|

|

|

AGENDA

Ordinary Council meeting

Monday, 4 March 2024

|

|

I hereby give notice that an Ordinary meeting of

Council will be held on:

|

|

Date:

|

Monday, 4 March 2024

|

|

Time:

|

8.30am

|

|

Location:

|

Bay of Plenty Regional Council Chambers

Regional House

1 Elizabeth Street

Tauranga

|

|

Please note that this

meeting will be livestreamed and the recording will be publicly available on

Tauranga City Council's website: www.tauranga.govt.nz.

|

|

Marty Grenfell

Chief Executive

|

Membership

|

Chairperson

|

Commission

Chair Anne Tolley

|

|

Members

|

|

|

Quorum

|

Half

of the members physically present, where the number of members (including

vacancies) is even; and a majority of the members physically

present, where the number of members (including vacancies) is odd.

|

|

Meeting frequency

|

As required

|

Role

·

To ensure the effective and efficient governance

of the City.

·

To enable leadership of the City including

advocacy and facilitation on behalf of the community.

Scope

·

Oversee the work of all committees and

subcommittees.

·

Exercise all non-delegable and non-delegated

functions and powers of the Council.

·

The powers Council is legally prohibited from

delegating include:

○ Power to make a rate.

○ Power to make a bylaw.

○ Power to borrow money, or purchase or dispose of assets, other than

in accordance with the long-term plan.

○ Power to adopt a long-term plan, annual plan, or annual report

○ Power to appoint a chief executive.

○ Power to adopt policies required to be adopted and consulted on

under the Local Government Act 2002 in association with the long-term plan or

developed for the purpose of the local governance statement.

○ All final decisions required to be made by resolution of the

territorial authority/Council pursuant to relevant legislation (for example:

the approval of the City Plan or City Plan changes as per section 34A Resource

Management Act 1991).

·

Council has chosen not to delegate the

following:

○ Power to compulsorily acquire land under the Public Works Act 1981.

·

Make those decisions which are required by

legislation to be made by resolution of the local authority.

·

Authorise all expenditure not delegated to

officers, Committees or other subordinate decision-making bodies of Council.

·

Make appointments of members to the CCO Boards

of Directors/Trustees and representatives of Council to external organisations.

·

Consider any matters referred from any of the

Standing or Special Committees, Joint Committees, Chief Executive or General

Managers.

Procedural matters

·

Delegation of Council powers to Council’s

committees and other subordinate decision-making bodies.

·

Adoption of Standing Orders.

·

Receipt of Joint Committee minutes.

·

Approval of Special Orders.

·

Employment of Chief Executive.

·

Other Delegations of Council’s powers,

duties and responsibilities.

Regulatory matters

Administration, monitoring and

enforcement of all regulatory matters that have not otherwise been delegated or

that are referred to Council for determination (by a committee, subordinate

decision-making body, Chief Executive or relevant General Manager).

|

Ordinary

Council meeting Agenda

|

4

March 2024

|

7 Confirmation

of minutes

7.1 Minutes

of the Council meeting held on 12 February 2024

File

Number: A15591214

Author: Anahera

Dinsdale, Governance Advisor

Authoriser: Anahera

Dinsdale, Governance Advisor

|

Recommendations

That the Minutes of the

Council meeting held on 12 February 2024 be confirmed as a true and correct

record.

|

Attachments

1. Minutes

of the Council meeting held on 12 February 2024

|

Ordinary Council meeting minutes Ordinary Council meeting minutes

|

12, 13 & 14 February 2024

|

|

|

|

MINUTES

Ordinary Council meeting

Monday, 12 February 2024

Tuesday, 13 February 2024

Wednesday, 14 February 2024

2024-2034 Long-term Plan Hearings

|

Order of Business

1 Opening karakia. 3

2 Apologies. 3

3 Public forum.. 3

4 Acceptance of

late items. 3

5 Confidential

business to be transferred into the open. 3

6 Change to the

order of business. 3

7 Confirmation of

minutes. 3

Nil

8 Declaration of

conflicts of interest 4

9 Deputations,

presentations, petitions. 4

Nil

10 Recommendations from other

committees. 4

Nil

11 Business. 4

11.1 2024-2034

Long-term Plan - Hearings. 4

12 Discussion of late items. 61

13 Public excluded session. 61

Nil

14 Closing karakia. 61

MINUTES

OF Tauranga City Council

Ordinary Council meeting HELD ON

MONDAY, 12 FEBRUARY

2024 AT 1.30PM

Bay of Plenty Regional Council Chambers,

Regional House,

1 Elizabeth Street, Tauranga

Tuesday, 13 February 2024 at 1pm,

Club Mount Maunganui, 45 Karaka Street, Mount

Maunganui

Wednesday, 14 February 2024 AT 9AM,

Huria Marae, 1 Kaponga Street, Judea, Tauranga

PRESENT: Commission

Chair Anne Tolley, Commissioner Shadrach Rolleston, Commissioner Stephen

Selwood, Commissioner Bill Wasley

IN ATTENDANCE: Marty

Grenfell (Chief Executive), Paul Davidson (Chief Financial Officer), Barbara

Dempsey (General Manager: Community Services Christine Jones (General Manager:

Strategy, Growth & Governance), Alastair McNeill (General Manager:

Corporate Services), Gareth Wallis (General Manager: City Development &

Partnerships), Josh Logan (Team Leader: Corporate Planning), Ella Quarmby

(Corporate Planning Intern), Coral Hair (Manager: Democracy & Governance

Services), Shaleen Narayan (Team Leader: Governance Services), Anahera Dinsdale

(Governance Advisor), Janie Storey (Governance Advisor)

1 Opening

karakia

The karakia had been given at the Council meeting earlier in

the day.

2 Apologies

Nil

3 Public

forum

Nil

4 Acceptance

of late items

Nil

5 Confidential

business to be transferred into the open

Nil

6 Change

to the order of business

Nil

7 Confirmation

of minutes

Nil

8 Declaration

of conflicts of interest

Nil

9 Deputations,

presentations, petitions

Nil

10 Recommendations

from other committees

Nil

11 Business

|

11.1 2024-2034

Long-term Plan - Hearings

|

|

The

following members of the public spoke to their submission to the 2024-2034 Long-term Plan.

A copy of

all presentations and documents tabled at the hearing can be viewed on

Tauranga City Council’s (TCC) website.

(1)

Sub ID: 1101 - Jo Wills

Key points

·

Asked what the measures of success were for the LTP and the

challenges Council were facing.

·

Growth was occurring for the sake of growth and GDP seemed to

be the only measure.

·

There were no social or environmental outcomes noted as

measures.

·

If the measure was the GDP, the plan would have won as cash was

all that measured.

·

TCC was facing a number of problems with its transport,

housing, mental health, inequity and the like and there was no evidence of

looking at those or contributing to measuring them.

·

Council could not make an educated decision on what they were

achieving.

·

There was no overarching lens of the LTP other than growth and

items like sustainability were there as an add on.

·

Greenstar rating should be done regardless and was nothing to

do with the goals or where Council were wanting to head as a city.

Everything should have sustainability lens across it.

·

Questioned what would improve the lives of people living in

poverty, ratepayers living in poverty, not owning a car, connectivity and

reducing emission in a way that was game changing rather than doing something

less bad.

·

Council cannot just tinker around the edges, it needed to

change things.

(2)

Sub ID: 1065 - Des Heke

Key points

·

Noted the importance infrastructure for Māori land and the

LTP.

·

There were areas of the future urban limits of Kaitemako which

had been missed out in the of planning sequence of how Council could address

the anticipated growth areas.

·

Council’s relationship with a number of Kaitemako land

blocks some of which were currently rural that needed to go through a plan

change in order to be developed.

·

The plan change was reduced to the Ohauiti south area, and even

if it was a private plan change, the need to encourage the peripheral

Māori Land as they all share the same level of service of infrastructure

requirements and would result in better community outcomes with more

structured and integrated planning as was originally intended.

·

The Ohauiti-Welcome Bay planning study was put on hold but was

important to raise issues around current infrastructure.

·

There were new government invested projects to look at to

develop Māori land and Council supporting staff and what the housing

needs would look like.

·

The submitter questioned how Council’s proposals fitted

and integrated into the current infrastructure.

·

There was an opportunity for the Kaitemako land situated above

the rural/residential land had a resilient and soon to be main water line,

which was an opportunity to provide rider mains to service that

community. It still unaddressed and still sitting there as a

development issue.

·

Currently in the LTCCP and in communication with land trust representatives

the Otumanga pump station in the Welcome Bay catchment and across Maungatapu

and the Waimapu estuary to bottom of Turret Road had upgraded work carried

out in the mid 2000’s. The Marae whanau thought that the station

would have the capacity to service their land.

·

Council recently upgraded some asbestos pipe in the area, but

the trust land that were current anticipated growth areas had come to

feasibility plans with Council as well as the Trusts further up in the rural

zone but the Otumanga pump station had fallen off the LTCCP to be

upgraded. This means that all of that planning and efforts to address

some of the housing needs would be encumbered by the loss of investment by

Council into the Otumanga pump station which needed to be upgraded.

·

The submitter noted he was an Iwi representative mainly for

waste water, but put the submission in on behalf of all of the land trusts,

iwi, hapu and community that would benefit. If the Council were

upgrading the asbestos pipes why not the pump station also. Requested

that the costings to be brought to light as according to those housing

needs.

·

There were trustees of the three major land blocks –

Kaitemako B & C, Kaitemako M2 & N - had an idea of what they

want to build and create on their land and want that accommodated in the plan.

(3)

Sub ID: 675 - Phillip Brown, Papamoa Residents &

Ratepayers Association

Key points

·

Concerned at the tsunami evacuation pathways from Papamoa.

·

There was evidence of tsunami debris in the Papamoa hills so it

was a real threat to residents.

·

Considered that anything to help residents evacuate had been

put in the too hard basket.

·

The latest tsunami maps released in October 2023 indicate that

90% of Papamoa would be under water.

·

There were 30,000 people living in the community that was

expected to evacuate to the Papamoa hills which was a distance of 3 kms.

·

If a tsunami was from the Kermadec Islands it would reach land

within an hour.

·

There were no plans as to what was to be done in the future,

yet a tsunami could happen at any time.

·

Council’s attitude was irresponsible, how does 30,000

people get to the hills with no pathways directly to them.

·

Emergency sirens, as used by other towns had been

cancelled. Instead a group had met once and disbanded with no follow up

to residents.

·

Papamoa roads would be gridlocked and for those travelling by

foot or bike, they needed to cross the eastern link. There were only

three ways to cross, with the new interchange bridge adding a fourth

crossing.

·

When asked to put a pedestrian crossing on the interchange

bridge, the reply was any easement over private land was up to

developer.

·

Isn’t it one of Council’s obligations to look after

its residents.

·

In relation to a suggestion to close the expressway to allow

easy crossing, was told it was not possible, yet it had recently been closed

for a cycle race.

·

The current state of the sides of Domain Road only had ditches

and no footpath.

·

Papamoa residents had considered a set of pathways and

presented these to Council and NZTA at a cost of $20M. Nothing

had happened since that presentation.

·

There was responsibility of care and welfare for

residents.

·

Commissioners were driving change, this was an opportunity of a

lifetime but at Papamoa they want an opportunity for a life.

In response to questions

·

Staff were doing a lot of work since the release of the maps in

October 2023 and the issues raised were being taken seriously.

·

The matter of the closure of the expressway was raised with the

NZTA Board last year and it was agreed that it would be done.

·

Staff were prepared to work with the Association and this would

happen.

(4)

Sub ID: 1478 - Garth Mathieson, The Tauranga Millennium

Track Trust

Key points

·

Track Trust supports option 3 and opposes any form of stadium

being included in the LTP.

·

The business case provided by Priority One allowed for 15,000

seats, a community multi-sport facility and a university sports science

centre. Rotorua already had a 20,000 seat stadium, with half of the

population.

·

There was no carparking in that area of Tauranga.

·

A community stadium cannot be matched and would result in a

loss of a substantial part of the greenspace and limited use of the

fields.

·

It would be built on a recreation reserve and compete with

other function centres.

·

Community multi-sport facility was a flash name for changing

rooms.

·

Waikato University had indicated to the submitter that they

were not committed to a stadium and the inclusion of them as a proposed

tenant may suggest they were tenant, which was beyond any discussions held to

date.

·

Was there to be a proper account of noise that would come from

events held?

·

The creation of revenue streams was a fantasy. Did not

consider that the grounds would not get 248 events in first year or 5,000

attendees at each game.

·

NPS rugby games cost an average of $400,000 to stage and some

do not pay.

·

Why have a second regional rugby stadium, when Rotorua was 1

hour away and it was only 15 minutes from Bay Park. It would compete

with those facilities.

·

The cost of a new stadium was $250M with a loss of $15M per

year expected.

·

There was still $150M of funding to find.

·

Why target philanthropic donors and not??

·

How much was BOP Rugby contributing?

·

All local organisations should go out and get money and put in

an effort themselves if they want a stadium.

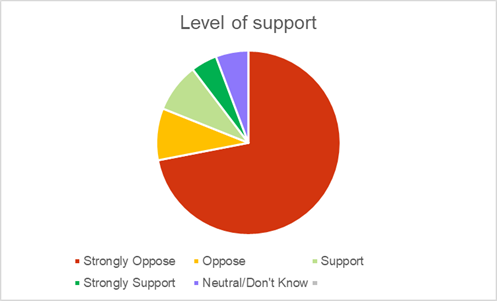

·

59% residents were against the proposal so the decisions should

be turned around as it was too soon to put it in the LTP and too soon to

justify it.

(5)

Sub ID: 868 - Barry Scott

Key points

·

Opposed to the Tauranga domain proposal.

·

Emphasise the contention that Council failed to validly consult

about the proposal.

·

Local Government Act notes the need to consider the views of

the community and encourage people to present those views and make a

presentation. Council was to receive these with an open mind and had failed

to do that adequately.

·

Online survey results revealed that the majority disagreed with

the proposal.

·

Council designed the survey and only gave submitters five

minutes to speak.

·

Not enough consultation was held which was a breach of the Act.

·

Another major breach was the discussions to be held in an open

and transparent manner. In May 2023 a Project Development Committee was

appointed to oversee feasibility study with nothing included on any web pages

and when asked for more information was advised it was not a formal Council

group and was a partnership with Council and Priority One.

·

Anne Tolley and the Chief Executive had attended the Governance

and Workshop Group meetings but no record of meetings were put on the

webpage.

·

Looks like people were being deliberately kept away and there

was nothing to indicate the partnership existed.

·

Council must consider all reasonable options and consider

advantages and disadvantages. The Working Group was to consider only

the domain for a stadium and other sites only if domain was impossible to use

as the site.

·

The majority of the group had some interest in proposal going

ahead, so was not completely unbiased and it was not unfair to wonder if

decisions were made from discussions at those meetings.

·

People were suspicious of outcomes and if you try to hide it

undermines the credibility and validity of those decisions.

·

There was no need to do the work under Priority One, it could

have been an in-house exercise which would have been more open and

transparent and free from any bias.

·

Would like Council to admit to itself and withdraw the project

from the LTP, put it back on the shelf and leave it for the new Council to

consider in due course.

·

Pause the whole process and extend the process of the adoption

of the LTP to end of September 2024 so that the elected representatives could

have a look at it.

·

Excellent submission of the Tauranga Historic Village Board

which should also be put on hold until it could be reviewed. The

Village was helping residents with mental health issues and was the best.

Council should support it and not make it harder.

(6)

Sub ID: 1252 - Scott Adams, Carrus

Key points

·

Applaud Commissioners for progressing the LTP to be operative

by July 2024.

·

Two developments progress delayed due to lack to

infrastructure.

·

Te Tumu was the number one priority growth area in the Western

Bay and rezoned in 2002 for future development and Council must find a

pathway to proceed.

·

Carrus request a change in the LTP to say that the Council and

main land owners were progressing the plan change with best case notification

target of July 2024 which was before the 10 years expired and before the new

Council was elected.

·

Te Tumu landowners had a desire and belief that this could be

done with the building of houses being commenced in 2030. Need to

accelerate the rezoning now and explore funding options with central

government.

·

49 Pukemapu Road – after purchasing more than 9 ha of

land the developers and having been assured by Council engineers there was

infrastructure capacity and entering into a $3.2M Rosedale residential share

compensation deal of which TCC contributed to and brought 2 houses for road

access.

·

Carrus spent 12 months carrying out iwi consultation and a

lengthy Heritage NZ process to remove an archaeological site from the land.

·

Now have grave concerns that the ability to develop the

residential zoned land to provide urgently needed housing was ruined because

of service network constraints.

·

Council engineers had advised that despite the land having been

zoned residential for 20 years, there was not sufficient water or wastewater

capacity to service the land with 460 new residences.

·

The Rosedale developers were not tasked by Council at the time

of their development to future proof their infrastructure, so why was the

land rezoned residential if there was no way to service it.

·

Had been advised that 2 of 4 waste water upgrades necessary

would be implemented between 2026-28 and the other two as late as 2044, so

unless Council engineers collaborate with Carrus construction team to come up

with alternative solutions which they had already indicated that they were

not willing to do, then ether would be no development in Pukemapu for the

next 10-20 years.

·

Wastewater was already near spillage and the nearest one to

service the land was located at Joplin Way, 1.2 k away from the boundary and

as developer would be responsible for the cost of the $7M for construction a

new dedicated sewer pipeline and which was not ready for use until

2028.

·

Because of wider downstream sewer network system improvements

would also be required for the development and some were not included in the

draft LTP so would not be available until after 2034.

·

Other upgrades to pump stations were not included in the

plan.

·

Request a follow up meeting with the Commissioners and Chief

Executive to explore with Council on site storage and off site peak discharge

could be used to ensure that the development could commence including

stormwater management, water, firefighting solutions, wastewater treatment

and future roading for both blocks.

·

Given the cost of $18M so far, Carrus request Commissioners put

pressure on the Council engineers to be more flexible so that Carrus commence

with the development. There were other solutions but have no transparency to

Council modelling and any collaboration to alternative solutions had so far

been rejected.

·

The Pukemapu project had been given key account status under

the Rosedale compensation agreement between Carrus and Council so all need

realise this. There need to be some serious outside the box thinking to

get it underway urgently with interim solutions and overall development

solutions so that consents could be lodged for earthwork and roading consents

for an October 2024 earthworks start.

·

Wants to work with Council towards a robust solution.

In response to questions

·

Commissioner Tolley noted that they were not aware of some of

the points raised and would follow up with staff.

(7)

Sub ID: 812 - Todd Morris, Otumoetai Cadets Cricket Club

Key points

·

Proposal of increase fees did the opposite and the more they

learned, the worse it got.

·

If groups of residents had a proposal, you could get a diverse

range of people.

·

The existing fields were used for a few hours a week and now

Council want to charge for it which was not fair or consistent, but a cash

grab.

·

The subjective terms were more propaganda than fact.

·

Social cohesion and were counter to Council’s own dos.

·

No impact analysis was done, they just want money for pet

projects not more.

·

Big money was being spent on skate parks, library and the like

with no consistency and fairness as people were not charged for the use of

those facilities.

·

If Council kill the senior clubs with the proposed charges, the

junior clubs would follow.

·

The club were already battling to survive.

·

Any health and wellbeing benefit comments were absent from the

proposal.

·

There was a legacy at stake that decision makers would have to

live with.

·

Already killed off many sports clubs. Council were for

destruction not cohesiveness.

·

Volunteers work long hours to maintain community groups.

·

Some kids and grandkids committed suicide and Council were

pouring petrol on that.

·

The charges would kill sports clubs with no analysis being

done.

·

Show decency and goodwill and put the proposal in the dustbin

where it belongs.

·

The players came from a lot of different backgrounds and make

connections on the field. There were lawyers and doctors playing

alongside beneficiaries.

·

While the submitter knows that Council want the city to survive

but wanted them to prove it.

(8)

Sub ID: 1546 - Keni Piahana, Kelly Waaka

Key points

·

The notion of industrial rate was sensible, with Tauranga a

centre for the country in many ways, and while there were reservations at

first on the cost of living but with the port activities, it looked like they

paid attention to the services as well.

·

Shortfall of 50% for Pyes Pa was seen as a catch up mode from

the 1990’s with the inception of the plan and greenfield subdivisions

which saw so much happened so quickly with the cost implications manifesting

later on.

·

If people could see the actual cost and what was involved in

infrastructure they would understand it more.

·

Selling of the car park buildings as a way to fund community

projects, but raised questions at Waimapu Marae as to what community projects

the proceeds were funding when they do not have footpaths or street

lighting.

·

Since the Commissioner’s had attended a hui at the Marae

they had gained so much more with staff commitment to the projects raised.

·

In 1860 the hapu withdrew and moved from Huria back into the

Waimapu. From then until now they had been in a position of withdrawal as

that gave them control. However over time although they had lost

control with new roads and pipes, they still had the view that it was still a

good move for them as the Waimapu Pa Road area was home and of significance

to them.

·

Now in 2024, there were all those things that they were going

without and now want to put pressure on as there were no footpaths for the

children to walk to school and the street lighting was poor.

·

An application had been made to have been considered previously

and staff had engaged with the Waimapu community well.

·

Request Council to look at road speed limits and the support

30km for the whole stretch of road right out Poike Road intersection as

people had to walk on the narrow stretch of road.

·

Support SmartTrip proposal which the considered could be taken

a lot further as making a modal shift would make a difference to the

congestion being seen at present.

·

An LTP performance measure for the iwi was that a child should

be able to leave home with their parents knowing they were safe as a common

place like it used to be and having children restoring their own independence

to go to school on their own.

·

Need good linkages, connectivity and public transport options

as some families were running 2-3 cars as the options for alternative public

transport were not strong.

In response to questions

·

Submitter was thanked and advised that a check would be made

with staff and an update provided.

(9)

Sub ID: 1663 - Lorin Waetford, Ngai Tukairangi Ahu

Whenua Trust

Key points

·

Trust not supportive on any of the consultative questions and

want to be more informed around the issues.

·

Request $150,000 be set aside for the Ngai Tukairangi Ahu

Whenua Trust to update their Hapu Management Plans to make sure they were

updated and sat above and fed into Council plans.

·

Too often hapu representatives provide time, effort and work

for the whole city before their own communities.

·

Hapu representations were ignored by staff or only had a

tangata whenua or mana whenua chapter layer added in to details at a later

time with no specified date.

·

Presented a submission to the SmartGrowth strategy and pointed

out the failure of Council to include Māori Land Trusts in the planning

process, or detailing who they were and what value they could have in it.

·

For the whole city - if tangata whenua were striving - all

would. This does not mean the replacement of hapu and iwi land trusts as they

all had a part to play.

·

The LTP consultation process did not target any iwi

consultation. Māori being able to come to any of the community

engagement events was not an inclusive process.

·

There was not enough time to show the issues that come from the

top down and to bring kaupapa to Māori communities.

·

Engage with the wider whanau was needed to ascertain if they

were aware of the LTP and if it had capacity for more than one member.

·

Lack of safety with some of the roads, noting the recent death

of a child and offering tai toko that the child was taken before Council were

doing anything. This was not the first time that Council had acted only

after a death had occurred.

·

Council could expect a letter of opposition to the SmartTrip

proposal as the Trust had tenants in Grey Street properties.

·

The life span of the Commissioners was coming to an end and

they were trying to get the LTP over the line. The Trusts were here way

before and would be long after the Councillors were elected in.

In response to questions

·

Noted that discussions had been held with Rangapu regarding the

plan and that they had also made a submission.

·

Point taken regarding the Land Trusts.

(10)

Sub ID: 1578 - Annie Hill, Creative BOP

Key points

·

Thanks for the community arts and culture that was occurring

and understanding the value of it to the city.

·

The group enhanced the health, wellbeing, educational outcomes

of residents while stimulating innovation and economic growth.

·

Had developed a strong track record of delivering programmes to

the art sector with positive changes.

·

Deep connections had been developed in the creative sector

which had positioned them well to add significant value to Council.

·

Well placed to help Council and maximise opportunities as they

arose.

·

Exciting opportunities to support an arts, culture heritage

investment plan.

·

Support for iwi and hapu to reach their aspirations.

·

Support for Māori and non-Māori to access resources

and contribute to the public art framework with historical and cultural

narratives,

·

Development of a strong sector in advocating for the arts as

member of Arts Aotearoa, developing strategic relationships and engaging with

the sector in arts culture and creativity.

·

Happy to talk more and were to open to opportunities to extend

their contract with the Council.

(11)

Sub ID: 1077 - Michel Galloway, Tauranga Lawn Tennis

Club

Key points

·

Concerned at the increased rent charges for clubs using Council

sports grounds with the new user pay fees as recovery fees.

·

Object to the stadium proposal.

·

Users pay for small clubs shows a disconnect to them.

·

No consultation had been done before putting these items into

the LTP.

·

100% recovery would provide a rent to increase from $800 to

$37,000 plus gst which was untenable and creating a lot of stress on small

clubs which would likely result in closure.

·

Most clubs were located in residential areas and contributed

much to the wellbeing of their community by providing programmes with juniors

and working with school children through to the older residents for no

revenue.

·

There were no foreseeable grounds for cost recovery unless the

Council want to pay for some of the sports development programmes from development

levies otherwise there would be a loss of membership and loss of clubs.

·

Why should the clubs be penalised when they did not have the

funds to pay.

·

Using the LTP to float the increase was unfortunate, as there

had been little input from users.

·

People value greenspaces but building a stadium would reduce

the free use of an area which had been used for generations. It would

also lead to a loss of some of the community sports currently operating on

the domain.

·

A stadium would be costly to build and to operate.

·

The majority of those surveyed strongly opposed the building

and paying for it.

·

Remove the stadium from the LTP and use the funding for other

community facilities.

(12)

Sub ID: 1492 - Peter McKinlay

Key points

·

Submission based on 30 years working within extensively with

local government and advisers around the globe.

·

The fees and charges policy and the Council decision making process

was non-compliant with the provisions of the Local Government Act as it

failed to address the purpose of the promotion of local democratic decision

making by and on behalf of communities and the promotion of the four well

beings and does not recognise that the role of local government was

furthering the purpose of local government in the district

·

There was nothing to indicate that Council had any

understanding of those requirements or of Section 14 of the Act where it must

consider the impact of each of the four well beings.

·

Similar to UK recently where as part of a general competence

provision, Councils were required to further community wellbeing. When

judicial review proceedings were undertaken many were overturned. This

was the view the courts would take was that the Act provided very clear

requirements. Most Councils in NZ do not observe them, and a practice grown

up in the sector over the years. This explains it but does not excuse

the non-compliance.

·

The submitter does not expect the Commissioners would have to

go back and redo the decision, the main purpose for the submission was to

raise understanding with the public that the Council had consistently not

complied with the requirements of the Act and to alert the incoming

Councillors that there was a serious and endemic problem of non-compliance

that they would need to deal with.

·

There were not individuals that should be blamed for this as it

was an endemic problem in the sector in large part because of the way central

government had treated local government which explains but does not

excuse.

·

Then only course open to Council if it wished to be compliant

was to go back and understand the requirements of the Act and apply them in future

decision making. This would require significant change in the way the

Council does its business but observing the law should not be seen as an

unduly onerous obligation.

In response to questions

·

In response to a query as to a sense of the nature of scope of

change the submitter believed necessary, he noted that in developing any

policy Council explicitly needed to consider and promote in the district of

what impact it had by and on other communities and what impact was being had on

the four well beings. Section 14 of the Act considers the impact of

each of the four well beings on each decision. It was more than showing

it in a document it was adopting it and implementing it as per the

requirements of the legislation.

(13)

Sub ID: 1362 - Kathryn Lellman, Nicky Hansen, Tauranga

Arts Festival Trust

Key points

·

Remind communities of the importance of arts and culture to the

city and its residents.

·

Significant debate had been held in the United Kingdom where

arts were seen as the cherry on cake, when actually the arts were the cake.

·

Support for Spaces and Places to connect, play and learn with

the revitalisation and bringing the heart of the city alive.

·

The Arts Festival in October and November 2023 had 52 ticketed

events and 7 free events which attracted over 10.000 people and school

children with artwork from a variety of artists from tangata whenua,

Pasifika, North and South Asia and LGBTQIA. .

·

Over 30% were first time attendees, with most being very

satisfied.

·

The attendees and visitors made the city a better place.

·

The arts were strongly contributing and creating exciting

things to do for all ages and abilities

·

The investment of the museum, library, theatre and outdoor

spaces, what happens there was justified. 452

·

Still have to justify the cost of the use of buildings such as

Baycourt and the Cargo shed

·

Acknowledge Council support for the use of the Crystal Palace

free of charge.

·

The cost for the use of other spaces needed to be cost

realistic and affordable as the arts were for the benefit of the community

and an investment in our future .

·

Acknowledge and appreciate the support given by Council during

2023.

·

Seek to ensure a balanced investment in the arts and not just

putting cherry on top. Continue to invest in the events still to come.

In response to questions

·

Commissioners acknowledged the Arts Festival as a great event.

(14)

Sub ID: 1237 - Warren Banks

Key points

·

41 years as a resident and life member of Priority One and a

CCO member.

·

Spending priorities of the Council were wrong as there was

nothing to bring businesses back into town.

·

Cameron Road pipe works became so much more and resulted in a

loss to all as it restricted traffic flow.

·

The proposal to implement a congestion charge when Council had

reduced parking in the town and had made attendance harder to get to the Bay

Oval.

·

More congestion had occurred with the on road cycleways as they

were unsafe and creating barriers to gain access to business premises.

People were looking for the premises not the cyclists.

·

Cost escalation was being put on sports and community clubs,

causing widespread damage to the health of all ages across the community as

they could not afford the increased fees. Should Council deprive parts of

community with these increased costs.

·

Community gardens were a cost.

·

The Mens Shed had an amended leases for more than one

tenant.

·

The increased cost for the Historic Village was unjustified.

The Village was a healthy and active community and any closure threatened all

ages.

·

Alfresco dining would also be affected.

·

Public transport system was flawed as there was an abundant

provision for bus lanes which only caused a congestion of the traffic flow.

·

Use smaller buses as the bigger ones were mostly empty.

·

Motorcycle access around the city was great.

·

If Council needed new revenue source for the nice to have

projects then cut costs. The focus should be on essentials not beauty

programmes.

·

The community deserved to see dollars and dates for the

projects.

·

Keep up the recycling and the track developments on Mt

Maunganui.

·

While there had been a dysfunctional Council before, it was now

a misaligned one.

·

Keep the people informed.

(15)

Sub ID: 1008 - Arun Baby

Key points

·

Proposed ground usage charges were from a concerned player and

parent perspective who was apprehensive of the increases being imposed.

·

The financial implication of the increases affected families

and the broader cricket community, especially the junior players.

·

There was a cost increase of 421% in competition fees for

senior players from $221 to $3,400 per team..

·

Families with multiple players would have double or triple the

subscription cost.

·

While respecting the plans, the reality was that all senior and

junior competitions would have the same cost which would make it harder for

them to transition from junior grade to the seniors.

·

Junior programmes relied on the dedication of senior players as

coaches, managers, mentors and role models. The loss of those senior

players would affect the junior programmes and have an impact on their

cricketing skills..

·

Accessibility – there would be financial barriers for

senior players to remain in the club and to embark on roles for the benefit

of all players.

·

Youth and junior groups would be adversely affected as the fee

increase would impact on those players as they like to see their seniors

actively playing the sport.

·

Appeal for the consideration of cricket in the community and to

have a commitment towards retaining the senior players as Council risk

disputing the delicate balance of the cricketing community.

(16)

Sub ID: 1653 - Evan Turbot, Tauranga Village Radio

Key points

·

The Radio station had been situated at the Historic Village for

40 years and was part of the cultural identity of the village and the city.

·

There were serious safety issues with the building and were

working with management to resolve those issues.

·

The Village was established in the 1970's as a permanent space

to work with the community.

·

People were invited to use spaces for little or no cost and the

Village radio station responded to that call.

·

While visions could change, the people of Tauranga had not changed.

·

Want the Council to hear that the Village was a place for

ratepayer investment.

·

Revenue gained from users pays and a return on assets would

bring distress to the many volunteers who run not for profit services at the

Village. 75% of the tenants were community organisations.

·

From a city wide average, the rent looked reasonable, but only

if you were a commercial entity not a local authority. It was too high,

even with a discount for community groups.

·

Questioned whether consideration had been given to the Local

Government Act in regard to the four well beings as there was no word of

social and cultural wellbeing in the revenue gathering statement.

·

Was Council discharging its obligations as it applied these

charges to the groups in the Historic Village.

In response to questions

·

In response to a query regarding income it was noted that the

station had limited resources, with the only real income coming from

charitable grant funders. A subscription of $5 a year was paid by some

supporters of the Village radio and they had $30,000 in the bank.

·

The group had serious financial constraints in the past and

they were once again scared that they would be facing them again in the

future.

(17)

Sub ID: 294 - Jaijus Pallippadan, Johny

Key points

·

Lived in Tauranga for three years and was a member of a cricket

club playing senior cricket.

·

The fees expected from users was unfair and it was crucial to

recognise these were non-profit community organisations.

·

There were a lot of health and wellbeing benefits relating to

sporting activities.

·

The players relied on affordable or free access as they

operated on minor budgets, many of whom were volunteers. It was tough

to get sponsors this year.

·

The financial strain being caused would reduce or cease the cricket

programmes.

·

Many non-profit organisations assist backward or under

privileged groups and provided valuable opportunities for these groups while

also giving them the ability to fulfil their missions to help their

community.

·

The increase in fees undermines equal opportunities for social,

health and recreation.

·

Request the decision makers to give further consideration for

the non-profit user fees for sports fields, uphold fairness and demonstrate

commitment in building a healthier and more vibrant community for all.

In response to questions

·

Commissioner Tolley thanked the submitter and noted the dilemma

Council was facing with sports users for indoor facilities paying more than

those using the outdoor sports fields and asked how did Council get that

balance right so all users get a fair go. Many of those users were also

on fixed incomes and were managing to keep their facilities up to

scratch.

·

Council also needed to look at filling in the gaps with

sporting facilities over the next 10 years, which was not an easy

outcome.

At 3.07pm the meeting adjourned.

At 3.30pm the meeting reconvened.

(18)

Sub ID: 1495 – Heidi Lichtwart, Larissa Cuff, Nick

Chambers Sport Bay of Plenty

Key points

·

Sport Bay of Plenty appreciated the gravity of the situation

with a growing city.

·

Sport was a key to healthier and more connected communities

which was shown in the submissions received.

In response to questions

·

Commissioner noted that they value of the relationship with

Sport Bay of Plenty.

·

Noted that when Bay Venues Limited set their fees and charges

they were higher for indoor sport creating a huge disparity in sporting costs

which was a big issue.

·

Art and environmental groups also wanted same amount of

funding.

·

Commissioners understood the value of all sport, play and

active recreation, along with the health and connected community benefits.

·

Mr Chambers noted at a recent indoor sport users forum that

there was a balancing act with the challenges of the city and active

recreation and sport. Collaborative partnerships together with outdoor

sports users, Council and ratepayers facing it together and understanding the

reasons and looking at how to remain solution focused without participation

dropping off.

·

Ensure engagement was held with clubs around the fees being

staged and more feasible to ensure increased participation not a reduction.

·

Other Councils had also gone through similar processes.

(19)

Sub ID: 851 - Ken Green

Key points

·

The comments on assumptions that most tend to make about

stadiums were from the people who want them.

·

Lots of research had been carried out from sports economists

around the world.

·

Criticism of the four assumptions in the report.

·

The cost were always wrong resulting in cost blow outs by

saying we also need this and that, or it would be so much better with a roof.

·

While the projects all start out as multi-use, they never were,

and as soon as the grass was put in that made it a rugby stadium for the local

franchise or players. These groups were only a small part of the

population.

·

Usually 90% of the facility was empty and stadiums always

looked inward not outward to the community and did nothing.

·

A stadium was not a good use of ratepayers money.

·

The cost to run these edifices were high. A really good

CEO and marketing team was needed as there were always promises made of how

much they make, but they hardly ever did and did not even make money to cover

capital costs.

·

The benefits to the community were always exaggerated, over

stated and utter nonsense. The prediction of 100% occupancy in hotels

was a farce when there was generally an 80% occupancy anyway.

·

Council was always on about how much was spent at games, but

$100 spent by a family on a rugby match was spent and they would not be able

to spend it anywhere else.

·

If Council spend $300M it would be a lost opportunity to do

something else. With all of the infrastructure problems money had to be

spent for a far better purpose.

·

Put the plans for a stadium on the shelf until Council feel the

city was wealthy or for someone with all the dough comes up.

(20)

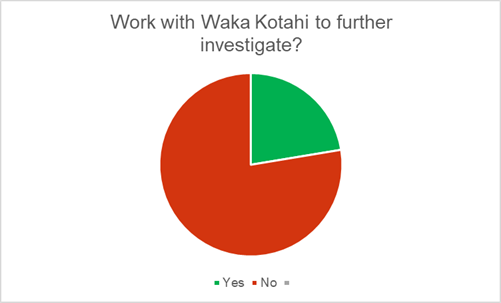

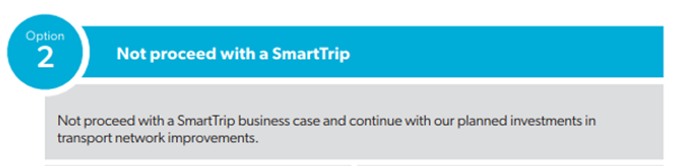

Sub ID: 1494 - Katie Mayes, NZTA - Waka Kotahi

Key points

·

Reiterate NZTA support for Tauranga City Councill and

SmartGrowth for road pricing.

·

Important to make the most of transport infrastructure that the

city had and manage the demand.

·

Pricing and other economic tools were important to manage the

demand.

·

Tauranga city had traffic issues and NZTA give support for

exploring road pricing schemes. The Minister of Transport noted

recently in the coalition agreement that the government wanted to get on with

roading quickly as it was an effective way to manage demand and other utility

services.

·

NZTA could see benefit to keep exploring and to support the

quality of life for residents and trades people to be able to move around the

city, using a bus or their own transport as their choice.

·

Keen to keep working with Council and national elements around

the country and noted the specific issues being faced around Tauranga.

In response to questions

·

Commissioner Tolley noted that a bad job had been done

explaining SmartGrowth to the people.

·

There were a number of good issues coming through the

submissions noting that whatever the government does it needed to take into

account that some people had no supermarket locally or had to drop their

children off to school as there was no bus for them. Council would

collate the issues raised in the submissions for the government to consider

and take into account when the legislation was being designed, as addressing

these would make it work or not work and make fair or not fair.

·

Ms Mayes noted that it was good to be collating the issues for

consideration at a national level and to see what those were. Pricing

was part of a package of how to manage traffic and people moving around a

city. There needed to be choices so public transport needed to be looked at

to see if there was sufficient frequency and range to give people a choice.

·

Funding and financing of transport was broken and widely

acknowledged with NZTA telling the Ministry to make sure to keep the purpose

closely aligned with what they were trying to achieve and to raise revenue to

manage the demand.

·

There was a need to return to the fundamentals to fully user

pays principal and take into account equity issues at a national scale and

local considerations to add on. It should be demand management rather

than revenue raising as many Councils had high debt levels and infrastructure

services so something had to give at a national and local level.

(21)

Sub ID: 1496 - Lee Siegle, Sustainability Options

Key points

·

Working in the Bay of Plenty for 11 years on a range of

different projects within the sustainability space, and in a social capacity

they were presently working in the housing space.

·

Make housing huge priority as the city did not have enough and

with what they did have, some was not in a great condition and needed

remediation work.

·

The group go into homes and teach residents how to run their

home more efficiently with items such as glass ventilation, drapes and the

like.

·

Economic impact notes that poor housing had a negative health

impact on many families and costs the country at least $1B a year. This also

adds to the cost of lost work with sick kids needing to be looked

after.

·

Following advice and tips to homeowners, some of the children

were now at school every day so the parents were able go to work.

·

Environmental impact of housing with old homes being drafty and

losing heat was an energy waste and if a house did not operate properly it

would become full of mould which was not good for health.

·

If any person wanted advice or assistance, they were there to

share education and help to make Tauranga a thriving city.

In response to questions

·

In response to a query it was noted that the group were not

working with Councils urban design panel.

·

There had not been any indication from Kainga Ora for funding

assistance or whether they were interested in expanding their funding to

allow sustainability options. The programme was open to all residents

to benefit.

·

Commissioners noted the great work being undertaken by

Sustainable Options.

(22)

Sub ID: 825 - Mark Dean and Lyall Holmes, Rotary Centennial

Trust

Key points

·

Could see potential with the enlivenment of the city centre and

asked the Council to get on with it.

·

Noted a river water pool seen in Brisbane which included sand

and beaches, which would be a winner for here. It could be located

between the Harbourside Restaurant and The Strand with the walkway and

underpass in place this could be the next stage. Request that a water

pool be added to the LTP to be investigated.

·

Grandchildren swim at the harbourside steps, but it was

difficult because of the tide. A salt waler pool would be used all the time

and draw people into the city and would not replace the use of the aquatic

centre.

·

It was secluded and safe to swim at the Mount and was popular

with families and young children.

·

The harbourside area was good for dining until you get rowdy

hoons driving through. Suggested the use of barrier arms from 6 pm to 6

am and let cafes put tables on the street that was free of traffic to create

an eating precinct second to none and a delightful place to dine.

·

Retailers were experiencing a down turn at present.

Suggest a full blown street market once month as it would not cost much to

put on.

·

Kopurererua Valley development off the State Highway and

Takitimu Drive extension where 350 ha of farmland was restored by the Rotary

Centennial Trust to a wetland was a unique area and had the potential to be a

wetland reserve in the city where people could connect with the environment.

·

The Rotary Centennial Trust was set up to raise money to

augment the Council budget and was not being used. There was a lot of

money available from TECT, Lotteries Commission and the like that was not

being sought.

·

The Trust had already put in a lot of plants and infrastructure

like bridges and it was considered that Council should use the Trust to

provide the funds to develop the area further.

·

It was a huge space for nature and an opportunity to encourage

people to take nature into their own gardens and get behind it like the

Western Bay District Council had done in Katikati and Te Puke.

In response to questions

·

In response to a query Mr Holmes, Chair of Rotary Centennial

Trust noted that no communication had taken place between the Trust, Council

and iwi and noted that they would like to start a conversation as all three

organisations were essential to make it all work.

·

It was important how, as a city, we could maximise benefit of

the Rotary Trust who also had the resources to raise funds as necessary from

groups that were not currently being used.

(23)

Sub ID: 1564 – Catherine Stewart, Simone Anderson, Phil

Hayho, Incubator Creative Hub (and supporters)

Key points

·

Noted in the room were a number of community people in support

of the submission.

·

Council needed to understand what had gone on with the Historic

Village and the hard work of volunteers, businesses and people who could not

afford the rent hike proposed.

·

Incubator was involved with the strategy and communication

process for the Village.

·

Urge Commissioners to speak with the people, the Village was

the heartbeat of the community and if the Council ramped up the rents it

would kill off many good community and not for profit organisations.

·

The group acknowledged the work of the Commissioners and

appreciate the work that had been done.

·

Seek engagement in a mutual vision for an arts and culture

community in Tauranga and region to add value for the city and have the LTP

create decisions so that the creative community could thrive.

·

The Village had created jobs and was attracting visitors and

pathways to a sustainable community and creative fabric of the city.

·

Noted the purpose of the four community well beings within the

environment of all parts of the Village and the viability with the hub which

had been tested and holds true.

·

Overwhelmed by the community support through the submission

process with 15% submissions supporting the Village and 25% on the proposed

increase in the fees and charges.

·

The submissions were diverse to make creative arts available to

all from grass roots up.

·

Tabled a request to open dialogue around the submission for a

trusted partnership with the Commissioners and Council Chief Executive .

·

Marty noted he was a Trustee of the Incubator and a psychiatrist

who had worked globally and in some significantly impoverished war torn areas

where he had learned a lot about mental health and social cohesion.

·

There were significant mental health and social cohesion issues

in the city with people battling substance use, homelessness, mental illness,

social issues, youth and engagement with youth more challenging, elderly

growing population. The arts was an industry which was what incubator

was and exactly the work a community should be doing.

·

Arts was an area for people to come together, to discuss things

and have a relationship. It provided a median to engage and create something

and develop themselves, more so than a lot of other strategies.

·

Management team had several hundred people coming in for the

vision, most of whom were unpaid They acted financially responsibly and

within financially wise strategies to do as much as they could within the

resources available.

·

There was a lot of anxiety and stress in organisations with

people leaving because of the ongoing tension.

·

Would appreciate and benefit from it if there was greater

stability and understanding around the funding and a greater degree of longer

term commitment to allow them to do better with the planning and to form a

greater partnership and engagement with the city.

·

Council had been excellent with funding, but there was always

more needed and more would be appreciated.

·

Simone was an advocate for arts and creativity and was

overwhelmed with the 318 submitters who had put forward their views, 12 of

which were speaking at the meeting.

·

All of the submitters were everyday people and while she

acknowledges change never suits all, investing in the future was necessary

and to embrace the appetite for change and foster creativity in

infinity.

·

Overcome hurdles. The strategy highlights the city vision

“Together we can”. Change requires commitment drawn on

years of this to breathe life in this Village where everyone was

valued. Now with the proposed increased charges to recover capex and

opex costs it was unrealistic and puts the vibrant city at risk.

·

The costs were not sympathetic to the value of the work in the

Village, as it was a flourishing community hub with a variety of accessible

services for the community. But those restrictions would make it hard to

deliver.

·

Everyone was in the same boat working for the same challenges

and through partnership and creative thinking we could do it together.

·

It was a situation of not only what Council could get from us

but what they could do together to get a momentum of results.

·

There had been a lot of fundraising and hours of volunteer time

put into the Village which provides a strong and flexible core for community

art programmes.

·

Want to engage in discussions around the growth of the language

of arts and creativity.

·

Thank you for the opportunity and look forward to an outcome of

forward thinking leadership. Without Art was the same as without mauri

and wairua.

(24)

Incubator Sub ID: 305 - Jill Leyton, Robin and Anne Wikingi

Key points

·

The group were known as the Jack Duster Ukulele Players and

wanted to express enormous gratitude to Incubator.

·

They were originally a group of 7 and were now up to 40, mostly

of the older age group.

·

There was a huge need for older age group people to get

together and have common interests.

·

The group were invited to play at the Village and had ongoing

relationships.

·

People in the group now had the confidence to play in public.

·

They also had members suffering from dementia and special needs

joining.

·

Other community groups were now asking the group to play, with

any money earned going back into the community.

·

The group sung a Waiata of unity and togetherness.

(25)

Incubator Sub ID: 063 - Hayley Smith, Okorore Nga toi

Māori

Key points

·

The art group and heritage building was gifted to the Incubator

and iwi took great pride that the whare tupuna had given the whare house to

the Incubator so that their Tipuna could use it.

·

All involved were paying residents and artists that fund the

Village and all were involved with creativity, delivery of volunteer hours

and service to the community.

·

180 years to celebrate Okorore Māori gallery was stemmed

from loins of iwi – so began the infrastructure of the Tauranga Moana,

hapu and iwi fabric of society of the Historic Village.

·

The history of the whare was deeply engraved within iwi who

continue to set pathways for their toi and fabric of many kaupapa to the

community, volunteer hours and services that they pay to fund and to deliver.

·

$7,000 was being paid for water which they do not have in their

space, so were struggling to understand how capex and opex cost could can be

dropped on the group as servants to their forefathers. This could not

equate to the volunteer hours and trying to make Okorore a destination as it

was a gallery in one of the oldest homesteads of the area.

·

Council must allow them to hold the space for the delivery

whakapapa and genealogy of the people where it started 180 years ago and still

had many years to come.

·

Their people had been here before and it shows.

(26)

Incubator Sub ID: 063 and Sub ID 311 - Carla Acacio

Key points

·

A tattoo artist originally from Brazil who had come to live in

this beautiful town, but had noticed that under surface something vital

missing.

·

Listened to many stories regarding mental health and addictions

within a few months of arriving here. Brazil had more.

·

Tauranga needs more spaces where people can use expression and

get the feel of truly being connected. The Village was a multi

culturalism space with a vibrancy because it was real.

·

There were no fancy flash buildings, what was there comes from

local artists and the only place to find this was at the Historic Village and

the Incubator where people could enjoy belonging and where everything was

truly alive and valuable.

·

Hopes that the Council understands that the Incubator was the

heart and soul of the town and should be protected.

(27)

Incubator Sub ID: 054- Sam Allen

Key points

·

Sam quoted a poem that he had written which was created with

art in his heart and paint in veins, all he saw was vultures and a home

without culture and a of lack of artistry in the Bay.

·

If funds were taken away from the community what was humanity

without artistry.

(28)

Incubator Sub ID: 176 - Tina Zhang, NZ China Friendship

Association

Key points

·

President of the local NZ China Friendship Association.

·

The Village was not just a place that Chinese could share a

culture and arts centre, but to build a home for the Chinese community and

cultural exchange.

·

It was not a typical commercial hub, it was a place where

culture could flourish, where they could celebrate heritage, share stories

and friendship in the spirit of bringing people together.

·

The group love their new home.

(29)

Incubator Sub ID: 130- Sequoia Trass

and MaryAnne

Key points

·

Sequoia was a 16 year old student from Otumoetai College who

had been going to the Village for 10 years as her mother was a worker at the

Incubator. She noted that she could not have spent that 10 years any

better and would continue to spend much time there.

·

She learnt a number of skills, including using watercolour,

sewing, ceramic lessons and was open to so much more with the hundreds of

diverse music gigs.

·

Mary Ann was 8 years old and does a number of different classes

and learns a lot of different skills and had spent many hours doing sewing

classes.

·

The Incubator also gets kids involved with scavenger hunts and

movies.

·

The students had met many other similar people who also go as

the focus was on everyday artists not just the elite.

·

The inaccessibly to get out and do something was being overrun

by greed.

·

After many years being connected to the Village and its resident

artists you could see what it does for Tauranga, providing a collaborative

environment, which would not be able to happen any more if the fees were

raised.

·

We want to see it flourish through art, culture and the

like. The Historic Village was about making a dream for a home in the

city a reality

·

Maryanne gave a gift of a soft toy tiki she had made from old

blankets to each of the Commissioners.

(30)

Incubator Sub ID: 300 – Cherie

Anderson, Northern Health School

Key points

·

Cherie Anderson worked with numerable groups of youth providing

opportunities that they could not access for various reasons including health.

·

They were a state school providing educational access to

students for kids not able to attend school full time, many of which had

severe mental and physical needs.

·

While the focus needs to be numeracy and literacy, if it were

not for the Incubator, they would not have any creativity in their

lives. This was how they expressed themselves.

·

The Village was taking vulnerable students and giving them some

mana and self-belief through the centre and were about to embark on a 20 week

art collaboration course to develop series of Pou Whenua for the front of the

school. This would be a life changing experience for some of the students.

·

A recent example of a 14 year old who would not leave home

started to work in the community garden and now leaves home several times a

week to water the gardens as it had given him a real sense of belonging.

·

Who would provide this if not the Incubator to establishments

such as schools if they had to pay market charges.

·

The Incubator cannot afford to pay full rental and the students

and future of Tauranga would miss out on the social capital gains which

far outstrip any financial gain from increasing the rents, which was short

sighted. Anõ me he whare pūngawerewere – behold, it

is like the web of a spider. If whakatauki was a full stretch of the

web it would be reaching out to the full city.

(31)

Incubator Sub ID: 069 – David

Henderson, Otumoetai College

Key points

·

David Henderson, Art teacher at Otumoetai College supported the

web metaphor.

·

The Incubator was a creative hub giving students a spotlight

and exhibiting their art which gave the students a buzz and an opportunity to

sell their work. The smiles from the families when they see the work

displayed was priceless.

·

The Village provides a futures pathway through workshops and

art pathways and does not know what they would do without it.

(32)

Incubator Sub ID: 017 – Sue

MacDougall

Key points

·

Submitted noted she was a passionate person and local artist

with a window at the gallery.

·

18 months ago and witnessed the impact on the community with

the artist window and 46 talented artists providing a platform for them to

shine.

·

It was a path to accessibility that was open 7 days a week and

everyday people were able to indulge in their passion.

·

Where else could you find such a dedicated and accessible

gallery that gave people the ability to maintain the level of dedication of

artists who volunteer their time to ensure it was open to the public.

·

Believes in the power of art to enrich lives.

·

In reality was Tauranga lacking adequate representation as

there were very few options to engage with the community like the Village

does.

·

The new status art window had begun to make waves for locals

and visitors from afar where they could express positively with the purchase

of art.

·

Cruise ship passengers visit and purchase art which spreads the

word here and overseas. We won’t have that soon and the increase

of fees was leaving the future in the balance if not subsidised 95%.

·

The vibrant support may not be available if the rent increases

and the artists would be left without a central hub of art.

·

Urge to stand with solidarity and rally support for the

preservation of art and encourage a vibrant and sensible art centre for

generations to come.

·

Walk the talk – Tauranga together we can as a city

vision.

(33)

Incubator Sub ID: 289 – Derek

Jacombs

Key points

·

Was a jobbing musician who had been touring NZ since 1983 who realises

the value of art to a community.

·

Some people believe we should all pay for self and others see

the richness of a community quantifiable other than money.

·

The work of the Incubator Jam Factory was valuable for

practitioners and audiences and was a musical wasteland as a place to play.

It was a glaring reason when potential audiences were much smaller than

expected.

·

There was a large elderly population in the facilities many of

whom had minimal community engagement and helped 18-25 year olds who were

lost to education elsewhere.

·

The closure would lead to a shortage of venues with Baycourt

and Totara St being expense and others not suitable for a lot of music that

they put on.

·

Many artists were excluded from the touring circuit and had to

travel elsewhere to interact with other musicians. The Jam Factory had

changed that and they now had an influx of folk musicians who did not used to

come here but do now.

·

It allows ticket prices to be made viable and for other acts to

come and had added vibrancy in many ways.

·

It helps the youth scene with a host of shows and was a band

hire venue for those who do not have a following and provided a real opportunity

for them to learn.

·

It was also a place where you could work with professionals and

learn from jam factory volunteers and to invite bands from other areas.

They now get invited to play in other areas.

·

The Village should be viewed as an investment in the culture of

the town within every tendril of growth. Don’t tinker with it as it was

making Tauranga a better place.

(34)

Incubator Sub ID: 284 – Kirsty

Clegg

Key points

·

Submitter was a Health professional who works at Tauranga

hospital.

·

The Village provides a place where all staff, patients and

families could go to have time out.

·

After 30 years of working in the health sector, you know that

all people need a supportive community connectivity and creativity to feel

well and connected. The Incubator gives that in biggies and in bucketloads.

·

Ask that Council continue to support a place where people could

go to connect, feel safe and access for all people to create their own

creativity or help others and was central to the human experience.

·

Art makes for better, healthier life choices and this had been

proved by research.

·

Tauranga was facing terrible health challenges, yet this

wonderful and unique place was here to allow them to be happier humans.

·

Why would Council want to dismantle this when it held so much

of what was needed in one place. It should support the amazing work and

continue to support the Incubator for their happiness and health.

·

Support creativity not cuts.

(35)

Incubator Sub ID: 025 – Sandy

Kerr – The Pothouse Collective

Key points

·

Part of the potter’s collective who were more happy

mucking with mud than being at this meeting.

·

Had provided a full submission but wanted to provide a visual

face to face and stand with the wider Incubator community and the life blood

of the power house.

·

Newbies would lose the opportunity to stand next to and on the

shoulders of nationally recognised potters.

·

Any closure would be bad for the whole of the art community and

would be multiplied if they were not at the hub. It would not just be

ripples, it would be a tidal wave of loss for the community.

Discussion point raised

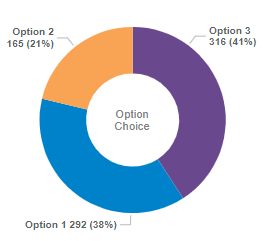

·

Commissioner Tolley noted to the group of submitters that the

description of the wellbeing of arts and culture was standing up and roaring

and that some others think it was a nice to have.

·

What had been shown to Commissioners today was that actually