|

|

|

AGENDA

Strategy, Finance and Risk Committee Meeting

Monday, 17 May 2021

|

|

I hereby give notice that a Strategy, Finance and

Risk Committee Meeting will be held on:

|

|

Date:

|

Monday, 17 May 2021

|

|

Time:

|

10.30am

|

|

Location:

|

Tauranga City Council

Council Chambers

91 Willow Street

Tauranga

|

|

Please

note that this meeting will be livestreamed and the recording will be

publicly available on Tauranga City Council's website: www.tauranga.govt.nz.

|

|

Marty Grenfell

Chief Executive

|

Terms of reference – Strategy,

Finance & Risk Committee

Membership

|

Chairperson

|

Commission

Chair Anne Tolley

|

|

Deputy

chairperson

|

To be

decided

|

|

Members

|

Commissioner

Shadrach Rolleston

Commissioner Stephen Selwood

Commissioner Bill Wasley

|

|

|

Matire Duncan – Te

Rangapū Mana Whenua o Tauranga Moana Chairperson

Dr Wayne Beilby – Tangata

Whenua representative

Te Pio Kawe – Tangata

Whenua representative

Rohario Murray – Tangata

Whenua representative

Bruce Robertson – External

appointee with finance and risk experience

|

|

Quorum

|

Five (5) members must be physically present, and at

least three (3) commissioners and two (2) externally appointed members must

be present.

|

|

Meeting

frequency

|

Six weekly

|

Role

The role of the Strategy, Finance and Risk Committee (the

Committee) is:

(a)

to assist and advise the Council in discharging

its responsibility and ownership of health and safety, risk management,

internal control, financial management practices, frameworks and processes to

ensure these are robust and appropriate to safeguard the Council’s staff

and its financial and non-financial assets;

(b)

to consider strategic issues facing the city and

develop a pathway for the future;

(c)

to monitor progress on achievement of desired

strategic outcomes;

(d)

to review and determine the policy and bylaw framework

that will assist in achieving the strategic priorities and outcomes for the

Tauranga City Council.

Membership

The Committee will consist of:

·

four commissioners with the Commission Chair

appointed as the Chairperson of the Committee

·

the Chairperson of Te

Rangapū Mana Whenua o Tauranga Moana

·

three tangata whenua representatives

(recommended by Te Rangapū Mana Whenua o Tauranga

Moana and appointed by Council)

·

an independent external person with finance and

risk experience appointed by the Council.

Voting Rights

The tangata whenua representatives and the independent

external person have voting rights as do the Commissioners.

The Chairperson of Te Rangapu Mana Whenua o Tauranga Moana

is an advisory position, without voting rights, designed to ensure mana whenua

discussions are connected to the committee.

Committee’s Scope and Responsibilities

A. STRATEGIC ISSUES

The

Committee will consider strategic issues, options, community impact and explore

opportunities for achieving outcomes through a partnership approach.

A1

– Strategic Issues

The Committee’s

responsibilities with regard to Strategic Issues are:

·

Adopt an annual work

programme of significant strategic issues and projects to be addressed. The

work programme will be reviewed on a six-monthly basis.

·

In respect of each

issue/project on the work programme, and any additional matters as determined

by the Committee:

·

Consider existing

and future strategic context

·

Consider

opportunities and possible options

·

Determine preferred

direction and pathway forward and recommend to Council for inclusion into

strategies, statutory documents (including City Plan) and plans.

·

Consider and approve

changes to service delivery arrangements arising from the service delivery

reviews required under Local Government Act 2002 that are referred to the

Committee by the Chief Executive.

·

To take appropriate

account of the principles of the Treaty of Waitangi.

A2

– Policy and Bylaws

The Committee’s

responsibilities with regard to Policy and Bylaws are:

·

Develop, review and

approve bylaws to be publicly consulted on, hear and deliberate on any

submissions and recommend to Council the adoption of the final bylaw. (The

Committee will recommend the adoption of a bylaw to the Council as the Council

cannot delegate to a Committee the adoption of a bylaw.)

·

Develop, review and

approve policies including the ability to publicly consult, hear and deliberate

on and adopt policies.

A3

– Monitoring of Strategic Outcomes and Long Term Plan and Annual Plan

The Committee’s

responsibilities with regard to monitoring of strategic outcomes and Long Term

Plan and Annual Plan are:

·

Reviewing and

reporting on outcomes and action progress against the approved strategic

direction. Determine any required review/refresh of strategic direction or

action pathway.

·

Reviewing and

assessing progress in each of the six (6) key investment proposal areas within

the 2021-2031 Long Term Plan.

·

Reviewing the

achievement of financial and non-financial performance measures against the

approved Long Term Plan and Annual Plans.

B. FINANCE AND RISK

The Committee will review the effectiveness of the

following to ensure these are robust and appropriate to safeguard the

Council’s financial and non-financial assets:

·

Health and safety.

·

Risk management.

·

Significant projects and programmes of work

focussing on the appropriate management of risk.

·

Internal and external audit and assurance.

·

Fraud, integrity and investigations.

·

Monitoring of compliance with laws and regulations.

·

Oversight of preparation of the Annual Report

and other external financial reports required by statute.

·

Oversee the relationship with the

Council’s Investment Advisors and Fund Managers.

·

Oversee the relationship between the Council and

its external auditor.

·

Review the quarterly financial and non-financial

reports to the Council.

B1

- Health and Safety

The Committee’s responsibilities with regard to

health and safety are:

·

Reviewing the effectiveness of the health and

safety policies and processes to ensure a healthy and safe workspace for

representatives, staff, contractors, visitors and the public.

·

Assisting the Commissioners to discharge their

statutory roles as “Officers” in terms of the Health and Safety at

Work Act 2015.

B2

- Risk Management

The Committee’s responsibilities with regard to risk

management are:

·

Review, approve and monitor the implementation of the Risk

Management Policy, Framework and Strategy including the Corporate Risk

Register.

·

Review and approve the Council’s “risk

appetite” statement.

·

Review the effectiveness of risk management and internal control

systems including all material financial, operational, compliance and other

material controls. This includes legislative compliance, significant projects

and programmes of work, and significant procurement.

·

Review risk management reports identifying new and/or emerging

risks and any subsequent changes to the “Tier One” register.

B3

- Internal Audit

The Committee’s responsibilities with regard to the

Internal Audit are:

·

Review and approve the Internal Audit Charter to confirm the

authority, independence and scope of the Internal Audit function. The Internal

Audit Charter may be reviewed at other times and as required.

·

Review and approve annually and monitor the implementation of the

Internal Audit Plan.

·

Review the co-ordination between the risk and internal audit

functions, including the integration of the Council’s risk profile with

the Internal Audit programme. This includes assurance over all material

financial, operational, compliance and other material controls. This includes

legislative compliance (including Health and Safety), significant projects and

programmes of work and significant procurement.

·

Review the reports of the Internal Audit functions dealing with

findings, conclusions and recommendations.

·

Review and monitor management’s responsiveness to the

findings and recommendations and enquire into the reasons that any

recommendation is not acted upon.

B4

- External Audit

The Committee’s responsibilities with regard to the

External Audit are:

·

Review with the external auditor, before the audit commences, the

areas of audit focus and audit plan.

·

Review with the external auditors, representations required by

commissioners and senior management, including representations as to the fraud

and integrity control environment.

·

Recommend adoption of external accountability documents (LTP and

annual report) to the Council.

·

Review the external auditors, management letter and management

responses and inquire into reasons for any recommendations not acted upon.

·

Where required, the Chair may ask a senior representative of the

Office of the Auditor General (OAG) to attend the Committee meetings to discuss

the OAG’s plans, findings and other matters of mutual interest.

·

Recommend to the Office of the Auditor General the decision

either to publicly tender the external audit or to continue with the existing

provider for a further three-year term.

B5

- Fraud and Integrity

The Committee’s responsibilities with regard to

Fraud and Integrity are:

·

Review and provide advice on the Fraud Prevention and Management

Policy.

·

Review, adopt and monitor the Protected Disclosures Policy.

·

Review and monitor policy and process to manage conflicts of

interest amongst commissioners, tangata whenua representatives, external

representatives appointed to council committees or advisory boards, management,

staff, consultants and contractors.

·

Review reports from Internal Audit, external audit and management

related to protected disclosures, ethics, bribery and fraud related incidents.

·

Review and monitor policy and processes to manage

responsibilities under the Local Government Official Information and Meetings

Act 1987 and the Privacy Act 2020 and any actions from the Office of the

Ombudsman’s report.

B6

- Statutory Reporting

The

Committee’s responsibilities with regard to Statutory Reporting relate to

reviewing and monitoring the integrity of the Annual Report and recommending to

the Council for adoption the statutory financial statements and any other

formal announcements relating to the Council’s financial performance,

focusing particularly on:

·

Compliance with, and the appropriate application of, relevant

accounting policies, practices and accounting standards.

·

Compliance with applicable legal requirements relevant to

statutory reporting.

·

The consistency of application of accounting policies, across

reporting periods.

·

Changes to accounting policies and practices that may affect the

way that accounts are presented.

·

Any decisions involving significant judgement, estimation or

uncertainty.

·

The extent to which financial statements are affected by any

unusual transactions and the manner in which they are disclosed.

·

The disclosure of contingent liabilities and contingent assets.

·

The basis for the adoption of the going concern assumption.

·

Significant adjustments resulting from the audit.

Power to Act

·

To make all

decisions necessary to fulfil the role, scope and responsibilities of the

Committee subject to the limitations imposed.

·

To establish

sub-committees, working parties and forums as required.

·

This Committee has not

been delegated any responsibilities, duties or powers that the Local Government

Act 2002, or any other Act, expressly provides the Council may not

delegate. For the avoidance of doubt, this Committee has not

been delegated the power to:

o

make a rate;

o

make a bylaw;

o

borrow money, or purchase

or dispose of assets, other than in accordance with the Long Term Plan (LTP);

o

adopt the LTP or Annual

Plan;

o

adopt the Annual Report;

o

adopt any policies required

to be adopted and consulted on in association with the LTP or developed for the

purpose of the local governance statement;

o

adopt a remuneration and

employment policy;

o

appoint a chief executive.

Power to Recommend

To Council and/or any standing committee

as it deems appropriate.

8 Business

8.1 Appointment

of Deputy Chairperson for the Strategy, Finance and Risk Committee

File

Number: A12541775

Author: Coral

Hair, Manager: Democracy Services

Authoriser: Susan

Jamieson, General Manager: People & Engagement

Purpose of the Report

1. The purpose of the

report is to set out the process to appoint a Deputy Chairperson for the

Strategy, Finance and Risk Committee.

|

Recommendations

That the Strategy, Finance and Risk Committee:

(a) Receives the Appointment of

Deputy Chairperson for the Strategy, Finance and Risk Committee report.

(b) In accordance with Clause 25

of Schedule 7 of the Local Government Act 2002, confirms that the voting

system to be used to elect or appoint the Deputy Chairperson for the Strategy,

Finance and Risk Committee is:

System A; OR

System B

(c) Appoints

____________________ as the Deputy Chairperson for the Strategy, Finance and

Risk Committee.

|

Background

2. On 27 April 2021

the Council established the Strategy, Finance and Risk Committee and appointed

five of the nine members and on 10 May 2021 appointed the other four members.

3. Council committees

are not required to appoint a Deputy Chairperson, however it is customary to do

so and this is usually carried out at the first meeting of the committee. In

the absence of a Chairperson, the Deputy Chairperson will assume the

responsibilities of the Chairperson.

Strategic / Statutory Context

4. Clause 25 of Schedule

7 of the LGA 2002, sets out the voting systems for certain appointments

including a deputy chairperson of a committee. Before the process starts

the Committee is required to determine by resolution that a person is to be

elected or appointed by using either System A or System B. The systems

are described below:

System A

The candidate will be elected or

appointed if he or she receives the votes of a majority of the members of the

local authority or committee who are present and voting. This system has

the following characteristics:

(a) there is a

first round of voting for all candidates;

(b) if no

candidate is successful in the first round, there is a second round of voting

from which the candidate with the fewest votes in the first round is excluded;

and

(c) if no

candidate is successful in the second round, there is a third round, and if

necessary subsequent rounds, of voting from which, each time, the candidate

with the fewest votes in the previous round is excluded.

In any round of voting, if two or more candidates

tie for the lowest number of votes, the person to be excluded from the next

round is resolved by lot.

System B

The candidate will be elected or

appointed if he or she receives more votes than any other candidate. This

system has the following characteristics:

(a) there is

only one round of voting; and

(b) if two or

more candidates tie for the most votes, the tie is resolved by lot.

5. System B is

recommended as the system to be adopted as it is the simplest.

6. Once that decision

is made by the Committee, the Chairperson calls for candidates for the position

of Deputy Chairperson of the Strategy, Finance and Risk Committee. If more than

one candidate is standing, a vote is undertaken in accordance with either

System A or System B as previously resolved. If one candidate only is nominated

that person is appointed by resolution of the Committee.

Options Analysis

7. The Committee has

two options, to appoint or not appoint a Deputy Chairperson.

8. There is no

requirement in the LGA 2002 to appoint a Deputy Chairperson however it is

customary and considered best practice to appoint a Deputy Chairperson who can

take on the duties and responsibilities of the Chairperson in their absence.

9. Clause 26 (6) of

Schedule 7 of the LGA 2002 sets out the process for electing a member to

preside at the meeting if the Chairperson is absent and the Deputy Chairperson

has not been appointed.

Financial Considerations

10. There

are no financial impacts from this decision.

Legal Implications / Risks

11. There

are no legal implications or risks from appointing a Deputy Chairperson.

Significance

12. The Local Government Act 2002

requires an assessment of the significance of matters, issues, proposals and

decisions in this report against Council’s Significance and Engagement

Policy. Council acknowledges that in some instances a matter, issue,

proposal or decision may have a high degree of importance to individuals,

groups, or agencies affected by the report.

13. In making this assessment,

consideration has been given to the likely impact, and likely consequences for:

(a) the

current and future social, economic, environmental, or cultural

well-being of the district or region

(b) any

persons who are likely to be particularly affected by, or interested in, the

issue, proposal, decision, or matter

(c) the

capacity of the local authority to perform its role, and the financial and

other costs of doing so.

14. In accordance with the

considerations above, criteria and thresholds in the policy, it is considered

that the decision is of low significance.

ENGAGEMENT

15. Taking into consideration the

above assessment, that the decision is of low significance, officers are of the

opinion that no further engagement is required prior to the Committee making a

decision.

Click here to view the TCC

Significance and Engagement Policy

Next Steps

16. Update the Terms of Reference.

Attachments

Nil

8.2 Financial

Monitoring Report for Nine Months to 31 March 2021

File

Number: A12495812

Author: Kathryn

Sharplin, Manager: Finance

Tracey Hughes, Financial

Insights & Reporting Manager

Authoriser: Paul

Davidson, General Manager: Corporate Services

Purpose of the Report

1. The

purpose of this report is to inform Council and the public of our financial

performance for the nine months of the financial year to 31 March 2021. It also

notes how the projected underspend of capital budget and some operational projects

will be addressed as part of the Long-term plan (LTP) process.

|

Recommendations

That the Strategy, Finance and Risk Committee:

(a) Receives the Financial

Monitoring Report for Nine Months to 31 March 2021 report.

(b) Notes that the projected

capital under-delivery for 2021 along with some deferred operational

expenditure will result in rephasing of aspects of the capital programme and

rebudgeting of expenditure as part of the LTP process through to July 2021.

|

Executive Summary

2. The full year financial projection for operating surplus is for an

operating result $9.5m favourable to budget. The overall surplus, which

includes asset revenue as well as operational revenue, is a projected full year

surplus of $49m, which is $2.7m favourable to budget.

3. The key operational variances occur across non-rate funded

activities. In particular, user fees revenue for the airport and building

services is closer to the pre-Covid expectations of revenue than was expected

when budgets were set. The rates requirement is currently projected to be as

budgeted.

4. Net debt at year end is projected to be $610m-$620m which is

$66m-$76m below budget due to slower timing of capital delivery. The main risk

to this debt projection is timing and cost of the final two months of capital project

delivery.

5. The financial summaries for operational budgets, borrowing and

capital are included as Attachments A and B to this report.

Background

6. This report is for monitoring and reporting purposes showing,

Council’s financial performance in delivering services to the community

and undertaking capital investment as set out in the 2018-28 Long-term Plan and

the subsequent 2020-21 Annual Plan. The financial results and forecasts are normally provided to Council

along with non-financial results. Due to timeframes to collate

non-financials, the financial report is provided separately as the information

is relevant to the Long-Term plan.

7. In

July 2020, following the Covid19 lockdown, the 2020-21 Annual Plan was revised

to reflect an expectation of slower economic activity and building

development. This has not proved the case with building development and

asset revenue from development contributions being at pre-Covid levels.

Strategic / Statutory Context

8. Maintaining expenditure within budget ensures delivery of services

in a financially sustainable way, e.g., a shortfall of rates funding or other

revenue not matched by lower expenditure would result in higher levels of debt.

DISCUSSION

Part 1: Financial Performance

9. Attachments A and B to this report provide a summary of

Council’s financial performance for the year to date. The content of this

report includes:

(a) A summary of

revenue and expenditure year to date with revised full year projections

presented as a Statement of Comprehensive Revenue and Expense (Attachment A).

(b) The Treasury

report which shows borrowing year to date and full-year projections, the

average cost of funds and money market investments benchmarked to average

return (Attachment A).

(c) The Capital

Programme spend to date and full year projections, also identifying key

projects (Attachment B).

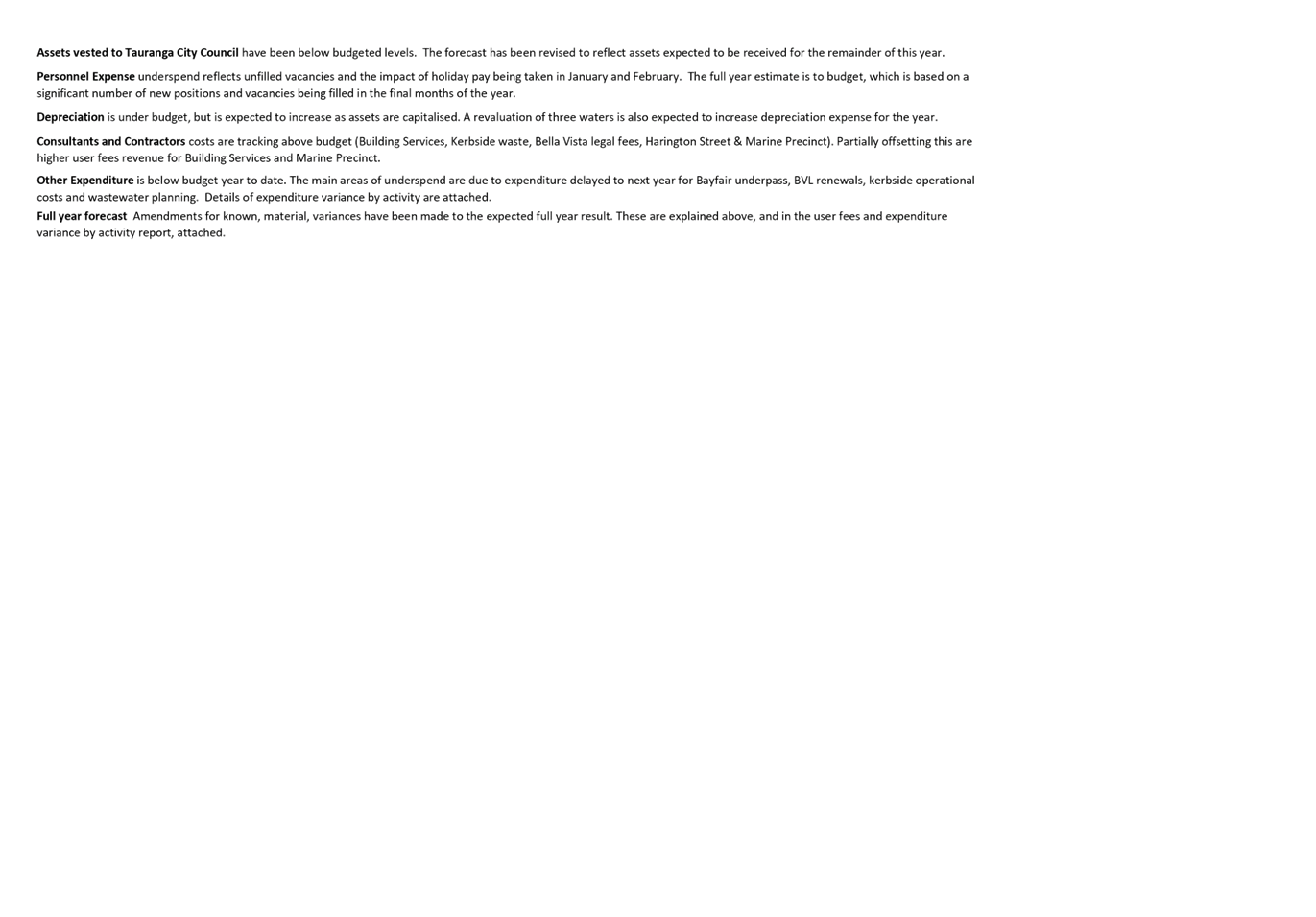

10. Summary Statement of Comprehensive Revenue and Expense (SOCRE, Attachment A) shows the operating and capital revenue and

expenses in a format consistent with the Annual Report. It shows the year to date

results for revenue and expenditure and provides full-year forecasts.

11. The nine-month result in the SOCRE forecasts

a full year operational result which is $9.5m favourable to budget ($19.4m

operating deficit). The overall surplus including asset revenue is $49.1m

which is $2.7m favourable to budget. Revenue and expenditure budgets had been

reduced in the revised annual plan post Covid-19. Actual operating revenue is

ahead of budget.

12. Operating revenue is projected to be $6.7m

above budget by year end. User fees are projected to be $4.6m above

budget. User fee revenue has been particularly strong across Building

services and airport activities as follows:

(a) Building

services - up $3.8m

(b) Airport

revenue - up $1.4m

13. Operating expenditure is projected to be

below budget by $2.8m with other expenses lower than budget due primarily to

budgeted contribution to Bayfair underpass, operating costs of kerbside, lower

renewals undertaken by BVL, and some wastewater planning all not occurring

until next financial year. These lower costs have been partially offset

by higher costs associated with increased activity, particularly in building

services. Some of these expenditure budgets will be requested to be

carried forward into 2022 as part of the LTP process.

14. Development contribution revenue is

tracking at pre-Covid19 levels and is expected to achieve $30m for the year.

15. Capital Expenditure is tracking well

behind budget with a $108m underspend forecast. This underspend is over

and above the capital adjustment of $43m budgeted as expected under-delivery of

budgeted projects. Key projects such as Waiāri, Te Maunga and streetscape are underway, and expenditure is

expected to be carried forward to the early months of 2022.

16. Debt is now projected to be

significantly below annual plan budgeted levels largely as a result of slower

capital delivery. The annual plan budget was for year-end debt of $686m. We are

now projecting the year end position to be closer to $610-$620m.

Depending on decisions on carryforward budgets and capital programme rephasing

the debt position in the early years of the LTP is likely to be below that in

the current draft LTP.

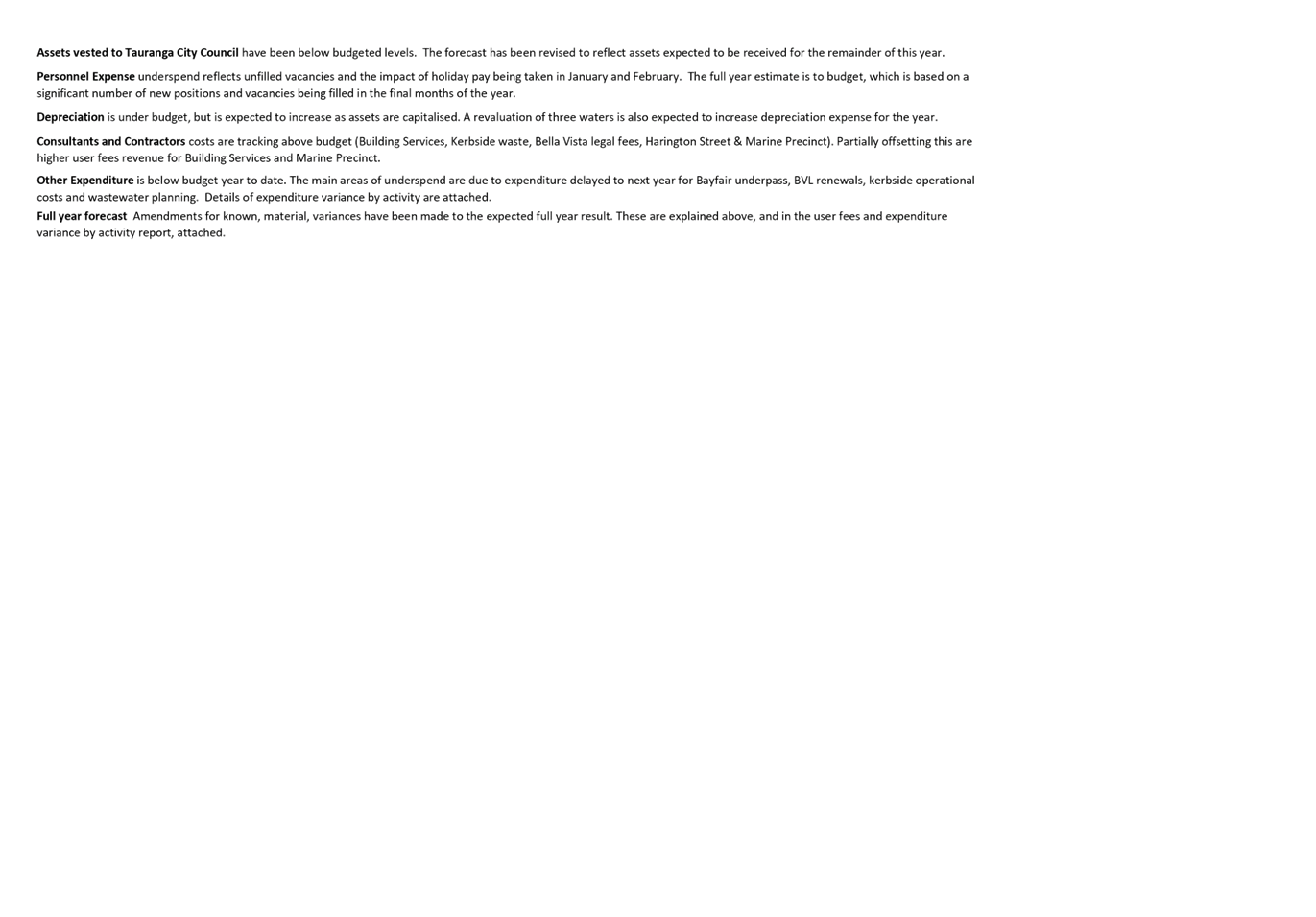

17. Summary Revenue and Expenditure variance by activity (Attachment A) highlights key variances by activity and provides a

full year forecast. These results feed into the whole of council forecasts

contained in the SOCRE.

18. The Treasury Report (Attachment A) shows total net debt to 31 March 2021 of $554m

with the full year net debt forecast in the range of $610m-$620m, which is

lower than budget by $66m to $76m as a result of slower timing of capital

delivery.

19. The interest rate average at the end of March was 3.05%. Total

HIF borrowing at 0% interest has increased to $96.5m. The year-end forecast

average interest rate is approximately 3%.

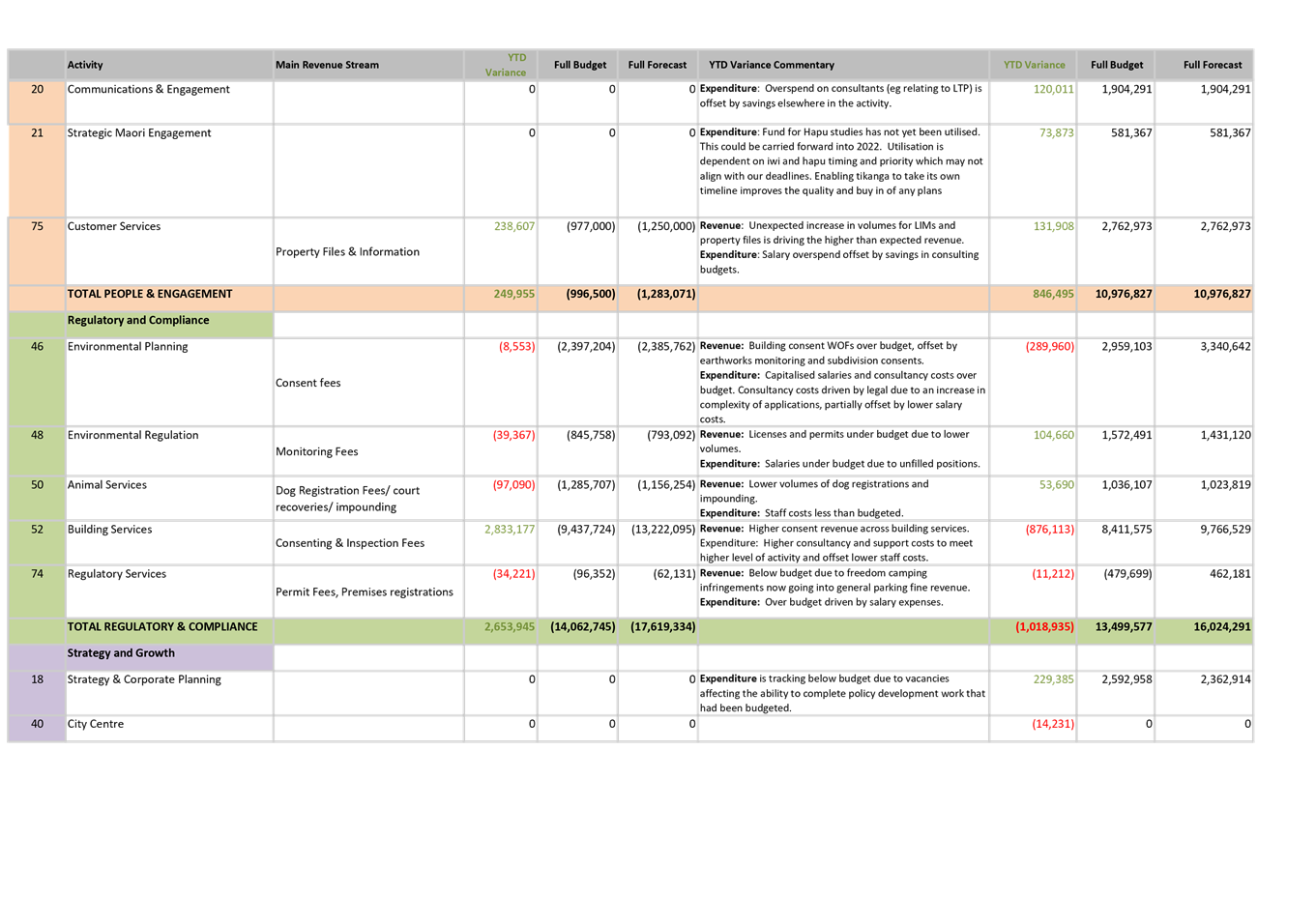

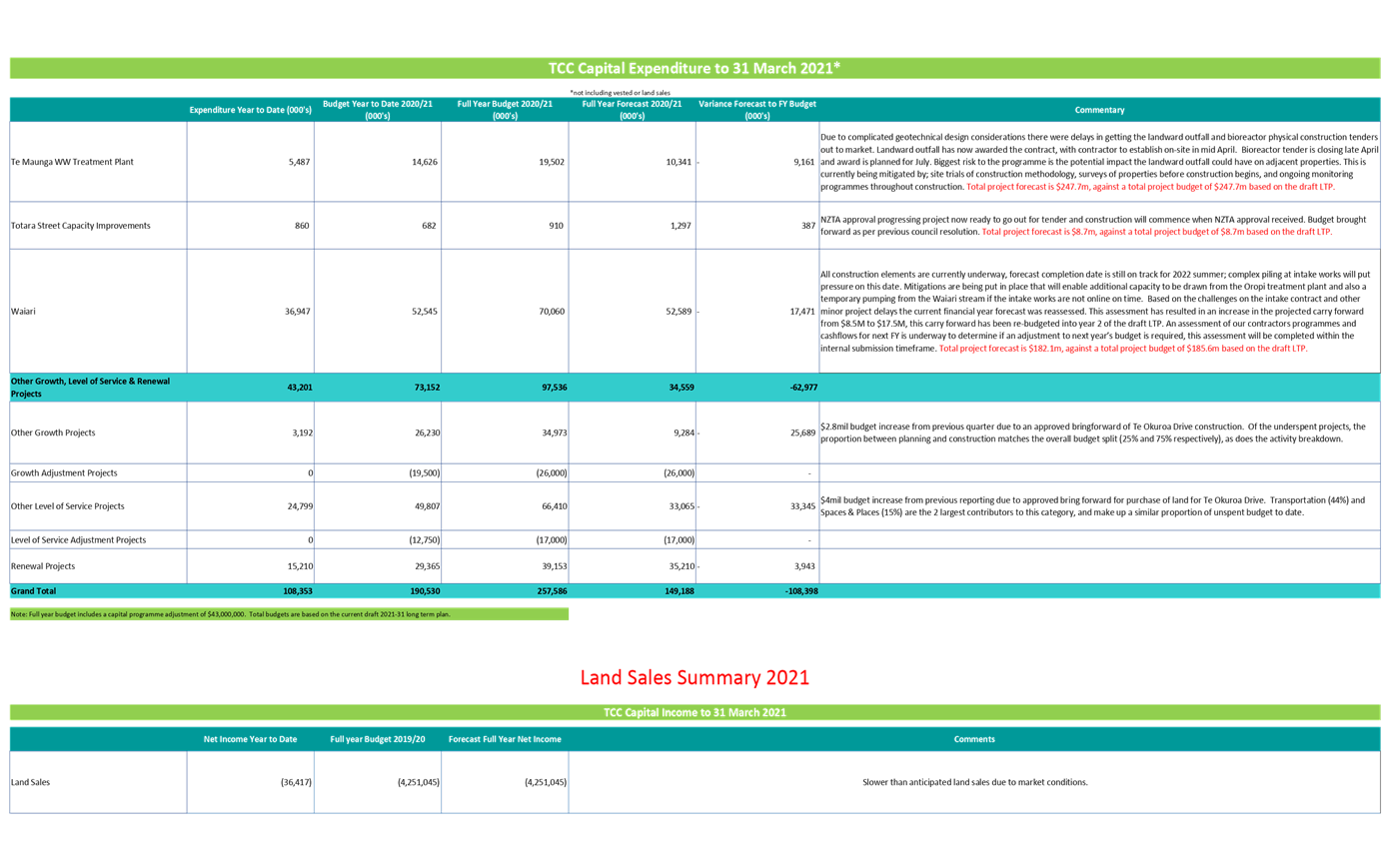

20. The TCC Capital expenditure table

(Attachment B) identifies capital project budgets for the year by significant

projects and remaining growth, level of service and renewal project

expenditure. It also shows $43m of capital expenditure adjustment which was the

budgeted amount of capital non-delivery for the year. To the end of

March 2021, capital spend has been $108m, which is 42% of full year

budget. The full year projections at the end of March have been revised

down to forecast expenditure of $149m, $58% of the full year budget.

21. Key pieces of work will

continue to increase both internal and external capacity to deliver larger

capital programmes. Throughout the LTP hearings and deliberations phases,

staff will look to rephase capital expenditure, taking into account the ability

of the organisation and sector to deliver on substantially larger

programmes.

OPTIONs

22. There are no options associated with this report. The report is

provided as information only.

Significance

23. The

Local Government Act 2002 requires an assessment of the significance of

matters, issues, proposals and decisions in this report against Council’s

Significance and Engagement Policy. Council acknowledges that in some

instances a matter, issue, proposal or decision may have a high degree of

importance to individuals, groups, or agencies affected by the report.

24. In

making this assessment, consideration has been given to the likely impact, and

likely consequences for:

(a) the current

and future social, economic, environmental, or cultural well-being of the

district or region

(b) any persons who are likely to be

particularly affected by, or interested in, the issue, proposal, decision, or

matter

(c) the capacity of the local authority to

perform its role, and the financial and other costs of doing so.

25. In

accordance with the considerations above, criteria and thresholds in the

policy, it is considered that the matter is of low significance.

ENGAGEMENT

26. Taking

into consideration the above assessment, that the matter is of low significance,

officers are of the opinion that no engagement is required.

Next Steps

27. This report ensures monitoring of Council performance to ensure

compliance with Council’s budgets, policies and delegations. The

review of spend to budget in 2020-21 for both capital projects and key

operational expenditure (e.g. city planning) will be undertaken over coming weeks

to form the basis of an executive report to deliberations on the LTP. Progress on this

will be reported through the LTP process and budgets adjusted in July to

reflect the latest information available which is expected to particularly

impact on the early years of the capital expenditure programme in the Long-Term

Plan.

Attachments

1. Attachment

A - March 21 Financial Report - A12481624 ⇩

2. Attachment B -

March 21 Capital Project Summary - A12506505 ⇩

|

Strategy,

Finance and Risk Committee Meeting Agenda

|

17 May 2021

|

|

Strategy, Finance and Risk Committee

Meeting Agenda

|

17 May 2021

|

8.3 Audit

NZ Report on the 30 June 2020 Annual Report and Preparation for the 2021 Annual

Report and Audit

File

Number: A12503821

Author: Kathryn

Sharplin, Manager: Finance

Tracey Hughes, Financial

Insights & Reporting Manager

Marin Gabric, Senior Financial

Accountant

Authoriser: Paul

Davidson, General Manager: Corporate Services

Purpose of the Report

1. The purpose of this

report is to advise the Strategy Finance and Risk committee of the process and

timetable for the annual audit of Tauranga City Council (TCC) and to present

for information the Audit New Zealand Report to the Council on the Audit of

Tauranga City Council for the year ended 30 June 2020.

|

Recommendations

That the Strategy Finance and Risk Committee:

(a) Receives the report Audit

New Zealand Report on the 30 June 2020 Annual Report and Preparation for the

2021 Annual Report and Audit

(b) Receives the Report to

Council from Audit New Zealand on the audit of Tauranga City Council for the

year ended 30 June 2020

|

Executive Summary

2. TCC is audited

annually by Audit New Zealand on the Annual Report for the year ended 30

June. The report includes information for the past year, including

financial statements and non-financial performance measures set by Council

during the Long-term plan (LTP) and annual plan processes.

3. As part of the

audit process Audit New Zealand provide a report to Council on the audit.

It sets out audit findings and draws attention to areas where the city council

is doing well and where there are recommendations for improvement.

Council staff review the findings and recommendations in the report and

implement improvements.

4. The audit report

was received in November 2020 and would normally be presented to council

earlier than May of the following year. However, due to the appointment

of commissioners and prioritisation of the LTP, this report has on this

occasion been incorporated in discussions on the 2021 Annual Report and audit

process. In the interim, staff have reviewed and where possible implemented

changes as a result of the audit recommendations.

Background

5. Every year council

produces an annual report. The annual report provides the community, the

government, lending agencies, councillors and staff with a summary of work

completed by council during the year and our performance both financial and

non-financial compared with our proposed performance as set out in the relevant

LTP (prepared three-yearly) and annual plans (prepared in the two years between

adopting the LTP).

6. The audit process

includes an interim audit which reviews council’s information systems,

processes and internal controls. This is followed by a final audit of the

financial and non-financial information for the year and its presentation in

the Annual Report.

Audit New Zealand

Recommendations on the 2020 Annual Report

7. Audit New Zealand

identified main audit risks and issues prior to the audit which included:

(a) Covid-19,

(b) Fair value assessment of

assets

(c) Valuation of weathertightness

liabilities

(d) Management override of

internal controls

(e) Revaluation of airport

infrastructure and improvements and parks facilities

(f) Transition of finance

system from Ozone to SAP

8. No issues were

raised in relation to these risks.

9. A number of new

recommendations were made and along with comments on progress against existing

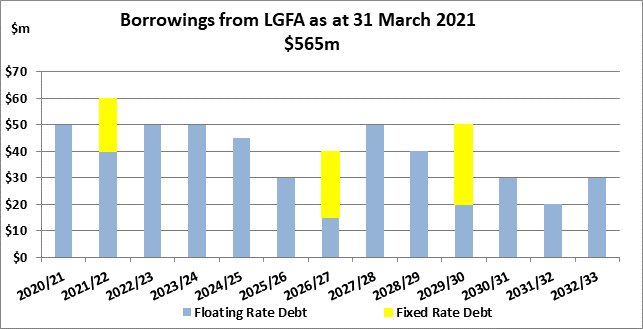

recommendations. Recommendations are coded under three categories:

(a) Urgent – significant

deficiency exposes council to significant risk

(b) Necessary – deficiencies

that need to be addressed to meet best practice including internal control

(c) Beneficial – where

council is falling short of best practice and improvement would be beneficial

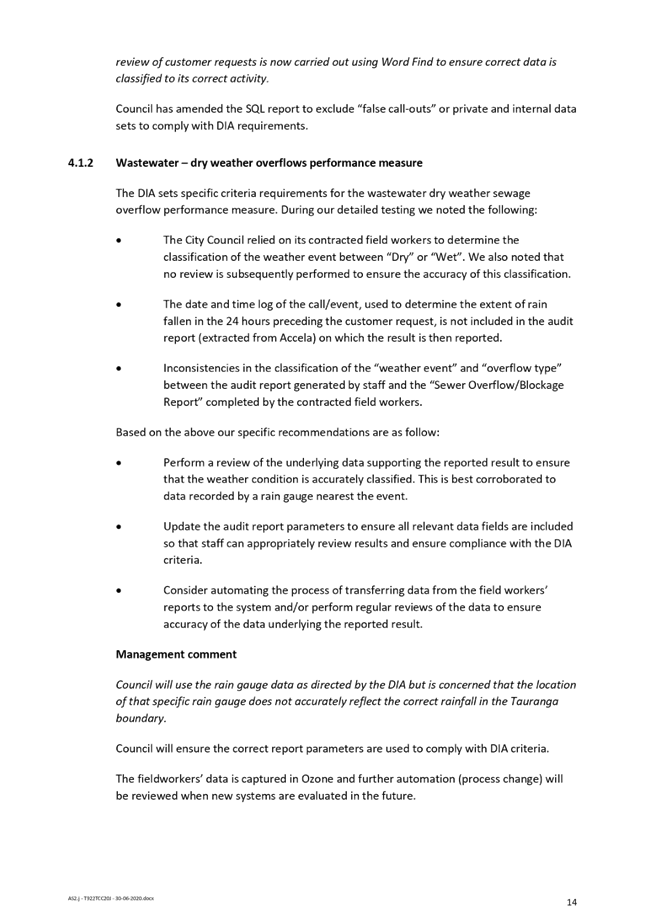

10. Page 5 of the Audit New

Zealand report identifies new recommendations.

(a) No urgent recommendations were

identified

(b) Four necessary recommendations

were identified relating to performance measure data (4.1), timing of

capitalisations (4.2), reviewing of journal entries (4.3) and updating of

disclosure of interest in other entities.

(c) No beneficial recommendations

were identified

11. All the necessary

recommendations have been reviewed and items 4.2, and 4.3 have been addressed

through process and system changes. The disclosure amendments required in

4.4 will be addressed as part of the year end processes. For item 4.1, from 2021-22,

the first year of the 2021-31 LTP, measures and their measurement have been

updated.

Timetable for Audit of the

2021 Annual Report

12. Audit New Zealand will

commence their interim audit in the week of 10 May 2021, and will be on site

for the finalisation of the audit in August 2021. Adoption of the audited

Annual Report is planned for the final week of October 2021.

Strategic / Statutory Context

13. Requirements for the Annual

Report and audit are set out in the Local Government Act 2002.

Options Analysis

14. This

report and the attached Audit New Zealand report are for information.

Financial Considerations

15. There

are no financial considerations arising directly from this report.

Legal Implications / Risks

16. There

are no legal implications or risks arising from this report.

Consultation / Engagement

17. The Audit New Zealand report

provides feedback to council and staff on areas for improvement. It is an

internal document not requiring consultation with the community.

Consultation on budgets occurs on the LTP and annual plans that are reported

against in the annual report. The audited Annual Report is made public

and included on the TCC website once adopted.

Significance

18. The Local Government Act 2002

requires an assessment of the significance of matters, issues, proposals and

decisions in this report against Council’s Significance and Engagement

Policy. Council acknowledges that in some instances a matter, issue,

proposal or decision may have a high degree of importance to individuals,

groups, or agencies affected by the report.

19. In making this assessment,

consideration has been given to the likely impact, and likely consequences for:

(a) the current and future social,

economic, environmental, or cultural well-being of the district or region

(b) any

persons who are likely to be particularly affected by, or interested in, the

issue, proposal, decision, or matter

(c) the

capacity of the local authority to perform its role, and the financial and

other costs of doing so.

20. In accordance with the

considerations above, criteria and thresholds in the policy, it is considered

that the matter is of low significance.

ENGAGEMENT

21. Taking into consideration the

above assessment, that the matter is of low significance, officers are of the

opinion that no further engagement is required prior to Council making a

decision.

Next Steps

22. Staff will work with

councillors during the internal audit process for the audit of the 2021 Annual

Report.

Attachments

1. Report

to the Council on the Audit of Tauranga City Council - 30 June 2020 - A12147401

⇩

|

Strategy,

Finance and Risk Committee Meeting Agenda

|

17 May 2021

|

8.4 Treasury

Strategy

File Number: A12519791

Author: Mohan

De Mel, Treasurer

Authoriser: Paul

Davidson, General Manager: Corporate Services

Purpose of the Report

1. Treasury Policy requires strategies to be approved on a

six-monthly basis. Treasury Policy was last reviewed November 2020.

This report seeks approval for strategies for treasury risk management

activities, debt issuance, investments, foreign exchange exposure management

and interest rate hedging activities.

|

Recommendations

That the Strategy, Finance and Risk Committee:

(a) Receives

the Treasury Strategy report.

(b) Approves

the issuance of long and short-term debt on a wholesale basis to manage

cash-flows.

(c) Approves

the management of fixed interest rate hedging in the range of 50% to 60% at 2

years forward, and the range of 30% to 40% at 5 years forward.

(d) Approves

maintenance of a minimum of $15m of cash and short-term investments to manage

cash-flows.

(e) Approves

hedging of all significant foreign exchange exposures.

(f) Recommends

to Council to approve an interim Borrowing of $30m for the month of July

2021.

|

Executive Summary

2. This report outlines

all significant treasury operational activities and seeks confirmation of

existing strategies and approval for planned strategies.

3. Treasury Strategy is an important element of sound

financial management and allows Council to efficiently manage its funding and

associated risks.

4. This report notes that borrowing may be undertaken during

July 2021, prior to the approval of the Long-term Plan (LTP) for general

funding.

Background

Debt Management

5. Council

has a large investment in infrastructural assets which have a long economic

life and long-term benefits. Debt is utilised to fund infrastructure and

it is recognised as an efficient mechanism to allocate the cost of

infrastructure to the community.

6. Core

external debt and working capital requirements are managed by issuing a

combination of long-term and short-term debt. The maturity dates for new

debt issuance are assessed under the following criteria:

· Borrowing margins for short vs long-term

· Investor demand including bank funding

· Local Government Funding Agency (LGFA) or other wholesale

margins / maturities offered

· Compliance with LGFA covenants

· Housing Infrastructure Fund (HIF) drawdowns

· Existing maturity profile

· Available undrawn bank facilities

7. The

graph below shows the debt maturity profile as at 31 March 2021 (years ending

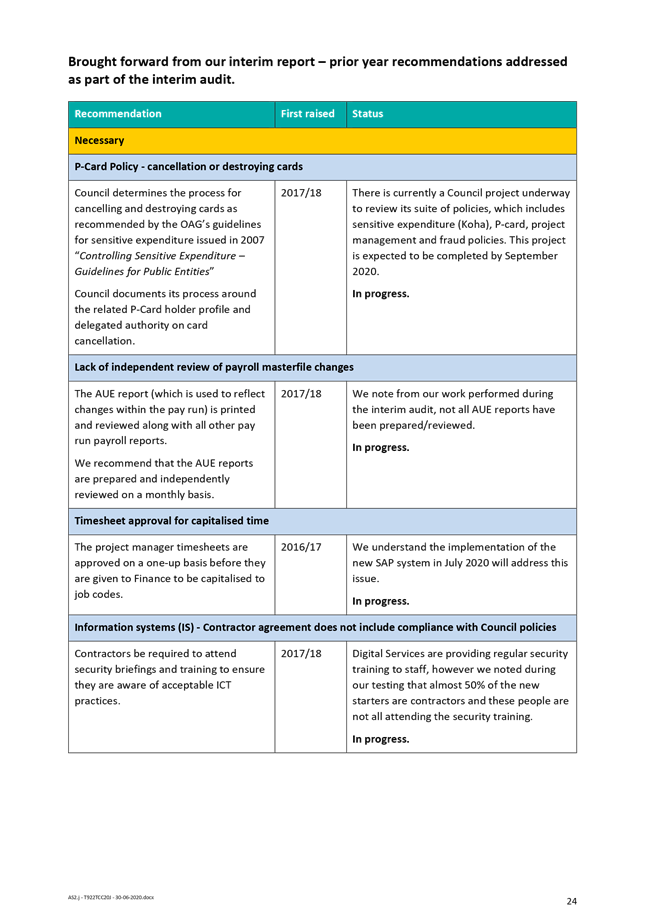

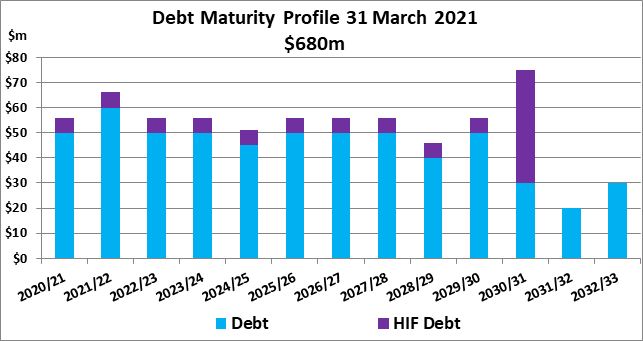

June).

8. Over

the last 9 months a total of $148m of new medium to long-term debt has been

issued. In addition, a further $20m of short-term debt was issued during

the year to manage intra-year cash flows and this has now been repaid.

9. Debt

duration (i.e. average maturity) is now at 5.43 years and it is planned to

maintain duration above 5.0 years while ensuring no more than 33% of debt shall

be subject to refinancing an any rolling 12 month period.

10. During

2020-21, $56m of long-term debt is due to mature and these maturities have been

progressively pre-funded.

11. Debt

position up to 30 June 2021:

Debt

as at 31 March 2021

$680m

Drawdown

from HIF during May / June or arrange funding from LGFA

$ 10m

Long-term

debt – May 2021 (maturity)

($ 50m)

HIF

– June 2021 (maturity)

($ 6m)

Forecast gross debt 30

June 2021 (Net Debt approximately $600m) $634m

12. Net

debt forecast has been revised down to $610 based on actual cashflows for April

and is subject to change based on the level of capital expenditure undertaken

over the next 2 months.

13. Forecast

debt position for the 2021/2022 year:

Forecast gross debt 30 June 2021 $634m

New debt issuance 2021/2022 $182m

Long-term debt maturity ($66m)

Forecast gross debt 30 June

2022 $750m

The forecast gross debt of $750m

by 30 June 2022 is $50m less than assumed in the draft LTP and expected

delivery of capital during 2022 will be reassessed as part of finalising the

LTP.

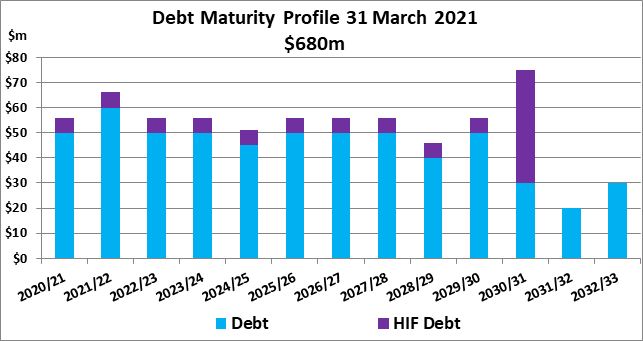

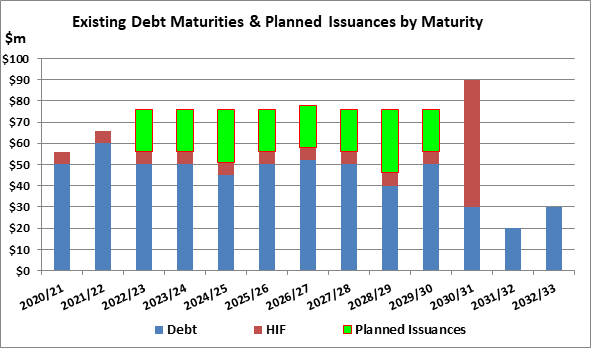

The chart below shows the

indicative debt issuances planned by maturity for the 2021/22 financial year

commencing July 2021.

14. Under Council’s Treasury

Policy, Council is required to approve the borrowing programme annually.

Normally this approval is sought in conjunction with the annual plan in June

for the subsequent year. As the LTP approval is now planned to be completed

post 30 June 2020, an interim borrowing approval of up to $30m is requested to

manage cash flows. This borrowing will be scheduled only if detailed cash

flows show a requirement for the period 1 July through to 31 July.

Bank Facilities

15. Currently

Council has a $70m bank facility which is undrawn. This facility

matures on 31 October 2023 and it is planned to renegotiate to extend the

maturity date to October 2024. Generally, bank facilities are

maintained within the ‘2 to 4 year’ maturity band.

16. Finance,

Audit and Risk Committee Council previously approved to increase bank

facilities by a further $30m as the debt levels increase to manage liquidity

risk. An alternative basis to manage liquidity risk being to maintain a

higher cash / short term investments position.

17. In

general, bank facilities are available to be drawn down at short notice,

provided if drawn, they are able to be repaid on a quarterly basis.

18. Access

to liquidity funding by way of committed bank facilities and or liquid investments

is required to manage liquidity risk.

19. Both

Council’s Treasury Policy and LGFA financial covenants require a level of

undrawn committed bank facilities or liquid investments or a combination of

these. The key objective is to maintain adequate liquidity in the context

of managing debt maturities and debt servicing on a 12-month rolling basis.

20. It

is important to note that any drawdown from bank facilities would need to be

managed within the existing net debt to revenue ratio.

21. LGFA

now are also offering committed facilities to Councils. Consideration will be

given to undertake the increased $30m of facilities with LGFA.

22. Current

annual facility costs are 0.20% ($140k for $70m). Generally pricing on

facilities are reviewed on an annual basis.

Liquidity Risk

23. Treasury

Policy outlines the management framework for funding, liquidity and credit

risks. Liquidity risk primarily focuses on ensuring that there are

sufficient funds available to meet obligations in an orderly manner.

24. Two

key liquidity risk management indicators are:

(a) The

primary debt maturity limit requires ‘external debt, committed bank

facilities and cash / cash equivalent investments’ to be maintained above

100% on 12-month peak forecast net external debt, and

(b) No

more than 33% of debt be refinanced in any rolling 12-month period.

Forecast

debt levels remain compliant with the above liquidity risk indicators.

25. New

debt issuances are managed to maintain debt duration above 5 years.

Local

Government Funding Agency (“LGFA”)

26. The New Zealand Local

Government Funding Agency (“LGFA”) is an agency specialising in

financing of the local government sector. LGFA was established to raise

debt on behalf of councils on terms that are more favourable to them than if they

raised the debt directly.

27. LGFA was incorporated as a

limited liability company under the Companies Act 1993 on 1 December

2011. Following the enactment of the Local Government Borrowing Act

2011. As LGFA is majority owned by councils, it constitutes a

“Council Controlled Organisation” (“CCO”) under the

Local Government Act 2002.

28. LGFA currently has 45m ordinary

shares on issue, 20m of which remain uncalled. Currently there are 30

council shareholders owning 80% and New Zealand Government owning 20%.

29. The capital structure of LGFA

also includes Borrower Notes. These are subordinated convertible debt

instruments which each council that borrows from LGFA must subscribe for 2.5%

of any long-term borrowing from LGFA by a council. Under normal circumstances,

these Borrower Notes are redeemed at the maturity of the associated debt.

30. LGFA has credit ratings from

S&P Global Ratings and Fitch Rating Services. Credit rating was

upgraded to AAA (local-currency) by S&P on 21 February 2021 and is equivalent

to the New Zealand Government’s offshore rating.

31. LGFA’s debt obligations

are guaranteed by council shareholders and any other councils that borrow in

excess of $20m (total guarantors 60). The New Zealand Government does not

guarantee LGFA. Any call under the guarantee will be allocated across all

the guarantors on a pro rata basis in relation to their rates revenue.

32. Now 71 councils (out of 78) are

members of LGFA.

33. The LGFA Board is responsible

for the strategic direction and control of LGFA’s activities and

comprises five independent directors and one non-independent director.

34. The LGFA Shareholders’

Council comprises five to ten appointees from the council shareholders and the

New Zealand Government. The role of the Shareholders’ Council being

to:

· Review

and report performance of LGFA and the Board;

· Recommend

the appointment, removal, replacement and remuneration of directors;

· Recommend

changes to polices, or the Statement of Intent, or any other matters requiring

council approval; and

· Update

shareholders on LGFA matters.

35. LGFA can lend to councils and

to 100% council owned Council Controlled Organisations (CCOs) (only exception

being those with a partial Crown ownership). Any lending to CCOs requires

parent council(s) approval with appropriate security structure arrangements.

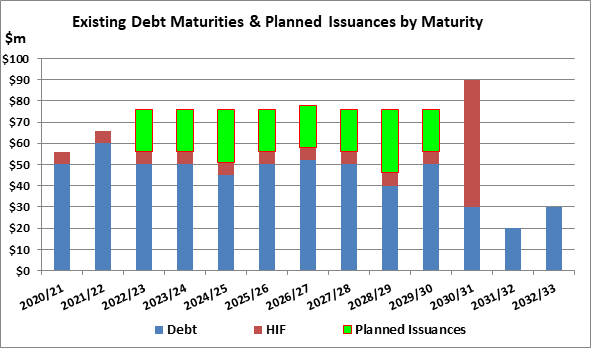

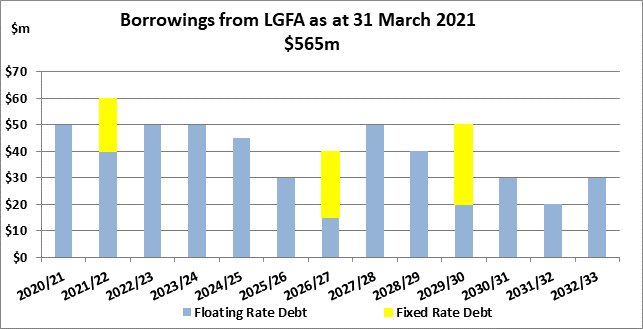

36. As at 31 March 2021, total LGFA

bonds (long-term) on issue were $14,240m, of which $565m have been on-lent to

Tauranga City Council.

37. The graph below shows the

borrowings from LGFA on a fixed interest vs floating interest rate basis.

38. Current new fixed rate

borrowing rates from LGFA are:

1 Year 0.71% 6

Year 1.76%

2 Year 0.84% 8

Year 2.18%

3 Year 1.06% 12

Year 2.69%

4 Year 1.30% 16

Year 3.06%

5 Year 1.55%

Latest

LGFA Borrowing rates attached.

Security

39. Generally, debt will be issued under the existing

Council’s Debenture Trust Deed (“DTD”) which offers rates

revenue as security to attract lower borrowing margins. Council’s

Trustee appointed under the DTD is Covenant Trustee Services Limited. All

debt obligations are registered with Link Market Services Limited.

Interest

Rate Risk Management

40. The overall objective of the

interest rate risk management strategy is to:

· Minimise the average net interest cost on borrowings over

the long-term.

· Minimise large concentrations of interest rate risk.

· Increase duration of the interest rate re-pricing profile.

· Maintain an appropriate mix of floating / fixed interest

rate exposures.

41. Council

is exposed to interest rate fluctuations on existing and future

borrowings. Interest rate risk is minimised by managing floating and

fixed interest rate exposures within the Treasury Policy limits

framework. The overall outcome of interest rate risk management is

reflected in the average interest rate on borrowings.

42. As

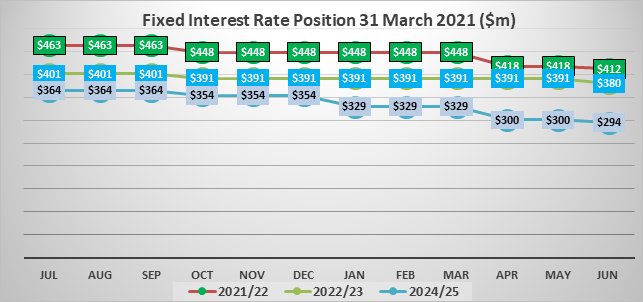

at 31 March 2021 the fixed interest position was $504m which was 79% of

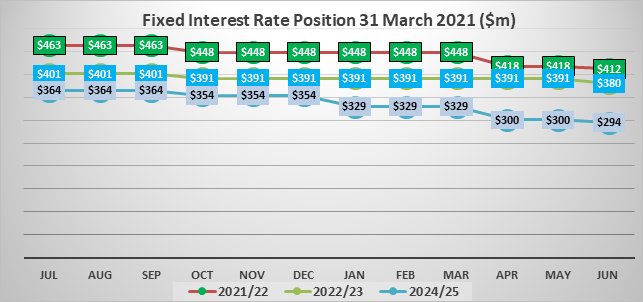

debt. The graph below shows the existing fixed interest rate

positions (fixed rate debt and interest rate hedging) over the next 3 years on

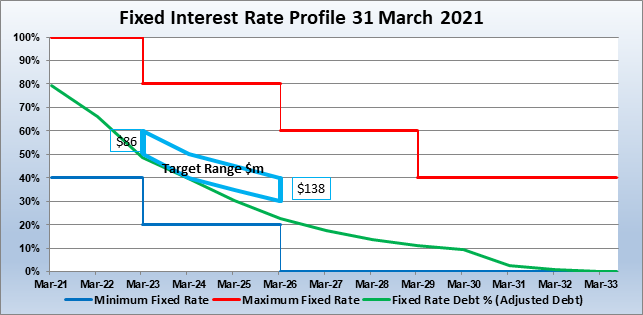

a monthly basis:

43. Treasury

Policy outlines the framework for interest rate risk management

activities. Interest rate risk is managed with minimum and maximum fixed

rate debt percentages by time bands. These minimum and maximum levels by

time bands are designed to minimise interest rate re-price risks.

44. The

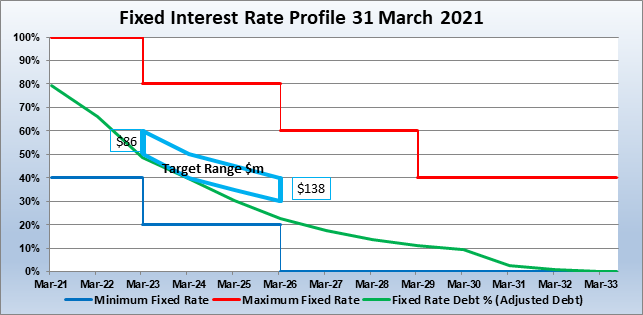

chart below shows the fixed interest rate positions relative to forecast debt

over time. The fixed interest rate positions include fixed rate debt

issued, planned drawdowns from HIF and existing interest rate hedging.

Forecast debt levels have been adjusted to recognise future lower capital

delivery / carry forwards at the end of each year throughout the LTP period,

these adjustments range from $50m to $120m. This adjustment is required to

ensure interest rate hedging is maintained at the appropriate level and not

over hedged.

45. To

illustrate the above graph, at March 2023 the fixed interest rate position is

at 49% based on forecast debt of $858m.

46. Analysis

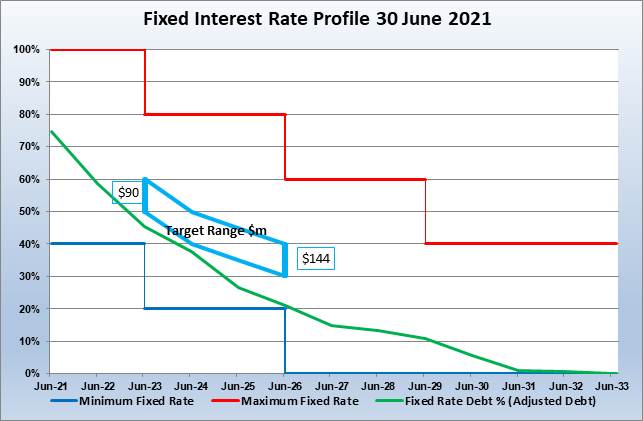

of debt levels and associated fixed rate positions are reviewed on a monthly

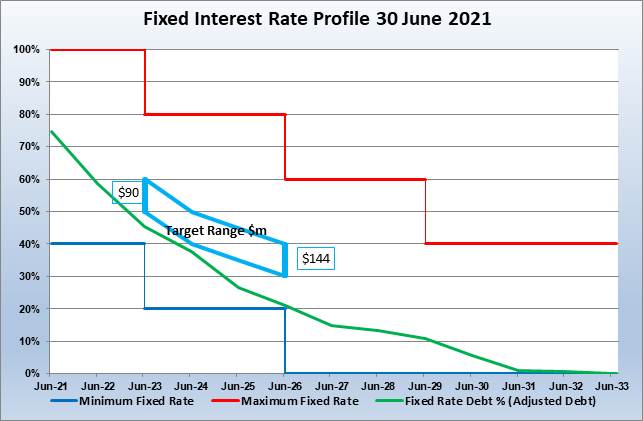

rolling basis. The graph below shows the current position rolled forward

to 30 June 2021. Changes from the above graph reflects debt and interest

rate hedging maturing between 1 April and 30 June 2021.

47. The

fixed interest rate profile (%) will be amended once the LTP is finalised.

48. In

terms of managing longer term interest rate risks, it is recommended to

maintain an interest rate hedging profile between 50% to 60% at 2 years forward

and 30% to 40% at 5 years forward. It is planned to increase the interest

rate hedging levels over the next 6 months.

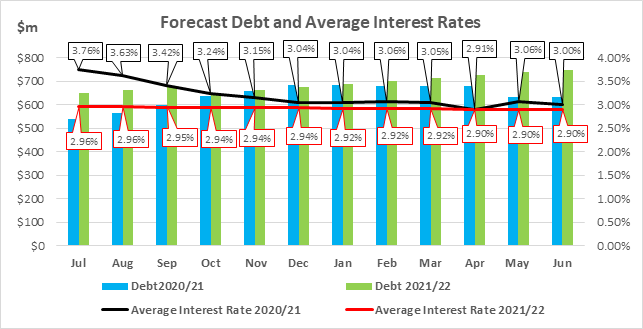

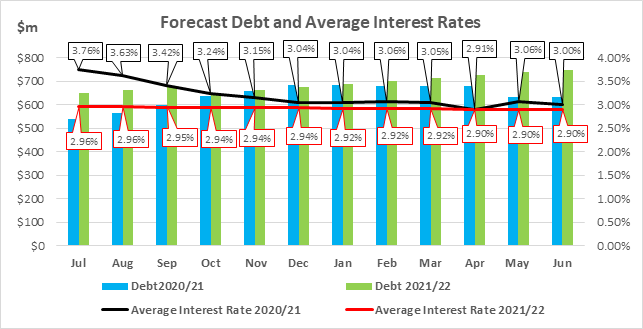

Net Interest Budget

49. Gross

debt is forecast to be $635m with net debt of $610m as at 30 June 2021.

The average interest rate for 30 June 2021 is forecast to be 3.0%.

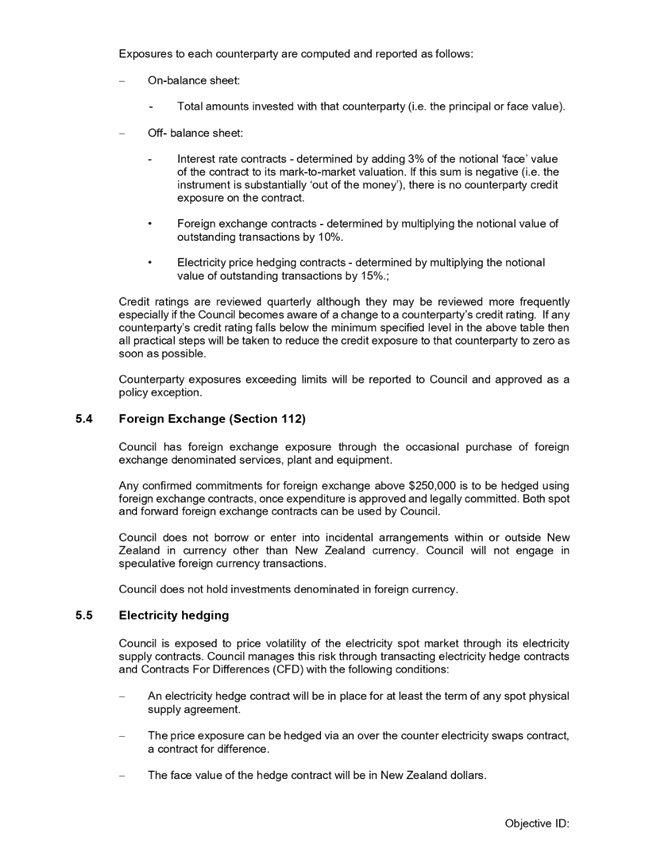

50. The table below shows the net external interest position

for the current year and 2021/22 year. Forecast interest savings for the

current year resulting from Reserve Bank reducing the Official Cash Rate (March

2020), long-term interest rates reducing due to global risks and slower capital

expenditure delivery.

|

Net External

Interest

|

Budget

|

Forecast

|

Variance

Fav (Unfav.)

|

|

2020/21

|

$20.30m

|

$19.66m

|

$0.64m

|

|

2021/22

|

$21.69m

|

|

|

The higher net interest budget for

2021/22 reflects higher debt and a gradual increase in interest rates during

the 2nd half of the year.

51. The

graph below shows the forecast monthly debt levels together with the average

interest rates for the current and next financial years.

Investments

52. From a short-term working capital management

perspective, it is proposed to maintain a minimum liquid investments balance of

$15m. This level of working capital is sufficient to manage the net cash

flows during an average month. Overall, the investment portfolio is

managed in line with the detailed monthly cash flow forecast.

Foreign

Exchange

53. Under the policy, upon

approval of expenditure, all significant commitments for foreign exchange are

hedged. Generally foreign exchange exposures above NZ$100,000 are

regarded as significant.

Currently

there are no outstanding foreign exchange contracts.

Treasury

Policy

54. Treasury Policy was reviewed by

Bancorp Treasury Services and approved by Finance, Audit and Risk Committee

November 2020. Key changes were:

· Revision of interest rate hedging time bands (Treasury

Policy section 5.1.1);

· Simplification of the debt maturity structure to no more

than 33% of debt maturing in any 12 month period; and

· Introduction of the treasury performance measuring

methodology.

Copy of

the Treasury Policy attached.

Strategic / Statutory Context

55. The Treasury Strategy is an

important element of sound financial management and allows Council to

efficiently manage its funding and associated risks. These strategies

ensure compliance with Treasury Policy Limits.

Options Analysis

56. Option

1: Approve Recommendations

The Committee is recommended to

approve the above treasury strategies. The recommendations ensure

compliance with Council’s Treasury Policy: the effective management of

both interest rate and funding risks and allows the achievement of existing net

interest rate budgets.

Option 2: Do not Approve

Recommendations

Council may decide not to approve

the recommendations. This may risk Council not complying with its

Treasury Policy and may lead to increased interest rate and funding risks, and

sub-optimal net interest costs. Council would not be able to borrow to

fund its capital programme for the month of July without an approved borrowing

resolution.

Consultation / Engagement

57. Taking

into consideration the above assessment, that the matter is of low significance,

officers are of the opinion that no engagement is required.

Significance

58. The

Local Government Act 2002 requires an assessment of the significance of

matters, issues, proposals and decisions in this report against Council’s

Significance and Engagement Policy. Council acknowledges that in some

instances a matter, issue, proposal or decision may have a high degree of

importance to individuals, groups, or agencies affected by the report.

59. In

making this assessment, consideration has been given to the likely impact, and

likely consequences for:

(a) the current and future social,

economic, environmental, or cultural well-being of the district or region

(b) any

persons who are likely to be particularly affected by, or interested in, the

issue, proposal, decision, or matter

(c) the

capacity of the local authority to perform its role, and the financial and

other costs of doing so.

60. The

consideration of treasury risk management activities is considered of low

significance, in terms of Council’s Significance and Engagement

Policy. These approvals support ongoing operational risk management

activities.

Next Steps

61. Implementation

of Treasury Strategy within the Treasury Policy framework.

Attachments

1. Treasury Policy

Final 3 November 2020 - A12519938 ⇩

2. Council Borrower

Weekly Email - 27 April 2021 - A12520101 ⇩

|

Strategy,

Finance and Risk Committee Meeting Agenda

|

17 May 2021

|

|

Strategy,

Finance and Risk Committee Meeting Agenda

|

17 May 2021

|

8.5 Quarter

2&3 LGOIMA Requests and Commission Queries

File

Number: A12492477

Author: Will

Henry, Democracy Services Advisor

Authoriser: Coral

Hair, Manager: Democracy Services

Purpose of the Report

1. To

update the Committee on Local Government Information and Meetings Act 1987

(LGOIMA) and Privacy requests as well as the Commission queries and the final

Mayor and Councillor request data.

|

Recommendations

That the Strategy, Finance and Risk Committee receives the

report: Quarter 2 & 3 Local Government Official Information and Meetings

Act 1987, the final Mayor and Councillor requests and the Commission queries.

|

introduction

2. This

report is for six months and includes data on the LGOIMA and Privacy Act requests.

It includes Commissioner queries and the last update on the Mayor and

Councillors requests. There are no observable trends noted in this

reporting period. Further analysis in the table:

|

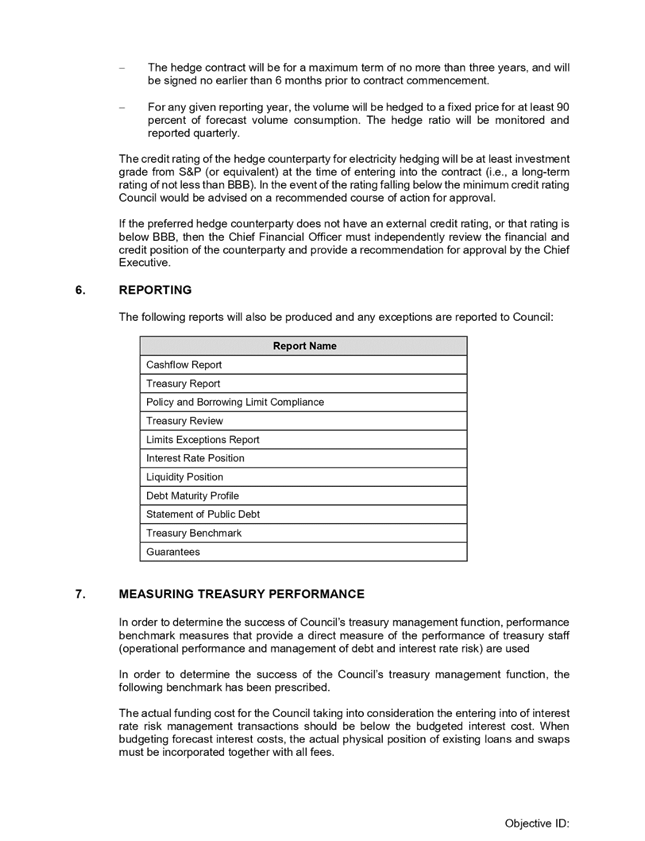

Analysis

of LGOIMA and privacy requests received 1 October

2020 to 31 March 2021

|

|

Measure

|

Statistics

|

|

Total received

|

114

|

|

Total finalised

|

138[3]

|

|

Total LGOIMA

|

107 (94%)

|

|

Total privacy

|

2 (2%)

|

|

Total both LGOIMA &

privacy

|

5 (4%)

|

|

Total withdrawn

|

4 (3%)

|

|

Total withheld in part

|

27 (24%)

|

|

Total withheld

|

14 (12%)

|

|

Total provided in full

|

69 (61%)

|

|

Total finalised within

statutory timeframes

|

130 (93%)[4]

|

|

Total chargeable time

|

681 hours[5]

|

|

Average chargeable time

taken

|

7.3 hours

|

|

Longest time taken

|

50 hours

|

|

Total requesters who made

two or more requests

|

10 requesters[6]

|

|

Total extensions of time

|

8

|

data analysis

3. The

top four allocations by business group for the official information requests

received in the period were: People and Engagement (26%), Corporate Services

26%, Regulatory and Compliance (23%) and Infrastructure (18%).

|

Source of Requests 1

October 2020- 31 March 2021

|

|

Source

|

Statistics

|

|

Total received from individuals

|

81 (72%)

|

|

Total received from organisations

|

20 (17%)

|

|

Total received from the media

|

13 (11%)

|

4. Three

Ombudsman complaints and one Privacy Commissioner complaint in relation to

official information requests are currently open. Of these, one Privacy

Commissioner complaint was received in Q2 and two Ombudsman complaints were

received in Q3. Two of the Q2/Q3 complaints belong to the amended response

process.

5. All

LGOIMA considered to be of public interest are published on the TCC website.

These can be searched for by subject or date, the published responses can be

found under the Council page, Official Information requests, view LGOIMA

responses. The link to the responses is below:

https://www.tauranga.govt.nz/council/about-your-council/official-information-requests/lgoima-responses

commissioner and mayor and

councillors queries

6. Commissioner

enquiries come mainly through the Commissioner clinics. These are logged and

responded to. Statistics for the period 9 February to 31 March 2021 are

set out below.

|

Commissioner

enquiries – 9 February 2021 to 31 March 2021

|

|

Type of measure

|

Statistics

|

|

Number received

|

11

|

|

Number finalised

|

9 (2 enquiries are outstanding)

|

|

Business Group allocation

|

Regulatory and Compliance (36%), Community Services (27%),

Infrastructure (18%), Chief Executive (18%)

|

7. Between

1 October 2020 and 8 February 2021, we received 178 Mayor and Councillors

queries. All of these have been finalised.

Ombudsman’s report and

policy

8. The

report on LGOIMA compliance and practice at TCC was published by the Office of

the Ombudsman on 3 February 2021. A progress report was provided to the Office

of the Ombudsman on 14 April 2021. Of the 37 suggested actions from the initial

investigation there are now nine outstanding that the staff Working Group

continues to progress.

9. Over

this period the Charging Policy, Complaints Procedures, Unreasonable

Complainant Conduct Policy have all been completed and are published on the TCC

website. These documents along with the Unreasonable Complainant Guidelines

have been sent to People Leaders to discuss with their teams so staff are aware

of the new policies and procedures.

Attachments

Nil

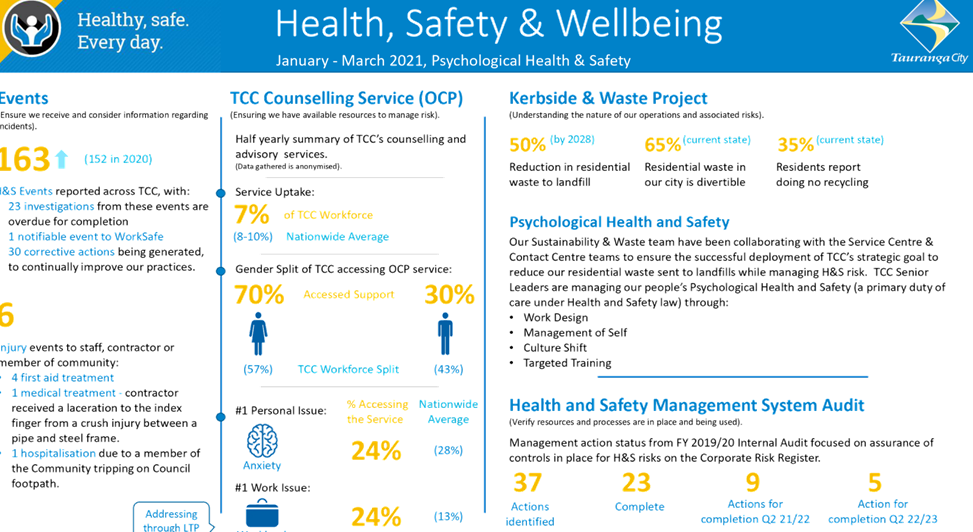

8.6 Health,

Safety and Wellbeing - January to March 2021

File

Number: A12532673

Author: Angelique

Fraser, Health & Safety Change Manager

Authoriser: Susan

Jamieson, General Manager: People & Engagement

Purpose of the Report

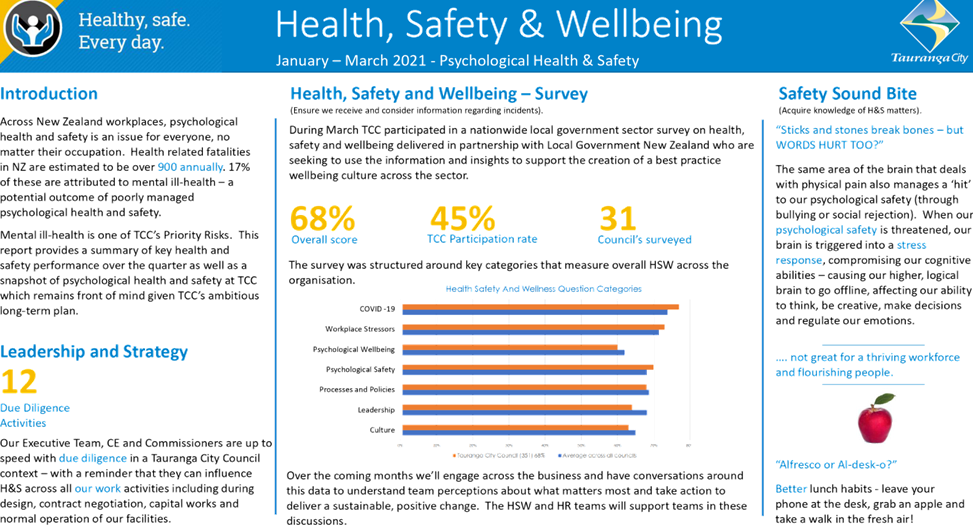

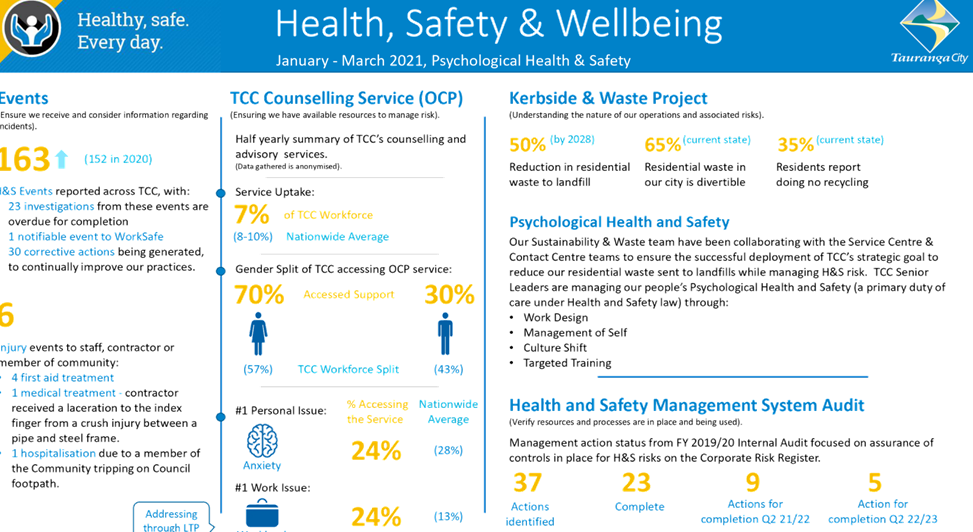

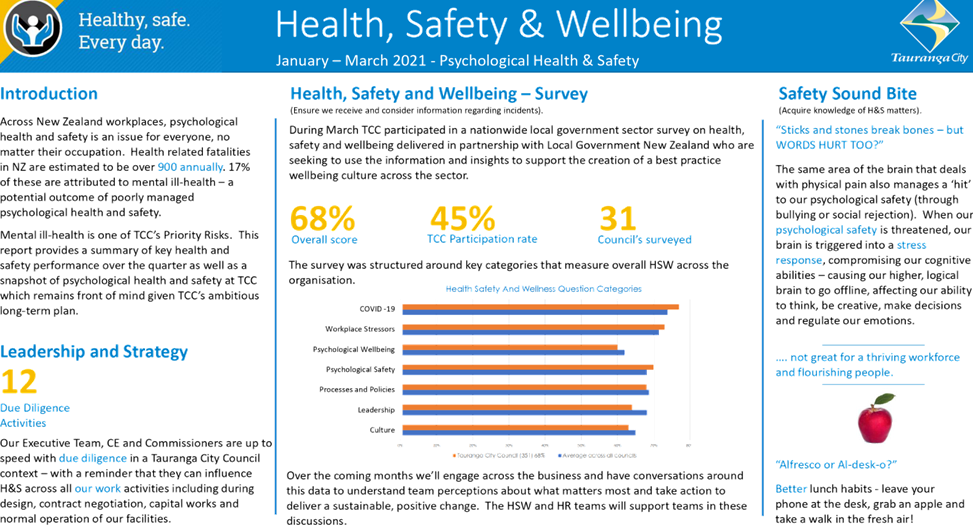

1. To provide a

summary of key health and safety performance and provide a snapshot of

psychological health and safety at Tauranga City Council for the period 1

January 2021- 31 March 2021.

|

Recommendations

That the Strategy, Finance and Risk Committee receives the

report: Health, Safety and Wellbeing – January to March 2021.

|

Discussion

2. This is a new

report presented to this committee; and its format is aligned with the

requirements of s44 of the Health and Safety at Work Act 2015.

3. The report

(attached) will be provided quarterly and will be themed to provide an

understanding of health and safety as it relates to current business

context. This quarter is focused on psychological health and safety.

4. Any feedback

regarding content or topics that the Committee would like is welcomed.

Attachments

1. Health,

Safety and Wellbeing Report Q1 - A12532648 ⇩

|

Strategy,

Finance and Risk Committee Meeting Agenda

|

17 May 2021

|

8.7 Sustainability

Update

File

Number: A12506212

Author: Sarah

Searle, Strategic Advisor

Authoriser: Christine

Jones, General Manager: Strategy & Growth

Purpose of the Report

1. To provide an

update on the sustainability work programme (“Sustainability Framework

Project”), including sustainability stocktake and next steps.

|

Recommendations

That the Strategy, Finance and Risk Committee receives the

report – Sustainability Update.

|

Executive Summary

2. A comprehensive

sustainability stocktake (“the Stocktake”) is being undertaken by

sustainability consultants Proxima Consulting Ltd (“Proxima”) and

this will be shared with Commissioners and relevant stakeholders in coming

weeks.

3. Next steps and

intended phases of the Sustainability Framework Project are outlined below,

namely -

(a) Sustainability

Stocktake and Advice (Phase One) – underway

– completion by end of this Financial Year

(b) Development

of Sustainability Strategy and Action Plan (Phase Two)

(c) Implementation,

monitoring and measurement, and reporting of progress against the action plan

(Phase Three)

4. Progress updates

will be brought back to this Committee per the draft Committee work programme

under development.

Background

5. As

part of the 2020/21 Annual Plan process, Council approved a refreshed approach

to sustainability encompassing social, environmental, cultural and economic

wellbeing. That approach included:

· the delivery of a stocktake of council’s current approach to

sustainability

· the creation and implementation of a sustainability framework for

the organisation

· the development and implementation of action plans

· the establishment of an independent sustainability advisory board

· a $400,000 budget for the board, consultants and staff to enable

this work to occur

6. It

is important to emphasise that sustainability through this resolution and

subsequent work is defined holistically, not solely environmental

sustainability.

7. Papers brought to

Council and the Policy Committee on 16 July, 08 September and 20 October 2020

focussed on establishment of the proposed Independent Sustainability Advisory

Board (“ISAB”) and commencement of the sustainability stocktake.

8. Due to factors

including the appointment of Commissioners and desire to avoid duplication of

processes and delays to decision-making, a decision was made at the Council

meeting of 08 March 2021 to discontinue establishment of the ISAB as it was no

longer the best strategic fit to achieve the desired sustainability objectives.

Sustainability

stocktake

9. In December 2020

Proxima were appointed to undertake the Stocktake in order to provide a

snapshot of current council activities and advice around applicability of

potential frameworks for guiding sustainability.

10. Work on the Stocktake began in

late January 2021.

11. Proxima’s work has

involved –

· A

TCC workshop around applicability of different sustainability frameworks

· Benchmarking

of all council activities against a methodology called “Thriving

Cities” (which is derived from Doughnut Economics), cross-referenced

against Council’s activities and other relevant sustainability frameworks

such as the United Nations’ Sustainable Development Goals

· Development

of recommendations and high-level observations and insights (including

sustainability success stories, big challenges, obvious gaps and insights from

stakeholder discussions).

12. At the time of writing this

report a first draft of the stocktake had been completed, and it is anticipated

that the stocktake will be finalised by mid May.

Next steps and

sustainability work programme

13. Significant planning is

underway in relation to the Sustainability Framework Project. This has included

the addition of a Sustainability Specialist role within the Strategy &

Growth group.

14. The intended work programme is

divided into three phases, namely –

(a) Sustainability

Stocktake and Advice (Phase One) – underway – completion by

end of this Financial Year

(b) Development

of Sustainability Strategy and Action Plan (Phase Two)

(c) Implementation,

monitoring and measurement, and reporting of progress against the action plan

(Phase Three)

Phase one

15. Per the summary above, Phase

One of the Sustainability Framework Project is underway. This phase

includes:

· The

Stocktake being undertaken by Proxima,

· Review

of reports prepared for Council considerations related to sustainability (as referenced

above),

· Assessment/review

of the Stocktake,

· Benchmarking

sustainability work across other ‘like’ councils, including

resourcing and organisational structure,

· Peer

review/comparison of Proxima work to Sustainable Development Goals, Global Reporting

Initiative / other indicators; and

· Planning

for linkages between the City Futures Project, strategic framework refresh, and

Sustainability Framework Project.

16. Phase One is the information

gathering stage and includes initial engagement with TCC activity managers, and

already-engaged stakeholders to ensure a representative view of the current

state of sustainability performance of the council for its own operations, and

the city.

17. At the end of Phase One, we will

be in a position to provide the Executive Team and Commissioners with:

· a

completed ‘sustainability stocktake’,

· a

draft proposal of the way in which sustainability could be incorporated into

the council’s strategic framework,

· a

comparison of TCC’s current performance/position compared to other

‘like’ councils in New Zealand and Australia; and

· a

recommendation on which sustainability framework or goals to adopt to develop a

sustainability strategy and associated action plan (which will include the

proposed scope, engagement, and the funding and resource requirement).

18. Phase Two (remainder of

2021 calendar year) will involve:

· Genuine

co-design and collaboration with key stakeholders to develop the sustainability

strategy and action plan.

· Agreeing resourcing for the first two years through the 2022/23

Annual Plan process.

19. Phase

Three (2022 and beyond) will involve:

· The implementation of the action plan.

· Agreeing resourcing for the subsequent ten years through the 2024-34

Long Term Plan process.

· Monitoring and measurement of the quantitative and qualitative

outcomes of the action plan implementation.

· Reporting of the achievements, challenges, and opportunities

realised from the implementation of the action plan.

Link with other key projects

20. As outlined above, it is

crucial that the Sustainability Framework Project aligns with other major

strategic projects underway.

21. These include the City Futures

Project and council’s own strategic framework refresh. Updates on both

these projects will be brought to this Committee per the draft work programme

under development, and direction sought from the Committee.

22. One important sub-initiative

is that work (previously stalled) has recommenced on finalising the draft

Environment Strategy, as part of the strategic framework refresh. As noted

above, “environment” and “sustainability” are not the

same, however an environment strategy (including climate change) will be an

essential sub-component to our overall sustainability focus. A workplan is

currently being developed for continuing / finalising an environment strategy.

Significance

23. The Local Government Act 2002

requires an assessment of the significance of matters, issues, proposals and

decisions in this report against Council’s Significance and Engagement

Policy. Council acknowledges that in some instances a matter, issue,

proposal or decision may have a high degree of importance to individuals,

groups, or agencies affected by the report.

24. In making this assessment,

consideration has been given to the likely impact, and likely consequences for:

(a) the current and future social,

economic, environmental, or cultural well-being of the district or region

(b) any

persons who are likely to be affected by, or interested in, the issue,

proposal, decision, or matter

(c) the

capacity of the local authority to perform its role, and the financial and

other costs of doing so.

25. In accordance with the

considerations above, while the matter of sustainability affects all Tauranga

residents, current and future, and is therefore of high significance, the

current report relates to operationalising previous council decisions and the

overall assessment of significance is therefore medium.

ENGAGEMENT

26. Per the work programme above

and next steps below, the stocktake and associated information will be shared

with relevant stakeholders, and broader engagement will be undertaken as part

of the next phase(s) of the Sustainability Framework Project.

Next Steps

27. The findings of the stocktake

will be shared in coming weeks with the Commissioners and other relevant

stakeholders (including those who participated in its preparation).

28. Work will continue on

completion of Phase One (as detailed above) of the Sustainability Framework

Project and commencement of Phase Two.

29. Regular updates will be

brought back to this Committee per the draft work programme.

Attachments

Nil

8.8 Monitoring

and Update Report - City Plan Review

File

Number: A12520161

Author: Janine

Speedy, Team Leader: City Planning

Authoriser: Christine

Jones, General Manager: Strategy & Growth

Purpose of the Report

1. The purpose of this

report is to provide an update on the City Plan Review project.

|

Recommendations

That the Strategy, Finance and Risk Committee:

(a) Receives the Monitoring and

Update Report - City Plan Review report.

(b) Notes progress with the City

Plan Review project in accordance with the approved project plan.

|

Executive Summary

2. The review of the

Tauranga City Plan project is a significant project for Council and is included

in the Long-Term Plan. A project plan was approved by the Urban Form and

Transport Development Committee on 21 July 2020.

3. The City Plan

Review project is a 4-6 year project, with a proposed plan required to be

notified by April 2024 under the National Planning Standards.

4. This report

provides an update on the project, and discusses the implications of the

Government’s Resource Management Reform.

Background

5. The City Plan

Review is currently in Phase 1 (research and investigation) and Phase 2 (issues

and options), which are being run concurrently. A dedicated project manager,

technical director and community engagement managers have been in place to

implement the approved project plan and task requirements. The project

structure was implemented in July 2020, with an internal Project Steering

Group, Project Team and five workstreams established.

6. Chapter project

plans have been prepared for each chapter of the new City Plan to identify

scope, resources, risks and deliverables. The 22 chapter project plans provide

the basis for preparing a draft City Plan currently planned for public input in

2022 based on the mandatory National Planning Standards.

7. The potential impact

of central Government’s Resource Management Reform (RM Reforms) was

identified as a significant risk to the City Plan Review during the project

planning phase, and noted in the approved Project Plan as potentially having a high

impact on the project.

8. On 10 March 2021,

the Minister for the Environment, Hon David Parker, announced that Government

would introduce three new pieces of legislation to replace the Resource

Management Act (RMA). The Natural and Built Environment Act (NBA) would see a combined

plan for each region prepared developed collaboratively by all councils within

a region.

9. Council are yet to

have clear direction from central Government on the implications for a combined

plan on the City Plan Review. To manage this risk, staff will be delaying the