|

|

|

AGENDA

Strategy, Finance and Risk Committee Meeting

Monday, 28 March 2022

|

|

I hereby give notice that a Strategy, Finance and

Risk Committee Meeting will be held on:

|

|

Date:

|

Monday, 28 March 2022

|

|

Time:

|

10.00am

|

|

Location:

|

Bay of Plenty Regional Council Chambers

Regional House

1 Elizabeth Street

Tauranga

|

|

Please note that this

meeting will be livestreamed and the recording will be publicly available on

Tauranga City Council's website: www.tauranga.govt.nz.

|

|

Marty Grenfell

Chief Executive

|

Terms of reference – Strategy,

Finance & Risk Committee

Membership

|

Chairperson

|

Commission Chair Anne Tolley

|

|

Deputy chairperson

|

Dr Wayne Beilby – Tangata

Whenua representative

|

|

Members

|

Commissioner Shadrach Rolleston

Commissioner Stephen Selwood

Commissioner Bill Wasley

|

|

|

Matire

Duncan, Te Rangapū Mana Whenua o Tauranga Moana Chairperson

Te Pio Kawe – Tangata

Whenua representative

Rohario Murray – Tangata

Whenua representative

Bruce

Robertson – External appointee with finance and risk

experience

|

|

Quorum

|

Five

(5) members must be physically present, and at least three (3) commissioners

and two (2) externally appointed members must be present.

|

|

Meeting frequency

|

Six weekly

|

Role

The role of the Strategy, Finance and Risk Committee (the

Committee) is:

(a)

to assist and advise the Council in discharging

its responsibility and ownership of health and safety, risk management,

internal control, financial management practices, frameworks and processes to

ensure these are robust and appropriate to safeguard the Council’s staff

and its financial and non-financial assets;

(b)

to consider strategic issues facing the city and

develop a pathway for the future;

(c)

to monitor progress on achievement of desired

strategic outcomes;

(d)

to review and determine the policy and bylaw framework

that will assist in achieving the strategic priorities and outcomes for the

Tauranga City Council.

Membership

The Committee will consist of:

·

four commissioners with the Commission Chair

appointed as the Chairperson of the Committee

·

the Chairperson of Te

Rangapū Mana Whenua o Tauranga Moana

·

three tangata whenua representatives

(recommended by Te Rangapū Mana Whenua o Tauranga

Moana and appointed by Council)

·

an independent external person with finance and

risk experience appointed by the Council.

Voting

Rights

The tangata whenua representatives and the independent

external person have voting rights as do the Commissioners.

The Chairperson of Te Rangapu Mana Whenua o Tauranga Moana

is an advisory position, without voting rights, designed to ensure mana whenua

discussions are connected to the committee.

Committee’s

Scope and Responsibilities

A. STRATEGIC ISSUES

The

Committee will consider strategic issues, options, community impact and explore

opportunities for achieving outcomes through a partnership approach.

A1 – Strategic Issues

The Committee’s

responsibilities with regard to Strategic Issues are:

·

Adopt an annual work

programme of significant strategic issues and projects to be addressed. The

work programme will be reviewed on a six-monthly basis.

·

In respect of each

issue/project on the work programme, and any additional matters as determined

by the Committee:

·

Consider existing

and future strategic context

·

Consider

opportunities and possible options

·

Determine preferred direction

and pathway forward and recommend to Council for inclusion into strategies,

statutory documents (including City Plan) and plans.

·

Consider and approve

changes to service delivery arrangements arising from the service delivery

reviews required under Local Government Act 2002 that are referred to the

Committee by the Chief Executive.

·

To take appropriate

account of the principles of the Treaty of Waitangi.

A2 – Policy and Bylaws

The Committee’s

responsibilities with regard to Policy and Bylaws are:

·

Develop, review and

approve bylaws to be publicly consulted on, hear and deliberate on any

submissions and recommend to Council the adoption of the final bylaw. (The

Committee will recommend the adoption of a bylaw to the Council as the Council

cannot delegate to a Committee the adoption of a bylaw.)

·

Develop, review and

approve policies including the ability to publicly consult, hear and deliberate

on and adopt policies.

A3 – Monitoring of Strategic

Outcomes and Long Term Plan and Annual Plan

The Committee’s

responsibilities with regard to monitoring of strategic outcomes and Long Term

Plan and Annual Plan are:

·

Reviewing and

reporting on outcomes and action progress against the approved strategic

direction. Determine any required review/refresh of strategic direction or

action pathway.

·

Reviewing and

assessing progress in each of the six (6) key investment proposal areas within

the 2021-2031 Long Term Plan.

·

Reviewing the

achievement of financial and non-financial performance measures against the

approved Long Term Plan and Annual Plans.

B.

FINANCE AND RISK

The Committee will review the

effectiveness of the following to ensure these are robust and appropriate to

safeguard the Council’s financial and non-financial assets:

·

Health and safety.

·

Risk management.

·

Significant projects and programmes of work

focussing on the appropriate management of risk.

·

Internal and external audit and assurance.

·

Fraud, integrity and investigations.

·

Monitoring of compliance with laws and regulations.

·

Oversight of preparation of the Annual Report

and other external financial reports required by statute.

·

Oversee the relationship with the

Council’s Investment Advisors and Fund Managers.

·

Oversee the relationship between the Council and

its external auditor.

·

Review the quarterly financial and non-financial

reports to the Council.

B1 - Health and Safety

The Committee’s responsibilities through regard to

health and safety are:

·

Reviewing the effectiveness of the health and

safety policies and processes to ensure a healthy and safe workspace for

representatives, staff, contractors, visitors and the public.

·

Assisting the Commissioners to discharge their

statutory roles as “Officers” in terms of the Health and Safety at

Work Act 2015.

B2 - Risk Management

The Committee’s responsibilities with regard to risk

management are:

·

Review, approve and monitor the implementation of the Risk

Management Policy, Framework and Strategy including the Corporate Risk

Register.

·

Review and approve the Council’s “risk

appetite” statement.

·

Review the effectiveness of risk management and internal control

systems including all material financial, operational, compliance and other

material controls. This includes legislative compliance, significant projects

and programmes of work, and significant procurement.

·

Review risk management reports identifying new and/or emerging

risks and any subsequent changes to the “Tier One” register.

B3

- Internal Audit

The Committee’s responsibilities with regard to the

Internal Audit are:

·

Review and approve the Internal Audit Charter to confirm the

authority, independence and scope of the Internal Audit function. The Internal

Audit Charter may be reviewed at other times and as required.

·

Review and approve annually and monitor the implementation of the

Internal Audit Plan.

·

Review the co-ordination between the risk and internal audit

functions, including the integration of the Council’s risk profile with

the Internal Audit programme. This includes assurance over all material

financial, operational, compliance and other material controls. This includes

legislative compliance (including Health and Safety), significant projects and

programmes of work and significant procurement.

·

Review the reports of the Internal Audit functions dealing with

findings, conclusions and recommendations.

·

Review and monitor management’s responsiveness to the

findings and recommendations and enquire into the reasons that any

recommendation is not acted upon.

B4

- External Audit

The Committee’s responsibilities with regard to the

External Audit are:

·

Review with the external auditor, before the audit commences, the

areas of audit focus and audit plan.

·

Review with the external auditors, representations required by

commissioners and senior management, including representations as to the fraud

and integrity control environment.

·

Recommend adoption of external accountability documents (LTP and

annual report) to the Council.

·

Review the external auditors, management letter and management

responses and inquire into reasons for any recommendations not acted upon.

·

Where required, the Chair may ask a senior representative of the

Office of the Auditor General (OAG) to attend the Committee meetings to discuss

the OAG’s plans, findings and other matters of mutual interest.

·

Recommend to the Office of the Auditor General the decision

either to publicly tender the external audit or to continue with the existing

provider for a further three-year term.

B5

- Fraud and Integrity

The Committee’s responsibilities with regard to

Fraud and Integrity are:

·

Review and provide advice on the Fraud Prevention and Management

Policy.

·

Review, adopt and monitor the Protected Disclosures Policy.

·

Review and monitor policy and process to manage conflicts of

interest amongst commissioners, tangata whenua representatives, external representatives

appointed to council committees or advisory boards, management, staff,

consultants and contractors.

·

Review reports from Internal Audit, external audit and management

related to protected disclosures, ethics, bribery and fraud related incidents.

·

Review and monitor policy and processes to manage

responsibilities under the Local Government Official Information and Meetings

Act 1987 and the Privacy Act 2020 and any actions from the Office of the

Ombudsman’s report.

B6

- Statutory Reporting

The

Committee’s responsibilities with regard to Statutory Reporting relate to

reviewing and monitoring the integrity of the Annual Report and recommending to

the Council for adoption the statutory financial statements and any other

formal announcements relating to the Council’s financial performance,

focusing particularly on:

·

Compliance with, and the appropriate application of, relevant

accounting policies, practices and accounting standards.

·

Compliance with applicable legal requirements relevant to

statutory reporting.

·

The consistency of application of accounting policies, across

reporting periods.

·

Changes to accounting policies and practices that may affect the

way that accounts are presented.

·

Any decisions involving significant judgement, estimation or

uncertainty.

·

The extent to which financial statements are affected by any

unusual transactions and the manner in which they are disclosed.

·

The disclosure of contingent liabilities and contingent assets.

·

The basis for the adoption of the going concern assumption.

·

Significant adjustments resulting from the audit.

Power

to Act

·

To make all

decisions necessary to fulfil the role, scope and responsibilities of the

Committee subject to the limitations imposed.

·

To establish

sub-committees, working parties and forums as required.

·

This Committee has not

been delegated any responsibilities, duties or powers that the Local Government

Act 2002, or any other Act, expressly provides the Council may not

delegate. For the avoidance of doubt, this Committee has not

been delegated the power to:

o

make a rate;

o

make a bylaw;

o

borrow money, or purchase

or dispose of assets, other than in accordance with the Long Term Plan (LTP);

o

adopt the LTP or Annual

Plan;

o

adopt the Annual Report;

o

adopt any policies required

to be adopted and consulted on in association with the LTP or developed for the

purpose of the local governance statement;

o

adopt a remuneration and

employment policy;

o

appoint a chief executive.

Power

to Recommend

To Council and/or any standing committee

as it deems appropriate.

8 Business

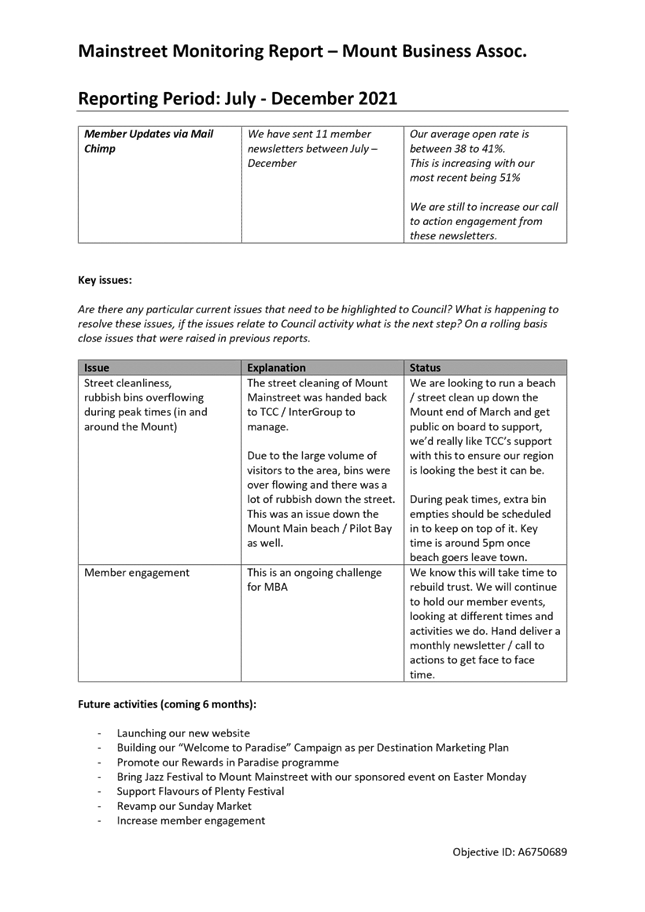

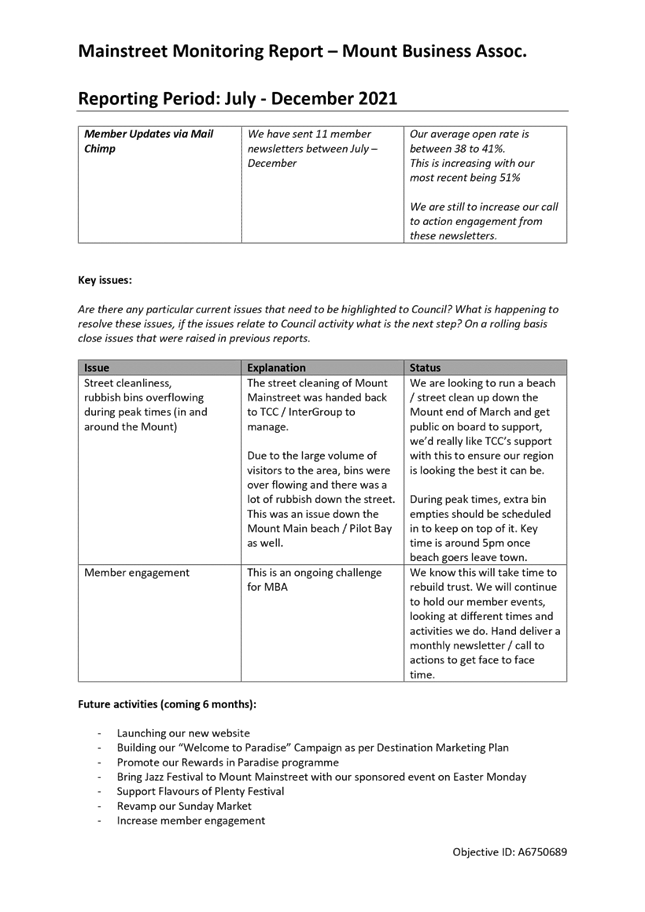

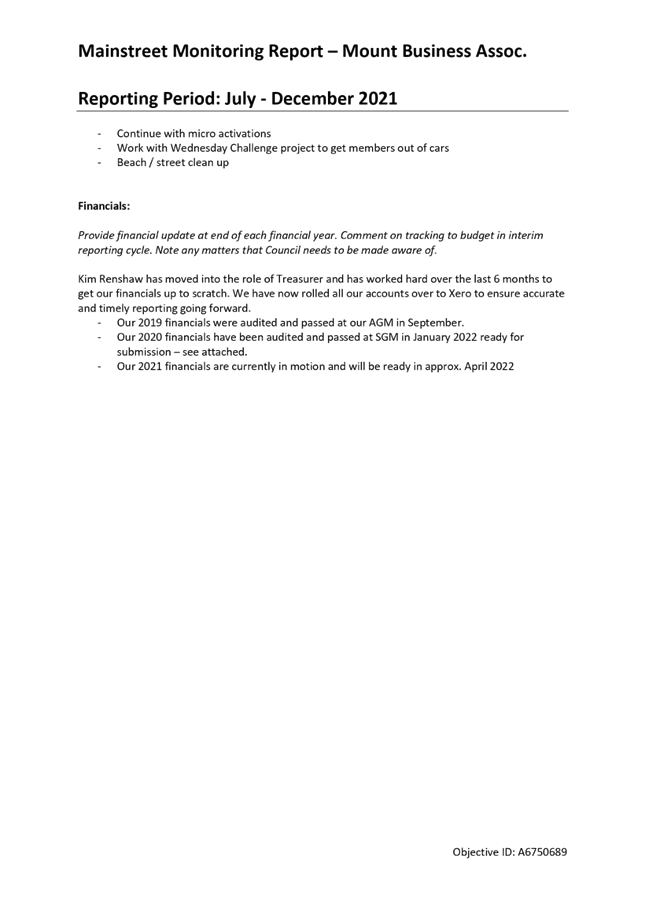

8.1 Mainstreets

Monitoring Report for the period to 31 December 2021

File Number: A13171629

Author: Anne

Blakeway, Manager: Community Partnerships

Authoriser: Gareth

Wallis, General Manager: Community Services

Purpose

of the Report

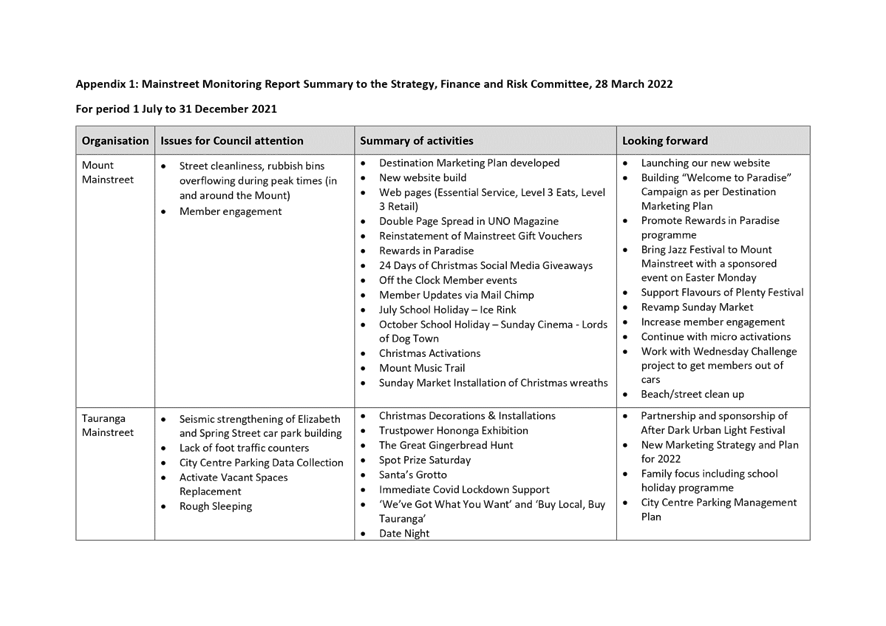

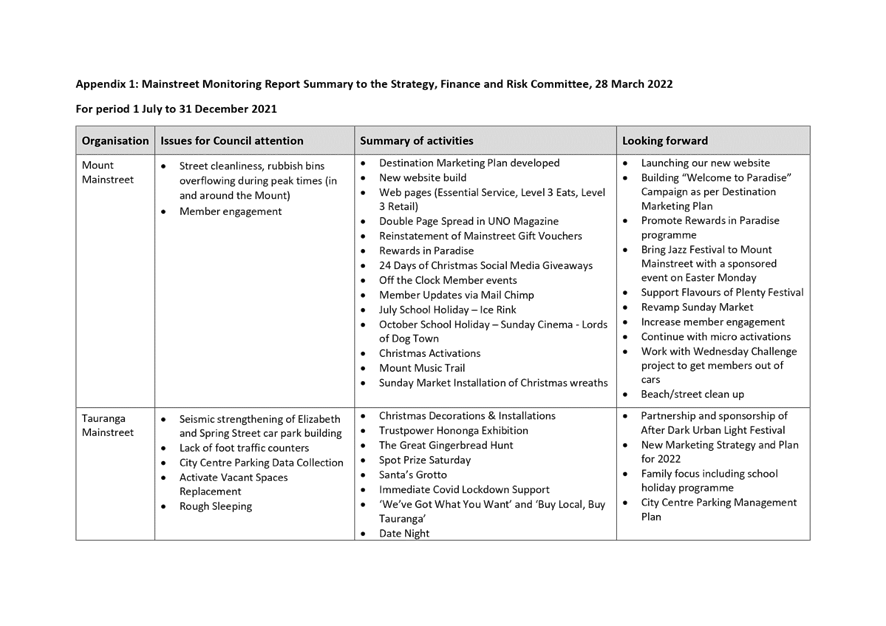

1. For

mainstreet organisations to report to Council on their activities for the

period July to December 2021, to highlight issues, to provide a financial

update, and to outline plans for future activities.

|

Recommendations

That the Strategy,

Finance and Risk Committee:

(a) Receives the

Mainstreets’ Monitoring Report for the period to 31 December 2021.

(b) Receives the Mount Business

Association Report to 31 December 2021.

(c) Receives the Mainstreet

Tauranga Report to 31 December 2021.

(d) Receives the Greerton

Village Mainstreet Report to 31 December 2021.

(e) Receives

the Papamoa Unlimited Report to 31 December 2021.

|

Executive

Summary

2. Mainstreet

organisations receive a targeted rate through Council.

3. As

part of Council’s agreement with the four mainstreet organisations, they

are required to report every six months on activities achieved, activities

planned, and any issues they want to bring to the attention of Council. They

are expected to provide a financial update for each reporting period and

audited financials after the end of the financial year.

4. This

report reflects the period 1 July to 31 December 2021.

5. A

summary of performance – both financial and non-financial – is

provided for Mainstreet Tauranga, Greerton Village Mainstreet, Mount Business

Association and Papamoa Unlimited. All mainstreet organisations are in good

financial health.

6. Notwithstanding

the ongoing challenges of COVID to foot traffic and event cancellations, the

mainstreet organisations appear to be having a positive effect on the

activation and economic vibrancy of their areas, largely through a number of events

and promotions.

7. Following

an independent review of the four mainstreet organisations, on 15 November 2021

Council approved the appointment of a 0.5FTE City Partnerships Specialist who

would provide one point of contact for mainstreets within Tauranga City Council

(TCC).

8. The

appointee to this role will commence on 14 March 2022, and will begin work on

developing and implementing a new accountability regime, including the

development of a letter of expectation as the mechanism for ensuring strategic

alignment between the mainstreet organisations and TCC. They will also review

the existing arrangements with the mainstreet organisations to reflect the

proposed accountability regime and to standardise, where possible, the

terminology in the agreements.

Background

9. There

are agreements in place between TCC and the four mainstreet organisations for

the delivery of services. The intent of the agreements is to the effect that:

· The

mainstreet organisations will contribute to the achievement of a strong and

vibrant city and town centres, by promoting the appeal of their respective

areas to residents and visitors through events, promotions, and other means.

· That

TCC will provide funding for these mainstreet services by way of a targeted

rate on commercial property within each of the respective mainstreet business

areas.

· The

mainstreet organisations are incorporated societies and all business operators

within their respective targeted rates areas are regarded by the mainstreet organisations

as being their members.

Discussion

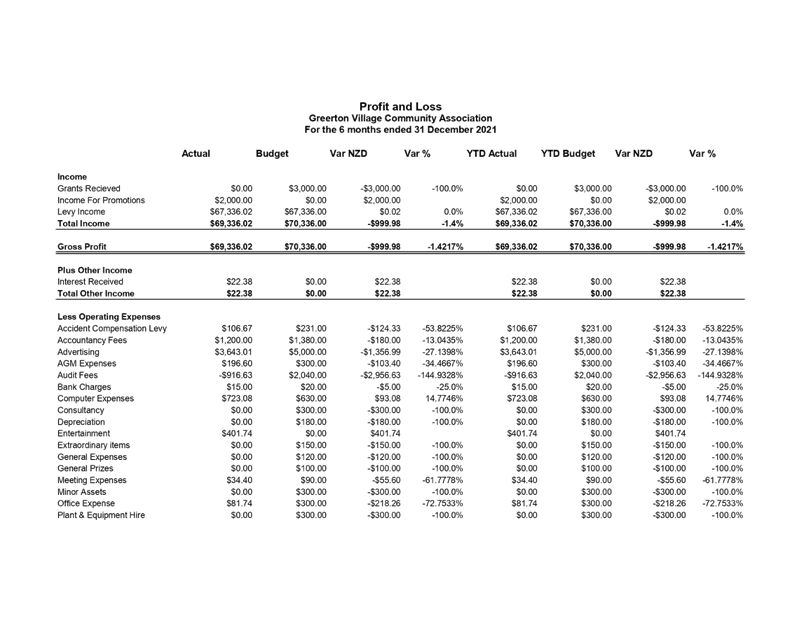

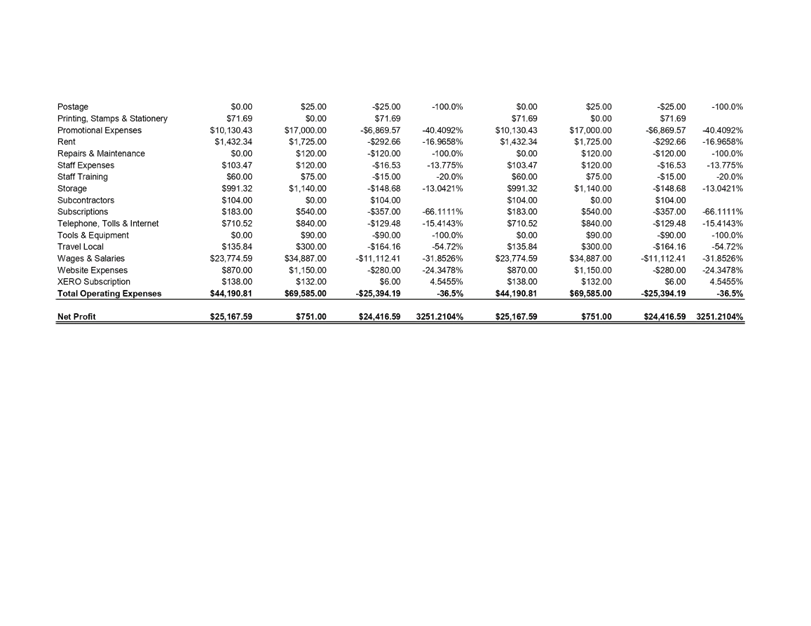

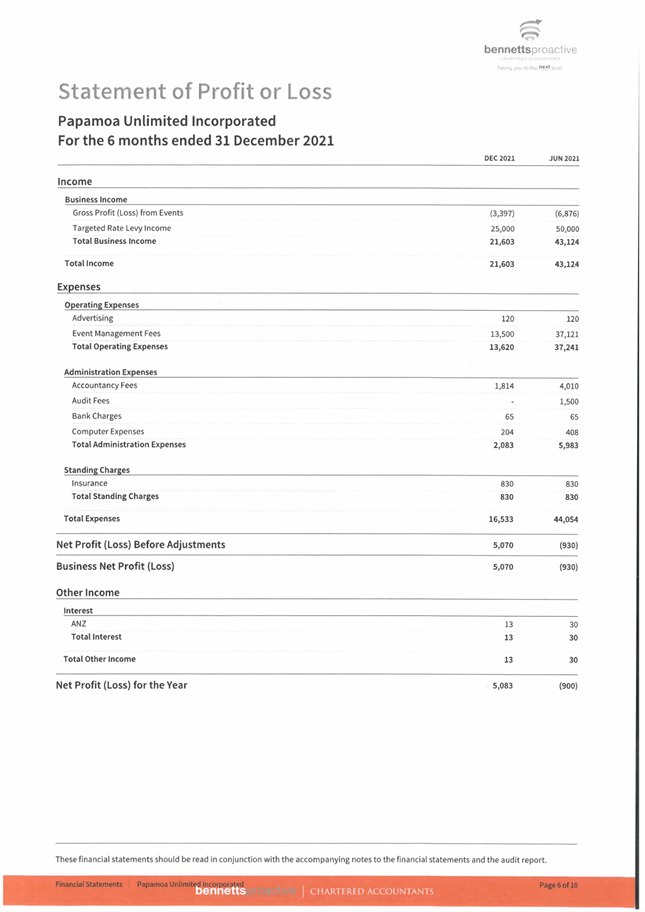

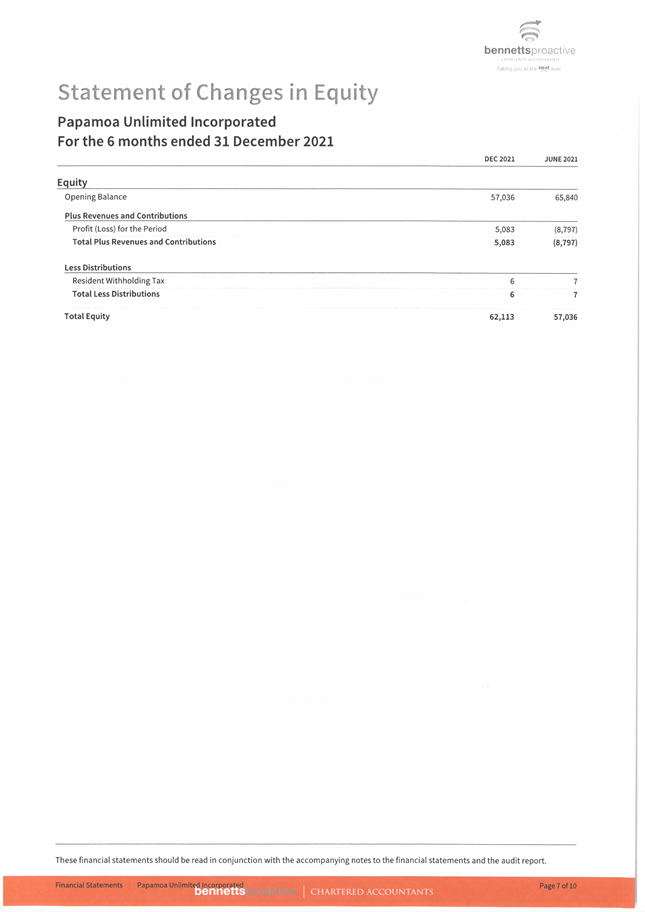

10. Audited

financial accounts were due from all mainstreet organisations by 28 January

2022.

11. Financial

statements provided by Mainstreet Tauranga, Papamoa Unlimited and Greerton

Village Mainstreet indicate that they are in good financial health, showing

annual operating surpluses and positive equity.

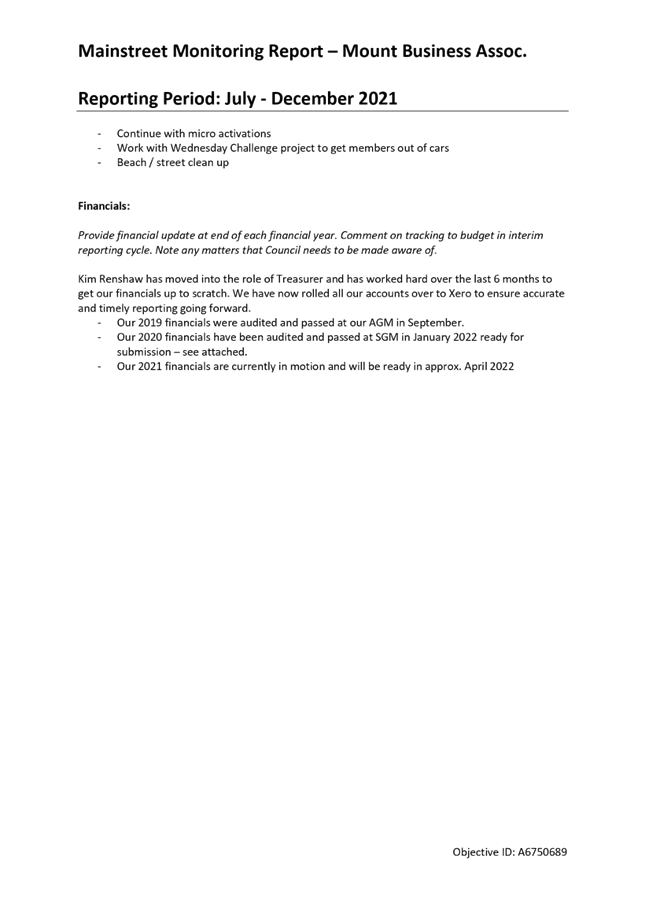

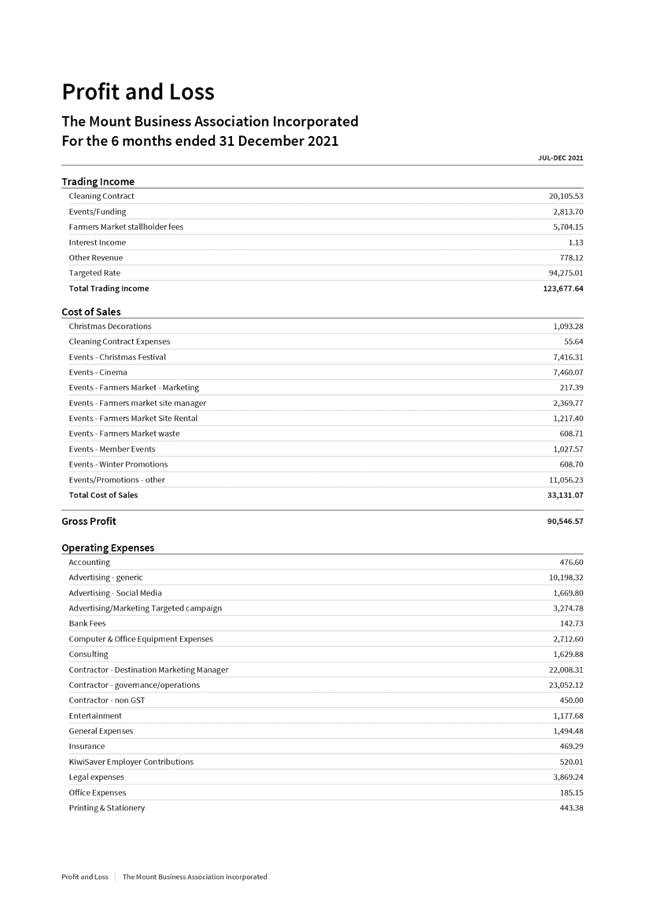

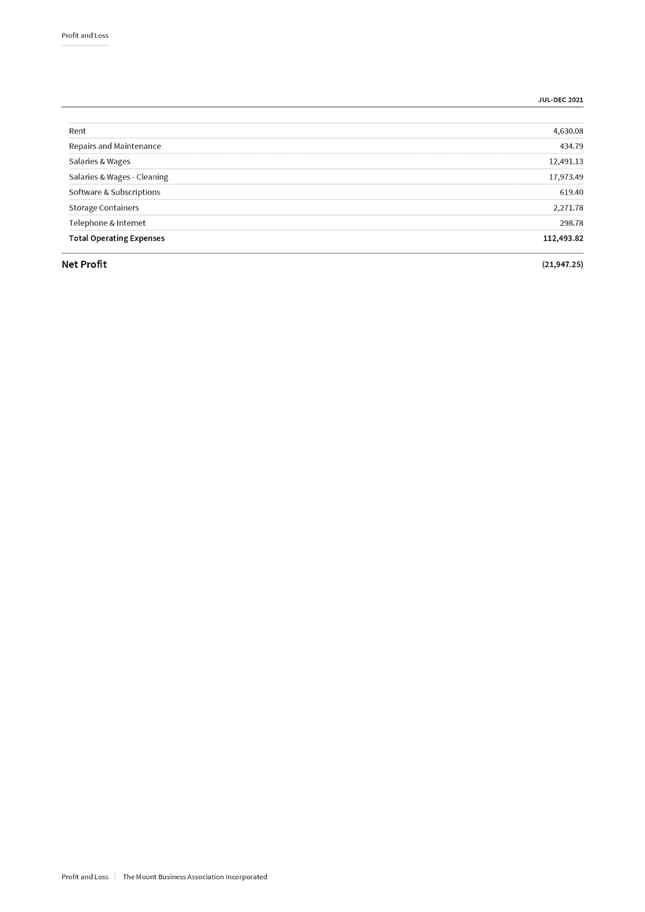

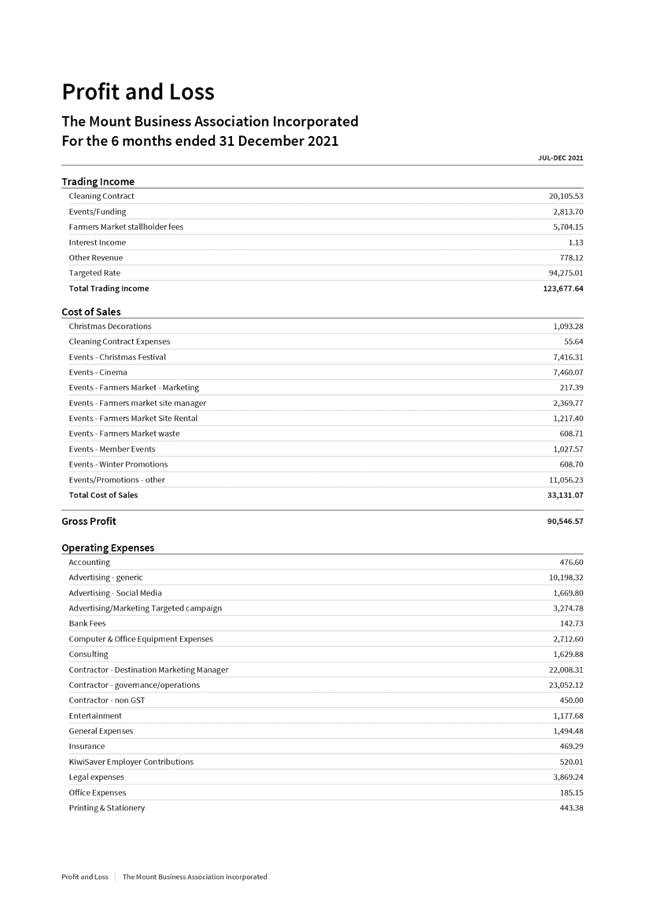

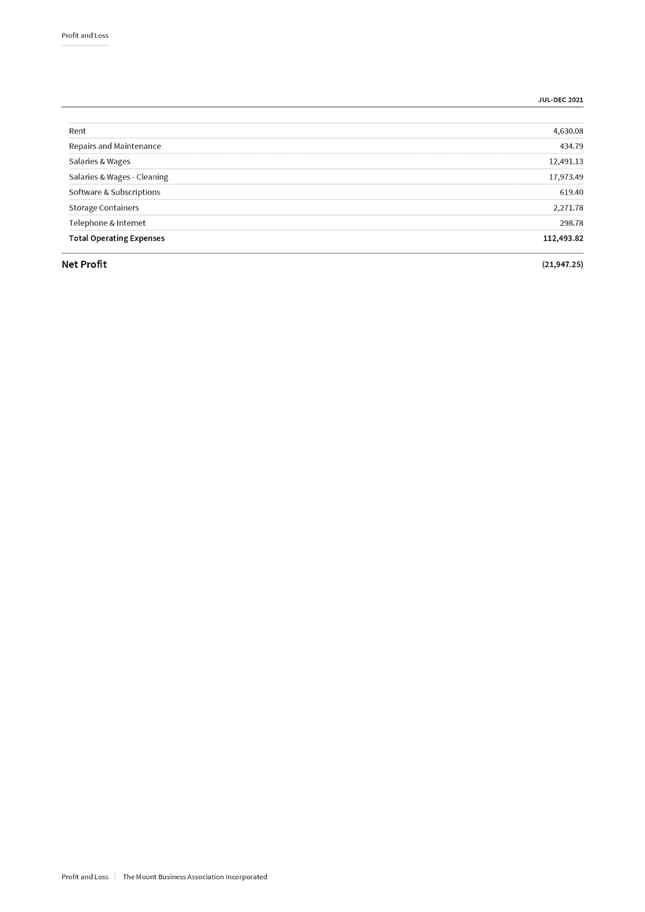

12. Mount

Business Association made a net loss of $21,947 over the last six months due to

the Board approving additional spend, above normal operating expenses, for

specific initiatives to improve service to their members. This was taken out of

reserves left over from previous years’ underspend and supports the

greater level of activity now taking place compared to previous years.

13. Activities

undertaken by all mainstreet organisations appear to be having a positive

effect on the activation and economic vibrancy of their areas, largely through

events and promotions.

14. Please

see Attachment 1 for a summary of the mainstreet reports, including issues to

present to Council.

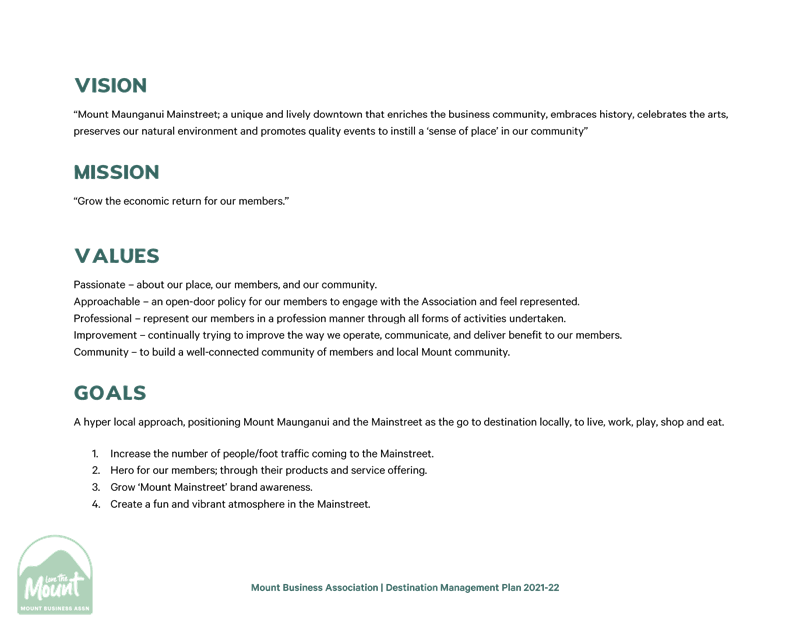

Mount Business Association:

a) The current agreement for

the delivery of mainstreet services has been in place since 1 July 2009.

Funding of $188,550 from targeted rates is provided by TCC under the agreement

for the year ended 30 June 2022.

b) It is pleasing to see that

Mount Business Association has undertaken a significant self-review, which has

led to the development of a new constitution and destination marketing

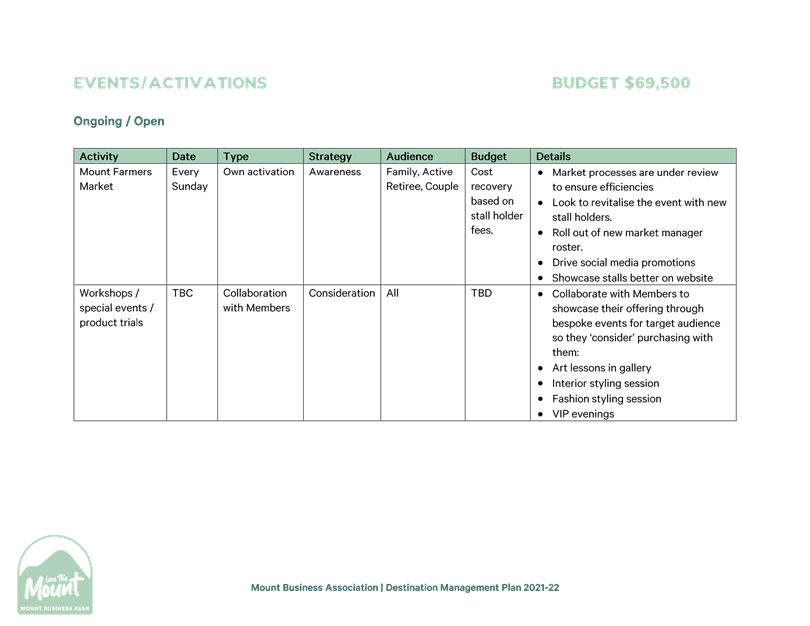

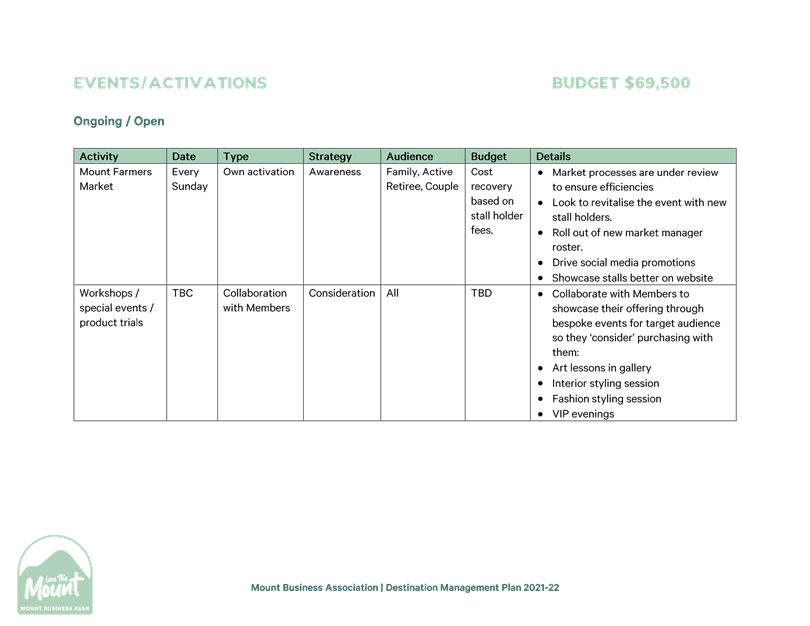

strategic plan (Attachment 2), which outlines how the targeted rate will be

spent on marketing, activations, and member engagement.

c) A Destination Marketing

Manager has been appointed on a 25 hours per week contract, along with an

Operations Manager working 4 – 6 hours per week. In addition, Kate

Barry-Piceno (Mauao Legal Chambers) has been appointed to chair a new Board.

d) Members have stuck it out

through the various COVID restrictions and have been rewarded with record

summer trading.

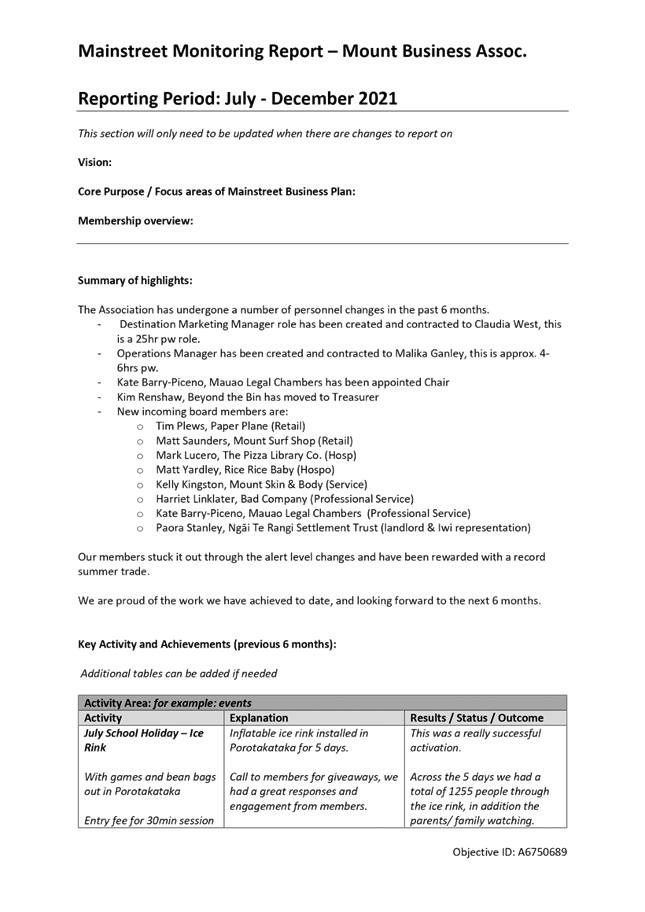

e) A number of events and

promotions have been rolled out in the first half of the year, which has proved

there is demand from the public and members for events to be held down the mainstreet,

especially those with a family focus.

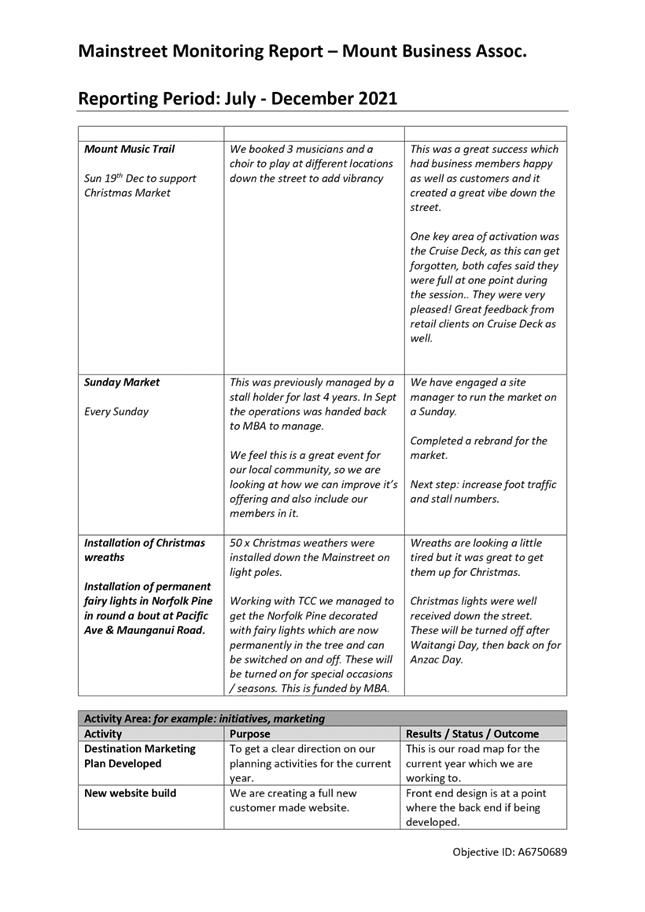

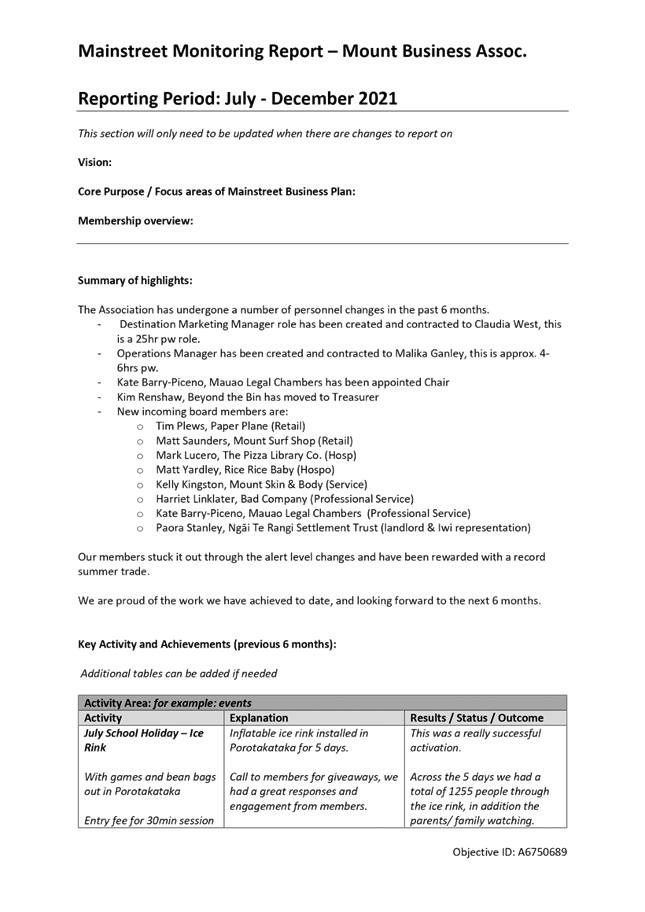

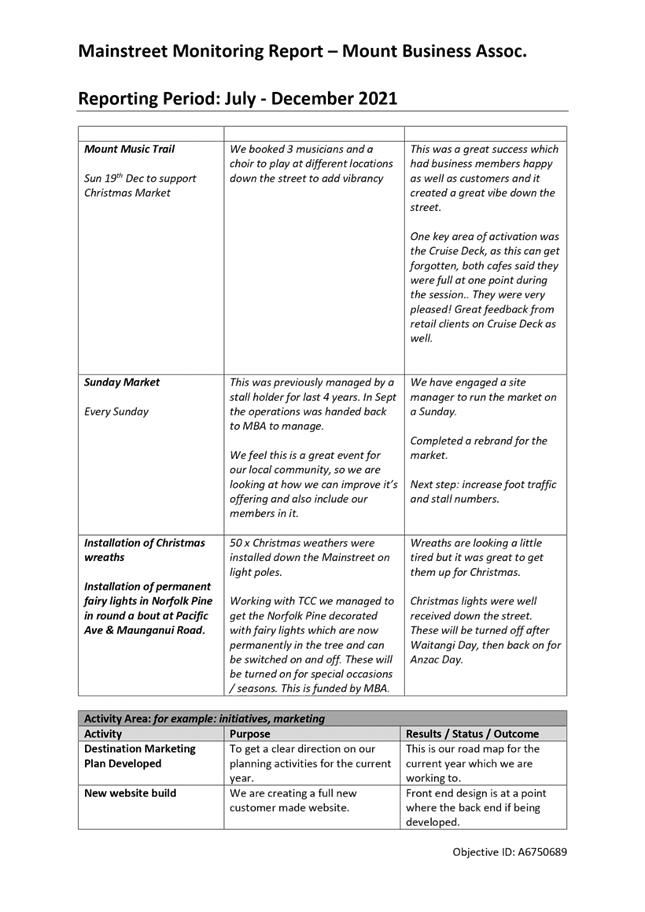

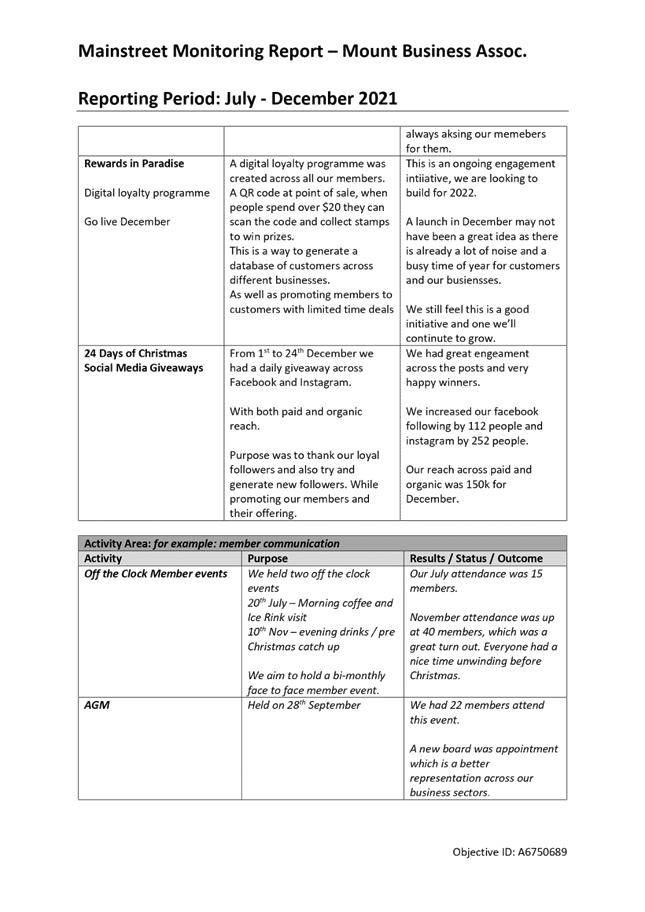

f) Highlights include

the July school holiday ice rink, Christmas activations including the Mount

Music Trail. Further details can be found in the Mount Business Association

Six-Month Monitoring Report and Profit and Loss statement for July to December

2021 (Attachment 3).

g) The “Welcome to

Paradise” marketing campaign will help drive a hyper-local approach to

promoting Mount Maunganui and its mainstreet to identified target audiences,

and growing brand awareness.

h) Key issues include street

cleanliness, overflowing rubbish bins and member engagement. This will be a

major focus over the coming year, including rebuilding trust with old members

while helping new members understand the role of the association in supporting

their business and creating a connected community.

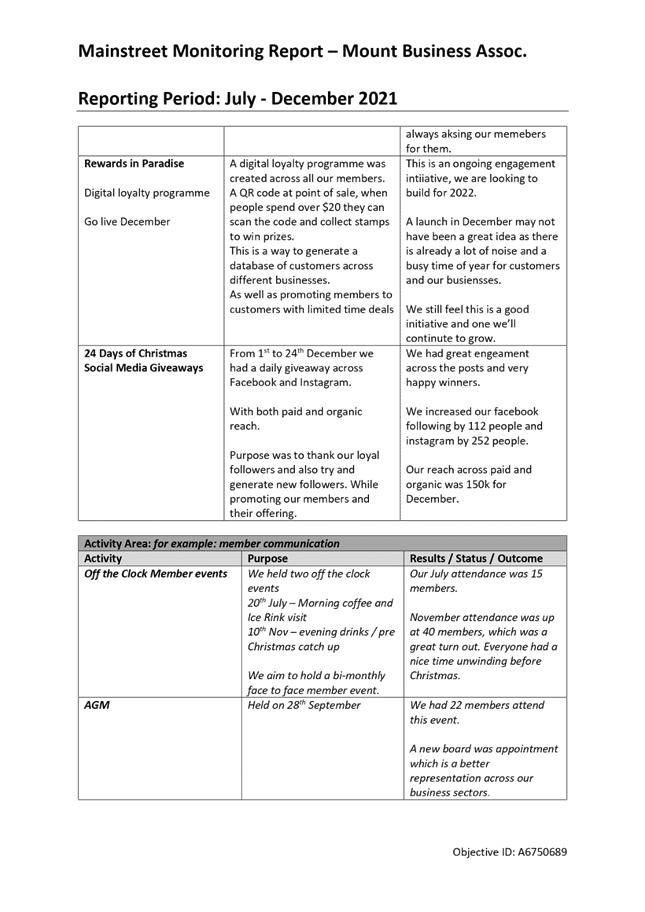

i) Mount Business

Association looks forward to working with the new City Partnerships Specialist

to develop some clear Key Performance Indicators (KPIs) but have provided a

draft of initial thinking in Attachment 4.

Mainstreet Tauranga:

a) The

current agreement for the delivery of mainstreet services has been in place

since 1 July 2009. Funding of $353,934 from targeted rates is provided by TCC

under the agreement for the year ended 30 June 2022.

b) Mainstreet

Tauranga contracts Tuskany Agency for the day-to-day management and delivery of

the mainstreet programme in downtown Tauranga. The Tuskany Agency Manager

reports to the Board of Mainstreet Tauranga.

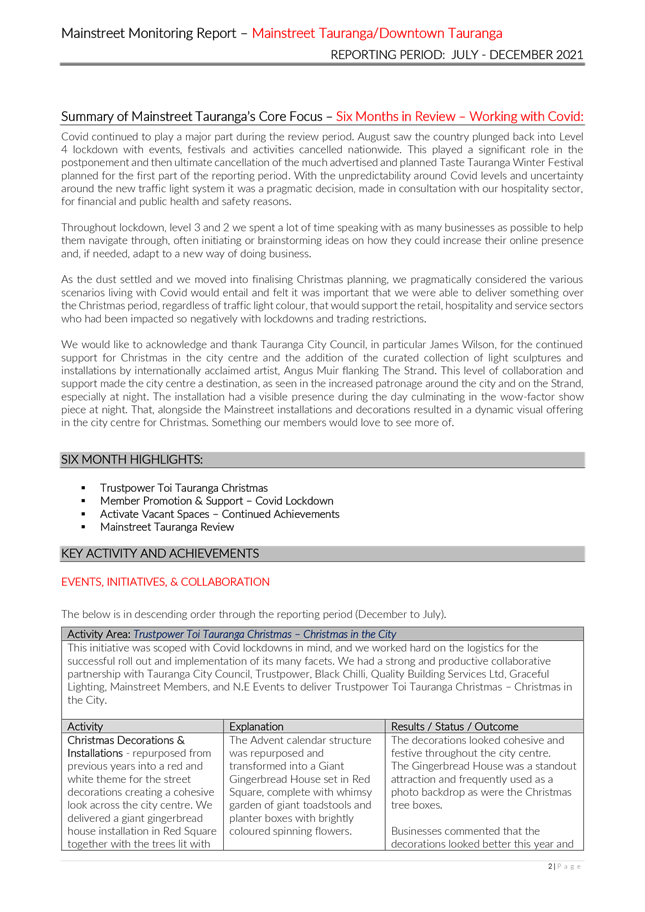

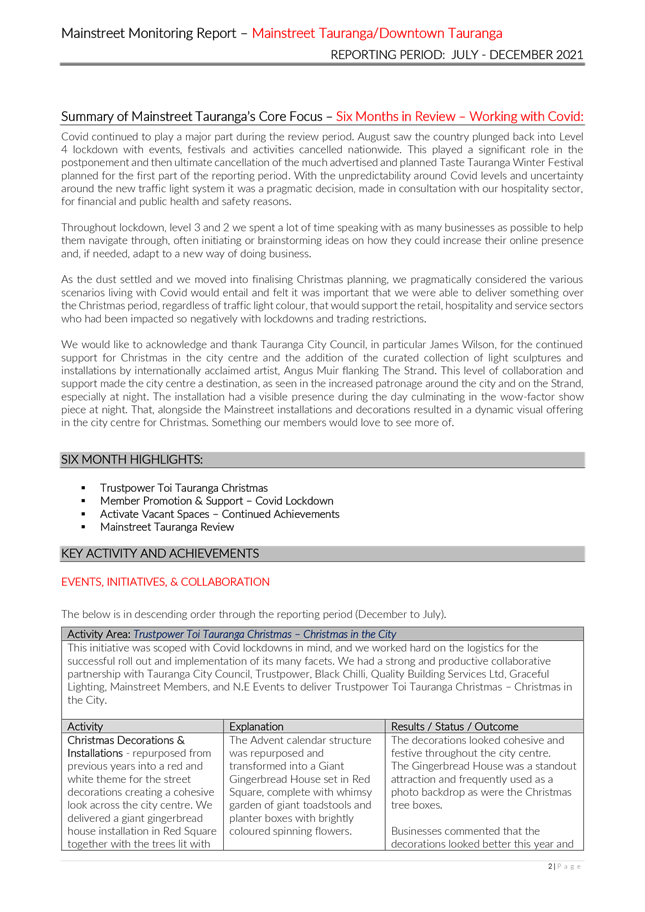

c) Highlights

from the last six months include Trustpower Toi Tauranga Christmas, member

promotion and support during the COVID lockdown period, and continued

achievements with activating vacant spaces. Further details can be found

in Mainstreet Tauranga’s Six-Month Monitoring Report and Profit and Loss

statement for July to December 2021 (Attachment 5).

d) Special

mention is made of James Wilson and TCC’s support for Christmas in the

city centre, and the addition of the curated collection of light sculptures and

installations on The Strand by internationally acclaimed artist, Anguis Muir.

This resulted in increased foot traffic around the city and on The Strand,

especially at night, and is something members would like to see more of.

e) Key issues for

Mainstreet Tauranga are:

· Seismic strengthening of Elizabeth and Spring Street car

park buildings.

· Lack of foot traffic counters, despite budget being

allocated to Tauranga Traffic Operations Centre (TTOC) in the Long-term Plan.*

· Accurate city centre parking data collection.

· New

initiatives from Council to replace Activate Vacant Spaces.

· Rough

sleeping issues with one individual – since resolved.

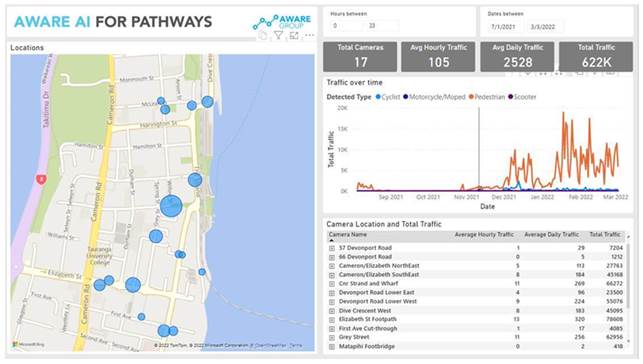

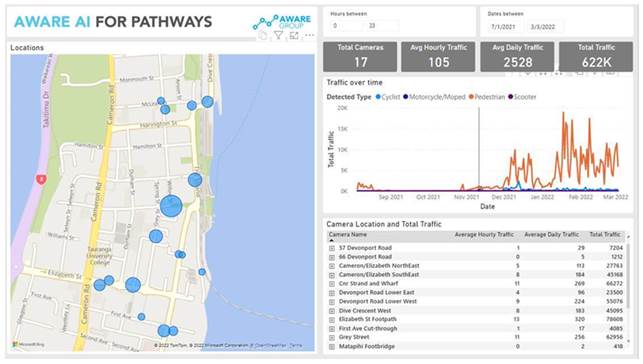

* An update from TTOC

indicates that 17 foot traffic counters have been installed and are now operational

and collecting data (see below). The Asset Management team are trying to fill a

vacancy for a data scientist to turn the data into a dashboard. This has been

communicated to Mainstreet Tauranga staff.

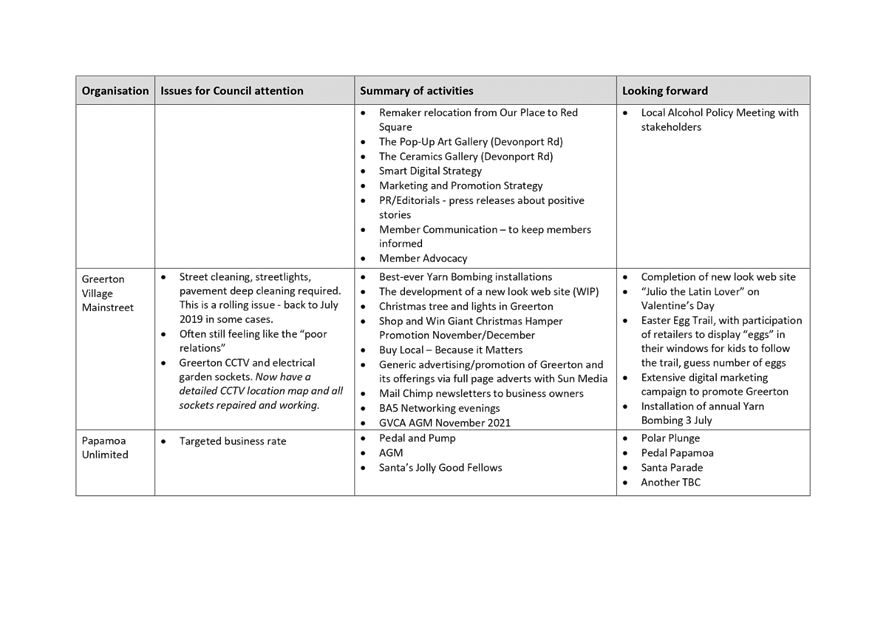

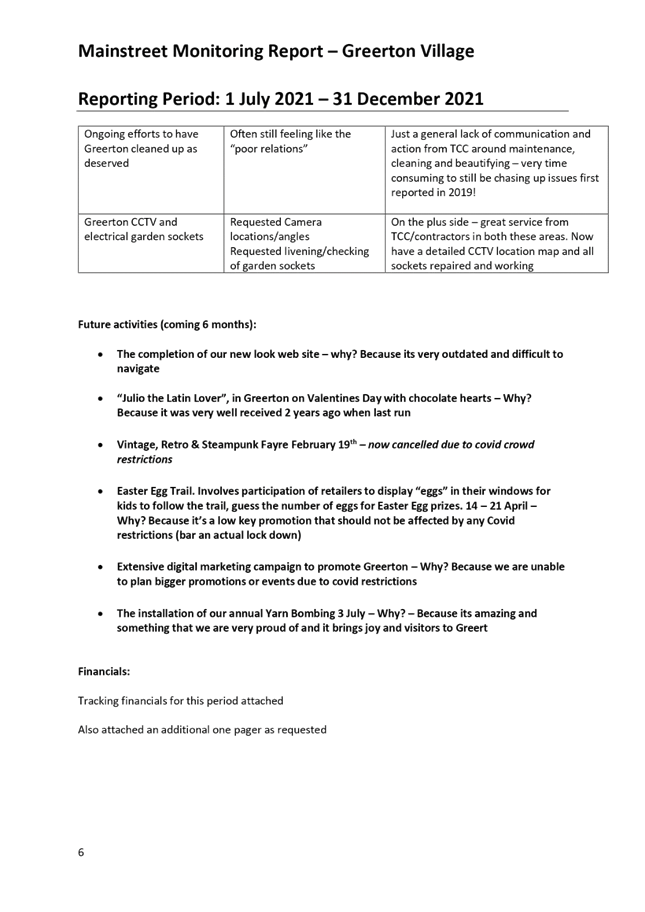

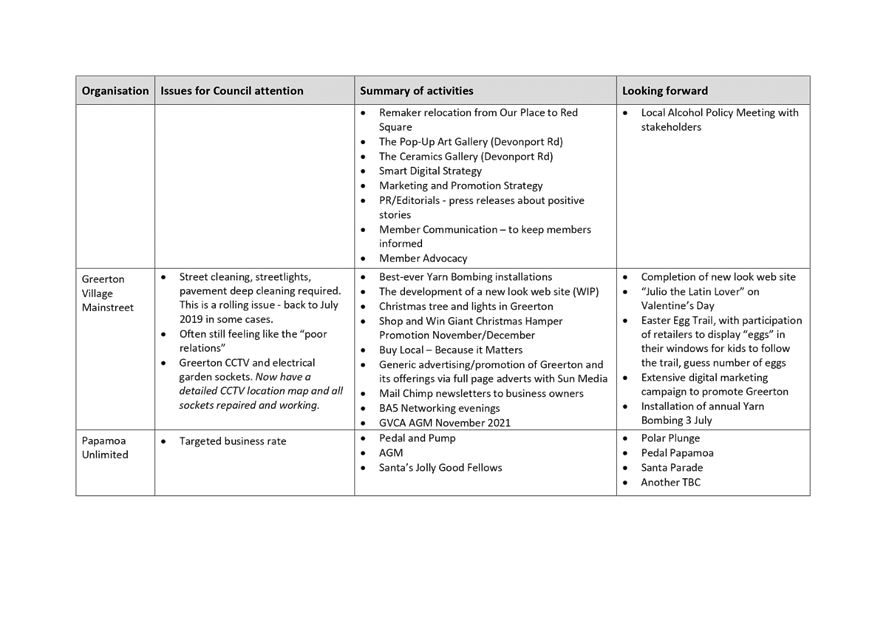

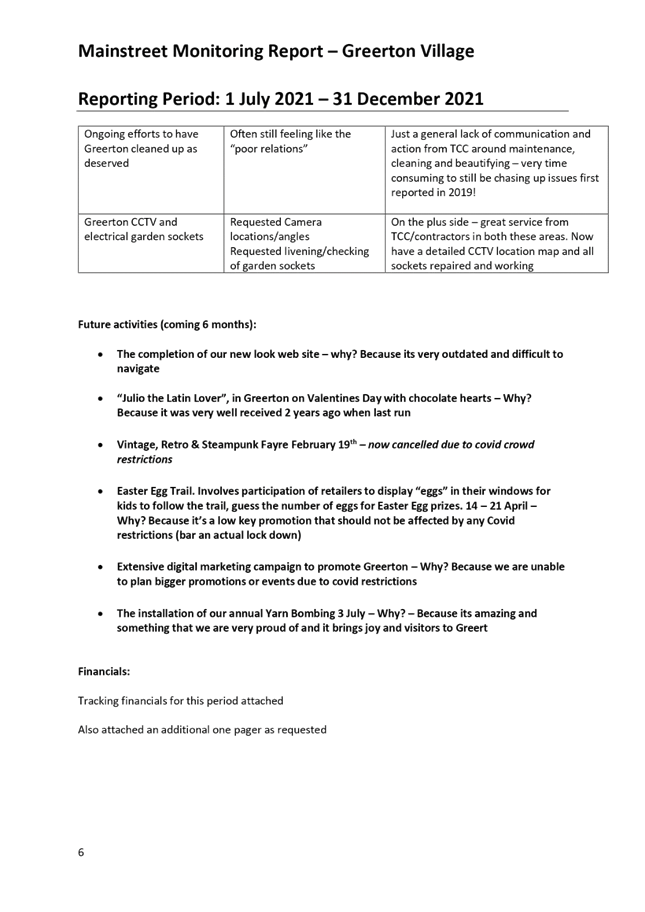

Greerton Village Mainstreet:

a) The current agreement for

the delivery of mainstreet services has been in place since 1 July 2011.

Funding of $134,672 from targeted rates is provided by TCC under the agreement

for the year ended 30 June 2022.

b) Greerton Village

Mainstreet employs a manager who is responsible to the organisation’s

Board for the day-to-day delivery of the mainstreet programme in Greerton,

including a range of events and promotions designed to attract people to the

Greerton business area.

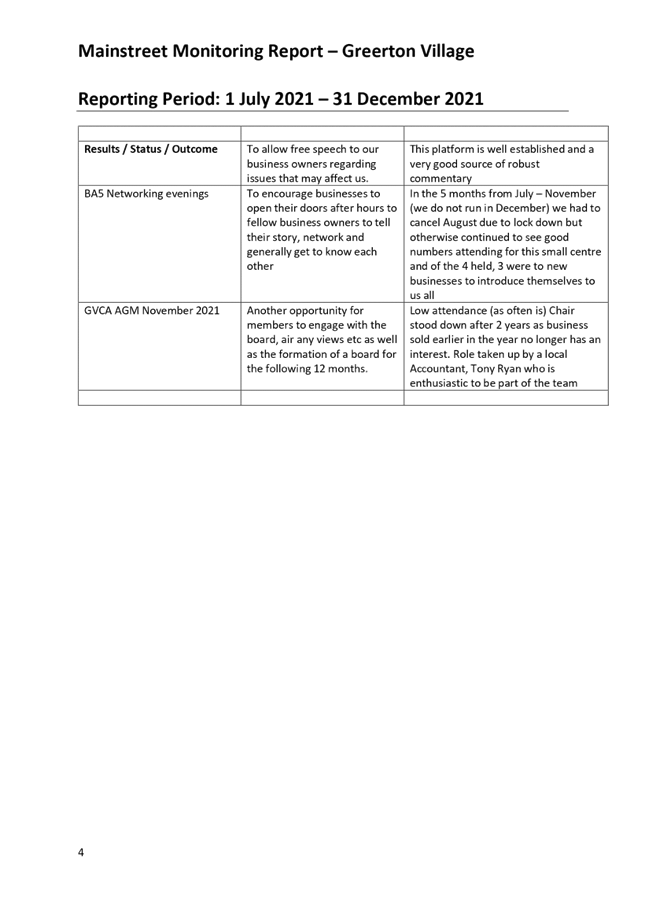

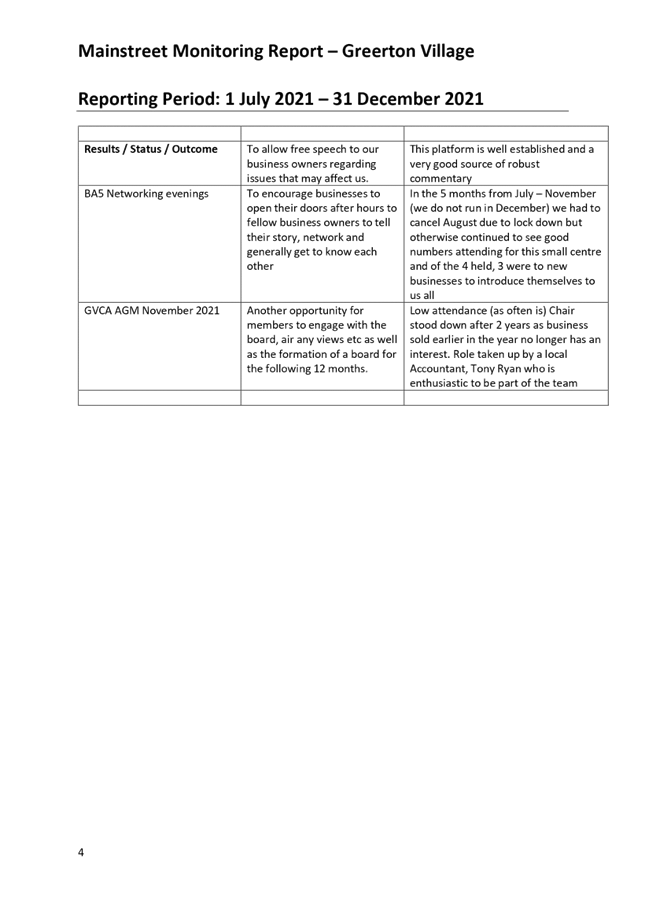

c) This reporting period has

been a particularly challenging one for Greerton Village Mainstreet, with the

cancellation of many planned events and promotions mainly due COVID

restrictions, and a downturn in foot traffic and turnover for mainstreet

businesses. Further details can be found in the Greerton Village Mainstreet

Six-Month Monitoring Report and Profit and Loss statement for July to December

2021 (Attachment 6).

d) Highlights include the

Yarn Bombing installations in July, the Christmas lights (installed by

volunteers), and the support of over 60 businesses for the Giant Christmas

Hamper promotion.

e) There continue to be issues with pavement

deep cleaning, street cleaning, and streetlight cleaning. While the TCC

Transportation team are now working with Greerton Village Mainstreet on ongoing

‘tidy-up’ maintenance work, including streetlights, pavements, and

benches, this has taken much longer than Greerton Village Mainstreet had hoped,

leaving them feeling like the “poor relations”.

f) On the plus side, Greerton Village

Mainstreet has received great service from TCC and contractors re the

installation of additional CCTV cameras and checking of garden sockets.

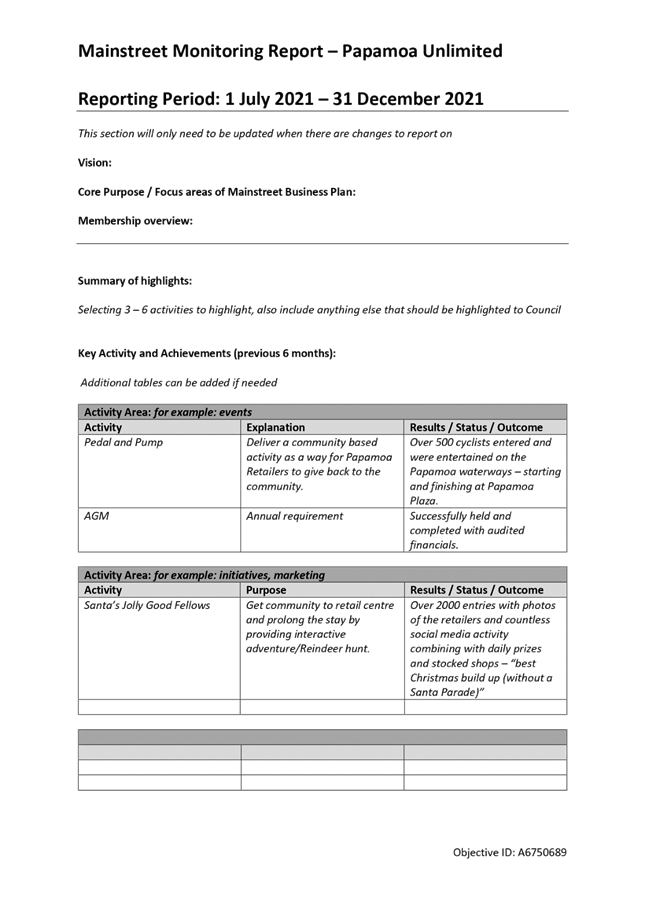

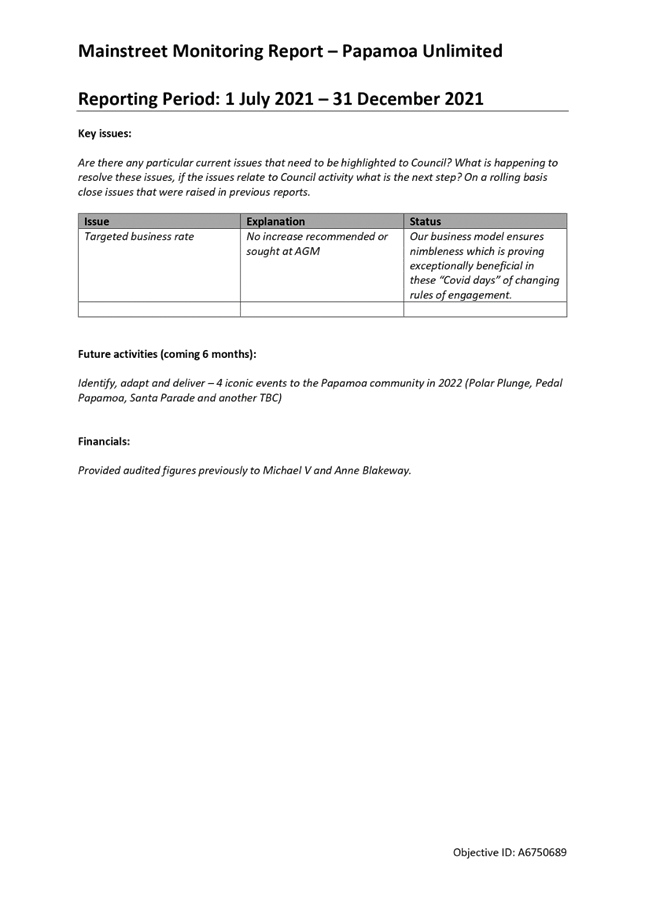

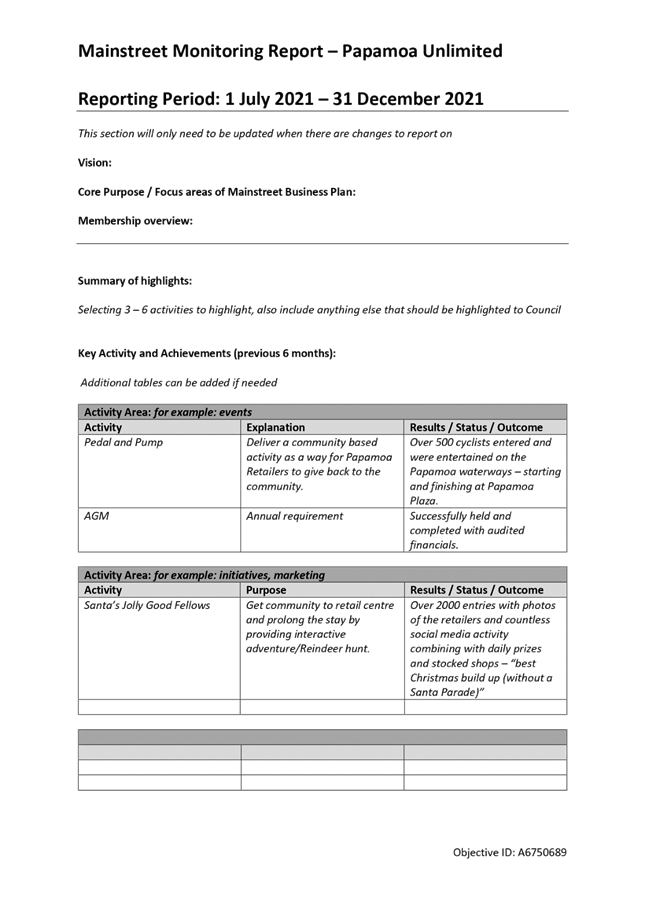

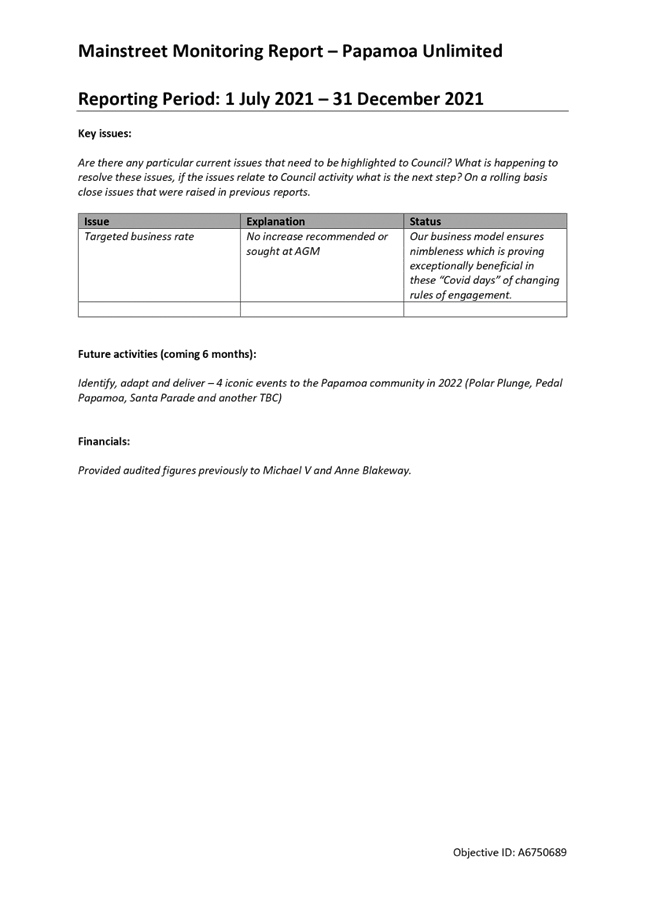

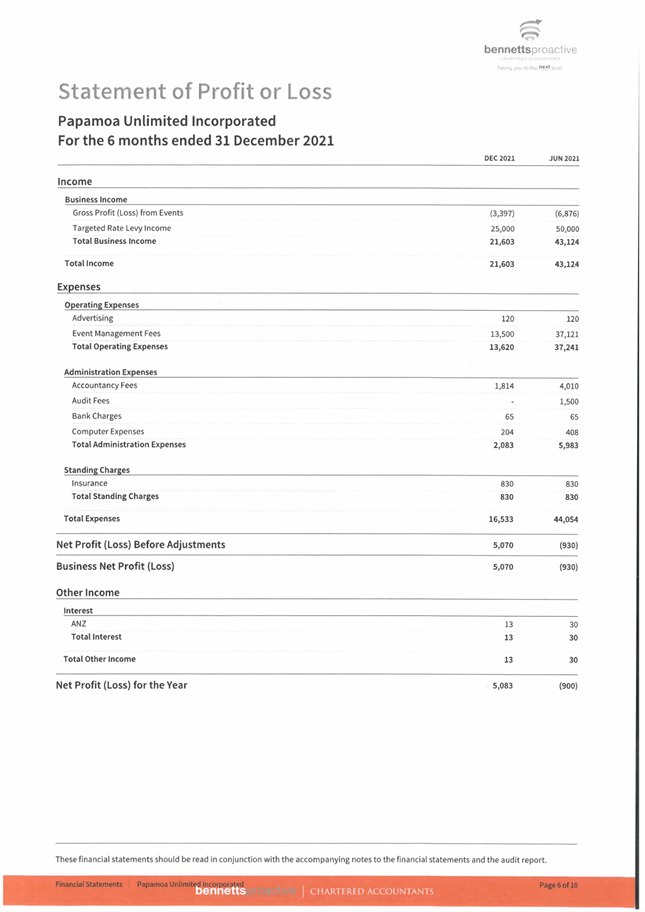

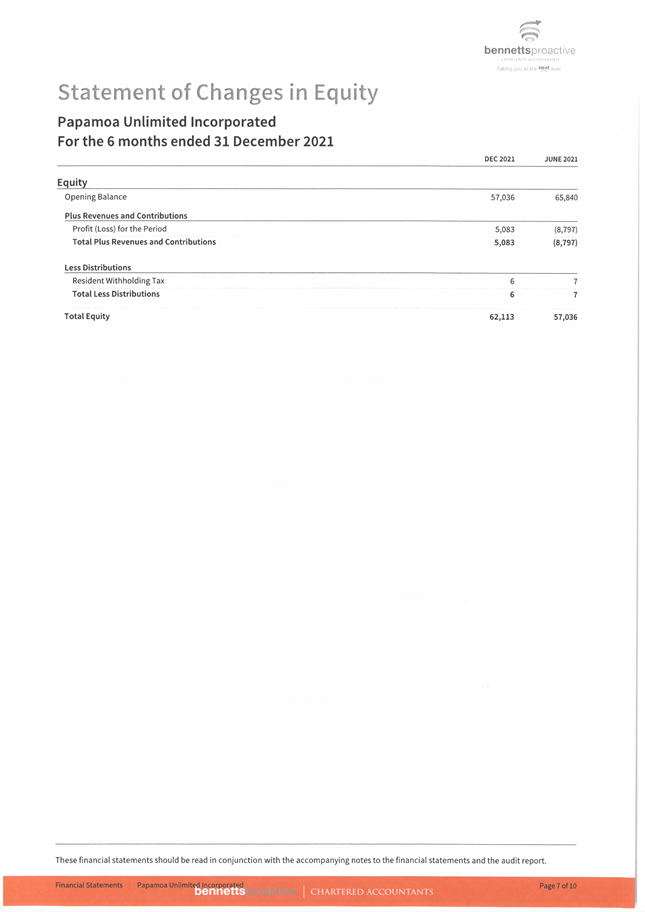

Papamoa Unlimited:

a) The current agreement for

the delivery of mainstreet services has been in place since 1 July 2014.

Funding of $50,000 from targeted rates is provided by TCC under the agreement

for the year ended 30 June 2022.

b) Papamoa Unlimited is

managed by a volunteer chair who engages a contractor to assist with the

running of events. The sole focus of Papamoa Unlimited is to hold three or four

community events each year. An element of each event occurs within the Papamoa

business area and as such, attracts people to that location and in doing so,

promotes the business area as well as the vibrancy of Papamoa generally.

c) Highlights for this period include Pedal

and Pump and Santa’s Jolly Good Fellows. Financial results impacted by

the cancellation of events due to the uncertainty of changing alert levels and

corresponding restrictions on numbers. Further details can be found in the

Papamoa Unlimited Six-Month Monitoring Report and Profit and Loss statement for

July to December 2021 (Attachment 7).

d) No increase in the targeted business rate

was recommended or sought at the AGM. Papamoa Unlimited feels that its business

model ensures agility, which has proven to be beneficial during the COVID

pandemic.

Strategic / Statutory

Context

15. The City Centre

Strategy (2012), which is currently under review, is relevant to Mainstreet

Tauranga to the extent that its vision is to create a thriving commercial

centre. Specific actions may be assigned to Mainstreet Tauranga to implement as

a key strategy stakeholder.

16. In terms of

TCC’s community outcomes that were in the Long-term Plan 2021-2031,

well-run mainstreet programmes make a worthwhile contribution to city centre

vibrancy and to “a city that is well planned with a variety of

successful and thriving compact centres and resilient infrastructure.”

17. Well-run mainstreet programmes

also have a key role in making a significant contribution “to

the social, economic, cultural and environmental well-being of the

region.”

Financial Considerations

18. Mainstreet

organisations receive a targeted rate through Council, as detailed above,

totalling $727,156 per annum across the four organisations.

19. It is difficult to

measure the outcomes achieved by the mainstreet programmes in economic terms,

meaning that generally only anecdotal and informal measures of success are

available. However, informal measures, such as estimated numbers of people

attending events, to determine if customer foot traffic or turnover was

improved by events and promotions etc., are useful, providing they are

objective.

20. One task for the new City Partnerships

Specialist will be to undertake independent surveys of retailers as a method of

determining the success of the mainstreet programmes.

Legal Implications /

Risks

21. Each

of the mainstreet organisations has met their funding agreement requirements by

providing Council with their half yearly reports for 1 July 2021 to 31 December

2021.

Consultation /

Engagement

22. It

is not required or expected to consult on half yearly reports under the Local

Government Act 2002.

Significance

23. The Local

Government Act 2002 requires an assessment of the significance of matters,

issues, proposals and decisions in this report against Council’s Significance

and Engagement Policy. Council acknowledges that in some

instances a matter, issue, proposal, or decision may have a high degree of

importance to individuals, groups, or agencies affected by the report.

24. In

making this assessment, consideration has been given to the likely impact, and

likely consequences for:

(a) the current and future social,

economic, environmental, or cultural well-being of the district or region

(b) any

persons who are likely to be particularly affected by, or interested in, the

matter.

(c) the capacity of the local authority to

perform its role, and the financial and other costs of doing so.

25. In

accordance with the considerations above, criteria and thresholds in the

Significance and Engagement Policy, it is considered that the decision is of

low significance as the receipt of the half yearly reports and the activities

of the mainstreet organisations would have an impact on a sub group of people

within the city and it is likely these documents will be of moderate public

interest.

ENGAGEMENT

26. Taking

into consideration the above assessment, that the matter is of low significance,

officers are of the opinion that no further engagement is required prior to

Council making a decision.

Next Steps

27. Feedback

will be provided to the mainstreet organisations at the Strategy, Finance and

Risk Committee meeting on 28 March 2022, when representatives from each of the

mainstreets will talk to their reports (for a maximum of 10 minutes).

28. The

City Partnerships Specialist commences on 14 March 2022 and will begin work on

developing and implementing a new accountability regime (including new KPIs),

as outlined in the recent review of the mainstreets. This will include the

development of a letter of expectation as the mechanism for ensuring strategic

alignment between the mainstreet organisations and TCC.

29. The

City Partnerships Specialist will also review the existing arrangements with

the mainstreet organisations to reflect the proposed accountability regime, and

to standardise, where possible, the terminology in the agreements.

Attachments

1. Mainstreet

Monitoring Report - Summary for July to December 2021 - A13242895 ⇩

2. Mount

Business Association - Destinating Marketing Plan 2021/2022 - A13240926 ⇩

3. Mount

Business Association Monitoring Report - July to December 2021 - A13273617 ⇩

4. Mount

Business Association Draft KPIs - A13273618 ⇩

5. Mainstreet

Tauranga Monitoring Report - July to December 2021 - A13240903 ⇩

6. Greerton

Village Mainstreet Monitoring Report - July to December 2021 - A13273608 ⇩

7. Papamoa Unlimited

Monitoring Report - July to December 2021 - A13273619 ⇩

|

Strategy, Finance and Risk

Committee Meeting Agenda

|

28 March 2022

|

|

Strategy, Finance and Risk Committee

Meeting Agenda

|

28 March 2022

|

|

Strategy, Finance and Risk Committee

Meeting Agenda

|

28 March 2022

|

|

Strategy, Finance and Risk Committee

Meeting Agenda

|

28 March 2022

|

|

Strategy, Finance and Risk Committee

Meeting Agenda

|

28 March 2022

|

|

Strategy, Finance and Risk Committee

Meeting Agenda

|

28 March 2022

|

|

Strategy, Finance and Risk Committee

Meeting Agenda

|

28 March 2022

|

8.2 Audit

New Zealand Report on the Audit of Tauranga City Council for the year ended 30

June 2021 and Audit Plan for the year ended 30 June 2022

File

Number: A13295052

Author: Kathryn

Sharplin, Manager: Finance

Authoriser: Paul

Davidson, General Manager: Corporate Services

Purpose

of the Report

1. This

report presents the Audit New Zealand report to the commissioners on the audit

of Tauranga City Council for the year ended 30 June 2021, along with council

comments on recommended improvements. The Plan for the audit of Tauranga

City Council for the year ended 30 June 2022 is also presented. Audit

Director Clarence Susan will be in attendance for discussion of any of the

matters raised in the report and attachments.

|

Recommendations

That the Strategy, Finance

and Risk Committee:

(a) Receives

the report - Audit New Zealand Report on the Audit of Tauranga City Council

for the year ended 30 June 2021 and Audit Plan for the year ended 30 June

2022

|

Executive

Summary

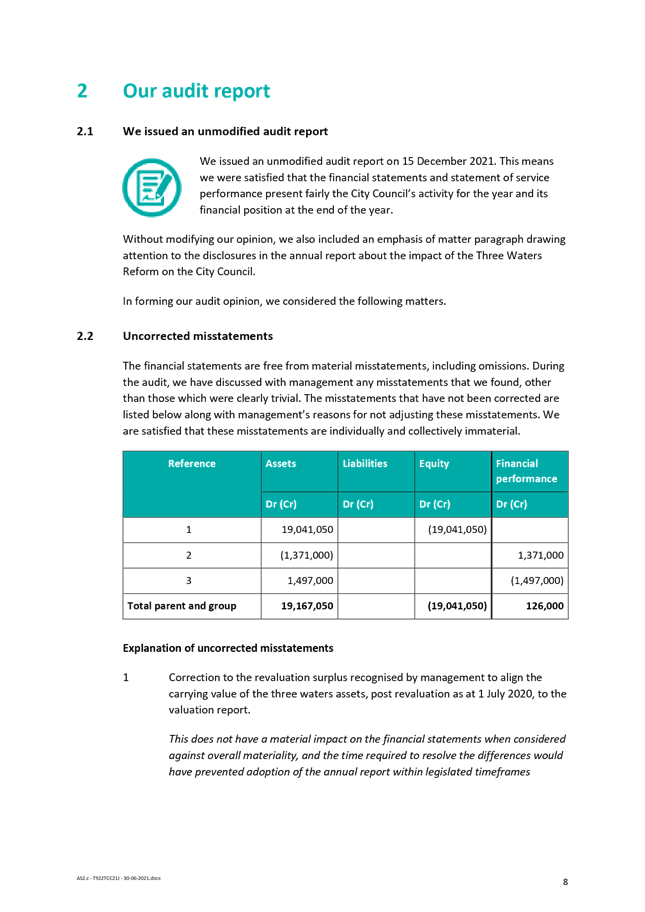

2. Audit

New Zealand has completed its audit of Tauranga City Council (TCC)for the year

ended 30 June 2021.

3. The

audit report outlines matters identified during the audit, makes

recommendations and includes council comments on these recommendations.

An update on matters identified during the previous audit are also provided.

4. Audit

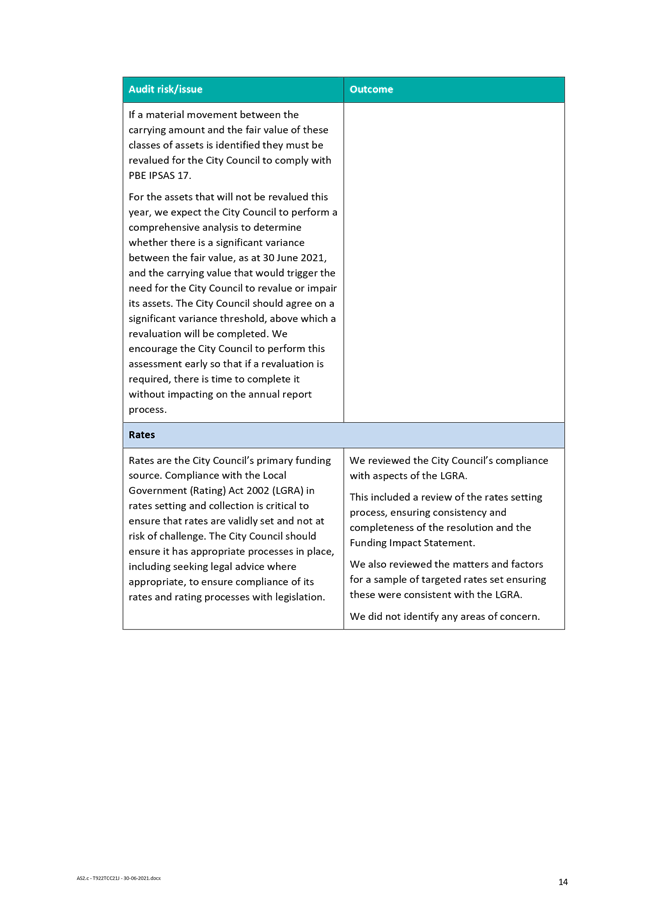

New Zealand has also provided a plan for the audit of TCC for 2022. Focus

for this year continues to be assets including capitalisation including large

capital projects and digital investment relating to software as a service.

Background

5. Audit New Zealand

has completed its audit of TCC for the year ended 30 June 2021. An unmodified

audit opinion was given for the adoption of the 2021 Annual report on 15

December 2021, which included an emphasis of matter paragraph regarding the

Government’s announcement on the three waters reform programme.

6. The audit report

outlines matters identified during the audit, makes recommendations and

includes council comments on these recommendations. An update on matters

identified during the previous audit is also provided.

7. Audit

New Zealand provides recommendations for improvement and prioritises these as

urgent, necessary, or beneficial.

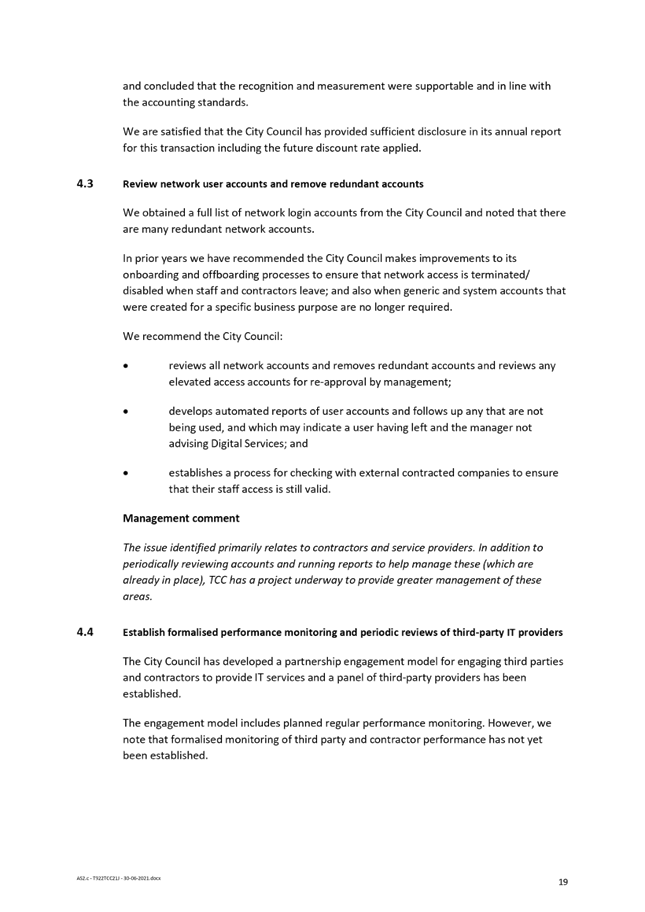

8. No

urgent recommendations were made. Eleven necessary recommendations were made as

outlined on pages 5 and 6 of the attached report. Of these, six related

to improvements related to asset and project accounting. The other 5 related to

a range of internal controls and processes across the business. Audit NZ

recommends that necessary recommendations are addressed within 6 months.

9. In

response to the identified matters and the challenges of delivering the annual

report, council has focussed additional resource in the asset and financial

accounting area. It is expected that some of the matters will be

addressed in time for the next annual report, while others will take longer to

implement. The very late adoption of the annual report in December 2021

has a flow on impact to the timing of improvements.

10. The

attached audit report includes council’s comments on proposed actions

against each of the new matters raised by Audit New Zealand.

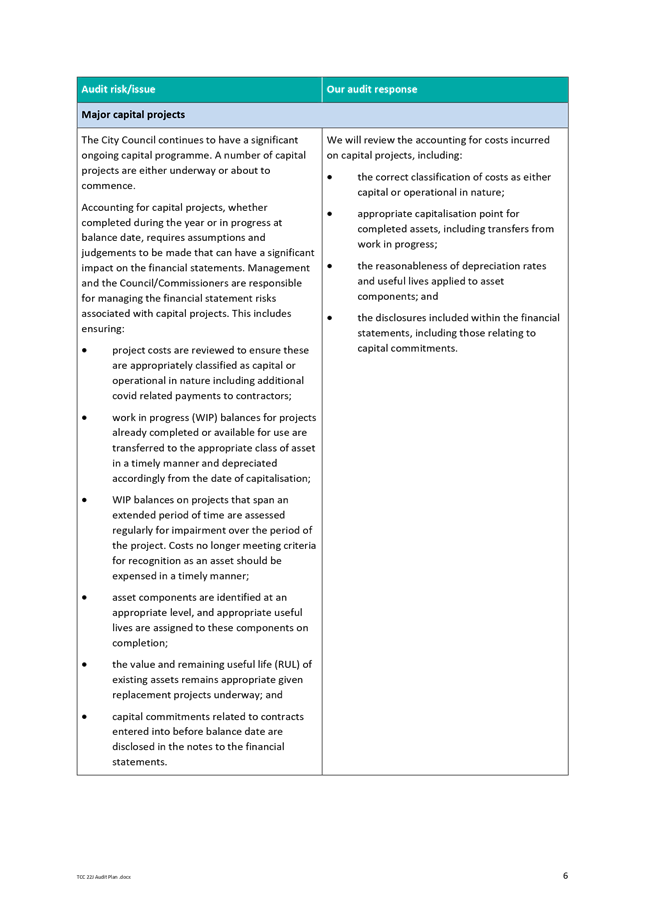

The audit plan for 2022 identifies key matters for attention

during the Audit for the year to 30 June 2022. Focus for this year continues to

be on assets including:

1. treatment

of expenditure on software as a service and what we capitalise

2. accounting

for large capital projects – costs and whether they are operational or

capital in nature, and the timeliness of capitalisation

3. revaluations

of roading and marine assets

4. three

waters

5. confirmation

that other asset classes, particularly three waters, have not moved materially

from current values.

Strategic / Statutory

Context

11. The

audit report is part of the processes of Financial accounting and reporting set

out under the Local Government Act 2002.

Options Analysis

12. There

are no options presented in this report.

Financial Considerations

13. The

recommendations of the audit report include recommendations regarding asset

accounting and other internal controls and reporting requirements which will be

addressed by the finance team going forward.

Legal Implications /

Risks

14. There

are no specific legal implications or risks as a result of this report.

Consultation /

Engagement

15. There

is no consultation required as a result of this report.

Significance

16. The

Local Government Act 2002 requires an assessment of the significance of

matters, in this report against Council’s Significance and Engagement

Policy. Council acknowledges that in some instances a matter, may have a

high degree of importance to individuals, groups, or agencies affected by the

report.

17. In

making this assessment, consideration has been given to the likely impact, and

likely consequences for:

(a) the current

and future social, economic, environmental, or cultural well-being of the

district or region

(b) any persons who are likely to be

particularly affected by, or interested in, the .

(c) the capacity of the local authority to

perform its role, and the financial and other costs of doing so.

18. In

accordance with the considerations above, criteria and thresholds in the policy,

it is considered that the matter is of low significance.

ENGAGEMENT

19. Taking

into consideration the above assessment, that the matter is of low significance,

officers are of the opinion that no further engagement is required prior to Council

making a decision.

Next Steps

20. Council

will engage with Audit New Zealand on the interim and final audits of Tauranga

City Council in accordance with the agreed audit plan.

21. Council

will continue to work through recommendations for improvement in our processes

and reporting.

Attachments

1. Audit

New Zealand Tauranga City Council - Report to the Commissioners - 30 June 2021

- Final - A13308556 ⇩

2. Audit New Zealand

Tauranga City Council Audit Plan for 30 June 2022 - A13308560 ⇩

|

Strategy, Finance and Risk

Committee Meeting Agenda

|

28 March 2022

|

|

Strategy, Finance and Risk Committee

Meeting Agenda

|

28 March 2022

|

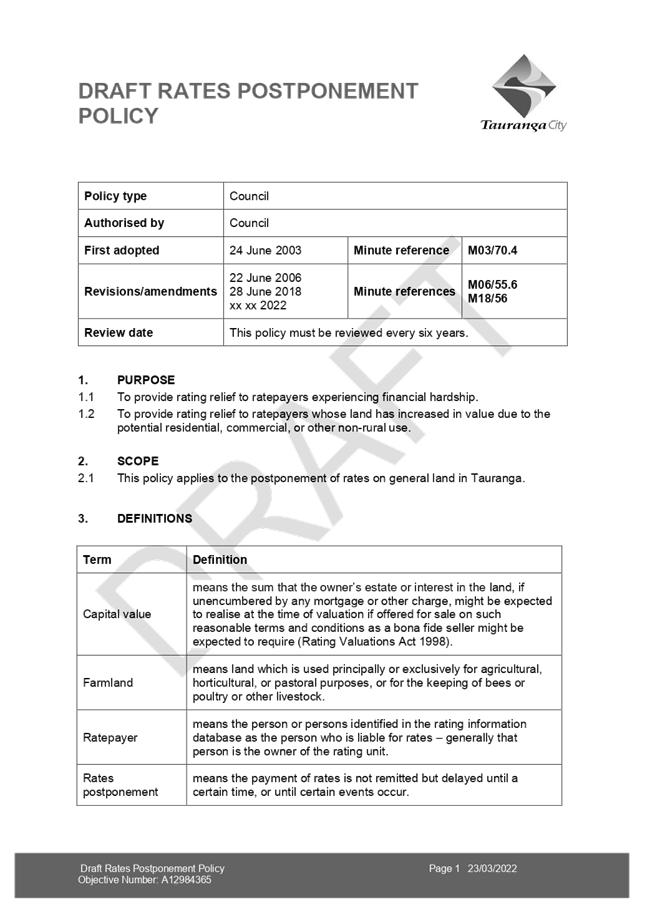

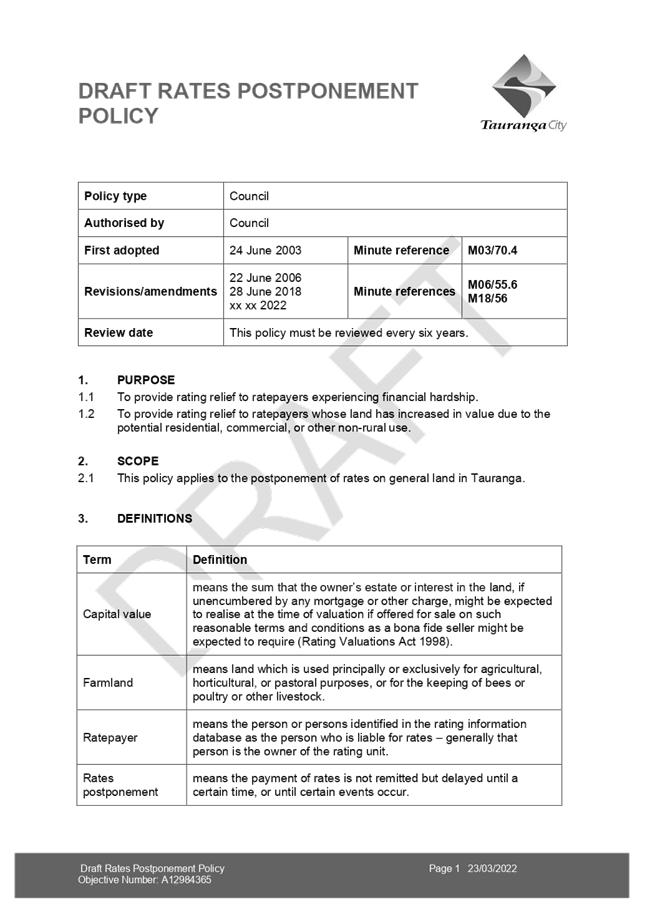

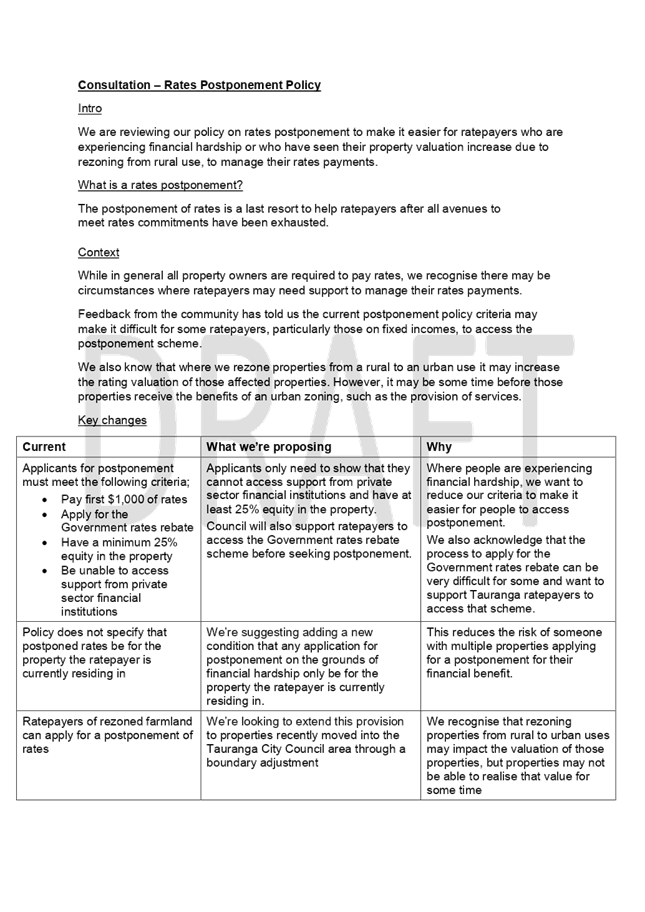

8.3 Adoption

of draft Rates Remission Policy and draft Rates Postponement Policy for

consultation

File

Number: A13167367

Author: Jim

Taylor, Transactional Services Manager

Emma Joyce, Policy Analyst

Authoriser: Paul

Davidson, General Manager: Corporate Services

Purpose

of the Report

1. To

adopt the draft Rates Remission Policy (attachment 1) and draft Rates

Postponement Policy (attachment 2) (the draft policies) for consultation.

|

Recommendations

That the Strategy,

Finance and Risk Committee:

(a) Adopt

the draft Rates Remission Policy for consultation

(b) Adopt

the draft Rates Postponement Policy for consultation.

|

Executive

Summary

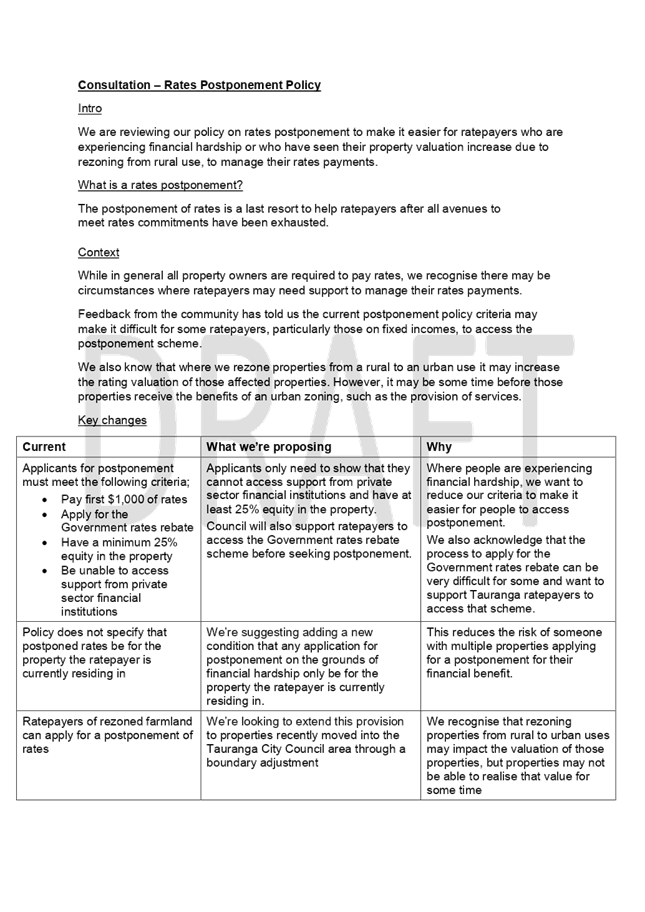

2. In

general, all ratepayers are expected to pay rates. However, rates postponement

and remission policies allow Council to recognise financial or other special

circumstances where ratepayers may require support to manage their rates payments.

In adopting the Long-term Plan 2021-2031 (LTP) and in response to public

feedback, Commissioners requested a review of council policies on the remission

and postponement of rates, particularly for those on fixed incomes.

3. Recent

legislative changes also require councils to review their policies on rates

remission and postponement to confirm they support the principles in the

Preamble to Te Ture Whenua Māori Act 1993 (TTWMA 93).

4. The

Strategy, Finance and Risk Committee (the Committee) considered a range of

options to amend the policies at its February 2022 meeting. Those amendments

have now been incorporated into draft policies for adoption. This report

recommends the Committee adopt the draft policies for consultation.

Background

5. While

there are some exceptions outlined in legislation, in general, all land is

rateable. However, there may be circumstances where ratepayers need support to

manage their rates. Councils can choose to provide for rates postponement

(whereby rates are paid at an agreed later date) or remit rates (where council

forgoes rates income) through policies stating the objectives and criteria for

postponement or remission.

6. This

council has previously recognised a need to offer rates postponement where the

ratepayer is experiencing financial hardship, and to acknowledge that Council

decisions to rezone farmland may impact the rating valuation of a property

regardless of how the ratepayer prefers to use the property. The Committee

agreed at its February 2022 meeting to remove some criteria for accessing the

postponement for financial hardship and expand the provisions for farmland to

properties recently moved into Tauranga City Council area through a boundary

adjustment.

7. The

Committee also agreed at its February 2022 meeting to introduce a temporary

partial remission for gold kiwifruit orchards. This partial remission provides

for a transition to a new rating valuation that includes the value of the

licence to grow gold kiwifruit and the planted vines. However, a recent decision

from Gisborne held that the rating valuation of gold kiwifruit orchards should not

consider the value of the licence to grow gold kiwifruit. As this may impact on

how other councils rate gold kiwifruit orchards, the policy provides for gold

kiwifruit orchards to receive 100% remission of the portion of rates relating

to the capital value component of the G3 licence in year one.

8. A

copy of the February 2022 minutes are below.

That the

Strategy, Finance and Risk Committee:

(a) Notes

that reference to the Preamble to Te Ture Whenua Māori Act 1993 will be

added to Council’s Revenue and Financing Policy.

(b) Agree

that the following matters be addressed in a draft Rates Postponement Policy

for consultation (for adoption by Council);

(i) deletion of all criteria for rates

postponement for financial hardship except the requirement for there to be at

least 25% equity in the property and that the ratepayer must not be able to

access support from private sector financial institutions.

(ii) addition a new criterion that applications for

rates postponement for financial hardship may only be for the property the

ratepayer is currently residing in.

(iii) addition of a new criterion providing for postponement

of rates on rating units where the valuation may have increased due to boundary

adjustments and re-zoning from rural to urban uses, noting that a maximum of

six years postponed rates will be due when the property is sold or developed.

(c) Agree

that the following matters be addressed in a draft Rates Remission Policy for

consultation (for adoption by Council);

(i) Addition of a provision for

partial remission of general rates and targeted rates set at the capital value

on rating units with both a license to grow gold kiwifruit and planted vines

where the rates have increased by more than the citywide average, noting that

the remission will be for the portion of rates relating to the capital value

component of the G3 licence and for a maximum of three years with 100%

remission in the 2022/2023 financial year and two thirds remission in year two

(2023/2024).

(ii) Deletion of

provisions pertaining to remission of wastewater rates for schools and

reference to remission of rates on land designated a Māori reservation.

9. The

draft policies also include an additional principle acknowledging that while

all ratepayers are required to pay rates, there may be circumstances where

ratepayers need additional support to manage payments. These principles are

consistent with the overarching principles in the Revenue and Financing Policy.

10. These

amendments are highlighted in the attached draft policies.

Options Analysis

11. The

Committee could choose to adopt the draft policies with or without amendments,

or not adopt the draft policies. The table below outlines the advantages and

disadvantages of each option.

|

Option

|

Advantages

|

Disadvantages

|

|

1

|

Adopt

the draft policies

(recommended)

|

· Consistent with

amendments approved in February 2022

· Ensures policies

are reviewed prior to 2024 to assess compliance with TTWMA 93

· Provides for

rates remission on gold kiwifruit orchards while implications

|

· Nil

|

|

2

|

Adopt

the draft policies with amendments

|

· ·

| 3 |

Do not

adopt the draft policies

|

· Nil

|

· Constrained

timeframes to consult with public before next financial year

|

Other matters

Rates Postponement Policy

12. The

draft Rates Postponement Policy includes a minor edit to make it clearer that

postponed rates are due on the sale of the property. The current wording could

be interpreted to mean that a property could be sold but the rates could

continue to be postponed if no consent in line with the revised zoning is

issued.

Rates

Remission Policy

13. As

part of the review, adjustments have been made to the amount of rates penalty

that may be remitted upon application. This means that staff will remit

penalties where the penalty is less than $50 for general rates and less than $5

for water rates. These adjustments recognise the administrative cost of

processing penalties for relatively low amounts while also providing some

relief to ratepayers.

14. In

response to feedback received from the Committee at its February 2022 meeting,

the principles have been amended to add reference to fairness and equity.

15. Minor

amendments to the draft policies have been made to include TTWMA 93 and the

Rating Valuations Act 1998 in the list of related legislation.

Strategic / Statutory

Context

16. Section 102 of the Local

Government Act 2002 allows councils to adopt policies on the remission and

postponement of rates. Where councils have adopted such policies, they must be

reviewed prior to 1 July 2024 to confirm that they support the principles in

TTWMA 93.

Financial Considerations

17. There

are no financial considerations with the recommended option.

18. Council

seeks to recover some of the costs of postponement through the application fee

and charging of interest. This reduces the potential burden on other

ratepayers.

Legal Implications /

Risks

19. The

ability to remit 100% of rates attributed to the G3 licence acknowledges the

recent Land Valuation Tribunal decision that the licence is not an improvement

for the land or for the benefit of the land.

Consultation /

Engagement

20. No

specific consultation or engagement was undertaken in preparing the draft

policies. Council committed to a review of the rates postponement policy in

response to concerns that rates increases were placing a burden on persons with

fixed incomes.

21. Consultation

on the draft policies is required to be undertaken in accordance with section

82 of the Local Government Act 2002. The draft consultation material is

appended at attachment 3 for information.

Significance

22. The

Local Government Act 2002 requires an assessment of the significance of

matters, issues, proposals and decisions in this report against Council’s

Significance and Engagement Policy. Council acknowledges that in some

instances a matter, issue, proposal or decision may have a high degree of

importance to individuals, groups, or agencies affected by the report.

23. In

making this assessment, consideration has been given to the likely impact, and

likely consequences for:

(a) the current

and future social, economic, environmental, or cultural well-being of the

district or region

(b) any persons who are likely to be particularly

affected by, or interested in, the decision.

(c) the capacity of the local authority to

perform its role, and the financial and other costs of doing so.

24. In

accordance with the considerations above, criteria and thresholds in the policy,

it is considered that the decision is of low significance. However, it is noted

that the remission and postponement of rates is a matter of medium

significance.

ENGAGEMENT

25. Taking

into consideration the above assessment, that the decision is of low significance,

officers are of the opinion that no further engagement is required prior to

Council making a decision on adoption of the draft policies.

Next Steps

26. Consultation

on the draft policies will take place in May 2022. Feedback relating to rates

postponement or remission received during the annual plan process will also be

considered as feedback for this policy review.

Attachments

1. Draft

Rates Remission Policy 2022 - A12984594 ⇩

2. Draft

Rates Postponement Policy 2022 - A12984365 ⇩

3. Draft

Consultation Material - Rates Remission and Rates Postponement Policies -

A13285446 ⇩

|

Strategy, Finance and Risk

Committee Meeting Agenda

|

28 March 2022

|

|

Strategy, Finance and Risk Committee

Meeting Agenda

|

28 March 2022

|

|

Strategy, Finance and Risk Committee

Meeting Agenda

|

28 March 2022

|

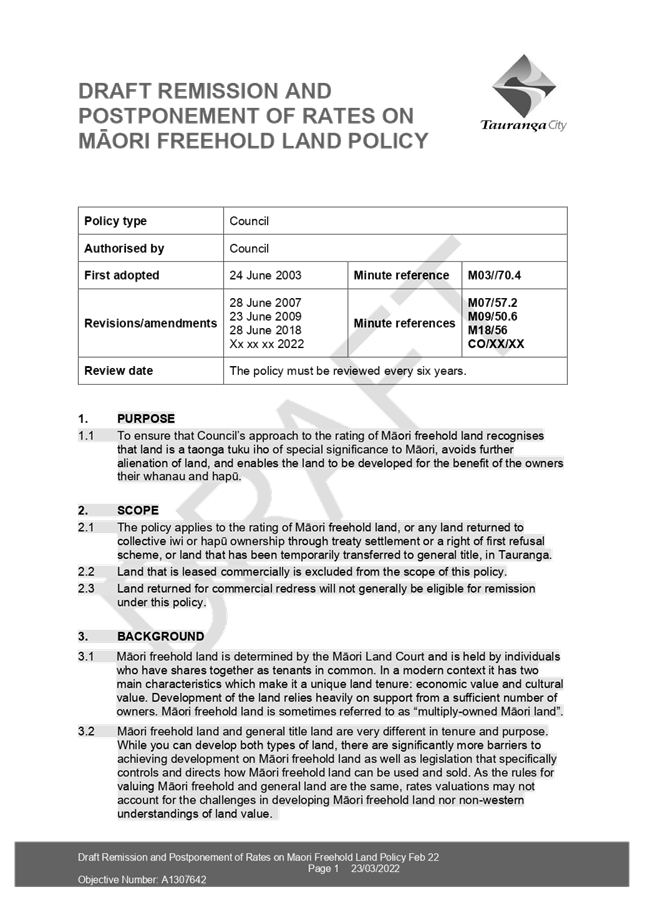

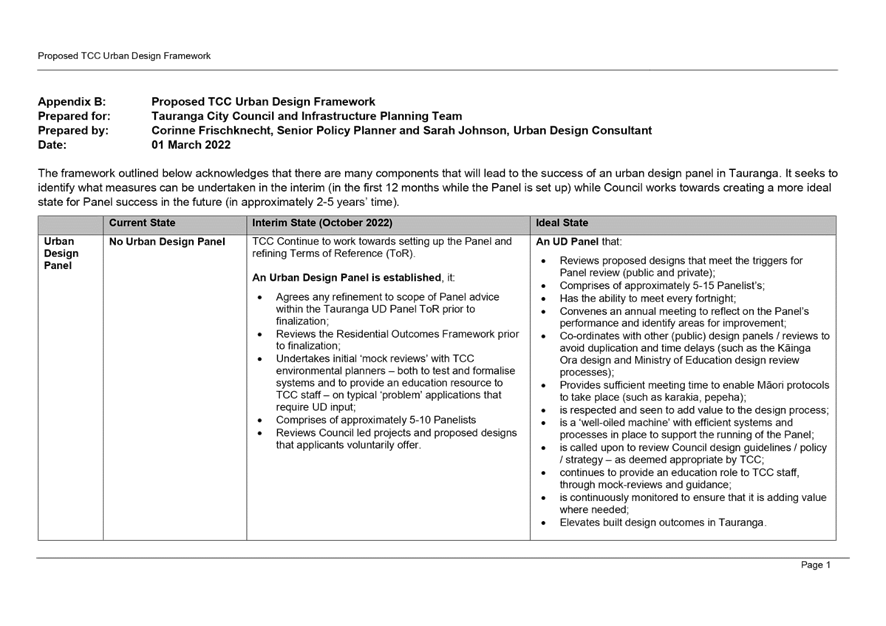

8.4 Review

of the Remission and Postponement of Rates on Māori Freehold Land Policy -

Issues and Options

File

Number: A13241823

Author: Jim

Taylor, Transactional Services Manager

Emma Joyce, Policy Analyst

Authoriser: Paul

Davidson, General Manager: Corporate Services

Purpose

of the Report

1. To adopt the draft

Remission and Postponement of Rates on Māori Freehold Land Policy (draft

policy) (attachment 1) for consultation.

|

Recommendations

That the Strategy,

Finance and Risk Committee:

(a) Adopts

the draft Remission and Postponement of Rates on Māori Freehold Land

Policy for consultation, noting the following amendments:

(i) A

new purpose statement paraphrasing the Preamble from Te Ture Whenua

Māori Act 1993.

(ii) Revised

criteria for remission of rates, except service charges, on land subject to

development to only require assessment against the benefits outlined at

section 114A of the Local Government (Rating) Act 2002.

(iii) Provisions

extending the ability to remit rates, except service charges, on land

intended for development to land returned through a right of first refusal

scheme or Treaty settlement or where the land is temporarily transferred to

general title and held in collective ownership.

(iv) Provision

for 100% remission of rates, except service charges, on land subject to

development, or defined and agreed development or stage of development, until

such time as the development or stage of development is generating income or persons

are residing in the houses.

(v) Provision

for Māori freehold land rates remission which reflects a rate based on

Maori freehold land value excluding any subdivision potential unlikely to be realised

in Māori ownership.

(vi) Provision

for partial or full remission of rates, except service charges, on land that

may be partially used for limited or seasonal productive use.

(vii) Provision

clarifying that land providing non-commercial community benefit to Māori

or papakāinga is eligible for 100% remission of rates, except service

charges.

|

Executive

Summary

2. Council

is required to review its policy on the remission and postponement of rates on

Māori freehold land by 1 July 2022 in response to the Local Government

(Rating of Whenua Māori) Amendment Act 2021. This Act introduced

provisions to the Local Government (Rating) Act (LG(R)A 02) and Local

Government Act 2002 (LGA 02) to better enable development of Māori

freehold land, particularly for housing and papakāinga, and to modernise

rating legislation affecting Māori freehold land.

3. Developing

Māori freehold land for the economic, social and cultural benefit of the

owners and beneficiaries will benefit the whole community. New housing and

associated papakāinga will further Māori cultural identity and iwi /

hapū connection to Tauranga Moana. It will also reduce the overall

shortfall of healthy housing for everyone in our community through increased

supply and reduced demand for rentals or privately-owned homes. Creating

commercial business ventures on Māori freehold land will create new jobs

within our rohe and benefit our city and the wider region’s economy.

4. The

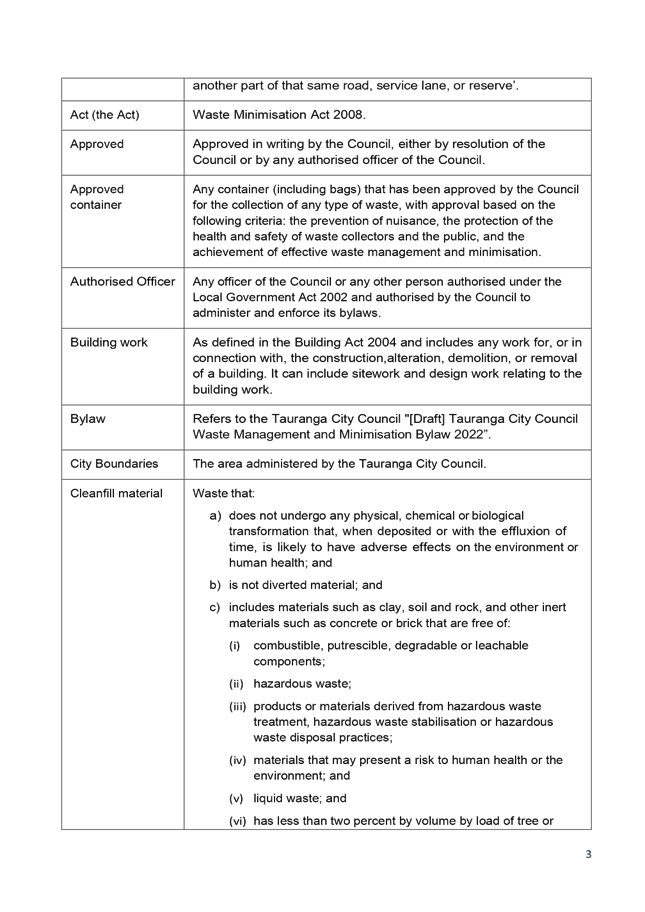

table below provides a summary of the proposals recommended through the policy

review and notes where certain land is automatically non-rateable

|

Type of remission

|

Amount of remission

|

Application

|

|

Land under development

|

Proposal for 100%

remission until such time as development is complete (people are residing in

homes or income is being generated).

Services charges are not

remitted

|

Māori freehold

land, general land returned to collective ownership (except where part of

commercial redress) through Treaty settlement or right of first refusal

|

|

Land under development

but partially complete (e.g. houses are being lived in)

|

Proposal for rates to be

paid on completed development but if development is staged rates can be

remitted on the yet to be completed part of the development

|

Māori freehold

land, general land returned to collective ownership (except where part of

commercial redress) through Treaty settlement or right of first refusal

|

|

Land with limited

productive use

|

Proposal for partial or

full remission of rates

|

Māori freehold land

|

|

Māori freehold land

leased on a commercial basis

|

Fully rateable (no

remission)

|

|

Land providing non-commercial

activity benefitting Māori (eg. hauora provider; sports club)

|

100% of rates, except

service charges, (Partial remission of wastewater rates may apply- see

councils remission policy)

|

All land

|

|

Unused rating unit of

Māori freehold land

|

Non-rateable per the

Local Government (Rating) Act 2002

|

Māori freehold land

|

|

Marae and urupā

|

5. This

report requests that the Strategy, Finance and Risk Committee (the Committee)

adopt the draft policy for consultation. The highlighted text in the attached

draft policy shows how the recommendations have been expressed in the policy or

other notable changes such as the incorporation of an explanatory background

section and new definitions. Consultation on the draft policy is scheduled for

May 2022.

Background

6. In

1860, Māori owned most of the land in the North Island. Through a

combination of raupatu (confiscation), compulsory public works acquisitions,

and land sales, most of this land has now been alienated from Māori. The

role of rating of Māori land potentially contributed to land loss.

Remaining tracts tended to be less desirable land, more remote, and more

challenging to make productive. The cumulative effect of the purchases,

raupatu, and acquisitions is that collectively-owned Māori land is now

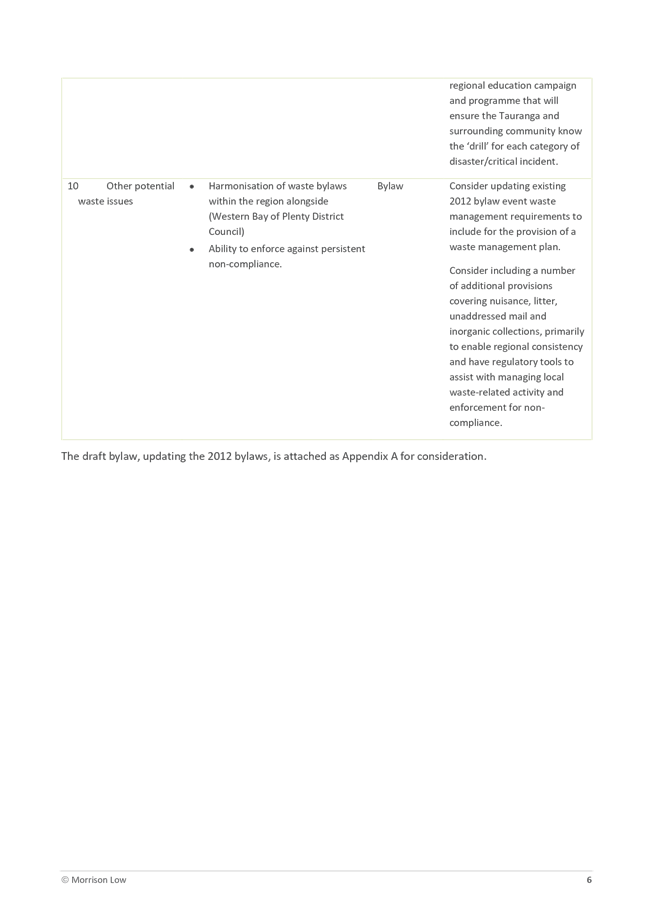

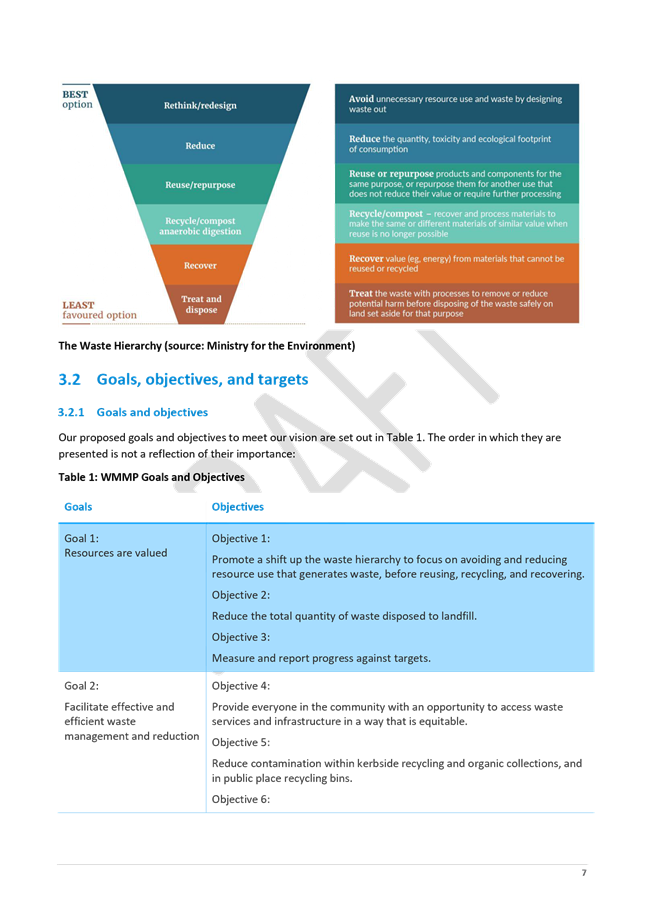

less than five per cent of New Zealand's total land area. The figure below

illustrates Māori land in the North Island in 1860 and then in 2000.

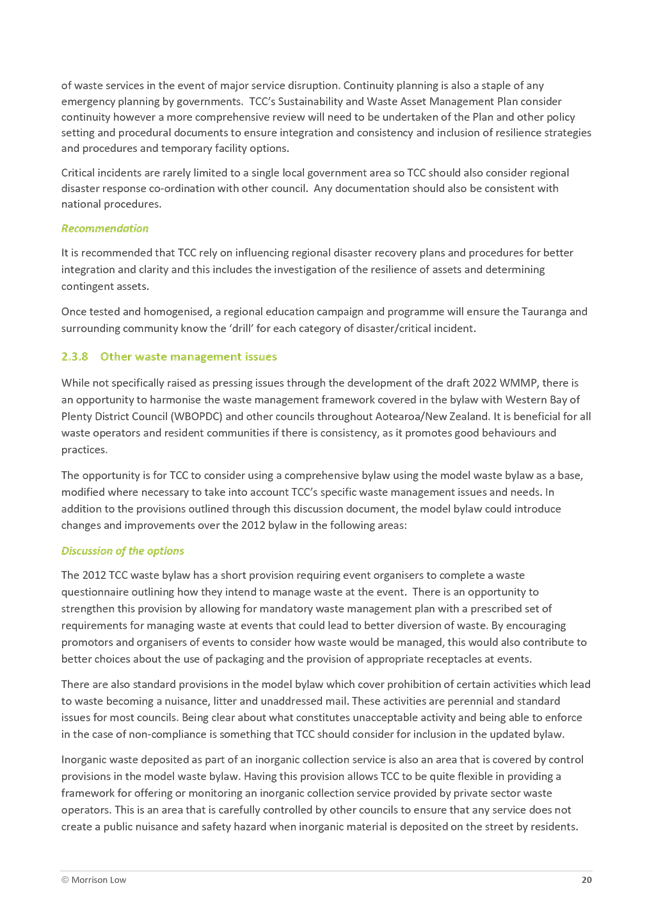

Figure 1: Land in Māori

ownership 1860 to 2000

1860 2000

Source: nzhistory.govt.nz

7. Te

Ture Whenua Māori Act 1993 (TTWMA 93) is the primary legislation governing

Māori land. Two key principles expressed in its Preamble (attachment 2)

are that land is a taonga tuku iho of special significance to Māori and as

such we should avoid further loss of Māori land. TTWMA 93 aims to balance

the protection of Māori land for future generations with the ability to

use and develop land to meet the aspirations of the landowners and their whānau.

Council’s Remission and Postponement Policy on Māori Freehold Land

Policy is now required to support those principles.

8. TTWMA

93 gives the Māori Land Court jurisdiction to determine by status order

the particular status of any parcel of land. Māori

freehold land is most often held by large numbers of individuals who have

shares together as tenants in common. Shares are succeeded by family members

which generally increases the number of beneficial owners whilst fragmenting

interests over time. Apart from

the difficulty of getting agreement from all individuals on a common project,

utilisation of the land may rely on western mechanisms of using the land as

security to raise finance (with an assumption the land could be sold if debt

remains unpaid). As Māori freehold land is unlikely to be sold on the open

market, it is difficult to raise finance on Māori land.

9. In

the contemporary environment, Māori freehold land has two main

characteristics which make it a unique land tenure: economic value and cultural

value. (Māori freehold land is sometimes referred to as

“multiply-owned Māori land”, however, this is not a term

defined in legislation). Māori freehold land and

general title land are very different in tenure and purpose. While you can to

an extent do many of the same things on both types of land, there are

significantly more barriers to achieving development on Māori freehold

land as well as legislation that specifically controls and directs how

Māori freehold land can be used and sold.

10. The

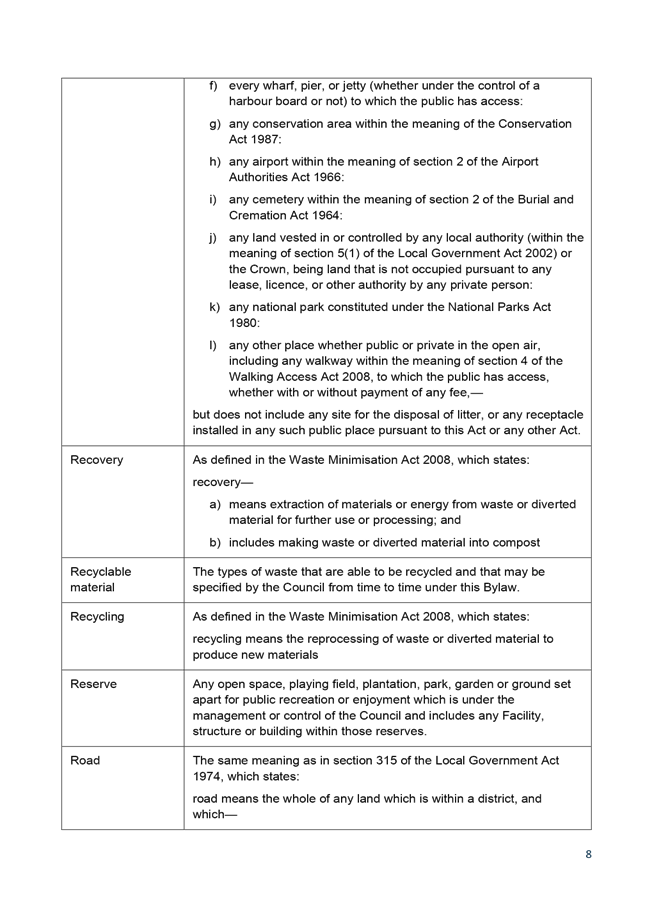

table below highlights key differences between general and Māori freehold

land.

|

|

Māori

freehold land

|

General

land

|

|

Land sales

|

· Shares in a land block can generally

only be sold to someone who is in the “preferred class of

alienees” (likely descendants or whanau)

|

· Can be sold to anyone on the open

market for the highest price

|

|

Borrow against title to secure mortgage

|

· As land is held in multiple ownership,

it is not practical to use Māori freehold land as security in financial

markets to borrow capital to invest in development

|

· Can borrow against the land to secure

a mortgage and enable investment in developing the land

· Investment may increase the

property’s capital value

|

|

Building a house on the land

|

· Māori freehold land may have

multiple owners. As such, Council requires proof that the applicant has the

right to build on the land

· Land is more likely to be landlocked

with limited or no access to services or utilities

|

· Can build anything on the land subject

to compliance with City Plan and Building Code provisions

|

|

Subdivision

|

· Māori freehold land can only be “partitioned” if it

meets an extensive list of restrictions set by the Māori Land Court.

· Court could decline the application as primary aim is the retention

of land in iwi and hapū ownership

|

· Can subdivide property so long as it meets the provisions in the City

Plan

|

11. Land

returned to Māori ownership in general title (for example, through Treaty

settlement or a right of first refusal scheme) is not always immediately

transferred to Māori freehold land. “Returned” land is also

often required to be purchased at current market value. As general land, it

might be used as security to access capital for developing other Māori

land, or for commercial leases which are placed on the title before

transferring to Māori title. However, general land in common Māori

ownership likely has the same purposes as other Māori land.

12. Rates

on Māori freehold land are based on the rating valuations of the land.

Despite the noted barriers to, and complexities of, developing Māori

freehold land, general title and Māori freehold land are valued for rating

purposes in the same way. Rating valuations are assessed on the following

factors;

· market evidence

· relevant planning

provisions as well as physical and locational aspects,

· the impact of

district plan designations

· access

difficulties, landlocked situations, contour challenges and subdivision

restrictions.

13. Adjustments

are applied to the general land value: up to 10% for over 100 owners and up to

5% for cultural aspect such as pā, urupā, rūnanga, or wāhi

tapu sites.

14. In

summary, the rating valuations are as if the land was available for sale on the

open market (where it could achieve the highest and best use value) and subject

to the same subdivision conditions as general title. The Valuer-General

determines the rules under which councils must set valuations. At present,

those rules do not provide for recognition of the legislative barriers to

realising the “highest and best use” on Māori freehold land,

nor a te ao Māori worldview where land may have an intrinsic value.

However, councils can account for different perceptions of land value in their

remission policies.

15. The

LGA 02 gives Council the ability to recognise the unique characteristics of

Māori freehold land and assess fair rates on Māori freehold land. All

councils are required to have a policy on the remission and postponement of

rates on Māori freehold land and are now required (following the

legislative changes) to consider all applications for rates remission on land

subject to development where it meets one or more of the five benefits of

development outlined in the legislation. Remission and postponement policies

must now also support the principles in the Preamble to TTWMA 93 with councils

required to review their policies by 1 July 2022.

16. The

review of our policy, and the requirement to show support for the Preamble

principles, allows us to recognise the differences between general title and

Māori Freehold land, the challenges and restrictions placed on development

of Māori freehold land, and the potentially different conception of land

value. As such, we are proposing the following policy amendments:

· support the

development of Māori freehold land by remitting rates for a period while

development is taking place

· treat land

returned through right of first refusal, Treaty settlements or temporarily in

general title for the purposes of progressing commercial leases, as if it was

Māori freehold land for the purposes of development

· remit rates to the

extent that the rates reflect the actual use of the Māori land, without

subdivision potential as that is unlikely to happen. If it does then the land

will be rated at that level of use.

· remit up to 100%

of rates on Māori land with limited productive use. This allows for some

use of the land without the whole block becoming liable for rates because it is

partially used to grow kai or medicinal plants (rongoā Māori) for

personal or community use or for a minor seasonal crop. (Note that if

Māori land remains unused it is non-rateable but would become liable for

rates when used even for a minor activity such as growing food. Therefore, it

is appropriate to provide for remission of rates on the unused portion.

Services charges for water supply, wastewater and waste may still be applied).

17. The

changes outlined above will result in a fairer allocation of rates on

Māori freehold land. Although this is a principled decision based on a

fairer way to assess rates on Māori land, the initial financial impact to

council is estimated at less than 0.02% (or up to $50,000) of the annual rates

budget. The proposed changes will increase our rates base in the future.

18. If

council does not implement these changes we will not be meeting our obligations

to support the preamble in the Te Ture Whenua Act in good faith by recognising

the benefits to the district by creating new employment opportunities, by

creating new homes, by increasing the council’s rating base in the long

term, by providing support for marae in the district or by facilitating the

occupation, development, and utilisation of the land.

19. If

council implements these changes to the rating of Māori freehold land, we

will be actively removing barriers preventing economic and cultural benefit to

Māori and the wider community through the provision of papakāinga,

housing and commercial enterprise. Over time development would grow

council’s rating database and increase the rates contribution from land

that would otherwise be unused and non-rateable.

20. As

Māori freehold land blocks cross over Tauranga and Western Bay of Plenty

District boundaries, it is desirable to have consistent treatment for rating of

whenua Māori throughout the sub-region. The draft policy is broadly

similar to the draft policy proposed by Western Bay of Plenty District Council.

Both drafts seek to add the new provision to remit a portion of rates

attributed to subdivision potential and to acknowledge that some minor use can

take place on Māori freehold land without it becoming used (and therefore

liable for rates). (The main differences between the two policies relate to

style and wording of policy provisions).

Strategic / Statutory

Context

21. A

policy on the remission and postponement of rates on Māori freehold land

is a requirement of all councils under section 102(1) of the LGA 02 (noting

that councils do not have to offer remission or postponement of rates).

Policies must include the objectives sought by remission, and the criteria in

order for rates to be remitted. The objectives and criteria must have regard to

the “desirability and importance” of a range of objectives such as

protection of indigenous biodiversity, protection of wāhi tapu, and

avoiding further alienation of land. These criteria are listed at schedule 11

to LGA 02 – Matters relating to the relief of rates on Māori

freehold land. This is in addition to the recent requirement noted in the

above background section that policies support the principles contained within

the Preamble to TTWMA 93.

22. Other legislative changes to the rating of

Māori freehold land do not require an amendment to the policy. They are

noted below to illustrate the intention of the legislative changes to address

some of the inequities with, and challenges of, rating Māori freehold

land.

· Allowing the Chief

Executive to waive rates deemed unrecoverable (also applies to general land)

· Marae land and

land protected through a Ngā Whenua Rāhui kawenata now automatically

non-rateable

· Wholly unused land

now non-rateable

· Ability for

council (upon request) to rate individual houses on Māori land as a

separate rating unit enabling ratepayer to access the Government rates rebate

scheme.

23. Council

has previously shown support for the development of Māori land through the

development of a policy to provide grants to cover payment of development

contributions for papakāinga.

Options Analysis

Issue 1 –

Show support for Preamble in policy

24. As

noted in the background section, the main reason for this review is the new

requirement to show support in our policy for the principles in the Preamble to

TTWMA 93. Council can show this support through the addition of a new clause

that paraphrases the Preamble or imply support through provisions in the

policy. The table below outlines the advantages and disadvantages of adding an

additional provision either as a purpose or principle or not adding a new

provision.

|

Option

|

Advantages

|

Disadvantages

|

|

1.1

|

Show

support for the Preamble through a new policy purpose

(recommended)

|

· Clear alignment

between the policy and demonstrating support for development of Māori

land and principles in the Preamble

· Ensures that following

policy provisions must connect to the purpose

· Reflects intent of

policy and legislation to better enable development of Māori freehold

land

· Complies with

legislation

|

· Nil

|

|

1.2

|

Retain

current purpose but show support for the Preamble through a new policy principle

|

· Some alignment between

the policy and demonstrating support for development of Maori land.

· Complies with

legislation

|

· Potentially less

emphasis on supporting the Preamble and the principles of the Preamble

|

|

1.3

|

Do not

include provision demonstrating support for the Preamble / imply support

through policy provisions

|

· Support for principles

can be implied through other policy provisions

|

· Potential that policy

does not comply with legislation

· Potential that policy

does not show clear support for the principles in the Preamble

|

Issue

2- Criteria for remission for land subject to development

25. Under

the amended LG(R)A, where Māori freehold land is subject to development,

councils need only be satisfied that one of the five benefits listed below is

met in order to grant remission. (Applications may meet more than one). This is

in addition to the matters relating to rates relief on Māori freehold land

listed in schedule 11 to the LGA 02.

· benefits to the

district by creating new employment opportunities:

· benefits to the

district by creating new homes:

· benefits to the

council by increasing the council’s rating base in the long term:

· benefits to

Māori in the district by providing support for marae in the district:

· benefits to the

owners by facilitating the occupation, development, and utilisation of the

land.

26. The

focus on outcomes and benefits contrasts with the current compliance-focused

criteria in the policy. Council could retain the current criteria or replace

that criteria with a statement that remission will be granted where one or more

of the benefit(s) outlined in the legislation are met.

|

Option

|

Advantages

|

Disadvantages

|

|

2.1

|

Criteria

for land subject to remission need only demonstrate one of the five benefits listed

in the legislation

(recommended)

|

· Aligns with intention

of legislation and Preamble principles to enable development of Māori

freehold land

· Consistent with

legislation, including schedule 11 matters

· Less onus on

landowners to provide supporting information to show compliance with criteria

· Eliminates

administrative burden of requiring annual assessments

|

· May not show explicit

reference to the matters referred to in schedule 11 of the LGA 02

|

|

2.2

|

Retain

current criteria for land under development

|

· Retains strong

reference to the matters referred to in schedule 11 of the LGA 02

|

· May not reflect

intention of legislation or support the principles in the Preamble to be

enabling of land development

· Places onus on

applicant to comply rather than Council being seen to be enabling and

supportive of land development

· Current criteria are

not required to assess benefits of land development

· Council may already

hold this information in its systems – avoids duplication

|

Issue

3 – Land included in scope of policy

27. While

the legislation and our existing policy only apply to Māori freehold land,

there is an opportunity to extend the policy to land returned to iwi or

hapū through Treaty settlement (non-commercial redress) or right of first

refusal. This land is usually held in general title. Auckland and Far North

District Councils currently have similar provisions extending the remissions

policy to Treaty settlement land held in general title. Western Bay of Plenty

District is consulting on an amended draft policy that applies to “[A]ny

land, regardless of its status, returned to a Māori trust, iwi, hapū

or other entity, by the Crown or Local Government body, as redress or

compensation for a historic wrongdoing or breach of the Treaty of

Waitangi” (as well as Māori freehold land).

28. The

advantages and disadvantages of each option are outlined below.

|

Option

|

Advantages

|

Disadvantages

|

|

3.1

|

Include

land returned through Treaty settlement in the scope of the policy

(non-commercial redress)

(recommended)

|

· Recognises importance

of land

· Recognises not all

land is Māori freehold land but owners may similarly wish to develop

that land for their benefit or benefit of their hapū

· Supports principles in

the Preamble, particularly recognising the significance of land and allowing

the ability for it to be developed

· Acknowledges the

recent adoption of right of first refusal scheme for surplus council land

|

· Nil

|

|

3.2

|

Include

land returned through right of first refusal in scope of policy

(recommended)

|

· ·

| 3.3 |

Include

land temporarily transferred to general title in scope of policy

(recommended)

|

· ·

| 3.4 |

Policy

only applies to Māori freehold land (status quo)

|

· Consistent with

legislation that remission is only for Māori freehold land

|

· Does not acknowledge

potential aspirations for development of land

· Potential does not

acknowledge Māori view of land

· Potential that policy

does not support principles of the Preamble, particularly providing for the development

of land

|

Issue

4 – Rate of remission

29. The

legislation does not specify the rate of remission and allows councils to

determine if they will remit all or part of the rates for the duration of a

development, differently during the different stages of a development and

subject to any other conditions specified in the policy (s114A(4) LGA 02).

Subject to a decision on issue three above, the same level of remission would

apply to rating units returned or purchased through Treaty settlement or right