|

Ordinary Council meeting Agenda

|

28 April 2025

|

11 Business

11.6 Council

and Standing Committees' Terms of Reference

File

Number: A17902601

Author: Mahé

Drysdale, Mayor

Authoriser: Mahé

Drysdale, Mayor

Purpose of the Report

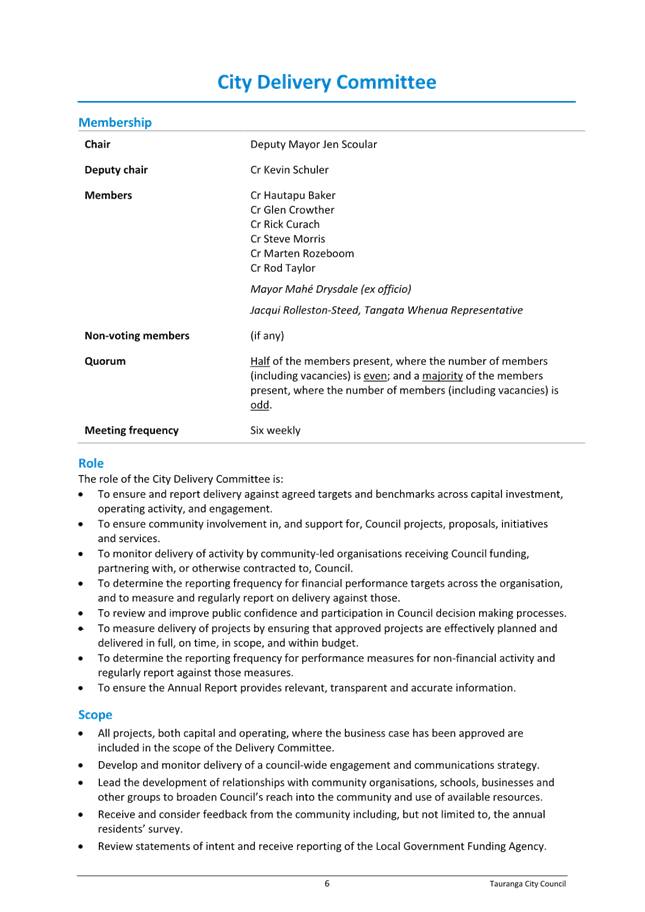

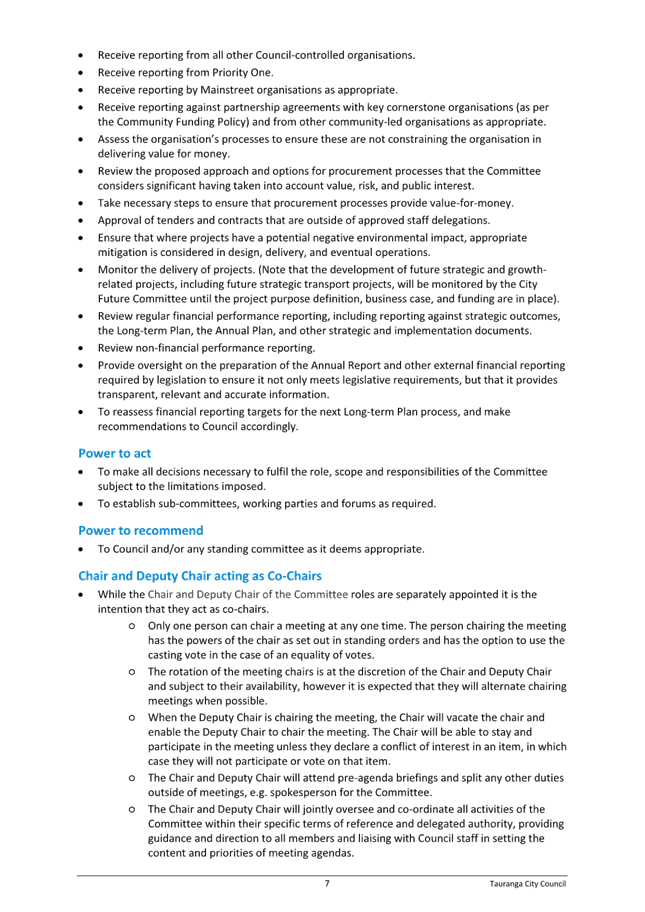

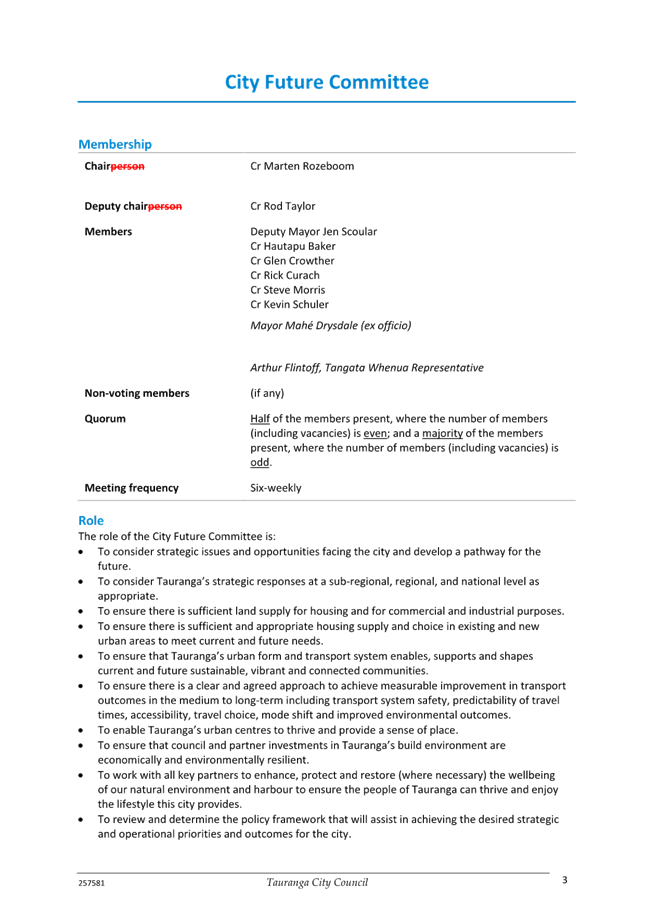

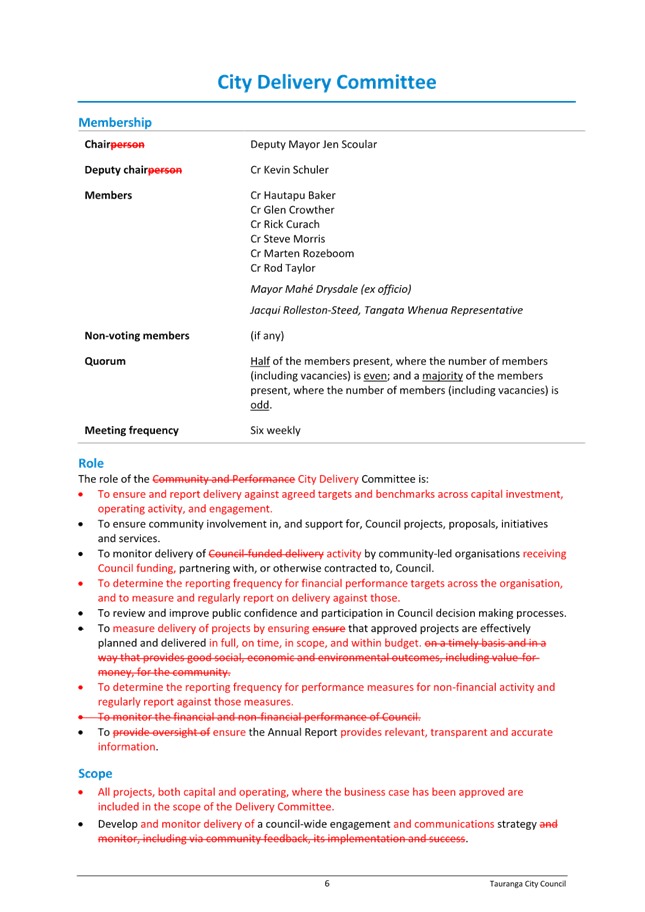

1. To present revised terms

of reference for Council, the City Future Committee, and the City Delivery

Committee.

|

Recommendations

That the Council:

(a) Receives the report

"Council and Standing Committees' Terms of Reference".

(b) Acknowledges that the Mayor

has exercised his powers under section 41A(3)(b) of the Local Government Act

2002 to review the standing committees of Council.

(c) Adopts the amended terms of

reference for, and makes the delegations to, the City Future Committee and

City Delivery Committee, and the amended definition of scope for Council, as

detailed in Attachment 1.

|

Background

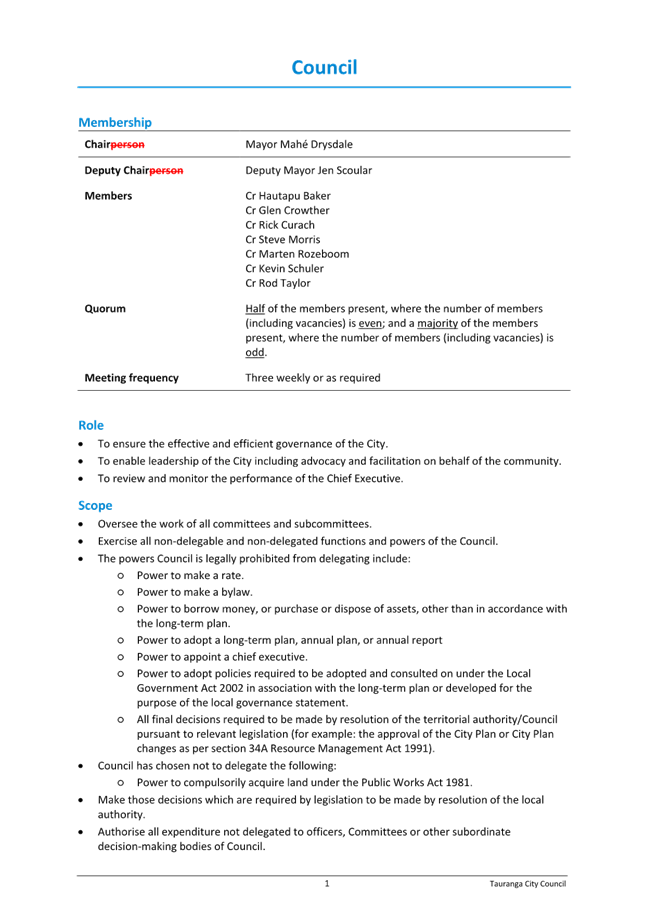

2. Council

adopted a governance structure on 15 August 2024. That structure was

amended by Council on 9 December 2024, principally to replace four standing

committees with two new ones. This report does not propose any change to

the overall structure.

3. As noted in my

report to Council on 9 December 2024, “we need to continue to evolve

and will continue to look for efficiencies and make changes if we feel things

can be improved.” As such, I have identified some changes to

the specific role and scope of Council, the City Delivery Committee, and the

City Future Committee that I believe will improve the operation of Council and

those committees.

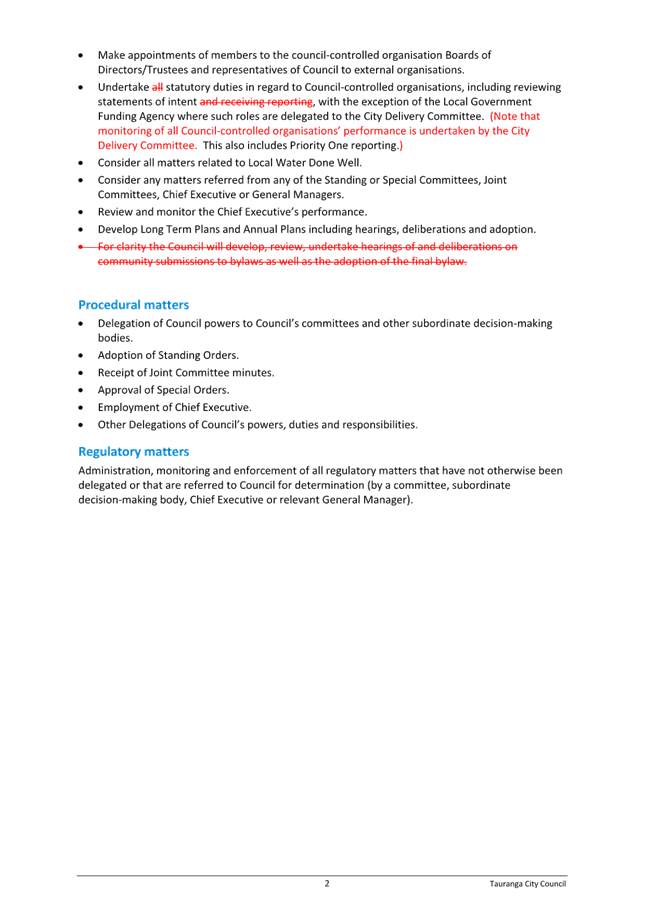

4. The key changes are:

· Transferring

Council-controlled organisation (“CCO”) monitoring from Council to

the City Delivery Committee (while retaining the consideration of CCOs’

statements of intent, other than that of the Local Government Funding Agency,

in Council’s scope).

· Similarly

transferring Priority One monitoring from Council to the City Delivery

Committee.

· Transferring

responsibility for the development, review, and consultation on bylaws from

Council to the City Future Committee (noting that Council retains

responsibility for the final adoption of bylaws, as required by legislation).

· Transferring

responsibility for monitoring major growth, transport and waters projects from

the City Future Committee to the City Delivery Committee, once those projects

have moved into the implementation phase. The development of such

projects to a stage where the project purpose definition, business case, and

funding are all in place remains with the City Future Committee.

· Within

the City Development Committee role and scope, providing separate recognition

of financial reporting and monitoring, and non-financial reporting and

monitoring.

· Formally

recognising the ability of the City Delivery Committee to determine the

frequency of reporting to it of performance against financial measures and,

separately, non-financial measures.

· Clarifying

a number of existing elements of the role and scope of the City Delivery

Committee, including merging existing elements under more succinct descriptions

where possible.

· Recognising

that the City Delivery Committee will undertake a review of financial reporting

targets to inform the development by Council of the next Long-term Plan.

5. The full amended

terms of reference and delegations for Council and the two committees are

included as Attachment 1 to this report. Attachment 2 to

this report shows all of the changes annotated in red.

6. There are no other

changes proposed to the governance structure.

Statutory Context

7. Section 41A(3)(b) of

the Local Government Act 2002 provides for the Mayor to establish committees of

Council. This report is formal notification that I have exercised that power to

amend the scope of the existing committees.

8. Clause 32(1)(b) of

Schedule 7 to the Local Government Act 2002 specifies that Council can not

delegate the adoption (or ‘making’) of a bylaw to a committee or

other subordinate decision-making body.

STRATEGIC ALIGNMENT

9. This contributes to

the promotion or achievement of the following strategic community outcome(s):

|

Contributes

|

|

We are an inclusive city

|

ü

|

|

We value, protect and enhance the environment

|

ü

|

|

We are a well-planned city

|

ü

|

|

We can move around our city easily

|

ü

|

|

We are a city that supports business and education

|

ü

|

Financial Considerations

10. There are no financial

implications of changing the scope of Council and the two

committees.

Legal Implications / Risks

11. The new committee structure

comes into effect immediately, though I note that the agenda for the 5 May

2025 City Future Committee may be published before the changes can be given

effect to in the formal document.

TE AO MĀORI APPROACH

12. The specific changes proposed

have minimal implications for Council’s Te Ao Maori Approach. The

delegation of some scope matters (council-controlled organisation reporting and

bylaw development) from Council to the City Delivery Committee and City Future

Committee respectively mean that these matters will now be considered by

committees which include tangata whenua representatives as voting members (as

well as the Te Awanui ward councillor).

CLIMATE IMPACT

13. The specific changes proposed

have no impact on Council’s approach to climate matters.

Significance

14. The Local Government Act 2002

requires an assessment of the significance of matters, issues, proposals and

decisions in this report against Council’s Significance and Engagement

Policy. Council acknowledges that in some instances a matter, issue,

proposal or decision may have a high degree of importance to individuals,

groups, or agencies affected by the report.

15. In making this assessment,

consideration has been given to the likely impact, and likely consequences for:

(a) the current

and future social, economic, environmental, or cultural well-being of the

district or region

(b) any persons who are likely to be

particularly affected by, or interested in, the decision.

(c) the capacity of the local authority

to perform its role, and the financial and other costs of doing so.

16. In accordance with the

considerations above, criteria and thresholds in the policy, it is considered

that the decision is of low significance.

ENGAGEMENT

17. Taking into consideration the

above assessment, that the decision is of low significance, officers are of the

opinion that no engagement is required prior to Council making a decision.

Next Steps

18. The revised terms of reference

take effect immediately,and will be updated and published on council’s

website as soon as practicable.

Attachments

1. Amended

Governance Structure Terms of Reference 2024-2028 - clean copy - A17954775 ⇩

2. Amended

Governance Structure Terms of Reference 2024-2028 - changes highlighted -

A17954694 ⇩

|

Ordinary

Council meeting Agenda

|

28

April 2025

|

|

Ordinary

Council meeting Agenda

|

28

April 2025

|

|

Ordinary

Council meeting Agenda

|

28

April 2025

|

11.7 Tauranga Parking

Management Plan Implementation

File

Number: A17125546

Author: Reece

Wilkinson, Parking Strategy Manager

Shawn Geard, City

Centre Infrastructure Lead

Authoriser: Nic

Johansson, General Manager: Infrastructure

Purpose of the Report

1. Two parking management plans are paused,

these being City Centre (implementation), and Mount Maunganui (community

engagement), a decision on the future of these plans is now required.

Alternatively, council can opt for a change of focus, and review parking management

plans for urban centres across the city. This report sets out the background,

purposes, and next steps for parking management in Tauranga.

|

Recommendations

That the

Council:

(a) Receives the report "Tauranga

Parking Management Plan Implementation".

(b) Approves implementation of the City

Centre Parking Management Plan including paid parking in the city centre

fringe and time restrictions, conditional on approval of appropriate bylaw

updates and the agreement of a resident parking permit.

(i) Paid Parking within a city centre fringe

zone between Arundel Street and Park Street excluding the existing city

centre paid parking zone,

(ii) Additional P120 time restrictions between

Eleventh Avenue and Marsh Street (inclusive), excluding areas covered by a

paid parking zone,

(c) Approves undertaking community

engagement on the development of a Mount Maunganui Parking Management Plan,

including provision for a Salisbury Avenue Cruise Ship Management Plan,

reporting back to Council to enable implementation for the 2025/ 2026 summer

period

Alternatively;

(d) Staff are to initiate a city-wide Urban

Centres Parking Management Plan, reporting back to the City Futures Committee

with a city-wide engagement plan. Approving $75,000 of additional spend for

this activity in the 2025/ 2026 Financial Year.

(e) Undertake development of a Salisbury Avenue

Cruise Ship Management Plan, reporting back to Council to enable

implementation for the 2025/ 2026 Cruise Season.

|

Executive Summary

2. The existing Tauranga Parking Strategy (refer to

Attachment 2 of this report) defines the need for parking management across the

Tauranga, subsequently to the adoption of this strategy the City Centre Parking

Management Plan was approved for implementation, and the Mount Maunganui

Parking Management Plan required a first community engagement step however

these steps were paused pending a future decision in March 2024,

3. As the strategy is considered city wide the need for

area specific implementation plans are required to define an area’s

required parking management approach.

4. Two priority areas being City Centre and Mount

Maunganui have parking management plans in varying stages of development

(although currently paused), it is the intention of the strategy to have other

areas requiring parking management assessed for their needs.

5. Both the Urban Form and Transport

Initiative (UFTI) and Western Bay of Plenty Transport System Plan (TSP)

identify parking management as a key component of delivering and realising the

benefits of the Connected Centres growth model.

6. The need for parking management stems from

an increased demand on the transportation infrastructure through increased

demand from a variety of users. Parking management plans look to balance

competing users demands of space.

7. The carparking finance activity is

envisioned to be self-sufficient finance activity and has historically been

focused on the city centre as the predominant source of parking revenue, owing

to an understanding that carparking comes at a cost and should be a user pays

activity.

City Centre

8. The City Centre

Parking Management Plan (paid parking and time limit expansion) is approved

however implementation is on hold to allow for further consideration of more

information on the city centre, it is recommended this is restarted with some

amendments as outlined in this report,

9. Tauranga City

Council regularly receives complaints from residents within the city centre

fringe regarding the lack of on-street parking for themselves and their guests

due to commuters parking in this fringe area, while the city centre parking infrastructure

has adequate parking capacity for these commuters. It is forecast that pressure

on the city fringe parking will continue to increase. Often parking management

is introduced after an issue has reached breaking point, rather than the

proposed proactive approach to parking management where all users are informed

of the approach and able to adjust to their behaviour accordingly.

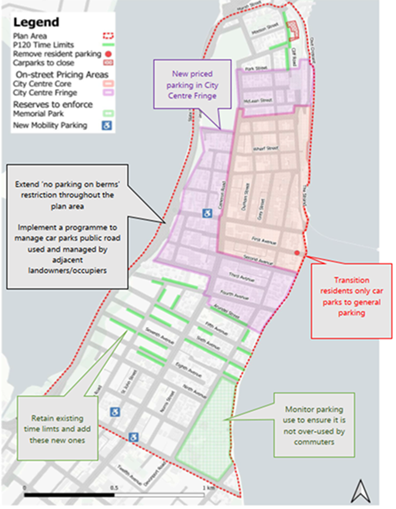

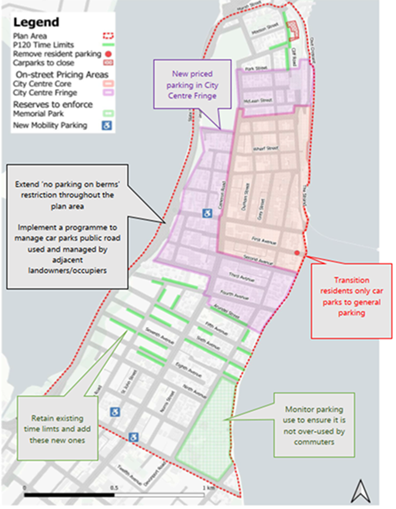

10. It is recommended to recommence

an expansion of parking management in the city centre, including a city centre

fringe paid parking zone, time restricted parking, however also to include a

residents permit scheme. This option will allow a means of managing demand of

user groups, providing for efficient use of existing infrastructure, preparing

the City Centre fringe for future growth.

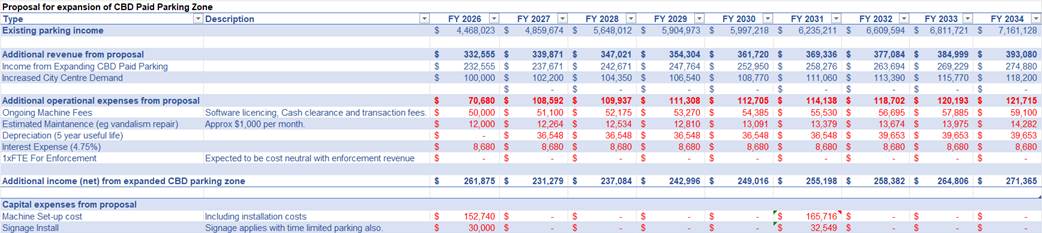

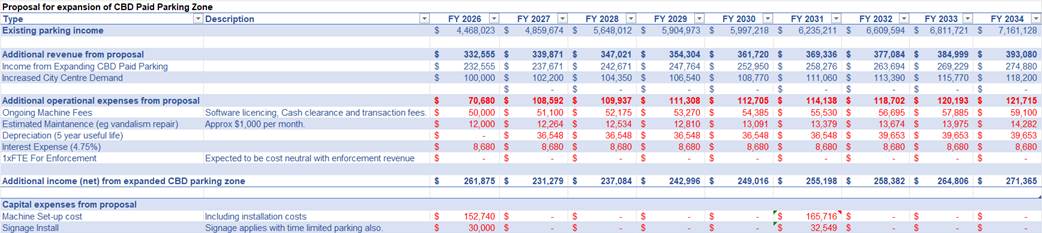

11. The recommendation is expected

to result in an increased net operational income of $261,875 (excluding CAPEX

costs) in the first financial year and over $200,000 in the following years

(including depreciation).

Mount

Maunganui

12. The

Mount Maunganui Parking Management Plan has not yet started development as

engagement is currently on hold as the previous initial discussions was poorly

received by some in the community,

13. It is

also recommended that engagement occurs on parking management for Mount

Maunganui, including gaining an understanding of community desires, and their

input into potential solutions to challenges they experience. This will enable

staff to develop a parking management plan that aims to address challenges

experienced by the community. The plan will be presented to Council and aims to

start addressing these challenges by end of 2025 as it is understood these

challenges present predominantly over the summer months.

14. It is known that a

number of other areas also experience parking related tension. These areas will

be considered for a Parking Management Plan as a second tranche and

when parking occupancy begins to regularly exceed 85% or increased

development or a requirement from the community for more investment in the

local parking network becomes apparent.

15. Engagement of a Mount Maunganui

Parking Management Plan is expected to cost approximately $20,000.

Urban

Centre Parking Management Plan

16. While Mount Maunganui and City

Centre face the highest parking demand other areas of the district also suffer

from increased parking pressure. The Urban Centre Parking Management Plan would

give council the opportunity to engage publicly with all urban centres

discussing what works best for them.

(a) It is envisioned that parking

management will include options including charging, time limits, and special

uses (loading or mobility bays),

17. Undertaking city wide

engagement would require resource allocation and time that could be a detriment

to areas that are currently facing parking pressures. It is currently expected

to cost approximately $75,000 to undertake this city-wide community engagement,

this expenditure is currently not budgeted.

18. A potential solution to this

could be allowing for some ‘quick fixes’ to be implemented in

tandem with the creation of the engagement plan.

Background

19. The Tauranga Parking

Strategy was adopted by Council on 15 November 2021 as is included in

Attachment 1.

20. Parking Management Plans

(PMP’s) are developed to provide a focus to parking in local areas. Each

local area has its own challenges and expectation from customers, the Parking

Management Plans are to be designed reflecting that.

21. Parking Management Plans are

required to provide an environment where different parking users are able to

coexist within boundaries set by Council.

22. The parking strategy outlines

five key outcomes for parking strategy to support the wider UFTI direction:

(a) Improving vibrant centres and

access to centres,

(b) Enable a multi-modal transport

system,

(c) Enable a more attractive and

compact urban form,

(d) Supporting access for all,

(e) Ensuring value for money and

best use of resources.

23. Currently paid parking is

available in the below locations:

(a) On Street – City Centre

from Second Ave to Harrington Street ($2ph for the first two hours and $5ph

afterwards).

(b) Off Street:

(i) Cliff Road – daily

charge $6.50

(ii) Dive Crescent – daily

charge $8.00

(iii) TV3 – daily charge

$12.50

(iv) Devonport Rd – daily charge

$12.50

24. The Cameron Road Warehouse site

is also expected to come online in the new financial year offering a cheaper

all day parking option for both workers in the area and those wanting to park

then use other travel modes for the final 1.5km trip into the city centre.

25. In line with typical parking

business practice, each parking area is priced individually to focus on

achieving an 85% occupancy rate. Each carpark has individual catchment areas

that result in valuations being slightly different much like the private rental

market. The goal of which is to ensure carparks are well used while also always

ensuring a space is available. In the event a carpark is not hitting 85%

staff will be recommending a price reduction.

26. The 85% occupancy rate is

typically the target in parking management as shows efficient use of the space

however a parking space is always available to those that require it. Any less

and the land isn’t being efficiently used and at 100% people are missing

out on carparks and are less likely to travel.

27. It is also important to note

that Tauranga is unique in having minimal private parking facilities off

street. The private parking market has been unable to develop to the same

extent as similar sized city elsewhere as council has historically been heavily

involved in significantly undercutting a potential private city centre parking

market e.g. trialling free parking. This has resulted in some hesitance for the

private sector to invest in private carparks.

28. In the city centre conflicting pressures on parking is

expected to increase as 600 new dwellings are expected in the next 10 years,

supporting an increase of 15,000 people living in the Te Papa peninsula over

the next 30 years, in addition to an additional 25% in workers traveling into

the city centre in 30 years.

29. The Mount to Arataki Spatial Plan identifies significant

growth over the next 20 to 30 years, equating to a 18% increase in population

supported by 2,600 more dwellings with 29% additional jobs within the

commercial and business areas. This growth, along with the increase demand from

other Tauranga residents is expected to increase pressure on the limited

parking infrastructure.

City

Centre Parking Management Plan

30. The Tauranga City Centre

Parking Management Plan was adopted in October 2022 which was followed by the

re-introduction of paid parking in December 2022.

31. The reasons for implementation

of the City Centre Parking Management Plan are:

(i) being prepared for

future growth in demand for parking on the Te Papa Peninsula. Current

projections are 2300 homes from 2024-2034 with an approximate of 2 cars per

household: and,

(ii) ensuring the cost of

parking is covered by its users limiting the burden to the rate payer.

32. An expansion of time

limits and paid parking was planned for November 2023 however this was deferred

until March 2024, and again deferred until March 2025.

33. Prior

to adoption of the parking management plan, several initiatives to manage

parking within the city centre had been trialled, most recently making most

spaces in the city P120 time limited.

34. A

two-hour free parking trial was introduced during covid in an attempt to

revitalise the city centre. The result was spaces being taken up early in the

morning by city centre staff and they rotated around spaces throughout the day.

This resulted in a shortage of carparks with many potential customers finding

themselves unable to find a carpark when coming into the city to shop. The city

centre saw no benefit to retail spend outside of what was matching wider covid

trends.

35. From 1 December 2022, the two-hour free parking

trial ended and paid on-street parking in the city centre was re-introduced.

The initial area for charges to be applied was from Harington Street to Second

Ave, with a planned expansion to city fringe areas in November 2023.

36. At

the 16 October 2023 Council meeting, Council decided to pause the

planned expansion of paid parking.

37. Challenges

with parking were expected to continue to early 2024 (covered in the November

2023 report) and in the March 2024 report. Parking demand was expected to be

impacted by a number of factors in the city centre for the remainder of 2024,

including:

a) completion of the Harrington Street Parking

Building,

b) 160-176 Devonport Rd completion

c) Te Manawataki o Te Papa

d) completion of TCC offices at 90 Devonport Road.

e) Private

developments.

38. Parking demand and constraints

continue to develop due to housing intensification within the city centre

fringe (along with the wider Te Papa Peninsula). As well as increased pressure

on parking from commuters with increased numbers expected as the city centre

development is completed. The Parking Management Plan is seeking to strike a

balance between the pressure caused by the three major competitors for parking

space in the city centre;

(i) Residents

(ii) Commuters

(iii) Customers

39. Commuters often utilise parking

within Memorial Park and further restrictions on parking in the city centre is

likely to exacerbate existing issues at Memorial Park. Commuters and

tradespeople are using parking all day in the park resulting in no parking for

genuine reserve users. The Reserves Act states that parking on recreation

reserves is only provided “where necessary for the convenience of reserve

users”. Upon a decision providing for expanded city centre parking

restrictions, staff will submit a report requesting an amendment to the Traffic

and Parking Bylaw to introduce time-limited car parking in Memorial Park,

addressing this issue.

40. Multiple residents have over

the past year requested extra time limits in certain areas or residents permit

programmes to guarantee parking access, these requests come from both

residential addresses where kerbside parking has been historically used, and

those who occupy newer higher density housing without carparking sufficient for

the residents.

41. When the parking

management plan is implemented, staff recommend the introduction of a residents

permit programme in conjunction with the continuation for one for the below

options:

i. Time Limits with no paid

expansion.

ii. Paid parking with no time

limit expansion.

iii. Expanding paid parking and time

limits. (recommended)

42. It is noted that details

around a resident’s permit will be the subject of a further decision

however the recommendation stands that these permits should be to help manage

current use rather than offset higher density developments providing less

parking spaces for their residents.

Mount maunganui parking management plan

43. On 11 of

September 2023 Council approved the development of the Mount Parking Management

Plan with engagement due to take place from the 13th of November to

December 15th. The Mount Parking Management Plan was deferred before

the completion of consultation to be discussed with council March 2024.

44. On November 27 Staff

recommended that the parking management plan was deferred to allow staff to

consider how best to implement the Parking Management Strategy in response to

community concerns about the wider infrastructure challenges in the city.

45. This additional time allowed

for a more holistic examination of how several parking initiatives happening at

once may compound issues and cause concern in the community. It also allowed

time to prepare and adjust to changes in a more realistic manner.

46. On 18th of March 2024 staff

provided a Parking Management Plan update to council requesting an extension of

the deferrals to allow time for staff to gather information and continue to

discuss option with stakeholders. Key points of focus for staff during the last

12 months have been:

(i) Monitoring user

demand and activity in the city centre.

(ii) Monitoring compliance

in the Mount Town Centre with more proactive time limit enforcement, continued

monitoring of parking occupancy.

47. At the 11 September 2023 Council meeting, Council

approved engagement for the development of the Mount Maunganui Parking

Management Plan. Initial engagement was due to be undertaken with the affected

community from 13 November – 15 December 2023.

48. The purpose of this was to begin initial

discussions about how a Parking Management Plan could be implemented within the

Mt Maunganui area. No specific plans or details were proposed, and it was

simply a request to begin conversations with affected parties, especially local

businesses, and residents. A draft plan would then have been presented to

Council in March 2024.

49. This engagement was put on hold as some

stakeholders believed this consultation was a way for council to introduce paid

parking in Mount Maunganui, leading to a difficult conversation that revolved

solely around paid parking, rather than the challenges experienced and what

solutions the community would like to see. This delay has also allowed the

current scenario to be tested with enforcement of the time limits and the

impact of this enforcement of the status quo.

50. Staff received approval from council to

enforce time limits more proactively in the Mount Town Centre and monitor

compliance in the area.

51. Initially compliance improved steadily

throughout the year but has been sliding back as the summer tourist season

starts to get busier. Numbers remain lower than initially seen when enforcement

started with a peak of around 100 per day (over the time limit), in comparison

to 150 last year.

52. While compliance has improved across the

Town Centre, we have not seen a decrease in overall occupancy and development

like the Pitau Rd retirement village continues to put pressure on parking

supply. Marine Parade also has occupancy issues during peak times with vehicles

parking over night or all day.

53. This last year has also seen a number of

conflicts between spaces required by the public and our cruise ship traffic

management plans. The Mount Parking Management Plan will give us the

opportunity to discuss and update our bylaws to better accommodate mixed use of

the Salisbury Wharf space.

54. An example of options able to be discussed

during an engagement process based on issues currently identified:

i. Possible

time limits along Marine Parade eg P240 (4 hours).

ii. Possible

bylaw adjustments to facilitate cruise ship season, limit reliance on traffic

management and make more spaces available.

iii. Potential

residents permit system in conjunction with expanded time limits and/or paid

parking to ensure peak season demand management and locals still retain

access.

55. Staff are requesting approval to engage on

the Mount Maunganui Parking Management Plan again and provide a draft Parking

Management Plan to Council to discuss in the new financial year.

Urban Centre Parking Management

Plan

56. Multiple areas are expected to face

parking pressure in the future as the city develops with some facing them

already. The definition of an ‘Urban Centre’ in relation to parking

management could be defined through the initial engagement process, with the

starting point being an area where parking supports a commercial benefit or

subject to utilisation by medium – high density residential users.

Outlined below are some examples of areas we would be discussing in the case of

city-wide engagement for an Urban Centre Management Plan.

(a)

Mt Maunganui

(b)

Papamoa

(c)

Greerton

(d)

Historic village/hospital

(e)

Brookfield

(f)

Cherrywood

(g)

Bethlehem

(h)

Bayfair/Arataki

57. Implementation of an Urban Centres Parking

Management Plan would likely not be until mid 2026. For some communities facing

challenges today we may be required to implement some quick fixes. Despite

impending economic headwinds parking demand is not expected to decrease, in

some residential neighbourhoods we may find pressure increases as we see more

adults per dwelling. Quick fixes could include:

(a)

Edgecumbe Rd yellow line removal.

(b)

Cruise Ship parking bylaw update in Mount Maunganui (reducing need for

TMP).

58. An advantage of the citywide discussion is it

would allow a public discussion about areas not often considered in Parking

Management Plans. New housing developments in areas like Papamoa face increased

parking pressure as many don’t have sufficient off-street parking for the

vehicles of the residents in the house. Staff are also aware of the impacts

single large employers could have on the surrounding parking such as the

Historic Village area and the Hospital. The ability to discuss this city wide

will allow us to restart conversations with organisations with a larger

impact.

Statutory

Context

59. The Tauranga Parking Strategy was approved in 2021. The

Tauranga Parking Strategy remains a necessary tool for managing increasing

parking demand in Tauranga.

60. On 27th June 2024, the Government

released the Government Policy statement (GPS) on Land Transport. The GPS

includes four strategic priorities:

(iii) Economic Growth and

Productivity

(iv) Increased maintenance and

resilience

(v) Safety

(vi) Value for money

61. The current outcomes

of the Parking Strategy have natural alignment to the strategic priorities in

the draft GPS.

62. Council is also required to be actively

involved in parking management due to the removal of minimum parking

requirements nationwide for new development.

STRATEGIC ALIGNMENT

63. This contributes to the promotion or achievement

of the following strategic community outcome(s):

|

Contributes

|

|

We are an inclusive city

|

ü

|

|

We value, protect and enhance the environment

|

☐

|

|

We are a well-planned city

|

ü

|

|

We can move around our city easily

|

ü

|

|

We are a city that supports business and education

|

ü

|

Options Analysis

64. Parking Management Plans for the City Centre and Mount

Maunganui where the first to be discussed by council (under the commission)

this was due to the high parking use in both areas. City Centre was approved

first as paid parking had existed in the area previously with engagement for

the Mount Maunganui area set to begin afterwards. The expectation was for other

town centres and sub regions facing parking pressure to follow.

65. Council has the option of either continuing with City

Centre/ Mount Maunganui plans with the option of discussing further areas to

receive Parking Management Plans after implementation such as industrial zones

with parking issues or areas affected by a major employer like around the

hospital. Or,

66. Abandoning the remaining work on the two current

planned Parking Management Plans and reviewing a city-wide Urban Centres Plan.

This would allow for city wide engagement on the use of the space on the side

of the road, this option however is expected to defer implementation negatively

effecting areas suffering from parking pressure being put aside until

engagement is complete.

67. All options have financial considerations which will

be outlined in the next section of the report below.

Options for Tauranga City Centre Parking Management

Plan.

2Option 1: Time Limits with no paid parking

expansion

|

Advantages

|

Disadvantages

|

|

·

Frees up space in city fringe for those visiting residents.

·

Provides certainty to residents and businesses.

|

·

Will negatively impact the parking activity’s

contribution to financing arrangements.

·

Limits availability for all day parking for city fringe

businesses.

·

Requires increased enforcement to ensure compliance,

potentially requiring increased parking warden headcount.

·

Apprehension from residents over not

being able to park on their street all day during the day.

|

Option

2 (Recommended): Time Limits and paid parking expansion

|

Advantages

|

Disadvantages

|

|

·

Potential revenue can be used to implement further projects

in the City Centre.

·

Paid Parking could be used to provide all day parking

locations in certain areas.

·

Provides certainty to residents and businesses.

|

·

Paid parking is unpopular.

·

Apprehension from residents over not being able to park

on their street all day during the day.

|

Option

3: Status Quo.

|

Advantages

|

Disadvantages

|

|

·

No costs to the organisation.

|

·

Will negatively impact the parking activity’s

contribution to financing arrangements.

·

Current parking pressures remain.

·

Residents find it increasingly difficult to access

streets they live on as Te Papa develops.

|

Options

1&2 can be augmented with a residents parking permit system to be agreed

upon with council to help mitigate negative impacts to those currently living

within these areas.

Options for Mount Maunganui Parking

Management Plan

Option

1 (Recommended): Continue with consultation, providing a draft Parking

Management Plan to council for discussion at the end of the financial year,

allowing for implementation of decisions to occur for summer 2025/ 2026.

|

Advantages

|

Disadvantages

|

|

· Allows

council staff to discuss options for improving parking availability in Mount

Maunganui.

· Gives

residents and stakeholders the opportunity to discuss the pressures faced in

Mount Maunganui.

|

· Proposed

Parking Management Plan draft will need to be a compromise and will not

ensure 100% approval.

|

Option

2: Status Quo

|

Advantages

|

Disadvantages

|

|

· Easy

to implement.

|

· No

changes to parking issues in Mount Maunganui.

· No

management of increased parking demand by private development and increased

visitor numbers.

|

Option for Urban Centre Parking Management Plan

|

Advantages

|

Disadvantages

|

|

· Allows

for each urban centre to be reviewed at the same time.

· Opportunity

for district wide public engagement on parking.

|

·

A delay to city centre parking expansion is likely to impact the parking

activity’s contribution to financing arrangements.

· Process

will be long while parking demand continues to change.

|

Financial Considerations

68. High-level operating surplus/

deficit forecast over the ten-year period and total debt position of the

Parking Management activity has been assessed from the LTP to recognise more

debt and higher rates expense associated with commercial properties.

69. The 2024-34 LTP and Draft 2026

Annual Plan included net revenue from parking expansion. If these expansions

are not approved, the surplus would be less and the debt would be higher, which

may negatively impact the parking activity’s contribution to financing

arrangements for investment that the activity is intended to support.

Once decisions are made, further work will be undertaken to inform

financial modelling.

70. City Centre Parking Management

Plan

|

Options

|

Costs

|

Potential

Revenue

|

|

Option

1 – Time Limits with no paid parking expansion.

|

Approximately

$100k This includes the potential cost of signage and any required extra line

marking + Staff time and enforcement resource (1xFTE) which is cost neutral

due to enforcement revenue.

|

Enforcement

revenue dependant on noncompliance.

Enforcement

revenue dependant on noncompliance however is assumed to cover the cost of

enforcement.

|

|

Option

2 – Time Limits and paid parking expansion.

|

Approximately

$215k This includes the same as above but with extra cost added for the

machines. Will also include and enforcement officer (1xFTE) witch will be

cost neutral due to enforcement revenue.

|

Revenue

from paid parking $400k pa.

Enforcement

revenue dependant on noncompliance however is assumed to cover the cost of

enforcement.

|

|

Option

3 – Status Quo

|

No

change

|

No

change

|

71. A residents permit

system if required could be cost neutral as the Land Transport Act gives us the

ability to recover costs for the permits.

72. Restarting the Mount

Maunganui Parking Management Plan will cost staff time and any printing

required for public notification. A more accurate picture of costs will be

covered in the draft Parking Management Plan.

73. Current Parking Revenue

Overview (with ongoing costs) – costs are approximate due to being

influenced by total transaction numbers and potential vandalism etc.

(i) On Street revenue for the

last 12 months - $1,493,557

(ii) On Street costs per year

(approx). $280,000. Yearly cost per pay machine (approx) - $2,400

(iii) Expected increase of 20

machines if approved (approx) $50,000 per annum in upkeep added.

(iv) Enforcement costs not included as it

is cost neutral.

|

Ordinary

Council meeting Agenda

|

28

April 2025

|

74. Expanded city centre paid

parking is expected to provide a net positive income to TCC during it’s

establishment year with a higher return in future years.

|

Ordinary

Council meeting Agenda

|

28

April 2025

|

Significance

75. The Local Government Act 2002

requires an assessment of the significance of matters, issues, proposals and

decisions in this report against Council’s Significance and Engagement

Policy. Council acknowledges that in some instances a matter, issue,

proposal or decision may have a high degree of importance to individuals,

groups, or agencies affected by the report.

76. In making this assessment,

consideration has been given to the likely impact, and likely consequences for:

(a) the current

and future social, economic, environmental, or cultural well-being of the district

or region

(b) any persons who are likely to be

particularly affected by, or interested in, the decision.

(c) the capacity of the local authority

to perform its role, and the financial and other costs of doing so.

77. In accordance with the

considerations above, criteria and thresholds in the policy, it is considered

that the decision is of medium significance.

ENGAGEMENT

78. Taking into consideration the

above assessment, that the decision is of medium significance, officers are of

the opinion that no further engagement is required prior to Council making a

decision.

Next Steps

79. If staff recommendations

are approved:

(a) Staff will begin work on

implementation of the City Centre Management Plan. Aiming for implementation Q1

financial year 2025/26. The expectation is the changes should take 3 months to

implement not including any required adjustments to enforcement coverage.

(b) Staff will begin developing an engagement plan for Mount

Maunganui in collaboration with interested councillors, with a desire to

undertake the engagement in May 2025. A draft Parking Management Plan developed

out of the engagement is to be provided to council by the end of the financial

year with an aim to have implementation of agreed changes to help address

challenges for the 2025/26 summer period.

80. If Urban Centre Parking

Management Plan Approved

(a) Staff begin working on

quickfire interventions while preparing for engagement district wide.

(b) An engagement plan is provided

to council by end of August 2025.

Attachments

1. Parking

Management Plan City Centre - A17517239 (Separate Attachments 1)

2. Parking

Strategy - A17517204 (Separate Attachments 1)

3. Parking

Data 17.02.25 - A17520436 (Separate Attachments 1)

4. Operating

Surplus/(Deficit) Forecast and Total Debt Position of the Parking Management

Activity - A17125546 (Separate Attachments 1)

|

Ordinary

Council meeting Agenda

|

28

April 2025

|

11.8 Shareholder Feedback

on Council-Controlled Organisations' Draft Statements of Intent 2025/26

File

Number: A17123292

Author: Sam

Fellows, Manager: City Partnerships

Authoriser: Gareth

Wallis, General Manager: City Development & Partnerships

Purpose of the Report

1. The

purpose of this report is to provide shareholder feedback on the draft

Statements of Intent (SOI) for Tauranga City Council’s (TCC or Council)

six council-controlled organisations (CCOs) by 1 May 2025, as required by the

Local Government Act (2002).

|

Recommendations

That the Council:

(a) Receives the report

"Shareholder Feedback on Council-Controlled Organisations' Draft

Statements of Intent 2025/26".

(b) Receives the draft SOI

2025/28 for Bay Venues Limited (Bay Venues), Tauranga Art Gallery Trust

(TAGT), Tourism Bay of Plenty (TBOP), Te Manawataki o Te Papa Limited

(TMOTPL), Te Manawataki o Te Papa Charitable Trust (The Charitable Trust) and

Bay of Plenty Local Authority Shared Services Limited (BOPLASS) (Attachments

1 to 6).

(c) Approves the shareholder

feedback on the substantive CCOs’ draft SOIs of Bay Venues, TAGT, TBOP

and TMOTPL, outlined in this report.

(d) Notes

that as joint shareholder of TBOP, Western Bay of Plenty District Council

(WBOPDC) will be asked to approve their separate shareholder comments on the

draft SOI for TBOP at their upcoming Council meeting.

|

exEcutive summary

2. Council has a total

of seven CCOs. These CCOs are required by the Local Government Act (2002) to

prepare a draft SOI consisting of information about the organisation’s

activities, performance measures and financials over a three-year financial

period, and is prepared and adopted by the CCO board annually.

3. The draft SOI must

be provided to their shareholder, TCC, by 1 March each year, and Council has an

opportunity to comment on the draft SOIs before they are finalised and adopted

by the CCO boards by 30 June 2025. Shareholder comments must be provided by 1

May 2025.

4. Council’s 28

April 2025 meeting is the first suitable meeting for the draft SOIs to be

formally received and shareholder feedback to be approved. Note, the Local

Government Funding Agency’s draft SOI was received at the City Delivery

Committee on 7 April 2025.

5. Each CCO’s

draft SOI is provided as Attachments 1 to 6. All six SOIs have met the

statutory requirements as outlined in the Local Government Act (Part 5, Section

64, Schedule 8).

6. This report includes

Council’s feedback and suggested amendments on the substantive

CCOs’ draft SOIs, and have been assessed against the Letters of

Expectation (LOEs) 2025/26.

7. Any issues raised

during this meeting and from the feedback, will be discussed with the Chairs to

ensure changes to the draft SOIs are made and that the CCOs continue to operate

efficiently, and be accountable to the residents of Tauranga.

8. Next steps will be

to formally receive the final SOIs at the Council meeting on 15 July 2025,

following adoption of the final documents by the CCO boards.

Background

Summary of shareholder

feedback on the draft statements

Bay Venues Limited

9. Overall, the Bay

Venues’ Draft Statement of Intent (Attachment 1) shows alignment

with our Letter of Expectation, with an emphasis on community, collaboration,

partnership and value for money. It also shows commitment to achieving

Council’s outcomes for the wider community and people’s wellbeing

in Tauranga Moana, through the use of its facilities.

10. Suggested amendments:

(a) Consider a

greater emphasis on using tangible examples to describe how the ratepayer is

receiving value for money from Bay Venues.

(b) Provide specific examples of

how Bay Venues has improved systems or processes to reduce operating costs,

including providing information on how Bay Venues will achieve

a minimum 7% operational grant saving in the upcoming financial year.

(c) Include a note

that Bay Venues will have regular reporting and bi-monthly meetings with the

Mayor, Deputy Mayor, and Councilors.

(d) Provide more

information about the Bay Venues asset renewals project(s).

(e) Consider

updating information to clearly illustrate the number of responses that are

received when reporting on KPIs and relevant benchmarking.

(f) Consider including

information about what good looks like and how Bay Venues is measuring and

working towards achieving that i.e. qualitative benchmarking.

TAGT

11. Overall TAGT’s Statement

of Intent (Attachment 2) is well presented and shows alignment with our

Letter of Expectation, particularly in outlining their approach to financial

prudence.

12. TAGT are an integral part of

the Te Manawataki o Te Papa Civic Precinct development, and their document

highlights their commitment and the key partnership role they play in the

development of that project.

13. TAGT have clearly linked each

of their strategic objectives and measures with TCC’s community outcomes.

14. Suggest amendments:

(a) If TAGT is focused on being the

best, consider demonstrating how this can be achieved and measured, both the

current status, and ongoing year-on year improvements.

(b) Consider using

industry-relevant benchmarking to demonstrate progress against TAGT goals, and

illustrate how TAGT compares to galleries of a similar size, scale and offering

throughout the country.

(c) Consider setting stretch

targets (e.g. five years) and describe how TAGT will work towards achieving

them.

(d) Collect more information about

what visitors like and dislike, and how that information will feed into ongoing

gallery improvements.

TBOP

15. TBOP’s draft Statement of

Intent (Attachment 3), is well presented, refers to TCC’s

community outcomes and others matters outlined in this year’s Letter of

Expectations.

16. Overall, the document

demonstrates TBOP have been responsive to TCC’s feedback, particularly in

regard to value for money.

17. Suggested amendments:

(a) If TBOP is focused on being the

best, consider demonstrating how this can be achieved and measured, both the

current status, and ongoing year-on year improvements.

(b) Consider including information

about what good looks like and how TBOP is measuring and working towards

achieving that i.e. qualitative benchmarking.

(c) Consider demonstrating the

economic impact of the work TBOP does and the return on investment the Tauranga

ratepayers receive for TCC’s investment.

(d) Include

regular reporting on the Tauranga destination brand project.

TMOTPL

18. Overall, TMOTPL’s

Statement of Intent (Attachment 4) is well presented and aligned with

our Letter of Expectation.

19. The document highlights the

array of critical projects TMOTPL is and will be responsible for delivering, as

part of its significant role governing the Te Manawataki o Te Papa Civic

Precinct development.

20. Suggested amendments:

(a) Provide

clearer KPIs and specific information on delivery in full, on time, in scope

and on budget.

The Charitable Trust

21. As Council and the Otamataha

Trust jointly govern the Charitable Trust, there was no LOE provided to this

CCO.

22. Attachment 5 is this

CCO’s SOI for 2024/27, however, the Charitable Trust’s intentions

and direction as a joint land ownership CCO, in partnership with the Otamataha

Trust, remain very similar to the previous years and since its establishment in

October 2022.

23. TCC staff are working with the

Otamataha Trust on the drafting and finalising of the new Statement of Intent

for 2025/28, following the recent half-yearly meeting, which took place on 8

April 2025.

24. Council encourages

representatives of the Otamataha Trust to continue to act as the cultural

advisor to the TMOTPL Civic Development Advisory Group, to ensure that the Te

Manawataki o Te Papa Civic Precinct Development project respects and reflects

the significant history and importance of the area to mana whenua.

25. Council

encourages representatives of the Otamataha Trust to continue to meet regularly

with Council and the TMOTPL Board.

BOPLASS

26. As Council one of nine

shareholder members, there was no LOE provided to BOPLASS.

27. BOPLASS’ draft SOI is

provided as Attachment 6.

28. BOPLASS has six key performance

targets in their draft SOI to maximise value for money, benefits, and best

practice to BOPLASS councils.

(a) Ensure

supplier agreements are proactively managed.

(b) Investigate new joint

procurement initiatives for goods and services.

(c) Identify opportunities to

collaborate with other local authority shared services across the country.

(d) Implement shared services.

(e) Communicate with each

shareholder council at appropriate levels.

(f) Ensure current funding

model is appropriate.

29. BOPLASS

manages a variety of joint procurement projects which require ongoing

management for performance, renewal or replacement. These joint procurement

projects will continue across the three financial years (page 14).

30. Alongside these joint

procurement projects, BOPLASS also manages a variety of shared services. These

shared services will continue across the three financial years (page

15).

31. BOPLASS has listed several

projects for consideration by the shareholding councils across the three

financial years (page 15), including archive services, consents processing,

drug and alcohol testing, LGOIMA requests, and vehicle monitoring.

32. The Collaboration Portal

established by BOPLASS for the sharing of information on Shared Services or

Joint Procurement opportunities, has been made available to the wider Local

Government Sector to provide better visibility and to encourage cross-regional

collaboration.

33. BOPLASS recognises and is

committed to the importance of environmental and social sustainability for a

brighter and better future, by ensuring that integrated risk management,

non-financial outcomes and Te Tiriti o Waitangi are considered in all joint procurement

and shared services initiatives.

34. BOPLASS

is committed to regular and extensive stakeholder engagement at project,

management and governance level, ensuring communication is clear and frequent,

and that quality information from shareholding councils are used to guide

decision making.

CCOs’ core purpose and TCC OPEX Grant FY26:

|

CCO

|

Core purpose

|

OPEX grant forecast for FY2025/26 (based on Council’s Long-term Plan 2024/34). Notes

Bay Venues, TAGT, TBOP and TMOTPL have been asked by Council to identify and

implement 7% OPEX cost savings for FY26

|

|

Bay Venues

|

Council’s largest CCO and the kaitiaki of more than 20 community

facilities. Connecting the community with exceptional experiences through

hosting activities and events at community facilities across Tauranga

including aquatic centres, indoor sport and fitness facilities, event venues,

community centres and halls, and the Adams Centre for High Performance.

|

$7,958,000

|

|

TAGT

|

Creating exceptional art experiences that engage, inspire, challenge

and educate through exhibitions, public programmes and events.

|

$1,534,540

|

|

TBOP

|

Leading the sustainable growth of the Western BOP visitor economy, the

management of the region as a visitor destination, and the management of

iSITE Visitor Information Centres at Tauranga, Mount Maunganui and the Port

of Tauranga (during the cruise season only).

|

$2,133,309 (includes iSITE Visitor Information Centres)

|

|

TMOTPL

|

Governing the effective delivery of a suite of projects across

Tauranga city centre, to benefit the whole community.

|

$778,625

|

|

The Charitable Trust

|

Owning the land referred to as ‘Site A’ of the Te

Manawataki o Te Papa civic precinct (the site bounded by Durham, Hamilton,

Wharf and Willow streets and includes Masonic Park), and to provide certainty

on how the land will be used in the future, so that everyone in the community

benefits.

Supporting and encouraging the development of Site A of the civic

precinct, including (but not limited to) a library, civic whare, museum and

exhibition centre and the beautification of surrounding areas.

The Charitable Trust’s Statement of Intent outlines the

following to complement the purpose of this CCO:

· Formally recognise long-standing grievances associated with this land and provide certainty for

how the land will be owned and used in the future, so that everyone in the

community can benefit.

· Ensure that Te Manawataki o Te Papa development

respects and reflects the

significant history and importance of the area to mana whenua.

· Restore the original trust relationship to which our ancestors (both Māori and the

Church Missionary Society) agreed. The relationship with mana whenua will be

pivotal to the success of many of the outcomes to be achieved on the civic

precinct site.

|

This CCO is a registered charity.

Similar to the prior financial year’s annual report, the

accounts for the Charitable Trust are still at zero, with no transactions

being processed as yet.

|

|

BOPLASS

|

Fostering collaboration in the delivery of shared services and joint

procurement on behalf of the participating councils, maximising cost savings

and developing opportunities for sharing of services. Council is one of nine

shareholder councils.

|

No more than $20,000

|

Statutory Context

35. The SOI is one of the

CCO’s key governance and planning documents.

36. Engaging with the CCOs

throughout the development of the annual SOIs is one of the main ways Council

can influence its CCOs while ensuring they are aligned with Council’s

strategic outcomes.

STRATEGIC ALIGNMENT

37. The CCOs contribute to the

promotion or achievement of the following strategic community outcome(s):

|

Contributes

|

|

We are an inclusive city

|

ü

|

|

We value, protect and enhance the environment

|

ü

|

|

We are a well-planned city

|

ü

|

|

We can move around our city easily

|

ü

|

|

We are a city that supports business and education

|

ü

|

38. The

CCOs actively work in partnership with Council, mana whenua and our community

to achieve great outcomes, value for money, and delivering more with less

resources. This is reflected in their SOIs and their performance against

financial and non-financial measures.

Options Analysis

Option 1: Receive the

draft SOIs and approve the feedback to be provided to the CCOs –

RECOMMENDED

39. Receive

the draft SOIs 2025/28 from Bay Venues, TAGT, TBOP, TMOTPL, The Charitable

Trust and BOPLASS. Agree with the suggested shareholder comments outlined in

this report, noting that WBOPDC will confirm shareholder feedback to TBOP at

their upcoming Council meeting.

|

Advantages

|

Disadvantages

|

|

· Council meets

its legislative requirements under the Local Government Act (2002) by formally

receiving the draft SOIs and providing feedback within the required

timeframe.

· Final SOIs are aligned with Council’s strategic

direction.

|

· The CCOs do not receive any useful information on

Council’s expectations about the content of their final SOIs.

|

Option 2: Receive the

draft SOIs and do not approve the feedback to be provided to the CCOs –

NOT RECOMMENDED

40. Receive

draft SOIs 2025/28 from Bay Venues, TAGT, TBOP, TMOTPL, The Charitable Trust

and BOPLASS. Do not agree with the suggested shareholder comments outlined in

this report, noting that WBOPDC will confirm shareholder feedback to TBOP at

their upcoming Council meeting.

|

Advantages

|

Disadvantages

|

|

· Council meets its legislative requirements under the

Local Government Act (2002) by formally receiving the draft SOIs and deciding

not to provide feedback within the required timeframe.

|

· The CCOs do not receive any useful information on

Council’s expectations about the content of their final SOIs.

· The final SOIs may contain inaccurate information or be

misaligned with Council’s strategic direction and expectations.

|

Financial Considerations

41. Budgets for all CCOs, including

Council’s contributions, are included in the draft SOIs.

Legal Implications / Risks

42. If Council does not approve the

provision of the suggested feedback to the CCOs, the final SOIs may not be

consistent with Council’s strategic direction and may contain

inaccuracies (financial and governance risk).

TE AO MĀORI APPROACH

43. While the Te Ao Māori

approach is important, the matters addressed in this report are of a procedural

nature.

CLIMATE IMPACT

44. While climate impact is

important, the matters addressed in this report are of a procedural

nature.

Consultation / Engagement

45. It is not required or expected

to consult on an SOI under the Local Government Act (2002).

Significance

46. The Local Government Act (2002)

requires an assessment of the significance of matters, issues, proposals and

decisions in this report against Council’s Significance and Engagement

Policy. Council acknowledges that in some instances a matter, issue, proposal

or decision may have a high degree of importance to individuals, groups, or

agencies affected by the report.

47. In making this assessment,

consideration has been given to the likely impact, and likely consequences for:

(a) the current

and future social, economic, environmental, or cultural well-being of the

district or region;

(b) any persons who are likely to be

particularly affected by, or interested in, the decision; and

(c) the capacity of the local authority

to perform its role, and the financial and other costs of doing so.

48. In accordance with the

considerations above, criteria and thresholds in the policy, it is considered

that the decision is of medium significance.

ENGAGEMENT

49. Taking into consideration the

above assessment, that the decision is of medium significance, officers are of

the opinion that no further engagement is required prior to Council making a

decision.

Click

here to view the TCC

Significance and Engagement Policy

Next Steps

50. A copy of this report and the

resolutions will be provided to each CCO by 1 May 2025. WBOPDC will do the same

following their upcoming Council meeting.

51. Any feedback provided in this

report should be given consideration by the CCO boards when producing their

final SOIs.

52. The final SOIs are to be

provided to Council by 30 June 2025, and will be formally received at 15 July

2025 Council meeting.

Attachments

1. Bay

Venues - Draft Statement of Intent 2025-2028 - A17910529 (Separate Attachments

1)

2. TAGT

- Draft Statement of Intent 2025-2028 - A17910532 (Separate Attachments 1)

3. TBOP

- Draft Statement of Intent 2025-2028 - A17910535 (Separate Attachments 1)

4. TMoTPL

- Draft Statement of Intent 2025-2028 - A17910540 (Separate Attachments 1)

5. TMOTP

Charitable Trust - Draft Statement of Intent 2025-2028 - A17911163 (Separate

Attachments 1)

6. BOPLASS - Draft

Statement of Intent 2025-2028 - A17910531 (Separate Attachments 1)

|

Ordinary

Council meeting Agenda

|

28

April 2025

|

11.9 Council-Controlled

Organisations - Half-Year Reports 2024/25

File

Number: A17123306

Author: Caroline

Lim, CCO Specialist

Sam Fellows,

Manager: City Partnerships

Authoriser: Gareth

Wallis, General Manager: City Development & Partnerships

Purpose of the Report

1. The

purpose of this report is for Tauranga City Council (TCC or Council) to

formally receive the Half-Year Reports 2024/25 from six of its Council

Controlled Organisations (CCOs) as required by the Local Government Act (2002).

|

Recommendations

That the Council:

(a) Receives the report

"Council-Controlled Organisations - Half-Year Reports 2024/25".

(b) Receives Bay Venues

Limited’s (Bay Venues) Half-Year Report (Attachment 1).

(c) Receives Tauranga Art Gallery

Trust’s (TAGT) Half-Year Report (Attachment 2).

(d) Receives Tourism Bay of

Plenty’s (TBOP) Half-Year Report (Attachment 3).

(e) Receives Te Manawataki o Te

Papa Limited’s (TMOTPL) Half-Year Report (Attachment 4).

(f) Receives Te Manawataki

o Te Papa Charitable Trust’s (The Charitable Trust) Half-Year Report (Attachment

5).

(g) Receives

Bay of Plenty Local Authority Shared Services Limited’s (BOPLASS)

Half-Year Report (Attachment 6).

|

Executive Summary

2. Council has a total

of seven CCOs. These CCOs are required by the Local Government Act (2002) to

provide Half-Year Reports regarding their financial and non-financial

performance, against the activities, performance

measures and financials outlined in their Statements of Intent (SOIs).

3. Note: the Local

Government Funding Agency’s Half-Year Report was presented to the City

Delivery Committee on 7 April 2025.

4. These reports must

be submitted by 28 February each year and Council’s 28 April 2025 meeting

is the first suitable meeting for the Half-Year Reports 2024/25 to be formally

received.

5. Each CCO’s

report is provided as Attachments 1 to 6, with a short summary included in this

covering report.

6. These reports have

all met the legislative and SOI requirements as outlined in the Local

Government Act (2002).

7. A CCO’s

Half-Year Report is a key indicator of how well it is performing. Overall,

Council’s CCOs are meeting their KPIs and have worked hard to ensure they

continue to meet the expectations of Council and the community, as well as

operating in a financially prudent manner.

Key highlights of the Half-Year Report 2024/25

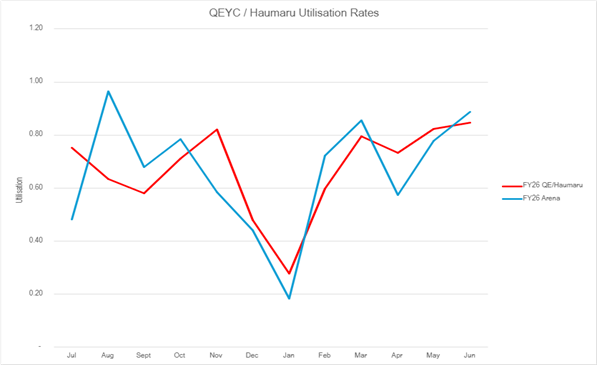

8. Bay

Venues as of 31 December 2024:

· Financial

performance: EBITDA is at $111k, slightly behind budget ($50k) but on track

to achieve budget by year end.

· Visitor

numbers: Over 1.1 million visitors across aquatics, community halls,

community centres, sports and fitness, and Mercury Baypark facilities.

· Achievements:

High customer satisfaction (87%), new revenue streams, and sustainability

initiatives.

9. TAGT

as of 31 December 2024:

· Financial

performance: Achieved a surplus of $168,432.

· Achievements:

Delivering a suite of educational programmes and art talks, and securing new

commercial partnerships.

10. TBOP

as of 31 December 2024:

· Financial

performance: Achieved a surplus of $199,991 which was better than budgeted.

· Achievements:

Cruise sector hosting and operator support, domestic and event marketing,

leading cultural and sustainability initiatives, digital kiosk installations,

and winning the 2024 Tourism Award for Industry Collaboration and Alignment for

Flavours of Plenty.

11. TMOTPL

as of 31 December 2024:

· Financial

performance: Broke even with total revenue and expenses at $368,582. Total

expense in FY25 was 15.5% less than in FY24.

· Achievements:

Completion of key public spaces like Masonic Park, and successful ongoing

delivery of major projects such as the Te Manawataki o Te Papa

Library/Community Hub.

12. The

Charitable Trust as of 31 December 2024:

· Achievements:

Completion of the title amalgamation and transfer for 'Site A' of the civic

precinct, ensuring future development benefits the community.

13. BOPLASS

as of 31 December 2024:

· Financial

performance: Half-year surplus of $442. Forecast to deliver savings of $2.5

million to councils by year end.

· Achievements:

Significant cost savings through joint procurement and shared services

projects, including CCTV monitoring and cyber risk management.

14. Challenges

faced by CCOs: The following challenges are proactively monitored

and addressed by the CCOs to ensure they continue to meet their performance

targets, and deliver value to both Council and the residents of Tauranga:

· Bay

Venues: Current economic conditions, increased costs, and anti-social

behaviour.

· TAGT:

Operating without a physical site due to the Art Gallery refurbishment project,

and the specific challenges of the refurbishment project.

· TBOP:

The expected net deficit of $300,000 by June 2025, despite sufficient cash

reserves, requires careful financial management.

· TMOTPL:

Unforeseen delays with the Art Gallery refurbishment, may incur additional

costs and impact timelines.

Background

Summary of the Half-Year Reports 2024/25

15. Bay

Venues:

· Bay

Venues report for the six months to 31 December 2024 is included as Attachment

1.

· Bay

Venues is in a sound financial situation and is on track to achieve

budget.

· Challenging

economic conditions have impacted on revenue in some areas for Bay Venues and

it has driven cost savings to offset this, whilst minimising any impact on the

community. This has included some roles being disestablished from the

organisation.

· New

revenue generating initiatives have also been a focus including commercial

leases, a digital billboard, and a partnership with The University of Waikato.

Along with cost savings, these initiatives are helping ensure that Bay Venues

is financially on track.

· Bay

Venues is tracking well against all KPIs, including customer satisfaction (2%

ahead of target).

· The Board welcomed a new

intern, Sam Hastings, as part of Council’s CCO Board Internship

Programme.

16. TAGT:

· TAGT

report for the six months to 31 December 2024 is included as Attachment 2.

· TAGT

is in a sound financial situation and achieved a surplus of $168,432.

· Despite

operating without a physical site due to the Art Gallery refurbishment, TAGT is

tracking well to achieve 12 of its KPIs.

· TAGT

is busy preparing behind the scenes on the reopening of the Art Gallery in late

2025. Significant work is underway including working with the TCC project team

on the fit out, along with fit out of the new collection site, and resource

development to enhance the visitor experience.

· TAGT

has delivered a suite of educational programmes and art talks including Frances

Hodgkins @ Waihirere Lane, Ans Westra Book Launch @ Tauranga City Libraries,

Claudia Jarman Lecture @ University of Waikato, and Playback @ The Strand.

· TAGT

has secured a three-year new partnership with Craig’s Investment Partners

for the reopening, and other funding channels including the Lottery Grants

Board for accommodating and protecting the Art Collection.

· The

Board welcomed a new trustee and Mana Whenua representative Allanah

Winiata-Kelly, who replaced Sylvia Wilkinson, and a new board intern Grace

Hakaria, as part of Council’s CCO Board Internship Programme.

17. TBOP:

· TBOP

report for the six months to 31 December 2024 is included as Attachment 3.

· TBOP

is in a sound financial situation and achieved a surplus of $199,991, better

than budgeted of a surplus of $127,238.

· TBOP

is tracking well to achieve all of its 10 KPIs, and continues to deliver key

outcomes and work collaboratively with Council on a number of significant

projects, including Te Manawataki o Te Papa, digital kiosks and wayfinding,

major events promotion, and business climate change adaption.

· TBOP’s

achievements include hosting the cruise ship season and facilitating the

visitation of 28 ships, 25 ship days, 50,219 passengers and 22,109 crew.

Sixty-eight ships are scheduled for the second half of the FY2024/25

season.

· TBOP

continues to elevate our region’s cultural tourism proposition through

the Native Nations indigenous youth exchange between Australia, Canada and New

Zealand, and supporting the Ōmanawa Falls project.

· TBOP

won the coveted 2024 Tourism Award for Industry Collaboration and Alignment for

Flavours of Plenty, and was also a finalist in the same category for the Green

Room sustainability programme.

18. TMOTPL:

· TMOTPL

report for the six months to 31 December 2024 is included as Attachment 4.

· TMOTPL

is in a sound financial situation and broke even with total revenue and

expenses at $368,582.

· TMOTPL

is tracking well to achieve all of its 14 KPIs. The one KPI not measured is

about developing and maintaining with TCC, contractors and consultants, a

comprehensive risk register. As this register is proactively managed by TCC, it

is not necessary for TMOTPL to maintain a separate one.

· TMOTPL

has achieved the completion of key public spaces such as Masonic Park, Te

Hononga Ki Te Awanui Stage 1, Waterfront Park North, and the Waterfront

Playground. These projects have been warmly welcomed by the community and local

businesses.

· TMOTPL

is overseeing the ongoing projects of the Library/Community Hub, Civic Whare,

Exhibition and Museum (CWEM), Haumaru Indoor Sports Centre (Cameron Road), 90

Devonport Road Administration Building, and the Tauranga Art Gallery

Refurbishment.

· CWEM

is scheduled to begin construction in May 2025, Haumaru is scheduled for

completion April 2025, TCC staff will be able to relocate to 90 Devonport Road

in April/May 2025, and the Tauranga Art Gallery refurbishment is scheduled for

completion in Quarter 3 2025.

· Projects

in design overseen by TMOTPL include the Central Waterfront Plaza and Wharewaka

projects.

· TMOTPL

has worked hard to build trusted and collaborative relationships with Council,

the Otamataha Trust, wider Council teams such as Spaces and Places, Library and

Museum teams, other CCOs such as TAGT, TBOP and Bay Venues, the media, local

businesses, and the general public.

19. The

Charitable Trust:

· The

Charitable Trust’s report for the six months to 31 December 2024 is

included as Attachment 5.

· The

biggest highlight has been the completion of the title amalgamation, transfer

and ground lease for ‘Site A’ of the civic precinct development

– or the land between Hamilton Street, Willow Street, Wharf Street and

Durham Street – to Te Manawataki o Te Papa Charitable Trust. This has

formally recognised long-standing grievances associated with the site and

provides certainty for how the land will be owned and used in the future, so

that everyone in the community can benefit.

· The

Charitable Trust continues to meet regularly with TCC and TMOTPL Board.

· The

Charitable Trust continues to act as the cultural advisor to the TMOTPL Civic

Development Advisory Group, to ensure that the Te Manawataki o Te Papa Civic

Precinct Development project respects and reflects the significant history and

importance of the area to mana whenua.

· The

Charitable Trust recently conducted its annual general meeting on 5 November

2024. The Trustees resolved to appoint Mayor Mahé Drysdale as Chair of

the Charitable Trust for the ensuing year, and to institute a policy of

rotating the Chair position between the Otamataha Trust and Tauranga City

Council appointed trustees each year, starting from 2025.

20. BOPLASS:

· BOPLASS

report for the six months to 31 December 2024 is included as Attachment 6.

· BOPLASS’s

progress to date shows all six KPIs are on track to be met.

· BOPLASS

is in a sound financial situation and is forecast to return in excess of $2.5

million in savings by end of the FY.

· Of

interest to Council are the following joint procurement and shared services:

(a) CCTV

monitoring/crime prevention – working together with NZ Police,

BOPLASS is investigating establishing three regional hubs for CCTV monitoring

across BOPLASS councils.

(b) Insurance

renewals – by renewing insurance collectively through BOPLASS, this

has achieved significant savings for the shareholder councils e.g. reduced

premium rates and improved insurance terms.

(c) Aerial

imagery – tender awarded for urban and rural orthophotography

covering Taupō, Rotorua, Western Bay of Plenty, Gisborne and Tauranga

regions.

(d) Waste