|

|

|

AGENDA

Ordinary Council meeting

Monday, 24 July 2023

|

|

I hereby give notice that an Ordinary meeting of

Council will be held on:

|

|

Date:

|

Monday, 24 July 2023

|

|

Time:

|

10.30am

|

|

Location:

|

Bay of Plenty Regional Council Chambers

Regional House

1 Elizabeth Street

Tauranga

|

|

Please note that this

meeting will be livestreamed and the recording will be publicly available on

Tauranga City Council's website: www.tauranga.govt.nz.

|

|

Marty Grenfell

Chief Executive

|

Membership

|

Chairperson

|

Commission

Chair Anne Tolley

|

|

Members

|

|

|

Quorum

|

Half of the members

physically present, where the number of members (including vacancies) is even;

and a majority of the members physically present, where the number of

members (including vacancies) is odd.

|

|

Meeting frequency

|

As required

|

Role

1.

To ensure the effective and

efficient governance of the City

2.

To enable leadership of the City

including advocacy and facilitation on behalf of the community.

Scope

3.

Oversee the work of all

committees and subcommittees.

4.

Exercise all non-delegable and

non-delegated functions and powers of the Council.

5.

The powers Council is legally prohibited from delegating include:

- Power

to make a rate.

- Power

to make a bylaw.

- Power

to borrow money, or purchase or dispose of assets, other than in

accordance with the long-term plan.

- Power

to adopt a long-term plan, annual plan, or annual report

- Power

to appoint a chief executive.

- Power

to adopt policies required to be adopted and consulted on under the Local

Government Act 2002 in association with the long-term plan or developed

for the purpose of the local governance statement.

- All

final decisions required to be made by resolution of the territorial

authority/Council pursuant to relevant legislation (for example: the

approval of the City Plan or City Plan changes as per section 34A Resource

Management Act 1991).

6.

Council has chosen not to delegate the following:

- Power

to compulsorily acquire land under the Public Works Act 1981.

7.

Make those decisions which are required by legislation to be made by

resolution of the local authority.

8.

Authorise all expenditure not delegated to officers, Committees or other

subordinate decision-making bodies of Council.

9.

Make appointments of members to the CCO Boards of Directors/Trustees and

representatives of Council to external organisations.

10. Consider

any matters referred from any of the Standing or Special Committees, Joint

Committees, Chief Executive or General Managers.

Procedural matters

11. Delegation

of Council powers to Council’s committees and other subordinate

decision-making bodies.

12. Adoption

of Standing Orders.

13. Receipt

of Joint Committee minutes.

14. Approval

of Special Orders.

15. Employment

of Chief Executive.

16. Other

Delegations of Council’s powers, duties and responsibilities.

Regulatory matters

Administration, monitoring and

enforcement of all regulatory matters that have not otherwise been delegated or

that are referred to Council for determination (by a committee, subordinate

decision-making body, Chief Executive or relevant General Manager).

|

Ordinary

Council meeting Agenda

|

24

July 2023

|

7 Confirmation

of minutes

7.1 Minutes

of the Council meeting held on 3 July 2023

File

Number: A14862970

Author: Anahera

Dinsdale, Governance Advisor

Authoriser: Anahera

Dinsdale, Governance Advisor

|

Recommendations

That the Minutes of the

Council meeting held on 3 July 2023 be confirmed as a true and correct

record.

|

Attachments

1. Minutes

of the Council meeting held on 3 July 2023

|

Ordinary Council meeting minutes Ordinary Council meeting minutes

|

3 July 2023

|

|

|

|

MINUTES

Ordinary Council meeting

Monday, 3 July 2023

|

Order of Business

1 Opening karakia. 3

2 Apologies. 3

3 Public forum.. 3

4 Acceptance of

late items. 3

5 Confidential

business to be transferred into the open. 3

6 Change to the

order of business. 3

7 Confirmation of

minutes. 3

7.1 Minutes

of the Council meeting held on 19 June 2023. 3

8 Declaration of

conflicts of interest 4

9 Deputations,

presentations, petitions. 4

Nil

10 Recommendations from other

committees. 4

Nil

11 Business. 4

11.1 Council-Controlled

Organisation Board Remuneration Review, June 2023. 4

11.2 Traffic

& Parking Bylaw Amendment No.45. 5

11.3 Transport

System Plan Transport System Operating Framework (TSOF)v2 Endorsement 6

12 Discussion of late items. 8

13 Public excluded session. 8

13.1 Public

Excluded Minutes of the Council meeting held on 19 June 2023. 9

13.2 Appointment

of Additional Urban Design Panel Members. 9

13.3 Progression

of the Dam 5 and Wetland 5 stormwater project 9

13.4 Construction

of Car Parks 160-176 Devonport Road. 10

14 Closing karakia. 10

MINUTES

OF Tauranga City Council

Ordinary Council meeting

HELD

AT THE Bay of Plenty Regional Council

Chambers, Regional House, 1 Elizabeth Street, Tauranga

ON

Monday, 3 July 2023 AT 9.30am

PRESENT: Commission

Chair Anne Tolley, Commissioner Shadrach Rolleston (via Zoom), Commissioner

Stephen Selwood, Commissioner Bill Wasley

IN ATTENDANCE: Marty

Grenfell (Chief Executive), Paul Davidson (Chief

Financial Officer), Manager: Strategy, Growth & Governance), Christine

Jones (General Manager, Strategy, Growth and Governance), Anne Blakeway

(Manager: City Partnerships), Brendan Bisley (Director of Transport), Coral

Hair (Manager: Democracy & Governance Services), Anahera Dinsdale

(Governance Advisor), Janie Storey (Governance Advisor)

1 Opening

karakia

Anahera Dinsdale opened the meeting

with a karakia.

2 Apologies

Nil

3 Public

forum

Nil

4 Acceptance

of late items

Nil

5 Confidential

business to be transferred into the open

Nil

6 Change

to the order of business

Nil

7 Confirmation

of minutes

8 Declaration

of conflicts of interest

Nil

9 Deputations,

presentations, petitions

Nil

10 Recommendations

from other committees

Nil

11 Business

|

11.1 Council-Controlled

Organisation Board Remuneration Review, June 2023

|

|

Staff Anne

Blakeway, Manager: City Partnerships

Key points

·

Anne Blakeway noted that she had an interest in this item as

her husband was a Member of the Tourism Bay of Plenty Board.

·

Figures in recommendations (f), (g) and (h) were incorrect and

had been amended in the resolution.

In response to questions

·

The methodology used for the schedule was the same framework

that had been used in the past.

·

The remuneration was reviewed every three years in line with

the Long Term Plan cycle.

·

No remuneration was allocated to the Te Manawataki o Te Papa

Charitable Trustees.

|

|

Resolution CO11/23/2

Moved: Commissioner

Bill Wasley

Seconded: Commissioner Stephen Selwood

That the Council:

(a) Receives

the report "Council-Controlled Organisation Board Remuneration Review,

June 2023".

(b) Agrees to increase the remuneration

for trustees of the Tauranga Art Gallery, with the new base fee set at $7,500

per annum.

(c) Agrees to increase the remuneration

for the Tauranga Art Gallery Trust Chair to $15,000 per annum.

(d) Agrees to increase the remuneration

for the Tauranga Art Gallery Trust Deputy Chair to $9,375 per annum.

(e) Agrees to increase the funding grant

for Tauranga Art Gallery by $25,625 from the 2023-24 financial year onwards, to be funded through the

existing City Partnerships council-controlled organisation budget (effective

from 1 July 2023). Going forwards, this increase will be included in the Long-term

Plan 2024-2034.

(f) Agrees to increase the

remuneration for trustees of Tourism Bay of Plenty, with the new base fee set

at $13,500 per annum.

(g) Agrees to increase the remuneration

for the Tourism Bay of Plenty Chair to $27,000 per annum.

(h) Agrees to increase the remuneration

for the Tourism Bay of Plenty Deputy Chair to $16,875 per annum.

(i) Noting that Western Bay of Plenty

District Council have agreed that $10,000 of the increased total cost of

trustee remuneration of $10,875 will be funded out of their opex budget and the remaining $875

would come from Council’s existing City Partnerships council-controlled

organisation budget (effective from 1 July 2023). Going forwards, this

increase will be included in the Long-term Plan 2024-2034.

(j) Agrees to increase the

remuneration for the directors of Bay Venues Limited, with the new base fee

set at $35,000 per annum.

(k) Agrees to increase the remuneration

for the Bay Venues Limited Chair to $70,000 per annum.

(l) Agrees to increase the

remuneration for the Bay Venues Limited Deputy Chair to $43,750 per annum.

(m) Agrees that the increased total cost of director

remuneration of $14,500 will be funded out of Bay Venues Limited’s

operational budgets, to be included in the Long-term Plan 2024-2034.

(n) Agrees that the remuneration for the

directors of Te Manawataki o Te Papa Limited is currently, and remains set

at, $40,000 per annum.

(o) Agrees that the remuneration for the

Chair of Te Manawataki o Te Papa Limited is currently, and remains set at,

$80,000 per annum.

Carried

|

|

11.2 Traffic & Parking

Bylaw Amendment No.45

|

|

Staff Nic

Johansson, General Manager: Infrastructure Services

Brendon Bisley, Director of Transport

Key points

·

The amendment related to changes to loading spaces, taxi stands

and parking spaces due to construction.

·

The restriction was only for the period of the construction and

was then revoked at the end of the works.

In response to questions

·

The area included three construction sites which were being

built to the boundary of their sites.

·

Staff prioritised which corridors could take a parking

reduction and which must stay open.

·

Goods vehicles coming into the sites needed somewhere to pull

up and a spot was required for the crane to be located.

·

Robust conversations had been held with the development site

mangers to get the best compromise between all of the sites. Their

building plans had been structured around the use of the carparks.

·

The task force set up to co-ordinate the developments for the

city centre were linked in with these proposals.

·

Full payment of the per day rate was received for each carpark

being used for the duration of the time.

·

Completion dates had been provided with corridor access requests

for each of the site applications which could be added to the amendments to

the Traffic and Parking Bylaw.

Discussion points raised

·

The inclusion of maps was requested in future reports of this

nature.

·

Members considered that as these were valuable parking spaces within

the City Centre, a completion date needed to be added.

|

|

Resolution CO11/23/3

Moved: Commissioner

Bill Wasley

Seconded: Commissioner Stephen Selwood

That the Council:

(a) Receives

the report "Traffic & Parking Bylaw Amendment No.45".

(b) Adopts

the proposed amendments to the Traffic and Parking Bylaw (2012) Attachments

as per Appendix A, relating to minor changes for general safety, operational

or amenity purposes, to become effective on or after 4 July 2023 subject to

appropriate signs and road markings being implemented.

(c) Adds

a maximum date for the changes to loading spaces, taxi stands and parking

spaces in the amendments to the Traffic and Parking Bylaw.

Carried

|

|

11.3 Transport System Plan Transport

System Operating Framework (TSOF)v2 Endorsement

|

|

Staff Nic

Johansson, General Manager: Infrastructure Services

Brendan Bisley, Director of Transport

External Shaun

Jones – Programme Manager Transport Systems Plan

Refer to the presentation as included

in the agenda.

Key points

·

The programme started with the Urban Form and Transport

Initiative (UFTI), which was the future state of city growth areas, connected

centres concepts and transport. Under that sat the transport system operating

framework (TSOF) that would deliver on the outcomes of UFTI.

·

The transport model that underpinned that outlined what the

level of service was today, the desired level of service of all modes into

the future and created a gap analysis to generate the projects needed to

implement and meet the future state.

·

The timing was critical with the development of the Long Term

Plan (LTP) and also the development of the new Regional Land Transport Plan

(RLTP) which was to be locked in by March 2024.

·

This was an update of the Transport System Plan (TSP)

which had been provided two years ago.

·

Our Journey was the tag line and purpose statements and key

messages included connecting with sustainable, safe and smart journeys and

was a collaborative approach with nine partners.

·

Delivers on strategic outcomes with strategic alignment with

SmartGrowth, UFTI and the TSP.

·

The Governance of TSP included an Independent Chair, Dean

Kimpton, and the tactical delivery of the outcomes with a governance group,

partner management group and then the partners delivering on the

infrastructure outcomes.

·

Key pressures noted included the key policy changes,

constraints enabling growth affecting land supply costs and housing

affordability, affordability due to construction inflation, funding

availability, scope changes and cost increases.

·

Process included refreshed investment objectives, reviewed the

programme so it was fit for purpose, refreshed modelling costs, mapping

benefits and was packaged into the updated programme to be delivered in draft

to each of the councils for use in their LTPs and to develop the regional

plan. It would also be used by Waka Kotahi to develop their state highway

improvement plan and vehicle kilometres travelled (VKT) reduction

programme.

·

Objectives included access, safety, sustainable urban growth,

and emissions.

·

It was a 30 year $7.9B investment programme with 84 prioritised

projects.

·

The ten-year plan was $2.8B, plus the public transport (PT)

services investment programme and 13 committed projects of $1.5B.

·

The model brought in existing and future land use patterns and

the programme consists of four key tables including committed projects,

complementary projects, strategy, policy and studies and a proposed list of

activities to be delivered and the list of plans to be collaborated with.

·

Next steps included updating the TSP Executive Summary,

endorsement from the governance group and combined councils’

endorsements to feed into the funding process underway.

In response to questions

·

Concern was raised as to what extent the priorities of the

subregion were reflected strategically and whether the development of the

western corridor (SH29) was included.

·

While the process may be strong there did not seem to be

alignment with the urban growth strategy which brought the prioritisation

into question and it was queried whether sufficient weighting had been made

of that change of direction, albeit on an informal basis, until it was

embedded in the SmartGrowth Strategy.

·

Mr Jones noted that the western corridor had been the subject

of ongoing conversations and they were consistently testing for future

proofing in an informal way, however the TSP was a tactical delivery

partnership with signals taken from UFTI and SmartGrowth. When a formal

decision was received from SmartGrowth around the western corridor it would

be a priority and the TSP would be updated at that point. The same

applied with the road pricing strategies and other initiatives in the process

of being worked through. They were aware of them and looked at the

implications from a risk perspective, but they could not be brought into the

programme at this stage.

·

The TSP was initiated by Tauranga City Council to fill the gap

because of the government policy statement changes and the urgent need for a

programme that met government requirements to get funding. Other

partners came on board to make it a total network, including state highways.

For Waka Kotahi this formed part of their national planning and funding

programme, as these were inter-regional routes, however these networks also

provided a local roading function. It was an ongoing journey and the

points raised would be picked up and incorporated into the TSP.

·

The timeline for the Council was that the draft LTP budgets

needed to be completed by mid-August, with the LTP consultation document

adopted to go to audit on 11 September 2023.

·

In response to a query on whether public transport services required

land to be purchased and whether infrastructure costs would be included with

the delivery of the service, it was noted that the public transport business

case was being worked through at present with early indications being that

this would be more of a through service. The working group had considered

each of the bus facilities individually and the assumptions around the form

and function of each hub location were used as a basis for the cost

estimate. Detailed information could be provided for the workshop.

Discussion points raised

·

Appreciation was noted for the work done to date on the plan as

it provided a good base for conversations that needed to happen and to be

reassured that the modelling was taking into account everything in relation

to Tauranga.

·

Commissioners requested that the item lie on the table and a

governance workshop be held with the other entities to test the thinking

around the plan and shape it for endorsement.

·

A series of queries were raised to be considered at the

combined councils’ workshop that would provide for high level

questioning of the TSP process

·

what was actually delivered and what would become better and by

how much, when taking into account all the four outcomes e.g. how much of the

city would be opened up for housing, how much of a carbon reduction would be

gained

·

to what extent does the modelling test the strategy e.g. to

what extent does the transport investment shape the land use?

·

how does variable road pricing link to the travel demand

management component of the TSP and demonstrate the outcomes?

·

how does the investment in transport connect with the future

development strategy?

·

does the sustainable urban growth modelling provide sufficient

priority rating for multi-modal and alternative forms of transport?

·

The upcoming workshop was to include decisions on housing and

investigations into the wider growth area, as these formed part of the

context and overall picture. It also needed to show clarity around the

western corridor and the intensification of the Te Papa peninsula to provide

clear guidance in those areas.

·

Clarity was required around the scope of the future pipeline of

projects including the SH29 corridor upgrade with Waka Kotahi and whether

that was for all of SH29A, or the component from The Lakes to Barkes Corner,

and ensuring that the business case work being undertaken was for all of that

corridor.

·

It was suggested that a joint submission be made to the RLTP

rather than each council having a separate submission as this would provide

influence sub regionally, regionally, and nationally.

·

There was a need to line up the terminology of the TSP with the

business cases so that everyone was clear on the subject matter.

|

|

Resolution CO11/23/4

Moved: Commissioner

Stephen Selwood

Seconded: Commissioner Bill Wasley

That the Council:

·

Receives the report "Transport System Plan Transport

System Operating Framework (TSOF)v2 Endorsement".

·

Lays the report on the table and an urgent workshop be held

through the SmartGrowth Leadership Group, with an invitation to be extended

to elected members of the Western Bay of Plenty District Council and Bay of

Plenty Regional Council to attend.

Carried

|

12 Discussion

of late items

Nil

13 Public

excluded session

Resolution to exclude the public

|

Resolution CO11/23/5

Moved: Commissioner

Bill Wasley

Seconded: Commissioner Stephen Selwood

That the public be excluded from

the following parts of the proceedings of this meeting.

The general subject matter of each matter to be considered

while the public is excluded, the reason for passing this resolution in

relation to each matter, and the specific grounds under section 48 of the

Local Government Official Information and Meetings Act 1987 for the passing

of this resolution are as follows:

|

General subject of each matter to be considered

|

Reason for passing this resolution in relation to each

matter

|

Ground(s) under section 48 for the passing of this

resolution

|

|

13.1 - Public Excluded Minutes of the Council meeting

held on 19 June 2023

|

s7(2)(a)

- The withholding of the information is necessary to protect the privacy of

natural persons, including that of deceased natural persons

s7(2)(b)(ii)

- The withholding of the information is necessary to protect information

where the making available of the information would be likely unreasonably

to prejudice the commercial position of the person who supplied or who is

the subject of the information

s7(2)(c)(i)

- The withholding of the information is necessary to protect information

which is subject to an obligation of confidence or which any person has

been or could be compelled to provide under the authority of any enactment,

where the making available of the information would be likely to prejudice

the supply of similar information, or information from the same source, and

it is in the public interest that such information should continue to be

supplied

s7(2)(h)

- The withholding of the information is necessary to enable Council to

carry out, without prejudice or disadvantage, commercial activities

s7(2)(i)

- The withholding of the information is necessary to enable Council to

carry on, without prejudice or disadvantage, negotiations (including

commercial and industrial negotiations)

|

s48(1)(a)

- the public conduct of the relevant part of the proceedings of the meeting

would be likely to result in the disclosure of information for which good

reason for withholding would exist under section 6 or section 7

|

|

13.2 - Appointment of Additional Urban Design Panel

Members

|

s7(2)(a)

- The withholding of the information is necessary to protect the privacy of

natural persons, including that of deceased natural persons

|

s48(1)(a)

- the public conduct of the relevant part of the proceedings of the meeting

would be likely to result in the disclosure of information for which good

reason for withholding would exist under section 6 or section 7

|

|

13.3 - Progression of the Dam 5 and Wetland 5

stormwater project

|

s7(2)(h)

- The withholding of the information is necessary to enable Council to

carry out, without prejudice or disadvantage, commercial activities

|

s48(1)(a)

- the public conduct of the relevant part of the proceedings of the meeting

would be likely to result in the disclosure of information for which good

reason for withholding would exist under section 6 or section 7

|

|

13.4 - Construction of Car Parks 160-176 Devonport Road

|

s7(2)(b)(ii)

- The withholding of the information is necessary to protect information

where the making available of the information would be likely unreasonably

to prejudice the commercial position of the person who supplied or who is

the subject of the information

s7(2)(h)

- The withholding of the information is necessary to enable Council to

carry out, without prejudice or disadvantage, commercial activities

s7(2)(i)

- The withholding of the information is necessary to enable Council to

carry on, without prejudice or disadvantage, negotiations (including

commercial and industrial negotiations)

|

s48(1)(a)

- the public conduct of the relevant part of the proceedings of the meeting

would be likely to result in the disclosure of information for which good

reason for withholding would exist under section 6 or section 7

|

Carried

|

14 Closing

karakia

Commissioner Shadrach Rolleston closed the meeting with a

karakia.

The meeting closed at 11.35 am.

The minutes of this meeting were confirmed as a true and

correct record at the Ordinary Council meeting held on 24 July 2023.

........................................................

CHAIRPERSON

|

Ordinary

Council meeting Agenda

|

24

July 2023

|

11 Business

11.1 Te

Manawataki o Te Papa - Overview Report

File

Number: A14855075

Author: Christine

Jones, General Manager: Strategy, Growth & Governance

Gareth Wallis,

General Manager: City Development & Partnerships

Authoriser: Christine

Jones, General Manager: Strategy, Growth & Governance

Purpose of the Report

1. The purpose of this report is to

provide an overview of the suite of reports included on this agenda. This

includes providing the information that is pertinent to all of the reports, as

well as an overview of how each report fits within the wider programme of

works. This report provides context only and no decision is sought.

|

Recommendations

That the Council:

(a) Receives the

report "Te Manawataki o Te Papa - Overview Report".

|

Background

2. In

2018, Council adopted the Civic Precinct Masterplan. The plan provided

direction for the future development of the Council-owned site bounded by

Willow, Hamilton, Wharf and Durham Streets (Site A); and the Council-owned site

at 21-41 Durham Street (Site B), formerly known as the TV3 site. Extensive

community consultation took place but for various reasons, the Civic Precinct

Masterplan was not implemented at this time.

3. More

recently, Council included a budget in the Long-term Plan (LTP) 2021-31 for the

development of a new library and community hub on the civic precinct site.

Following the adoption of the LTP 2021-31, Council issued a design brief to

Willis Bond to prepare a Civic Masterplan Refresh, to reflect the strategic

decisions the Council had made as part of the LTP process, including:

· a

decision to lease a new civic administration building at 90 Devonport Road;

· to

respond to public submissions in favour of a museum located on the civic

precinct site; and

· to

reflect the history and cultural significance of the site to tangata whenua,

and to tell the stories of Tauranga Moana.

4. Te

Manawataki o Te Papa (Civic Precinct) Masterplan (Refreshed 2021) was prepared by Willis Bond in collaboration with mana whenua,

including representatives from Ngai Tamarāwaho, Ngāti Tapu and Te

Materāwaho, as represented by the Otamataha Trust. As part of the refresh,

the Masterplan was expanded to include the waterfront reserve, between Hamilton

and Wharf Streets, linking the moana with the civic precinct via Masonic Park.

5. Te

Manawataki o Te Papa was formally adopted by the Commission at the Council

meeting on 6 December 2021. At the same meeting, Council requested a further

report to enable the Commission to make a decision on inclusion of the full

Civic Masterplan in a Long-term Plan Amendment (LTPA), acknowledging that

components of the Masterplan, to develop a new library and community hub, and

associated urban space enhancements, had already been resolved through the LTP

2021-31, and work on these components was already commencing.

6. On

21 February 2022, Council approved the development of an LTPA for the

implementation of Te Manawataki o Te Papa, including public consultation from

25 March to 26 April 2022. The focus of consultation was to gather an

understanding of the community’s views regarding the delivery and

timeframes for the additional components of the Civic Precinct Masterplan, and

did not revisit those components that had already been consulted on and agreed

through the LTP 2021-31.

7. Community

consultation on the LTPA was undertaken in conjunction with consultation on the

draft Annual Plan 2022-23, and results were considered by Council on 24 May

2022. It was considered that the proposal to include

the full Civic Masterplan as one programme of work (Option

1), would provide wide ranging social, economic, cultural, and environmental

benefits that will have a positive impact on our communities, today and in the

future.

8. This

option included a capital cost of $303.4 million, subject to achieving 50% of

the required funding from sources other than rates-funded debt and therefore,

an estimated net cost to ratepayers of $151.5 million. At the 24 May 2022

Council meeting, Council resolved to include the full Civic Masterplan in the

LTPA.

9. On

12 December 2022, the Council received the preliminary design and costs, which

removed part of the project relating to the waterfront and indicated an

increase in the total programme cost of $4.5 million. This resulted in the

total revised cost estimate for this portion of the project moving from $270.4

million to $274.95 million.

10. At

that meeting, the Council authorised the Chief Executive to enter into a

Development Commitment with Willis Bond to progress the developed and detailed

designs, and noted that the detailed design would be brought back to Council

for approval prior to entering into a Development Agreement.

11. On 20 March 2023, the Council approved an additional

$1.88 million of non-rate funded expenditure to increase the Tauranga Art

Gallery project budget to $3.38 million, bringing the total programme cost of

Site A to $276.83 million. (Refer Design and Cost Update Report on this

agenda paragraph 16 for further details of the approved budgets and estimated

costs).

Landownership

Council Controlled Organisation

12. As part of the pre-work for the development of Te

Manawataki o Te Papa, Council worked closely with Iwi and Hapū to resolve

historical grievances relating to the ownership of the Site A land. This work

resulted in the creation of a new ownership structure. Site A is now owned by a

Council Controlled Organisation (CCO) Charitable Trust and governed jointly by

Tauranga City Council and mana whenua. This key move forms part of

Council’s overall intention for the site, which is to use it to build

community cohesion and civic pride, recognise and honour our history, and to

connect mana whenua and the people of Tauranga with the land and their stories.

Reports

related to Te Manawataki o Te Papa on Council agenda 24 July 2023

13. There are a number of reports on this 24 July 2023

Council agenda which consider a range of matters which are directly, or

indirectly related to, Te Manawataki o Te Papa.

14. Below is a summary of the reports and the matters which

they address:

|

Report Title

|

Purpose

|

|

Te

Manawataki o Te Papa Design and Cost Update Report

|

Presents

the updated Design and Cost Report

Seeks

delegated authority for the Chief Executive to enter contracts for the

delivery of packages of works.

|

|

Te

Manawataki o Te Papa Business Case

|

Presents

the Te Manawataki o Te Papa Business Case for approval.

|

|

Te

Manawataki o Te Papa Financial Strategy

|

Provides

a financial strategy, which will deliver funding for the Te Manawataki o Te

Papa budgeted capital works programme.

|

|

Asset

Realisation Reserve

|

Seeks

Council approval to create an Asset Realisation Reserve approach to be used

to identify property and assets for divestment, and to hold resulting

disposal proceeds. Council will be able to allocate funding from the Reserve

to capital projects by way of Council resolution, including Te Manawataki o

Te Papa.

|

|

Willis

Bond – Development Management Agreement

|

Seeks

delegated authority for the Chief Executive to enter into a Development

Management Agreement (DMA) appointing Willis Bond as Council’s

Development Manager for delivery of the Te Manawataki o Te Papa (Site A) programme of works (Te Manawataki o Te Papa) pursuant to the Tauranga City Council / Willis Bond 2018 Partnering Agreement (PA).

|

|

Tauranga

Moana Waterfront – Updated Masterplan

|

Presents

the updated Masterplan for the Tauranga Moana Waterfront.

|

Governance

Council Controlled Organisation

15. The Council has created a separate entity to govern

project delivery, Te Manawataki o Te Papa Limited (CCO). In addition, oversight

of the programme is also informed by a Project Control Group, steering groups,

and design and technical reference group. Actual operational delivery is by way

of resources either employed by or contracted to Council. Council is the

principal to all project development contracts with suppliers and the employer

of the project management team.

16. The Te Manawataki o Te Papa Board have reviewed the

reports which are being considered on this agenda. The Board Chairperson will

speak at the 24 July Council meeting to present the views of the Board on the

matters contained within the report. It is expected that the Board Chairperson

will table a short written paper on behalf of the Board.

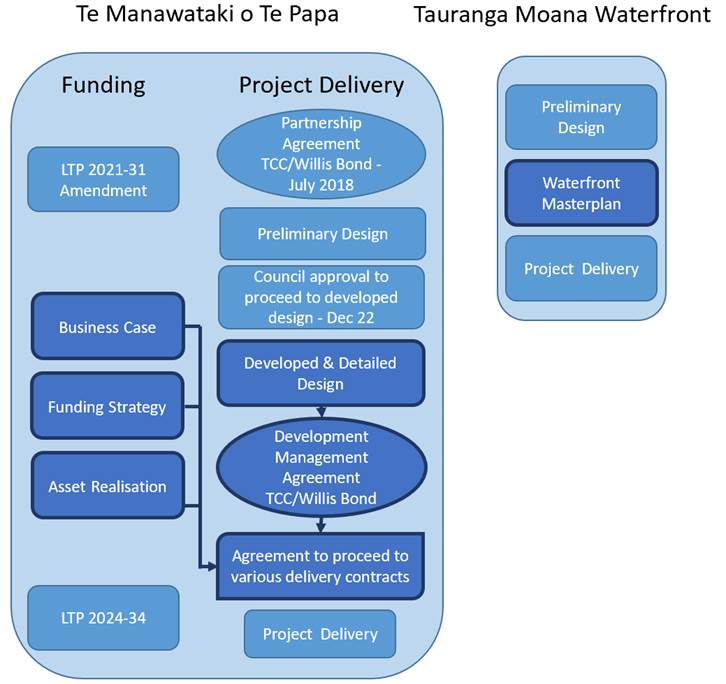

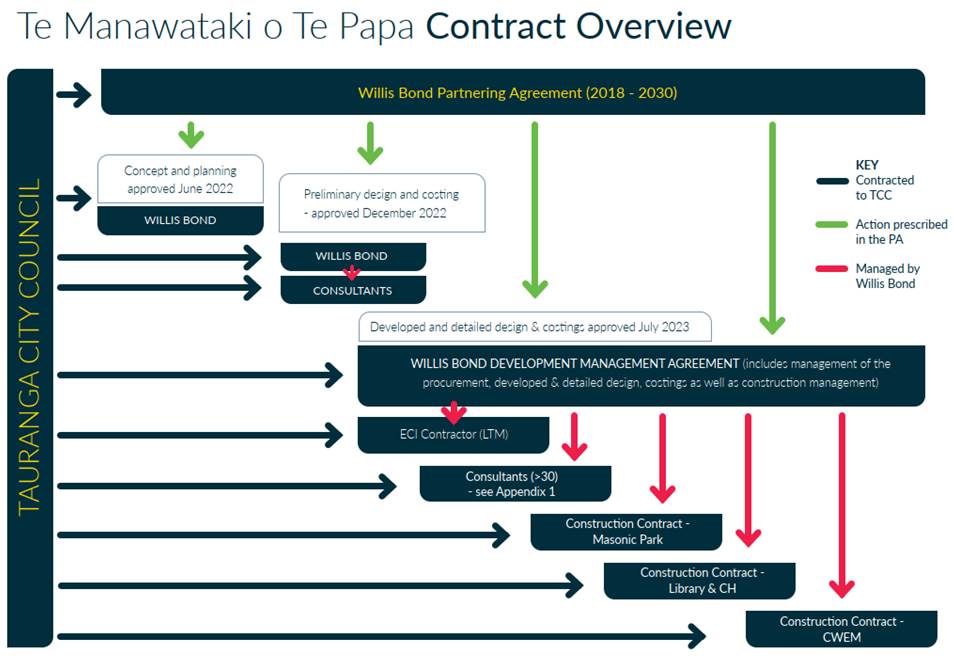

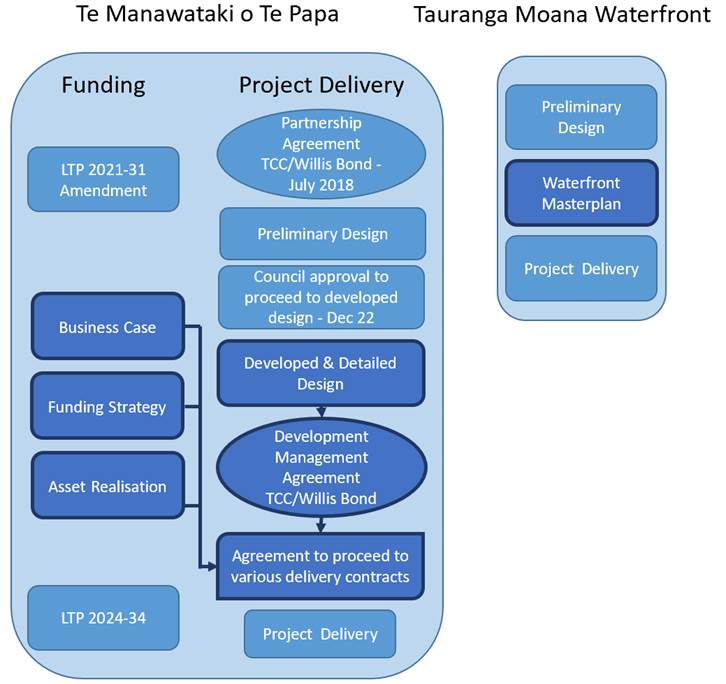

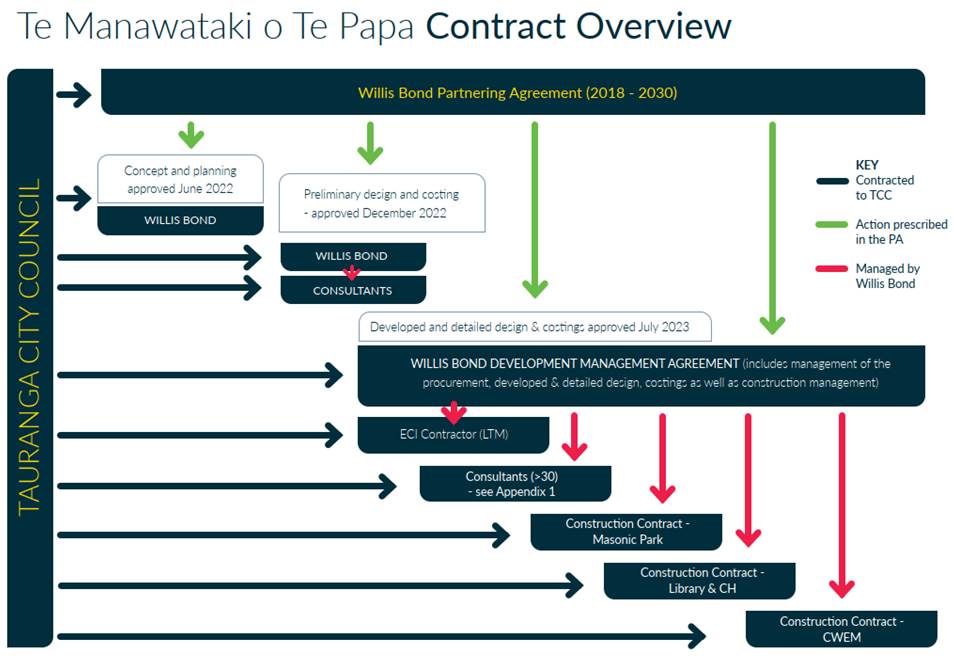

Programme delivery

17. This diagram shows an overview of the

programme delivery, including those stages covered in reports on this agenda

(depicted in dark blue):

Strategic / Statutory Context

18. Council adopted a new vision for Tauranga

City Council in June 2022, and also endorsed it as a shared Vision for

Tauranga. The vision is based on three key themes clearly expressed by our

communities as being important for a future Tauranga – environment,

community and inclusivity, and vibrancy. These three themes form the basis of

the vision statement:

Tauranga, together we can

Prioritise nature

Tauranga is a city where… we celebrate, protect and

enhance our natural environment, integrating it into the city for all to enjoy

Lift each other up

Tauranga is a city where… we foster and grow our

communities, celebrate our differences, and lift up those who are vulnerable

Fuel possibility

Tauranga is a city where… we foster creativity and

innovation, celebrate our arts and culture, and empower our changemakers to

create a vibrant city into the future

With everyone playing their part, together we

can create the change our city needs.

Kei a tātou te pae tawhiti

The future is all of ours.

Because, Tauranga, together we can.

19. The delivery of Te Manawataki o Te Papa directly responds to the

city vision, with each of the three pillars being embodied by the plans for the

precinct. Our community has told us loud and clear that they want a

vibrant, well-planned city centre that is inclusive, accessible, and diverse,

with more activities and events for all to enjoy.

20. Te

Manawataki o Te Papa has clear alignment with the city and Council’s

strategic direction, from the aspirational community vision to Council’s

action and investment plans.

21. One

of six strategic priorities for Council is to drive delivery of the City Centre

Masterplan – Te Manawataki o Te Papa, the broader City Centre Action and

Investment Plan, and the Te Papa Peninsula Spatial Plan, to revitalise and

reactivate the heart of the city.

22. Te

Manawataki o Te Papa clearly seeks to strengthen Tauranga’s city centre

as the commercial, civic, and cultural heart of the Western Bay of Plenty sub

region – the cultural and community focus of the city centre; a unique

civic destination for the stories and decision making of Tauranga, and its

people.

23. As

Tauranga continues to grow, our city centre will continue to transform from a

commercial business centre into a sub-regional destination, providing a wide

range of activities and facilities that support our economy, strengthen our

community, and celebrate who we are.

Financial Considerations

24. The budgets for Te

Manawataki o Te Papa have been approved through the LTPA and subsequent Annual

Plan processes. Specific financial considerations are addressed within each of

the individual reports.

Legal Implications / Risks

25. Legal considerations

are addressed within each of the individual reports.

Consultation / Engagement

26. The proposal to implement Te Manawataki o Te Papa required

an amendment to the Council’s LTP 2021-31 under section 93(5) of the

Local Government Act 2002. As such, a full consultation process has been

undertaken from 25 March to 26 April 2022.

Significance

27. The Local Government

Act 2002 requires an assessment of the significance of matters, issues,

proposals and decisions in this report against Council’s Significance and

Engagement Policy. Council acknowledges that in some instances a matter, issue,

proposal or decision may have a high degree of importance to individuals,

groups, or agencies affected by the report.

28. In making this

assessment, consideration has been given to the likely impact, and likely

consequences for:

(a) the current

and future social, economic, environmental, or cultural well-being of the

district or region;

(b) any persons who are likely to be particularly

affected by, or interested in, the decision; and

(c) the capacity of the

local authority to perform its role, and the financial and other costs of doing

so.

29. This report is an overview report, and is for

information only with no decision sought. In accordance with the criteria and

thresholds in the policy, it is considered that the issue addressed in this

report is of low significance.

Attachments

Nil

|

Ordinary

Council meeting Agenda

|

24

July 2023

|

11.2 Te

Manawataki o Te Papa - Design and Cost Update Report

File

Number: A14828132

Author: Mike

Naude, Director of Civic Developments

Authoriser: Gareth

Wallis, General Manager: City Development & Partnerships

Please

note that this report contains confidential attachments.

|

Public Excluded Attachment

|

Reason why Public Excluded

|

|

Item 11.2 - Te

Manawataki o Te Papa - Design and Cost Update Report - Attachment 2 -

Confidential attachment - Delegation to Chief Executive

|

s7(2)(i) - The

withholding of the information is necessary to enable Council to carry on,

without prejudice or disadvantage, negotiations (including commercial and

industrial negotiations).

|

Purpose of the Report

1. The

purpose of this report is to:

· present the Design

and Cost Update Report July 2023 for Te Manawataki o Te Papa for approval.

· seek delegated

authority for the Chief Executive to enter contracts on behalf of Council for

the delivery of the Te Manawataki o Te Papa (Site A) programme in accordance

with the Tauranga City Council / Willis Bond Partnering Agreement 2018 and

Development Management Agreement 2023.

|

Recommendations

That

the Council:

(a) Receives

the report "Te Manawataki o Te Papa - Design and Cost Update

Report".

(b) Receives

the Library Community Hub Developed Design and approves the associated cost

estimates.

(c) Receives

the Civic Whare, Exhibition and Museum Preliminary Design and approves the

associated cost estimates.

(d) Receives

the Masonic Park Detailed Design and approves the associated cost estimates.

(e) Receives

the Civic Precinct Landscaping 50% Developed Design and approves the

associated cost estimates.

(f) Reallocates

$1.0 million unspent Civic Heart Demolition budget to Te Manawataki o Te

Papa.

(g) Requires

that the overall cost estimate will be further refined, including exploring

value engineering opportunities during the detailed design phase of the

programme, to within a revised budget of $306.3 million ($303.4 million

approved in May 2022, $1.88 million approved in March 2023 and $1.0 million

Civic Heart demolition underspend).

(h) Delegates

to the Chief Executive authority to enter contracts on behalf of Council for

the delivery of the Te Manawataki o Te Papa (Site A) programme of works as

further outlined within the Te Manawataki o Te Papa Design and Cost Update

Report – July 2023 (attachment 1), subject to:

(i) Endorsement

by the Te Manawataki o Te Papa Board (Ltd.); and

(ii) Sufficient

funds being available in accordance with the Te Manawataki o Te Papa

Financial Strategy Report resolutions approved by Council at this 24 July

2023 meeting; and

(iii) Condition of commercial

sensitivity (as per attachment 2 confidential resolution).

(i) Transfers

Attachment 2 into the open when contract negotiations are complete.

|

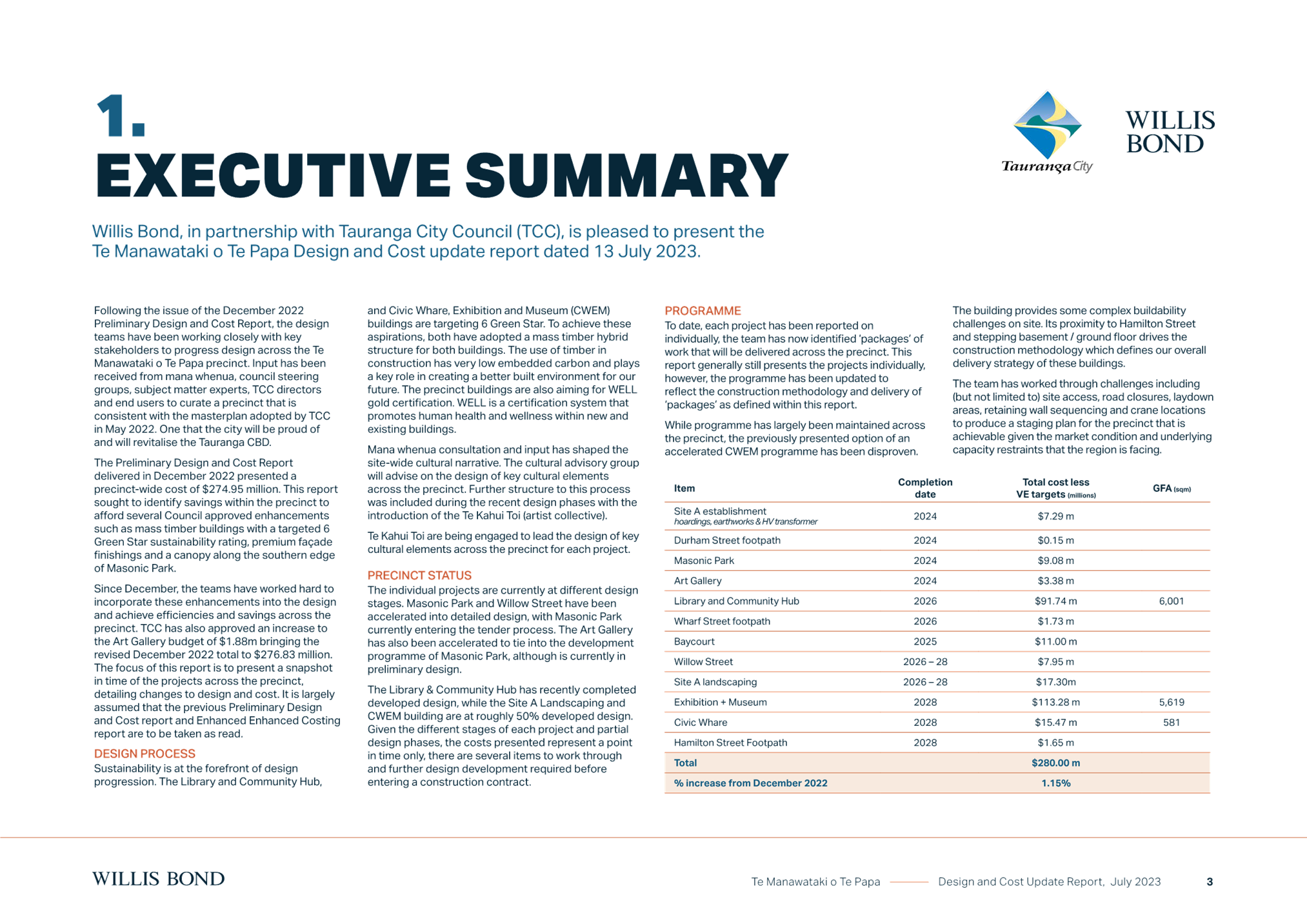

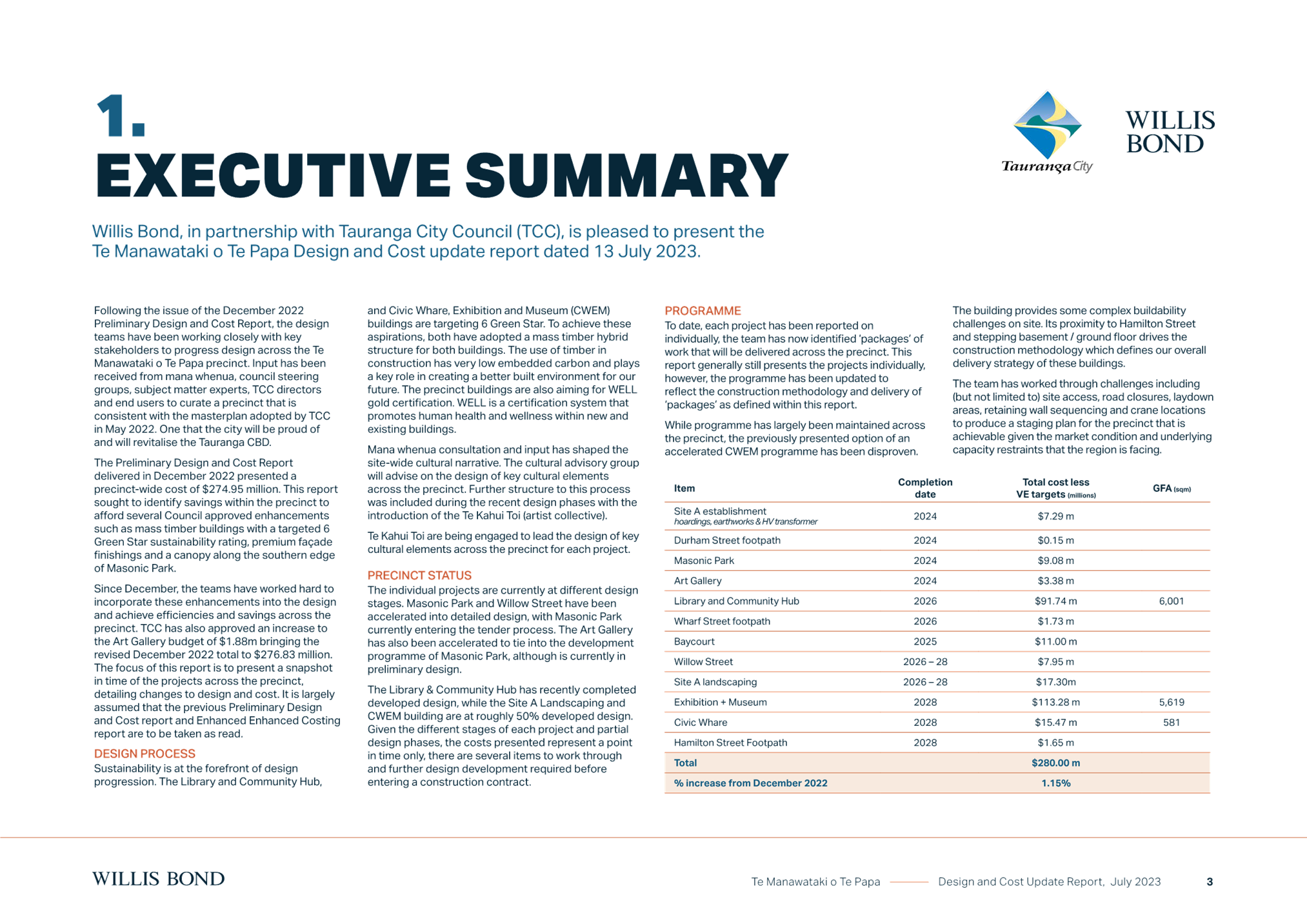

Executive Summary

2. The

Council adopted the Civic Precinct Masterplan on 6 December 2021. The new civic

precinct, to be called Te Manawataki o Te Papa – the heartbeat of Te

Papa, is envisaged as a vibrant space which includes a library and community

hub, civic whare (public meeting house), exhibition gallery, museum, upgrade of

Baycourt Theatre, upgrade of Masonic Park, the landscaping of the wider

precinct, and a section of the Tauranga Moana Waterfront.

3. Following community

consultation, at the 24 May 2022 Council meeting, Council resolved to include

the full Civic Masterplan in the Long-term Plan. Council approved a capital

cost of $303.4 million, subject to achieving 50% of the required funding from

sources other than rates-funded debt and therefore, an estimated net cost on

rates of $151.5 million.

4. On 12 December 2022,

the Council received the preliminary design and costs, which removed part of

the project relating to the waterfront and indicated an increase in the total

programme cost of $4.5 million. This resulted in the total revised cost

estimate for this portion of the project moving from $270.4 million to $274.95

million. At that meeting, the Council authorised the Chief Executive to enter

into a Development Commitment with Willis Bond to progress the developed and

detailed designs, and noted that the detailed design would be brought back to

Council for approval, prior to entering into a Development Agreement.

5. On 20 March 2023,

the Council approved an additional $1.88 million of non-rate funded expenditure

to increase the Tauranga Art Gallery budget to $3.38 million, bringing the

total programme cost to $276.83 million.

6. This

report is the next key gateway stage built into the programme structure to

ensure prudent Council governance and oversight.

7. It provides the

Council the design and cost estimates for various developments within Te

Manawataki o Te Papa Site A and seeks approval from Council to authorise the

Chief Executive to enter contracts on behalf of Council for the delivery of the

Te Manawataki o Te Papa (Site A) programme of works as further outlined within

the Te Manawataki o Te Papa Design and Cost Update Report – July 2023

(Appendix 1).

8. Further

enhanced costings have been undertaken to reflect the progression from

preliminary design to detailed design. These costings have resulted in a number

of changes to various components of the programme, with increases in some

components being largely offset by decreases in other areas.

9. The

overall change is a $5.78 million increase in Te Manawataki o Te Papa (Site A)

costs, resulting in the total revised cost estimate for this portion of the

project moving from $276.83 million to $282.61 million, which represents a

2.08% increase from the December report. The driving factor for this cost

change is attributed to the increased cost relating to the Exhibition Gallery

and Museum.

10. It is

important to note that included in the above cost estimates is a 10%

contingency, and 7.5% average escalation costs across the programme.

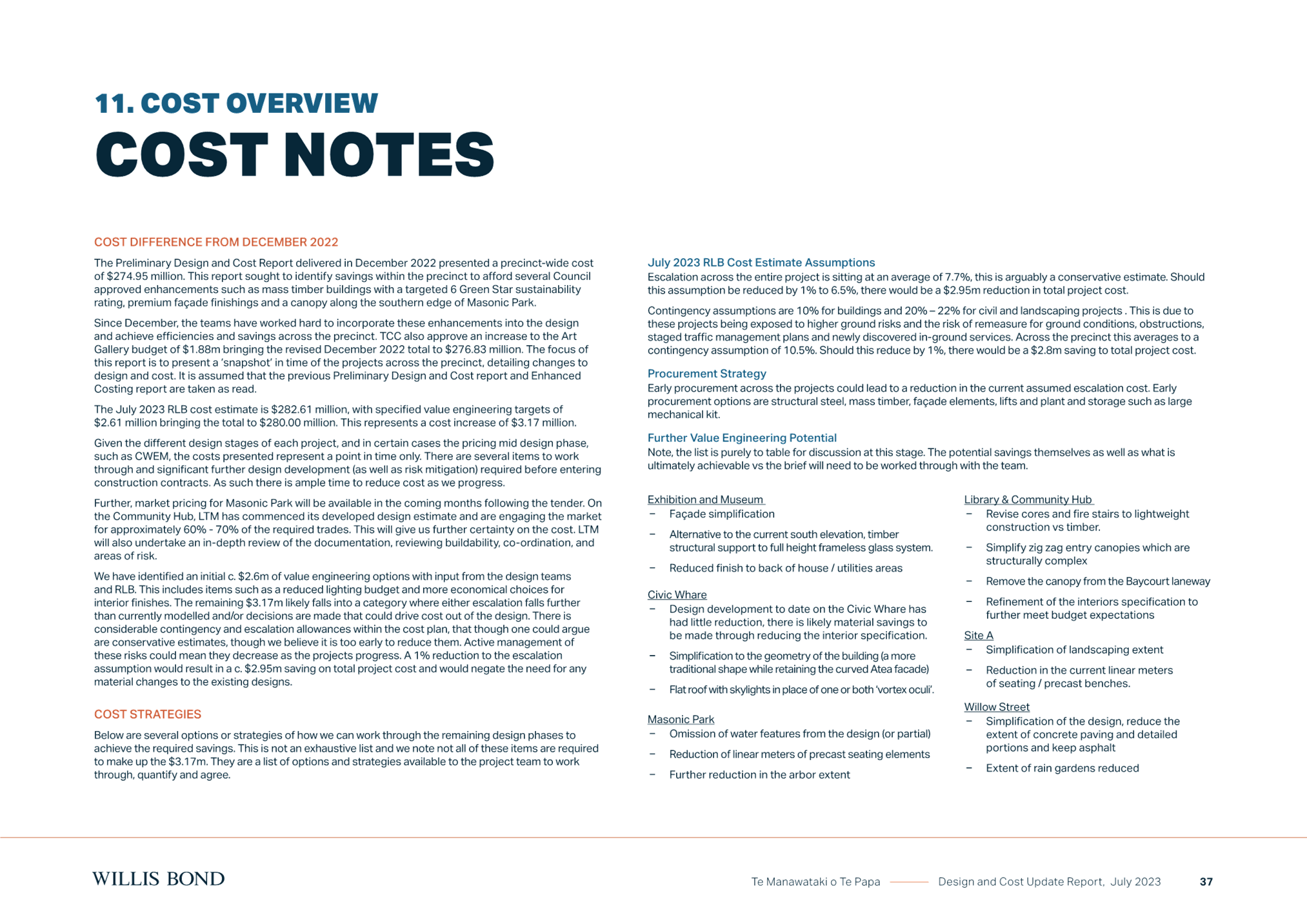

11. The Willis Bond Report identifies a potential

value engineering target of $2.6 million resulting a predicted shortfall of

$3.17 million which represents a 1.15% increase from the December report.

12. The approved budget of $306.3

million takes the base approved budget of $303.4 million from the LTPA, adds

the Art Gallery additional budget approved in March 2023 of $1.88 million and

$1.0 million reallocated from an underspend in the demolition budget. It is

expected that value engineering to the tune of $1.9 million will be achieved to

bring the approved budget to $306.3 million.

13. The designs

and cost estimates will be further refined through the developed design, and

tendering and procurement processes with the view to deliver the programme

within the overall project budget of $306.3 million.

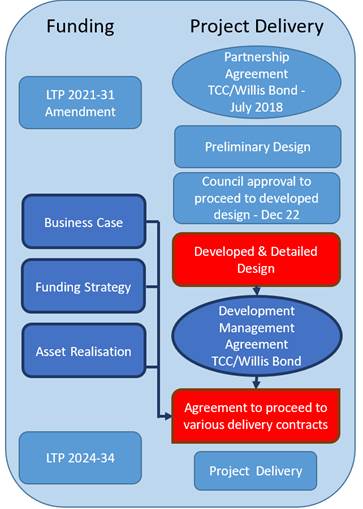

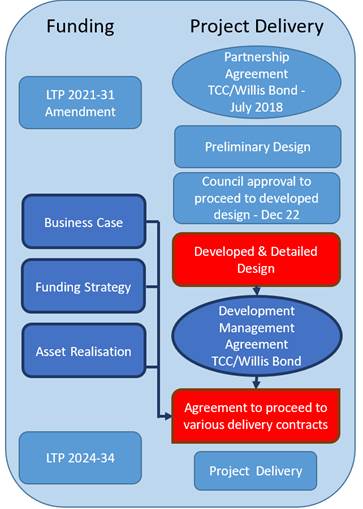

STAGE IN THE PROJECT

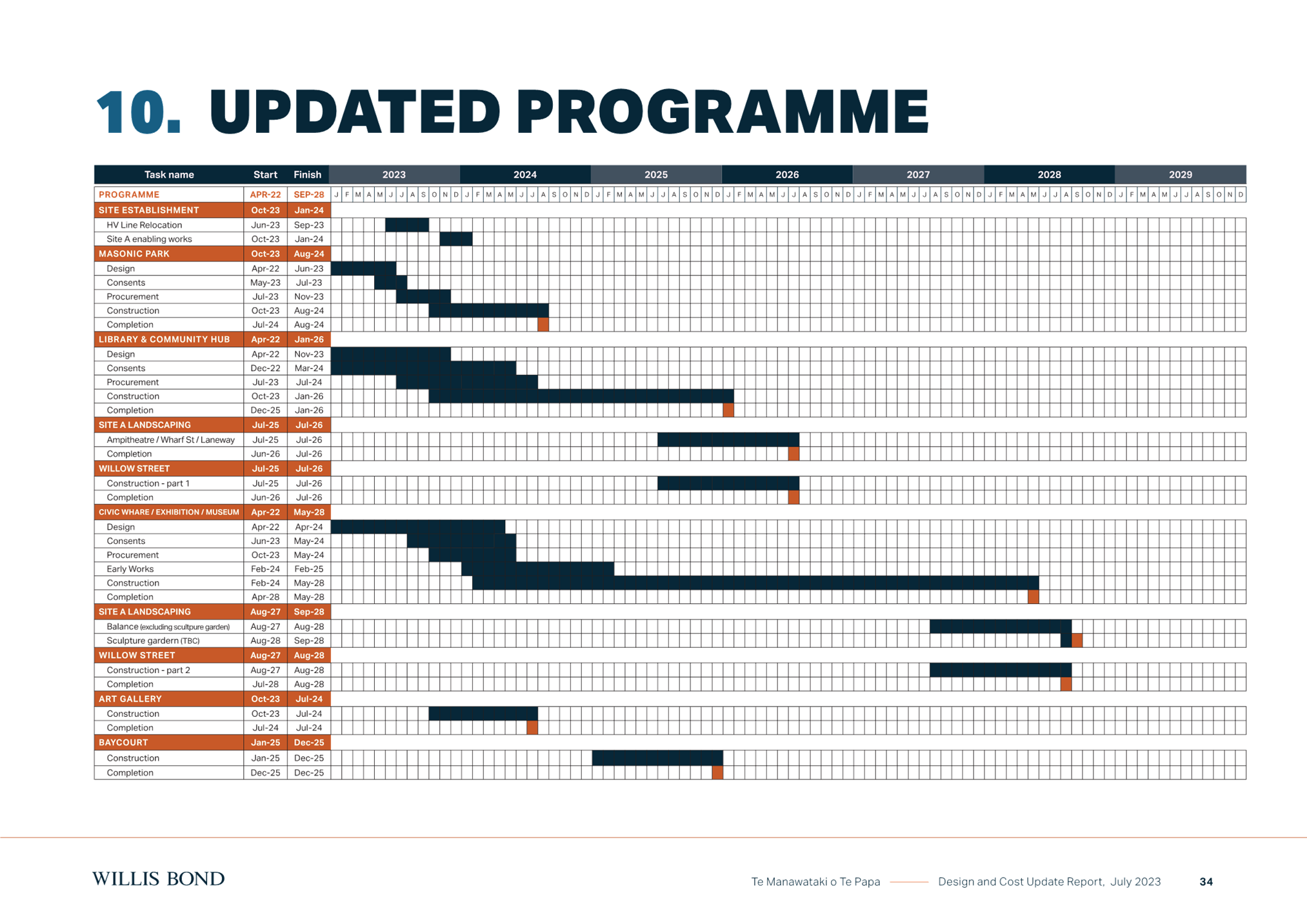

14. This diagram

summarises the key Te Manawataki o Te Papa project delivery approval processes,

as well as the suite of reports being considered on this agenda. The red shapes

identify where this report fits into the wider process:

15. This report is

one of the gateways identified in the above diagram and seeks approval to

proceed to various delivery contracts. In progressing, Council is committing to

delivering the project, with a cost estimate of $276.83 million.

16. The updated

Tauranga Moana Waterfront Masterplan is the subject of an additional paper on

this agenda.

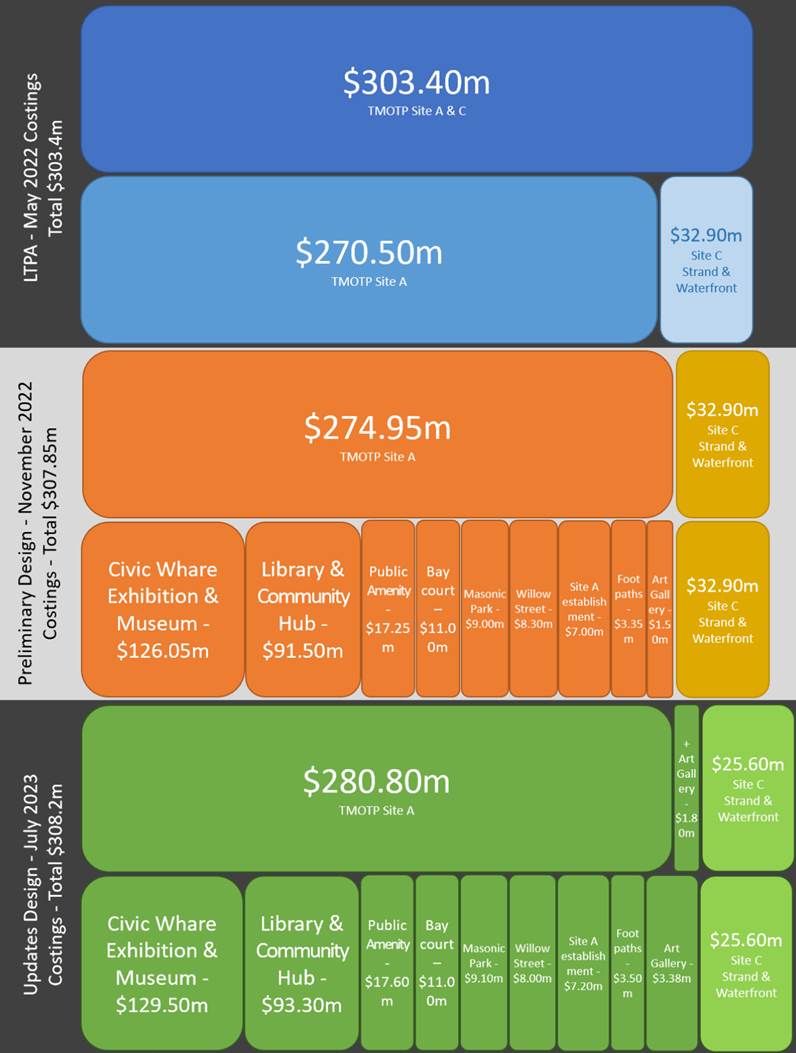

Project costs

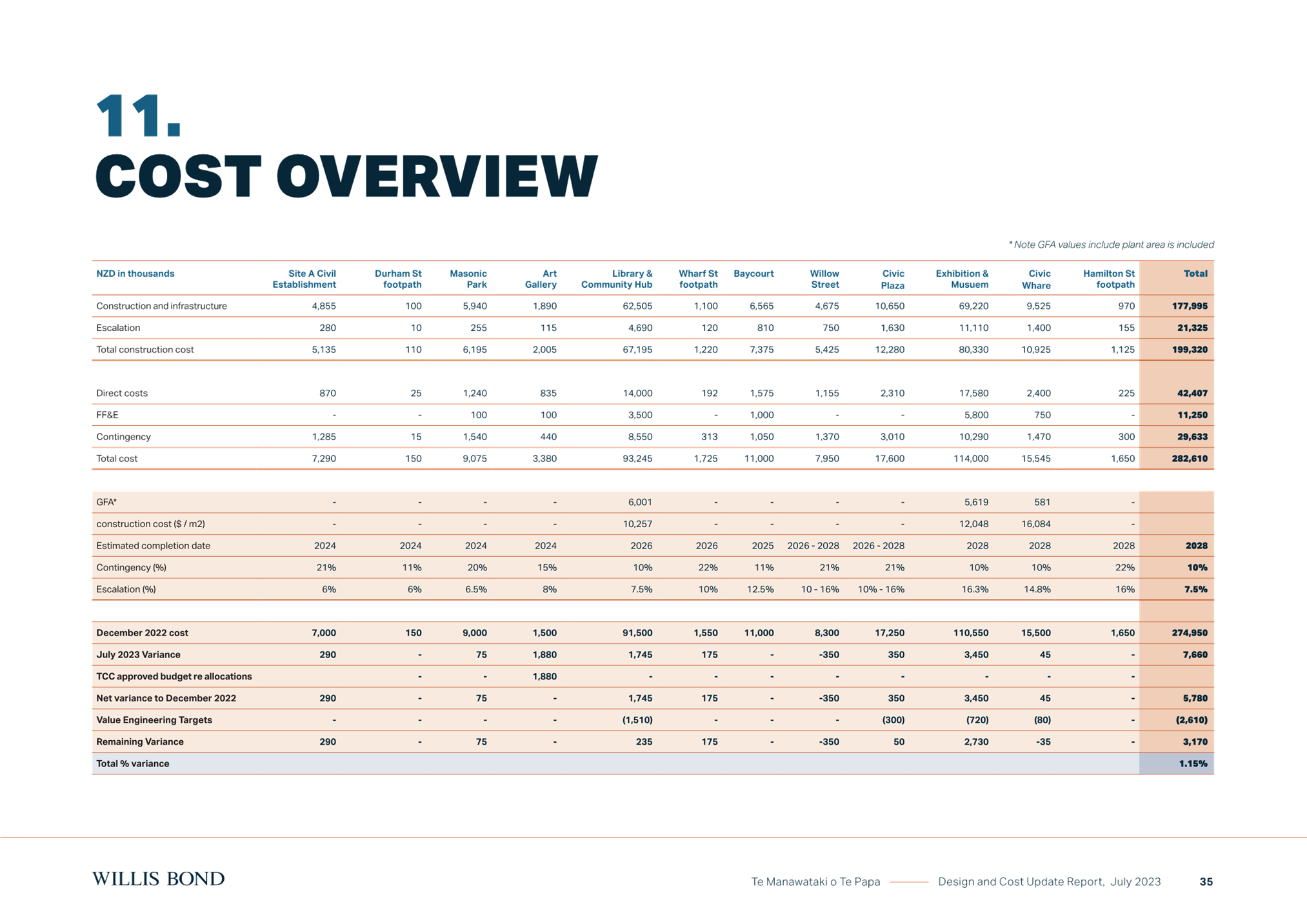

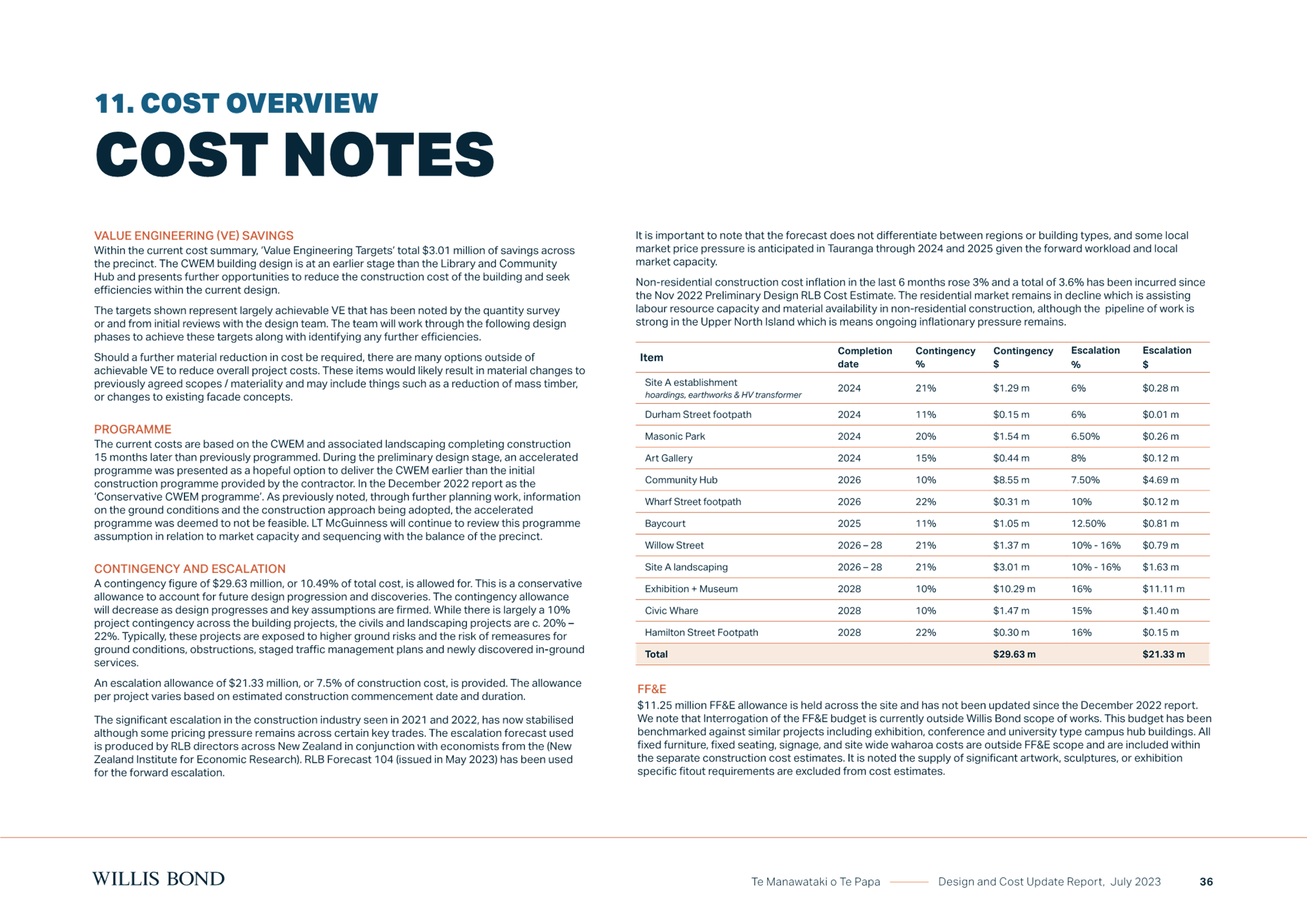

17. Table

1 (below) outlines project costs for key elements of the Te Manawataki o Te

Papa programme. Costs included in the LTPA are included, as well as updated

project costs resulting from the preliminary design process and latest costs

resulting from detailed designs. Project costs (including cost escalation) have

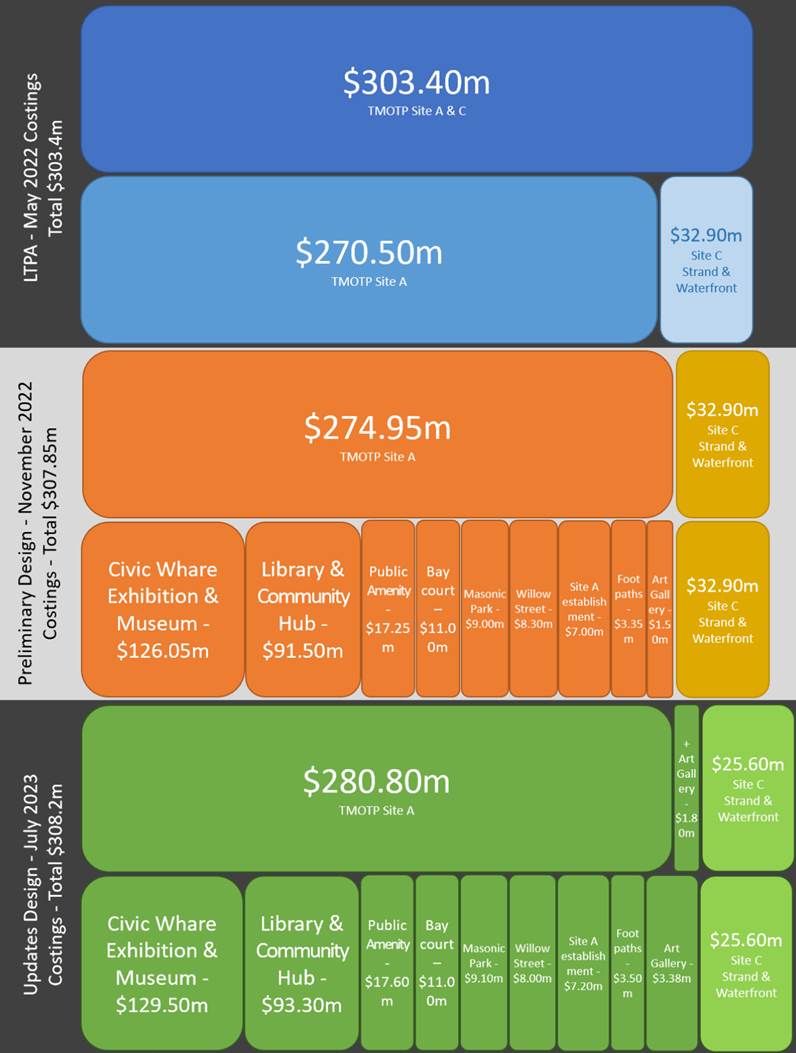

increased from $303.4 million in the LTPA to a total of $308.2 million, and are

delivered over the 2022-28 timeframe.

|

Project

|

Proposed Completion

Date

|

Approved in LTPA

Document – May 2022 ($mil)

|

Revised costs from

Enhanced Concept Plan – November 2022 ($mil)

|

Revised costs from

Enhanced Concept Plan – July 2023 ($mil)

|

|

Site A establishment

|

Jan-24

|

$7.0

|

$7.0

|

$7.2

|

|

Art Gallery*

|

Jul-24

|

-

|

$1.5

|

$3.4

|

|

Masonic Park upgrade

|

Aug-24

|

$10.9

|

$9.0

|

$9.1

|

|

The Strand Road Reserve and

adjacent reserve upgrade**

|

Jun-25

|

$7.5

|

$7.5

|

$1.4

|

|

Baycourt upgrade

|

Dec-25

|

$11.0

|

$11.0

|

$11.0

|

|

Library and Community Hub

|

Jan-26

|

$88.2

|

$91.5

|

$93.3

|

|

Durham/Hamilton/Wharf

Street footpath upgrade

|

Jun-28

|

$9.2

|

$3.4

|

$3.5

|

|

Museum and Exhibition Gallery

|

May-28

|

$104.2

|

$110.5

|

$114.0

|

|

Civic Whare

|

May-28

|

$15.4

|

$15.5

|

$15.5

|

|

Wharf and Central Strand Plaza**

|

Jun-28

|

$25.4

|

$25.4

|

$24.2

|

|

Willow Street shared

space

|

Jul-26 & Aug-28

|

$8.9

|

$8.3

|

$8.0

|

|

Public amenity space

– staged

|

Jul-26 & Sept-28

|

$15.7

|

$17.3

|

$17.6

|

|

TOTAL ESTIMATED COSTS

|

$303.4

|

$307.9

|

$308.2

|

*Art Gallery costs are included within the individual project

cost items in the LTPA Document. These have been separated into their own

project line for the Enhanced Costs presented. An increase in budget of ~$1.9m

was further approved by the Council on 20 March 2023 to cover an approved

change in scope.

** Following approval of the $303.4m a number of scope changes

made to the programme. For example, the Strand Road Reserve and Central Plaza

and Wharf are being delivered separately as part of the Waterfront Masterplan

programme.

Table 1: Project costs for Te

Manawataki o Te Papa[1]P

18. Once developed, the precinct

will be operated as a campus operating model, resulting in efficiencies in

service delivery and cost. It is currently expected that the average annual

operating costs will be ~$26 million, once construction is complete. Further

information regarding operating costs can be found in the Business Case,

included as a separate report on this agenda. These operating costs are

continually being refined and updated as the programme progresses. The LTP 2024-34

will include updated and more detailed ongoing operating costs.

19. Of

the $303.4 million LTP budget adopted for Te Manawataki o Te Papa, $32.9

million was allocated for Site C, waterfront and The Strand, leaving a budget

of $270.5 million for Site A. The preliminary designs in December 2022

suggested a $4.5 million budget increase for Site A to a total of $274.95

million. In March, the Council approved an increase in the budget for the Art

Gallery of $1.88 million, reflecting an increase in scope. The updated design

and costings provided through this report include an additional $1.88 million

in respect of the Art Gallery.

Figure 1

– Funding changes from May 2022 to July 2023

20. Further

enhanced costings have been undertaken to reflect the progression of the

detailed design from preliminary design (attached as Appendix 1). These

costings have resulted in a number of changes to various components of the

programme, with increases in some components being largely offset by decreases

in other areas (see Table 1 in section 16).

21. Figures are based on the

costings provided in the Preliminary Design and Costings Report, and have been

developed by Rider Levett Bucknall (quantity surveyors) and reviewed by LT

McGuinness (construction partner). These costs are based on the following

conservative assumptions:

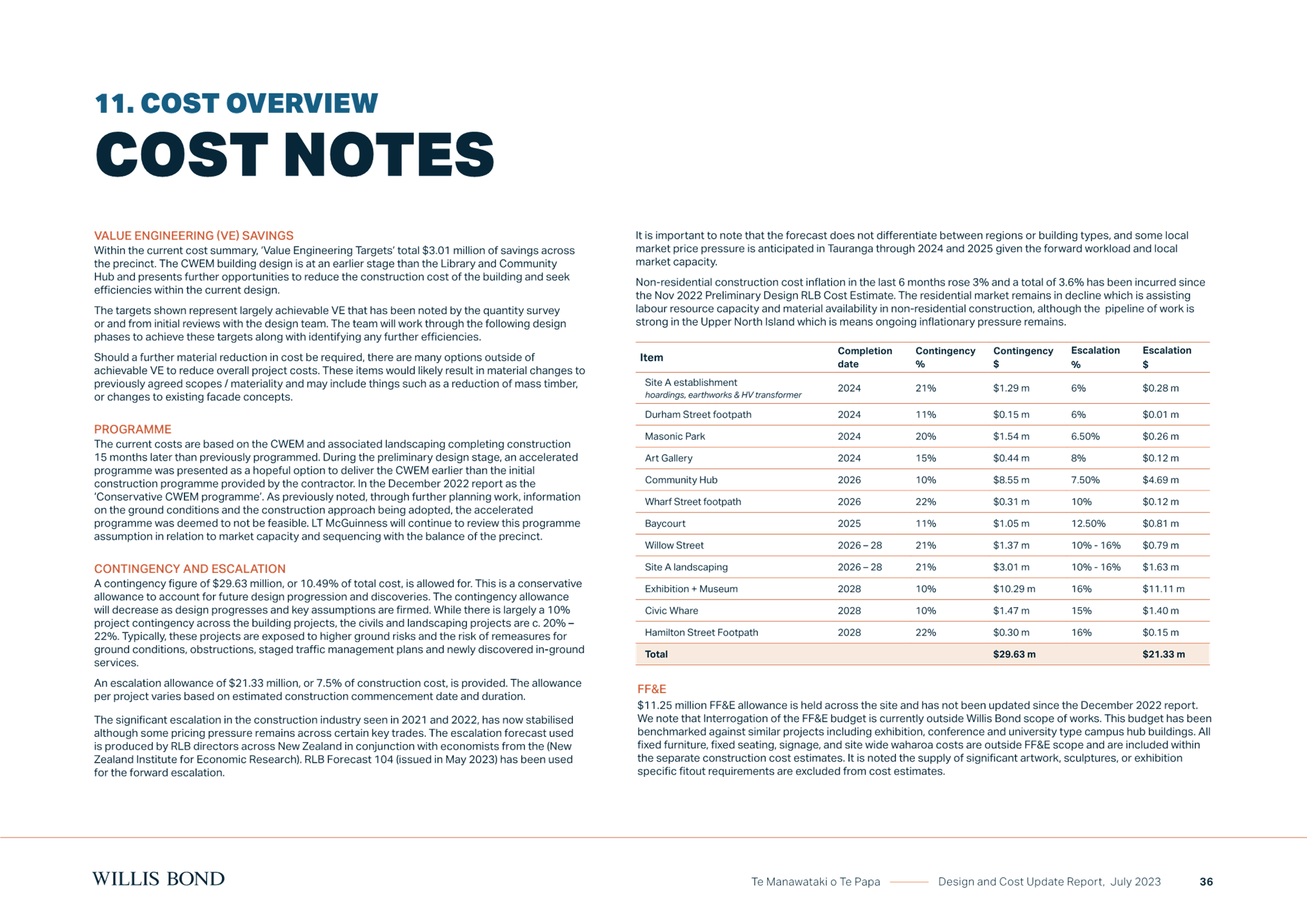

· Cost

escalation of 7.5% of construction costs across the five years, totalling

$21.33 million (down from $21.52 million in December 2022 budgets).

· Contingency

of 10% of total cost across five years, resulting in $29.63 million total

contingency (up from $29.35 million in December 2022 budgets).

· Programme

of works commencing with construction staged over the following five years.

· Programme

completion by September 2028.

22. Included within the capital

project costs are costs associated with the museum and exhibition gallery

fitout. These costs are currently under review and any changes in costs will be

managed within the constraints of the current budget, or considered through the

established approval processes and gateways for this project.

Options Analysis

23. The decision

to progress with Te Manawataki o Te Papa to its current state was previously

made through the LTPA. This report seeks approval to enter into a Development

Agreement for the delivery of the packages of works within the Te Manawataki o

Te papa (Site A) programme. The Council has two options for consideration:

(a) Option 1: Delegates authority to

the Chief Executive to enter into contracts to progress with delivery of the

packages of works within the Te Manawataki o Te papa (Site A) programme; or

(b) Option 2:

Decide not to progress with the Te Manawataki o Te Papa programme of

works.

24. Key benefits

and disadvantages for each option are outlined below.

Option 1: Authorises the Chief Executive to enter into

contracts to progress with delivery of the packages of works within the Te

Manawataki o Te papa (Site A) programme – RECOMMENDED

Advantages

25. In delegating

authority to the Chief Executive to enter into contracts to progress the

delivery of the packages of works within the Te Manawataki o Te papa (Site A)

programme, the programme can proceed at the pace and quality planned.

26. In progressing

to the delivery stage, Council will be making progress towards delivering on

the broad community benefits of the Te Manawataki o Te Papa programme, as

detailed further in the Te Manawataki o Te Papa Business Case.

27. Approving

Option 1 is consistent with the Council’s LTPA and delivers on the

commitment set through that process.

28. Council has

set an expectation with the community that the city centre will be revitalised,

and enhanced community facilities such as a museum, library, exhibition gallery

and civic whare will be developed over the next five years and be available for

the community to use and enjoy. By progressing to the next stage of the

programme, Council is delivering on that community expectation.

29. As a flagship

community development, the project is proposed to attract significant external

funding that is expected to significantly enhance community outcomes.

30. As the project

progresses through the developed and detailed design phases to the tendering

stage, costs will continue to be refined. There are potential opportunities to

bring the costs back within the total programme budget. This may include

amending the design, without negatively impacting the project deliverables.

Therefore, this report does not look to increase the budget, at this stage, as

future savings may mean that additional budget doesn’t eventuate as being

necessary.

Disadvantages

31. In authorising

delivery of the next phase of the project, Council is committing to the next

portion of project investment. This includes an estimated $276.83 million to

complete the delivery of the packages of works within the Te Manawataki o Te

papa (Site A) programme.

32. The current costings show an

increase of $5.78 million from already approved budgets. The Willis Bond Report

identifies a potential value engineering target of $2.6 million resulting a

predicted shortfall of $3.17 million. There is a reputational risk that the

community will see the current projected increase as a sign that the overall

programme cost will increase over time. This is why the Financial Strategy

report recommends a separate resolution to reconfirm that the ratepayer funded

loan shall be a maximum of $151.5 million.

Option

Two: Decide not to progress with Te Manawataki o Te Papa – NOT

RECOMMENDED.

Advantages

33. By not

continuing to the delivery phases of the programme, Council would limit further

expenditure on design and construction.

34. Not delivering

Te Manawataki o Te Papa will see financial savings for ratepayers and reduced

loan funding, which may present an opportunity cost for alternative project

delivery.

Disadvantages

35. The Council

has already committed costs to get to this stage of the programme. By deciding

not to continue the programme at this stage, those costs will be sunk with no

discernible community outcome to show for it.

36. Extensive

community consultation and partner collaboration has set an expectation that Te

Manawataki o Te Papa will deliver great outcomes for the Tauranga community.

Not continuing with the project means that those outcomes will not be realised,

including revitalising the city centre, and enhancing mana whenua’s

relationship with the land. This poses a reputational risk for the Council with

mana whenua, with Council’s key partners, and with the broader community.

37. Extensive

external funding is proposed for this programme. If the programme does not

continue, the investment into Tauranga from other sources will not be realised.

38. Discontinuing

the programme at this stage will see Council break its Partnering Agreement

with Willis Bond.

39. If Te

Manawataki o Te Papa is not built, further work would be required to determine

an alternative use for the land where the civic precinct is currently planned.

financial considerations

40. This report outlines the

updated cost estimates for the Te Manawataki o Te Papa (Site A) Programme of

works. The Financial Strategy Report on this agenda outlines the funding

implications of this programme. Operational costs are covered in more detail in

the Te Manawataki o Te Papa Business Case.

Legal Implications

41. The legal

implications of entering into contracts for the delivery of Te Manawataki o Te

Papa are covered off in more detail in the Development Management Agreement

report included on this agenda.

Risks

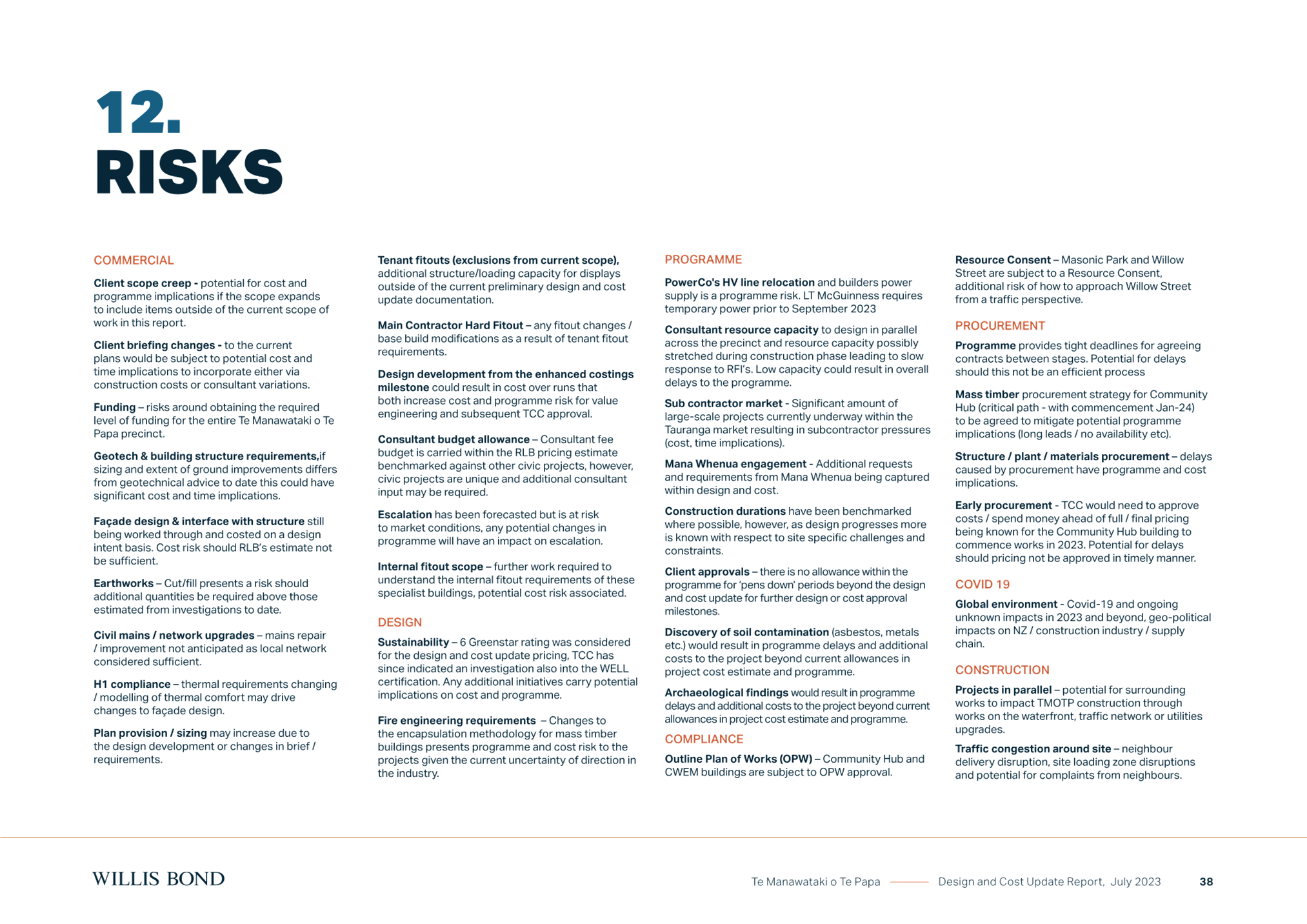

Key project risks

42. The different

projects are at various stages of design development and therefore may risk

being stalled due to various factors e.g. lack of external funds and/or project

cost escalation. This risk is further amplified by the interconnected nature of

this programme of works, with many projects co-dependent on another through the

sharing of spaces and/or facilities. The governance structure that has been

developed to oversee the programme and several key gateway decisions points,

will ensure appropriate Council oversight is provided throughout the programme.

43. Funding

arrangements will need to be investigated and secured. If adequate funding is

not secured, this will put the overall benefits to be realised through Te

Manawataki o Te Papa at risk. As above, this risk is further amplified by the

interconnected nature of the programme of works, with many projects

co-dependent on another through the sharing of spaces and/or facilities.

Depending on the success or otherwise of potential funding streams, this may

require a level of flexibility in the timing and phasing of civic precinct

projects. A multi-pronged funding strategy has been developed to help alleviate

this risk.

44. For a detailed

description of key project risks, please refer to Section 12 of the Te

Manawataki o Te Papa Design and Cost Update Report – July 2023.

Key

financial risks

45. The projects

that make up this programme of works, includes assumptions regarding the level

of project contingencies and cost escalation. However, there is always a risk

that significant unplanned events may have an impact on overall and eventual

project costs.

46. Several of the

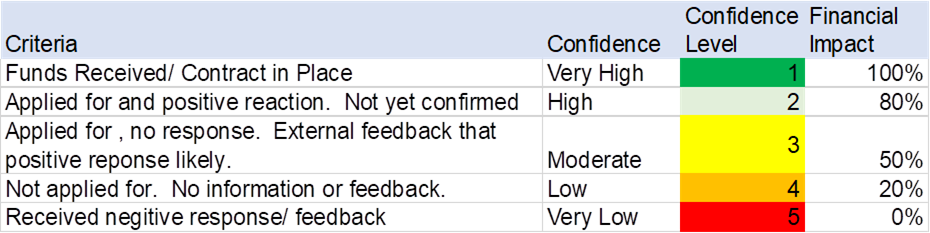

key projects include a level of external funding. An update on the likelihood

of achieving this level of external funding is included in the Funding Strategy

Report on this agenda.

Key

reputational risk

47. Council has

consulted on a total project budget of $303.4 million. If that budget changes

at this stage of the programme, or if there is cost creep and overspend later

in the project, that could have a detrimental impact on the community

perception of the Council.

Significance

48. The

Local Government Act 2002 requires an assessment of the significance of

matters, issues, proposals and decisions in this report against Council’s

Significance and Engagement Policy. Council acknowledges that in some instances

a matter, issue, proposal or decision may have a high degree of importance to

individuals, groups, or agencies affected by the report.

49. In making this

assessment, consideration has been given to the likely impact, and likely

consequences for:

(a) the current

and future social, economic, environmental, or cultural well-being of the

district or region;

(b) any persons who are likely to be particularly

affected by, or interested in, the decision; and

(c) the capacity of the

local authority to perform its role, and the financial and other costs of doing

so.

50. This report is

part of a wider process for the development of Te Manawataki o Te Papa. In

accordance with the considerations above, and criteria and thresholds in the

policy, it is considered that the decision to deliver Te Manawataki o Te Papa

is of high significance. As a result, the Council undertook a thorough

decision-making process to approve the programme of work, including developing

an LTPA and corresponding community consultation using the Special Consultative

Procedure.

51. The decision

made through this report is materially consistent with the decisions made by

Council on 24 May 2022 and 12 December 2022. The extensive community feedback

received through the LTPA process has been incorporated throughout the design

phase of this project, and Council has a thorough understanding of the views of

the community and has approved a clear plan for the delivery of the project.

52. Option 1 of

this report is considered to be of low significance, in accordance with the

considerations above, and criteria and thresholds in the policy, as the

decision has a strong and logical flow from a prior decision of Council, and

approves expenditure that is within existing budget.

ENGAGEMENT

53. The

proposal to implement Te Manawataki o Te Papa required an amendment to the

Council’s LTP 2021-31 under section 93(5) of the Local Government Act

2002. As such, a full consultation process has been undertaken from 25 March to

26 April 2022.

54. Taking into

consideration the above information, if Council approves Option 1, further

community consultation is assessed as not being required at this stage of the

project.

Next Steps

55. This report

seeks approval to progress the Te Manawataki o Te Papa project to delivery

stage. In addition to this report, separate reports on this agenda also seek

approval to enter into a Development Management Agreement and approval of the

funding strategy for Te Manawataki o Te Papa. Subject to approval by Council of

all of these reports, the delivery of Te Manawataki o Te Papa will commence as

approved.

Attachments

1. TMOTP

design and cost update report - 13 July 2023 - final - A14862960 ⇩

2. Confidential

attachment - Delegation to Chief Executive - A14862967 - Public Excluded

|

Ordinary

Council meeting Agenda

|

24

July 2023

|

|

Ordinary

Council meeting Agenda

|

24

July 2023

|

11.3 Te

Manawataki o Te Papa Business Case

File

Number: A14655033

Author: Sarah

Stewart, Principal Strategic Advisor

Authoriser: Christine

Jones, General Manager: Strategy, Growth & Governance

Purpose of the Report

1. This

report presents the Te Manawataki o Te Papa Business Case (the Business Case)

for adoption (Attachment 1). The Business Case supports the case for

investing $309.8 million in capital that will transform the city centre site

into a vibrant community, civic and cultural focal point that meets our

people’s needs and aspirations now and in the future.

2. This report is one in a suite of

reports presented to Council today to progress Te Manawataki o Te Papa –

refer to ‘Te Manawataki o Te Papa – Overview Report’ for

detail of the overall report package and interactions between reports.

3. Completion of the Business Case is

one of the key gateways and approval processes outlined in the Tauranga City

Council / Willis Bond Partnering Agreement.

|

Recommendations

That the Council:

(a) Receives the report "Te

Manawataki o Te Papa Business Case"; and

(b) Adopts Te Manawataki o Te

Papa Business Case that recommends proceeding with the delivery of the

programme of works.

|

Overview of business case

4. The

Business Case recommends proceeding with the delivery of the programme of works

over the next six years. The suite of Te Manawataki o Te Papa projects

will transform the co-owned site in the heart of the city centre, delivering

social, cultural and economic benefits for the city.

5. With

plans for Te Manawataki o Te Papa well-advanced, the Business Case re-confirms

the validity of the programme of works to ensure the best value for our

communities is delivered. Promoting social cohesion and economic stimulus

for the city centre will result in local, subregional, and national benefits

being realised. An adaptive funding pathway is recommended as the best way of

managing funding challenges, thereby providing confidence that Council can

deliver.

6. The

Business Case is guided by The Treasury’s five case model –

strategic, economic, commercial, financial and management cases.

Investment objectives

7. Three

investment objectives underpin the Business Case and specify the desired

outcomes for the proposed investment. Each investment objective is based

on demand forecasting modelling by Rationale (2023) and/or GHD’s (2023)

assessment of wider benefits that Te Manawataki o Te Papa could contribute to

the city:

· To

improve central city vibrancy and liveability by attracting 2,000,000 visits

per annum to Te Manawataki o Te Papa by 2035.

· To

increase the present value of local and regional economic output by $500

million and wider economic benefits by $500 million over the life of the

buildings.

· To

enhance inclusiveness, sense of belonging and cultural identity by attracting

greater than 300,000 annual museum visits and greater than 800,000 annual

community hub visits, with 60 percent of residents being prepared to recommend

Tauranga as a visitor destination by 2035.

Single-stage Te Manawataki o Te Papa is the preferred

approach

8. The

Business Case provides structured and comprehensive analysis to evaluate a

range of approaches, alongside the Single-stage Te Manawataki o Te Papa

option that Council is progressing.

9. This

option is assessed in the Business Case using multi-criteria analysis (MCA)

against a mix of five other options. These included the option considered

previously by Council (stand-alone library and community hub) and new options

that represent ‘book-ends’ or ‘do minimum’ (high

amenity green space) and ‘do maximum’ (selling the land for

commercial purposes) approaches to assess

value for money to the community.

10. Through

the MCA process, the Single-stage Te Manawataki o Te Papa is reconfirmed as the

preferred option, ranking first against the other five options. As well

as contributing fully to all three investment objectives, it is assessed as

making a high contribution of benefits with a medium risk profile.

Although relatively costly, with total costs amounting to $703 million over 60

years (including $309.8 million of capital cost over the next six years), this

option does have a positive cost benefit assessment of 1.17 when considering

all monetary and non-monetary benefits that are able to be quantified).

It also:

· recognises the

need for an integrated programme of investment that will help transform the

civic heart of the city centre

· has a focus on

connection between projects in relation to shared spaces, shared facilities and

sharing of costs

· is developed in

partnership with mana whenua and is steeped in cultural design, providing

connection with our past and with our environment, particularly Te Awanui

(Tauranga harbour)

· clearly aligns

with current strategy and policy and will provide wide-ranging social,

economic, cultural, and environmental benefits ensuring the project will have a

positive impact on our communities today and in the future

· has community

support, as shown through the Long-Term Plan Amendment consultation process.

Wide-ranging benefits for our communities

11. The

benefits Te Manawataki o Te Papa will bring are widespread, reaching out to the

region and providing a site that captures and reflects Tauranga’s unique

cultural heritage. Te Manawataki o Te Papa will significantly contribute to

city centre GDP and deliver wider economic benefits, generating an additional

$788.4 million to $1,370.5 million in estimated quantified benefits in net

present terms over the next 60 years (assuming a 4% discount rate)[2].

12. With

a focus on creating connected, cohesive, and inclusive communities and a

vibrant and thriving city centre, the benefits that will flow from the

investment are anticipated to fast-track social, economic, and cultural

outcomes. Key benefits and key performance indicators (KPIs) outlined in

the Business Case are reproduced in the following table.

Table

2: Key benefits and key performance indicators for the investment

proposal

|

Benefits

|

KPIs

|

|

Improved central city vibrancy & liveability Improved central city vibrancy & liveability

|

Utilisation

|

|

Increased tourism

|

|

Increased

inner city housing

|

|

Increased local

& regional sustainable economic development Increased local

& regional sustainable economic development

|

Increased business & employment (GDP)

|

|

Increased events

|

|

Increased bed nights

|

|

Enhanced inclusiveness, sense of

belonging & cultural identity

|

Participation

|

|

Reputation /Brand

|

|

Educational opportunities

|

Ensuring successful delivery

13. The

Management Case demonstrates that robust arrangements are in place for the

delivery, monitoring and evaluation of Te Manawataki o Te Papa. It sets

out that the external Te Manawataki o Te Papa Board govern the design and

construction phase, with the preferred approach for the on-going management and

operation of Te Manawataki o Te Papa once built being brought back in-house and

governed by Council.

14. Programming of works is also

outlined in the Management Case. The draft programme indicates the completion

of the project in January 2028.

15. Effective

benefit management is about giving investments the greatest possibility of

delivering in a way that optimises benefits. A benefits map in the

Business Case illustrates alignment with Council’s strategic direction

and how benefits will be measured (key performance indicators, measures, and

targets). The approach to benefits management largely aligns with

Council’s Long-Term Plan and annual reporting processes, in that they

share KPIs and measures. This ensures those responsible for relevant

Council activities (and associated benefits) can actively monitor, respond, and

report on benefits with ease.

Strategic / Statutory Context

16. The

proposed delivery of Te Manawataki o Te Papa has clear alignment with the city

and Council’s strategic direction, from the aspirational community vision

and primary strategies, through to Council’s action and investment plans,

including:

· Our

Direction – Tauranga 2050 (including the City Vision)

· Tauranga

City Council Community Outcomes

· Te

Papa Spatial Plan 2020

· City

Centre Action and Investment Plan 2022-2032

· Tauranga

Events Action and Investment Plan 2022-2032

17. It

also aligns with sub-regional, regional and national strategies, most notably

the Urban Form and Transport Initiative, and SmartGrowth. At a national

level, Te Manawataki o Te Papa will contribute to a range of central government

policy initiatives, including The Treasury’s ‘Living Standards

framework’, Ministry of Social Development’s ‘Social Cohesion

Strategic Framework’, the Ministry of Education’s ‘Aotearoa

New Zealand’s Histories and Te Takanga o Te Wā’ and Creative

New Zealand’s ‘Te Whakaputa Hua Ki Te Hunga o Aotearoa’.

option Analysis

18. The Council

has two options for consideration:

(a) Option 1: Adopt Te Manawataki o

Te Papa business case. (Recommended)

(b) Option 2: Do

not adopt Te Manawataki o Te Papa business case. (Not Recommended)

19. Key benefits

and disadvantages for each option are outlined in the table below.

|

OPTION

ONE: Adopt Te Manawataki o Te Papa business case

|

|

Benefits

|

Disadvantages

|

|