|

|

|

AGENDA

Audit & Risk Committee meeting

Wednesday, 19 February 2025

|

|

I hereby give notice that a Audit & Risk

Committee meeting will be held on:

|

|

Date:

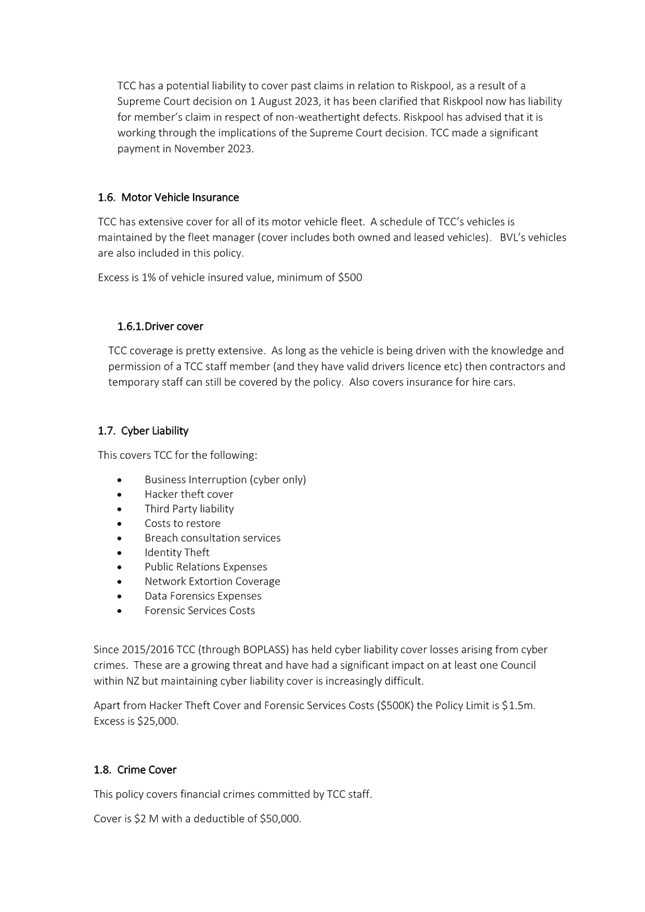

|

Wednesday, 19 February

2025

|

|

Time:

|

9.30am

|

|

Location:

|

Tauranga City Council Chambers

Ground Floor Meeting Room

306 Cameron Road

Tauranga

|

|

Please note that this

meeting will be livestreamed and the recording will be publicly available on

Tauranga City Council's website: www.tauranga.govt.nz.

|

|

Marty Grenfell

Chief Executive

|

Terms of reference – Audit & Risk Committee

Common

responsibility and delegations

The following common responsibilities and delegations apply

to all standing committees.

Responsibilities of standing committees

·

Establish priorities and guidance on programmes

relevant to the Role and Scope of the committee.

·

Provide guidance to staff on the development of

investment options to inform the Long Term Plan and Annual Plans.

·

Report to Council on matters of strategic

importance.

·

Recommend to Council investment priorities and

lead Council considerations of relevant strategic and high significance

decisions.

·

Provide guidance to staff on levels of service

relevant to the role and scope of the committee.

·

Establish and participate in relevant task

forces and working groups.

·

Engage in dialogue with strategic partners, such

as Smart Growth partners, to ensure alignment of objectives and implementation

of agreed actions.

·

Confirmation of committee minutes.

Delegations to standing committees

·

To make recommendations to Council outside of

the delegated responsibility as agreed by Council relevant to the role and

scope of the Committee.

·

To make all decisions necessary to fulfil the

role and scope of the Committee subject to the delegations/limitations imposed.

·

To develop and consider, receive submissions on

and adopt strategies, policies and plans relevant to the role and scope of the

committee, except where these may only be legally adopted by Council.

·

To consider, consult on, hear and make

determinations on relevant strategies, policies and bylaws (including adoption

of drafts), making recommendations to Council on adoption, rescinding and

modification, where these must be legally adopted by Council.

·

To approve relevant submissions to central

government, its agencies and other bodies beyond any specific delegation to any

particular committee.

·

Engage external parties as required.

Terms of reference – Audit & Risk Committee

Membership

|

Chairperson

|

Independent (to be

appointed)

|

|

Deputy chairperson

|

Cr Steve Morris

|

|

Members

|

Deputy Mayor Jen Scoular

Mayor Mahé Drysdale (ex officio)

|

|

Non-voting members

|

(if any)

|

|

Quorum

|

Half of the members

present, where the number of members (including vacancies) is even;

and a majority of the members present, where the number of members

(including vacancies) is odd.

|

|

Meeting frequency

|

Five weekly

|

Role

The role of the Audit and Risk Committee is:

·

To assist and advise the Council in discharging its

responsibility and ownership of health and safety, risk management, internal

control, and financial management practices, frameworks and processes to ensure

that these are robust and appropriate to safeguard the Council’s staff

and its financial and non-financial assets.

Scope

·

Oversee Council’s relationship with the external auditor.

·

Review with the external auditor, before the audit commences, the

areas of audit focus and the audit plan.

·

Review with the external auditor, representations required by

elected representatives and senior management for the purposes of the audit.

·

Receive and review the external auditor’s report on the

audit and management’s responses to any issues raised.

·

Make any recommendations necessary to the Office of the

Auditor-General regarding the appointment or re-appointment of an external

auditor.

·

Review and approve an annual internal audit plan, including the

integration of that plan with Council’s risk profile, and monitor the

implementation of that plan.

·

Review the reports of the internal audit function, in particular

considering findings, conclusions, and recommendations and management’s

response to such. Make any recommendations to Council on such as the

Committee considers appropriate.

·

Review, approve and monitor the implementation of Council’s

Risk Management Policy, including regular review of the corporate risk

register.

·

Review reporting of new or emerging risks as needed.

·

Review the effectiveness of risk management and internal control

systems including all material financial, operational, compliance, and other

managerial controls.

·

Review the effectiveness of health and safety policies and

processes to ensure a healthy and safe workplace for representatives, staff,

contractors, visitors and the public.

·

Assist elected representatives and the Chief Executive to

discharge their statutory roles as 'officers' in terms of the Health and Safety

at Work Act 2015.

·

Monitor compliance with laws and regulations as appropriate.

·

Review and provide advice on policies relevant to the

Committee’s role including, but not limited to, policies addressing

fraud, protected disclosures, and conflicts of interest.

·

Review and monitor policy and processes to manage

responsibilities under the Local Government Official Information and Meetings

Act 1987 and the Privacy Act 2020 and any actions from any Office of the

Ombudsman's report.

·

Review and monitor current and potential litigation and other

legal risks.

Power

to Act

·

To make all decisions necessary to fulfil the role, scope and

responsibilities of the Committee subject to the limitations imposed.

·

To establish sub-committees, working parties and forums as

required.

Power

to Recommend

·

To Council and/or any standing committee as it deems appropriate.

|

Audit & Risk Committee meeting Agenda

|

19 February 2025

|

8 Business

8.1 Audit

NZ Final Audit Results

File

Number: A16452935

Author: Sheree

Covell, Treasury & Financial Compliance Manager

Authoriser: Paul

Davidson, Chief Financial Officer

Purpose of the Report

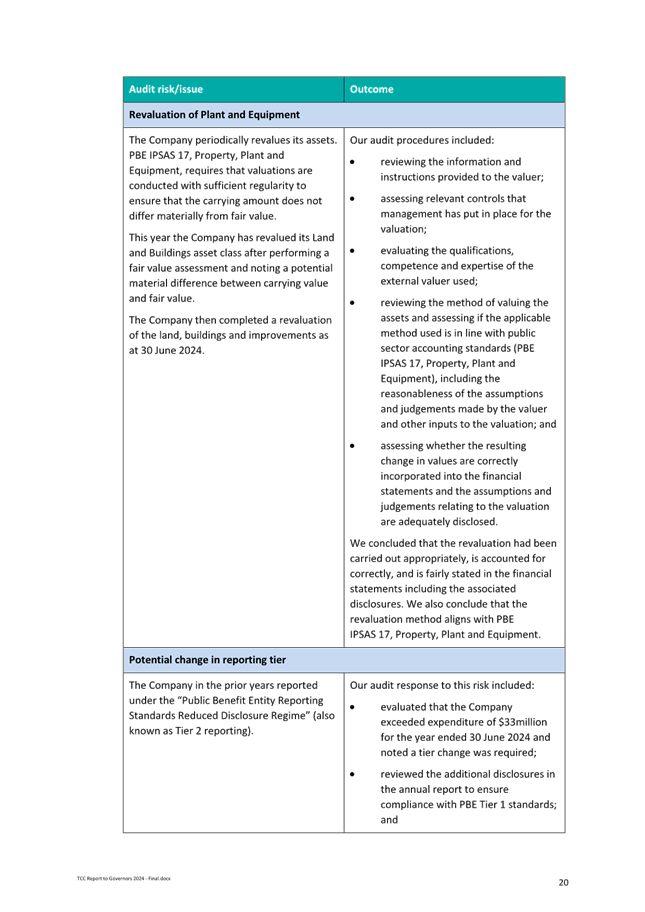

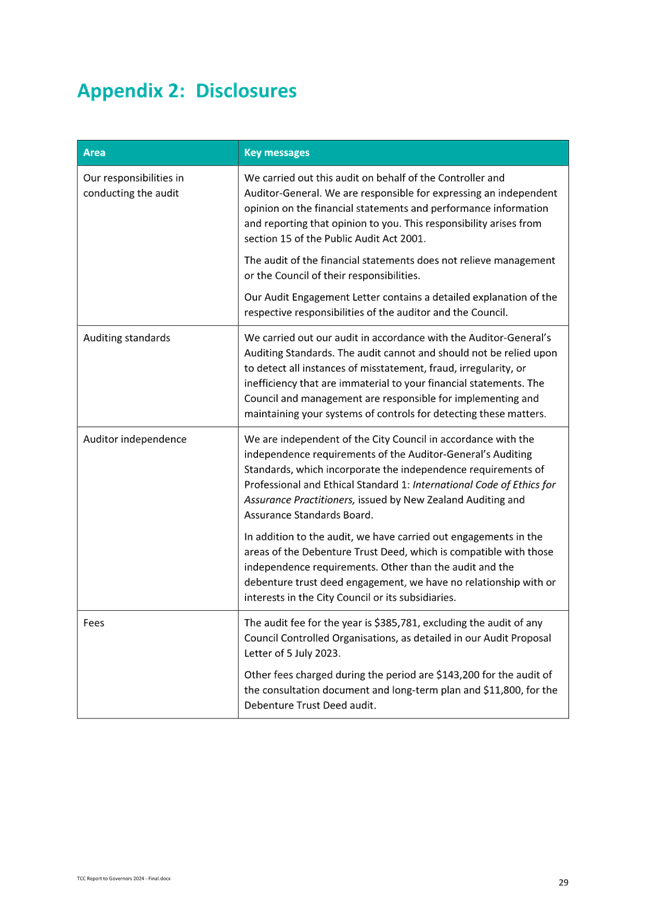

1. The purpose of this

report is to present Audit New Zealand’s (Audit NZ) report to the Council

on the audit of Tauranga City Council (TCC) for the year ended 30 June

2024. The Audit NZ report sets out findings from the annual audit and

draws attention to areas where the Council is doing well and where improvements

can be made.

|

Recommendations

That the Audit &

Risk Committee:

(a) Receives the report

"Audit NZ Final Audit Results".

|

Executive Summary

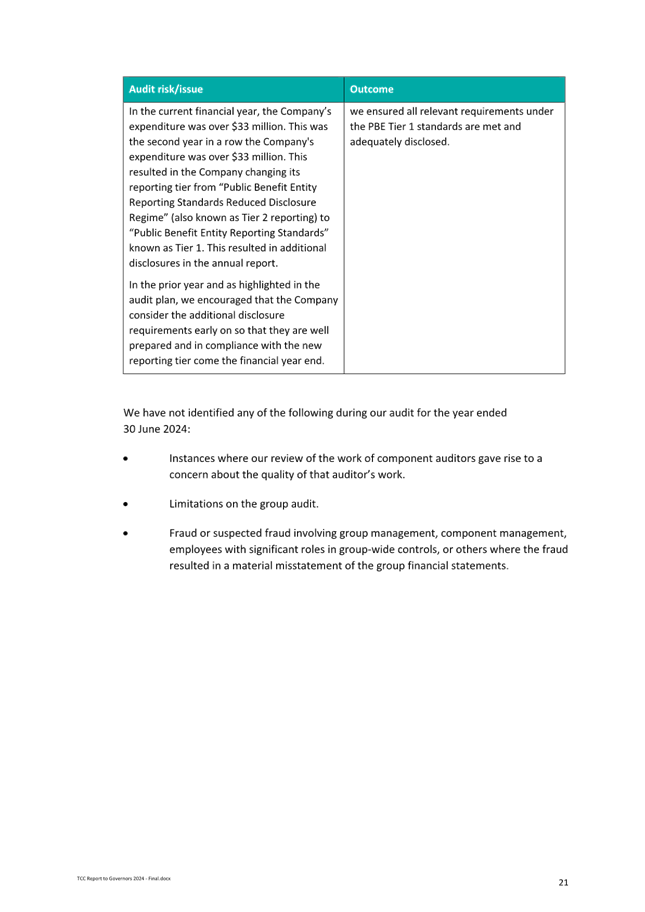

2. Audit NZ has

completed its audit of Tauranga City Council for the year ended 30 June 2024.

3. The attached audit

report outlines matters identified during the audit, makes recommendations and

includes staff comments on these recommendations. An update on matters

identified during previous audits is also included.

4. There are no

significant risks to be brought to this Committee’s attention, however a

summary of all new matters has been included in the background section of this

report.

Background

5. Audit New Zealand

has completed its audit of TCC for the year ended 30 June 2024. An

unmodified opinion was given for the adoption of the 2023 Annual Report on 29

October 2024.

6. The audit report

outlines matters identified during the audit, makes recommendations and

includes Council comments on these recommendations. An update on matters

identified during the previous audit is also provided.

7. Audit New Zealand

provides recommendations for improvement and prioritises these as urgent,

necessary, or beneficial. The report also reviews earlier recommendations and

notes whether these have been addressed by TCC.

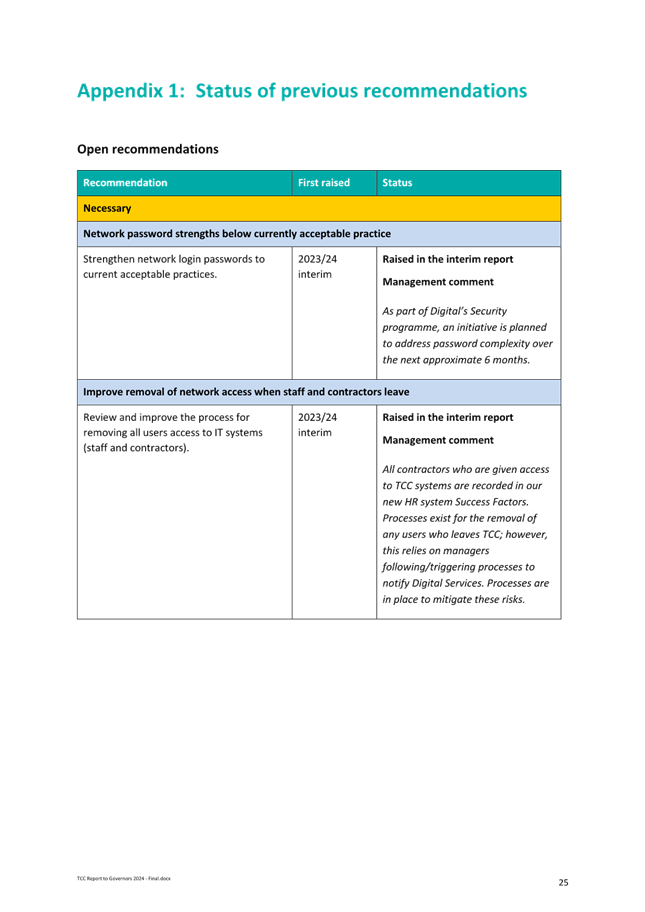

8. There were three

new recommendations made by audit, two of which are deemed necessary and one

beneficial. These are detailed below.

New

Recommendation #1: Obtain independent external accounting advice as early

as possible when considering unique contractual arrangements.

9. TCC has entered

into several contracts in the past several years which have required complex

and considered application of accounting standards. This includes the

creation of a CCO that owns the land for the development of Te Manawa o Te

Papa, the sale of the Marine Precinct and the sale and lease back of the civic

admin building. While the TCC in-house financial accounting team have the

expertise and experience to account for these transactions, Audit NZ has

required independent accounting advice to ensure the treatment is correct and

fairly presented. This does come at a cost above the audit fee so TCC

staff will only seek independent advice on future complex transactions that are

significant in value.

New

Recommendation #2: Annual provision of the detailed contract information

for recent infrastructure projects.

10. The complexity and quantum of

asset values and subsequent revaluations has increased significantly in recent

years. This year Audit NZ requested additional information to be provided

by our valuers and asset management teams to assist in the audit of the

revaluations. This will be an ongoing requirement which TCC have agreed

to.

New

Recommendation #3: Consider if CCOs can be assisted to meet their

statutory deadlines.

11. TCC’s newest CCOs have

not yet had an auditor appointed by the Auditor General and Bay Venues Limited

statutory reporting requirements changed as a result their higher expenditure

resulting in a change in the applicable accounting standards tier. The

TCC finance team work closely the CCOs and we note that the Annual Reports are

being prepared in a timely manner but market for auditors still remains

constrained and beyond the control of TCC.

Prior

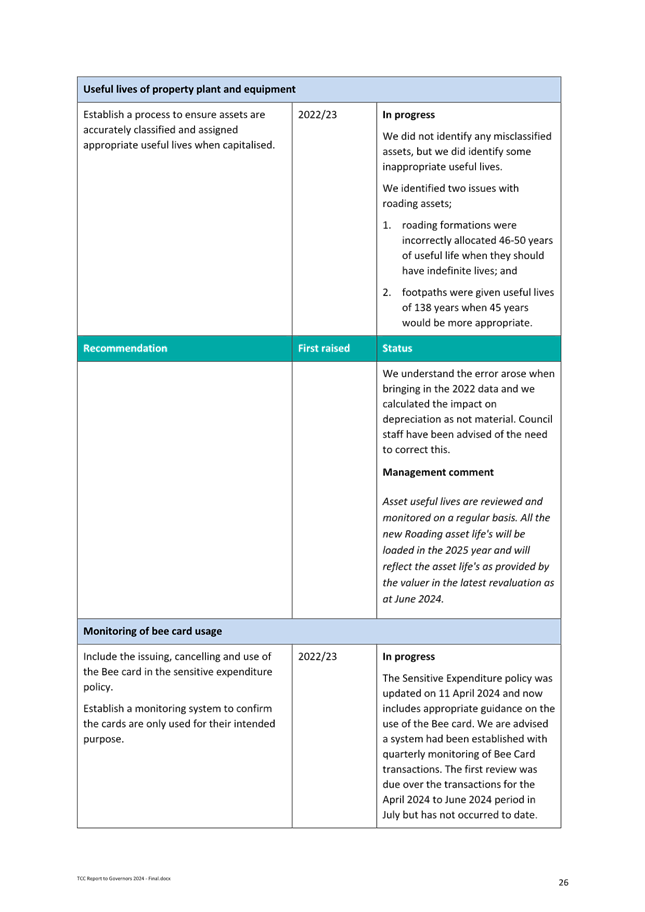

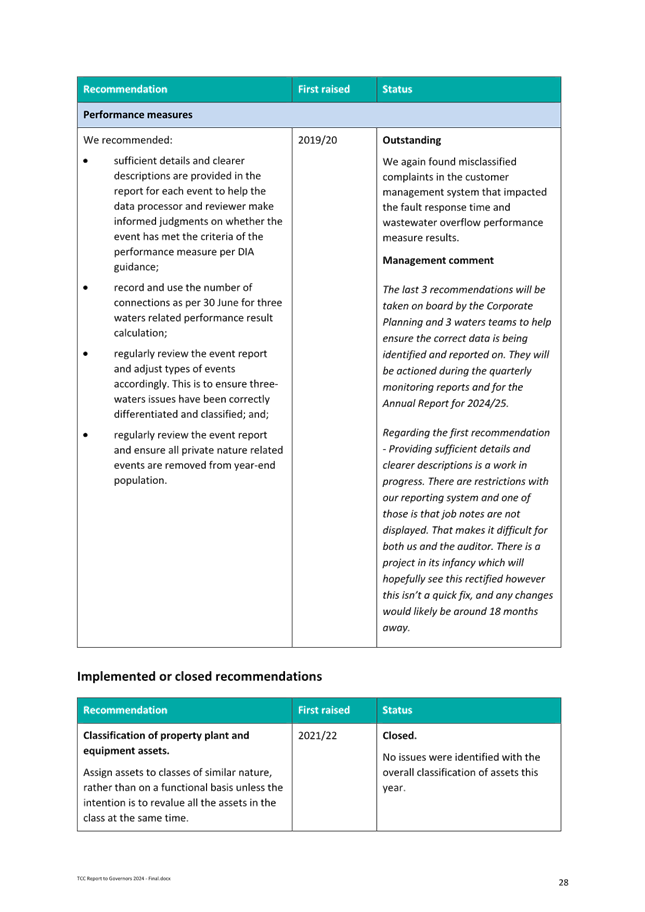

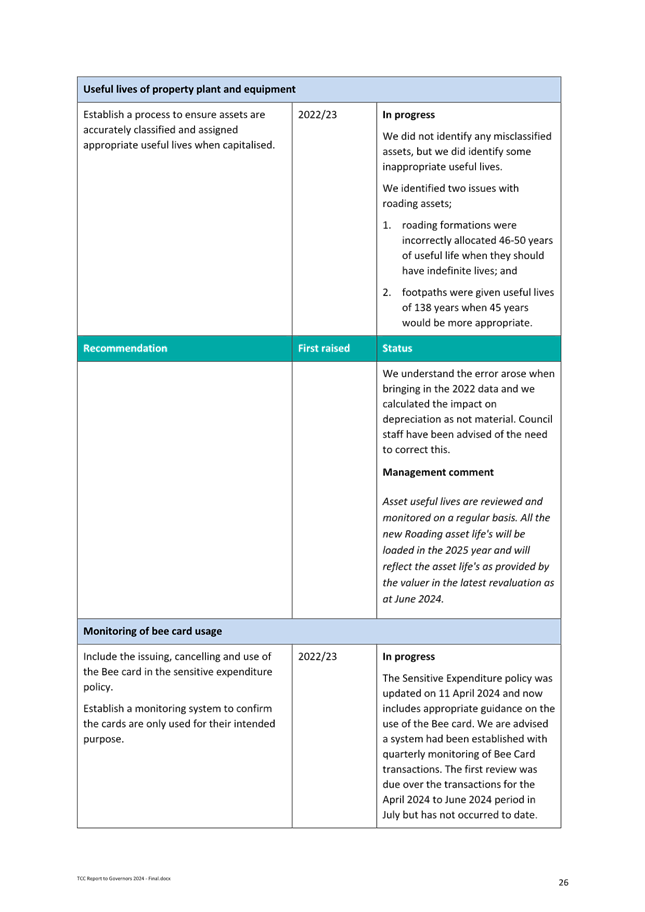

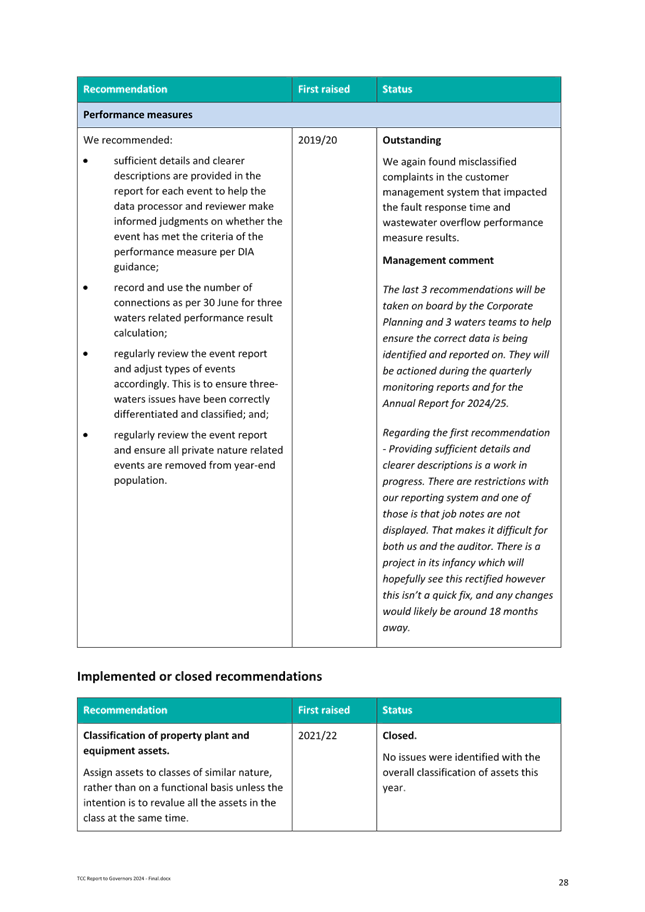

Year Recommendations

12. There are seven

recommendations from prior years all of which continue to be monitored and

worked on. The detail and TCC staff comments are on pages 25-28 of the

audit report. Staff continue to work on solutions for these

recommendations but consider them of a low risk to the organisation.

Statutory Context

13. The audit report is part of

the processes of Financial Accounting and reporting set out under the Local

Government Act 2002.

Options Analysis

14. There are no options

presented in this report.

Financial Considerations

15. The costs associated with the

additional revaluation information request will be absorbed into exiting

budgets, however the request to obtain independent accounting advice cannot be

quantified until the nature of any future transactions is known. The cost

of independent accounting advice for the 2024 financial year was $30k.

Legal Implications / Risks

16. There are no specific legal

implications or risks directly as a result of this report. Consultation /

Engagement

Significance

17. The Local Government Act 2002

requires an assessment of the significance of matters, issues, proposals and

decisions in this report against Council’s Significance and Engagement

Policy. Council acknowledges that in some instances a matter, issue,

proposal or decision may have a high degree of importance to individuals,

groups, or agencies affected by the report.

18. In making this assessment,

consideration has been given to the likely impact, and likely consequences for:

(a) The current

and future social, economic, environmental, or cultural well-being of the

district or region.

(b) Any persons who are likely to be

particularly affected by, or interested in, the matter.

(c) The capacity of the local authority

to perform its role, and the financial and other costs of doing so.

19. In accordance with the

considerations above, criteria and thresholds in the policy, it is considered

that the matter is of low significance.

ENGAGEMENT

20. Taking into consideration the

above assessment, that the matter is of low significance, officers are of the

opinion that no further engagement is required prior to Council making a

decision.

Next Steps

21. Council will continue to work

through recommendations for improvement in our processes and reporting.

Attachments

1. Audit

NZ - TCC Report to Governors 2024 - Final - A17330700 ⇩

|

Audit

& Risk Committee meeting Agenda

|

19

February 2025

|

|

Audit

& Risk Committee meeting Agenda

|

19

February 2025

|

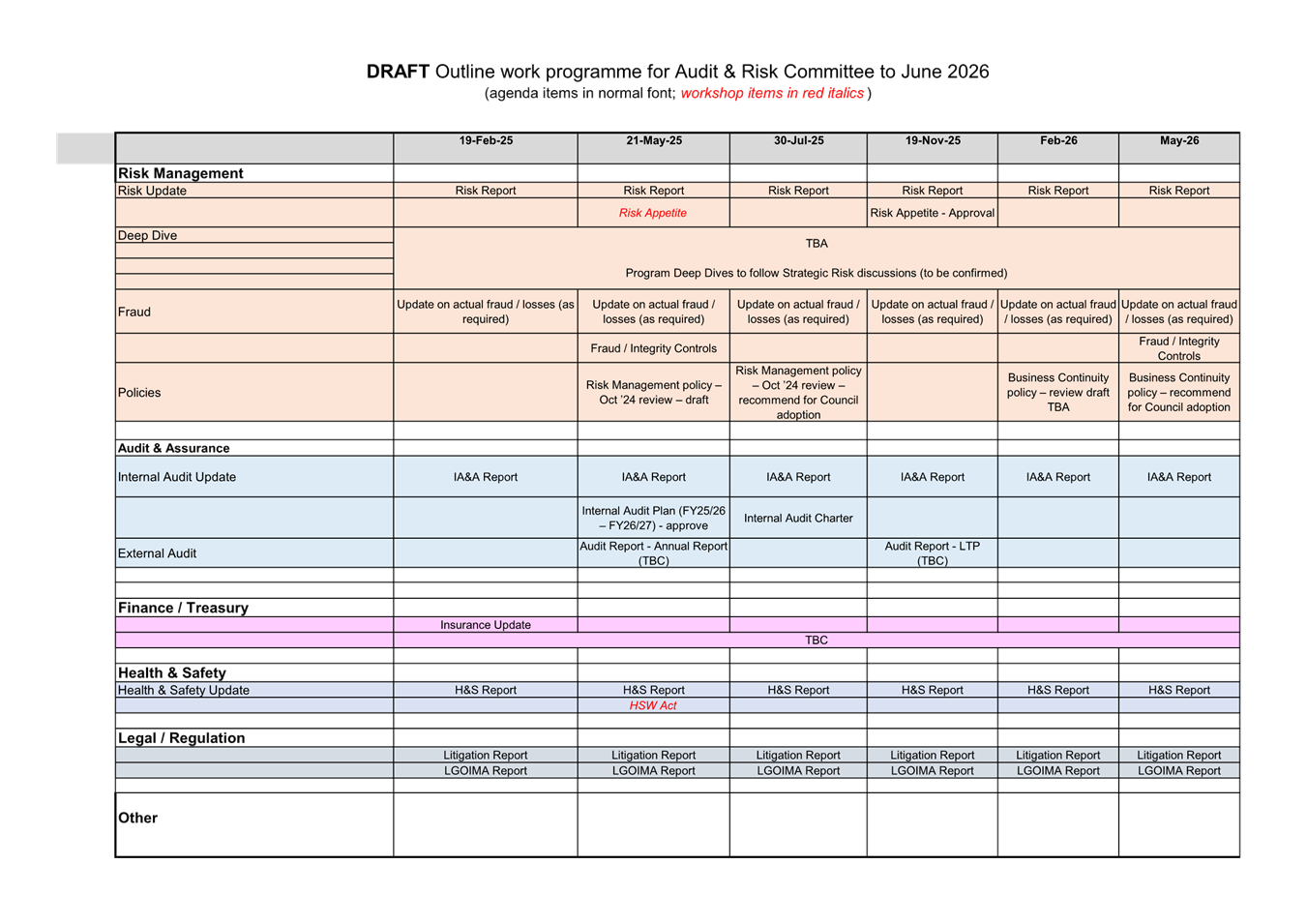

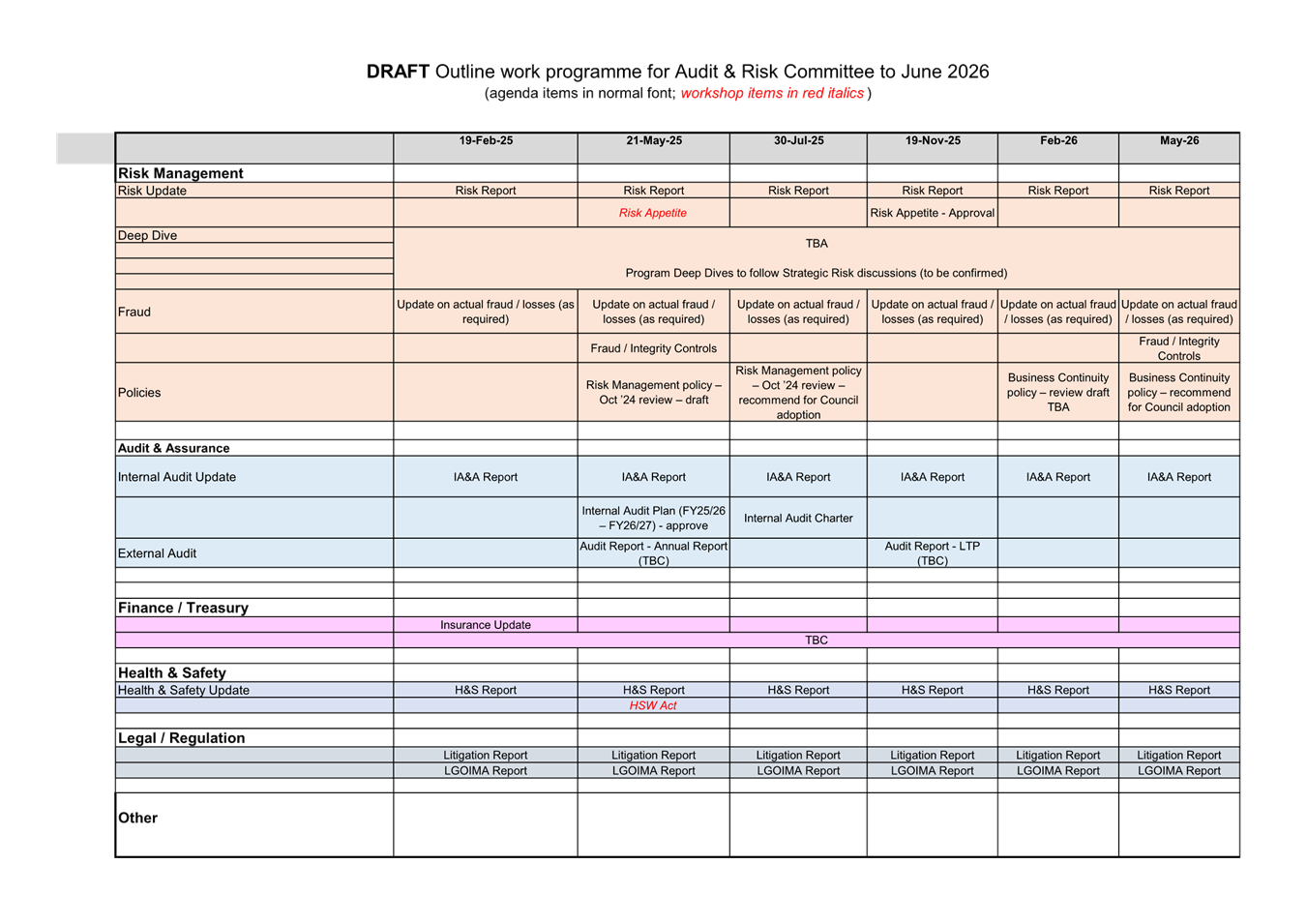

8.2 Audit &

Risk Committee Proposed Forward Work Plan

File

Number: A17424884

Author: Chris

Smith, Risk & Business Continuity Advisor

Authoriser: Alastair

McNeil, General Manager: Corporate Services

Purpose of the Report

1. The purpose of this

report is to introduce risk and risk management practices undertaken by

Tauranga City Council (TCC), and an outline a proposed forward-looking work

plan for consideration.

|

Recommendations

That the Audit &

Risk Committee:

(a) Receives the report

"Audit & Risk Committee Proposed Forward Work Plan".

(b) Approves the draft forward

work plan.

|

Executive Summary

2. The forward work

plan is designed to align activities with organisational goals, address

emerging risks, and ensure compliance with best practices in public sector

governance:

a) A key recommendation is to conduct regular,

in-depth reviews of critical risks through workshops with subject matter

experts. These deep dives provide valuable insights to ensure risks are

appropriately managed in a dynamic evolving environment.

b) A clear definition of the Council’s

risk appetite is essential to balance innovation and risk management, promote

accountability and transparency. Establishing this framework supports effective

decision-making and enhances public safety.

c) The Office of the Auditor General emphasises

the importance of appointing an independent chair for the committee to

reinforce governance, objectivity, and accountability. Until an independent

chair is appointed, the committee may consider delaying discussions on defining

the Council’s risk appetite to ensure alignment with best practices and

expert guidance.

Background

3. The forward work

plan, guided by an independent chair, is focused on aligning activities with

organisational goals, addressing emerging risks, and ensuring compliance with

best practices in public sector governance. It is recommended deep dives on

Council’s critical risks are conducted on a regular basis through

workshops with subject matter experts. The overarching purpose of deep dives is

to give the committee insight into whether a risk is being managed

appropriately. To note, as councils operate in a complex environment the

forward work plan needs to be flexible, agile, and responsive to changing

environments:

a) Risk appetite, as set by resolution of

Council (refer Risk Policy, 5.2.1), should be set during strategic planning

processes, reviewed regularly, and updated when there are significant changes

to legislation, community priorities, or the Council’s operational

environment, at a minimum each triennium. It involves defining the level and

type of risk the Council is willing to accept to achieve strategic objectives

while ensuring the safety of public assets and services. By establishing a

clear risk appetite, the committee provides a framework for decision-making,

enabling the Council to balance innovation and risk management effectively.

This promotes accountability, transparency, and alignment with best governance

practices, ensuring risks are managed appropriately while pursuing council

priorities.

b) The Office of the Auditor-General (OAG)

recommends appointing an independent Chair for the Audit and Risk Committee to

strengthen governance, impartiality, and oversight. An independent chair brings

objectivity, enhances accountability, and ensures the committee affectively

addresses critical areas such as financial reporting, risk management, and

internal controls. In line with best practice, the chairperson holds a critical

role through sharing their subject matter expertise with the committee to enable

members to effectively discharge their responsibilities. The committee may

choose to wait until an independent chair is appointed to facilitate the

discussion on setting a risk appetite.

Statutory Context

4. Effective risk

management contributes to improved management systems, and

informed-decision-making.

STRATEGIC ALIGNMENT

5. This contributes

to the promotion or achievement of the following strategic community

outcome(s):

|

Contributes

|

|

We are an inclusive city

|

ü

|

|

We value, protect and enhance the environment

|

ü

|

|

We are a well-planned city

|

ü

|

|

We can move around our city easily

|

ü

|

|

We are a city that supports business and education

|

ü

|

6. Identified TCC

risks have impacts on, at differing levels, each of the community outcomes, and

therefore on TCC organisational activity. Regular review and assessment of our

risk management processes helps better understand and manage key organisational

and city risks.

Options Analysis

7. There are no

specific options for this meeting to consider in respect of this report,

although direction may be given in respect of the forward work plan.

Financial Considerations

8. Not applicable

Legal Implications / Risks

9. Not applicable

Consultation / Engagement

10. Risk analysis is an integral

part of developing the Long-Term Plan and Annual Plan which are consulted upon

with community to align with their needs and expectations. As the Audit and

Risk Committee work plan focuses on internal process to ensure effective

governance and risk management, community consultation is not required in this

instance.

Significance

11. The Local Government Act 2002

requires an assessment of the significance of matters, issues, proposals, and

decisions in this report against Council’s Significance and Engagement

Policy. Council acknowledges that in some instances a matter, issue,

proposal or decision may have a high degree of importance to individuals,

groups, or agencies affected by the report.

12. In making this assessment,

consideration has been given to the likely impact, and likely consequences for:

(a) The current

and future social, economic, environmental, or cultural well-being of the

district or region.

(b) Any persons who are likely to be

particularly affected by, or interested in, the matter.

(c) The capacity of the local authority

to perform its role, and the financial and other costs of doing so.

In

accordance with the considerations above, criteria and thresholds in the

policy, it is considered that the matter is of high significance, however the

decision proposed in this report is of low significance.

ENGAGEMENT

13. Taking into consideration the

above assessment, that the matter is of low significance, officers are of the

opinion that no further engagement is required prior to Council making a

decision.

Next Steps

14. Regular workshops will be

planned involving subject matter experts to review and analyse the

Council’s critical risks (deep dives):

(a) The setting of workshop to

develop a clear and comprehensive risk appetite framework will be prioritised

in line with direction.

15. The forward workplan will

remain adaptable to emerging risks and changing environments.

Attachments

1. Audit

& Risk Committee - Proposed Work Plan to June 2026 - A17430246 ⇩

|

Audit

& Risk Committee meeting Agenda

|

19

February 2025

|

|

Audit

& Risk Committee meeting Agenda

|

19

February 2025

|

8.3 Insurance

Update

File

Number: A17098545

Author: Frazer

Smith, Manager: Strategic Finance & Growth

Kat Mills, Financial

Accountant

Authoriser: Paul

Davidson, Chief Financial Officer

Purpose of the Report

1. This report presents the

current insurance holdings for Tauranga City Council for the period from 1

November 2024 to 1 November 2025.

|

Recommendations

That the Audit &

Risk Committee:

(a) Receives the report

"Insurance Update".

|

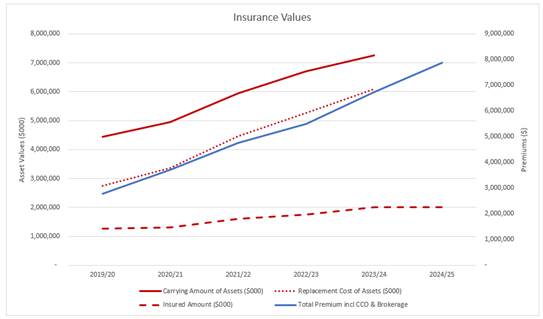

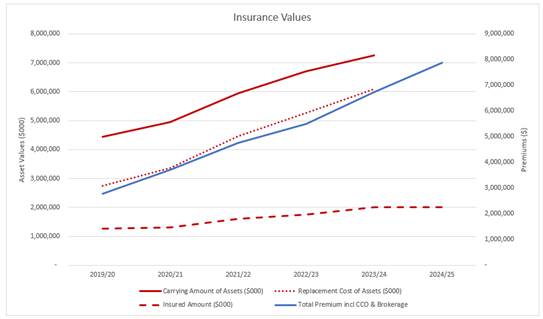

Executive Summary

2. Tauranga City

Council’s annual insurance renewal programme has been completed for the

2024/2025 period.

3. There have been

significant increases in premiums over the last few years. These

increases have been driven both by a tight inflation market and significant

increases in the values of insurable assets. While material damage

markets have started to ease (not for Professional Indemnity), asset price

increases are still driving inflation increases.

4. Council have had a

significant modelling exercise completed (not finalised) that confirms that our

underground cover is sufficient at $380M. A similar exercise is likely to

commence for rest of BOPLASS Councils.

Background

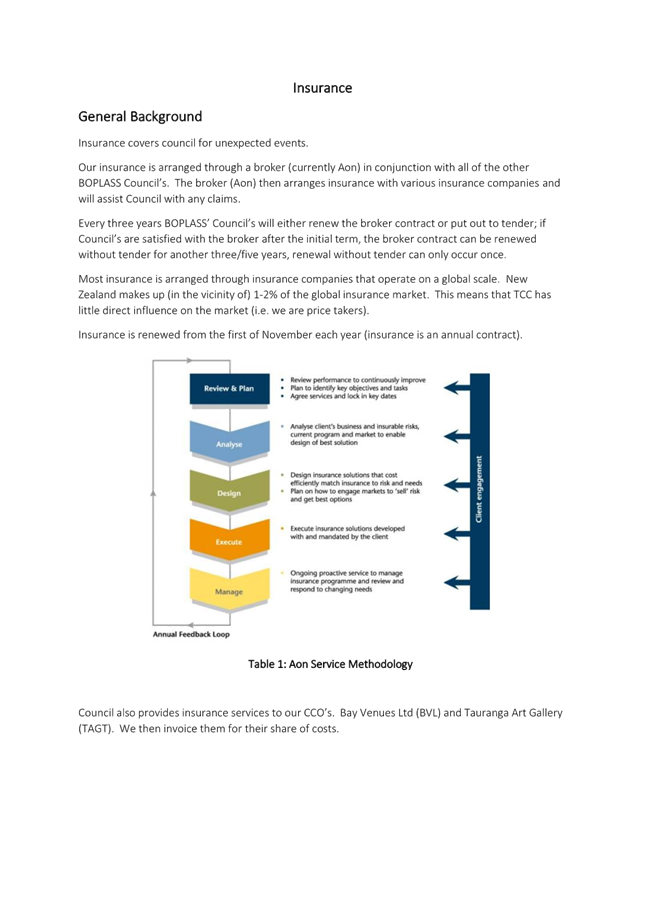

5. Insurance is a key

plank in Council’s risk mitigation strategy. Insurance enables some

of Council’s residual risks to be passed to another entity.

6. Insurance is a

global market with a very small number of large organisations. Premiums

are largely set on an international basis.

7. Tauranga City

Council’s insurance is arranged through a broker, currently Aon, who is

appointed through a tender process for BOPLASS Councils’.

8. Insurance is

renewed from the first of November each year.

9. Council holds

cover around:

(a) organisational activities;

(b) asset protection;

(c) specialised operations e.g.

Airport; and

(d) business

continuity/interruption.

10. Council also provides

insurance services to our CCO’s, Bay Venues Ltd and Tauranga Art Gallery,

with costs recovered via invoicing.

11. Insurance information is

available in the annual report:

(a) Insurance expense –

Other Operating Expenses Note (pg. 273 in 2024

Annual Report), and

(b) Asset values –

Property, Plant & Equipment Note (pg. 306 in 2024 Annual Report).

12. Three Waters Assets

contributes approximately 40% of the total insurance premium.

13. The below graphs present year

on year change in the total insurance values and the percentage increases:

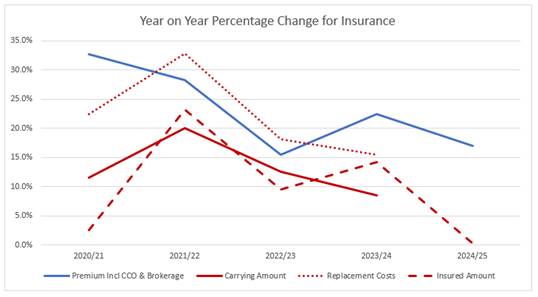

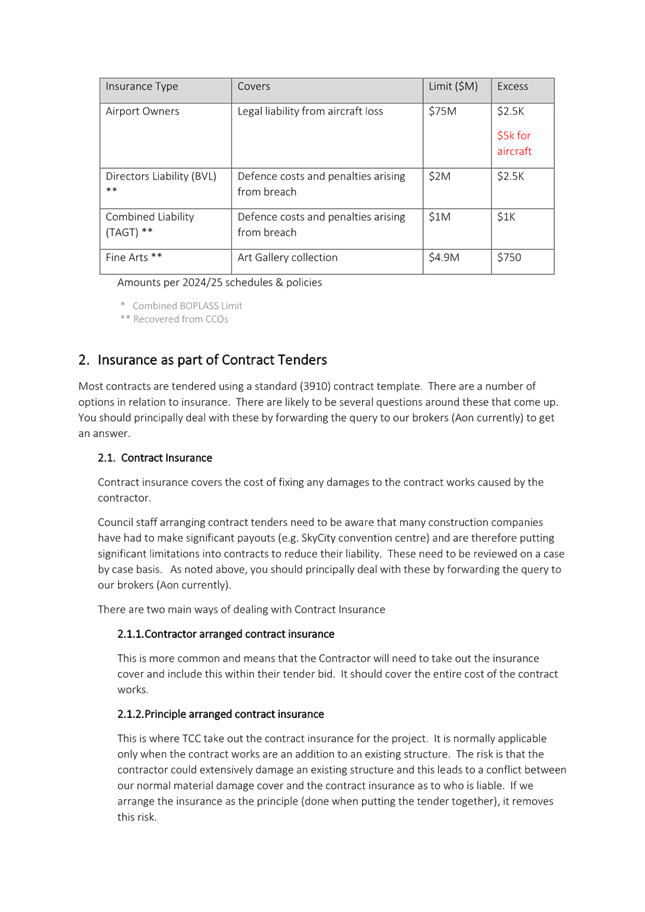

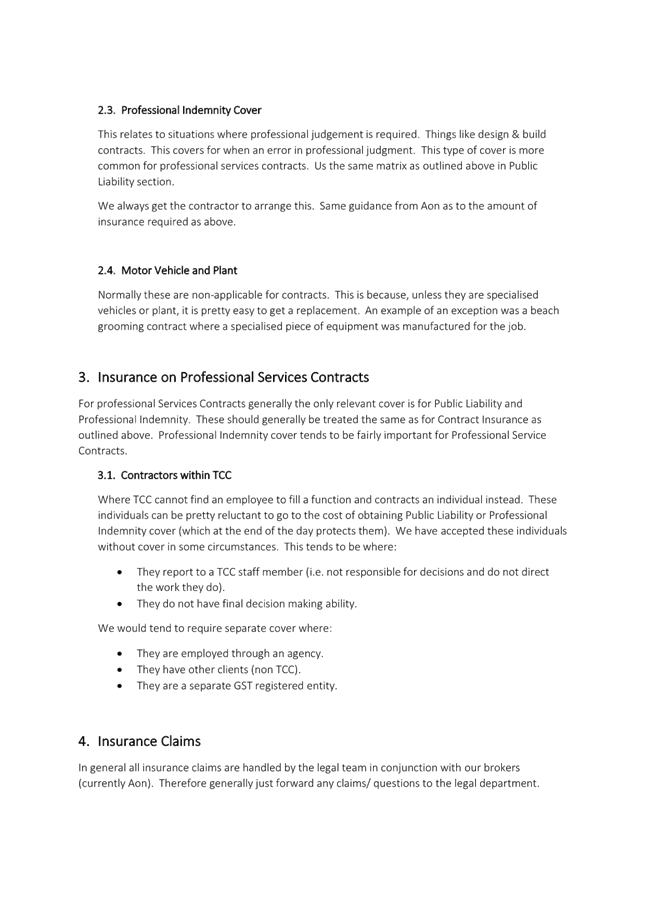

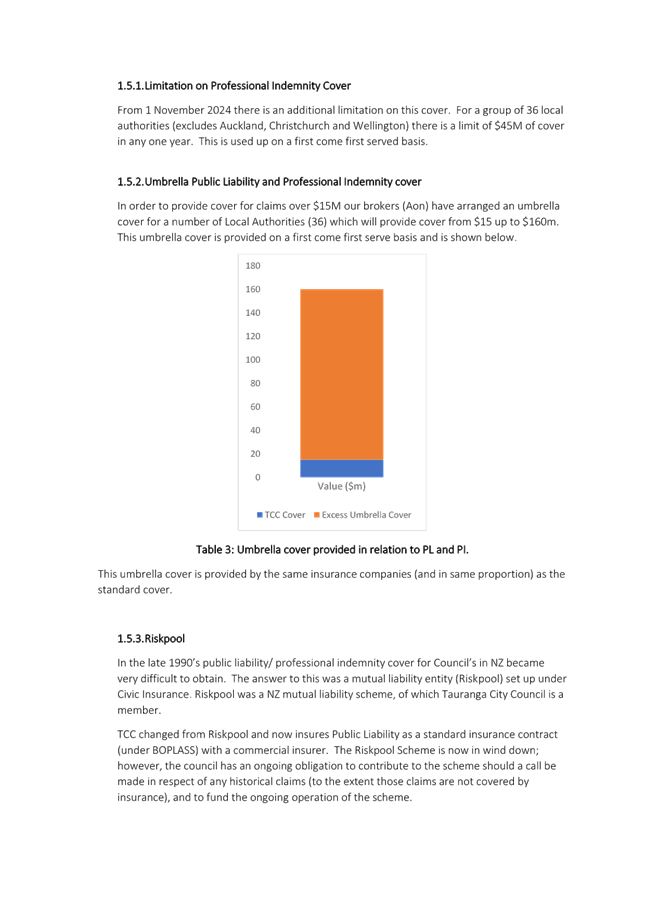

(a) Premiums,

(b) Replacement cost of Assets

(NB replacement costs for 2024/25 have not yet been updated as asset valuations

are in progress),

(c) Carrying Amount of Assets,

(NB Carrying amounts for 2024/25 have not yet been updated as asset valuations

are in progress),

(d) Insured Amount of Assets. (NB

for underground assets this has stayed the same ($380M) even though the value

and number of assets has increased).

14. Recent Issues in Insurance

(a) Market

(i) Material Damage -

Recently the global insurance market has faced increasing pressures (multiple

global events in short period of time), which meant that insurance was more

difficult to obtain, and what was available was more expensive. The most recent

renewal saw a lessening in these pressures on the market, and therefore a

decline in premiums rates but Council’s increase in asset holdings

outweighed the small gain in premiums.

(ii) General Liability &

Indemnity (Including building consents) – these types of insurance are

more difficult to obtain and maintain, and therefore the pricing pressures on

these types continue to increase.

(b) New Limits to Claims

(i) Building Claims under

Primary Policy Layer of Professional Indemnity have been limited to a total of

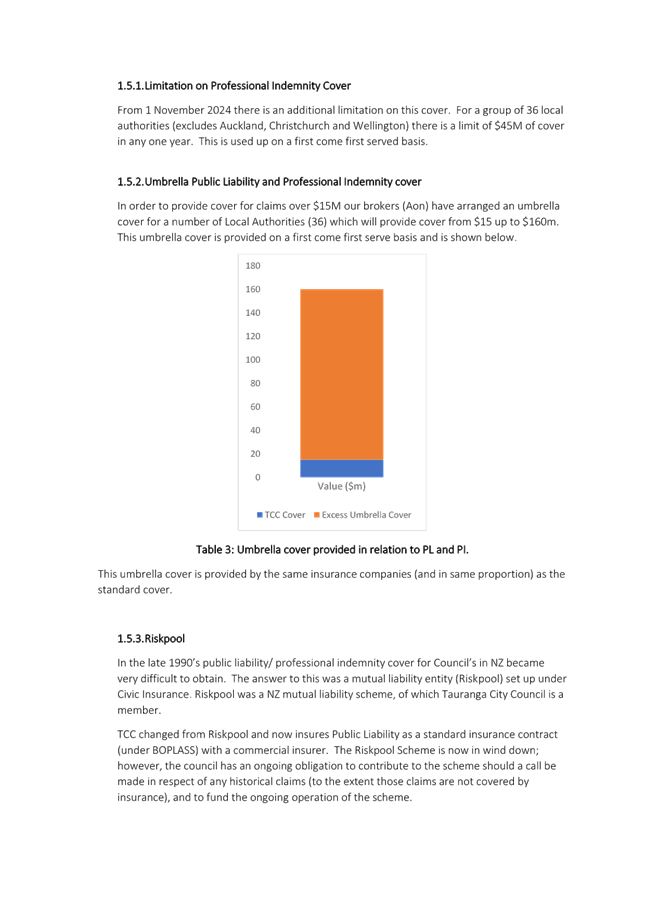

$45m in any policy period, across the 37 Councils in New Zealand

(excludes Auckland and Wellington). Tauranga City Council has participated in a

secondary layer which will cover claims in excess of $15m, up to a joint limit

to $145m.

(c) Reworking of Probable Loss

Modelling for Underground Assets

(i) Tauranga City Council

has undertaken a review with Aon and Tonkin & Taylor, of the probable loss

for these assets, the final report is still pending, but we have been given

assurance that our current limit is sufficient. The review and report is based

upon the most recent seismic survey pronouncements.

(ii) BOP LASS as a whole is to

undertake a similar review to ensure the total loss limit of $500m is

appropriate.

(iii) Taupo District Council has

recently joined the BOP LASS Underground Infrastructure Assets Policy

(previously they were self-insuring) but Taupo District Council held other BOP

LASS Group policies.

(d) Riskpool, is a now defunct

mutual liability entity created by Councils in the 1990s, which is no longer in

operation. Council has been notified of a likely call in March 2025

(Tauranga City Council portion estimated to be less than $100k).

Statutory Context

15. Effective risk management

contributes to improved management systems, and informed-decision-making.

STRATEGIC ALIGNMENT

16. This contributes to the

promotion or achievement of the following strategic community outcome(s):

|

Contributes

|

|

We are an inclusive city

|

ü

|

|

We value, protect and enhance the environment

|

ü

|

|

We are a well-planned city

|

ü

|

|

We can move around our city easily

|

ü

|

|

We are a city that supports business and education

|

ü

|

17. Insurance provides Tauranga

City Council with the capability to continue to operate and recover quickly in

the event of natural disaster, which impacts on community outcomes, and

Council’s overall organisational activity.

Options Analysis

18. There are no options

presented in this report.

Financial Considerations

19. There are no specific

financial implications directly associated with this report.

Legal Implications / Risks

20. There are no specific legal

implications or risk directly as a result of this report.

Consultation / Engagement

21. Community consultation is not

deemed necessary for this report.

Significance

22. The Local Government Act 2002

requires an assessment of the significance of matters, issues, proposals and

decisions in this report against Council’s Significance and Engagement

Policy. Council acknowledges that in some instances a matter, issue,

proposal or decision may have a high degree of importance to individuals,

groups, or agencies affected by the report.

23. In making this assessment,

consideration has been given to the likely impact, and likely consequences for:

(a) the current

and future social, economic, environmental, or cultural well-being of the

district or region

(b) any persons who are likely to be

particularly affected by, or interested in, the matter.

(c) the capacity of the local authority

to perform its role, and the financial and other costs of doing so.

24. In accordance with the

considerations above, criteria and thresholds in the policy, it is considered

that the matter is of medium significance; however, the decision proposed in

this report is of low significance.

ENGAGEMENT

25. Taking into consideration the

above assessment, that the matter is of low significance, officers are of the

opinion that no further engagement is required prior to Council making a

decision.

Next Steps

26. Council will continue to work

with BOPLASS for insurance.

Attachments

1. Insurance

Desk File - January 2025 - A17432026 ⇩

|

Audit

& Risk Committee meeting Agenda

|

19

February 2025

|

|

Audit

& Risk Committee meeting Agenda

|

19

February 2025

|

|

Audit

& Risk Committee meeting Agenda

|

19

February 2025

|

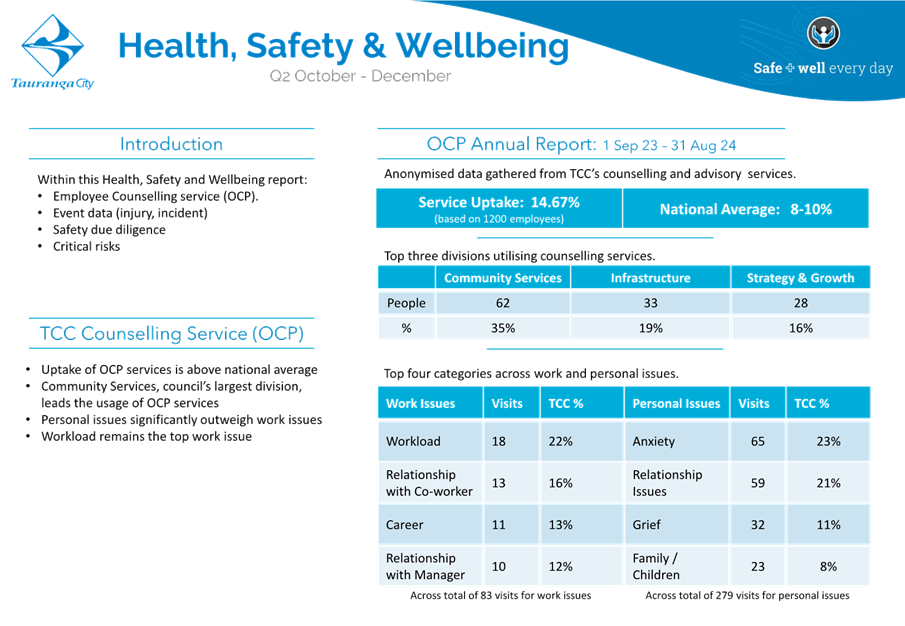

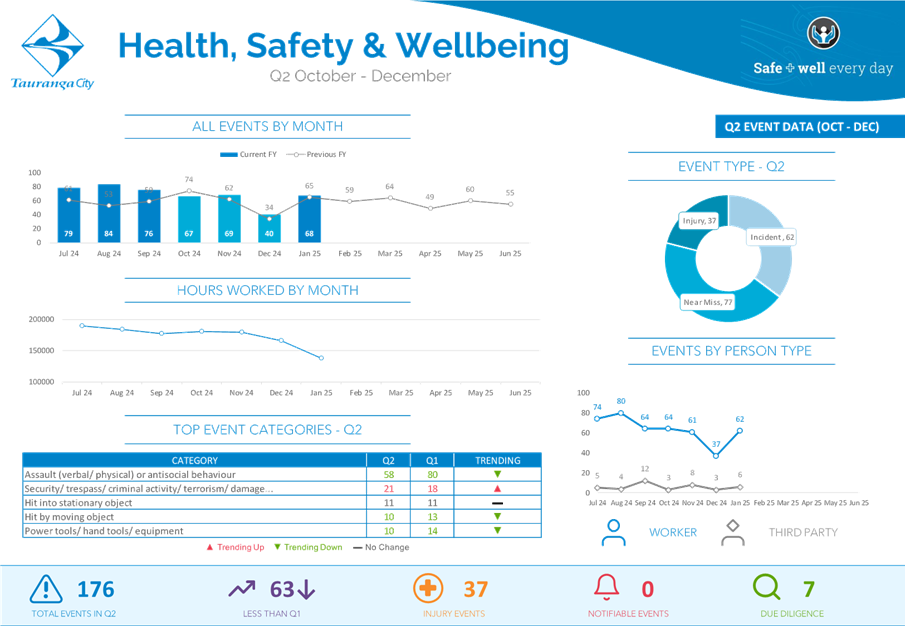

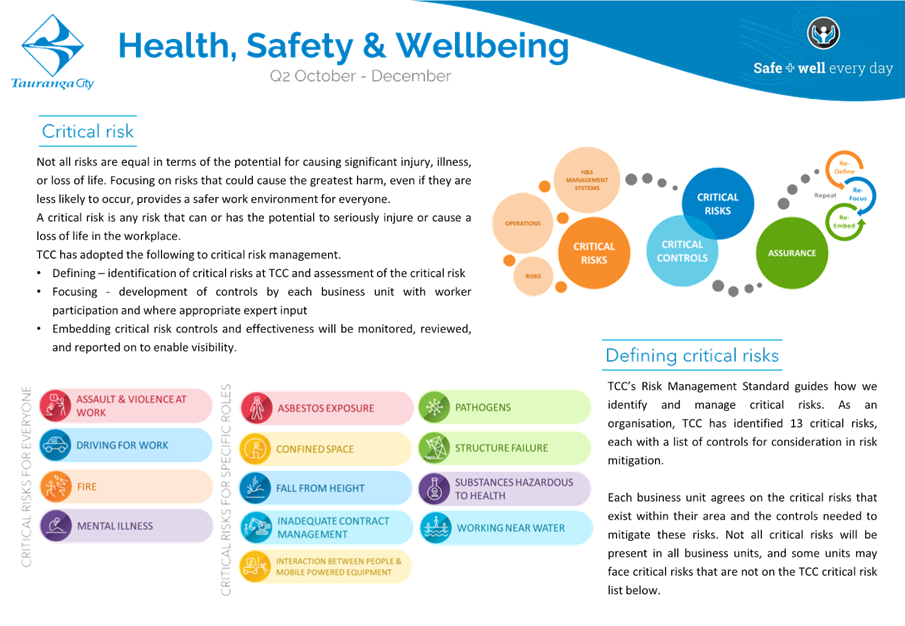

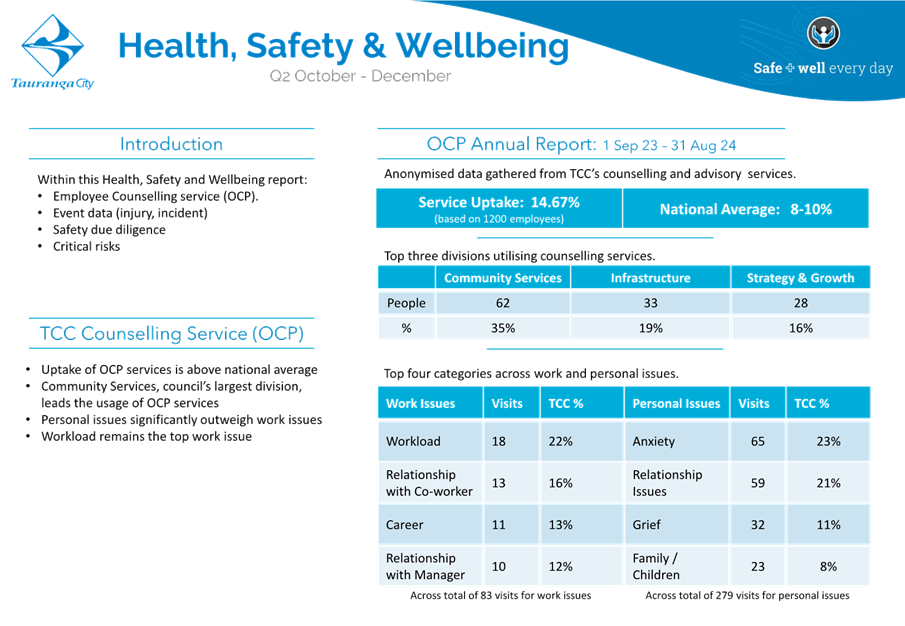

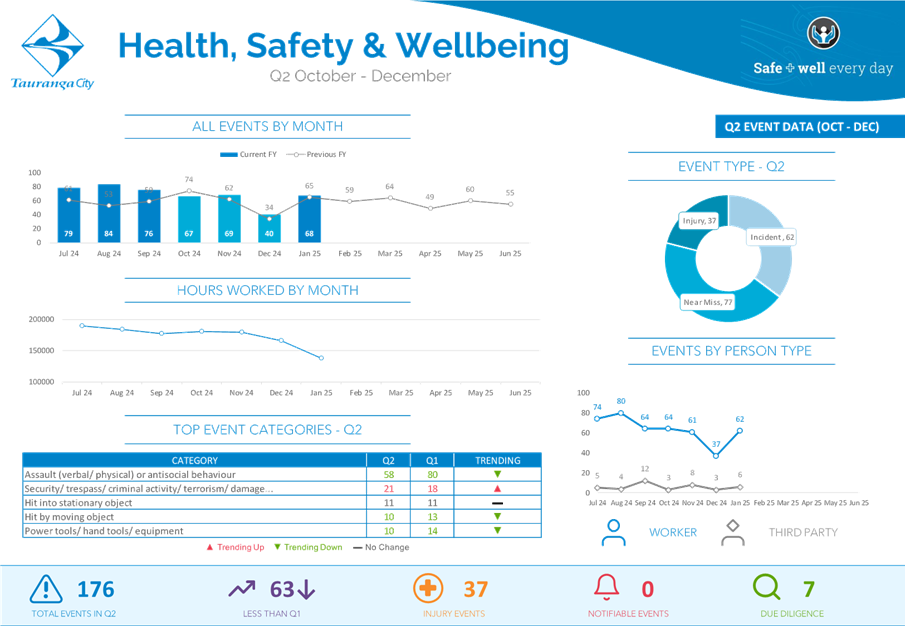

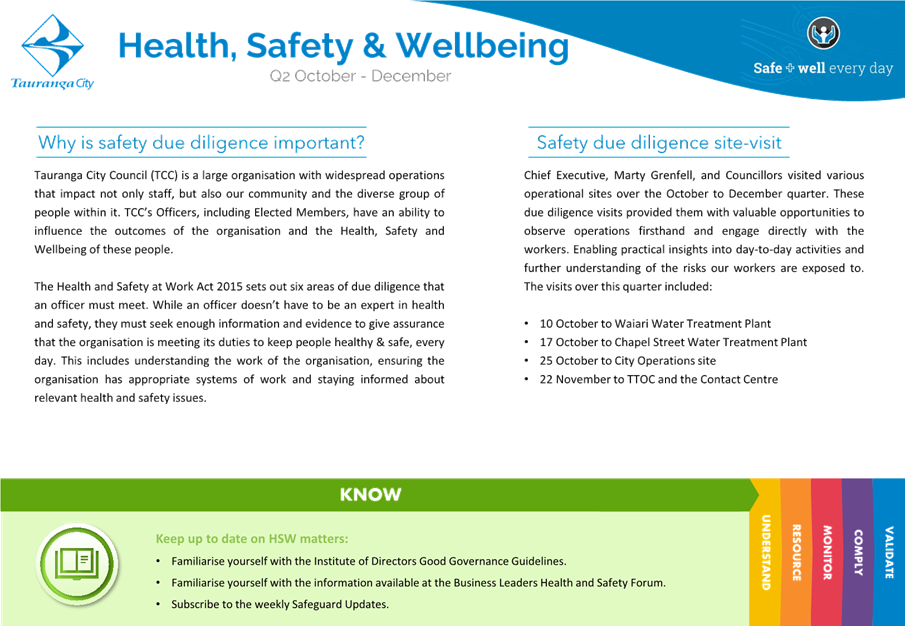

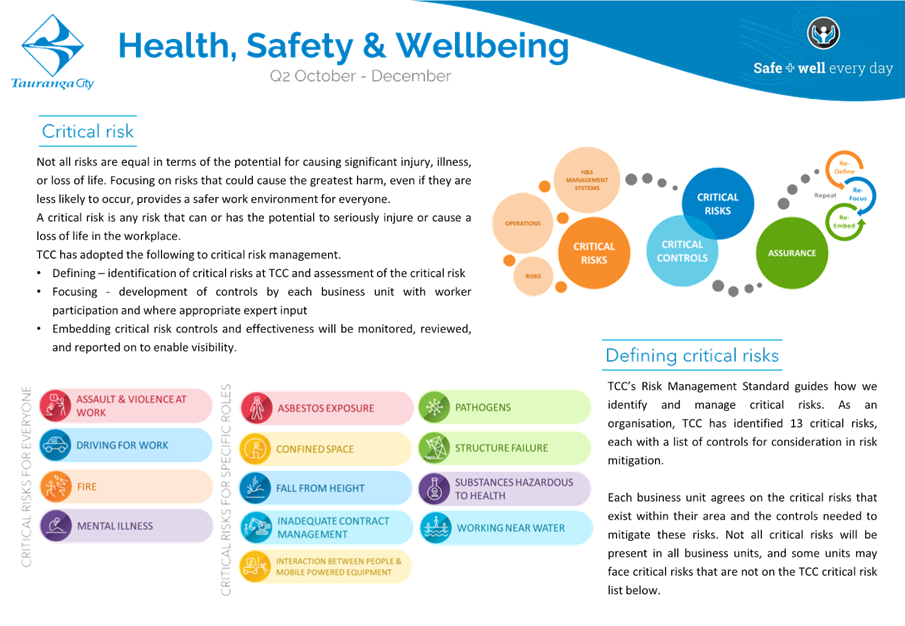

8.5 Health,

Safety and Wellbeing Quarterly Report: Q2 October to December 2024

File

Number: A17469227

Author: Tracy

Benjamin, Health, Safety & Wellness Manager

Authoriser: Alastair

McNeil, General Manager: Corporate Services

Purpose of the Report

1. To provide a summary of

Health, Safety and Wellbeing activities over the October to December 2024

quarter.

|

Recommendations

That the Audit &

Risk Committee:

(a) Receives the report

"Health, Safety and Wellbeing Quarterly Report: Q2 October to December

2024".

|

Executive Summary

2. This is a

quarterly report provided to the Committee, designed to monitor Health, Safety,

and Wellbeing activities and share learnings.

3. Any feedback

regarding content or topics that the Committee would like is welcomed.

Attachments

1. Health

Safety & Wellbeing Quarterly Report - Q2 October to December 2024 -

A17469180 ⇩

|

Audit

& Risk Committee meeting Agenda

|

19

February 2025

|

|

Audit & Risk Committee meeting Agenda

|

19 February 2025

|

9 Discussion

of late items

|

Audit & Risk Committee meeting Agenda

|

19 February 2025

|

10 Public

excluded session

Resolution to exclude

the public

|

Recommendations

That the public be

excluded from the following parts of the proceedings of this meeting.

The general subject

matter of each matter to be considered while the public is excluded, the

reason for passing this resolution in relation to each matter, and the

specific grounds under section 48 of the Local Government Official

Information and Meetings Act 1987 for the passing of this resolution are as

follows:

|

General subject of each matter to be

considered

|

Reason for passing this resolution in

relation to each matter

|

Ground(s) under section 48 for the

passing of this resolution

|

|

10.1 - Digital/Cyber Risk Presentation

|

s7(2)(a) - The withholding of the information is

necessary to protect the privacy of natural persons, including that of

deceased natural persons

s7(2)(b)(i) - The withholding of the information

is necessary to protect information where the making available of the

information would disclose a trade secret

|

s48(1)(a) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

10.2 - Internal Audit & Assurance

- Quarterly Update

|

s7(2)(j) - The withholding of the information is

necessary to prevent the disclosure or use of official information for

improper gain or improper advantage

|

s48(1)(a) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

10.3 - Risk Register - Quarterly

Update

|

s7(2)(j) - The withholding of the information is

necessary to prevent the disclosure or use of official information for

improper gain or improper advantage

|

s48(1)(a) - the public conduct of the relevant

part of the proceedings of the meeting would be likely to result in the

disclosure of information for which good reason for withholding would exist

under section 6 or section 7

|

|

|

Audit & Risk Committee meeting Agenda

|

19 February 2025

|

11 Closing

karakia