|

|

|

AGENDA

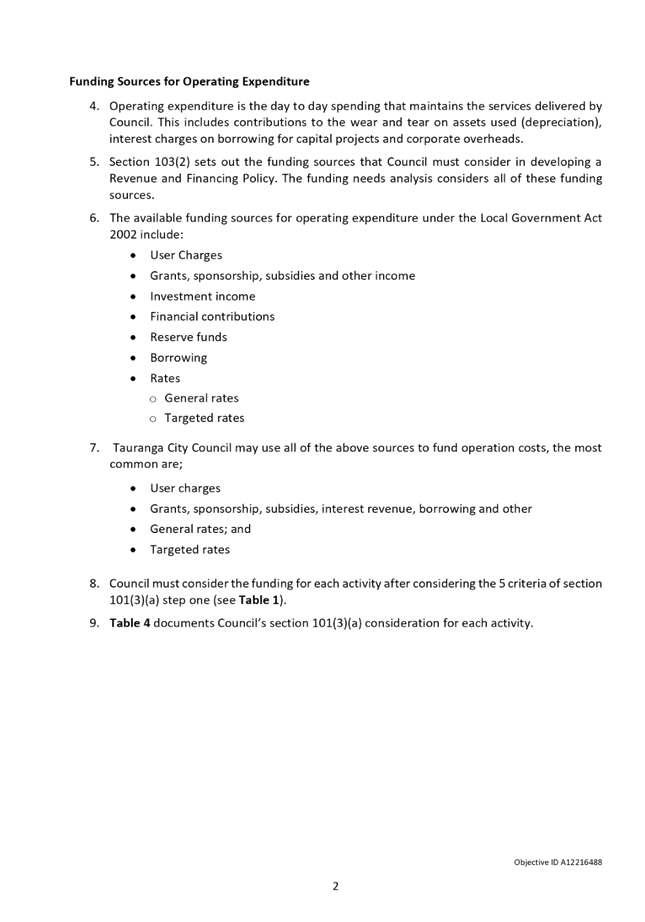

Ordinary Council Meeting

Monday, 8 March 2021

|

|

I hereby give notice that an Ordinary Meeting of

Council will be held on:

|

|

Date:

|

Monday, 8 March 2021

|

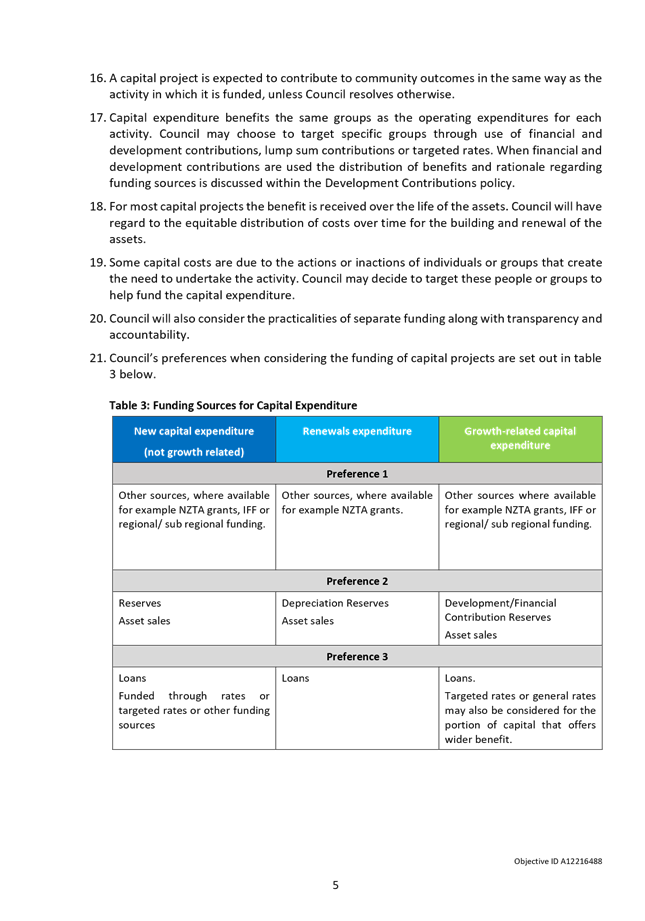

|

Time:

|

9am

|

|

Location:

|

Tauranga City Council

Council Chambers

91 Willow Street

Tauranga

|

|

Please

note that this meeting will be livestreamed and the recording will be

publicly available on Tauranga City Council's website: www.tauranga.govt.nz.

|

|

Marty Grenfell

Chief Executive

|

Membership

|

Chairperson

|

Commission Chair Anne Tolley

|

|

Members

|

|

|

Quorum

|

Half of the members physically present, where the

number of members (including vacancies) is even; and a majority

of the members physically present, where the number of members (including

vacancies) is odd.

|

|

Meeting

frequency

|

As required

|

Role

·

To ensure the effective and

efficient governance of the City

·

To enable leadership of the City

including advocacy and facilitation on behalf of the community.

Scope

·

Oversee the work of all

committees and subcommittees.

·

Exercise all non-delegable and

non-delegated functions and powers of the Council.

·

The powers Council is legally prohibited from delegating include:

o Power to make a

rate.

o Power to make a

bylaw.

o Power to borrow

money, or purchase or dispose of assets, other than in accordance with the

long-term plan.

o Power to adopt

a long-term plan, annual plan, or annual report

o Power to

appoint a chief executive.

o Power to adopt

policies required to be adopted and consulted on under the Local Government Act

2002 in association with the long-term plan or developed for the purpose of the

local governance statement.

o All final

decisions required to be made by resolution of the territorial

authority/Council pursuant to relevant legislation (for example: the approval

of the City Plan or City Plan changes as per section 34A Resource Management

Act 1991).

·

Council has chosen not to delegate the following:

o Power to

compulsorily acquire land under the Public Works Act 1981.

·

Make those decisions which are required by legislation to be made

by resolution of the local authority.

·

Authorise all expenditure not delegated to officers, Committees

or other subordinate decision-making bodies of Council.

·

Make appointments of members to the CCO Boards of

Directors/Trustees and representatives of Council to external organisations.

·

Consider any matters referred from any of the Standing or Special

Committees, Joint Committees, Chief Executive or General Managers.

Procedural matters

·

Delegation of Council powers to Council’s committees and

other subordinate decision-making bodies.

·

Adoption of Standing Orders.

·

Receipt of Joint Committee minutes.

·

Approval of Special Orders.

·

Employment of Chief Executive.

·

Other Delegations of Council’s powers, duties and

responsibilities.

Regulatory matters

Administration,

monitoring and enforcement of all regulatory matters that have not otherwise

been delegated or that are referred to Council for determination (by a

committee, subordinate decision-making body, Chief Executive or relevant

General Manager).

6 Confirmation

of Minutes

6.1 Minutes

of the Council Meeting held on 22 February 2021

File

Number: A12264380

Author: Jenny

Teeuwen, Committee Advisor

Authoriser: Robyn

Garrett, Team Leader: Committee Support

|

Recommendations

That the Minutes of the Council Meeting held on 22 February

2021 be confirmed as a true and correct record.

|

Attachments

1. Minutes

of the Council Meeting held on 22 February 2021

|

Ordinary

Council Meeting Minutes Ordinary

Council Meeting Minutes

|

22 February

2021

|

|

|

|

MINUTES

Ordinary Council Meeting

Monday, 22 February 2021

|

Order Of Business

1 Apologies. 3

2 Public

Forum.. 3

3 Acceptance

of Late Items. 3

4 Confidential

Business to be Transferred into the Open. 3

5 Change to

the Order of Business. 3

6 Confirmation

of Minutes. 4

Nil

7 Declaration

of Conflicts of Interest 4

8 Deputations,

Presentations, Petitions. 4

Nil

9 Recommendations

from Other Committees. 4

Nil

10 Business. 4

10.1 Governance

Structure, Joint Committee appointments and Standing Orders. 4

10.2 Executive

Report 7

10.3 2021-2031

Long-term Plan Timeline. 10

10.4 Adoption

of the Tangata Whenua Remuneration Policy 2021. 11

10.5 Traffic

and Parking Bylaw 2012 Amendments. 11

10.6 Water

Services Bill - Draft Submission. 11

11 Discussion of Late Items. 12

12 Public Excluded Session. 12

Nil

MINUTES OF Tauranga

City Council

Ordinary Council

Meeting

HELD AT THE Tauranga

City Council, Council Chambers, 91 Willow Street, Tauranga

ON Monday, 22 February 2021 AT 9am

PRESENT: Commission

Chair Anne Tolley, Commissioner Shadrach Rolleston, Commissioner Stephen

Selwood and Commissioner Bill Wasley

IN

ATTENDANCE: Marty Grenfell (Chief Executive), Paul Davidson (General

Manager: Corporate Services), Barbara Dempsey (General Manager: Regulatory

& Compliance), Susan Jamieson (General Manager: People & Engagement),

Nic Johansson (General Manager: Infrastructure), Christine Jones (General

Manager: Strategy & Growth), Gareth Wallis (General Manager: Community

Services), Carlo Ellis (Manager: Strategic Maori Engagement), Nick

Swallow (Manager: Legal & Commercial), Brendan Bisley (Director of

Transport), Paul Dunphy (Director of Spaces and Places), Jeremy Boase (Manager:

Strategy & Corporate Planning), Ariell King (Team Leader: Policy), Coral

Hair (Manager: Democracy Services), Scott MacLeod (Group Communication

Advisor), Robyn Garrett (Team Leader: Committee Support), Raj Naidu (Committee

Advisor), and Jenny Teeuwen (Committee Advisor)

Carlo Ellis, Manager: Strategic Maori Engagement, opened the meeting with a

Karakia.

The Commission Chair,

Anne Tolley, acknowledged the 10-year anniversary of the Christchurch earthquake

and asked that the meeting observe a moment of silence.

Anne Tolley, Commission Chair, introduced herself to the

meeting, followed by Commissioners Stephen Selwood, Shadrach Rolleston and Bill

Wasley.

1 Apologies

Nil

2 Public

Forum

Nil

3 Acceptance

of Late Items

Nil

4 Confidential

Business to be Transferred into the Open

Nil

5 Change

to the Order of Business

Nil

6 Confirmation

of Minutes

Nil

7 Declaration

of Conflicts of Interest

Nil

8 Deputations,

Presentations, Petitions

Nil

9 Recommendations

from Other Committees

Nil

10 Business

|

10.1 Governance

Structure, Joint Committee appointments and Standing Orders

|

|

Staff Coral

Hair, Manager: Democracy Services

The report was taken as read.

Key Points

·

Two further amendments to Standing Orders had been requested:

-

Time limits for members speaking to motions, rights of reply

and discussing motions be revoked (Standing Order 21.2). As the

Commission was only four people, the more formal approach did not

apply. The Commission wanted to have as much open discussion as

possible.

-

Amend the public forum speaking time to up to 5 minutes in

total per person or group (Standing Order 15.1 and 16.1) to enable more

people to be able to speak at a meeting. This could be reviewed again

if the timing did not work.

In response to questions

·

Proposed commissioner appointments for the City Plan Hearings

Committee were expected to be reported back to the council for consideration

and approval in May 2021.

|

|

Resolution CO1/21/1

Moved: Commissioner

Stephen Selwood

Seconded: Commissioner

Shadrach Rolleston

That the Council:

(a) Receives

the report “Governance Structure, Joint Committee appointments and

Standing Orders”.

(b) Discharges the following

Standing Committees:

· Finance,

Audit and Risk Committee

· Policy

Committee

· Projects,

Services and Operations Committee

· Urban

Form and Transport Development Committee

· Regulatory

Committee

· Chief

Executive’s Performance Committee

(c) Confirms

the following Standing and Special Committees continue with the same Terms of

Reference but with a change in membership as follows:

|

Committee

|

Membership (Tauranga City Council)

|

|

Tangata Whenua/Tauranga City Council Committee

|

The Tauranga City Council elected members are discharged,

and the following persons are appointed in their stead:

-

Commission Chair Anne Tolley

-

Commissioner Shadrach Rolleston

-

Commissioner Stephen Selwood

-

Commissioner Bill Wasley

The following existing members are confirmed:

-

Independent Chairperson Huikakahu Kawe

-

Ms Matire Duncan

-

Mr Puhirake Ihaka

-

Mr Whitiora McLeod

-

Mr Buddy Mikaere

-

Mrs Irene Walker

Mr Hayden Henry is

discharged and replaced with Mr Nathan James

|

|

City Plan Hearings Committee

|

The Tauranga City Council elected members are discharged.

Commissioner Bill Wasley is appointed as Chairperson.

The other members (yet to be appointed) will be external

independent hearing commissioners accredited under the Resource Management

Act 1991.

|

|

Wastewater Management Review Committee

|

The Tauranga City Council elected members

are discharged, and the following persons are appointed in their stead:

-

Commissioner Stephen Selwood

-

Commissioner Bill Wasley

The following existing members are confirmed:

-

Ms Matire Duncan – Nga Potiki (Deputy Chairperson)

-

Mr Whitiora McLeod - Ngai Te Rangi

-

Mr Carlton Bidois - Ngati Ranginui

-

Vacant – Nga Potiki (TBC)

|

(d) Confirms

the District Licensing Committee continues without any changes to its Terms

of Reference or membership.

(e) Confirms

the following Joint Committees continue with the same Terms of Reference but

with a change in the appointment of the Tauranga City Council representatives

as set out below:

The

Tauranga City Council elected members who were appointed to these Joint

Committees are discharged and the following persons appointed in their stead:

|

Committee

|

Membership (Tauranga City Council)

|

|

Smartgrowth Leadership Group

|

Commission Chair Anne Tolley

Commissioner Stephen Selwood

Commissioner Bill Wasley

Alternate: Commissioner Shadrach Rolleston

|

|

Bay of Plenty Civil Defence Emergency Management Group

|

Commission Chair Anne Tolley

Alternate: Commissioner Bill Wasley

|

|

Te Maru o Kaituna (Kaituna River Authority)

|

Commissioner Shadrach Rolleston

Alternate: Commissioner Bill Wasley

|

|

Regional Transport Committee

|

Commission Chair Anne Tolley

Alternate: Commissioner Stephen Selwood

|

|

Public Transport Committee (Bay of Plenty Regional Council

Committee)

|

Commissioner Stephen Selwood

Commissioner Bill Wasley

|

(f) Appoints

the following persons as the Tauranga City Council representatives/members to

these advisory groups, external organisations and internal working groups in

the stead of the Tauranga City Council elected members who are discharged

from these groups/organisations:

|

Group/organisation

|

Membership on behalf of Tauranga City

Council

|

|

Tauranga Moana Advisory Group

|

Commissioner Shadrach Rolleston

Commissioner Bill Wasley

|

|

Waiāri Kaitiaki Advisory Group

|

Commissioner Shadrach Rolleston

Commissioner Bill Wasley

|

|

Ngā Poutiriao ō Mauao

|

Commissioner Shadrach Rolleston

Commissioner Bill Wasley

|

|

Mount Air Quality Working Party

|

Commissioner Shadrach Rolleston

Commissioner Bill Wasley

Existing TCC appointee, Ms Emily Gudsell, is reconfirmed.

|

|

Dive Crescent Governance Group

|

To be decided

|

|

Omanawa Project Governance Group Meeting

|

To be decided

|

|

Event Funding Panel

|

To be decided

|

|

Community Development Match Fund Panel

|

To be decided

|

|

Creative Communities Tauranga Funding Panel

|

To be decided

|

|

Tauranga Western Bay Safer Communities

|

To be decided

|

(g) In

respect of the advisory groups, external organisations and internal working

groups where Tauranga City Council representatives are yet to be decided,

delegates to the Chief Executive and/or his sub-delegate(s) the authority to

attend meetings of these groups/organisations on behalf of Tauranga City

Council, until those appointments are decided and confirmed.

(h) Confirms

and adopts the Terms of Reference and delegations for the above Committees and

Governance Groups as set out in Attachment 1.

(i) Confirms

the next meeting of the Council (Commission) will be held on Monday, 8 March

2021 commencing at 9:00 am in the Council Chamber, 91 Willow Street,

Tauranga.

(j) Adopts

the current Standing Orders in Attachment 2 with the following changes:

(i) Casting

vote provision is retained (Standing Order 19.3 and Appendix 8: Powers of a

Chairperson).

(ii) Option

C for motions and amendments (Standing Order 22.4) and

Appendix 5.

(iii) Remove

references to Code of Conduct.

(iv) Amend

the public forum time set aside at the beginning of each meeting to state

this is at the discretion of the Chairperson; and amend the time speakers on

behalf of an organisation or topic can speak to up to 5 minutes in total,

unless the Chairperson (at their discretion) otherwise agrees (Standing Order

15.1 and 16.1).

(v) For the term of the

Commission, where the Standing Orders refer to the Mayor, this will be taken

to refer to the Commission Chair, and where it refers to the elected members,

this will be taken to refer to the Commissioners.

(vi) Time limits for members speaking

to motions, rights of reply and discussing motions be revoked (Standing Order

21.2).

Carried

|

|

10.2 Executive

Report

|

|

Staff Paul

Davidson, General Manager: Corporate Services

Barbara Dempsey, General Manager:

Regulatory & Compliance

Susan Jamieson, General Manager:

People & Engagement

Nic Johansson, General Manager:

Infrastructure

Christine Jones, General Manager:

Strategy & Growth

Gareth Wallis, General Manager:

Community Services

Key

points

·

Growth and Strategy

Highlighted

work currently underway on changes to the Tauranga City Plan; in particular

Plan Change 26 – Housing Choice, and Plan Change 27 – Flooding

from intense rainfall.

·

Infrastructure

Highlighted

the Waters Reform and the Water Services Bill. Tauranga City

Council’s (TCC) draft submission to the Bill would be considered later

in the meeting.

·

Community Services

-

The uncertainty of COVID-19 was still providing some challenges

for Baycourt but one of the unintended upsides was that more local product

was touring the country.

-

The Cricket Women’s World Cup had also been affected by

COVID-19 and would now take place in 2022. Although Tauranga had lost

hosting a semi-final, it had picked up an extra match and was now hosting the

first match of the whole tournament with an estimated viewing audience of 1.2

billion.

-

Positive feedback had been received for the Trail Rider

project. The trail rider was a wheeled apparatus manned by four people

which enabled a person with accessibility issues to get to the top of

Mauao. The trail rider was available to be booked from the Mount

Holiday Park and was proving to be incredibly popular.

-

The replacement mobile library bus was about a month away.

-

The Wharf Street streetscape project was fundamentally

complete, with a few cultural elements still to do. The project would

come in under budget.

·

People and Engagement

-

TCC had been one of four councils selected last year to be

audited by the Ombudsman. The audit report was received in

February. Good feedback had been received with no formal

recommendations made, but a number of suggestions to improve TCC’s

transparency with the community. Many of the opportunities for

improvement were well underway.

-

During rates month, members of the customer services team were

stationed at the libraries to provide a mobile rates payments service and to

take enquiries.

·

Regulatory and Compliance

-

The Building and Environmental Planning teams had increasing

workloads and it was a challenge to recruit suitably qualified people.

-

The downwards trend in acts of aggression by dogs was noted and

the work of the Animal Services team in this area acknowledged.

-

COVID-19 had set the programme of inspections of food premises

back. The Environmental Health and Licencing team was aiming to have

caught up by the end of the financial year.

·

Corporate Services

-

It was noted that the Finance and Legal and Risk services of

this group were reported separately.

-

External reporting had been carried out on TCC’s digital

security last year and a programme was currently being developed to lift

TCC’s security maturity for the future.

-

The airport was going very well at the moment despite all the

implications of COVID-19. The Tauranga airport was one of the few that

were close to 100% of schedule and load factors were strong at present.

-

The Mount Holiday Park was also enjoying the impact of local

tourism and had produced its best result ever.

-

The Marine Precinct continued to grow and the lifts were now

gaining a lot of profile.

In

response to questions

·

Strategy and Growth

-

City Plan changes

o Hearings

for submissions to the City Plan changes would be in this calendar year.

A report was expected to be presented back to council in around May 2021 on

the nature of submissions and a proposed timeline for hearings.

o Some

submissions had stated that City Plan 26 did not go far enough, predominately

related to height in the Te Papa Peninsula. Some submitters were not

aware of existing sightlines (cultural view shafts) to Mauao. The

geographical land form, view shafts and transport corridors would need to be

fully considered and understood before a decision could be made on whether

there was room for further density than what was proposed in the initial plan

change.

o Frequent

newsletters were being sent out to people who had registered an interest in

the plan changes or had engaged with TCC in any way. Following

submissions being publicly notified for further submissions, the next stage

of the community engagement plan would be developed for each of the streams,

which included clearly identifying what was and was not in scope. Those

whose submissions fell outside of scope would be given alternative avenues

for their concerns to be raised.

o Plan

Change 27 in particular had been of concern to the public, and this had been

exacerbated by the distribution of inaccurate information by other

parties. Drop-in information sessions and one to one meetings with

staff had been able to address and respond to a lot of concerns. Staff

were currently working on how to best communicate with those who had not

taken up the opportunity to meet with staff and still had concerns.

·

Infrastructure

-

The findings of the three waters multi-regional initiative was

expected to be presented to council within the next two months with a

proposal for how the future may look.

-

Engagement with affected stakeholders for the No.1 Road

pipeline project had happened since the beginning of the project around 18

months ago. The disruption to residents and stakeholders was being

mitigated by regular information updates on how the project was progressing,

timelines and next steps.

-

The Totara St cycleway project was a temporary solution which

was not ideal long-term but provided a safer cycling facility in the

meantime. There was a parallel initiative as part of the Transport

System Plan (TSP) business case looking at the whole Hull, Hewletts and

Totara roads area.

-

Cameron Road:

o The

final design for Cameron Rd would be presented to council for approval around

late March.

o Any

review or changes to the project scope could compromise the deadlines in

place with the funding partner. There were some significant constraints

in the corridor and there would be compromises. The compromises, along

with the pros and cons, would form part of the final design report. The

Cameron Road project scope limitations would be circulated to the

commissioners.

o Information

on tangata whenua involvement in the urban design for Cameron Rd would also

be provided to the commissioners.

o The

communication component around the bigger picture (outcome) for this project

was difficult. The City Vision, the 2021-2031 Long-term Plan (LTP) and

the TSP would help to provide a better understanding to the community of what

the city could look like. It was noted that some

projects happened in the absence of understanding and acceptance of mode

shift, but once the project was completed, the community tended to embrace

the project outcome e.g. the Maunganui Road project.

·

Community Services

-

Commissioners would be informed of applicants being recommended

for the Art Gallery Trust, along with the reasons for the recommendations for

those appointments.

-

The Elizabeth St streetscape project and funding had been

approved by council. Regular operational updates on how the project was

progressing would be provided to the commissioners. The project was

going well as this point.

-

The next steps planned for the Kulim Park upgrade would be

provided to the commissioners.

·

People and Engagement

-

The Communications and Engagement Team acted as an advisory

function for the organisation to help teams and projects set their

communications and engagement plans, and provided advice on how they might

reach their stakeholders and what mechanisms and channels could be

used. Ultimately, the ownership of communication and engagement plans

sat with the project owner or the business unit owner.

·

Regulatory and Compliance

-

There were currently four vacancies in the Environmental

Planning team and 12 vacancies in the Building team. Filling these

particular types of roles was not just a TCC issue but a broader issue across

the country.

-

The Building function was around 80% self-funded. The

component of the activity that was not 100% funded was general enquiries, enforcement

and following up with people.

·

Corporate Services

-

The first phase of the Procurement Policy review was a tidy up

of the policy and looked at limits and bringing in local and sustainability

practices. The second phase was a much bigger piece of work which would

be more strategic. Phase two work would begin later this year.

-

There was currently a good depth of response to tenders going

to market but the sector was heating up and it was becoming more

difficult. The long-term procurement plan would help TCC become an

attractive partner for the design and delivery sector.

-

There had been a change to the late February timeframe for

presenting the SmartGrowth report on regional funding options to the Chief

Executives of the SmartGrowth partnership. The new timeframe had yet to

be confirmed.

|

|

Resolution CO1/21/2

Moved: Commissioner Bill

Wasley

Seconded: Commissioner

Stephen Selwood

That the Council receives the Executive Report.

Carried

|

|

Staff

Action

The following information to be circulated to Commissioners:

·

Cameron Road project scope limitations.

·

Information

on tangata whenua involvement in the urban design for Cameron Rd.

·

The

next steps for the Kulim Park upgrade.

|

|

10.3 2021-2031

Long-term Plan Timeline

|

|

Staff Christine

Jones, General Manager Strategy and Growth

Key

points

·

The 30 June 2021 timeframe for adoption of the 2021-2031

Long-term Plan (LTP) was not achievable and it was recommended to move the

timeline to the end of July 2021.

·

It was noted that timelines would still be very tight, even

with the deadline extended beyond the statutory deadline.

·

The Local Government Act 2002 provided the ability for

amendments to the LTP at any point in time, subject to public consultation.

·

If the LTP timeline was extended beyond the statutory deadline,

it was suggested that the Commission write to formally advise the Minister

for Local Government to ensure transparency of the decision and clear

communication of the extension.

In

response to questions

·

A LTP amendment process could begin at any point in time after

the LTP had been adopted. Changes could be either discrete or

substantive across the entire plan. A new plan would be produced but

the focus for community consultation would be on what was being

amended.

|

|

Resolution CO1/21/3

Moved: Commission Chair

Anne Tolley

Seconded: Commissioner

Bill Wasley

That the Council:

(a)

Receives the 2021-2031 Long-term Plan Timeline report.

(b)

Endorses option two to extend the timeframe to allow for late

adoption of the 2021-2031 Long-term Plan in the

week beginning 26 July 2021.

(c)

Writes to inform the Minister of Local Government of the

decision to extend the 2021-2031 Long-term Plan timeframe.

Carried

|

|

10.4 Adoption

of the Tangata Whenua Remuneration Policy 2021

|

|

Staff Ariell

King, Team Leader: Policy

Carlo Ellis, Manager:

Strategic Maori Engagement

The report

was taken as read.

In

response to questions

·

Although the current policy had been adopted in 2009, the

current meeting fees pre-dated this.

·

Te Rangapū was broadly supportive of the policy and

appreciated that it had been independently evaluated, but looked for more

regular reviews in the future.

·

The review had been carried out by Strategic Pay and the State

Services Commission cabinet fees framework had been used to set the

rate. The rate set was similar to Western Bay of Plenty District

Council’s rate.

|

|

Resolution CO1/21/4

Moved: Commissioner

Shadrach Rolleston

Seconded: Commissioner

Bill Wasley

That

the Council:

(a)

Receives the Adoption of the Tangata Whenua

Remuneration Policy 2021 report.

(b)

Adopts the Tangata Whenua Remuneration Policy

2021.

(c) Rescinds

those parts of the External Representatives’ Remuneration Policy

relating to tangata whenua remuneration and the Tangata Whenua Collective.

(d) Delegates

authority to staff to make minor editorial changes to the Tangata Whenua

Remuneration Policy 2021 for the purposes of correction or clarification.

Carried

|

|

10.5 Traffic

and Parking Bylaw 2012 Amendments

|

|

Staff Nic

Johansson, General Manager: Infrastructure

Brendan Bisley, Director of

Transport

The report

was taken as read.

|

|

Resolution CO1/21/5

Moved: Commissioner

Stephen Selwood

Seconded: Commissioner

Shadrach Rolleston

That the Commission:

(a) Receives the Traffic

and Parking Bylaw 2012 Amendments Report.

(b) Adopts the proposed amendments to the Traffic and Parking Bylaw 2012

Attachment as per Appendix B, effective from 23 January 2021.

Carried

|

|

10.6 Water

Services Bill - Draft Submission

|

|

Staff Nic

Johansson, General Manager: Infrastructure

The report was taken as read.

In

response to questions

·

The impact of backflow on the quality of water was a big issue

and needed to be regulated.

·

Following a request from the Commission, standard wording would

be used in future for recommendations that delegated authority to the Chief

Executive and/or staff to make minor editorial changes to formal documents

for the purposes of correction or clarification.

·

Engagement for the submission had been undertaken with

TCC’s immediate neighbours as well as the broader water supply sector

of local government across the country.

|

|

Resolution CO1/21/6

Moved: Commissioner Bill

Wasley

Seconded: Commissioner

Shadrach Rolleston

That the Council:

(a) Receives

the Water Services Bill – Draft Submission report; and

(b) Approves

Tauranga City Council’s draft submission to the Water Services Bill,

subject to final drafting changes as:

(i) Noted

during this Council meeting; and/or

(ii) any subsequent minor editorial changes for the purposes of correction or

clarification as approved by the Chief Executive.

Carried

|

|

Staff Action

Standard wording to be used in

future for recommendations that delegate authority to the Chief Executive

and/or staff to make minor editorial changes to formal documents for the

purposes of correction or clarification:

“Delegates

authority to the Chief Executive and/or staff to make minor editorial changes for the purposes of correction or

clarification.”

|

11 Discussion

of Late Items

Nil

12 Public

Excluded Session

Nil

Carlo Ellis, Manager: Strategic Maori Engagement, closed the

meeting with a Karakia.

The meeting closed at 10.34am.

The minutes of this meeting were confirmed at the Ordinary

Council meeting held on 8 March 2021.

...........................................................

CHAIRPERSON

10 Business

10.1 2021-2031 Long-term Plan -

Update and revised working draft

File Number: A12263838

Author: Jeremy Boase, Manager: Strategy and Corporate Planning

Kathryn

Sharplin, Manager: Finance

Paul

Davidson, General Manager: Corporate Services

Authoriser: Christine Jones, General Manager: Strategy & Growth

Purpose of the Report

1. This report provides an

update on the process to develop the draft 2021-31 Long-term Plan, invites

decision-making on outstanding matters, and introduces a workshop session to consider

the revised working draft of the long-term plan and budget.

|

Recommendations

That the Council:

(a) Receives the report ‘2021-2031

Long-Term Plan – Update and revised working draft’.

(b) Notes that to address the

transportation, housing and community infrastructure needs of the city the

revised working draft Long-Term Plan is based on ‘Scenario C

Plus’ and includes further amendments and additions as detailed in this

report.

Issue 1:

Road resealing

(c) Rescinds the decision of the Policy

Committee on 20 October on to ‘Approve option 2 into the LTP

prioritisation process and request further advice on funding this through a

city-wide or a local targeted rate or combination of both’

(d) Retains the existing ‘fit for

purpose’ level of service for road resealing and incorporate this

decision into the draft Long-Term Plan process.

(e) Highlights the proposed approach to

road resealing in the LTP consultation document and actively seeks community

input on it.

Issue 2:

City centre stocktake

(f) Supports a stocktake of

strategic documents relating to the city centre and allocates $50,000 in the

2021/22 draft budget to complete this work.

(g) Notes that a further report-back on

this work will occur before the final Long-Term Plan is adopted.

Issue 3:

Tropical display house in Robbins Park

(h) Defers consideration of the future of

the tropical display house in Robbins Park until after the completion of the

stocktake of city centre strategy.

Issue 4: Omanawa Falls

(i) Amends the budget allocation for

the Omanawa Falls project to include a Council contribution of $3.5 million.

Issue 5:

Sustainability

(j) Confirms the continuation of the

$400,000 annual budget for the development and implementation of a

sustainability framework and action plans.

(k) Ceases the process to establish an

independent sustainability advisory board.

|

Executive Summary

2. The process to develop the

2021-31 Long-Term Plan (“LTP”) has been underway for many months

and draws on a number of critical workstreams that have been underway for, in

some case, years.

3. A substantial update was

provided to Council on 14 December 2020. This report references that

December report and decisions made by Council at that time, and provides a

summary of progress on a number of relevant issues since.

4. As part of the meeting, a

workshop session will be held where an up-to-date presentation of investment

proposals and the associated financial information will be shared, and options

discussed. This workshop session will help inform material required for

formal decision-making at the subsequent Council meeting on 15 March.

5. This report also considers

five matters where the Executive seek further direction on matters subject to

prior resolutions.

Background

Legislative background

6. The purpose of a Long-Term

Plan (“LTP”) is to:

(a) describe the activities of the local

authority; and

(b) describe the community outcomes of the

local authority’s district; and

(c) provide integrated decision-making and

co-ordination of the resources of the local authority; and

(d) provide a long-term focus for the

decisions and activities of the local authority; and

(e) provide a basis for accountability of

the local authority to the community[1].

7. An LTP is prepared every

three years, covers ten years (and includes an infrastructure strategy that

covers 30 years), must include specific information described in the Local

Government Act 2002, must be audited, and can only be adopted after a period of

public consultation on a consultation document which itself also needs to be

audited[2].

Community outcomes

8. On 8 September 2020, after a

public consultation process, the Policy Committee adopted the following

community outcomes as part of the preparation process for the LTP. Those

community outcomes are:

· We value and protect our environment -

Tauranga is a city that values our natural environment and outdoor lifestyle,

and actively works to protect and enhance it.

· We have a well-planned city - Tauranga

is a city that is well planned with a variety of successful and thriving

compact centres and resilient infrastructure.

· We can move around our city easily -

Tauranga is a well-connected city, easy to move around in and with a range of

sustainable transport choices.

· We support business and education -

Tauranga is a city that attracts and supports a range of business and education

opportunities, creating jobs and a skilled workforce.

· We are inclusive, and value our culture and diversity - Tauranga is a city that recognises and values culture and

diversity, and where people of all ages and backgrounds are included, feel

safe, connected and healthy.

Previous reports

9. This report builds on a

succession of other reports relating to both the process of developing an LTP

and on individual components of the LTP.

10. Regarding the process of developing the

LTP, these preceding reports include a report to Council on 11 August 2020

titled Long-Term Plan Workstreams which introduced (and received

approval for) a number of workstreams under the following categories:

11. Using this framework, progress updates

have been reported to:

· Policy Committee on 8 September 2020

· Finance, Audit, and Risk Committee on 22 September 2020

· Policy Committee on 22 October 2020

· Council on 17 November 2020

· Policy Committee on 1 December 2020

· Council on 14 December 2020.

Report to Council meeting of 14 December 2020 (“the 14 December report”)

12. The 14

December report sets out in some detail the journey and the challenges at that

time. As such, the 14 December report is included as Attachment 1

to this report[3].

13. For the

purposes of background, the reader’s attention is drawn to:

(a) the list of

strategic direction workstreams that have informed the preparation of the

working draft (paragraph 17)

(b) the principles

underpinning the preparation of the LTP (paragraph 18)

(c) the section

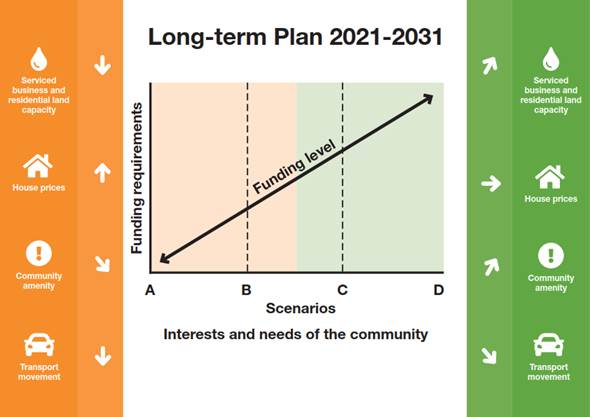

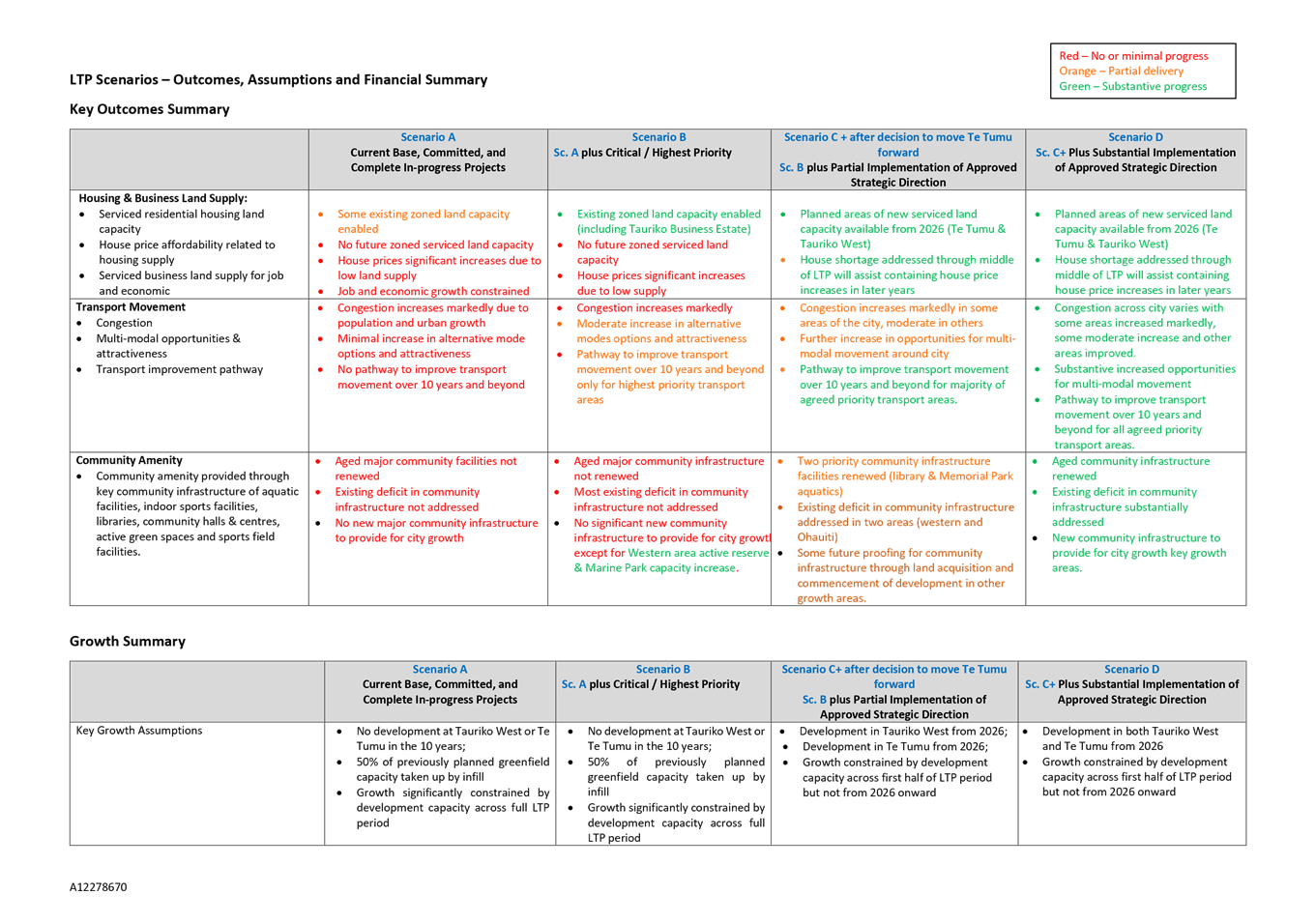

titled ‘Background to Council’s Financial Position’ (paragraphs

22 to 32)

(d) the

sub-section titled ‘Scenario-based approach’ and the description of

the four scenarios A, B, C, and D (paragraphs 38 to 46)

(e) the

sub-section titled ‘Future years’ costs resulting from past

decisions’ (paragraph 50).

Council decisions after consideration of the 14 December report

14. As a result of

consideration of the matters included in the 14 December report, Council

resolved as follows:

(b) Requests the Executive report back in

February 2021 with an updated working draft Long-Term Plan (LTP) for further

detailed consideration that:

(i) Notes that Scenarios A & B

have been useful for establishing the foundations of the 2021-2031 LTP;

(ii) Recognises that to address the

transportation, housing and community infrastructure needs of the city, a

‘Scenario C Plus’ which includes expenditure to prepare Te Tumu for

housing and the Papamoa East Interchange (PEI) infrastructure by 2026 is to be

the baseline for the development of the Draft LTP;

(iii) Notes that any further funding over

(that) allocated in ‘Scenario C Plus’ (per (ii) above) for Tauranga

City Council commitment to the Western Bay of Plenty Transport System

Plan (TSP) will be dependent on the alternative funding including outcomes

of the Smartgrowth Funding and Financing project

(c) Requests the

Chief Executive engage with Urban Form and Transport Initiative (UFTI) and TSP

partners to explore their willingness / ability to contribute funding to enable

the outcomes of Scenario D to be delivered for our communities

15. The decision

to move to ‘Scenario C Plus’ as the baseline for the draft LTP has

been reflected in an amended LTP Scenarios summary (initially attached to the

14 December report) which is included as Attachment 2 to this report.

Progress since 14 december report and decision-making

16. Since the

above decisions were made, the Executive has continued to refine the contents

of the working draft LTP and budgets. Key workstreams are briefly noted

below.

Transport Systems Plan

17. The Western

Bay of Plenty Transport System Plan (“TSP”) was endorsed by the

SmartGrowth partners in October 2020. At that time, it was noted that

further work would continue to be undertaken by TSP project partners to further

refine the individual project scopes, timing and costs.

18. This ongoing

work has helped to better understand the inter-dependency of projects with

others (e.g. the issues one project needs to investigate and confirm before

another project commences) and this in turn has enabled further refinement of

project timing. This has meant that some projects are now programmed to occur

earlier or later in the LTP than in the TSP.

19. In addition,

project costs have been further considered. This has included further applying

council’s cost estimation methodology to project costs included in the

TSP. In general, this had led to higher project costs being reflected in

the LTP than in the TSP as project risk and optimism bias cost factors are

applied.

20. The revised

working draft capital programme now includes $1.067 billion of TSP projects

over the ten years of the LTP. Given council’s financial

sustainability issues, options for debt retirement and/or targeted rates are

being considered as part of the funding package for this work.

21. Despite the

quantum of projects included, there are still a number of TSP projects that

Council is unable to fund in the revised working draft.

Deliverability of capital programme

22. In recent weeks, the LTP capital

programme has been reviewed to determine the confidence of the organisation to

deliver the current portfolio of projects over the next 10 years.

23. This review has identified a number of

factors, both at project level and also across the wider programme, that have

led to adjustments to the working draft capital programme included with the 14

December report. These adjustments are particularly evident in the first three

years where capital project cashflows have been pushed into later years as a

result of challenging reviews of “project readiness”.

24. Staff continue to assess and review the

programme and it is envisaged that there will be further adjustments

recommended by staff prior to the adoption of both the draft and then final LTP

capital programmes.

25. Capital project cashflow timing will

also be informed by the programme of work underway to make improvements to the

way the organisation delivers projects. This programme of work will

improve the capability of the organisation to deliver projects on time, to

budget and delivering agreed benefits with our community.

Community facilities investment plan

26. Encouraged by

the 14 December decision to accelerate budgeting for development of the eastern

corridor, and by public messaging relating to the appointment of the

Commission, the Executive have refreshed consideration of the city’s

community facility needs and how those needs are reflected in the revised

working draft.

27. That

reconsideration has focused on the need to ensure that new and existing parts

of the city have the community facilities that are necessary to enable

connected communities to thrive under a ‘live-work-play’

model. This has resulted to changes in the revised working draft capital

programme that adds the following to the Scenario C programme included in the

14 December report:

(a) stage 2

development of the Memorial Park recreation hub (being the ‘dry’

facilities) – construction in 2026/27 to 2028/29 to start once stage 1

(aquatics) has been completed (additional $45m in years 6-8 of the LTP)

(b) develop, or

commence development of, active reserves, library and community centre in the

western corridor (additional $33m in years 7-10 of the LTP)

(c) capitalisable

pre-construction costs for the community centre, indoor sports facility,

library and aquatic facility in Te Tumu (additional $3.4m in years 9 and 10 of

the LTP)

(d) capitalisable

pre-construction costs for the indoor sports and aquatic facilities in the western

corridor (additional $1.5m in year 10 of the LTP.

28. Note that land

purchase costs for the projects in items (b) to (d) above were already included

in the working draft as at 14 December 2020.

29. The overall

capital expenditure impact of these additions to the Executive’s revised

working draft are:

|

Year

6

2026/27

|

Year

7

2027/28

|

Year

8

2028/29

|

Year

9

2029/30

|

Year

10

2030/31

|

Ten-year

total

|

|

$3.0m

|

$23.0m

|

$21.2m

|

$14.7m

|

$21.0m

|

$82.9m

|

30. As

with the TSP above, because of council’s financial sustainability issues,

options for debt retirement and/or targeted rates are being considered as part

of the funding package for this work.

Resourcing levels

31. The Executive

have conducted a further review of organisational resourcing and new resourcing

requests. This included a reconsideration of both the organisational need

for additional resources and then the proposed timing of each specific proposal

to meet the agreed needs.

32. The executive’s

agreed resourcing approach has been incorporated into the revised working draft

financials that are recommended to Council.

Minor Spaces & Places capital projects

33. The working

draft capital programme excluded a large number of individually small capital

projects, predominantly related to better activating a large number of passive

and active spaces across the city. These projects were prepared in line

with the Tauranga Reserves Management Plan but were ‘prioritised

out’ during preparations of the working draft.

34. After

reconsideration, the Executive has supported a $500,000 annual bulk fund to

cover the implementation of such projects. This is not sufficient to

cover all such projects, but is intended to provide opportunities for improvements

across the city as the Spaces & Places team determine. The $500,000

per annum bulk fund is included in the revised working draft capital programme.

35. Note that the

full list of ‘parks minor capital development and upgrade’ projects

not included in the working draft (and therefore to be potentially funded from

the bulk fund) totals $19.2million over 10 years. As such, the bulk fund

will be able to progress only a little over a quarter of these projects.

Major Spaces & Places capital projects

36. There are a

number of ‘major’ capital projects in the parks portfolio that are

also not included in the revised working draft. These involve greater

investment (individually ranging from $1m to $17m and totalling $38m) and

generate greater city-wide amenity than the ‘minor’ projects noted

above.

37. Work is

currently underway to consider funding options (such as a city-wide targeted

rate or other external funding sources) to bring these projects into a future

revision of the working draft. That work is not complete and as at the

time of writing these capital projects are not included in the revised working

draft capital programme.

38. Options will

be presented to Council to bring some or all of these projects into the final

LTP, potentially funded as part of a targeted rate alongside the community

facilities investment plan projects considered above. Community

consultation could be focused on a draft set of proposed projects to be so

included.

Papamoa East Interchange

39. Council

resolution (b)(ii) in response to the 14 December report brings forward the

Papamoa East Interchange (“PEI”) project as part of the enablement

of the development of the Wairakei/Te Tumu town centre and the wider Te Tumu

urban growth area.

40. Work is

underway with Waka Kotahi NZTA and other stakeholders to understand the

opportunities and barriers to fast-tracking the construction of the PEI and

identifying possible funding / financing pathways. An update on this work

will be provided during the 15 March 2021 Council meeting.

Smartgrowth Funding & Financing

41. Council

resolution (b)(iii) in response to the 14 December report references the

Smartgrowth Funding & Financing project.

42. Work

undertaken to date aims to identify a set of principles for the Smartgrowth

partners to apply to consideration of funding projects to achieve the outcomes

recognised through sub regional strategies and projects. These principles

can apply over a number of projects and focus on providing mechanisms to

provide better community outcomes. These may include transport projects,

community amenity projects and other initiatives that may cross existing

boundaries.

43. These

principles are currently being completed and will be discussed with

partners. They may be included in our submissions to Western Bay of

Plenty District Council’s and Bay of Plenty Regional council’s LTP

consultation documents with a view to providing more clarity around these

opportunities through this LTP process.

UFTI and TSP partner funding

44. Council resolution (c) in response to the 14 December report

references the willingness of UFTI and TSP partners to contribute to funding to

allow Scenario D projects (which are currently excluded

from the working draft) to be delivered for the benefit of the community.

45. As noted above, the Executive have

included in the options for future decision-making on the LTP additional

expenditure relating to additional community infrastructure projects.

Efforts continue to develop additional funding and financing options for these projects,

including those with our partners. However, it is acknowledged that

agreement on such options is unlikely to occur prior to the release of the LTP

consultation document on the draft. Therefore, various rating options

have been explored to fund this potential expenditure including the use of

targeted rates and debt retirement charges to enable these projects to be

delivered within council’s constrained debt-to-revenue levels.

46. The Executive recognise that there are

potential opportunities to obtain better outcomes for our community through

more equitable allocations of funding and financing and will continue to

explore further options. These may be able to be recognised in the final

adopted LTP or in future LTPs (including as an amendment to the adopted 2021-31

LTP if necessary).

Revised working draft

financials

47. During this

meeting the Executive will present the revised working draft financials for the

LTP. This revised working draft is based on the ‘Scenario C

Plus’ resolution of Council on 14 December 2020, together with the

outcome of the additional work outlined in the above section.

48. It is expected

that the revised working draft financials will be discussed in a workshop

session during the meeting. External members of the recently

disestablished council committees will also be invited to the workshop session.

49. The

information provided to the workshop session will be included in a formal

report that will be prepared for the 15 March 2021 Council meeting.

Matters to be

addressed

50. This section

of the report considers a small number of matters where formal direction is

sought.

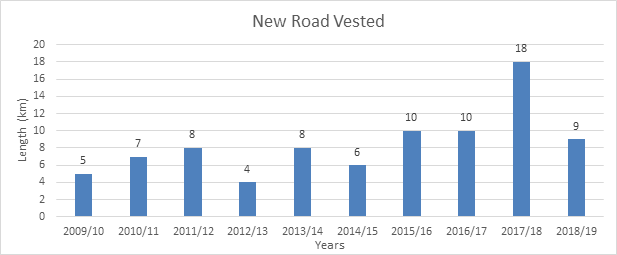

Issue 1: Road resealing

51. On 20 October

2020, the Policy Committee considered a paper titled ‘LTP 2021-2031 Road

Resealing Level of Service Issues and Options Paper’. That paper

(“the 20 October report”) is included as Attachment 3 to

this report[4].

52. That paper

addresses council’s level of service for road resealing and recommended

that council:

Retains the current level of service for road resurfacing, including

the replacement of asphalt with chipseal on neighbourhood roads (road

categories 4 and 5)

53. This level of

service, in place since 2012, is colloquially known as ‘fit for

purpose’. In other words, the material used for road resealing is

chosen to suit the use of the road, particularly relating to road

categorisations and traffic volumes.

54. The Policy

Committee did not accept the Executive’s recommendation and instead

resolved (by 9-1 majority) to

Approve option 2 (‘Like for like’ or road resurfacing

with the same material that is existing) into the LTP prioritisation process

and request further advice on funding this through a city-wide or a local

targeted rate or combination of both

55. As the name

suggests, a ‘like for like’ policy means that a road that is

currently surfaced in asphalt will be resurfaced with asphalt, while a road

currently surfaced in chipseal will be resurfaced in chipseal, regardless of

the engineering or traffic needs.

Cost

implications

56. The 20 October

paper highlighted the significant variance in costs between chipseal and

asphalt for local and access roads (being the category 4 and 5 roads most

affected by this policy decision[5]).

This variance recognises:

(a) the higher

cost per square metre of asphalt resealing

(b) that council

will only receive subsidy for the lower chipseal cost if it undertakes

resealing using asphalt that is considered by Waka Kotahi NZTA to be more than

the necessary level of service

(c) the longer

expected useful life of asphalt surfaces compared to chipseal surfaces.

57. Using the above parameters, the

comparable costs of chipseal and asphalt are shown below.

|

Road

category 4 & 5 (local and access roads)

|

Fit for purpose =

chipseal (i.e. eligible for full subsidy)

|

Like for like = Asphalt

(i.e. not eligible for full subsidy)

|

|

Gross cost

|

$6 per m2

|

$30 per m2

|

|

Subsidy

|

$3.06 per m2

|

$3.06* per m2

|

|

Net

cost (to ratepayer) / m2

|

$2.94 per m2

|

$26.94 per m2

|

|

Differential

cost per square metre between policy options. This cost is fully borne

by TCC.

|

|

$24 per m2

|

|

Net cost

(to ratepayer) for nominal 500m long road, 8m wide (4000m2)

|

$11,760

|

$107,760

(nine times

greater)

|

|

Expected

useful life of surface

|

12 years

|

16 years

|

|

Per annum

net cost (to ratepayer) per year of seal life for nominal 500m long road, 8m

wide.

|

$980 p.a.

|

$6,735 p.a.

(six times

greater)

|

*subsidy amount up to the value ‘fit for purpose’ only

as per Waka Kotahi NZTA advice

Other

councils’ approach

58. The 20 October report (paragraph 50)

discussed the approach of other councils as follows:

Most Councils in New Zealand

have adopted a ‘fit for purpose’ resurfacing policy in line with

NZTA funding assistance criteria. This includes the four major cities with

network configuration or growth similar to Tauranga City (Auckland, Wellington,

Christchurch and Hamilton).

There are a number of smaller

councils who have adopted a ‘like for like’ policy approach, such

as Hurunui District Council, Mackenzie District Council and Ashburton District

Council. These smaller networks have a lot of unsealed and chipseal roads, so

retaining similar surfacing is a more cost-effective option. Further,

these smaller districts tend to have very little asphalt roads and therefore

residents do not have the same expectation for asphalt on neighbourhood

roads.

In addition, Selwyn District Council

advised that they have experienced considerable growth in recent times

resulting in asphalt being used in new subdivision areas. Consequently,

Selwyn District Council are reviewing their ‘like for like’ policy

as a result of increased cost, technical and equity issues.

Options

summary

59. The options,

including advantages, disadvantages, risks and costs are as included in the 20

October report (paragraphs 40 to 49) and are summarised here in the interests

of brevity.

· Option 1: Fit for purpose (recommended)

o Maximises NZTA subsidy; consistent level of service city-wide;

responsible use of financial resources; reduced level of service for some

neighbourhood roads currently in asphalt and therefore some community

dissatisfaction; total net costs to council over 10 years of $32 million.

· Option 2: Like for like

o Amenity in all areas remains as is; inequitable across the city;

over-investment from a technical perspective; total net costs to council over

10 years of $57 million.

· Option 3: All asphalt

o Improvement in amenity of areas currently in chipseal; NZTA will not

fund over ‘fit for purpose’; over-investment from a technical

perspective; total net costs to council over 10 years of $86 million.

60. The 20 October

report summarised the capital expenditure impacts of these options over the ten

years of the LTP as follows:

|

|

Overall programme

|

NZTA subsidy

|

Net cost to Council

|

|

Option 1

|

|

|

|

|

Road Categories

1, 2 & 3

|

$33.0M

|

$16.8M

|

$16.2M

|

|

Road Categories

4 & 5

|

$32.0M

|

$16.2M

|

$15.2M

|

|

Total

|

$65.0M

|

$33.0M

|

$32.0M

|

|

Option 2

|

|

|

|

|

Road Categories

1, 2 & 3

|

$33.0M

|

$16.8M

|

$16.2M

|

|

Road Categories

4 & 5

|

$57.0M

|

$16.2M

|

$40.8M

|

|

Total

|

$90.0M

|

$33.0M

|

$57.0M

|

|

Option 3

|

|

|

|

|

Road Categories

1, 2 & 3

|

$39.0M

|

$19.8M

|

$19.2M

|

|

Road Categories

4 & 5

|

$90.0M

|

$13.0M

|

$67.0M

|

|

Total

|

$129.0M

|

$32.8M

|

$86.2M

|

61. Note that, under option 3, the total

cost to upgrade all roads across the city to asphalt is estimated at $176

million additional to current budgets. This includes a (conservative)

estimate that 30% of the existing chipseal network would require additional

pavement-strengthening work to support surfacing in less-flexible

asphalt.

Funding and Financing implications

62. The rating

impact of a decision to move to options 2 or 3 will depend on policy decisions

yet to be made. For example, whether the costs are recovered on

street-by-street or area-by-area targeted rates or whether they are absorbed

into a city-wide rate.

63. The 20 October

report included an example of the potential impact of a street-by-street

targeted rate. This showed an additional rate of between $160 and $240 per

annum depending on assumptions used.

64. Initial

calculations have also been prepared on a city-wide targeted rate if all

existing chip-seal roads were converted to asphalt. Existing chipseal

roads make up approximately 45% of the city’s network. Using the

$176 million capital cost identified above and upgrading all roads to asphalt

over 15 years (used for modelling purposes), early indications suggest that a

city-wide targeted rate of at least $300 would be required. Further work

will be undertaken on these calculations if this option is preferred.

65. Note that this

city-wide targeted rate would be paid by all properties: those currently on

chipseal being upgraded to asphalt; those currently on asphalt who would retain

asphalt that under a fit-for-purpose approach would have reverted to chipseal;

and, those on asphalt who would have retained asphalt under a fit-for-purpose

approach (because of traffic volumes, for instance).

66. Under options

2 and 3, additional debt will be incurred placing further pressure on

Council’s balance sheet. In order to manage this additional debt

pressure, additional funding (rating) via a debt retirement charge would need

to be included in the LTP. This would be in addition to the direct rates

amounts required as noted above for the reseal costs.

Executive

recommendation

67. Option 1 is

recommended, as it was in the 20 October report. If the recommendation is

accepted, Council is advised to formally rescind the resolution of the Policy

Committee on 20 October and then separately to resolve to retain the status quo

of a ‘fit for purpose’ level of service. This is addressed in

recommended resolutions (c) and (d).

68. Due to the

previous public interest in this matter and the fact that the local road

resealing level of service has impacts across the city, it is recommended that

this issue and council’s proposed approach is highlighted in the LTP

consultation document and public feedback sought. This is addressed in

recommended resolution (e).

Issue 2: City centre stocktake

69. The Tauranga

city centre has been the subject of a number of strategic planning exercises in

recent years. These include the City Centre Strategy (2012 but still

extant), the Tauranga Waterfront Masterplan (prepared for Council by LandLab in

2018), the City Centre Spatial Framework (from 2019), and significant work

undertaken in various iterations on the civic campus and its surrounds.

70. In recent

months three significant workstreams that affect the city centre (and other

areas) have been completed. These are:

(a) The

preparation and adoption on 13 October 2020[6]

of the Te Papa Spatial Framework

(b) The completion

of council’s natural hazards planning work (reported as part of the

resilience project on 24 November 2020[7]),

coupled with an increasing understanding of the impact of the Regional Policy

Statement on Natural Hazards

(c) The UFTI

report approved by Council on 1 July 2020 and the subsequent Transport System

Plan (approved by Council on 28 October) which collectively identify

implications for transport movements and planning within the city centre.

71. Given the importance of these three

workstreams, it is intended to commence a stocktake of the existing city centre

strategic documents taking into consideration the impacts of these

workstreams. This work will commence in 2020/21 using existing budgets

but will a need for an additional budget in 2021/22 to complete (estimate at

$50,000).

72. It is intended to report back progress

on the stocktake during Council’s deliberations on the draft LTP in

June. At this time, any additional resourcing implications on the LTP

emerging from the stocktake will be highlighted and direction sought.

Options analysis

73. There are two

principal options for consideration.

· Option 1 – support the stocktake and include an additional

$50,000 of operational funding in the 2021/22 year to enable its completion (recommended)

o This option ensures the stocktake can be completed and the

implications for the city centre of recent planning workstreams understood.

o Further reporting back will occur before the final LTP is adopted.

· Option 2 – do not support the stocktake and do not provide

additional operational funding in 2021/22

o Under this option, a detailed understanding of the implications on

the city centre of the recent planning workstreams will not be obtained.

o There is a risk that city centre decisions will be made in isolation

of a broad strategic understanding.

74. Option 1 is

recommended and is reflected in recommended resolutions (f) and (g).

Issue 3: Tropical display house in Robbins Park

75. During the

2020/21 Annual Plan process, as part of Covid-related cost-saving measures,

Council consulted on the future of the tropical display house. The

proposal in the draft Annual Plan was to retain the service provided by the

tropical display house and the $61,000 per annum budget.

76. Submissions on

the matter were split between those wishing to retain the service and the

budget and those wishing to remove the service and the budget.

77. After considered

debate, Council resolved on 16 July 2020 to retain the budget in the 2020/21

Annual Plan and to:

… review the decision in the LTP including the options to

upgrade, relocate or demolish the tropical display house.

78. This review

was not commenced prior to or during the 14 December 2020 council meeting.

Options

analysis

79. There are two

principal options for consideration.

· Option 1 – defer the review of the tropical display house

until completion of the stocktake of city centre strategic planning (recommended)

o This option ensures the best strategic approach to the wider city

centre, including the role that the tropical display house, and the wider

Robbins Park, may have.

o This option requires the continuation of the annual operational

budget in the LTP until (and if) a decision is made that it is no longer

warranted.

· Option 2 – undertake the review before the draft LTP is

adopted as per the 16 July 2020 resolution

o Given the timeframe available and the relatively minor nature of

this matter compared to other matters that Council needs to address ahead of

the adoption of the LTP consultation document, this option is not considered

feasible.

80. Option 1 is recommended

and is reflected in recommended resolution (h).

Issue 4: Omanawa Falls

81. The Omanawa

Falls are located on land owned by Tauranga City Council within the Western Bay

of Plenty district. There is no safe formed access to the Falls and as

such the site is currently closed to public access. Despite this, members

of the public continue to attempt to access the site and in recent years this

has resulted in a number of serious injuries and two fatalities.

82. The Omanawa

Falls project is intended, in the first phase, to provide safe access to the

Omanawa Falls.

83. The

project is being delivered in two stages to achieve safe access by summer

2021/22. All components except the lookout location in the Ngahere walk

are scheduled to be complete by mid-November 2021. The lookout will be

completed by October 2022.

84. The project is currently budgeted at $3.857 million (in 2019

dollars). There is a significant degree of uncertainty regarding this

total. A more certain budget estimate will not be established

until contractor engagement is finalised. This is largely due to site

constraints requiring the preferred contractor to be responsible for final

detailed design of a number of elements.

85. In

the meantime, it is recognised that construction cost inflation needs to be

applied to this original budget. As such, it is recommended that the

project budget be updated to a total of $4.5 million to better reflect 2021

likelihood.

86. Staff are currently working to provide cost certainty for the

project. At present the project programme estimates that the final

budget will be confirmed as follows:

Works

|

QS Budget Estimate

|

Cost Certainty

|

|

Early works

|

February 2021

|

March 2021

|

|

Cliff Stabilisation

|

NA

|

April 2021

|

|

Track works

|

NA

|

April 2021

|

|

Lower landing

|

To be confirmed

|

To be confirmed

|

|

Carpark

|

February 2021

|

June 2021

|

|

Upper platform (lookout)

|

June 2021

|

September 2021

|

87. An

update on total project costs will be provided during the deliberations on the

LTP in June.

88. During the 2020/21 Annual Plan process,

Council supported the project and confirmed a total budget split as follows:

|

|

Original

estimate

|

Updated

for new total estimate

|

|

Council

contribution

|

$711,000

|

$1,354,000

|

|

Tourism

Infrastructure Fund (already agreed)

|

$1,000,000

|

$1,000,000

|

|

Other

external sources

|

$2,146,000

|

$2,146,000

|

|

Total

|

$3,857,000

|

$4,500,000

|

89. The staff

report to council at the time this decision was made noted that the key risks

of this option were: ‘External funding will not be found, serious

safety concerns if the project doesn’t continue’.

90. A Funding

Action Plan has been prepared for this project and is updated regularly.

Many of the potential funding sources require consents to be secured prior to

providing funding.

91. As consents

are dependent on designs, and designs are dependent on contractor engagement,

and good faith contractor engagement is dependent on funding certainty, the

inability to guarantee funding sources for the project is not allowing the

project to proceed with confidence. The opportunity to complete the

project for safe access in the 2021/22 summer is at risk.

Options

analysis

92. There are two

principal options for consideration.

· Option 1 – increase council funding to $3.5 million (recommended)

o The $3.5m reflects council absorbing the increased total budget cost

due to inflation ($4.5m minus $3.857m) as well as underwriting the proposed

external contribution of $2.146m.

o This option provides funding certainty for the project and allows

progress to continue.

o Efforts would continue to secure other external funding to reduce

council’s commitment, but the project would proceed on the understanding

that council will fund it.

o Note that the quantum of funding may change when the ‘cost

certainty’ information is reported back in June. This will be

considered trough the LTP deliberations.

o Other than the increased debt servicing involved with a greater

capital contribution, there are no changes to operating expenditure as a result

of this decision.

· Option 2 – retain the existing funding mix for planning

purposes

o Under this option, the current issues with securing funds and the

current risks to project delivery would remain. It is unlikely that the

project will be delivered for the 2021/22 summer.

93. Option 1 is

recommended and is reflected in recommended resolution (i).

Issue 5: Sustainability

94. As part of the

2020/21 Annual Plan process, Council approved a refreshed approach to

sustainability encompassing social, environmental, cultural and economic

wellbeing. That approach included:

· the delivery of a stock-take of council’s current approach to sustainability

· the creation and implementation of a sustainability framework for

the organisation

· the development and implementation of action plans

· the establishment of an independent sustainability advisory board

· a $400,000 budget for the board, consultants and staff to enable

this work to occur.

Stocktake, framework, action plan

95. The

Policy Committee meeting of 20 October agreed that the most effective way to

conduct the stocktake would be through external consultants.

96. In

late 2020 staff undertook a closed Request for Proposal (“RFP”)

process and appointed Proxima Consulting. Proxima are sustainability experts

who came highly recommended from numerous sources and have deep connections and

knowledge around sustainability.

97. Work

commenced in January 2021 and a draft report will be produced by the end of

March. This report will cover -

· High

level analysis of different frameworks for assessing sustainability, pros and

cons and recommendation of a suitable option (developed following a TCC

workshop and targeted internal and external engagement)

· List

of topics / themes in relation to sustainability (defined in a holistic sense

and including a city-wide lens with consideration of council’s role

– “control / influence / take an interest in”)

· A

snapshot of our current progress / status across the topics and themes

identified

98. The

RFP only covered the initial stage (i.e. consideration of frameworks and

stocktake of performance against relevant framework). Phase two (not yet

tendered) will cover development of “action plans” to address gaps

in current performance and respond to opportunities and challenges.

99. There

are natural links between the sustainability framework and action plan and the

broader ‘City Futures’ project that has previously been reported to

Council and the Policy Committee. Those links will be further explored as

the two workstreams are progressed.

Independent

board

100. In accordance with

Council’s resolution, during the fourth quarter of 2020, the Chief

Executive and staff progressed the establishment of an independent

sustainability advisory board. While significant progress has been made,

this process is not yet complete; for instance, the terms of reference have not

yet been finalised and as such the involvement of preferred candidates has not

yet been confirmed.

101. During the establishment