|

|

|

AGENDA

Ordinary Council meeting

Monday, 11 September 2023

|

|

I hereby give notice that an Ordinary meeting of

Council will be held on:

|

|

Date:

|

Monday, 11 September

2023

|

|

Time:

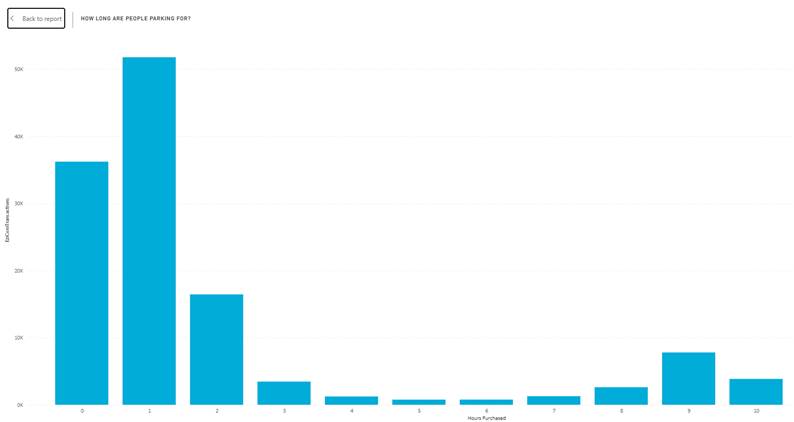

|

9.30am

|

|

Location:

|

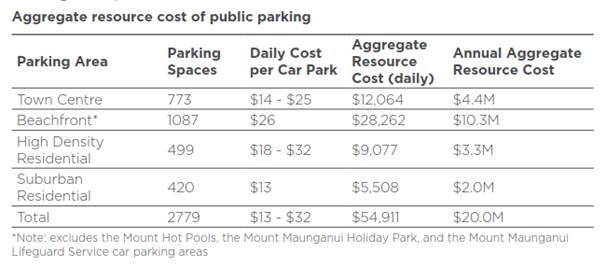

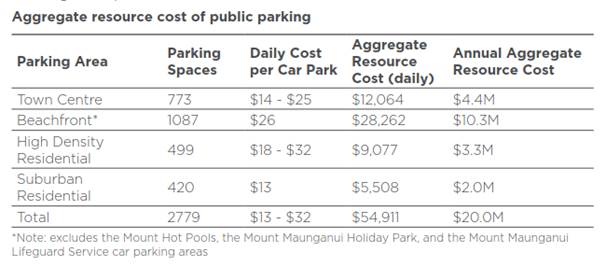

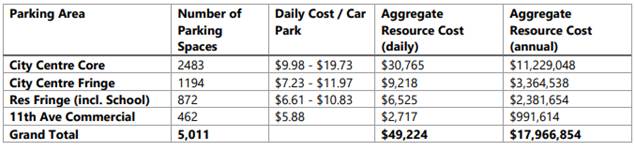

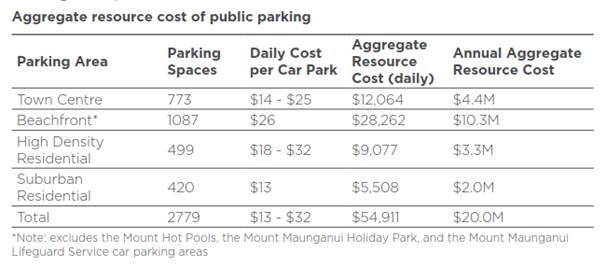

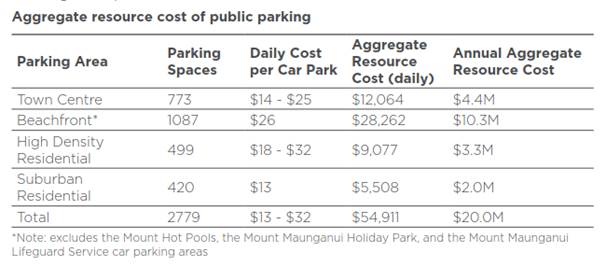

Bay of Plenty Regional Council Chambers

Regional House

1 Elizabeth Street

Tauranga

|

|

Please note that this

meeting will be livestreamed and the recording will be publicly available on

Tauranga City Council's website: www.tauranga.govt.nz.

|

|

Marty Grenfell

Chief Executive

|

Membership

|

Chairperson

|

Commission

Chair Anne Tolley

|

|

Members

|

|

|

Quorum

|

Half of the members

physically present, where the number of members (including vacancies) is even;

and a majority of the members physically present, where the number of

members (including vacancies) is odd.

|

|

Meeting frequency

|

As required

|

Role

·

To ensure the effective and

efficient governance of the City

·

To enable leadership of the City

including advocacy and facilitation on behalf of the community.

Scope

·

Oversee the work of all

committees and subcommittees.

·

Exercise all non-delegable and

non-delegated functions and powers of the Council.

·

The powers Council is legally prohibited from delegating include:

1. Power to

make a rate.

2. Power to

make a bylaw.

3. Power to

borrow money, or purchase or dispose of assets, other than in accordance with

the long-term plan.

4. Power to

adopt a long-term plan, annual plan, or annual report

5. Power to

appoint a chief executive.

6. Power to

adopt policies required to be adopted and consulted on under the Local

Government Act 2002 in association with the long-term plan or developed for the

purpose of the local governance statement.

7. All final

decisions required to be made by resolution of the territorial

authority/Council pursuant to relevant legislation (for example: the approval

of the City Plan or City Plan changes as per section 34A Resource Management

Act 1991).

·

Council has chosen not to delegate the following:

8. Power to

compulsorily acquire land under the Public Works Act 1981.

·

Make those decisions which are required by legislation to be made

by resolution of the local authority.

·

Authorise all expenditure not delegated to officers, Committees

or other subordinate decision-making bodies of Council.

·

Make appointments of members to the CCO Boards of

Directors/Trustees and representatives of Council to external organisations.

·

Consider any matters referred from any of the Standing or Special

Committees, Joint Committees, Chief Executive or General Managers.

Procedural matters

·

Delegation of Council powers to Council’s committees and

other subordinate decision-making bodies.

·

Adoption of Standing Orders.

·

Receipt of Joint Committee minutes.

·

Approval of Special Orders.

·

Employment of Chief Executive.

·

Other Delegations of Council’s powers, duties and

responsibilities.

Regulatory matters

Administration, monitoring and

enforcement of all regulatory matters that have not otherwise been delegated or

that are referred to Council for determination (by a committee, subordinate

decision-making body, Chief Executive or relevant General Manager).

|

Ordinary

Council meeting Agenda

|

11

September 2023

|

7 Confirmation

of minutes

7.1 Minutes

of the Council meeting held on 21 August 2023

File

Number: A15035780

Author: Anahera

Dinsdale, Governance Advisor

Authoriser: Anahera

Dinsdale, Governance Advisor

|

Recommendations

That the Minutes of the

Council meeting held on 21 August 2023 be confirmed as a true and correct

record.

|

Attachments

1. Minutes

of the Council meeting held on 21 August 2023

|

Ordinary Council meeting minutes Ordinary Council meeting minutes

|

21 August 2023

|

|

|

|

MINUTES

Ordinary Council meeting

Monday, 21 August 2023

|

Order of Business

1 Opening karakia. 3

2 Apologies. 3

3 Public forum.. 3

4 Acceptance of

late items. 4

4.1 Acceptance

of late item - Draft Long Term Plan Operational Financials. 4

5 Confidential

business to be transferred into the open. 4

6 Change to the

order of business. 4

7 Confirmation of

minutes. 4

Nil

8 Declaration of

conflicts of interest 4

9 Deputations,

presentations, petitions. 4

10 Recommendations from other

committees. 4

10.1 Review

of Rating Categories to Differentiate Industrial Ratepayers. 4

10.2 Report

- 2024 - 2034 Long-term Plan - Update - Funding and Reserves. 5

11 Business. 5

11.1 2024-2034

Long-term Plan - Tauranga Community Stadium - update. 5

11.2 Draft

Long Term Plan 2024-2034 - Memorial to Elizabeth Waterfront Recreation

Connection \ Te Hononga ki Te Awanui 8

11.3 Our

Direction (Council's strategic framework) - adopt final action and investment

plans and strategies. 10

11.4 Tauranga

Climate Action and Investment Plan - adoption. 12

11.5 Long-term

Plan 2024 - 2034 Update. 13

11.6 Draft

Revenue and Financing Policy Framework. 15

11.7 Paying

a Fair Share - Approaches to Funding the draft 2024/34 Long-term Plan. 16

11.8 Review

of Rating Categories to Differentiate Industrial Ratepayers. 18

12 Discussion of late items. 19

13 Public excluded session. 19

14 Closing karakia. 20

MINUTES

OF Tauranga City Council

Ordinary Council meeting

HELD

AT THE Bay of Plenty Regional Council

Chambers, Regional House,

1 Elizabeth Street, Tauranga

ON

Monday, 21 August 2023 AT 9.30am

PRESENT: Commission

Chair Anne Tolley, Commissioner Shadrach Rolleston, Commissioner Stephen

Selwood, Commissioner Bill Wasley

IN ATTENDANCE: Marty

Grenfell (Chief Executive), Paul Davidson (Chief Financial Officer - via Teams),

Barbara Dempsey (General Manager: Community Services), James Woodward (Acting General

Manager: Infrastructure), Jeremy Boase (Acting General Manager: Strategy,

Growth & Governance), Sarah Omundsen (General Manager: Regulatory and

Compliance), Gareth Wallis (General Manager: City Development &

Partnerships), Kelvin Eden (Capital Programme Manager: Major Community

Amenity), Anne Payne (Principal Strategic Advisor), Nick Chester (Principal

Strategic Advisor), Sarah Searle (Principal Strategic Advisor), Kathryn

Sharplin (Manager: Finance), Tracey Hughes (Financial Insights & Reporting

Manager), Malcolm Gibb (Project Manager – Rating Review), Reece Wilkinson

(Parking Strategy Manager), Coral Hair (Manager: Democracy & Governance

Services), Sarah Drummond (Governance Advisor), Anahera Dinsdale (Governance

Advisor), Janie Storey (Governance Advisor)

1 Opening

karakia

Commissioner

Shadrach Rolleston opened the meeting with a karakia.

2 Apologies

Nil

3 Public

forum

Mr Murray Guy interjected

from the public gallery and objected to not been given permission to speak in

the public forum. Mr Guy was asked by the Chairperson to sit down. The

Chairperson cautioned Mr Guy to stop disrupting the meeting or she may ask him

to leave the meeting. Mr Guy continued to interject and refused to leave,

and the Chairperson advised Mr Guy that he was required to withdraw immediately

as his conduct was disorderly and creating a disturbance.

Mr Guy continued to

interject, and the Chairperson advised Mr Guy that she was now requesting

staff/security personnel to remove him from the meeting for the rest of the

meeting as his conduct was disorderly and creating a disturbance.

The Chairperson adjourned

the meeting at 9.37 am and Mr Guy left the room.

At 9.41am the meeting

reconvened.

4 Acceptance

of late items

|

4.1 Acceptance

of late item - Draft Long Term Plan Operational Financials

|

|

Resolution CO14/23/1

Moved: Commissioner

Shadrach Rolleston

Seconded: Commissioner Bill Wasley

That the Council:

(a) Accepts

the late tabled item “Draft Long Term Plan Operational

Financials” for consideration in the report “Long Term Plan

2024-2034 update at the meeting:

The above item was not

included in the original report because it was not available at the time the

agenda was issued, and discussion cannot be delayed until the next scheduled

meeting of the Committee because a decision is required in regard to this

item.

Carried

|

5 Confidential

business to be transferred into the open

Nil

6 Change

to the order of business

Nil

7 Confirmation

of minutes

Nil

8 Declaration

of conflicts of interest

Nil

9 Deputations,

presentations, petitions

10 Recommendations

from other committees

|

10.1 Review

of Rating Categories to Differentiate Industrial Ratepayers

|

|

Staff Paul

Davidson, Chief Financial Officer

|

|

Resolution CO14/23/2

Moved: Commissioner

Stephen Selwood

Seconded: Commissioner Shadrach Rolleston

That the Council:

(a) Receives

the report "Review of Rating Categories to Differentiate Industrial

Ratepayers

(b) Approves

the recommendations of the Strategy, Finance and Risk Committee to consider

introducing a new rating category for industrial properties (Option 1) in the

development of the 2024-34 Long-term Plan.

Carried

|

|

10.2 Report - 2024 - 2034

Long-term Plan - Update - Funding and Reserves

|

|

Staff Paul

Davidson, Chief Financial Officer

|

|

Resolution CO14/23/3

Moved: Commissioner

Bill Wasley

Seconded: Commissioner Shadrach Rolleston

That the Council:

(a) Receives

the report "Report - 2024 - 2034 Long-term Plan - Update - Funding and

Reserves".

(b) Approves the recommendations

of the Strategy, Finance and Risk Committee that the following matters are

considered in the LTP to address both the significant impacts of large asset

revaluations on depreciation and the current risks and impacts on the

depreciation reserves.

(i) Phasing in of

increased funding of depreciation expense in the early years of the LTP to

mitigate the otherwise significant up-front increases in rates arising from

significant asset revaluation.

(ii) Restoring

depreciation funding and the level of reserve balances within the ten years

of the LTP.

(iii) Short term loan funding of

capital renewals for activities where there are insufficient depreciation

reserves.

(iv) additional rates funding to

retire debt for those activities where there are insufficient depreciable

assets to repay debt over time.

(c) Approves

the recommendations of the Strategy, Finance and Risk Committee that the

phased retirement of debt in the weathertight and unfunded liabilities

reserve subject to rates affordability should aim to significantly reduce

these reserve deficits through the period of the LTP.

(d) Approves

the recommendations of the Strategy, Finance and Risk Committee to consider

the value of risk reserve funded through the LTP taking into account both

debt headroom maintained in the debt to revenue ratio below LGFA funding

limits and the value of the reserve.

Carried

|

11 Business

|

11.1 2024-2034 Long-term

Plan - Tauranga Community Stadium - update

|

|

Staff Gareth

Wallis, General Manager: City Development & Partnerships

Kelvin Eden, Capital

Programme Manager: Major Community Amenity

Jeremy Boase, Acting

General Manager, Strategy, Growth and Governance

External Nigel

Tutt – Priority One

Key points

·

The work to date had been a team effort with a number of people

involved.

·

Public engagement had included a survey carried out by Key

Research, which was a demographically representative view and resulted in

more people in favour of the stadium than not in favour.

·

There was more support with the younger age group and males but

this diminished when the questions got to willingness to pay.

·

A self-select survey was carried out via a link, however there

were more negative comments and misinformation sent out by groups which

coloured the results somewhat. Some support letters had been received

from businesses and individuals who were generally in favour of the stadium.

·

Benefits included the attraction of events and the alignment of

the CBD rejuvenation with negative comments including parking and disruption.

·

The social and economic benefits outlined by Market Economics

was more comprehensive and outlined the many benefits that could be realised

across the Western Bay of Plenty and the wider Bay of Plenty.

·

The facility would take the load off Baypark as it was

currently at capacity with more facilities needing to be provided. The

economic development report outlined that the lack of investment in community

amenities also led to poor attraction and retention of talent, and there was

a need to ensure there was a good workforce into the future.

·

Investigations had been commenced to set up a charitable trust

to generate external funding for civic amenities.

·

Key risks included ground conditions. Initial geotech reporting

had been undertaken, based on the information to hand, showed an additional

$9M would need to be included for the grandstand than what was included in

the business case, but more borehole testing was needed on the site.

There may be a possibility to decrease the length of the piles which would

result in a lesser cost. There was also some slope stability and retaining

work required on the western bank which could cost up to $19M in the

worst-case scenario.

·

Continued engagement was being undertaken with the athletic,

bowls and croquet clubs and other users.

·

Consideration was being given to the relocation of the athletic

track to Baypark in the long term. The current track would need to be

replaced in 2028 and had a useful lifespan up until then.

·

The lawn bowls and croquet clubs’ leases were due to

expire in 2029 and the team were working through some relocation options with

them.

·

The recommendation was to push out the development of the

stadium in association with the wider masterplan to relocate users and the

development of the Te Manawataki o Te Papa precinct.

·

Option 2 was the preferred option, with a staged plan and

thorough community consultation, with the project team continuing to work on

funding mechanisms and staging the design and cost. Once the project

was included in the 2024-34 Long Term Plan (LTP) for deliberation there would

be more community feedback and more information to guide the decision

making.

In response to questions

·

In relation to a query regarding the cost, access to external

funding and engagement with regional and sub-regional partners to share the

costs, it was noted that the cost of developing the first stage was estimated

at $70M, which was subject to what was to be built. The $30M

relating to displacement costs was already in the budget as part of the

Active Reserves Masterplan work.

Discussion points raised

Commissioners noted the

following comments:

·

There was a divided view within the community and the

recommendations set a clear pathway for the need for further consultation.

·

Option 2, the staged implementation plan, would be out for

consultation as part of the LTP and would provide opportunities for all the

community to express their views.

·

The Commission was appointed to provide and focus on the long-term

best interests of the city it serves. This included infrastructure and

community amenities, of which sporting and wider community amenities and

facilities were a key component of a great city.

·

The proposal provided existing users to have their current

needs met and provided opportunities for them to have better amenities as a

result of the decision. Some clubs also had divided views.

·

The proposal would have wider social and economic benefits

across the city and would release the capacity at Bay Park which was not able

to accommodate some indoor sports because of lack of space.

·

Commissioners needed to consider both sides of the story based

on the evidence and information before any decision was made. The

process had started before the Commission commenced and it would do the

community a disservice if the Commissioners did not follow through with this

process and make a considered decision as part of the LTP 2024-34.

·

The two surveys were helpful in terms of perspectives provided

and understating the demographic of those inputting, and to get a full

perspective of age groups across the city.

·

There were 4,000 new residents entering the city each year and

more coming into the Western Bay of Plenty, with a projected population for

the sub-region in 2063 being 300,000. This was a 50% increase from

2018. Council needed to respond to the transformation, recognise that

growth, listen to the needs of those coming to live here and provide for

them.

·

There had been a lot of misinformation of what the stadium was

going to be and seeks to do for the community. It would not be locked

up and unattainable on a daily basis, it would still be a community

greenspace valued by the community and the public would continue to have

access, there would be no restricted access to the Domain.

Activities would include rugby, soccer, cricket, indoor sports, events and

concerts and the proposed stadium would provide for all opportunities.

·

Parking and noise were some of the concerns expressed, and

while these needed to be carefully considered. The Council was exploring with

the Bay of Plenty Regional Council better transport options and opportunities

to move around the city more easily.

·

The Commission would protect and look after the trees in the

Domain during this process.

·

Financially the city could not afford the stadium at present

with the building of Te Manawataki o Te Papa. The proposal would not be

included into the budget in the next few years.

·

Working in with the athletic club to relocate their track by

its use by date made sense. It would take time to move some of the

existing users from the site and to make sure that they were well looked

after and provided for with better facilities.

·

Council was required by law to make room for more housing to

cope with the growing population and had a responsibility to the young people

to increase the economic activity in the city.

·

Growth had not adequately been addressed in the last two

decades which had overwhelmed the city but now it had to be managed.

With the underinvestment in infrastructure and the city centre dying,

Commissioners had to make hard decisions on what was best for the long-term

interests of the city and make investments.

·

There was a clear divide between the young and older residents,

but Council needed to look at what was best for the city in next 30 years.

The underinvestment in community facilities had been obvious and resulted in

the Commission reviewing all community facilities. This including

looking at The Domain which could take more use by more people on a regular

basis.

|

|

Resolution CO14/23/4

Moved: Commissioner

Stephen Selwood

Seconded: Commissioner Bill Wasley

That the Council:

(a) Receives

the report "2024-2034 Long-term Plan - Tauranga Community Stadium -

update".

(b) Approves

Option 2 – Staged Implementation Plan for inclusion in the draft

2024-2034 Long-term Plan, and budgets and consultation document. Current

details of this option include:

(i) Staged

delivery of the stadium commencing in 2029/30.

(ii) Capital

expenditure of $70 million for the first stage of which $40 million is

financed for budgeting purposes from rates-funded loans and $30 million from

other sources.

(iii) Balance

of the capital expenditure budget to be incurred beyond the term of the

2024-2034 Long-term Plan.

(iv) Operating

costs of $1 million per annum, plus appropriate debt servicing and

depreciation allocations.

(v) Continuation

of work with existing users of the Tauranga Domain to explore alternative

site options (e.g. athletics, bowls and croquet).

(vi) Continuation

of efforts to secure non-council funding for the capital costs of the

community stadium.

(c) Notes

that further details of the ‘staged implementation plan’ approach

will be established prior to the adoption of the final 2024-2034 Long-term

Plan, currently scheduled for April 2024.

(d) Approves

unbudgeted expenditure of a maximum of $900,000 in 2023/24 to further develop

and cost the ‘staged implementation plan’ option, and to seek

funding contributions from other project partners to share these costs.

Council’s share of the expenditure to be loan-funded operating expenditure, based on the expenditure

offering long-term benefit associated with the proposed investment. Rate

funded debt retirement over ten years should be included in the budgets from

2024/25 onwards.

(e) Attachment

4 can be transferred into the open when all funding negotiations have

been completed.

Carried

|

|

11.2 Draft Long Term Plan

2024-2034 - Memorial to Elizabeth Waterfront Recreation Connection \ Te

Hononga ki Te Awanui

|

|

Staff Gareth

Wallis, General Manager: City Development & Partnerships

Kelvin Eden, Capital

Programme Manager: Major Community Amenity

External Rebecca

Ryder – Boffa Miskell

Craig Batchelor –

Independent Consultant

Rachel Wright –

Boffa Miskell

Key points

·

The work began in 2021 to consider a walkway from Memorial Park

to the CBD in two parts, stage 2 of which was to provide an extended harbour

edge connection between Memorial Park and the city centre.

·

Objectives were adopted in July 2022 to understand the key

priorities and became the focus for all of the project.

·

Engagement was undertaken with tangata whenua and one on one

meetings with landowners with waterfront-based properties to understand their

needs, interests and issues on the recreation connection in front of their

properties. A meeting was also held with the Tauranga Harbour

Protection Society on 5 March 2023 where discussions were held in detail.

·

There were 10 different topology options and 17 properties with

riparian rights for which the property rights were investigated.

·

Two workshops in May 2023 had also been held covering off the

options and to get the three viable options that were noted within the report.

These had been further informed from the workshops and focused to the public

realm area and dropping some of the components that had been raised by

landowners as a way of responding to them.

·

Each of the three options had been considered against the

planning framework requirements for district, regional and national coastal

plans. Most came under the Regional Environmental Coastal Plan as they

were all discretionary activities with lots of assessments required.

·

While there were no critical issues to obtaining a resource

consent, a real critical risk was around resolving the riparian rights,

property and access rights with the property owners. The property

owners’ legal advisor proposed that the Council look at a declaration

from the High Court on the legality of what’s proposed. The view

of the landowners was that any infringement of their access across their

frontage was contrary to their legal rights, however the Council’s

legal advice was that this could be managed and ensure that their rights could

be provided for in a reasonable way. The intention is to develop design

solutions and have those tested with evidence before a high court or other

alternative. It was critical this be sorted before any resource consent

process was undertaken.

·

There were also issues around hazard management in the long

term, as the area was affected by land instability and complications of a

walkway, including mitigation and repair work, as some properties had

structures close to the space.

·

While the matters were complex, these were not insurmountable.

·

The team was not in a position to recommend that the funding be

put into the LTP but were seeking funds to proceed with the design and go

through the legal processes. This highlighted the opportunity to use the $6M

already included in the LTP and provide time to design avenue connections to

allow public access to the waterfront and low tide access to the CBD.

It would also allow proceeding with some capital works where they were able

to achieve access.

·

The team thanked all residents and landowners that they had

engaged with, they had been welcomed into many homes and spent time with

people who were passionate about their properties and had held some robust

and challenging conversations.

In response to questions

·

If Option C, limited intervention, was adopted it would remain

as it was and no declaration from the court would be required.

·

The use of the $6M would include creating the nodes, beach

replenishment where it was a viable option and creating the walkway in areas

that were not subject to riparian rights as included in the 2021-31 LTP for

the years 2026-27. In parallel with that, work would be carried out to

get the High Court determination and set up a Memorandum of Understanding

with tangata whenua.

·

Beach replenishment has been seen as a positive concept with a

number of property owners, with an issue raised as to whether it would lead

to accretion and if so, would landowners be able to claim the land.

While this was not considered a risk, any claim would become a court

process.

·

The team were aware of pending iwi claims and potential changes

around the sea floor and this had been part of the conversation with tangata

whenua. Part of the process going forward was that they be included in

each step to avoid any issues later. Engagement with mana whenua had

been positive to date.

Discussion points raised

·

Commissioners acknowledged the work done by Boffa Miskell and

Tonkin and Taylor noting that the evidence-based information with the

comprehensive engagement, analysis, range of issues and considerations had

been helpful.

·

Additions were made to the recommendations to include the

amount of the consultancy costs in recommendaitons (c) and (d) and to provide

a determination of the legal position regarding property right issues.

|

|

Resolution CO14/23/5

Moved: Commissioner

Bill Wasley

Seconded: Commissioner Stephen Selwood

That the Council:

(a) Receives

the report "Draft Long Term Plan 2024-2034 - Memorial to Elizabeth

Waterfront Recreation Connection \ Te Hononga ki Te Awanui".

(b) Approves

delivery of Option C, which is limited intervention of the city fringe and

escarpment link zones from 1st to 7th Avenue, which may

include some beach replenishment between 6th and 7th

Avenues as an achievable short/medium-term outcome, acknowledging that it

does not achieve the accessible linear connection along the shoreline but

does however, improve public access at the road ends to the harbour edge.

(c) Approves

consultancy costs of $585,000 to progress the consenting, legal, planning and

design work for short/medium-term Option C, acknowledging

the construction costs of $6M, which are currently included in the Draft

Long-term Plan 2024-2034.

(d) Approves

consultancy costs of $1.65M to progress the consenting, legal, planning and

design work for long-term Option B, including determination of the legal

position regarding property right issues. Any construction costs to be

considered as part of deliberations for the following long-term plan.

(e) Enters into a Memorandum of

Understanding with Mana Whenua.

Carried

|

|

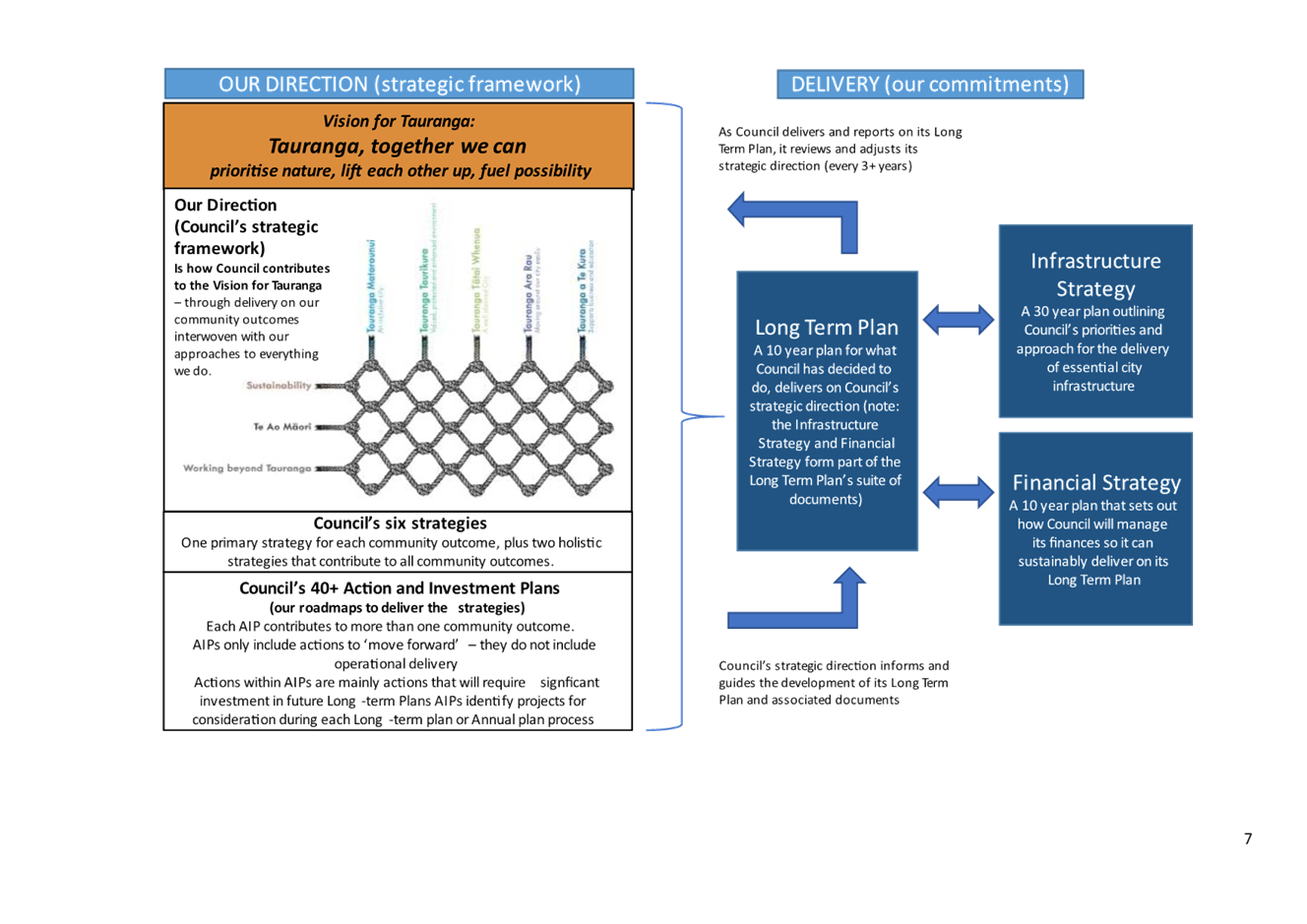

11.3 Our Direction

(Council's strategic framework) - adopt final action and investment plans and

strategies

|

|

Staff Anne

Payne, Principal Strategic Advisor

Jeremy Boase, Manager: Strategy & Corporate Planning

Nick Chester, Principal Community Advisor

Key points

·

The project work had begun in mid-2021 with action and

investment plans being developed in 2022 to deliver on Council’s

strategic directions.

·

Eight plans were being presented as part of this report and the

Tauranga Climate Action and Investment Plan would be presented in a separate

report to this meeting.

·

Two strategies had been held in draft until the Action and

Investment Plans were completed to ensure consistency across the framework.

·

As a result of the plans, 10 strategies could be superseded.

In response to questions

·

In relation to beliefs being omitted from the Community Centres

Action and Investment Plan opening statement it was noted that citizenship

ceremonies were held every month with 70-80 people from a variety of

denominations and religious beliefs becoming New Zealand residents and it was

noted that the city needed to make room for those beliefs as they were a

strong part of people’s cultures. Staff apologised for the

miscommunication and agreed to add beliefs back into the opening statement.

Discussion points raised

·

Commissioners acknowledged that the plans had been a huge

amount of work and staff had been challenged at every step. They noted

their appreciation for the work from all of the team for such a good and

robust process.

·

It was requested that if the framework for accessing the plans

was on the website, was it possible to have a diagram as the link point to

funding as this was important.

·

It was suggested that an increased focus was needed on the use

of grey water and the opportunities this would bring.

·

It was requested that the names of the Action and Investment

Plans be included in the recommendation (e), the inclusive city strategy

added into recommendation (f) and the plans that were to be superseded in

recommendation (i).

|

|

Resolution CO14/23/6

Moved: Commissioner

Bill Wasley

Seconded: Commissioner Stephen Selwood

That the Council:

(a) Receives the report

"Our Direction (Council's strategic framework) - adopt final action and

investment plans and strategies", including Attachments 1 to 5 to this

report.

(b) Acknowledges and thanks Te

Rangapū Mana Whenua o Tauranga Moana, particularly the appointed AIP

representatives, for their valuable contribution to development of these

plans and strategies.

(c) Acknowledges and thanks the

many other groups, organisations and individuals from our communities who

have also provided valuable contributions to development of these plans and

strategies.

(d) Approves the eight Action

and Investment Plan consultation feedback and proposed response summaries,

July 2023, contained in Attachment 1, including the resultant

proposed amendments to the draft plans.

(e) Adopts the eight Tauranga

City Council Action and Investment Plans contained in Attachment 2 (Appendices

A to H), namely:

Accessible Tauranga,

Safer Communities,

Art, Culture and Heritage,

Our Public Places Strategic Plan,

Reserves and Open Space,

Play, Active Recreation and Sport,

Community Centres,

Nature and

Biodiversity

and notes

that the eight adopted plans will be:

(i) Updated to reflect

final 2024-2034 Long-term Plan funding once the Long-term Plan is adopted in

April 2024, and

(ii) Available online as

designed documents in early October 2023, with printed copies available on

request.

(f) Adopts Tauranga City

Council’s Tauranga Mataraunui – Inclusive City Strategy, 2023-2033,

contained in Attachment 3, noting the summary of final changes

provided and that the strategy’s opening aspiration statement is to be

retained as:

We lift

each other up. We are an inclusive city that celebrates our past, is

connected in our present and invested in our future, where people of all

ages, beliefs, abilities and backgrounds are included, feel safe, connected

and healthy.

(g) Adopts Tauranga City

Council’s Tauranga Taurikura – Environment Strategy,

2023–2033, contained in Attachment 4, noting the summary of

final changes provided.

(h) Delegates the Group Manager:

Strategy, Growth and Governance to approve minor amendments to the eight

Action and Investment Plans and two strategies if required prior to

publication.

(i) Formally supersedes or

rescinds the ten existing strategies or plans as proposed in section C

of this report, and notes that partners to any superseded joint strategies or

plans will be advised accordingly, namely

Age-Friendly Strategy 2013

Disability Strategy 2013

Tauranga Western Bay Safer Communities Strategic Plan

2020-2025

City Safety Action Plan 2018

Toi Moana Arts and Culture Strategy 2018-2021

Vegetation Management Strategy (Growing Tauranga

Green) 2006

Aquatic Network Strategy 2012

Open Space Strategy 2012

Our Community Places Strategy 2008

Sport and Active Living Strategy 2006

(j) Notes

that, subject to today’s decisions, Tauranga City Council’s

strategic framework, Our Direction, has now been refreshed and is

presented on Council’s Our Future / Our

Direction webpages. A summary of where strategies and plans fit is

contained in Attachment 5 of this report.

Carried

|

|

11.4 Tauranga Climate Action

and Investment Plan - adoption

|

|

Staff Sarah

Searle, Strategic Advisor

Jeremy Boase, Manager: Strategy & Corporate Planning

Key points

·

Working with dedicated interested group to create the first

climate action plan which would continue to be updated and improved.

In response to questions

·

In relation to priority actions 33 and 34 regarding

sub-regional waste it was noted that the business case was currently being

reworked, and funding was provided in the LTP. It was requested that

regional input would also be sought.

·

Staff would recheck priority 34 as to whether a community

recovery and waste minimisation education centre was still proposed due to

lack of room on the site.

·

Additional information would be provided on the sources of

funding for priority 56 – the Mana Kai Mana Ora - WBoP Food Sovereignty

and Food Security Plan.

·

In response to a comment regarding any meaningful change to

reducing carbon emissions through road pricing, it was noted that the LTP

needed to start that conversation for it to gain momentum across the city.

·

Much of the feedback was challenging the concept of having

alternative modes of transport available before changing the targets.

Discussion points raised

·

While ambitious goals could be set there was no way they would

ever be reached in the city, therefore the plan needed to be realistic to encapsulate

that some targets would be met, but also acknowledging that there was no way

to achieve some of the science-based targets as some of the changes needed

were not ones that the Council could influence. The goal around

mitigation was amended in resolution (e) - as a city we will work towards

reducing our greenhouse gas emissions in line with national net zero 2050

commitments.

·

Commissioners thanked the staff, Te Rangapū Mana Whenua o

Tauranga Moana and others for the significant amount of the work done to

provide the plan.

|

|

Resolution CO14/23/7

Moved: Commissioner

Bill Wasley

Seconded: Commissioner Shadrach Rolleston

That the Council:

(a)

Receives the report " Tauranga Climate

Action and Investment Plan - adoption" including attachments 1

and 2.

(b)

Acknowledges and thanks Te Rangapū Mana Whenua o Tauranga Moana

for their valuable contribution to development of the Plan.

(c)

Acknowledges and thanks the many other groups, organisations and

individuals from our communities who have also provided valuable

contributions to development of the Plan.

(d)

Approves the Action and Investment Plan consultation feedback and

proposed response summary, July 2023, contained in Attachment 1,

including the resultant proposed amendments to the Plan.

(e)

Approves the updated goal around mitigation to “as a city we

will work towards reducing our greenhouse gas emissions in line with national

net zero 2050 commitments”

(f)

Adopts the Tauranga Climate Action and Investment Plan, 2023-2033,

contained in Attachment 2, and notes that the adopted Plan will be:

(i)

Updated to reflect final 2024-2034 Long-term Plan funding once the

Long-term Plan is adopted in April 2024, and

(ii)

Available online as a designed document in early October 2023, with

printed copies available on request.

(g)

Delegates the Group Manager: Strategy, Growth and Governance to

approve minor amendments to the Plan if required prior to publication.

Carried

|

At 11.35am the meeting adjourned.

At 11.49am the meeting reconvened.

|

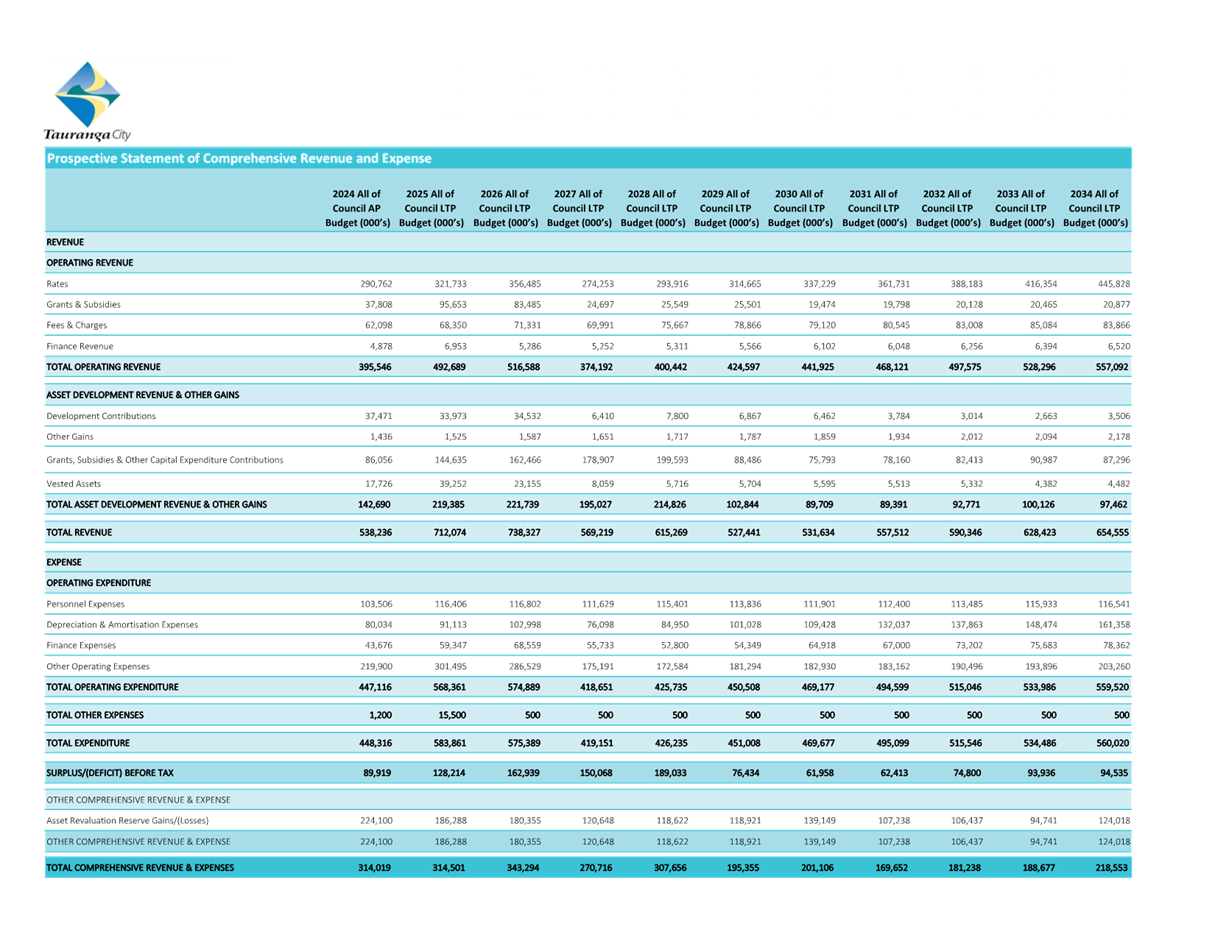

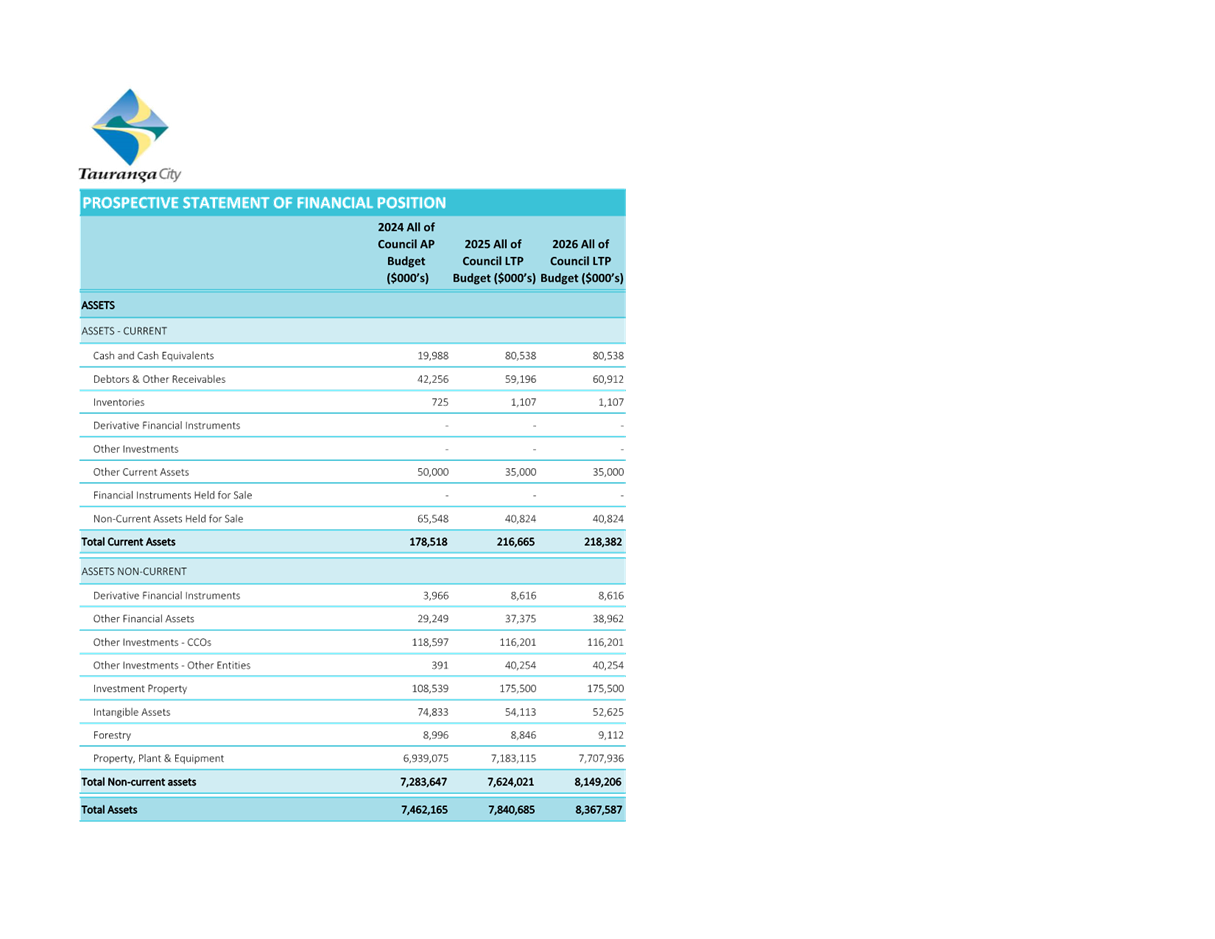

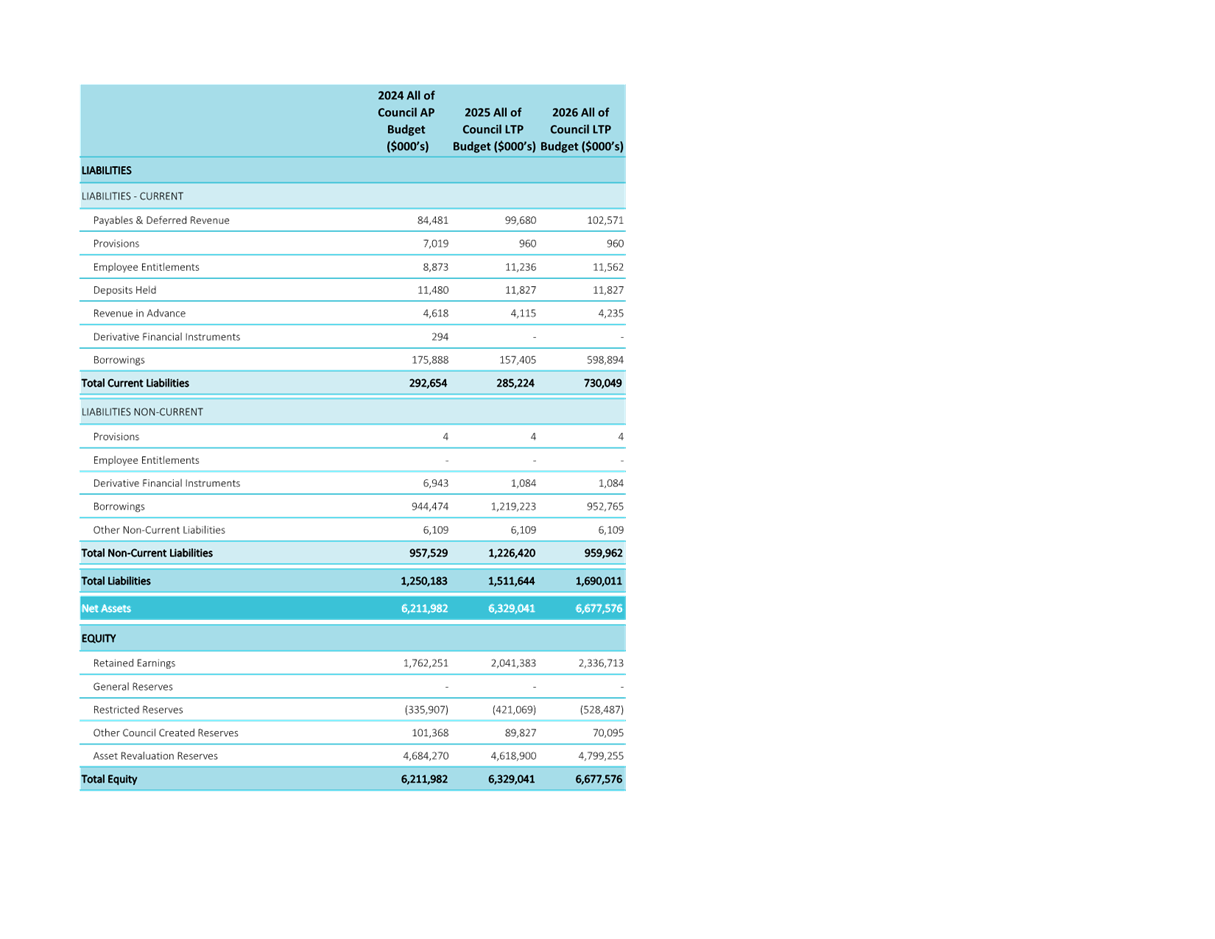

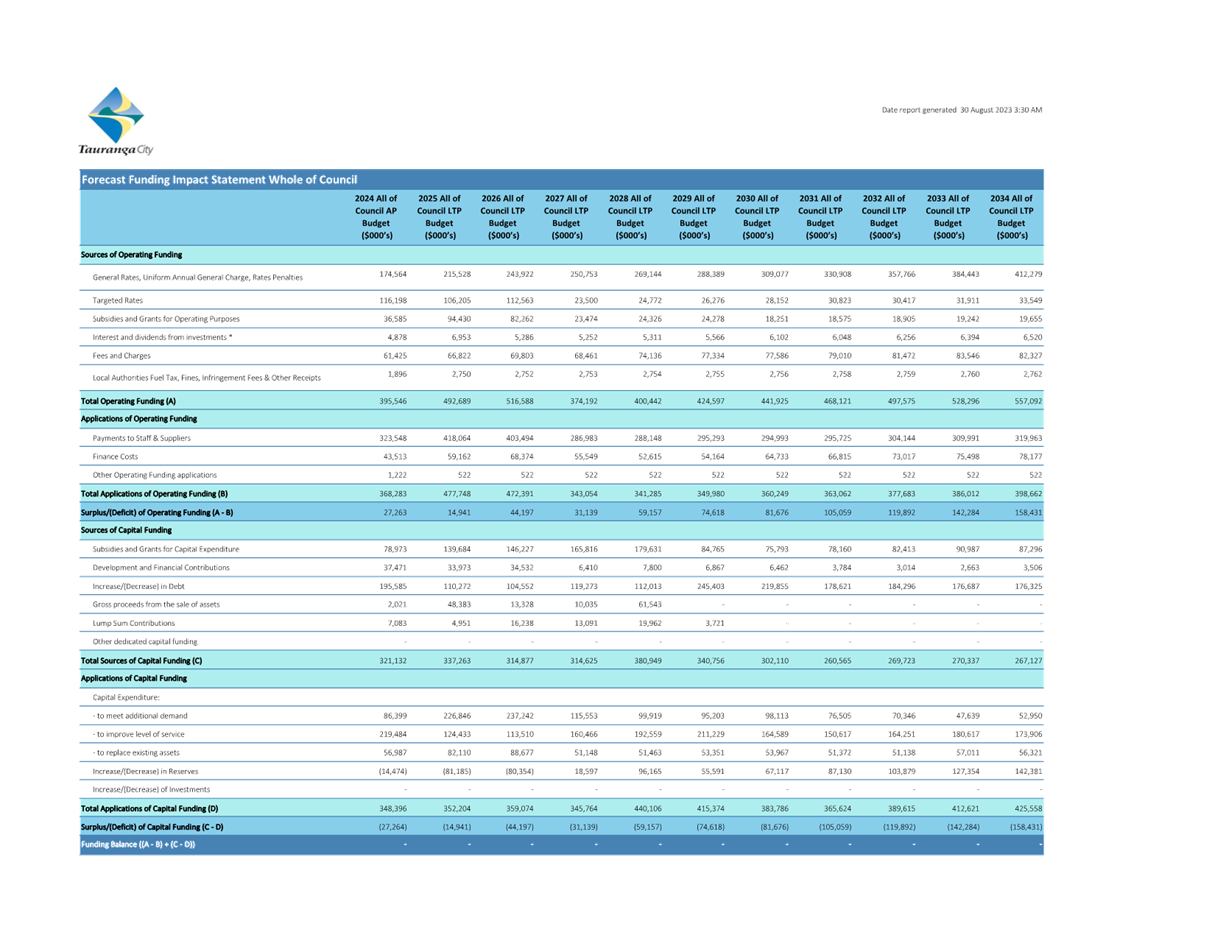

11.5 Long-term Plan 2024 -

2034 Update

|

|

Staff Paul

Davidson, Chief Financial Officer

Kathryn Sharplin, Manager: Finance

Tracey Hughes, Financial Insights & Reporting Manager

Tabled were a copy of the Draft

LTP Operational Financials prior to final decisions.

Key points

·

The budget reflected the recommendations made by the Strategy,

Finance and Risk Committee in relation to lessening the funding of

depreciation in the early years and reversing it in later years and

reflecting the size and scale of the revaluations that had occurred.

·

The LTP increased debt requirement of unfunded liability and

weathertightness reserves after year 3 of the LTP and sought resolution

around long-term loan funding where there was a long-term

benefit.

·

It assumes that the infrastructure funding and financing (IFF)

transactions for decisions on Te Manawataki o Te Papa were included but this

would be separately consulted in the next month.

·

No IFF levy had been added in the rates which would be an

additional 2% in 2026 to reflect that transaction. All of the debt had been

included in the budget.

·

The financials reflect the priorities set for the LTP as a flow

through from 2021-31 priorities

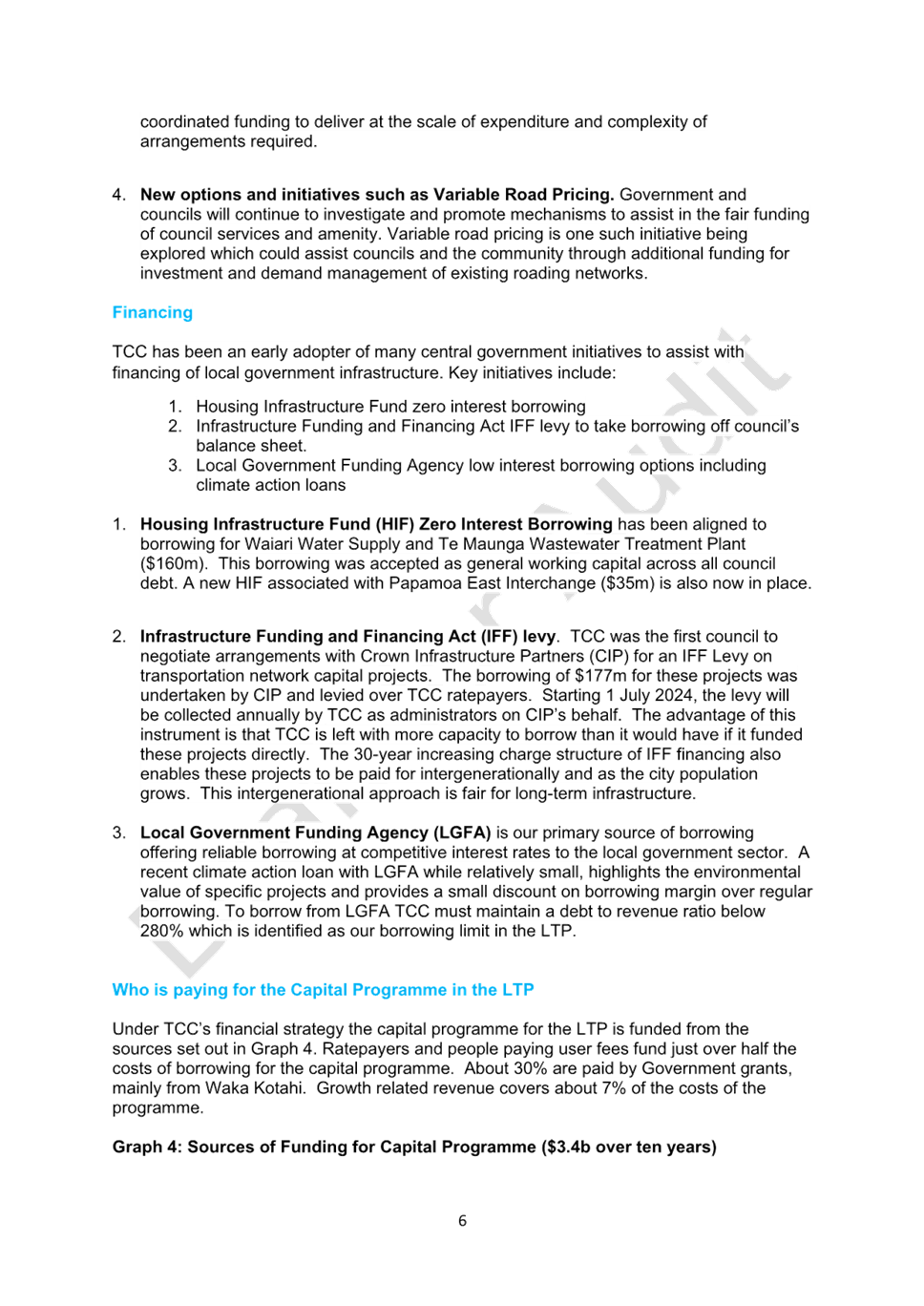

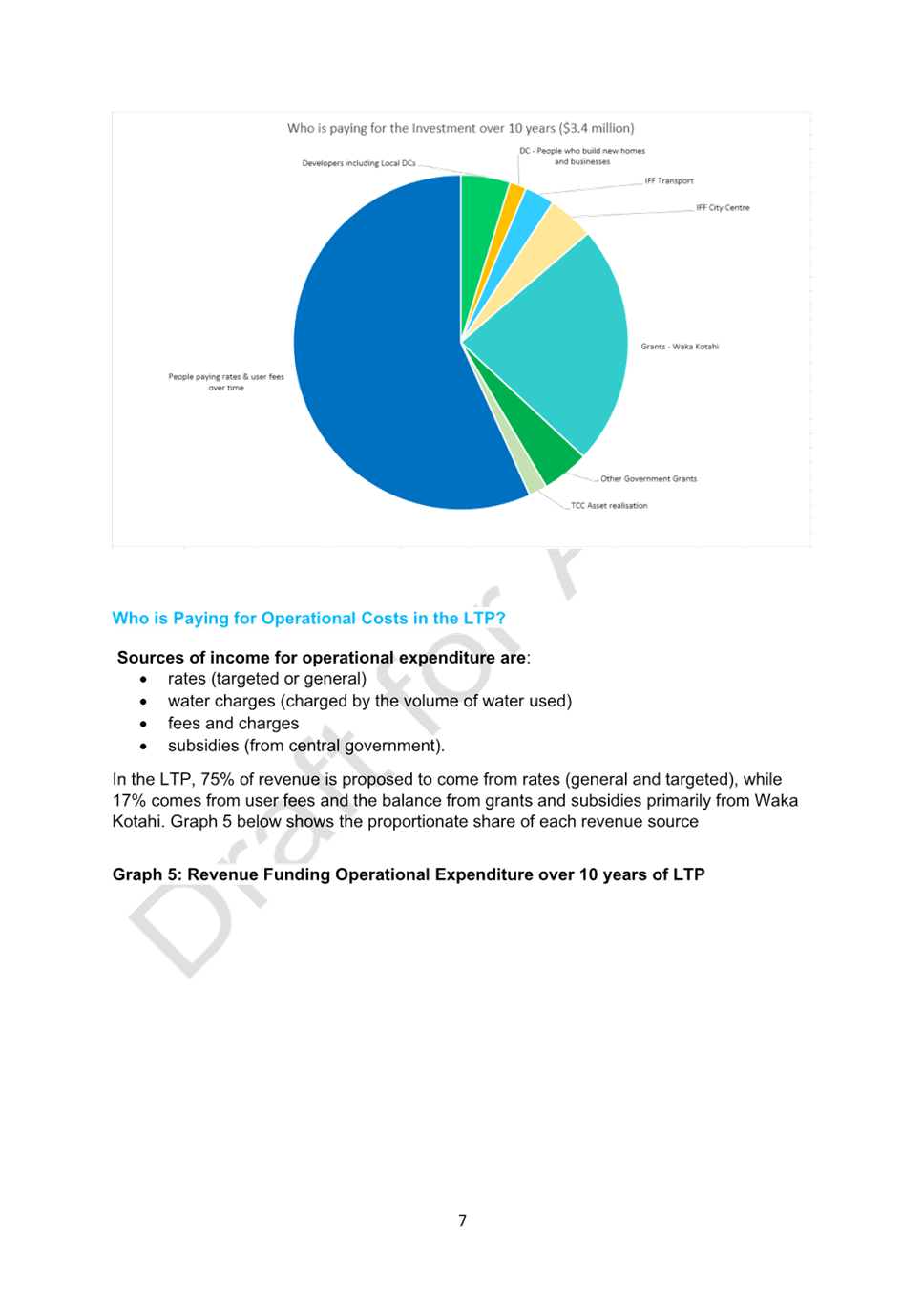

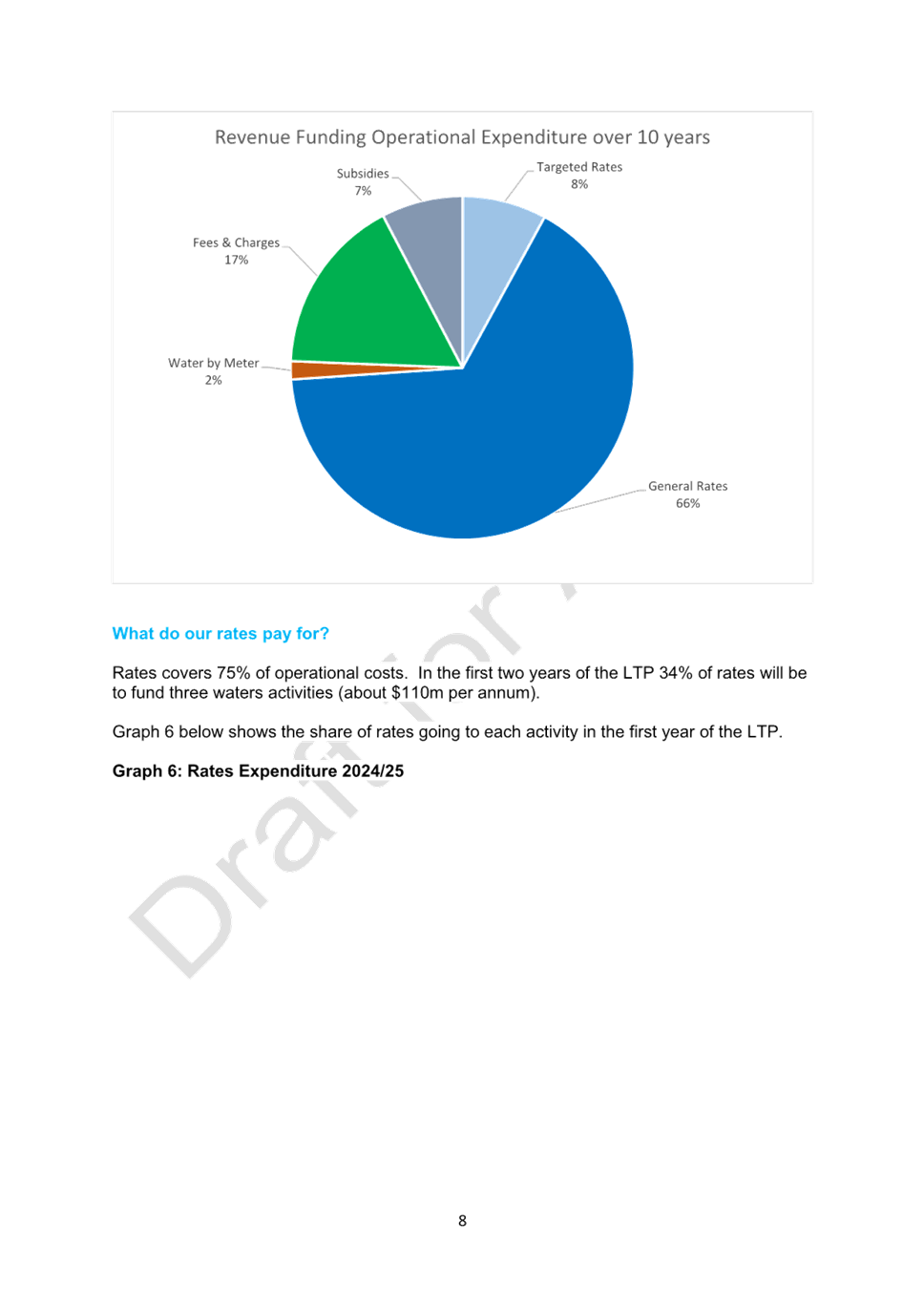

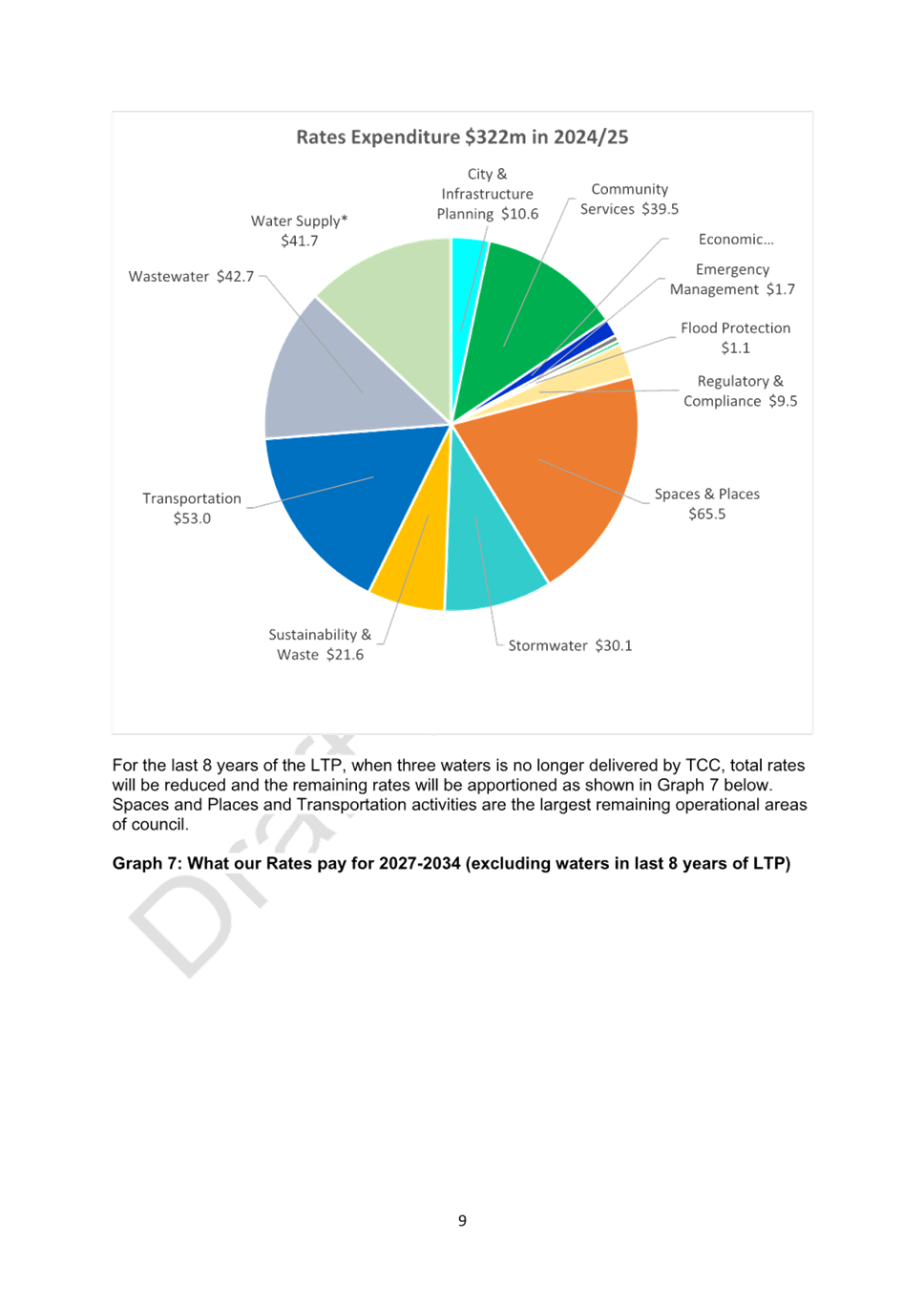

·

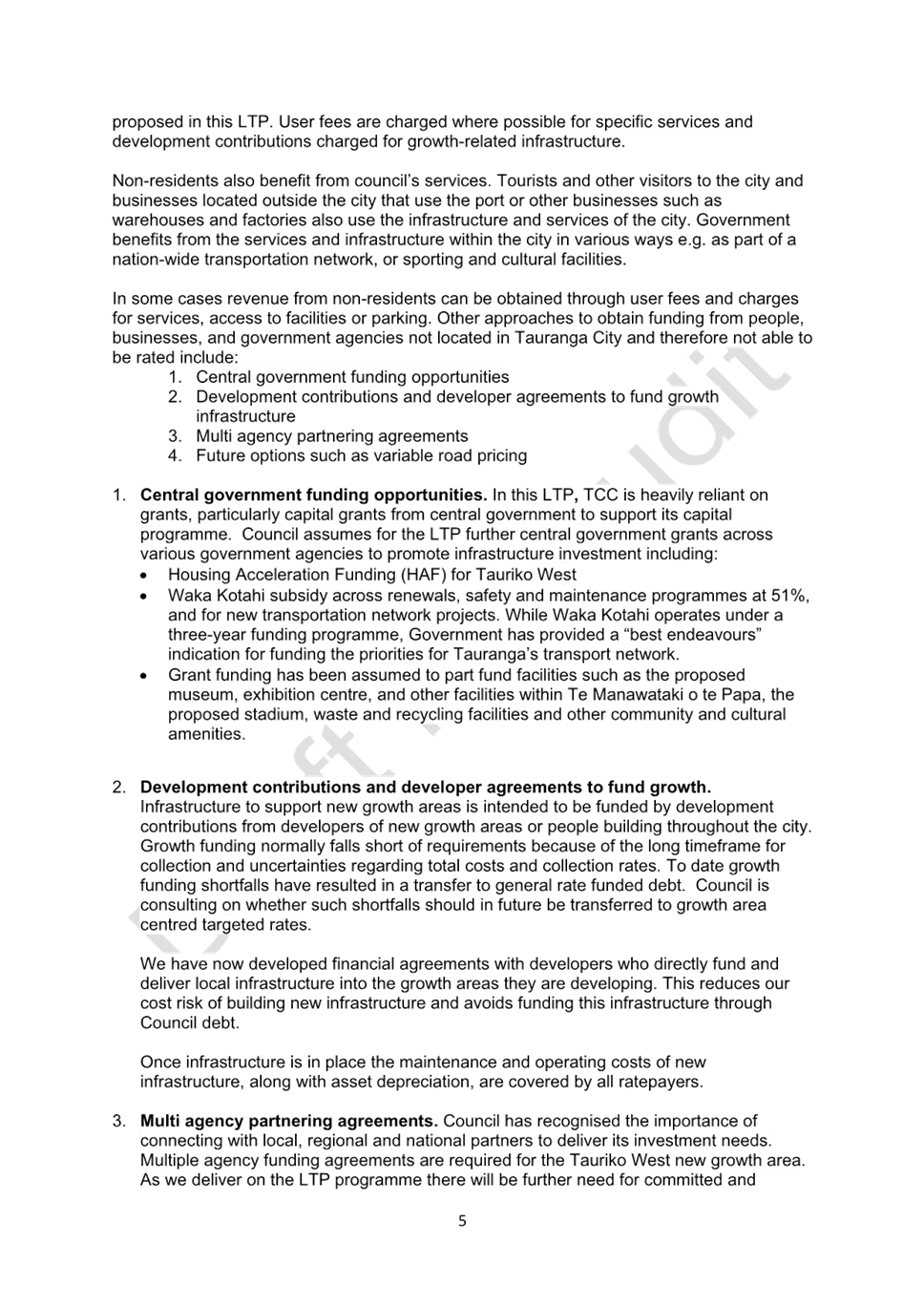

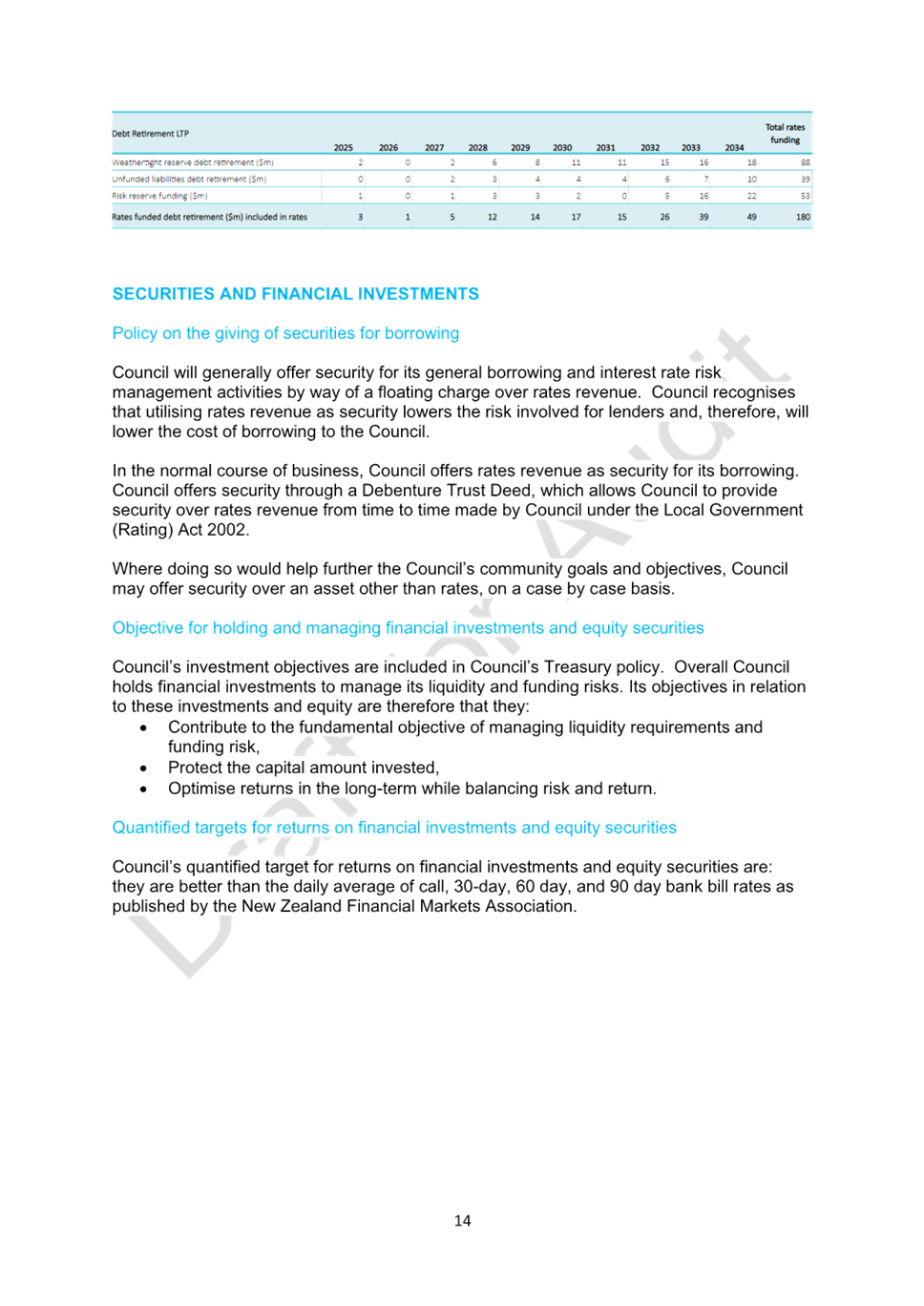

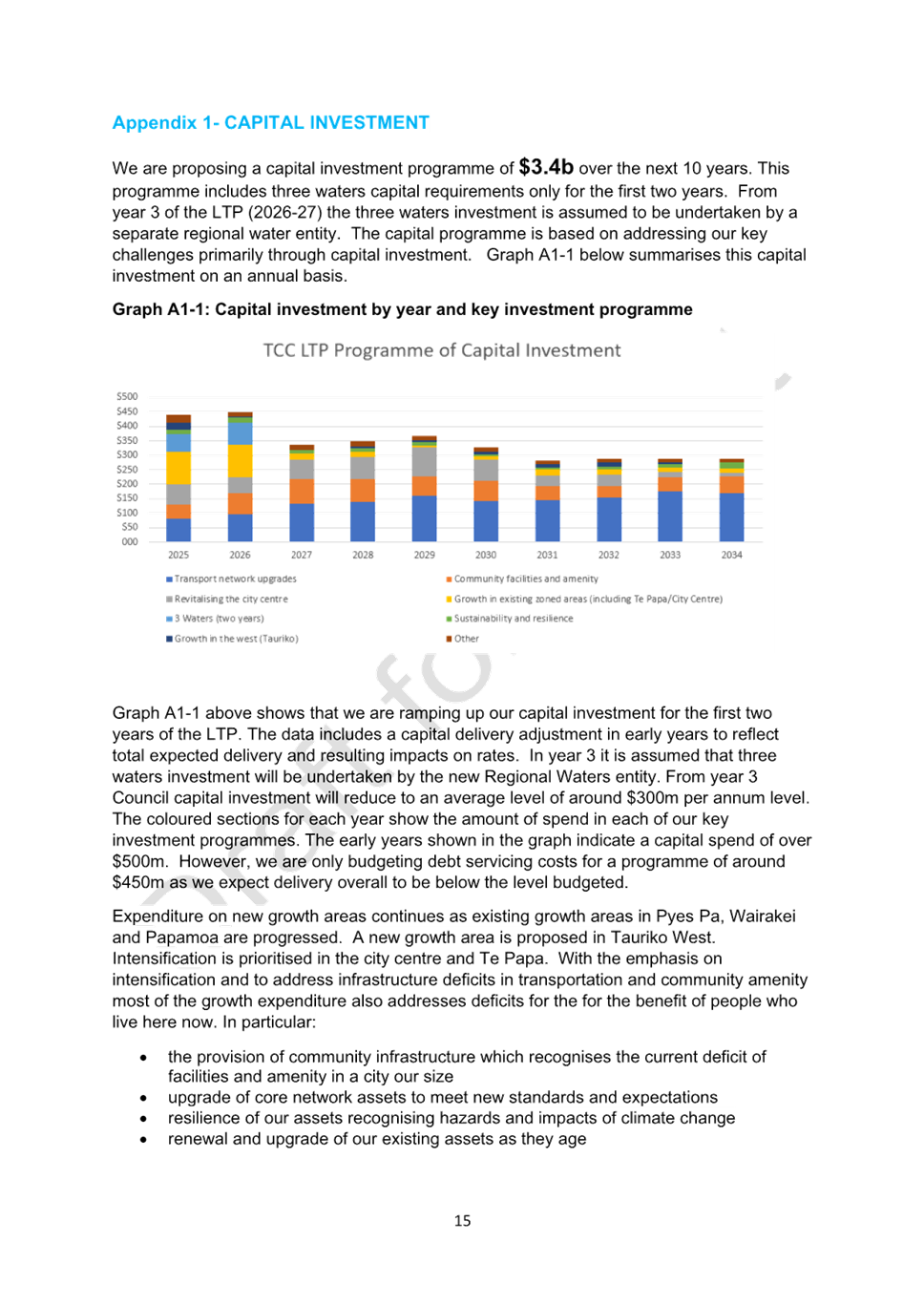

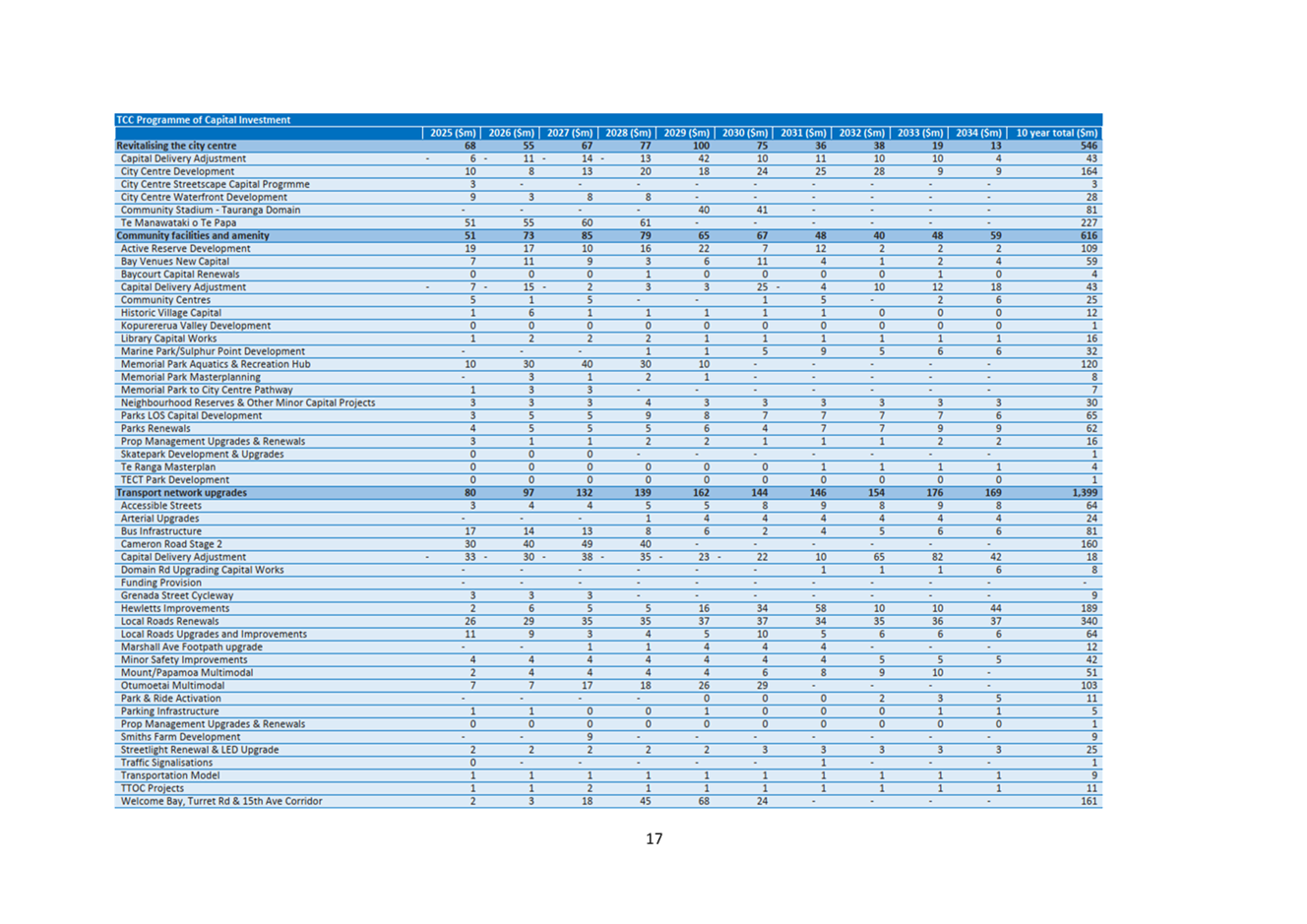

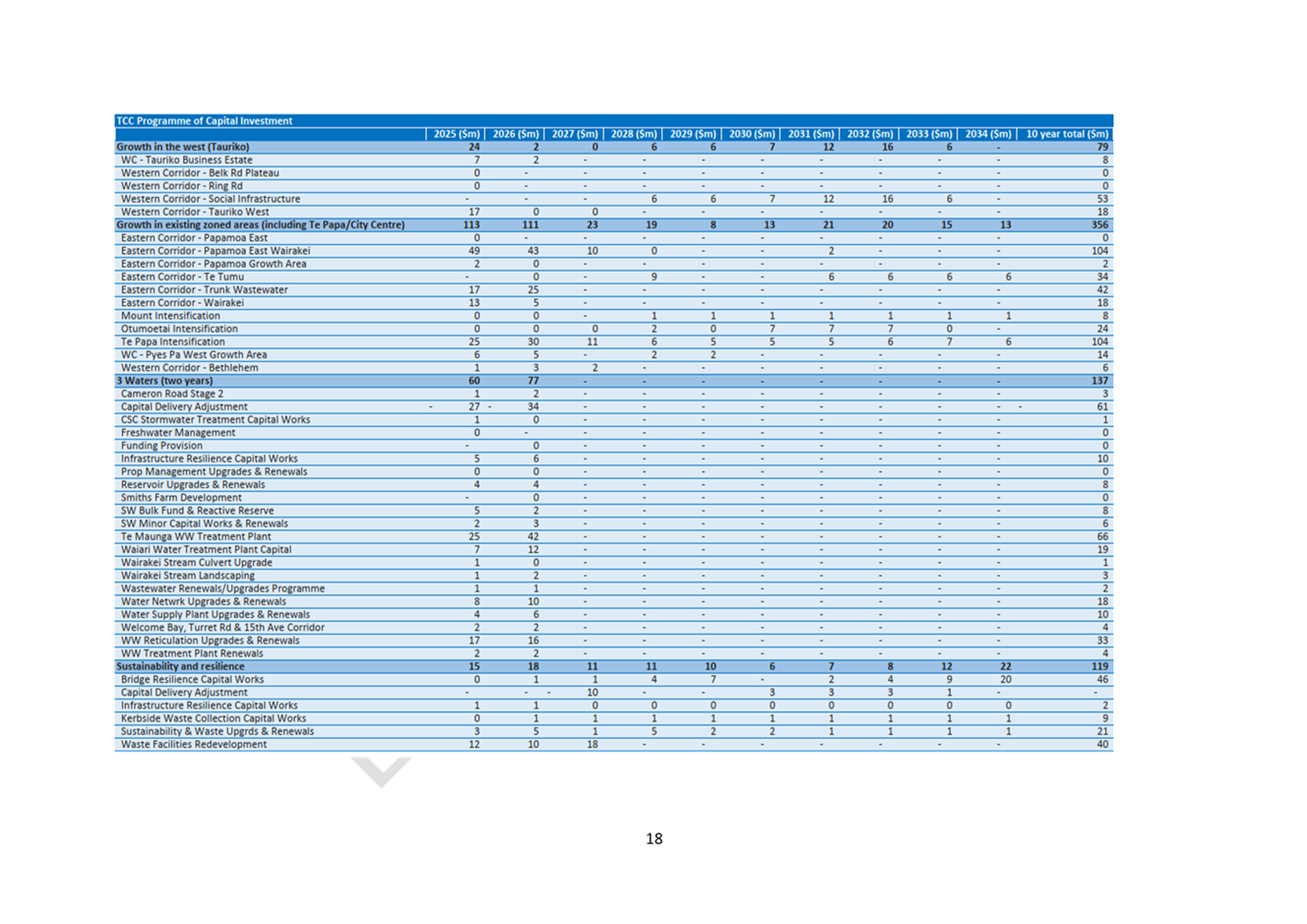

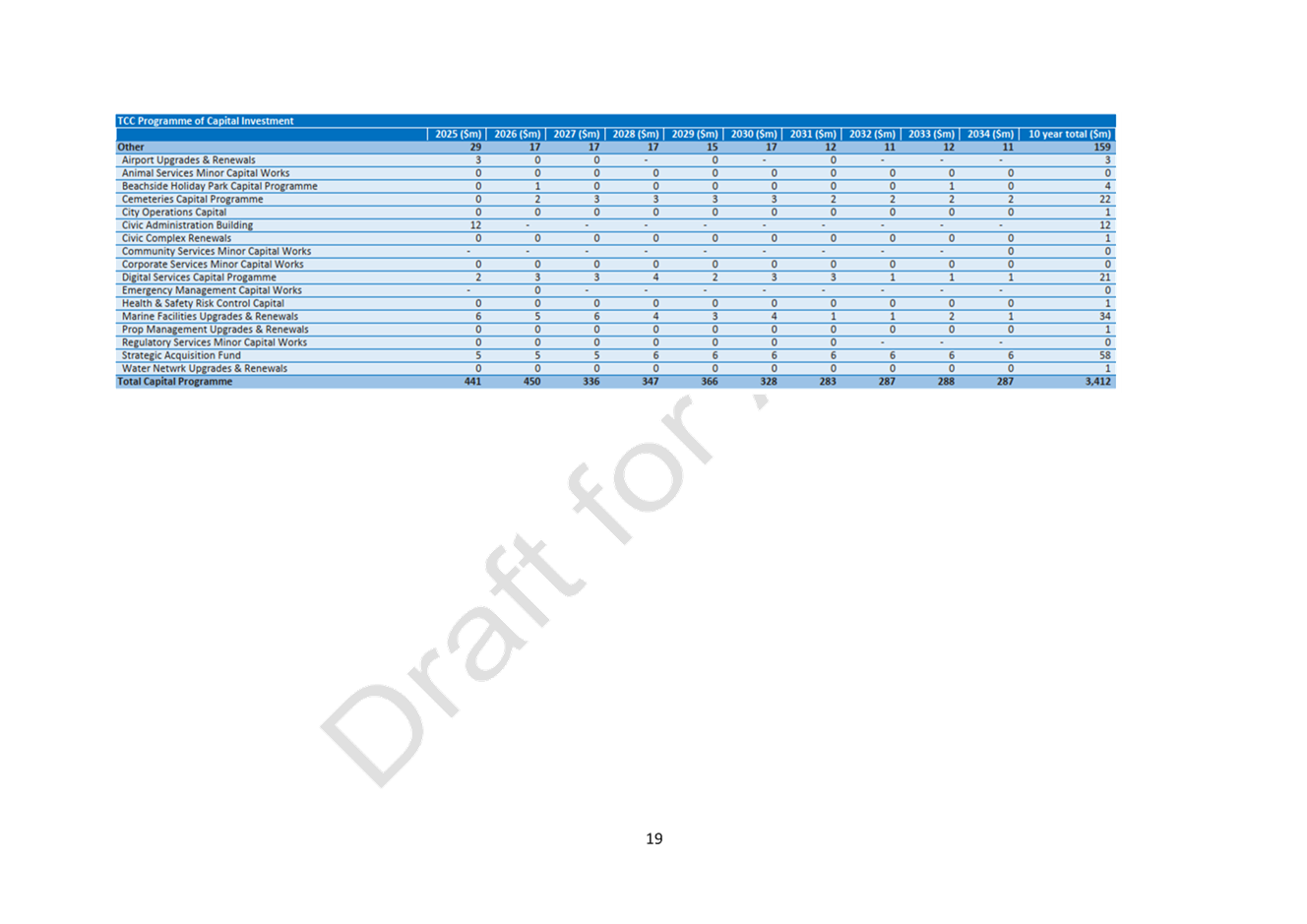

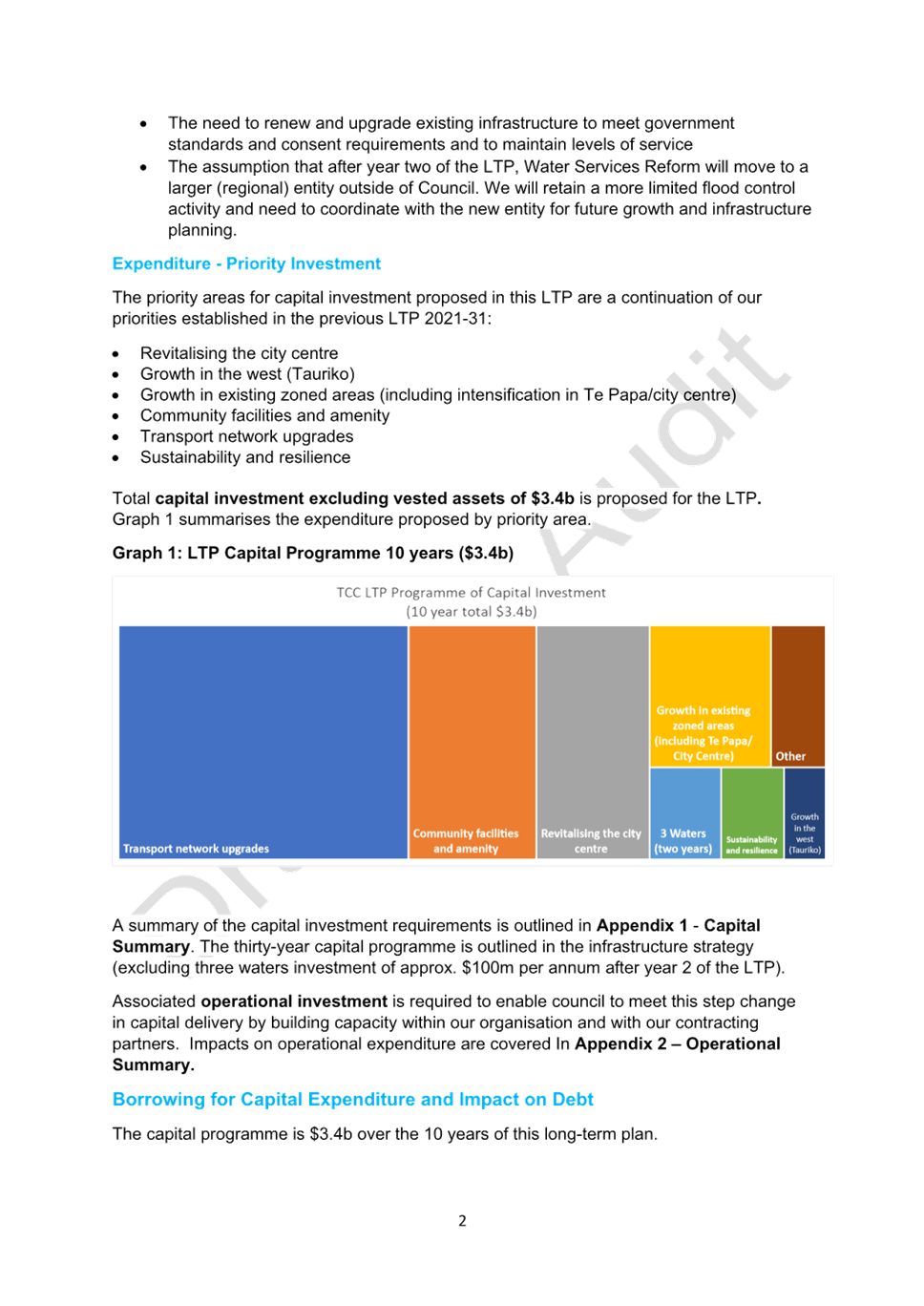

The capital programme summaries were high level capital

expenditure in the key priority areas of existing growth, intensification,

growth in the west, the city centre and transportation. In total $3.4B over

the 10 years.

·

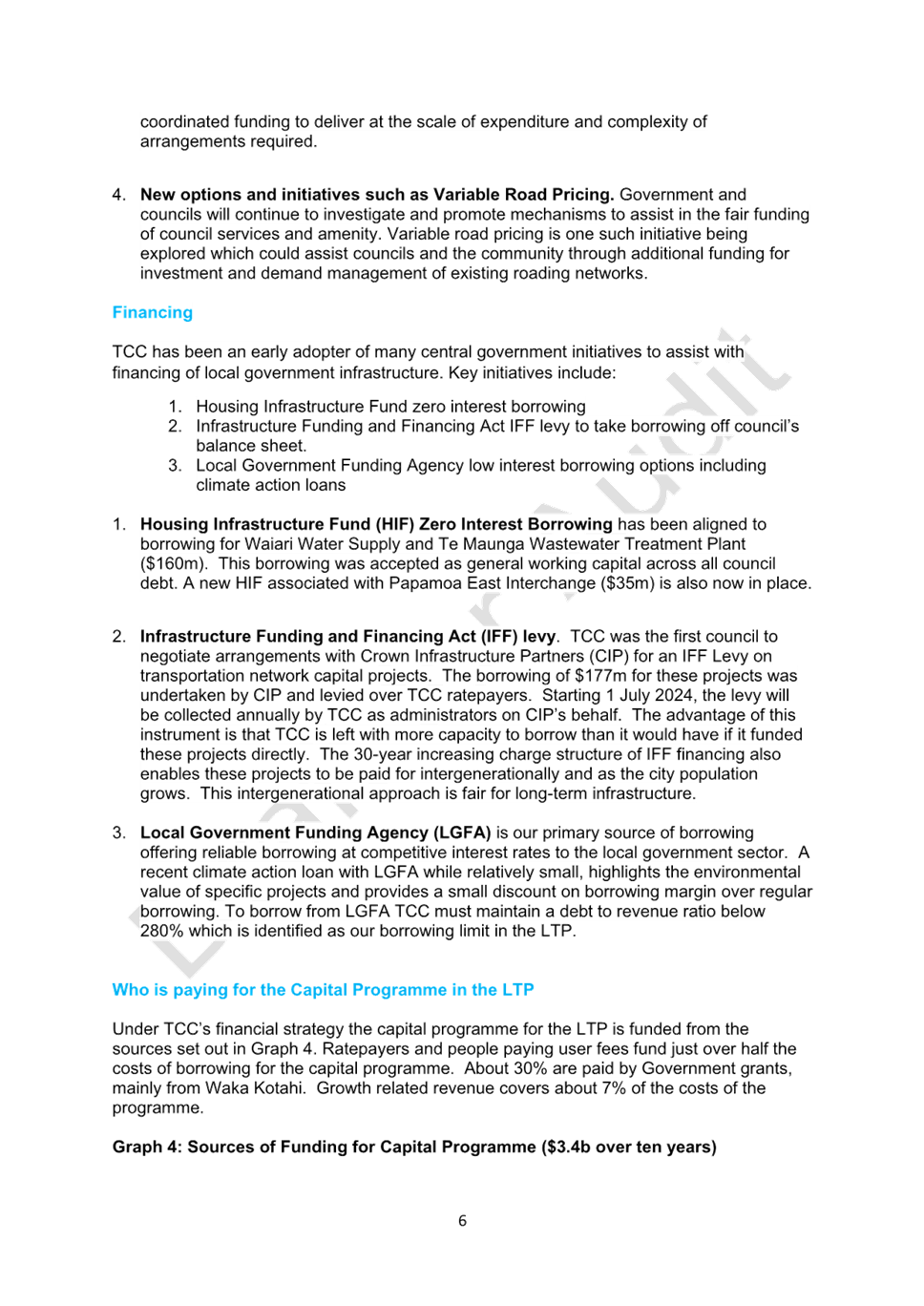

There was a programme of works was larger in the earlier years

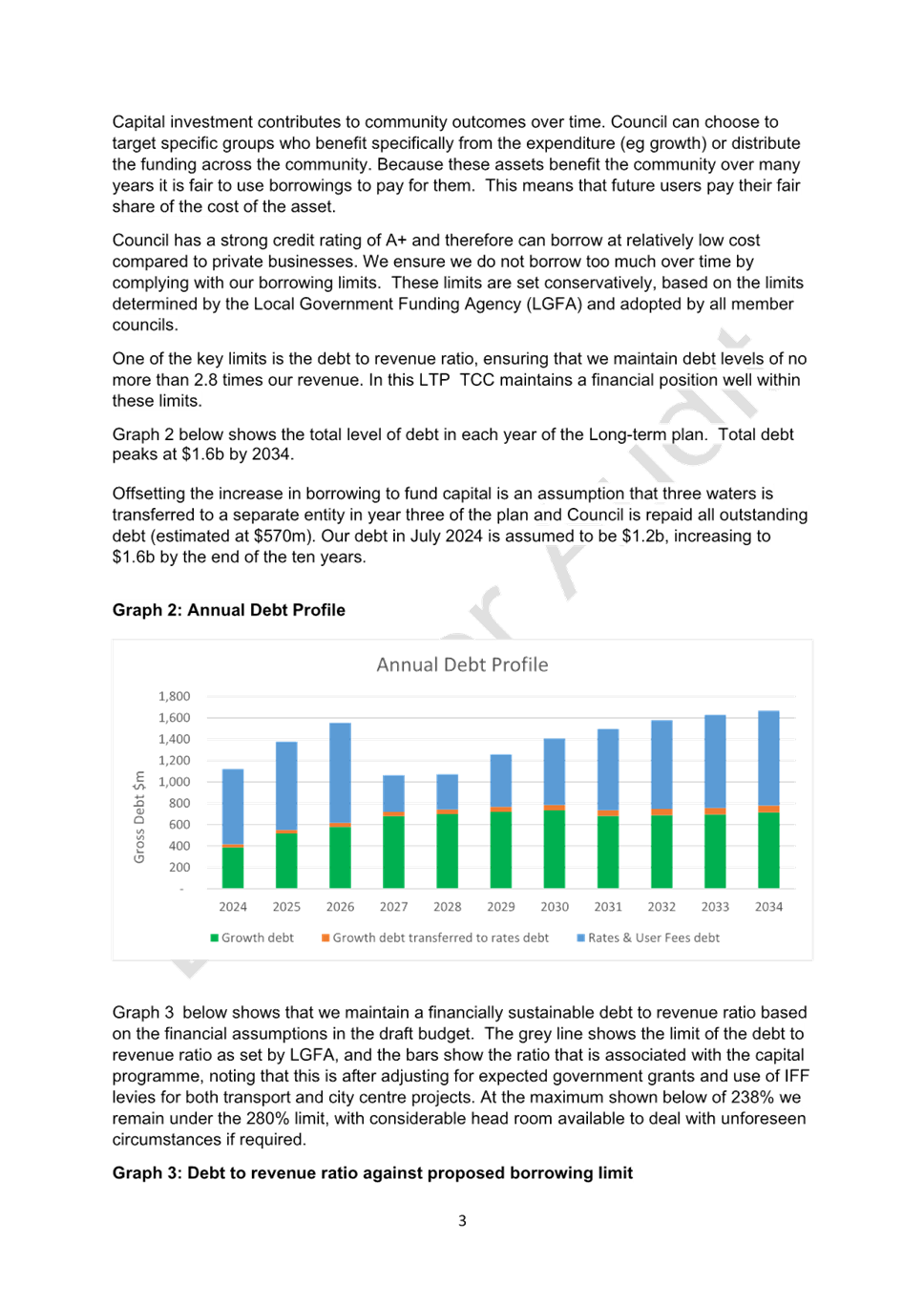

than Council expected to achieve, so debt and interest would not be

rated. There was a capital ability adjustment to bring it to more

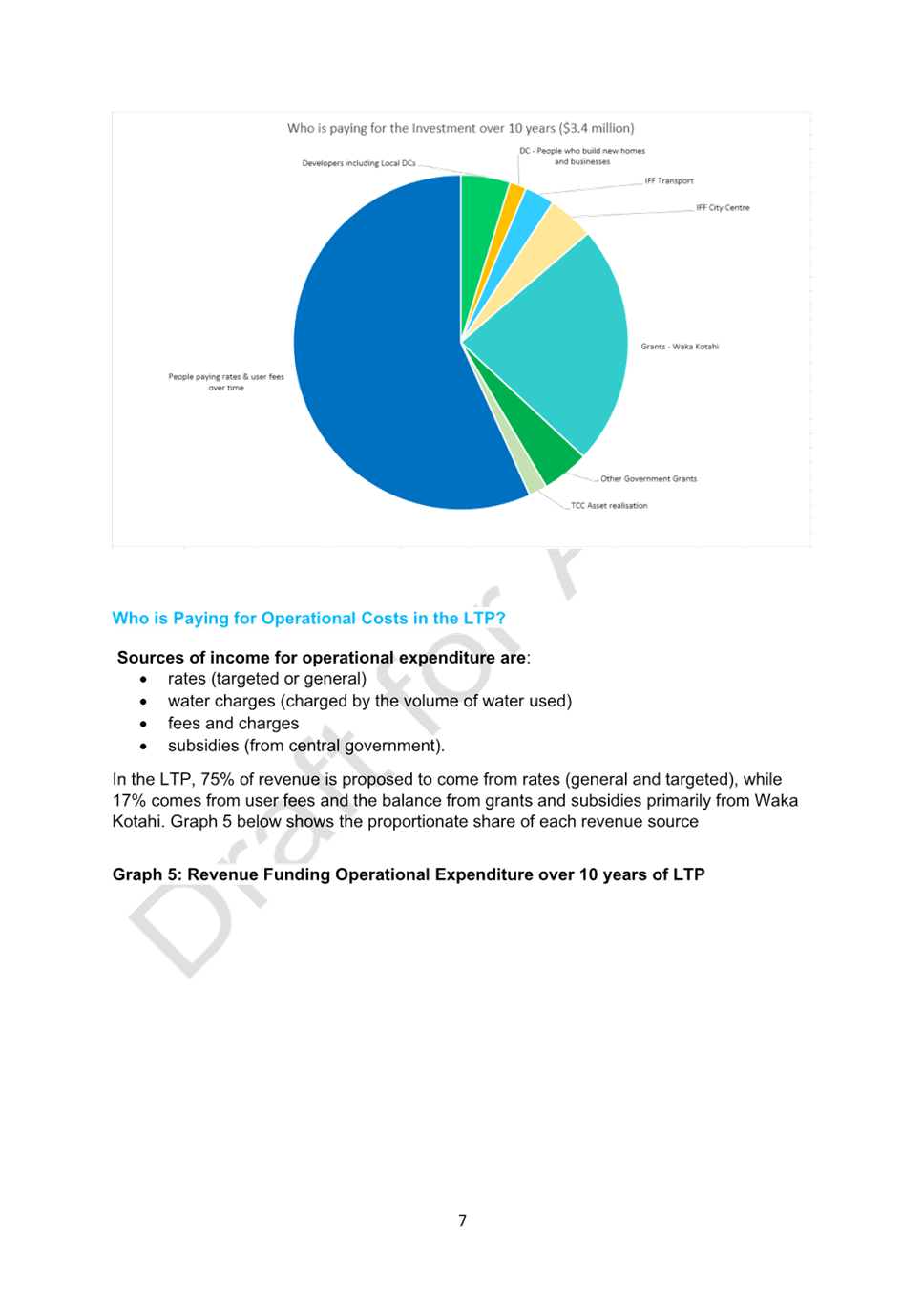

realistic associated rate increases.

·

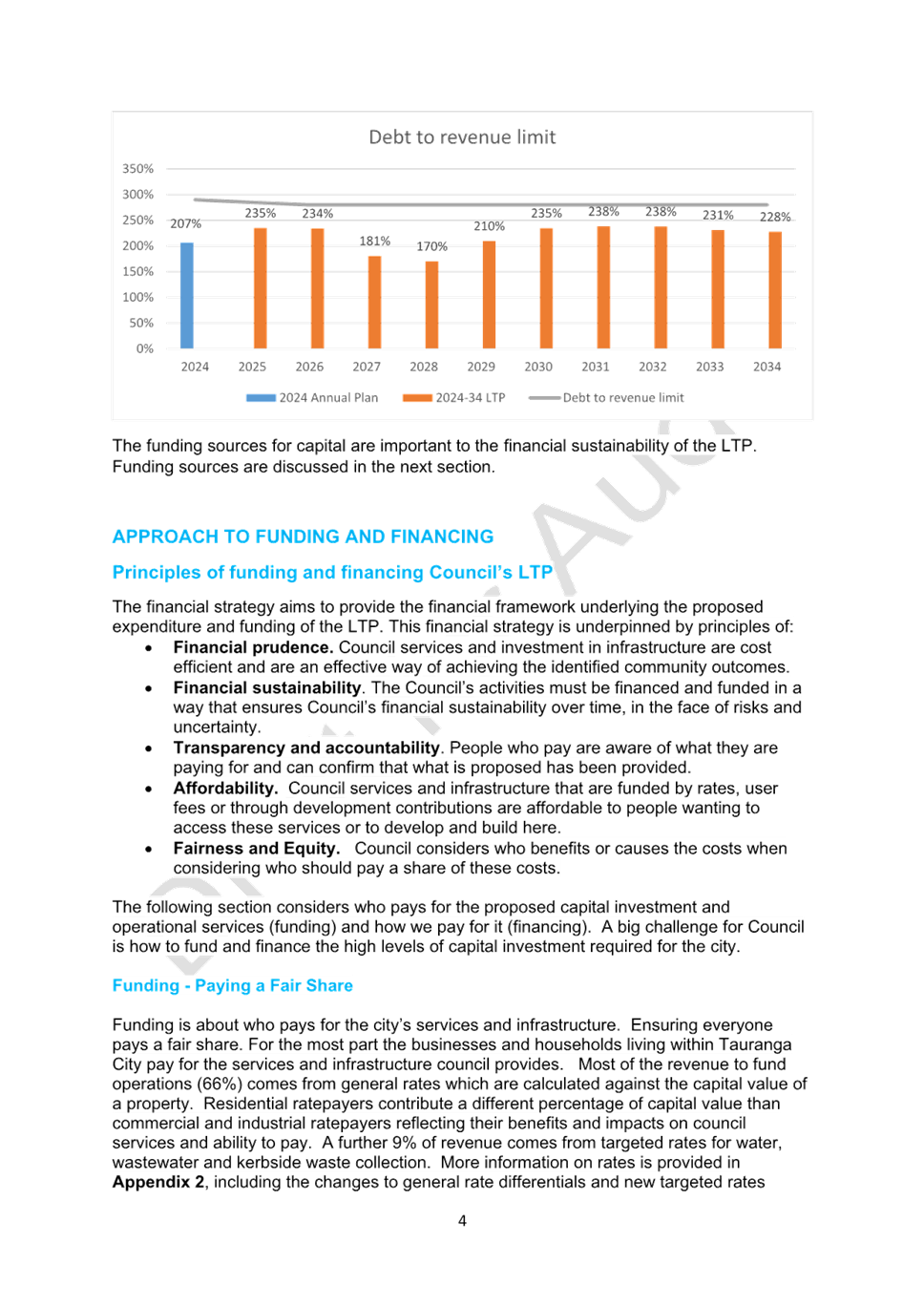

Three waters had not been included from Year 3 and changes to

the existing programme of funding for Te Manawataki o Te Papa and ongoing

changes for Tauriko West funding .

·

The operational financials were tabled. The capital

programme and the flow through costs that come from interest were influenced

by the expectation of external funding or asset realisation for Te Manawataki

of Te Papa of $150M and Waka Kotahi supporting the transportation capital

programme. If the funding was not realised the ratios would be worse

and decisions would need to be made around timing of those projects.

·

The revenue included those assumptions, and the growth was

expected to be 1%.

·

The medium rates increase modelling was based on the first year

only and included the transport plan and the IFF which had already been

agreed to.

In response to questions

·

In response to a question regarding the Department of Internal

Affairs (DIA) approval on the stormwater levy being renamed to the flood

control reserve, it was noted that they would look at the draft.

Discussions had been held with DIA staff around remediation of those areas

and addressing future flooding, but it would be put through as part of the

consultation process. Flood control activities were a legislative set

activity for councils after movement of three waters to a separate entity.

·

In relation to clarity around the funding of depreciation cost

funding over the life of the LTP now and as new completed projects were

brought in with messaging around addressing the inadequate funding

previously. It was noted that would be included in the financial strategy

and reserves identified for each activity over the ten years.

|

|

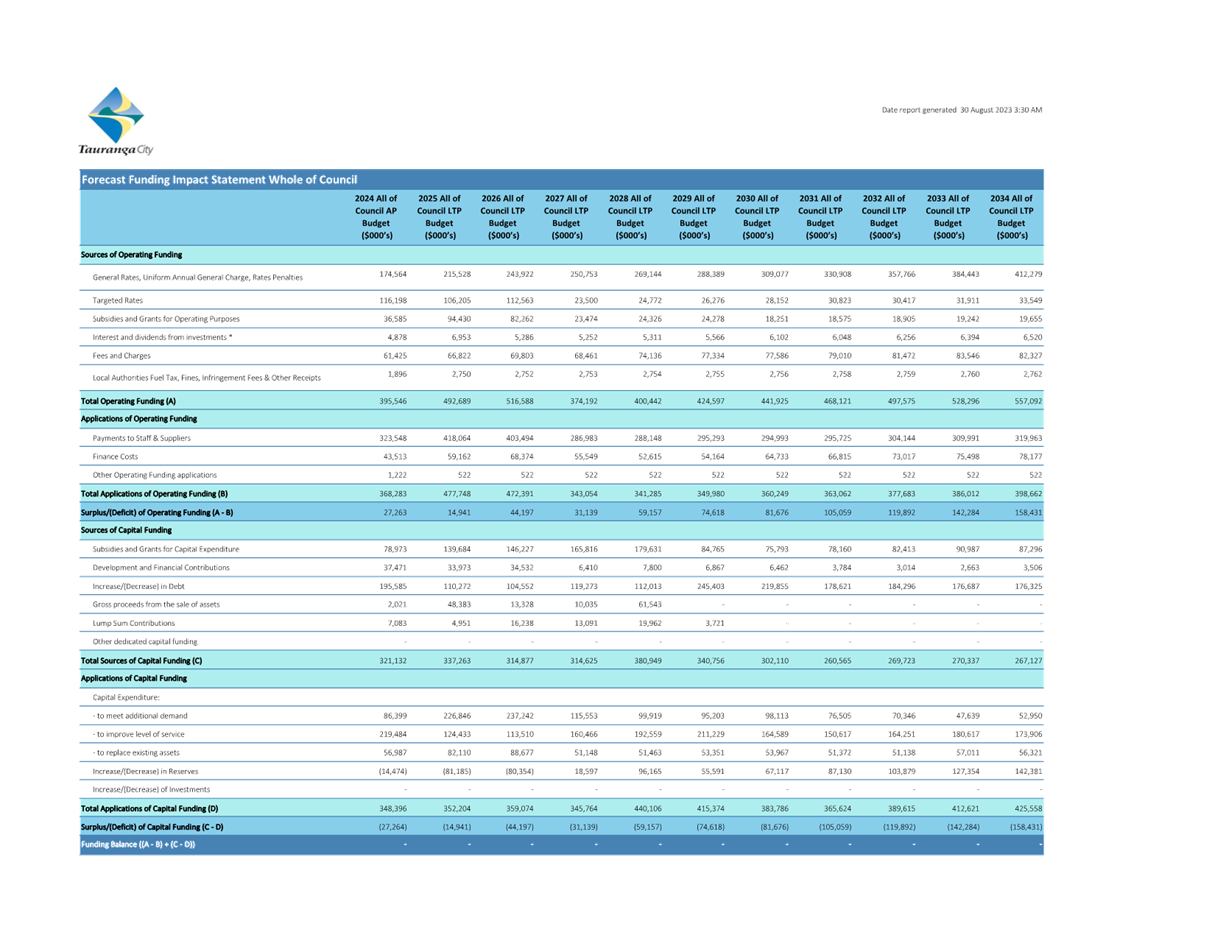

Resolution CO14/23/8

Moved: Commissioner

Bill Wasley

Seconded: Commissioner Shadrach Rolleston

That the Council:

(a)

Receives the report developing LTP Budgets.

(b) Receives the tabled draft

financials based on continuation of the strategic direction set in the

2021-31 LTP for both capital and operational expenditure, to be further

amended as decisions are made by Council at this meeting.

(c) Agrees to draft capital

budgets for the LTP as summarised in Attachment A as the basis for LTP

draft financials, and consultation which includes:

(i) updated

projects from 2021-31 LTP with revisions to cost and timing

(ii) new

projects and revised scope for projects from previous council decision or

Chief Executive delegation for minor projects.

(d) Agrees

to include the following funding decisions with respect to operational costs:

(i) the

phasing in of funding of depreciation across activities of council and CCOs

through the period of the LTP and other approaches to manage depreciation

reserves back into balance

(ii) increasing

debt retirement of unfunded liability and weathertight reserve deficits after

year 3 of the long term plan

(iii) phasing

further rates funding to the risk reserve over the period of the LTP

(iv) Renaming

of the stormwater reserve to flood control reserve to remain with Tauranga

City Council in the new Flood Control activity after movement of three waters

to a separate entity

(v) Increases

in user fees and adoption of additional user fees

(vi) loan

funding of operational costs associated with a portion of the increased

expenditure on climate action and sustainability and of software as a

service-related development, where this work provides benefit of a long-term

nature

(vii) Phasing in of additional

operational grant to Bay Venues Limited

(e) Agrees to develop financials

on the basis of using Infrastructure Funding and Financing through IFF levy

to fund the ratepayer portion of Te Manawataki o te Papa.

(f) Notes that full

financials and funding impact statements by activity will be presented within

the groups of activities to the September 11 Council meeting and financial

statements in the supporting documentation.

Carried

|

|

Attachments

1 Tabled

Document - Council - Draft LTP financials 21 Aug 2023

|

|

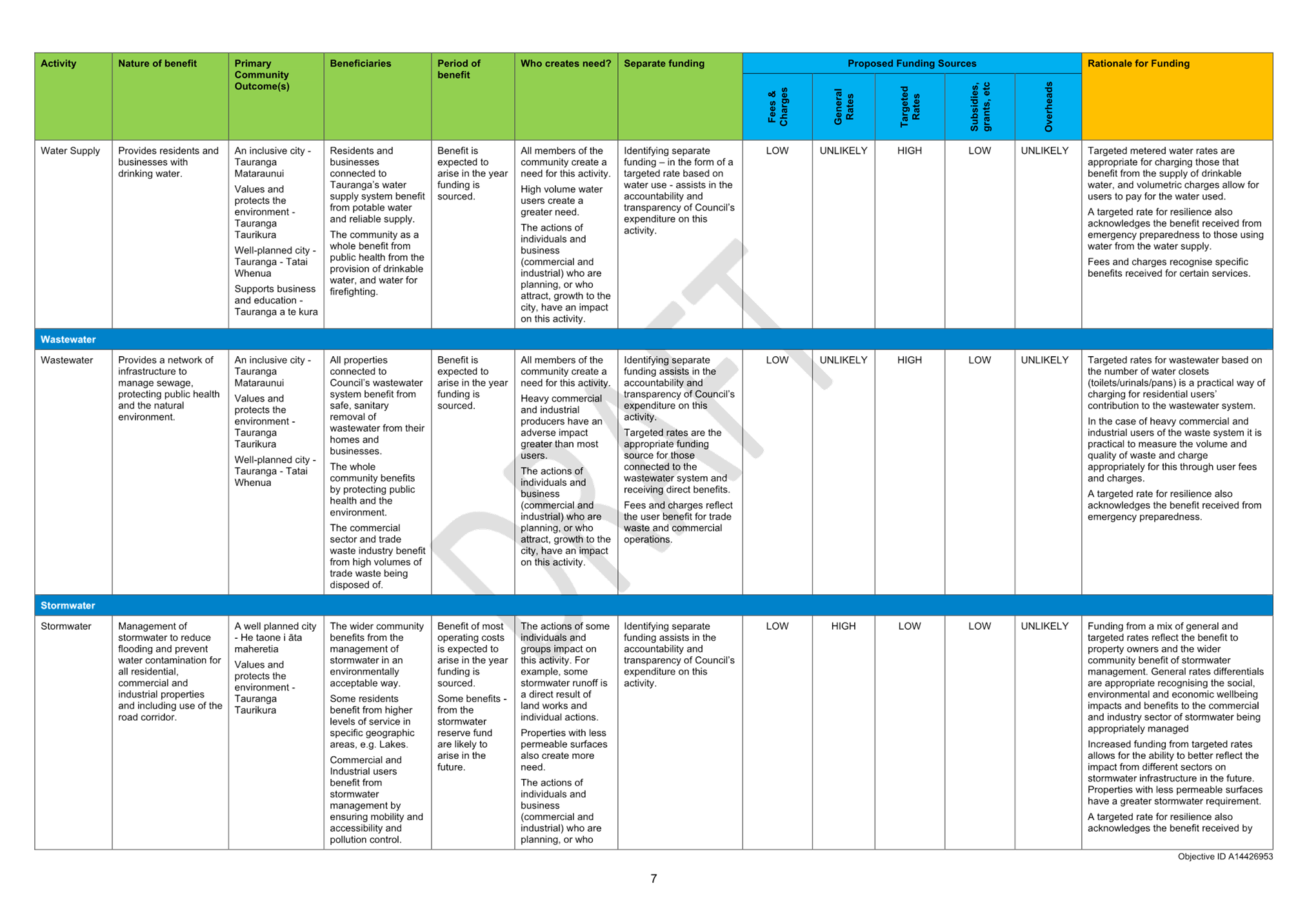

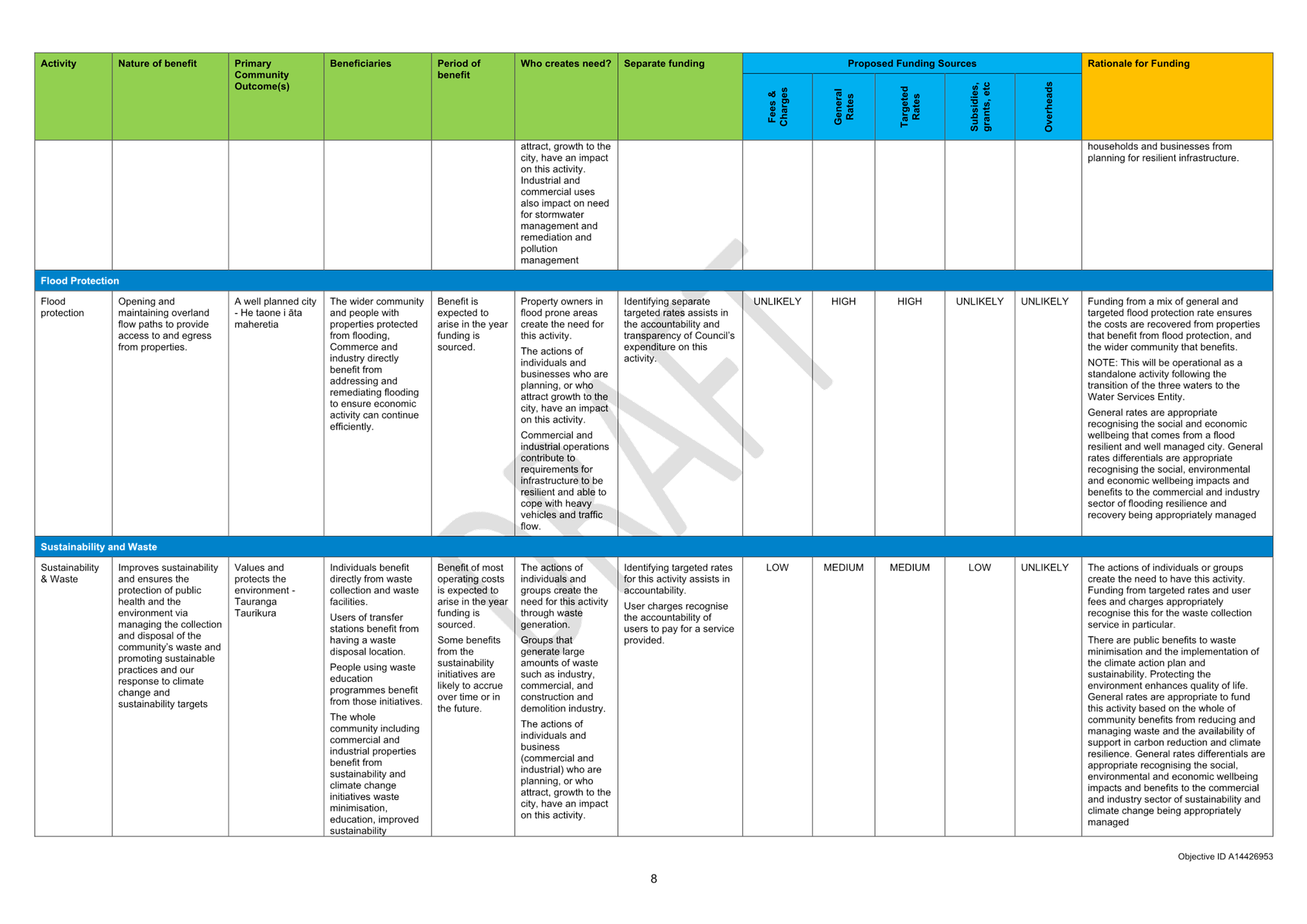

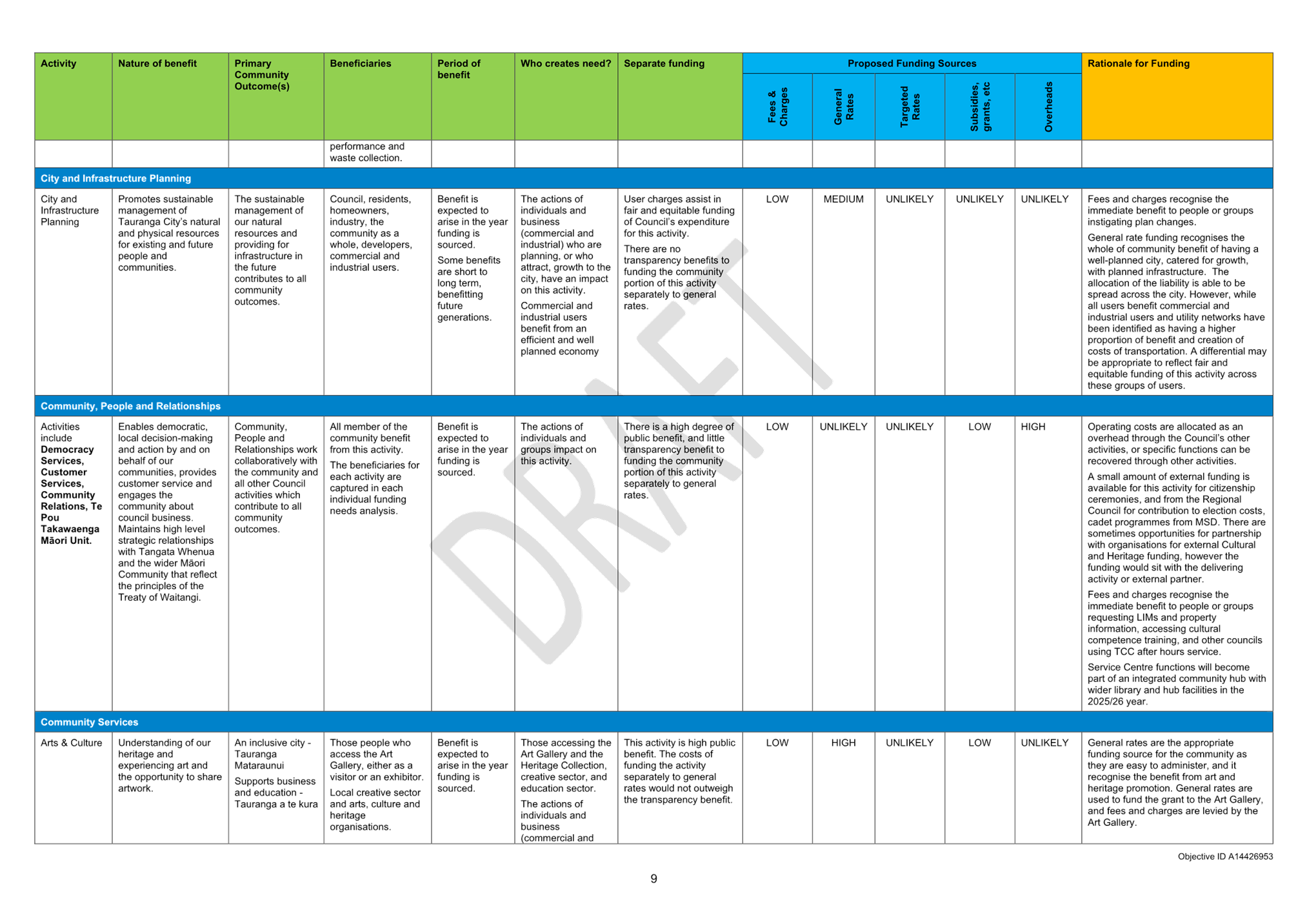

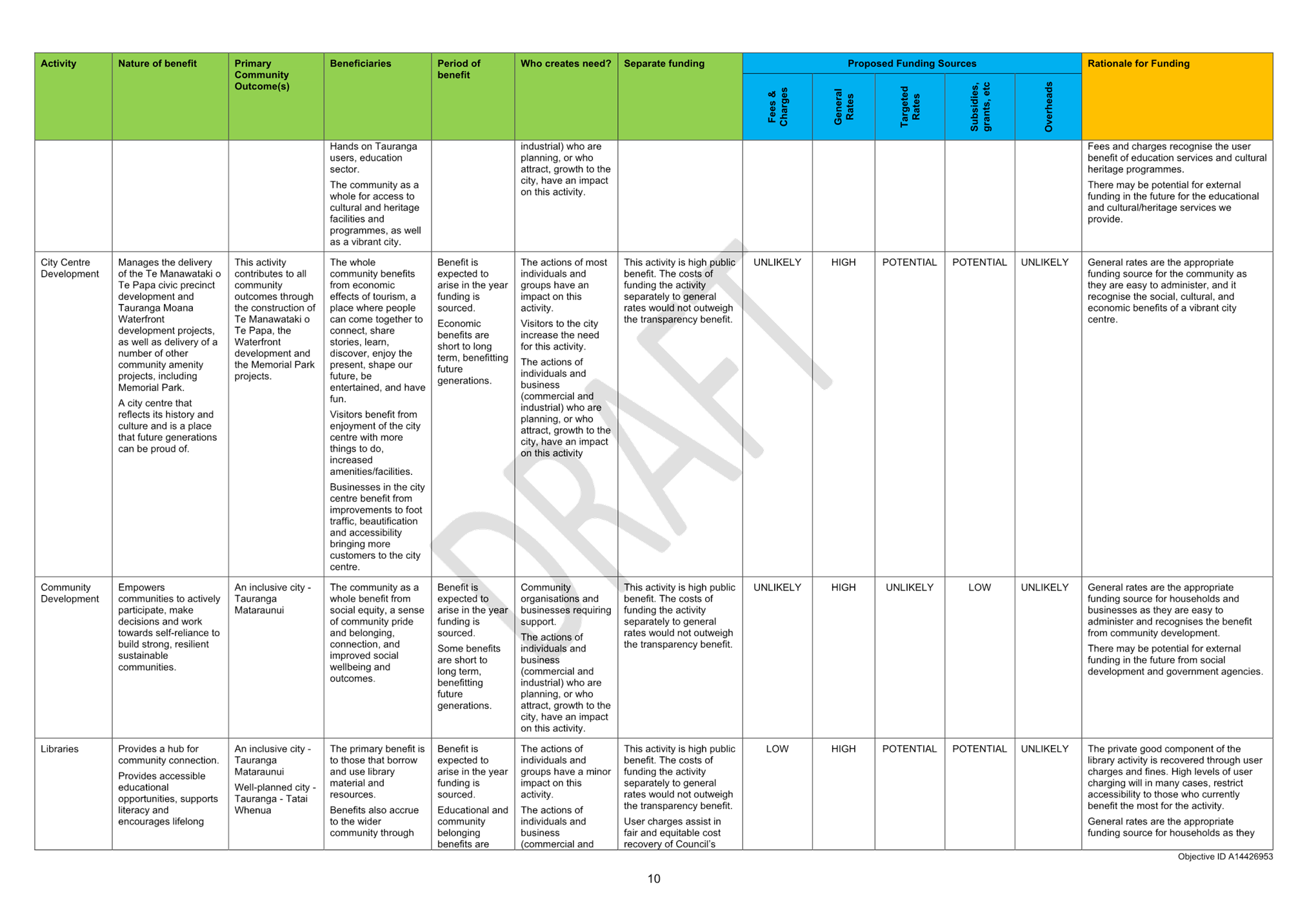

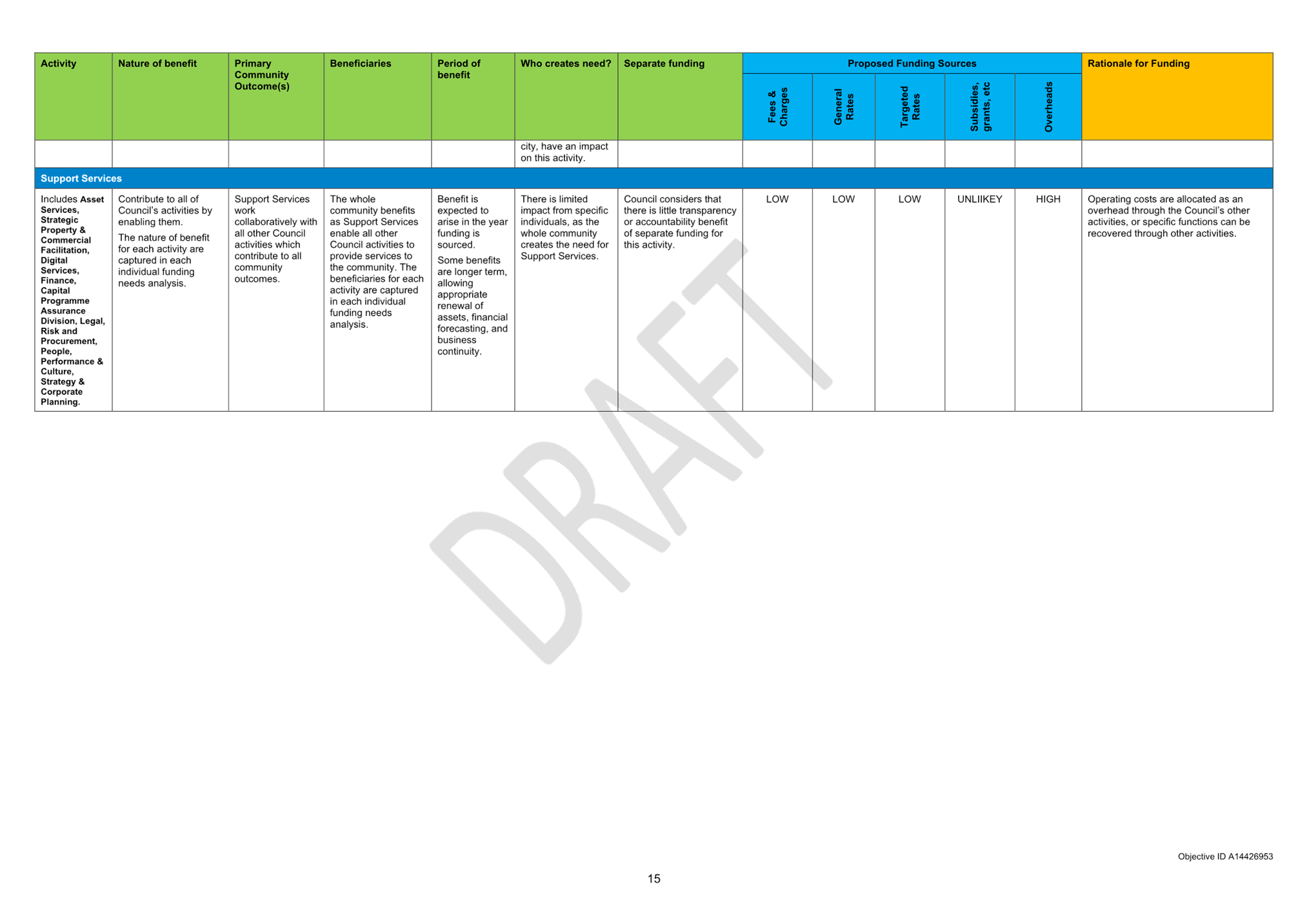

11.6 Draft Revenue and

Financing Policy Framework

|

|

Staff Paul

Davidson, Chief Financial Officer

Kathryn Sharplin, Manager: Finance

Key points

·

All of paragraph 23 in the report was incorrect and should be

removed as neither Site B nor the stadium were included in the draft

financials.

·

The policy incorporated IFF as a preferred option and would be

looking at an industrial rating category as an option later in the meeting.

·

A specific annual targeted rate was being considered for

private pool inspections as an alternative to a user fee.

In response to questions

·

In response to being able to revert back to a community

facilities targeted rate if required, it was noted that this was being

consulted on and staff would come back with any provisions that may come out

of that process.

·

The IFF would be consulted on separately to the LTP and as a

result of that process it would allow either the IFF levy or a targeted rate

based on the feedback.

·

The proceeds from any asset sales would include the reserve

fund for that asset.

·

The asset realisation reserve would be an alternative funding

source once the balance grew.

|

|

Resolution CO14/23/9

Moved: Commissioner

Stephen Selwood

Seconded: Commissioner Bill Wasley

That the Council:

(a) Receives the report

"Draft Revenue and Financing Policy Framework".

(b) Approves (as amended) the

draft Revenue and Financing Policy and Funding Needs Analysis, acknowledging

that:

(i) The draft policy is

subject to legal review, and

(ii) It will be presented

back to Council on 11 September as part of the supporting information to the

2024-34 Long-term Plan Consultation Document, and

(iii) Public

views will be sought through consultation alongside the 2024-34 Long-term

Plan.

Carried

|

|

11.7 Paying a Fair Share -

Approaches to Funding the draft 2024/34 Long-term Plan

|

|

Staff Paul

Davidson, Chief Financial Officer

Kathryn Sharplin, Manager: Finance

Reece Wilkinson, Parking Strategy Manager

Malcolm Gibb, Contractor – Rating Review

Key points

·

User Fees and Charges were part of paying a fair share, with

the Funding and Financing Policy considering who benefits, which then flows

into either charging user fees or rates.

·

A solid review had been undertaken of activities and some areas

identified as potential new user fees and areas where self-funding was more

challenging and may result in some more significant increases in

charges.

·

Consistency across councils was a feature with some of the

sporting codes charges.

·

Reflecting capital investment, looking at how the Council

funded new investments with opportunities to relate that to who was accessing

and using them and a way to capture non-ratepayer users.

·

Fees had helped with demand management, to reflect the value of

the asset and the environment it was impacting.

·

The animal and building services reflect assessments of costs

against potential deficits over the 10 years and looked to model what the

increase in fees and charges would be to balance out the deficit. The

dog registration fees would see an increase of $21 a year to $121 and

building services an increase in fees by 5% annually.

·

There was a need to ensure that parking was applied throughout

the city fairly and equitably.

·

The expansion of paid parking would come in November to areas

within a 15 minute walk to the city centre and domain.

·

A Parking Management Plan for Mount Maunganui would be provided

in the future. It was acknowledged that all of the same stresses from

introducing paid parking years ago in the area still existed.

·

A review was carried out of all the community services fees and

charges and the team had been asked to go through their specific fees to

understand if they were covering the cost of providing the service, whether

they met the Revenue and Financing Policy and provide a benchmark. The

information would be provided to the 11 September 2023 Council meeting.

·

There were more complex areas that had not been charged and

there were opportunities to pick up more fees so a direction was

needed. Some of these would be picked up over time and some had

contractual arrangements not to increase, but staff wished to deliver on

principles, provide a clear direction to look at user pay, be consistent and

to look at capital investment with activities. The holiday park and

Historic Village were several examples of which Council had heavily invested

in.

In response to questions

·

In answer to a question in relation to any opportunity to

encourage Western Bay of Plenty District Council to align their dog fees with

Tauranga City Council’s it was noted that conversations were held with

them regularly. They had a smaller dog pool with much of the animal

control services in the rural area and dealt with other animals and had to be

rated differently, so it was not the same comparison.

·

The dog registration fees reflected a way of recovering the

costs of the activity such as running the dog pound and the animal services

teams rather than it being charged across the Council. It was only

recently that they had been able to see that the deficit was larger than

anticipated.

·

Commissioners wanted to be sure that the parking spaces were

being utilised well and to ensure there was parking for workers in the city

and at Mount Maunganui. Information was requested on the difference between

summer congestion to winter use, the turnover of parking and time limits and

what provisions had been made for parking in the CBD for people coming into

work each day. This would provide alternative options so that any

resentment could be covered by offering good solutions. There were also a

number of tensions and frustrations around Marine Parade and Pilot Bay by

locals with much of the parking being used for accommodation. Given there was

no requirement for parking provision for accommodation because of government

policy direction, this information needed to be included in the report.

·

The income from parking was ringfenced for the activity unless

it was used on an investment supported by parking activity. It could be

noted that any excess funds from parking at the Mount would only be used in

the Mount.

·

Telfer Young provided a valuation on reserve land which was

discounted from a market value within the different zones providing a

difference in valuation and square metre rate. Staff then looked at the

charge rate to community organisations against these valuations. The

rate currently started at $2.68 m² with the range going from $8 to

$21.50m² at Mt Maunganui which was quite a big difference in what was

being charged and what was a reasonable rate based on a reserve

valuation. This showed a derived subsidy for use of Council reserve

land.

·

The report illustrated where the subsidy was invested in golf

courses and land for horse sports, marine society etc. It gave a better

understanding of where the subsidy was and whether it was fair and reasonable

or whether it should be done differently as it segregates different groups

that use that land. Over time the policy could put the Council in a

better position financially.

·

In response to a query relating to different areas of the city

having different valuations, it was noted that the recommendation was to use

an average across the city for community organisations where each sporting

code would be treated the same.

·

The Council had requested more public access to the land leased

to the Racing and Golf Clubs at Greerton. It was noted that a percentage

could be applied to incorporate a type of methodology that would take into

account the added public use benefit and come up with a fair rate. Also

taken into consideration would be the work done by an organisation on the

upkeep and maintenance of the areas they used.

·

The fees collected from community services activities countered

the expenditure and offset the amount of rates needed to go towards that

activity.

·

Cemetery and Crematorium fees would be included in the report

to the 11 September 2023 Council meeting. No general rates were

currently applied to this activity.

·

A further report with more information and detail on the user

fees would be provided to the 11 September 2023 Council meeting.

Discussion points raised

·

To make the recommendation clearer and to provide further

detail prior to the adoption of the fees and charges, recommendation (c) was

amended adding - to be included in the user fees and charges schedule to

be adopted at the 11 September 2023 Council meeting

|

|

Resolution CO14/23/10

Moved: Commissioner

Stephen Selwood

Seconded: Commissioner Bill Wasley

That the Council:

(a) Receives the report " Paying a Fair Share - Approaches to Funding the draft

2024/34 Long-term Plan".

(b) Notes in areas requiring

full or partial cost recovery fees are increased to cover costs consistent

with the revenue and financing policy

(c) Approves the following

specific funding recommendations to be included in the user fees and charges schedule

to be adopted at the 11 September 2023 Council meeting for the draft 2024/34

Long-term Plan for community facilities:

(i)

The introduction of new fees and charges for the use of boat ramps and

active reserves (sport fields and cricket wickets for adult/seniors use only)

to reduce the extent of general rate revenue needed to fund these activities,

(ii)

Introduction of Boat Ramps charges at the Sulphur Point, Pilot Bay and

Whareroa boat ramps, to park vehicles and trailers at the designated parking,

to be charged at a rate of $20 per day (incl GST) or $200 per annum (incl

GST).

(iii) Exclusive

use of sport fields and cricket wickets at the rate of $225 (plus GST) per

winter or summer season per pitch for adult/senior participants only.

(iv) Use

of council land for a lease or licence or licence to occupy by commercial

organisations at the zonal market rates currently valued at between $25.00

(plus GST) to $65.00 (plus GST) per m2 per annum subject to updated

valuations.

(v)

Use of council land for a lease or licence or licence to occupy by

community organisations at a city average rate based on a 50% subsidy of the

city-wide average of the zonal reserve rates. Including the subsidy

this is currently valued at $6.05 (plus GST) per m2 per annum subject to

current valuations

(vi) Note

that negotiations will be undertaken with the bespoke community organisations

who use large areas of council land for their activities to align their

charges, over time, closer to the proposed levels for other community

organisations.

(vii) Moving

the range of Licence to Occupy fees for buildings at the Historic Village to

one set fee for the different bands and using the mid-point independent

valuation rate for most categories, with the exception of the retail and office

LTOs which will be at the higher end of the valuation bands.

(viii) Develop

an engagement plan for these community fees for the draft 2024/34 Long-term

Plan which provides sufficient resource and time to consult with user and

stakeholder groups who may be impacted by these proposals.

(d)

Notes a report will be considered by Council on 4 September on options for

parking management and charging at Mount Maunganui and in other areas outside

the city centre.

Carried

|

|

11.8 Review of Rating

Categories to Differentiate Industrial Ratepayers

|

|

Staff Paul

Davidson, Chief Financial Officer

Jim Taylor, Manager: Rating Policy and Revenue

Kathryn Sharplin, Manager: Finance

Malcolm Gibb, Contractor – Rating Review

Key points

·

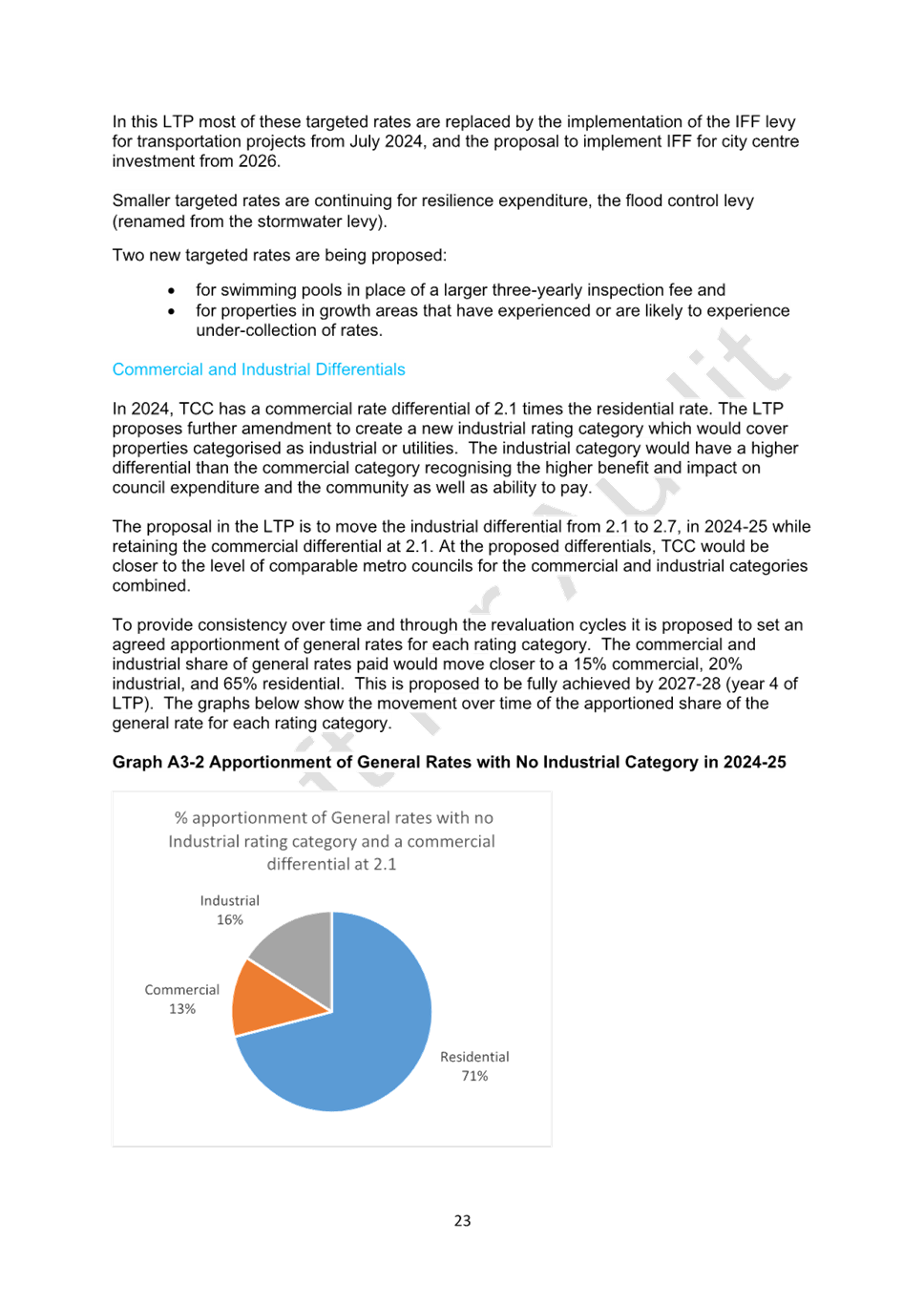

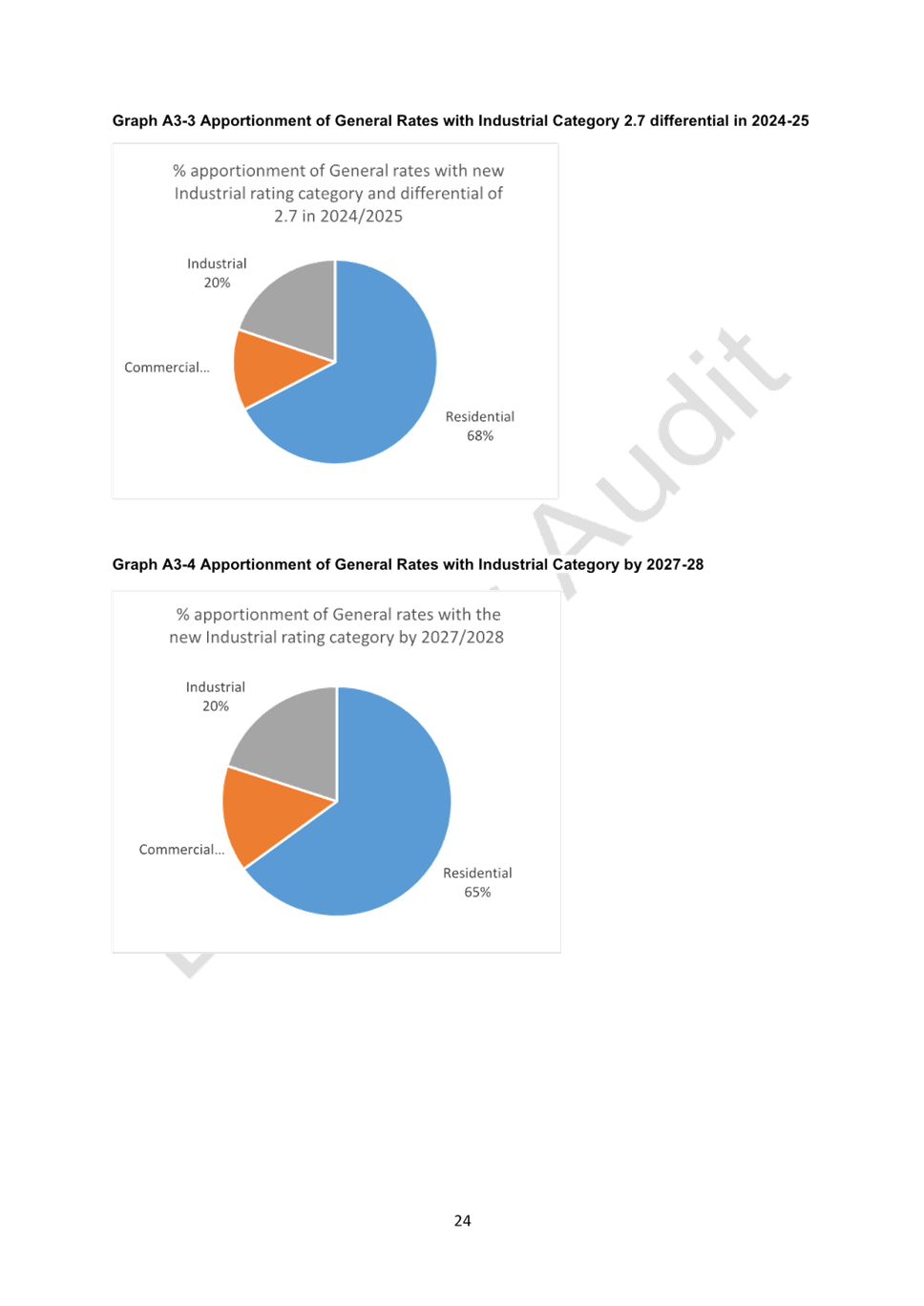

A new industrial rating category suggested moving to a 2.7:1

category in the first year of the LTP which was comparable to other

authorities commercial rates given the amount of small and medium size

enterprises.

·

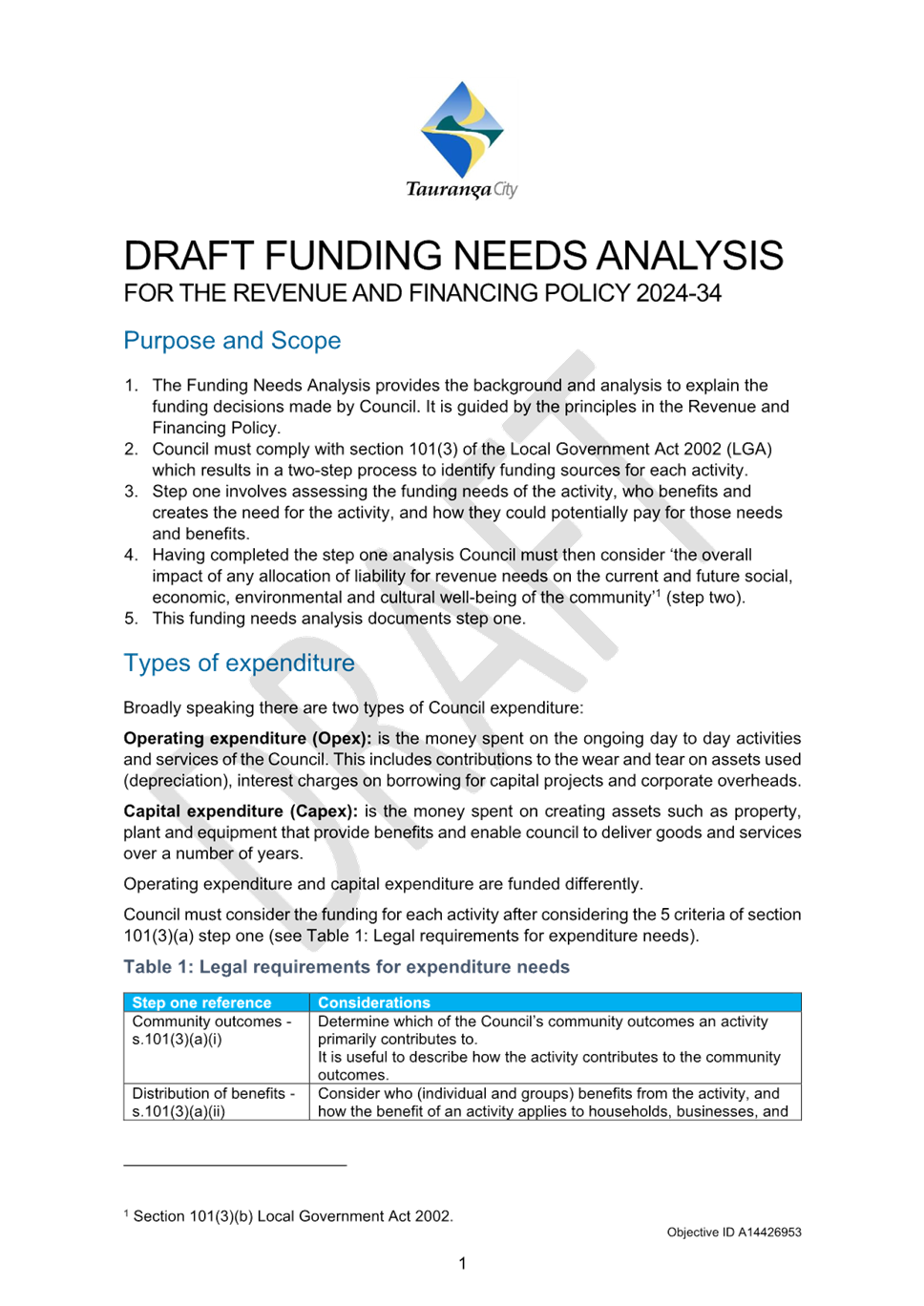

From Year 2 onwards the plan was to go away from a fixed

differential and move to a percentage split, so that each time there was a

general revaluation, the percentages could still be worked on these and was a

consistent approach as opposed to the amount of money collected from each

sector as it moved quite a lot with the valuation increases.

·

The proposal was a continuation of the review the Commissioners

commenced in the 2021-31 LTP, to ensure fairness and equity with all funding

and to decide whether to split the commercial category into industrial and

commercial categories.

·

Non-financial impacts on heavy traffic on the whole community

was provided in the report which also noted other impacts and a funding needs

analysis. It provided three options to consider including the

introduction of an industrial category at 2.7:1 and leaving the commercial at

2.1:1, or to introduce an industrial category but not change the differential

as getting the information to show the impacts as it could take some time to

collect. The third option was to retain the status quo.

·

Definition of the possible industrial rating category included

the Port, industrial related sites over the city and utilities which use the

roading corridor substantially in their daily operation. With utilities

it was difficult to get specific information on how much they used and what

impact they had on the transportation and roading activity especially when

digging up the road to get to their utilities on council land. This had

not been fitted into the definition and did not have the same rationale as

the overall benefits that the industrial and port related businesses got from

all of Council’s activities. Further work could be done on this

to get the link if required.

Discussion points raised

·

Commissioners noted that it was a good report with the

comparisons of light and heavy vehicles and the significance of the

difference between the two and agreed that more work should be done on this

and on the industrial category definition.

·

There was a change to recommendation (b) to include - to

propose the introduction of the new rating category.

·

Add a further resolution (g) Agree staff continue further

work on the appropriate definition of industrial category and the appropriate

share of rates to be paid by each category.

|

|

Resolution CO14/23/11

Moved: Commissioner

Bill Wasley

Seconded: Commissioner Stephen Selwood

That the Council:

(a) Receives

the report "Review of Rating Categories to Differentiate Industrial

Ratepayers".

(b) Approves

the Recommendation from the Strategy, Finance and Risk Committee to propose

the introduction of a new rating category for industrial properties (Option

1) in the development of the 2024-34 Long-term Plan.

(c) Agrees

the evidence around roading costs and other wellbeing impacts including congestion

and safety provides justification for considering a higher differential

charge for the industrial category.

(d) Agrees

to consult as part of the LTP on setting a rating differential for the

industrial category at 2.7:1 (Option 1) over the residential rate.

(e) Agrees

to retain the commercial differential category to 2.1:1 (option 1) over the

residential rate as previously resolved.

(f) Agrees

to phase in further differential changes over years 2 to 4 of the LTP to

reach a percentage share of general rates by category of approximately 65%

residential, 15% commercial and 20% industrial.

(g) Agrees

that staff continue further work on the appropriate definition of industrial

category and the appropriate share of rates to be paid by each category

Carried

|

12 Discussion

of late items

Nil

13 Public

excluded session

A resolution to exclude the public was not required as the

item had been dealt with in resolution (e) of Item 11.1 - 2024-2034 Long-term Plan - Tauranga Community Stadium –

update.

14 Closing

karakia

Commissioner Shad Rolleston closed the meeting with a karakia.

The meeting closed at 1.01 pm.

The minutes of this meeting were confirmed as a true and

correct record at the Ordinary Council meeting held on 11 September 2023.

........................................................

CHAIRPERSON

|

Ordinary

Council meeting Agenda

|

11

September 2023

|

11 Business

11.1 Mount

Maunganui Parking Strategy

File

Number: A14964754

Author: Reece

Wilkinson, Parking Strategy Manager

Authoriser: Nic

Johansson, General Manager: Infrastructure

Purpose of the Report

1. To request approval

to begin the process of engaging with the public regarding the draft Mount

Maunganui Parking Strategy.

|

Recommendations

That the Council:

(a) Receives the report

"Mount Maunganui Parking Strategy".

(b) Approve engagement for finalisation

and implementation of the Mount Maunganui Parking Management Plan to be

undertaken with the affected community.

|

Executive Summary

2. With the approval

and implementation of the Tauranga Parking Strategy (November 2021) and the

following Tauranga Central City Parking Management Plan implemented in October

2022, we have seen the re-introduction of paid parking in the City Centre since

November 2022. 5 key outcomes were outlined in the Tauranga Parking Strategy

(i) Improving vibrant centres

and access to centres

(ii) Enabling multi-modal

transport system

(iii) Enabling more attractive

compact urban form

(iv) Supporting access for all

(v) Ensuring value for money and

best use of resources

3. The central city

parking plans have been adjusted as the implementation of paid parking has been

underway to respond to changing economic situations for businesses and workers

in the central city.

4. In late 2022 a draft

Parking Management Plan (PMP) for Mount Maunganui was commissioned. The plan utilised

the same methodology and goals as our wider Parking Strategy and the Tauranga

Central City Parking Management Plan. This plan has highlighted issues

associated with parking availability in the Mount area especially over the

summer period. The plan seeks to provide better parking turnover to better

cater for business needs, worker parking and to reduce the amount of traffic

circling the area to locate a carpark in the peak times.

5. Staff are requesting

approval to move forward with engagement for the Mount Maunganui PMP with the

community to ensure assist in resolving the issues raised in the parking plan

and to ensure a consistent parking strategy is applied Tauranga wide avoiding

potential inequities from inconsistent application of our wider strategy.

Background

6. The Tauranga Parking

Strategy was implemented in 2021 and while it applies across the city it also

outlines the needs for a variety of tailored Parking Management Plans. Council

has completed the central City and Mount plans and has commissioned a plan for

the Greerton and hospital areas.

7. The parking strategy

was developed to guide the provision of carparking across the city and to guide

how it was provided and the aspects such as recovery of the costs for the

provision of parking. In addition it linked how parking and parking provision

influences aspects such as mode choice, housing intensification etc.

8. Some

challenges faced in wider Tauranga area outlined in the Parking Strategy are:

(i) Strong growth and

increasing demand for parking.

(ii) Availability of parking

spaces.

(iii) Cost of providing parking for

rate payers.

9. While Mount

Maunganui is not the only area facing these challenges it is the busiest

example outside of the City Centre due to the busy commercial area and the

number of visitors going to the Mount to visit and holiday. It is preferrable

to provide a tailored Parking Management Plan to key areas in the City to

ensure local challenges and considerations are taken into account.

10. The plan developed by MRCagney

is a technical piece of work and outlines what is required to balance the

parking needs in the area. This needs to be tested with the community to ensure

it aligns with their aspirations and views which is why staff would like to

undertake community engagement on the plan. The final plan to be implemented

will be influenced by the community views.

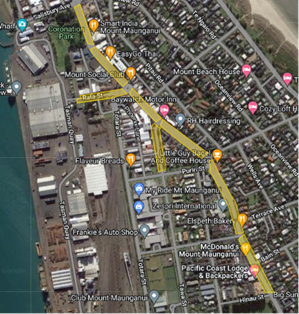

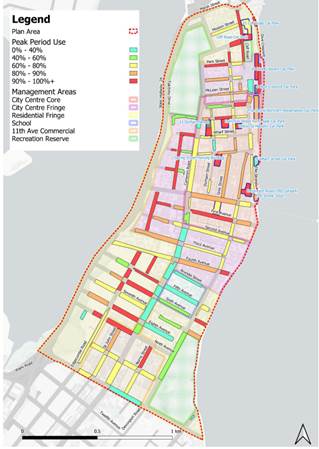

11. The Mount Maunganui area

outlined below currently contains approximately 2600 parking spaces with 83%

being uncontrolled. Occupancy in these areas is constrained during peak seasons

and good weather days. It is not uncommon to be faced with vehicles moving

around in circles as they wait for a space to be available further exasperating

traffic woes in the area.

12. Limited parking controls do

exist most notably along Maunganui Rd in the form of P60 time limits.

Unfortunately, the P60 time limits are not fit for purpose during high demand

days and seasons. Infrequent enforcement means it’s not uncommon for people

to park well beyond the 60 minutes allotted along the main street. The

60-minute time frame also does not allow visitors long enough to be able to use

the area as intended, a meal and some shopping will push most people beyond

that time frame.

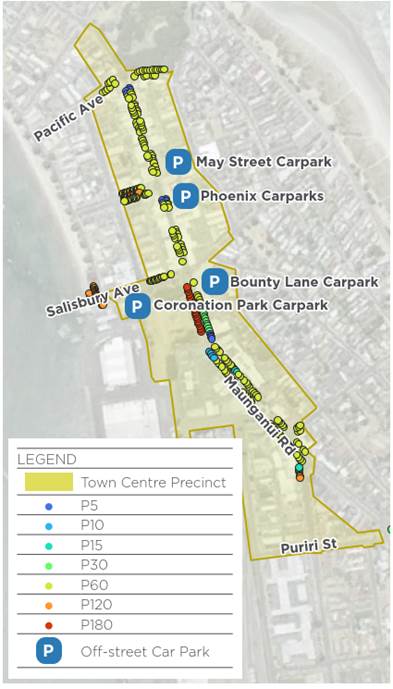

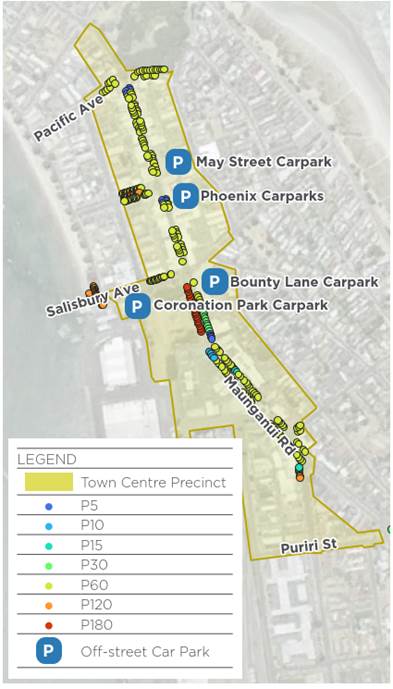

The map

below outlines the time restriction currently in the Mount Maunganui Town

Centre.

An

initial survey conducted on the 19th of August took place covering

the Mount Area from Sutherland Ave up and showed the average length of stay was

2 hours, with approximately 859 vehicles parking out of 1907 parking longer

than an hour (the area covered is shown below).

13. Parking frequently reaches

capacity in the central residential area (north of Banks Ave) with people often

being unable to find parking to visit destinations in the area, contributing to

increasing traffic by circling the area waiting to find a carpark. The area is

also known to handle many staff for the businesses located in the area who

don’t want to risk overstaying the time limits on Maunganui Rd.

14. The situation in the outlined

area results in an area that is difficult to access for all parties, customers

visitors and tourists. Pedestrians find safety an issue as drivers lose

patience waiting for spaces and are distracted while driving through tightly

packed residential streets. Those with extra mobility requirements also often

find vehicles parked across pavements and kerbs limiting their access to the

area.

Strategic / Statutory Context

15. While the City Centre has had

paid parking implemented for decades in various forms, paid parking outside of

the central city is new to Tauranga. However, Mount Maunganui is now seeing

more pressure for parking than the city centre was during the implementation of

the City Centre parking management plan.

Peak

occupancy is higher than was seen over most of the city centre.

16. Parking is a cost to Council

who need to build the additional road space and then maintain the signage, road

marking, street cleaning and renewal of the road surface. This cost is paid for

via rates and ratepayers as part of the annual costs to provide a roading

network.

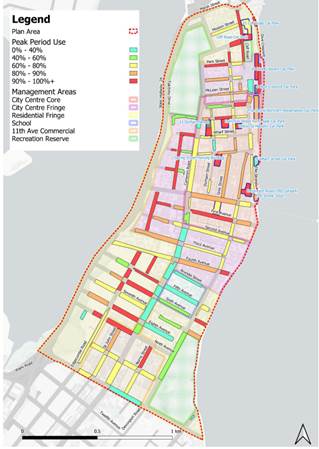

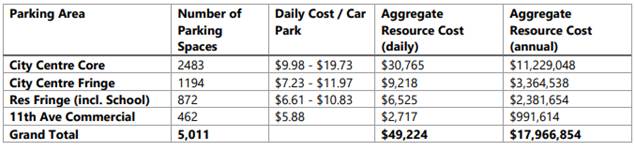

For

your information I have included the below costs for from both the City Centre

Parking Management Plan and Mount Maunganui. Currently the rate payer is covering

a higher annual resource cost for Mount Maunganui than it was when City Centre

parking was free.

17. In the central city, the

parking charges ensure that the costs of providing the infrastructure is partly

covered by the direct users of the space. It is appropriate that a similar

structure is implemented in other areas of the city to ensure the costs for the

provision of carparking is appropriately split between ratepayers and

users.

18. Parking for different types of

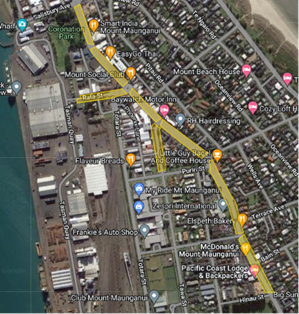

users is a major consideration with parking in Mount Maunganui. In the Mount

Maunganui Town Centre parking is split between workers, customers, and

visitors.

In the

City Centre workers are covered by our off-street parking sites while Visitors

and Customers use the on-street parking facilities. In Mount Maunganui we are

limited for off street parking facilities as free parking in the area has

limited the ability for companies to establish off street parking sites.

The

Mount Maunganui area is split between 4 precincts marked on the map below.

Over

the medium term the beach front could be utilised during the off season, and

the Suburban Residential area would remain uncontrolled allowing people to stay

all day. Moving traffic away from high occupancy Town Centre and High-Density

Residential Sites.

Over

time we expect Town Centre businesses to utilise any carparks available along

the back of the lanes for either paid parking or staff parking as

required.

We

could also institute workers passes during the tourist season that allow them

to park in various zones (like the high density residential) at a reduced rate.

Though we will have to monitor usage of these in the future.

19. Expected outcomes for the plan

could vary based on engagement with the public. However, if we implemented a

plan broadly similar to the city centre parking management plan we could expect

the below outcomes.

(i) Higher turnover of town

centre spaces with an average stay of less than 2 hours for on street.

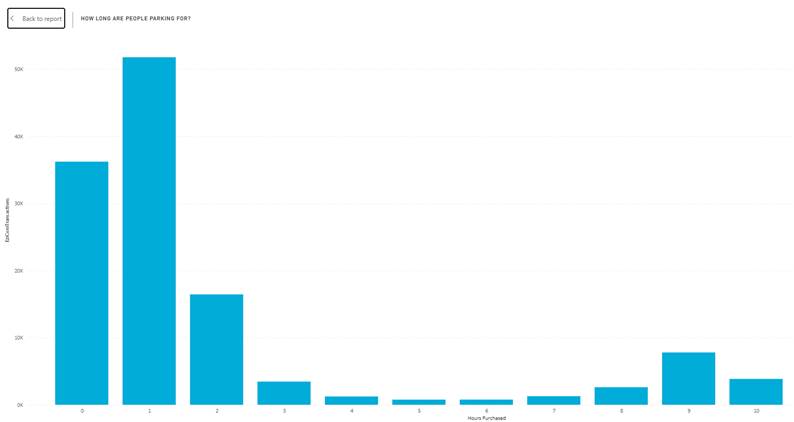

Current

break down of city centre parking times.

(ii) Lower occupancy allowing

people to park outside their destination.

(iii) Less burden on ratepayer for

parking in the Mount Maunganui Area.

(iv) Development of private

off-street carparks over the long term.

20. Engagement will be a requirement

when approaching the community regarding the proposed changes. The public will

have valuable input into the issues at hand that will need to be

considered.

Options Analysis

21. Options for creation and

implementation of the Mount Parking Management Plan are relatively limited. Our

recommendation is to begin engagement as the area has never had paid parking

before. Other options include

(i) Informing the public

without consultation or engagement (least preferred option as doesn’t

allow for adjustment to the plan based on public feedback)

(ii) Consultation with the

public

(iii) Engagement with the public

(recommended)

22. Engagement with the public will

allow Council to adjust paid parking zones and parking type throughout the

engagement phase. While the initial plan is for the beach front areas to be

seasonal and the town centre to be year-round for parking charges this could be

adjusted accordingly. A plan will have to be established for all day parking to

provide options for workers requiring all day parking.

Financial Considerations

23. Parking is not free. On-street

parking is expensive to maintain and limits the ability for transport corridors

to focus on moving people efficiently. When you consider car parks outside

areas of high demand, the cost increases, as it limits the ability for

customers to access stores add the increasing cost of land in higher density

areas this problem is exasperated.

24. Currently Tauranga rate payers

subsidise free parking through their rates. The increasing maintenance costs of

the transport network is applicable nationwide and does apply to the road

networks, parking spaces. We also need to keep in mind that the Mount faces

parking pressures from visitors who may not be paying into maintaining our

network.

25. Aggregate resource cost of

parking as outlined in the first draft parking management plan is below.

26. Depending on how paid parking

is introduced at the Mount we could see some major benefits to the local

community.

·

Paid parking – based on hourly parking charges in town

centre – estimated revenue of $1.6 million - and beachfront parking bays

– estimated revenue of $0.2 million - and total annual operating costs of

$0.3 million. Forecast surplus of $1.5 million.

·

Time limited parking – The level of revenue is unlikely to

cover the costs of enforcement.

27. With the surpluses gained from

implementing paid parking we limit the burden on the rate payer for subsidising

parking in the area. We also have the opportunity to use the funds to cover

further improvements such as boardwalk and dune maintenance, beach grooming,

beach ambassadors rather than these services be entirely rate funded.

Legal Implications / Risks

28. A potential risk when engaging

in public consultation is that we may not get support from all members of

public included. A communications plan will be necessary to ensure public

involvement from all perspectives.

Consultation / Engagement

29. Engagement for the Parking

Management Plan is planned to take place in November with the wider LTP

engagement ensuring time to include provisions with all stakeholders in the

Mount Maunganui Area.

Significance

30. The Local Government Act 2002

requires an assessment of the significance of matters, issues, proposals and