|

|

|

AGENDA

Strategy, Finance and Risk Committee meeting

Tuesday, 6 June 2023

|

|

I hereby give notice that a Strategy, Finance and

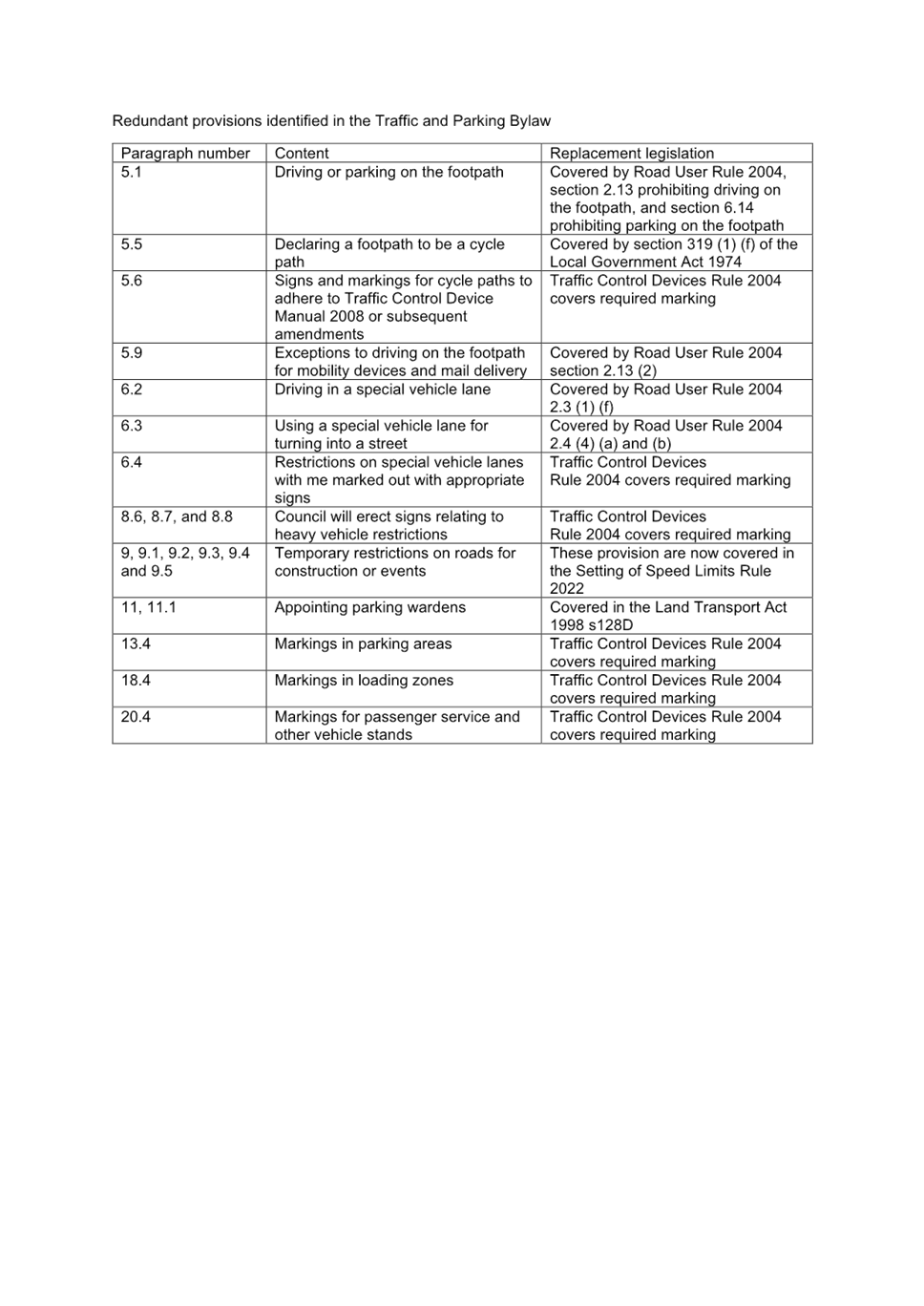

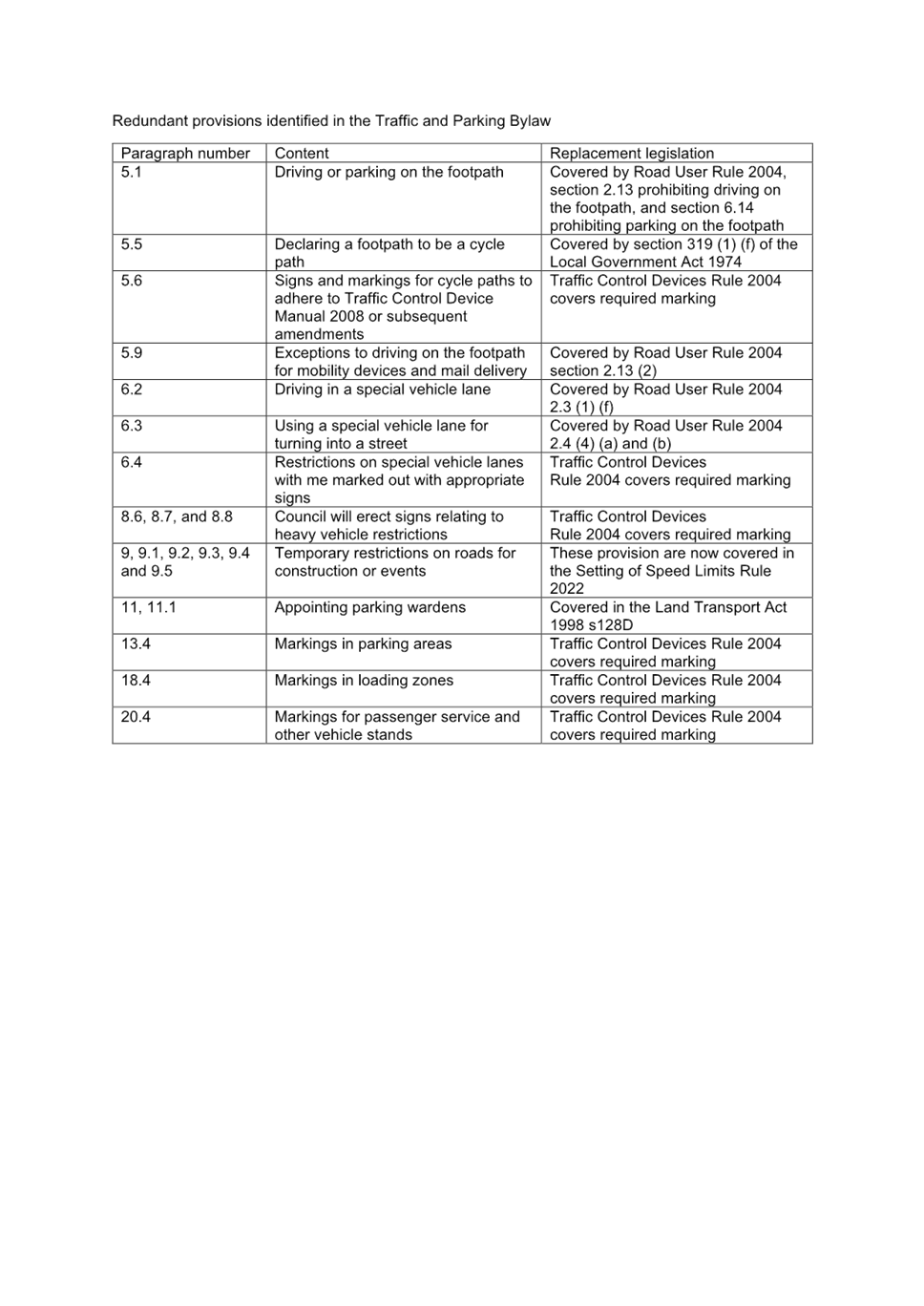

Risk Committee meeting will be held on:

|

|

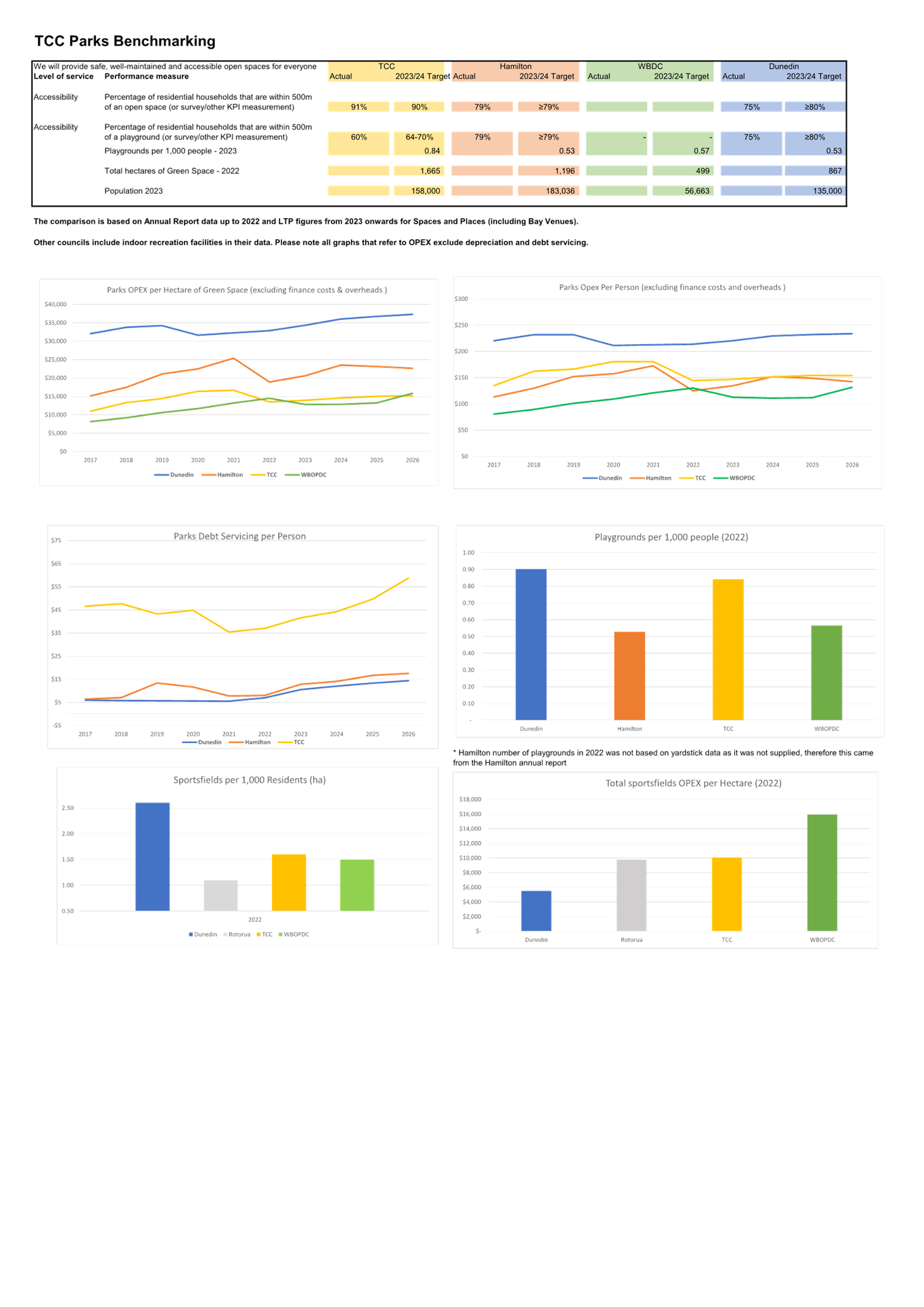

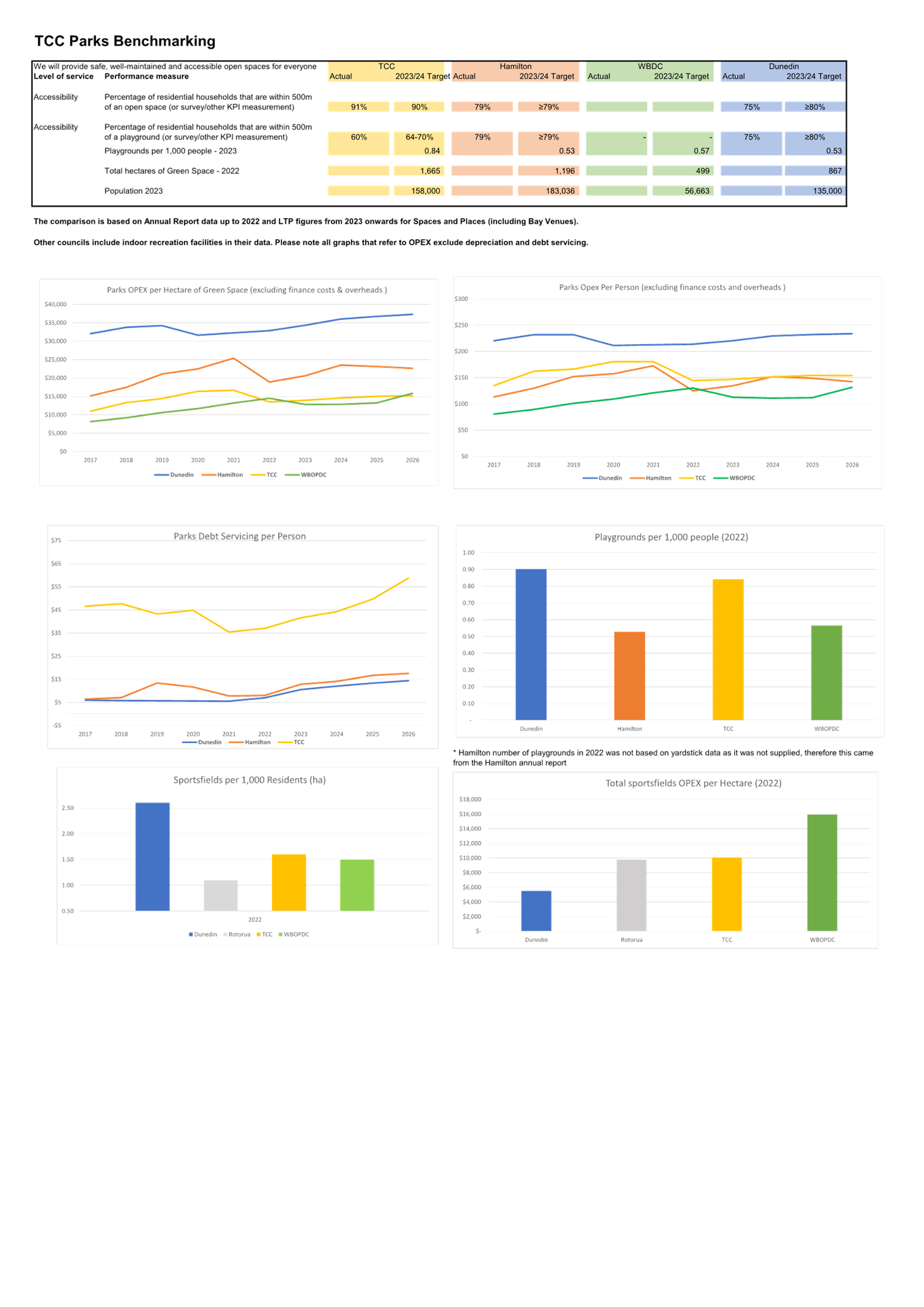

Date:

|

Tuesday, 6 June 2023

|

|

Time:

|

1pm

|

|

Location:

|

Ground Floor Meeting Room 1

306 Cameron Road

Tauranga

|

|

Please note that this

meeting will be livestreamed and the recording will be publicly available on

Tauranga City Council's website: www.tauranga.govt.nz.

|

|

Marty Grenfell

Chief Executive

|

Terms of reference – Strategy,

Finance & Risk Committee

Membership

|

Chairperson

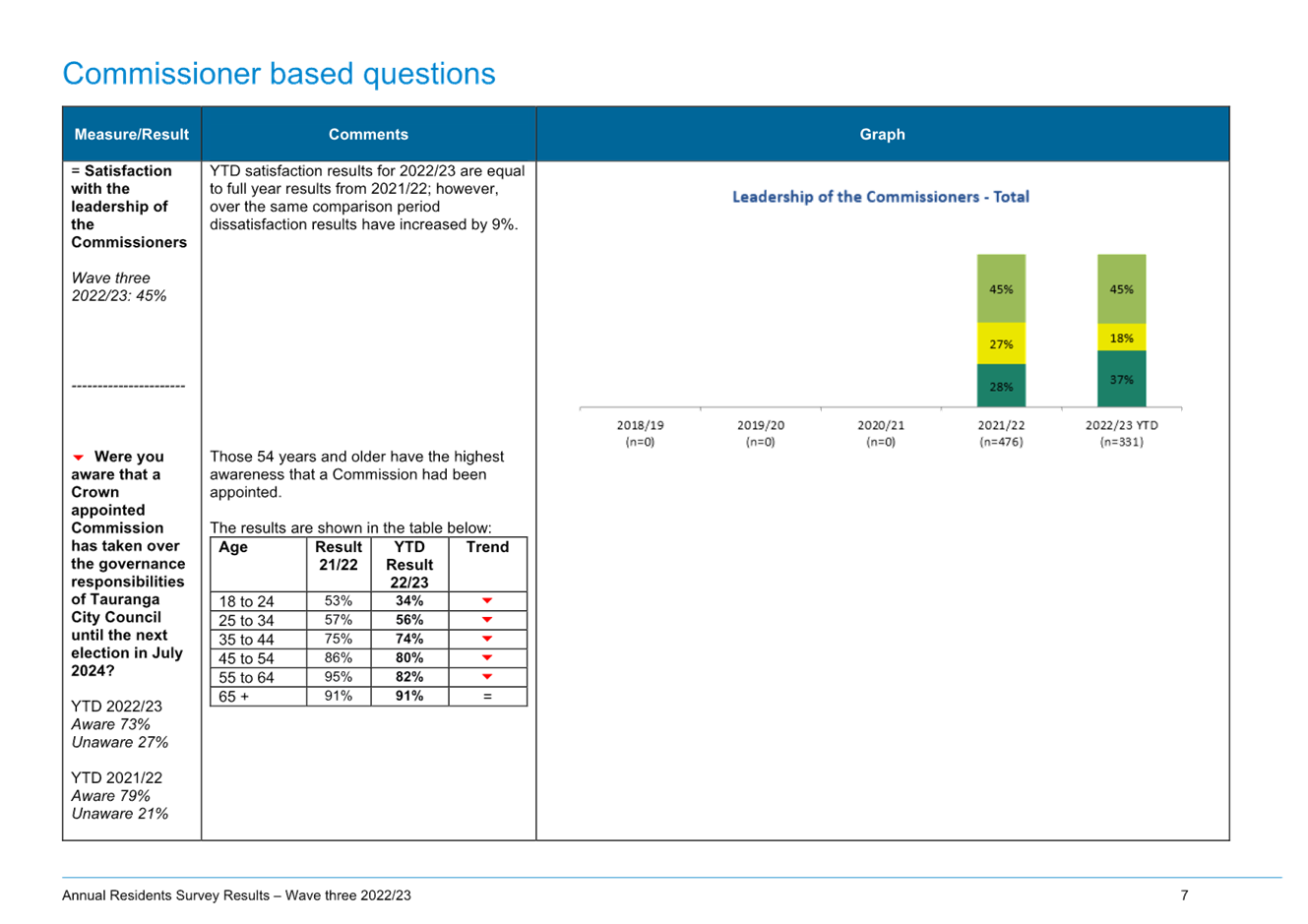

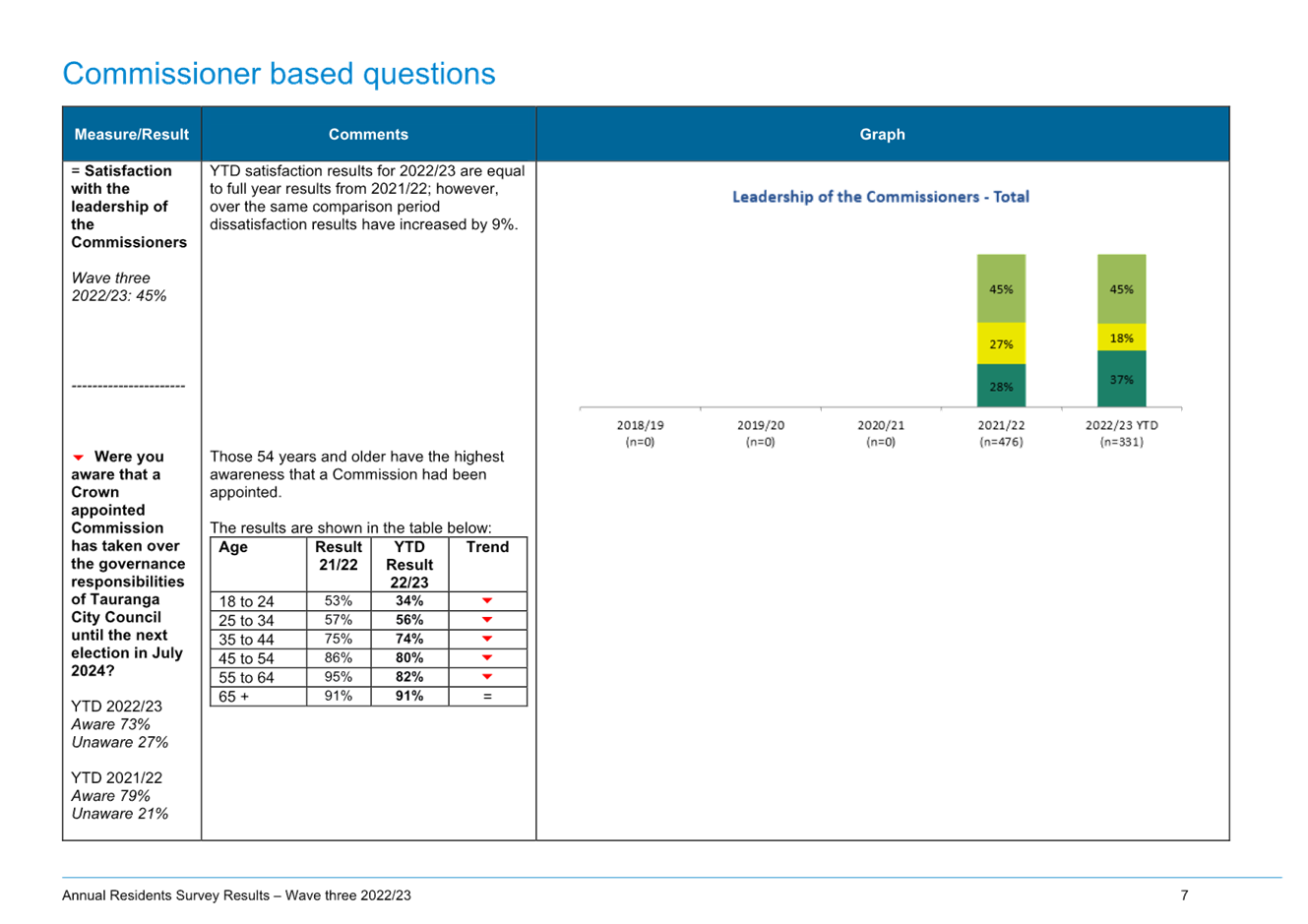

|

Commission Chair Anne Tolley

|

|

Deputy chairperson

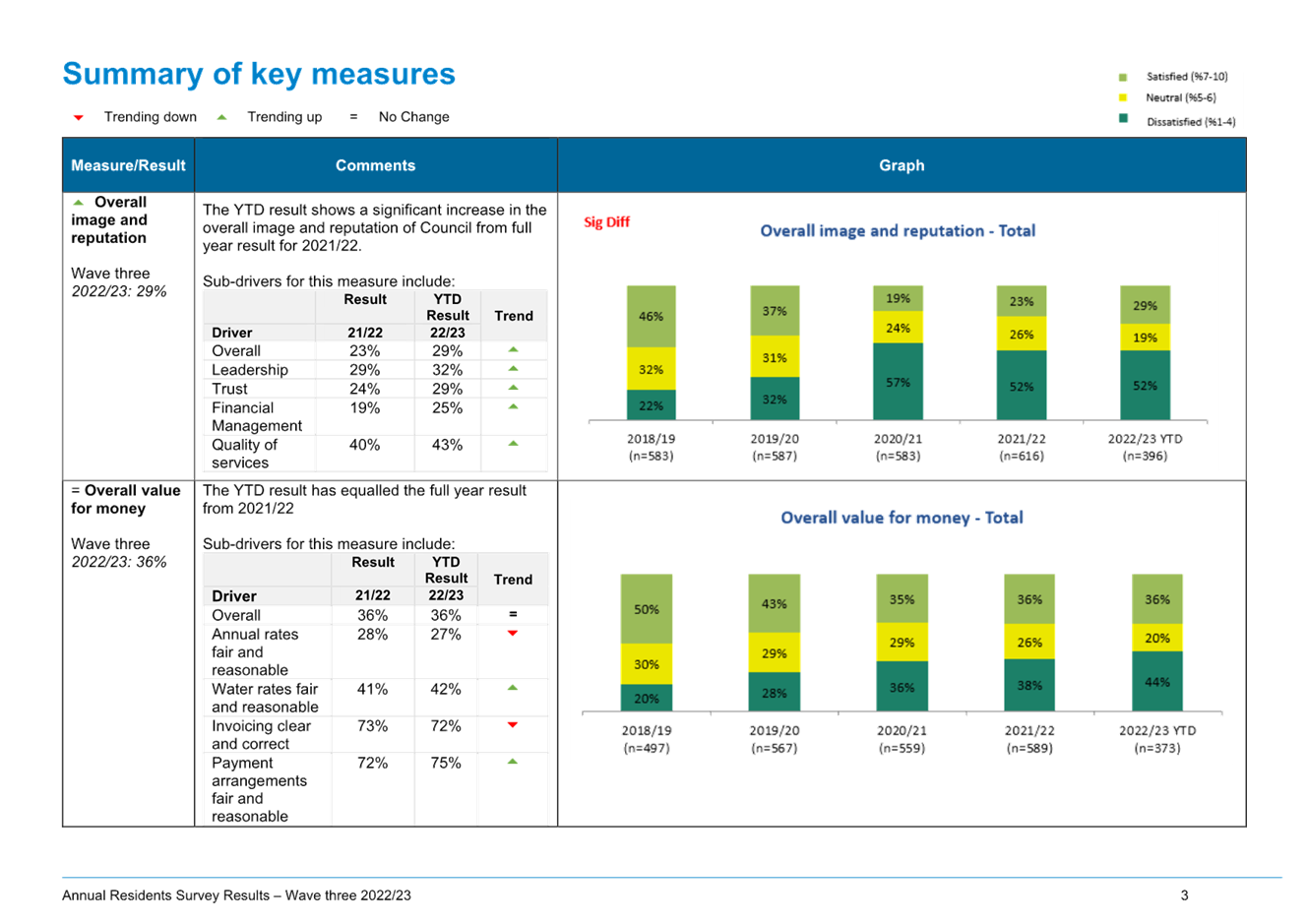

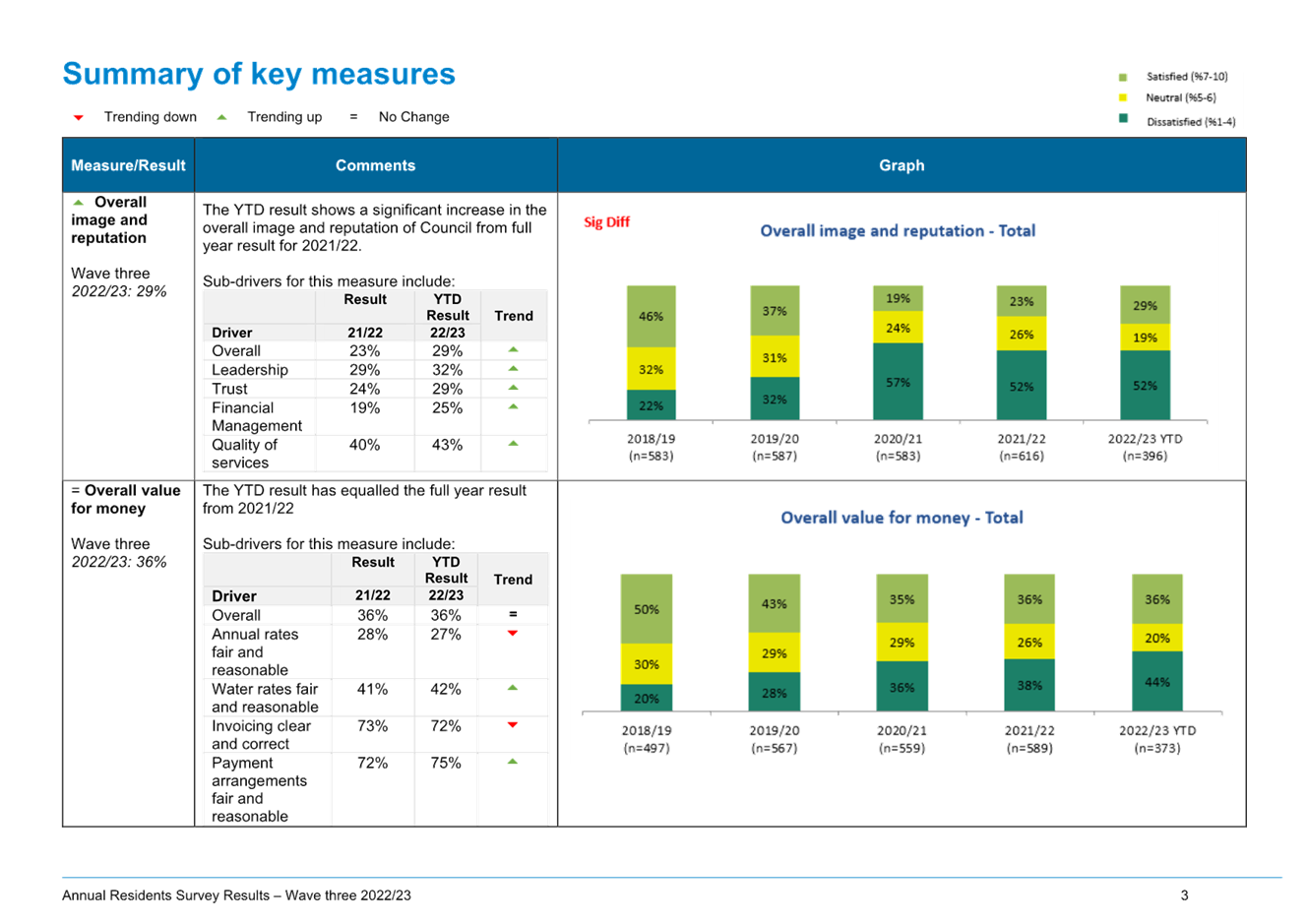

|

Dr Wayne Beilby – Tangata

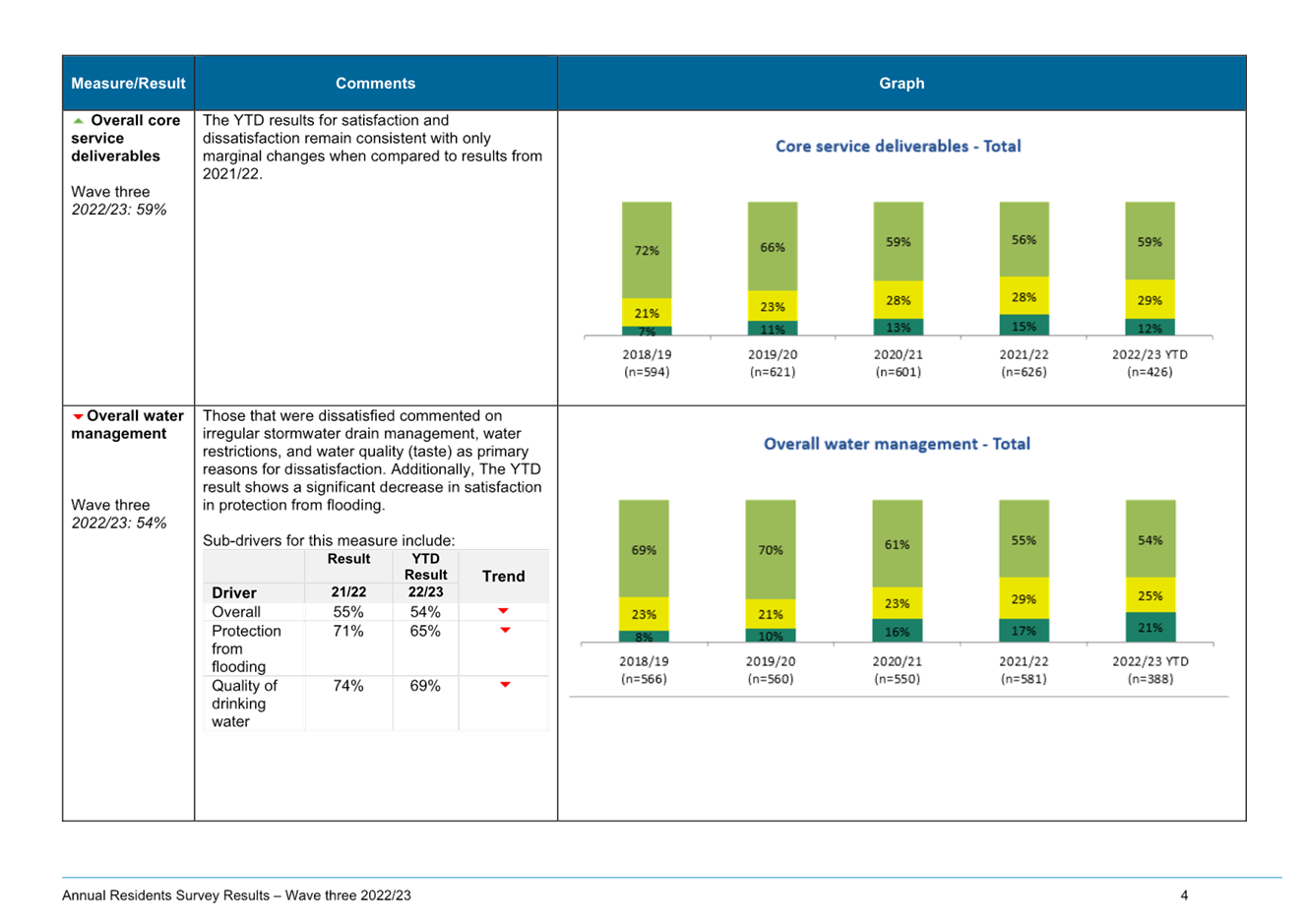

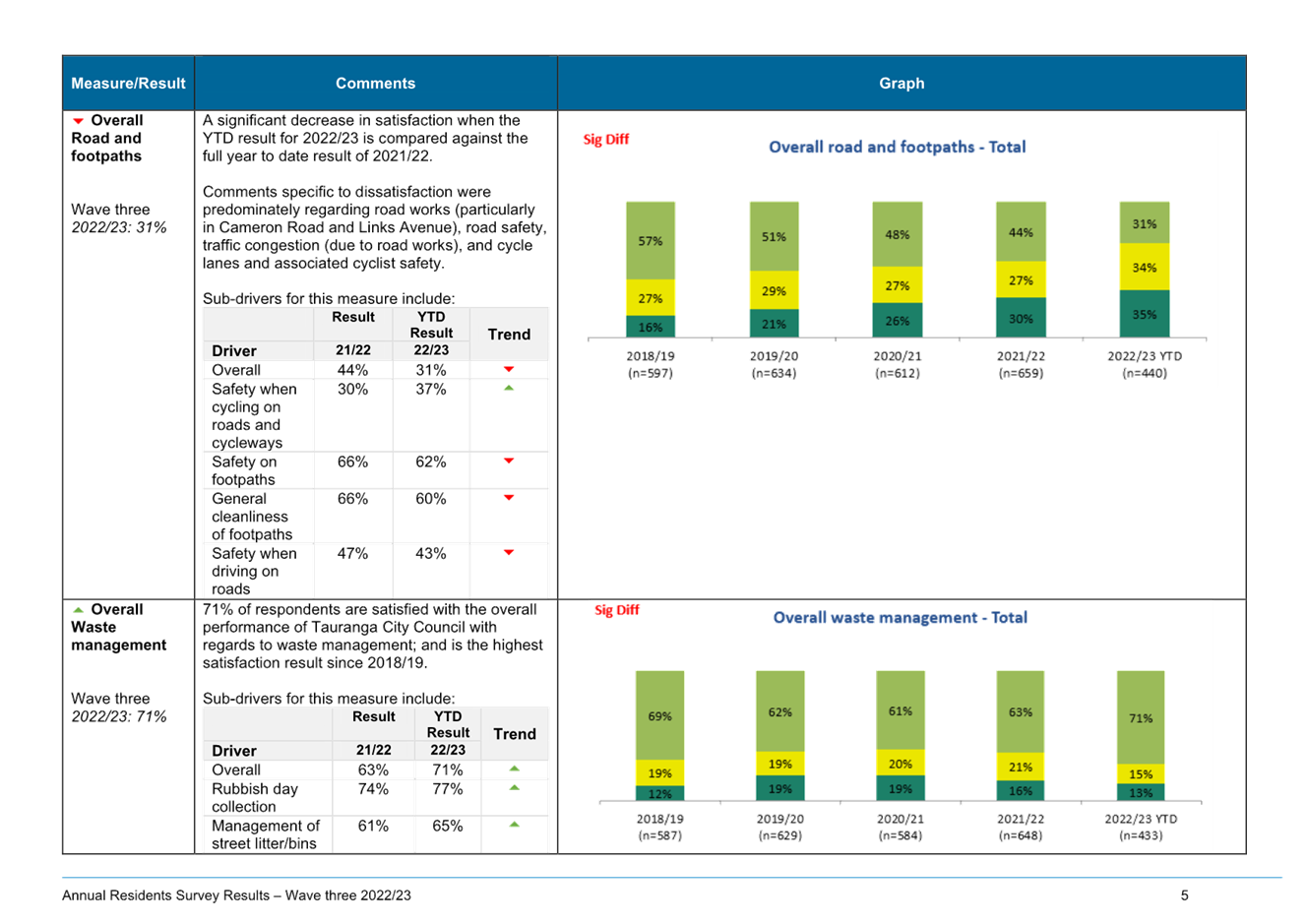

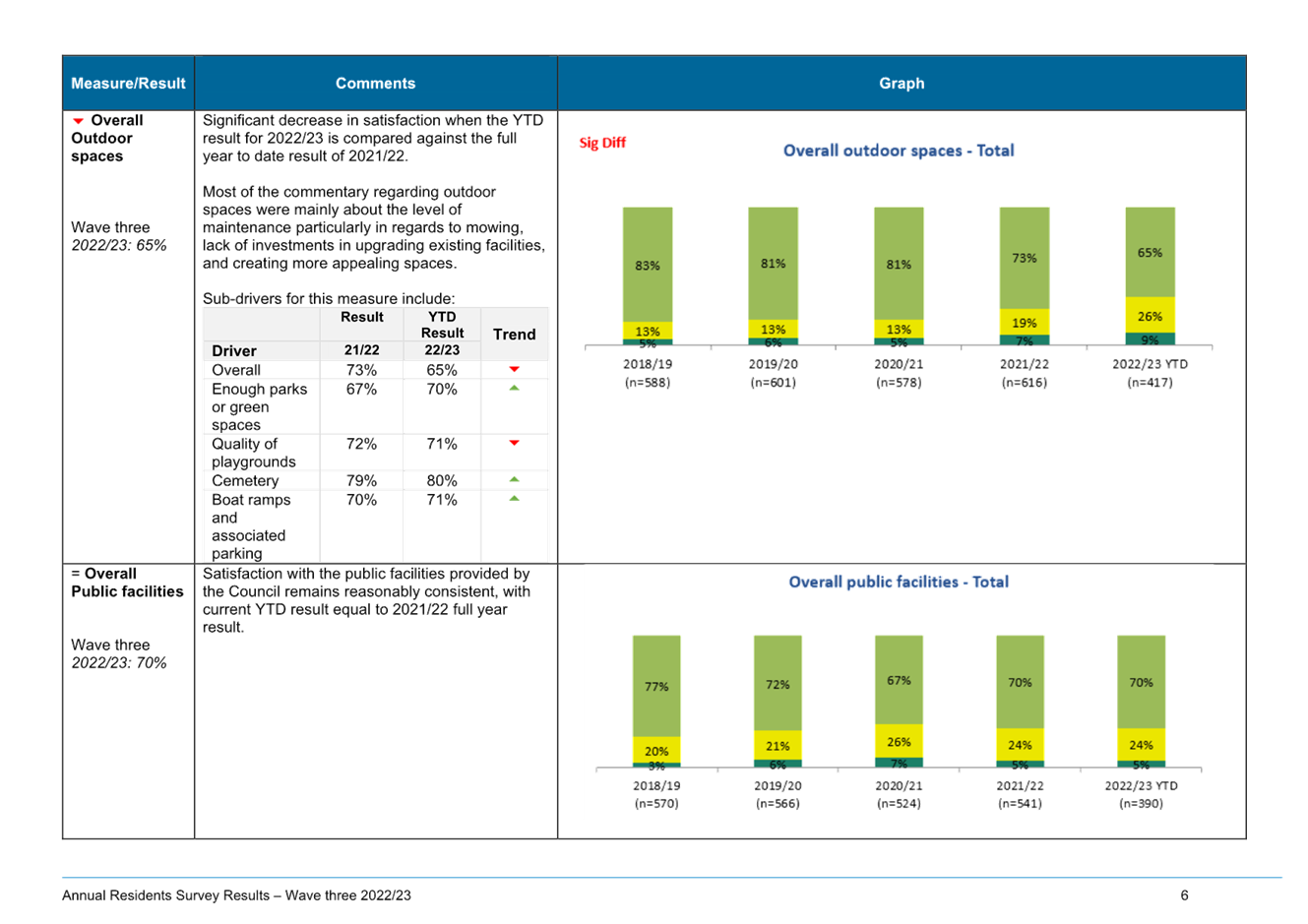

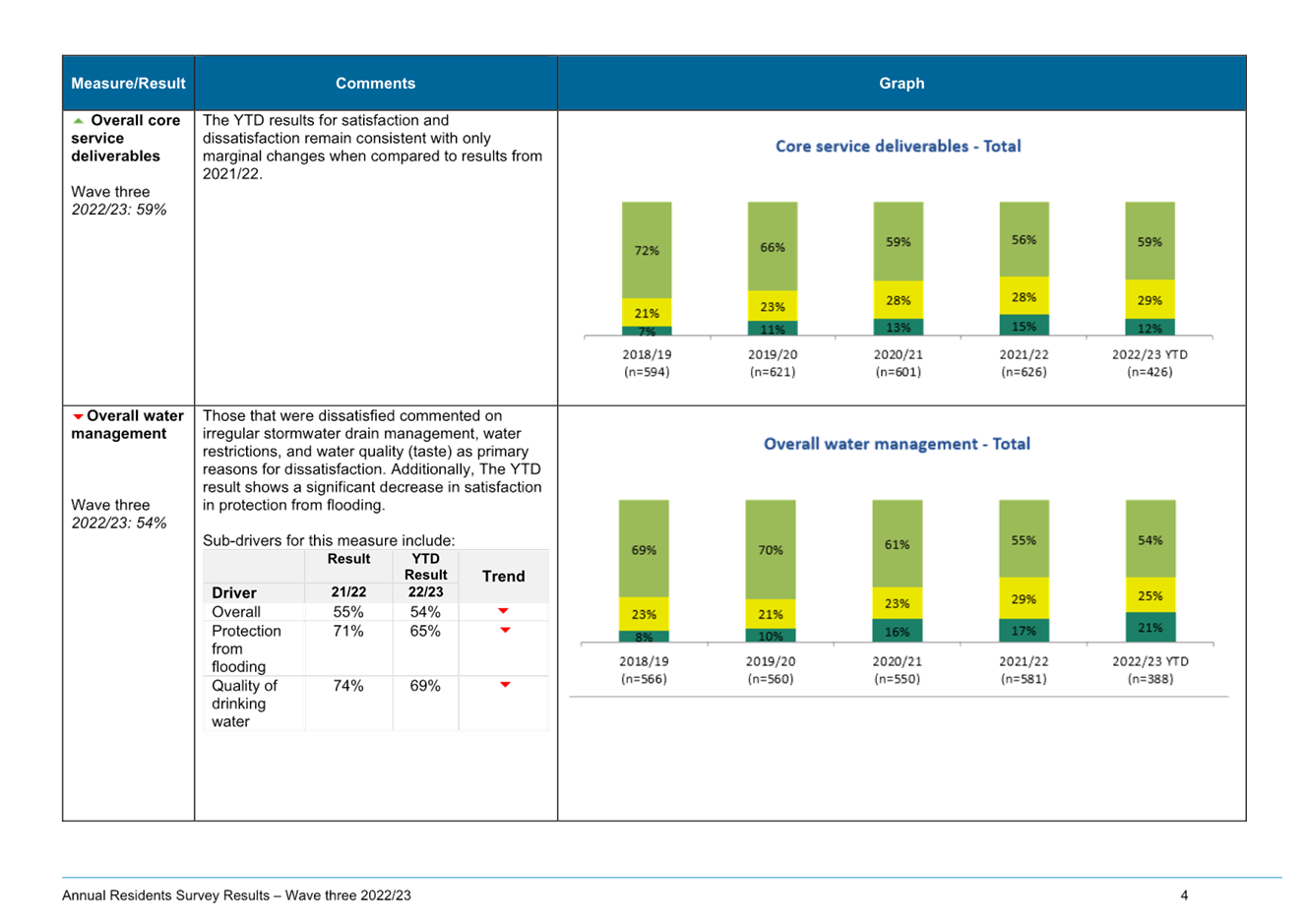

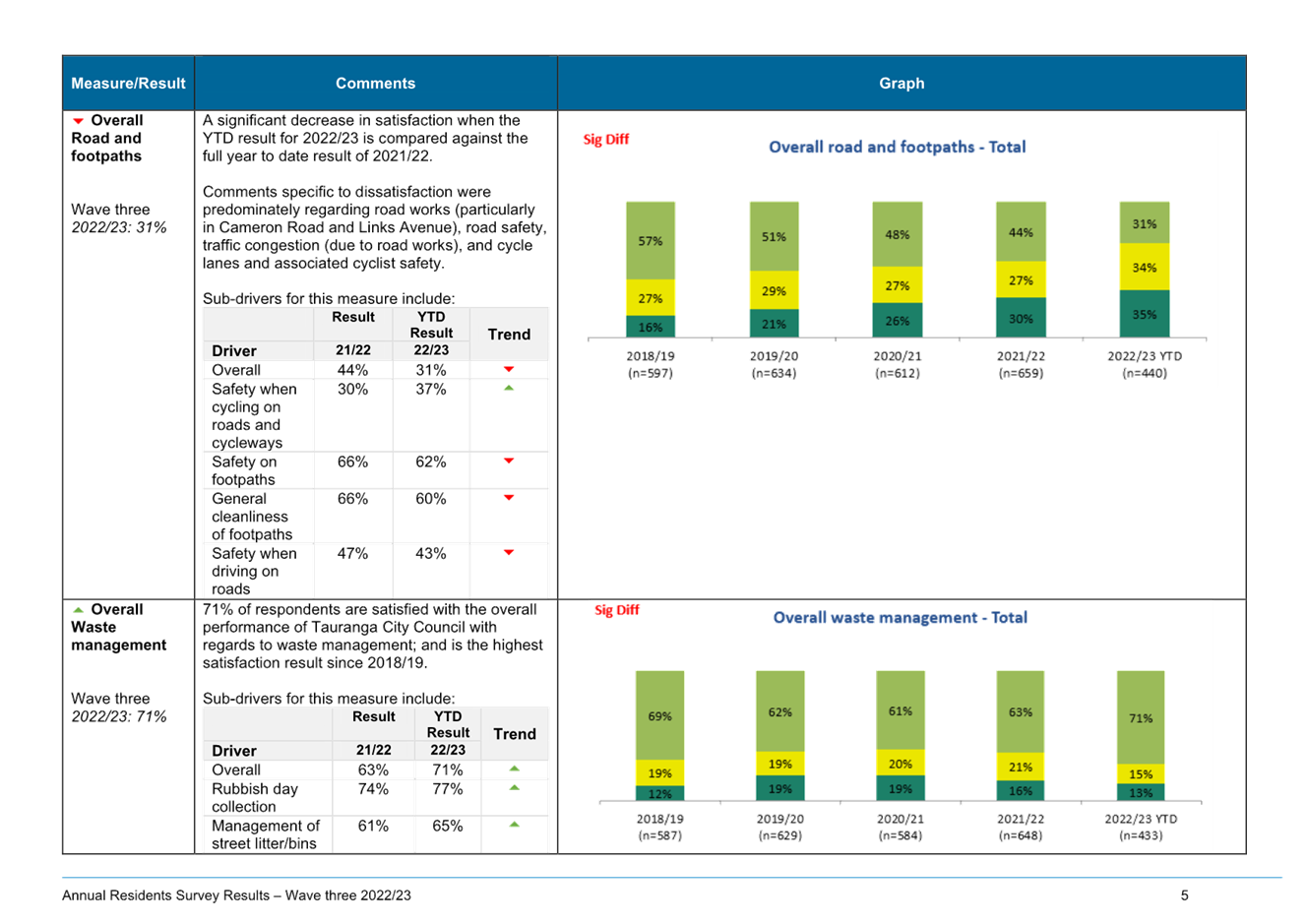

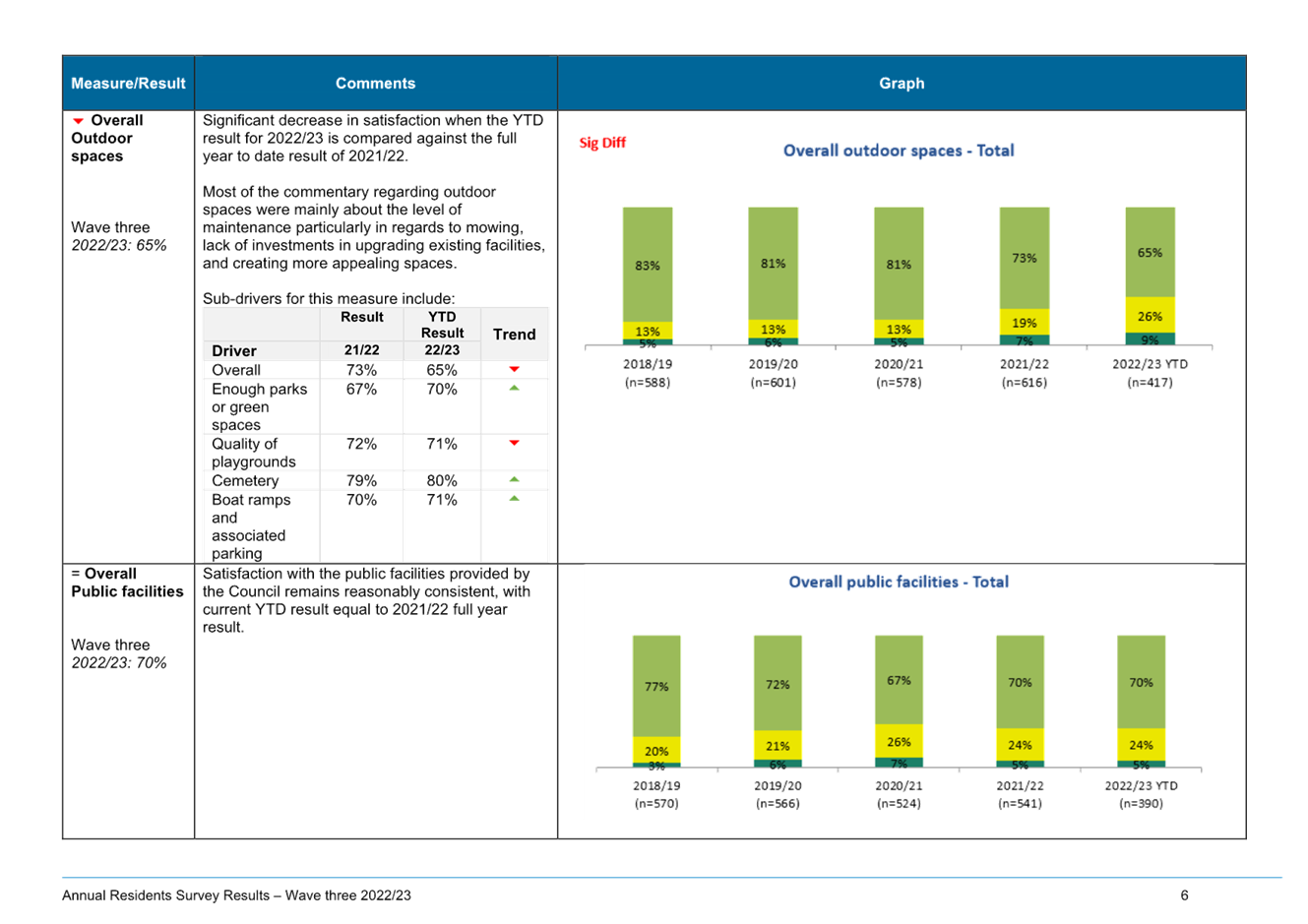

Whenua representative

|

|

Members

|

Commissioner Shadrach Rolleston

Commissioner Stephen Selwood

Commissioner Bill Wasley

|

|

|

Matire Duncan, Te Rangapū Mana

Whenua o Tauranga Moana Chairperson

Te Pio Kawe – Tangata

Whenua representative

Rohario Murray – Tangata

Whenua representative

Bruce Robertson – External

appointee with finance and risk experience

|

|

Quorum

|

Five (5) members must be

physically present, and at least three (3) commissioners and two (2) externally

appointed members must be present.

|

|

Meeting frequency

|

Six weekly

|

Role

The role

of the Strategy, Finance and Risk Committee (the Committee) is:

(a)

to assist and advise the Council in discharging

its responsibility and ownership of health and safety, risk management,

internal control, financial management practices, frameworks and processes to

ensure these are robust and appropriate to safeguard the Council's staff and

its financial and non-financial assets;

(b)

to consider strategic issues facing the city and

develop a pathway for the future;

(c)

to monitor progress on achievement of desired

strategic outcomes;

(d)

to review and determine the policy and bylaw

framework that will assist in achieving the strategic priorities and outcomes

for the Tauranga City Council.

Membership

The Committee will consist of:

·

four commissioners with the Commission Chair

appointed as the Chairperson of the Committee

·

the Chairperson of Te

Rangapū Mana Whenua o Tauranga Moana

·

three tangata whenua representatives

(recommended by Te Rangapū Mana Whenua o Tauranga

Moana and appointed by Council)

·

an independent external person with finance and

risk experience appointed by the Council.

Voting

Rights

The

tangata whenua representatives and the independent external person have voting

rights as do the Commissioners.

The

Chairperson of Te Rangapu Mana Whenua o Tauranga Moana is an advisory position,

without voting rights, designed to ensure mana whenua discussions are connected

to the committee.

Committee's

Scope and Responsibilities

A. STRATEGIC

ISSUES

The Committee will consider

strategic issues, options, community impact and explore opportunities for

achieving outcomes through a partnership approach.

A1 – Strategic Issues

The Committee's responsibilities with regard to Strategic

Issues are:

·

Adopt an annual work

programme of significant strategic issues and projects to be addressed. The

work programme will be reviewed on a six-monthly basis.

·

In respect of each

issue/project on the work programme, and any additional matters as determined

by the Committee:

○ Consider existing and future strategic

context

○ Consider opportunities and possible

options

○ Determine preferred direction and

pathway forward and recommend to Council for inclusion into strategies,

statutory documents (including City Plan) and plans.

·

Consider and approve

changes to service delivery arrangements arising from the service delivery

reviews required under Local Government Act 2002 that are referred to the

Committee by the Chief Executive.

·

To take appropriate

account of the principles of the Treaty of Waitangi.

A2 – Policy and Bylaws

The Committee's responsibilities with regard to Policy and

Bylaws are:

·

Develop, review and

approve bylaws to be publicly consulted on, hear and deliberate on any

submissions and recommend to Council the adoption of the final bylaw. (The

Committee will recommend the adoption of a bylaw to the Council as the Council

cannot delegate to a Committee the adoption of a bylaw.)

·

Develop, review and

approve policies including the ability to publicly consult, hear and deliberate

on and adopt policies.

A3 – Monitoring of Strategic

Outcomes and Long Term Plan and Annual Plan

The Committee's responsibilities with regard to monitoring

of strategic outcomes and Long Term Plan and Annual Plan are:

·

Reviewing and

reporting on outcomes and action progress against the approved strategic

direction. Determine any required review / refresh of strategic direction or

action pathway.

·

Reviewing and

assessing progress in each of the six (6) key investment proposal areas within

the 2021-2031 Long Term Plan.

·

Reviewing the

achievement of financial and non-financial performance measures against the

approved Long Term Plan and Annual Plans.

B. FINANCE AND RISK

The Committee will review the effectiveness of the

following to ensure these are robust and appropriate to safeguard the Council's

financial and non-financial assets:

·

Health and safety.

·

Risk management.

·

Significant projects and programmes of work

focussing on the appropriate management of risk.

·

Internal and external audit and assurance.

·

Fraud, integrity and investigations.

·

Monitoring of compliance with laws and regulations.

·

Oversight of preparation of the Annual Report

and other external financial reports required by statute.

·

Oversee the relationship with the

Council’s Investment Advisors and Fund Managers.

·

Oversee the relationship between the Council and

its external auditor.

·

Review the quarterly financial and non-financial

reports to the Council.

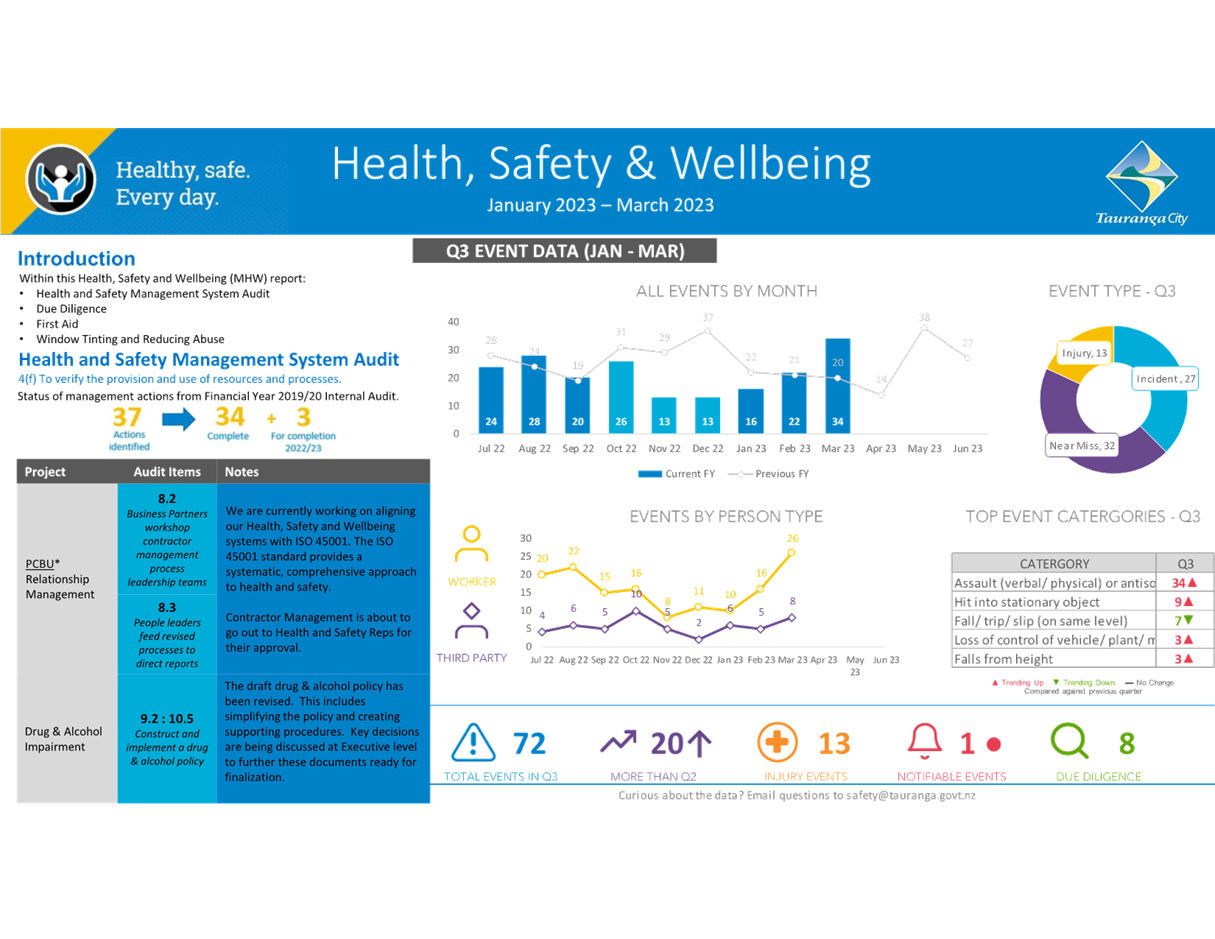

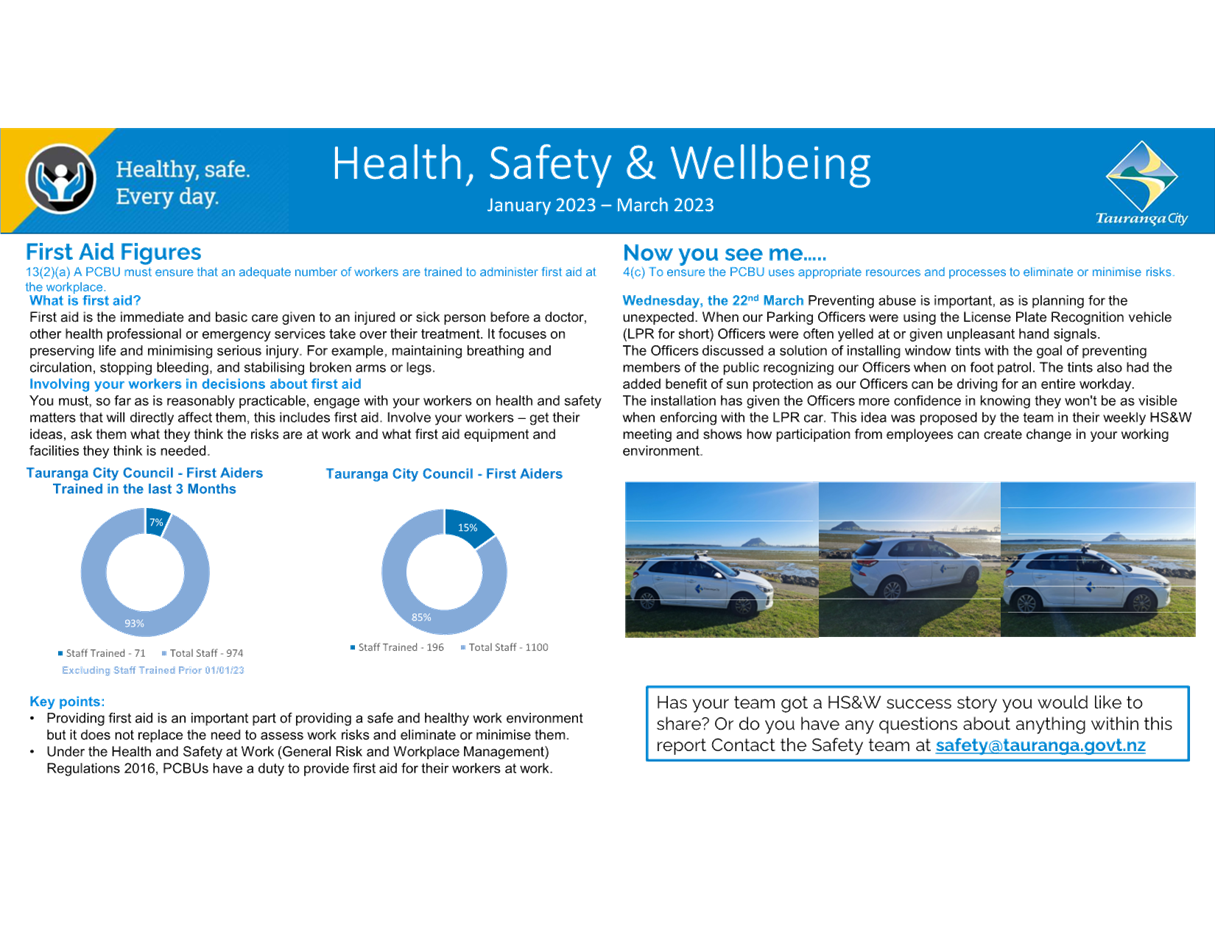

B1 - Health and Safety

The

Committee’s responsibilities through regard to health and safety are:

·

Reviewing the effectiveness of the health and

safety policies and processes to ensure a healthy and safe workspace for

representatives, staff, contractors, visitors and the public.

·

Assisting the Commissioners to discharge their

statutory roles as "Officers" in terms of the Health and Safety at

Work Act 2015.

B2 - Risk Management

The

Committee's responsibilities with regard to risk management are:

·

Review, approve and monitor the implementation of the Risk

Management Policy, including the Corporate Risk Register.

·

Review and approve the Council’s "risk appetite"

statement.

·

Review the effectiveness of risk management and internal control

systems including all material financial, operational, compliance and other

material controls. This includes legislative compliance, significant projects

and programmes of work, and significant procurement.

·

Review risk management reports identifying new and/or emerging

risks and any subsequent changes to the "Tier One" register.

B3

- Internal Audit

The

Committee’s responsibilities with regard to the Internal Audit are:

·

Review and approve the Internal Audit Charter to confirm the

authority, independence and scope of the Internal Audit function. The Internal

Audit Charter may be reviewed at other times and as required.

·

Review and approve annually and monitor the implementation of the

Internal Audit Plan.

·

Review the co-ordination between the risk and internal audit

functions, including the integration of the Council's risk profile with the

Internal Audit programme. This includes assurance over all material financial,

operational, compliance and other material controls. This includes legislative

compliance (including Health and Safety), significant projects and programmes

of work and significant procurement.

·

Review the reports of the Internal Audit functions dealing with

findings, conclusions and recommendations.

·

Review and monitor management’s responsiveness to the

findings and recommendations and enquire into the reasons that any

recommendation is not acted upon.

B4

- External Audit

The

Committee's responsibilities with regard to the External Audit are:

·

Review with the external auditor, before the audit commences, the

areas of audit focus and audit plan.

·

Review with the external auditors, representations required by

commissioners and senior management, including representations as to the fraud

and integrity control environment.

·

Recommend adoption of external accountability documents (LTP and

annual report) to the Council.

·

Review the external auditors, management letter and management

responses and inquire into reasons for any recommendations not acted upon.

·

Where required, the Chair may ask a senior representative of the

Office of the Auditor General (OAG) to attend the Committee meetings to discuss

the OAG's plans, findings and other matters of mutual interest.

·

Recommend to the Office of the Auditor General the decision

either to publicly tender the external audit or to continue with the existing

provider for a further three-year term.

B5

- Fraud and Integrity

The

Committee's responsibilities with regard to Fraud and Integrity are:

·

Review and provide advice on the Fraud Prevention and Management

Policy.

·

Review, adopt and monitor the Protected Disclosures Policy.

·

Review and monitor policy and process to manage conflicts of

interest amongst commissioners, tangata whenua representatives, external

representatives appointed to council committees or advisory boards, management,

staff, consultants and contractors.

·

Review reports from Internal Audit, external audit and management

related to protected disclosures, ethics, bribery and fraud related incidents.

·

Review and monitor policy and processes to manage

responsibilities under the Local Government Official Information and Meetings

Act 1987 and the Privacy Act 2020 and any actions from the Office of the

Ombudsman's report.

B6

- Statutory Reporting

The

Committee's responsibilities with regard to Statutory Reporting relate to

reviewing and monitoring the integrity of the Annual Report and recommending to

the Council for adoption the statutory financial statements and any other formal

announcements relating to the Council's financial performance, focusing

particularly on:

·

Compliance with, and the appropriate application of, relevant

accounting policies, practices and accounting standards.

·

Compliance with applicable legal requirements relevant to

statutory reporting.

·

The consistency of application of accounting policies, across

reporting periods.

·

Changes to accounting policies and practices that may affect the

way that accounts are presented.

·

Any decisions involving significant judgement, estimation or

uncertainty.

·

The extent to which financial statements are affected by any

unusual transactions and the manner in which they are disclosed.

·

The disclosure of contingent liabilities and contingent assets.

·

The basis for the adoption of the going concern assumption.

·

Significant adjustments resulting from the audit.

Power

to Act

·

To make all

decisions necessary to fulfil the role, scope and responsibilities of the

Committee subject to the limitations imposed.

·

To establish

sub-committees, working parties and forums as required.

·

This Committee has not

been delegated any responsibilities, duties or powers that the Local Government

Act 2002, or any other Act, expressly provides the Council may not delegate.

For the avoidance of doubt, this Committee has not been delegated

the power to:

o

make a rate;

o

make a bylaw;

o

borrow money, or purchase

or dispose of assets, other than in accordance with the Long-Term Plan (LTP);

o

adopt the LTP or Annual

Plan;

o

adopt the Annual Report;

o

adopt any policies required

to be adopted and consulted on in association with the LTP or developed for the

purpose of the local governance statement;

o

adopt a remuneration and

employment policy;

o

appoint a chief executive.

Power

to Recommend

To Council and/or any standing committee

as it deems appropriate.

|

Strategy,

Finance and Risk Committee meeting Agenda

|

6

June 2023

|

7 Confirmation

of minutes

7.1 Minutes

of the Strategy, Finance and Risk Committee meeting held on 27 March 2023

File

Number: A14695650

Author: Sarah

Drummond, Governance Advisor

Authoriser: Sarah

Drummond, Governance Advisor

|

Recommendations

That the Minutes of the

Strategy, Finance and Risk Committee meeting held on 27 March 2023 be

confirmed as a true and correct record.

|

Attachments

1. Minutes

of the Strategy, Finance and Risk Committee meeting held on 27 March 2023

|

Strategy, Finance and Risk Committee meeting minutes Strategy, Finance and Risk Committee meeting minutes

|

27 March 2023

|

|

|

|

MINUTES

Strategy, Finance and Risk Committee meeting

Monday, 27 March 2023

|

Order of Business

1 Opening karakia. 3

2 Apologies. 3

3 Public forum.. 3

4 Acceptance of late items. 3

5 Confidential business to be transferred into the open. 4

6 Change to order of business. 4

7 Confirmation of open minutes and public excluded minutes. 4

7.1 Minutes of the Strategy, Finance and Risk Committee meeting held on

13 February 2023. 4

8 Declaration of conflicts of interest 4

9 Business. 4

9.1 Western Bay of Plenty International Strategy 2023-2025. 4

9.2 Mainstreets' Monitoring Reports for the period 1 July to 31 December

2022. 5

9.3 Adoption of Public Art Framework. 7

9.4 Mount Planning and Delivery Programme Update. 8

9.5 Refreshed outline plan of Committee's upcoming work programme. 9

9.6 Long-term Plan 2021-31 actions tracker 10

9.7 Second Quarter Financial and Non-Financial Monitoring report to 31

December 2022. 10

10 Discussion of late items. 11

11 Public excluded session. 11

12 Closing karakia. 11

MINUTES OF Tauranga City

Council

Strategy, Finance and Risk

Committee meeting

HELD AT THE BoP Regional

Council Chambers, Regional House, 1 Elizabeth Street, Tauranga

ON Monday, 27 March 2023 AT

9.30am

PRESENT: Commission Chair Anne Tolley, Dr Wayne Beilby, Commissioner Shadrach

Rolleston, Commissioner Stephen Selwood, Commissioner Bill Wasley, Mr Te Pio

Kawe, Ms Rohario Murray, Mr Bruce Robertson

IN ATTENDANCE: Marty

Grenfell (Chief Executive), Paul Davidson (Chief Financial Officer), Barbara

Dempsey (General Manager: Community Services), Nic Johansson (General Manager:

Infrastructure), Christine Jones (General Manager: Strategy, Growth &

Governance), Sarah Omundsen (General Manager: Regulatory and Compliance), Anne

Blakeway (General Manager: City Development & Partnerships), Lisa Gilmour

(City Partnership Specialist), Kendyl Sullivan (City Partnerships Specialist),

James Wilson (Manager: Arts & Culture), Carl Lucca (Team Leader: Urban

Communities), Jeremy Boase (Manager: Strategy & Corporate Planning),

Kathryn Sharplin (Manager: Finance), Tracey Hughes (Financial Insights &

Reporting Manager), Josh Logan (Team Leader: Corporate Planning), Coral Hair

(Manager: Democracy & Governance Services), Robyn Garrett (Team Leader:

Governance Services), Sarah Drummond (Governance Advisor), Anahera Dinsdale

(Governance Advisor)

1 Opening

karakia

Commissioner Shadrach Rolleston opened the

meeting with a karakia.

2 Apologies

|

Apology

|

|

Committee Resolution SFR2/23/1

Moved: Ms Rohario Murray

Seconded: Commissioner

Stephen Selwood

That the apologies for absence received

from Committee members Matire Duncan and Te Pio Kawe for lateness and Dr

Wayne Beilby for early leaving be accepted.

Carried

|

3 Public

forum

Nil

4 Acceptance

of late items

Nil

5 Confidential

business to be transferred into the open

Nil

6 Change

to order of business

Nil

7 Confirmation

of open minutes and public excluded minutes

8 Declaration

of conflicts of interest

Deputy Chair Dr Wayne Beilby declared an

interest in agenda item 9.1 as a board member of Priority One.

9 Business

|

9.1 Western

Bay of Plenty International Strategy 2023-2025

|

|

Staff Gareth

Wallis, General Manager: Central City Development

Lisa

Gilmour, City Partnership Specialist

External Greg

Simmonds, General Manager: Workforce and Policy, Priority One

Key points

·

This was the latest iteration of the strategy.

It was last fully updated in 2020, however, given Covid, there had been a

refresh. Reengagement on the strategy would now begin in the post-Covid

environment.

In response to questions

·

The Committee would like to see more work on

opportunities with students around how to re-connect and grow the sector back

to previous numbers of students within the region.

·

Queried whether sister city relationships

could be leveraged to increase these numbers.

·

The framework would begin to bring all these

strands together so there was visibility of what was being achieved in

education in Tauranga.

·

This year delegations would be going back to

Korea and re-engaging with partners in China, mostly in the primary and

secondary school areas, to provide chances to grow student numbers.

·

The Committee would like to see key

performance indicators and metrics around the strategy and would like to see

these reported back to the Committee annually.

Discussion points raised

·

Recognition of mana whenua relationships and

partnerships in the sector was raised. It was suggested that the

Welcoming Communities programme could be used to develop greater

relationships beyond welcoming new migrants.

·

At present each partner in Priority 1 has

their own framework to engage with mana whenua.

·

Education Tauranga as an entity with its own

board could undertake further liaising with other organisations with a

purpose of destination marketing to attract a wide range of students to

Tauranga.

|

|

Committee Resolution SFR2/23/3

Moved: Commissioner Bill

Wasley

Seconded: Dr

Wayne Beilby

That

the Strategy, Finance and Risk Committee:

(a) Receives

the “Western Bay of Plenty International Strategy 2023-2025”

report.

(b) Endorses

the updated Western Bay of Plenty International Strategy 2023-2025

(Attachment 1).

Carried

|

|

9.2 Mainstreets'

Monitoring Reports for the period 1 July to 31 December 2022

|

|

Staff Gareth

Wallis, General Manager: Central City Development

Kendyl

Sullivan, City Partnerships Specialist

External Brian Berry

and Sally Cooke - Mainstreet Tauranga

Mahia

Martelli - Greerton Mainstreet

Claudia

West - Mount Maunganui Mainstreet

Downtown Tauranga

Key points

·

The Mainstreet Association felt that the

Central Business District (CBD) was in crisis. The association was working to

solve the matters concerning them in a timely manner.

·

There were perception issues that the CBD was

not a destination and was also a hard area to navigate in due to ongoing roadworks

and development and construction. Concerned that the area had significant

issues with vagrancy and was perceived as being an unsafe area.

·

The introduction of paid parking had been

confusing and the Association felt that a park and ride system would have

assisted in alleviating parking pressure and parks not being utilised.

·

The Association was aware of 12 businesses in

the CBD that had recently closed or were about to close.

·

Solutions in the medium to long-term were

being worked through but the Association felt that a solution in the short

term would be to provide rates relief across the CBD.

·

There was a concern property values had

decreased significantly.

·

Safety issues within the CBD continued to be

seen as a weak point in the CBD development and an area of concern to all

businesses in the area.

·

A return to use of the Māori Wardens was

mooted and questions raised on who could or would fund this option.

·

Reports had been received by the Association

(particularly from hospitality workers) needing security to get to their cars

at the end of shifts and of staff too scared to park in the CBD.

Discussion points raised

·

Ferry patronage was strongly weather

dependant, but the return of the cruise ships was a welcome addition.

·

Work on CBD security measures would continue,

and the Council aimed to keep working with Mainstreet on safety issues.

·

Māori Wardens was a paid service and

worked in conjunction with police. There was the potential to work

together for solutions and provide more communications on CBD activities and

opportunities for retail investment.

Greerton Mainstreet

Key points

·

A new board had been appointed and was

beginning to bed in.

·

37 trees were yarn bombed this year and the

festival had taken a new direction and had proved as popular as ever.

·

Fund raising initiatives for the area were

being investigated and a new website had been created and was up and running.

·

The community was looking forward to Easter

and the traditional Easter Egg hunt and fun day.

·

Work had commenced at Blake Park for tree

planting although with a limited budget.

·

Member accounts had been completed and audited

on time and in full.

Discussion

·

The Committee requested that a letter of

appreciation be sent to retiring Greerton Mainstreet Manager Sally Benning

for her constant and valuable contribution to Greerton; she was a pillar of

the community who tirelessly worked to make her community more visible.

Mount Maunganui Mainstreet

Key points

·

The Association was reviewing their yearly

progress to develop strategic plans for further community engagement and

events particularly to increase foot traffic and patronage through the

quieter winter months. To also encourage new membership of the association.

They had been heartened to see their work starting to create big and

small wins, such as their new website now being live and increasing in receiving

traffic.

·

The outdoor movies run in conjunction with a

local radio station continued to be a great success with good attendance. The

Association hoped that these would become a tradition for local families.

·

Another success was the decoration of 15 Christmas

trees by local schools; it created great excitement with many school groups

coming to find their tree.

·

The Association was excited to bring the first

set of sales data to the Committee. They had distilled the figures down to

three major groups into which 73% of their members fitted. The total spend

for the 2021/2022 financial year was $153million with $73m of that belonging

to the largest group of hospitality retailers.

·

The data showed sales slowdowns with Covid

lockdowns in Auckland and locally and reflected the seasonal nature of

trading in the Mount with foot traffic and sales falling off markedly from

March. The Association, as part of their forward planning, was looking to

ways of countering the autumn/winter slowdown with increasing both local patronage

and tourist numbers.

·

The first few months of foot traffic data had

been received and would be used in an ongoing capacity to assist with

planning and looking at patronage trends.

·

The Association was proud of the handbook that

had been created for existing and new members which provided information on

what the Association offered.

·

Security issues continued to be of concern to

members and a WhatsApp group chat for members to communicate on security

issues as they happened had been formed, which also offered a

member-to-member support system and had proved a vital link to police and

security companies.

·

Financials were now audited and up to date;

were currently tracking on budget

·

The Association still saw a need for more

on-street cameras and would like to progress a Crime Prevention through

Environmental Design report to look at other ways safety could be improved.

·

Improved safety measures were still needed in

laneways and to slow traffic coming through the main streets of the Mount.

·

The Association had looked towards ambassadors

on bikes helping tourists and providing a safe presence on the streets, with

a direct line to council and police.

·

Looking ahead, the Association would be

working on the strategic plan, having a members’ voice session for a range

of topics, a session for Association board members in governance training,

and ongoing work as key stakeholders in the development of the Mount

strategic plan. Noted the desire, as part of this planning, to keep free

parking and help reduce congestion in summer months.

The Association thanked TCC staff member Kendyl Sullivan for her

support in developing the handbook, provision of street foot traffic counts

and liaising with other groups.

Discussion points raised

·

The Committee acknowledged the long journey

the Association had been on and were extremely pleased to see the work they

were completing and that the financial records had been audited and were on

track.

·

It was noted that the data collected on Eftpos

spend would be invaluable for not only the Mount but for individual retailers

to utilise.

·

The summer had been a challenging one with

adverse weather causing large drops in foot traffic and patronage, contrasted

with fine days with large volumes of foot traffic.

·

The idea of ambassadors was still currently a

work in progress.

·

The initiative of the old Mount Events Cinema

being an events venue of value to the community had grown organically and

involved bringing in other groups to grow ideas. The Association was

facilitating this process where possible. Feasibility studies were needed.

This may include looking to Council as a partner with other organisations.

·

Noted the possibility of shared resourcing

with the potential to take these ideas and share them across other Mainstreet

organisations.

·

Graffiti was still an ongoing problem, but the

Association had had a great response from the contractor to remove graffiti

when they were contacted. Use of the TCC reporting app had been a key

for graffiti removal and clearing of overflowing rubbish bins.

·

Regarding the issues of overflowing rubbish

bins, extra bins and collections were deployed but over the holiday period in

January the bins still overflowed. There was a need for further conversations

between the Association, the contractor and Council.

|

|

Committee Resolution SFR2/23/4

Moved: Commissioner Bill

Wasley

Seconded: Commissioner

Stephen Selwood

That

the Strategy, Finance and Risk Committee:

(a) Receives

the report "Mainstreets' Monitoring Reports for the period 1 July to 31

December 2022 ".

(b) Receives

the Mainstreet Tauranga Report to 31 December 2022

(c) Receives

the Papamoa Unlimited Report to 31 December 2022

(d) Receives

the Greerton Village Community Association Report to 31 December 2022

(e) Receives

the Mount Business Association Report to 31 December 2022

Carried

|

|

9.3 Adoption of

Public Art Framework

|

|

Staff Barbara

Dempsey, General Manager: Community Services

James

Wilson, Manager: Arts & Culture

Key points

·

Staff provided a brief overview of the

strategy and noted that it was now a ‘plan on a page’ designed to

encourage public art for the artist community and provide art organisation

frameworks for Council staff.

·

The framework was also developed to provide

for community input and to encourage public art with the support of both

Council and the community.

·

The framework would help to develop the

cultural narrative of the city, providing vision and a future development

pathway for art works.

In response to questions

·

The advisory panel would be appointed by

Council and contain at least two local Māori liaison seats. It was

also expected that panel members would consult with local mana whenua and

Mainstreet Associations.

Discussion points raised

·

The Committee commended the framework for its

collaborative approach but was concerned that in the past maintenance of

artwork had been haphazard and noted the importance of maintenance plans

being in place. These should include looking after the artwork currently in

and around the city and reconnecting with the Mainstreet Associations. This

would be part of the Advisory Panel’s working brief.

·

Funding was currently through operational

expenditure, but where possible there would be work done to see if there were

opportunities for private funding partnerships as well.

|

|

Committee

Resolution SFR2/23/5

Moved: Commission Chair Anne

Tolley

Seconded: Commissioner

Bill Wasley

That

the Strategy, Finance and Risk Committee:

(a) Receives

the report "Adoption of Public Art Framework".

(b) Adopts

the draft public art framework (Appendix 1)

(c) Establishes

a proposed public art fund (“1% for art”), for inclusion in the

Long Term Plan as follows:

(i) Year

1: 0.25% of total eligible capital spend

(ii) Year

2: 0.5% of total eligible capital spend

(iii) Year

3: 0.75% of total eligible capital spend

(iv) Year

4-10: 1% of total eligible capital spend

Carried

|

|

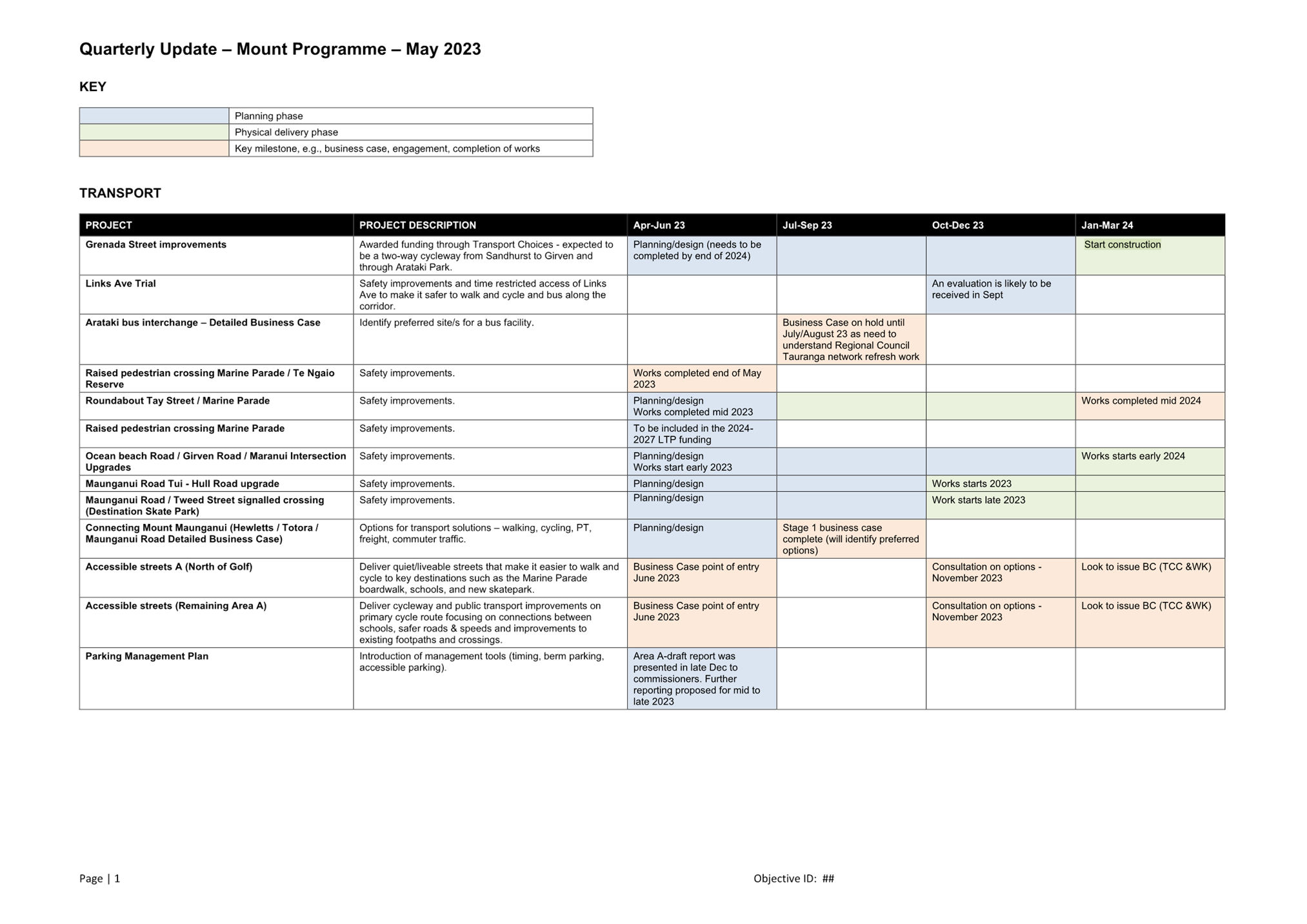

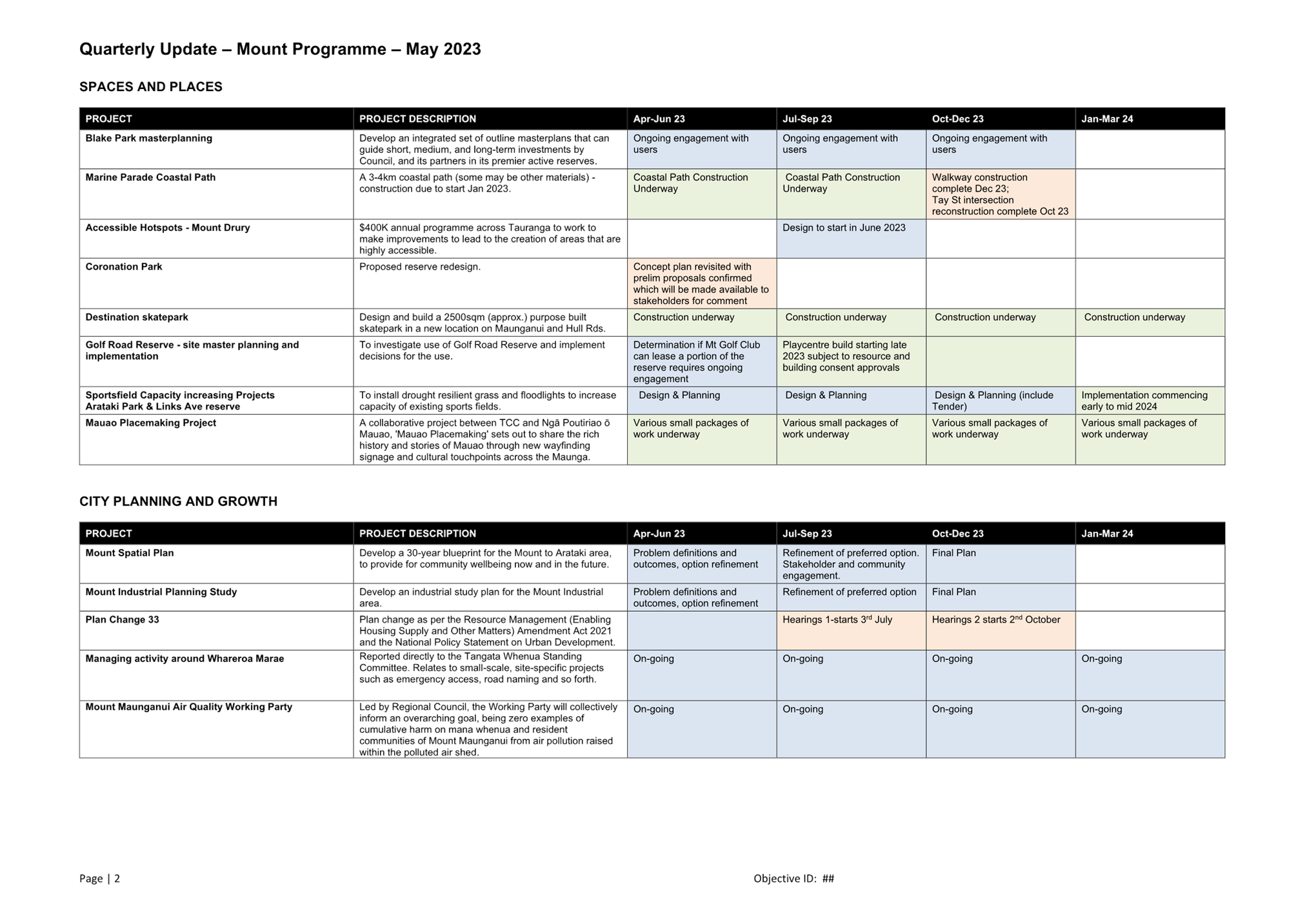

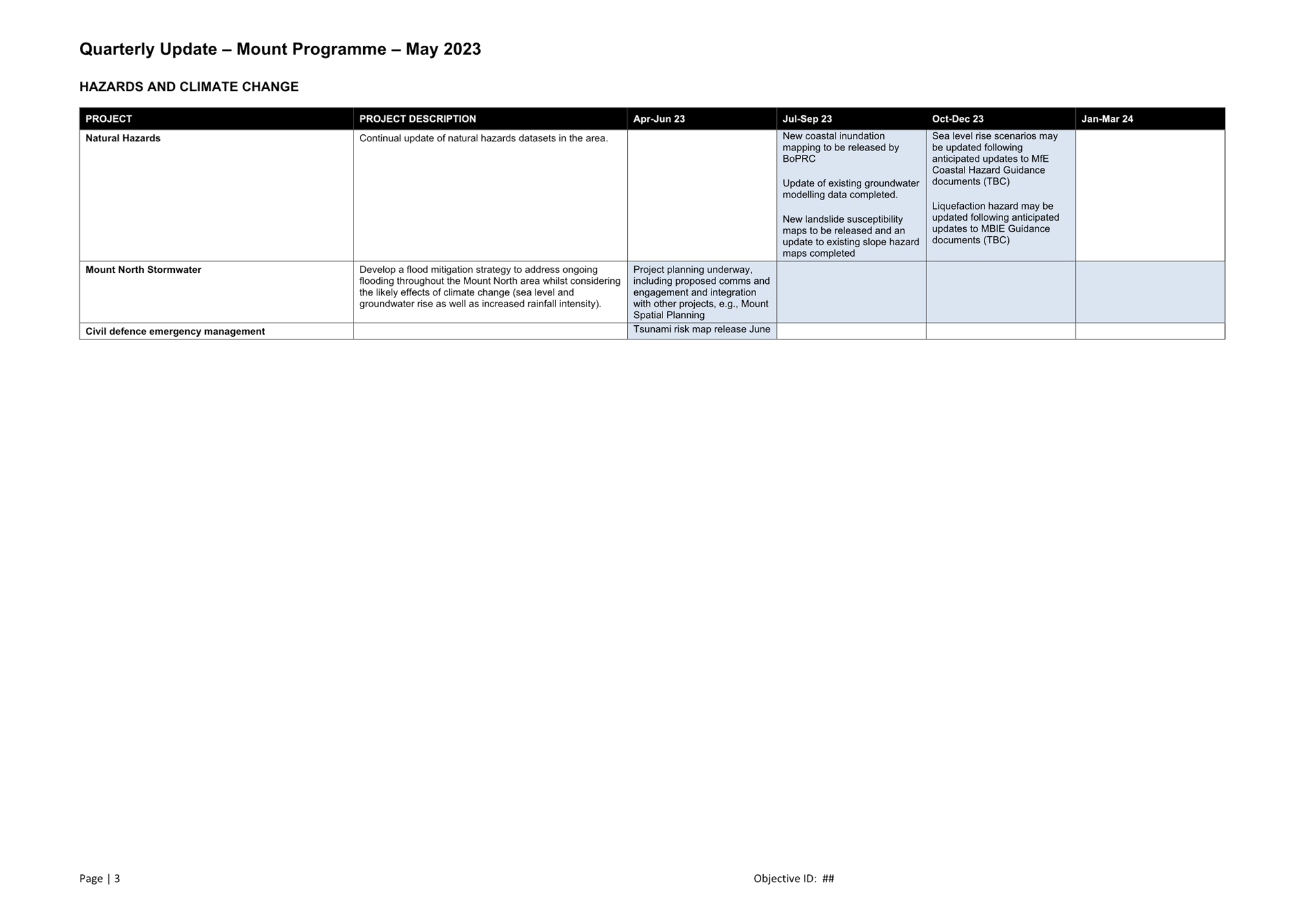

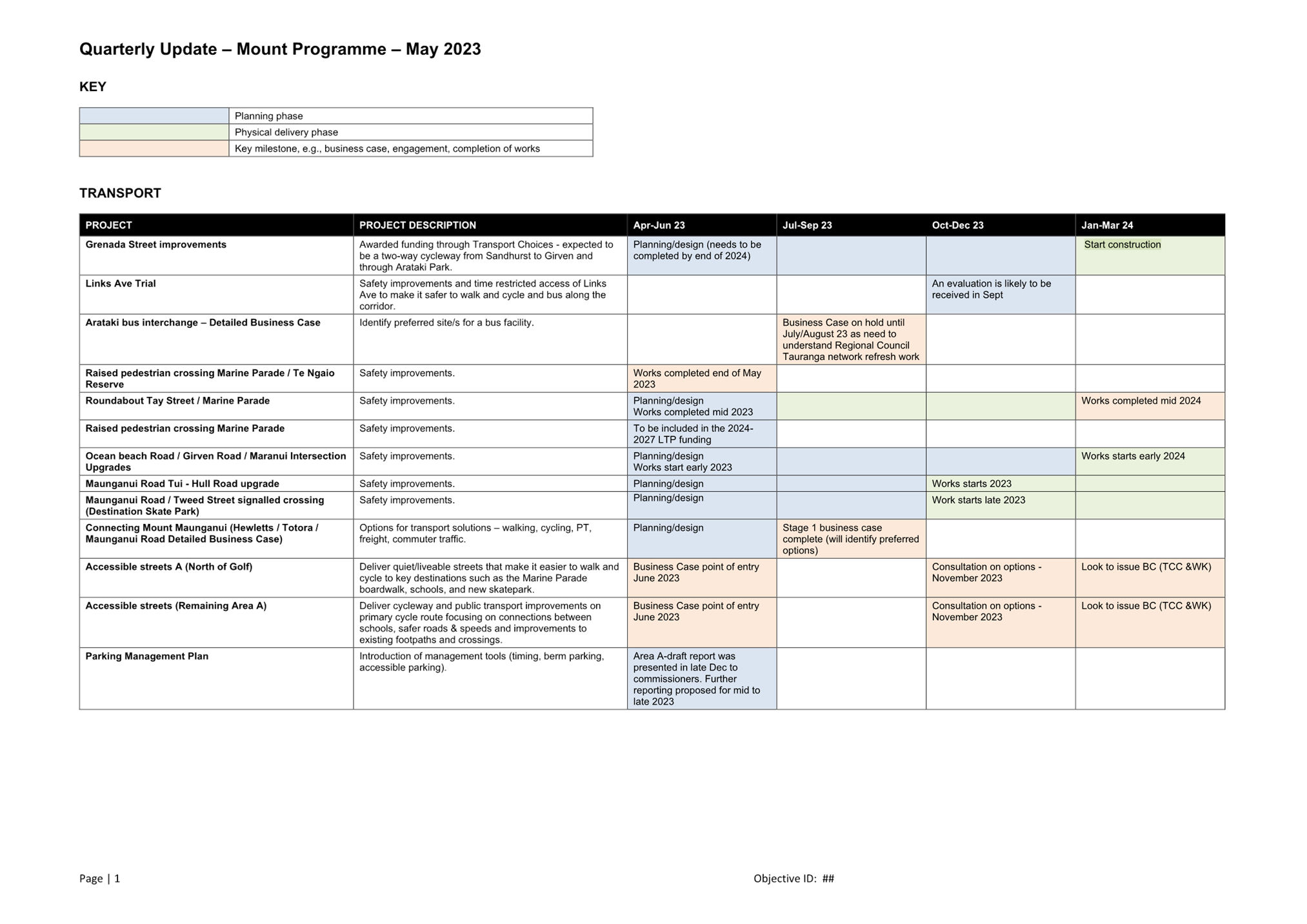

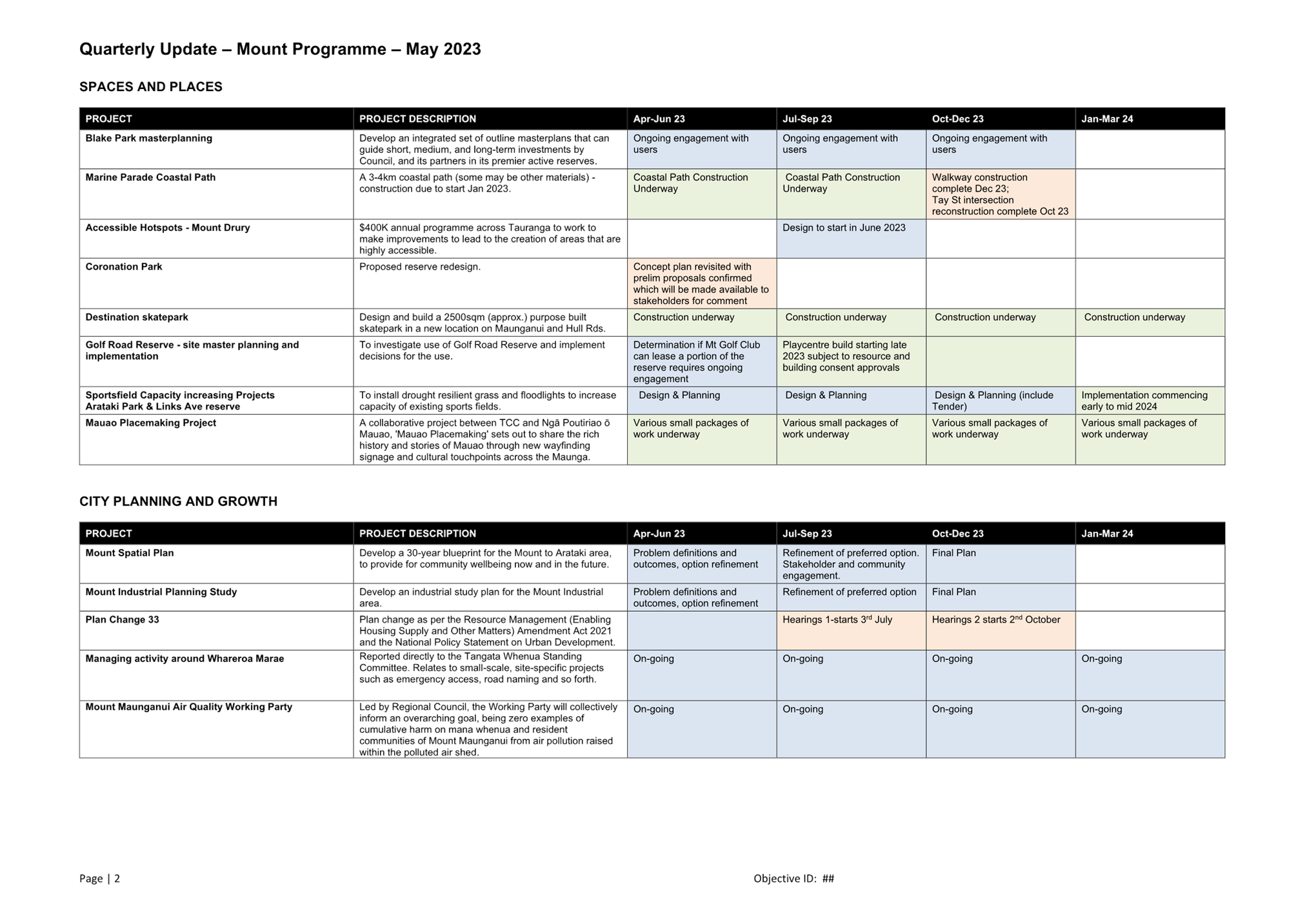

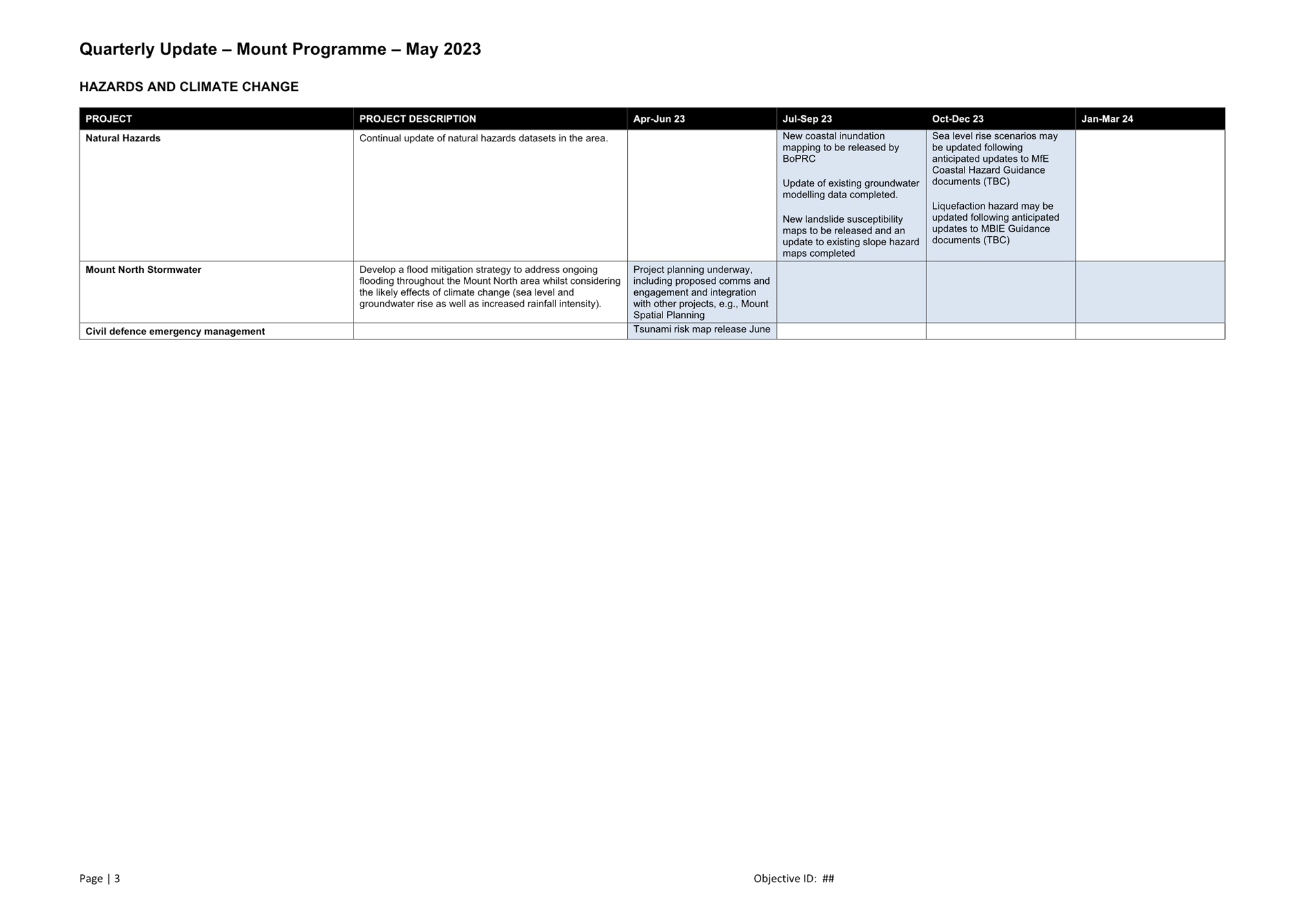

9.4 Mount

Planning and Delivery Programme Update

|

|

Staff Sarah

Omundsen, General Manager: Regulatory and Compliance

Carl

Lucca, Programme Director: Urban Communities

Key points

·

Staff noted this was an overview report to

update the Committee on the mahi completed in the last three months across

relevant projects.

In response to questions

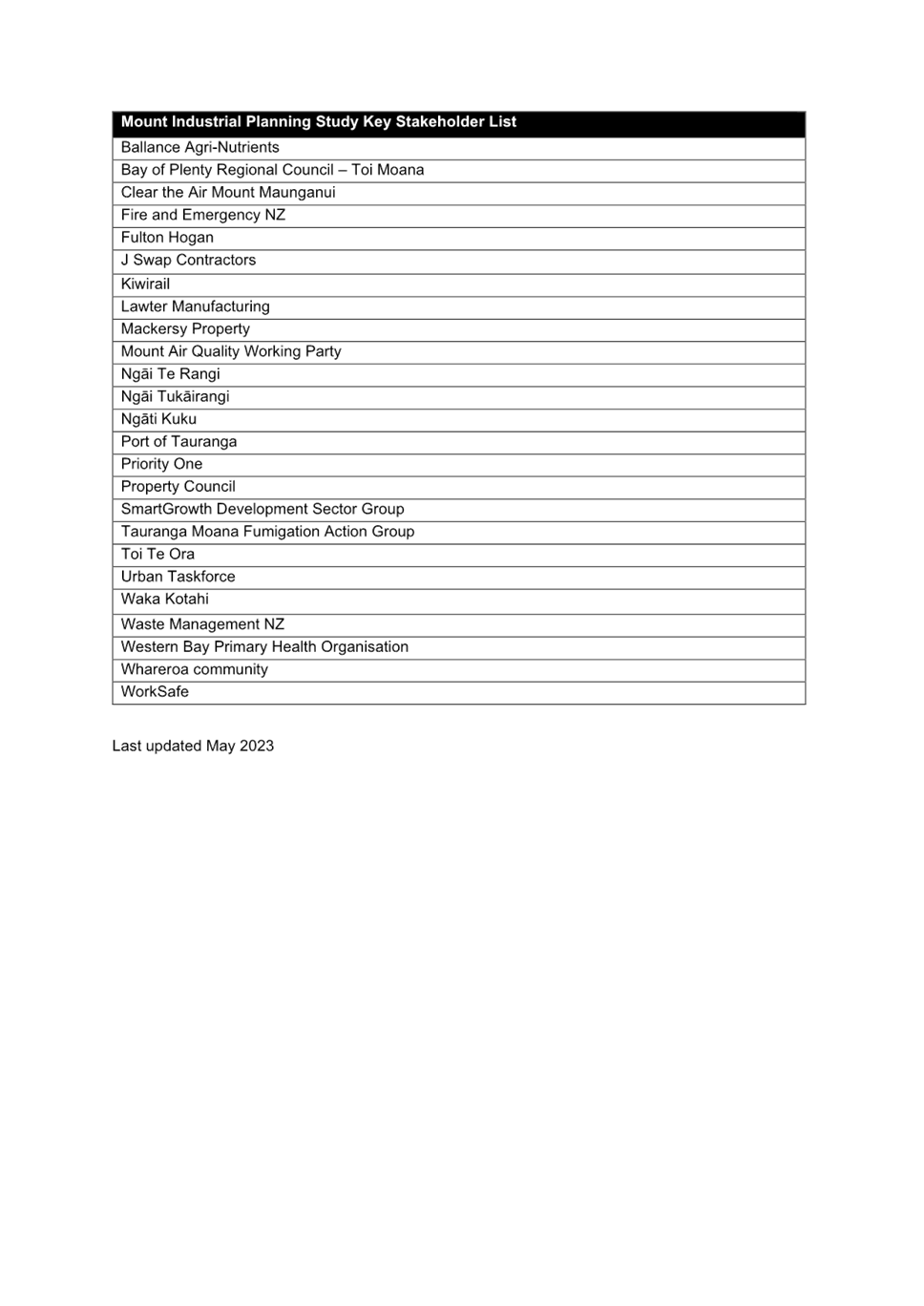

·

Work was currently being completed on the

industrial plan to be integrated into the wider spatial plan. This included

discussion with the Port Authority.

·

The Grenada Street cycling track, Maunganui

Road and the destination skate park were still in construction; Grenada

Street had an estimated completion time of 4-6 weeks.

·

A steering group had been created which was

working with mana whenua to ensure they were integrated into discussions.

There was direct liaison with the Mount Mainstreet Association, and Priority

One was preparing an early outline of the group’s work which would be

presented to Council.

Discussion points raised

·

The Committee supported the discussion with

the steering group but noted that during engagement a wide range of views

from the public must be taken into consideration. The community needed to

travel the journey with the steering group and discussion between communities

was vital to facilitate better planning.

·

The Committee would like to see the process on

paper, highlighting a ‘red risk’ list, timelines of working

groups within the steering committee and monitoring of potential gaps within

the plan.

|

|

Committee

Resolution SFR2/23/6

Moved: Commission Chair Anne

Tolley

Seconded: Commissioner

Bill Wasley

That

the Strategy, Finance and Risk Committee:

(a) Receives

the report "Mount Planning and Delivery Programme Update".

(b) Notes

the coordination underway and proposed across significant projects in the

Mount to Arataki area including tangata whenua, stakeholder, and community

engagement related matters.

(c) Requests

future reporting to the Strategy, Finance and Risk Committee includes

overview of programme risks and a table summary of programme related

projects.

Carried

|

Committee member Dr Wayne Beilby left the meeting at 11.30am.

|

9.5 Refreshed

outline plan of Committee's upcoming work programme

|

|

Staff Christine

Jones, General Manager: Strategy, Growth & Governance

Jeremy

Boase, Manager: Strategy & Corporate Planning

Key points

·

Presently a resource consents policy review

was underway, the principal planners would continue with this work given the changes

to the Resource Management Act that were progressing through central

government.

·

The Gambling Venues Policy was due for review

and would be added to the work programme.

|

|

Committee

Resolution SFR2/23/7

Moved: Commission Chair Anne

Tolley

Seconded: Commissioner

Bill Wasley

That

the Strategy, Finance and Risk Committee:

(a) Receives

the report "Refreshed outline plan of Committee's upcoming work

programme".

(b) Notes

the updated outline work programme for the Committee per Attachment 1.

(c) Adds

the review of the Gambling Venues Policy to the work programme.

Carried

|

The meeting adjourned at 11.34am

The meeting resumed at 11.39am

|

9.6 Long-term

Plan 2021-31 actions tracker

|

|

Staff Christine

Jones, General Manager: Strategy, Growth & Governance

Key points

·

Staff noted that there may be challenges with

staffing levels at Audit NZ in May which had implications for the proposed

Annual Plan and the next Long-term Plan.

·

Staff would remove from further reports any

completed rates postponements.

·

A minor error was corrected on page 137:

Te Ranga reserve should be noted as Work to be Done.

In response to questions

·

Blake Park work was not yet complete; there

were further alterations to be made.

·

The approximate cost for funding the

Gloucester Road work was $4 million. There was community benefit from the

project and, as this was an issue of urban growth, could have ongoing benefit

to the region, however; the funding issues remained a problem for the Council

to consider. There was some potential funding available from central

government agencies, but not for the whole budget.

Discussion points raised

·

The Committee was pleased with the succinct

Kingswood Road update and would receive further updates in future.

·

School water and water tanks could be an area

of staff focus for water saving.

·

The Committee wished to see urgency accorded

to the work on the Tauriko Hall and a site wide date for completion to be

provided to the Committee.

|

|

Committee Resolution SFR2/23/8

Moved: Commissioner Bill

Wasley

Seconded: Commissioner

Shadrach Rolleston

That

the Strategy, Finance and Risk Committee:

(a)

Receives the Long-term

Plan 2021 – Actions Report.

(b) Notes the

progress to date as reported in Attachment 1.

Carried

|

|

9.7 Second

Quarter Financial and Non-Financial Monitoring report to 31 December 2022

|

|

Staff Christine

Jones, General Manager: Strategy, Growth & Governance

Kathryn

Sharplin, Manager: Finance

Tracey

Hughes, Financial Insights & Reporting Manager

Key points

·

Staff gave a brief overview of the report

following the round table discussion previously held with the Committee.

·

Encroachments onto public land were estimated

at 20 cases, of which three had been finished and dealt with.

In response to questions

·

Current projects were still on track and on

budget, with a clearer budget update to be provided to the Committee in April

that would show any effect of recent adverse weather.

·

It was noted that there had been changes to

the scope of the Maunganui Road project and, while there had been a cost

increase, the value of the project was kept intact and within the funding

cap.

·

Stage four of these works would cost Council

an estimated $8 million.

Discussion points raised

·

The Committee thanked staff for the report and

noted that it was a good presentation of the last financial quarter, and that

expenses had been signed off with little or no change to operational or

capital expenditure projections.

·

The Committee would write to central

government ministers again to express their concerns regarding infrastructure

spend and planning and the onflow effect this had on housing availability and

the ability of the city to grow.

|

|

Committee Resolution SFR2/23/9

Moved: Commissioner Bill

Wasley

Seconded: Commissioner

Shadrach Rolleston

That the Strategy, Finance & Risk Committee:

(a)

Receives the report "Second Quarter

Financial and Non-Financial Monitoring report to 31 December 2022".

Carried

|

10 Discussion

of late items

Nil

11 Public

excluded session

Nil

12 Closing

karakia

Commissioner Shadrach Rolleston closed the

meeting with a karakia.

The meeting closed at 12.24pm.

The minutes of this meeting were

confirmed as a true and correct record at the Strategy, Finance and Risk

Committee meeting held on 15 May 2023.

...................................................

CHAIRPERSON

|

Strategy,

Finance and Risk Committee meeting Agenda

|

6

June 2023

|

9 Business

9.1 Audit

Plan for 2023 Annual Report, Fees and Engagement Letter

File

Number: A14438302

Author: Sheree

Covell, Treasury & Financial Compliance Manager

Authoriser: Paul

Davidson, Chief Financial Officer

Purpose of the Report

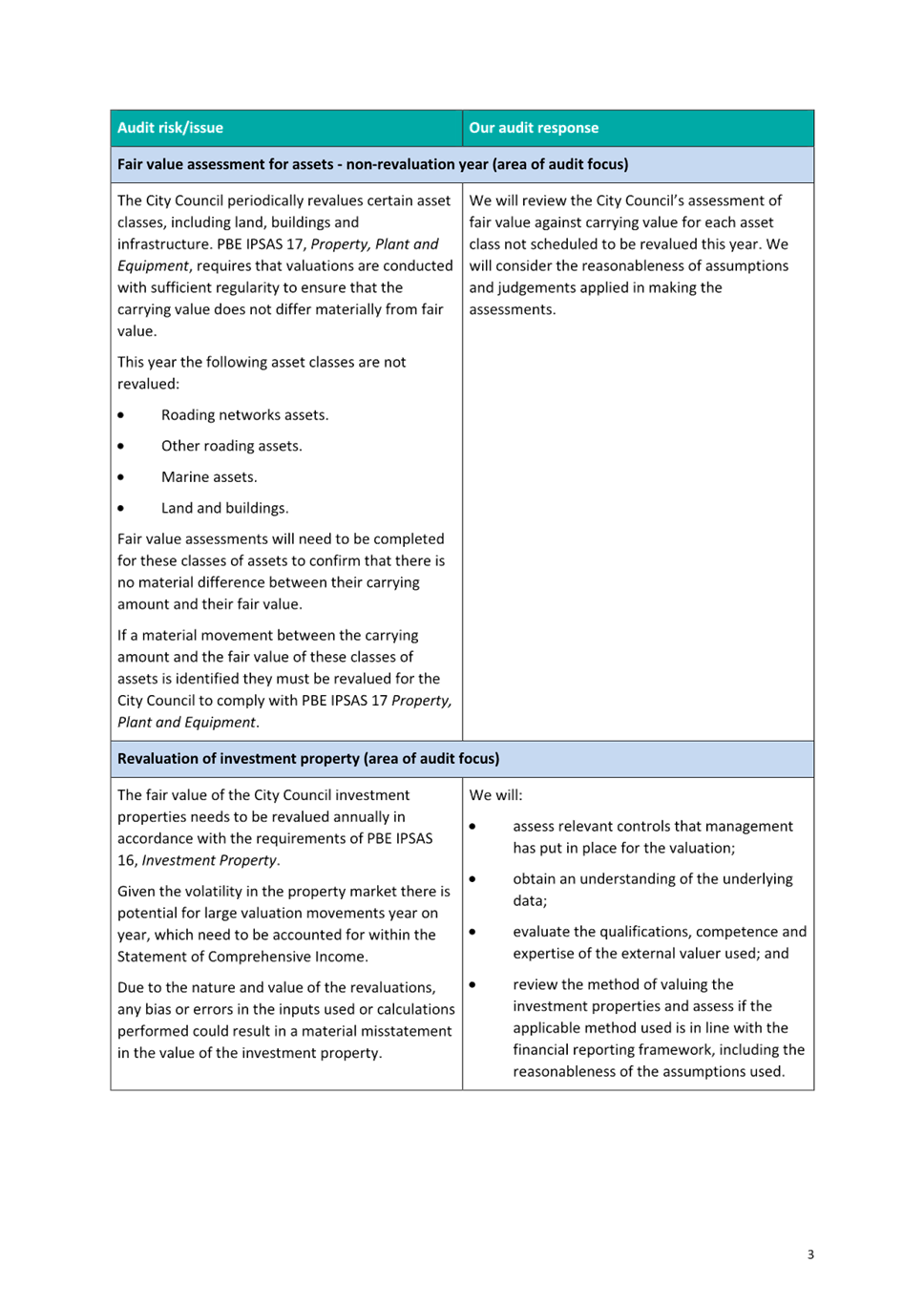

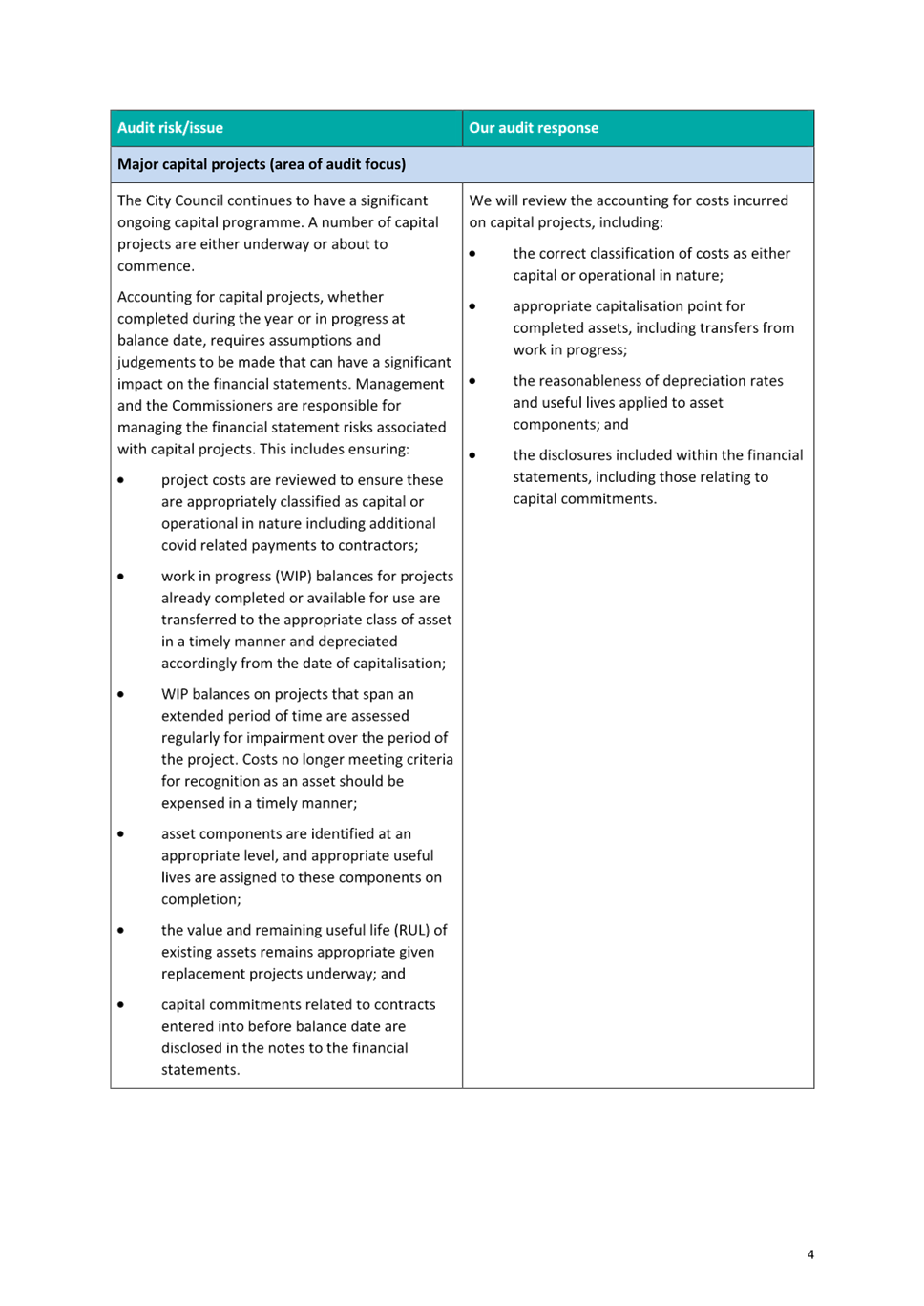

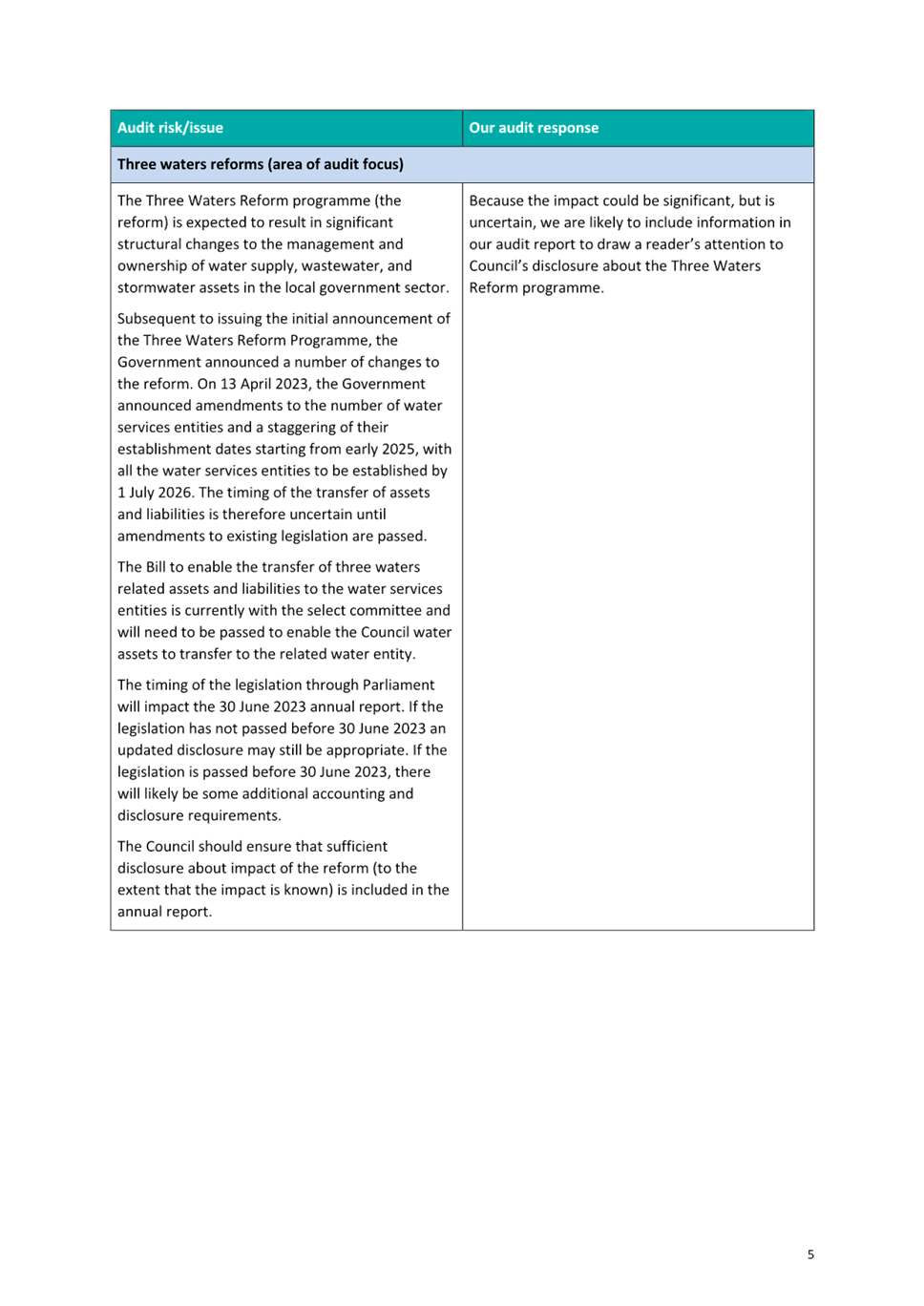

1. This report presents

the Audit New Zealand Audit Plan for the year ended 30 June 2023.

|

Recommendations

That the Strategy,

Finance and Risk Committee:

(a) Receives the report

"Audit Plan for 2023 Annual Report, Fees and Engagement Letter".

|

Executive Summary

2. Audit New Zealand

have provided their plan for the audit of Tauranga City Council for the year

ended 30 June 2023. The focus for this year continues to be the value and

capitalisation of assets as well as three waters reform and reporting of

significant financial transactions and non-financial performance measures.

Background

3. The interim audit

for the 2023 financial year will commence on 15 May 2023. The interim

audit focuses on systems and controls.

4. The final audit is

planned to commence on 15 August 2023. A workshop will be conducted with

Strategy, Finance and Risk Committee on 4 September to present the draft 2023

Annual Report and provide an opportunity for commissioners to offer feedback on

the content and tone of the document.

5. The audit plan for

2023 identifies key matters for attention during the audit for the year ended

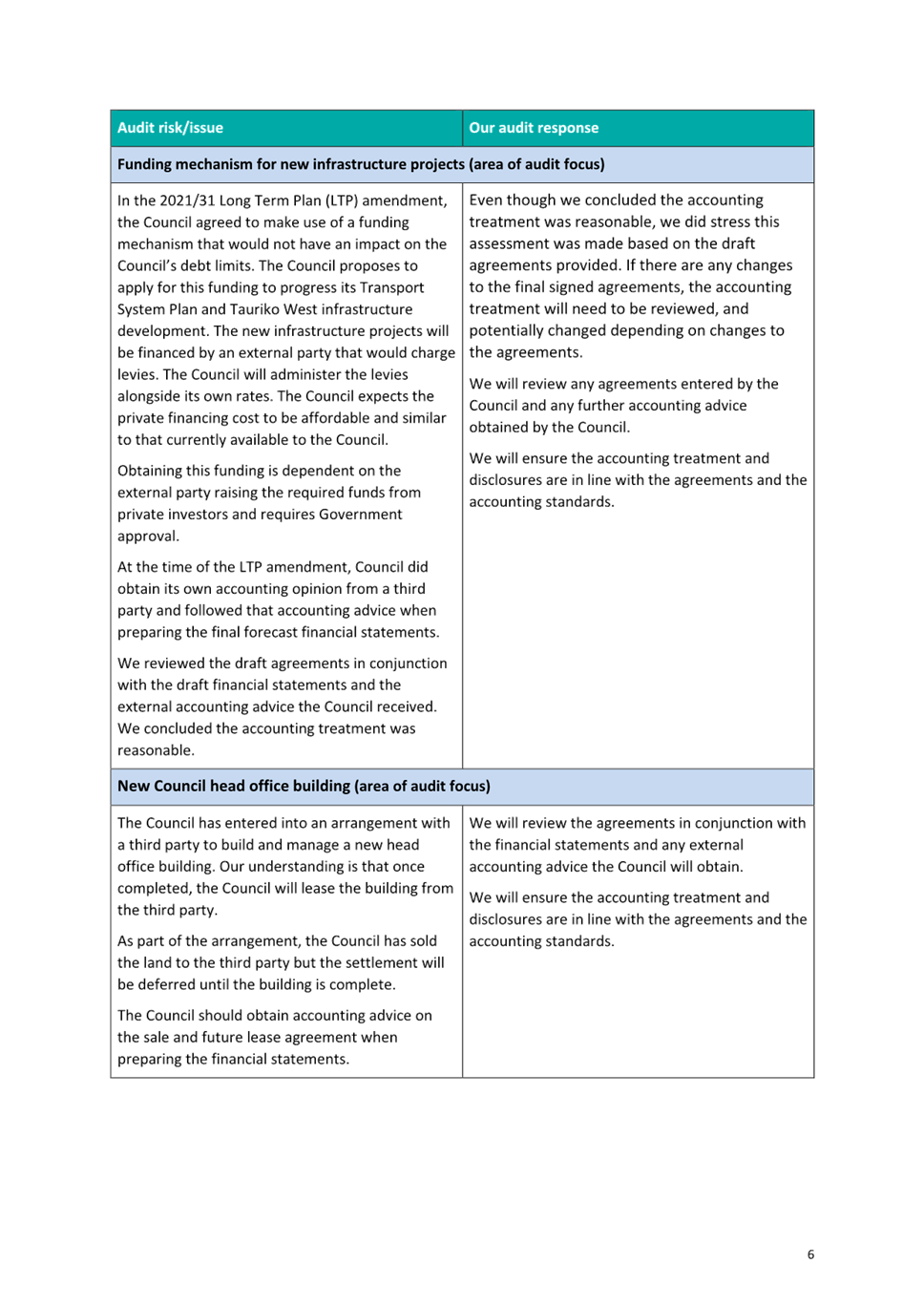

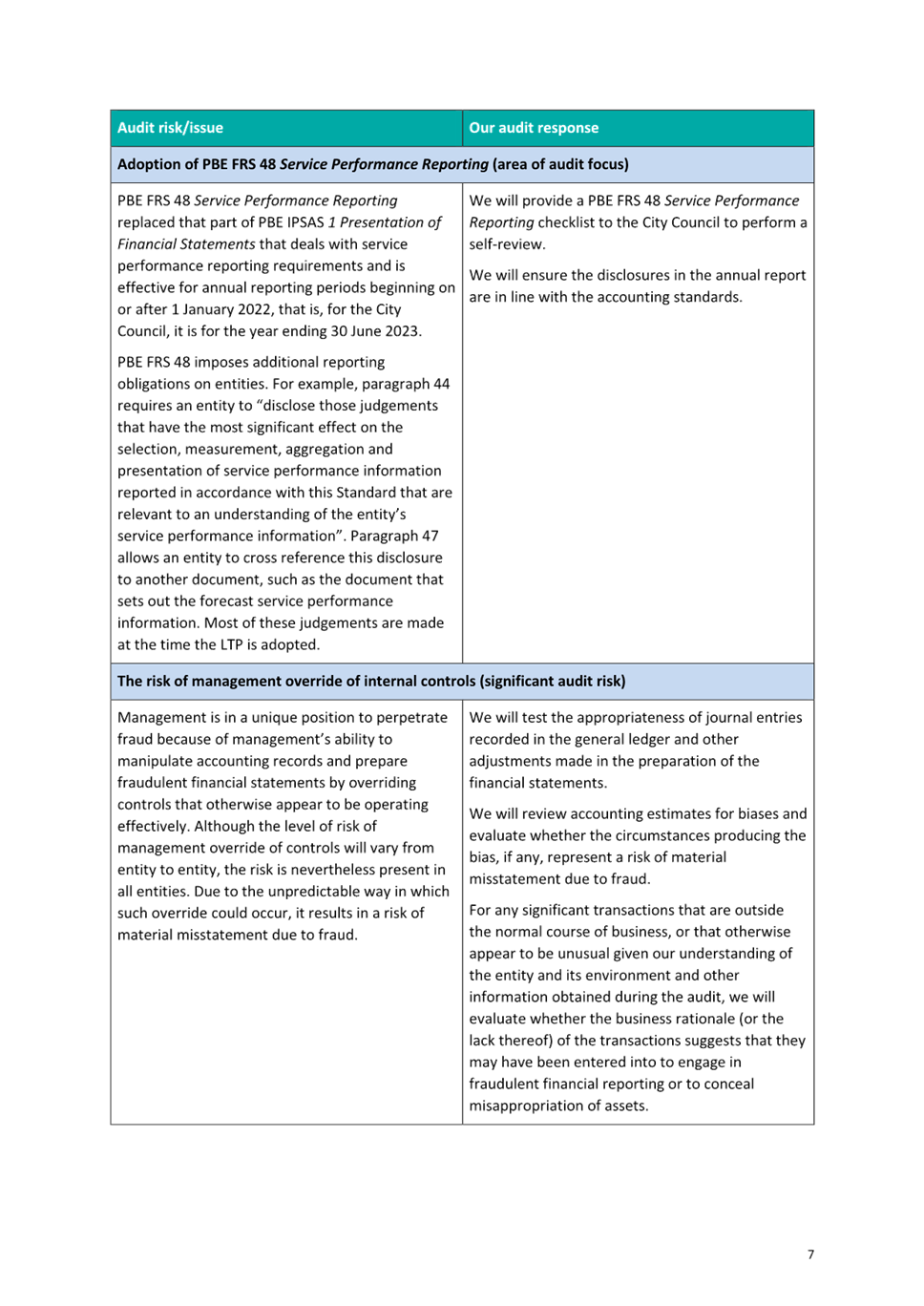

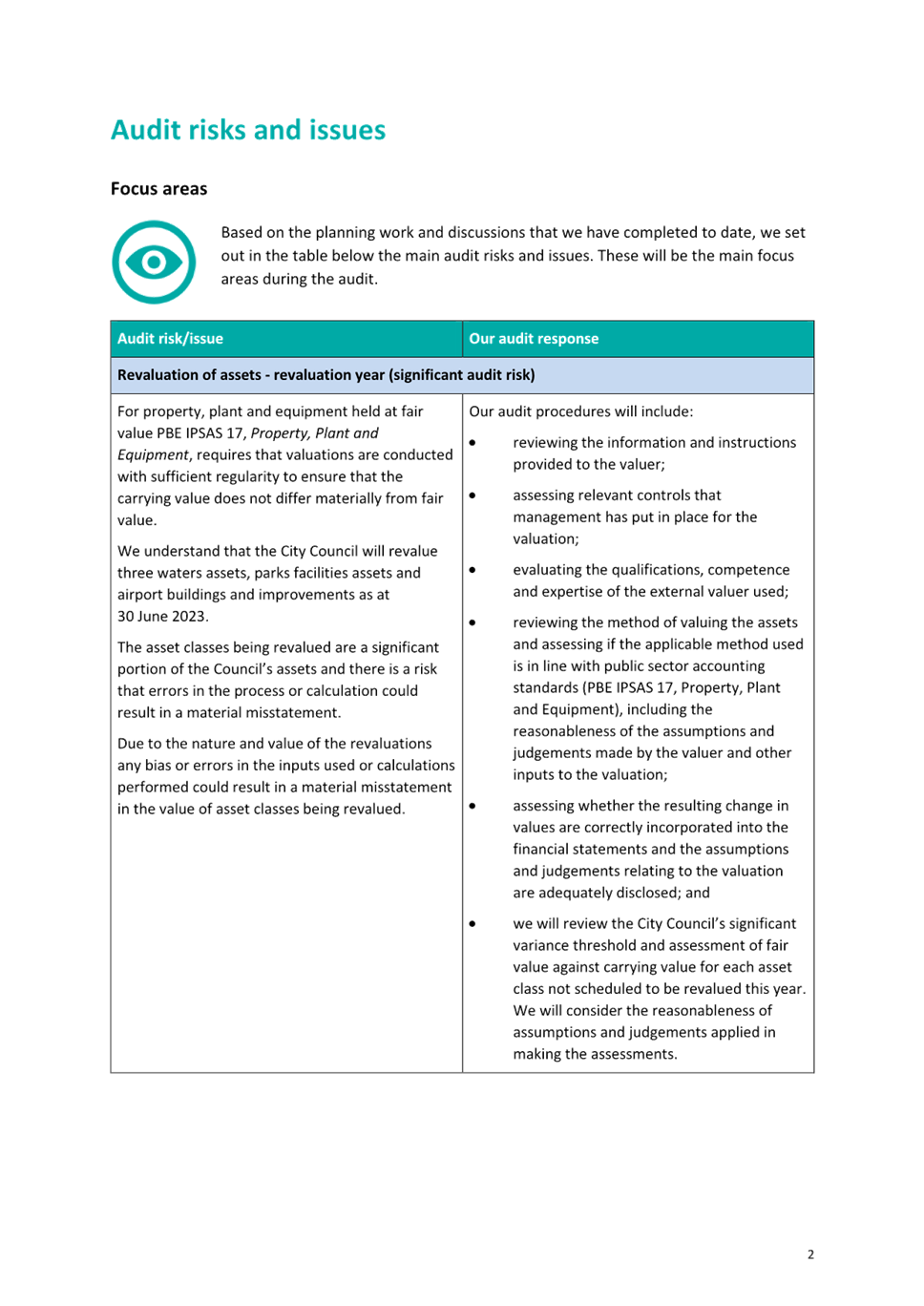

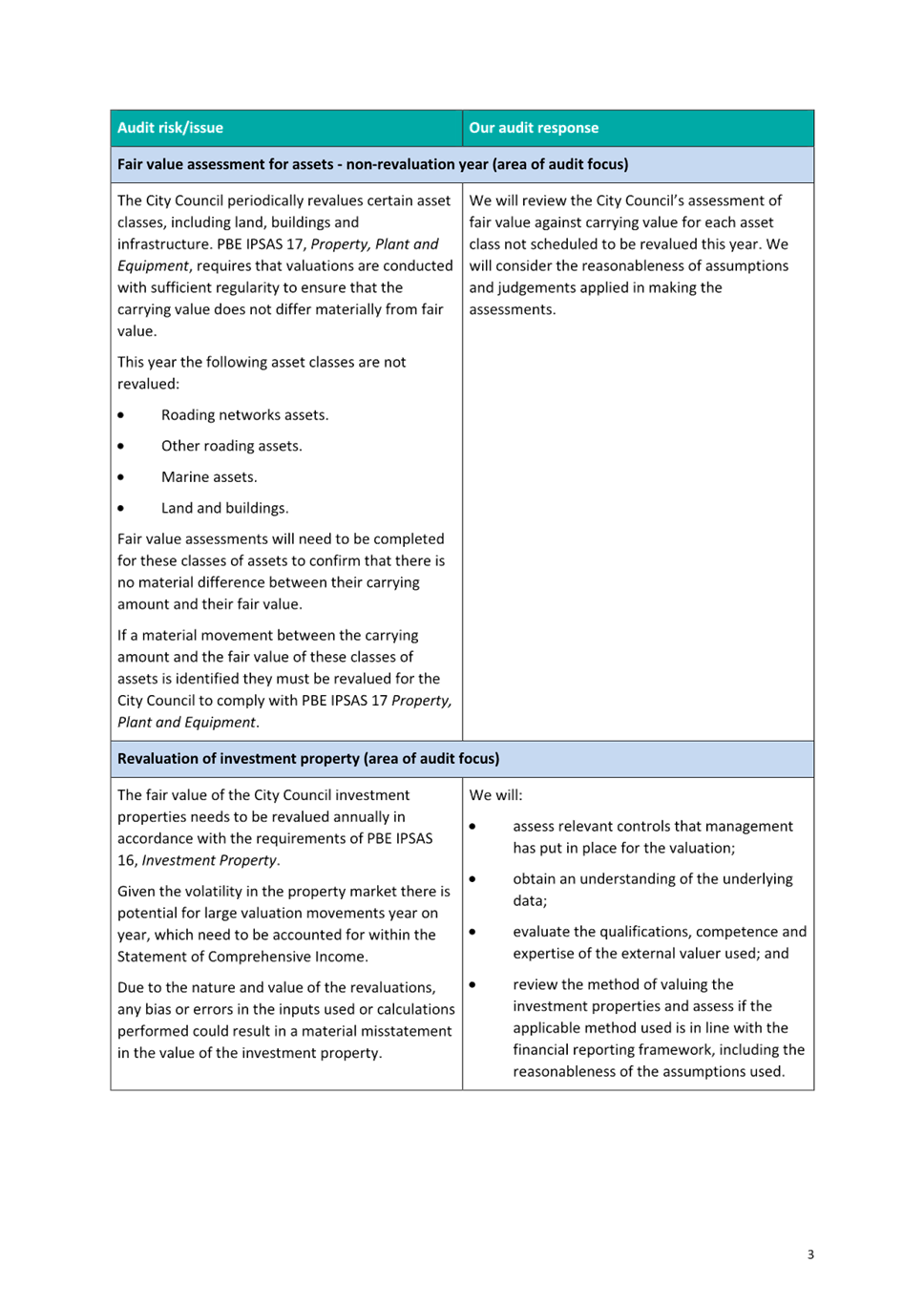

30 June 2023. Focus for this year includes the following:

· Revaluation

of three waters, parks & facilities and airport infrastructure assets

· Fair

value assessment of roading, marine, land and building assets

· Revaluation

of investment property

· Accounting

treatments of major capital projects

· Three

waters reform

· Funding

mechanism for new infrastructure projects (IFF)

· New

council head office building (deferred settlement and lease back)

· Adoption

of PBE FRS 48 Service Performance Reporting

· The

risk of management override of internal controls

6. Adoption of final

annual report will be on 16 October 2023 at Strategy, Finance and Risk Committee.

Strategic / Statutory Context

7. The audit plan is

part of the formal process of financial accounting and reporting set out in the

Local Government Act 2022.

Options Analysis

8. There are no options

presented in this report.

Financial Considerations

9. The audit will have

confirm and verify that Tauranga City Council has adhered to all appropriate

financial reporting standards and legislation when reporting the financial

performance and position of Tauranga City Council.

Legal Implications / Risks

10. There are no specific legal

implications or risks as a result of this report.

Consultation / Engagement

11. There is no consultation

required as a result of this report.

Significance

12. The Local Government Act 2002

requires an assessment of the significance of matters, issues, proposals and

decisions in this report against Council’s Significance and Engagement

Policy. Council acknowledges that in some instances a matter, issue,

proposal or decision may have a high degree of importance to individuals,

groups, or agencies affected by the report.

13. In making this assessment,

consideration has been given to the likely impact, and likely consequences for:

(a) the current

and future social, economic, environmental, or cultural well-being of the district

or region

(b) any persons who are likely to be

particularly affected by, or interested in, the matter.

(c) the capacity of the local authority to

perform its role, and the financial and other costs of doing so.

14. In accordance with the considerations

above, criteria and thresholds in the policy, it is considered that the matter

is of low significance.

ENGAGEMENT

15. Taking into consideration the

above assessment, that the matter is of low significance, officers are of the

opinion that no further engagement is required prior to Council making a

decision.

Next Steps

16. Commission Chair to sign Audit

Engagement Letter

17. Council staff will engage with

Audit New Zealand on the interim and final audits of Tauranga City Council with

agreed audit plan.

Attachments

1. TCC

Audit Plan 2023 - A14655938 ⇩

|

Strategy,

Finance and Risk Committee meeting Agenda

|

6

June 2023

|

9.2 Quarter

3 Update of Capital Programme, presentations from Delivery Teams

Attachments

Nil

|

Strategy,

Finance and Risk Committee meeting Agenda

|

6

June 2023

|

9.3 Q3

Financial and Non-Financial Monitoring report to 31 March 2023

File

Number: A14644661

Author: Kathryn

Sharplin, Manager: Finance

Tracey Hughes,

Financial Insights & Reporting Manager

Raj Naidu, Corporate

Planner

Authoriser: Paul

Davidson, Chief Financial Officer

Purpose of the Report

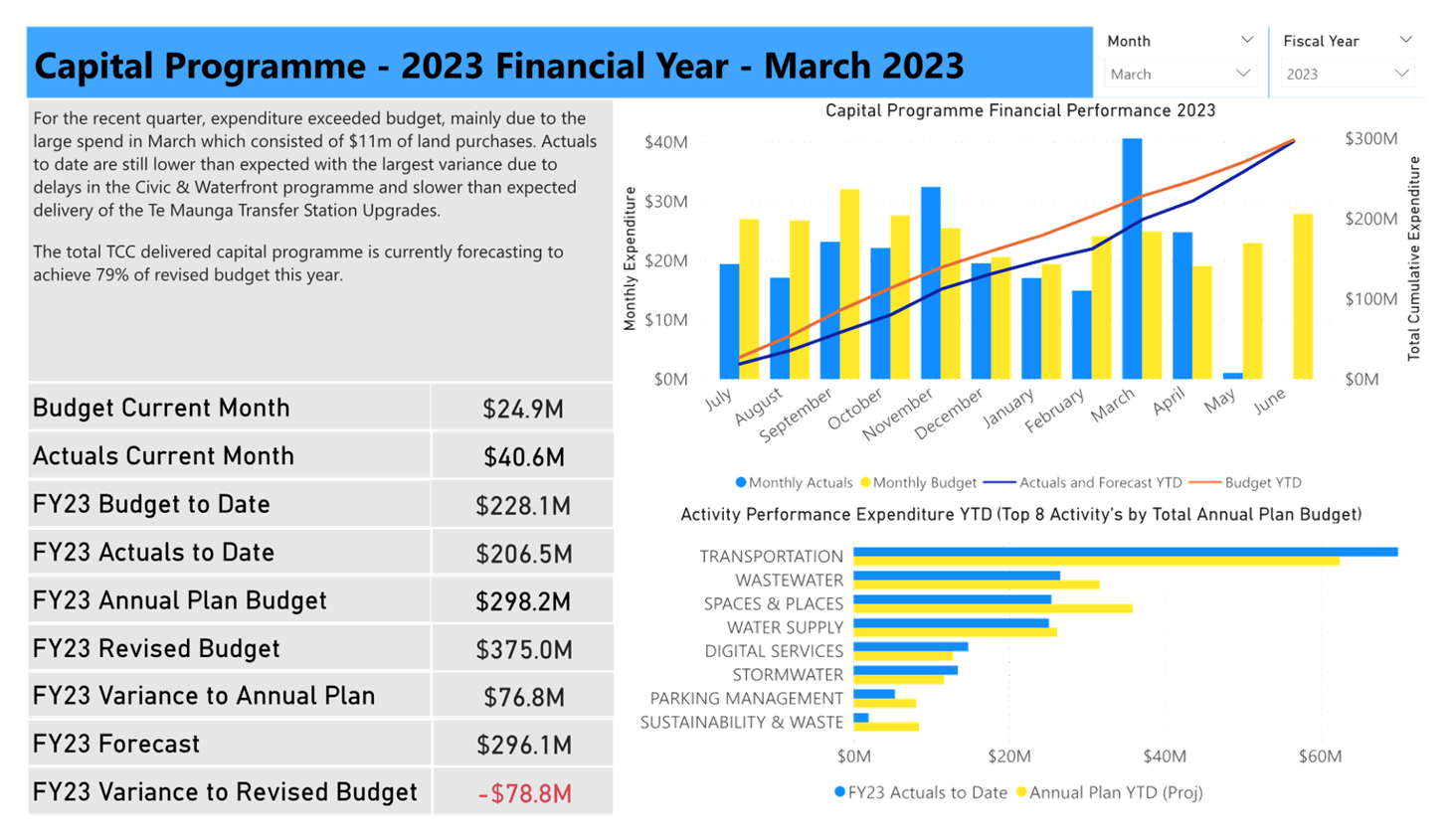

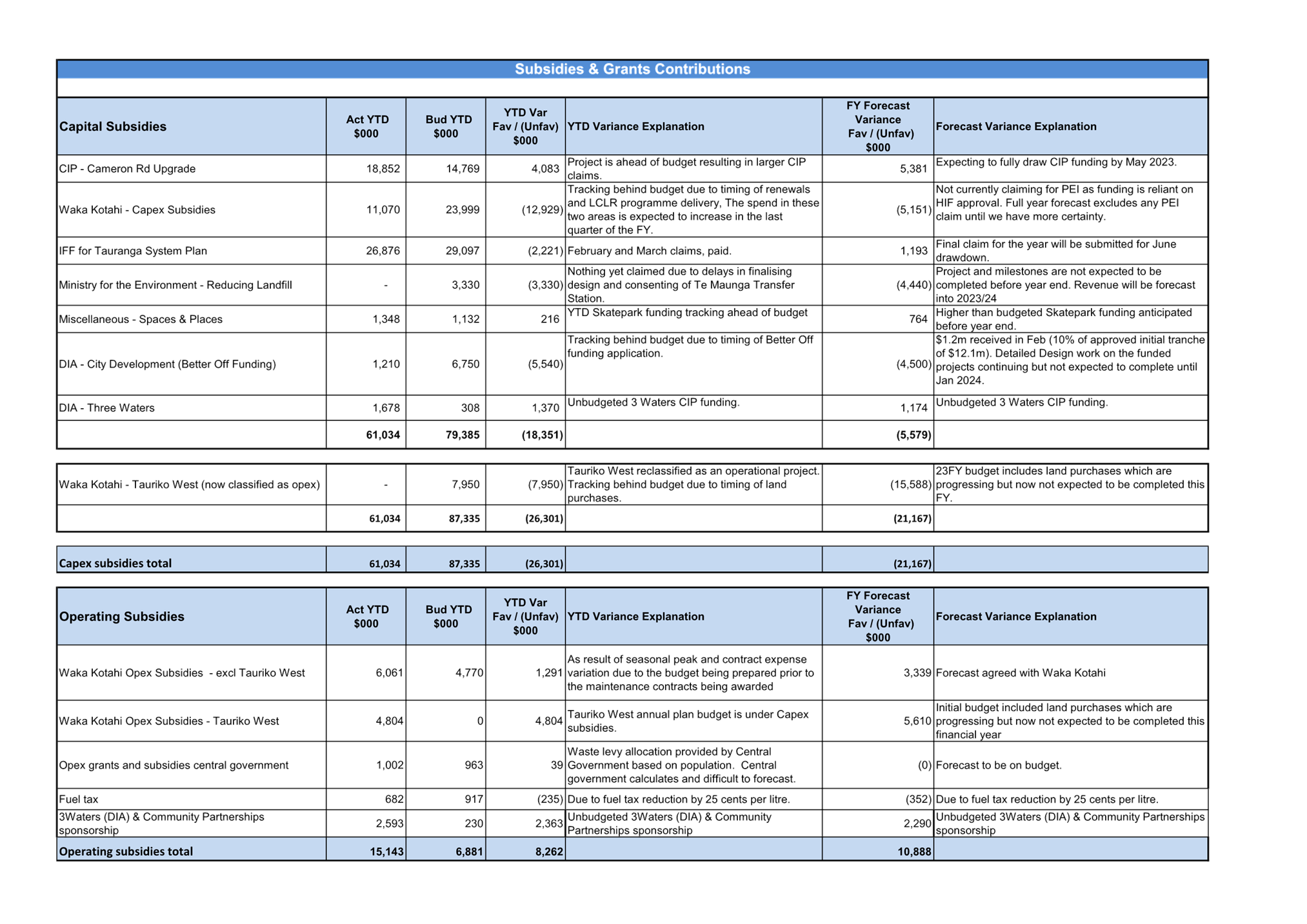

1. The

purpose of this report is to provide information of council’s performance

for the first three quarters of the 2022/23 financial year and identify key

variances risks and implications for the performance for the year.

2. This

report also includes an overview of the results from the Annual Residents

Survey for the third quarter and a summary of initial benchmarking data for

spaces and places including facilities.

|

Recommendations

That the Strategy,

Finance and Risk Committee:

(a) Receives

the report "Q3 Financial and Non-Financial Monitoring report to 31 March

2023".

|

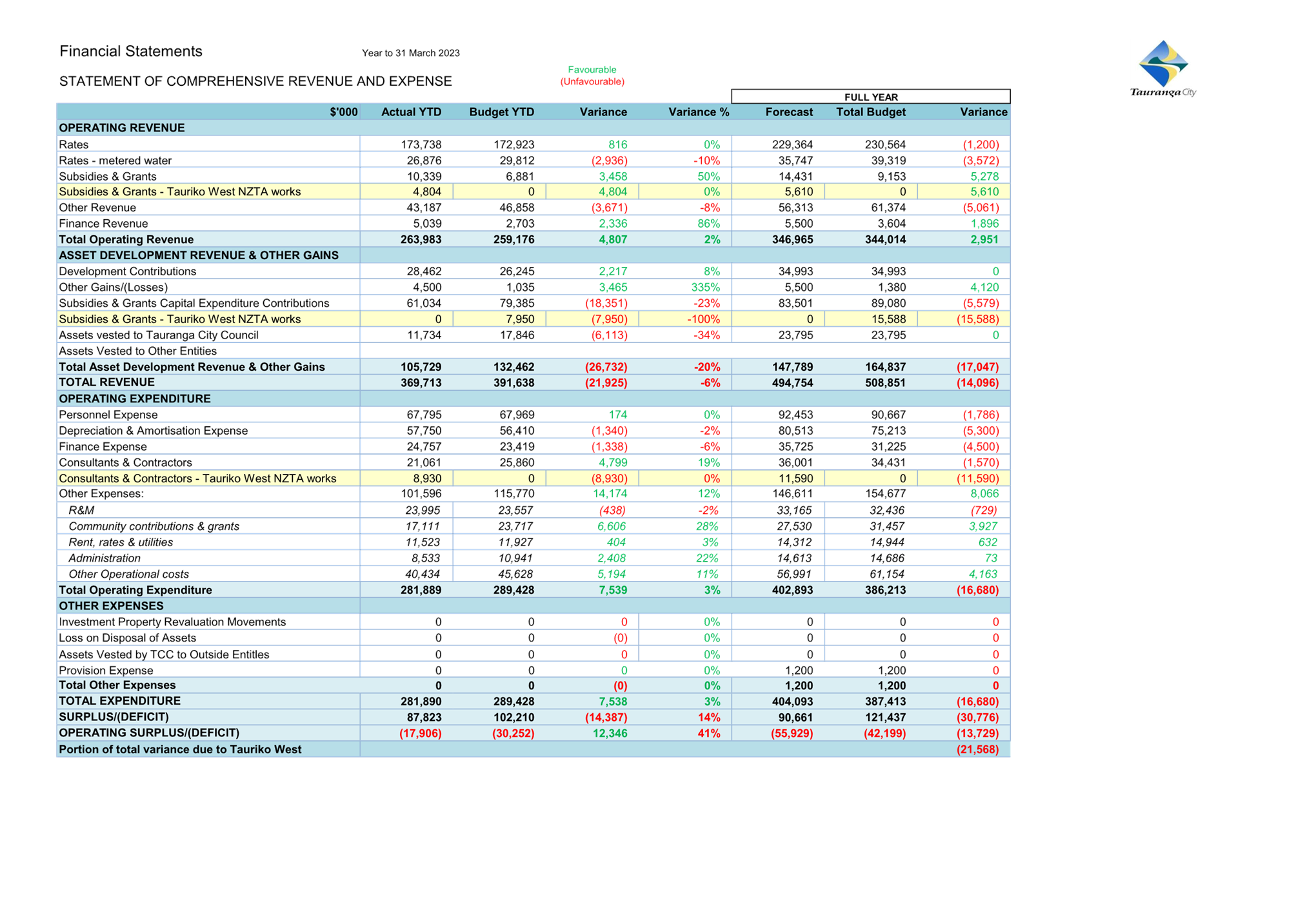

Executive Summary

3. This

report along with the material in attachment one outlines council’s

financial performance against budget for the 9 months to 31 March 2023.

4. The

operating deficit for the 9 months is favourable to budget overall with a

smaller than budget net deficit ($12.3m favourable).

5. However,

including budgeted asset development revenue the 9 months result is reported as

unfavourable to budget. Most of the full year forecast variance is due to

a change in accounting treatment rather than unfavourable performance. It is

due to a change from budget in the accounting treatment of the Tauriko West

capital works undertaken by NZTA and partially funded by TCC. Overall,

this contributes $21.6m toward the $30.8m forecast unfavourable result.

6. The

remaining $9.2m of unfavourable net movements arise from lower revenue across

various activities, including some subsidies now not expected to be received in

this financial year, and higher transportation operational costs. These are

partially offset by some operational costs not occurring in the year.

7. Capital

Expenditure is currently tracking below budget. However, as some projects are

tracking more slowly, others have been delivered more quickly or costs have

increased so that overall an additional $40m of project budgets have been

brought forward into the year from later years under CE delegation or as new

budget approved by council.

8. The

level of expenditure across the capital programme and lower revenue from user

fees and delays in subsidies and asset sales has put pressure on debt levels

relative to budget and on debt servicing costs.

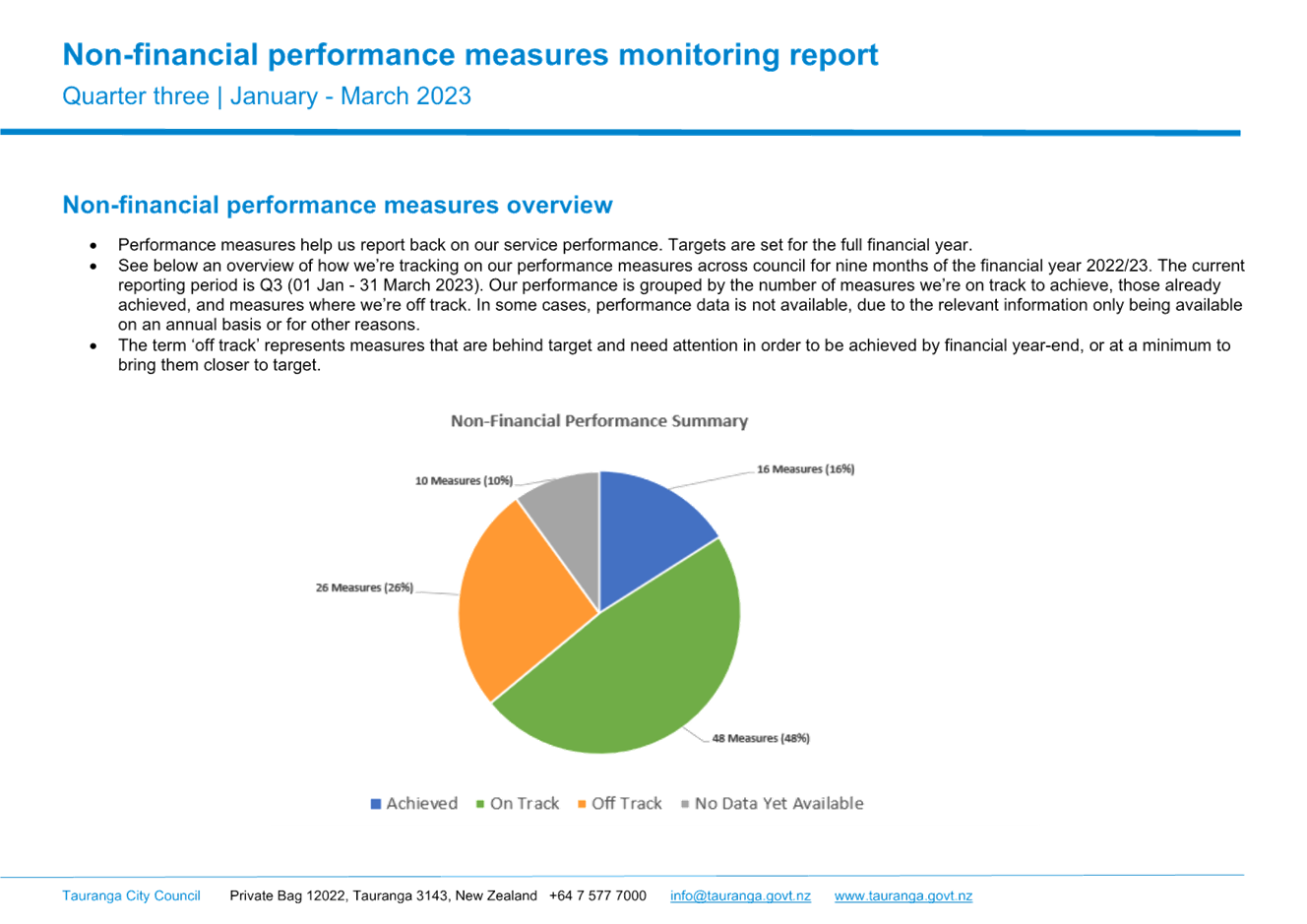

9. Attachment

2 presents how Council, and the community are tracking towards achieving

Council’s non-financial performance measures and levels of service in

Quarter three.

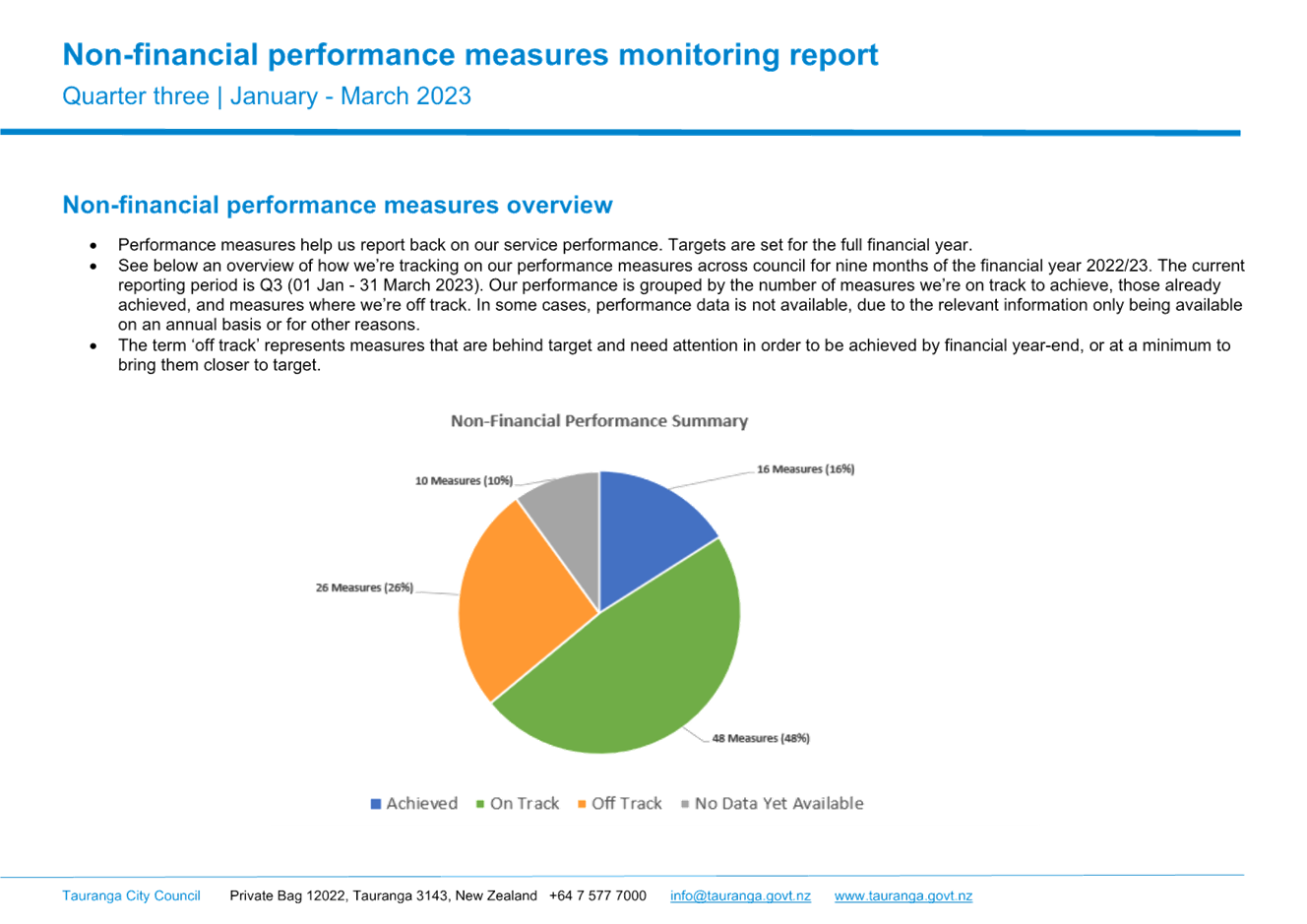

10. Of the 100 non-financial

performance measures, 16 measures (16%) have achieved the annual target, 48

measures (48%) are on track and 26 measures (26%) are off track. Data is not

yet available for ten (10%) of measures.

11. Attachment

3 presents a high-level summary of the wave three results of the Annual

Residents Survey.

12. Attachment

4 provides some high-level expenditure benchmarks in spaces and places

including facilities. These benchmarks indicate that TCC is broadly in

line with other councils of a similar size when looking at a per hectare or per

playground comparison. However, there is quite a lot of variation across

cities in the amount of green space and playgrounds provided and the data

available for comparison either through public documents or the yardstick

benchmarking is incomplete and does not allow ready comparisons.

Background

13. This report

is for monitoring and reporting purposes showing Council’s financial and

non-financial quarterly performance in delivering services to the community.

14. The

operational budgets were set during the annual plan process with some changes

to year two of the Long-term Plan (LTP) to deliver on agreed service levels and

capital investment. In an LTP, the level of service that the council will

deliver along with operational budgets and the capital investment programme are

agreed upon by the council in consultation with the public. Rates and user

charges are set based on these budgets.

15. The Local

Government Act 2002 requires local authorities to report on how well they are

performing in delivering these levels of service to their communities as

measured by the non-financial performance indicators.

16. In the 2021-31

LTPA there were 100 KPIs that were agreed upon, 23 of which are mandatory

measures as per section 261B of the Local Government Act.

17. Council

requested some information on benchmarking against other councils. In the December

quarterly report high-level benchmarks were provided for transportation and

three waters. The spaces and places benchmarks have taken more time to put

together because of limited available information and the significant variation

in the services included in budgets and the size of areas and facilities

provided.

Strategic

/ Statutory Context

18. Maintaining

expenditure within budget ensures delivery of services in a financially

sustainable way.

19. Monitoring

non-financial performance is a key function of the committee.

Discussion

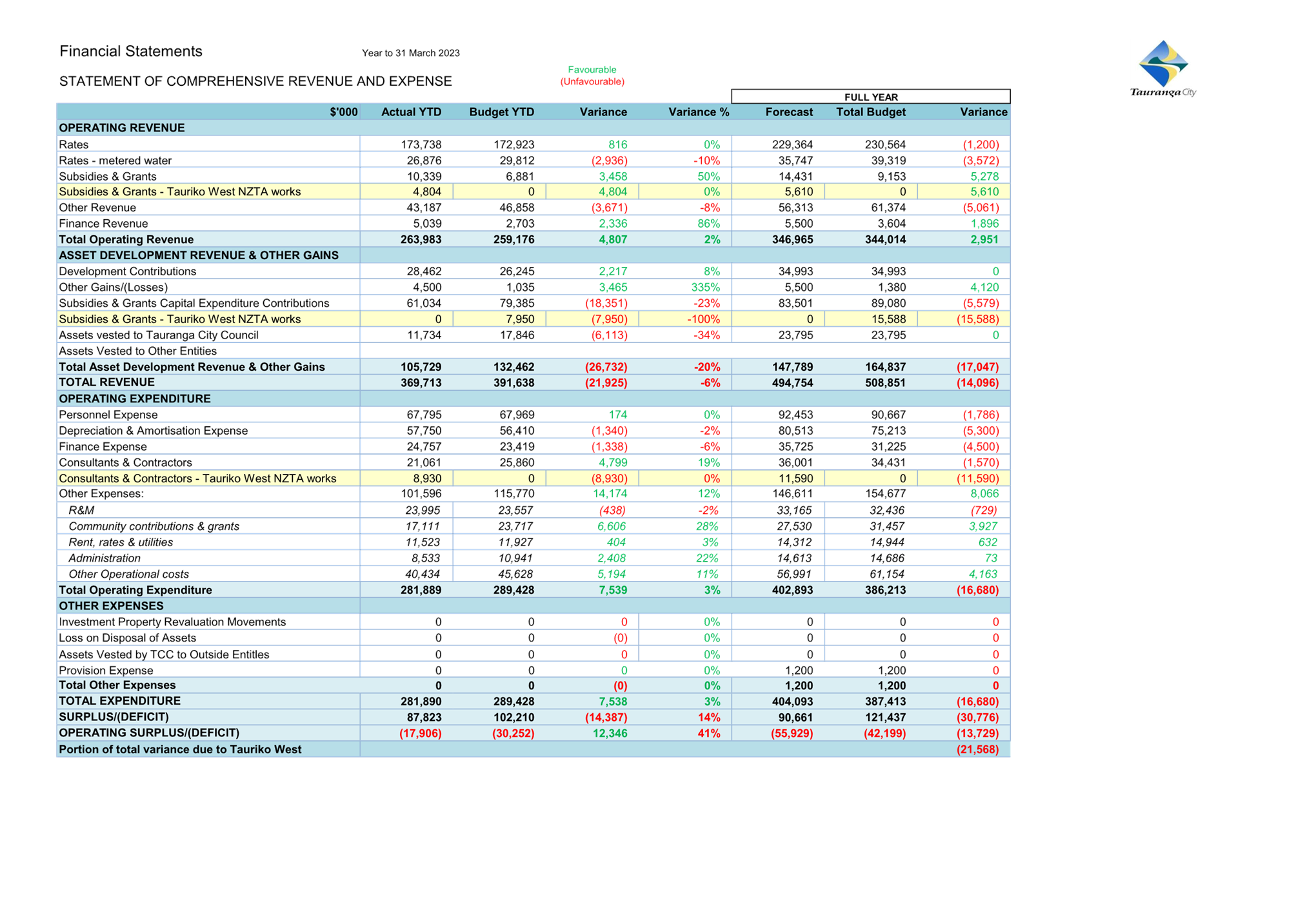

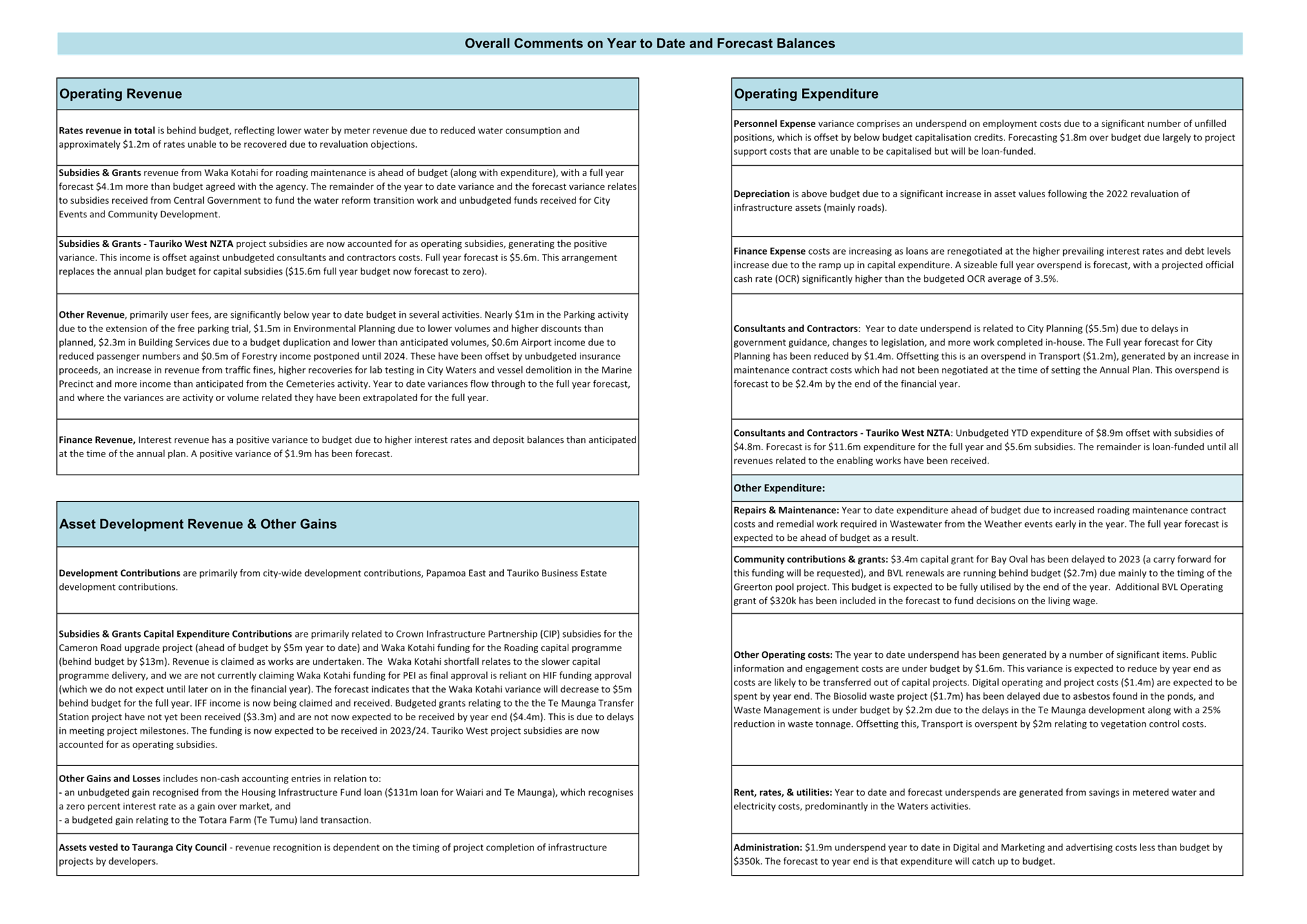

Part 1: Financial Performance

20. The

financial results for the first 9 months of the financial year are presented in

Attachment 1. The results to date are favourable to budget in terms of

operational revenue and expenditure recording a deficit of $17.9m, which is $12.3m

favourable to budget. However, once Asset Development Revenue is included

the overall surplus is $88m year to date, which is $14m unfavourable to

budget.

21. Most of this

result is not due to poor financial performance but instead is caused by a

change in accounting treatment to that assumed in the budget. A portion

of the Tauriko West capital programme is State Highway rather than local road

works and are to be delivered by Waka Kotahi. As a result, the projects

initially budgeted as capital have now been recognised as operational

expenditure. This has resulted in an additional $4.1m of operating deficit. The

deficit created by this treatment is not intended to be rate funded. The change

in delivery of Tauriko West is forecast to reduce the reported year end surplus

by $21.6m. This is because along with the forecast $6m net operational

expenditure there is a loss of NZTA capital subsidy revenue of $15.6m.

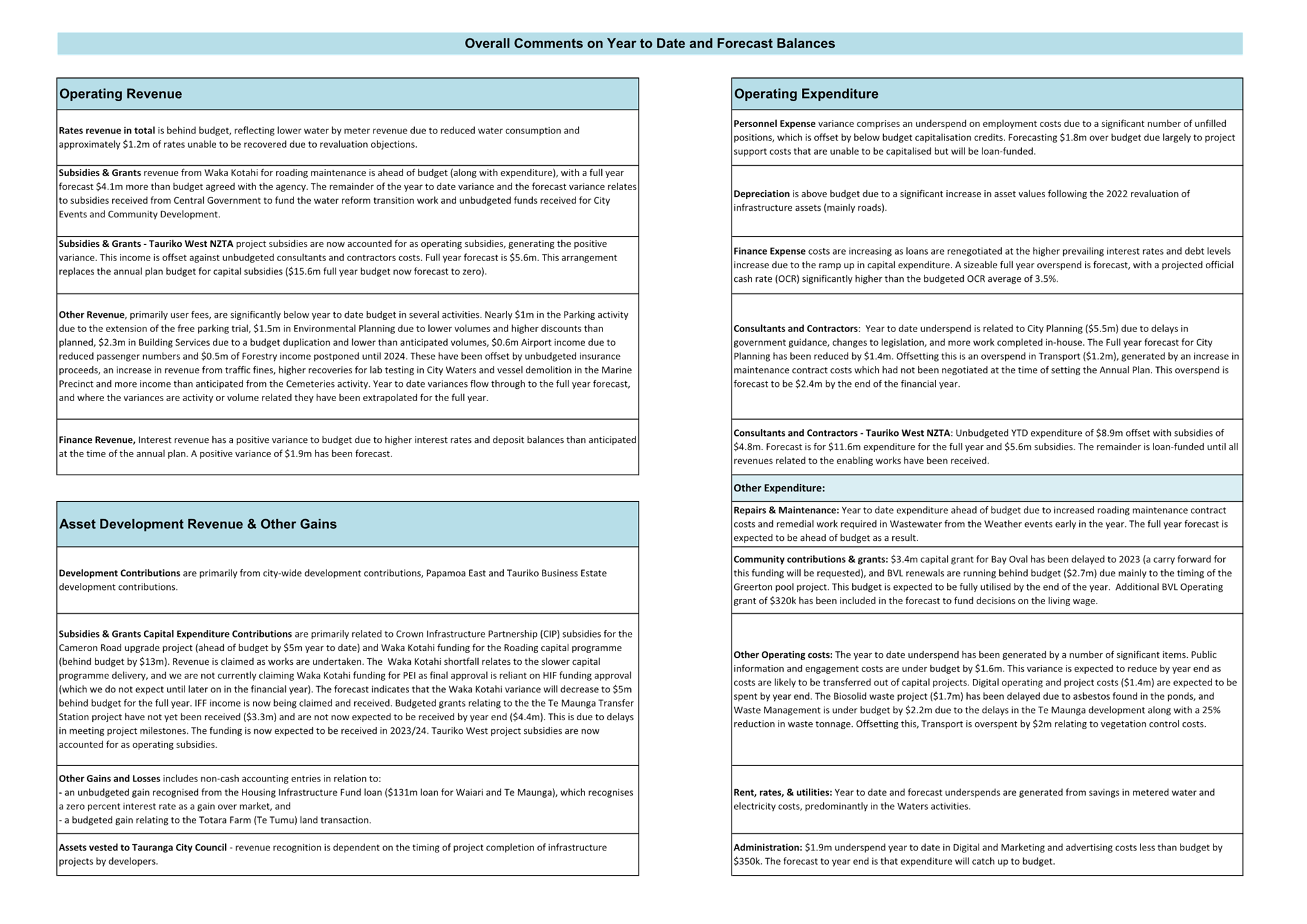

Revenue Variance

22. Operating

revenue is forecast to be slightly ahead of budget only due to the accounting

treatment of Tauriko West. User fee revenue is significantly below

budget. Key areas of lower revenue include building services and

environmental planning where volumes have been reducing and in the case of

planning, delays in consents processing have led to higher than budgeted

discounts, parking revenue has been down due to the extension of the free

parking trial and airport revenue is still recovering post covid.

23. Rates revenue

is under budget year to date and forecast to be $4.8m in total under budget for

the full year. This reflects lower than expected water by meter revenue

due to reduced consumption, and lower rates to be charged to properties as a

result of challenges to values resulting from the last property valuation.

24. Subsidies and

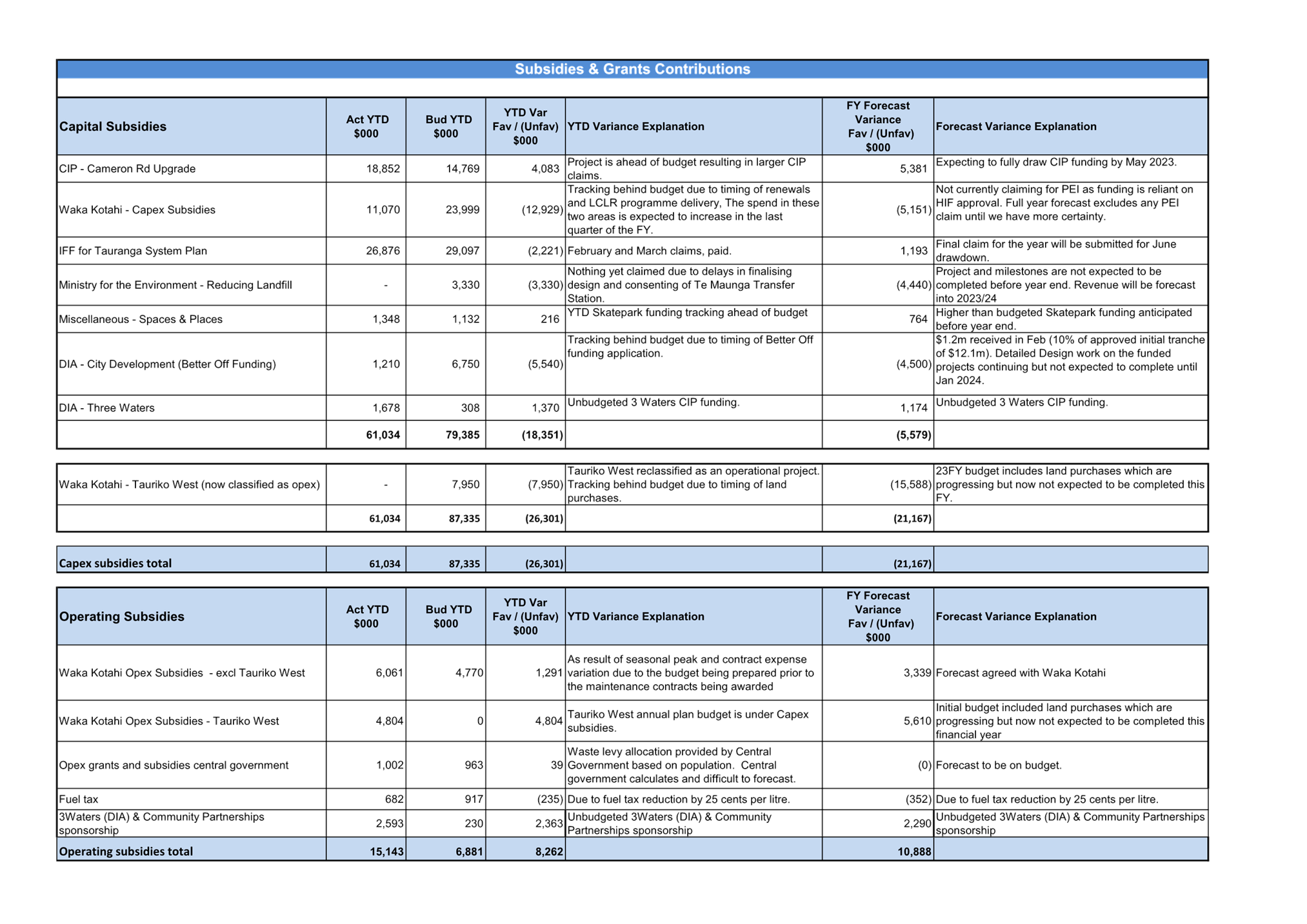

grants are an area of increasing focus as we strive to identify sources of

funding other than the ratepayer. Attachment 1 also provides an overview of how

we are tracking against budgets for both operating and capital subsidies,

noting that where forecast subsidies are forecast to not be received by year

end they are expected to be received in 2023-24.

Expenditure Variance

25. Operational

expenditure shows a year-to-date positive variance of $7.5m. By year end

this variance is expected to be unfavourable as community grants are paid and

the operational costs of projects including digital projects and the Civic

precinct are brought to charge as operational rather than capital. Transportation

is the main activity where an unfavourable operating result is recorded.

The cost pressure on the transportation activity has been reported to council,

which has approved over-spend to budget on transport operations and maintenance

costs through to the end of the year ($5.5m). Benchmarking analysis

provided in December had indicated that prior to recognising these additional

costs TCC expenditure was tracking significantly below comparator councils.

26. Personnel

expenses are on budget year to date and are forecast to be $1.8m over budget

for the full year as vacancies are filled by permanent staff or contractors at

higher rates and a concentration of staff time in the preliminary project

stages is unable to be capitalised. Capitalised salaries (which reduce

the reported expenditure) are considerably behind budget and further work is

underway to ensure the correct level of capitalisation occurs. Even so,

capitalisation is expected to be under budget at year end, generating the

forecast negative variance in Personnel expenses.

27. Consultants

are $4.8m under budget year to date. This is largely in the City &

Infrastructure Planning activity which has forecast $1.4m under budget for the

full year.

28. Depreciation

is over budget due to the very large roading revaluation in 2022.

29. Other operational expenditure is underspent particularly in

community contributions and grants (timing of grants particularly for Community

Partnerships, BVL and Bay Oval) and operational costs (slower expenditure for biosolids

disposal, software licenses and general operational costs).

Full Year Forecasts

30. Full year forecasts have now been assessed for both capital and

operational costs and reflect the ongoing impacts of Tauriko West, increased

interest rates, the 2022 asset revaluation and salaries capitalisation.

Overall, the full

year surplus is forecast at $91m, which is $31m below that budgeted.

Exlcuding the impact of Tauriko West the surplus is forecast to be $9m less

than budgeted.

Overall the

biggest drivers of the deficit increase are:

(a) Tauriko West

change in accounting treatment and programme timing $21m

(b) Net borrowing

costs $2.6m greater due to higher interest costs and higher borrowing levels

(c) Depreciation

$5.3m greater than budget mainly in tansportation

(d) Transport costs

$6.4m increase including maintenance contract, mowing level of service increase

greater than budget and capitalisation below budget

(e) Community

contributions and grants $3.9m not paid out by year end

(f) Various

other differences across revenue and expenditure largely offset each

other. They are summarised in Attachment 1.

31. Higher

expenditure in rate funded transportation will also put pressure on the year

end rates position.

Capital

32. Capital

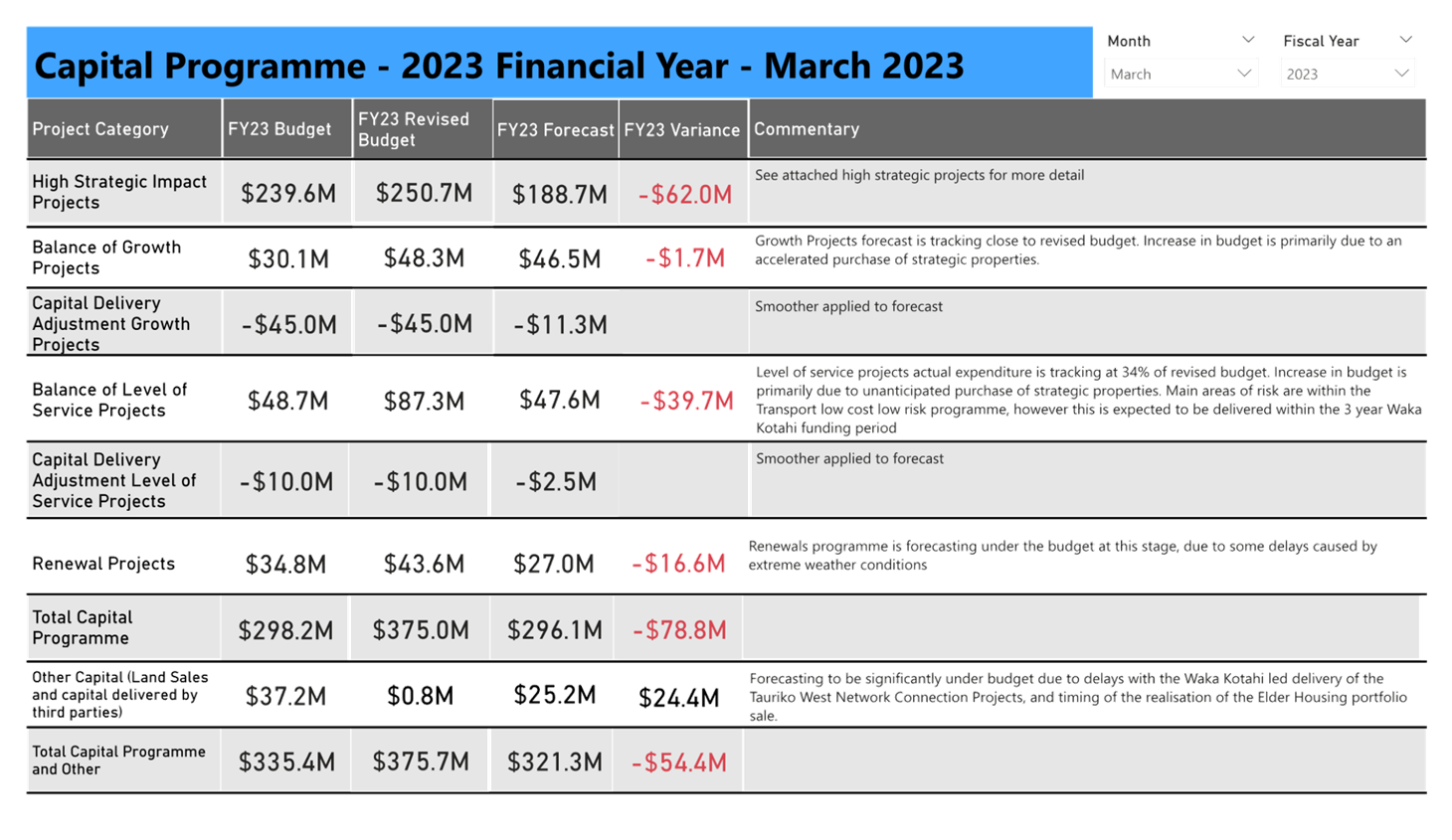

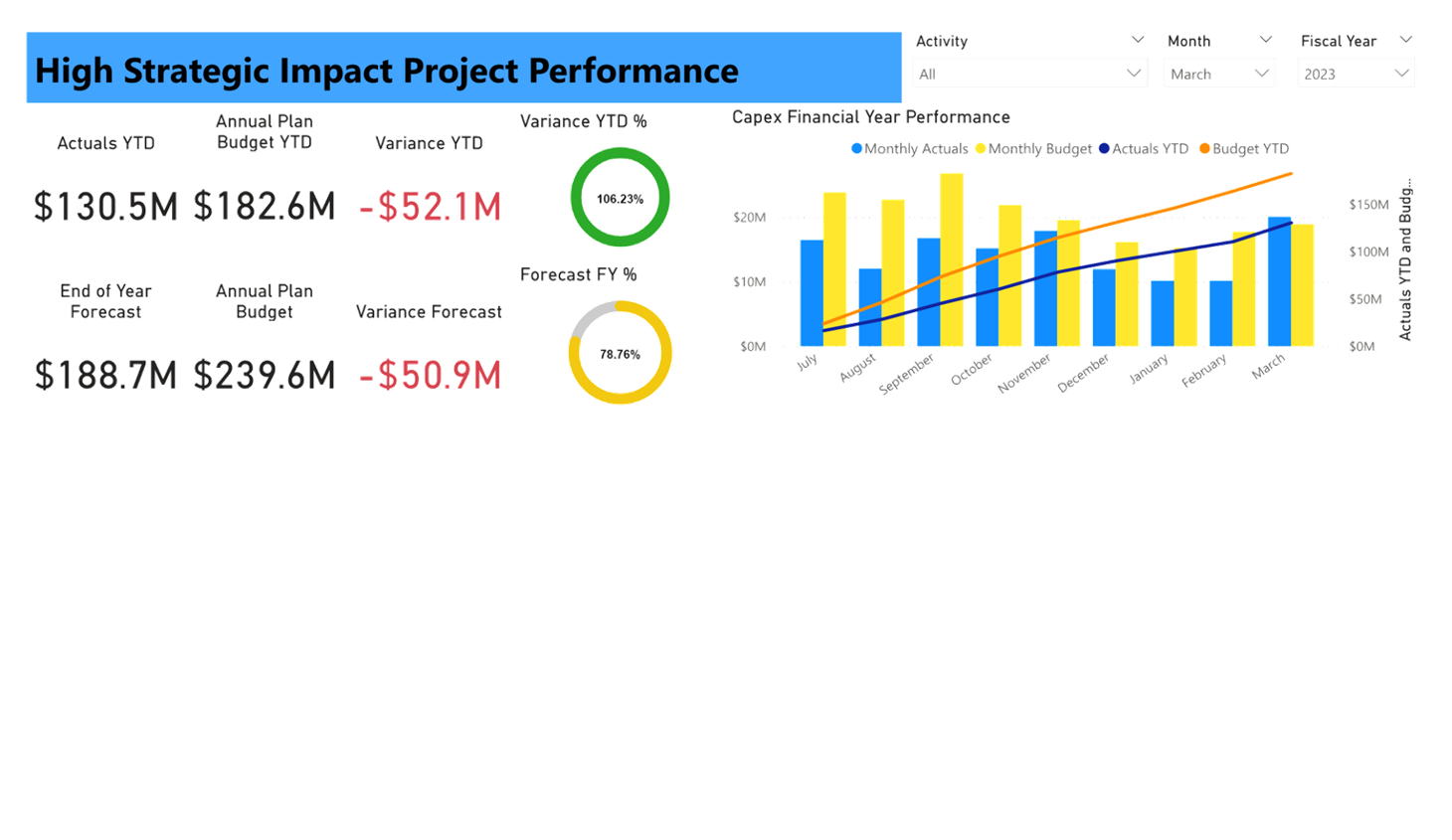

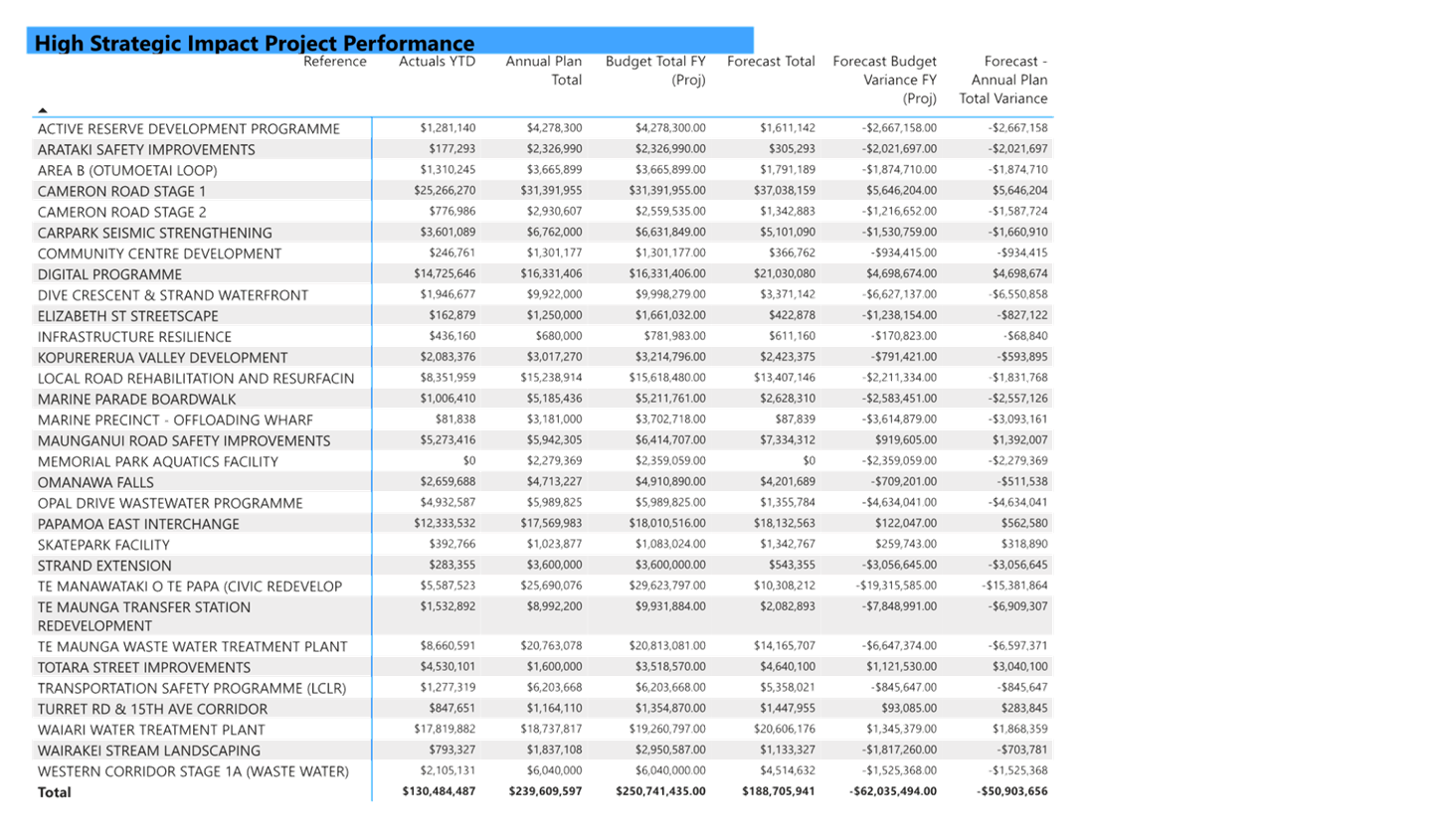

delivery has continued to ramp up in the third quarter with the spend for March

recorded at $40.6m.

33. The annual

plan budget was set at $298m. Attachment 2 records the overall upward revision

in budgets of $77m which means that even though some annual plan projects have

been delayed (valued at about $79m). Other projects have been undertaken

to replace this spend so that overall we expect to spend $296m. Overall,

these adjustments primarily represent movement in timing of projects across the

LTP years and some strategic land purchases.

34. In summary,

the capital programme budget has been revised up by $77m throughout the year

including:

(a) carryforwards

from 2022 ($23.3m),

(b) bring forward

of budget from later years of LTP ($27.5m),

(c) cost

increases on existing projects ($2.2m) and

(d) new projects approved

by council relating to airport, strategic land purchase and the SH2 Wairoa

Bridge ($22m).

(e) Movements to

reflect adjustments including the Waka Kotahi delivery of Tauriko west projects

and elder housing sale delays.

35. Transportation

spend year to date is ahead of budget reflecting Cameron Road Stage 1 capital

works forecast to be $5.6m ahead of budget due to both cost and timing

differences. Te Manawatake O Te Papa which is delivering slower than

budget and forecast to be $19m behind revised budget by year end.

Similarly, the Te Maunga Transfer Station redevelopment is tracking behind

budget and forecast to be $6.6m behind revised budget. These projects

will continue through 2023-24.

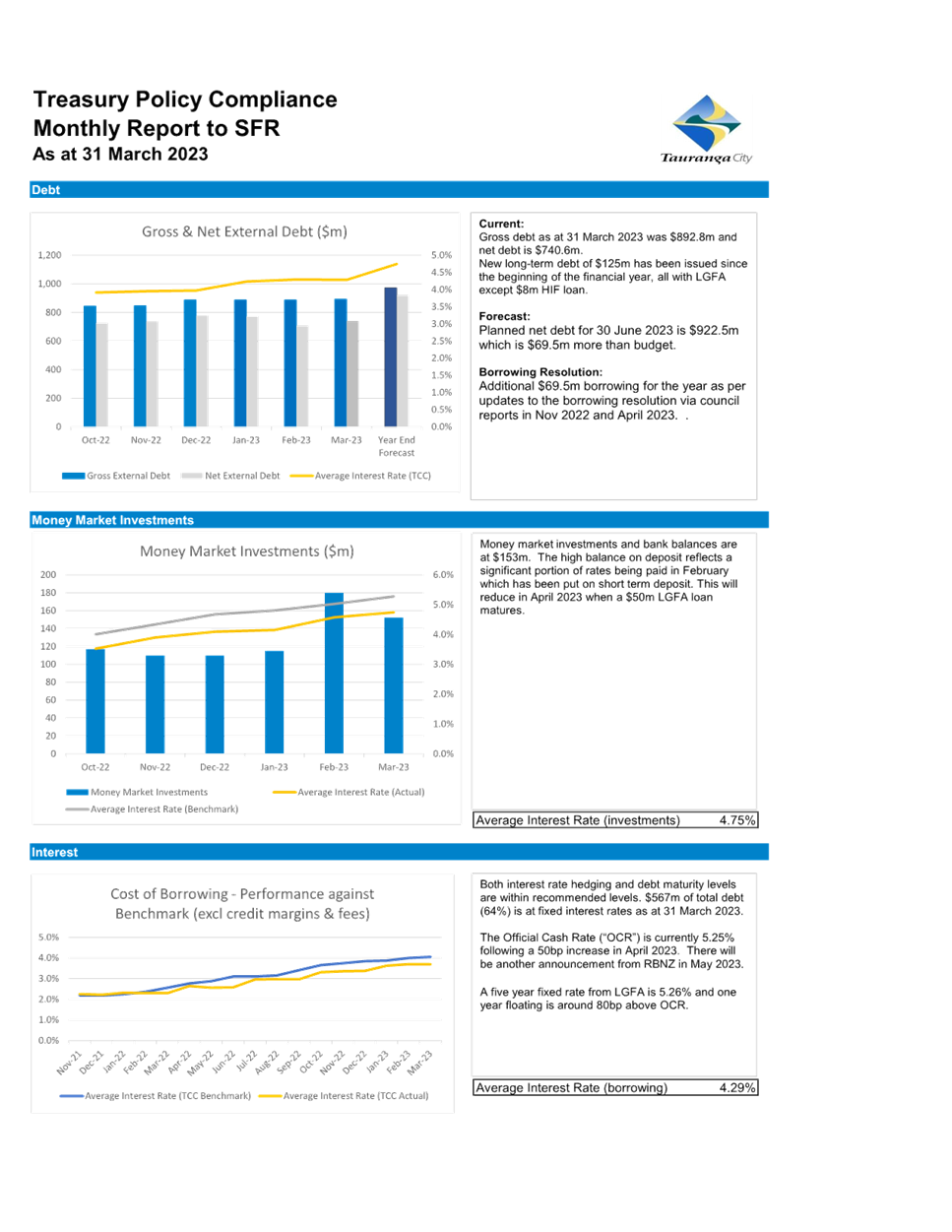

Borrowing and Debt

36. The level of

expenditure across the capital programme and lower revenue from user fees and

delays in subsidies and asset sales has put pressure on debt levels relative to

budget and on debt servicing costs. It is

forecast the debt to revenue position at year end will increase by 16% over

budget to 220% which is still within limits (295% in 2023). The cost of

borrowing has increased particularly for short-term borrowing with longer term

borrowing rates beginning to track back down to earlier levels (under 4%0 which

puts less pressure on our average cost of borrowing which is currently 4.29%.

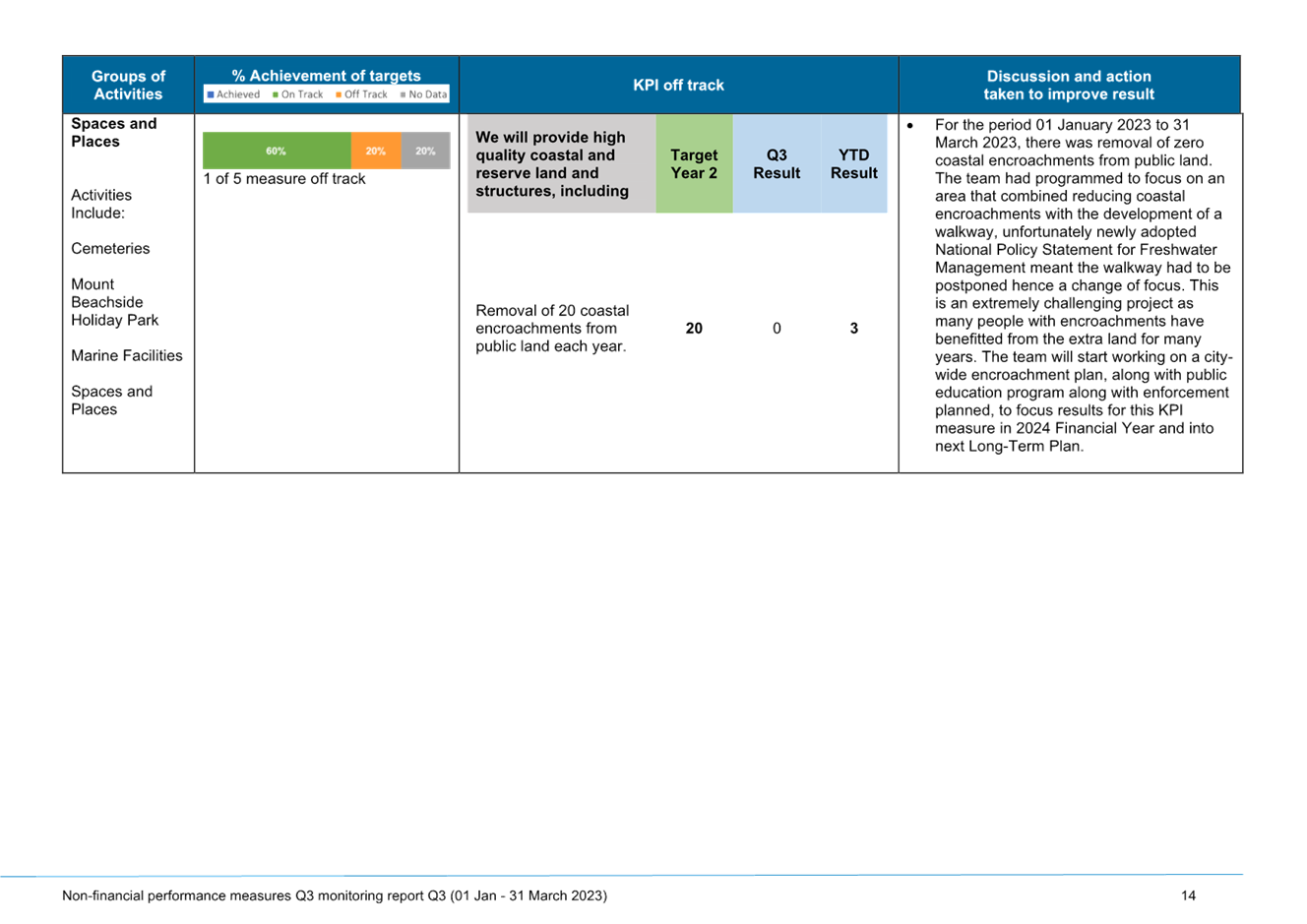

Benchmarking – Spaces and Places

37. Further work

has been undertaken to assess available benchmarking information with other

councils for spaces and places including facilities (BVL). For these

activities there are no standardised benchmarks across

the local government sector unlike for waters and transportation. There

is also inconsistency in what services are included in this activity group and

in the level of service provided. The attached benchmarks have reported

on total spend as provided in funding impact statements and some level of

service data available through annual reports. Overall Tauranga Council

provides more land area in open space and when costs are adjusted for land area

and population appears to be within a competitive range.

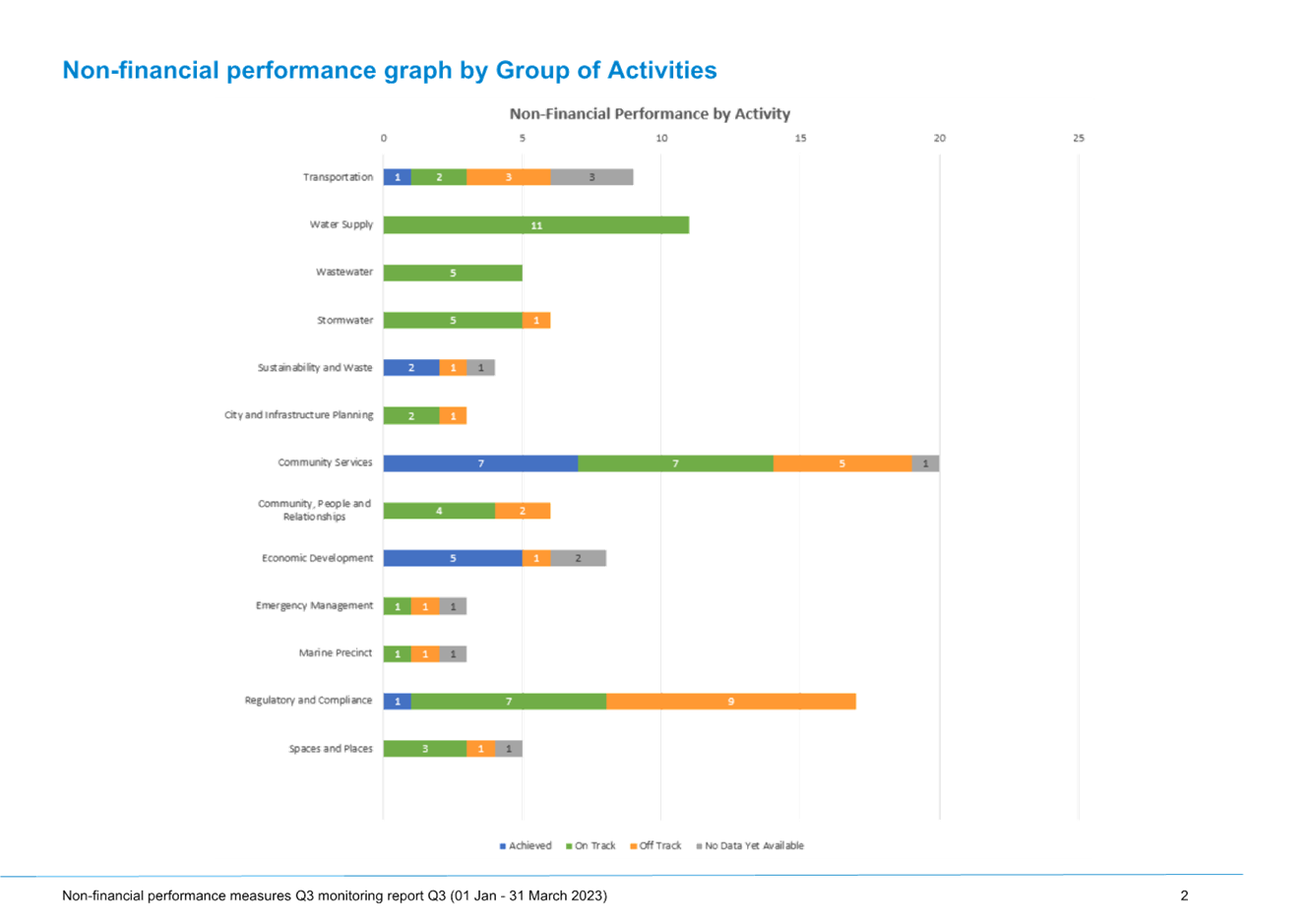

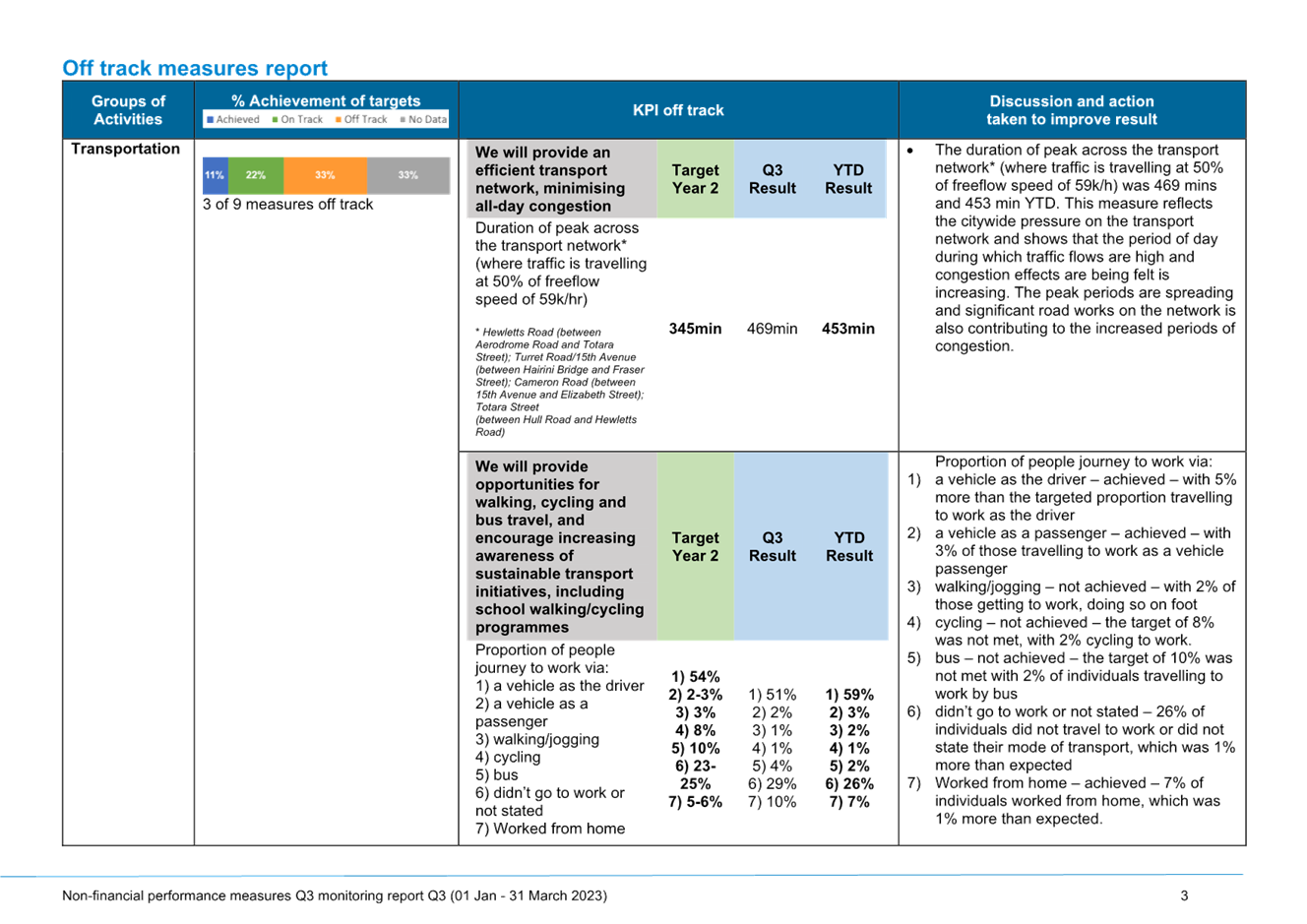

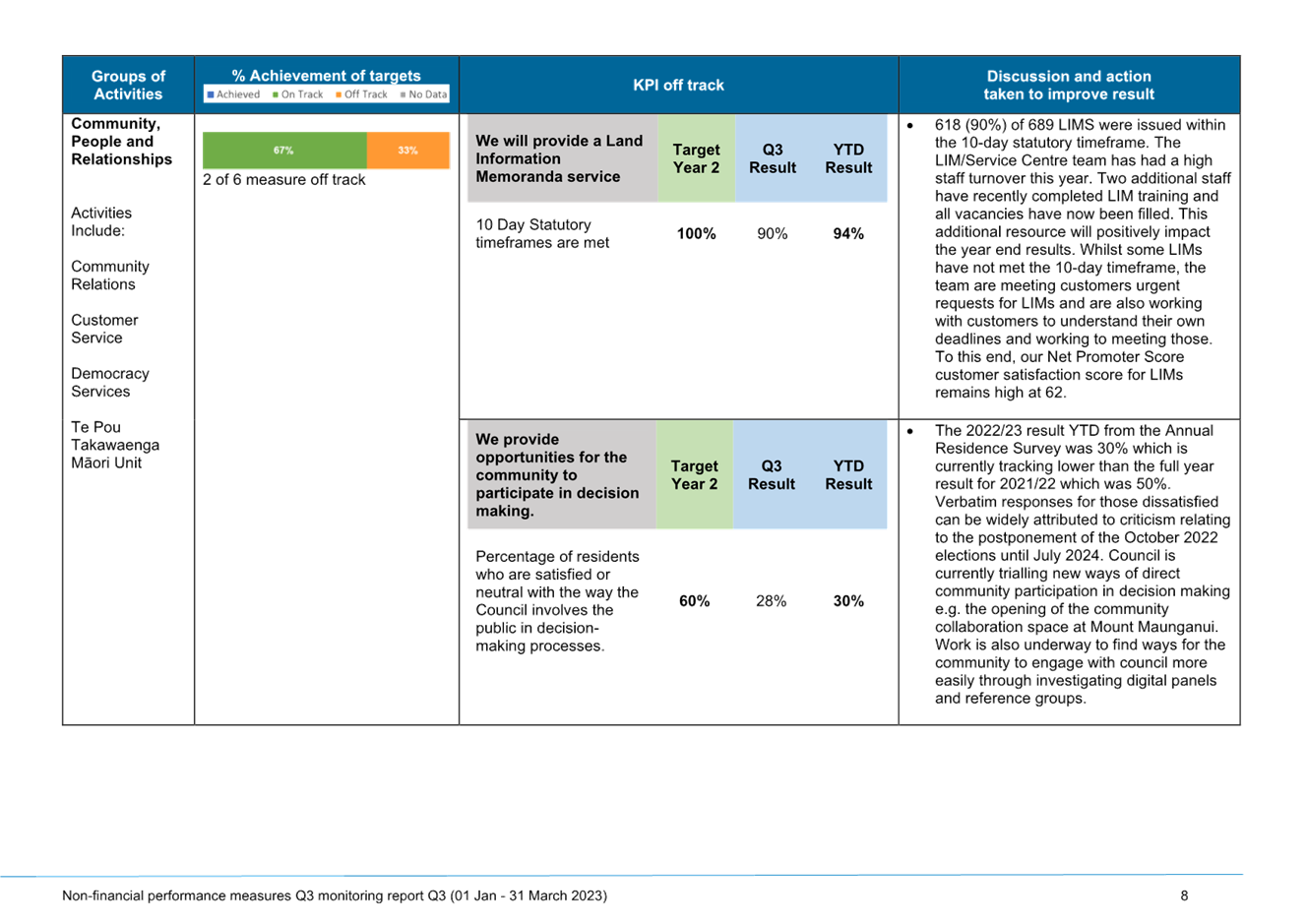

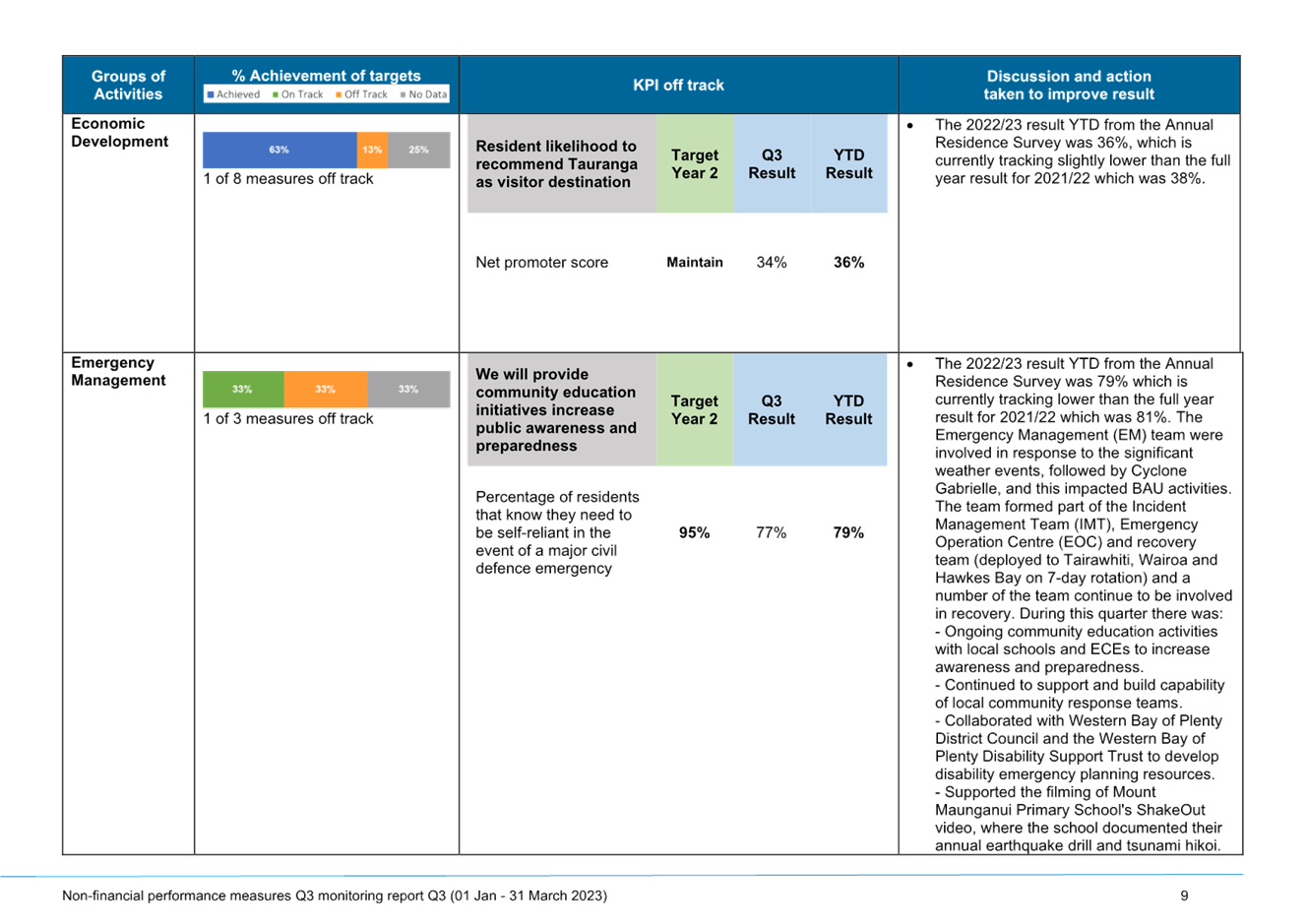

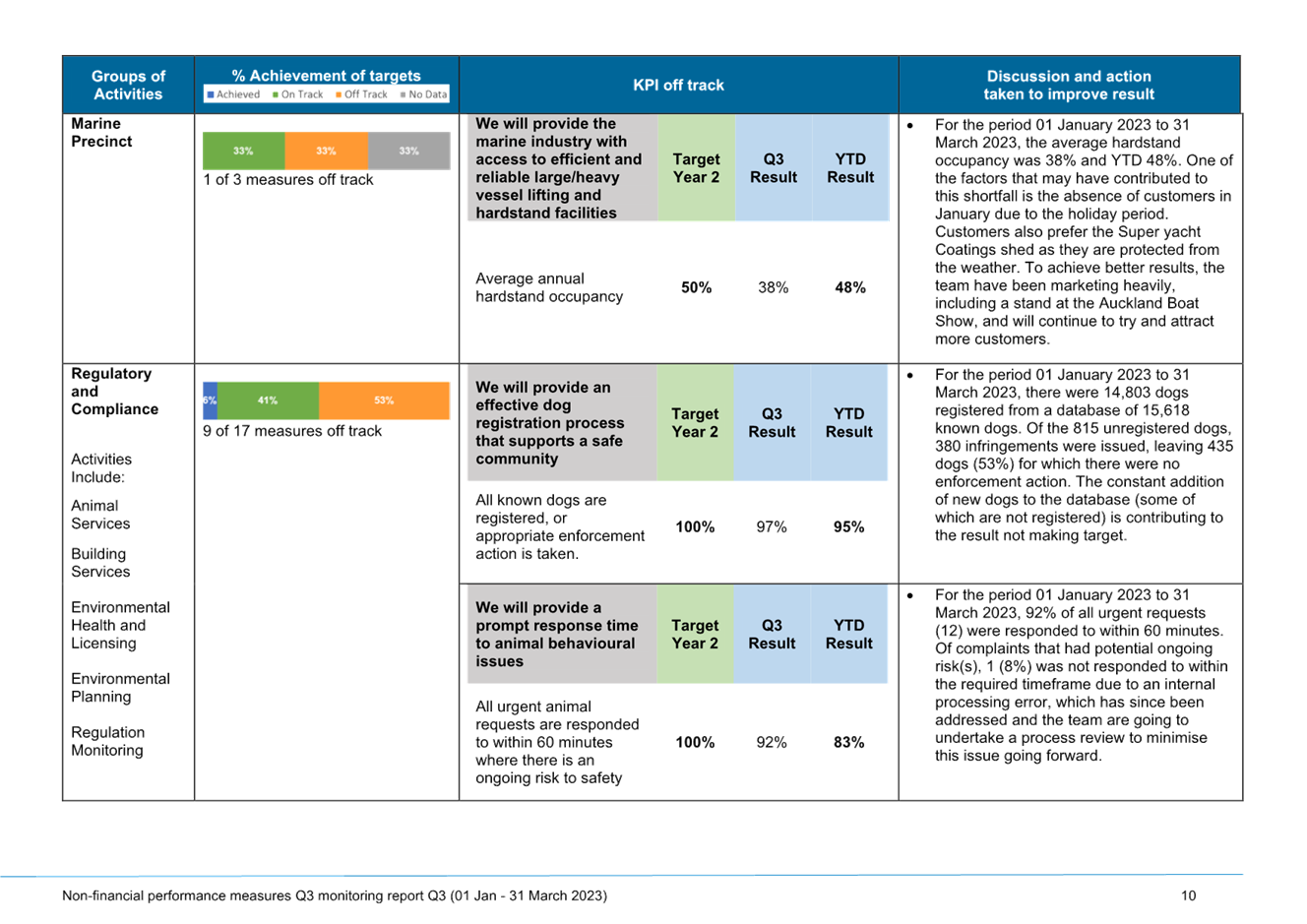

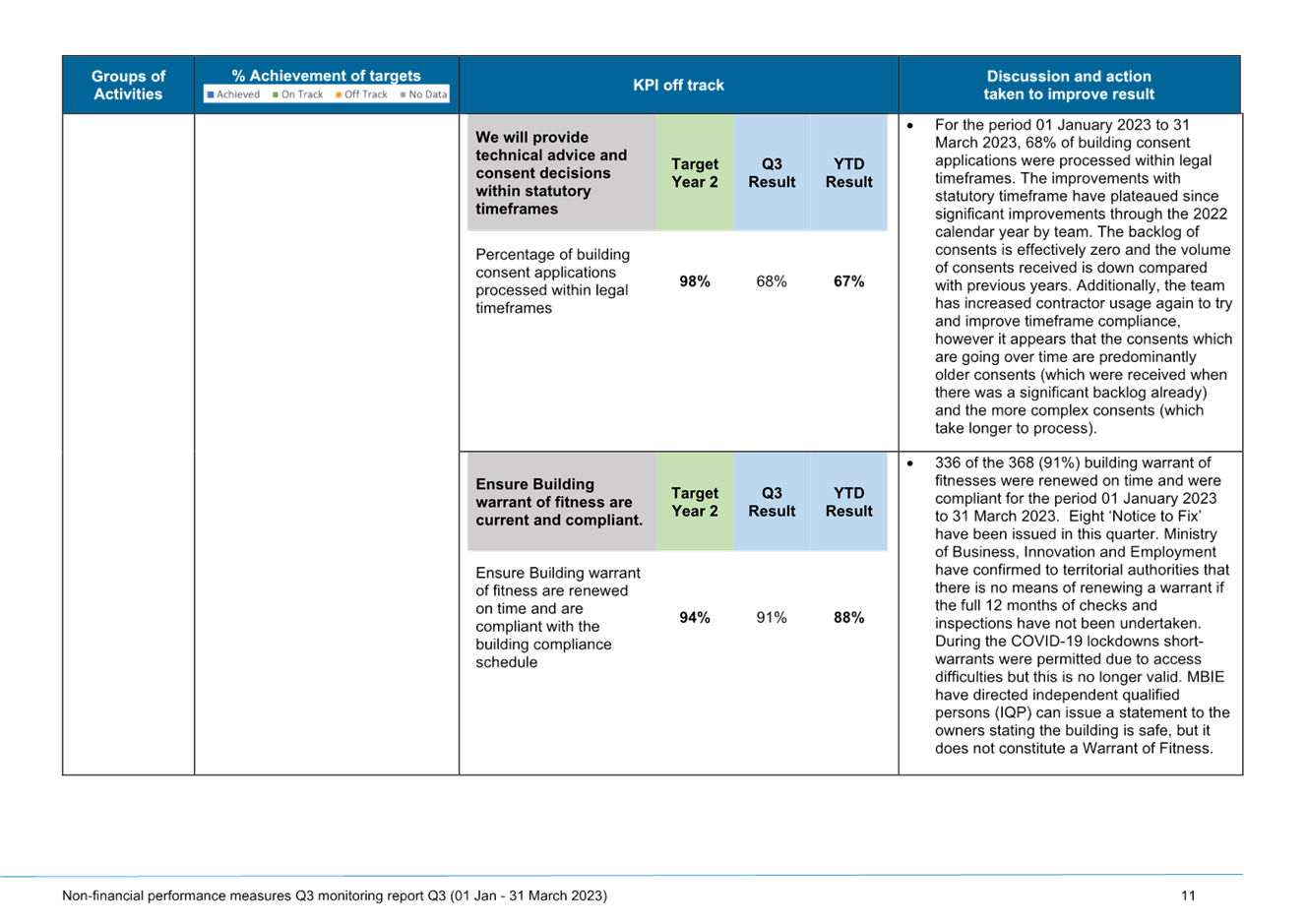

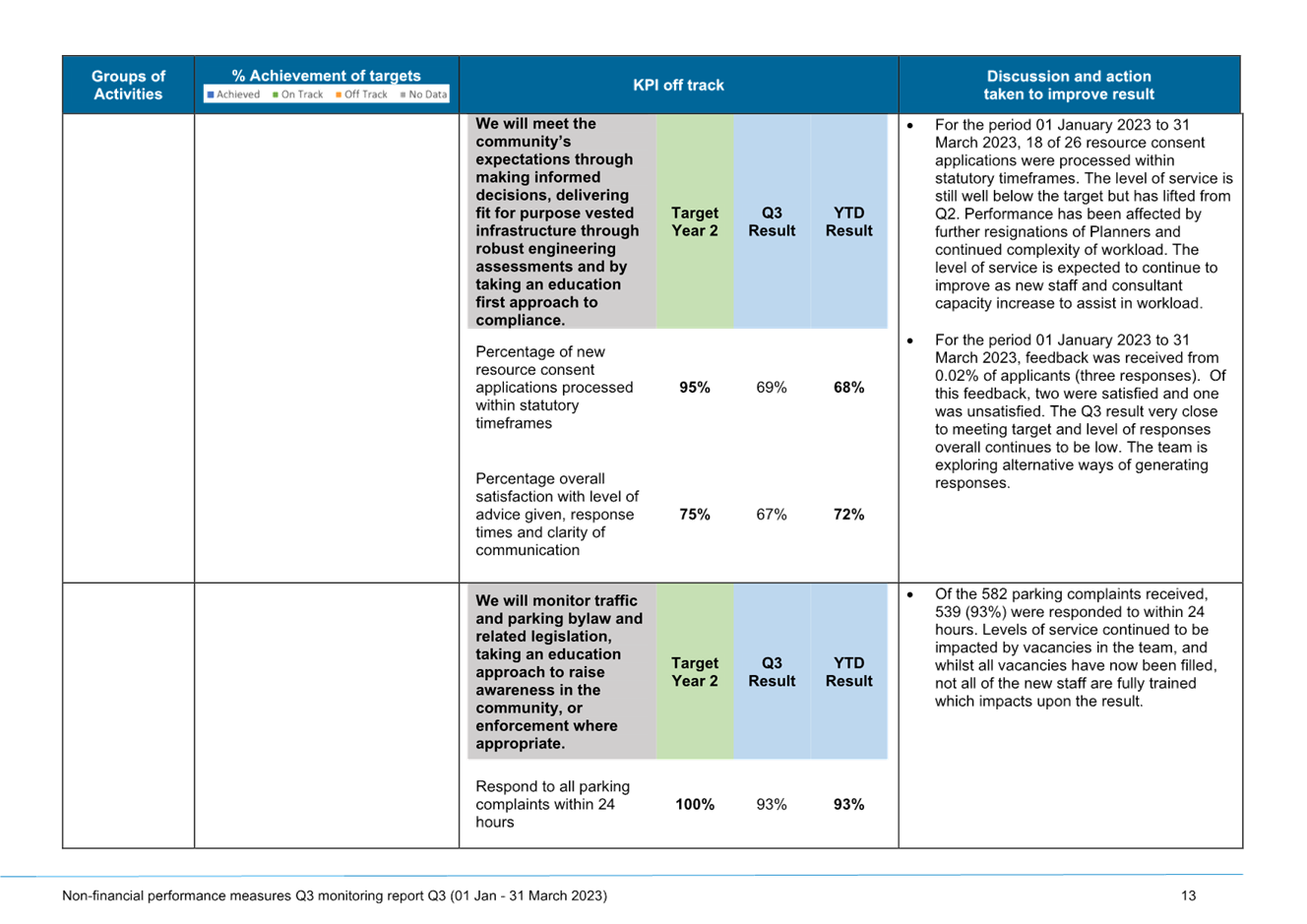

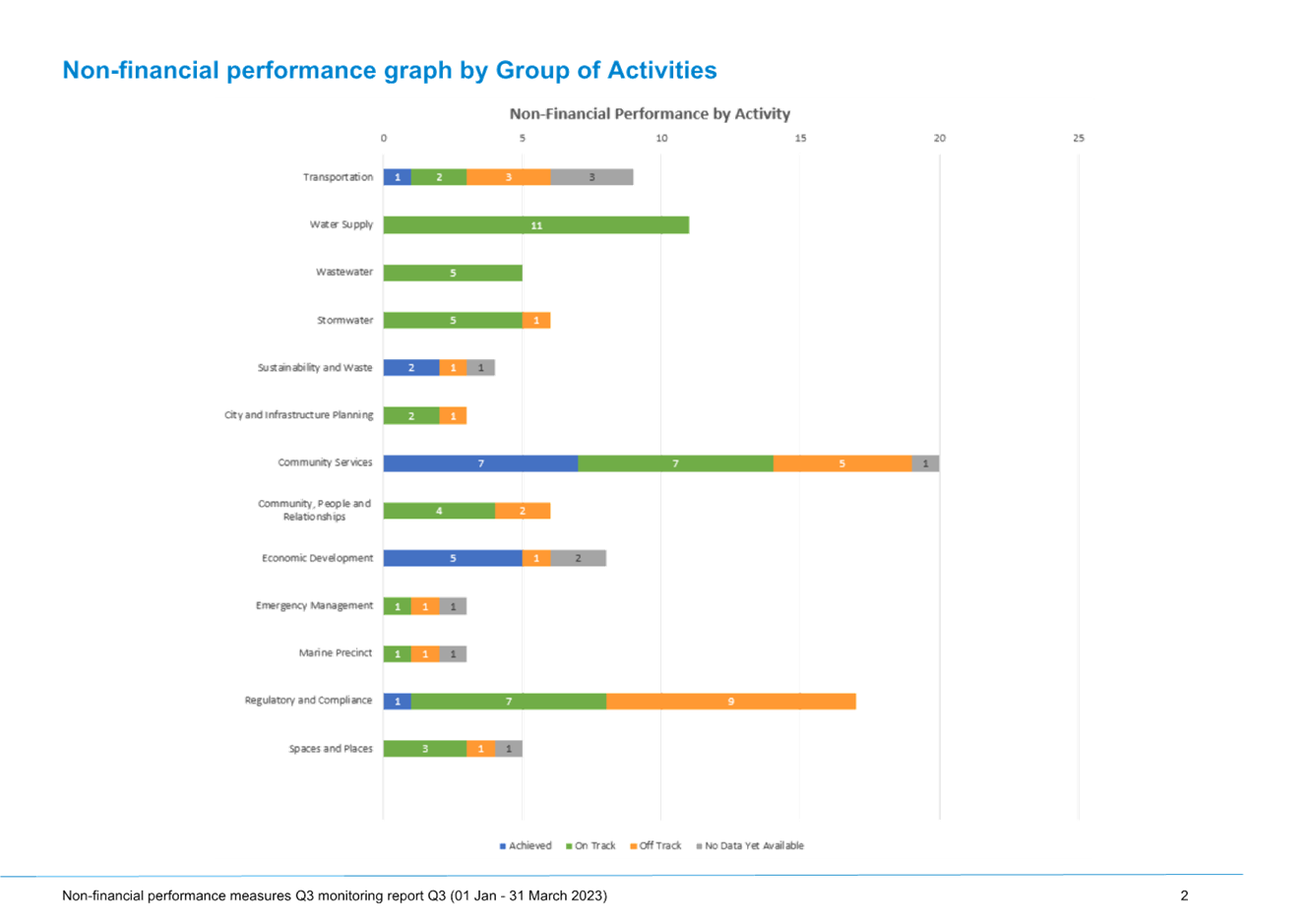

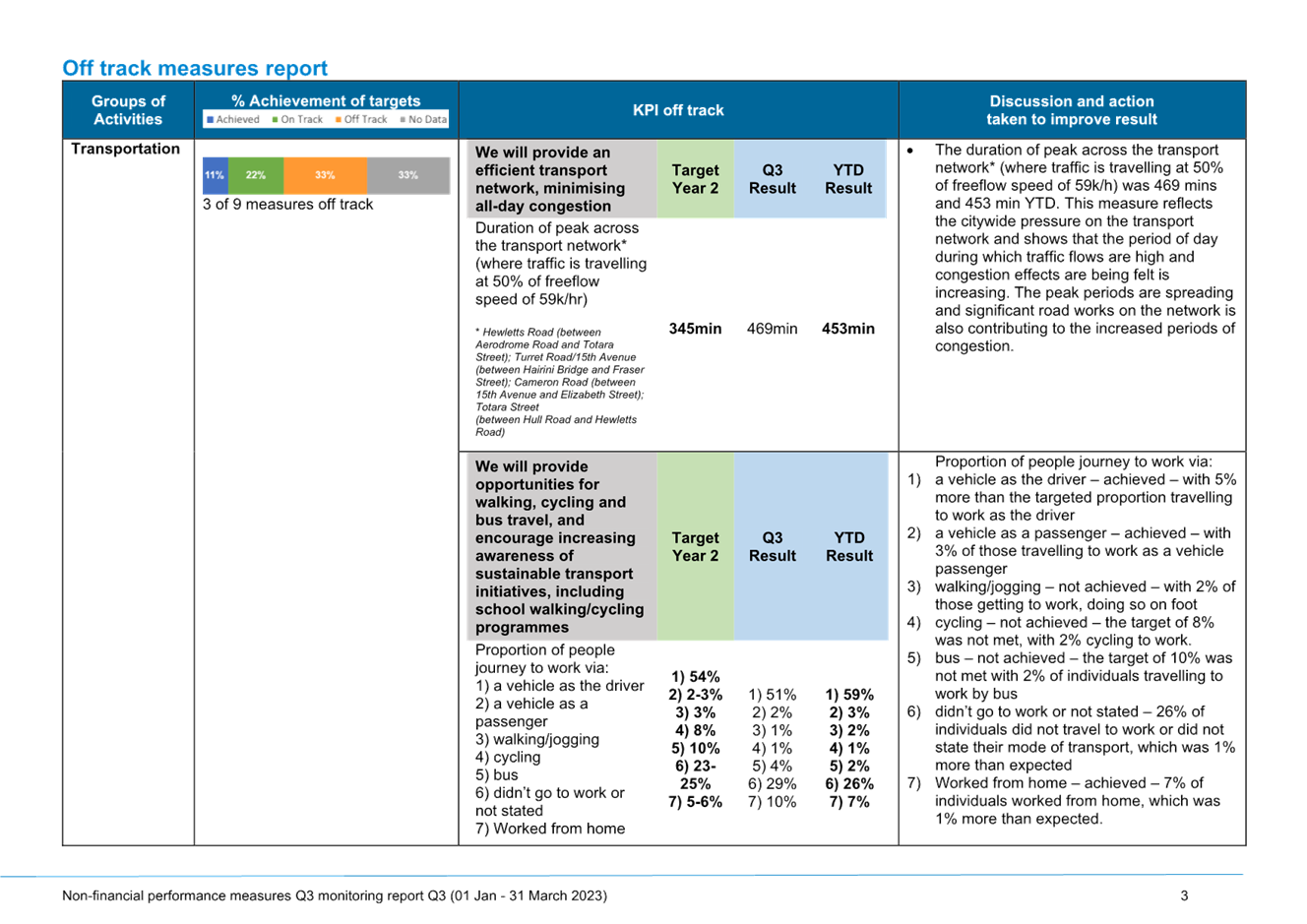

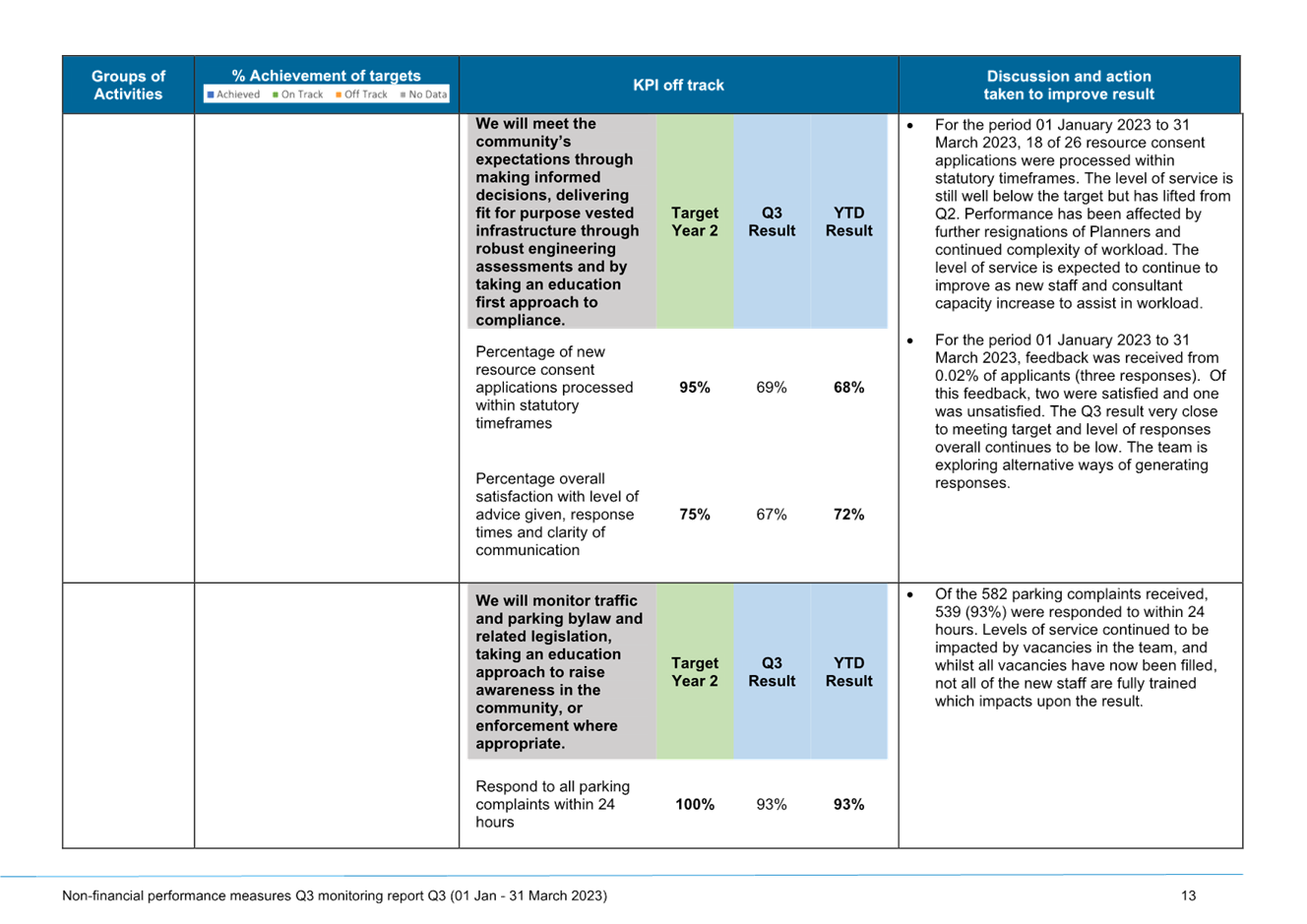

Part 2: Non-Financial Performance to

March 2023

38. Attachment 2 presents how Council, and the community are tracking

towards achieving Council’s non-financial performance measures and levels

of service.

39. Of the 100 non-financial

performance measures, 16 measures (16%) have achieved the annual target, 48

measures (48%) are on track and 26 measures (26%) are off track. Data is not

yet available for ten (10%) of measures.

40. Where data is not available,

the majority relate to annual measures which are only surveyed at one point

through the year.

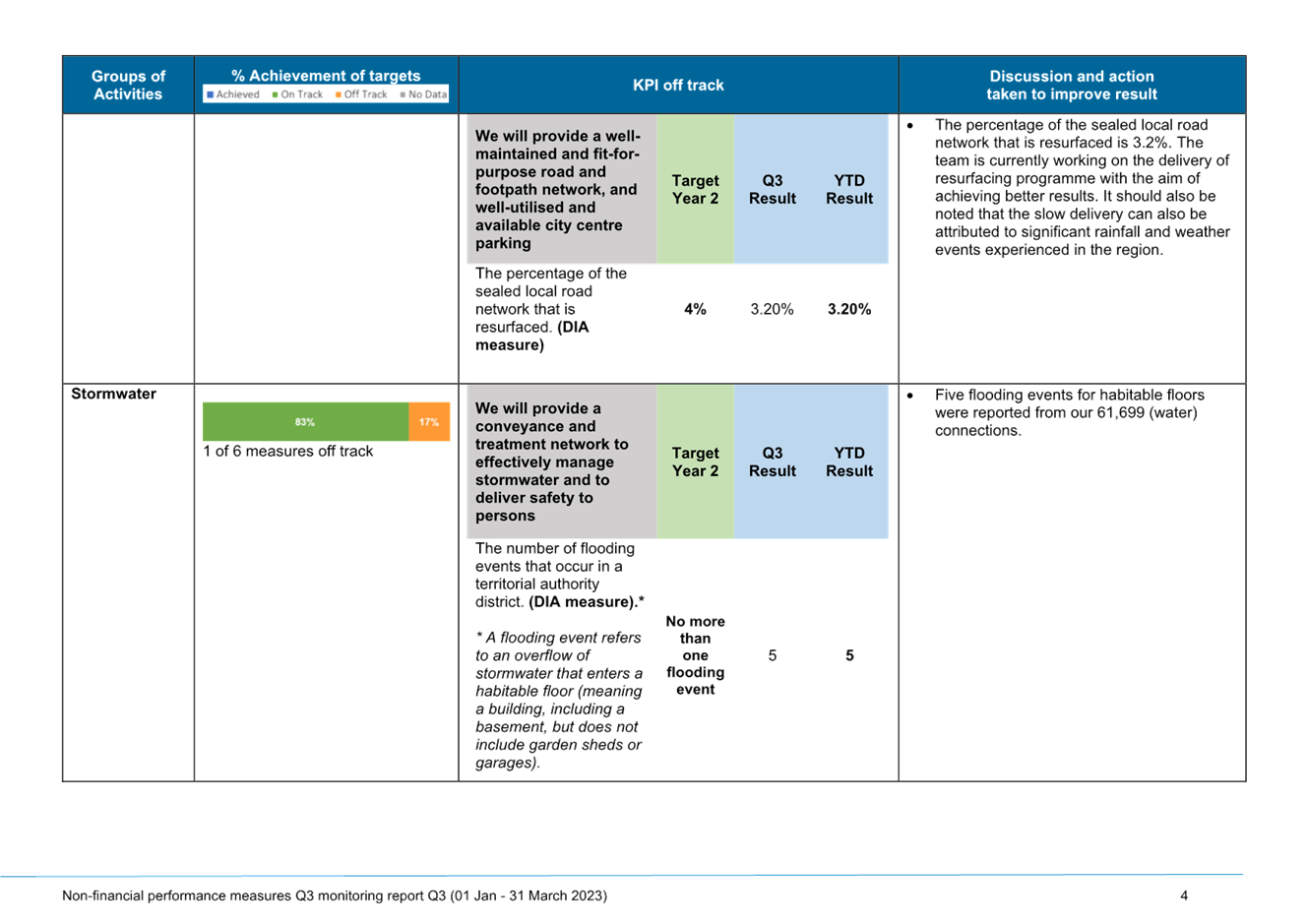

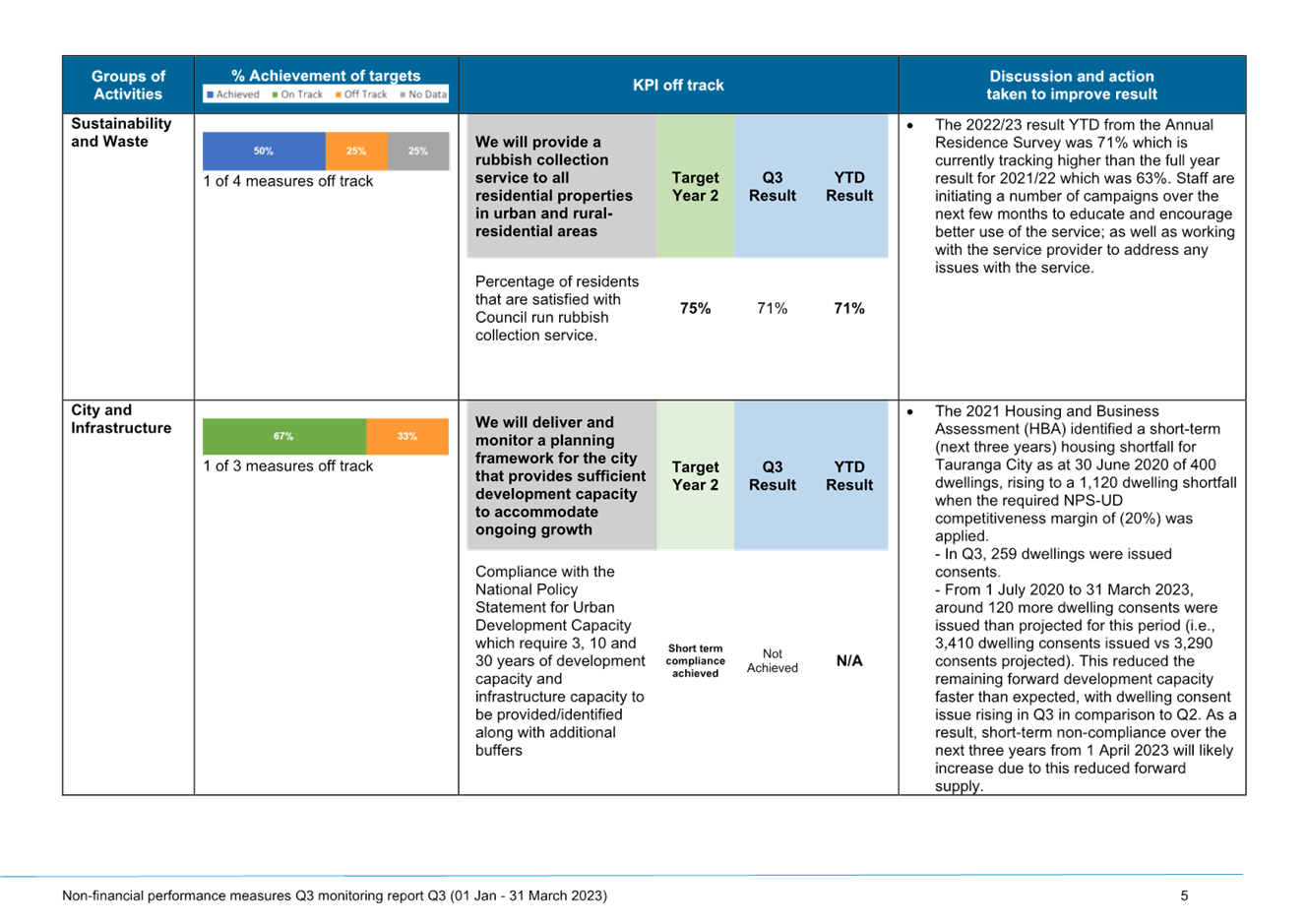

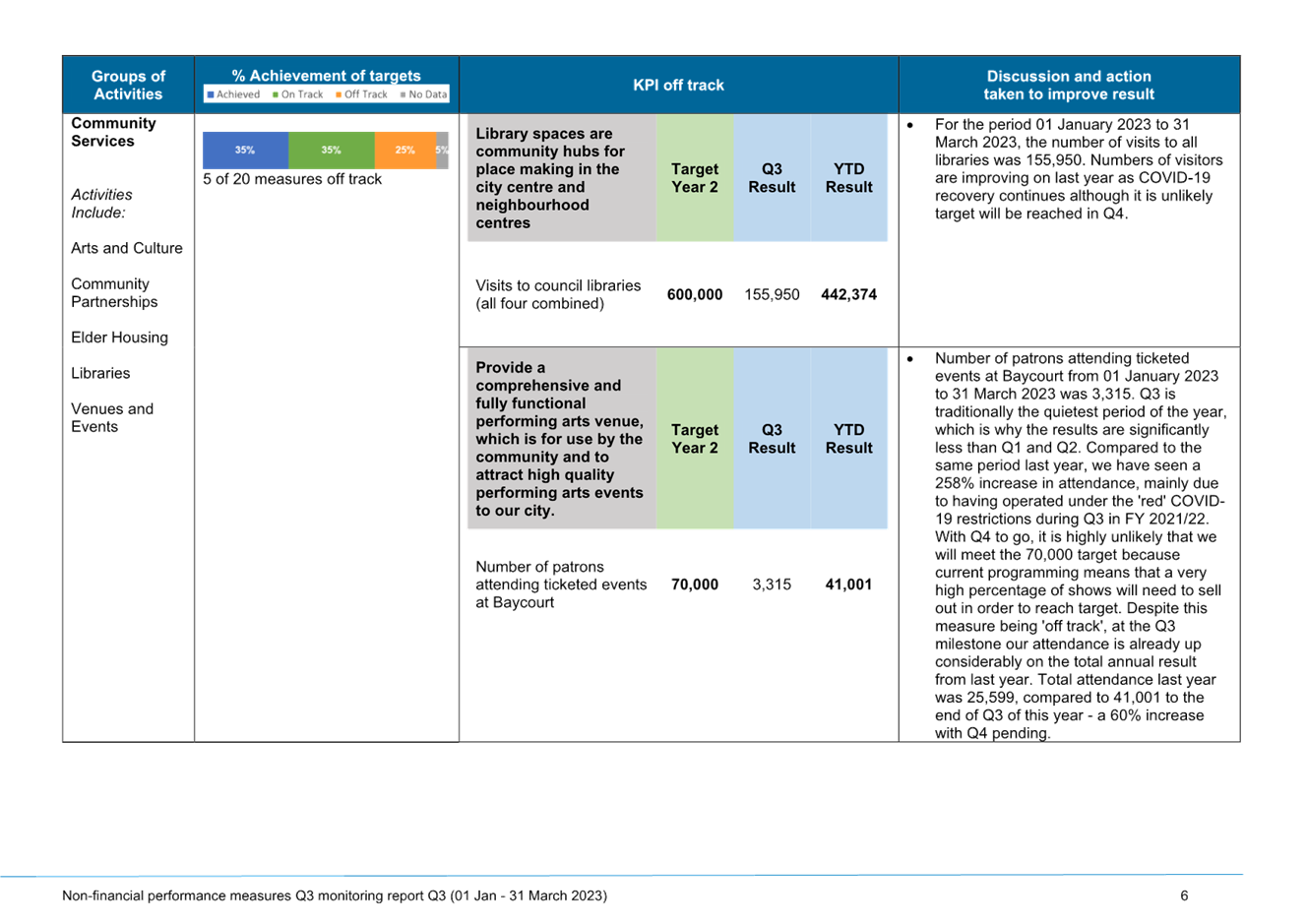

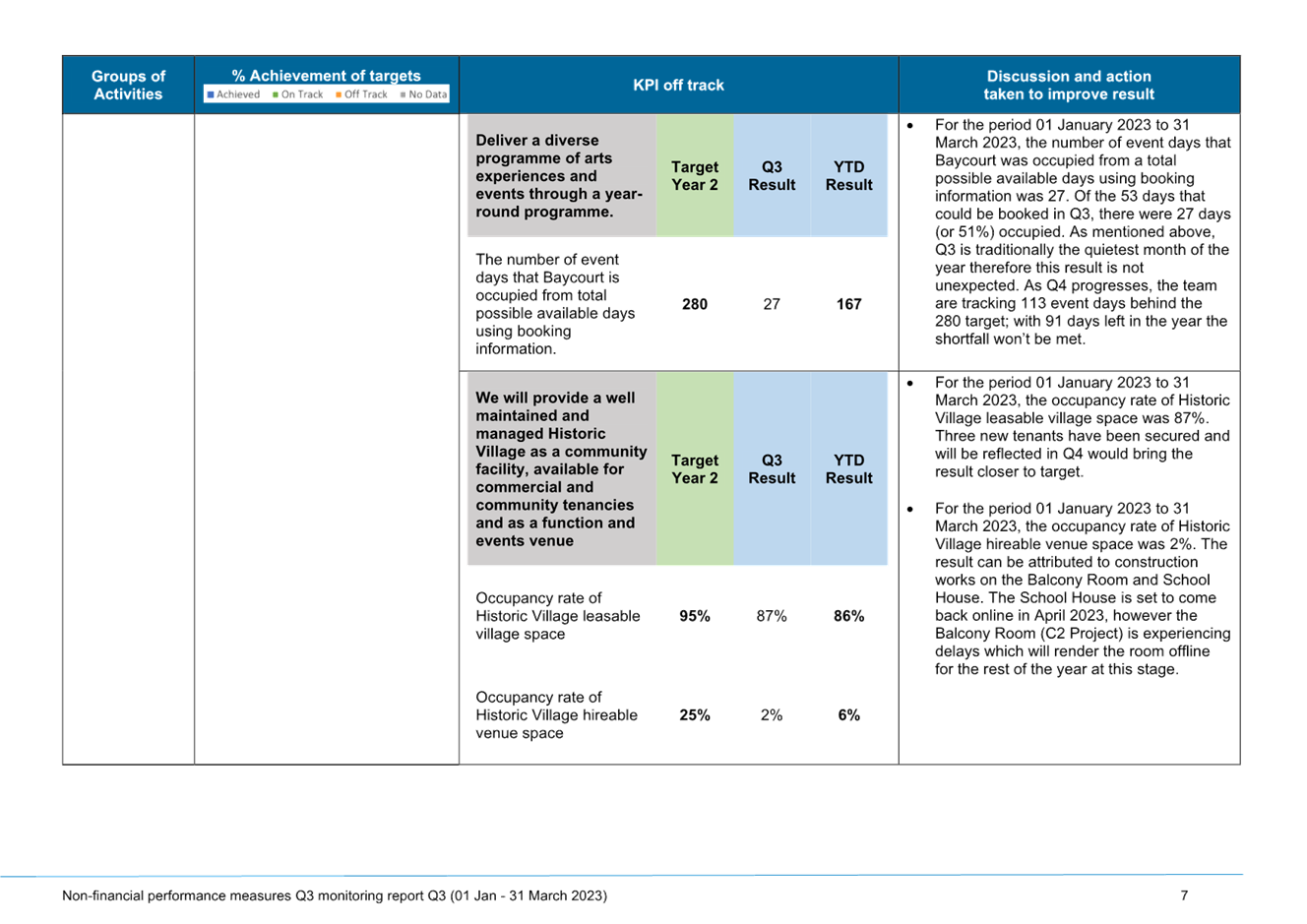

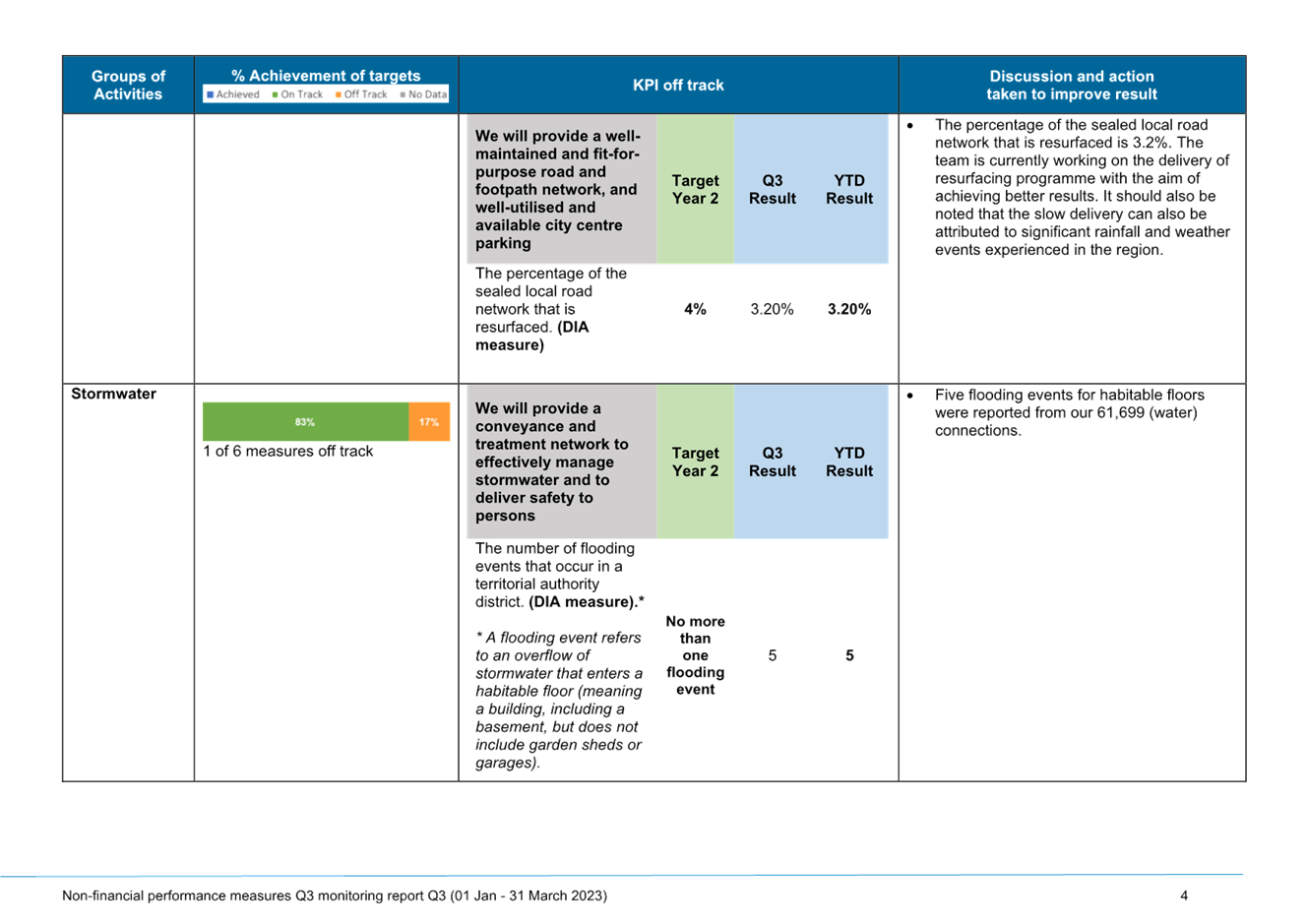

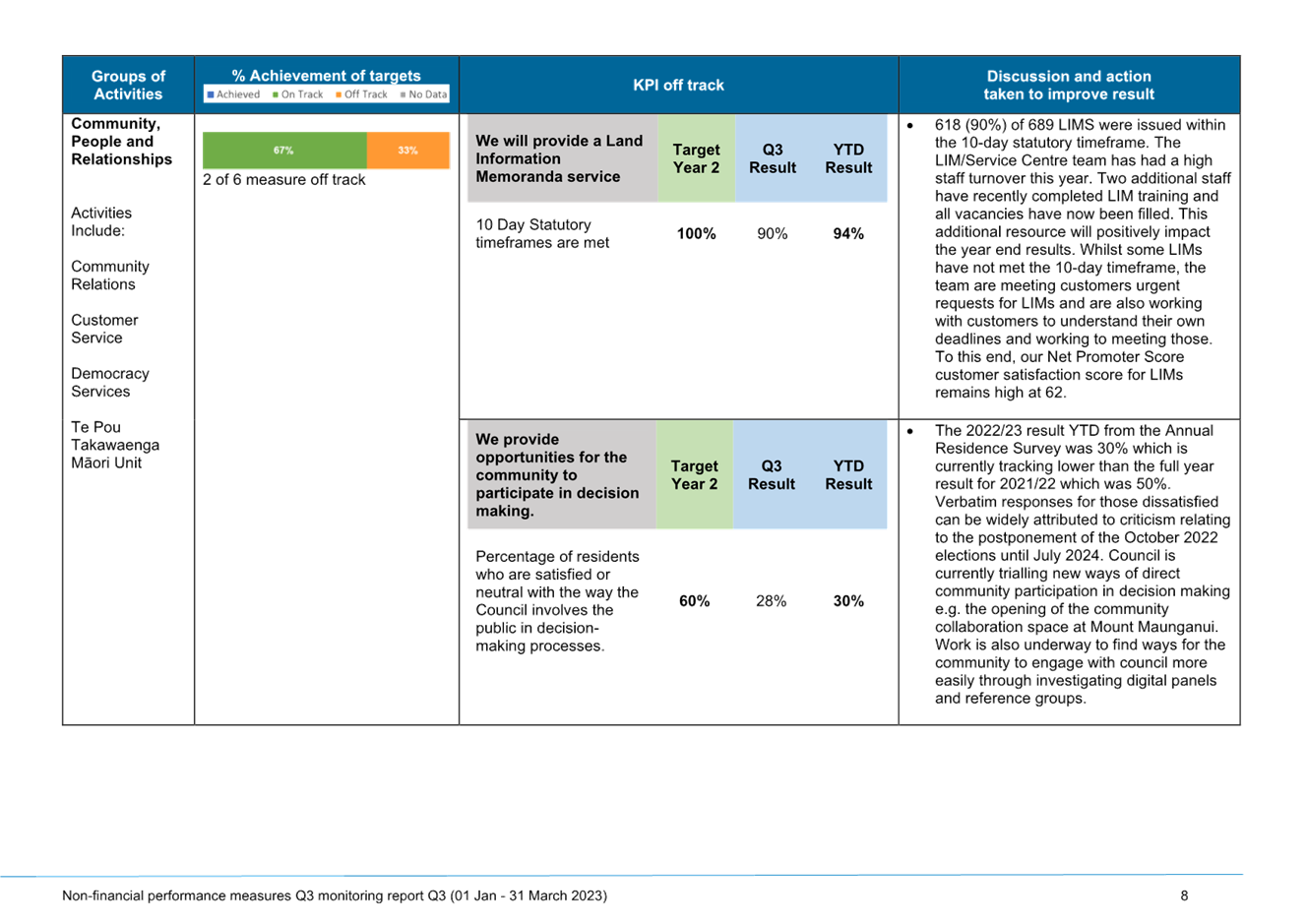

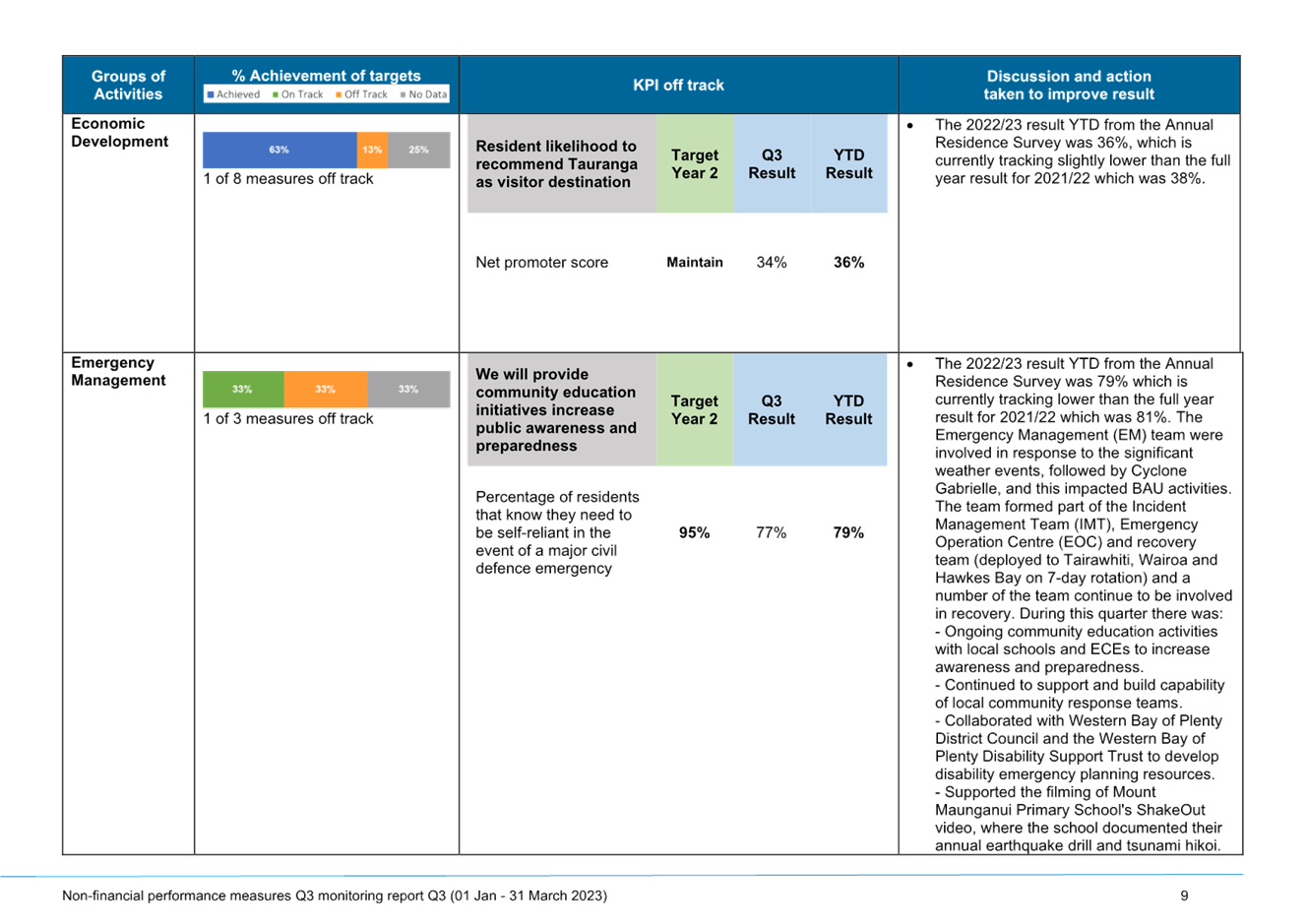

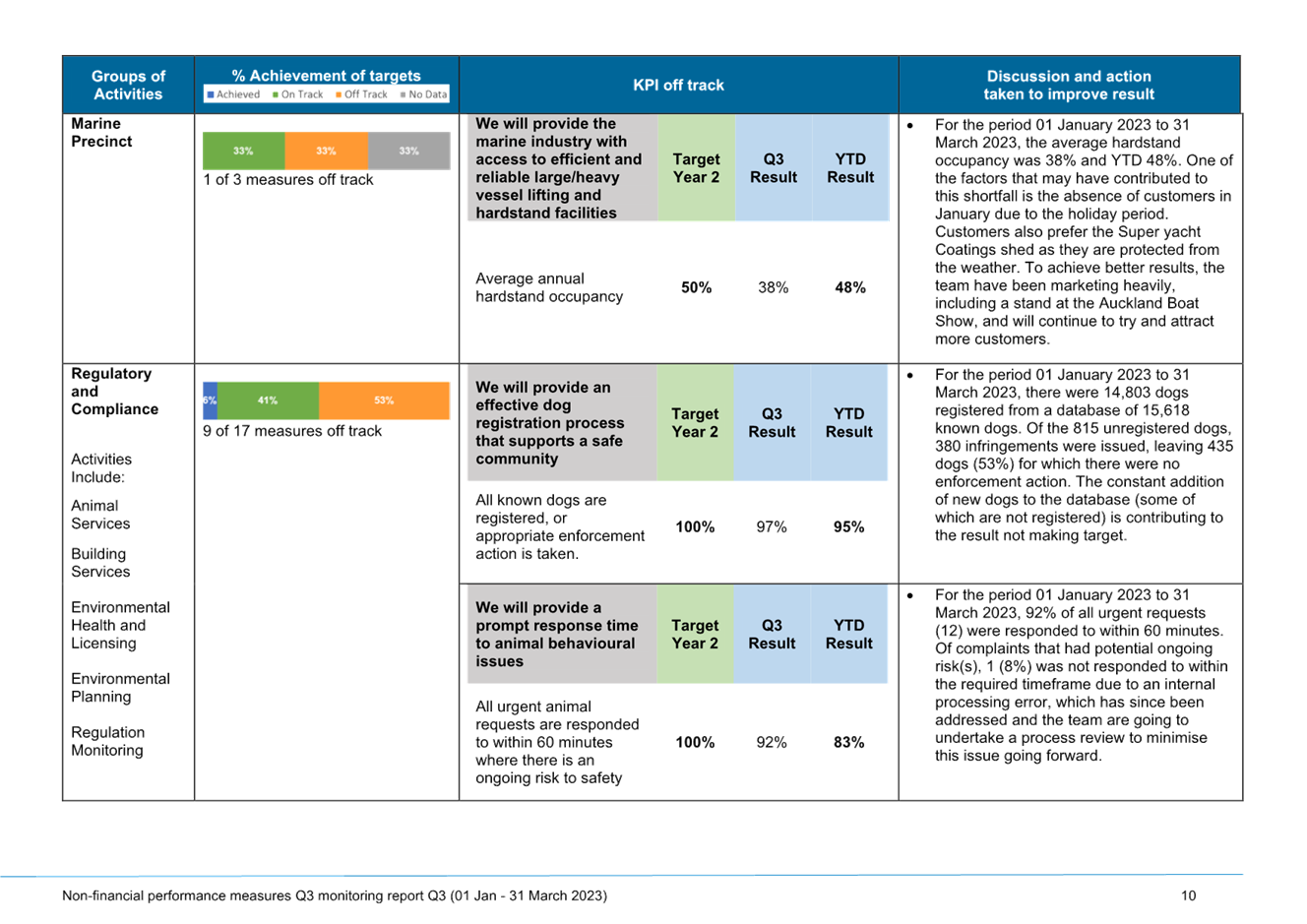

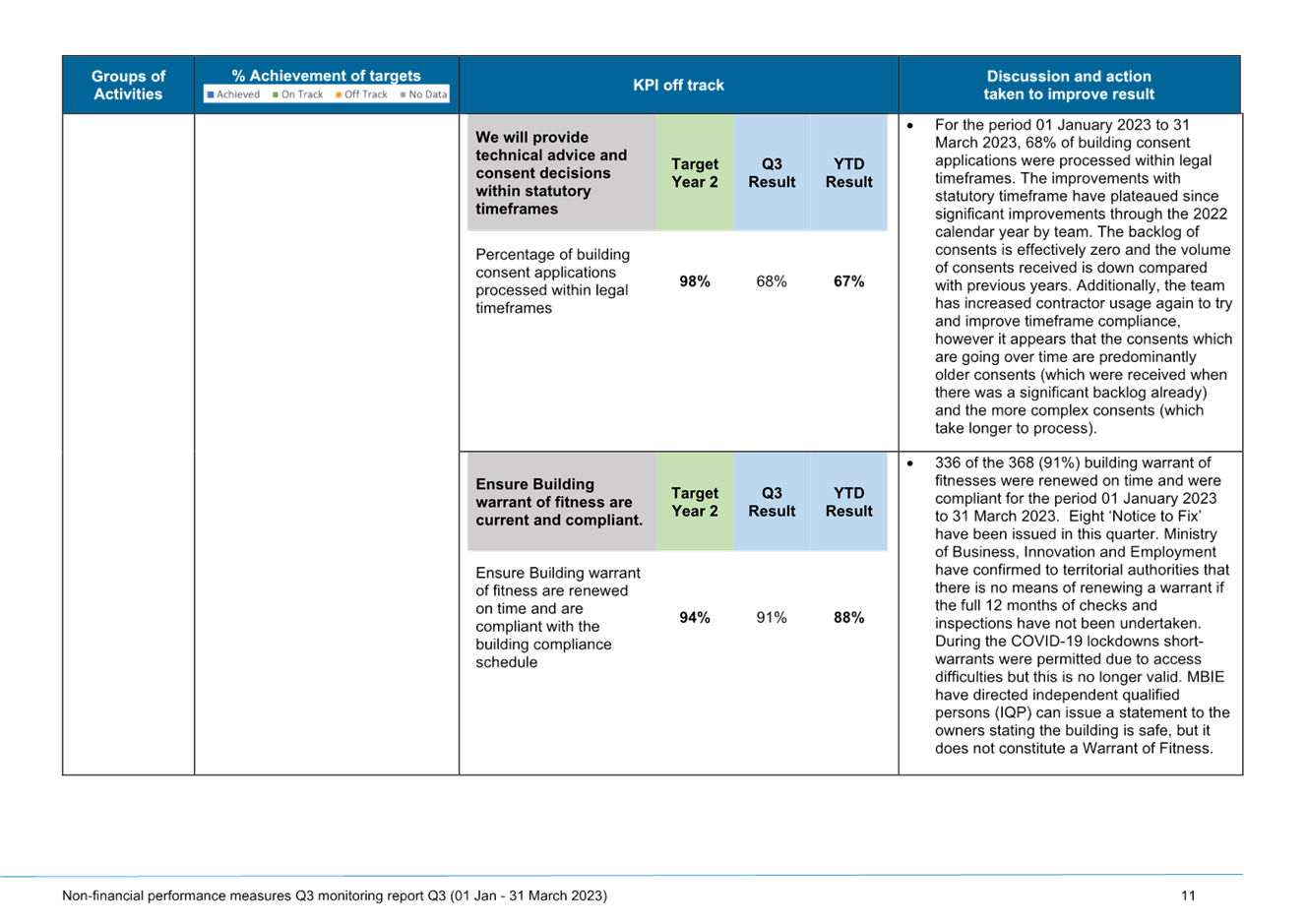

41. 26 measures, across 11 groups

of activities, are off-track. In detail, these are:

· Regulatory

and Compliance – nine off-track from 17 measures

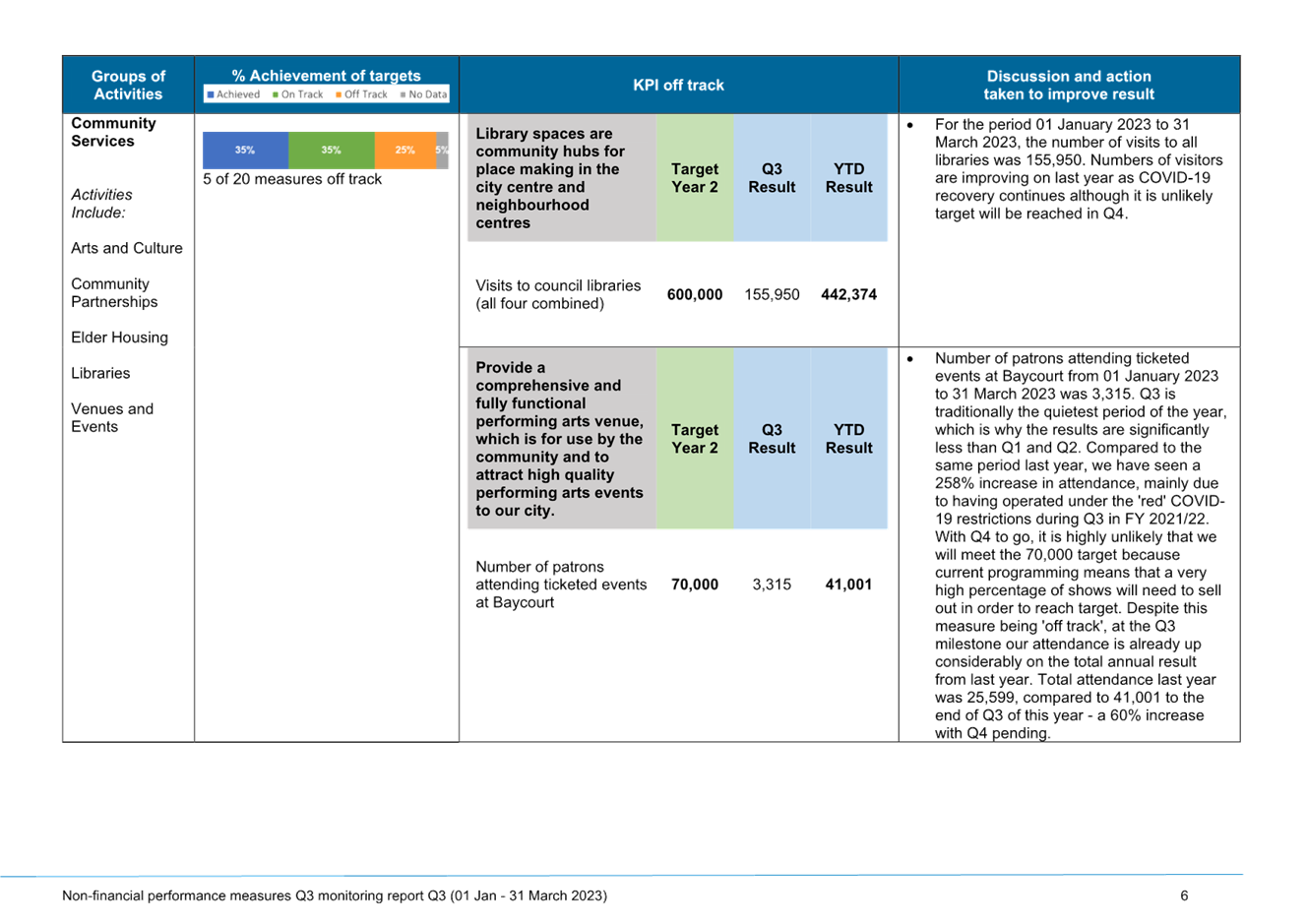

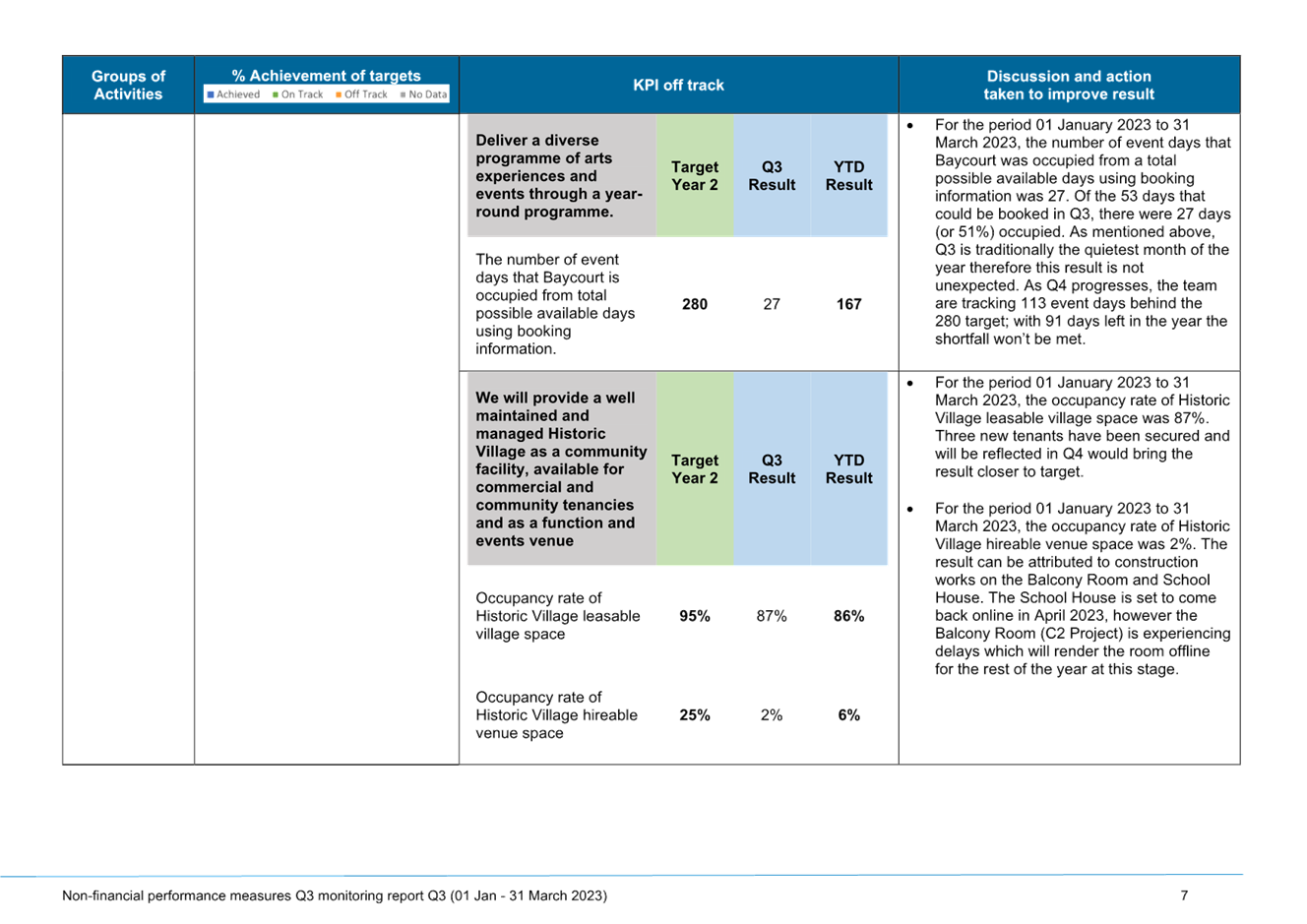

· Community

Services – five off-track from 20 measures

· Transportation

– three off-track from nine measures

· Community,

People and Relationships – two off-track from six measures

· Stormwater

– one off-track from six measures

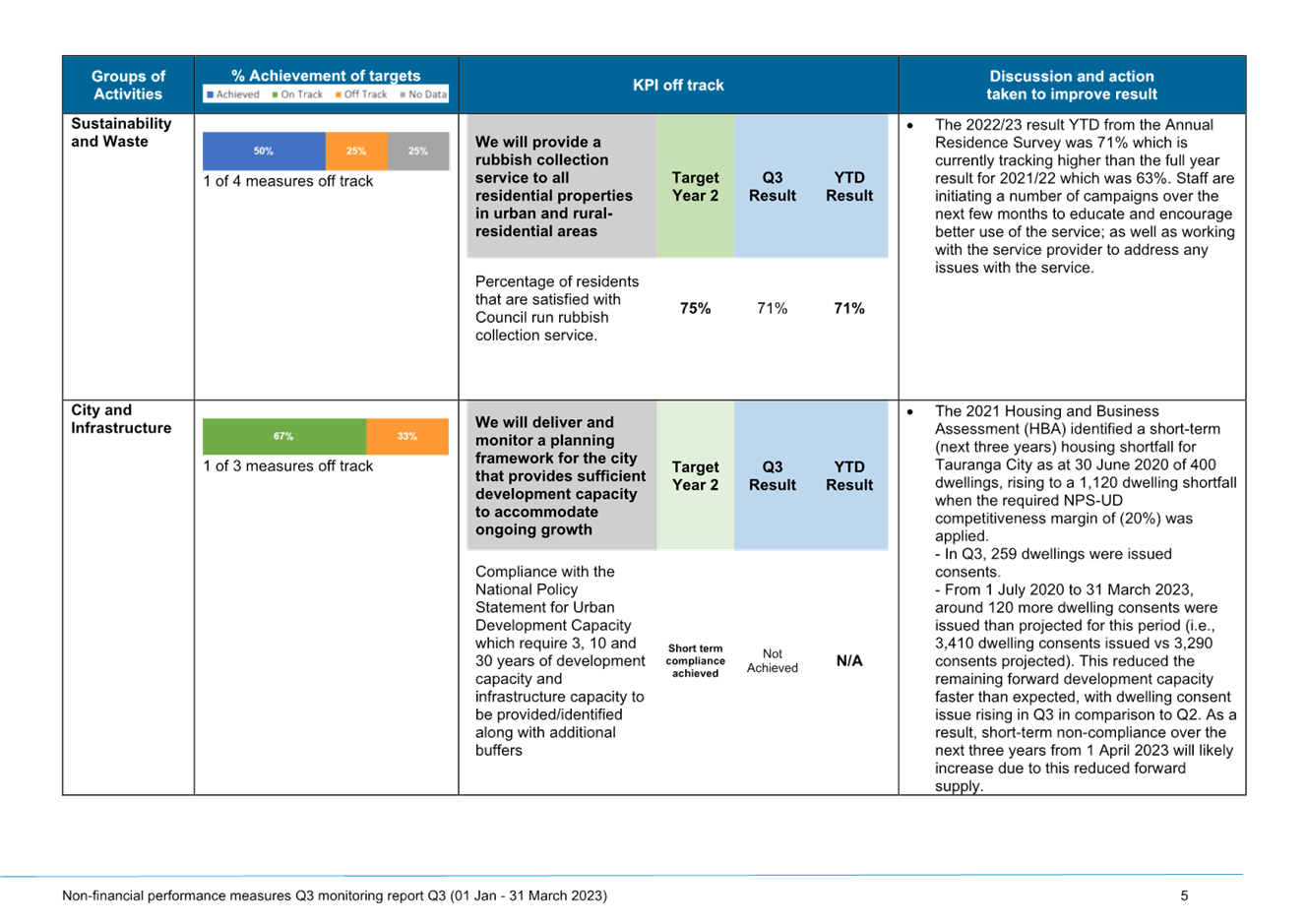

· Sustainability

and Waste – one off-track from four measures

· City

and Infrastructure Planning – one off-track from three measures

· Economic

Development – one off-track from eight measures

· Marine

Precinct – one off-track from three measures

· Emergency

Management – one off-track from three measures

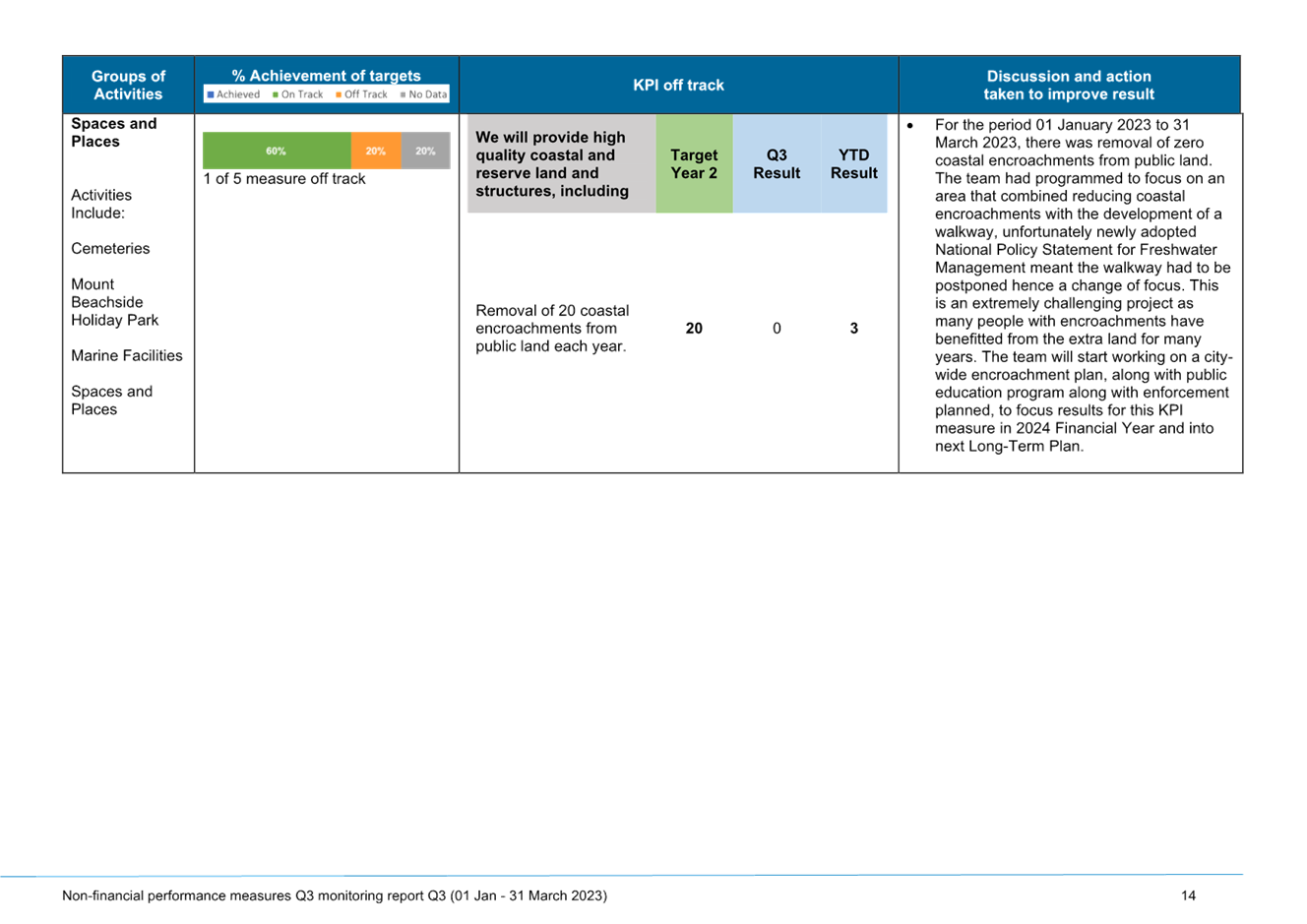

· Spaces

and Places – one off-track from five measures.

Part 3: Annual Residents Survey

42. The Annual

Residents’ Survey supports non-financial reporting by measuring the

perceptions of residents regarding various aspects of services that Council

provides.

43. The survey is conducted in

four waves across the year. Each wave's mail out quotas are applied

according to age, gender and ward, to ensure that a representative sample of

Tauranga City’s population is achieved. The data is weighted to account

for variances in the achieved quotas and to ensure that the sample reflects the

population profile achieved.

44. The overall results have an

anticipated margin of error of +/- 4.6% at the 95% confidence level. Scores for

the reporting periods exclude 'Don't know' responses.

45. A summary of

the highlights is attached at Attachment 3. The summary helps provide an

insight into how different elements of Council’s core service

deliverables, reputation and the perception of value for money contribute to

respondents’ perception of Council’s overall performance.

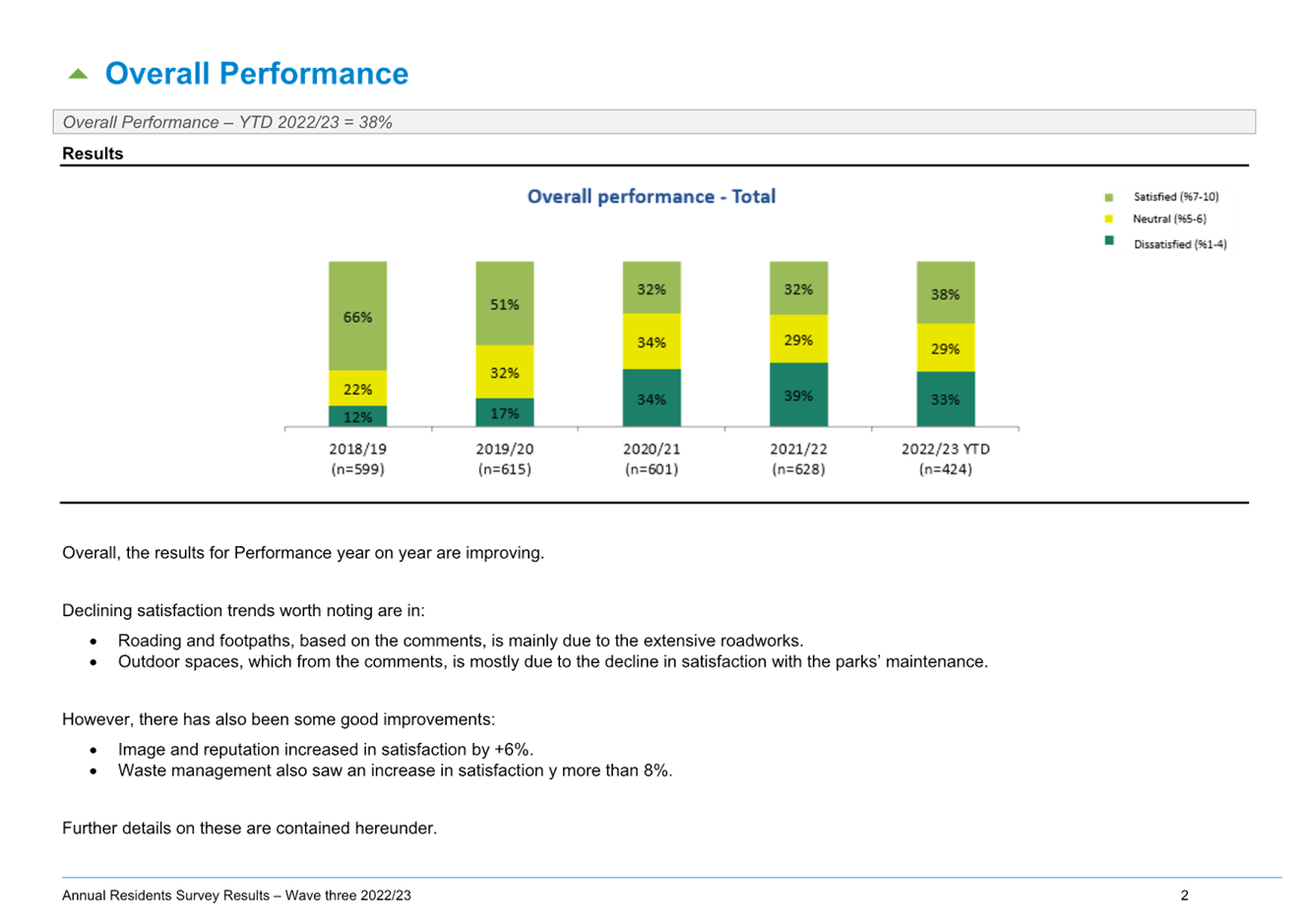

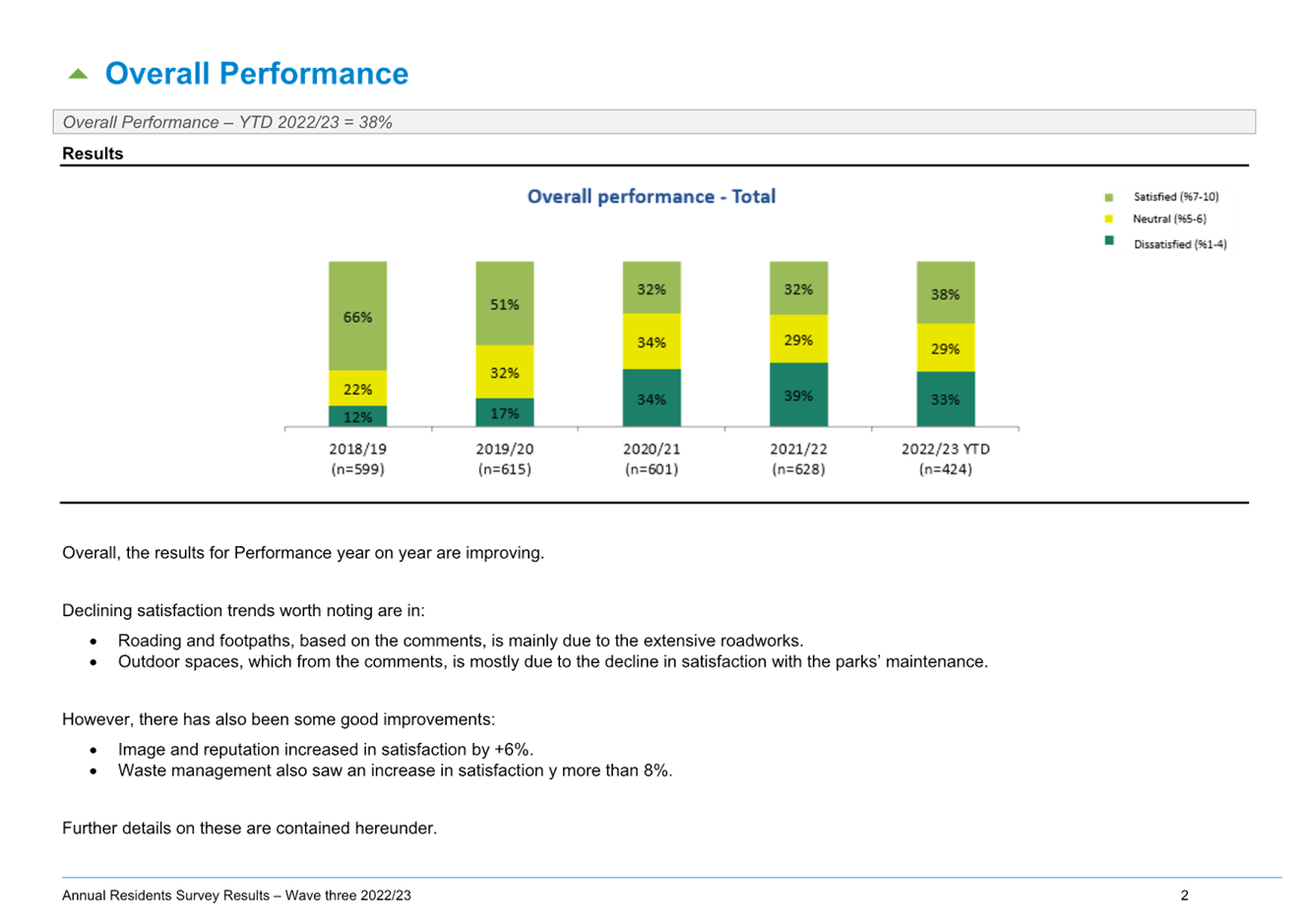

46. Overall performance, the

year-to-date result is 38% of respondents are satisfied or very satisfied with

Tauranga City Council in general, which is up from the 32% result from

2021/22.

47. Reputation

measures the community’s perception of four key areas – leadership,

faith and trust, financial management and quality of services/facilities. Under

reputation, the year-to-date result is that 29% of respondents

are satisfied or very satisfied, up from the full year result for 2021/22

which was 23%.

48. Within reputation, there is

the measure in terms of respondent’s trust in Council, the year-to-date

result is that 29% of respondents are satisfied or very satisfied, up from the

full year result for 2021/22 which was 24%.

49. A summary of the rest of the

high-level survey results of the 2021/22 full year compared to the year-to-date

result for 2022/23, and their trend is summarised in the table below:

|

Measure

|

2021/22 result

|

2022/23 YTD

|

Trend

|

|

Overall performance

|

32%

|

38%

|

5

|

|

Overall image and reputation

|

23%

|

29%

|

5

|

|

Overall value for money

|

36%

|

36%

|

=

|

|

Overall core services deliverables

|

56%

|

59%

|

5

|

|

Overall water management

|

55%

|

54%

|

6

|

|

Overall road and footpaths

|

44%

|

31%

|

6

|

|

Overall waste management

|

63%

|

71%

|

5

|

|

Overall outdoor spaces

|

73%

|

65%

|

6

|

|

Overall public facilities

|

70%

|

70%

|

=

|

50. The final wave is due to be

collected in May 2023 with the results retuned in June 2023, and a performance

report scheduled to be submitted to this committee in the August 2023 meeting.

Options

Analysis

51. There

are no options associated with this report. The report is provided as

information only.

Financial

Considerations

52. This

report monitors performance to budget to ensure council delivers on proposed

expenditure within allocated budgets to ensure financial sustainability and

accountability.

Legal

Implications / Risks

53. This

monitoring report has no specific legal implications or risks.

Consultation

/ Engagement

54. This

report is made public.

Significance

55. The

Local Government Act 2002 requires an assessment of the significance of

matters, issues, proposals and decisions in this report against Council’s

Significance and Engagement Policy. Council acknowledges that in some

instances a matter, issue, proposal or decision may have a high degree of

importance to individuals, groups, or agencies affected by the report.

56. In

making this assessment, consideration has been given to the likely impact, and

likely consequences for:

(a) the current

and future social, economic, environmental, or cultural well-being of the

district or region

(b) any persons who are likely to be

particularly affected by, or interested in, the matter.

(c) the capacity of the local authority to

perform its role, and the financial and other costs of doing so.

57. In

accordance with the considerations above, criteria and thresholds in the

policy, it is considered that the matter is of low significance.

ENGAGEMENT

58. Taking

into consideration the above assessment, that the matter is of low significance,

officers are of the opinion that no further engagement is required prior to

Council making a decision.

Next

Steps

59. This report ensures monitoring of Council performance to ensure

compliance with Council’s budgets, policies and delegations. The

non-financial monitoring report summary will be presented on the Council

website.

Attachments

1. Financial

Report - 9 Months to 3 March 2023 - A14667089 ⇩

2. Quarter

3 Non-Financial Performance Off Track Measures Report - A14652547 ⇩

3. Annual

Residents Survey Wave 3 Performance Report - A14652544 ⇩

4. Benchmarking -

Parks - 2022 Data Yardstick & FIS - A14665577 ⇩

|

Strategy,

Finance and Risk Committee meeting Agenda

|

6

June 2023

|

|

Strategy,

Finance and Risk Committee meeting Agenda

|

6

June 2023

|

|

Strategy,

Finance and Risk Committee meeting Agenda

|

6

June 2023

|

|

Strategy,

Finance and Risk Committee meeting Agenda

|

6

June 2023

|

|

Strategy,

Finance and Risk Committee meeting Agenda

|

6

June 2023

|

9.4 Traffic

and Parking Bylaw Review Issues and Options Paper

File

Number: A14500675

Author: Vicky

Grant-Ussher, Policy Analyst

Authoriser: Nic

Johansson, General Manager: Infrastructure

Purpose of the Report

1. To provide direction

on the issues identified through the review of the Traffic and Parking Bylaw.

|

Recommendations

That the Strategy,

Finance and Risk Committee:

(a) Receives the report

"Traffic and Parking Bylaw Review Issues and Options Paper".

(b) Agrees to the following

recommended options for the purpose of updating the bylaw, including:

(i) removing redundant

provisions now covered under relevant legislation to reflect legislative

updates since the last review

(ii) introducing a registered parking

category to better monitor time-limited parking

(iii) clarifying that secondary vehicle

crossings require written council approval.

(c) Confirms that primary

vehicle crossings which comply with the Infrastructure Development Code do

not need council permission.

|

Executive Summary

2. An analysis of the

Traffic and Parking bylaw[1]

has shown the bylaw is working well to enable a responsive approach to traffic

and parking issues in Tauranga. Several changes are recommended to futureproof

the bylaw to refresh legislative references, better monitor free parking, and

address issues with vehicle crossings.

Background

3. The Traffic and

Parking Bylaw sets the requirements for control of traffic and parking in

respect of roads, parking places and transport stations owned or controlled by

Tauranga City Council. The bylaw is one of several legal instruments that

supports the council in its role as a road controlling authority. The bylaw

must be reviewed every ten years, the last review of the bylaw was in 2012.

4. The current bylaw is

made under both the Local Government Act 2002 (LGA) and the Land Transport Act

1998 (LTA). The LGA provides a bylaw making power where the council believes it

is the most appropriate way to address nuisances, protect, promote, or maintain

public health and safety and/or minimise the potential for offensive behaviour

in public places. The LTA provides a bylaw making power to regulate

road-related matters and, unlike the LGA, allows for enforcement through

infringement fines in addition to prosecution.

5. The bylaw provides a

framework for decisions with the substance of many provisions being made

subsequently by resolution. For example, the bylaw gives Council the power to

specify which roads are one way only, but the specific roads would be decided

by Council resolution. This allows council to change specific decisions quickly

without the need for a full bylaw review.

6. We spoke to council

regulatory staff, transportation staff, asset services staff, legal staff,

utility companies and parking experts in other councils as part of reviewing

the effectiveness of the current bylaw. Their feedback has informed the issues

and options contained in this report.

Strategic / Statutory Context

7. Tauranga City

Council is committed to sustainability as a core way of how we work. Traffic

and parking management can help influence and enable more sustainable transport

choices, for example through regulating what types of vehicles and activities

can use roads and carparks. Council adopted a Parking Strategy in 2021 and is

in the process of developing more detailed parking management plans for

Tauranga, with a finalised plan for the city centre already adopted and a plan

for Mount Maunganui under development. Traffic and parking management also

contributes to achieving the community outcome Tauranga Ara Rau, a city we can

move around easily.

8. The bylaw helps give

effect to these strategies and plans through setting traffic and parking rules

and enabling their enforcement. The bylaw enables many traffic and parking

rules to be implemented, as needed, by Council resolution.

Options Analysis

Issue 1: Updating

bylaw provisions to account for legislative changes

9. Since the bylaw

review in 2012, several legislative instruments have been updated which means

that some matters no longer need to be covered in the bylaw. For example, the

update to the Land Transport Rule: Setting of Speed Limits in 2022. In addition

to these changes, a review of the bylaw has also noted some additional

redundant provisions that are covered by road user rules or sections of the

LTA. A table of the redundant provisions is provided in Attachment 1. We

propose updating the bylaw to remove redundant provisions and refreshing

wording where possible to better align with the updated

legislation.

Table

One: Updating bylaw provisions to account for legislative changes

|

Option

|

Advantages

|

Disadvantage

|

Recommendation

|

|

Option One: Status Quo

– No update of provisions

|

· None

|

· Retains

redundant provisions

|

Not recommended

|

|

Option Two: Update of

bylaw provisions to account for legislative changes

|

· Removes

redundant provisions from the bylaw

|

· None

|

Recommended

|

Issue 2: Introducing a

registered parking category to better monitor time-limited parking

10. Different categories of parking

are used to promote different outcomes across the city. For example, paid

parking uses price to manage demand, whereas time-limited free parking is used

to create a turnover of parking spaces. These parking outcomes are only

achieved if people comply with the parking rules.

11. At present the council has

either paid parking, free time-limited parking or free unlimited parking.

Compliance with paid parking is high, as anyone who has not paid for parking

may be subject to a fine. As people are required to provide their plate number

to pay it is easy to identify non-compliance through automated machines which

match car plates with payment records.

12. Monitoring free time-limited

parking is less straightforward. Under the current bylaw people cannot be

required to enter their plate number to access free parking, however they must

not exceed the time limit. This approach makes monitoring the time used

difficult. Regulation staff must undertake ongoing visual checks of parking

spaces to ensure people comply with the time limit.

13. A “registered

parking” category would help council monitor time-limited parking.

“Registered parking” would require people to register their plate

to park (even if the parking is free). Council could then declare by resolution

(subject to appropriate consultation and signage) that an area be a registered

parking area. This would require users to register at a parking machine,

enabling the easy time monitoring of use through the existing pay by plate

enforcement system. Those that do not register may be subject to a fine

(similar to paid parking). Given this would be a new approach to parking, a

significant communications exercise, including comprehensive on street signage,

would need to be undertaken to support any use of this provision.

14. This new registered parking

requirement would support the council to take innovative approaches to parking

in future without enforcement concerns. For example, supporting incremental

parking charging where an initial period is free but then a charge would apply

at a certain period, and increase over time.

Table

Two: Registered parking provisions in the bylaw

|

Option

|

Advantages

|

Disadvantages

|

Recommendation

|

|

Option One: Status Quo

- do not include an ability to require people to register at a parking

machine in the bylaw

|

· Does

not require people to register at a machine for time-limited parking

|

· Would

be difficult to monitor the use of any time-limited free parking provisions

· May

limit the use of time-limited free parking provisions due to monitoring

issues

|

Not recommended

|

|

Option Two: include a

new registered parking requirement

|

· Would

mean the use of time-limited free parking can be easily monitored

· Helps

ensure parking spaces are used as intended to achieve parking outcomes

|

· Potential

for confusion if people are not aware they need to register

· Would

require people to register at a machine for time limited parking

|