|

|

|

AGENDA

Strategy, Finance and Risk Committee meeting

Monday, 13 May 2024

|

|

I hereby give notice that a Strategy, Finance and

Risk Committee meeting will be held on:

|

|

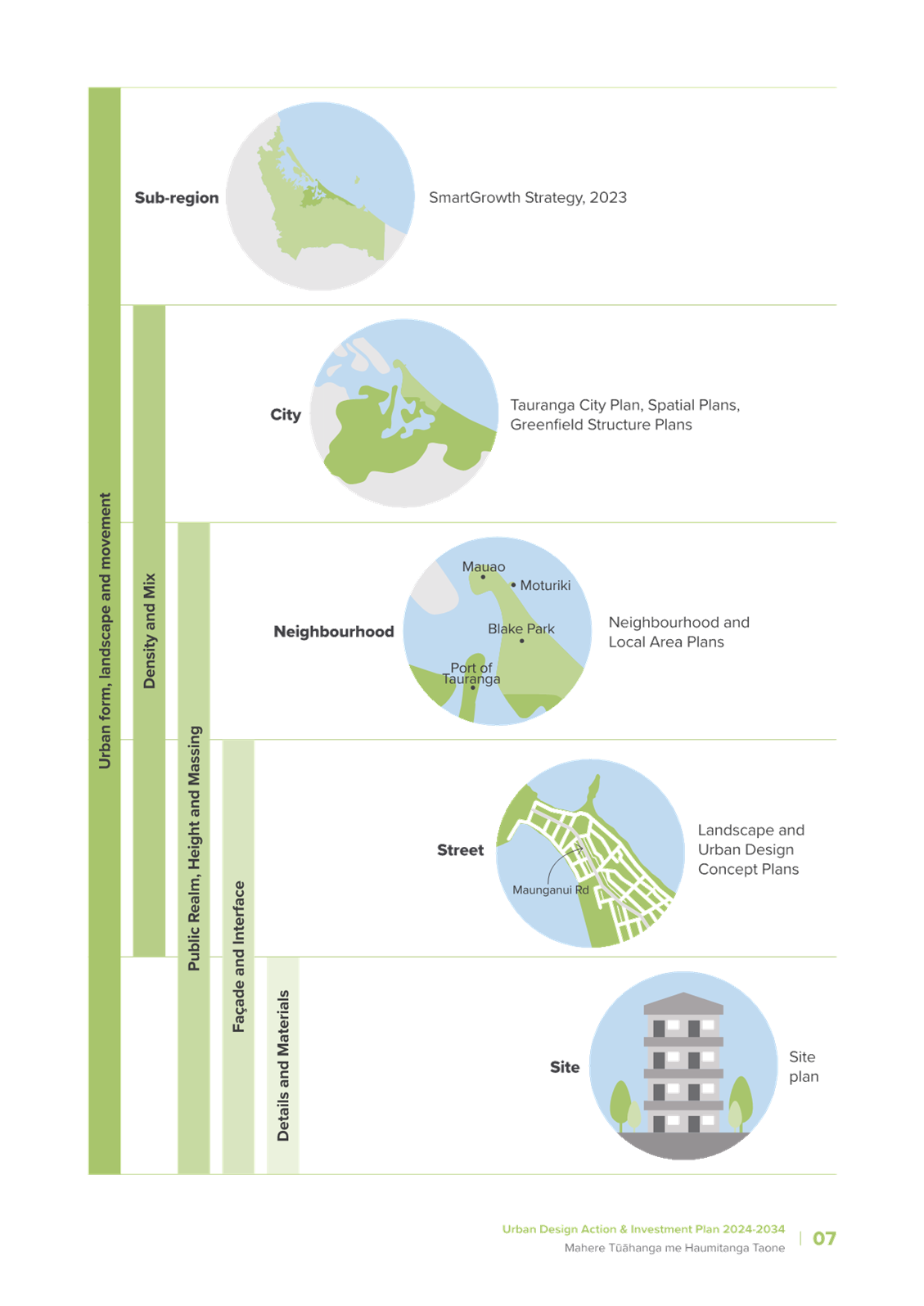

Date:

|

Monday, 13 May 2024

|

|

Time:

|

1pm

|

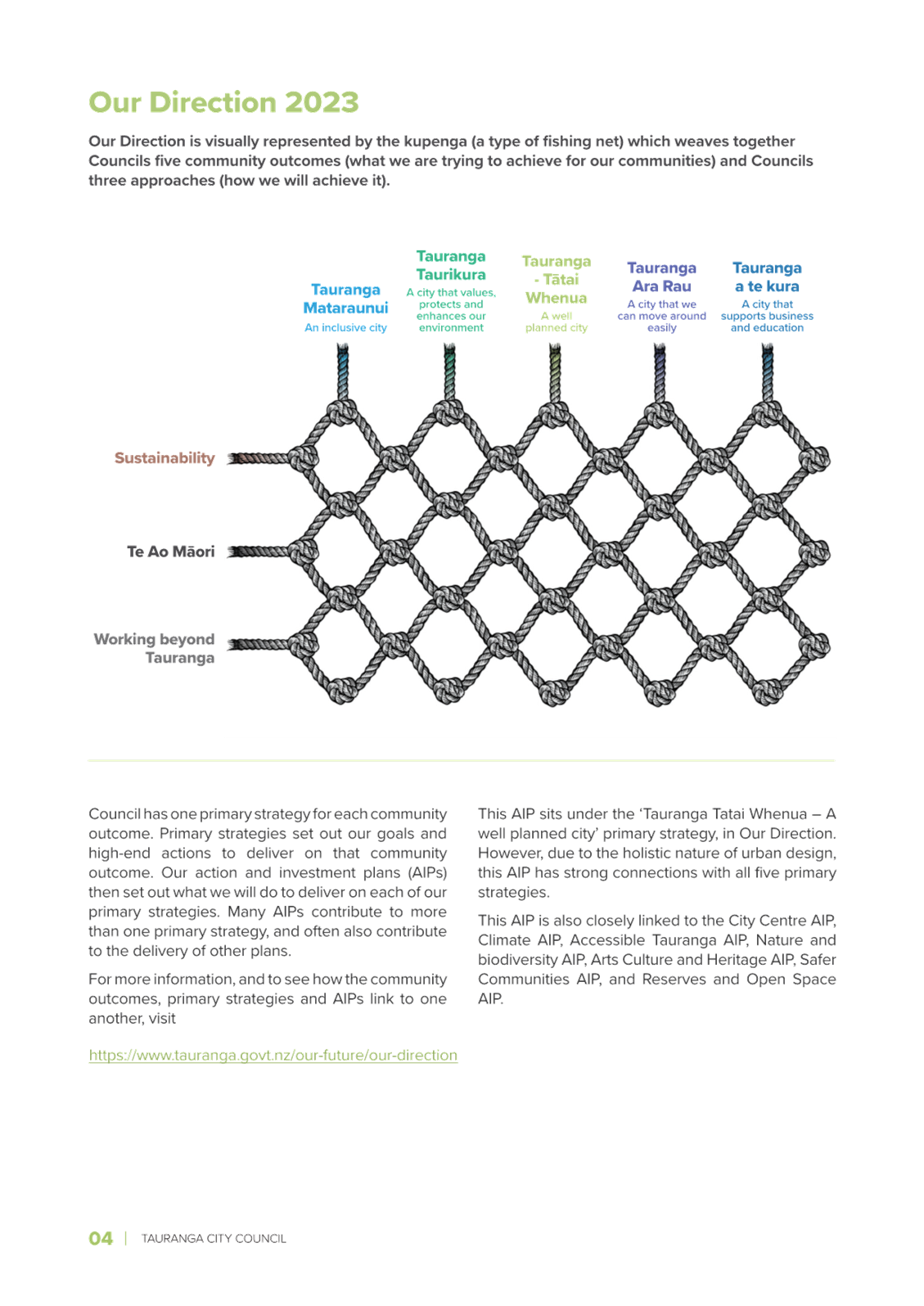

|

Location:

|

Bay of Plenty Regional Council Chambers

Regional House

1 Elizabeth Street

Tauranga

|

|

Please note that this

meeting will be livestreamed and the recording will be publicly available on

Tauranga City Council's website: www.tauranga.govt.nz.

|

|

Marty Grenfell

Chief Executive

|

Terms of reference – Strategy,

Finance & Risk Committee

Membership

|

Chairperson

|

Commission

Chair Anne Tolley

|

|

Deputy

chairperson

|

Dr

Wayne Beilby – Tangata Whenua representative

|

|

Members

|

Commissioner

Shadrach Rolleston

Commissioner Stephen

Selwood

Commissioner Bill Wasley

|

|

|

Matire

Duncan, Te Rangapū Mana Whenua o Tauranga Moana Chairperson

Te Pio Kawe – Tangata

Whenua representative

Rohario Murray – Tangata

Whenua representative

Bruce

Robertson – External appointee with finance and risk experience

|

|

Quorum

|

Five

(5) members must be physically present, and at least three (3) commissioners

and two (2) externally appointed members must be present.

|

|

Meeting

frequency

|

Six

weekly

|

Role

The role

of the Strategy, Finance and Risk Committee (the Committee) is:

(a)

to assist and advise the Council in discharging

its responsibility and ownership of health and safety, risk management,

internal control, financial management practices, frameworks and processes to

ensure these are robust and appropriate to safeguard the Council's staff and

its financial and non-financial assets;

(b)

to consider strategic issues facing the city and

develop a pathway for the future;

(c)

to monitor progress on achievement of desired

strategic outcomes;

(d)

to review and determine the policy and bylaw

framework that will assist in achieving the strategic priorities and outcomes

for the Tauranga City Council.

Membership

The Committee will consist of:

·

four commissioners with the Commission Chair appointed as the

Chairperson of the Committee

·

the Chairperson of Te Rangapū Mana Whenua o Tauranga Moana

·

three tangata whenua representatives (recommended by Te

Rangapū Mana Whenua o Tauranga Moana and appointed by Council)

·

an independent external person with finance and risk experience

appointed by the Council.

Voting

Rights

The tangata whenua representatives and the independent

external person have voting rights as do the Commissioners.

The Chairperson of Te Rangapu Mana Whenua o Tauranga Moana

is an advisory position, without voting rights, designed to ensure mana whenua

discussions are connected to the committee.

Committee's

Scope and Responsibilities

A. STRATEGIC ISSUES

The

Committee will consider strategic issues, options, community impact and explore

opportunities for achieving outcomes through a partnership approach.

A1 – Strategic Issues

The Committee's

responsibilities with regard to Strategic Issues are:

·

Adopt an annual work programme of significant strategic issues

and projects to be addressed. The work programme will be reviewed on a

six-monthly basis.

·

In respect of each issue/project on the work programme, and any

additional matters as determined by the Committee:

o

Consider existing and future strategic context

o

Consider opportunities and possible options

o

Determine preferred direction and pathway forward and recommend

to Council for inclusion into strategies, statutory documents (including City

Plan) and plans.

·

Consider and approve changes to service delivery arrangements

arising from the service delivery reviews required under Local Government Act

2002 that are referred to the Committee by the Chief Executive.

·

To take appropriate account of the principles of the Treaty of

Waitangi.

A2 – Policy and Bylaws

The Committee's

responsibilities with regard to Policy and Bylaws are:

·

Develop, review and approve bylaws to be publicly consulted on,

hear and deliberate on any submissions and recommend to Council the adoption of

the final bylaw. (The Committee will recommend the adoption of a bylaw to the

Council as the Council cannot delegate to a Committee the adoption of a bylaw.)

·

Develop, review and approve policies including the ability to

publicly consult, hear and deliberate on and adopt policies.

A3 – Monitoring of Strategic Outcomes

and Long Term Plan and Annual Plan

The Committee's

responsibilities with regard to monitoring of strategic outcomes and Long Term

Plan and Annual Plan are:

·

Reviewing and reporting on outcomes and action progress against

the approved strategic direction. Determine any required review / refresh of

strategic direction or action pathway.

·

Reviewing and assessing progress in each of the six (6) key

investment proposal areas within the 2021-2031 Long Term Plan.

·

Reviewing the achievement of financial and non-financial

performance measures against the approved Long Term Plan and Annual Plans.

B.

FINANCE AND RISK

The Committee will review the

effectiveness of the following to ensure these are robust and appropriate to

safeguard the Council's financial and non-financial assets:

·

Health and safety.

·

Risk management.

·

Significant projects and programmes of work focussing on the

appropriate management of risk.

·

Internal and external audit and

assurance.

·

Fraud, integrity and investigations.

·

Monitoring of compliance with laws and regulations.

·

Oversight of preparation of the Annual Report and other external

financial reports required by statute.

·

Oversee the relationship with the Council’s Investment

Advisors and Fund Managers.

·

Oversee the relationship between the Council and its external

auditor.

·

Review the quarterly financial and non-financial reports to the

Council.

B1 - Health and Safety

The Committee’s responsibilities through regard to

health and safety are:

·

Reviewing the effectiveness of the health and safety policies and

processes to ensure a healthy and safe workspace for representatives, staff,

contractors, visitors and the public.

·

Assisting the Commissioners to discharge their statutory roles as

"Officers" in terms of the Health and Safety at Work Act 2015.

B2 - Risk Management

The Committee's responsibilities with regard to risk

management are:

·

Review, approve and monitor the implementation of the Risk

Management Policy, including the Corporate Risk Register.

·

Review and approve the Council’s "risk appetite"

statement.

·

Review the effectiveness of risk management and internal control

systems including all material financial, operational, compliance and other

material controls. This includes legislative compliance, significant projects

and programmes of work, and significant procurement.

·

Review risk management reports identifying new and/or emerging

risks and any subsequent changes to the "Tier One" register.

B3

- Internal Audit

The Committee’s responsibilities with regard to the

Internal Audit are:

·

Review and approve the Internal Audit Charter to confirm the

authority, independence and scope of the Internal Audit function. The Internal

Audit Charter may be reviewed at other times and as required.

·

Review and approve annually and monitor the implementation of the

Internal Audit Plan.

·

Review the co-ordination between the risk and internal audit

functions, including the integration of the Council's risk profile with the

Internal Audit programme. This includes assurance over all material financial,

operational, compliance and other material controls. This includes legislative

compliance (including Health and Safety), significant projects and programmes

of work and significant procurement.

·

Review the reports of the Internal Audit functions dealing with

findings, conclusions and recommendations.

·

Review and monitor management’s responsiveness to the

findings and recommendations and enquire into the reasons that any

recommendation is not acted upon.

B4

- External Audit

The Committee's responsibilities with regard to the

External Audit are:

·

Review with the external auditor, before the audit commences, the

areas of audit focus and audit plan.

·

Review with the external auditors, representations required by

commissioners and senior management, including representations as to the fraud

and integrity control environment.

·

Recommend adoption of external accountability documents (LTP and

annual report) to the Council.

·

Review the external auditors, management letter and management

responses and inquire into reasons for any recommendations not acted upon.

·

Where required, the Chair may ask a senior representative of the

Office of the Auditor General (OAG) to attend the Committee meetings to discuss

the OAG's plans, findings and other matters of mutual interest.

·

Recommend to the Office of the Auditor General the decision

either to publicly tender the external audit or to continue with the existing

provider for a further three-year term.

B5

- Fraud and Integrity

The Committee's responsibilities with regard to Fraud and

Integrity are:

·

Review and provide advice on the Fraud Prevention and Management

Policy.

·

Review, adopt and monitor the Protected Disclosures Policy.

·

Review and monitor policy and process to manage conflicts of

interest amongst commissioners, tangata whenua representatives, external

representatives appointed to council committees or advisory boards, management,

staff, consultants and contractors.

·

Review reports from Internal Audit, external audit and management

related to protected disclosures, ethics, bribery and fraud related incidents.

·

Review and monitor policy and processes to manage

responsibilities under the Local Government Official Information and Meetings

Act 1987 and the Privacy Act 2020 and any actions from the Office of the

Ombudsman's report.

B6

- Statutory Reporting

The

Committee's responsibilities with regard to Statutory Reporting relate to

reviewing and monitoring the integrity of the Annual Report and recommending to

the Council for adoption the statutory financial statements and any other

formal announcements relating to the Council's financial performance, focusing

particularly on:

·

Compliance with, and the appropriate application of, relevant

accounting policies, practices and accounting standards.

·

Compliance with applicable legal requirements relevant to

statutory reporting.

·

The consistency of application of accounting policies, across

reporting periods.

·

Changes to accounting policies and practices that may affect the

way that accounts are presented.

·

Any decisions involving significant judgement, estimation or

uncertainty.

·

The extent to which financial statements are affected by any

unusual transactions and the manner in which they are disclosed.

·

The disclosure of contingent liabilities and contingent assets.

·

The basis for the adoption of the going concern assumption.

·

Significant adjustments resulting from the audit.

Power

to Act

·

To make all decisions necessary to fulfil the role, scope and

responsibilities of the Committee subject to the limitations imposed.

·

To establish sub-committees, working parties and forums as

required.

·

This Committee has not been delegated any

responsibilities, duties or powers that the Local Government Act 2002, or any

other Act, expressly provides the Council may not delegate. For the avoidance

of doubt, this Committee has not been delegated the power to:

o

make a rate;

o

make a bylaw;

o

borrow money, or purchase or dispose of assets, other than in

accordance with the Long-Term Plan (LTP);

o

adopt the LTP or Annual Plan;

o

adopt the Annual Report;

o

adopt any policies required to be adopted and consulted on in

association with the LTP or developed for the purpose of the local governance

statement;

o

adopt a remuneration and employment policy;

o

appoint a chief executive.

Power

to Recommend

To Council and/or any standing committee

as it deems appropriate.

|

Strategy,

Finance and Risk Committee meeting agenda

|

13

May 2024

|

7 Confirmation

of minutes

7.1 Minutes

of the Strategy, Finance and Risk Committee meeting held on 25 March 2024

File

Number: A15910798

Author: Caroline

Irvin, Governance Advisor

Authoriser: Anahera

Dinsdale, Acting Team Leader: Governance Services

|

Recommendations

That the minutes of the

Strategy, Finance and Risk Committee meeting held on 25 March 2024 be

confirmed as a true and correct record, subject to the following

correction/s:

(a)

|

Attachments

1. Minutes

of the Strategy, Finance and Risk Committee meeting held on 25 March 2024

|

Strategy, Finance and Risk

Committee meeting minutes Strategy, Finance and Risk

Committee meeting minutes

|

25 March 2024

|

|

|

|

MINUTES

Strategy, Finance and Risk Committee

meeting

Monday, 25 March 2024

|

Order of Business

1 Opening karakia. 3

2 Apologies. 3

3 Public forum.. 4

4 Acceptance of late items. 4

5 Confidential business to be transferred into the open. 4

6 Change to order of business. 4

7 Confirmation of minutes. 4

7.1 Minutes of the Strategy, Finance and Risk Committee meeting held on

19 February 2024. 4

8 Declaration of conflicts of interest 4

9 Business. 4

9.1 Mainstreets' Monitoring Report for the period 1 July to 31 December

2023. 4

9.2 Local Alcohol Policy. 9

9.3 Adoption of Mount to Arataki Spatial Plan. 12

9.4 Non-Financial Performance Report - 6 monthly 2023/24 and Annual

Resident Survey 2023/24 - Wave 2. 13

9.5 Growth & Land Use Projects Progress Report - March 2024. 14

9.6 Urban Design Panel - Terms of Reference Update. 15

10 Discussion

of late items. 16

11 Public

excluded session. 16

11.1 Public Excluded minutes of the Strategy, Finance and Risk Committee

meeting held on 19 February 2024. 17

11.2 Appointment of Additional Urban Design Panel Members. 17

12 Closing

karakia. 17

Resolutions transferred into the open section

of the meeting after discussion. 17

11.2 Appointment

of Additional Urban Design Panel Members. 18

MINUTES OF Tauranga City

Council

Strategy, Finance and Risk

Committee meeting

HELD AT THE Bay of Plenty

Regional Council Chambers,

Regional House, 1 Elizabeth Street,

Tauranga

ON Monday, 25 March 2024, at

9.30 am

PRESENT: Commissioner Anne Tolley (Chairperson), Deputy Chairperson Dr Wayne

Beilby, Commissioner Shadrach Rolleston, Commissioner Bill Wasley and Ms

Rohario Murray and via Zoom Commissioner Stephen Selwood, Mr Te Pio Kawe and Mr

Bruce Robertson

IN ATTENDANCE: Christine Jones (General Manager: Strategy, Growth &

Governance), Sarah Omundsen (General Manager: Regulatory and Compliance),

Gareth Wallis (General Manager: City Development & Partnerships), Libby

Dodds (Team Leader: Community Relations), Jeremey Boase (Manager: Strategy

& Corporate Planning), Kendyl Sullivan, (City Partnerships Specialist),

Jane Barnett (Policy Analyst), Nigel McGlone (Manager: Regulatory and Compliance),

Carl Lucca, (Team Leader: Urban Communities), Kathryn

Hooker, (Corporate Planner), Andy Mead (Manager: City Planning & Growth),

Coral Hair (Manager: Democracy & Governance Services), Anahera Dinsdale

(Acting Team Leader: Governance Services), Caroline Irvin (Governance Advisor),

Aimee Aranas (Governance Advisor)

EXTERNAL: Mainstreet

Organisations:

Mahia Martelli (Manager)

Greerton

Genevieve Whitson (Manager) and Ash Gee

(Chairperson)

Mainstreet

Tauranga / Downtown Tauranga

Michael Clark

(Manager), Malika Ganley (Governance and Management Advisor), Mount Business

Association

Julia Manktelow (Events Contractor), Leah

Sutton (Chairperson)

Papamoa Unlimited

1 Opening

karakia

A karakia to open the meeting was given at the commencement of the

Extraordinary Council meeting.

2 Apologies

|

Committee Resolution SFR2/24/1

Moved: Dr

Wayne Beilby

Seconded: Ms Rohario Murray

That the apology for lateness from Mr Te Pio Kawe and Mr Bruce

Robertson, and the apology for absence received from Ms

Matire Duncan, be accepted.

Carried

|

3 Public forum

Nil

4 Acceptance of

late items

Nil

5 Confidential

business to be transferred into the open

Nil

6 Change to

order of business

Nil

7 Confirmation

of minutes

8 Declaration

of conflicts of interest

Commissioner

Shadrach Rolleston declared a conflict of interest in relation to item 9.5: ‘Resource Management Reforms and the Fast Track

Approvals Bill’ and took no part in the

discussion or voting on the matter.

Commissioner

Bill Wasley declared a conflict of interest in relation to item 9.5: ‘Growth & Land Use Projects

Progress Report - March 2024’ and took no part in the discussion or

voting on the matter.

Ms

Rohario Murray declared a conflict of interest in relation to item 9.5: ‘Resource Management Reforms and the Fast Track Approvals

Bill’ and took no part in the discussion or

voting on the matter.

9 Business

|

9.1 Mainstreet’s

Monitoring Report for the Period 1 July to 31 December 2023

|

|

Staff Gareth Wallis, General Manager: City Development &

Partnerships

Kendyl Sullivan, City Partnerships

Specialist

External Mahia Martelli (Manager) Greerton;

Genevieve

Whitson (Manager) and Ash Gee (Chairperson TBC) Mainstreet Tauranga /

Downtown Tauranga;

Michael

Clark (Manager) Malika Ganley (Governance and Management Advisor), Mount

Business Association; and

Julia

Manktelow (Events Contractor) Leah Sutton (Chairperson TBC) Papamoa Unlimited

1.

Greerton Village Community Association

- Mahia Martelli (Manager)

·

Ms Martelli thanked Tauranga City Council

(TCC) for its support.

·

The annual Cherry Blossom festival celebrated

spring and supported Greerton Village School. There were a record

number of visitors to last year’s celebration.

·

A Halloween Trail had been held for the

children in the community and a vintage market had been held outside the

Greerton Library in support of 150 years of Tauranga racing.

·

All trees outside the Greerton Library had

been covered in fairy lights as well as several others in the township.

·

In order to bring the organisation in line

with the new Mainstreet Agreement and its new constitution, the

organisation’s name had been changed to ‘Greerton Business

Association’ (GBA).

·

The organisation had been continuing to

experiment with digital advertising for its events and had received great

feedback.

·

Marketing activities over the last six months

included winter online giveaways, a Sun Media partnership, a website update, and

social media (Greerton Facebook page) which continued to attract people to

events and promotions, advertising space in local magazines and posters and

flyers in Matamata as there had been an increase in people from the Waikato

wishing to travel to the Greerton events.

·

A significant increase in the use of social

media within the younger and older demographic had been observed.

·

GBA continued to work closely with business

owners to build trust when dealing with issues and engaging them to buy into

local promotions and continued to work with TCC on Cameron Road Stage 2 from

its concept to its conclusion,

·

There were ongoing issues with homeless and

transient people. GBA was working together with local police and

business on what to do in serious events.

·

Looking forward, future activities included

changes to the Cherry Blossom festival including a renaming to ‘Cherry

Spring Fling Festival’ and more inclusivity, a nine star Matariki

celebration display, a strategic plan for Greerton, a possible Kiwiana street

display, a December tree light promotion and continued personal contact with

business owners.

·

Ms Martelli specifically thanked the Tauranga

City Urban Forest Team for their help with the contractors during the

lighting of the trees in Greerton last year, and the City Safety and

Engagement Advisor for his support with the ongoing issues with homeless and

transient people in the Greerton area.

In response to questions

·

There had only been initial conversations with

the City Partnerships Specialist regarding widening the area of interest to

include Maleme Street.

·

Parking concerns had been raised in regard to

the concept plans for Cameron Road Stage 2, however in the current plan there

would only be about four carparks removed. Local retailers situated at this

area were not concerned about this.

·

As part of GBA’s plan and intention for

the year, funding had and would further be, applied for through the various

available funding providers. The organisation had already applied for funding

to support the Matariki event and funding would also be applied for to

support the Greerton Spring Fling Festival.

·

The Chadwick Road end of Sherson Street was a

very industrialised area and as such it was felt that Maleme Street had more

of an attraction to businesses. However, this would be looked in to.

2.

Mainstreet Tauranga Downtown Tauranga -

Genevieve Whitson (Manager) and Ash Gee (Chairperson )

·

A new business model for downtown Tauranga had

been deployed on 1 July 2023 with a new vision for the city centre (defined

in the long term and short-term strategy).

·

The aim was to make downtown Tauranga

‘the best city centre in New Zealand’ given the incredible

potential within the city to be vibrant, diverse, and thriving. Included in

this was the aim to make it the region’s commercial, cultural, and

civic hub.

·

KPI’s included engaged membership, city

safety, community consideration and a city centre for everyone.

At 9.50pm, Mr

Bruce Robertson entered the meeting.

·

Key Highlights and Achievements included: appointment

of new manager Genevieve Witson, pro-active support for people and businesses,

the hiring of a social media company to promote a clear marketing and

promotion strategy for the city centre, a very successful ‘Christmas in

the City’ event, a well-attended Annual General Meeting and continued

work on building a solid foundation of trust and collaboration by advocating

for city centre businesses. A standout result of this was the

work done with the City Safety and Engagement Advisor in addressing

anti-social behaviour and the positive feedback from retailers.

·

In progress projects included working on a new

website, customer relationship management, media strategy and collaborative

stakeholder engagement.

·

Specific areas of interest were the analysis

of city centre foot traffic on Devonport Road which provided valuable insight

into current trends and future projections.

·

The general consensus from businesses was that

an increase in foot traffic had not always translated to additional revenue.

There needed to be more focus on revenue derived from people movement and

sales transactions across the city.

·

Accommodation sales had increased between July

to December in 2023, in comparison to 2022, and hospitality had experienced a

significant downturn in customers nationally for the same period in 2023.

·

Challenges included ongoing safety in the city

centre, more access routes and a variety of affordable transport options to

get into the city centre as well as more parking options.

·

Actions included a range of activities and

initiatives to increase support for members, exploring short and long-term

office space activations and projects and initiatives to generate a city

perception change.

·

Looking ahead a key objective was to finalise

and begin implementing the five-year strategy with a number of key

characteristics identified that illustrated the city centre’s true

potential.

In response to questions

·

There had been a very positive reaction from

the commercial sector in terms of the new direction and a trend that

businesses were wanting to bring their offices back downtown.

·

At this point, there was no plan to

extend/expand the revenue targeted base area, however there were many

retailers spreading further out to the avenues. This raised the question as

to how these businesses could be incorporated and supported going forward.

·

The importance of mana whenua was recognised

in terms of the strategic plan. Conversations with all parties

would begin shortly.

·

It had taken time to get the right people on

board to fully start the initiatives in the budget for the year but now that

this had been completed, the organisation was better placed to achieve its

goals for the 2023/2024 year.

Discussion points raised

·

Commission Chair Tolley thanked Downtown

Tauranga for their presentation, adding that the next five years would be

critical for Tauranga’s city.

·

There was a need to change the language and

the perception of Downtown Tauranga and that the report presented today had

completely encapsulated this. The strategic plan was very strong and

positive and had links to evidence and concrete actions in a very proactive

way.

·

Commission Chair Tolley advised that here was

merit and benefits in putting initiatives temporarily in place so that they

could be changed if not successful.

·

A fantastic job had been done in changing the

organisation which had been reflected in the report, in particular with

regards to how tough things were at the moment in terms of the cost of living

and disruption.

·

The vision for the city was great.

3.

Mount Business Association (MBA) -

Michael Clark (Manager)

Mr Clark

provided a summary of the following:

·

Key activities and achievements;

·

Retail sales data – total spend, hospitality

July to December and local versus non local;

·

2022/2023 KPI’s: member engagement,

safety and security and Placemaking;

·

Financials;

·

Opportunities to collaborate; and

·

Future activities.

In response to questions

·

MBA had held a meeting with Tourism Bay of

Plenty to discuss a ‘way finding’ strategy and would take a

collaborative working approach with them. TBOP would be invited to attend an

MBA member event where initial ideas would be put forward. It was recognised

this needed to be worked on sooner rather than later to be organised ahead of

the next cruise season.

·

MBA was open to the idea of building a

collaborative relationship between the Tauranga and Mount Associations. A

ferry crossing between the two locations would provide an amazing opportunity

to showcase the best of both worlds. This could be explored over the next six

months.

·

MBA would be providing advice to businesses on

how to market themselves for the next cruise season.

Discussion points raised

·

It would be good to see a drive to further

enhance the cultural connection of Mauao as this was definitely something

that encouraged passengers to disembark from the cruise ships, even in bad

weather. Passengers read about the connections iwi and hapu had with Mauao

and were eager to visit the site.

·

Several Commissioners were working with Bay of

Plenty Regional Council regarding a ferry crossing between Tauranga City and

Mount Maunganui. Presently the Tauranga city centre was not such a

tourist attraction as it was more of a construction site, but this would

eventually change. Staff were investigating an offer that had been made to

Council and would approach the Associations when this was completed. This was

a great idea not only for visitors but also for commuters.

·

The idea of a ferry between Tauranga City and

Mount Maunganui was not new and was the best way to get across the

harbour. Reinstating this would be advantages for both locations.

·

The process of each organisation presenting

their reports to the Committee today was very advantageous as each could see

and understand the others information and perspectives and as such find more

ways to collaborate and market themselves.

·

‘Placemaking’ helped to link

different elements of an area and provided benefits, in particular from a

business perspective.

·

Commission Chair Tolley requested that the lay

runners on the flag poles be followed up in relation to the way finding

strategy.

3.

Papamoa Unlimited - Julia Manktelow

(Events Contractor) and Leah Sutton (Chairperson)

·

Ms Manktelow and Ms Sutton advised that

Papamoa Unlimited’s purpose was to create three or four annual events

for the region that brought people into the area, to increase visitor numbers

from previous years and to promote the destination.

·

Over the past six months two major events had

taken place: ‘Mānawatia a Matariki - Papamoa Light up the

Stormwater Trail’ and the Papamoa Santa Parade. The next

‘Mānawatia a Matariki’ event would soon take place.

·

The Papamoa Santa Parade last Christmas was

700 metres long with a lot more diversity in the parade including many

multi-cultural associations participating, creating a very positive energy.

·

‘Mānawatia a Matariki - Papamoa

Light up the Stormwater Trail’ had been nominated as an event finalist

for excellence at the Western Bay of Plenty Community Awards. The

organisation was looking forward to Matariki again this year.

·

Papamoa Unlimited was working on

‘Ngā mounga tahorā’ – the story of the three

Whales which was synonymous with the region. This was something that was being

worked on at the moment with full engagement from iwi which was greatly

appreciated.

·

Next steps included data collection/creation,

a strategic plan for Papamoa, an increase/change in the ratepayer zone, and engagement

with key stakeholders to grow and strengthen those associations, with iwi

relationships being a defining characteristic of ‘who we are’ as

a town centre.

Discussion points raised

·

It was great to see Papamoa Unlimited

represented at the Western Bay of Plenty Community Awards.

·

Commercial entities needed to see the value of

what Papamoa Unlimited was bringing to the table. Promoting events and

ideas was a great way to link and draw in the wider commercial base.

·

The work being done and overall engagement

with mana whenua was to be commended. Incorporating the purako/stories

within the area was important and unique.

|

|

Committee Resolution SFR2/24/3

Moved: Commissioner

Bill Wasley

Seconded: Dr Wayne Beilby

That the Strategy,

Finance and Risk Committee:

(a) Receives the

report "Mainstreets' Monitoring Report for the period 1 July to 31

December 2023".

(b) Receives the Greerton Village Community

Association Report to 31 December 2023.

(c) Receives the Mainstreet Tauranga Report to 31

December 2023.

(d) Receives the Mount Business Association Report

to 31 December 2023.

(e) Receives the Papamoa Unlimited Report to 31

December 2023.

Carried

|

At 10.45am Mr Te Pio Kawe entered the

meeting.

At 10.48am Commission Chair Tolley withdrew

from the meeting.

At 10.50am Dr

Wayne Beilby assumed the role of Chairperson for the remainder of the meeting.

|

9.2 Local

Alcohol Policy

|

|

Staff Sarah Omundsen, General Manager: Regulatory and Compliance

Jane Barnett, Policy Analyst

Nigel McGlone, Manager: Environmental

Regulation

Key points

·

The background of the report set out the

policy development process which commenced in late 2021.

·

This Committee discontinued the approved Local

Alcohol Policy (LAP) in December 2023 in order to further understand the

impacts of any changes to the current LAP and to have conversations with

individuals and organisations over that period of time.

·

The decisions to be considered were reviewed

in October 2023 and related to both on and off licence operating provisions.

·

Each of the recommendations for the seven

issues were taken separately with clauses (c), (d), (e) and (f) taken at the

end of the discussions.

|

|

Committee Resolution SFR2/24/4

Moved: Ms

Rohario Murray

Seconded: Commissioner

Shadrach Rolleston

PART 1/A

That the Strategy,

Finance and Risk Committee:

(a) Receives

the report "Local Alcohol Policy".

Carried

|

|

Committee Resolution SFR2/24/5

PART 2/B

Moved: Commissioner

Stephen Selwood

Seconded: Ms Rohario

Murray

That the Strategy,

Finance and Risk Committee approves:

|

Item No.

|

Issue

|

Option

|

|

One

|

Starting sales time for off-licensed

premises

|

Option B:

Retain current starting time for

off-licensed premises at 7am.

|

Carried

|

|

Committee Resolution SFR2/24/6

PART 3/B

Moved: Commissioner

Bill Wasley

Seconded: Commissioner

Shadrach Rolleston

That the Strategy,

Finance and Risk Committee approves:

|

Item No.

|

Issue

|

Option

|

|

Two

|

Final sales time for off-licensed

premises

|

Option A:

Retain the current final sales time of

10pm for all off-licensed-premises.

|

CARRIED

|

|

Committee Resolution SFR2/24/7

PART 4/B

Moved: Commissioner

Bill Wasley

Seconded: Commissioner

Stephen Selwood

That the Strategy,

Finance and Risk Committee approves:

|

Item No.

|

Issue

|

Option

|

|

Three

|

Locations for new bottle stores

|

Option B:

No new bottle stores to be established in areas with a

deprivation index of 9 or 10.

Does

not apply to new licences for an existing premises that has been sold, or

for an existing premises that relocates to a new site within the same area

of deprivation (being a defined proxy for ‘suburb’).

|

Carried

|

|

Committee Resolution SFR2/24/8

PART 5/B

Moved: Commissioner

Bill Wasley

Seconded: Commissioner

Stephen Selwood

That the Strategy,

Finance and Risk Committee approves:

|

Item No.

|

Issue

|

Option

|

|

Four

|

New on-licensed premises in industrial

areas

|

Option C:

Retain the current LAP position: no

location restrictions for on-licensed premises.

|

Carried

|

|

Committee Resolution SFR2/24/9

PART 6/B

Moved: Ms Rohario

Murray

Seconded: Commissioner

Stephen Selwood

That the Strategy,

Finance and Risk Committee approves:

|

Item No.

|

Issue

|

Option

|

|

Five

|

Final

sales time for on-licensed premises in the city centre

|

Option B:

Change the

final sales time to 2am.

|

Carried

|

|

Committee Resolution SFR2/24/10

PART 7/B

Moved: Ms

Rohario Murray

Seconded: Commissioner

Bill Wasley

That the Strategy,

Finance and Risk Committee approves:

|

Item No.

|

Issues

|

Options

|

|

Six

|

One

way door policy

|

Option A:

Remove

the one-way door provision.

|

CARRIED

|

|

Committee Resolution SFR2/24/11

PART 8/B

Moved: Commissioner

Bill Wasley

Seconded: Commissioner

Shadrach Rolleston

That the Strategy,

Finance and Risk Committee approves:

|

Item No.

|

Issues

|

Options

|

|

Seven

|

Discretionary conditions for off-licensed

premises

|

Option B:

Include the discretionary conditions in the revised draft LAP

with the following amendments:

Replace ‘No single sales of beer or ready to drink

spirits (RTDs) in bottles, cans or containers of less than 440 mls in

volume may occur except for craft beer’ with ‘Restrictions on single sales’.

Remove ‘restrictions on sales

based on the type of product and/or its price’ from the list of discretionary conditions for off-licensed

premises.

|

CARRIED

|

|

Committee Resolution SFR2/24/12

Moved: Commissioner

Bill Wasley

Seconded: Commissioner

Shadrach Rolleston

That the Strategy,

Finance and Risk Committee:

(c) Approves the final Local Alcohol Policy

incorporating the options approved in (b) above

and gives public notice in accordance with the regulations made under the

Sale and Supply of Alcohol Act 2012.

(d) Approves the Local Alcohol Policy

approved in resolution (c) above coming into force on 8 July 2024.

(e) Delegates to the General Manager

Regulatory and Compliance to make any necessary minor drafting or

presentation amendments to the Local Alcohol Policy, prior to public

notification.

(f) That a review of the Local

Alcohol Policy be included in the report on development of the Policy Work

Programme considered by the incoming Council.

CARRIED

|

|

9.3 Adoption

of Mount to Arataki Spatial Plan

|

|

Staff: Christine Jones, General Manager: Strategy, Growth and Governance

Carl Lucca, Team

Leader: Urban Communities

External: David Phizacklea (Planning Consultant)

Key points

·

The spatial plan delivered a 30-year blueprint

that provided strategic direction for existing and future growth needs of the

area, working together with mana whenua, key stakeholders and the community.

·

This included a ten-year implementation plan

that focused on key issues that had been identified and needed to be invested

in. It therefore formed the basis for Council’s Long Term Plan (LTP)

and was in strong alignment with the draft 2024 to 2034 LTP.

·

This area was of local, national and

international importance due to its outstanding natural environment and as

such this plan was about seeking to balance competing demands on the area to

ensure a sustainable future for everyone.

·

This had been a 15-month process that included,

amongst other things, ongoing engagement with stakeholders, community

engagement and analysis. This included the Mount Industrial Planning study

which had been done by Mr Phizacklea.

·

The structure of the spatial plan consisted of

elements that would be brought together to achieve key outcomes that included

wellbeing of the community and their environment, better housing, proactive management

of hazards and supporting an economically healthy industrial environment.

These would be incorporated into neighbourhood based action plans.

·

Hapu aspirations included place-based values,

guiding principles, takiwa mapping and environmental wellbeing.

In response to questions

·

A lot of work had been undertaken by the Mauao

Trust to protect and enhance Mauao. The spatial plan looked to reflect this

with a leading story around Mauao, and at the same time find a balance within

the broader urban context.

·

Plan change 33 provided for a centre based

approach.

·

Engagement had taken place with Priority One

and the Industrial Steering group over the last six months. The steering

group consisted of a number of key businesses and had provided guidance for

the industrial blueprint.

·

A confidential draft of the blueprint provided

confidence that key elements had been picked up. It would, however take a

business perspective in terms of making recommendations as to how businesses

themselves could respond.

·

It was hoped the Environmental Accord would be

released shortly. It was understood this was a commitment from the businesses

as to how they would proactively respond to the issues identified through the

Mount Industrial Planning study and the Mount Spatial plan.

·

Many of the actions and initiatives of the

spatial plan were intended to support overall economic wellbeing. Economic

wellbeing could be strengthened and carried through as a key directive.

Discussion points raised

·

In terms of importance and relationships,

Mauao could be reflected more within the spatial plan.

·

It was important to get links to economic

performance and wellbeing strongly captured within the spatial plan.

·

The General Manager Strategy, Growth and

Governance advised that, in respect of Plan Change 33, factual alignment was

needed, while retaining the direction. This meant that if someone were to

pick it up in six months’ time, essentially staff would ensure the

facts would align at that point in time without changing the direction.

|

|

Committee Resolution SFR2/24/13

Moved: Commissioner

Stephen Selwood

Seconded: Commissioner Bill Wasley

That the Strategy,

Finance and Risk Committee:

(a) Receives

the report "Adoption of Mount to Arataki Spatial Plan".

(b) Adopts

the ‘Mount to Arataki Spatial Plan – Te Mahere ā-Takiwā

o Mauao ki Arataki’ in Attachment A, to guide development and

investment prioritisation in the Mount to Arataki area.

(c) Delegates

to the General Manager: Strategy, Growth and Governance to approve any

necessary or minor amendments to the spatial plan including to ensure

alignment and consistency with the following projects (as endorsed by

Council):

(i) Plan

Change 33 – Enabling Housing Supply

(ii) Connecting Mount Maunganui Indicative

Business Case.

Carried

|

At 12.09pm, the meeting adjourned.

At 12.42pm, the meeting reconvened.

|

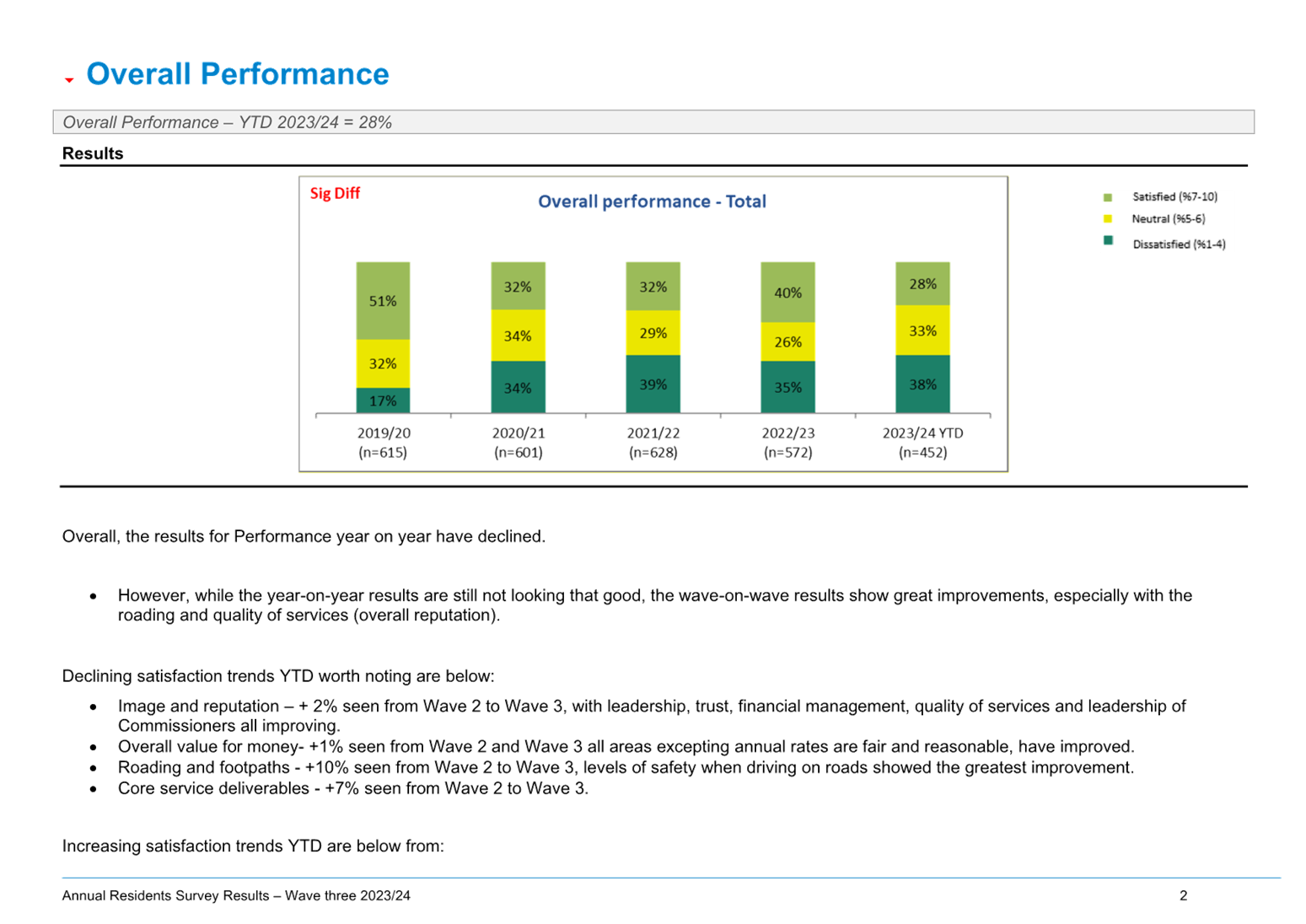

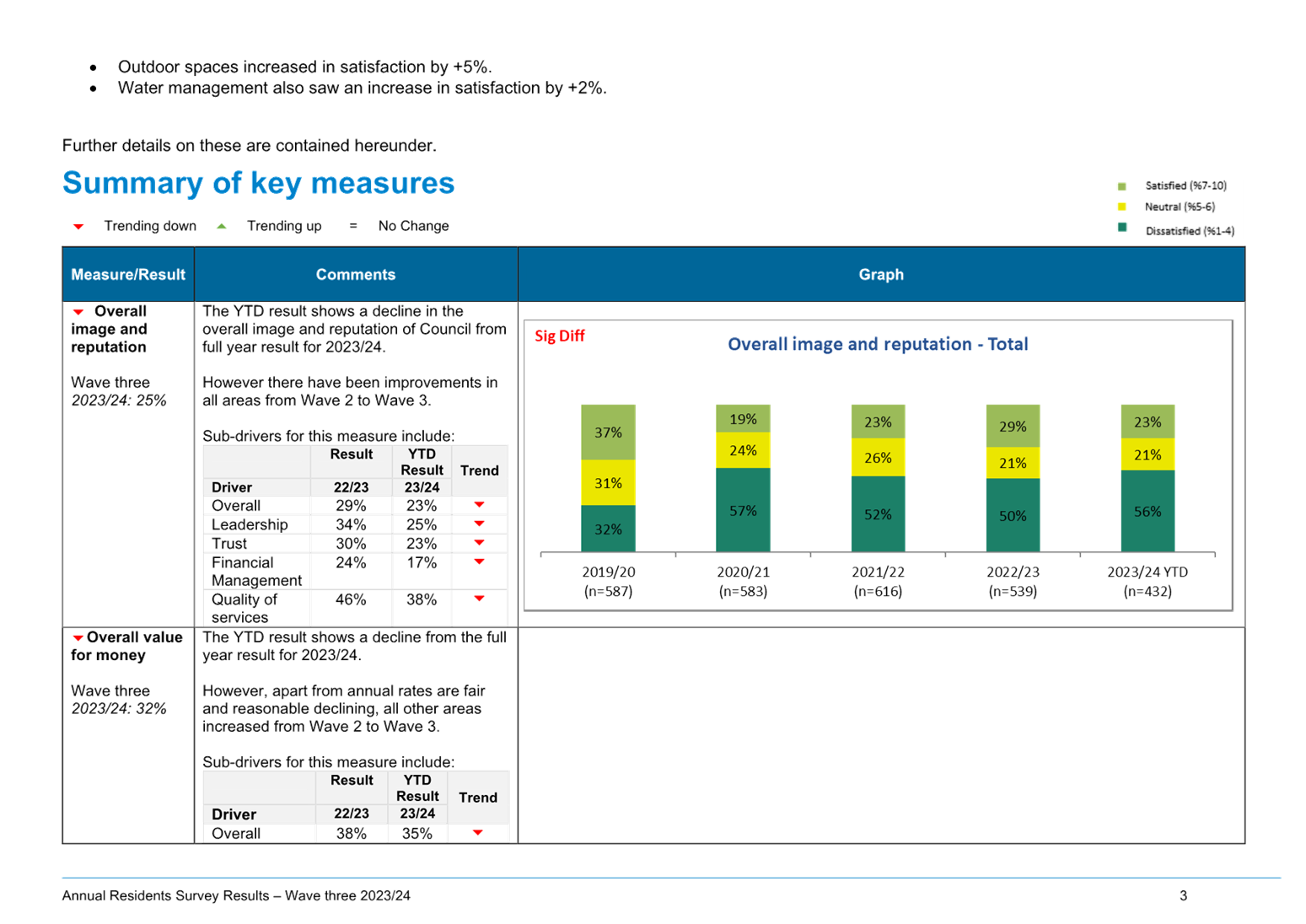

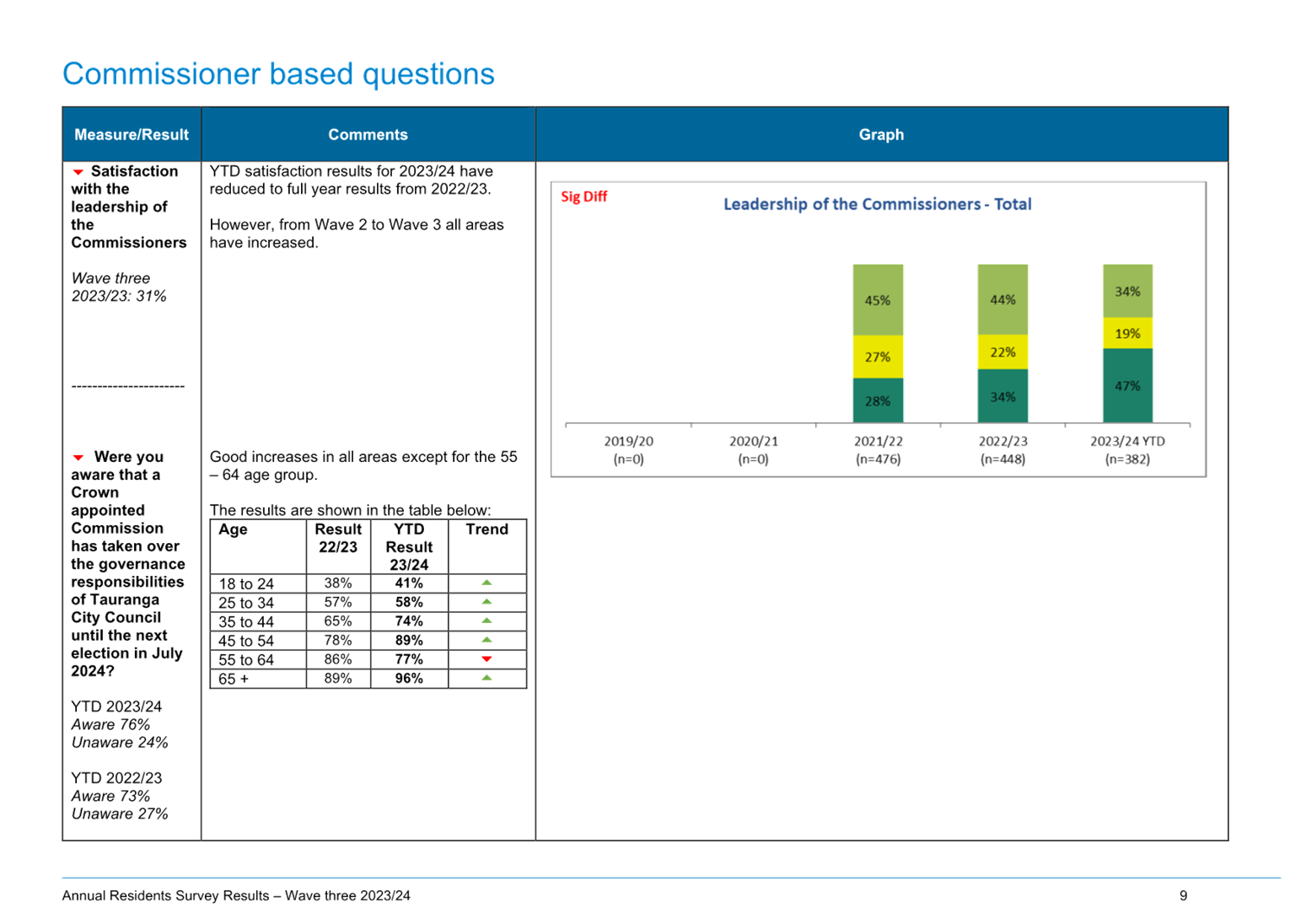

9.4 Non-Financial

Performance Report - 6 monthly 2023/24 and Annual Resident Survey 2023/24 -

Wave 2

|

|

Staff Kathryn Hooker, Corporate Planner

Christine Jones, General Manager

Strategy, Growth and Governance

In response

to questions

·

There were four separate waves of feedback

that took about four weeks each, effectively covering 16 weeks of the

year. This assisted in minimising the impact of any individual

event. Staff would continue to engage with the Communications Team on

how best to engage with the community.

·

Council had a ‘feedback and complaints’

website service that recorded how satisfied customers were with a service

they had received. ‘Kōrero mai’ was a platform that

people could subscribe to, to be kept up to date with what was happening

across the city and share their feedback.

·

Every time Council went through the LTP

process, activities were revisited and questioned as to whether the

information captured was useful and if it was being used. If not, this

would be rephrased and repurposed by better information gathering from the

community.

·

There were no national standardised system of

questions, however, they were similar between councils and generally comprised

of satisfaction questions around how services were being received within the

community. The questions were sent out by a market research company who

ensured that, in terms of demographics, the right weighting across the city

would be achieved.

Discussion points raised

·

There had been an interesting amount of

engagement from the community, however, it did not seem to translate into

feedback that Council was doing as much as it could to connect with the

community. This was disappointing.

·

The survey may have been impacted by a number

of events happening in the city at the same time such as the Cameron Road

works and its impacts, traffic, which consistently came up as a key

aggravating issue, and parking which was also a very emotive topic. Hopefully,

the community would see things coming to fruition and that projects were

happening.

|

|

Committee Resolution SFR2/24/14

Moved: Commissioner

Shadrach Rolleston

Seconded: Commissioner Bill Wasley

That the Strategy,

Finance and Risk Committee:

(a) Receives the report

"Non-Financial Performance Report - 6 monthly 2023/24 and Annual

Resident Survey 2023/24 - Wave 2".

Carried

|

|

9.5 Growth

& Land Use Projects Progress Report - March 2024

|

|

Staff Christine Jones, General Manager: Strategy, Growth and Governance

Andy Mead, Manager:

City Planning & Growth

Key points

·

Milestones achieved over the last three months

included the Greenfield Projects and the achievement of notification of a

number of plan change projects, in particular for Tauriko West and the

Tauriko Business Estate. The Enabling Works contract was now in place

and construction underway.

·

Good progress had been made regarding the

updated SmartGrowth future development strategy. Deliberations had been

completed with further reporting work to be done to get the strategy

endorsed.

·

The government was doing a lot of work around

the Resource Management Act (RMA) reform. Fast tracking consenting bills had

been introduced to Parliament which provided opportunities for urban

development and infrastructure projects in Tauranga. Staff were assessing

this and were expecting another lot of bills later this year, heading towards

next year with the replacement legislation of the RMA.

·

A substantial redraft of the Government Policy

Statement for Land Transport had been released which was significantly

changed in focus towards economic development and efficiency, in particular

state highway projects. There was less focus on public transport,

walking and cycling which meant that considerable work was going on in terms

of the implications of this and the submission Council would make on

this.

·

Paragraph 26 in the report contained requested

information around the Greenfield development capacity allocations including

land that had been consented but not developed and land where the consenting

processes had not commenced.

In response to questions

·

Development capacity in the Greenfield areas

was definitely running out without the rezoning of new areas like Tauriko

West.

·

Generally, Tauranga developers and landowners

were active. Not a lot of land was being held back or banked for future

development.

·

In terms of the anticipated timeline for 6000

houses, it was thought the bulk this would be achieved within five to ten

years. The challenge was that there were some sites that were more problematic

and would take longer than this.

·

Staff were working closely with the Māori

Land Trust to identify barriers and which of those related back to Council.

At 1.10pm, Mr Bruce Robertson entered the meeting.

·

The Committee would be provided with a table

listing the Brownfields and Greenfields capacity projects and their timelines.

·

Plan Change 38 was a big plan change with a

lot of work being done on it this year and next year. Notification was

expected to take place towards the end of 2025. The existing Council would

sign off and endorse this plan, so it would be well underway by the time the

new Council was in place. This could be incorporated and reflected in the

SmartGrowth implementation plan so that it would come through as part of the

SmartGrowth package that would be signed off a the SmartGrowth Leadership

Group partnership level.

|

|

Committee Resolution SFR2/24/15

Moved: Commissioner

Shadrach Rolleston

Seconded: Commissioner Bill Wasley

That the Strategy,

Finance and Risk Committee:

(a) Receives the

report "Growth & Land Use Projects Progress Report - March 2024".

Carried

|

|

9.6 Urban

Design Panel - Terms of Reference Update

|

|

Staff Christine Jones, General Manager: Strategy, Growth and Governance

Carl Lucca, Team Leader: Urban

Communities

In response

to questions

·

Often, an application had many matters beyond

urban design that had to be dealt with. The purpose of the process was to

bring people to the table and help clear pathways by working with the

panel. To date this was proving to be advantageous.

·

The Terms of Reference did not specifically

respond to the establishment of Public Art Panel.

·

There were kaupapa Māori members and

kaupapa Māori design experts on the panel. Each time the panel

received an application/proposal, it would be looked at and a suitable specialist

chosen if needed. Sometimes projects needed direct hapu and mana whenua

engagement. If there was any uncertainty around this, input would be sought

from Te Pou Takawaenga.

·

The role of the Māori design expert was

to do a review and obtain appropriate input from tangata whenua, look at the

design process that had been undertaken and ask if the input/direction was

appropriate. If not, there would be an opportunity to talk with tangata

whenua representatives.

·

Acknowledging the importance of finding the

right experts to determine tangata whenua values for each

application/proposal could be built into the Terms of Reference. A draft

example of this wording could be brought back to the Committee.

Discussion points raised

· The panel should give consideration to innovation and design

around material, sustainability, energy use and zero impacts on water

discharge to the moana which was particularly important in terms of

intergenerational aspects of the city and the landscape.

·

The following would be added to the Terms of

Reference at the request of Commissioner Wasley:

o

Public Art Panel as a specific reference, with

the onboarding of experts;

o

‘Public Realm’ be added to

the list of triggers for panel review; and

o

Heritage considerations be added to draft

information requirements – context analysis.

|

|

Committee Resolution SFR2/24/16

Moved: Commissioner

Bill Wasley

Seconded: Commissioner

Shadrach Rolleston

That the Strategy,

Finance and Risk Committee:

(a) Receives

the report "Urban Design Panel - Terms of Reference Update".

(b) Endorses

the updated Urban Design Panel Terms of Reference.

(c) Notes

that reporting on the Urban Design Panel will be provided to the Strategy,

Risk and Finance Committee on a regular basis as part of the City Planning

and Growth quarterly reporting.

(d) Notes

that a full review of the Urban Design Panel will be reported to the

Strategy, Risk and Finance Committee on a three yearly basis.

(e) Delegates authority to the Chief

Executive Officer to make minor changes to the Terms of Reference and changes

to panel membership.

Carried

|

10 Discussion of late items

Nil

11 Public excluded session

Resolution to exclude the public

|

Committee Resolution SFR2/24/17

Moved: Ms

Rohario Murray

Seconded: Commissioner

Bill Wasley

That

the public be excluded from the following parts of the proceedings of this

meeting.

The

general subject matter of each matter to be considered while the public is excluded,

the reason for passing this resolution in relation to each matter, and the

specific grounds under section 48 of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

|

General subject of each

matter to be considered

|

Reason for passing this

resolution in relation to each matter

|

Ground(s) under section 48

for the passing of this resolution

|

|

11.1 - Public Excluded minutes

of the Strategy, Finance and Risk Committee meeting held on 19 February

2024

|

s6(b) - The making available of the

information would be likely to endanger the safety of any person

s7(2)(a) - The withholding of the

information is necessary to protect the privacy of natural persons,

including that of deceased natural persons

s7(2)(b)(i) - The withholding of the

information is necessary to protect information where the making available

of the information would disclose a trade secret

s7(2)(b)(ii) - The withholding of the

information is necessary to protect information where the making available

of the information would be likely unreasonably to prejudice the commercial

position of the person who supplied or who is the subject of the

information

s7(2)(d) - The withholding of the

information is necessary to avoid prejudice to measures protecting the

health or safety of members of the public

s7(2)(g) - The withholding of the

information is necessary to maintain legal professional privilege

s7(2)(h) - The withholding of the

information is necessary to enable Council to carry out, without prejudice

or disadvantage, commercial activities

s7(2)(j) - The withholding of the

information is necessary to prevent the disclosure or use of official

information for improper gain or improper advantage

|

s48(1)(a) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

11.2 - Appointment of

Additional Urban Design Panel Members

|

s7(2)(a) - The withholding of the

information is necessary to protect the privacy of natural persons,

including that of deceased natural persons

|

s48(1)(a) - the public conduct of the

relevant part of the proceedings of the meeting would be likely to result

in the disclosure of information for which good reason for withholding

would exist under section 6 or section 7

|

Carried

|

12 Closing karakia

Commissioner Shadrach Rolleston closed the

meeting with a karakia.

Resolutions transferred into the open section of

the meeting after discussion

|

11.2 Appointment

of Additional Urban Design Panel Members

|

|

Committee Resolution SFR2/24/18

Moved: Commissioner

Bill Wasley

Seconded: Commissioner Shadrach Rolleston

That the Strategy, Finance and Risk Committee:

(a) Receives the report

"Appointment of Additional Urban Design Panel Members".

(b) Appoints the following

people to the Tauranga Urban Design Panel:

(i) Shannon Bray

(ii) Jack Jiang

(iii) Claire Graham

(iv) Haley Hooper.

(c) Transfers

this report and resolutions (excluding Attachments) into the open section of

the meeting once the successful appointees have been informed. Attachment 1

will remain confidential to protect the privacy of natural persons in

accordance with section 7(2)(a) of Local Government Official Information and

Meetings Act 1987.

Carried

|

The meeting closed at 1.49pm.

The

minutes of this meeting were confirmed as a true and correct record at the

Strategy, Finance and Risk Committee meeting held on 13 May 2024.

...................................................

Commission Chair Anne Tolley

CHAIRPERSON

|

Strategy,

Finance and Risk Committee meeting agenda

|

13

May 2024

|

9 Business

9.1 Tauranga

Urban Design Action and Investment Plan Adoption

File

Number: A15780590

Author: Carl

Lucca, Team Leader: Urban Communities

Authoriser: Christine

Jones, General Manager: Strategy, Growth & Governance

Purpose of the Report

1. This report presents the Tauranga Urban

Design Action and Investment Plan (“the

UD AIP”) for adoption.

|

Recommendations

That the Strategy, Finance and Risk Committee:

(a) Receives the report

"Tauranga Urban Design Action and Investment Plan Adoption

2024-2034".

(b) Adopts the Tauranga Urban

Design Action and Investment Plan Adoption 2024-2034 (Attachment A) to

improve urban design outcomes in Tauranga.

(c) Delegates the Group Manager: Strategy, Growth and

Governance to approve minor amendments to the Plan, if required prior to

publication.

(d) Notes that the Tauranga Urban Design Strategy (2006) is

superseded by the Urban Design Action and Investment Plan and approves that

the Strategy be rescinded.

|

Executive

Summary

2. This report outlines the

need for a comprehensive strategy to enhance urban design outcomes in Tauranga

due to significant growth and environmental change. Currently, there is a lack

of consolidated guidance despite various existing documents promoting quality

urban design in Tauranga. This UD AIP replaces the 2006 Urban Design Strategy

and provides an action plan to support Council’s role in design leadership

and supporting design excellence as our city continues to grow.

3. The UD AIP aligns with

national and local strategies such as the New Zealand Urban Design Protocol,

National Policy Statement on Urban Development, and SmartGrowth Strategy.

4. As part of the UD AIP

preparation process, engagement has been undertaken with key built environment

stakeholders, including Tauranga City Council teams, professional bodies and

community organisations, Kaupapa Māori Design experts, Te Rangapū

Mana Whenua o Tauranga Moana, government agencies and the Tauranga Urban Design

Panel. Feedback received during stakeholder engagement has informed the

development of key directives and actions contained within the UD AIP.

5. The key directives of

the UD AIP include Design Leadership and Design Excellence, focusing on

leadership, communication, partnership, and promoting high-quality design

outcomes.

6. No ‘action’

in the UD AIP has any additional financial implications for Council – all

budgets are operational in nature and provided for through the 2024-2034 Long

Term Plan.

Background

Where we are now

7. Tauranga continues to

experience significant growth. As the city grows, there is a need for a greater

emphasis on the role of urban design. Currently, Council is providing for

growth in greenfield areas and through a continued transition to a more

compact, mixed-use and multi-unit residential outcomes. Recent increases in

extreme weather events in New Zealand is also driving an increased focus on

sustainable design and designing for climate resilience.

8. In line with national,

sub-regional and local direction to accommodate density and in response to

current housing and environmental challenges, Tauranga is undergoing numerous

plan changes and updates to its City Plan.

9. Alongside current

changes to the City Plan, there are several existing documents and resources

which promote high-quality urban design outcomes in Tauranga. These include:

(a) The

Tauranga Moana Design Principles

(b) The

Residential Outcomes Framework

(c) The

Te Papa, Otumoetai and Mount to Arataki Spatial Plans

(d) The

Street Design Guide and Infrastructure Development Code and

(e) The

Tauranga Urban Design Panel.

10. While

these documents help to promote quality urban design outcomes, there is not one

current and consolidated document which provides overarching direction and

guidance for urban design in Tauranga. The existing Urban Design Strategy for

Tauranga (‘Great City, Great Design’) was prepared in 2006. The

context and actions contained within this document are now outdated. The UD AIP

will effectively replace the 2006 Strategy, providing direction for urban

design over the coming decade.

Why this Plan was Developed

11. The UD AIP serves as a blueprint

for actions that supporting high-quality urban design outcomes in Tauranga. It

builds upon existing documents which promote quality urban design (including

the 2006 Urban Design Strategy. It addresses current challenges, acknowledges

the importance of collaboration, and guides future development in Tauranga

through stated directions and actions.

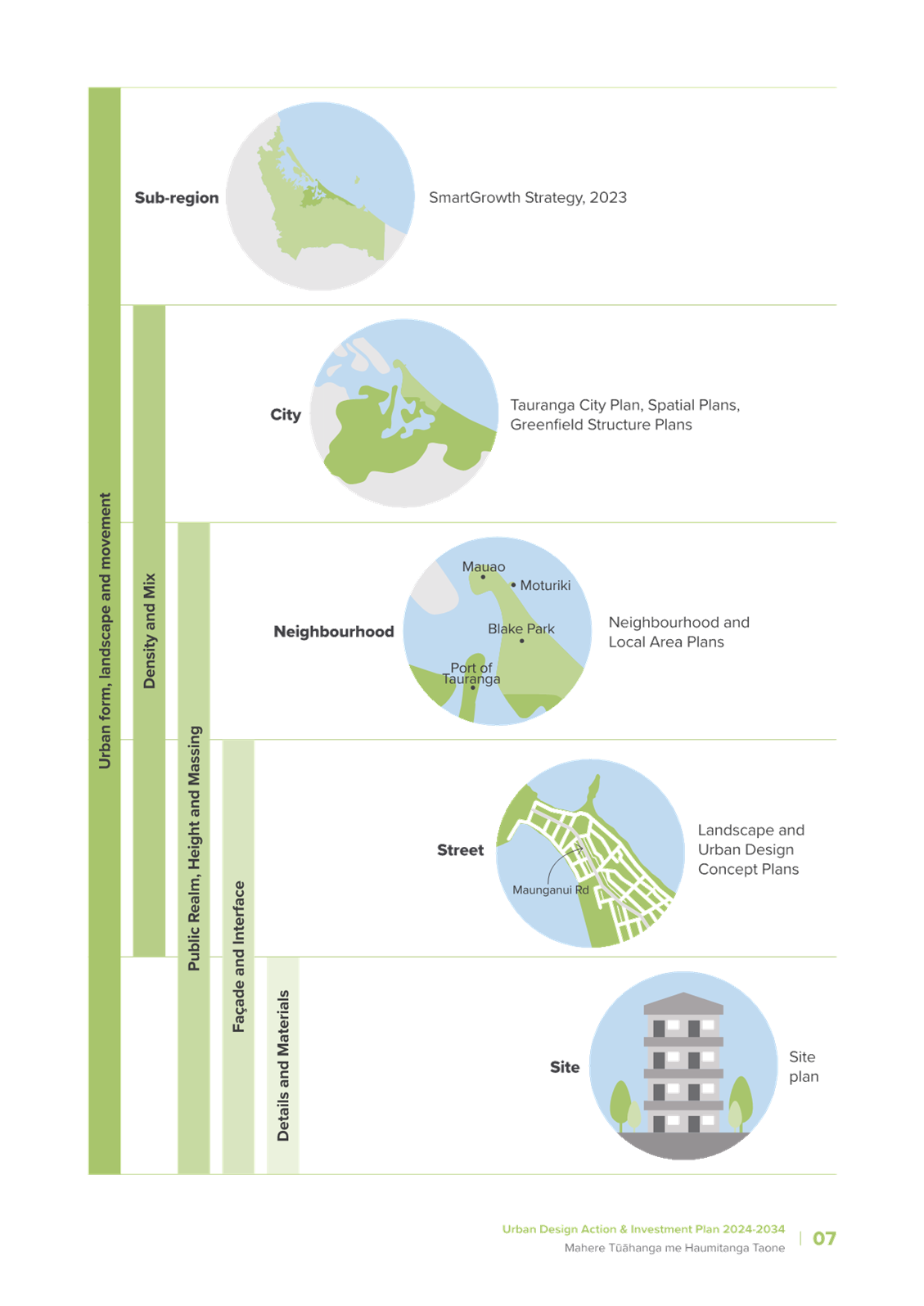

12. Urban design is vital for shaping

Tauranga’s identity, functionality, and liveability. Operating across a

wide range of scales, from city-wide initiatives and interventions through to

the design of individual buildings and streetscapes, urban design aims to

create places where people thrive. This includes recognition of historical and

cultural aspects, as well as the integration of natural features into urban

landscapes.

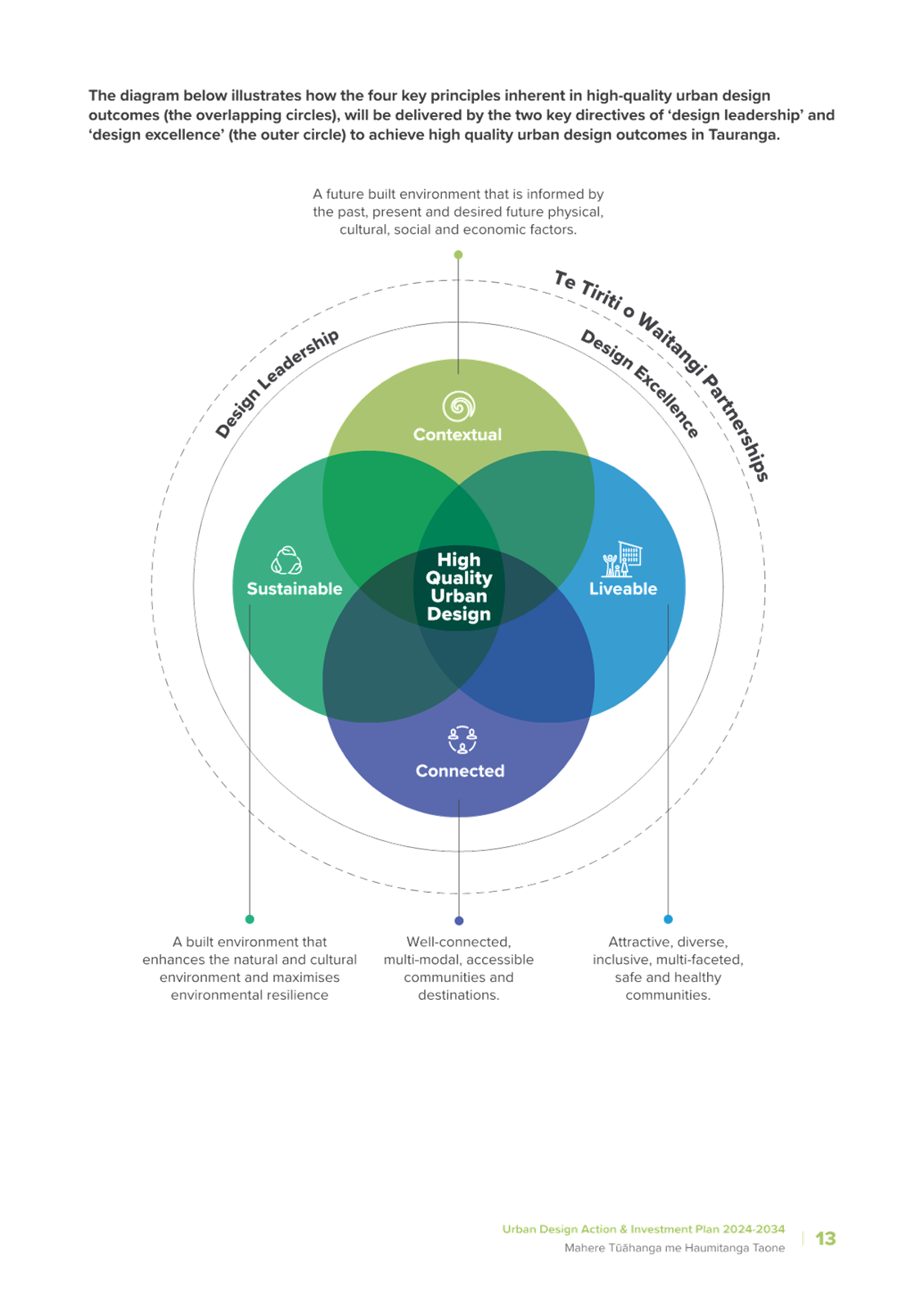

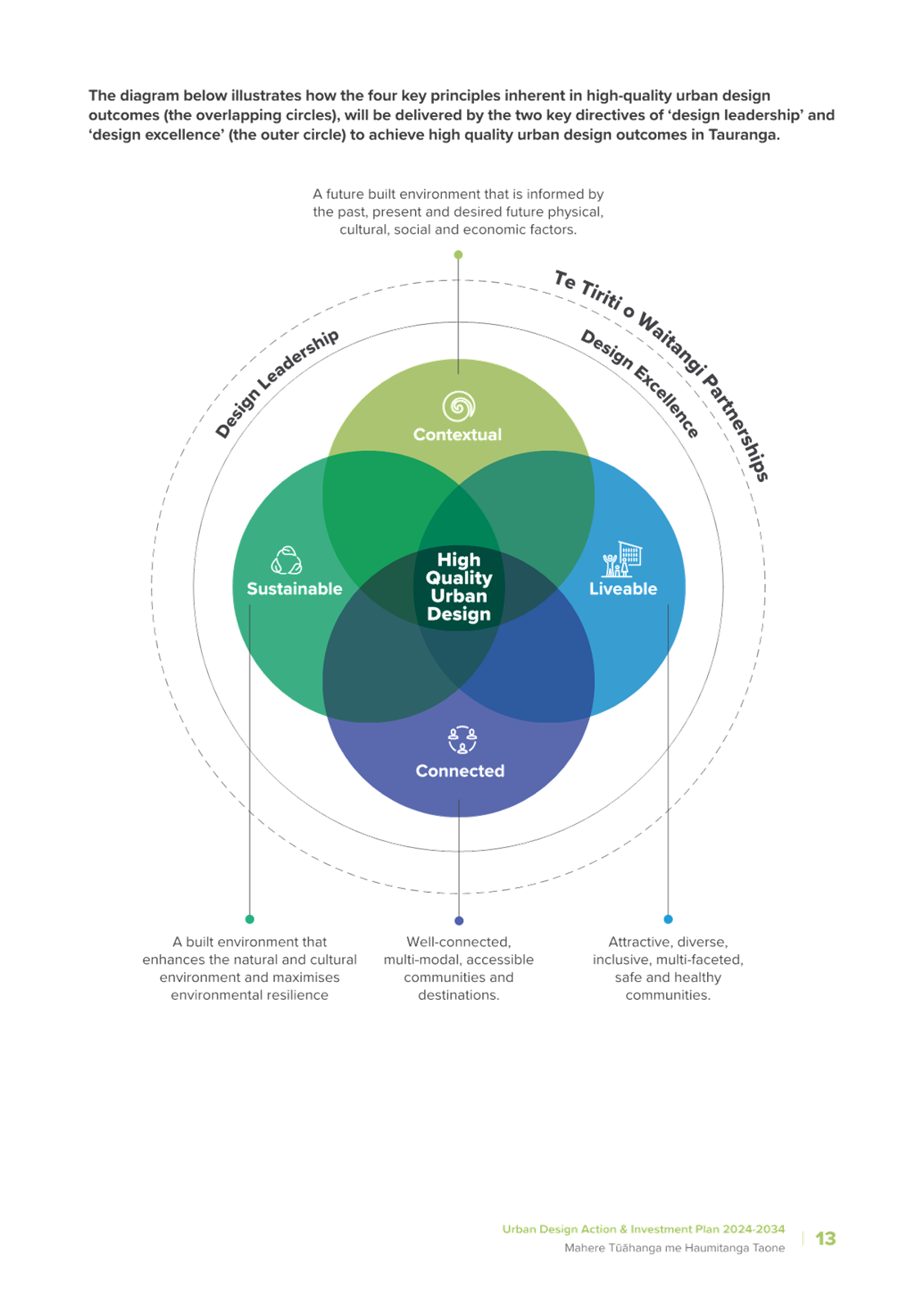

13. Core principles of good urban

design have been outlined in the UD AIP. These principles reflect current best

practice and input from partners and key stakeholders. They form the basis of

how we should plan, design and develop our cities and are framed around

developments that are – contextual, liveable, connected and sustainable.

14. Improved communication and

education on urban design will also assist to socialise strategic outcomes and

benefits of urban design and showcase and celebrate high quality outcomes as

they are delivered.

Key Directives

15. Council has a key leadership role

in supporting urban design outcomes in Tauranga. For urban design to function

effectively in Tauranga, it must be integrated into various facets of council

activities, spanning from the development of urban design guidance to

leadership, education and stakeholder collaboration initiatives.

16. Design Leadership and Design

Excellence have been selected as the key urban design directives to address

the challenges facing Tauranga today and to promote the overarching principles

of good urban design.

17. Design Leadership focuses on

providing urban design leadership through processes and projects (both in

planning and investment) and acknowledges the importance of:

(a) Communicating the value of urban design.

(b) Leading by example through projects and processes.

(c) Promoting good urban design outcomes in city

planning and projects.

(d) Encouraging co-design and partnership approaches with

the community and stakeholders.

(e) Fostering connections across projects and between built

environment professionals and the community.

18. Design Excellence aims to

support and enable high-quality urban design outcomes, and acknowledges the

importance of:

(a) Providing clear urban design direction and guidance.

(b) Promoting safety and accessibility for all in design.

(c) Supporting vibrant and liveable communities,

places, and spaces by enhancing community identity, culture, heritage,

sustainability, resilience, natural environments, and biodiversity.

(d) Connecting people, places, and spaces, supporting the

aspirations and perspectives of mana whenua (indigenous people) through the

utilization of Tauranga Moana Design Principles.

(e) Celebrating and acknowledging projects that exemplify

good urban design.

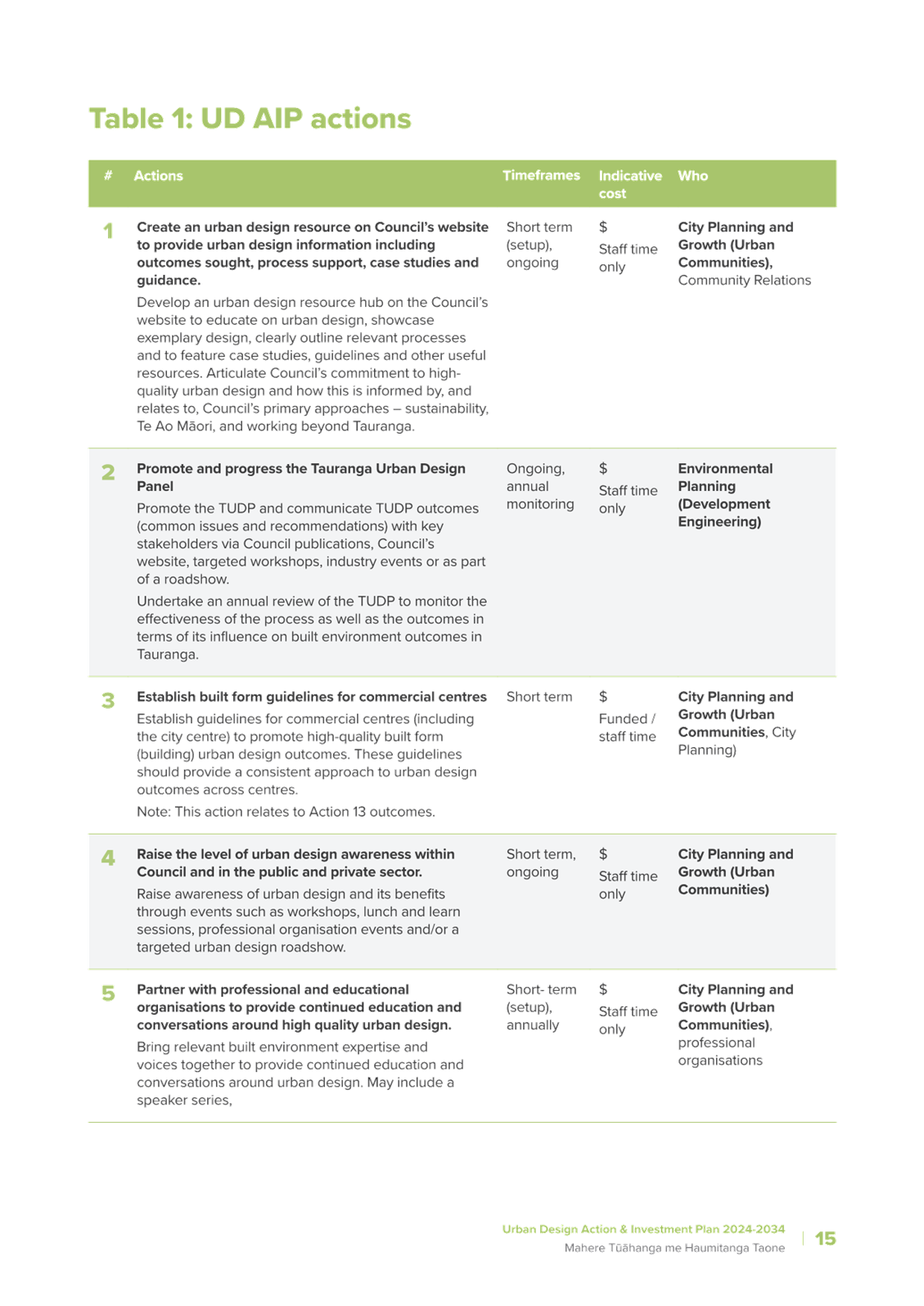

19. The actions contained within the UD

AIP seek to promote the key directives of Design Leadership and Design

Excellence and describe how Council will deliver upon our commitment to quality

urban design in Tauranga.

Strategic / Statutory Context

20. High-quality urban design outcomes in

Tauranga are supported nationally and locally through a framework of strategies

and policies, which this Plan will assist to deliver on. These include:

· New Zealand Urban

Design Protocol, 2005

· National Policy

Statement on Urban Development (NPS-UD), 2020

· Bay of Plenty

Regional Policy Statement (RPS), 2018

· SmartGrowth

Strategy, 2023

· Our Direction,

2023.

21. The UD AIP helps to progress our

city vision and community outcomes. It sits under the ‘Tauranga Tatai

Whenua – a well-planned city’ primary strategy within Councils Our

Direction Strategic Framework (2023). Due to the holistic nature of urban

design – the Plan has strong connections with all five primary strategies

and close connections with other Action and Investment Plans (City Centre,

Climate, Accessible Tauranga, Nature and Biodiversity, Arts, Culture and

Heritage, Safer Communities, and Reserves and Open Space).

PREPARATION PROCESS

22. Best practice research was

undertaken into other urban design strategies / action plans to inform the

development of this UD AIP.

23. An urban design stocktake report

was prepared outlining the current resources available to promote quality urban

design outcomes in Tauranga and capturing urban design related actions

contained with other AIPs.

24. Principles of good urban design

were drafted. These were informed by the previous Urban Design Strategy (2006),

Tauranga City Council’s ‘Our Direction’ strategic framework,

the Tauranga Moana Design Principles, national and international best practice,

urban design strategy research and other relevant Council documents.

25. Workshops and wānanga were

held key built environment stakeholders. These workshops and wānanga

provided targeted feedback with regards to:

·

The challenges facing Tauranga in the coming decade – and the urban

design opportunities that might arise in response to these challenges.

·

What is working in terms of promoting quality urban design outcomes in

Tauranga.

·

What is not working or is detracting from quality urban design outcomes in

Tauranga.

·

What gaps exist in terms of urban design strategy, guidance, policy,

engagement, research, education, and marketing.

·

What needs greater visibility.

26. Stakeholder feedback was translated

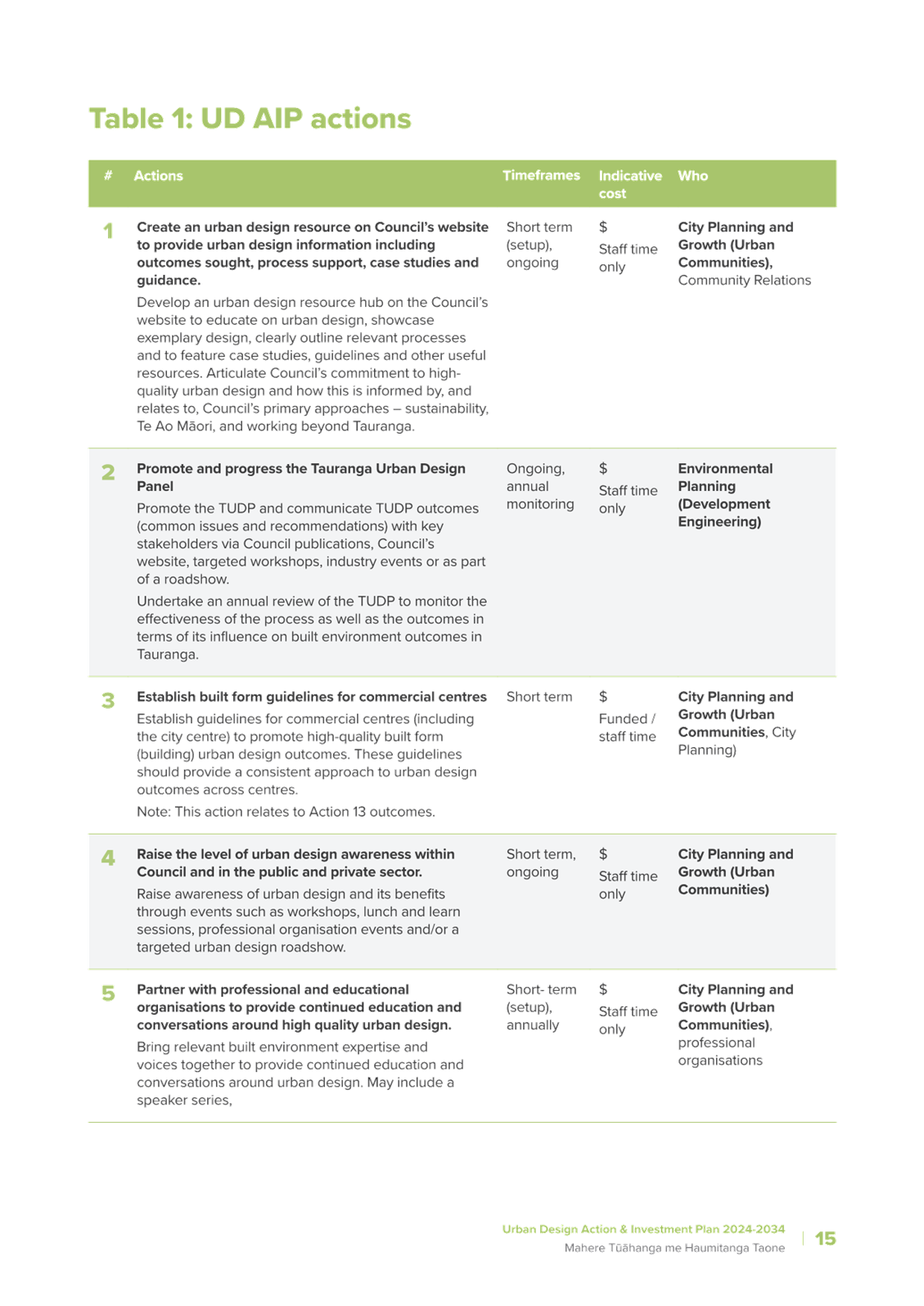

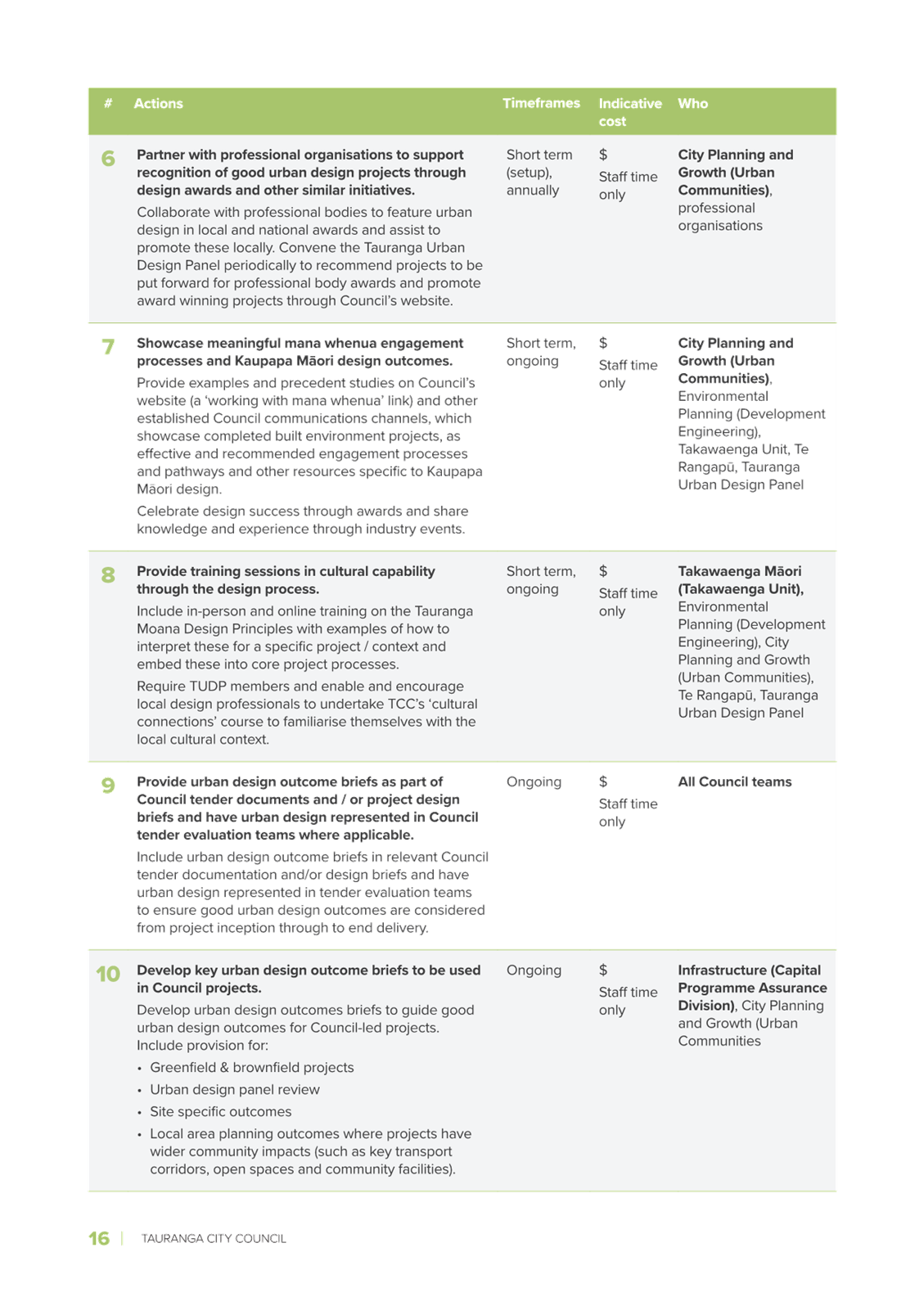

into our two key directives and 13 UD AIP actions, and feedback sought from key

stakeholders to refine the draft UD AIP.

Consultation / Engagement

27. As part of the UD AIP preparation

process, engagement has been undertaken with key built environment

stakeholders. Input was received though a number of workshops with various

built environment stakeholders as outlined in the table below:

|

Organisation

|

Explanation

|

|

Tauranga City Council

|

Workshop with

representatives from different Council teams with a vested interest in urban

design.

|

|

Targeted feedback on

the draft UD AIP from relevant Council teams.

|

|

Professional Bodies and

Community Organisations

|

Workshop with

representatives from Urban Task Force, Property Development Forum, Mount

Business Association, NZILA, NZIA, Connected Communities reps, Mainstreet

organisations (e.g., Mount Business Association) and relevant other

stakeholder entities.

|

|

The Tauranga Urban

Design Panel

|

Workshops with Tauranga

Urban Design Panel members. A selection of eight Tauranga Urban Design Panel

members from a range of disciplines reviewed the document and provided

feedback.

|

|

Government Agencies

|

Workshop with

representatives from Waka Kotahi, Kainga Ora, Ministry of Education, Bay of

Plenty Health Board, Ministry for the Environment. All representatives were

provided the opportunity to review the draft UD AIP.

|

Kaupapa

Māori design expertise and Te Rangapū Mana Whenua o Tauranga Moana

Partnership input

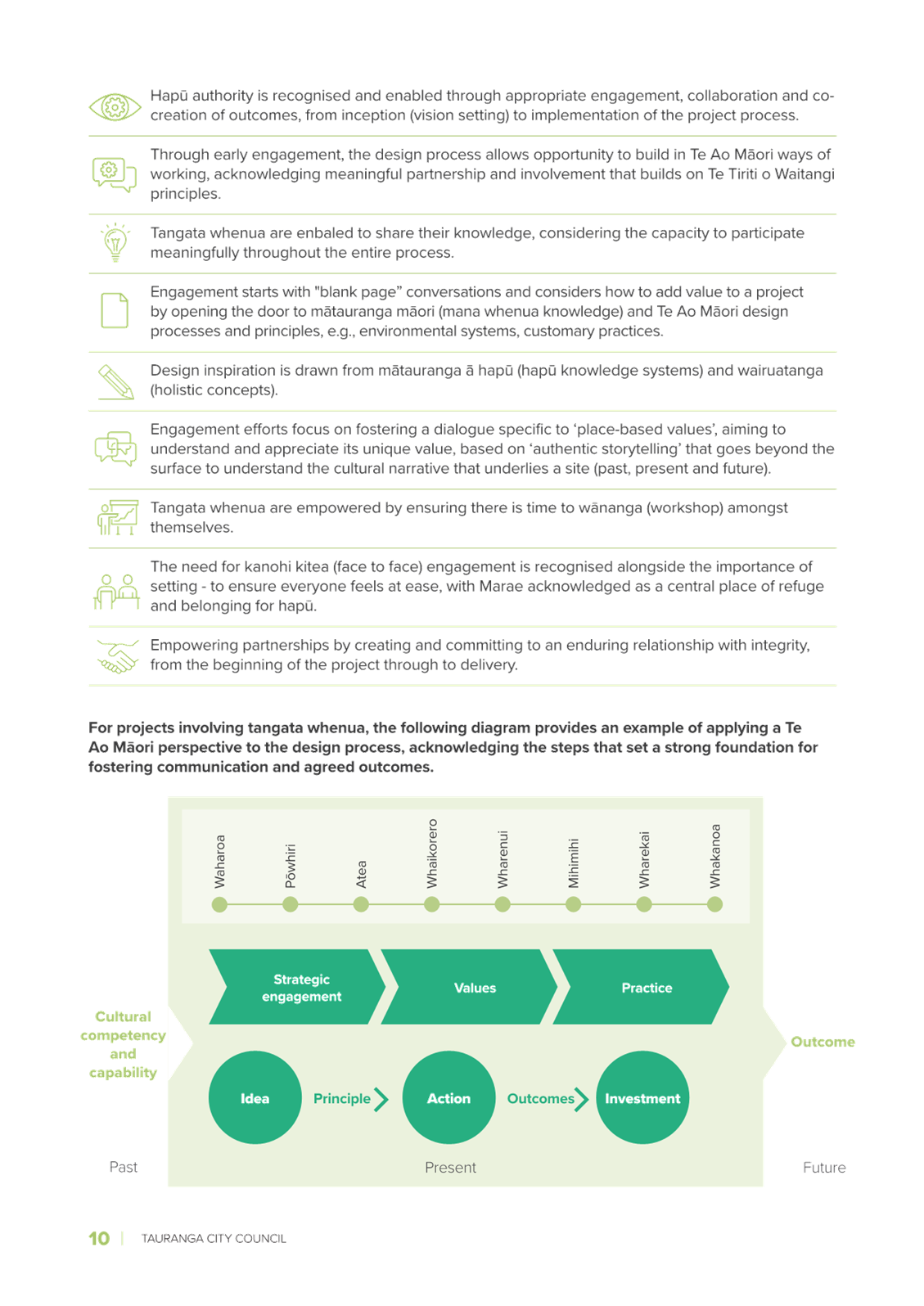

28. Alongside stakeholder engagement,

specific input was also sought from Kaupapa Māori design experts

(including those with local whakapapa and knowledge) and Te Rangapū Mana

Whenua o Tauranga Moana Partnership. Three wānanga were held with the

Kaupapa Māori Design experts. These sessions helped to inform:

(a) The development of principles for strategic engagement

– when working on projects of a significant nature, scale, and / or of

cultural importance to tangata whenua.

(b) Key actions to showcase meaningful mana whenua

engagement process and Kaupapa Māori Design outcomes and to promote

cultural capability.

29. Following the wānanga, the

relevant UD AIP content was presented to Te Rangapū on the 28th

of March 2024 and received positive feedback.

Options Analysis

Option

One (recommended) – Adopt the Tauranga Urban Design Action and Investment

Plan included in Attachment A

|

Advantages

|

Disadvantages

|

|

· Provides

current, clear and consolidated direction on how to promote high quality

urban design outcomes in Tauranga over the coming decade - through stated

principles, directives, actions and measures.

· Replaces

the outdated Urban Design Strategy for Tauranga (2006).

· Has

gone through stakeholder engagement sessions in the form of workshops,

wānanga and peer review. Proposed directions and actions have sought to

be reflective of the feedback received from consulted groups and to address

identified challenges and opportunities related to urban design.

|

· Will

require staff time to implement and monitor the progress of proposed actions.

|

Option

Two – Do not adopt the Tauranga Urban Design Action and Investment Plan

included in Attachment A

|

Advantages

|

Disadvantages

|

|

· Business

as usual – no staff time required to implement and monitor the progress

of proposed actions.

|

· There

is not a current, consolidated, and unified direction on how to promote

quality urban design outcomes in Tauranga.

· The

2006 Urban Design Strategy for Tauranga is not replaced (and outdated actions

remain).

· The

stakeholder engagement process undertaken as part of the UD AIP does not

result in the articulation of a current, consolidated future direction for

urban design in Tauranga.

· Actions

supporting design excellence and leadership will not be endorsed, resulting

in potential negative urban design impacts on the city.

|

Financial Considerations

30. No ‘action’ in the UD

AIP has any additional financial implications for Council - all budgets are

operational in nature and provided for through the 2024-2034 Long Term Plan.

31. All Action and Investment Plans

will be reviewed in the year prior to development of each long-term plan, to

ensure they appropriately inform its development and budgets are appropriately

allocated.

Legal Implications / Risks

32. There are no identified legal

implications for this Plan.

33. The primary risk is that the

council may not be able to resource the actions identified in the UD AIP and,

as a result, may not be able to deliver on urban design aspirations articulated

within Our Direction.

Significance

34. The Local Government Act 2002

requires an assessment of the significance of matters, issues, proposals and

decisions in this report against Council’s Significance and Engagement

Policy. Council acknowledges that in some instances a matter, issue,

proposal or decision may have a high degree of importance to individuals,

groups, or agencies affected by the report.

35. In making this assessment,

consideration has been given to the likely impact, and likely consequences for:

(a) The current and future social, economic,

environmental, or cultural well-being of the district or region.

(b) Any persons who are likely to be

particularly affected by, or interested in, the matter.

(c) The capacity of the local authority to perform

its role, and the financial and other costs of doing so.

36. In accordance with the

considerations above, criteria and thresholds in the policy, it is considered

that the matter is of low significance.

Next Steps

37. The

adopted UD AIP will be available on Councils website as soon as possible.

38. Implementation of the actions identified in the plan.

Attachments

1. Attachment

A: Urban Design Action and Investment Plan 2024-2034 - A15889436 ⇩

|

Strategy,

Finance and Risk Committee meeting agenda

|

13

May 2024

|

|

Strategy,

Finance and Risk Committee meeting agenda

|

13