|

|

|

AGENDA

Ordinary Council meeting

Monday, 24 February 2025

|

|

I hereby give notice that an Ordinary meeting of

Council will be held on:

|

|

Date:

|

Monday, 24 February 2025

|

|

Time:

|

9.30am

|

|

Location:

|

Bay of Plenty Regional Council Chambers

Regional House

1 Elizabeth Street

Tauranga

|

|

Please note that this

meeting will be livestreamed and the recording will be publicly available on

Tauranga City Council's website: www.tauranga.govt.nz.

|

|

Marty Grenfell

Chief Executive

|

Terms of reference – Council

Membership

|

Chairperson

|

Mayor

Mahé Drysdale

|

|

Deputy Chairperson

|

|

|

Members

|

|

|

Quorum

|

Half of the members

present, where the number of members (including vacancies) is even;

and a majority of the members present, where the number of members

(including vacancies) is odd.

|

|

Meeting frequency

|

Three weekly or as required

|

Role

·

To ensure the effective and efficient governance

of the City.

·

To enable leadership of the City including

advocacy and facilitation on behalf of the community.

·

To review and monitor the performance of the

Chief Executive.

Scope

·

Oversee the work of all committees and

subcommittees.

·

Exercise all non-delegable and non-delegated

functions and powers of the Council.

·

The powers Council is legally prohibited from

delegating include:

○ Power to make a rate.

○ Power to make a bylaw.

○ Power to borrow money, or purchase or dispose of assets, other than

in accordance with the long-term plan.

○ Power to adopt a long-term plan, annual plan, or annual report.

○ Power to appoint a chief executive.

○ Power to adopt policies required to be adopted and consulted on

under the Local Government Act 2002 in association with the long-term plan or

developed for the purpose of the local governance statement.

○ All final decisions required to be made by resolution of the

territorial authority/Council pursuant to relevant legislation (for example:

the approval of the City Plan or City Plan changes as per section 34A Resource

Management Act 1991).

·

Council has chosen not to delegate the

following:

○ Power to compulsorily acquire land under the Public Works Act 1981.

·

Make those decisions which are required by

legislation to be made by resolution of the local authority.

·

Authorise all expenditure not delegated to

officers, Committees or other subordinate decision‑making bodies of

Council.

·

Make appointments of members to the council-controlled

organisation Boards of Directors/Trustees and representatives of Council to

external organisations.

·

Undertake all statutory duties in regard to

Council-controlled organisations, including reviewing statements of intent and

receiving reporting, with the exception of the Local Government Funding Agency

where such roles are delegated to the City Delivery Committee. This also

includes Priority One reporting.

·

Consider all matters related to Local Water Done

Well.

·

Consider any matters referred from any of the

Standing or Special Committees, Joint Committees, Chief Executive or General

Managers.

·

Review and monitor the Chief Executive’s

performance.

·

Develop Long Term Plans and Annual Plans

including hearings, deliberations and adoption.

·

For clarity the Council will develop, review,

undertake hearings of and deliberations on community submissions to bylaws as

well as the adoption of the final bylaw.

Procedural matters

·

Delegation of Council powers to Council’s

committees and other subordinate decision-making bodies.

·

Adoption of Standing Orders.

·

Receipt of Joint Committee minutes.

·

Approval of Special Orders.

·

Employment of Chief Executive.

·

Other Delegations of Council’s powers,

duties and responsibilities.

Regulatory matters

Administration,

monitoring and enforcement of all regulatory matters that have not otherwise

been delegated or that are referred to Council for determination (by a

committee, subordinate decision‑making body, Chief Executive or relevant

General Manager).

1 Opening

karakia

2 Apologies

|

Ordinary Council meeting Agenda

|

24 February 2025

|

3 Public

forum

3.1 Jan

Jamieson on behalf of the Tauranga Harbour Protection Society - Te Hononga ki

Te Awanui (Memorial Park to Elizabeth Recreation Connection)

Attachments

Nil

3.2 Brian

Scantlebury - Te Hononga ki Te Awanui (Memorial Park to Elizabeth Recreation

Connection)

Attachments

Nil

|

Ordinary Council meeting Agenda

|

24 February 2025

|

10 Recommendations

from other committees

10.1 Recommendatory

Report from the Accountability, Performance & Finance Committee - Rating

Categories and Rating Policy

File

Number: A17351721

Author: Caroline

Irvin, Governance Advisor

Authoriser: Coral

Hair, Manager: Democracy and Governance Services

Purpose of the Report

1. The

purpose of this report is to bring a recommendation from the Accountability,

Performance and Finance Committee to Council for consideration. At its meeting

on 5 November 2024, the Committee passed the following resolution which

includes a recommendation to Council.

Committee Resolution APF3/24/3

Moved:

Deputy Mayor Jen Scoular

Seconded: Mayor Mahé

Drysdale

That the Accountability, Performance & Finance Committee:

(a)

Receives the report "Rating Categories and Rating Policy".

(b) Notes that consideration of “who

pays”, including for transportation, is part of the annual planning

process and Council will have the opportunity to further consider the level of

general rates, and the impact on differential ratepayers through

this process.

(c)

Recommends to Council that as part of the annual plan process, Council considers along with the draft budget in February,

options regarding the industrial category including:

(i)

Removing smaller operations from the industrial category.

(ii)

Reviewing the level of differential.

(iii)

Recombining commercial and industrial rating categories.

(d)

Recommends to Council that as part of the annual plan process, Council

considers whether to continue to move toward general rates set at a fixed

proportion of residential 65%, Commercial 15%, industrial 20% as included in

the LTP.

(e)

Recommends that Council directs staff to bring back a brief business case to

develop a rates estimator calculator on council’s property search page

for the first 3 years of the Long-Term Plan, to be ready before council’s

next Long-term Plan.

Carried

2. In accordance with the

Committee recommendations (c), (d) and (e) Council are now asked to:

· Consider,

along with the draft budget in February, options regarding the industrial

category including:

(i) Removing smaller operations from the

industrial category.

(ii) Reviewing the level of differential.

(iii) Recombining commercial and industrial rating

categories.

· As part of the annual plan process, consider whether to continue to

move toward general rates set at a fixed proportion of residential 65%,

Commercial 15%, industrial 20% as included in the LTP.

And

· Direct

staff to bring back a brief business case to develop a rates estimator

calculator on Council’s property search page for the first 3 years of the

Long-Term Plan, to be ready before Council’s next Long-term Plan.

|

Recommendations

That the Council:

(a) Receives the report

"Recommendatory Report from the Accountability, Performance &

Finance Committee - Rating Categories and Rating Policy".

(b) Adopts the recommendations

of the Accountability, Performance & Finance Committee and considers,

along with the draft budget in February, options regarding the industrial

category including:

(i)

Removing smaller operations from the industrial category.

(ii)

Reviewing the level of differential.

(iii) Recombining commercial and industrial rating

categories.

(c) Adopts the recommendations

of the Accountability, Performance & Finance Committee and as part of the

annual plan process, consider whether to continue to move toward general

rates set at a fixed proportion of residential 65%, Commercial 15%, industrial

20% as included in the LTP.

(d) Directs

staff to bring back a brief business case to develop a rates estimator

calculator on Council’s property search page for the first 3 years of

the Long-Term Plan, to be ready before Council’s next Long-term Plan.

|

Attachments

Nil

|

Ordinary Council meeting Agenda

|

24 February 2025

|

11 Business

11.1 Te Hononga ki Te Awanui (Memorial Park to Elizabeth

Recreation Connection)

File

Number: A16901783

Author: Amanda

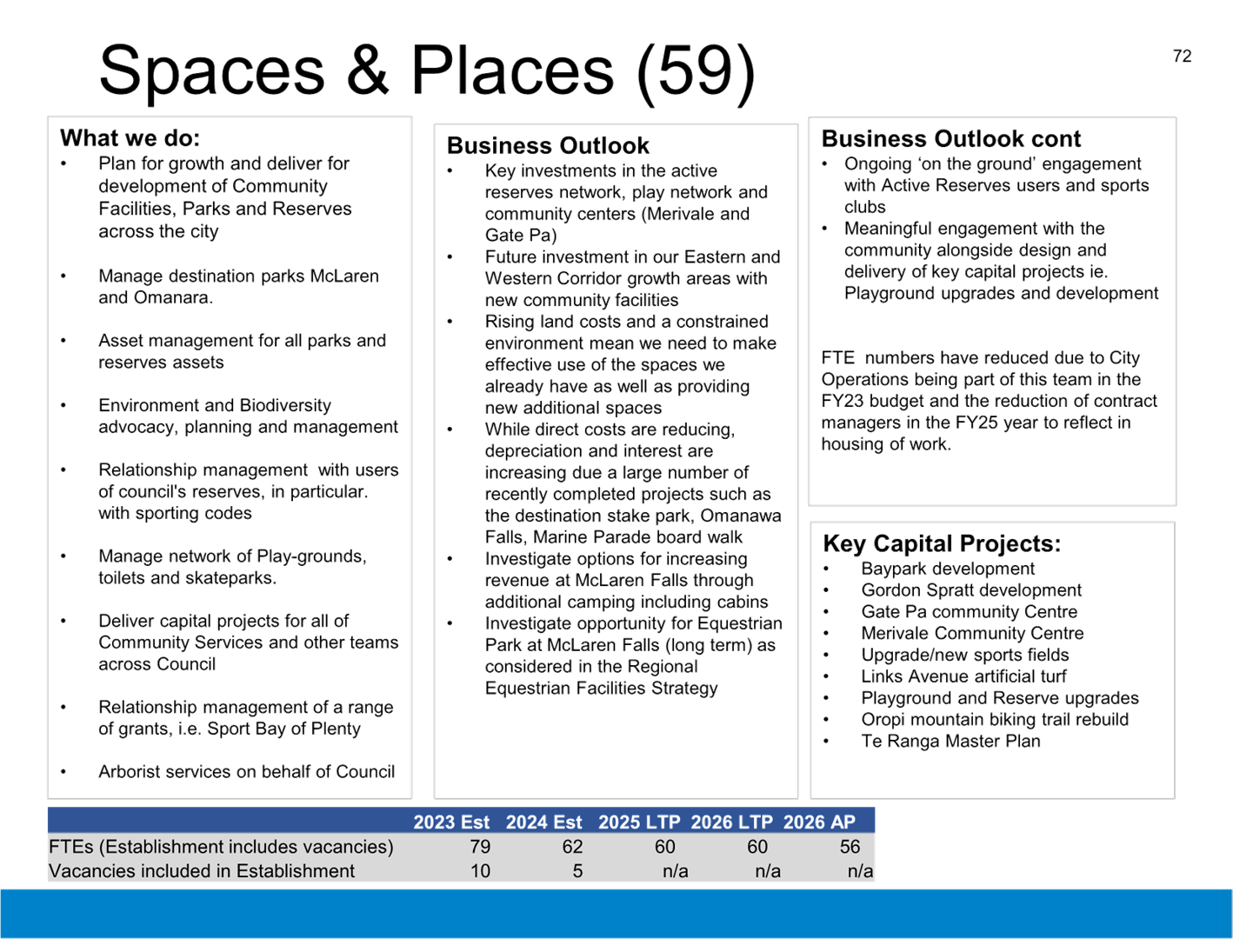

Davies, Manager: Spaces and Places Project Outcomes

Authoriser: Barbara

Dempsey, General Manager: Community Services

Purpose of the Report

1. To seek Council direction

on whether they wish staff to complete the preliminary design for Te Hononga ki

Te Awanui (Memorial Park to Elizabeth Recreation Connection) to allow staff to

seek a legal determination on its feasibility.

|

Recommendations

That the Council:

(a) Receives the report

"Te Hononga ki Te Awanui (Memorial Park to Elizabeth Recreation

Connection)".

(b) Approves:

· Option

i – Suspends all non-committed work on the project; or

· Option

ii – Complete work required to get a legal determination on the

proposed design for the full recreation connection; or

· Option

iii – Deliver of node enhancement only; or

· Option

iv – Delivery of node enhancement and completion of work required to

get a legal determination.

(c) (If Option i or Option ii

or Option iii is approved under recommendation (b),rescinds parts (b), (c),

and (d) of resolution CO14/23/5 made at the council meeting of 21 August 2023

meeting)

|

Executive Summary

2. A

coastal connection between Memorial Park and the city centre has been formally

included in a variety of TCC strategy and policy documents since 2004.

3. In

August 2023, a paper was presented to council around the options for

progressing this work, with a resolution being made to progress Option C of the

report, which included undertaking work to improve Harbour access/connectivity,

and progressing the work required to test the legal position regarding property

riparian rights for future development work.

4. As

part of the reforecasting of budgets to deliver the current annual plan

commitments, the scope of this project has been reviewed.

5. A

reduced scope is proposed, that would see the work on the improvements for

Harbour access/connectivity being put on hold, but the work required to

undertake a legal determination regarding the property riparian rights for

future development work is progressed.

6. Any

legal determination would mean that the feasibility of the project could be

tested bringing certainty to both TCC and Landowners around the future

feasibility of the recreation connection.

7. If

the outcome of the legal determination was favourable for the construction of

the recreation connection, a full project costing (including completion of

design, consenting and construction) could be undertaken for consideration as

part of the next LTP.

Background

8. Council has formally

considered providing a coastal connection between Memorial Park with the city

centre several times over the last 20 years, commencing 2004. The primary

benefit of this connection centres around improving the connection of people

with the water/the coastal edge and providing a safer cycle route into the city

centre as an alternative to Devonport Rd.

9. Further information on

the project, including options and outcomes, was provided via Council report on

25 July 2022[1]

and 21 August 2023[2].

In August 2023, the estimated cost of delivering the connection (from Elizabeth

St to Memorial Park) was approximately $28.2m. The decisions from the 21 August

2023 meeting are below.

RESOLUTION

CO14/23/5

That

the Council:

(a)

Receives the report "Draft Long Term Plan 2024-2034 - Memorial to

Elizabeth Waterfront Recreation Connection \ Te Hononga ki Te Awanui".

(b)

Approves delivery of Option C, which is limited intervention of the city fringe

and escarpment link zones from 1st to 7th Avenue, which may include some beach

replenishment between 6th and 7th Avenues as an achievable short/medium-term

outcome, acknowledging that it does not achieve the accessible linear

connection along the shoreline but does however, improve public access at the

road ends to the harbour edge.

(c)

Approves consultancy costs of $585,000 to progress the consenting, legal,

planning and design work for short/medium-term Option C, acknowledging the

construction costs of $6M, which are currently included in the Draft Long-term

Plan 2024-2034.

(d)

Approves consultancy costs of $1.65M to progress the consenting, legal,

planning and design work for long-term Option B, including determination of the

legal position regarding property right issues. Any construction costs to be

considered as part of deliberations for the following long-term plan.

(e)

Enters into a Memorandum of Understanding with Mana Whenua.

10. Council

decided to proceed with the delivery of Option C and B above, which would

create harbour ‘access’ nodes between 1st to 7th

Avenue together with the completion of design work to obtain a determination of

the legal determination regarding property riparian right issues, to assess the

feasibility of the project long term.

11. Option

C also minimised some of the identified risks with the provision of the

recreation connection, notably those relating to riparian rights, as whilst the

project concept has been well received by the wider community, private

landowners along the harbour’s edge with riparian rights have largely

opposed it.

12. The Tauranga Harbour Protection

Society (THPS) have suggested a joint application to the High Court for a

declaratory judgement (determination) to provide certainty before proceeding

further with the any consent process. This would require completing a preliminary

design for the proposed connection, so that the impacts, if any, of the design

on harbour access and riparian rights could be accurately assessed.

13. Council resolved to making a joint

application, and completing the work required for this was approved by Council

at the 21 August 2023 meeting (see resolution CO14/23/5 (d) above). Note that

Option B referred to above is the delivery of the full recreation connection

from Memorial Park to Elizabeth Street in the city centre.

14. To date Council has completed the

Draft Concept Design for Option C, and this is being progressed to Preliminary

Concept Design (currently on hold). Landowners have provided feedback on the

Draft Concept Design and this will be reflected in the Preliminary Concept

Design. The Preliminary Concept Design can be finalised once Council has

received and considered the findings of completed geotechnical surveys and

resulting design elements and updated costings are completed.

15. Note that Stage 1 of Te Hononga ki

Te Awanui has been completed. Stage 1 included the construction of a railway

underpass next to the Harbourside Restaurant (completed) and a new section of

boardwalk joining the underpass with the southern end of The Strand. This links

the waterfront boardwalk from The Strand through to Tunks Reserve at the

eastern end of Elizabeth Street.

16. The options discussed by this

report refer to Stage 2 of Te Hononga ki Te Awanui.

17. This report presents a range of

options to Council:

i. Suspend all non-committed work on this

project, with no retention of budget for work in the future. This would result

in delivering on current contractual commitments only.

ii. The completion of work required to get a

legal determination on the proposed design for the full recreation connection

(Option B) only with no implementation of Option C, and no

retention of the associated $6.5m capex budget.

iii. Delivery of Option C, node enhancement, only (no

legal determination is sought regarding Option B).

iv. Delivery

of Option C node enhancement, and the completion of work required to get a

legal determination on the proposed design for the full recreation connection.

18. The options above are discussed in

more detail under the options analysis section.

Options analysis

Option i. – Suspend all non-committed work

19. Suspend

all non-committed work on this project, with no retention of budget for work in

the future. This would result in delivering on current contractual commitments

only.

20. Cost:

$964,000 ($564,000 actual expenditure in 2023/2024 and $400,000 for 2024/2025

to cover actual expenditure to date, and close out costs – all OPEX).

21. Key

risks: no clarity is gained regarding the feasibility of the project, and the

$964,000 spent does not deliver any outcomes.

|

Advantages

|

Disadvantages

|

|

· Council does not

commit further funds to a project which is unlikely to be delivered in full

at this time

|

· It remains

unclear as to whether the project could be feasibly delivered from a legal standpoint.

· No benefit is

derived from the $964,000 spent.

|

Option ii. – Complete work required to get a legal

determination on the proposed design for the full recreation connection

22. The

completion of work required to get a legal determination on the proposed design

for the full recreation connection only, with no development of

‘nodes’ on the coastal edge at the bottom of improved Avenue links

(First Avenue through to Seventh Avenue) and no retention of the $6.5m capex

budget for this work. This would however, determine if the project is

legally feasible for the future and provide certainty for landowners and

private landowners.

23. Cost:

$1,681,701 ($564,000 actual expenditure in 2023/2024 and $400,000 for 2024/2025

to cover actual expenditure to date, and FY2025/2026 additional $717,701

to undertake a legal determination - all OPEX ).

24. If

the outcome of the legal determination is favourable for the construction of

the recreation connection, a full project cost estimate would be undertaken for

consideration as part of a future LTP process.

25. Key

risks: Legal costs are estimated only, and dependent on length of process

additional funding for legal fees may be required.

|

Advantages

|

Disadvantages

|

|

· Provides clarity

as to whether the project is legally feasible. As this project has been

considered in various forms since 2004, but the legal viability of it has

been in question for this period, this would provide needed certainty for

both Council and private landowners.

|

· Requires additional

investment beyond the current financial year to complete preliminary design

work and legal fees.

· Given

Council’s current financial position, the project is unlikely to be

delivered within the current LTP.

· Legal costs are estimated

only, and dependent on length of process additional funding for legal

fees may be required

|

Option iii. – Delivery of node enhancement only

26. The development of

‘nodes’ on the coastal edge at the bottom of improved Avenue links

(First Avenue through to Seventh Avenue) only.

27. Cost: $964,000 opex ($564,000

actual expenditure in 2023/2024 and $400,000 for 2024/2025 to cover actual

expenditure to date – OPEX) plus $6.5M Capex (2024/25 $41,364 actual

expenditure, 2025/26 $1.5M construction costs, 2026/27 $4M construction costs,

2027/28 $1M construction costs)

28. Key risks: that the nodes are

delivered but provide minimal community benefit in isolation (without delivery

of the connection as a whole).

|

Advantages

|

Disadvantages

|

|

· Provides

additional community amenity and connection to harbour.

|

· Requires

additional investment beyond the current financial year.

· Will not resolve

the issue of the legal status of the project, which would need to be provided

if the project was to proceed in the future

|

Option iv. – Delivery of node enhancement and

completion of work required to get a legal determination

29. Delivery of node enhancement, and

the completion of work required to get a legal determination on the proposed

design for the full recreation connection. This is the current status quo

option, as approved via the LTP 2024-2034.

30. Cost: The cost for delivery of this

options would be broken into capex and opex as follows:

(a) Delivery of node enhancement

- Cost: $964,000 opex ($564,000 actual expenditure in 2023/2024 and $400,000

for 2024/2025 to cover actual expenditure to date – OPEX) plus $6.5M

Capex (2024/25 $41,364 actual expenditure, 2025/26 $1.5M construction costs,

2026/27 $4M construction costs, 2027/28 $1M construction costs

(b) Legal Determination -

$1,681,701 ($564,000 actual expenditure in 2023/2024 and $400,000 for 2024/2025

to cover actual expenditure to date, and FY2025/2026 additional $717,701

to undertake a legal determination -OPEX ).

31. Key risks: that the nodes are

delivered but the legal review of the proposed design for the connection (as a

whole) finds it not legally viable.

|

Advantages

|

Disadvantages

|

|

· Provides clarity

as to whether the project is legally feasible.

· Improves access

and amenity to those walking to and along the foreshore at mid – low

tide

· Aligns with the

wider redevelopment of Memorial Park

|

· Requires

additional investment beyond the current financial year.

· Access to the

foreshore would not be provided to all physical abilities.

· Legal costs are estimated

only, and dependent on length of process additional funding for legal

fees may be required

|

Financial considerations

32. Expenditure

to date on this iteration of the project is as follows:

· 2023/2024 -

$564,000 Opex

· 2024/2025 -

$343,000 Opex costs at the end of November. A total Opex budget is required the

current year of $400,000 is required to close out current contracts (an

additional $40,000 Opex costs have been incurred at the end of November, post

budget reforecast for FY 25. All project expenditure to date was spent in

accordance with the council resolution CO14/23/5.

33. Any

future expenditure on the project is outlined in the options above.

34.

If the outcome of the legal determination was favourable for the construction

of the recreation connection, a full project costing (including completion of

design, consenting and construction) would be undertaken for consideration as

part of the next LTP.

|

|

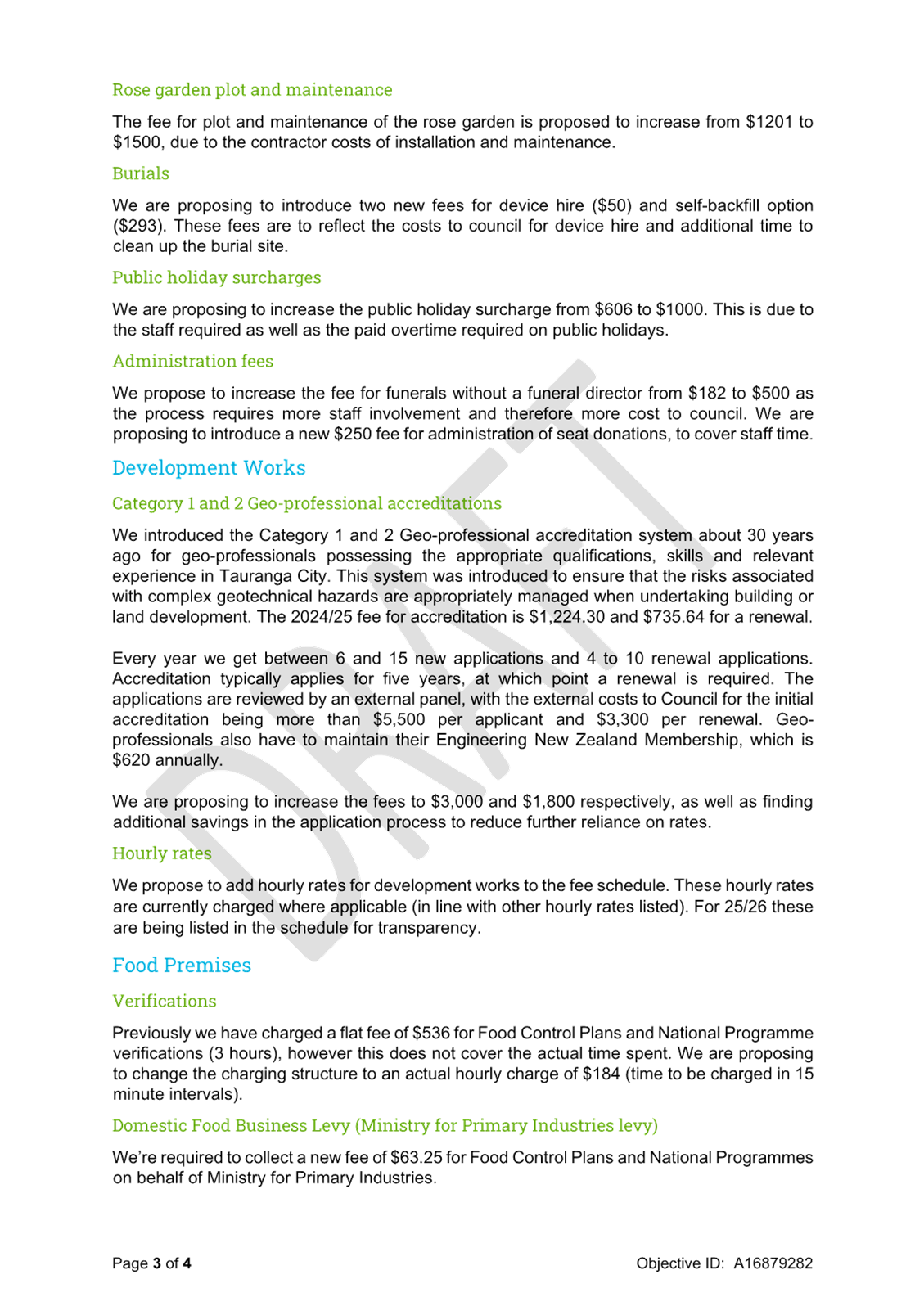

Option i –

Suspend Work

|

Option ii –

Legal Determination Only

|

Option iii –

Node enhancement Only

|

Option iv –

Node enhancement plus Legal Determination

|

|

OPEX

|

|

|

|

|

|

2023/24

|

564,000

|

564,000

|

564,000

|

564,000

|

|

2024/25

|

400,000

|

400,000

|

400,000

|

400,000

|

|

2025/26

|

|

717,701

|

|

717,701

|

|

TOTAL

|

964,000

|

1,681,701

|

964,000

|

1,681,701

|

|

|

|

|

|

|

|

CAPEX

|

|

|

|

|

|

2023/24

|

|

|

|

|

|

2024/25

|

41,364

|

41,364

|

41,364

|

41,364

|

|

2025/26

|

|

|

1,500,000

|

1,500,000

|

|

2026/27

|

|

|

4,000,000

|

4,000,000

|

|

2027/28

|

|

|

1,000,000

|

1,000,000

|

|

TOTAL

|

41,364

|

41,364

|

6,541,364

|

6,541,364

|

Statutory Context

35. Council

allocated funds to this project via the LTP 2024-2034. This report revisits

this decision and seeks confirmation of funding for the completion of work

required to get a legal determination on the proposed design for the full

recreation connection.

STRATEGIC ALIGNMENT

36. This contributes to the promotion

or achievement of the following strategic community outcome(s):

|

Contributes

|

|

We are an inclusive city

|

ü

|

|

We value, protect and enhance the environment

|

☐

|

|

We are a well-planned city

|

☐

|

|

We can move around our city easily

|

ü

|

|

We are a city that supports business and education

|

☐

|

Legal Implications / Risks

37. Sixteen

properties along the coastal connection route have riparian rights.

38. The Tauranga Harbour Protection

Society (THPS) have suggested a joint application to the High Court for a

declaratory judgement to provide certainty around riparian rights before

proceeding further with the any consent process. This would require completing

a preliminary design for the proposed connection, so that the impacts, if any,

of the design on harbour access and riparian rights could be accurately

assessed.

39. Council

has agreed to making a joint application, and completing the work required for

this was approved by Council at the 21 August 2023 meeting (see resolution

CO14/23/5 (d) above). Note that Option B referred to above is the delivery of

the full recreation connection from Memorial Park to Elizabeth Street in the

city centre.

40. It

should be noted that any legal process does carry some risk around the duration

and process involved could impact project costs.

TE AO MĀORI APPROACH

41. Modification

of Te Awanui is generally opposed by iwi and hapu. In this case, the project is

supported because of its restorative and public access focus.

42. The

coastal connection was gifted the name or ingoa “Te Hononga ki Te

Awanui” by mana whenua representatives on 10 May 2022. In te reo

Māori, the kupu or word Hononga holds the meaning of union, connection,

relationship or bond. Te Awanui is the traditional name for the Tauranga

Harbour. In gifting the name, representatives said “the essence of the

journey from Taiparirua to Mareanui, the Matapihi Railway Bridge and the

Waterfront is the connection with the harbour”.

43. The

ingoa Te Awanui in the project name is also a reference to the Te Awanui

Waka, and the mana whenua aspiration to develop a Whare Waka and relocate the

Te Awanui Waka to the waterfront.

44. It

is important for mana whenua to continue to be closely involved in the project

as the design and consenting process proceeds. A Memorandum of Understanding

has been developed to ensure that expectations are clearly understood and met.

CLIMATE IMPACT

45. Te

Hononga ki Te Awanui Recreation Connection directly supports the Climate

Investment and Action plan as it supports Tauranga Residents to use a variety

of public transport, walking, biking, and micro-mobility transport modes.

Consultation / Engagement

46. Consultation

on the concept of a connection between Memorial Park and the city centre has

occurred a number of times over the years, since the project was first proposed

in 2004.

47. As

a generalisation, the project is well supported by the wider community but

opposed by private landowners along the harbour’s edge.

48. Submitters

to the LTP 2024-2034 noted the long-standing plans to develop a walkway between

Memorial Park and the city centre. They contended that construction of this

path will bring more visitors into the city centre through the provision of an

off-street walking and cycling pathway. Envirohub also noted that construction

of a pathway will increase access to Tauranga’s coastal and marine

environment aligning with Council objectives of connecting people to nature.

49. Some

submitters to the LTP 2024-2034 suggested that Council should redirect proposed

funding for the stadium to enable this project.

Significance

50. The

Local Government Act 2002 requires an assessment of the significance of

matters, issues, proposals and decisions in this report against Council’s

Significance and Engagement Policy. Council acknowledges that in some

instances a matter, issue, proposal or decision may have a high degree of

importance to individuals, groups, or agencies affected by the report.

51. In

making this assessment, consideration has been given to the likely impact, and

likely consequences for:

(a) the current and future

social, economic, environmental, or cultural well-being of the district or

region

(b) any

persons who are likely to be particularly affected by, or interested in, the decision.

(c) the

capacity of the local authority to perform its role, and the financial and

other costs of doing so.

52. In

accordance with the considerations above, criteria and thresholds in the

policy, it is considered that the decision is of medium significance.

ENGAGEMENT

53. Taking

into consideration the above assessment, that the decision is of medium significance,

officers are of the opinion that the following consultation/engagement is

suggested/required under the Local Government Act:

(a) Continue to work with Mana

Whenua in accordance with the Memorandum of Understanding that is in place

(b) Individual and group

engagement continue to take place with all affected property owners

Next Steps

54. The

below next steps are based on the current options contained within this report,

and subject to approval of council of the relevant option.

55. Close

out the existing work programme, which included undertaking work to improve

Harbour access/connectivity that the from 1st to 7th

Avenue, and progressing the work required to test the legal position regarding

property riparian rights for future development work (if option i

approved),

56. Progress the completion of the

preliminary design and engagement for the full recreation connection required

for the legal determination (if option ii approved).

57. Progress design and engagement work

on the development of the node enhancements, and close out work on the full

recreation connection and legal determination (if option iii approved).

58. Progress design and engagement work

on the node enhancement and to progress the legal determination for the full

recreation connection (if option iv approved)

Attachments

Nil

|

Ordinary

Council meeting Agenda

|

24

February 2025

|

11.2 2025/26 User Fees and

Charges: Policy Alignment and Changes

File

Number: A16895674

Author: Kathryn

Sharplin, Manager: Finance

Frazer Smith,

Manager: Strategic Finance & Growth

Sarah Holmes,

Corporate Planner

Jane Barnett, Policy

Analyst

Authoriser: Paul

Davidson, Chief Financial Officer

Purpose of the Report

1. This report presents the

draft 2025/26 User Fees and Charges schedule for Council’s consideration

and amendment prior to final approval for public consultation in March.

2. It outlines the scope of

fee adjustments permitted under the Revenue and Financing Policy and highlights

key changes based on inflationary adjustments, cost recovery needs, and

legislative requirements.

3. The report also

recommends the revocation of the Funding Depreciation and Use of Depreciation

Reserves Policy 2009, as its provisions have been incorporated into the Revenue

and Financing Policy 2024 and are no longer required as a standalone document.

|

Recommendations

That the Council:

(a) Receives the report

"2025/26 User Fees and Charges: Policy Alignment and Changes".

(b) Revokes the Funding

Depreciation and Use of Deprecation Reserves Policy 2009.

(c) Agrees the Draft User Fees

and Charges schedule forms the basis of the schedule to be adopted at the 3

March 2025 Council meeting, subject to any updates agreed through reports to

3 March Council meeting or changes agreed by Council at this meeting.

|

Executive Summary

4. Each year, council

reviews its user fees and charges to ensure they remain appropriate, align with

cost recovery principles, and reflect changes in service delivery costs. The

proposed 2025/26 User Fees and Charges Schedule has been developed based on:

· Inflationary

adjustments and cost recovery considerations

· Benchmarking

with other councils

· Changes

required due to legislative updates or operational adjustments.

5. Additionally, this

report recommends revoking the Funding Depreciation and Use of Depreciation

Reserves Policy 2009, as its principles have been fully integrated into the

Revenue and Financing Policy 2024. The revocation is considered an

administrative update with low significance.

6. Following

council’s consideration of this report, any required adjustments will be

incorporated into the final draft User Fees and Charges Schedule for public

consultation alongside the 2025/26 Annual Plan. The consultation period will

run from 28 March – 28 April 2025, with hearings scheduled for May 2025

and final adoption in June 2025.

Background

7. Council’s user

fees and charges are updated each year. Updates reflect changing circumstances,

Consumer Price Index (CPI) adjustments, new or removed fee requirements, or

benchmarking with other councils.

8. The draft user fees and

charges reflect the outcome of this review process and provides some certainty

for the public on what they can expect to be charged for our services.

Statutory Context

9. User fees and charges

are set under various legislation, with different requirements for consultation

and public notification.

STRATEGIC ALIGNMENT

10. User fees and charges align with

all of council’s community outcomes, and the principles set out in

council’s Revenue and Financing Policy.

Options Analysis

USER FEES AND CHARGES

11. A preliminary schedule of user fees

and charges is included in Attachment 1, along with reason for changes

outlined in Attachment 2 (the Statement of Proposal summary). This

reflects the annual process undertaken to review fees and charges, applying

inflation and including changes identified by the business.

12. A number of items will be

considered on 3 March:

(a) Airport carparking fees and

charges will be considered further at the Council meeting on 3 March.

(b) The water supply activity is

funded primarily by volumetric charging with a small portion of fixed rate

charging. These charges are set under the Rating Act but included for

information in the fees and charges schedule. They have not yet been

updated in the schedule attached. Water cost per meter and fixed charge

proposals will be confirmed in the report to 3 March council meeting.

13. The intention in reviewing charges

and introducing new charges where appropriate is to reflect the cost to council

of provision of these services. User fees and charges are proposed to

cover the costs of services where it is efficient to identify and charge those

who benefit directly from a service. The analysis underlying the use of

fees and charges is covered in the Funding Needs Analysis in the 2024-34

Long-term Plan.

14. Attachment 4 to this report

contains an Analysis of User Fee Sufficiency by Activity. This summary

shows in red those activities that are not sufficient to meet the requirements

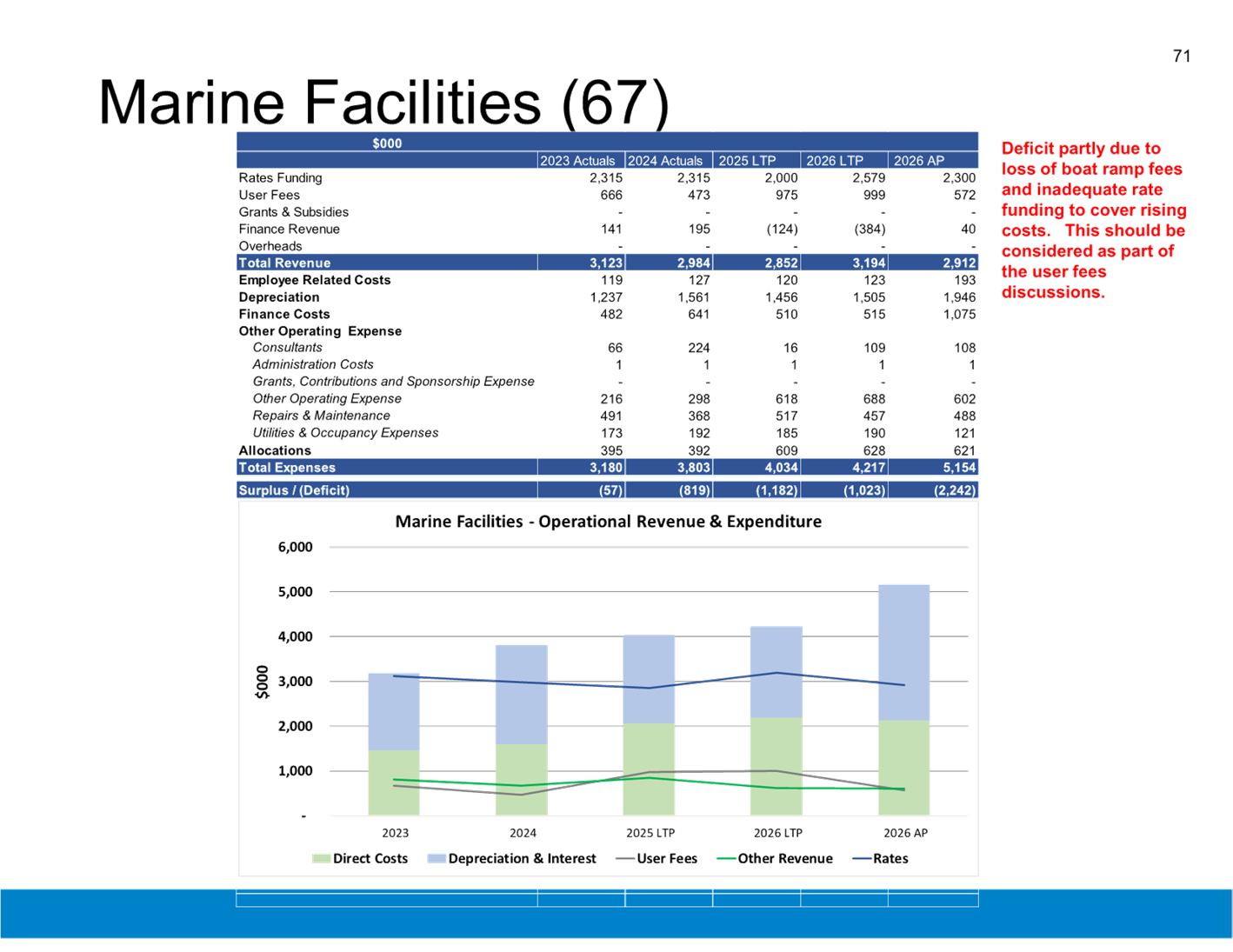

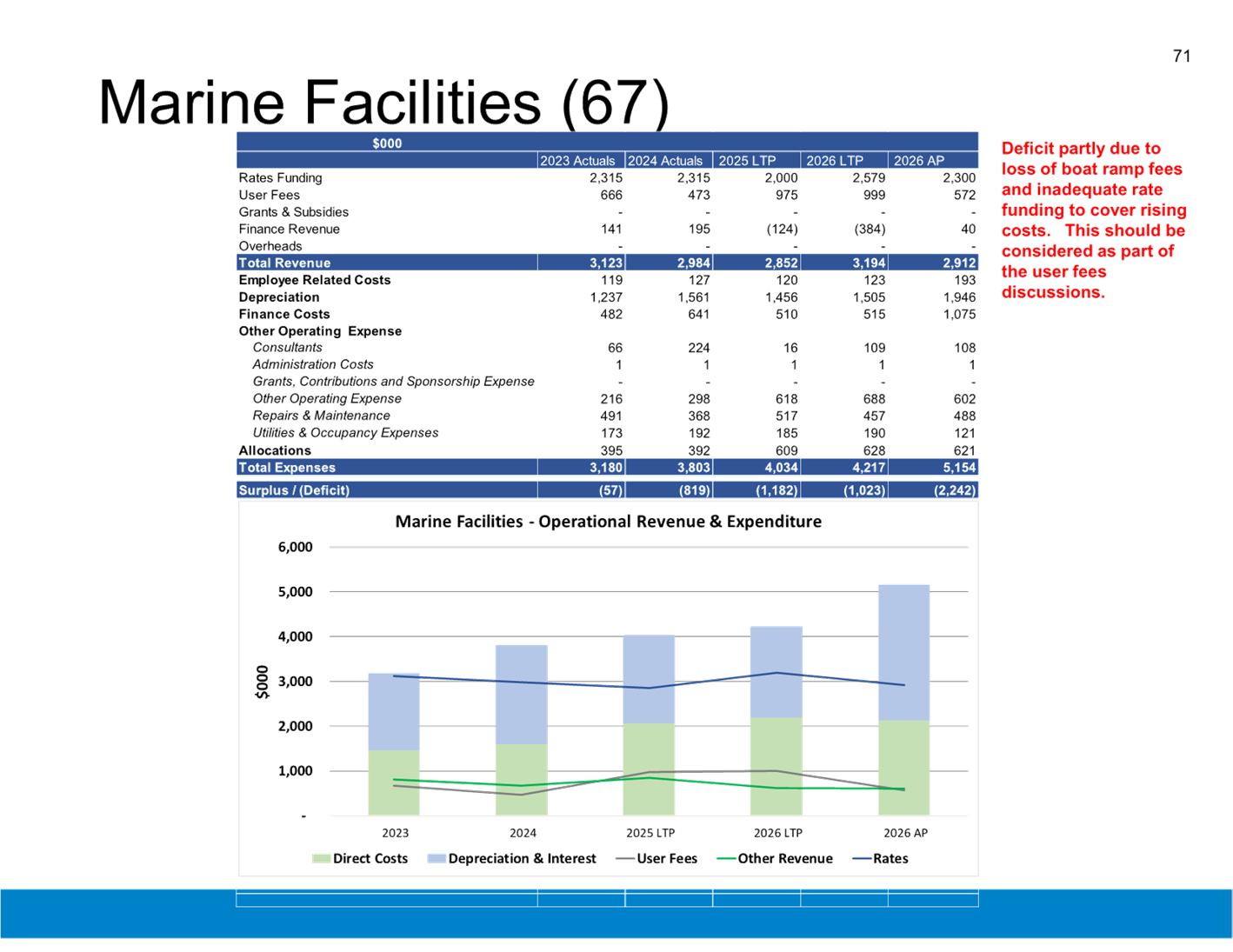

of the revenue and financing policy and include marine facilities and property

management. Two other activities Animal Services and Building Services

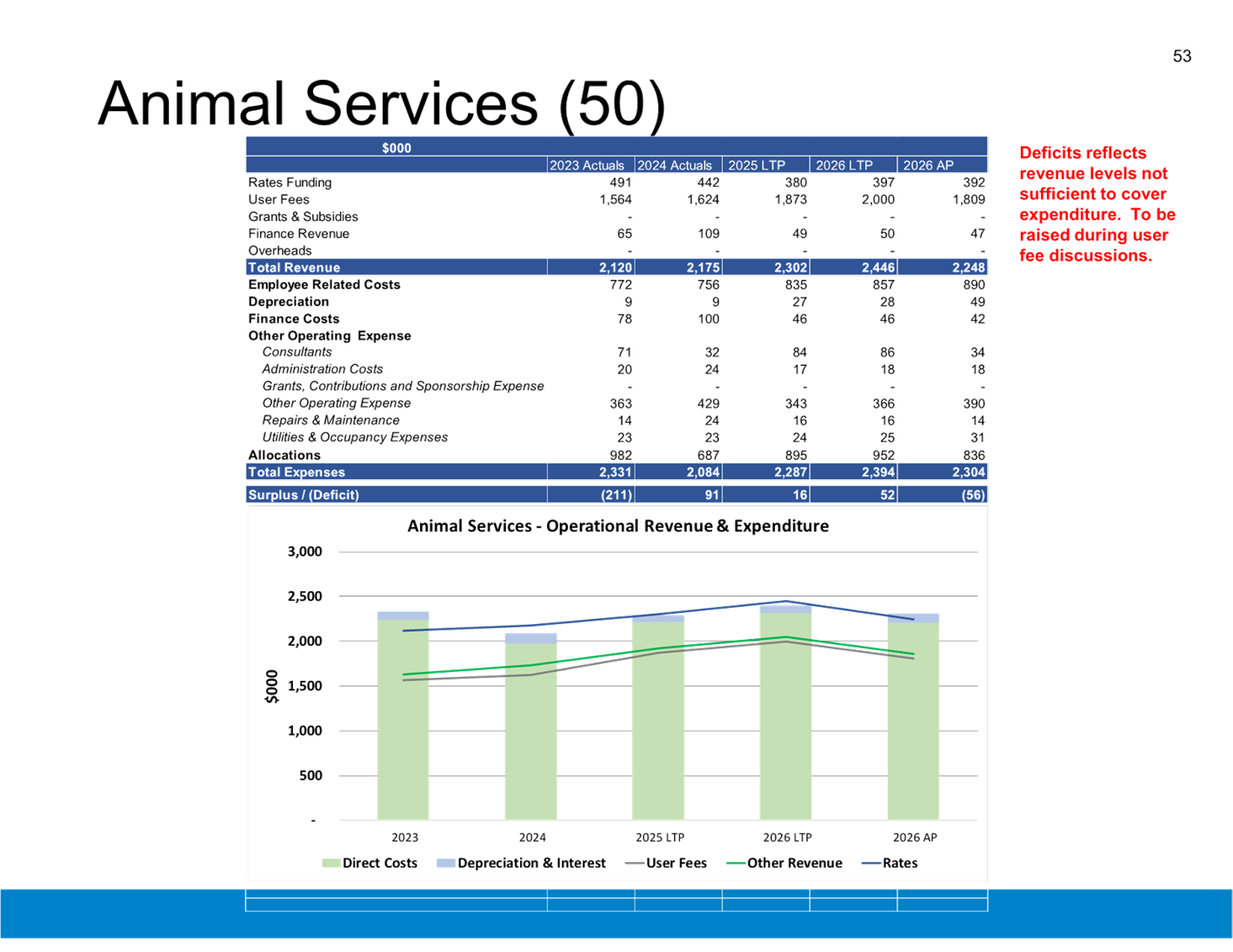

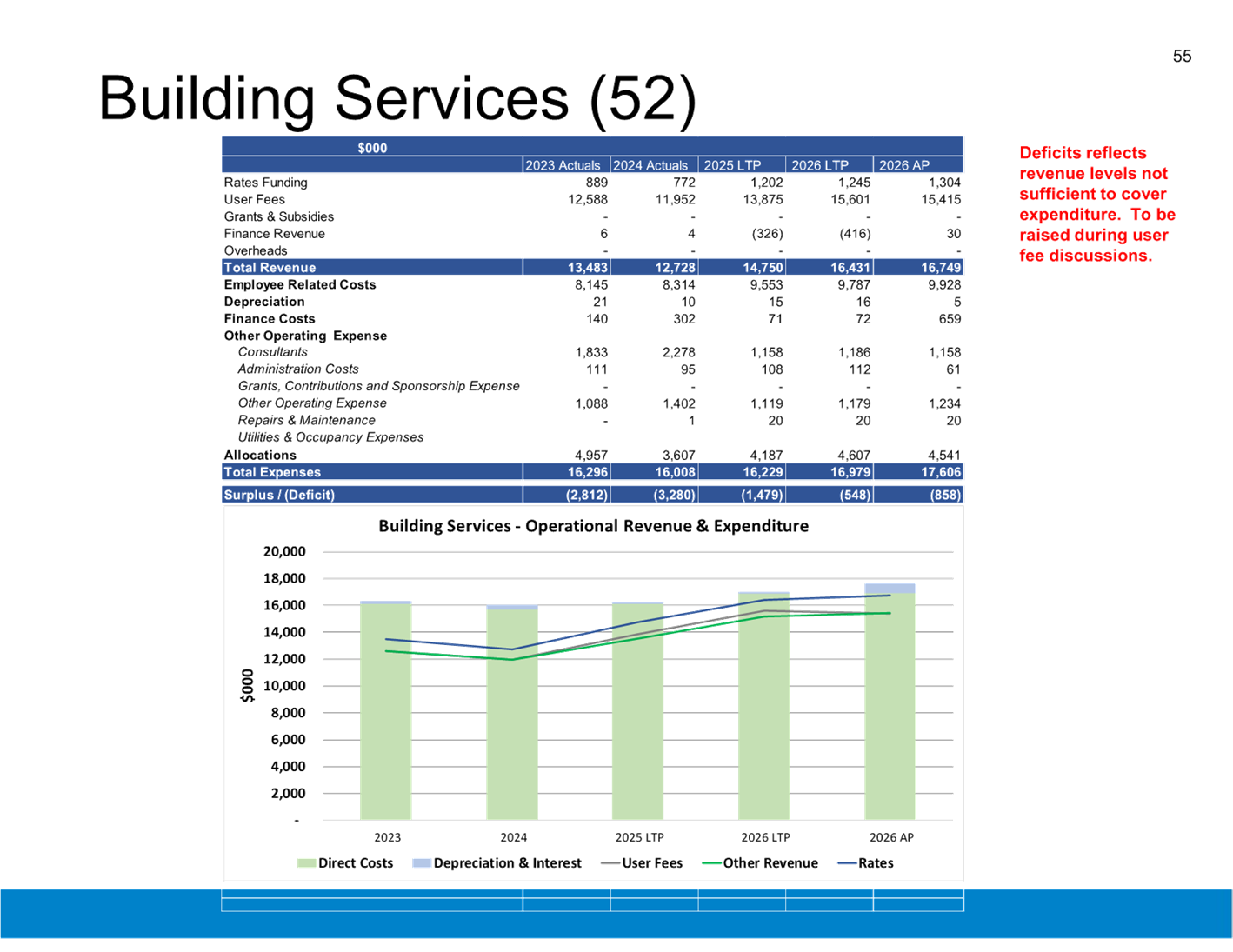

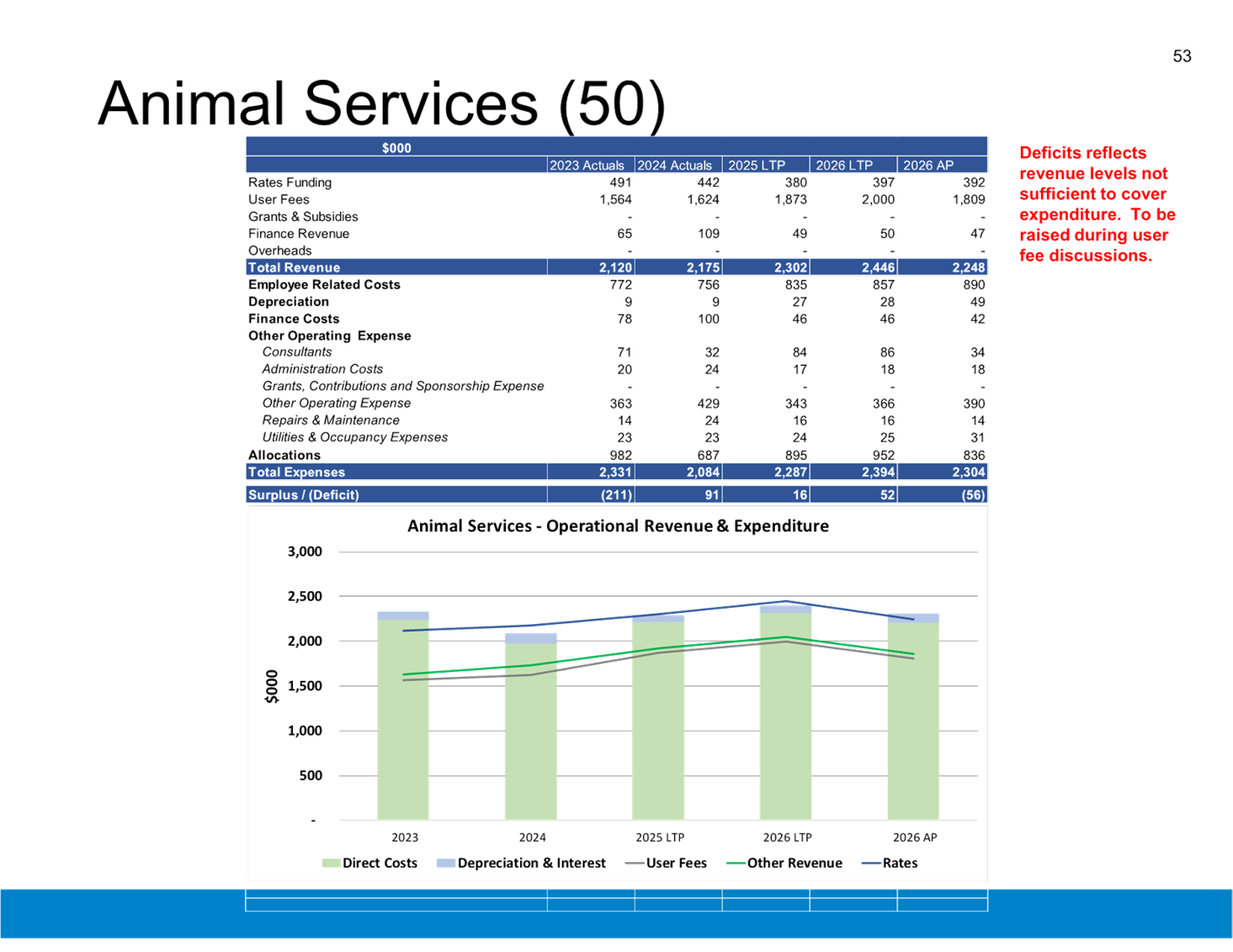

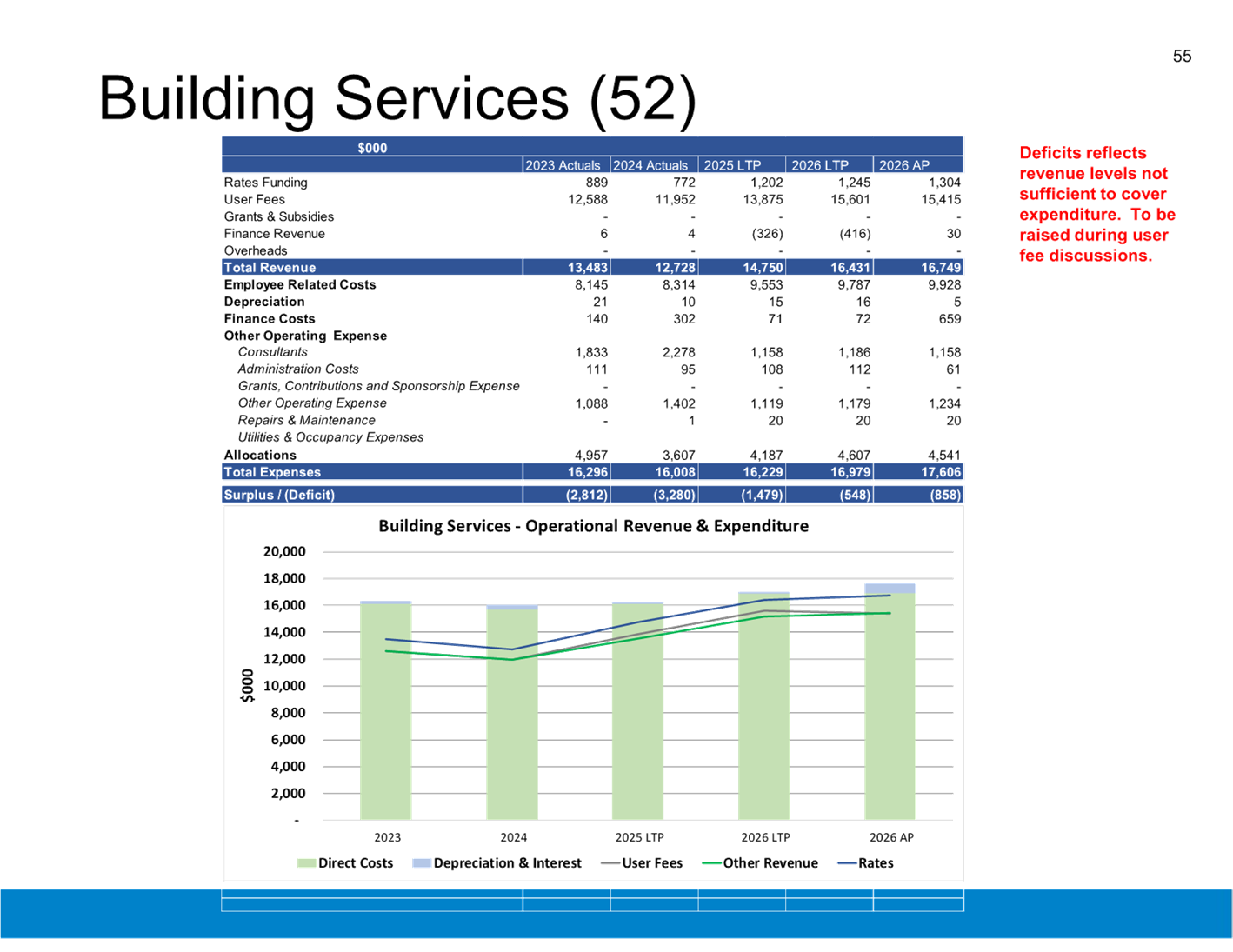

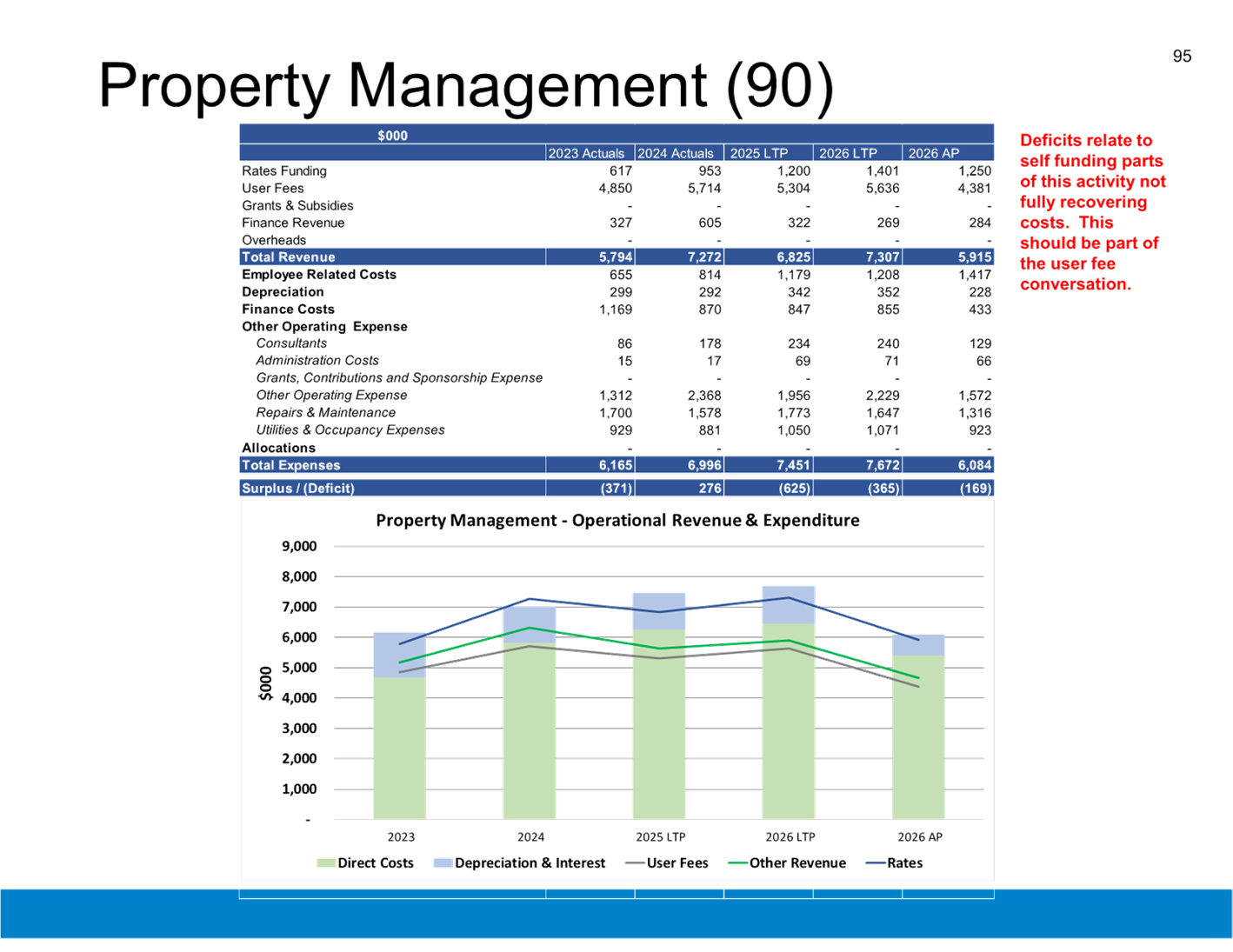

are currently in deficit, but increasing revenue over time.

15. Changes to the draft 2025/26 user

fees and charges schedule as a result of this report can be incorporated into

the schedule following the meeting. Confirmation of the changes can be

presented as a late item at the council meeting of 3 March 2025, or approved by

delegation prior to the adoption of the consultation document on 24 March 2025.

FUNDING DEPRECIATION

POLICY 2009

16. During a recent policy stocktake,

it was identified that council’s Funding Depreciation and Use of

Deprecation Reserves Policy 2009 (Attachment 3) is no longer needed.

This policy was developed as a supporting document to the Revenue and Financing

Policy 2009.

17. Considering that the Revenue and

Financing Policy has been through numerous reviews since then, staff consider

that all matters within the 2009 policy have either been superseded by or are

now included in the Revenue and Financing Policy 2024.

18. It’s recommended that the

Funding Depreciation and Use of Deprecation Reserves Policy 2009 be revoked.

Table 1 compares content in the 2009 policy with the current RFP.

19. This decision is considered to be

an administrative change with low significance.

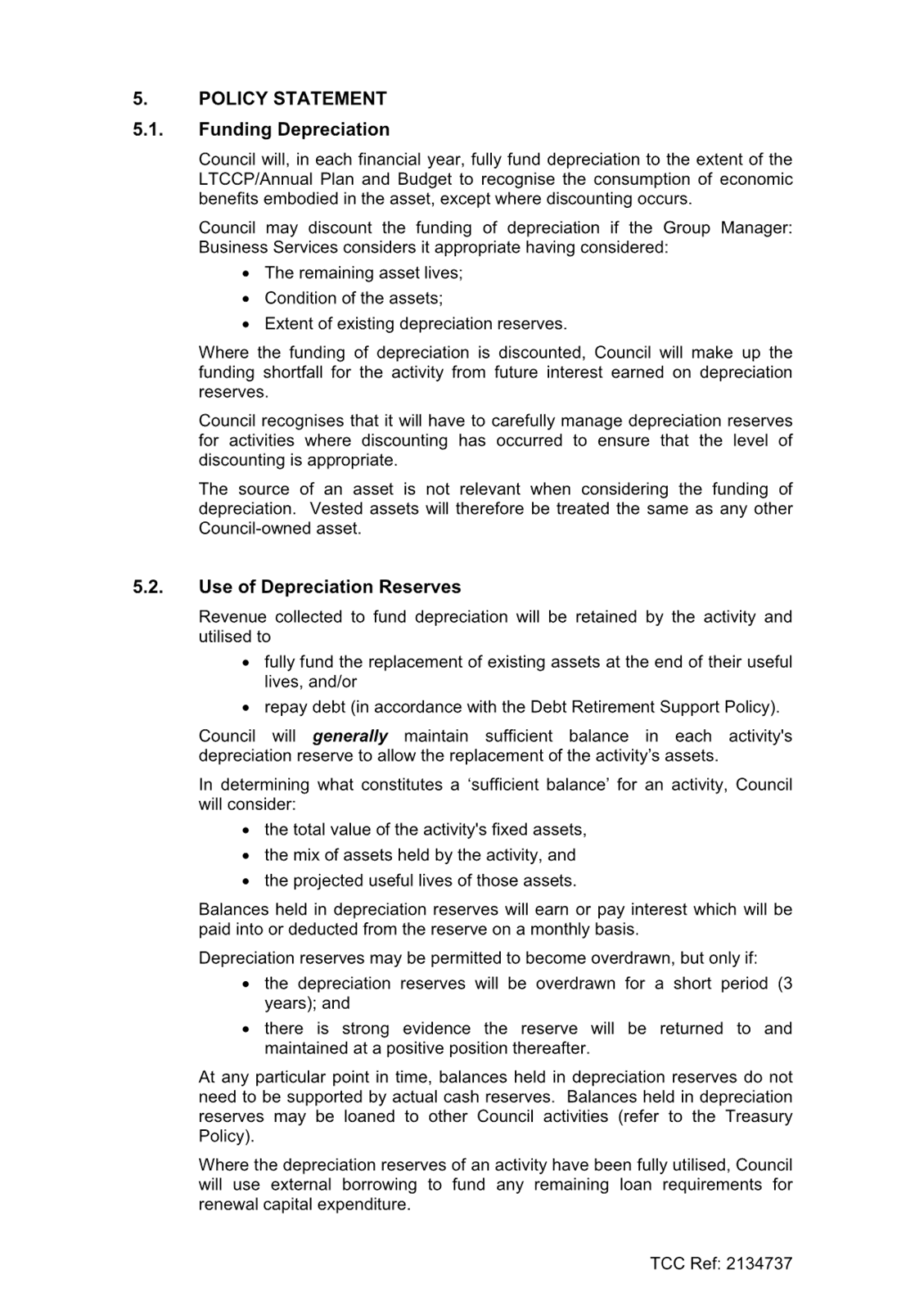

Table 1: Comparison of content – 2009 policy vs

2024 policy

|

Content

|

Funding Depreciation Policy 2009

|

Revenue and Financing Policy 2024

|

|

Definition

of Depreciation Reserves

|

Definition section

the accumulated funds

retained by each activity from the depreciation, which is funded each

financial year, less any outgoings to pay for capital renewal of assets or

debt repayment.

Background

section

Within each of

Council’s activities, revenue is raised to fund the depreciation

expense, and the money is transferred to a depreciation reserve for that

activity. These reserves are used to fund the replacement of existing assets

at the end of their useful lives. When an asset is replaced (that is, it is

not a new asset), it is described as renewal capital expenditure. New capital

is almost always funded by loans, but there are many instances where an asset

purchase is a mixture of renewal and new capital expenditure.

|

Under depreciation

heading

the accumulated funds

retained by each activity from the depreciation on all Council’s fixed

assets (excluding land) Within each of Council’s activities, revenue is

raised to fund the depreciation expense, and the money is transferred to a depreciation

reserve for that activity. Renewals are funded through this reserve and

activity debt is regularly retired based on a set % of the activity debt.

|

|

Depreciation

- an operating expense

|

Under deprecation

heading in background section

Depreciation is

calculated on all Council’s fixed assets excluding land. Depreciation

is an operating expense recorded in Council’s financial statements

|

Under types of

expenditure section and operating expenditure section

Operating expenditure

(Opex): is the money spent on the ongoing day to day activities and services

of the Council. This includes contributions to the wear and tear on assets

used (depreciation), interest charges on borrowing for capital projects and

corporate overheads.

|

|

Balanced

budget requirement

|

Under depreciation

heading in background section

Council raises revenue

(from rates, user charges, or other sources) to fund its operating expenses

including depreciation, as required under the Local Government Act (S.100).

|

Under operating

expenditure section

Balanced budget –

In accordance with section 100 of the LGA, Council will set each year’s

projected operating revenues at a sufficient level to meet the year’s

projected OPEX, except in limited situations where Council considers it

prudent not to do so.

|

Financial Considerations

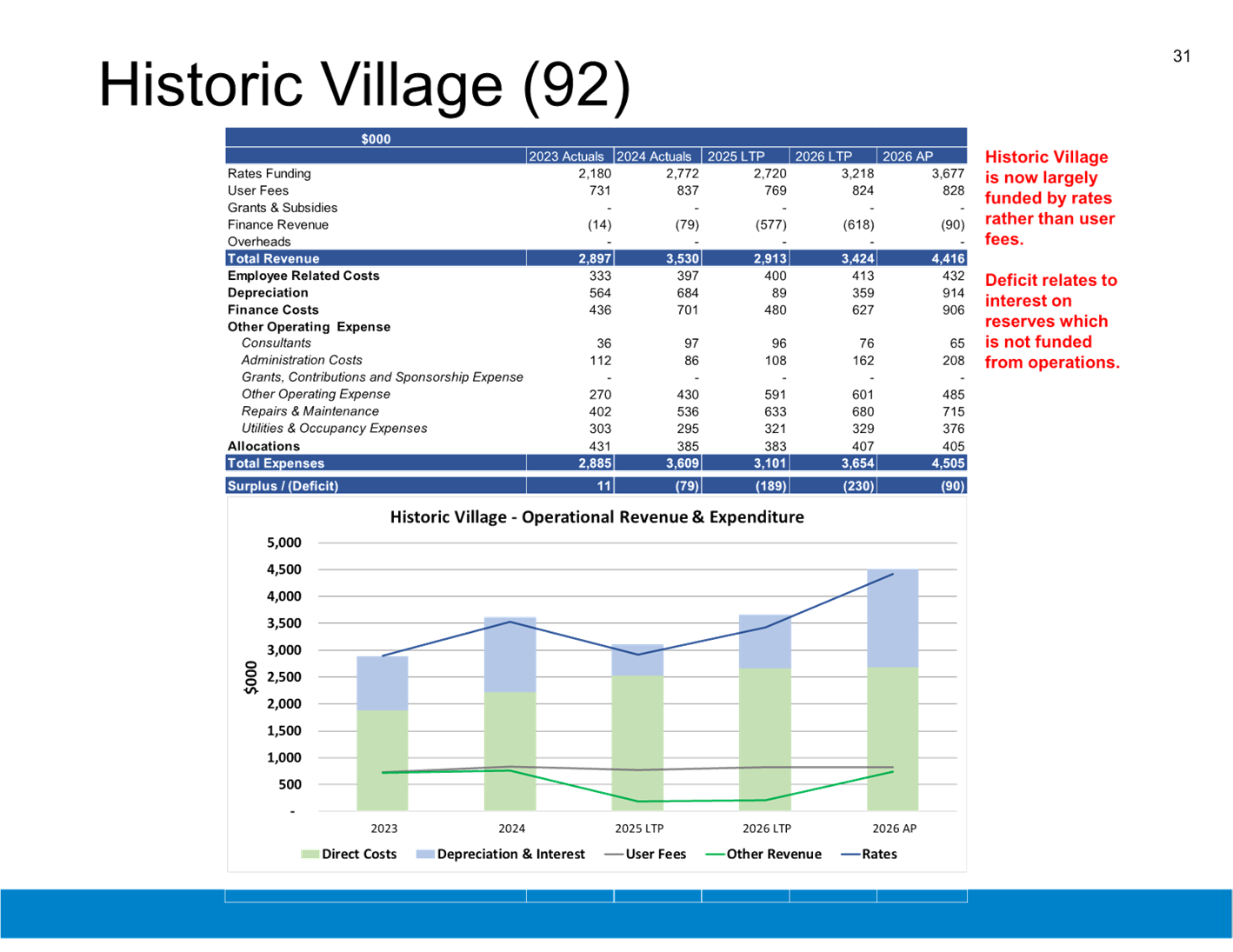

20. Overall, the use of fees and

charges to fund activities can reduce the reliance on rates to cover the costs

of services. While some activities continue to set charges to maintain

sufficient revenue to cover the costs of services, others such as Historic

Village and Marine Facilities have increased reliance on rates over time.

User fees are currently 17% of operating revenue while rates make up 78%.

Legal Implications / Risks

21. The proposed changes to user fees

and charges must comply with the relevant statutory requirements under the

Local Government Act 2002 (LGA) and other applicable legislation governing

specific services (e.g., Resource Management Act 1991, Building Act 2004, and

Health Act 1956).

22. Key risks associated with the

proposed user fee changes include:

(a) Potential public concern

regarding increased fees, which will be mitigated through public consultation

alongside the 2025/26 Annual Plan.

(b) Revenue shortfalls if fees do

not adequately recover costs, requiring ongoing monitoring and potential

adjustments in future reviews.

(c) Legal challenges if fees are

perceived as inconsistent with statutory requirements, highlighting the

importance of ensuring all changes align with council’s Revenue and

Financing Policy and relevant legislation.

23. The revocation of the Funding

Depreciation and Use of Depreciation Reserves Policy 2009 does not introduce

any legal risk, as its provisions are now fully incorporated into the Revenue

and Financing Policy 2024. The revocation is considered an administrative

update and does not affect council’s financial management practices.

Significance

24. The Local Government Act 2002

requires an assessment of the significance of matters, issues, proposals and

decisions in this report against Council’s Significance and Engagement

Policy. Council acknowledges that in some instances a matter, issue, proposal

or decision may have a high degree of importance to individuals, groups, or

agencies affected by the report.

25. In making this assessment,

consideration has been given to the likely impact, and likely consequences for:

(a) the current

and future social, economic, environmental, or cultural well-being of the

district or region

(b) any persons who are likely to be

particularly affected by, or interested in, the issue.

(c) the capacity of the local authority

to perform its role, and the financial and other costs of doing so.

26. In accordance with the

considerations above, criteria and thresholds in the policy, it is considered

that the issue is of medium significance. Some of the proposed changes to user

fees and charges will have varying impacts certain individuals and groups, the

users of our services.

27. Subsequent decisions as a result of

this report may be of higher significance.

ENGAGEMENT

28. Consultation on the full user fees

and charges schedule is proposed to be completed alongside the 2025/26 Annual

Plan, with the public consultation period being 28 March – 28 April 2025.

Next Steps

29. Incorporation of changes to the

user fees and charges as a result of council feedback and direction.

30. Council review of updated user fees

and charges schedule on 3 March 2025 (if desired).

31. Adoption of draft 2025/26 user fees

and charges schedule for public consultation on 24 March 2025.

32. Public consultation period –

28 March – 28 April 2025, followed by hearings in May 2025.

33. Adoption of the final 2025/26 User

Fees and Charges is proposed for June, and these would come into force on 1

July 2025.

Attachments

1. Draft

2025/26 User Fees and Charges - Tracked Changes - A17468068 (Separate

Attachments 1)

2. Draft

2025/26 User Fees and Charges - Statement of Proposal - A16879282 ⇩

3. Funding

Depreciation and Use of Depreciation Reserves - A6029732 ⇩

4. Analysis of User Fee

Revenue Sufficiency by Activity - A17520635 ⇩

|

Ordinary

Council meeting Agenda

|

24

February 2025

|

|

Ordinary

Council meeting Agenda

|

24

February 2025

|

|

Ordinary

Council meeting Agenda

|

24

February 2025

|

|

Ordinary

Council meeting Agenda

|

24

February 2025

|

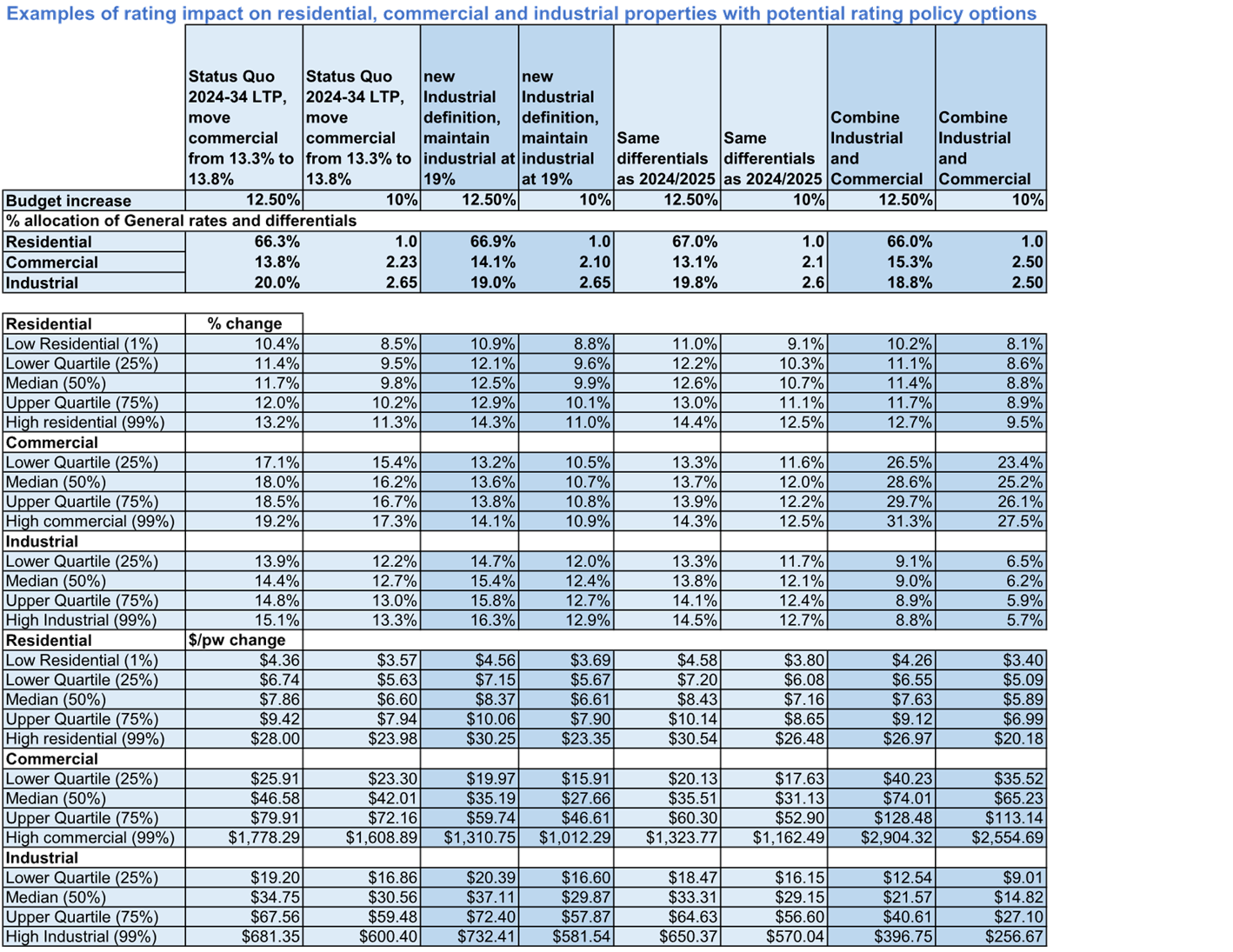

11.3 Rating Policy Review

2025/2026 Annual Plan

File

Number: A17410245

Author: Jim

Taylor, Manager: Rating Policy and Revenue

Kathryn Sharplin,

Manager: Finance

Authoriser: Paul

Davidson, Chief Financial Officer

Purpose of the Report

1. The purpose of this report

is to confirm changes to Council’s rating policy to be included in the

2025/2026 Annual Plan consultation.

|

Recommendations

That the Council:

(a) Receives the report

"Rating Policy Review 2025/2026 Annual Plan".

(b) Changes the definition of Industrial

rating category to exclude any rating unit with a land area less than 250m2,

(or exclusive use area less than 250m2 for cross lease or unit titles),

which will be classified in the commercial rating category.

(c) Continues with the

Long-term Plan decision to move to a fixed proportion of the general rates

for each rating category and change the proportions for the residential

rating category to 66%, the Commercial rating category to 15% and the

industrial rating category to 19% by the 2027/28 rating year.

|

Executive Summary

2. At the Council meeting

of 5 November 2024, Council recommended reconsideration of decisions made as

part of the 2024-34 Long-Term Plan (LTP), which established an industrial

rating category, and the establishment of targeted proportions of rates that

would be contributed to by each of residential, commercial and industrial

rating categories.

3. This report considers

the following:

· removing

smaller operations (under 250m2) from the industrial category.

· reviewing

the level of differential.

· Considering

recombining commercial and industrial rating categories.

· The

proportions of rates to be paid by each of the three rating categories.

4. This report recommends

changes to the definition of industrial category to remove smaller operations,

and making a small change to the proportions of rates to be paid by each

category that maintains the current intentions regarding the existing differentials.

5. Changes that are agreed

by Council will be included as part of the 2025/2026 Annual Plan.

Background

6. Through the 2024-34

Long-Term Plan (LTP), the Financial Strategy and Revenue and Financing Policy

were developed, which underpinned the funding and financing of the investments

and services provided and planned for the city. As part of the LTP process,

the commercial rating category was further considered with respect to its

impact on the costs of the city, particularly the impacts on transportation

costs including safety and environmental impacts.

7. Recognising these

impacts, industrial properties were separated from the commercial category and

set at a higher differential of 2.6 times, an allocation of 20% of the general

rates.

8. In November 2024, Report

9.2 to the Accountability, Performance & Risk Committee entitled Rating

Categories and Rating Policy, discussed options for addressing Council concerns

regarding the coverage of the Industrial rating category. The Committee

requested a report back on the following matters which have now been redirected

for Council consideration:

(a) Options regarding the

industrial category including.

i. Removing smaller operations from the industrial

category.

ii. Reviewing the level of differential.

iii. Recombining

commercial and industrial rating categories.

(b) As part of the annual plan

process, consider whether to continue to move toward general rates set at a

fixed proportion of residential 65%, Commercial 15%, industrial 20% as included

in the Long-Term Plan.

9. These matters are

considered below.

Moving small industrial rating

units to the commercial rating category

10. In November

Council had considered a range of options for defining which properties would

apply to the industrial and commercial categories to enable certain smaller

uses of industrial premises to not necessarily be caught within that category.

11. Council’s current definition

for the general rating categories is based on (a) the use to which the land is

put and aligns with the land use designation in the District Valuation

Roll. The Industrial Rating Category definition includes rating units

with a primary land use beginning with 3- Transport, 6 – Utility services

or 7 - Industrial services.

12. This existing categorisation is

developed during the current rating valuation process. Using a separate

local process which involved inspecting each rating unit to assess the use

would be costly to implement, difficult to administer and would be likely to

involve a more complex and subjective decision-making process.

13. Removing smaller businesses from

the current industrial categorisation is an alternative option. This

could be achieved by using the existing valuation processes and categorisation

but introducing logic within Council’s own SAP system to divert

qualifying smaller industrial properties to the commercial category for the

purpose of applying the differential. It could apply a logical limit on

land area (or exclusive use area) to properties equal to or greater than 250m2

land area for the Industrial rating category. Smaller areas would default

to the commercial category for the differential application. This

option would require some additional programming in the new rates module in

SAP. However, it would be simple to administer and simple for ratepayers, and

council staff, to understand.

Financial

Impact of removing smaller rating units from Industrial Category

14. If the 682 smaller industrial use

rating units (landuse grp 7), with a land area less than 250 m2 (or

exclusive use area less than 250m2 for cross lease or unit titles) were

included in the commercial rating category, the reduction in rates to these

rating units would be $119,000 because they would be at a lower rating

differential of 2.1 times rather than 2.6 times.

15. Assuming the fixed proportion of

rates for industrial continuing to apply at 20%, the lower number of Industrial

ratepayers means rates paid by the remaining Industrial ratepayers would

increase around $450,000 (a rates increase for the median industrial ratepayer

of 20.2% in 2025/26). This would equate to a differential of 2.82 times.

The residential sector share would reduce by $300,000.

16. This redistribution of rating

burden to the remaining industrial category was not the intended consequence of

the proposal to move smaller ratepayers to the commercial ratepayer.

17. Options for mitigating the impact

on the remaining industrial rating units are discussed in the section below.

Reviewing the Level of

Differential

18. Allocation of the general rates is

a section 101(3)(b) matter for council to decide, after considering “the

overall impact of any allocation of liability for revenue needs on the current

and future social, economic, environmental, and cultural well-being of the

community”.

19. Tauranga City Councils commercial

differential of 2.1:1 is the lowest differential in the New Zealand

metro’s that we benchmark with. This is shown in table 1. below and for

TCC was a Council decision arising from a review of the impacts of commercial

and industrial activities.

20. As well as setting a differential,

Council chose that future differentials would be based on a set proportion of

the general rate to be paid by each of the rating categories.I n the 2024-2034

Long Term Plan, Council resolved to apportion the general rates at residential

65%, commercial 15% and Industrial 20% by the 2027-2028 rating year.

21. This apportionment is close to the

average apportionment of metro councils for residential and commercial (including

Industrial) rating categories which is 34% commercial 66%

residential. The summary by Metro Council is shown in the table below.

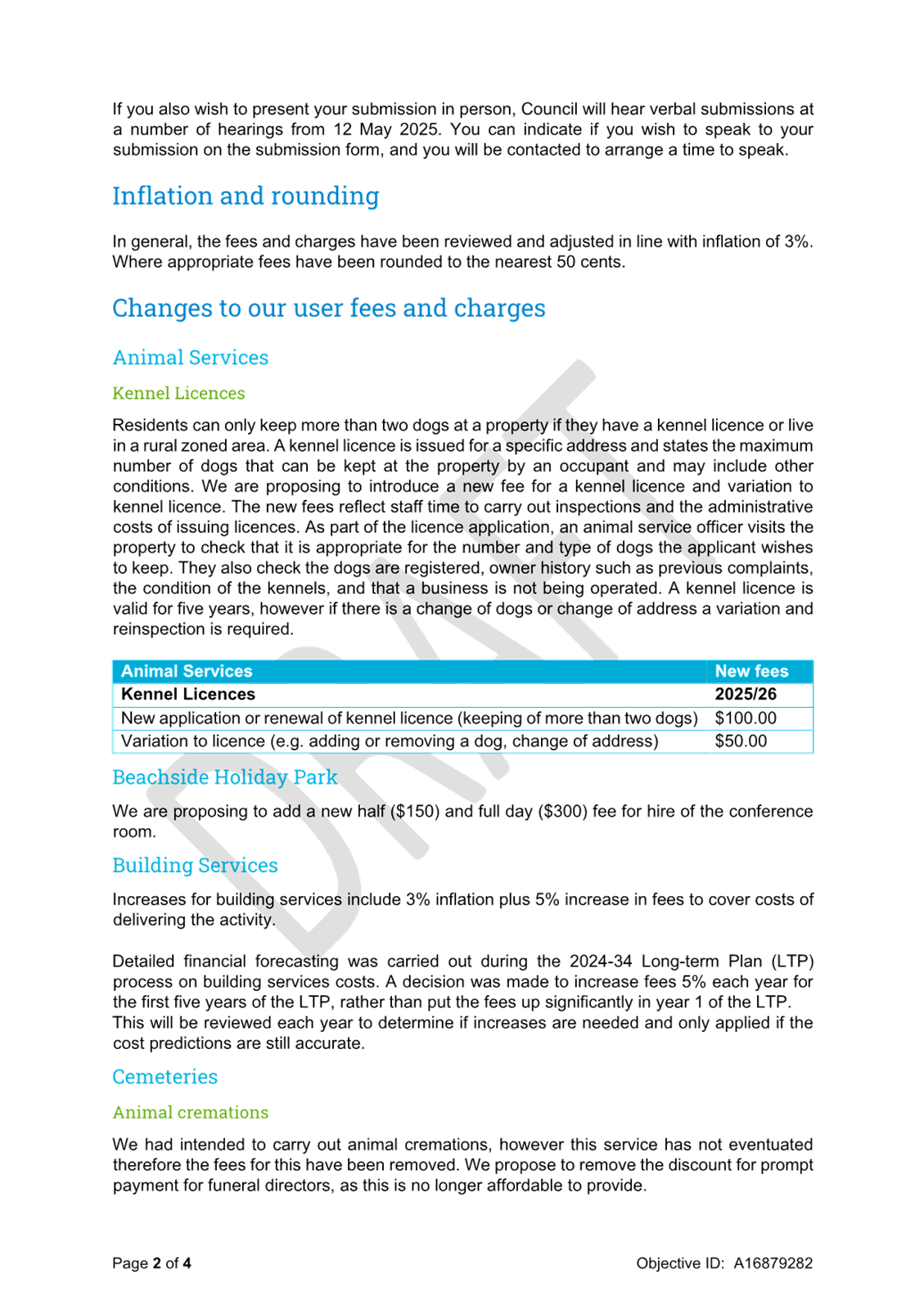

22. Table 1: Summary of

differential, portion of general rates and average rates

|

|

Differential

|

General rates for commercial/

Industrial categories (%)

|

Total Rates in 2024/25 estimate

average residential $

|

Uniform Annual General Charge ($)

|

|

Tauranga

|

2.1/2.6

|

33% (LTP move to 35%)

|

5,055

|

298

|

|

Auckland

|

2.64

|

31%

|

5,091

|

567

|

|

Hamilton

|

2.9765

|

34%

|

4,276

|

749

|

|

Christchurch

|

2.22

|

34%

|

4,394

|

177

|

|

Dunedin

|

2.47

|

31%

|

$4,159

|

0

|

|

Wellington

|

3.66

|

40%

|

6,371

|

0

|

|

Porirua

|

3.1

|

N/A

|

N/A

|

425

|

|

Hutt City

|

3.525

|

40%

|

N/A

|

0

|

23. There is no published source on

comparative rates data for recent years. However, column 4 above is based

on informal information shared between metro council officers in April 2024 when

councils were deciding on the 2024/2025 rates (updated where final

information is available). It is not published information from those

councils.

The

rates are for the “average” residential ratepayer. Tauranga City

Council’s average residential property is around the 70% percentile zone

and is different from our published median residential ratepayer where 50% of

properties pay more and 50% pay less.

Reviewing

the percentage allocation of general rates for each rating category

24. As discussed in paragraphs 14 and

15 above, moving the small industrial rating units into the commercial rating

category has consequences for the remaining Industrial rating units, if the

allocation remains at 20% they will end up paying a larger share. This can be

mitigated by reducing the industrial rating category to 19% from 20%.

25. Moving the small industrial rating

units to commercial increases the commercial rates collection to a 14.1% share

of general rates, if the differential remains at 2.1. Under the LTP decision to

move the commercial category gradually toward 15% they would have been moved to

a differential of 2.23 times and a proportion of general rate of 13.8%.

26. Council could choose to set the

Industrial rating category at 19% and continue to move the commercial rating

category toward 15% over time. This would result in a combined Industrial

/commercial allocation of 34%, which is consistent with the average metro

allocation.

Recombining the commercial and

industrial rating categories.

27. Council could choose to recombine

the commercial and industrial categories. Given the set proportion of

general rates by the combined commercial and industrial categories at 34% of

general rates there would be a significant redistribution impact within these

categories with industrial ratepayers paying less and commercial ratepayers

paying more.

28. Recombining the commercial and

industrial categories in the 2025/2026 rating year would result in a

significant increase for the commercial sector. The median commercial ratepayer

increase would be 28.6% or $74.01 per week.

Summary of Analysis

29. In summary Council has choices in

the annual plan regarding rating structure including:

(a) whether or not to proceed

toward the agreed proportions of rates paid by different categories with the

following choices:

i. proceed with the resolution made by

Council in the LTP to move the commercial rating category up from 13.3% to 15%

by 2027/2028, or not (with the first step being a move for 2025/26 to 13.8%.

ii. maintain the level of contribution of

industrial category (20%) or reduce to 19%.

(b) Recombine the Commercial and

Industrial Rating Categories and set a new combined differential at an

allocation of for example 34%.

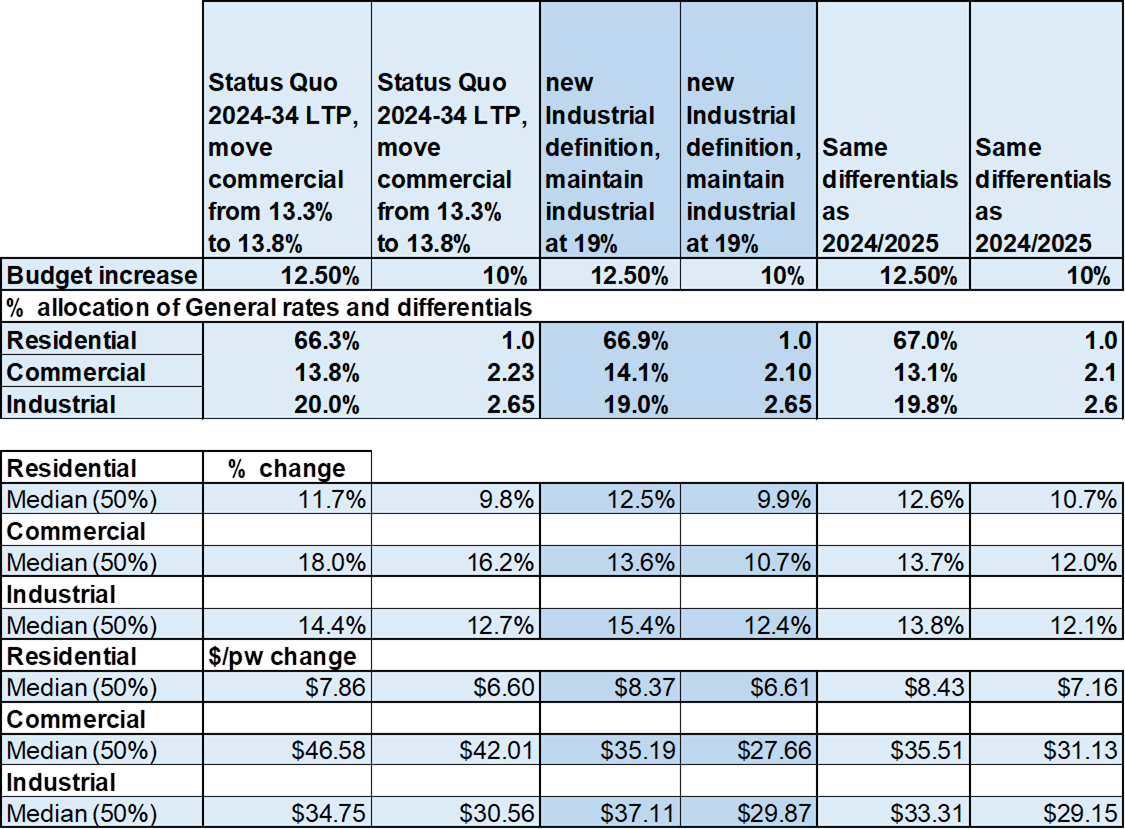

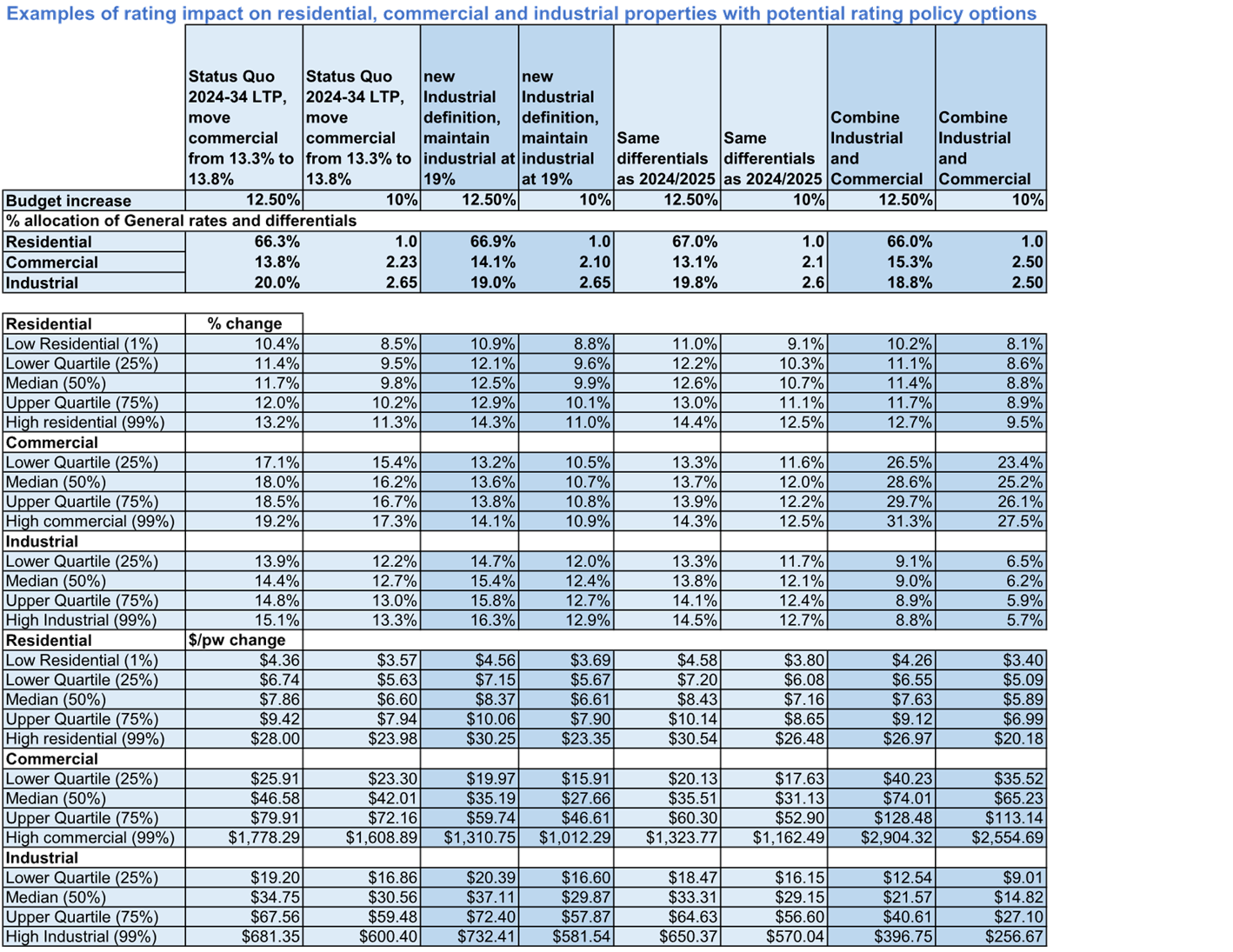

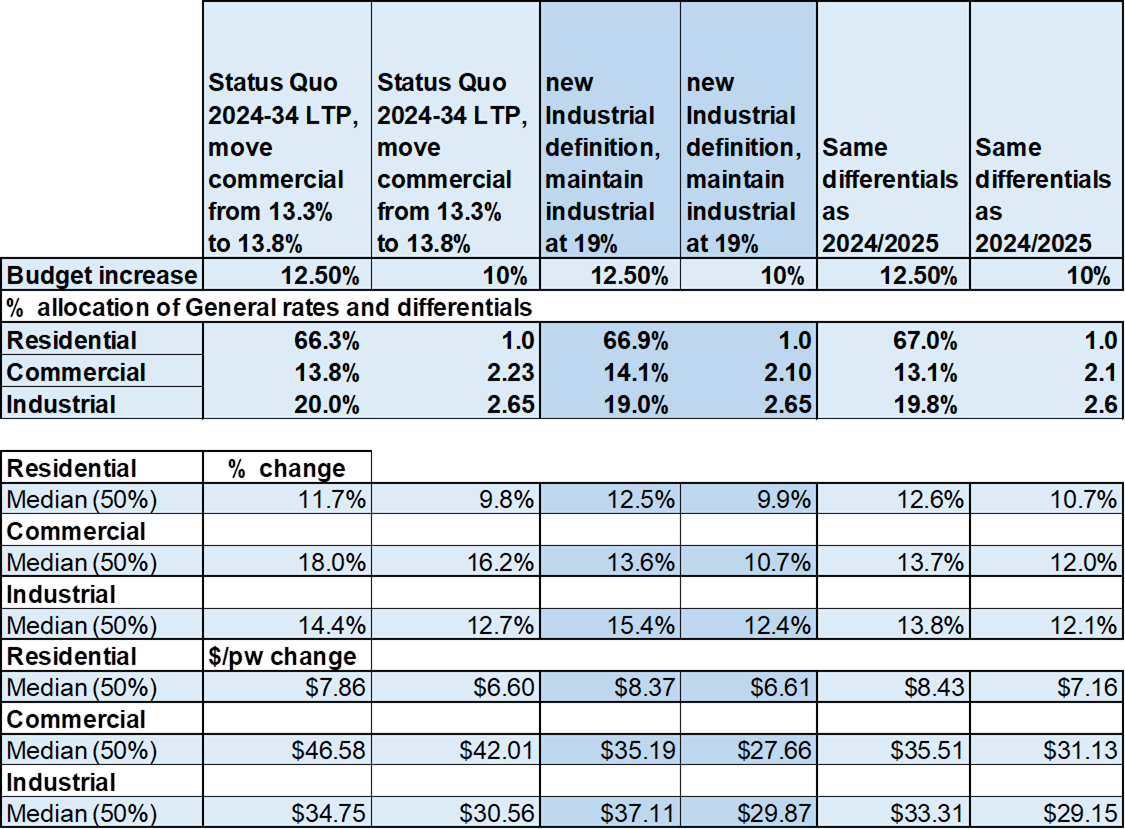

30. The impact for the medium

residential, medium commercial and medium industrial rating units are shown in

Table 2 below based on a draft 12.5% rates increase and an indicative 10%

option. Note that the budget increase below shows 12.5%

inclusive of water however the table shows rates excluding water.

Including water will reduce the median rates in the table.

31. If Council continues with

the LTP decisions (status quo columns), continuing to move the allocation of

the commercial rating category to 15% by 2027/2028 the median residential rates

increase would be 11.7%, median commercial 18.0% and median industrial 14.4%.

The smaller industrial rating units would continue to be categorised in the

Industrial rating category. (note that while overall rates are at 12.5% this

analysis excludes the water rate components which are below the other rates

increases)

32. Assuming

the commercial differential is not less than the current 2.1, if council

redefined the Industrial rating category to exclude rating units under 250m2

and maintained the industrial category allocation at the 2024/25 level of 19%[3], the median

residential rates increase would be 12.5%, median commercial 13.6% and median

industrial 15.4%. This option would mean that the eventual allocation split

would be residential 66%, commercial/industrial 34% which is the average split

in other metro councils.

33. If Council decided to maintain the

2024/2025 general rates differentials (without changing the definition of

the Industrial rating category) the median residential rates increase would

be 12.6%, median commercial 13.7% and median industrial 13.8%.

34. If council recombined the

commercial and industrial rating categories the median residential rates

increase would be 11.4%, median commercial 28.6% and median industrial 9.0%.

35. Recombining the commercial and

industrial categories in the 2025/2026 rating year would result in a

significant increase for the commercial sector. The median commercial ratepayer

increase would be 28.6% or $74.01 per week. Alternatively, this option could be

reconsidered as part of the next LTP, after the commercial differential is

fully phased in so that the impacts on commercial and industrial would be less

pronounced.

36. If Council decides to reduce the

kerbside waste by $20 as part of rates reduction options to be considered on 3

March this would reduce the median residential rates by approximately 0.2%.

37. Council can also choose to remove

any activity or part of activity, including Transportation, into a targeted

rate calculated on capital value and set the proportions of the general rates

plus the new targeted rate to be the same as the options above. Setting a

targeted rates instead of a general rate provides increased transparency to

some extent while somewhat restricting benchmarking and the flexibility to make

choices with those funds. These options have not been modelled as part of this

report.

Statutory Context

38. The decisions in this paper on

rating policy will become part of the 2025-2026 Annual Plan.

STRATEGIC ALIGNMENT

39. This contributes to the promotion

or achievement of the following strategic community outcome(s):

|

Contributes

|

|

We are an inclusive city

|

ü

|

|

We value, protect and enhance the environment

|

ü

|

|

We are a well-planned city

|

ü

|

|

We can move around our city easily

|

ü

|

|

We are a city that supports business and education

|

ü

|

40. Fair and equitable funding of

council’s investment in services and infrastructure through a

proportional allocation of rates liability on the whole community will

contribute to all of the above outcomes.

Options Analysis

Options (MOVING SMALL INDUSTRIAL

RATING UNITS TO THE COMMERCIAL RATING CATEGORY)

Option

1 - Council does not change the definition of Industrial, aligns with the

land use code in the District Valuation Roll. (Status Quo)

Option

2 - Council changes the definition of Industrial to exclude any rating unit

with a land area less than 250m2 (or exclusive use are for cross lease and

unit titles), which will be classified as commercial rating category.

Options Analysis (MOVING SMALL

INDUSTRIAL RATING UNITS TO THE COMMERCIAL RATING CATEGORY)

Option 1 - Council does not changes the definition

of Industrial, aligns with the land use code in the District Valuation Roll.

(Status Quo)

|

Advantages

|

Disadvantages

|

|

·

Provides clarity to the rating treatment and is consistent with

council’s valuation service provider designation of use in the District

Valuation Roll (DVR).

·

Simple to administer. Council’s new SAP will automatically assign,

reducing human error and creating efficiencies.

|

·

Does not respond to council’s concerns around small to medium

Industrial units, including private storage, and those ratepayers will be

charged the higher industrial rating category general rate.

|

|

Key risks

|

|

|

Recommended?

|

No (Section 101(3)(b)

decision)

|

Option 2 – Council changes the definition of

Industrial to exclude any rating unit with a land area less than 250m2 (or

exclusive use are for cross lease and unit titles), which will be

classified as commercial rating category.

|

Advantages

|

Disadvantages

|

|

· Reduces

rates liability for smaller industrial rating units, including those used for

private storage, which would have a lower general rate differential.

· Addresses

Council’s concerns that the new Industrial rating category should not

include smaller industrial rating units.

|

· Changes

to inclusion within industrial category could put higher apportionment on

remaining industrial users.

· Other

industrial rating units, for example vacant industrial land waiting for

infrastructure delivery, may feel that they should also be recategorized.

|

|

Key risks

|

|

|

Recommended?

|

Yes (Section 101(3)(b)

decision)

|

Options (ALLOCATION OF GENERAL

RATES)

Option

1 –Council to continue with the Long-term

Plan decision to move to a fixed proportion of the general rates for each

rating category and change the proportions for the residential rating category

to 65%, the Commercial rating category to 15% and the industrial rating

category to 20% by the 2027/28 rating year (Status Quo).

Option

2 – Council to continue with the Long-term Plan decision to move to a

fixed proportion of the general rates for each rating category and change the

proportions for the residential rating category to 66%, the Commercial rating

category to 15% and the industrial rating category to 19% by the 2027/28 rating

year.

Option

3 – Council proposes to set the differential for each rating

category, consulted with the community in the 2025/2026 Annual Plan.

Option

4 – Council proposes to recombine the commercial and industrial

rating units into a single rating category, consulted with the community in the

2025/2026 Annual Plan.

Options Analysis (ALLOCATION OF

GENERAL RATES)

Option 1 - Council to continue with the Long-term

Plan decision to move to a fixed proportion of the general rates for each

rating category and change the proportions for the residential rating category

to 65%, the Commercial rating category to 15% and the industrial rating

category to 20% by the 2027/28 rating year (Status Quo).

|

Advantages

|

Disadvantages

|

|

· Recognises

the increasing volumes of heavy vehicle to Industrial related businesses in

the city from journeys originating or finishing outside the city’s

boundary.

· Recognises

the social and environmental impacts such as congestion, safety, and

pollution on the city of heavy vehicles and industrial activity.

· Provides

certainty and mitigates future valuation swings between sectors and rating

categories.

· Does

not require annual reviews.

|

· Industrial

rating units may think that they are paying more than is equitable and fair.

· Increases

for the commercial sector phased in over three years.

· Local

hospitality sector and Tauranga CDB retail struggling due to construction and

economic downturn (partly mitigated by reduced rating valuations in those

areas for some commercial properties).

|

|

Key risks

|

|

|

Recommended?

|

No (Section 101(3)(b)

decision)

|

Option 2 - Council to continue with the Long-term

Plan decision to move to a fixed proportion of the general rates for each

rating category and change the proportions for the residential rating category

to 66%, the Commercial rating category to 15% and the industrial rating

category to 19% by the 2027/28 rating year.

|

Advantages

|

Disadvantages

|

|

· Recognises

the increasing volumes of heavy vehicle to Industrial related businesses in

the city from journeys originating or finishing outside the city’s

boundary.

· Recognises

the social and environmental impacts such as congestion, safety, and

pollution on the city of heavy vehicles and industrial activity.

· Provides

certainty and mitigates future valuation swings between sectors and rating

categories.

· Does

not require annual reviews.

· Moderates

a redefined (reduced) Industrial Rating Category and brings TCC general rate

allocation into line with other NZ metros (34% commercial/ Industrial)

|

· Industrial

rating units may think that they are paying more than is equitable and fair.

· Increases

for the commercial sector phased in over three years.

· Local

hospitality sector and Tauranga CDB retail struggling due to construction and

economic downturn (partly mitigated by reduced rating valuations in those

areas for some commercial properties, and by an increased number of rating

units in the commercial rating category).

|

|

Key risks

|

|

|

Recommended?

|

Yes (Section 101(3)(b)

decision)

|

Option 3 - Council

proposes to set the differential for each rating category, consulted with the

community in the 2025/2026 Annual Plan.

|

Advantages

|

Disadvantages

|

|

· Council

can consider localised factors in the short term and set the differentials at

each annual plan or long-term plan.

|

· Changing

the proportions frequently creates uncertainty over the long term,

particularly at each triennial revaluation.

· May

increase the rates liability on one of more sectors and

rating categories.

· Would

not mitigate future valuation swings for rating categories.

· Residential

ratepayers may pay more as a proportion than other similar growth New Zealand

metros who set the allocation at a fixed percent.

|

|

Key risks

|

|

|

Recommended?

|

No (Section 101(3)(b) decision)

|

Option 4 - Council

proposes to recombine the commercial and industrial rating units into a single

rating category, consulted with the community in the 2025/2026 Annual Plan.

|

Advantages

|

Disadvantages

|

|

· Is

simple to administer and understand.

· Easier

to benchmark with other NZ metropolitan cities.

|

· Large

increase the rates liability on the commercial rating category (can be

mitigated by phasing in over a period of years)

· Does

not recognise the relative impact on each sector or rating category on

council’s activities and services.

|

|

Key risks

|

|

|

Recommended?

|

No – potential to

review at next LTP (Section 101(3)(b) decision)

|

Financial Considerations

41. Changing the definition of rating

category or allocation of the general rates will not impact council’s

finances directly as they change the allocation of rates liability over the

whole community. If some ratepayers pay less others would pay a greater share

of the total rates requirement set by Council.

Legal Implications / Risks

42. Council should follow due process,

particularly the chronological order in section 101 Financial management of the

Local Government Act (2002), when setting rating policy.

TE AO MĀORI APPROACH

43. Fair and equitable allocation of

rates ensures that the Industrial sector and other heavy vehicle users contribute

to the costs of a safe transportation network. This aligns to the concept of

Manaakitanga which is best practice and a strong duty of care and safety for

our people.

CLIMATE IMPACT

44. While Transportation Activity, in

particular road traffic, is a key contributor to negative environmental

impacts, the rating policy changes are unlikely to change any behaviour of

heavy vehicle traffic to, or from, Industrial rating units. The Port of Tauranga

is New Zealand’s only deep water port and is unlikely to move from the

centre of Tauranga.

Consultation / Engagement

45. Changes to rating Policy or the

Revenue and Financing Policy will be consulted with the whole community as part

of the 2025-2026 Annual Plan.

Significance

46. The Local Government Act 2002

requires an assessment of the significance of matters, issues, proposals, and

decisions in this report against Council’s Significance and Engagement

Policy. Council acknowledges that in some instances a matter, issue,

proposal, or decision may have a high degree of importance to individuals,

groups, or agencies affected by the report.

47. In making this assessment,

consideration has been given to the likely impact, and likely consequences for:

(a) the current

and future social, economic, environmental, or cultural well-being of the

district or region

(b) any persons who are likely to be

particularly affected by, or interested in, the decision.

(c) the capacity of the local authority

to perform its role, and the financial and other costs of doing so.

48. In accordance with the

considerations above, criteria and thresholds in the policy, it is considered

that the decision is of high significance.

ENGAGEMENT

49. Taking into consideration the above

assessment, that the decision is of high significance, officers are of the

opinion that the following consultation/engagement is suggested/required under

the Local Government Act 2002.

50. Any proposed changes to rating

category definitions or general rate allocations will be consulted with the

community as part of the 2025/2026 Annual Plan.

Next Steps

51. Decisions will be included in the

2025-2026 Annual Plan consultation and/or supporting documents. In the 10 March

report on the draft Annual Plan, with final adjustments, the calculation will

be based on rates budget movements across all general and targeted rates

Attachments

1. Funding

Impact on rates for rating categories under different rating policy options -

A17515906 ⇩

|

Ordinary

Council meeting Agenda

|

24

February 2025

|

|

Ordinary

Council meeting Agenda

|

24

February 2025

|

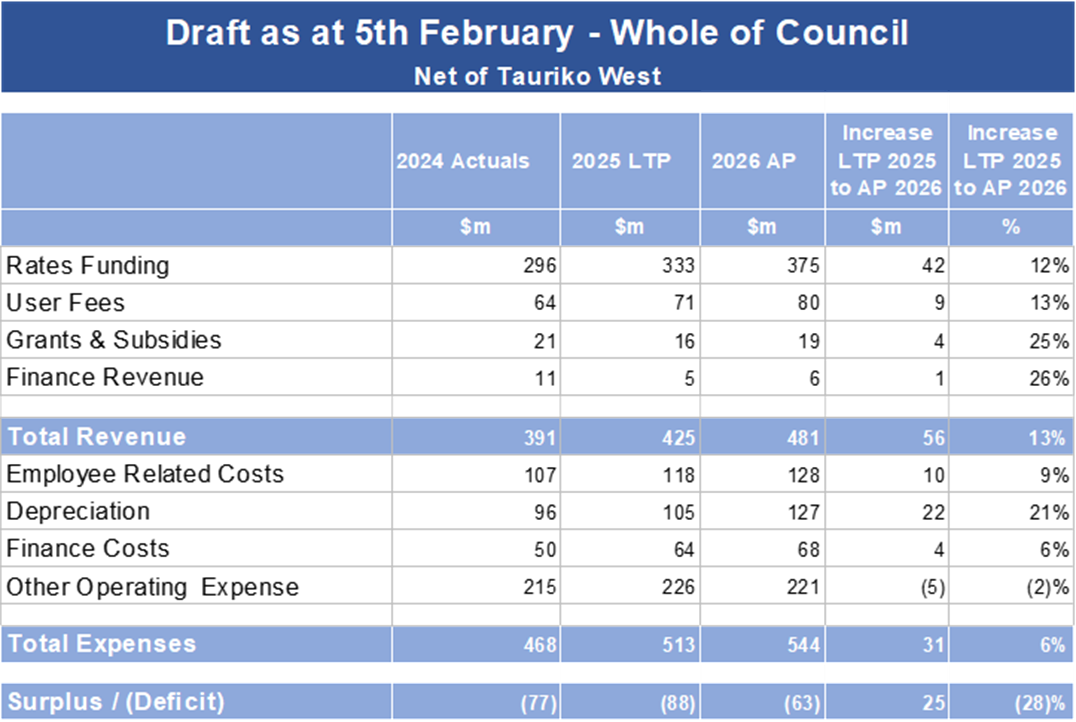

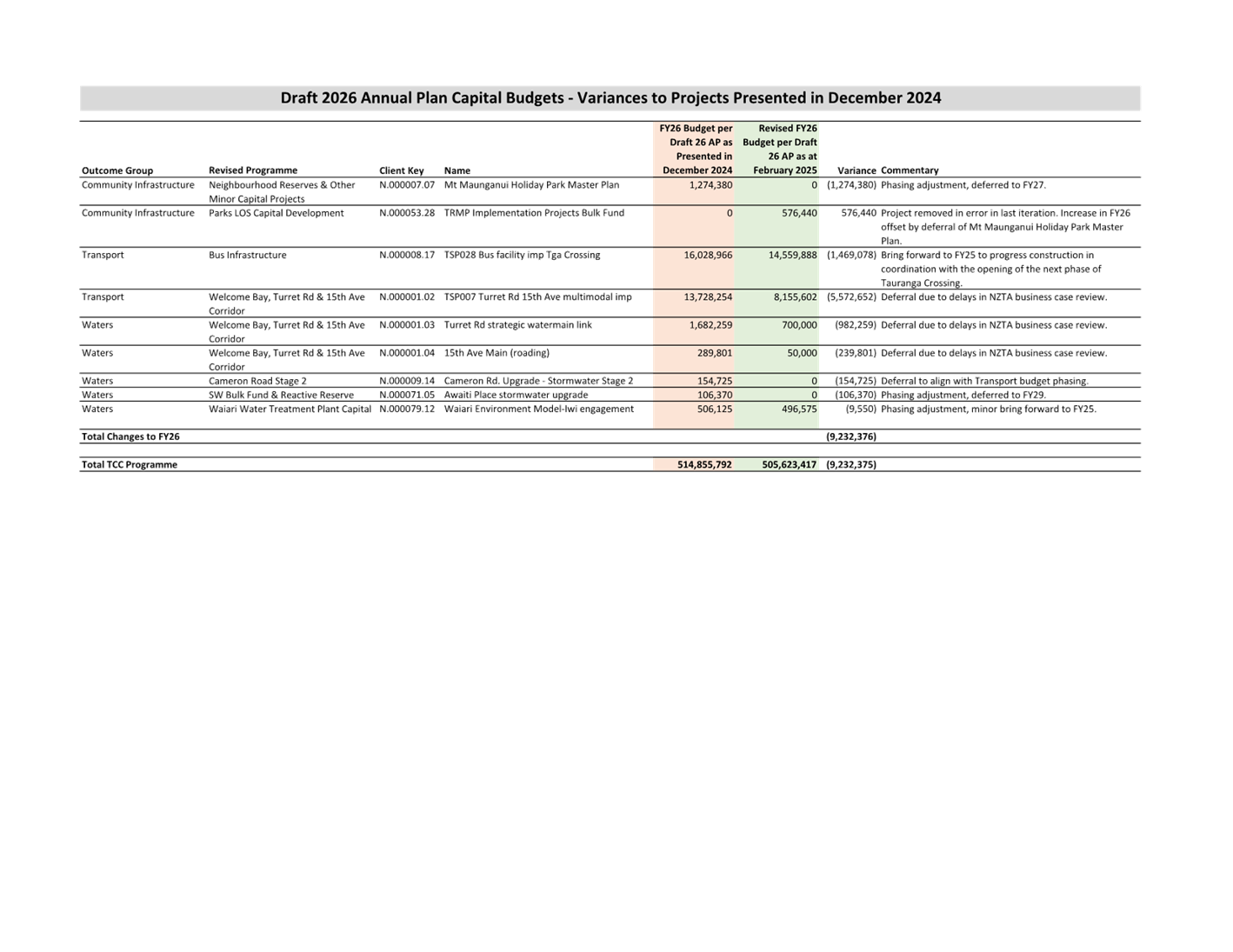

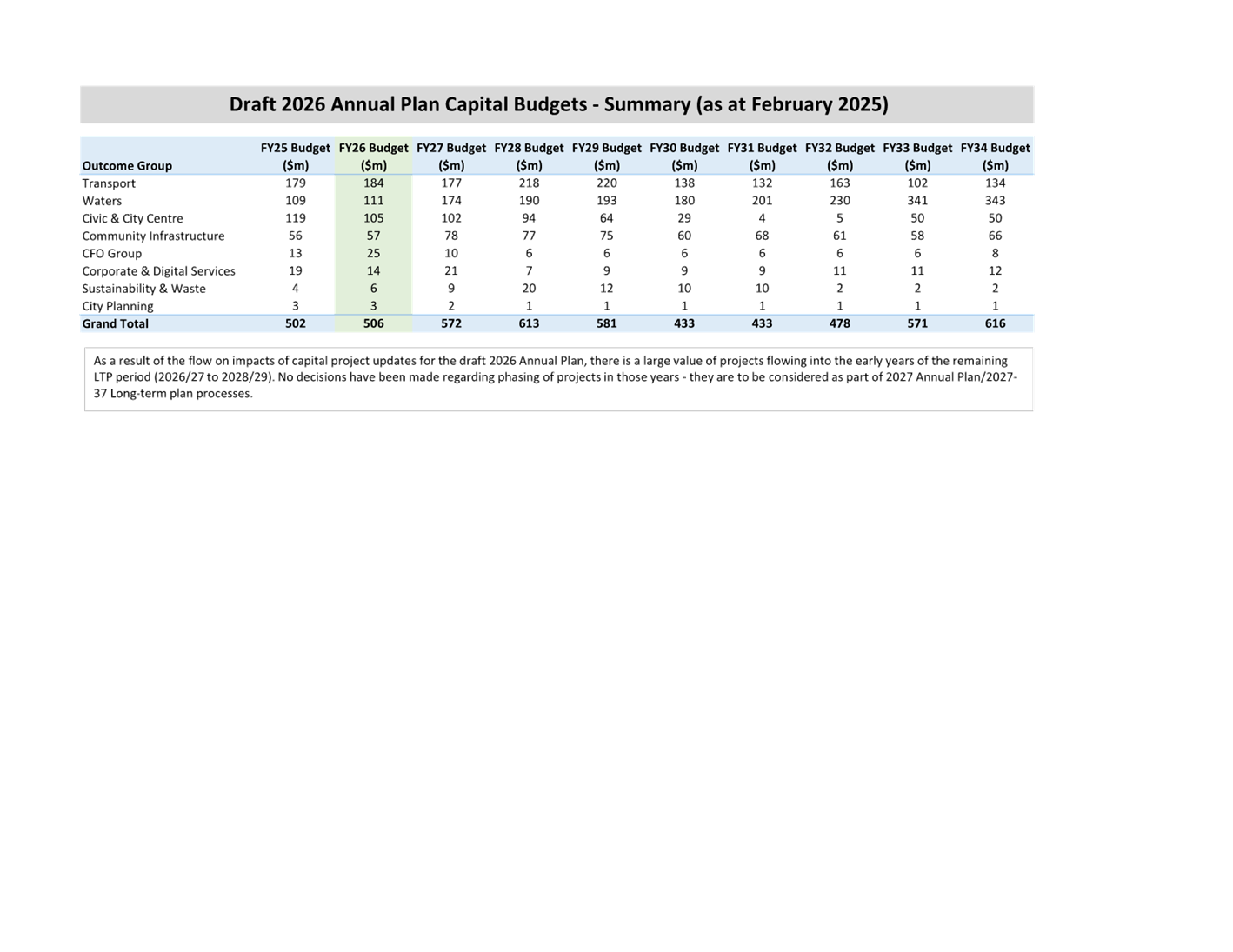

11.4 Draft

Annual Plan 2025/26 - Decision Making

File

Number: A17099631

Author: Josh

Logan, Team Leader: Corporate Planning

Kathryn Sharplin,

Manager: Finance

Tracey Hughes,

Financial Insights & Reporting Manager

Susan Braid, Finance

Lead Projects Assurance

Authoriser: Paul

Davidson, Chief Financial Officer

Purpose of the Report

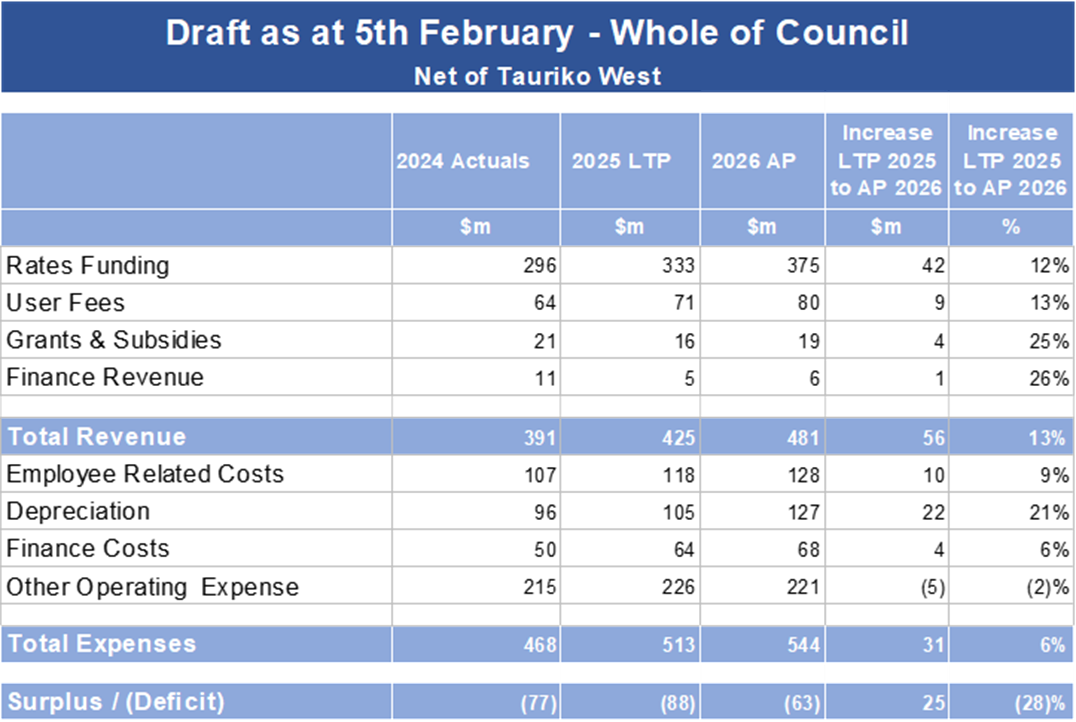

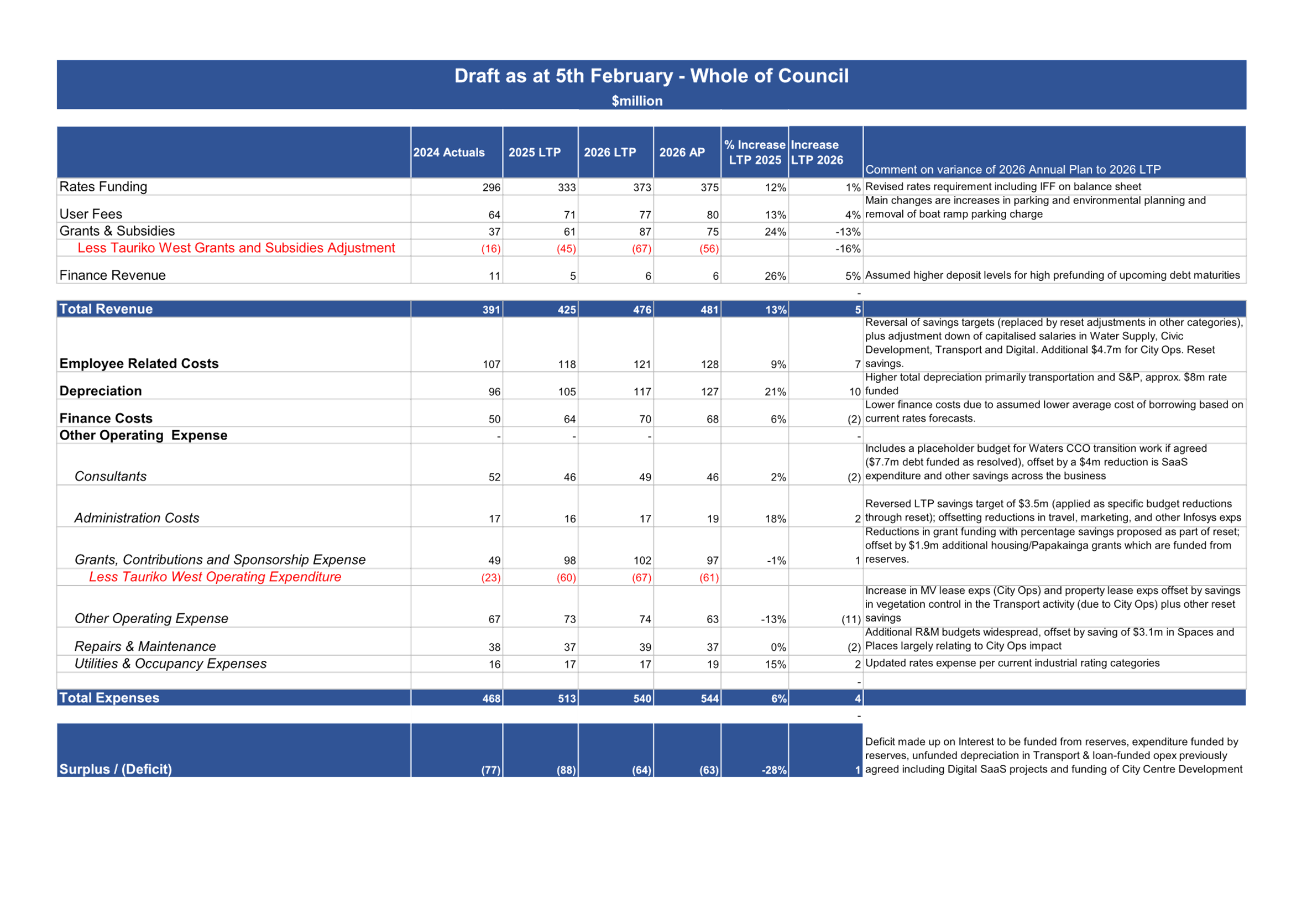

1. To

seek direction/approval of the Annual Plan 2025/26 draft baseline budget and

provide an update on the development of the annual plan.

|

Recommendations

That the Council:

(a) Receives the report

"Draft Annual Plan 2025/26 - Decision Making".