|

|

|

AGENDA

Strategy, Finance and Risk Committee meeting

Monday, 18 September 2023

|

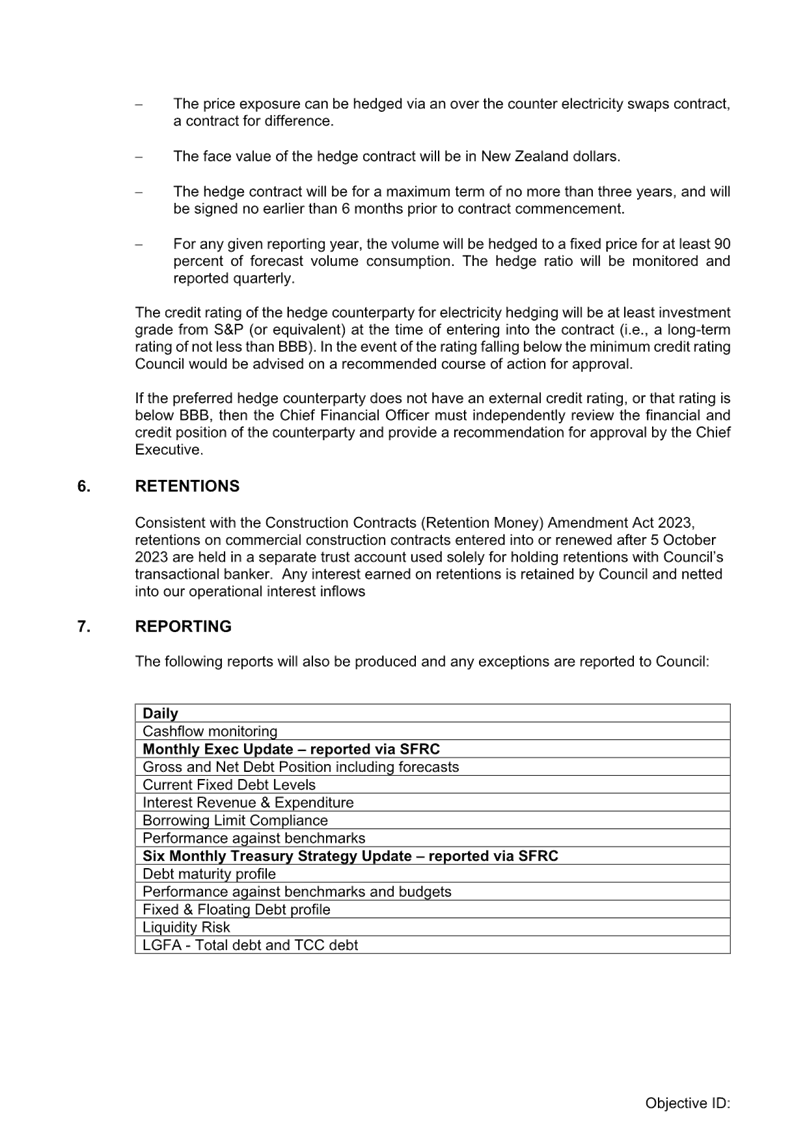

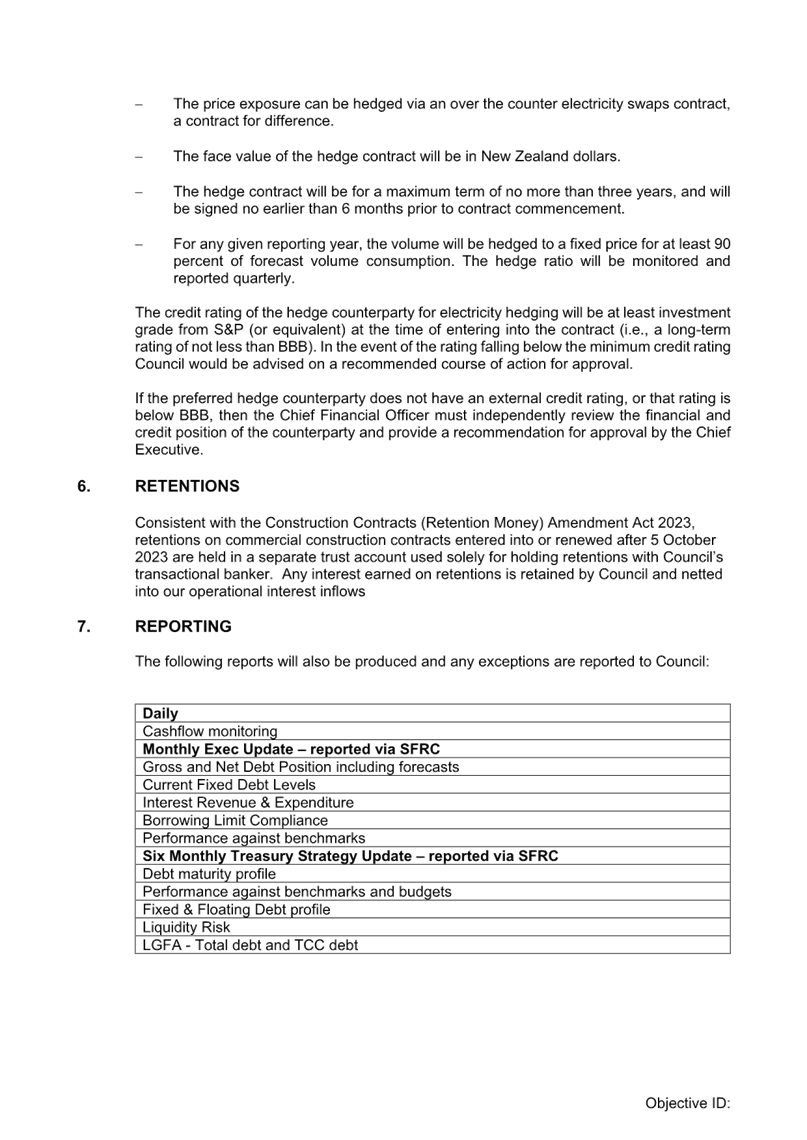

|

I hereby give notice that a Strategy, Finance and

Risk Committee meeting will be held on:

|

|

Date:

|

Monday, 18 September

2023

|

|

Time:

|

9.30am

|

|

Location:

|

Bay of Plenty Regional Council Chambers

Regional House

1 Elizabeth Street

Tauranga

|

|

Please note that this

meeting will be livestreamed and the recording will be publicly available on

Tauranga City Council's website: www.tauranga.govt.nz.

|

|

Marty Grenfell

Chief Executive

|

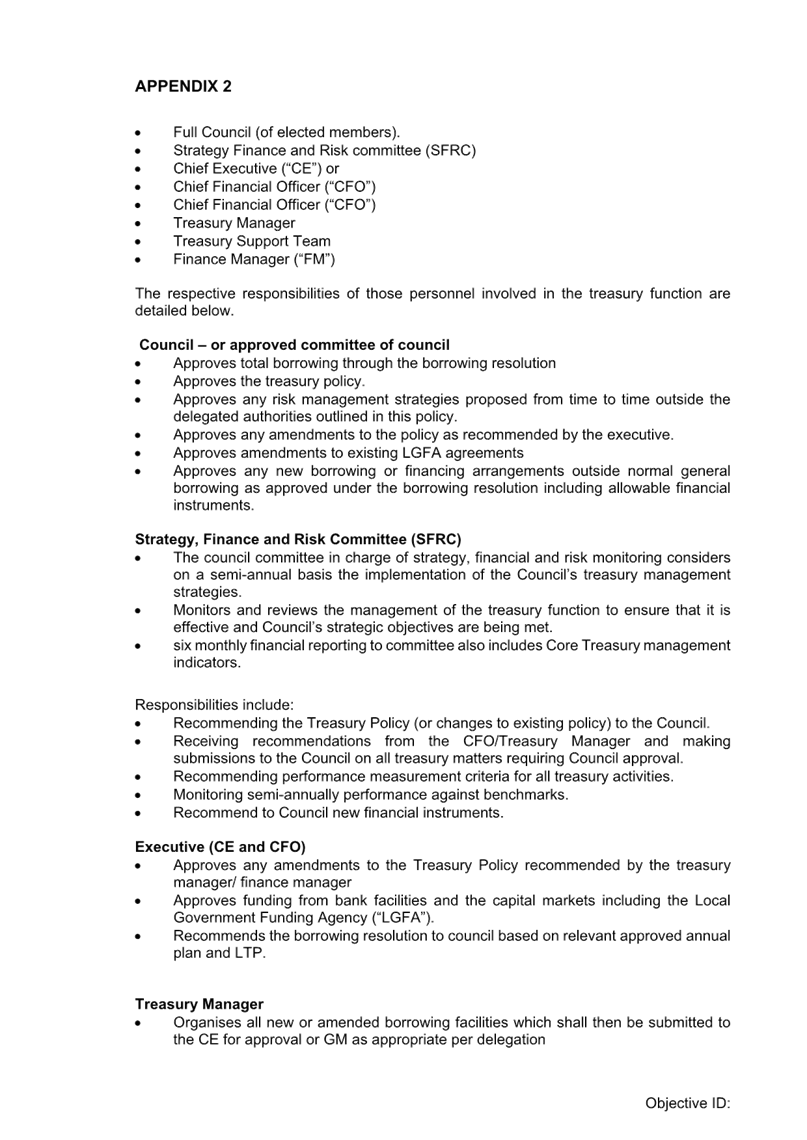

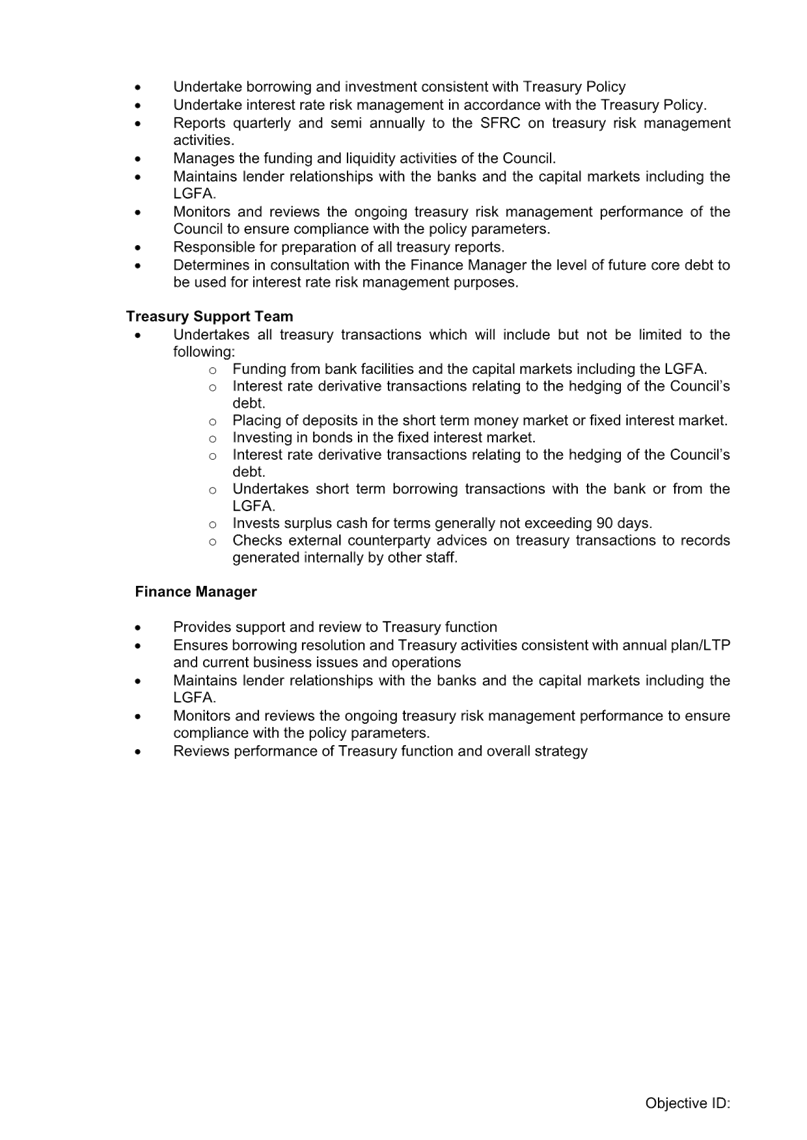

Terms of reference – Strategy,

Finance & Risk Committee

Membership

|

Chairperson

|

Commission Chair Anne Tolley

|

|

Deputy chairperson

|

Dr Wayne Beilby – Tangata

Whenua representative

|

|

Members

|

Commissioner Shadrach Rolleston

Commissioner Stephen Selwood

Commissioner Bill Wasley

|

|

|

Matire Duncan, Te Rangapū Mana

Whenua o Tauranga Moana Chairperson

Te Pio Kawe – Tangata

Whenua representative

Rohario Murray – Tangata

Whenua representative

Bruce Robertson – External

appointee with finance and risk experience

|

|

Quorum

|

Five (5) members must be

physically present, and at least three (3) commissioners and two (2)

externally appointed members must be present.

|

|

Meeting frequency

|

Six weekly

|

Role

The role

of the Strategy, Finance and Risk Committee (the Committee) is:

(a)

to assist and advise the Council in discharging

its responsibility and ownership of health and safety, risk management,

internal control, financial management practices, frameworks and processes to

ensure these are robust and appropriate to safeguard the Council's staff and

its financial and non-financial assets;

(b)

to consider strategic issues facing the city and

develop a pathway for the future;

(c)

to monitor progress on achievement of desired

strategic outcomes;

(d)

to review and determine the policy and bylaw

framework that will assist in achieving the strategic priorities and outcomes

for the Tauranga City Council.

Membership

The Committee will consist of:

·

four commissioners with the Commission Chair

appointed as the Chairperson of the Committee

·

the Chairperson of Te

Rangapū Mana Whenua o Tauranga Moana

·

three tangata whenua representatives

(recommended by Te Rangapū Mana Whenua o Tauranga

Moana and appointed by Council)

·

an independent external person with finance and

risk experience appointed by the Council.

Voting

Rights

The

tangata whenua representatives and the independent external person have voting

rights as do the Commissioners.

The

Chairperson of Te Rangapu Mana Whenua o Tauranga Moana is an advisory position,

without voting rights, designed to ensure mana whenua discussions are connected

to the committee.

Committee's

Scope and Responsibilities

A. STRATEGIC

ISSUES

The Committee will consider

strategic issues, options, community impact and explore opportunities for

achieving outcomes through a partnership approach.

A1 – Strategic Issues

The Committee's responsibilities with regard to Strategic

Issues are:

·

Adopt an annual work

programme of significant strategic issues and projects to be addressed. The

work programme will be reviewed on a six-monthly basis.

·

In respect of each

issue/project on the work programme, and any additional matters as determined

by the Committee:

○ Consider existing and future strategic

context

○ Consider opportunities and possible

options

○ Determine preferred direction and

pathway forward and recommend to Council for inclusion into strategies,

statutory documents (including City Plan) and plans.

·

Consider and approve

changes to service delivery arrangements arising from the service delivery

reviews required under Local Government Act 2002 that are referred to the

Committee by the Chief Executive.

·

To take appropriate

account of the principles of the Treaty of Waitangi.

A2 – Policy and Bylaws

The Committee's responsibilities with regard to Policy and

Bylaws are:

·

Develop, review and

approve bylaws to be publicly consulted on, hear and deliberate on any

submissions and recommend to Council the adoption of the final bylaw. (The

Committee will recommend the adoption of a bylaw to the Council as the Council

cannot delegate to a Committee the adoption of a bylaw.)

·

Develop, review and

approve policies including the ability to publicly consult, hear and deliberate

on and adopt policies.

A3 – Monitoring of Strategic

Outcomes and Long Term Plan and Annual Plan

The Committee's responsibilities with regard to monitoring

of strategic outcomes and Long Term Plan and Annual Plan are:

·

Reviewing and

reporting on outcomes and action progress against the approved strategic

direction. Determine any required review / refresh of strategic direction or

action pathway.

·

Reviewing and

assessing progress in each of the six (6) key investment proposal areas within

the 2021-2031 Long Term Plan.

·

Reviewing the

achievement of financial and non-financial performance measures against the

approved Long Term Plan and Annual Plans.

B. FINANCE AND RISK

The Committee will review the effectiveness of the

following to ensure these are robust and appropriate to safeguard the Council's

financial and non-financial assets:

·

Health and safety.

·

Risk management.

·

Significant projects and programmes of work

focussing on the appropriate management of risk.

·

Internal and external audit and assurance.

·

Fraud, integrity and investigations.

·

Monitoring of compliance with laws and regulations.

·

Oversight of preparation of the Annual Report

and other external financial reports required by statute.

·

Oversee the relationship with the

Council’s Investment Advisors and Fund Managers.

·

Oversee the relationship between the Council and

its external auditor.

·

Review the quarterly financial and non-financial

reports to the Council.

B1 - Health and Safety

The

Committee’s responsibilities through regard to health and safety are:

·

Reviewing the effectiveness of the health and

safety policies and processes to ensure a healthy and safe workspace for

representatives, staff, contractors, visitors and the public.

·

Assisting the Commissioners to discharge their

statutory roles as "Officers" in terms of the Health and Safety at

Work Act 2015.

B2 - Risk Management

The

Committee's responsibilities with regard to risk management are:

·

Review, approve and monitor the implementation of the Risk

Management Policy, including the Corporate Risk Register.

·

Review and approve the Council’s "risk appetite"

statement.

·

Review the effectiveness of risk management and internal control

systems including all material financial, operational, compliance and other

material controls. This includes legislative compliance, significant projects

and programmes of work, and significant procurement.

·

Review risk management reports identifying new and/or emerging

risks and any subsequent changes to the "Tier One" register.

B3

- Internal Audit

The

Committee’s responsibilities with regard to the Internal Audit are:

·

Review and approve the Internal Audit Charter to confirm the

authority, independence and scope of the Internal Audit function. The Internal

Audit Charter may be reviewed at other times and as required.

·

Review and approve annually and monitor the implementation of the

Internal Audit Plan.

·

Review the co-ordination between the risk and internal audit

functions, including the integration of the Council's risk profile with the

Internal Audit programme. This includes assurance over all material financial,

operational, compliance and other material controls. This includes legislative

compliance (including Health and Safety), significant projects and programmes

of work and significant procurement.

·

Review the reports of the Internal Audit functions dealing with

findings, conclusions and recommendations.

·

Review and monitor management’s responsiveness to the

findings and recommendations and enquire into the reasons that any

recommendation is not acted upon.

B4

- External Audit

The

Committee's responsibilities with regard to the External Audit are:

·

Review with the external auditor, before the audit commences, the

areas of audit focus and audit plan.

·

Review with the external auditors, representations required by

commissioners and senior management, including representations as to the fraud

and integrity control environment.

·

Recommend adoption of external accountability documents (LTP and

annual report) to the Council.

·

Review the external auditors, management letter and management

responses and inquire into reasons for any recommendations not acted upon.

·

Where required, the Chair may ask a senior representative of the

Office of the Auditor General (OAG) to attend the Committee meetings to discuss

the OAG's plans, findings and other matters of mutual interest.

·

Recommend to the Office of the Auditor General the decision

either to publicly tender the external audit or to continue with the existing

provider for a further three-year term.

B5

- Fraud and Integrity

The

Committee's responsibilities with regard to Fraud and Integrity are:

·

Review and provide advice on the Fraud Prevention and Management

Policy.

·

Review, adopt and monitor the Protected Disclosures Policy.

·

Review and monitor policy and process to manage conflicts of

interest amongst commissioners, tangata whenua representatives, external

representatives appointed to council committees or advisory boards, management,

staff, consultants and contractors.

·

Review reports from Internal Audit, external audit and management

related to protected disclosures, ethics, bribery and fraud related incidents.

·

Review and monitor policy and processes to manage

responsibilities under the Local Government Official Information and Meetings

Act 1987 and the Privacy Act 2020 and any actions from the Office of the

Ombudsman's report.

B6

- Statutory Reporting

The

Committee's responsibilities with regard to Statutory Reporting relate to

reviewing and monitoring the integrity of the Annual Report and recommending to

the Council for adoption the statutory financial statements and any other

formal announcements relating to the Council's financial performance, focusing

particularly on:

·

Compliance with, and the appropriate application of, relevant

accounting policies, practices and accounting standards.

·

Compliance with applicable legal requirements relevant to statutory

reporting.

·

The consistency of application of accounting policies, across

reporting periods.

·

Changes to accounting policies and practices that may affect the

way that accounts are presented.

·

Any decisions involving significant judgement, estimation or

uncertainty.

·

The extent to which financial statements are affected by any

unusual transactions and the manner in which they are disclosed.

·

The disclosure of contingent liabilities and contingent assets.

·

The basis for the adoption of the going concern assumption.

·

Significant adjustments resulting from the audit.

Power

to Act

·

To make all

decisions necessary to fulfil the role, scope and responsibilities of the

Committee subject to the limitations imposed.

·

To establish

sub-committees, working parties and forums as required.

·

This Committee has not

been delegated any responsibilities, duties or powers that the Local Government

Act 2002, or any other Act, expressly provides the Council may not delegate.

For the avoidance of doubt, this Committee has not been delegated

the power to:

o

make a rate;

o

make a bylaw;

o

borrow money, or purchase

or dispose of assets, other than in accordance with the Long-Term Plan (LTP);

o

adopt the LTP or Annual

Plan;

o

adopt the Annual Report;

o

adopt any policies required

to be adopted and consulted on in association with the LTP or developed for the

purpose of the local governance statement;

o

adopt a remuneration and

employment policy;

o

appoint a chief executive.

Power

to Recommend

To Council and/or any standing committee

as it deems appropriate.

|

Strategy,

Finance and Risk Committee meeting Agenda

|

18

September 2023

|

7 Confirmation

of minutes

7.1 Minutes

of the Strategy, Finance and Risk Committee meeting held on 7 August 2023

File

Number: A15050485

Author: Sarah

Drummond, Governance Advisor

Authoriser: Sarah

Drummond, Governance Advisor

|

Recommendations

That the Minutes of the

Strategy, Finance and Risk Committee meeting held on 7 August 2023 be

confirmed as a true and correct record.

|

Attachments

1. Minutes

of the Strategy, Finance and Risk Committee meeting held on 7 August 2023

|

Strategy, Finance and Risk Committee meeting minutes Strategy, Finance and Risk Committee meeting minutes

|

7 August 2023

|

|

|

|

MINUTES

Strategy, Finance and Risk Committee meeting

Monday, 7 August 2023

|

Order of Business

1 Opening karakia. 3

2 Apologies. 3

3 Public forum.. 4

4 Acceptance of

late items. 4

5 Confidential

business to be transferred into the open. 4

6 Change to order

of business. 4

7 Confirmation of

minutes. 4

7.1 Minutes

of the Strategy, Finance and Risk Committee meeting held on 26 June 2023. 4

8 Declaration of

conflicts of interest 4

9 Business. 4

9.1 Six

Monthly Treasury Strategy Update. 4

9.2 Review

of Rating Categories to Differentiate Industrial Ratepayers. 7

9.3 Capital

Programme 23/24 Update. 9

9.4 Q4

Financial and Non-Financial Monitoring report to 30 June 2023 - Draft results. 11

9.5 Annual

Residents' Survey 2022/23. 11

9.6 2024

- 20234 Long-term Plan - Revenue and Finance Policy Framework - Funding Needs

Analysis. 12

9.7 2024

- 2034 Long-term Plan - Update - Funding and Reserves. 14

9.8 2024-2034

Long-Term Plan - Non-Financial Performance Measures. 15

9.9 Parking

Management Plan roll out adjustment. 15

9.10 Street

Use Policy Review - Issues and Options Report 16

9.11 Water

Services Reform Update. 19

9.12 2023

Q4 Apr-June Health and Safety Report 20

9.13 LGOIMA

and Privacy Annual Report and Q4 for 2022/2023 year 20

10 Discussion of late items. 21

11 Public excluded session. 21

11.1 Corporate

Risk Register - Quarterly Update. 21

11.2 Internal

Audit & Assurance - Quarterly Update. 21

12 Closing karakia. 22

Resolutions transferred into the open section of the meeting

after discussion. 22

MINUTES

OF Tauranga City Council

Strategy, Finance and Risk Committee meeting

HELD

AT THE Bay of Plenty Regional Council

Chambers, Regional House, 1 Elizabeth Street, Tauranga

ON

Monday, 7 August 2023 AT 9.30am

PRESENT: Commission

Chair Anne Tolley, Dr Wayne Beilby, Commissioner Shadrach Rolleston,

Commissioner Stephen Selwood, Ms Matire Duncan, Mr Te Pio Kawe, Ms Rohario

Murray, Mr Bruce Robertson

IN ATTENDANCE: Christine

Jones (Acting Chief Executive),Paul Davidson (Chief Financial Officer), Nic

Johansson (General Manager: Infrastructure), , Alastair McNeill (General

Manager: Corporate Services), Gareth Wallis (General Manager: City Development

& Partnerships),Brendan Bisley ( Director of Transport), Diane

Bussey, (Contractor - Three Water Reforms), Jeremy Boase (Manager: Strategy and

Corporate Planning) Sheree Covell, (Treasury & Financial Compliance

Manager), Amanda Davies (Manager: Spaces and Places Project Outcomes), Cathy Davidson ( Manager: Directorate

Services) Malcolm Gibb, (Contractor - Rating

Review), Vicky Grant-Ussher, (Policy Analyst), Kelvin Hill ( Manager:

Water Infrastructure Outcomes) Sarah Holmes, (Corporate Planner),

Kathryn Hooker, (Corporate Planner), Tracey Hughes, (Financial Insights

& Reporting Manager), Josh Logan, (Team Leader: Corporate Planning), Rob

Lahey, (Principal Strategic Advisor) , Kathryn Sharplin (Manager: Finance),

Frazer Smith, (Manager: Strategic Finance & Growth), Jim Taylor, (Manager:

Rating Policy and Revenue), Kath Norris, (Team Leader: Democracy Services),Darren

West (Health, Safety & Wellbeing Manager),

Reece Wilkinson (Parking Strategy Manager), Coral Hair (Manager: Democracy

& Governance Services), Sarah Drummond (Governance Advisor), Anahera

Dinsdale (Governance Advisor),

External Suresh

Ranchhod, Head of Treasury Advisory, (Bancorp)

Philip Jones, Principal, (PJ and

Associates)

1 Opening

karakia

Commissioner Shadrach Rolleston

opened the meeting with a karakia.

2 Apologies

|

Apology

|

|

Committee Resolution SFR5/23/1

Moved: Commissioner

Shadrach Rolleston

Seconded: Commissioner Stephen Selwood

That the apology for absence received from Commissioner

Bill Wasley be accepted.

Carried

|

3 Public

forum

Nil

At 9.34 am, Mr Te Pio Kawe entered the meeting.

4 Acceptance

of late items

Nil

5 Confidential

business to be transferred into the open

Nil

6 Change

to order of business

Nil

7 Confirmation

of minutes

8 Declaration

of conflicts of interest

Commissioner Shadrach Rolleston declared that he had worked

on the Three Waters Legislation and Resource Management Act reform and would

not take part in discussion or voting of any reports on the agenda that

regarded these matters.

Committee Member Rohario Murray declared that she had worked

on the Three Waters Legislation and Resource Management Act reform, and would

not take part in discussion or voting of any reports on the agenda that

regarded these matters.

9 Business

|

9.1 Six

Monthly Treasury Strategy Update

|

|

Staff Paul

Davidson, Chief Financial Officer

Sheree

Covell, Treasury & Financial Compliance Manager

Kathryn Sharplin, Manager:

Finance

External Suresh

Ranchhod, Head of Treasury Advisory, Bancorp Treasury

Key points

·

Mr Ranchhod of Bancorp attended the meeting on-line and

provided a presentation to the Committee.

·

Inflation was still an unfolding story and a matter of concern.

It appeared that the peak of inflation had been reached and globally

inflation was on a downward trend as evidenced in the United States of

America (USA) where inflation had last been reported at 3%.

·

Due to quarterly reporting (as opposed to monthly in other

Countries) used in New Zealand inflation was last reported at 6%. That showed

more work would be required to control inflation, and that we were yet to see

a peak in the reported inflation number. An assumption had been made that

inflation had moved, reducing from that peak.

·

A greater concern for New Zealand was the position of our

largest trading partner the Peoples Republic of China (China) where inflation

was reported at 0%. That was a new concern and caused more significant worry

than inflationary pressure, as it indicated the possibility of an unstable

inflationary environment in China that could tip their economy into deflation

that could affect our trading market.

·

Inflation cost for household food increased by 12.3% and

household utilities (rent, rates and related household services) increased by

6%.

·

Commodity prices had fallen, and the New Zealand dollar was

under pressure at the value of 0.61 cents against the American Dollar.

·

Fonterra New Zealand had released their forecast milk commodity

price payment to farmers and it had reduced by one dollar. The effect of that

reduction had cost the New Zealand economy an estimated $5 billion dollars.

·

Most sectors are declining in their borrowing, especially

household and business borrowing.

·

The agriculture sector had for the previous five years paid

down debt and the slight increase in borrowing in the sector was seen as a

case of having to borrow to keep business going.

·

There was still a concern that New Zealand placed at number 55

of 56 of the worst worldwide markets that ranked housing unaffordability.

That was an improvement from 2022 when New Zealand was ranked number two

behind Turkey (with an inflation of between 50% and 80%). That measurement

reflected l unease on the position of high interest rates in New Zealand,

that were considered unsustainable for the long term but the current curtailment

of inflation seemed to be working..

·

The Reserve Bank of New Zealand (RBNZ) considered house price

inflation had peaked. Noted that house prices were now at the level last

reached during the 2007 Global Financial Crisis (GFC). Headline mortgage

interest rates would peak at an expected 7%. The effect of that rate on

consumer spending and household expense had not been seen, as a tranche of

households had yet to be required to refix/refinance their mortgages rates.

The rate was currently at around the 4% mark.

·

The effect of that anticipated interest rate rise had been seen

in the projected and actual number of resource consents lodged to build new

houses or develop new housing areas and investment in those areas. It was

expected that high interest rates would continue to cause a downward trend in

the number of houses available.

·

Further change to the Official Cash Rate (OCR) (last adjusted

by the RBNZ in May 2023). The RBNZ still saw the neutral rate between 2% and

3.75%, with the OCR well above that at 5.50%, and this would expect to do

damage to the economy. .

·

The rates were at their peak and the swap rates reflected

guidance on when interest rates would fall. The market had priced cuts by

August 2024 with the OCR anticipated below 5%. This would depend on how the

economy behaved. Hopefully next year all councils would get some relief on

interest rates.

·

Staff then provided a brief overview of the report and

highlighted pertinent points to the Committee.

·

The report sought to increase cash holdings from $10 Million

Dollars ($10M) to $15M reflected the increased cash flow requirements in

monthly outflows.

·

Ongoing work had been completed on where our retentions would

be held, either in Trust or through another financial vehicle. Further

information on this would be provided next month.

·

Outstanding debt as at 30 June 2023 had increased from the

projected $903M to $948M, an increase of $45M, that had been

approved during the year to cover borrowing requirements.

·

The level of debt for 2024 would be $1.1 Billion.. The

average cost of borrowing was 3.92%.

·

The fixed debt profile of Council was projected both with and

without Three Waters included and was based on high level assumptions around

the debt settlement.

·

Debt swaps had allowed this profile to remain above the line

until there was certainty on water reform

In response to questions

·

The Committee thanked Mr Raschhod for his insight and

presentation and acknowledged that while the situation was largely

unchanged from previous reports, it made for depressing reading at times.

·

Household costs were already under extreme pressure and the

drivers of those costs (increase in food, rent, mortgages, rates, power, debt

levels ), were mostly outside the control of households and had to be paid.

·

Under pressure households would find cost increases, including

potential rate rises, a further burden. The situation was not unique and was

faced by most Territorial Authorities in New Zealand. There would be a

flow through in potential debt risk of unpaid rates and a downturn in the

local economy, that resulted from reduced discretionary spending as people

prioritised budgets and household commitments under those constraints.

·

Staff confirmed that retentions would be held in trust to

protect subcontractors who had completed Council contracted work.

·

Staff were in constant negotiations and conversations with the

National Transition Unit (NTU) Three Waters Reform . Negotiations

would be ongoing, although agreement had been reached on the numbers to the

end of 2022.

·

That issues had not yet concluded, and staff had been in close

contact with the NTU on the matter and noted that while there was still

on-going work, the numbers were close to the debt ceiling and did not allow

for large movement.

·

.

·

Staff constantly monitored rates collection data.

·

Interest rates were factored into the Long Term Plan with the

best information that was provided at the time of preparation.

·

In the preparation of the Long-Term Plan, the modelling of the

debt to revenue ratio, staff provided for internal limits that built in

capacity for unforeseen circumstances..

Discussion points raised

·

In the near term (three years) potential would occur that a

“new normal” for household costs and pressures would be reached,

that reduced discretionary spending and the flow on effects to the wider

economy. In that term, interest rate rises, and inflationary pressures, would

encourage councils to look at funding models and sources that were not

provided through rates.

·

Noted increased pressure to find new funding sources and other

tools to manage risk and the potential rate arrears that could occur would require

further investigation by Council.

·

Those investigations were to be included in the ongoing

conversation with Central Government on the shape and funding of Local

Government, Three Waters and the need for Local Government to continue to

provide services and the investment that infrastructure and other priority

areas required.

·

The Committee Chair Anne Tolley noted that council had begun to

look at all the services provided by the Council to consider who was

benefiting from these services to ensure those who benefitted paid their fair

share of these services. .

·

Concern was expressed that should the peak inflation last

longer than anticipated, or have a longer tail than expected, there was

assurance that this would not impact negatively on council’s budget.

|

|

Committee Resolution SFR5/23/3

Moved: Commissioner

Stephen Selwood

Seconded: Mr Bruce Robertson

That the Strategy, Finance and Risk Committee:

(a) Receives the report

"Six Monthly Treasury Strategy Update".

(b) Approves the issuance of

long- and short-term debt on a wholesale basis to manage cashflows.

(c) Approves maintenance of a

minimum of $15M of cash and short-term investments to manage cashflows.

(d) Approves hedging of all

significant foreign exchange exposures.

(e) Approves to hold new retentions

monies in a trust account to adhere to new legislation.

Carried

|

|

Attachments

1 Presentation

from S Rachhod - Bancorp - Update - to Strategy Finance and Risk Committee -

7 August 2023

|

|

9.2 Review of

Rating Categories to Differentiate Industrial Ratepayers

|

|

Staff Paul

Davidson, Chief Financial Officer

Jim Taylor, Manager: Rating Policy and Revenue

Kathryn Sharplin, Manager: Finance

Malcolm Gibb, Contractor - Rating

Review

External Philip Jones, Principal - PJ and Associates

Key points

·

The Rating Policy was amended in the 2022/2023 Annual Plan that

phased in a commercial rating differential for the general rate and a

transportation targeted rate that reflected a 50/50 funding split between

commercial and residential rating units.

·

The differential was considered insufficient by commercial

sector and they sought that further differentiation be considered by Council

to reflect the significant benefits received by the industrial sector..

·

The Judgement of the Supreme Court of New Zealand in the

successful appeal by Auckland Council, for a targeted rate on commercial

accommodation providers, had provided important principles in setting rates

by a local authority.

·

Commissioners requested and staff had investigated whether

there was justification to introduce a new industrial rating category which

provided a fairer and more equitable funding outcome.

·

Staff concluded there was insufficient data that supported

further separation of the commercial and industrial rating category. That was

in part reflected by Tauranga City Council’s (TCC) data

limitations. The earlier studies had not considered the impact of heavy

vehicles on the Council’s costs or community wellbeing.

·

Mr Philip Jones, of PJ and Associates, had been engaged and

investigated and reported on whether the introduction of a new rating

category could be supported.

·

Noted that the report focused of the assessment of proposed

Council expenditure to the developed Asset Management Plan, in conjunction

with the development process followed for the Draft Long-Term Plan 2024/34.

·

A lack of data had made support of that process unsustainable.

In response to questions

·

S101(3)(b) Local Government Act (LGA) could be used by Council

to assess data collected and the effect on not only the City but how that

affected the four wellbeings for all residents not only industrial and

commercial users. This was not commonly done around the country, but there

were some cases before the courts that had opened the door. This needed to be

carefully explained and articulated. Council would need to understand

the impacts and clearly articulate why it would have a higher differential

for that group of properties.

·

It was noted that the industrial categories had effect on

people and communities using the four wellbeing measures set out in

s101(3)(b) of the LGA and this would allow Council to assess impacts on

people and infrastructure

·

That further allowed for the use of differentials for

calculations and forecasting of budgets.

·

There remained a number of unidentified issues that were not

covered in data collected to date. That included differentials that

were not in common use (two had been identified at present), Congestion and

projected City Growth and its impact.

·

The primary data to be collected would be congestion on local

roads and State Highways, and the impact of congestion on residents and

ratepayers ability to undertake their normal course of activities.

·

As data collection increased other challenges had been

identified, e.g. there was no state highway access to the Port of Tauranga

which created additional impacts.

·

Environment Impacts would also need to be considered to include

in the differential.

·

City expansion in areas such as the Industrial estate in

Tauriko highlighted the need for timely and accurate collection of data to

enable future planning and budgeting.

Discussion points raised

·

Future growth demand would require further investment in the

quality of the roading network.

·

Using the collated data would allow Council to create policy

where costs were paid for using a ‘fair share’ model. Determining

the benefits derived from the industrial sector, identifying the costs and

identifying who were the beneficiaries and who were the exacerbators would

build evidence to justify more equitable funding models.

·

Industrial and Commercial users had indicated a willingness to

pay increased costs, however, there remained a risk that ratepayers

would be burdened with increased costs as work was completed and paid for

from rates revenue.

·

As more accurate data was received, Council had the ability to

develop policy that would look at additional funding sources outside of rates

e.g. road tolls and partnership agreements with industrial users and

determine impacts of growth on environment effects and roading congestion.

·

Data that related to bus use and effects was already collected,

and not included in the data collected for this report.

·

The current resolution did not clearly reflect Council’s

ability to use s101(3)(b) in the development of a ‘Fair Share, user

pays model.

·

The Committee thanked Mr Jones and staff for a clear and

informative report.

|

|

Committee Resolution SFR5/23/4

Moved: Commissioner

Stephen Selwood

Seconded: Commissioner Shadrach Rolleston

That the Strategy, Finance and Risk Committee:

(a) Receives the council report

"Review of Rating Categories to Differentiate Industrial

Ratepayers".

(b) Receives the attachment

“Report on Rating Categories – Differential by P J and

Associates”.

(c) Recommends to Council to

consider introducing a new rating category for industrial properties (Option

1) in the development of the 2024-34 Long-term Plan.

Carried

|

|

9.3 Capital

Programme 23/24 Update

|

|

Staff Nic

Johansson General Manager: Infrastructure

Amanda Davies, Manager:

Spaces and Places Project Outcomes

Kelvin Hill, Manager: Water Infrastructure Outcomes

Brendan Bisley, Director of Transport

Refer to attached

Presentation Capital Programme Update 23/24

Key points

·

The Committee received reports from the major project groups

that provided an update on current project deliverables and recent projects

completed.

·

The Committee directed that this update be attached to the

confirmed minutes.

Spaces and Places – Amanda Davies

·

Graphics and brief updates of completion dates for specific

projects.

·

Marine Parade Coastal Path – completion early 2024

·

Pāpāmoa

shared pathway – completion early 2024

·

Kopurererua steam

– northern alignment and path network – completion summer 202

·

Omanawa Falls – completion early 2024

·

Destination Skatepark – completion early 2024

·

Gate Pa and Merivale Community Centres

·

Gordon Spratt Community Sports Pavillion

·

Links Ave Artificial Turf

·

Transport Brendan Bisley

·

Artificial intelligence was revolutionising fault data

collection of our roading network.

·

50 safety improvement projects completed before the end of the

year.

·

Te Okuroa Drive and Sands intersection – completion by

Christmas 2023.

·

Pāpāmoa

East Interchange –embankment works completed and would allow for ground

settlement. Construction would be later in the year.

·

Positive feedback provided to staff on smaller projects, such

as the crossing outside St Mary’s School showed that small jobs could

have high positive impact for communities.

·

Totara Street resealing had taken longer than projected, the

delay had occurred due to two factors. Concrete was used in sealing the road

to provide a longer life before replacement was needed. Inclement weather

lengthened the curing time for the road.

Waters – Kelvin Hill

·

Waters was a 24/7 operation that had faced a challenging year.

·

Opal Drive work had progressed well and was on track.

·

Tatau raw water pipeline duplication to enhance supply

resilience between the stream intake pump station and Oropi Gorge Road

reservoir.

·

Bioreactor ground improvements were being constructed under

adverse weather conditions to stop liquefaction in earthquake conditions.

·

A robot was designed to investigate the ocean outfall and had

the capacity to take CCTV camera footage of the pipe as well as pull out

large pieces of concrete material from the previous joint repairs.

·

As part of the upgrade of the wastewater pipe a boardwalk had

been installed behind Fashion Island to mount the pipeline alongside the

board walk. This had proved a popular addition to the area. Residents raised

concerns on the lack of security along the boardwalk and Council had

responded with the installation of CCTV. This was appreciated by residents.

City Centre and Civic Programme – Gareth Wallis

·

Work was now completed on the Dive Crescent North car park and

would be opened shortly.

·

Dive Crescent South carpark – completion before Christmas

2023.

·

Elizabeth Street East – completion before Christmas 2023.

·

97 carparks at 160 Devonport Road – completion before

Christmas 2023.

·

Red square and Grey street activation – completion before

Christmas 2023.

·

End of trip cycle facilities – Grey Street - 80 bike

parks – completion before Christmas 2023.

·

Detailed design of Library/Community Hub – completion by

Christmas 2023

·

Concept design and costings for Memorial Park -completion by

Christmas 2023

·

79 Grey Street Laneways concept design – completion

Christmas 2023

·

Waterfront Boardwalk construction – completion –

March 2024.

·

Strand North and shared pathway construction – completion

– April 2024

·

Beacon Walk – completion April 2024

·

Masonic Park and Tauranga Art Gallery– start 1 October

2023 completion by mid-2024.

·

Waterfront Playground – completion July 2024.

·

Northern Sea Wall – commence before year end 2023.

·

Elizabeth Street West streetscape and laneway –

competition February 2024.

In response to questions

·

Project Management had been an ongoing area of assessment,

process improvement and training for staff. A further report would be brought

back to the Committee.

·

A cultural lens was used in all project planning. Project Teams

worked closely with the internal teams and external iwi and hapū groups to provide that lens.

·

Noted a threefold increase in capital expenditure programmes in

three years.

·

Noted the work completed by the teams was a great news story

and one that should be told to Tauranga through media channels.

·

Health and Safety procedures and adherence to guidelines had

received a renewed focus and was included in all contracts with external suppliers.

That work was being actively managed with training and ensuring expectations

were understood and met.

·

Delayed roading work had caused concern there was a lack of

communication from Council on that work. Delays were at times not able to be

identified until work had commenced. Staff had taken learnings of earlier

projects and had improved communication plans for the active projects.

Discussion points raised

·

More communication of the fantastic work on-going in the city

was needed.

·

More communication of timeframes and delays in projects.

·

The Committee was extremely proud of the Dive Crescent project

now completed and commended all involved.

|

|

Committee Resolution SFR5/23/5

Moved: Mr

Bruce Robertson

Seconded: Dr Wayne Beilby

That the Strategy, Finance and Risk Committee:

(a) Receives the council

report "Capital Programme 23/24 Update”.

Carried

|

|

Attachments

1 Capital

Programme Update Presentation

|

At 11.30am the meeting adjourned.

At 11.36am the meeting reconvened.

|

9.4 Q4 Financial

and Non-Financial Monitoring report to 30 June 2023 - Draft results

|

|

Staff

Paul Davidson, Chief Financial Officer

Tracey Hughes, Financial Insights & Reporting Manager

Jeremy Boase, Manager: Strategy and Corporate Planning

Refer to attached Memorandum -

Draft Results Amendment to Report Attachment 7.

Key points

·

A minor corrections memorandum was provided to the Committee,

that updated figures from the original report. The Committee directed that

this be attached to the minutes.

·

Noted that the financial figures were still preliminary and

would be refined.

·

A year end adjustment from the purchase and licence agreements

for Software as a Solution (SaSS) was an operational expenditure (OPEX) and a

resolution would come to the Council to loan fund that expenditure of

$10M.

In response to questions

·

No questions were received from the Committee.

Discussion points raised

·

There were no surprises in the report or memorandum figures

that had not already been communicated to the Committee.

·

The Committee was pleased to see the timeframes for processing

resource consents was improving, but still allowed for reporting of any

long-term lag in the timeframe data.

·

|

|

Committee Resolution SFR5/23/6

Moved: Dr

Wayne Beilby

Seconded: Commissioner Stephen Selwood

That the Strategy, Finance and Risk Committee:

(a)

Receives the report "Q4 Financial and Non-Financial Monitoring

report to 30 June 2023 Draft results and tabled Memorandum - Draft Results

Amendment to Report Attachment.

"Carried

|

|

Attachments

1 Memo

to Item 9.4 - Draft Results Amendment to Report - Attachment - 7 August 2023

|

|

9.5 Annual

Residents' Survey 2022/23

|

|

Staff Christine

Jones, General Manager: Strategy, Growth & Governance

Jeremy Boase, Manager: Strategy and Corporate Planning

Key points

·

The report brought together four ‘waves’ of

Community feedback.

·

The report was taken as read.

In response to questions

·

There were no questions from the Committee

Discussion points raised

·

A majority of measures surveyed had risen.

·

Roading and footpaths and outdoor spa es continued to be of

concern to residents.

|

|

Committee Resolution SFR5/23/7

Moved: Commissioner

Stephen Selwood

Seconded: Ms Rohario Murray

That the Strategy, Finance and Risk Committee:

(a) Receives

the report "Annual Residents' Survey 2022/23".

Carried

|

|

9.6 2024 - 20234

Long-term Plan - Revenue and Finance Policy Framework - Funding Needs

Analysis

|

|

Staff Paul

Davidson, Chief Financial Officer

Kathryn Sharplin, Manager: Finance

Jeremy Boase, Manager: Strategy and Corporate Planning

Key points

·

Analysis was ongoing of depreciation and funding requirements.

·

Proposed fee for flood protection was included, despite there

being a targeted Three Waters Levy, it did not allow for flood related damage

or issues.

·

A proposed targeted rate for swimming pool inspections to be

paid by one third each year over three years.

·

Fair Share/user payments. There have been a number of these

proposed in the Long Term Plan discussion on user fees and charges, e.g.,

boat ramps and use of sports fields and facilities and parking charges.

In response to questions

·

There were no questions to the report.

Discussion points raised

·

A separate report would be provided to Council regarding the Industrial

and Commercial Rates.

·

The targeted rate for swimming pool inspections was the

preferred method as it did not incur set up costs.

|

|

Committee Resolution SFR5/23/8

Moved: Commissioner

Shadrach Rolleston

Seconded: Commissioner Stephen Selwood

That the Strategy, Finance and Risk Committee:

(a) Receives the report

"2024 - 20234 Long-term Plan - Revenue and Finance Policy Framework -

Funding Needs Analysis".

(b) Adopt the draft Funding

Needs Analysis (Attachment 1) to confirm step one of the processes and to

inform the drafting of the Revenue and Finance Policy for consideration at

Council on 21 August 2023.

Carried

|

|

9.7 2024 - 2034

Long-term Plan - Update - Funding and Reserves

|

|

Staff Paul

Davidson, Chief Financial Officer

Kathryn Sharplin, Manager: Finance

Frazer Smith, Manager: Strategic Finance & Growth

Key points

·

Depreciation and funding to the Council (over the ten-year

long-term plan) in the current economic climate remained challenging.

·

Reserves for liabilities e.g., weather tight building pays

outs, resulted in there being some head room in Council budgets.

·

If Council was required to ‘smooth’ funding in the

event of unexpected increases in values and or of larger than expected

depreciation, budgets could, at the current data be moved back to their

original terms. That would have the effect of smaller rates revenue and

require increased debt levels.

In response to questions

·

No questions were asked by the Committee

Discussion points raised

·

The funding and financing of Local Government in New Zealand

was no longer relevant or sufficient to meet the demands placed on councils.

The level of funding to run operations on a day to day level and provide

future investment in infrastructure was too large a burden for growth councils.

Central Government was receiving the benefit of these works at the detriment

of councils.

|

|

Committee Resolution SFR5/23/9

Moved: Commissioner

Shadrach Rolleston

Seconded: Dr Wayne Beilby

That the Strategy, Finance and Risk Committee:

(a) Receives the report

"2024 - 2034 Long-term Plan - Update - Funding and Reserves".

(b) Recommends to Council that

the following matters are considered in the LTP to address both the

significant impacts of large asset revaluations on depreciation and the current

risks and impacts on the depreciation reserves.

(i) Phasing in of

increased funding of depreciation expense in the early years of the LTP to

mitigate the otherwise significant up-front increases in rates arising from

significant asset revaluation.

(ii) Restoring depreciation

funding and the level of reserve balances within the ten years of the LTP.

(iii) Short term loan funding of

capital renewals for activities where there are insufficient depreciation

reserves.

(iv) additional rates funding to

retire debt for those activities where there are insufficient depreciable

assets to repay debt over time.

(c) Recommends to Council that

the phased retirement of debt in the weathertight and unfunded liabilities

reserve subject to rates affordability should aim to significantly reduce

these reserve deficits through the period of the LTP.

(d) Recommends that Council

consider the value of risk reserve funded through the LTP taking into account

both debt headroom maintained in the debt to revenue ratio below LGFA funding

limits and the value of the reserve.

Carried

|

|

9.8 2024-2034

Long-Term Plan - Non-Financial Performance Measures

|

|

Staff Christine

Jones, General Manager: Strategy, Growth & Governance

Rob Lahey, Principal Strategic

Advisor

Key points

·

The Local Government Act 2002 required councils to consult on

24 Mandatory performance measures.

·

Tauranga City Council previously had consulted on 100 measures.

·

Staff had reviewed those measures and provide a sharpened focus

of measures.

·

Measures were reduced to 80 and further work on how these would

be presented was underway and would be reported back through the Long Term

Plan process.

In response to questions

·

A report on measurements would be brought to the Committee in

early 2024 prior to final adoption of the Draft Long-Term Plan 2024-2034.

Discussion points raised

·

The Committee would like to see further rationalisation of

measures and that they were produced in aformat that would allow the public

to easily see and understand the measurements based on high level outcomes

under key metrics relating to the existing pillars of the Council’s

Vision and Strategic Direction

|

|

Committee Resolution SFR5/23/10

Moved: Commissioner

Stephen Selwood

Seconded: Mr Bruce Robertson

That the Strategy, Finance and Risk Committee:

(a) Receives the report

"2024-2034 Long-Term Plan - Non-Financial Performance Measures".

(b) Approves

the draft non-financial performance measures for inclusion the Groups of

Activities section of the Long-term Plan 2024-2034 as proposed in Attachment

1 – Appendices 1-12.

(c) Recommends to Council that

Council:

(i) Adopts the draft non-financial performance measures for

inclusion in the Long-term Plan 2024-2034 (Attachment 1 – Appendices

1-12) to form part of the supporting documentation for the purpose of

public consultation for the proposed Long-term Plan 2024-2034.

(ii) Authorises

the Chief Executive to make any minor amendments to the documentation

necessary to ensure accuracy and to correct minor drafting errors.

Carried

|

|

9.9 Parking

Management Plan roll out adjustment.

|

|

Staff Nic

Johansson, General Manager: Infrastructure

Reece Wilkinson, Parking Strategy

Manager

Brendan Bisley, Manager of

Transport

Key points

·

As proposed in the parking management plan, Council was due to

roll out the next phase of changes from 1 November 2023 onwards. The reduced

number of all-day parking spaces in the city centre, disruption caused by

ongoing development and cost of living concerns among residents were seen as

barriers to the roll out of the policy.

·

There was an opportunity for Council to consider and amend the

timeframe of the roll out.

·

Transactions showed that the majority of payments were made on

Wednesday and Thursday.

Changes to extend parking to 11th Avenue in October

2023 could have unforeseen issues that may affect parking use.

·

There was a need for flexibility around parking with ongoing

road and construction work in the city centre.

In response to questions

·

Reserved parking spaces were increasing in the City as building

work was completed.

·

The Committee noted that there were still misconceptions on the

availability of parking in the City and more positive communications were

needed.

·

Further work with the Regional Council and Central Government

was needed to further investigate bus routes and fees, recovery of parking

costs and where those funds were spent.

Discussion points raised

·

Staff had initiated a stream of work that investigated options

for parking for construction workers.

|

|

Committee Resolution SFR5/23/11

Moved: Commissioner

Stephen Selwood

Seconded: Commissioner Shadrach Rolleston

That the Strategy, Finance and Risk Committee:

(a) Receives the report

"Parking Management Plan roll out adjustment.

(b) Approves the following changes

to the Parking Management Plan, to modify the implementation of parking

restrictions across the city centre fringe and wider areas in Te Papa up to

Eleventh Avenue as follows:

(i) Parking

restrictions to be introduced on First Avenue, Second Avenue West, Third

Avenue, Fourth Avenue and Mclean Street from 1 November 2023.

(ii) From

1 April 2024 paid parking will be expanded West of Cameron Road from Third

Ave until Wharepai Domain. From 1st September 2024 will see the

introduction of time restricted zones down to 11th Ave (map

showing proposed changes in below report).

Carried

|

|

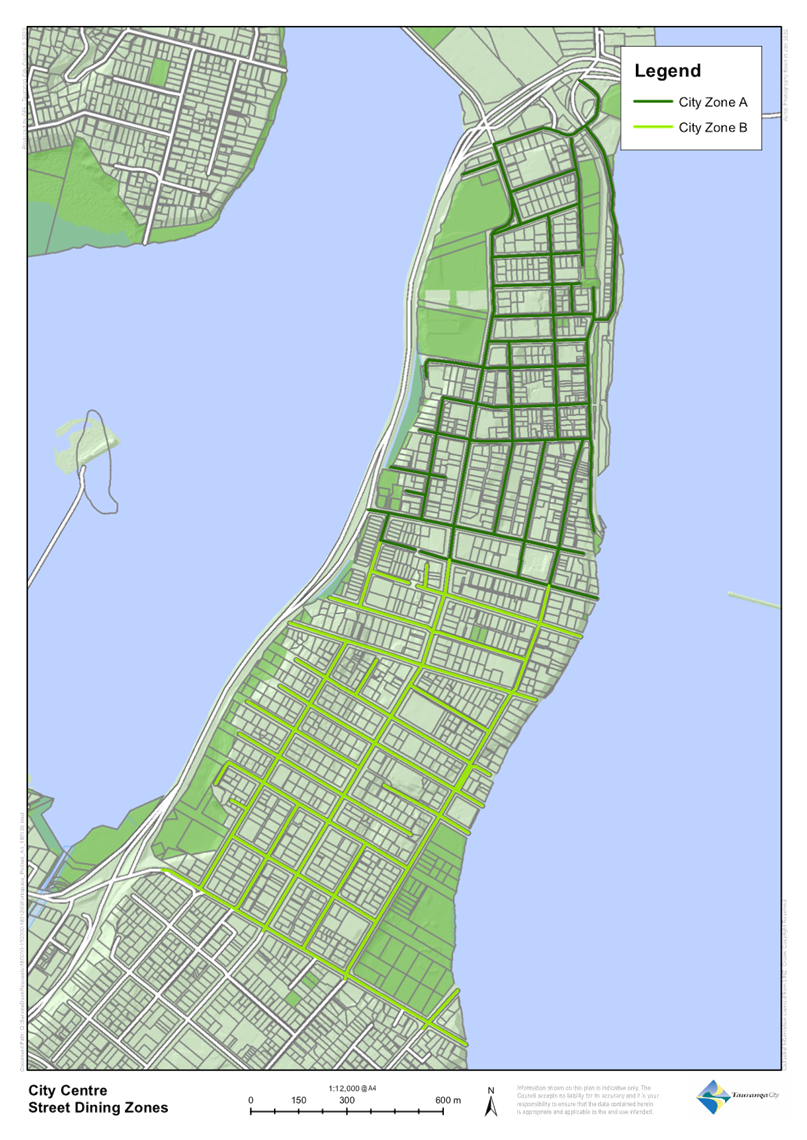

9.10 Street Use Policy

Review - Issues and Options Report

|

|

Staff Nic

Johansson, General Manager: Infrastructure

Vicky Grant-Ussher, Policy Analyst

Key points

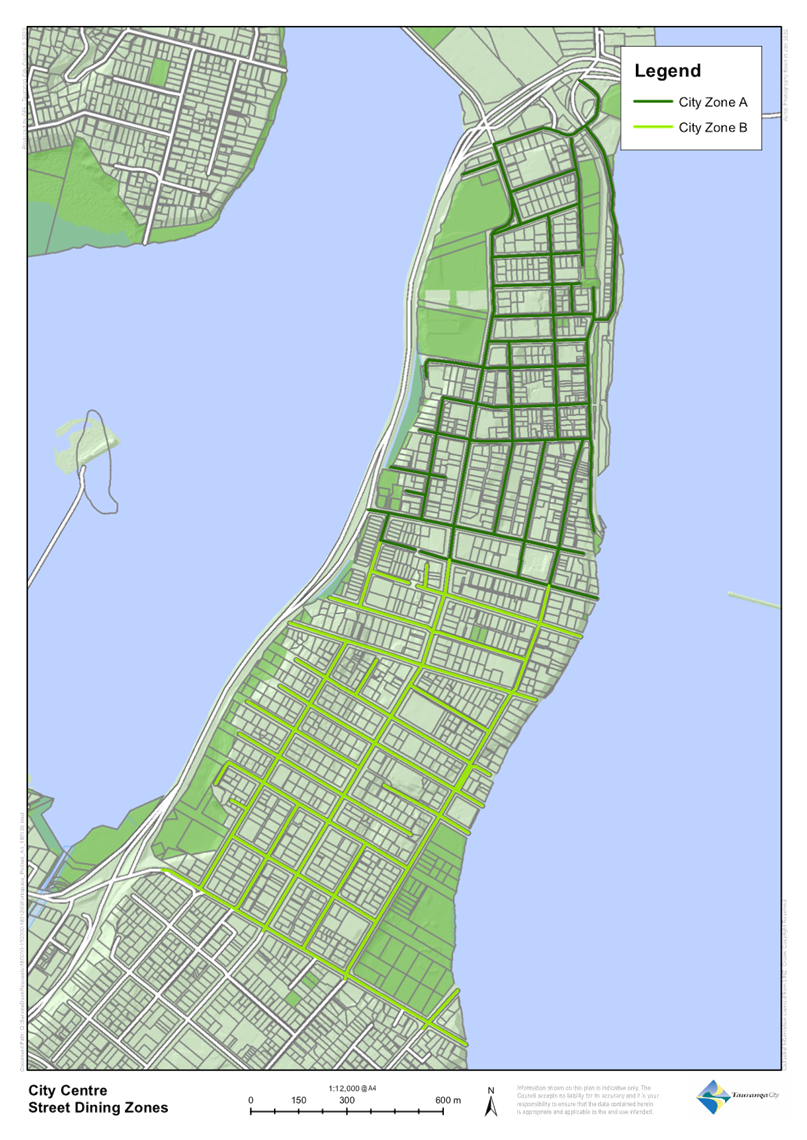

·

The review would retire old policy that was not in use and

bring together a number of policies in one place.

·

The review provided for input from both applicants and council

that used good principals and design in the streetscape.

·

Use of zones for outdoor dining including balconies.

·

Greater clarity for business owners on expectations.

In response to questions

·

The Committee was pleased to see the changes proposed allowed

for clarity for business.

·

Would like to see vaping and smoking banned in dining areas.

·

Artificial grass had issues relating to microplastics entering

the environment, was wasteful in that it needed to be replaced often (2-10

years) and then went to landfill and degraded quickly with cigarettes melting

the plastic. It did not provide the same permeability as grass and

other planting options other than grass would be preferable.

·

Balcony dining areas could be considered differently however

the commercial benefit was similar to street dining. Flexibility in the

future for road space was also a factor to be considered. Airspace could be

charged for the private benefit of balcony dining and this would be a policy

decision and there was discretion on postponing the introduction of this

charge.

·

Feedback on smoking and vaping free requirements would be

discussed with businesses and brought back to the Committee.

Discussion points raised

·

The Committee directed staff to contact the Main Streets

Association to discuss the proposed policy, and that staff provide the

Committee with further information on the proposal in relation to balcony

areas of establishments.

|

|

Committee Resolution SFR5/23/12

Moved: Commissioner

Stephen Selwood

Seconded: Commissioner Shadrach Rolleston

That the Strategy, Finance and Risk Committee:

(a) Receives the report

"Street Use Policy Review - Issues and Options Report".

(b) Gives direction on the

following issues to inform the creation of a combined street policy:

Issue One: Principles of the policy

(i) Include the proposed

tailored policy principles (outlined in Attachment One).

Issue Two: Inconsistent charging for street and

balcony dining

(ii) Include eligibility

criteria for a temporary reduction in street dining fees.

(iii) Include zoned dining

charges for street dining.

(iv) Include aligned charges for

balcony dining and street dining.

Issue

Three: Compliance issues

(v) Require application fees

reflective of the costs of inspection and administration and require bonds to

cover potential remediation that could be required from private or commercial

users of the street.

(vi) Waive application fees and bonds

where an activity is a community activity or has a primarily community

benefit.

(vii) Do not require design features

or verandas approved by council to have a lease or licence to occupy, and do

not require ongoing fees.

Issue

Four: Accessibility

(viii) Progress accessibility improvements

through a working group made up of council, businesses, disability

representatives, mainstreet associations, and community members.

Issue

Five: Other matters

(ix) Include a reference to street

dining aesthetics and design guidelines in the policy.

(x) Include smoke-free and

vape-free requirement for new licences or leases for street dining.

(xi) Include information on vehicle

crossing relocations in the policy.

(xii) Do not permit artificial grass

in the policy.

Carried

|

|

9.11 Water Services Reform

Update

|

|

Staff Nic

Johansson, General Manager: Infrastructure

Diane Bussey, Contractor - Three Water

Reforms

Cathy Davidson Manager: Directorate Services

Key points

·

A high level of uncertainty around the requirements and

expectations of council around water reform still existed.

·

The submission from the Council to Government on Water Reform

was prepared in a short timeframe at a high level only given the information

available.

·

Ongoing work included consultation with Te Rangapū Mana

Whenua o Tauranga Moana on an issue-by-issue basis, The work was still guided

by the original intent of the legislation until such time as more information

was released from Central Government.

·

Transition matters had been handed to the Department of

Internal Affairs from Central Government. This had created extra time for

information to be received by Council.

In response to questions

·

Council would continue to work with other councils that had

expressed support of its submission.

Discussion points raised

·

Commissioners, and following the end of their term in office

Councillors, would continue to work with the Minister responsible for

transition to Three Waters and local Members of Parliament to ensure that a

clear understanding of the issues facing the region, including the cost and

financing expected from Council in relation to this transition.

·

Given the existing uncertainties work with neighbouring

councils was essential.

|

|

Committee Resolution SFR5/23/13

Moved: Mr

Bruce Robertson

Seconded: Dr Wayne Beilby

That the Strategy, Finance and Risk Committee:

(a) Receives the report

"Water Services Reform Update".

(b) Notes that a joint

submission on the Water Services Entities Amendment Bill was submitted on 5

July 2023 (Joint between TCC and Te Rangapu).

(c) Endorses the Water Services

Reform project team to continue with the next steps, summarised as follows: -

(i) Engage with the

remaining legislative processes for Water Services Reform, with relevant

communication and engagement activities,

(ii) Completion of outstanding

deliverables, per National Transition Unit (NTU) advice, and revise

transition planning for reforms, once the establishment date for Entity C and

regional transition approach have been confirmed.

Carried

|

|

9.12 2023 Q4 Apr-June Health

and Safety Report

|

|

Staff Alastair

McNeil, General Manager: Corporate Services

Darren West, Health, Safety

& Wellbeing Manager

Key points

·

The report was taken as read.

In response to questions

·

Work had been finished on contracts and standards, that allowed

a start to finish process of expectations, health and safety training and

site management with contractors completing Council work.

·

This would feed into procurement processes.

·

There was still a level of concern at disorder incidents in

library spaces Council had been proactive in engagement with local Community

Constables and Human Resources business partners that resulted in library

staff expressing that they felt supported.

·

Animal Control staff had been equipped with body cameras for

safety.

Discussion points raised

·

From the 2019 Policy Review the only outstanding issue was

completion of the Drug and Alcohol Policy.

·

Data used in reporting could not be shared with other bodies

given its sensitive nature or that it was related to the procurement process.

·

Staff had worked proactively to facilitate the provision of

monthly reports to the Committee.

|

|

Committee Resolution SFR5/23/14

Moved: Commissioner

Stephen Selwood

Seconded: Ms Rohario Murray

That the Strategy, Finance and Risk Committee:

(a) Receives the report

"2023 Q4 Apr-June Health and Safety Report".

Carried

|

|

9.13 LGOIMA and Privacy

Annual Report and Q4 for 2022/2023 year

|

|

Staff Christine

Jones, General Manager: Strategy, Growth & Governance

Kath Norris: Team Leader,

Democracy Services

Key points

·

A good year had been had for the team, there had been a steady

increase in information requests, those were seen to relate to construction

work in the city and health and safety issues.

·

The marked increase in requests during March 2023 was

determined to be in relation to requests regarding extreme weather events and

by requests from the Tax Payers Union for their annual reporting.

·

The Ombudsman had no questions of Council.

In response to questions

·

No questions were asked by the Committee

Discussion points raised

·

No points raised by the Committee.

|

|

Committee Resolution SFR5/23/15

Moved: Mr

Bruce Robertson

Seconded: Dr Wayne Beilby

That the Strategy, Finance and Risk Committee:

(a) Receives the report

“LGOIMA and Privacy Annual Report and Q4 for 2022/2023 year.

Carried

|

10 Discussion

of late items

Nil

11 Public

excluded session

Resolution to exclude the public

|

Committee Resolution SFR5/23/16

Moved: Commissioner

Stephen Selwood

Seconded: Ms Rohario Murray

That the public be excluded from the following parts of

the proceedings of this meeting.

The general subject matter of each matter to be considered

while the public is excluded, the reason for passing this resolution in

relation to each matter, and the specific grounds under section 48 of the

Local Government Official Information and Meetings Act 1987 for the passing

of this resolution are as follows:

|

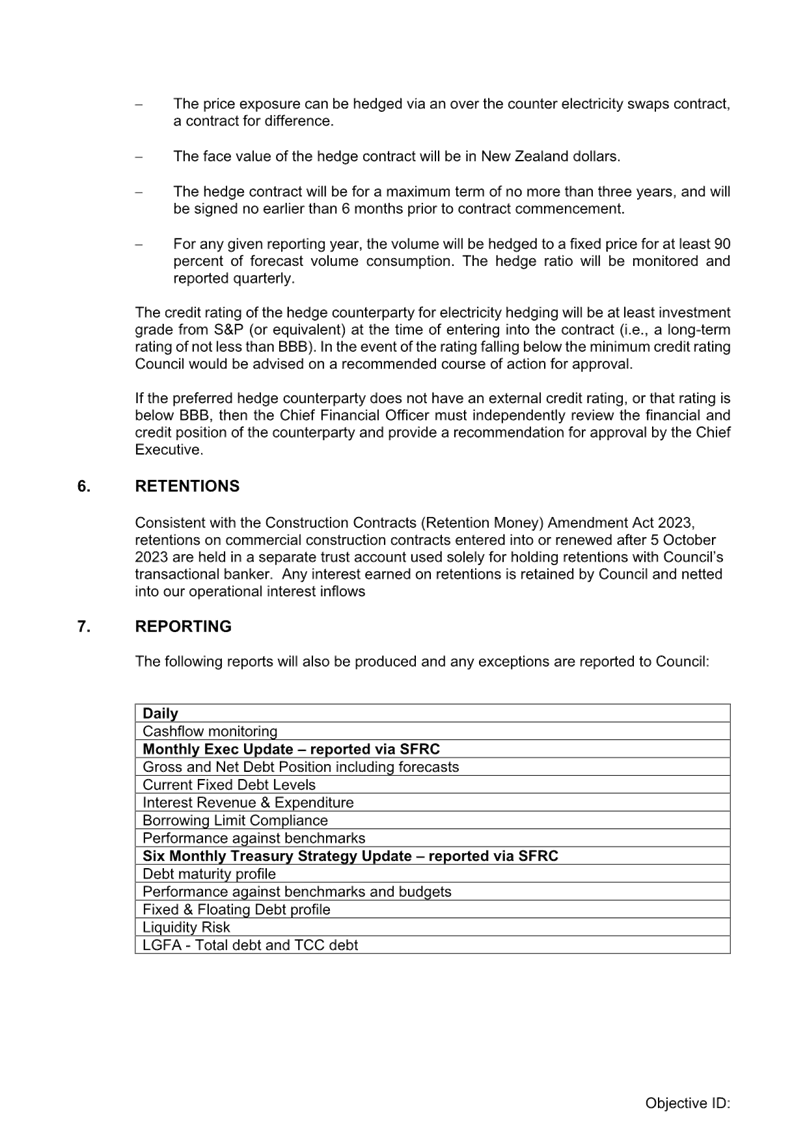

General subject of each matter to be considered

|

Reason for passing this resolution in relation to each

matter

|

Ground(s) under section 48 for the passing of this

resolution

|

|

11.1 - Corporate Risk Register - Quarterly Update

|

s7(2)(b)(i)

- The withholding of the information is necessary to protect information

where the making available of the information would disclose a trade secret

s7(2)(b)(ii)

- The withholding of the information is necessary to protect information

where the making available of the information would be likely unreasonably

to prejudice the commercial position of the person who supplied or who is

the subject of the information

s7(2)(h)

- The withholding of the information is necessary to enable Council to

carry out, without prejudice or disadvantage, commercial activities

s7(2)(i)

- The withholding of the information is necessary to enable Council to

carry on, without prejudice or disadvantage, negotiations (including

commercial and industrial negotiations)

|

s48(1)(a)

- the public conduct of the relevant part of the proceedings of the meeting

would be likely to result in the disclosure of information for which good

reason for withholding would exist under section 6 or section 7

|

|

11.2 - Internal Audit & Assurance - Quarterly

Update

|

s6(b)

- The making available of the information would be likely to endanger the

safety of any person

s7(2)(a)

- The withholding of the information is necessary to protect the privacy of

natural persons, including that of deceased natural persons

s7(2)(d)

- The withholding of the information is necessary to avoid prejudice to

measures protecting the health or safety of members of the public

s7(2)(g)

- The withholding of the information is necessary to maintain legal

professional privilege

s7(2)(j)

- The withholding of the information is necessary to prevent the disclosure

or use of official information for improper gain or improper advantage

|

s48(1)(a)

- the public conduct of the relevant part of the proceedings of the meeting

would be likely to result in the disclosure of information for which good

reason for withholding would exist under section 6 or section 7

|

Carried

|

12 Closing

karakia

Commissioner Shadrach Rolleston closed the meeting with a

karakia.

Resolutions transferred into the open section of

the meeting after discussion

Item 11.1 Corporate Risk

Register - Quarterly Update report

Committee Resolution SFR5/23/17

Moved: Mr

Bruce Robertson

Seconded: Dr Wayne Beilby

That the Strategy, Finance and Risk Committee:

(a) Receives the Corporate Risk

Register - Quarterly Update report.

(b) Transfers this report and

attachments to open at the conclusion of this meeting.

Item 11.2 Audit & Assurance quarterly update report

Committee Resolution SFR5/23/18

Moved: Mr

Bruce Robertson

Seconded: Commissioner Stephen Selwood

That the Strategy, Finance and Risk Committee:

(a) Receives

the Audit & Assurance quarterly update report.

(b) Transfers

this report to open at the conclusion of this meeting.

(c) Retains

the Attachments (Unexpected failure of a critical infrastructure asset) as

confidential to prevent the disclosure or use of official information for

improper gain or improper advantage.

The meeting closed at 2.25pm.

The minutes of this meeting were confirmed as a true and

correct record at the Strategy, Finance and Risk Committee meeting held on 18

September 2023.

...................................................

CHAIRPERSON

|

Strategy,

Finance and Risk Committee meeting Agenda

|

18

September 2023

|

9 Business

9.1 2022/23

Interim Audit Report

File

Number: A14851336

Author: Sheree

Covell, Treasury & Financial Compliance Manager

Marin Gabric, Senior

Financial Accountant (Compliance & External Reporting)

Authoriser: Paul

Davidson, Chief Financial Officer

Purpose of the Report

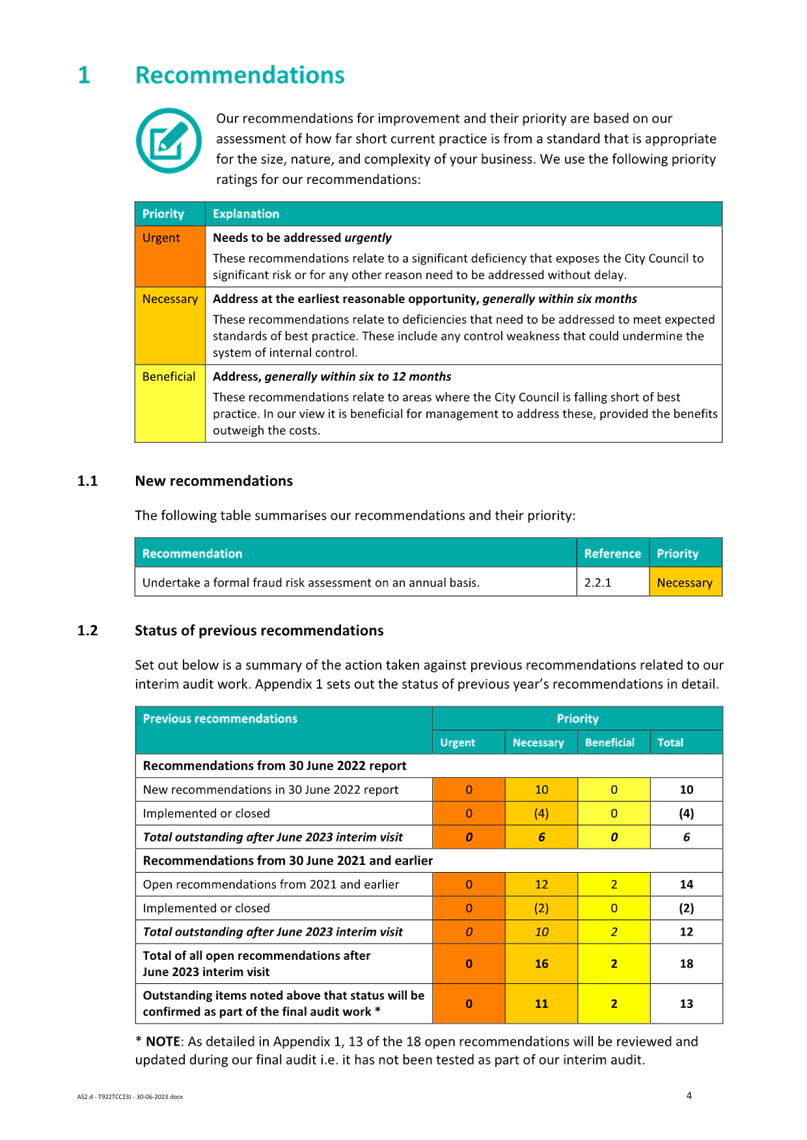

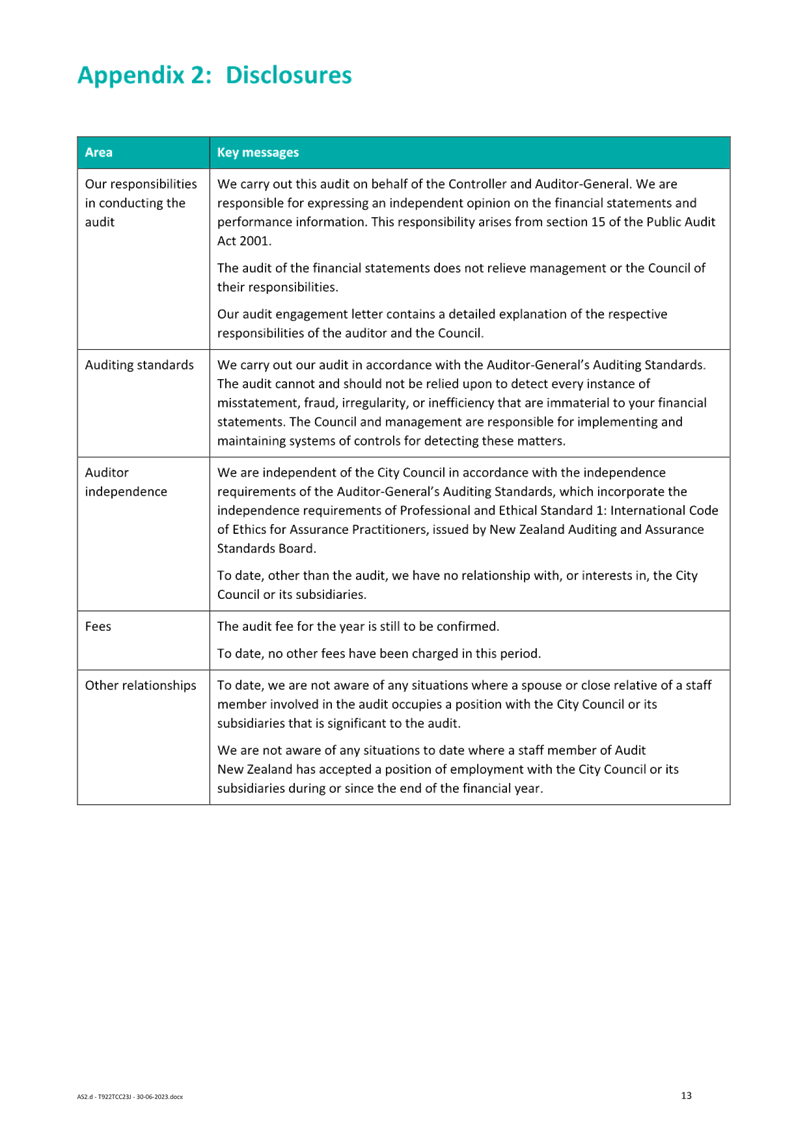

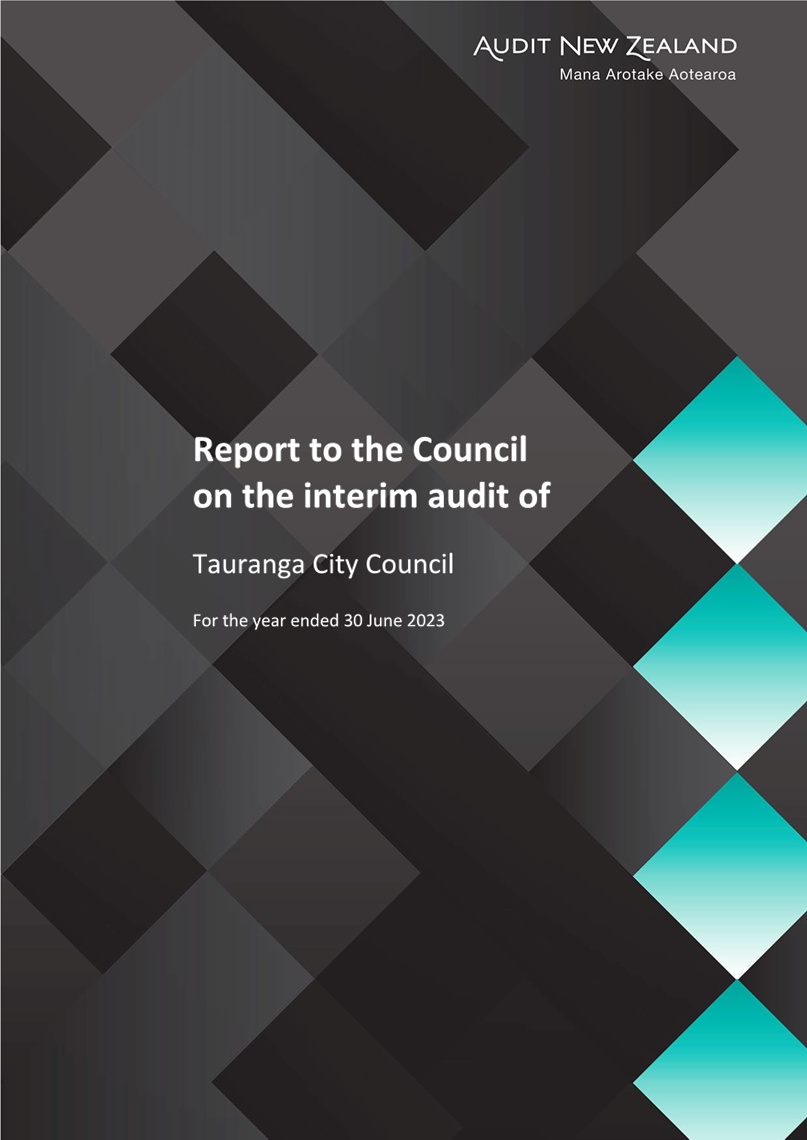

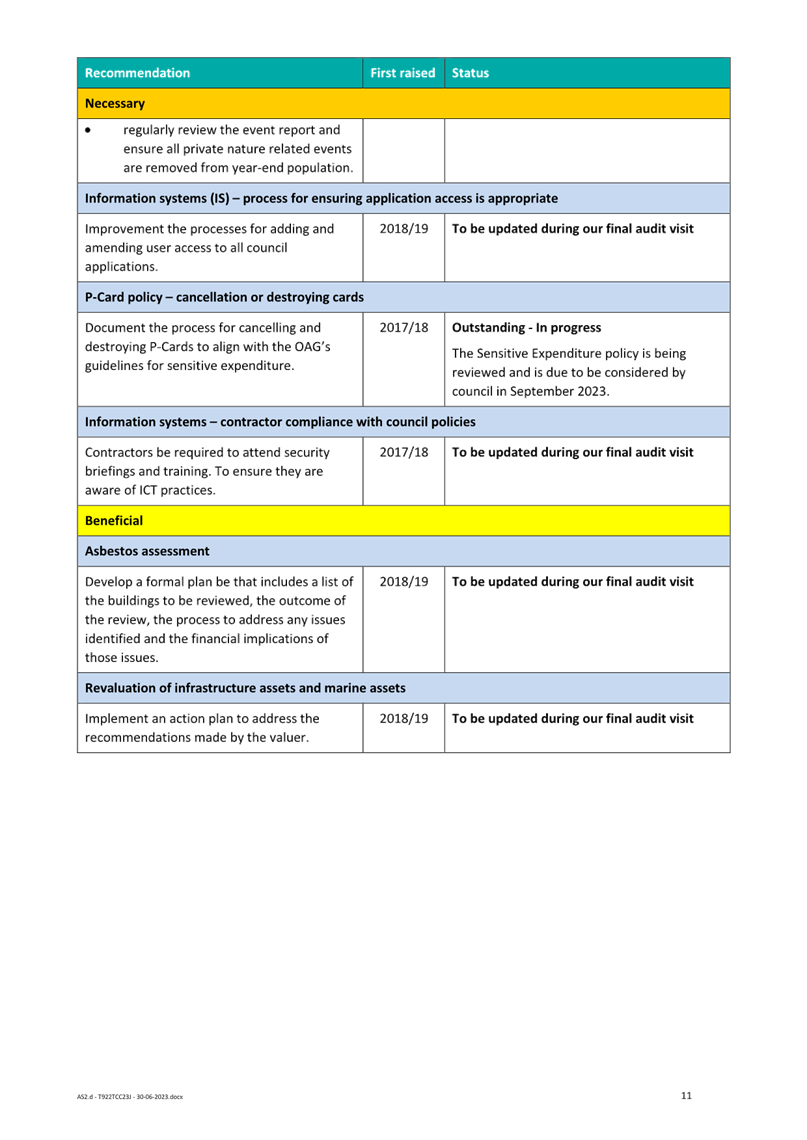

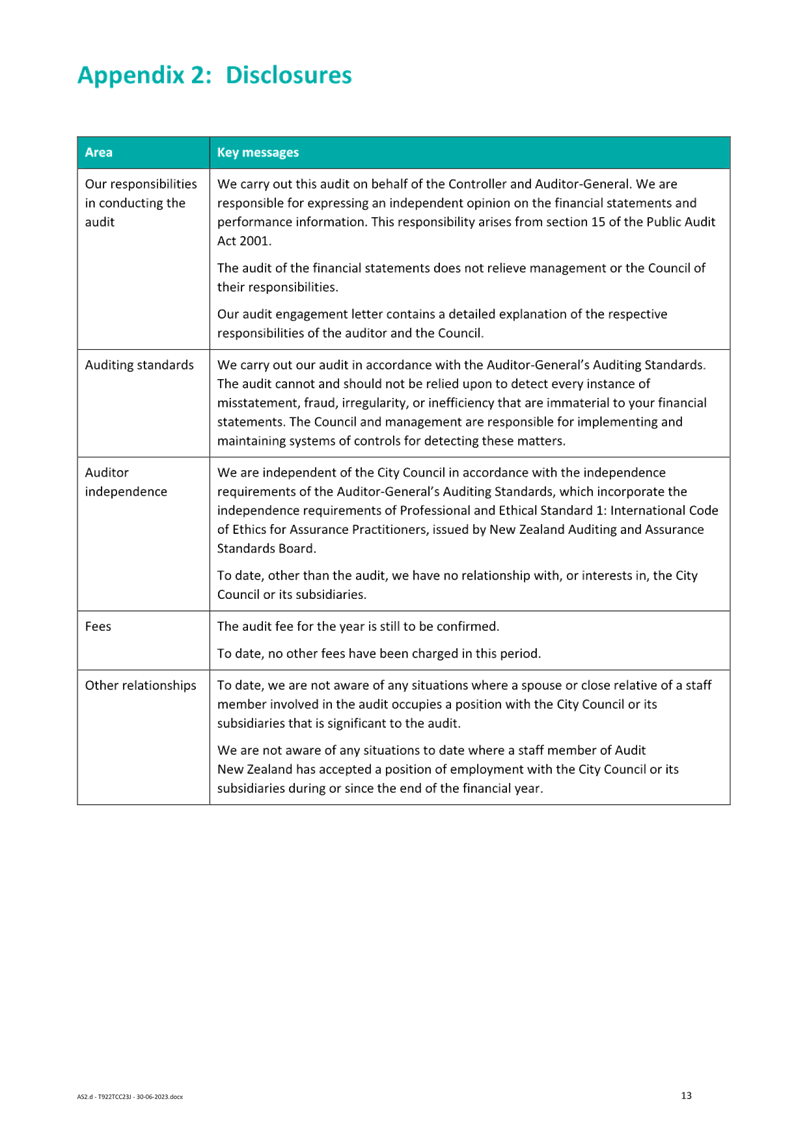

1. This report

presents Audit New Zealand’s report to Council following the interim

phase of the annual Council audit for 2022/23.

|

Recommendations

That the Strategy,

Finance and Risk Committee:

(a) Receives the

report "2022/23 Interim Audit Report".

(b) Note the recommendations

contained within the report to Council by Audit New Zealand, including

recommendations from the previous audit.

(c) Notes the

management responses and support on going implementation of improvements as

required.

|

Executive Summary

2. This report

presents Audit New Zealand’s report to Council following the interim

phase of the annual Council audit for 2022/23.

3. The interim

audit phase was focused on the assessment of Council’s control

environment and review of a number of prior year audit recommendations.

There is one new recommendation and six resolved recommendations. The

attached report includes management responses to the recommendations.

Strategic / Statutory Context

4. The audit

process helps build trust in Council’s systems and processes for service

provision, management control and financial accountability. The audit of

Council’s systems and Annual Report is a key element of Council’s

accountability to the community.

Background

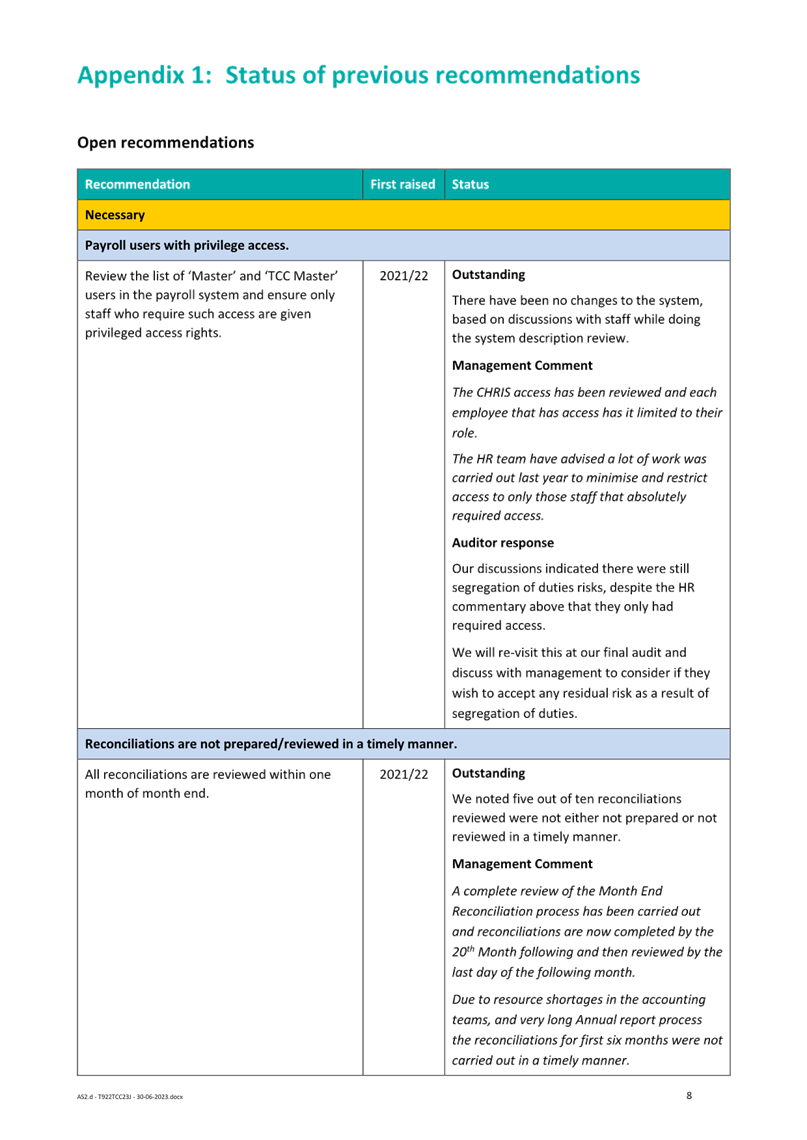

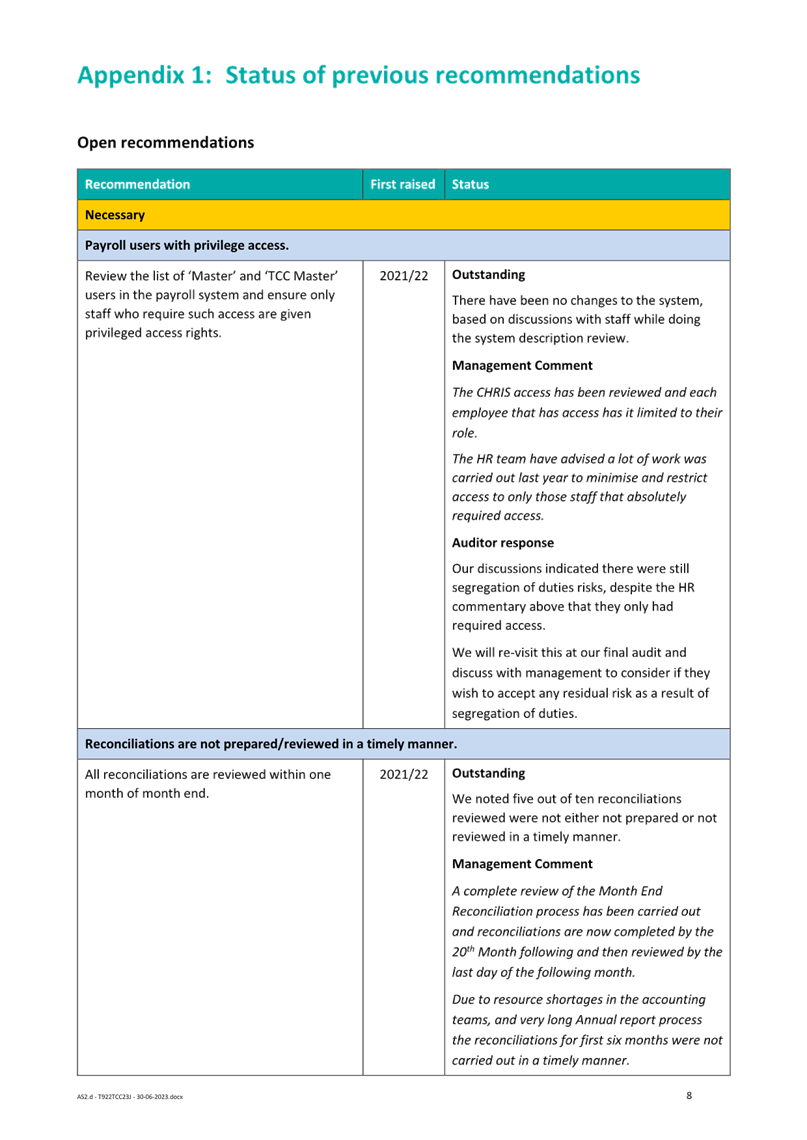

5. Prior to

the interim audit there were 24 open recommendations for council to

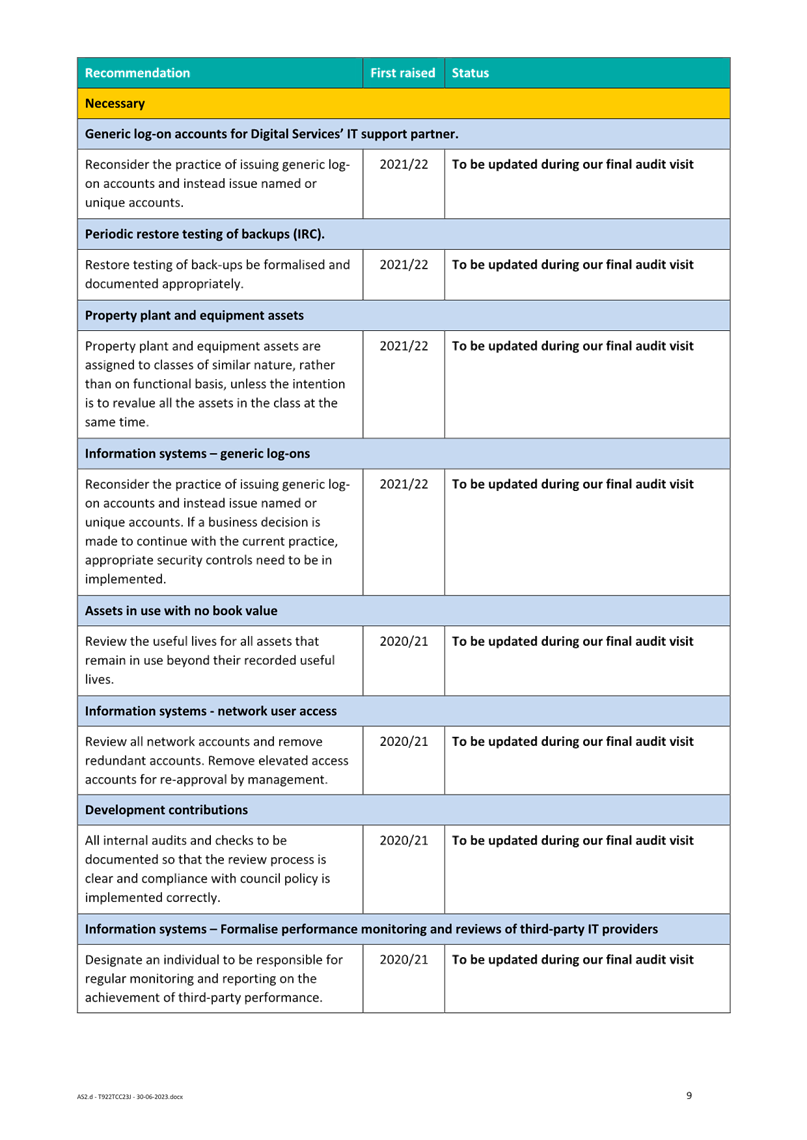

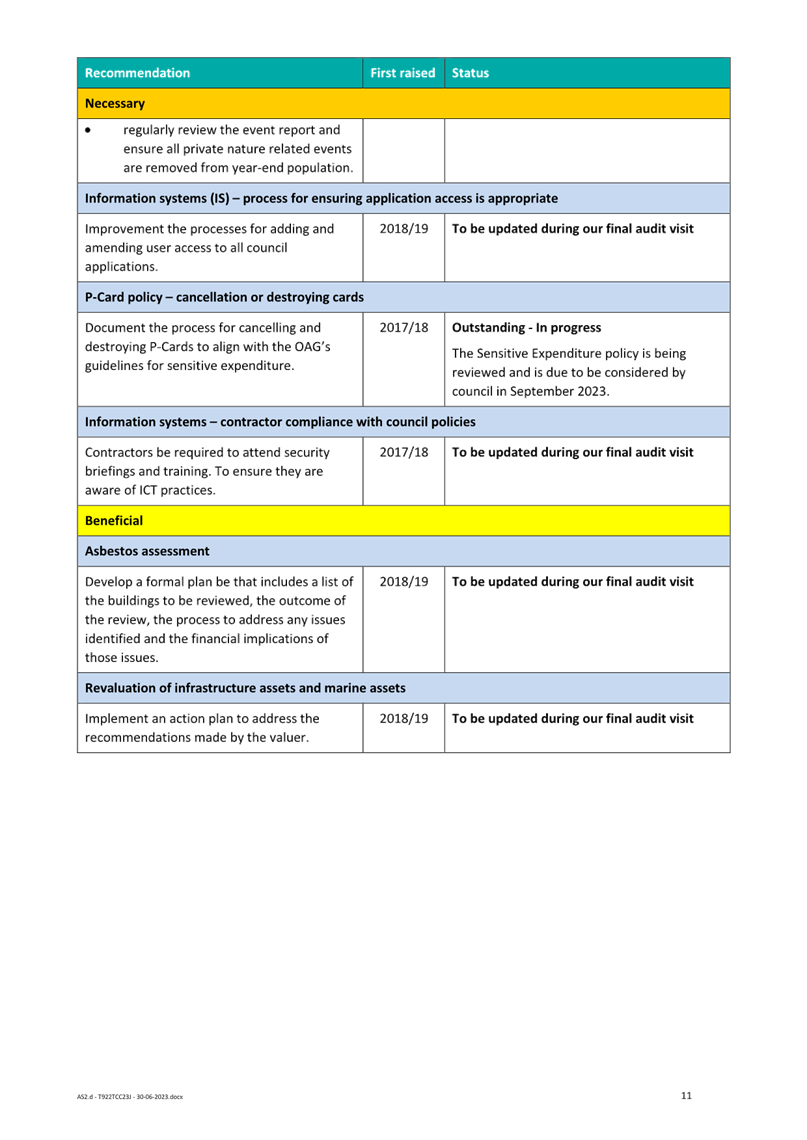

address. Audit New Zealand focused on 11 of these outstanding matters

during the interim audit, six have been closed and the five that were not

closed have been addressed below. There are a further 13 matters

that were not reviewed during the interim audit and will be reviewed at the

final. There is also one new item.

6. The five

matters that were reviewed and not closed during the interim audit are listed

below along with the business area responsible. TCC’s management

comment and audit’s responses are available on pages 8-11 of the

attachment.

· Access

to payroll systems (Human Resources)

· Timing

and review of reconciliations (Finance)

· Clearing

of suspense accounts (Finance)

· Completeness

of Interests Register (Risk)

· P-

Card Policy – cancellation or destroying cards (Finance)

7. Staff have been working on

improvements on the above open items and will

continue to work with audit NZ to clear these matters.

8. The new item relates to annual fraud risk

assessments which staff have responded to on page 6 of the attachment.

9. The 13 matters that remain open and have not

been reviewed by audit cover business areas in digital, finance, waters and

policy. The Council Financial Compliance and Risk teams are working with relevant

staff across the organisation to address the remaining open matters and expect

the majority to be closed once reviewed by audit.

10. The Audit New Zealand report includes Council’s

response to the issues raised and the actions that will be taken.

11. A representative of Audit New Zealand will attend the

meeting to discuss the report as necessary.

NEXT STEPS

12. The audit is expected to be finalised and the Annual

Report adopted on 27 November 2023. The final audit management report

will be received after that time and presented at the first SFR Committee

available.

Significance

13. The audit of

Council’s Annual Report is a significant element of Council’s

accountability to the community. However, in terms of the significance

and engagement policy, the interim audit and the subsequent report received is

of low significance and community engagement is not planned.

Significance

1.

The audit is expected to be finalised and the Annual Report

adopted on 27 November 2023. The final audit management report will be

received after that time and presented to this committee.

Attachments

1. TCC

- Final Interim Report to Council (23J) - A14986695 ⇩

|

Strategy,

Finance and Risk Committee meeting Agenda

|

18

September 2023

|

|

Strategy,

Finance and Risk Committee meeting Agenda

|

18

September 2023

|

9.2 Treasury

Policy Review

File

Number: A14721343

Author: Sheree

Covell, Treasury & Financial Compliance Manager

Authoriser: Paul

Davidson, Chief Financial Officer

Purpose of the Report

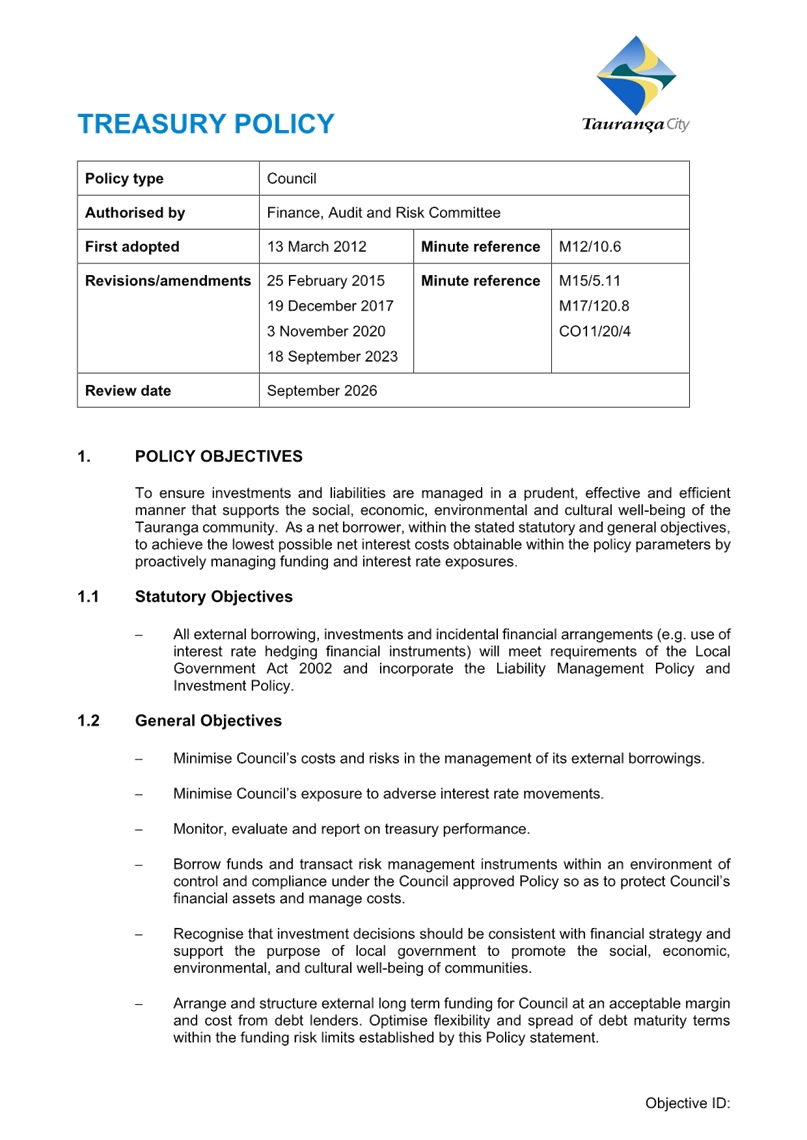

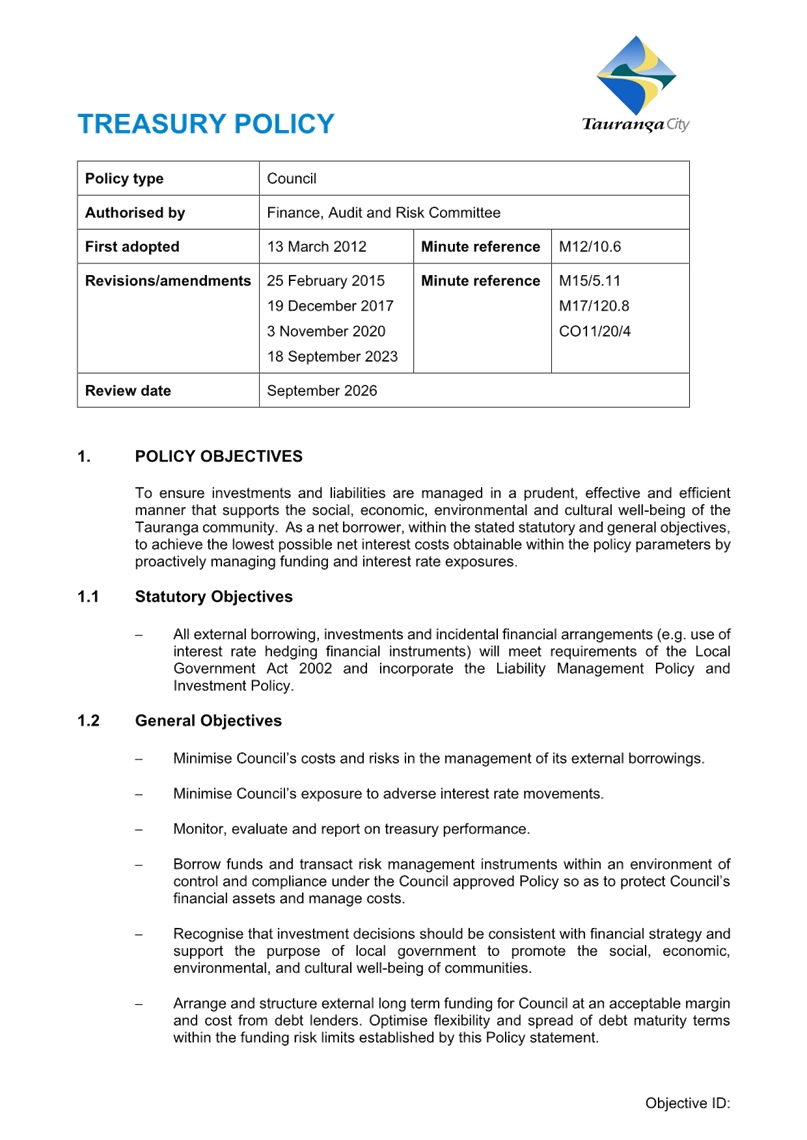

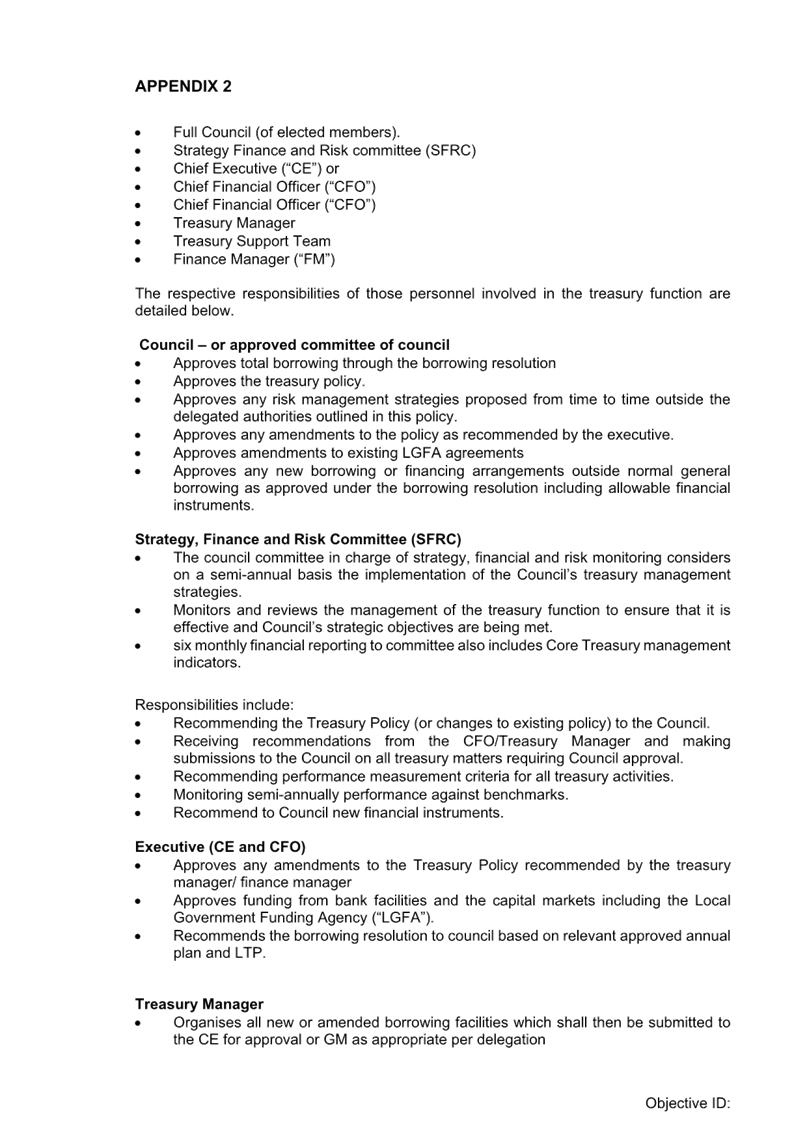

1. This report seeks

approval for the proposed Treasury Policy amendments.

|

Recommendations

That the Strategy,

Finance and Risk Committee:

(a) Receives the report

"Treasury Policy Review".

(b) Adopt the amended Treasury

Policy

|

Executive Summary

2. Section 8 of the

Treasury Policy requires review on a triennial basis. Bancorp Treasury

Services Limited was engaged to perform this formal review. This report

outlines the amendments to the Treasury Policy as recommended by Bancorp.

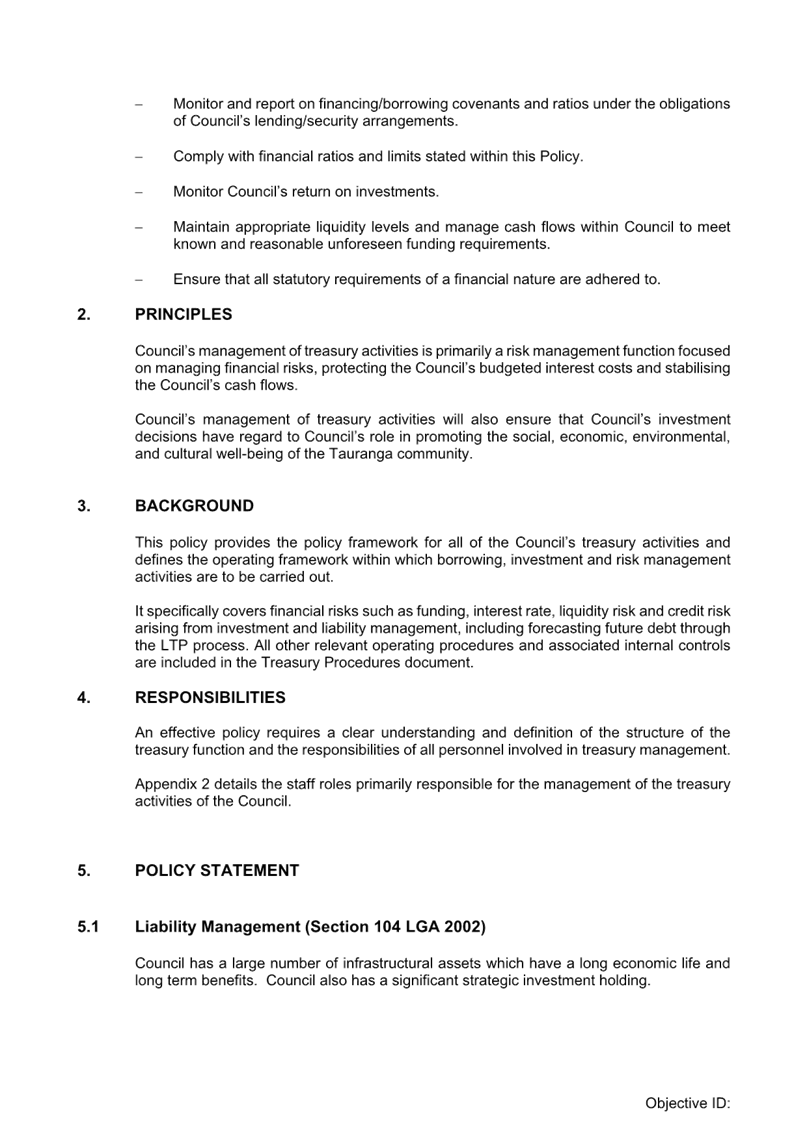

Background

3. The Treasury Policy

objective is to ensure that investments and liabilities (treasury risks) are

managed in a prudent, effective and efficient manner, as well as ensuring that

all external borrowing, investments and incidental financial arrangements meet

the requirements of the Local Government Act 2002. The Treasury Policy

sets the treasury operational risk framework. The policy was last

reviewed as part of the Long Term Plan 2021-2031 in November 2020.

4. The Treasury Policy is

required to be formally reviewed on a triennial basis under section 8 of the

policy.

5. There are a number of

proposed changes to better align with current market operational practice,

recognise the new interest rate environment and the increasing size of

Council’s balance sheet.

6. Key changes to the

Treasury Policy relate to:

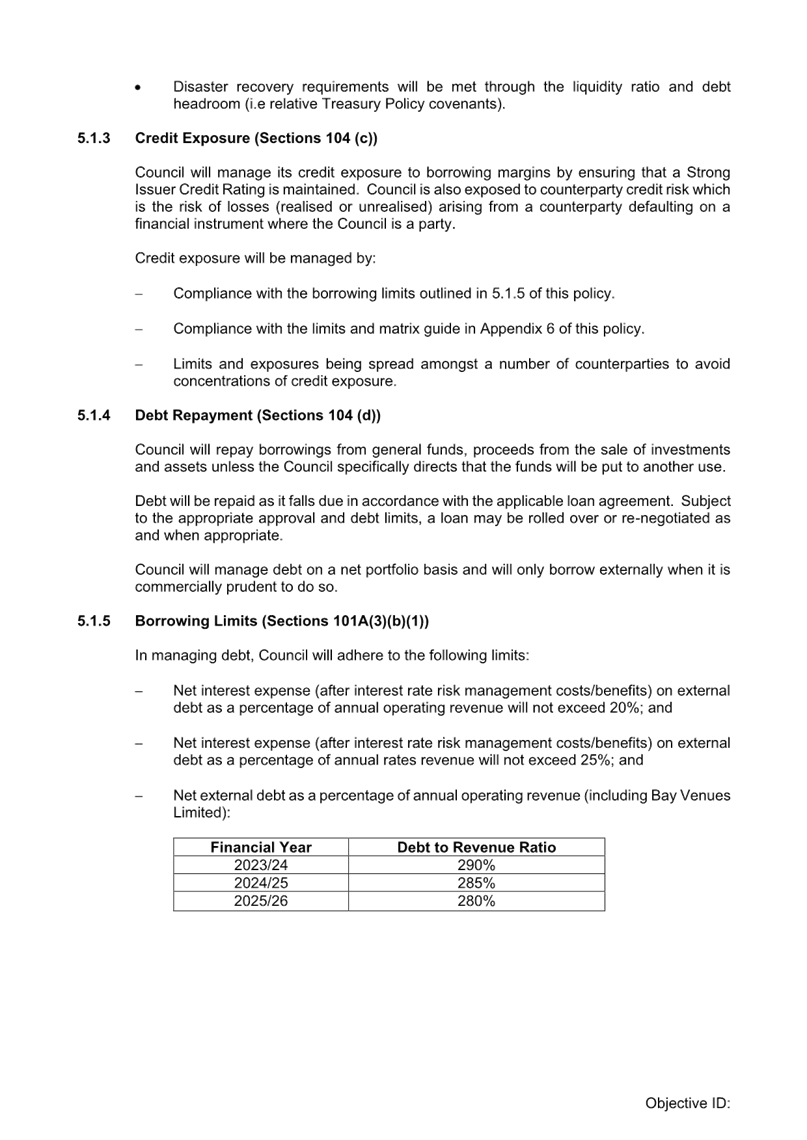

(a) Interest Rate Exposure

(b) Liquidity

(c) Borrowing

(d) Investing

(e) Reporting

(f) Instruments

(g) Delegations

(h) Borrowing Resolution

(i) Retentions

7. The changes are outlined

below:

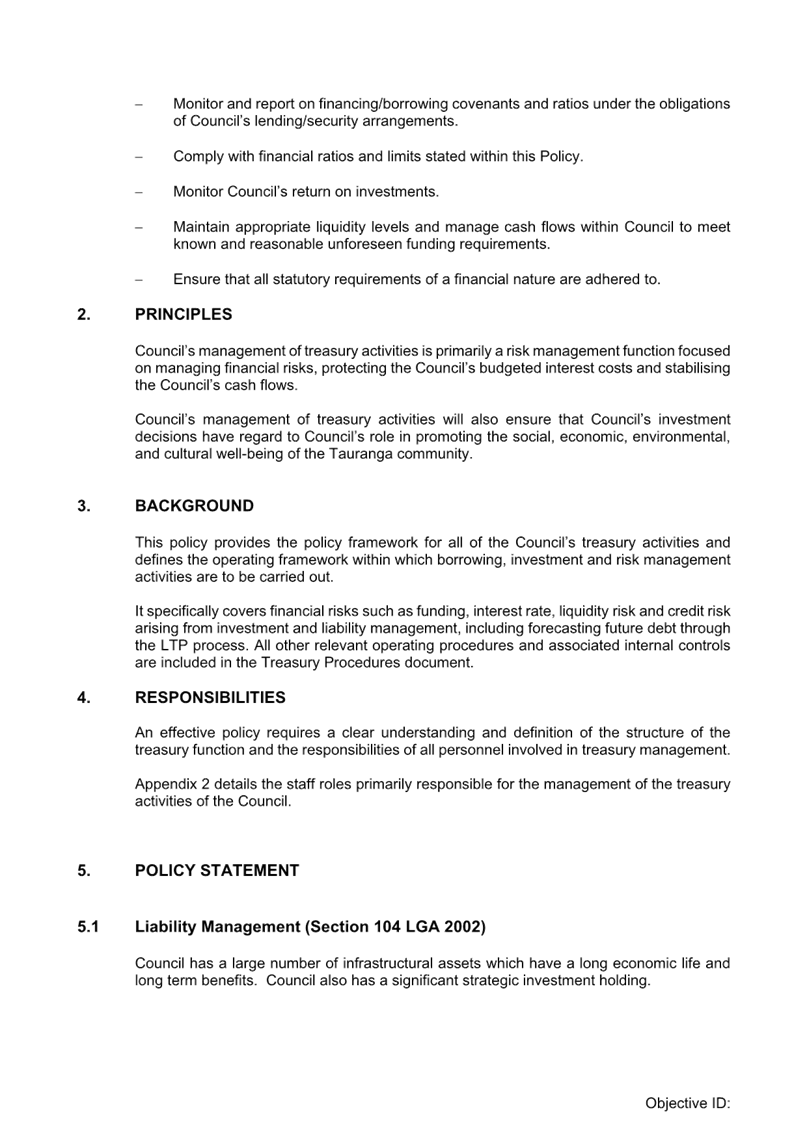

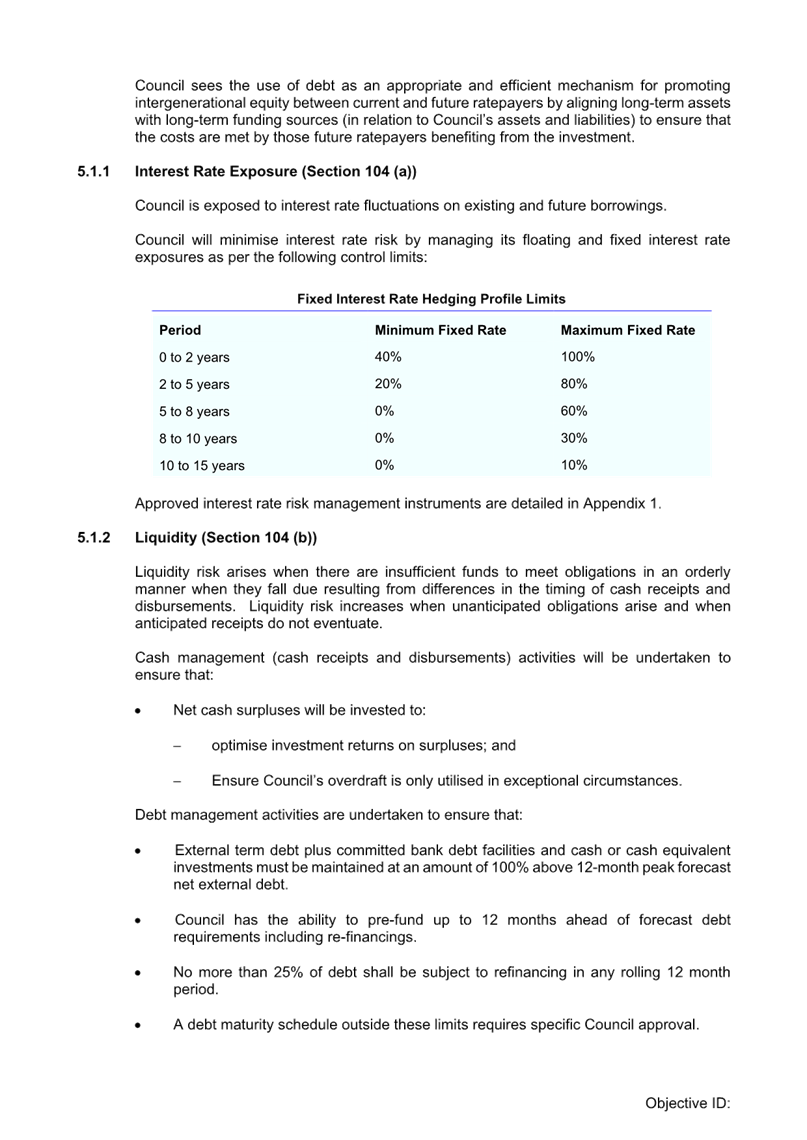

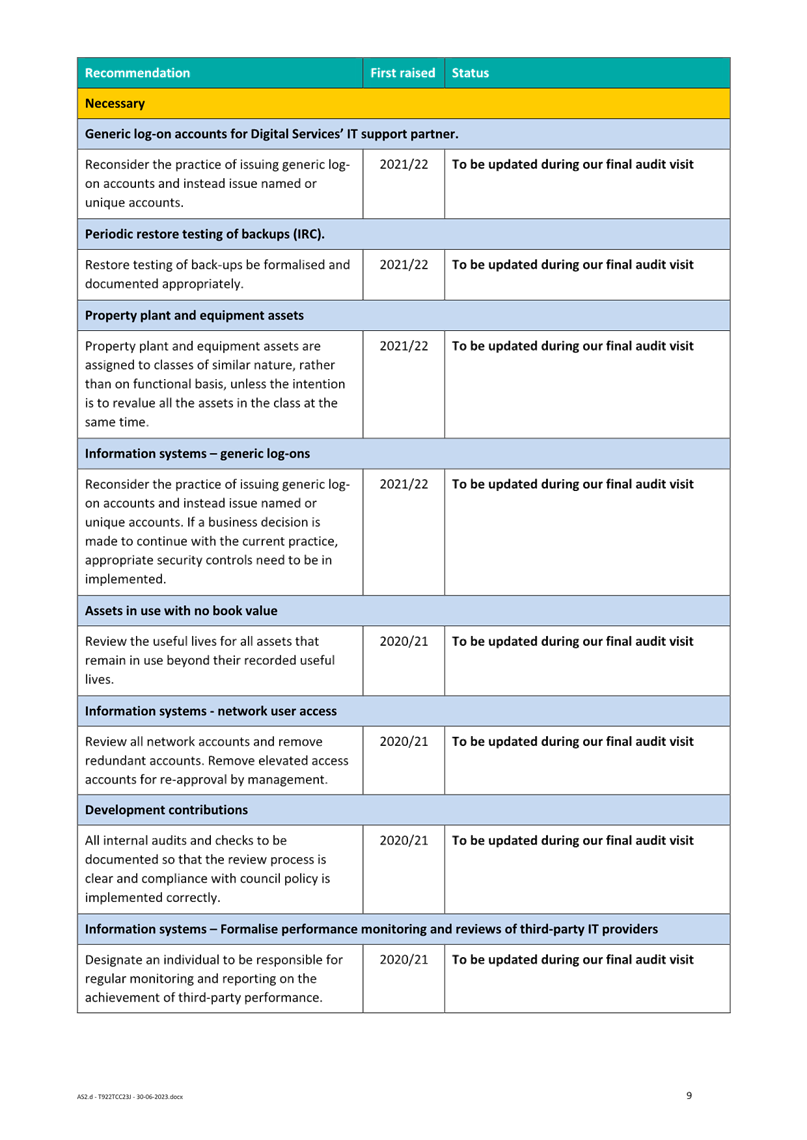

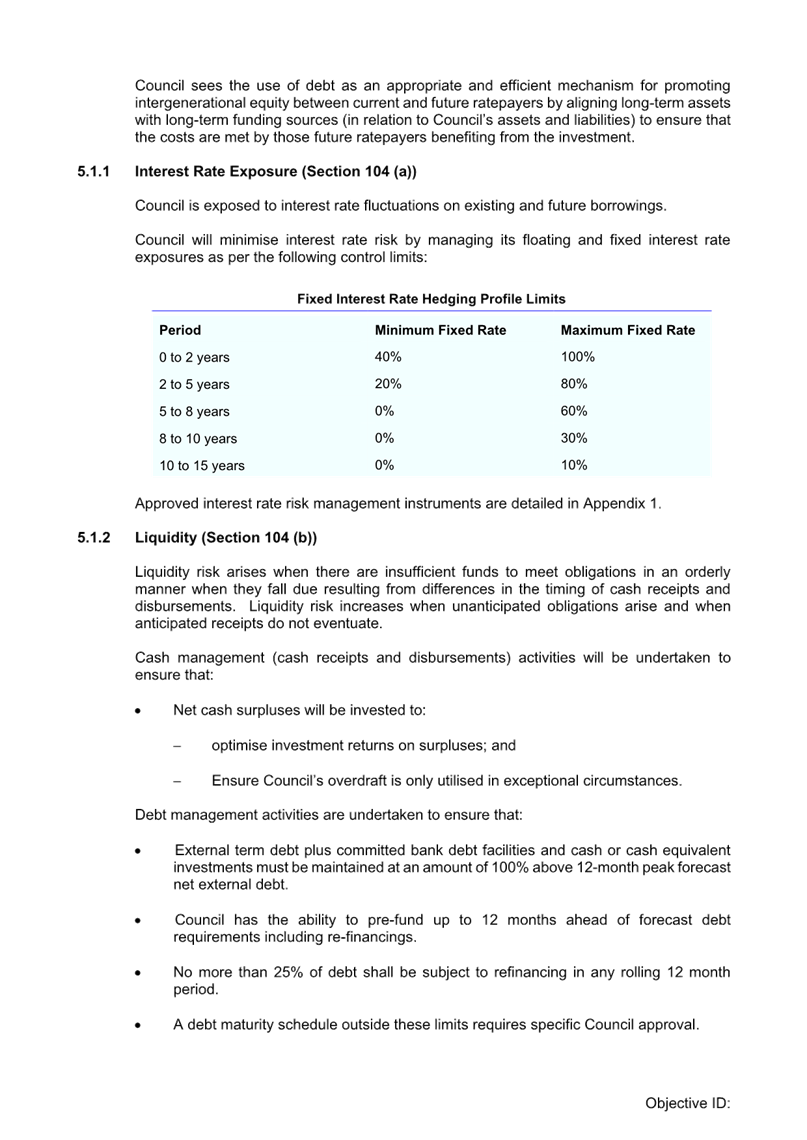

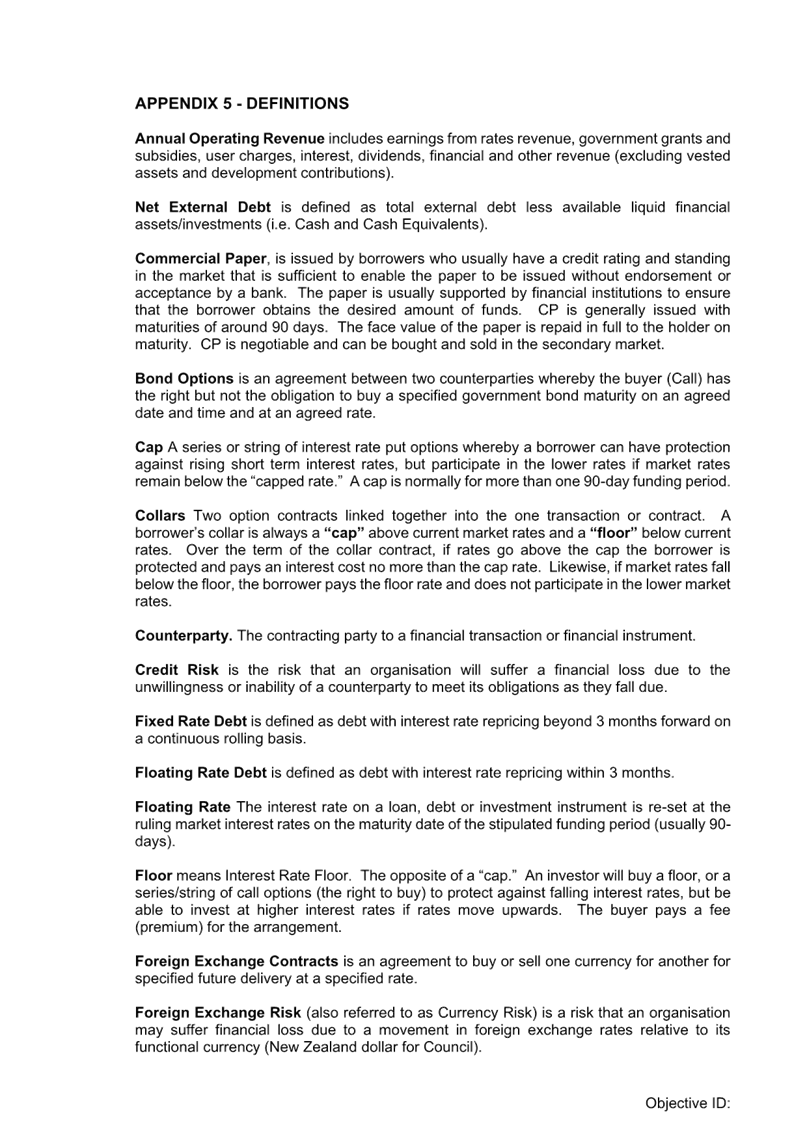

Interest

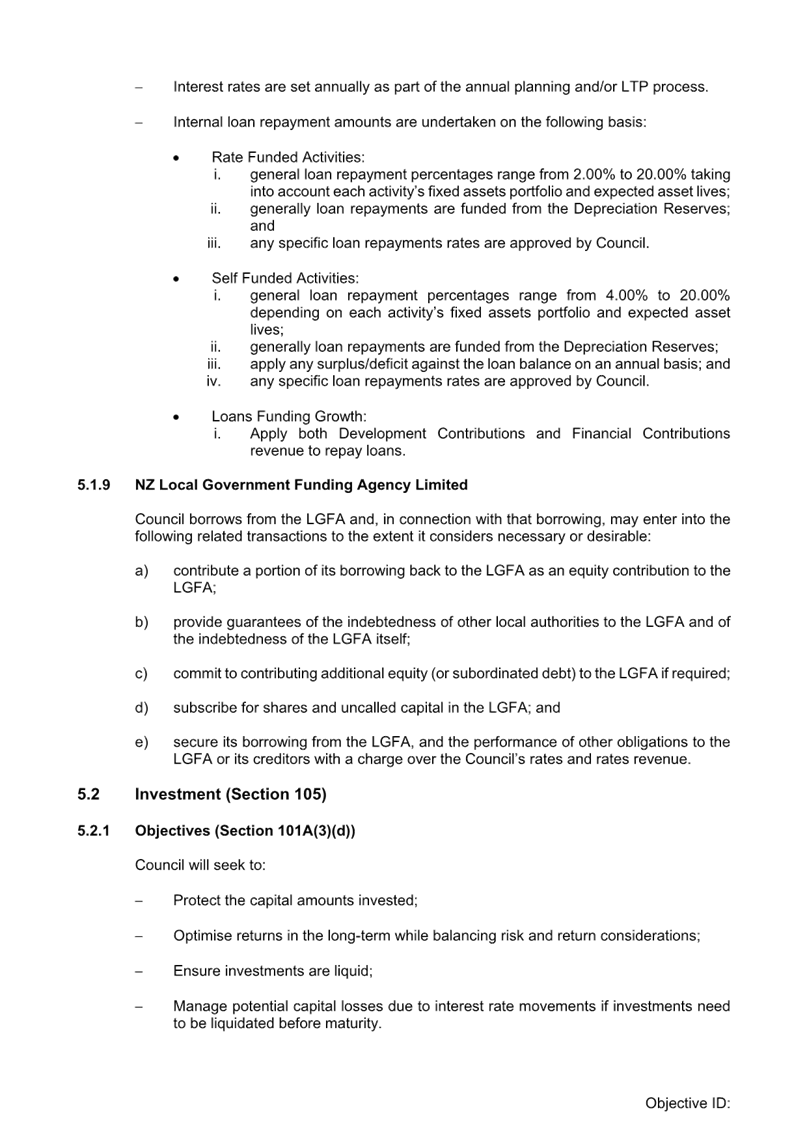

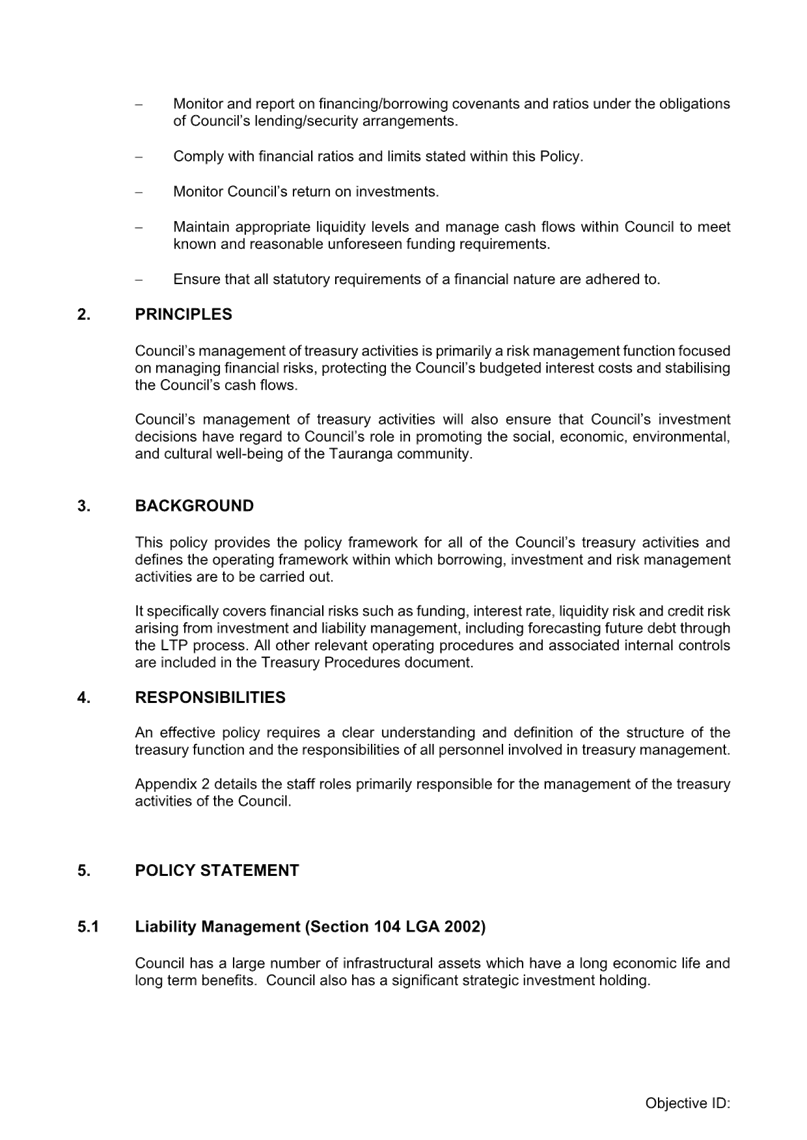

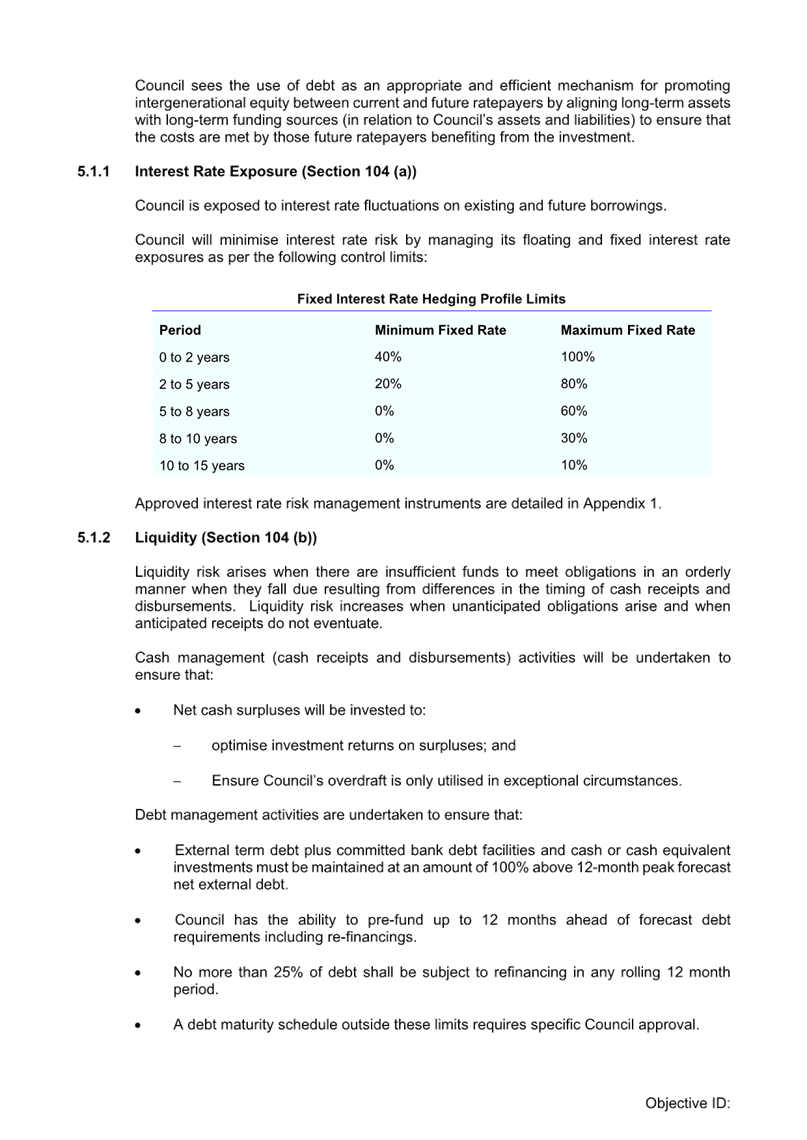

Rate Exposure (Section 5.1.1)

8. It is proposed to revise

the fixed interest rate hedging time bands from 12 years to 15 years. The

extended time band allows council to utilise all LGFA fixed term maturities and

aligns to the significant investment in long life infrastructure assets

(25 to 100 years).

|

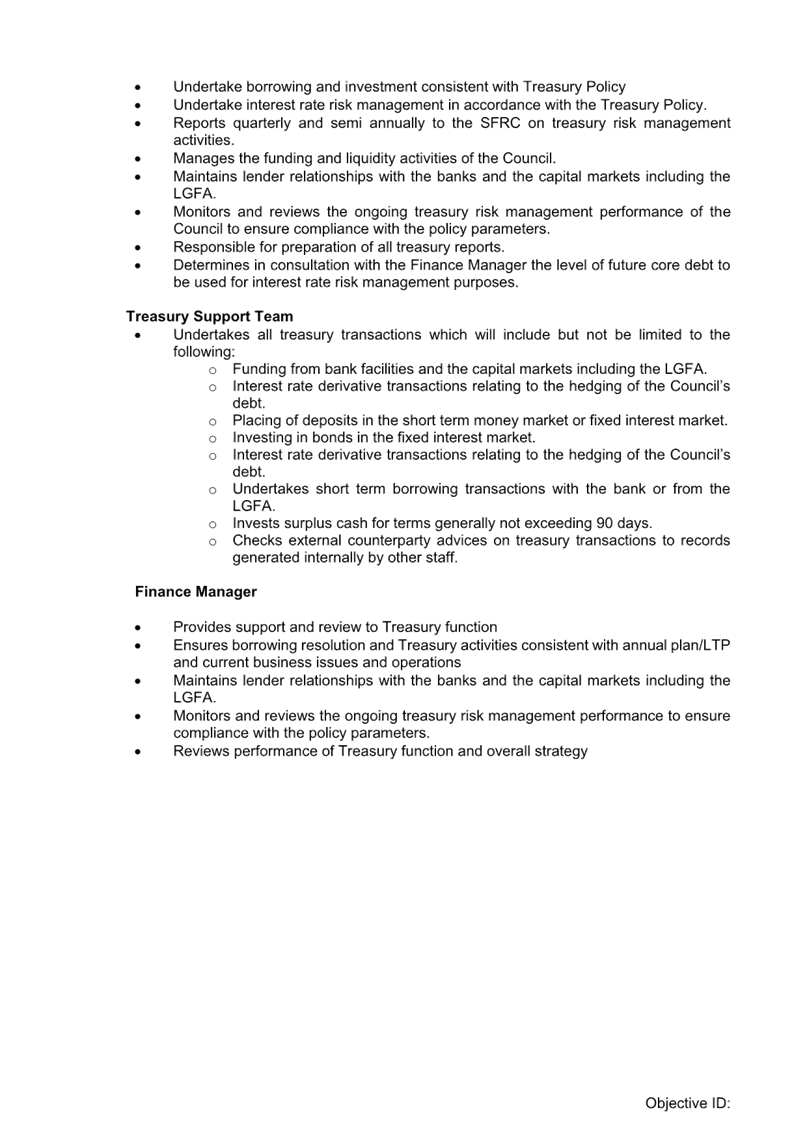

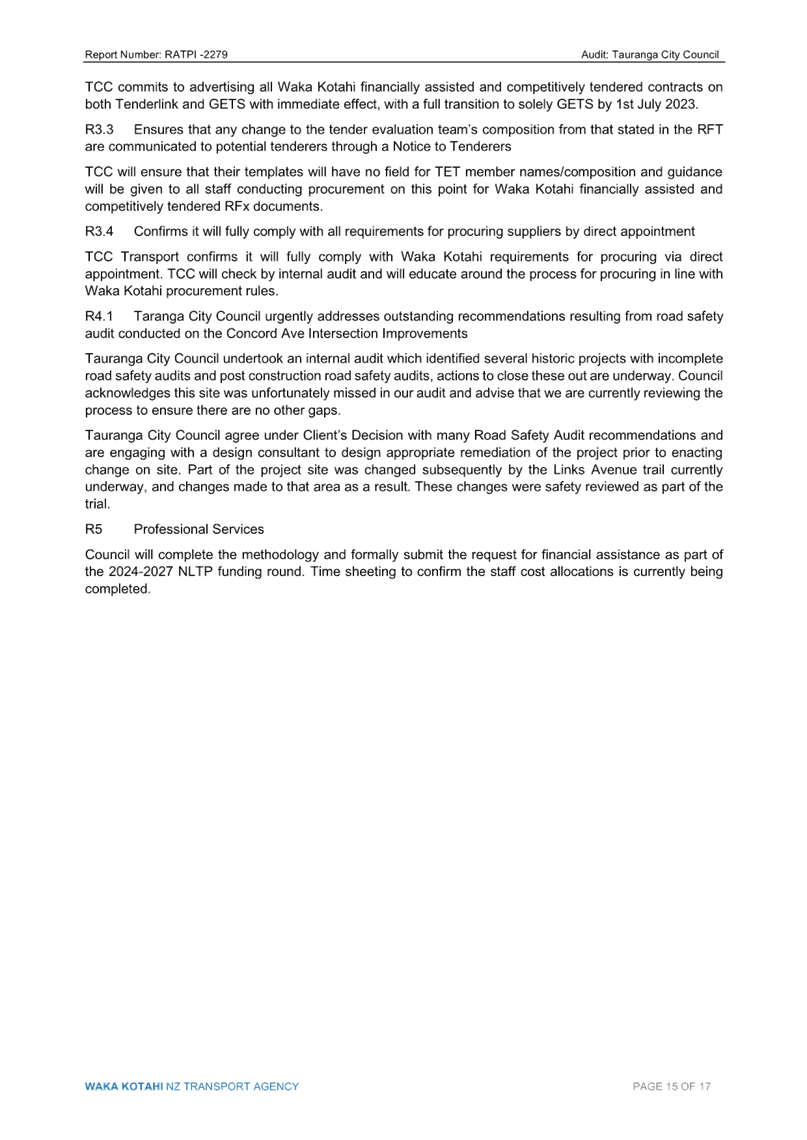

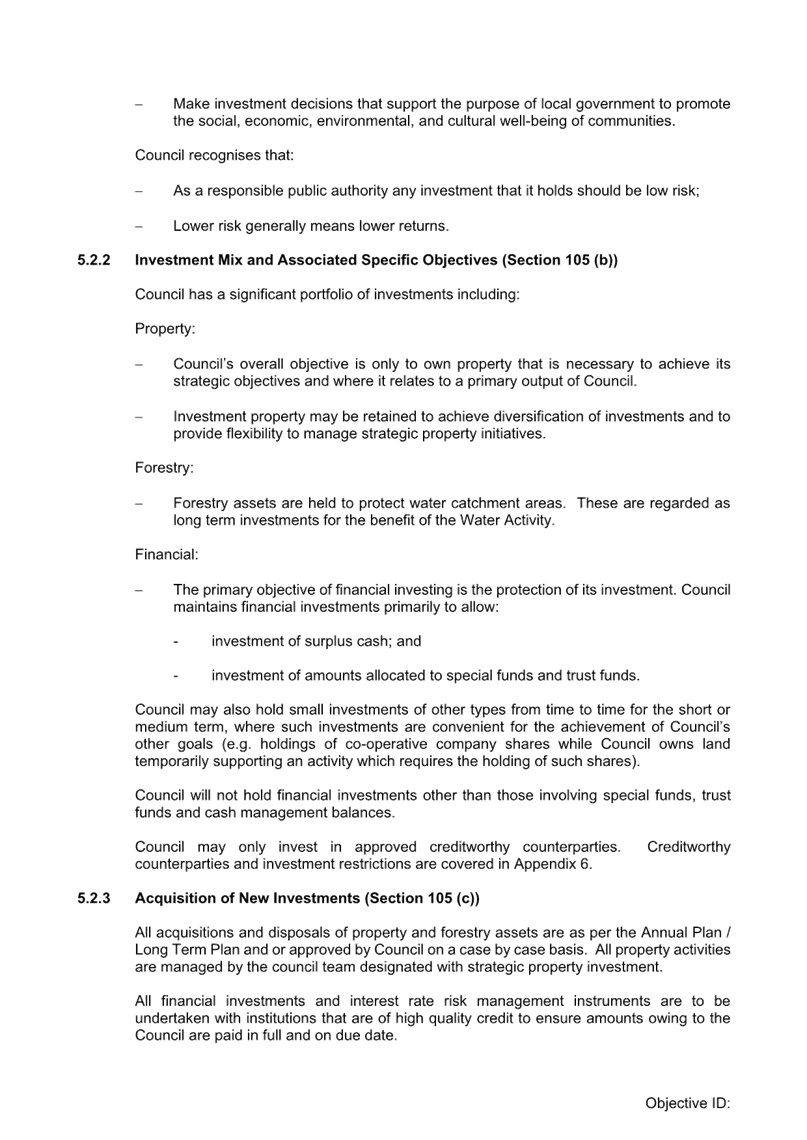

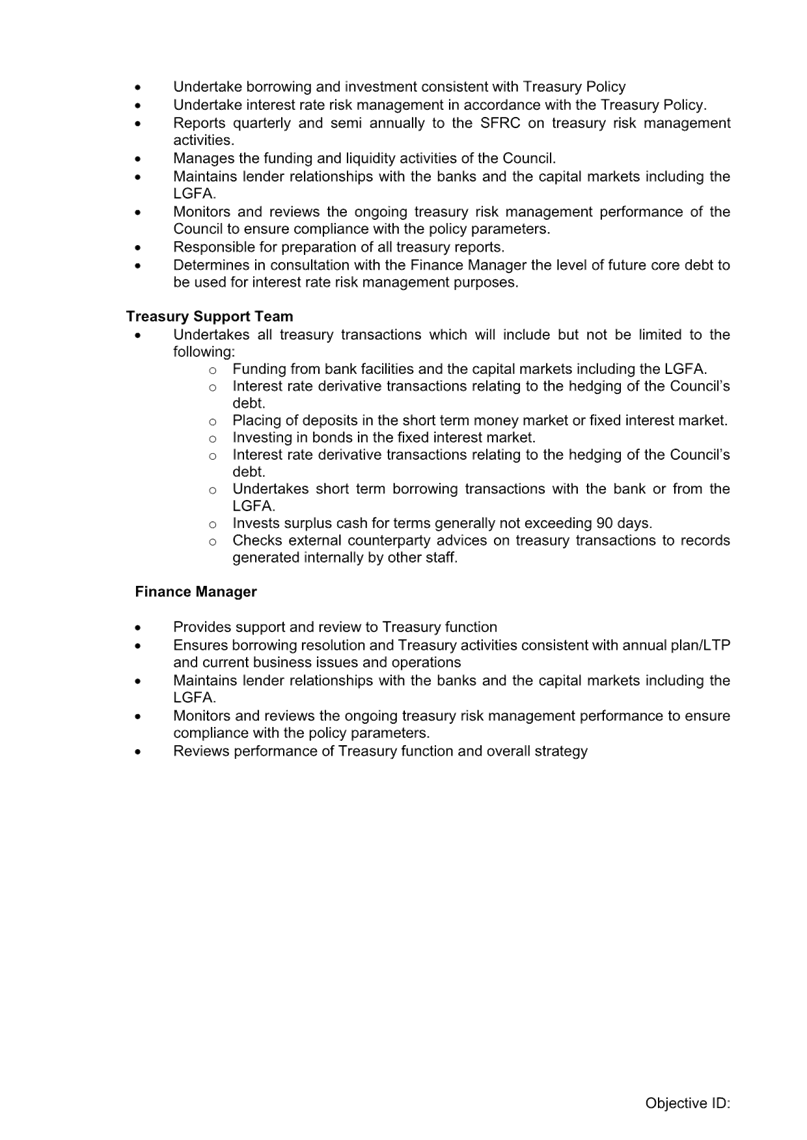

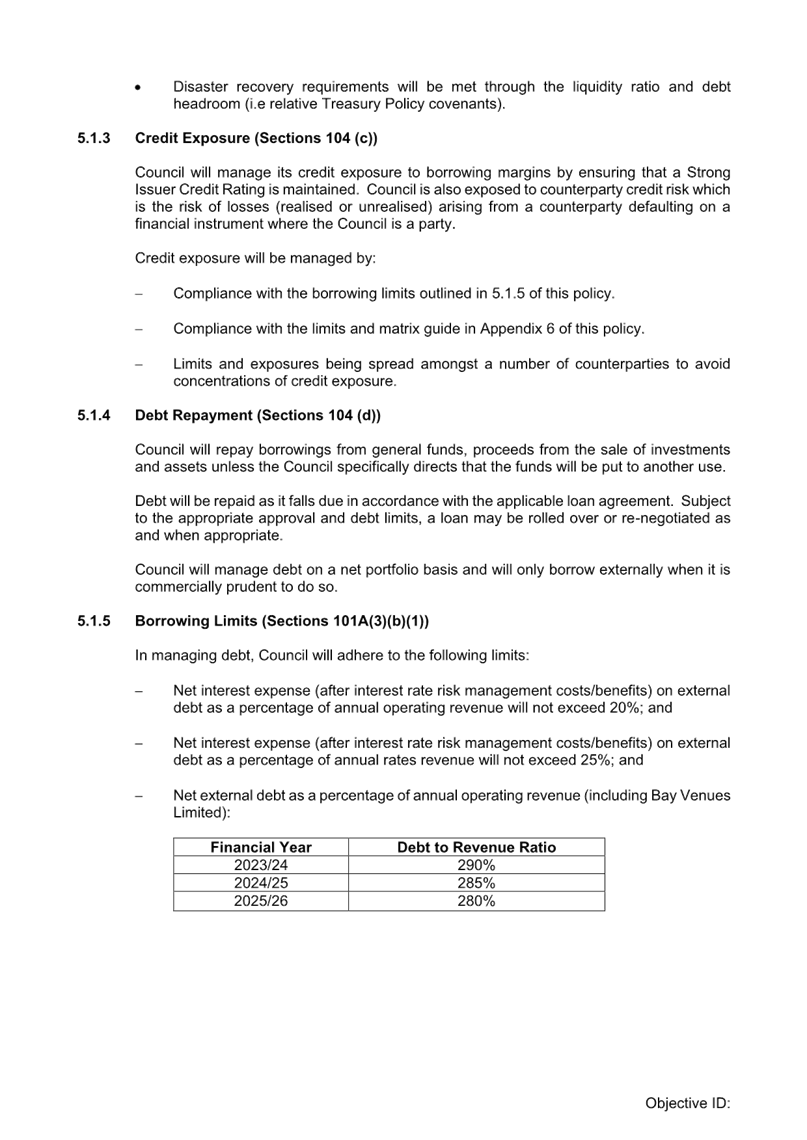

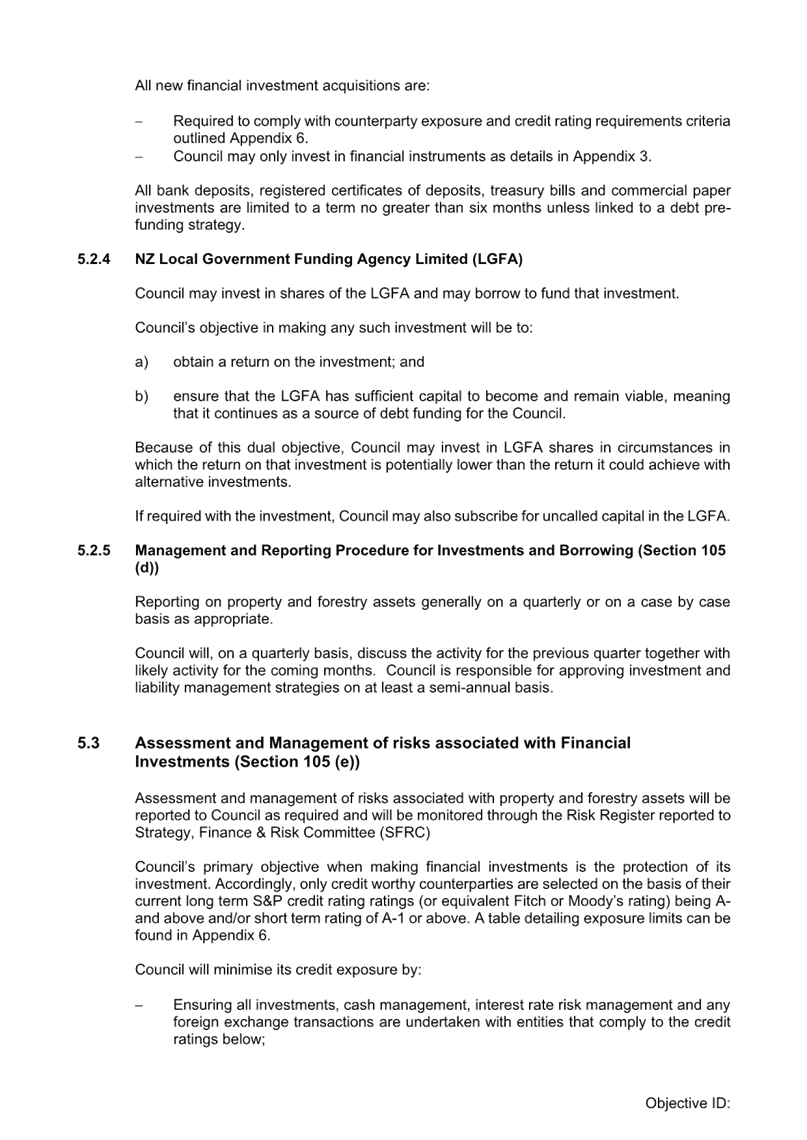

Period

|

Minimum Fixed

Interest Rate

|

Maximum Fixed

Interest Rate

|

|

0 to 2 years

|

40%

|

100%

|

|

2 to 5 years

|

20%

|

80%

|

|

5 to 8 years

|

0%

|

60%

|

|

8 to 10 years

|

0%

|

30%

|

|

10 to 15 years

|

0%

|

10%

|

Liquidity

(Section 5.1.2)

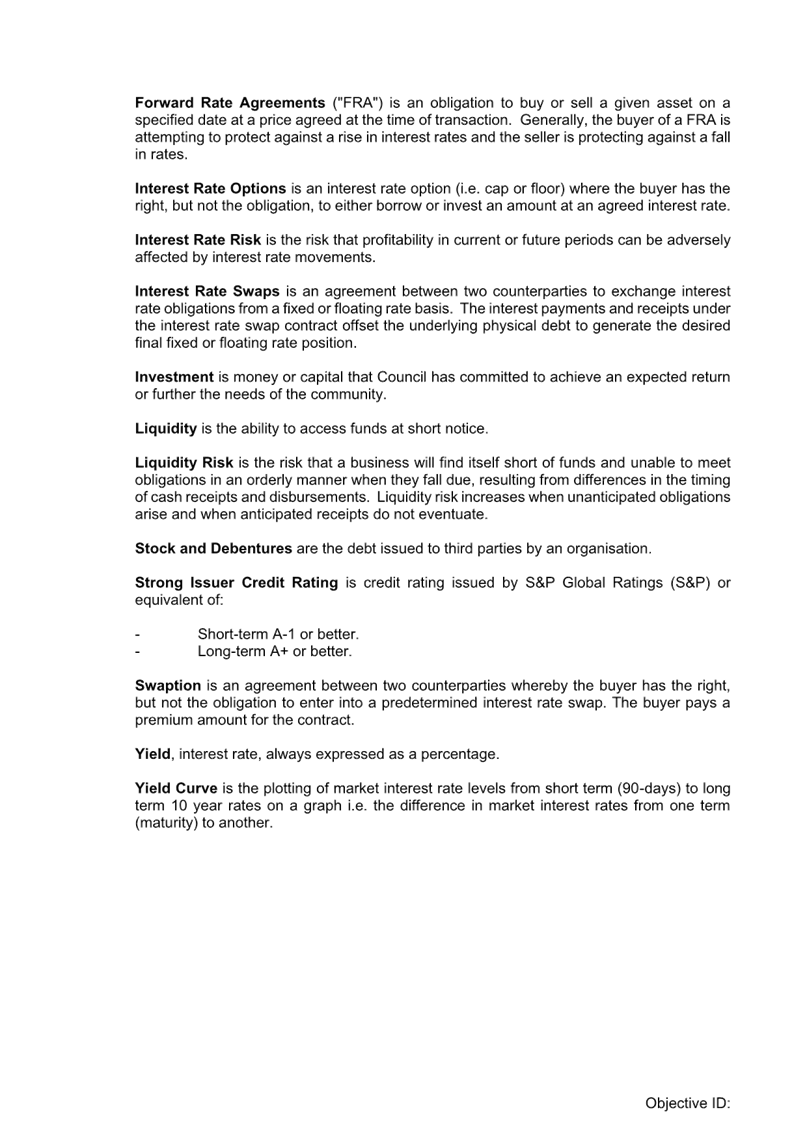

9. The wording regarding

how net cash surpluses are treated has been amended to reflect the current cash

management strategy which is to retain a $10-$15m buffer in the operating

account at any given time to meet unexpected cashflows. Following the

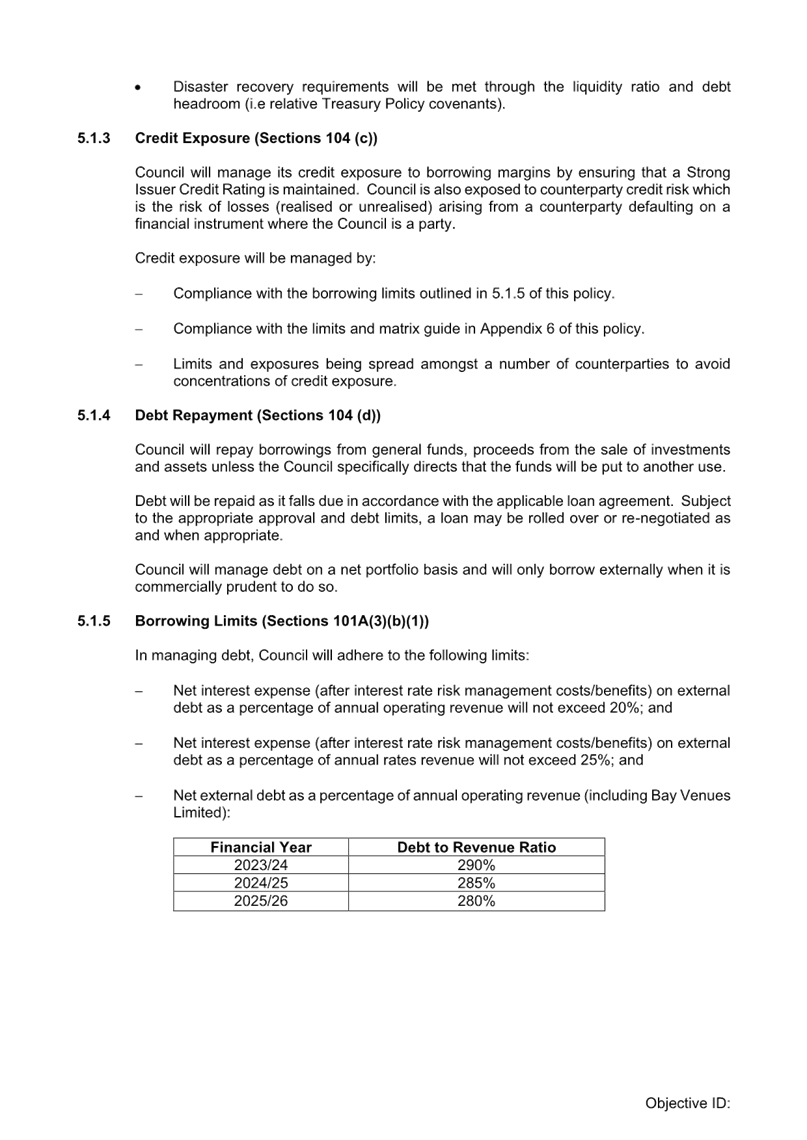

Global Financial Crisis the flexibility for Council to terminate term deposits