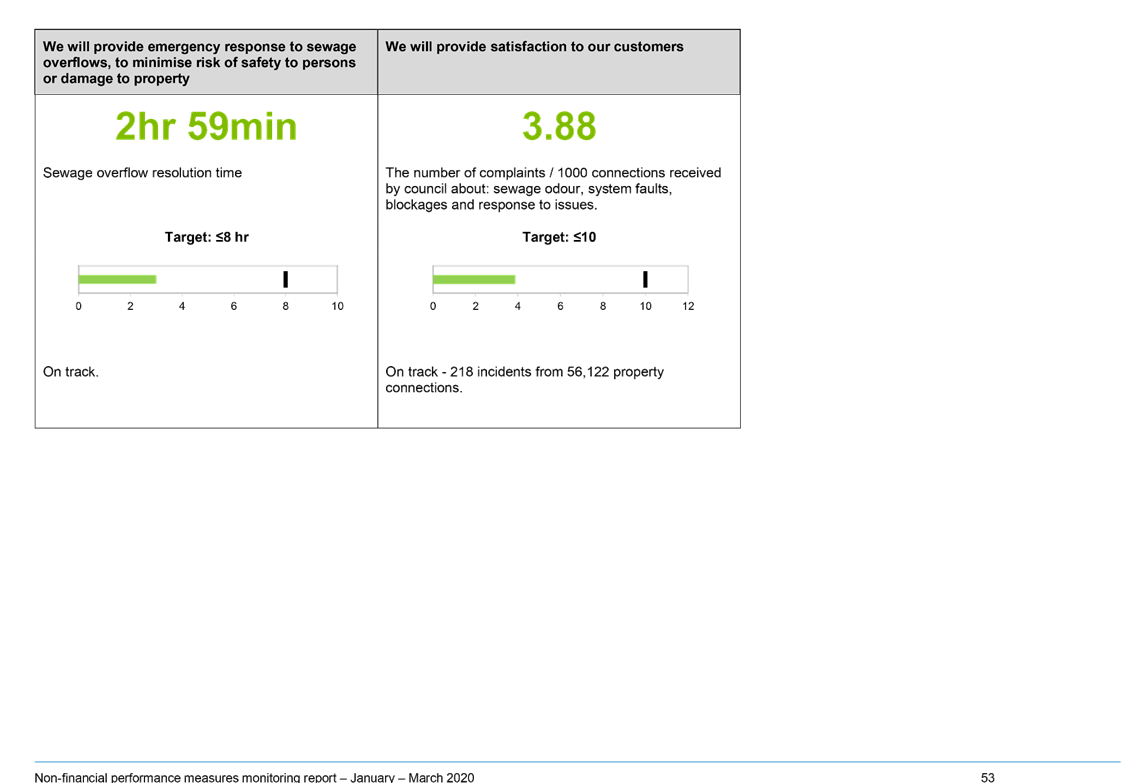

3. Attachment 4 presents how Council

and the community are tracking towards achieving Council’s non-financial

performance measures and levels of service.

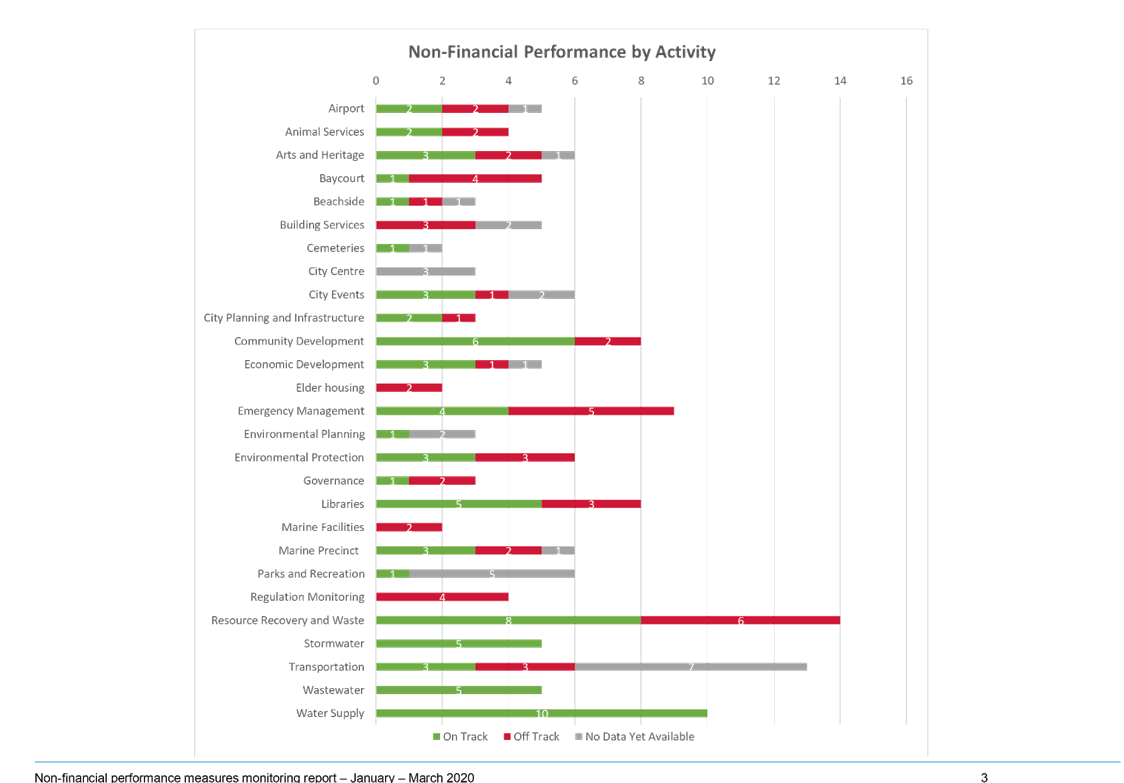

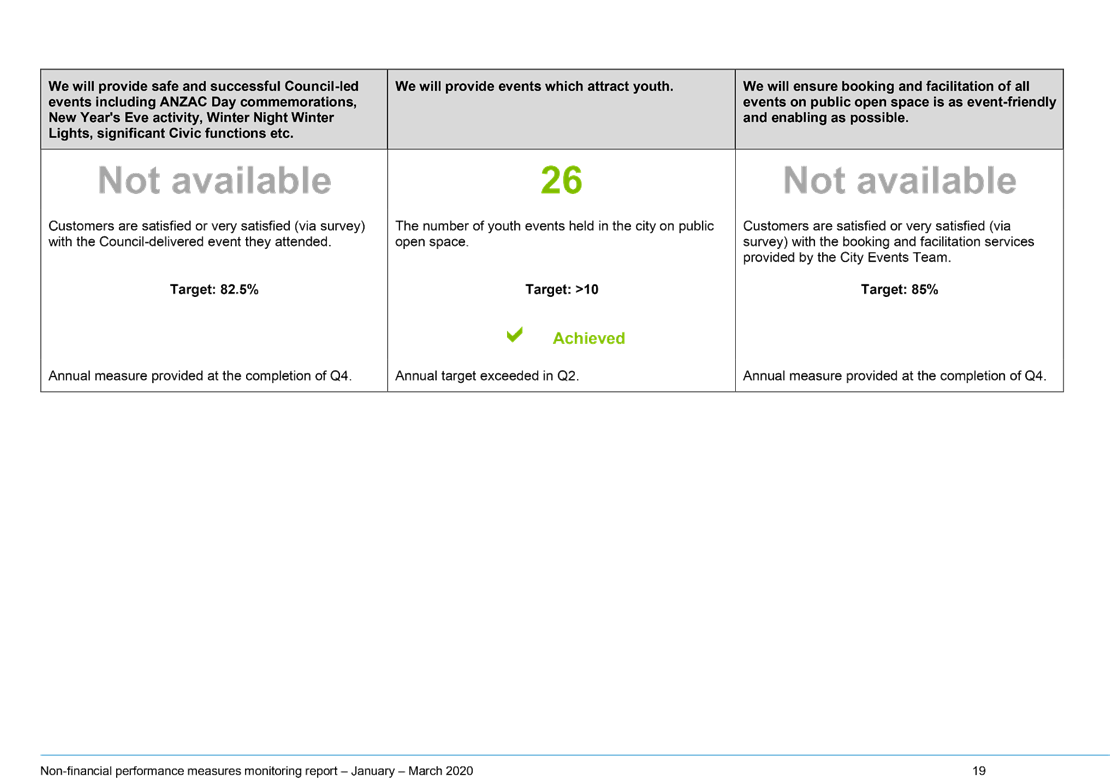

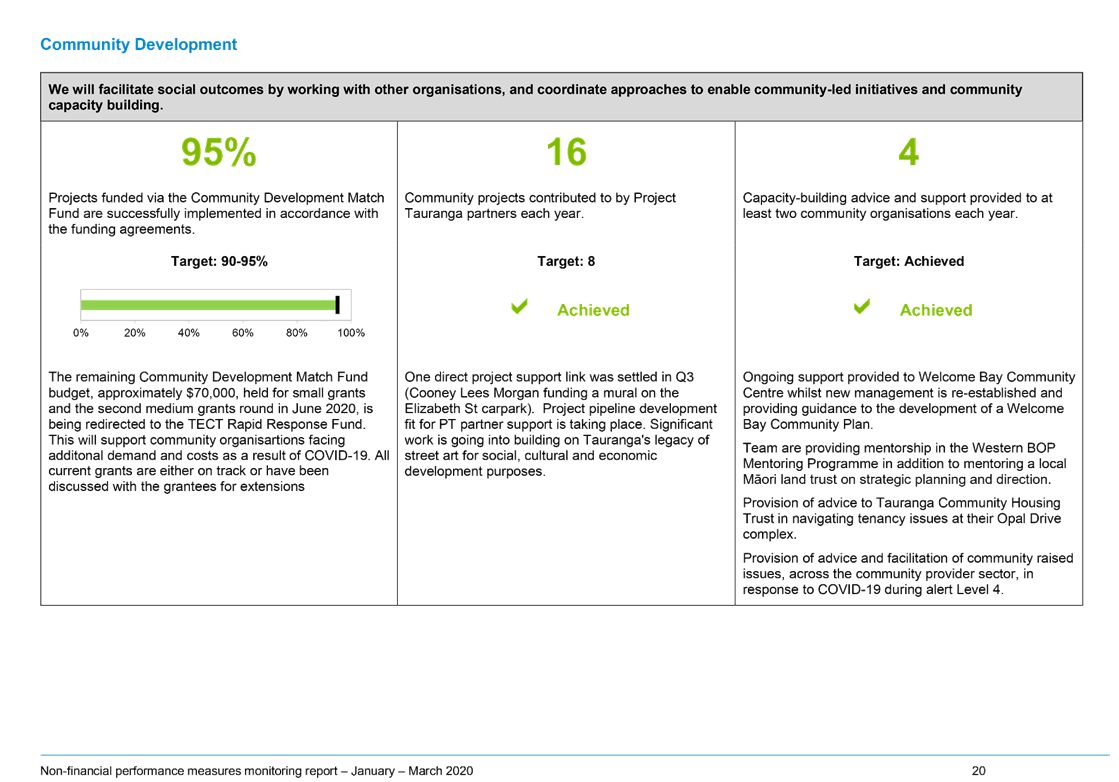

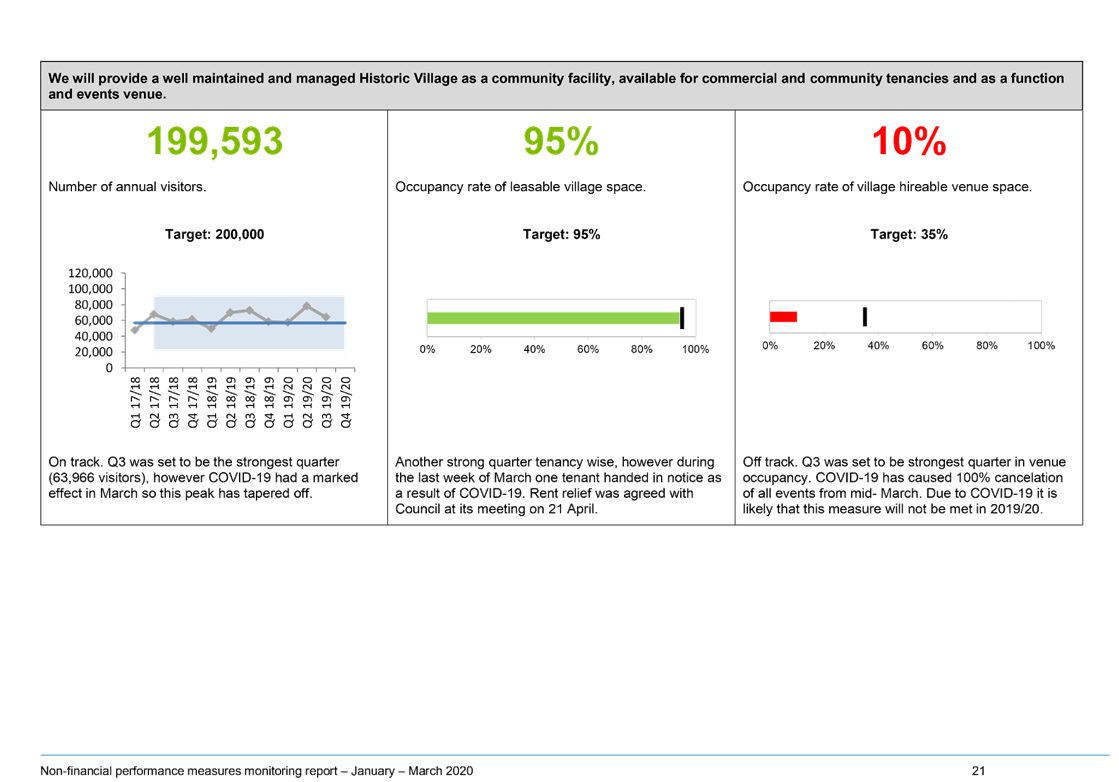

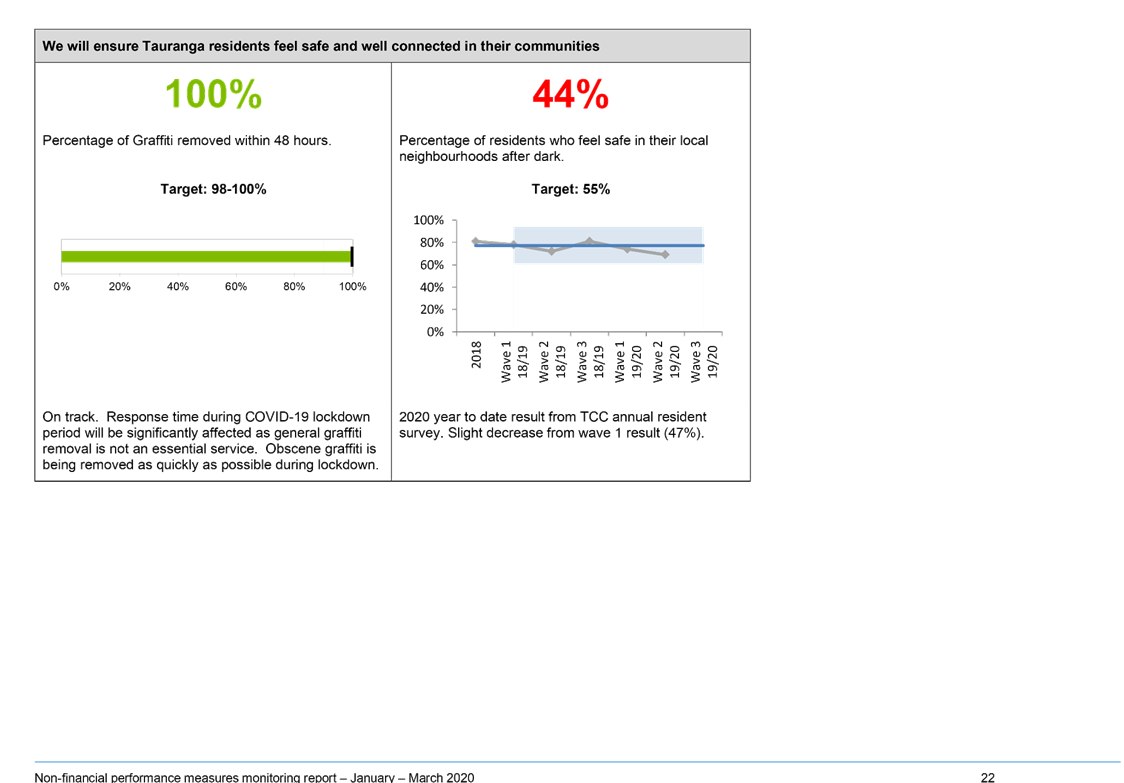

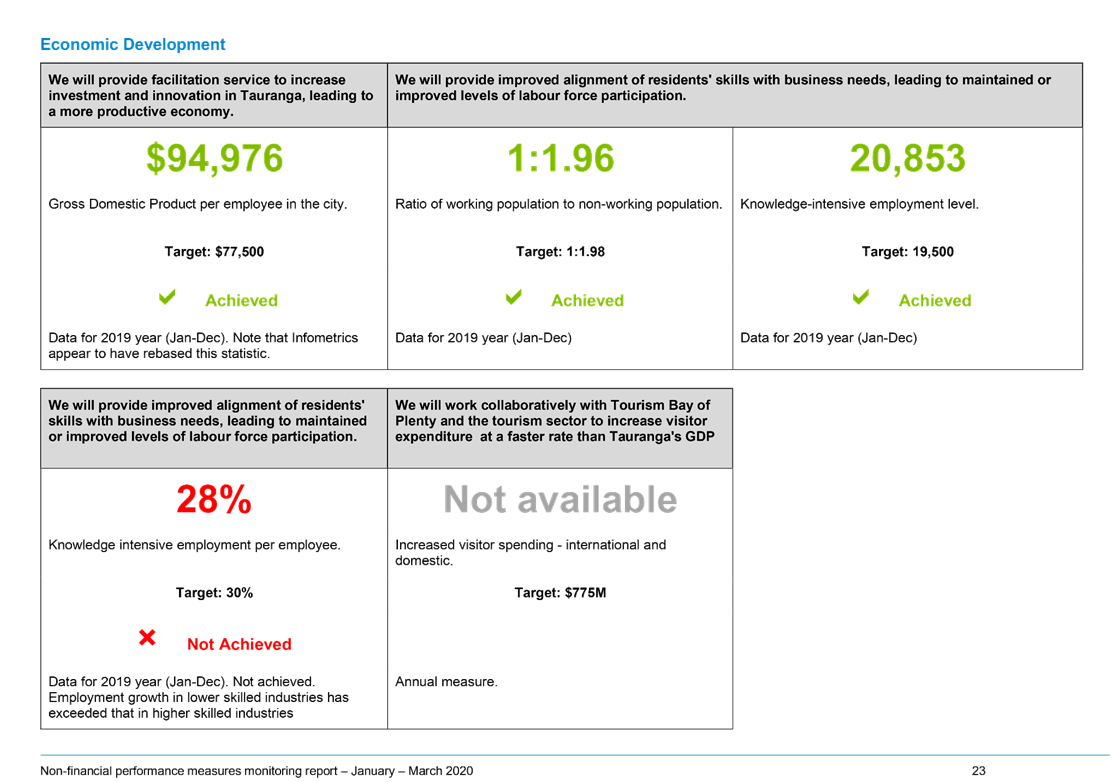

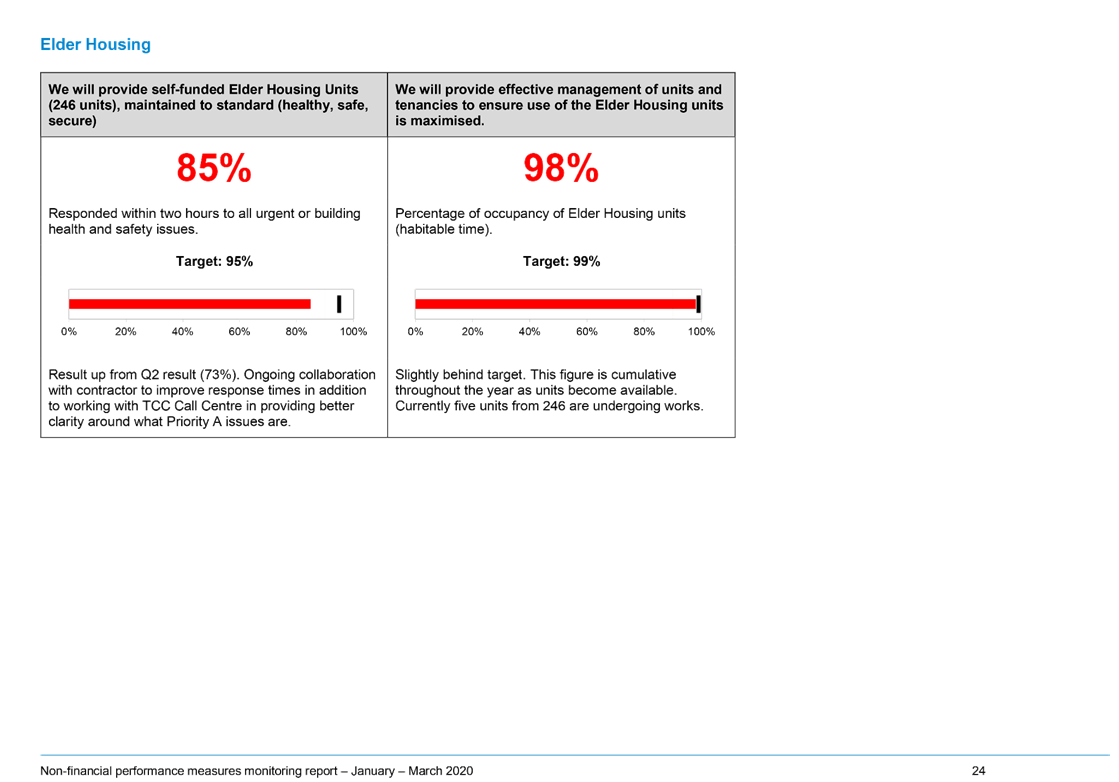

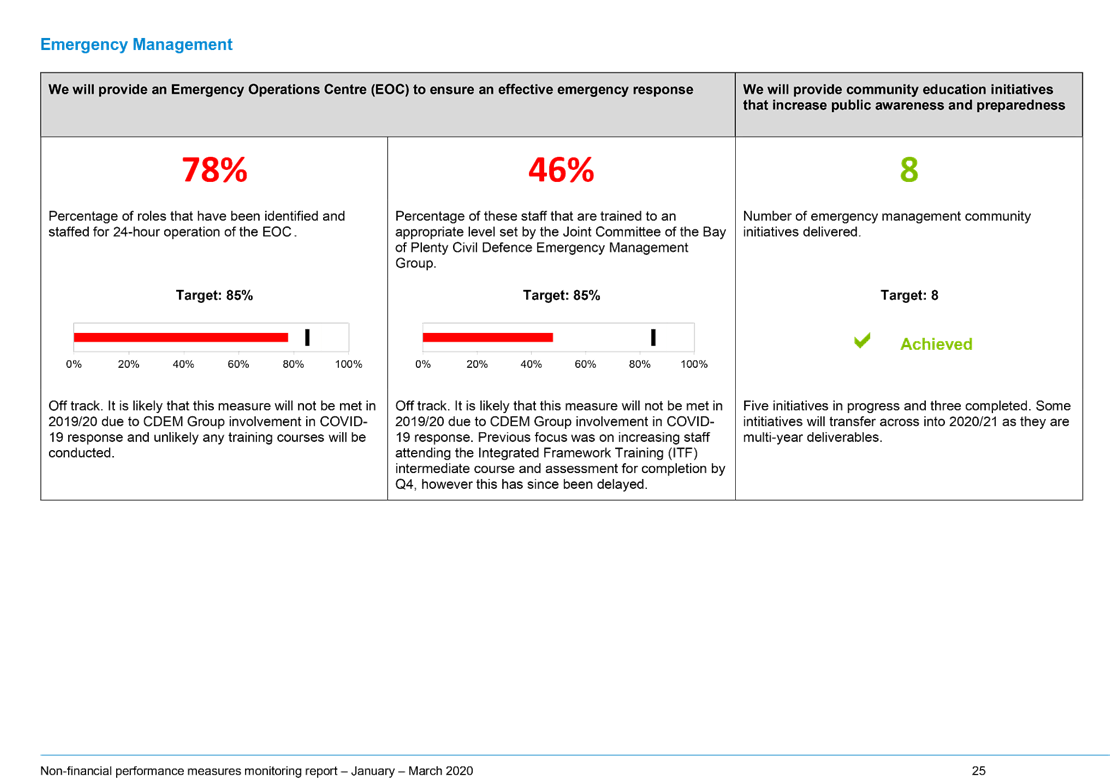

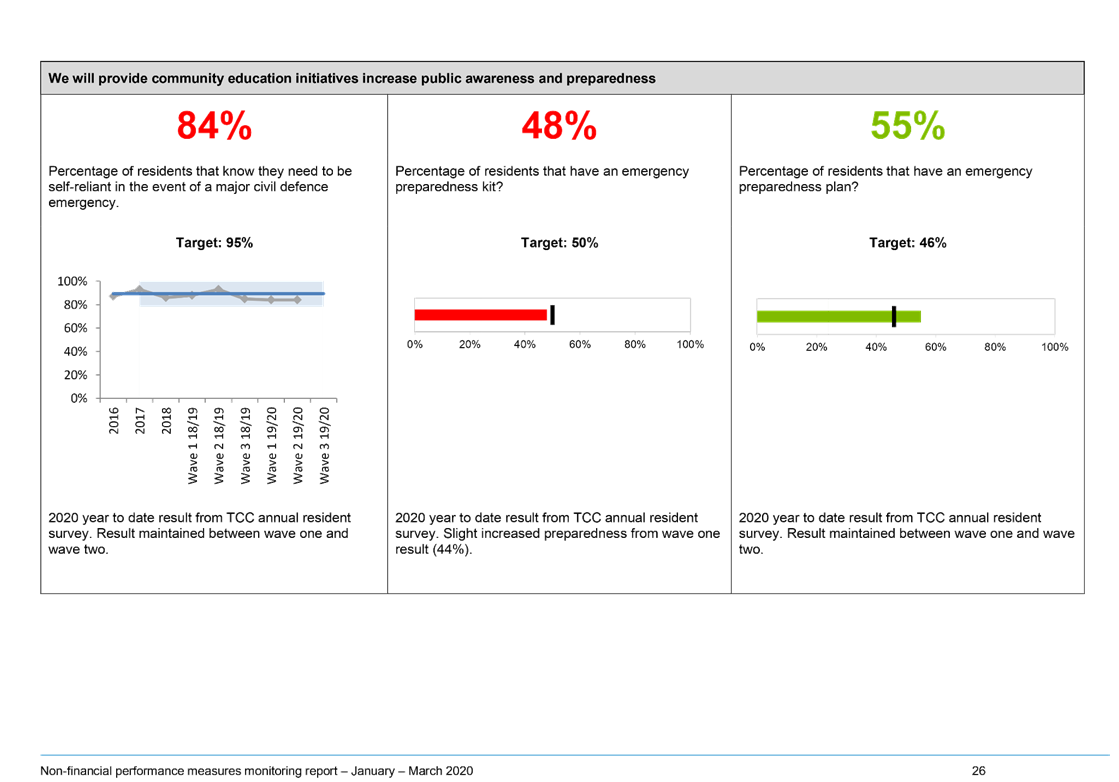

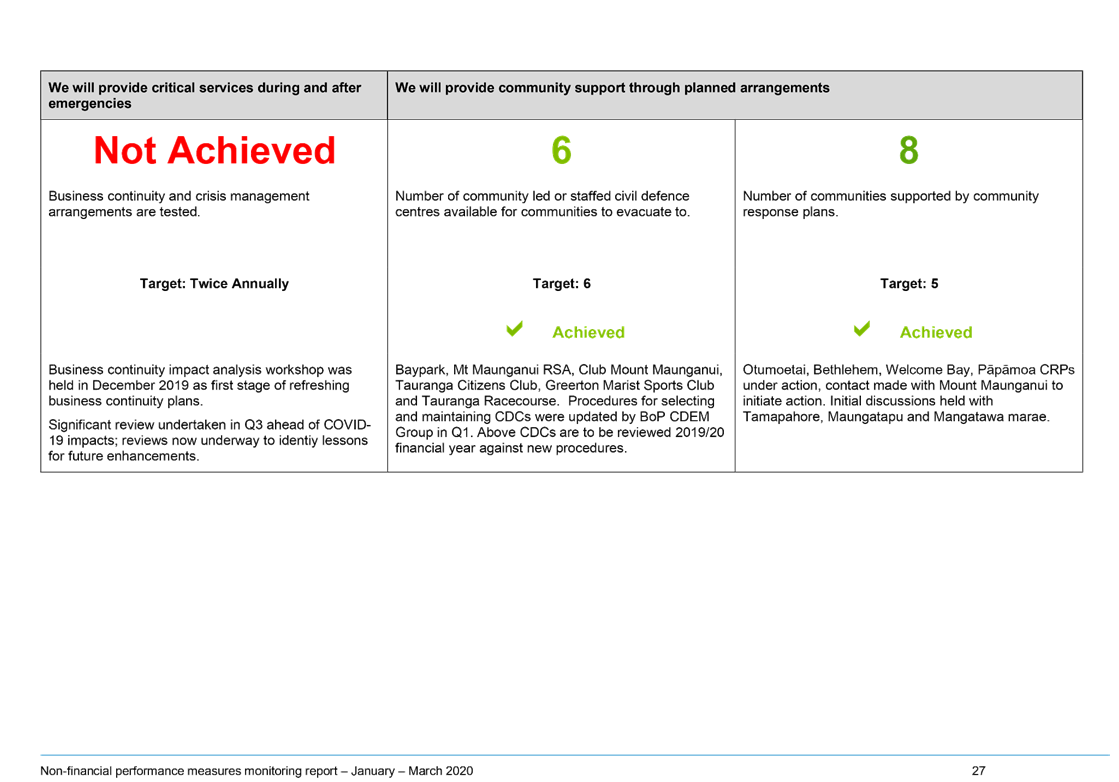

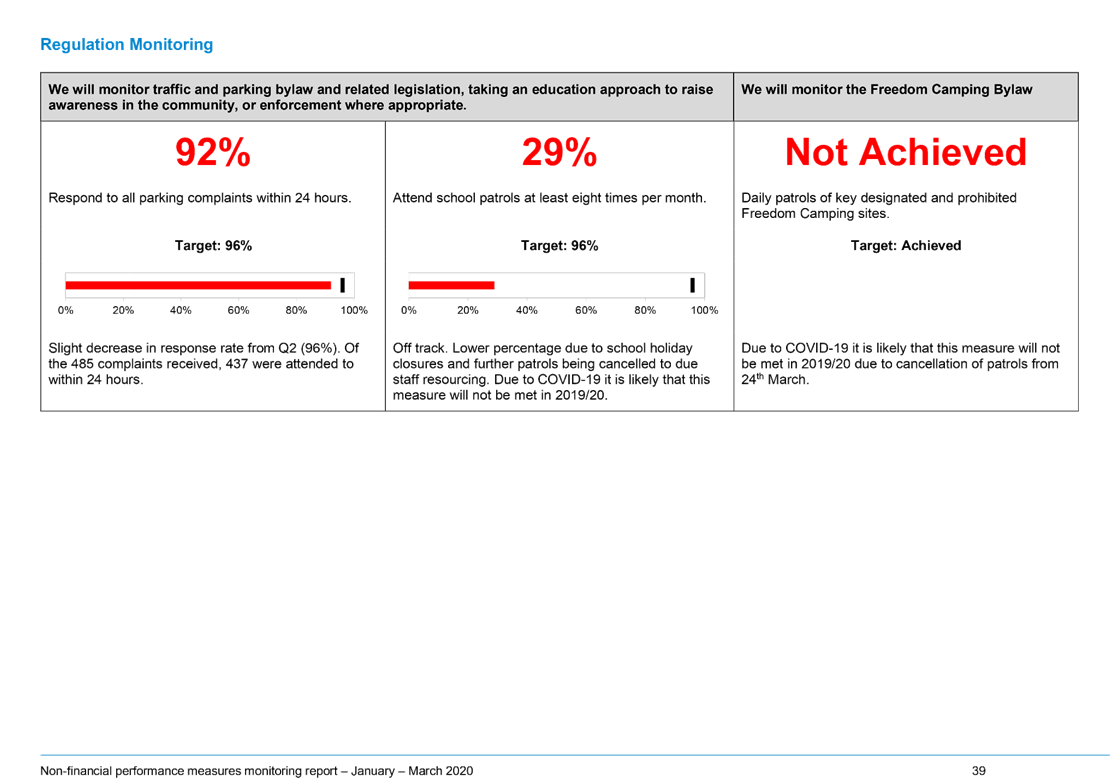

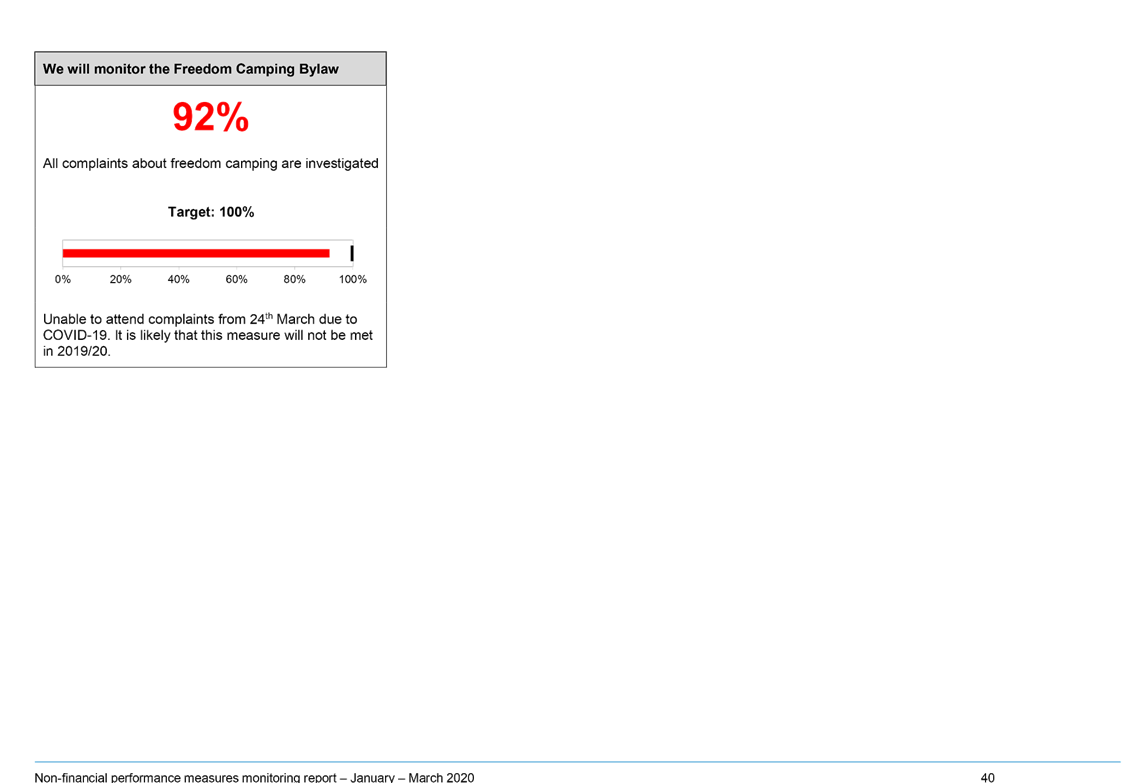

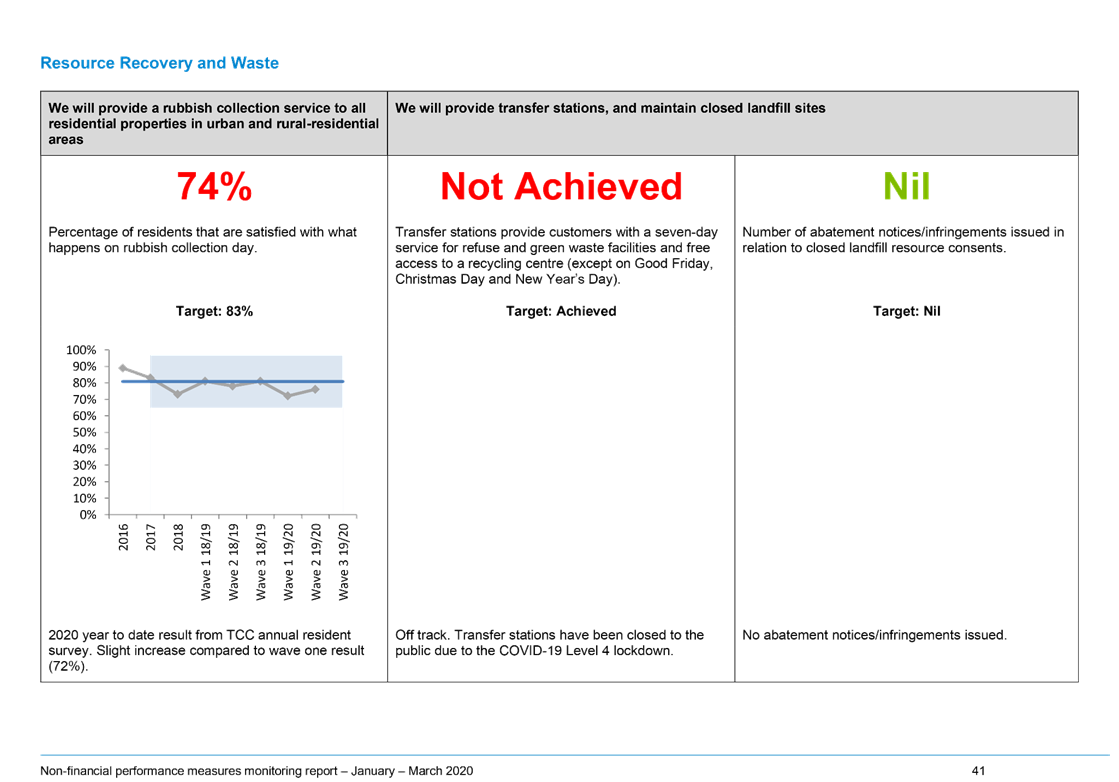

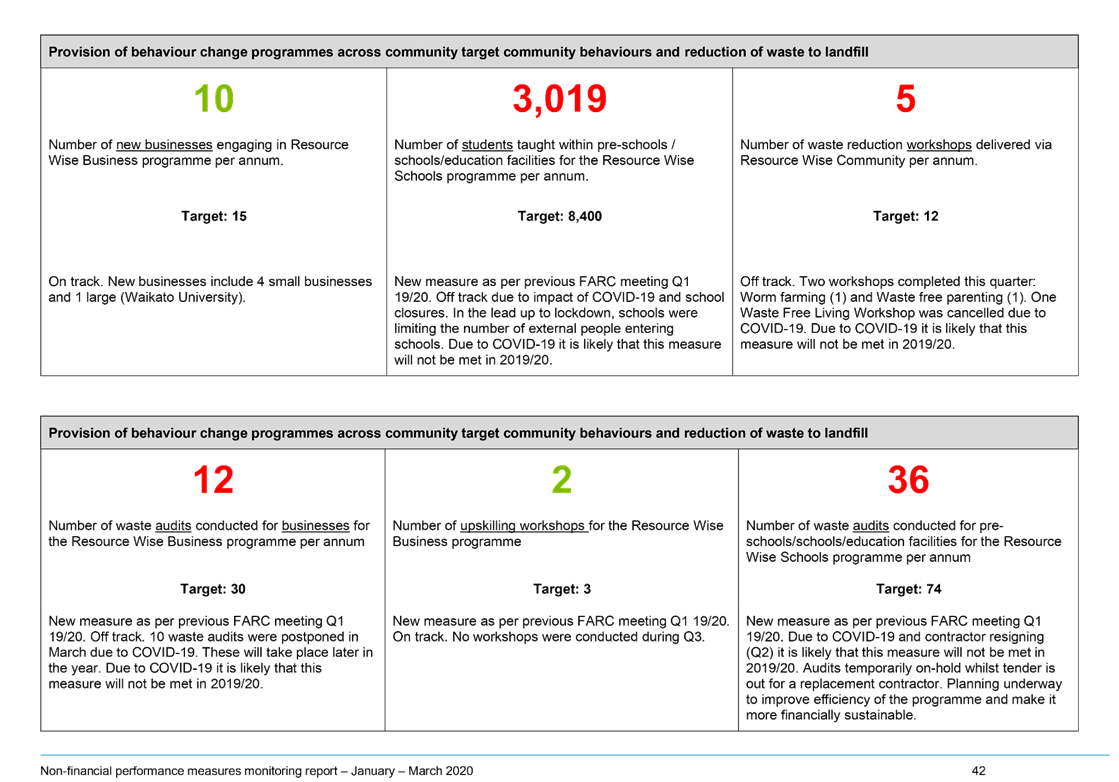

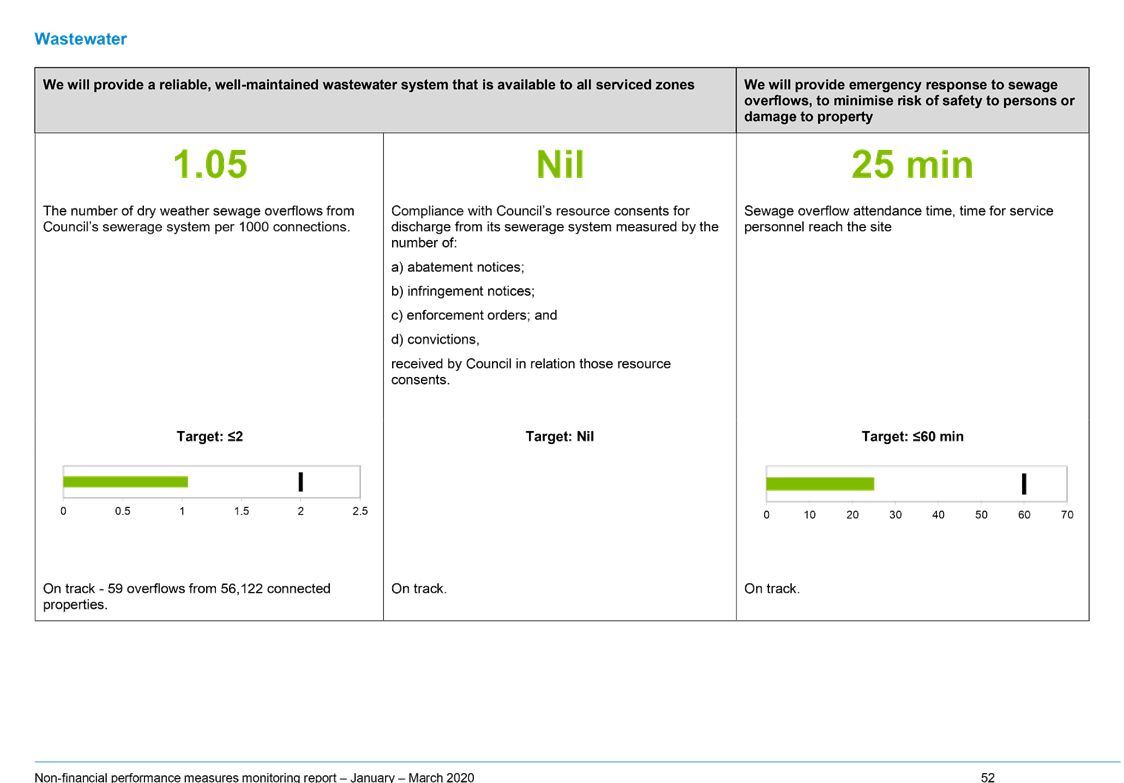

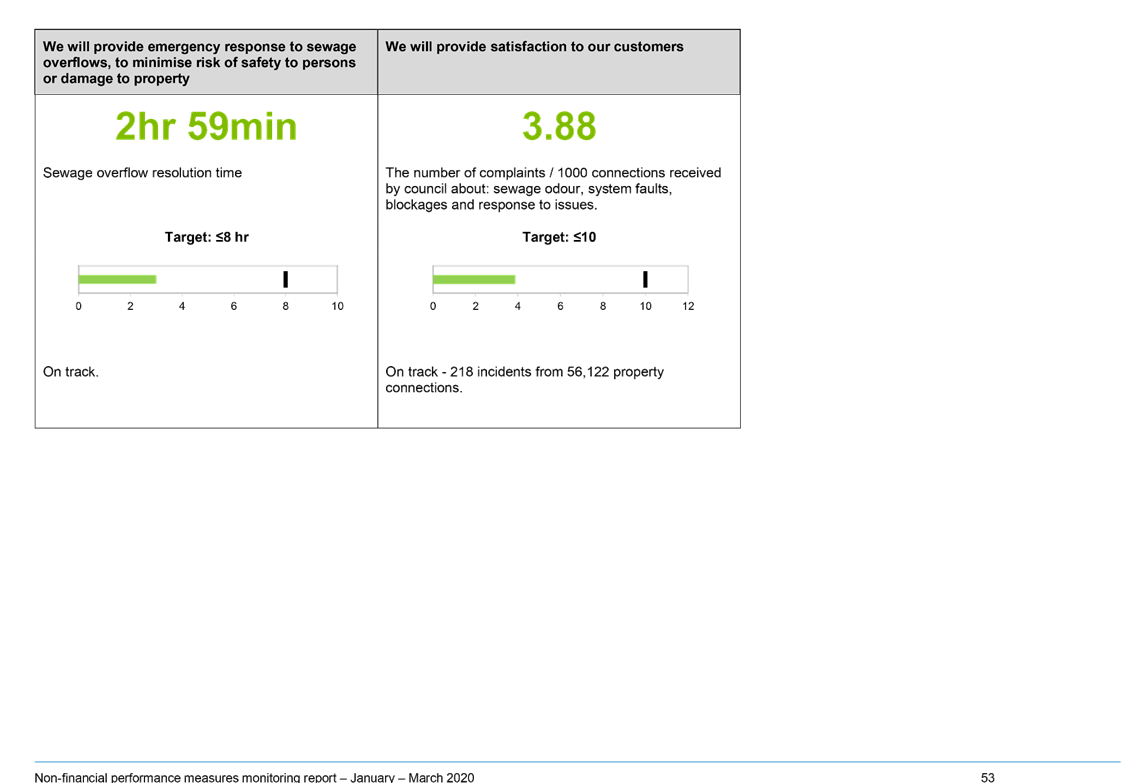

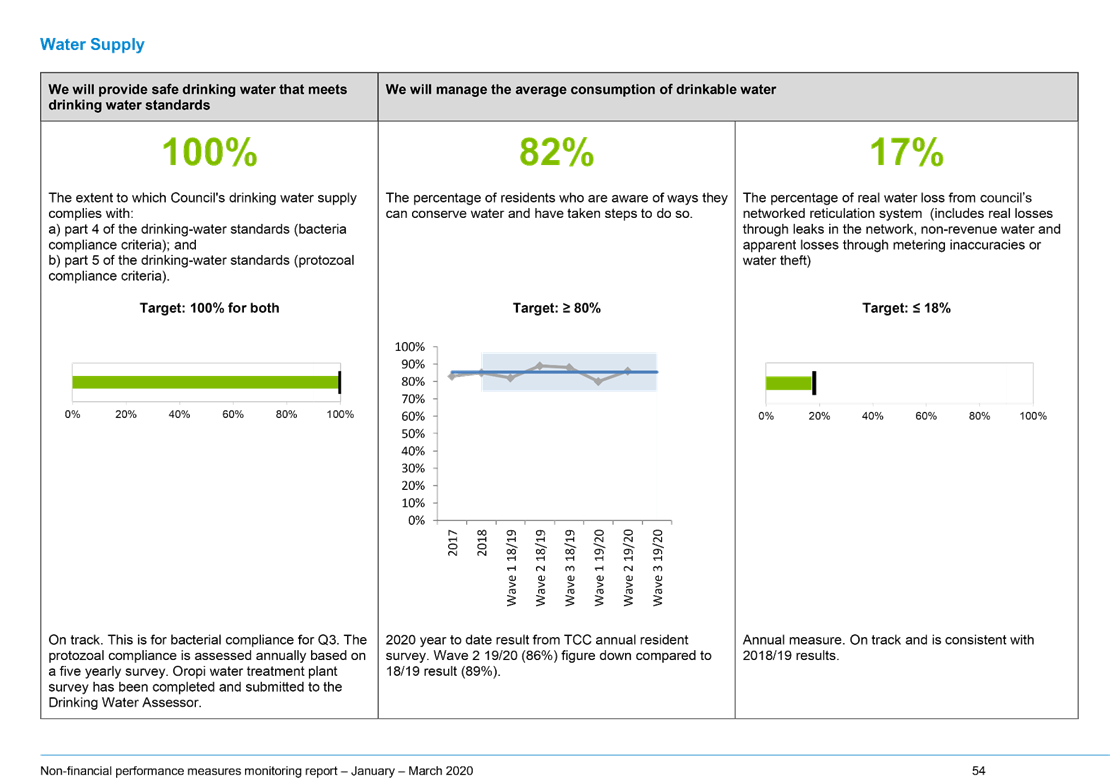

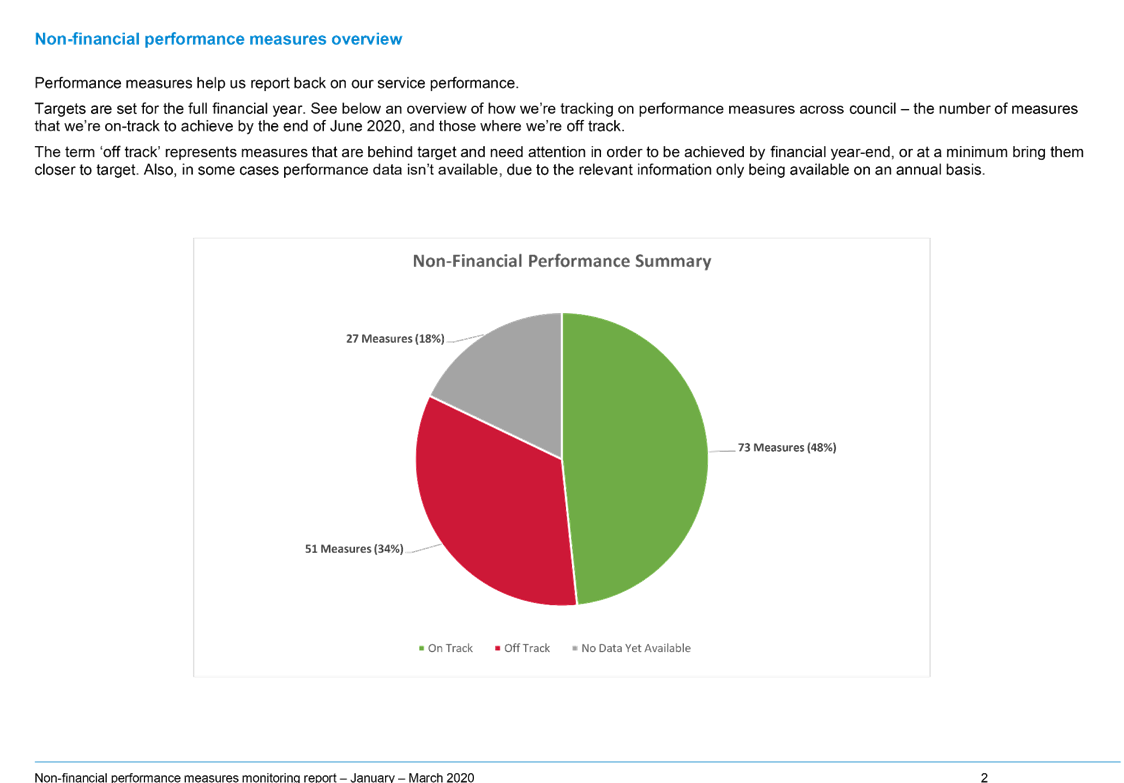

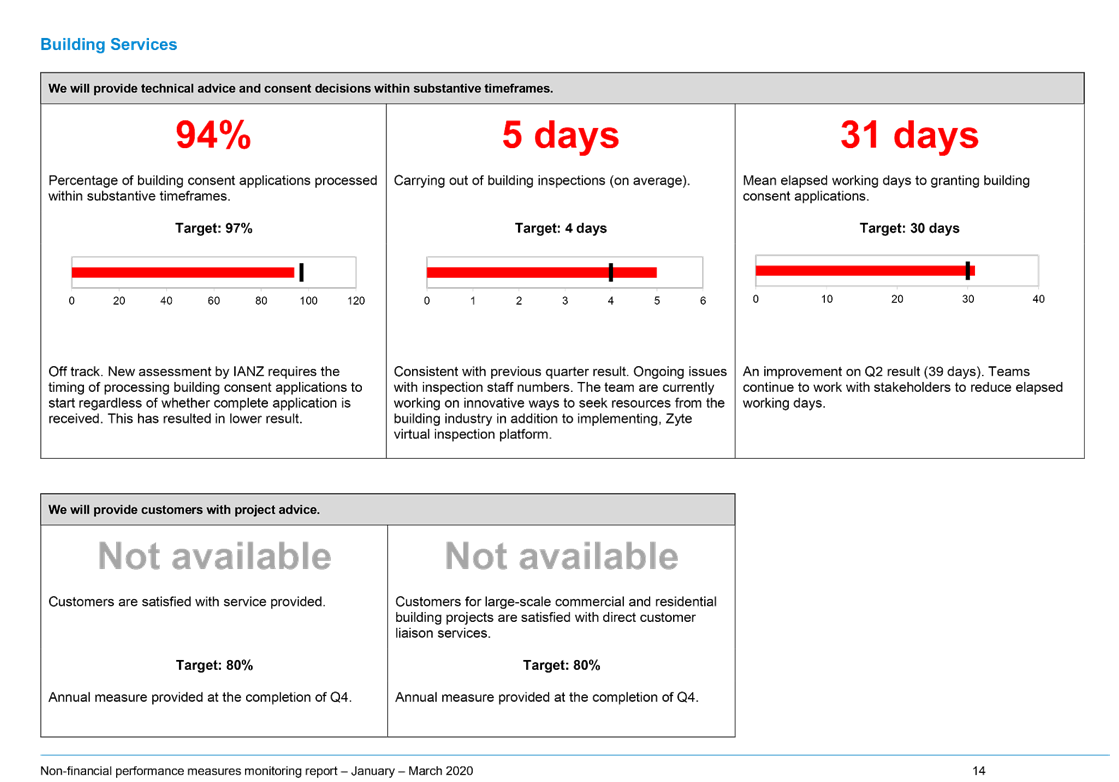

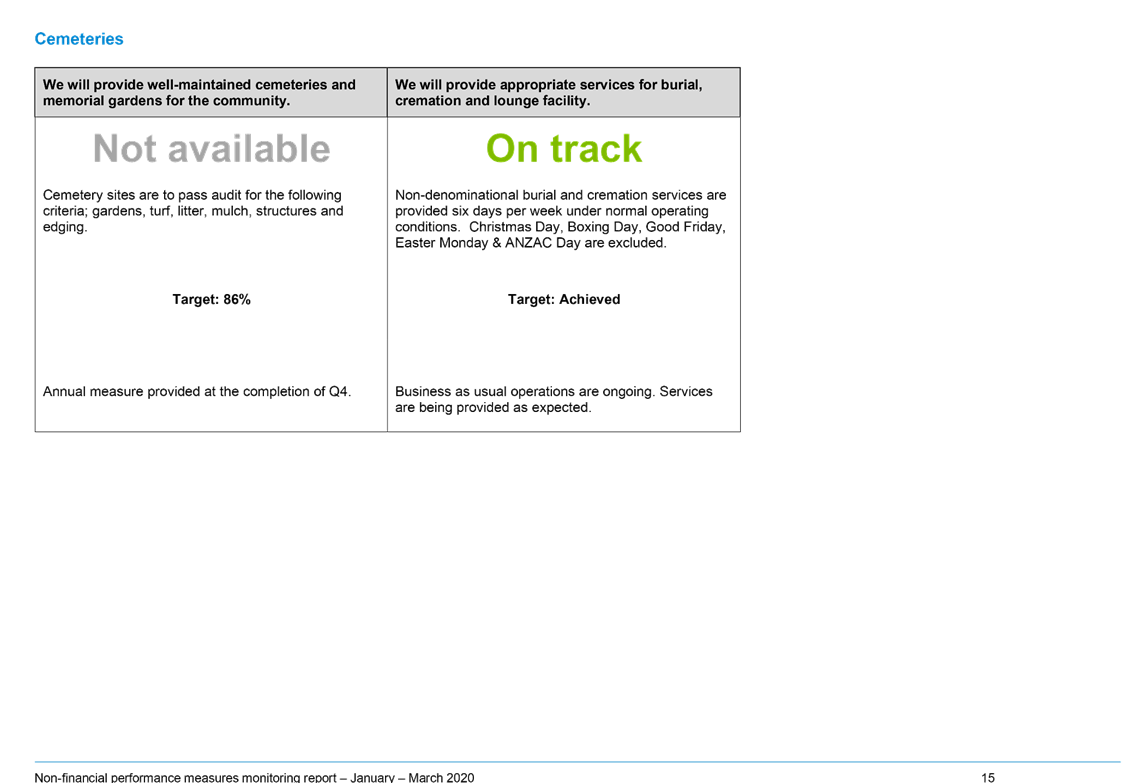

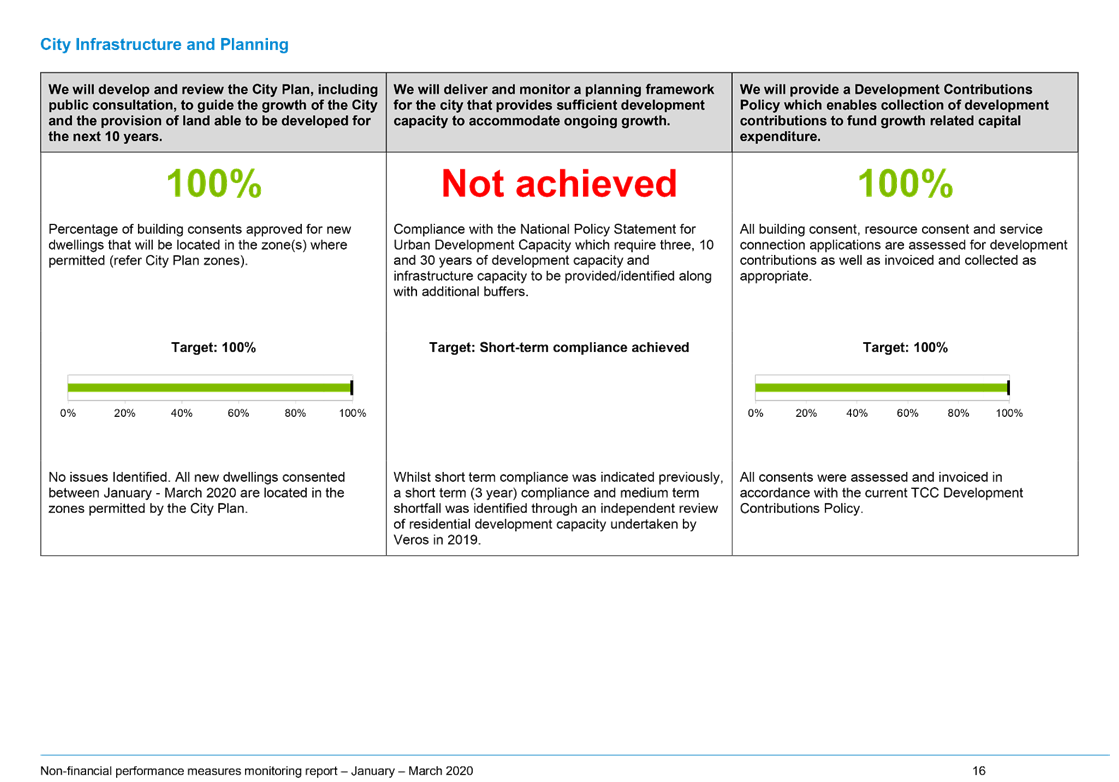

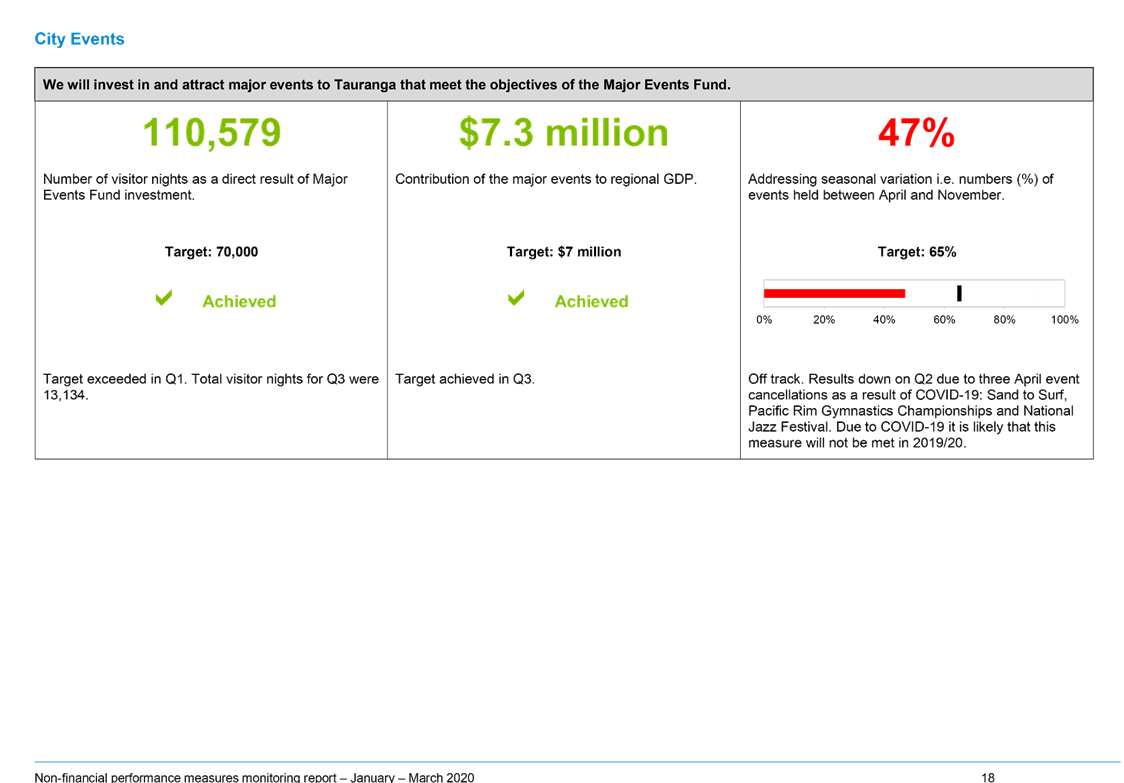

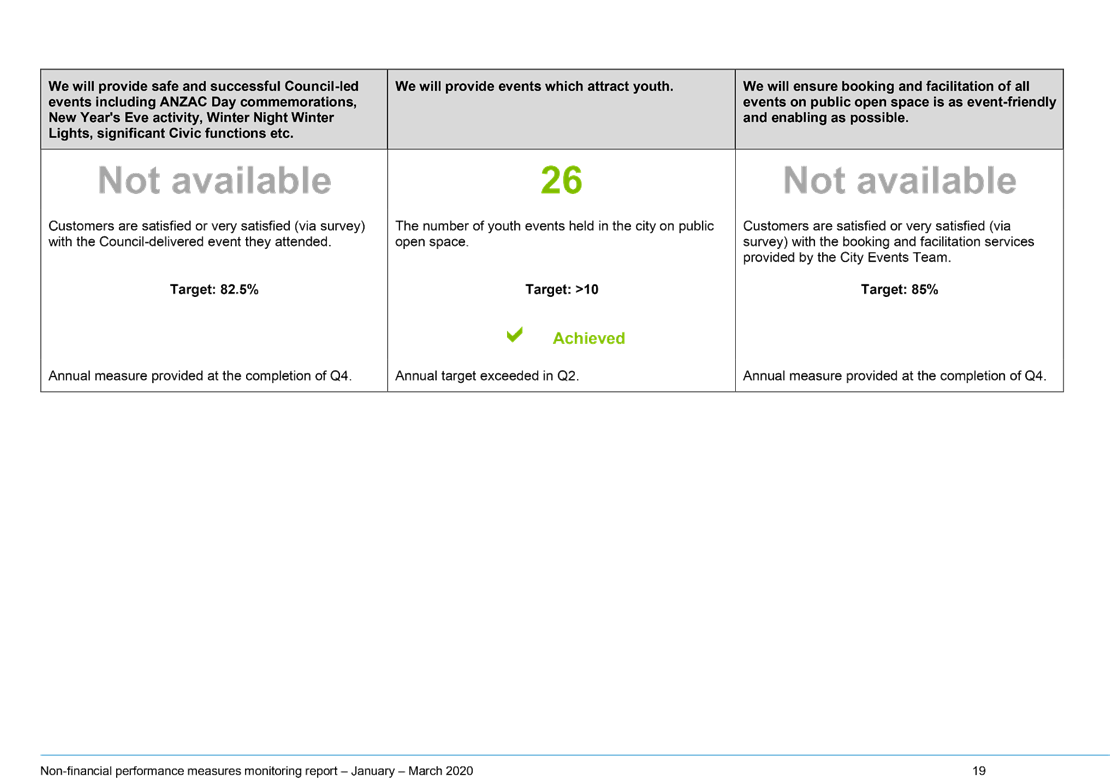

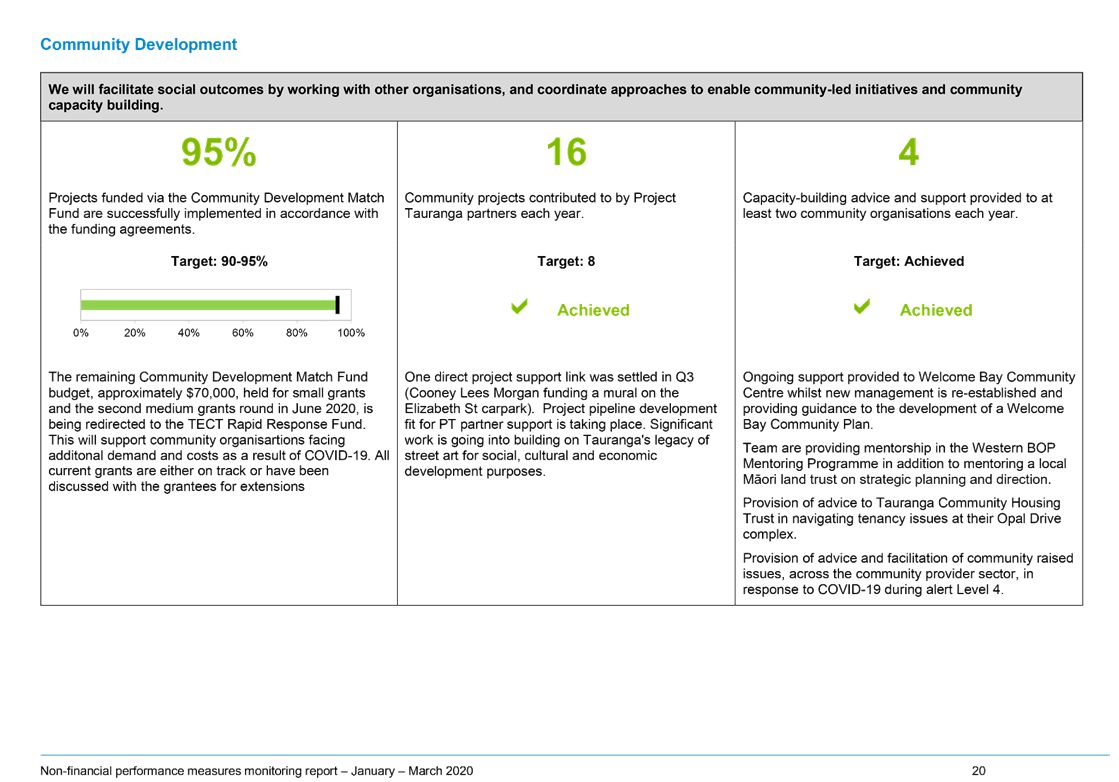

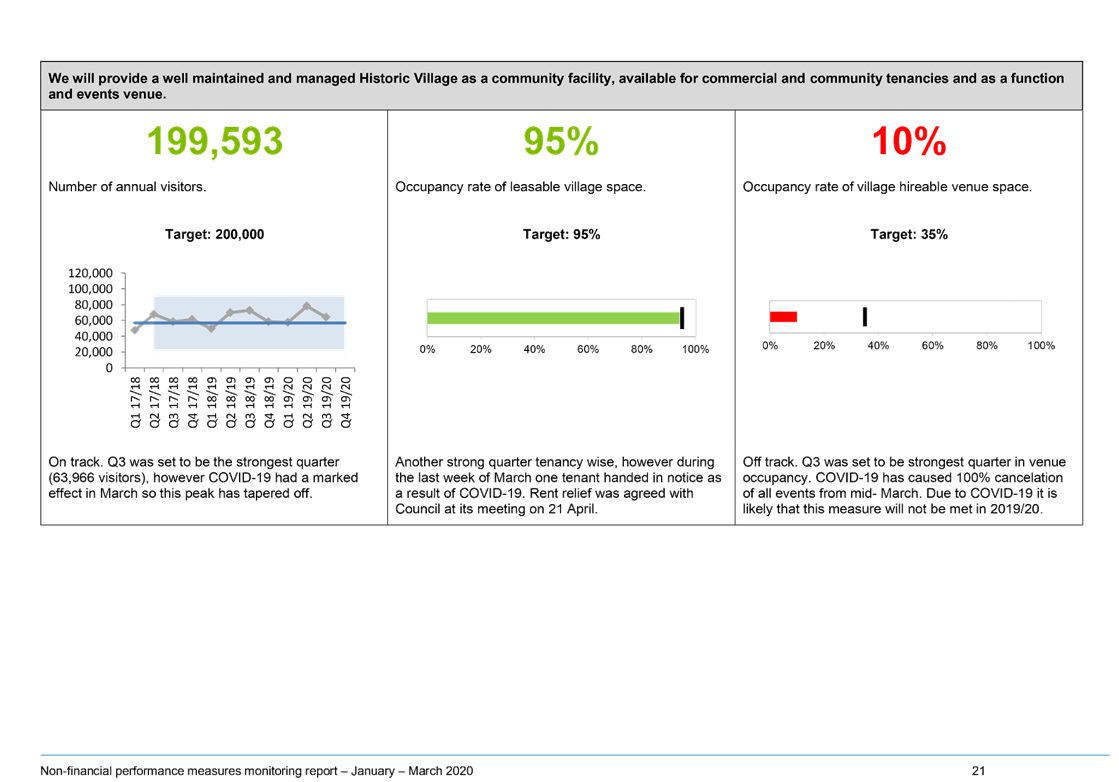

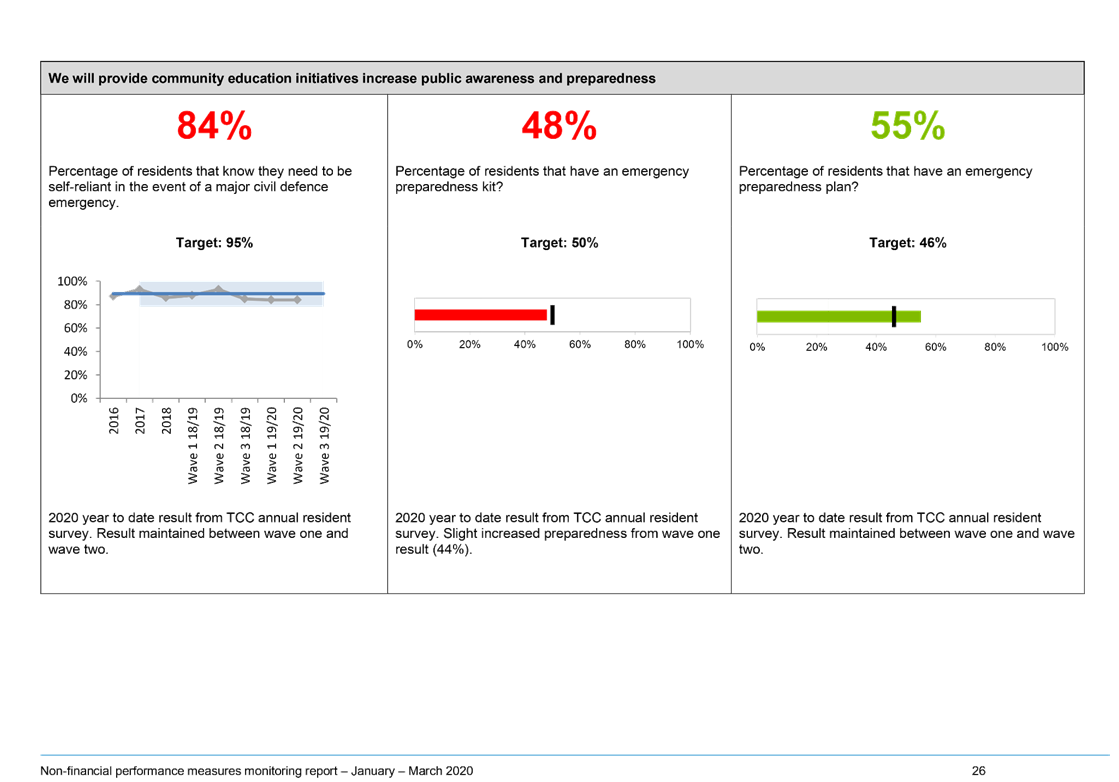

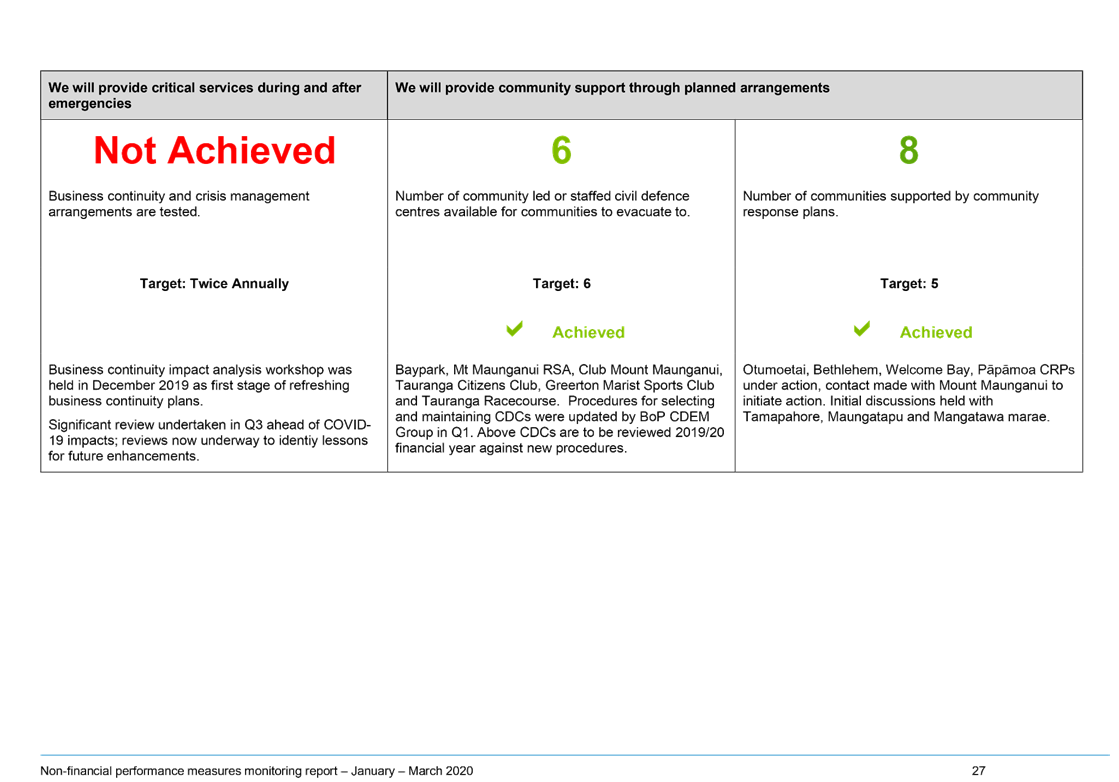

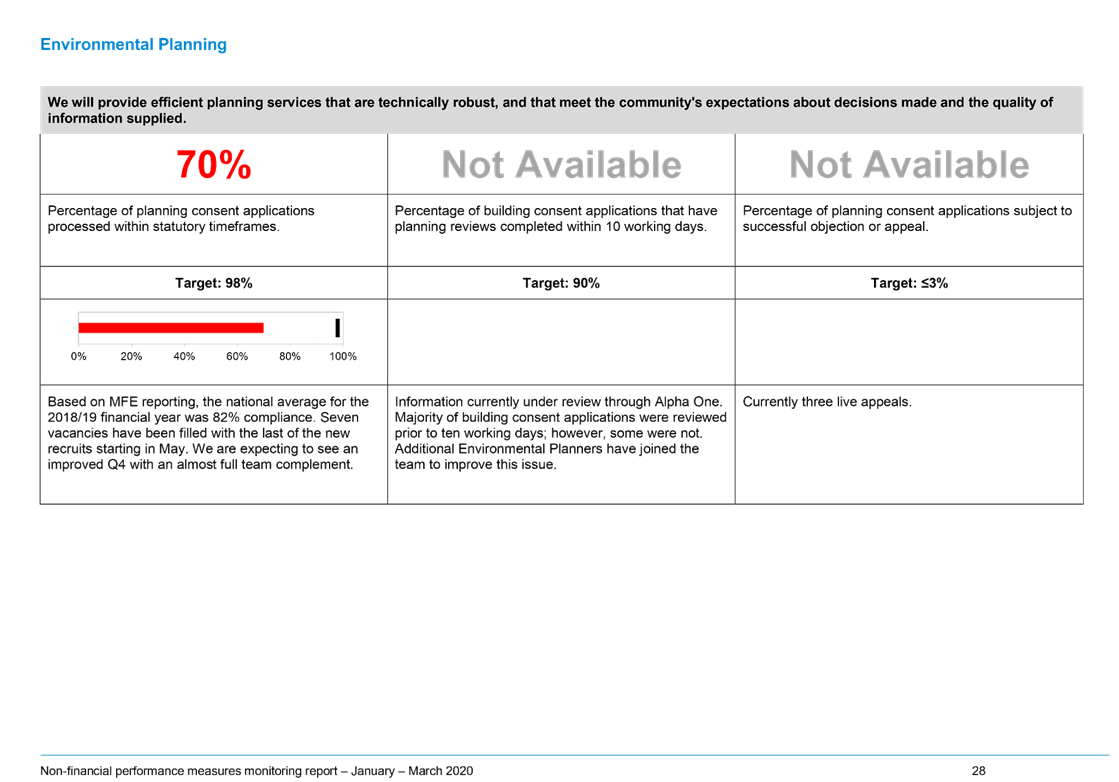

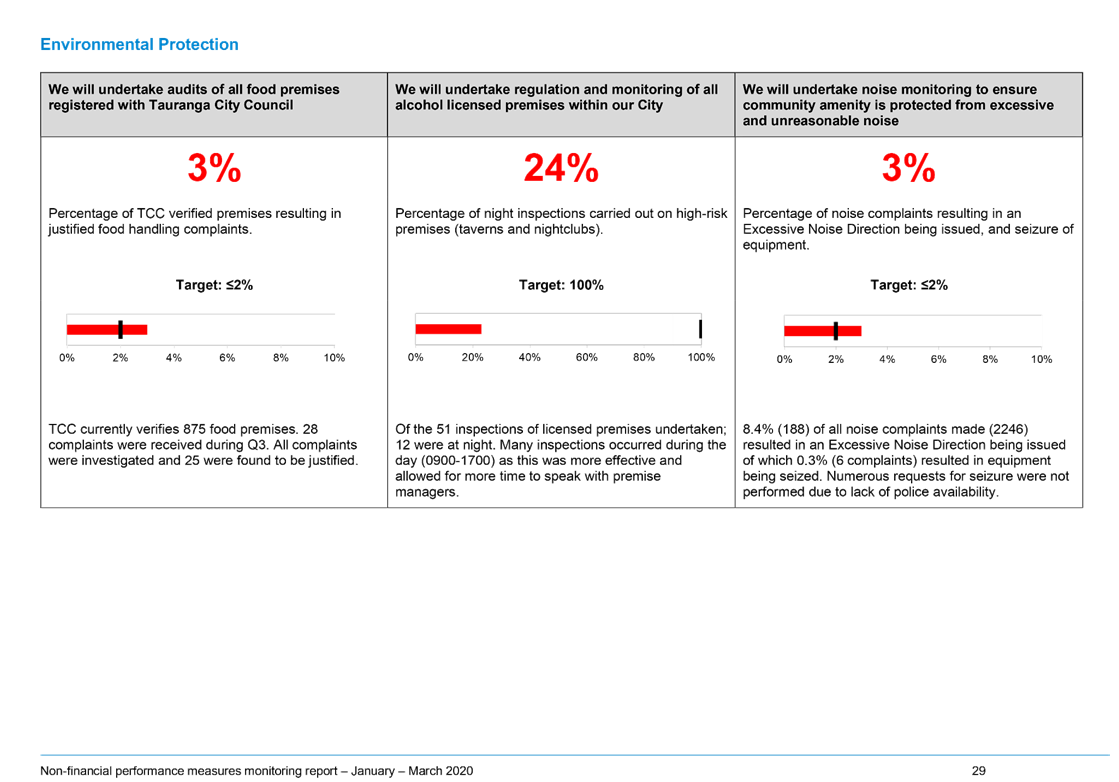

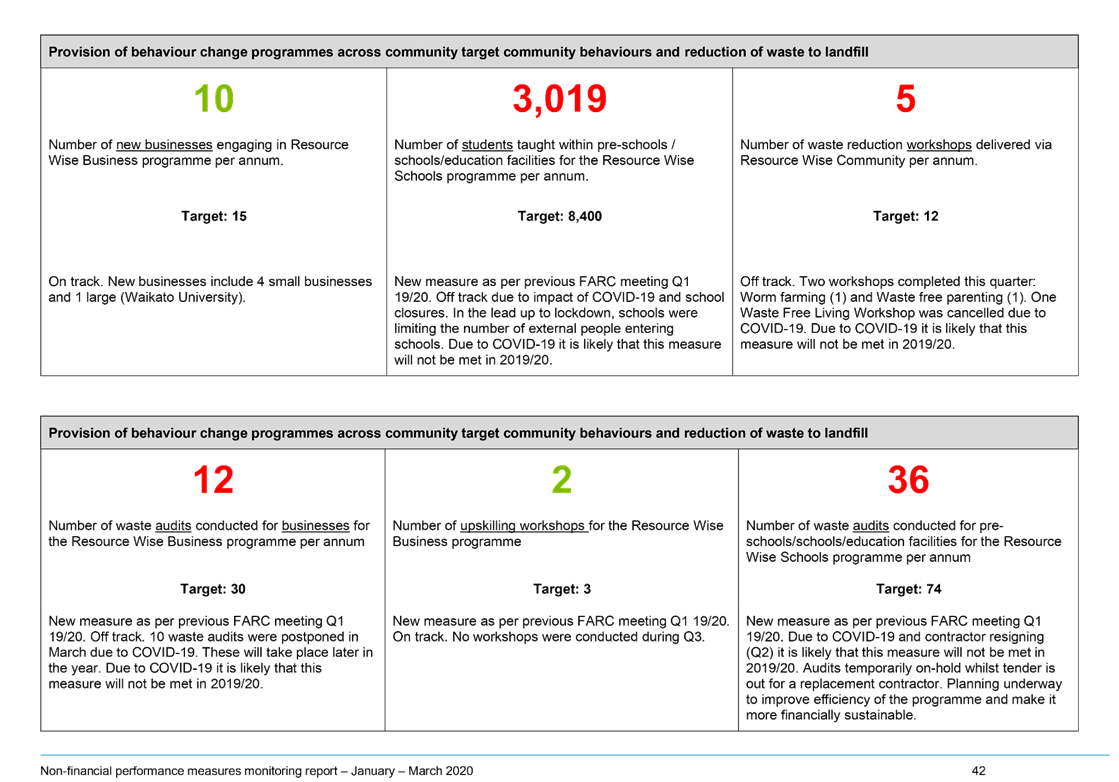

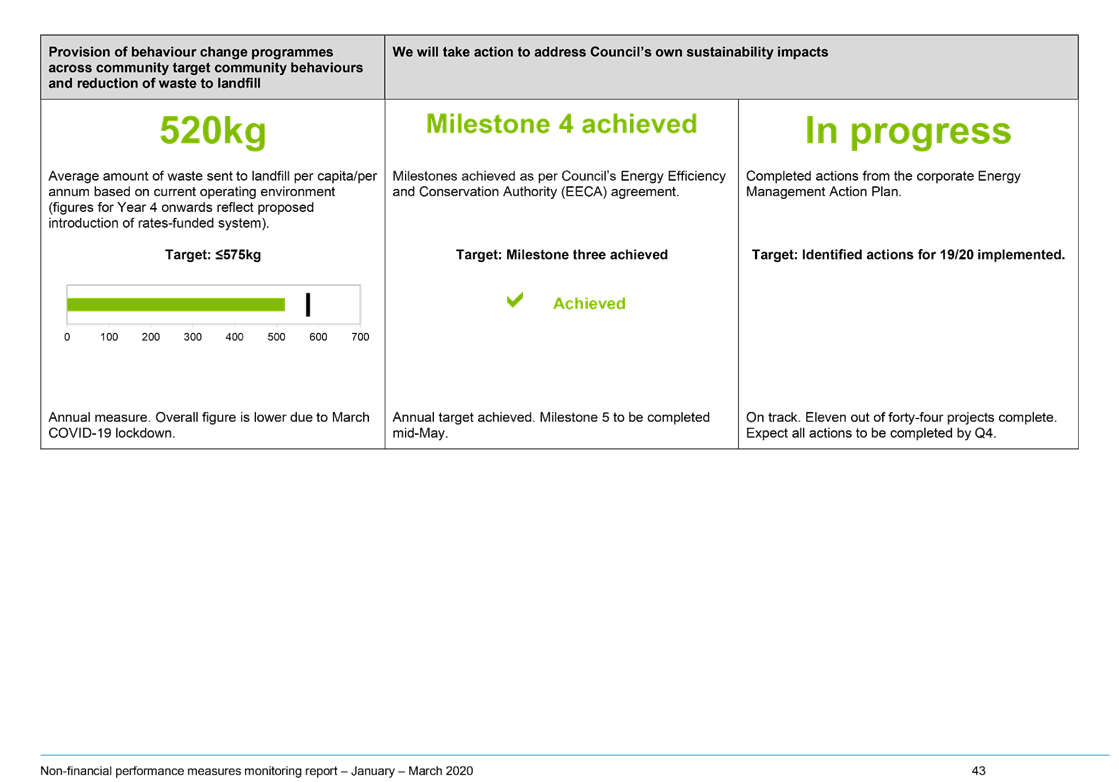

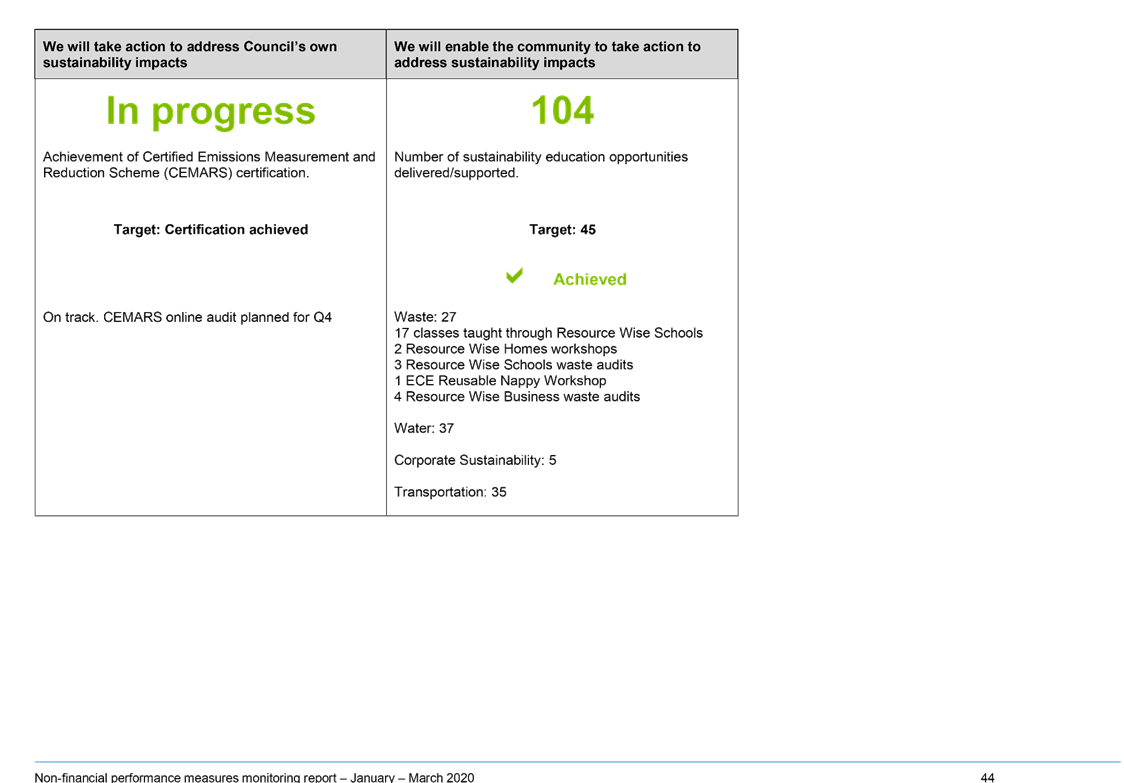

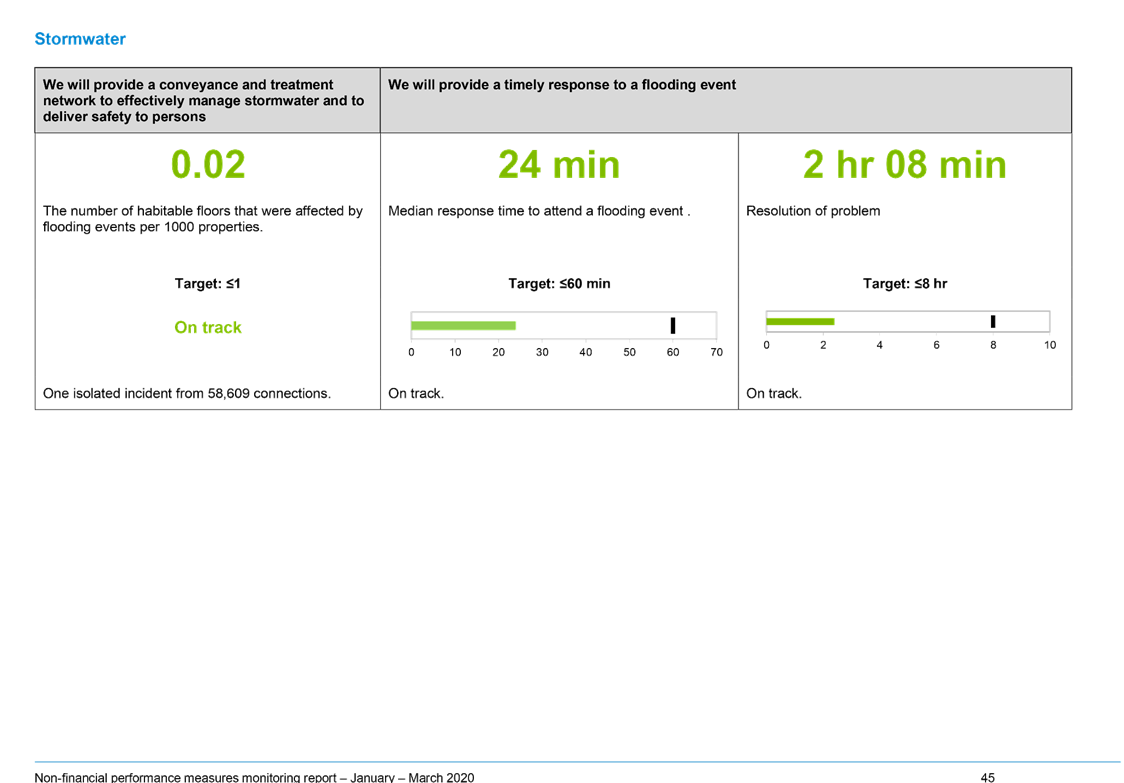

4. Of the 151 non-financial

performance measures, 124 have been measured and reported on. 73 measures (48%)

are on track with 51 measures (34%) off track and 27 measures (18%) yet to be

measured.

5. Initial analysis of non-financial

performance measures is that of the 51 measures off track, 22 measures have

been affected by the impact of COVID-19. It is also likely that those 22

measures will not be met this financial year.

Background

6. This report is for monitoring and

reporting purposes showing Council’s financial and non-financial

performance in delivering services to the community

7. In a long-term plan (LTP), the

level of service that the council will deliver is agreed upon by the council in

consultation with the public.

8. The Local Government Act 2002

stipulates that local authorities are required to report on how well they are

performing in delivering these levels of service to their communities as

measured by the non-financial performance Indicators.

9. In the 2018-28 Long-term Plan there

were 148 KPIs that were agreed upon (subsequent measures have also been added

to increase total to 151 via this committee, no levels of services have been

changed), 23 of which are mandatory measures as per section 261B of the Local

Government Act.

10. The budget to achieve the agreed level of

service is set in the LTP. Rates are set based on the agreed budget.

Strategic Context

11. Maintaining expenditure within budget ensures

delivery of services in a financially sustainable way.

12. Monitoring non-financial performance is a key

function of the committee.

DISCUSSION

Part 1: Financial Performance

13. Attachments to this report provide a summary

of Council’s financial performance for the year to date. The content of

this report includes:

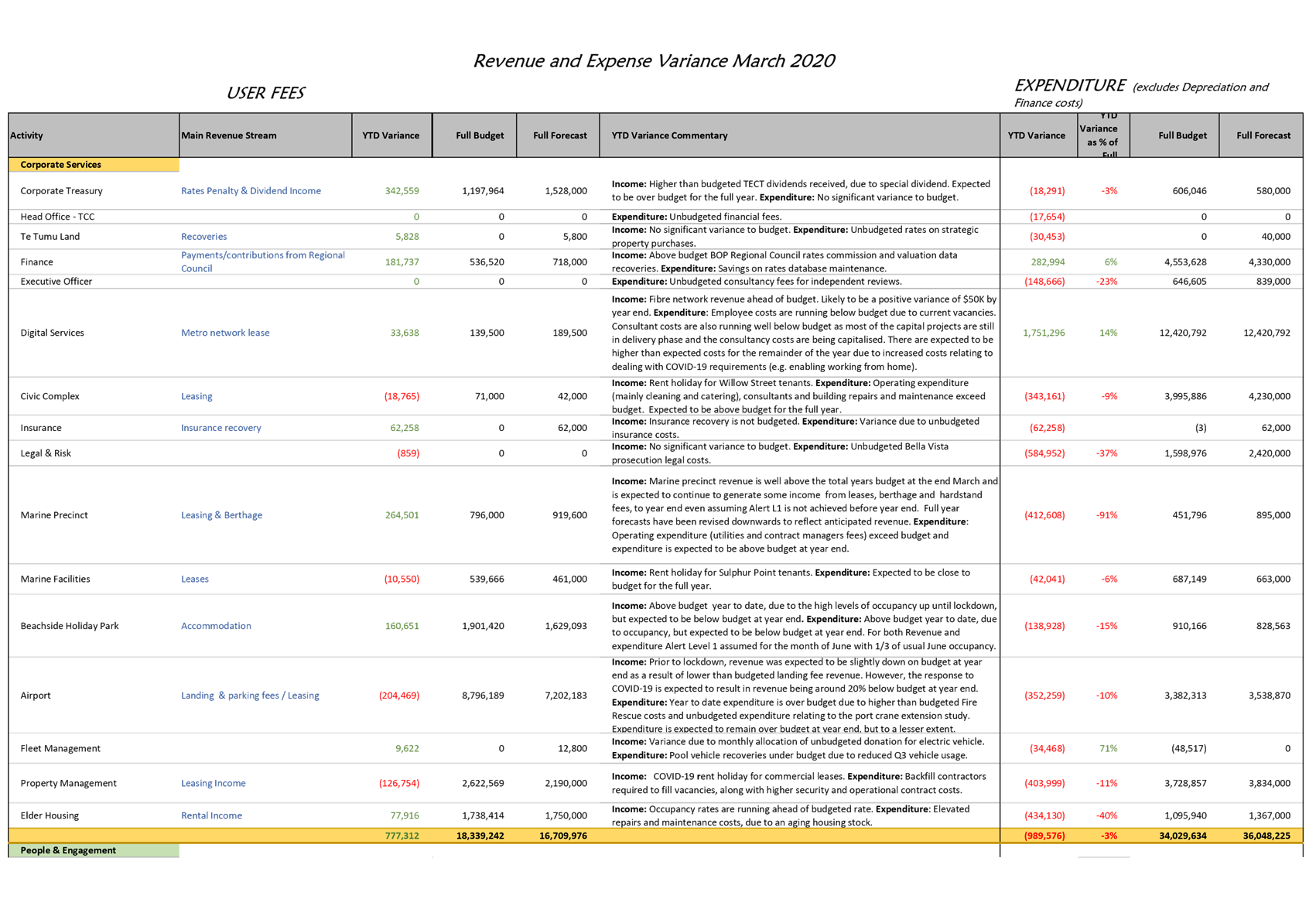

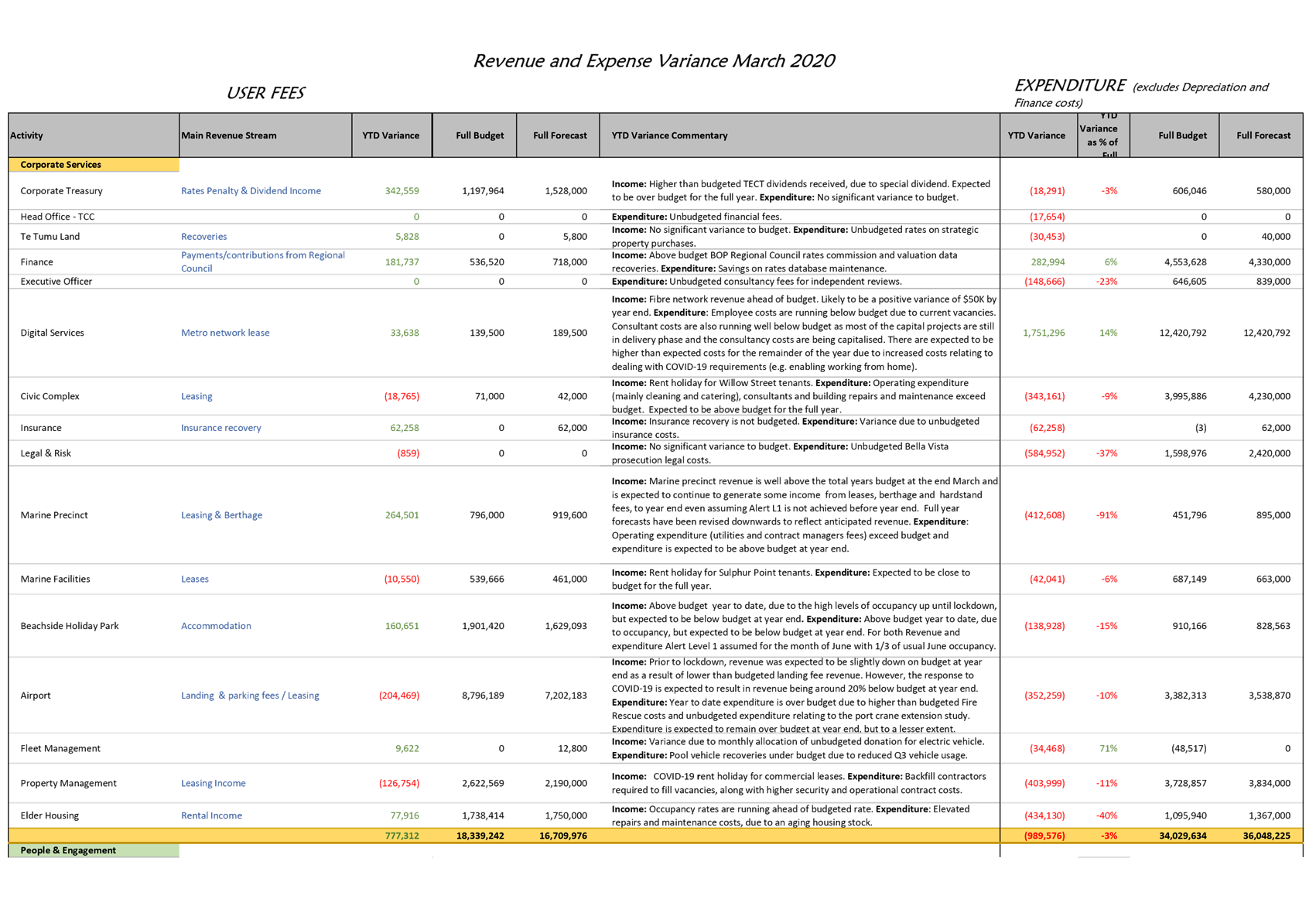

(a) A summary of revenue and expenditure

year to date with revised full year projections presented as a Statement of

Comprehensive Revenue and Expense (Attachment 1).

(b) The Treasury report which shows

borrowing year to date and full year projections, the average cost of funds and

money market investments benchmarked to average return (Attachment 2).

(c) The Capital Programme spend to date and

full year projections, also identifying key projects (Attachment 3).

14. Forecasting to the end of the 2019/20 financial

year (and into 2020/21) has been a focus since the beginning of COVID-19 Level

4 lockdown. The results of that work to date are included in the attachments to

this report on operational and capital expenditure including forecasts, noting

that the environment is very fast moving with assumptions changing frequently

as new or updated information is received.

15. Updates on projections, based on the effects

of the COVID-19 response, will be included in the fortnightly Financial Update

– COVID 19 report for this committee.

16. The Statement of Comprehensive Revenue and

Expenditure shows the operating and capital revenue and expenses in a format

consistent with the Annual Report. It shows the year to date results for

revenue and expenditure and provides a full year forecast.

17. Operating revenue is now projected to be

unfavourable to budget for the year by $11m. The largest variances between

forecast and budget are as follows:

|

Activity

|

Variance

|

Comment

|

|

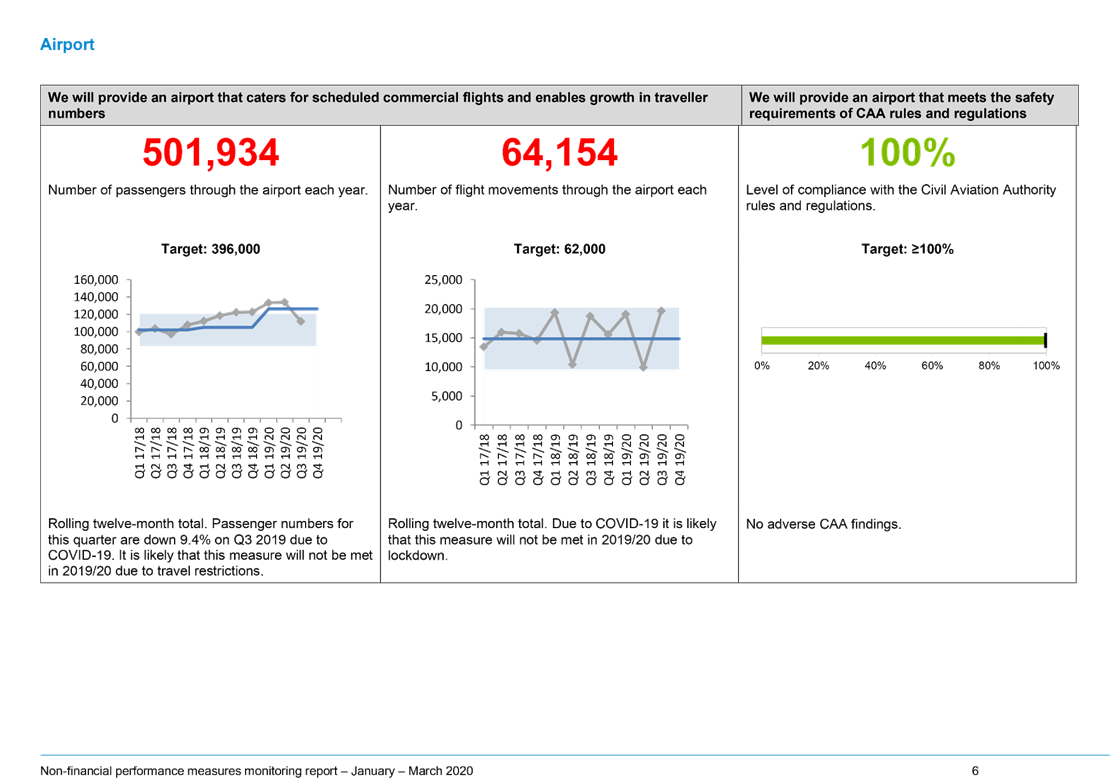

Airport

|

$(1.6)m

|

Lower than expected landing revenue

exacerbated by COVID-19 response.

|

|

Water Supply

|

$(1.8)m

|

Forestry harvesting revenue (from the

Oropi water catchment) deferred due to low prices and community consultation

timeframes.

|

|

Parking

|

$(4.1)m

|

Forecasting little parking revenue for

the remainder of the year; delayed opening of Harington Street carpark

building; casual parking fees behind budget YTD.

|

|

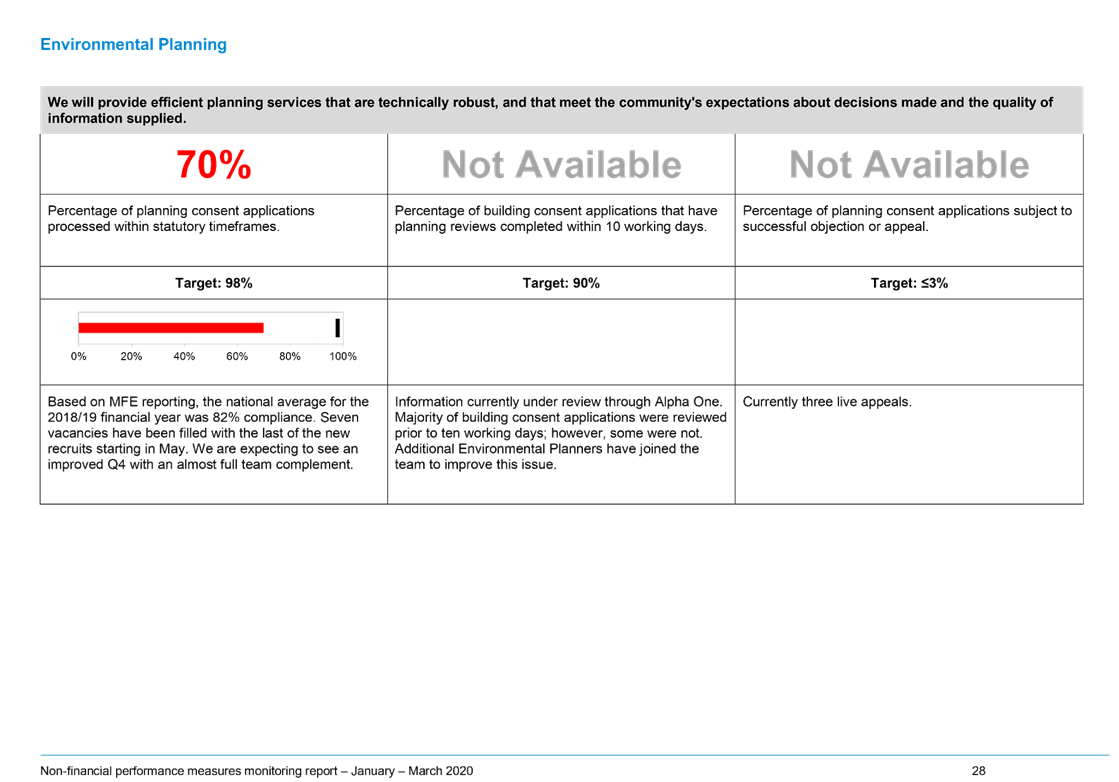

Environmental Planning

|

$(0.7)m

|

Lower than budgeted consent numbers and

starting to see the impact of reduced residential consents due to restricted

land supply.

|

|

Building Services

|

$(1.3m)

|

Lower numbers of code of compliance

applications and reduced charging of swimming pool inspections.

|

18. Operating cost variances are favourable

primarily due to lower depreciation on three waters infrastructure arising from

last year’s asset revaluation which extended the useful life of some of

our plant. Personnel expenses are $1.1m behind budget reflecting vacant

positions across the business including Building Services and Environmental

Planning. Due to these vacancies, contractor costs are running over budget.

19. The Treasury Report (Attachment 2) shows total

net debt to 31 March of $480m with the full year forecast at $525m (against a

full year budget of $543m). The lower expenditure on capital more

than offsets lower revenue, including operating and capital revenue resulting in the lower forecast debt position.

20. TCC Capital Expenditure (Attachment 3)

summarises expenditure on the capital programme, identifying significant

capital projects. The capital programme is tracking behind budget by $74m year

to date which is 51% spent with 75% of the year gone. Project delivery

usually increases in later months however the impact of COVID-19 on capital

expenditure is forecast to be substantial and we continue to refine these

forecasts. At the time of writing, the forecast is $48m less than budget. For

the most part, this variance can be considered a delay, or timing difference.

We would therefore expect the unspent budget to be carried forward to 2020/21.

(Note the capital budget at $203m includes a $60m underspend assumption).

21. The Capital Overspends table (Attachment 3)

identifies project overspends for the year totalling $24m. The largest of

these relates to the Waiari water supply programme of works and is a timing

difference for which approval to bring forward budget from 2020/21 will be sought.

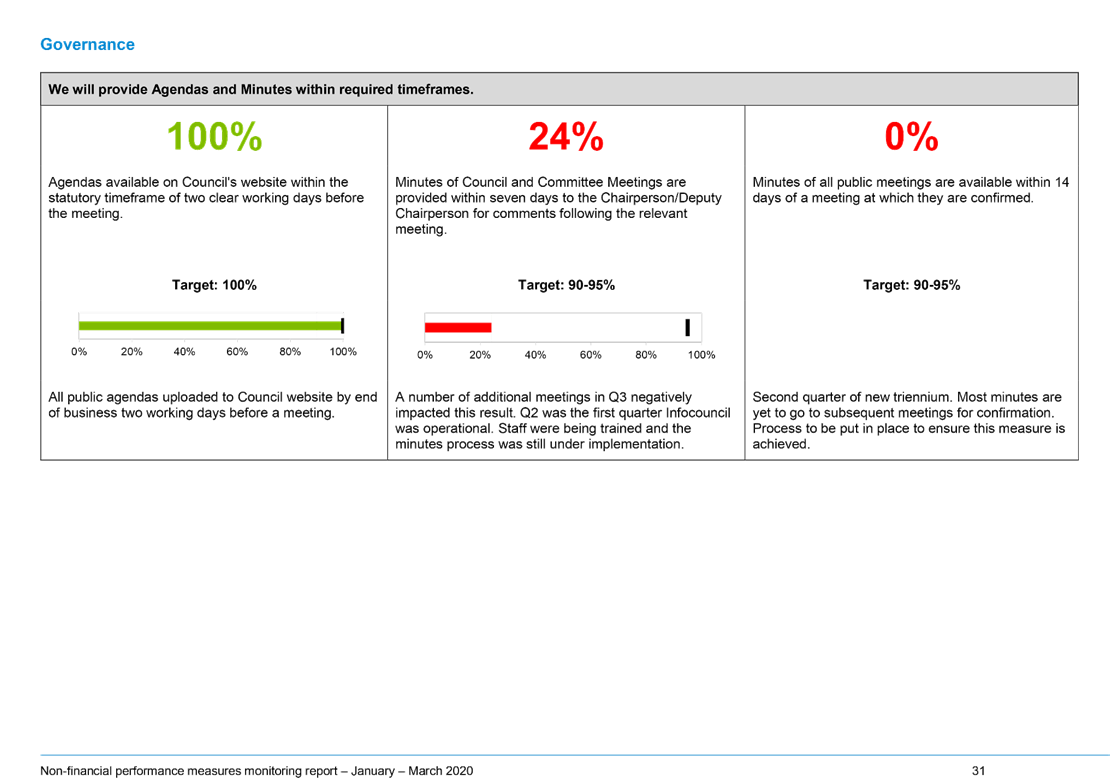

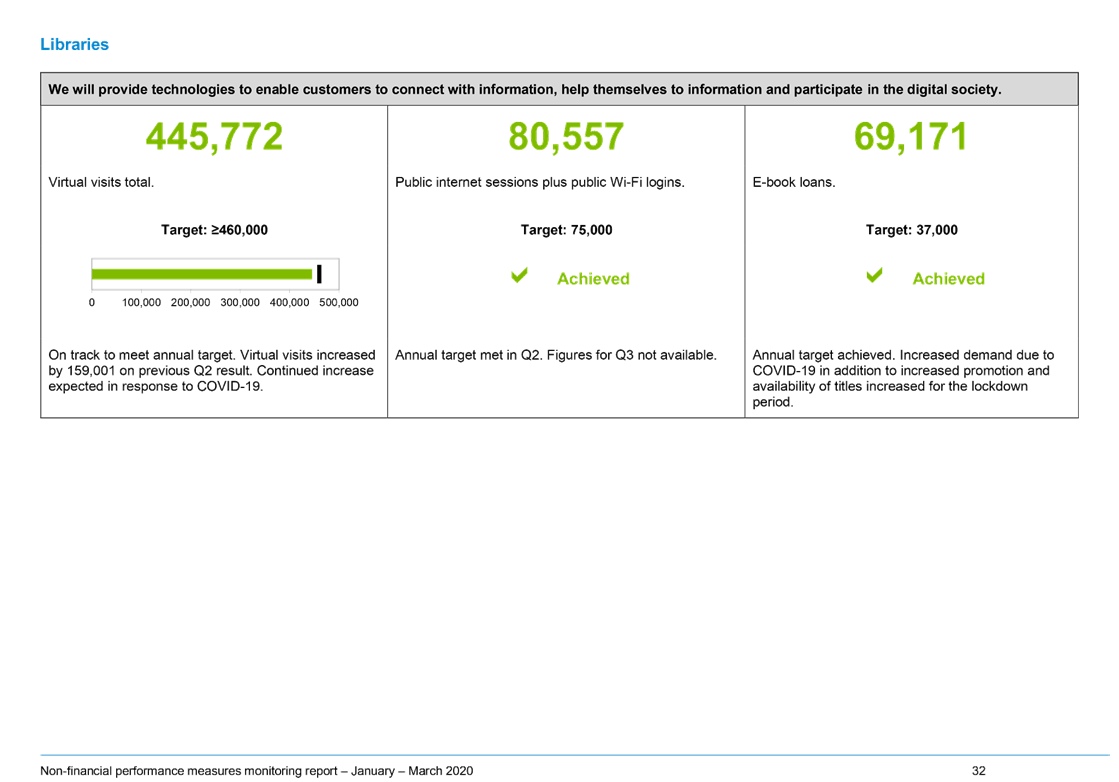

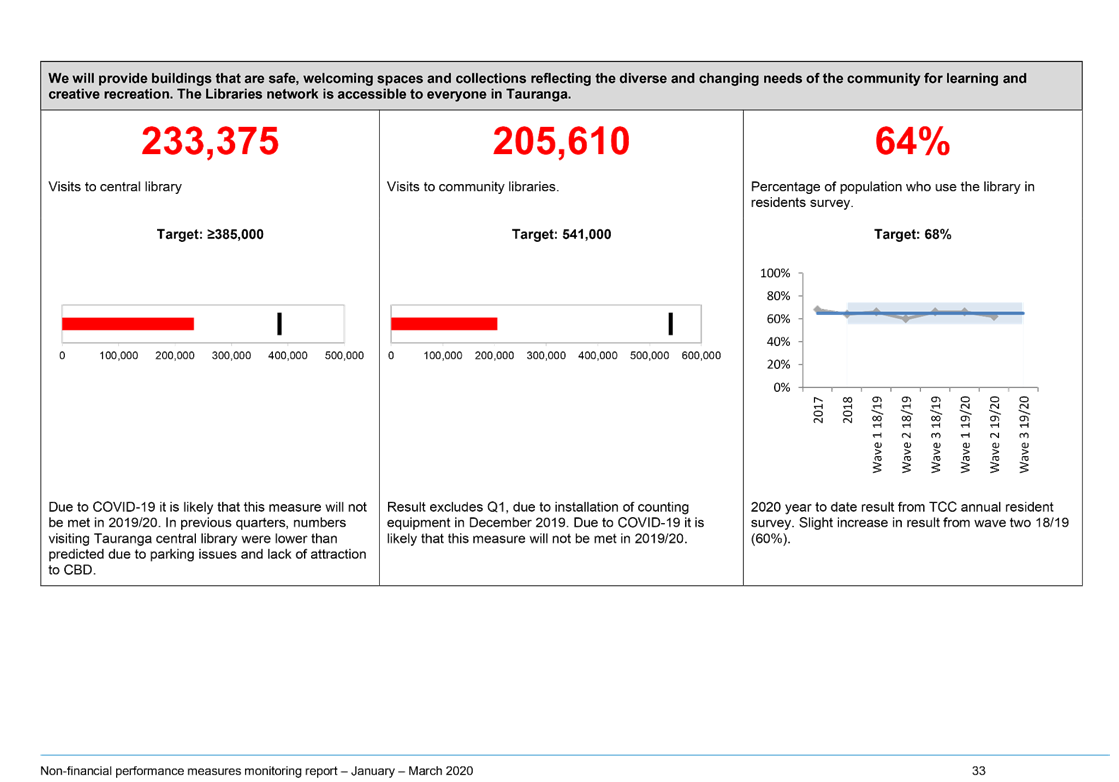

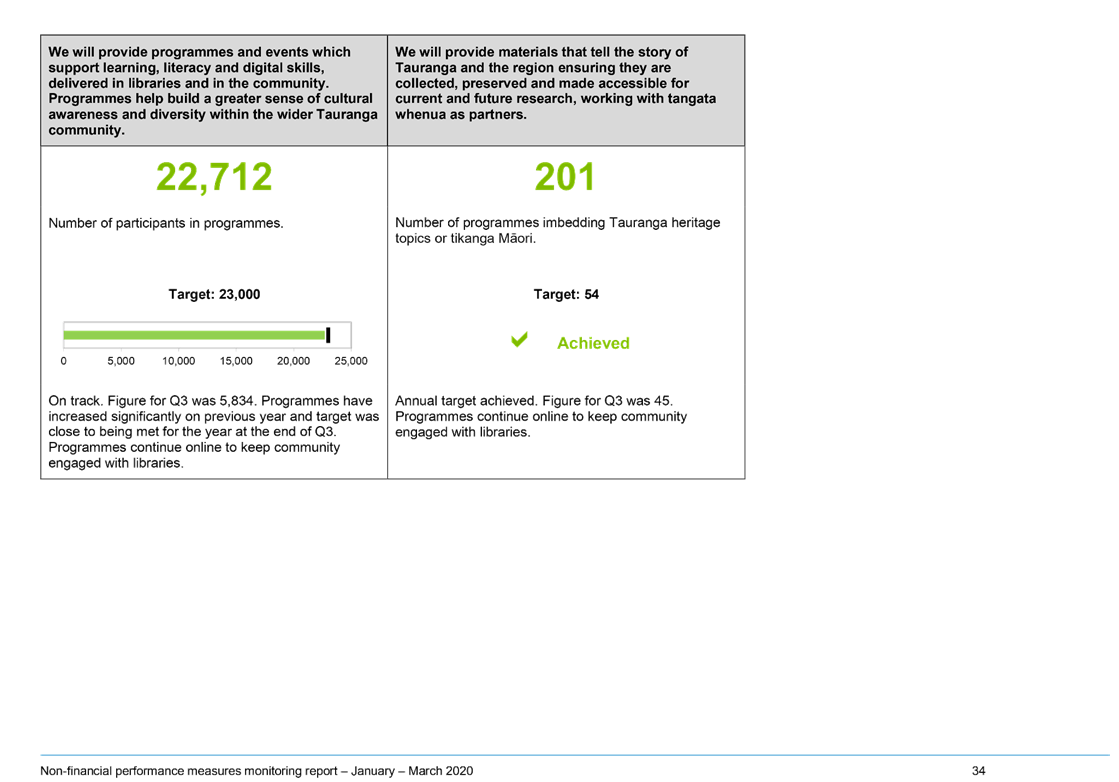

Part 3: Non-Financial Performance Measures

22. Attachment 4 presents how Council and the

community are tracking towards achieving Council’s non-financial

performance measures and levels of service.

23. Of the 151 non-financial performance measures (four

measures were added in as part of the recommendation when this was last

reported in November 2019), 124 have been measured and

reported on. Data is not yet available for 27 measures.

24. Of those that have been measured, 73 measures

(48%) are on track with 51 measures (34%) off track.

25. Of the 51 measures off track, 22 measures have

been affected by the impact of COVID-19. It is also likely that these measures

will now not be met this financial year.

26. Where data is not available, the majority

relate to annual measures which are only surveyed at one point through the year

or to measures that have no current method of assessment.

Perceptions Monitor

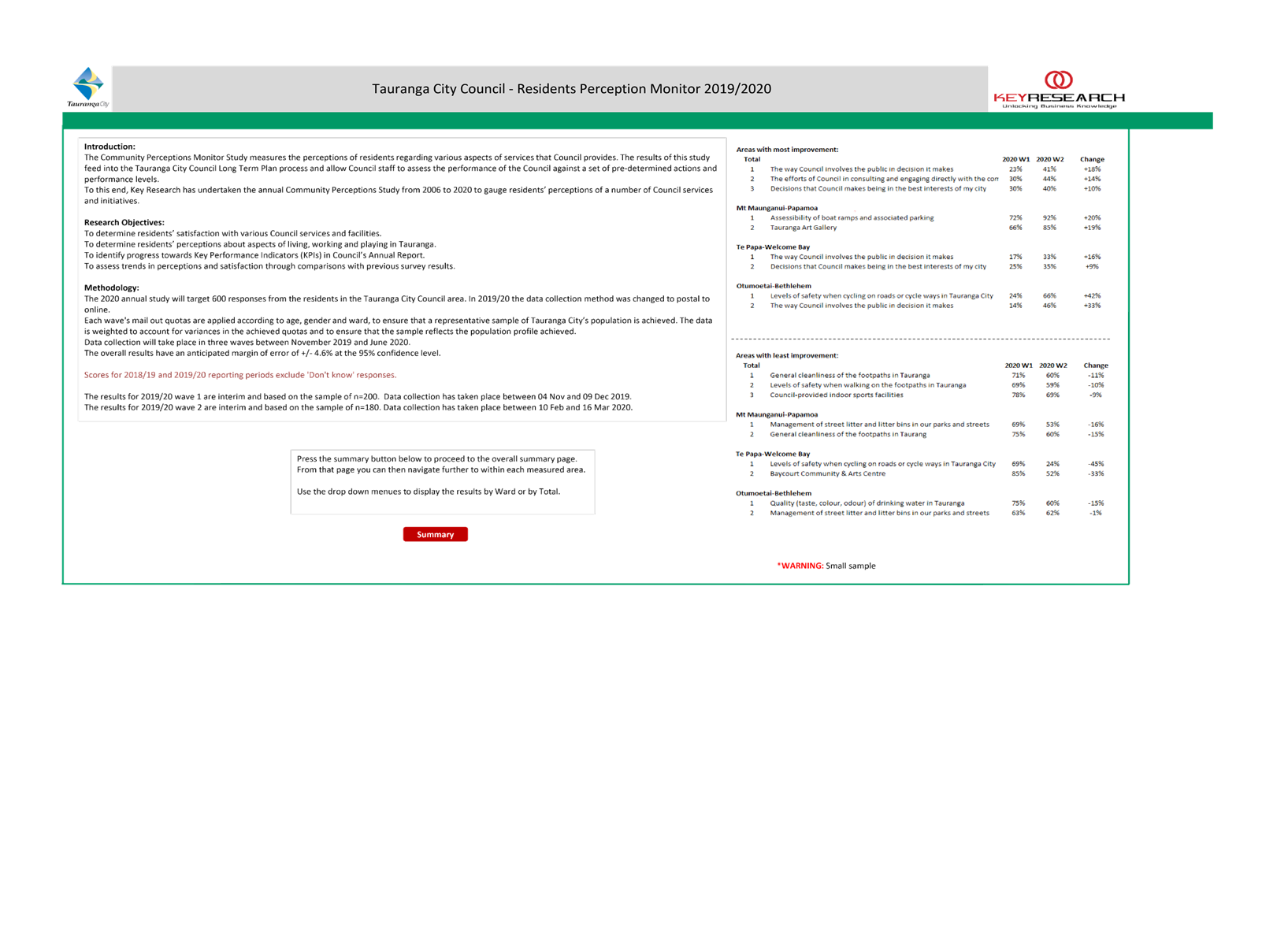

27. The Annual Residents’ Survey supports

non-financial reporting by measuring the perceptions of residents regarding

various aspects of services that Council provides.

28. Each

wave's mail out quotas are applied according to age, gender and ward, to ensure

that a representative sample of Tauranga City’s population is achieved.

The data is weighted to account for variances in the achieved quotas and to

ensure that the sample reflects the population profile achieved.

29. The

overall results have an anticipated margin of error of +/- 4.6% at the 95%

confidence level. Scores for 2018/19 and 2019/20 reporting periods exclude

'Don't know' responses.

30. The

results for 2019/20 wave 2 are interim and based on the sample of n=180. Data

collection has taken place between 10 Feb and 16 March 2020.

31. A summary of the highlights of the second wave

are attached at Attachment 5. The summary helps provide an insight into

how different elements of Council’s core service deliverables, reputation

and the perception of value for money contribute to respondents’

perception of Council’s overall performance.

32. The level of satisfaction (reputation

measure) with Tauranga City Council in general has decreased from 66% in

2018/19 to 47% year-to-date. Reputation measures the community’s

perception of four key areas – leadership, acting honesty/fairly,

financial management and quality of services/facilities.

33. Perceptions of each of the three

drivers of overall performance have decreased:

a. The

perception of value for money, which is the major driver of the overall

perception score, has dropped from 50% to 41% year to date. This has been

driven by a decline in the perception that annual property rates are fair and

reasonable.

b. The

second biggest driver, overall service and facilities, decreased from 72% to

64% year-to-date.

c. Reputation

has dropped from 46% in 2018/19 to 35% year-to-date.

34. The

final wave will be due to be reported in August with the draft annual report.

OPTIONS

35. There

are no options associated with this report. The report is provided as

information only.

Significance

36. Under the Significance and Engagement Policy

2014, the decision to receive this report is of low significance. The

decisions to approve the capital overspends are also of low significance as the

size of the overspends do not reach a higher threshold.

Next Steps

37. This report ensures monitoring of Council

performance to ensure compliance with Council’s budgets, policies and

delegations.

Attachments

1. Statement

of Comprehensive Revenue and Expenditure - A11437048 ⇩

2. Treasury

Overview - A11437050 ⇩

3. Capital

Programme - A11437045 ⇩

4. Non-Financial

Performance Measures - Q3 2020 - A11411310 ⇩

5. Tauranga

City Council Dashboard 2019/20 Wave 2 Summary - A11411294 ⇩

|

Finance, Audit

and Risk Committee Meeting Agenda

|

12 May 2020

|

|

Finance, Audit and Risk Committee

Meeting Agenda

|

12 May 2020

|

|

Finance, Audit

and Risk Committee Meeting Agenda

|

12 May 2020

|

|

Finance, Audit

and Risk Committee Meeting Agenda

|

12 May 2020

|

|

Finance, Audit and Risk Committee Meeting

Agenda

|

12 May 2020

|

7.2 Financial

Update - COVID-19

File

Number: A11429123

Author: Kathryn

Sharplin, Manager: Finance

Authoriser: Paul

Davidson, General Manager: Corporate Services

Purpose of the Report

1. The purpose of this report

is to provide an update on:

(a) the short-term financial impacts

of COVID-19 through to June 30, 2020.

(b) Information affecting the

2020-21 annual plan.

(c) Information on key areas of

financial risk

2. This

report is a regular update on the financial situation as a result of COVID-19

and any other significant funding and financing outcomes.

Executive Summary

2019-20 Current Year

3. Results for April are

consistent with projections in the March quarterly report. Overall

revenue and capital expenditure are below monthly averages.

4. Cash Payments in April

were higher than monthly average levels reflecting higher project expenditure and

grant payments to the end of March, with May payments expected to be lower

reflecting the lower activity in April due to the lockdown at Alert Level 4.

5. Net debt is projected to

be $525m at year end, with total external debt at about $550m. Currently 78% of

total debt is at fixed interest rates.

6. Average interest rates at

30 June are projected to be 3.7%-3.75% based on a mix of existing debt and new

borrowing at rates between 1%-2.5% depending on duration. Wholesale rates have

been very low since the Reserve Bank actions to lower the OCR to 0.25% and

intervene in the wholesale market to lower long-term interest rates.

2020-21 Annual Plan

7. Scenario analysis and

capital project review for the annual plan is ongoing.

8. An

assumed reduction of 20-40% in business and housing-related revenue for the

2020-21 is being modelled for the annual plan. This is consistent with recent

economic projections, along with review of the reduction in council’s

housing-related revenue during the period of the Global Financial Crisis (GFC).

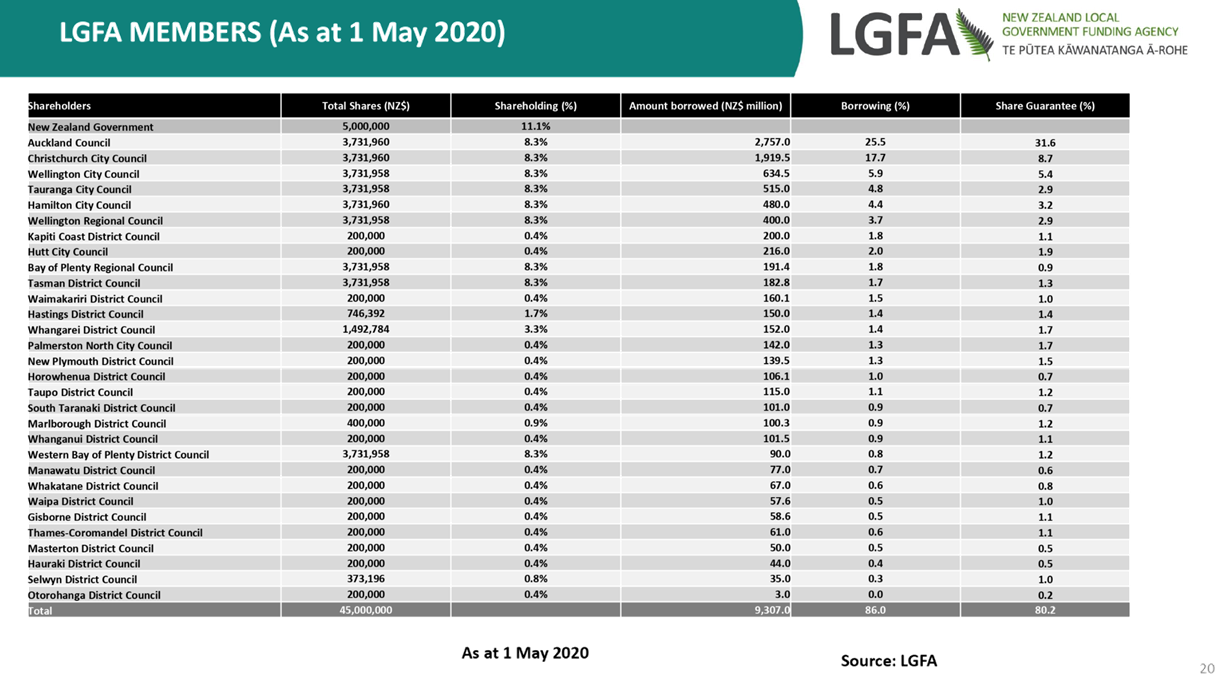

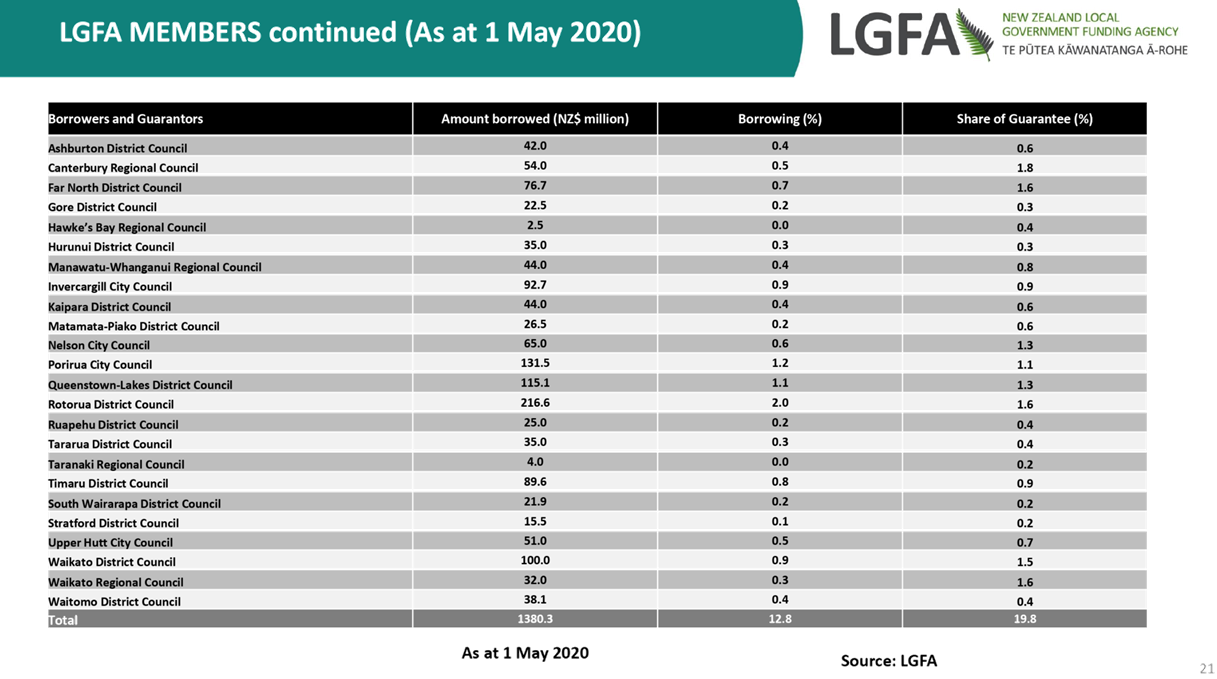

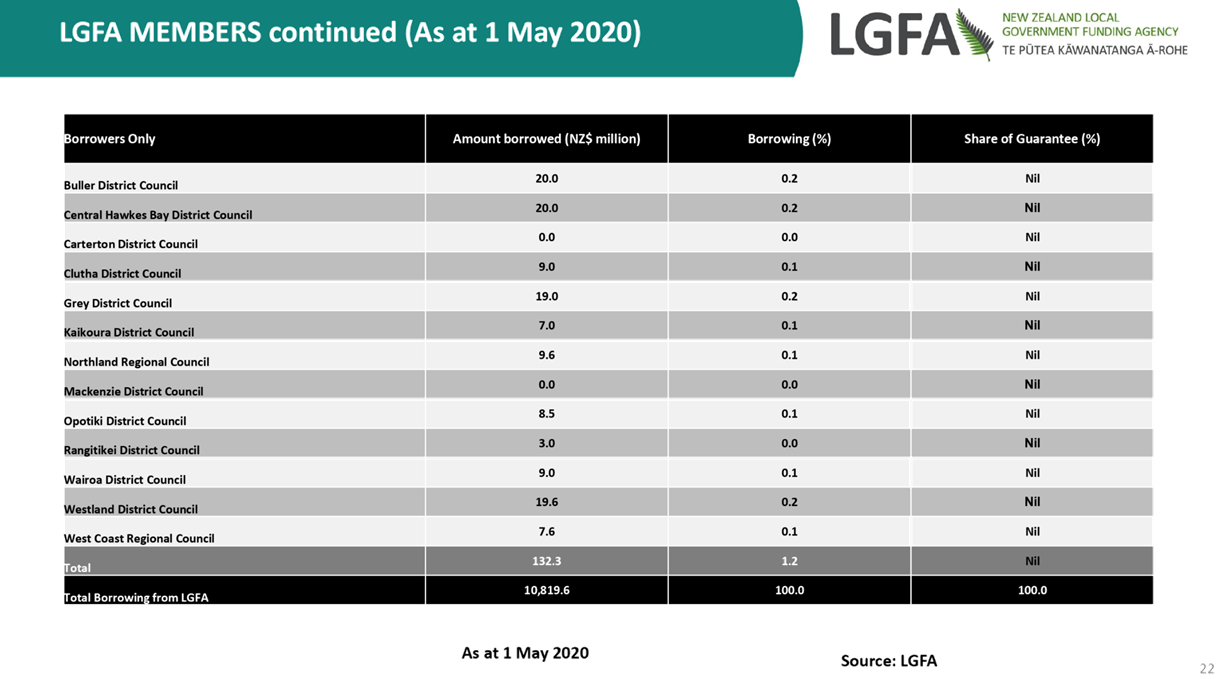

9. The annual plan is

modelled on borrowing continuing to be sourced from the Local Government

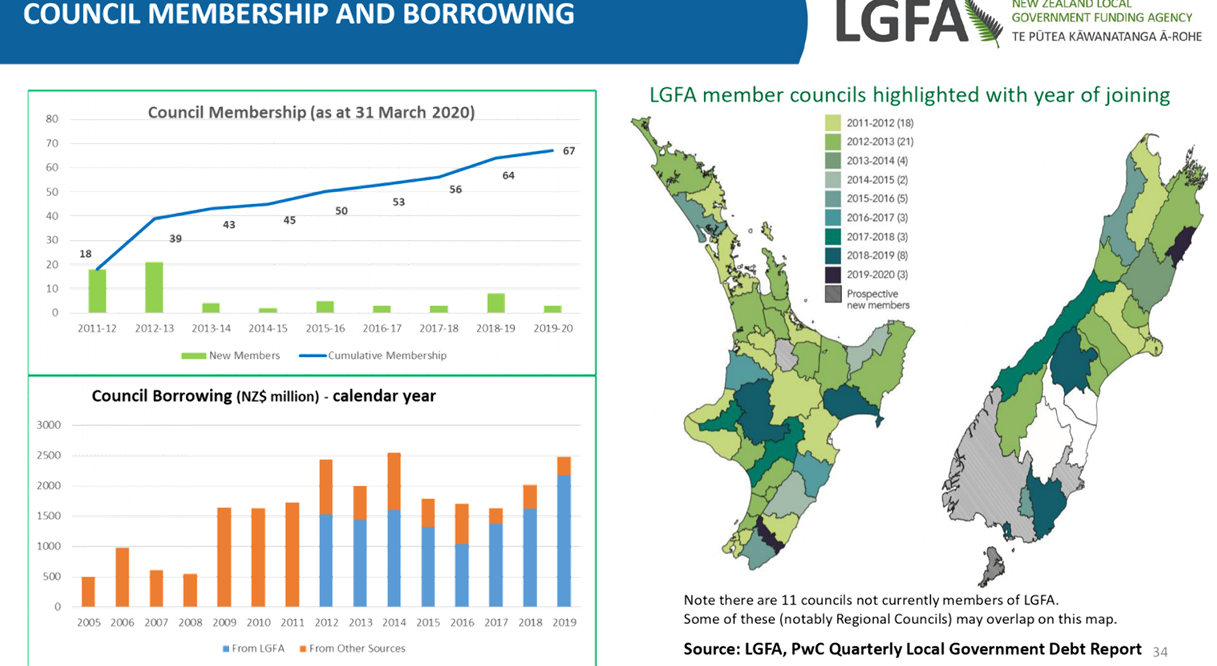

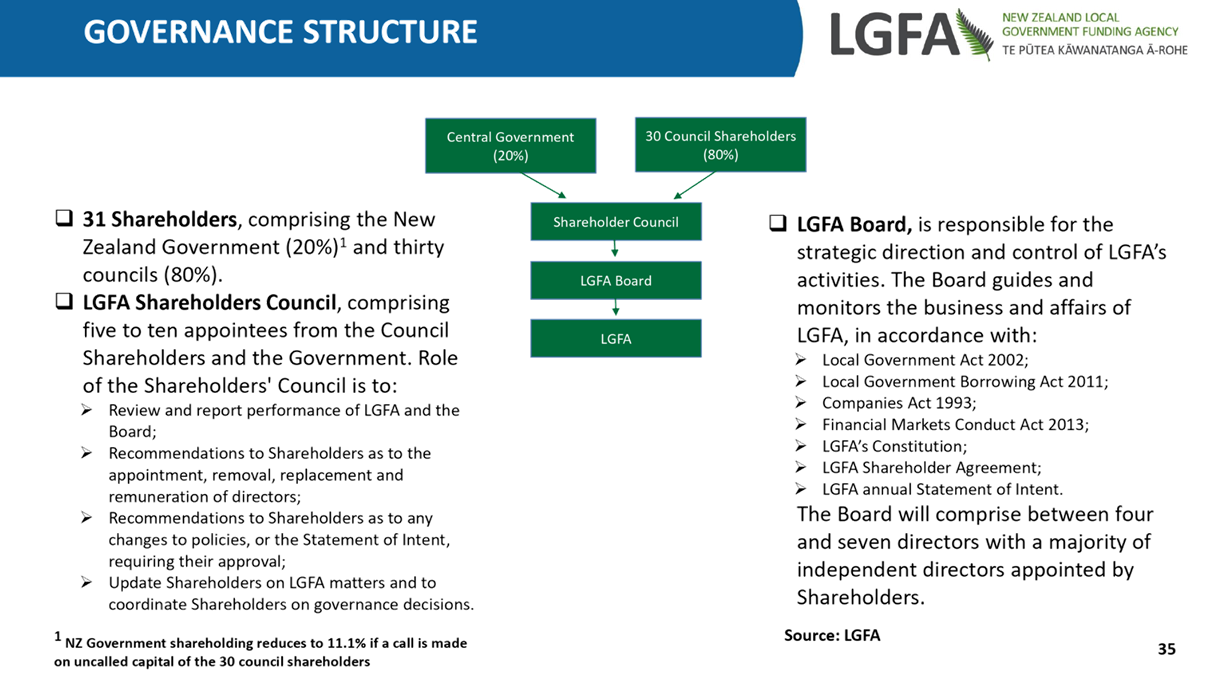

Funding Agency (LGFA).

10. The LGFA has

announced that it will recommend at a June Special General Meeting of the

shareholders of the Local Government Funding Agency to amend the net debt

/total revenue foundation policy financial covenant.

Financial Risks

11. To date there has been no

significant indication of the extent of pressure likely on the collection of

rates revenue next year.

12. Additional costs are likely to be

incurred on capital projects due to the lockdown period and with the controlled

work conditions required under alert level 3. We are working through the

financial implications for council associated with these costs.

Background

2019-20 Current Year

13. Monitoring of the current financial

year outcomes is continuing across revenue, operating and capital expenditure.

14. Activities significantly affected by

loss of operational revenue in April include council businesses closed during

the lockdown eg, Tauranga Airport, Baycourt, Beachside, and parking activity,

along with those activities with revenue from property leases where relief has

been provided. Building and planning consent activities have not shown an

immediate downturn in consent applications, which is assumed to be due to catch

up from prior periods.

15. Operating expenditure for April was

also down $5m on average monthly payments, while capital expenditure in April

was $10m, about $4m below the monthly average.

16. Cash outflows to suppliers in April

were $4m higher than the previous month, reflecting higher project expenditure

in March and grant payments. The lower expenditure levels identified for

April will be reflected in May payments to suppliers.

17. Interest rates remain low. Wholesale

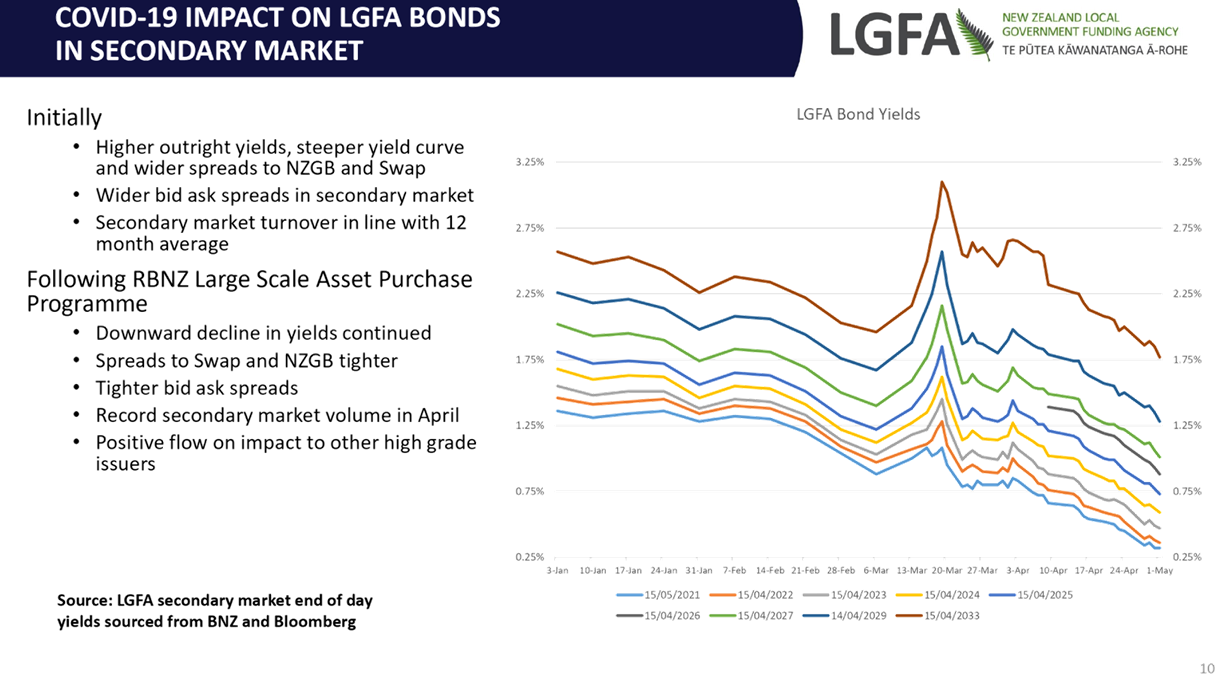

short-term interest rates have decreased in line with Reserve Bank’s

interest rate (OCR) cut to 0.25%. Long-term interest rates which would

otherwise be more elevated have been lowered as a result of Reserve Bank

intervention in the wholesale market. Interest rates on debt sourced from the

LGFA range from 1% for one-year borrowing, to 2.5% for 13-year borrowing.

2020-21 Annual Plan

18. Work is ongoing to assess the

impacts of COVID-19 on activity revenue and costs for next financial

year.

19. An assumed reduction of 20-40% in

business and housing-related revenue for the 2020-21 is being modelled for the

annual plan. This is based on recent economic projections, along with review of

the reduction in council’s housing-related revenue during the period of

the Global Financial crisis. While April results in the building services

activity do not support this reduction, it is anticipated that the reduction

will occur as the recessional impacts of COVID-19 begin to show over the next

few months. This assumption is in line with the initial high-level

estimate of revenue reduction for 2020-21.

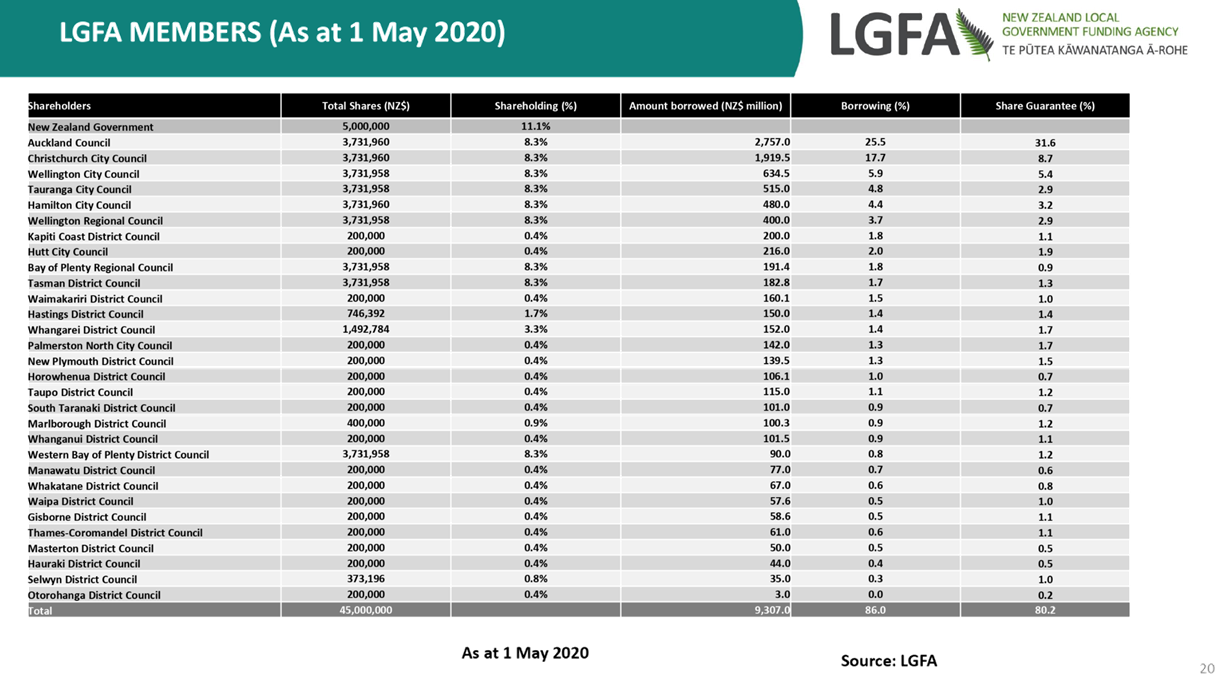

20. Council

borrowing assumptions for the annual plan are based on continued funding

through LGFA. Currently, about 75%-78% of council borrowing is at fixed

interest rates either from borrowing at fixed interest rates or from hedging

with interest rate swaps. Because of the high amount of fixed interest

positions and current very low interest rates, the cost to terminate our fixed

interest positions at this time would be high. Attachment 1 contains more

information on debt and interest risk management.

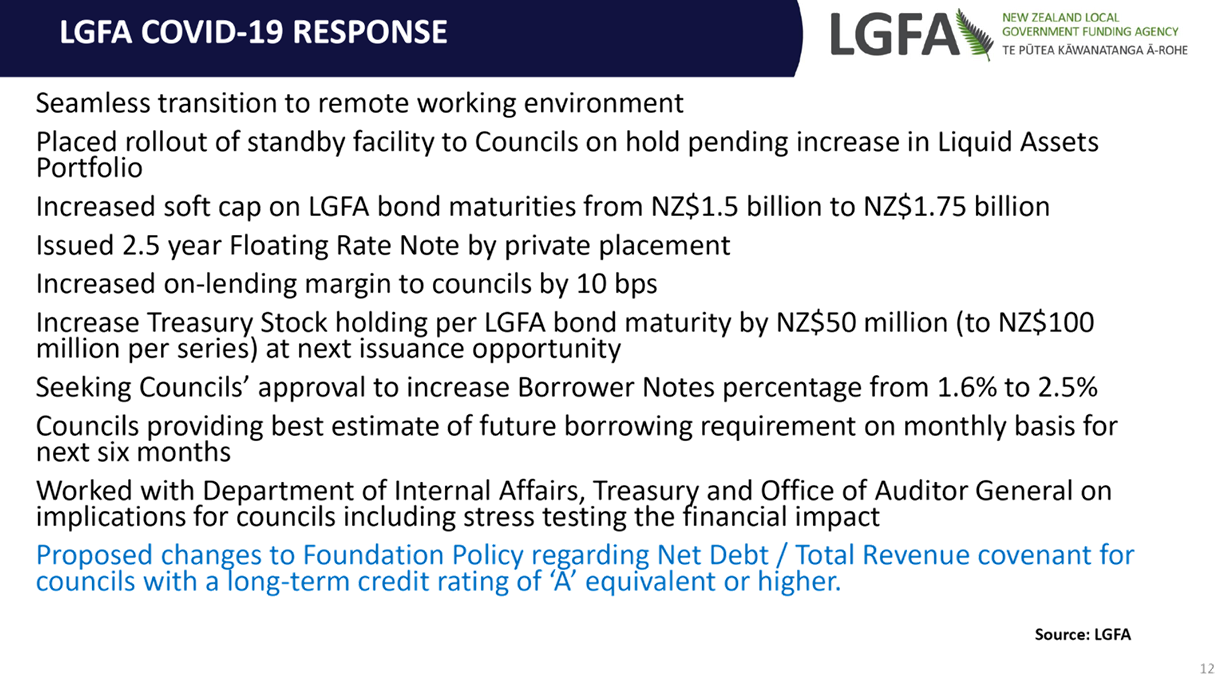

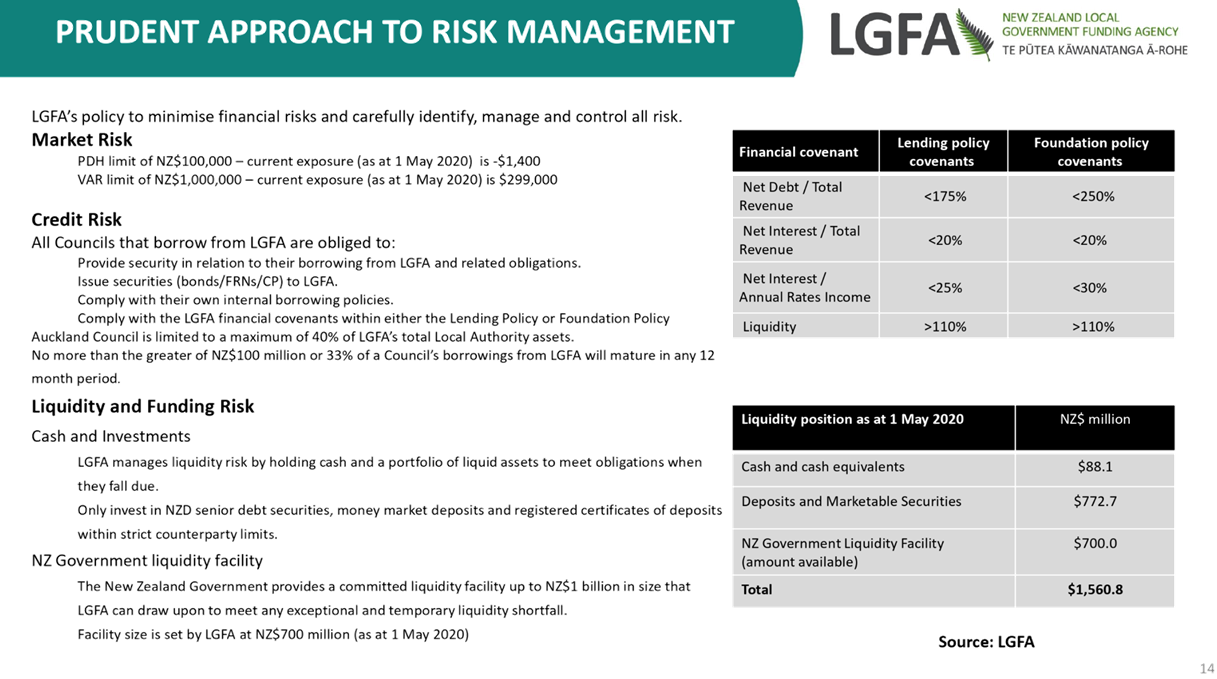

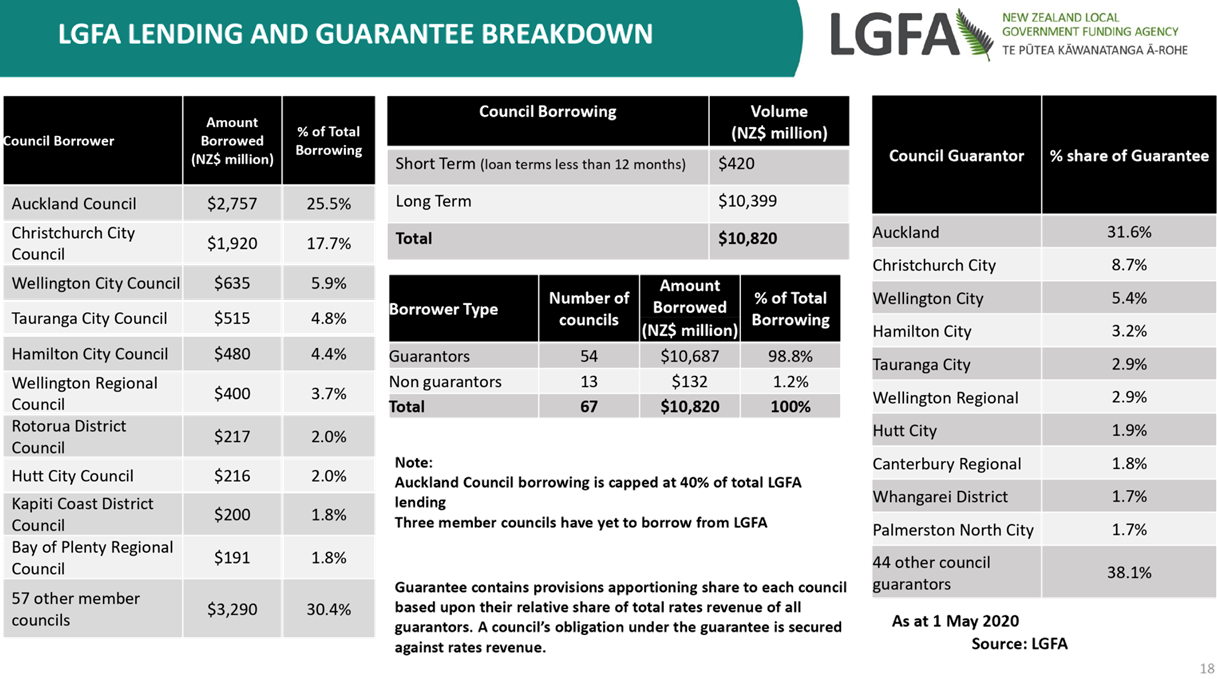

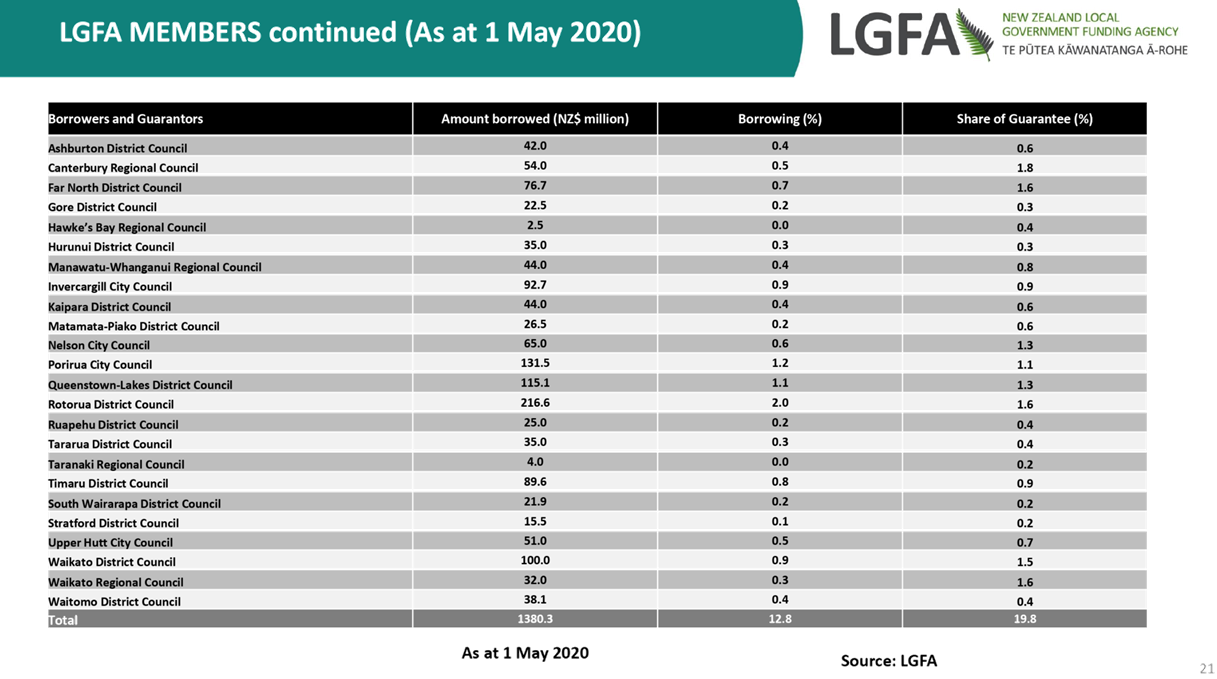

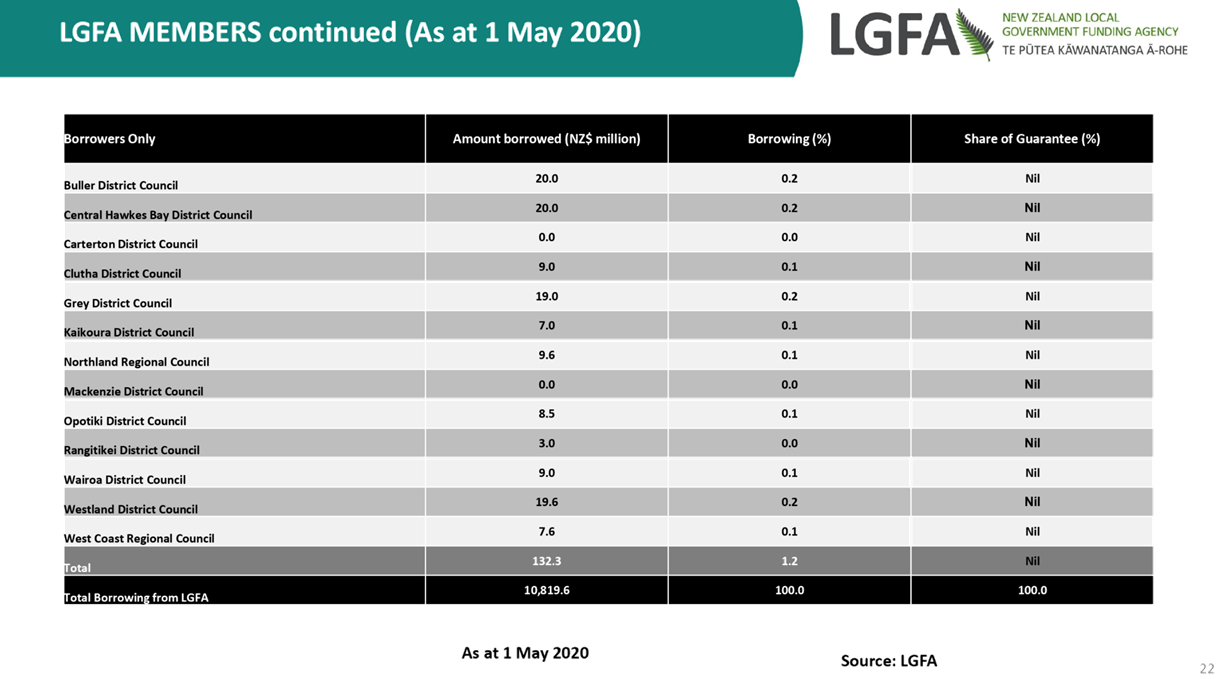

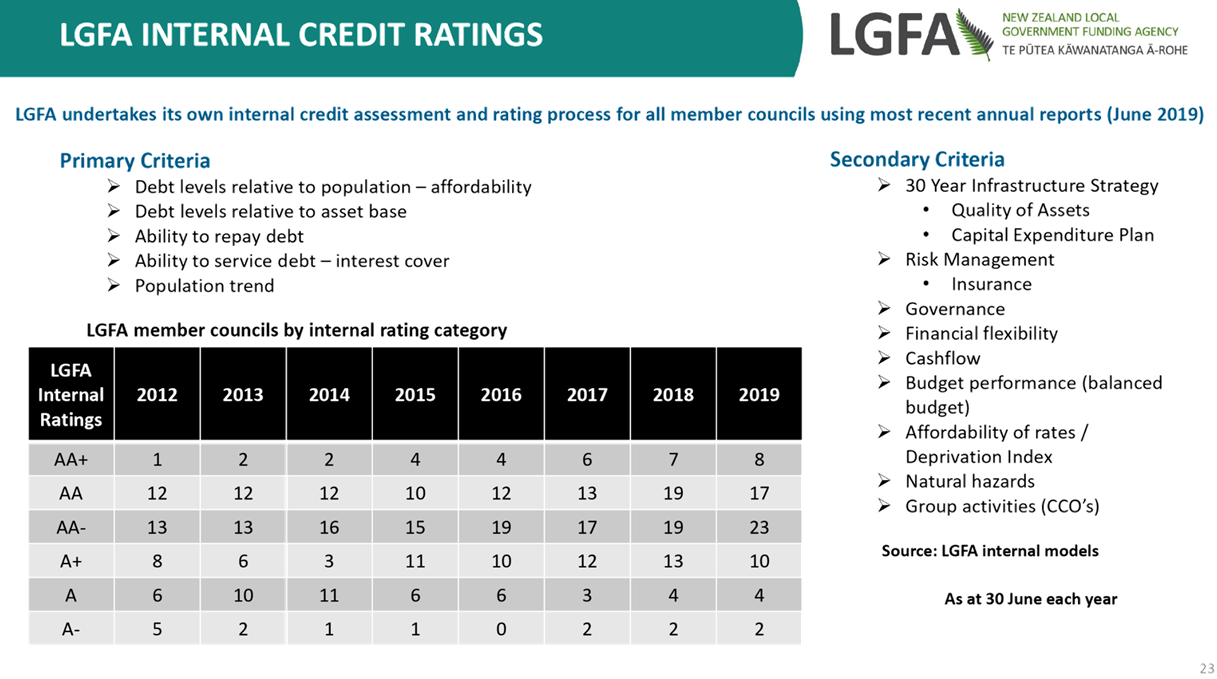

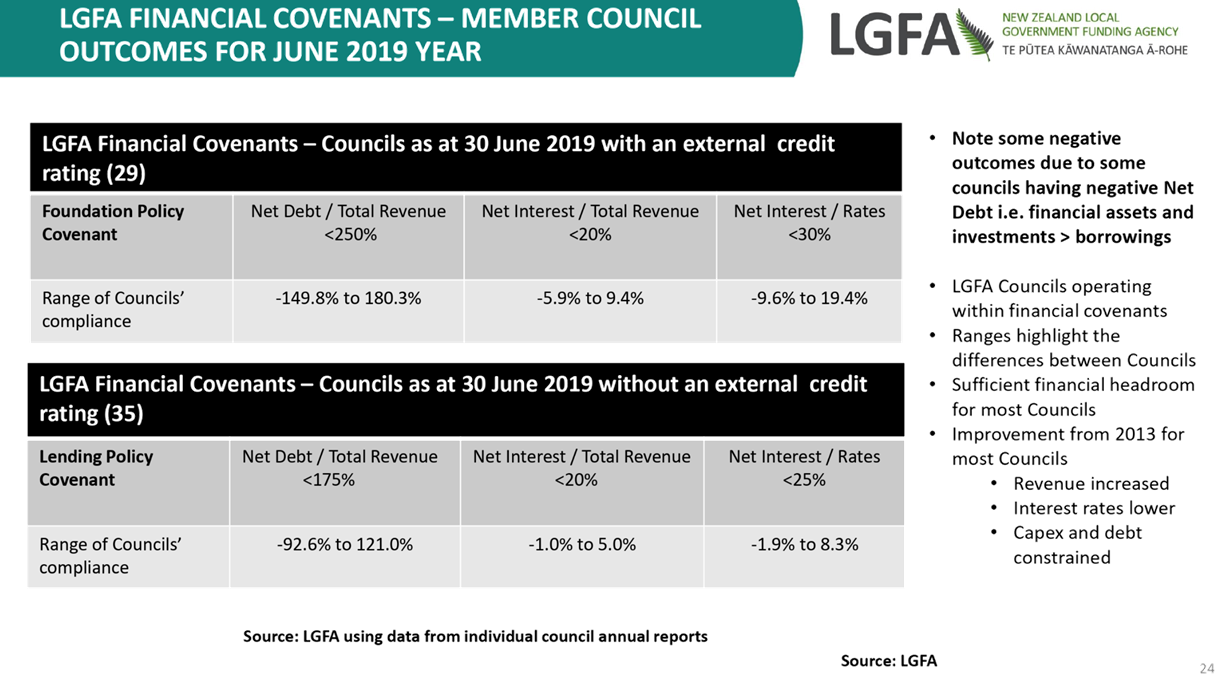

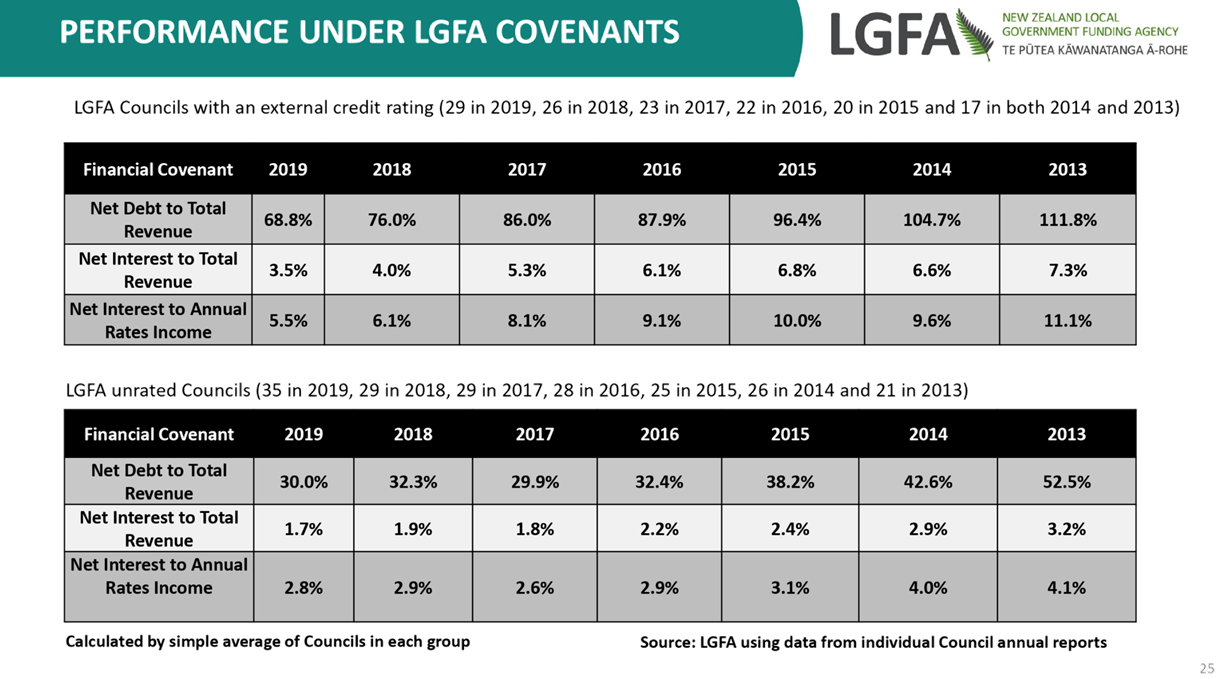

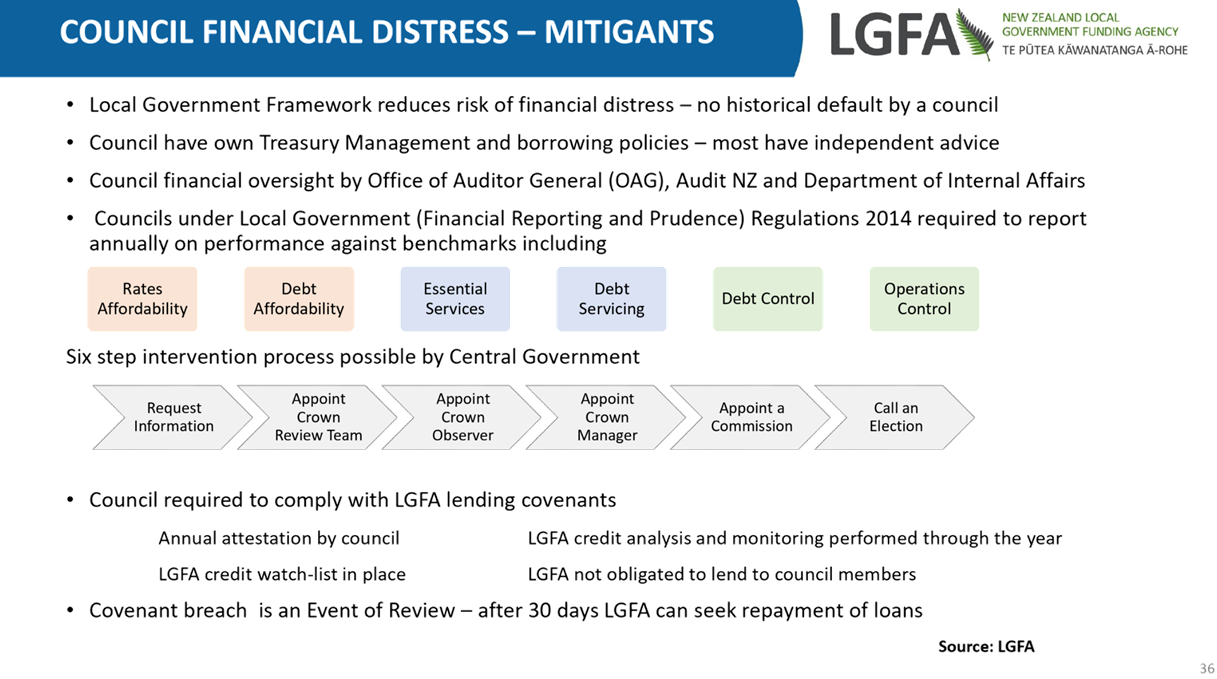

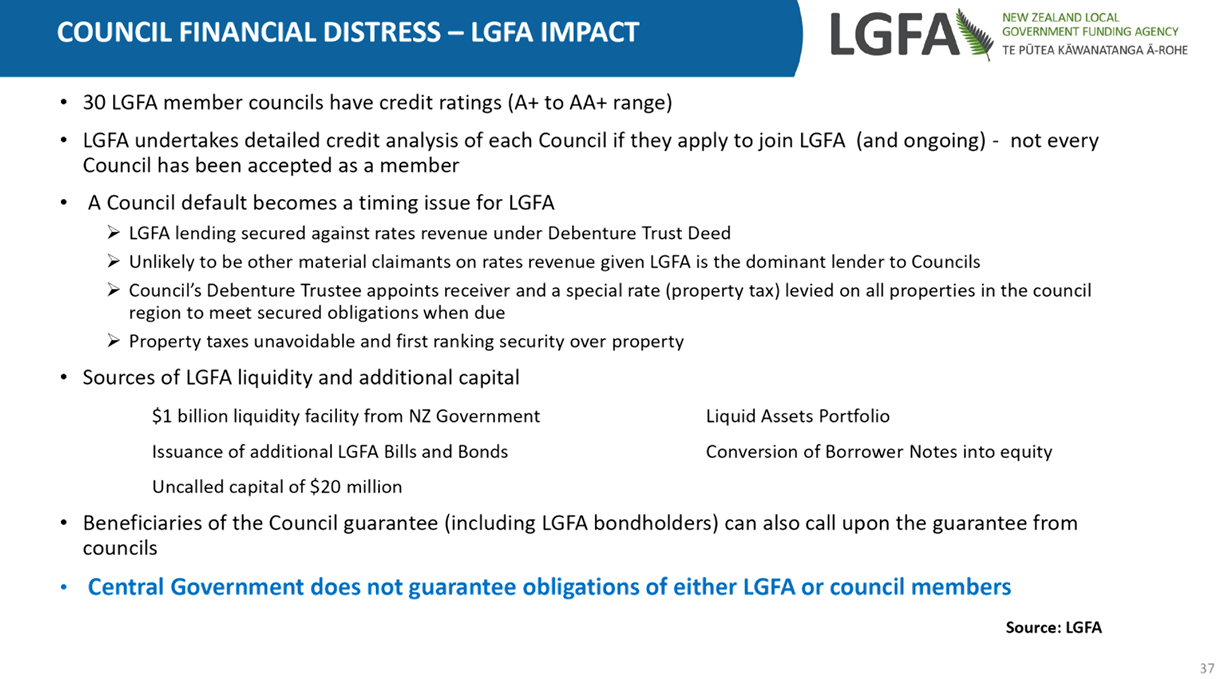

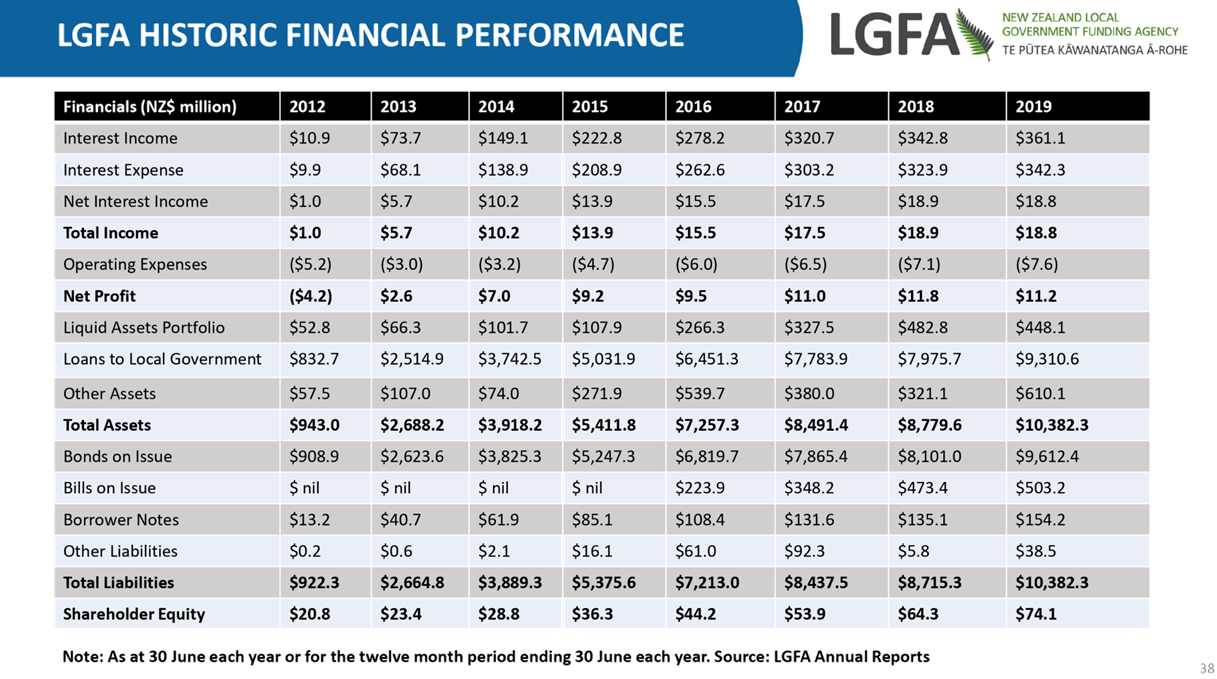

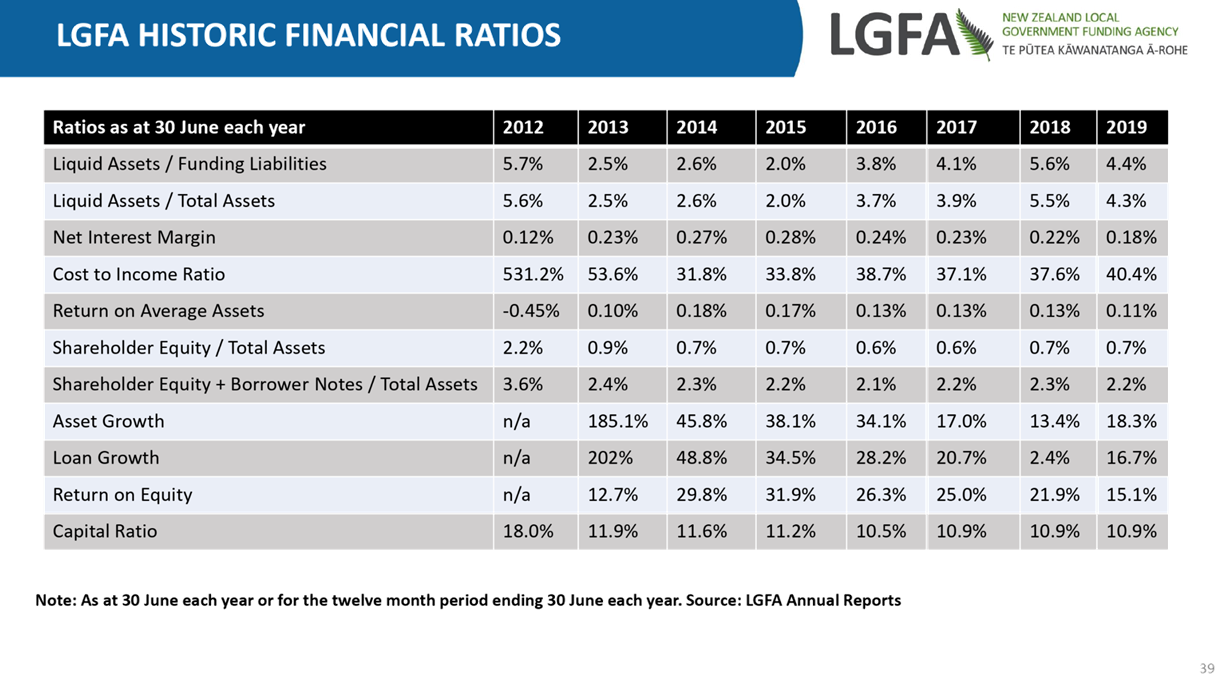

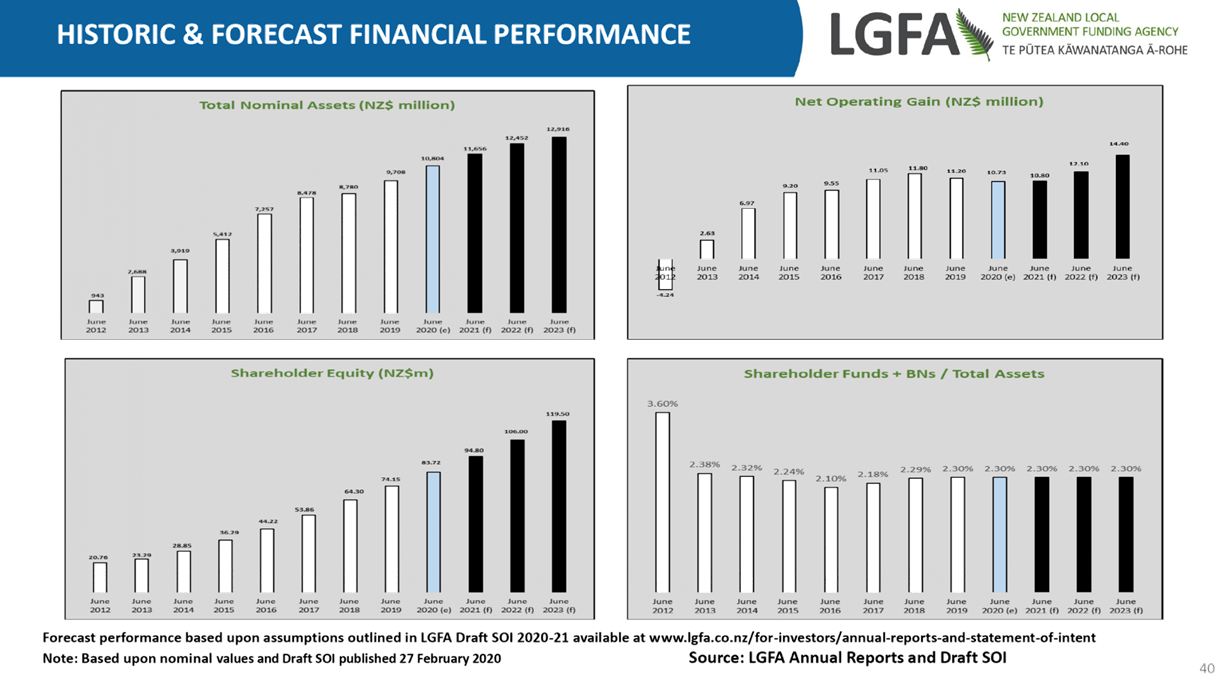

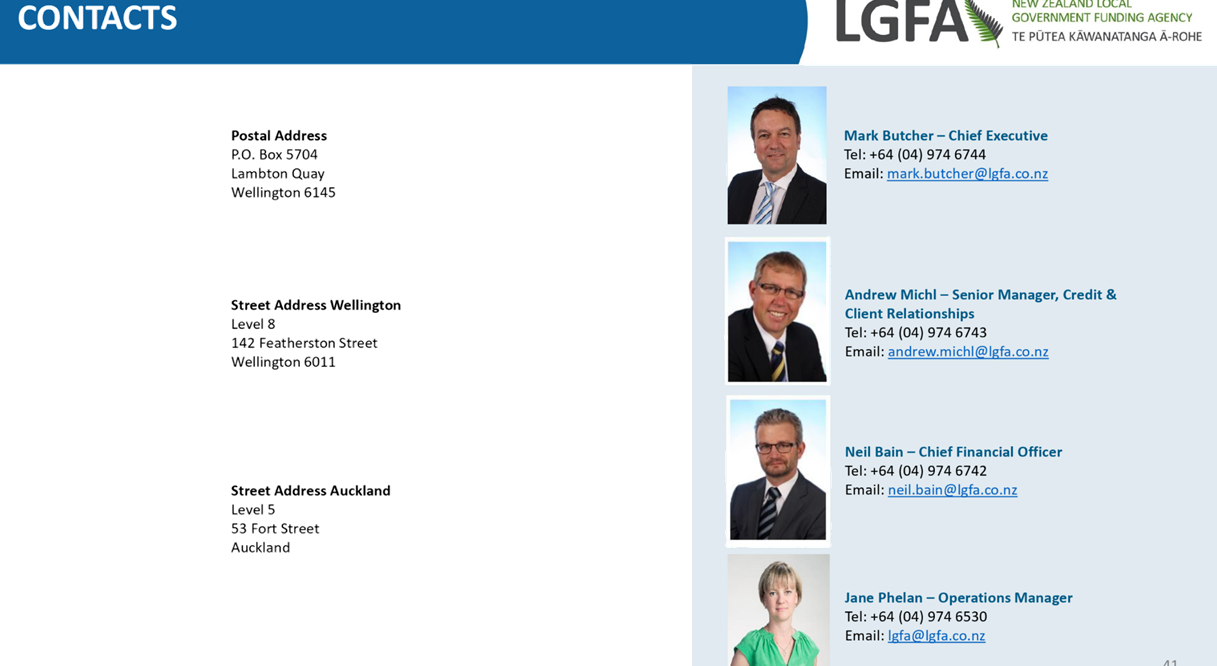

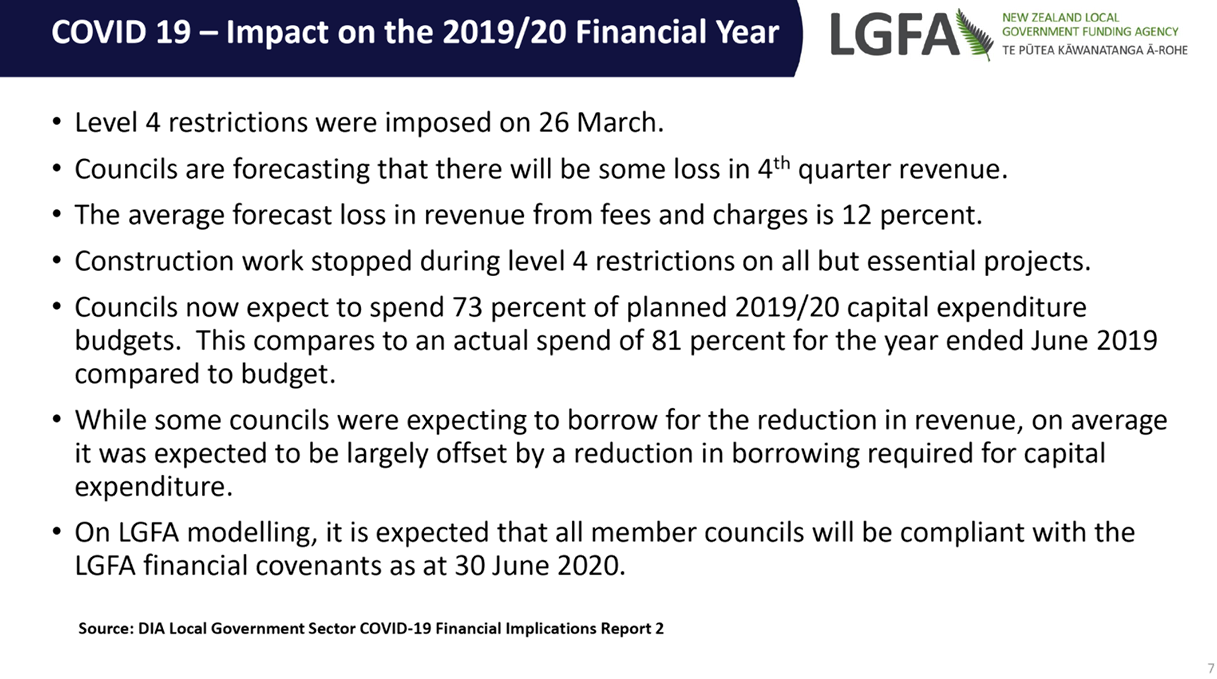

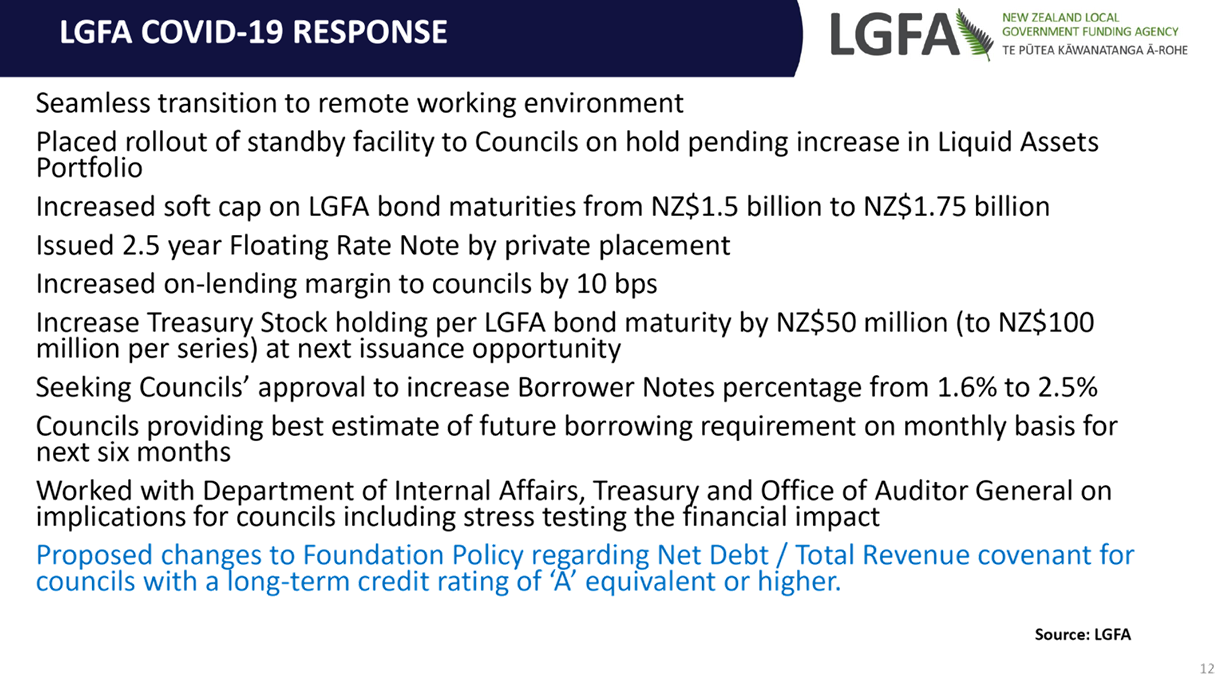

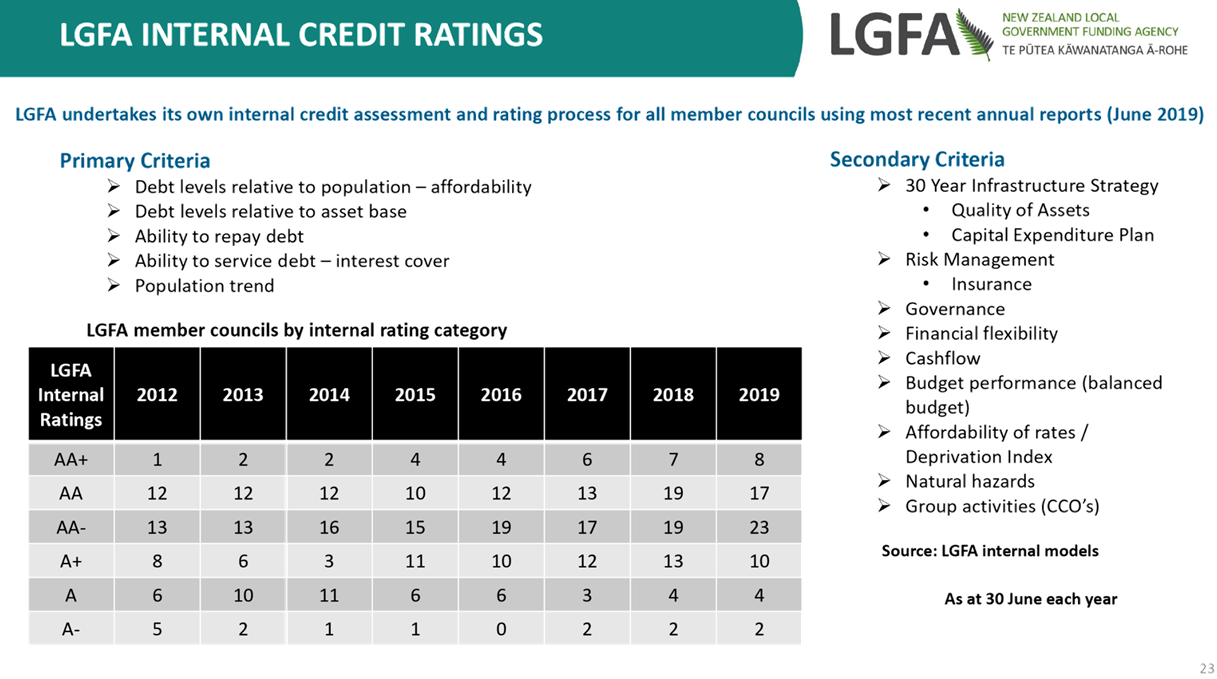

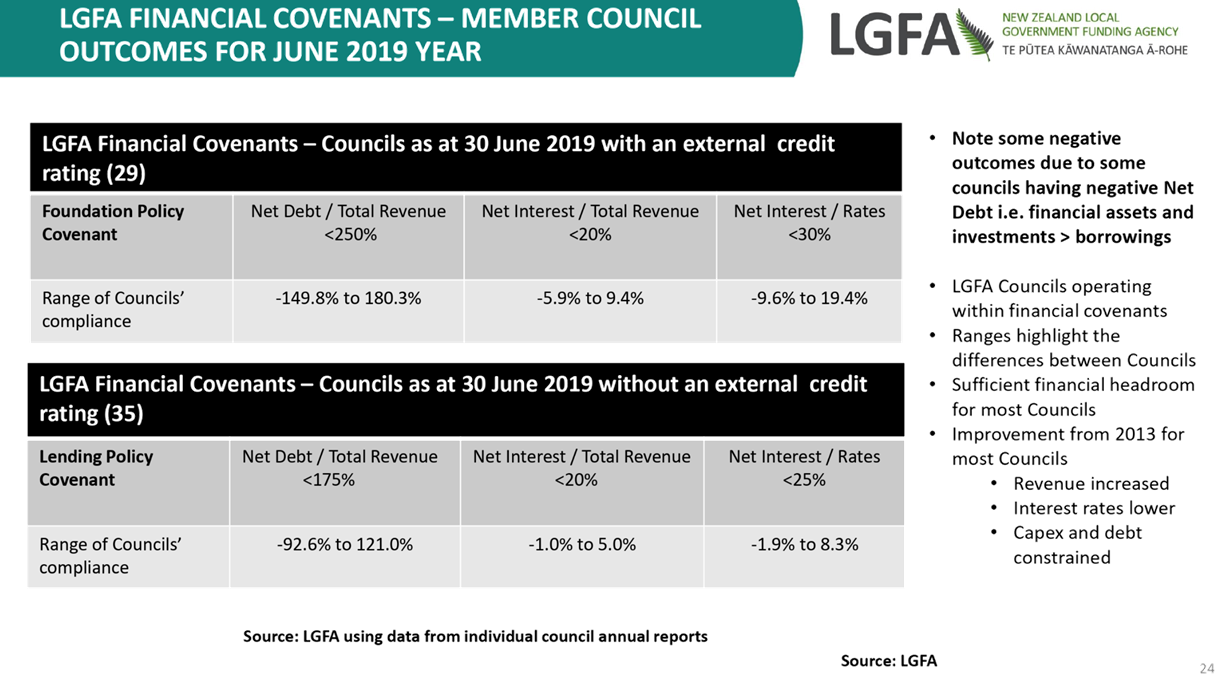

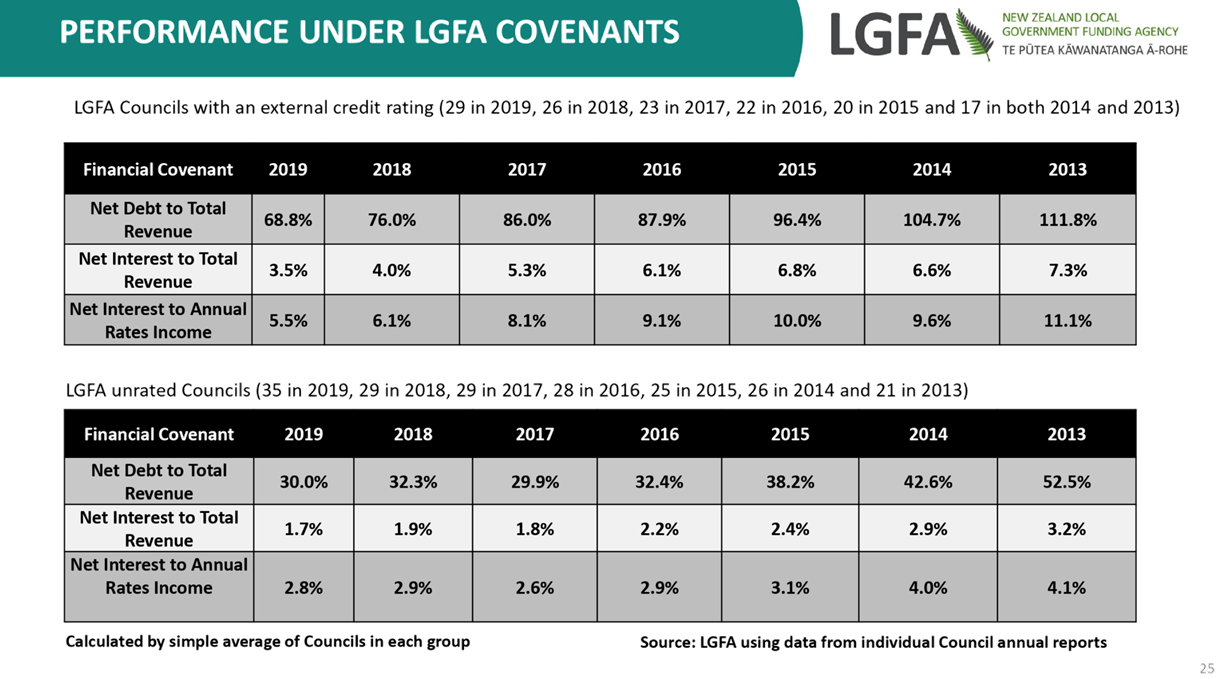

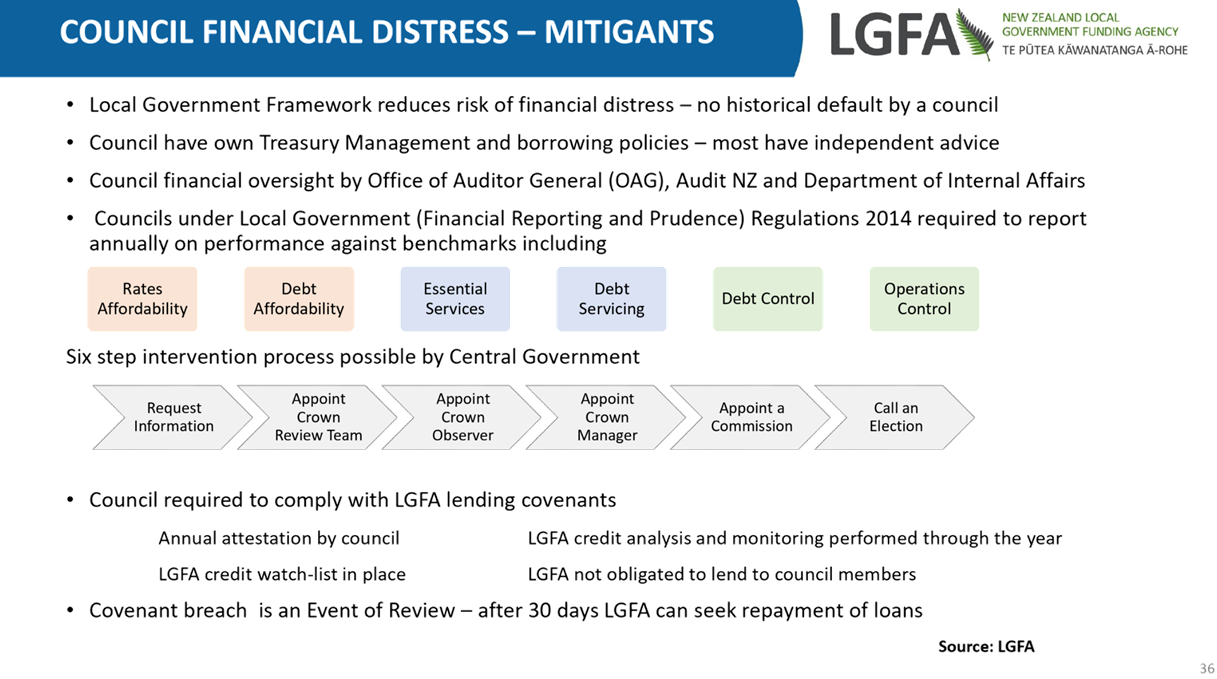

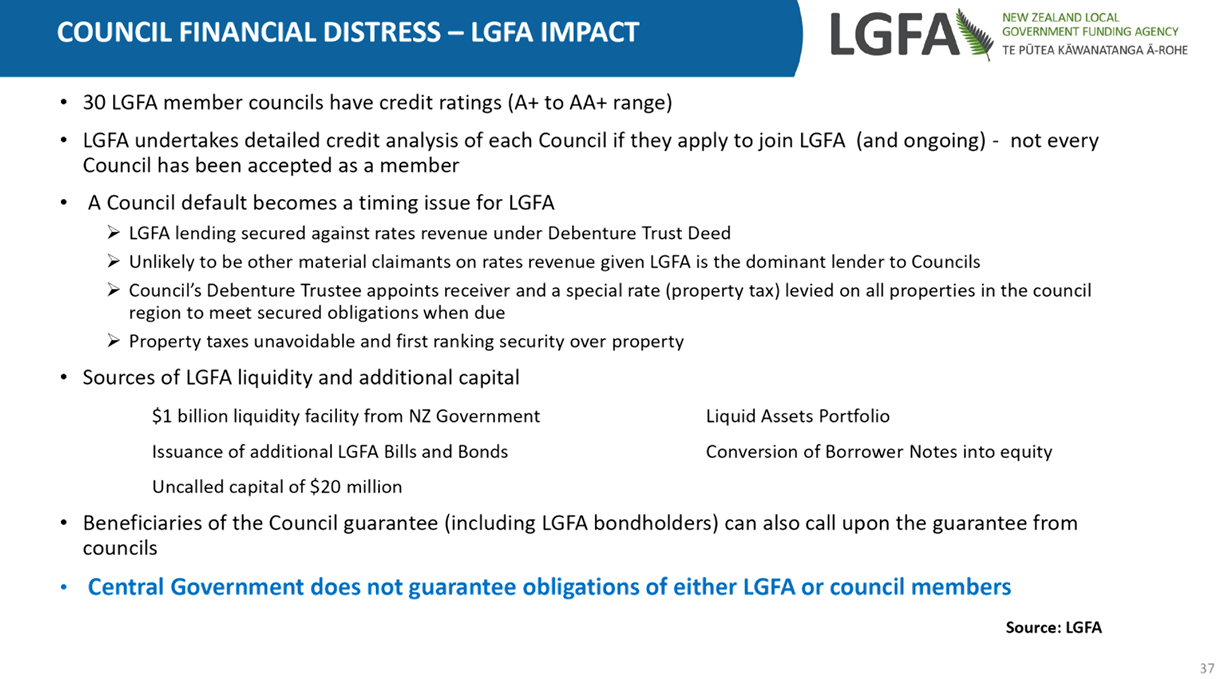

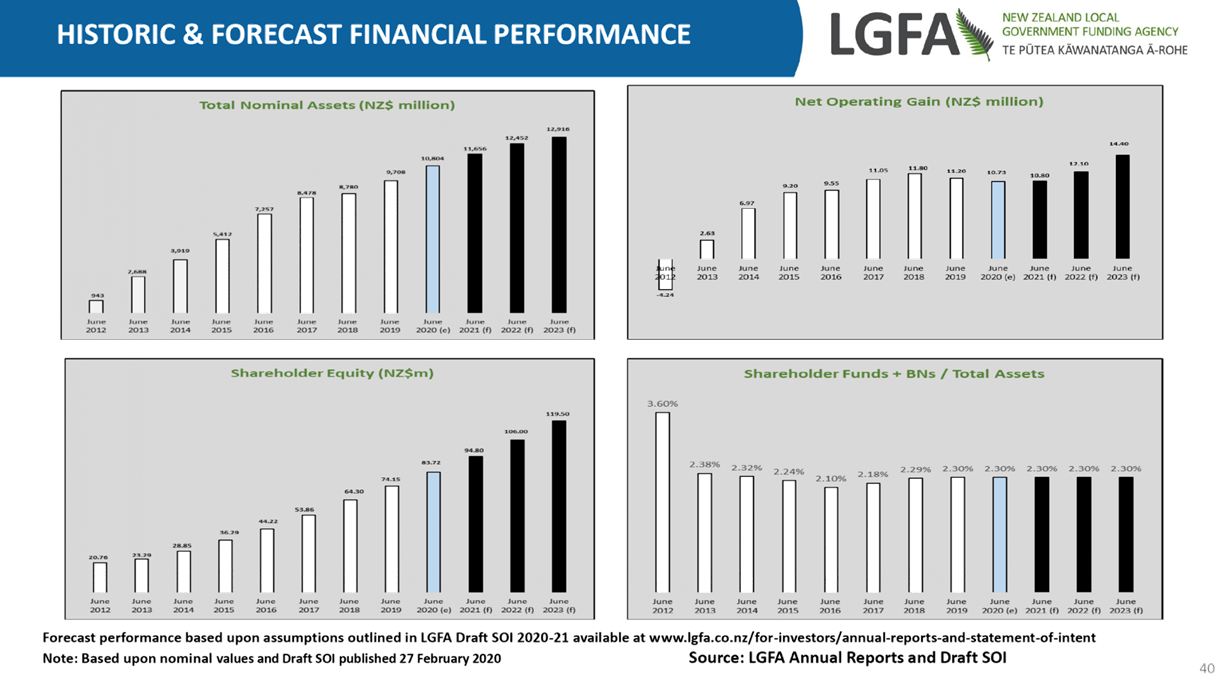

21. The LGFA announced to the NZX on 4

May 2020 that it has reviewed the financial policy financial covenants.

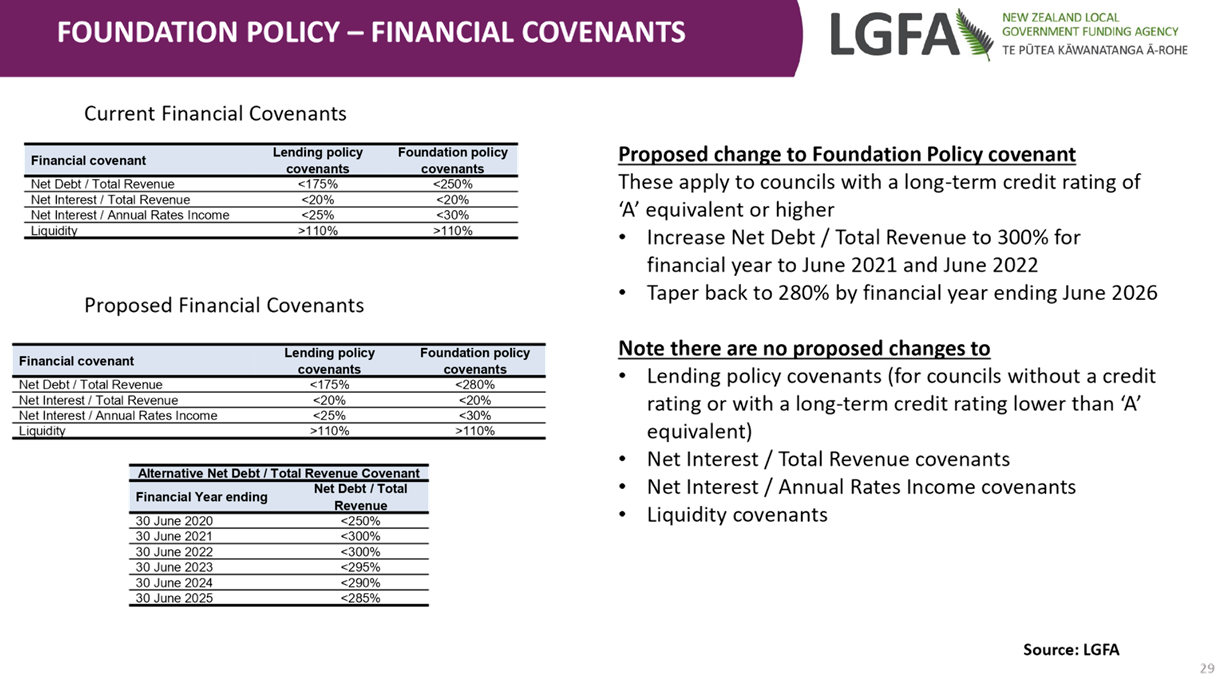

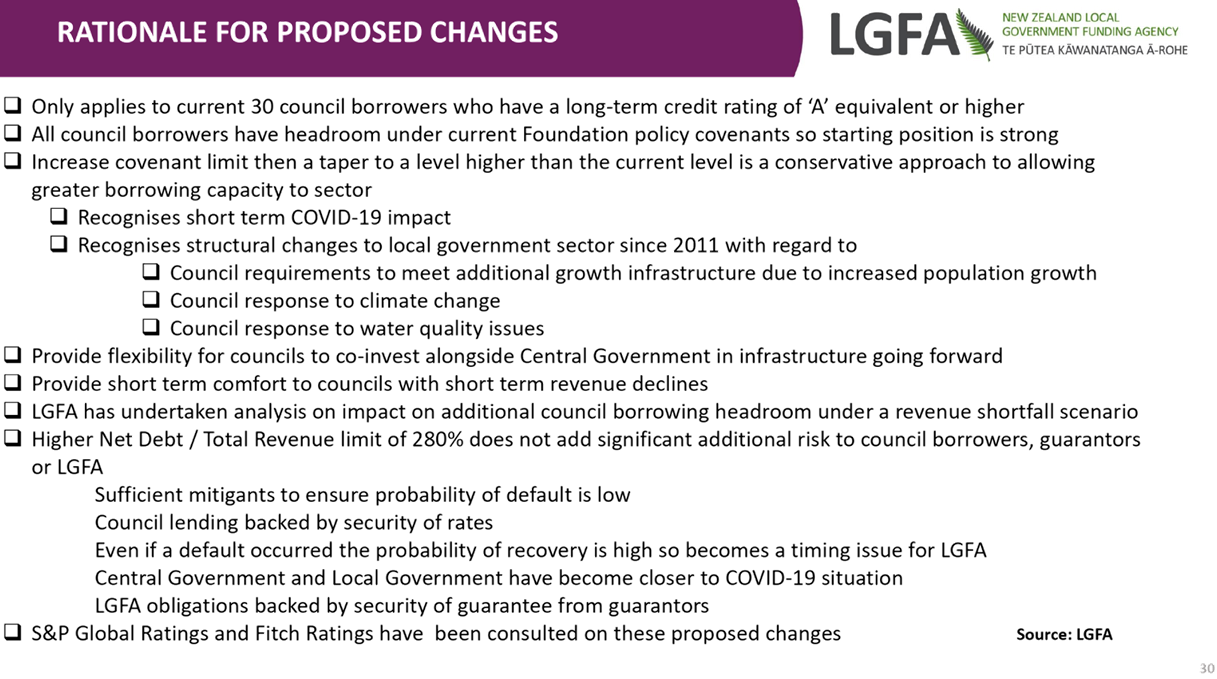

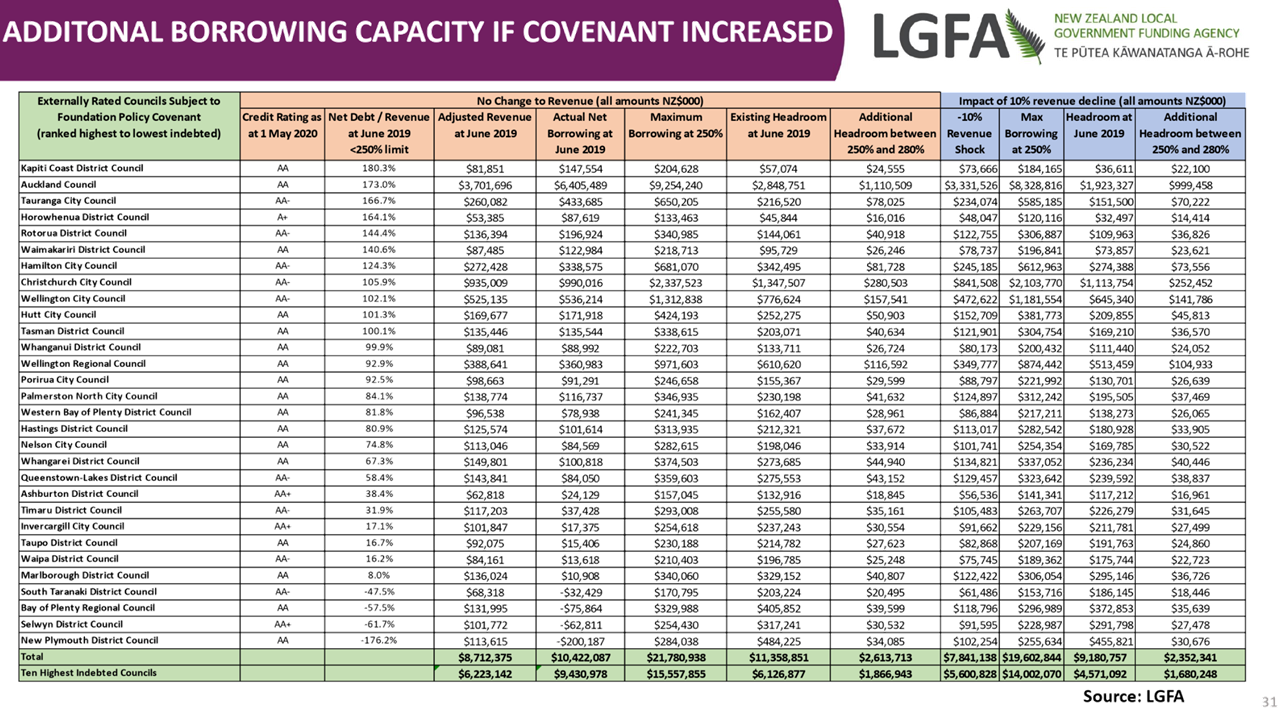

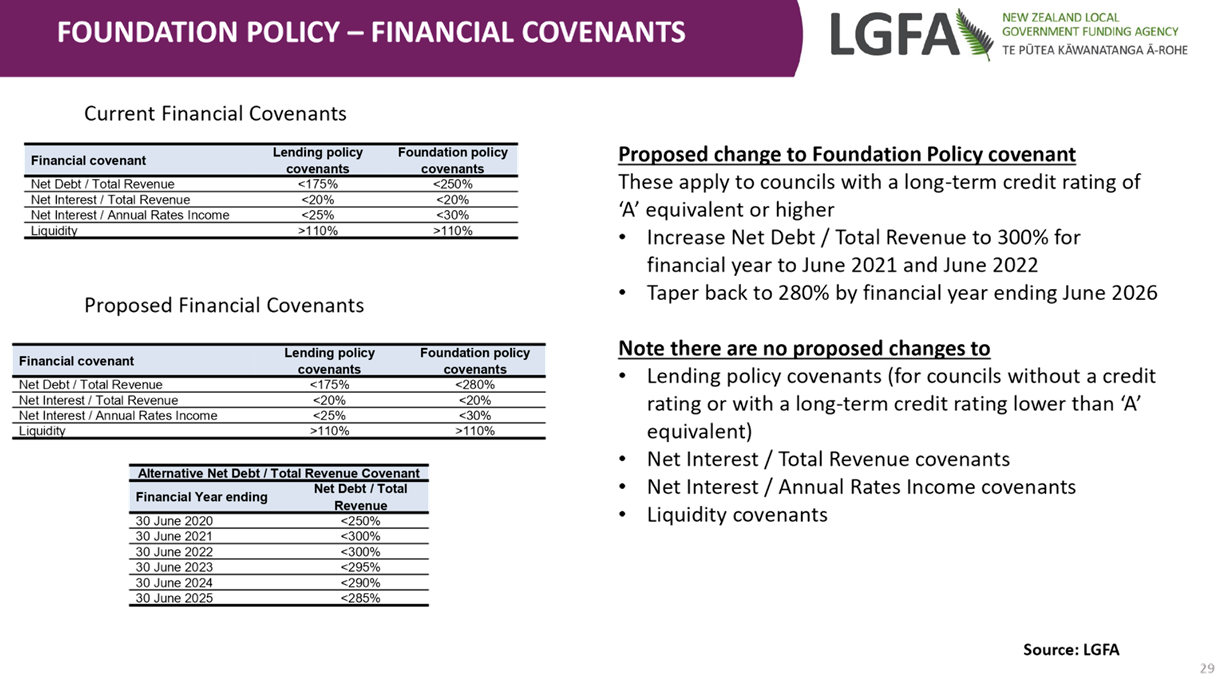

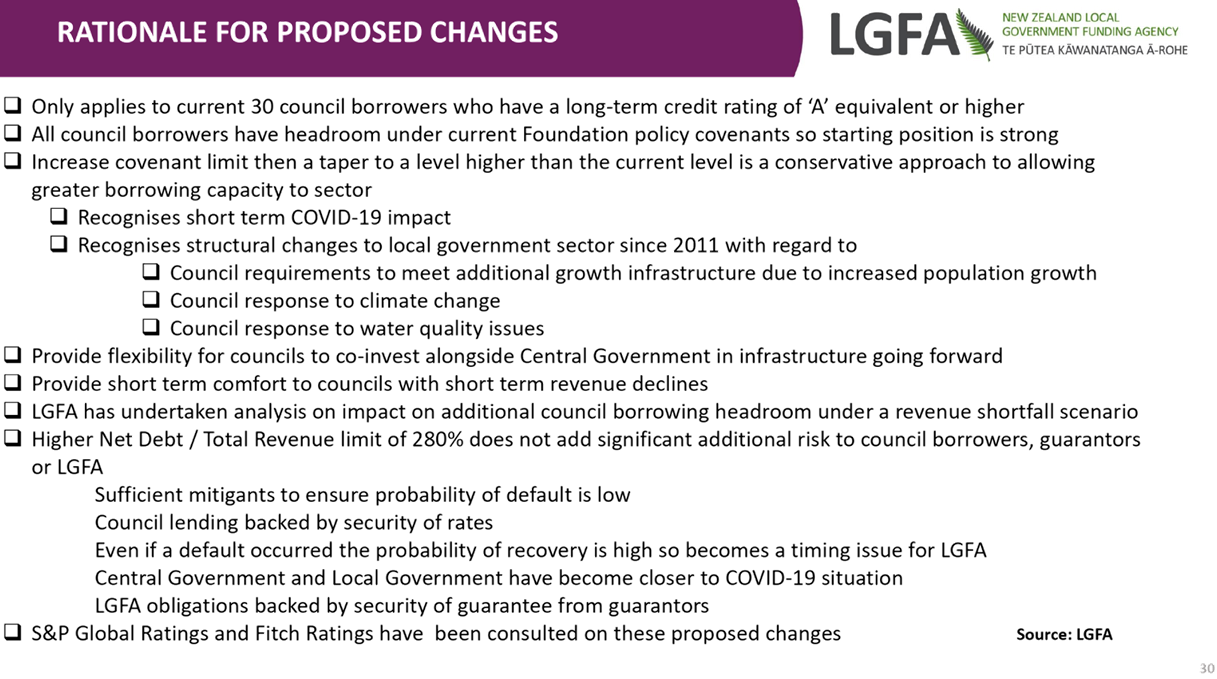

It will recommend to shareholders at a Special General Meeting in June an

amendment to the net debt/ to total revenue foundation policy financial

covenant. Currently, local authority borrowers are required to maintain a net

debt/ total revenue ratio below 250%. The proposed changes enable a ratio

up to 300% for the years to June 2021 and June 2022, reducing over subsequent

years to 280% by 2026. The details of the proposed amendment are included

in Attachment 2. The LGFA presentation supporting this proposal is

included as Attachment 3.

22. The amended ratios will come into

effect if they are supported by a majority of shareholder councils at the June

Special General meeting. Prior to that meeting a report will be prepared for

council seeking approval for the proposed LGFA amendment, along with amendment

to TCC treasury policy if required.

23. The proposed debt to revenue

amendment would increase borrowing capacity as a one-off. The annual plan

capital programme would be able to be delivered within the 300% ratio, subject

to assumptions on revenue loss and expenditure reduction. There will be an

ongoing requirement in the LTP to increase revenue to support this higher

borrowing as the debt to revenue ratio is required to reduce over the next few

years, and capital expenditure has associated operational costs.

Financial Risks

24. Monitoring of receipts and requests

for rates assistance is ongoing. Discussions with ratepayers around rates

collection are more likely to happen in July-August. To date, we have not

had significant communication with ratepayers about their ability to pay rates

for next year. There has been no significant change to the amount collected in

advance for next year under direct debit arrangements. There have been a

small number of people under payment arrangement asking to ease these payments.

25. Additional costs are likely to be

incurred on projects due to the lockdown period and with the controlled work

conditions required under Alert Level 3. Staff are working through the

financial implications for council associated with these costs.

Strategic / Statutory Context

26. COVID-19 represents a significant

challenge to the financial sustainability and effectiveness of Council.

Regular update of the financial situation and risks enables Council to be

informed and to take these matters into account in its key decision making,

particularly in relation to the annual plan.

Options Analysis

27. There are no

options associated with this report. The report is provided as information only.

Significance

28. Under the

Significance and Engagement Policy 2014, the decision to receive this report is

of low significance.

Next Steps

29. This report is intended to regularly

update the FARC committee on Council’s financials and risks. This

information will also feed into the work on the annual plan 2020-21 that is

ongoing.

30. A report will be prepared for

council to confirm support for the proposed amendment to LGFA financial

covenants.

Attachments

1. Debt and interest rate

risk management 4 May 2020 - A11439515 ⇩

2. Attachment 2: NZX

Announcement LGFA Proposed Change to Foundation Policy Covenant 04 May 2020 -

A11450531 ⇩

3. Attachment 3: LGFA 5

May 2020 Investor Presentation - Proposed Changes to Foundation Policy -

A11450545 ⇩

|

Finance, Audit

and Risk Committee Meeting Agenda

|

12 May 2020

|

Attachment 1: Debt and Interest Rate Risk Management 4 May 2020

1. Council’s external

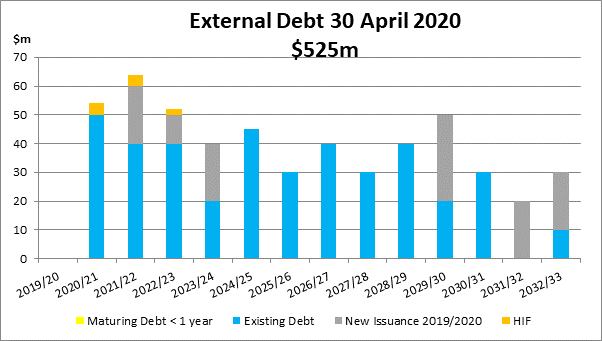

debt as at 30 April 2020 was $525m and forecast to be between $550m and $555m

by 30 June 2020. Net debt, which is adjusted for deposits, is projected

to be $525m at 30 June.

2. Average interest rate is

forecast to be between 3.70% and 3.75% at 30 June 2020. This average

includes new borrowings and rate sets as well existing debt at higher rates.

3. Current market interest

rates on debt sourced from LGFA range from 1.0% for 1 year to 2.5% for 13

years. Current market interest rates for new borrowing is significantly lower

as a result of the Reserve Bank cutting the Official Cash Rate to 0.25% and

intervening in the wholesale market commencing last week to lower long-term

interest rates.

4. Currently 78% of the debt

is at fixed interest rates, from 1 year to 13 years (longest dated borrowing -

15 April 2033). This percentage is a combination of borrowing at fixed rates

($85m) and hedging (balance approx. $310m).

5. The fixed interest rate

debt position is forecast to decrease to 75% by 30 June 2020 as a result of new

borrowing.

6. Fixed interest rate

position on debt is achieved by issuing debt at fixed interest rates (currently

at $85m) and undertaking hedging with interest rate swaps. To terminate

these fixed interest positions it would cost in the order of $75m or more.

7. The

table below shows the existing fixed interest rate position as at 30 April

2020:

|

1.

Month End

|

2.

Fixed Rate

|

3.

Month End

|

4.

Fixed Rate

|

|

5.

30 Jun 2020

|

6.

$399m

|

7.

30 June 2025

|

8.

$209m

|

|

9.

30 Jun 2021

|

10.

$360m

|

11.

30 June 2026

|

12.

$194m

|

|

13.

30 Jun 2022

|

14.

$311m

|

15.

30 June 2027

|

16.

$144m

|

|

17.

30 Jun 2023

|

18.

$283m

|

19.

30 June 2028

|

20.

$128m

|

|

21.

30 June 2024

|

22.

$283m

|

23.

30 June 2029

|

24.

$98m

|

8. The

table below shows the existing debt maturity profile as at 30 April 2020:

|

Finance, Audit and Risk Committee

Meeting Agenda

|

12 May 2020

|

|

Finance, Audit and Risk Committee

Meeting Agenda

|

12 May 2020

|

9 Public

Excluded Session

RESOLUTION TO

EXCLUDE THE PUBLIC

|

Recommendations

That the public be excluded from the following parts of

the proceedings of this meeting.

The general subject matter of each matter to be considered

while the public is excluded, the reason for passing this resolution in

relation to each matter, and the specific grounds under section 48 of the

Local Government Official Information and Meetings Act 1987 for the passing

of this resolution are as follows:

|

General subject of each matter to be considered

|

Reason for passing this resolution in relation to

each matter

|

Ground(s) under section 48 for the passing of this

resolution

|

|

9.1 - COVID-19 Pandemic - Risk

Register

|

s7(2)(b)(ii) - the withholding of the information

is necessary to protect information where the making available of the information

would be likely unreasonably to prejudice the commercial position of the

person who supplied or who is the subject of the information

s7(2)(i) - the withholding of the information is

necessary to enable Council to carry on, without prejudice or disadvantage,

negotiations (including commercial and industrial negotiations)

|

s48(1)(a) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

9.2 - Litigation Report

|

s7(2)(a) - the withholding of the information is

necessary to protect the privacy of natural persons, including that of

deceased natural persons

s7(2)(g) - the withholding of the information is

necessary to maintain legal professional privilege

s7(2)(i) - the withholding of the information is

necessary to enable Council to carry on, without prejudice or disadvantage,

negotiations (including commercial and industrial negotiations)

|

s48(1)(a) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

9.3 - Organisational change -

Presentation (verbal) by Mr Michael Smith, Chairman, Bay Venues Limited

|

s7(2)(a) - the withholding of the information is

necessary to protect the privacy of natural persons, including that of

deceased natural persons

|

s48(1)(a) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|