Terms of reference – Strategy,

Finance & Risk Committee

Membership

|

Chairperson

|

Commission Chair Anne Tolley

|

|

Deputy chairperson

|

Dr Wayne Beilby – Tangata

Whenua representative

|

|

Members

|

Commissioner Shadrach Rolleston

Commissioner Stephen Selwood

Commissioner Bill Wasley

|

|

|

Matire

Duncan, Te Rangapū Mana Whenua o Tauranga Moana Chairperson

Te Pio Kawe – Tangata

Whenua representative

Rohario Murray – Tangata

Whenua representative

Bruce

Robertson – External appointee with finance and risk

experience

|

|

Quorum

|

Five

(5) members must be physically present, and at least three (3) commissioners

and two (2) externally appointed members must be present.

|

|

Meeting frequency

|

Six weekly

|

Role

The role of the Strategy, Finance and Risk Committee (the

Committee) is:

(a)

to assist and advise the Council in discharging

its responsibility and ownership of health and safety, risk management,

internal control, financial management practices, frameworks and processes to

ensure these are robust and appropriate to safeguard the Council’s staff

and its financial and non-financial assets;

(b)

to consider strategic issues facing the city and

develop a pathway for the future;

(c)

to monitor progress on achievement of desired

strategic outcomes;

(d)

to review and determine the policy and bylaw framework

that will assist in achieving the strategic priorities and outcomes for the

Tauranga City Council.

Membership

The Committee will consist of:

·

four commissioners with the Commission Chair

appointed as the Chairperson of the Committee

·

the Chairperson of Te

Rangapū Mana Whenua o Tauranga Moana

·

three tangata whenua representatives

(recommended by Te Rangapū Mana Whenua o Tauranga

Moana and appointed by Council)

·

an independent external person with finance and

risk experience appointed by the Council.

Voting

Rights

The tangata whenua representatives and the independent

external person have voting rights as do the Commissioners.

The Chairperson of Te Rangapu Mana Whenua o Tauranga Moana

is an advisory position, without voting rights, designed to ensure mana whenua

discussions are connected to the committee.

Committee’s

Scope and Responsibilities

A. STRATEGIC ISSUES

The

Committee will consider strategic issues, options, community impact and explore

opportunities for achieving outcomes through a partnership approach.

A1 – Strategic Issues

The Committee’s

responsibilities with regard to Strategic Issues are:

·

Adopt an annual work

programme of significant strategic issues and projects to be addressed. The

work programme will be reviewed on a six-monthly basis.

·

In respect of each

issue/project on the work programme, and any additional matters as determined

by the Committee:

·

Consider existing

and future strategic context

·

Consider

opportunities and possible options

·

Determine preferred direction

and pathway forward and recommend to Council for inclusion into strategies,

statutory documents (including City Plan) and plans.

·

Consider and approve

changes to service delivery arrangements arising from the service delivery

reviews required under Local Government Act 2002 that are referred to the

Committee by the Chief Executive.

·

To take appropriate

account of the principles of the Treaty of Waitangi.

A2 – Policy and Bylaws

The Committee’s

responsibilities with regard to Policy and Bylaws are:

·

Develop, review and

approve bylaws to be publicly consulted on, hear and deliberate on any

submissions and recommend to Council the adoption of the final bylaw. (The

Committee will recommend the adoption of a bylaw to the Council as the Council

cannot delegate to a Committee the adoption of a bylaw.)

·

Develop, review and

approve policies including the ability to publicly consult, hear and deliberate

on and adopt policies.

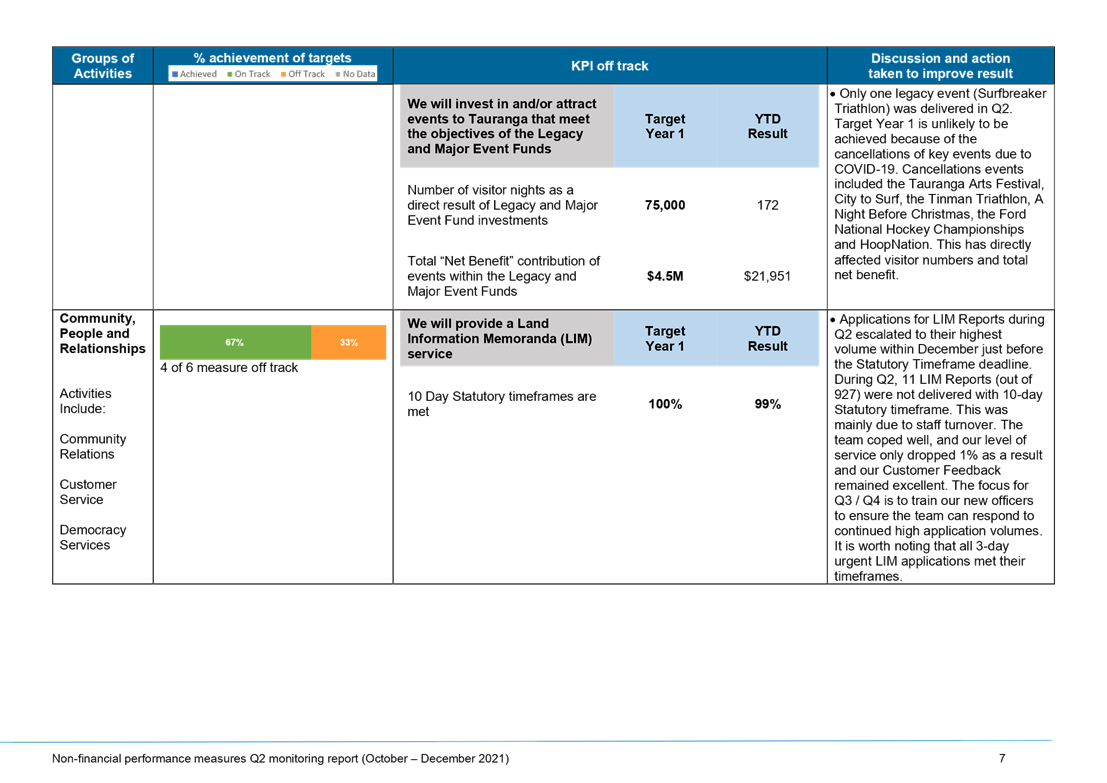

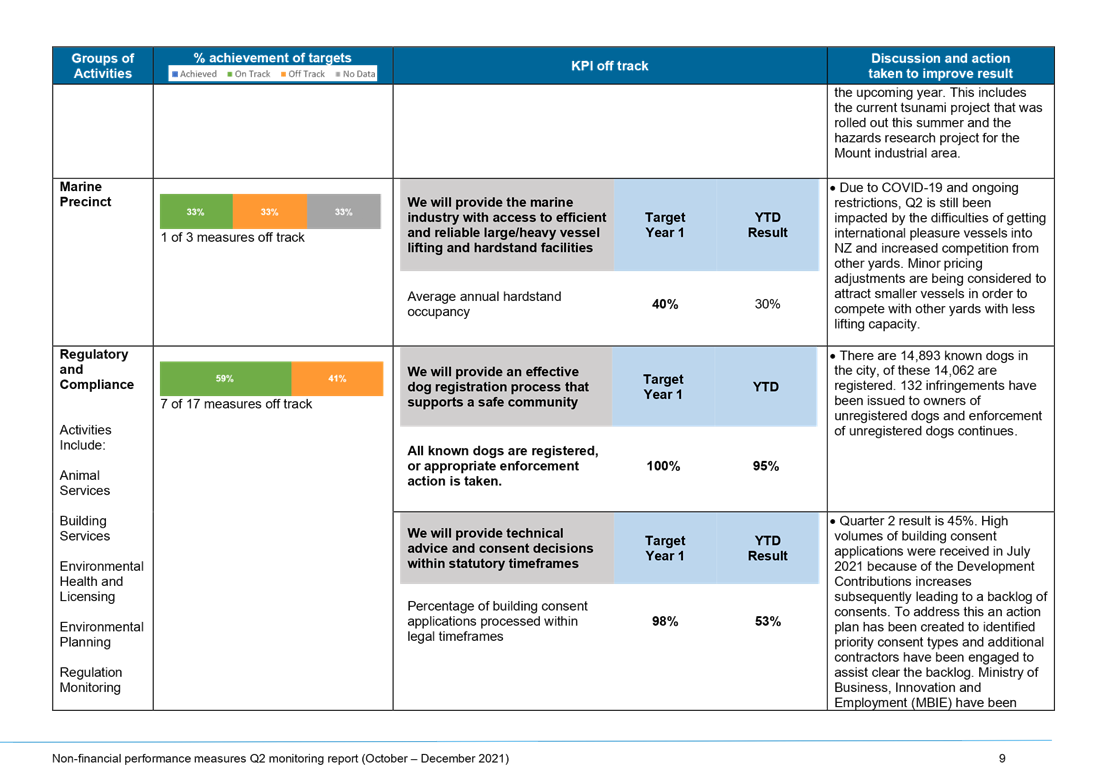

A3 – Monitoring of Strategic

Outcomes and Long Term Plan and Annual Plan

The Committee’s

responsibilities with regard to monitoring of strategic outcomes and Long Term

Plan and Annual Plan are:

·

Reviewing and

reporting on outcomes and action progress against the approved strategic

direction. Determine any required review/refresh of strategic direction or

action pathway.

·

Reviewing and

assessing progress in each of the six (6) key investment proposal areas within

the 2021-2031 Long Term Plan.

·

Reviewing the

achievement of financial and non-financial performance measures against the

approved Long Term Plan and Annual Plans.

B.

FINANCE AND RISK

The Committee will review the

effectiveness of the following to ensure these are robust and appropriate to

safeguard the Council’s financial and non-financial assets:

·

Health and safety.

·

Risk management.

·

Significant projects and programmes of work

focussing on the appropriate management of risk.

·

Internal and external audit and assurance.

·

Fraud, integrity and investigations.

·

Monitoring of compliance with laws and regulations.

·

Oversight of preparation of the Annual Report

and other external financial reports required by statute.

·

Oversee the relationship with the

Council’s Investment Advisors and Fund Managers.

·

Oversee the relationship between the Council and

its external auditor.

·

Review the quarterly financial and non-financial

reports to the Council.

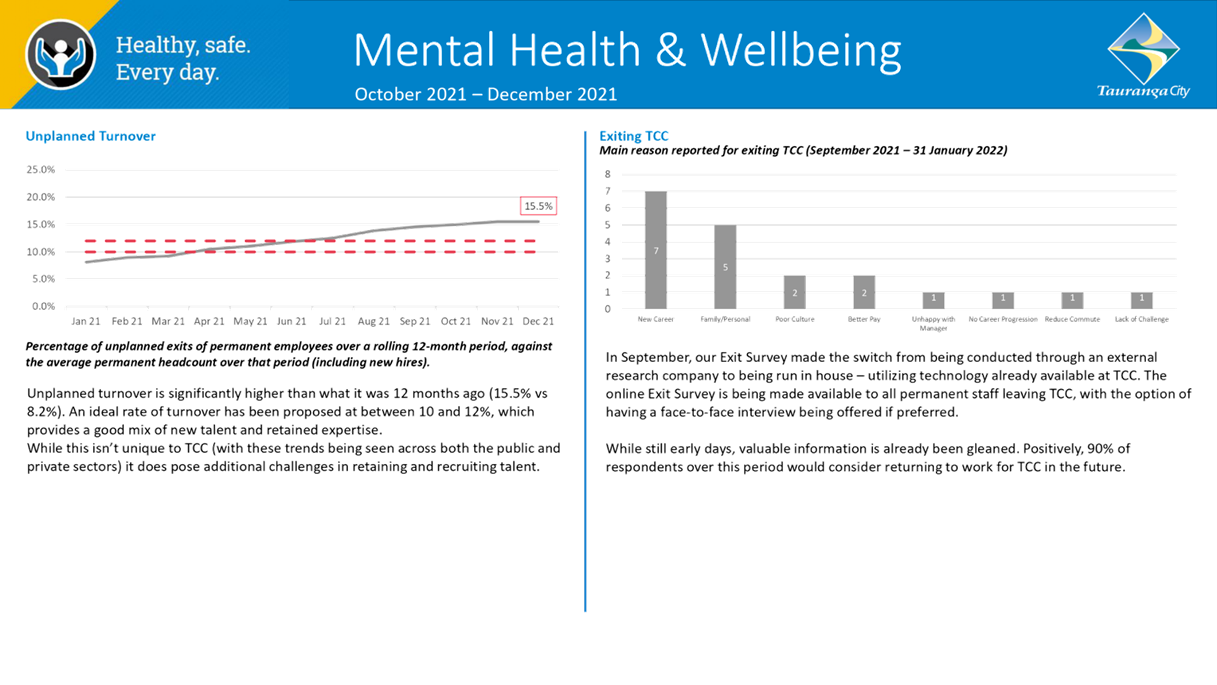

B1 - Health and Safety

The Committee’s responsibilities through regard to

health and safety are:

·

Reviewing the effectiveness of the health and

safety policies and processes to ensure a healthy and safe workspace for

representatives, staff, contractors, visitors and the public.

·

Assisting the Commissioners to discharge their

statutory roles as “Officers” in terms of the Health and Safety at

Work Act 2015.

B2 - Risk Management

The Committee’s responsibilities with regard to risk

management are:

·

Review, approve and monitor the implementation of the Risk

Management Policy, Framework and Strategy including the Corporate Risk

Register.

·

Review and approve the Council’s “risk

appetite” statement.

·

Review the effectiveness of risk management and internal control

systems including all material financial, operational, compliance and other

material controls. This includes legislative compliance, significant projects

and programmes of work, and significant procurement.

·

Review risk management reports identifying new and/or emerging

risks and any subsequent changes to the “Tier One” register.

B3

- Internal Audit

The Committee’s responsibilities with regard to the

Internal Audit are:

·

Review and approve the Internal Audit Charter to confirm the

authority, independence and scope of the Internal Audit function. The Internal

Audit Charter may be reviewed at other times and as required.

·

Review and approve annually and monitor the implementation of the

Internal Audit Plan.

·

Review the co-ordination between the risk and internal audit

functions, including the integration of the Council’s risk profile with

the Internal Audit programme. This includes assurance over all material

financial, operational, compliance and other material controls. This includes

legislative compliance (including Health and Safety), significant projects and

programmes of work and significant procurement.

·

Review the reports of the Internal Audit functions dealing with

findings, conclusions and recommendations.

·

Review and monitor management’s responsiveness to the

findings and recommendations and enquire into the reasons that any

recommendation is not acted upon.

B4

- External Audit

The Committee’s responsibilities with regard to the

External Audit are:

·

Review with the external auditor, before the audit commences, the

areas of audit focus and audit plan.

·

Review with the external auditors, representations required by

commissioners and senior management, including representations as to the fraud

and integrity control environment.

·

Recommend adoption of external accountability documents (LTP and

annual report) to the Council.

·

Review the external auditors, management letter and management

responses and inquire into reasons for any recommendations not acted upon.

·

Where required, the Chair may ask a senior representative of the

Office of the Auditor General (OAG) to attend the Committee meetings to discuss

the OAG’s plans, findings and other matters of mutual interest.

·

Recommend to the Office of the Auditor General the decision

either to publicly tender the external audit or to continue with the existing

provider for a further three-year term.

B5

- Fraud and Integrity

The Committee’s responsibilities with regard to

Fraud and Integrity are:

·

Review and provide advice on the Fraud Prevention and Management

Policy.

·

Review, adopt and monitor the Protected Disclosures Policy.

·

Review and monitor policy and process to manage conflicts of

interest amongst commissioners, tangata whenua representatives, external

representatives appointed to council committees or advisory boards, management,

staff, consultants and contractors.

·

Review reports from Internal Audit, external audit and management

related to protected disclosures, ethics, bribery and fraud related incidents.

·

Review and monitor policy and processes to manage

responsibilities under the Local Government Official Information and Meetings

Act 1987 and the Privacy Act 2020 and any actions from the Office of the

Ombudsman’s report.

B6

- Statutory Reporting

The

Committee’s responsibilities with regard to Statutory Reporting relate to

reviewing and monitoring the integrity of the Annual Report and recommending to

the Council for adoption the statutory financial statements and any other

formal announcements relating to the Council’s financial performance,

focusing particularly on:

·

Compliance with, and the appropriate application of, relevant

accounting policies, practices and accounting standards.

·

Compliance with applicable legal requirements relevant to

statutory reporting.

·

The consistency of application of accounting policies, across

reporting periods.

·

Changes to accounting policies and practices that may affect the

way that accounts are presented.

·

Any decisions involving significant judgement, estimation or

uncertainty.

·

The extent to which financial statements are affected by any

unusual transactions and the manner in which they are disclosed.

·

The disclosure of contingent liabilities and contingent assets.

·

The basis for the adoption of the going concern assumption.

·

Significant adjustments resulting from the audit.

Power

to Act

·

To make all

decisions necessary to fulfil the role, scope and responsibilities of the

Committee subject to the limitations imposed.

·

To establish

sub-committees, working parties and forums as required.

·

This Committee has not

been delegated any responsibilities, duties or powers that the Local Government

Act 2002, or any other Act, expressly provides the Council may not

delegate. For the avoidance of doubt, this Committee has not

been delegated the power to:

o

make a rate;

o

make a bylaw;

o

borrow money, or purchase

or dispose of assets, other than in accordance with the Long Term Plan (LTP);

o

adopt the LTP or Annual

Plan;

o

adopt the Annual Report;

o

adopt any policies required

to be adopted and consulted on in association with the LTP or developed for the

purpose of the local governance statement;

o

adopt a remuneration and

employment policy;

o

appoint a chief executive.

Power

to Recommend

To Council and/or any standing committee

as it deems appropriate.

9 Business

9.1 Review

of the Remission and Postponement of Rates on Māori Freehold Land Policy -

Issues and Options

File

Number: A13133716

Author: Jim

Taylor, Transactional Services Manager

Emma Joyce, Policy Analyst

Authoriser: Paul

Davidson, General Manager: Corporate Services

Purpose

of the Report

1. To agree amendments to

the Remission and Postponement of Rates on Māori Freehold Land Policy (the

policy). A copy of the current policy is attachment 1.

|

Recommendations

That the Strategy,

Finance and Risk Committee:

(a) Agree

that the following be incorporated into a draft Remission and Postponement of

Rates on Māori Freehold Land Policy for consultation (to be adopted by

Council):

(i) A

new purpose statement paraphrasing the Preamble from Te Ture Whenua

Māori Act 1993.

(ii) Revised

criteria for remission of rates on land subject to development to only

require assessment against the benefits outlined at section 114A of the Local

Government (Rating) Act 2002.

(iii) Provisions

extending the ability to remit rates on land intended for development to land

returned through a right of first refusal scheme or treaty settlement or

where the land is temporarily transferred to general title and held in

collective ownership.

(iv) Provision

for 100% remission of general rates on land subject to defined and agreed

development or stage of development until such time as the development or

stage of development is generating income or persons are residing in the

houses.

(v) Provision

for Māori freehold land rates remission which reflects a rate based on

Maori freehold land value excluding any subdivision potential unlikely to be

realised in Māori ownership.

(vi) Provision

clarifying that land providing non-commercial community benefit to Māori

or papakāinga is eligible for 100% remission of general rates.

(vii) Provision

for partial or full remission of general rates on land that may be partially

used for the growing of kai or medicinal plants, or used for a minor economic

activity.

|

Executive

Summary

2. Recent

changes to the Local Government Act 2002 (LGA 02) and the Local Government

(Rating) Act 2002 (LG(R)A 02) require councils to review (and amend if

necessary) their policies on the remission and postponement of rates on

Māori freehold land before 1 July 2022. In particular, council

rating policies must show support for the principles in the Preamble to Te Ture

Whenua Māori Act 1993 (TTWMA 93). (A copy of the Preamble is attachment

2). The principles acknowledge that as land is a taonga tuku iho for

Māori, we need to avoid further alienation of land and provide mechanisms

that enable the development of Māori freehold land for the benefit of

owners, their whanau and hapū.

3. The

LG(R)A 02 now also requires councils to consider any request for remission of

rates on Māori freehold land where the owners seek to develop the land.

This provides an opportunity to review this council’s approach to the

remission of rates on Māori freehold land to align with the more relaxed

criteria for remission expressed in the legislation. While Council has had a

policy on the remission and postponement of rates on Māori freehold land

for some time, the provisions have largely remained the same at each review.

4. This

report requests that the Strategy, Finance and Risk Committee (the Committee)

agree preferred options arising from a review of the policy. Staff will then

bring back a draft policy incorporating any agreed amendments to the 28

February Council meeting for adoption for consultation.

5. The

table below provides a summary of the proposals recommended through the policy

and notes where certain land is automatically non-rateable

|

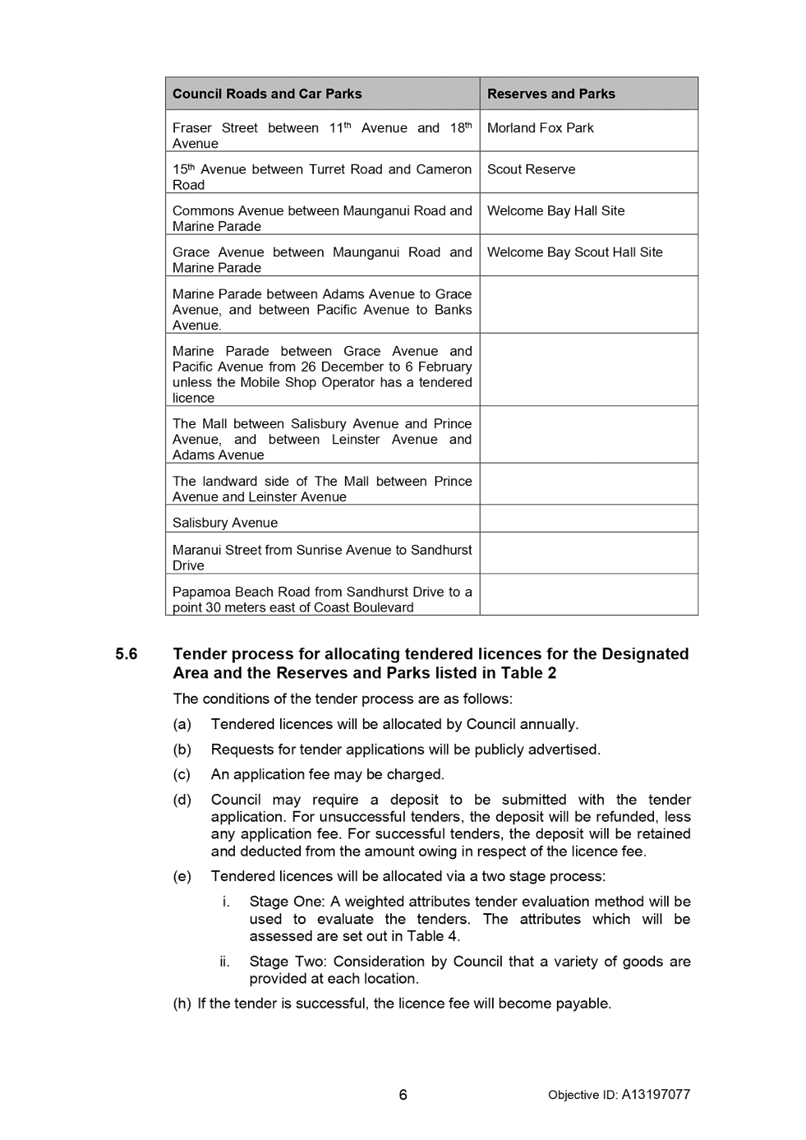

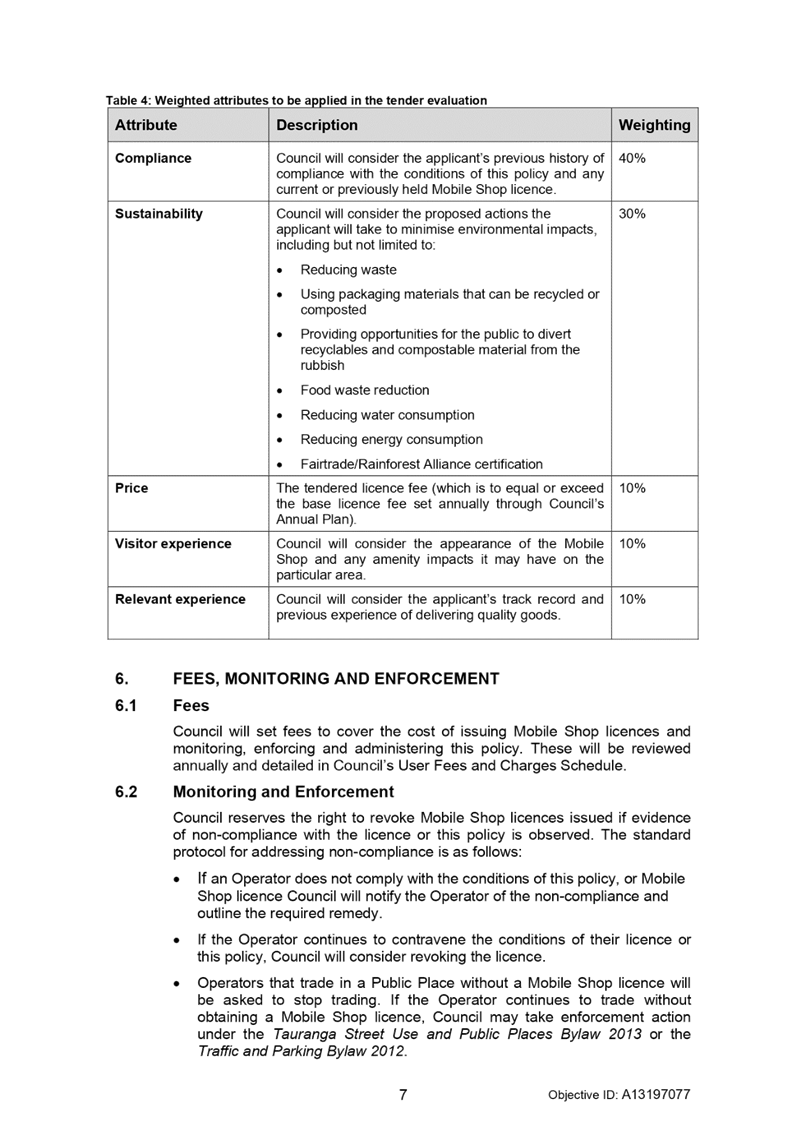

Type of remission

|

Amount of remission

|

Application

|

|

Land under development

|

Proposal for 100%

remission until such time as development is complete (people are residing in

homes or income is being generated).

Services charges are not

remitted

|

Māori freehold

land, general land returned to collective ownership (except where part of

commercial redress) through treaty settlement or right of first refusal

|

|

Land under development

but partially complete (eg houses are being lived in)

|

Proposal for rates to be

paid on completed development but if development is staged rates can be

remitted on the yet to be completed part of the development

|

Māori freehold

land, general land returned to collective ownership (except where part of

commercial redress) through treaty settlement or right of first refusal

|

|

Land partially used for

seasonal crops

|

Proposal for partial or

full remission on consideration of amount of income earned from the crop

|

Māori freehold land

|

|

Land partially used to

cultivate kai or medicinal plants for personal or community use

|

Proposal for 100%

remission of general rates

|

Māori freehold land

|

|

Māori freehold land

leased on a commercial basis

|

Fully rateable (no

remission)

|

|

Land providing non-commercial

activity benefitting Māori

|

100% of general rates.

Partial remission of wastewater rates

|

All land

|

|

Unused rating unit of

Māori freehold land

|

Non-rateable per the

Local Government (Rating) Act 2002

|

Māori freehold land

|

|

Marae and urupā

|

Background

6. Māori

freehold land is land where the Māori Land Court has issued a freehold

order, or was set aside by the Crown as freehold land, or was determined by the

Court to be freehold land. Land is held by individuals who have shares in the

land. Land will have economic and cultural value. There is approximately 1,982

hectares of Māori freehold land in Tauranga.

7. Recognising

that rating law and practice could be an impediment to the development of

Māori freehold land, Government legislated changes to the LGA 02 and

LG(R)A 02 to better enable the occupation, development, and utilisation of

Māori land for the benefit of the landowners. In particular, the

legislation now requires councils to review their mandatory policies on the

rating of Māori freehold land to identify how they can support the

principles referenced in the Preamble to TTWMA 93. The Preamble to TTWMA 93

acknowledges that as land is a taonga tuku iho for Māori it is important

that we avoid further alienation of land and enable its development for the

benefit of the landowners, their hapū and whanau.

8. Providing

for remission of rates on land where the owners wish to develop is one means

that councils can support the principles in the Preamble. While Tauranga has

provided for rates remission and postponement on Māori freehold land for

almost 20 years, other councils used their discretion to not offer rates

remission and postponement.

In order to achieve a nationally consistent approach to rates remission, the

revised legislation now requires councils to “consider” all

requests for rates remission on land under development.

9. While

this council has long provided for rates remission, the policy criteria for

granting remission are less enabling than envisioned in the amended legislation.

The policy currently requires applications for rates remission (regardless of

whether the land is under development or not) to include the following:

· the number of

owners on the land; and

· the physical

location of the land; and

· the nature and

extent of any wāhi tapu and the impact of that wāhi tapu on land

development and usage; and

· the amount of

income being derived from the block; and

· whether the land

is occupied and to what extent it is occupied; and

· whether the block

of land is connected to council services eg. water and sewerage; and

· whether there are

any potential development options for the block of land.

10. The

above policy criteria reference the matters outlined in Schedule 11 of the LGA

02 (attachment 3) that councils must be cognisant of in developing their

policies. However, in considering requests for rates remission for land under

development, councils now need only be satisfied that the development is likely

to have one or all of the following benefits (section 114A(3) LG(R)A 02):

· benefits to the

district by creating new employment opportunities

· benefits to the

district by creating new homes

· benefits to the

council by increasing the council’s rating base in the long term

· benefits to

Māori in the district by providing support for marae in the district

· benefits

to the owners by facilitating the occupation, development, and utilisation of

the land.

11. A

review of the criteria for rates remission is required to assess whether it

supports the principles of the Preamble and the general intent of the

legislative changes to reduce the barriers to developing Māori freehold

land. The policy also currently requires staff to undertake annual assessments

of Māori freehold land to determine eligibility for rates remission using

the above criteria.

12. The

legislation does not prevent councils from including additional criteria in

their policies to consider when determining remissions. Councils also retain

flexibility to determine the level of remission. The policy does not currently

specify a level of remission instead noting that the “level of

remission will be negotiated with an owner or occupier according to the

benefits of occupation, having regard to equity with charges made to other

ratepayers (clause 4.2)”. Some councils state the level of remission

in their policies. For example, Western Bay of Plenty states that the maximum

level of remission is 80% in the first year sliding down to no remission in

year five.

13. The

policy currently only applies to Māori freehold land. Owners of land held

in general title (such as that returned through treaty settlement or right of

first refusal) may aspire to develop their land. However, the incentives

provided through rates remission do not apply to land held in general title.

Other councils have extended the provisions to land returned through treaty

settlement and held in multiple ownership.

Similarly, the mechanism proposed by landowners for economic development may

require land to be transferred (either permanently or temporarily) to general

title. However, once converted to general title, owners would not be

automatically entitled to seek consideration of rates remission and would need

to seek a specific Council decision.

14. At

present, Māori freehold land is rated on its capital value (the same as

land held under general title). Feedback received at a workshop with Te

Rangapū was that this practice was potentially unfair as Māori

freehold land is unlikely to ever be sold and therefore the capital value would

not be realised. Rating of Māori freehold land on the same basis as

general land and within western ideas of land value is an issue of longstanding

in Tauranga.

Auckland Council recognises that Māori freehold land may not realise its

capital value and therefore notes in its policy that “the land will be

valued to exclude any potential for subdivision and / or development that the

land may have that is unlikely to be achieved in Māori ownership”.

Provision remains for this calculation to be equitable to similar properties.

The Committee may wish to consider adding a similar provision to this

council’s policy. Council’s general Rates Postponement Policy

already provides for the postponement of rates on farmland where the

development potential has increased the value of the property, but the property

has not yet realised that potential.

15. While

the legislation now requires consideration of rates remission on land subject

to development, councils can continue to choose to offer (either full or

partial) remission of rates on Māori freehold land not under development.

Council’s general Rates Remission Policy notes that “[L]and used

primarily for the promotion of sport, art, health, recreation or education and

not used for private pecuniary profit may receive a 100% remission on General

rates”. (Services charges still apply). This includes marae. However,

feedback from Te Rangapū is that it was not clear if this provision

extended to land providing non-commercial, community benefit to Māori or

papakāinga.

16. The

“desirability and importance” of land providing economic and

infrastructure support to marae and papakāinga is one of the matters

relating to rates relief outlined in Schedule 11 of the LGA 02 that councils

should consider in developing their policy on the remission and postponement of

rates on Māori freehold land. While unused Māori freehold land is

automatically unrateable (cl. 14A Schedule 1 LG(R)A 02), the land may become

liable for rates if used for agricultural or commercial purposes beyond the

simple “gathering” of kai or medicinal plants. This includes where

land may be used to grow food to support marae or papakāinga or where the

land is used on a seasonal basis to grow maize. Council has discretion to

introduce provisions in the policy to remit rates where land may be used to

grow kai or medicinal plants, or where a minor economic benefit is gained

through the land being used for a seasonal commercial crop cultivation.

17. Issues

for the Committee to consider in reviewing the policy are, in summary:

· Demonstrating

support for the principles included in the Preamble to TTWMA 93

· Amending the

criteria for remission to align with the more enabling criteria in the

legislation

· Scope of land

included in policy eligible for rates remission

· Rate and duration

of remission

· Valuation of

Māori freehold land

· Land supporting

non-commercial activity benefitting Māori

· Land partially

used to grow kai or medicinal plants or small commercial, seasonal crops.

Strategic / Statutory

Context

18. A

policy on the remission and postponement of rates on Māori freehold land

is a requirement of all councils under section 102(1) of the LGA 02 (noting

that councils do not have to offer remission or postponement of rates).

Policies must include the objectives sought by remission, and the criteria in

order for rates to be remitted. The objectives and criteria must have regard to

the “desirability and importance” of a range of objectives such as

protection of indigenous biodiversity, protection of wāhi tapu, and

avoiding further alienation of land (schedule 11 to LGA 02). This is in

addition to the recent requirement noted in the above background section that

policies support the principles contained within the Preamble to TTWMA 93.

19. This

review is part of a wider council project reviewing council’s rating

policy. All council rating policies must similarly be reviewed to determine

compliance with the Preamble by 1 July 2024.

20. Other legislative changes

to the rating of Māori freehold land do not require an amendment to the

policy. They are noted below to illustrate the intention of the legislative

changes to address some of the inequities with, and challenges of, rating

Māori freehold land.

· Allowing the Chief

Executive to waive rates deemed unrecoverable (also applies to general land)

· Marae land and

land protected through a Ngā Whenua Rāhui kawenata now automatically

non-rateable

· Wholly unused land

now non-rateable

· Ability for

council (upon request) to rate individual houses on Māori land as a

separate rating unit enabling ratepayer to access the Government rates rebate

scheme.

21. Council

has previously shown support for the development of Māori land through the

development of a policy to provide grants to cover payment of development

contributions for papakāinga.

Options Analysis

Issue 1 –

Show support for Preamble in policy

22. As

noted in the background section, the main reason for this review is the new

requirement to show support in our policy for the principles in the Preamble to

TTWMA 93. Council can show this support through the addition of a new clause

that paraphrases the Preamble or imply support through provisions in the

policy. The table below outlines the advantages and disadvantages of adding an

additional provision either as a purpose or principle or not adding a new

provision.

|

Option

|

Advantages

|

Disadvantages

|

|

1.1

|

Show

support for Preamble through a new policy purpose

(recommended)

|

· Clear alignment

between the policy and demonstrating support for development of Māori

land and principles in the Preamble

· Ensures that following

policy provisions must connect to the purpose

· Reflects intent of

policy and legislation to better enable development of Māori freehold

land

· Complies with

legislation

|

· Nil

|

|

1.2

|

Retain

current purpose but show support for Preamble through a new policy principle

|

· Some alignment between

the policy and demonstrating support for development of Maori land.

· Complies with

legislation

|

· Potentially less

emphasis on supporting Preamble and the principles of the Preamble

|

|

1.3

|

Do not

include provision demonstrating support for Preamble / imply support through

policy provisions

|

· Support for principles

can be implied through other policy provisions

|

· Potential that policy

does not comply with legislation

· Potential that policy

does not show clear support for the principles in the Preamble

|

Issue

2- Criteria for remissions

23. As

noted in the above background section, the LG(R)A 02 includes five types of

benefits to consider when assessing requests for remission of rates for land

under development. (Unused Māori freehold land is non-rateable). This is

in addition to the matters listed in schedule 11 of the LGA 02.

24. The

criteria for remission need to be reviewed to be consistent with the

legislative direction to more easily enable the development of Māori

land. Council could retain the current criteria or replace that criteria

with a statement that remission will be granted where one or more of the

benefit(s) outlined in the legislation are met.

|

Option

|

Advantages

|

Disadvantages

|

|

2.1

|

Criteria

for land subject to remission need only demonstrate one of the five benefits

listed in the legislation

(recommended)

|

· Aligns with intention

of legislation and Preamble principles to enable development of Māori

freehold land

· Consistent with

legislation, including schedule 11 matters

· Less onus on

landowners to provide supporting information to show compliance with criteria

· Eliminates

administrative burden of requiring annual assessments

|

· May not show explicit

reference to the matters referred to in schedule 11 of the LGA 02

|

|

2.2

|

Retain

current criteria for land under development

|

· Retains strong

reference to the matters referred to in schedule 11 of the LGA 02

|

· May not reflect

intention of legislation or support the principles in the Preamble to be

enabling of land development

· Places onus on

applicant to comply rather than Council being seen to be enabling and supportive

of land development

· Current criteria are

not required to assess benefits of land development

· Council may already

hold this information in its systems – avoids duplication

|

Issue

3 – Land included in scope of policy

25. While

the legislation and our policy only apply to Māori freehold land, there is

an opportunity to extend the policy to land returned to iwi or hapū

through treaty settlement (non-commercial redress) or right of first refusal.

This land is usually held in general title. The advantages and disadvantages of

each option are outlined below.

|

Option

|

Advantages

|

Disadvantages

|

|

3.1

|

Include

land returned through treaty settlement in the scope of the policy

(non-commercial redress)

(recommended)

|

· Recognises importance

of land

· Recognises not all

land is Māori freehold land but owners may similarly wish to develop

that land for their benefit or benefit of their hapū

· Supports principles in

Preamble, particularly recognising the significance of land and allowing the

ability for it to be developed

· Acknowledges the

recent adoption of right of first refusal scheme for surplus council land

|

· Nil

|

|

3.2

|

Include

land returned through right of first refusal in scope of policy

(recommended)

|

· ·

| 3.3 |

Include

land temporarily transferred to general title in scope of policy

(recommended)

|

· ·

| 3.4 |

Policy

only applies to Māori freehold land (status quo)

|

· Consistent with

legislation that remission only for Māori freehold land

· Potentially less

impact on rates take

|

· Does not acknowledge

potential aspirations for development of land

· Potential that policy

does not support principles of Preamble, particularly providing for the

development of land

|

Issue

4 – Rate of remission

26. The

legislation does not specify the rate of remission and allows councils to

determine if they will remit all or part of the rates for the duration of a

development, differently during the different stages of a development and

subject to any other conditions specified in the policy (s114A(4) LGA 02).

Subject to a decision on issue three above, the same level of remission would

apply to rating units returned or purchased through treaty settlement or right

of first refusal where that land is intended for development.

27. At

present, the policy allows staff to negotiate remission with landowners. The

table below outlines the advantages and disadvantages of retaining the status

quo or setting a rate of remission in the policy.

|

Option

|

Advantages

|

Disadvantages

|

|

4.1.1

|

Retain

flexibility to negotiate level of remission

(status

quo)

|

· Flexibility to respond

to remission applications based on type of development proposed

· Potentially does not

reflect intent of legislation to be enabling of development

|

· Less certainty for

staff in determining remissions

· Potential for

inconsistent treatment of applications over time

|

|

4.1.2

|

Set a

rate of remission in the policy

(recommended)

|

· Provides certainty to

Council and staff

· Ensures consistent

practice over time

|

· Potentially less

flexibility to adjust remission for proposed developments with differing or

greater benefits

|

28. If

the Committee chooses option 4.1.2, consideration must be given to the rate of

remission. Councils are required to consider the following in determining the

proportion of rates to remit during or at any stage of the development (section

114A(5) LG(R)A) 02;

· Expected duration

of the development

· When income is

expected to be generated from commercial developments

· When

the ratepayer or others person is likely to be able to reside in the dwellings.

|

Option

|

Advantages

|

Disadvantages

|

|

4.2.1

|

Remission

over five years with 80% in first year and zero in fifth year

|

· Consistent with

legislation

· Consistent with

current Western Bay of Plenty policy

|

· Some developments may

take longer than five years

· Potential inequities

with other ratepayers who are developing properties but cannot have rates

remitted during that time

|

|

4.2.2

|

100%

remission for the defined and agreed development or stage of development

until income generated or dwelling is inhabited

(recommended)

|

· Consistent with

legislation

· Provides certainty to

council staff when working with landowners

· Recognises that a

range of factors can influence how long a development takes to be completed

|

· Potential inequities

with other ratepayers who are developing properties but cannot have rates

remitted during that time

|

Issue 5 – Remission to adjust Māori rateable

land values

29. In

general, all properties are rated on their capital value. Where Māori

freehold land is valued for a highest and best use that is unlikely to be

realised under Māori ownership, there is an option to rate Māori

freehold land based on its value excluding any development potential. There is

also potential that where land is developed, it may not be the “highest

and best use” of that land. The Committee could consider confirming in

the policy its intention to rate Māori land on its capital value, on its

land value, excluding development potential unlikely to be realised in

Māori ownership, or to allow for rates postponement on a similar basis to

that available to farmland.

30. It

is expected that this could apply to Māori freehold land over eight

hectares in area. There are around 20 properties that fit this criterion with annual

rates of $125,000. Council’s valuers estimate the remission would be

between zero and 40% depending on current valuation methodology.

|

Option

|

Advantages

|

Disadvantages

|

|

5.1

|

Māori

freehold land rated on its capital value

|

· Consistent with land

held in general title

· Equity with other

ratepayers who may not desire to realise capital value of their property

|

· Māori freehold

land unlikely to realise the capital value

· Less support for

Preamble principle noting importance of land to Māori

|

|

5.2

|

Māori

freehold land rates remission which reflects a rate based on Maori freehold

land value excluding any subdivision potential unlikely to be realised

in Māori ownership

(recommended)

|

· Recognises that

Māori freehold land is unlikely to be sold or in some cases achieve its

highest and best use

· Supports Preamble

principle noting importance of land to Māori

· May better acknowledge

Māori views of land value and ownership

|

· Inconsistent with land

held in general title

· Potential impact on

rates take

|

|

5.3

|

Postponement

similar to farmland

(only if

option 5.2 not approved)

|

· Consistent with policy

on rates remission for general land

|

· Potential to

disincentivise development

· Postponement requires

payment of rates at future date (usually when sold) and approval of owners

which might not be possible with Māori freehold land

|

Issue

6 – Remission on land used for non-commercial purposes for the community

benefit of Māori

31. Council’s

policy on rates remission for general land provides for 100% remission on

general rates where that land is used for non-pecuniary community benefit. The

provision is unclear if that applies to land used for the benefit of

Māori, such as hauora providers.

|

Option

|

Advantages

|

Disadvantages

|

|

6.1

|

Add

provision to this policy providing for remission on land used for

non-commercial community benefit of Māori

(recommended)

|

· Consistent with policy

to offer 100% remission on general rates for community organisations

· Greater clarity that

land providing community benefit to Māori is eligible for 100% remission

of general rates

· Consistent with

schedule 11 provisions to take into account role of land in providing

economic and infrastructure support for marae or papakāinga

|

· Nil

|

|

6.2

|

Adjust

Rates Remissions Policy to clarify and extend existing provision to land

providing benefit for Māori

|

· Consistent with policy

to offer 100% remission on general rates for community organisations

· General Remissions

Policy already notes exceptions for marae and Māori reservations

|

· Potential confusion as

references to remission for land providing benefit to Māori is split

between two policies

|

|

6.3

|

Do not

clarify that 100% remission includes land providing community benefit for

Māori

|

· Potential that issue

is covered through existing provisions in Rates Remission Policy

|

· Potential confusion as

to the applicability of current provision in Rates Remission Policy to

organisations providing benefit mainly to Māori

|

Issue

7 – Rates remission on partially used Māori Freehold Land

32. Councils

retain discretion to offer remission on partially used land. The table below

outlines the advantages and disadvantages of offering remission on land

partially used for a minor economic activity (such as seasonal maize crops) or

used to grow kai and medicinal plants.

|

Option

|

Advantages

|

Disadvantages

|

|

7.1

|

Provide

remission of rates on land used for minor economic activity

(recommended)

|

· Consistent with

schedule 11 provisions to provide for economic use

· Consistent with

schedule 11 provisions to take into account role of land in providing

economic and infrastructure support for marae or papakāinga

· Consistent with

schedule 11 provisions to recognise use of land for traditional purposes

|

· Potential challenges

in determining minor economic activity, particularly where other landowners

may pay full rates on small parcels of land used for crops

|

|

7.2

|

Provide

remission of rates on land that is used for growing kai or medicinal plants

(recommended)

|

·

· Nil |

|

7.3

|

Do not

provide remission of rates on land used for minor economic activity

|

· Nil

|

· Potential that policy

does not align with the schedule 11 provisions

· Council required to

rate land where the land returns limited financial benefit

|

|

7.4

|

Do not

provide remission of rates on land that is used for growing kai or medicinal

plants

|

· ·

33. If

the Committee agrees to the recommended option, the amount of rates remitted

will consider the percentage of the income derived from partial use

subsequently required to be expended on rates. Staff will also have regard to

comparable rating units in Tauranga or neighbouring districts.

Financial

Considerations

34. There

are 442 Māori freehold land rating units in Tauranga with a total land

area of 1,982 hectares. Total rates assessed in 2021/2022 were $420,000 with

$150,000 rates remission on land with part use.

35. It should be noted that one of the

benefits to be considered in providing for remission on land subject to

development is the likelihood of an increase in council’s rating base in

the future.

Legal Implications /

Risks

36. There

are no legal implications arising from the recommended options. A draft policy

may be subject to legal review before adoption.

Consultation /

Engagement

37. Staff

discussed the legislative changes with Te Rangapū in June 2021 before

taking a draft policy to Te Rangapū for discussion in October 2021.

Feedback was sought on the following issues;

· Meeting the

requirement to show support for the Preamble through a revised purpose statement

· Criteria for

remission

· Including land

returned through treaty settlement or right of first refusal in the policy for

the purposes of remission.

· Retention of

clauses relating to postponement in the policy

· Appropriate

level of remission.

38. Feedback

from Te Rangapū was generally supportive. Of particular note is the need

to approach the policy from a te ao Māori perspective and acknowledge

that papakāinga is not just housing. With regards to papakāinga, any

definition of papakāinga used in this policy will be consistent with the

definition in the recently adopted Grants for Development Contributions on

Papakāinga Policy.

39. Other

matters raised by Te Rangapū are discussed in issues five and six.

40. Some

Te Rangapū members noted that the contribution of hapū and iwi to

the growth of Tauranga was not acknowledged in rating policies and practices,

in particular charging targeted rates for services. This is an issue of

longstanding. Schedule 11 provides for councils to

recognise the “levels of community services provided to the land and its

occupiers” when considering the issue of rates relief on Māori

freehold land.

41. This

report and the recommended options have been provided to trusts and

landowners. Initial feedback was generally positive with more detailed

responses being reserved for the submission process.

42. Staff

have also discussed the policy with staff from Bay of Plenty Regional and

Western Bay of Plenty District Councils with a view to having consistent

approaches to the rating of Māori freehold land.

Significance

43. The

Local Government Act 2002 requires an assessment of the significance of

matters, issues, proposals and decisions in this report against

Council’s Significance and Engagement Policy. Council acknowledges

that in some instances a matter, issue, proposal or decision may have a high

degree of importance to individuals, groups, or agencies affected by the

report.

44. In

making this assessment, consideration has been given to the likely impact, and

likely consequences for:

(a) the current

and future social, economic, environmental, or cultural well-being of the

district or region

(b) any persons who are likely to be

particularly affected by, or interested in, the matter.

(c) the capacity of the local authority to

perform its role, and the financial and other costs of doing so.

45. In

accordance with the considerations above, criteria and thresholds in the

policy, it is considered that the matter is of medium significance.

ENGAGEMENT

46. All

rating policies adopted under section 102 of the LGA 02 must be consulted on

in accordance with the principles of section 82 of the LGA 02.

Next Steps

47. Staff

will incorporate any amendments agreed at this meeting into a draft policy to

be adopted for consultation at the 28 February Council meeting.

48. Statutory

consultation on the draft policy will take place as part of the draft Annual

Plan consultation.

Attachments

1. Remission

and Postponement of Rates on Māori Freehold Land Policy - A13134641 ⇩

2. Preamble

to Te Ture Whenua Māori Act 1993 - A13132247 ⇩

3. Schedule 11 Local

Government Act 2002 - Matters relating to rates relief on Māori freehold

land - A13133092 ⇩

|

Strategy, Finance and Risk

Committee Meeting Agenda

|

14 February 2022

|

|

Strategy, Finance and Risk Committee

Meeting Agenda

|

14 February 2022

|

|

Strategy, Finance and Risk

Committee Meeting Agenda

|

14 February 2022

|

9.2 Review

of Rates Remission and Rates Postponement Policies - Issues and Options

File

Number: A13134749

Author: Jim

Taylor, Transactional Services Manager

Emma Joyce, Policy Analyst

Authoriser: Paul

Davidson, General Manager: Corporate Services

Purpose

of the Report

1. To

agree amendments to the Rates Postponement and Rates Remission Policies (the

policies) (attachments 1 and 2).

|

Recommendations

That the Strategy,

Finance and Risk Committee:

(a) Notes

that reference to the Preamble to Te Ture Whenua Māori Act 1993 will be

added to Council’s Revenue and Financing Policy.

(b) Agree

that the following matters be addressed in a draft Rates Postponement Policy

for consultation (for adoption by Council);

(i) deletion

of all criteria for rates postponement for financial hardship except the

requirement for there to be at least 25% equity in the property and that the

ratepayer must not be able to access support from private sector financial

institutions.

(ii) addition

a new criterion that applications for rates postponement for financial

hardship may only be for the property the ratepayer is currently residing in.

(iii) addition

of a new criterion providing for postponement of rates on rating units where

the valuation may have increased due to boundary adjustments and re-zoning

from rural to urban uses, noting that a maximum of six years postponed rates

will be due when the property is sold or developed.

(c) Agree

that the following matters be addressed in a draft Rates Remission Policy for

consultation (for adoption by Council);

(i) Addition

of a provision for partial remission of general rates and targeted rates set

at the capital value on rating units with both a license to grow gold

kiwifruit and planted vines where the rates have increased by more than the

citywide average, noting that the remission will be for the portion of rates

above the citywide average and for a maximum of three years with 100%

remission in the 2022/2023 financial year and two thirds remission in year

two (2023/2024).

(ii) Deletion

of provisions pertaining to remission of wastewater rates for schools and

reference to remission of rates on land designated a Māori reservation.

|

Executive

Summary

2. In

adopting the Long-term Plan 2021-2031 (LTP) and in response to public feedback,

Commissioners requested a review of council policies on the remission and

postponement of rates, particularly for those on fixed incomes. Recent

legislative changes also require councils to review their policies on rates

remission and postponement to confirm they support the principles in the

Preamble to Te Ture Whenua Māori Act 1993 (TTWMA 93) (copy of preamble

appended at attachment 3).

3. This

report asks the Strategy, Finance and Risk Committee (the Committee) to agree

any amendments to the policies. Draft policies incorporating any agreed

amendments will be presented to the 28 February Council meeting for adoption

for consultation.

Background

4. Recent

legislative changes require councils to review their rates postponement and

remission policies to confirm they support the principles in the Preamble to

TTWMA 93. These principles acknowledge the significance of land to Māori

and the need to avoid further alienation while providing for the development of

land.

5. During

consultation on the LTP, feedback was received that increasing rates would

place a particular burden on persons on fixed incomes, particularly people

whose sole income was New Zealand superannuation. While persons receiving New

Zealand superannuation may be eligible to receive the government rates rebate,

Council committed to looking at options to further support people on fixed

incomes manage their rates payments. This included a review of our remissions

and postponement policies.

6. Under

section 102(3) of the Local Government Act 2002 (LGA 02), councils may adopt

policies on the remission and postponement of rates. Rates postponement

policies must state the objectives sought by the policy and the conditions and

criteria that must be met for rates to be postponed. The objectives of this

council’s policy are to support ratepayers experiencing financial

hardship and to recognise council zoning changes that may impact on rating

valuations. Applicants seeking postponement on the grounds of financial

hardship must currently meet all of the following criteria;

· Payment

of the first $1,000 of rates

· Have

at least 25% equity in the property

· Applied

for the government rates rebate scheme.

· Unable

to access financial assistance from private sector financial institutions.

7. These

criteria were introduced into the policy at its last review in 2018 in order to

provide some certainty to applicants and avoid a council committee deciding on

postponement applications. Providing for postponements for financial hardship

recognised that the decision to charge higher rates on higher value properties

may impact ratepayers on fixed incomes but residing in a high value property.

While postponement policies must contain some criteria, a review of the above

criteria can consider whether all of the criteria remain necessary or

potentially place additional burden on persons seeking postponement for

financial hardship.

8. Some

councils (including Christchurch City and Western Bay of Plenty District Councils)

provide for anyone aged 65 or over to postpone all or part of their rates.

Dunedin only requires the applicant to prove that they do not have the

financial capacity to pay their rates or doing so would create financial

hardship. While Taupō offers postponement for persons receiving New

Zealand superannuation, it also requires the person to have been a residential

ratepayer in the district for at least ten years.

9. In

general, this council’s rates postponement criteria are consistent with

other councils. Wellington similarly requires the applicant to have first

applied for a reverse mortgage from their bank. As reported to the November

2021 Committee meeting, we are collaborating with other metro councils to

develop a rates postponement scheme that would provide an equity release

scheme. This would be a more cost efficient and less expensive scheme than

keeping the postponed rates on council’s books.

10. Other

councils provide assurance that any postponement is for the property the

ratepayer is currently residing in. Consideration should be given to adding

this condition to this council’s postponement policy. Ratepayers seeking

postponement are asked to confirm that the application concerns their current

residence, however, it is not currently a criterion in the policy for approving

an application.

11. Land

is rated on its highest and best use. Recognising that not all land will be

utilised for its highest and best use, the policy currently provides for

ratepayers of rezoned farmland to postpone part of their rates. The level of

postponement is calculated on the difference between the rateable value of the

rateable unit and the valuation of a comparable farmland rating unit elsewhere

in Tauranga or surrounding district. Postponed rates are due when the land is

sold, subdivided or has a change in use. A property could have postponed rates

for several years but would only be required to pay up to six years of

postponed rates when the land is sold, subdivided or has a change in use.

12. There

is no intention to review the above provisions relating to farmland. However,

consideration could be given to extending this provision to other rating units

where the value may have increased due to council re-zoning the land from rural

to residential use. This is likely to apply to properties moved into the

Tauranga City Council area as a result of recent boundary adjustments. Such

properties will be rated for their “highest and best use” but may

not be able to realise that use until such time appropriate service provisions

are put in place (potentially ten years away).

13. The

Valuer-General recently accepted the view that rating valuations for kiwifruit

orchards must now include the licence to grow gold kiwifruit and the planted

vines. This view was supported by an assessment against the Rating Valuations

Act 1998 definition of value of improvements, which requires the assessment of

the value of all work done on or for the benefit of the land. While a recent

decision from Land Valuation Tribunal has held that gold kiwifruit licenses

should not be included in the land valuation

, if the change is upheld it will mean an increase in the capital value and the

value of improvements of gold kiwifruit properties. This change will affect

approximately 22 properties in Tauranga who may have an increase in their

rating valuation significantly above the citywide average. Staff are finalising

data on the actual financial impact of this change and will provide this

information to the Committee at its meeting.

14. Councils

have discretion to introduce provisions in their rates remission policy to ease

the transition to the increased rating valuation for gold kiwifruit orchards.

Unlike the properties described in paragraph 12, the properties are used for

their highest and best use. As such, it is more appropriate to consider

offering remission than postponement.

15. In

summary, the issues for consideration are

· Ensuring policies

support the principles in Preamble to TTWMA 93

· Criteria for

postponement of rates

· Postponement or

remission of rates on re-zoned properties

· Remission

of rates on gold kiwifruit orchards

Strategic / Statutory

Context

16. Section

102 of the LGA 02 provides for councils to adopt policies on the remission or

postponement of rates. Councils are required to review (and amend if necessary)

their remission and postponement policies to confirm they support the

principles in the Preamble to TTWMA 93 by 1 July 2024.

Options Analysis

Issue 1 –

showing support for principles in the Preamble

17. The

principles in the two policies reference back to the general principles

included in the Revenue and Financing Policy – accountability,

exacerbators, affordability, benefits and practicalities. The Committee could

add an additional principle to the Revenue and Financing Policy to address the

preamble or add an additional statement to both the postponements and

remissions policy.

18. Table

below outlines the advantages and disadvantages of each option.

|

Option

|

Advantages

|

Disadvantages

|

|

1.1

|

Add

provision to the policies referencing Preamble

|

· Clear reference to the Preamble

· Meets legislative requirement to

review policies to ensure support for Preamble to TTWMA 93

|

· Nil

|

|

1.2

|

Do not

add provision to the policies but add provision to Revenue and Financing

Policy (recommended)

|

· Recognises that there is limited

reference to Māori freehold land in the two policies

· Acknowledges that the Preamble

principles are best reflected in council’s overall policy on rating

(Revenue and Financing Policy)

· Meets legislative requirement to

review policies to ensure support for Preamble to TTWMA 93

|

· No explicit reference to

supporting the preamble in the policies

|

19. If the Committee prefers

option 1.1, any references to the Preamble will be consistent with that

proposed for the Remission and Postponement of Rates on Māori Freehold

Land Policy.

Issue 2 –

Criteria for postponement for financial hardship

20. The

table below outlines the advantages and disadvantages of retaining the current

criteria for postponement for financial hardship (options 2.1 – 2.5) and

adding new criteria (options 2.6 and 2.7).

|

Option

|

Advantages

|

Disadvantages

|

|

2.1

|

Must

have minimum 25% equity in the property

(recommended)

|

· Sufficient equity remains in the

property for council to recover any postponed rates upon sale

|

· Nil

|

|

2.2

|

Pay

first $1000 of rates

|

· Ratepayer pays a portion of their

rates

|

· Retention of criteria may place

additional burden on ratepayers, particularly those on fixed incomes

· Application process for government

rates rebate may be administrative burden for some people

|

|

2.3

|

Apply

for Government rates rebate

|

· Ratepayer pays a portion of the

rates

· Does not impact on council

|

· Retention of criteria may place

additional burden on ratepayers

· Application process for government

rates rebate may be administrative burden for some people

|

|

2.4

|

Ratepayer

must prove they are unable to access financial assistance from private sector

financial institutions

(recommended)

|

· Council does not carry debt burden

· Recognises other forms of

financial assistance available to ratepayers

· Recognises that Council would be

unlikely to cover costs of a postponement scheme the same as a private institution

would be

· Potential for national rates

postponement scheme in the future

|

· Policy may not recognise the

burden of rates for people on fixed incomes

· Addition of new criteria may place

unnecessary burden on ratepayers, particularly those on fixed incomes

|

|

2.5

|

Postponement

available to anyone aged 65 or older

|

· Recognises the impact of rates on

people whose sole income is New Zealand superannuation

· Consistent with some other

councils

|

· Inconsistent with Revenue and

Financing Policy that people who receive the benefits should contribute to

them.

· Does not recognise availability of

Government rates rebate for people on low incomes

· Younger people who may similarly

have fixed incomes not entitled to automatic postponement and must meet other

criteria

· Potential impact on rates take

|

|

2.6

|

Postponement

only available for home ratepayer is residing in

(recommended)

|

· Mitigates any potential risk of

people with multiple homes accessing postponement scheme for their financial

benefit

|

· Nil

|

|

2.7

|

Ratepayer

to have paid rates in Tauranga for a period of time

|

· Provides for recognition of

previous contribution

|

· Addition of new criteria may place

unnecessary burden on ratepayers, particularly those on fixed incomes

|

|

2.8

|

No

postponement of rates at all

|

· Nil

|

· Inconsistent with current practice

· Inconsistent with some other

councils

· No policy recognition that rates

may place a financial burden on some ratepayers

|

Issue

3 – Postponement or remission of rates on rezoned land

21. Boundary

adjustments confirmed in 2021 resulted in several rural zoned properties moving

into the jurisdiction of this Council. These properties are likely to be

re-zoned from rural to urban uses (i.e. residential,

employment or commercial) over time, potentially increasing the value of

these properties. The Committee could consider offering a postponement scheme

similar to that offered for farmland (as is currently provided for in the

existing policy). Other options include remitting the portion of rates

attributed to the land’s development potential, or not providing a policy

mechanism to address the potential increase in the rating value of these

properties.

22. The

table below outlines the advantages and disadvantages of each option.

|

Option

|

Advantages

|

Disadvantages

|

|

3.1.1

|

Provide

for postponement of rates on properties where rating valuation may

have increased due to boundary adjustments and rezoning from rural to urban

uses (i.e. residential, employment or commercial)

(recommended)

|

· Consistent with current rules for

farmland

· Recognises that Council action to

re-zone may increase rates on some properties

· Ensures Council receives postponed

rates in the future when property sold or developed.

|

· Reduction in cashflow

until postponed rates are paid

|

|

3.1.2

|

Provide

for remission of rates for properties where rating valuation may have

increased due to boundary adjustments and rezoning

(recommended

if option 3.1.1 not supported)

|

· Recognises that Council action to

re-zone may increase rates on some properties

|

· Inconsistent with current rules

for farmland

· Does not allow Council to receive

rates in the future when property sold or developed.

|

|

3.1.3

|

Do not

provide for remission or postponement of rates on properties rezoned from

rural to urban uses (i.e. residential, employment or commercial)

|

· Council collects full amount of

rates in year rates are due

|

· Potential that Council action to

rezone puts financial burden on some ratepayers whose land value changes, but

may not be able to make full use of the new zoning (until infrastructure

provision is at boundary of properties).

· Inconsistent with current

provisions for farmland

|

23. If the Committee opted for

either 3.1.1 or 3.1.2, consideration needs to be given to the period of time in

which postponement (or remissions) would apply. The current rules for farmland

allow rates to be postponed until such time as the land is sold, changes use or

is subdivided. However, the ratepayer would only be required to pay the

postponed rates for the previous six years (for example, a property could have

its rates postponed for ten years but would only pay for six).

24. The

six year timeframe references section 65 of the LG(R)A 02 that states “an

action to recover unpaid postponed rates must not be commenced in a court of

competent jurisdiction later than 6 years after the date or event to which the

rates were postponed”. Council could allow postponement for a maximum of

six years, or until such time is the land is sold or developed with six years

of postponed rates due, or until such time as the land is sold or developed

upon which all postponed rates would become due.

|

Option

|

Advantages

|

Disadvantages

|

|

3.2.1

|

Postponement

available for a maximum of six years

|

· Council receives higher rates

(full rates amount) after 6 years.

|

· Inconsistent with current rules

for farmland

· In certain cases, while the land

may be zoned to provide for urban land uses, the ability to implement these

uses may be limited due to the lack of infrastructure capacity in place.

· Restricts ratepayers’ choice

to retain current use and enjoyment of the property

· Ratepayer may not be getting the

benefit of the valuation after six years

|

|

3.2.2

|

Postponement

available until such time an application in line with the zoning is received,

or the property is connected to services, or changes ownership. Up to six

years (inclusive) of postponed rates would be due at that time. (recommended)

|

· Consistent with current rules for

farmland

|

· Rates are not based on highest and

best use in the same way as other properties

· Potential Council forgoes some

rates income if a property postpones their rates for more than six years

|

|

3.2.3

|

Postponement available until such time an application in line with

the zoning is received, or the property is connected to services, or changes

ownership. All postponed rates would be due at that time.

|

· Council does not

forgo any rates income

|

· Potential

that landowner builds up significant debt or feels forced to sell earlier

than desired due to rates burden

· Potential

that ratepayers’ choice to retain current use and enjoyment of the

property is restricted

· Inconsistent with

current practice for farmland in other parts of the city

|

Issue 4 – Remission rates on properties with license

to grow gold kiwifruit and planted vines

25. Noting

that properties with a licence to grow gold kiwifruit and planted vines may

face an increase in rates significantly above the citywide average, the

Committee can choose to offer a partial remission of rates to ease the

transition to the new rating valuation. (The remission would only be for the

portion of rates above the citywide average attributed to the gold kiwifruit).

This partial remission would apply both to the general rates and any targeted

rates set at the capital value. The Committee could also choose to offer

remission to only those properties where the planted vines are not yet earning

income.

|

Option

|

Advantages

|

Disadvantages

|

|

4.1.1

|

Provide

for partial remission of rates on all properties with gold kiwifruit license

and planted vines only where valuation above citywide average

(recommended)

|

· Recognises potential impact on

rates of new approach to valuation

|

· Does not acknowledge that

properties have been potentially undervalued for some time

· Council forgoes some rates income

|

|

4.1.2

|

Provide

for partial remission only where planted vines are not yet productive

and only where valuation above citywide average

|

· Acknowledges that planted vines

may not yet be earning income

· Consistent with proposed provision

for remission on Māori freehold land under development until such time

as the land is generating income

|

· Generally understood that income

on orchards may be limited in initial years after planting vines

· Some properties may be receiving

income from green kiwifruit variety

· Potentially difficult to

administer

|

|

4.1.3

|

Do not

provide for partial remission of rates on all properties with gold kiwifruit

license and planted vines

|

· Acknowledges that properties have

been potentially undervalued for some time

· Council collects full amount of

rates in year rates are due

|

· Some ratepayers potentially facing

increased rates burden

· Potential reputational risk

|

26. If the Committee prefers

option 4.1.1 or 4.1.2, consideration needs to be given to the period of time in

which any remission would apply, and the rate of remission. Options include

offering larger remission over a shorter period, or less remission over a

longer period. These options are outlined in the table below.

|

Option

|

Advantages

|

Disadvantages

|

|

4.2.1

|

100%

remission in the 2022/2023 with partial remission of 2/3 in year two, and 1/3

in year three

(recommended)

|

· Recognises recent review decision

that gold kiwifruit license should not be considered in land valuation may

have implications

· Provides for higher remission in

first year when rates increase will be most noticeable

· Provides for transition to new

rating valuation over the time

|

· Nil

|

|

4.2.2

|

Partial

remission available over two years with 2/3 remission and 1/3 remission in

year two, No remission in third year

|

· Provides for higher remission in

first year when rates increase will be most noticeable

· Provides for transition to new

rating valuation over the time

|

· Some ratepayers may still need to

manage significant increases

|

|

4.2.3

|

Partial

remission available over three years with 3/4 in first year, sliding to full

rates in year 4.

|

· Provides for transition to new

rating valuation over time

|

· Potentially insufficient to ease

the immediate financial impact of new rating valuations

· Some ratepayers may still need to

manage significant increases

|

Other matters - Rates Remission Policy

27. Māori

reservations are now non-rateable under the recent legislative changes. As

such, reference to remission on this land can be deleted. The remission policy