|

|

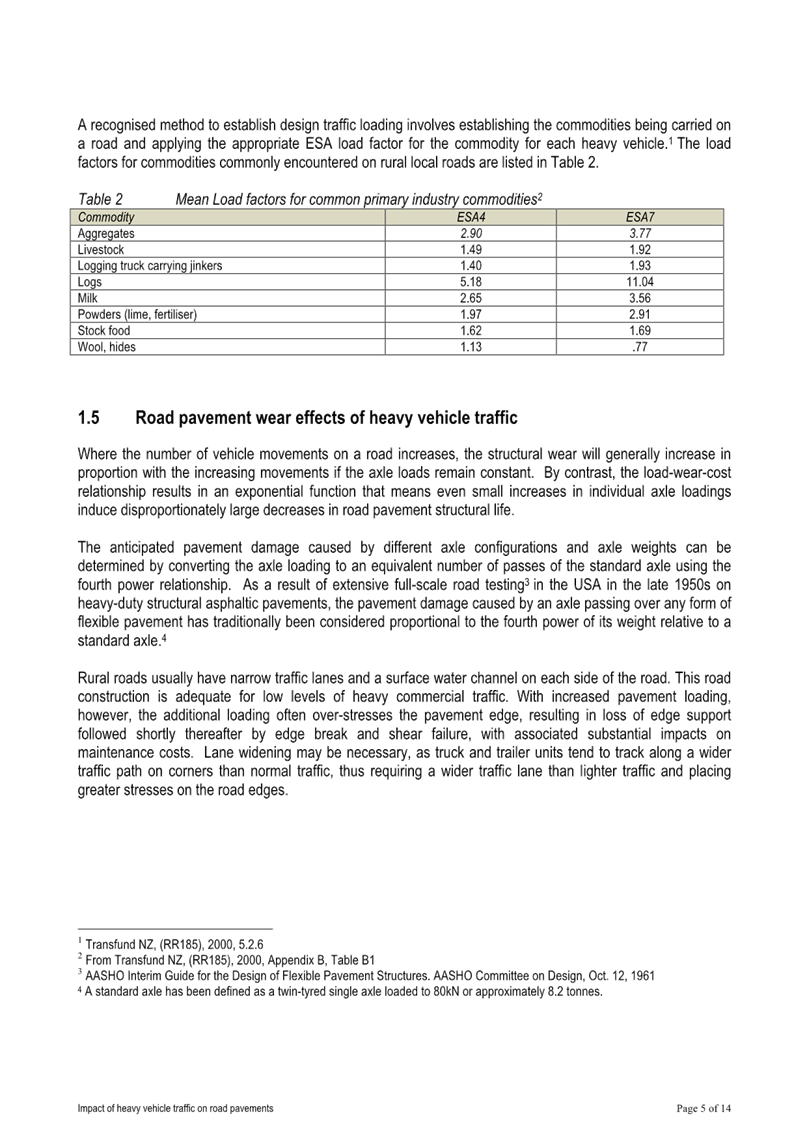

|

AGENDA

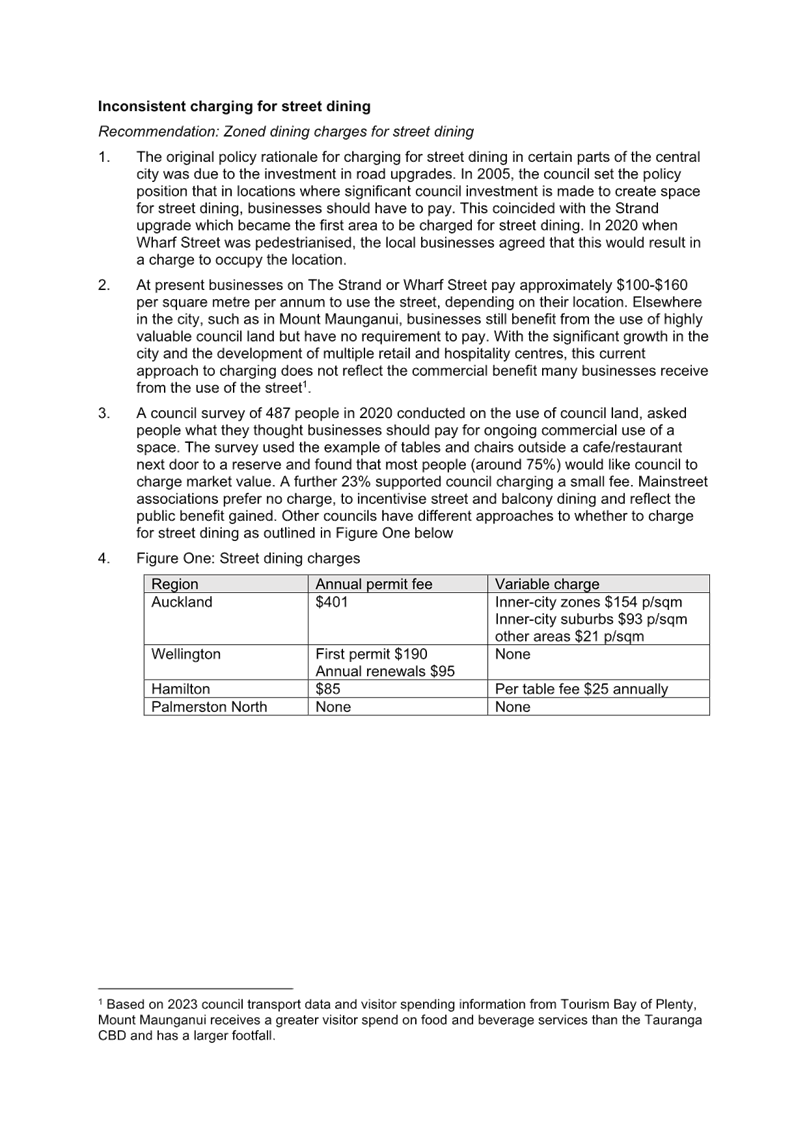

Strategy, Finance and Risk Committee meeting

Monday, 7 August 2023

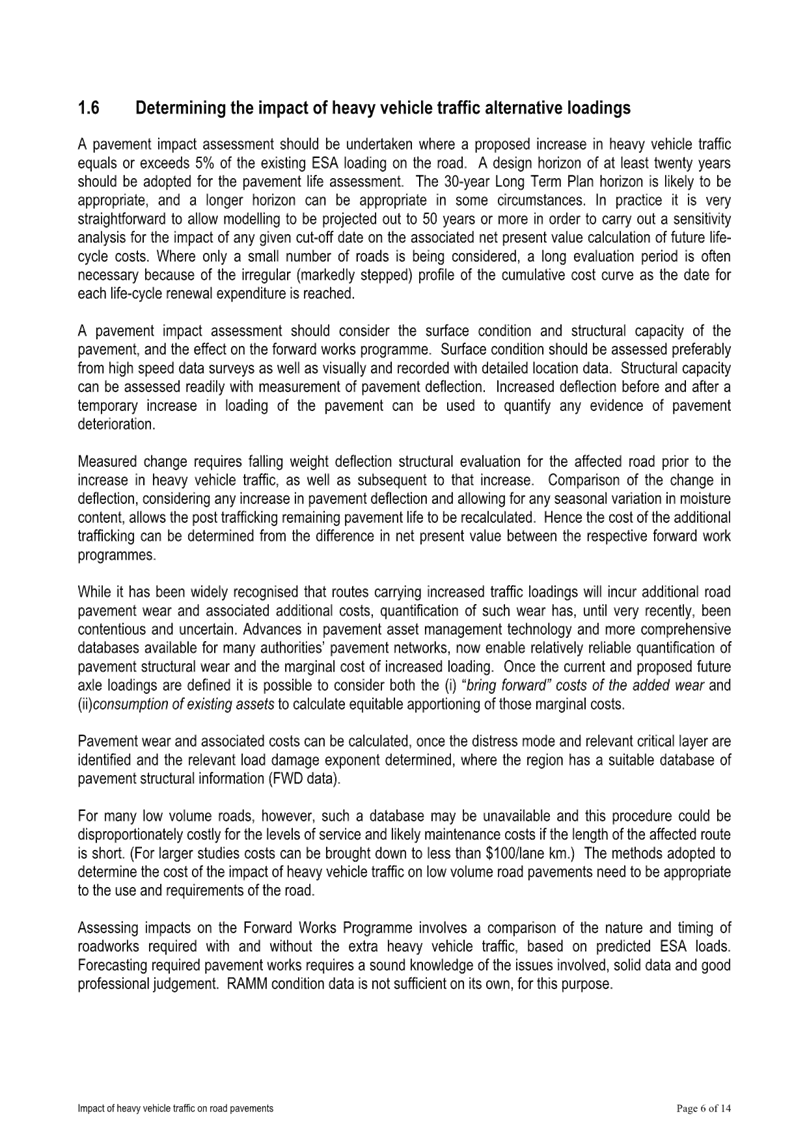

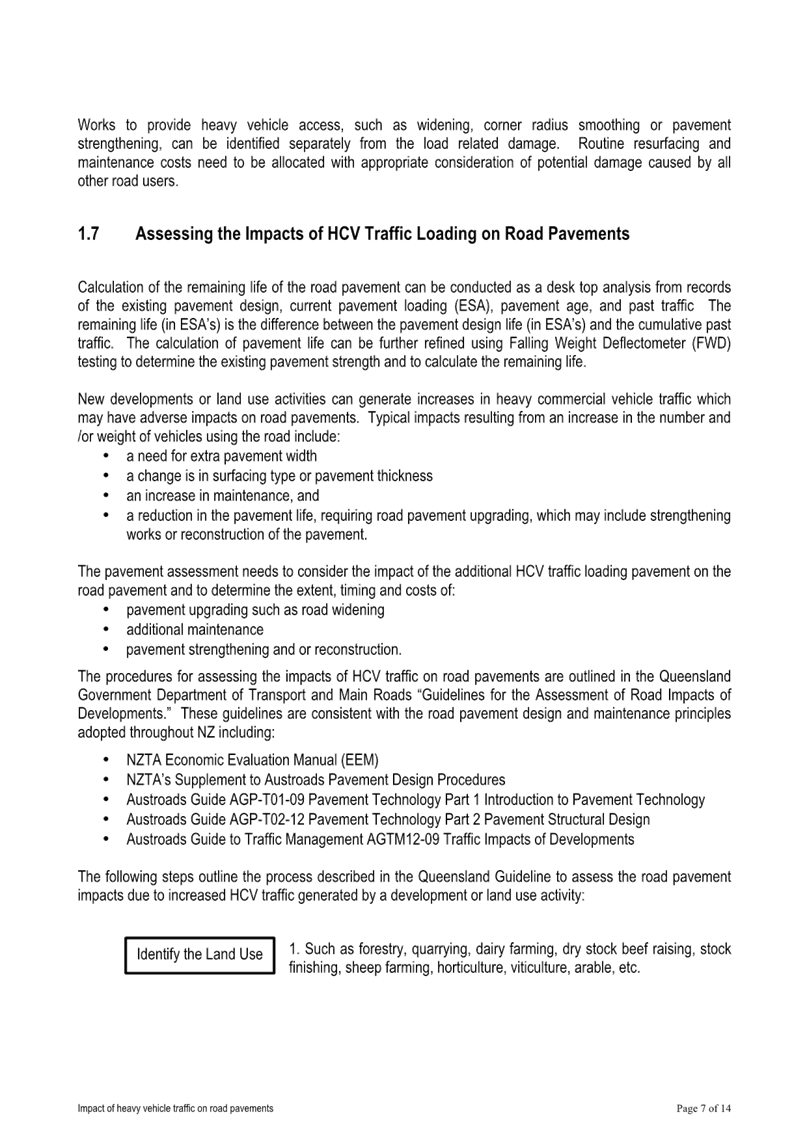

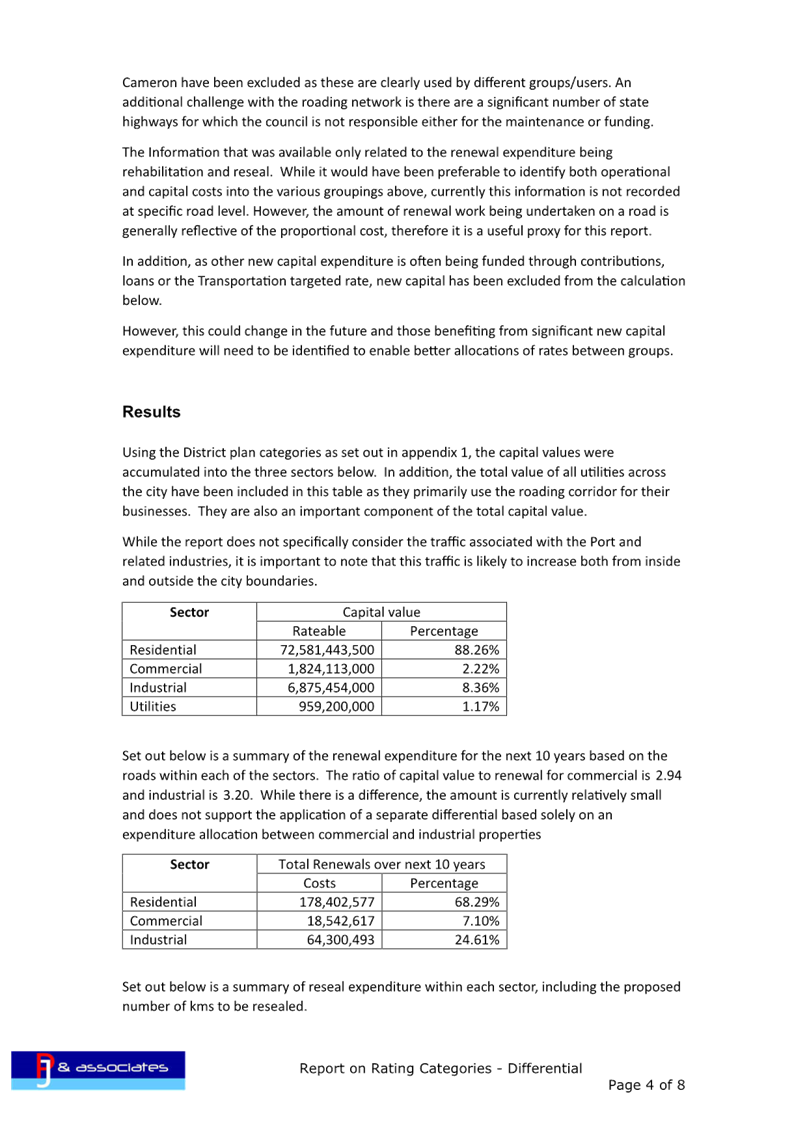

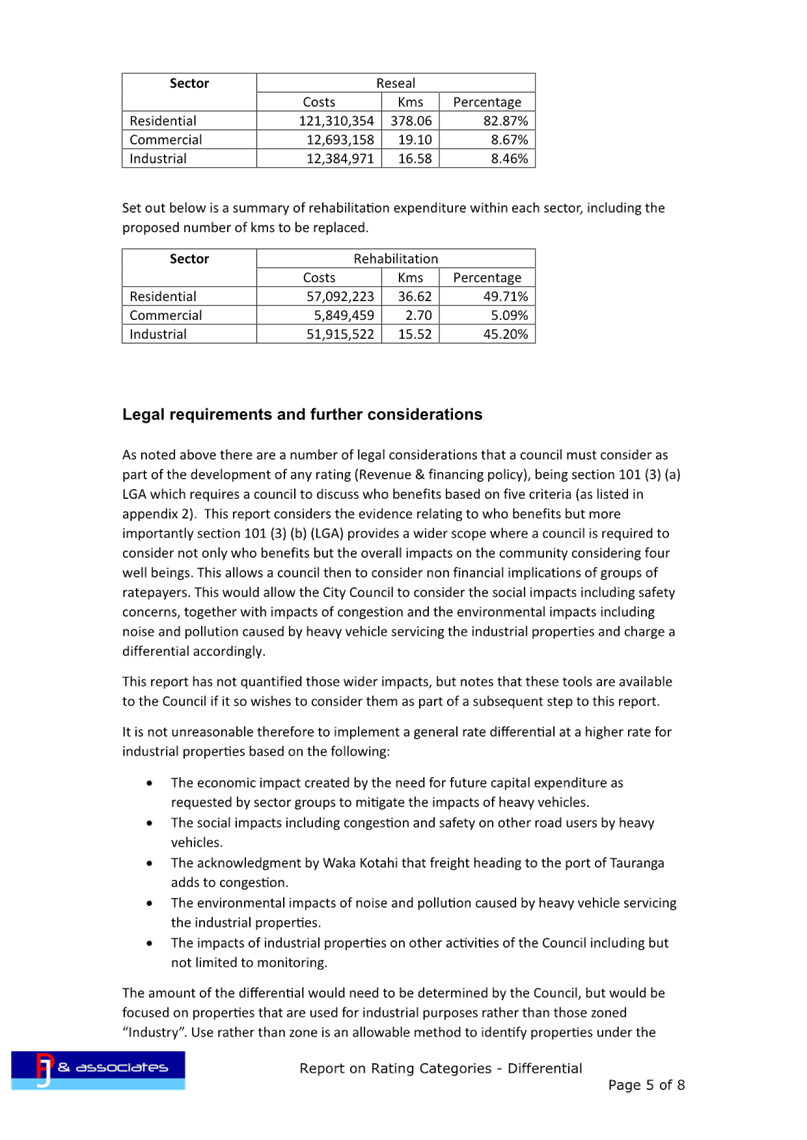

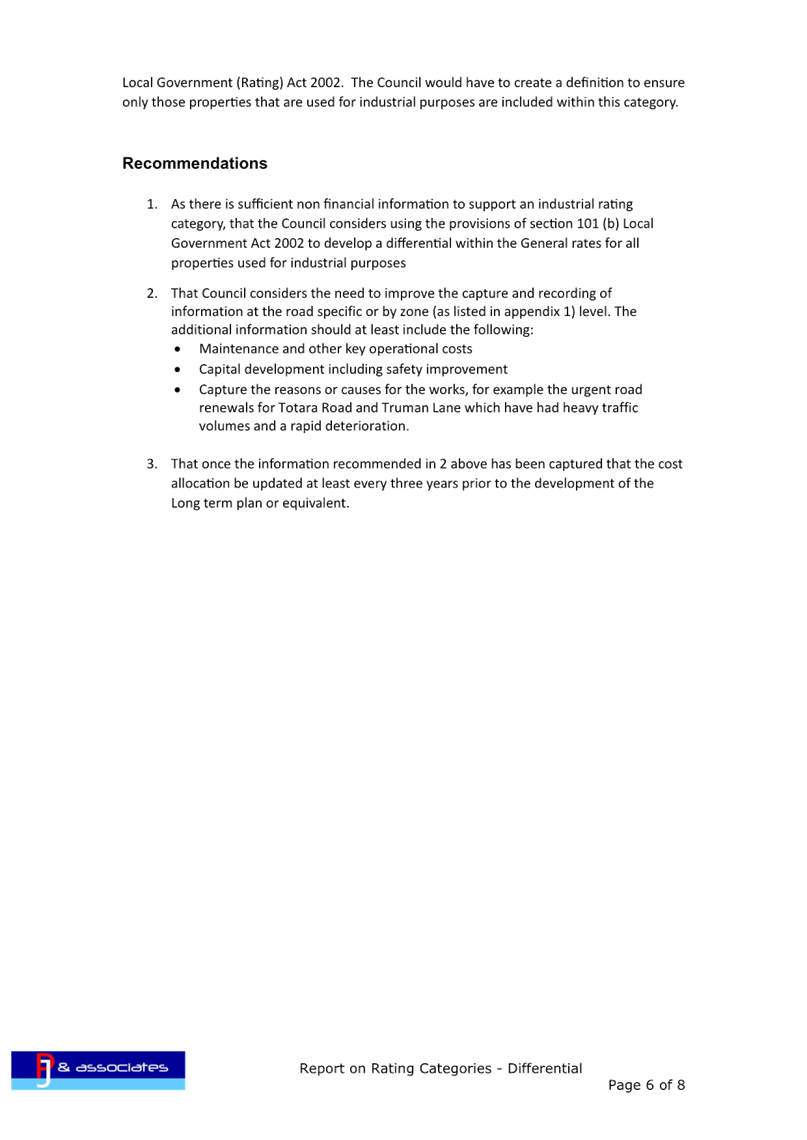

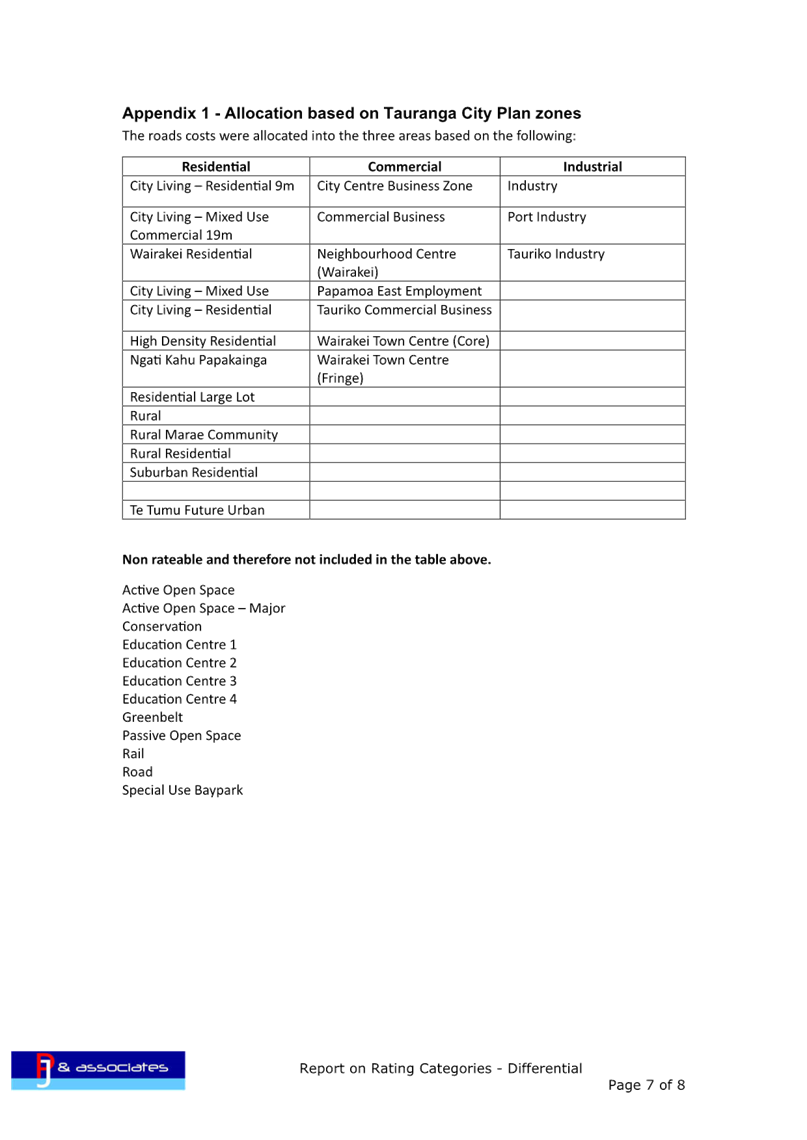

|

|

I hereby give notice that a Strategy, Finance and

Risk Committee meeting will be held on:

|

|

Date:

|

Monday, 7 August 2023

|

|

Time:

|

9.30am

|

|

Location:

|

Bay of Plenty Regional Council Chambers

Regional House

1 Elizabeth Street

Tauranga

|

|

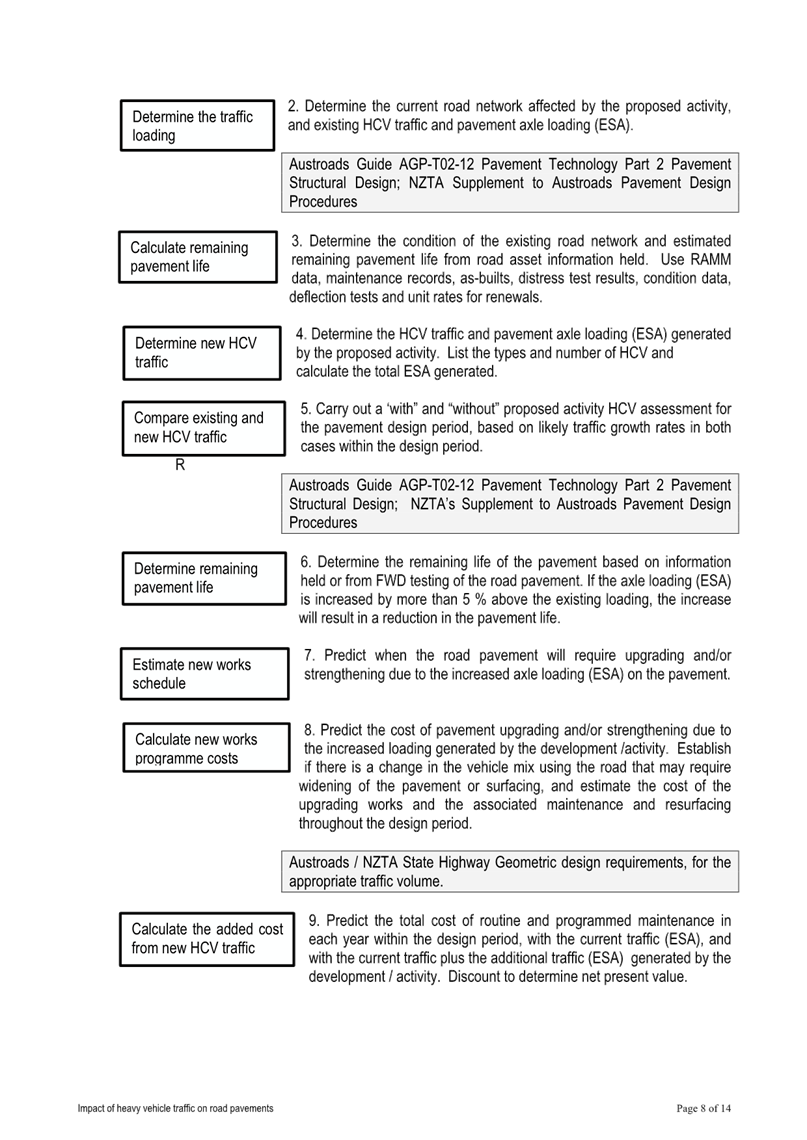

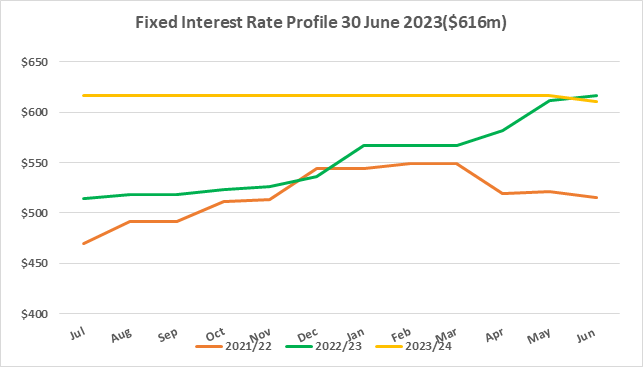

Please note that this

meeting will be livestreamed and the recording will be publicly available on

Tauranga City Council's website: www.tauranga.govt.nz.

|

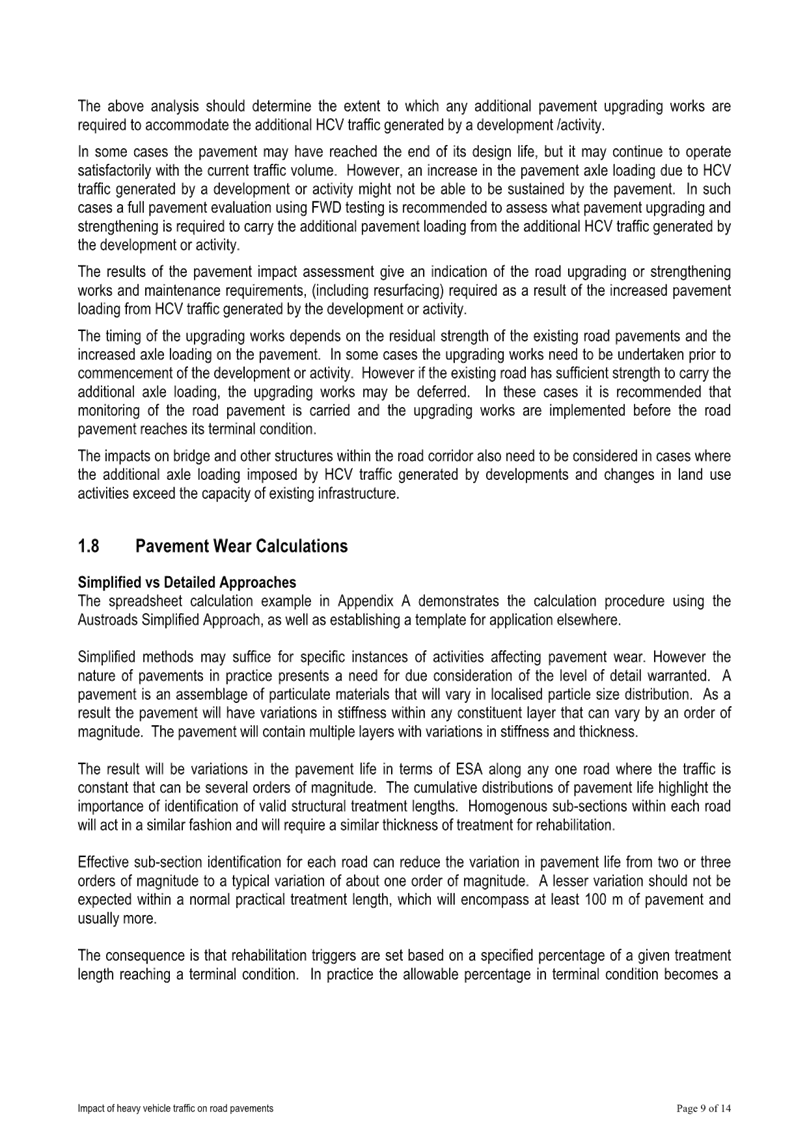

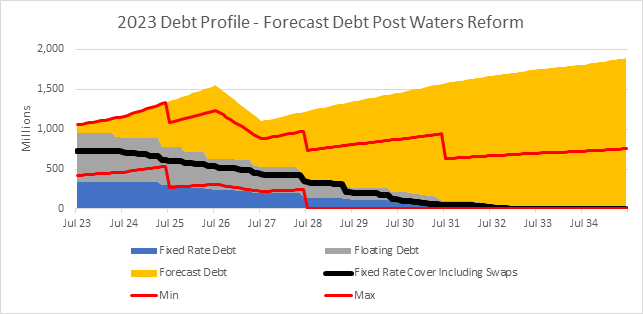

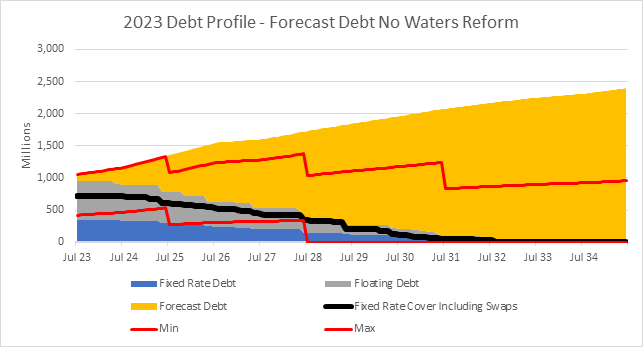

|

Marty Grenfell

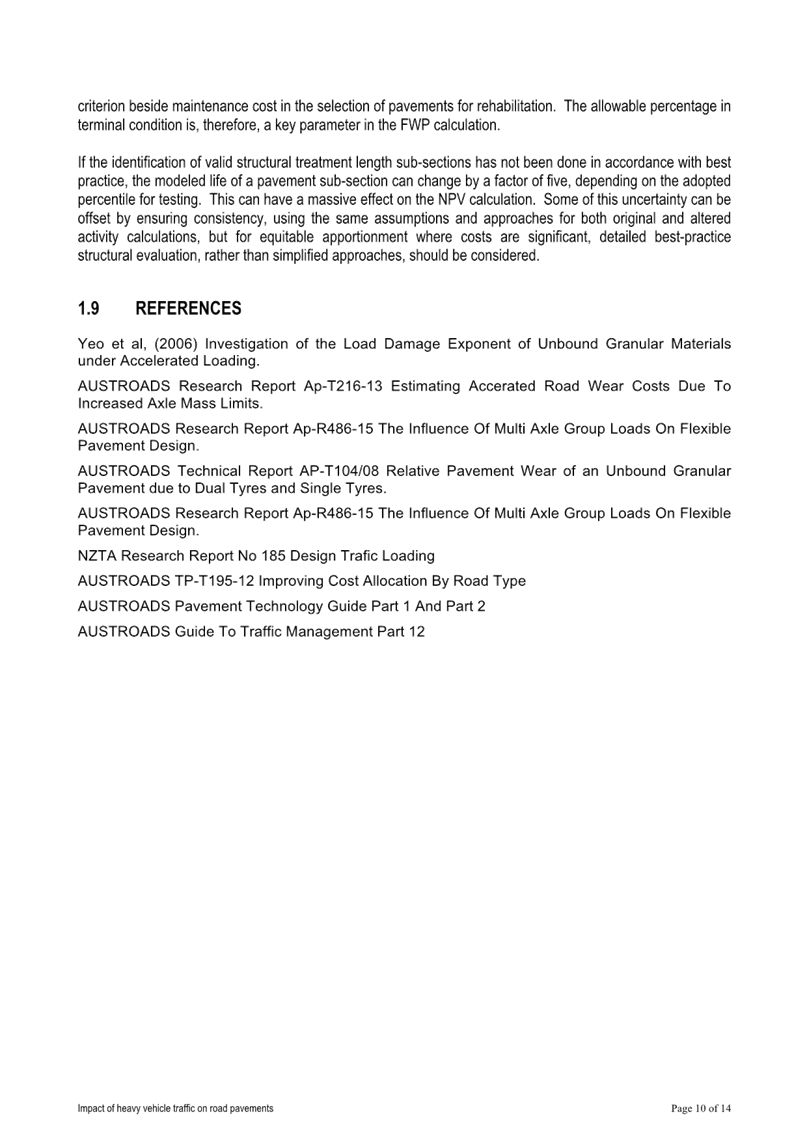

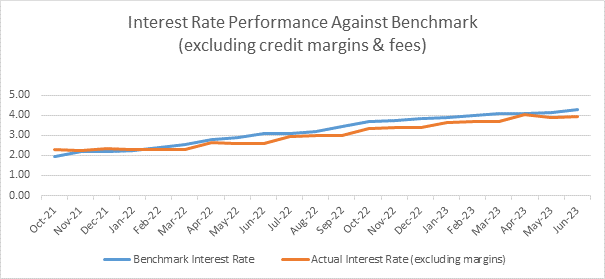

Chief Executive

|

Terms of reference – Strategy,

Finance & Risk Committee

Membership

|

Chairperson

|

Commission Chair Anne Tolley

|

|

Deputy chairperson

|

Dr Wayne Beilby – Tangata

Whenua representative

|

|

Members

|

Commissioner Shadrach Rolleston

Commissioner Stephen Selwood

Commissioner Bill Wasley

|

|

|

Matire Duncan, Te Rangapū Mana

Whenua o Tauranga Moana Chairperson

Te Pio Kawe – Tangata

Whenua representative

Rohario Murray – Tangata

Whenua representative

Bruce Robertson – External

appointee with finance and risk experience

|

|

Quorum

|

Five (5) members must be

physically present, and at least three (3) commissioners and two (2)

externally appointed members must be present.

|

|

Meeting frequency

|

Six weekly

|

Role

The role

of the Strategy, Finance and Risk Committee (the Committee) is:

(a)

to assist and advise the Council in discharging

its responsibility and ownership of health and safety, risk management,

internal control, financial management practices, frameworks and processes to

ensure these are robust and appropriate to safeguard the Council's staff and

its financial and non-financial assets;

(b)

to consider strategic issues facing the city and

develop a pathway for the future;

(c)

to monitor progress on achievement of desired

strategic outcomes;

(d)

to review and determine the policy and bylaw

framework that will assist in achieving the strategic priorities and outcomes

for the Tauranga City Council.

Membership

The Committee will consist of:

·

four commissioners with the Commission Chair

appointed as the Chairperson of the Committee

·

the Chairperson of Te

Rangapū Mana Whenua o Tauranga Moana

·

three tangata whenua representatives

(recommended by Te Rangapū Mana Whenua o Tauranga

Moana and appointed by Council)

·

an independent external person with finance and

risk experience appointed by the Council.

Voting

Rights

The

tangata whenua representatives and the independent external person have voting

rights as do the Commissioners.

The

Chairperson of Te Rangapu Mana Whenua o Tauranga Moana is an advisory position,

without voting rights, designed to ensure mana whenua discussions are connected

to the committee.

Committee's

Scope and Responsibilities

A. STRATEGIC

ISSUES

The Committee will consider

strategic issues, options, community impact and explore opportunities for

achieving outcomes through a partnership approach.

A1 – Strategic Issues

The Committee's responsibilities with regard to Strategic

Issues are:

·

Adopt an annual work

programme of significant strategic issues and projects to be addressed. The

work programme will be reviewed on a six-monthly basis.

·

In respect of each

issue/project on the work programme, and any additional matters as determined

by the Committee:

○ Consider existing and future strategic

context

○ Consider opportunities and possible

options

○ Determine preferred direction and

pathway forward and recommend to Council for inclusion into strategies,

statutory documents (including City Plan) and plans.

·

Consider and approve

changes to service delivery arrangements arising from the service delivery

reviews required under Local Government Act 2002 that are referred to the

Committee by the Chief Executive.

·

To take appropriate

account of the principles of the Treaty of Waitangi.

A2 – Policy and Bylaws

The Committee's responsibilities with regard to Policy and

Bylaws are:

·

Develop, review and

approve bylaws to be publicly consulted on, hear and deliberate on any

submissions and recommend to Council the adoption of the final bylaw. (The

Committee will recommend the adoption of a bylaw to the Council as the Council

cannot delegate to a Committee the adoption of a bylaw.)

·

Develop, review and

approve policies including the ability to publicly consult, hear and deliberate

on and adopt policies.

A3 – Monitoring of Strategic

Outcomes and Long Term Plan and Annual Plan

The Committee's responsibilities with regard to monitoring

of strategic outcomes and Long Term Plan and Annual Plan are:

·

Reviewing and

reporting on outcomes and action progress against the approved strategic

direction. Determine any required review / refresh of strategic direction or

action pathway.

·

Reviewing and

assessing progress in each of the six (6) key investment proposal areas within

the 2021-2031 Long Term Plan.

·

Reviewing the

achievement of financial and non-financial performance measures against the

approved Long Term Plan and Annual Plans.

B. FINANCE AND RISK

The Committee will review the effectiveness of the

following to ensure these are robust and appropriate to safeguard the Council's

financial and non-financial assets:

·

Health and safety.

·

Risk management.

·

Significant projects and programmes of work

focussing on the appropriate management of risk.

·

Internal and external audit and assurance.

·

Fraud, integrity and investigations.

·

Monitoring of compliance with laws and regulations.

·

Oversight of preparation of the Annual Report

and other external financial reports required by statute.

·

Oversee the relationship with the

Council’s Investment Advisors and Fund Managers.

·

Oversee the relationship between the Council and

its external auditor.

·

Review the quarterly financial and non-financial

reports to the Council.

B1 - Health and Safety

The

Committee’s responsibilities through regard to health and safety are:

·

Reviewing the effectiveness of the health and

safety policies and processes to ensure a healthy and safe workspace for

representatives, staff, contractors, visitors and the public.

·

Assisting the Commissioners to discharge their

statutory roles as "Officers" in terms of the Health and Safety at

Work Act 2015.

B2 - Risk Management

The

Committee's responsibilities with regard to risk management are:

·

Review, approve and monitor the implementation of the Risk

Management Policy, including the Corporate Risk Register.

·

Review and approve the Council’s "risk appetite"

statement.

·

Review the effectiveness of risk management and internal control

systems including all material financial, operational, compliance and other

material controls. This includes legislative compliance, significant projects

and programmes of work, and significant procurement.

·

Review risk management reports identifying new and/or emerging

risks and any subsequent changes to the "Tier One" register.

B3

- Internal Audit

The

Committee’s responsibilities with regard to the Internal Audit are:

·

Review and approve the Internal Audit Charter to confirm the

authority, independence and scope of the Internal Audit function. The Internal

Audit Charter may be reviewed at other times and as required.

·

Review and approve annually and monitor the implementation of the

Internal Audit Plan.

·

Review the co-ordination between the risk and internal audit

functions, including the integration of the Council's risk profile with the

Internal Audit programme. This includes assurance over all material financial,

operational, compliance and other material controls. This includes legislative

compliance (including Health and Safety), significant projects and programmes

of work and significant procurement.

·

Review the reports of the Internal Audit functions dealing with

findings, conclusions and recommendations.

·

Review and monitor management’s responsiveness to the

findings and recommendations and enquire into the reasons that any

recommendation is not acted upon.

B4

- External Audit

The

Committee's responsibilities with regard to the External Audit are:

·

Review with the external auditor, before the audit commences, the

areas of audit focus and audit plan.

·

Review with the external auditors, representations required by

commissioners and senior management, including representations as to the fraud

and integrity control environment.

·

Recommend adoption of external accountability documents (LTP and

annual report) to the Council.

·

Review the external auditors, management letter and management

responses and inquire into reasons for any recommendations not acted upon.

·

Where required, the Chair may ask a senior representative of the

Office of the Auditor General (OAG) to attend the Committee meetings to discuss

the OAG's plans, findings and other matters of mutual interest.

·

Recommend to the Office of the Auditor General the decision

either to publicly tender the external audit or to continue with the existing

provider for a further three-year term.

B5

- Fraud and Integrity

The

Committee's responsibilities with regard to Fraud and Integrity are:

·

Review and provide advice on the Fraud Prevention and Management

Policy.

·

Review, adopt and monitor the Protected Disclosures Policy.

·

Review and monitor policy and process to manage conflicts of

interest amongst commissioners, tangata whenua representatives, external

representatives appointed to council committees or advisory boards, management,

staff, consultants and contractors.

·

Review reports from Internal Audit, external audit and management

related to protected disclosures, ethics, bribery and fraud related incidents.

·

Review and monitor policy and processes to manage

responsibilities under the Local Government Official Information and Meetings

Act 1987 and the Privacy Act 2020 and any actions from the Office of the

Ombudsman's report.

B6

- Statutory Reporting

The

Committee's responsibilities with regard to Statutory Reporting relate to

reviewing and monitoring the integrity of the Annual Report and recommending to

the Council for adoption the statutory financial statements and any other

formal announcements relating to the Council's financial performance, focusing

particularly on:

·

Compliance with, and the appropriate application of, relevant

accounting policies, practices and accounting standards.

·

Compliance with applicable legal requirements relevant to statutory

reporting.

·

The consistency of application of accounting policies, across

reporting periods.

·

Changes to accounting policies and practices that may affect the

way that accounts are presented.

·

Any decisions involving significant judgement, estimation or

uncertainty.

·

The extent to which financial statements are affected by any

unusual transactions and the manner in which they are disclosed.

·

The disclosure of contingent liabilities and contingent assets.

·

The basis for the adoption of the going concern assumption.

·

Significant adjustments resulting from the audit.

Power

to Act

·

To make all

decisions necessary to fulfil the role, scope and responsibilities of the

Committee subject to the limitations imposed.

·

To establish

sub-committees, working parties and forums as required.

·

This Committee has not

been delegated any responsibilities, duties or powers that the Local Government

Act 2002, or any other Act, expressly provides the Council may not delegate.

For the avoidance of doubt, this Committee has not been delegated

the power to:

o

make a rate;

o

make a bylaw;

o

borrow money, or purchase

or dispose of assets, other than in accordance with the Long-Term Plan (LTP);

o

adopt the LTP or Annual

Plan;

o

adopt the Annual Report;

o

adopt any policies required

to be adopted and consulted on in association with the LTP or developed for the

purpose of the local governance statement;

o

adopt a remuneration and

employment policy;

o

appoint a chief executive.

Power

to Recommend

To Council and/or any standing committee

as it deems appropriate.

|

Strategy,

Finance and Risk Committee meeting Agenda

|

7

August 2023

|

7 Confirmation

of minutes

7.1 Minutes

of the Strategy, Finance and Risk Committee meeting held on 26 June 2023

File

Number: A14900735

Author: Janie

Storey, Governance Advisor

Authoriser: Sarah

Drummond, Governance Advisor

|

Recommendations

That the Minutes of the

Strategy, Finance and Risk Committee meeting held on 26 June 2023 be

confirmed as a true and correct record.

|

Attachments

1. Minutes

of the Strategy, Finance and Risk Committee meeting held on 26 June 2023

|

Strategy, Finance and Risk Committee meeting minutes Strategy, Finance and Risk Committee meeting minutes

|

26 June 2023

|

|

|

|

MINUTES

Strategy, Finance and Risk Committee meeting

Monday, 26 June 2023

|

Order of Business

1 Opening karakia. 3

2 Apologies. 3

3 Public forum.. 3

4 Acceptance of

late items. 4

5 Confidential

business to be transferred into the open. 4

6 Change to order

of business. 4

7 confirmation of

minutes. 4

7.1 Confirmation

of Minutes. 4

8 Declaration of

conflicts of interest 4

9 Business. 4

9.1 2024-2034

Long-term Plan - Significant Forecasting Assumptions Update. 4

9.2 Alcohol

Control Bylaw Amendment 6

9.3 Draft

Revised Community Funding Policy. 7

9.4 Retrospective

approval of submission on Discussion document: Review of the Electricity

(Hazards from Trees) Regulation 2003. 9

9.5 House

it going? Dashboard. 9

9.6 Infrastructure

Resilience Programme update. 10

9.7 Mount

to Arataki Spatial Plan Update. 11

10 Discussion of late items. 12

7 Public excluded

session. 12

MINUTES

OF Tauranga City Council

Strategy, Finance and Risk Committee meeting

HELD

AT THE Bay of Plenty Regional Council

Chambers, Regional House, 1 Elizabeth Street, Tauranga

ON

Monday, 26 June 2023 AT 9.30am

PRESENT: Commission

Chair Anne Tolley, Dr Wayne Beilby, Commissioner Shadrach Rolleston,

Commissioner Stephen Selwood, Commissioner Bill Wasley, Ms Rohario Murray, Mr

Bruce Robertson

IN ATTENDANCE: Marty

Grenfell (Chief Executive), Nic Johansson (General Manager: Infrastructure),

Christine Jones (General Manager: Strategy, Growth & Governance), Alastair

McNeill (General Manager: Corporate Services), Josh Logan (Team Leader:

Corporate Planning), James Woodward (Manager: Capital Programme

Assurance), Jane Barnett (Policy Analyst), Nigel McGlone (Manger: Environmental

Regulation), Sandy Lee (Policy Analyst), Richard Butler (Community Partnerships

Funding Specialist), Paula Naude (Manager: Community Development &

Emergency Management), Emma Joyce (Open Space and Community Facilities

Planner), Mark Armistead (Principal Urban Forester), Rory Bayliss Chalmers

(Senior Business Analyst), Kim Martelli (Resilience Specialist: Natural Hazards

and Infrastructure), Natalie Rooseboom (Manager: Asset Services), Carl

Lucca (Team Leader: Urban Communities), Coral Hair (Manager: Democracy &

Governance Services), Sarah Drummond (Governance Advisor), Anahera Dinsdale

(Governance Advisor)

1 Opening

karakia

Commissioner Shadrach Rolleston opened the meeting with a

karakia.

2 Apologies

|

An apology from Matire Duncan was received and an apology

for Te Pio Kawe was noted during the meeting. Dr Wayne Beilby advised

that he would be leaving the meeting early.

|

|

Committee Resolution SFR4/23/1

Moved: Commissioner

Shadrach Rolleston

Seconded: Commissioner Bill Wasley

That an apology from Matire

Duncan be received.

CARRIED

|

3 Public

forum

Nil

4 Acceptance

of late items

|

Committee Resolution SFR4/23/2

Moved: Mr

Bruce Robertson

Seconded: Commissioner Stephen Selwood

That the following items be

included in the agenda:

7.1 Minutes

of the Strategy, Finance and Risk Committee meeting held on 6 June 2023.

11.2 Public Excluded Minutes

of the Strategy, Finance and Risk Committee meeting held on 6 June 2023.

Carried

|

5 Confidential

business to be transferred into the open

Nil

6 Change

to order of business

Nil

7 confirmation

of minutes

|

7.1 Confirmation

of Minutes

|

|

Committee Resolution SFR4/23/3

Moved: Commissioner

Stephen Selwood

Seconded: Mr Bruce Robertson

That the public and public

excluded minutes for the Strategy, Finance and Risk Committee meeting held on

6 June 2023 be confirmed as a true and correct record.

Carried

|

8 Declaration

of conflicts of interest

Nil

9 Business

|

9.1 2024-2034

Long-term Plan - Significant Forecasting Assumptions Update

|

|

Staff Christine

Jones, General Manager: Strategy, Growth & Governance

Josh Logan, Team Leader: Corporate Planning

James Woodward, Manager: Capital Programme Assurance

External David

Norman, GHD Chief Economist

A copy of the presentation for this item can be viewed on

Tauranga City Council’s website in the Minutes Attachments document for

this committee meeting.

Key points

·

Mr Norman had worked with staff on the assumptions that were to

be fed into the Long-Term Plan (LTP).`

·

A challenge with the Waka Kotahi categories were that they were

backward looking and their indices did not take into account the specific mix

of capital works programmes at the different councils.

·

Developed a series of indices which accounted for 81% of the

capital works programme.

·

Outlined the process undertaken to develop the forecasts,

provided background on materials, supply chain costs and risks and the

management of these.

·

Cost escalation continued to be a major challenge for capital

works programmes even though some indices were slowing down.

·

Forecasting was being developed that quantified new risks

and/or priorities of the budgeting process.

·

The valuation of existing assumption/indices required

moderation that enabled further development.

·

Price rises and inflation were not expected to drop markedly.

The New Zealand dollar remained weak and would strengthen slowly.

·

Cyclones and other weather related events had increased costs, bitumen

was expected to be the same price as it was at present, but petrol and steel

were increasing.

·

Immigration numbers had approached a record high month on month

compared to the previous Long-Term Plan.

·

Mr Norman stated that in his view Tauranga City Council was ahead

of other councils in management mitigation and management of risk.

·

The next update to the Committee would provide updated

assumptions with forecasts being reviewed every six months.

In response to questions

·

Overall rises of construction costs were expected to be a bit

more moderate with inflation expected to be higher. Beyond the first three

years the predictions were based on discussions held with a number of sectors

including our own contractors and from year 4 and beyond assumes inflation

reduced to just above 2%, with construction costs just above 2.5%.

·

In response to a query as to whether the impact on growth was

sufficiently captured regarding the use now, and the potential future use, of

council community facilities, it was noted that this was captured when

planning new facilities at an individual project level. As part of the LTP

the timing of growth and investment was considered and staff were looking at

what it would do to the growth rollout, which may result in some refinement

to the current assumptions. Any flow on to the growth projections would be brought

back to Council within the LTP. A section could be added to specify how

infrastructure met the current demand, growth demand within the TCC area and

outside the TCC area to clearly recognise future demand for council

facilities.

·

The rapid movement of Artificial Intelligence (AI) technology

had not been specifically recognised in the assumptions, but an environmental

scan was carried out at the start of the process which included information

on AI as part of the digital services activity planning. Information

could be added to the assumptions to cover AI.

·

In answer to a query on assumption 12 as to whether the risk

covered the contracting out of facilities as opposed to the best outcome of

the delivery of those services, it was noted that the Council had a statutory

requirement to look at options for delivering services including

non-financial benefits and costs.

·

It was noted that the population percentages in the report on

page 23, needed to be corrected.

·

The information used in the assumptions would be reviewed up

until the LTP was adopted to go to audit on 11 September 2023 and these would

be the assumptions used for consultation.

·

The Committee requested staff to circulate the power point

presentation that focused on assumptions, RMA, and water costs.

Discussion points raised

·

Appreciation was given to all who had worked on the

assumptions.

|

|

Committee Resolution SFR4/23/4

Moved: Commissioner

Bill Wasley

Seconded: Commissioner

Stephen Selwood

That the Strategy, Finance and Risk Committee:

(a) Receives the report

“2023-2034 Long-Term Plan – Significant Forecasting Assumptions

Update”.

(b) Approves the recommended

changes to the Significant Forecasting Assumptions as proposed in Attachment

1, noting that Assumption 41 “Impact on growth beyond city

boundaries” was to be updated.

(c) Approves the updated Draft

2023 – 2034 Long-Term Plan Significant Forecasting Assumptions and

associated mitigation actions as set out in Attachment 2.

(d) Recommends to Council that

Council:

(i) Adopts the full

updated Draft Significant Forecasting Assumptions (Attachment 2) to

form part of the supporting documentation for the purpose of public

consultation for the proposed Long-term Plan 2024-2034 in November 2023.

(ii) Authorises

the Chief Executive to make minor amendments to the documentation to ensure

accuracy and correct minor drafting errors.

Carried

|

|

Attachments

1 GHD

Presentation - Tauranga Cost Escalation

|

|

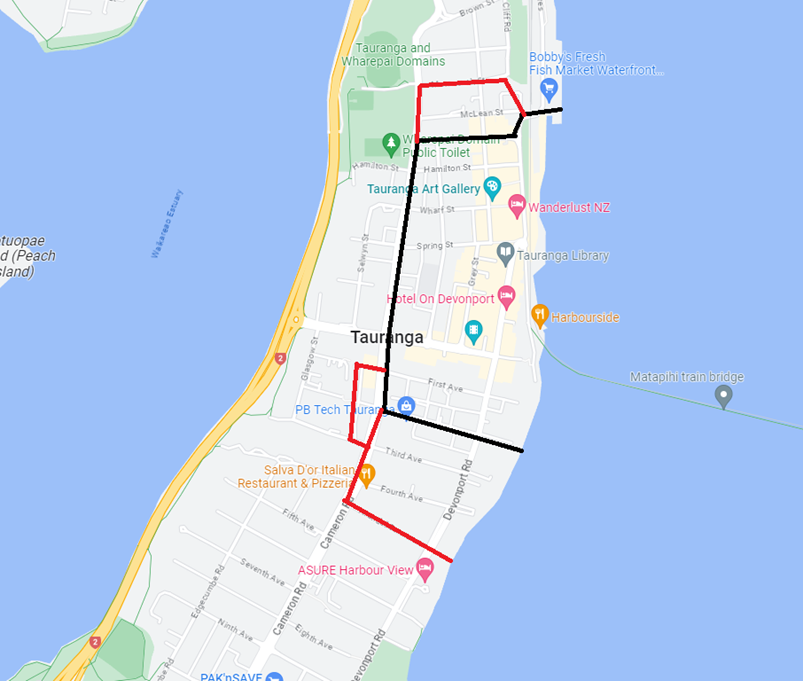

9.2 Alcohol

Control Bylaw Amendment

|

|

Staff Christine

Jones, General Manager: Strategy, Growth & Governance

Jane Barnett, Policy Analyst

Nigel McGlone, Manger: Environmental Regulation

Key points

·

The temporary alcohol-free area over the summer period had been

in place over the last five years, the amendment was now incorporating that

as part of the bylaw.

·

Approval was being sought to consult on the proposed amendment.

In response to questions

·

It was noted that working group meetings had been held with the

New Zealand Police regarding the bylaw changes they had requested.

Discussion points raised

·

Reference was made to the plans that were in place for events

on the green spaces along the waterfront, Masonic Park and similar areas and

it was noted that the bylaw amendment was at odds with that. It was

requested that staff take note of the future use of these areas and consider

whether the bylaw aligns with those uses.

·

It was suggested that the bylaw be revisited in its entirety

and carry a separate review of the bylaw be carried out in the new

year.

·

The temporary bylaw provisions could be approved at this

meeting to enable these provisions to stay in place over summer and allow the

Police to enforce the bylaw.

·

The review of the bylaw also needed to be aligned with the

spatial reviews and how spaces were to be used given the changes to the city

centre and the Mount Maunganui since the bylaw was introduced.

·

As part of the review it was requested that evidence be

provided of the differences the temporary bylaw provisions had made.

·

It was requested that definitions be included in the bylaw

review rather than referenced to other legislation.

|

|

Committee Resolution SFR4/23/5

Moved: Commissioner

Bill Wasley

Seconded: Commissioner Shadrach Rolleston

That the Strategy, Finance and Risk Committee:

(a)

Receives the report "Alcohol Control Bylaw Amendment".

(b)

Approves that a temporary alcohol-free area be put in place during the

summer period along the coastal strip along Marine Parade from its

intersection with Grove Avenue, and Ocean Beach Road and Maranui Street in a

similar manner to previous years.

(c)

Requests a report back on options in respect of the Alcohol Control

Bylaw review, particularly in respect of the city centre and Mt Maunganui

area.

Carried

|

Dr Wayne Beilby left the meeting

at 10.35 am

|

9.3 Draft

Revised Community Funding Policy

|

|

Staff Christine

Jones, General Manager: Strategy, Growth & Governance

Sandy Lee, Policy Analyst

Richard Butler, Community Partnerships Funding Specialist

Paula Naude, Manager: Community Development &

Emergency Management

Key points

·

The comments received in previous meetings had been

incorporated in the document providing information on all the funding sources

and purposes in one policy.

·

An additional exception had been included in clause 5.1.5 which

enabled marae that technically sit outside the Tauranga City Council boundary

to be eligible for funding where they were providing services to the Tauranga

community.

In response to questions

·

Requiring community organisations to be a registered charity

provided council with a level of accountability and assurance that these

organisations were meeting the requirements of the Act and staff did not need

to replicate this process.

·

Reference to one source of funding per project rather than per

organisation needed to be made clearer in the policy.

·

It was intended that all allocations of funding allocated to

organisations be captured in the programme of work to build one overall

picture on assistance given. This was expected to be completed in 12 months

and reported back to the Committee.

·

Community leases for a sports field, verses the indoor use of a

basketball court, and the benefit received from those sports fields for

exclusive use, was beyond the scope of this work. As user fees did not

normally cover the true cost of the facility that would become a decision

about the proportion of cost that was attributed to user fees and what

proportion was considered community good. There was a piece of work on

this happening that would be considered as part of the LTP process.

·

In response to a query as to whether the ease of the groups

doing business with the Council had been tested, it was noted that this was

not currently undertaken. Staff do seek comment from recipients as to

how they found the process, but it could be expanded wider.

·

It was noted that the partnership arrangements had been managed

in the past through community grants as the funding had come from this

source. However a more optimal approach would be to manage these

relationships with the contractual part of the Council that was responsible

for overseeing and delivering the activities, with a contract for service in

place of a grant to fund this service. The feedback received would be

considered and it was agreed that partnership agreements be removed from the

recommendations in the report as it was more about having an outcome-based

relationship with these groups rather than it just being a financial

transaction.

·

Members noted that they expected to consider each of the

partnership agreements currently in place.

Discussion points raised

·

There was a focus on the partner obligations with partnership

agreements but not on the Council meeting their requirements. A better

balance was required to ensure that there was more than just a funding

transactional process, but rather an opportunity to undertake roles and tasks

which needed to be made clearer.

·

Contestable funding should be about developing more effective

relationships with our partners with the possiblity of having a relationship

longer than three years.

·

In relation to having one partnership agreement per sector, it

was suggested that given the breadth of some of the sectors, there could be

more than one. It was felt that a much more effective relationship was

needed in terms of the arrangements.

·

It may be more beneficial from a partnership perspective to

know where the Council’s policies and strategies were not working

rather than having these partners as advocates. The groups were another way

of Council getting good information about what was working in the community,

and what was not working, as these were trusted organisations. There was a

need to get the essence of the partnerships well defined and the expectations

from both sides to be contributing to it.

·

Recommendation (h) in the report - to provide delegated

authority to the Chief Executive to approve future amendments was removed.

·

The process to amend the funding schedules would need to come

back to this Committee for approval.

|

|

Committee Resolution SFR4/23/6

Moved: Commissioner

Bill Wasley

Seconded: Commissioner Stephen Selwood

That the Strategy, Finance and Risk Committee:

(a) Receives the report

"Draft Revised Community Funding Policy".

(b) Agrees to establishing a

Community Funding Programme to identify and make visible the whole collection

of community funding provided by the Council, excluding partnership

agreements.

(c) Agrees to include Capital Funding

and Community Leases in the scope of the Community Funding Policy.

(d) Agrees to continue to

exclude Community Event Funding, funds provided by central government, Grants

for Development Contributions for Community Housing and Papakāinga

Housing, and Rates Remissions from the scope of the Community Funding Policy

but include them in the Community Funding Programme.

(e) Agrees to continue to

exclude Service Agreements, partnership agreements and Mayoral Grants from

the scope of the Community Funding Policy and from the Community Funding

Programme.

(f) Agrees to include the

definitions for each of the principles specified in 4.1 of the revised

policy.

(g) Agrees to remove specific

details in the policy in line with making it an umbrella policy for community

funding.

(h) Approves the draft revised

Community Funding Policy and attached Funding Schedules (Attachment 1) for

community consultation from early July to early Aug 2023, excluding

partnership agreements.

(i) Authorises the Chief Executive

to make any necessary minor drafting or presentation- amendments to the draft

revised Community Funding Policy and Funding Schedules and related

consultation material prior to the commencement of consultation.

Carried

|

|

9.4 Retrospective

approval of submission on Discussion document: Review of the Electricity

(Hazards from Trees) Regulation 2003

|

|

Staff Emma

Joyce, Open Space and Community Facilities Planner

Mark Armistead, Principal Urban Forester

|

|

Committee Resolution SFR4/23/7

Moved: Commissioner

Shadrach Rolleston

Seconded: Commissioner Bill Wasley

That the Strategy, Finance and Risk Committee:

(a) Receives the report

"Retrospective approval of submission on Discussion document: Review of

the Electricity (Hazards from Trees) Regulation 2003".

(b) Approve the staff submission

to Ministry of Business, Innovation and Employment (MBIE) Discussion document: Review of

the Electricity (Hazards from Trees) Regulation 2003 (attachment

1) noting the key points of the submission as follows:

· Differences

between well-managed trees in urban environments and commercial forestry plantations

· Willingness

to collaborate with works owners (lines companies) on a risk-based approach

to managing trees in urban environments

· Role

of trees in meeting strategic and legislative obligations to increase tree

canopy and indigenous vegetation

· Role

of trees in mitigating climate change effects.

Carried

|

|

9.5 House it

going? Dashboard

|

|

Staff Alastair

McNeil, General Manager: Corporate Services

Rory Bayliss Chalmers, Senior Business Analyst

Key points

·

The dashboard aimed to tell the story of Tauranga’s

housing shortfall in a succinct and dynamic way, showing the challenges being

faced with housing in the city.

·

The dashboard included a number of assumptions on the capacity

and what and where housing could be achieved in future years.

·

The city was lacking over 5,000 houses to meet the overall

demand and this widened slightly over the next 15 years.

·

It also included the number of building consents being

approved.

In response to questions

·

The data was provided by the strategy team and the assumptions

included the feasible amount of housing that could be accommodated such as

greenfield areas as well as the infrastructure available to determine the

number of houses that could be accommodated. Factors such as

stormwater, natural hazards etc had also been considered.

·

In response to a request that the data be included from the

wider sub-region and reported regularly, it was noted that the data had been

sourced through the SmartGrowth Housing and Business Assessment (HBA) for the

Western Bay of Plenty sub-region and was reported through SmartGrowth.

·

More regular reporting on housing supply would come through

this Committee via the regular Growth & Land Use Projects Progress re.

·

It was noted that the dashboard would also include information

on Māori land.

Discussion points raised

·

Acknowledged the information and ease of use of the resource

and it was requested that it be expanded to become a sub-regional tool.

·

Sourcing reliable data on the capacity of each of the potential

areas was recognised as a challenge, as were other details including the

supply and demand by tenure, type, rental verses ownership.

·

There was a need to think about how to address the deeper

underlying issue of providing affordable housing.

|

|

Committee Resolution SFR4/23/8

Moved: Commissioner

Stephen Selwood

Seconded: Commissioner Bill Wasley

That the Strategy, Finance and Risk Committee:

(a)

Receives the report "House it going? Dashboard".

Carried

|

|

9.6 Infrastructure

Resilience Programme update

|

|

Staff Nic

Johansson, General Manager: Infrastructure Services

Kim Martelli, Resilience Specialist: Natural Hazards and

Infrastructure

Natalie Rooseboom, Manager: Asset Services

Key points

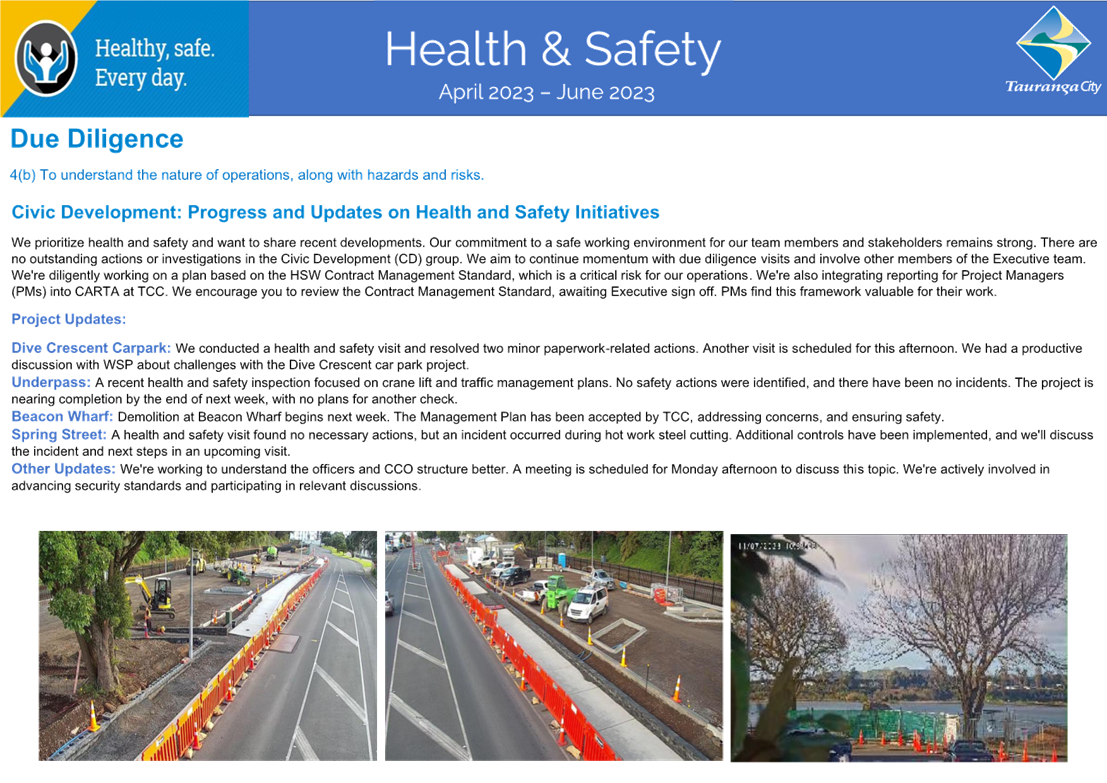

·

Provides a first cut indication of the resilience component of

the Resilience and Sustainability Programme and an outline of how to de-risk

and rank the resilience component of Council work resulting in a good picture

of the hazards in the city.

·

The improvements of the infrastructure were evident as it had

coped and helped to reduce the damage during the recent weather events.

·

Started with 320 projects of which 130 had dropped out for

various reasons including some becoming operational rather than capital

expenditure.

·

A focus in the LTP was for bridges of $40m, including lead up

and causeways, and water projects of $20m.

·

Four of the five projects in the last LTP had carried on into

this period.

·

The data that the risks were based on was changing and these

had been adapted to feed into the upcoming LTP.

·

The bridges provided key connections throughout the city, and

several had also been included in the Waka Kotahi resilience programme to

address seismic, tsunami and storm issues.

In response to questions

·

In relation to a query regarding the citywide landslide study

it was noted that it was currently going through a quality assessment.

The topography data was better than the previous information from 2000, the

number of properties added were in areas that were formally outside the city

boundary at that time with no slope hazard data available. Once this

data was available, it would be reported to the Council and the affected

landowners notified and form part of the information on the Land Information

Memorandum (LIM) for that property.

·

Discussion ensued on what an acceptable level of risk was for

each asset and a consensus of whether it was a political decision from a

total network rather than an individual asset perspective.

·

Broader discussions would be held once the national direction

came out regarding the inclusion of private sector assets, managed retreats,

and whole life cycle planning, noting what an area may look like in 60

years’ time.

Discussion points raised

·

Well done with adapting to the changing conditions,

understanding and being better placed to manage the risk.

|

|

Committee Resolution SFR4/23/9

Moved: Commissioner

Stephen Selwood

Seconded: Ms Rohario Murray

That the Strategy, Finance and Risk Committee:

(a) Receives the report

"Infrastructure Resilience Programme update".

(b) Notes

that the Executive will review and propose prioritisation of the projects

within the Infrastructure Resilience Programme for consideration by Commissioners

through the Long-term Plan process.

Carried

|

|

9.7 Mount to

Arataki Spatial Plan Update

|

|

Staff Christine

Jones, General Manager: Strategy, Growth & Governance

Carl Lucca, Team Leader: Urban Communities

Key points

·

The Mount to Arataki Spatial Plan (MSP) sought to deliver a

30-year blueprint to provide a strategic direction for existing and future

growth needs of the area, forming the basis for the co-ordination of decision

making within and across multiple agencies in a growth context.

·

The Mount Industrial Planning Study (MIPS) was being prepared

at the same time and staff were working closely together to move both

forward.

·

Good engagement feedback had been received on the plan with 960

survey responses, of which 75% were from people living in the Mount spatial

plan area. There were also several drop-in sessions and workshops,

receiving around 10,000 comments.

·

Staff were engaging directly with mana whenua representatives

with a number of hui being held.

·

Transport, parks, open spaces, healthy and safe communities,

and road maintenance were the highest response items with many other

consistent themes featuring strongly.

·

Residents wanted to be connected to their communities,

supporting growth around centres, and recognising the different communities

also featuring strongly as well as being aware of and being responded to with

the right actions. Protection of the environment was a strong theme.

·

Consideration was needed of how to buffer the industrial area,

with possible land use or softening the boundary and cross connections where

people work.

·

Environmental accord with business was also coming through

strongly with key stakeholders who were willing and open to moving forward in

that direction.

·

Culture and identity was a theme at a number of levels from

working with mana whenua to the holiday area where people walked down the

road with a surfboard to head to the beach.

·

A draft plan would be brought back to Council for consideration

after the consultation period which would take place in September. It would

have a stronger policy content as responses were made on the key land issues

in the area.

In response to questions

·

The Mount Business Association were not included in the

reference group as they represented one community, however specific

engagement, including workshops, was being undertaken with the Association.

·

The proposed bus lanes being able to be used for freight was

also a good suggestion.

·

In response to a query as to whether some of the side streets

in the suburbs could be used as a safer route for multi- model transport,

rather than the main arterial routes, it was noted that this was a common

message throughout the engagement. Staff would work with the Accessible

Streets project team to determine where the routes could be located.

·

It would take time and partnerships between Council, Bay of

Plenty Regional Council, Priority One, other key stakeholders and the

businesses to finalise the Mount Industrial Planning Study and would require

an amalgam of responses including voluntary environmental accords as well as

plan changes to achieve changes over time. The outcomes sought may not

be acceptable to all parties and this would also need to be worked through.

The next process would outline the key issues and the proposed responses to

them.

·

A list of the next group of prioritised plan changes would be

brought to the Committee before the end of the year including centre

hierarchy and industrial land as core priorities for clear direction in order

for them to be progressed.

Discussion points raised

·

Lack of confidence by the young people to walk around the

streets was noted, and it was suggested they needed to be encouraged to use

different modes of travel.

·

It was noted that Whakatane District Council had a specific

bylaw banning trucks from going through the Ohope residential community and

it was questioned whether this could be applied to Maunganui Road. This was

noted for investigation.

|

|

Committee Resolution SFR4/23/10

Moved: Commissioner

Bill Wasley

Seconded: Mr Bruce Robertson

That the Strategy, Finance and Risk Committee:

(a) Receives the report

"Mount to Arataki Spatial Plan Update".

Carried

|

10 Discussion

of late items

Nil

7 Public

excluded session

Nil

The meeting closed at 12.10 pm.

The minutes of this meeting were confirmed as a true and

correct record at the Strategy, Finance and Risk Committee meeting held on 7

August 2023.

.......................................................

CHAIRPERSON

|

Strategy,

Finance and Risk Committee meeting Agenda

|

7

August 2023

|

9 Business

9.1 Six

Monthly Treasury Strategy Update

File

Number: A14802196

Author: Sheree

Covell, Treasury & Financial Compliance Manager

Kathryn Sharplin,

Manager: Finance

Authoriser: Paul

Davidson, Chief Financial Officer

Purpose of the Report

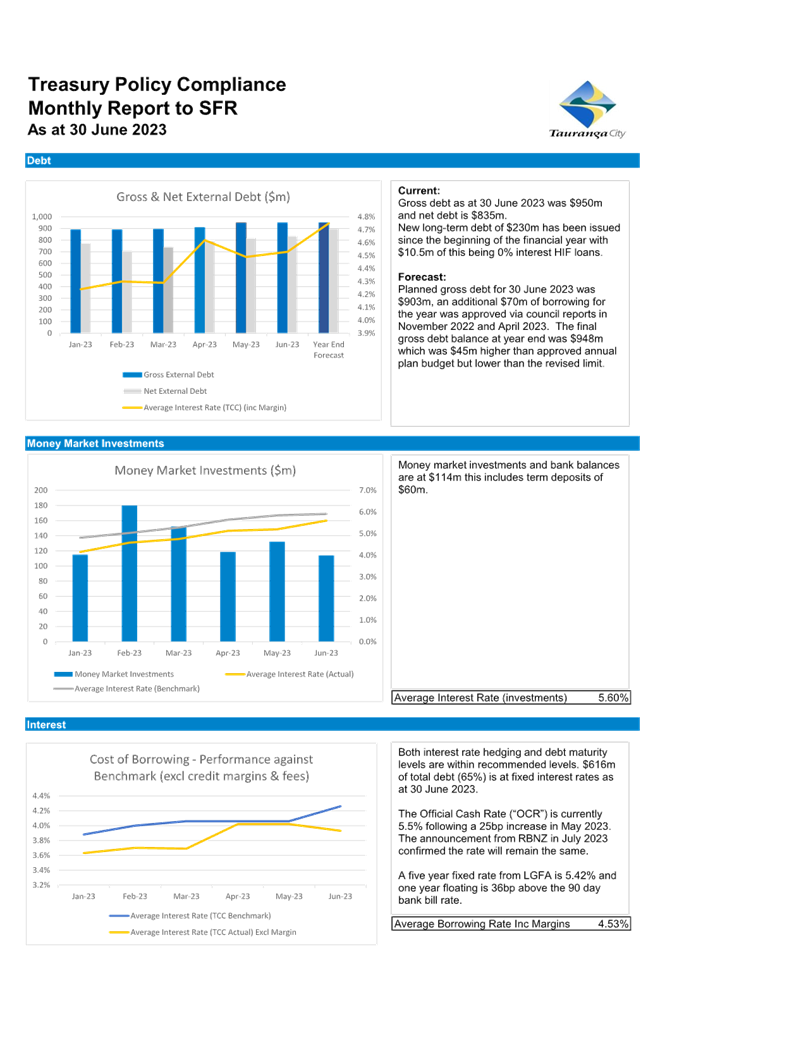

1. The Treasury Policy

requires strategies to be approved on a six monthly basis. This report provides

an update on the performance and status of Council’s treasury function

and seeks approval for strategies for treasury risk management activities, debt

issuances, investments, foreign exchange exposures and interest rate hedging

activities.

|

Recommendations

That the Strategy,

Finance and Risk Committee:

(a) Receives the report

"Six Monthly Treasury Strategy Update".

(b) Approves the issuance of

long and short term debt on a wholesale basis to manage cashflows.

(c) Approves maintenance of a

minimum of $15m of cash and short term investments to manage cashflows.

(d) Approves hedging of all

significant foreign exchange exposures.

(e) Approves to hold new

retentions monies in a trust account to adhere to new legislation.

|

Executive Summary

2. This report outlines all

significant treasury operational activities and seeks confirmation of existing

strategies and approvals for planned strategies.

3. Treasury strategy is an

important element of sound financial management and allows Council to

efficiently manage its funding and associated risks.

Background

Debt

Management - General

4. Council has a large

investment in infrastructure assets which have long economic lives and long

term benefits. Debt is used to fund infrastructure and it is recognised

as an efficient mechanism to allocate the cost of infrastructure to the

community.

5. Core external debt and

working capital requirements are managed by issuing a combination of long and

short term debt. The maturity dates for new debt issuance are assessed

under the following criteria:

· Borrowing

margins for short versus long term debt

· Investor

demand including bank funding

· Local

Government Funding Agency (LGFA) or other wholesale margins/maturities offered

· Compliance

with LGFA covenants

· Housing

Infrastructure Fund (HIF) drawdowns

· Existing

maturity profile

· Available

undrawn bank facilities

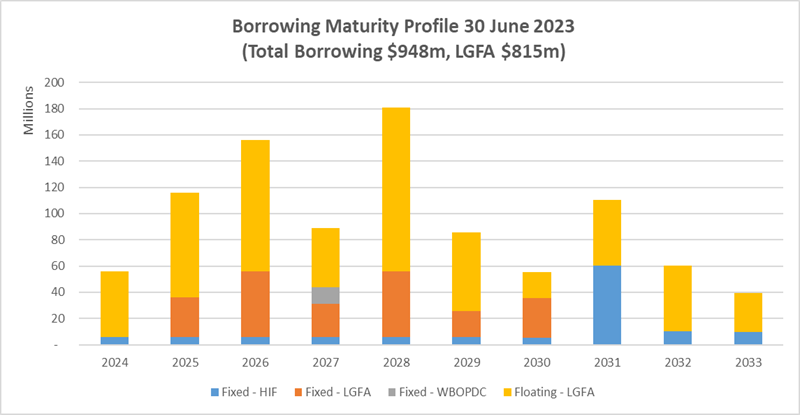

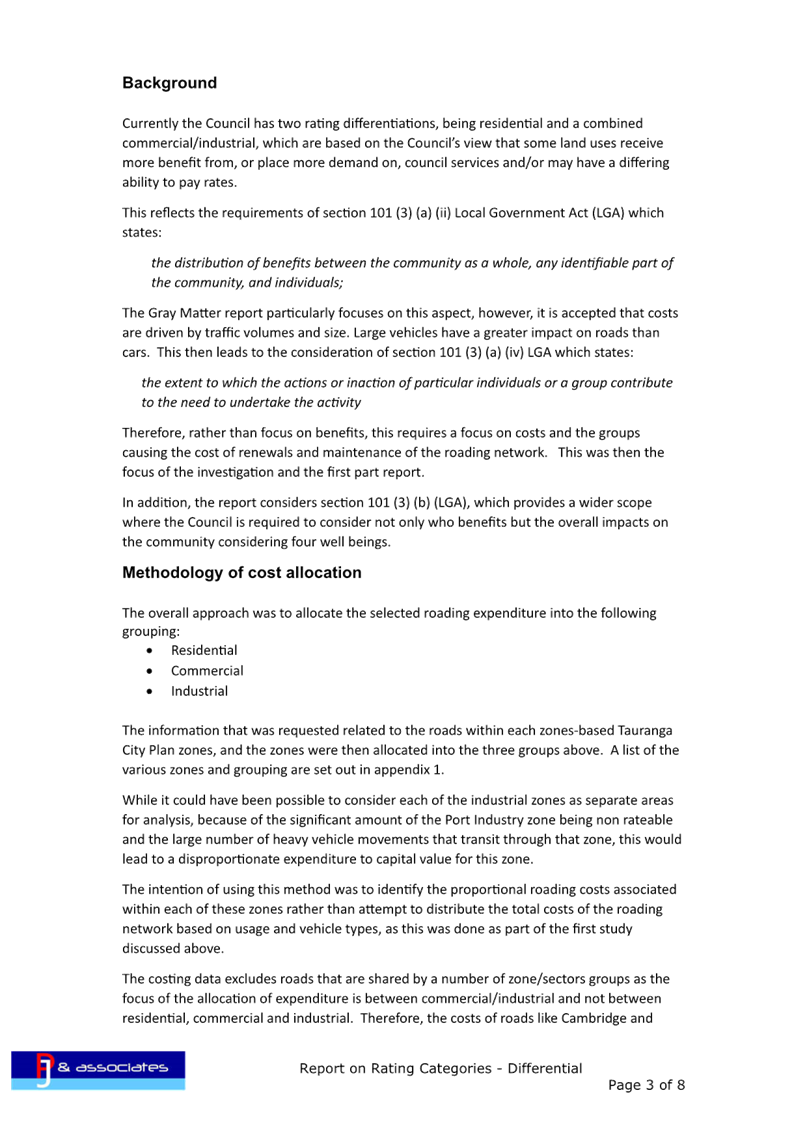

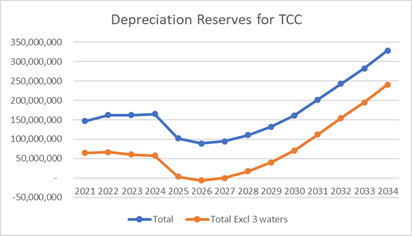

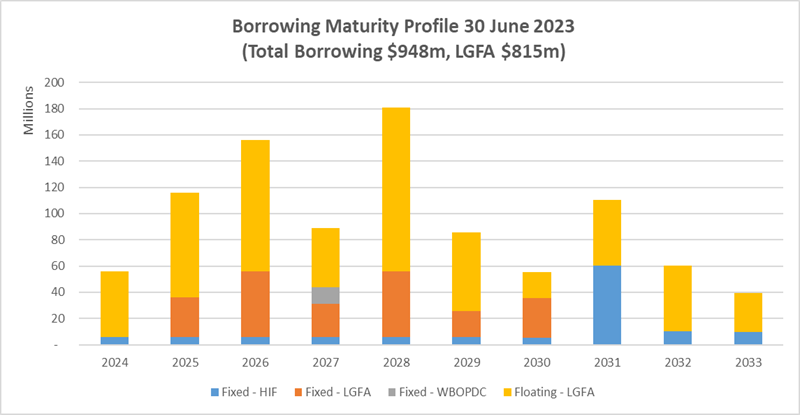

6. The graph below shows

the current debt maturity profile as at 30 June 2023

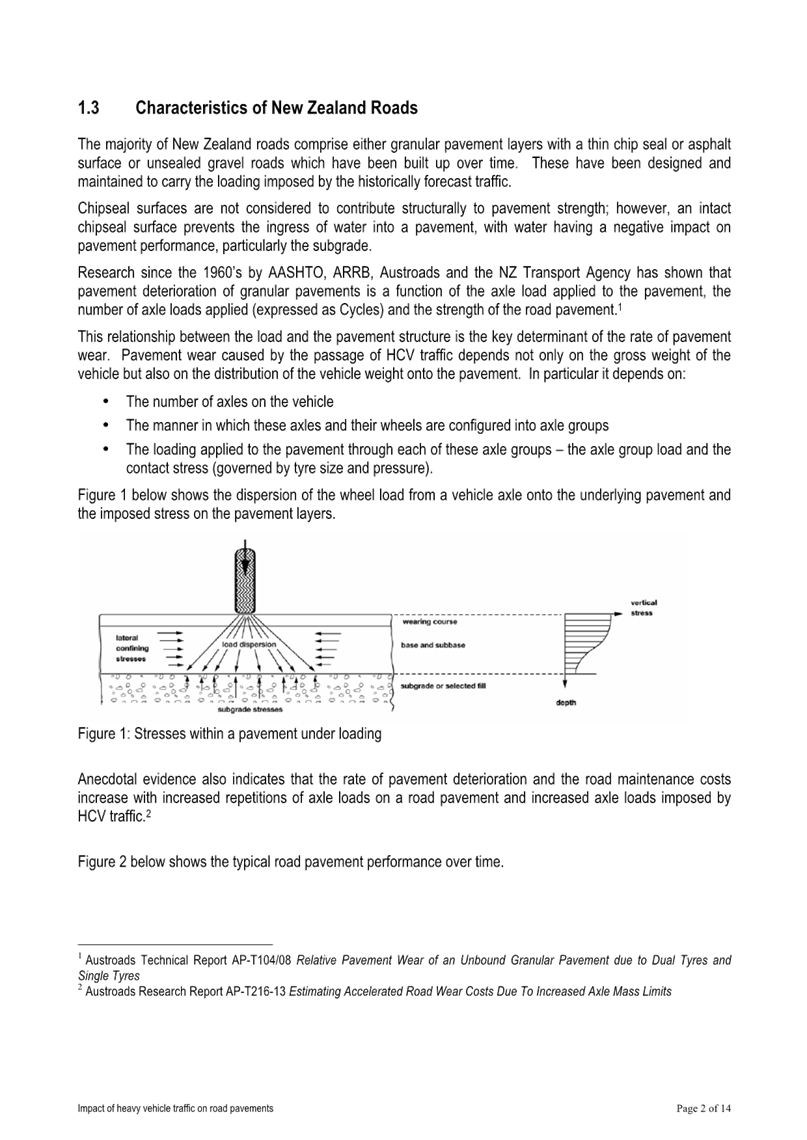

7. As at 30 June 2023

outstanding debt was $948.3m of which $230m was issued since the beginning of

this financial year.

8. This exceeds the

budgeted debt per the 2022/23 Annual Plan by $46m. Two additional

borrowing programme resolutions were approved by this committee in December

2022 and May 2023 for additional borrowing totalling $70m.

9. The 2023/24 Annual plan

budgeted total debt is $1.1bn which will be monitored over the coming months as

the impact of a $46m higher then budgeted opening debt balance rolls into the

2023/24 financial year.

10. During the 2022/23 financial year

$56m of long term debt matured. A further $56m will mature in the 2023/24

financial year.

Debt

Management – Waters Reform

11. The previous treasury strategy

report was presented in May 2022 and at the time Waters Reform was expected to

occur on 1 July 2024. A strategy for issuing short term debt to match

expected waters reform debt paydowns was considered, however now that Waters

reform has been delayed this strategy has been put on hold.

12. Council staff are in ongoing discussions

with the Department of Internal Affairs in regards to debt negotiations and

will adjust the councils debt issuance strategy once there is more

certainty.

Bank

Facilities

13. Access to liquid funding by way of

committed bank facilities and/or liquid investments is required in order to

manage liquidity risk.

14. Both Council’s Treasury

Policy and LGFA financial covenants require a level of undrawn committed bank

facilities or liquid investments or a combination of both. The key

objective is to maintain adequate liquidity in the context of managing debt

maturities and debt servicing on a 12 month rolling basis.

15. Bank facilities are $100m.

This facility matures on 31 October 2026. Generally, the maturity date is

extended by one year each year. It is planned to maintain the facility

within the 2 to 4 year maturity band.

16. In general, bank facilities are

available to be drawn down at short notice, provided that if they are drawn

they are able to be repaid on a quarterly basis.

17. Council was required to utilise the

bank facility on one occasion this financial year in order to meet higher than

expected operational cashflows. $10m was drawn and paid back within one

week of issuance.

18. Current facility costs are 2%

($200k for $100m facility). Generally pricing on facilities are renewed

on an annual basis.

19. It is important to note that any

funds drawn down from bank facilities would need to be managed within the

existing debt to revenue ratio. The limit for the debt to revenue ratio

for the 2022/23 financial year was 295% and the Annual Plan ratio was

180%. The anticipated actual ratio for 2022/23 is estimated to be

approximately 195%.

Liquidity

Risk

20. The Treasury policy outlines the

management framework for funding, liquidity and credit risks. Liquidity

risk primarily focuses on ensuring that there are sufficient funds available to

meet obligations in an orderly manner.

21. The key liquidity risk management

indicators are:

(a) The primary debt maturity

limit requires external debt committed bank facilities and cash/cash

equivalents to be maintained above 100% above 12th month peak

forecasted net external debt

(b) No more than 33% of debt to

be refinanced in any rolling 12 month period

Local

Government Funding Agency (LGFA)

22. The LGFA is an agency specialising

in financing of the local government sector. LGFA was established to

raise debt on behalf of councils on terms that are more favourable to them than

if they raised the debt directly.

23. LGFA was incorporated as a limited

liability company under Companies Act 1993 on 1 December 2011 following the

enactment of the Local Government Borrowing Act 2011. As LGFA is majority

owned by Councils it constitutes a Council Controlled Organisation (CCO) under

the Local Government Act 2002.

24. LGFAs debt obligations are

guaranteed by Council shareholders and any other Councils that borrow in excess

of $20m (total guarantors is 60). The New Zealand Government does not

guarentee LGFA. Any call under the guarantee will be allocated across all

guarantors on a pro rata basis in relation to their rates revenue.

25. As at 30 June 2002, total LGFA

bonds (long term) on issue was $17.8bn of which $815m have been on lent to

Tauranga City Council.

26. Fixed rate borrowing rate from LGFA

for a A+ council are:

|

Term

|

LGFA rate (A+)*

|

|

2 Year

|

5.98%

|

|

5 year

|

5.50%

|

|

10 Year

|

5.58%

|

|

15 Year

|

5.79%

|

*Rates

are current at 19 July 2023

Security

27. Generally debt will be issued under

the existing Council’s Debenture Trust Deed (DTD) which offers rates

revenue as security to attract lower borrowing margins. Councils Trustee

appointed under the DTD is Covenant Trustee Services Limited. All debt

obligations are registered with Link Market Services Limited.

Interest

Rate Management

28. The overall objective of the

interest rate risk management strategy is to:

(a) Minimise the average net

interest cost on borrowings over the long term

(b) Minimise large concentrations

of interest rate risk

(c) Increase duration of the

interest rate re pricing profile

(d) Maintain an appropriate mix

of floating and fixed rate exposures.

29. Council is exposed to the interest

rate fluctuations on existing and future borrowings. Interest rate risk

in minimised by managing floating and fixed exposures within the Treasury

Policy limits framework. The overall outcome of interest rate risk

management is reflected in the average interest rate on borrowings which is

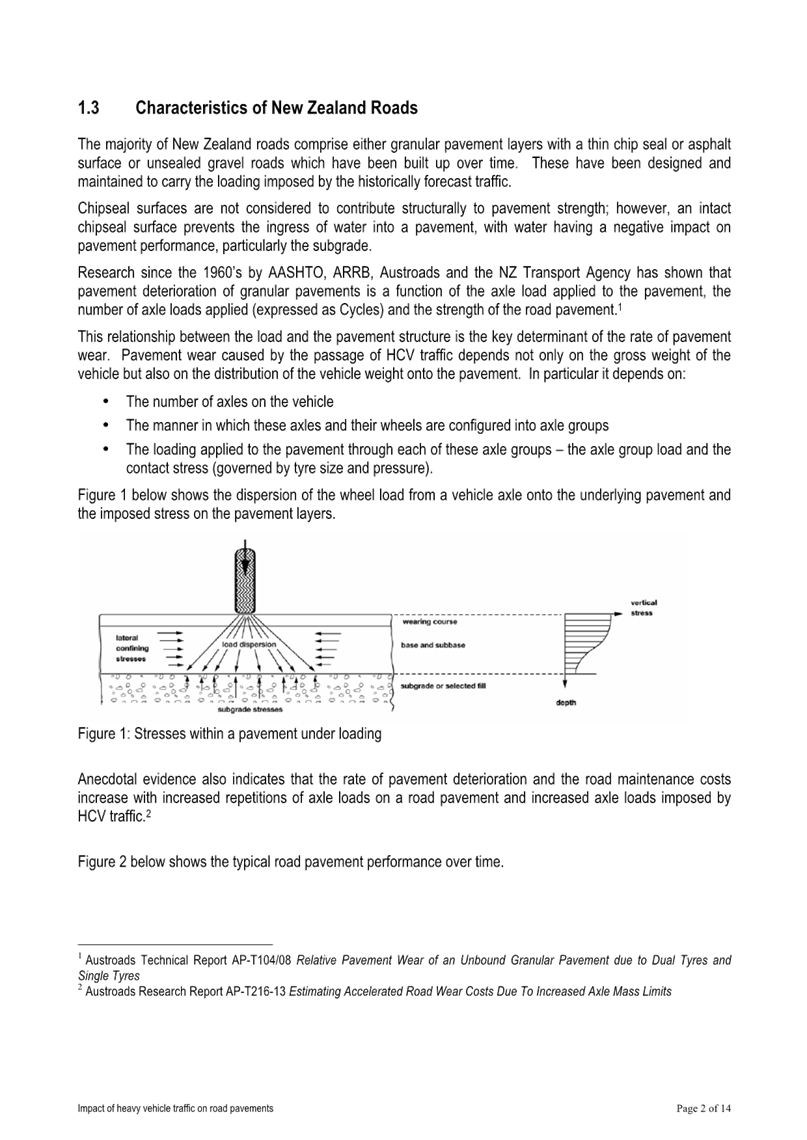

4.53% (including margin) at 30 June 2023.

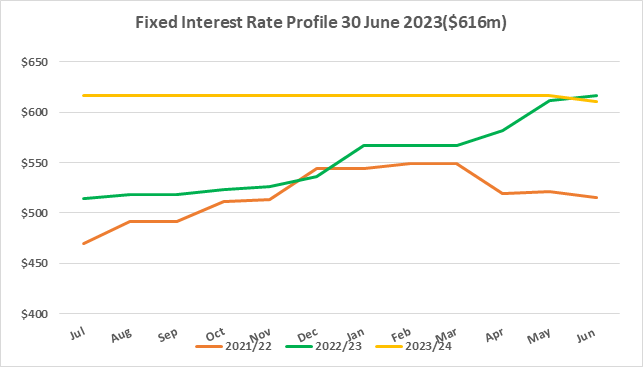

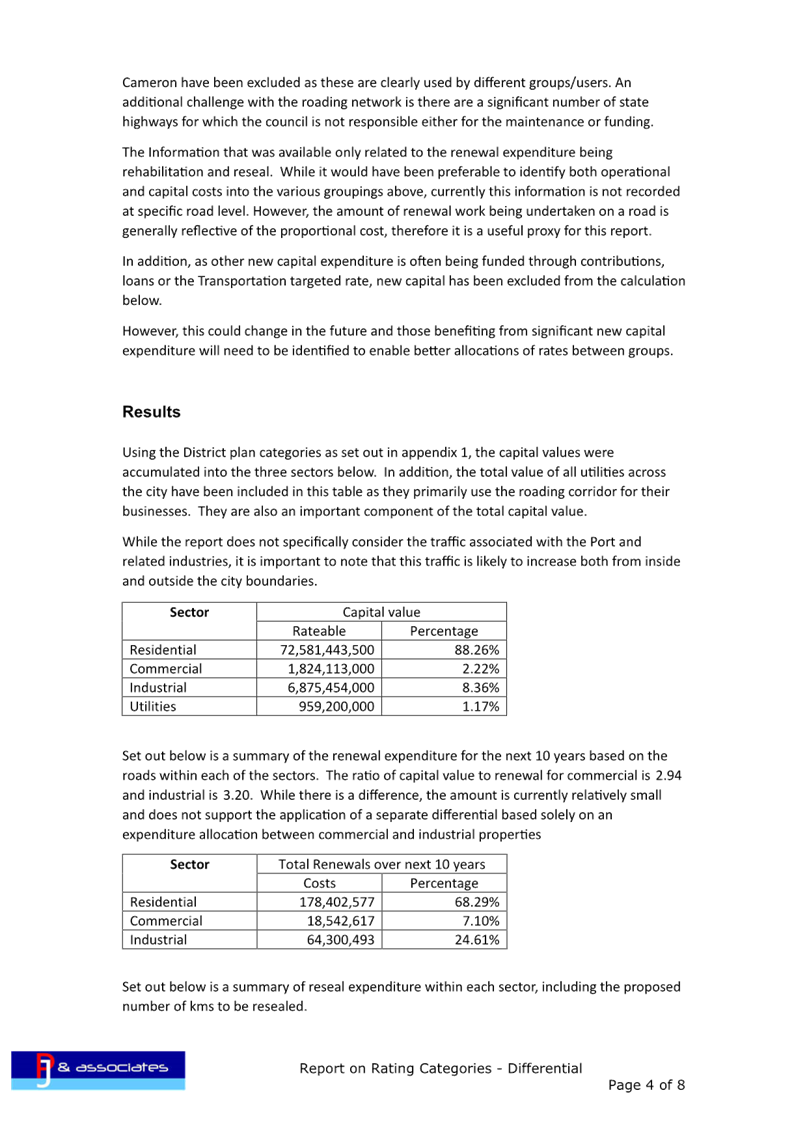

30. As at 30 June 2023 the fixed

interest rate position was $616m which is 65% of debt. The graph below

shows the existing fixed interest rate positions (fixed debt and interest rate

hedging) for the previous, current and next financial years.

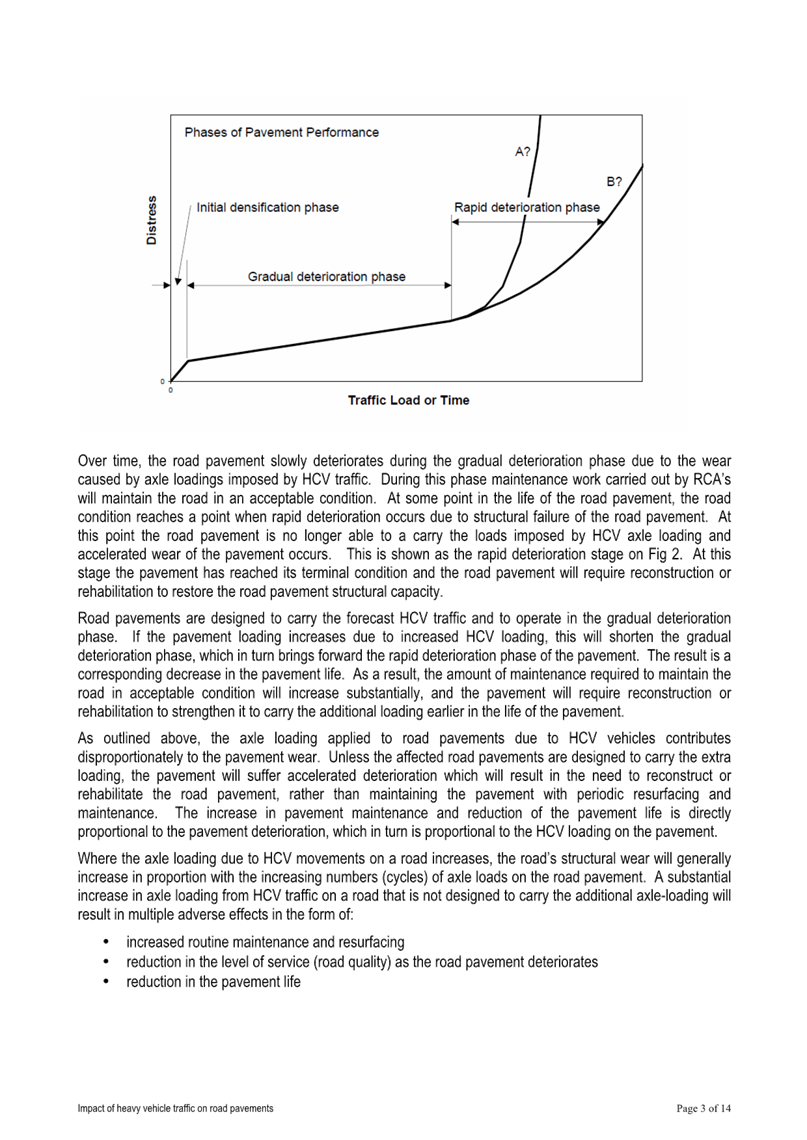

31. The treasury policy outlines the

framework for interest rate management activities. Interest rate risk is

managed with minimum and maximum fixed debt percentages by time bands.

These minimum and maximum levels by time bands are designed to minimise

interest rate re-price risks.

32. During the 2022/23 financial year

$105m of interest rate swaps were executed of which $70m are forward start

swaps to move the fixed rate debt position closer to the middle of policy

bands. The total amount of interest rate swaps is now $353m with

maturities ranging from now to July 2032.

33. Analysis of debt levels and

associated interest rate hedging positions are reviewed on a monthly rolling

basis.

Fixed

Debt Profile

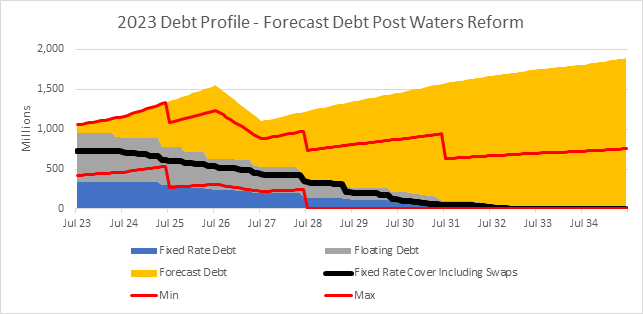

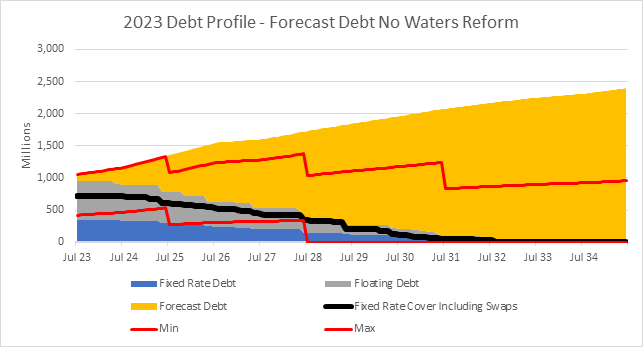

The

chart below shows the fixed interest rate positions relative to forecast debt

over time. Due to the timing of Long Term Plan data not yet being

available at the time of this report the forecast debt used in this example is

based on projected levels so is an estimate for the purposes of this report.

34. The above graphs show that fixed

rate debt remains above the minimum policy band regardless of whether waters

reform proceeds or not. If three waters remain in council operations

there is minimal headroom in 2028. This being monitored and managed with

interest rate swaps at each debt issuance until waters reform is

confirmed.

Interest

Costs

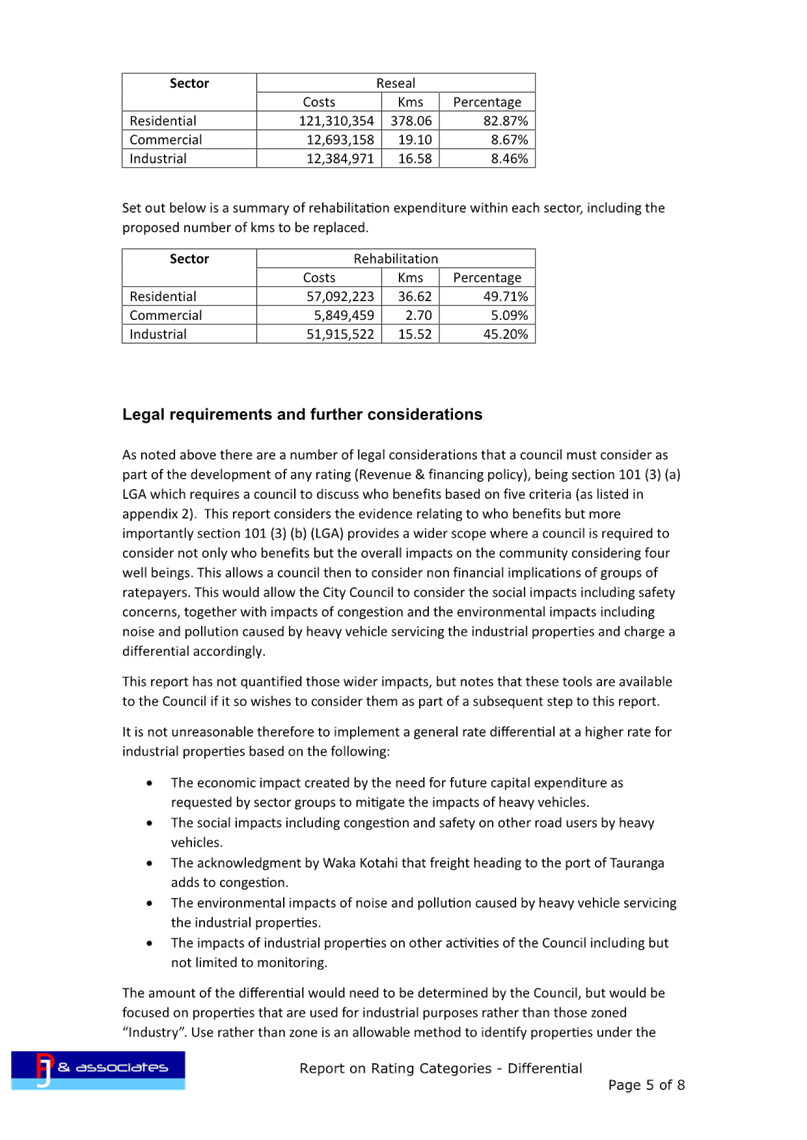

35. Interest is based on closing debt

of $948m at 30 June 2023. The annual plan assumption for the average

interest rate for the 2022/23 financial year was 3.55% and the actual average

interest rate for the same period was 4.50% including margins.

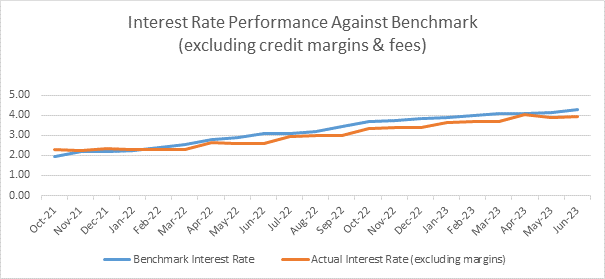

36. The graph below shows the actual

average interest rate (excluding margins and fees) against market rate

benchmarks as set in the Treasury Policy. Benchmark rates are a

proportional calculation of the 90 day, 2,5,7 and 10 year swap rates. The

average interest rate remains below benchmarks due to hedging placed during a

low rate environment and high interest debt maturing during the 2022/23

financial year.

Investments

37. From a short-term working capital

management perspective it is proposed to increase the minimum liquid investment

balance from $10m to $15m to reflect the increasing cash outflows of

Council. Investment rates aligning to OCR have been negotiated with our

transactional banker (ANZ). This level of working capital is sufficient

to manage the net cashflows during an average month. Overall, the

investment portfolio is managed in line with the detailed forecast.

38. As at 30 June 2023 there was $54m

in cash and $60m on deposit. The funds on deposit are on short terms to

align with cashflow forecasts over the coming months.

Foreign

Exchange

39. Under

the treasury policy upon approval of expenditure, all significant commitments

for foreign exchange are hedged. Generally foreign exchange exposure

above $100,000 is regarded as significant.

40. Currently

there are no outstanding foreign exchange contracts.

Retentions

41. New legislation will require

council to change the way Council deals with retentions on construction

contracts. The changes come into force on 5 October 2023 and applies to

commercial construction contracts entered into or renewed after this

date. The key changes for Council relate to securing retention monies and

reporting to contractors.

42. Council will now transfer

retentions money into a separate trust account to hold until such time that the

retentions are agreed to be released. The Trust account will earn

interest at the official cash rate and Council can retain the interest earned.

43. This change will be included in the

triennial Treasury Policy review which is currently underway as part of the

Long Term Plan process and will be reported to council in October 2023.

Strategic / Statutory Context

44. The treasury strategy is an important

element of sound financial management and allows Council to efficiently manage

its funding and associated risks. These strategies ensure compliance with

Treasury Policy limits.

Options Analysis

45. Option 1: Approve

Recommendations

The

committee is recommended to approve the above Treasury strategies. The

recommendations ensure compliance with the Council’s Treasury Policy: the

effective management of both interest rate and funding risks and allows the

achievement of existing net interest rate budgets.

46. Option 2: Do Not Approve

Recommendations

47. Council may decide not to approve

the recommendations. This may risk Council not complying with its

Treasury Policy and may lead to increased interest rate and funding risks and

sub-optimal net interest costs

Significance

48. The Local Government Act 2002

requires an assessment of the significance of matters, issues, proposals and

decisions in this report against Council’s Significance and Engagement

Policy. Council acknowledges that in some instances a matter, issue,

proposal or decision may have a high degree of importance to individuals,

groups, or agencies affected by the report.

49. In making this assessment,

consideration has been given to the likely impact, and likely consequences for:

(a) the current

and future social, economic, environmental, or cultural well-being of the

district or region

(b) any persons who are likely to be

particularly affected by, or interested in, the matter.

(c) the capacity of the local authority to

perform its role, and the financial and other costs of doing so.

50. In accordance with the

considerations above, criteria and thresholds in the policy, it is considered

that the matter is of low significance.

ENGAGEMENT

51. Taking into consideration the above

assessment, that the matter is of low significance, officers are of the opinion

that no further engagement is required prior to Council making a decision.

Next Steps

52. Implementation of Treasury Strategy

within the Treasury Policy framework.

Attachments

Nil

|

Strategy,

Finance and Risk Committee meeting Agenda

|

7

August 2023

|

9.2 Review

of Rating Categories to Differentiate Industrial Ratepayers

File

Number: A14848445

Author: Jim

Taylor, Manager: Rating Policy and Revenue

Kathryn Sharplin,

Manager: Finance

Malcolm Gibb,

Contractor - Rating Review

Authoriser: Paul

Davidson, Chief Financial Officer

Purpose of the Report

1. The report considers

matters relevant to the consideration of further differentiation of the

commercial rating category to set a separate industrial rating category and

whether this could reflect a fairer and more equitable balance of

funding.

|

Recommendations

That the Strategy,

Finance and Risk Committee:

(a) Receives the council report

"Review of Rating Categories to Differentiate Industrial

Ratepayers".

(b) Receives the attachment

“Report on Rating Categories – Differential by P J and

Associates”.

(c) Recommends to Council to

consider this material in the development of the 2024-34 Long-term Plan.

|

Executive Summary

2. The Port of Tauranga

(POT) and industrial companies are particularly significant to the city’s

economy. They bring significant employment and wealth to the city and its

community.

3. The planning and

provision of infrastructure services is crucial to this sector as well as the

need for housing and social, environmental and cultural amenity.

4. There are costs and

pressures on the city which come with this business activity including

increased congestion both on the state highway network and city roading

infrastructure, higher maintenance and renewals requirements from heavy vehicle

use along with other wellbeing impacts both positive and negative on the

community that come with a large industrial sector particularly related to a

busy Port.

5. The Rating Policy was

amended in the 2022/2023 Annual Plan to phase in a commercial rating

differential for the general rate and a transportation targeted rate to reflect

a 50/50 funding split between commercial and residential rating units.

6. In submissions, members

of the commercial sector requested council to further differentiate the

contributions of the commercial sector by separately recognising the benefits

received and impacts of the industrial sector in the city.

7. The issue particularly

relates to industrial warehousing, manufacturing, transportation of goods and

other industrial activity related to industrial properties both within

proximity of the Port of Tauranga and within other industrial areas in the

city.

8. Commissioners have

requested staff to investigate whether there is justification to introduce a

new Industrial rating category which could provide for a fairer and more

equitable funding outcome.

9. The recent Judgement by

the Supreme Court of NZ in the successful appeal by Auckland Council, for a

targeted rate on commercial accommodation providers has presented some

important principles in the setting of rates by a local authority.

Background

CURRENT

APPROACH

10. Currently council has two rating

categories

· “Residential”

which includes land whose primary use is residential, rural, educational,

recreation, leisure, or conservation

· “Commercial”

which includes land whose primary use is commercial, industrial, port,

transportation or utilities networks, and any land not in the residential

category.

11. During the 2022/23 Annual Plan

process, council approved an increase in the commercial general rate differential

from 1.6 in financial year 2021/22 to 1.9 in 2022/23 with a further increase to

2.1 in 2023/24. The commercial transport targeted rate was also approved

to move from 1.6 in financial year 2021/22 to 3.33 in 2022/23 and with a

further increase to 5.2 in 2023/24.

12. The decision was to ensure a fairer

balance between the residential and commercial ratepayers in the city whereby

the funding split to fund the transportation activity was shared 50:50.

13. The issue about whether the

commercial rating category fairly reflected all the constituent activity,

particularly by the “Industrial and Port related sector”, was

raised by commissioners and other commercial ratepayers during the Long-term

Plan deliberations. The independent reports from Insight Economics and

subsequently supported by Gray Matter Ltd, looked at the volume of use of

different categories of users of the transportation network. On the basis

of usage statistics available at that time it was concluded that there was

insufficient data to support further separating the commercial and industrial

rating category. This in part reflected Tauranga City Councils (TCC) data

limitations. The earlier studies did not look at the impact of heavy

vehicles on the council’s costs or community wellbeing.

Other Reviews on Options for

Fair Contribution

14. As part of the funding mix for the

future, Council is also considering the use of variable road pricing for the

city. The viability and impacts of variable road pricing in Tauranga

could provide a range of benefits, including reduced congestion and faster,

more reliable journey times. It could also deliver significant economic and

social benefits, encourage different transport choices, reduce

transport-related greenhouse gas emissions and support the Government’s

objective of reducing vehicle trips in main urban centres.

15. Variable road pricing could charge

all vehicle users for access to Tauranga’s main transport corridors. The

charge could vary, depending on the time of day, day of the week and traffic

demand. It is similar in concept to the charges applied to toll roads and would

include using prepayment systems and vehicle recognition technology. The

introduction of variable road pricing would require new legislation,

comprehensive work on its benefits and implications and a significant community

consultation process to ensure the concept was supported.

16. For identified new capital

expenditure in the transportation activity TCC has reached agreement with Crown

infrastructure partners on an Infrastructure Funding and Financing arrangement

under which ratepayers will be levied over a period of 30 years to fund these

projects. This financing arrangements enables future ratepayers who will

benefit from this investment to contribute a fair share rather than focussing

the costs on ratepayers over a shorter term which would have been the case

under normal TCC financing arrangements.

17. Large industrial businesses are

both a contributor to costs and a beneficiary of the roading network. As

some of our largest businesses as evidenced by capital value and supported by

published accounts they can have a greater ability to pay a larger share which

council can consider, under section 101(3)(iv).

Comparison with other Councils

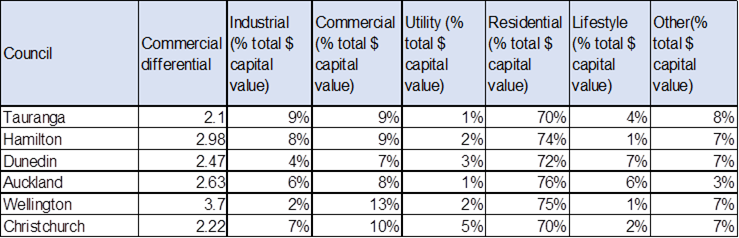

18. The table below shows that

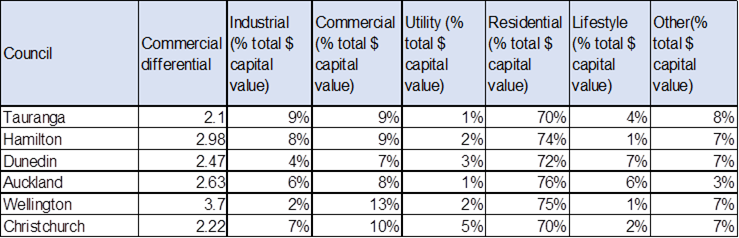

TCC’s commercial differential, at 2.1, is the lowest compared with other

metro councils that we benchmark against. It also confirms that the capital

value of the industrial sector as a percentage of the city’s total

capital value, at 9%, is higher than these councils. This is consistent

with the location and function of the Port of Tauranga and the proximity of New

Zealand’s busiest port to the centre of Tauranga.

19. It is noted that further review is

needed to incorporate the impact of TCC’s economic development rate and

other metro councils’ similar rates into this comparison. At present it

is based on the commercial differential on the general rate only

20. The Waikato region will also face

cost and impact issues from the development of an inland port in the Waikato

region. The Port of Tauranga Limited (POTL), through their subsidiary Quality

Marshalling, manage the Ruakura Inland Port, which is a joint venture between

POTL and Tainui Group Holdings. The 34-hectare site is located within the

Ruakura Superhub which is a 490-hectare industrial, commercial and residential

development.

21. The inland port is adjacent to the

East Coast Main Truck line and the Waikato Expressway for efficient

connectivity to the Port of Tauranga. The rates on the Ruakura Superhub site

will be assessed by Hamilton City Council.

22. It is noted that under the current

rating regime road and rail traffic destined for the Port of Tauranga or

returning to the Ruakura Inland Port will utilise this city’s

infrastructure but contribute no rate revenue. It is expected to

significantly increase traffic flows and therefore increase the costs to

council and the community of industrial and port-related activity.

FURTHER INDEPENDENT

REVIEW

23. PJ and Associates were engaged

earlier this year to investigate and report on whether the introduction of a

new rating category could be supported. Philip Jones is a recognised expert in

finance and asset management in the local government sector and is a member of

several local authority audit and risk committees in NZ.

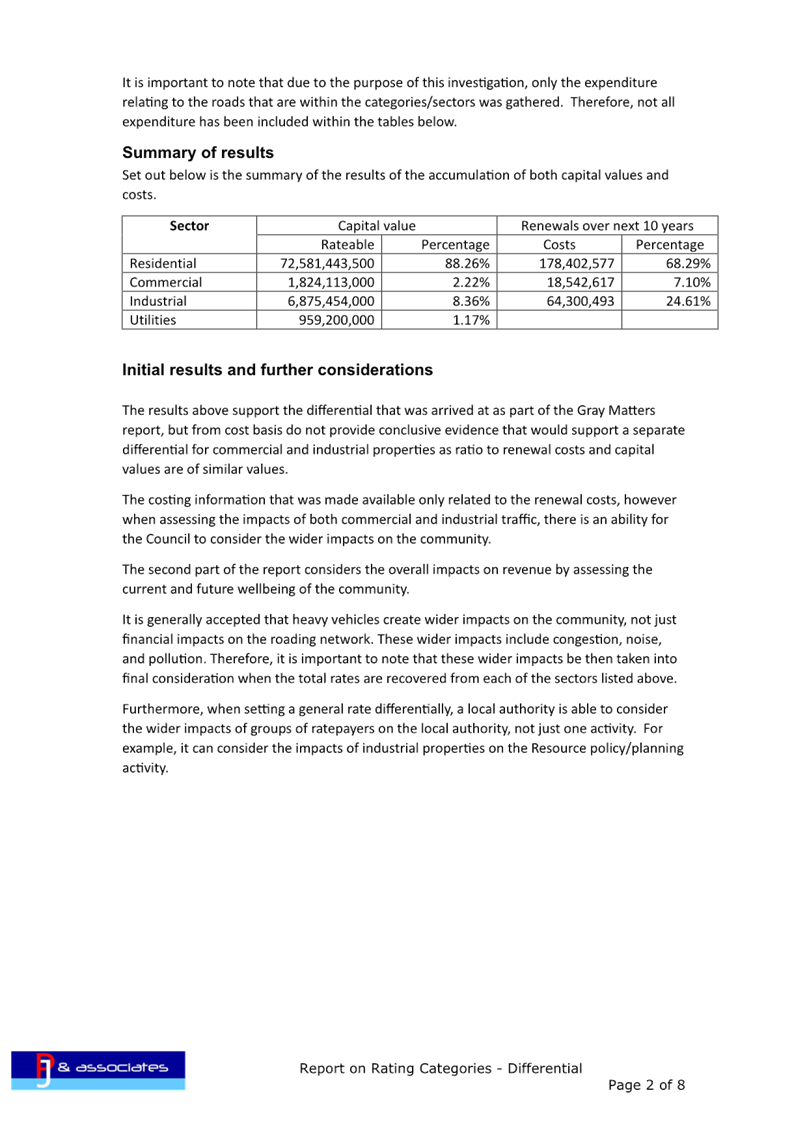

24. The report (attached) focuses on an

assessment of the council’s proposed expenditure as part of the

development of the asset management plan in conjunction with the 2023/24 Annual

Plan and 2024/34 Long Term Plan.

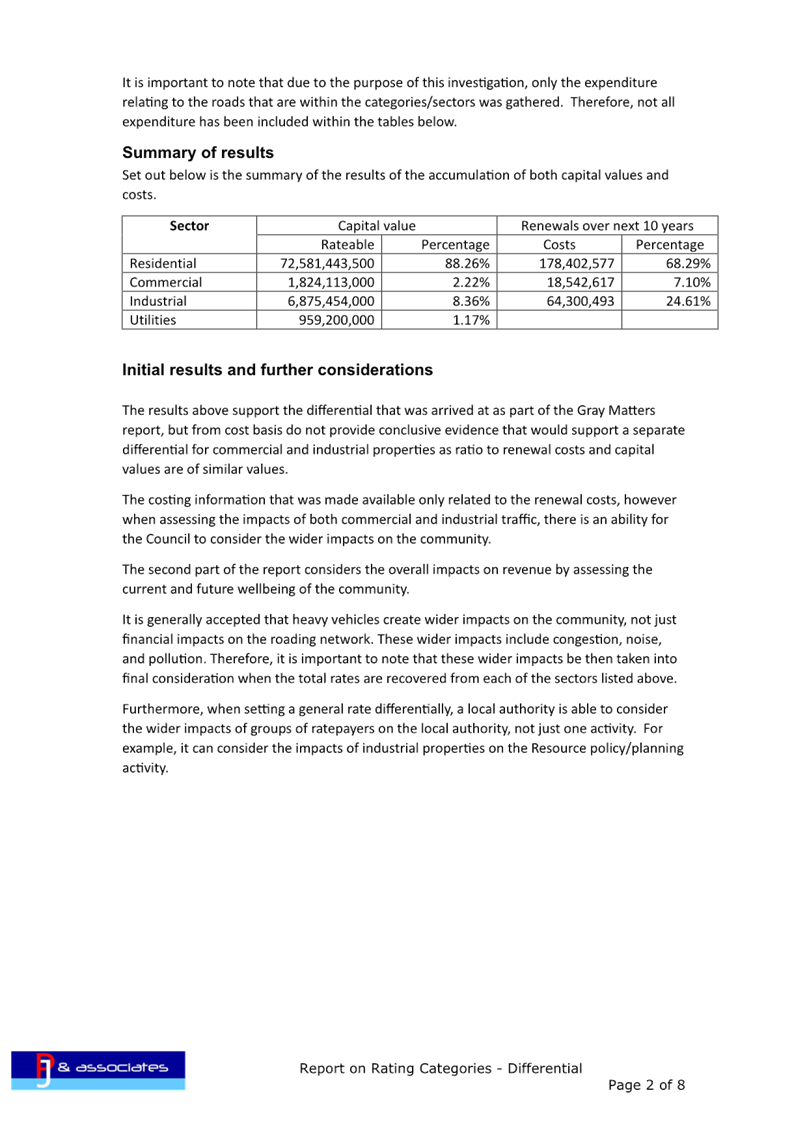

25. The report concludes that while the

information on current renewal proposals supports the existing differential,

there is insufficient existing TCC data collected to directly support a higher

ratio. The ratios for each category for renewal costs and capital values are

relatively close.

26. The report noted that other

transportation expenditure, relating to both operational and capital

expenditure, including the financial and non-financial impact of safety and

congestion in the city, was not available for analysis. This information

is not currently recorded in council’s asset management system (RAMM) for

each road in the city.

27. The report does not specifically

consider traffic associated with the Port and related industries but notes that

this traffic is likely to increase both from inside and outside the city

boundaries in the coming years.

28. The report does, however, mention

the opportunity for council to consider section 101(3)(b) and the overall

impacts on the community and particularly the four well beings. The

social, economic, environmental and cultural impacts which could be considered

include safety, congestion, noise and pollution.

29. The industrial sector uses

particular vehicle types (axle weights), travel different trip lengths and need

certain road facility types which are factors in their differential impacts on

the city network.

30. The PJ & Associates report

recommends that Council continue to develop the systems and processes capable

of providing the financial and asset management information to support the

industrial rating category and the benefits provided to industry with the city.

OTHER SUPPORTING

INFORMATION FOR AN INDUSTRIAL CATEGORY

31. A report produced by Road

Controlling Authorities attached as Appendix 2, provides an independent

analysis of the impact of heavy vehicles on a road network.

32. The report references that the

typical impacts from an increase in the number and/or weight of heavy vehicles

using a road include

· A

need for extra pavement width

· Change

in surfacing type and pavement thickness

· Increase

in maintenance and

· Reduction

in pavement life requiring road pavement upgrading (either strengthening or

reconstruction)

33. Further research concluded that heavier

vehicles do a lot more damage on a road due to the "fourth power law". Basically,

the more weight each axle of a vehicle is required to bear, the damage done to

the road increases exponentially, to the power of four - so an axle bearing 10

tonnes, for example, would put 10,000 times as much stress on the road as one

carrying a single tonne.

RECENT LEGAL DECISIONS

34. The recent Judgement made by the

Supreme Court of NZ (May 2023) in the successful appeal by Auckland Council,

for a targeted rate on commercial accommodation providers, has provided some

important principles in the setting of rates by a local authority.

35. Key principles are the extent to

which a local authority needs to ensure a rational connection between the

imposition of the rate and the benefits from the activity. This does not need

to be an exact equivalence, or a close correlation and it is reasonable for the

local authority to consider the intended or expected future benefits from an

activity that is to be funded.

36. This Judgement is significant with

regard to the matter being discussed in this report and given the opportunity

provided by section 101(3)(b), council staff have developed options which can

now be considered.

Strategic / Statutory Context

37. This report considers the options

to fund the transportation activity which could be included in the 2024/34

Long-term plan consultation to ensure adequate consultation and feedback

opportunities for the community and particularly the groups and individuals who

may be affected by any proposal.

Options Analysis

38. Having considered the factors in

section 101(3)(a) of the Rating Act, council can then consider section

101(3)(b) and the overall impact of any allocation of liability for revenue

needs on the current and future social, economic, environmental, and cultural

wellbeing of the community. The options for strategy Finance and Risk to

consider and recommend on to Council are summarised below:

39. Option

1: Include a proposal to introduce a new rating category for

“Industrial” properties as part of the draft 2024/2034 Long Term

Plan.

The

current commercial differential would remain at 2.1:1 and the industrial

properties would be created as a separate category. The level of general rates

differential for the industrial category when split could initially remain at

2.1:1. This category’s differential would be expected to develop

over time as the costs, impacts of and benefits to the industrial sector

increase.

|

Advantages

|

Disadvantages

|

|

- Responds

to the commercial sector’s concerns that they are paying a disproportionate

rate.

- Recognises

the increasing volumes of heavy vehicle to Industrial and Port related

businesses in the city from journeys originating or finishing outside the

city’s boundary.

- Recognises