|

|

|

AGENDA

Ordinary Council meeting

Monday, 28 April 2025

|

|

I hereby give notice that an Ordinary meeting of

Council will be held on:

|

|

Date:

|

Monday, 28 April 2025

|

|

Time:

|

9.30am

|

|

Location:

|

Bay of Plenty Regional Council Chambers

Regional House

1 Elizabeth Street

Tauranga

|

|

Please note that this

meeting will be livestreamed and the recording will be publicly available on

Tauranga City Council's website: www.tauranga.govt.nz.

|

|

Marty Grenfell

Chief Executive

|

Terms of reference – Council

Membership

|

Chairperson

|

Mayor

Mahé Drysdale

|

|

Deputy Chairperson

|

|

|

Members

|

|

|

Quorum

|

Half of the members

present, where the number of members (including vacancies) is even;

and a majority of the members present, where the number of members

(including vacancies) is odd.

|

|

Meeting frequency

|

Three weekly or as required

|

Role

·

To ensure the effective and efficient governance

of the City.

·

To enable leadership of the City including

advocacy and facilitation on behalf of the community.

·

To review and monitor the performance of the

Chief Executive.

Scope

·

Oversee the work of all committees and

subcommittees.

·

Exercise all non-delegable and non-delegated

functions and powers of the Council.

·

The powers Council is legally prohibited from

delegating include:

○

Power to make a rate.

○

Power to make a bylaw.

○

Power to borrow money, or purchase or dispose of

assets, other than in accordance with the long-term plan.

○

Power to adopt a long-term plan, annual plan, or

annual report.

○

Power to appoint a chief executive.

○

Power to adopt policies required to be adopted

and consulted on under the Local Government Act 2002 in association with the

long-term plan or developed for the purpose of the local governance statement.

○

All final decisions required to be made by

resolution of the territorial authority/Council pursuant to relevant

legislation (for example: the approval of the City Plan or City Plan changes as

per section 34A Resource Management Act 1991).

·

Council has chosen not to delegate the

following:

○

Power to compulsorily acquire land under the

Public Works Act 1981.

·

Make those decisions which are required by

legislation to be made by resolution of the local authority.

·

Authorise all expenditure not delegated to

officers, Committees or other subordinate decision‑making bodies of

Council.

·

Make appointments of members to the council-controlled

organisation Boards of Directors/Trustees and representatives of Council to

external organisations.

·

Undertake all statutory duties in regard to

Council-controlled organisations, including reviewing statements of intent and

receiving reporting, with the exception of the Local Government Funding Agency

where such roles are delegated to the City Delivery Committee. This also

includes Priority One reporting.

·

Consider all matters related to Local Water Done

Well.

·

Consider any matters referred from any of the

Standing or Special Committees, Joint Committees, Chief Executive or General

Managers.

·

Review and monitor the Chief Executive’s

performance.

·

Develop Long Term Plans and Annual Plans

including hearings, deliberations and adoption.

·

For clarity the Council will develop, review,

undertake hearings of and deliberations on community submissions to bylaws as

well as the adoption of the final bylaw.

Procedural matters

·

Delegation of Council powers to Council’s

committees and other subordinate decision-making bodies.

·

Adoption of Standing Orders.

·

Receipt of Joint Committee minutes.

·

Approval of Special Orders.

·

Employment of Chief Executive.

·

Other Delegations of Council’s powers,

duties and responsibilities.

Regulatory matters

Administration,

monitoring and enforcement of all regulatory matters that have not otherwise

been delegated or that are referred to Council for determination (by a

committee, subordinate decision‑making body, Chief Executive or relevant

General Manager).

1 Opening

karakia

2 Apologies

|

Ordinary Council meeting Agenda

|

28 April 2025

|

3 Public

forum

3.1 Peter

and Kate Mulligan - Cellphone Towers

Attachments

Nil

3.2 A

representative from the Waimapu Street Group - Cellphone Towers

Attachments

Nil

3.3 Margaret

Murray-Benge - Cellphone Towers

Attachments

Nil

|

Ordinary Council meeting Agenda

|

28 April 2025

|

7 Confirmation

of minutes

7.1 Minutes

of the Extraordinary Council meeting held on 11 March 2025

File

Number: A17901999

Author: Clare

Sullivan, Team Leader: Governance Services

Authoriser: Christine

Jones, General Manager: Strategy, Growth & Governance

|

Recommendations

That the Minutes of the

Extraordinary Council meeting held on 11 March 2025 be confirmed as a true

and correct record.

|

Attachments

1. Minutes

of the Extraordinary Council meeting held on 11 March 2025

|

Extraordinary

Council meeting minutes

|

11 March 2025

|

|

|

|

MINUTES

Extraordinary Council meeting

Tuesday, 11 March 2025

|

Order of Business

1 Opening

karaka. 3

2 Apologies. 3

3 Acceptance

of late items. 3

4 Confidential

business to be transferred into the open. 3

5 Change to

the order of business. 3

6 Declaration

of conflicts of interest 3

7 Business. 3

7.1 Draft

Budget and Rating Policy for the Annual Plan Consultation. 4

8 Discussion

of late items. 7

9 Closing

karakia. 7

Resolutions transferred into the open section of the meeting

after discussion. 7

MINUTES

OF Tauranga City Council

Extraordinary Council meeting

HELD

AT THE Tauranga City Council, Ground

Floor Meeting Rooms 1 & 1b, 306 Cameron Road, Tauranga

ON

Tuesday, 11 March 2025 AT 10:00am

PRESENT: Mayor

Mahé Drysdale, Deputy Mayor Jen Scoular, Cr Hautapu Baker, Cr Glen

Crowther, Cr Rick Curach, Cr Steve Morris, Cr Marten Rozeboom, Cr Kevin

Schuler, Cr Rod Taylor

IN ATTENDANCE: Marty

Grenfell (Chief Executive), Paul Davidson (Chief Financial Officer), Barbara

Dempsey (General Manager: Community Services), Nic Johansson (General Manager:

Infrastructure), Christine Jones (General Manager: Strategy, Growth &

Governance), Alastair McNeill (General Manager: Corporate Services), Sarah

Omundsen (General Manager: Regulatory & Compliance), Gareth Wallis (General

Manager: City Development & Partnerships), Jim Taylor ( Manager: Rating

Policy & Revenue), Kathryn Sharplin ( Manager: Finance), Tracey Hughes ( Financial

Insights and Reporting Manager) Clare Sullivan (Team Leader:

Governance Services), Caroline Irvin (Governance Advisor).

Timestamps are

included beside each of the items and relate to the recording of the meeting

held on 11 March 2025 at Council Website.

1 Opening

karaka

Cr Steve Morris opened the meeting with a karakia.

2 Apologies

Nil

3 Acceptance

of late items

Nil

4 Confidential

business to be transferred into the open

Nil

5 Change

to the order of business

Nil

6 Declaration

of conflicts of interest

Nil

7 Business

TIMESTAMP 13:09

|

7.1 Draft Budget

and Rating Policy for the Annual Plan Consultation

|

|

Staff Paul Davidson,

Chief Financial Officer

Kathryn Sharplin, Manager: Finance

Jim Taylor, Manager: Rating Policy & Revenue

Tracey Hughes, Financial Insights and Reporting Manager

Changes to recommendations:

·

The Mayor moved a motion with changes to the recommendations in

the report noting that staff and elected members were continuing to look for

savings, to smooth out the allocation of the general rates between

residential, commercial and industrial and to establish a working group to

undertake a review of operational costs and service levels.

|

|

A MOTION WAS PROPOSED

Moved: Mayor

Mahé Drysdale

Seconded: Cr Marten Rozeboom

That the Council:

(a) Receives the report

"Draft Budget and Rating Policy for the Annual Plan Consultation ".

(b) In respect of the draft

operating budget and rates requirement for consultation:

(i) Agrees to an overall

rates increase after growth arising from the proposed budget of 12.5% noting

that this includes up to $1.3m of placeholder budget savings to be identified

in budgets prior to the adoption of the annual plan,

(c) Agrees that the additional

rates funded savings of $8.3m (equivalent to 2.5% decrease in rates) to be

considered for inclusion in the 2025/26 Annual Plan, with further savings

targets pursued through the 2026/27 annual plan and subsequent annual or long

term plans.

(d) In respect of rating policy,

agrees to continue with the Long-term Plan decision to move to a fixed

proportion of the general rates for each rating category and change the

proportions for the residential rating category to 65%, the Commercial rating

category to 15% and the industrial rating category to 20% by the 2027/28

rating year.

(e) Agrees for the 2025/2026

rating year the allocation of the general rates will be:

· Residential

category 66.5%

· Commercial

category 14.3

· Industrial

category 19.2%

(f) Agrees the commercial

and industrial rating category general rates allocation of 15% and 20% will

be fully phased in by the 2027/2028 rating year.

(g) Notes that a rates increase

of 12.5% is 0.5% higher than the rates limit adopted in the financial

strategy of the 2024/34 Long Term Plan however that limit excluded the second

Infrastructure Funding and Financing levy of 2.2%.

(h) Establishes a working group

comprising the Mayor, Deputy Mayor, Chief Executive, Chief Financial Officer

and councillors to undertake a detailed review of operational costs and

service levels. The purpose of the working group is to identify further cost

savings to reduce the proposed rates increase. The working group will report

back with recommendations prior to the adoption of the Annual Plan 2025/26.

At 11.50am the meeting

adjourned.

At 12.23pm the meeting

reconvened.

AN AMENDMENT WAS

PROPOSED

Moved: Cr

Rick Curach

Seconded: Cr Glen Crowther

That the proposed resolution (c) be amended to read:

(c) Agrees

to additional placeholder savings to achieve a 9.9% rate revenue increase be

applied to the final 2025/26 Annual Plan.

FOR:

Cr Glen Crowther and Cr Rick Curach

AGAINST: Mayor

Mahé Drysdale, Deputy Mayor Jen Scoular, Cr Hautapu Baker, Cr Steve

Morris,

Cr Marten Rozeboom, Cr Kevin Shuler and Cr Rod Taylor

LOST

|

|

Resolution CO/25/4/1

Moved: Mayor

Mahé Drysdale

Seconded: Cr Marten Rozeboom

That the Council:

(a)

Receives the report "Draft Budget and Rating Policy for the

Annual Plan Consultation ".

(c) Agrees that the additional

rates funded savings of $8.3m (equivalent to 2.5% decrease in rates) to be

considered for inclusion in the 2025/26 Annual Plan, with further savings

targets pursued through the 2026/27 annual plan and subsequent annual or long

term plans.

(d) In respect of rating policy,

agrees to continue with the Long-term Plan decision to move to a fixed

proportion of the general rates for each rating category and change the

proportions for the residential rating category to 65%, the Commercial rating

category to 15% and the industrial rating category to 20% by the 2027/28

rating year.

(f) Agrees the commercial

and industrial rating category general rates allocation of 15% and 20% will

be fully phased in by the 2027/2028 rating year.

(g) Notes that a rates increase

of 12.5% is 0.5% higher than the rates limit adopted in the financial

strategy of the 2024/34 Long Term Plan however that limit excluded the second

Infrastructure Funding and Financing levy of 2.2%.

(h) Establishes a working group

comprising the Mayor, Deputy Mayor, Chief Executive, Chief Financial Officer

and councillors to undertake a detailed review of operational costs and

service levels. The purpose of the working group is to identify further cost

savings to reduce the proposed rates increase. The working group will report

back with recommendations prior to the adoption of the Annual Plan 2025/26.

CARRIED

|

|

Resolution CO/25/4/2

Moved: Mayor

Mahé Drysdale

Seconded: Cr Marten Rozeboom

That the Council:

(b) In respect of the draft

operating budget and rates requirement for consultation:

(i) Agrees to an overall rates increase after growth

arising from the proposed budget of 12.5% noting that this

includes up to $1.3m of placeholder budget savings to be identified in

budgets prior to the adoption of the annual plan

FOR:

Mayor Mahé Drysdale, Deputy Mayor Jen Scoular, Cr Hautapu Baker, Cr

Marten Rozeboom, Cr Kevin Shuler and Cr Rod Taylor

AGAINST: Cr Steve

Morris, Cr Glen Crowther and Cr Rick

Curach

Carried

|

|

Motion

Moved: Mayor

Mahé Drysdale

Seconded: Cr Marten Rozeboom

That the Council:

(e) Agrees for the 2025/2026

rating year the allocation of the general rates will be:

· Residential

category 66.5%

· Commercial

category 14.3

· Industrial

category 19.2%

FOR:

Mayor Mahé Drysdale, Deputy Mayor Jen Scoular, Cr Marten Rozeboom,

AGAINST: Cr Hautapu

Baker, Cr Glen Crowther, Cr Rick Curach, Cr Steve Morris, Cr Kevin Shuler and

Cr Rod Taylor

LOST

|

|

Resolution CO/25/4/3

Moved: Mayor

Mahé Drysdale

Seconded: Cr Marten Rozeboom

That the Council:

(e) Agrees for the 2025/2026

rating year the allocation of the general rates will be:

· Residential

category 66. %

· Commercial

category 14.8%

· Industrial

category 19.2%

FOR:

Cr Hautapu Baker, Cr Glen Crowther, Cr Rick Curach, Cr Steve Morris, Cr Kevin

Shuler and Cr Rod Taylor

AGAINST: Mayor

Mahé Drysdale, Deputy Mayor Jen Scoular, Cr Marten Rozeboom

Carried

|

8 Discussion

of late items

Nil

9 Closing

karakia

Cr Morris closed the meeting with a karakia

The meeting closed at 12.43 pm.

The minutes of this meeting were confirmed at the

Ordinary meeting of the Tauranga City Council held on 24

March 2025.

...................................................

CHAIRPERSON

|

Ordinary

Council meeting Agenda

|

28

April 2025

|

7.2 Minutes of

the Council meeting held on 24 March 2025

File

Number: A17911957

Author: Clare

Sullivan, Team Leader: Governance Services

Authoriser: Christine

Jones, General Manager: Strategy, Growth & Governance

|

Recommendations

That the Minutes of the

Council meeting held on 24 March 2025 be confirmed as a true and correct

record.

|

Attachments

1. Minutes

of the Council meeting held on 24 March 2025

|

Ordinary

Council meeting minutes

|

24 March 2025

|

|

|

|

MINUTES

Ordinary Council meeting

Monday, 24 March 2025

|

Order of Business

1 Opening karakia. 4

2 Apologies. 4

3 Public

forum.. 4

4 Acceptance

of late items. 6

4.1 Resolution

to accept late items. 6

5 Confidential

business to be transferred into the open. 6

5.1 Resolution

to move Public Exlcuded items to Public. 6

6 Change to

the order of business. 6

7 Confirmation

of minutes. 7

7.1 Minutes

of the Council meeting held on 24 February 2025. 7

7.2 Minutes

of the Council meeting held on 3 March 2025. 7

8 Declaration

of conflicts of interest 7

9 Deputations,

presentations, petitions. 7

Nil

10 Recommendations from

other committees. 7

Nil

11 Business. 8

11.1 Draft

Development Contributions Policy 2025/26. 8

11.2 Adoption

of Supporting Material and Consultation Document - Annual Plan 2025/26. 8

11.3 Local

Water Done Well - Adoption of Consultation Document and Update on Progress 9

11.4 Street

Dining License to Occupy Implementation Plan. 11

11.5 Transport

Resolutions Report: 54. 11

11.6 Remuneration

for Tangata Whenua Representatives Appointed to Three Standing Committees. 12

11.7 Appointment

of Tangata Whenua representatives to standing committees. 13

11.8 Appointments

to the Board - Bay Venues Limited, the Tauranga Art Gallery Trust and Tourism

Bay of Plenty. 14

12 Discussion of late

items. 15

13 Public excluded

session. 15

13.1 Public

Excluded Minutes of the Council meeting held on 10 February 2025. 16

13.2 Public

Excluded Minutes of the Council meeting held on 24 February 2025. 16

13.3

Information on the Appointment of Tangata Whenua representatives to standing

committees. 16

13.7 In

formation on the Appointments to the Board - Bay Venues Limited, the Tauranga

Art Gallery Trust and Tourism Bay of Plenty. 17

14 Closing karakia. 17

MINUTES

OF Tauranga City Council

Ordinary Council meeting

HELD

AT THE Bay of Plenty Regional Council

Chambers, Regional House, 1 Elizabeth Street, Tauranga

ON

Monday, 24 March 2025 AT 9.30am

|

MEMBERS PRESENT:

|

Mayor Mahé Drysdale,

Deputy Mayor Jen Scoular, Cr Hautapu Baker, Cr Glen Crowther, Cr Rick Curach,

Cr Steve Morris, Cr Marten Rozeboom, Cr Kevin Schuler, Cr Rod Taylor

|

|

IN ATTENDANCE:

|

Marty Grenfell (Chief Executive),

Paul Davidson (Chief Financial Officer), Nic Johansson (General Manager:

Infrastructure), Christine Jones (General Manager: Strategy, Growth &

Governance), Gareth Wallis (General Manager: City Development & Partnerships),

Ben Corbett (Team Leader: Growth Funding), Andrew Mead (Manager: City

Planning and Growth), Kathryn Sharplin (Manager Finance), Tracey Hughes

(Financial Insights & Reporting Manager), Sarah Stewart (Principal

Strategic Advisor), Stephen Burton (Transportation Lead – Water

Services), Cathy Davidson (Manager: Directive Services), Shawn Geard (City

Centre Infrastructure Lead), Karen Hay (Manager: Network Safety and

Sustainability), Stacey Mareroa-Roberts (Manager: Strategic Māori

Engagement), Ceilidh Dunphy (Community Relations Manager), (Coral Hair

(Manager: Democracy & Governance Services), Clare Sullivan (Team Leader:

Governance Services), Anahera Dinsdale (Governance Advisor),

|

Timestamps are included beside each of the items and relate

to the recording of the meeting held on 24 March 2025

https://www.youtube.com/watch?v=NlB76gN6HEk

1 Opening

karakia

Cr Baker opened the meeting with a karakia

Mayor Drysdale noted the achievements of Sam Ruthe who

became the first person under the age of 16 to run an impressive 4-minute mile

and wished him all the best for his career.

2 Apologies

Nil

3 Public

forum

|

3.1 Harris

Williams – Mount Business Association

|

|

Timestamp: 0:05

Key Points

·

Sought the removal or reconsideration of the new licence to

occupy fees for the street dining as they place an unreasonable and

disproportionate burden on all businesses not just at the Mount.

·

Preferred outcome was to drop the fees altogether, but if they

were to continue Mount Maunganui should be exempt or have the fees

substantially reduced.

·

The proposed charge of $150 per m² was the highest

proposed charge by a large margin as it was linked to land value.

·

Despite higher rates, there had been a lack of public

investment to the streetscape, there had been no enhancements to the street

amenities for over 25 years.

·

Tauranga had seen upgrades specifically to enhance outdoor

dining appeal and foot traffic.

·

There had been no net analysis to determine if net profits

rather than the turnover resulted in more profit for the businesses and had

failed to meet the onground conditions or represent value for money.

·

A reduced rate of $30 per m² for 2024/25 was still a

significant cost to local businesses who had not previously paid the fee. The

costs were detrimental and not sustainable as they were already grappling

with increasing costs.

·

Request that the fees not be imposed and only create a bylaw

for safety and street amenity and rely on commercial rates to cover public

infrastructure to serve commercial businesses or until such time as Council

invests in upgrades to warrant an additional fee.

·

Alternately apply a flat nominal fee across the whole Council,

adjusted for public investment in that zone.

In response to

questions

·

In relation to a question relating to the businesses making

money from the use of a Council asset, it was noted that it was the

entrepreneurial vision of the businesses that had created an amenity in those

spaces.

|

|

3.2 Jan

Gyenge

|

|

Key Points

·

Councillors were tasked to uphold democracy with

accountability, transparency and integrity and asked if they were doing this.

In reponse to

questions

·

In relation to specifics the submitter would like Councillors

to consider, she noted that it was the prime objective of what they were

elected to do.

·

Mayor Drysdale advised the Council were out in the community

talking to people to do what was best for the city based on the information

provided.

|

4 Acceptance

of late items

|

4.1 Resolution

to accept late items

|

|

Resolution CO/25/5/1

Moved: Cr

Rick Curach

Seconded: Deputy Mayor Jen Scoular

That the Council:

(a)

Accepts the following late items for consideration at the meeting:

·

Confirmation of the open part of the minutes of the Council

meeting held on 3 March 2025

·

Confirmation of the public excluded part of the minutes of the

Council meeting held on 3 March 2025

·

Appointment to Board - Bay Venues Limited, the Tauranga Art

Gallery Trust and Tourism Bay of Plenty

(b) The

above items were not included in the original agenda because it was not

available at the time the agenda was issued, and discussion cannot be delayed

until the next scheduled meeting.

Carried

|

5 Confidential

business to be transferred into the open

|

5.1 Resolution

to move Public Exlcuded items to Public

|

|

Resolution CO/25/5/2

Moved: Mayor

Mahé Drysdale

Seconded: Cr Rick Curach

That the Council:

Move the following items from public excluded to the

public part of the meeting:

·

Item13.3 Appointment of Tangata Whenua representatives to

standing committees and

·

Item 13.4 Appointment to Board – Bay Venues Limited, The

Tauranga Art Gallery Trust and Tourism Bay of Plenty.

Carried

|

6 Change

to the order of business

The Mayor noted that there were a number of separately

circulated papers that contain attachments. They related to:

Item 7.2 Minutes of the meeting of

3 March 2025

Item 11.1 Draft Development Contributions

Policy

Item 11.2 Adoption of Supporting Material

and Consultation Document – Annual Plan 2025/26

Item 11.3 Local Water Done Well - Adoption

of Consultation Document and Update on Progress

Item 13.5 Public Excluded Minutes of the

meeting of 3 March 2025

7 Confirmation

of minutes

8 Declaration

of conflicts of interest

Nil

9 Deputations,

presentations, petitions

Nil

10 Recommendations

from other committees

Nil

11 Business

|

11.1 Draft Development

Contributions Policy 2025/26

|

|

Timestamp: 28 minutes

Staff Christine

Jones, General Manager: Strategy, Growth and Governance

Ben

Corbett, Team Leader: Growth Funding

Andy

Mead. Manager: City Planning & Growth

|

|

Resolution CO/25/5/5

Moved: Cr

Marten Rozeboom

Seconded: Mayor Mahé Drysdale

That the Council:

(a) Receives the report

"Draft Development Contributions Policy 2025/26".

(b) Agrees to incorporate the

proposed updates to local and citywide development contributions in the draft

Development Contributions Policy 2025/26.

(c) Agrees to incorporate three

new local development contributions catchments in the draft Development

Contributions Policy 2025/26 for Tauriko Business Estate Stage 4, Tauriko

West and Upper Ohauiti.

(d) Adopts the Statement of

Proposal and draft Development Contributions Policy 2025/26 for the purposes

of public consultation.

(e) Delegates authority to the

General Manager: Strategy, Growth & Governance to make amendments to the

draft Development Contributions Policy 2025/26 to correct minor errors in

wording or financial information

Carried

|

|

11.2 Adoption of Supporting

Material and Consultation Document - Annual Plan 2025/26

|

|

Timestamp: 47minutes

Staff: Paul

Davidson, Chief Financial Officer

Christine Jones. General Manager: Strategy, Growth &

Governance

Kathryn Sharplin, Manager: Finane

Tracey Hughes, Financial Insights & Reporting Manager

Ceilidh Dunphy, Community Relations Manager

Reasons for decisions:

·

Amendments were made to the consultation document as reflected

in the resolution to provide additional explanations and better transparency

with the cost of running the city, the operating expenditure, capital

expenditure and the amount of staff and consultant costs.

|

|

Resolution CO/25/5/6

Moved: Mayor

Mahé Drysdale

Seconded: Deputy Mayor Jen Scoular

That the Council:

(a) Receives the report

"Adoption of Supporting Material and Consultation Document - Annual Plan

2025/26".

(b) Agrees

to the overall rates increase for the consultation document at 12% after

growth which includes operational expenditure of

$599m.

(c) Notes that the additional

rates funded savings to be sought of $8.3m (equivalent to 2.5% decrease in

rates), to be considered for inclusion in the 2025/26 Annual Plan, with

further savings targets pursued through the 2026/27 annual plan and

subsequent annual or long-term plans, has reduced to $6.7m due to higher

growth assumptions.

(d) Adopts the Draft Annual Plan

2025/26 supporting financial information.

(e) Adopts

the Draft User Fees and Charges 2025/26 schedule and statement of proposal.

Noting that the fees schedule will be updated to reflect the decision on the

licence to occupy fees from the paper on this same agenda titled "Street

Dining License to Occupy Implementation Plan."

(f) Adopts

the Draft Annual Plan 2025/26 consultation document (CD) content

(attachment 3) and as tabled in the design

version of the CD for public consultation from 28 March to 28 April 2025

subject to the inclusion of further information as follows:

(i) Include

a section “cost of running the city” – high-level numbers

including operating expenditure, capital expenditure, number of staff.

(ii) provide

more detailed breakdown of the operating expenditure of $599M such as

consultant costs, staff numbers.

(iii) add

operational expenditure to the table on page 30 of the draft consultation

document.

(iv) refer

to a reduction in “council emissions” instead of “city

emissions”.

(v) simplify

the explanation of salary savings.

(vi) add

average Residential, Commercial and Industrial rates increase figures as a

footnote on page 29 of the Consultation Document, and/or on the page of the

Financials appendix that shows rates increases.

(g) Authorises

the Chief Executive to approve minor drafting, financial and presentation

amendments to the Draft Annual Plan 2025/26 consultation document and any

supporting documentation prior to printing if necessary.

Carried

|

At 11.38am the meeting adjourned.

At 11.52am the meeting reconvened.

|

11.3 Local Water Done Well -

Adoption of Consultation Document and Update on Progress

|

|

Timestamp: 2 hours 23minutes

Staff Christine

Jones, General Manager: Strategy, Growth & Governance

Paul Davdson, Chief Financial Officer

Kathryn Sharplin, Manager Finance

Stephen Burton, Transformation Lead – Water Services

Cathy Davidson, Manager: Directorate Services

|

|

Resolution CO/25/5/7

Moved: Mayor

Mahé Drysdale

Seconded: Cr Marten Rozeboom

That the Council:

(a) Receives the report

"Local Water Done Well - Adoption of Consultation Document and Update on

Progress".

(b) Agrees that if a

multi-council controlled organisation is established, differences in prices

across councils will be maintained to reflect the differences in investment,

borrowing, and costs of service; and that any movement to price harmonisation

should require an explicit resolution from TCC.

(d) Notes that the implications

for TCC’s risk and credit rating are being further considered in line

with the 9 December 2024 Council decisions to ensure any multi-council

controlled organisation option is mutually beneficial, including for the

multi-council controlled organisation and remaining TCC organisation.

(e) Adopts the Draft Why Wai

Matters 2025 Consultation Document content (attachment 1) and Summary content

(attachment 2) for public consultation, noting design versions are being

developed.

(f) Authorises the General

Manager Strategy, Growth and Governance to approve minor drafting, financial

and presentation amendments to the Draft Why Wai Matters 2025 Consultation

and Summary Documents if necessary.

Carried

Abstention: Cr Glen

Crowther

|

|

Resolution CO/25/5/8

Moved: Mayor

Mahé Drysdale

Seconded: Cr Marten Rozeboom

That the Council:

(c) Notes that further financial

modelling has been completed by both Martin Jenkins and the Department of

Internal Affairs and that these both align with key conclusions from the

Indicative Business Case adopted by Council on 9 December 2024.

For:

Mayor Mahé Drysdale, Crs Hautapu Baker, Rick Curach, Marten

Rozeboom, Kevin Schuler and Rod Taylor

Against: Deputy Mayor Jen Scoular, Crs Glen

Crowther and Steve Morris

Carried

|

At 1.35pm the meeting adjourned.

At 2.10pm the meeting reconvened.

|

11.4 Street Dining License

to Occupy Implementation Plan

|

|

Timestamp: 4hours 40minutes

Staff Nic

Johannson, General Manager: Infrastructure

Shawn Geard, City Centre Infrastructure Lead

Reasons for decisions:

Changes were made

to the recommendations to allow for a staged rollout to include charges for

current areas this Annual Plan followed by a review of the bylaw. The

proposed changes also provide a flat rate across all the zones with a 50%

discount across all areas.

|

|

Resolution CO/25/5/9

Moved: Mayor

Mahé Drysdale

Seconded: Cr Rod Taylor

That the Council:

(a) Receives the report

"Street Dining License to Occupy Implementation Plan ".

Carried

|

|

Resolution CO/25/5/10

Moved: Mayor

Mahé Drysdale

Seconded: Cr Rod Taylor

That the Council:

(c) Approves Option 2a: Staged

rollout to include charges for current areas this Annual Plan, followed by a

review of the Street Use and Public Places Bylaw during FY26 in time for a

full city implementation in the next Annual Plan.

Carried

|

|

Resolution CO/25/5/11

Moved: Mayor

Mahé Drysdale

Seconded: Cr Rod Taylor

That the Council

(e) Amend

the user fees and charges schedule for street dining adopted by Council on 3

March 2025 with $100 per square metre at an 50% discount to apply to the

areas covered by the bylaw from 1 July 2025.

In

Favour: Mayor Mahé Drysdale, Crs

Hautapu Baker, Marten Rozeboom, Kevin Schuler and Rod Taylor

Against: Crs

Jen Scoular, Glen Crowther, Rick Curach and Steve Morris

carried

|

|

11.5 Transport Resolutions

Report: 54

|

|

Timestamp: 5 hours 51 minutes

Staff Nic

Johannson, General Manager: Infrastructure

Karen

Hay, Manager: Network Safety and Sustainability

Shawn

Geard, City Centre Infrastructure Lead

|

|

Resolution CO/25/5/12

Moved: Cr

Rod Taylor

Seconded: Cr Kevin Schuler

That the Council:

(a) Receives the report

"Transport Resolutions Report: 54".

(b) Resolves to amend the Traffic

and Parking Bylaw 2023 by adopting the proposed traffic and parking controls

relating to new subdivisions and minor changes for general safety,

operational or amenity purposes, as per Attachment A of this report.

(c) Confirms that parking on the

ground floor of the Elizabeth Street carpark is P120 minutes, as per

Attachment A of this report

(d) The changes are to become

effective on or after the 25th of March 2025 subject to

installation of appropriate signs and road markings.

Carried

|

|

11.6 Remuneration for

Tangata Whenua Representatives Appointed to Three Standing Committees

|

|

Timestamp: 6 hours 3 minutes

Staff Christine

Jones, General Manager: Strategy, Growth & Governance

Coral Hair, Manager: Democrary and Governance Services

Stacey Mareroa-Roberts, Manager: Strategic Māori

Engagement

Reasons for decisions:

·

Change to remove the maximum number of days per year. Mayor

will note a list of approved duties

|

|

Resolution CO/25/5/13

Moved: Mayor

Mahé Drysdale

Seconded: Deputy Mayor Jen Scoular

That the Council:

(a) Receives the report

"Remuneration for Tangata Whenua Representatives Appointed to Three

Standing Committees".

(b) Approves remuneration for the

Tangata Whenua representatives on the City Future Committee, the City

Delivery Committee and the Audit and Risk Committee at

(i) $1,085

per Committee meeting, $542 per workshop or approved duties.

In

Favour: Crs Mahé Drysdale, Jen

Scoular, Hautapu Baker, Rick Curach, Kevin Schuler and Rod Taylor

Against: Crs

Glen Crowther, Steve Morris and Marten Rozeboom

carried

|

At 4.05pm the meeting adjourned.

At 4.23pm the meeting reconvened.

The next two items were considered in the public part of the

meeting

|

11.7 Appointment

of Tangata Whenua representatives to standing committees

|

|

Timestamp: 6 hours 52 minutes

Staff Christine

Jones, General Manager: Strategy, Growth & Governance

|

|

Resolution CO/25/5/14

Moved: Deputy

Mayor Jen Scoular

Seconded: Cr Rod Taylor

That the Council:

(a) Receives the report

"Appointment of Tangata Whenua representatives to standing committees".

(b) Appoints the following

Tangata Whenua representatives to the respective committees as set out below,

based on the recommendations of Te Rangapū Mana Whenua o Tauranga Moana:

|

Committee

|

Name of

representative

|

|

Audit and Risk

Committee

|

Rohario

Murray

|

|

City Future

Committee

|

Arthur

Flintoff

|

|

City Delivery

Committee

|

Jacqui

Rolleston-Steed

|

(b)

Notes that attachments 1, 2 and 3, the CVs of the appointees, are to

remain in confidential.

In

Favour: Mayor Mahé Drysdale,

Crs Jen Scoular, Hautapu Baker, Glen Crowther, Rick Curach, Steve Morris, Kevin

Schuler and Rod Taylor

Against: Cr

Marten Rozeboom

Carried

|

|

11.8 Appointments

to the Board - Bay Venues Limited, the Tauranga Art Gallery Trust and Tourism

Bay of Plenty

|

|

Timestamp: 7 hours

Staff Christine

Jones, General Manager: Strategy, Growth & Governance

Reasons for decision:

·

To enable further discussions with relevant parties and receive

further infomration

|

|

Resolution CO/25/5/15

Moved: Mayor

Mahé Drysdale

Seconded: Cr Rick Curach

That the Council:

(a) Receives the report

"Appointments to the Board - Bay Venues Limited, the Tauranga Art

Gallery Trust and Tourism Bay of Plenty".

(b) That the item lies on the

table until the Council meeting on 28 April 2025.

Carried

|

12 Discussion

of late items

Nil

13 Public

excluded session

Resolution to exclude the public

|

Resolution CO/25/5/16

Moved: Cr

Hautapu Baker

Seconded: Deputy Mayor Jen Scoular

That the public be excluded from the following parts of

the proceedings of this meeting.

The general subject matter of each matter to be considered

while the public is excluded, the reason for passing this resolution in

relation to each matter, and the specific grounds under section 48 of the

Local Government Official Information and Meetings Act 1987 for the passing

of this resolution are as follows:

|

General

subject of each matter to be considered

|

Reason for

passing this resolution in relation to each matter

|

Ground(s)

under section 48 for the passing of this resolution

|

|

13.1 -

Public Excluded Minutes of the Council meeting held on 10 February 2025

|

s6(b) - The making

available of the information would be likely to endanger the safety of any

person

s7(2)(b)(ii) - The

withholding of the information is necessary to protect information where

the making available of the information would be likely unreasonably to

prejudice the commercial position of the person who supplied or who is the

subject of the information

s7(2)(g) - The

withholding of the information is necessary to maintain legal professional

privilege

s7(2)(h) - The

withholding of the information is necessary to enable Council to carry out,

without prejudice or disadvantage, commercial activities

s7(2)(i) - The

withholding of the information is necessary to enable Council to carry on,

without prejudice or disadvantage, negotiations (including commercial and

industrial negotiations)

|

s48(1)(a) - the public

conduct of the relevant part of the proceedings of the meeting would be

likely to result in the disclosure of information for which good reason for

withholding would exist under section 6 or section 7

|

|

13.2 -

Public Excluded Minutes of the Council meeting held on 24 February 2025

|

s7(2)(i) - The

withholding of the information is necessary to enable Council to carry on,

without prejudice or disadvantage, negotiations (including commercial and

industrial negotiations)

|

s48(1)(a) - the public

conduct of the relevant part of the proceedings of the meeting would be

likely to result in the disclosure of information for which good reason for

withholding would exist under section 6 or section 7

|

|

13.3 -

Appointment of Tangata Whenua representatives to standing committees

|

s7(2)(a) - The

withholding of the information is necessary to protect the privacy of

natural persons, including that of deceased natural persons

|

s48(1)(a) - the public

conduct of the relevant part of the proceedings of the meeting would be

likely to result in the disclosure of information for which good reason for

withholding would exist under section 6 or section 7

|

|

13.4 -

Appointments to the Board - Bay Venues Limited, the Tauranga Art Gallery

Trust and Tourism Bay of Plenty

|

s7(2)(a) - The

withholding of the information is necessary to protect the privacy of

natural persons, including that of deceased natural persons

|

s48(1)(a) - the public

conduct of the relevant part of the proceedings of the meeting would be

likely to result in the disclosure of information for which good reason for

withholding would exist under section 6 or section 7

|

Carried

|

Noted that Item 13.3 and 13.4 were conducted in the open

part of the meeting as items 11.7 and 11.8 respectively

14 Closing

karakia

Cr Hautapu Baker closed the meeting with a karakia.

The meeting closed at 6.08pm.

The minutes of this meeting were confirmed as a true and

correct record at the Ordinary Council meeting held on 28 April 2025.

...........................................................

Mayor Mahé Drysdale

CHAIRPERSON

|

Ordinary

Council meeting Agenda

|

28

April 2025

|

7.3 Minutes of

the Extraordinary Council meeting held on 25 March 2025

File

Number: A17911631

Author: Clare

Sullivan, Team Leader: Governance Services

Authoriser: Christine

Jones, General Manager: Strategy, Growth & Governance

|

Recommendations

That the Minutes of the

Extraordinary Council meeting held on 25 March 2025 be confirmed as a true

and correct record.

|

Attachments

1. Minutes

of the Extraordinary Council meeting held on 25 March 2025

|

Extraordinary

Council meeting minutes

|

25 March 2025

|

|

|

|

MINUTES

Extraordinary Council meeting

Tuesday, 25 March 2025

|

Order of Business

1 Opening

karaka. 3

2 Apologies. 3

3 Acceptance

of late items. 3

4 Confidential

business to be transferred into the open. 3

5 Change to

the order of business. 4

6 Declaration

of conflicts of interest 4

7 Business. 4

7.1 Draft

Alcohol Licensing Fees Bylaw - Hearings. 4

8 Discussion

of late items. 6

9 Closing

karakia. 6

Resolutions transferred into the open section of the meeting

after discussion. 6

MINUTES

OF Tauranga City Council

Extraordinary Council meeting

HELD

AT THE Ground Floor, 306 Cameron Road ,

Tauranga

ON

Tuesday, 25 March 2025 AT 4:00 pm

PRESENT: Mayor

Mahé Drysdale, Deputy Mayor Jen Scoular, Cr Glen Crowther, Cr Rick

Curach, Cr Steve Morris, Cr Marten Rozeboom, Cr Kevin Schuler, Cr Rod Taylor

APOLOGIES: Cr

Hautapu Baker

IN ATTENDANCE: Sarah

Omundsen (General Manager: Regulatory & Compliance), Clare Sullivan (Team

Leader: Governance Services)

1 Opening

karaka

Cr Kevin Schuler opened the meeting with a karakia.

2 Apologies

|

2.1 Resolution

to receive apologies

|

|

Resolution CO/25/0/1

Moved: Cr

Steve Morris

Seconded: Cr Marten Rozeboom

That the Council

Accepts the apologies of Cr Hautapu Baker.

Carried

|

3 Acceptance

of late items

Nil

4 Confidential

business to be transferred into the open

Nil

5 Change

to the order of business

Nil

6 Declaration

of conflicts of interest

Cr Taylor noted that he was the

holder of two liquor licences in the city he would observe but not

participate in the meeting or vote

on the issue.

7 Business

|

7.1 Draft

Alcohol Licensing Fees Bylaw - Hearings

|

|

Timestamp :04

Sebastian Miklos (via teams)

Key Points

·

Had been an alcohol inspector for Auckland Council and the

Ministry of Justice for 14 years.

·

Congratulate TCC for a good bylaw, noting that ratepayers

should not fund the process.

·

People adjust to the reduced hours of licenced premises.

·

A licence for a concert should not be the same as it was for a

wedding.

Timestamp :09

Christine Gore – Vetro Mediterranean

Foods

Key Points

·

All in the industry were working towards reducing alcohol harm

and were on the same side as Council.

·

Would like to work together with Council to reduce cumbersome

costs of licencing and streamline the costs that fell on the businesses.

·

There was no assessment on the impact of the bylaw on

businesses, some of which add character to the city may fail due to

costs.

·

Increasing costs could lead to some outlets pushing more sales

to cover costs which would not be ideal.

·

There was only a 20-22% retail margin on alcohol in resturants

and taxes were already imposed on it.

In response to questions

·

The submitter’s rates were already increasing by 17% and

the businesses were contrtibuting to making Tauranga an attractive place to

come to and ratepayers needed to be made aware of that.

Timestamp :17

Kerry McCaffery

Key Points

·

There was currently an alcohol pandemic in Tauranga with 80% of

adults drinking on a regular basis. 85% of drinkers were in the least

deprived neighbourhoods.

·

Much of drinks available had a high percentage of alcohol.

·

Drink driving was common, many were not picked up and Police

patrols needed to increase.

·

Alcohol was now part of the weekly grocery shop.

·

If an alcholic wants to stop drinking there was no safe place

for them to go and they were taking up medical time. A medical detox centre

was required in Tauranga.

Timestamp :24

Jennifer Lamm – Alcohol

Healthwatch (via Teams)

Key Points

·

Commend Council on the bylaw specific to alcohol licencing fees

as it was another key measure to reduce alcohol related harm with

enforcement.

·

Alcohol was the most harmful drug available in our society

which had far reaching effects that harmed individuals, whanau and

communities at a cost of $9.1b annually.

·

Local government had a role in promoting the social, economic

and cultural wellbeing of its communities and alcohol regulation was an

important control to create a safer enviornment, to reduce drinking and

instances of alcohol harm.

·

Supports the recovery of the cost of licencing as the licencing

regulations had not kept pace wth the cost and were overdue for a review.

Timestamp :29

Harris William, Mt Maunganui

Business Association

Key Points

·

Considered that Council did not adequately engage with affected

parties before drafting the bylaw which had been created with a lack of

detail context and transparency.

·

Council were imposing more costs on businesses without placing

internal scrutiny on its own systems.

·

Queried whether a small restaurant would need to pay the same

fee as a liquor store and why a business should pay for a hearing if the only

objections were raised by the general public.

·

Requested the Council to engage with stakeholders and proivde a

trasnparent breakdown of fees, cost and structures to allow meaningful

feedback to be provided.

In response to questions

·

In relation to whether it was a cost recovery or set fee, staff

advised that the process was to allow Council to be able to set a fee with a

separate decision making process around what the fee would be. The fee

was currently fixed fee for each category.

·

With the reallocation of the $750,000 cost, there were factors

and fairness that needed to be taken into account and the bylaw needed to go

back to the drawing board.

Timestamp :36

Luke van Veen, Hospitality

New Zealand

Key Points

·

Recognise Council were facing cost pressures, but the

hosptality industry was also over burdened with unnecessary costs with many

struggling to continue to operate and others closing.

·

Noted that the fees had not increased since 2013, and request

that consideration be given to a 33% inflation adjustment rather than a 240%

increase. Imposing the same increase on a $15 drink would increase the sale

to $36.60.

·

The proposal to take all costs from ratepayers ignored that the

businesses were also ratepayers at a higher rate percentage than

residential.

·

There was no evidence to show that the costs could be recovered

by other means and asked that Council look at streamlining its own system

process efficiencies and undertake less hearings.

·

Want to see fees set by licencing regulation.

In response to questions

·

In answer to a query as to where Council could make

improvements, the submitter noted that he was not aware of the Council

process but it seemed to be a lot of people being involved and the timeline

to sign off was lenghty. Applicants had to adhere strictly to the time

constraints when applying for a licence, so it should be the same for Council

to issue the licence.

·

The industry want compliance and as an customer he was happy to

assist with having those conversations but to date as a stakeholder he had

not been approached.

·

In response to a query as to where the responsibility of the

cost lay, the submitter considered that there was an imbalance of costs and

there were a lot of Council facilities that the businesses did not use but

knew they had to pay for them. Most of the businesses sold alcohol in a

controlled premise environment and Council should be investing in them to

drive the communtiy to flourish.

·

Data could be provided on what other local authorities do and

how they operated to compare them to TCC.

Timestamp: : 53

Staff: Sarah

Omundsen, General Manager: Regulatory & Compliance

In response to staff questions

raised

·

Comparison information from other local authorities and an

analysis of the decisions would be provided to Council in the upcoming report

to set the fees. It would include a number of relevant factors

including the number of staff, the time taken, the cost, the ratio of

ratepayer and business to provide a benchmark and to ensure that all

processss were being undertaken as efficiently as possible.

|

|

Resolution CO/25/0/2

Moved: Cr

Rick Curach

Seconded: Cr Glen Crowther

That the Council:

(a) Receives the report

"Draft Alcohol Licensing Fees Bylaw - Hearings".

(b) Receives the submissions and

feedback to the draft Alcohol Licensing Fees Bylaw (Attachment One).

Carried

|

8 Discussion

of late items

Nil

9 Closing

karakia

Cr Kevin Schuler closed the meeting with a karakia.

The meeting closed at 5.16 pm.

The minutes of this meeting were confirmed at the

Ordinary meeting of the Tauranga City Council held on 28

April 2025.

...................................................

CHAIRPERSON

|

Ordinary Council meeting Agenda

|

28 April 2025

|

11 Business

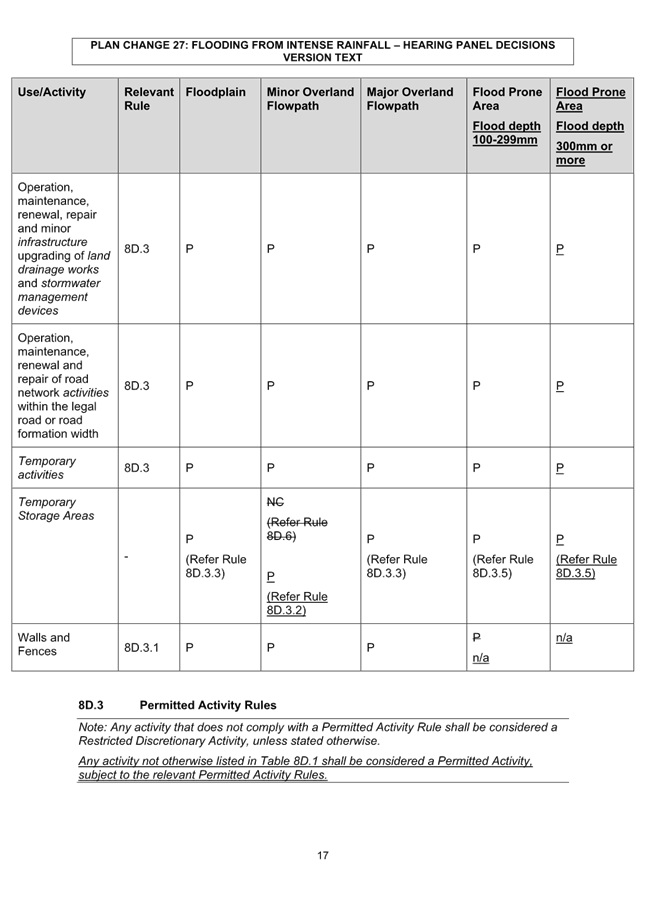

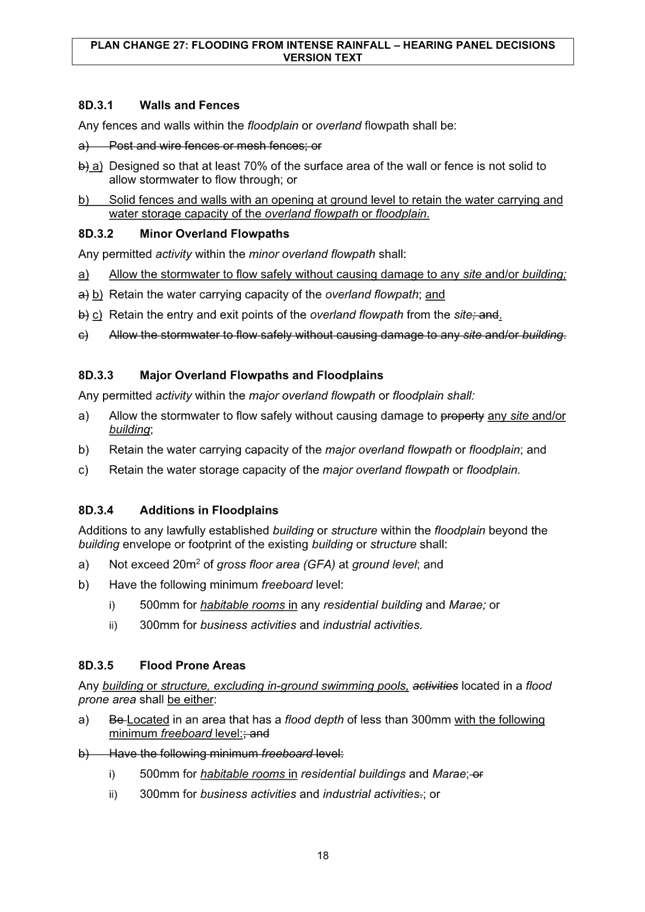

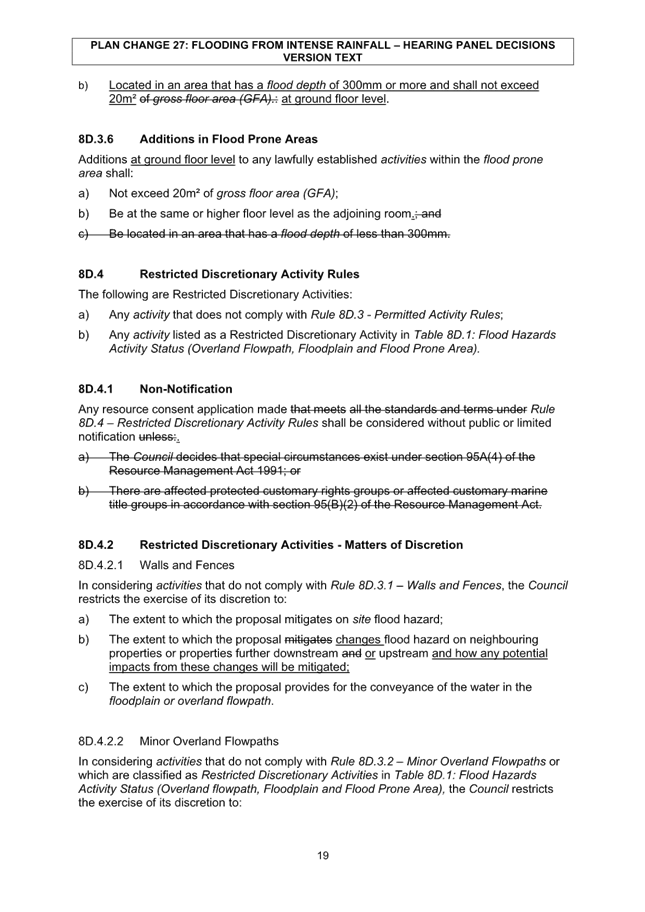

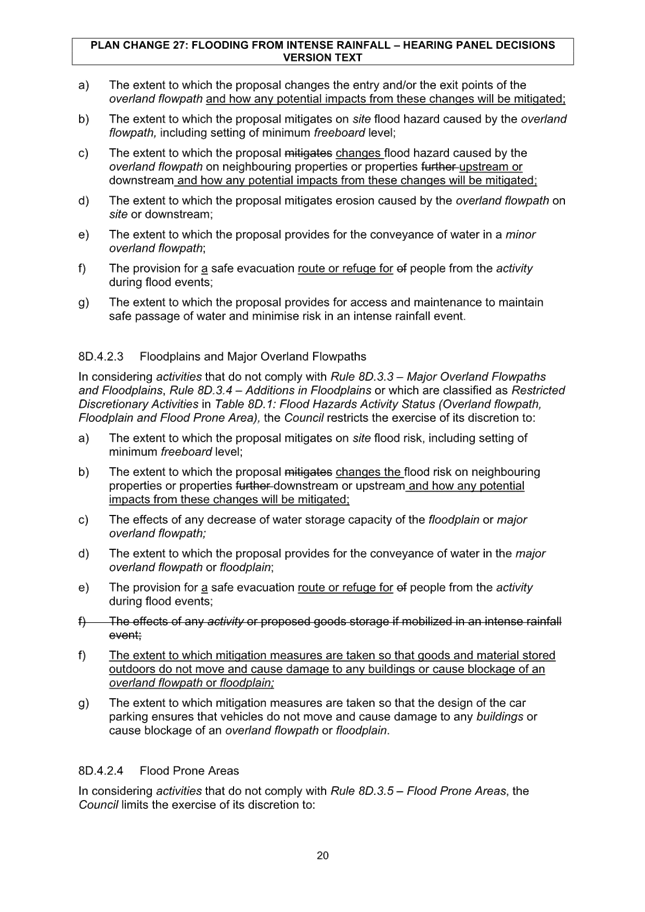

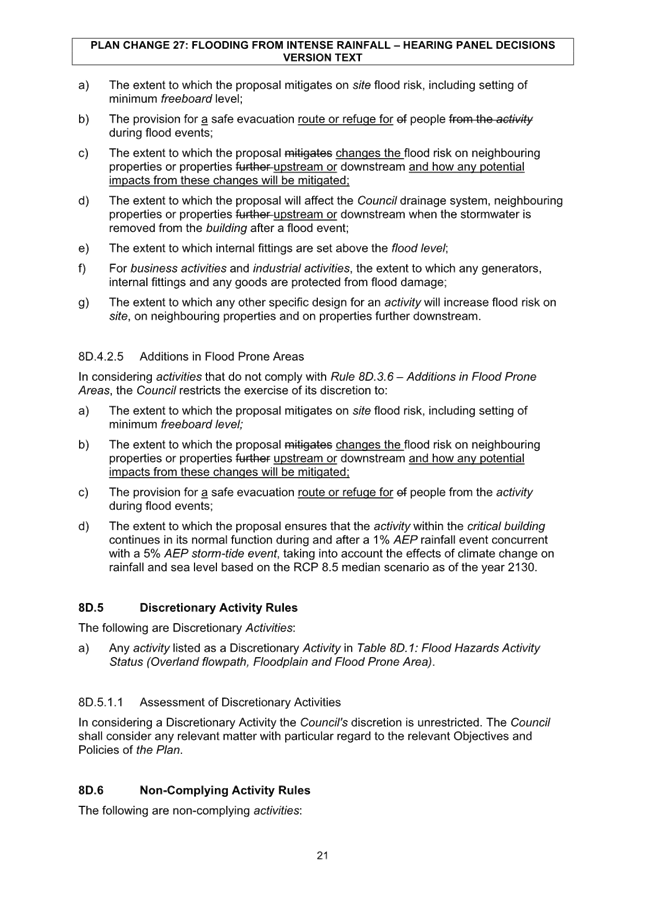

11.1 Plan

Change 27 (Flooding from Intense Rainfall): To Make Operative

File

Number: A17108970

Author: Manasi

Vaidya, Senior Policy Planner

Janine Speedy, Team

Leader: City Planning

Authoriser: Christine

Jones, General Manager: Strategy, Growth & Governance

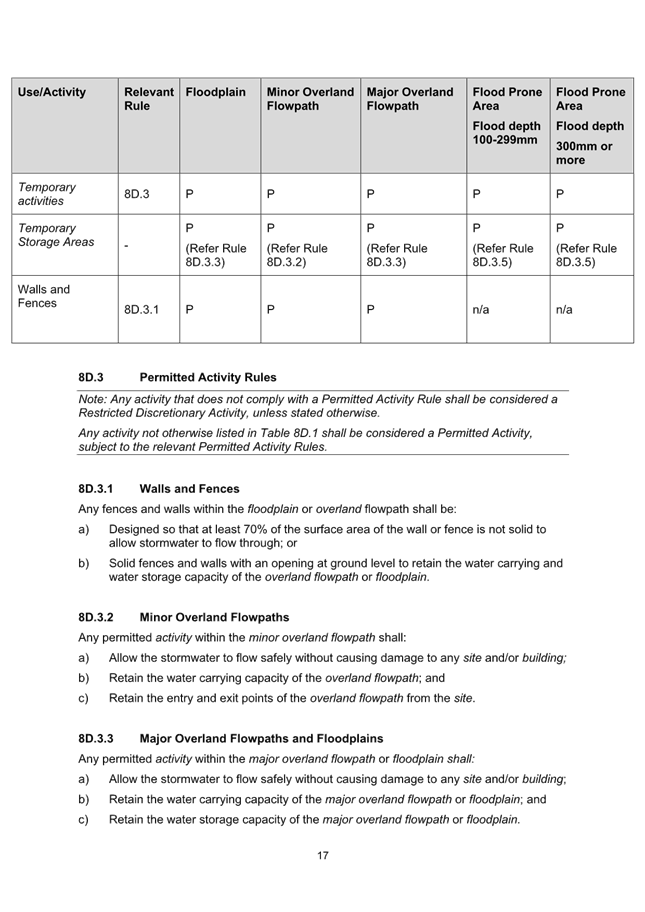

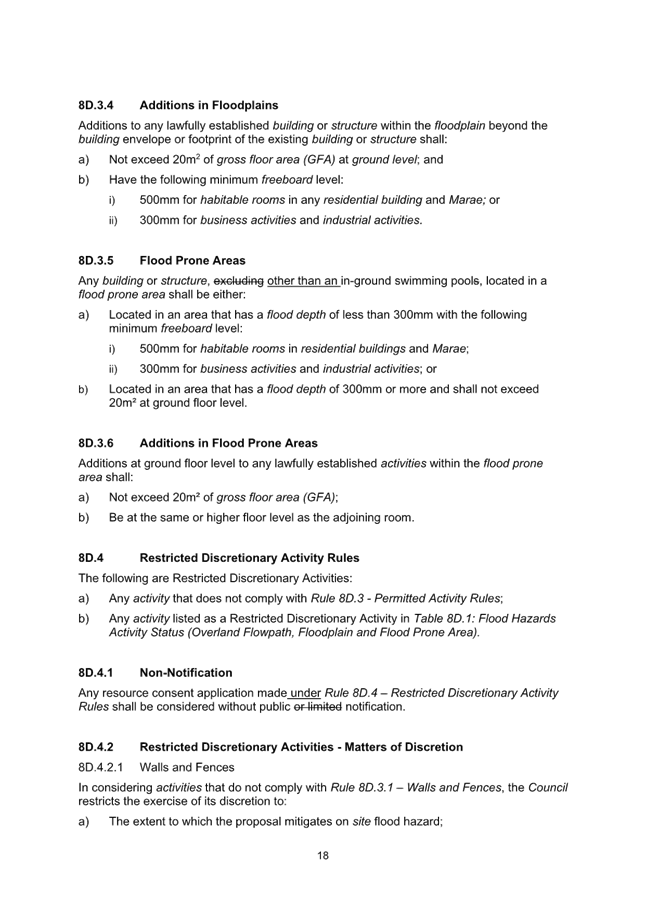

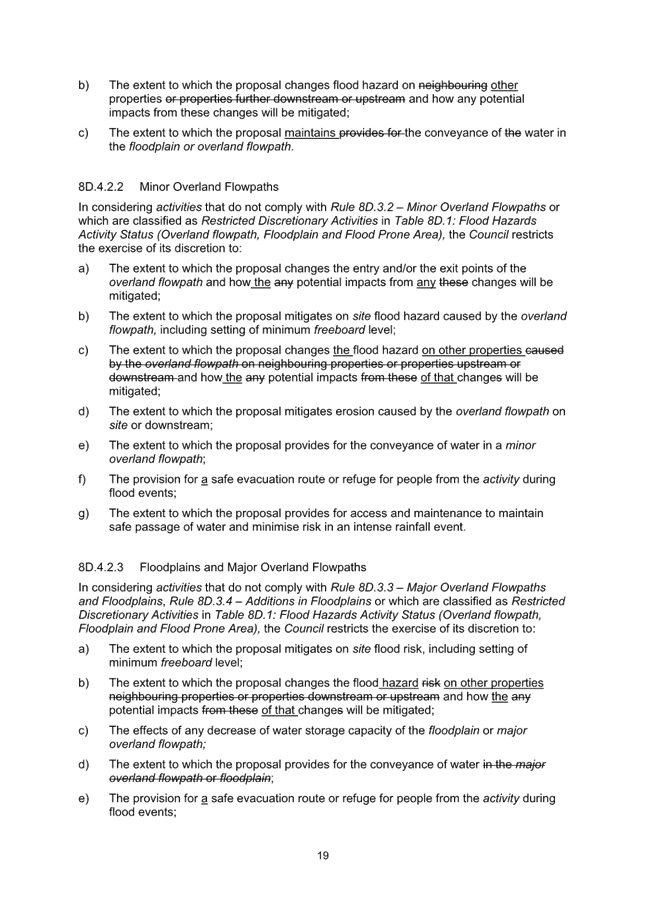

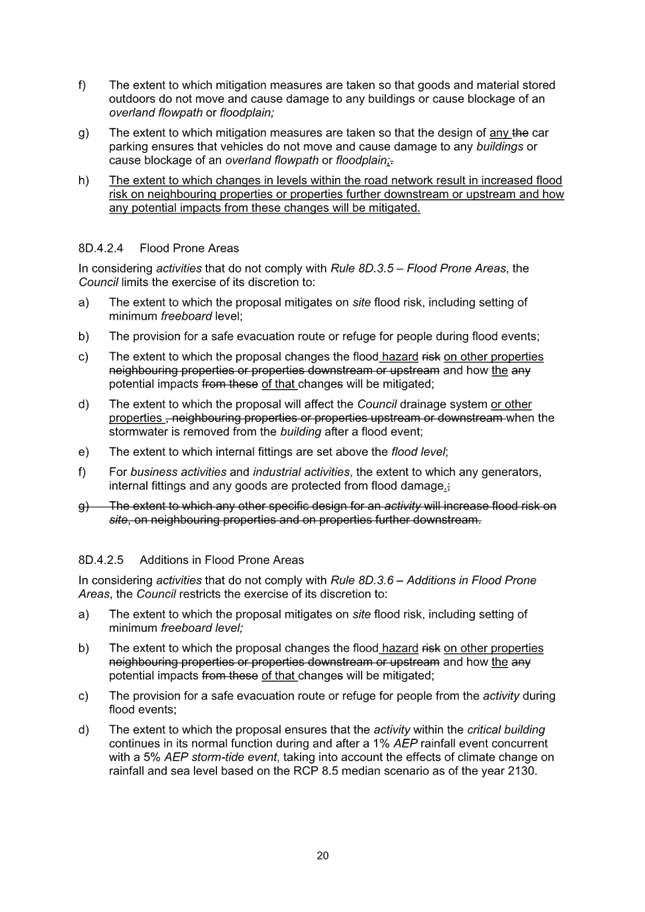

Purpose of the Report

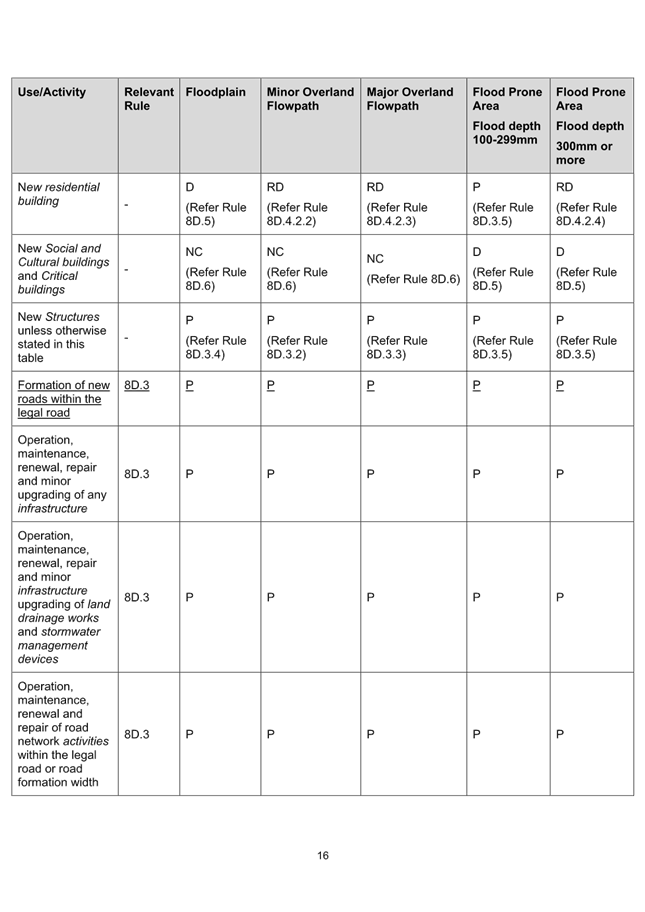

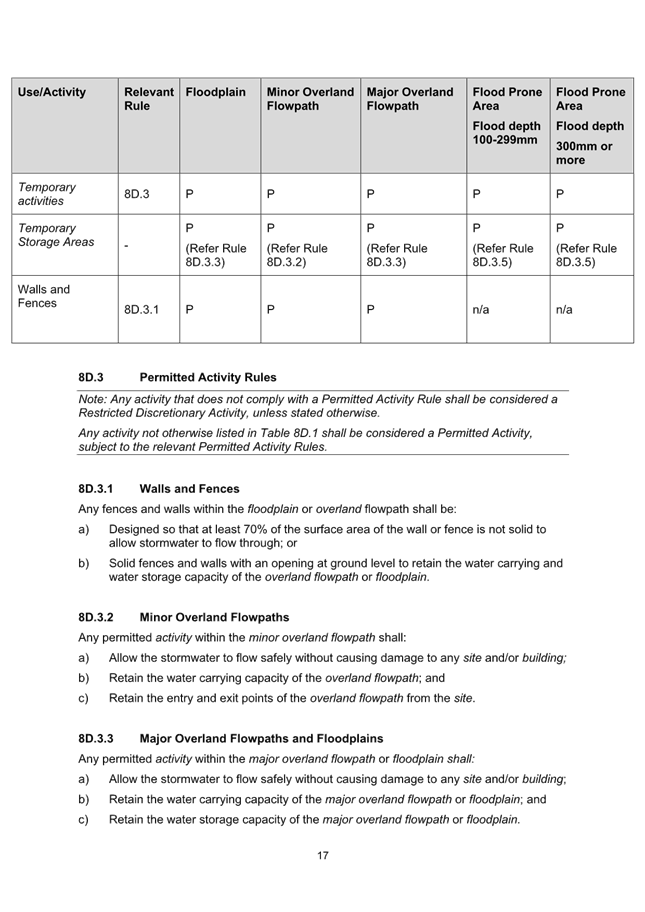

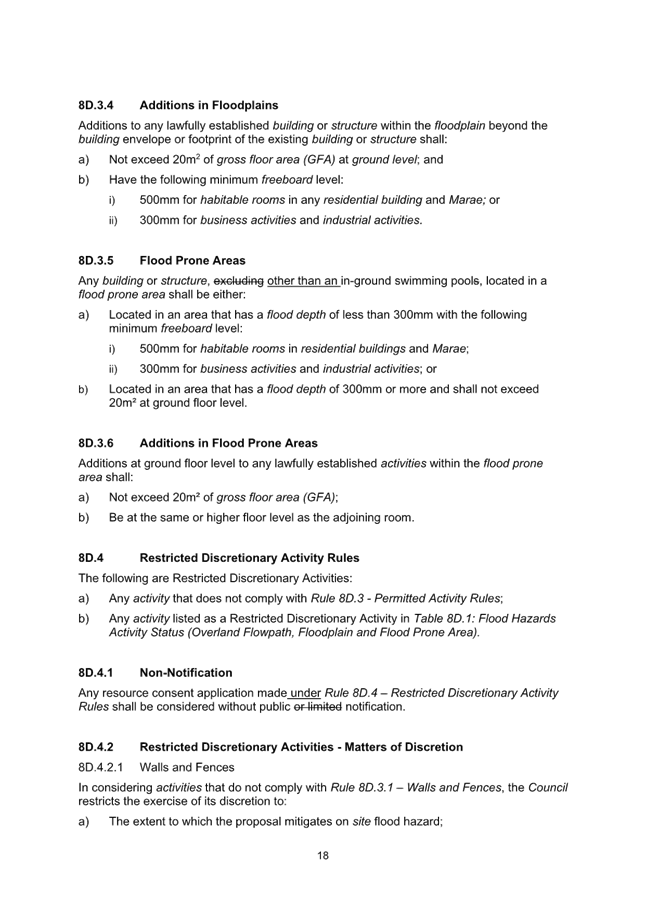

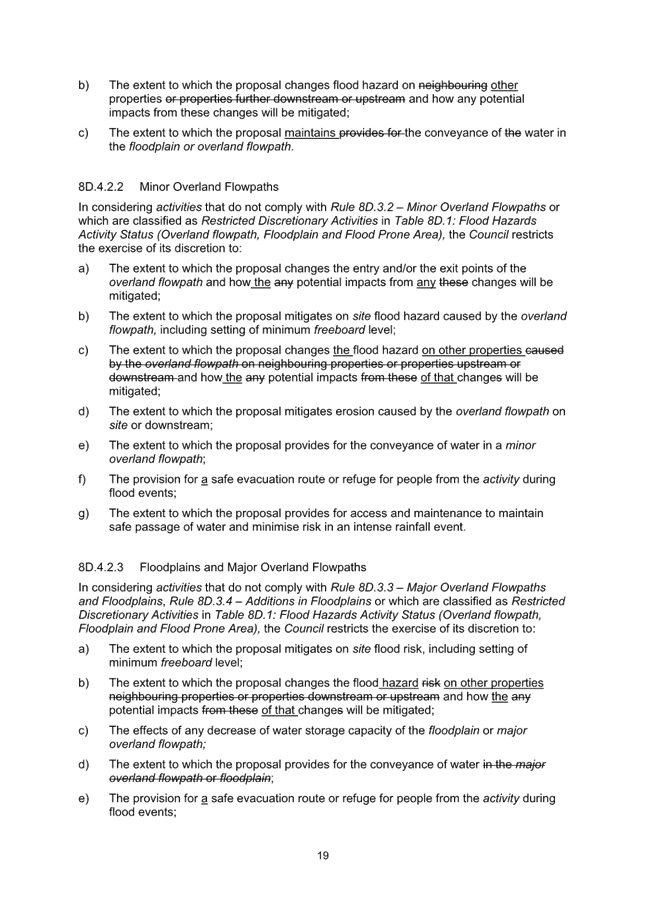

The purpose of this

report is to approve and make operative Plan Change 27 (Flooding from intense

rainfall) as part of the operative Tauranga City Plan.

|

Recommendations

That the Council:

(a) Receives the report

"Plan Change 27 (Flooding from Intense Rainfall): To Make

Operative".

(b) Pursuant to Clause 17(1) of

Schedule 1 of the Resource Management Act 1991, and Consent Order of

the Environment Court dated 27 March 2025 (Decision No. [2025] NZEnvC 93)

(Attachment 1) approves Plan Change 27 – Flooding from intense rainfall

(Attachment 2) and authorises the Mayor and Chief Executive to affix the seal

of Council to the plan change documents in accordance with Clause 17(3) of

Schedule 1 of the Resource Management Act 1991.

(c) Pursuant to Clause 20(2) of

Schedule 1 of the Resource Management Act 1991, notifies that Plan Change 27

as approved shall become operative on 13 May 2025.

|

Executive Summary

1. Tauranga

has faced several significant flood events, notably in 2005, 2010, 2011, and

2013. These events prompted Council to invest in stormwater infrastructure

upgrades and reconsider its flood risk management strategies. As an outcome of

this process, in 2015 Council adopted the Integrated Stormwater Project (ISP)

through the Long-Term Plan (2015-25). The ISP included implementing a

regulatory response.

2. Plan

Change 27 is the regulatory response to the ISP, focusing on managing flood

hazard risk caused by intense rainfall through provisions in the Tauranga City

Plan (City Plan).

3. Additionally,

the Bay of Plenty Regional Policy Statement (RPS) mandates that the Council

classify and reduce natural hazard risks, including flooding from intense

rainfall, which must take into account climate change over the next 100 years.

Plan Change 27 ensures the City Plan gives effect to the RPS and addresses

significant risk from a natural hazard as required by the Resource Management

Act 1991 (RMA).

4. The

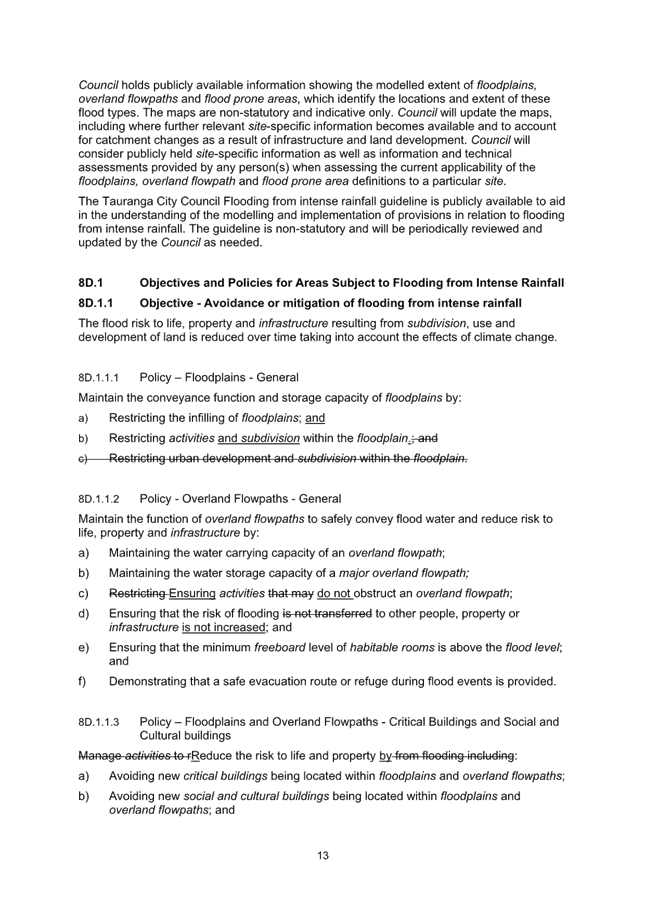

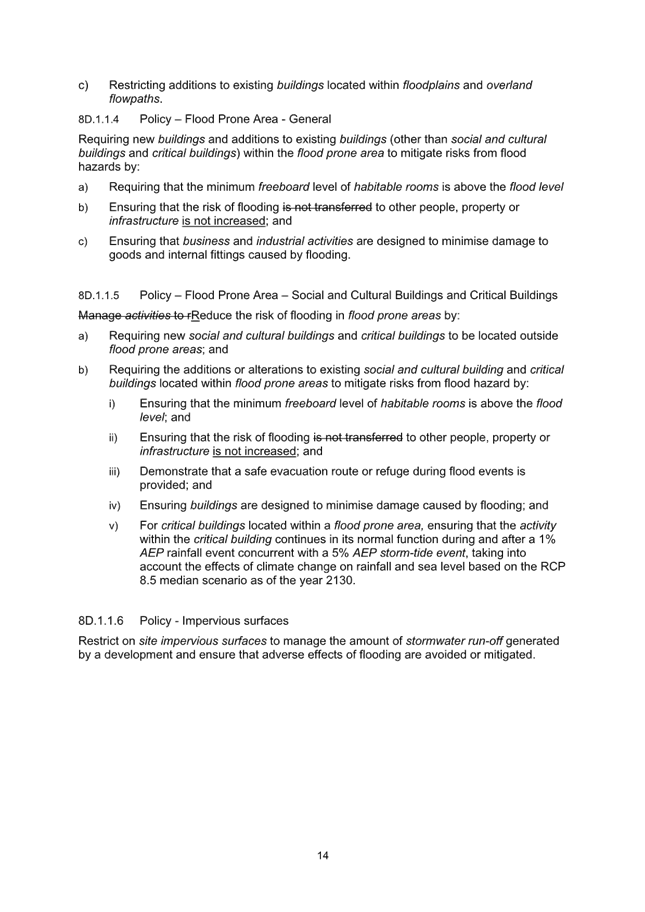

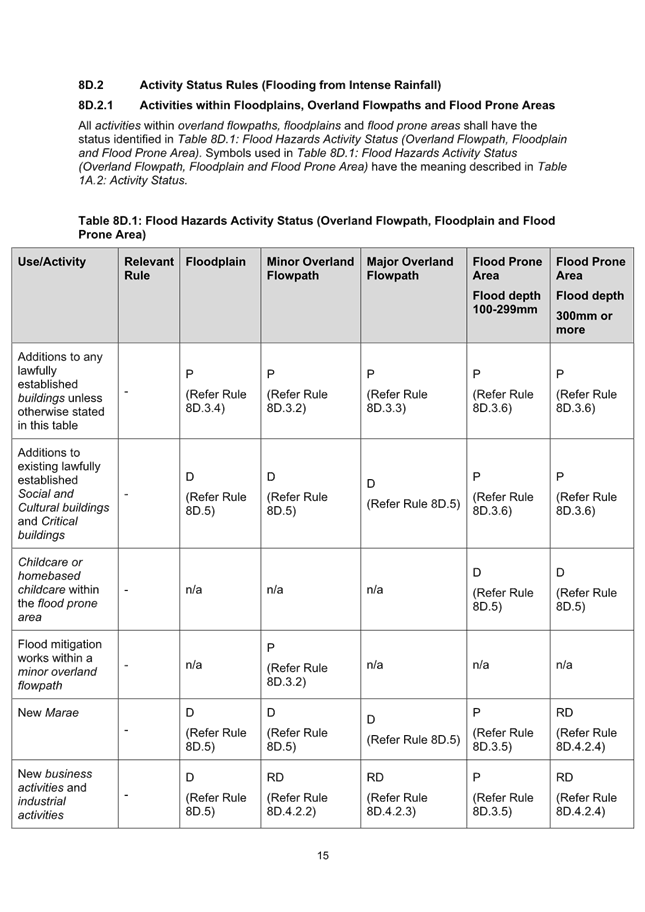

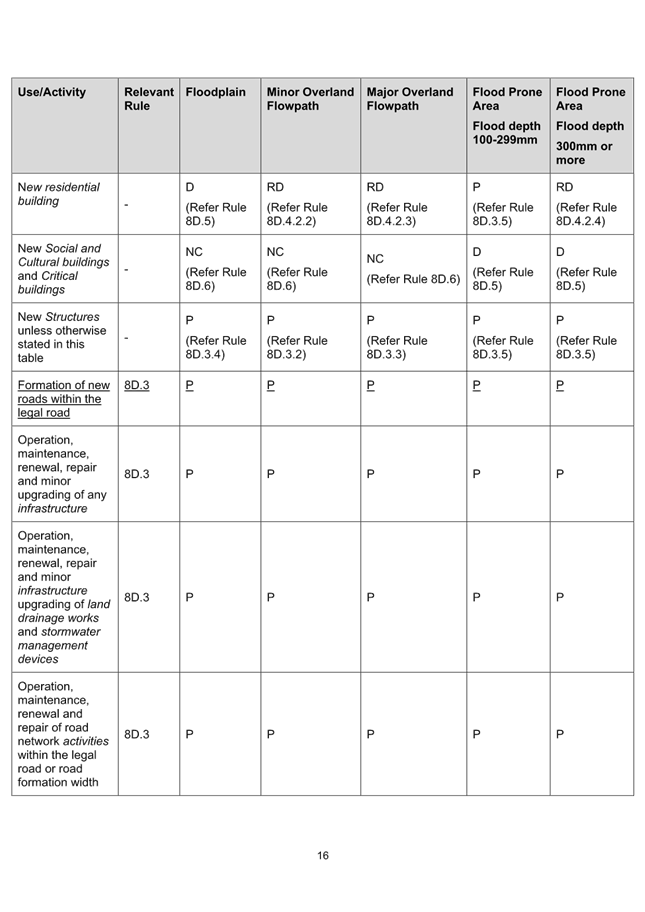

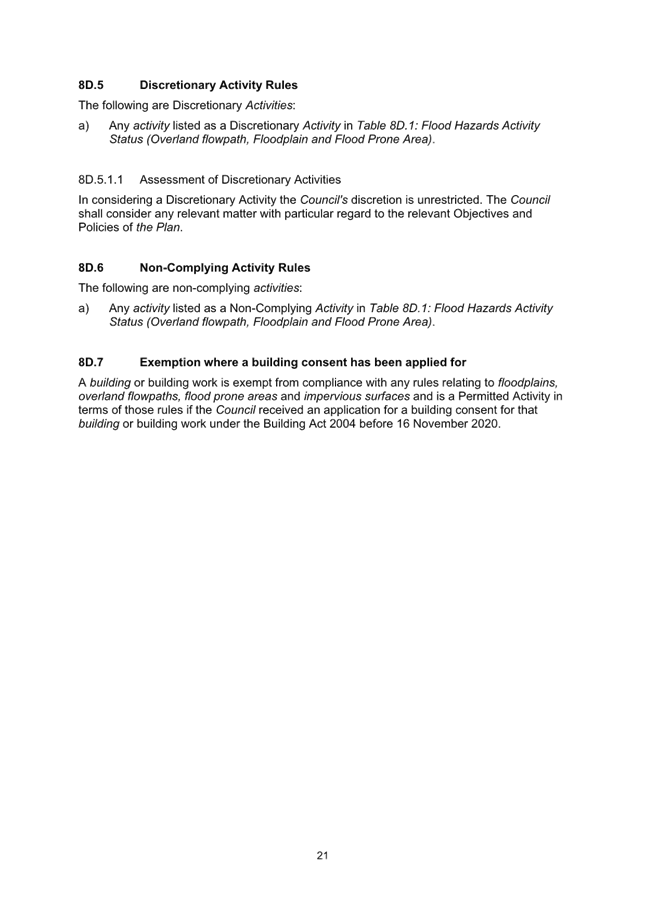

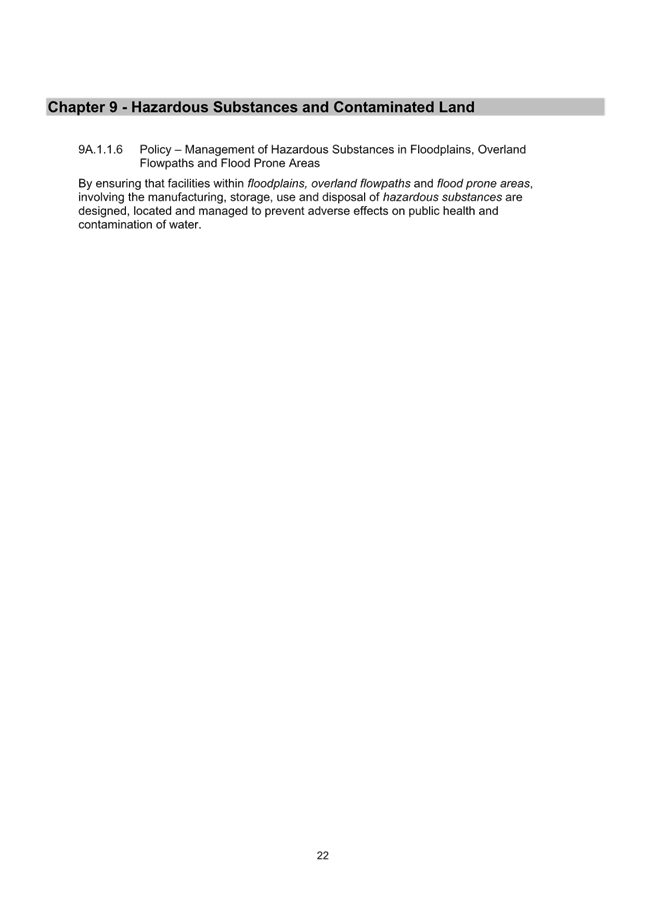

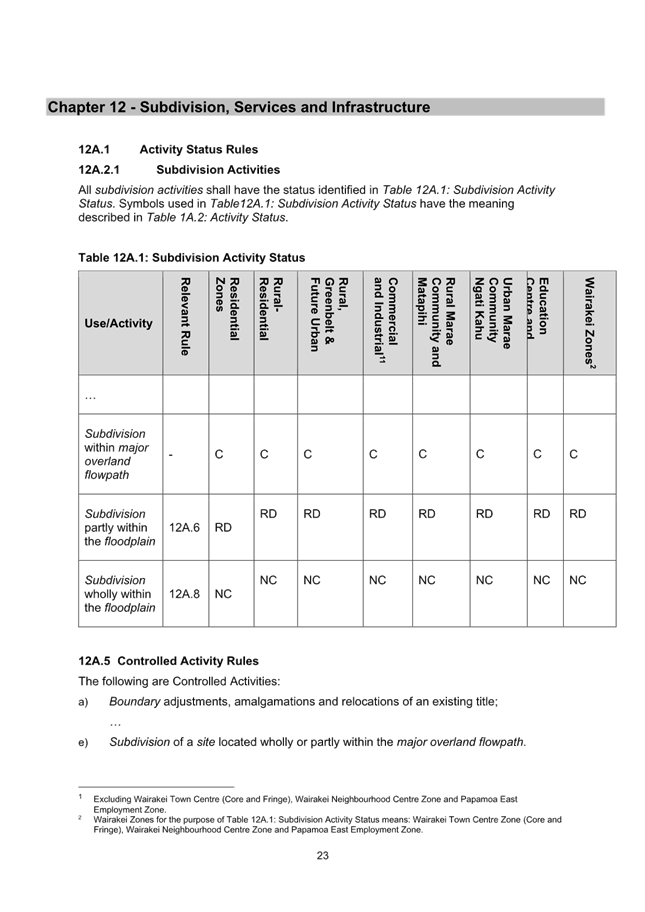

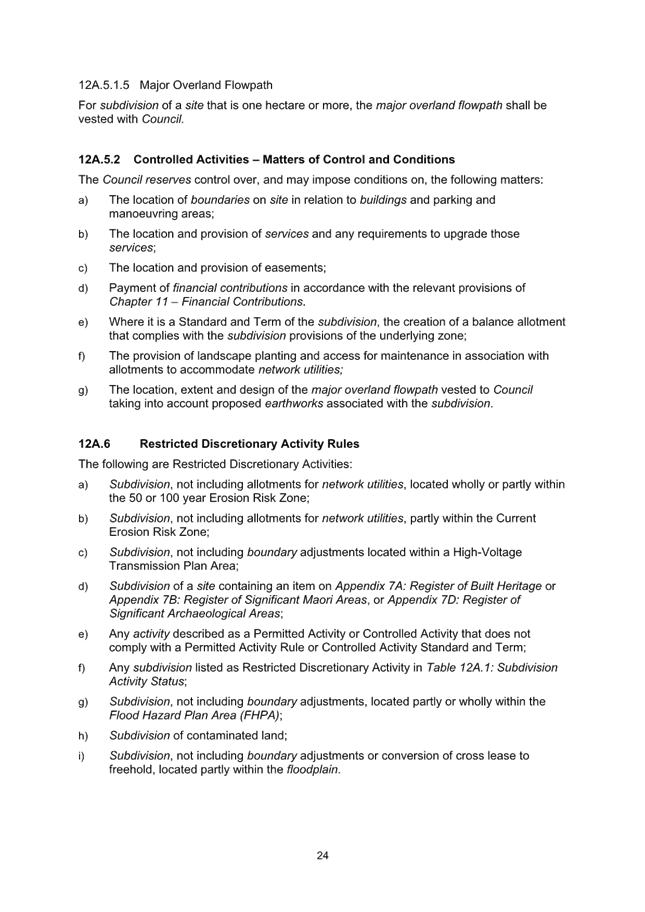

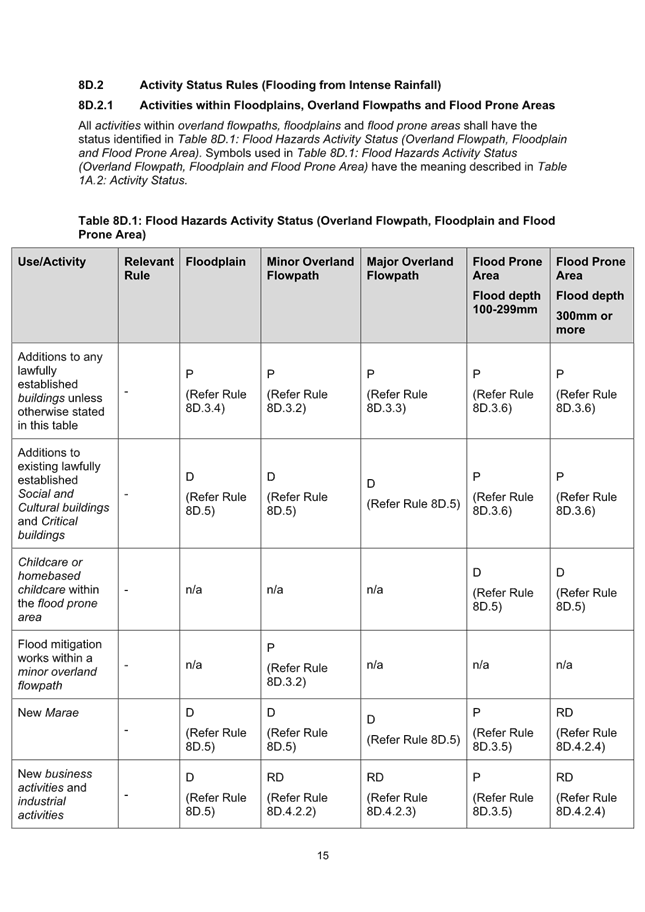

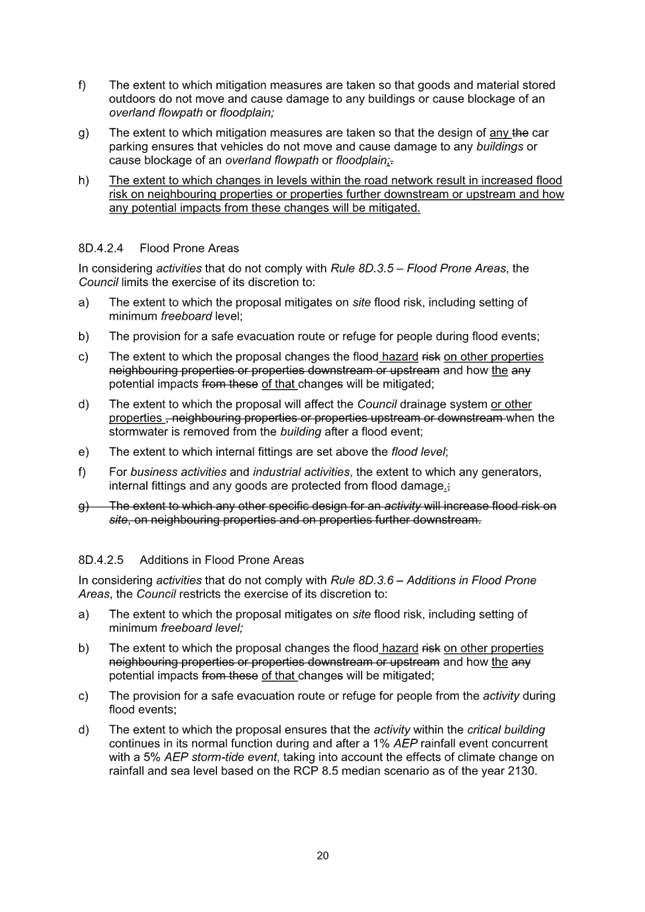

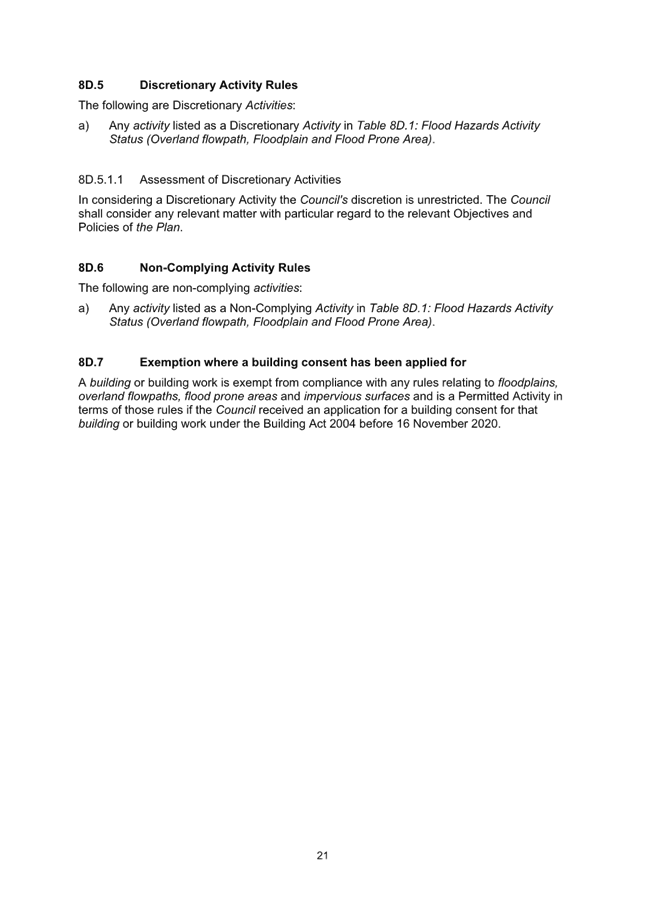

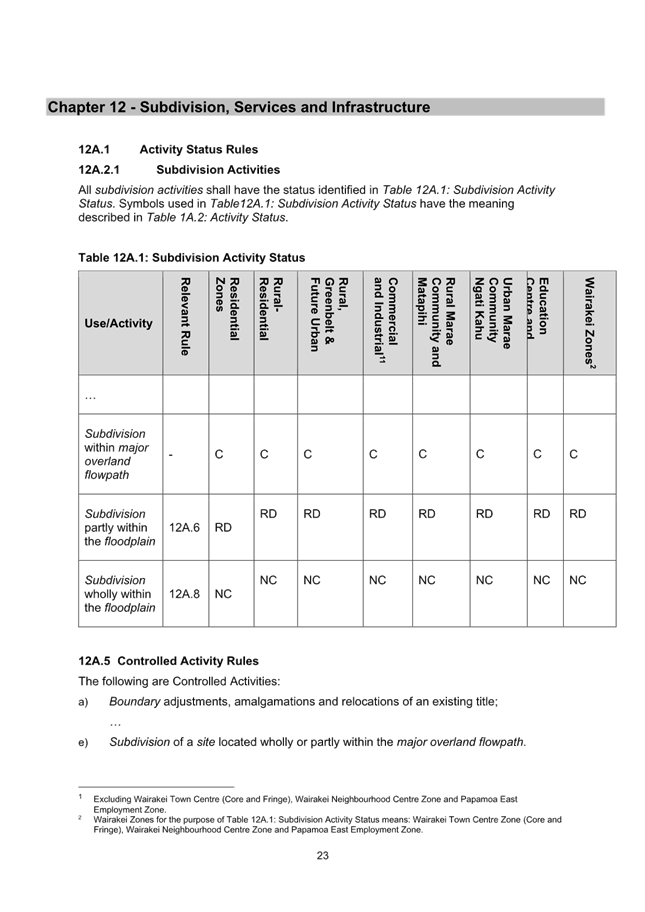

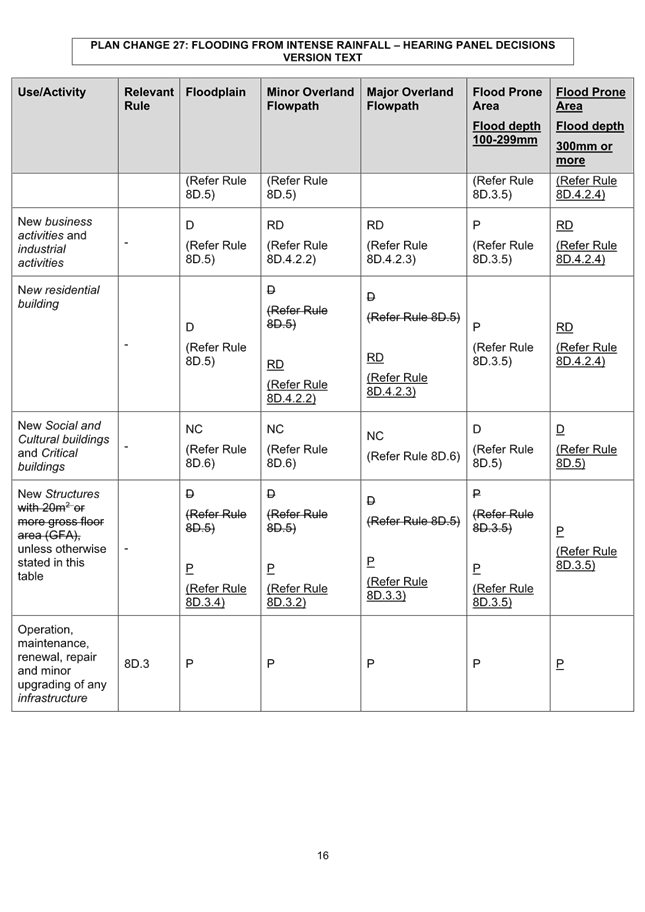

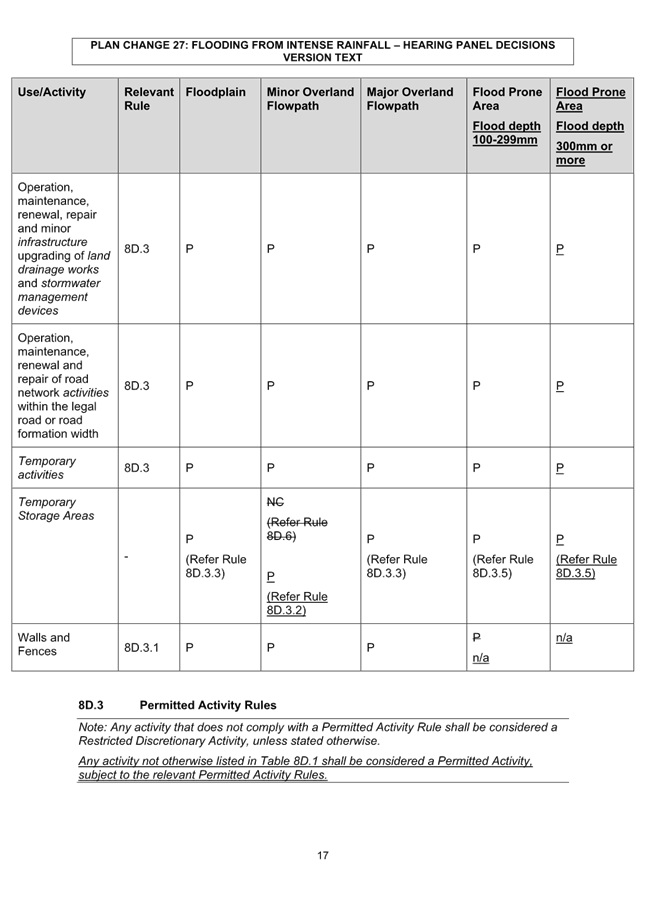

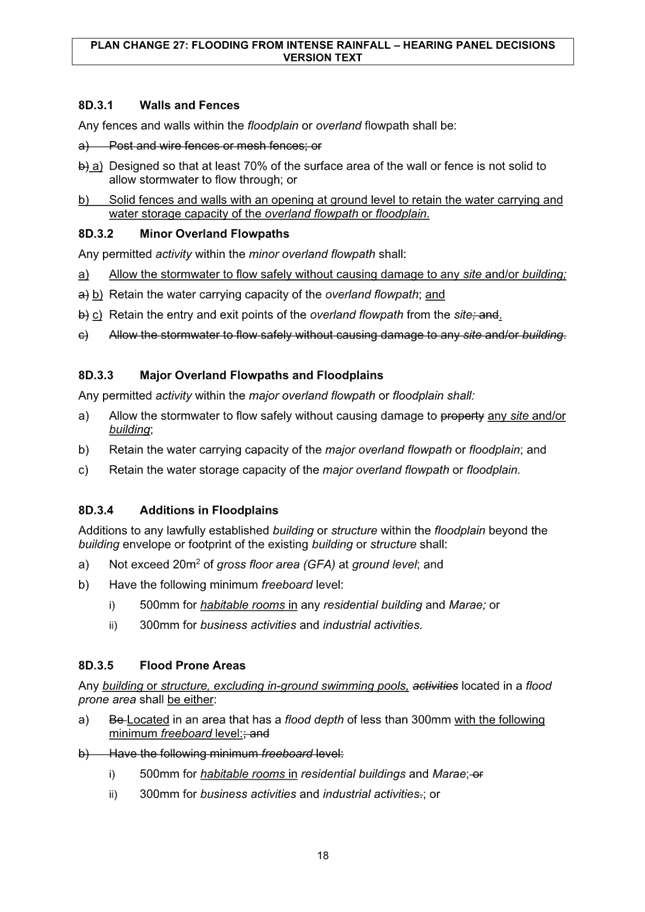

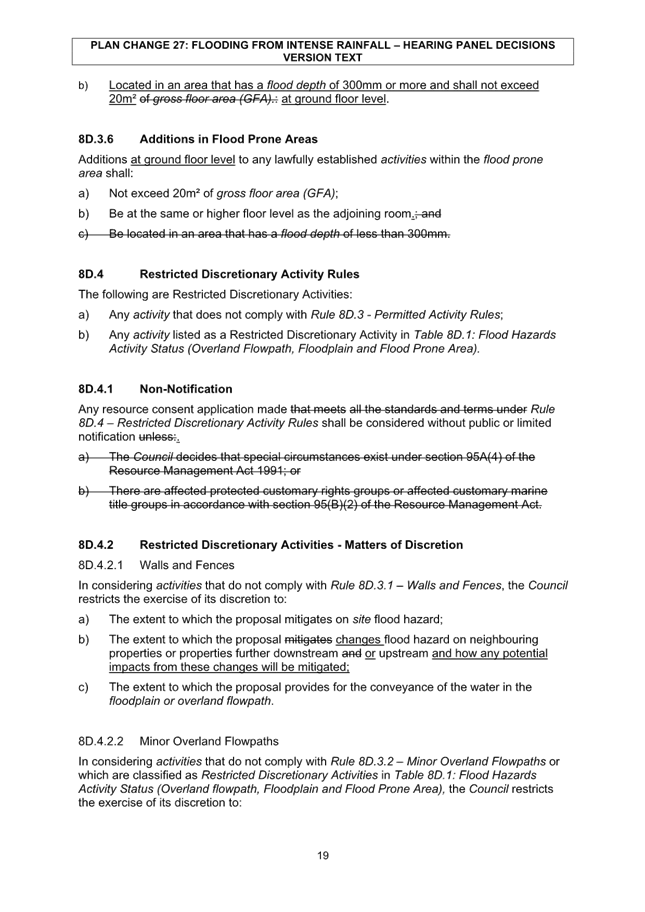

key provisions of the plan change include:

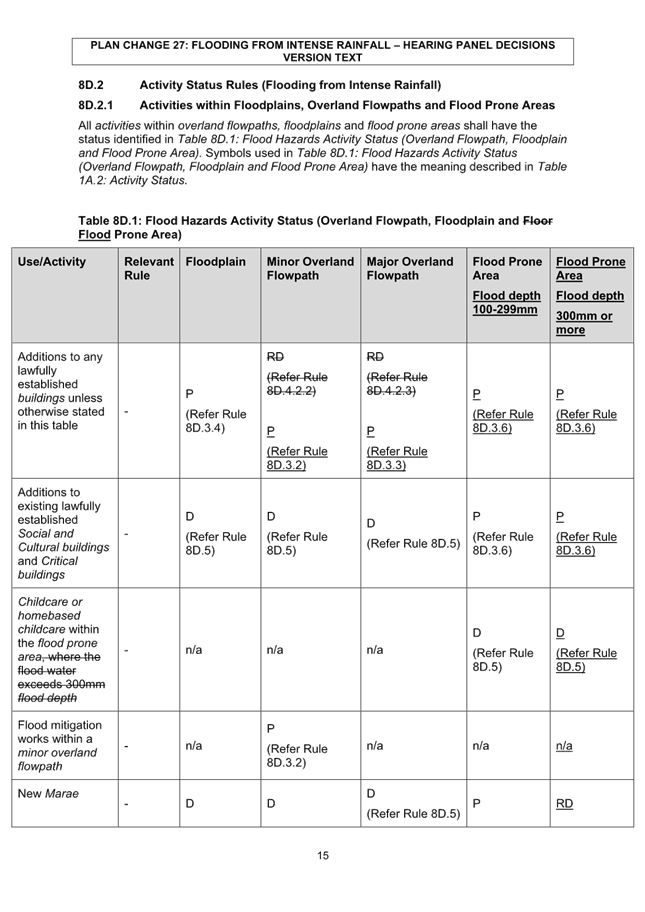

i. Protecting

floodplains and overland flowpaths.

ii. Managing

development in flood prone areas to ensure safety and proper evacuation routes.

iii. Controlling

displacement effects of water onto other properties from inappropriate

subdivision and earthworks within flood prone areas, overland flowpaths and

floodplains.

iv. Setting

floor levels to minimise flood damage.

5. Plan

Change 27 was publicly notified on 16 November 2020, following Council adoption

on 13 October 2020. An Independent Hearings Panel (IHP) heard the plan change

from 30 November to 2 December 2021. The IHP recommendations were notified on

11 April 2022, with a subsequent appeal period.

6. Three

appeals were lodged with the Environment Court on 20 May 2022 by Aotearoa Park

Development Limited (APDL), Bluehaven Developments Limited (Bluehaven) and

Urban Taskforce for Tauranga Incorporated (UTF). There were twenty parties to

the appeals.

7. Following

further discussions between staff and APDL, the APDL appeal was withdrawn on 10

November 2023.

8. Following

further discussions between staff and Bluehaven and UTF, the consent order was

signed by all parties and filed with the Environment Court on 29 November 2024.

9. The appeals relating

to Plan Change 27 have been disposed. The plan change is now required to be

made operative in accordance with the RMA.

Background

10. Historically,

Tauranga has experienced a number of major flood events from intense rainfall,

the most significant being the localised flooding as a result of a 1% Annual

Exceedance Probability (AEP)[1]

rainfall event in May 2005 which caused substantial damage to private and

public property.

11. Tauranga

experienced further flood events in 2010, 2011 and a more significant localised

flood event in 2013. Following the flood events of 2013, the ISP was adopted by

Council through the Long-Term Plan 2015-25, which included undertaking flood

modelling and mapping for a 1% AEP present day situation across the City. The

purpose of the ISP was to identify the wider stormwater issues and implications

so that Citywide flood risk management could be considered. As an outcome of

this process, Council resolved to take the following risk reduction approach to

stormwater management:

1. A

safety focused level of service (LoS), (reduction in risk to persons safety);

2. Education;

3. Residual

risk and emergency management;

4. Reactive

response capacity (stormwater reactive reserve); and

5. Regulatory

response.

12. Plan Change

27 is the regulatory response to the ISP, following the completion of all other

steps.

Regulatory Response

13. The

RPS includes objectives and policies which require Council, prior to any

development or redevelopment to classify and reduce the risk of natural

hazards, including flooding from intense rainfall. The RPS requires the Council

to take into account climate change over at least the next 100 years.

14. In

order to classify the natural hazard risk of flooding, Council was required to

undertake a risk assessment, including flood risk modelling and mapping. The

flood models built for the ISP were updated to identify flood risk in a 1% AEP

rainfall event, taking into account the effects of climate change[2] as of the year 2130,

as required by the RPS. The risk assessment identified that the flood risk in

Tauranga is High. There is ongoing flood modelling programme to ensure the

models are up to date taking into account factors such as a change in landform.

15. Plan

Change 27 includes objectives, policies and rules to manage flood hazards from

intense rainfall. The key aspects of the provisions introduced through the plan

change are:

a) Protect floodplains and overland flowpaths,

because if managed inappropriately the effects can be hazardous, causing damage

to life, property and infrastructure.

b) Manage development and redevelopment within

flood prone areas, including safe evacuation from building and safety of

people.

c) Manage displacement effects because

development and earthworks can increase or cause flooding.

d) Manage floor levels to reduce damage caused by

flooding to life and property.

16. Plan

Change 27 is supported with an online mapping tool which is publicly available

where floodplains, overland flowpaths and flood prone areas are located across

the City with the modelling scenario set out in paragraph 14.

17. Plan

Change 27 had legal effect since the date of notification, 16 November 2020,

under s86B of the RMA, which means any property affected by flooding from

intense rainfall has been assessed against the rules proposed in Plan Change 27

since this date.

Notification

and Hearing

18. The

operative Tauranga City Plan is a statutory document that guides the Council in

managing the effects of subdivision, use, and development under s31 of the RMA.

As a dynamic document, it can be updated through the plan change process,

allowing adjustments to address resource management issues outside of a full

plan review.

19. The

work on a flood hazard plan change commenced in 2018, following Council

direction. Council adopted Plan Change 27 for public notification on 13 October

2020. Plan Change 27 was publicly notified on 16 November 2020. Ten open days

were held during the public notification period and one-on-one consultation was

available with affected property owners until 28 January 2021.

20. The

plan change was heard by an Independent Hearings Panel (IHP) from 30th November

to 2nd December 2021. The decisions to approve the plan change was notified on

11 April 2022 and three appeals were lodged with the Environment Court on 20

May 2022 by:

· Aotearoa Park Development

Limited (ENV-2022-AKL-000114)

· Bluehaven Developments Limited

(ENV-2022-AKL-000115)

· Urban Taskforce for Tauranga

Incorporated (ENV-2022-AKL-000118)

21. There

were twenty parties to the appeals, who participated in the appeal proceedings

(section 274 parties).

Appeals

22. The

APDL appeal sought either that Plan Change 27 be declined or amended to include

spatial flood maps into the City Plan and include a matter of discretion that

provides recognition of the reasonable use of a site if already zoned for urban

use.

23. The

Bluehaven appeal sought to exclude the Wairakei Urban Growth Area from Plan

Change 27 and further relief to address concerns relating to the

Council’s flood hazard mapping process.

24. The

UTF appeal sought that Plan Change 27 be declined due to concerns about the

Council’s flood hazard mapping process and exclusion of the maps from the

City Plan, consistency with higher order planning instruments and Part 2 of the

RMA, and adequacy of the section 32 evaluation report.

Mediation

25. Court-assisted

mediation took place on 11 and 12 October 2022, which was attended by Council

staff, the three appellants and a number of s274 parties. A number of steps

agreed at mediation relate to matters which sit outside the City Plan, but

which have been agreed with the appellants, including:

a) Amending the Flood Hazard Modelling and

Mapping Practice Note and uploading it to the Council website, addressing

various matters broadly relating to the management of the modelling and mapping

processes, model accessibility;

b) A meeting of experts nominated by the

parties, for the purpose of reaching a common understanding on the

appropriateness of the model inputs and agreeing on recommendations to improve

accuracy and validity;

c) Updating and re-evaluating the rainfall

depth used in the flood modelling, with a further peer review process;

d) Minor amendments to the Tauranga City

Council Infrastructure Development Code;

e) A review of the flood hazard information

and agreed wording provided in Land Information Memoranda (LIMs) for properties

within the Wairakei Urban Growth Area;

f) Confirming

that Council will continue to undertake and/or accept site-specific flood risk

evaluations;

g) Confirming

that the flood maps will remain outside the City Plan; and

h) Amending

the provisions to simplify and clarify the rules.

Resolution and Next Steps

26. Following

the mediation, further discussions were undertaken between staff and the

technical expert engaged by APDL, specifically regarding the management of

onsite flooding. Subsequently an agreement was reached on possible resource

consent pathways to manage the impact of the overland flowpath. The appeal by

APDL was withdrawn on 10 November 2023.

27. Upon

the completion of the steps agreed to through mediation, undertaken between

October 2022 and November 2024, the consent order was signed by Council,

Bluehaven and UTF and filed with the Environment Court on 29 November 2024.

28. The

Environment Court issued the Consent Order (Attachment 1) on 27 March 2025.

29. As

the appeals relating to Plan Change 27 have been disposed of, the plan change

is now required to be approved, as amended by the Consent Order, in accordance

with clause 17(2) of Schedule 1 of the RMA. This approval necessitates a

Council resolution, public notification, and amendments to the City Plan text

to give effect to the decision. The remaining steps constitute an

administrative process.

Statutory Context

30. Relevant statutory provisions

are addressed in paragraph 29 above. Pursuant to clause 17(3), the Mayor

and Chief Executive are authorised to affix the Council’s seal as formal

evidence of approval. Plan Change 27 will then be made operative under clause

20(2) of Schedule 1 of the RMA.

STRATEGIC ALIGNMENT

31. This contributes to the

promotion or achievement of the following strategic community outcome(s):

|

Contributes

|

|

We are an inclusive city

|

☐

|

|

We value, protect and enhance the environment

|

☐

|

|

We are a well-planned city

|

ü

|

|

We can move around our city easily

|

☐

|

|

We are a city that supports business and education

|

☐

|

32. Tauranga

city is currently facing high population growth. Council is required to provide

housing capacity to cater for the increasing population. Plan Change 27 ensures

that as Tauranga continues to grow, development and redevelopment occurs in a

manner that reduces the risk of flooding from intense rainfall over time.

33. Plan Change 27 is the

regulatory response to the wider ISP and gives effect to the natural hazard

policies in the RPS, consistent with the city’s key strategic outcome to

have a well-planned city, through managing development and redevelopment within

Tauranga while reducing the risk of flooding to life, property and

infrastructure from intense rainfall events over time.

Financial Considerations

34. The

remaining costs are only associated with the preparation and release of the

public notice and process of updating the City Plan. These are covered within

the existing budget for the plan change.

Legal Implications / Risks

35. There

are no legal implications / risks involved in approving and then making Plan

Change 27 operative given that the plan change has been through all necessary

statutory processes.

TE AO MĀORI APPROACH

36. This was considered through the

earlier phases of the plan change process, including staff having undertaken

consultation with relevant iwi and hapu representatives throughout the plan

change process.

CLIMATE IMPACT

37. Plan Change 27 has been

prepared with consideration to the effects of climate change on flooding from

intense rainfall event. The definitions introduced through Plan Change 27

require planning for a 1% AEP rainfall event concurrent with a 5% AEP storm-tide

event, taking into account the effects of climate change on rainfall and sea

level based on the Representative Concentration Pathway (RCP) 8.5 median

scenario as of the year 2130.

Consultation / Engagement

38. Consultation is not necessary

at this point. The release of the public notice will be for information

purposes only and to satisfy the statutory requirements set out under the RMA.

Significance

39. The Local Government Act 2002

requires an assessment of the significance of matters, issues, proposals and

decisions in this report against Council’s Significance and Engagement

Policy. Council acknowledges that in some instances a matter, issue,

proposal or decision may have a high degree of importance to individuals,

groups, or agencies affected by the report.

40. In making this assessment,

consideration has been given to the likely impact, and likely consequences for:

(a) the current

and future social, economic, environmental, or cultural well-being of the

district or region

(b) any persons who are likely to be

particularly affected by, or interested in, the decision.

(c) the capacity of the local authority

to perform its role, and the financial and other costs of doing so.

41. In accordance with the

considerations above, criteria and thresholds in the policy, the plan change is

of medium significance, however the decision to make the plan change operative

is of low significance because the plan change has been through a significant

engagement process in accordance with Schedule 1 of the RMA, and the plan

change is already in effect.

ENGAGEMENT

42. Taking into consideration the

above assessment, that the decision is of low significance, officers are of the

opinion that no further engagement is required prior to Council making a

decision.

Next Steps

43. In

accordance with Clause 20 of Schedule 1 of the RMA, Council must publicly

notify the date on which Plan Change 27 will become operative. This notice must

be issued at least five working days prior to the operative date, which is

proposed as 13 May 2025.

44. Following this, the City Plan

will be updated to formally incorporate the approved provisions of the plan

change. In accordance with the RMA, a copy of the plan change will then be

provided to specified persons including the tangata whenua of the area.

Attachments

1. Consent

Order - Bluehaven Management & Urban Taskforce v TCC -ENV-2022-AKL-115

& 118 - 2025 NZEnvC 93 - A17844956 ⇩

2. FINAL_PC27

Flooding from intense rainfall_ IHP Decision and provisions combined_pdf -

A13337839 ⇩

|

Ordinary

Council meeting Agenda

|

28

April 2025

|

|

Ordinary

Council meeting Agenda

|

28

April 2025

|

|

Ordinary

Council meeting Agenda

|

28

April 2025

|

11.2 Draft Alcohol

Licensing Fees Bylaw - Deliberations

File

Number: A17679220

Author: Jane

Barnett, Policy Analyst

Nigel McGlone,

Manager: Environmental Regulation

Authoriser: Sarah

Omundsen, General Manager: Regulatory and Compliance

Purpose of the Report

1. To consider the issues

raised by submitters to the draft Alcohol Licensing Fees Bylaw and to decide

whether to adopt the bylaw.

|

Recommendations

That the Council:

(a) Receives the report

"Draft Alcohol Licensing Fees Bylaw - Deliberations ".

(b) Adopt the Alcohol Licensing

Fees Bylaw 2025 (Attachment One).

(c) Delegates to the General

Manager: Regulatory and Compliance to make any necessary minor drafting or

presentation changes to the Alcohol Licensing Fees Bylaw 2025, prior to it

being published.

|

Executive Summary

2. Under

the Sale and Supply of Alcohol Act 2012 (Act), Council is responsible for

administering alcohol licensing in Tauranga, including processing applications,

supporting the District Licensing Committee (DLC), and monitoring compliance

and enforcement.

3. These

licensing functions are funded by fees prescribed in legislation which

currently cover 40% of costs and mean general rates cover the remaining 60%.

4. The

prescribed fees have not changed since they were first set over 11 years ago.

The intention was that these fees would recover the total costs of

councils’ alcohol licensing functions. However, in recognition that these

fees may not result in cost recovery for each council (due to the differing

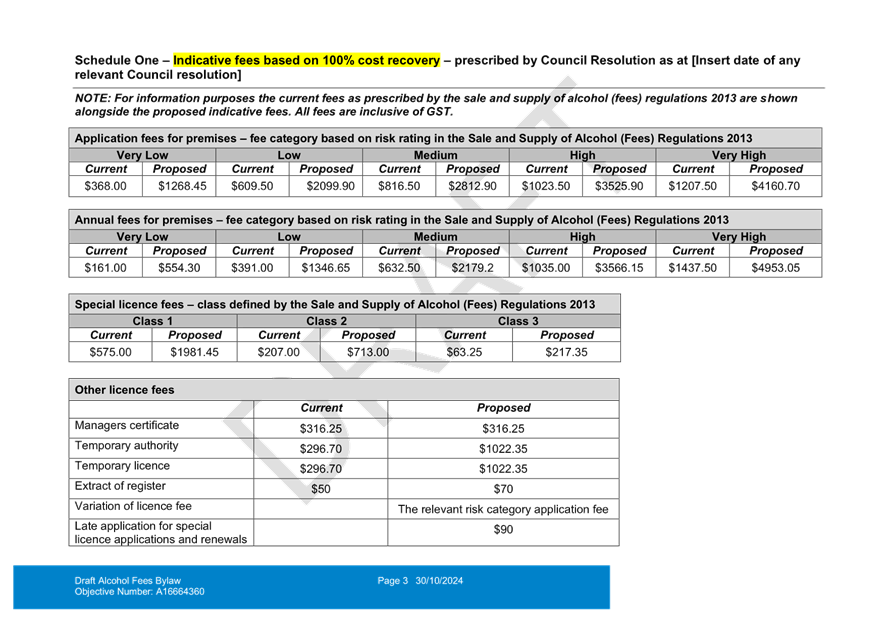

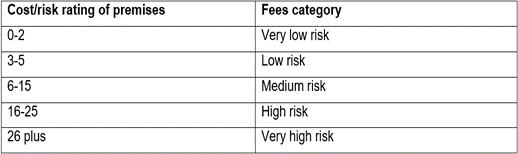

needs and demands of each district) secondary legislation[3] allows councils to set their own

fees through a bylaw.

5. An

Alcohol Licensing Fees bylaw (bylaw) would allow Council to set its own fees

and reduce general rates funding for alcohol licensing. With a bylaw in place

alcohol licensing fees could be consulted on (as part of the User Fees and

Charges consultation) during the annual plan or long-term plan process and set

by Council resolution.

6. Seven

other Councils have adopted bylaws in order to set their own alcohol licensing

fees, and one other is mid-way through the process.

7. Community

consultation on a proposed bylaw was carried out from 31 January to 7 March

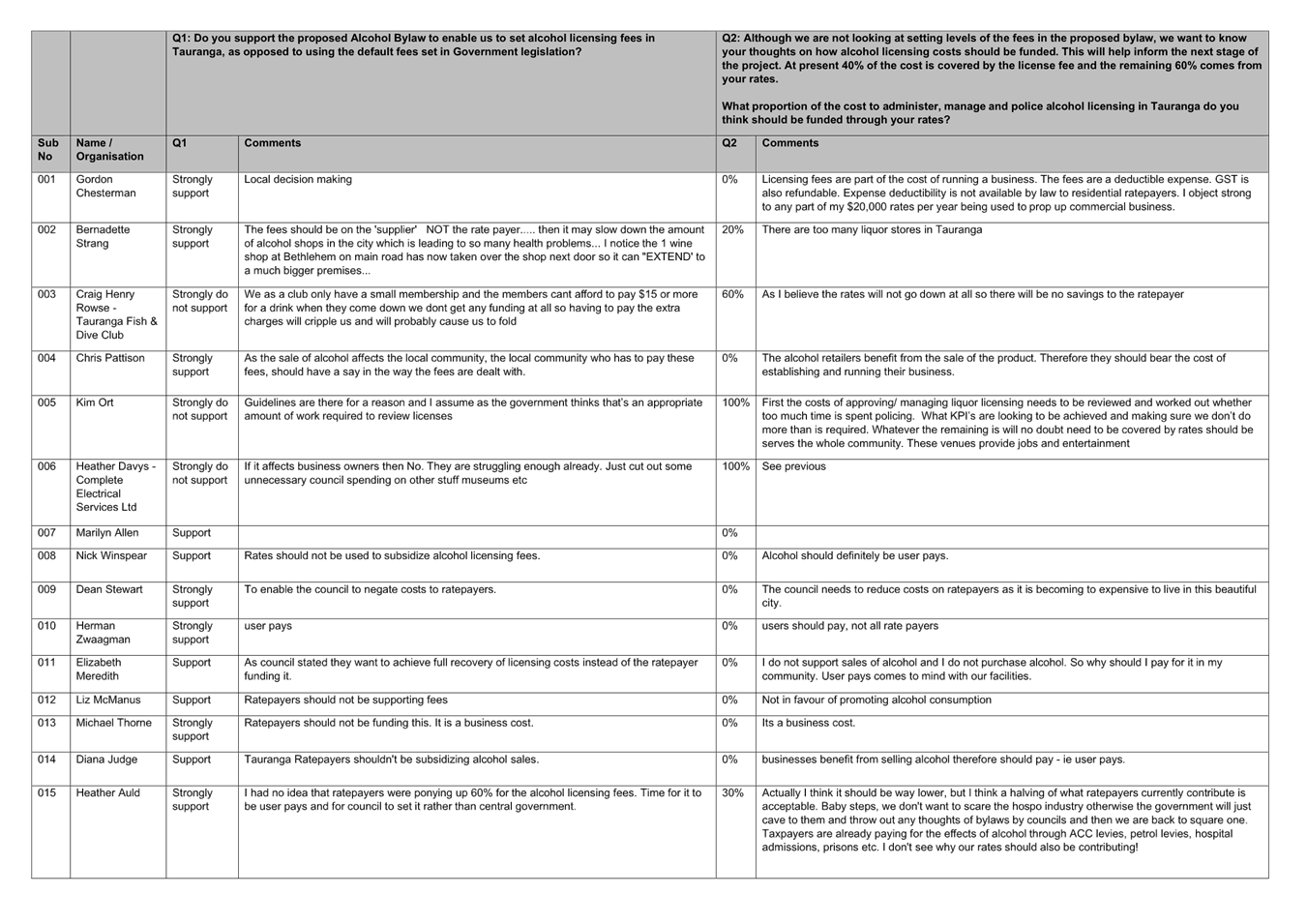

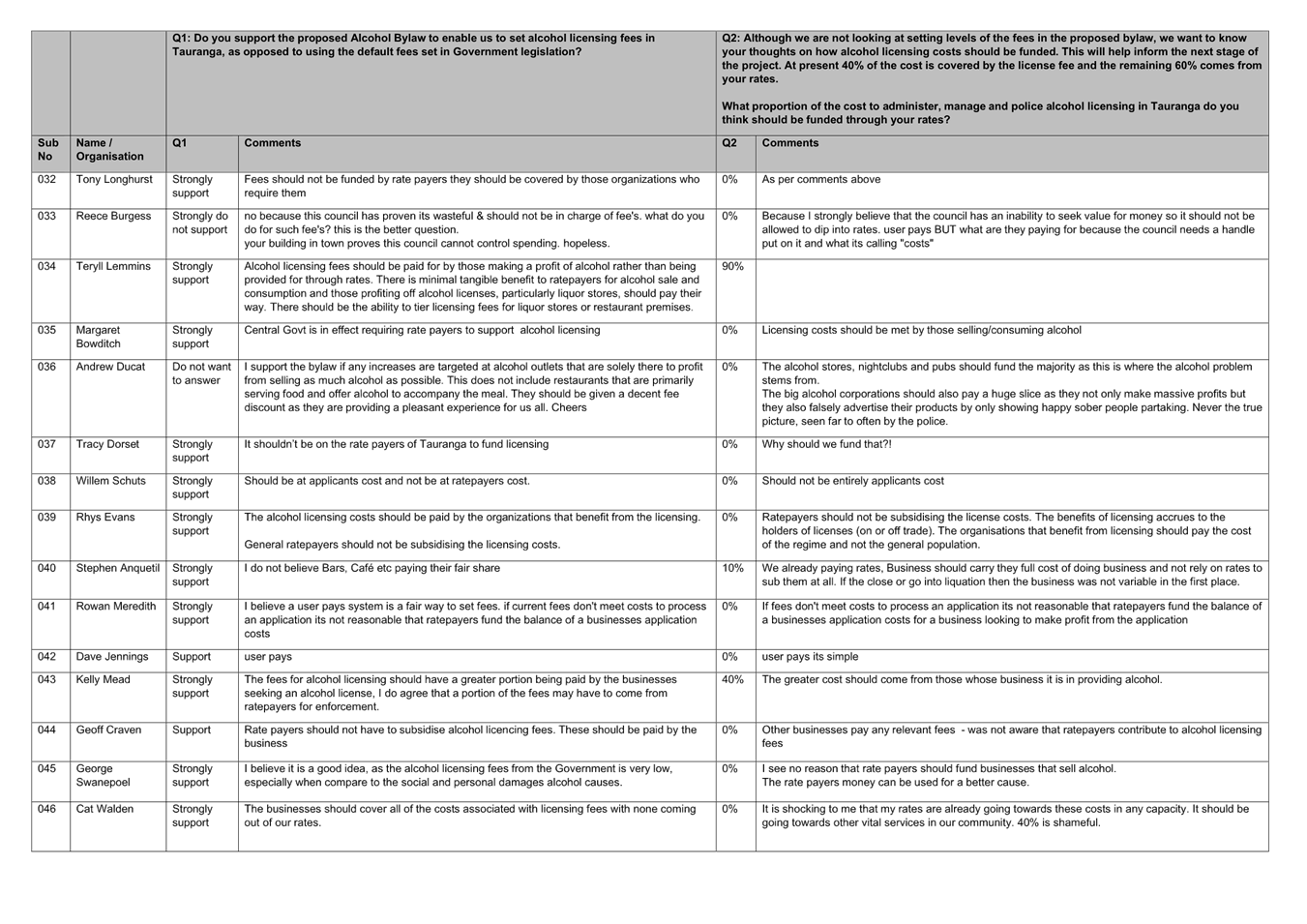

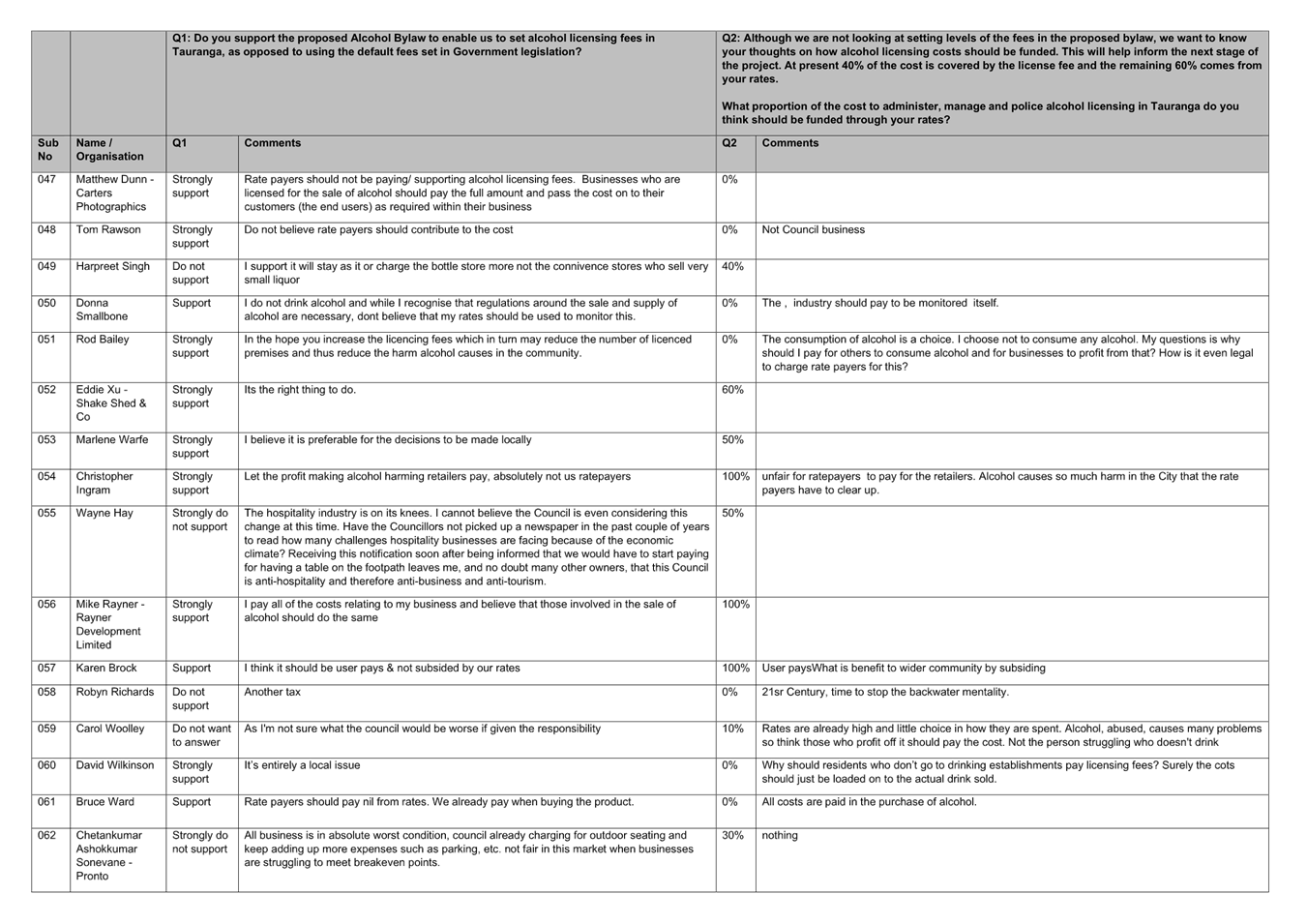

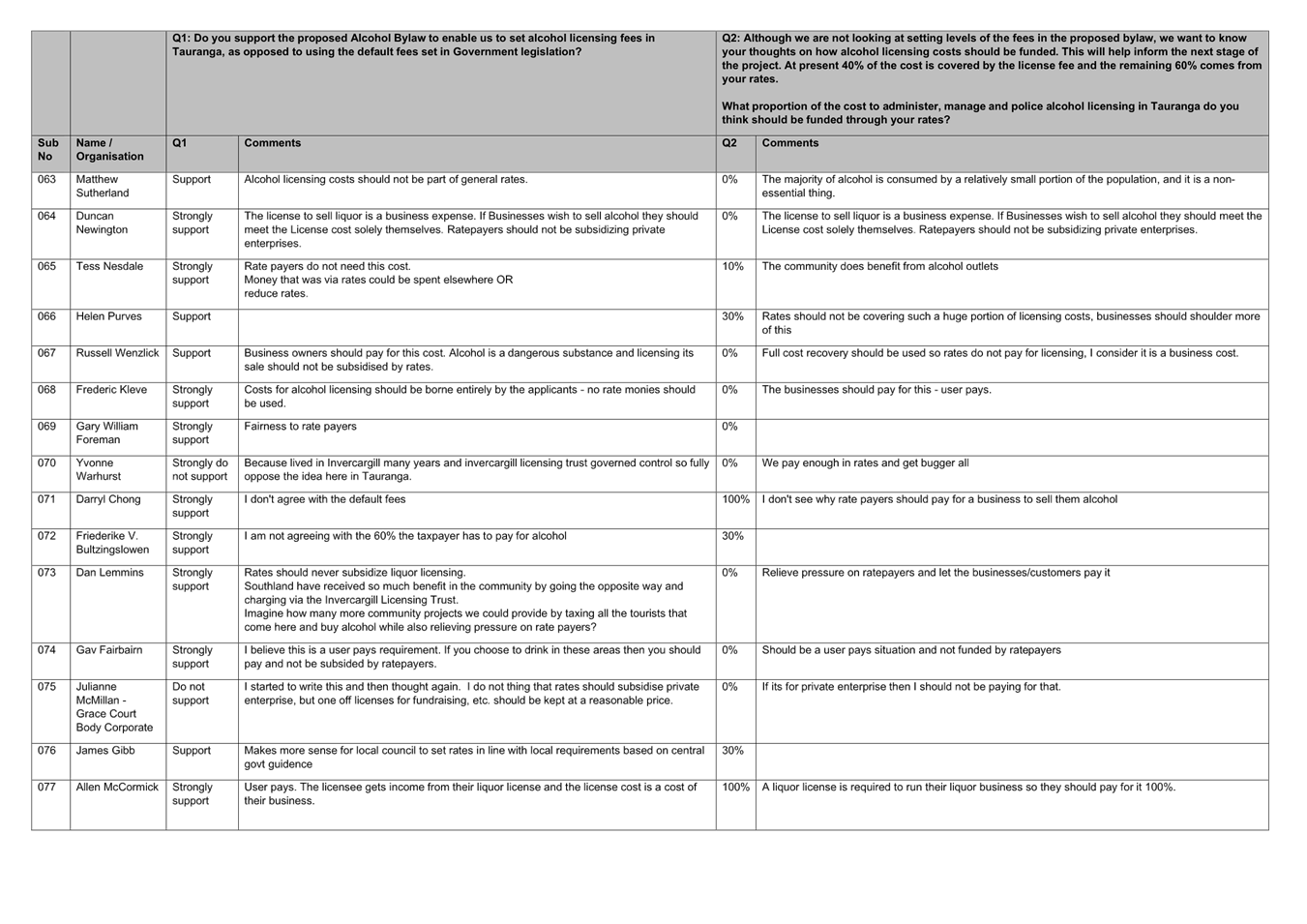

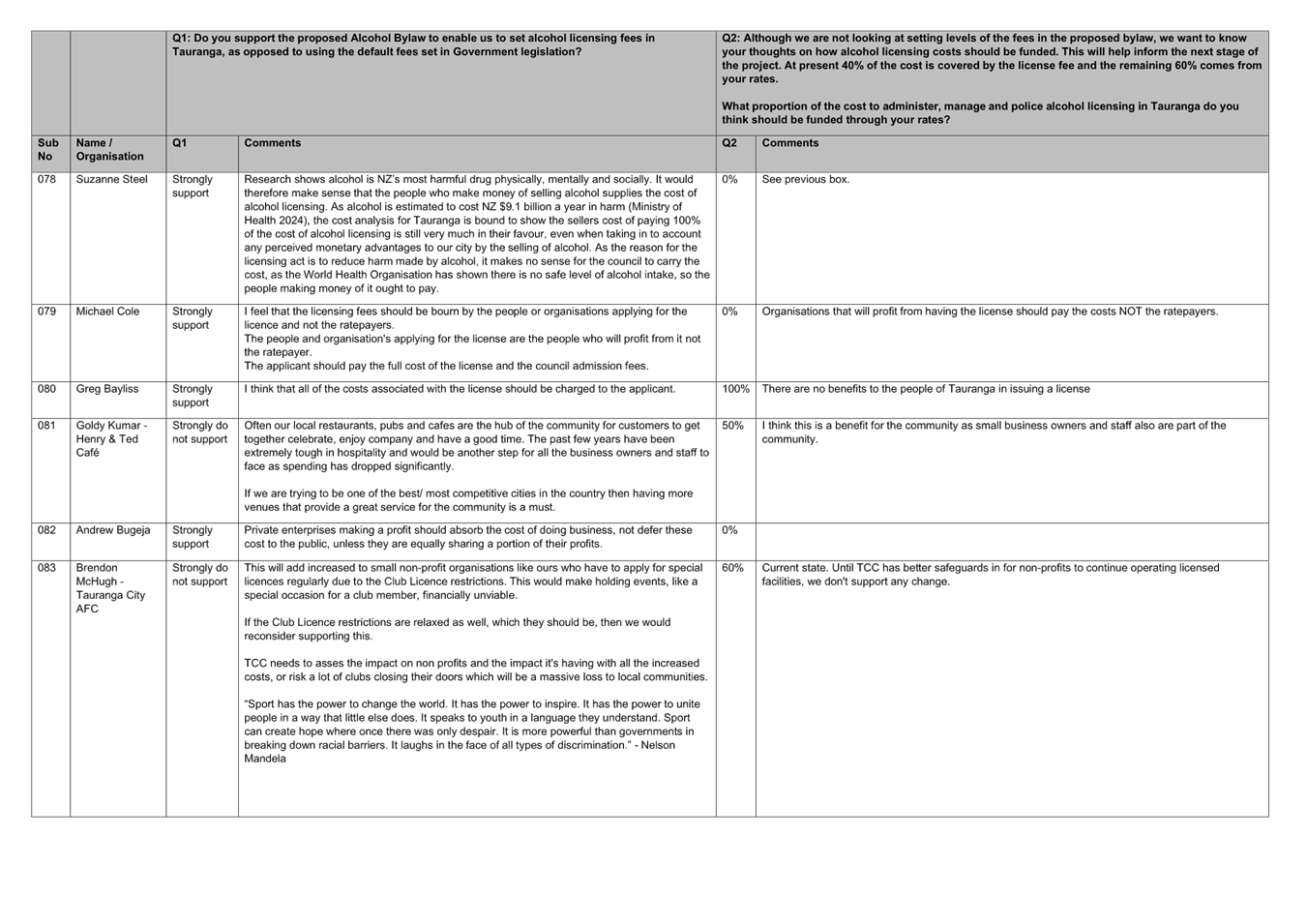

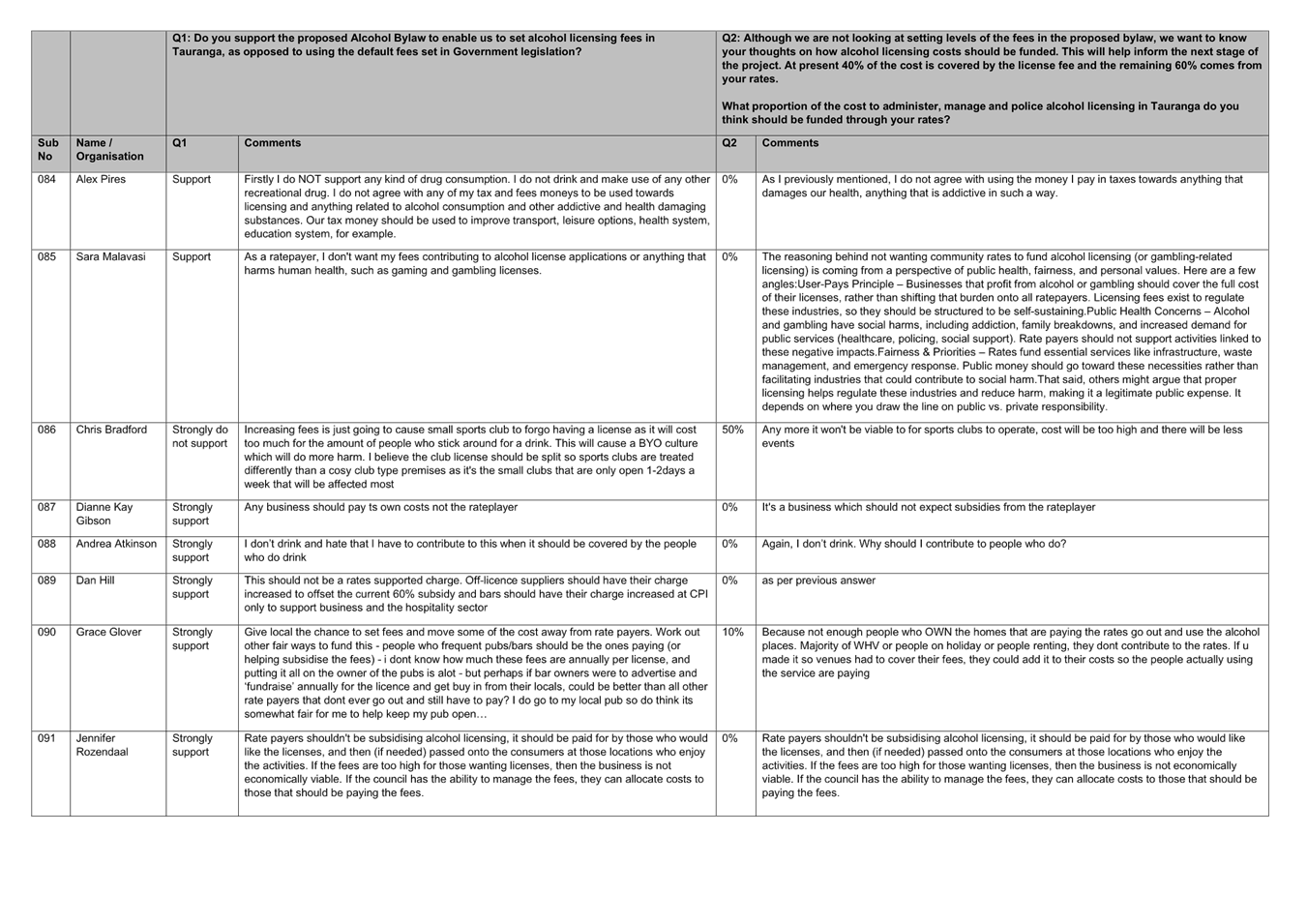

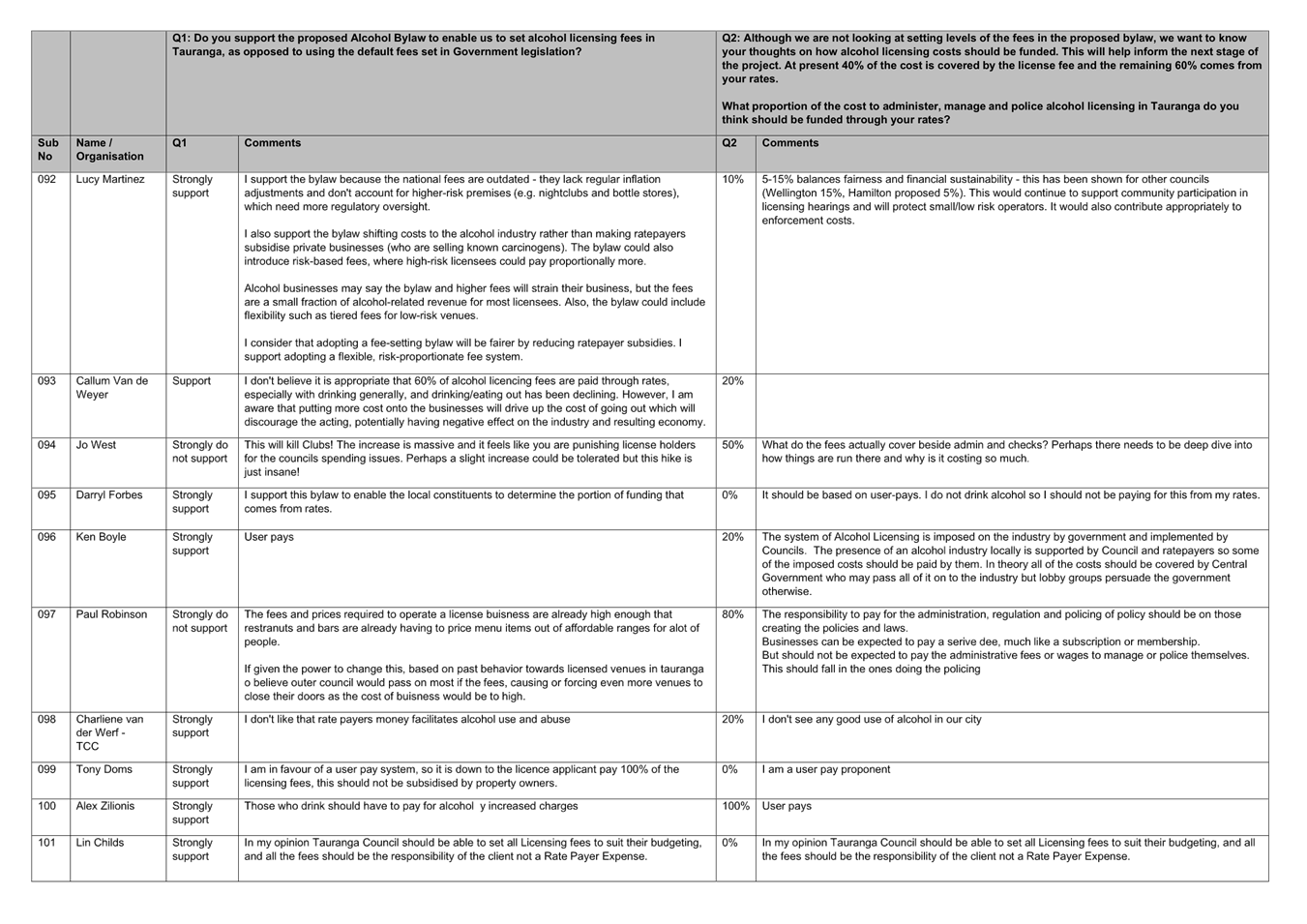

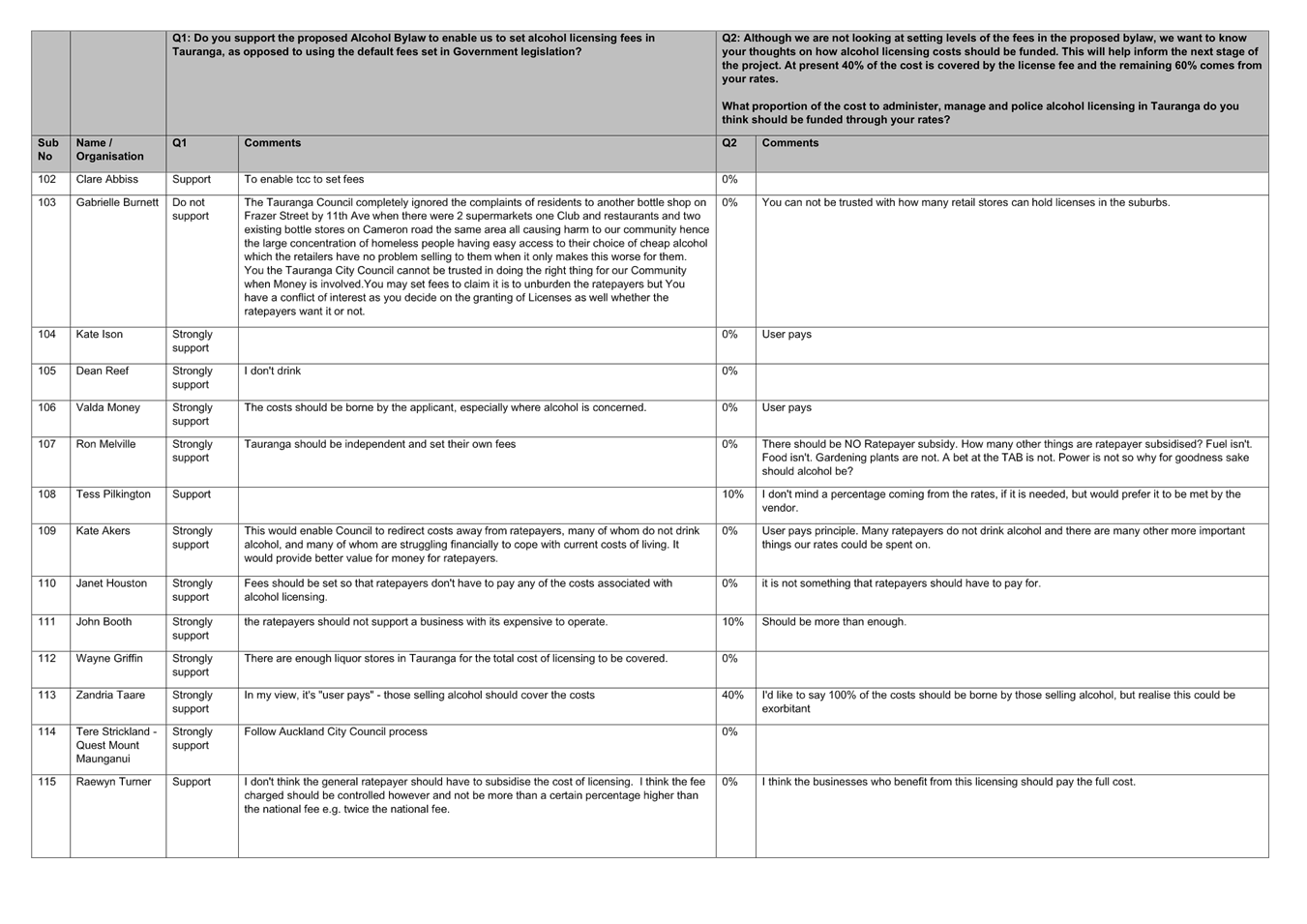

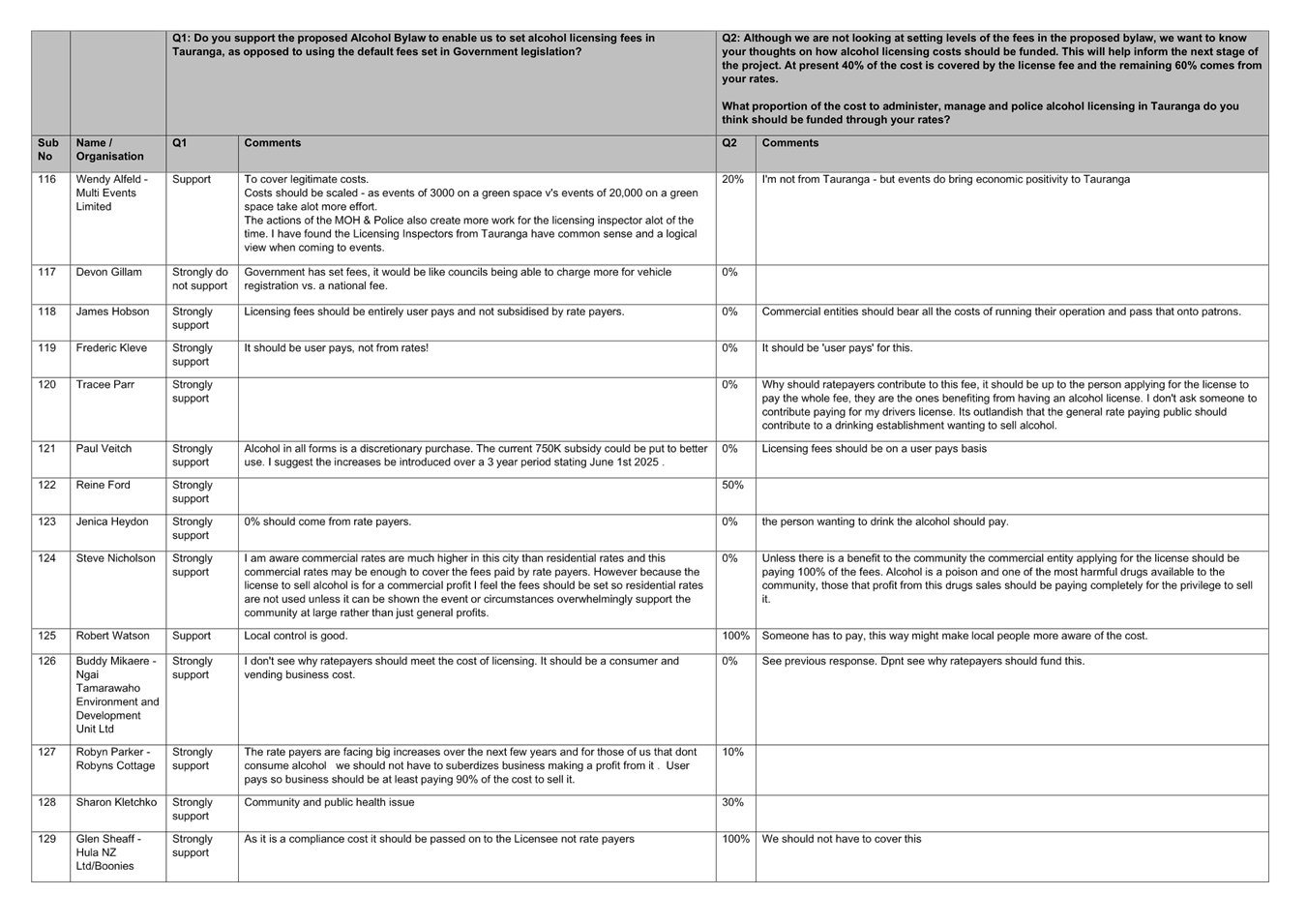

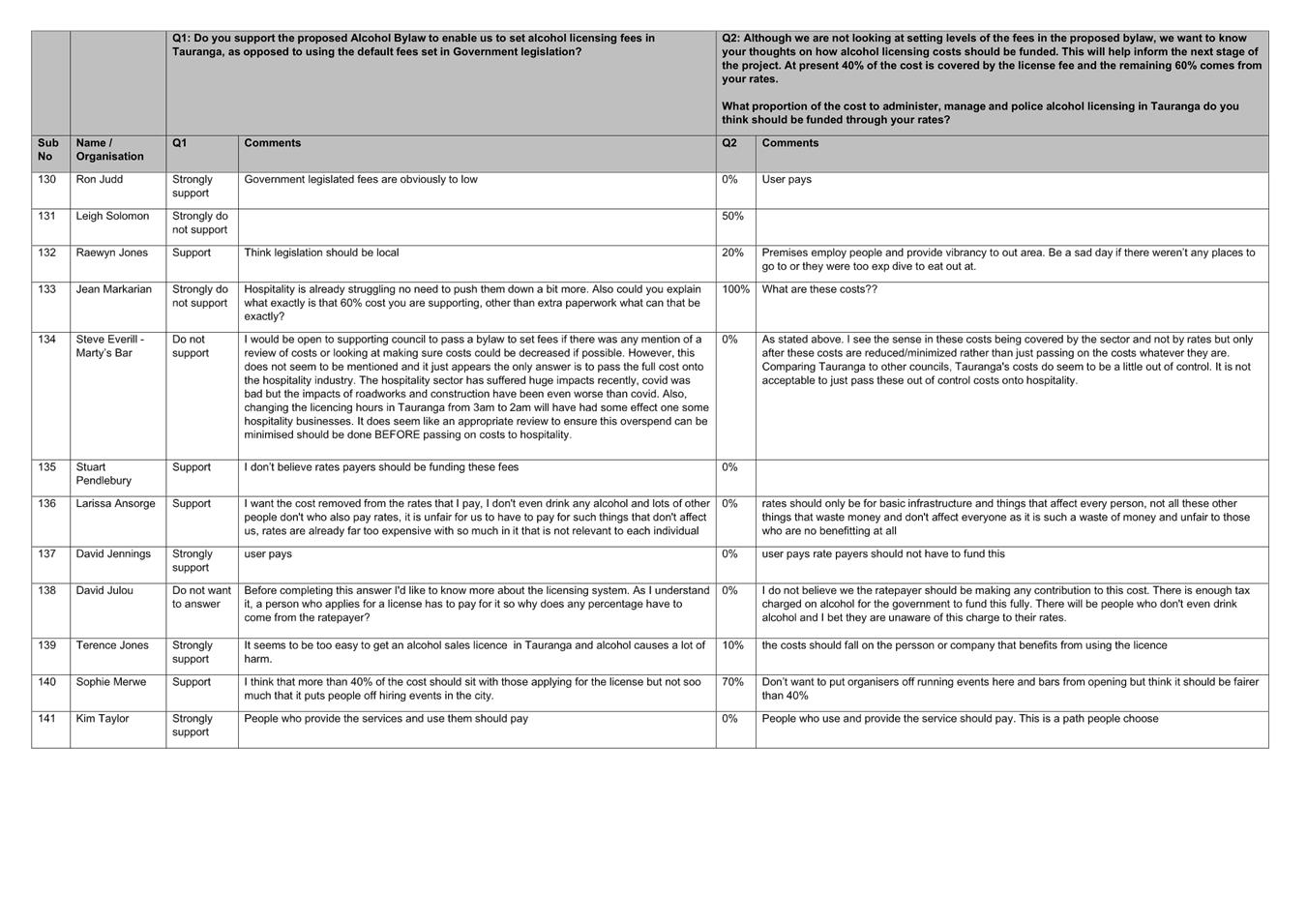

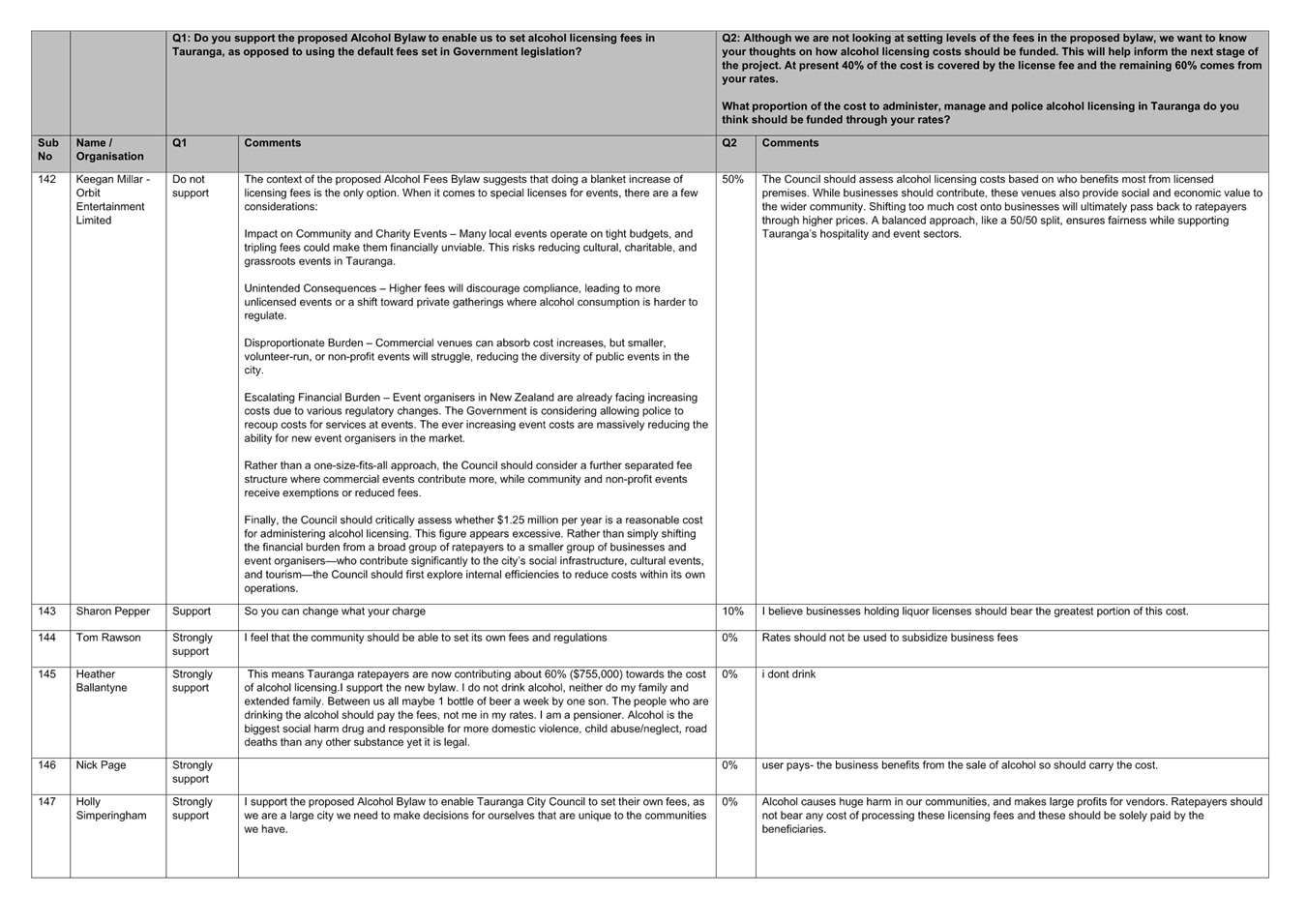

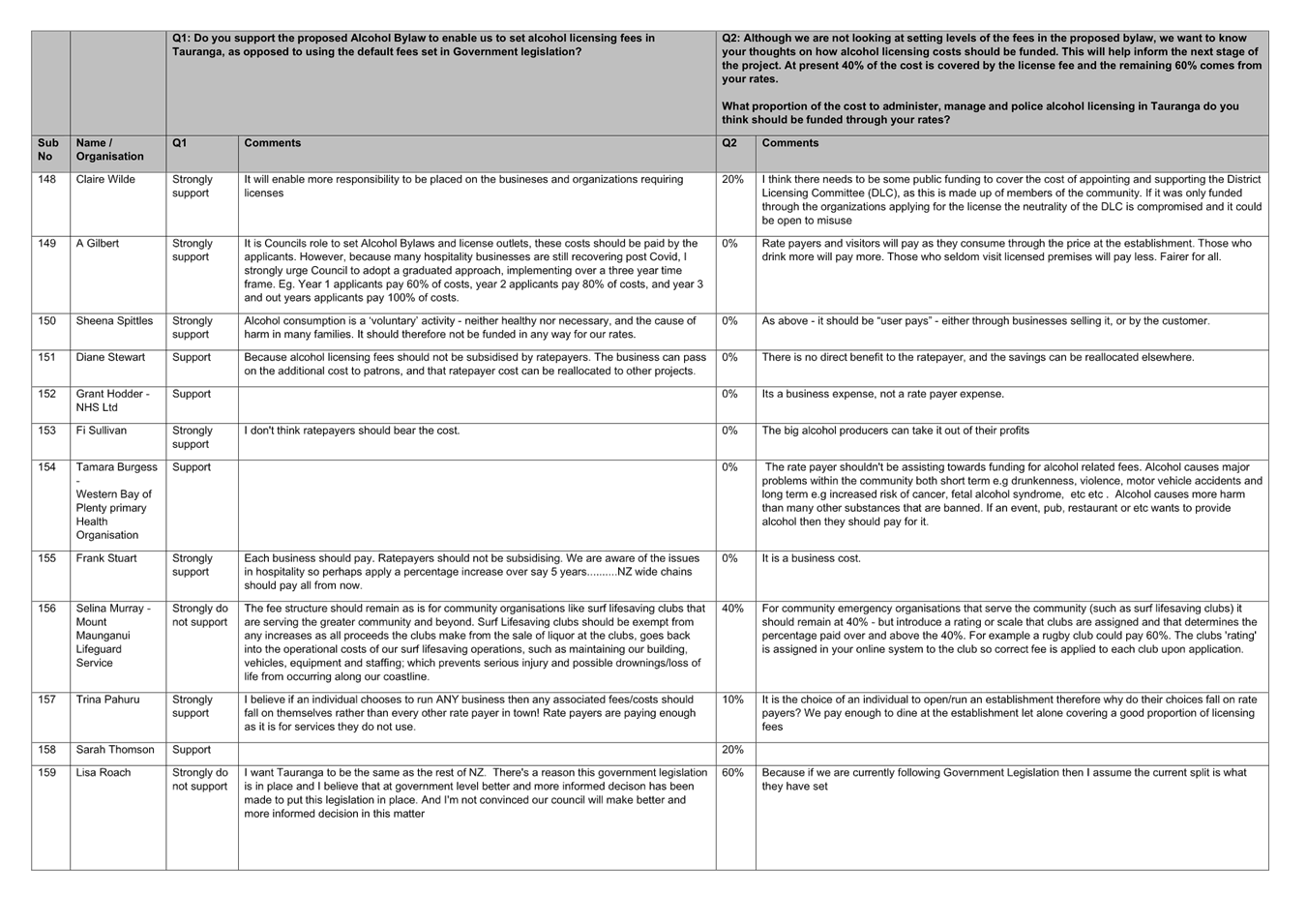

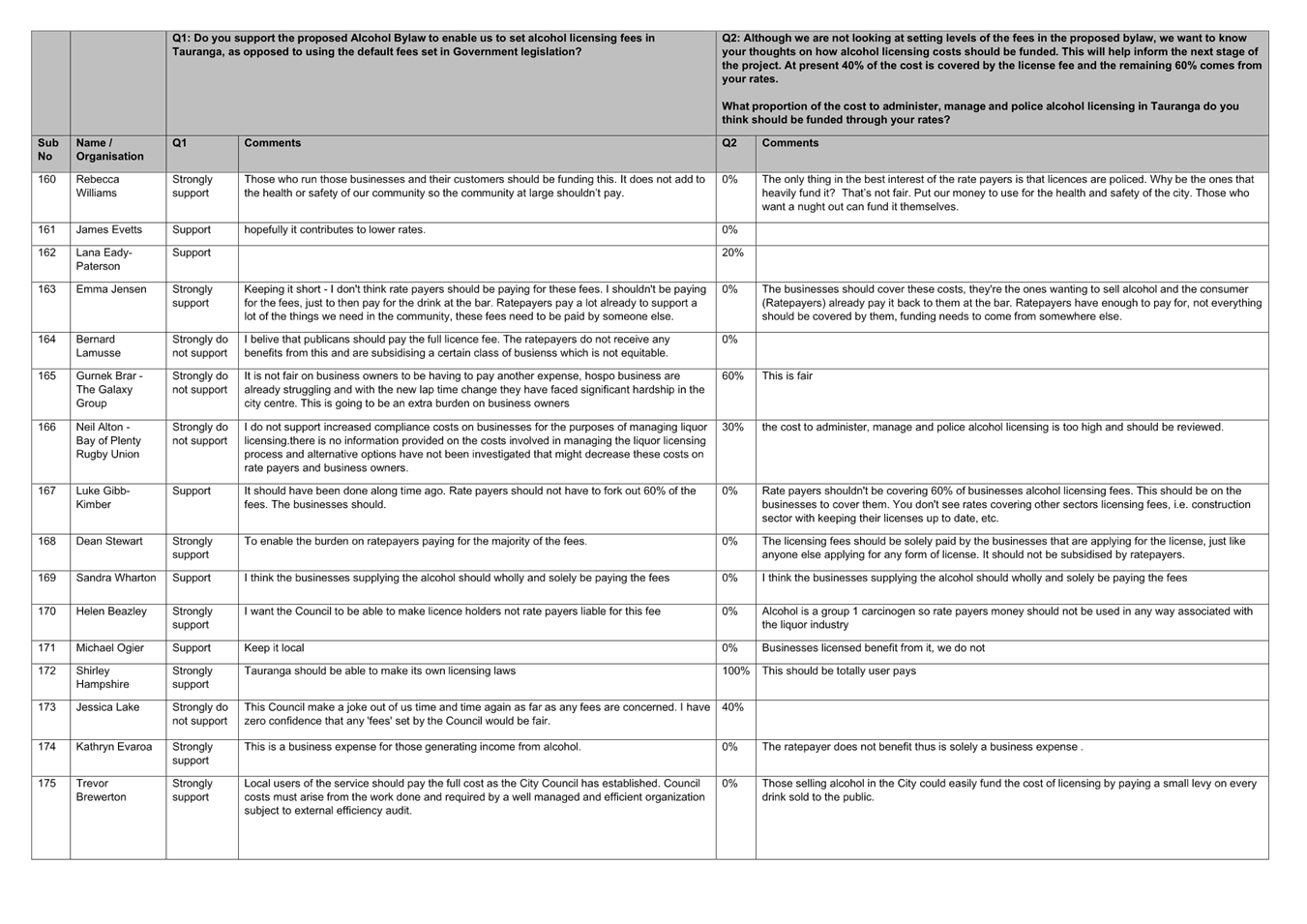

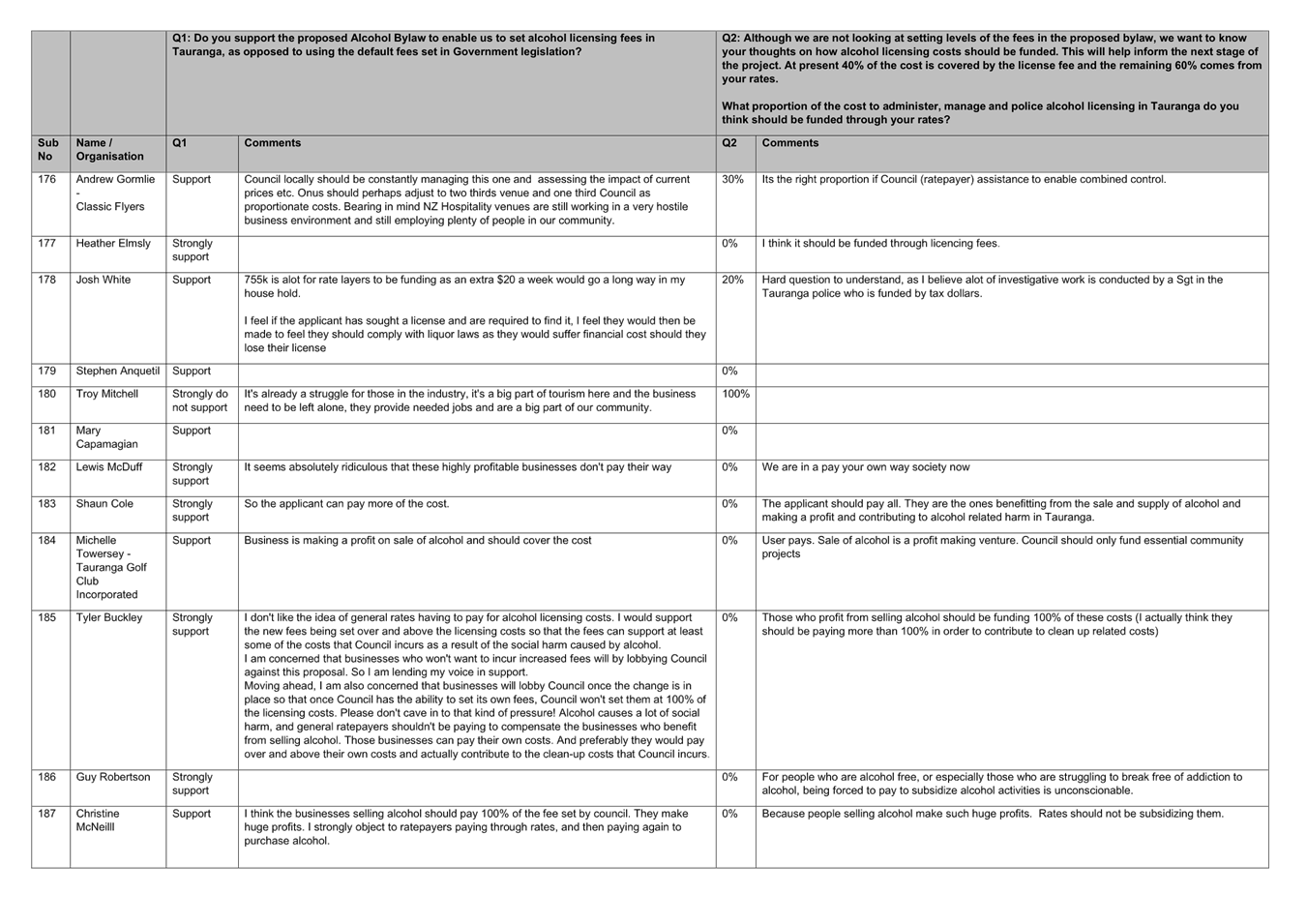

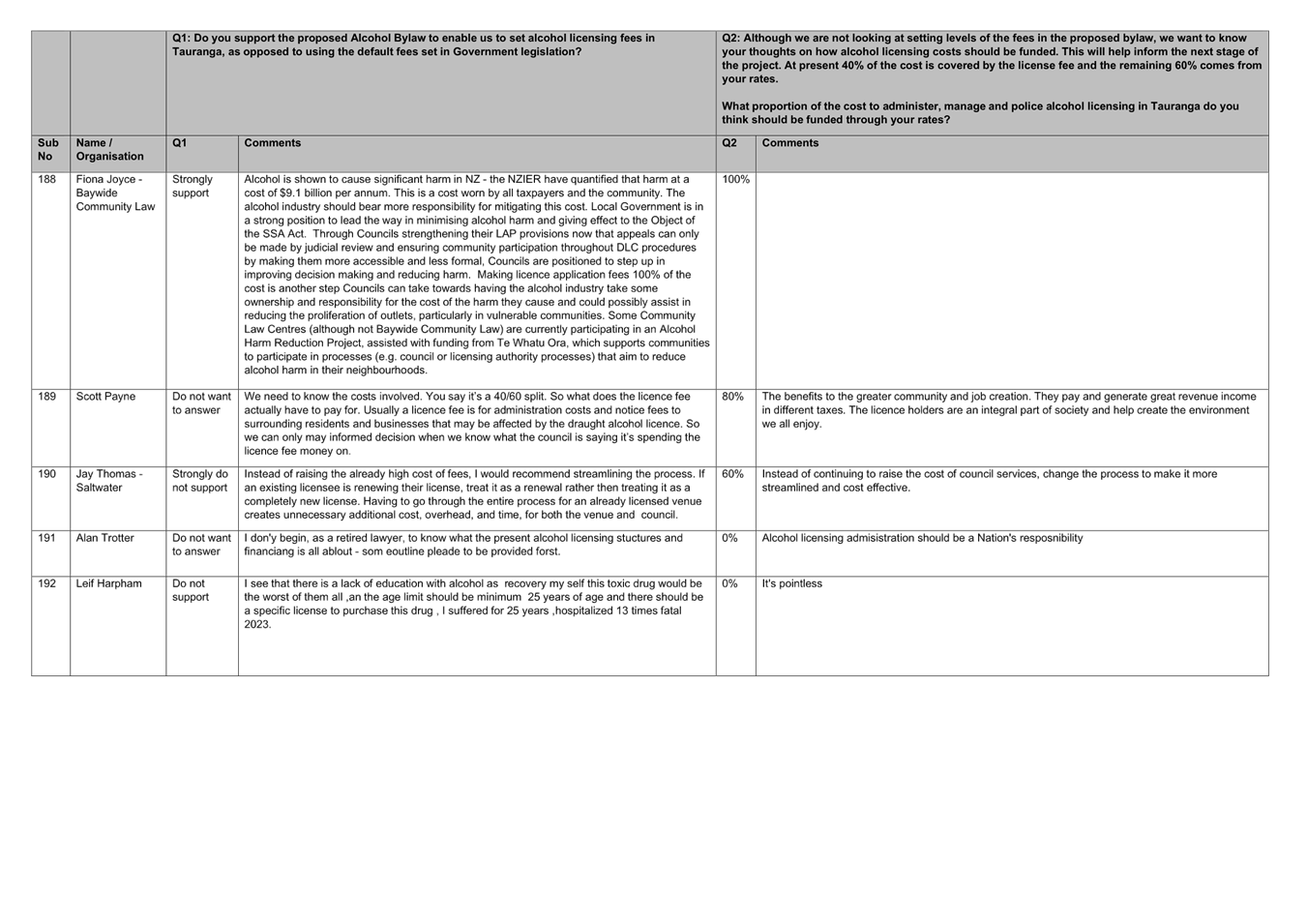

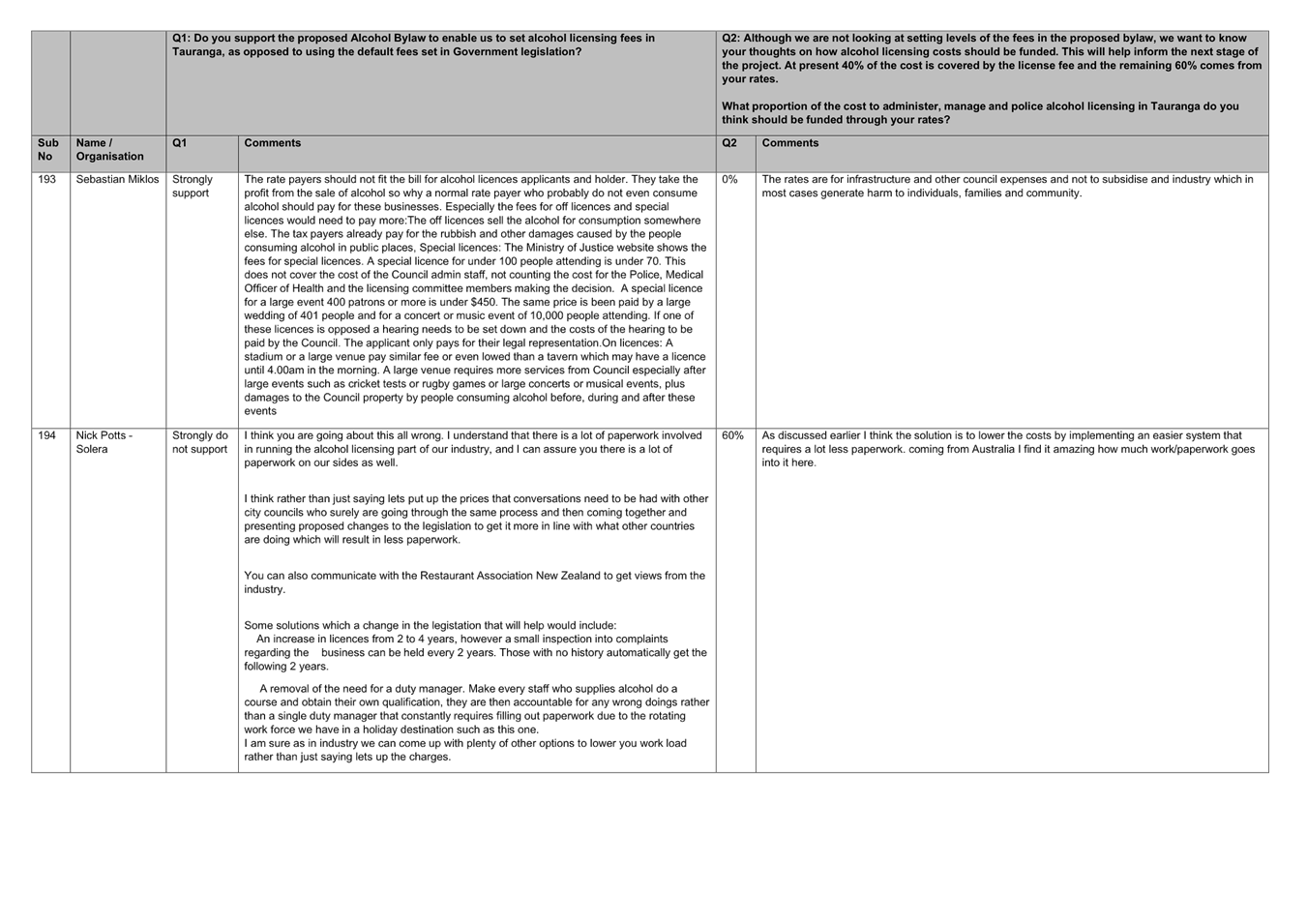

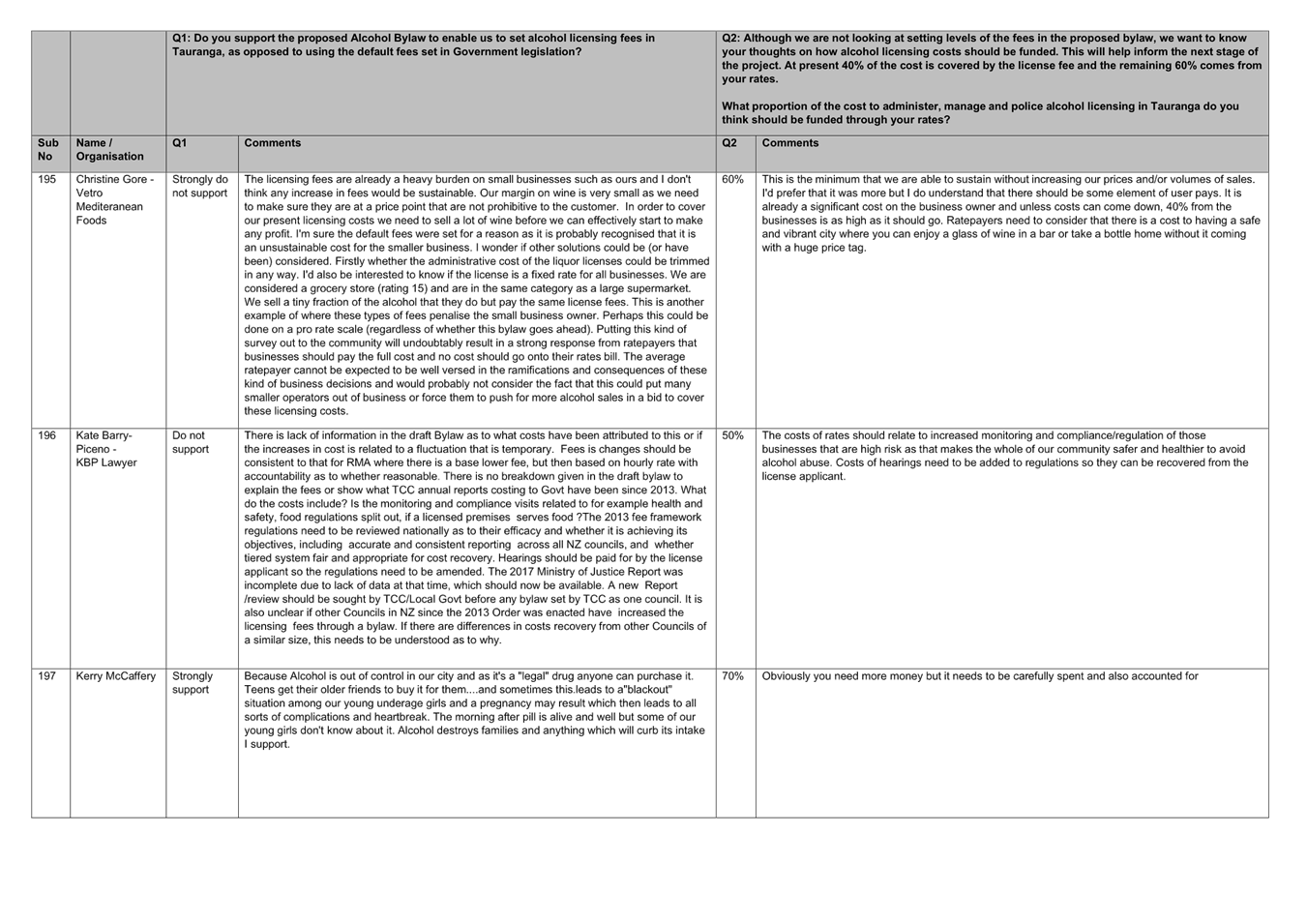

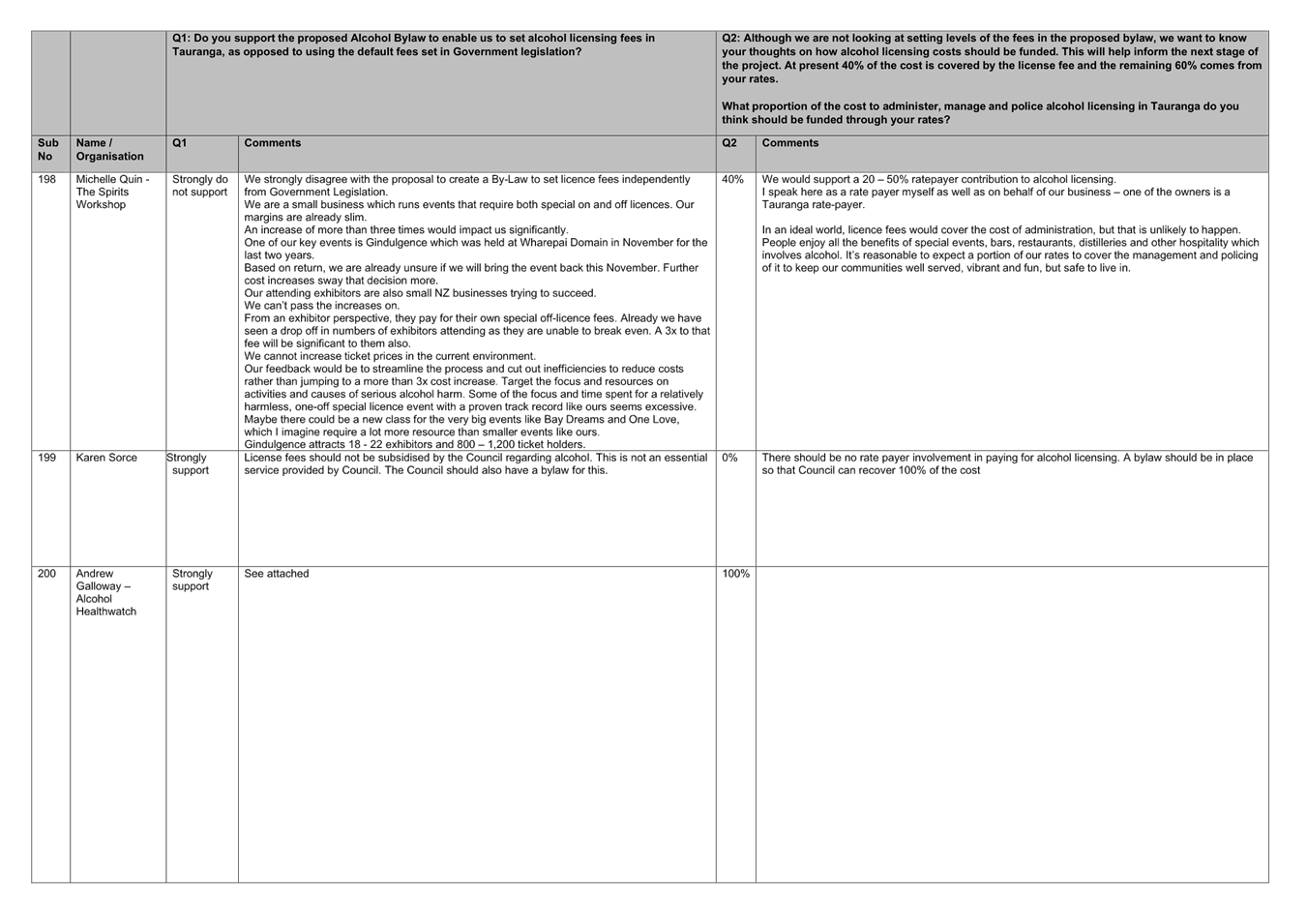

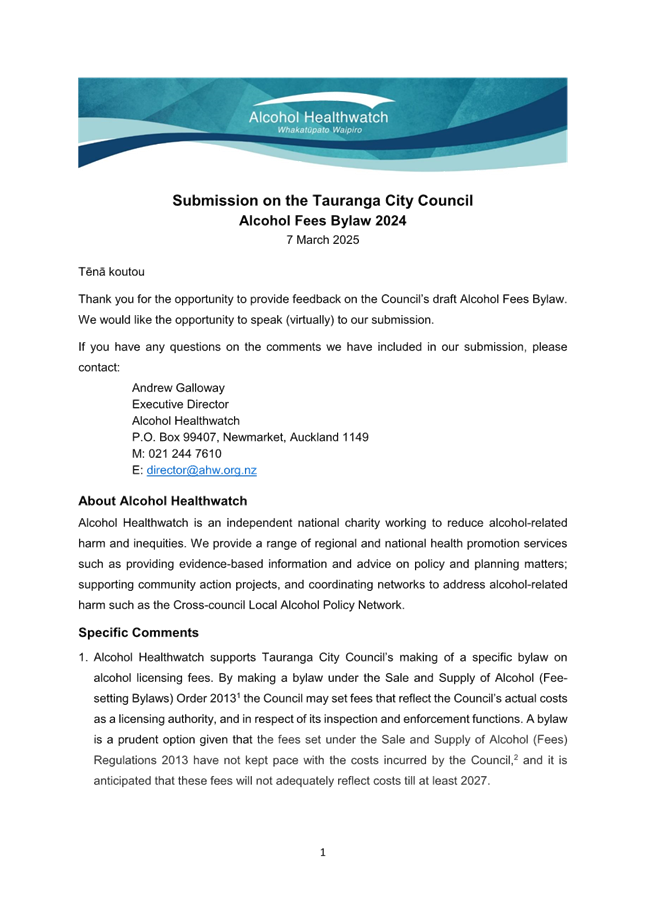

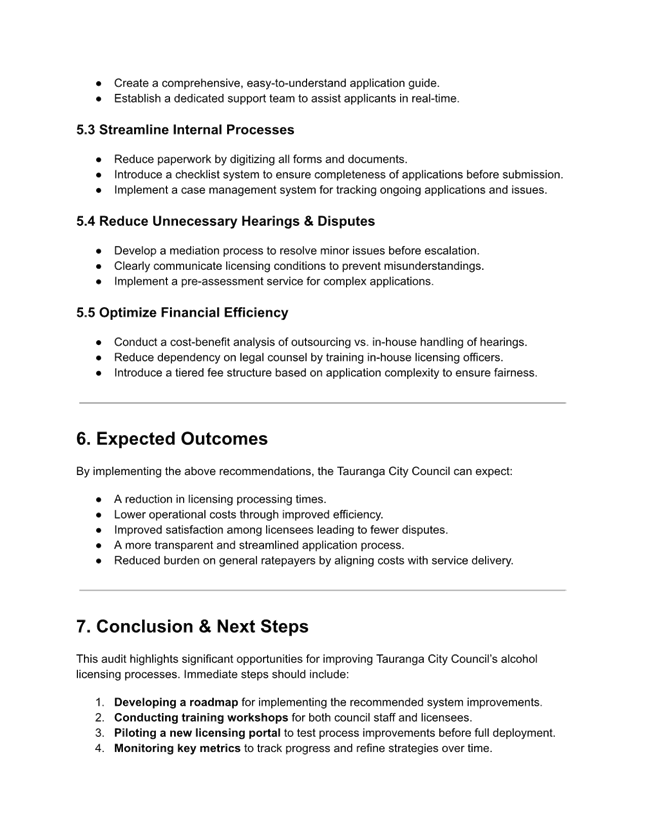

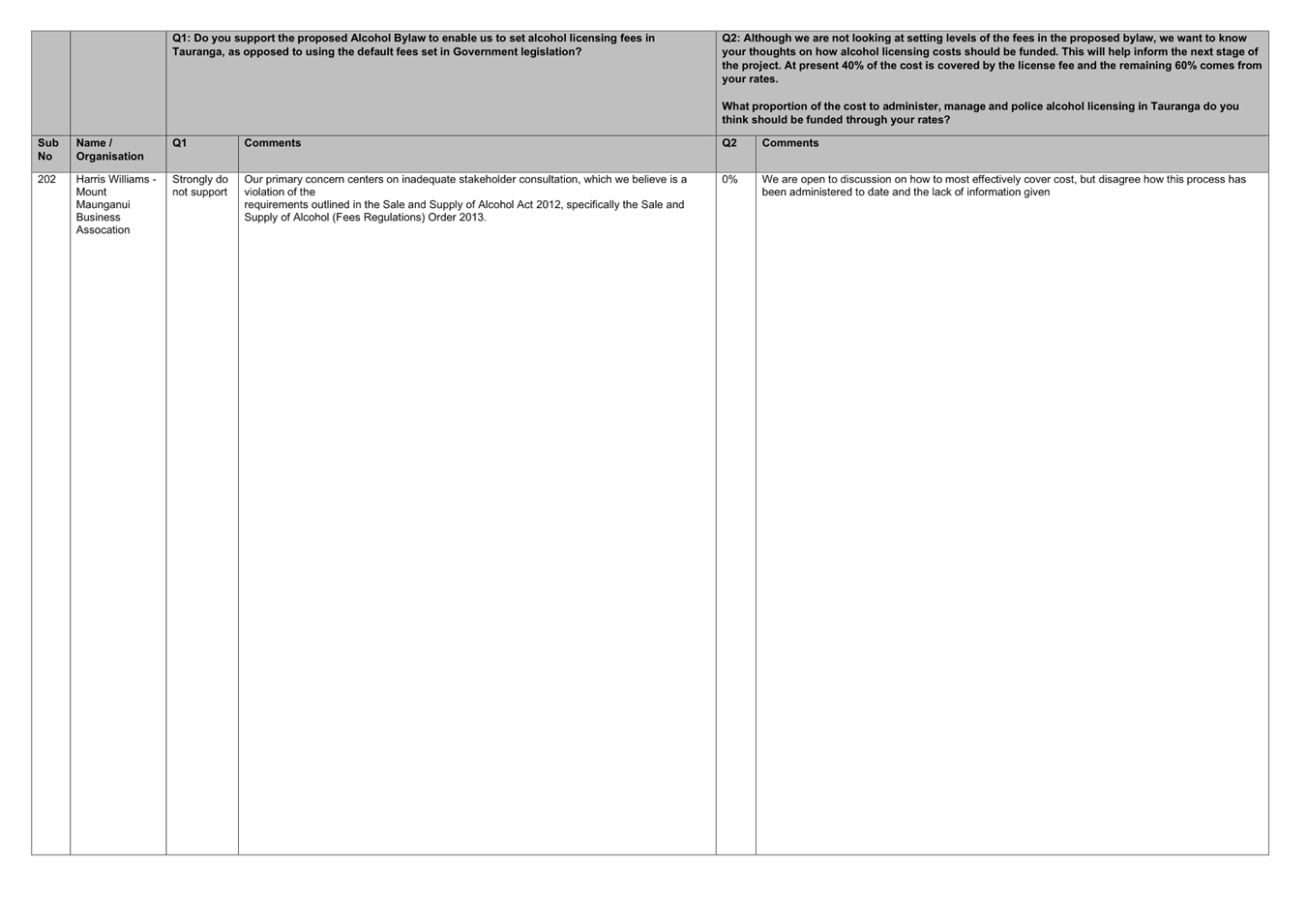

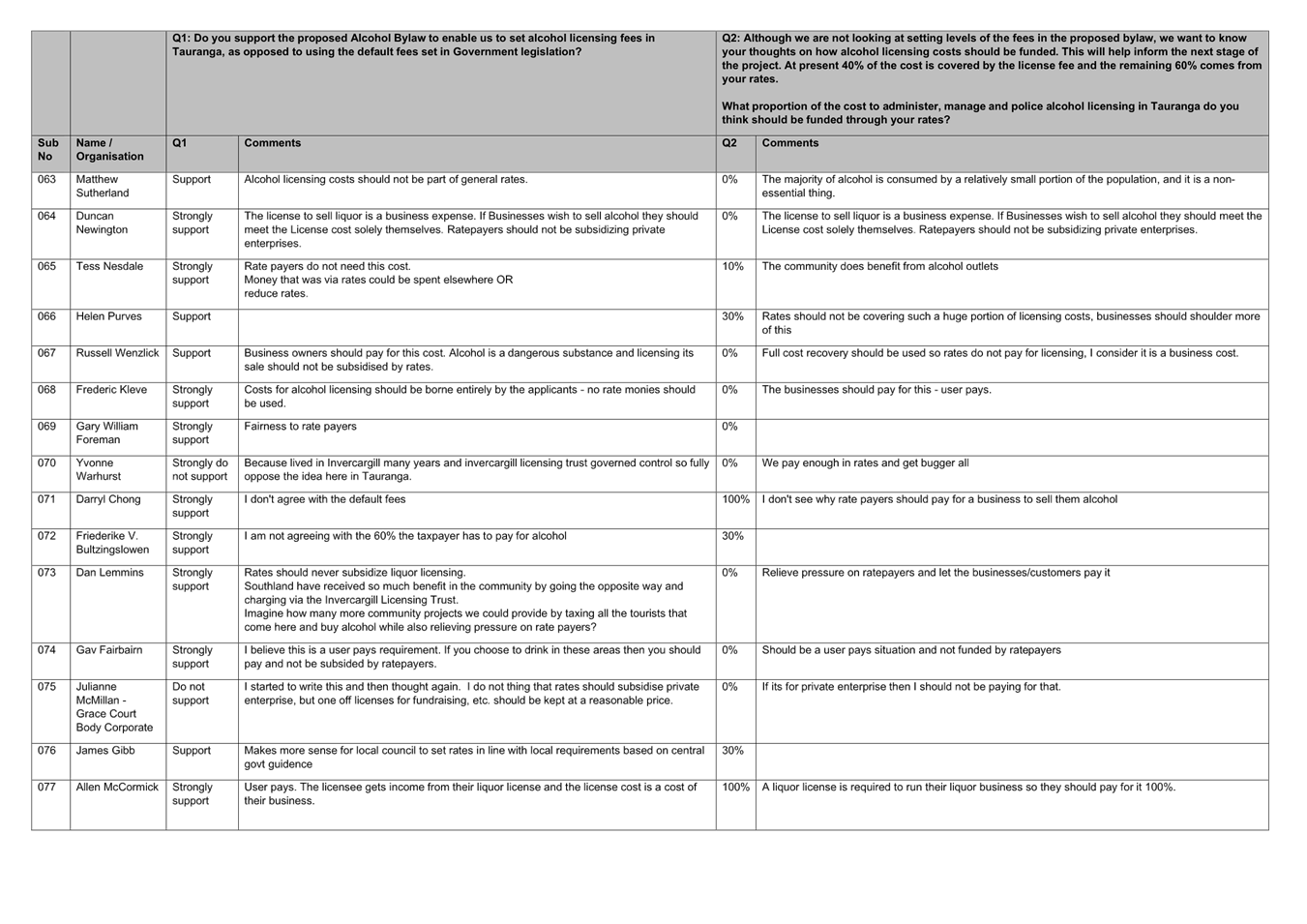

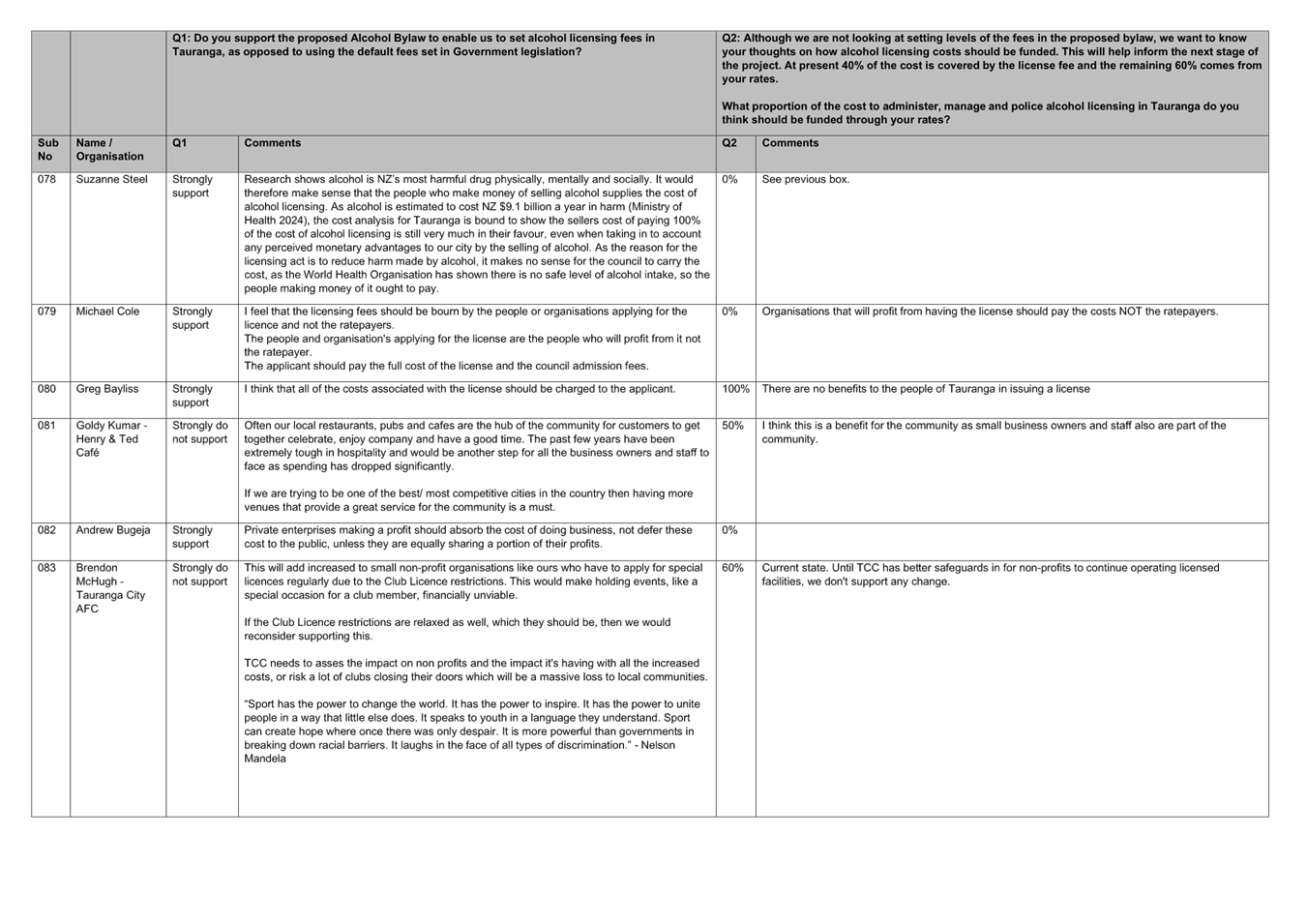

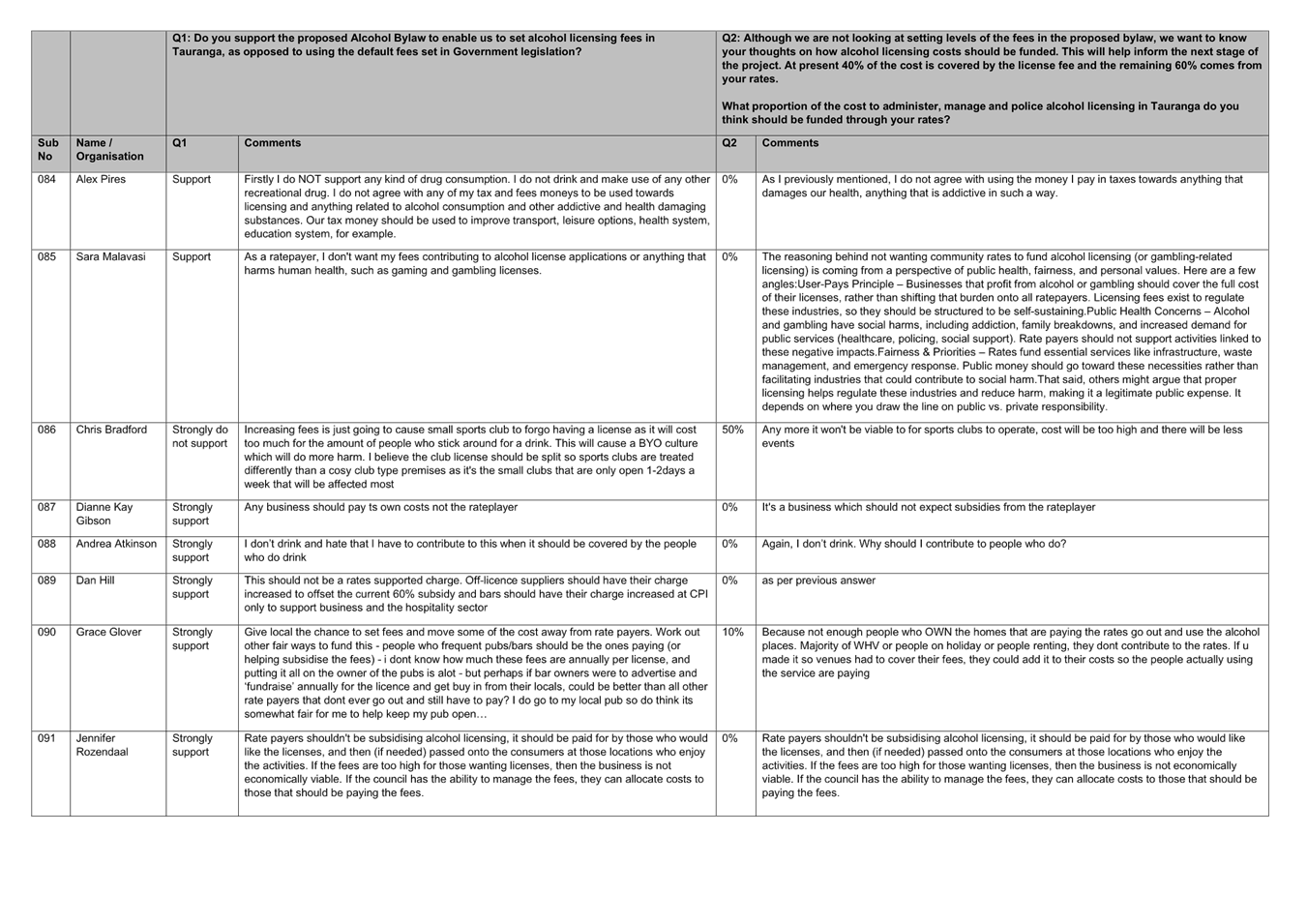

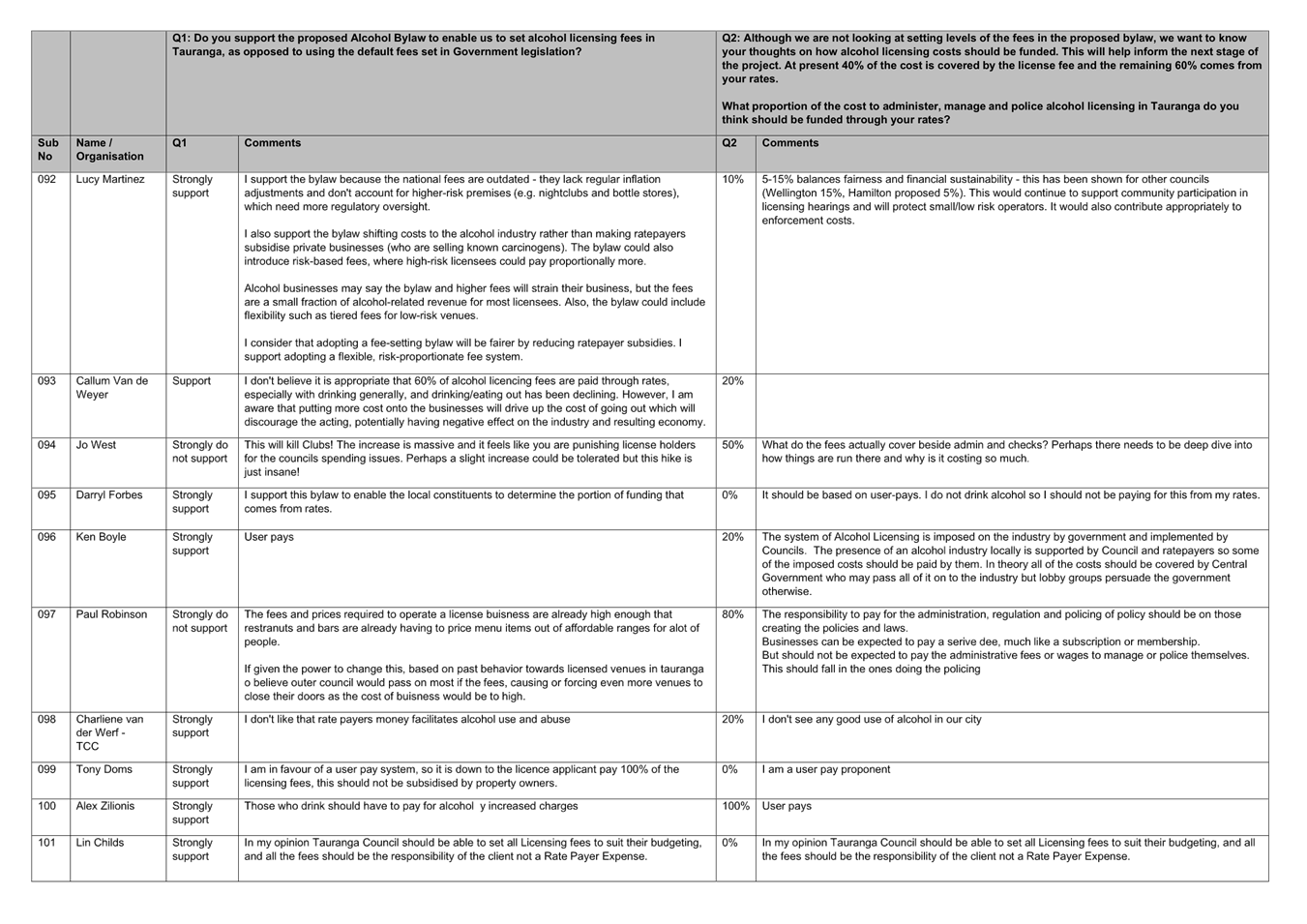

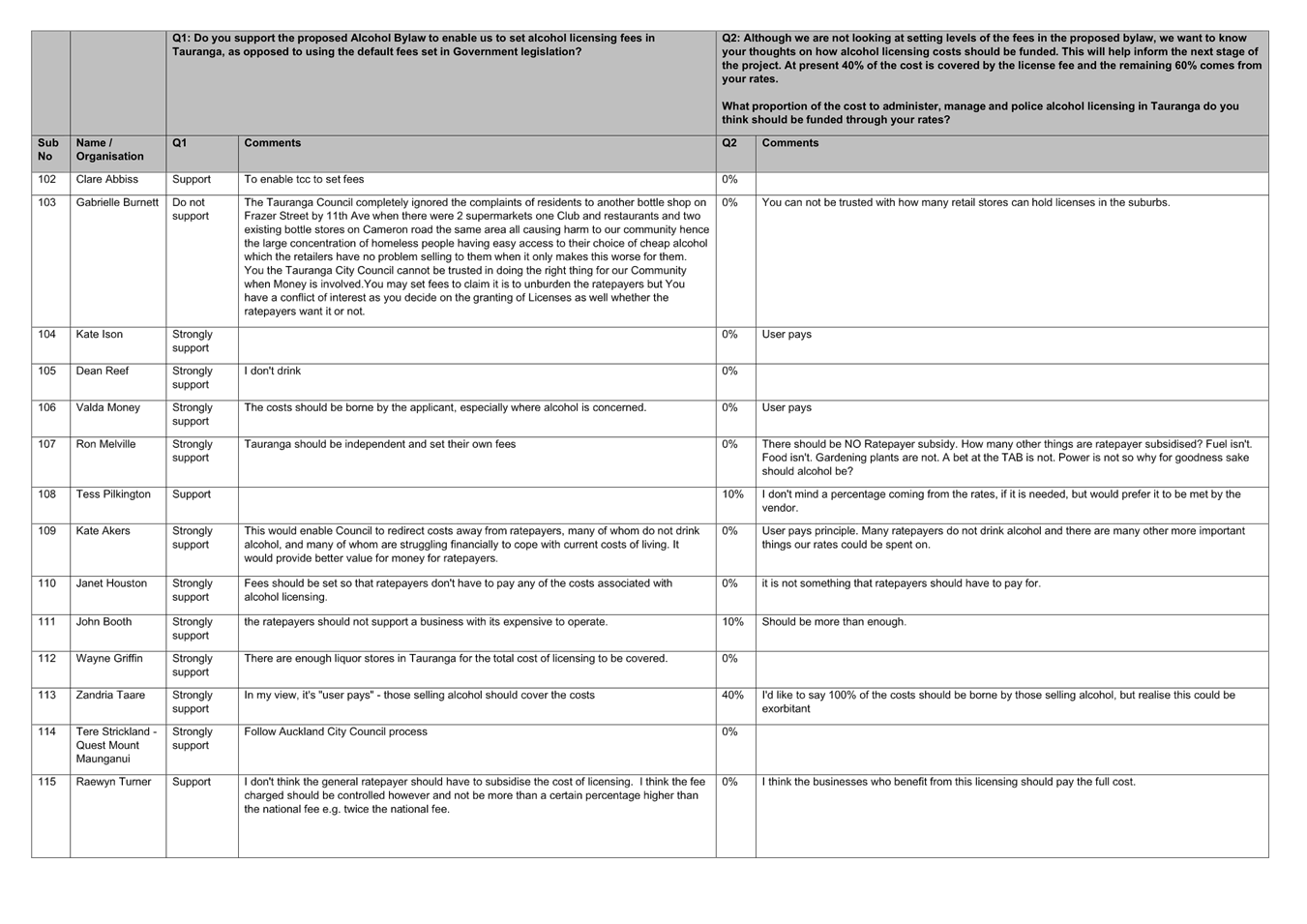

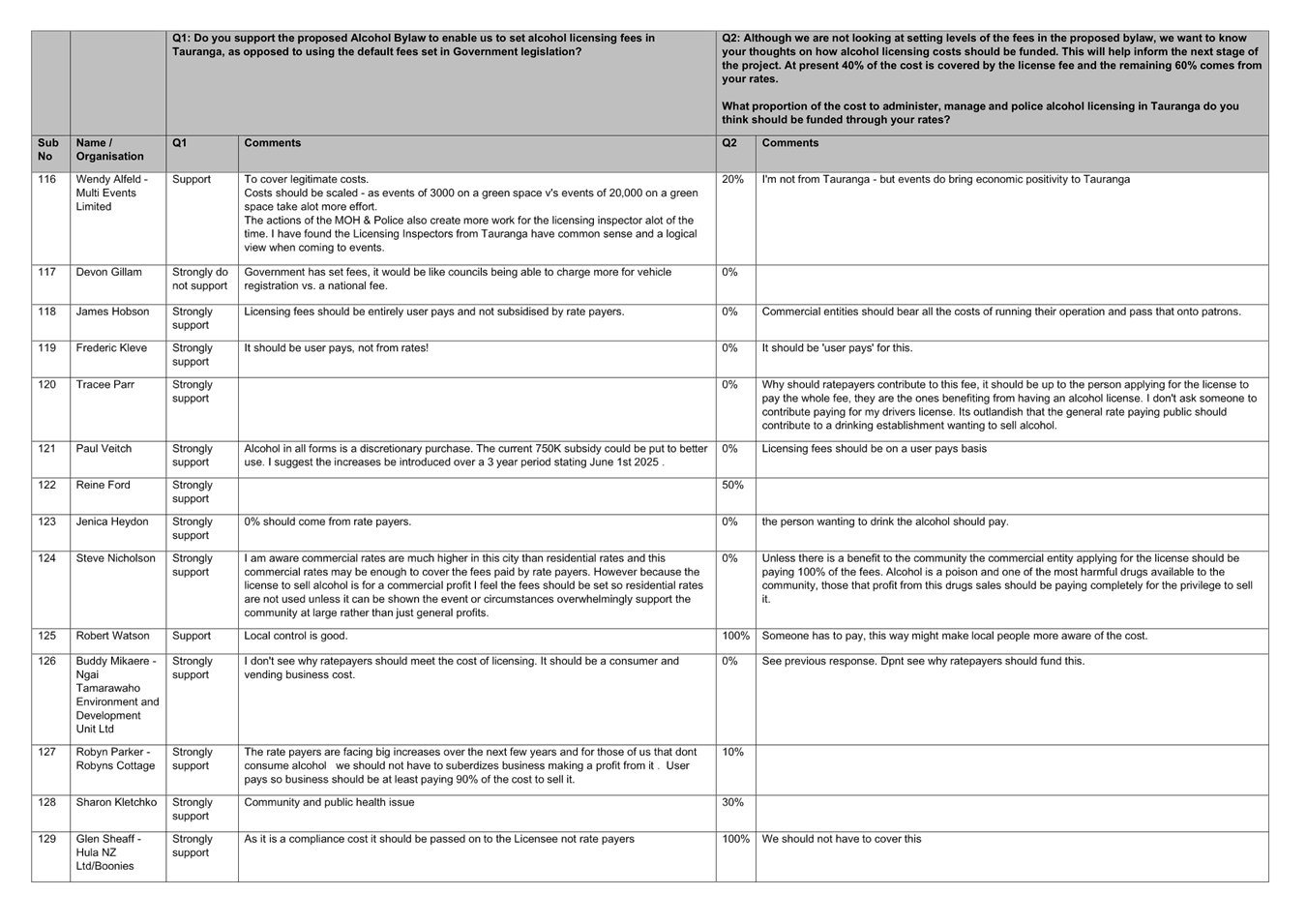

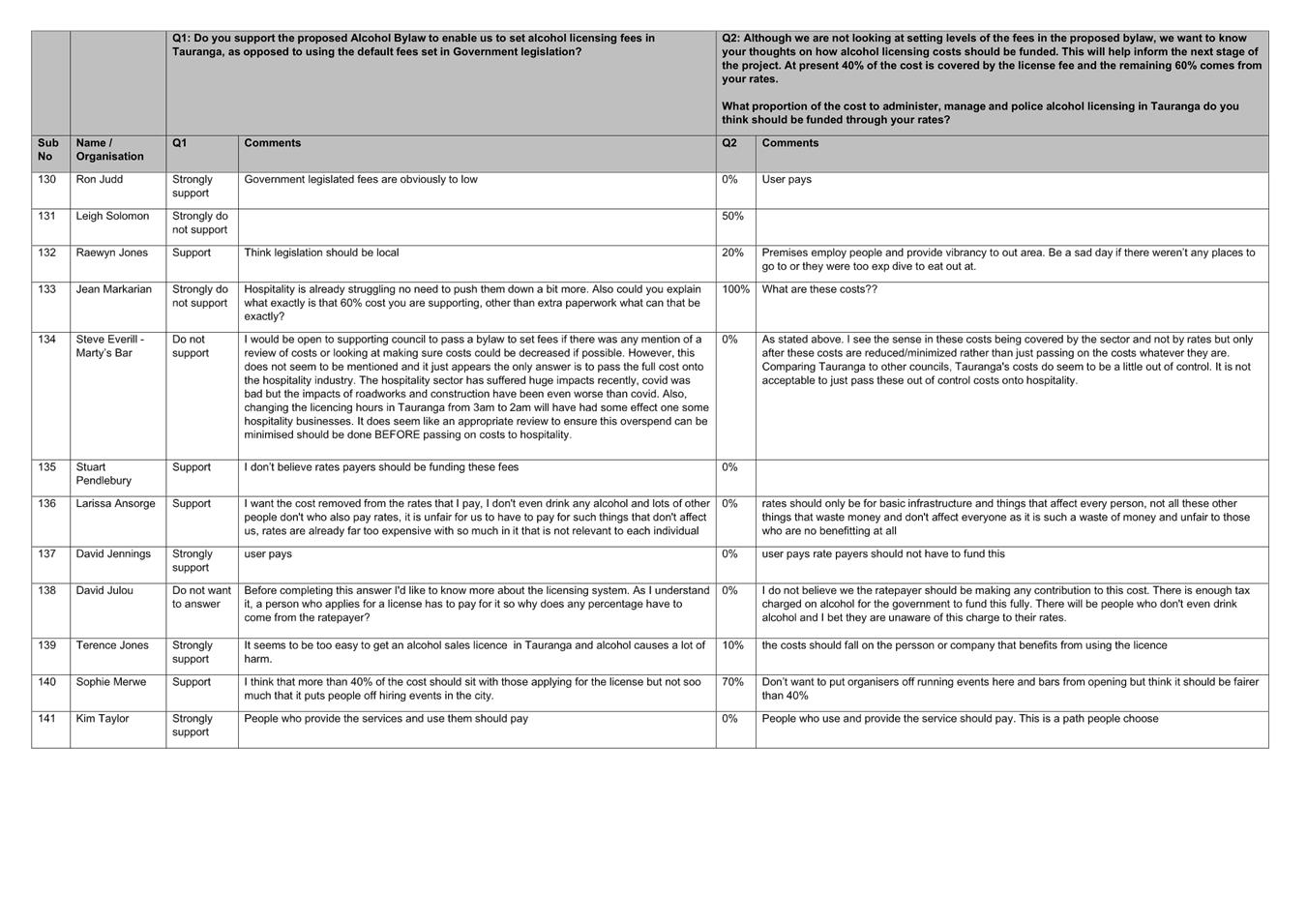

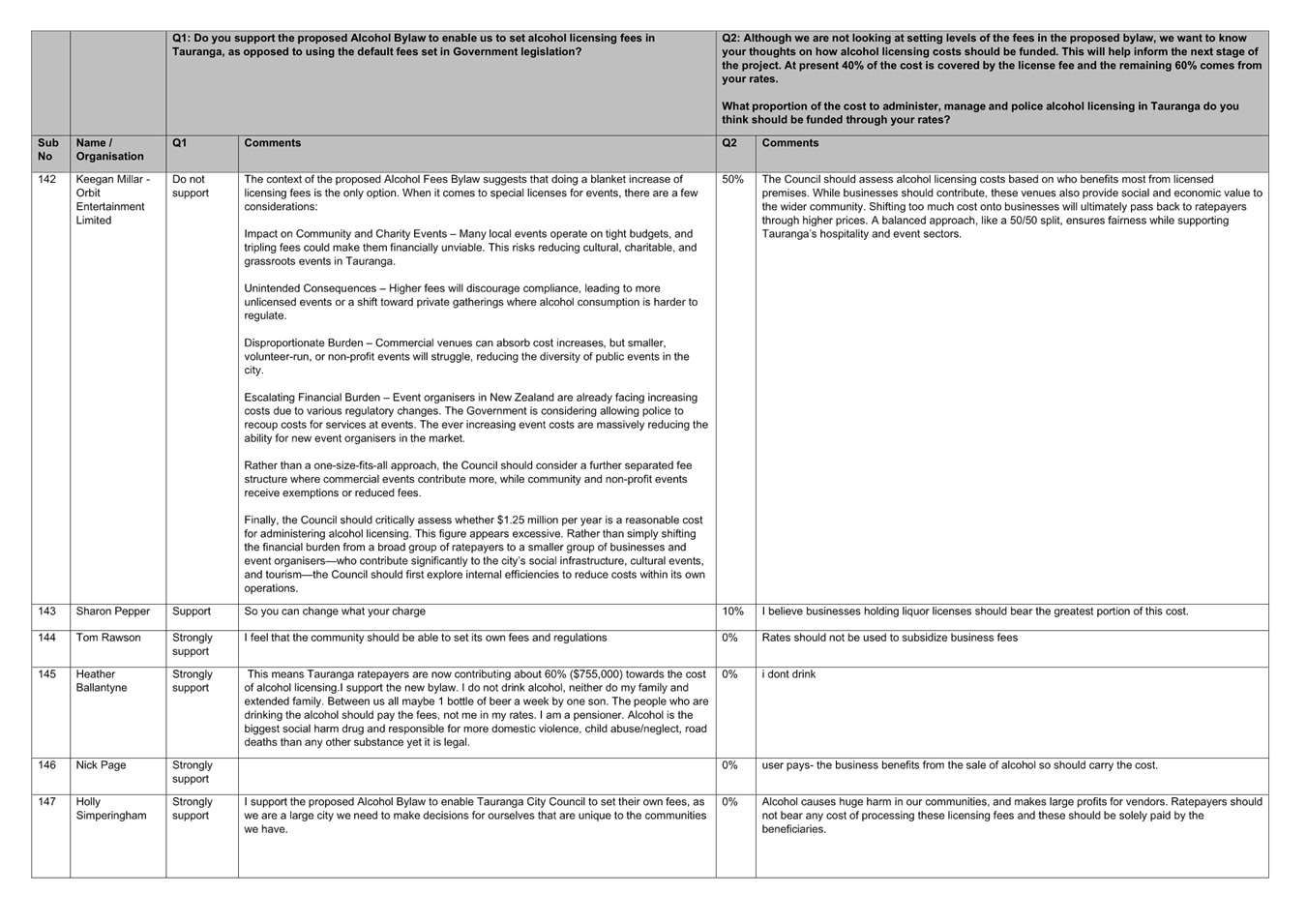

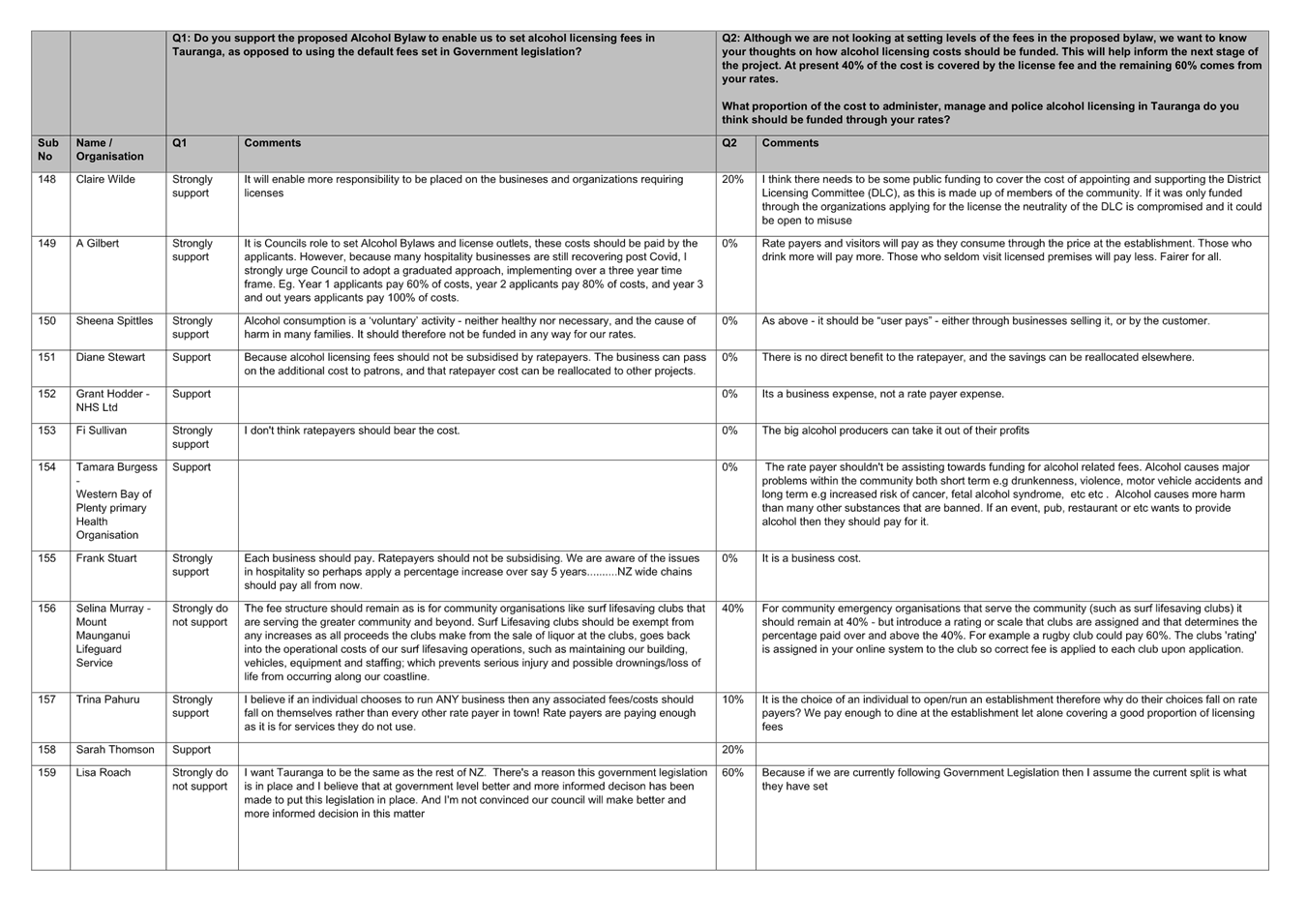

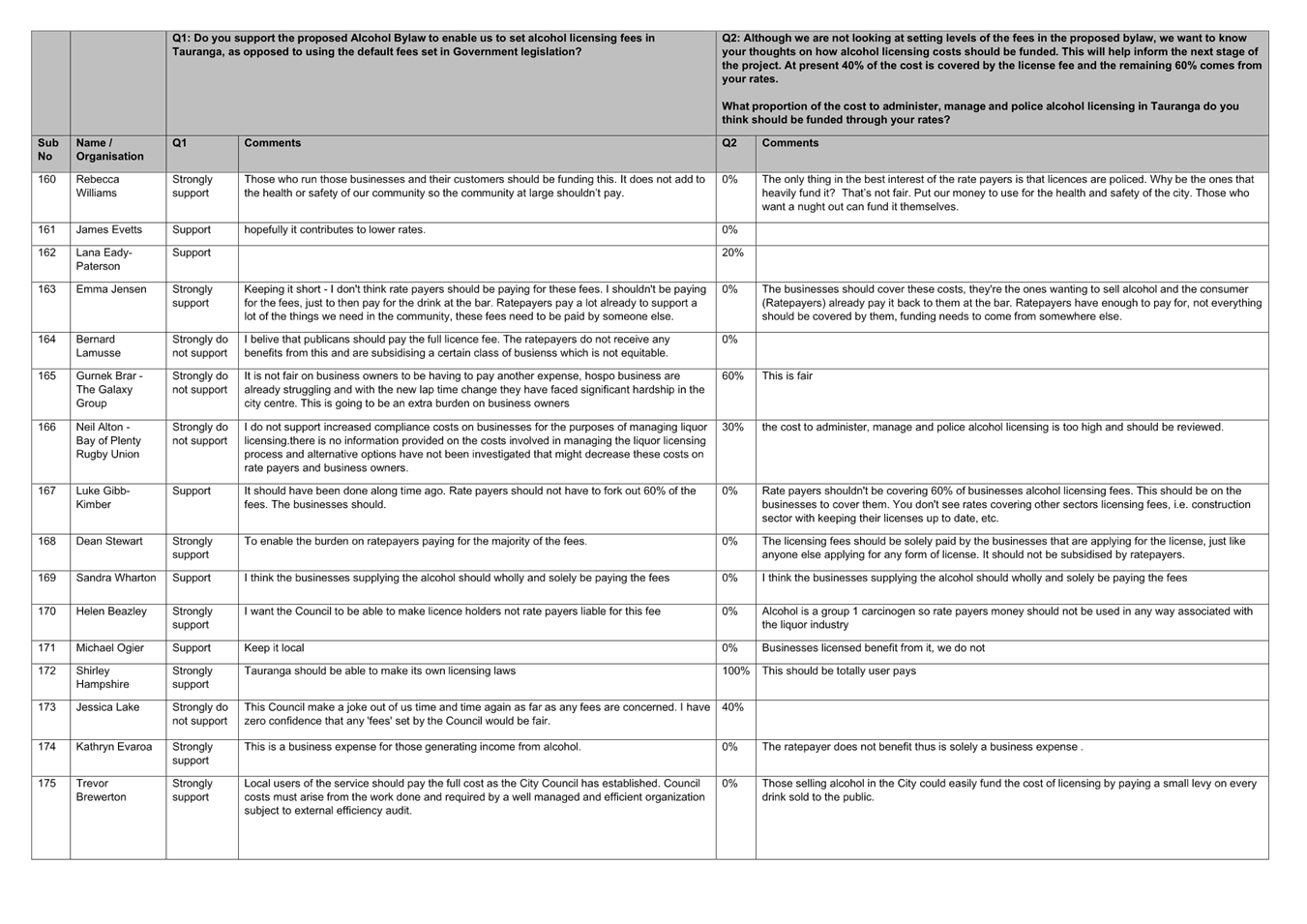

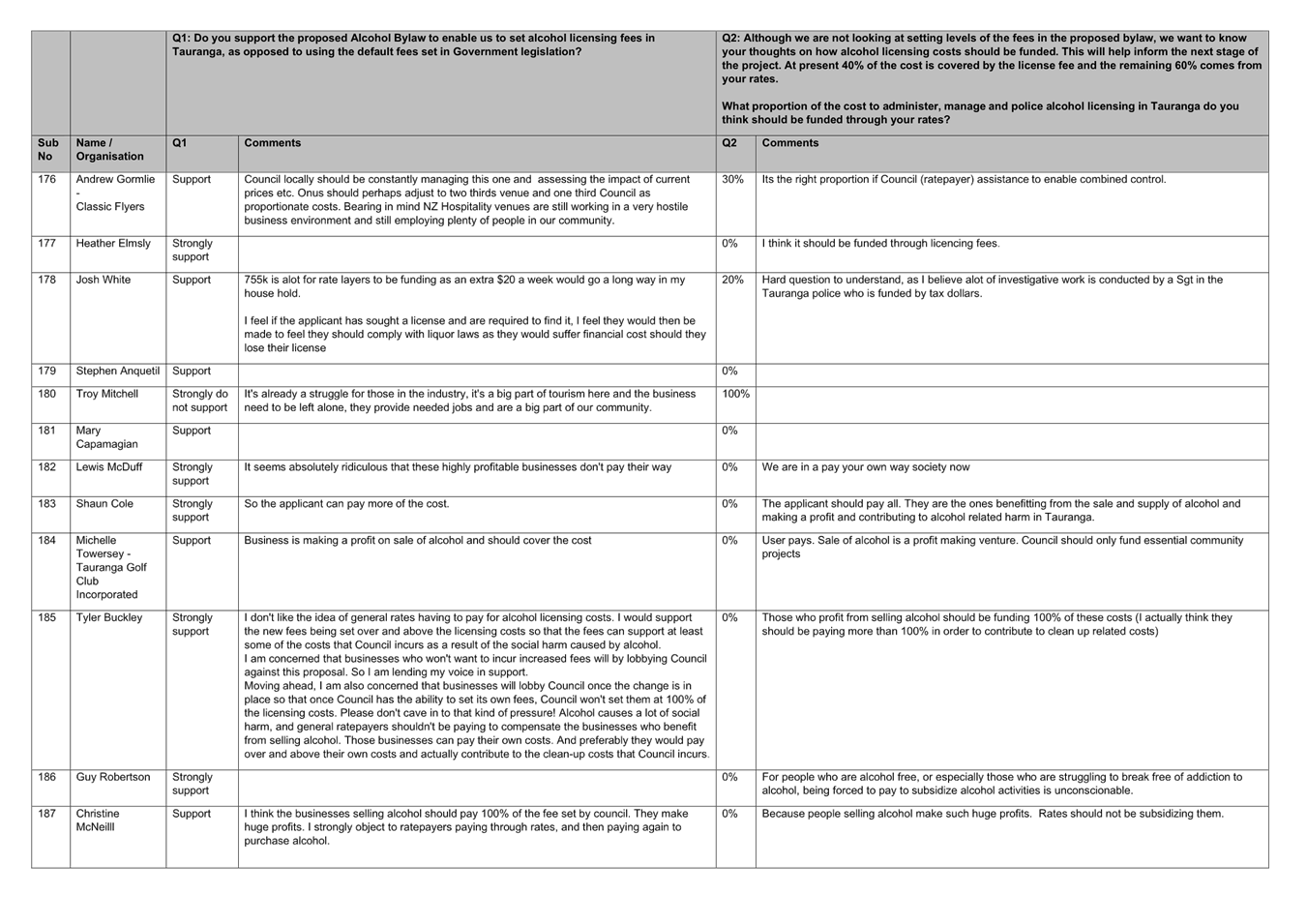

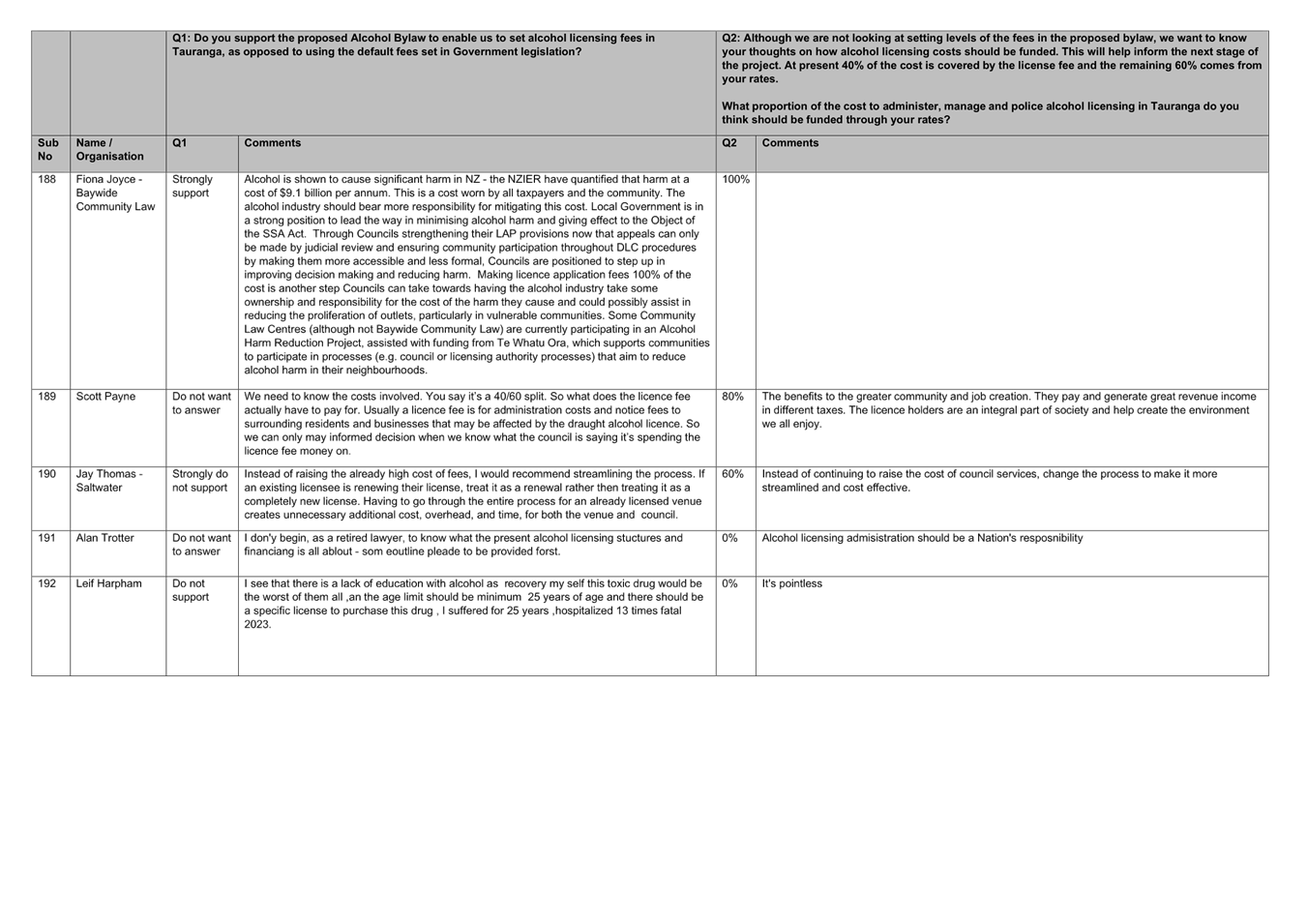

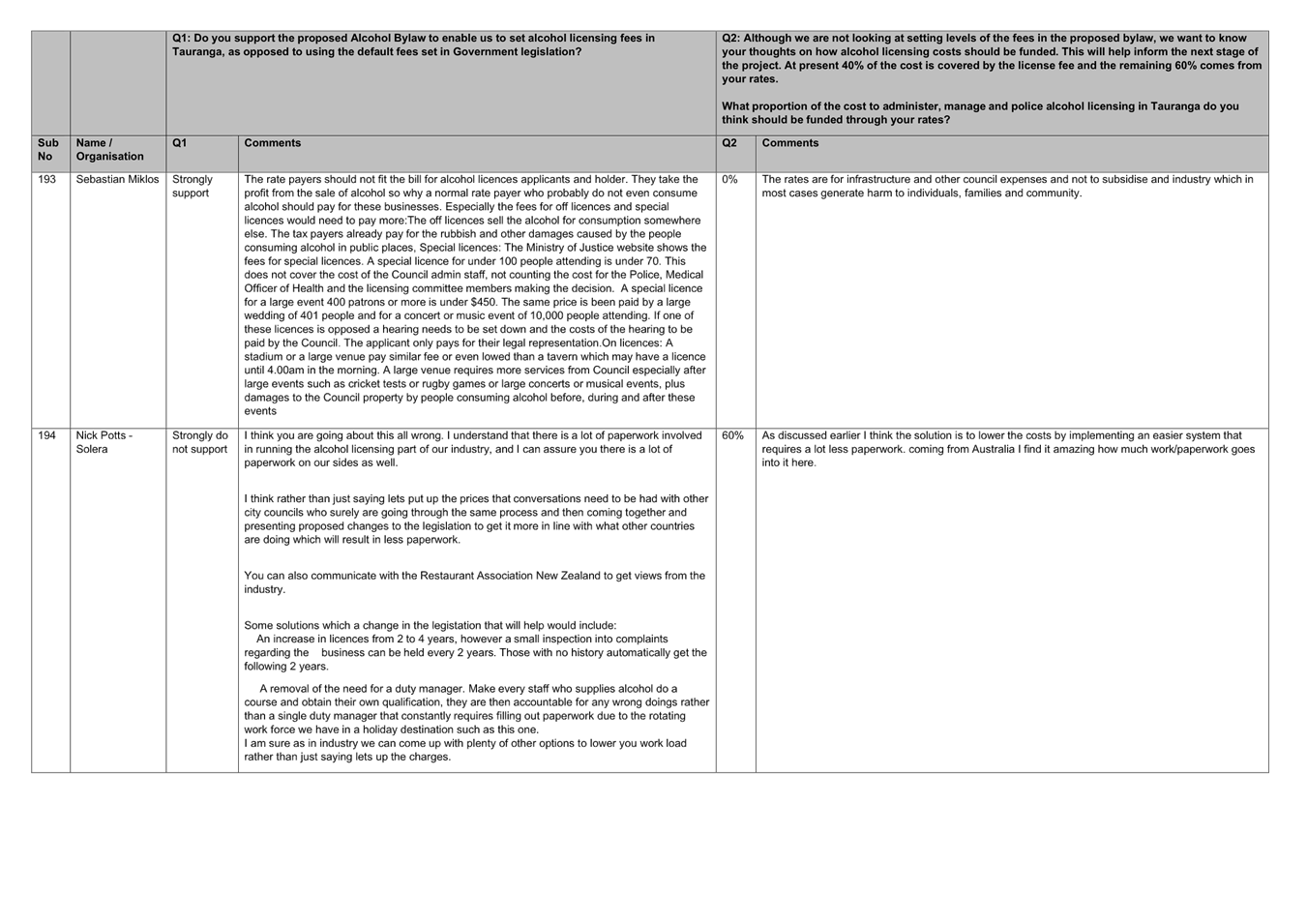

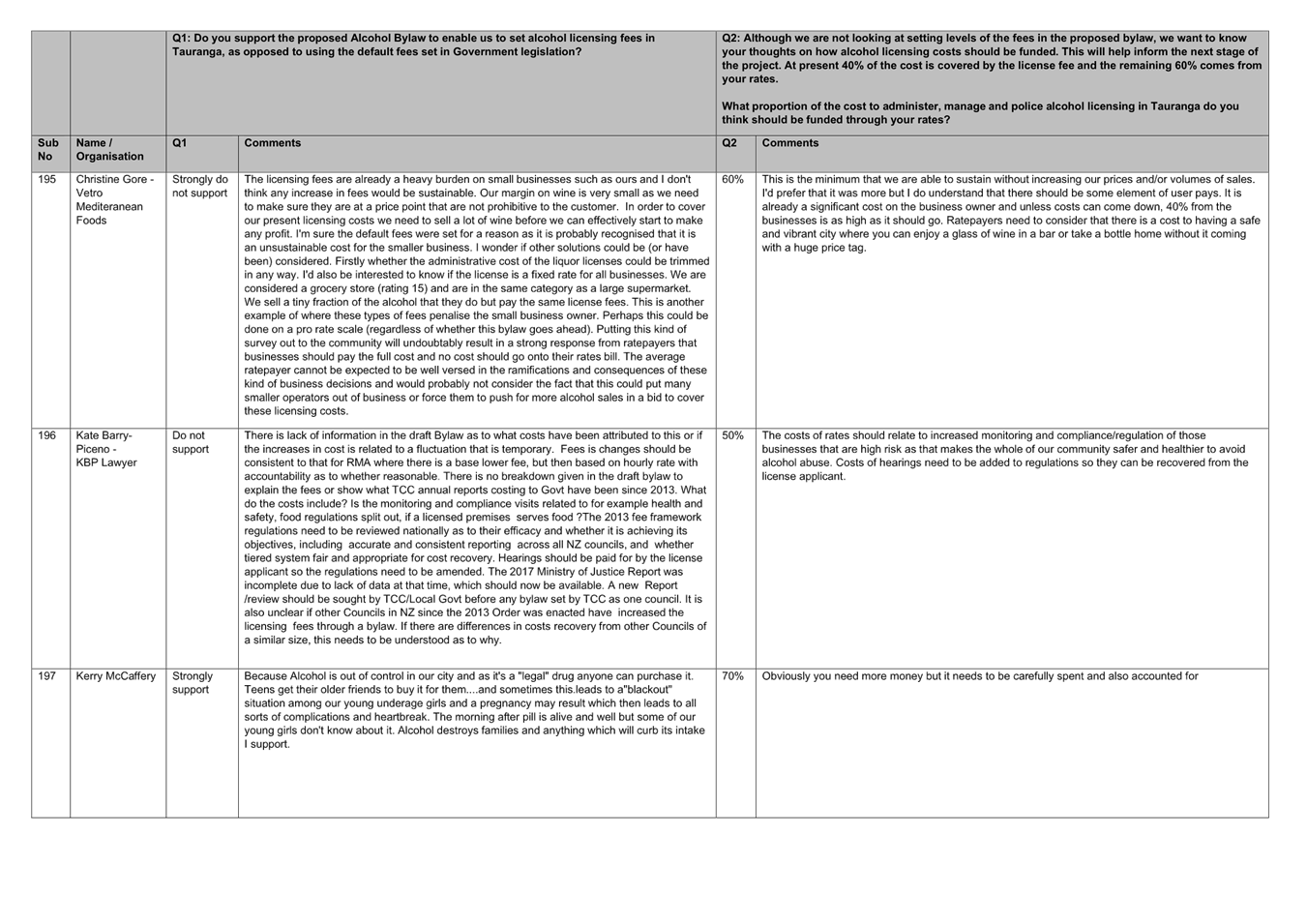

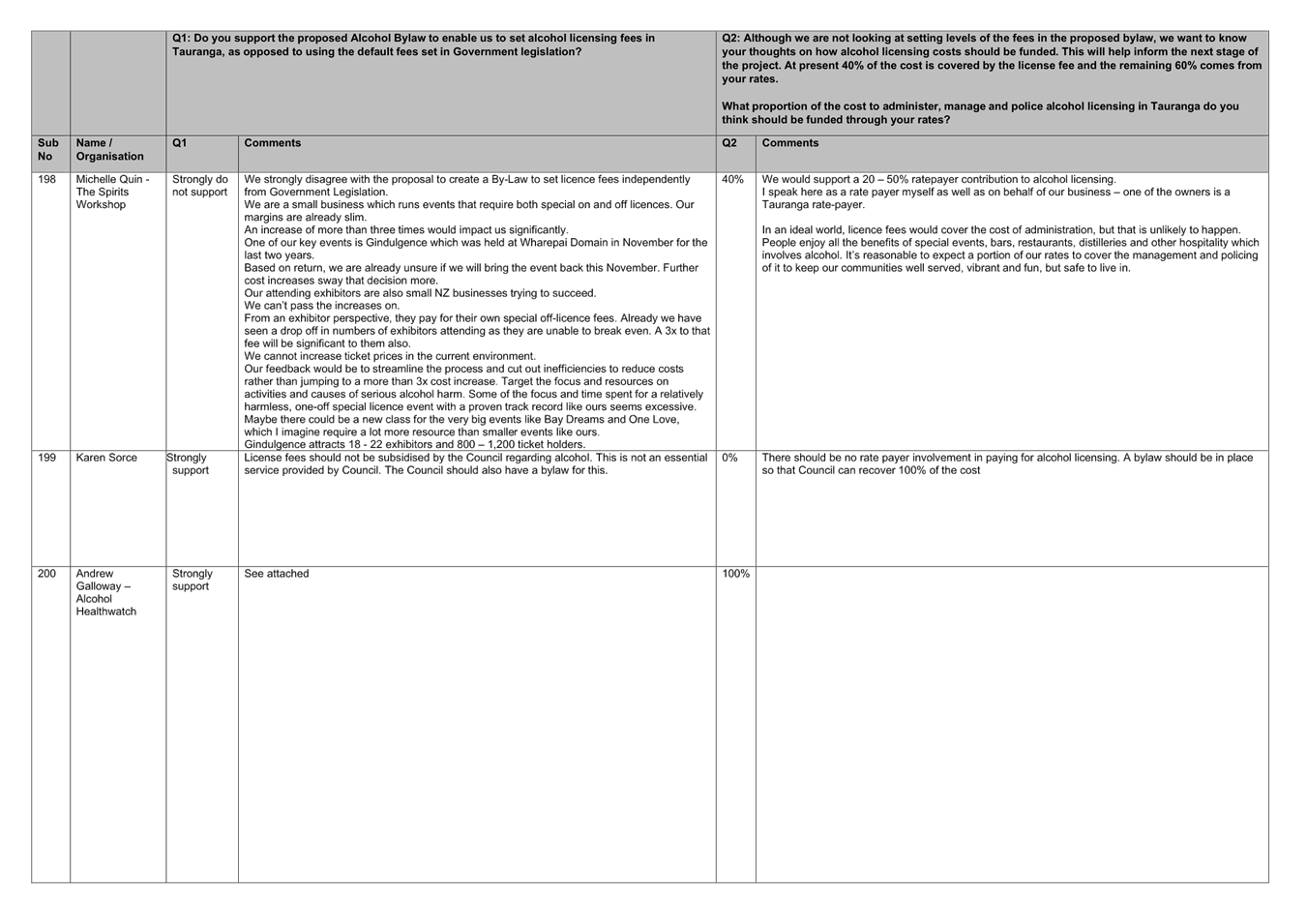

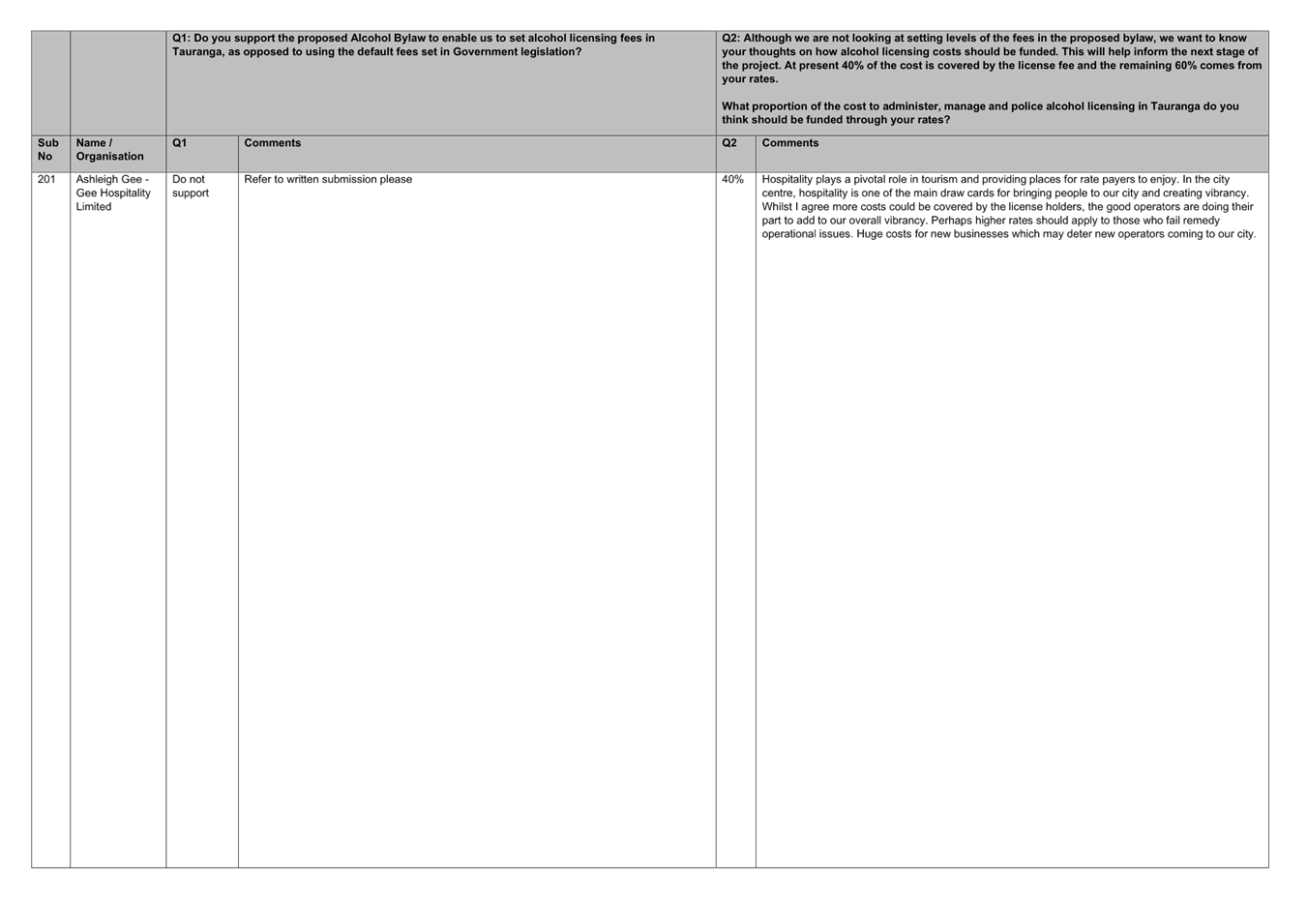

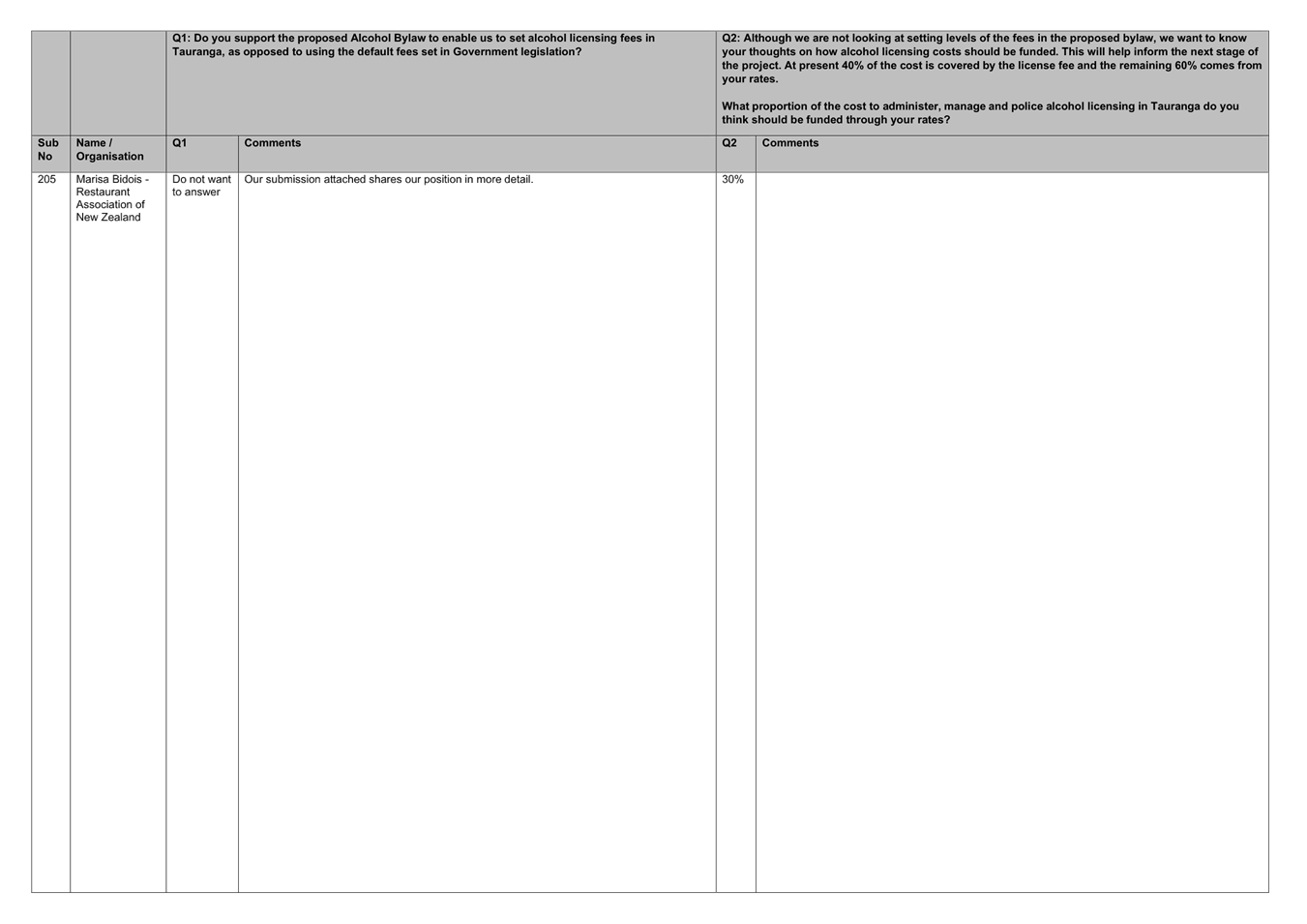

2025. 207 submissions were received (Attachment

Two).

8. Feedback

from submitters can be separated into two broad categories:

· support/opposition

of the bylaw itself and the ability for Council to set its own alcohol

licensing fees; and

· the

way in which Council carries out its alcohol licensing function and how fees

will be set.

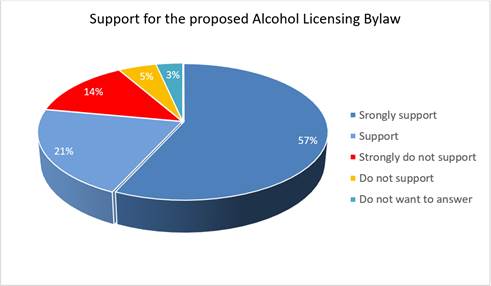

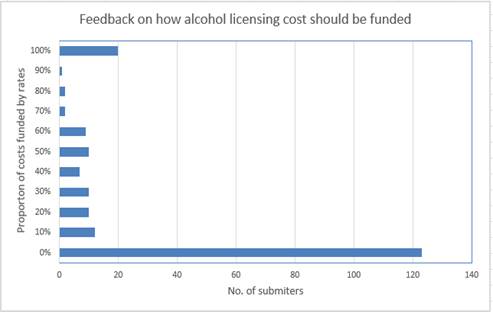

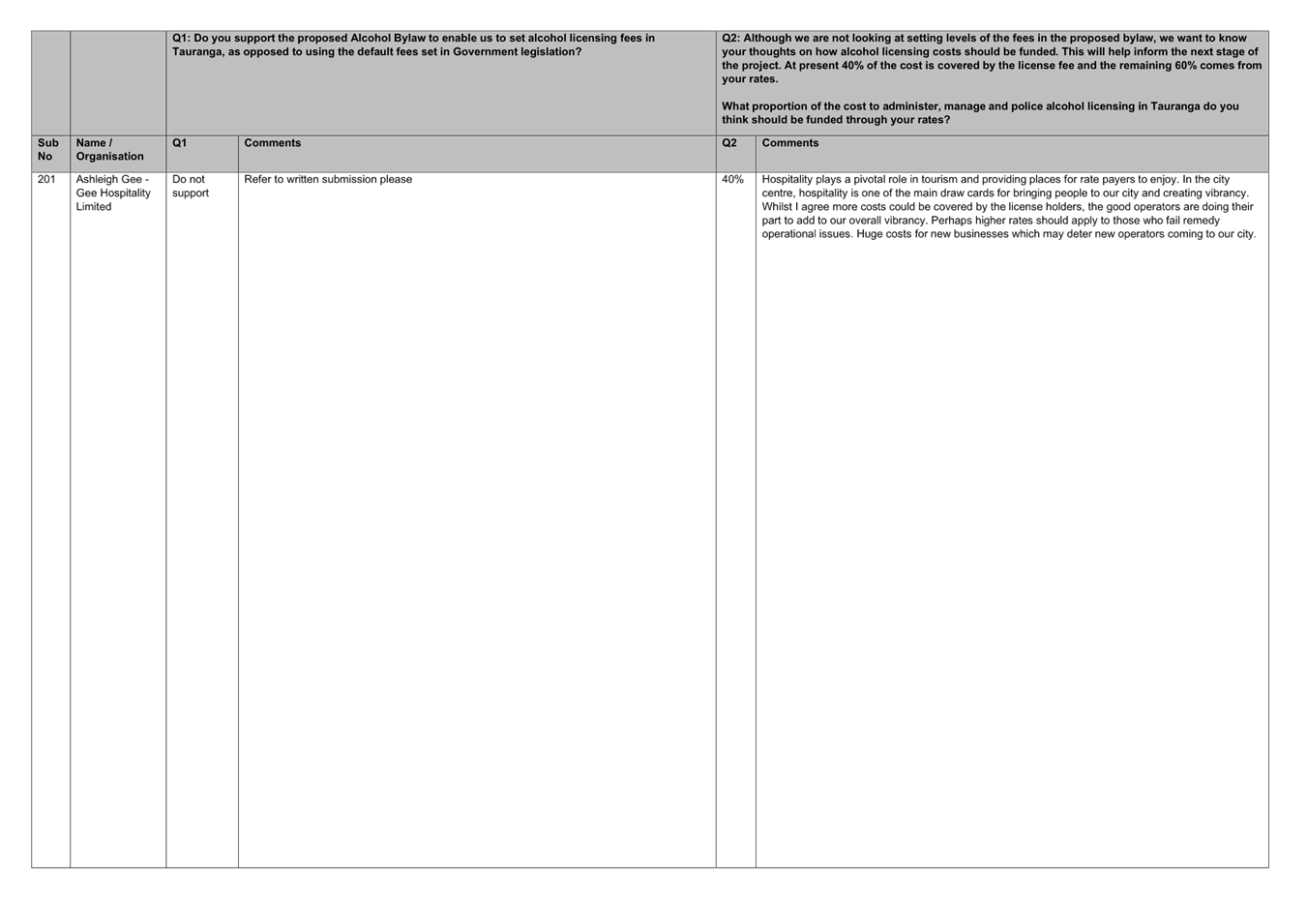

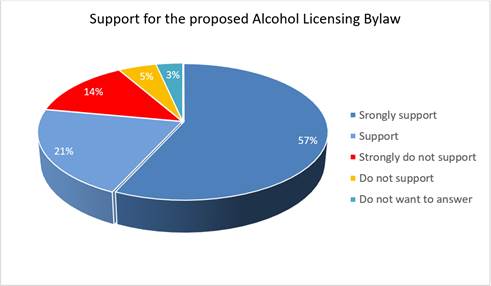

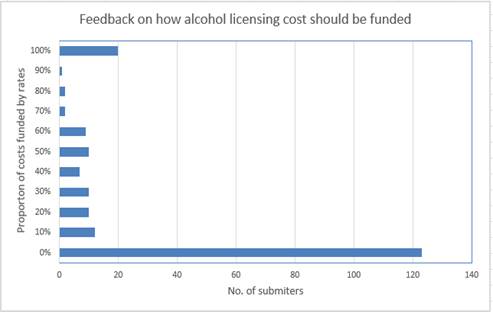

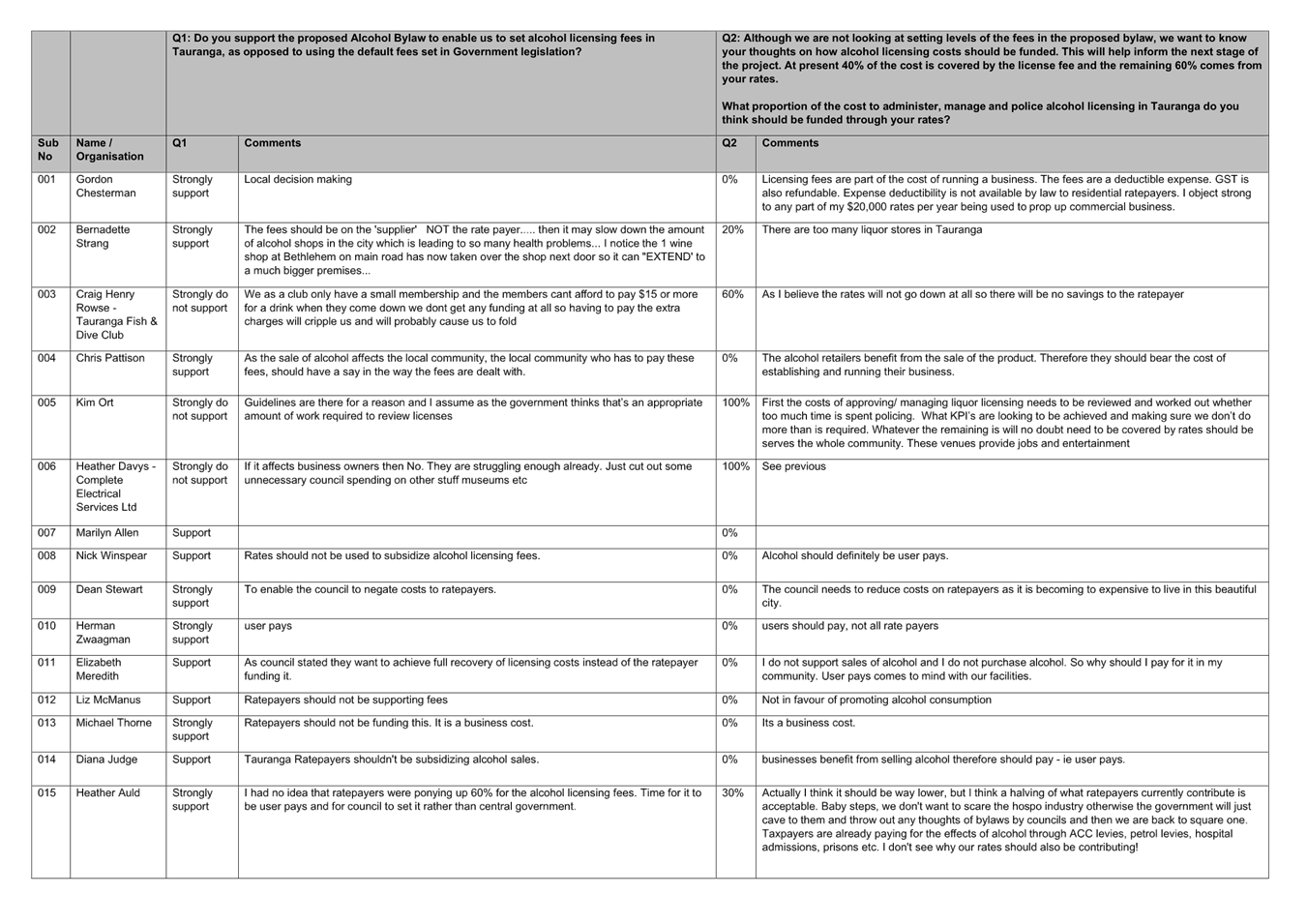

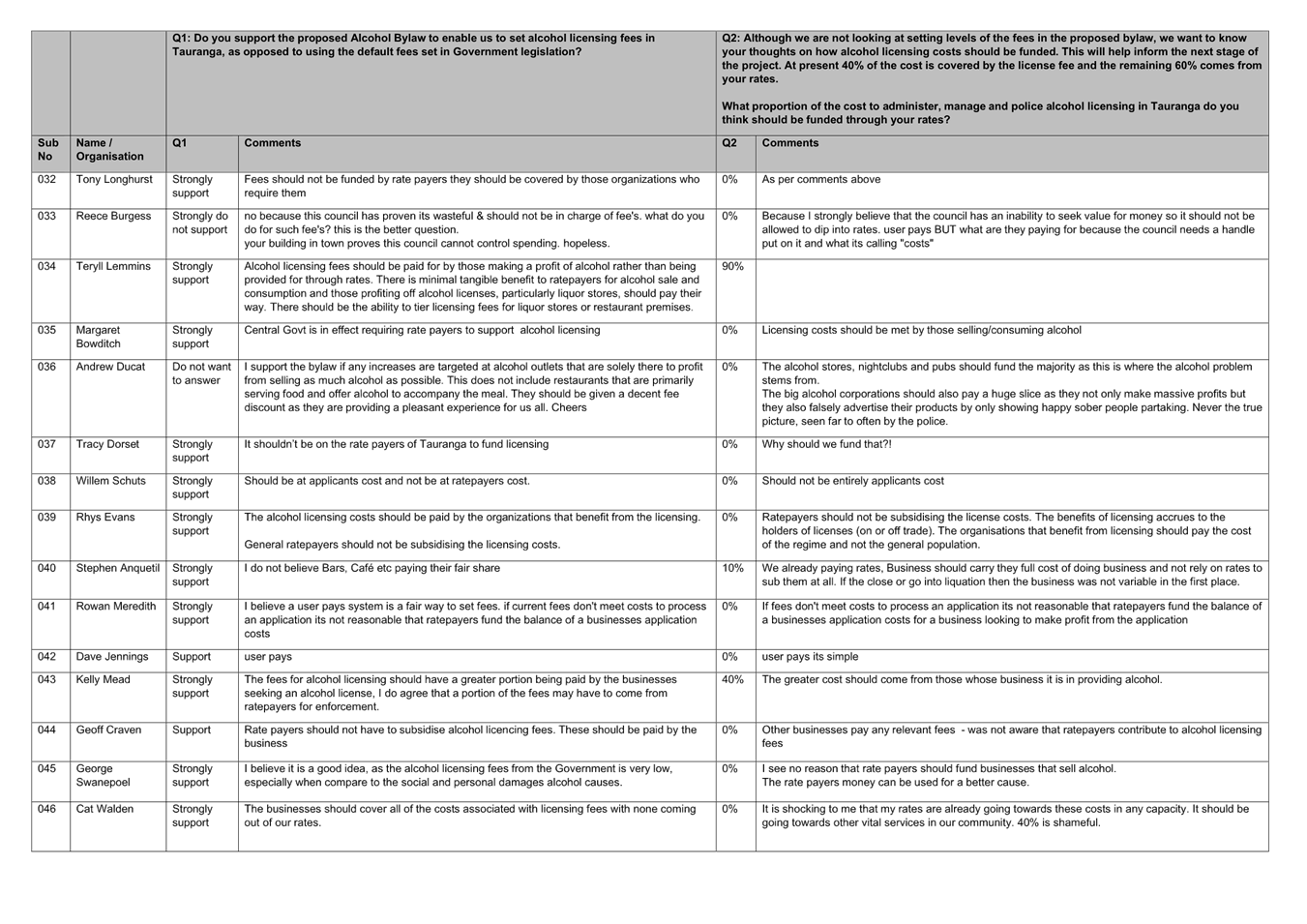

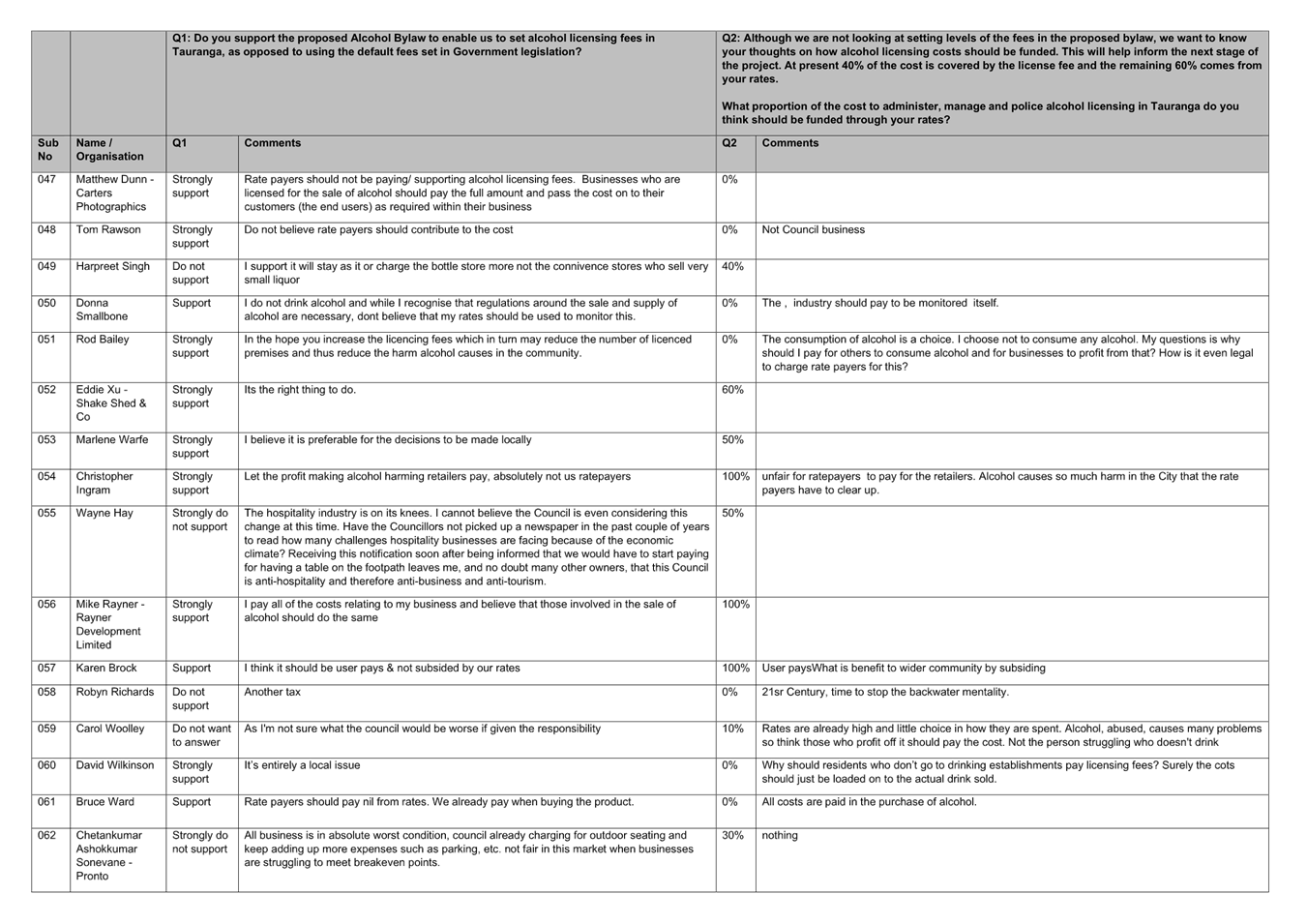

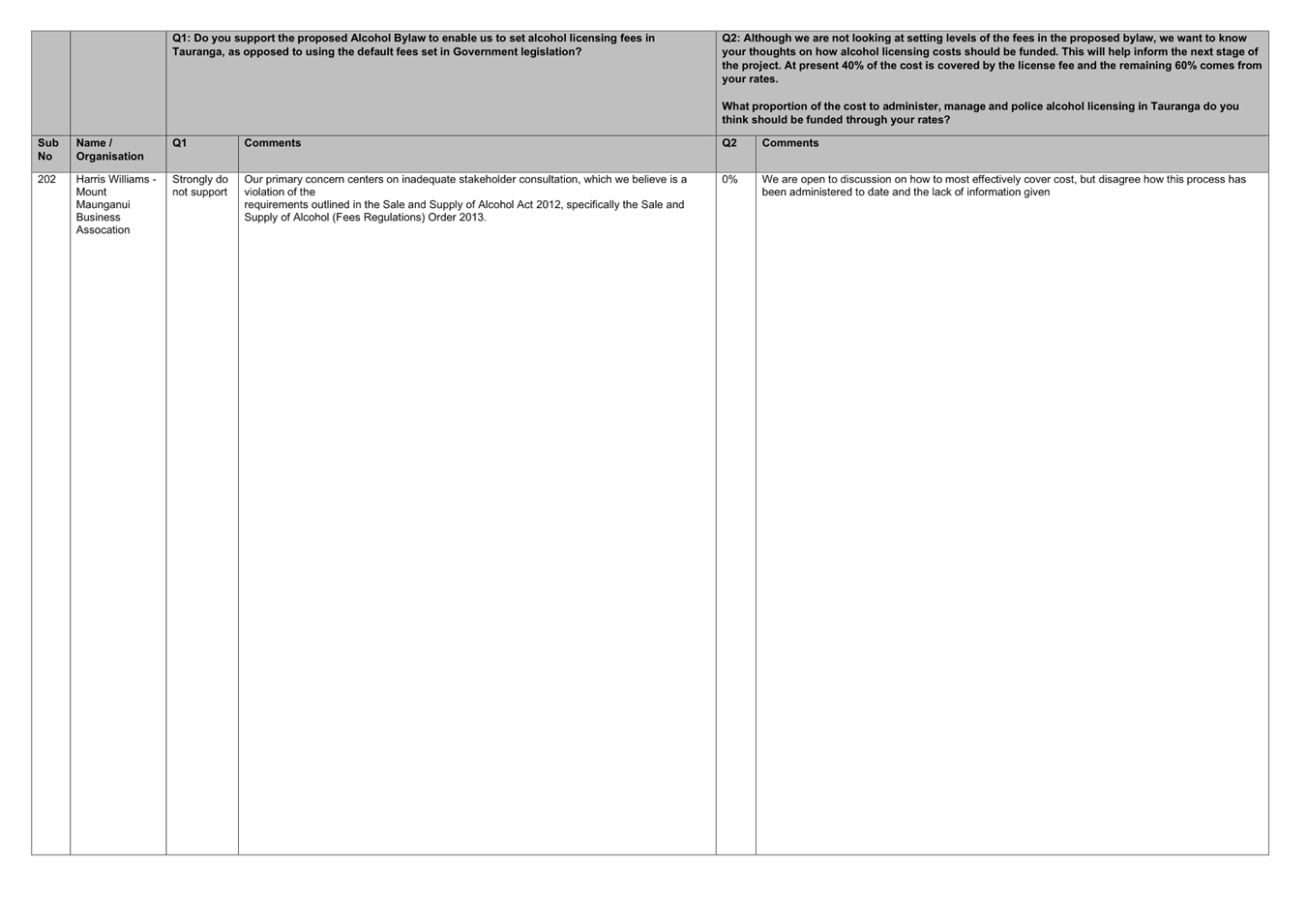

9. 78% of submitters support an alcohol fees bylaw to provide

Council with the ability to set fees. Submitters who supported the proposed

bylaw believe that alcohol licensing should be user pays and not subsided by

rates.

10. 19% of submitters do not support the proposed bylaw and

have concerns on the impact any potential future fee changes will have on

businesses, events and clubs.

11. Some submitters want more information on licensing costs

before they are set and sought greater efficiencies and transparency in the

licensing process. Work is underway to get more detailed information on the

breakdown of specific licensing costs and to review those costs for

efficiencies. Staff have provided responses to these issues and no decision

from Council is required.

12. Council is asked to consider

the adoption of the Alcohol Licensing Fees Bylaw.

This would give Council the option of setting fees appropriate to the

local context and to be deliberate on the fee vs rates funding split. It will

also mean alcohol licensing fees can be considered alongside all other User

Fees and Charges as part of the review being carried out as part of the lead-in

to the 2026/27 annual plan process.

13. If Council adopt the bylaw and

decide to consider setting their own fees further information on alcohol

licensing costs will be presented to inform this decision. Any proposed fees

and associated timing of these proposed fees will be consulted on during the

subsequent annual plan process.

14. There are no financial

implications in adopting the bylaw. Financial implications will only apply if

there changes to alcohol licensing fees.

15. The key risk in adopting the

bylaw is that some submitters are opposed to the bylaw and concerned about the

impact of any potential future fee changes.

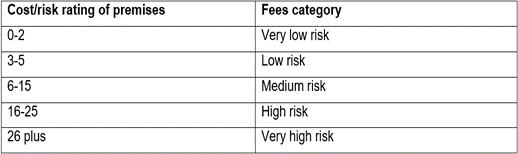

Background

Alcohol licensing in Tauranga

16. Council is responsible for