|

|

|

AGENDA

Strategy, Finance and Risk Committee Meeting

Monday, 20 June 2022

|

|

I hereby give notice that a Strategy, Finance and

Risk Committee Meeting will be held on:

|

|

Date:

|

Monday, 20 June 2022

|

|

Time:

|

9.30am

|

|

Location:

|

Bay of Plenty Regional Council Chambers

Regional House

1 Elizabeth Street

Tauranga

|

|

Please note that this

meeting will be livestreamed and the recording will be publicly available on

Tauranga City Council's website: www.tauranga.govt.nz.

|

|

Marty Grenfell

Chief Executive

|

Terms of reference – Strategy,

Finance & Risk Committee

Membership

|

Chairperson

|

Commission Chair Anne Tolley

|

|

Deputy chairperson

|

Dr Wayne Beilby – Tangata

Whenua representative

|

|

Members

|

Commissioner Shadrach Rolleston

Commissioner Stephen Selwood

Commissioner Bill Wasley

|

|

|

Matire

Duncan, Te Rangapū Mana Whenua o Tauranga Moana Chairperson

Te Pio Kawe – Tangata

Whenua representative

Rohario Murray – Tangata

Whenua representative

Bruce

Robertson – External appointee with finance and risk

experience

|

|

Quorum

|

Five

(5) members must be physically present, and at least three (3) commissioners

and two (2) externally appointed members must be present.

|

|

Meeting frequency

|

Six weekly

|

Role

The role of the Strategy, Finance and Risk Committee (the

Committee) is:

(a)

to assist and advise the Council in discharging

its responsibility and ownership of health and safety, risk management,

internal control, financial management practices, frameworks and processes to

ensure these are robust and appropriate to safeguard the Council's staff and

its financial and non-financial assets;

(b)

to consider strategic issues facing the city and

develop a pathway for the future;

(c)

to monitor progress on achievement of desired

strategic outcomes;

(d)

to review and determine the policy and bylaw

framework that will assist in achieving the strategic priorities and outcomes

for the Tauranga City Council.

Membership

The Committee will consist of:

·

four commissioners with the Commission Chair

appointed as the Chairperson of the Committee

·

the Chairperson of Te

Rangapū Mana Whenua o Tauranga Moana

·

three tangata whenua representatives

(recommended by Te Rangapū Mana Whenua o Tauranga

Moana and appointed by Council)

·

an independent external person with finance and

risk experience appointed by the Council.

Voting

Rights

The tangata whenua representatives and the independent

external person have voting rights as do the Commissioners.

The Chairperson of Te Rangapu Mana Whenua o Tauranga Moana

is an advisory position, without voting rights, designed to ensure mana whenua

discussions are connected to the committee.

Committee's

Scope and Responsibilities

A. STRATEGIC ISSUES

The

Committee will consider strategic issues, options, community impact and explore

opportunities for achieving outcomes through a partnership approach.

A1 – Strategic Issues

The Committee's

responsibilities with regard to Strategic Issues are:

·

Adopt an annual work

programme of significant strategic issues and projects to be addressed. The

work programme will be reviewed on a six-monthly basis.

·

In respect of each

issue/project on the work programme, and any additional matters as determined

by the Committee:

○ Consider existing and future strategic

context

○ Consider opportunities and possible

options

○ Determine preferred direction and

pathway forward and recommend to Council for inclusion into strategies,

statutory documents (including City Plan) and plans.

·

Consider and approve

changes to service delivery arrangements arising from the service delivery

reviews required under Local Government Act 2002 that are referred to the

Committee by the Chief Executive.

·

To take appropriate

account of the principles of the Treaty of Waitangi.

A2 – Policy and Bylaws

The Committee's

responsibilities with regard to Policy and Bylaws are:

·

Develop, review and

approve bylaws to be publicly consulted on, hear and deliberate on any

submissions and recommend to Council the adoption of the final bylaw. (The

Committee will recommend the adoption of a bylaw to the Council as the Council

cannot delegate to a Committee the adoption of a bylaw.)

·

Develop, review and

approve policies including the ability to publicly consult, hear and deliberate

on and adopt policies.

A3 – Monitoring of Strategic

Outcomes and Long Term Plan and Annual Plan

The Committee's

responsibilities with regard to monitoring of strategic outcomes and Long Term

Plan and Annual Plan are:

·

Reviewing and

reporting on outcomes and action progress against the approved strategic

direction. Determine any required review / refresh of strategic direction or

action pathway.

·

Reviewing and assessing

progress in each of the six (6) key investment proposal areas within the

2021-2031 Long Term Plan.

·

Reviewing the

achievement of financial and non-financial performance measures against the

approved Long Term Plan and Annual Plans.

B.

FINANCE AND RISK

The Committee will review the

effectiveness of the following to ensure these are robust and appropriate to

safeguard the Council's financial and non-financial assets:

·

Health and safety.

·

Risk management.

·

Significant projects and programmes of work focussing

on the appropriate management of risk.

·

Internal and external audit and assurance.

·

Fraud, integrity and investigations.

·

Monitoring of compliance with laws and regulations.

·

Oversight of preparation of the Annual Report

and other external financial reports required by statute.

·

Oversee the relationship with the

Council’s Investment Advisors and Fund Managers.

·

Oversee the relationship between the Council and

its external auditor.

·

Review the quarterly financial and non-financial

reports to the Council.

B1 - Health and Safety

The Committee’s responsibilities through regard to

health and safety are:

·

Reviewing the effectiveness of the health and

safety policies and processes to ensure a healthy and safe workspace for

representatives, staff, contractors, visitors and the public.

·

Assisting the Commissioners to discharge their

statutory roles as "Officers" in terms of the Health and Safety at

Work Act 2015.

B2 - Risk Management

The Committee's responsibilities with regard to risk

management are:

·

Review, approve and monitor the implementation of the Risk

Management Policy, Framework and Strategy including the Corporate Risk

Register.

·

Review and approve the Council’s "risk appetite"

statement.

·

Review the effectiveness of risk management and internal control

systems including all material financial, operational, compliance and other

material controls. This includes legislative compliance, significant projects

and programmes of work, and significant procurement.

·

Review risk management reports identifying new and/or emerging

risks and any subsequent changes to the "Tier One" register.

B3

- Internal Audit

The Committee’s responsibilities with regard to the

Internal Audit are:

·

Review and approve the Internal Audit Charter to confirm the

authority, independence and scope of the Internal Audit function. The Internal

Audit Charter may be reviewed at other times and as required.

·

Review and approve annually and monitor the implementation of the

Internal Audit Plan.

·

Review the co-ordination between the risk and internal audit

functions, including the integration of the Council's risk profile with the

Internal Audit programme. This includes assurance over all material financial,

operational, compliance and other material controls. This includes legislative compliance

(including Health and Safety), significant projects and programmes of work and

significant procurement.

·

Review the reports of the Internal Audit functions dealing with

findings, conclusions and recommendations.

·

Review and monitor management’s responsiveness to the

findings and recommendations and enquire into the reasons that any

recommendation is not acted upon.

B4

- External Audit

The Committee's responsibilities with regard to the

External Audit are:

·

Review with the external auditor, before the audit commences, the

areas of audit focus and audit plan.

·

Review with the external auditors, representations required by

commissioners and senior management, including representations as to the fraud

and integrity control environment.

·

Recommend adoption of external accountability documents (LTP and

annual report) to the Council.

·

Review the external auditors, management letter and management

responses and inquire into reasons for any recommendations not acted upon.

·

Where required, the Chair may ask a senior representative of the

Office of the Auditor General (OAG) to attend the Committee meetings to discuss

the OAG's plans, findings and other matters of mutual interest.

·

Recommend to the Office of the Auditor General the decision

either to publicly tender the external audit or to continue with the existing

provider for a further three-year term.

B5

- Fraud and Integrity

The Committee's responsibilities with regard to Fraud and

Integrity are:

·

Review and provide advice on the Fraud Prevention and Management

Policy.

·

Review, adopt and monitor the Protected Disclosures Policy.

·

Review and monitor policy and process to manage conflicts of

interest amongst commissioners, tangata whenua representatives, external

representatives appointed to council committees or advisory boards, management,

staff, consultants and contractors.

·

Review reports from Internal Audit, external audit and management

related to protected disclosures, ethics, bribery and fraud related incidents.

·

Review and monitor policy and processes to manage

responsibilities under the Local Government Official Information and Meetings

Act 1987 and the Privacy Act 2020 and any actions from the Office of the

Ombudsman's report.

B6

- Statutory Reporting

The

Committee's responsibilities with regard to Statutory Reporting relate to

reviewing and monitoring the integrity of the Annual Report and recommending to

the Council for adoption the statutory financial statements and any other

formal announcements relating to the Council's financial performance, focusing

particularly on:

·

Compliance with, and the appropriate application of, relevant

accounting policies, practices and accounting standards.

·

Compliance with applicable legal requirements relevant to

statutory reporting.

·

The consistency of application of accounting policies, across

reporting periods.

·

Changes to accounting policies and practices that may affect the

way that accounts are presented.

·

Any decisions involving significant judgement, estimation or

uncertainty.

·

The extent to which financial statements are affected by any

unusual transactions and the manner in which they are disclosed.

·

The disclosure of contingent liabilities and contingent assets.

·

The basis for the adoption of the going concern assumption.

·

Significant adjustments resulting from the audit.

Power

to Act

·

To make all

decisions necessary to fulfil the role, scope and responsibilities of the

Committee subject to the limitations imposed.

·

To establish

sub-committees, working parties and forums as required.

·

This Committee has not

been delegated any responsibilities, duties or powers that the Local Government

Act 2002, or any other Act, expressly provides the Council may not delegate.

For the avoidance of doubt, this Committee has not been delegated

the power to:

o

make a rate;

o

make a bylaw;

o

borrow money, or purchase

or dispose of assets, other than in accordance with the Long-Term Plan (LTP);

o

adopt the LTP or Annual

Plan;

o

adopt the Annual Report;

o

adopt any policies required

to be adopted and consulted on in association with the LTP or developed for the

purpose of the local governance statement;

o

adopt a remuneration and

employment policy;

o

appoint a chief executive.

Power

to Recommend

To Council and/or any standing committee

as it deems appropriate.

7 Confirmation

of minutes

7.1 Minutes

of the Strategy, Finance and Risk Committee meeting held on 14 February 2022

File

Number: A13578144

Author: Sarah

Drummond, Committee Advisor

Authoriser: Robyn

Garrett, Team Leader: Committee Support

|

Recommendations

That the Minutes of the Strategy, Finance and Risk Committee

meeting held on 14 February 2022 be confirmed as a true and correct record.

|

Attachments

1. Minutes

of the Strategy, Finance and Risk Committee meeting held on 14 February

2022

|

Strategy, Finance and Risk Committee Meeting Minutes Strategy, Finance and Risk Committee Meeting Minutes

|

14 February 2022

|

|

|

|

MINUTES

Strategy, Finance and Risk Committee Meeting

Monday, 14 February 2022

|

Order of Business

1 Opening Karakia. 3

2 Apologies. 3

3 Public forum.. 3

3.1 Ms

Holly Shaw - Mobile Shop Policy. 3

4 Acceptance of

late items. 4

5 Confidential

business to be transferred into the open. 4

6 Change to order

of business. 4

7 Confirmation of

Minutes. 4

7.1 Minutes

of the Strategy, Finance and Risk Committee meeting held on 13 December 2021. 4

8 Declaration of

conflicts of interest 4

9 Business. 5

9.1 Review

of the Remission and Postponement of Rates on Māori Freehold Land Policy -

Issues and Options. 5

9.2 Review

of Rates Remission and Rates Postponement Policies - Issues and Options. 6

9.3 Rating

Policy Review.. 7

9.4 Mobile

Shop Policy Review: Issues and Options Paper 8

9.5 2021

Q2 Oct-Dec Health and Safety Report 9

9.6 Financial

and Non-Financial Monitoring Report: Period ended 31 December 2021. 10

10 Discussion of late items. 12

11 Public excluded session. 12

11.1 Tauriko

Business Estate (TBE) Potential Liability on Council 13

11.2 Public

Excluded Minutes of the Strategy, Finance and Risk Committee meeting held on 13

December 2021. 13

12 Closing Karakia. 14

MINUTES OF Tauranga City Council

Strategy, Finance and Risk Committee Meeting

HELD

AT THE Bay of Plenty Regional Council

Chambers, Regional House, 1 Elizabeth Street, Tauranga

ON

Monday, 14 February 2022 AT 10.30am

PRESENT: Commission

Chair Anne Tolley, Dr Wayne Beilby, Commissioner Shadrach Rolleston,

Commissioner Stephen Selwood, Commissioner Bill Wasley, Ms Matire Duncan, Mr Te

Pio Kawe, Ms Rohario Murray, Mr Bruce Robertson

IN

ATTENDANCE: Marty Grenfell (Chief Executive), Paul

Davidson (General Manager: Corporate Services), Susan Jamieson (General

Manager: People & Engagement), Christine Jones (General Manager: Strategy

& Growth), Gareth Wallis (General Manager: Community Services), Jeremy Boase

(Manager: Strategy & Corporate Planning), Brendan Bisley (Director of

Transport), Jim Taylor (Transactional Services Manager), Emma Joyce (Policy

Analyst), Malcolm Gibb (Project Manager – Rating Review), Ruth Woodward

(Team Leader: Policy), Vicky Grant-Ussher (Policy Analyst), Angelique Fraser

(Health & Safety Change Manager), Allan Lightbourne (Chief Digital

Officer), Coral Hair (Manager: Democracy Services), Robyn Garrett (Team Leader:

Committee Support), Sarah Drummond (Committee Advisor), Anahera Dinsdale

(Committee Advisor)

At the commencement of

the meeting the Chairperson Anne Tolley and the committee acknowledged the

passing of Mr Bruce Fraser and his long contribution to Tauranga Moana in many

areas including many years working for the Bay of Plenty Regional Council, as a

member of the Smart Growth Programme and leading recovery efforts following the

grounding of the Rena.

1 Opening

Karakia

Commissioner Rolleston

opened the meeting with a karakia.

2 Apologies

|

Apology

|

|

Committee Resolution SFR1/22/1

Moved: Commissioner

Shadrach Rolleston

Seconded: Ms

Rohario Murray

That the apology for lateness received from Mr Bruce

Robertson accepted.

Carried

|

3 Public

forum

|

3.1 Ms Holly

Shaw - Mobile Shop Policy

|

|

Key Points and Questions

·

Ms Shaw provided the Committee with a PowerPoint Presentation

on her business and the effect of the current policy.

·

The business had been operating in the Omanu Beach carpark

full-time for about a year.

·

Ms Shaw considered her business provided a community service,

contributed to the local economy, and was involved in local fundraising and

sponsorship.

·

Ms Shaw had been very proactive in ensuring that the business

was environmentally friendly and sustainable; and operated in a safe

contactless manner.

Discussion points raised

·

The Committee advised staff that they did not want changes to

the current policy that would stifle growth especially in areas that were

greatly benefitting from the presence of mobile shops.

·

The Committee commended Ms Shaw on the thoroughness of her

presentation and the way in which she was conducting her business. The

presentation from Ms Shaw had provided valuable on the ground feedback from a

business owner of a mobile shop that could contribute to amendments to the

current policy.

|

4 Acceptance

of late items

Nil

5 Confidential

business to be transferred into the open

Nil

6 Change

to order of business

Nil

7 Confirmation

of Minutes

|

7.1 Minutes

of the Strategy, Finance and Risk Committee meeting held on 13 December 2021

|

|

Committee Resolution SFR1/22/2

Moved: Commissioner

Bill Wasley

Seconded: Commissioner

Stephen Selwood

That the minutes of the Strategy, Finance and Risk Committee

meeting held on 13 December 2021 be confirmed as a true and correct record,

subject to the following corrections:

· Minor

administrative corrections required to show Committee Member Ms Matire Duncan

present at the meeting.

· A

correction to show that on Issue 7 of item 10.1 the Committee was amenable to

the promotion of and larger number of community gardens.

Carried

|

8 Declaration

of conflicts of interest

Member Mr Te Pio Kawe declared a conflict with Agenda Item

9.1.

9 Business

|

9.1 Review of

the Remission and Postponement of Rates on Māori Freehold Land Policy -

Issues and Options

|

|

Staff Jim

Taylor, Transactional Services Manager

Emma Joyce, Policy Analyst

Key points

·

Staff provided the Committee a short summary of the paper and

its effect and implications.

·

The policy looked to support and enable development of

Māori owned land, by revising the current criteria, considered too

onerous and cumbersome. Under the proposed plan there would only be a need to

show the five benefits.

·

Rates were currently set via capital value; this was not

considered a method that reflected the actual values of the land in its

current use. The proposed policy would allow the inherent value to be

realised.

·

Legislative change must be made by 1 July 2022.

·

The Committee requested that staff included Te Tiriti

principles in the preamble to the policy.

·

The policy would be opened for consultation.

In response to questions

·

Legislative change was required to review the policy and must

be in place or the process started by 1 July 2022.

·

The policy was not proposed as part of the current Annual Plan

given the need to have its own consultation process.

·

The Committee received the report and requested further

discussion with staff to inform the proposed policy for consultation. It was

agreed that staff would facilitate this discussion and bring a further report

to the Committee with the final policy for consultation.

·

Work and discussion had been started with the Western Bay of

Plenty District Council. Although each region would have its own policy,

staff were working together.

·

An adoption date of 1 July 2022 could still be achieved even

with an amended proposed policy returning to the Committee. Consultation

would be open for one month.

·

This proposed policy relates to capital value being balanced to

achieve fair and equitable rateable values. Currently remaining undeveloped

land was underutilised but paid the same rates as developed land. There would

only be minor financial consequences for Council.

·

Staff were writing the policy to be as flexible as possible and

still meet the legislative requirements.

|

|

Committee Resolution SFR1/22/3

Moved: Dr

Wayne Beilby

Seconded: Commissioner

Stephen Selwood

That the Strategy,

Finance and Risk Committee:

(a) Receives

the report: Review of the Remission and

Postponement of Rates on Māori Freehold Land Policy - Issues and

Options.

Carried

|

|

9.2 Review of

Rates Remission and Rates Postponement Policies - Issues and Options

|

|

Staff Jim

Taylor, Transactional Services Manager

Emma Joyce, Policy Analyst

Key points

·

The report was taken as read and staff highlighted key points

noting that due to a recent high court decision they would be proposing a

minor wording change to the recommendation to amend how remissions are used

for kiwifruit orchards in relation to gold kiwifruit licences.

·

Government aid for rates relief was currently hard to access

and the Committee acknowledged the work staff had put into this area.

·

The proposed policy would clarify issues, be easier to

understand and use, and set clear principles in terms of fairness.

In response to questions

·

Ratepayers seeking remission must prove that they could not

access assistance. The Committee sought clarification about what this

proof would look like. Staff advised that the hardship provisions were

a safety net if ratepayers could not access further support from other

sources e.g. through commercial banks. All that would need to be provided was

a formal letter.

·

The committee advised staff to make clear in the policy issues

that there was currently no provision to obtain government or market funding,

and that criteria needed to be clearly set out.

·

The committee would like to see the establishment of a national

scheme that all councils adopted, rather than councils becoming lenders of

last resort or default debt holders.

Discussion points raised

·

Remission would be for up to three years.

|

|

Committee Resolution SFR1/22/4

Moved: Commissioner

Bill Wasley

Seconded: Mr Te

Pio Kawe

That the Strategy,

Finance and Risk Committee:

(a) Notes

that reference to the Preamble to Te Ture Whenua Māori Act 1993 will be

added to Council’s Revenue and Financing Policy.

(b) Agrees

that the following matters be addressed in a draft Rates Postponement Policy

for consultation (for adoption by Council);

(i) deletion

of all criteria for rates postponement for financial hardship except the

requirement for there to be at least 25% equity in the property and that the

ratepayer must not be able to access support from private sector financial

institutions.

(ii) addition

a new criterion that applications for rates postponement for financial

hardship may only be for the property the ratepayer is currently residing in.

(iii) addition

of a new criterion providing for postponement of rates on rating units where

the valuation may have increased due to boundary adjustments and re-zoning

from rural to urban uses, noting that a maximum of six years postponed rates

will be due when the property is sold or developed.

(c) Agrees

that the following matters be addressed in a draft Rates Remission Policy for

consultation (for adoption by Council);

(i)

Addition of a provision for partial remission of general rates and

targeted rates set at the capital value on rating units with both a license

to grow gold kiwifruit and planted vines where the rates have increased by

more than the citywide average, noting that the remission will be for the

portion of rates relating to the capital value component of the G3 licence

and for a maximum of three years with 100% remission in the 2022/2023

financial year and two thirds remission in year two (2023/2024).

(ii) Deletion

of provisions pertaining to remission of wastewater rates for schools and

reference to remission of rates on land designated a Māori reservation.

Carried

|

|

9.3 Rating Policy

Review

|

|

Staff Malcolm

Gibb, Project Manager: Rating Review

Paul Davidson, General Manager: Corporate Services

Jim Taylor, Transactional Services Manager

Key points

·

50% split of transport rates between residential transport and commercial

and industrial sector transport.

·

This split would be achieved through a differential rather than

a targeted rate.

·

These recommendations would come back to Council on 21st

February 2022.

In response to questions

·

Insight Economics had completed the analysis of the difference

between the two existing transport ratepayer groups, residential and

commercial; and considered options for creating new or different ratepayer

groups. Further information would be provided on how this analysis was

developed.

·

Staff were conscious of retaining alignment with the

infrastructure levy.

·

Insight Economics had been previously engaged by the city for

similar types of work. This source of information was provided by TCC for

robustness, as asset management planning had become more comprehensive and

this advice and analysis supported that work.

Discussion points raised

·

The report outlined preliminary findings; final proposals would

come to the 21 February 2022 meeting.

|

|

Committee Resolution SFR1/22/5

Moved: Commissioner

Stephen Selwood

Seconded: Commissioner

Bill Wasley

That the Strategy,

Finance and Risk Committee:

(a) Receives

the report: Rating Policy Review and

(i) Notes

that the report provides evidence from internal and external sources that the

commercial and industrial sector should contribute a higher share of the rate

funding for the transportation activity

(ii) Notes

that comparable Councils use general rate differentials rather than targeted

rates to fund their transportation activities

(iii) Agrees

that the extent and quantum of any amendments to the rating policy could be a

mix of differential general and targeted rates

(iv) Confirms

that further consideration will be given to a suitable proposal for the

rating policy being included in the draft 2022/23 draft Annual Plan on 21st

February 2022.

Carried

|

|

9.4 Mobile Shop

Policy Review: Issues and Options Paper

|

|

Staff Ruth

Woodward, Team Leader: Policy

Vicky Grant-Ussher, Policy Analyst

Key points

·

Staff provided an overview of the proposed

policy and current issues that had led to the need to review and amend the

policy.

·

The proposed policy was brought to Council in

February 2021 to bring Tauranga City Council policy in line with the rest of

New Zealand.

·

There was currently no allowance for previous

or existing holders.

·

A licence would be required to allow mobile

shops to trade in identified areas.

·

Current policy objective was primarily around

public health and safety with little focus on public amenity.

·

The committee did not want to be overly

restrictive while still complying with health and safety requirements,

environmental considerations, and parking requirements.

In response to questions

·

Development of criteria for consideration could be devolved to

the Chief Executive.

Discussion points raised

·

Noted the importance of flexibility with changing use, and the

balance between not being overly restrictive but allowing for enhanced

trading as required.

·

Staff would bring back new proposals for previous Issue

2.

|

|

Committee Resolution SFR1/22/6

Moved: Commissioner

Bill Wasley

Seconded: Commissioner

Shadrach Rolleston

That the Strategy,

Finance and Risk Committee:

Issue 1: Policy structure for mobile shop trading

(a) Agrees to incorporate the

Mobile Shops Policy into the Community, Private and Commercial Use of

Council-Administered Land policy review and consult on the issues outlined

below through the review.

Issue 2:

Non-compliant behaviour by a small cohort of mobile shops that is causing

traffic safety concerns

(c) Requires mobile shops to

have a plan to manage health and safety risks.

(d) Adds a category in the

Traffic and Parking Bylaw to cover mobile shops’ operation on the road.

Issue 3:

Waste minimisation opportunities

(e) Requires mobile shops to

complete a waste minimisation survey as part of the mobile shop licence

process.

Issue 4:

Changes in road traffic volumes and changes in speed zones

(f) Prohibits mobile shops

trading on roads with a speed limit higher than 50km/hr.

Issue 5:

Noise levels of generators

(g) Requires mobile shops to

connect to power where this is available, and their set up allows.

Carried

|

|

9.5 2021 Q2

Oct-Dec Health and Safety Report

|

|

Staff Angelique

Fraser, Health & Safety Change Manager

Tony Aitken, General Manager: People and Engagement

Key points

·

Report had been summarised and split into core elements; the

second half specifically looked at mental health and wellbeing.

·

Statistics had been provided for specific incidents.

·

The report themes were on learning from incidents and ensuring

Council focused on the areas and roles for which it was responsible.

·

A varied approach was being taken. For example, with stress

management, risk management, digital learning, work exposure and alternate

training were all used.

·

Current reporting was showing no great jump in issues of

wellbeing concerns among staff.

·

The Covid pandemic and alert levels had provided a number of

challenges in maintaining contracting staff and hiring of new staff; and

created a challenging environment for staff to navigate with issues like the

introduction of vaccine pass requirements.

·

The current exit interviews and statistics were pleasing.

In response to questions

·

There had been good discussion and openness from people to talk

about day to day operations.

·

The Committee commended the format and content of the report

for providing clear and concise information.

·

Where health and safety incidents occurred, there was a process

of learning for the individual, including an ability to comment on how the

system was doing and why it failed on that occasion.

·

Noted the importance of minimising the chance that accidents

were being normalised.

Discussion points raised

·

The Committee would like to see more information from staff on

how any potential or actual cultural clashes between individuals and/or teams

were worked through and what processes were in place.

|

|

Committee

Resolution SFR1/22/7

Moved: Mr

Bruce Robertson

Seconded: Commissioner

Bill Wasley

That the Strategy,

Finance and Risk Committee:

(i) Receives

the 2021 Q2 Health and Safety Report

(ii) Receives

the 2021 Q2 Mental Health and Wellbeing Report

Carried

|

At 1pm the meeting adjourned.

At 1.45pm the meeting reconvened.

|

9.6 Financial

and Non-Financial Monitoring Report: Period ended 31 December 2021

|

|

Staff Paul

Davidson, General Manager: Corporate Services

Kathryn

Sharplin, Manager: Finance

Key points

·

The report covered the first six months of the year.

·

Overall operating and capital was currently below budget.

·

Operational delivery was moving slowly through a combination of

Covid, workload and staff availability with recruitment.

·

The updated forecasts were optimistic; staff noted that the

next few months might see more delays.

·

Baycourt and the airport were currently under budget.

In response to questions

·

Staff would provide an updated ‘top 25 projects’

forecast.

·

Staff were assessing at a macro level the implications of delay

and consequent carry forwards for the Annual Plan budget. The main revisions

related to the Tauriko West and Cameron Road projects.

·

A more realistic time frame for roading projects had been set.

NZTA Waka Kotahi delays had impacted the Tauriko project which could have

implications for rates levels and timing.

·

As projects were revisited, estimates previously provided had

seen cost increases.

·

Cameron Road was anticipated to be back on schedule by

May. There had been timeframe adjustments due to ongoing delays in

arrival of materials; however, the targeted completion date was still on

track.

·

TCC was in a similar position to other councils, with inflation

at 5%, shortages of qualified staff and supply of materials impacting on an

ambitious capital programme.

|

|

Committee Resolution SFR1/22/8

Moved: Dr

Wayne Beilby

Seconded: Commissioner

Stephen Selwood

That the Strategy,

Finance and Risk Committee:

(a) Receives Report Financial and Non-Financial Monitoring Report:

Period ended 31 December 2021.

Carried

|

10 Discussion

of late items

Nil

11 Public excluded

session

RESOLUTION TO

EXCLUDE THE PUBLIC

|

Committee Resolution SFR1/22/9

Moved: Commissioner

Bill Wasley

Seconded: Ms

Rohario Murray

That the public be

excluded from the following parts of the proceedings of this meeting.

The general subject

matter of each matter to be considered while the public is excluded, the

reason for passing this resolution in relation to each matter, and the

specific grounds under section 48 of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Ground(s) under section 48 for the

passing of this resolution

|

|

11.1 - Tauriko Business Estate (TBE)

Potential Liability on Council

|

s7(2)(h) - The withholding of the information is

necessary to enable Council to carry out, without prejudice or

disadvantage, commercial activities

|

s48(1)(a) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

11.2 - Public Excluded Minutes of the

Strategy, Finance and Risk Committee meeting held on 13 December 2021

|

s7(2)(a) - The withholding of the information is

necessary to protect the privacy of natural persons, including that of

deceased natural persons

s7(2)(b)(ii) - The withholding of the information

is necessary to protect information where the making available of the

information would be likely unreasonably to prejudice the commercial

position of the person who supplied or who is the subject of the

information

s7(2)(g) - The withholding of the information is

necessary to maintain legal professional privilege

s7(2)(h) - The withholding of the information is

necessary to enable Council to carry out, without prejudice or

disadvantage, commercial activities

s7(2)(i) - The withholding of the information is

necessary to enable Council to carry on, without prejudice or disadvantage,

negotiations (including commercial and industrial negotiations)

s7(2)(j) - The withholding of the information is

necessary to prevent the disclosure or use of official information for

improper gain or improper advantage

|

s48(1)(a) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

Carried

|

12 Closing

Karakia

The meeting was closed with a karakia.

The meeting closed at 3.20pm.

The minutes of this

meeting were confirmed as a true and correct record at the Strategy, Finance

and Risk Committee Meeting held on 20 June 2022.

...................................................

CHAIRPERSON

7.2 Minutes

of the Strategy, Finance and Risk Committee meeting held on 28 March 2022

File

Number: A13578147

Author: Sarah

Drummond, Committee Advisor

Authoriser: Robyn

Garrett, Team Leader: Committee Support

|

Recommendations

That the Minutes of the Strategy, Finance and Risk Committee

meeting held on 28 March 2022 be confirmed as a true and correct record.

|

Attachments

1. Minutes

of the Strategy, Finance and Risk Committee meeting held on 28 March 2022

|

Strategy, Finance and Risk Committee Meeting Minutes Strategy, Finance and Risk Committee Meeting Minutes

|

28 March 2022

|

|

|

|

MINUTES

Strategy, Finance and Risk Committee Meeting

Monday, 28 March 2022

|

Order of Business

1 Opening karakia. 3

2 Apologies. 3

3 Public forum.. 3

4 Acceptance of

late items. 4

5 Confidential

business to be transferred into the open. 4

6 Change to order

of business. 4

7 Declaration of

conflicts of interest 4

8 Business. 4

8.1 Mainstreets

Monitoring Report for the period to 31 December 2021. 4

8.2 Audit

New Zealand Report on the Audit of Tauranga City Council for the year ended 30

June 2021 and Audit Plan for the year ended 30 June 2022. 5

8.3 Adoption

of draft Rates Remission Policy and draft Rates Postponement Policy for

consultation. 6

8.4 Review

of the Remission and Postponement of Rates on Māori Freehold Land Policy -

Issues and Options. 7

8.5 TCC

Urban Design Framework. 8

8.6 Plan

Change Work Programme for 2022. 9

8.7 Adoption

of draft Waste Management and Minimisation Bylaw 2022 for consultation. 11

8.8 Adoption

of draft Waste Management and Minimisation Plan 2022-2028 for consultation. 12

8.9 Q2

2021/22 LGOIMA and Privacy Requests. 13

8.10 Three

Waters Reform Update Report 13

9 Discussion of

late items. 14

10 Public excluded session. 14

10.1 Quarterly

Security Report - Q4 2021. 15

10.2 Corporate

Risk Register - Quarterly Update. 15

10.3 Internal

Audit - Quarterly Update. 15

10.4 Litigation

Report 16

11 Closing karakia. 16

MINUTES OF Tauranga City Council

Strategy, Finance and Risk Committee Meeting

HELD

AT THE Bay of Plenty Regional Council

Chambers,

Regional House, 1 Elizabeth Street,

Tauranga

ON

Monday, 28 March 2022 AT 10.02am

PRESENT: Commission

Chair Anne Tolley, Dr Wayne Beilby, Commissioner Shadrach Rolleston,

Commissioner Stephen Selwood, Commissioner Bill Wasley, Ms Matire Duncan, Ms

Rohario Murray, Mr Bruce Robertson

IN

ATTENDANCE: Marty Grenfell (Chief Executive), Tony

Aitken (Acting General Manager: People & Engagement), Paul Davidson

(General Manager: Corporate Services), Barbara Dempsey (Acting General Manager:

Community Services), Nic Johansson (General Manager: Infrastructure), Christine

Jones (General Manager: Strategy & Growth), Gareth Wallis (General Manager:

Central City Development), Steve Pearce (Acting General Manager: Regulatory and

Compliance), Anne Blakeway (Manager: Community Partnerships), Kendyl Sullivan

(City Partnerships Specialist), Jim Taylor (Transactional Services Manager),

Ceilidh Dunphy (Community Relations Manager), Carl Lucca (Team Leader: Urban

Communities), Emma Joyce (Policy Analyst), Corinne Frischknecht (Senior Policy

Planner), Janine Speedy (Team Leader: City Planning), Sam Fellows (Manager:

Sustainability and Waste), Kath Norris (Team Leader: Democracy Services), Cathy

Davidson (Manager: Directorate Services), Coral Hair (Manager: Democracy

Services), Robyn Garrett (Team Leader: Committee Support), Sarah Drummond

(Committee Advisor), Anahera Dinsdale (Committee Advisor)

1 Opening

Karakia

Commissioner Rolleston opened the meeting with a karakia.

2 Apologies

|

2.1 Apologies

|

|

Committee Resolution SFR3/22/1

Moved: Commissioner

Bill Wasley

Seconded: Ms

Rohario Murray

That apologies from Mr Te Pio Kawe and Mr Bruce Robertson

be received and accepted.

Carried

|

3 Public

forum

Nil

4 Acceptance

of late items

Nil

5 Confidential

business to be transferred into the open

Nil

6 Change

to order of business

Nil

7 Declaration

of conflicts of interest

Committee Member Matire Duncan

declared a conflict in relation to item 8.10 Three Waters Reform.

8 Business

|

8.1 Mainstreets

Monitoring Report for the period to 31 December 2021

|

|

Staff Anne

Blakeway, Manager: Community Partnerships

Kendyl Sullivan, City Partnerships Specialist

External Sally

Cooke, Mainstreet Tauranga

Claudia West, Mount Business Association

Sally Benning, Greerton Village Mainstreet

Key points

·

All reports were taken as read and external speakers provided

the committee with updates on their particular areas.

·

All parties were glad of the relaxation of

Covid 19 alert levels, this would allow for street pedestrian counts to be

repeated in October.

Mount Mainstreet

·

There were a number of well received

activities in the Mount over the period including an inflatable ice

rink, fairy lights and a music trail.

·

Working was ongoing to revamp the monthly

awards; gift vouchers had been reinstated. Outdoor movies were on hold

until restrictions were further lifted to allow greater numbers of people to

attend.

·

Issues of street cleanliness and rubbish were

being addressed.

·

A new website was to be launched.

All financial reports have now

been audited and a slight loss noted

Downtown Tauranga

·

There was now a feeling of optimism in the CBD; however

challenges still remained and there were still many empty street fronts to

fill. The Association had worked to provide more good stories and sites of

interest across all Main Streets.

·

Commercial sector had been less active; landlords and

property owners were looking at ways to draw people into the conversation .

Mainstreet and council staff would look at further work in this area, the

light display at Christmas was a great example of joint activation.

Greerton

Village Mainstreet

·

Greerton had been particularly hard hit by Covid. The

businesses that had closed were not due to Covid but those that had struggled

through had been very quiet for the last month. This related to the easing of

restrictions and nervousness of an older population.

·

Yarn bombing was a highlight, it was a major event and last

year was declared the best year ever. Mainstreet hoped to have the Cherry

Blossom Festival this year.

·

Mainstreet was very proud of their Christmas light display and

had invested money in new lights. Great support had been received for a

Christmas hamper from a cross section of businesses.

·

A new website was planned.

In response to questions

·

Expanding lighting opportunities would be budget dependant.

·

The Committee expressed its thanks that the Mainstreets,

particularly Mount Mainstreet, had gone from zero to hero in a very

short time.

·

Several metrics were key to all the Mainstreets, such

as pedestrian traffic counts. If Mainstreet members were willing to

provide anonymised data on turnover, that would allow overall trends to be

assessed.

·

On street parking was always an issue for members, and the

Mainstreets were working with the Wednesday Challenge to initiate

change.

Discussion points raised

·

The committee noted a common theme of problems

with street cleaning and levels of service, especially around deep

cleans, This had been noted; there was a need to make sure there

were clear goals.

|

|

Committee Resolution SFR3/22/2

Moved: Commissioner

Bill Wasley

Seconded: Ms

Rohario Murray

That the Strategy,

Finance and Risk Committee:

(a) Receives the

Mainstreets’ Monitoring Report for the period to 31 December 2021.

(b) Receives the Mount Business

Association Report to 31 December 2021.

(c) Receives the Mainstreet

Tauranga Report to 31 December 2021.

(d) Receives the Greerton

Village Mainstreet Report to 31 December 2021.

(e) Receives

the Papamoa Unlimited Report to 31 December 2021.

Carried

|

|

8.2 Audit New

Zealand Report on the Audit of Tauranga City Council for the year ended 30

June 2021 and Audit Plan for the year ended 30 June 2022

|

|

Staff

Paul Davidson, General Manager: Corporate Services

External Clarence

Susan, Audit New Zealand

Key points

·

Noted that the first report of the year was under the old SAP

system; the second report dealt with the upcoming 2022 audit.

·

These reports closed the financial reporting of 2021 and the

issuing of an audit plan for 2022 year. There would be a balancing required

to account for the 3 Waters reform.

·

Supply chains were still causing issues with increase of rates.

·

Of the remaining matters in the report (15 items), these had

now been resolved or would be integrated into other programmes. The

most important would be dealt with as a matter of urgency.

·

Audit NZ had been working with Tauranga City Council to resolve

these matters. Some recommendations would be resolved with the implementation

of new systems; some would require a change to reporting.

The Committee requested that the 15 outstanding matters be highlighted to

show those repaired by the new SAP system, those completed and those that

would require further changes.

·

Mr Susan from Audit New Zealand noted that there was currently

a shortage of auditors in New Zealand and they would work with staff as best

they could.

·

The Committee commended all involved in the process of a clear

audit.

|

|

Committee Resolution SFR3/22/3

Moved: Commissioner

Bill Wasley

Seconded: Commissioner

Shadrach Rolleston

That the Strategy,

Finance and Risk Committee:

(a) Receives

the report - Audit New Zealand Report on the Audit of Tauranga City Council

for the year ended 30 June 2021 and Audit Plan for the year ended 30 June

2022.

Carried

|

|

8.3 Adoption of

draft Rates Remission Policy and draft Rates Postponement Policy for

consultation

|

|

Staff Jim

Taylor, Transactional Services Manager

Emma Joyce, Policy Analyst

Key points

·

The report incorporated changes from February.

In response to questions

·

Clarification was provided regarding valuation and possible

remission of gold kiwifruit licences. Staff were waiting for the legal

proceedings to be resolved, and would then follow any direction from the

courts for valuation and remission.

|

|

Committee Resolution SFR3/22/4

Moved: Commissioner

Stephen Selwood

Seconded: Commissioner

Shadrach Rolleston

That the Strategy,

Finance and Risk Committee:

(a) Adopts

the draft Rates Remission Policy for consultation

(b) Adopts

the draft Rates Postponement Policy for consultation.

Carried

|

|

8.4 Review of

the Remission and Postponement of Rates on Māori Freehold Land Policy -

Issues and Options

|

|

Staff Jim

Taylor, Transactional Services Manager

Emma Joyce, Policy Analyst

Key points

·

The Committee commended staff on a good report that included

and highlighted the consultation and conversations that had already taken

place. Staff noted that there had been another hui since the report was

signed off.

·

Staff had been in discussion with the Western Bay of Plenty

District Council, which was currently consulting on their policy, and had

aimed to achieve consistency with the Western Bay. Staff however noted that,

while following a similar policy approach and staff having confirmed broadly

similar consensus, there were some areas and approaches that th two councils

would have to agree to disagree on.

·

Staff suggested that this should be highlighted in the

consultation documents to allow targeted responses

|

|

Committee Resolution SFR3/22/5

Moved: Commissioner

Bill Wasley

Seconded: Ms

Rohario Murray

That the Strategy,

Finance and Risk Committee:

(a) Adopts

the draft Remission and Postponement of Rates on Māori Freehold Land

Policy for consultation, noting the following amendments:

(i) A

new purpose statement paraphrasing the Preamble from Te Ture Whenua

Māori Act 1993.

(ii) Revised

criteria for remission of rates, except service charges, on land subject to

development to only require assessment against the benefits outlined at

section 114A of the Local Government (Rating) Act 2002.

(iii) Provisions

extending the ability to remit rates, except service charges, on land

intended for development to land returned through a right of first refusal

scheme or Treaty settlement or where the land is temporarily transferred to

general title and held in collective ownership.

(iv) Provision

for 100% remission of rates, except service charges, on land subject to

development, or defined and agreed development or stage of development, until

such time as the development or stage of development is generating income or

persons are residing in the houses.

(v) Provision

for Māori freehold land rates remission which reflects a rate based on

Māori freehold land value excluding any subdivision potential unlikely

to be realised in Māori ownership.

(vi) Provision

for partial or full remission of rates, except service charges, on land that

may be partially used for limited or seasonal productive use.

(vii) Provision

clarifying that land providing non-commercial community benefit to Māori

or papakāinga is eligible for 100% remission of rates, except service

charges.

Carried

|

|

8.5 TCC Urban

Design Framework

|

|

Staff Corinne

Frischknecht, Senior Policy Planner

Carl Lucca, Team Leader: Urban Communities

Key points

·

The report was taken as read and minor

amendments were made to the resolution following discussion and questions.

In response to questions

·

Staff undertook to provide more information and reports from

the Auckland Unitary Authority on their Design Panel Process.

·

The Committee noted a lack of specific emphasis on greening of

the urban landscape and a restriction of panel members that might inhibit

innovation from other areas. These matters would be addressed by

incorporation into the Design Panel Guidelines.

·

Public design space would be captured through the Environment Strategy

refresh process. This report covered private spaces.

·

The Committee noted that these matters would need to operate in

both spaces.

·

It was intended that the Panel would provide a strong local

voice and be able to provide good advice and learning from the city as a

whole.

·

Under this process, there would be an urban design planner

assigned from the time of application to the end of the application process.

·

There would be strong advice and advocacy for applicants of the

benefit of the Urban Design Panel process.

·

Mana whenua values should be considered at the front of the

application process and reflected as a voice both on the Panel and in the

application documentation.

·

The cCmmittee considered this process would provide great

benefit, would like to see it include public transport and also come

together as part of overall urban design.

·

The Committee noted that the scope of panel advice required

some rationalisation and prioritisation.

|

|

Committee Resolution SFR3/22/6

Moved: Commission

Chair Anne Tolley

Seconded: Commissioner

Stephen Selwood

That the Strategy,

Finance and Risk Committee:

(a) Adopts an Urban Design

Framework to promote and facilitate high quality urban design outcomes in

Tauranga City, including:

(i) Setting up an Urban Design Panel,

in line with the proposed Terms of Reference

(ii) Incorporating urban design policy into

the City Plan, supported by appropriate urban design guidelines

(iii) Providing for ongoing awareness and promotion of urban

design requirements and outcomes sought through educational and promotional

material.

(iv) Establishing internal staff

resources to implement the Urban Design Framework.

(v) Ensuring alignment with

other relevant planning documents (including but not limited to the Street

Design Guide and Strategy Refresh).

(b) Delegates

authority to the Chief Executive and General Manager, Strategy & Growth

to refine the draft Terms of Reference;

(c) Notes that the Executive

Report on the 2022/23 Annual Report will include provision for funding for

the senior urban design and

support administration roles, totalling an estimated $173,000 per annum.

(d) Requests that staff report

back to the Committee on progress and implementation in no later than 18

months’ time.

Carried

|

|

8.6 Plan Change

Work Programme for 2022

|

|

Staff Christine

Jones, General Manager: Strategy and Growth

Janine

Speedy, Team Leader: City Planning

Key points

·

Staff provided a brief overview of the report noting that at

present Plan Change 26 (PC 26) remained on hold as further direction was

expected from the Minister that may provide a better pathway.

In response to questions

·

The proposed Plan Change would incorporate key corridors in

Greerton, Gate Pa and potentially The Mount and Cherrywood. The Plan Change

would be notified in August then appeals would only be on points of law.

·

This process would allow the same intensification as PC 26 but

was a more streamlined process; either pathway would require the same process

of including all spatial work into the plan which would come back to the

Committee by end of June for further discussion.

·

The proposed legislation was restrictive on what Council could

do, the raw frameworks completed for PC26 would be used to inform the work.

·

The new framework would not allow the previous approach of

rules that did not allow encroachment on the building envelope. For example,

PC 26 had a blank façade rule which could not now be implemented under

the proposed legislative process. There are other potential legal impacts on

issues such as fencing and waste management that staff are working through

one by one.

·

The Council would define a walkable catchment; staff would

bring proposals back to the Committee and seek guidance from the Committee on

this matter once affected corridors and areas have been defined. Currently

staff were working to align with other councils as practicably as possible on

these rules.

·

Council’s submission voiced concern over the ‘three

dwellings as of right’ rules, as these might cause unforeseen

consequences for infrastructure development and planning. Staff advised that

where a resource consent was required there was an infrastructure capacity

rule available that looked at non RMA rules. Staff were working to

determine if some controls could be added at this point around

infrastructure.

·

There were currently some timeframes that may require further

engagement with central government on these areas of concern e.g.

transportation risk.

Discussion points raised

·

Feedback was provided that at present what was not in the

proposal was what was not available – an ability to achieve rapid

processes for rapid changes for the city, there were no provisions for

greenfield development.

·

The Committee acknowledged the previous great work from staff

on PC26 and noted that it must be hugely disappointing to not take that

forward.

·

The Committee might not be able to work to paragraph 8 and have

no other plan changes. They would like to revisit this at the end of 2022 and

for staff to report back.

·

The Commissioners had been tasked to look after the city and

grow it in a proud way. They and the Committee acknowledged that the proposed

legislation presented a challenge to those coming forward for future

councils.

|

|

Committee Resolution SFR3/22/7

Moved: Commissioner

Bill Wasley

Seconded: Commissioner

Shadrach Rolleston

That the Strategy,

Finance and Risk Committee:

(a) Approves

proceeding with a plan change to implement the Resource Management (Enabling

Housing Supply and Other Matters) Amendment Act by:

(i) Applying

the Medium Density Residential Standards to residential zones (currently

identified as Suburban Residential, Wairakei Residential, City Living and

High-Density Residential zones) with an appropriate rule framework; and

(ii) Giving

effect to Policy 3 in the National Policy Statement on Urban Development to

maximise heights in the City Centre Zone, enable at least 6 storeys within a

walkable catchment of the city centre and enable residential building height

and density appropriate to local, neighbourhood and town centres.

(b) Notes that greenfield urban

growth areas (Te Tumu and Tauriko West) and private plan changes will be

progressed through planning processes separate from (a) above.

(c) Notes that Plan Change 26

(Housing Choice) remains on hold to retain the opportunity to notify a

variation if subsequently identified as the most appropriate pathway.

Carried

|

At 12.27pm the meeting adjourned.

At 1.15pm the meeting reconvened.

|

8.7 Adoption of

draft Waste Management and Minimisation Bylaw 2022 for consultation

|

|

Staff Nic

Johansson, General Manager: Infrastructure

Sam Fellows, Manager: Sustainability and Waste

Key points

·

In current practice multi-unit dwellings as an area of rubbish

collection had been set by an ad hoc bylaw. The new bylaw would allow

developers to place waste minimisation practices into development plans; a

second phase would be to add in demolition waste. At present, as staff are

working on a region-wide approach with the Western Bay of Plenty,

conditions had not been made too onerous.

·

The proposed bylaw included recognition of the Treaty of

Waitangi.

·

Staff noted that there will be new legislation released from

central government that would be taken into account.

In

response to questions

·

The Morrison Low report had been reviewed and advised the

formation of the proposals. It compared Tauranga city operations with

other cities and provided a basis for the proposed plan and bylaw.

·

There is a small but wide definition of Māori values in

the proposal especially as related to Māori land blocks, to ensure the

right consultation is undertaken to have all views and perspectives on board.

·

The proposed bylaw was mirrored throughout the Bay of Plenty

and acknowledged the need to bring the commercial sector on a journey to

change.

|

|

Committee Resolution SFR3/22/8

Moved: Commissioner

Bill Wasley

Seconded: Dr

Wayne Beilby

That the Strategy,

Finance and Risk Committee:

(a) Approves the draft Waste

Management and Minimisation Bylaw 2022 (Attachment A) for community consultation.

(b) Adopts the Statement of

Proposal for the draft Waste Management and Minimisation Bylaw 2022 (Attachment

B) for community consultation.

(c) Resolves that in accordance

with section 155 of the Local Government Act 2002, the proposed draft Waste

Management and Minimisation Bylaw 2022, is the most appropriate and

proportionate way of addressing the perceived problem and does not give rise

to any implications under the New Zealand Bill of Rights Act 1990.

(d) Delegates to staff the

ability to make any minor edits or amendments to the draft Waste Management

and Minimisation Bylaw 2022 or Statement of Proposal to correct any

identified errors or typographical edits.

Carried

|

|

8.8 Adoption of

draft Waste Management and Minimisation Plan 2022-2028 for consultation

|

|

Staff Nic

Johansson, General Manager: Infrastructure

Sam Fellows, Manager: Sustainability and Waste

Key points

·

Staff provided a summary of the Plan.

In response to questions

·

The Committee noted that the report told the story of current

problems and set the case for change but no summary for actions.

·

There would be a large amount of monitoring that would be

required.

·

There were currently not many hard facts or details for the Committee

to look at. At higher levels this would enable the region to apply for central

government levy money that would see half of waste charges returned to be

directed to further initiatives.

·

Ii was anticipated that the Plan would form a living document

and may change in yearly effect, with concrete actions added, legislative

change incorporated and a proactive focus on not creating double handling or

workload.

·

It was expected that a yearly delivery report containing plans

for the following year would be provided to Council.

·

Given recent Covid disruptions to recycling and green waste

disposal, under the proposed plan these could be elevated in priority.

|

|

Committee Resolution SFR3/22/9

Moved: Commissioner

Bill Wasley

Seconded: Commissioner

Shadrach Rolleston

That the Strategy,

Finance and Risk Committee:

(a) Approves the draft Waste

Management and Minimisation Plan 2022-2028 (Attachment A) for

community consultation.

(b) Delegates to staff the

ability to make any minor edits or amendments to the draft Waste Management

and Minimisation Plan 2022-2028 or Statement of Proposal to correct any

identified errors or typographical edits.

Carried

|

|

8.9 Q2 2021/22

LGOIMA and Privacy Requests

|

|

Staff Tony

Aitken, Acting General Manager: People and Engagement

Kath Norris, Team Leader: Democracy Services

Key points

·

Staff provided a summary of recent trends and the number of

requests received.

In response to questions

·

It was expected that the current trend of increasing requests

would continue.

|

|

Committee Resolution SFR3/22/10

Moved: Commissioner

Stephen Selwood

Seconded: Dr

Wayne Beilby

That the Strategy,

Finance and Risk Committee:

(a) Receives

the report Q2 2021/22 LGOIMA and Privacy Requests.

Carried

|

|

8.10 Three Waters Reform

Update Report

|

|

Staff Nic

Johansson, General Manager: Infrastructure

Cathy

Davidson, Manager: Directorate Services

Key points

·

The staff summary of the report noted that there had been

little recent movement and the report was mainly an information report

detailing facts as known.

·

Following expected further announcements, this issue would come

back to a future Council meeting after consultation with the community and

including staff comment on those concerns raised.

Discussion points raised

·

Noted the importance of consultation with Te Rangapū.

|

|

Committee Resolution SFR3/22/11

Moved: Commissioner

Shadrach Rolleston

Seconded: Commissioner

Stephen Selwood

That the Strategy,

Finance and Risk Committee:

(a) Receives the

report Three Waters Reforms Programme update to the end of February 2022.

(b) Notes

the establishment of the following structures to undertake ongoing work

related to the three waters reforms.

(i) Project

Team

(ii) Project

Steering Group

(c) Supports the

continuation of Tauranga City Council working with National Transition Unit,

including the responses to information requests, nominations for National

Reference Groups and Entity B Local Transition Team and working alongside

other local authorities in the Entity B region.

(d) Notes the

recommendations of the Working Group on Representation,

Governance and Accountability.

(e) That

the Project Steering Group appraises the recommendations from the Working

Group on Representation, Governance and Accountability report, and reports to

Council how those recommendations respectively respond, or otherwise, to

concerns captured from community, Te Rangapū and commission, in relation

to the original governance proposal.

Carried

|

9 Discussion

of late items

Nil

10 Public excluded

session

RESOLUTION TO

EXCLUDE THE PUBLIC

|

Committee Resolution SFR3/22/12

Moved: Commissioner

Shadrach Rolleston

Seconded: Commissioner

Bill Wasley

That the public be

excluded from the following parts of the proceedings of this meeting. Mr

Nathan Speir of Rice Speir (Counsel) will be present for item 10.4

The general subject

matter of each matter to be considered while the public is excluded, the

reason for passing this resolution in relation to each matter, and the

specific grounds under section 48 of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Ground(s) under section 48 for the

passing of this resolution

|

|

10.1 - Quarterly Security Report - Q4

2021

|

s7(2)(c)(ii) - The withholding of the information

is necessary to protect information which is subject to an obligation of

confidence or which any person has been or could be compelled to provide

under the authority of any enactment, where the making available of the

information would be likely otherwise to damage the public interest

|

s48(1)(a) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

10.2 - Corporate Risk Register -

Quarterly Update

|

s7(2)(b)(i) - The withholding of the information

is necessary to protect information where the making available of the

information would disclose a trade secret

s7(2)(b)(ii) - The withholding of the information

is necessary to protect information where the making available of the

information would be likely unreasonably to prejudice the commercial

position of the person who supplied or who is the subject of the

information

s7(2)(h) - The withholding of the information is

necessary to enable Council to carry out, without prejudice or disadvantage,

commercial activities

s7(2)(i) - The withholding of the information is

necessary to enable Council to carry on, without prejudice or disadvantage,

negotiations (including commercial and industrial negotiations)

|

s48(1)(a) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

10.3 - Internal Audit - Quarterly

Update

|

s6(b) - The making available of the information

would be likely to endanger the safety of any person

s7(2)(a) - The withholding of the information is

necessary to protect the privacy of natural persons, including that of

deceased natural persons

s7(2)(d) - The withholding of the information is

necessary to avoid prejudice to measures protecting the health or safety of

members of the public

s7(2)(g) - The withholding of the information is

necessary to maintain legal professional privilege

s7(2)(j) - The withholding of the information is

necessary to prevent the disclosure or use of official information for

improper gain or improper advantage

|

s48(1)(a) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

10.4 - Litigation Report

|

s7(2)(a) - The withholding of the information is

necessary to protect the privacy of natural persons, including that of

deceased natural persons

s7(2)(g) - The withholding of the information is

necessary to maintain legal professional privilege

s7(2)(i) - The withholding of the information is

necessary to enable Council to carry on, without prejudice or disadvantage,

negotiations (including commercial and industrial negotiations)

|

s48(1)(a) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

Carried

|

Mr Robertson entered the

meeting at 2.30 pm

Commissioner Wasley left

the meeting at 2.33 pm

11 Closing

Karakia

Commissioner Rolleston

closed the meeting with a karakia.

The meeting closed at 2.39

pm.

The minutes of this

meeting were confirmed as a true and correct record at the Strategy, Finance

and Risk Committee Meeting held on 20 June 2022.

...................................................

CHAIRPERSON

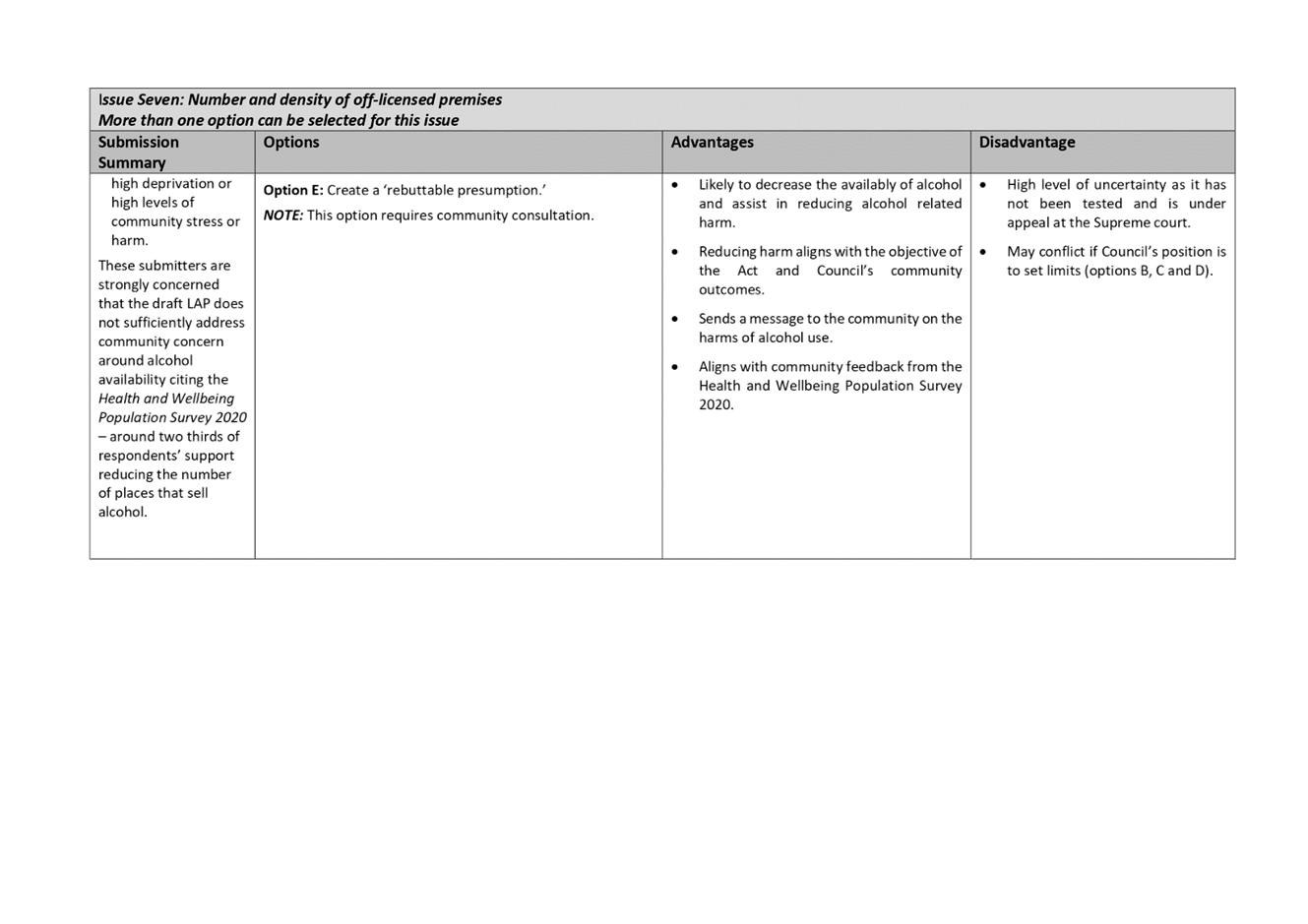

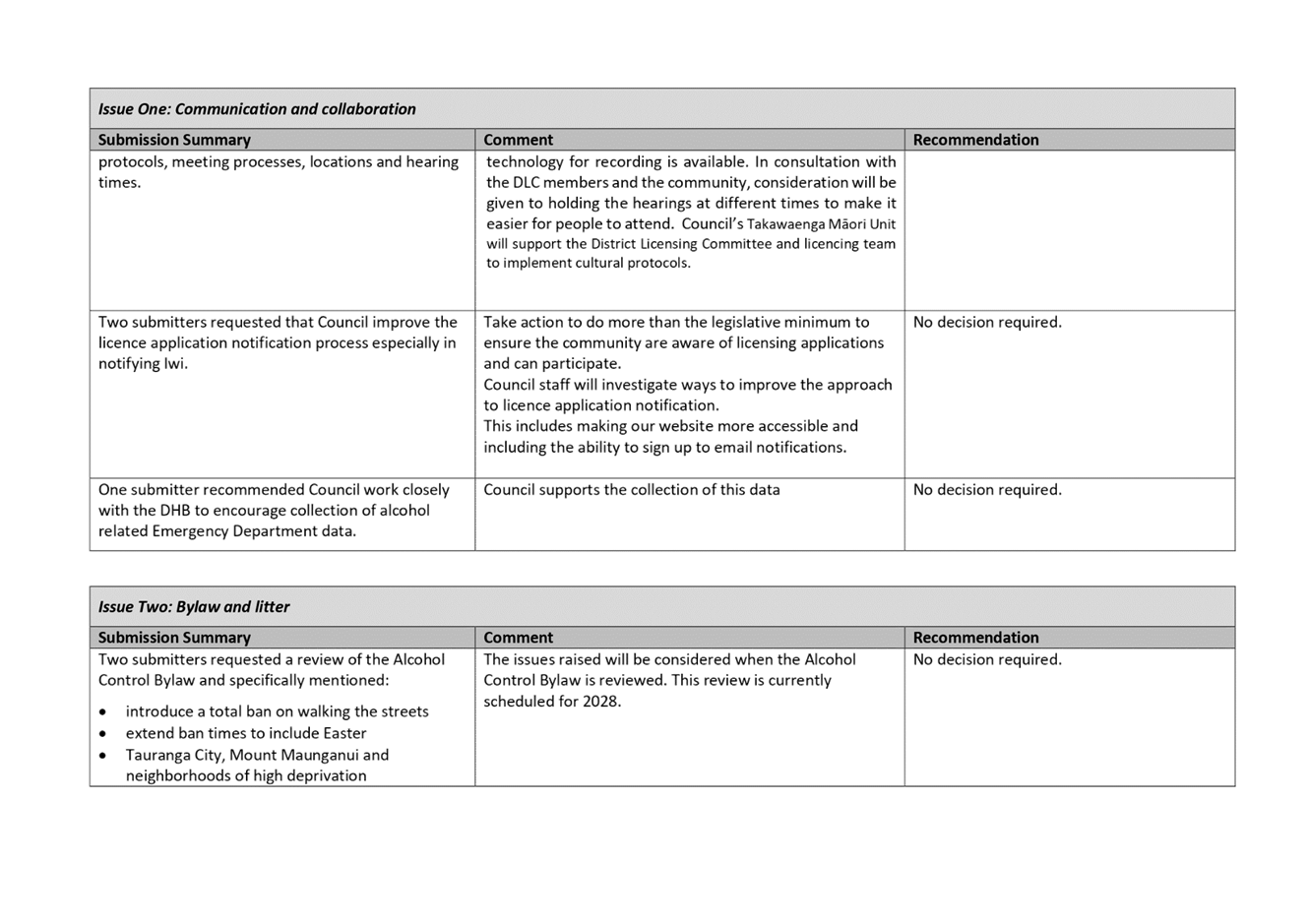

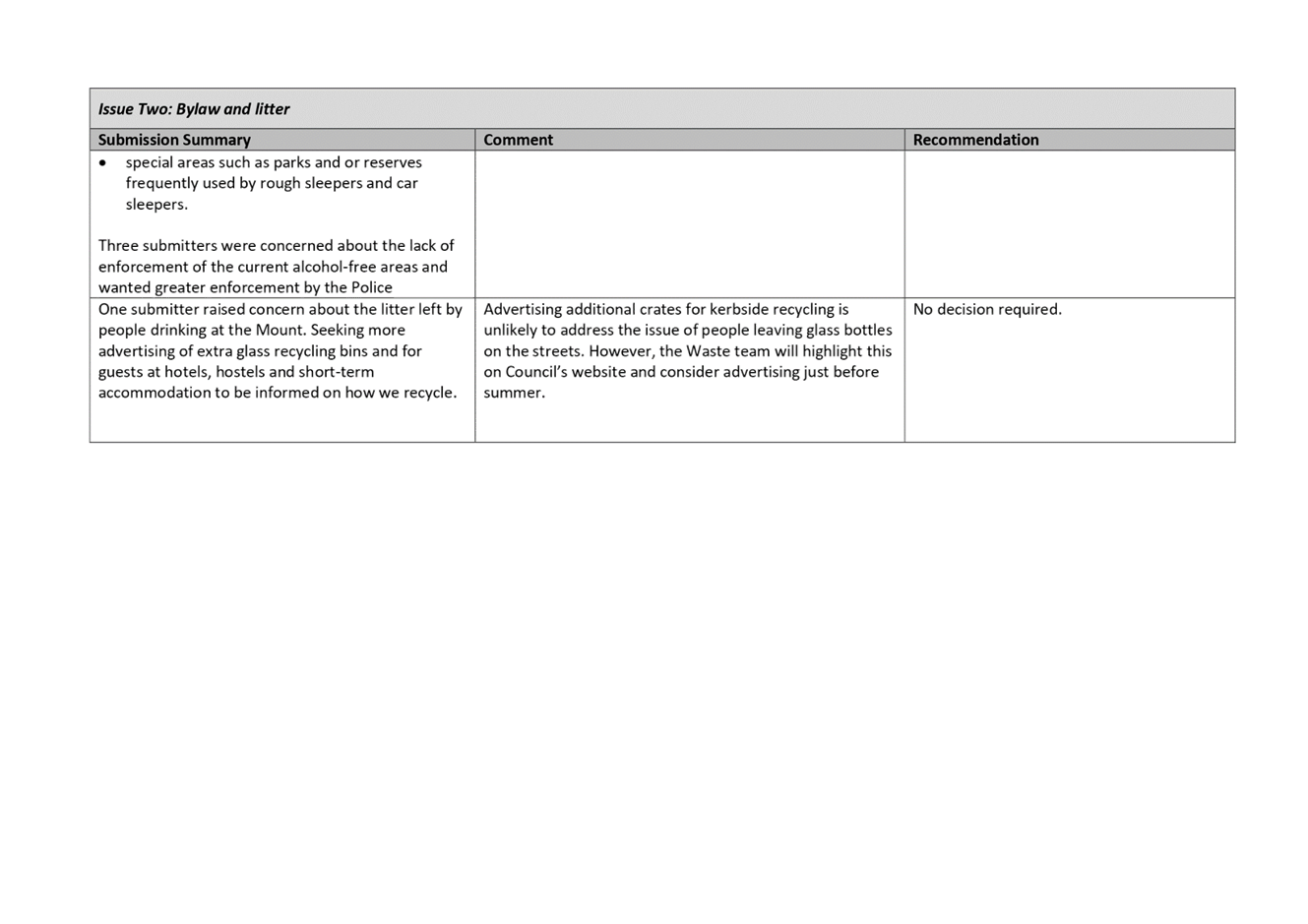

9 Business

9.1 Local

Alcohol Policy Review: Deliberations

File

Number: A13239261

Author: Jane

Barnett, Policy Analyst

Ruth Woodward, Team Leader:

Policy

Jeremy Boase, Manager:

Strategy and Corporate Planning

Authoriser: Steve

Pearce, Acting General Manager: Regulatory and Compliance

Purpose of the Report

1. To consider the

submissions received on the draft Local Alcohol Policy (the draft policy).

|

Recommendations

That the Strategy,

Finance and Risk Committee:

(a) Decides on the options in the

submission summary document (Attachment One) as follows.

|

No.

|

Issue

|

Option

|

|

One

|

Closing time for on-licensed premises in Tauranga

Central City

|

Option A: Change the closing time to 2am.

Recommended

|

|

Two

|

One-way door provision

|

To be determined at meeting

|

|

Three

|

Presentation of club licence provisions

|

Option A:

Create a separate section for club licences.

Recommended

|

|

Four

|

Club trading hours

|

To be determined at meeting

|

|

Five

|

Opening sales time for off-licensed premises

|