|

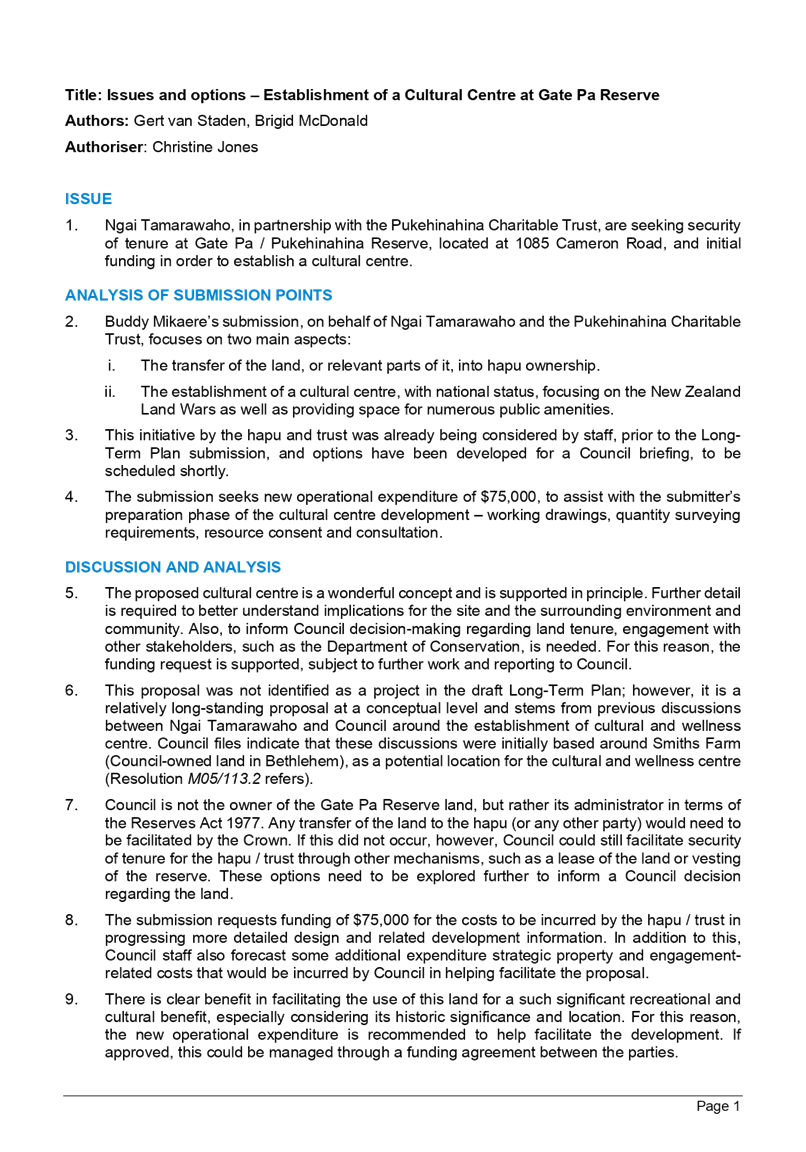

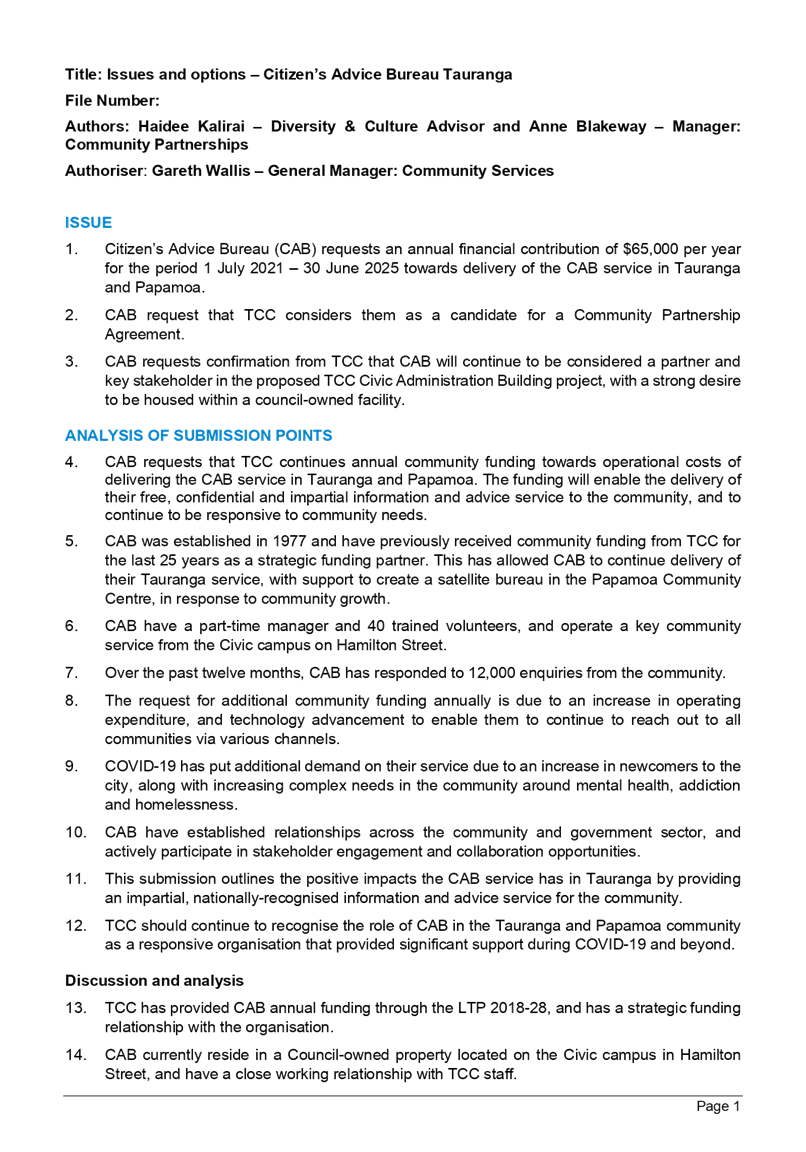

|

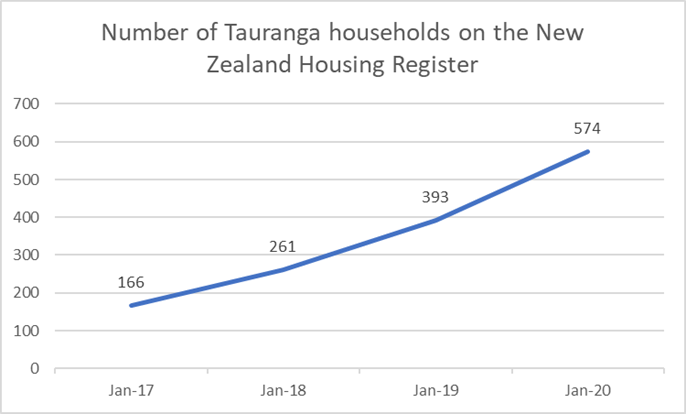

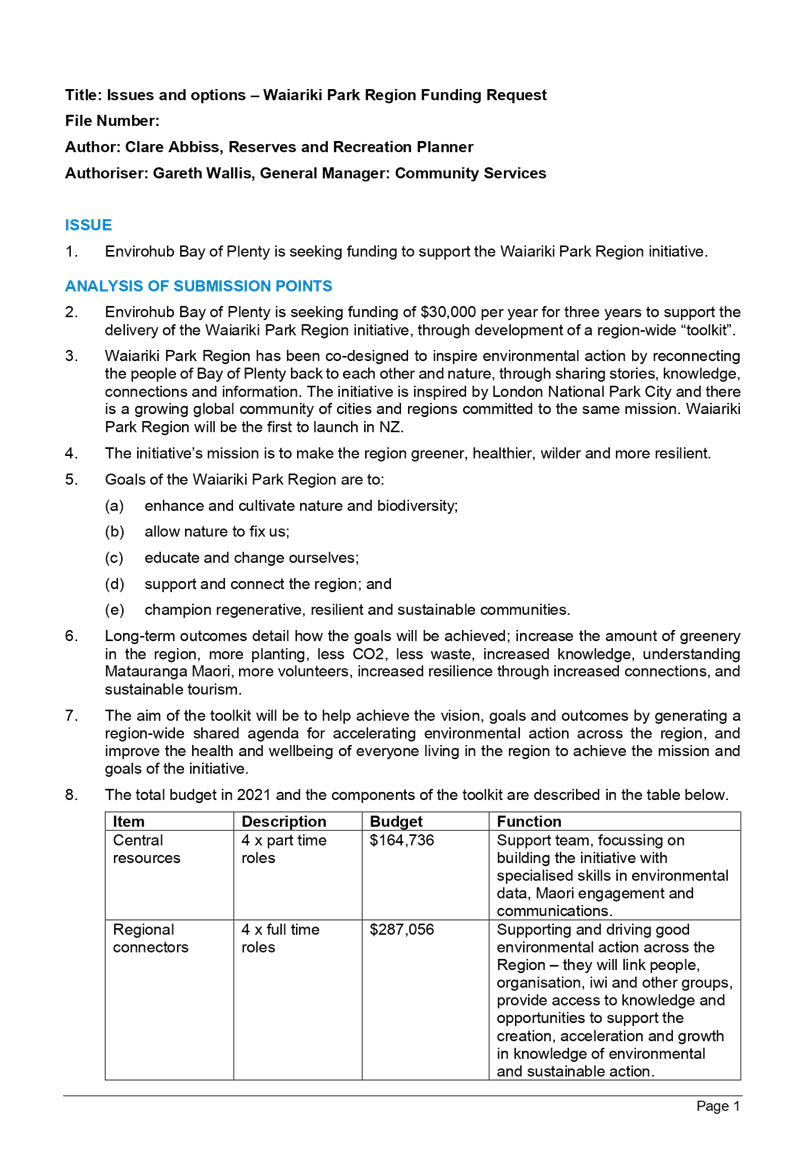

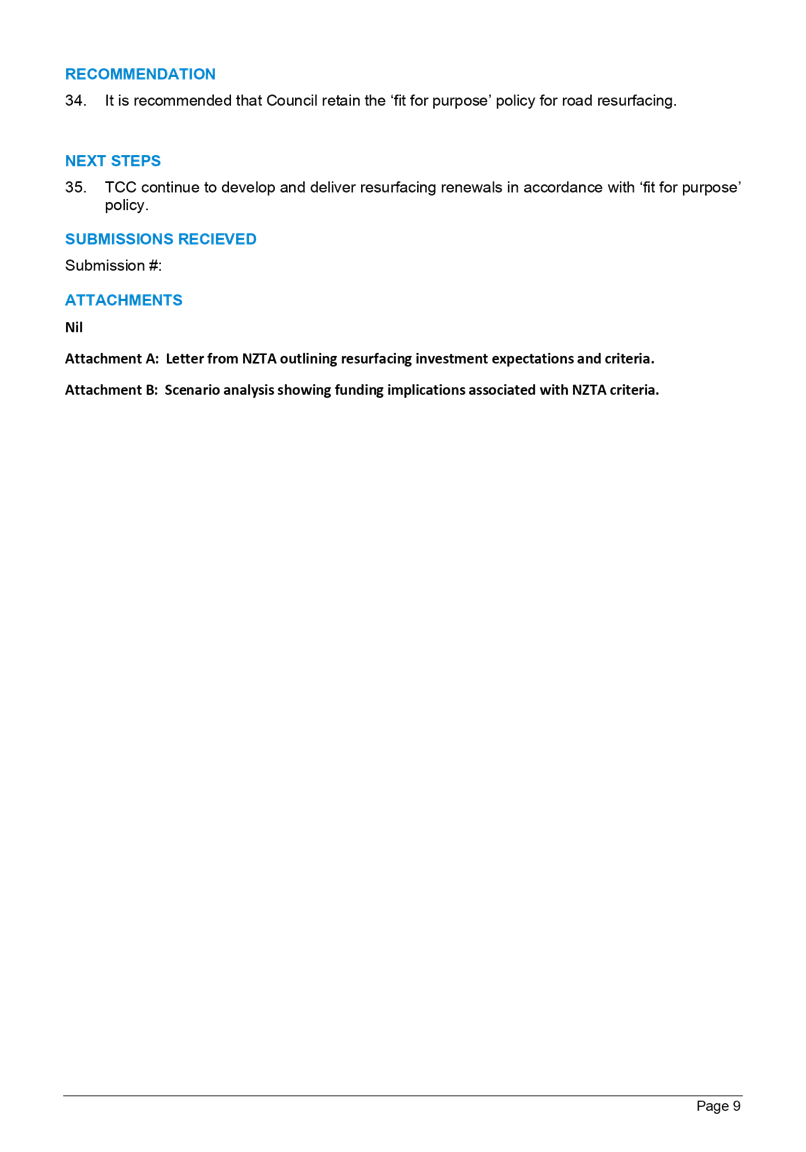

|

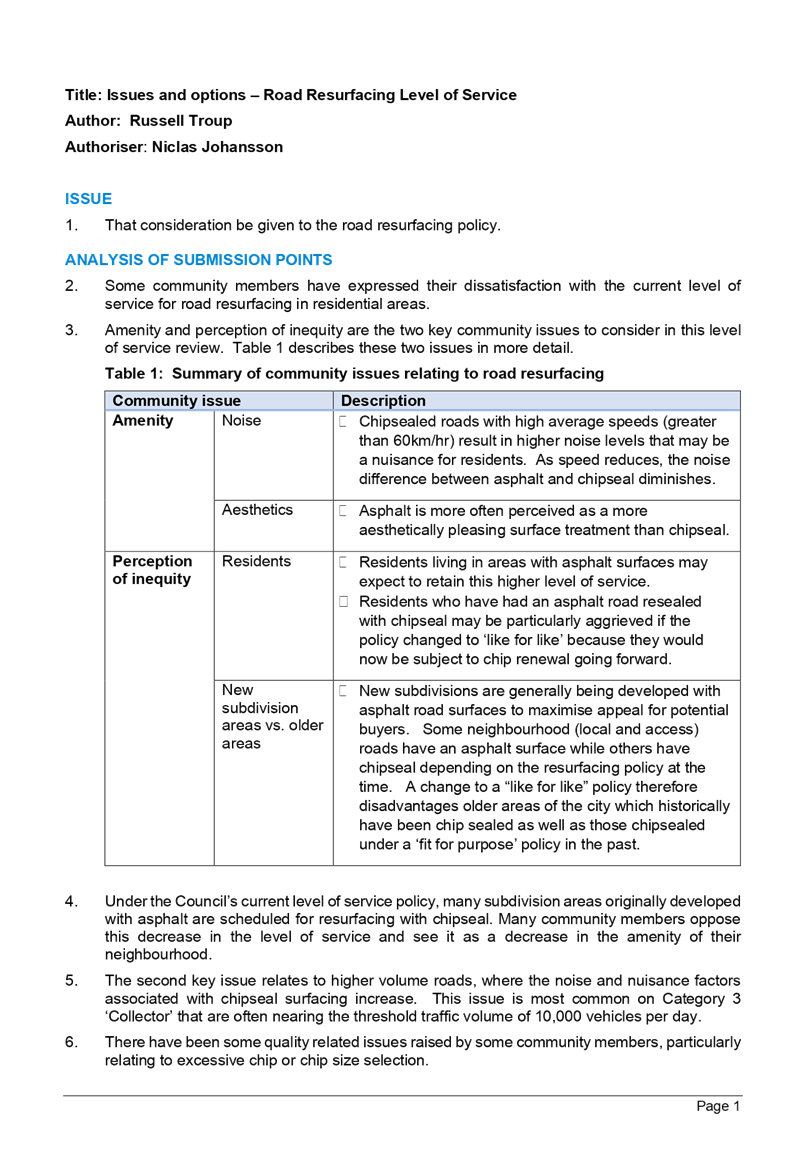

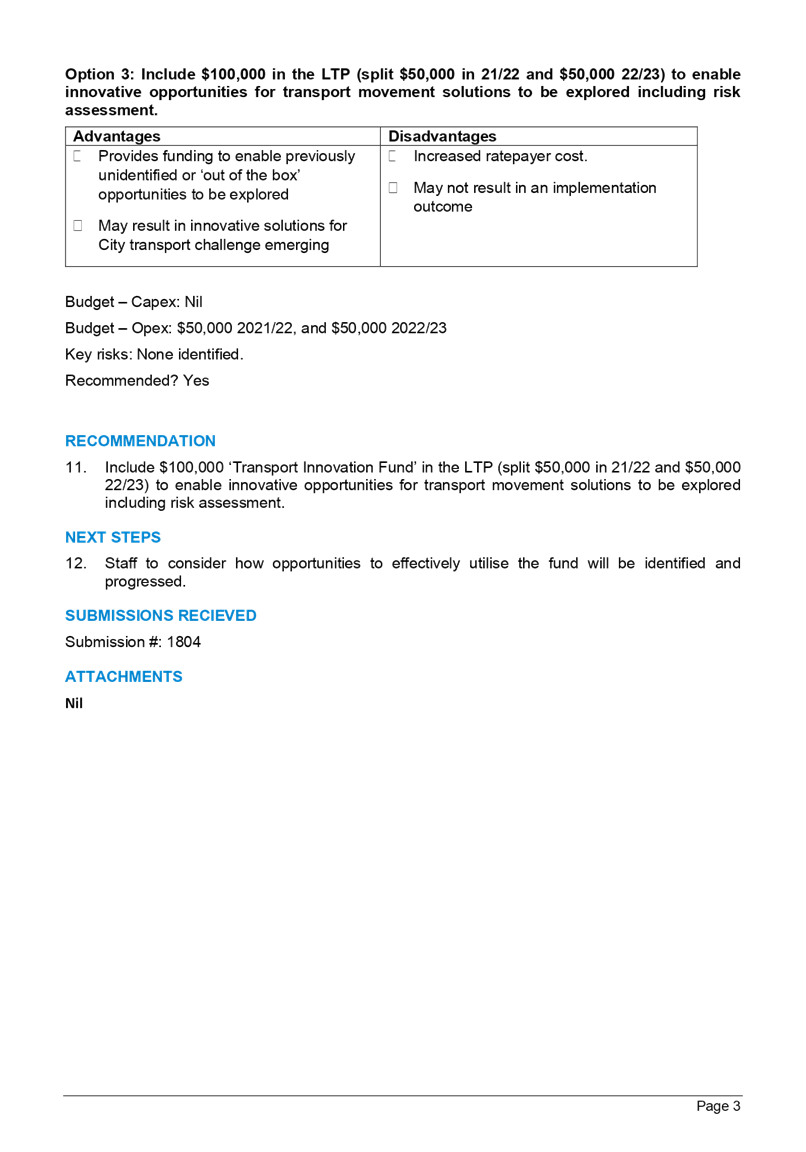

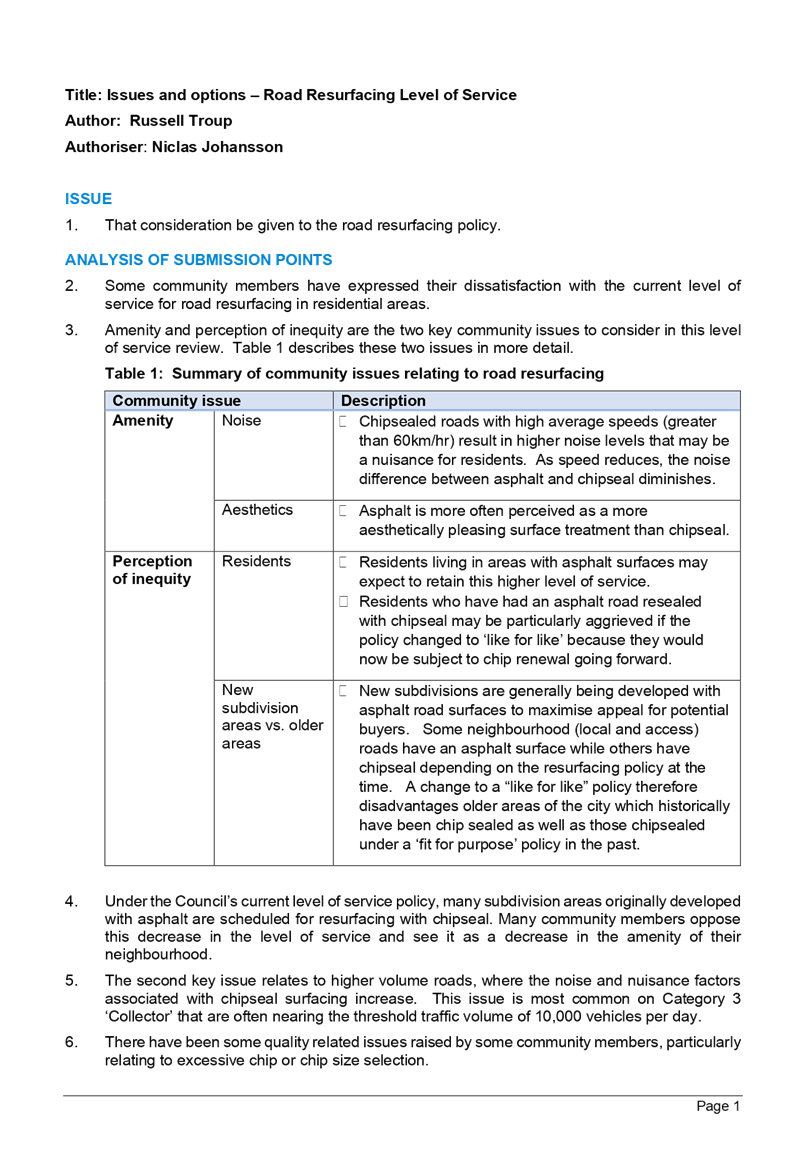

AGENDA

Ordinary Council Meeting

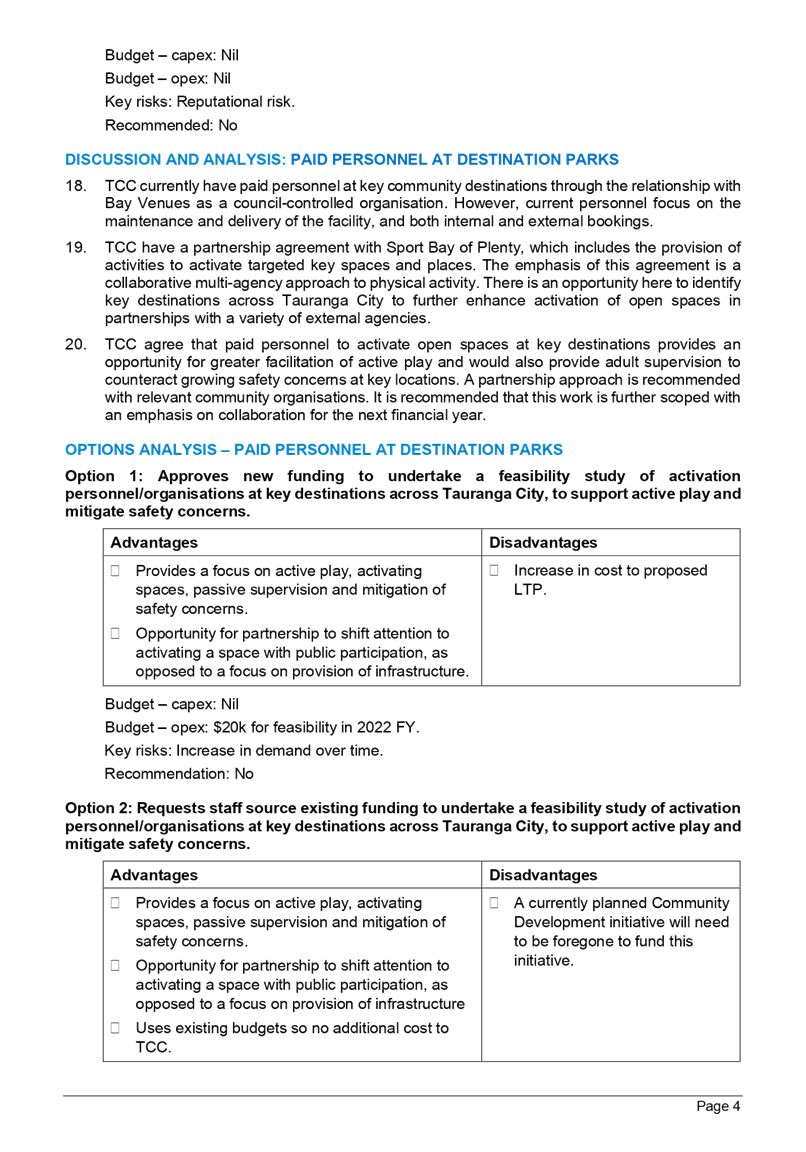

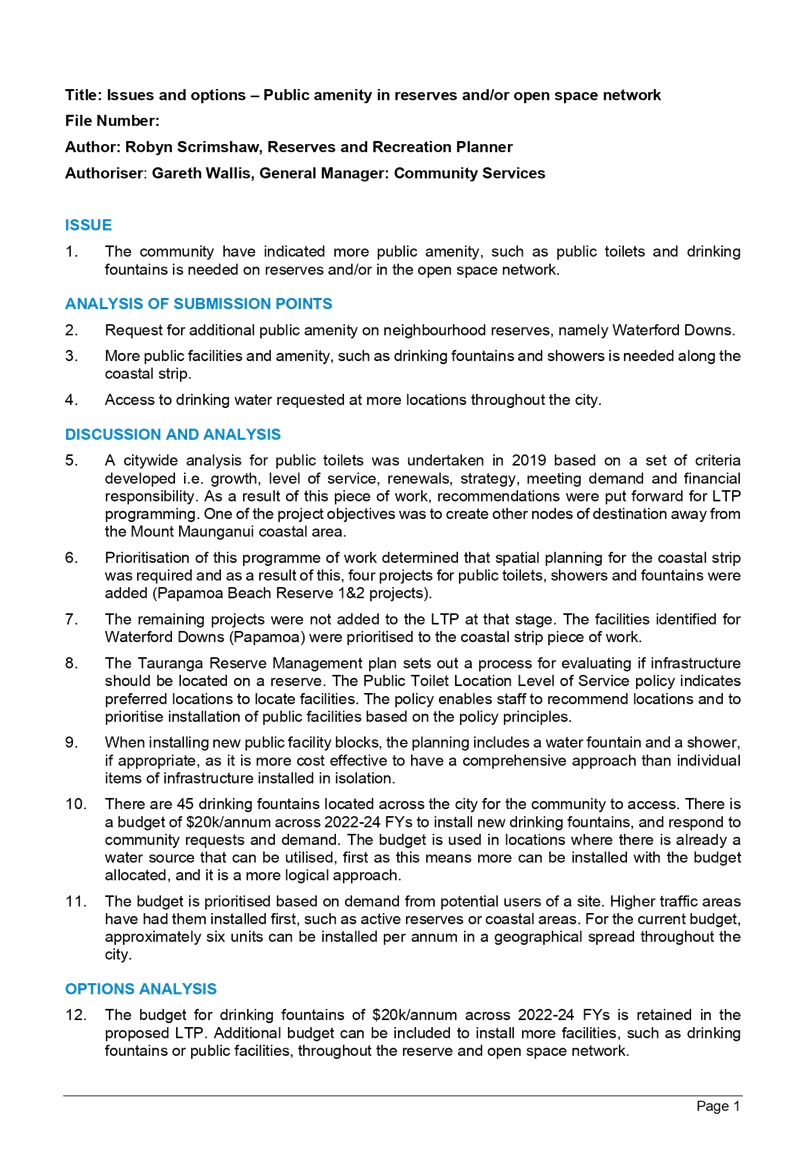

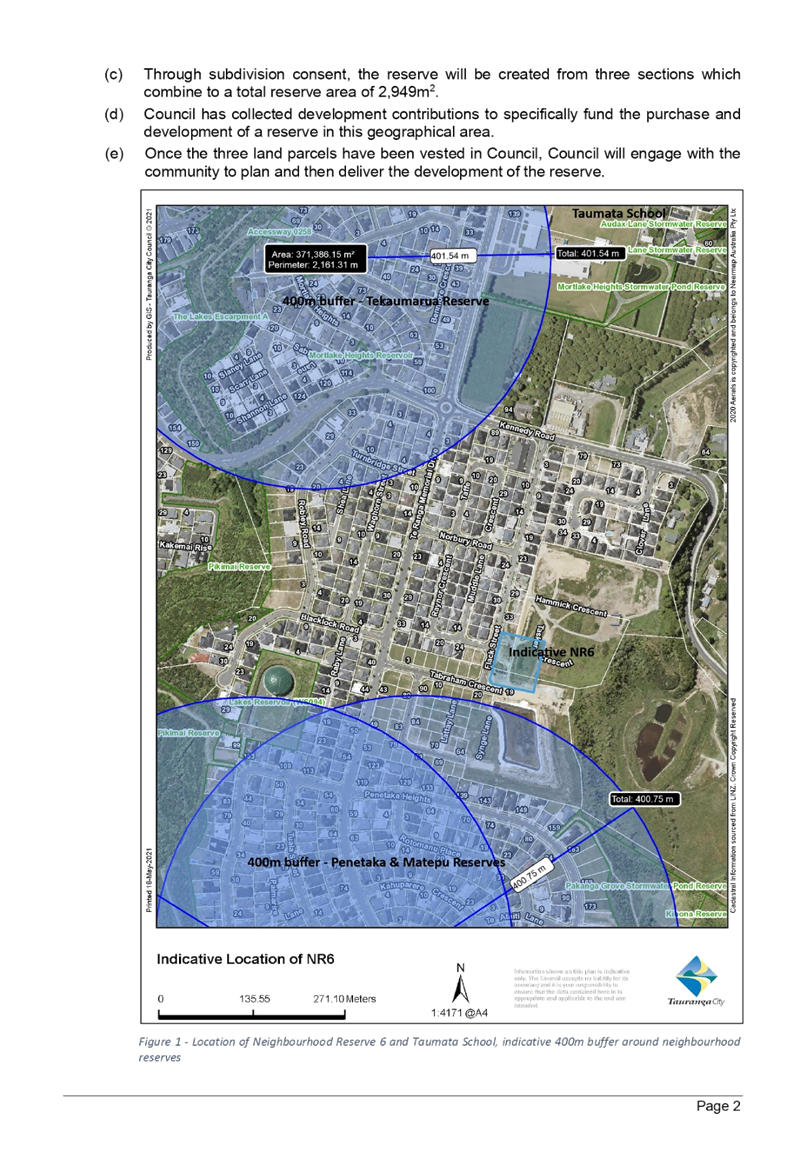

Thursday, 24 June 2021

|

|

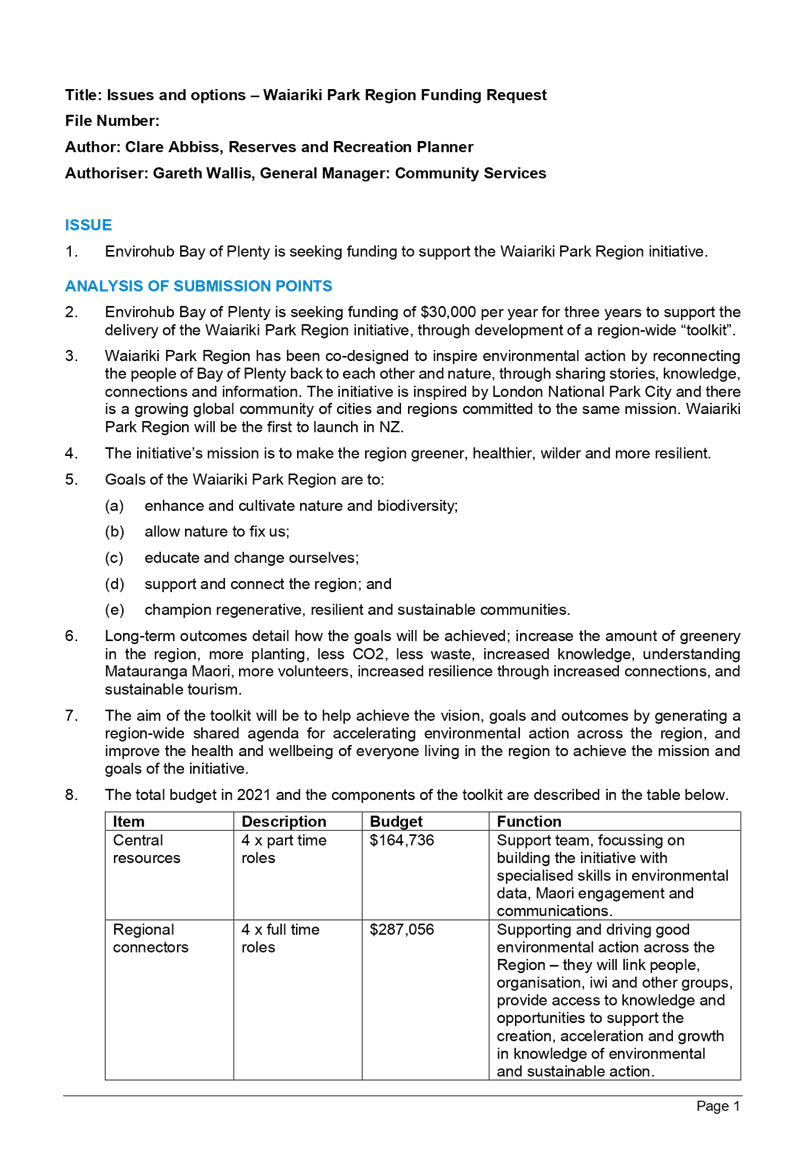

I hereby give notice that an Ordinary Meeting of

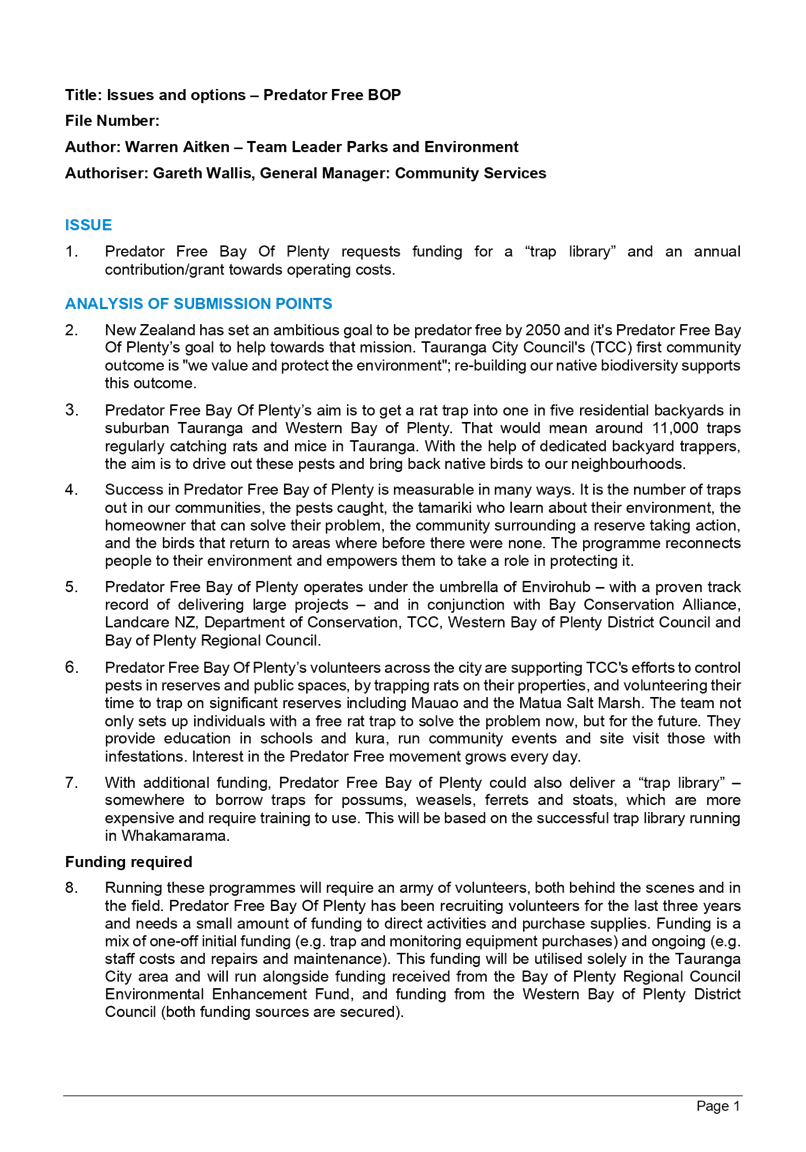

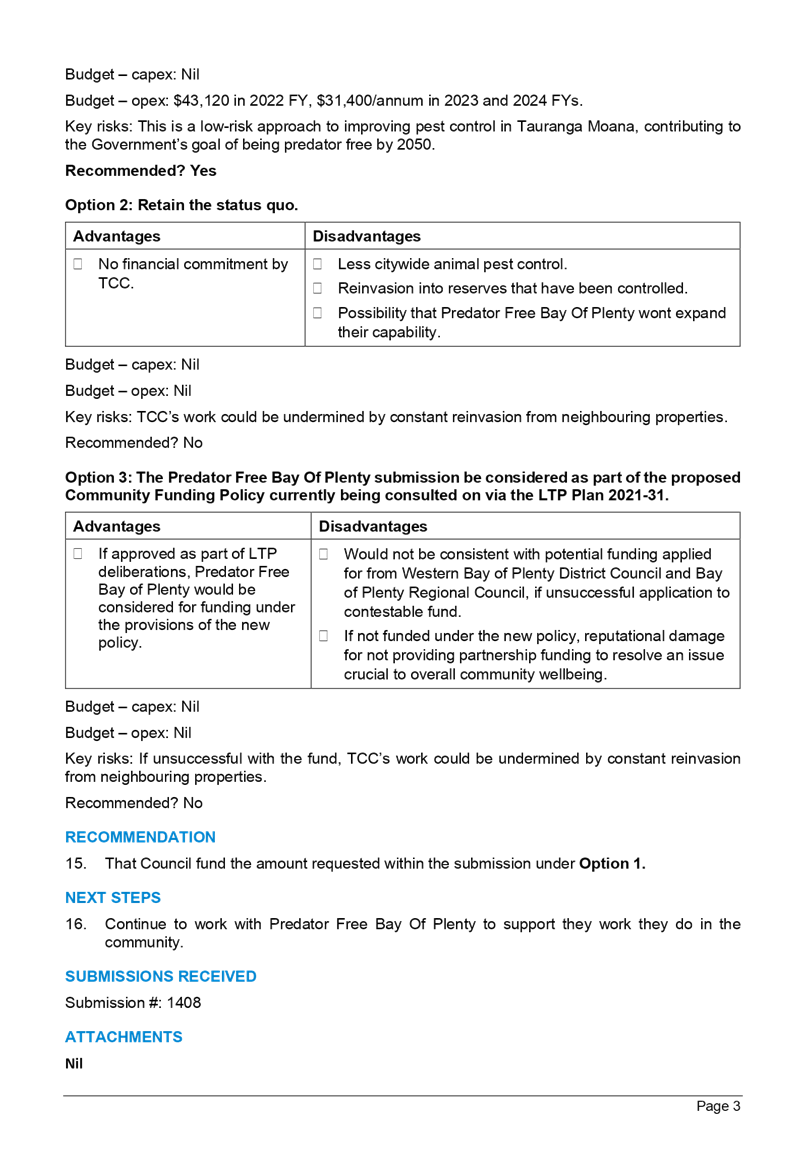

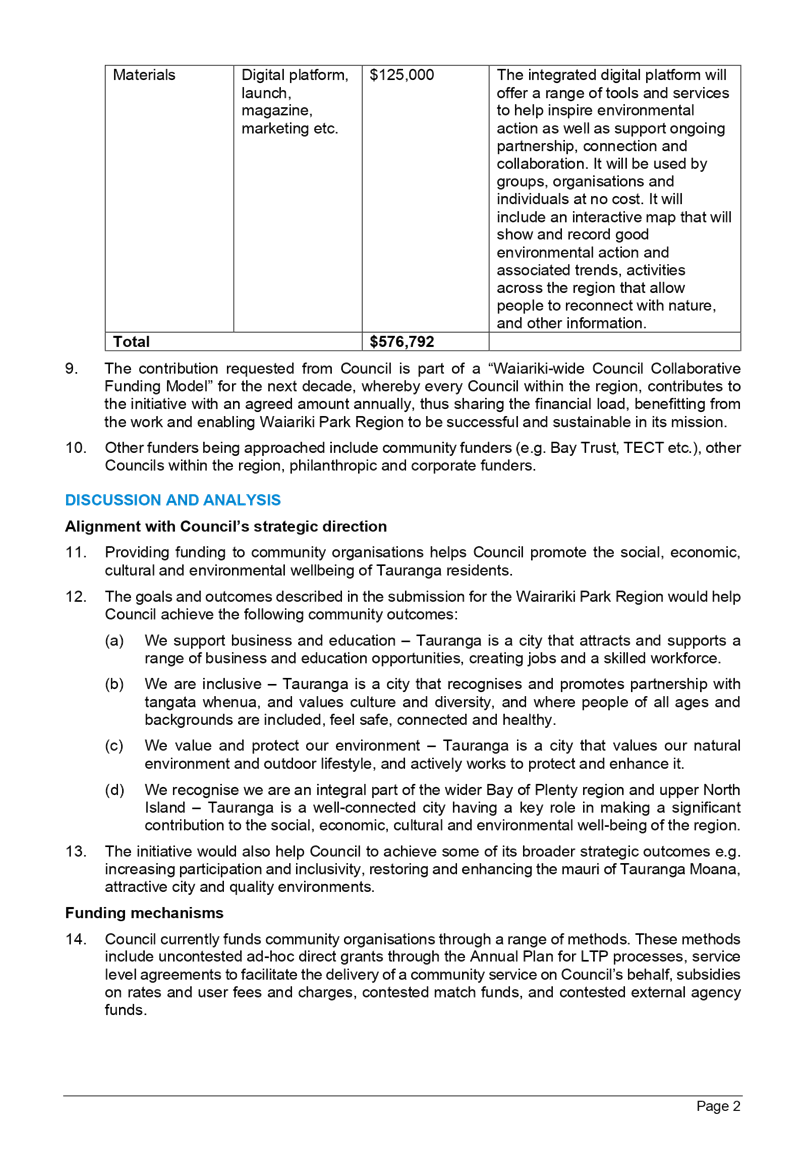

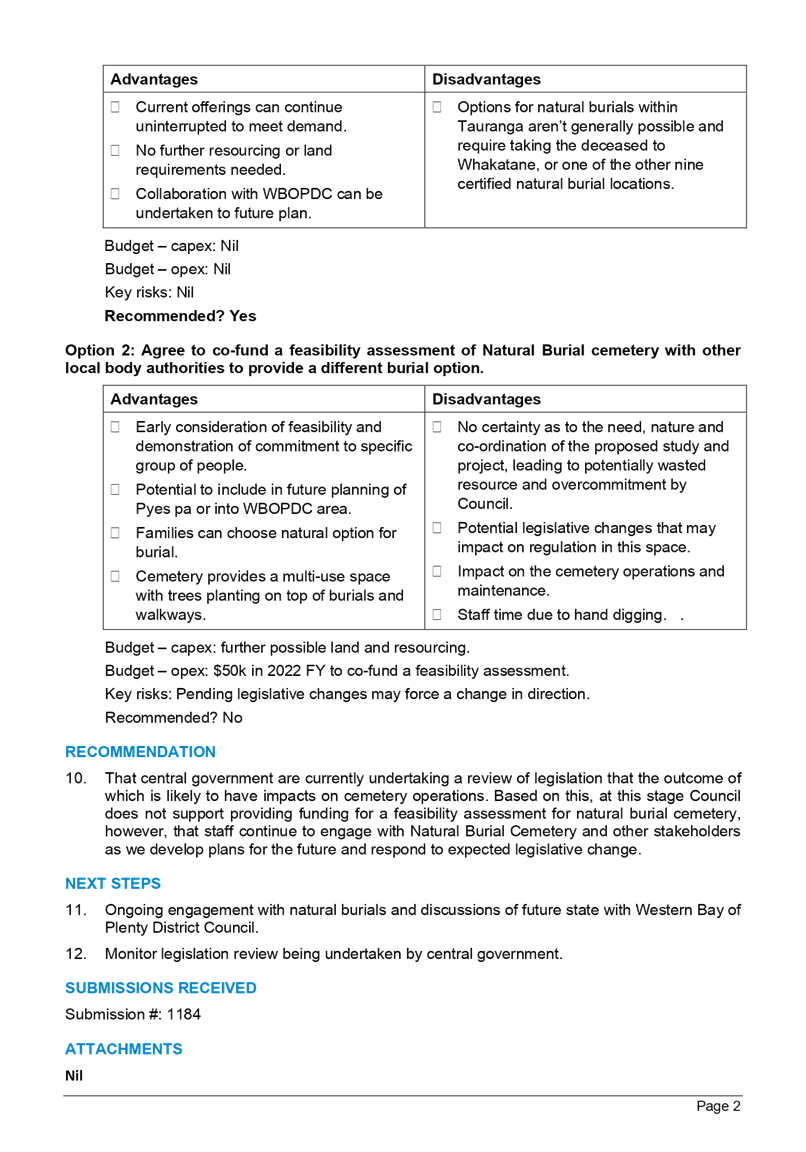

Council will be held on:

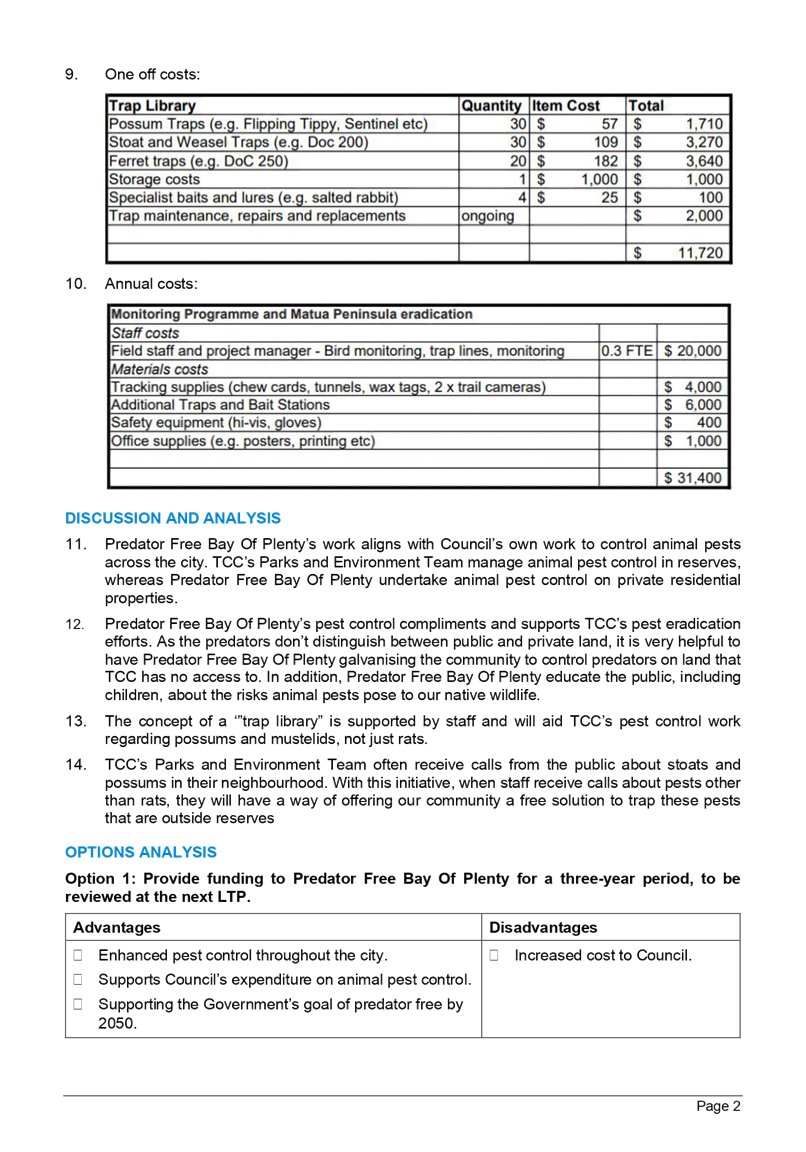

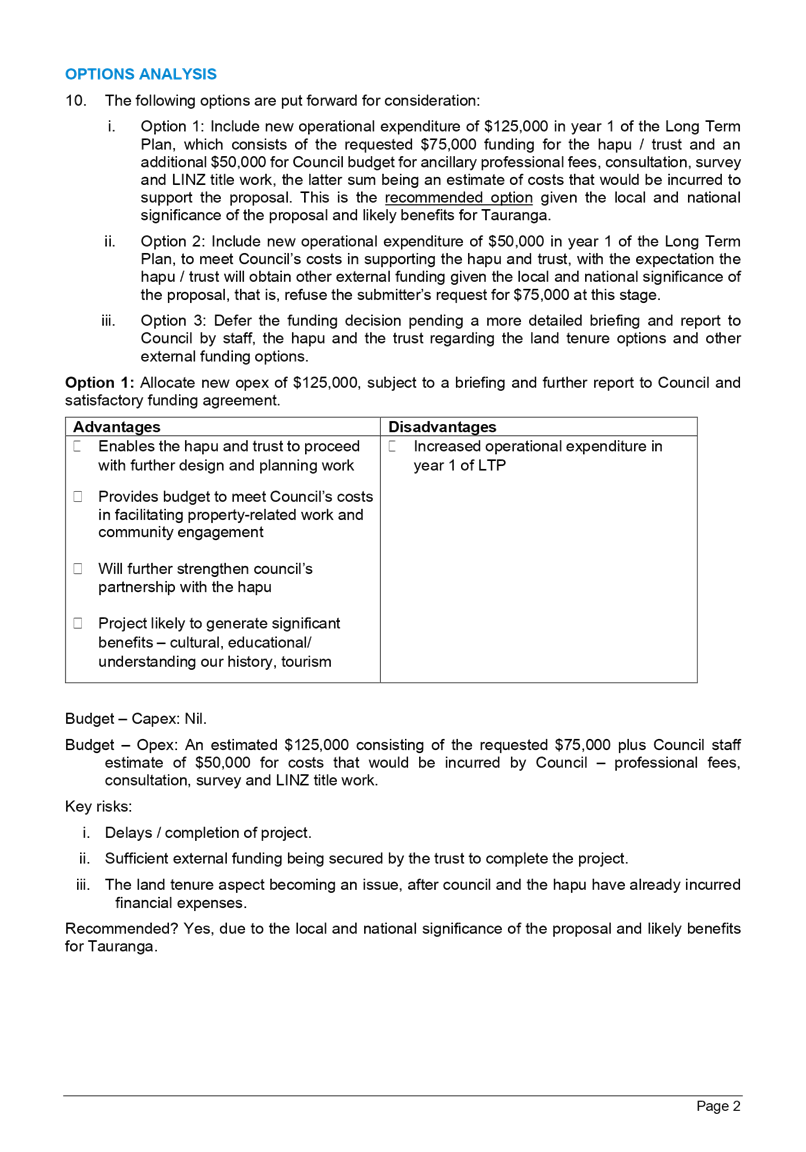

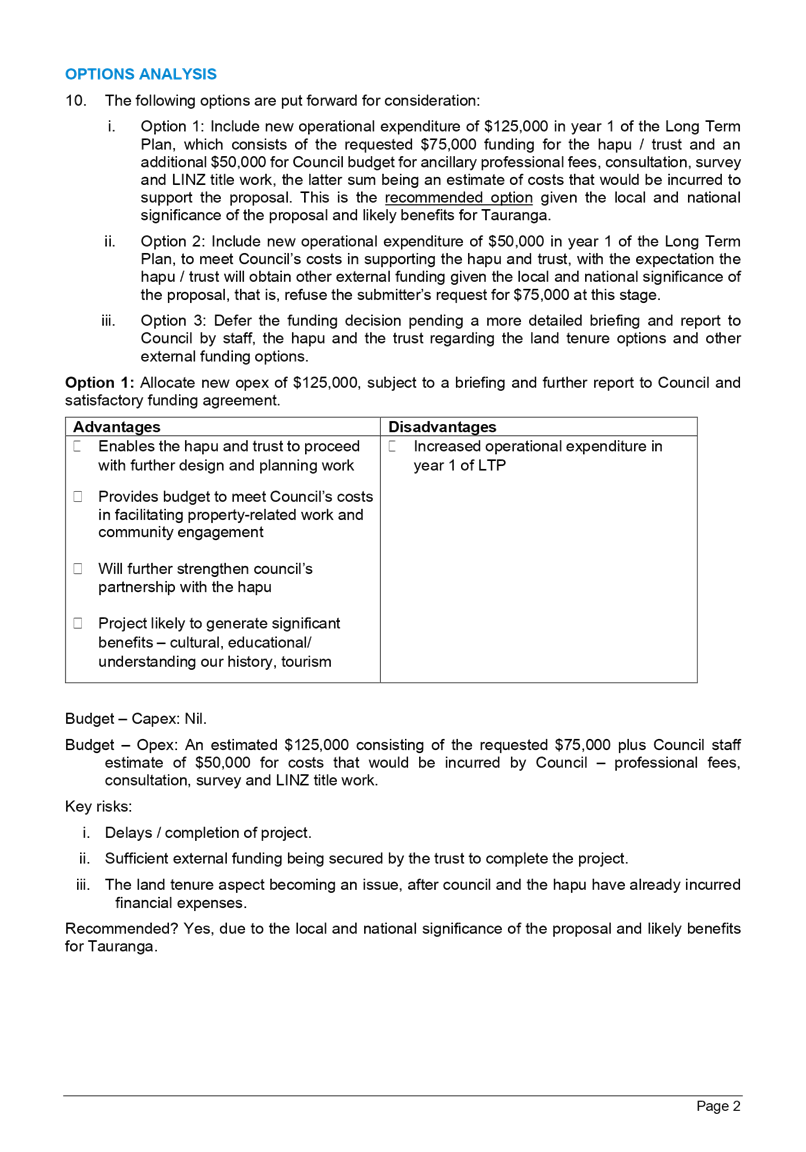

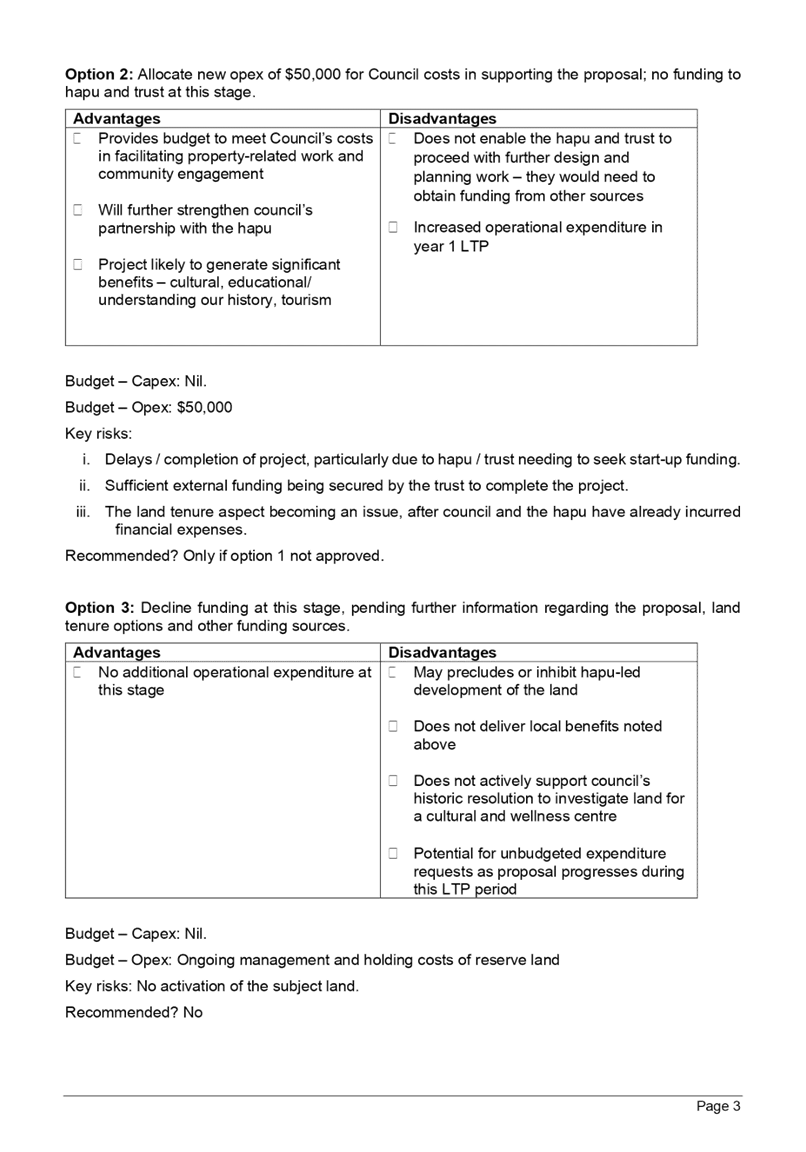

|

|

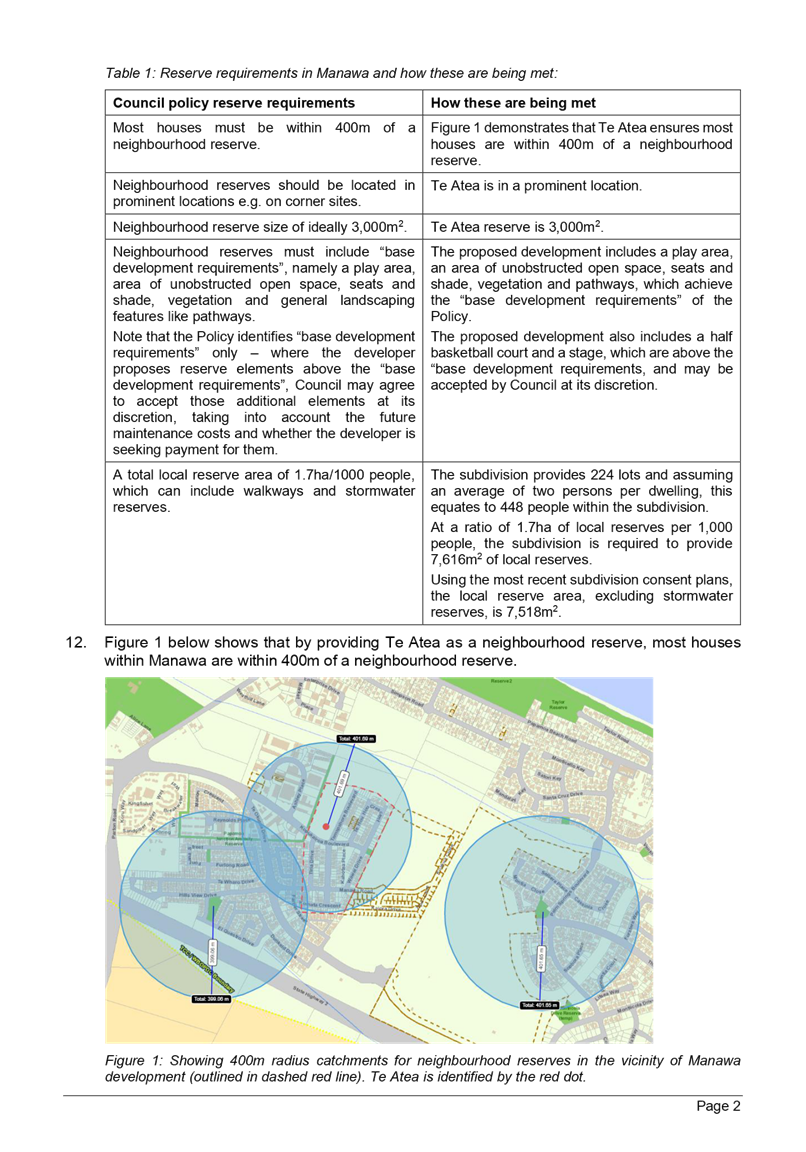

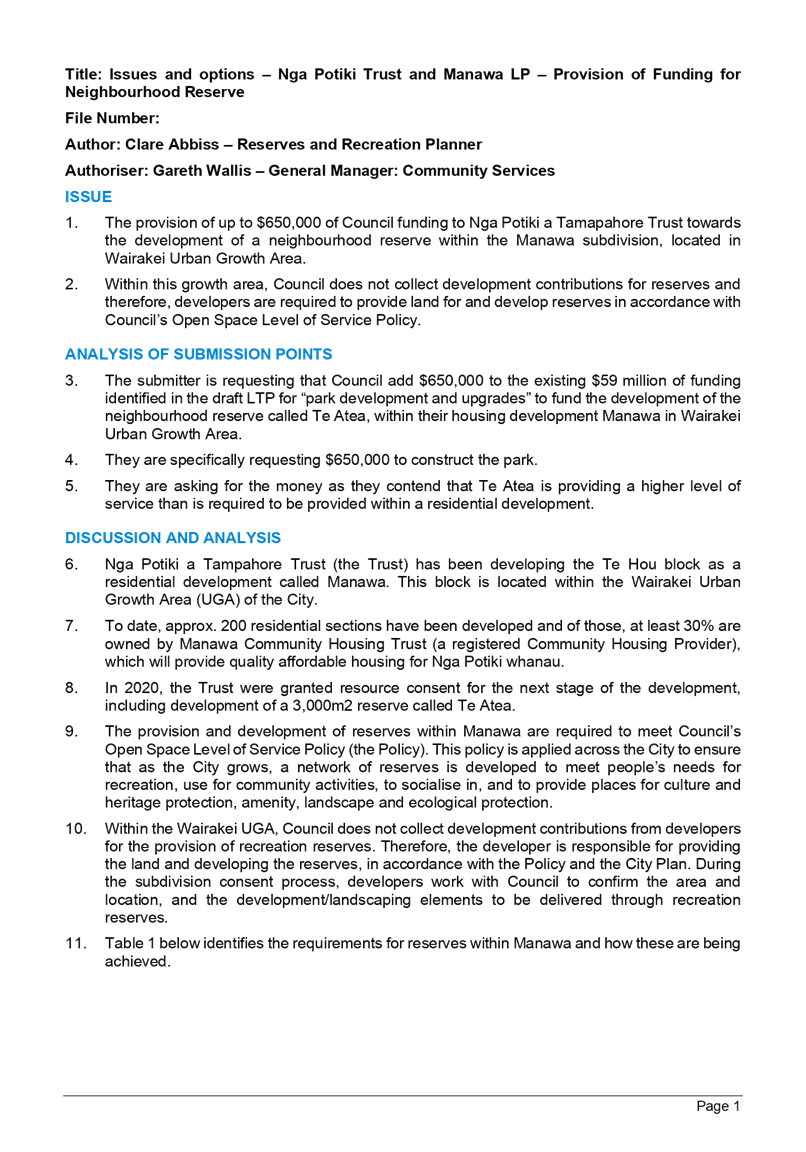

Date and time:

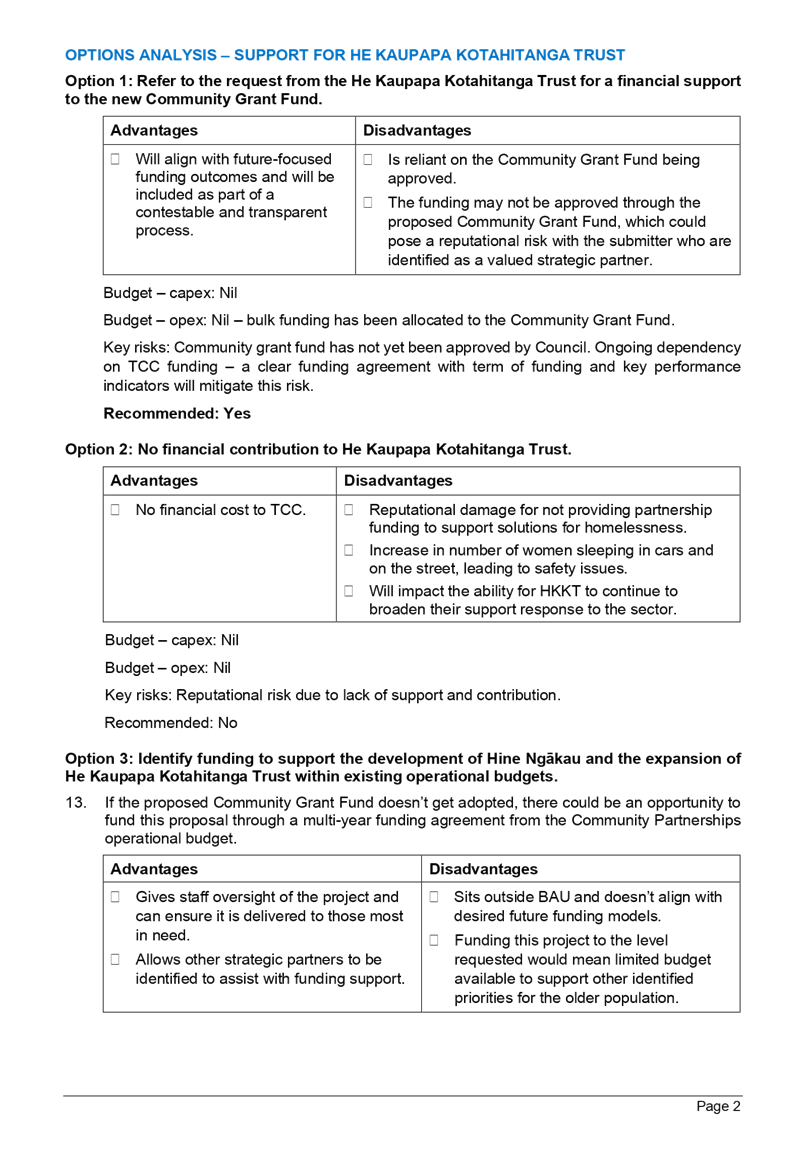

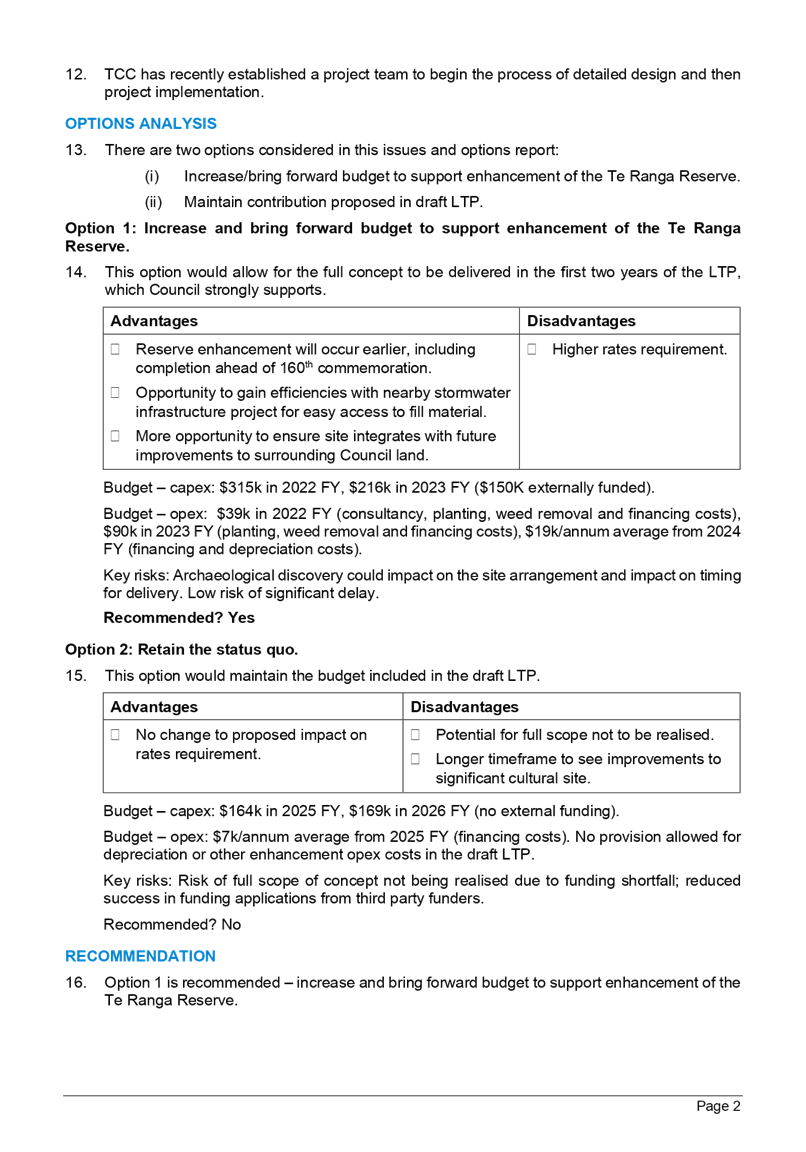

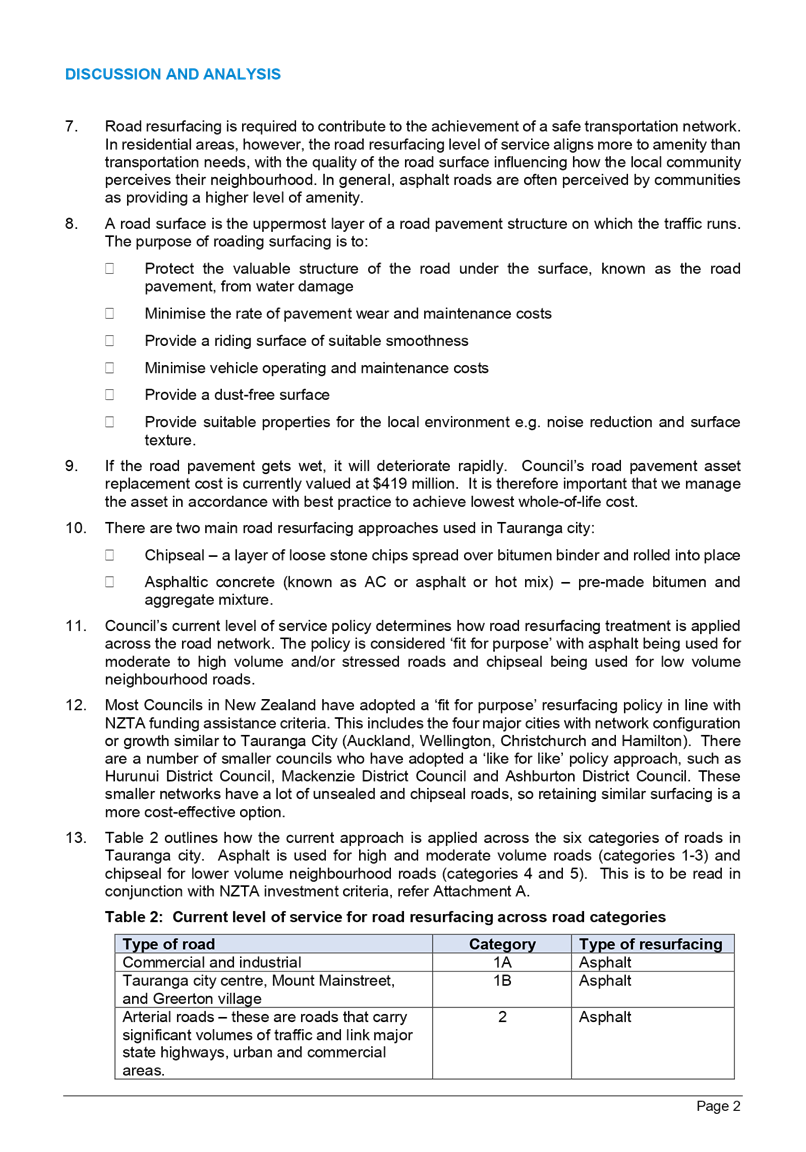

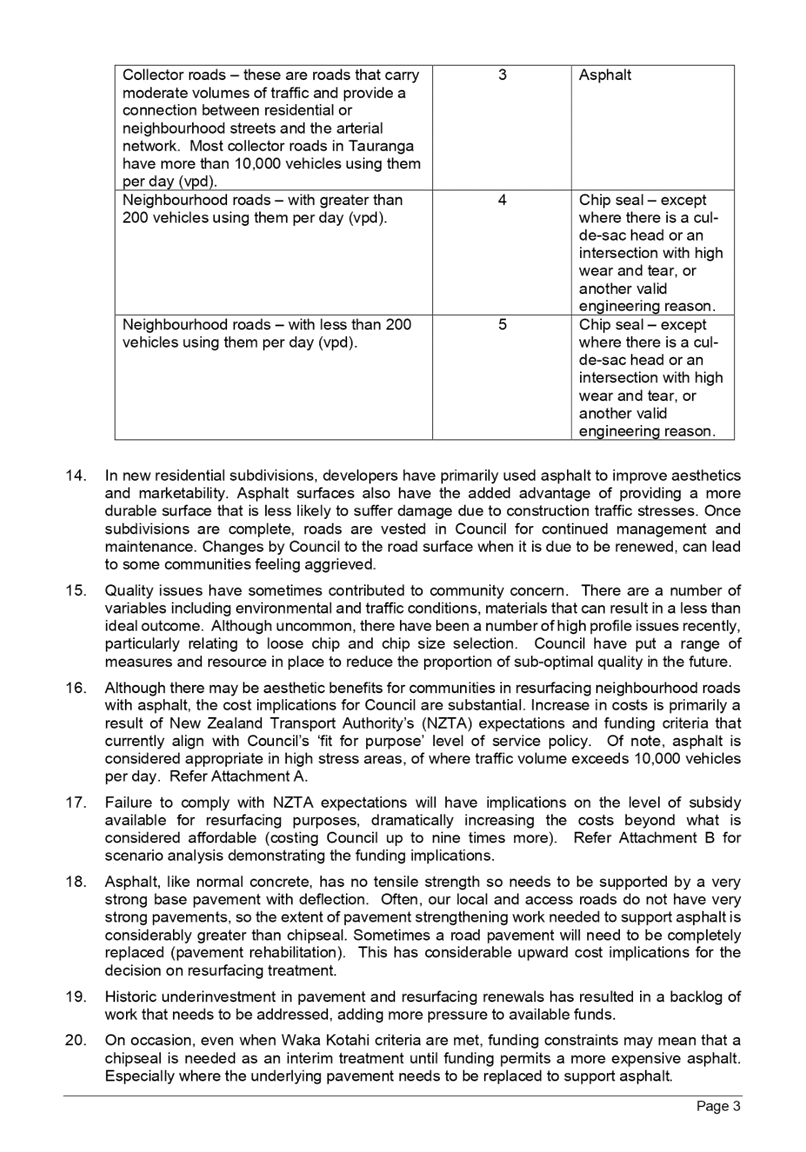

|

Thursday, 24 June 2021

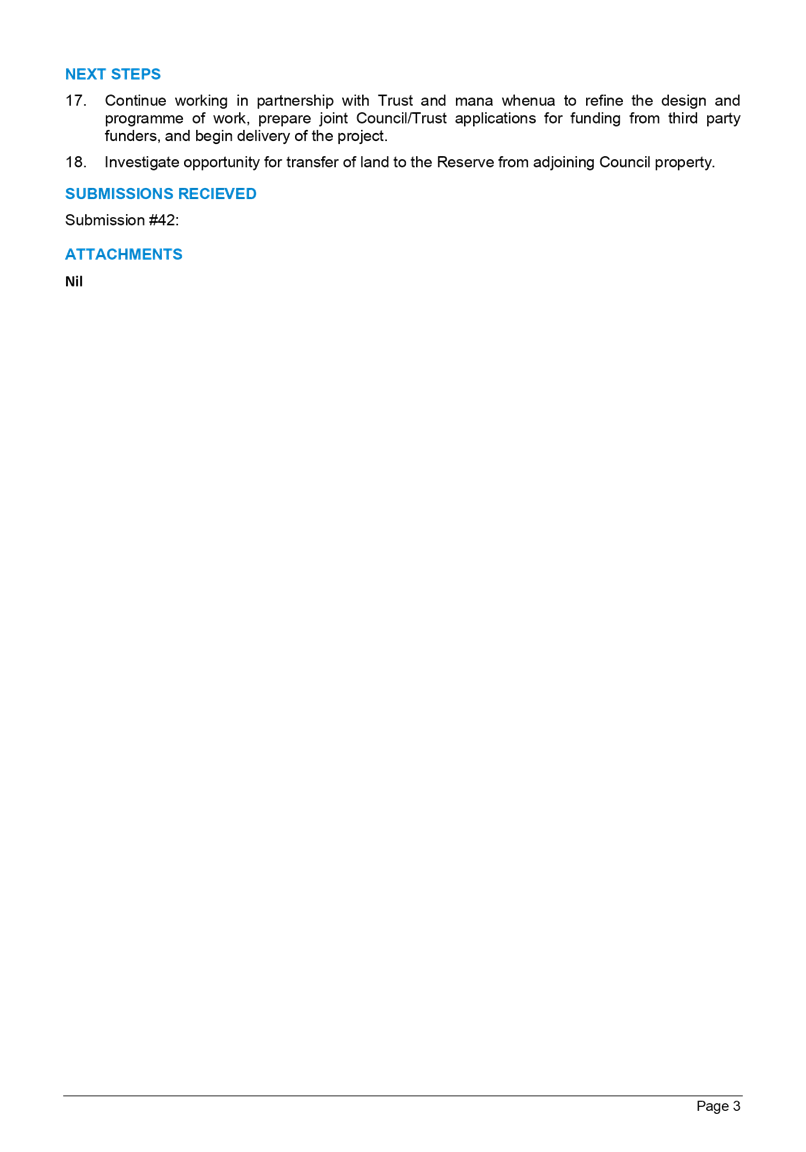

at 9.30am; and

Friday, 25 June 2021 at

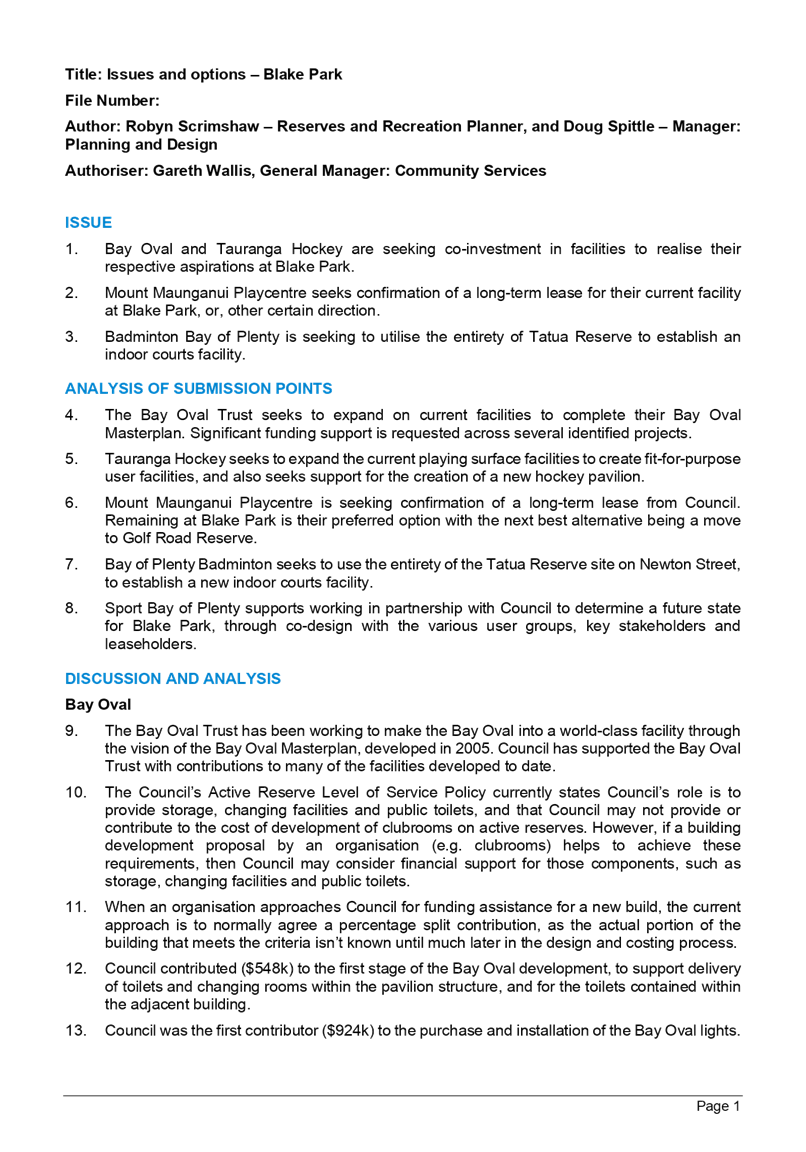

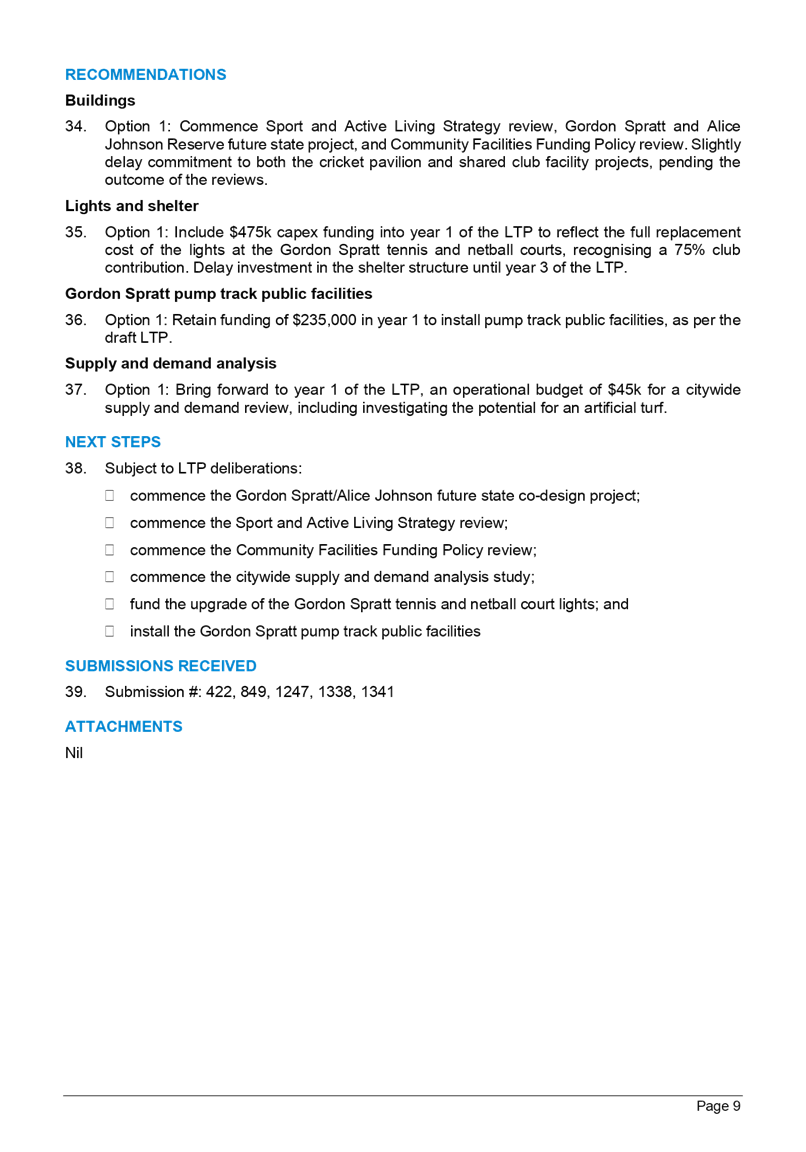

9.00am

|

|

Location:

|

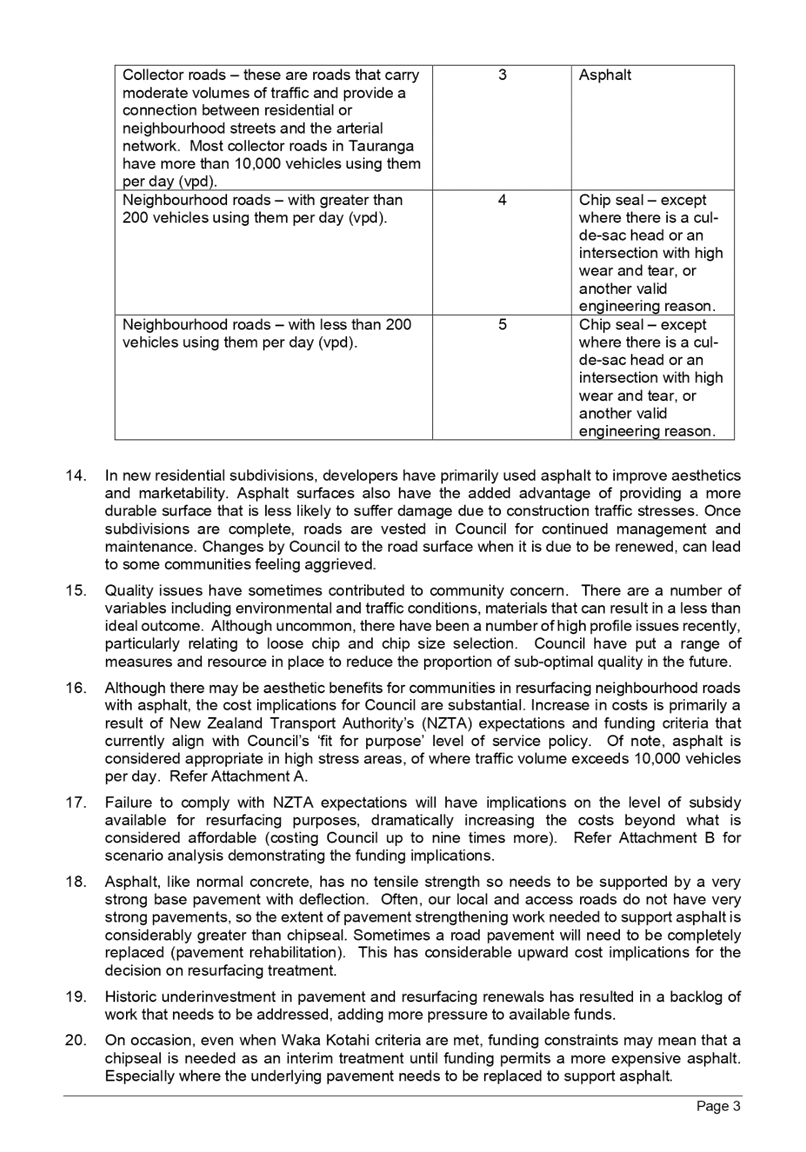

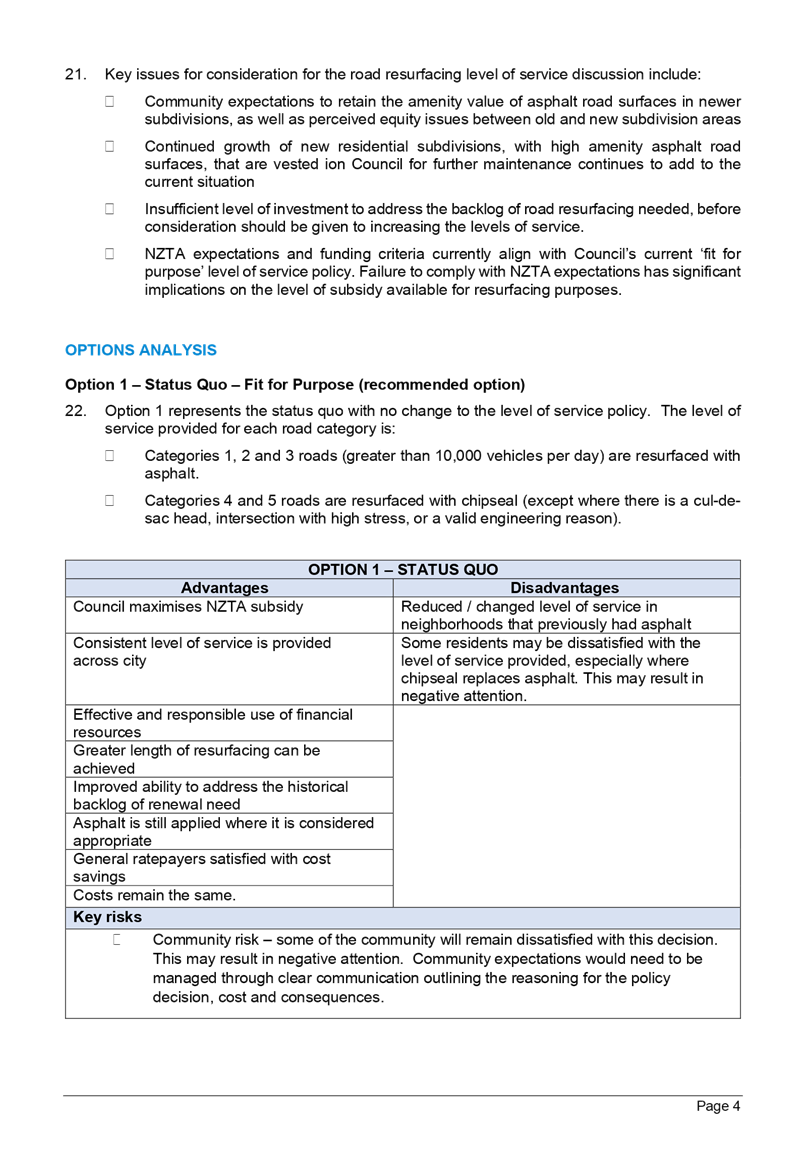

Tauranga City Council

Council Chambers

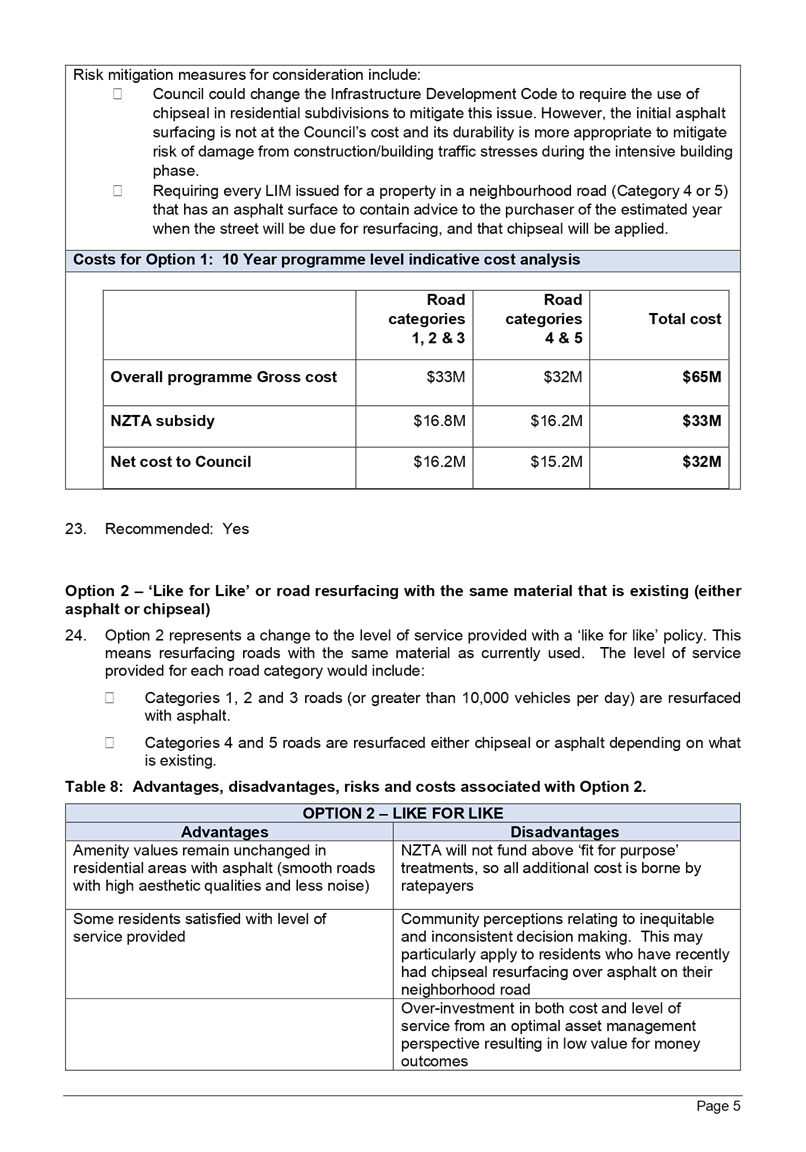

91 Willow Street

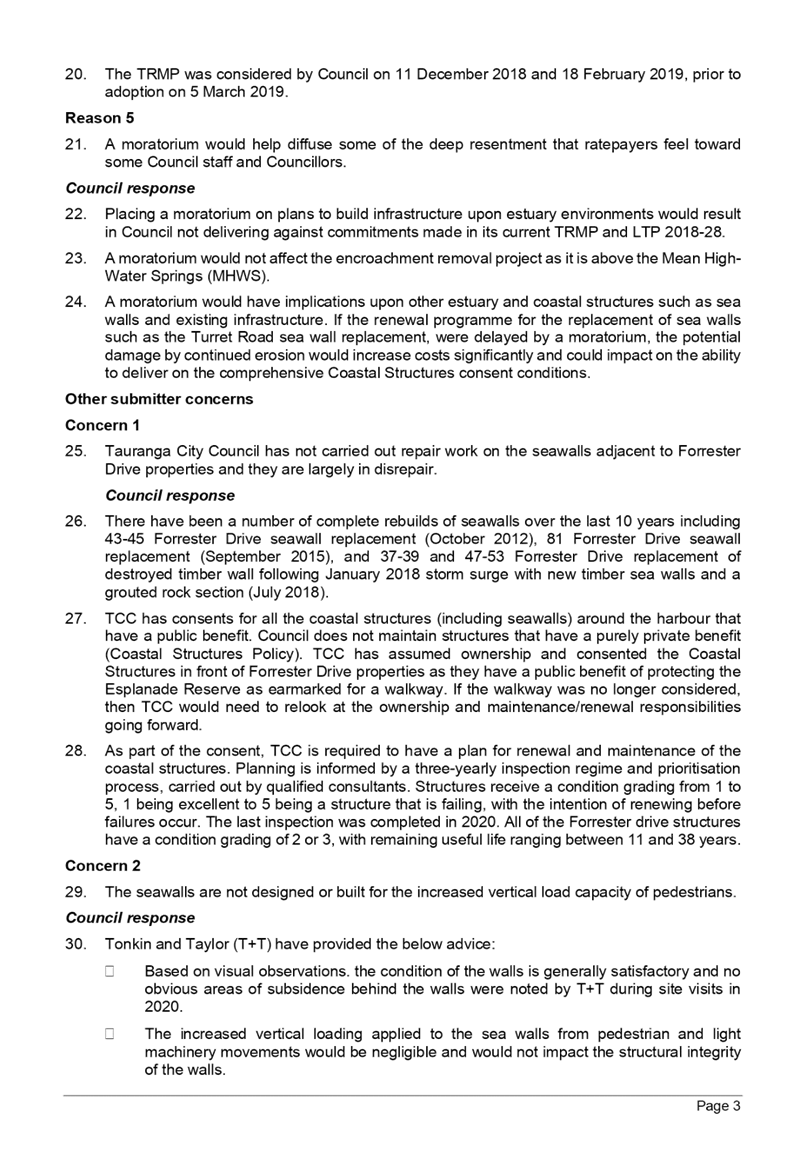

Tauranga

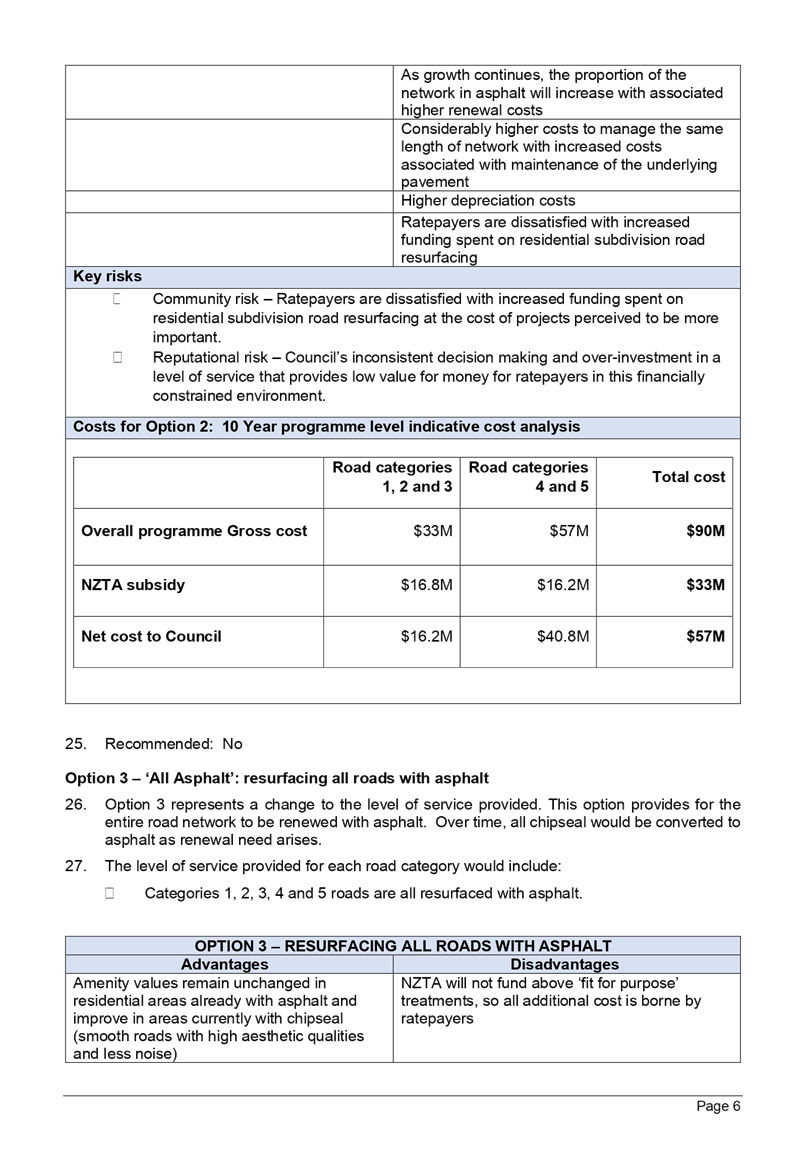

|

|

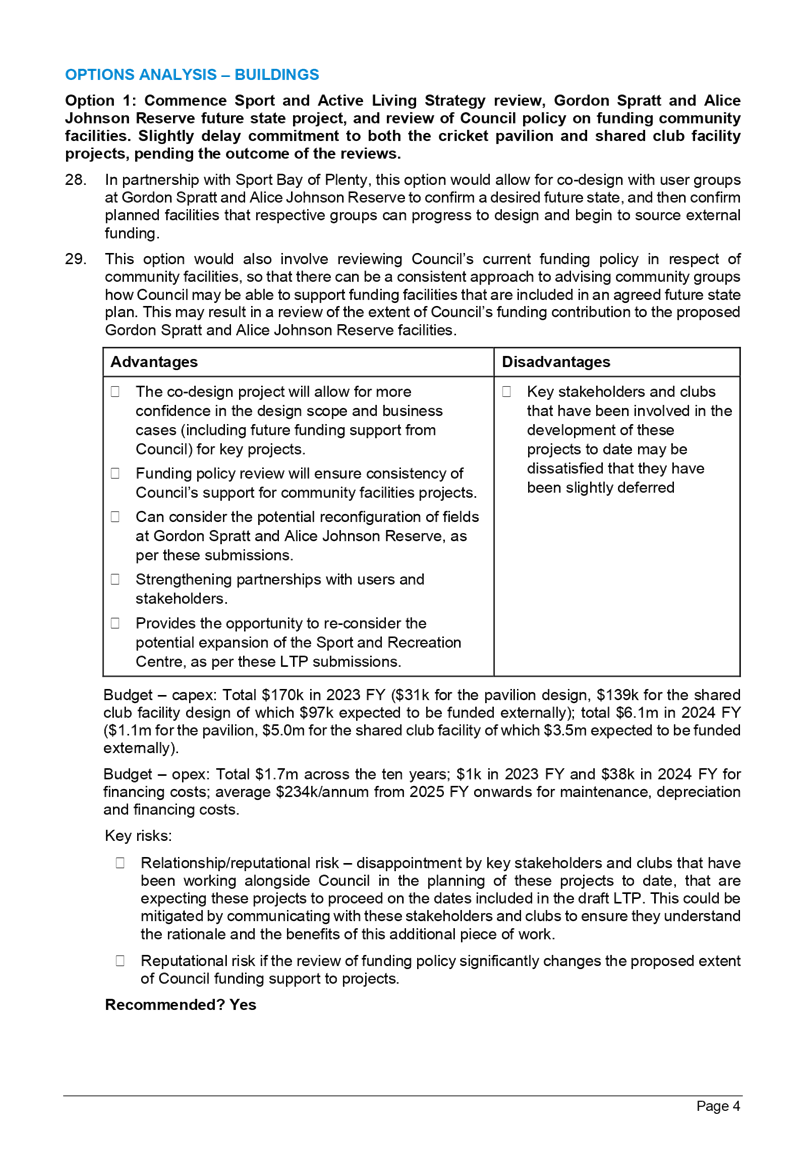

Please

note that this meeting will be livestreamed and the recording will be

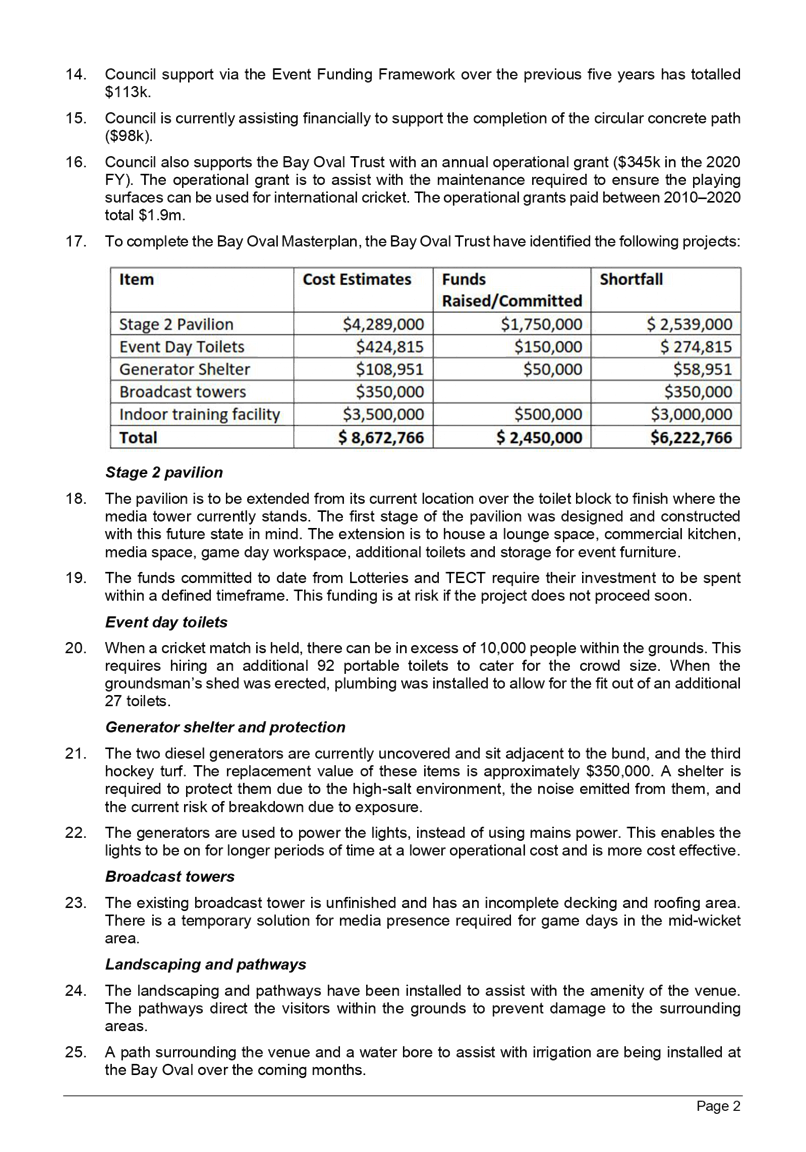

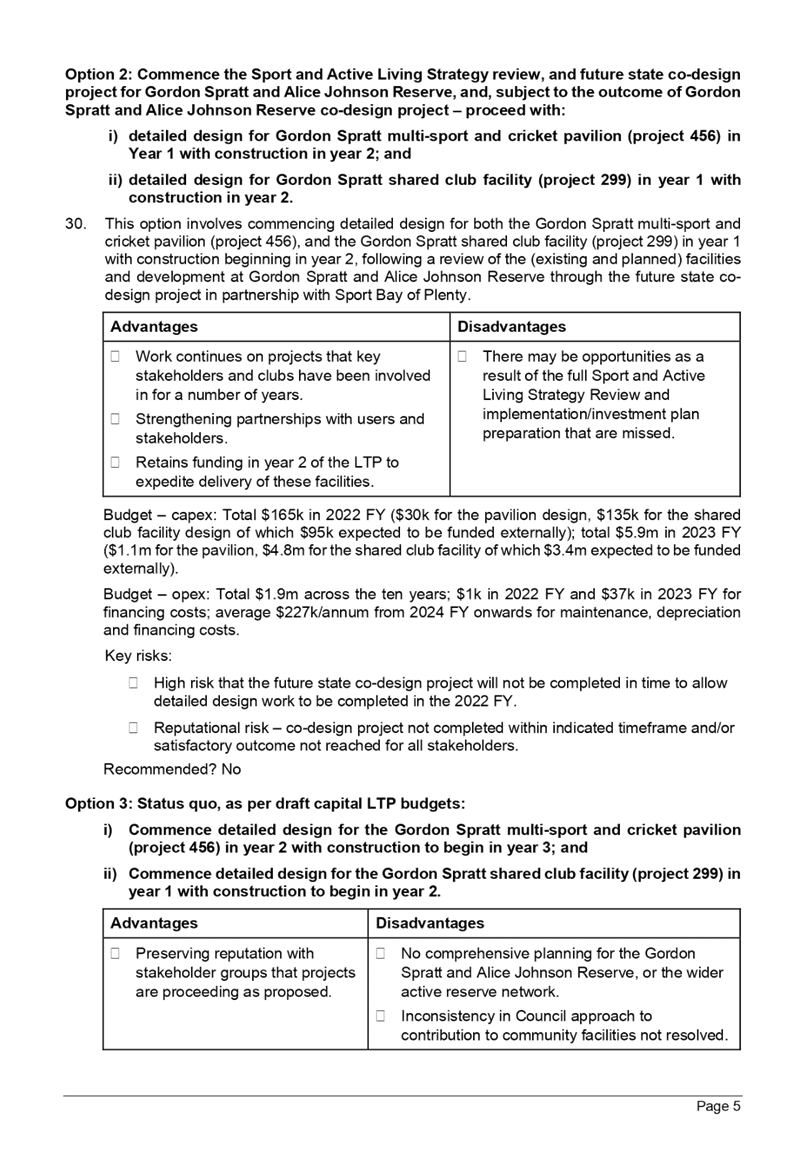

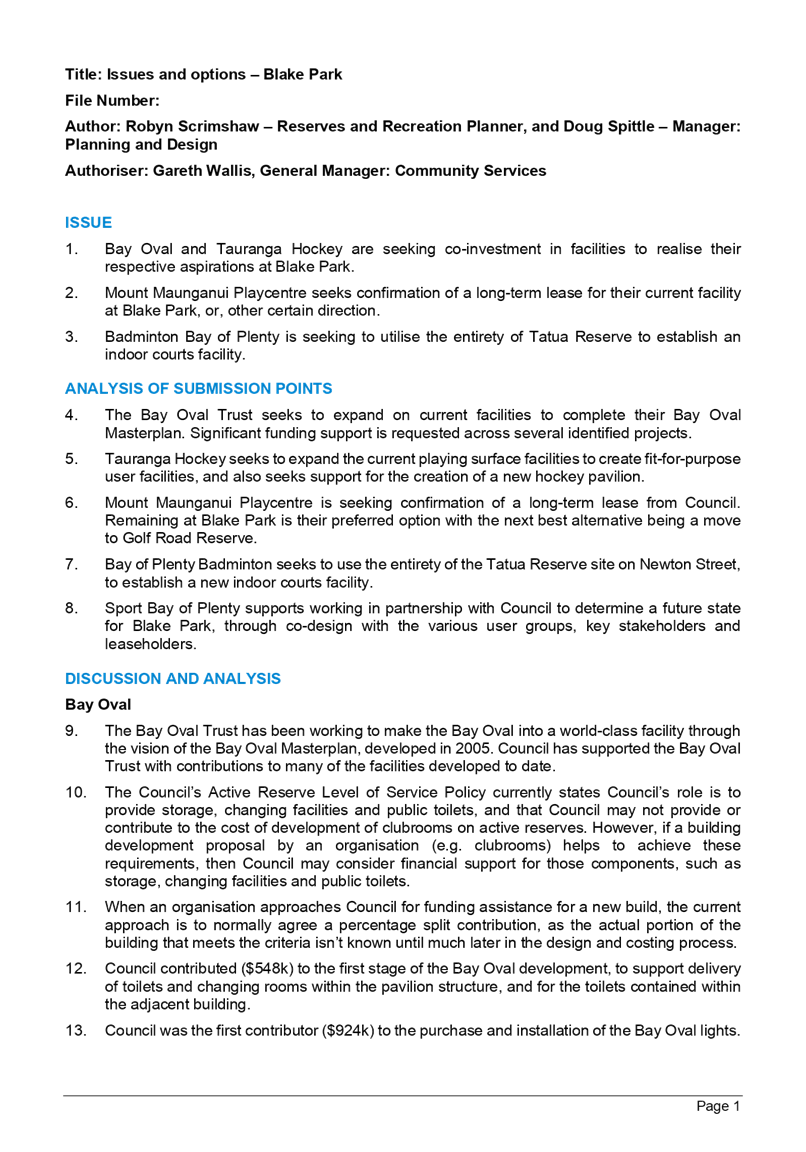

publicly available on Tauranga City Council's website: www.tauranga.govt.nz.

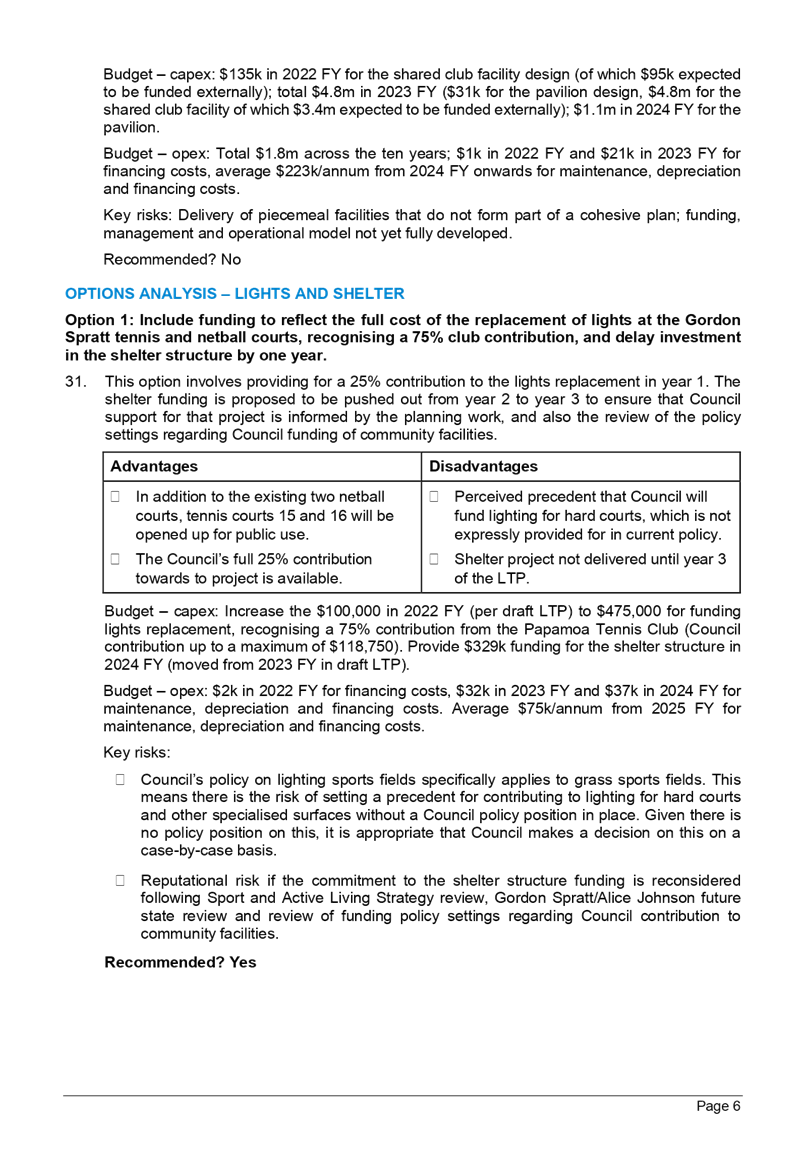

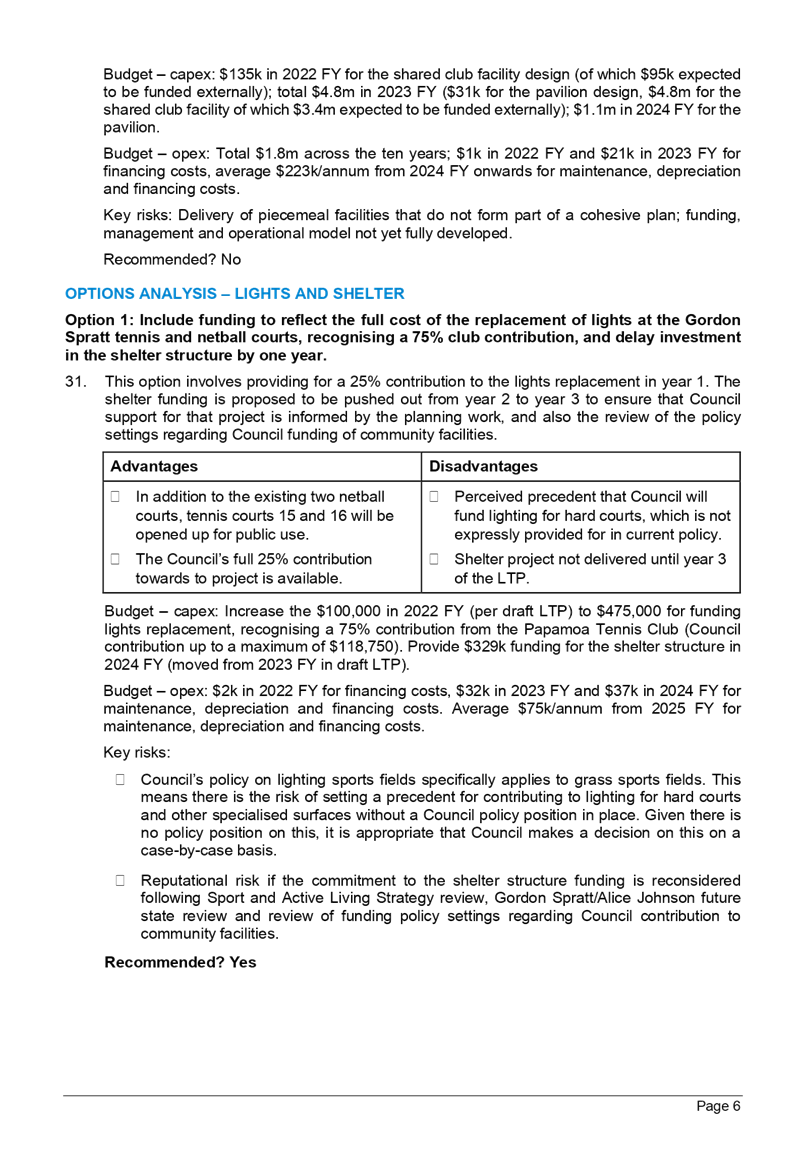

|

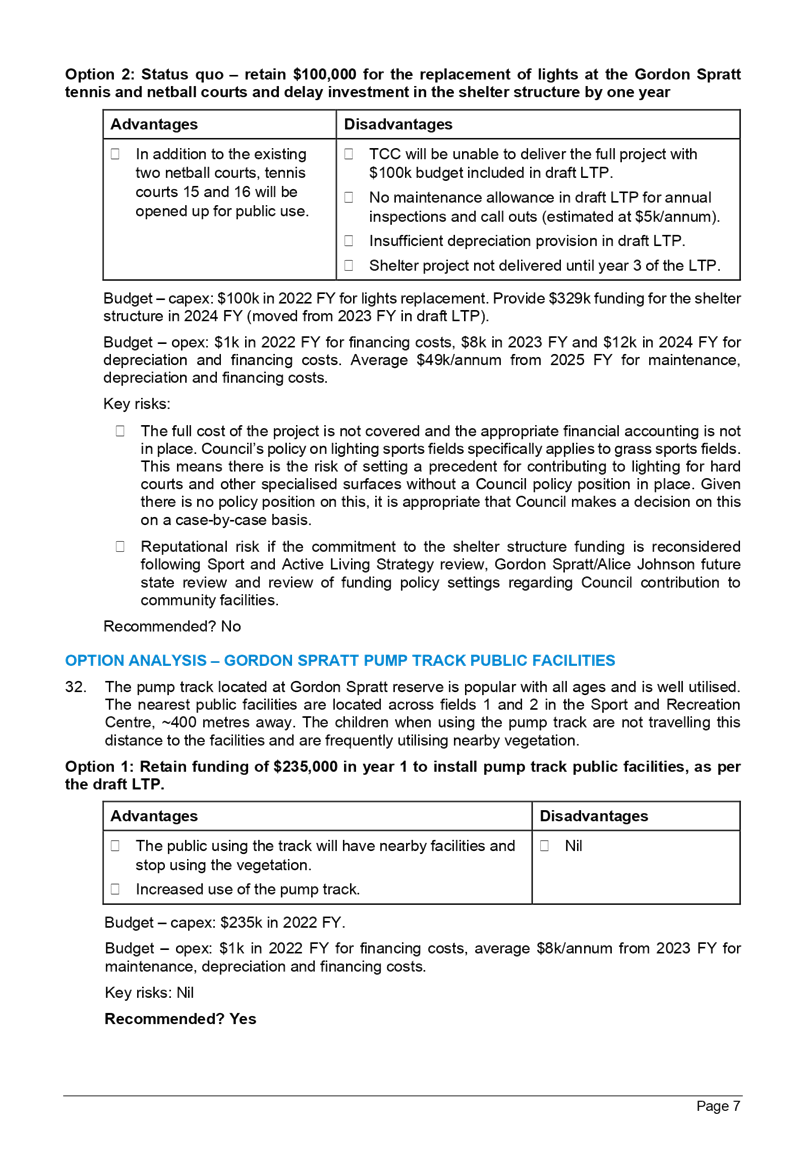

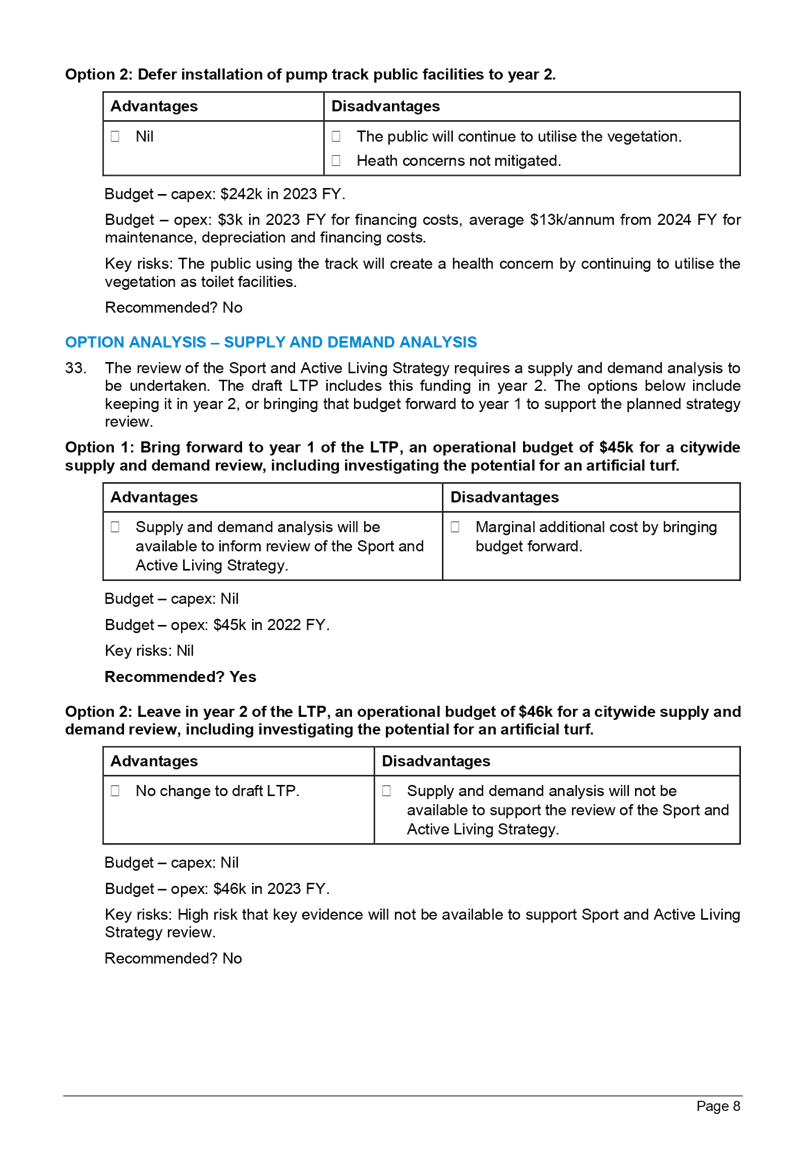

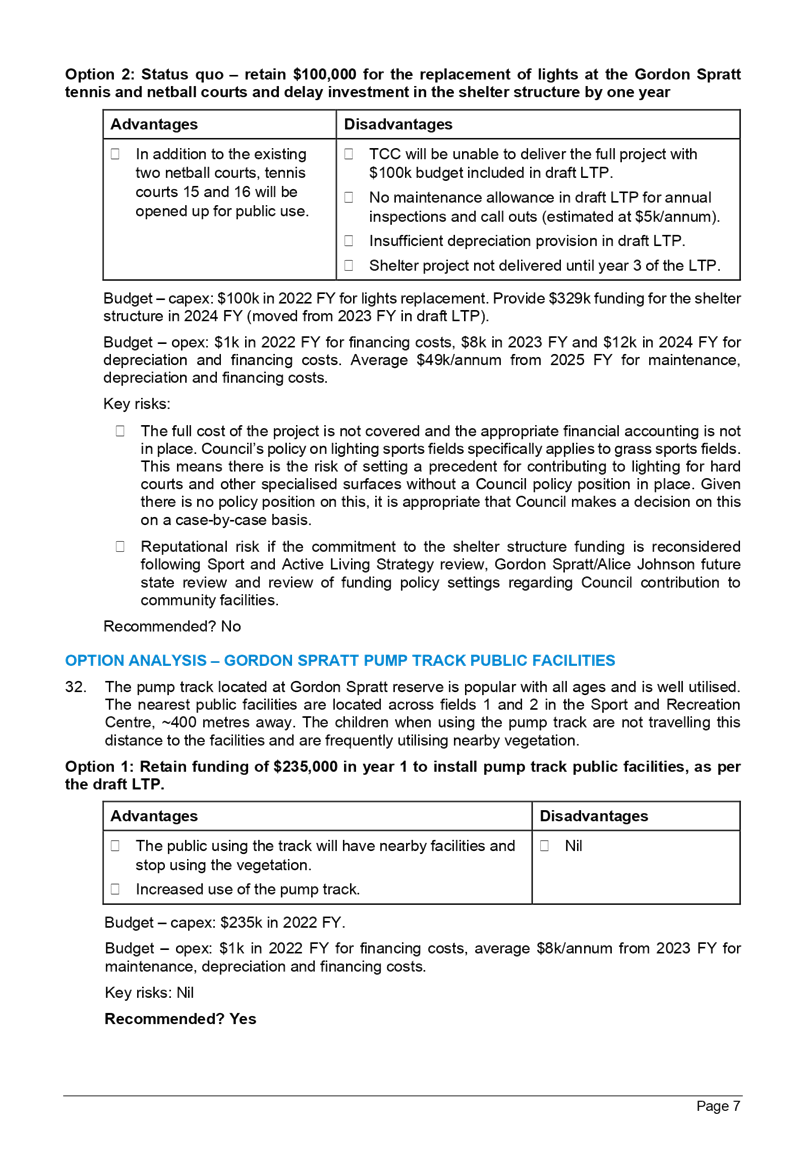

|

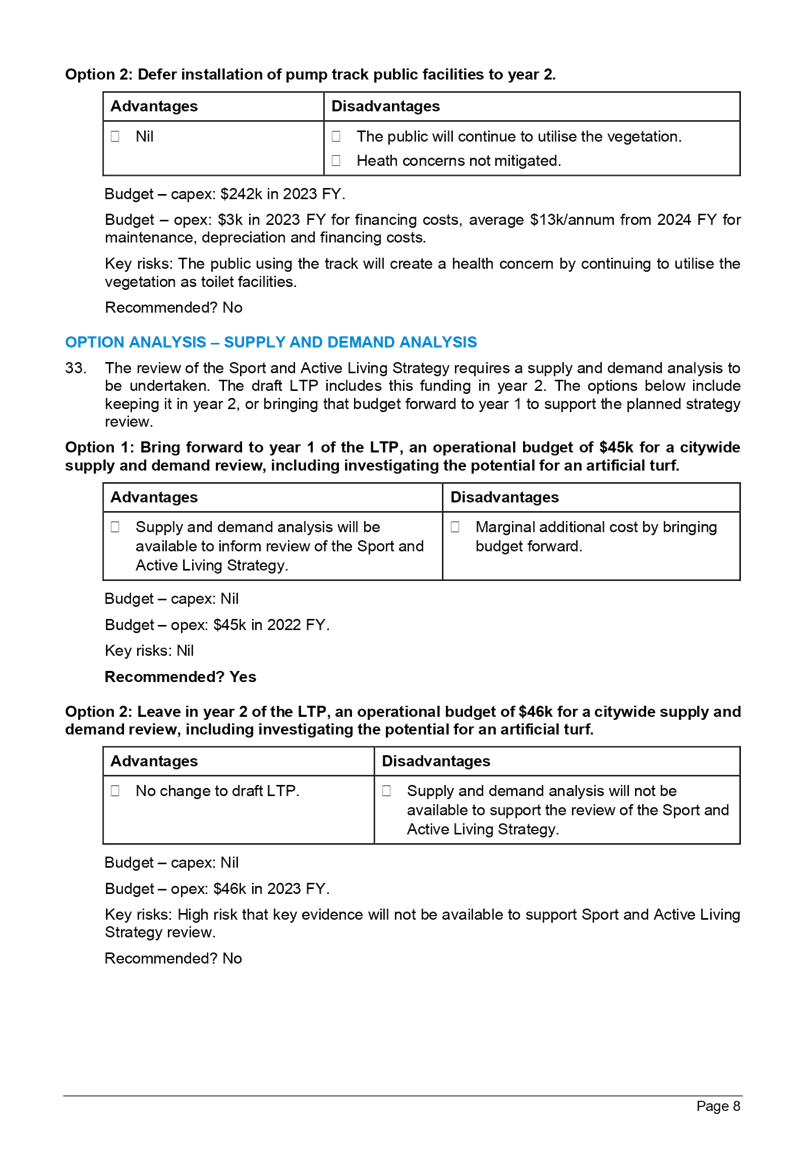

Marty Grenfell

Chief Executive

|

Membership

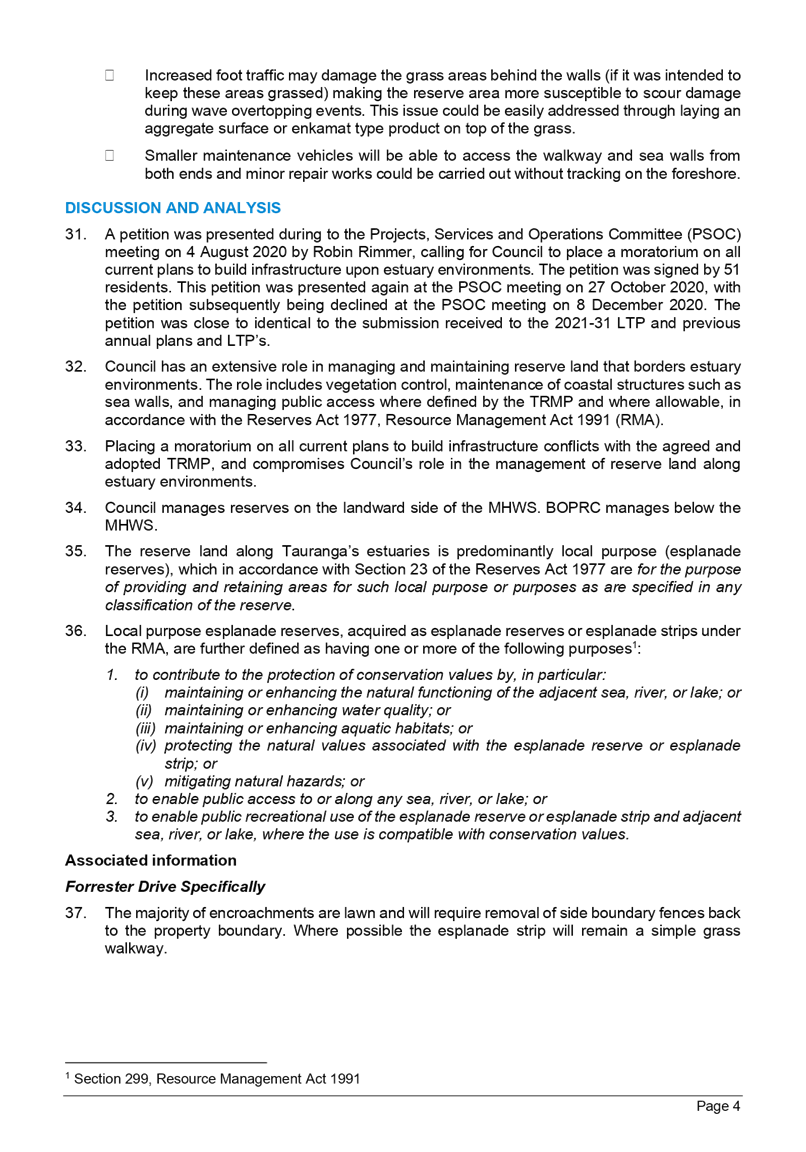

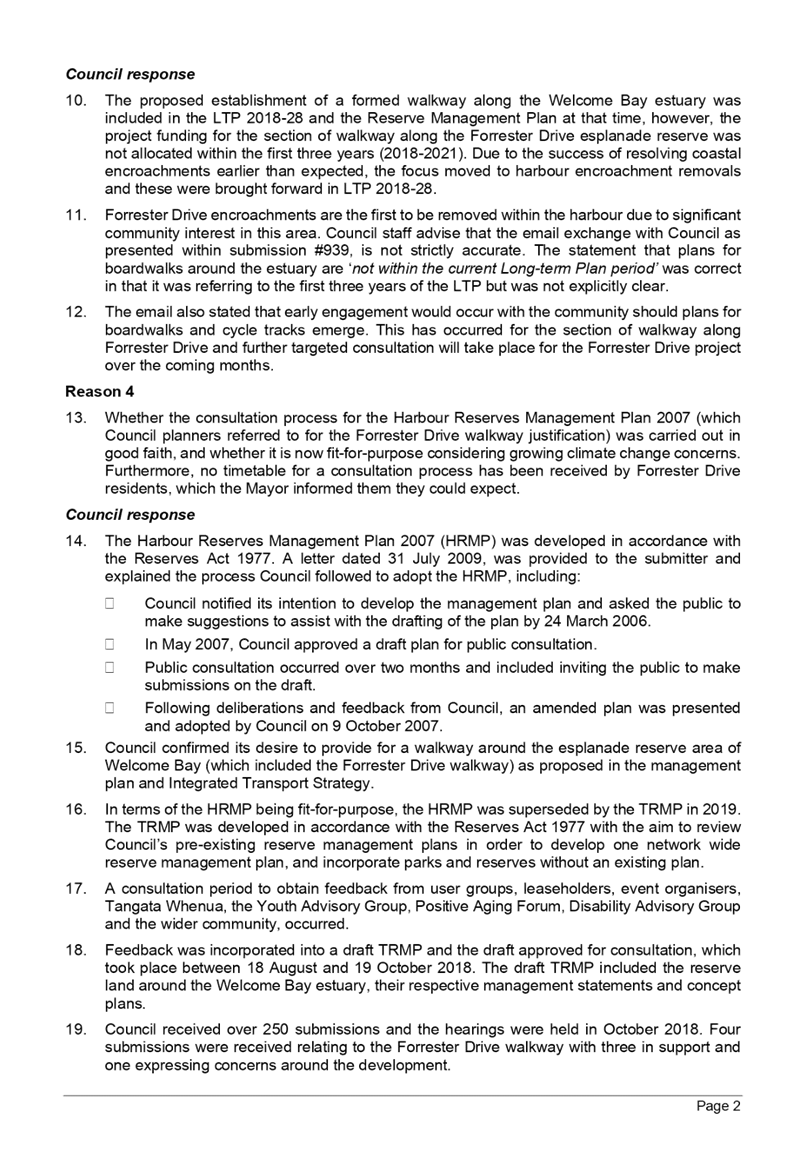

|

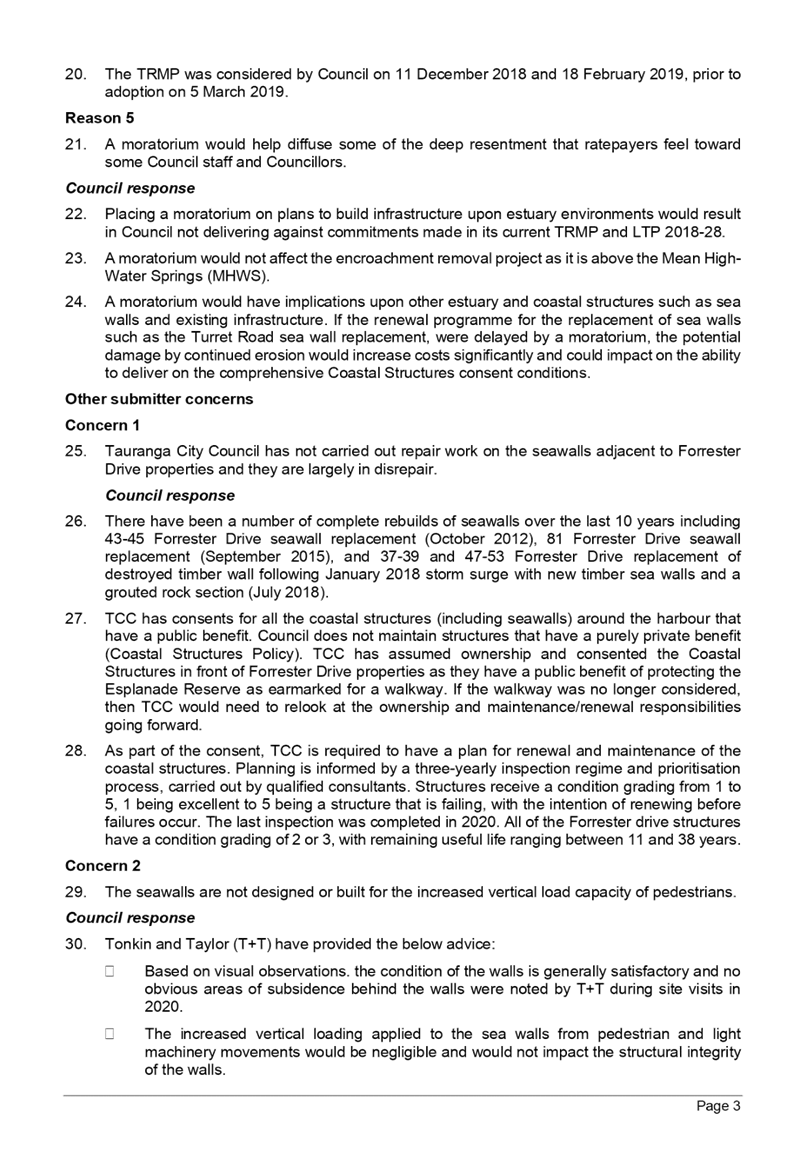

Chairperson

|

Commission Chair Anne Tolley

|

|

Members

|

|

|

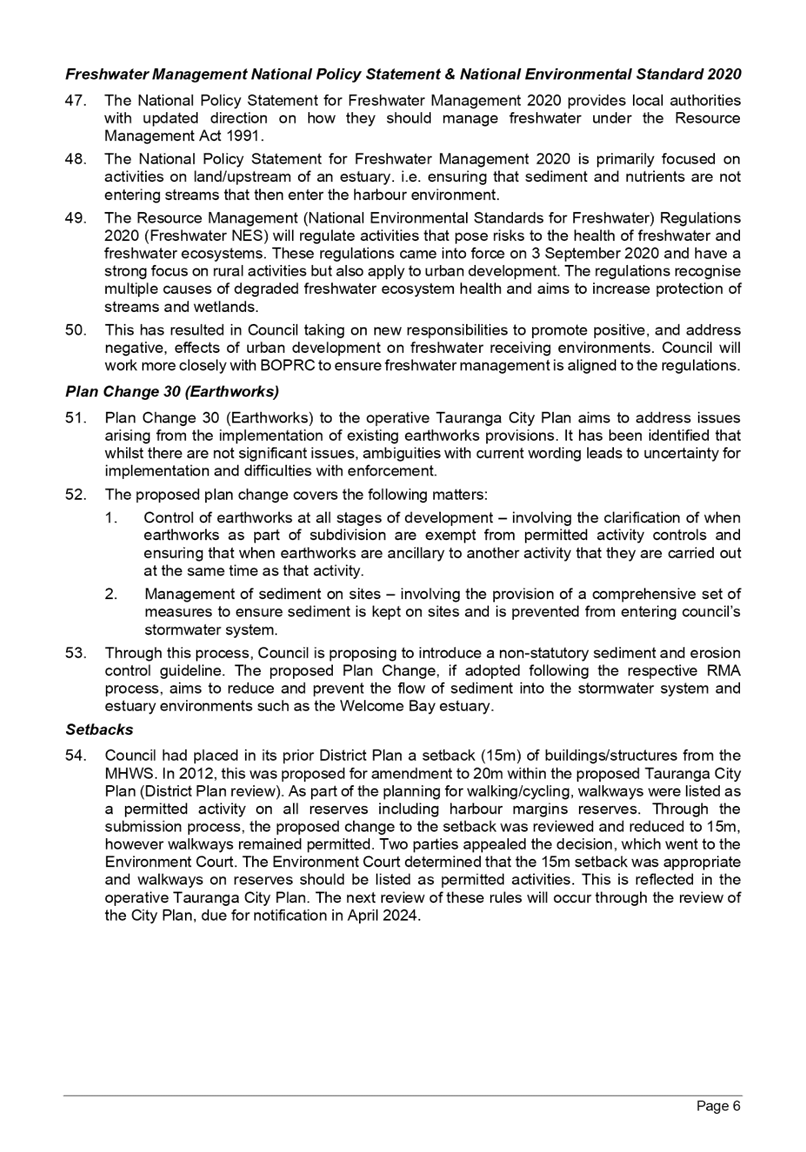

Quorum

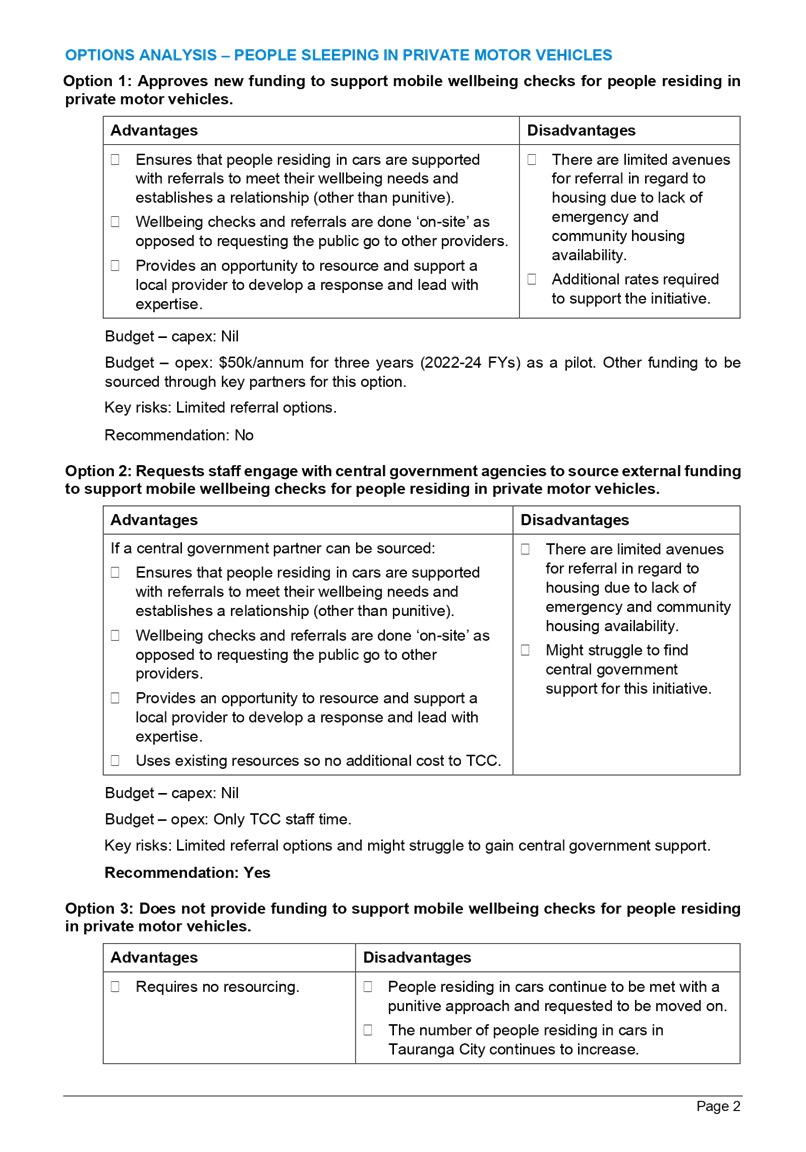

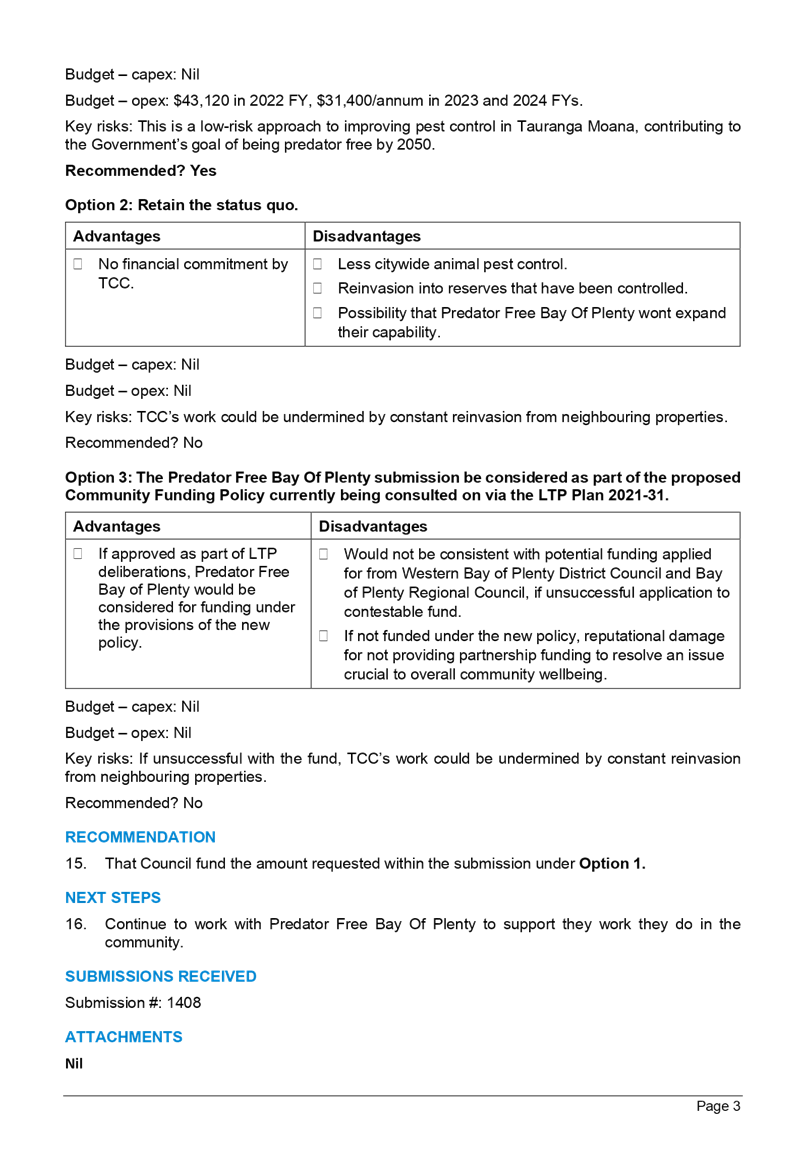

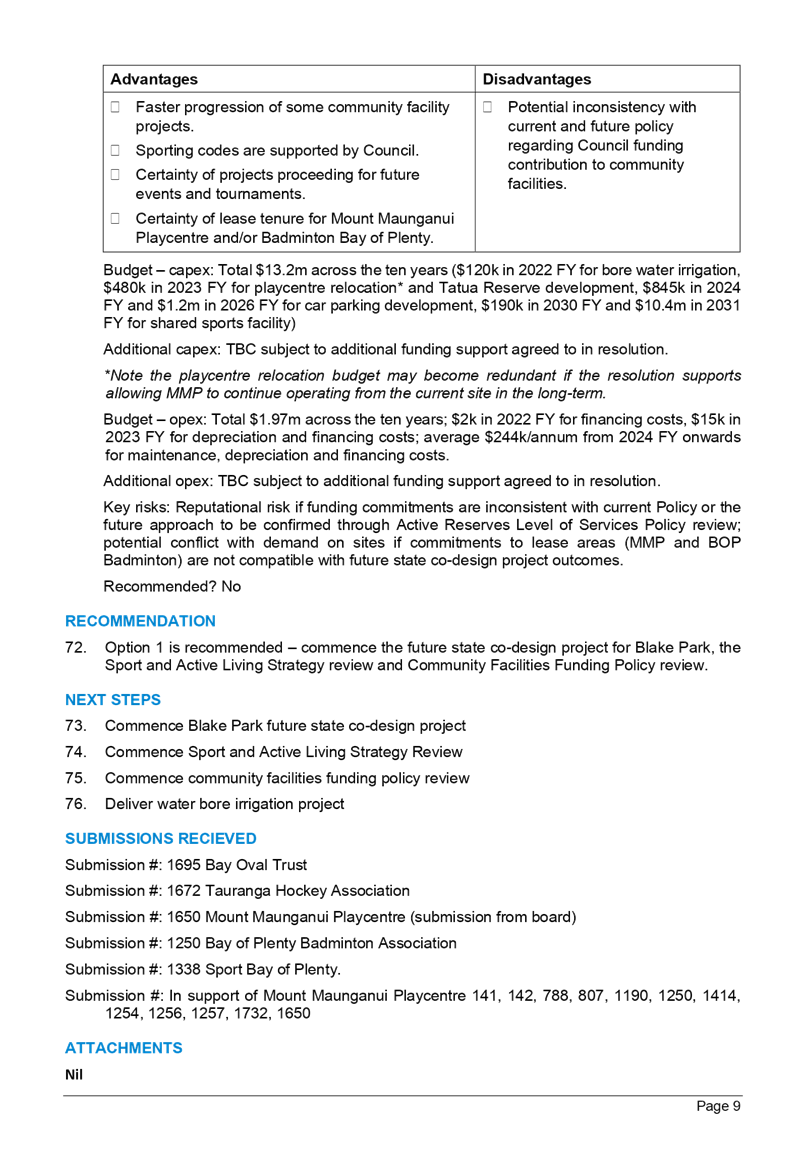

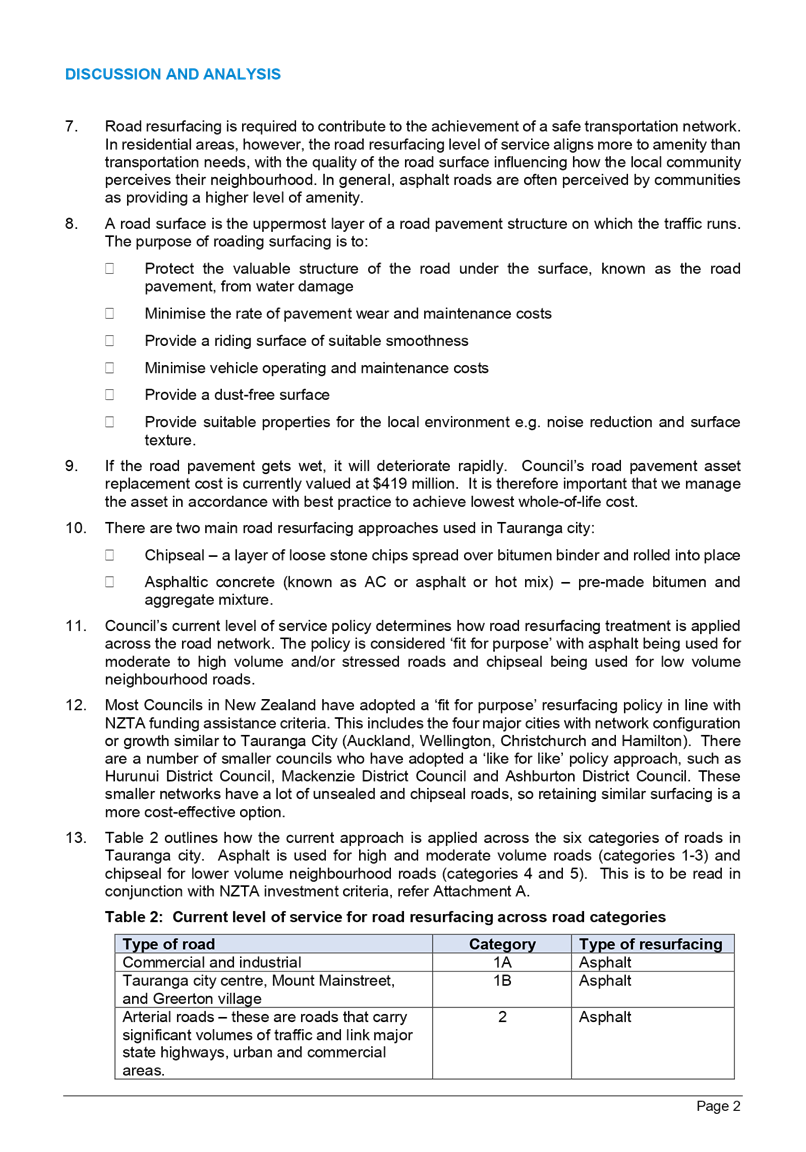

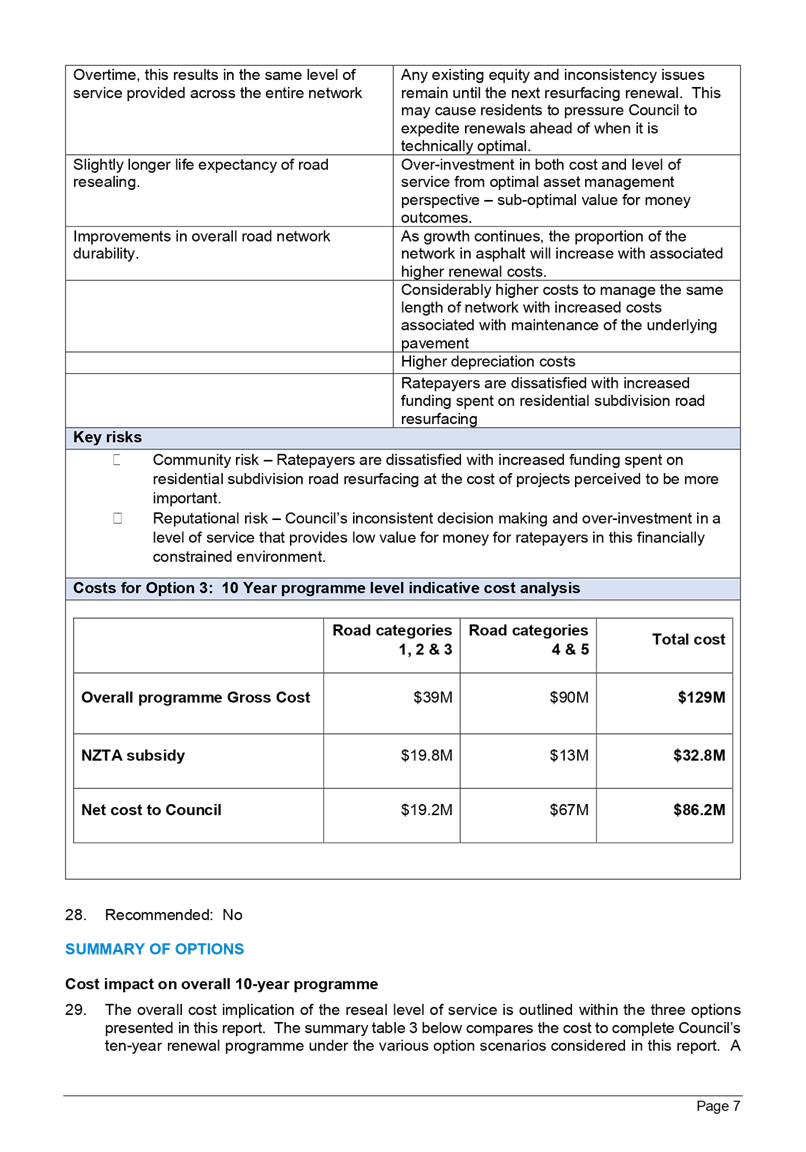

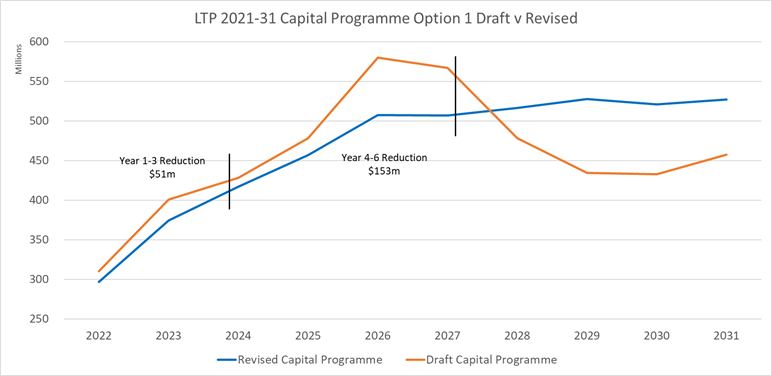

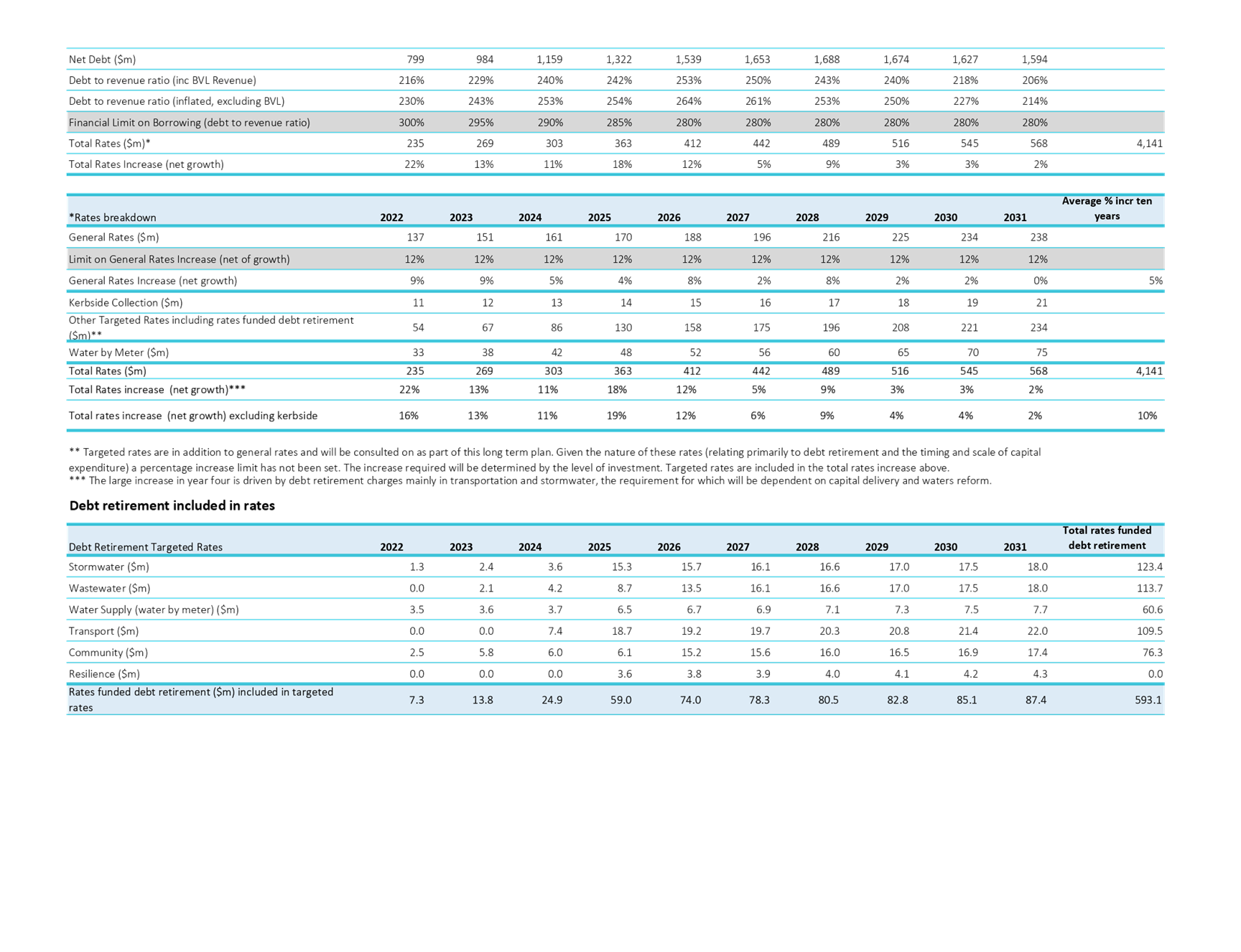

|

Half of the members physically present, where the

number of members (including vacancies) is even; and a majority

of the members physically present, where the number of members (including

vacancies) is odd.

|

|

Meeting

frequency

|

As required

|

Role

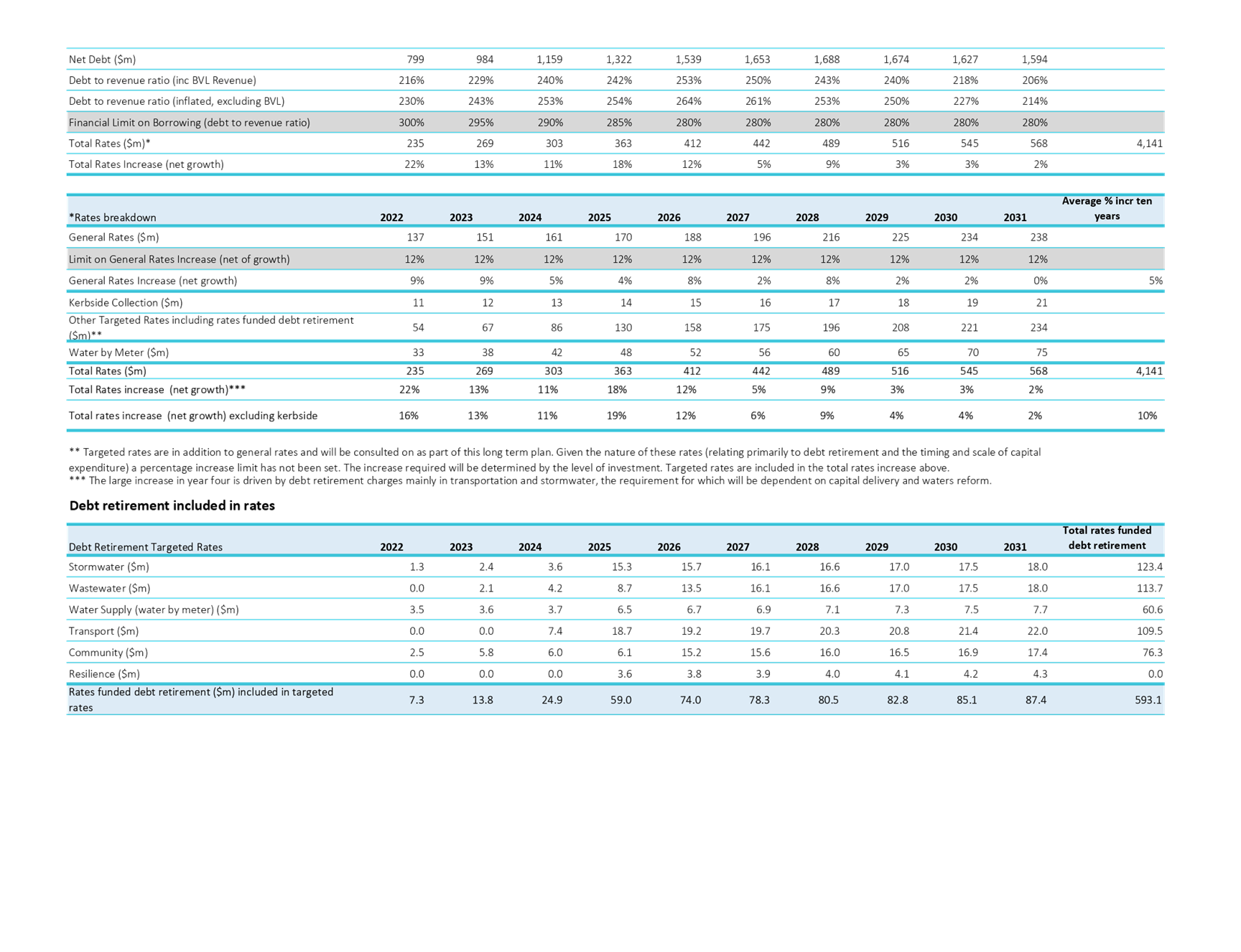

·

To ensure the effective and

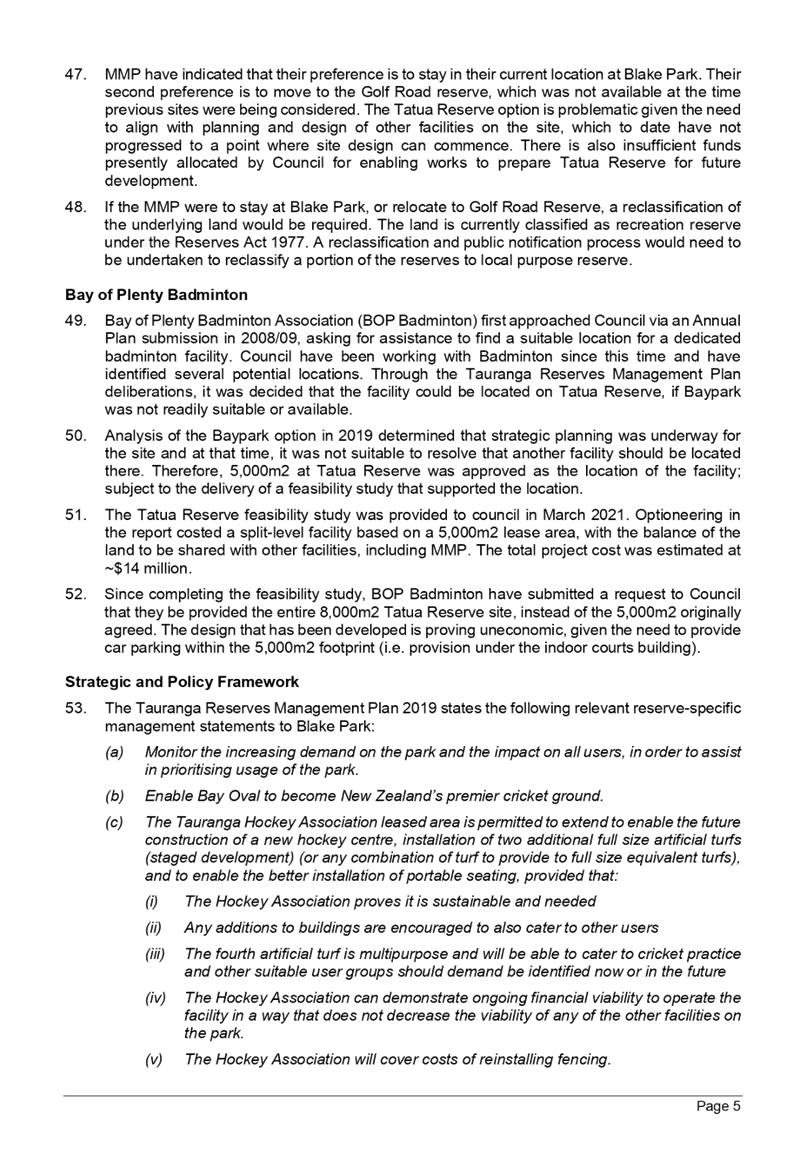

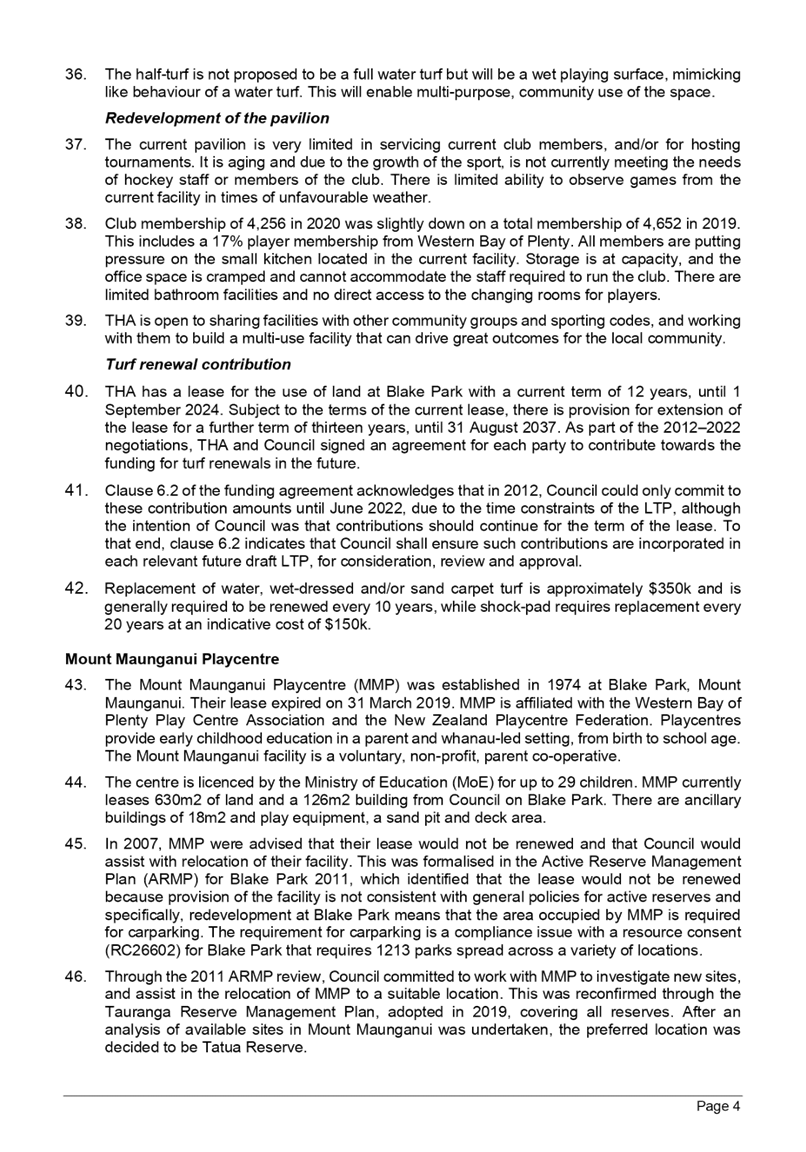

efficient governance of the City

·

To enable leadership of the City

including advocacy and facilitation on behalf of the community.

Scope

·

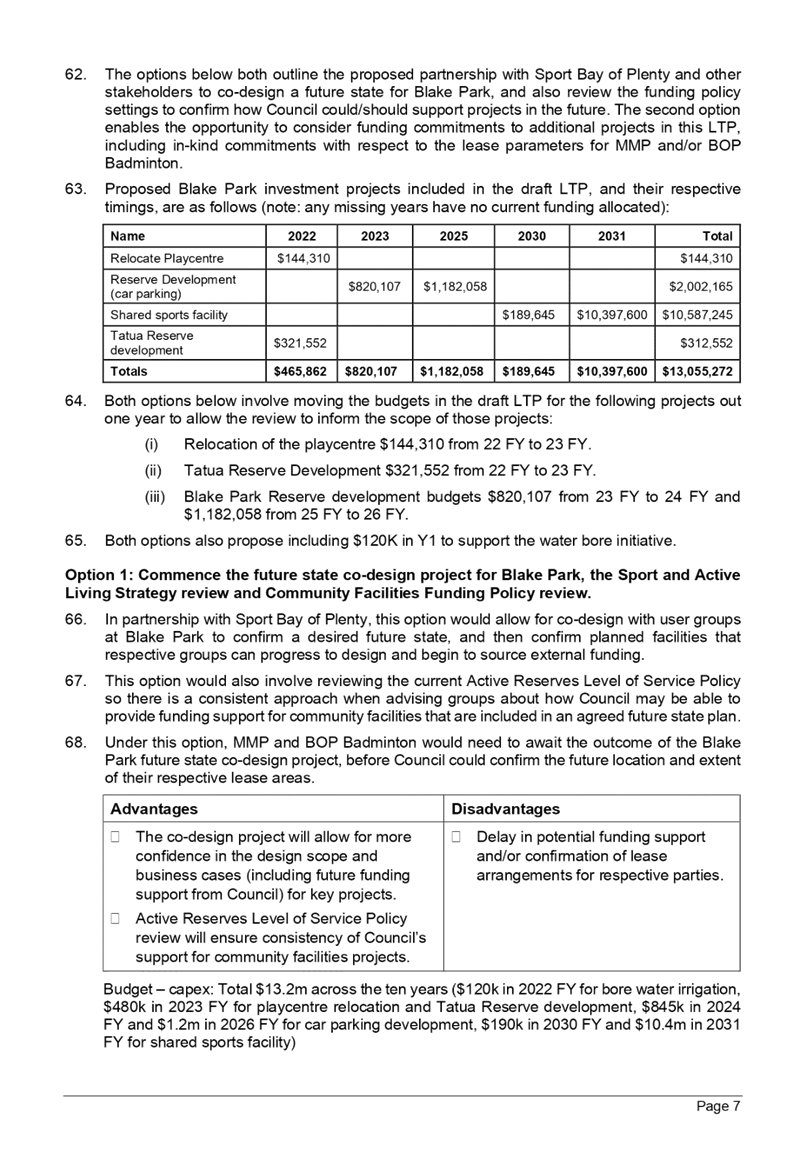

Oversee the work of all committees

and subcommittees.

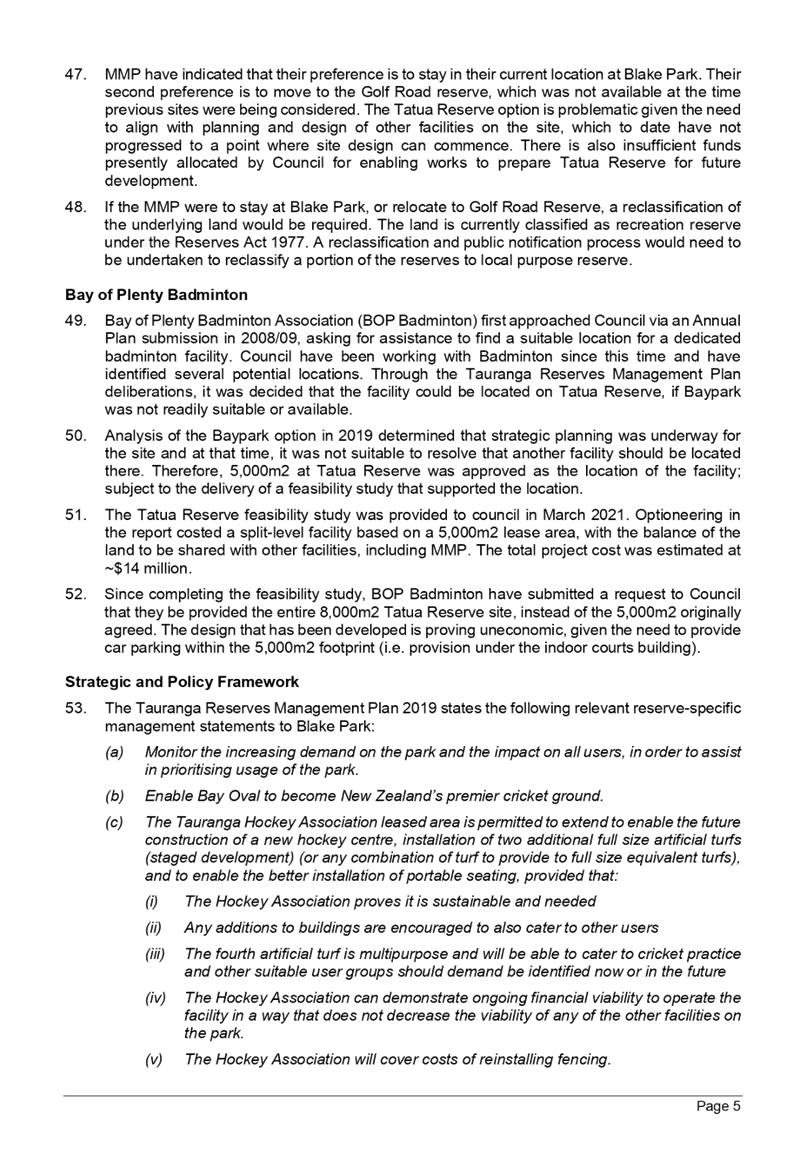

·

Exercise all non-delegable and

non-delegated functions and powers of the Council.

·

The powers Council is legally prohibited from delegating include:

o Power to make a

rate.

o Power to make a

bylaw.

o Power to borrow

money, or purchase or dispose of assets, other than in accordance with the

long-term plan.

o Power to adopt

a long-term plan, annual plan, or annual report

o Power to

appoint a chief executive.

o Power to adopt

policies required to be adopted and consulted on under the Local Government Act

2002 in association with the long-term plan or developed for the purpose of the

local governance statement.

o All final

decisions required to be made by resolution of the territorial

authority/Council pursuant to relevant legislation (for example: the approval

of the City Plan or City Plan changes as per section 34A Resource Management

Act 1991).

·

Council has chosen not to delegate the following:

o Power to

compulsorily acquire land under the Public Works Act 1981.

·

Make those decisions which are required by legislation to be made

by resolution of the local authority.

·

Authorise all expenditure not delegated to officers, Committees

or other subordinate decision-making bodies of Council.

·

Make appointments of members to the CCO Boards of Directors/Trustees

and representatives of Council to external organisations.

·

Consider any matters referred from any of the Standing or Special

Committees, Joint Committees, Chief Executive or General Managers.

Procedural matters

·

Delegation of Council powers to Council’s committees and

other subordinate decision-making bodies.

·

Adoption of Standing Orders.

·

Receipt of Joint Committee minutes.

·

Approval of Special Orders.

·

Employment of Chief Executive.

·

Other Delegations of Council’s powers, duties and

responsibilities.

Regulatory matters

Administration,

monitoring and enforcement of all regulatory matters that have not otherwise

been delegated or that are referred to Council for determination (by a

committee, subordinate decision-making body, Chief Executive or relevant General

Manager).

11 Business

11.1 Deliberations

Report - Options for the Level of Investment and Implications for Rates and Debt

File

Number: A12605351

Author: Kathryn

Sharplin, Manager: Finance

Tracey Hughes, Financial

Insights & Reporting Manager

James Woodward, Delivery

Manager

Authoriser: Paul

Davidson, General Manager: Corporate Services

Purpose of the Report

1. The

purpose of this report is to present options for the level of investment in the

2021-31 Long-Term Plan (LTP) and the impact on rates and debt. These

options take into account submissions on the LTP consultation document in

relation to how much to invest along with further information affecting the

capital and operating budgets. As other deliberations reports are worked

through there may be further changes to the financials presented in this

report.

|

Recommendations

That the Council:

a) Receives

the Deliberations Report - Options for the Level of Investment and

Implications for Rates and Debt

b) Agrees

to the proposed level of capital investment for the LTP proposed in Option 1

and detailed in Attachment A, with the associated level of rates and debt in

Attachment C.

c) Notes

that the proposed level of rates and debt in later years of the LTP may be

reduced as a result of reforms or alternative funding arrangements and that

any such impact would be incorporated in subsequent Annual and Long-Term

Plans.

d) Agrees to the proposed capital delivery

adjustments in Option 1 that have been increased and adjusted to reflect

revised assumptions or uncertainty of timing of funding agreements with

partners including Waka Kotahi NZTA (Waka Kotahi) and challenges around

project readiness regarding resilience projects identified within the bulk

fund.

e) Agrees

that the level of maintenance and renewals to be delivered in the first three

years of the LTP will be less than budgeted in the draft LTP based on the

lower Waka Kotahi funding.

f) Agrees

to the list of projects in Attachment B that may be brought forward into 2022

from 2023 and later years to manage deliverability of the overall capital

programme and support delivery of key outcomes.

g) Notes

the reduction from the draft in rates-funded operational costs of $1.7m from

lower opening debt position in July 2021 that resulted from slower capital

delivery in 2021, and lower salary market movement than assumed in the draft.

h) Notes

other deliberations reports recommend additional operational budgets to be

added to 2022, which if agreed would offset some of the reduction in rates

requirement noted in (g).

i) Agrees

that the proposed budget includes areas of operating costs to be loan funded

including:

i. Keenan Road and Tauriko Business Estate structure

planning and

ii. Transport

System Plan (TSP) programme management and stakeholder engagement and

iii. A

portion of the community grants fund that may relate to capital items

purchased through the grant

j) Agrees

to debt retirement associated with these items over a period of five years to

be rate-funded consistent with rate-funding for the appropriate activity.

|

Executive Summary

2. Tauranga

City is a growth city with a legacy of underinvestment to cater for both its

existing and future communities. It is experiencing a significant deficit

in housing supply, transport infrastructure, community amenity, wastewater and

water capacity. This is negatively impacting on the well-being of our

community. The LTP provides the opportunity for Council to define a clear

pathway forward to address these issues and to support this with an investment

plan which is transparent for our community.

3. To

address the issues facing the city and the outcomes sought on behalf of the

community, significant capital investment is required in the LTP across three

waters, transportation and community facilities. The first consultation topic

in the LTP consultation document was “Invest in our City Now and for the

Future. The proposal considered the amount and type of investment over

the next ten years across six main areas of expenditure.

4. Overall,

submissions have been in support of additional investment across the priority

investment areas. However, many submissions have opposed the proposed rates

increases, throughout the LTP. A balance between additional investment and

rates has been suggested.

5. As

well as the options consulted upon, this report identifies a further option for

consideration in response to submissions and subsequent risk around Waka Kotahi

(NZTA) funding and timing of the Transport System Plan (TSP).

6. As

noted in the financial strategy, rate-funded debt retirement is not the

preferred option to enable capital investment at the scale proposed.

Local Government reform and alternative funding and financing arrangements have

the potential to reduce the need for debt retirement. Several submissions

supported the greater use of alternative funding and financing tools.

7. Deliverability

was questioned in submissions and particularly in relation to justification for

the proposed rating increases. It has also been subject to ongoing review

by staff who recommend amendment to the programme under all options, based

around rephasing projects not delivered in 2021, updated cost, timing, funding

and deliverability information. Planning will continue to be able

to increase delivery capability and project readiness so that should further

funding become available needed investment can continue.

8. Waka

Kotahi has revised down the projected subsidy rates for maintenance and

renewals for the period 2022-2024 by $7m. The agency is still in the

process of assessing relative priority of the larger transportation programme,

including TSP against other priorities, which will affect the amount of funding

available to Tauranga over time. Some of the programme adjustments

recommended are to allow for uncertainty in the level of funding for TSP.

9. Operational

budgets have been amended with no net increase in rates from these adjustments.

Salary budgets have been amended to reflect revised establishment budgets and

this has been fully offset by increased capitalisation across the business.

10. As

a result of slower capital delivery, the rates requirement in 2022 has reduced

by $1m, with a further $0.7m reduction in salary market movement. Revised lower

capital spend in the early years of the LTP means lower debt servicing and

depreciation costs continue through the early years of the LTP.

11. Specific

areas of loan-funded operating expenditure have been identified for next year

for which specific council approval is requested. Carry forward of

operational budgets funded from rates in 2021 is also included in the revised

budget and will be confirmed after the annual report.

Background

12. On 15 March 2021 council considered

the issues and options facing the city, the outcomes sought on behalf of the

city and the capital investment programme required to deliver on those

outcomes. This work followed from earlier work on 14th and 15th

December 2020 on investment options which were presented as scenarios of

investment and financial implications along with the extent to which they

delivered outcomes for the city.

13. As summarised in the 15 March 2021

council report, Tauranga has been on a fast growth track for much of the past

40 years and this is expected to continue.

14. However, during that time the

city’s supply of housing and business land, its transport options, its

water and wastewater networks, and its community facilities have not kept

pace. A legacy of underinvestment has brought Tauranga to where it

currently is, under-performing as a city and not meeting the needs of its

residents, businesses and visitors.

15. In general, Tauranga’s

infrastructure is running at or beyond its capacity. Nowhere is this more

evident than on its transport system. But population growth and increased

community demands are also putting increased pressure on other asset types and

services. For instance, the city’s community facilities, the places

that support the things we love to do, are often old and under-capacity;

Baycourt was opened in 1983 and is half the size that might be expected for a

city of 150,000 people; Memorial Park pool was opened in 1955; and the Domain

grandstand was built in 1962 and has significant seismic issues. And

while council is currently constructing a third water supply on the Waiari

Stream, modelling shows that planning needs to start now to secure a fourth

supply.

16. The Local Government Act 2002

requires that councils:

‘promote

the social, economic, environmental, and cultural well-being of communities in

the present and for the future’.[1]

17. In terms of the Local Government Act

requirement, it is arguable that the city is currently able to promote the well-being

of communities in the present. It is certain that without significant

investment it will not be able to promote those same well-beings ‘for the

future’.

18. In addition, significant planning has

been completed at both sub-regional and city scale defining the strategic needs

and gaps. This includes the Urban Form and Transport Initiative, Western Bay of

Plenty Transport Systems Plan, Community Infrastructure Facilities Plan,

corridor wastewater studies, infrastructure resilience plan. These various

planning studies all build on the concept of creating well-serviced, connected

communities to enable communities to thrive. Collectively these and other

plans emphasise:

· the

need for greater transport choices

· the

need to invest in housing supply including intensification of existing urban

areas

· the

need to invest in facilities, not just transport corridors and pipes

· the

need to future-proof investments in long-life capital assets

· the

need to be resilient to climate change and other natural hazards.

19. Recognising these investments issues,

the first consultation topic in the LTP consultation document was “Invest

in our City Now and for the Future. The proposal considered the amount

and type of investment over the next ten years across six main areas of

expenditure:

(i) Community

spaces and places

(ii) Supplying

land for homes and businesses

(iii) Transport

(iv) City

centre

(v) Resilience

(vi) Delivery

Investment

Options Developed for Consultation

20. Two

options were presented in the consultation document.

a) The

preferred option 1 - to invest $4.6b, with an increase in rates (excluding

water charges and including new kerbside service) paid by an average

residential property of $7.58 per week and by an average commercial property of

$32.45 per week.

b) The

alternative option “to invest less” proposed a lower level of

investment of $4.0b, with an increase in rates (excluding water charges and

including a ) paid by an average residential property of $6.65 per week and by

an average commercial property of $30.21 per week increase. This

alternative option proposes projects not undertaken across community,

transport, city centre, and resilience. The level of investment for

supplying homes and businesses remained at the same level as option 1, which

was to commence the two new growth areas at Te Tumu and Tauriko West by 2026.

21. The

rates impact in 2022 was similar in option 2 as both options identified a need

for significant capital expenditure over the ten years so that the costs of

delivering, planning and providing the agreed levels of service next year

remained similar. Both options included the new kerbside waste collection

service. Future years rates were lower in option 2 with lower debt

retirement required and lower operating costs from capital investment.

22. Further

options for lower investment and rates were not provided in the consultation

document. This is because lower investment options did not achieve required

outcomes, particularly around housing supply, in the early years of the

LTP.

23. The

basis of the investment options for the draft consultation had been set at the

council meetings of 14th and 15th December 2020. As part of the LTP

development, Council considered report 10.3 Long-Term Plan 2021/31 –

Update and Working Draft. In this report four fiscal scenarios (A to D) were

considered that reflected a balance between investment to meet the current and

future needs of the community and its fiscal impact on debt and revenue

requirements.

24. Scenario

A&B were restricted investment scenarios that focussed only on development

of critical core infrastructure and did not support new community

infrastructure or development of Tauriko West or Te Tumu new growth

areas. These scenarios did not meet the strategic direction of council,

the identified current and future needs of the community or Government

requirements for new land supply for housing. Scenario C built on the base

scenarios with partial implementation of approved strategic direction with only

Tauriko West new growth area supported by council investment and limited

community and transportation investment. Scenario D involved substantial

implementation of approved strategic direction including community and

transportation infrastructure.

25. On

15 December Council agreed Scenarios A&B had been useful for establishing

the foundations of the LTP, and agreed that the draft for the baseline LTP

should be at a Scenario C-Plus level that included Te Tumu growth area

development within the ten years and further transportation investment from the

scenario D option. This formed the basis of Option 2 levels of investment on

the consultation document.

26. Subsequently,

commissioners proposed a preferred option that included more community

investment and more rapid implementation of resilience infrastructure

investment within the ten years. This formed the basis of Option 1 the

preferred option for the consultation document.

Submission responses

27. The consultation process involved

feedback both verbal through community consultation and hearings and written

through the written submission process. Commissioners held 34 different

meetings over the 30-day consultation period involving 2200 people. 26

meetings were organised with the help of community leaders as well as a further

4 community drop in sessions and 4 pop up meetings at the home show, Saturday

sports and farmers markets.

28. The

core themes discussed at every meeting were:

(i) The

six key investment areas

(ii) Who

pays

(iii) Can

we deliver and what assurance do we have

(iv) The

city needs a vision

(v) What

is going to happen in October and after the commissioners leave

29. The

common sentiment of the meetings was that people were generally supportive of

the LTP direction of the commissioners.

30. Of

the 1054 submissions that directly commented on the level of investment and

debt and rates impact- option 1 or 2:

(i) 490

(46%) were in support of the proposed level of investment in option 1.

(ii) 164

(16%) supported the lower level of investment proposed in option 2.

(iii) 20

(2%) commented on priority areas of investment but did not indicate support for

either investment option 1 or 2.

(iv) 380

(36%) (355 of which were proforma responses from individual members of the

Tauranga Ratepayers Alliance) supported much lower rates increases and the

implied lower level of investment.

31. Of

the 380 submissions that supported much lower rates most did not identify

priority expenditure, but noted investment was needed and that growth

infrastructure should be paid for by development contributions and targeted

rates applicable to new properties and developments. These submissions

expressed concern at one or a number of the following:

(i) The

average rates increase for next year both residential and commercial

(ii) continued

increases in rates over the ten years which would be unaffordable for some

ratepayers

(iii) the

size of capital expenditure proposed.

(iv) The

ability of the council to deliver investment competently and efficiently

(v) The

staff costs driving part of the rates increase for next year

32. Taken

together the support for option 2 (164 submissions) and much lower rates (380

submissions including pro forma submissions) totals 533, exceeding the number

of submissions supporting the proposed increased level of investment as per the

draft LTP (490 submissions).

Options

added in response to submissions

33. In

response to concern about the level of rates increases two more options are

presented in this report.

34. Option

3. This option aims to deliver on investment more slowly. By

budgeting to complete the proposed investment over a longer timeframe outside

the ten years, some of the rates increases arising from the large debt

retirement charges proposed for transportation and resilience investment are

also deferred outside the ten years.

35. This

option is costed as to rates impact and total level of capital investment

(Attachment C). The total capital proposed is $4.3b. It includes delivery of

both new growth areas and of community infrastructure. The delivery of

resilience, transportation (including TSP), and community projects includes a

portion of expenditure phased outside the ten years. This is achieved

through capital delivery adjustments across the programme and not by moving out

specific projects. The difference from option 1 is an additional $371m

moved out of the ten years. The detail of which projects would be moved

out would be developed in later LTPs. The reduction in capital expenditure in

the ten years reduces the required rate funded debt retirement over the ten

years, by moving some of this beyond 2031. The programmes phased out of the ten

years include $220m of TSP, and $151m of resilience.

36. Option

4. This option is identified as the investment level that would support

ongoing single digit rates increases (excluding the impact of kerbside waste

collection in year one). This would require a return to a level of

investment between scenario B and C as considered by council in December

2020. These options were not supported by council in December as the

baseline for the draft LTP. Option 4 is not fully costed because of uncertainty

as to which areas of investment would be removed.

37. The

capital programme would be closer to $2b over the ten years along the lines of

scenario B/C in the December scenarios reported to council. It is likely to

mean no significant community projects, new growth area investment limited to

Tauriko West and not Te Tumu and not undertaking transportation projects agreed

with our regional and NZTA partners. This option is not consistent with

the strategic direction of council and Government requirements for land

supply. This option has not been modelled as to detailed rates impacts

from 2023 but would be expected to retain rates increases at single digit levels

based on the key drivers of rates increases over time being due to capital

investment (debt servicing, depreciation and debt retirement).

38. No

option is presented to significantly reduce rates in 2022 from what is proposed

in option 1. The level of rates is largely committed to as a result of

past decisions on:

(i) The

new kerbside waste collection service; and

(ii) staff

and consultancy budget increases to enable higher capital delivery, programme

assurance, planning and stakeholder engagement.

39. There

would be some potential to reduce consultancy budgets and not recruit into new

vacancies if decisions were made to reduce levels of service or specific

initiatives.

Deliverability and Costs– Revisions to LTP phasing

and budgets

40. Deliverability

has been commented on frequently in submissions, even where higher investment

levels are supported.

41. Further

review of the investment programme that was proposed in option 1 and 2 of the

consultation document has been undertaken by council staff in response to:

(i) slower

capital delivery in 2021 ($66m),

(ii) revised

costs and timing within and beyond the ten years ($111m),

(iii) third

party funding and other project deliverability information.

42. These

amendments to the programme have been applied to options 1,2, and 3. In option

1 it has resulted in $66m of budget from 2021 added to the 2022 programme,

about $66m of budget from 2022 moved out to 2023 or later years which keeps the

first year of capital investment similar to the draft budget. The overall

increase of $177m in the ten-year programme has been largely offset by moving

$155m of projects outside the ten years. The capital programme therefore

remains at $4.6b for option 1. (Attachment A)

43. To

achieve this movement outside the ten years high-level capital programme

adjustments have been made to the resilience programme.

44. Staff

will continue to plan for increased project delivery so that should additional

funding become available will be in a position to deliver projects phased to

later years or beyond the LTP period. The list of projects included in

Attachment B relate to later year projects that may be able to be brought

forward in order to ensure capital delivery is maximised. This provides

some flexibility in managing the capital programme to ensure project delivery

is maximised provided it is managed within the overall debt envelope.

Transport Investment and Waka

Kotahi funding

45. A

key assumption of this LTP is that most transport investment receives 51%

subsidy from Waka Kotahi. Since the consultation, NZTA has advised that they

are not able to fully fund TCC’s Maintenance, Operations and Renewal

(MOR) request for 2022-2024. The reduction in Waka Kotahi funding is $7m

less than budgeted meaning $14m of work is affected[2].

46. The

reduction in Waka Kotahi funding for MOR for 2022-2024 will eventually result

in a reduced level of service. While we will be able to deliver the

expected level of service under the new contract in year one and two, a lower

level of funding will show for example more potholes, less sweeping / cleaning,

more chip-seal where asphalt is justifiable, in year three of the LTP. The

reduction in expected MOR has been factored into a wider transport programme

capital adjustment which sees this expenditure moved out of year 3 and into

later years of the LTP.

47. There

is also risk around the amount and timing of Waka Kotahi investment in the TSP

and other transport projects. To reflect this uncertainty about funding

levels and timing, transport investment in the first five years has been

reduced by $145m, with this budget moved into the last five years.

Further information will be forthcoming over the next months and refined in

later years as NZTA considers its funding priorities. The capital adjustments included

for TSP across all investment options provide flexibility for council to

respond to deliverability and funding uncertainty.

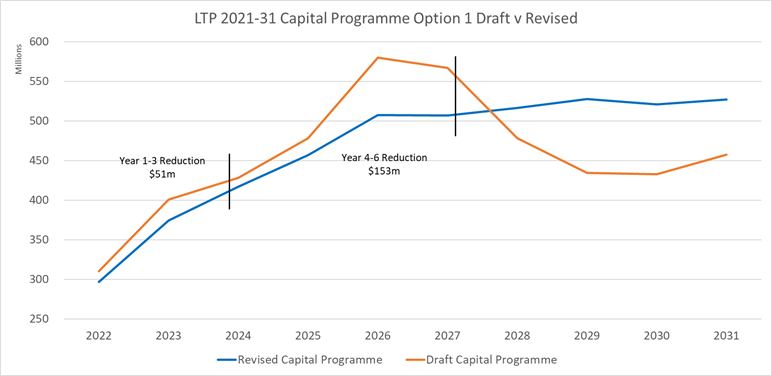

Revised Capital Programme

– option 1

48. The

revised option 1 programme capital expenditure after the adjustments described

above is shown below, with the orange line representing the draft budget that

was consulted on. The blue line represents the revised profile of expenditure

including more substantial capital adjustments for TSP and resilience,

particularly in the middle years of the 10-year programme. The revised

programme is likely to be more deliverable as it suggests a more consistent

level of annual expenditure.

49.

50. There

is considerable supply side risk on costs of infrastructure with both the costs

of materials and labour supply under pressure. Risk and contingency

allowances have been included in current project budgets. However, further work

is required to identify the potential impact on the programme over time of

continued increases. The capital project delivery team will continue to

review and manage this area of risk.

Operational Budgets

51. Operational

budgets at the activity level have been amended within and amongst activities

to reflect corrections, changes in timing, carry forward of 2021-funded operating

projects and some reprioritisation of initiatives. There has been no net

increase in rates from these changes. Salary budgets have been amended to

reflect revised establishment position budgets and this has been fully offset

by increased capitalisation across the project design and delivery parts of the

business. The revised financials for each option from option 1 to 3 are

shown as Attachment C.

52. There

have been savings in operating costs and rates requirement in 2022 which flow

through the next few years as a result of the lower opening debt balance from

slower capital delivery in 2021. The revised phasing of projects also

flows through to a proposed later start to rates-funded debt retirement to fund

investment.

53. In

2022 a reduction in rates requirement of $1.7m (0.8% lower rates increase)

comes from lower debt servicing and depreciation. This reduction applies

across all options.

54. Under

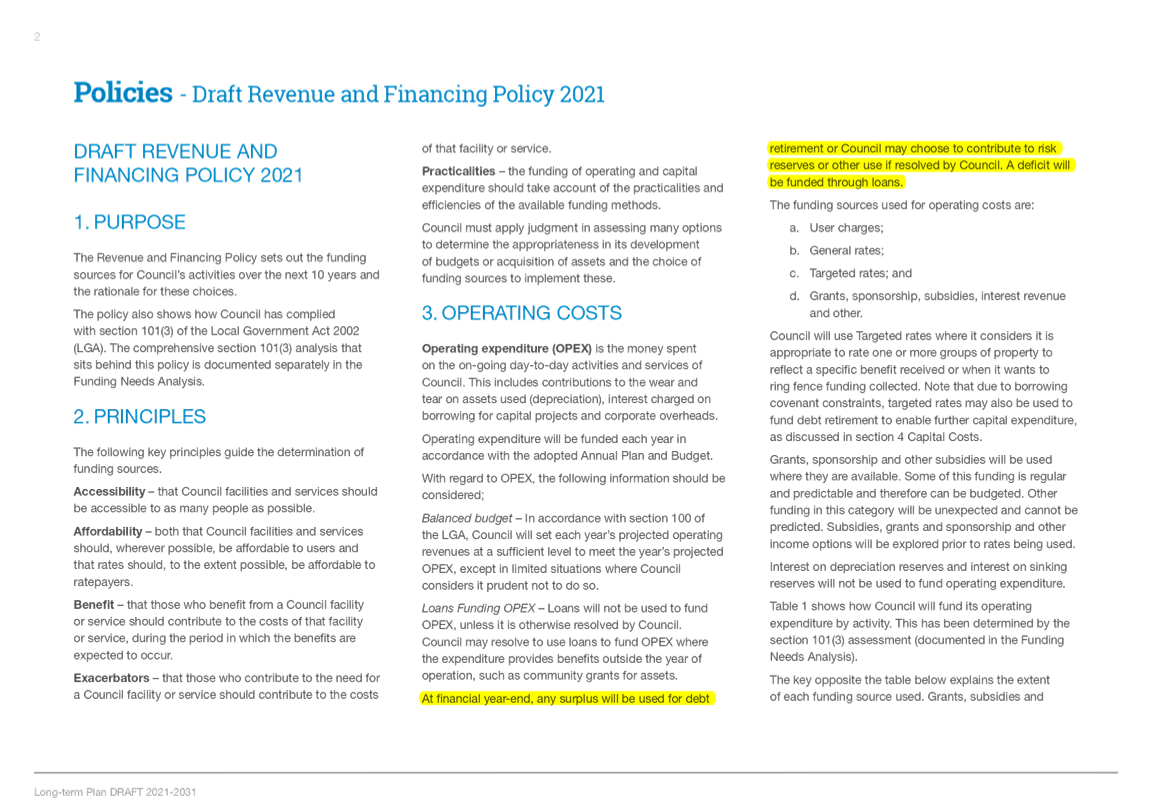

the revenue and financing policy operating expenditure can be loan funded where

there is long-term benefit from the expenditure rather than benefits occurring

in the year of spend. This rationale has been applied in the past for

grants to the community for capital projects (eg, surf life-saving building) or

for plans that provide long term benefit such as new growth area structure

plans (Tauriko West, Te Tumu). In the LTP draft budgets these items of

expenditure were identified as loan funded but they now require specific

council resolution to support this.

55. The

specific areas of operating expenditure requiring council support to be loan

funded include:

a) Keenan

Road and Tauriko Business Estate structure planning and

b) Transport

System Plan (TSP) programme management and stakeholder engagement and depending

on decisions regarding funding of the community grants

c) The

portion of community grants relating to capital expenditure where these are

recommended to be rate funded.

56. Loans

used to fund operating costs are recommended to be paid back over 5 years with

an associated rates requirement to retire these loans and cover interest.

57. Some

items of operational expenditure budgeted and rated in 2021 will now not be

undertaken till 2022. Budgets and funding for these areas of expenditure

proposed to be carried forward to 2022 are outlined in Attachment D.

58. Operational

budgets have been set based on the best available information at this time

however the significant increase in this LTP investment programme together with

a rapidly changing planning and delivery environment may require further

changes throughout the year. Every attempt will be made to manage any

changes within existing budgets and any implications that cannot be managed

within budgets will be reported to Council.

Alternative

Funding and Financing of Investment and reducing Debt Retirement

59. Some

submissions supported greater use of government funding or alternative funding

and financing tools. Council staff continue to work with Government agencies

and regional partners to consider alternative ways of funding new

infrastructure. At this stage there are no specific alternative funding

and financing options secured. However, future annual plans and LTPs are

expected to incorporate these options as an alternative to rates-funded debt

retirement.

60. The

proposed water reform, which could see council water assets and liabilities

transferred to a separate entity, would free up significant balance sheet

capacity and reduce the need for rate funded debt retirement as has been

proposed in the draft LTP.

Strategic / Statutory Context

This report is prepared in

response to submissions on the consultation document on the LTP. The process

for preparation of the Long-Term Plan is set out under the Local Government Act

2002.

61. Table of investment options and rates

and Debt impact

|

Option

|

Description

|

pros

|

cons

|

Financial implications

|

|

1 - from Consultation

Document amended for timing of capital programme

|

$4.6b revised for:

1. 2021 non-delivered projects,

2. additional cost information,

3. deliverability assessment and adjustment

for timing of third-party funding.

The increase in capex

because of 2021 budgets carried into 2022 has been offset by the same amount

moved outside the ten years . (attachment A)

|

The programme is

budgeted to deliver on the city’s priority needs in terms of key

investment areas.

The proposed capital

programme supports the ramping up of our capacity to plan and deliver

infrastructure and community investment planning and construction alongside

our suppliers and partners.

The full amount of the

transportation programme (TSP) that has been agreed with our transportation

partners continues to be budgeted, but with timing to reflect an expectation

of slower phasing of funding and project delivery subject to funding

confirmation from Waka Kotahi.

|

There is pressure to

deliver infrastructure in the early years of the LTP with risks around supply

of materials and construction. There is also risk around the level and

timing of third- party funding including Waka Kotahi.

Rates are higher than

would be the case with lower investment through the ten years reflecting the

operating costs of new infrastructure and the need to retire debt to maintain

balance sheet capacity.

Three waters reform

would lift pressure from TCC’s balance sheet reducing the need to

retire further debt through additional rates as would some other form of

infrastructure funding, although that may come at higher financing costs.

|

2022 rates $233m

compared with $235m in draft

Total rates over ten

years $4.1b

Total capital over ten

years $4.6b

|

|

2 - from Consultation

Document amended for timing of capital programme

|

$4.1b revised as above

|

Key advantage is a

lower capital programme which is more deliverable. Lower expenditure

means reduced rates and debt.

|

This option excludes a

number of community projects that are included in option 1, which means that

community outcomes are not met.

Resilience investment

and transport investment outcomes are achieved more slowly than option one

|

2022 rates $233m

compared with $235m in draft LTP

Rates over ten years

$4b

Capital Investment over

ten years $4.1b

|

|

New option 3 for

delayed capital programme adjusted from option 1

|

Capital Programme

$4.3b. As per option 1 with $371m moved outside ten years and some debt

retirement on investment moved outside the ten years.

|

This option includes

community projects that were excluded from option 2. This option

retains the option one investment in the plan but delays the budgeting of

financing for projects of $371m outside the 10 years in the areas of

transport and resilience. This achieves lower debt levels and

reduced rates relative to option 1.

As the LTP period

progresses further assessments and updates will be made to deliverability

assumptions which may result in variations to the financing assumptions

around this programme.

|

Because investment is

budgeted to take longer the outcomes particularly for transportation and

resilience would take longer to achieve than for option 1.

May require higher debt

and rating levels in future years if more capacity is available to increase

deliverability of the programme.

|

2022 rates $233m

compared with the $235m in the draft LTP.

Rates over ten years

$4b

Capital Investment

$4.6b however financing is based on a programme of $4.3b

|

|

New Option 4

|

Lower capital

investment to achieve single digit rates increases across the LTP after year

1, which remains at consulted levels. Investment would be along the lines of

a scenario B/C option from December report to support this level of rates.

Detailed financials

have not been completed for this option as no investment has been identified

to reduce to get to this level.

Indicative high-level

estimates have been included and would require identification of projects and

expenditure to enable this option to be achieved.

|

Rates would remain at

single digit levels for residential ratepayers and lower levels for

commercial ratepayers.

|

Would not achieve

Council’s strategic direction and desired community and business

productivity needs and outcomes across transportation, land supply for

housing, city centre community and resilience investment.

Would not meet

Government requirements for urban land supply to address population growth

pressures.

|

Financials not fully

developed as dependent on investment choices.

Estimate rates 2022

approx $230m if resourcing requirements reduced due to lower capital

programme.

Rates over ten years

increasing in single digits so less than $4b over ten years.

Identification and adjustment of individual projects including their funding

sources is required to fully cost the rates requirement in this option.

Capital investment

approximately $2-$3b over ten years.

|

|

Ordinary Council

Meeting Agenda

|

24 June 2021

|

Financial Considerations

62. Financial impacts are included in the

table above

Legal Implications / Risks

63. The LTP budgets and associated

Revenue and Financing Policy must be prepared in accordance with the Local

Government Act 2002.

Consultation / Engagement

64. This deliberations report is part of

the consultation and engagement for the LTP. Once deliberation decisions

have been made responses will be sent to submitters.

Significance

65. The Local Government Act 2002

requires an assessment of the significance of matters, issues, proposals and

decisions in this report against Council’s Significance and Engagement

Policy. Council acknowledges that in some instances a matter, issue,

proposal or decision may have a high degree of importance to individuals,

groups, or agencies affected by the report.

66. In making this assessment,

consideration has been given to the likely impact, and likely consequences for:

(a) the current

and future social, economic, environmental, or cultural well-being of the

district or region

(b) any persons who are likely to be

particularly affected by, or interested in, the proposal.

(c) the capacity of the local authority to

perform its role, and the financial and other costs of doing so.

67. In accordance with the considerations

above, criteria and thresholds in the policy, it is considered that the

decisions are of high significance.

ENGAGEMENT

68. Taking into consideration the above

assessment, that the decisions are of high significance, but are

part of a formal consultation process so that officers are of the opinion that no

further engagement is required prior to Council making a decision.

Next Steps

69. The

decisions from this report will be incorporated in the financials for the LTP

to be audited prior to adoption on 26 July 2021.

Attachments

1. Attachment A LTP

Deliberations - Capital Investment Programme Option 1 - A12639885 ⇩

2. Attachment B LTP

Deliberations Capital Investment Projects to allow Bring Forward - A12639890 ⇩

3. Attachment C - LTP

Deliberations Investment Options - financials - A12641766 ⇩

4. Attachment D

Deliberations report - Investment rates and debt Main Operating Budget

Adjustments from Draft LTP and Explanation - A12641764 ⇩

|

Ordinary Council

Meeting Agenda

|

24 June 2021

|

|

Ordinary Council Meeting Agenda

|

24 June 2021

|

|

Ordinary Council Meeting Agenda

|

24 June 2021

|

|

Ordinary Council Meeting Agenda

|

24 June 2021

|

11.2 Deliberations

Report - Rating Structure Proposals for the 2021-31 Long-term Plan

File

Number: A12614351

Author: Kathryn

Sharplin, Manager: Finance

Jim Taylor, Transactional

Services Manager

Authoriser: Paul

Davidson, General Manager: Corporate Services

Purpose of the Report

1. This report considers

community feedback on the 2021-31 Long-Term Plan (LTP) on options for rating

structure, which defines who pays what share of the total rates requirement.

Specifically, the report considers responses to consultation on preference for

targeted or general rates, and the proposed increase in the commercial

differential from 1.2 to 1.6 from 2022.

|

Recommendations

That the Council:

(a) Receive the Deliberations

Report – Rating Structure Proposals for the 2021-31 Long-term Plan

(b) Agree to targeted rates to

ring-fence specific investment areas of council vs general rates - option 1

(c) Agree to commercial

differential to be applied during the period of the LTP – option 1

(d) Agree to a further $150,000

budget to undertake further work on possible rating categories that reflect

different affordability and benefit profiles within the community, including,

but not limited to, the Central Business District, Port and related

industries, a wider industry grouping, Airbnb, and location-based groups. This

would also include future changes to differential levels across these

categories and may lead to proposals for higher commercial rates in

future years.

(e) Agree to undertake further

work on possible amendment to rates postponement involving both a review of

Tauranga’s rates postponement policy including financial implications,

and support for the development of a national rates postponement scheme or

other third party schemes before February 2022.

(f) Agree to contribute

$50,000 from existing finance budget to the design of the national rates

postponement scheme referred to in resolution (e).

|

Executive Summary

2. Two

specific proposals for rating structure were consulted on as part of the LTP:

(a) the greater use of targeted

rates to support investment in specific activities of council

(b) an increase in the commercial

differential from 1.2 to 1.6 from 2022.

3. The level of rates was

discussed in the Deliberations Report, which outlined options for investment

and the rating requirements associated with those options. This report

considers rating structure - who pays what share of the total rates

requirement.

4. There were a total of

1,228 submissions relating to rating structure:

(a) 632 covered the use of

targeted rates rather than general rates, with 421 in favour of the proposed

move to greater targeting. Between 20-30 submissions were by

organisations representing their members.

(b) 596 covered the commercial

differential, of which 175 were from commercial ratepayers or business groups.

Many of the business group submissions on the commercial differential requested

lower commercial differentials or exemptions for particular groups due to

hardship. 421 from residential submitters supported an increased

commercial differential. Several proposed ongoing increases in commercial

differential through the LTP. A new option presented below is based on a

further increase in the differential after 2022 by 0.1 per annum to a

differential of 2.5 by 2031.

(c) Several submissions covered

the need for additional rating groups or differential treatment including:

(1) a

Port and related Industry rating category

(2) a

Central Business District (CBD) category

(3) small

retail in larger higher value building complexes e.g., shopping malls

(4) Airbnb

residential properties subject to commercial rates

(5) accessible

properties on the grounds of affordability, and the desire to retain financial

capacity to build more affordable properties

(d) Rates postponement was

proposed in submissions to enable ratepayers with low incomes but growing

property values to postpone rates while remaining in their current homes.

Background – Topic Two – funding the investment

priority areas

Targeted vs general rates

5. A

total of 632 submitted on this consultation topic with the following results:

6. The discussions below

present the synthesis of the key questions asked in the Tauranga City Council

Draft Long Term Plan 2021-2031 Submission Form.

Targeted rates

Targeted rates

|

Option 1

|

Option 2

|

No

response

|

Comments

only

|

|

421

|

211

|

1,155

|

45

|

The chart and

table above present the preferences selected by online survey and paper survey submitters.

The options were:

Option

1: Introduce new targeted rates for stormwater, transportation and community

facilities, and to extend the resilience targeted rate to include capital

expenditure (our preferred option)

Option

2: No new targeted rates but continue to collect through general rates

7. There

was some misunderstanding in submissions that proposed targeted rates would

charge specific geographic areas for the specific community investments

proposed. However, this had not been proposed as it could not be fairly or

efficiently achieved. The large council investments proposed across

waters, roading, parks and community facilities are for investments that form

part of city-wide networks. This means the utilisation of and benefit

from an individual investment, including community spaces and places, would be

wider than only people within a geographic radius of that investment.

8. The

benefit of the targeted rates proposed was to enable revenue to be ring-fenced

for the agreed activity. This is particularly relevant where revenue is

to support particular investments as proposed through the community facility

targeted rate and the transportation rate. If the expenditure was delayed

the revenue would be retained for that investment when it occurred rather than

redirected elsewhere. Debt retirement charges are part of each targeted

rate and would be directed to debt in the activities in which the investment is

undertaken.

9. The

targeted rate concept, particularly in transport, is consistent with the

Infrastructure Funding and Financing levy being investigated for potential

inclusion in later years of the LTP.

Option – Commercial Differential

10. The consultation document proposed

increasing the commercial differential from 1.2 to 1.6, noting the following

arguments:

(a) the benefit of investment to

the commercial sector

(b) the much higher differentials

charged in other cities

(c) and the tax advantages to the

commercial sector with post tax rates closer to the residential rate at a

differential of 1.6.

11. A

total of 596 submitted on this topic with the following results

|

Option 1

|

Option 2

|

No

response

|

Comments

only

|

|

421

|

175

|

1,191

|

58

|

The chart and table above present the preferences selected

by online survey and paper survey submitters. The options were:

Option 1: Increase the commercial

differential to 1.6 in 2021/22 (our preferred option)

Option 2: Increase the commercial

differential to 1.4 in 2021/22 and then to 1.6 in 2022/23 and onwards

Additional Rating Categories

or means of offering different rating treatment for specific groups

12. A number of submissions called out

specific categories of ratepayers who are likely to feel more strongly the

impact of rates, including the commercial differential. Some submissions

identified the possibility of creating additional rating categories that may

better differentiate the commercial sector and the beneficiaries of investment.

It may also help to support some groups currently struggling in the economic

environment. These suggested categories included:

(a) a port industries group

reflecting the impact the port and related activities have in particular on

transport infrastructure and requirements within and leading into the city.

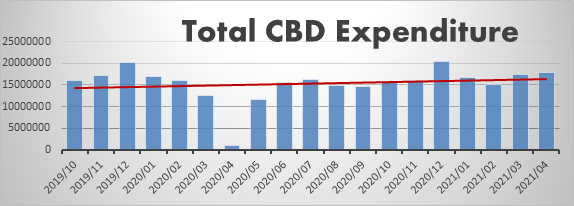

(b) A CBD group which reflected an

area of the city currently struggling as reinvestment is made and economic

changes reflected in that investment. The options could include recognising the

benefit of that investment in later rating differentials and other matters

referred to in the separate issues and options report on the city centre.

(c) small retail in larger higher

value building complexes

(d) Airbnb residential properties

subject to commercial rates

(e) accessible properties on the

grounds of affordability, and the desire to retain financial capacity to build

more affordable properties

13. These options were not consulted on

in the LTP and it is recommended that further work be undertaken on various

options to differentiate the commercial sector and identify the beneficiaries

of proposed and required council investment. This work would require

additional budget of $150,000. It would include analysis of the benefits

of council investment that may accrue to specific groupings or the extent to

which these operations may contribute to council costs, legal advice and

engagement costs to help support such a separate rating category. The outcome

of such work could be consulted on through later annual plans and long term

plans and may lead to proposals to increase commercial rates via an increased

differential or other rates.

Rates Postponement

14. Rates postponement was proposed in

submissions to enable ratepayers with low incomes but growing property values

to postpone rates while remaining in their current homes. At present

postponed rates recognised on land title would be reflected in higher debt for

councils. A review of the existing rates postponement policy including

financial impacts could be undertaken to be consulted on in a subsequent annual

plan, but would not be able to be completed in time for the 2022 year. Some

councils do operate rates postponement schemes with low uptake and high cost

which is reflected in their interest rate and other charges.

15. There has been work done to date

supported by some growth councils, Local Government Funding Agency (LGFA) and

Local Government New Zealand (LGNZ) to look at a national scheme for postponing

residential rates with a charge against the property to be realised on sale.

16. This national scheme has a number

elements one of which is referred to above as rates postponement. The

other elements of the scheme being explored are property development loans,

development contribution deferrals and as an aggregator for smaller projects to

support levies via the Infrastructure Funding and Financing legislation. There

is still more work to be done on this option to provide an off-balance-sheet

solution for councils. It is recommended that council support LGNZ to

promote a national rates financing scheme which would enable residential

ratepayers to postpone rates with a charge on their title while ensuring that

councils still receive the required revenue stream so that council debt is not

increased. Alternative schemes could also be reviewed as part of these

investigations.

17. TCC contributed $30K in 2020 towards

the establishment of a national scheme. Further funding has been requested from

LGNZ and the supporting councils to continue work to assess options.

Contributions have been agreed to by a number of Councils and it is proposed

that TCC contribute $50k to this scheme, which could be funded from within

existing finance budget. Further requests for funding may be made as the

project proceeds and it is unlikely that this solution will be finalised before

the next LTP.

Options Analysis

18. Option

- Targeted vs general rates -.

|

Option

|

Option description

|

Pros

|

Cons

|

Financial Implications

|

|

1

|

Adopt targeted

rates to support the proposed debt retirement and investment in community,

stormwater, transportation and extend the targeted rate for resilience to

cover debt retirement and proposed investment. (recommended)

|

Greater

transparency and accountability to the community regarding debt retirement

and rates collected to support investment.

Leads into the

development of an Infrastructure Funding and Financing (IFF) levy in future

plans.

|

Less flexible as

rates collected for investment would need to be used for that purpose or any

decision to redirect those rates would need to be through council decision.

|

No impact on

total rates.

Specific

accounting treatment required such as the use of reserves to report balance

of revenue collected against expenditure. A minor amendment to the Revenue

and Financing policy is proposed to clarify this approach to ring fencing

targeted rates surpluses.

|

|

2

|

Continue to fund

the bulk of expenditure across transportation, community (spaces and places

and libraries), stormwater and resilience investment through general rates.

|

Simpler to

administer.

More flexible

for use of rates revenue collected – can be applied across the business

and forms part of base rates revenue for reporting.

|

Less

transparent.

Reduces

accountability that funds collected to support investment remain available

for that investment.

|

No impact on

total rates.

No change to

current accounting treatment of rates.

|

19. Option

– Commercial Differential

|

Option

|

Option description

|

Pros

|

Cons

|

Financial impacts

|

|

1

|

Increase the

commercial differential to 1.6. (recommended)

|

Commercial

sector pays a higher share of the rates take and is closer to, but considerably

below, that of other metro-councils

At 1.6 times the

commercial ratepayers are paying the same as residential ratepayers (post

tax) based on capital value of properties.

City investment

is more likely to be at appropriate levels because the benefit to business

productivity from investment such as reducing congestion, is paid for by

those who receive that benefit.

The increase in

differential may also help to reduce the risk that ongoing large increases in

residential property values relative to commercial values puts growing

pressure on residential property owners.

|

The higher

commercial differential would impact some businesses, such as small

businesses located in buildings with higher capital value, or those

struggling in the current economic and post-covid environment such as some

tourism and retail operations.

|

At the proposed

budget level, the median residential rate would be $2,719 and the median

commercial rate $6,436

|

|

2

|

Increase the

commercial differential to 1.4 in 2022 and 1.6 in 2023

|

Commercial

sector has more time to prepare for the increase in differential. Allows time

for those businesses still adjusting post-covid in the current economic

environment.

The commercial

sector pays a higher share of the rates requirement and moves closer to

that of other metro-councils over time.

Other benefits

as for option 1 above

|

The commercial

differential would impact some businesses, such as small businesses located

in buildings with higher capital value or those struggling in the current

economic and post-covid environment such as some tourism and retail

operations.

|

At the proposed

budget level the median residential rate would be $2,775 and the median

commercial rate $5,984

|

|

3

|

Retain

commercial differential at 1.2

|

Commercial

sector will have taken into account this level of differential for 2022

|

Commercial

sector continues to pay a much lower share of total rates bill than other

metro councils. Residential ratepayers therefore will pay a higher

share of rates.

|

At the proposed

budget level the median residential rate would be $2,835 and the median

commercial rate $5,503

|

|

4

|

Increase the

commercial differential to 1.6 in 2022 and continue to increase further

thereafter, by 0.1 per annum through to 2.5 by 2031

(this could also

be reconsidered as part of the review proposed in the targeted rates section

of this report).

|

Commercial

sector pays a higher share of the rates take and moves closer to that

of other metro-councils over time.

The increase

over time would mean that businesses are able to prepare for the higher

rating levels.

Residential

ratepayers experience lower ongoing rates increases

Other benefits

as for option 2 above

|

The higher

commercial differential would impact some businesses, such as small

businesses located in more expensive new buildings or those struggling in the

current economic and post-covid environment such as some tourism and retail

operations.

Ongoing

increases in the commercial differential were not consulted on in the LTP and

would need further consultation before adoption. This option could be

considered as part of a later annual plan or LTP.

|

At proposed

budget level median residential rate would be $2,719 and the median

commercial rate $6,436 in 2022. In 2023 the share covered by commercial

ratepayers would increase so that the median residential rate would be $3,057

and the median commercial rate $7,546 in 2023

|

Option - Rates

postponement

20. Rates postponement was proposed in

submissions to enable ratepayers with low incomes but growing property values

to postpone rates while remaining in their current homes. This was not

consulted on and it is recommended that further work be undertaken in the next

financial year looking at both opportunities for TCC postponement policies and

the development of a national scheme. $50k is proposed to be contributed

from existing finance budgets to help facilitate this work.

21. Eligible ratepayers can access

financial assistance of up to $665 per annum through central government’s

rates rebate scheme.

22. Ratepayers can pay their rates in

smaller increments through direct credit or through weekly or fortnightly

direct debit.

Option - Additional Rating Categories

23. A number of submissions identified

the possibility of additional rating categories that may better differentiate

the commercial sector and the beneficiaries of investment.

24. These options were not consulted on

in the LTP and it is recommended that further work be undertaken on various

options to differentiate the commercial sector and identify the beneficiaries

of proposed and required council investment. The outcome of such work

could be consulted on through later annual and long term plans. Additional

budget of $150,000 for this investigation is recommended.

Airbnb commercial rating

25. A submission proposed including

residential properties that are significantly involved in Airbnb as commercial

properties that should contribute both to the economic targeted rate and be

subject to the differential. The submission noted that technology now

enables these properties to be more readily recognised and that their inclusion

would provide a greater share of revenue and be fairer to other businesses in

contributing to the costs of economic development. This issue has been

considered in the past but not proceeded with. It is recommended that council

request further work to be undertaken by staff in this area to report back as

part of the wider review of rating categories identified above.

26. An additional $150k is proposed to

be included in the 2022 financial year in order to undertake further rating

reviews.

Financial Considerations

27. The

financial impacts of the various options are included in the tables above and

shown in more detail in Attachment A

Strategic / Statutory Context

28. This deliberations report reflects

some of the proposals consulted on as part of the LTP. The options

discussed include both those identified and others contained in

submissions. The requirement to consider submissions prior to setting a

Long-Term Plan are set out in the Local Government Act 2002.

Legal Implications / Risks

29. The

Local Government Act 2002, requires councils to consult on the proposed long term

plan and this deliberations report is part of that process.

Consultation / Engagement

30. This

report is in response to consultation on the LTP. Feedback on

deliberations will be provided to submitters.

Significance

31. The

Local Government Act 2002 requires an assessment of the significance of

matters, issues, proposals and decisions in this report against Council’s

Significance and Engagement Policy. Council acknowledges that in some

instances a matter, issue, proposal or decision may have a high degree of

importance to individuals, groups, or agencies affected by the report.

32. In

making this assessment, consideration has been given to the likely impact, and

likely consequences for:

(a) the current

and future social, economic, environmental, or cultural well-being of the

district or region

(b) any persons who are likely to be

particularly affected by, or interested in, the proposal.

(c) the capacity of the local authority to

perform its role, and the financial and other costs of doing so.

33. In

accordance with the considerations above, criteria and thresholds in the

policy, it is considered that the proposal is of high significance.

ENGAGEMENT

34. Taking

into consideration the above assessment, that the proposal is of high

significance, officers are of the opinion that the following

consultation/engagement undertaken through the LTP is sufficient.

Next Steps

35. Decisions on rating structure in

this report will be incorporated in the financials prepared for adoption of the

LTP, and the rates applied commencing in the July 2021 rating year.

Attachments

1. Attachment

A Deliberations report -Rating Structure Proposals - rates impact summary -

A12640088 ⇩

|

Ordinary Council

Meeting Agenda

|

24 June 2021

|

11.3 Deliberations

Report - Pitau Road Village and Hinau Street Village

File

Number: A12564612

Author: Fiona

Nalder, Strategic Advisor

Authoriser: Christine

Jones, General Manager: Strategy & Growth

Purpose of the Report

1. This report presents the

results of consultation on options for the future of Pitau Road and Hinau

Street villages. It recommends that Pitau Road and Hinau Street villages are

separated from the elder housing portfolio and sold for private redevelopment.

|

Recommendations

That the Council:

(a) Resolves that Pitau Road

village and Hinau Street village are separated from the elder housing

portfolio and sold for private redevelopment.

(b) Resolves that the net

proceeds from the sale of Pitau Road village and Hinau Street village are retained,

together with the net proceeds from the sale of the elder housing portfolio,

in an elder housing and social/public housing reserve, until such time as

Council confirms its application.

|

Executive Summary

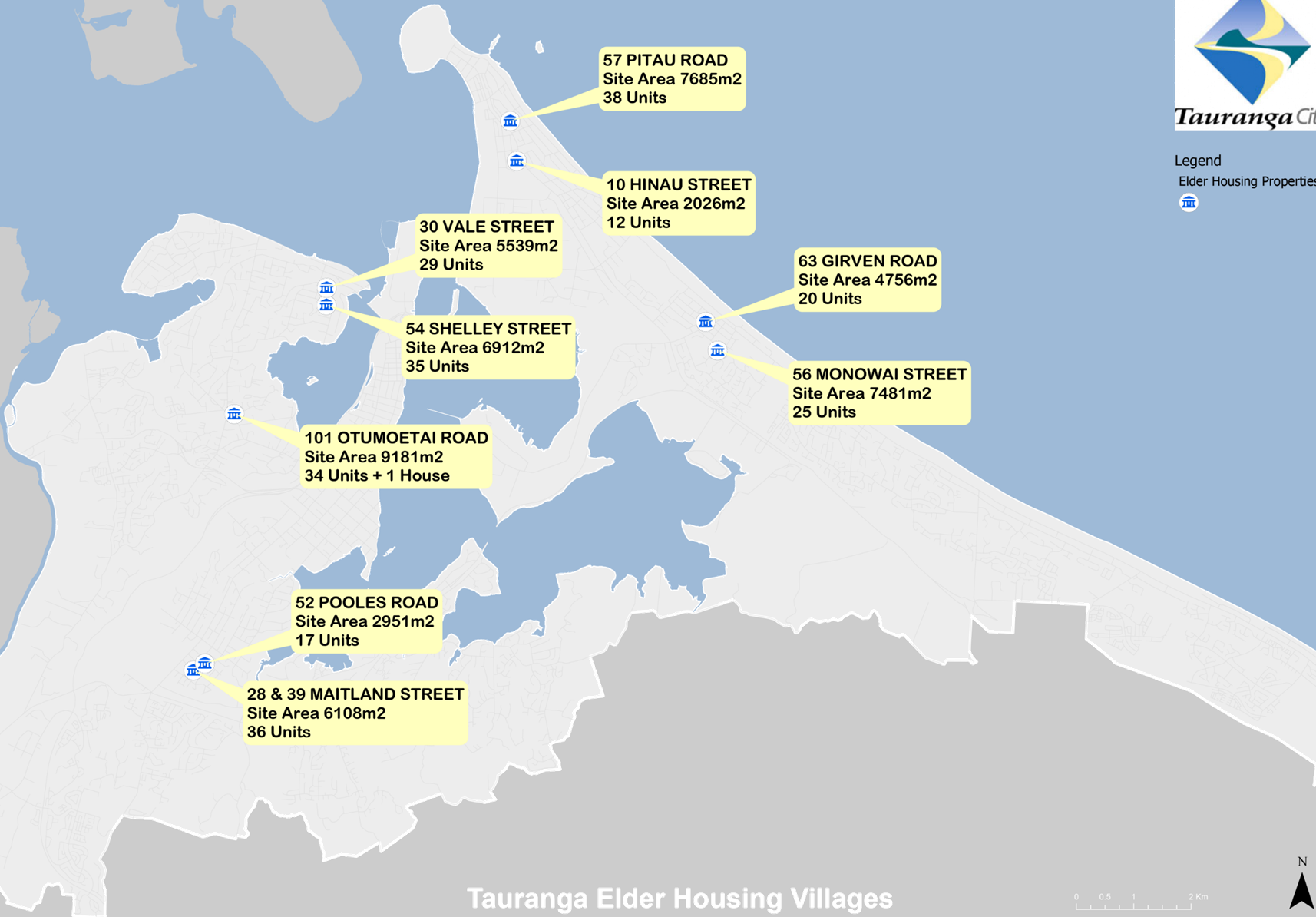

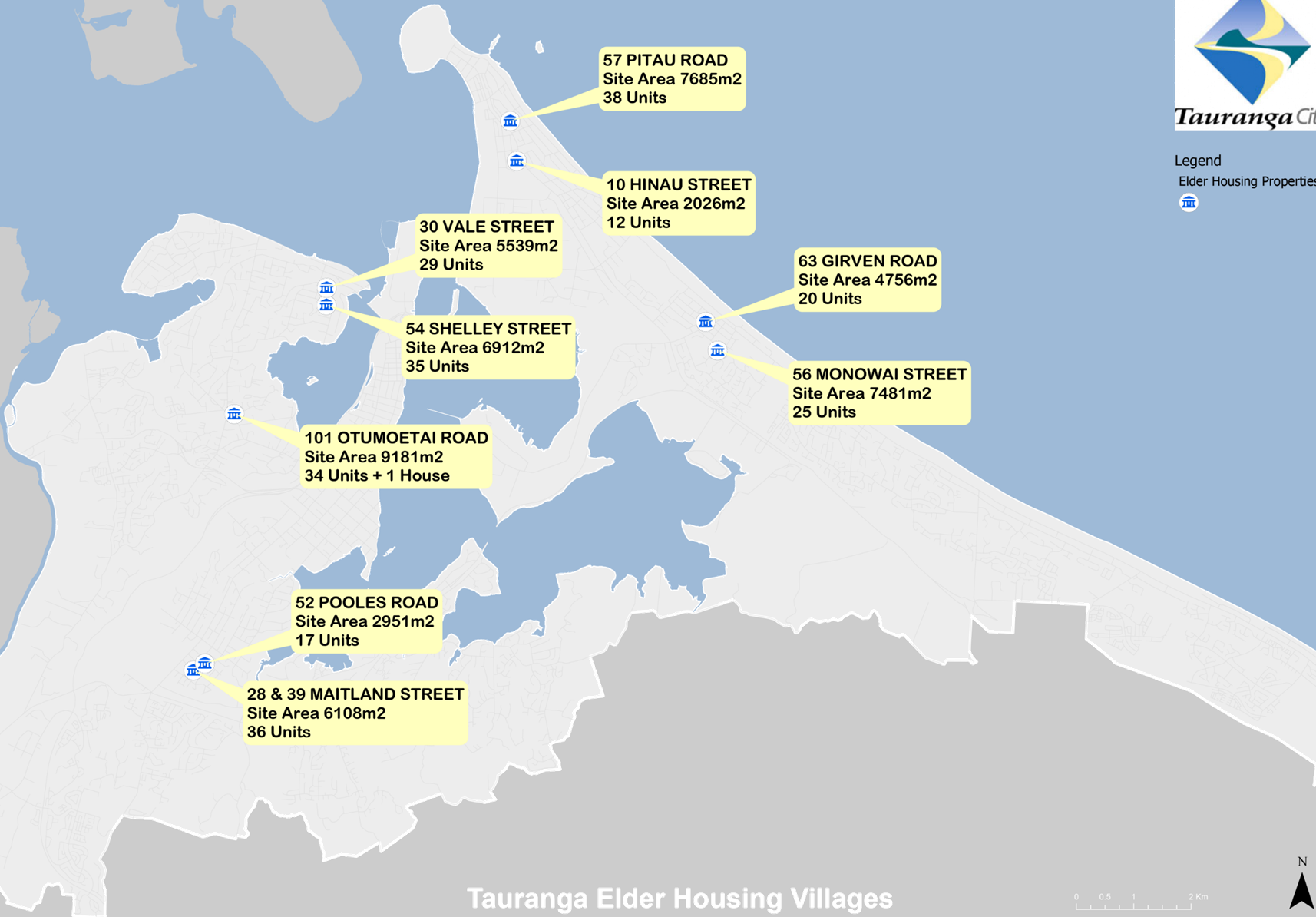

2. Council’s elder housing

portfolio consists of 246 units across nine villages located in Tauranga and

Mount Maunganui (see Attachment 1 - Map of Elder Housing Villages). In 2018,

following a review of the elder housing activity and community consultation,

Council decided to divest of the elder housing portfolio to one or more public

housing providers.

3. Council is negotiating to

sell seven of the nine villages to Kāinga Ora: Homes and Communities.

4. Council decided in March

2021 to consult on the future of the remaining two villages - Pitau Road

village and Hinau Street village - as part of the 2021-2031 Long Term Plan

process. Two options were consulted on:

i. Council’s

preferred option: Pitau Road village and/or Hinau Street village are separated

from the elder housing portfolio and sold for private redevelopment.

ii. Alternative

option: Pitau Road village and/or Hinau Street village are sold as part of the

elder housing portfolio.

5. Council received a total

of 1,788 submissions. Of these, 576 people chose one of the two options, and

1,212 chose neither option.

6. Out of those who chose

either option 1 or option 2, 79.5% wanted Pitau Road village and/or Hinau

Street village to be separated from the elder housing portfolio and sold for

private development (option 1) and 20.5% of submitters thought these villages

should be sold as part of the elder housing portfolio (option 2).

7. The most common reasons

provided in support of option 1 were that elder housing should not be delivered

by Council and that the location was not a suitable location for subsidised

housing (either public or elderly).

8. The most common themes

expressed by those in support for option 2 (sell as part of the elder housing

portfolio) were concern as to where the current tenants would go and a general

desire to see more elderly housing across the city rather than less.

9. Both those in support of

option 1 and those in support of option 2 commented on the need to care for the

current tenants and to reinvest disposal proceeds into elder and social/public

housing.

10. This report recommends that Pitau

Road village and Hinau Street village are separated from the elder housing

portfolio and sold for private redevelopment (option 1) and that the net

proceeds from these sales is retained in an elder housing and/or social/public

housing reserve until Council decides on its specific application.

11. If Council does decide in favour of

option 1:

· further

work would occur identifying and analysing divestment options. A report

outlining the options would be presented to Council later this year.

· tenants

from these villages would be re-housed in affordable and secure housing

elsewhere. All tenants would be supported through this process and offered a

unit in one of Council’s remaining seven elder housing villages.

Background

12. Council’s elder housing portfolio

consists of 246 units across nine villages located in Tauranga and Mount

Maunganui (see Attachment 1 - Map of Elder Housing Villages). In 2018,

following a review of the elder housing activity and community consultation,

Council decided to divest of the elder housing portfolio to one or more public

housing providers, with sale proceeds to be retained to an elder or social

housing specific reserve, until such time as Council has confirmed potential

application. Council also resolved that the welfare of tenants was to be the

guiding principle of the divestment process.

13. Council has begun formal non-binding

negotiations to sell seven of the nine villages to Kāinga Ora: Homes and

Communities (central government’s public housing provider). Pitau Road

village and Hinau Street village are not included within these negotiations.

14. Instead, Council decided in March

2021 to consult on the future of Pitau Road village and Hinau Street village as

part of the 2021-2031 Long Term Plan process. Two options were consulted on:

i. Council’s

preferred option: Pitau Road village and/or Hinau Street village are separated

from the elder housing portfolio and sold for private redevelopment.

ii. Alternative

option: Pitau Road village and/or Hinau Street village are sold as part of the

elder housing portfolio.

15. Council’s preferred option

provides a balance between delivering a better outcome for ratepayers, whilst

still being committed to achieving positive outcomes for the community. It

offsets the discounted prices that the remainder of the elder housing portfolio

is expected to be sold for.

16. The financial cost of providing

public housing is reflected in the discounted value assigned to land sold for

public housing purposes. In New Zealand, sales of land for public housing (to

either Kāinga Ora or registered community housing providers) have

typically achieved 50% or less of market value. The estimated combined market

value of Pitau Road village and Hinau Street village is $18-$23 million.

17. This report recommends that the net

proceeds from the sale of the Pitau Road village and Hinau Street village are

retained to an elder or social/public housing specific reserve, until such time

as Council has confirmed potential application. These proceeds will reduce debt

whilst they remain in this reserve.

PItau Road village

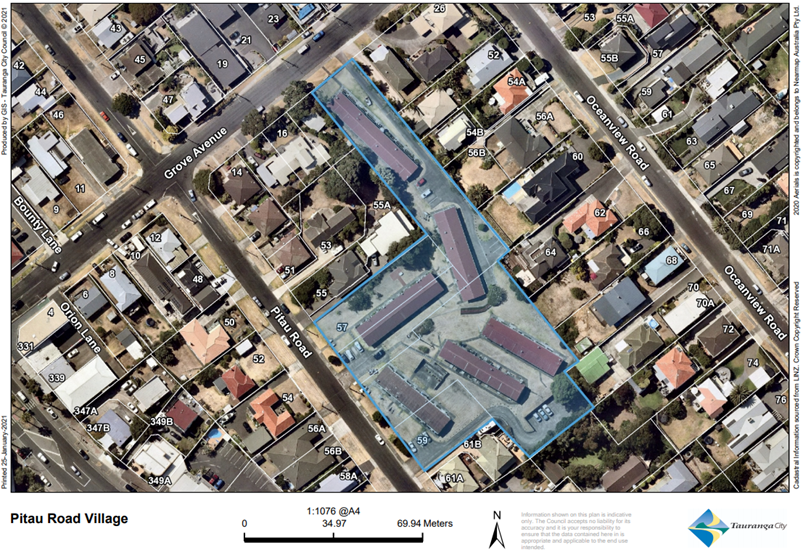

18. Pitau Road village is the oldest and

second largest village, with 38 units spread across a site of 7677m2.

It is on undulating land in a suburban area of central Mount Maunganui. The

units are poorly designed, small (32m2) and no longer meet

recommended minimum standards (primarily accessibility).

19. In addition to design limitations,

the units are ageing, with one unit permanently vacant due to subsidence (i.e.

there are 37 occupiable units). Pitau Road village reaches the end of its asset

life in 2021 and requires either significant renewal or redevelopment. Recent

work completed in the village has focused on protecting the health and safety

of tenants, but if the village was to stay as public housing it would require a

significant further investment of funds.

20. Whilst possible to maintain the

liveability of the units via extensive renewals, this would not overcome the

basic design flaws of the units, such as size and accessibility. As a result,

maintaining Pitau Road village as public housing would require the site to be

redeveloped.

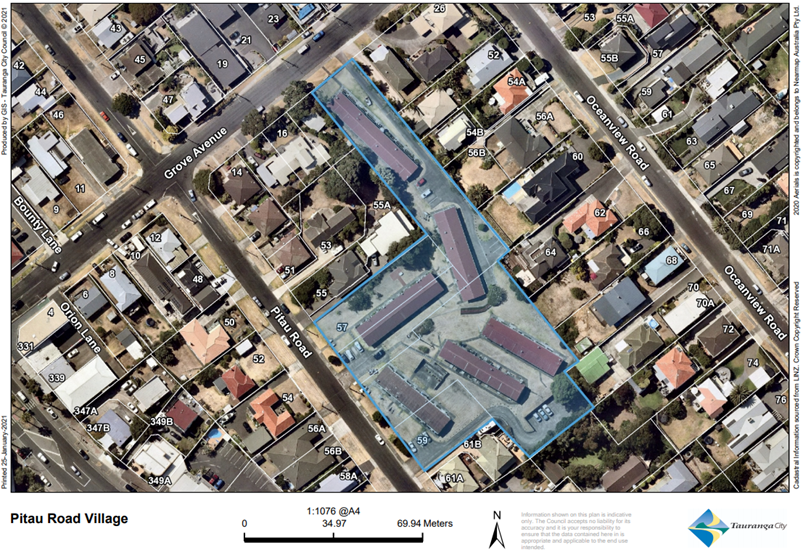

Figure 1: Pitau

Road village

Hinau

Street village

21. Hinau Street village is the smallest

village in the elder housing portfolio in terms of both land size (2,022m2) and

number of units (12). It is on flat land, in central Mount Manganui, and is

close to Blake Park and cafes. It was constructed in 1975 and unit sizes range

between 36m2 to 42m2. Whilst units do not meet accessibility standards and the

village is ageing, the overall condition of the village is acceptable, with its

end of asset life estimated as 2031.

22. The village is currently zoned as

high density residential, which allows for one dwelling per 100m2.

Multi-storey housing is located nearby. Although the condition of the village

does not require immediate redevelopment or renewal, its zoning and underlying

land value make it a good candidate for redevelopment and intensification.

Under its current zoning, redevelopment would allow for an additional 8

dwellings to be provided on the site.

Figure 2: Hinau

Street village

Consultation

process

23. The options for Pitau Road village

and Hinau Street village were consulted on as part of the Long Term Plan

consultation process, which ran from 7 May to 7 June 2021.

24. The consultation for the Long Term

Plan included city-wide advertising, drop in sessions across the city,

promotion at events, such as the Little Big Market and the Farmers Market, and

meeting with key stakeholders, such as ratepayer groups. In addition to this,

targeted consultation occurred as follows:

· Drop-in

sessions at each of the nine elder housing villages. These sessions provided

information and support for all tenants, ensuring they knew how to make a

submission and supporting them to do so, if they wished.

· A

letter-drop to residents to live nearby Pitau Road village and Hinau Street

village

· Emails

directly to potentially interested parties, including Grey Power, local members

of parliament, Mount Maunganui RSA and Age Concern.

Summary of

Long Term Plan submissions

25. Council received a total of 1,788

submissions. Of these, 576 people chose one of the two options and 1,212 chose

neither option. In many cases, those who chose neither option did so because

their submission was a targeted submission highlighting a particular issue or

funding need (e.g. The Incubator).

26. Out of those who chose either option

1 or option 2, 79.5% wanted Pitau Road village and/or Hinau Street village to

be separated from the elder housing portfolio and sold for private development

(option 1) and 20.5% of submitters thought these villages should be sold as

part of the elder housing portfolio (option 2).

27. The table below shows the total

breakdown of submissions.

Table 1: Analysis of LTP

submissions

|

Total no. of submissions

|

1,788

(100%)

|

|

No. of submissions in support of

option 1 (sell for private redevelopment)

|

458 (25.6%)

|

|

No. of submissions in support of

option 2 (sell as part of the elder housing portfolio)

|

118 (6.6%)

|

|

No. of submissions selecting