|

|

|

AGENDA

Strategy, Finance and Risk Committee meeting

Monday, 19 February 2024

|

|

I hereby give notice that a Strategy, Finance and

Risk Committee meeting will be held on:

|

|

Date:

|

Monday, 19 February 2024

|

|

Time:

|

9.30am

|

|

Location:

|

Bay of Plenty Regional Council Chambers

Regional House

1 Elizabeth Street

Tauranga

|

|

Please note that this

meeting will be livestreamed and the recording will be publicly available on

Tauranga City Council's website: www.tauranga.govt.nz.

|

|

Marty Grenfell

Chief Executive

|

Terms of reference – Strategy,

Finance & Risk Committee

Membership

|

Chairperson

|

Commission Chair Anne Tolley

|

|

Deputy chairperson

|

Dr Wayne Beilby – Tangata

Whenua representative

|

|

Members

|

Commissioner Shadrach Rolleston

Commissioner Stephen Selwood

Commissioner Bill Wasley

|

|

|

Matire Duncan, Te Rangapū Mana

Whenua o Tauranga Moana Chairperson

Te Pio Kawe – Tangata

Whenua representative

Rohario Murray – Tangata

Whenua representative

Bruce Robertson – External

appointee with finance and risk experience

|

|

Quorum

|

Five (5) members must be

physically present, and at least three (3) commissioners and two (2)

externally appointed members must be present.

|

|

Meeting frequency

|

Six weekly

|

Role

The role

of the Strategy, Finance and Risk Committee (the Committee) is:

(a)

to assist and advise the Council in discharging

its responsibility and ownership of health and safety, risk management,

internal control, financial management practices, frameworks and processes to

ensure these are robust and appropriate to safeguard the Council's staff and

its financial and non-financial assets;

(b)

to consider strategic issues facing the city and

develop a pathway for the future;

(c)

to monitor progress on achievement of desired

strategic outcomes;

(d)

to review and determine the policy and bylaw

framework that will assist in achieving the strategic priorities and outcomes

for the Tauranga City Council.

Membership

The Committee will consist of:

· four

commissioners with the Commission Chair appointed as the Chairperson of the

Committee

· the

Chairperson of Te Rangapū Mana Whenua o Tauranga Moana

· three

tangata whenua representatives (recommended by Te Rangapū Mana Whenua o

Tauranga Moana and appointed by Council)

· an

independent external person with finance and risk experience appointed by the

Council.

Voting

Rights

The

tangata whenua representatives and the independent external person have voting

rights as do the Commissioners.

The

Chairperson of Te Rangapu Mana Whenua o Tauranga Moana is an advisory position,

without voting rights, designed to ensure mana whenua discussions are connected

to the committee.

Committee's

Scope and Responsibilities

A. STRATEGIC

ISSUES

The Committee will consider

strategic issues, options, community impact and explore opportunities for

achieving outcomes through a partnership approach.

A1 – Strategic Issues

The Committee's responsibilities with regard to Strategic

Issues are:

· Adopt

an annual work programme of significant strategic issues and projects to be

addressed. The work programme will be reviewed on a six-monthly basis.

· In

respect of each issue/project on the work programme, and any additional matters

as determined by the Committee:

o

Consider existing and future strategic context

o

Consider opportunities and possible options

o

Determine preferred direction and pathway forward and recommend

to Council for inclusion into strategies, statutory documents (including City

Plan) and plans.

· Consider

and approve changes to service delivery arrangements arising from the service

delivery reviews required under Local Government Act 2002 that are referred to

the Committee by the Chief Executive.

· To

take appropriate account of the principles of the Treaty of Waitangi.

A2 – Policy and Bylaws

The Committee's responsibilities with regard to Policy and

Bylaws are:

· Develop,

review and approve bylaws to be publicly consulted on, hear and deliberate on

any submissions and recommend to Council the adoption of the final bylaw. (The

Committee will recommend the adoption of a bylaw to the Council as the Council

cannot delegate to a Committee the adoption of a bylaw.)

· Develop,

review and approve policies including the ability to publicly consult, hear and

deliberate on and adopt policies.

A3 – Monitoring of Strategic

Outcomes and Long Term Plan and Annual Plan

The Committee's responsibilities with regard to monitoring

of strategic outcomes and Long Term Plan and Annual Plan are:

· Reviewing

and reporting on outcomes and action progress against the approved strategic

direction. Determine any required review / refresh of strategic direction or

action pathway.

· Reviewing

and assessing progress in each of the six (6) key investment proposal areas

within the 2021-2031 Long Term Plan.

· Reviewing

the achievement of financial and non-financial performance measures against the

approved Long Term Plan and Annual Plans.

B. FINANCE AND RISK

The Committee will review the effectiveness of the

following to ensure these are robust and appropriate to safeguard the Council's

financial and non-financial assets:

· Health

and safety.

· Risk

management.

· Significant

projects and programmes of work focussing on the appropriate management of risk.

· Internal

and external audit and assurance.

· Fraud,

integrity and investigations.

· Monitoring

of compliance with laws and regulations.

· Oversight

of preparation of the Annual Report and other external financial reports

required by statute.

· Oversee

the relationship with the Council’s Investment Advisors and Fund

Managers.

· Oversee

the relationship between the Council and its external auditor.

· Review

the quarterly financial and non-financial reports to the Council.

B1 - Health and Safety

The

Committee’s responsibilities through regard to health and safety are:

· Reviewing

the effectiveness of the health and safety policies and processes to ensure a

healthy and safe workspace for representatives, staff, contractors, visitors

and the public.

· Assisting

the Commissioners to discharge their statutory roles as "Officers" in

terms of the Health and Safety at Work Act 2015.

B2 - Risk Management

The

Committee's responsibilities with regard to risk management are:

· Review,

approve and monitor the implementation of the Risk Management Policy, including

the Corporate Risk Register.

· Review

and approve the Council’s "risk appetite" statement.

· Review

the effectiveness of risk management and internal control systems including all

material financial, operational, compliance and other material controls. This

includes legislative compliance, significant projects and programmes of work,

and significant procurement.

· Review

risk management reports identifying new and/or emerging risks and any

subsequent changes to the "Tier One" register.

B3

- Internal Audit

The

Committee’s responsibilities with regard to the Internal Audit are:

· Review

and approve the Internal Audit Charter to confirm the authority, independence

and scope of the Internal Audit function. The Internal Audit Charter may be

reviewed at other times and as required.

· Review

and approve annually and monitor the implementation of the Internal Audit Plan.

· Review

the co-ordination between the risk and internal audit functions, including the

integration of the Council's risk profile with the Internal Audit programme.

This includes assurance over all material financial, operational, compliance

and other material controls. This includes legislative compliance (including

Health and Safety), significant projects and programmes of work and significant

procurement.

· Review

the reports of the Internal Audit functions dealing with findings, conclusions

and recommendations.

· Review

and monitor management’s responsiveness to the findings and

recommendations and enquire into the reasons that any recommendation is not

acted upon.

B4

- External Audit

The

Committee's responsibilities with regard to the External Audit are:

· Review

with the external auditor, before the audit commences, the areas of audit focus

and audit plan.

· Review

with the external auditors, representations required by commissioners and

senior management, including representations as to the fraud and integrity

control environment.

· Recommend

adoption of external accountability documents (LTP and annual report) to the

Council.

· Review

the external auditors, management letter and management responses and inquire

into reasons for any recommendations not acted upon.

· Where

required, the Chair may ask a senior representative of the Office of the

Auditor General (OAG) to attend the Committee meetings to discuss the OAG's

plans, findings and other matters of mutual interest.

· Recommend

to the Office of the Auditor General the decision either to publicly tender the

external audit or to continue with the existing provider for a further

three-year term.

B5

- Fraud and Integrity

The

Committee's responsibilities with regard to Fraud and Integrity are:

· Review

and provide advice on the Fraud Prevention and Management Policy.

· Review,

adopt and monitor the Protected Disclosures Policy.

· Review

and monitor policy and process to manage conflicts of interest amongst

commissioners, tangata whenua representatives, external representatives

appointed to council committees or advisory boards, management, staff,

consultants and contractors.

· Review

reports from Internal Audit, external audit and management related to protected

disclosures, ethics, bribery and fraud related incidents.

· Review

and monitor policy and processes to manage responsibilities under the Local

Government Official Information and Meetings Act 1987 and the Privacy Act 2020

and any actions from the Office of the Ombudsman's report.

B6

- Statutory Reporting

The

Committee's responsibilities with regard to Statutory Reporting relate to

reviewing and monitoring the integrity of the Annual Report and recommending to

the Council for adoption the statutory financial statements and any other

formal announcements relating to the Council's financial performance, focusing

particularly on:

· Compliance

with, and the appropriate application of, relevant accounting policies,

practices and accounting standards.

· Compliance

with applicable legal requirements relevant to statutory reporting.

· The

consistency of application of accounting policies, across reporting periods.

· Changes

to accounting policies and practices that may affect the way that accounts are

presented.

· Any

decisions involving significant judgement, estimation or uncertainty.

· The

extent to which financial statements are affected by any unusual transactions

and the manner in which they are disclosed.

· The

disclosure of contingent liabilities and contingent assets.

· The

basis for the adoption of the going concern assumption.

· Significant

adjustments resulting from the audit.

Power

to Act

· To

make all decisions necessary to fulfil the role, scope and responsibilities of

the Committee subject to the limitations imposed.

· To

establish sub-committees, working parties and forums as required.

· This

Committee has not been delegated any responsibilities, duties or

powers that the Local Government Act 2002, or any other Act, expressly provides

the Council may not delegate. For the avoidance of doubt, this Committee has not

been delegated the power to:

o

make a rate;

o

make a bylaw;

o

borrow money, or purchase or dispose of assets, other than in

accordance with the Long-Term Plan (LTP);

o

adopt the LTP or Annual Plan;

o

adopt the Annual Report;

o

adopt any policies required to be adopted and consulted on in

association with the LTP or developed for the purpose of the local governance

statement;

o

adopt a remuneration and employment policy;

o

appoint a chief executive.

Power

to Recommend

To Council and/or any standing committee

as it deems appropriate.

|

Strategy,

Finance and Risk Committee meeting Agenda

|

19

February 2024

|

7 Confirmation

of minutes

7.1 Minutes

of the Strategy, Finance and Risk Committee meeting held on 4 December 2023

File

Number: A15491507

Author: Anahera

Dinsdale, Governance Advisor

Authoriser: Anahera

Dinsdale, Governance Advisor

|

Recommendations

That the Minutes of the

Strategy, Finance and Risk Committee meeting held on 4 December 2023 be

confirmed as a true and correct record.

|

Attachments

1. Minutes

of the Strategy, Finance and Risk Committee meeting held on 4 December

2023

|

Strategy, Finance and Risk Committee meeting minutes Strategy, Finance and Risk Committee meeting minutes

|

4 December 2023

|

|

|

|

MINUTES

Strategy, Finance and Risk Committee meeting

Monday, 4 December 2023

|

Order of Business

1 Opening karakia. 3

2 Apologies. 3

3 Public forum.. 3

4 Acceptance of

late items. 4

4.1 Acceptance

of late item - Local Alcohol Policy - Legal Advice (public excluded) 4

5 Confidential

business to be transferred into the open. 4

6 Change to order

of business. 4

7 Confirmation of

minutes. 4

7.1 Minutes

of the Strategy, Finance and Risk Committee meeting held on 30 October 2023. 4

7.2 Minutes

of the Strategy, Finance and Risk Committee meeting held on 13 November 2023. 5

8 Declaration of

conflicts of interest 5

9 Business. 5

9.1 Refreshed

outline plan of the Committee's upcoming work programme. 5

9.2 Priority

One Annual Report 2022/2023. 6

9.3 Mount

Industrial Planning Study Key Recommendations. 8

9.8 Review

of policies on grants for development contributions on Papakāinga Housing

and Community Housing. 11

9.4 Delivering

on Our Direction - keeping it live. 13

9.5 Audit

New Zealand - report to the commissioners on the audit of the consultation

document for the 2024-34 long-term plan. 14

9.6 Growth

& Land Use Projects Progress Report - December 2023. 14

9.7 City

Plan Work Programme. 16

9.9 Deliberations

Report on the Street Use Policy. 17

9.10 Deliberations

Report for Traffic and Parking Bylaw.. 18

9.11 Deliberations

Report - Gambling Venues Policy. 19

9.12 LGOIMA

and Privacy Report Q1 for 2023/2024 year 20

10 Discussion of late items. 20

11 Public excluded session. 20

11.1 Corporate

Risk Register - Quarterly Update. 21

11.2 Internal

Audit & Assurance - Quarterly Update. 21

11.3 Litigation

Report 21

11.4 Local

Alcohol Policy – Legal Advice. 22

12 Closing karakia. 22

MINUTES

OF Tauranga City Council

Strategy, Finance and Risk Committee meeting

HELD

AT THE Bay of Plenty Regional Council

Chambers,

Regional House, 1 Elizabeth Street, Tauranga

ON

Monday, 4 December 2023 AT 9.30am

PRESENT: Commission

Chair Anne Tolley (Chairperson), Commissioner Shadrach Rolleston, Commissioner

Stephen Selwood, Mr Te Pio Kawe, Ms Rohario Murray

IN ATTENDANCE: Marty

Grenfell (Chief Executive), Paul Davidson (Chief Financial Officer), Barbara

Dempsey (General Manager: Community Services), Nic Johansson (General Manager:

Infrastructure), Christine Jones (General Manager: Strategy, Growth &

Governance), Ceilidh Dunphy (Acting General Manager: Corporate Services), Sarah

Omundsen (General Manager: Regulatory and Compliance), Lisa Gilmour (City

Partnership Specialist), Carlo Ellis (Manager: Strategic Māori Engagement), Carl

Lucca (Team Leader: Urban Communities), Jeremy Boase (Manager: Strategy &

Corporate Planning), Andy Mead (Manager: City Planning & Growth), Janine

Speedy (Team Leader: City Planning), Sharon Herbst (Policy Analyst), Richard

Butler (Community Partnerships Funding Specialist), Ruth Woodward (Team Leader:

Policy), Vicky Grant-Ussher (Policy Analyst), Jennifer Ross (Policy Analyst),

Nigel McGlone (Manager: Environmental Regulation), Reece Wilkinson (Parking

Strategy Manager), Coral Hair (Manager: Democracy & Governance Services),

Anahera Dinsdale (Governance Advisor),

EXTERNAL: Nigel

Tutt (Chief Executive) and Greg Simmonds (General Manager: Workforce and

Policy), (Priority One) and David Phizacklea (Consultant – Mount

Maunganui Industrial Study),

1 Opening

karakia

Commissioner Shadrach Rolleston opened the meeting with a

karakia.

2 Apologies

|

Committee Resolution SFR9/23/1

Moved: Commissioner

Stephen Selwood

Seconded: Ms Rohario Murray

That apologies from Dr Wayne Beilby, Commissioner Bill

Wasley, Ms Matire Duncan and Mr Bruce Robertson be received and accepted.

Carried

|

3 Public

forum

None

4 Acceptance

of late items

|

4.1 Acceptance

of late item - Local Alcohol Policy - Legal Advice (public excluded)

|

|

Committee Resolution SFR9/23/2

Moved: Commissioner

Shadrach Rolleston

Seconded: Commissioner Stephen Selwood

That the Strategy, Finance and Risk Committee:

(a)

Accepts the late tabled report "Local

Alcohol Policy – Legal Advice" to be considered in the public

excluded section of the meeting as the legal advice was received after the

agenda, it cannot be delayed to a subsequent meeting as there was a statutory

timeframe to a decision which expires on 10 December 2023.

Carried

|

5 Confidential

business to be transferred into the open

None

6 Change

to order of business

None

7 Confirmation

of minutes

|

7.1 Minutes

of the Strategy, Finance and Risk Committee meeting held on 30 October 2023

|

|

Committee Resolution SFR9/23/3

Moved: Commissioner

Shadrach Rolleston

Seconded: Commissioner Stephen Selwood

That the minutes

of the Strategy, Finance and Risk Committee meeting held on 30 October 2023

be confirmed as a true and correct record subject to the following

correction:

7.1 Minutes of the Strategy, Finance & Risk

Committee meeting held on 18 September 2023

Wording Correction below as it was incorrect.

Committee Member, Rohario Murray. declared she had

worked on Resource Management Act reform and, while she didn’t directly

work on legislative reforms for Three Waters, there may be potential

interactions between the two. She would not take part in any discussions relating

to the RMA or Three Waters reforms

Commissioner Rolleston

mentioned this change would be necessary for his declaration as well.

Carried

|

8 Declaration

of conflicts of interest

None

9 Business

|

9.1 Refreshed

outline plan of the Committee's upcoming work programme

|

|

Staff Christine

Jones, General Manager: Strategy, Growth & Governance

Jeremy

Boase, Manager: Strategy & Corporate Planning

Key points

·

Staff delayed the introduction of new projects/processes that

would not be completed by this Committee before the change of Council in July

2024.

In response to questions

·

Trees and Vegetation Policy Action and Investment Plan was in

place now However the fine grain rules that staff follow needed to be tidied

up.

·

A discussion was held around the removal of Risk Deep Dives.

This item would be further discussed in 2024.

Discussion points raised

·

The Commission Chair noted that there was potentially further

work on the Local Alcohol Policy (LAP) given the report in the public

excluded session of this meeting, and therefore the LAP should not be removed

from the work programme in 2024.

·

It was noted that the Election Signs Policy was to be removed

from the work programme and would be considered again after the Council

elections in July 2024.

|

|

Committee Resolution SFR9/23/5

Moved: Commissioner

Stephen Selwood

Seconded: Commissioner Shadrach Rolleston

That the Strategy, Finance and Risk Committee:

(a) Receives the report

“Refreshed outline plan of the Committee’s upcoming work

programme”.

(b) Notes the updated outline

work programme for the Committee per Attachment 1 and that further work on

the Local Alcohol Policy is likely to be added to the work programme and the

Election Signs Review be removed.

Carried

|

|

9.2 Priority

One Annual Report 2022/2023

|

|

Staff Lisa

Gilmour, City Partnership Specialist

External Nigel

Tutt (Chief Executive) and Greg Simmonds (General Manager: Workforce and

Policy, Priority One

PowerPoint presentation.

Key points

·

The report was taken as read.

·

The Annual Report was provided by the economic development

agency to Council as part of its role to ensure the organisation’s

performance was consistent with Council’s partnership agreement with

them.

·

Key achievements were outlined in the PowerPoint presentation

which set out key economic metrics that included the sub-region and Tauranga

City.

·

The economy was in reasonable shape with jobs being created and

historically low unemployment figures. The mean annual income and housing and

rental affordability were weaker parts of the economy and had longer term

structural implications for the economy.

·

While Tauranga was the fifth largest city with a fast growing

economy, the mean annual income was below the New Zealand average. It

was important that people shared in the prosperity and Priority One was

working to increase the mean annual income by innovatively creating higher

value industries with higher value jobs.

·

Priority One encouraged industry scale and success and focused

on leveraging education systems to target skills. Priority One did a

lot of work to get youth t into university/trade pathways. The focus was also

to improve Māori

education and workforce outcomes to increase mean annual earnings for Māori.

·

In terms of the economic outlook there was a decline in

business confidence in the last few months due to high inflation and interest

rates and this would continue to impact on businesses for the next six

months. Some degree of retrenchment was occurring, although not wholesale,

and it was more pronounced than a year ago.

·

With a tight talent market businesses were holding onto staff

which impacted on the costs for businesses. Businesses here needed more

talent as there was a loss due to people moving to Australia and the aging

workforce coming up for retirement.

·

Kiwifruit was on the way up, after two bad years and, at 12% of

the economy, this had an impact on retail spend and unemployment.

·

In terms of what the Council could expect to see from Priority

One in 2024 there would be a focus on businesses assisting with the

infrastructure deficit; sustainability to get businesses engaged to develop a

better environmental footprint; attracting and retaining talent and

developing higher value industries that paid more and required more skilled

workers.

In response to questions

·

Agreed that the largest economic risk would be housing,

especially with the future demographics of an aging population that needed to

be supported and needed people to do that, with the largest employing

sectors, health care and construction, at risk. Priority One would

emphasis this risk.

·

In terms of the future workforce Priority One was focussed on

education and pathways to ensure local home grown talent was assisted into

employment and creating talent pipelines for the region’s

businesses. Local Authorities can assist by including procurement

policies that include local Māori businesses.

·

In response to questioning about understanding the future

workforce in Tauranga, the next generation and dealing with millennials, Gen

X and Gen Z, Priority One saw the future was Māori, given that

Tauranga had the second highest proportion of Māori Youth in the

country, outside of South Auckland. Priority One had strong partnerships with

Toi Kai Rawa (the Bay of Plenty’s Regional Māori economic development

agency) and supported them to deliver STEAM (science, technology,

engineering, arts and mathematics) in schools, as well as internship

programmes with local primary industries, so that Māori and Pacific youth

could see themselves in those high value roles of the future. Congratulated

TCC on employing 23 interns this year and Priority One worked with employers

to encourage this type of programme and believed it was a benefit to

employers to access youth early.

·

Launched a series “Business beyond Usual” that

included an education programme on the future of work looking at

employment law and ramifications and examples of where employers were

utilising the older age demographics and transferring skills to younger

employees.

·

In response to how to attract talent when rental costs were so

high and more houses were needed, Priority One stated that it was a circular

discussion i.e. needed more people to serve other people, but to get there

houses were needed to be built. Needed to press both levers at the same

time, but it was difficult to get the balance. Priority One focussed on

ensuring people that came to Tauranga, were retained here, thrived and got

their dream they came to Tauranga to find, which relied on good housing and

roading networks. A constant push on infrastructure and housing was one

thing and right sized talent attraction was the other thing. In terms of

it’s role in helping the city through re-build, Priority One saw that

it was much better if done together and included educating the community on

what to expect and why. Priority One looked at 10-15 year future planning

for talent to provide for infrastructure projects. Priority One could

be of assistance with understanding specific parts of the city i.e.

industrial location. .

Discussion points raised

·

Thanked for work and partnership. Enjoyed the data driven

approach to determine priorities.

·

It was powerful to have a joined up message from Priority One

and the Council to central government on the issues the city was facing in

terms of the lack of affordable housing, with housing being 10x the average

income, among the worst in New Zealand.

·

However, the link between infrastructure and the cost of

housing needed to be emphasised more by Priority One.

·

The lack of transport infrastructure enabling land availability

was driving house prices up. Failure to deliver the infrastructure meant less

land available for housing. This story was not well understood in Wellington

and collectively we needed to do more to get an understanding of this

politically and within the community.

·

A recent presentation by Dr Paul Spoonley on changing demographics

nationally had highlighted the need for Council to be aware of the changing

demographics and include this in future thinking and consider how to cater to

the needs of an aging population. Dr Spoonley gave an example that a female

pakeha woman born today had a life expectancy of 93 – 94 years and half

of her cohort would be over the age of 100 years. In terms of housing for

example, the Council needed to be thinking about providing more 1-2 bedroom

houses for people over 65 years to move into and freeing up larger 3-4

bedroom houses with low occupancy rates by the over 65s to achieve greater

housing optimisation.

·

In terms of migration, Tauranga has the highest net internal

migration but did not have the same levels of international migration as

other metros. There was a change in migration from China to other parts of

Asia, including the Philippines. Priority One’s focus on higher skilled

talent was supported to attract skilled people that were needed to be able to

grow as a city and region.

|

|

Committee Resolution SFR9/23/6

Moved: Commissioner

Stephen Selwood

Seconded: Commissioner Shadrach Rolleston

That the Strategy, Finance and Risk Committee:

(a)

Receives the report "Priority One Annual Report 2022/2023".

Carried

|

|

Attachments

1 Presentation

- Nigel Tutt - Priority One

|

|

9.3 Mount

Industrial Planning Study Key Recommendations

|

|

Staff Christine

Jones, General Manager: Strategy, Growth & Governance

Carl Lucca, Team Leader: Urban Communities

David Phizacklea, Consultant – Mount Maunganui

Industrial Study

PowerPoint presentation.

Key points

·

The report was taken as read. Report follows on from the

workshop that was held on the 30 October 2023.

·

The Mount Industrial Planning Study was the plan for the future

of the industrial area and identified a programme of actions.

·

The Mount Industrial Plan was part of the Mount to Arataki

Spatial Plan.

·

This work also fed into the transport options for

Hewlett’s Road, Totara Street and Hull Road which was being led by Waka

Kotahi.

·

Over the last 12 months, the staff worked with mana whenua,

community, the impacted businesses, and Priority One. The community voice was

strong with phase one and two engagement from the Mount to Arataki Spatial

Plan.

·

If a plan change was undertaken, Tauranga City Council needed

to adopt requirements under the National Planning Standards. Council

currently had one industrial zone across the whole city.

·

The Tauranga City Plan recognised the existing use rights of

businesses and provided for their future operations.

·

It was recommended that land use interventions were intended to

look at how city’s would look at transitioning industrial areas to

lighter industrial uses with less impact on the environment.

Vision and Objectives

Key points

·

Eight key challenges were identified and stakeholders were

asked to reflect on these challenges when they thought about

interventions.

·

The vision was developed with three scenarios (Business as

usual, expansion and environmental limits) through various workshops held

with stakeholders and individuals. A balanced approach was taken and

reflected in the vision and objectives in recommendations (b) and

recommendation (c) took a partnership approach.

·

Priority One would be working with the industrial businesses

and a cultural report was currently being completed for the Mount to Arataki

Spatial Plan. This report included cultural mapping.

In response to questions

·

Higher value land use was determined economically.. In terms of

the Council’s role in promoting higher value land use it was not about

replacing industrial use with commercial use but using the limited amount of

land more efficiently i.e. taller, larger buildings with more capacity,

higher employment yields at edges with transition areas other land uses..

·

When the eight objectives of the vision were implemented they

needed to be considered together. A balanced approach was required with

best practice to ensure that the interface areas with mana whenua were

improved over time and the issues that currently existed were addressed.

·

The vision and objectives were future focussed.

Discussion points raised

·

One of the key challenges that had not been

addressed were the businesses who did not want to move from their current

location.

·

It was noted that ‘reverse

sensitivity’ was a term used by Council planners that could be

misinterpreted by the public.

·

It was identified that the inherent conflict

was that Whareroa Marae was surrounded by an industrial area and the largest

export port in Aotearoa. It was noted that this would not change immediately

but this vision was implemented to manage this conflict and the affects on

Whareroa and to seek change over time.

Policy options and recommendations

Key points

·

Four main recommendations in the report set

out the policy interventions to be considered through the Tauranga City Plan.

·

The first recommendation was adopting

appropriate zoning consistent with the National Planning Standards

requirements.

·

The second recommendation was to introduce land

use interventions to progress a transition to lighter industry over time

adjacent to sensitive land uses in proximity to Whareroa and Newton Street

and MacDonald Street and create a greater separation distance.

·

The third recommendation was to restrict residential

activities in current commercial zoned areas of the Mount Maunganui Airshed

at Newton Street and MacDonald Street.

·

The fourth recommendation was to provide for

avoiding and mitigating existing environmental impacts of existing

businesses.

·

Reviewed best practice approaches with

industrial land use interfacing sensitive areas in the Auckland Unitary Plan

and the Wellington City District Plan.

·

three options were identified and staff recommended Option 2,

introducing controls to regulate future industrial land use activities.

·

Priority One Mount Maunganui Industrial

Blueprint was currently under develoment.

·

Connecting Mount Maunganui transport and

movement options was also under development. An Indicative Business

Case was expected in April 2024.

In response to questions

·

One of the considerations to work through was

that any plan change did not contain an economic disadvantage. Businesses

were concerned that a different set of regulations may impact on the value of

the land.

·

Demand for container storage areas was growing

and the City Plan provided for these activities currently and these would be

provided for under a light industrial zone with controls to deal with the

effects, e.g. hours of operation, noise generation etc. A section 32 report

economic analysis would be undertaken to understand what industries might

thrive and what industries may require bespoke rules to avoid negative

impacts.

·

Option 3, relocation of industrial businesses

with tighter controls, was constrained by the existing use rights that

businesses currently had, and there was no ability to compel businesses to

move. Any movement would be based on business decisions.

·

Under Option 2, an existing business would not

be allowed to add a new activity that included discharge to air, however any

activity that would improve environmental outcomes would be a permitted

activity. This would provide certainty to businesses.

·

Two bitumen plants were proceeding through

resource consent processes and issues relating to odour and air quality were

being addressed through this process.

·

The detail of the Connecting Mount Maunganui

preferred option was not known, however alignment would occur once decisions

were made and be integrated with the Mount Industrial Planning Study and the

Mount Arataki Spatial Plan.

·

Recommendation (e) was to endorse key

interventions listed in Attachment B for consideration through the Mount to

Arataki Spatial Plan which would set a direction and enable the Committee to

pick this up in the new year.

·

Ngāti Kuku’s preference was to see the historic Whareroa

viewshaft to Mauao returned and it was important this was recognised.

·

An

intervention was included in Attachment B for ongoing and enchanced

monitoring of air quality, waterways and land to work with the BOP Regional

Council, mana whenua and businesses to monitor environmental effects and

understand the cumulative effects over time from all sources and the impact

of interventions in reducing these effects.

Discussion points raised

·

Concern was expressed about the proliferation

of container storage areas under a light industrial zone could potentially

result in worse amenity value and finanical impacts for the city.

·

Keen to investigate non-regulatory methods.

·

Important to have a conversation with mana

whenua on their aspirations for residential development around Whareroa.

·

The main concern for the Council was the

wellbeing of the people and determining how to hold existing businesses to

account to achieve better environmental and social outcomes.

·

Noted that matters from Connecting Mount

Maunganui would flow into the Mount Industrial Plan and the Mount to Arataki

Spatial Plan. Caution was required until there was good understanding of how

the interventions would work and until then there was a level of

discomfort.

·

The airport was not included in the Mount

Industrial Planning Study, however it would be useful for the Manager

Tauranga Airport to address the Committee in the new year on the statistics

of flights over Whareroa marae.

The following changes were made to the resolutions:

·

Recommendation (b) bullet point five of the vision be

elaborated to read “Promoting opportunities for higher value land

uses that promotes economic, environmental, social and cultural outcomes”.

·

Recommendation (b) bullet point two, add the words “and

providing for” to read “Recognising the importance and

providing for the importance of the area to mana whenua.”

·

Recommendation (c) added the words “noting that the environmental standards would have the most

immediate impacts, and any land use changes will have most impact over the

longer term.”

·

Recommendation (e ) add the words after the

Tauranga City Plan “Industrial and Commercial zoning review”.

·

Recommendation (e) (ii) delete the sentence “for

the purpose of providing a buffer between heavy industrial and sensitve land

uses, and/or requireing any new heavy industrial activities to go through a

resource consent process for the use of that land”

·

Recommendation (e ) new (iv) “Engage

with Whareroa around future aspirations for residential activity”.

|

|

Committee Resolution SFR9/23/7

Moved: Commission

Chair Anne Tolley

Seconded: Commissioner Stephen Selwood

That the Strategy, Finance and Risk Committee:

(a) Receives the

report "Mount Industrial Planning Study Key Recommendations".

(b) Endorses the

vision and objectives from the Mount Industrial Planning Study, being:

An economically productive,

healthy and connected industrial area that fits with the surrounding

environment and communities.

We will work together to deliver

on this vision by:

· Proactively managing

land use activities to enhance the environmental, cultural and social

wellbeing of our community

· Recognising and providing

for the importance of the area to mana whenua

· Adopting best

practice and innovation

· Improving

accessibility and movement within and through the area of both people and

goods

· Promoting

opportunities for higher value land uses that promotes economic, environmental,

social and cultural outcomes

· Delivering the

necessary infrastructure to support business growth

· Considering our

response to climate change, technological changes and hazard risks.

(c) Recognises

that achieving the vision will require partnership with Bay of Plenty

Regional Council – Toi Moana, mana whenua and stakeholders noting that

the environmental standards would have the most immediate impacts, and any

land use changes will have most impact over the longer term.

(d) Endorses

the key interventions listed in Attachment B to this report for consideration

through the Mount to Arataki Spatial Plan and notes the implementation of

these is dependent on funding and commitments from all agencies and

stakeholders.

(e) Approves

the following land use policy interventions for consideration through the

Tauranga City Plan (Industrial and Commercial zoning review), subject to

robust analysis and the requirements of Schedule 1 to the Resource Management

Act 1991 being met:

i) Adopting

the appropriate zoning to manage existing and future industrial activities,

consistent with the National Planning Standards 2019 requirements.

ii) Introducing

controls to regulate future industrial land use activities adjacent to

sensitive land uses in proximity to:

· Whareroa

· Newton Street

and MacDonald Streets

iii) Restricting

residential activities in current commercial zoned areas of the Mount

Maunganui Airshed.

iv) Engage

with Whareroa around future aspirations for residential activity.

v) Provide

for the ongoing operation and investment of existing businesses where

environmental impacts are able to be effectively avoided or mitigated.

(f) Supports

a joint agency approach to better managing noise, air quality, odour, amenity,

hazards, climate change and transport within the industrial area and

adjoining sensitive land uses.

(g) Acknowledges

that mana whenua and the community has requested to see health and

environmental impacts addressed.

Carried

|

|

Attachments

1 Presentation

- Mount Industrial Planning Study

|

|

9.8 Review

of policies on grants for development contributions on Papakāinga

Housing and Community Housing

|

|

Staff Christine

Jones, General Manager: Strategy, Growth & Governance

Sharon Herbst, Policy Analyst

Ruth Woodward, Policy Analyst

Richard

Butler (Community Partnerships Funding Specialist)

Key points

·

The development contributions on Papakāinga housing and

community housing grants were reviewed for a second time.

·

A decision was made in early 2023 to allocate a further

$500,000 per grant per annum over three years. This needed to be included in

both policies.

·

Requested a move from an annual review to a three yearly review

in both policies.

·

Update the definition of a registered community housing

provider (CHP) in the Community Housing Policy to align with the

Community Housing Regulatory Authority definition.

·

Update the Community Housing Policy to include leasehold home

ownership schemes.

·

This currently does not meet the criteria.

·

The Committee was asked to consider

whether to refund GST to CHPs who were not GST registered. One CHP had

raised a concern about the treatment of GST. Currently, because the grant was

retrospective, GST was initially paid as part of the development

contribution. If the CHP was not GST registered, then when the grant was

paid, the GST portion was not refunded. This effectively leaves the CHP

out-of-pocket as the full amount of the development contribution paid was not

covered by the grant.

In response to questions

·

If GST was paid, Council would be able to claim this back.

·

Only one CHP was impacted by the GST provision and as outlined

in paragraph 32 of the report the CHP was a large corporate charity with

large net profits and accumulated funds. The Papakāinga Development

Contribution grant was an internal transfer and no GST changed hands and the

applicant should not be impacted by GST.

·

The forecasted papakāinga development would exceed the

accumulative value of the Papakāinga Development Contribution grant for

the next three years. The quantum of the grant was a resourcing decision as

part of the Annual Plan and Long Term Plan processes.

Discussion points raised

The Committee declined the

CHP’s request to refund GST.

|

|

Committee Resolution SFR9/23/8

Moved: Commissioner

Stephen Selwood

Seconded: Commissioner Shadrach Rolleston

That the Strategy, Finance and Risk Committee:

(a) Receives the report "Review of policies on grants for development

contributions on Papakāinga Housing and Community Housing".

(b) Makes the following

amendments to the Grants for Development Contributions on Papakāinga

Housing Policy:

(i) update the policy to

reflect the recent decision to extend the allocation of $500,000 per annum

for a further three years to 2027. This will include amendments for

consistency in the definitions of the Grant Fund for Community Funding, the

Grant Fund for Papakāinga Housing, and clause 5.1.1.

(ii) update the policy

from an annual review to a three-yearly review. This will include amendments

for consistency in the review

date/process box on page one, and clause 5.5.1 and 5.5.2.

(c) Make the following

amendments to the Grants for Development Contributions on Community Housing

Policy:

(i) update the policy to

reflect the recent decision to extend the allocation of $500,000 per annum

for a further three years to 2027 This will include amendments for

consistency in the definitions of the Grant Fund for Community Funding, and

the Grant Fund for Papakāinga Housing, and clause 5.1.1

(ii) update the policy

from an annual review to a three-yearly review. This will include amendments

for consistency in the review

date/process box on page one, and clause 5.5.1 and 5.5.2

(iii) update the definition of a

registered community housing provider to include that the Community Housing

Regulatory Authority requires the community housing provider to “either

retain ownership of the community housing, or to oversee tenancy management

for the duration of their Income-Related Rent Subsidy agreement”

(iv) update clause 2.2 to

include leasehold home ownership schemes, so that it reads “community

housing developed and owned by, or on land leased from, registered community

housing providers (registered CHPs) and accredited transitional housing

providers”.

(d) Adopt the revised policies

included as Attachment 3 and 4 in this report and delegate authority

to the General Manager: Strategy, Growth and Governance for any minor tidy

ups prior to publication.

Carried

|

|

9.4 Delivering

on Our Direction - keeping it live

|

|

Staff Jeremy

Boase, Manager: Strategy & Corporate Planning

Carlo Ellis, Manager: Strategic Māori Engagement

Key points

·

It was noted this project journey was coming to an end.

·

Our Direction was visually represented by Te Kupenga (fishing

net) and was a system tailored to portray Tauranga Moana. This aligned with

Tai Whanake.

·

This strategic framework was built to assist with planning for

the city and understand the importance of interconnections.

·

Te Kupenga included the five community outcomes and the three

approaches.

·

Te Kupenga was well-constructed and the different aspects would

be considered and connected to have an effective tool to capture all of our

aspirations. If one of the outcomes or approaches was missed this would

leave a hole in the net and would be less effective as it took all the

individual streams being connected to get optimal results. This was

considered an improvement of an earlier version.

·

A six monthly review of the current year Action and Investment

Plan (AIP) actions was proposed with reporting against the current actions

starting next year.

In response to questions

·

There were currently 38 to 40 Action and Investment Plans

in Tauranga City Council. The Commission had adopted 13 and one was currently

in the works. Another assessment of the remaining AIPs would happen in the

lead up to the 2027 Long Term Plan.

Discussion points raised

·

It was suggested that the three approaches, Te Aho Māori,

Sustainability and Working beyond Tauranga be reported against and included

in the annual reporting cycle.

·

Te Kupenga best represented Tauranga as a port city. The net

was a representation of Tauranga Moana. The analogy of a hole in a net should

assist staff with identifying issues in the framework and repair the

‘hole’.

·

It was noted that this framework was a clear direction and

commitment.

·

“Ka pū te ruha, ka hao te Rangatahi (The old net

cast aside, the new net goes fishing)” This whakatauki refers to Te

Kupenga being an updated and better version of the old framework.

|

|

Committee Resolution SFR9/23/9

Moved: Commissioner

Stephen Selwood

Seconded: Ms Rohario Murray

That the Strategy, Finance and Risk Committee:

(a) Receives

the report "Delivering on Our Direction - keeping it live" for

information, and

(b) Notes

the proposed monitoring, reporting and review programme outlined in this

report.

(c) Approves

the three approaches, Te Aho Māori, Sustainability and Working beyond

Tauranga be reported against annually.

Carried

|

|

9.5 Audit

New Zealand - report to the commissioners on the audit of the consultation

document for the 2024-34 long-term plan

|

|

Staff Paul

Davidson, Chief Financial Officer

Jeremy Boase, Manager: Strategy & Corporate Planning

Key points

·

The document outlined the audit of the consultation document

for the 2024-34 Long Term Plan provided by Audit New Zealand.

·

It was noted there was technical disclosures related to three

waters.

·

It was noted that there were no concerns raised around debt

levels and funding of the capital programme.

Discussion points raised

·

The ratepayers and residents can have confidence that the LTP for

investment and management of the city stands up to a rigorous audit process.

·

This was confirmation that Audit New Zealand, along with the

Standard and Poors credit rating of A+ clearly demonstrated that the

organisation was managing its financial affairs well and these independent

reviews confirmed sound financial management.

|

|

Committee Resolution SFR9/23/10

Moved: Commission

Chair Anne Tolley

Seconded: Commissioner Stephen Selwood

That the Strategy, Finance & Risk Committee:

(a)

Receives the report "Audit New Zealand - report to the

commissioners on the audit of the consultation document for the 2024-34

long-term plan".

Carried

|

|

9.6 Growth

& Land Use Projects Progress Report - December 2023

|

|

Staff Christine

Jones, General Manager: Strategy, Growth & Governance

Andy Mead, Manager: City Planning & Growth

Janine Speedy, Team Leader: City Planning

Carl Lucca, Urban Planner

Key points

·

It was noted that this report was a regular quarterly update of

Growth and Land Use Projects.

·

Staff worked with Mr Te Pio Kawe around Māori Housing

information. This information would be included in the next quarterly update.

·

It was noted that the SmartGrowth Strategy was currently in

hearing process and decisions were to come.

·

The engagement report around Mount to Arataki Spatial Plan

would be outlined in more detail.

·

The matters included were raised through the submissions and

the hearings for Plan Change 33.

Mount to Arataki Spatial Plan

Engagement

·

The outcomes of engagement primarily with the

community and key stakeholder for Stages one and two were included in the

report. Specific engagement with mana whenua partners was on-going.

·

It was noted that the engagement supported

improving air quality and improving walking and cycling connections and safety

and strong support was expressed for the coastal path and wanted to see that

continued.

·

Providing housing choice, increasing visitor

accommodation and projects that resulted in conflicts of land use were not

supported.

·

Staff were committed to continued engagement

and communication of the benefits from the Mount to Arataki Spatial Plan.

·

The staff did engage with Rangatahi and local

schools about the Mount to Arataki Spatial Plan. It was noted that the most

diversity for engagement was found at the Bayfair shopping mall. It was

suggested for better engagement with Rangatahi/teens were to go to their

known hot spots.

·

The character of the Mount and the surfing history was not

strongly expressed in the report. Staff were aware of the culture and this

would come through strongly in the final Mount to Arataki Spatial Plan.

·

The engagement process included connectivity

with the ocean and the community’s main concern was safer access.

·

It was noted an additional 5,000 residents

over a three year period migrated to the Tauranga area.

In response to questions

·

There was a need for ongoing and robust conversations with the

community about the reasons why a more compact city was beneficial. The

challenge was to truly engage and inform the community on the strategic

direction provided through SmartGrowth that supported intensification.

Innovative and interesting ways to get the message out and engage with the

wider community would be considered next year.

·

Tier One councils had difficulty proceeding with density

changes due to the unknown future of the legislation. One of the

uncertainties for TCC was to how the legislation was drafted and once this

was known staff would then seek direction from the Council.

·

Tauranga has a major housing shortage and would need to

increase housing by going up as well as out and would not be able to opt out.

·

It was suggested that the best practice for TCC was to continue

with current plan change processes until further instruction from

Central Government.

Discussion points raised

·

It was suggested for the next quarterly report that the number

of houses required be included.

·

It was noted that Council needed to find new

ways to fund infrastructure development such as IFF.

·

The dilemma facing all councils was the NIMBY

response to intensification of housing.

|

|

Committee Resolution SFR9/23/11

Moved: Commissioner

Stephen Selwood

Seconded: Mr Te Pio Kawe

That the Strategy, Finance and Risk Committee:

(a) Receives the report "Growth

& Land Use Projects Progress Report - December 2023".

(b) Confirms that the:

(i) Plan

Change 33 process will identify the future residential zoning for the Mount

to Arataki area.

(ii) Mount

to Arataki Spatial Plan will reflect the outcomes of the Plan Change 33

process and provide direction on future investment and policy to support the

existing community and future growth.

Carried

|

|

9.7 City

Plan Work Programme

|

|

Staff Christine

Jones, General Manager: Strategy, Growth & Governance

Andy Mead, Manager: City Planning & Growth

Janine Speedy, Team Leader: City Planning

Key points

·

Council had substantially completed Plan Change 33 and the

remaining work now sat with the City Plan Hearings Panel.

·

A significant amount of work sat with the City Planning team,

the majority being on green field development, some of which were large

scale. Some works included were private and smaller plan changes.

·

The report at this stage suggested a commencement of a

significant Plan Change to review the commercial and industrial hierarchy

provisions in the current Tauranga City Plan.

·

It was noted there were a range of Resource Management issues

that had not reached a plan change stage. These included papakāinga,

development view shafts, zoning at Baypark, and work that included the

benefits of water tanks for new development.

·

The Tauranga City Plan currently no hierarchy within

commercial zoning. There was also no differentiation between a large format

centre or a small neighbour centre. There was a need to review the commercial

and industrial zones to differentiate types of commercial and industrial

activities. The rezoning of new land introduced bespoke commercial zones.

·

Plan Change 33 raised concerns about differentiating the

commercial and bespoke commercial zones in Tauranga City.

·

The development community had raised issues around barriers to

development. Reviewing rules on current limits on gross floor area would

require an economic analysis of how big centres were, how much land was

needed and where there were shortages..

·

Central government requirement to apply the National Planning

Standards and the Council had to apply those zones and draft the rule

framework for those zones.

·

Need to look at supporting rules such as transportation

provisions that lacked requirements for multi model outcomes e.g. bicycle. If

the committee agreed with commencing the commercial and industrial plan

change then staff would begin the detailed thinking on these issues.

|

|

Committee Resolution SFR9/23/12

Moved: Commissioner

Stephen Selwood

Seconded: Commissioner Shadrach Rolleston

That the Strategy, Finance and Risk Committee:

(a) Receives the report

"City Plan Work Programme".

(b) Notes the current and committed

plan change projects.

(c) Approves

proceeding with the development of a plan change to comprehensively

review the commercial and industrial zones and relevant provisions in the

City Plan, including the commercial centres network and hierarchy.

(d) Notes

that work programme updates will be provided through the regular

three-monthly progress reporting to the Committee.

Carried

|

|

9.9 Deliberations

Report on the Street Use Policy

|

|

Staff Nic

Johansson, General Manager: Infrastructure Services

Vicky Grant-Ussher, Policy Analyst

Commission Chair advised that

she had read all the submissions.

Key points

·

The Street Use Policy was reviewed in early 2023 and a number

of submissions were received.

·

Identified some policy issues that needed another look at,

these were the rational for charging street to street dining and balcony

dinning, smoke-free and vape-free requirement and prohibiting the use of

artificial grass on berms.

·

Through the submission process, there were mixed views

regarding the changes proposed in terms of the timing due to the current

economic conditions and other cost of living pressures.

·

The proposed changes would be phased in through user fees and

charges that would go out for consultation in 2024 and take effect from

the 2025-26 Annual Plan.

In response to questions

·

The recommendations do not make it clear that this was a

phrased approached and this clarity could be added.

·

Balcony dining was already been paid and accounted in their

current leases.

·

The policy clarified user fees and charges would be part of the

annual user fees and charges consultation rather than part of licence

agreements to ensure greater transparency.

·

While the Council had flexibility under the Policy to determine

when fees would be introduced and what levels they were set, it was suggested

that additional wording to section 6.8 of the Policy be included to widen the

criteria.

·

There was currently no fee for the Mount and consultation on

phasing in the fees would be undertaken through the LTP process.

Discussion points raised

·

The balcony spaces do not affect pedestrian walking space

and the Council was effectively charging for air space. There was

general support for charging for ground level street dining charges but not

for balcony dining.

·

Smoke and vape free areas received strong community support,

however feedback from operators was that the requirement to regulate smokers

was considered problematic.

·

It was agreed to amend the Policy as follows:

·

promoting smoke-free and vape-free environments.

·

new applications for artificial grass on berms would be

prohibited.

·

Balcony dining would be free.

·

Add a further bullet point to clause 6.8 of the Policy “or

for other reasons determined by resolution of Council” to enable

flexibility around fees and charges.

·

Fee reductions under clause 6.8 would be considered through the

LTP process.

|

|

Committee Resolution SFR9/23/13

Moved: Commissioner

Stephen Selwood

Seconded: Commissioner Shadrach Rolleston

That the Strategy, Finance and Risk Committee:

(a)

Receives the report "Deliberations Report on the Street Use

Policy".

(b) Approves the following

changes to the Street Use Policy:

(i) promoting smoke-free

and vape-free environment for new licences or leases for street dining from 1

March 2024.

(ii) prohibit new

applications for the use of artificial grass on berms.

(c) Approves draft Street Use

Policy (Attachment One) with charges to be phased in from the 2024-34 Long

Term Plan:

(i)

zoned dining charges for street dining and free balcony dining

(ii)

Add a further bullet point to 6.8 in the

policy “or for other reasons determined by resolution of Council”

(iii)

Note that through the 2024-2034 Long Term Plan

deliberations Council will give consideration to fee reductions under clause

6.8 of the policy.

(d) Adopts draft Street Use

Policy incorporating Resolutions (b) and (c) above.

(e) Delegates to the General

Manager: Infrastructure authority to make any necessary minor drafting or

presentation amendments to the consolidated Street Use Policy, prior to it

taking effect.

Carried

|

|

9.10 Deliberations

Report for Traffic and Parking Bylaw

|

|

Staff Nic

Johansson, General Manager: Infrastructure Services

Vicky Grant-Ussher, Policy Analyst

Key points

·

A statutory review of the traffic and parking bylaw was due for

review.

·

Staff were seeking to include the recommendations into the

Traffic and Parking Bylaw.

·

Adding a new parking category to enable electronic permits can

be used instead of physical permits.

In response to questions

·

Free parking; staging engagement with community to ensure all

were informed of the change as there was a penalty if people did not

register.

·

Challenge would be that people would not understand where to

register, and when to register, therefore communication had to be done

effectively.

|

|

Committee Resolution SFR9/23/14

Moved: Commissioner

Stephen Selwood

Seconded: Commissioner Shadrach Rolleston

That the Strategy, Finance and Risk Committee:

(a) Receives the report

"Deliberations Report for Traffic and Parking Bylaw".

(b) Notes that work is underway

to address mobility parking concerns in the city centre

(c) Agrees

to the following updates to the Traffic and Parking Bylaw 2012:

(i) clarifying

that secondary vehicle crossings require written council approval

(ii) introducing

a registered parking category to better monitor time-limited parking with

implementation subject to a further Council resolution

(iii) incorporating

drafting changes to the bylaw to clarify that council may issue approval

through electronic permits

(iv) removing

redundant provisions now covered under relevant legislation to reflect

legislative updates since the last review, correcting an omission and

editorial changes to improve clarity.

(d) Recommends to Council:

(i) the adoption of the

draft Traffic and Parking Bylaw 2023 (Attachment One), pursuant to section

145 of the Local Government Act and section 22AB of the Land Transport Act to

be bought into force on 20 December 2023

(ii) to resolve that, in

accordance with section 155 of the Local Government Act 2002, the proposed

draft Traffic and Parking Bylaw is the most appropriate and proportionate way

of addressing the perceived problem and does not give rise to any

implications under the New Zealand Bill of Rights Act 1990

(iii) to

delegate to the General Manager Infrastructure, the authority to make any

minor edits or presentation amendments to the draft Traffic and Parking Bylaw

2023 to correct any identified errors or typographical edits, before the

bylaw comes into force.

Carried

|

|

9.11 Deliberations

Report - Gambling Venues Policy

|

|

Staff Sarah

Omundsen, General Manager: Regulatory and Compliance

Jennifer Ross, Policy Analyst

Ruth Woodward, Team Leader: Policy

Nigel McGlone, Manager: Environmental Regulation

Key points

·

The report was taken as read.

·

The existing policy only allowed relocation of gambling venues

under specific criteria.

·

The proposed amendments would enable changing locations within commercial

zone or industrial zones.

·

Consultation was taken in October 2023 and submissions

overwhelmingly supported this approach.

·

The original deprivation index was an area to consider 8,9

and,10, however reflecting on the Local Alcohol Policy decisions taken a

couple of weeks ago this has been amended to 9 and 10.

·

Suggested adding a requirement to include the proximity of

relocated venues to sensitive locations such as schools, marae and places of

worship when considering the granting of a consent to relocate a venue, which

would be consistent with the legislation.

|

|

Committee

Resolution SFR9/23/15

Moved: Commissioner

Stephen Selwood

Seconded: Mr Te Pio Kawe

That the Strategy, Finance and Risk Committee:

(a) Receives the report "Deliberations

Report - Gambling Venues Policy".

(b) Agrees to amend the Gambling

Venues Policy to:

(i) allow gambling venues

to relocate to alternative premises for any reason as long as the alternative

premises are in a commercial or industrial zone identified in the Tauranga

City Plan, that is more than 100 metres from residential zones with a deprivation index of 9 or

10, measured on the NZ Index of Deprivation – section 5.4

(ii) add a requirement to

include the proximity of relocated venues to sensitive locations such as

schools, marae and places of worship when considering the granting of a

consent to relocate a venue - section 5.4

(iii) remove the out-of-date

city maps (currently in Schedule 1) and refer to online maps on the council

website instead – section 5.4

(iv) make minor clarifications

and updates to text.

(c) Adopts the updated Gambling

Venues Policy (Attachment One).

(d) Delegates to the General

Manager: Regulatory and Compliance the authority to make minor editorial or

presentation changes to the draft policy for correction or clarity.

Carried

|

|

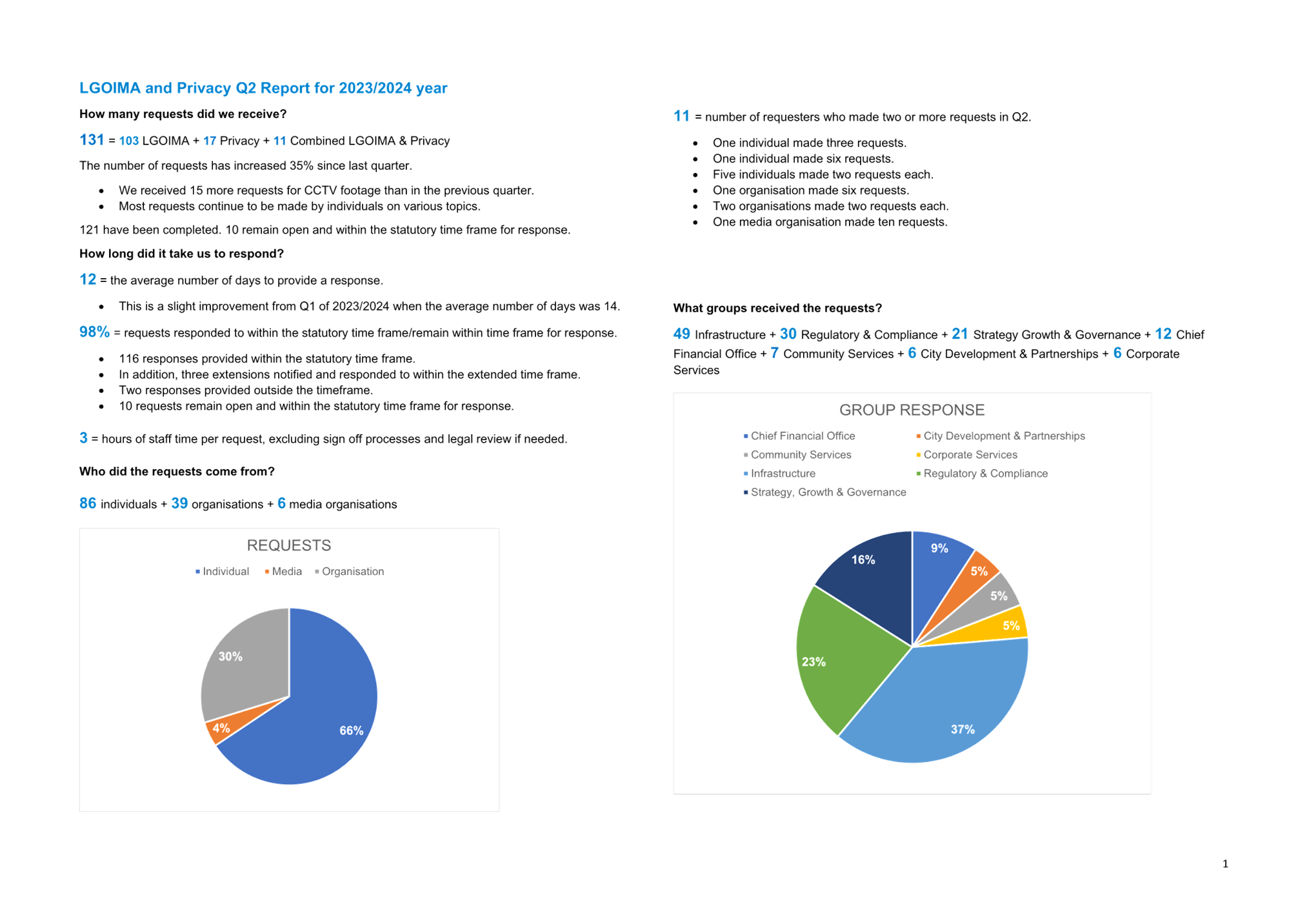

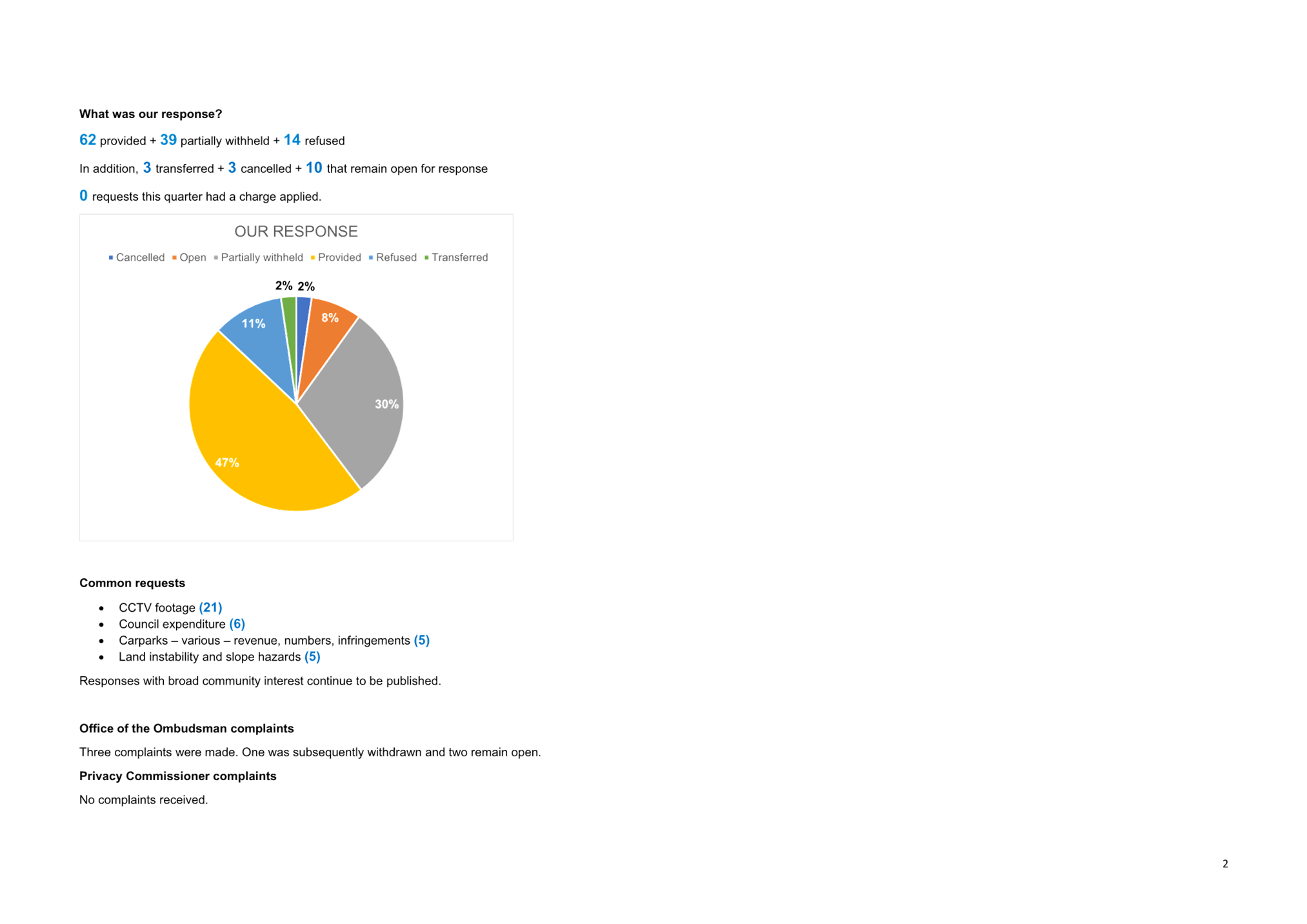

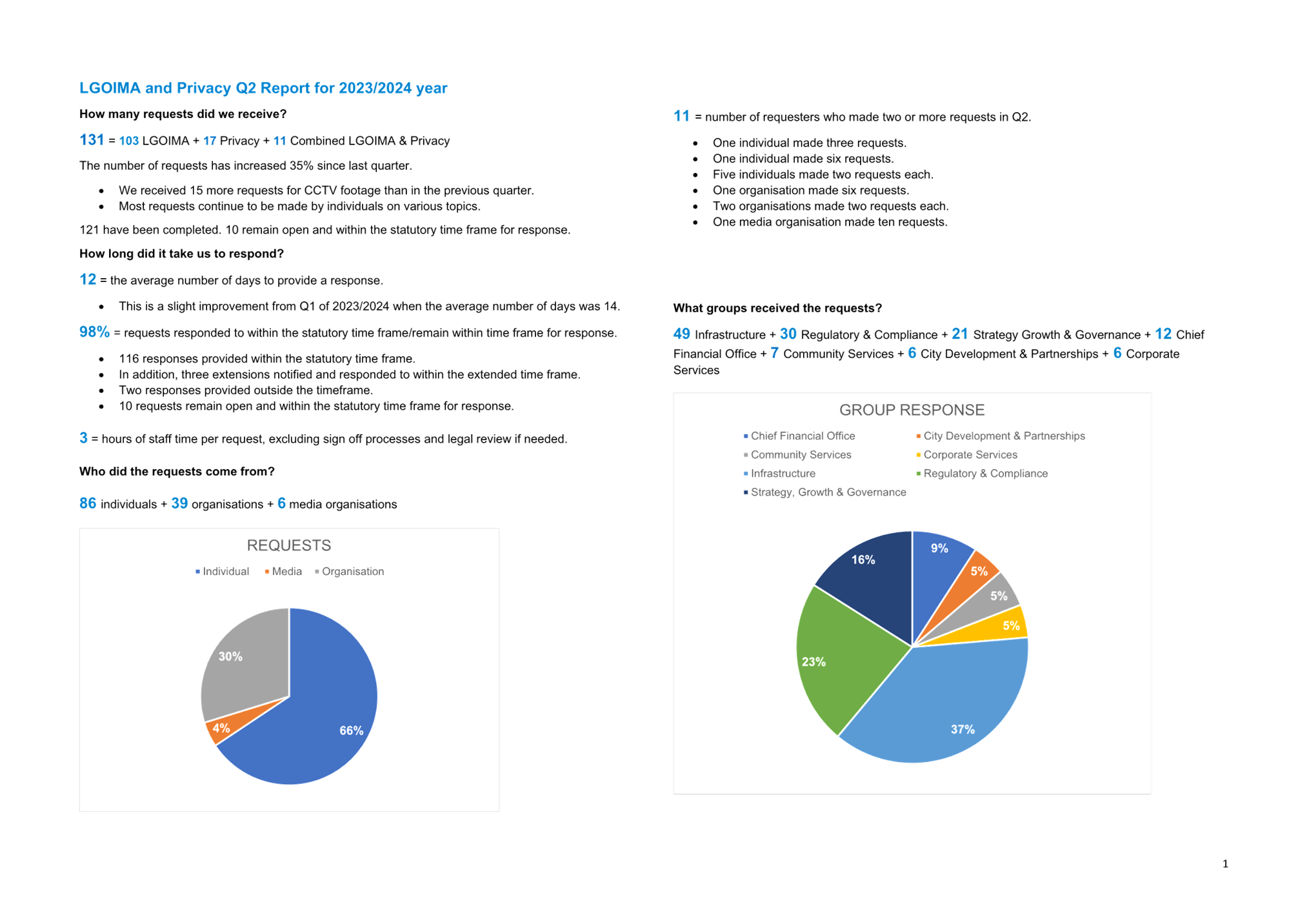

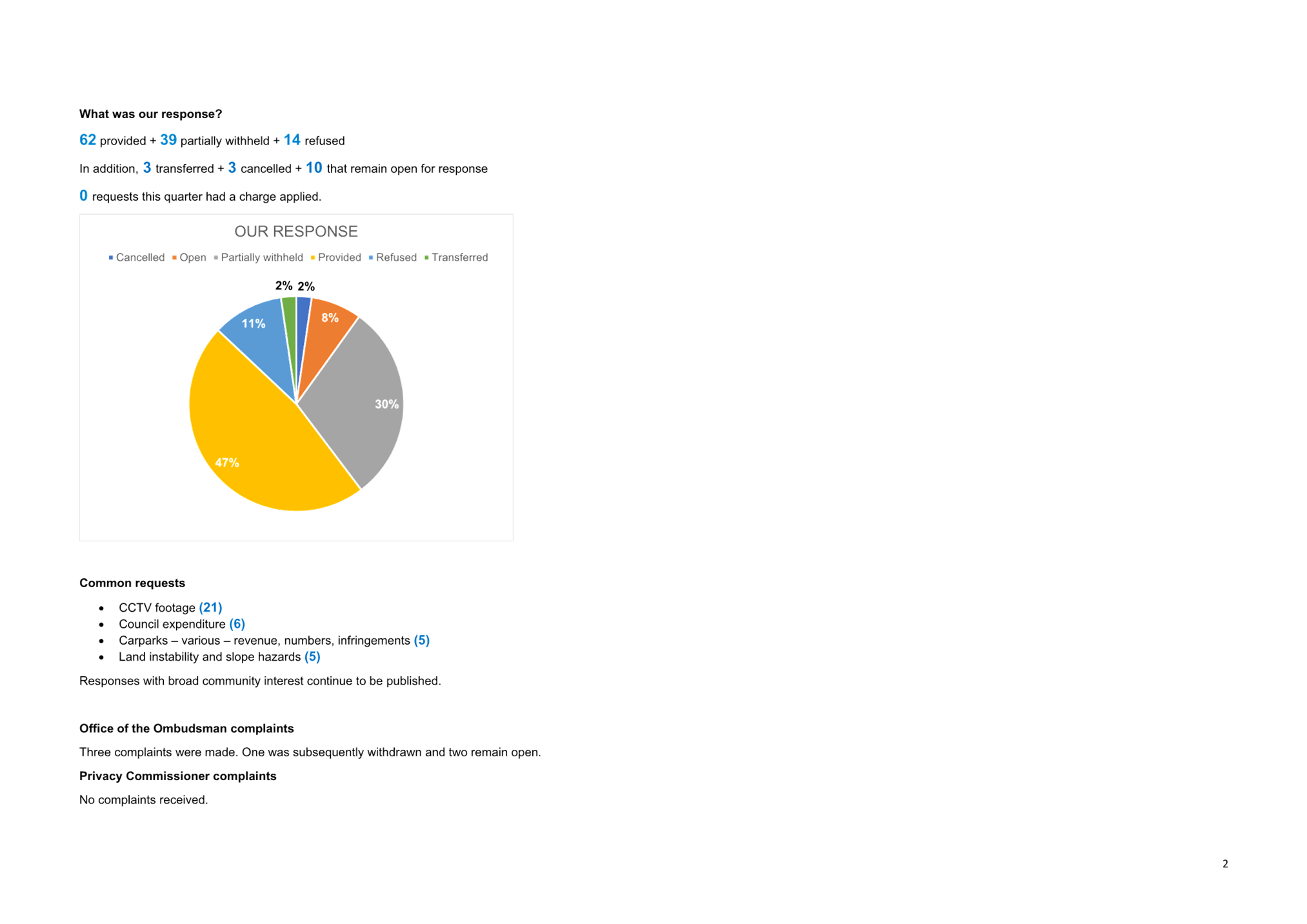

9.12 LGOIMA

and Privacy Report Q1 for 2023/2024 year

|

|

Staff Christine

Jones, General Manager: Strategy, Growth & Governance

Coral Hair, Manager: Democracy & Governance Services

Key points

·

The report was taken as read.

·

There was a 42% increase in LGOIMA requests from the first

quarter of the previous financial year.

In response to questions

·

The majority of LGOIMA requests were from individuals.

|

|

Committee Resolution SFR9/23/16

Moved: Commissioner

Shadrach Rolleston

Seconded: Ms Rohario Murray

That the Strategy, Finance and Risk Committee:

(a) Receives the report

“LGOIMA and Privacy Report Q1 for 2023/2024 year.

Carried

|

10 Discussion

of late items

The late item was discussed in Public Excluded session of

the meeting.

11 Public

excluded session

Resolution to exclude the public

|

Committee Resolution SFR9/23/17

Moved: Commissioner

Stephen Selwood

Seconded: Ms Rohario Murray

That the public be excluded from the following parts of

the proceedings of this meeting.

The general subject matter of each matter to be considered

while the public is excluded, the reason for passing this resolution in

relation to each matter, and the specific grounds under section 48 of the

Local Government Official Information and Meetings Act 1987 for the passing

of this resolution are as follows:

|

General subject of each matter to be considered

|

Reason for passing this resolution in relation to each

matter

|

Ground(s) under section 48 for the passing of this

resolution

|

|

11.1 - Corporate Risk Register - Quarterly Update

|

s7(2)(b)(i)

- The withholding of the information is necessary to protect information

where the making available of the information would disclose a trade secret

s7(2)(b)(ii)

- The withholding of the information is necessary to protect information

where the making available of the information would be likely unreasonably

to prejudice the commercial position of the person who supplied or who is

the subject of the information

s7(2)(h)

- The withholding of the information is necessary to enable Council to

carry out, without prejudice or disadvantage, commercial activities

s7(2)(i)

- The withholding of the information is necessary to enable Council to

carry on, without prejudice or disadvantage, negotiations (including

commercial and industrial negotiations)

|

s48(1)(a)

- the public conduct of the relevant part of the proceedings of the meeting

would be likely to result in the disclosure of information for which good

reason for withholding would exist under section 6 or section 7

|

|

11.2 - Internal Audit & Assurance - Quarterly

Update

|

s6(b)

- The making available of the information would be likely to endanger the

safety of any person

s7(2)(a)

- The withholding of the information is necessary to protect the privacy of

natural persons, including that of deceased natural persons

s7(2)(d)

- The withholding of the information is necessary to avoid prejudice to

measures protecting the health or safety of members of the public

s7(2)(g)

- The withholding of the information is necessary to maintain legal

professional privilege

s7(2)(j)

- The withholding of the information is necessary to prevent the disclosure

or use of official information for improper gain or improper advantage

|

s48(1)(a)

- the public conduct of the relevant part of the proceedings of the meeting

would be likely to result in the disclosure of information for which good

reason for withholding would exist under section 6 or section 7

|

|

11.3 - Litigation Report

|

s7(2)(a)

- The withholding of the information is necessary to protect the privacy of

natural persons, including that of deceased natural persons

s7(2)(g)

- The withholding of the information is necessary to maintain legal

professional privilege

s7(2)(i)

- The withholding of the information is necessary to enable Council to

carry on, without prejudice or disadvantage, negotiations (including

commercial and industrial negotiations)

|

s48(1)(a)

- the public conduct of the relevant part of the proceedings of the meeting

would be likely to result in the disclosure of information for which good

reason for withholding would exist under section 6 or section 7

|

|

11.4 - Local

Alcohol Policy – Legal Advice

|

s7(2)(g) - The withholding of the information is

necessary to maintain legal professional privilege

|

s48(1)(a)

- the public conduct of the relevant part of the proceedings of the meeting

would be likely to result in the disclosure of information for which good

reason for withholding would exist under section 6 or section 7

|

Carried

|

12 Closing

karakia

Commissioner Shadrach Rolleston closed the meeting with a

karakia.

The meeting closed at 3:20pm.

The minutes of this meeting were confirmed as a true and

correct record at the Strategy, Finance and Risk Committee meeting held on 19

February 2024.

...................................................

CHAIRPERSON

|

Strategy,

Finance and Risk Committee meeting Agenda

|

19

February 2024

|

9 Business

9.1 Audit

New Zealand Report on the audit of Tauranga City Council for the year ended 30

June 2023

File

Number: A15425147

Author: Sheree

Covell, Treasury & Financial Compliance Manager

Marin Gabric, Senior

Financial Accountant (Compliance & External Reporting)

Authoriser: Paul