|

|

|

AGENDA

Finance, Audit and Risk Committee Meeting

Thursday, 10 December 2020

|

|

I hereby give notice that a Finance, Audit and Risk

Committee Meeting will be held on:

|

|

Date:

|

Thursday, 10 December

2020

|

|

Time:

|

9.30am

|

|

Location:

|

Tauranga City Council

Council Chambers

91 Willow Street

Tauranga

|

|

Please

note that this meeting will be livestreamed and the recording will be

publicly available on Tauranga City Council's website: www.tauranga.govt.nz.

|

|

Marty Grenfell

Chief Executive

|

Terms of reference –

Finance, Audit & Risk Committee

Common

responsibilities and delegations

The following common responsibilities and delegations apply

to all standing committees.

Responsibilities of standing committees

·

Establish priorities and guidance on programmes

relevant to the Role and Scope of the committee.

·

Provide guidance to staff on the development of

investment options to inform the Long Term Plan and Annual Plans.

·

Report to Council on matters of strategic

importance.

·

Recommend to Council investment priorities and

lead Council considerations of relevant strategic and high significance

decisions.

·

Provide guidance to staff on levels of service

relevant to the role and scope of the committee.

·

Establish and participate in relevant task

forces and working groups.

·

Engage in dialogue with strategic partners, such

as Smart Growth partners, to ensure alignment of objectives and implementation

of agreed actions.

- Confirmation of committee minutes.

Delegations to standing committees

·

To make recommendations to Council outside of

the delegated responsibility as agreed by Council relevant to the role and

scope of the Committee.

·

To make all decisions necessary to fulfil the

role and scope of the Committee subject to the delegations/limitations imposed.

·

To develop and consider, receive submissions on

and adopt strategies, policies and plans relevant to the role and scope of the

committee, except where these may only be legally adopted by Council.

·

To consider, consult on, hear and make determinations

on relevant strategies, policies and bylaws (including adoption of drafts),

making recommendations to Council on adoption, rescinding and modification,

where these must be legally adopted by Council.

·

To approve relevant submissions to central government,

its agencies and other bodies beyond any specific delegation to any particular

committee.

·

To appoint a non-voting Tangata Whenua

representative to the Committee.

·

Engage external parties as required.

Terms of reference – Finance, Audit & Risk Committee

Membership

|

Chairperson

|

Mr Bruce

Robertson

|

|

Deputy

chairperson

|

Cr John Robson

|

|

Members

|

Deputy

Mayor Tina Salisbury

Cr Larry

Baldock

Cr Kelvin

Clout

Cr Bill

Grainger

Cr Andrew

Hollis

Cr Heidi

Hughes

Cr Dawn

Kiddie

Cr Steve

Morris

|

|

|

Dr Wayne

Beilby – Tangata Whenua representative

A maximum

of two external appointments may be made by Council on recommendation from

the Committee

|

|

Quorum

|

Half

of the members physically present, where the number of members (including

vacancies) is even; and a majority of the members physically

present, where the number of members (including vacancies) is odd.

|

|

Meeting

frequency

|

Six weekly

|

Role

·

To ensure that Council is delivering on agreed

outcomes.

·

To ensure that Council is managing its finances

in an appropriate manner.

·

To ensure that Council is managing risk in an

appropriate manner.

Scope

·

Monitor financial and non-financial performance

against the approved Long Term Plan and Annual Plan (Note:

Council cannot delegate to a Committee the adoption of the Long Term Plan and

Annual Plan).

·

Oversee the development of the council’s

Annual Report.

·

Oversee the development of financial and

treasury management strategies and policies.

·

Consider and approve external audit arrangements

and receiving Audit reports.

·

Consider the outcome of internal and external

audit reviews.

·

Advise Council on matters of finance and provide

objective advice and recommendations for its consideration.

·

Advise Council on matters of risk and provide

objective advice and recommendations for its consideration.

·

Consider matters which are related to quality

assurance and internal controls in council and ensure the financial management practices

and processes comply with the Local Government Act 2002, other relevant

legislation and Council’s own policies.

·

Consider, monitor and recommend (where

appropriate) in respect to Council’s financial interest in CCOs.

·

Consider all matters regarding the Local

Government Funding Agency (LGFA).

·

Monitor key activities, projects and services

(without operational interference in the services) in order to better inform

the members and the community about key Council activities and issues that

arise in the operational arm of the council.

Power to act

·

To make all decisions necessary to fulfil the

role and scope of the Committee subject to the limitations imposed.

·

To appoint a non-voting Tangata Whenua

representative to the Committee.

·

To establish working parties and forums as

required.

·

For the avoidance of doubt, this Committee has not

been delegated the power to:

o

make a rate;

o

borrow money, or purchase or dispose of assets, other than in

accordance with the Long Term Plan.

Power to recommend

·

To Council and/or any standing committee as it

deems appropriate.

6 Confirmation

of Minutes

6.1 Minutes

of the Finance, Audit and Risk Committee Meeting held on 11 August 2020

File

Number: A12088483

Author: Robyn

Garrett, Team Leader: Committee Support

Authoriser: Robyn

Garrett, Team Leader: Committee Support

|

Recommendations

That the Minutes

of the Finance, Audit and Risk Committee Meeting held on 11 August 2020 be

confirmed as a true and correct record.

|

Attachments

1. Minutes

of the Finance, Audit and Risk Committee Meeting held on 11 August 2020

|

Finance,

Audit and Risk Committee Meeting Minutes Finance,

Audit and Risk Committee Meeting Minutes

|

11 August 2020

|

|

|

|

MINUTES

Finance, Audit and Risk Committee Meeting

Tuesday, 11 August 2020

|

Order of

Business

1 Apologies. 3

2 Public Forum.. 3

3 Acceptance of Late Items. 4

4 Confidential Business to be Transferred into the Open. 4

5 Change to Order of Business. 4

6 Confirmation of Minutes. 4

6.1 Minutes of the Extraordinary Finance, Audit and Risk Committee

Meeting held on 28 April 2020. 4

7 Declaration of Conflicts of Interest 4

8 Business. 4

8.1 Mainstreet Monitoring Report for January to June 2020. 4

9 Discussion of Late Items. 6

10 Public Excluded Session. 6

10.1 Bay Venues Limited - Independent Legal Review of the Bay Dreams

Festival 6

10.2 Pool fencing issues and communications. 6

10.3 Litigation Report 6

10.4 Corporate Risk Register - Quarterly Update. 7

10.5 Revised Internal Audit Programme for 2019/20 to 2020/21. 7

10.6 Internal Audit Report - Health & Safety and NZTA Funding. 7

MINUTES OF Tauranga City Council

Finance,

Audit and Risk Committee Meeting

HELD AT THE Tauranga City Council, Council Chambers, 91 Willow Street, Tauranga

ON Tuesday,

11 August 2020 AT 9.30am

PRESENT: Mr Bruce Robertson (Chairperson), Cr John Robson (Deputy

Chairperson), Mayor Tenby Powell, Cr Jako Abrie, Cr Larry Baldock, Cr Kelvin

Clout, Cr Bill Grainger, Cr Andrew Hollis, Cr Heidi Hughes, Cr Dawn Kiddie, Cr

Steve Morris, Cr Tina Salisbury

NON VOTING Dr Wayne Beilby

MEMBER

IN ATTENDANCE: Marty Grenfell (Chief Executive), Paul Davidson (General Manager:

Corporate Services), Barbara Dempsey (General Manager: Regulatory &

Compliance), Susan Jamieson (General Manager: People & Engagement),

Christine Jones (General Manager: Strategy & Growth), Gareth Wallis

(General Manager: Community Services), Michael Vujnovich (Manager: Project

Tauranga), Coral Hair (Manager: Democracy Services), Anne Blakeway (Manager:

CCO Relationships and Governance), Nick Swallow (Manager: Legal &

Commercial), Graeme Frith (Team Leader: Legal), Kathryn Sharplin (Manager:

Finance), Jenny Teeuwen (Committee Advisor), Raj Naidu (Committee Advisor),

Robyn Garrett (Team Leader: Committee Support)

1 Apologies

|

Apology

|

|

Committee

Resolution FI7/20/1

Moved: Mr

Bruce Robertson

Seconded: Cr

Tina Salisbury

That the apologies received for lateness

from Cr Morris and for absence from Cr Grainger and Cr Kiddie be accepted.

Carried

|

2 Public

Forum

|

2.1 Mr

David Holland and Mr Murray Osmond

|

|

Key points

·

Requested that public excluded agenda items

10.2 and 10.3 be provided to the presenters as requested, as they considered

withholding the reports under grounds of legal privilege was unjustified and

that the agenda items referred to personal correspondence already in the

public domain. The grounds of legal privilege and individual privacy could

both be waived.

·

Noted that councillors were elected to represent

community views but also to exercise common sense; and to operate under the

appropriate rules. Emphasised the need for accountability; and for

councillors to have independence of thought and advice.

·

Elected members needed appropriate advice to

make decisions and could disagree with staff advice.

·

There were a number of checks and balances in

the system e.g. appeals and queries to the Office of the Ombudsman.

·

Recommendations to hear items in committee

with the public excluded could be challenged and information could also be

brought out into the public domain. Council could also allow certain

people to be present in a public excluded session.

·

Clarified that there was not an invitation to

the presenters attend the afternoon’s Council meeting

at this time.

|

At 9.37am, Cr Steve Morris entered the

meeting.

3 Acceptance

of Late Items

Nil

4 Confidential

Business to be Transferred into the Open

Agenda

item 10.2 – councillors could look at the possibility of public release

of information contained in that report when considering the report.

5 Change

to Order of Business

Nil

6 Confirmation

of Minutes

7 Declaration

of Conflicts of Interest

Nil

8 Business

|

8.1 Mainstreet

Monitoring Report for January to June 2020

|

|

Staff Michael Vujnovich, Manager: Project Tauranga

External Tauranga

Mainstreet – Sally Cooke, Fiona Corkery and Brian Berry (Chair).

Greerton

Mainstreet – Sally Benning

Key points

·

Mainstreet operation was different this year

with many events having to be postponed or cancelled due to COVID-19.

Activities were much more limited than normal.

·

Collectively the three Mainstreets had run a

joint Buy Local media campaign. The campaign was designed to be

personal and reintroduce the face of the business owners, and highlighted the

impact of the lockdown on local businesses.

·

Greerton – noted that this year’s

Cherry Blossom Festival coincided with election day. Generally, around

5000-6000 people attended the Festival. Some assistance had been

provided with facilitating click and collect and online shopping during the

lockdown. Did not lose any businesses in Greerton from the COVID

lockdown.

·

Tauranga – did their best with the

resourcing available; contributed to CBD revitalisation; worked actively with

members and stakeholders. The Activate vacant spaces programme had been

reinstated post-lockdown.

·

Supported the Careers Expo held in Durham St

in conjunction with University of Waikato, Toi Ohomai and local businesses.

In response to questions

·

There had not been any specific co-ordinated

work between the Mainstreets regarding upskilling of businesses in a more

online world.

·

The police had been contacted regarding any

grey areas not covered in Greerton by cameras or community patrols;

information not yet received. Council support for cameras and community

patrols would need to be requested in writing once the relevant information

was received from the police.

·

Concern about the streetscape of the Greerton

village centre was expressed e.g. removal of bollards; replacement/repair of

timber seating. Very slow progress.

·

Mainstreet Tauranga had asked for foot counter

trackers to be installed across the city. In terms of free carparking,

a resurgence in people in town had been observed; however, enforcement was

critical.

·

Central city landlords were generally very

supportive of the city centre and were doing what they could to retain and

stimulate business.

·

Able to access Paymark data to get a better

picture of retail spend.

·

Unlikely to see international cruise ship

passengers for some time.

|

|

Committee Resolution FI7/20/3

Moved: Cr

John Robson

Seconded: Cr

Jako Abrie

That the Finance,

Audit and Risk Committee:

(a) Receives

the report: Mainstreet Monitoring Report for January to June 2020.

Carried

|

9 Discussion

of Late Items

Nil

10 Public

Excluded Session

RESOLUTION

TO EXCLUDE THE PUBLIC

|

Committee Resolution FI7/20/4

Moved: Cr

Larry Baldock

Seconded: Mayor

Tenby Powell

That

the public be excluded from the following parts of the proceedings of this

meeting.

The

general subject matter of each matter to be considered while the public is

excluded, the reason for passing this resolution in relation to each matter,

and the specific grounds under section 48 of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Ground(s) under section 48 for the

passing of this resolution

|

|

10.1 - Bay Venues Limited -

Independent Legal Review of the Bay Dreams Festival

|

s7(2)(h) - the withholding of the information is

necessary to enable Council to carry out, without prejudice or

disadvantage, commercial activities

|

s48(1)(a) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

10.2 - Pool fencing issues and

communications

|

s7(2)(a) - the withholding of the information is

necessary to protect the privacy of natural persons, including that of

deceased natural persons

s7(2)(g) - the withholding of the information is

necessary to maintain legal professional privilege

|

s48(1)(a) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

10.3 - Litigation Report

|

s7(2)(a) - the withholding of the information is

necessary to protect the privacy of natural persons, including that of

deceased natural persons

s7(2)(g) - the withholding of the information is

necessary to maintain legal professional privilege

s7(2)(i) - the withholding of the information is

necessary to enable Council to carry on, without prejudice or disadvantage,

negotiations (including commercial and industrial negotiations)

|

s48(1)(a) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

10.4 - Corporate Risk Register -

Quarterly Update

|

s7(2)(b)(i) - the withholding of the information

is necessary to protect information where the making available of the

information would disclose a trade secret

s7(2)(b)(ii) - the withholding of the information

is necessary to protect information where the making available of the

information would be likely unreasonably to prejudice the commercial

position of the person who supplied or who is the subject of the

information

s7(2)(h) - the withholding of the information is

necessary to enable Council to carry out, without prejudice or

disadvantage, commercial activities

s7(2)(i) - the withholding of the information is

necessary to enable Council to carry on, without prejudice or disadvantage,

negotiations (including commercial and industrial negotiations)

|

s48(1)(a) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

10.5 - Revised Internal Audit

Programme for 2019/20 to 2020/21

|

s6(b) - the making available of the information

would be likely to endanger the safety of any person

s7(2)(a) - the withholding of the information is

necessary to protect the privacy of natural persons, including that of

deceased natural persons

s7(2)(b)(i) - the withholding of the information

is necessary to protect information where the making available of the

information would disclose a trade secret

s7(2)(d) - the withholding of the information is

necessary to avoid prejudice to measures protecting the health or safety of

members of the public

s7(2)(g) - the withholding of the information is

necessary to maintain legal professional privilege

s7(2)(j) - the withholding of the information is

necessary to prevent the disclosure or use of official information for

improper gain or improper advantage

|

s48(1)(a) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

10.6 - Internal Audit Report - Health

& Safety and NZTA Funding

|

s6(b) - the making available of the information

would be likely to endanger the safety of any person

s7(2)(a) - the withholding of the information is

necessary to protect the privacy of natural persons, including that of

deceased natural persons

s7(2)(d) - the withholding of the information is

necessary to avoid prejudice to measures protecting the health or safety of

members of the public

s7(2)(g) - the withholding of the information is

necessary to maintain legal professional privilege

|

s48(1)(a) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

(b) Permit Mr

Rhys Harrison QC and Mr Mark Beech, Barrister to remain at this meeting,

after the public has been excluded, for Agenda Item 10.2, because of their

knowledge of litigation, official information and consent processes.

Carried

|

The meeting closed at 1.12pm.

The

minutes of this meeting were confirmed at the Finance, Audit and Risk Committee

meeting held on 10 December 2020.

...................................................

CHAIRPERSON

6.2 Minutes

of the Finance, Audit and Risk Committee Meeting held on 22 September 2020

File

Number: A12090719

Author: Robyn

Garrett, Team Leader: Committee Support

Authoriser: Robyn

Garrett, Team Leader: Committee Support

|

Recommendations

That the Minutes

of the Finance, Audit and Risk Committee Meeting held on 22 September 2020 be

confirmed as a true and correct record.

|

Attachments

1. Minutes

of the Finance, Audit and Risk Committee Meeting held on 22 September

2020

|

Finance,

Audit and Risk Committee Meeting Minutes Finance,

Audit and Risk Committee Meeting Minutes

|

22 September

2020

|

|

|

|

MINUTES

Finance, Audit and Risk Committee Meeting

Tuesday, 22 September 2020

|

Order of

Business

1 Apologies. 3

2 Public Forum.. 3

3 Acceptance of Late Items. 3

4 Confidential Business to be Transferred into the Open. 4

5 Change to Order of Business. 4

6 Confirmation of Minutes. 4

6.1 Minutes of the Finance, Audit and Risk Committee Meeting held on 12

May 2020. 4

7 Declaration of Conflicts of Interest 4

8 Deputations, Presentations, Petitions. 4

8.1 Presentation from Bay of Plenty Regional Council and Quayside

Holdings Limited. 4

9 Business. 6

9.1 Annual Residents Survey 2020. 6

9.2 CCO Draft and Final Annual Reports for 2019/2020. 6

9.3 Tauranga City Council Draft Annual Report 9

9.4 Funding and Financing for the Long Term Plan. 10

9.5 Quarter 4 Local Government Official Information Requests and Mayor

and Councillors' Requests. 11

10 Discussion of Late Items. 11

11 Public Excluded Session. 12

11.1 Public Excluded Minutes of the Finance, Audit and Risk Committee

Meeting held on 12 May 2020. 12

11.2 Litigation Report 12

11.3 Corporate Risk Register - Quarterly Update. 12

11.4 Quarterly Cyber Security Report - Q4 2020. 13

11.5 Update: Kerbside Waste Collection, Waste Facilities and Litter

Services. 13

MINUTES

OF Tauranga City Council

Finance, Audit and Risk Committee

Meeting

HELD AT THE Tauranga City Council,

Council Chambers, 91 Willow Street, Tauranga

ON Tuesday, 22 September 2020 AT 9.30am

PRESENT: Mr Bruce Robertson (Chairperson), Cr John Robson (Deputy

Chairperson), Mayor Tenby Powell, Cr Jako Abrie, Cr Larry Baldock, Cr Kelvin

Clout, Cr Bill Grainger, Cr Andrew Hollis, Cr Heidi Hughes, Cr Dawn Kiddie, Cr

Steve Morris, Cr Tina Salisbury, Dr Wayne Beilby

IN ATTENDANCE: Marty Grenfell (Chief Executive), Paul Davidson (General Manager:

Corporate Services), Susan Jamieson (General Manager: People & Engagement),

Christine Jones (General Manager: Strategy & Growth), Nic Johansson

(General Manager: Infrastructure), Gareth Wallis (General Manager: Community

Services), Jeremy Boase (Manager: Strategy & Corporate Planning), Josh

Logan (Team Leader: Corporate Planning), Anne Blakeway (Manager: CCO

Relationships and Governance), Nick Swallow (Manager: Legal & Commercial),

Graeme Frith (Team Leader: Legal), Hemi Leef (Corporate Solicitor), Allan

Lightbourne (Chief Digital Officer), Sam Fellows (Manager: Sustainability and

Waste), Kathryn Sharplin (Manager: Finance), Rhea Brooks (Corporate Planner),

Mohan De Mel (Treasurer), Chris Quest (Team Leader: Risk), Coral Hair (Manager:

Democracy Services), Jenny Teeuwen (Committee Advisor), Raj Naidu (Committee

Advisor), Robyn Garrett (Team Leader: Committee Support)

1 Apologies

|

Apology

|

|

Committee

Resolution FI0/20/1

Moved: Mr

Bruce Robertson

Seconded: Deputy

Mayor Tina Salisbury

That the apology for absence received

from Mayor Powell be accepted.

Carried

|

2 Public

Forum

Nil

3 Acceptance

of Late Items

|

Committee

Resolution FI0/20/2

Moved: Mr

Bruce Robertson

Seconded: Cr

Kelvin Clout

That the following item be included in the public excluded agenda:

11.5 Update: Kerbside

waste collection, waste facilities and litter services.

This

item was not able to be included in the agenda when published as information

relevant to the report was unavailable at that time.

Carried

|

4 Confidential

Business to be Transferred into the Open

Nil

5 Change

to Order of Business

Nil

6 Confirmation

of Minutes

7 Declaration

of Conflicts of Interest

Nil

8 Deputations,

Presentations, Petitions

|

8.1 Presentation

from Bay of Plenty Regional Council and Quayside Holdings Limited

|

|

External: Chairman Doug Leeder, Deputy

Chair Jane Nees and Councillors Norm Bruning, Stuart Crosby, David Love,

Matemoana McDonald, Stacey Rose, Paula Thompson, Andrew von Dadelszen and

Lyall Thurston; Chief Executive Fiona McTavish, General Managers Mat

Taylor and Namouta Poutasi; Compliance Manager Alex Miller; and Chief

Executive Quayside Holdings Ltd Scott Hamilton.

PowerPoint presentation

Key points

Bay of Plenty Regional Council (BOPRC)

·

Noted the Regional Council’s vision

statement “Thriving together”. Different focus from

territorial authorities – land, water and air and the interactions of

these with the community and people.

·

Responsible for flood protection

·

Responsible for regional civil defence; noted

the number of emergencies in the region recently. Outlined response to

the COVID pandemic and noted the close working relationship with TCC for that

response; including stepping into social responses.

·

Involved in regional economic development.

BOPRC played a role in regional development; with a sustainable and focused

financial strategy which delivered transparent results for the region.

·

BOPRC was working through the strategic

framework needed to deliver its Long-Term Plan (LTP). Four main

challenges and opportunities – implications of climate change; natural

resource limitations and implications; transport planning and urban and

sub-regional growth; and the complex landscape of Maori engagement.

·

The current operating environment was very

complex with central government environmental reforms e.g. NPS-Freshwater,

Three Waters reform; new look Environmental Protection Agency.

·

Key focus and top priority was improving the

quality of freshwater systems and efficient management of allocation of

freshwater. These areas were a major pressure for BOPRC work programme.

·

BOPRC had taken a forward-thinking approach to

climate change. Had created a Climate Change Action Plan and was

looking for further feedback from the community as part of the LTP process.

·

In terms of thriving tangata whenua

relationships, local authorities needed to be working more collaboratively in

this space; aware of challenges for Māori for resourcing and capacity for participation in this

spacer. It was the responsibility of Komiti Māori to reach out to TCC and Maori representatives on TCC

committees.

·

Transport planning outcomes were fundamental

to the region and the city; the port was a key driver and its success

required a regional approach to transport planning. It was a key role

of the Regional Transport Committee to ensure collaboration between

authorities and to access funding. Noted an increase in student use of

public buses since the free school trials were introduced; noted the

introduction of tag-on tag-off Bee card ticketing across the region which

would provide good data to enable good public transport planning. Need

to work on efficient, effective and reliable bus services to stimulate the

mode shift change necessary for the city.

At 10:32am, Cr Heidi Hughes left the

meeting.

·

Natural hazards work was being undertaken as a

critical part of urban development.

·

Noted collaboration on joint spatial planning

via SmartGrowth and UFTI; and implementation through the TSP.

·

BOPRC was committed to improving air quality

in the region, especially in the Mount industrial area. Had increased

the number of monitors in the area and was actively communicating with the

community.

·

Acknowledged the work of the Tauranga Moana

Advisory Group. Noted the co-governance work of Te Maru o Kaituna as an

example of collaborative work with all parties around the table; precedent

for Tauranga Moana once settlement was reached. Co-governance entities

offered part of the solution around engagement and iwi joint management.

·

BOPRC’s current financial situation

included an increased focus on the four well-beings; all financial settings

were being examined with PWC engaged to carry out a financial review.

Outlined the structure and role of Quayside Holdings and noted that a diversification

strategy was being implemented to reduce reliance on Port of Tauranga

revenue.

Quayside Holdings Ltd

·

Quayside was the investment arm of BOPRC;

started in 1991 when it acquired a 55% share in the Port of Tauranga

Lt.

·

Note that Quayside was an independent vehicle

from BOPRC.

·

Currently trying to diversity its portfolio

and was looking for opportunities to grow its own backyard. Aim of

$350m non-port income for BOPRC.

·

Quayside a strategic asset for BOPRC; about

24% of BOPRC income.

·

The port was a strategic asset; NZ’s

largest bulk exporter. Had a market listing and a very commercial

strategy. Noted the port’s responsibility to the Tauranga environment.

·

Noted long-term relationships with

Fonterra and Zespri.

·

Outlined the development of Rangiuru Industrial

Park.

In response to questions

·

Opportunities for collaborative work between

the two councils’ engineering and planning teams could be discussed

further.

·

Quayside Board had a Diversity and Culture

Charter and was aware of its obligations in that space. Quayside is

primarily an investment vehicle; skill set required was based around

financial and investment skills.

·

Responsibility of the Regional Transport

Committee to prioritise; some feeling that the region had not received a fair

share of transport funding.

·

Considered more work could take place in the

joint governance space between the three Western Bay authorities; assist with

alignment between the three councils.

·

Quayside provided an opportunity for BOPRC to

invest for the benefit of ratepayers in the region; offset rates costs.

·

Clarification was provided regarding asset and

liability values; and distribution of asset values.

·

If the port had not been able to distribute

dividends due to COVID then Quayside would have stepped in to deliver the

required revenue.

The Chair thanked BOPRC and Quayside

Holdings for their presentations.

|

|

At 10.54am the

meeting adjourned.

At 11am the

meeting reconvened.

|

9 Business

|

9.1 Annual

Residents Survey 2020

|

|

Staff Josh Logan,

Team Leader: Corporate Planning

Jeremy Boase,

Manager: Strategy & Corporate Planning

External Elena

Goryacheva, Key Research

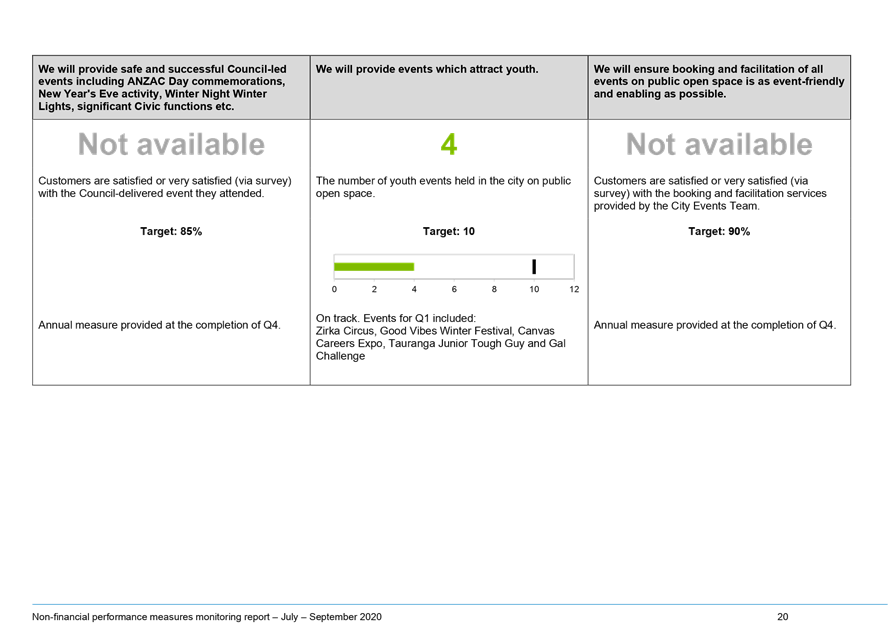

Key points

·

Over half the respondents were satisfied with

TCC

·

Areas of dissatisfaction included: less rate

increases; Council making poor decisions; need for recycling and waste to be

included in rates.

·

Reputation, value for money and core services

were the three main drivers of satisfaction; reputation had the highest

impact.

·

Used a mail-out this year rather than Telecom

landline calls. A profile of residents had been generated based on responses

provided e.g. champions/pragmatists/sceptics. Residents profile had

remained very similar over the years of the survey.

|

|

Committee Resolution FI0/20/4

Moved: Cr

John Robson

Seconded: Cr

Jako Abrie

That

the Finance, Audit and Risk Committee:

(a) Receives

Report – Annual Residents Survey 2020

(Cr

Hughes absent)

Carried

|

|

9.2 CCO

Draft and Final Annual Reports for 2019/2020

|

|

Staff Anne

Blakeway, Manager: CCO Relationships and Governance

External CCO Chief

Executives (CE), Chairs and staff as listed.

Key points

·

Noted these were draft unaudited reports as

had an extension to November to file audited annual reports.

Bay Venues Limited (BVL)

Justine Brennan, Acting CE; Michael

Smith, Chairperson

·

Had achieved five targets out of seven; missed

the two targets regarding to financial targets and venue utilisation.

·

Total revenue – the TCC grant to BVL was

about 14% of revenue which was a decrease from 18%. Outlined the total

COVID related revenue impact for BVL; the financial target would still have

been missed without COVID, but by a smaller amount. Per person cost was

$1.49, up from $1.22 in the 2019 financial year.

·

Noted the utilisation rates of various BVL

venues; aquatic facilities led the way. Noted the capacity restraints

from the various levels of COVID lockdown.

At 11:22am, Cr Heidi Hughes returned to

the meeting.

·

Highlighted the Baywave upgrade; visitor

numbers had increased after installation of the aquaplay area. Other

community pool facilities would be the focus of the next year. Noted the

introduction of the “Keep me safe” pool supervision policy and

process for parents of young children.

·

89% of customers across the BVL network

responded as satisfied or highly satisfied with the customer service

received.

·

Now an accredited provider of school lunches

with the Ministry of Education “Our healthy kai” initiative and

already contracted to provide lunches to a number of schools.

·

BVL was also looking at opportunities to work

with community meal providers with BVL community facilities.

·

Required to complete a revaluation of assets

which was underway and would be completed in time for November

sign-off.

In response to questions

·

Clarification was provided regarding the

depreciation reserve. TCC rated for depreciation within BVL;

depreciation was divided between community assets (cost covered by TCC) and newer

more commercial assets (cost covered by BVL).

BOPLASS Ltd

Stephen Boyle, CE; Craig

O’Connell, Independent Chair

·

Primary purpose was to save money for

ratepayers in the long run. Primary function had evolved into

procurement. There had been negligible impact from COVID; no projects

missed targets and revenue was not impacted to any extent.

·

Savings were passed back to TCC rather than

retained within BOPLASS.

·

Clarified that Item 35 (pg. 188) should have

shown a zero budget; $329,000 was inaccurate. Performance was close to

target with a small deficit of $15,000.

·

BOPLASS was working more closely with the

other LASSes; each LASS has developed its own speciality or focus e.g.

Waikato software development; BOP procurement.

·

Created a forum to discuss collaboration

opportunities whether or not the LASS was the implementation vehicle.

·

A number of new initiatives had been

undertaken in the last 12 months and regional collaboration had

increased. There was opportunity to share best practice across a large

group.

·

Noted the appointment of an insurance

broker/provider with a better price achieved. Noted the joint project

with Waikato around development of consistent waste management standards and

performance indicators. Underground infrastructure was harder to insure

every year and was obtained through the BOPLASS process.

Tauranga Art Gallery Trust (TAGT)

Mary Stewart, Acting Gallery Director; Mark Wassung, Chair;

Jillian Peck, Gallery Services Manager

·

Acknowledged the contributions of the previous

Chair and trustees; and recent departure of Director Alice Hutcheson.

·

The gallery had achieved 18-22,000 visitors

for signature exhibitions. Gallery downtime was significantly higher

(eight weeks) due to the COVID lockdown; normally only down for four days per

year.

·

Education programme went online and a suite of

online projects were developed; virtual exhibitions were scoped.

·

TAGT had managed a financial turnaround and

made a surplus this year. Donations from international tourists and

cruise ship passengers had performed well.

·

The number of exhibitions was reduced from

20-30 per year to 12-16 per year, with decreased install and marketing costs.

·

TAGT had met 26 of 28 performance

targets. Did not meet the 60,000 visitation target and the closure days

target due to COVID.

·

The gallery’s exhibition reputation was

growing around the country.

·

Achieved a 99% satisfaction rate. Two

thirds of visits were return visits; 55% of visitors from local area.

·

Prudent financial management; was assisted

this year by the COVID wage subsidy. Achieved above target for non-TCC

income.

·

Installation of solar panels on the roof was

being investigated.

·

TAGT was working on further outreach

initiatives e.g. with Our Place, with marae, with the Collective.

·

The Annual Report would be signed off at

the 28 October Board meeting.

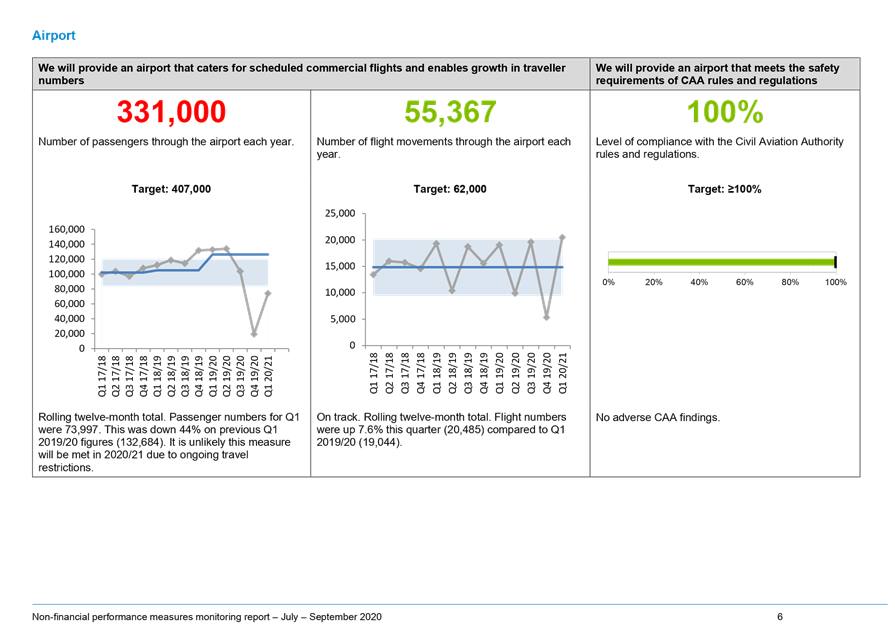

Tourism Bay of Plenty (TBOP)

Esther Goldsworthy, Partnerships

Manager; Stacey Linton, Marketing Research Analyst; Russ Browne, Trustee

·

Noted the eruption of Whakaari as the worst

tourism disaster in New Zealand and acknowledged the victims and their

families.

·

The COVID border closure had a devastating

impact on tourism in NZ. TBOP had suffered a 32% reduction in

independent income sources, but had finished the year very slightly in

surplus.

·

Achieved 53 out of 65 key measures; four

measures missed directly related to visitor spend.

·

“No place like home” campaign was

relaunched; encouraged locals to stay home and experience local activities

and experiences.

·

TBOP continued to build a strong relationship

with Air New Zealand. Was now seeing strong growth in the ability to

come and go from Tauranga post-COVID.

·

Outlined annual visitor spend figures. Due to

the impact of COVID the June year-end showed a decline. While visitor

spend in Tauranga was down 7% at year end, the impacts of recession and the

border lockdown were still to be fully realised.

·

TBOP had received an additional $700,000 in central

government funding, with additional funding sources for 12 months from the

Strategic Tourism Assets Protection Programme (STAPP) and the Regional Events

Fund.

·

Continued to implement destination management

and regeneration tourism.

·

Audit was on track and should be completed for

the next Board meeting in October.

Local Government Funding Agency (LGFA)

Staff: Mohan de Mel, Treasurer

·

LGFA had a good year; equity had built up and

its credit rating was confirmed.

·

Negative interest rates should have minimal

impact on LGFA.

Discussion points raised

·

Noted the importance of receiving CCO Annual

Reports and reflecting on CCO performance; showed good accountability.

·

Noted the impact of COVID and the management

initiatives taken by the CCOs to respond.

·

Noted the control and detailed management of

expenses by TAGT to achieve a financial turnaround.

·

Importance of domestic tourism to Tauranga

noted.

·

Noted a theme of importance of collaboration.

|

|

Committee Resolution FI0/20/5

Moved: Mr

Bruce Robertson

Seconded: Cr

Kelvin Clout

That

the Finance, Audit and Risk Committee:

(a) Receives

the council-controlled organisations’ draft and final annual reports

for 2019/2020.

(b)

Writes letters of thanks to the CCOs for work undertaken

this year and the time taken to present to the Committee.

Carried

|

|

At 12.40pm the

meeting adjourned.

At 12:40pm, Cr Larry Baldock left the

meeting.

At 1.17pm the

meeting reconvened.

|

|

9.3 Tauranga

City Council Draft Annual Report

|

|

Staff Paul

Davidson, General Manager: Corporate Services

Kathryn

Sharplin, Manager: Finance

Josh

Logan, Team Leader: Corporate Planning

Marin

Gabric, Senior Financial Accountant

Key points

·

On track for the Annual Report to be adopted

by the end of October.

·

Reviewed the past financial year and how

Council had actually delivered compared to planned delivery; and summarised

the financial position at year end.

·

Noted there was a workshop scheduled for

October 5 2020 to review in more detail. Particularly welcomed

councillor feedback on the commentary parts of the Annual Report.

·

Noted the small general rates surplus.

·

Operating revenue was about $3m down on

budget; due to the impact of COVID on revenue streams and the decision not to

harvest forestry resource on reservoir areas.

·

The reduction from a budgeted surplus of $85m

to a surplus of $3.6m was largely due to the write-off of Harington St;

increased provision for weathertight claims; and revaluations of swaps due to

low interest rates.

·

The balanced budget benchmark was not achieved

– capital delivery was lower and revenue down due to COVID; the

operations control benchmark was also not met – the LTP budget had

anticipated greater rates increases.

·

135 non-financial KPIS measured; with 49 not

achieved. 22 were COVID affected. Those activities affected by

COVID were outlined in the report; numbers related indicators were impacted

by the lockdown.

In response to questions

·

There were no serious implications of missing

the benchmarks in terms of financial prudence. The fact that those benchmarks

were not achieved was reported, and highlighted areas of financial

risk. There would be other councils that would also breach those

benchmarks this year.

·

Regarding the implications of under-delivery

of 30% of the capital programme, infrastructure not delivered would have an

impact of delay and would create a bow-wave of capital works needing to be

done. Had also rated for this infrastructure. The budget was to

drive the progress of the city; it was an issue if not achieved.

Discussion points raised

·

Need to be aware that COVID only impacted the

last three months of the financial year; the nine months before that should

have been business as usual.

·

Need to be careful of messages portrayed in

the Annual Report; it should not only be good news stories.

·

Capital delivery issue was not only a COVID

impact but was an ongoing significant challenge.

·

Critical point was that the Annual Report was

about accountability and transparency.

·

Suggested consideration of a possible

performance measure for collaboration with other authorities and agencies.

|

|

Committee Resolution FI0/20/6

Moved: Cr

John Robson

Seconded: Cr

Andrew Hollis

That

the Finance, Audit and Risk Committee:

(a) Receives

Report on Tauranga City Council Draft Annual report

Carried

|

|

9.4 Funding

and Financing for the Long-Term Plan

|

|

Staff Paul

Davidson, General Manager: Corporate Services

Kathryn

Sharplin, Manager: Finance

Mohan De Mel,

Treasurer

Key points

·

The report was the first financial introduction

into the Long-Term Plan (LTP); outlined some of the financial and funding

issues. Forecast numbers only at this stage.

·

Noted the two scenarios agreed on at the

previous Policy meeting.

·

The report outlined key levers able to be

utilised during the LTP process. Direction was sought for LTP

priorities.

·

Highlighted paragraph 13 which modelled the

relationship between rates level, ability to deliver capital infrastructure

and debt/revenue ratio.

·

Direction sought on any other levers that

needed to be considered other than those identified in the report.

·

Three months behind due to COVID; resources

were stretched to deliver in a timely manner.

In response to questions

·

If there was $220m capex spent instead of

$200m the debt ratio went up 2% or 3%.

·

Aimed to have the capital expenditure

programme back in mid-October for consideration and prioritisation.

·

Progress and timeframes for appointments to

the Sustainability Board would be confirmed and reported back; the idea was

to have a core group in place to feed into the LTP process.

|

|

Committee Resolution FI0/20/7

Moved: Cr

John Robson

Seconded: Cr

Andrew Hollis

That

the Finance, Audit and Risk Committee:

(a) Agrees

to further consideration of the following funding and financing matters and prioritisation

for the Long-Term Plan

(i) Infrastructure

Funding and Financing (IFF) application to new greenfield growth areas

(ii) Prioritisation

and timing of expenditure

(iii) Targeted

rates for transportation and stormwater

(iv) Level

of commercial differential

(v) Treatment

of risk reserve and providing for weathertight claims and unforeseen events

(vi) Financial

limits on rates that take into account the wider funding impacts

(vii) Other

funding and finance opportunities at local, regional and national level

Carried

|

|

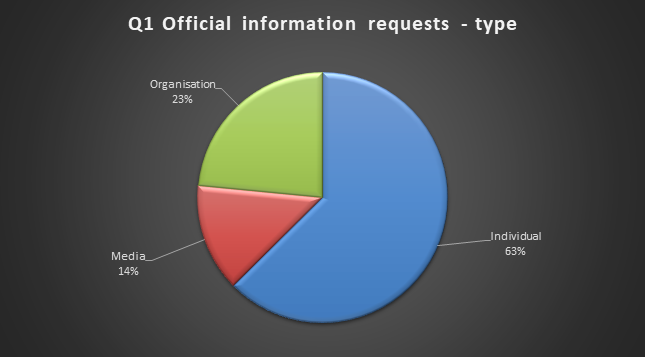

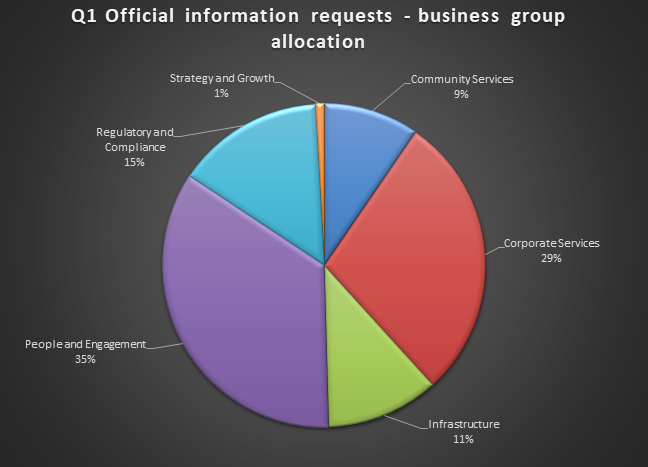

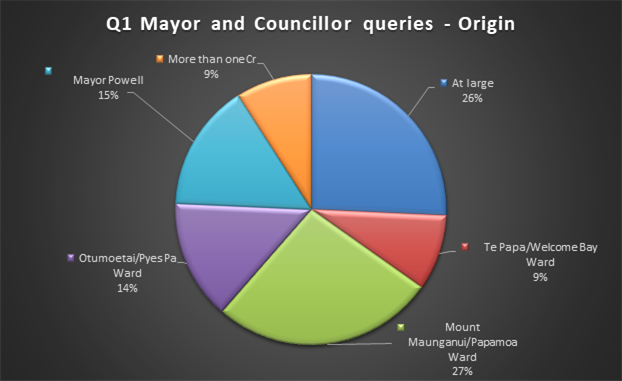

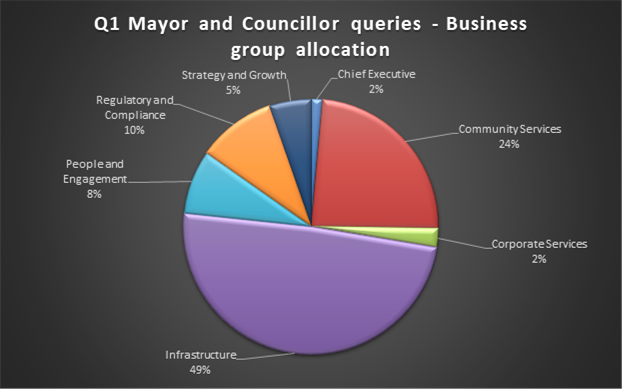

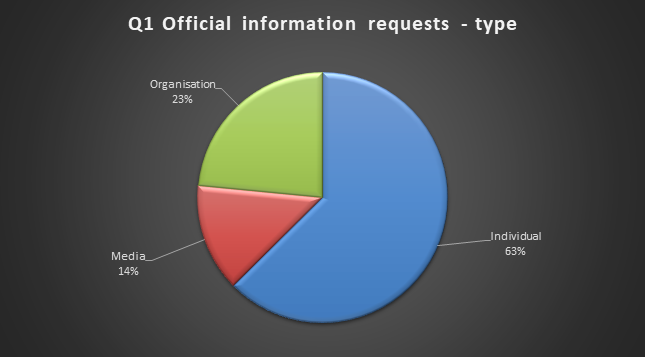

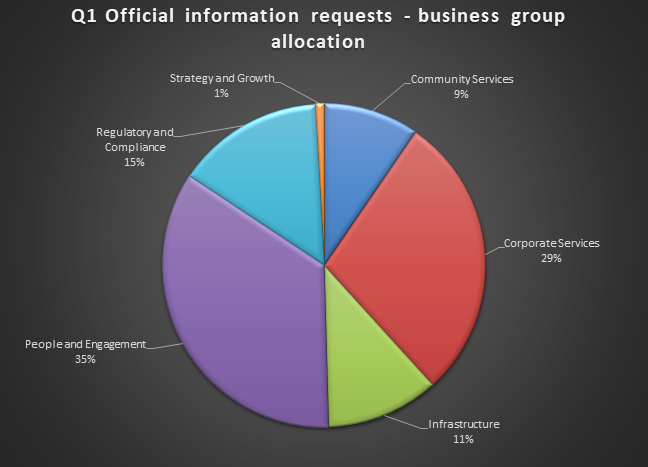

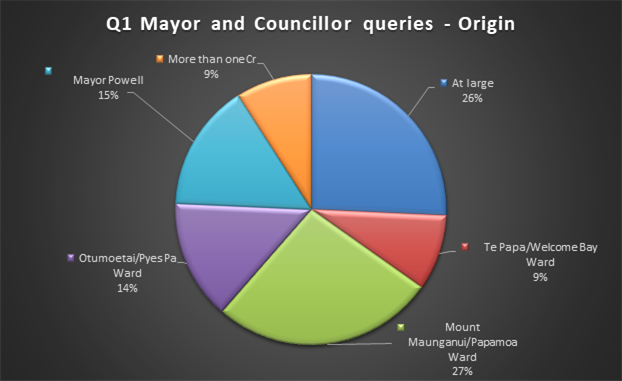

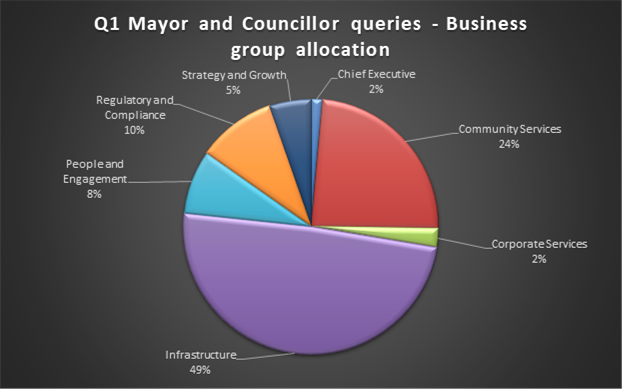

9.5 Quarter

4 Local Government Official Information Requests and Mayor and Councillors'

Requests

|

|

Staff Susan

Jamieson, General Manager: People & Engagement

Coral

Hair, Manager: Democracy Services

Key points

·

LGOIMA requests increased by about 100% during

this quarter.

In response to questions

·

Was a possible impact from the elections on

the LGOIMA requests for that quarter.

·

Had recently started publishing responses to

requests of public interest on the TCC website.

·

Any seasonal effect was not yet evident.

|

|

Committee Resolution FI0/20/8

Moved: Cr

Jako Abrie

Seconded: Cr

Andrew Hollis

That

the Finance, Audit and Risk Committee:

(a) Receives

the report Quarter 4 Local Government Official Information Requests and Mayor

and Councillors’ Requests.

Carried

|

10 Discussion

of Late Items

Nil

11 Public

Excluded Session

RESOLUTION

TO EXCLUDE THE PUBLIC

|

Committee

Resolution FI0/20/9

Moved: Mr

Bruce Robertson

Seconded: Cr

Dawn Kiddie

That

the public be excluded from the following parts of the proceedings of this

meeting.

The

general subject matter of each matter to be considered while the public is

excluded, the reason for passing this resolution in relation to each matter,

and the specific grounds under section 48 of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Ground(s) under section 48 for the

passing of this resolution

|

|

|

11.1 - Public Excluded Minutes of the

Finance, Audit and Risk Committee Meeting held on 12 May 2020

|

s7(2)(a) - the withholding of the information is

necessary to protect the privacy of natural persons, including that of

deceased natural persons

s7(2)(b)(ii) - the withholding of the information

is necessary to protect information where the making available of the

information would be likely unreasonably to prejudice the commercial

position of the person who supplied or who is the subject of the

information

s7(2)(g) - the withholding of the information is

necessary to maintain legal professional privilege

s7(2)(i) - the withholding of the information is

necessary to enable Council to carry on, without prejudice or disadvantage,

negotiations (including commercial and industrial negotiations)

|

s48(1)(a) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

|

11.2 - Litigation Report

|

s7(2)(a) - the withholding of the information is necessary

to protect the privacy of natural persons, including that of deceased

natural persons

s7(2)(g) - the withholding of the information is

necessary to maintain legal professional privilege

s7(2)(i) - the withholding of the information is

necessary to enable Council to carry on, without prejudice or disadvantage,

negotiations (including commercial and industrial negotiations)

|

s48(1)(a) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

|

11.3 - Corporate Risk Register -

Quarterly Update

|

s7(2)(b)(i) - the withholding of the information

is necessary to protect information where the making available of the

information would disclose a trade secret

s7(2)(b)(ii) - the withholding of the information

is necessary to protect information where the making available of the

information would be likely unreasonably to prejudice the commercial

position of the person who supplied or who is the subject of the

information

s7(2)(h) - the withholding of the information is

necessary to enable Council to carry out, without prejudice or

disadvantage, commercial activities

s7(2)(i) - the withholding of the information is

necessary to enable Council to carry on, without prejudice or disadvantage,

negotiations (including commercial and industrial negotiations)

|

s48(1)(a) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

|

11.4 - Quarterly Cyber Security Report

- Q4 2020

|

s7(2)(c)(i) - the withholding of the information

is necessary to protect information which is subject to an obligation of

confidence or which any person has been or could be compelled to provide

under the authority of any enactment, where the making available of the

information would be likely to prejudice the supply of similar information,

or information from the same source, and it is in the public interest that

such information should continue to be supplied

s7(2)(c)(ii) - the withholding of the information

is necessary to protect information which is subject to an obligation of

confidence or which any person has been or could be compelled to provide

under the authority of any enactment, where the making available of the

information would be likely otherwise to damage the public interest

|

s48(1)(a) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

|

11.5 - Update: Kerbside Waste

Collection, Waste Facilities and Litter Services

|

s7(2)(h) - the withholding of the information is

necessary to enable Council to carry out, without prejudice or

disadvantage, commercial activities

s7(2)(i) - the withholding of the information is

necessary to enable Council to carry on, without prejudice or disadvantage,

negotiations (including commercial and industrial negotiations)

|

s48(1)(a) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

|

|

|

|

Carried

|

At 3.42pm the meeting resumed in open

session.

The meeting had agreed during the public

excluded session that Agenda item 11.5 should be received in the open session.

|

11.5 Update:

Kerbside Waste Collection, Waste Facilities and Litter Services

|

|

Staff Sam

Fellows, Manager: Environmental Regulation

Key points

·

The maximum cost for the first year of the

kerbside recycling and waste collection service would be $230 per household.

This cost included the cost currently paid for the glass recycling service,

$10 per year for the government waste levy rise, and an optional $60 for

garden waste. All households

would be provided with a 140L rubbish bin, a 240L recycling bin and a 23L

food scrap bin to add to their existing 45L glass recycling crate.

·

The first year cost was increased to flatten

costs out across the longer term and to avoid a big jump in cost after the

first year.

In response to questions

·

Voting records for kerbside recycling and

waste collection decisions could go into the public domain when commercial

negotiations were concluded.

·

Noted that the cost was a flat rate which

would advantage some and disadvantage others compared to current cost.

·

The successful contractor had substantial

previous experience with kerbside collection, and would be working with TCC

to find the best solutions for multi-unit dwellings, apartments and houses

with difficult access.

·

A comprehensive project would be developed

around implementation and continued governance of the scheme.

|

|

Committee

Resolution FI0/20/10

Moved: Mr

Bruce Robertson

Seconded: Deputy

Mayor Tina Salisbury

That

the Finance, Audit and Risk Committee:

(a) Receives

the report – Update: kerbside waste collection, waste facilities and

litter services.

Carried

|

The

meeting closed at 3.55pm.

The

minutes of this meeting were confirmed at the Finance, Audit and Risk Committee

Meeting held on 10 December 2020.

...................................................

CHAIRPERSON

8 Business

8.1 Long

Term Plan 2020-30 Deliberations - Funding a Backlog of Development Contribution

(DC) Funded Projects

File

Number: A12030629

Author: Frazer

Smith, Manager: Strategic Finance & Growth

Authoriser: Paul

Davidson, General Manager: Corporate Services

Purpose of the Report

1. To

confirm the current principles in relation to funding the Development

Contribution Backlog.

2. To

establish the level of Development Contribution funded debt to be transferred

to ratepayer funded debt for the 2021/31 LTP.

|

Recommendations

That the Finance, Audit and Risk Committee:

(a) Receives

Report – Funding a Backlog of Development Contribution (DC) Funded

Projects

(b) Endorses

the current principles in relation to funding any backlog

(c) That

Council provides for the transfer of DC funded debt to rates funded debt to a

level of $3.98 Million a year for the next 10 years.

|

Executive Summary

3. While

Council has a policy of growth pays for growth, we have not been able to

collect the full costs of growth through development contributions.

Council’s financial DC reserves are less than they should be in order to

fully recover our capital costs.

4. Rather

than leave this as a problem for future ratepayers, Council (in 2011/12)

started making transfers from DC funded debt to rates funded debt.

5. The

transfers budgeted at this time have essentially been completed. Given

that there is still a considerable backlog, provision for further transfers is

recommended for inclusion in the 2020-30 LTP.

6. Rather

than leave this as a problem for future ratepayers making transfers from DC

funded debt to rates funded debt will remedy the problem. Spreading the

repayment over the LTP period recognises the intergenerational aspect (the

backlog has been built up over many years).

7. While

Council has made changes to its DC policy over the years to reduce the

likelihood of future backlogs (such as getting developers to directly construct

and fund key infrastructure), this process recognises that the current

legislation and funding tools do not permit full cost recovery to occur.

Background

8. TCC

has been collecting Development Contributions (DCs) (either as Development

Contributions (LGA) or as Financial Contributions (RMA)) since 1994.

While Council has a policy of growth pays for growth, in practical terms we

have not had sufficient knowledge of the future or the ability through the

legislation to fully recover our costs.

9. Over

time these charges have increased considerably. In many instances we have

found that the charges paid by developers in the past were too low, given the

greater information we have available now. More detail on this can be

seen in Attachment A.

10. The

result is that when the growth area is full, Council expect to have a shortfall

in the amount of DCs collected. This is referred to as the

‘backlog’. Legally TCC cannot charge current or future

developments more to recover this backlog.

11. Council

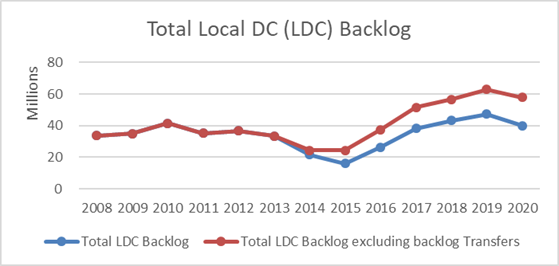

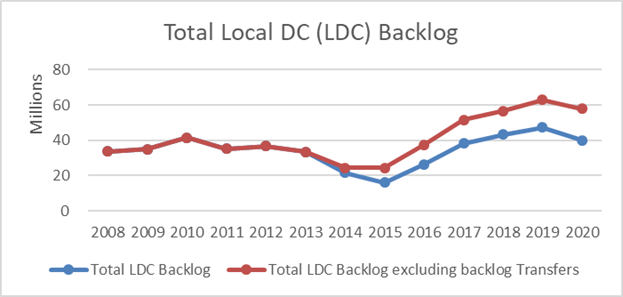

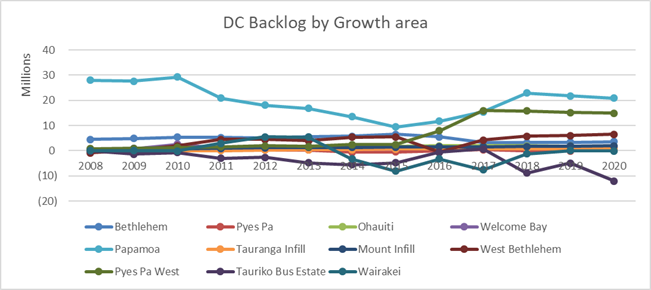

first quantified this backlog in 2008. Figure 1 shows the movement in

this backlog since then.

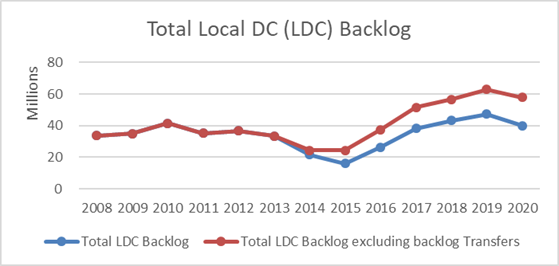

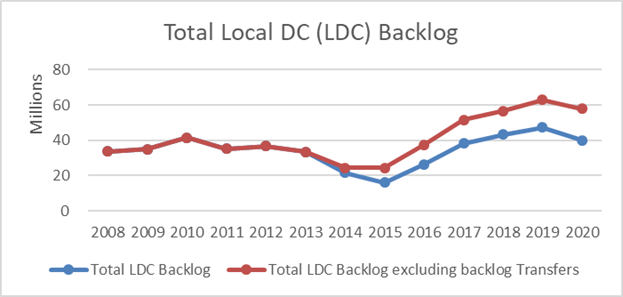

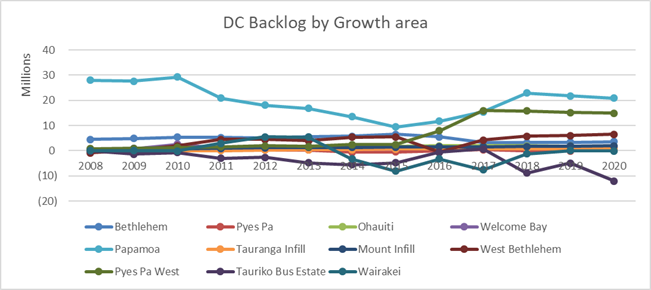

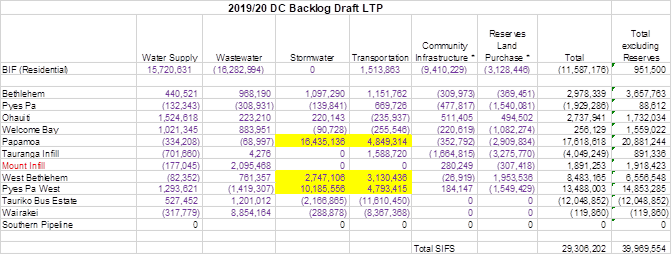

Figure 1: Graph of DC Backlog

12. This

backlog was reducing, predominantly due to a decision made by Council in 2011

to start funding this backlog by transferring some of the backlog growth debt

to rates funded debt. Since 2015 this has been offset by significant

project increases, predominantly in the Pyes Pa West growth area.

13. As

a proportion of total DC Revenue (adjusting for backlog transfers) TCC has

collected over 83% of the cost of DC funded projects.

14. It

is important to note that we cannot just look at the overall picture, but need

to examine each element in each growth area individually. This is because

gains in one area cannot be used to offset losses in another. The full

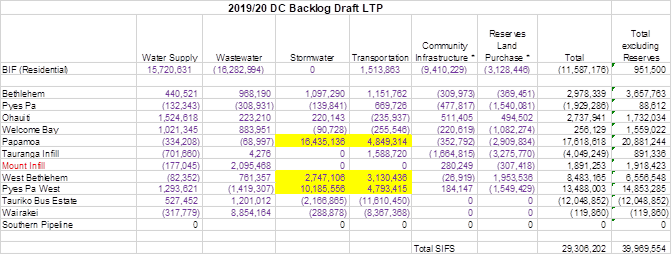

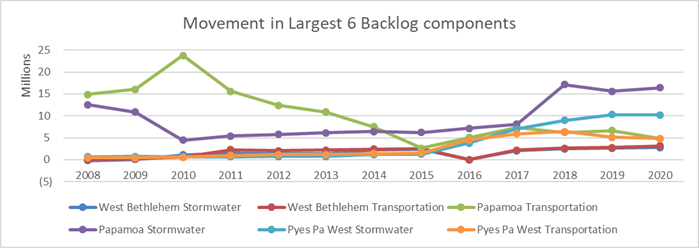

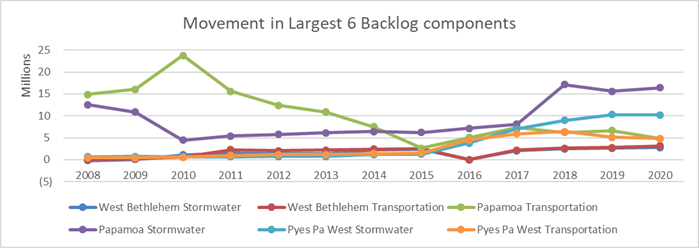

breakdown can be seen in Attachment A. The six key components (largest

and least likely to reverse) are shown on Table 1.

Table 1: Key Components of DC

Backlog

|

DC Component

|

2020 Backlog

|

|

West Bethlehem Stormwater

|

2,747,106

|

|

West Bethlehem Transportation

|

3,130,436

|

|

Papamoa Transportation

|

4,849,314

|

|

Papamoa Stormwater

|

16,435,136

|

|

Pyes Pa West Stormwater

|

10,185,556

|

|

Pyes Pa West Transportation

|

4,793,415

|

|

Total

|

42,140,962

|

|

Less 2020/21 Backlog Adjustment (already

budgeted)

|

(2,317,000)

|

|

Revised Total

|

39,823,962

|

15. These

key components represent over 100% of the total backlog ($40.0 Million).

This is because some of the growth areas are in credit and offset the smaller

balances.

16. In

2011/12 Council reviewed this backlog and determined that about $23 Million of

it (at least) was very likely to be permanent and outlined a process of

transferring this DC funded debt to rate funded debt.

17. Despite

the transfers that had occurred, this backlog has increased to $40.0 Million by

30 June 2020.

18. Up

until 30 June 2021 (including 2021 budgeted transfer) a total of $18.0 Million will

have been transferred from DC funded debt to rates funded debt in relation to

the backlog.

19. These

transfers were made on the basis of the following principles:

(a) There

is certainty that the shortfall is permanent

(b) The

amount of the shortfall is known and certain

(c) The

projects that the shortfall relates to have been completed

(d) The

amount that is transferred is treated as any other rate funded project would be

for debt retirement purposes i.e. debt would be retired as per Council’s

Debt Retirement Funding Policy which is part of its Revenue and Financing

Policy

(e) Elected

members have approved the transfer

20. The

remaining budgeted transfers from DC funded debt to rates funded debt ($18.5

million) will be insufficient to clear the backlog.

Strategic / Statutory Context

21. There

are no statutory implications.

Options Analysis

22. On

the basis that the principles adopted by Council (see above) remain valid,

doing nothing about the backlog balances (and leaving a problem for future ratepayers)

is not an option. The options below, therefore, relate to the timing of

transfers.

Option 1:

Transfer specific reserve balances from DC funded debt to rates funded debt in

2020/21

23. For

identified reserves (where there is a high backlog and no expectation of

recovering this), transfer the reserve balance from DC funded debt to ratepayer

funded debt.

|

Advantages

|

Disadvantages

|

|

· Matches current

principles

· Transparent

write-off

· Targets large

balances

· Resolves issue

quickly

|

· Would be a significant

financial impact in 2020/21 year.

|

|

|

|

|

Budget – Capital Expenditure

|

No change in capital expenditure or total debt, but there

would be an increase of approximately $39.8 M on rates funded debt (based on

Table 1 above).

|

|

Budget – Operating Expenditure

|

There would be an increase of rates funded interest of

approximately $1.4 M in the 2021/22 year (being interest at 3.5% on the debt

impact above). This represents a 0.7% increase in rates.

|

|

Key risks

|

|

|

Recommended?

|

No

|

|

|

|

Option 2: Transfer specific reserve

balances from DC funded debt to rates funded debt over a fixed period (3, 5 or

10 years)

24. For

identified reserves (where there is a high backlog and no expectation of

recovering this), transfer the reserve balance from DC funded debt to ratepayer

funded debt over a set period of years.

|

Advantages

|

Disadvantages

|

|

· Matches current

principles

· Transparent

write-off

· Targets large

balances

· Spreads the

impact more evenly

|

· .

|

|

|

|

|

Budget – Capital Expenditure

|

No change in capital expenditure or total debt, but there

would be an increase of approximately $13.3 M (3yrs), $8.0 M (5yrs) or $4.0 M

(10yrs) on rates funded debt (based on Table 1 above).

|

|

Budget – Operating Expenditure

|

There would be an increase of rates funded interest of

approximately $0.46 M (3yrs), $0.28M (5yrs) or $0.14 M (10yrs) in the 2021/22

year (being interest at 3.5% on the debt impact above). This represents

a 0.2% (3yrs), 0.1% (5yrs) or 0.1% (10yrs) increase in rates.

|

|

Key risks

|

|

|

Recommended?

|

The option to write this balance off over 10 years is

recommended. While the options to write this balance off over a shorter

period reduce the risk, the longer period option better reflects

intergenerational equity.

|

|

|

|

Option 3:

Transfer specific reserve balances from DC funded debt to rates funded debt in

line with future capital (option adopted before 2017)

25. For

identified reserves (where there is a high backlog and no expectation of

recovering this), transfer the reserve balance from DC funded debt to ratepayer

funded debt in proportion to the remaining capital expenditure remaining in

that growth area.

|

Advantages

|

Disadvantages

|

|

· Matches current

principles

· Transparent

write-off

· Targets large

balances

· Spreads the

impact more evenly

· Basis previously

used by Council (before 2017 decision)

|

· More difficult

to calculate.

· Most of the

remaining expenditure in these growth areas occurs over the next three years,

meaning significant impacts in these years.

|

|

|

|

|

Budget – Capital Expenditure

|

No change in capital expenditure or total debt, but there

would be an increase of approximately $15.4 M on rates funded debt in

2021/22. This is because almost 40% of the remaining Capital

Expenditure is expected in the 2021/22 year.

|

|

Budget Operating Expenditure

|

There would be an increase of rates funded interest of

approximately $0.54 M in the 2021/22 year (being interest at 3.5% on the debt

impact above). This represents a 0.3% increase in rates.

|

|

Key risks

|

|

|

Recommended?

|

No. While this was previously the preferred option,

the short timeline for the remaining capital expenditure in the growth areas

creates too large an impact.

|

|

|

|

Recommended

Option

26. Council

staff recommend that the previously adopted principles are retained.

27. In

terms of timing, it is recommended that the transfers are spread out over the

next 10 years (see option 2 above). This is consistent with the previous

approach. As this backlog has been built up over a long time (since 1994)

a longer period of adjustment is recommended.

Financial Considerations

28. The

financial implications of this approach are detailed in Table 2 below.

These changes will not have a material impact on the LTP.

Table 2: Funding of DC Backlog:

Proposed compared to current budgets

|

Financial Year

|

Impact on rates funded debt

|

Impact on rates (cumulative)

|

|

2021/22

|

3,983,000

|

139,405

|

|

2022/23

|

3,983,000

|

278,810

|

|

2023/24

|

3,983,000

|

418,215

|

|

2024/25

|

3,983,000

|

557,620

|

|

2025/26

|

3,982,000

|

696,990

|

|

2026/27

|

3,982,000

|

836,360

|

|

2027/28

|

3,982,000

|

975,730

|

|

2028/29

|

3,982,000

|

1,115,100

|

|

2029/30

|

3,982,000

|

1,254,470

|

|

2030/31

|

3,982,000

|

1,393,840

|

|

Total

|

39,824,000

|

|

Legal Implications / Risks

29. There

are no legal implications in relation to this decision.

30. The

backlog principally relates to Stormwater and Transportation projects.

The water reforms will have a significant impact only if Stormwater is

transferred out of Council control along with Water Supply and

Wastewater. We would mitigate this by applying the backlog transfer to

Transportation reserve balances in 2021/22 and reviewing future backlog

transfers in future years if Stormwater activities are transferred out of

Council control.

Consultation / Engagement

31. Due

to the size of the impact on rates no further consultation is planned.

Significance

32. Under

the Significance and Engagement Policy, this matter is of low significance as

it involves a rates impact of only $139,405 on the 2021/22 financial year.

Click here to view the TCC

Significance and Engagement Policy

Next Steps

33. Council

staff will complete these transfers based on Elected Members decisions.

Attachments

Attachment A: Background Paper on Development

Contributions Backlog - ID: A8734161

ATTACHMENT A

BACKGROUND PAPER ON development contributions

(DCs) BACkLOG

1. What is the DC backlog and how is it calculated?

The DC charge is

calculated each year based on the best (latest) information available.

Over time this tends to become more accurate, as more of the DC’s are

received and capital projects become actual figures.

In many

instances project costs were higher than originally budgeted. This means that

over time DC charges have increased. The Local Government Act does not

allow Council to recoup this shortfall from future developers.

The difference

between the lower DC that was charged in the past and what the DC charge is

today reflects the amount by which the reserve is likely to end up in a deficit

when the growth area is full.

Therefore the

backlog is the difference between what the actual balances of each reserve is

compared to the amount it should be. This backlog could be either:

· Permanent (eg cost of construction is much higher than estimated),

or

· Temporary (eg a delay in the timing of growth that is expected to

reverse)

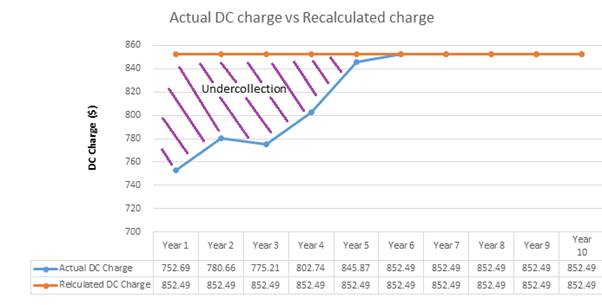

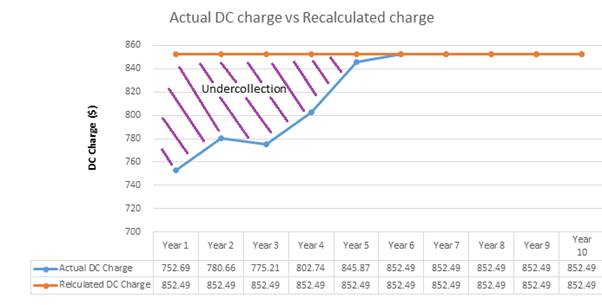

A worked example

of this is included in Table 1 below.

|

Finance, Audit and Risk Committee Meeting Agenda

|

10 December 2020

|

Table

1: Worked Example: Calculating the Development Contribution (DC) backlog

|

Actual project costs and

new dwellings

|

Estimated project costs

and new dwellings

|

|

|

Interest

Rate

|

6.00%

|

6.00%

|

5.80%

|

5.80%

|

6.00%

|

6.00%

|

6.25%

|

6.25%

|

6.25%

|

6.25%

|

6.25%

|

|

|

|

|

|

Current

AP Year

|

|

|

|

|

|

Year

1

|

Year

2

|

Year

3

|

Year

4

|

Year

5

|

Year

6

|

Year

7

|

Year

8

|

Year

9

|

Year

10

|

Total

|

|

Opening

Balance

|

0

|

5,910

|

12,478

|

18,110

|

28,640

|

25,428

|

18,932

|

22,397

|

10,610

|

2,482

|

0

|

|

Revenue

|

(4,262)

|

(5,967)

|

(10,230)

|

(12,787)

|

(12,787)

|

(12,787)

|

(12,787)

|

(12,787)

|

(8,525)

|

(2,557)

|

(95,479)

|

|

Plus

Interest

|

172

|

536

|

862

|

1,318

|

1,575

|

1,292

|

1,252

|

1,000

|

397

|

75

|

8,479

|

|

Less

Capital Expenditure

|

10,000

|

12,000

|

15,000

|

22,000

|

8,000

|

5,000

|

15,000

|

0

|

0

|

0

|

87,000

|

|

Closing

Balance

|

5,910

|

12,478

|

18,110

|

28,640

|

25,428 (A)

|

18,932

|

22,397

|

10,610

|

2,482

|

0

|

0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unit

Rate

|

852.49

|

852.49

|

852.49

|

852.49

|

852.49

|

852.49

|

852.49

|

852.49

|

852.49

|

852.49

|

|

|

Number

of new sections

|

5

|

7

|

12

|

15

|

15

|

15

|

15

|

15

|

10

|

3

|

112

|

|

Revenue

|

4,262

|

5,967

|

10,230

|

12,787

|

12,787

|

12,787

|

12,787

|

12,787

|

8,525

|

2,557

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Historical

Charge (Actual)

|

752.69

|

780.66

|

775.21

|

802.74

|