|

|

|

AGENDA

Ordinary Council meeting

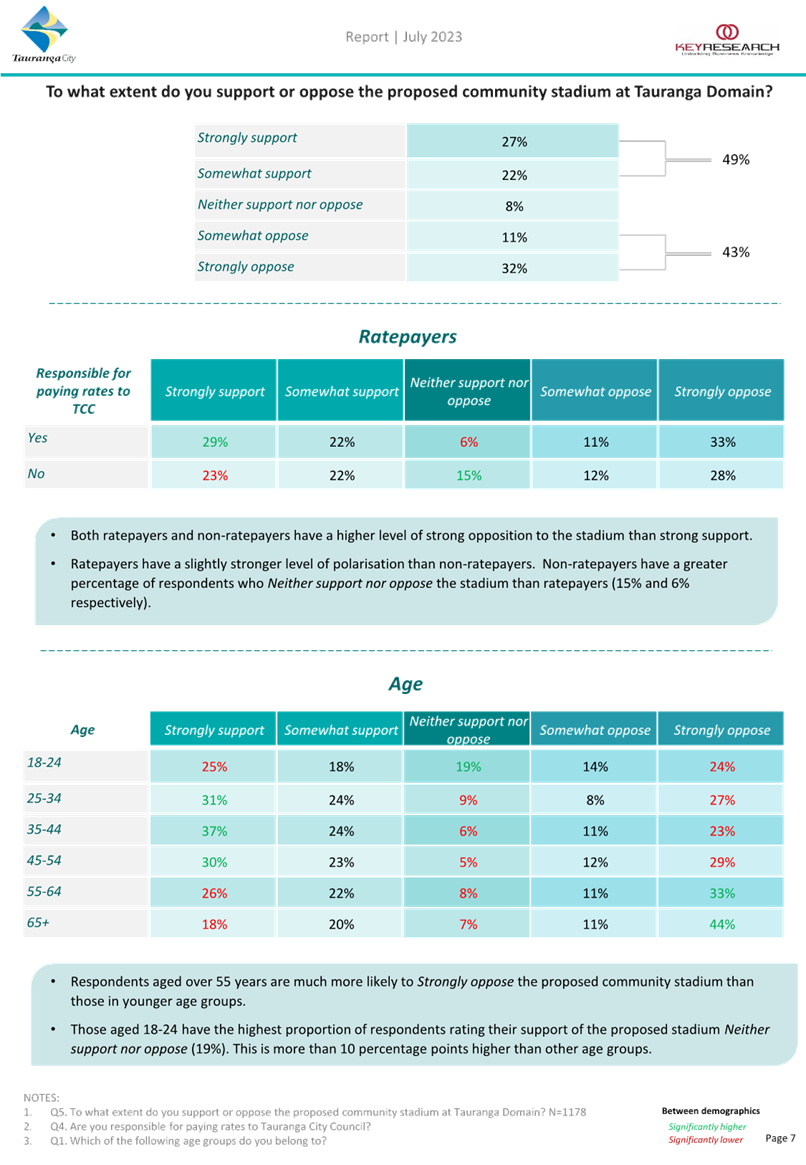

Monday, 21 August 2023

|

|

I hereby give notice that an Ordinary meeting of

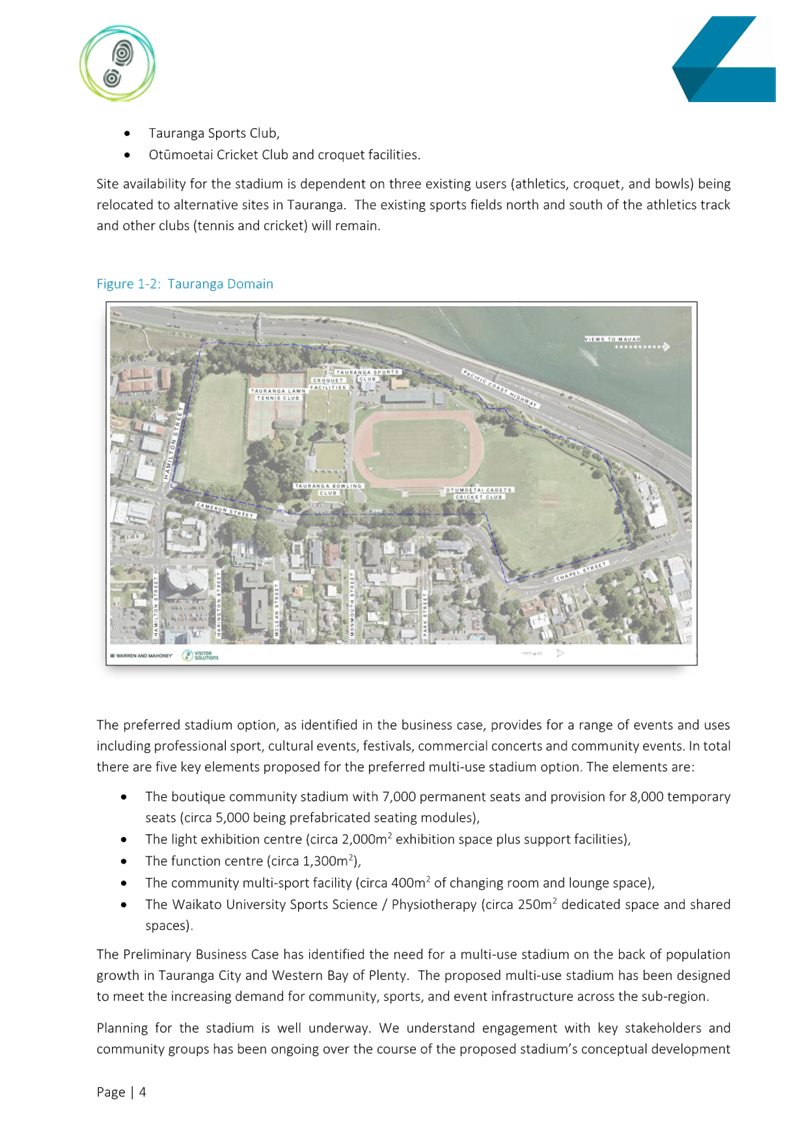

Council will be held on:

|

|

Date:

|

Monday, 21 August 2023

|

|

Time:

|

9.30am

|

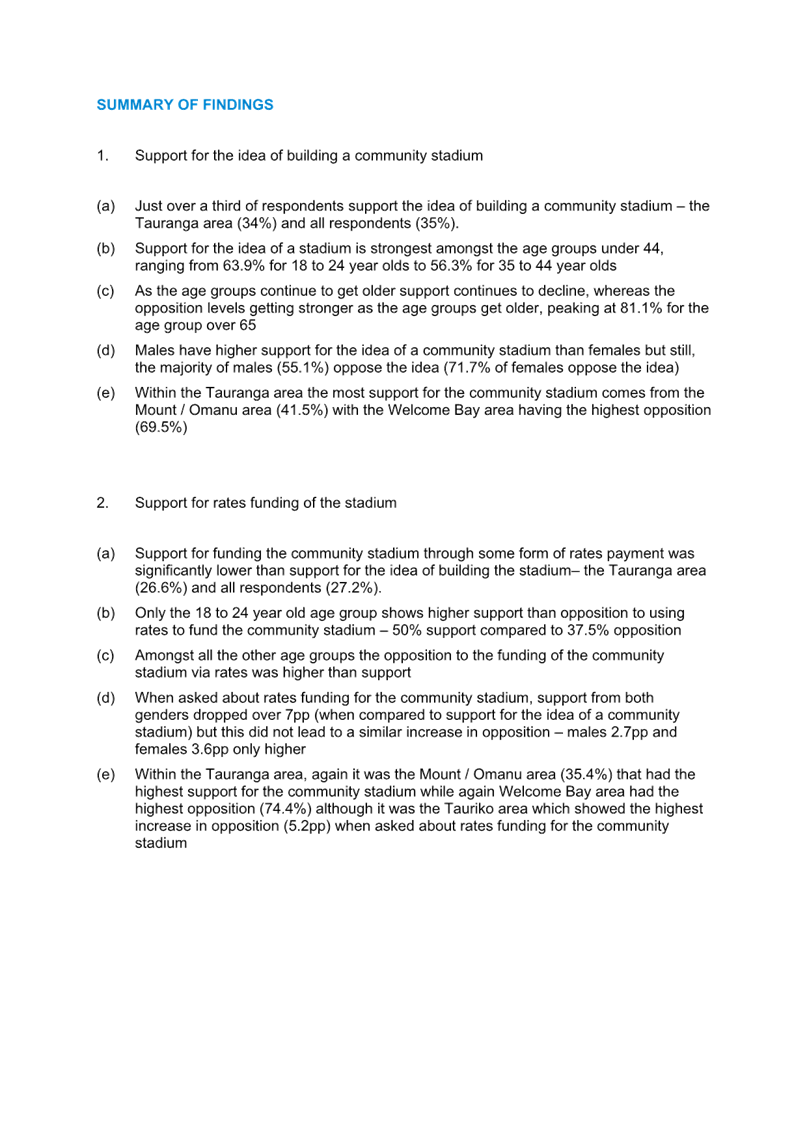

|

Location:

|

Bay of Plenty Regional Council Chambers

Regional House

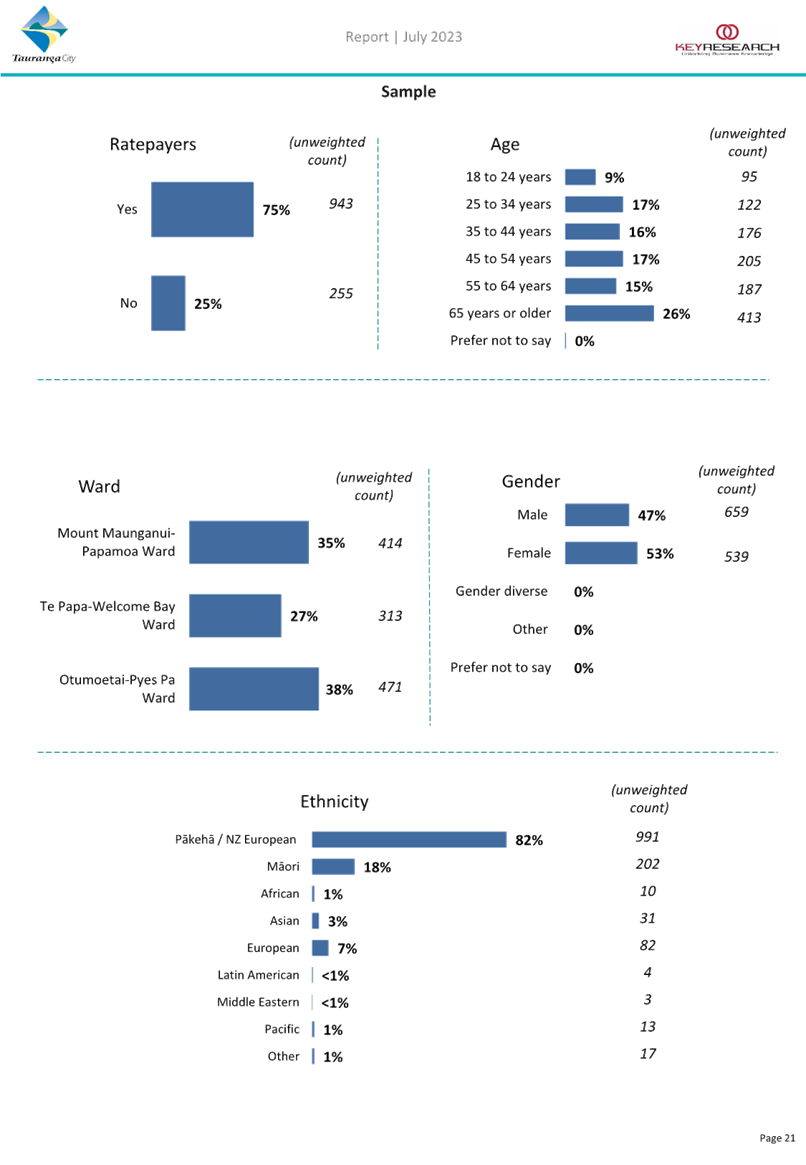

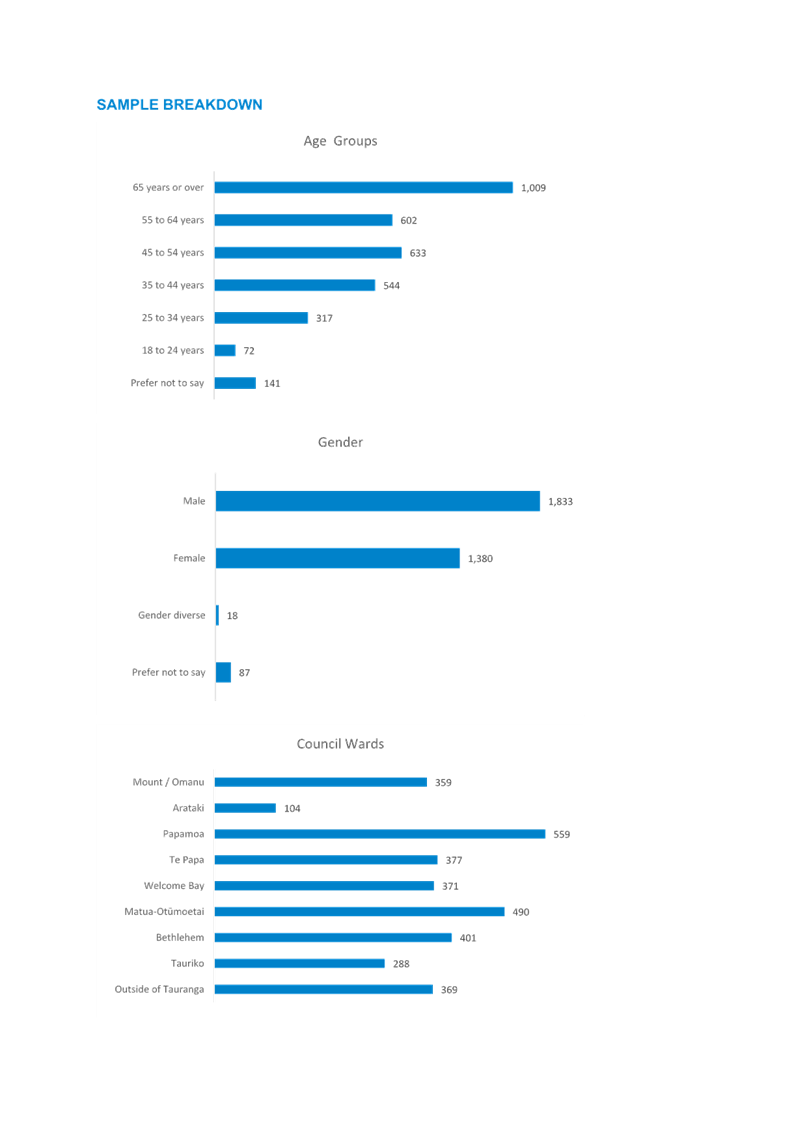

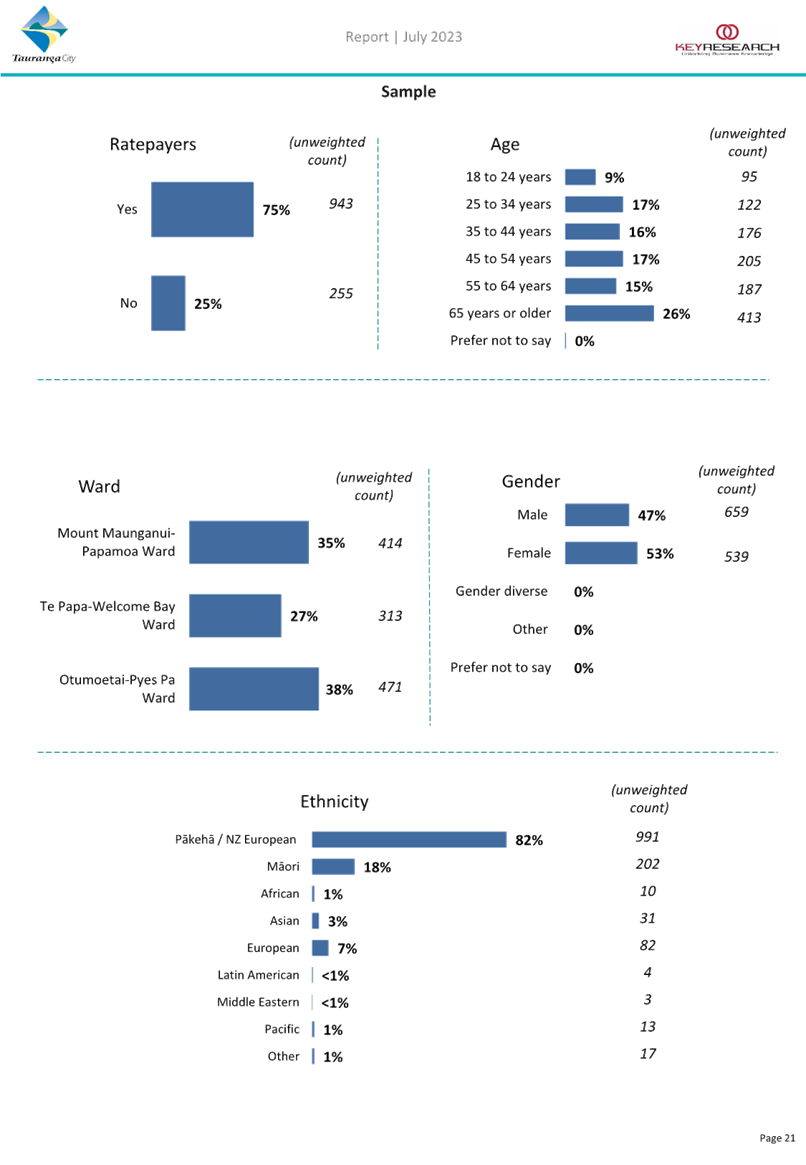

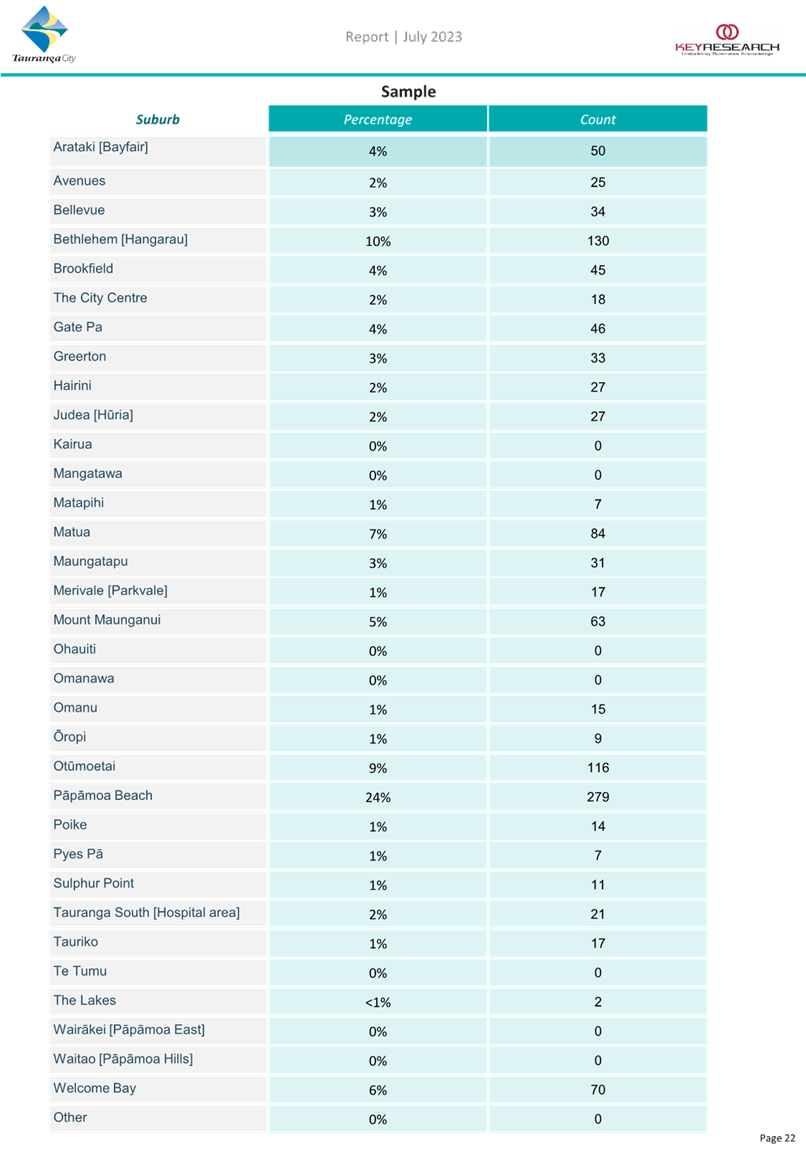

1 Elizabeth Street

Tauranga

|

|

Please note that this

meeting will be livestreamed and the recording will be publicly available on

Tauranga City Council's website: www.tauranga.govt.nz.

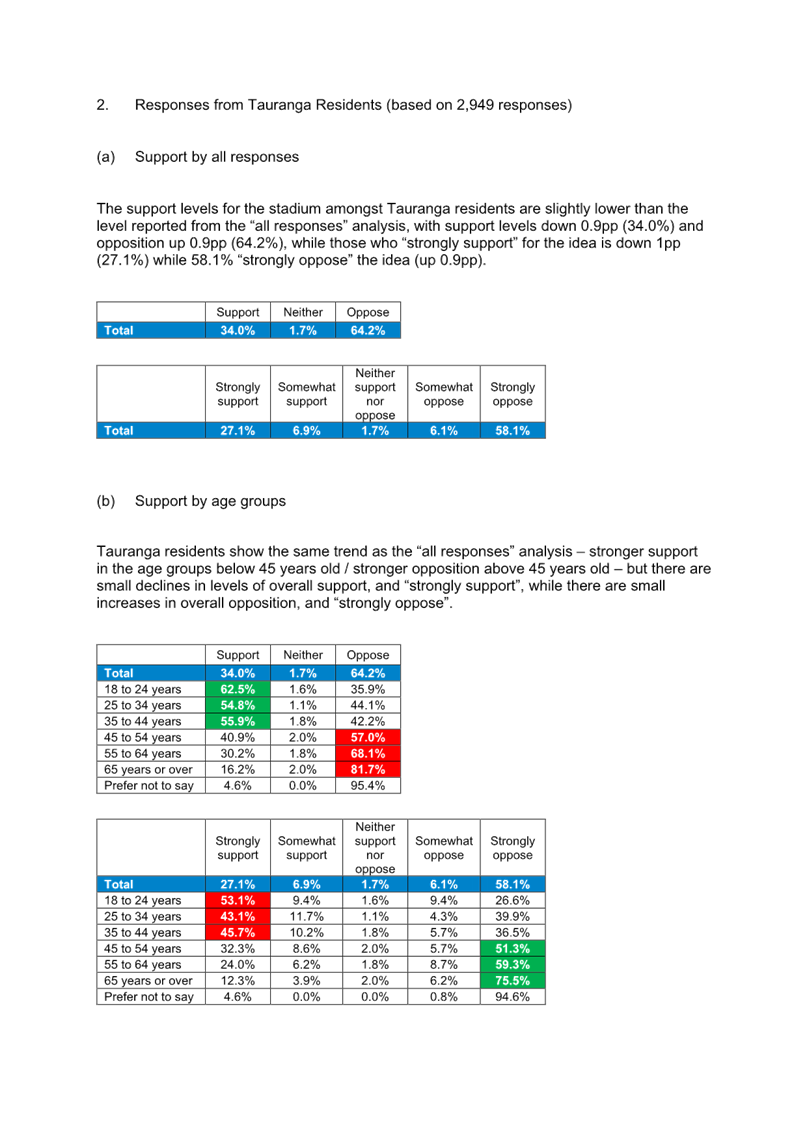

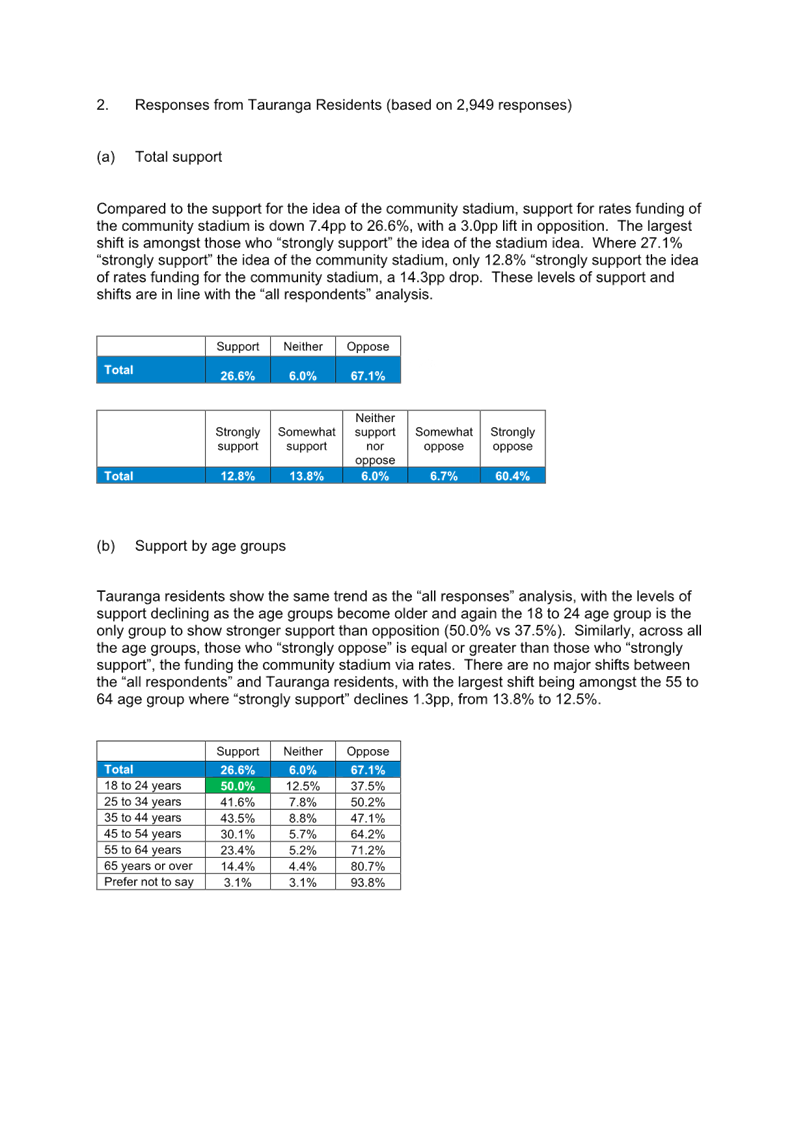

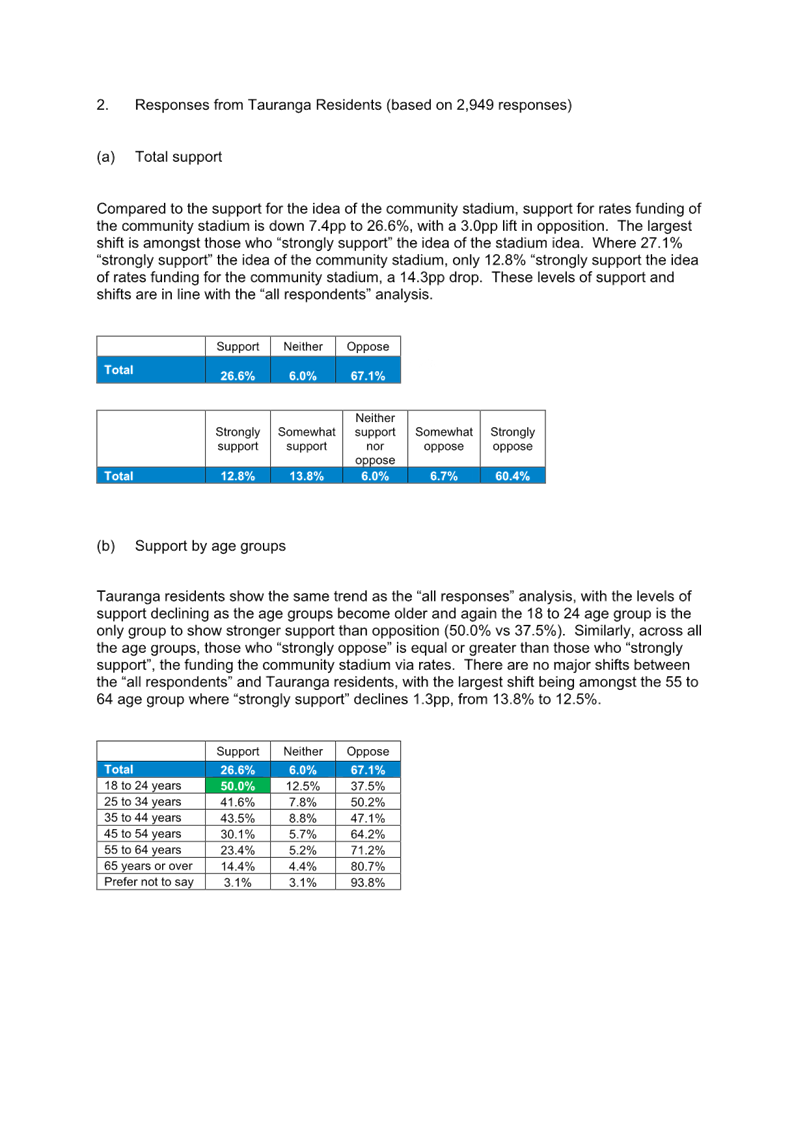

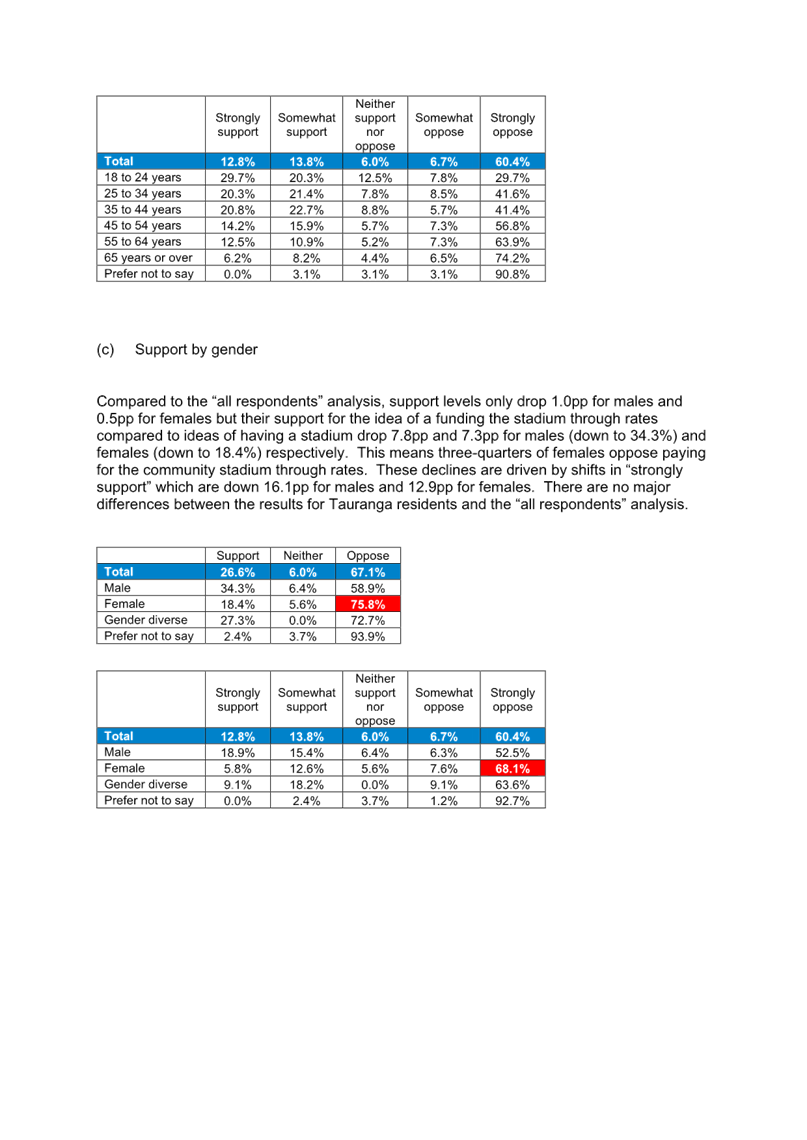

|

|

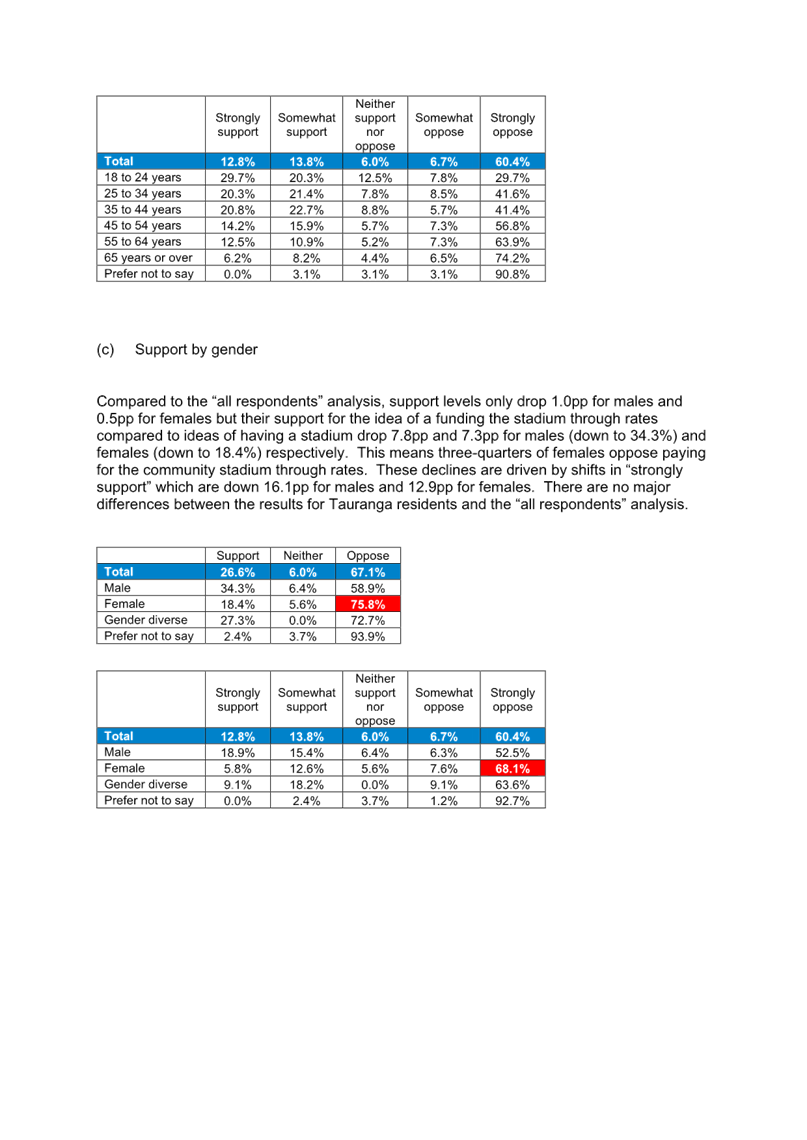

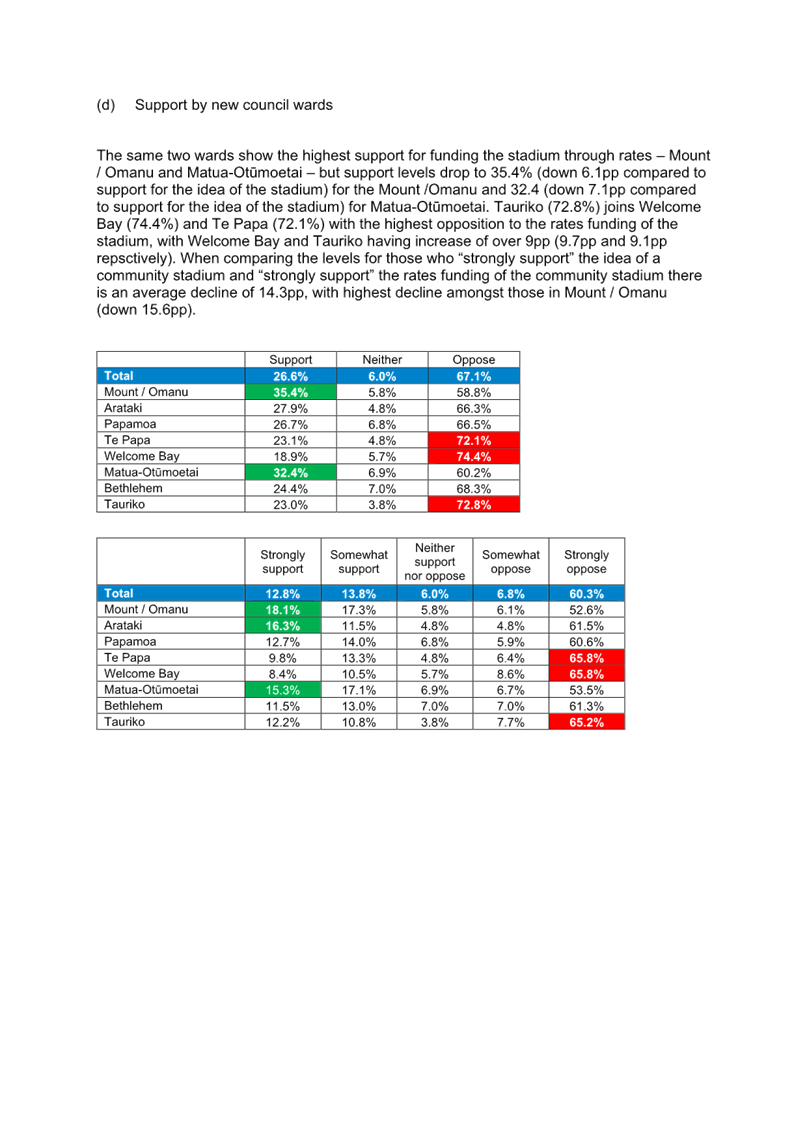

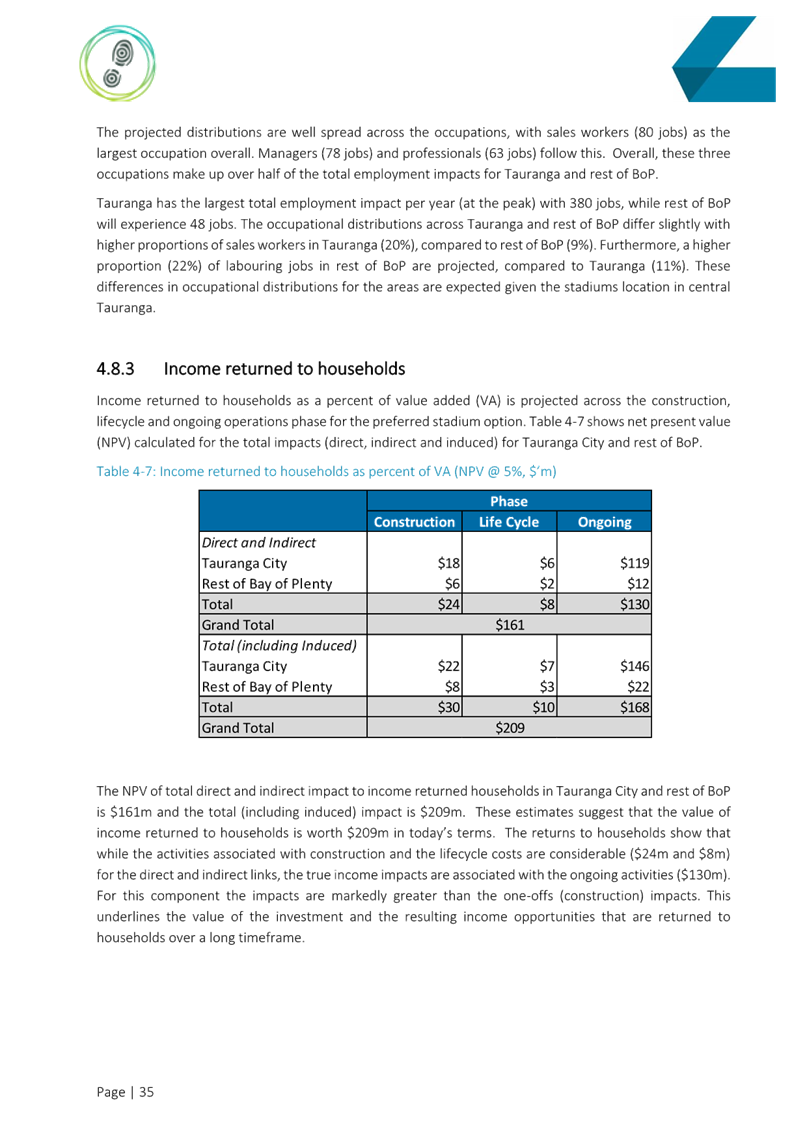

Marty Grenfell

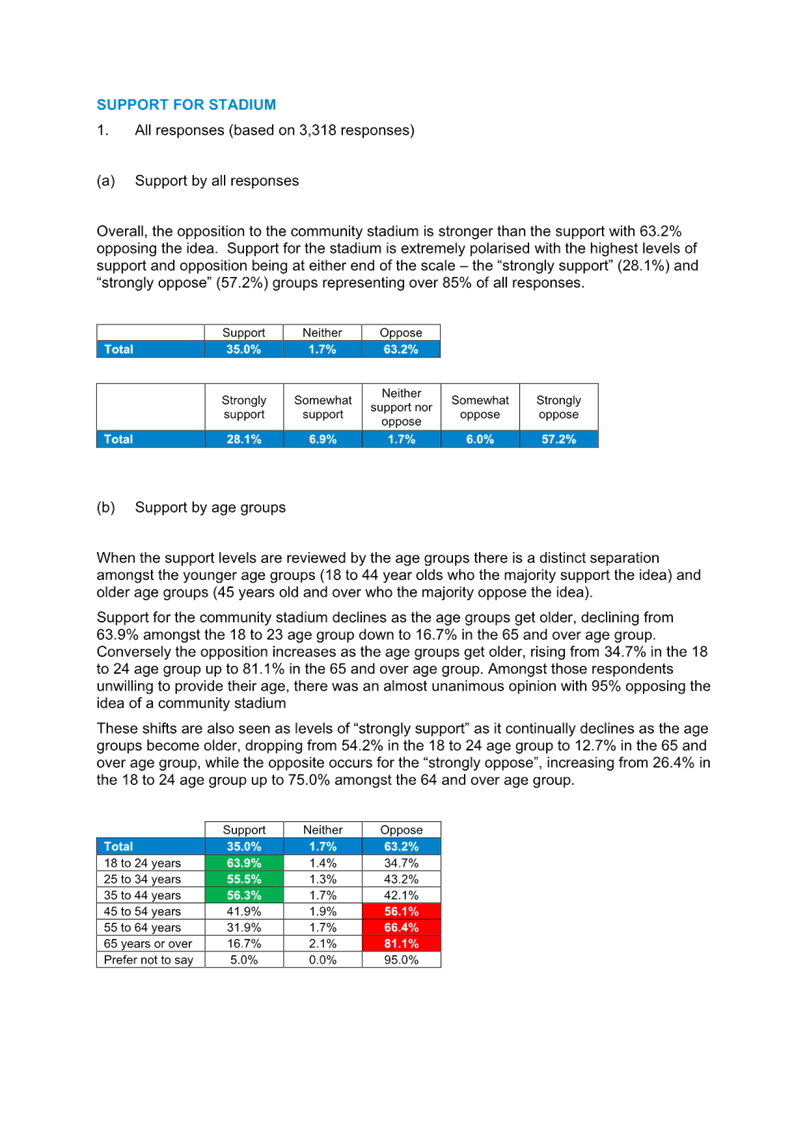

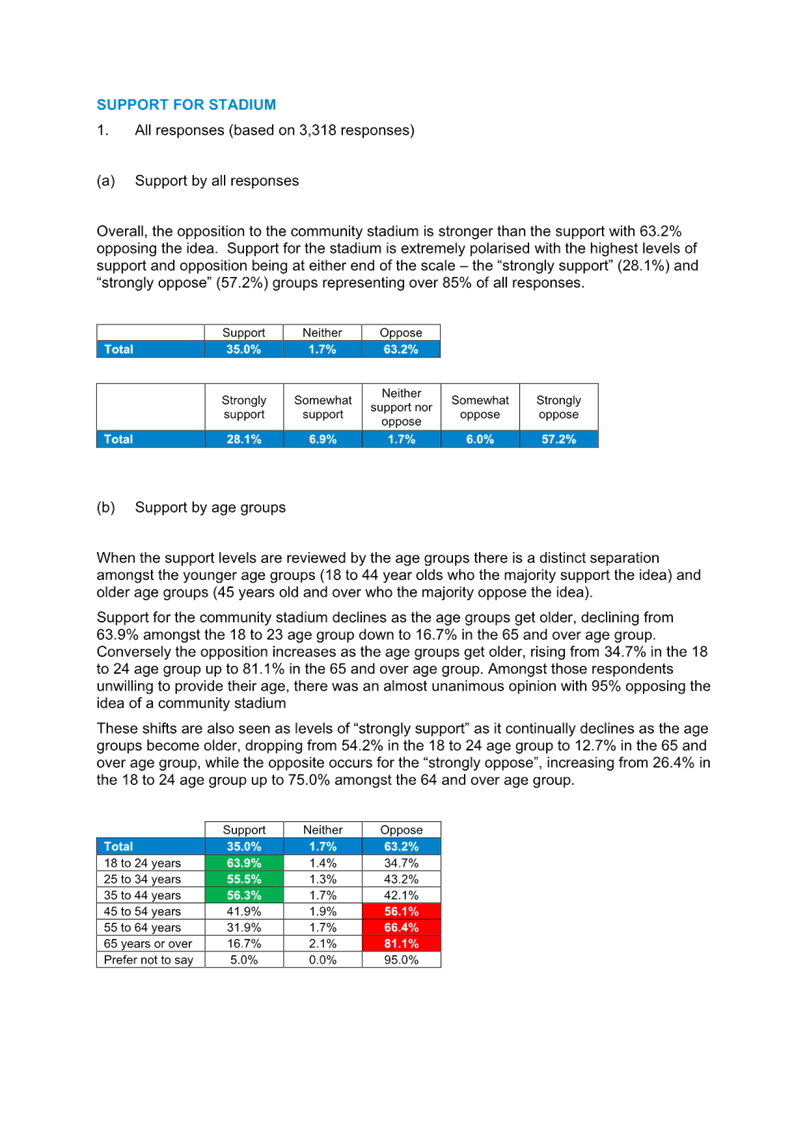

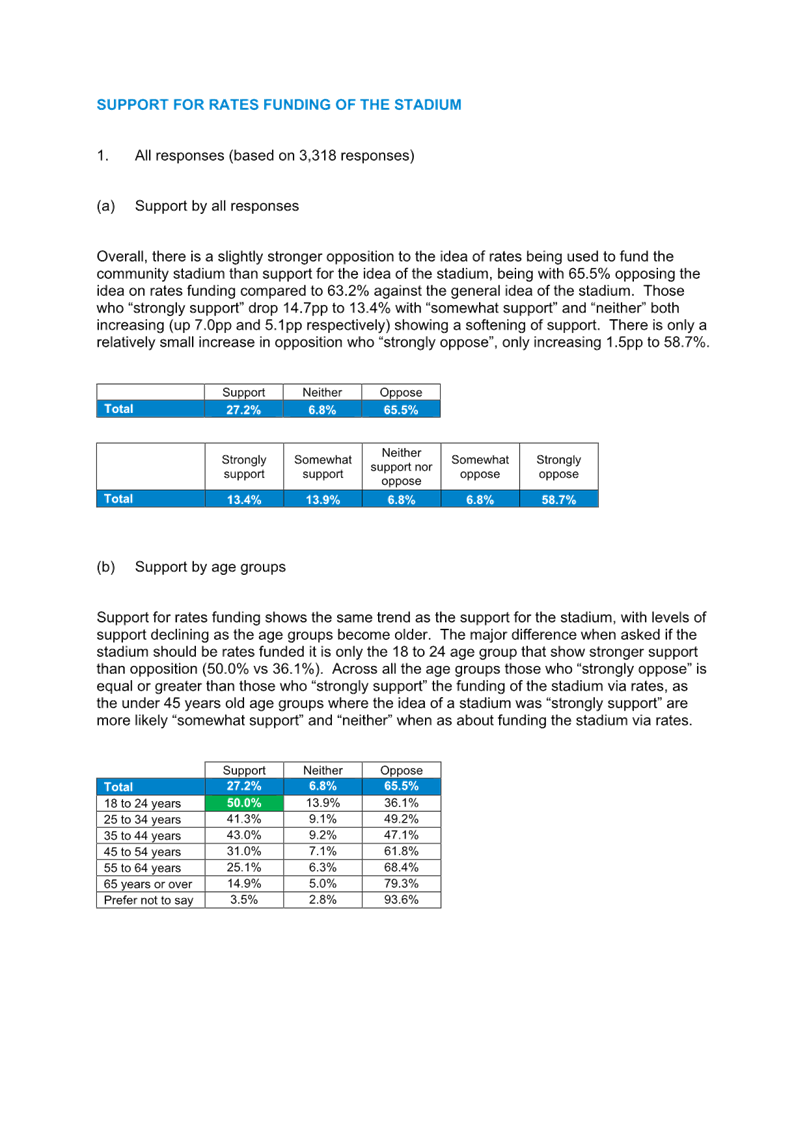

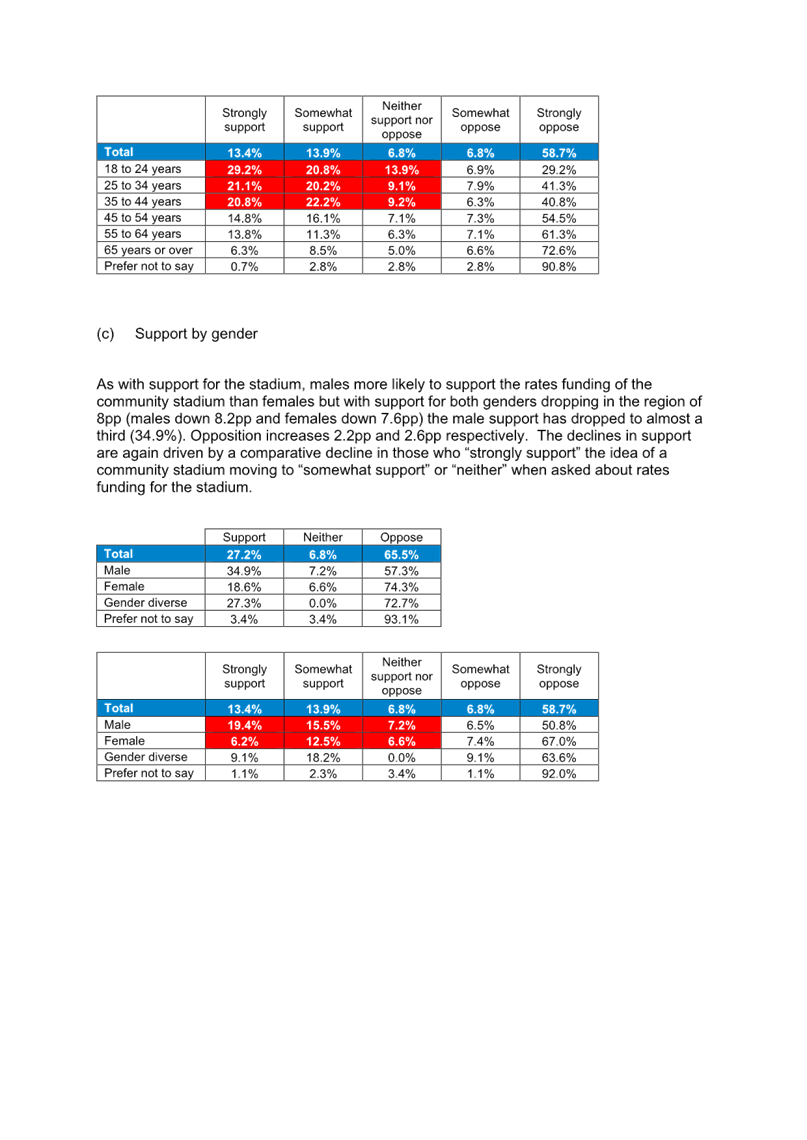

Chief Executive

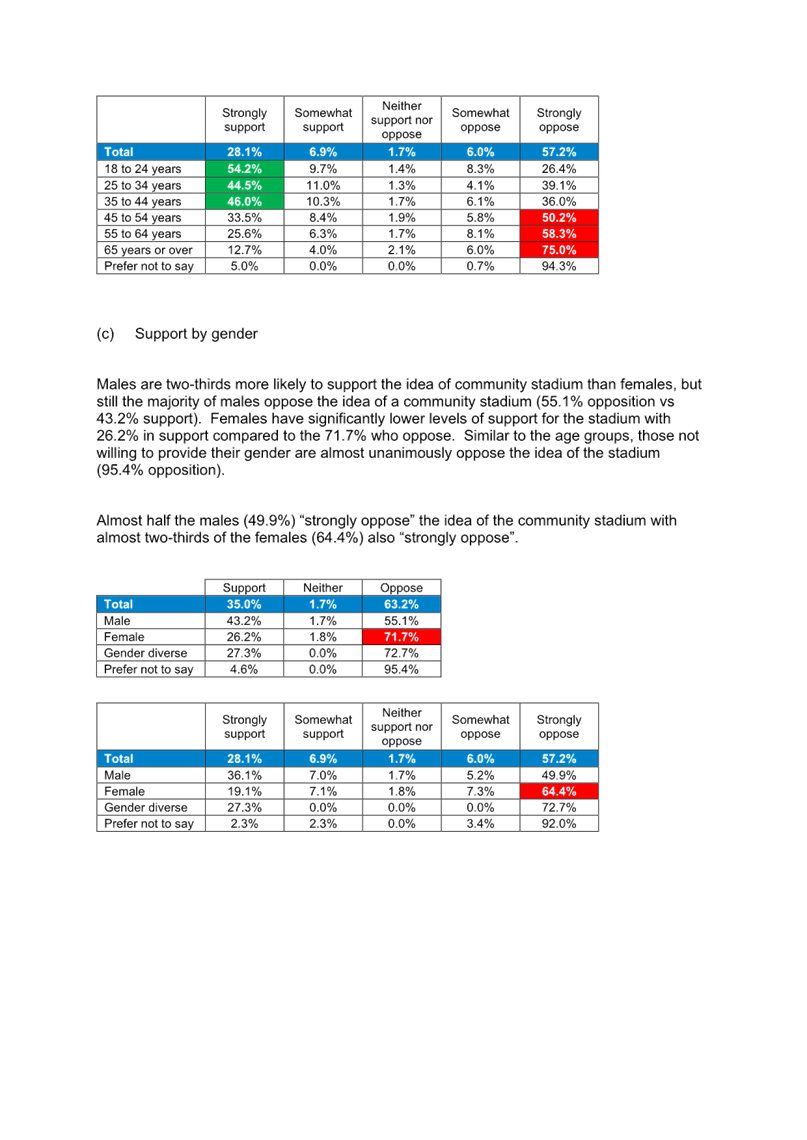

|

Membership

|

Chairperson

|

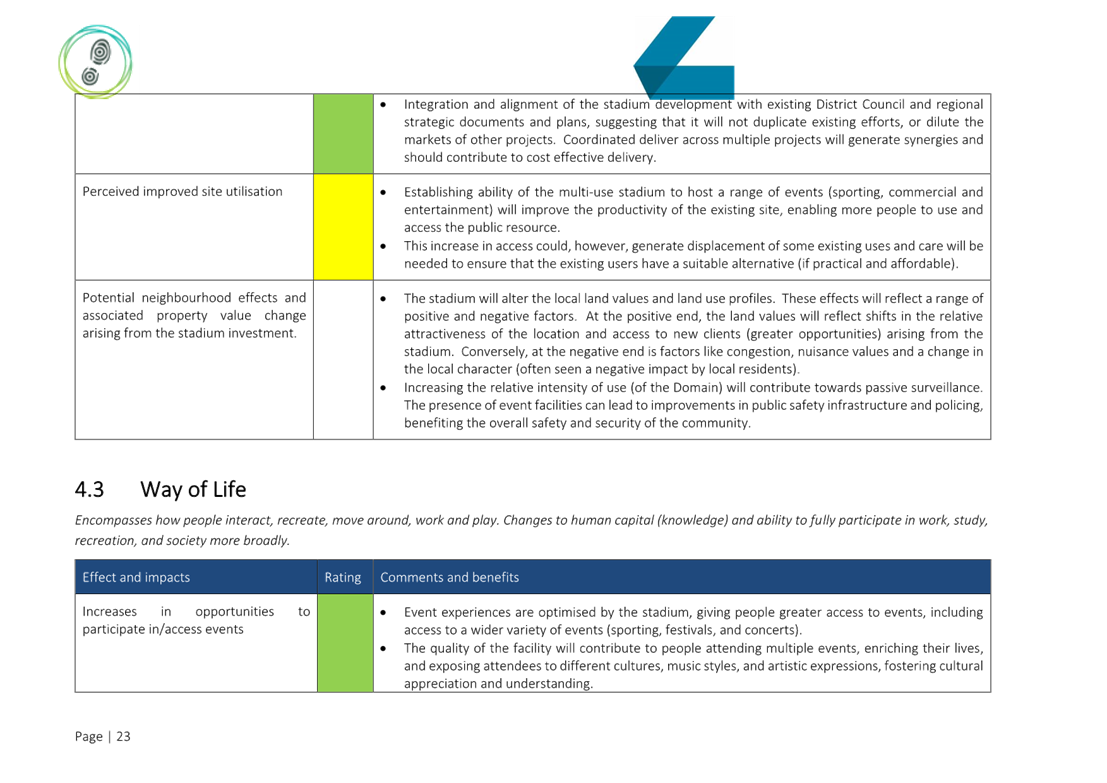

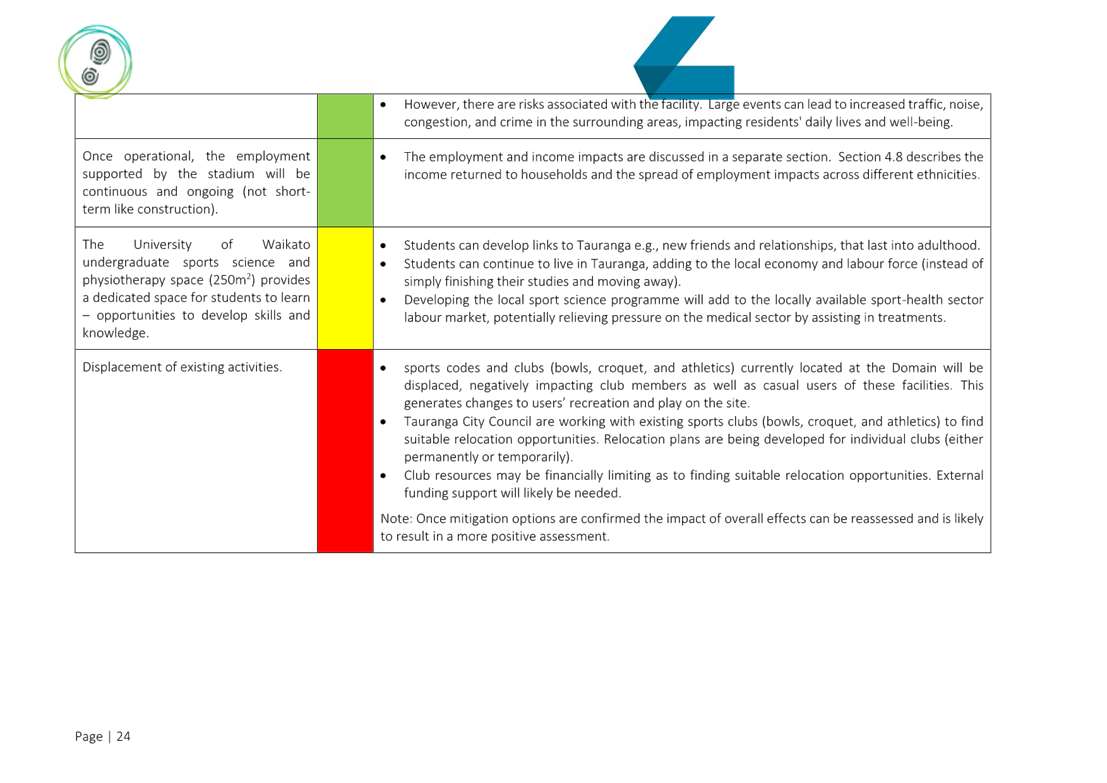

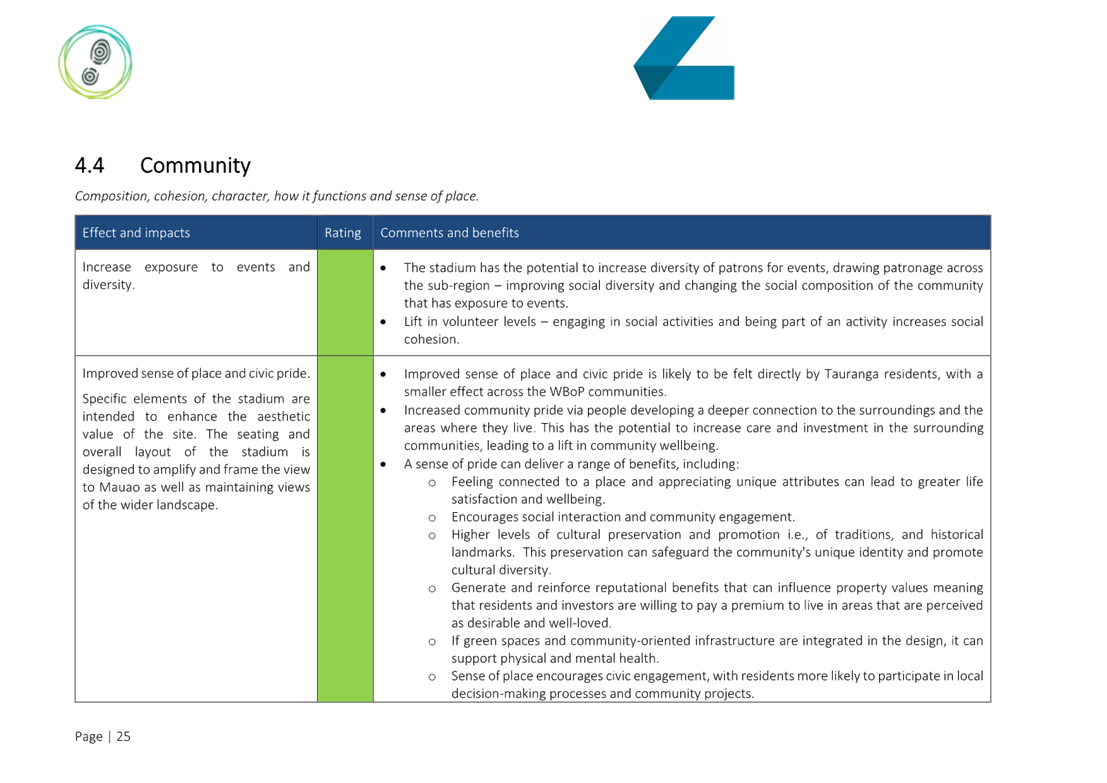

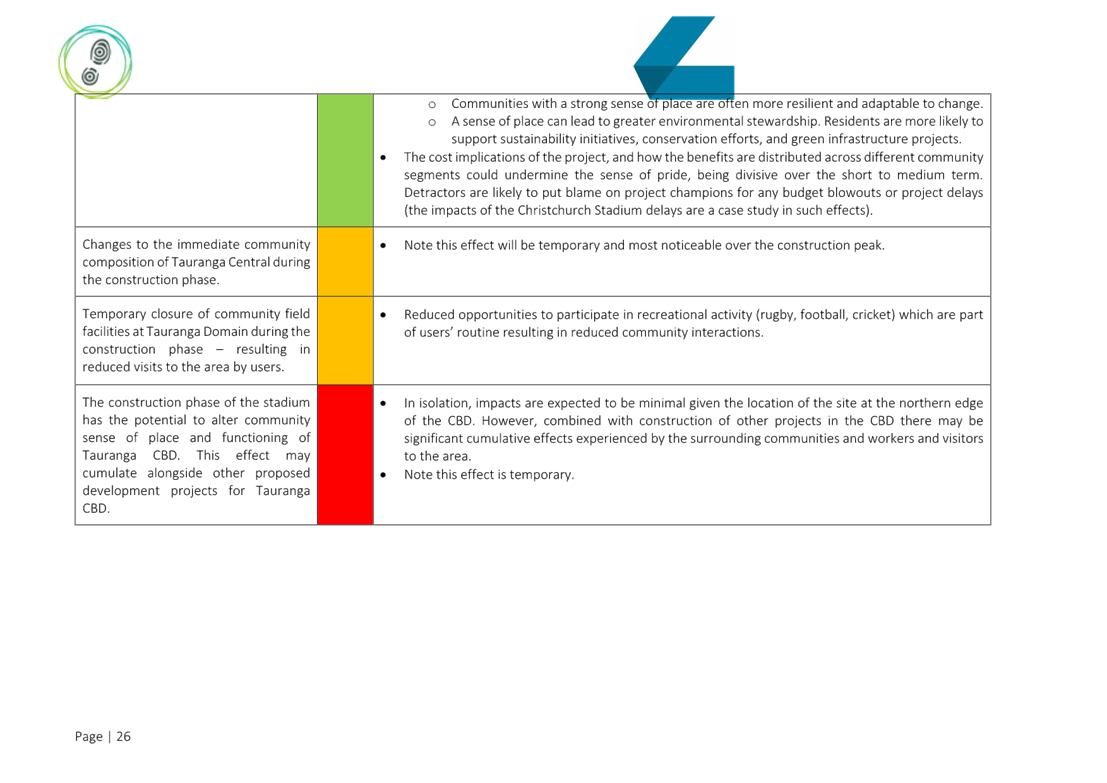

Commission

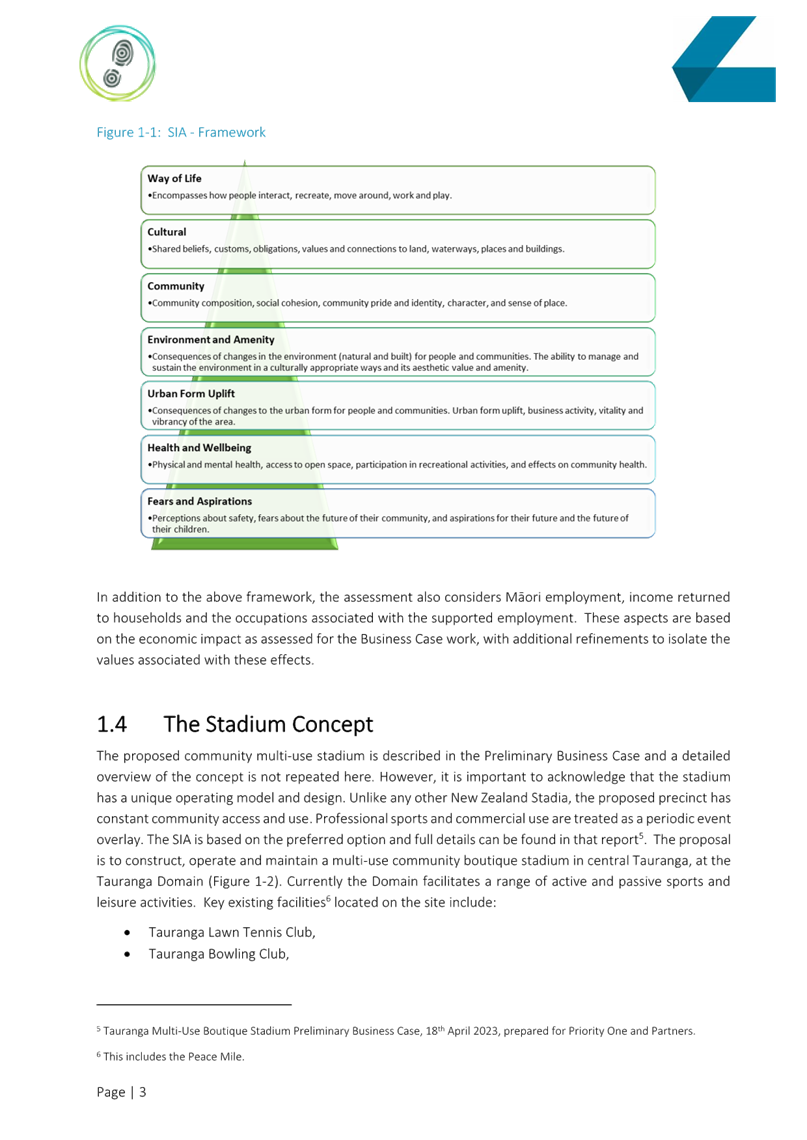

Chair Anne Tolley

|

|

Members

|

|

|

Quorum

|

Half of the members

physically present, where the number of members (including vacancies) is even;

and a majority of the members physically present, where the number of

members (including vacancies) is odd.

|

|

Meeting frequency

|

As required

|

Role

·

To ensure the effective and

efficient governance of the City

·

To enable leadership of the City

including advocacy and facilitation on behalf of the community.

Scope

·

Oversee the work of all committees

and subcommittees.

·

Exercise all non-delegable and

non-delegated functions and powers of the Council.

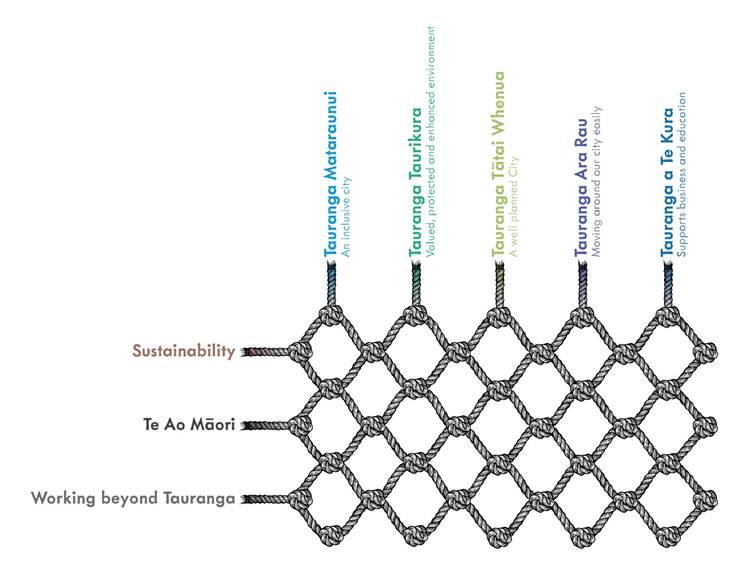

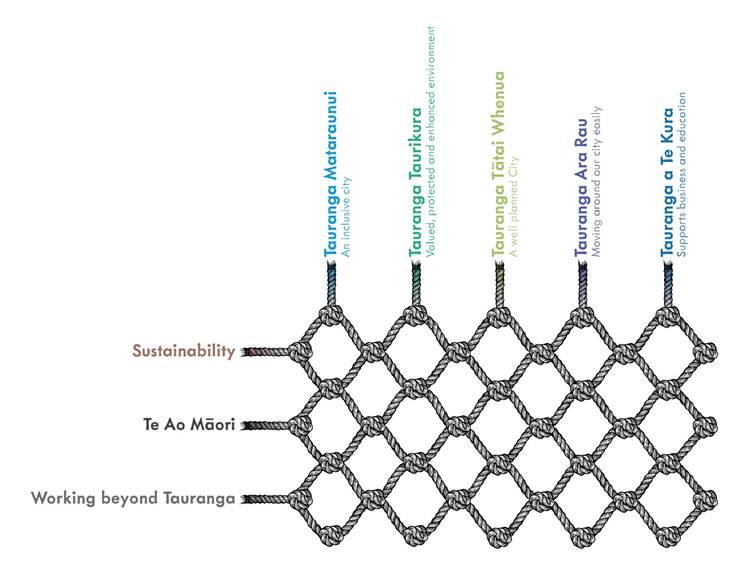

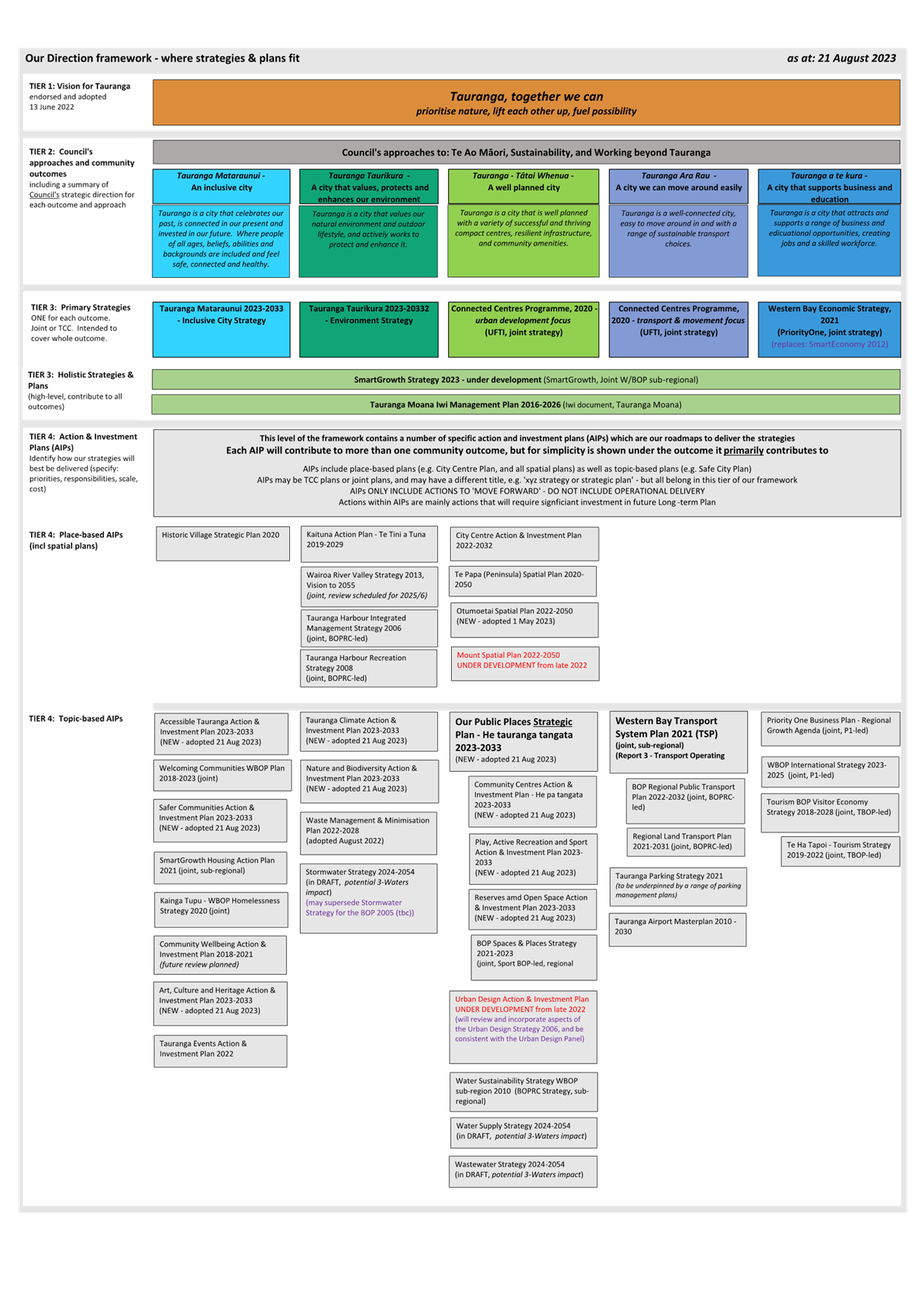

·

The powers Council is legally prohibited from delegating include:

o

Power to make a rate.

o

Power to make a bylaw.

o

Power to borrow money, or purchase or dispose of assets, other

than in accordance with the long-term plan.

o

Power to adopt a long-term plan, annual plan, or annual report

o

Power to appoint a chief executive.

o

Power to adopt policies required to be adopted and consulted on

under the Local Government Act 2002 in association with the long-term plan or

developed for the purpose of the local governance statement.

o

All final decisions required to be made by resolution of the

territorial authority/Council pursuant to relevant legislation (for example:

the approval of the City Plan or City Plan changes as per section 34A Resource

Management Act 1991).

·

Council has chosen not to delegate the following:

o

Power to compulsorily acquire land under the Public Works Act

1981.

·

Make those decisions which are required by legislation to be made

by resolution of the local authority.

·

Authorise all expenditure not delegated to officers, Committees

or other subordinate decision-making bodies of Council.

·

Make appointments of members to the CCO Boards of Directors/Trustees

and representatives of Council to external organisations.

·

Consider any matters referred from any of the Standing or Special

Committees, Joint Committees, Chief Executive or General Managers.

Procedural matters

·

Delegation of Council powers to Council’s committees and

other subordinate decision-making bodies.

·

Adoption of Standing Orders.

·

Receipt of Joint Committee minutes.

·

Approval of Special Orders.

·

Employment of Chief Executive.

·

Other Delegations of Council’s powers, duties and

responsibilities.

Regulatory matters

Administration, monitoring and

enforcement of all regulatory matters that have not otherwise been delegated or

that are referred to Council for determination (by a committee, subordinate

decision-making body, Chief Executive or relevant General Manager).

|

Ordinary

Council meeting Agenda

|

21

August 2023

|

3 Public

forum

3.1 Eamon

O'Connor - President -Tauranga Harbour Protection Society

Attachments

Nil

|

Ordinary

Council meeting Agenda

|

21

August 2023

|

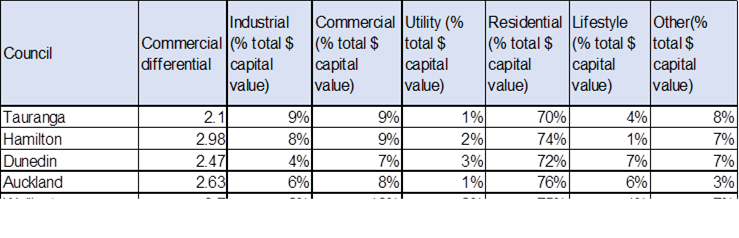

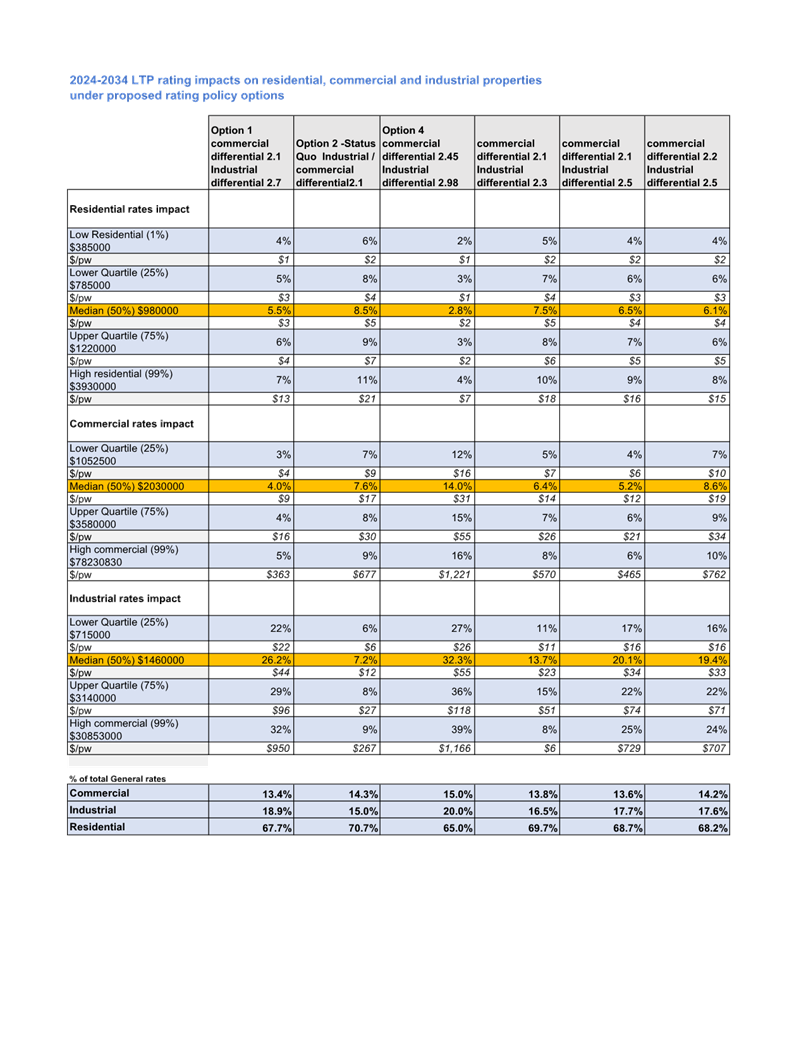

10 Recommendations

from other committees

10.1 Review

of Rating Categories to Differentiate Industrial Ratepayers

File

Number: A14959980

Author: Sarah

Drummond, Governance Advisor

Authoriser: Sarah

Drummond, Governance Advisor

Purpose of the Report

1. The purpose of this

report is to bring a recommendation from the Strategy Finance and Risk

Committer to Council for consideration. At its meeting on 7 August 2023, the

Committee passed the following resolution which includes a recommendation to

Council.

Item

9.2 - Review of Rating Categories to Differentiate Industrial Ratepayers Committee

Resolution SFR5/23/1

That

the Strategy, Finance and Risk Committee:

(a) Receives the council report

"Review of Rating Categories to Differentiate Industrial Ratepayers".

(b) Receives the attachment

“Report on Rating Categories – Differential by P J and

Associates”.

(c) Recommends

to Council to consider introducing a new rating category for industrial

properties (Option 1) in the development of the 2024-34 Long-term Plan.

2. In accordance with the

Committee recommendation SFR5/23/2 (c)

Council are now asked to consider introducing a new rating category for

industrial properties (Option 1) in the development of the 2024-34

Long-term Plan..

|

Recommendations

That the Council:

(a) Receives the report

"Review of Rating Categories to Differentiate Industrial Ratepayers

(b) Recommends to Council to

consider introducing a new rating category for industrial properties (Option

1) in the development of the 2024-34 Long-term Plan.

|

Attachments

Nil

|

Ordinary

Council meeting Agenda

|

21

August 2023

|

10.2 Report

- 2024 - 2034 Long-term Plan - Update - Funding and Reserves

File

Number: A14959985

Author: Sarah

Drummond, Governance Advisor

Authoriser: Sarah

Drummond, Governance Advisor

Purpose of the Report

1. The purpose of this

report is to bring a recommendation from the Strategy Finance and Risk

Committee to Council for consideration. At its meeting on 7 August 2023, the

Committee passed the following resolution which includes a recommendation to

Council.

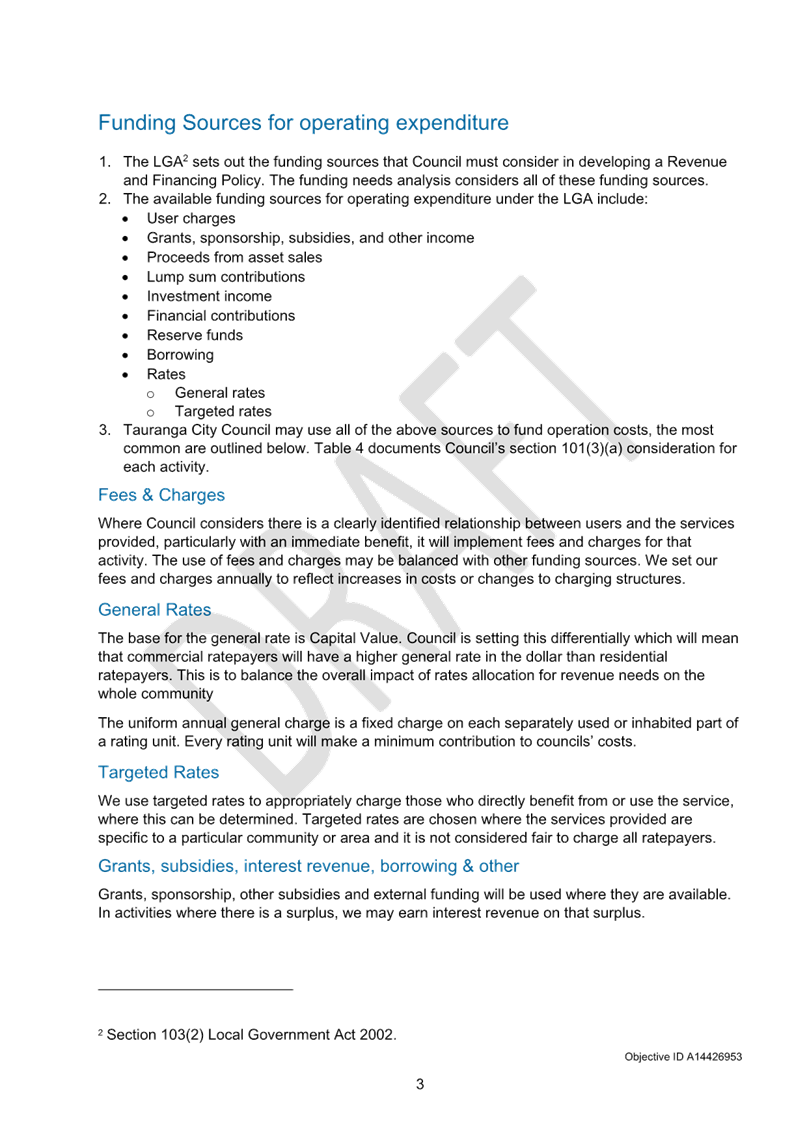

Item 9.7 2024 - 2034 Long-term Plan - Update - Funding and Reserves

That

the Strategy, Finance and Risk Committee:

(a) Receives the

report "2024 - 2034 Long-term Plan - Update - Funding and Reserves".

(b) Recommends to

Council that the following matters are considered in the LTP to address both

the significant impacts of large asset revaluations on depreciation and the

current risks and impacts on the depreciation reserves.

(i) Phasing in of increased

funding of depreciation expense in the early years of the LTP to mitigate the

otherwise significant up-front increases in rates arising from significant

asset revaluation.

(ii) Restoring depreciation

funding and the level of reserve balances within the ten years of the LTP.

(iii) Short term loan funding of

capital renewals for activities where there are insufficient depreciation

reserves.

(iv) additional rates funding to retire

debt for those activities where there are insufficient depreciable assets to

repay debt over time.

(c) Recommends to Council that

the phased retirement of debt in the weathertight and unfunded liabilities

reserve subject to rates affordability should aim to significantly reduce these

reserve deficits through the period of the LTP.

(d) Recommends that Council

consider the value of risk reserve funded through the LTP taking into account

both debt headroom maintained in the debt to revenue ratio below LGFA funding

limits and the value of the reserve.

2. In accordance with the

Committee recommendation SFR5/23/1 (b) (i) (ii) (iii) and (iv) (c) and (d) .

Council are now asked to consider those recommendations.

|

Recommendations

That the Council:

(a) Receives the report

"Report - 2024 - 2034 Long-term Plan - Update - Funding and

Reserves".

(b) Recommends to

Council that the following matters are considered in the LTP to address both

the significant impacts of large asset revaluations on depreciation and the

current risks and impacts on the depreciation reserves.

(i) Phasing in of

increased funding of depreciation expense in the early years of the LTP to

mitigate the otherwise significant up-front increases in rates arising from

significant asset revaluation.

(ii) Restoring depreciation

funding and the level of reserve balances within the ten years of the LTP.

(iii) Short term loan funding

of capital renewals for activities where there are insufficient depreciation

reserves.

(iv) additional rates funding to

retire debt for those activities where there are insufficient depreciable

assets to repay debt over time.

(c) Recommends to Council that

the phased retirement of debt in the weathertight and unfunded liabilities

reserve subject to rates affordability should aim to significantly reduce

these reserve deficits through the period of the LTP.

(d) Recommends that Council

consider the value of risk reserve funded through the LTP taking into account

both debt headroom maintained in the debt to revenue ratio below LGFA funding

limits and the value of the reserveType

Recommendation here

|

Attachments

Nil

|

Ordinary

Council meeting Agenda

|

21

August 2023

|

11 Business

11.1 2024-2034

Long-term Plan - Tauranga Community Stadium - update

File

Number: A14891193

Author: Kelvin

Eden, Capital Programme Manager: Major Community Amenity

Jeremy Boase,

Manager: Strategy and Corporate Planning

Authoriser: Gareth

Wallis, General Manager: City Development & Partnerships

Please

note that this report contains confidential attachments.

|

Public Excluded Attachment

|

Reason why Public Excluded

|

|

Item 11.1 - 2024-2034 Long-term

Plan - Tauranga Community Stadium - update - Attachment 4 - High level

funding assessment June 2023

|

s7(2)(i) - The

withholding of the information is necessary to enable Council to carry on,

without prejudice or disadvantage, negotiations (including commercial and

industrial negotiations).

|

Purpose of the Report

1. To provide an update on

the Tauranga Community Stadium project since Council considered the preliminary

business case, and to seek direction on the manner of any inclusion of the

project in the draft Long-Term Plan 2024-2034 budgets and consultation document.

|

Recommendations

That the Council:

(a) Receives

the report "2024-2034 Long-term Plan - Tauranga Community Stadium -

update".

(b) Approves

Option 2 – Staged Implementation Plan for inclusion in the draft

2024-2034 Long-term Plan, and budgets and consultation document. Current

details of this option include:

(i) Staged

delivery of the stadium commencing in 2029/30.

(ii) Capital

expenditure of $70 million for the first stage of which $40 million is

financed for budgeting purposes from rates-funded loans and $30 million from

other sources.

(iii) Balance

of the capital expenditure budget to be incurred beyond the term of the

2024-2034 Long-term Plan.

(iv) Operating

costs of $1 million per annum, plus appropriate debt servicing and

depreciation allocations.

(v) Continuation

of work with existing users of the Tauranga Domain to explore alternative

site options (e.g. athletics, bowls and croquet).

(vi) Continuation

of efforts to secure non-council funding for the capital costs of the

community stadium.

(c) Notes

that further details of the ‘staged implementation plan’ approach

will be established prior to the adoption of the final 2024-2034 Long-term

Plan, currently scheduled for April 2024.

(d) Approves

unbudgeted expenditure of a maximum of $900,000 in 2023/24 to further develop

and cost the ‘staged implementation plan’ option, and to seek

funding contributions from other project partners to share these costs.

Council’s share of the expenditure to be loan-funded operating

expenditure, based on the

expenditure offering long-term benefit associated with the proposed

investment. Rate funded debt retirement over ten years should be included in

the budgets from 2024/25 onwards.

(e) Attachment 4 can be

transferred into the open when all funding negotiations have been completed.

|

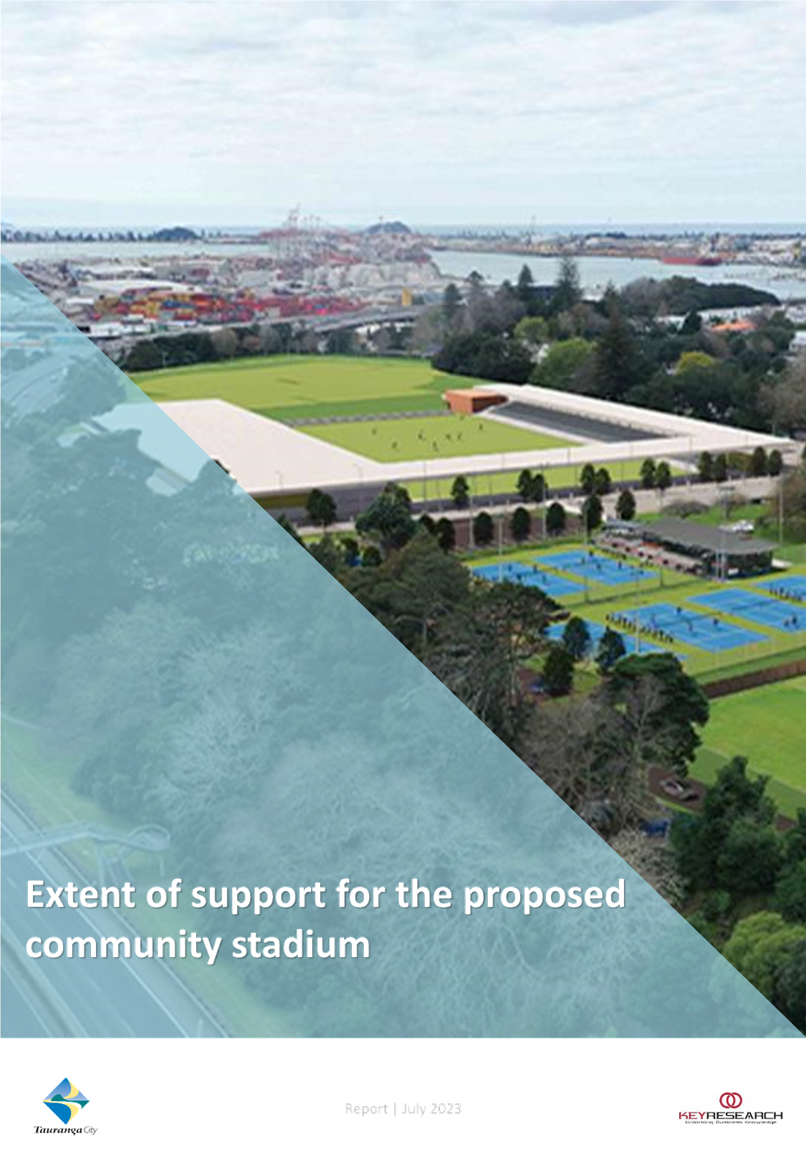

Executive Summary

2. Work on a proposed

community stadium has been underway for several years, led by Priority One in a

project partnership including Council. A needs assessment and a pre-feasibility

study have been completed, a detailed assessment process identified the

Tauranga Domain as the preferred location, and earlier this year a

comprehensive preliminary business case was completed and reported to Council.

3. That preliminary

business case supported a boutique multi-use community stadium including

flexible seating arrangements, a light exhibition centre, a function centre and

other ancillary facilities.

4. Following

Council’s receipt of the preliminary business case, project staff

undertook a significant community engagement exercise and simultaneously

continued investigating various aspects of the project in accordance with

Council’s direction. This report provides the outcome of the community

engagement exercise and also provides updates on other work undertaken.

5. In a demographically

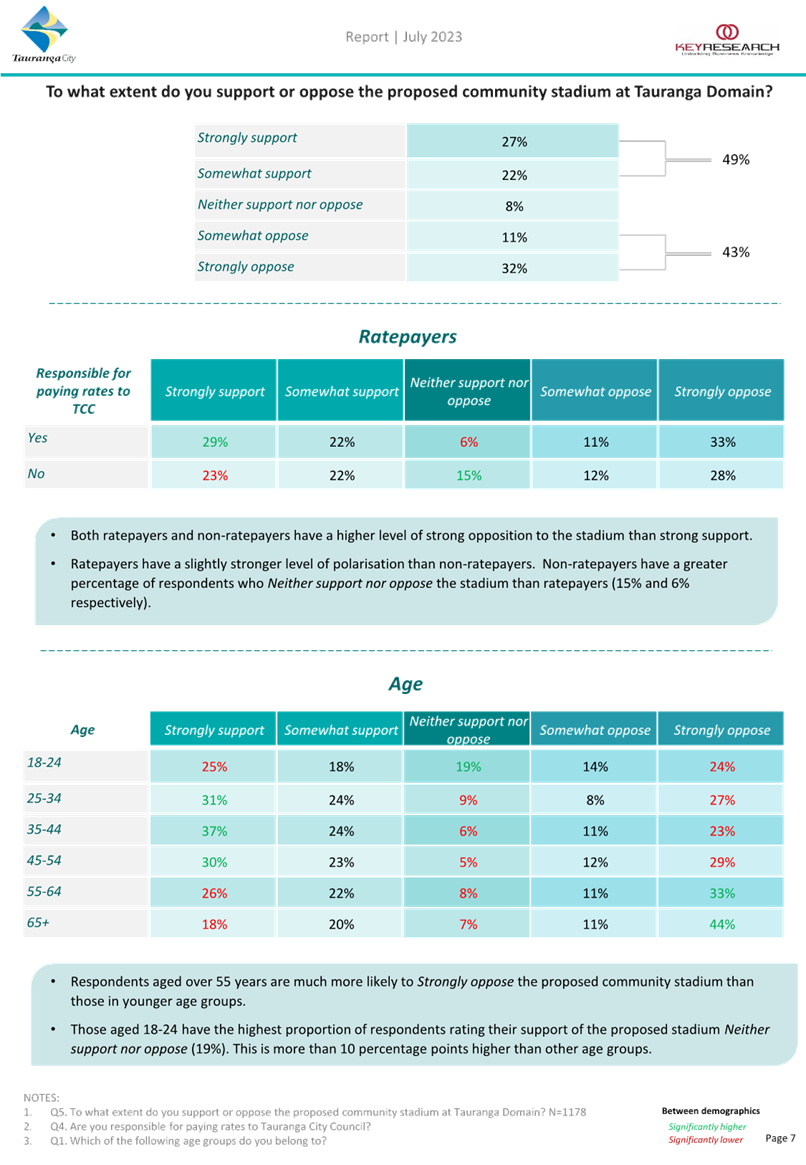

representative community survey, 49% of people strongly supported or somewhat

supported the proposed community stadium while 43% strongly opposed or somewhat

opposed it. When asked about a proportion of the funding of the proposed community

stadium coming from annual rates, support dropped and opposition increased.

6. When considered across

age-groups, support for the stadium was significantly greater in the 25-54

age-groups while opposition was significantly greater in the 55+ age-groups.

7. In recognition of

Council’s financial position and considering the interests of existing

users of the Tauranga Domain, a staged implementation plan has started to be

explored. This would enable the start of construction of the proposed community

stadium to be delayed until the current athletics track reaches the end of its

planned useful life and therefore, needs replacement. This staged

implementation approach is recommended for inclusion in the draft 2024-2034

Long-term Plan for the purposes of further community consultation.

8. In recognising that the

development of this approach is in its early stages, further funding is sought

in this financial year to better develop a practical implementation plan for

the staged approach. The results of this extra work will enable detailed

consideration of the approach by Council prior to the adoption of the final

2024-2034 Long-term Plan, scheduled for April 2024.

Background

Recent project history

9. Since late 2018, work

has been underway regarding the potential for establishing a sub-regional

stadium. This work has been led by a project partnership including Priority

One, Tauranga City Council, Bay of Plenty Regional Council and Sport New

Zealand. Between 2019 and 2022 the project partnership commissioned and

received reports titled:

· Needs assessment

report

· Pre-feasibility

study

· Site selection

report

· Feasibility

study.

10. When the feasibility study was

presented to Council (23 May 2022), Council agreed in principle that the

Tauranga Domain is the suitable site for a community stadium and approved

Council’s participation in the project’s next steps, including

development of a business case, further design work, and ongoing engagement

with mana whenua and affected parties.

11. Over the following 12 months, the

project partners commissioned a team of consultants, led by Visitor Solutions

Ltd and Tuhura Consulting, to prepare a preliminary business case.

12. On 1 May 2023, Council considered a

report titled Tauranga Community Stadium – preliminary business case.

13. The preliminary business case

recommended an option for a new multi-use community stadium with the following

elements:

· Boutique community

stadium with 7,000 permanent seats and provision for 8,000 temporary seats (circa

5,000 being prefabricated seating modules).

· Light exhibition

centre (circa 2,000m2 exhibition space plus support facilities).

· Function centre

(circa 1,300m2).

· Community

multi-sport facility (circa 400m2 of changing room and lounge

space).

· Waikato

University Sports Science / Physiotherapy facility (circa 250m2

dedicated space and shared spaces).

14. Following consideration of the 1

May 2023 report and the attached final preliminary business case, Council

resolved to:

(a) Receive

the report

(b) Note

that further consultation and any decisions regarding future Council

participation and funding of the Tauranga Community Stadium could occur via the

2024-2034 Long-term Plan Process, with ongoing community engagement (including

city, regional and subregional wide communities) occurring in addition to

formal consultation processes as appropriate.

(c) Refer

the Preliminary Business case to Tauranga Domain User Groups and any other

relevant groups for their information.

(d) Request

a report back from Tauranga City Council staff on funding and affordability

considerations including operational costs and the likely relocation costs of

existing groups so a comprehensive funding picture is provided prior to

consideration for inclusion in the 2024/2034 Long-term Plan.

(e) Ensure

that the region wide social and economic benefits are clearly enunciated in the

business case along with direct benefits and costs.

(f) Request

Tauranga City Council staff continue to engage with sporting groups on

identifying future options for relocation if the stadium project progresses.

(g) Report

back on potential ownership and operational delivery structure.

(h) Report back on the likely

costs of undertaking the above work and how it would be funded.

Response

to May 2023 resolutions

15. This report provides an update on

progress against the 1 May 2023 resolutions, including the outcome of recent

widespread community engagement, and seeks direction on how, if at all, the

project should be included in the 2024-2034 Long-term Plan consultation

document.

16. Resolution (a) from 1 May 2023

needs no further action.

17. Resolution (c) was actioned

following the 1 May 2023 meeting by provision of the final preliminary business

case document to all relevant groups as part of ongoing engagement between

council and those groups.

18. Resolution (f) has been actioned

through the continuation of extensive engagement with stakeholders that has

been underway since Council endorsed a preliminary masterplan for the Tauranga

and Wharepai Domains in October 2022 (alongside similar preliminary masterplans

for Blake Park and Baypark). The outcome of that engagement is scheduled to be

presented to the Council meeting on 4 September 2023 in a separate report

titled Active Reserves Masterplans.

19. With regard to resolution (h), the

work undertaken since May 2023 has largely been led by Priority One on behalf

of the project partners and has been funded from the original funding provided

to the project by the partners in 2022 (Council provided $100,000 in 2021/22 as

its share of the feasibility study and a further $200,000 in 2022/23 as its

share of the preliminary business case). In addition to this, council has

incurred approximately $34,000 of costs in regard to the community survey described

below and associated media costs.

20. The other resolutions from 1 May

2023 are considered in the following sections.

Community engagement process (1 May 2023 resolution

(b))

21. Commencing on 26 June 2023, council

undertook a significant community engagement exercise seeking to determine the

likely level of support for the proposed community stadium at the Tauranga

Domain. This engagement exercise was supported by printed press adverts and

articles, radio advertising, and online advertising.

22. The engagement exercise was split

into two strands:

(a) a

demographically representative market research survey managed by Key Research

Limited; and

(b) a self-select survey managed

by council.

23. Both surveys asked exactly the same

questions. These were:

(i) To

what extent do you support or oppose the proposed community stadium at Tauranga

Domain? (responses on a five-point scale)

(ii) To

what extent do you support or oppose a proportion of the funding of the

proposed community stadium to come from annual rates? (responses on a

five-point scale)

(iii) What

economic benefits, if any, do you think the construction and the use of the

proposed community stadium could bring to Tauranga? (free text responses)

(iv) What

community or social well-being benefits, if any, do you think the proposed

community stadium could bring to Tauranga? (free text responses)

(v) An

invitation to provide any further comments or feedback. (free text responses)

(vi) Demographic questions.

24. People completing both surveys were

directed to project information on council’s website before being invited

to complete the survey. Both surveys opened on 26 June 2023 and closed on 21

July 2023.

25. The only difference in the surveys

was in the methodology used to generate responses.

26. Key Research operated a

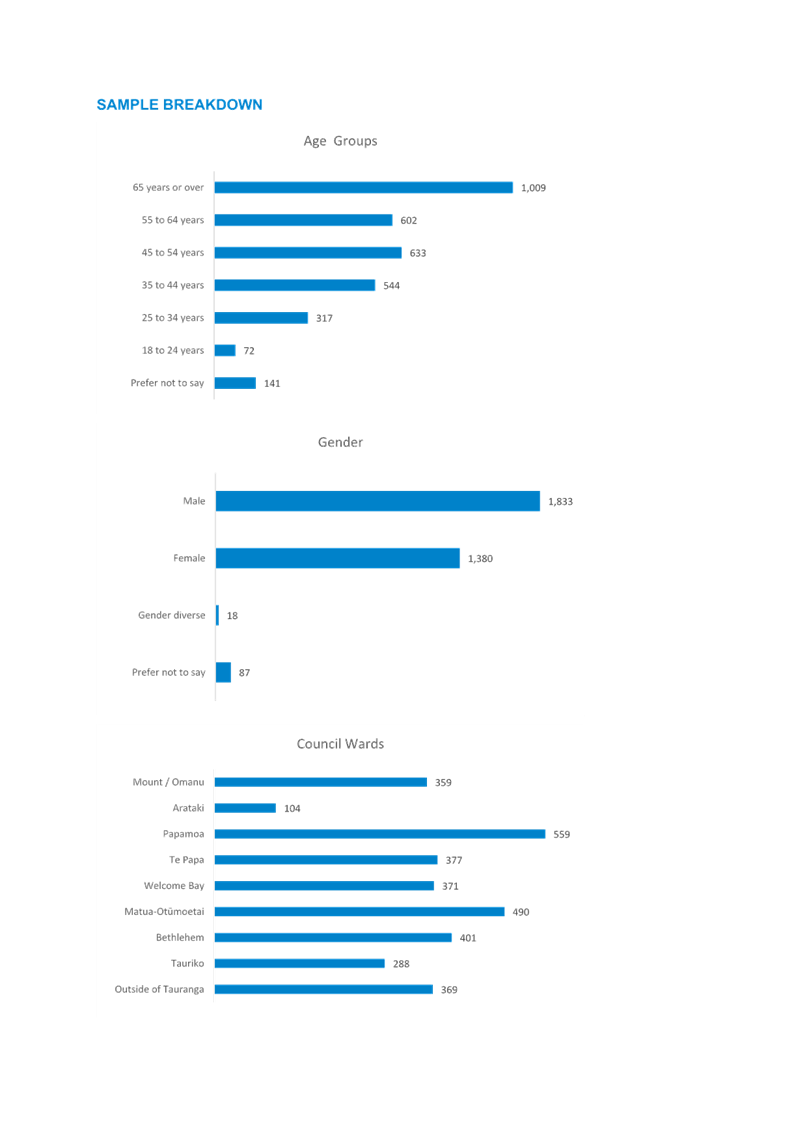

postal-to-online survey, sending invitations to take part to 10,000 people

randomly selected from the electoral roll in the Tauranga City area. The

objective was to generate 1,000 responses from this approach. By the time the

survey closed, 1,198 responses were received. Once data had been received, Key

Research weighted the sample to ensure reporting is exactly representative of

key population demographics per the 2018 census. The sample of 1,198

respondents has an expected 95% confidence interval (margin of error) of +/-

2.8%.

27. The council-managed survey was

available to all through council’s website. In total 3,318 responses were

received to the self-select survey. A self-select survey has an inherently

higher margin of error than a demographically representative survey of similar

size.

28. Taken together, 4,516 responses to

the two surveys were received.

Community engagement results – demographically

representative market research survey

29. A copy of the Key Research report

titled Proposed Community Stadium Survey 2023 is included as Attachment

1 to this report.

30. The key findings are summarised on

pages 4 and 5 of the Key Research report and are further summarised here in the

interests of brevity.

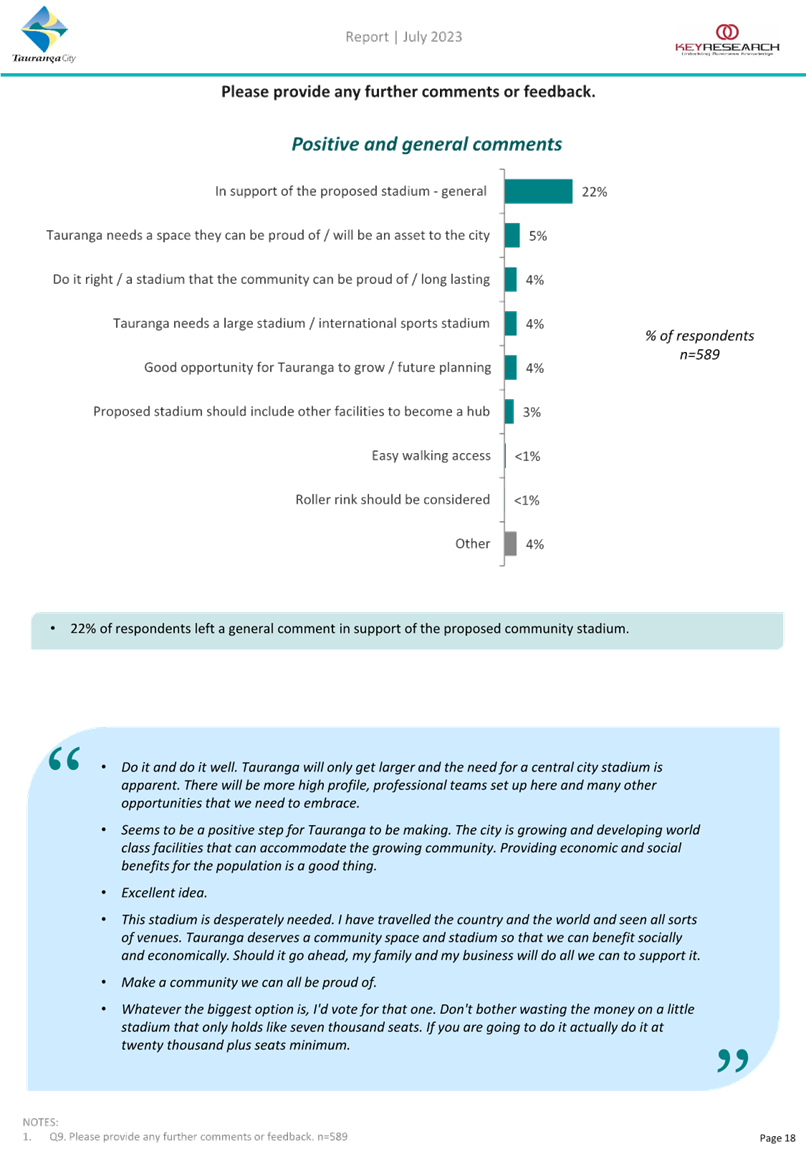

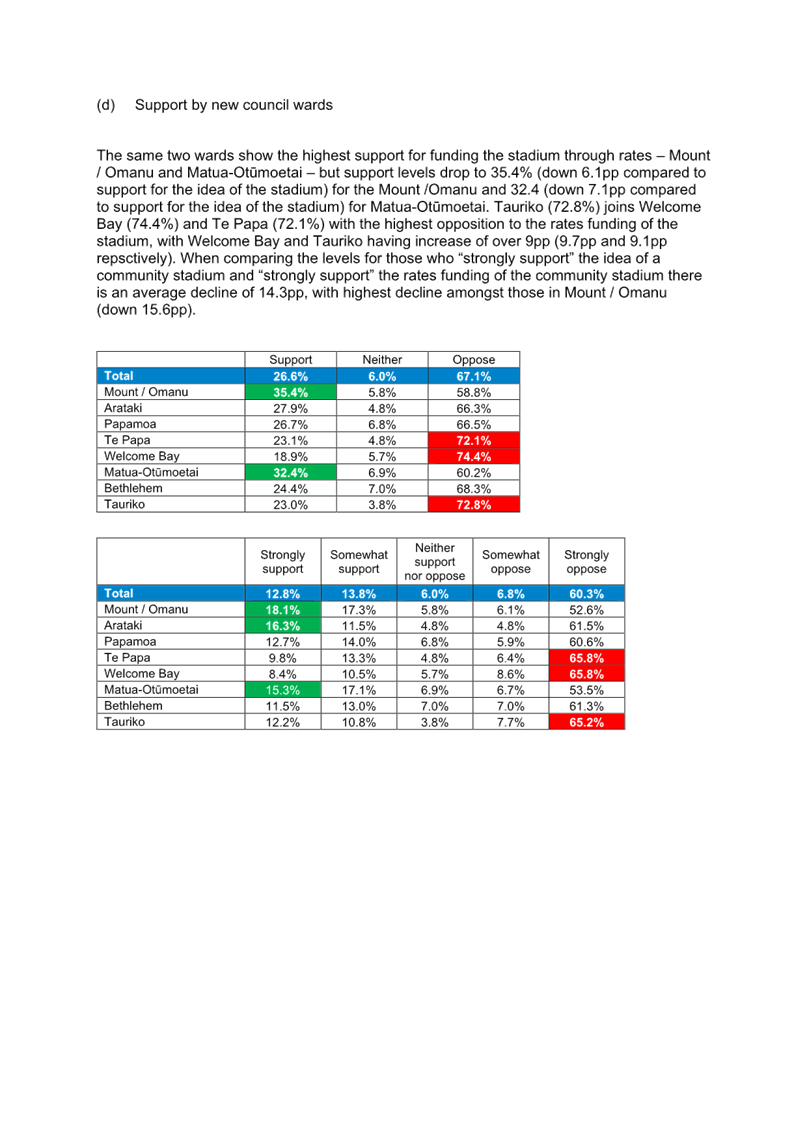

Community

stadium

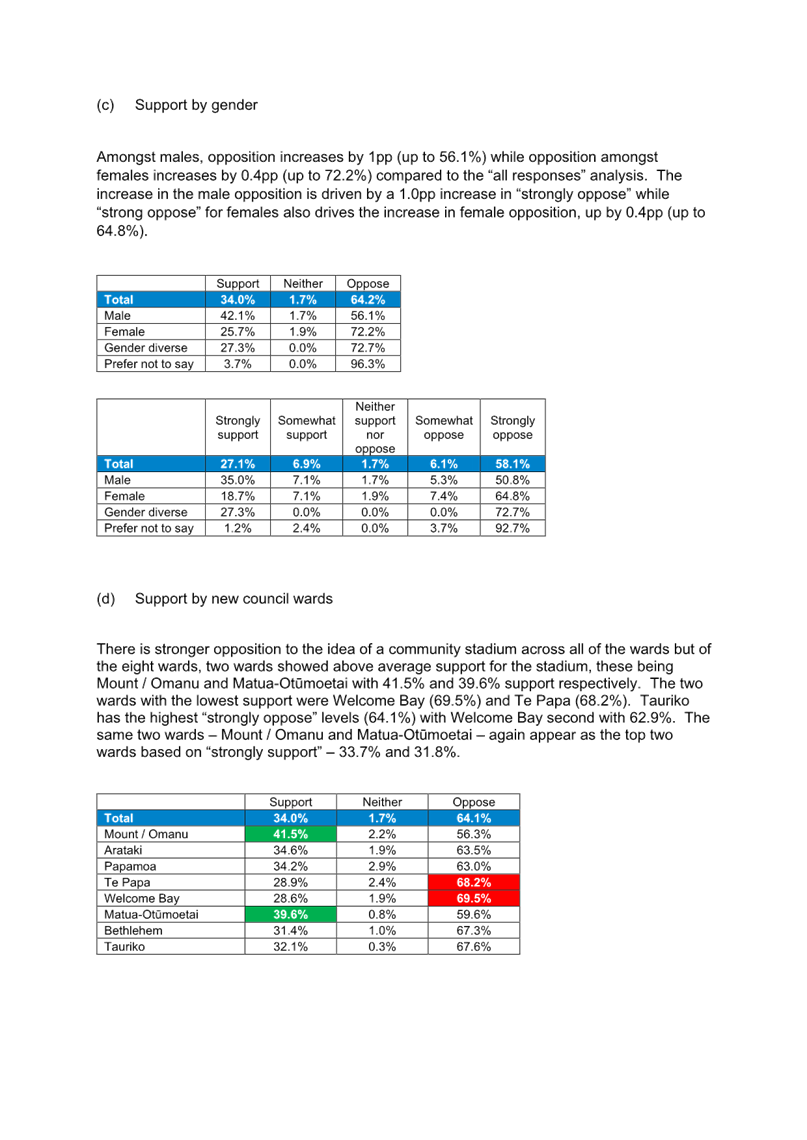

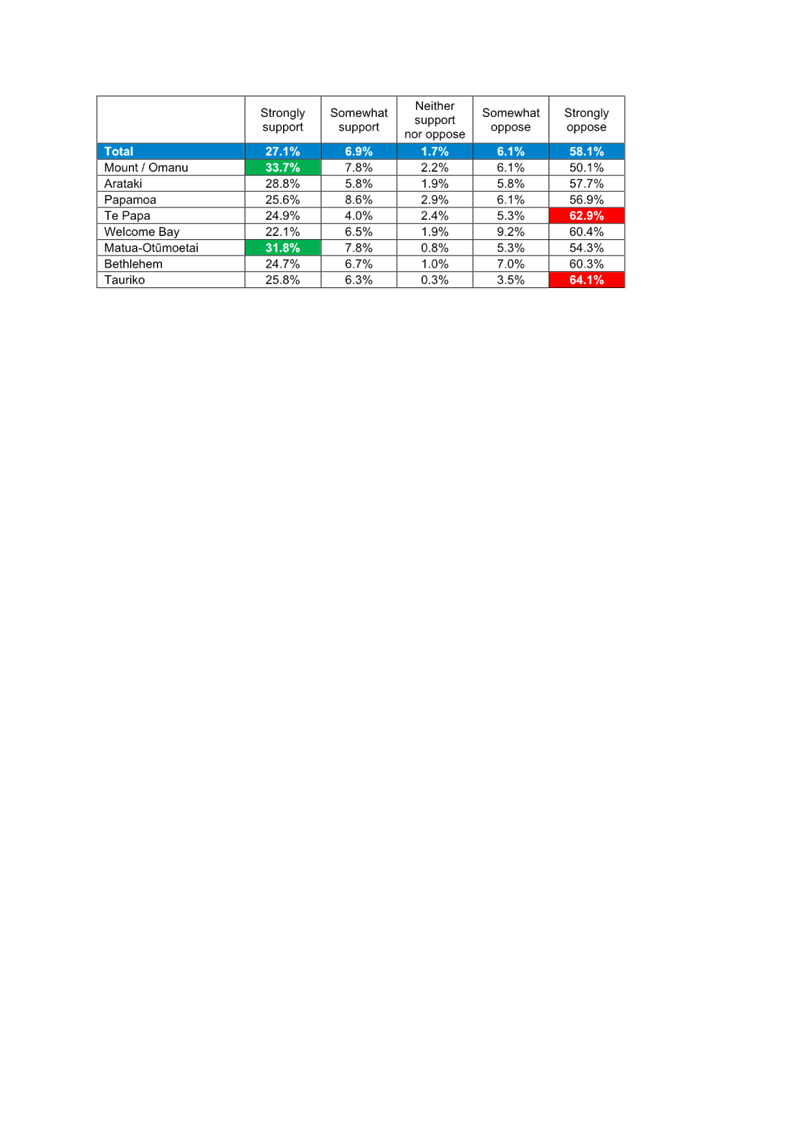

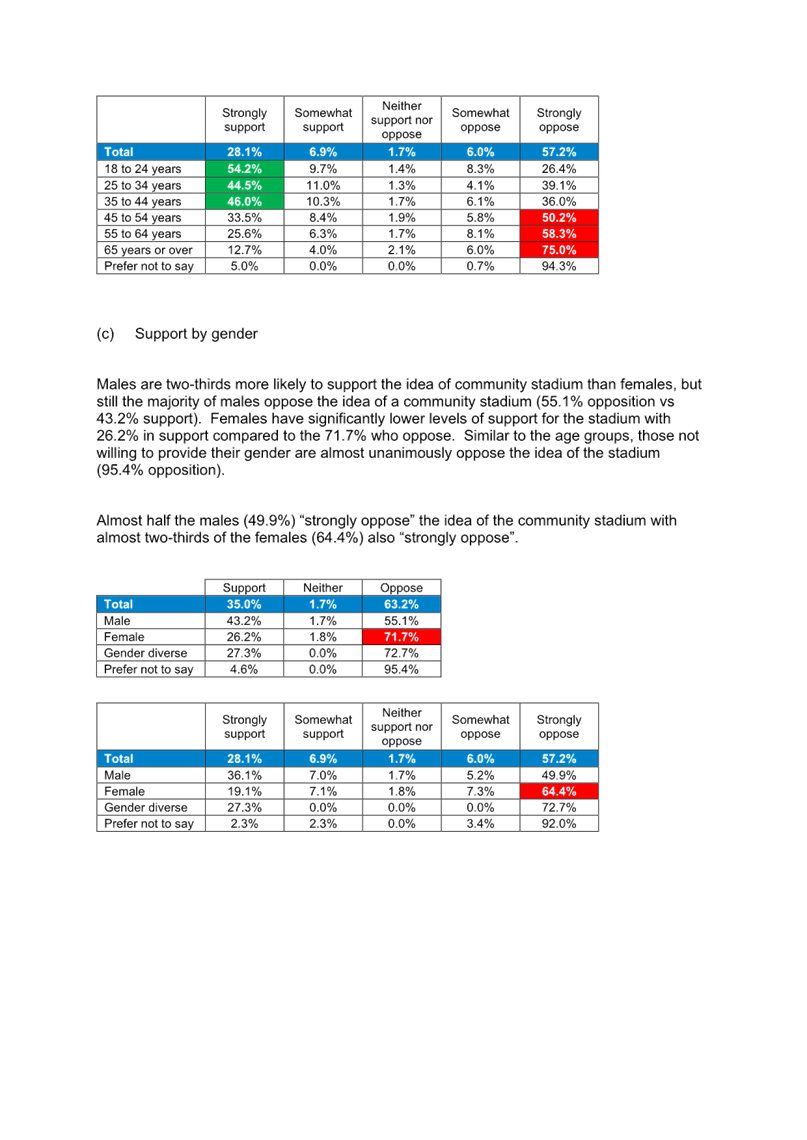

· 49% of people

strongly support or somewhat support the proposed community stadium.

· 43% of people

strongly oppose or somewhat oppose the proposed community stadium.

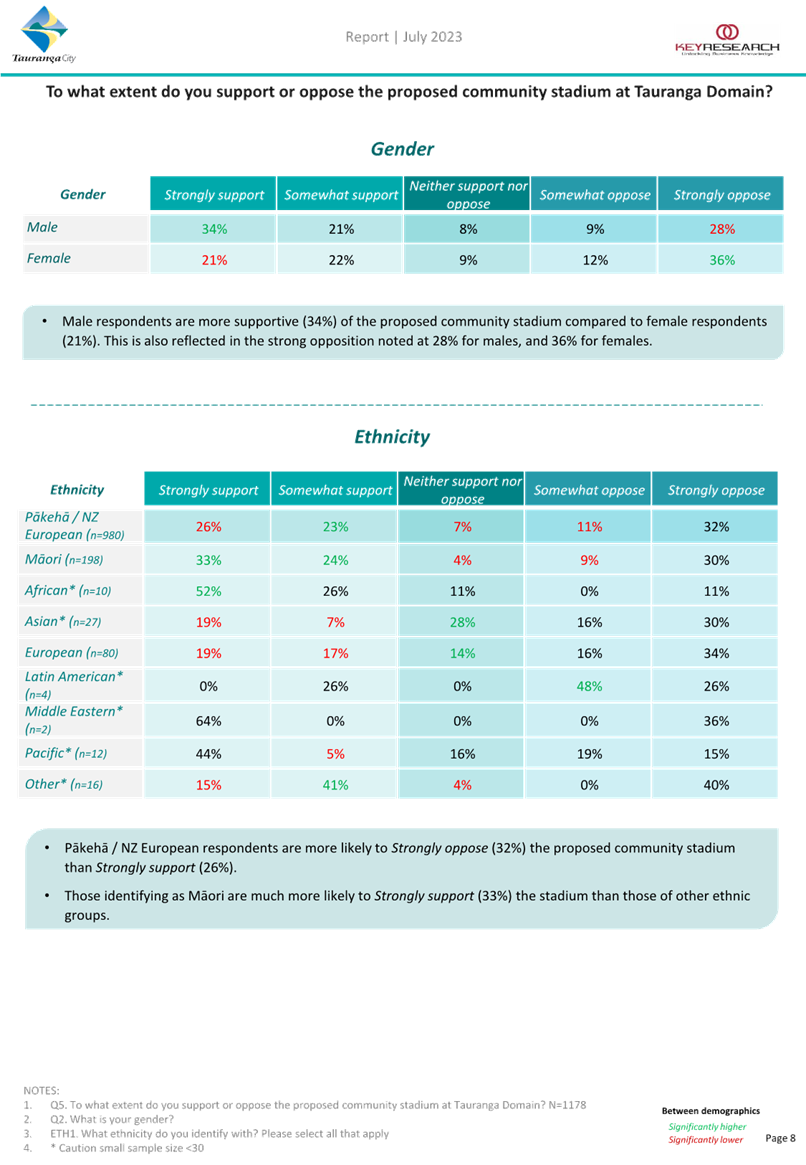

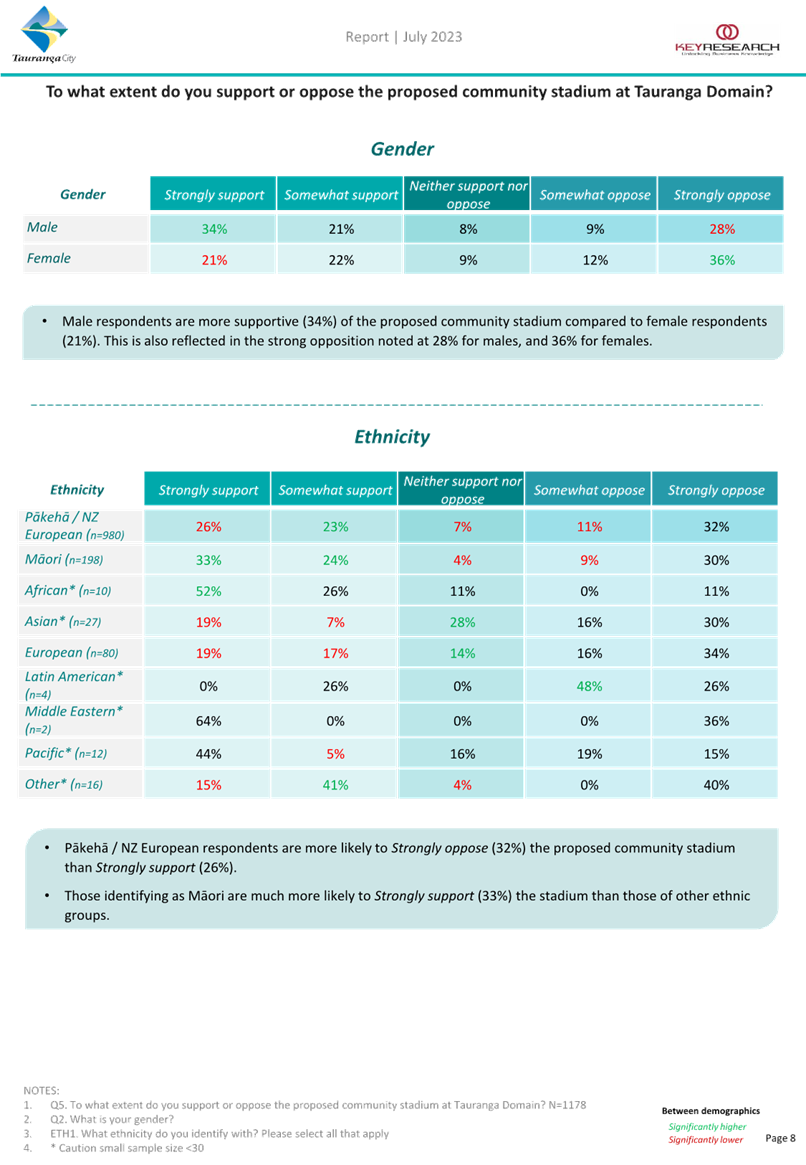

· Strong support for

the proposed community stadium was greater among males (34% strongly

supporting) than females (21% strongly supporting).

· People in the

25-54 age-group are more likely to strongly support the proposed community

stadium than people in other age-groups.

· People

in the 55+ age-group are more likely to strongly oppose the proposed community

stadium than people in other age-groups.

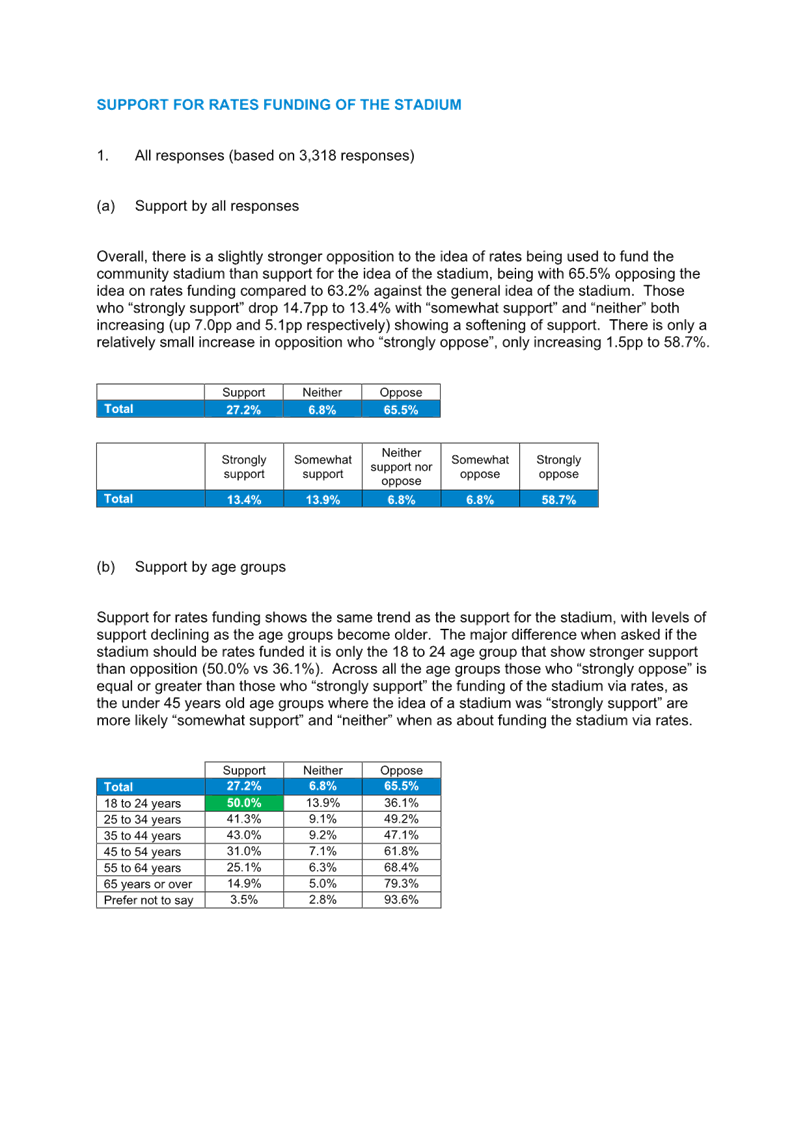

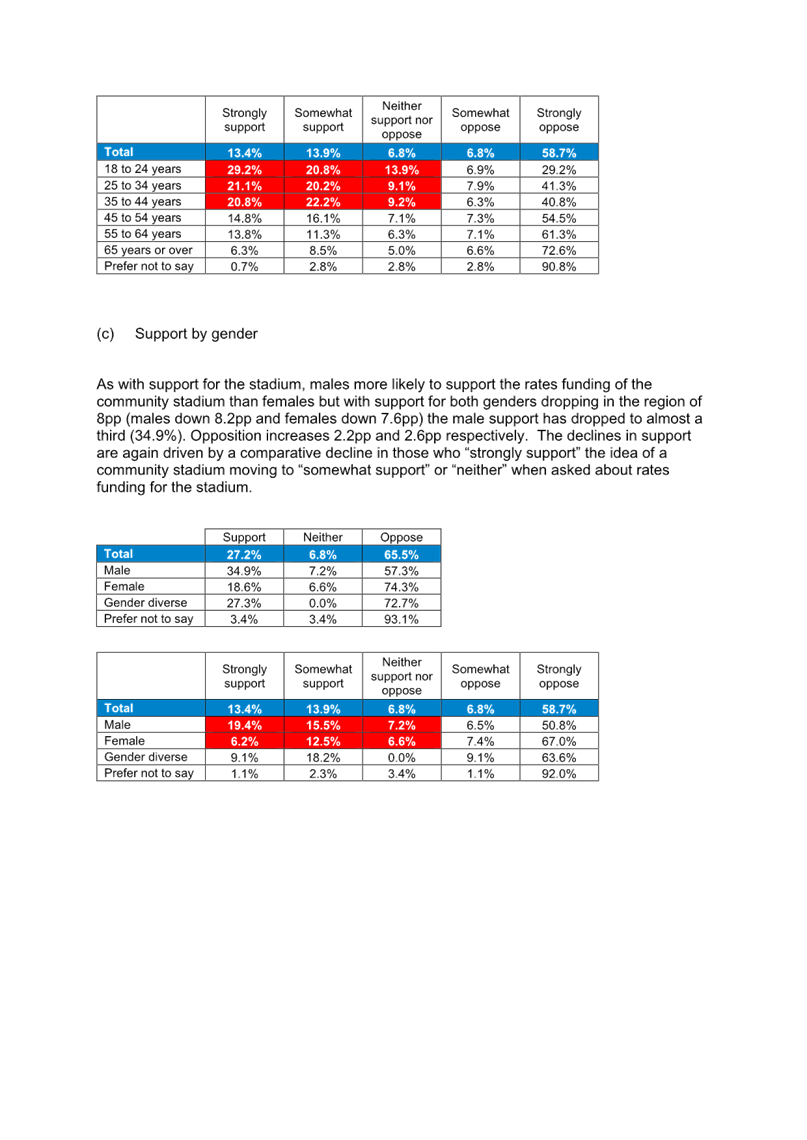

Funding

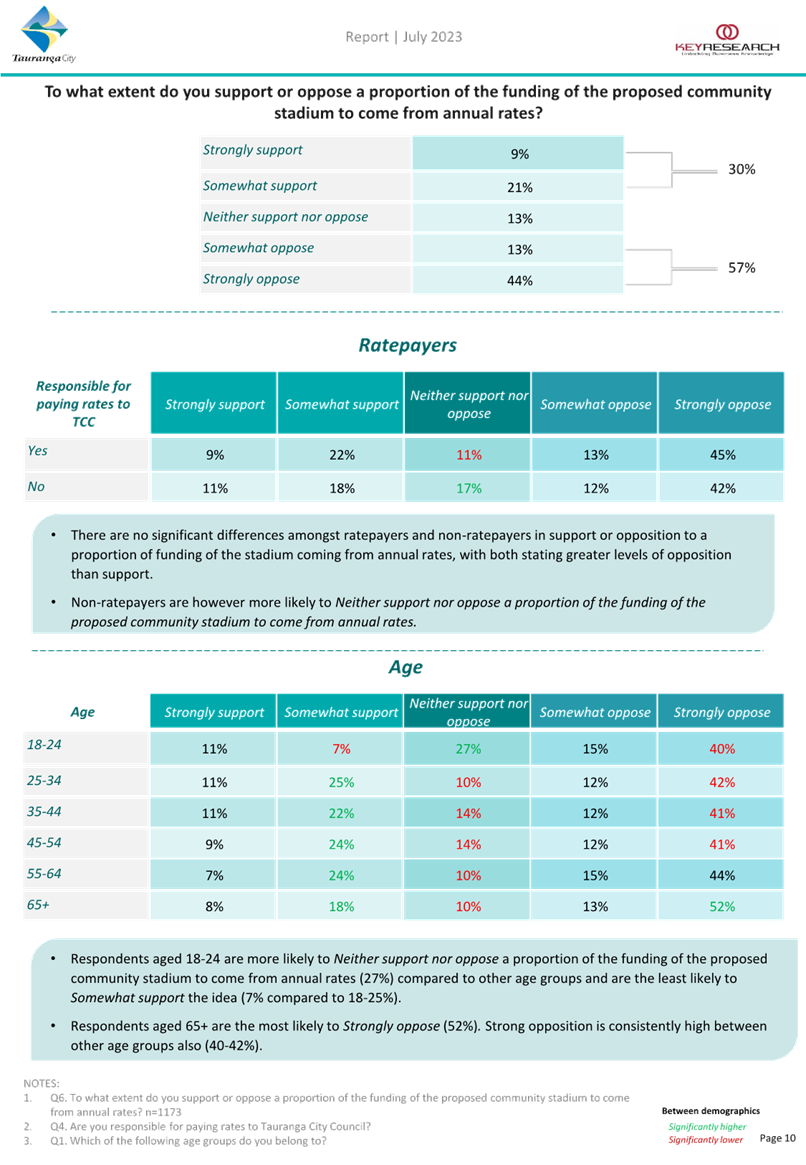

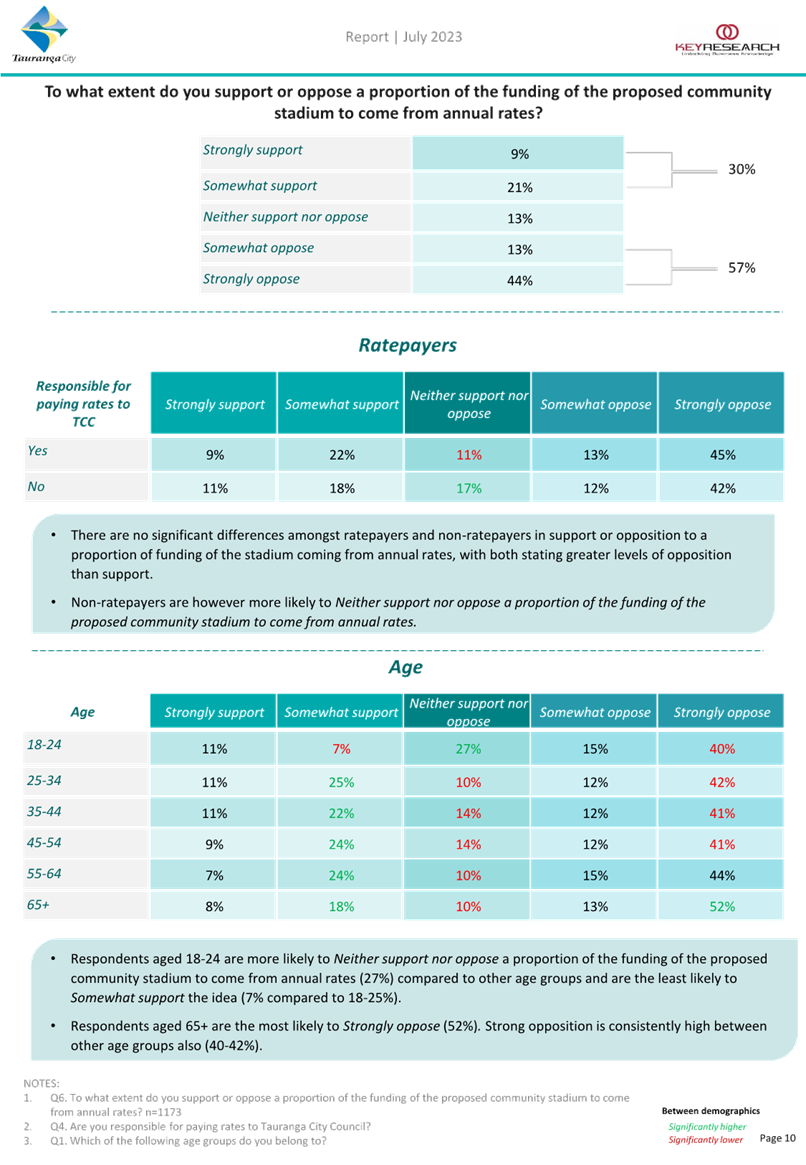

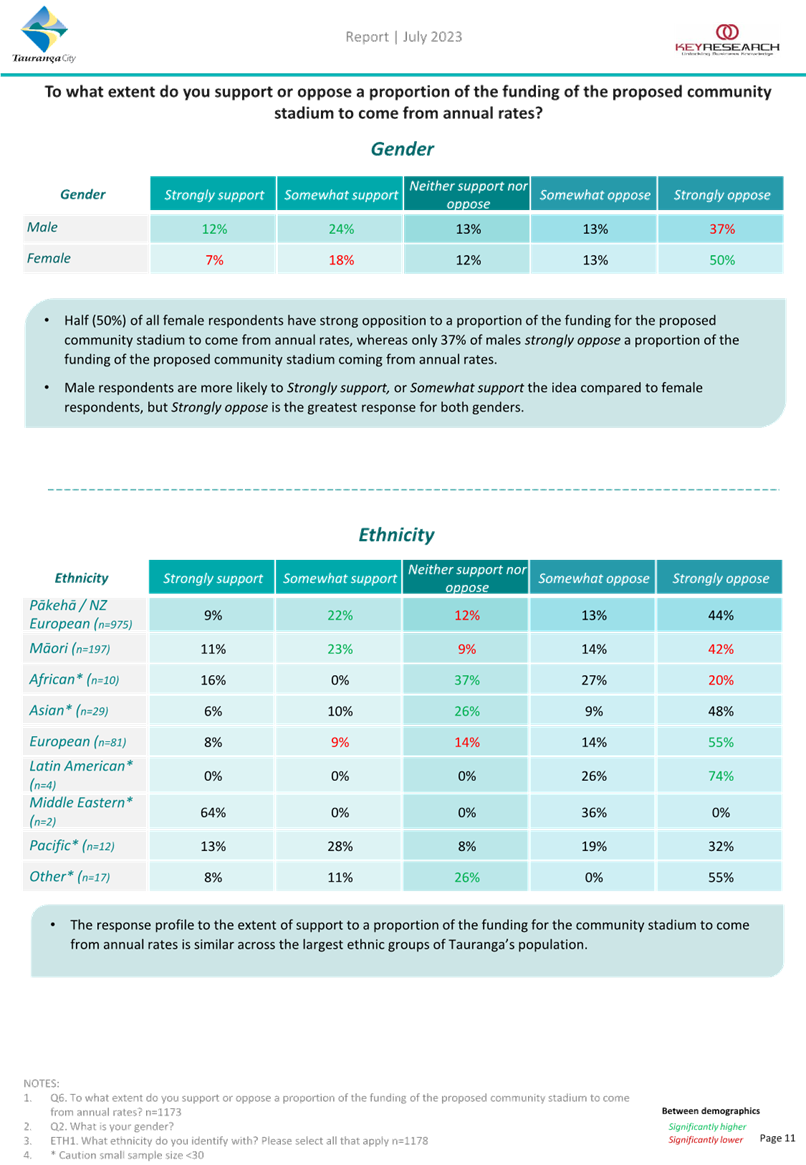

· Overall, 30% of

people strongly support or somewhat support a proportion of the funding of the

proposed community stadium coming from annual rates.

· Overall, 57% or

people strongly oppose or somewhat oppose a proportion of the funding of the

proposed community stadium coming from annual rates.

· Of the 49% of

people who support the proposed community stadium, 58% supported a proportion

of the funding of the proposed community stadium coming from annual rates,

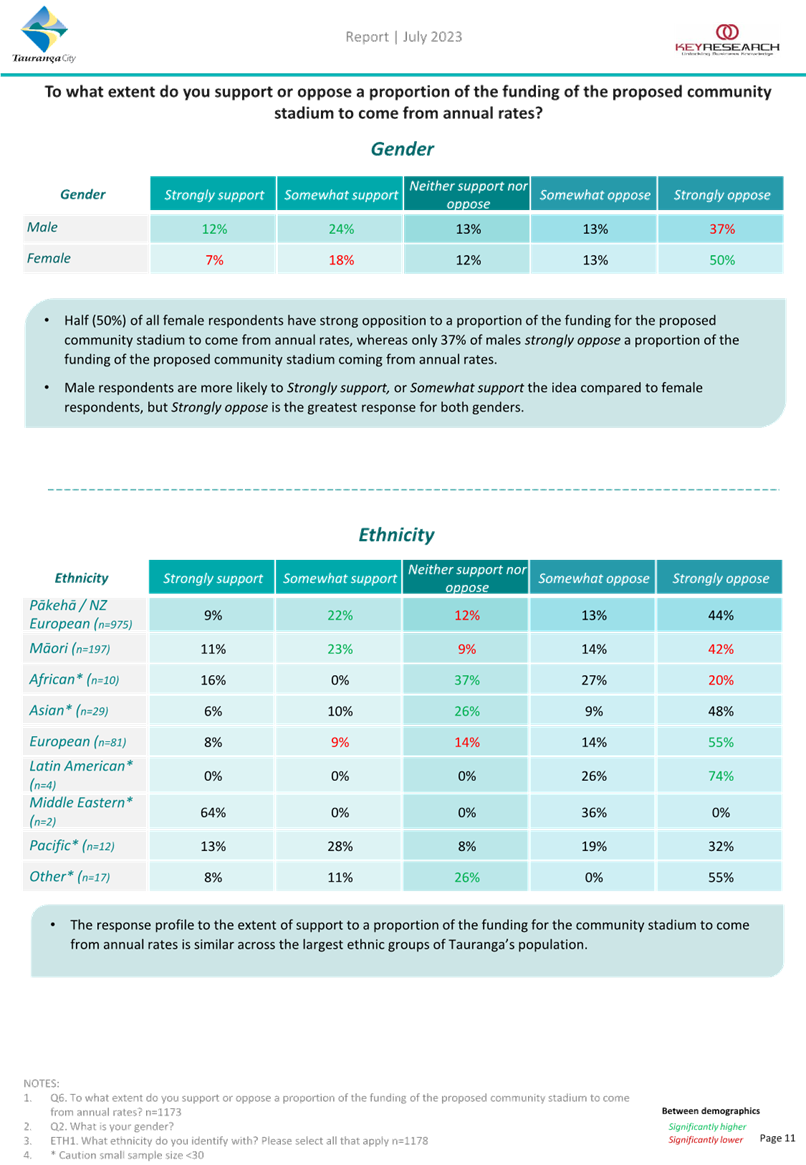

while 24% opposed such funding.

· Of

all respondents, 50% of females strongly oppose a proportion of the funding of

the proposed community stadium coming from annual rates.

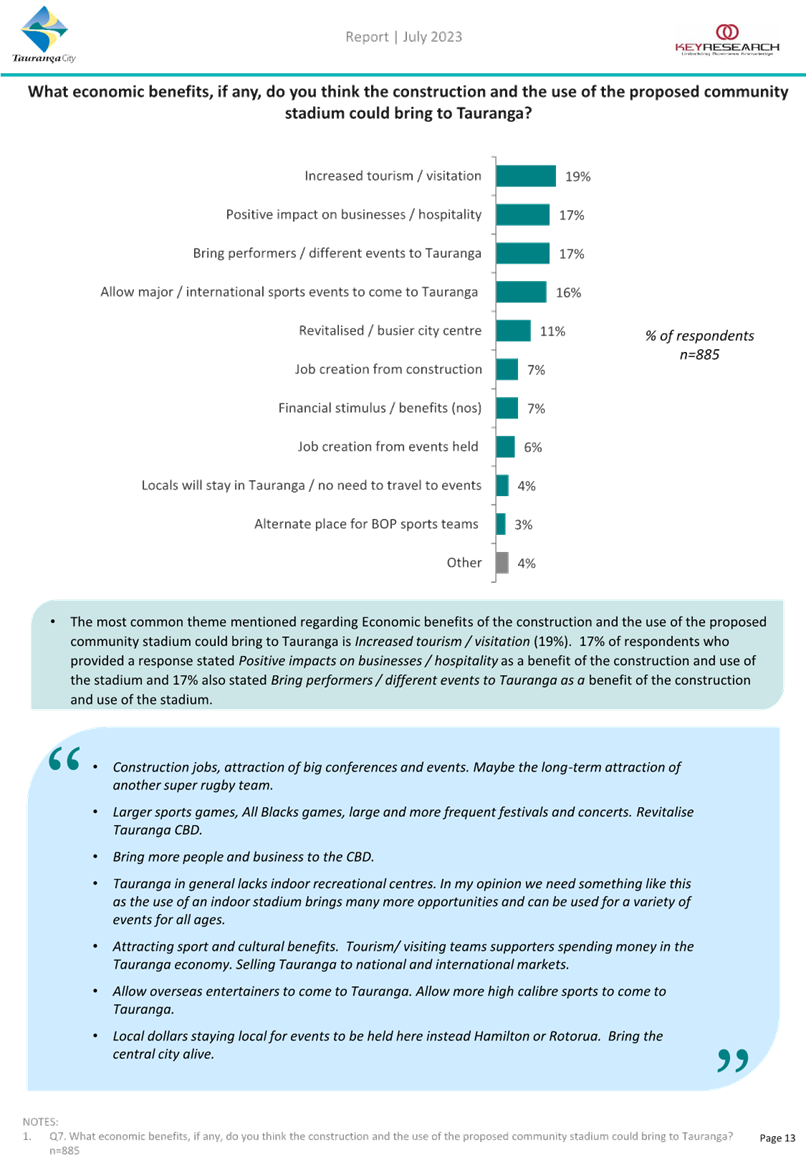

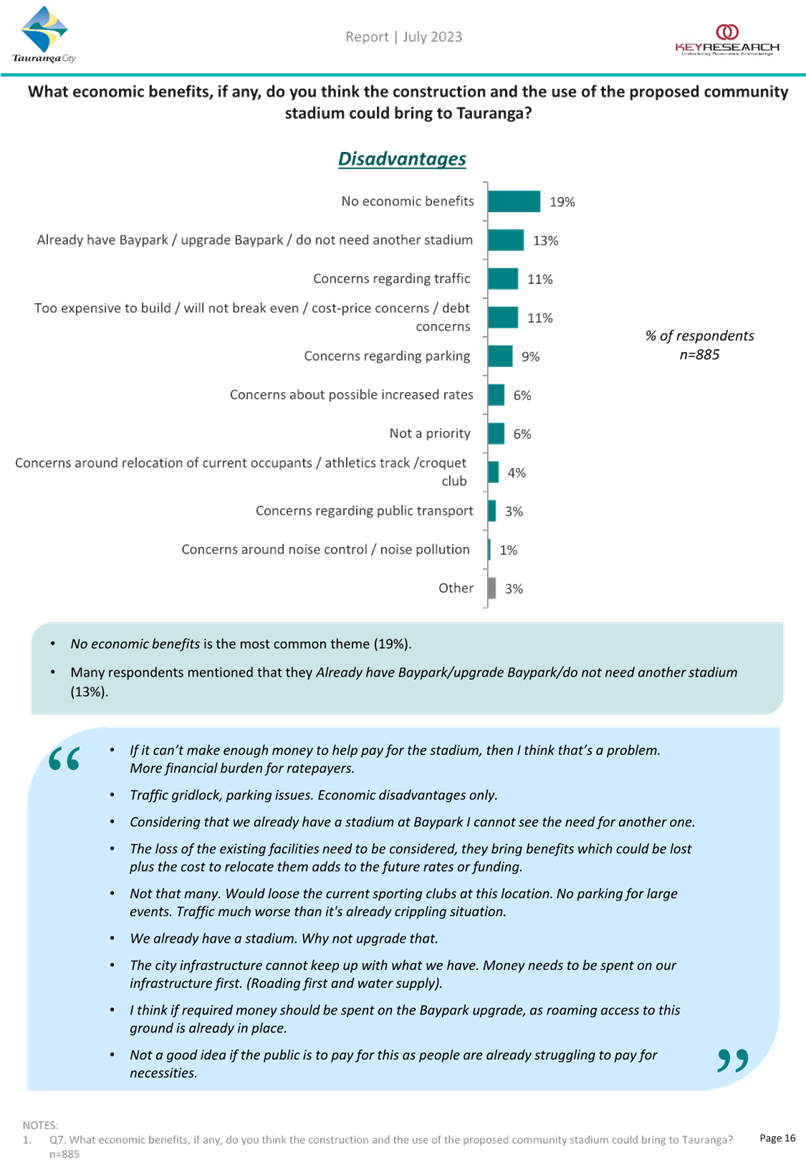

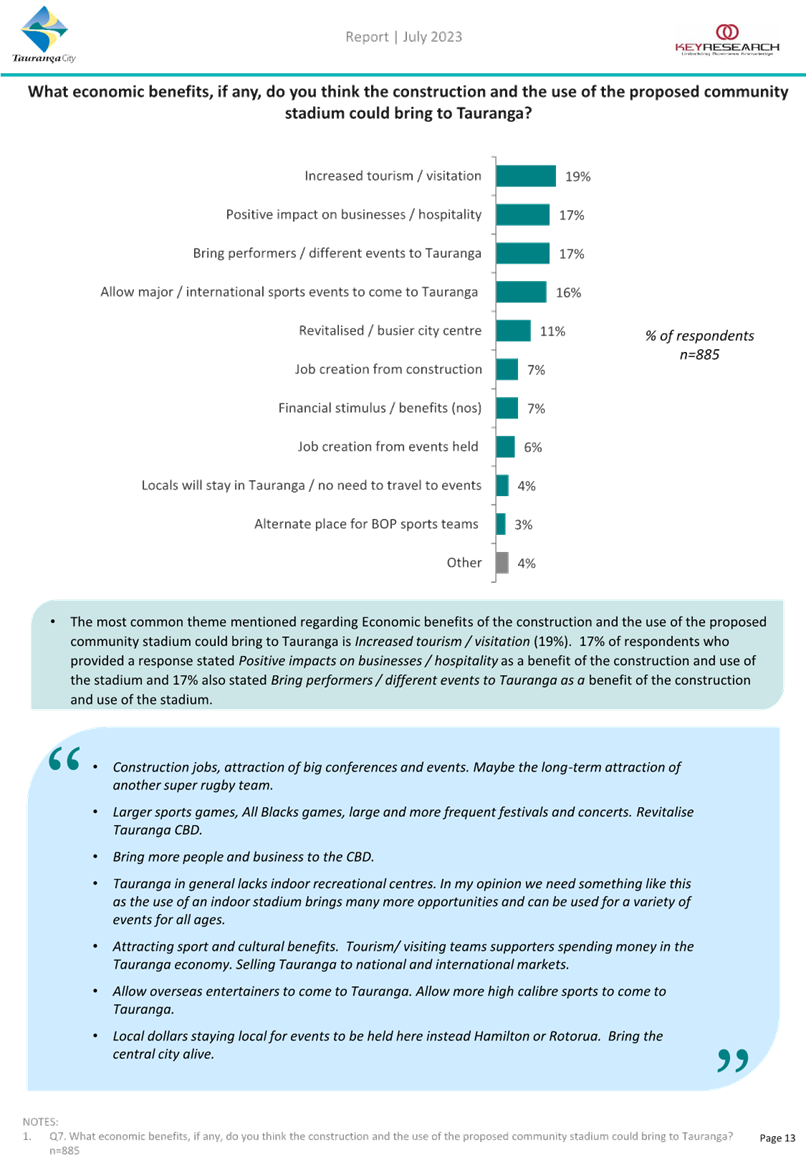

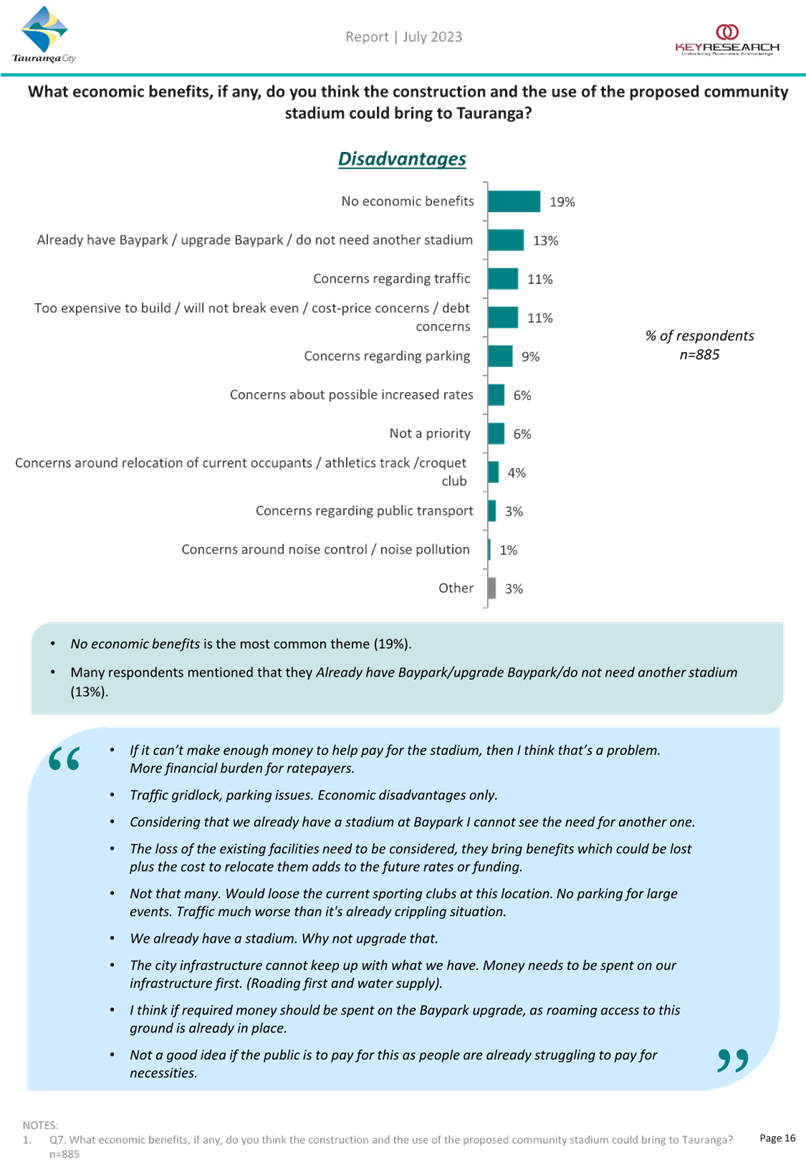

Economic

benefits

· The most common

positive responses were:

o Increased tourism / visitation

(19%).

o Positive impact on business /

hospitality (17%).

o Bring performers / different

events to the city (17%).

· In

addition, a proportion stated that there would be no economic benefits (19%) or

that we already have Baypark / could upgrade Baypark / don’t need another

stadium (13%).

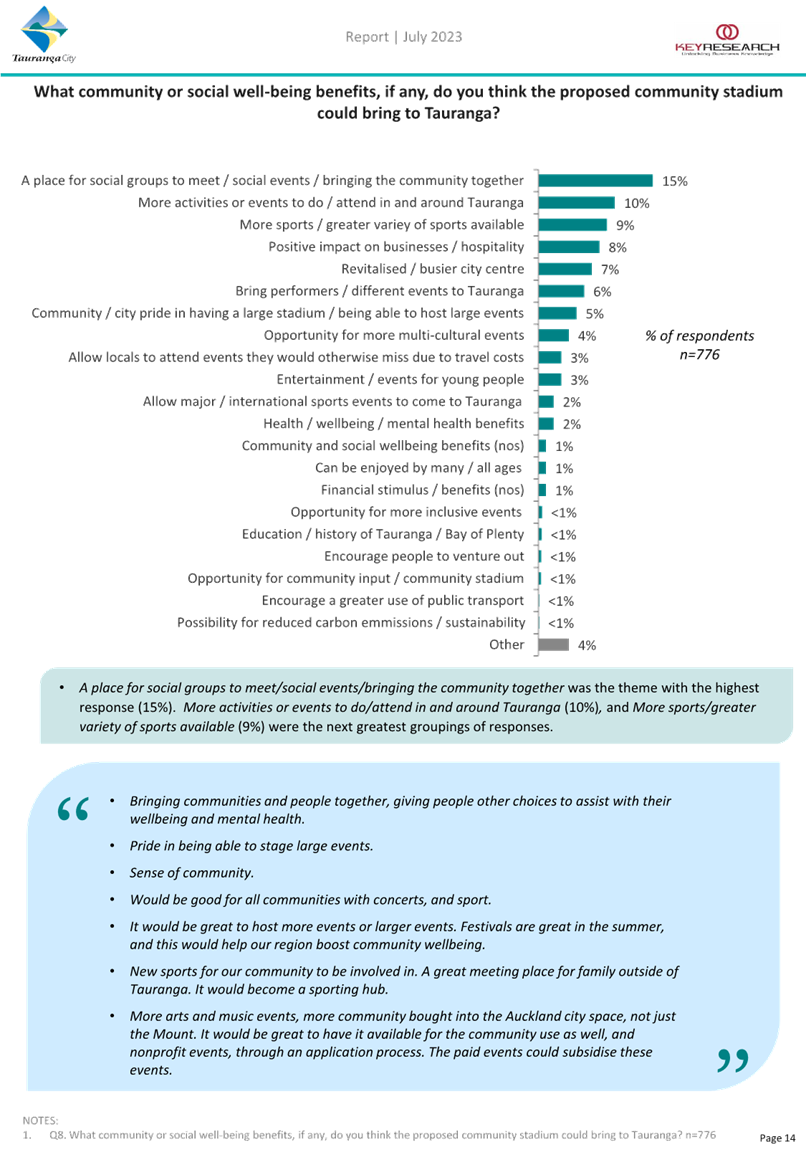

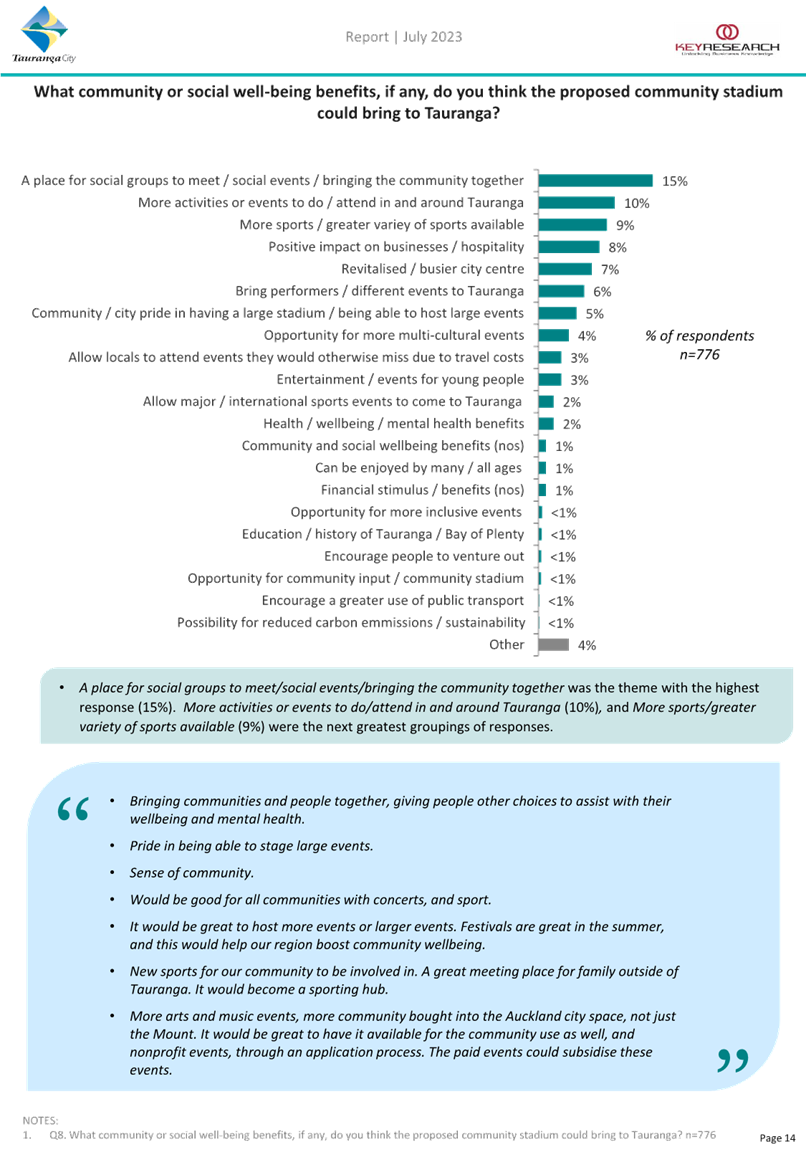

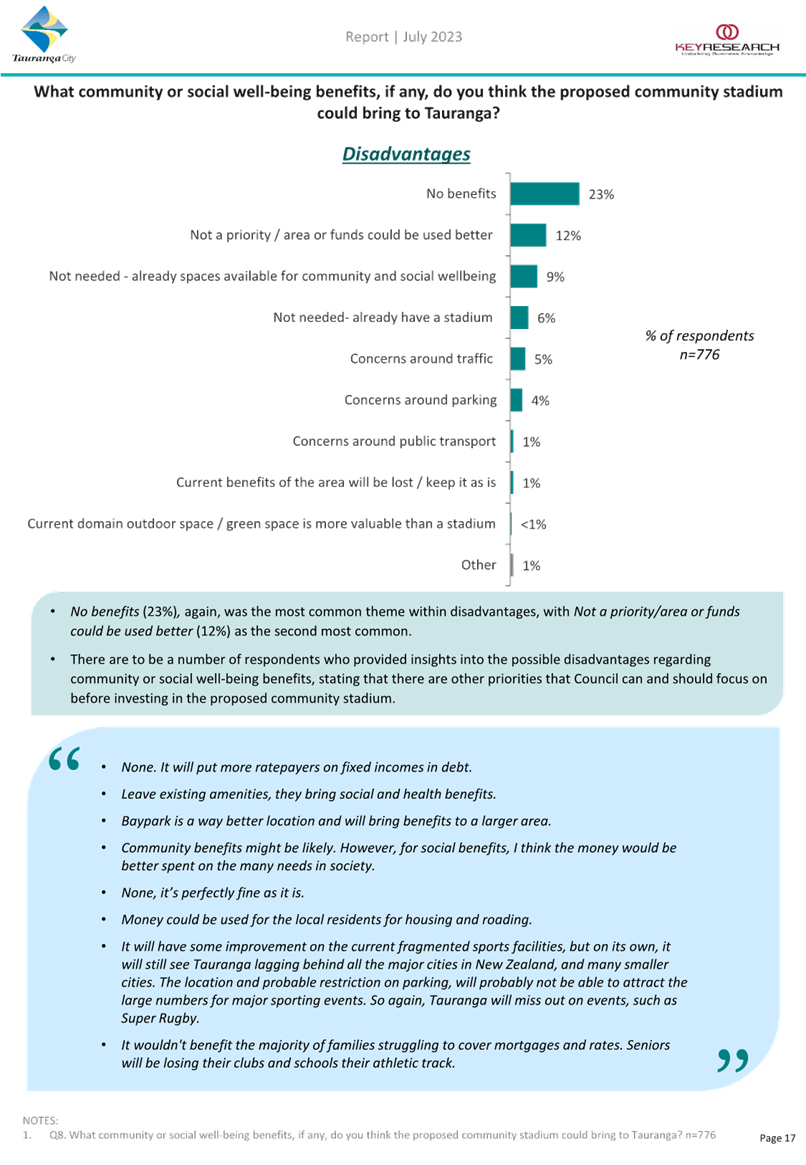

Community

or social well-being benefits

· The most common

positive responses were:

o A place for social groups to

meet / social events / bringing the community together (15%).

o More activities or events to

do / attend in and around Tauranga (10%).

o More sports / greater variety

of sports available (9%).

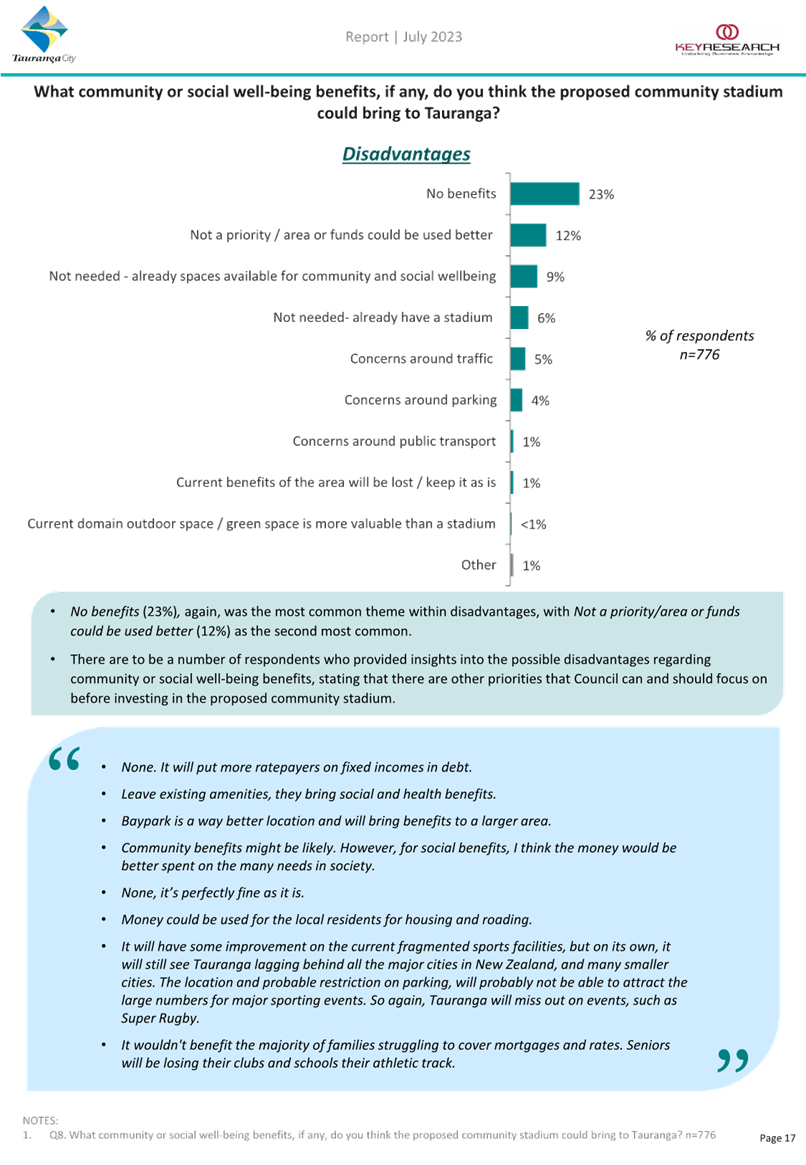

· In

addition, a proportion stated that there would be no community or social

well-being benefits (23%) or that the project was not a priority or that funds

could be used better (12%).

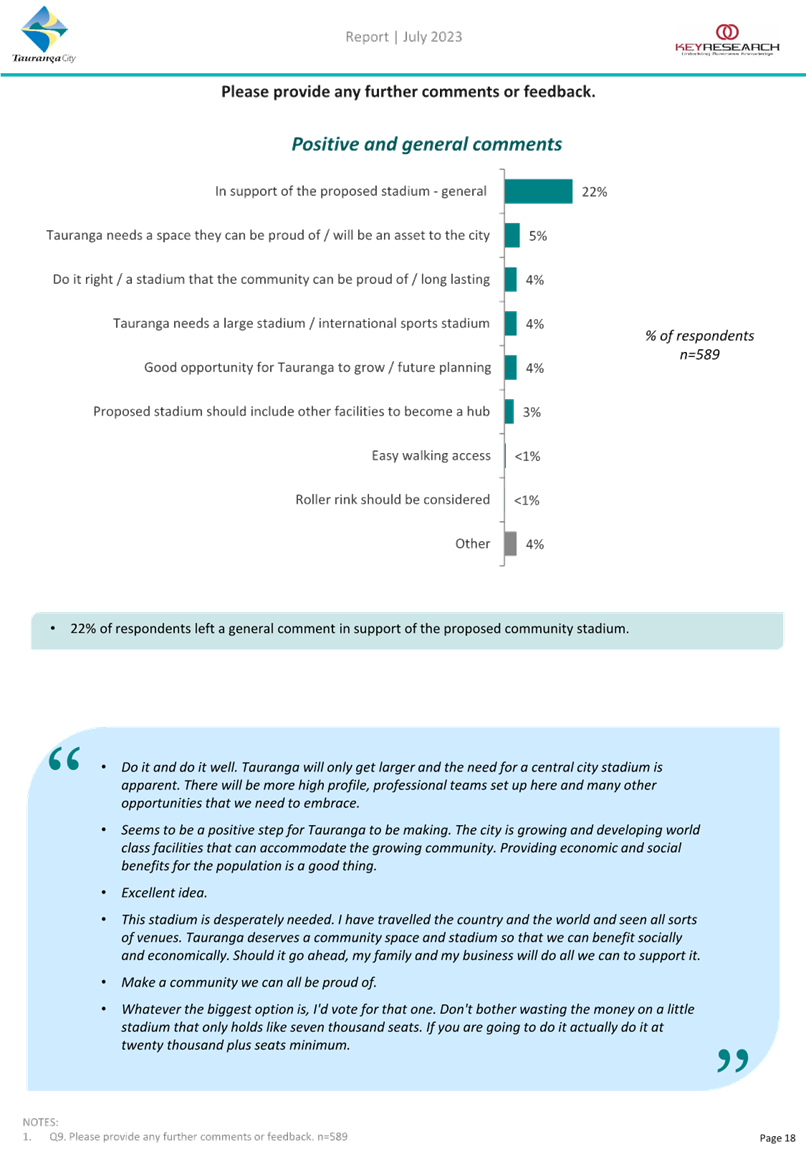

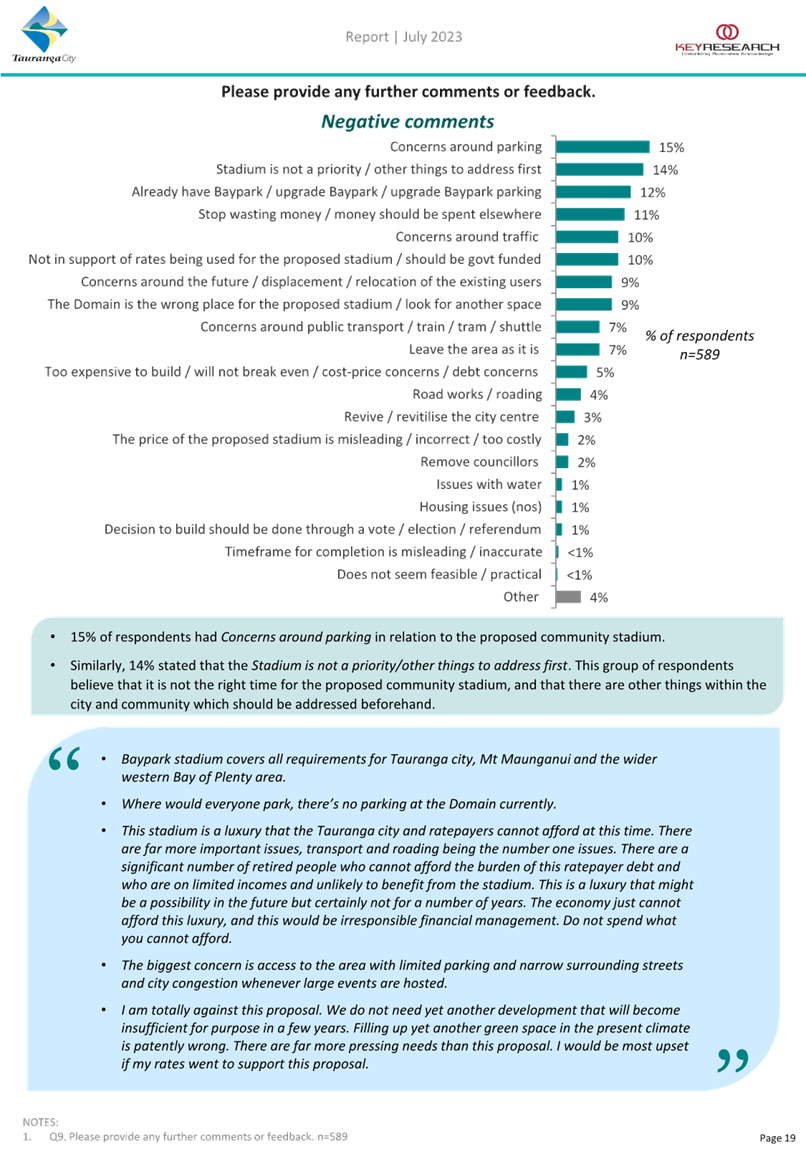

Further

comments question

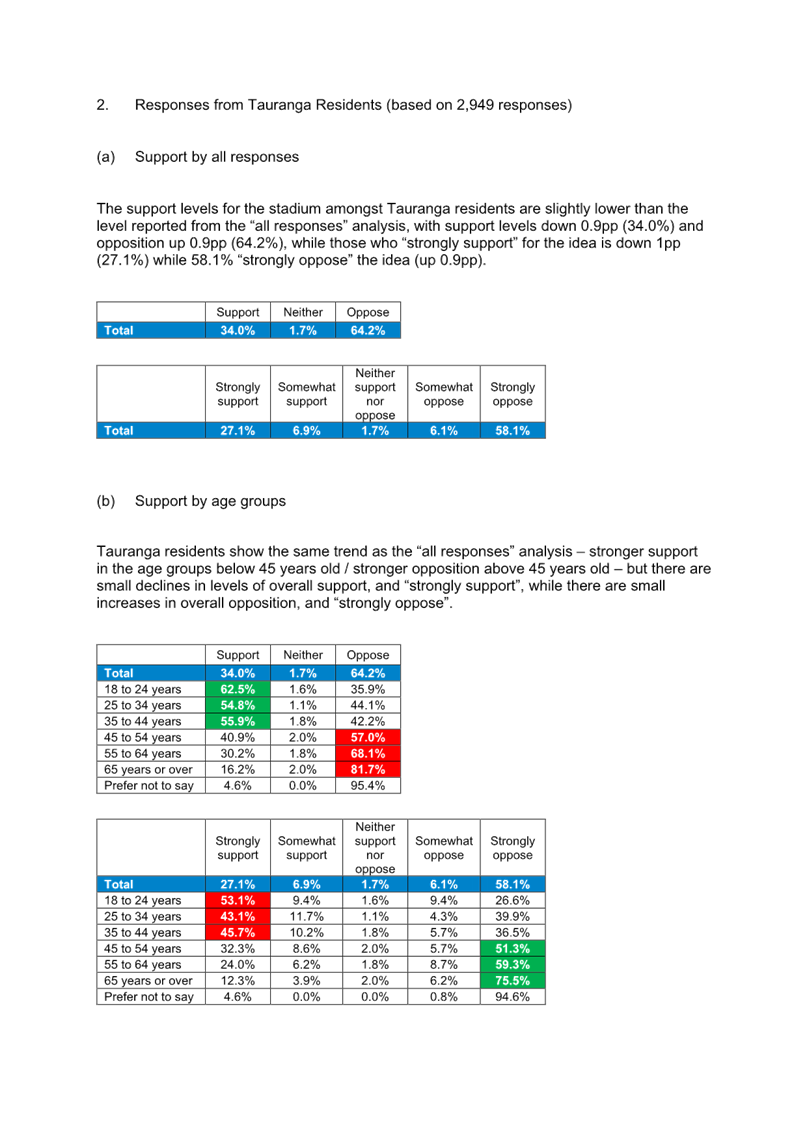

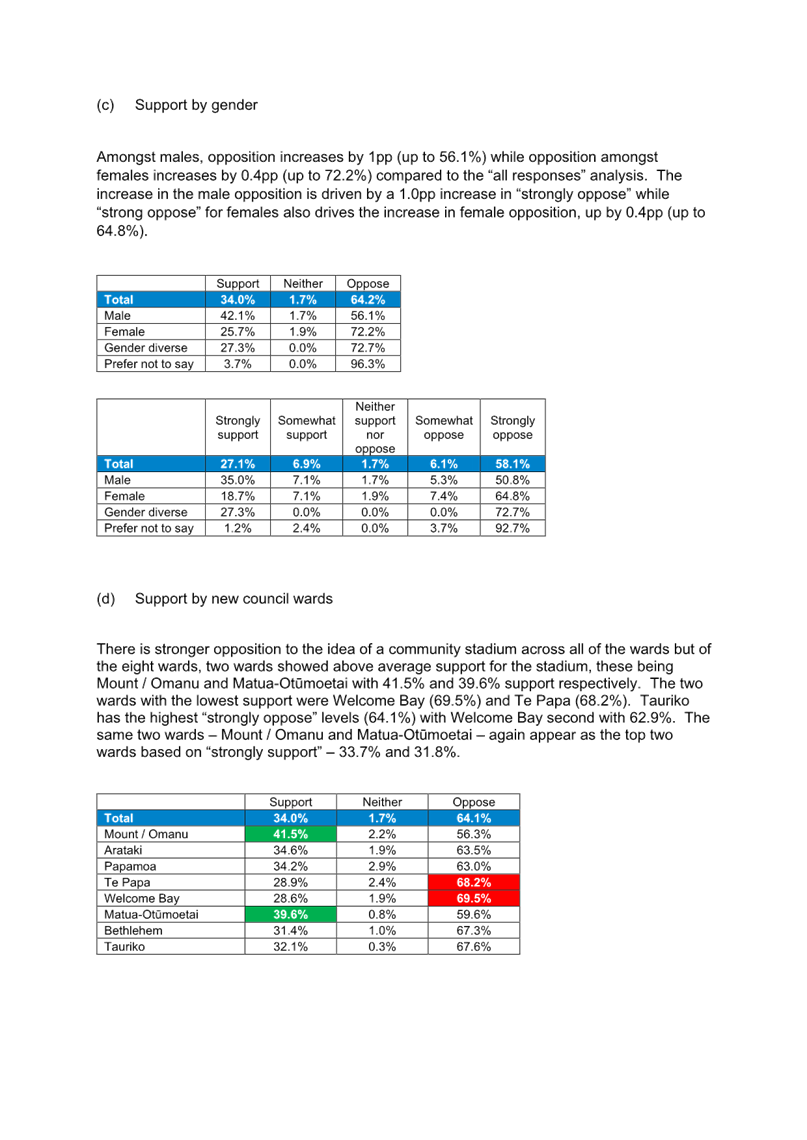

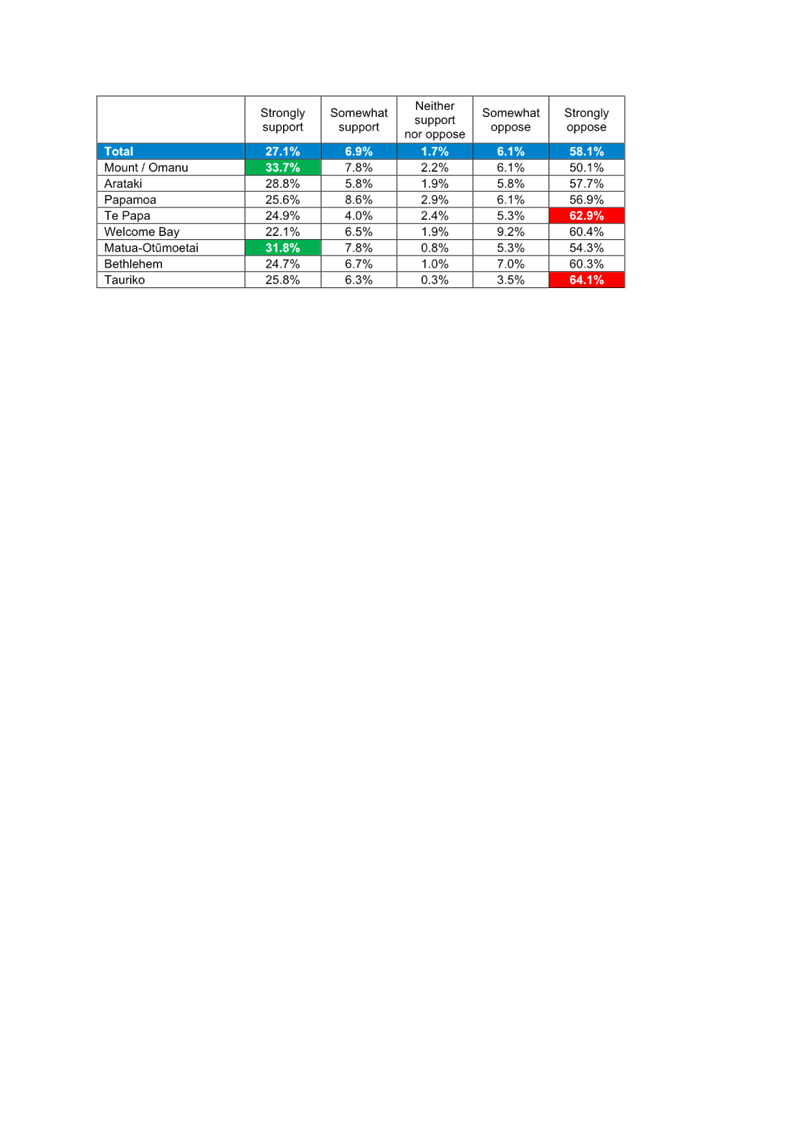

· 589 respondents

took the opportunity to provide further comments.

· Of these, 22% of

respondents left a general comment in support of the proposed community

stadium.

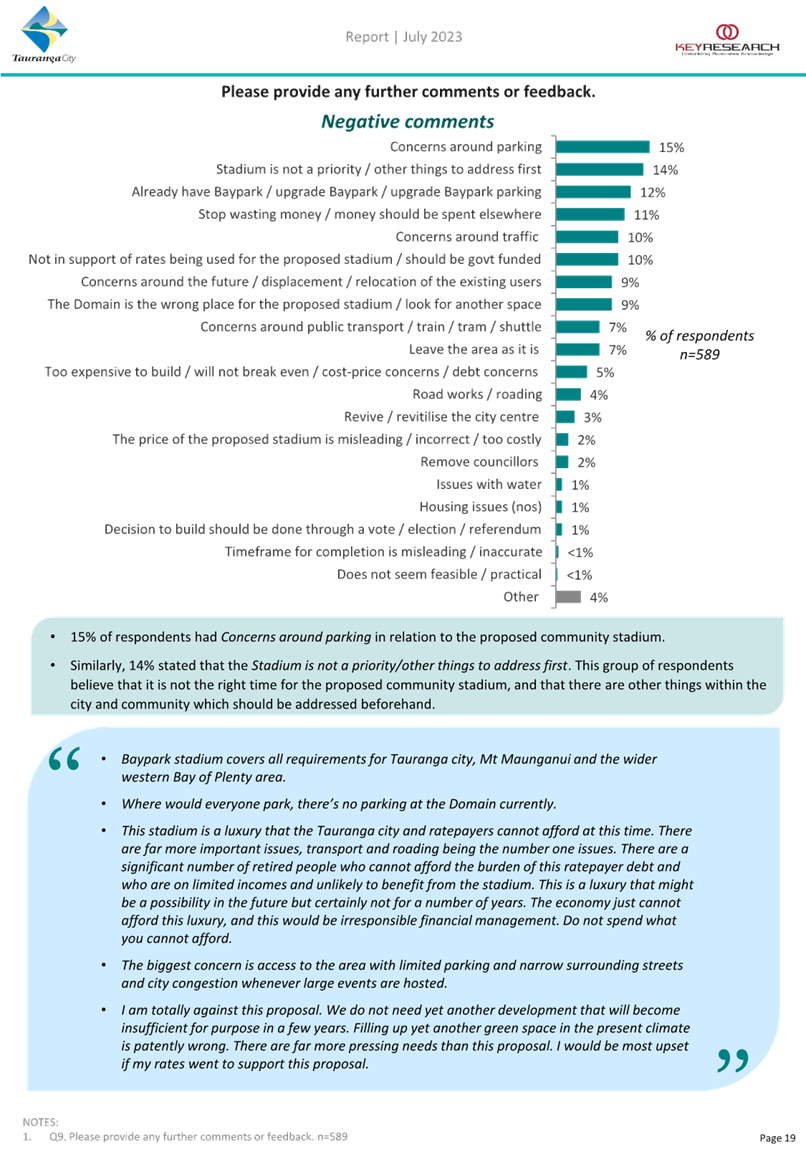

· Of

those providing negative comments, the most common related to traffic and

parking (10% and 15% of respondents respectively), the stadium not being a

priority (14%) or there being other priorities for spending money (11%), and

reference to Baypark being upgraded instead (12%).

Community engagement results – self-select

survey

31. A summary of the council-managed

self-select survey results are included as Attachment 2 to this report.

32. The self-select survey was able to

be completed by anyone with an interest in the matter. Because it is not

focused on a random sample of the population in the way that the

demographically representative market research survey was, the self-select

survey is more likely to be completed by people with strong views for or against

the proposed community stadium.

33. Of the 3,318 respondents, 2,949

(89%) were from people identifying as residents of Tauranga.

34. It should be noted that during the

survey period, a number of organisations distributed and published information

encouraging their members or the wider public to take part in the survey. Some

of the information published as part of this encouragement was misleading or

simply incorrect. For example, claims that the proposed stadium ‘will be

closed to the public except on a paid basis a few times a year’ or that

the costs of relocating existing users ‘are touted to double the cost of

the stadium’ are manifestly wrong.

35. Overall, the results of the

self-select survey are less supportive of the proposed community stadium and

less supportive of a proportion of funding coming from annual rates than the

demographically representative survey.

36. Key findings from the unweighted

data include the following:

· 35% of all

respondents strongly or somewhat support the proposed community stadium while

63% strongly or somewhat oppose it.

· 27%

of all respondents strongly or somewhat support a proportion of rates funding,

while 66% strongly or somewhat opposed a proportion of rates funding.

· the

self-select survey had a much higher proportion of strong opinions than the

demographically representative survey. For example, on the question of stadium

support, the demographically representative survey showed 41% in the bracket of

‘somewhat support / neither / somewhat oppose’ while the

self-select survey only showed 15% in this range.

37. Consistent with the demographically

representative survey, the self-select survey shows:

· Greater support

for the proposed community stadium among males compared to females.

· Greater support

for the proposed community stadium among those 44 and younger compared to those

45 and older (a slightly younger split than in the demographic survey).

· Greater

opposition to a proportion of rates funding among females (67% strongly oppose)

compared to males.

Community engagement results – other feedback

38. In addition to the online surveys,

council has also received, via Priority One, letters of support from a number

of Bay of Plenty Rugby partners including Bayleys and Eves Realty, the Urban

Task Force, Craigs Investment Partners, Uzabus, Central Demolition, LinkUp

Paints Bay of Plenty, Kaleprint, Ceilings Unlimited, R-Line Limited, and

Foundation Sports & Rehabilitation Clinic.

39. Common themes in these letters of

support are the balance of 90% community use and 10% professional events; the

social, economic and long-term strategic benefits to the city; and the diverse

range of events and users that the proposed community stadium will support.

40. Letters of support have also been

received from a number of sporting organisations and potential users of the

proposed community stadium.

41. Te Whatu Ora – Health New

Zealand have noted that while they support in principle any multi-use stadium

that contributes to community health and wellbeing, they do not support the

preferred location at the Tauranga Domain. This is because they feel the site

selection process and business case has not taken sufficient account of noise

emissions from the site, and that the risk of noise restrictions on potential

events has not been rated highly enough. Te Whatu Ora – Health New

Zealand recommend that Council conducts a health impact assessment of the

proposed community stadium.

Region-wide social and economic benefits (1 May 2023

resolution (e))

42. Council and Priority One commissioned

Market Economics Consulting, with support from Visitor Solutions, to assess the

anticipated social and community impacts of the proposed community stadium.

Their report (“the Market Economics report”) is included as Attachment

3 to this report.

43. The Market Economics report

identifies core effects of the proposed community stadium under the following

headings:

· Health and

wellbeing

· Urban form uplift

· Way of life

· Community

· Environment and

amenity

· Culture

· Fears

and aspirations.

44. There is also a section on

employment effects and income.

45. The Market Economic report

concludes:

‘The

wider social and community impacts of the proposed community multi-use stadium

are complex and multifaceted, and they are expected to be positive. This

is in large part due to the stadium precinct’s unique operating model

with community access and use, with a periodic commercial event overlay.’

46. Among the positive benefits that

the Market Economics report identifies are the following.

· An expanded range

of high-profile sporting matches, festivals, concerts and community events will

create opportunities for social interaction and will lift community wellbeing.

· The availability

of social amenity contributes to a better quality of life through reduced

stress, improved physical and mental health, and a sense of community support.

· The exhibition

centre will result in increased court hours being freed up at the Mercury

Arena, thereby allowing for more community sport access for basketball,

volleyball, netball, futsal, and pickleball.

· The proposed

community stadium supports the creation of a compact, high-amenity urban form

which is consistent with urban intensification.

· The proposed

community stadium supports other regeneration and development projects in the

central city.

· The capacity and

use of the proposed community stadium supports an increasing diversity of

patrons and an increasing diversity of cultural experiences.

· The

proposed community stadium helps to build an increased sense of pride and sense

of place, factors which support community resilience and community

environmental stewardship.

47. Among the risks, fears, and

negative impacts that the Market Economics report identifies are:

· Disruption, noise

and other temporary impacts during the construction phase.

· Displacement of

existing users leading to a loss of connection with the site, and a

diminishment of any sporting heritage and history associated with the site.

· Negative impacts

of large events such as increased traffic, noise, congestion and crime.

· The

cost and funding of the project and the distribution of benefits across the

community.

48. The Market Economics report

identifies that impacts (positive and negative) occur predominantly within the

Tauranga city but that there are also benefits that affect the wider

sub-region. The report also assesses that there are small benefits across the wider

region.

Funding, affordability and operating costs (1 May

2023 resolution (d))

Capital costs

49. The estimated total capital cost

for the stadium per the preliminary business case presented on 1 May 2023 was

$220,272,000. That figure included a contingency allowance of 20% and

escalation costs to 2026 (assuming a construction period of the 2026 and 2027

financial years).

50. At the time that report was

written, it was noted that ‘these costs are based on the high-level

concept design for the Stadium, and as a result do not have detailed

engineering input (e.g. geotechnical investigations have not yet been completed

for the site)’.

51. The only update to these capital

costs since May relates to further consideration of pile design and ground

stabilisation. This work has been undertaken by Maltbys NZ, quantity surveyors,

who were also involved in the development of the preliminary business case.

52. There are two elements to the

update. Firstly, the original costing in the preliminary business case included

$11.1 million for piling and ground beams, based on early sketch designs for

the western stand only. Following a draft preliminary geotech report prepared

by Beca in late May 2023, this figure has been adjusted to $20.1 million.

53. Further on-site testing is

scheduled to occur later in 2023. After this testing, the draft preliminary

geotech report will be finalised. The results of this testing should indicate

whether the additional $9m risk allowance is needed.

54. Secondly, there is the possibility

that further embankment stabilisation may need to occur. If this is the case,

an additional risk-related budget of $19.1 million has been calculated as being

appropriate. Further work on design and alignment on the site will help to

determine whether this additional budget is necessary.

Operating costs

55. There has been no further work on

operating costs since the preparation of the preliminary business case. Only

once further substantive work has been completed on the design will there be

meaningful information upon which to update the operating costs. If the

‘deferred stadium option’ identified below is further explored,

operating costs will need to be updated to reflect this.

Funding

56. An initial and high-level funding

assessment has been prepared and is included as Confidential Attachment 4.

That assessment includes assumptions relating to funding from the Lottery

Grants Board, key funding partners, gaming and community trusts, and corporate

and philanthropic sponsors. These assumptions currently amount to a minority of

the total funding required. The balance would likely be needed to be sourced

from further fundraising, central government, local government, and/or

loans.

57. Led by Priority One, investigations

have commenced regarding the establishment of a fundraising charitable trust.

Such a charitable trust would have tax benefits for potential donors and as

such may help generate additional external funds for community amenity projects

such as Te Manawataki o Te Papa, as well as the proposed community stadium.

58. Priority One and council staff are

also actively seeking commercial and external funding opportunities that will

benefit the construction and ongoing operation of the proposed community

stadium.

Relocation costs

59. An assessment of potential

relocation costs has been completed by Stellar Projects (consultants who are

supporting the active reserves master planning process). This assessment

includes:

· Construction costs

for the relocation of the athletics track (once it has reached end-of-life) and

associated infrastructure (including a shared-use pavilion, ablution block, and

seating) to Baypark.

· Construction costs

of the relocation of the bowls lawns and associated infrastructure (including

parking and an ablution block) to Tauranga South.

· Construction costs

of the relocation of the croquet lawn (site selection currently under

investigation), including an ablution block.

· Additional work at

the Tauranga Domain associated with re-working the site. This includes

relocating the cricket nets, developing a cultural trail, developing a

community walking/running track, establishing a new playground, and

improvements to the cricket oval (collectively referred to below as

‘Tauranga Domain Sundries’).

· Allowances for

preliminary and general contract costs, planning costs, design costs and so on

for each of the above projects.

· A 35% contingency

allowance on all of the above costs.

· An overall

allowance for optimism bias and a quantified probable risk allowance (covering

elements such as unknown ground conditions, unknown constructability etc.),

calculated using council’s capital project cost estimation tool (the

largest element of the risk allowance relates to the construction of the

athletics track at Baypark as that is where the largest number of unknowns

arise).

· The

purchase (already completed) of a property in Tutchen Street to facilitate the

bowls move.

60. The total relocation costs

identified above have been estimated as follows.

|

|

$million

|

|

Relocate athletics track

and build associated infrastructure

|

14.884

|

|

Relocate bowls lawns and

build associated infrastructure

|

0.728

|

|

Relocate croquet lawn

and build associated infrastructure

|

3.085

|

|

Tauranga Domain sundries

|

4.853

|

|

Optimism bias and

quantified probable risk allowance

|

5.600

|

|

Property purchase

(completed)

|

3.000

|

|

Total

|

32.150

|

61. Current

draft Long-term Plan budgets include some provision for the athletics track and

bowls moves as part of the wider master-planning of active reserves.

Potential ownership and delivery structures (1 May

2023 resolution (g))

62. Work is ongoing regarding both

ownership and delivery structures.

Operating model

63. The assumption in the preliminary

business case is that Bay Venues Limited are best placed to operate the

proposed community stadium once built. That assumption remains.

64. Bay Venues Limited have a team of

skilled and experienced professionals that currently work in planning,

developing, and delivering events and providing for extensive community use of

facilities. The in-house Bay Catering, Bay AudioVisual, ticketing

relationships, and facilities team have successfully managed indoor and outdoor

events at Mercury Baypark, Baywave Aquatic Centre and other venues for many

years.

65. Bay Venues limited have strong

existing relationships with promoters, event organisers, council’s events

team, and key local partners all of which position them well to operate the

proposed community stadium within the wider network of sporting and community

facilities that they currently operate.

Project delivery

66. Te Manawataki o Te Papa Limited has

now been established to deliver the Te Manawataki o Te Papa (the heartbeat of

Te Papa, the redevelopment of the civic precinct) capital projects. Discussions

will continue with the Te Manawataki o Te Papa Limited Board regarding the

suitability of that company also leading the delivery of the construction of

the proposed community stadium, if and when that occurs.

67. Other options for project delivery

include in-house by council or contracted out to another entity.

Ownership

68. No formal discussions have commenced

regarding the long-term ownership of the proposed community stadium. Options

that will need to be further explored include:

· Direct ownership

by council.

· Indirect ownership

by council through Bay Venues Limited (a council-controlled organisation).

· Ownership by a

not-for-profit third party, potentially a community-led charitable trust.

· Independent

commercial ownership.

· Other

ownership models.

69. Once direction is received on the

likely timing of construction and therefore future operations, discussions

regarding ownership are likely to commence.

Deferred

stadium option

70. As part of ongoing stakeholder

engagement on the masterplan for the Tauranga and Wharepai Domains, an

alternative approach to the re-development of the Domains and the development

of the proposed community stadium is emerging. [A report titled Active Reserves

Masterplans and including the Deferred Stadium Option concept is

scheduled to be included on the agenda of the Council meeting of 4 September

2023.]

71. The vision for the Tauranga Domains

is that they become a premier events space, as well as continuing to provide

for community sport and recreation. The current preliminary masterplan

positions the proposed community stadium as the centrepiece of that transition.

However, if the Community Stadium were to be deferred, there are still

worthwhile changes that can occur to enable the site to evolve, enabling

greater use for events, and enabling more effective use of the space by

community sports groups.

72. The alternative ‘Deferred

Stadium Option’ masterplan seeks to capture this transition, rather than

being a fixed view of the future. It proposes the following key changes to the

site over the next few years.

(a) The

athletics track relocated to Baypark, albeit at a later date than envisaged at

the time of the preliminary masterplan. With the track reaching its need for

renewal around the end of this decade, a decision will need to be taken as to

its future no later than 2028. Irrespective of the proposed community stadium,

a relocated athletics facility is considered to be beneficial for the athletics

community in the medium-term and for the use of the Domains by other sports

groups, casual users of the space, and as events space.

(b) The

Tauranga Lawn Bowls club relocated, with the building becoming available to

other sports user groups, noting that the alternative masterplan continues to

propose demolition of the buildings behind the current stand. Dialogue with

Tauranga Lawn Bowls is underway in respect of opportunities for relocation.

(c) Tauranga

Croquet Club retained on the site, at least until the end of the current lease

period to 2029, unless a suitable alternative site for the relocation of the

club can be agreed with the club prior to that date. Alternative sites are

under active investigation.

(d) Retention

of the Tauranga Lawn Tennis Club as it is currently, without moving the two

courts proposed through the preliminary masterplan. The tennis club would

benefit from additional parking onsite during regular use periods.

(e) Improvements

to site access and movement through the site for vehicles servicing events,

including additional hardstand spaces where the bowls greens, and buildings

behind and beside the grandstand are located. This is expected to be available

for regular site users outside of events.

(f) Improvements to the

Wharepai Domain and building to enable more community sport use and events use.

73. The above proposed approach opens

the possibility of a staged approach to constructing the proposed community

stadium. As other moves occur on the site, building may be able to commence on

aspects of the stadium. Further work needs to be undertaken on what this

staging may look like.

74. No detailed costings have yet been

undertaken on the concept of deferring and staging the development of a

proposed community stadium. Such work would need to be undertaken before final

decisions are made regarding including such an approach in the Long-term Plan

2024-2034. It is likely that this work would show that staging the development

of the proposed community stadium would result in overall higher capital costs,

but that those costs could be spread out over a longer time period and

therefore, be more able to be accommodated in Council’s financially

constrained Long-term Plan 2024-2034 (and potentially in years beyond 2034).

75. To this end, if the ‘Deferred

Stadium Option’ is preferred by Council, approval for unbudgeted

loan-funded operating expenditure will be sought in this (2023/24) financial

year of a maximum $900,000 to further progress design concepts, and to better

understand construction, operation, and financial impacts under this approach.

Such information would be made available to Council before the 2024-2034

Long-term Plan is adopted in April 2024.

Strategic / Statutory Context

76. The proposed community stadium

aligns and supports key Tauranga City Council strategic planning documents,

including:

· Our

Direction – Tauranga 2050 (including the City Vision)

· Tauranga

City Council Community Outcomes

· Sport

and Activity Living Strategy (2012)

· Te

Papa Spatial Plan 2020

· City Centre

Action and Investment Plan 2022-2032

· Tauranga

Events Action and Investment Plan 2022-2032

· Our

Public Places Strategic Plan 2023

· Play,

Active Recreation, and Sport Action and Investment Plan 2023-2033

· Masterplans

for Wharepai and Tauranga Domains, Baypark and Blake Park 2022.

77. It also aligns with sub-regional,

regional and national strategies, most notably the Urban Form and Transport

Initiative, SmartGrowth, the Bay of Plenty Spaces and Places Strategy, the

Living Standards Framework, and Sport New Zealand’s Strategy Plan

2020-2024.

78. Delivery of the proposed community

stadium could support the strategies and plans above by:

· Contributing

to the vibrancy of the city centre, complementing and enhancing other proposed

city centre initiatives such as Te Manawataki o Te Papa and the Memorial Park

to city centre coastal connection.

· Addressing

the city’s growing demand for open space by optimising the use of the

Domain. The proposed Stadium project forms part of Council’s wider work

to consider the future use of shared green spaces across the city.

· Complementing

the overall city facility network by providing light exhibition space which

frees up Mercury Baypark for increased community use.

· Providing

a sub-regional facility in a central location, connecting in with public

transport routes to minimise the need to travel via car to the stadium for

events, and maximising the population catchment serviced by the stadium (rather

than locating it on the outskirts of the city).

79. For a more detailed discussion of

how the proposed community stadium could deliver on strategic objectives for

the city and the region, refer to the Strategic Case included within the

preliminary business case[1].

Options Analysis

80. In considering the matters covered

in this report there are several interconnected issues that need to be

considered when developing options. These issues are:

(a) Whether

Council supports the concept of the proposed community stadium for Tauranga.

(b) If

so, whether Council supports inclusion of funding for the proposed community

stadium in the draft Long-term Plan (and how much that funding should be).

(c) If

so, whether Council supports the single-stage approach to development

contemplated in the programme business case, or whether a staged approach is

preferred.

(d) Whether

the timing of any construction is as per the preliminary business case or

deferred.

(e) Whether limited funding

should be allocated in the draft Long-term Plan (or earlier) to enable

continued work on the project to develop concept options, which would then

enable staging and cost opportunities to be explored further with all user

groups.

81. Consideration of these various

issues leads to the development of the following key options for consideration

(recognising that within options there are potential sub-options regarding

timing):

· Option 1 –

include the proposed community stadium in the draft Long-term Plan and budgets

and consult (per the preliminary business case approach, to be completed by

2027).

o Sub-option 1a – same but

with later timing.

· Option 2 –

include the proposed community stadium in the draft Long-term Plan and budgets

as a staged development and consult (with timing to be determined).

· Option

3 – do nothing – do not include the proposed community stadium in

the Long-term Plan and do not consult on it through the Long-term Plan

Consultation Document.

Option 1 – Single stage construction proposed

in the draft Long-term Plan and budgets

82. This option involves taking the

approach included in the preliminary business case and working towards an

immediate start to construction. Key elements include:

· Single-stage

development of a community stadium at the Tauranga Domain including:

o a boutique community stadium

with 7,000 permanent seats and provision for 8,000 temporary seats (circa 5,000

being prefabricated seating modules)

o a light exhibition centre

(circa 2,000m2 exhibition space plus support facilities)

o a function centre (circa

1,300m2)

o a community multi-sport

facility (circa 400m2 of changing room and lounge space)

o a sports science /

physiotherapy facility (circa 250m2 dedicated space and shared

spaces).

· Relocation of

existing athletics, bowls and croquet facilities as quickly as possible.

· Construction

predominantly in the 2026/27 and 2027/28 financial years[2].

· Operations

commencing in the 2028/29 financial year.

· Capex budget of

$220 million, plus $9 – $28 million of additional risk-related budget for

pile design and ground stabilisation.

· Additional costs

of approximately $32 million to relocate existing users to new facilities on

alternate sites (some of which is already budgeted).

· An

annual rating contribution of approximately $15 million to cover debt servicing

and depreciation (per the preliminary business case the proposed community

stadium generates a small – circa $1 – $2m – operating

surplus in each of the first 10 years of operation).

83. Advantages and disadvantages of

this option include:

|

Advantages of Option

1

|

Disadvantages of

Option 1

|

|

· Responds to

those in the community who support a community stadium and the additional

amenity it will provide for the city.

· Maintains

momentum in a project with strong stakeholder support.

· Positive signal

of intent to future funding partners in public, private, and charitable

sectors.

· Provides the

community a clear proposal to consider through the 2024-2034 Long-term Plan

consultation period.

|

· Further

prioritisation of council’s capital programme will be required to create

the financial capacity to support this project alongside all other competing

priorities.

· Potential

further disruption to the city centre area at the same time as Te Manawataki

o Te Papa, and other public and private development initiatives are taking

place in the vicinity.

· Significant

additional rating impost from 2028/29 onwards.

|

84. Risks

associated with this option are as included in the preliminary business case

and summarised below in the ‘legal implications / risks’ section of

this report.

85. This option is not

recommended.

Option 1a – Single stage construction but with

a deferred start date

86. This option involves the same

approach as Option 1 but with a further delayed start date. This is to avoid

the extreme pressure on council’s balance sheet currently evident in the

first four years of the 2024-2034 Long-term Plan period, and to allow more time

to seek alternative funding sources.

87. For the purposes of this paper, a

construction period of 2029/30 to 2031/32 has been identified as a potential

timeframe (a four-year delay compared to Option 1), but other deferred start

dates could equally be considered. This timing is consistent with the

expectation that the existing athletics track at the Tauranga Domain will be

end-of-life by the end of this decade and that a replacement will have been

constructed at Mercury Baypark by then.

88. Under this option, budget for

design fees of $20 million (approximately 10% of total capital expenditure) is

sought to be spread equally across the 2024/25 and 2025/26 years to enable

current progress to continue on the project, and to ensure detailed designs are

ready when the construction funding is available.

89. Advantages and disadvantages of

this option include:

|

Advantages of Option

1a

|

Disadvantages of

Option 1a

|

|

· Responds to

those in the community who support a community stadium and the additional

amenity it will provide for the city, albeit in a delayed manner.

· Provides

additional time to establish fundraising opportunities.

· Provides the

community a clear proposal to consider through the 2024-2034 Long-term Plan

consultation period, albeit in a timeframe that is less urgent.

· Provides

additional time to further prioritise council’s long-term capital

programme to ensure financial capacity.

· Construction

from 2029/30 avoids cross-over with the Te Manawataki o Te Papa project.

· Additional timeframe

allows for a more measured relocation process for existing facilities,

including enabling the existing athletics track to reach end-of-life stage

before being removed.

|

· Slows momentum

in a project with strong stakeholder support.

· Weaker signal of

intent to future funding partners in public, private, and charitable sectors.

· Significant

additional rating impost from 2032/33 onwards.

· Cost escalation

implications of delaying construction by four years.

|

90. Additional

risks associated with this option (comparted to Option 1) include increases to

the risk of future political change affecting the project, and increased risk

of cost escalations significantly affecting the business case.

91. This option is not

recommended.

Option 2 – Staged implementation plan for the

community stadium

92. This option involves the potential

staged development of the community stadium in a manner that ultimately

achieves the ambition championed in the preliminary business case, but executed

in a staged manner rather than as a single-stage project.

93. The details of such a staged

implementation process are not yet available. However, it is possible, for

instance, that the three main elements of the proposed stadium (the east stand

including food and beverage, admin, broadcast, and public facilities; the south

stand and concourse; and the west stand including exhibition and function

spaces as well as player facilities) could be built in separate construction

phases.

94. Very early estimates for a staged

implementation plan approach indicate the following possible scenario:

· A stand-by-stand

approach, starting with the east stand (plus necessary ancillary work).

· Staged relocations

of existing users consistent with the approach proposed under the section of

this report above titled ‘Deferred Stadium Option’.

· Construction of

the first stage to occur between 2029/30 and 2031/32.

· Construction of

further stages to be beyond the 2024-2034 Long-term Plan period (i.e. in years

2034/35 and onwards).

· Reduced capital

expenditure in the 2024-2034 period of approximately $70 million (plus the

relocation costs separately identified in this report).

· The $70 million of

capital expenditure to be funded $40 million from rates-funded loans and $30

million from other sources.

· An increased

overall project cost due to the staged nature of design and delivery.

· Additional

operating costs in the period before the stadium is fully complete and

operational (the facility is thought to be less likely to be able to meet its

operating costs when it is only partially complete).

· Reduced

debt servicing and depreciation costs in the short term as a direct result of

the reduced capital costs.

95. If this option is preferred,

further work will be done on this in order to better inform Council when it

deliberates on Long-term Plan submissions in the first quarter of 2024.

96. Under this option, budget of

$900,000 (opex) is sought in the 2023/24 (current) financial year to enable

further development of staged-delivery concept options, as well as additional

design work, and then cost management opportunities and construction staging to

be explored. Providing budget in 2023/24 would effectively be ‘unbudgeted

expenditure’ (as the 2023/24 Annual Plan has already been adopted) and would

therefore be required to be separately resolved by Council.

97. Advantages and disadvantages of

this option include:

|

Advantages of Option

2

|

Disadvantages of

Option 2

|

|

· Responds to

those in the community who support a community stadium and the additional

amenity it will provide for the city, albeit in a delayed and staged manner.

· Provides

additional time to establish fundraising opportunities.

· Provides the

community a proposal to consider through the 2024-2034 Long-term Plan

consultation period, albeit in a timeframe that is less urgent.

· Reduced

additional rating impost from 2032/33 onwards.

· Significantly

reduced pressure on council’s long-term capital programme and financial

capacity.

· Construction

from 2029/30 avoids cross-over with the Te Manawataki o Te Papa project.

· Additional

timeframe allows for a more measured relocation process for existing

facilities, including enabling the existing athletics track to reach

end-of-life stage before being removed.

|

· Slows momentum

in a project with strong stakeholder support.

· Weaker signal of

intent to future funding partners in public, private, and charitable sectors.

· Cost escalation

implications of delaying construction by four years.

· Cost increase

implications by staging the delivery of the project over an extended

timeframe.

|

98. An

additional challenge with this option is that at the time of writing, there are

limited details as to what the programme of work for this option could look

like. This will be addressed before the adoption of the 2024-2034 Long-term

Plan, if resources are allocated to enable it.

99. Because of the balance between

responding to momentum and community support for the project and fiscal

prudence, this option is recommended for the purpose of public

consultation through the 2024-2034 Long-term Plan process.

Option 3 – No further action at this stage

100. Under this option, and after carefully

considering the preliminary business case, the results of the public engagement

process, and other available information, Council would decide not to proceed

with inclusion of any form of proposed community stadium project in the

2024-2034 Long-term Plan process and consultation document. From a council

perspective, the project would stop and no further investment would be

considered.

101. Note, however that even under this option, the

proposed masterplan for the Tauranga and Wharepai Domains would still be

considered by Council and any changes (other than the proposed community

stadium) that are adopted would be actioned. This potentially includes many or

all of the moves described under the section of this report above titled

‘Deferred Stadium Option’.

102. Advantages and disadvantages of this option

include:

|

Advantages of Option

3

|

Disadvantages of

Option 3

|

|

· No further

pressure on council’s long-term capital programme and financial

capacity.

· No additional

rating impost in future years.

· No further

significant construction disruption to city centre.

· No stadium

development allows for a more measured relocation process for existing

facilities.

|

· Does not respond

to those in the community who support a community stadium and the additional

amenity it will provide for the city.

· Halts momentum

in a project with strong stakeholder support (or significantly slows momentum

if other stakeholders continue without council’s support).

· Does not provide

the community a clear proposal to consider through the 2024-2034 Long-term

Plan consultation period.

|

103. There

are few risks with this ‘do nothing’ option.

104. This option is not recommended.

Financial Considerations

105. Council is currently under significant

financial pressure, both in terms of its balance sheet and borrowing capacity,

and on the community’s ability to absorb increased rates. Council is

committed to significant community amenity upgrades in the city centre via the

Te Manawataki o Te Papa project, in its aquatic and indoor sport networks, and

in its active reserves through the master planning work. The proposed community

stadium complements all of these developments but imposes additional costs on

council and ultimately the ratepayer.

106. As outlined above, the preliminary business

case identified that the capital costs of a single-stage stadium development

would be $220 million (based on construction in 2025/26 and 2026/27). In

addition, further information suggests a risk allowance of between $9 –

$28 million relating to ground stabilisation should be allowed for. Funding

plans to date indicate that some of this may be met by third party funders but

that the majority of capital costs would need to be met by central government,

local government, and/or by further fundraising efforts.

107. The preliminary business case also identified

that approximately $15 million per annum would need to be rates-funded to

ensure debt servicing and depreciation costs for the stadium could be met.

108. The recommended option (Option 2 –

staged implementation plan) was not contemplated within the preliminary

business case and as such has had little exploration from a financial

perspective. Details disclosed above about the option are very early-stage thinking.

However, it is intuitive that a staged implementation will ultimately incur

more capital expenditure than a single-stage delivery of the same facility (due

to increased time-based escalation costs, additional site establishment /

disestablishment costs, and so on).

109. Similarly, the preliminary business case did

not contemplate the ongoing operational costs of a facility delivered in a

stage manner over a number of years. As such, the information provided in the

options section in this regard has a very low level of confidence attached to

it.

110. To enable staff and the wider project team to

provide better information for the Long-term Plan deliberations process in the

first quarter of 2024, additional budget of $900,000 is sought in the 2023/24

year. Because this budget is not provided for in the 2023/24 Annual Plan

(adopted by Council on 3 April 2023), additional budget needs to be considered

through a separate resolution of Council. This is provided for in the

Recommended Resolutions in this report.

Legal Implications / Risks

111. Project risks are comprehensively set out in

the preliminary business case[3]

and are managed on an ongoing basis by the project team. Risks identified in

the preliminary business case with a ‘residual risk’ assessment

(i.e. after known mitigation actions have occurred) of ‘medium’ (on

a scale of very high, high, medium, low) are as follows:

· Lack of

appropriate engagement with stakeholders during design phase

· Cost escalations

pre-tender

· Cost escalations

during construction

· Political changes

reduce support for the project

· Contractor

capacity

· Contractor

capability

· Geotechnical

conditions are worse than anticipated

· Disruption and

traffic management during construction

· Club displacement

· Site is found to

be susceptible to natural hazards

· Supply

chain constraints.

112. There were no risks identified in the

preliminary business case with a residual risk higher than

‘medium’.

Significance

113. The Local Government Act 2002 requires an

assessment of the significance of matters, issues, proposals and decisions in

this report against Council’s Significance and Engagement Policy. Council

acknowledges that in some instances a matter, issue, proposal or decision may

have a high degree of importance to individuals, groups, or agencies affected

by the report.

114. In making this assessment, consideration has

been given to the likely impact, and likely consequences for:

(a) the current and future social,

economic, environmental, or cultural well-being of the district or region;

(b) any

persons who are likely to be particularly affected by, or interested in, the

proposal; and

(c) the capacity of the local authority to

perform its role, and the financial and other costs of doing so.

115. In accordance with the considerations above,

criteria and thresholds in the policy, it is considered that the proposal is of

high significance.

ENGAGEMENT

116. Taking into consideration the above

assessment, that the proposal is of high significance, officers are of the

opinion that any decision to contemplate funding in the Long-term Plan

2024-2034 for the proposed community stadium should be highlighted in the

Long-term Plan Consultation Document and proceed to full public consultation in

accordance with section 93A of the Local Government Act 2002.

Click

here to view the TCC

Significance and Engagement Policy

Next Steps

117. Decisions made on this report will be

reflected in the Long-term Plan Consultation Document and ongoing Long-term

Plan preparation as appropriate.

Attachments

1. Community

Stadium Demographic Survey Final Report - A14942616 ⇩

2. Community

Stadium Public Consulation Analysis - A14940775 ⇩

3. Tauranga

Stadium Social Impact Assessment - Final Report - A14955967 ⇩

4. High level funding

assessment June 2023 - A14940820 - Public Excluded

|

Ordinary

Council meeting Agenda

|

21

August 2023

|

|

Ordinary

Council meeting Agenda

|

21

August 2023

|

|

Ordinary

Council meeting Agenda

|

21

August 2023

|

|

Ordinary

Council meeting Agenda

|

21

August 2023

|

11.2 Draft

Long Term Plan 2024-2034 - Memorial to Elizabeth Waterfront Recreation

Connection \ Te Hononga ki Te Awanui

File

Number: A14801550

Author: Kelvin

Eden, Capital Programme Manager: Major Community Amenity

Authoriser: Gareth

Wallis, General Manager: City Development & Partnerships

Purpose of the

Report

1. The purpose of this report

is to evaluate options and recommend a preferred option(s) for the provision of

a recreation connection along the Tauranga Harbour waterfront between the city

centre and Memorial Park.

|

Recommendations

That the Council:

(a) Receives the report "Draft

Long Term Plan 2024-2034 - Memorial to Elizabeth Waterfront Recreation

Connection \ Te Hononga ki Te Awanui ".

(b) Approves

delivery of Option C as an achievable short/medium-term outcome,

acknowledging that it does not achieve the accessible linear connection along

the shoreline but does however, improve public access at the road ends to the

harbour edge.

(c) Approves

consultancy costs (see para 37 and 39) to progress the consenting, legal,

planning and design work for short/medium-term Option C, the

construction costs of which are currently included in the Draft Long-term

Plan 2024-2034.

(d) Approves

consultancy costs (see para 37 and 39) to progress the consenting, legal,

planning and design work for long-term Option B, with construction costs to

be considered as part of deliberations for the following long-term plan.

(e) Enter a

Memorandum of Understanding with Mana Whenua.

|

Executive

Summary

2. Three options have been

short-listed and consulted on by the project team. These options have been

modified in some respects, including in order to respond to direct landowner

feedback. The updated versions of these options are summarised in the Options Analysis

section, and in detail in Attachment 1 – Boffa Miskell Council

Recommendations Report.

3. Option B provides a

recreation connection against the coastline from Memorial Park to Elizabeth

Street in the city centre, by incorporating reclamation, structural pathways

and accessways, as well as sand deposition with an integrated pathway behind.

Sand would need to be protected by several groyne structures, and these

structures can be designed to accommodate recreational access and amenities.

4. Option B includes

consolidation of riparian access, with improved small craft launching and

docking facilities provided by jetty structures or groynes, and ensuring that

existing coastal consents can be given effect to.

5. This option also includes

improved access down some of the Avenues to Te Awanui Tauranga Harbour, and the

development of ‘nodes’ on the coastal edge at the bottom of these

improved Avenue links, providing improved recreational access and amenities.

6. Option C would see the

delivery of some parts of the longer term Option B, including the development

of ‘nodes’ on the coastal edge at the bottom of improved Avenue

links, to provide for recreational access and amenities.

7. Option C also includes

some sand deposition and replenishment, with the construction of groynes to

entrap sand at the southern end of the project area between Sixth and Seventh

Avenue, and at First Avenue.

8. Option C minimises some of

the identified risks, notably those relating to riparian rights and consenting.

It makes good use of existing public land, and provides some improved

connection with the water, and increased recreational facility for public use.

9. It

is recommended that Option C is progressed to developed design for landowner

and public engagement, detailed design, resource consent and in turn, building

consent. Noting that projects are staged and access to First Avenue, Second

Avenue, and Fourth Avenue have been prioritised. Fifth Avenue East and existing

access points shall be addressed should funding allow.

BackgrounD

10. A coastal connection between Memorial

Park and the city centre has been formally included in a variety of TCC

strategy and policy documents since 2004, with several objectives being, in

summary to:

· provide

a continuous city-cycle network;

· connect

people with the water/the coastal edge;

· provide

greater uniformity of harbour edge;

· contribute

to public amenities offered in the city centre;

· provide

a safer cycle route into the city centre as an alternative to Devonport Rd; and

· provide

for safety and broad accessibility.

11. The coastal connection was gifted the

name or ingoa “Te Hononga ki Te Awanui” by mana whenua

representatives on 10 May 2022. In te reo Māori, the kupu or

word Hononga holds the meaning of union, connection, relationship or

bond. Te Awanui is the traditional name for the Tauranga Harbour. In

gifting the name the representatives said “the essence of the journey

from Taiparirua to Mareanui, the Matapihi Railway Bridge and the Waterfront is

the connection with the harbour”.

12. The ingoa Te Awanui in the

project name is also a reference to the Te Awanui Waka, and the mana whenua

aspiration to develop a Whare Waka and relocate the Te Awanui Waka to the

waterfront.

13. Stage 1 of Te Hononga ki Te Awanui is

underway. Stage 1 includes the construction of a railway underpass next to the

Harbourside Restaurant (completed) and a new section of boardwalk that will

join the underpass with the southern end of The Strand. This will link the

waterfront boardwalk from The Strand through to Tunks Reserve at the eastern

end of Elizabeth Street.

14. Stage 2 of Te Hononga ki Te Awanui,