|

|

|

AGENDA

Finance, Audit and Risk Committee Meeting

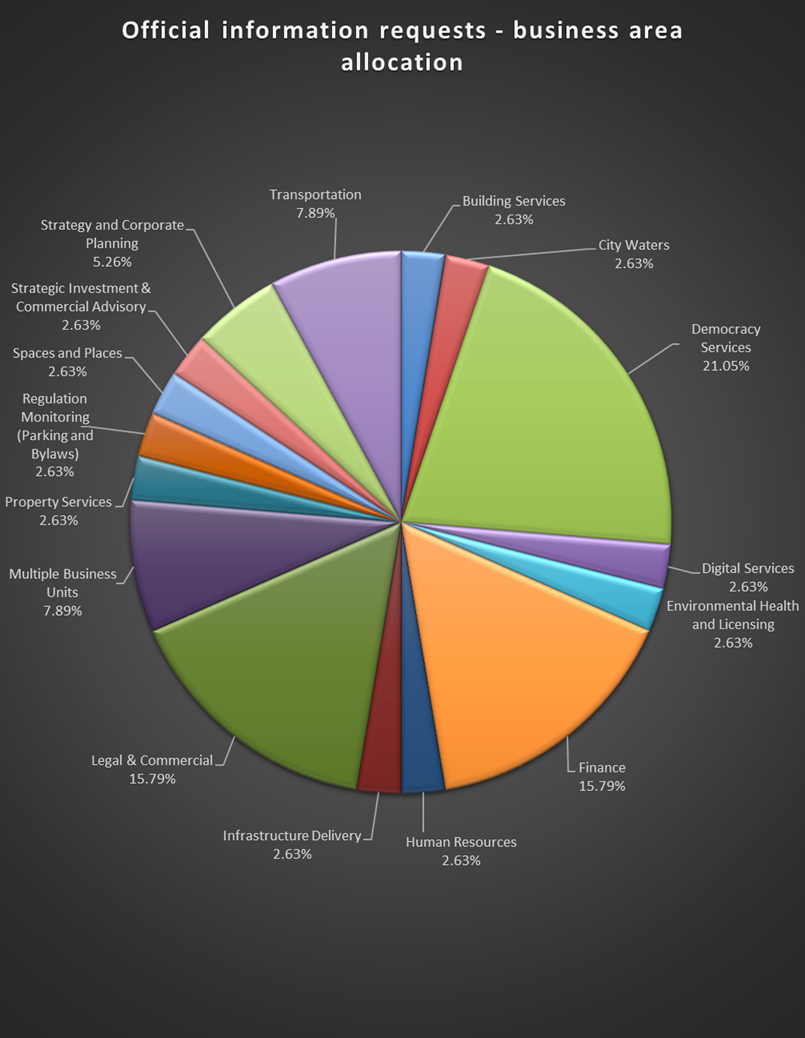

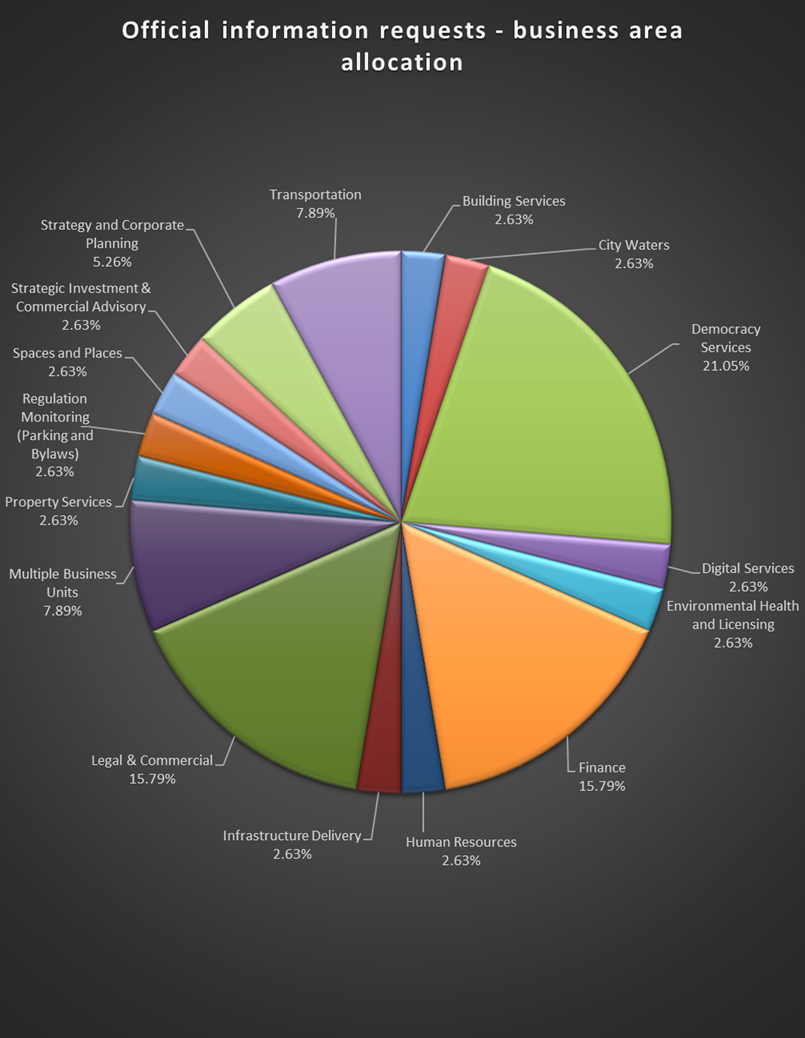

Tuesday, 26 May 2020

|

|

I hereby give notice that a Finance, Audit and Risk

Committee Meeting will be held on:

|

|

Date:

|

Tuesday, 26 May 2020

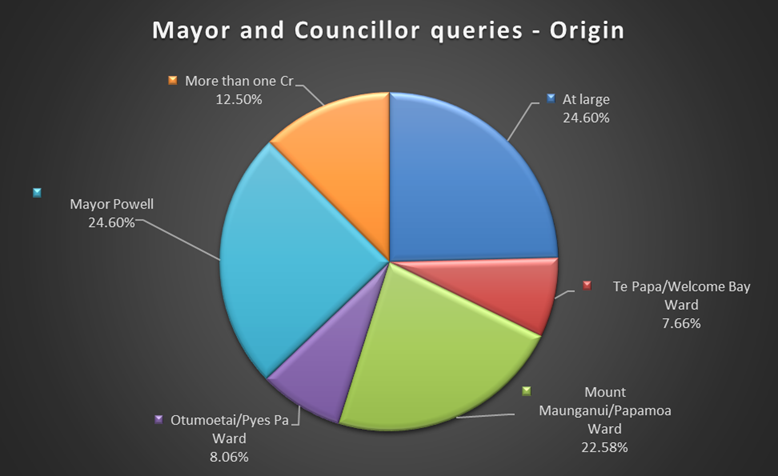

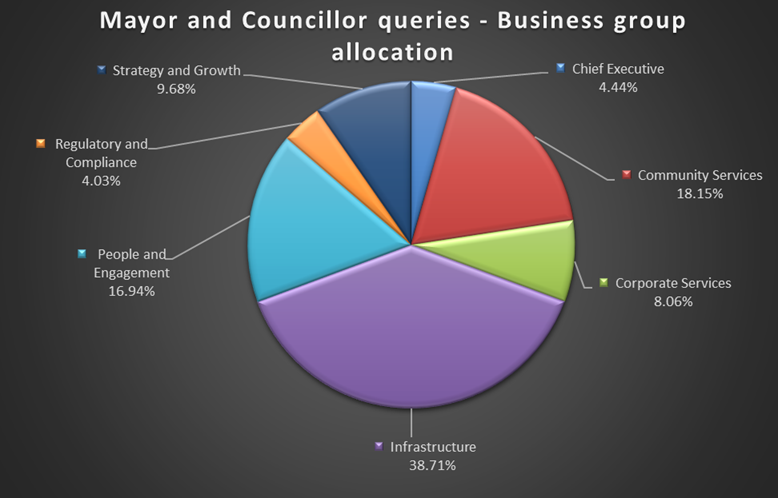

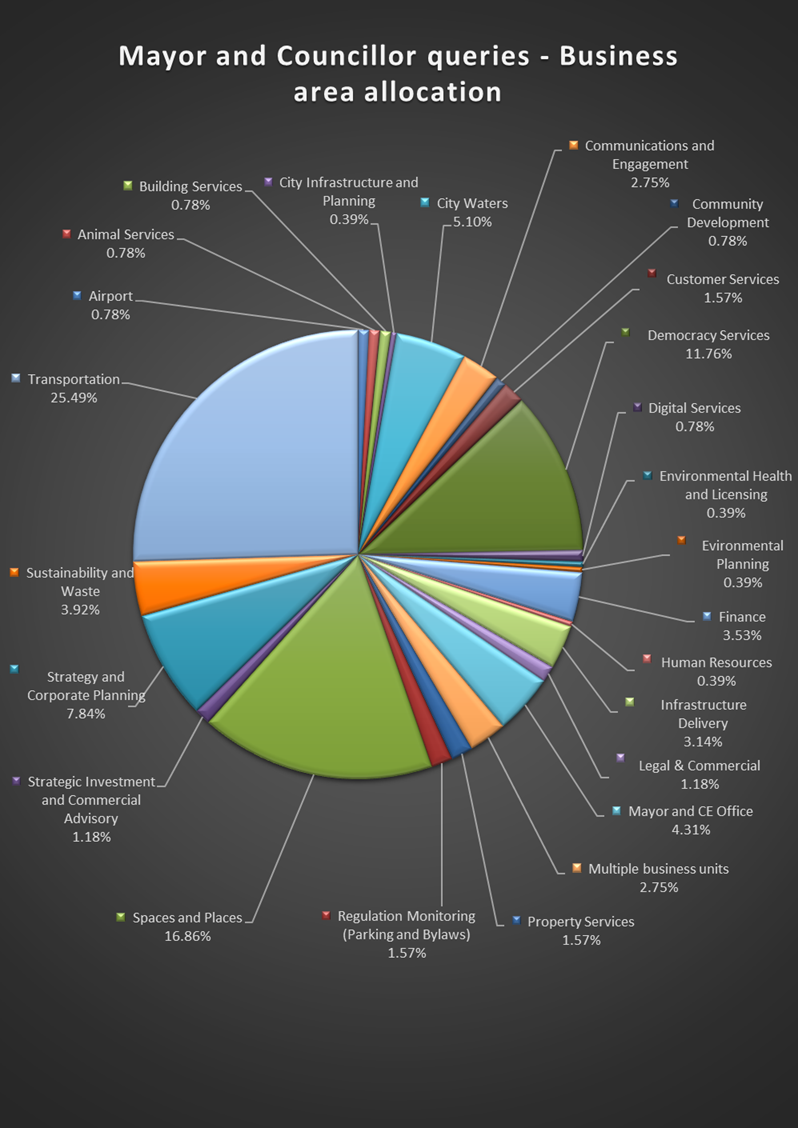

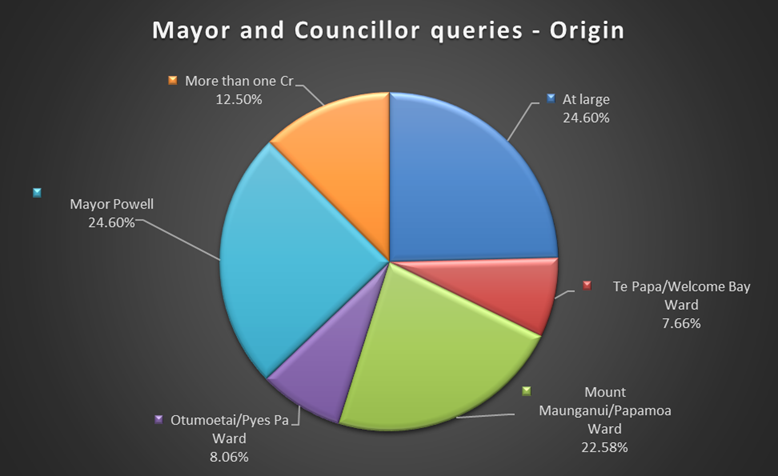

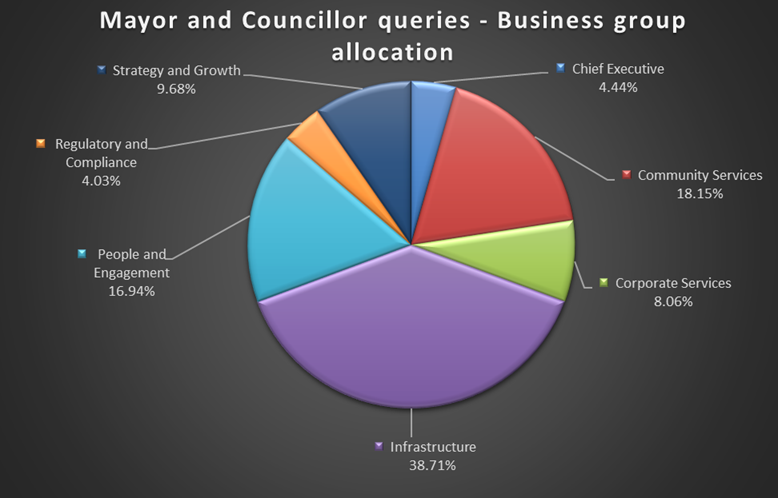

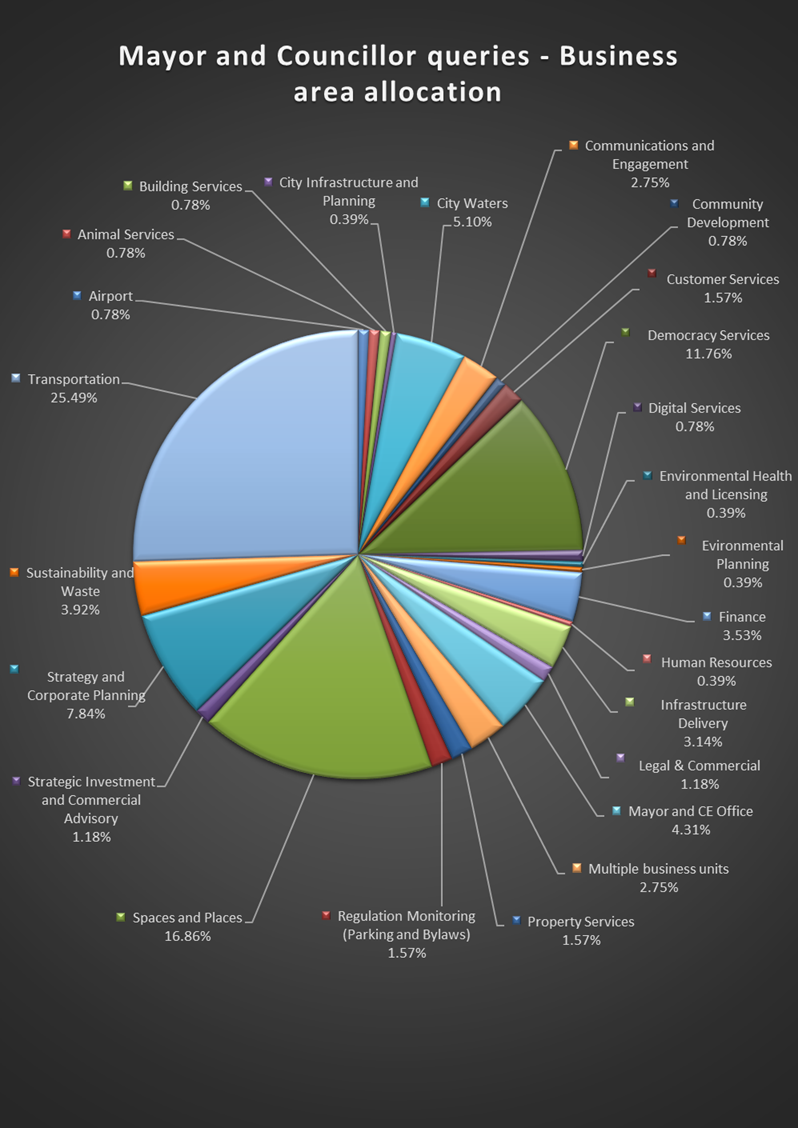

|

|

Time:

|

9am

|

|

Location:

|

Tauranga City Council

By video conference

|

|

Please

note that this meeting will be livestreamed and the recording will be

publicly available on Tauranga City Council's website: www.tauranga.govt.nz.

|

|

Marty Grenfell

Chief Executive

|

Terms of reference –

Finance, Audit & Risk Committee

Common

responsibilities and delegations

The following common responsibilities and delegations apply

to all standing committees.

Responsibilities of standing committees

·

Establish priorities and guidance on programmes

relevant to the Role and Scope of the committee.

·

Provide guidance to staff on the development of

investment options to inform the Long Term Plan and Annual Plans.

·

Report to Council on matters of strategic

importance.

·

Recommend to Council investment priorities and

lead Council considerations of relevant strategic and high significance

decisions.

·

Provide guidance to staff on levels of service

relevant to the role and scope of the committee.

·

Establish and participate in relevant task

forces and working groups.

·

Engage in dialogue with strategic partners, such

as Smart Growth partners, to ensure alignment of objectives and implementation

of agreed actions.

- Confirmation of committee minutes.

Delegations to standing committees

·

To make recommendations to Council outside of

the delegated responsibility as agreed by Council relevant to the role and

scope of the Committee.

·

To make all decisions necessary to fulfil the

role and scope of the Committee subject to the delegations/limitations imposed.

·

To develop and consider, receive submissions on

and adopt strategies, policies and plans relevant to the role and scope of the

committee, except where these may only be legally adopted by Council.

·

To consider, consult on, hear and make determinations

on relevant strategies, policies and bylaws (including adoption of drafts),

making recommendations to Council on adoption, rescinding and modification,

where these must be legally adopted by Council,

·

To approve relevant submissions to central government,

its agencies and other bodies beyond any specific delegation to any particular

committee.

·

To appoint a non-voting Tangata Whenua

representative to the Committee.

·

Engage external parties as required.

Terms of reference – Finance, Audit & Risk Committee

Membership

|

Chairperson

|

Mr Bruce

Robertson

|

|

Deputy

chairperson

|

Cr Tina

Salisbury

|

|

Members

|

Mayor

Tenby Powell

Cr Jako

Abrie

Cr Larry

Baldock

Cr Kelvin

Clout

Cr Bill

Grainger

Cr Andrew

Hollis

Cr Heidi

Hughes

Cr Dawn

Kiddie

Cr Steve Morris

|

|

Non-voting

members

|

Tangata

Whenua representative (TBC)

A maximum

of two external appointments may be made by Council on recommendation from

the Committee

|

|

Quorum

|

Half

of the members physically present, where the number of members (including

vacancies) is even; and a majority of the members physically

present, where the number of members (including vacancies) is odd.

|

|

Meeting

frequency

|

Six weekly

|

Role

·

To ensure that Council is delivering on agreed

outcomes.

·

To ensure that Council is managing its finances

in an appropriate manner.

·

To ensure that Council is managing risk in an

appropriate manner.

Scope

·

Monitor financial and non-financial performance

against the approved Long Term Plan and Annual Plan (Note:

Council cannot delegate to a Committee the adoption of the Long Term Plan and

Annual Plan).

·

Oversee the development of the council’s

Annual Report.

·

Oversee the development of financial and

treasury management strategies and policies.

·

Consider and approve external audit arrangements

and receiving Audit reports.

·

Consider the outcome of internal and external

audit reviews.

·

Advise Council on matters of finance and provide

objective advice and recommendations for its consideration.

·

Advise Council on matters of risk and provide

objective advice and recommendations for its consideration.

·

Consider matters which are related to quality

assurance and internal controls in council and ensure the financial management practices

and processes comply with the Local Government Act 2002, other relevant

legislation and Council’s own policies.

·

Consider, monitor and recommend (where

appropriate) in respect to Council’s financial interest in CCOs.

·

Consider all matters regarding the Local

Government Funding Agency (LGFA).

·

Monitor key activities, projects and services

(without operational interference in the services) in order to better inform

the members and the community about key Council activities and issues that

arise in the operational arm of the council.

Power to act

·

To make all decisions necessary to fulfil the

role and scope of the Committee subject to the limitations imposed.

·

To appoint a non-voting Tangata Whenua

representative to the Committee.

·

To establish working parties and forums as

required.

·

For the avoidance of doubt, this Committee has not

been delegated the power to:

o

make a rate;

o

borrow money, or purchase or dispose of assets, other than in

accordance with the Long Term Plan.

Power to recommend

·

To Council and/or any standing committee as it

deems appropriate.

7 Business

7.1 Financial

Update- Covid19

File

Number: A11515195

Author: Kathryn

Sharplin, Manager: Finance

Mohan De Mel, Treasurer

Authoriser: Paul

Davidson, General Manager: Corporate Services

Purpose of the Report

1. The

purpose of this report is to provide an update on:

(a) the

short-term financial impacts of COVID-19 through to June 30, 2020.

(b) Information

affecting the 2020-21 annual plan.

(c) Information

on key areas of financial risk

2. This

report is a regular update on the financial situation as a result of COVID-19

and any other significant funding and financing outcomes.

|

Recommendations

That the Finance, Audit and Risk Committee:

(a) Receives

Report COVID-19 Financial Update;

(b) Notes

that Council will apply for the Government Wage Subsidy arising from the loss

of revenue due to COVID-19.

|

Executive Summary

2019-20

Current Year

3. Council lost significant revenue

during April 2020 as a result of activities remaining closed due to

‘lockdown’, the impact on air travel and the recessional impacts

resulting from COVID-19. This revenue loss is expected to extend through

the final quarter of the 2019-20 financial year and through into the next

financial year.

4. The Government introduced the Wage

Subsidy to support businesses who have been impacted by COVID-19, requiring a

30% threshold of revenue loss to qualify for the subsidy.

5. Analysis shows that on a ‘cashflow’ basis for the month

of April 2020 the 30% revenue loss criteria can be met. Staff are currently

preparing an application for the wage subsidy on this basis. While acceptance

of our application is not guaranteed, staff believe that the application has a

reasonable likelihood of being accepted and therefore the application is

worthwhile.

6. Capital expenditure continues to track below budget with expected

total spend estimated at $70m less than budget for the year. This underspend

is largely a timing difference with the requirement to complete this work

carrying forward into the 2020-21 financial year and therefore impacting on the

2020-21 budgets.

2020-21

Annual Plan

7. Scenario analysis and capital

project review for the annual plan is ongoing.

Financial Risks

8. No new financial risks related to COVID-19 have emerged during the

last week.

Background

2019-20

Current Year

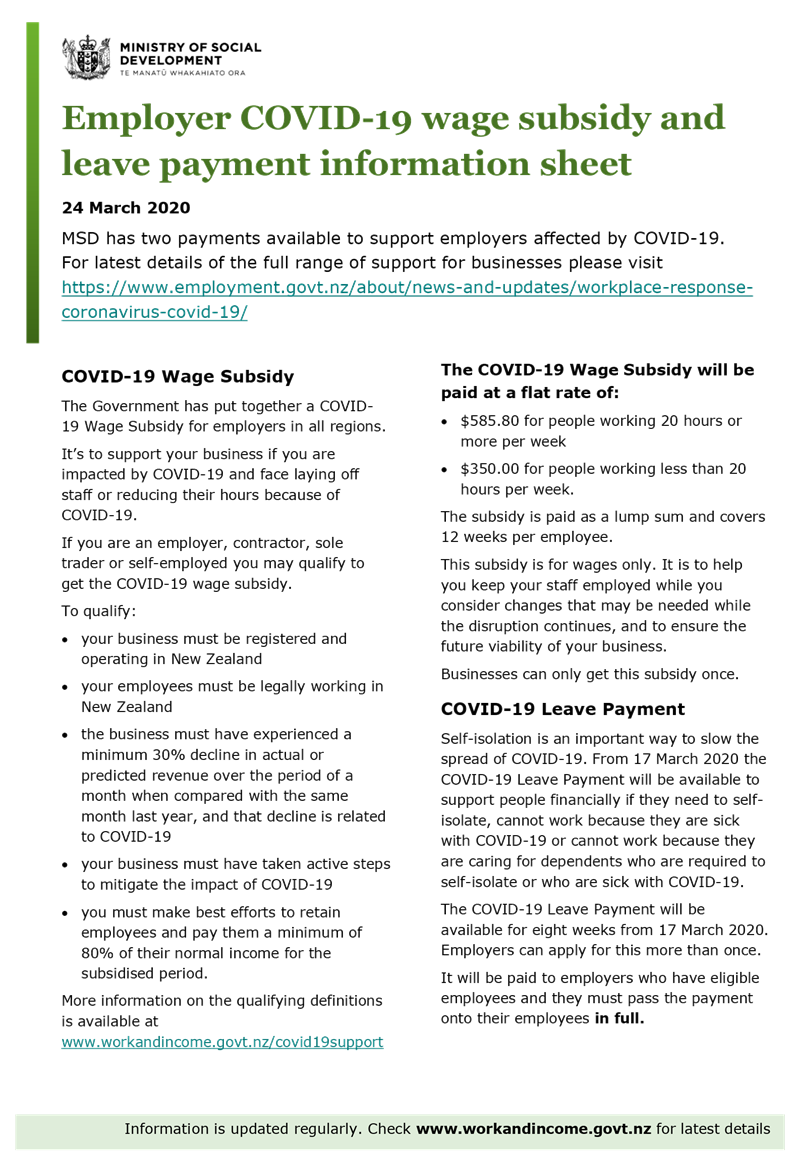

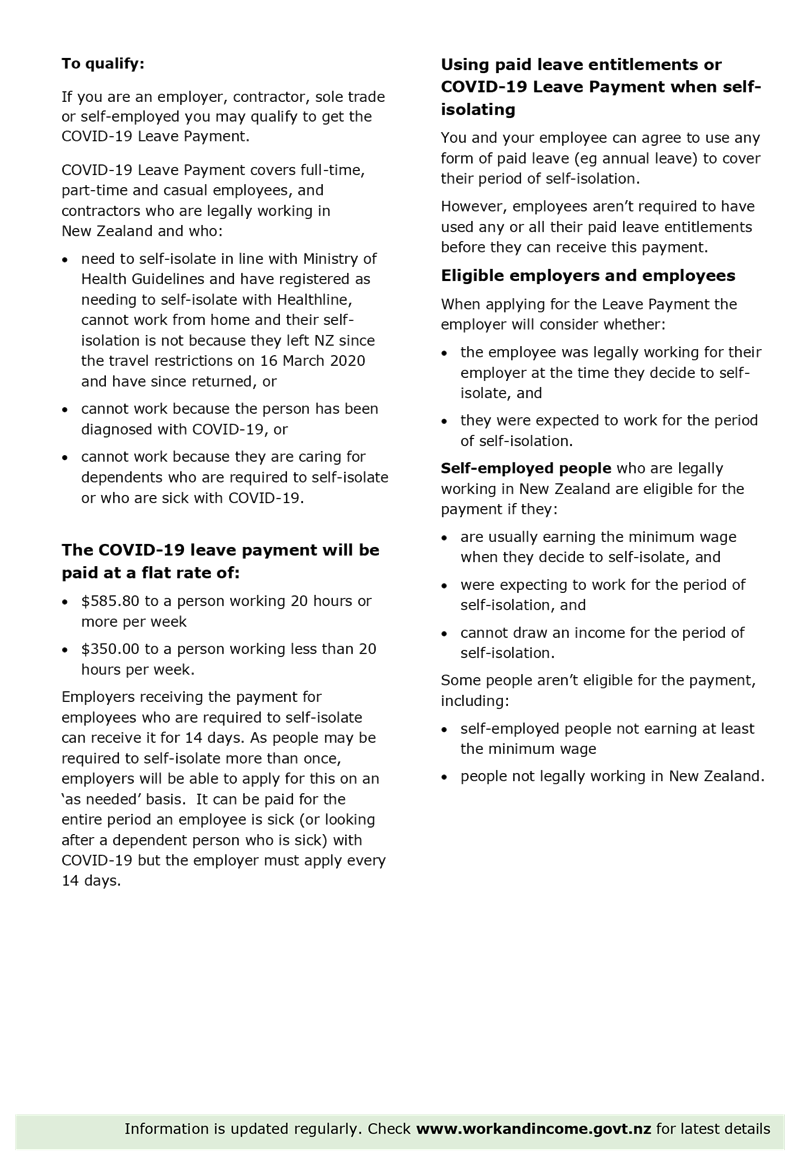

9. The Government introduced the Wage

Subsidy to support businesses who have been impacted by COVID-19. The

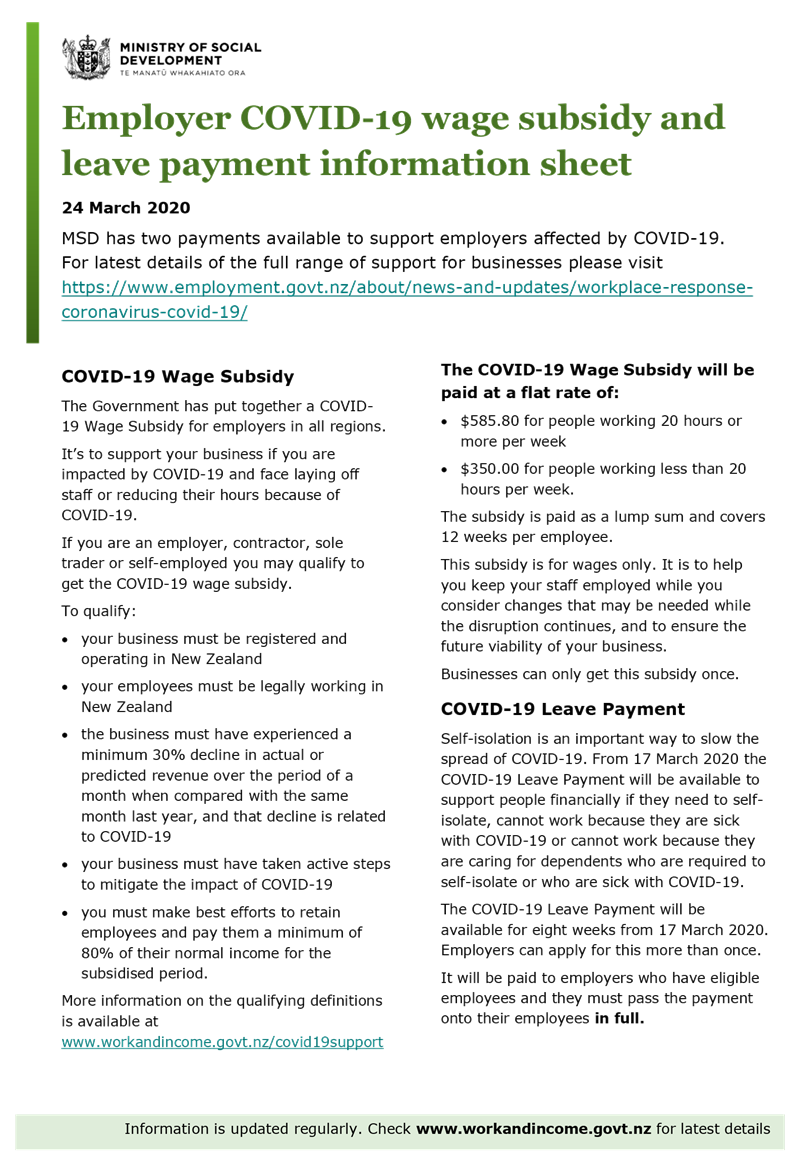

Wage Subsidy information sheet dated 24 March 2020 issued by Ministry of Social

Development (MSD) is included as Attachment 1.

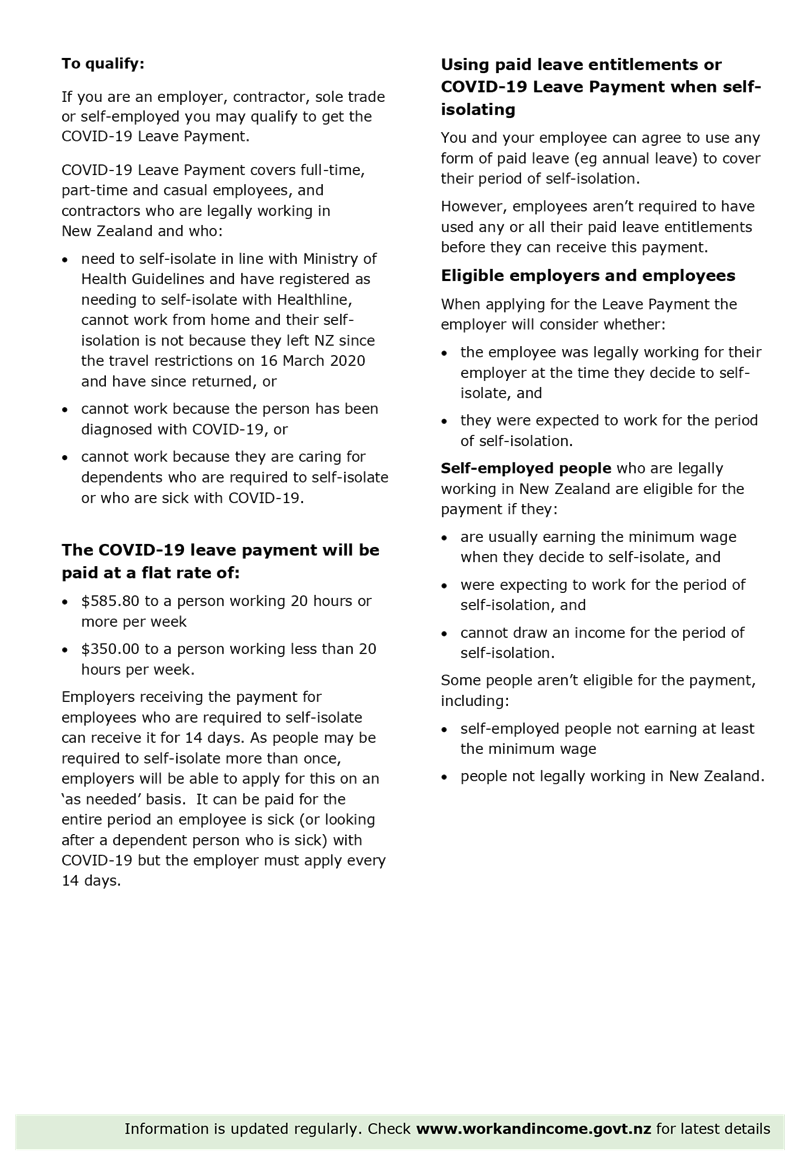

10. The Wage Subsidy is available to support

employers impacted by COVID-19, who face laying off staff or reducing their

hours. The wage subsidy criteria are included as Attachment 2.

11. Council has lost significant revenue during

April 2020 as a result of activities remaining closed due to

‘lockdown’ and subsequent effect on air travel and recession.

Analysis has been undertaken to assess whether Council can meet the criteria of

‘30% revenue reduction’ for any month between January and June 2020

as compared to the same month last year. This analysis shows that on a

‘cashflow’ basis for the month of April 2020 the 30% criteria can

be met.

12. Initial discussions with MSD have indicated

that they are comfortable to consider Council’s application. The

methodology used in calculation the 30% revenue reduction has been outlined to

MSD. It is our view that there is a better than 50% chance of this

application being successful and therefore worthwhile proceeding with the

application.

13. The application preparation is currently in

progress and as part of this a communication has been sent to staff to obtain

their consent to include their details in the application. The application also

needs to include a Declaration as per Attachment 3.

14. As at 15 May 2020, four councils have claimed

the Wage Subsidy.

2020-21

Annual Plan

15. Work is ongoing to assess the impacts of

COVID-19 on activity revenue and costs for next financial year.

16. A scenario is being developed which estimates user fees at just

under 20% below budget overall, based on most operations at Alert Level one and

building-related revenue reduced by up to 20%. Downward cost adjustments have

been made to employee costs to keep them close to 2019-20 budget levels

and other reductions have also been made to administrative and training budgets

reflecting a lower level of activity.

17. A reduction in the total level of new capital

next year has been included to reflect the delays in this year’s capital

delivery and likely pressures on ability to deliver capital next year.

The assumption for the programme is total capital delivery of about $200m next

year.

18. The assumptions for this scenario would bring

the rates requirement down below the level of the draft annual plan, despite

the lower operational revenue assumed. However net debt levels would be

higher.

19. Scenarios will also be developed that reflect

a larger reduction in user fee revenue and its flow through impact to the rates

requirement, debt levels and the debt to revenue ratio.

Financial Risks

20. No new financial risks arising from COVID-19 have emerged

during the last week.

Strategic / Statutory Context

21. COVID-19

represents a significant challenge to the financial

sustainability and effectiveness of Council. Regular update of the

financial situation and risks enables Council to be informed and to take these

matters into account in its key decision making, particularly in relation to

the annual plan.

Options Analysis

22. There are no options associated with this report. The report is

provided as information only.

Significance

23. Under

the Significance and Engagement Policy 2014, the decision to receive this

report is of low significance.

Next Steps

24. It is planned to lodge the Wage Subsidy application during the week

commencing 18 May 2020 once the staff consenting process is completed.

Attachments

1. Attachment 1 - Wage

Subsidy Information Sheet 24 March 2020 - A11505423 ⇩

2. Attachment 2-

Government Wage subsidy Further Information - A11515357 ⇩

3. Attachment 3-

Declaration - COVID-19 Wage Subsidy Scheme - A11505425 ⇩

|

Finance, Audit

and Risk Committee Meeting Agenda

|

26 May 2020

|

|

Finance, Audit and Risk Committee

Meeting Agenda

|

26 May 2020

|

Attachment

2: Government Wage Subsidy to support

businesses who have been impacted by COVID-19

1. The Government introduced the Wage

Subsidy to support businesses who have been impacted by COVID-19. The

Wage Subsidy information sheet dated 24 March 2020 issued by Ministry of Social

Development (MSD) is included as an attachment.

2. Details of the Wage Subsidy are

outlined in the MSD link below:

https://www.employment.govt.nz/leave-and-holidays/other-types-of-leave/coronavirus-workplace/wage-subsidy/#about

3. The Wage Subsidy is available to

support employers impacted by COVID-19, and face laying off staff or reducing

their hours.

4. Council has lost significant

revenue during April 2020 as a result of activities remaining closed due to

‘lockdown’ and subsequent effect on air travel and recession.

5. Wage Subsidy ‘Qualification

Criteria’ as outlined by MSD:

· “your business must be registered and operating in New Zealand

· your employees must be legally working in New Zealand

· the business must have experienced a minimum 30% decline in actual

or predicted revenue over the period of a month when compared with same month

last year, and decline is related to COVID-19

· your business must have taken active steps to mitigate the impact of

COVID-19

· you must make best efforts to retain employees and pay them a

minimum of 80% of their normal income for the subsidised period”.

· As part of this process, eligible staff for the application are

required to provide their consent to be included in the application. The

application requires the following details of staff included in the

application:

Name; date of birth; IRD

number and status (full or part time).

6. The Wage Subsidy is paid as a lump

sum and covers a period of 12 weeks per employee. This subsidy is for

wages only. It is to help business keep staff employed while the

disruption continues and to ensure the future viability of the business.

Wage

Subsidy is at the rate of:

· $585.80 per week (working 20 hours or more) or

· $350.00 per week (working less than 20 hours).

|

Finance, Audit and Risk Committee

Meeting Agenda

|

26 May 2020

|

Declaration – COVID-19 Wage Subsidy Scheme

This declaration applies to you if you applied for the

COVID-19 Wage Subsidy on or after 4pm on 27 March 2020.

By submitting this

form, you are declaring that:

You must meet the eligibility

criteria

· You meet the eligibility criteria for

the Wage Subsidy (subsidy):

o you operate a business (being a

registered business, sole trader, self-employed person, registered charity [1],

incorporated society [2], non-government organisation, or post settlement

governance entity) in New Zealand that employs and pays the employees named in

your application; and

o the employees (including you if

you are a sole trader or self-employed person) named in your application are

legally employed by your business and are employed in New Zealand; and

o your business has experienced a

minimum 30% decline in actual or predicted revenue [3] over the period of a

month when compared to the same month last year, or a reasonably equivalent

month for a business operating less than a year or a high growth business that

has experienced a significant increase in revenue, and that revenue loss is

attributable to the COVID-19 outbreak; and

o before making your application for the

subsidy, you have taken active steps to mitigate the impact of COVID-19 on your

business activities (including but not limited to engaging with your bank,

drawing on your cash reserves as appropriate, making an insurance claim); and

o you are not currently receiving the

COVID-19 Wage Subsidy, COVID-19 Leave Subsidy, COVID-19 Essential Workers Leave

Support or COVID-19 Leave Support Scheme in respect of any of the employees

named in your application.

Your obligations to

use the subsidy to retain and pay your employees

· You acknowledge that the granting of

your application and your receipt of the subsidy does not override your

existing obligations under the Employment Relations Act 2000;

· You will not make any changes to your

obligations under any employment agreement, including to rates of pay, hours of

work and leave entitlement, without the written agreement of the relevant

employee; [4]

· You will retain the employees named in

your application as your employees for the period you receive the subsidy in

respect of those employees;

· You will not unlawfully compel or

require any of the employees named in your application [5] to use their leave

entitlements for the period you receive the subsidy in respect of those

employees; [6]

· You will only use the subsidy for the

purposes of meeting your named employees ordinary wages and salary and your

obligations in relation to this subsidy.

· You remain responsible for paying your

employees ordinary wages and salary for the employees named in your

application.

· You will for the period you receive

the subsidy:

o use your best endeavours to pay at

least 80 per cent of each named employee’s ordinary wages or salary; and

o pay at least the full amount of the

subsidy to the employee; but

o where the ordinary wages or salary of

an employee named in your application was lawfully below the amount of the

subsidy before the impact of COVID-19, pay the employee that amount.

· The ordinary wages or salary of an

employee are:

o as specified in the employee’s

employment agreement as at 26 March 2020; or

o if you ended your employment

relationship with any employee named in your application as a result of your

business being adversely affected by the COVID-19 outbreak and have re-employed

that employee on or after 17 March 2020, as specified in the employee’s

employment agreement as at the date that employment relationship ended.

Providing information

about you, your business and your employees to the Ministry

· You will provide the Ministry of

Social Development [7] with information about you, your business and (with

their consent) the employees named in your application to the extent required

by the Ministry of Social Development or its auditors to make decisions about

your application, and to audit and review any subsidy that is granted (to you or

another applicant) and how any subsidy granted is paid to employees.

Consent to the

Ministry sharing information about your application with other agencies

· You consent to the Ministry of Social

Development sharing information about you or your business provided with

respect to your application (both at the time of application, and any

information provided at a later time) with other agencies (including

non-government agencies) to the extent necessary to make decisions about your

application, and to audit and review any subsidy that is granted (to you or

another applicant) and how any subsidy granted is paid to employees.

Consent to other

agencies providing information about you to the Ministry

· You consent to other agencies

(including non-government agencies) providing information about you or your

business to the Ministry of Social Development or its auditors, to the extent

necessary in order for the Ministry of Social Development to make decisions

about your application, and to audit and review any subsidy that is granted (to

you or another applicant) and how any subsidy granted is paid to employees.

Discuss your

application with your employees and gain their consent to information sharing

· You have discussed this application

with the employees named in it.

· The employees named in your

application have consented (in writing, if practicable) to the following

matters:

o The employees consent to:

§ the information about them in your

application being provided to the Ministry of Social Development; and

§ you providing the Ministry of Social

Development with any further information about them required in order for the

Ministry of Social Development to make decisions about your application, and to

audit and review any subsidy that is granted (to you or to another applicant)

and how any subsidy granted is paid to employees; and

§ you advising the Ministry of Social

Development if they end their employment relationship with your business at a

time when you are receiving a subsidy with respect to them.

o The employees consent to the

information about them provided to the Ministry of Social Development with

respect to this application (both at the time of application, and any

information provided at a later time):

§ being used by the Ministry of Social

Development to make decisions about your application, and to audit and review

any subsidy that is granted (to you or to another applicant) and how any

subsidy granted is paid to employees; and

§ being shared by the Ministry of Social

Development with other agencies (including non-government agencies) to the

extent necessary in order for the Ministry of Social Development and its

auditors to make decisions about your application, and to audit and review any

subsidy that is granted (to you or to another applicant) and how any subsidy

granted is paid to employees; and

§ being used by the Ministry of Social

Development to make decisions about other assistance and entitlements to the

extent your application and any subsidy granted is relevant to them (for instance,

where your application is relevant to an employee’s application for other

assistance).

o The employees consent to other

agencies (including non-government agencies) providing information about them

to the Ministry of Social Development and its auditors, to the extent necessary

in order for the Ministry of Social Development to make decisions about your

application, and to audit and review any subsidy that is granted (to you or to

another applicant) and how any subsidy granted is paid to employees.

Advise your employees

they can request access to information you have provided in your application

under the Privacy Act

· People have the right to request

access to all information held about them under the Privacy Act, they can

contact privacyofficer@msd.govt.nz (Link 1) to make a request.

Publication of

information about you

· You consent to the Ministry of Social

Development publishing information about your business and the level and

duration of any subsidy provided to you (excluding any personal information

about the employees named in your application) on a publicly accessible

register.

Notify changes in

eligibility

· You will notify the Ministry of Social

Development within 5 working days if anything changes that may affect your

eligibility or entitlement to the subsidy, including if any of the employees

named in your application end their employment relationship with you.

Repaying the subsidy

· You agree to repay the subsidy or any

part of the subsidy paid to you if you:

o fail to meet any of the obligations

about how you must use the subsidy; or

o were not or stop being eligible for

the subsidy or any part of the subsidy;

o provide false or misleading

information in your application; or

o receive insurance such as business

interruption insurance for any costs covered by the subsidy.

Provision of true and

correct information

· You acknowledge and agree that all of

the information you have provided to the Ministry of Social Development is true

and correct.

Consequences of

non-compliance with the obligations in this declaration

· You acknowledge that you may be

subject to civil proceedings for the recovery of any amount you receive that

you are not entitled to and/or to prosecution for offences under the Crimes Act

1961 if you:

o have provided false or misleading

information; or

o fail to meet any of the obligations

about how you must use the subsidy; or

o receive any subsidy or part of a

subsidy that you were not entitled to receive.

Authority to make

this declaration

· You are making this declaration of

behalf of your business and you have the authority to do so.

The Ministry may

amend this declaration

· You acknowledge that the Ministry of

Social Development may amend this declaration at any time and at its

discretion.

Declaration forms

part of your application

· You acknowledge that this declaration

forms part of your application.

In submitting your

application you also acknowledge and/or agree:

· The Ministry of Social Development collects

the information in this application to determine whether you are eligible to

receive assistance.

· The Ministry of Social Development

will use the information provided in this application for the purposes

addressed in this document, including to assess your eligibility to receive the

subsidy and to audit and review any subsidies granted. We may also use the

information to contact you or for research and reporting purposes, or to advise

you on the matters relating to the assistance you applied for.

· The Ministry will not use the

information provided in this application for any other purpose unless required

or authorised by law.

· Under the Privacy Act 1993 you have

the right to request access to all information held about yourself and to

request corrections to that information.

[1] Incorporated under the Incorporated Societies Act

1908 and registered under the Charities Act 2005; or registered the Charities

Act 2005.

[2] Incorporated under the Incorporated Societies Act

1908.

[3] Businesses can include a fall in projected capital

income as ‘revenue’ for the purpose of an application where:

· They have no revenue other than seed

or venture capital, or Government funding; and

· They are recognised by Callaghan

Innovation as a legitimate research and development start up business

[4] It is unlawful for you to unilaterally vary an

employment agreement to reduce an employee’s wages or salary in order to

receive the subsidy. You must continue to comply with your obligations under

the Employment Relations Act 2000.

[5] Including essential workers who are unable to work

for COVID-19 related reasons including their own illness or caring for

dependents.

[6] Other than as you are lawfully permitted to do,

including as provided for in an employee’s employment agreement.

[7] “Ministry of Social Development” includes

the Chief Executive of the Ministry of Social Development and her staff.

7.2 Quarter

3 - Local Government Official Information and Meetings Act 1987 and Mayor and

Councillor requests

File

Number: A11525272

Author: Kath

Norris, Team Leader: Democracy Services

Authoriser: Susan

Jamieson, General Manager: People & Engagement

Purpose of the Report

1. The purpose of the report is to update

the committee on Local Government Official Information and Meetings Act 1987

(LGOIMA) requests as well as the Mayor and councillor requests over the third

quarter (Quarter 3) from 1 January to 31 March 2020.

|

Recommendations

That the Finance, Audit and Risk Committee:

(a) Receives

the report: Quarter 3 - Local Government Official Information and Meetings

Act 1987 and Mayor and Councillors requests.

|

LGOIMA and privacy requests

2. A total of 38 requests

were received in Q3 (34 LGOIMA and four Privacy Act requests), compared with 69

requests received in Q2. This is a decrease of 45%

from the previous quarter.

3. There are no requests made

in Q3 that are still to be finalised. For two requests there were follow up

requests for information.

4. Nine requests made in Q3

were partially withheld and one request was refused. Two requests were

transferred to other government agencies.

5. More analysis of the

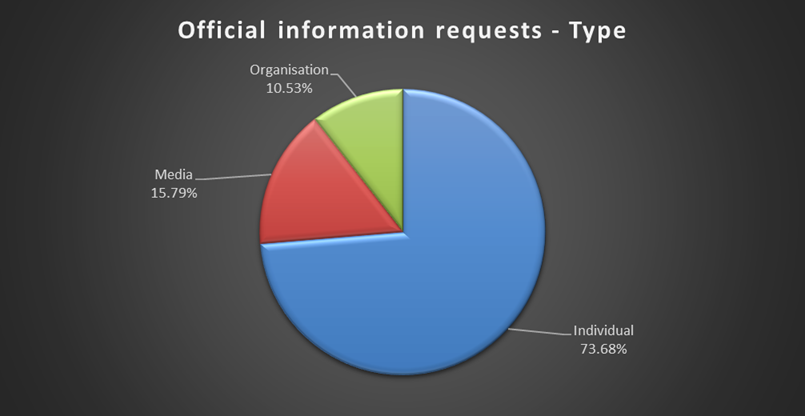

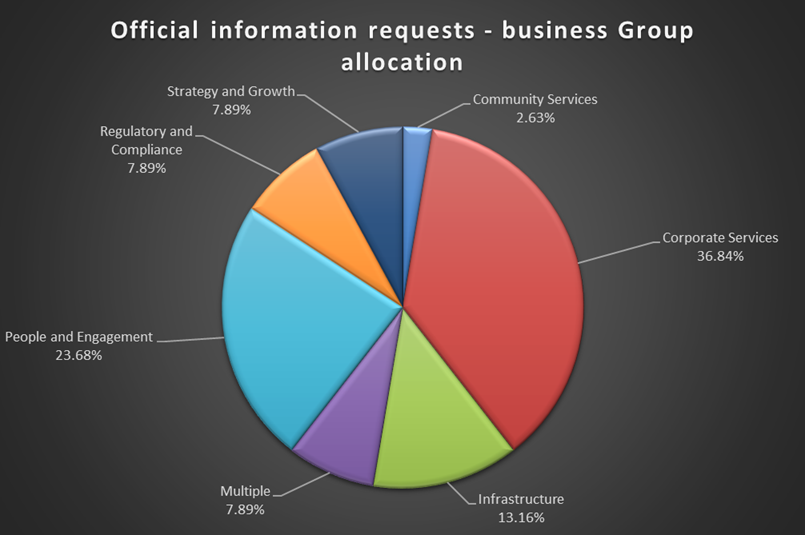

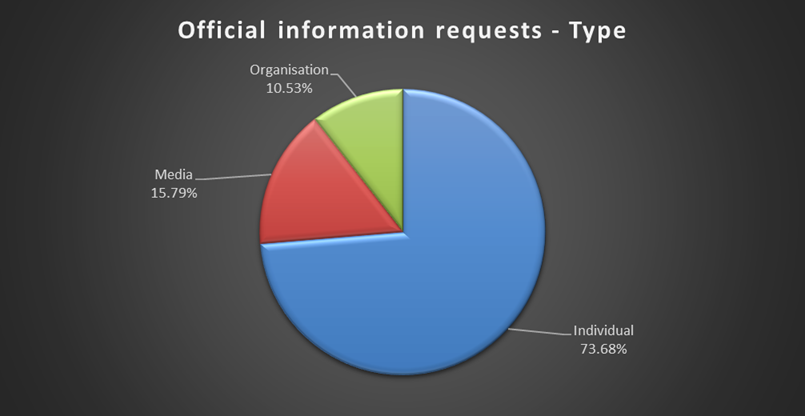

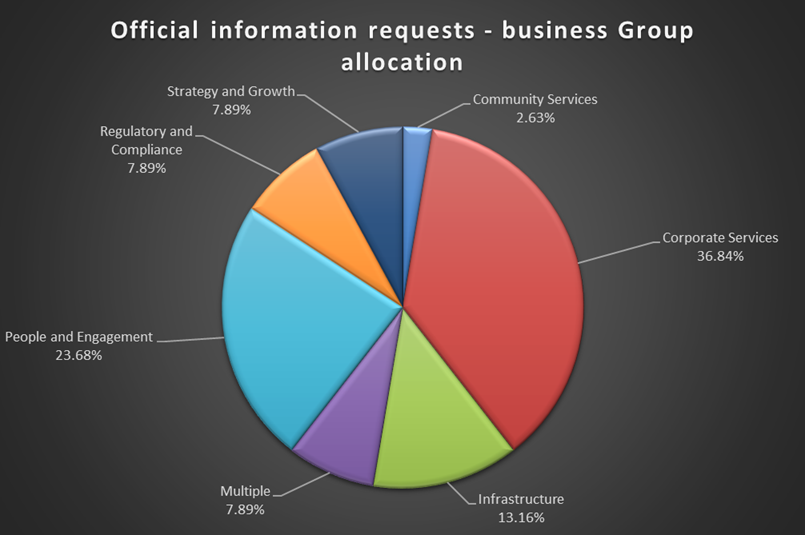

LGOIMA data is detailed in the pie graphs below.

6. Three requesters made

multiple requests (two or more). One of these requesters made eight requests

and the remaining two made two requests each. Multiple requests comprised 32%

of the total requests made in Q3.

7. In relation to information

requests made in Q3, we have been notified by the requester of two complaints

he intended to make to the Office of the Ombudsman. We have not yet received a

formal notification of these complaints from the Office. These complaints are

both from the same individual.

8. Two requests (LGOIMA) made

in Q3 had the response time extended, compared with one in Q1.

9. 93% of LGOIMA and Privacy

Act requests responded to in Q3 were within the statutory timeframes, compared

with 99% in Q2. Three responses made this quarter did not meet the deadline.

This was due to the substantial information that needed to be searched for,

collated and reviewed before the responses were finalised and sent.

10. We recorded an estimated total of

156.6 hours of staff time spent on processing information requests in Q3, which

equates to $11,901. This figure is used for internal purposes only.

11. The Executive has now approved an

amended response for one of the regular correspondents. This individual will be

required to direct all correspondence via a third party; in this case solicitor

Mark Beech.

12. The

Office of the Ombudsman investigation went into abeyance for a period of time

over Alert Level 4 but has now resumed. The Chief Ombudsman has now met with

the Chief Executive to discuss the investigation prior to the finalising of

their report.

13. Work has begun to draft a policy for

establishing a framework to support TCC to manage regular correspondence, this

will be completed by 30 June 2020.

14. The process to proactively publish

LGOIMA responses on the TCC website has been approved and the team are

finalising the preparations with the web team. We will begin to publish this

financial year’s responses in the week beginning 25 May 2020.

mayor and councillor queries

15. Democracy

Services received 261 Mayor and Councillor queries in Q3, compared with 77 in

Q2. This is an increase of 239%. There are four outstanding Q3 queries. Of

these, three of these have been marked for post-Covid-19 follow-up and one is

receiving further follow-up information following a response.

16. This

increase in requests is in part due to an improvement in the process of

recording all requests with Democracy Services and the Councillors logging

their requests with the Democracy Services team, rather than going directly to

staff members. In general, the Mayor’s responses are managed outside of

the Democracy Services process, so this report does not always capture 100% of

that data.

17. More

detailed analysis of the Mayor and Councillor queries is detailed in the pie

graphs below.

Q3 Official information requests (LGOIMA, Privacy Act

requests) – Graphs

Q3 Mayor and

Councillor query graphs

Attachments

Nil

9 Public

Excluded Session

RESOLUTION TO

EXCLUDE THE PUBLIC

|

Recommendations

That the public be excluded from the following parts of

the proceedings of this meeting.

The general subject matter of each matter to be considered

while the public is excluded, the reason for passing this resolution in

relation to each matter, and the specific grounds under section 48 of the

Local Government Official Information and Meetings Act 1987 for the passing

of this resolution are as follows:

|

General subject of each matter to be considered

|

Reason for passing this resolution in relation to

each matter

|

Ground(s) under section 48 for the passing of this

resolution

|

|

9.1 - Supplementary Legal Issues

Report

|

s7(2)(a) - the withholding of the information is

necessary to protect the privacy of natural persons, including that of

deceased natural persons

s7(2)(c)(ii) - the withholding of the information

is necessary to protect information which is subject to an obligation of

confidence or which any person has been or could be compelled to provide

under the authority of any enactment, where the making available of the

information would be likely otherwise to damage the public interest

s7(2)(g) - the withholding of the information is

necessary to maintain legal professional privilege

s7(2)(i) - the withholding of the information is

necessary to enable Council to carry on, without prejudice or disadvantage,

negotiations (including commercial and industrial negotiations)

|

s48(1)(a) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

9.2 - Bay Venues Limited Update

|

s7(2)(b)(ii) - the withholding of the information

is necessary to protect information where the making available of the

information would be likely unreasonably to prejudice the commercial

position of the person who supplied or who is the subject of the

information

|

s48(1)(a) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

9.3 - Quarterly Security Report - Q3

2020

|

s7(2)(c)(i) - the withholding of the information

is necessary to protect information which is subject to an obligation of

confidence or which any person has been or could be compelled to provide

under the authority of any enactment, where the making available of the

information would be likely to prejudice the supply of similar information,

or information from the same source, and it is in the public interest that

such information should continue to be supplied

s7(2)(c)(ii) - the withholding of the information

is necessary to protect information which is subject to an obligation of

confidence or which any person has been or could be compelled to provide

under the authority of any enactment, where the making available of the

information would be likely otherwise to damage the public interest

|

s48(1)(a) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|