|

|

|

AGENDA

City Delivery Committee meeting

Monday, 7 April 2025

|

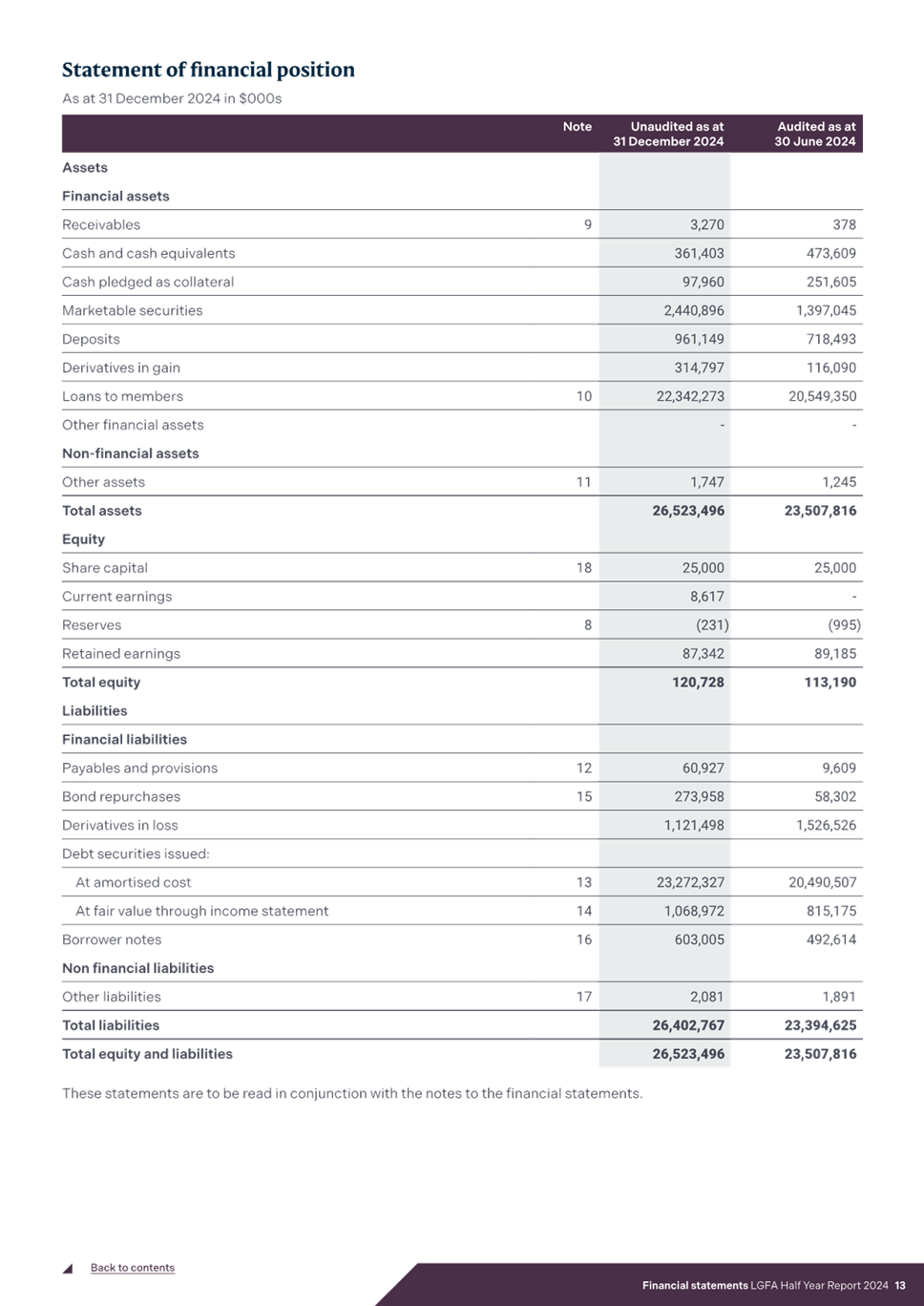

|

I hereby give notice that a City Delivery Committee

meeting will be held on:

|

|

Date:

|

Monday, 7 April 2025

|

|

Time:

|

9.30am

|

|

Location:

|

Bay of Plenty Regional Council Chambers

1 Elizabeth Street

Tauranga

|

|

Please note that this

meeting will be livestreamed and the recording will be publicly available on

Tauranga City Council's website: www.tauranga.govt.nz.

|

|

Marty Grenfell

Chief Executive

|

Terms of reference – City Delivery Committee

Common

responsibility and delegations

The following common responsibilities and delegations apply

to all standing committees.

Responsibilities of standing committees

· Establish priorities and guidance on programmes relevant to the Role

and Scope of the committee.

· Provide guidance to staff on the development of investment options

to inform the Long Term Plan and Annual Plans.

· Report to Council on matters of strategic importance.

· Recommend to Council investment priorities and lead Council

considerations of relevant strategic and high significance decisions.

· Provide

guidance to staff on levels of service relevant to the role and scope of the

committee.

· Establish and participate in relevant task forces and working

groups.

· Engage in dialogue with strategic partners, such as Smart Growth

partners, to ensure alignment of objectives and implementation of agreed

actions.

· Confirmation of committee minutes.

Delegations to standing committees

· To make recommendations to Council outside of the delegated

responsibility as agreed by Council relevant to the role and scope of the

Committee.

· To make all decisions necessary to fulfil the role and scope of the

Committee subject to the delegations/limitations imposed.

· To develop and consider, receive submissions on and adopt

strategies, policies and plans relevant to the role and scope of the committee,

except where these may only be legally adopted by Council.

· To consider, consult on, hear and make determinations on relevant

strategies, policies and bylaws (including adoption of drafts), making

recommendations to Council on adoption, rescinding and modification, where

these must be legally adopted by Council.

· To approve relevant submissions to central government, its agencies

and other bodies beyond any specific delegation to any particular committee.

· Engage external parties as required.

Terms of reference – City Delivery

Committee

Membership

|

Chairperson

|

Deputy

Mayor Jen Scoular

|

|

Deputy chairperson

|

Cr

Kevin Schuler

|

|

Members

|

Mayor Mahé Drysdale (ex officio)

Jacqui Rolleston-Steed - Tangata Whenua Representative

|

|

Non-voting members

|

(if any)

|

|

Quorum

|

Half of the members

present, where the number of members (including vacancies) is even;

and a majority of the members present, where the number of members

(including vacancies) is odd.

|

|

Meeting frequency

|

Six weekly

|

Role

The role of the Community and Performance Committee is:

· To

ensure community involvement in, and support for, Council projects, proposals,

initiatives and services.

· To

monitor delivery of Council-funded delivery by community-led organisations

partnering with, or otherwise contracted to, Council.

· To

review and improve public confidence and participation in Council decision

making processes.

· To

ensure that approved projects are effectively planned and delivered on a timely

basis and in a way that provides good social, economic and environmental

outcomes, including value-for-money, for the community.

· To

monitor the financial and non-financial performance of Council.

· To

provide oversight of the Annual Report.

Scope

· Develop

a council-wide engagement strategy and monitor, including via community

feedback, its implementation and success.

· Develop

and review engagement plans for projects, proposals, initiatives and services

that the Committee considers significant from a community interest perspective.

· Ensure

appropriate and accessible information is available to the community on current

and upcoming projects.

· Receive

and consider the community’s views on public transport and provide that

information to relevant Committees.

· Develop

and consider opportunities for Council to partner with the community,

organisations, and other agencies to enable good outcomes for the city.

· Lead

the development of relationships with community organisations, schools,

businesses and other groups to broaden Council’s reach into the community

and use of available resources.

· Ensure

promotion of the community’s trust and confidence in Council is embedded

in Council’s projects, proposals, initiatives and services.

· Where

gaps are identified, develop proposals for new projects or services for

recommendation to Council for inclusion in future Annual Plan or Long-term Plan

processes.

· Receive

and consider feedback that is fully representative of the community including,

but not limited to, the annual residents’ survey (undertaken in waves).

· Review

statements of intent and receive reporting of the Local Government Funding

Agency.

· Receive

reporting by Mainstreet organisations as appropriate.

· Receive

reporting against partnership agreements with key cornerstone organisations (as

per the Community Funding Policy) and from other community-led organisations as

appropriate.

· Assess

options for improving public participation in decision making and make

recommendations to Council that will strengthen democratic processes at all

levels of the organisation.

· Provide

input to operational proposals, options, and costs of projects as considered

appropriate by the Committee having taken into account value, risk, and public

interest (within scope and budgets approved through the Annual Plan or

Long-term Plan process or separately by Council).

· Provide

input to the proposed approach and options for procurement processes that the

Committee considers significant having taken into account value, risk, and

public interest.

· Take

necessary steps to ensure that procurement processes provide value-for-money.

· Approval

of tenders and contracts that are outside of approved staff delegations.

· Ensure

that the design and delivery of projects reflect Council’s strategic

framework ("Our Direction") as appropriate including, but not limited

to, the adopted community outcomes and Council’s four lead strategies

(Tauranga Taurikura – Environment Strategy; Tauranga Mataraunui –

Inclusive City Strategy; Connected Centres Programme; Western Bay Economic

Strategy).

· Ensure

that where projects have a potential negative environmental impact, appropriate

mitigation is considered in design, delivery, and eventual operations.

· Monitor

the delivery of projects. (Note that the ‘Five Transportation

Projects’ will be reported to the City Future Committee, and the projects

managed by Te Manawataki o Te Papa Ltd will be reported, alongside other

council-controlled organisation reporting, to Council).

· Review

regular financial and non-financial performance reporting, including reporting

against strategic outcomes, the Long-term Plan, the Annual Plan, and other

strategic and implementation documents (including, for instance, action and

investment plans adopted as part of Council’s strategic framework, Our

Direction).

· Provide

oversight on the preparation of the Annual Report and other external financial

reporting required by legislation.

Power to

Act

· To

make all decisions necessary to fulfil the role, scope and responsibilities of

the Committee subject to the limitations imposed.

· To

establish sub-committees, working parties and forums as required.

Power to

Recommend

· To

Council and/or any standing committee as it deems appropriate.

Chairperson and Deputy Chairperson acting as Co-Chairs

·

While the Chairperson and Deputy Chairperson of the Committee roles

are separately appointed it is the intention that they act as co-chairs.

○ Only

one person can chair a meeting at any one time. The person chairing the meeting

has the powers of the chairperson as set out in standing orders and has the

option to use the casting vote in the case of an equality of votes.

○ The rotation of

the meeting chairs is at the discretion of the Chairperson and Deputy

Chairperson and subject to their availability, however it is expected that they

will alternate chairing meetings when possible.

○ When the Deputy

Chairperson is chairing the meeting, the Chairperson will vacate the chair and

enable the Deputy Chairperson to chair the meeting. The Chairperson will be

able to stay and participate in the meeting unless they declare a conflict of

interest in an item, in which case they will not participate or vote on that

item.

○ The Chairperson

and Deputy Chairperson will attend pre-agenda briefings and split any other

duties outside of meetings, e.g. spokesperson for the Committee.

○ The Chairperson

and Deputy Chairperson will jointly oversee and co-ordinate all activities of

the Committee within their specific terms of reference and delegated authority,

providing guidance and direction to all members and liaising with Council staff

in setting the content and priorities of meeting agendas.

○ The Chairperson

and Deputy Chairperson will be accountable for ensuring that any

recommendations from the Committee are considered by the Tauranga City Council.

3 Public

forum

3.1 Barry

Scott - Establishment of a Trial Community Committee

Attachments

Nil

3.2 Deborah

Turner - Bus Stops and Road Safety

Attachments

Nil

7 Confirmation

of minutes

7.1 Minutes

of the City Delivery Committee meeting held on 10 March 2025

File

Number: A17832450

Author: Caroline

Irvin, Governance Advisor

Authoriser: Clare

Sullivan, Team Leader: Governance Services

|

Recommendations

That the Minutes of the

City Delivery Committee meeting held on 10 March 2025 be confirmed as a true

and correct record.

|

Attachments

1. Minutes

of the City Delivery Committee meeting held on 10 March 2025

|

City Delivery

Committee meeting minutes City Delivery

Committee meeting minutes

|

10 March 2025

|

|

|

|

MINUTES

City Delivery Committee meeting

Monday, 10 March 2025

|

Order of Business

1 Opening

karakia. 3

2 Apologies. 3

3 Public

forum.. 4

3.1 Christine

Currie – 7th Avenue Cul-de-sac. 4

4 Acceptance

of late items. 4

5 Confidential

business to be transferred into the open. 4

6 Change

to order of business. 4

7 Declaration

of conflicts of interest 4

8 Business. 4

8.1 Priority

One Annual Report 2023/2024. 4

8.2 7th

Avenue cul-de-sac Post-Implementation Review.. 5

8.3 Mount

Maunganui Hot Pools Opening Hours. 6

8.4 Links

Avenue Proposal to Conclude the Trial 6

8.5 Mainstreets'

Monitoring Report for the Period 1 July to 31 December 2024. 7

8.6 Tauranga

Business Chamber - Annual Report for SEBA Funding and Chamber Update. 8

8.7 Six

Monthly Treasury Strategy Update. 8

8.8 Half

Year Financial Performance Monitoring. 9

8.9 Six-Monthly

Non-Financial Performance Report 2024/25. 9

8.10 Tauranga

Māori Business Association - Half Year Update. 10

8.14 January

2025 Capital Programme Report 10

8.11 Annual

Residents Survey - Wave Two Results. 11

8.14 City

Delivery Committee Forward Work Plan 2025. 11

9 Discussion

of late items. 11

10 Closing karakia. 11

MINUTES

OF Tauranga City Council

City Delivery Committee meeting

HELD

AT THE Bay of Plenty Regional Council

Chambers, 1 Elizabeth Street, Tauranga

ON

Monday, 10 March 2025 AT 9.30am

|

MEMBERS PRESENT:

|

Deputy Mayor Jen Scoular (Chair),

Cr Hautapu Baker, Cr Glen Crowther, Cr Rick Curach, Cr Steve Morris, Cr

Marten Rozeboom, Cr Kevin Schuler, Cr Rod Taylor, Mayor Mahé Drysdale.

|

|

IN ATTENDANCE

|

Marty Grenfell (Chief

Executive), Paul Davidson (Chief Financial Officer), Barbara Dempsey (General

Manager: Community Services), Nic Johansson (General Manager:

Infrastructure), Alastair McNeil (General Manager: Corporate Services), Sarah

Omundsen (General Manager: Regulatory & Compliance), Gareth Wallis

(General Manager: City Development & Partnerships), Mike Seaborne

(Head of Transport), Alison Law (Manager: Spaces and Places), Jeremy Boase

(Manager: Strategy & Corporate Planning), Kathryn Sharplin (Manager:

Finance), Tracey Hughes (Financial Insights & Reporting Manager), Susan

Braid (Finance Lead Projects Assurance), Karen Hay

(Acting Manager Safety and Sustainability), Kendyl Sullivan (City

Partnerships Specialist), Amanda Davies (Manager: Spaces and Places Project

Outcomes), Lisa Gilmour (City Partnership Specialist), Clare Sullivan (Team

Leader Governance Services), Caroline Irvin (Governance Advisor).

|

|

EXTERNAL:

|

Nigel Tutt and Todd Muller,

Priority One

Rebecca Busby and Cameron

Templer, Greerton Village Community Association

Genevieve Whitson, Mainstreet

Tauranga

Harris Williams, Mount Business

Association

Julia Manktelow, Papamoa

Unlimited (online)

Matt Cowley, Tauranga Business

Chamber

Roz Irwin, Tauranga Business

Chamber

|

Timestamps are

included beside each of the items and relate to the recording of the meeting

held on 10 March 2025 at City Delivery

Committee Meeting 10 March 2025.

1 Opening

karakia

Deputy Mayor Jen Scoular opened the meeting with a karakia.

2 Apologies

Nil

3 Public

forum

TIMESTAMP 4.49

|

3.1 Christine

Currie – 7th Avenue Cul-de-sac

|

|

Key Points

·

Tenants and customers needed to be able to enter and exit 7th

Avenue from Cameron Road.

·

The closing of the road had created a bottle-neck situation and

needed to be opened for the sake of everyone on the road.

·

Consultation should have taken place about this.

In response to questions

·

The issue of opening the road was as

important as the parking issue.

·

For the owners of a business the

entering and exiting from Cameron Road was essential.

·

The closure of the access to and from

Cameron Road had lowered rents.

|

4 Acceptance

of late items

The Chair advised that two

additional, previously signalled attachments to item 8.12 were added to Stellar

library and published to the website on Friday, 7 March 2025.

5 Confidential

business to be transferred into the open

Nil

6 Change

to order of business

Nil

7 Declaration

of conflicts of interest

Nil

8 Business

TIMESTAMP 10.05

|

8.1 Priority One

Annual Report 2023/2024

|

|

External

Nigel Tutt, Chief Executive Priority One

Todd Muller, Chairperson Priority One

Key Points

·

Mr Nigel Tutt spoke to a Powerpoint presentation (see

attached).

Action

·

That staff provide Councillors with the Mayor’s letter to

Council-Controlled Orgnaisations/Priority One, requesting a 7% reduction in

funding from Council in the upcoming financial year.

|

|

Committee Resolution CDC/25/1/1

Moved: Cr

Rod Taylor

Seconded: Cr Hautapu Baker

That the City Delivery Committee

receives the Priority One Annual Report 2023/24

Carried

|

|

Attachments

1 Priority

One Annual Report Presentation

|

TIMESTAMP 40.05

|

8.2 7th Avenue

cul-de-sac Post-Implementation Review

|

|

Staff

Mike Seaborne, Head of Transport

Nic Johansson, General Manager

Infrastructure

Key Points

·

The Head of Transport provided the Committee with a summary of

the report.

|

|

Recommendations

Moved: Cr

Martin Rozeboom

Seconded: Cr Hautapu Baker

That the City Delivery Committee:

(a) Receives the report "7th

Avenue cul-de-sac Post-Implementation Review ".

(b) Notes the survey responses

indicate majority support for retaining the Seventh Avenue cul-de-sac

(c) Notes the survey feedback

indicates high interest in increasing parking in the area and provides

direction on whether further investigation is required.

(d) Notes the survey feedback

indicates interest in changes to Bus lanes/Bus stop and endorses Council

providing additional signage to demarcate short term parking on Cameron Road.

(e) Approves Option 1: Do Minimum.

By adoption of this report and the survey feedback as satisfying the

“engagement” requirement of Committee Resolution PPM3/24/3.

A PROCEDURAL MOTION WAS PROPOSED:

Moved: Cr

Glen Crowther

Seconded: Cr Jen Scoular

(a)

That the report lie on the table and staff provide Councillors with an

updated report

with more options.

In

Favour: Crs Jen Scoular (Chair)

Glen Crowther, Rick Curach, Steve Morris, Rod Taylor and Mayor Mahé

Drysdale

Against: Crs

Marten Rozeboom and Kevin Schuler

Abstained: Cr

Hautapu Baker

carried 6/2

|

|

Committee Resolution CDC/25/1/2

Moved: Cr

Glen Crowther

Seconded: Deputy Mayor Jen Scoular

That the City Delivery Committee:

(a)

Lets the report lie on the table and that

staff provide Councillors with an updated report with more options.

Carried

Reasons for the report to lie on

the table:

·

More options requested for the 7th Avenue cul-de-sac and

associated costs;

·

Additional parking on 6th Ave, 7th Ave, and 8th Ave and

associated costs; and

·

The Communications and Engagement approach needs to be finalised.

|

At 10.44am the meeting adjourned.

At 10.50am the meeting reconvened.

TIMESTAMP 1.22.52

|

8.3 Mount

Maunganui Hot Pools Opening Hours

|

|

Staff Alison

Law. Manager: Spaces and Places

Barbara

Dempsey, General Manager: Community Services

External Tina Harris-Ririnui, Bay Venues Limited

Action

·

That Councillors be provided with robust financial breakdowns

in all decision reports.

|

|

Committee Resolution CDC/25/1/3

Moved: Mayor

Mahé Drysdale

Seconded: Cr Hautapu Baker

That the City Delivery Committee:

(a) Receives the report

"Mount Maunganui Hot Pools Opening Hours".

(b) Approves Option 1 of the

report, that the Mount Hot Pools weekday opening hours remain at 7am.

Carried

Cr

Rod Taylor voted against the resolution.

|

TIMESTAMP 1.38.15

|

8.4 Links Avenue

Proposal to Conclude the Trial

|

|

Staff

Karen Hay, Acting Manager Safety and Sustainability

Mike Seaborne, Head of Transport

Nic Johansson, General Manager Infrastructure

|

|

Committee Resolution CDC/25/1/4

Moved: Mayor

Mahé Drysdale

Seconded: Deputy Mayor Jen Scoular

That the City Delivery Committee:

(a) Receives the report

"Links Avenue Proposal to Conclude the Trial".

(b) Approves the conclusion of

the Links Avenue trial in line with the current operating model.

(c) Confirms restricted hours are

Monday to Friday, 7.30 am - 9am and 2.30pm - 4pm (including public holidays

and school holidays). There are no restrictions outside of these hours.

(d) Notes residents

and visitors can avoid a fine during the restricted hours by:

(i) Entering

and exiting Links Avenue from the same point at any time (e.g. enter Links

Avenue through Concord Avenue and exit through Concord Avenue).

(ii) Ensuring

at least 15 minutes have passed between entering and exiting Links Avenue

from different roads (e.g. enter through Concord Avenue and exit through Golf

Road).

Carried

|

At 11.44am the meeting adjourned.

At 12.05pm the meeting reconvened.

TIMESTAMP 2.40.00

|

8.5 Mainstreets'

Monitoring Report for the Period 1 July to 31 December 2024

|

|

Staff

Kendyl Sullivan, City Partnerships Specialist

Gareth Wallis, General

Manager: City Development & Partnerships

External Each

Mainstreet organisation spoke to a PowerPoint presentation (see attached).

1. Greerton

Village Community Association – Current Chair Rebecca Busby and

incoming Chair Cameron Templer.

2. Mainstreet

Tauranga – Genevieve Whitson, Manager.

3. Mount

Business Association – Harris Williams, Business Improvement Manager.

4. Papamoa

Unlimited – Julia Manktelow, Event Contractor

|

|

Committee Resolution CDC/25/1/5

Moved: Deputy

Mayor Jen Scoular

Seconded: Cr Rod Taylor

That the City Delivery Committee:

(a) Receives the report

"Mainstreets' Monitoring Report for the Period 1 July to 31 December

2024".

(b) Receives the

Papamoa Unlimited Report to 31 December 2024.

(c) Receives the

Greerton Village Community Association Report to 31 December 2024.

(d) Receives the Mainstreet Tauranga Report to 31 December

2024.

(e) Receives the Mount Business Association Report

to 31 December 2024.

Carried

|

|

Attachments

1 Greerton

Village Community Association Presentation

2 Mainstreet

Tauranga Presentation

3 Mount

Business Association Presentation

4 Papamoa

Unlimited Presentation

|

TIMESTAMP 3.23.03

|

8.6 Tauranga

Business Chamber - Annual Report for SEBA Funding and Chamber Update

|

|

Staff Lisa

Gilmour, City Partnership Specialist

Gareth

Wallis, General Manager: City Development & Partnerships

External

Matt Cowley, Chief Executive, Tauranga Business Chamber

Roz Irwin, Head of Growth & Innovation, Tauranga Business Chamber

Key Points

·

Mr Matt Cowley and Ms Roz Irwin spoke to a PowerPoint

presentation (see attached).

|

|

Committee Resolution CDC/25/1/6

Moved: Cr

Rick Curach

Seconded: Cr Marten Rozeboom

That the City Delivery Committee:

(a) Receives

the Tauranga Business Chamber report to Tauranga City Council “2023 /

24 Report”.

Carried

|

|

Attachments

1 Tauranga

Business Chamber Presentation

|

TIMESTAMP 3.34.15

|

8.7 Six Monthly

Treasury Strategy Update

|

|

Staff

Sheree Covell, Treasury & Compliance Finance Manager

Paul

Davidson, Chief Financial Officer

|

|

Committee Resolution CDC/25/1/7

Moved: Deputy

Mayor Jen Scoular

Seconded: Mayor Mahé Drysdale

That the City Delivery Committee:

(a) Receives the report "Six

Monthly Treasury Strategy Update ".

(b) Notes that all aspects of the

Treasury policy have been met.

(c) Approves that all future borrowing, investing and hedging

adhere to the Treasury Policy.

Carried

|

TIMESTAMP 3.43.00

|

8.8 Half Year

Financial Performance Monitoring

|

|

Staff

Kathryn Sharplin, Manager, Finance

Tracey Hughes, Financial Insights & Reporting Manager

Susan Braid, Finance

Lead Projects Assurance

|

|

Committee Resolution CDC/25/1/8

Moved: Cr

Kevin Schuler

Seconded: Cr Hautapu Baker

That the City Delivery Committee:

(a) Receives the report

"Half Year Financial Performance Monitoring".

Carried

|

At 1.24pm the meeting adjourned.

At 1.52 pm the meeting reconvened.

TIMESTAMP 4.25.00

|

8.9 Six-Monthly

Non-Financial Performance Report 2024/25

|

|

Staff

Jeremy Boase, Manager: Strategy & Corporate Planning

Nic Johannson, General Manager, Infrastructure

Sarah Omundsen, General Manager: Regulatory & Compliance

|

|

Committee Resolution CDC/25/1/9

Moved: Deputy

Mayor Jen Scoular

Seconded: Cr Hautapu Baker

That the City Delivery Committee:

(a) Receives the report

"Six-Monthly Non-Financial Performance Report 2024/25".

Carried

|

TIMESTAMP 4.36.40

|

8.10 Tauranga Māori

Business Association - Half Year Update

|

|

Staff

Gareth Wallis, General Manager: City Development & Partnerships

|

|

Committee Resolution CDC/25/1/10

Moved: Cr

Hautapu Baker

Seconded: Cr Rod Taylor

That the City Delivery Committee:

(a) Receives

the report "Tauranga Māori Business Association - Half Year

Update”

Carried

|

The Chair advised item 8.14 would

be taken before item 8.11.

TIMESTAMP 4.38.50

|

8.14 January 2025 Capital

Programme Report

|

|

Staff

Jeremy Boase, Manager: Strategy & Corporate Planning

Kelvin Hill, Manager: Water Infrastructure Outcomes

Amanda Davies, Manager: Spaces and Places Project Outcomes

Alastair McNeil,

General Manager: Corporate Services

Nic Johannson,

General Manager, Infrastructure

Actions

·

That Cr Scoular be provided with the scope of the five most

significant open procurements, being the construction of the Waterfront

Central Plaza, Wharewaka Pavilion, Tarikura Drive Upgrade and Traffic Signals

Maintenance and Renewals, before the procurement happened.

·

That Councillors be provided with information and the work done

to date on the re-development of Bay Park.

·

That Councillors be provided with information on the three

separate improvement budgets, being the Te Manawataki o Te Papa budget, the

City Centre Development budget and the Streetscapes budget.

|

|

Committee Resolution CDC/25/1/11

Moved: Cr

Marten Rozeboom

Seconded: Cr Kevin Schuler

That the City Delivery Committee:

(a) Receives the report

"January 2025 Capital Programme Report".

Carried

|

TIMESTAMP 5.10.30

|

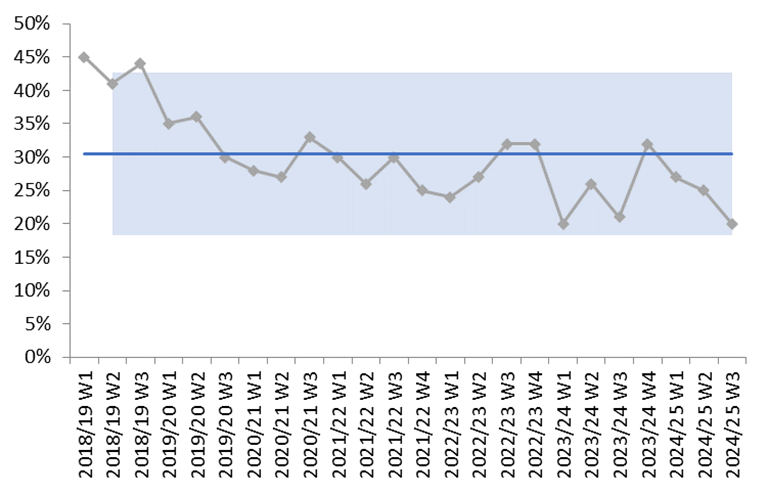

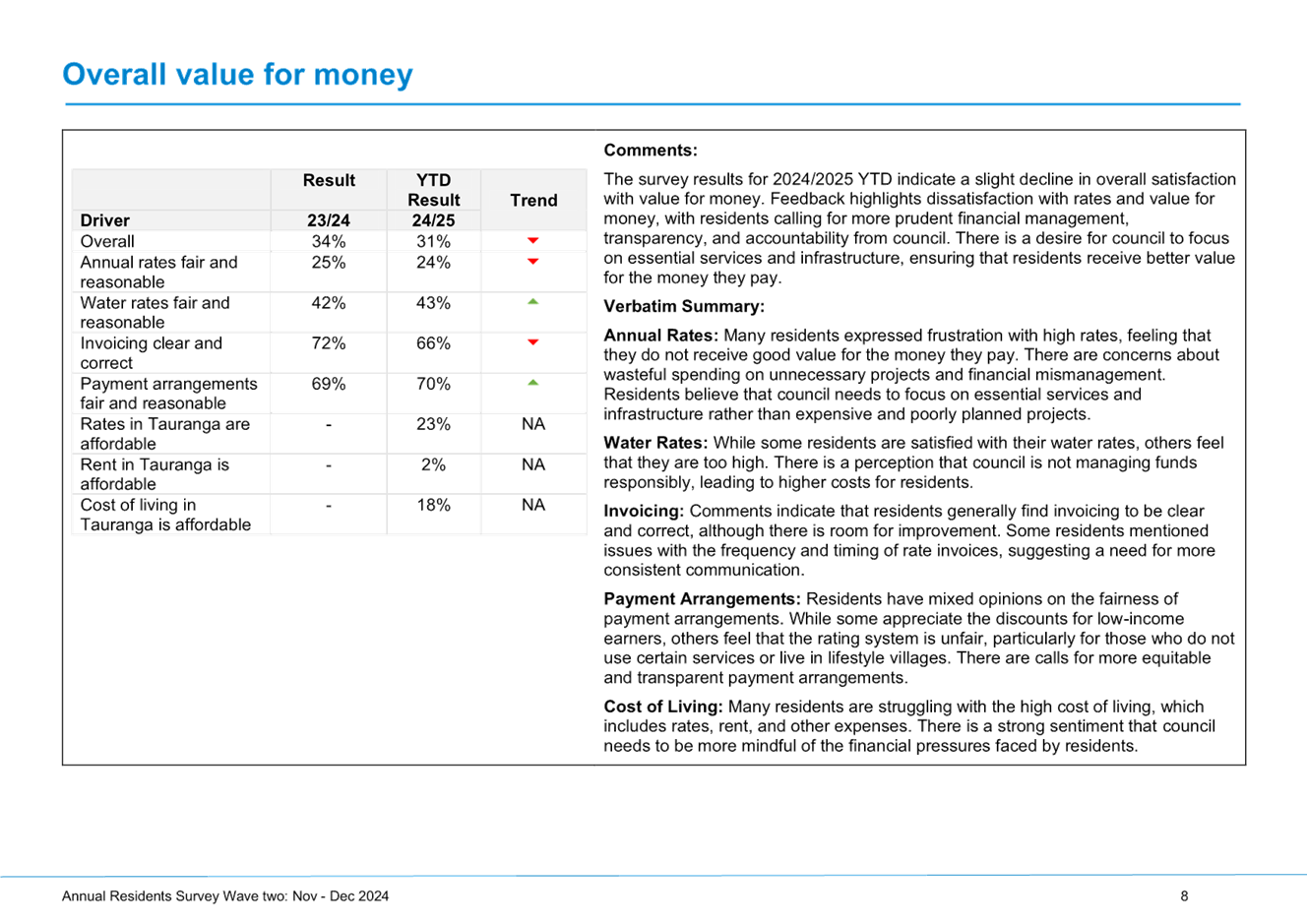

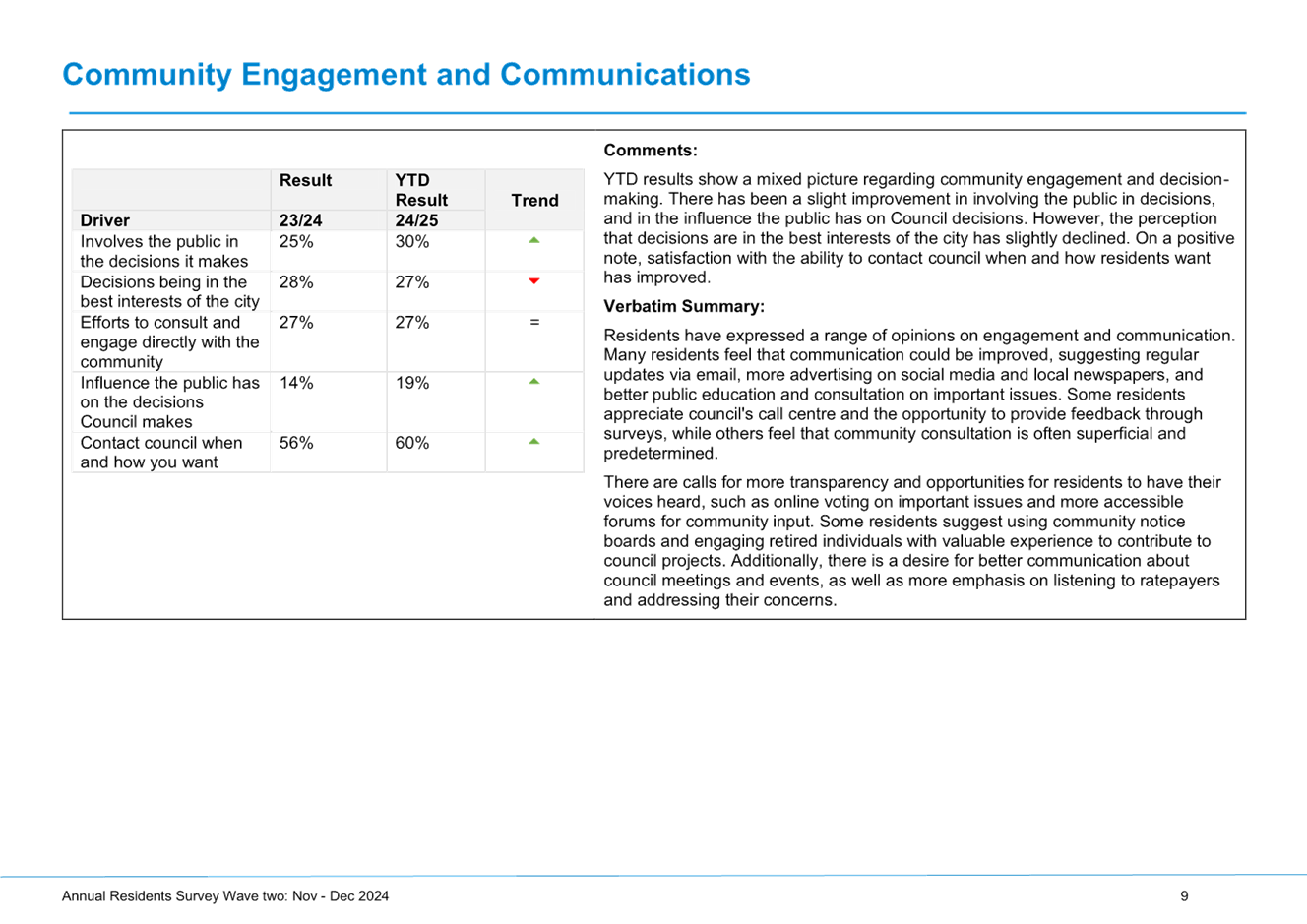

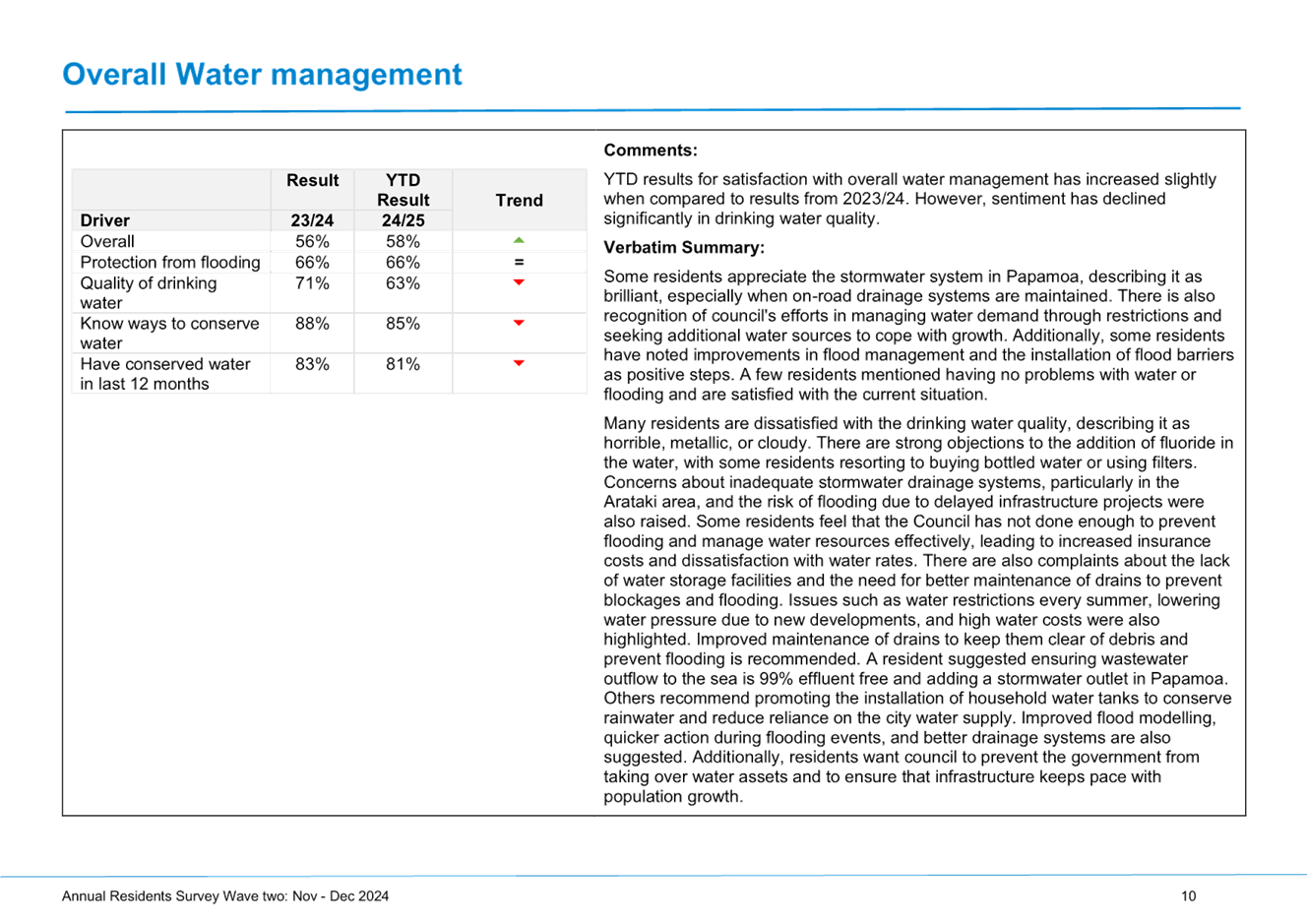

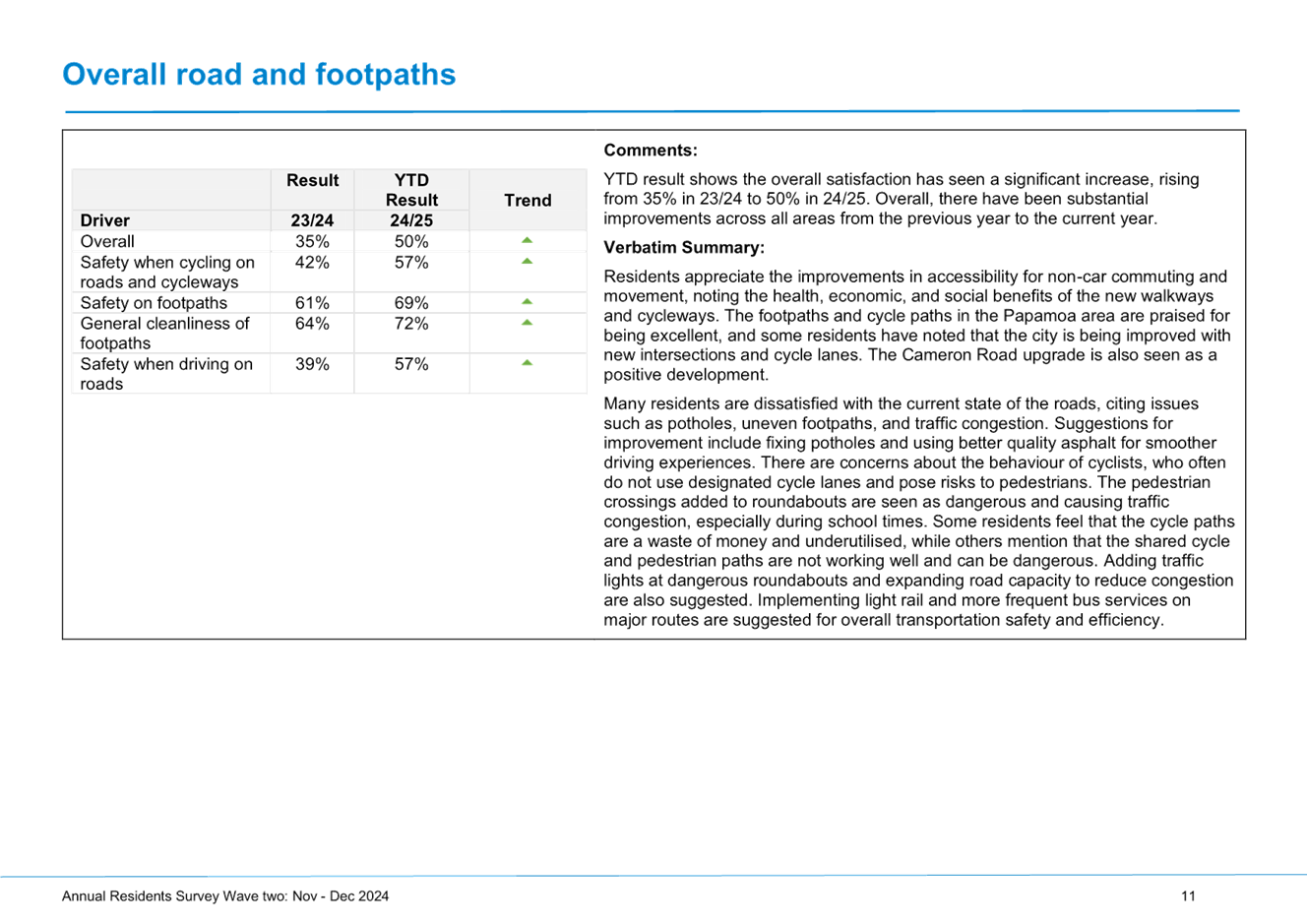

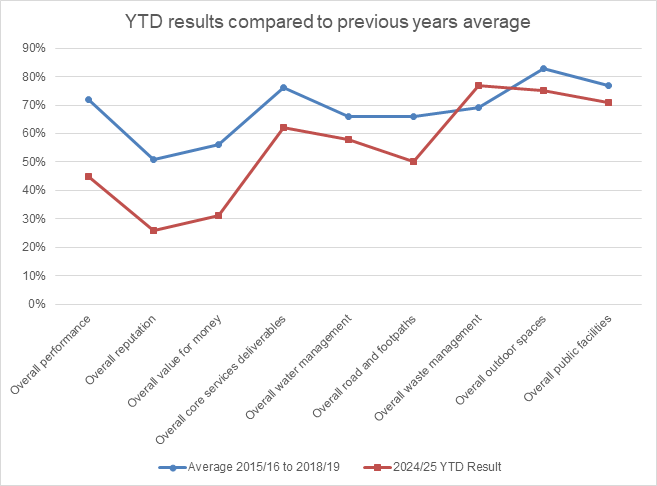

8.11 Annual Residents Survey

- Wave Two Results

|

|

Staff

Jeremy Boase, Manager: Strategy & Corporate Planning

|

|

Committee Resolution CDC/25/1/12

Moved: Deputy

Mayor Jen Scoular

Seconded: Mayor Mahé Drysdale

That the Community & Performance Committee:

(a) Receives the report

“Annual Residents Survey – Wave Two Results”.

Carried

|

TIMESTAMP 5.34.38

|

8.14 City Delivery Committee

Forward Work Plan 2025

|

|

Staff

Alastair McNeil, General Manager: Corporate Services

|

|

Committee Resolution CDC/25/1/13

Moved: Deputy

Mayor Jen Scoular

Seconded: Mayor Mahé Drysdale

That the City Delivery Committee:

(a) Receives the report

"City Delivery Committee Forward Work Plan 2025" and that work

continues on the plan to refine it.

Carried

|

9 Discussion

of late items

Nil

10 Closing

karakia

Cr Kevin Schuler closed the meeting with a karakia.

The meeting closed at 3.06pm.

The minutes of this meeting were confirmed as a true and

correct record at the City Delivery Committee meeting held on 7 April 2025.

......................................................

Deputy Mayor Jen

Scoular

CHAIRPERSON

8 Declaration

of conflicts of interest

9 Business

9.1 Film

Bay of Plenty - Update

File

Number: A17437819

Author: Lisa

Gilmour, City Partnership Specialist

Authoriser: Gareth

Wallis, General Manager: City Development & Partnerships

Purpose of the Report

1. For

Film Bay of Plenty to report to Council on their activities for the period 1

July 2024 to 18 March 2025, and to provide an update on the partnership

funding.

|

Recommendations

That the City Delivery

Committee:

(a) Receives

the report "Film Bay of Plenty - Update".

|

Executive Summary

2. Film

Bay of Plenty receives funding from Tauranga City Council, via a formal

Partnership Agreement, as detailed below:

|

Period

|

Amount (excl.

GST)

|

|

1 July 2024- 30 June

2025

|

$102,500

|

|

1 July 2025- 30 June

2026

|

$105,011

|

|

1 July 2026- 30 June

2027

|

$107,318

|

|

Total

|

$314,829

|

3. This

funding is granted for Film Bay of Plenty to undertake the delivery of services

in support of the development of the film sector in Tauranga.

4. Film Bay of Plenty

have provided an update report to Council for the first tranche of funding

under the Partnership Agreement. This report reflects the eight-month period

July 2024 to March 2025. This report provides information on progress and the

scope of work undertaken by the organisation.

5. Film Bay of Plenty

are on track to meet the Key Performance Indicators outlined in the Partnership

Agreement.

Background

6. Film Bay of

Plenty, Ngā Auaha Whakaari o Te Waiariki:

· is

a Regional Film Office, with the mission to stimulate regional economic growth

by attracting, facilitating, and marketing screen productions; developing the

film sector for regional business; and maximising opportunities for regional

film professionals; and

· grows,

strengthens and supports the screen sector in the Bay of Plenty. This includes

film, television, games, animation, high-end TV, branded-content,

vloggers/influencers, VFX, immersive tech and marketing and communications.

7. The following Key

Performance Indicators are being reported:

|

Description of Annual

Deliverables

|

|

Objective

|

Annual Key

Performance Indicators and Targets

|

|

Attract and facilitate

national and international productions to promote Tauranga and the Bay of

Plenty as a film-friendly environment.

|

· Service a

minimum of five national or international enquiries, providing relevant,

professional, and high-quality location options and information to their

productions.

· Support and

collaborate with Regional Film Office of NZ (RFONZ) and NZ Film Commission,

marketing Tauranga and the Bay of Plenty Internationally.

· Facilitate the

production of at least one TV mini-series or 1 NZ Feature films that use

Tauranga crew and / or Tauranga locations.

· Utilise the new

regional showreel to promote Tauranga and the Bay of Plenty to the national

and international sector.

· Attract at least

one scout for an international production to the Bay of Plenty, with Tauranga

featuring on their itinerary.

· Facilitate the

profiling of the Bay of Plenty region and industry through quarterly

interviews on show tools and Film Bay of Plenty’s social media, with at

least 4 of these features to be on Tauranga city centre based practitioners

or businesses.

· Collaborations

with Downtown Tauranga to promote local businesses that could work alongside

a screen media production.

· Film Bay of

Plenty monthly newsletters will include the promotion of screen media events

in the Tauranga city centre.

|

|

Grow and support local

productions.

|

· Identify and

support at least two productions with Tauranga involving local crew or

locations that are two strategic steps away from entering production.

· Ongoing support

for operational use of film app.

· Explore

innovation in the Film Industry.

|

|

Develop our crew base

through training and upskilling.

|

· Run two

Masterclass workshops for hand-picked professionals.

· Support industry

networking nights around the region.

· Facilitate

placements for Bay of Plenty Crew on productions shooting in the Bay.

· Facilitate

at least five apprenticeships for entry level crew from Tauranga.

· Facilitate

at least two attachments for mid-level crew from Tauranga.

|

8. The

Film Bay of Plenty update to Tauranga City Council can be found at Attachment

One. This report provides Film Bay of Plenty an opportunity to provide

information to Council on the scope and progress of their work.

9. The

Partnership Agreement was signed on 23 May 2024 for three years, with the

funding amounts detailed below:

|

Period

|

Amount (excl.

GST)

|

|

1 July 2024- 30 June

2025

|

$102,500

|

|

1 July 2025- 30 June

2026

|

$105,011

|

|

1 July 2026- 30 June

2027

|

$107,318

|

|

Total

|

$314,829

|

10. Further information about the

Film Bay of Plenty can be found here.

11. Their full annual report will

be provided to Council soon after 30 June 2025.

Six month report Summary

12. Film Bay of Plenty are on

track to meet the Key Performance Indicators outlined in the Partnership

Agreement.

Next Steps

13. The City Partnerships

Specialist will continue to support Film Bay of Plenty with their Partnership

Agreement.

Attachments

1. Film

BOP July 2024- March 2025 report - A17729139 ⇩

9.2 Local

Government Funding Agency - Half Year Report 2024/25

File

Number: A17123332

Author: Caroline

Lim, CCO Specialist

Kathryn Sharplin,

Manager: Finance

Authoriser: Gareth

Wallis, General Manager: City Development & Partnerships

Purpose of the Report

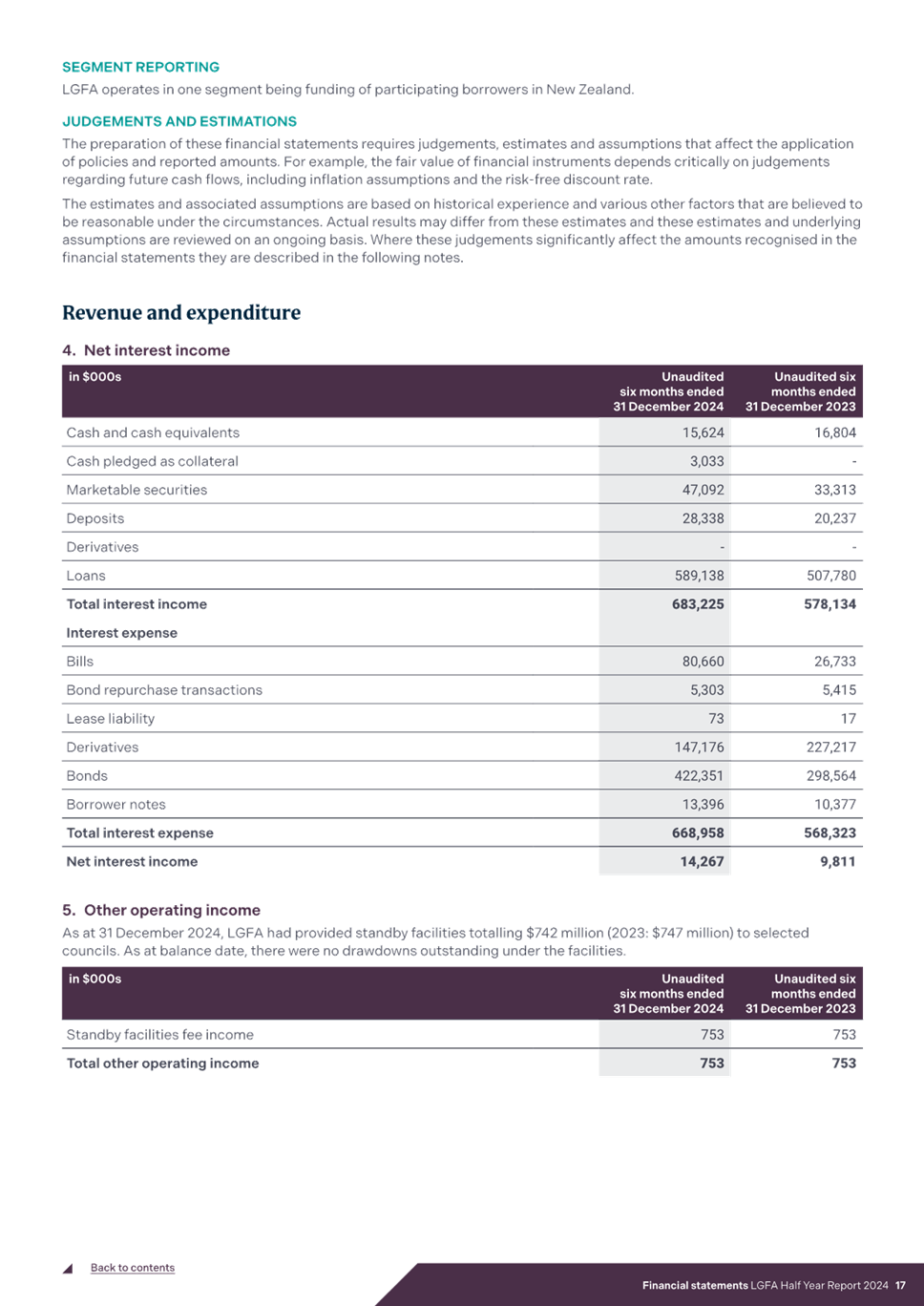

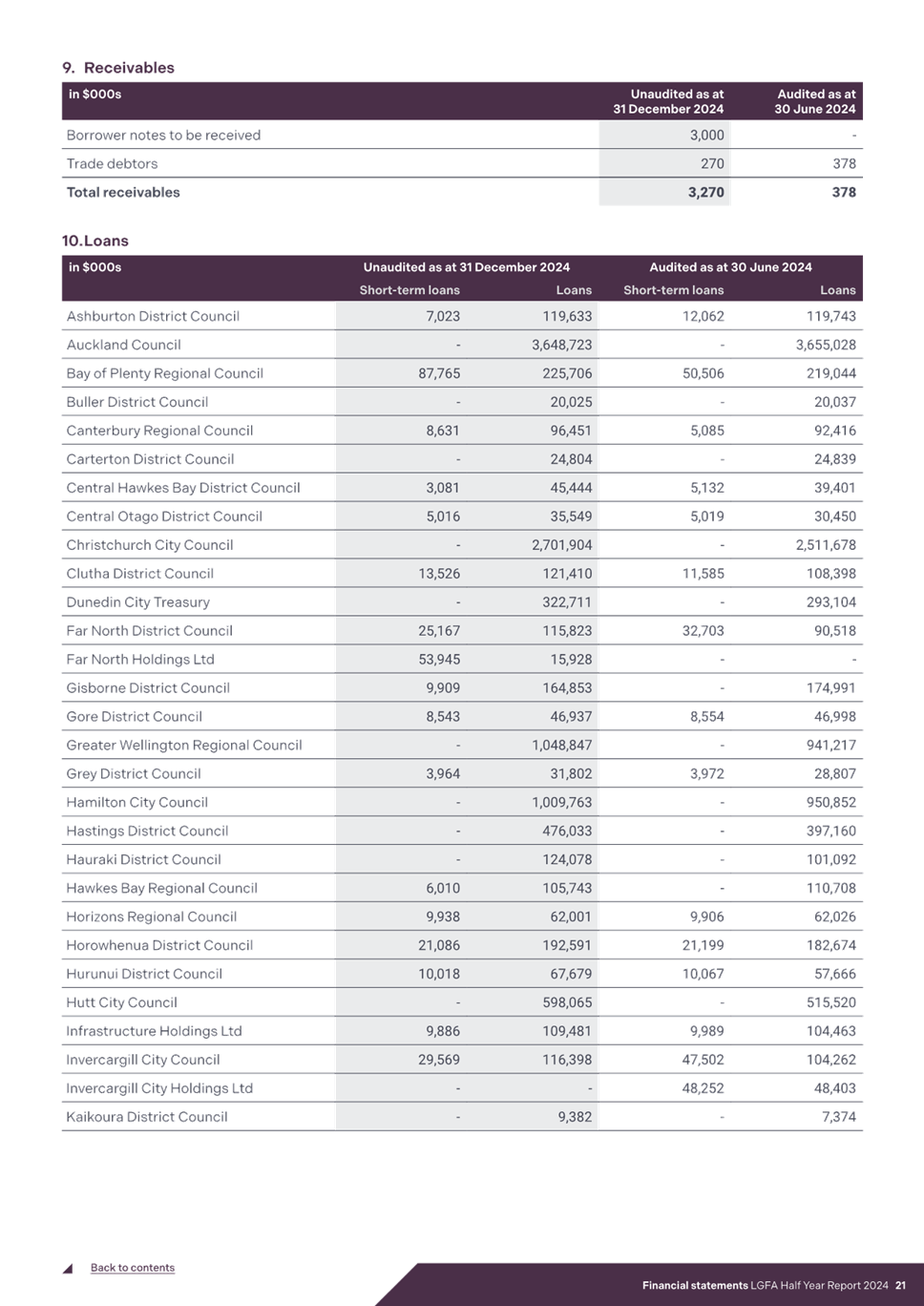

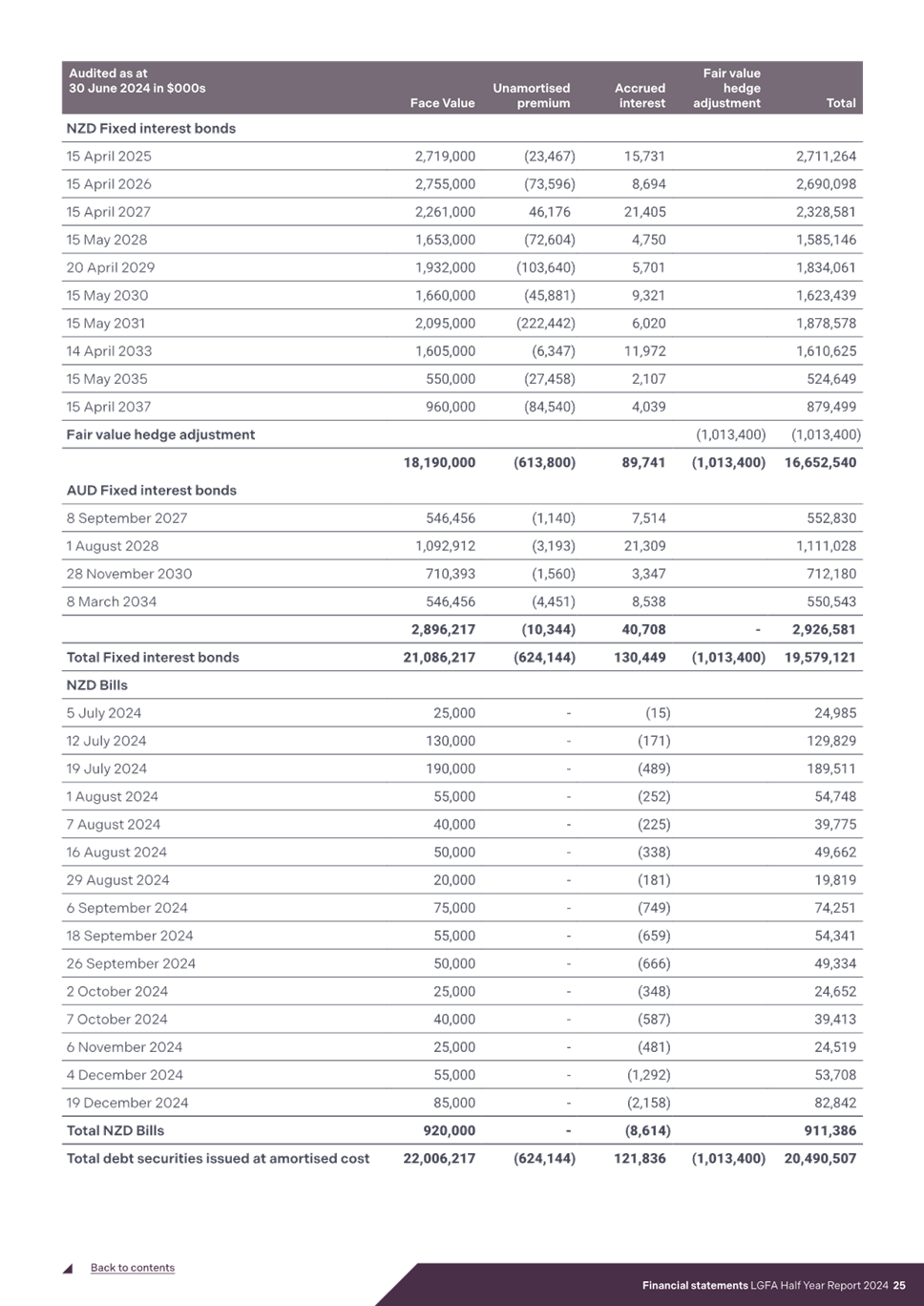

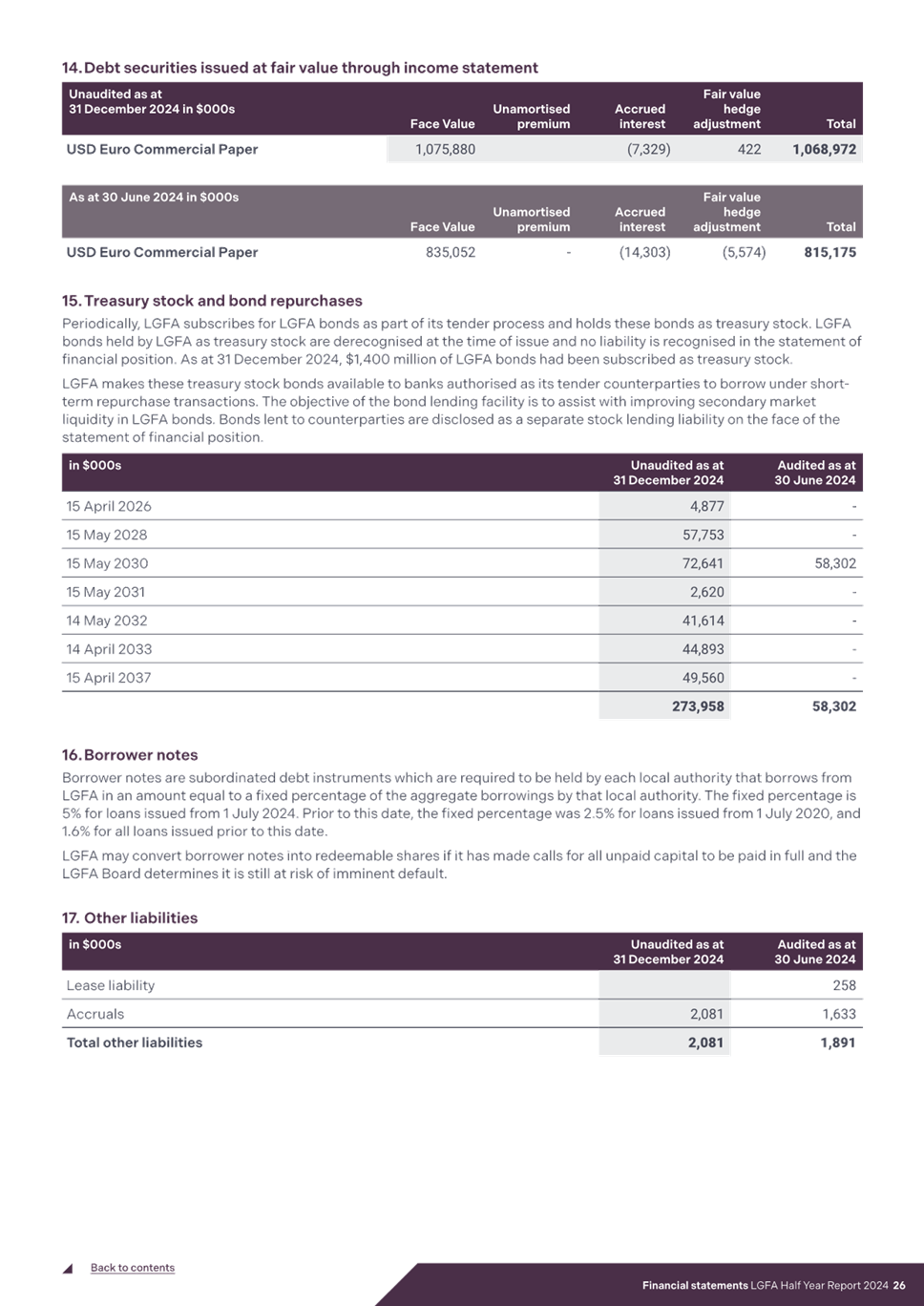

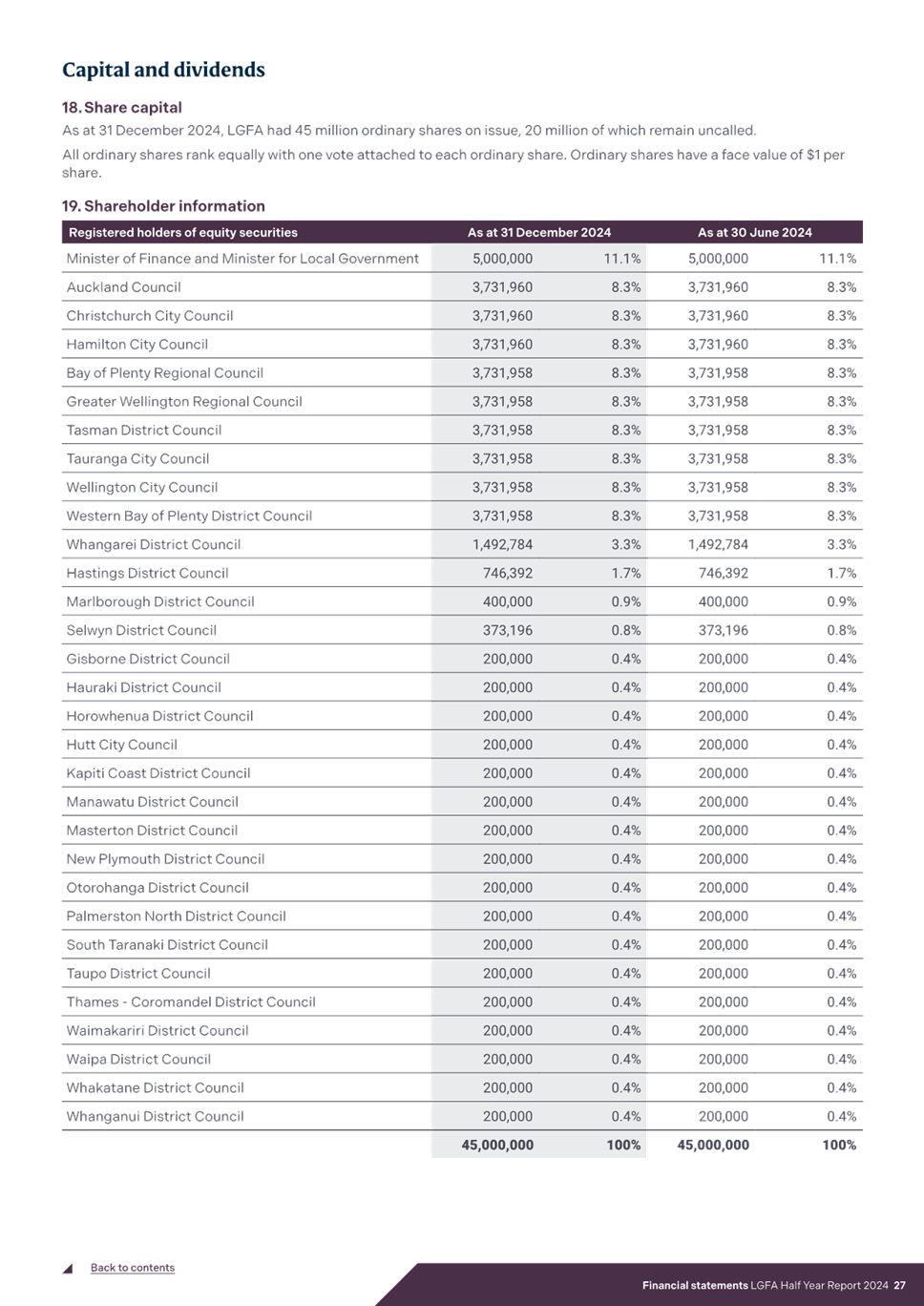

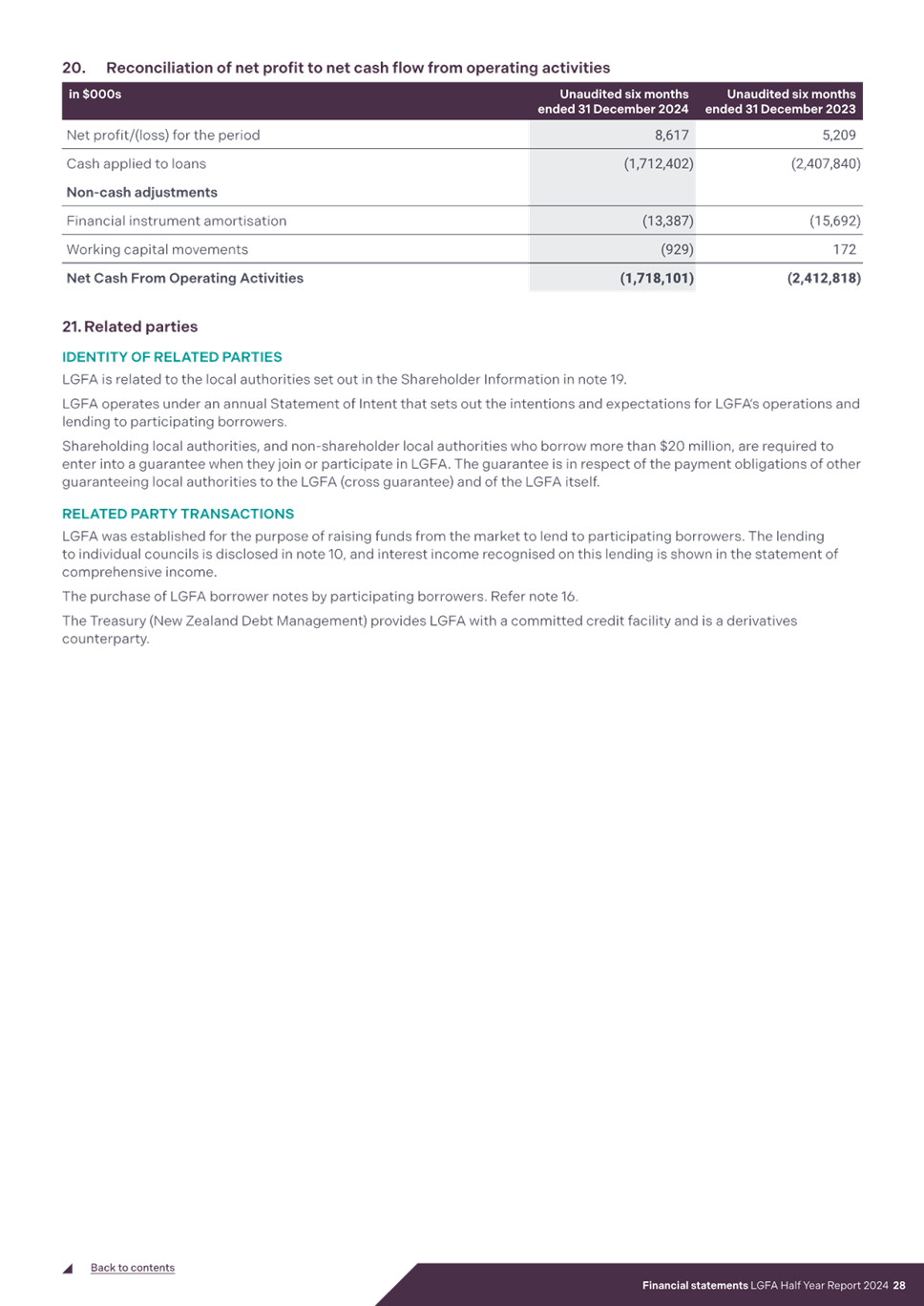

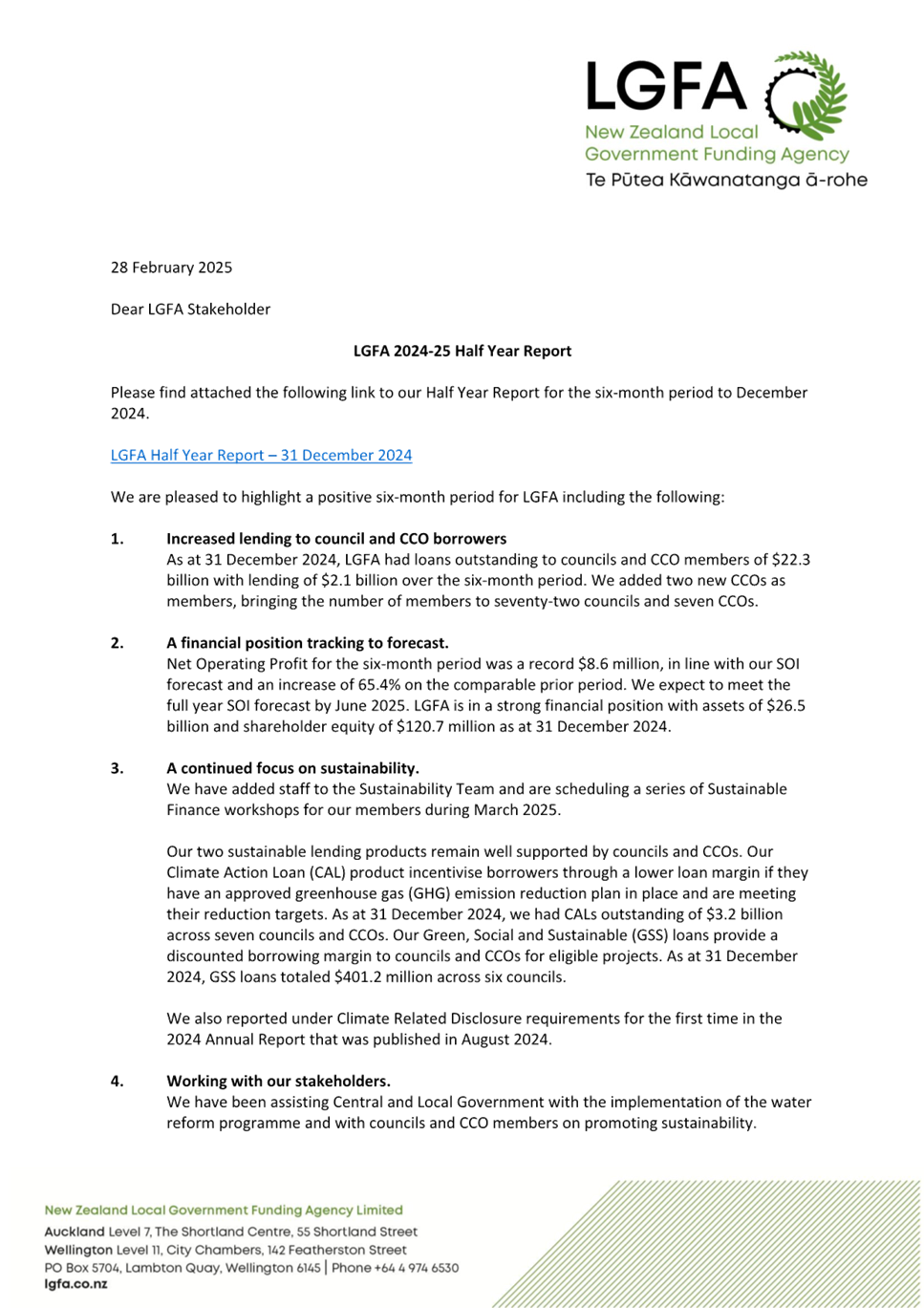

1. The

purpose of this report is for Tauranga City Council to formally receive the

Half Year Report 2024/25 from the Local Government Funding Agency (LGFA),

regarding its financial and non-financial performance for the 2024/25 financial

year, as required by the Local Government Act (2002).

|

Recommendations

That the City Delivery

Committee:

(a) Receives the report

"Local Government Funding Agency - Half Year Report 2024/25".

(b) Receives

the Local Government Funding Agency’s report on its performance for the

six months to 31 December 2024 (Attachment 1), and the Local Government

Funding Agency’s Letter to its shareholder members regarding its Half

Year Report (Attachment 2).

|

Executive Summary

2. Tauranga City

Council (TCC or Council) has seven Council-controlled Organisations (CCOs) that

are required to provide their half year reports to Council regarding their

financial and non-financial performance, against the activities, performance

measures and financials outlined in their Statements of Intent, and as required

by the Local Government Act (2002).

3. TCC’s 7

April 2025 City Delivery Committee meeting is the first suitable meeting for

the Half Year Report 2024/25 from LGFA to be formally received.

4. LGFA’s Half

Year Report summarises the financial and non-financial performance for the

period ended 31 December 2024 and is provided as Attachment 1, with a summary

in the main body of this report. The Half Year Report has met the legislative

and Statement of Intent requirements as outlined in the Local Government Act

(2002),

5. Similar

to the annual reports, a CCO’s Half Year Report is a key indicator of how

well it is performing. Overall for the six months to 31 December 2024, LGFA has

worked hard to ensure they continue to meet the expectations of its

shareholders by delivering on the Key Performance Indicators in the Statement

of Intent.

Key highlights of

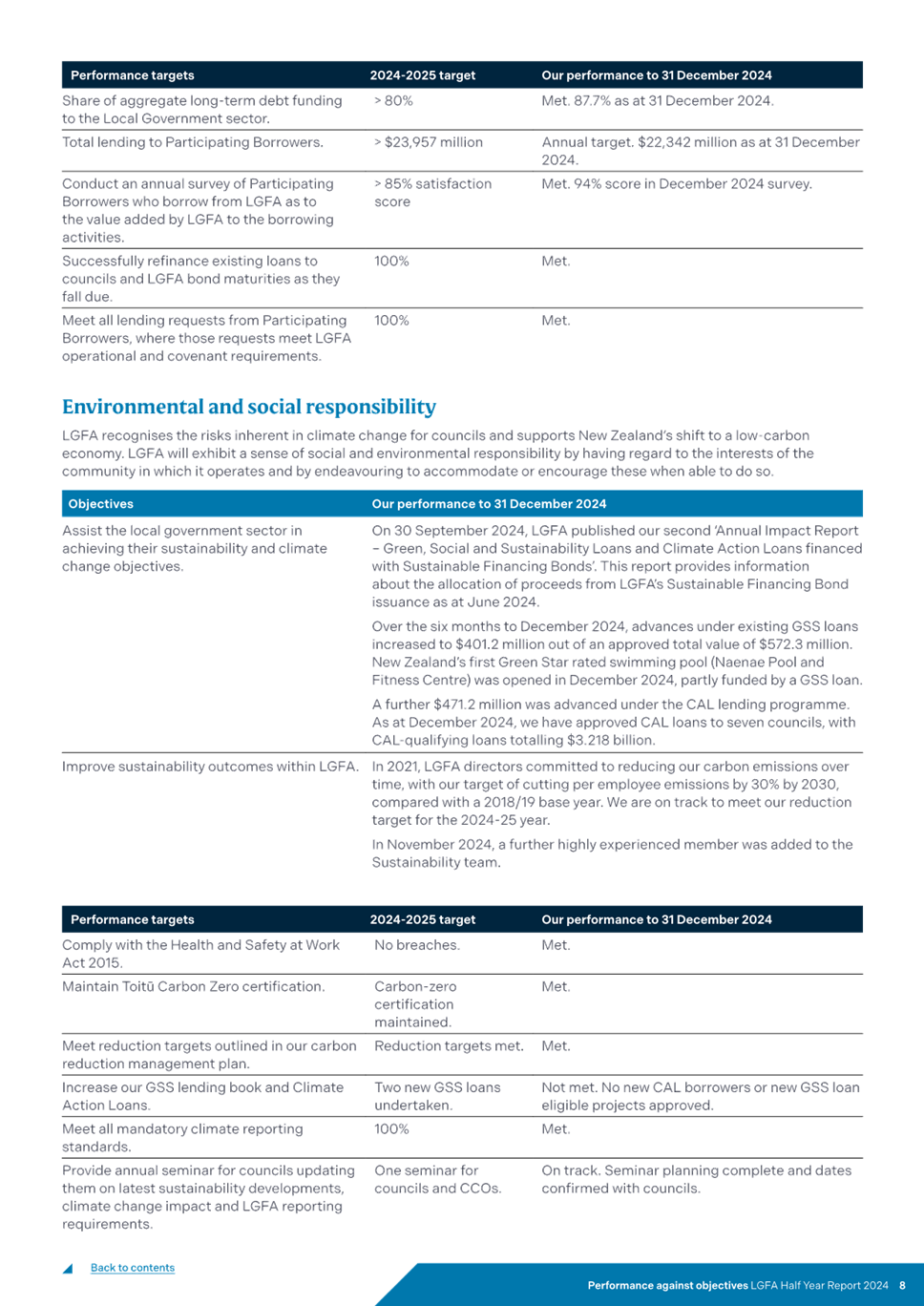

LGFA’s Half Year Report as of 31 December 2024:

6. This report

confirms LGFA’s strong financial position and its commitment to

supporting local government financing needs.

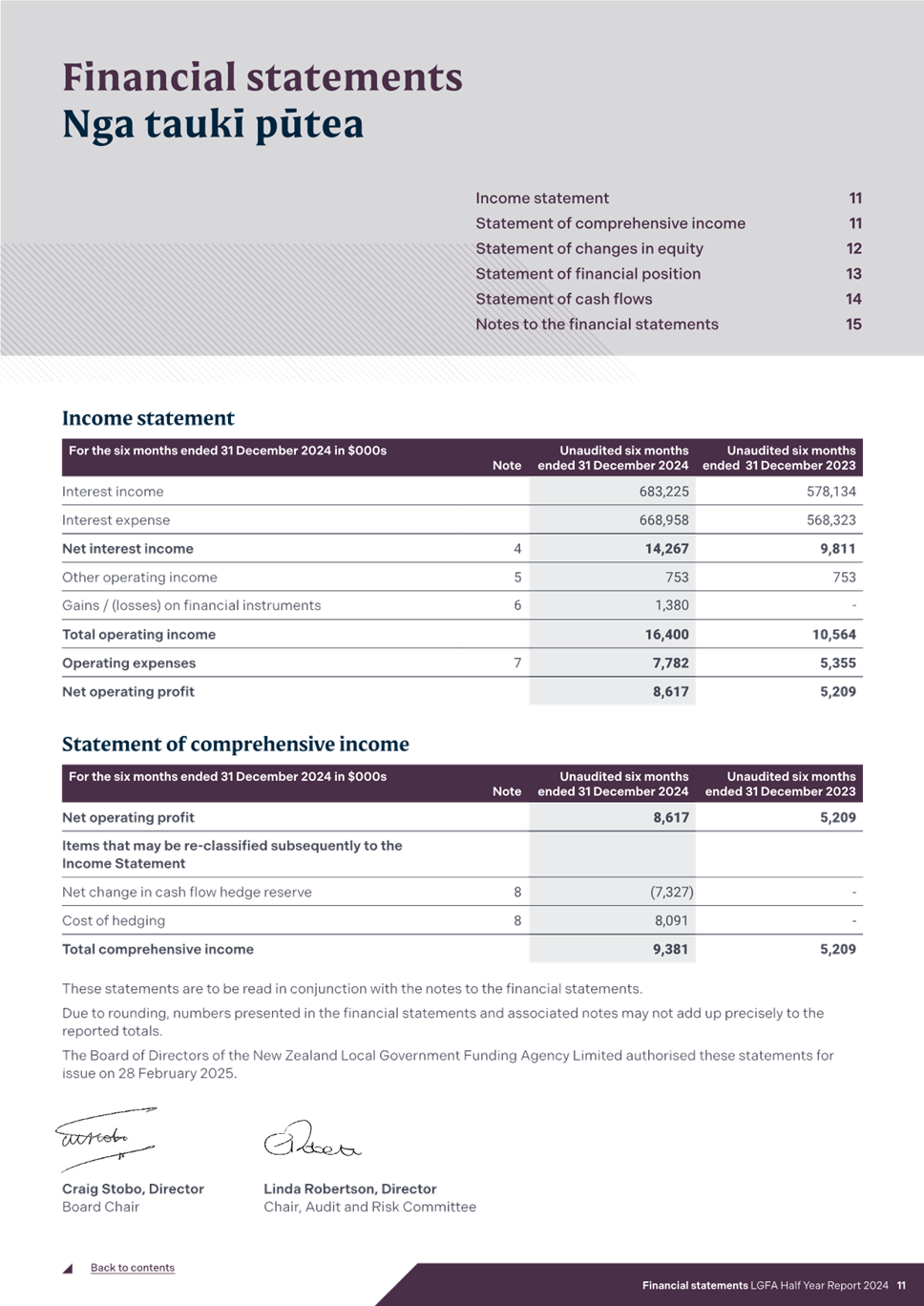

7. Financial

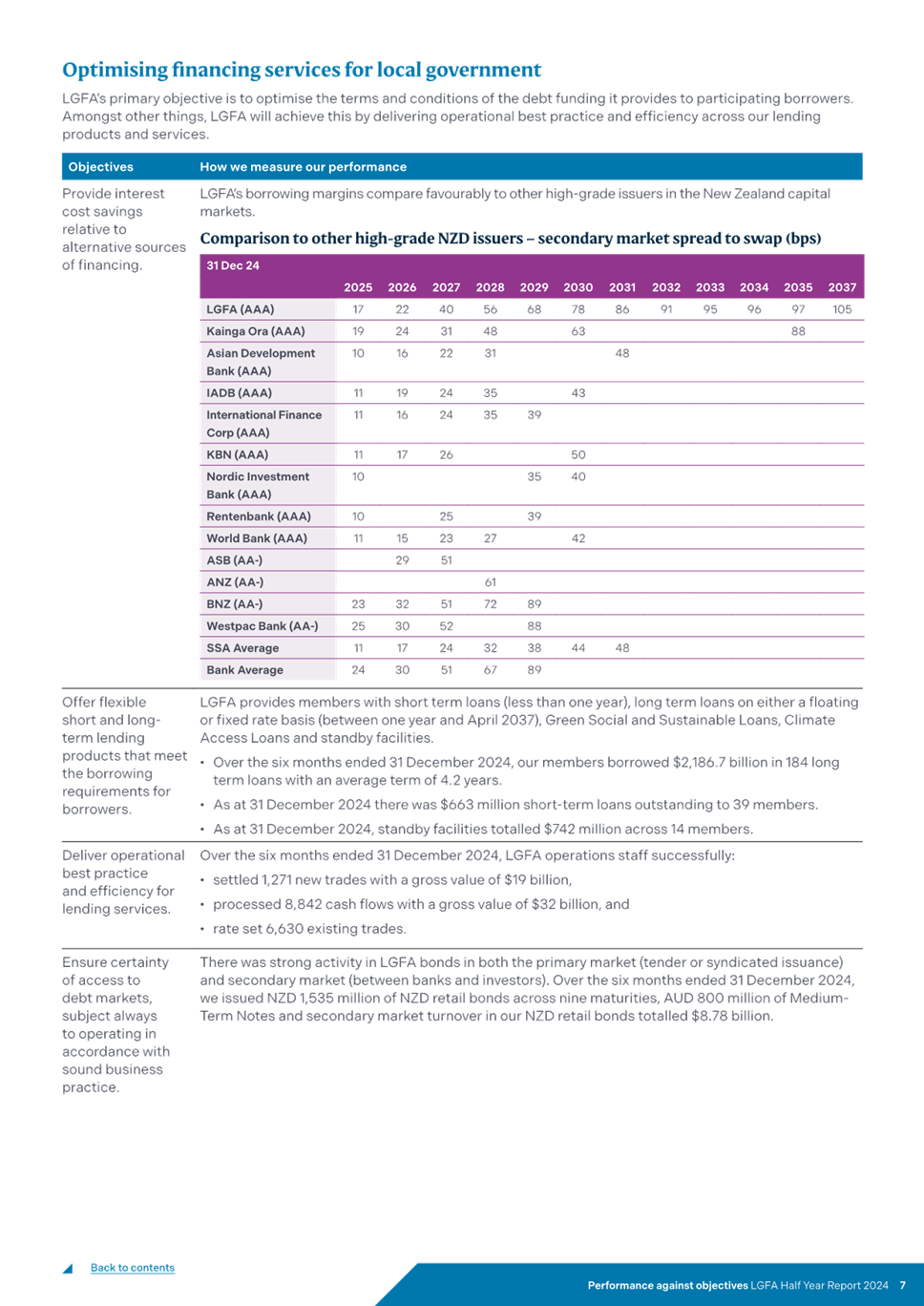

performance: LGFA reported a net operating profit of $8.6 million, which is a

65.4% increase from the previous year. Total assets stood at $26.5 billion,

with shareholder equity of $120.7 million.

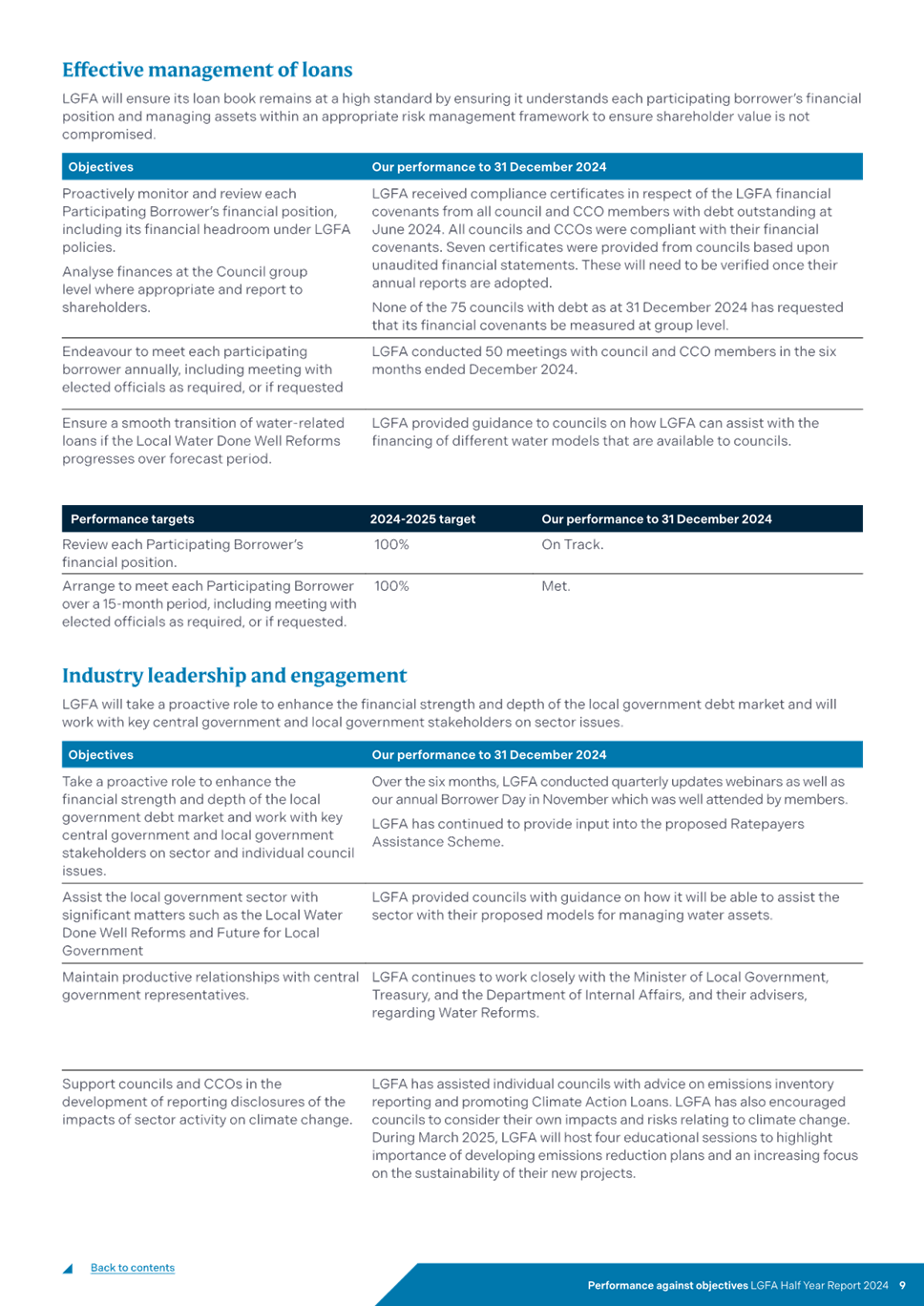

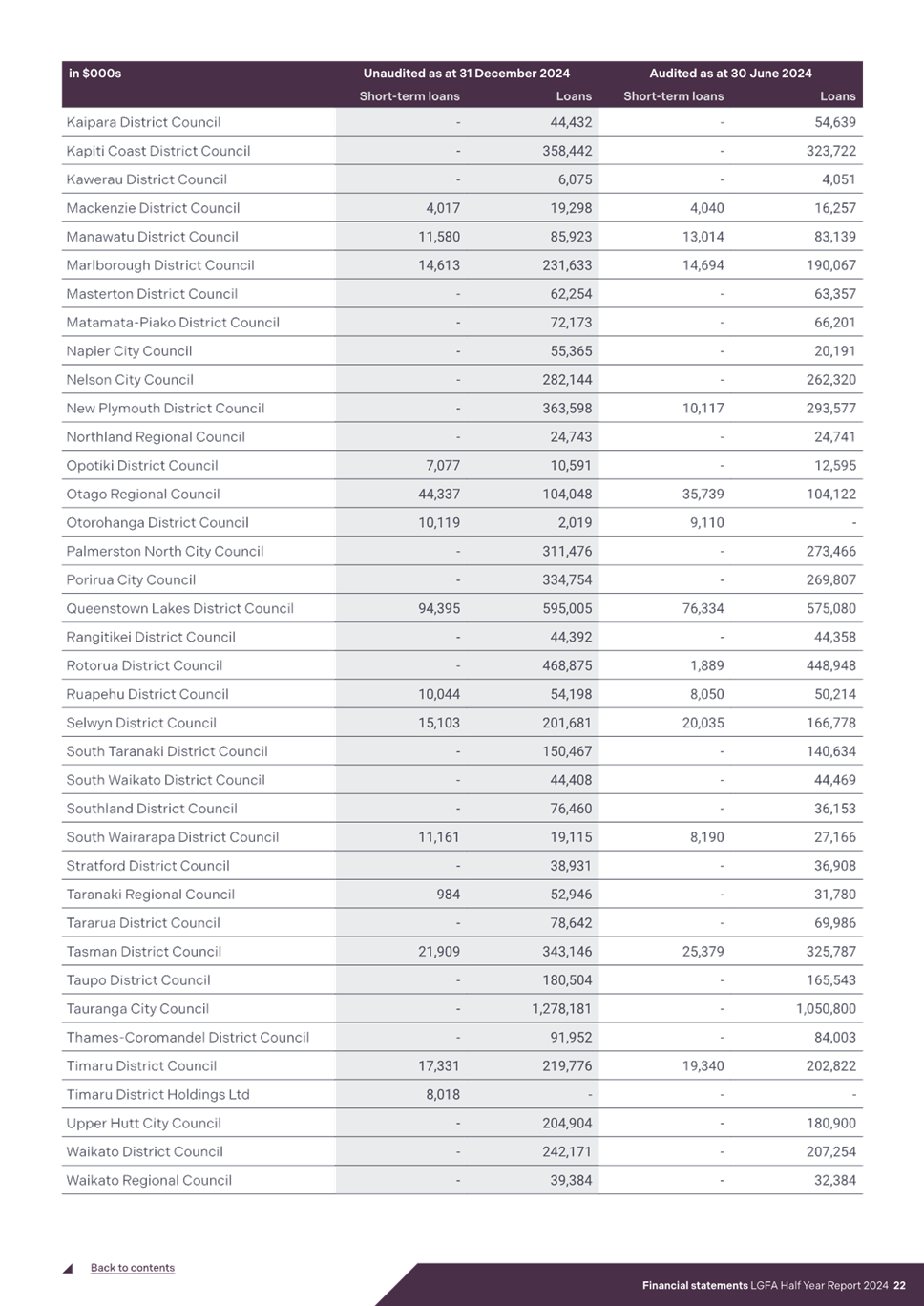

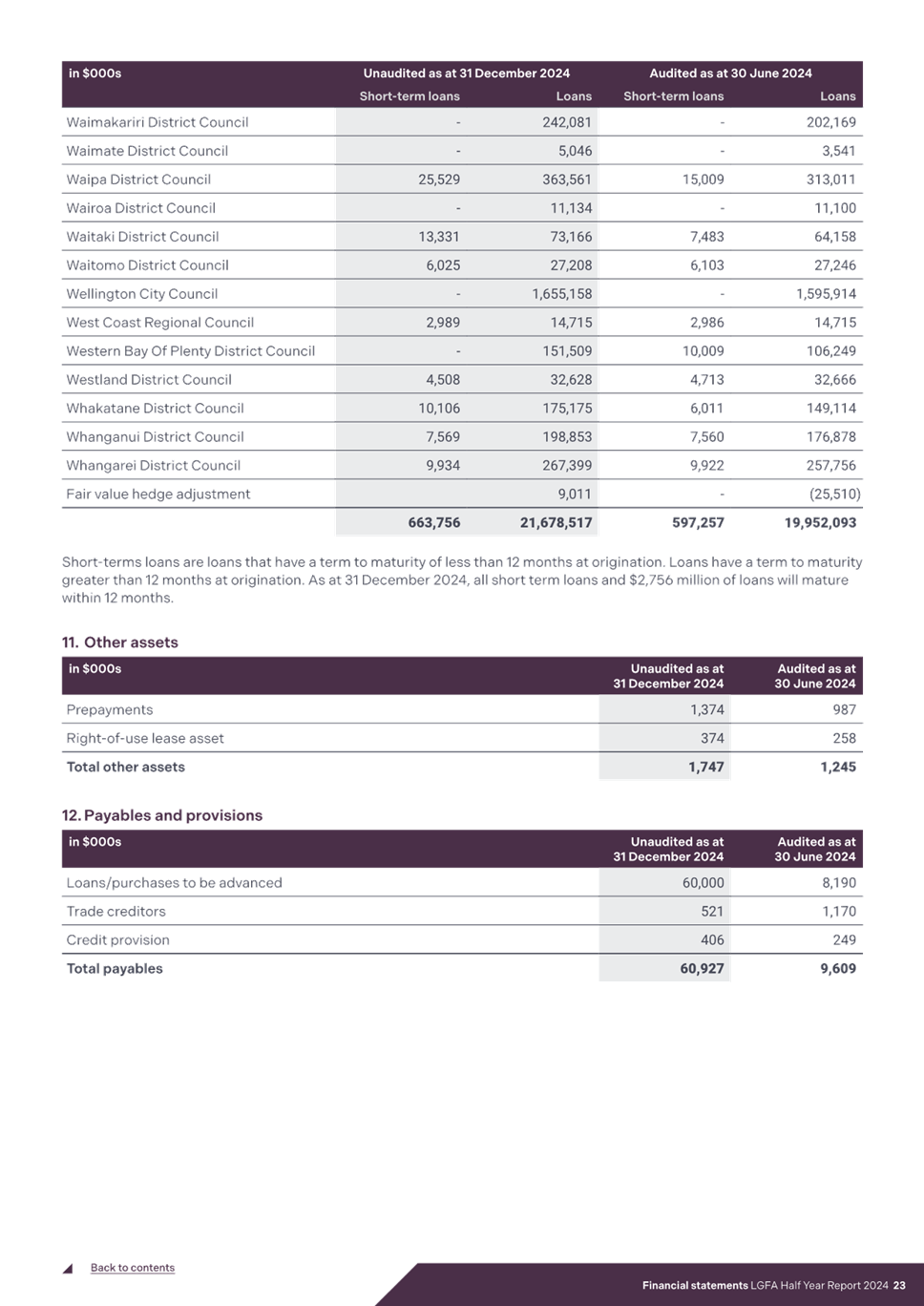

8. Lending: LGFA had

loans outstanding to 79 councils and CCO members totalling $22.3 billion. LGFA

issued $1.63 billion in NZD bonds.

9. Sustainability:

Continued focus on sustainable financing with $401.2 million in Green, Social,

and Sustainable Loans, and $3.217 billion in Climate Action Loans.

10. Engagement: Conducted 50

meetings with council and CCO members, and provided guidance on financing water

infrastructure and climate-related funding.

Background

Local

Government Funding Agency (LGFA)

11. Council holds an 8.3%

shareholding in LGFA, which has a total equity of $113 million.

12. The core purpose of LGFA is

benefiting communities through delivering efficient financing for the local

government sector. The LGFA has 31 shareholder members (including the

Government), 77 council members and seven CCO’s members. The LGFA’s

77 members represent all councils except for Chatham Islands District Council.

Summary of

LGFA’s performance on its financial and non-financial measures (based on

its Half Year Report)

13. The LGFA’s report for

the six months to 31 December 2024 was received by Council on 28 February and

is included as Attachment 1.

14. Similar to the annual

reports, a CCO’s Half Year Report is a key indicator of how well it is

performing. Overall for the six months to 31 December 2024, LGFA has worked

hard to ensure they meet the Key Performance Indicators set out in the Statement

of Intent. As summarised in the LGFA letter to Shareholders (Attachment 2),

LGFA continues to meet the expectations of its shareholders by delivering the

following:

a) Increased

lending to council and CCO members.

b) Financials

on track to forecast.

c) A

continued focus on sustainability.

d) Working with their stakeholders by

conducting 50 meetings with its council and CCO members.

15. LGFA’s focus remains on

adding value to the Local Government sector through:

a) Providing

cheaper loans.

b) Enabling

easier access to markets.

c) Providing

reliable financing.

d) Underpinning

confidence.

e) Encouraging

sustainability.

f) Enhancing

capital markets.

g) Being a centre of expertise.

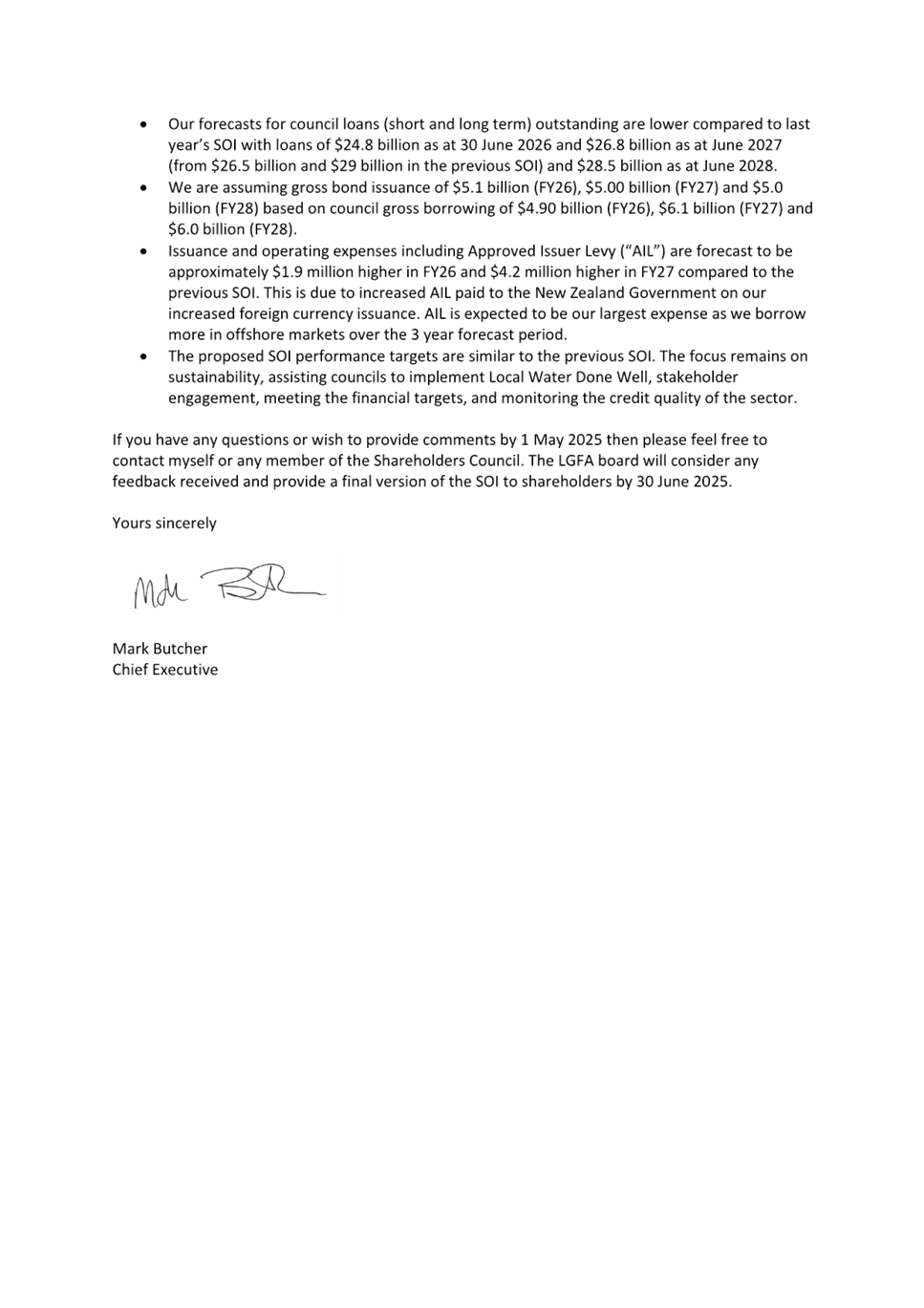

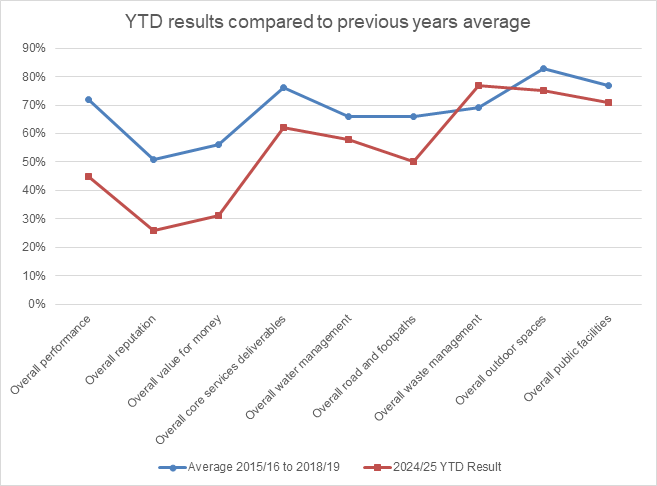

16. LGFA’s progress to date

shows all but one of its 21 KPIs have either been met or are on track to be

met, with one not currently on track being the number of new Green, Social and

Sustainability Loans, and the amount of council lending.

17. LGFA’s financials are

in a strong position for the six-month period to 31 December 2024, with a

record net operating profit of $8.6 million, which is in line with its SOI

forecast and an increase of 65.4% on the 2023 comparable period of $5.2 million.

18. The net operating profit was

$142k above budget with total operating income below budget by $14k, and total

operating expenses $156k under budget. LGFA is confident it will meet budget by

30 June 2025.

19. The single largest expense

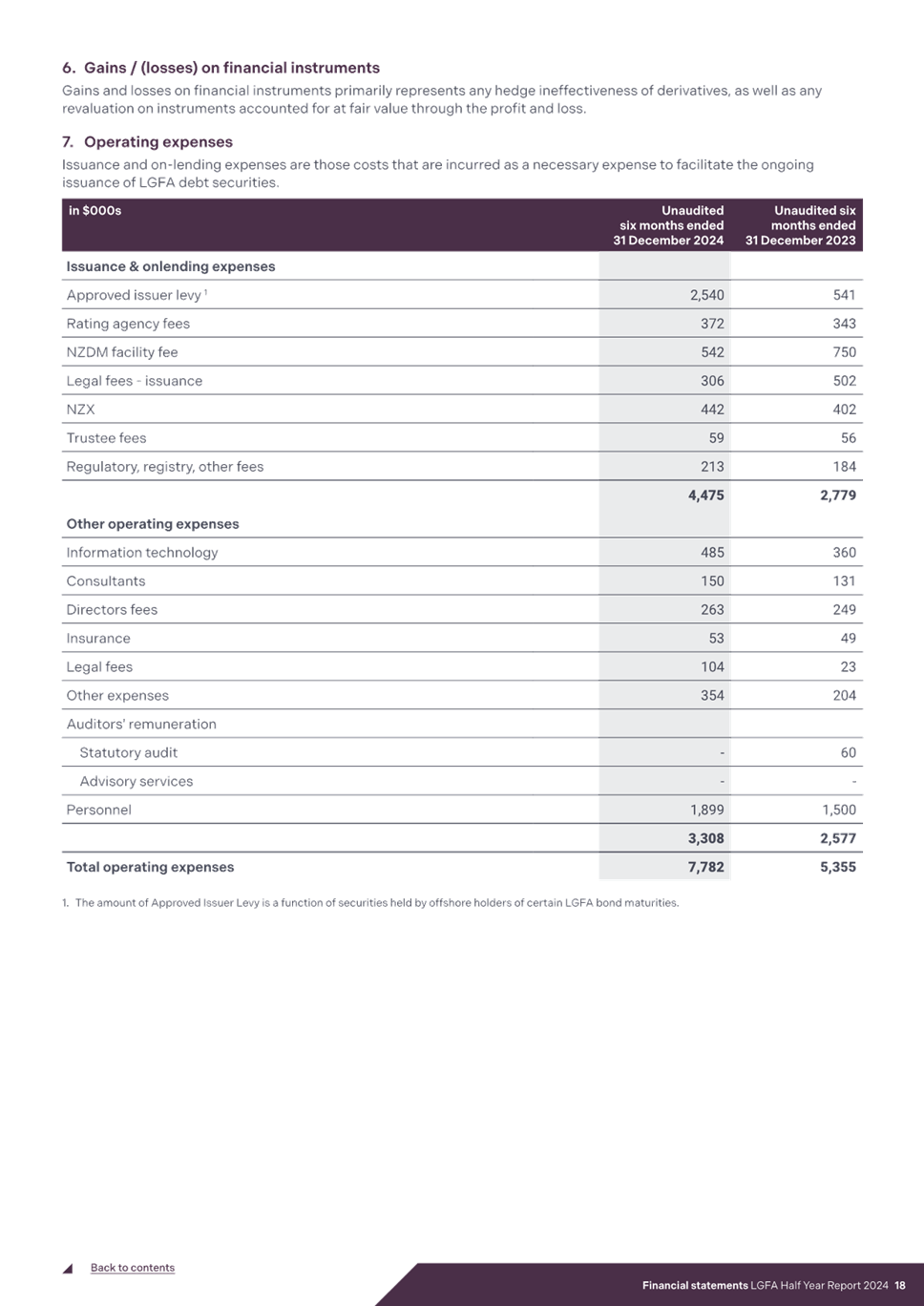

for the LGFA is its Approved Issuer Levy payment to the Government – it

was $2.54 million as of 31 December 2024 compared to the same time a year ago

at $0.54 million. This increase is because LGFA had to source a greater

proportion of its borrowing requirement from offshore markets.

20. As of 31 December 2024, LGFA

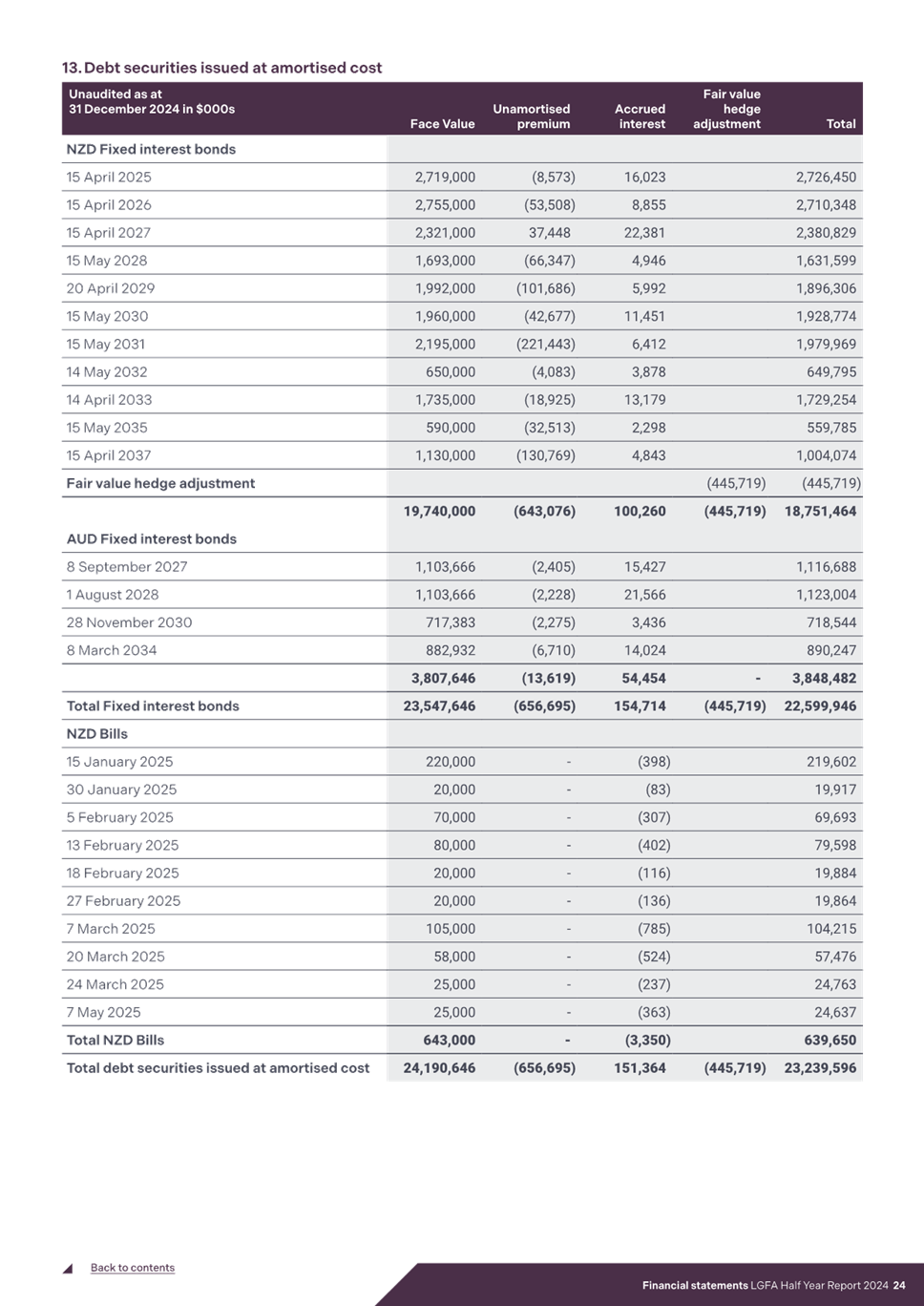

has assets of $26.5 billion and shareholder equity of $120.7 million.

21. As of 31 December 2024, LGFA

had loans outstanding to 79 councils and CCO members of $22.3 billion, with

lending of $2.1 billion.

22. As of 31 December 2024, LGFA

issued $1.63 billion of NZD bonds and outstandings now total $21.14 billion

across 11 maturities between 2025 to 2037.

23. LGFA continued to assist the

Government and the Local Government Sector with Local Water Done Well. LGFA

provided guidance to councils in December 2024 on options for financing water

infrastructure, including Water CCOs having access to the same financial

products as LGFA member councils.

24. LGFA continued to provide

guidance to councils on accessing climate-related funding and green, social and

sustainable financing instruments, by appointing a Senior Manager Sustainable

Finance to its Sustainability Team, and scheduling a series of Sustainable

Finance workshops for its members. In March 2025, this CCO will host four

90-minute sessions as part of its sustainable finance series. LGFA member

councils will find these sessions useful when considering their eligibility for

the green, social and sustainable lending programme and climate action loans.

25. LGFA’s two sustainable

lending products remain well supported by its members – Climate Action

Loan (CAL) and Green, Social and Sustainable Loans (GSS). As of 31 December

202, LGFA has undertaken $401.2 million of GSS Loans to six councils and $3.217

billion of CALs to seven councils and CCOs. LGFA’s sustainable loans now

comprise 16.9% of its total long-term loans to councils and CCOs.

26. LGFA added two new

council-controlled organisations as members over the six-month period to 31

December 2024, bringing the number of members to 77 councils and seven

council-controlled organisations.

27. LGFA’s AGM took place

on 19 November 2024 in Wellington. Two key things occurred at the annual

meeting – a new director, Elena Trout, was appointed (she joins the LGFA

Board, which consists of seven directors), and changes to LGFA’s Foundation

Policies with regards to a bespoke Net Debt/Total Revenue covenant up to 350%

were approved (previously this was at 280%).

28. The financial strength of

LGFA was affirmed by Fitch Ratings who maintained this CCO’s domestic

currency credit rating at AA+ in October 2024. LGFA’s AAA/AA+ rating from

S&P Global Ratings was affirmed in September 2024. Both credit ratings

remain the same as the New Zealand Government.

Statutory Context

29. In accordance with the

Statement of Intent and the LGA 2002, the LGFA is required to report to Council

on its financial and non-financial performance six monthly and annually.

30. The Half Year Report is helpful with tracking how the LGFA is

performing for the first six months of the financial year.

31. LGFA also provides quarterly

updates (by 31 January, 30 April, 31 July and 31 October each year) and the

latest December Quarter 2024 can be accessed via this link: https://youtu.be/aT8AP9O6590.

32. Council’s partnerships

with LGFA and its other CCOs help successfully deliver community outcomes and

facilitate Tauranga becoming a

vibrant city that attracts businesses, people and visitors, is well planned,

connected and inclusive.

STRATEGIC ALIGNMENT

33. LGFA contributes to the

promotion or achievement of the following strategic community outcome(s):

|

Contributes

|

|

We are an inclusive city

|

ü

|

|

We value, protect and enhance the environment

|

ü

|

|

We are a well-planned city

|

ü

|

|

We can move around our city easily

|

ü

|

|

We are a city that supports business and education

|

ü

|

34. Being part of the 31

shareholder members of LGFA ensures that TCC can continue to leverage optimal

financing conditions, which will enable Council to better plan and invest in

the future infrastructure of the city.

Options Analysis

35. There are no options as

Council is formally receiving the Half Year Report 2024/25 from LGFA.

Financial Considerations

36. There are no specific

implications for TCC from this half-yearly result of LGFA. The ongoing strong

financial performance of LGFA means Council can continue to borrow at

relatively attractive rates and is not at additional risk arising from its

guarantor status.

Legal Implications / Risks

37. There are no legal

implications.

38. The Half Year Report 2024/25

meets the legislative requirements for the LGFA to provide Council with an

overview of performance for the first half of the financial year against its

SOI on both financial and non-financial measures.

TE AO MĀORI APPROACH

39. While the Te Ao Māori

approach is important, the matters addressed in this report are of a procedural

nature.

CLIMATE IMPACT

40. While climate impact is

important, the matters addressed in this report are of a procedural nature.

Consultation / Engagement

41. No consultation or engagement

is required or planned.

Significance

42. The Local Government Act 2002

requires an assessment of the significance of matters, issues, proposals and

decisions in this report against Council’s Significance and Engagement

Policy. Council acknowledges that in some instances a matter, issue, proposal

or decision may have a high degree of importance to individuals, groups, or

agencies affected by the report.

43. In making this assessment,

consideration has been given to the likely impact, and likely consequences for:

(a) the current and future

social, economic, environmental, or cultural well-being of the district or

region;

(b) any

persons who are likely to be particularly affected by, or interested in, the

matter; and

(c) the capacity of the local authority

to perform its role, and the financial and other costs of doing so.

45. In accordance with the

considerations above, criteria and thresholds in the policy, it is considered

that the matter is of low significance.

ENGAGEMENT

46. Taking

into consideration the above assessment, that the matter is of low significance,

officers are of the opinion that no further engagement is required prior to

Council making a decision.

Next Steps

47. LGFA will be informed of

Council’s consideration of this report.

48. LGFA’s Half Year Report

to 31 December 2024 will be made available via TCC’s website.

Attachments

1. Attachment

1 - LGFA Half Year Report 2024-25 - A17637848 ⇩

2. Attachment 2 -

LGFA Letter to shareholders for Half Year Report to December 2024 - A17637835 ⇩

9.3 Tauranga

City Council Bespoke LGFA Borrowing Covenant and S&P update on Credit

Rating

File

Number: A17760238

Author: Kathryn

Sharplin, Manager: Finance

Sheree Covell,

Treasury & Financial Compliance Manager

Authoriser: Kathryn

Sharplin, Manager: Finance

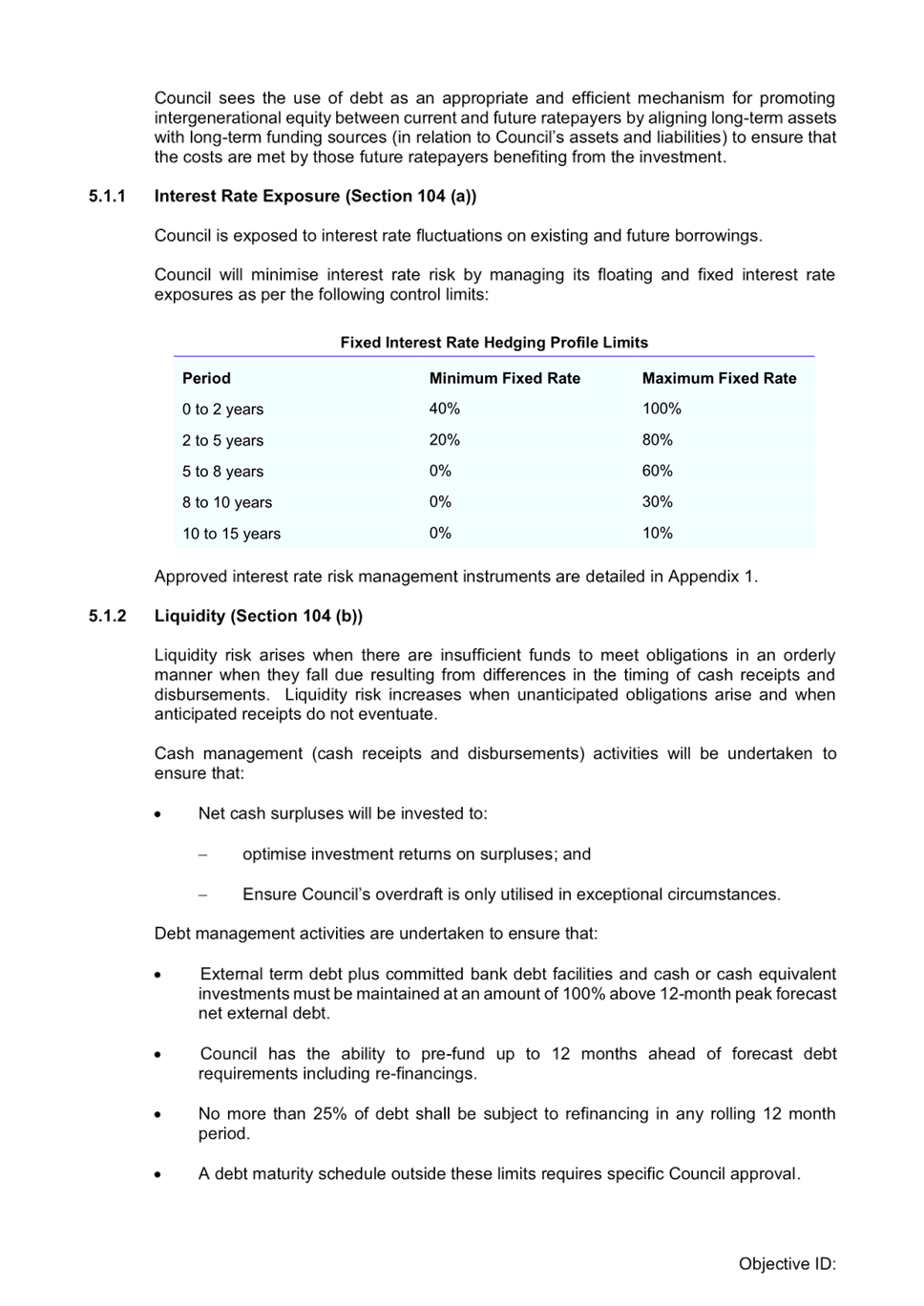

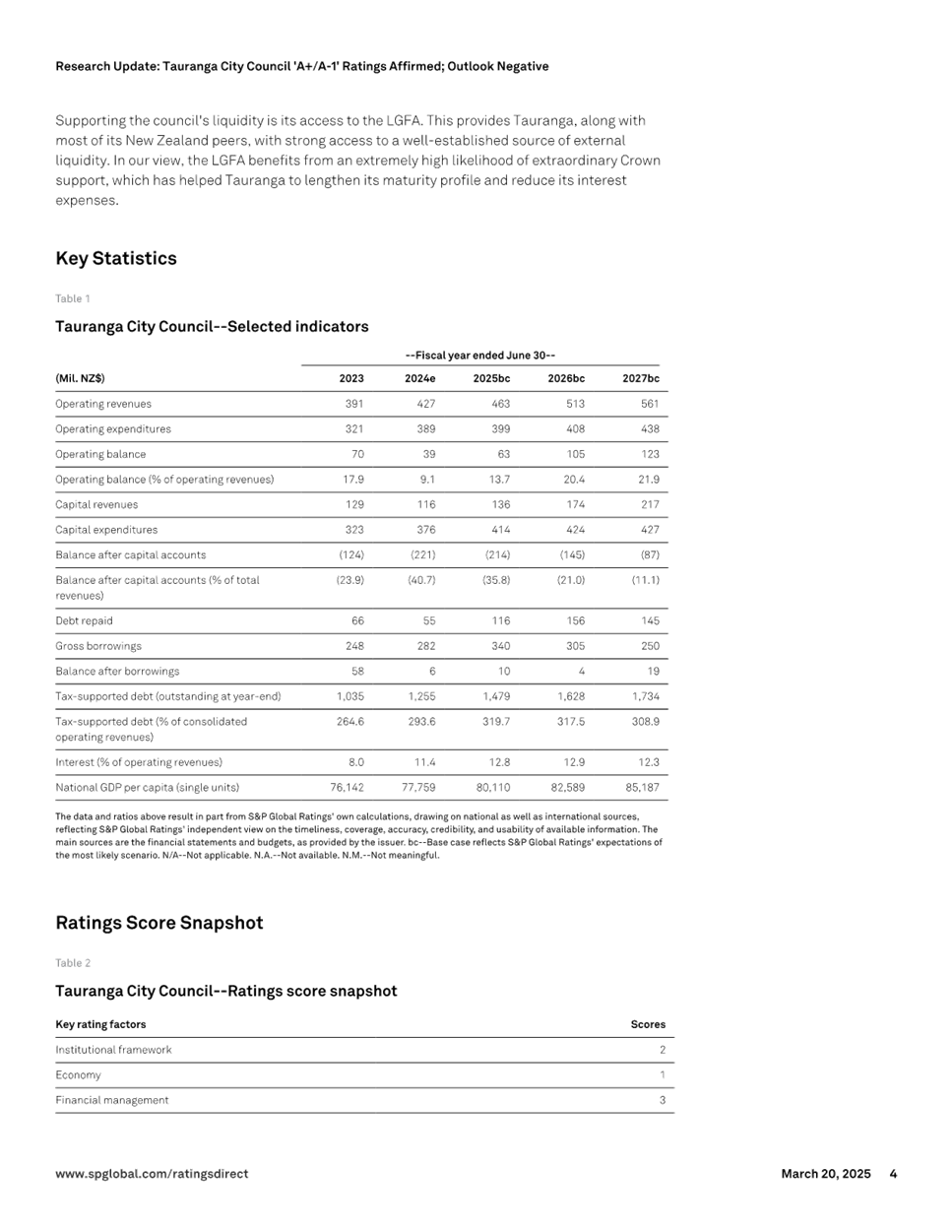

Purpose of the Report

1. The purpose of

this report is to present the Local Government Funding Agency (LGFA) agreed

bespoke borrowing covenant for Tauranga City Council (TCC or Council) and to

discuss the conditions and implications of this new covenant.

2. Also presented in

this report is the recent Standard and Poors (S&P) review of TCC’s

credit rating in the light of its downgrade of the Institutional Framework

Assessment (IFA) for Local Government in New Zealand.

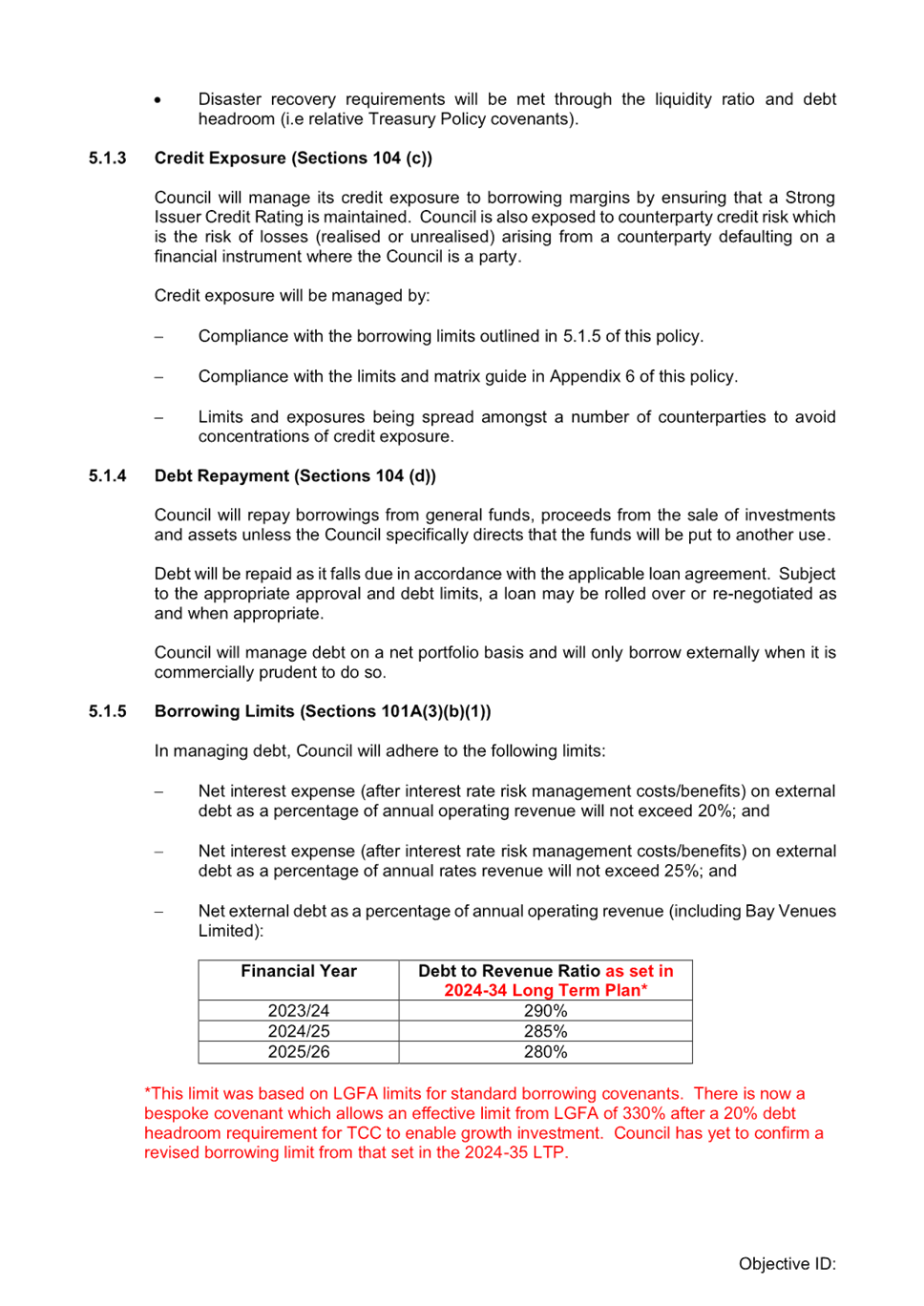

3. The report

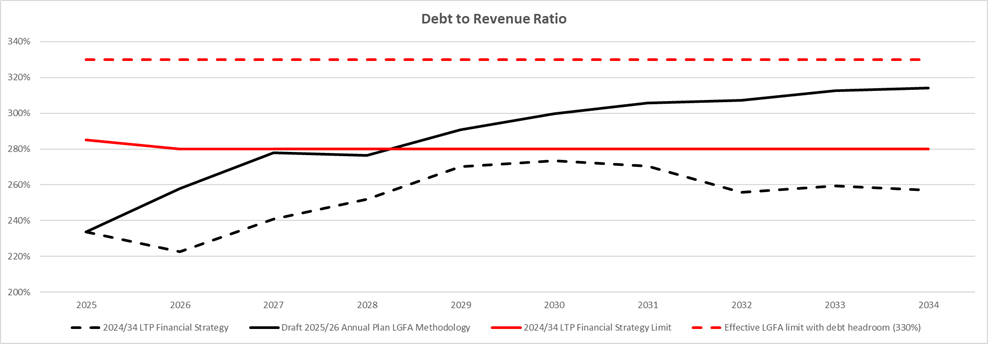

discusses current financial strategy borrowing limits that remain at 280%.

Executive Summary

4. Council’s

current financial strategy borrowing limit set in the 2024-34 Long-term Plan

(LTP) is based on a 280% debt to revenue ratio. This limit was at

the maximum level of borrowing under LGFA’s standard borrowing covenants.

Council currently remains within this covenant based on the draft 2025/26

Annual Plan, however there is pressure around its debt to revenue ratio over

the next few years. Furthermore, a 280% maximum borrowing covenant

provides limited debt headroom to address unexpected events, and borrowing

capacity has been a significant constraint in developing the capital programme

for each year of the LTP.

5. As a growth

council wanting to ensure adequate capacity to meet its infrastructure

requirements for growth and to provide adequate debt headroom, TCC applied to

LGFA for a bespoke covenant at a higher debt to revenue ratio maximum. The

application letter and supporting documentation was provided in the 10 February

2025 Council report showing the pressure on the debt to revenue ratio over the

projected ten years to 2034. Key graphs are provided below.

6. Council has

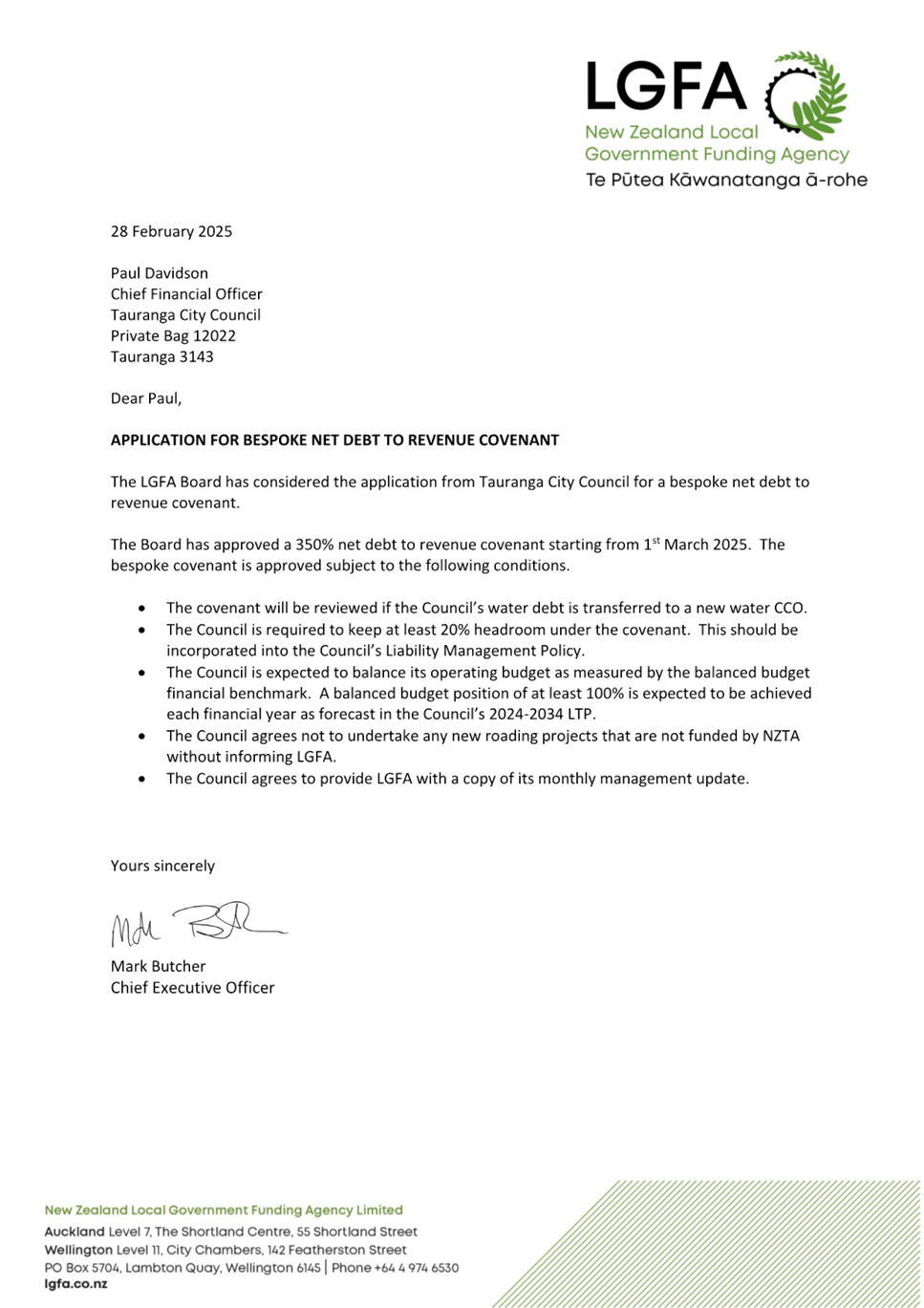

received approval from LGFA for a bespoke borrowing covenant of up to 350% net

debt to revenue ratio, with an effective limit of 330%. This lower

effective limit reflects a condition of the covenant that Council retains a

minimum of 20% debt headroom.

7. There are five

conditions of the covenant which are outlined below, with a significant one for

Council’s planning being the need to maintain a balanced budget ratio

(revenue/expenditure) of at least 100% as calculated under the Local Government

(Financial Reporting and Prudence) Regulations 2014 (prudence regulations).

8. The draft annual

plan for 2025/26 has a balanced budget ratio of 101% using the prudence

regulations calculation so is compliant with this condition.

9. The LGFA borrowing

covenant is higher than Tauranga City Council’s existing limit on

borrowing as set in the Financial Strategy to the 2024-34 Long-term Plan and

Council has yet to reconsider its financial strategy borrowing limit in the

light of the ability to borrow to a higher level under the bespoke covenant.

Council’s financial strategy borrowing limit must be considered as part

of the 2027-37 Long-term Plan and a change to this could be considered earlier

as part of an annual plan process. Future decisions on water service delivery

under the Local Water Done Well requirements would also impact the debt and

future capital programme of TCC and therefore would influence future

consideration of borrowing limits.

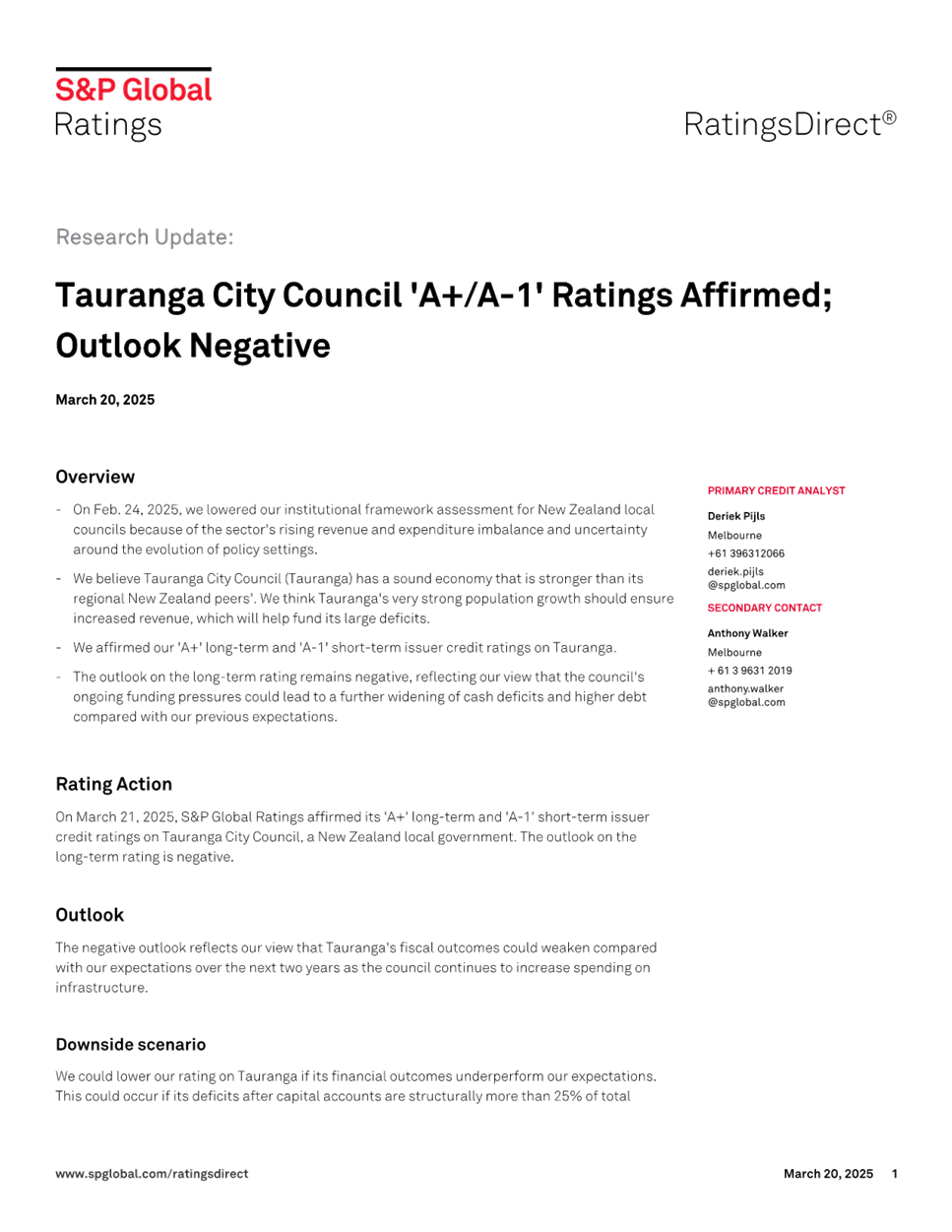

10. Standard & Poors

(S&P) last week revised down its Institutional

Framework Assessment (IFA) for Local Government in New Zealand from

extremely predictable and supportive to predictable and well balanced.

This resulted in credit rating downgrades for 18 New Zealand Councils.

TCC’s credit rating was affirmed at A+ with a negative outlook as S&P

consider Tauranga’s credit rating to have sufficient headroom to

withstand the IFA downgrade. S&P noted that Tauranga has a sound economy

that is stronger than its regional peers and the very strong population growth should

ensure increased revenue to help fund its large deficits. A negative

watch remains on TCC’s A+ long term rating.

11. S&P will undertake its

full review of TCC’s credit rating in May 2025, and the revised covenant

along with TCC’s projected debt levels and financials are considered as

part of that review.

background to Borrowing Covenant

Changes

12. On 9 December 2024 Council

decided to apply to the LGFA for a bespoke borrowing covenant based on a debt

to revenue ratio at 350% (report 11.15 to 9 December 2024 Council meeting). In

the report the risks of breaching current limits were outlined due to changes

to assumptions since the Long-term Plan. These changes included bringing

Te Manawataki o Te Papa (TMOTP) debt on balance sheet and lower than budgeted

NZTA capital subsidies in the next three years which have led to a rephasing of

affected capital projects to the later years of the LTP, pending full Council

review of the capital programme for the next LTP.

13. On 10 February 2025 Council

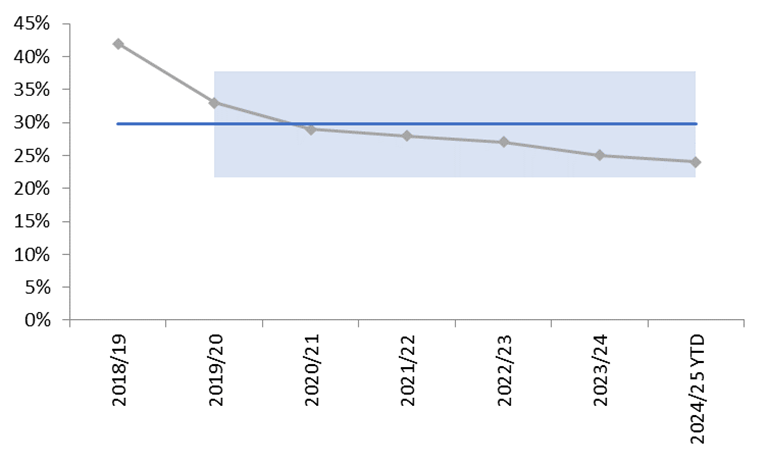

approved the proposed application letter and supporting documentation (Report

11.3 to 10 February 2025 Council meeting).

14. Graph 1 below shows the debt

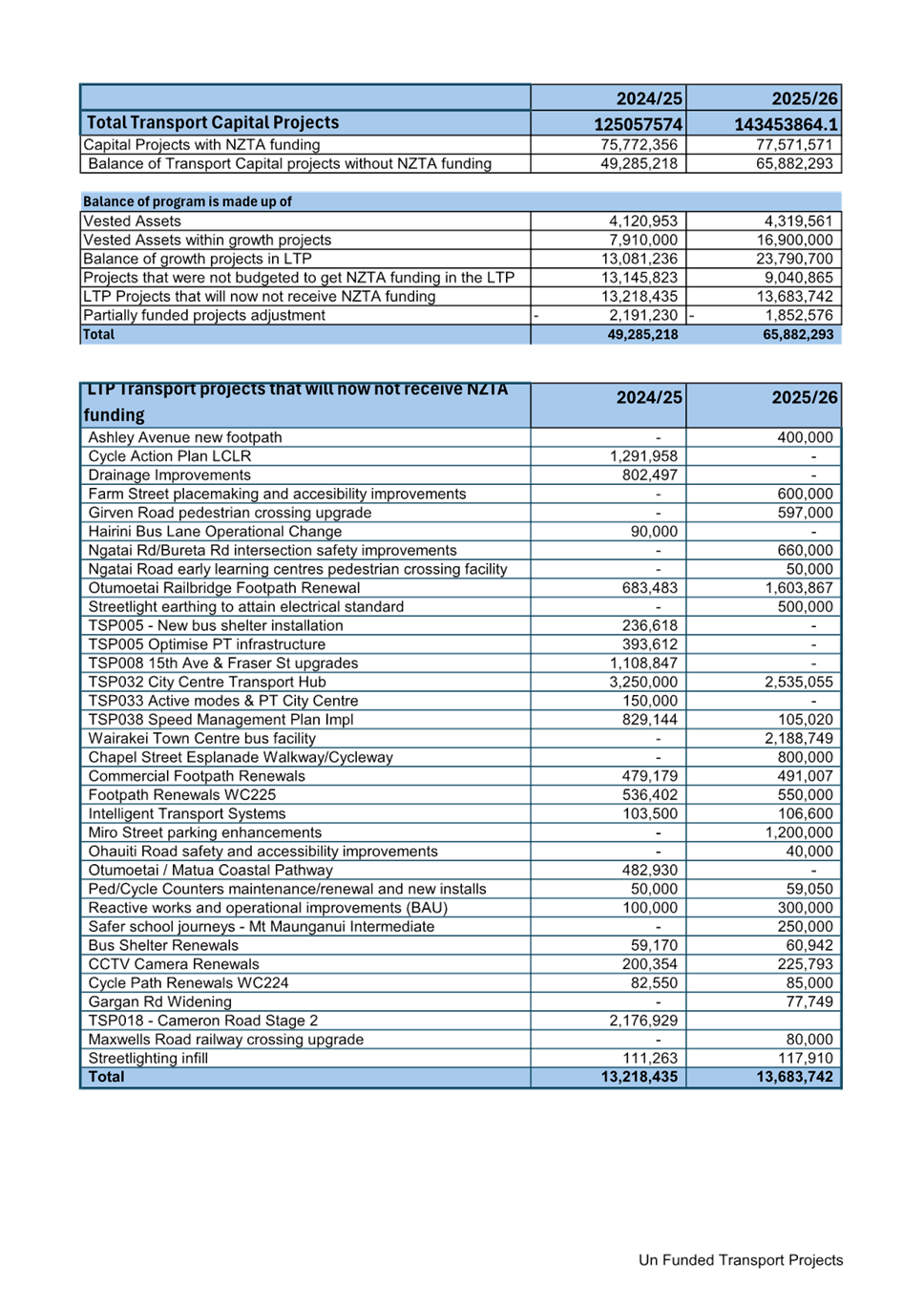

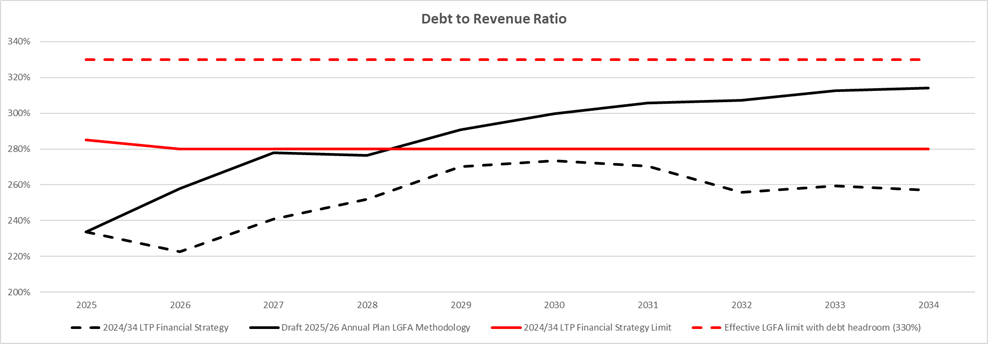

to revenue ratio arising from the 2025/26 draft Annual Plan and the LTP

assumptions for the remaining period (except for the changes outlined in

paragraph 12). Based on these assumptions, TCC would breach its existing

borrowing covenants by the 2028/29 year. Prior to that, debt headroom would be

increasingly reduced. This was a consideration in the application for the

bespoke covenant.

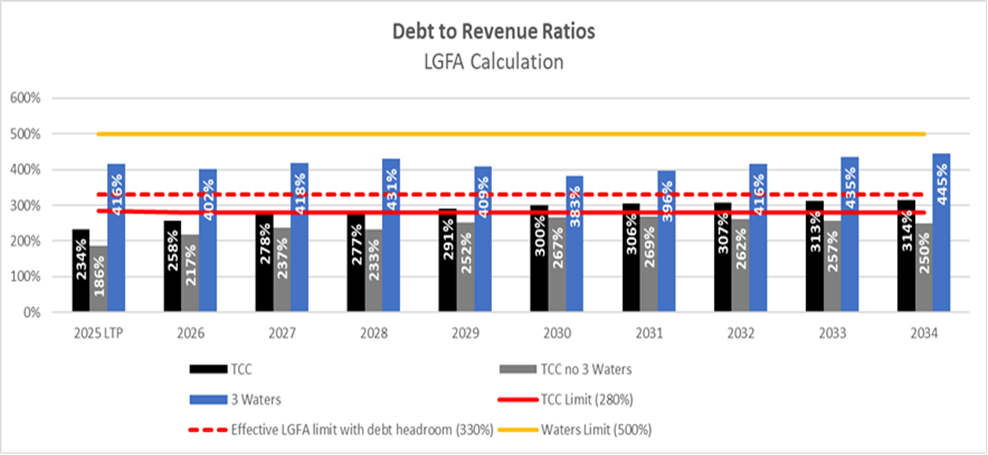

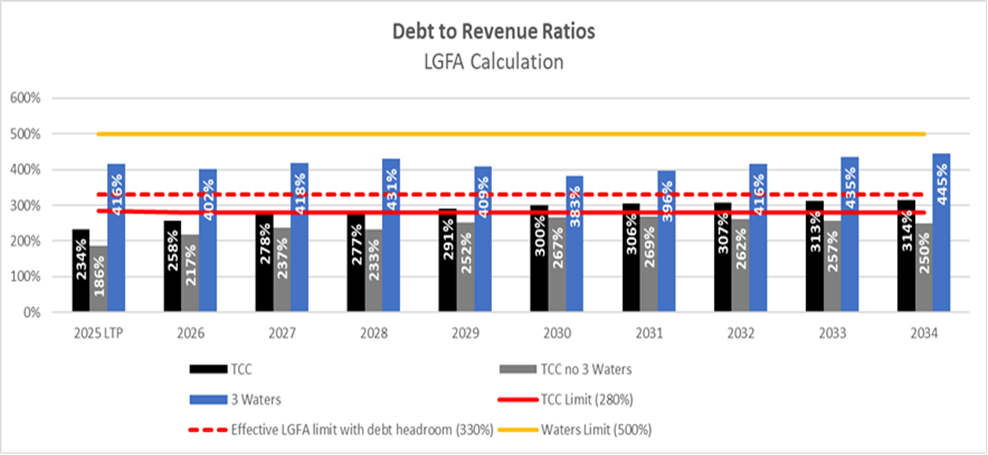

15. Graph 2 below shows the debt

to revenue ratio in graph 1, broken out separately for three waters and the

rest of council.

16. Graph 2 indicates that based

on the assumptions outlined in paragraph 12, Council would not require the debt

capacity provided by the bespoke covenant if waters debt was divested to a

Council controlled organisation (CCO). This is shown by the grey bars

which remain below the standard LGFA borrowing limits. However, in the 2027-37

LTP, Council will further consider its infrastructure needs including

investment needed to meet population growth requirements.

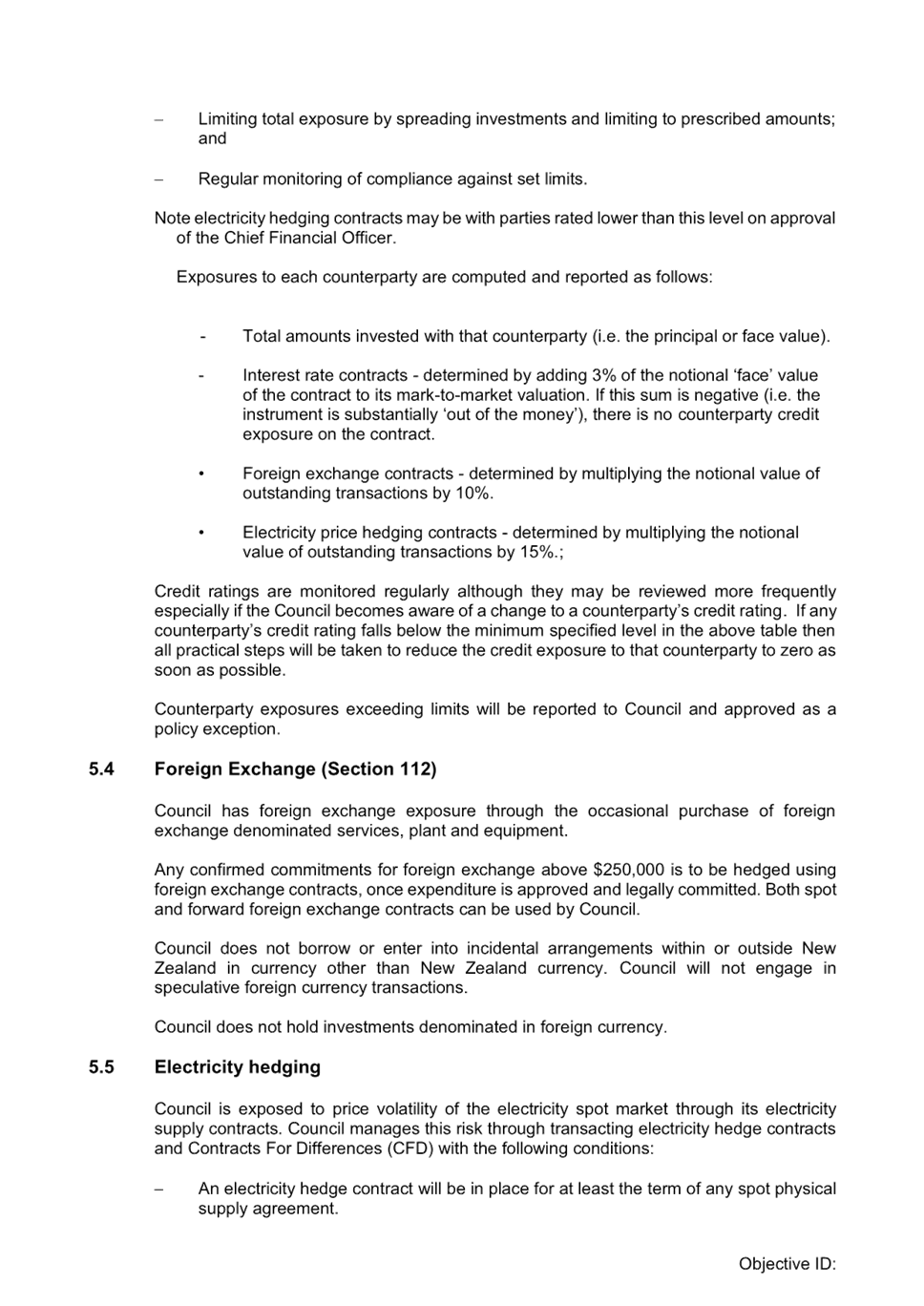

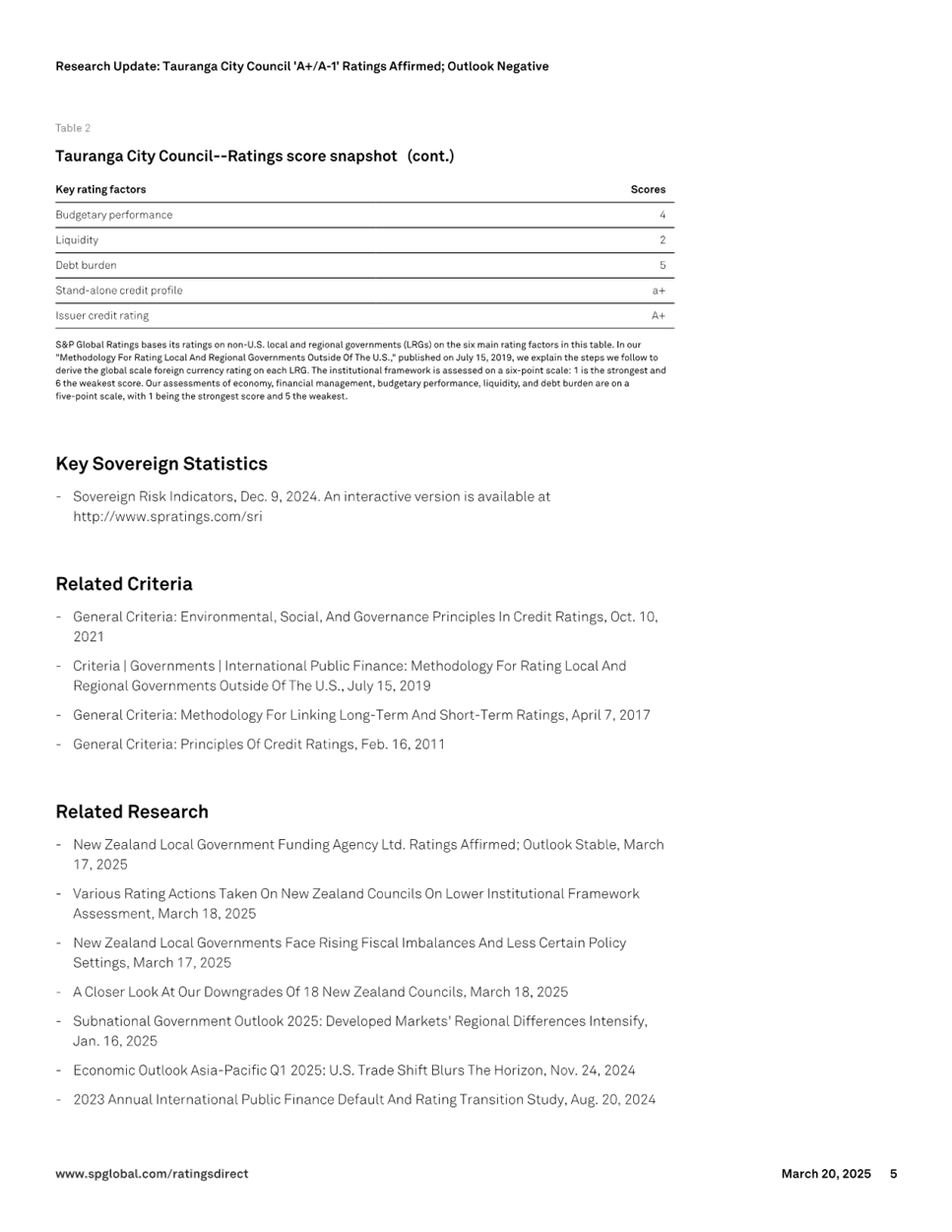

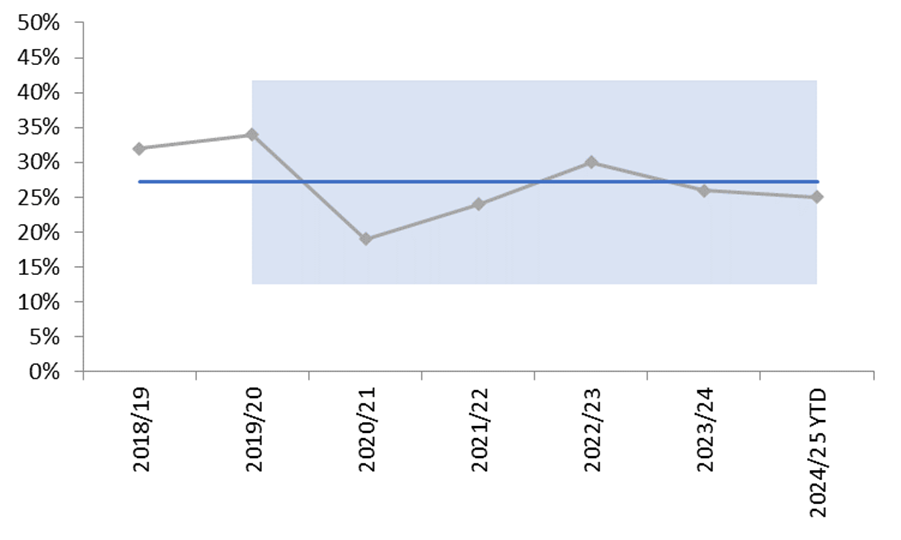

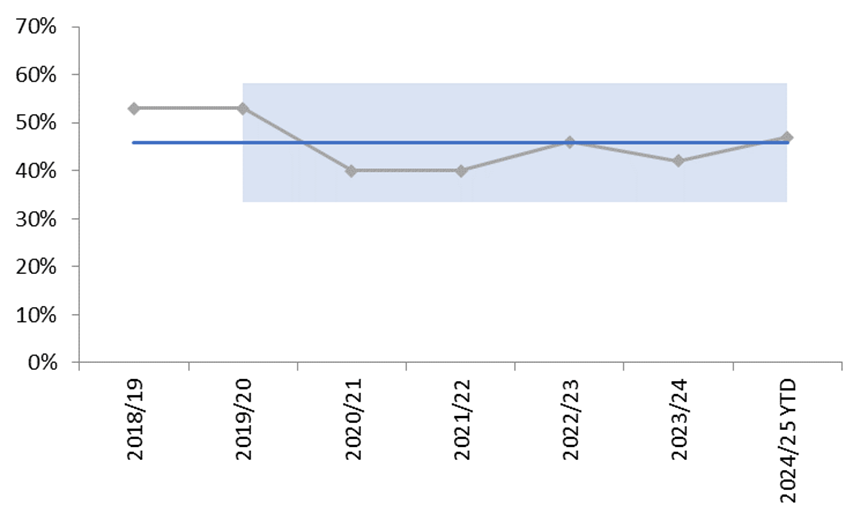

Graph

1: Debt to Revenue Ratio for the Ten Years

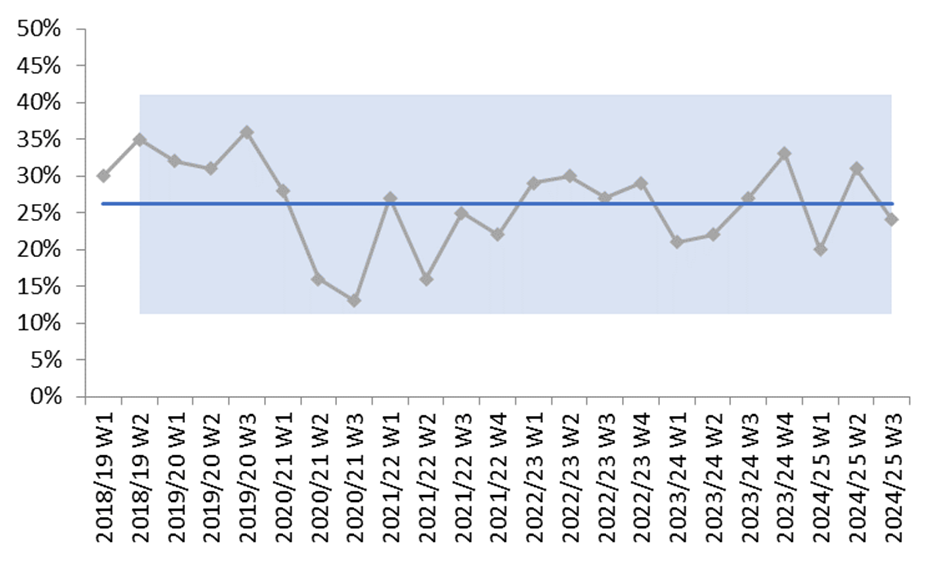

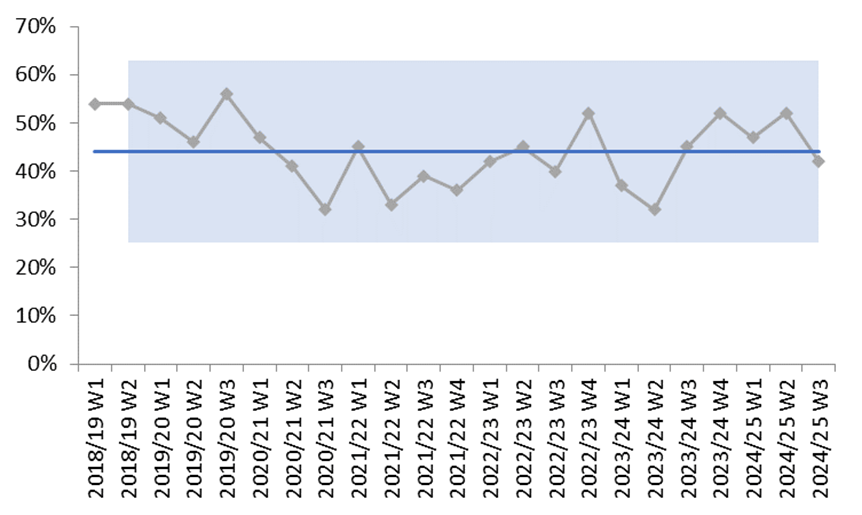

Graph 2: Debt to Revenue ratio separated for Three

waters and remaining council

17. The above graphs differ from

the graphs provided in the application to LGFA as they have been updated to

reflect Annual Plan changes made since February 2026.

18. The application was approved

by the LGFA Board on 28 February 2025.

Bespoke

Covenant Conditions

19. Council has received approval

from LGFA for a bespoke borrowing covenant of up to 350% net debt to revenue

ratio, with an effective limit of 330%. This lower effective limit

reflects a condition of the covenant that Council retains a minimum of 20% debt

headroom. The approval and conditions are included in Attachment 1.

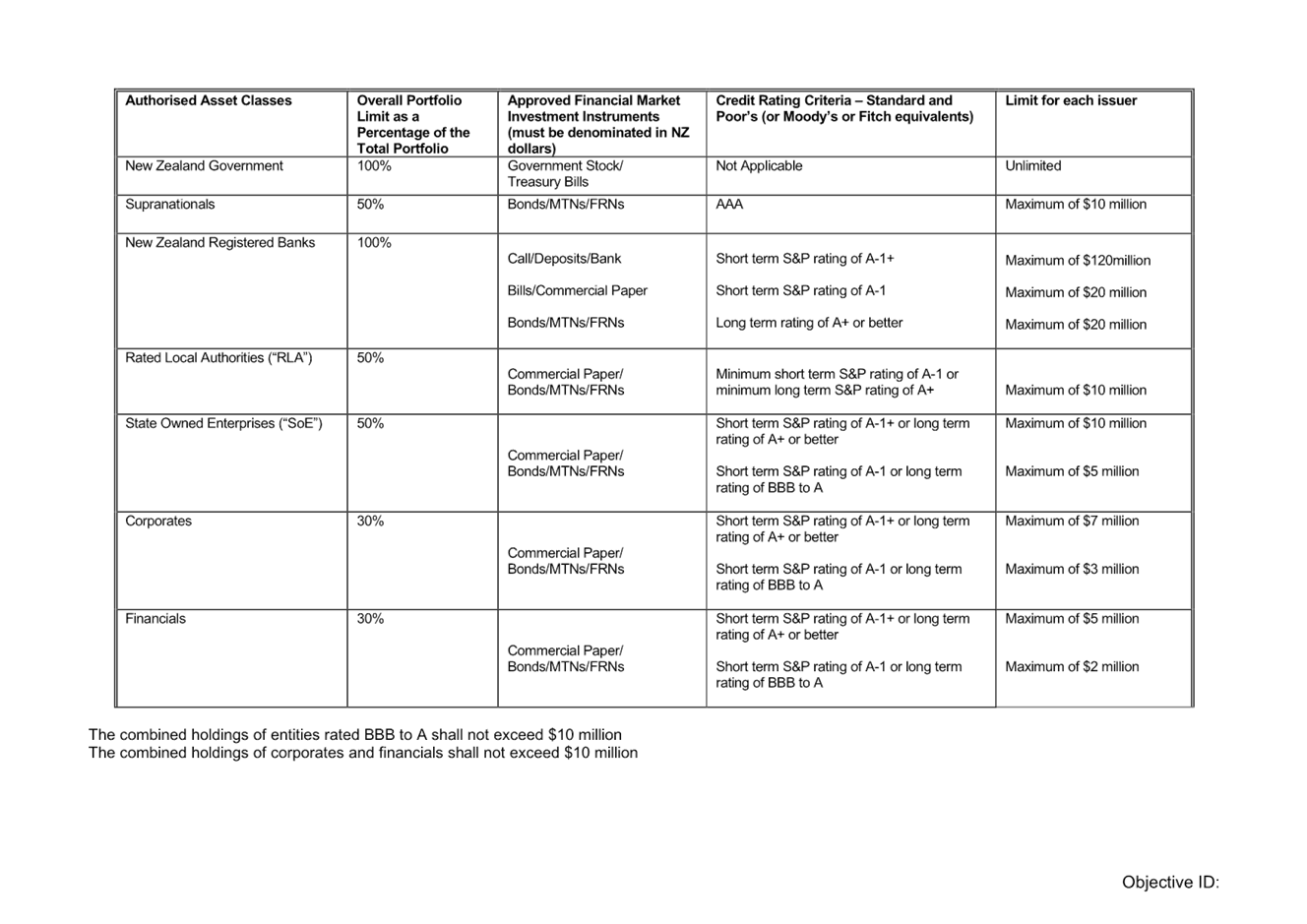

20. There are five conditions of

the covenant which are outlined below:

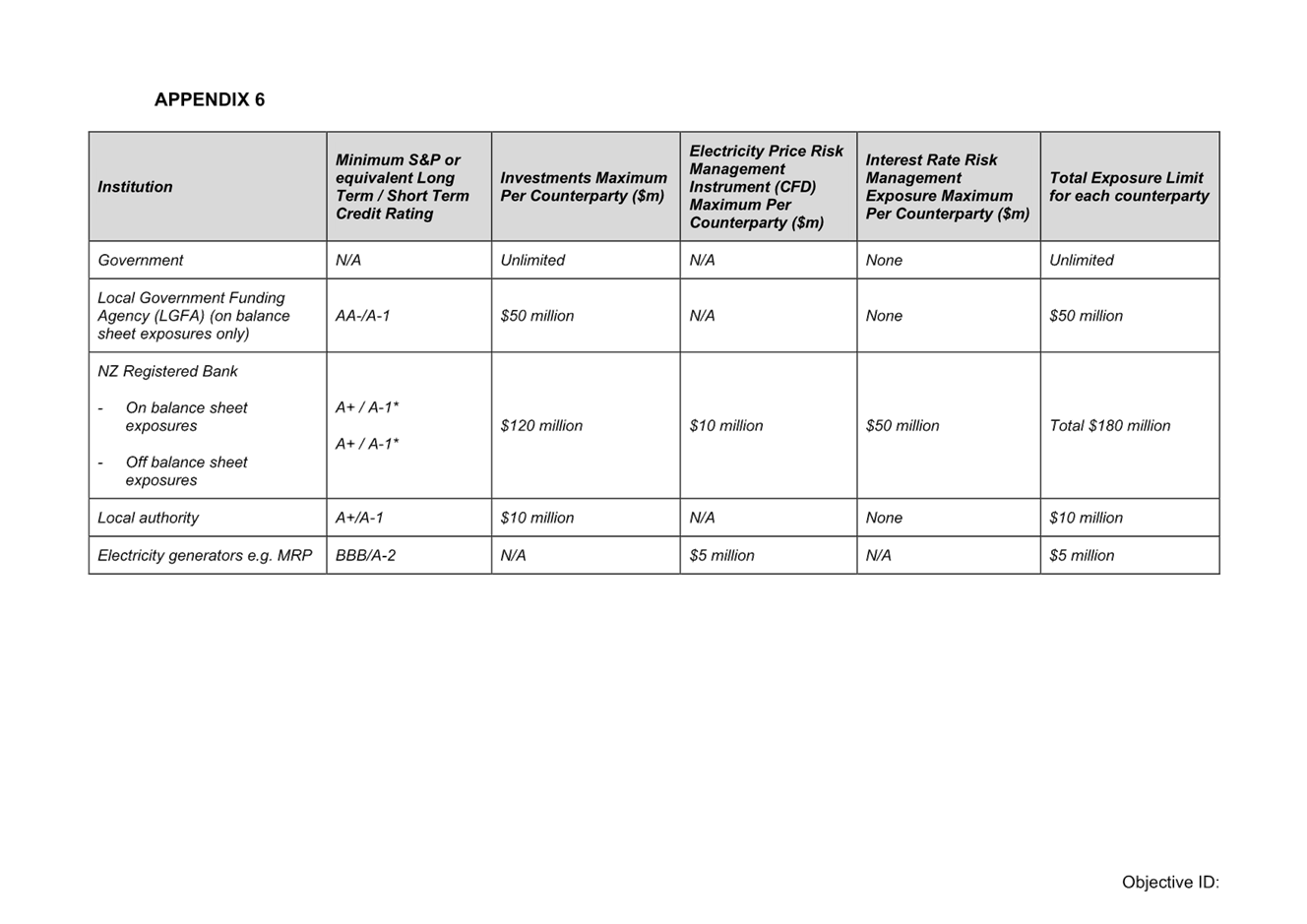

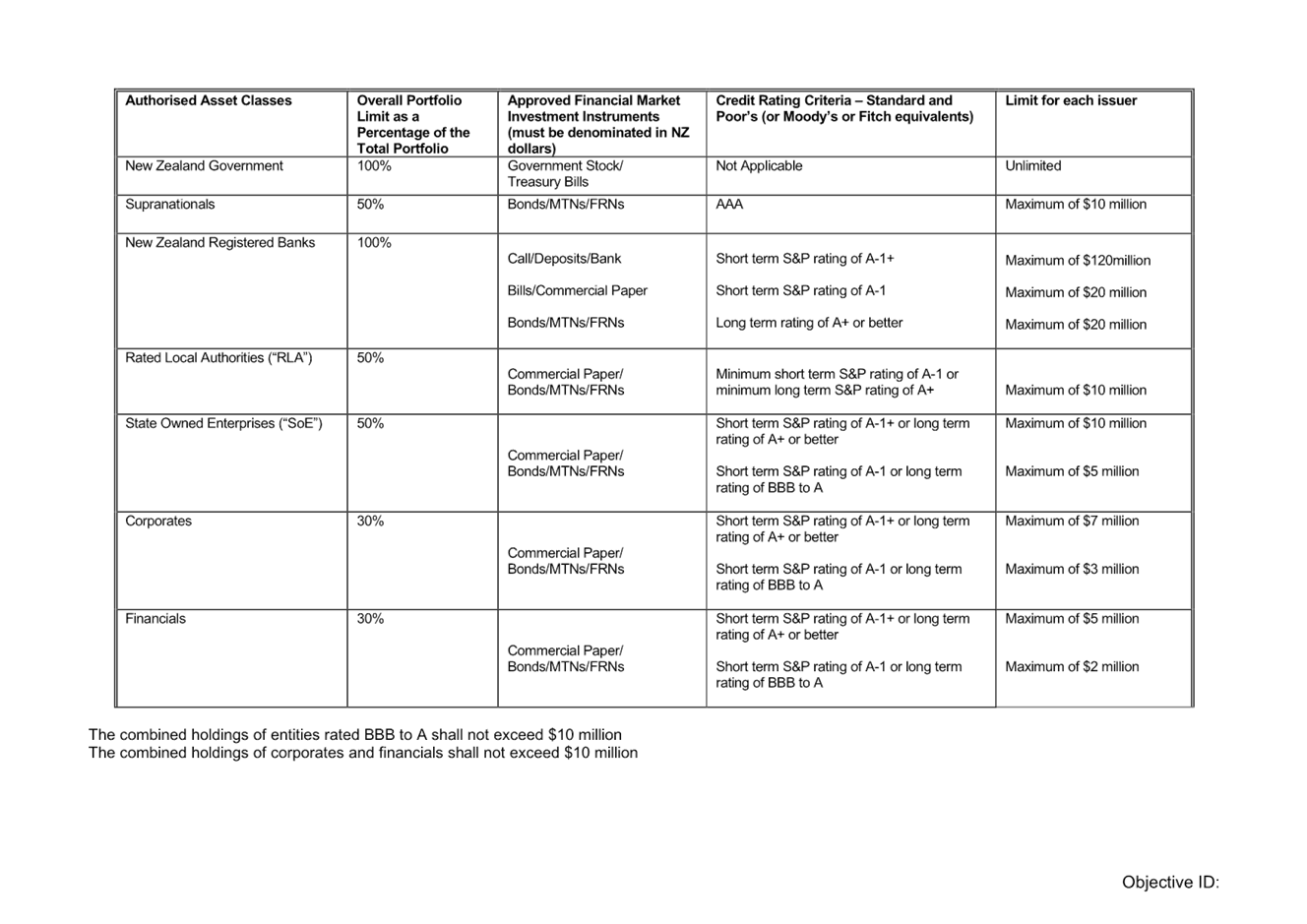

21. 1. 20% headroom must be

maintained and incorporated into Council’s Liability Management Policy.

(a) The liability Management

Policy is included in Section 5.1 of Council’s Treasury Policy.

Section 5.1.5 Borrowing Limits, specifies debt to revenue ratio limits as per

the 2024-34 Financial Strategy, which were also the standard LGFA borrowing

covenants which are currently 285% for the 2025 financial year and 280% from

the 2026 financial year onwards.

(b) In accordance with the

condition of the bespoke covenant the Treasury Policy section on Liability

Management has been updated to state the new limit on borrowing for TCC will

not exceed the effective LGFA covenant limit of 330% (being the LGFA bespoke debt

covenant for Tauranga City Council of 350% with minimum 20% debt

headroom).

(c) The revised Treasury Policy

is included as Attachment 2 for approval by this committee. Changes are

reflected in red. It should be noted that Appendix 2 of the policy has

also been updated to reflect the change in committee structure.

(d) Compliance with the debt to

revenue limit will be reviewed by LGFA based on year end results.

22. 2. A balanced budget

position of at least 100% as measured by the balanced budget benchmark.

(a) The balanced budget benchmark

set under the prudence regulations is included in Annual and Long-term Plans

and presented in the prudence section of the financials. The revenue

calculation under Prudence Regulations includes capital subsidies so it differs

from the balanced budget summaries that have been provided to Council by staff

based solely on operational revenue as identified in TCC’s Statement of

Comprehensive Revenue and Expense. Compliance with this condition will be

based on the annual plan or LTP financials.

(b) LGFA has noted that

unexpected events can occur during the year, such as weather events and year

end non-cash accounting adjustments such as WIP and asset write offs which

could impact a balanced budget measure. These impacts would therefore not

be considered a breach of the condition.

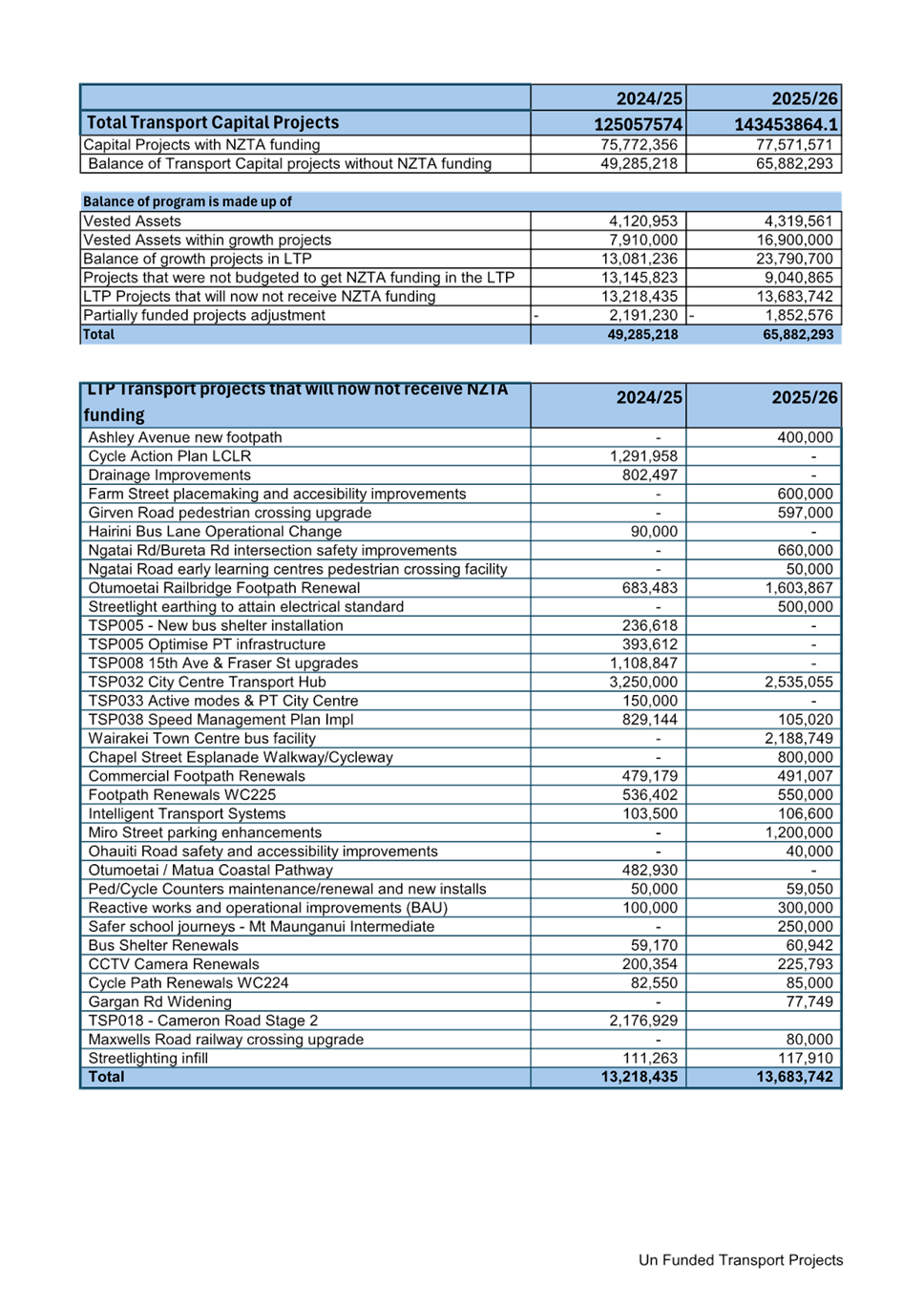

23. 3. No new roading projects

that are not funded by NZTA should be undertaken without informing LGFA.

(a) NZTA funding of transport

projects is confirmed in three-year cycles and factored into Annual and

Long-term Plans. In the case that a project is budgeted for NZTA funding

in an annual or long-term plan, but the funding is not approved post adoption,

council staff will be required to advise LGFA if council plans to continue with

these projects and how they will be funded. NZTA project funding has a

significant impact on the debt to revenue ratio as it impacts both revenue

(capital grants are included as revenue) and debt.

(b) Council has already proposed

in the 2025/26 draft annual plan to undertake expenditure on low-cost low-risk

projects even though NZTA funding has been revoked. This is less 10% of

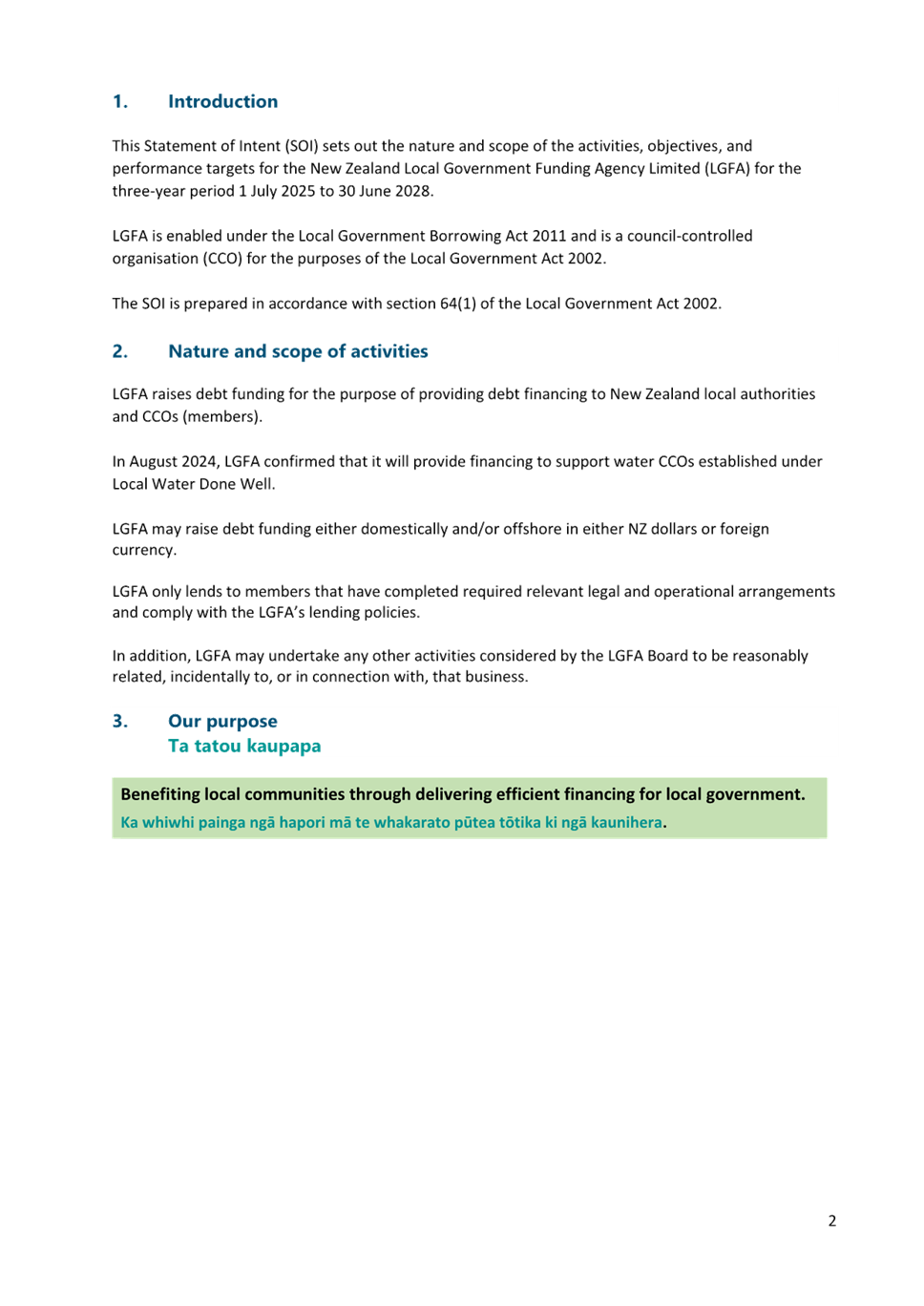

the total transportation capital programme. The list of Transport projects that

will no longer receive NZTA funding in the draft 2025/26 Annual Plan are

detailed in Attachment 4. This information will be sent to LGFA.

24. 4. Monthly management

accounts should be provided to LGFA.

(a) Monthly financial

performance is currently prepared and presented to the TCC Executive.

This will be provided to LGFA going forward.

25. 5. The covenant will be

reviewed if waters debt is transferred to a new water CCO.

(a) LGFA views this

condition as an opportunity for TCC to restate that the bespoke covenant is

still required, or whether a different ratio is required if debt is transferred

to a waters CCO. Before any decision could be made by Council on the need

to continue with a bespoke covenant, and at what level, Council would need to

be in a position to review and prioritise its intended capital programme into

the future alongside its revenue and expenditure. This review would best

occur as part of developing the 2027-37 LTP.

CREDIT RATING agency outlook

26. Standard and Poors (S&P)

has recently revised down the Institutional Framework Assessment (IFA) for

Local Government in New Zealand from extremely predictable and supportive to

predictable and well balanced. This resulted in credit rating downgrades

for 18 New Zealand Councils.

27. TCC’s credit rating was

reviewed during this process but was not changed as S&P consider that there

is sufficient headroom, on the current rating to withstand the IFA

downgrade. S&P noted that Tauranga has a sound economy that is stronger

than its regional peers and the very strong population growth should ensure

increased revenue to help fund its large deficits. A negative watch

remains on TCC’s A+ long term rating. Attachment 3 is a

report from Standard & Poors affirming Tauranga City Council’s credit

rating at A+ with a negative outlook.

28. Council’s rating is

subject to a full review in May 2025, during which impact of the IFA will be

considered again at that time as well as the revised debt covenant and its

implications for our projected debt levels. Results from annual credit

reviews generally take around three months to be released.

Options Analysis

29. There are no options

presented in this report as the decision to apply for bespoke covenants was

made by Council in December 2024. This report provides updated information

regarding matters associated with Council borrowing limits and credit rating.

Financial Considerations

30. The bespoke covenant provides

additional debt headroom and mitigates the risk that some of the revenue

sources assumed for the draft annual plan, e.g. subsidies, may not be received

within assumed timeframes. The increased borrowing capacity allowed under the

new covenant provides an opportunity for Council to consider earlier or higher

levels of capital investment related to growth which can be considered during

annual planning or long- term planning processes.

31. Council’s credit rating

could be reduced if debt increases above LTP levels without adequate additional

revenue associated with it.

29. If TCC’s credit rating is

downgraded at the next annual review there is no immediate additional borrowing

cost based on current LGFA borrowing margins because margins currently applying

for TCC apply to all investment grade ratings.

Legal Implications / Risks

32. There are no direct

implications arising from consideration of priorities and borrowing

Significance

33. The Local Government Act 2002

requires an assessment of the significance of matters, issues, proposals and

decisions in this report against Council’s Significance and Engagement

Policy. Council acknowledges that in some instances a matter, issue,

proposal or decision may have a high degree of importance to individuals,

groups, or agencies affected by the report.

34. In making this assessment,

consideration has been given to the likely impact, and likely consequences for:

(a) the current

and future social, economic, environmental, or cultural well-being of the

district or region

(b) any persons who are likely to be

particularly affected by, or interested in, the matter.

(c) the capacity of the local authority

to perform its role, and the financial and other costs of doing so.

35. In accordance with the

considerations above, criteria and thresholds in the policy, it is considered

that the matter is of medium significance.

ENGAGEMENT

36. Taking into consideration the

above assessment, that the matter is of medium significance, officers are of

the opinion that no further engagement is required prior to Council making a

decision.

37. Engagement with the community

will occur when a decision is made to increase any borrowing limits in future

annual or long-term plans.

Next Steps

38. 2025/26 Annual Plan debt will

continue to be measured against the current financial strategy limits until a

decision is made to change debt limits to reflect the bespoke debt covenants.

39. Finance staff will provide

the relevant information to LGFA from March 2025 to ensure the conditions are

met.

Attachments

1. Attachment

1 - Bespoke Borrowing Limits - LGFA Borrowing Covenants Letter - A17759414 ⇩

2. Attachment

2 - Bespoke Borrowing Limits Report - Updated Treasury Policy - A17782157 ⇩

3. Attachment

3 - Bespoke Borrowing Limits Report - Standard & Poors Publication on

Institutional Framework Settings - A17764587 ⇩

4. Attachment 4 -

Bespoke Borrowing Limits - Transportation Funding Material Provided to LGFA -

A17794297 ⇩

9.4 Local

Government Funding Agency - Draft Statement of Intent 2025/28 and Letter of

Expectations 2025/26

File

Number: A17123318

Author: Caroline

Lim, CCO Specialist

Kathryn Sharplin,

Manager: Finance

Authoriser: Gareth

Wallis, General Manager: City Development & Partnerships

Purpose of the Report

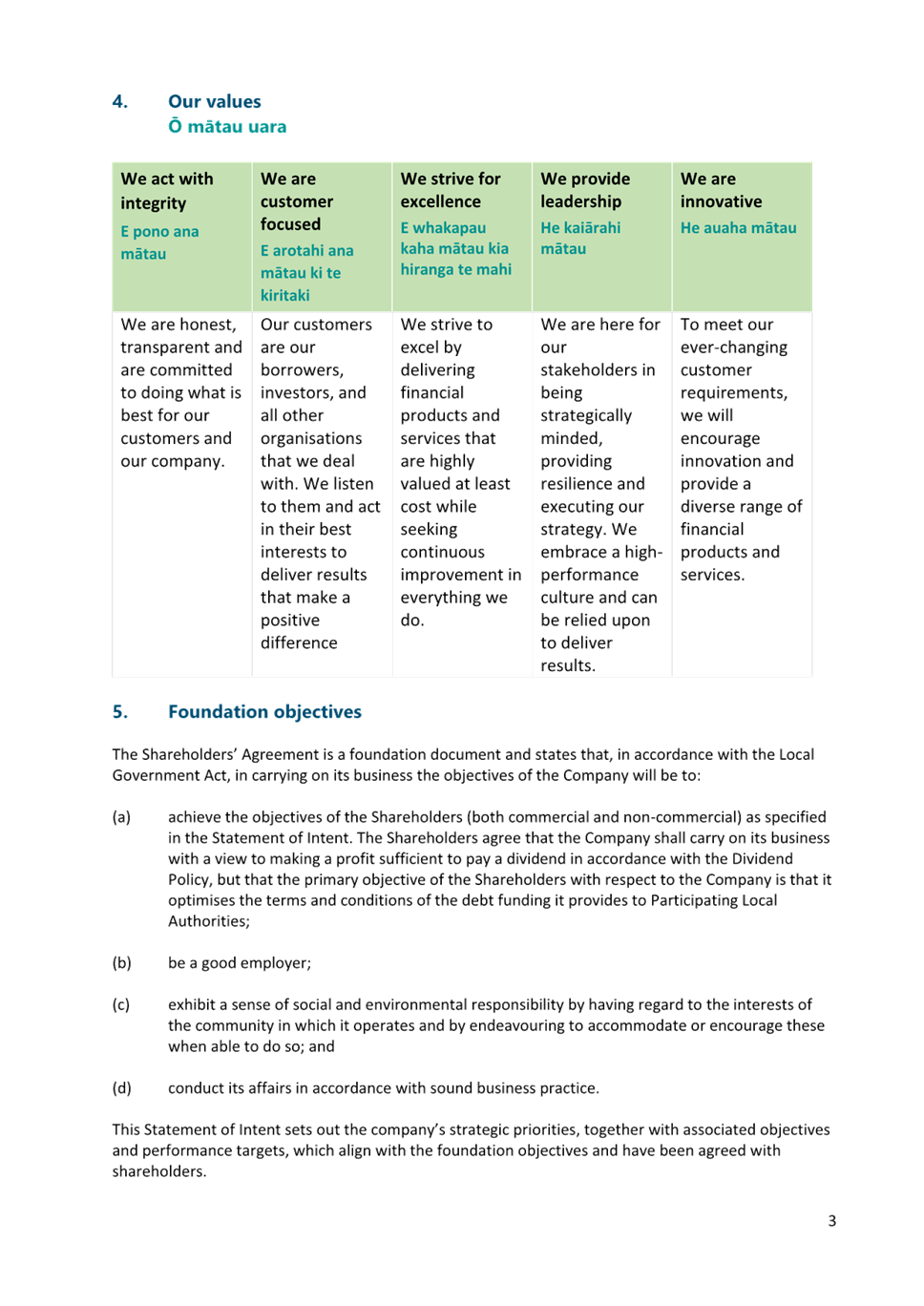

1. The

purpose of this report is for Tauranga City Council to formally receive the

Local Government Funding Agency’s (LGFA) draft Statement of Intent for

2025/28 and Letter of Expectations for 2025/26.

|

Recommendations

That the City Delivery

Committee:

(a) Receives

the report "Local Government Funding Agency - Draft Statement of Intent

2025/28 and Letter of Expectations 2025/26".

(b) Receives

the Local Government Funding Agency’s draft Statement of Intent 2025/28

(Attachment 1).

(c) Receives

the Local Government Funding Agency Shareholders’ Council Letter of

Expectations 2025/26 to the Local Government Funding Agency Board (Attachment

2).

(d) Receives

the Local Government Funding Agency’s Letter to its Shareholders on its

draft Statement of Intent 2025/28 (Attachment 3).

(e) Notes

that Tauranga City Council may provide feedback on the draft Statement of

Intent either directly to LGFA, or through the Shareholders Council if there

are matters it would like to be considered before the Statement of Intent is

finalised.

|

Executive Summary

2. Tauranga

City Council (TCC or Council) is one of 31 shareholders of the Local Government

Funding Agency (LGFA). LGFA is required by the Local Government Act (2002) to

prepare a draft Statement of Intent (SOI) and provide a copy to each of its

shareholders by 1 March each year.

3. TCC’s 7

April 2025 City Delivery Committee meeting is the first suitable meeting for

LGFA’s draft SOI 2025/28 and Letter of Expectations (LOE) 2025/26, to be

formally received

4. Feedback on the

draft SOI or expectations for the LGFA Board, will be provided to the Board by

1 May 2025, by the LGFA Shareholders’ Council. As TCC is one of 31

shareholder members of LGFA, it is not expected that Council provides LGFA with

a letter of expectations or provides direct feedback to LGFA on its draft SOI.

However, if there are specific matters Council would like to raise, LGFA would

welcome either direct feedback or feedback through the Shareholders Council of

which TCC is currently a member.

5. LGFA’s SOI

has met the statutory requirements as outlined in the Local Government Act

(Part 5, Section 64, Schedule 8).

6. The draft SOI

(Attachment 1) has been assessed against the LOE (Attachment 2). Overall:

LGFA’s draft SOI 2025/28 remains focused on continuing to deliver its

core purpose of providing relatively low cost debt to the sector, remaining

profitable and sustainable, and assisting councils to implement Local Water

Done Well.

7. LGFA aims to

continue to deliver strong stakeholder engagement, meeting the financial

targets and monitoring the credit quality of the Local Government sector.

8. The draft SOI has

been accompanied by a Letter to its Shareholders by LGFA explaining the KPIs

and financial projections over the next three years, including on the Local

Water Done Well Reform (Attachment 3).

9. LGFA’s final

SOI 2025/28 will be provided to Council by 30 June 2025 and received at the

City Delivery Committee meeting on 22 July 2025.

Background

10. Tauranga City Council (TCC or

Council) is one of 31 shareholders of the LGFA. LGFA is required by the Local

Government Act (2002) to prepare a draft SOI and provide a copy to each of its

shareholders by 1 March each year.

11. Council holds an 8.3%

shareholding in LGFA, which has a total equity of $113 million.

12. Feedback on the draft SOI or

expectations for the LGFA Board, will be provided to the Board by 1 May 2025,

by the LGFA Shareholders’ Council. The Shareholders’ Council is the

body that has been created to monitor accountability and performance. It

comprises of five to ten appointees from the Council Shareholders and the

Government. As TCC is one of 31 shareholder members of LGFA, it is not expected

that Council provides LGFA with LOEs or make direct feedback to this

CCO’s draft SOIs. However, it could provide direct feedback if Council

chooses or suggest matters to be considered by the shareholders council of

which TCC is currently a member.

13. The core purpose of LGFA is

benefiting communities through delivering efficient financing for the Local

Government sector. The LGFA has 31 shareholder members (including the

Government), 77 council members and five CCOs members. The LGFA’s 77

members represent all councils except for Chatham Islands District Council.

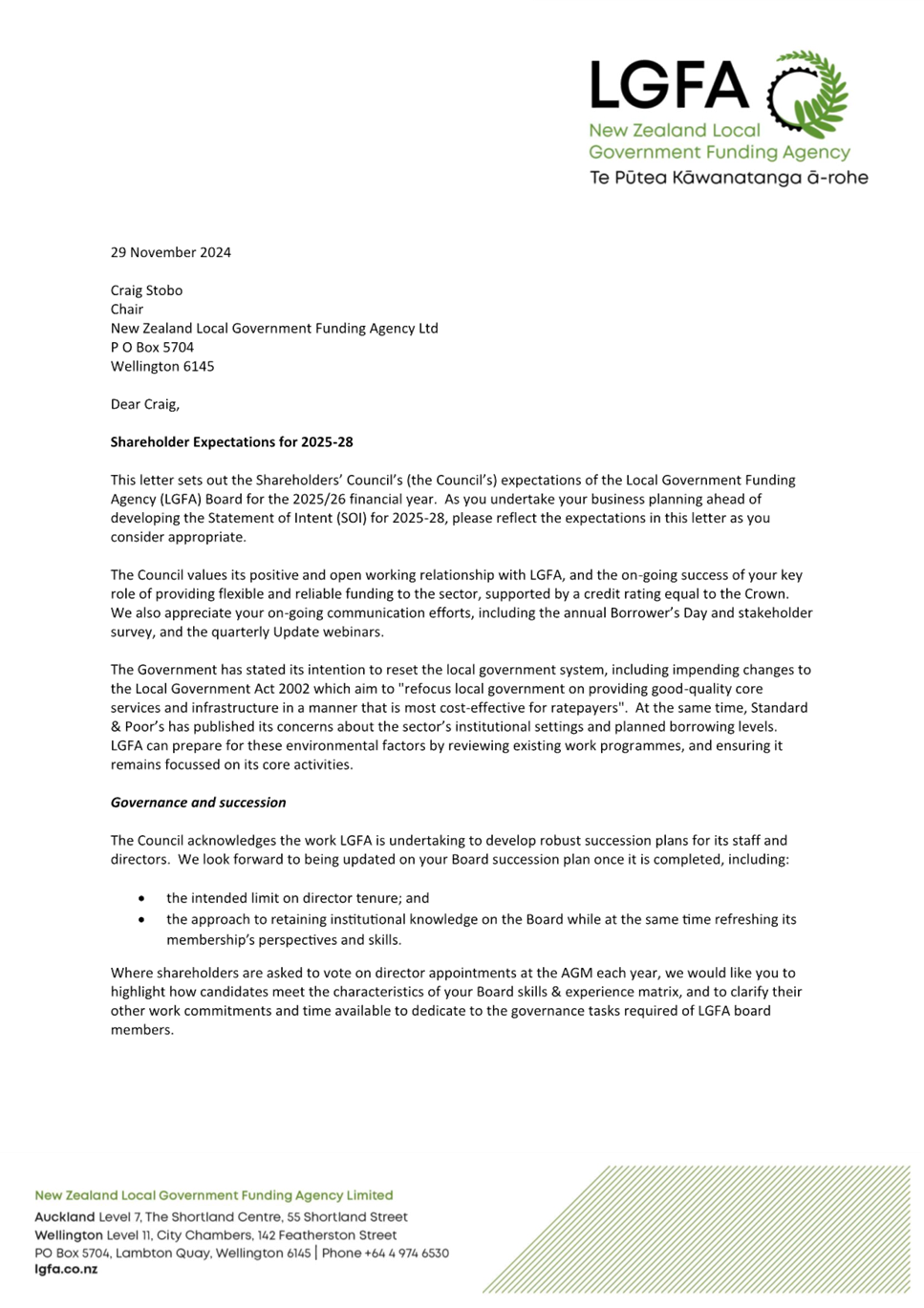

Letter of Expectations

2025/26

14. On 29 November 2024, the LGFA

Shareholders’ Council provided a LOE (Attachment 2) to the LGFA Board,

outlining the shareholders’ expectations for the 2025/26 financial year.

15. The expectations for the LGFA

Board are:

a) prepare

for the Government’s reset of the local government system including

impending changes to the Local Government Act 2002, which aim to “refocus

local government on providing good-quality core services and infrastructure in

a manner that is more cost effective for ratepayers”;

b) review

existing work programmes to ensure it remains focussed on its core activities;

c) develop

robust succession plans for its directors and staff;

d) balance

the need for LGFA directors being fairly remunerated for the work they

undertake and risks they bear, while ensuring they do not lose sight of the

public service element;

e) reduce

the cost pressure of the maturity mismatch between LGFA’s bond issuance

and loans to councils;

f) undertake

rigorous due diligence with analysis of potential costs, risks and benefits and

opportunities as progress on water reforms is achieved, recognising

shareholders’ relatively low risk appetite with this reform; and

g) include a clear statement of LGFA’s

emissions reduction target and pathways towards meeting this target.

Draft SOI 2025/28

16. LGFA’s draft SOI is

provided as Attachment 1 and was received on 28 February 2025, and has been

assessed against the LOE, provided as Attachment 2.

17. LGFA’s financial

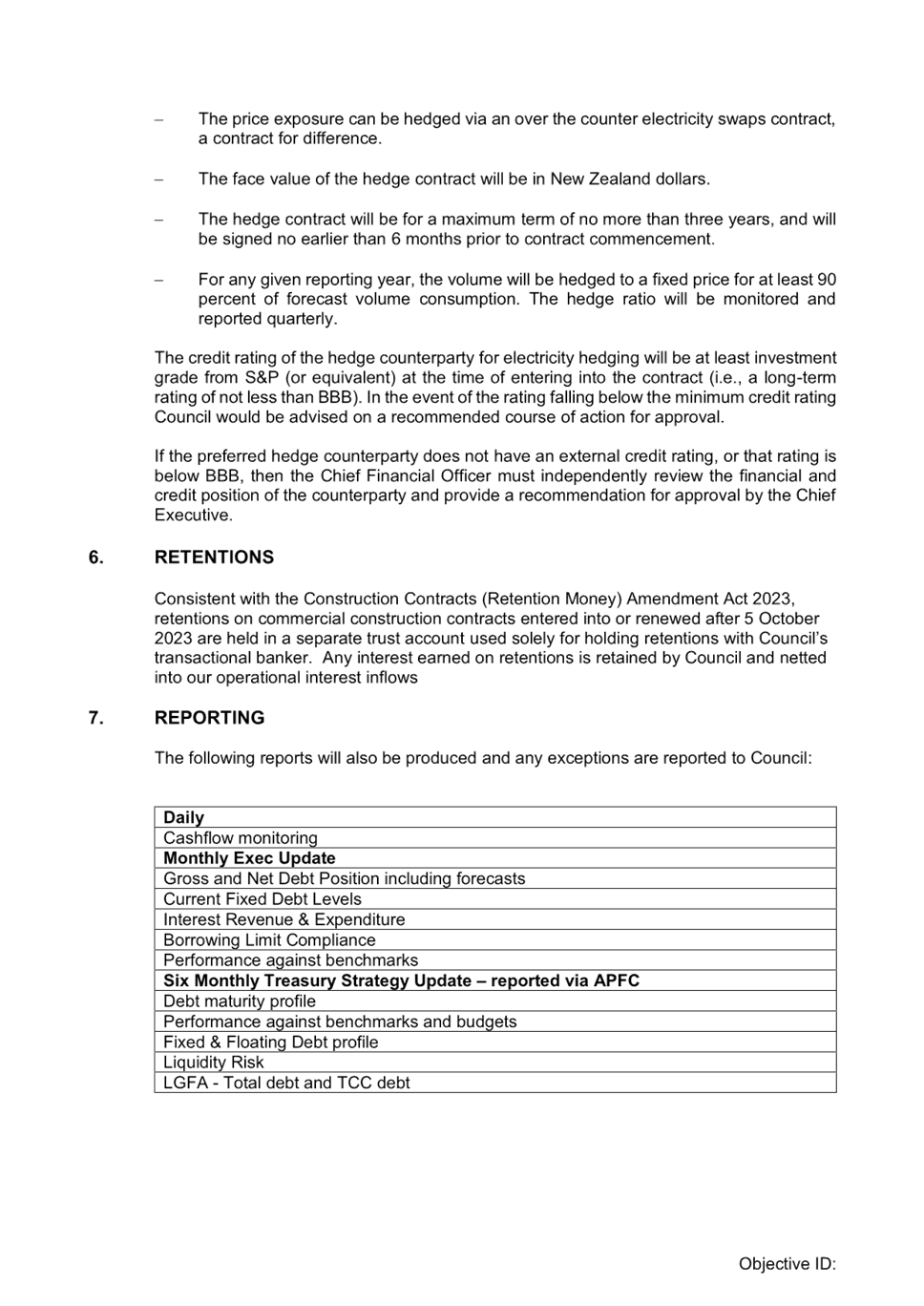

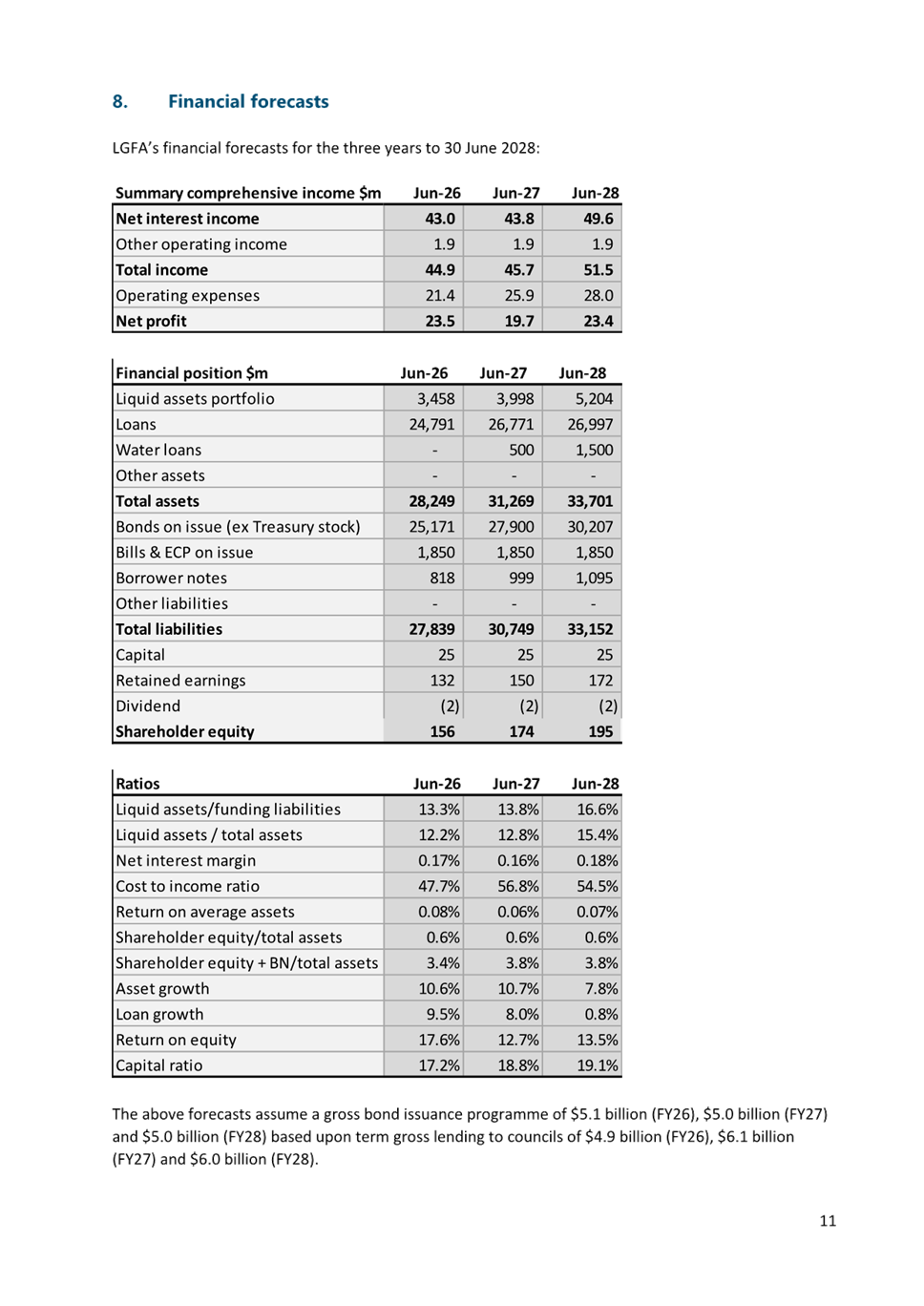

forecast over the next three years:

|

Forecast

|

FY26

|

FY27

|

FY28

|

Comment

|

|

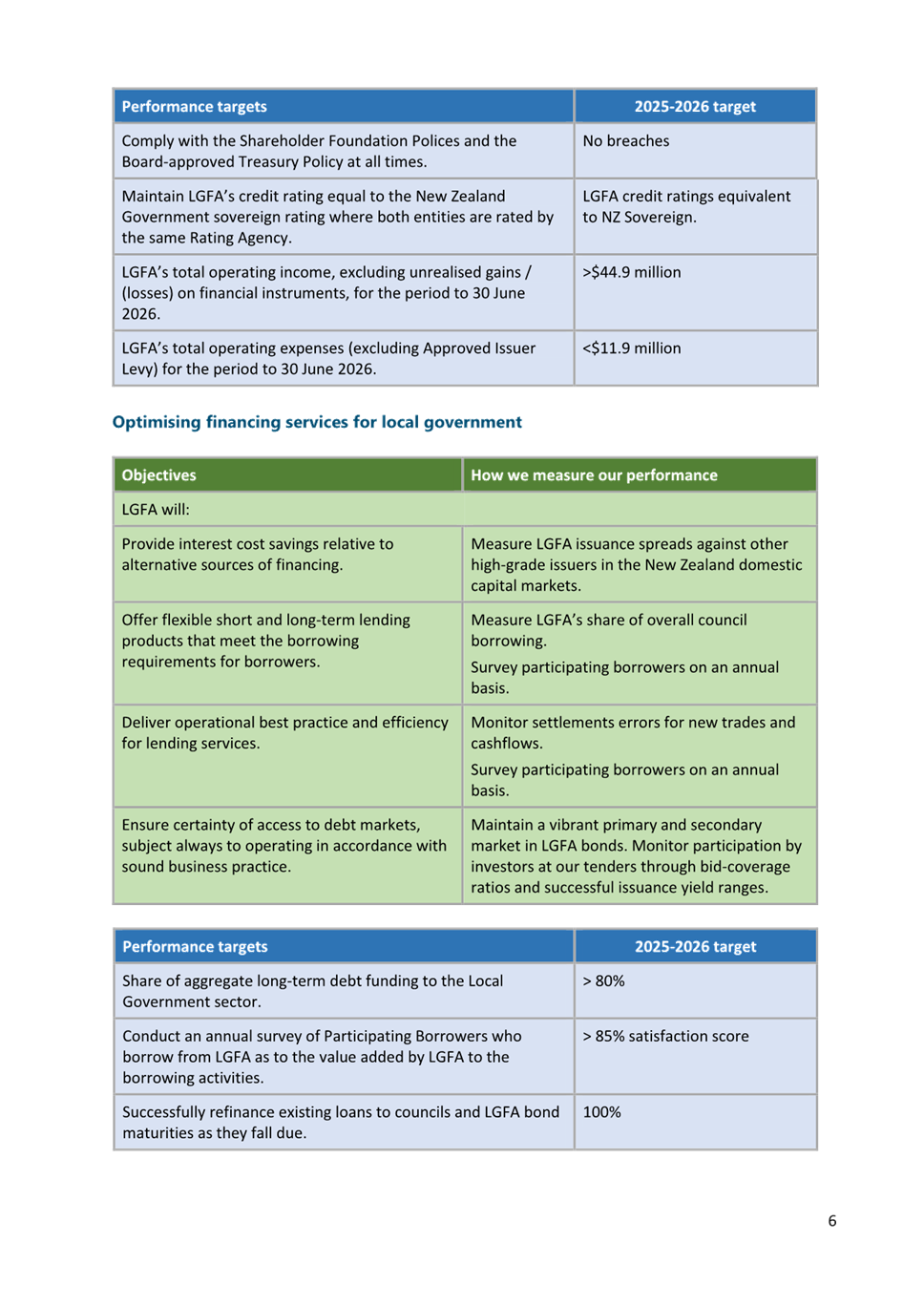

Net Operating Profit

|

$23.5 million

|

$19.7 million

|

$23.4 million

|

This CCO has also provided forecasts on its financial position and

ratios across the three financial years (pages 11-12).

|

|

Council loans (short- and long-term)

|

$24.8 billion

|

$26.8 billion

|

$28.5 billion

|

Lower compared to last year’s SOI.

|

|

Gross Bond Issuance Programme

|

$5.1 billion

|

$5 billion

|

$5 billion

|

Based upon term gross lending to councils.

|

|

Based upon term gross lending to councils

|

$4.9 billion

|

$6.1 billion

|

$6 billion

|

|

|

Issuance and Operating Expenses including Approved Issuer Levy (AIL)

|

$1.9 million higher

|

$4.2 million higher

|

|

Compared to the previous SOI. This is due to increased AIL paid to

the Government on its increased foreign currency issuance. AIL is expected to

be this CCO’s largest expense as it borrows more in offshore markets

over the three-year forecast period.

|

18. LGFA’s

financial forecast on the Local Water Done Well Reform is on track:

a) LGFA will provide financing to support

water CCOs being established under this reform more in FY2026/27 and FY2027/28,

once the reform has been implemented, rather than FY2025/26.

b) LGFA

notes that there is a high level of uncertainty regarding the financial

forecasts for both council borrowing and LGFA bond issuance. This is because of

the uncertainty relating to the timing of the establishment of water CCOs and

the impact on councils.

c) LGFA

will provide lending to the proposed water CCOs if they meet its qualifying

criteria for membership.

d) LGFA

will not be lending to financially independent CCOs as they are unlikely to

meet the qualifying criteria.

e) No final decisions have been made regarding

the transfer mechanism for assets, liabilities and revenue from councils to the

proposed water CCOs.

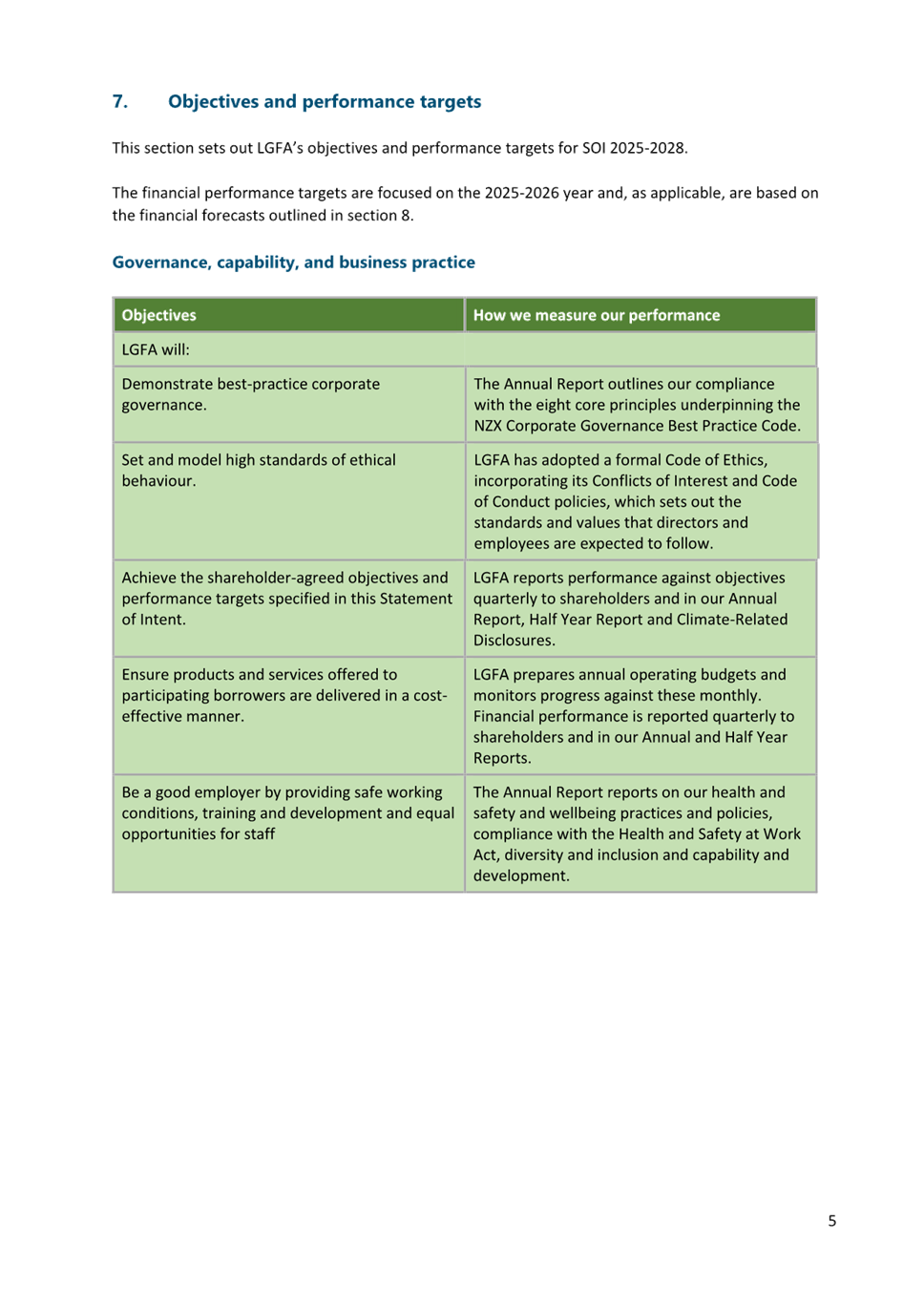

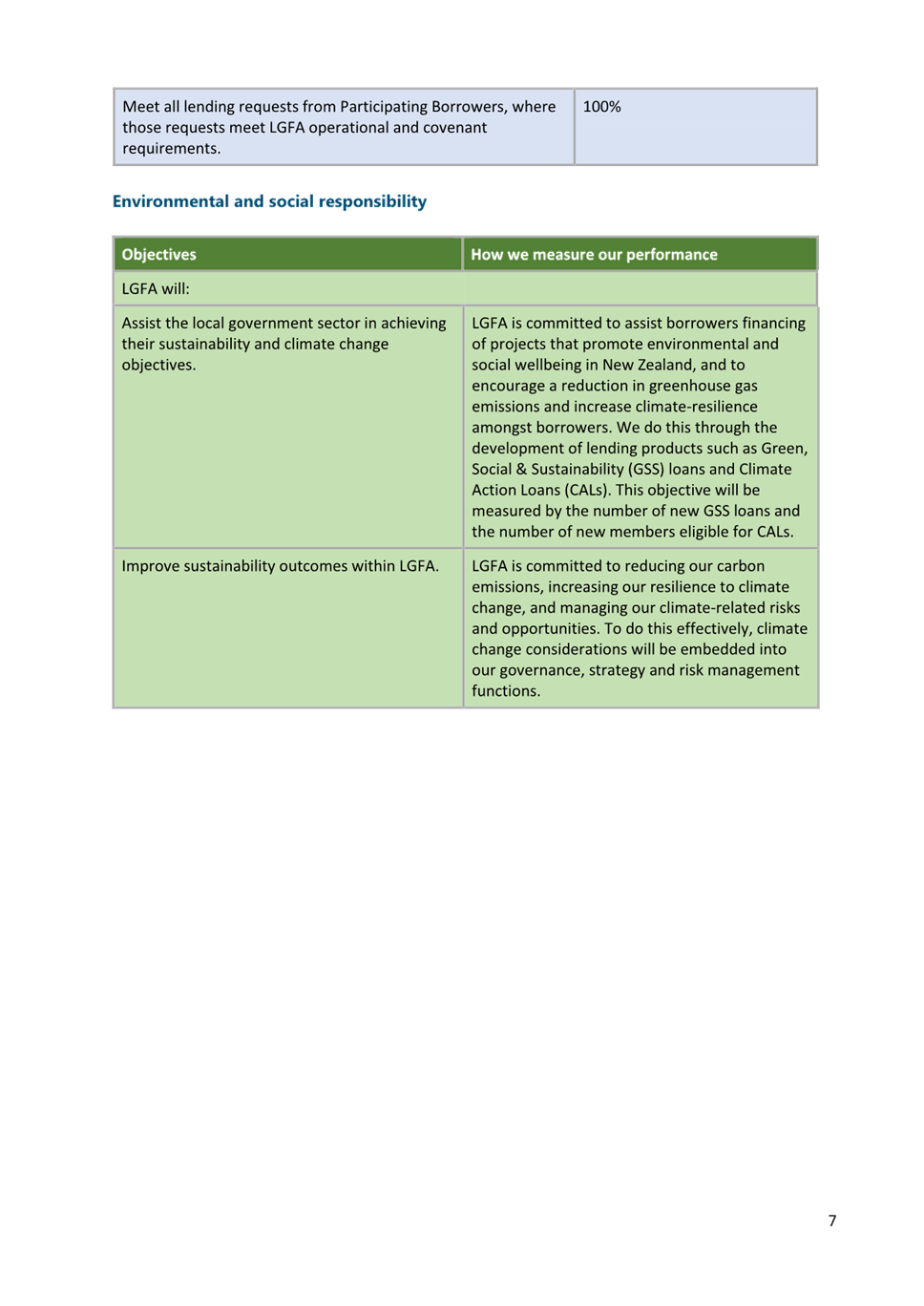

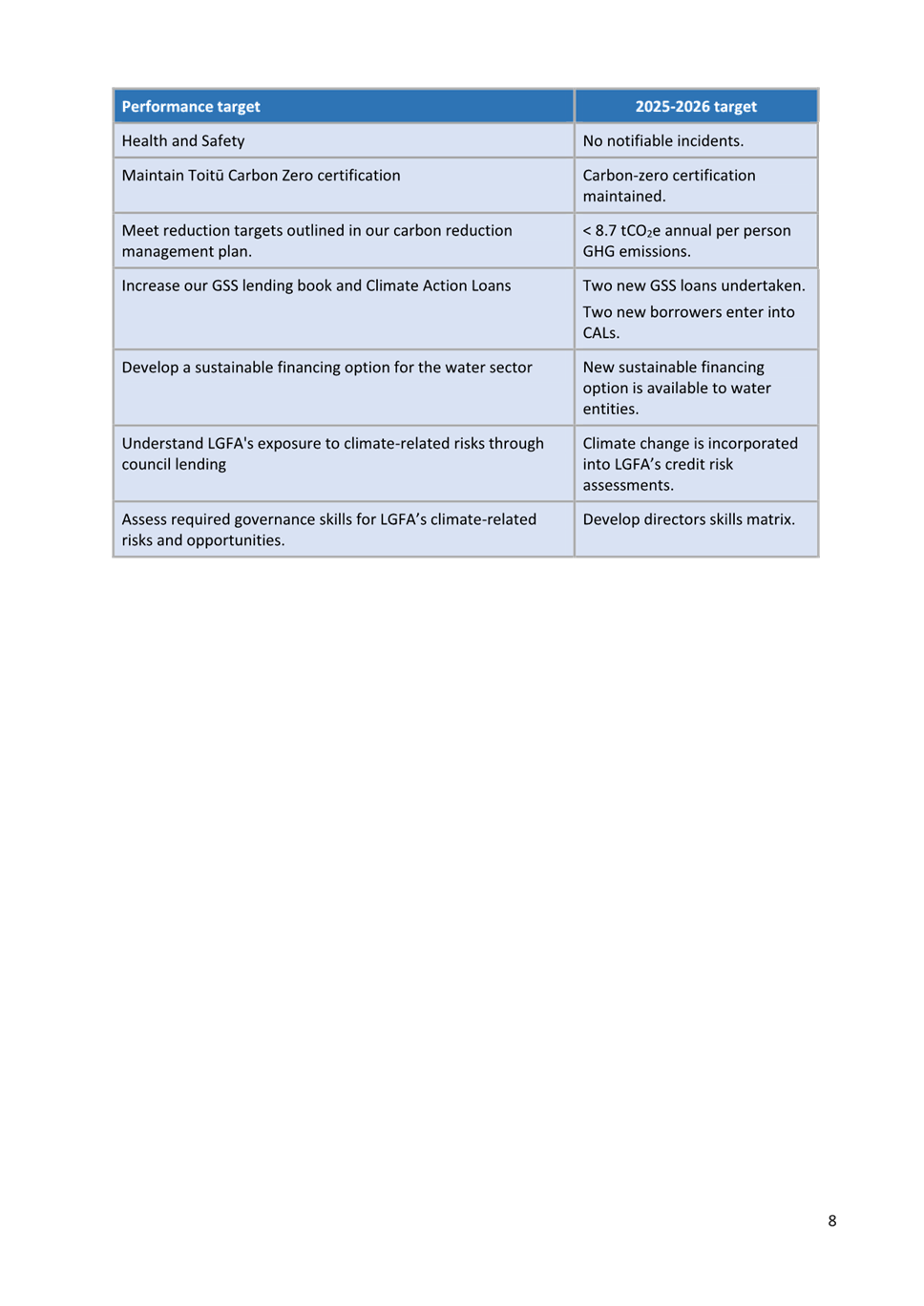

19. LGFA has set a total of 20

KPIs in the following areas (pages 5-10), similar to the previous SOI:

a) Governance,

capability and business practice – four KPIs.

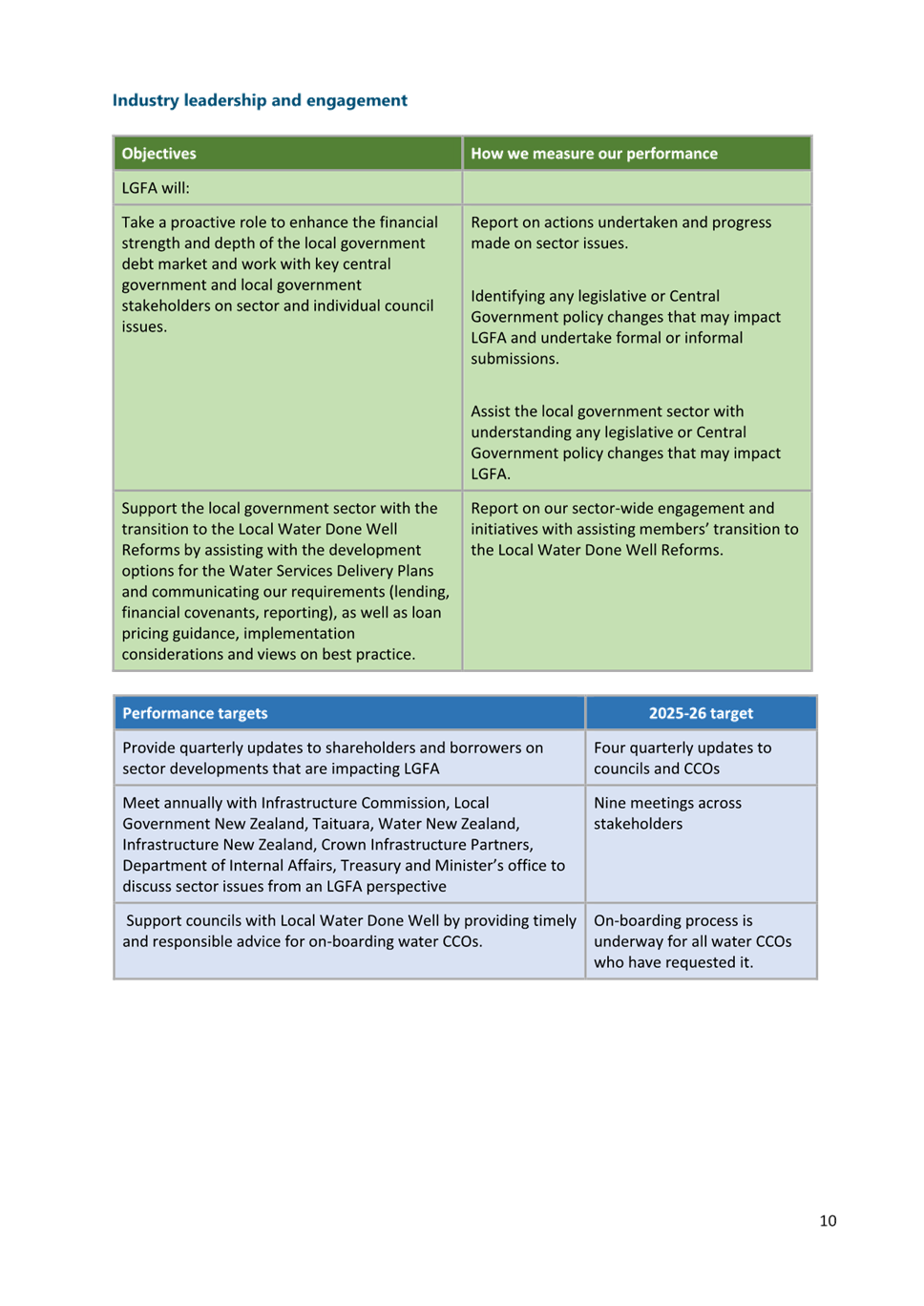

b) Optimising

financing services for local government – four KPIs.

c) Environmental

and social responsibility – seven KPIs.

d) Effective

management of loans – two KPIs.

e) Industry leadership and engagement –

three KPIs.

20. LGFA is committed to

demonstrating best practice corporate governance by setting and modelling high

standards of ethical behaviours, performing against its KPIs, providing value

for money to its members, and being a good employer.

21. LGFA is committed to

delivering operational best practice and efficiency for lending services,

offering flexible short- and long-term lending products that meet the borrowing

requirements for borrowers, and ensuring certainty of access to debt markets.

22. LGFA is committed to

assisting the Local Government sector in achieving their sustainability and

climate change objectives through the Green, Social and Sustainability and

Climate Action Loans.

23. In turn, the LGFA is

committed to improving sustainability outcomes within its own organisation by

reducing its carbon emissions, increasing resilience to climate change and

managing climate-related risks and opportunities.

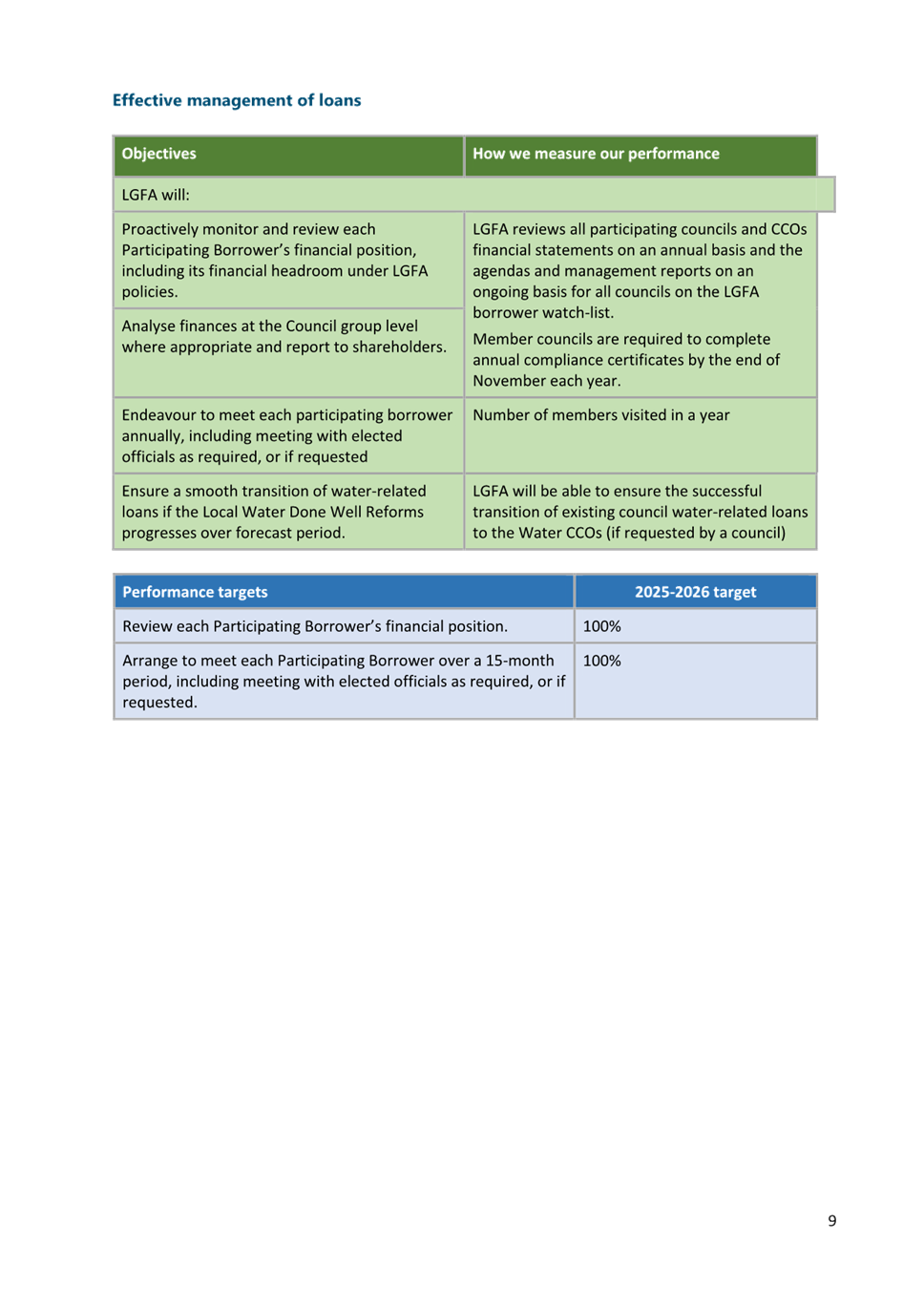

24. LGFA is committed to managing

loans in an effective manner by proactively monitoring and reviewing each

participating borrower’s financial position, meeting each participating

borrower annually, including meeting with elected officials as required and if

requested, and ensuring a smooth transition of water-related loans if the Local

Water Done Well Reforms progresses over the forecast period.

25. LGFA is committed to being

the industry leader by taking a proactive role to enhance the financial

strength and depth of the Local Government debt market and work with key

Central Government and Local Government stakeholders on sector and individual

council issues.

26. LGFA is committed to

supporting the Local Government sector with the transition to the Local Water

Done Well Reforms by assisting with the development options for the Water

Services Delivery Plans, communicating its requirements, loan pricing guidance,

implementation considerations and views on best practice.

Statutory Context

27. The SOI is one of

LGFA’s key governance and planning documents. Engaging with LGFA

throughout the development of its annual SOI is one of the main ways TCC as