|

|

|

AGENDA

Ordinary Council meeting

Monday, 11 December 2023

|

|

I hereby give notice that an Ordinary meeting of

Council will be held on:

|

|

Date:

|

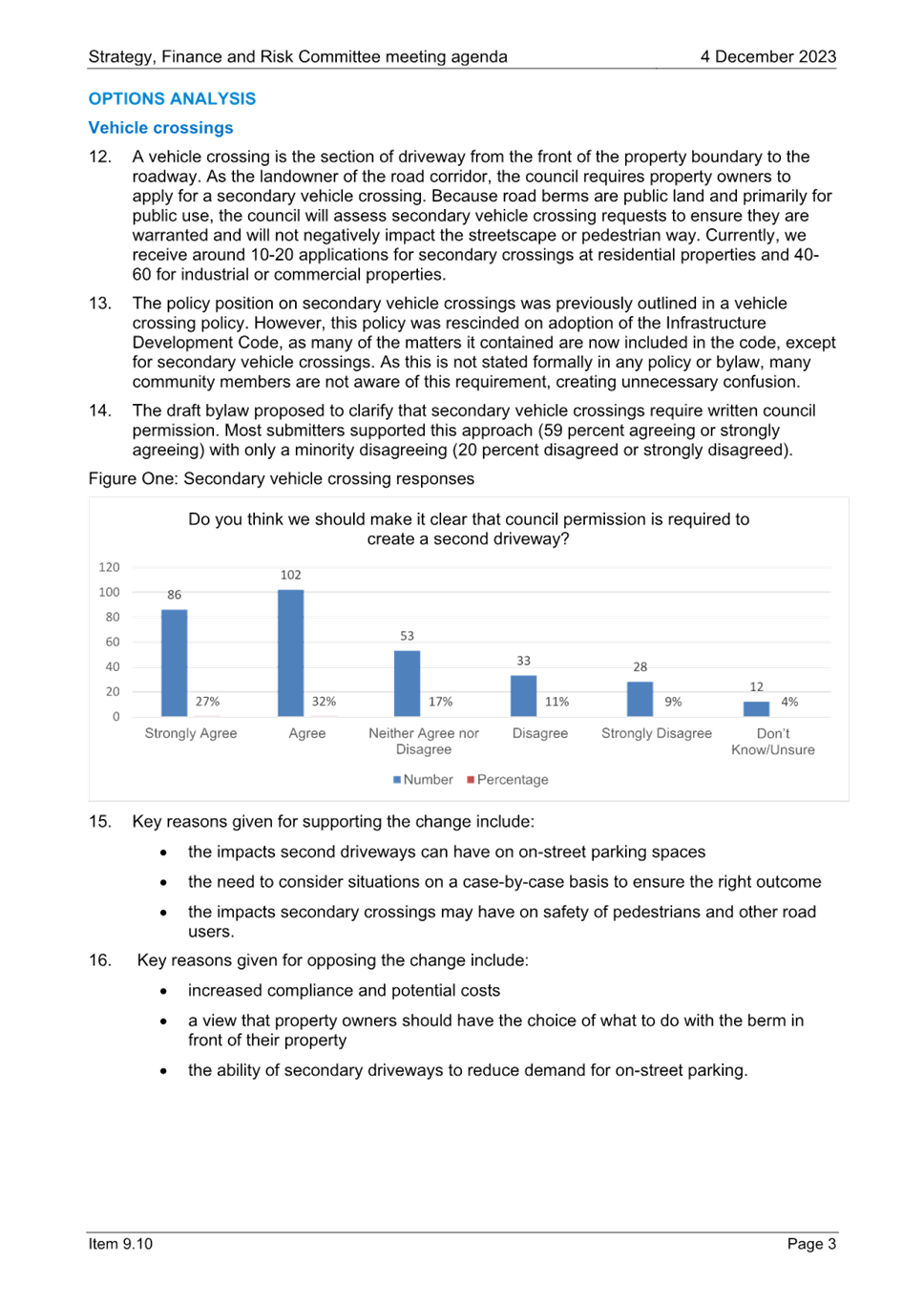

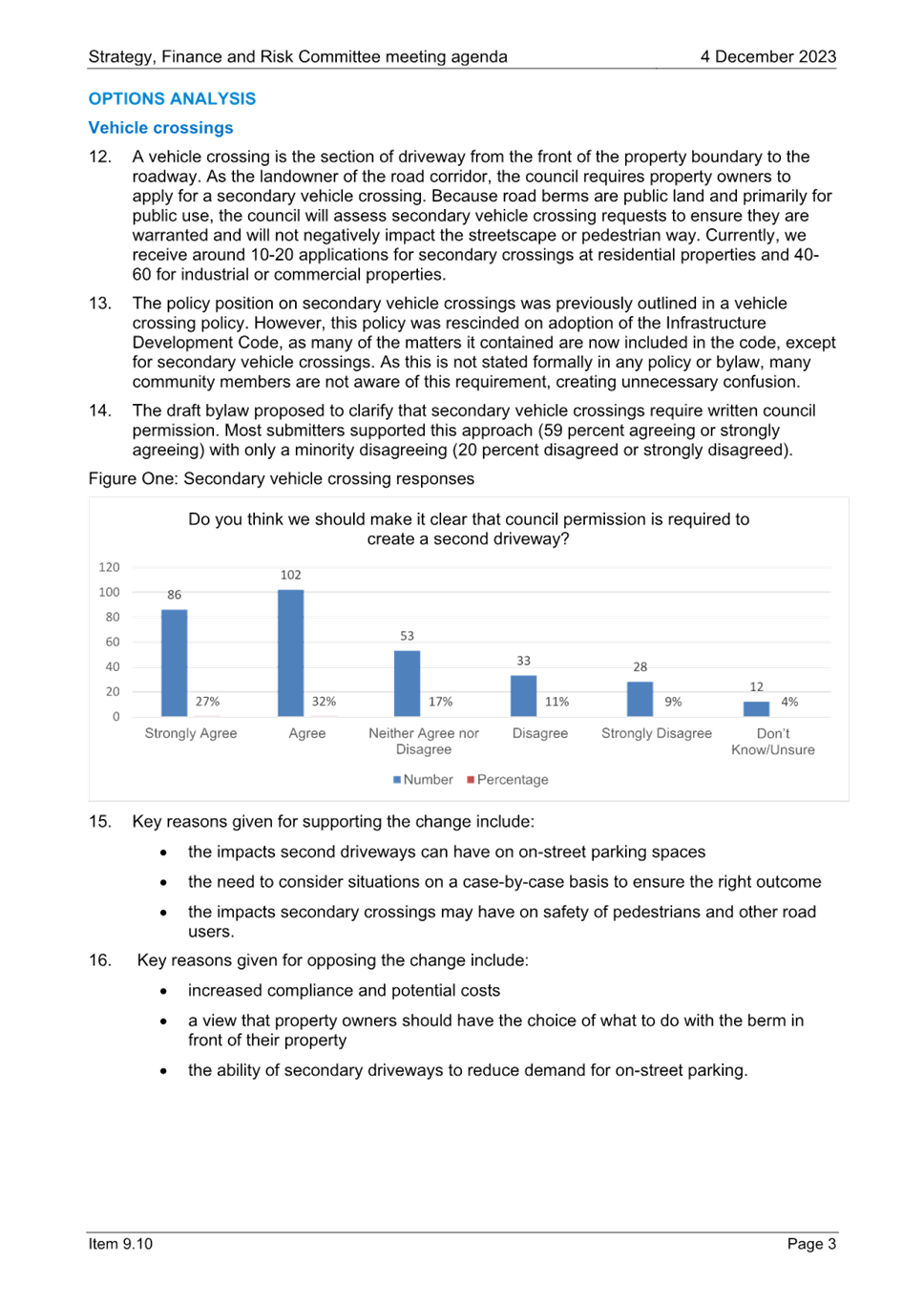

Monday, 11 December 2023

|

|

Time:

|

8.30am

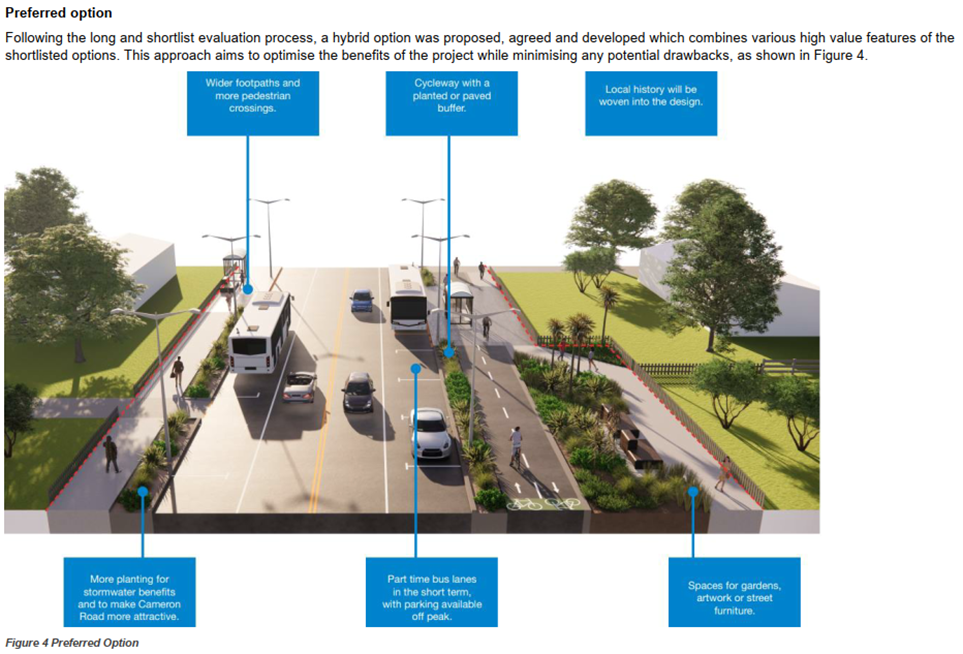

|

|

Location:

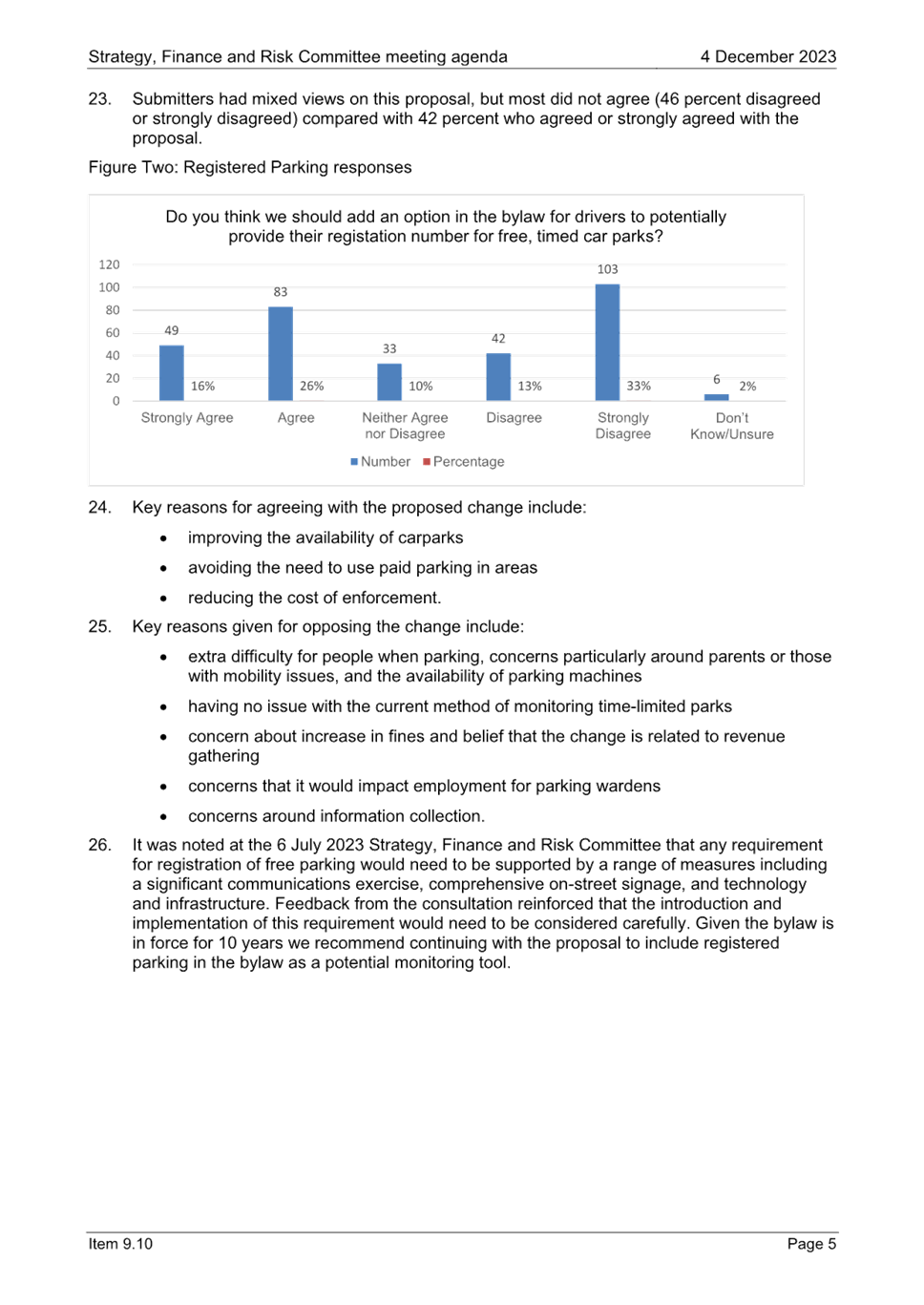

|

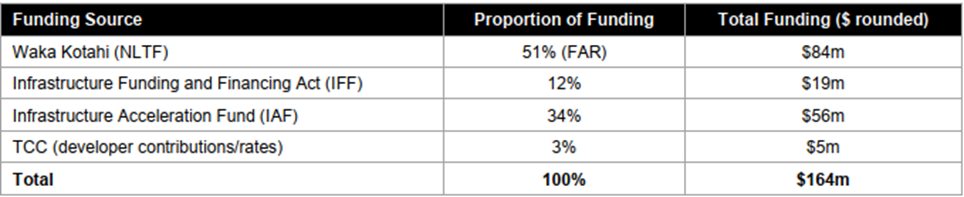

Bay of Plenty Regional Council Chambers

Regional House

1 Elizabeth Street

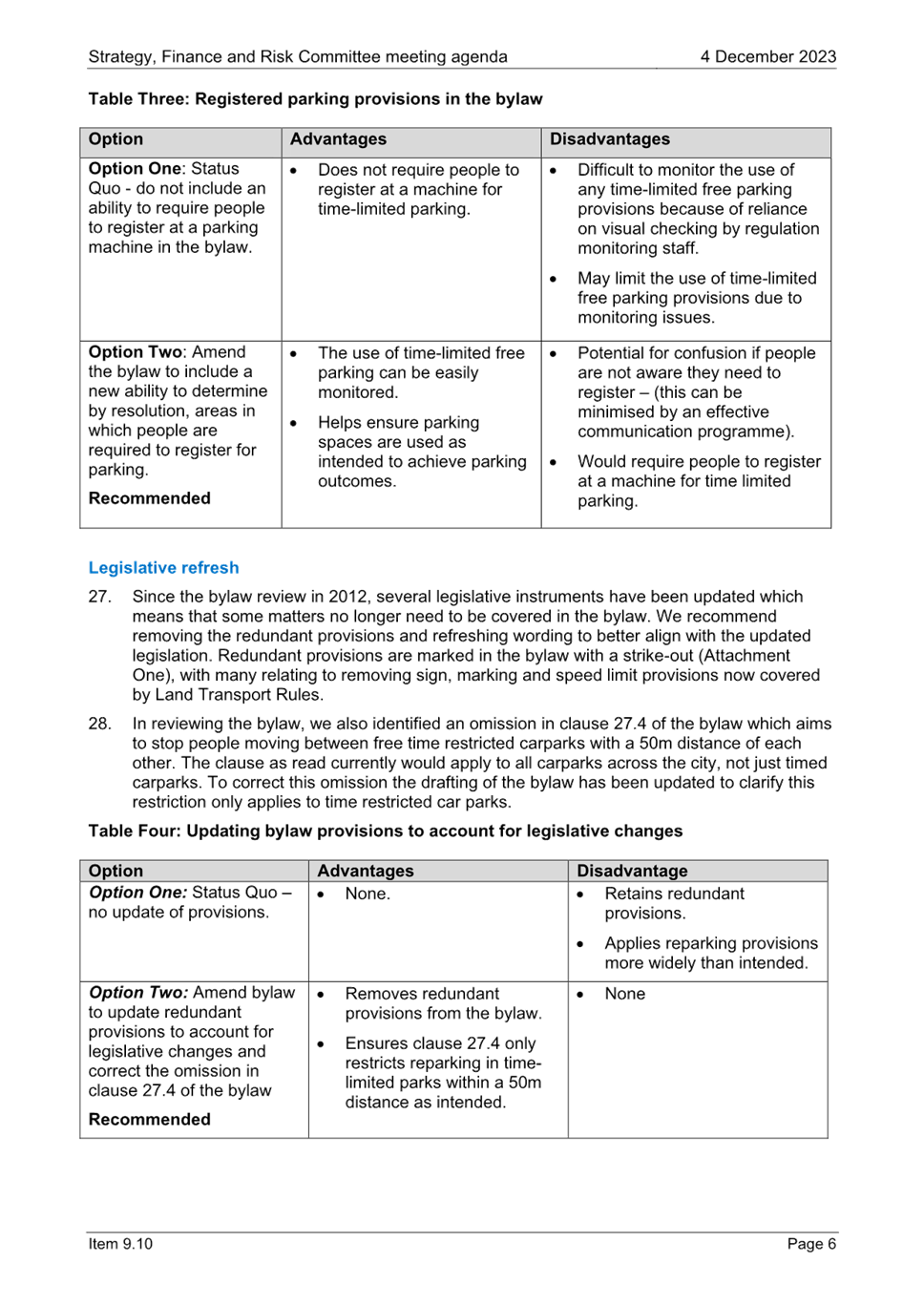

Tauranga

|

|

Please note that this

meeting will be livestreamed and the recording will be publicly available on

Tauranga City Council's website: www.tauranga.govt.nz.

|

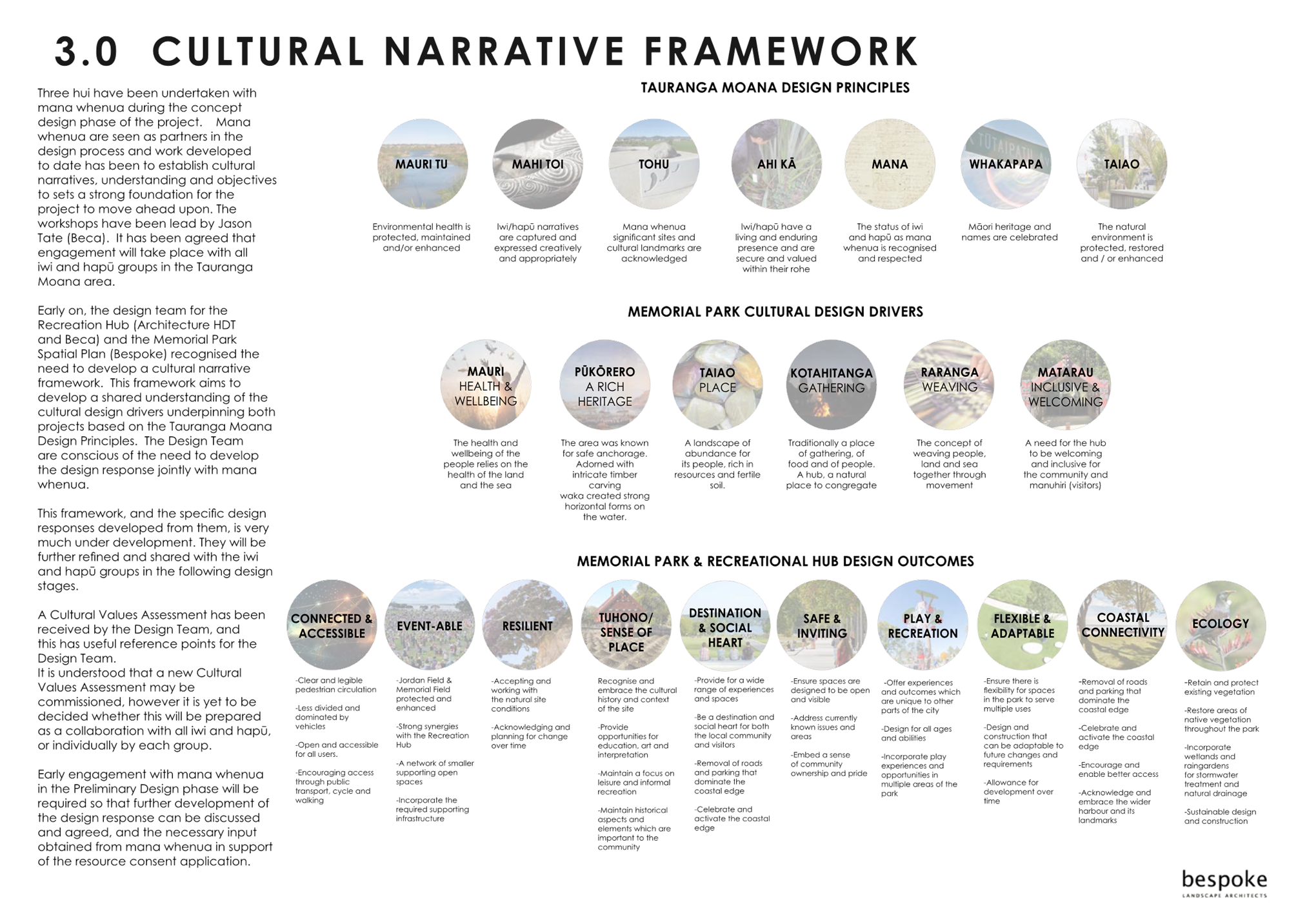

|

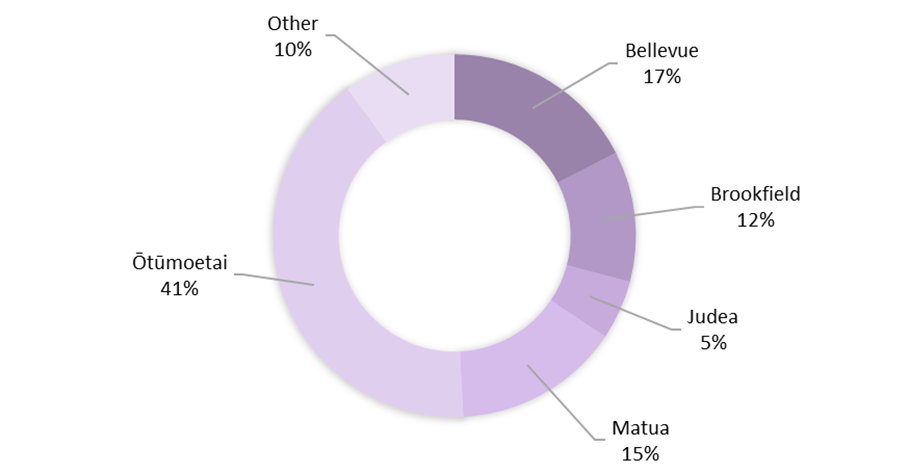

Marty Grenfell

Chief Executive

|

Membership

|

Chairperson

|

Commission

Chair Anne Tolley

|

|

Members

|

|

|

Quorum

|

Half of the members

physically present, where the number of members (including vacancies) is even;

and a majority of the members physically present, where the number of

members (including vacancies) is odd.

|

|

Meeting frequency

|

As required

|

Role

·

To ensure the effective and efficient governance

of the City.

·

To enable leadership of the City including

advocacy and facilitation on behalf of the community.

Scope

·

Oversee the work of all committees and

subcommittees.

·

Exercise all non-delegable and non-delegated

functions and powers of the Council.

·

The powers Council is legally prohibited from

delegating include:

○

Power to make a rate.

○

Power to make a bylaw.

○

Power to borrow money, or purchase or dispose of

assets, other than in accordance with the long-term plan.

○

Power to adopt a long-term plan, annual plan, or

annual report

○

Power to appoint a chief executive.

○

Power to adopt policies required to be adopted

and consulted on under the Local Government Act 2002 in association with the

long-term plan or developed for the purpose of the local governance statement.

○

All final decisions required to be made by

resolution of the territorial authority/Council pursuant to relevant

legislation (for example: the approval of the City Plan or City Plan changes as

per section 34A Resource Management Act 1991).

·

Council has chosen not to delegate the

following:

○

Power to compulsorily acquire land under the

Public Works Act 1981.

·

Make those decisions which are required by

legislation to be made by resolution of the local authority.

·

Authorise all expenditure not delegated to

officers, Committees or other subordinate decision-making bodies of Council.

·

Make appointments of members to the CCO Boards

of Directors/Trustees and representatives of Council to external organisations.

·

Consider any matters referred from any of the

Standing or Special Committees, Joint Committees, Chief Executive or General

Managers.

Procedural matters

·

Delegation of Council powers to Council’s

committees and other subordinate decision-making bodies.

·

Adoption of Standing Orders.

·

Receipt of Joint Committee minutes.

·

Approval of Special Orders.

·

Employment of Chief Executive.

·

Other Delegations of Council’s powers,

duties and responsibilities.

Regulatory matters

Administration, monitoring and

enforcement of all regulatory matters that have not otherwise been delegated or

that are referred to Council for determination (by a committee, subordinate

decision-making body, Chief Executive or relevant General Manager).

|

Ordinary

Council meeting Agenda

|

11

December 2023

|

7 Confirmation

of minutes

7.1 Minutes

of the Extraordinary Council meeting held on 13 November 2023

File

Number: A15335185

Author: Shaleen

Narayan, Team Leader: Governance Services

Authoriser: Shaleen

Narayan, Team Leader: Governance Services

|

Recommendations

That the Minutes of the

Extraordinary Council meeting held on 13 November 2023 be confirmed as a true

and correct record.

|

Attachments

1. Minutes

of the Extraordinary Council meeting held on 13 November 2023

|

Extraordinary Council meeting minutes Extraordinary Council meeting minutes

|

13 November 2023

|

|

|

|

MINUTES

Extraordinary Council meeting

Monday, 13 November 2023

|

Order of Business

Appoinment of

Chairperson. 3

1 Opening karaka. 3

2 Apologies. 3

3 Acceptance of

late items. 3

4 Confidential

business to be transferred into the open. 4

5 Change to the

order of business. 4

6 Declaration of

conflicts of interest 4

7 Business. 4

7.1 2024-34

Long Term Plan – Adoption of consultation document 4

8 Discussion of

late items. 7

9 Closing karakia. 7

MINUTES

OF Tauranga City Council

Extraordinary Council meeting

HELD

AT THE Bay of Plenty Regional Council

Chambers, Regional House,

1 Elizabeth Street, Tauranga

ON

Monday, 13 November 2023 AT 1pm

PRESENT: Commissioner

Bill Wasley (Chairperson), Commission Chair Anne Tolley (online/virtual), Commissioner

Shadrach Rolleston, Commissioner Stephen Selwood (online/virtual)

IN ATTENDANCE: Marty

Grenfell (Chief Executive) (online/virtual), Paul Davidson (Chief Financial

Officer) (online/virtual), , Christine Jones (General Manager: Strategy, Growth

& Governance) (online/virtual), Kathryn Sharplin (Manager Finance), Tracey

Hughes (Financial Insights and Reporting Manager), Josh Logan (Team Leader:

Corporate Planning), Coral Hair (Manager: Democracy & Governance Services),

Sarah Drummond (Governance Advisor), Shaleen Narayan (Team Leader: Governance

Services)

EXTERNAL: Leon

Pieterse (Audit New Zealand)

At 1.10pm the meeting adjourned due to technical

difficulties with the livestreaming and recording of the meeting.

At 1.25pm the meeting reconvened.

|

Appoinment

of Chairperson

|

|

Resolution CO21/23/1

Moved: Commission

Chair Anne Tolley

Seconded: Commissioner Shadrach Rolleston

That the Council:

(a)

Appoints Commissioner Bill Wasley as the Chairperson for this meeting

as the Commission Chair was attending the meeting remotely.

Carried

|

1 Opening

karaka

Commissioner Shadrach Rolleston opened the meeting with a

karakia.

2 Apologies

Nil

3 Acceptance

of late items

Nil

4 Confidential

business to be transferred into the open

Nil

5 Change

to the order of business

Nil

6 Declaration

of conflicts of interest

Nil

7 Business

|

7.1 2024-34

Long Term Plan – Adoption of consultation document

|

|

Staff Marty

Grenfell, Chief Executive

Paul Davidson, Chief Financial

Officer

Christine Jones, General Manager:

Strategy, Growth & Governance

Josh Logan, Team Leader: Corporate Planning

Kathryn Sharplin, Manager: Finance

Tracey Hughes, Financial Insights and Reporting Manager

External Leon

Pieterse, Audit New Zealand

Key points

·

At the Council meeting on 6 November 2023, the supporting information

for the proposed Long Term Plan (LTP) 2024-34 had been adopted, noting any

additional or amended. disclosures to be required by Audit New Zealand to be

tabled at the 13 November Council meeting. The Chief Executive was authorised

to make minor amendments to the documentation to ensure accuracy and correct

minor drafting errors.

·

During the final stages of the audit staff had been correcting

the LTP documents with some minor changes and including what the

Commissioners had asked for at the Council meeting on 6 November 2023.

·

There had been a few changes to the financial statements from 6

November 2023 Council meeting. A new version of the Draft

Underlying Financial Statements was set out in Attachment 3 and a

revised version was tabled. .Resolution (b) re-adopts the updated Financial

Statements with additional changes.

·

Tabled updated pages in the consultation document since the

publication of the version on the 13 November agenda.

·

Tabled new resolution (c) (i) which set out all the changes

that include the additional or amended disclosures in the consultation

document required by Audit New Zealand and as identified by staff review

since the version considered by Council on 6 November 2023 and the version of

the Consultation Document on the agenda, and Tabled (c) (ii) which set out

the tabled changes with additional or amended disclosures in the consultation

document as identified by staff between the version on the agenda and the

final version tabled.

·

Consultation opens on 15 November 2023 and closes 15 December

2023 at 5pm.

In response to questions

·

None

|

|

Resolution CO21/23/2

Moved: Commissioner

Bill Wasley

Seconded: Commissioner Shadrach Rolleston

That the Council:

(a) Receives the report

"2024-34 Long Term Plan – Adoption of consultation document".

(b) Adopts

the updated Draft Underlying Financial Statements (Attachment 3) as

supporting documentation for the proposed Long-term Plan 2024-34.

(c) (i)

Approves the following additional or amended

disclosures in the consultation document required by Audit New Zealand and as

identified by staff review since the version considered by Council on 6

November 2023:

·

Page 2 – reordered list of consultation items

·

Page 3 – significant reduction in water services reform

text and direction of the reader to page 84 for more details

·

Page 6 – correction of time and dates of consultation

events

·

Page 7 – index updated

·

Page 15 – updated city centre text to confirm covers more

than just Te Manawataki o Te Papa

·

Page 17 – include Memorial Pool disclosure previously on

page 20

·

Page 18 – additional disclosure required by Audit New

Zealand relating to Plan Change 33 and the National Policy Statement on Urban

Development

·

Page 20 – additional disclosure required by Audit New

Zealand relating to uncertainty on external funding

·

Page 20 – move Memorial Pool disclosure to page 17

·

Pages 28-53 – reordered the list of consultation items to

align with the summary document

·

Pages 50-52 – added disclosures on estimated operating

costs for the proposed stadium under each option

·

Pages 56-58 – added additional text, and removed

duplicate benefit bullet points, relating to the SmartTrip proposal

·

Page 66 – amendments to opening two paragraphs required

by Audit New Zealand to clarify message around projects that are not included

in the ten years of the Long-term Plan

·

Pages 71-72 – additional disclosure required by Audit New

Zealand relating to capital delivery

·

Page 72 – added a new graph showing capital investment

·

Pages 84-85 – additional disclosures required by Audit

New Zealand relating to water services reform

·

Pages 89-97 – order of consultation questions changed

·

Te reo headings reintroduced to pages 8, 10, 12, 14, 16, 18,

20, 22, 24, 26, 28, 33, 34, 37, 41, 45, 49, 54, 56, 62, 66, 68, 70, and 86

·

Minor changes to improve spelling, grammar, or formatting on

pages 1, 2, 6, 11, 16, 18, 20, 22, 25, 26, 27, 45, 46, 47, 49, 50, 51, 52,

58, 59, 69, 70, 71, 72, 73, 76, 79, 80, and 81.

(ii) Approves

the following tabled additional or amended disclosures in the consultation

document as identified by staff since the publication of the version on the

13 November agenda:

· Page

73 – updated debt disclosure to $1.6bn to ensure consistent with graph

on page 74

·

Page 79 – revised graph to ensure colours consistent with

page 73 graph

·

Pages 86-99 – re-ordered to place audit opinion before

submission form

·

Page 88 – removed the ‘preferred method of

contact’ tick-box for submitters

·

Page 89 – added Omanawa as a residential option

·

Pages 90-99 – re-ordered questions to match the

consultation document order and to make minor typographical improvements to

match changes made earlier in the document.

Carried

|

|

Auditor’s

Opinion

·

Tauranga City was the first council to have adopted the

”waters out” consultation document.

·

Mr Pieterse tabled his auditor’s opinion and advised that

he was comfortable that the consultation document provided an effective basis

for public participation and fairly represented the matters proposed for

inclusion in the LTP and the information and assumptions underlying the

information in the consultation document were reasonable.

·

Three emphasis of matters were drawn to the Council’s

attention in the audit opinion, the uncertainty over the water services

reforms with the change in government, external funding of capital

expenditure and uncertainty over the delivery of the capital programme.

·

Staff were acknowledged by Audit New Zealand for their hard

work and effort.

In response

to questions

None

Discussion points raised

·

Staff and Audit New Zealand teams were acknowledged by the

Commissioners for the level of commitment and they acknowledged the

additional workload created by Tauranga City being the first council to have

adopted the ”waters out” consultation document.

|

|

Resolution CO21/23/3

Moved: Commission

Chair Anne Tolley

Seconded: Commissioner Stephen Selwood

That the Council:

(d) Receives the audit opinion

on the consultation document for the proposed 2024-34 Long-term Plan,

pursuant to s93C (4) of the Local Government Act 2002.

Carried

|

|

Resolution CO21/23/4

Moved: Commission

Chair Anne Tolley

Seconded: Commissioner Stephen Selwood

That the Council

(e) Adopts

the audited Consultation Document (Attachment 4) for public consultation, using

the special consultative procedure pursuant to s93 and s93A of the Local

Government Act 2002.

(f) Authorises the Chief Executive to make any necessary

minor drafting or presentation amendments to the consultation document or

supporting documentation.

Carried

|

|

Attachments

1 CD

Adoption Attachment 3

2 Audit

New Zealand Report

3 Amended

recommended resolutions

4 Draft

Underlying Financial Statements

|

8 Discussion

of late items

Nil

9 Closing

karakia

Commissioner Shadrach Rolleston closed the meeting with a

karakia

The meeting closed at 1.45pm.

The minutes of this meeting were confirmed at the

Ordinary meeting of the Tauranga City Council held on 11

December 2023.

...................................................

CHAIRPERSON

|

Ordinary

Council meeting Agenda

|

11

December 2023

|

7.2 Minutes

of the Council meeting held on 27 November 2023

File

Number: A15370324

Author: Shaleen

Narayan, Team Leader: Governance Services

Authoriser: Shaleen

Narayan, Team Leader: Governance Services

|

Recommendations

That the Minutes of the

Council meeting held on 27 November 2023 be confirmed as a true and correct

record.

|

Attachments

1. Council

2023-11-27 [4551] Minutes.DOCX - A15333539 ⇩

|

Ordinary

Council meeting Agenda

|

11

December 2023

|

|

Ordinary

Council meeting Agenda

|

11

December 2023

|

10 Recommendations

from other committees

10.1 Appointment

of Chairperson for Wastewater Management Review Committee

File

Number: A15371094

Author: Anahera

Dinsdale, Governance Advisor

Authoriser: Shaleen

Narayan, Team Leader: Governance Services

Purpose of the Report

1. The purpose of this

report is to bring a recommendation from the Wastewater Management Review

Committee to Council for consideration. At its meeting on 22 November 2023, the

Committee passed the following resolution which includes a recommendation to

Council.

2. Item 9.1 –

Appointment of Chairperson of Wastewater Management Review Committee

Committee Resolution WW3/23/1

Moved: Commissioner

Bill Wasley

Seconded: Mr

Whitiora McLeod

That the Wastewater

Management Review Committee:

(a) Receives the report

"Appointment of Chairperson of Wastewater Management Review

Committee".

(b) Recommends to Council that

Spencer Webster (Ngā Potiki) is appointed as the Chairperson of the

Wastewater Management Review Committee.

(c) Thanks Lara Burkhardt for her

services as Chairperson of the Wastewater Management Review Committee.

Carried

3. In accordance with

the Committee recommendation WW3/23/3 (b) Council are now asked to appoint Mr

Spencer Webster as the Chairperson to Wastewater Management Review Committee.

|

Recommendations

That the Council:

(a) Receives the report

"Appointment of Chairperson for Wastewater Management Review

Committee".

(b) Appoint Spencer Webster (Nga

Potiki) as the Chairperson of Wastewater Management Review Committee.

|

Attachments

Nil

|

Ordinary

Council meeting Agenda

|

11

December 2023

|

11 Business

11.1 Approval

of Private Plan Change 35 (Tauriko Business Estate (Stage 4)) for Notification

File

Number: A15296800

Author: Phillip

Martelli, Project Leader: Urban Planning

Authoriser: Christine

Jones, General Manager: Strategy, Growth & Governance

Purpose of the Report

1. The purpose of this

report is to seek a recommendation from Council to accept, for the purposes of

notification, proposed Private Plan Change 35 Tauriko Business Estate (Stage

4), as requested by Element IMF.

|

Recommendations

That the Council:

(a) Receives the report

"Approval of Private Plan Change 35 (Tauriko Business Estate (Stage 4))

for Notification".

(b) Accepts, in accordance with

RMA Schedule 1 cl 25, Private Plan Change 35 Tauriko Business Estate (Stage

4) to the operative Tauranga City Plan for public notification.

(c) Authorises the General

Manager: Strategy, Growth & Governance to arrange the public notification

process in accordance with the provisions of the First Schedule to the

Resource Management Act 1991.

(d) Delegates authority to the

General Manager: Strategy, Growth & Governance to approve any minor and

technical changes to the Proposed Private Plan Change 35 documentation and

Technical Reports as required prior to public notification, and that any such

changes to be within the confines of the s92 Request for Further Information.

(e) Requires adherence to the

Council’s policy of full recovery of costs associated Private Plan

Change 35.

|

Executive Summary

2. Element IMF are the

developers of the Tauriko Business Estate and have prepared a private plan

change to allow development of Stage 4 of the Business Estate. The plan change

will rezone the land from Rural to Tauriko Industrial, plus related zones.

3. Private Plan Change

35 Tauriko Business Estate (Stage 4) has been prepared to the point of

notification.

4. The acceptance of

Private Plan Change 35 (PPC35) is sought by Council for public notification for

submissions under Schedule 1 of the Resource Management Act 1991.

Background

5. The existing Tauriko

Industry Zone land is close to reaching capacity and the developers of the

Business Estate are seeking to extend the Zone. The land in question (along

with other land) was transferred from Western Bay of Plenty District to

Tauranga City in 2021.

6. The area subject to

the Proposed Plan Change covers some 133ha of which 110ha is proposed to be

industrial. Approximately 80% is owned by Element IMF with the remainder being

in the ownership of private parties.

7. Development of the

Zone is proposed to be staged, with triggers relating to State Highway 29

upgrades and wastewater capacity.

8. A section 32

analysis is a detailed assessment required by the RMA to establish whether the

proposed Private Plan Change content is the most appropriate course of action.

This has been prepared by the proponents of the PPC and is included

as Attachment 1.

Strategic / Statutory Context

9. The National Policy

Statement – Urban Development requires Tauranga City Council to ensure that

it has sufficient capacity to meet the expected demand for business land. The

“Business Capacity Assessment” of Tauranga City and Western Bay of

Plenty was completed by M.E Consulting in December 2022. This revealed that the

land subject to the Proposed Plan Change is identified as being required to

help the City meet its short to medium term target.

STATUTORY CONTEXT / Options

Analysis

10. Private plan changes are

provided for in Schedule1 of the Resource Management Act.

11. The Proposed Plan Change was

lodged with Council on 18 October 2023. It was assessed by staff and has been

subject to a RMA Section 92 Further Information Request which was sent on 15

November 2023. The s92 initial response from the applicant was received on 17

November 2023 and meetings held over the subsequent week. There has been

no further request for information from staff and the Proposed Plan Change must

now be considered by Council as to how it should be processed.

12. Clause 25 of Schedule 1

requires the Council to consider the request and make a decision on one of the

options available. The options are:

· Adopt

the plan change as if it were its own plan change(25(2)(a)). This means the

Council supports the plan change (subject to the hearings process), including

providing all the necessary technical support for the hearing. All costs

associated with the plan change rest with Council. Although the Proposed Plan

Change addresses a strategic planning issue being a projected shortfall in

industrial land, it is primarily to benefit a single landowner who is the

applicant.

· Accept

the plan change in which case it remains a private plan change (25(2)(b)).

Council proceeds to process it and all costs associated with the request

(including notification and any hearing) are recoverable from the applicant.

Following from the bullet point above, as the applicant is the prime benefit of

the plan change, it is appropriate that they cover the costs. This includes all

necessary technical support, and Council’s policy is to also recoup all

processing costs including staff time. This includes engaging an independent

contractor to be the reporting planner as Council will have insufficient

resources through this period.

· Reject

the plan change based on limited grounds (25(4)) as follows:

a. The request or part of the request is

frivolous or vexatious; or

b. Within the last two years, the substance of the request

or part of the request

i. has been considered and given effect to, or rejected

by, the local authority or the Environment Court; or

ii. has been given effect to by regulations made under

Section 360A; or

c. The request or part of the request is not in accordance

with sound resource management practice; or

d. The request or part of the request would make the policy

statement or plan inconsistent with Part 5; or

e. In the case of a proposed change to a policy statement

or plan, the policy statement or plan has been operative for less than two

years.

None of the above five rejection options apply.

· Process

the PPC as if it were a resource consent in accordance with Part 6 of the RMA.

The PPC is primarily about zoning land along with some specific rule changes to

the City Plan. It still relies heavily on the existing rules in the City Plan,

and this points to a resource consent being inappropriate as all the relevant

rules would need to be included as conditions in the resource consent decision.

13. Accepting the proposed plan

change as a private plan change is the preferred option. It also recognises

there are some competing issues with the application and thus

‘accepting’ allows Council to maintain a neutral position. It will

be the hearings panel that will make the final recommendations to Council.

14. The Private Plan Change has

been subject of a s92 Request for Further Information request. A response has

been received from the applicant and staff are currently assessing whether

further or additional information is required (RMA Sch1 cl 23 (3)). There are

several matters that are still outstanding that will need to be addressed by

the applicant. Approval is sought from Council to delegate to the General

Manager Strategy, Growth and Governance to approve any changes as a result of

that process. Any changes will be confined to those matters raised in the s92

report.

Financial Considerations

15. Council policy is to recover

costs associated with private plan changes as provided for in the legislation

(as discussed in 12 above, bullet point 2.)

16. The applicant has raised the

issue of cost recovery for the processing of the Private Plan Change. Their

view is that it is a plan change that should have been undertaken by Council to

provide more industrial land for the City, and therefore Council should at

least cover its own costs. They have provided the following response:

“The

Stage 4 extension to TBE was included in the Smartgrowth Settlement Pattern

Review in 2016 with decisions that structure planning and RMA processes be

commenced. (see attached SGIC Agenda and Papers from 2016*) Council did not

action this and Element IMF commenced these processes in 2021 in the form of a

Private Plan Change. The reasons Council had not commenced those processes was

explained to be primarily a lack of resource and capacity due to focus being

applied to Tauriko West and Te Tumu Growth Areas.

Our

costs to date associated with the Private Plan Change are in excess of $800,000

and we expect these will exceed $1,000,000 once the process is complete. The

majority of these costs would have fallen to TCC (ratepayers) had Council

progressed the Plan Change itself.

We

have been told that resourcing is still an issue and even the processing of our

plan change is to be performed by external consultants on Councils behalf. We

are also told that these processing costs will be passed on to us as the

applicant.

This

is extraordinarily inequitable given the significant costs in preparing the

plan change have been borne by ourselves. We consider the disproportionately

smaller processing costs should remain with TCC as its contribution to a

process that it was to undertake as directed by Smartgrowth.”

*The

wording is as follows: “Agree to structure planning/RMA processes for the

extension of the Tauriko Business Estate (lower Belk Road) starting in 2016/17,

likely to be required in the next 5-10 years.”

17. Options for Council are

discussed in the table below.

|

Option

|

Advantages

|

Disadvantages

|

|

Cost recovery

|

Council fully recovers

all expenditure associated with the PPC

|

Additional expense to

the applicant

|

|

Partial cost recovery:

don’t charge for staff time, hearings commissioners. Charge for

consultant planner for reporting to the Hearing.

|

Staff costs can be

considered to be a given as their role is to input to such proposals. Staff

costs are covered by existing budgets.

The Hearings and

commissioners can be considered to be a cost of democracy.

The Consultant planner

is necessary to compliment staff resources.

|

The PPC is diverting

staff from other projects that are part of the adopted work programme.

|

|

Waiver all costs

|

Cost saving to the

applicant

|

Consultant planner is

not budgeted for.

|

18. If Council were to undertake

the plan change it would still be several years away because circumstances have

changed since 2016, including other higher priority plan changes. Hence the

decision by the applicant to not wait for Council but go down the private plan

change path. As stated in paragraph 6 above, the plan change primarily benefits

the applicant who owns 80% of the land involved, and therefore it is considered

appropriate that they fund the plan change.

19. On that basis, there are no

financial considerations associated with this report. The cost associated with

processing Private Plan Change 35 is recoverable from the applicant. Any

related administration costs are within existing LTP budgets.

Legal Implications / Risks

20. The risks associated with the

PPC lie with the applicant. Council’s risk is related to the actual

processing which is covered by the RMA and Council’s own Procedure and

Process Manual. Council’s risk is considered low.

Consultation / Engagement

21. Consultation and engagement is

required by the RMA. This has been undertaken by the applicant as part of

preparing their s32 report as required by Schedule 1 of the Act. The RMA also

requires the Proposed Plan Change to be publicly notified for submissions and

further submissions. This gives interested parties the opportunity to have

additional input into the process.

22. The RMA Schedule 1 clause 4A

requires pre-notification with iwi authorities. This is required to occur

between the Council decision on acceptance of the Private Plan Change and

notification.

Significance

23. Under the TCC Significance and Engagement

Policy, this decision is

of medium significance in terms of the consequences for the City in the

provision of additional industrial land.

24. Proposed Private Plan Change 35

will be publicly notified for submissions and further submissions as required

under Schedule 1 of the RMA.

Next Steps

25. Pre-notification is to occur

with iwi.

26. The final proposed Private Plan

Change and the accompanying section 32 analysis will be publicly notified in

accordance with the requirements of Schedule 1 of the RMA.

27. Following the submission and

further submission process, the Proposed Plan Change will proceed to a hearing

and associated decision process.

28. During the submissions and

further submissions process, approval will be sought from Council for the

appointment of a Hearings Panel or an Independent Hearings Commissioner(s) to

hear and make recommendations on the Plan Change to Council. This will

include whether there is elected member involvement as part of a Hearings

Panel.

29. The decision to adopt the

Hearing’s recommendations will rest with Council following the hearing of

submissions and receipt of the Hearing Panel or Independent Hearings

Commissioner(s) recommendation report.

Attachments

1. S32

Report Private Plan Change 35 - A15362593 (Separate Attachments 2)

2. S92

Request for Further Information Table - A15371105 (Separate Attachments 2)

3. Full Application

and all Technical Documents - A15370856 (Separate Attachments 2)

|

Ordinary

Council meeting Agenda

|

11

December 2023

|

11.2 Te

Tumu Urban Growth Areas

File

Number: A15360557

Author: Andy

Mead, Manager: City Planning & Growth

Brad Bellamy,

Project Leader: Urban Planning

Authoriser: Christine

Jones, General Manager: Strategy, Growth & Governance

Purpose of the Report

1. To reconfirm Te Tumu as a

priority urban growth area including Council’s commitment to progressing

a Plan Change to enable urban development, and to update progress on the

project.

|

Recommendations

That the Council:

(a) Receives the report "Te

Tumu Urban Growth Areas" and notes the update on key matters.

(b) Reconfirms Te Tumu as a priority

urban growth area.

(c) Reconfirms prioritising work

on the Te Tumu structure planning and rezoning project to prepare for

notification of a Plan Change to rezone Te Tumu concurrent with process with

Tumu Kaituna 14.

(d) Notes that regular updates will

be reported to Council through 2024 as various workstreams, including

infrastructure corridor and Kaituna Overflow workstreams are further

advanced.

|

Executive Summary

2. Te Tumu is a

long-standing component of Tauranga and the Western Bay subregion’s urban

development strategy and remains a priority to unlock for urban development.

3. This report provides

a further update of key workstreams associated with the Te Tumu urban growth

area plan change.

4. Efforts to plan and

rezone Te Tumu for urban development began in 2017 with an initial goal of

housing development by 2021. However, challenges such as divergent aspirations

among Māori landowners, differing opinions from iwi, and changes in

national policy, especially freshwater management, have led to delays. The

planning process remains lengthy and uncertain, with notification of a plan

change possibly not be able to occur until 2026, subject to further assessment

of any options to accelerate this. Nonetheless staff are actively

progressing the project to prepare for notification concurrent with TK14

workstreams.

5. The new government

has signalled changes to the RMA and associated national direction that may

alleviate some of the challenges and risks associated with the project.

Background

6. The last report that

is relevant to these matters was considered by Council on 11 September 2023.

Pursuant to that report, Council noted the range of strategic issues relevant

to progressing construction of infrastructure. To manage these risks

Council resolved to consult on a targeted rate through the draft 2024-34

LTP. The proposed targeted rate is based on:

· 50%

of the Te Tumu portion of the transport projects which have most of their

expenditure in the first 3 years of the Long-Term Plan.

· A

flat charge per ratepayer across the city with a higher charge (double) in the

wider benefit area in Papamoa East and (triple) for those in the full benefit

area in Papamoa East.

· A

20-year repayment period starting in Year 1 of the 2024-34 Long Term Plan

period.

7. Given the overall

fiscal challenges that Council is facing, the draft 2024 – 2034 LTP

provides for the following with respect of Te Tumu:

· Continuation

of land use planning and rezoning.

· Infrastructure

planning (including design).

· Securing

land required for infrastructure or public amenity purposes; and

· The

Kaituna Overflow, which is critical to development commencing, not being

completed until after the 2024-34 LTP period[1].

8. The implication of

this is that housing supply is unlikely to be delivered in Te Tumu until around

2040 once land development and civil works timeframes are considered.

9. A number of

submissions are expected on the draft LTP in relation to Te Tumu timing and the

proposed targeted rate, and these matters will be further considered through

the deliberations process in early 2024.

PLANNING AND ZONING MATTERS

10. Te Tumu is a long-standing

component of Tauranga and the Western Bay subregion’s urban development

strategy and remains a priority to unlock for urban development.

11. The planning and rezoning

efforts for Te Tumu have been in progress since 2017, initially with the goal

of initiating housing development by 2021. However, the project has encountered

various challenges and delays, notably:

(a) Legal proceedings taken by some

Māori landowners against TK14 Trust, impacting on the ability to progress

discussions on securing land rights to enable infrastructure delivery through

Māori land.

(b) Māori Trustees needing to

undertake an engagement process with beneficial owners to seek a mandate to

progress conversations with Council on land access.

(c) Differing opinions from iwi and

hapu regarding the suitability of urban development within Te Tumu.

12. The changes in national

direction under the Resource Management Act (RMA), particularly

concerning freshwater management, including wetlands, have further impeded

progress.

13. While

there has been some advancement, ongoing challenges persist, particularly as we

seek to implement national directives that impact existing technical work and

crucial elements of the project. In May this year, Council sought to recommence

engagement with iwi and hapu on this project. This followed a substantial

pause in engagement requested by iwi and hapu to allow time for issues between

the Tumu Kaituna 14 Trust (TK14) and its landowners to be resolved.

Discussions held with iwi and hapu to date have revealed some strong opposition

to progressing urban development in Te Tumu, despite TK14 having secured a

majority mandate for infrastructure negotiations to commence with TCC.

14. Despite recent adjustments to

the government's freshwater policy, not all of our suggested changes were

adopted. Staff are carefully considering these outcomes, especially concerning

the Kaituna Stormwater Overflow, which is essential for managing stormwater

runoff in Te Tumu and protecting existing development in the wider Wairakei

Stream catchment.

15. Additionally, judicial review

proceedings against the Minister for the Environment, seeking a return to more

stringent freshwater protection as per the NPS-FM, pose potential impacts on Te

Tumu's urban growth area planning.

16. The recent enactment of the

National Policy Statement for Indigenous Biodiversity, coupled with the new

freshwater policy, adds complexity to key projects associated with urban

development in Te Tumu. Compliance with the stringent requirements of the new

policy, especially in ecological and wetland areas, present significant

challenges.

17. Considering

these challenges, the planning process for rezoning Te Tumu for urban

development remains lengthy, intricate, and uncertain with notification of a

plan change currently assessed as possibly not able to occur until 2026,

subject to further investigations of options to accelerate this. In

addition, the level of staff and consultant resourcing for the project will be

increased.

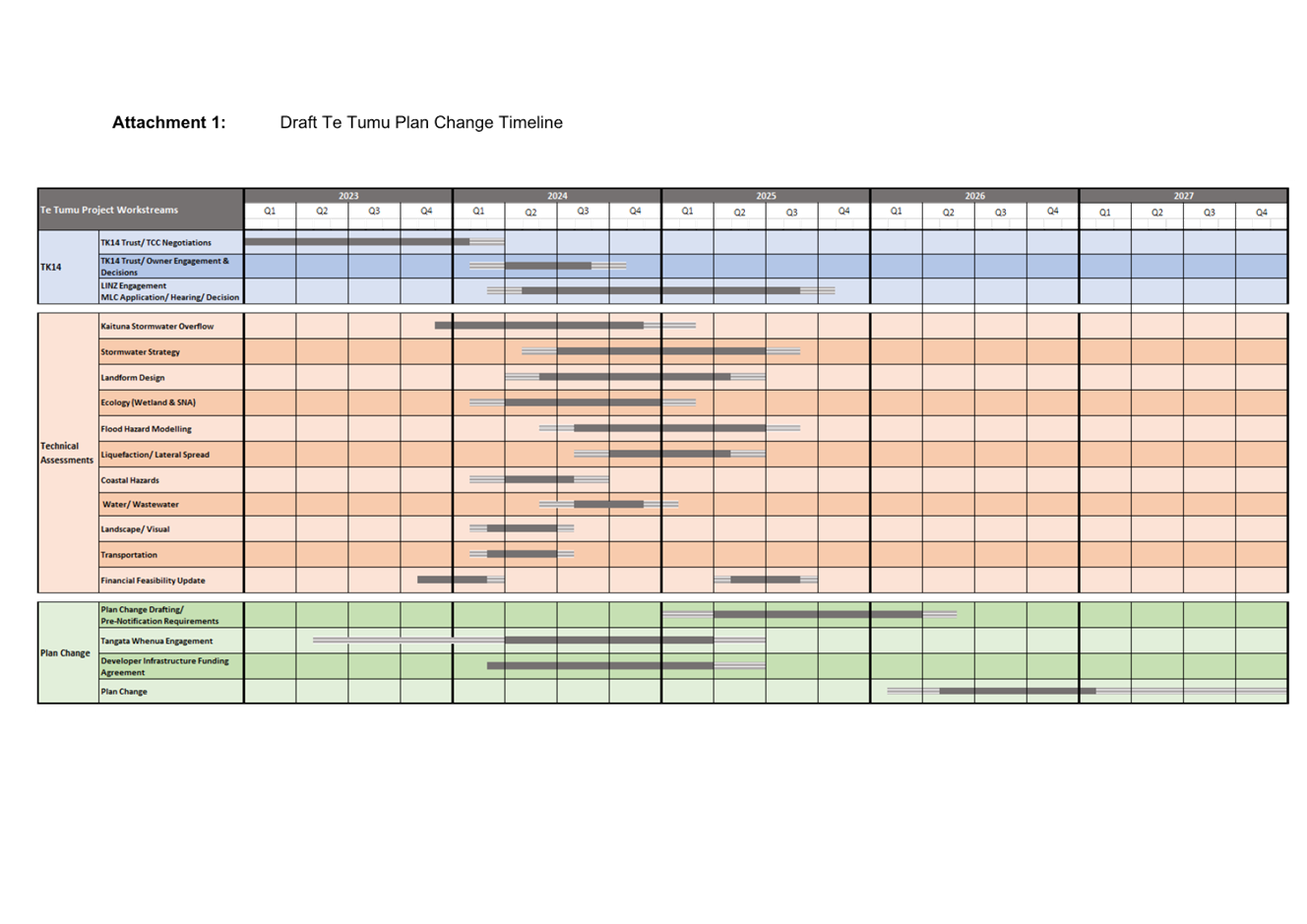

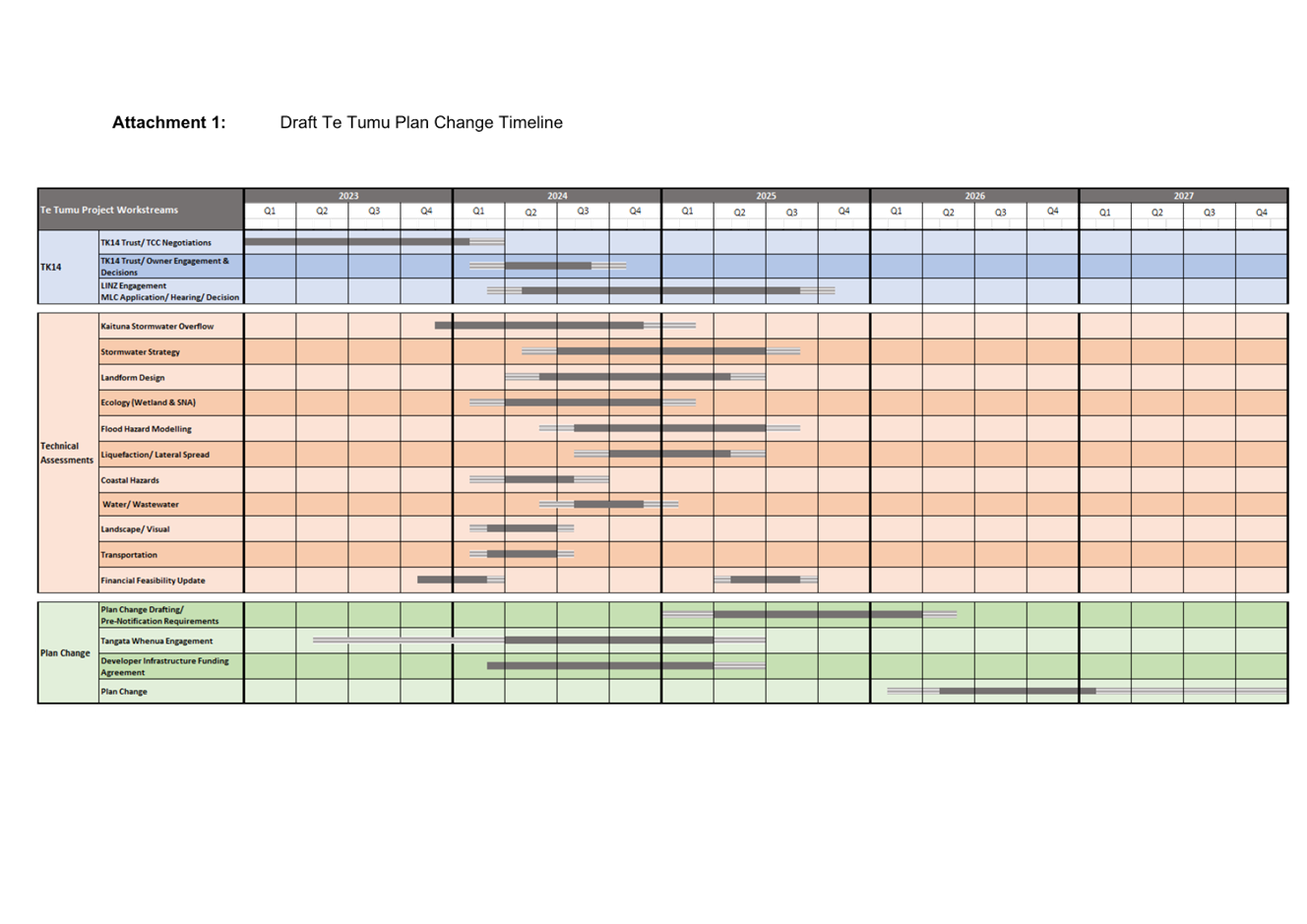

18. A Plan Change of this scale

could be expected to take two years from notification before decisions (to

2028) and may be subject to appeals which would extend timeframes further.

Staff have prepared a draft timeline of the various workstreams associated with

the project and will continue to refine this as further work is done. This

timeline reflects the complexities and uncertainty around updates required to

many of these workstreams given current national policy

direction.

19. The new government has

signalled changes to the RMA and associated national direction which may

alleviate some of the challenges and risks associated with this project.

The exact nature and timing of these changes remains uncertain.

20. There remains a risk that urban

development may not proceed in Te Tumu, potentially necessitating ratepayer

funding for capex costs related to this area. Continued monitoring and

mitigation strategies are crucial to navigate these challenges effectively.

STRATEGIC / STATUTORY CONTEXT

21. Te Tumu is a core component of

SmartGrowth’s strategic growth strategy as agreed through the SmartGrowth

Urban Form and Transport Initiative.

22. The SmartGrowth Strategy,

including the Future Development Strategy requirements of the NPS-UD are

currently under review and development. The TCC position on the timing of

development in Te Tumu as per this report will flow into that process which, in

summary, is that development in Te Tumu is likely to take quite some time to

commence but with Council and landowner aspirations for infrastructure funding

challenges to be overcome so development can commence earlier than currently

anticipated by the draft LTP.

Financial Considerations

Broader Te Tumu financial consideration

23. Over $600m of Council

infrastructure investment is required to enable development of Te Tumu, of

which over $300m is allocated to Te Tumu funding with the rest coming from

other funding sources eg other growth areas, rates etc. These costs

largely need to be incurred before development in Te Tumu commences and the

compounding impacts of interest mean that Te Tumu’s $300m+ share is

projected to become around $750m if development is delayed until 2040.

24. These matters were addressed in

the previous September Council report, and they resulted in a proposed targeted

rate to fund 50% of Te Tumu related transport costs being included in the draft

LTP. These matters will be further addressed through LTP submissions,

hearings, and deliberations.

25. A large amount of expenditure

is in three waters infrastructure. These matters were left to lie on the

table given uncertainty with waters reform and the statutory ability at this

time for TCC to only include waters expenditure and revenues in its upcoming

LTP for Years 1 and 2.

26. There may be some ability to

rescope trunk water and wastewater projects, so they are delivered in stages,

with Te Tumu capacity coming at a later point. This continues to be

investigated.

27. Financial considerations will continue

to be monitored and reported back to Council as required. This will

include an overall update of the financial feasibility of the development area

to take account of significant cost escalation in recent years that will affect

key development costs such as internal and external infrastructure and

earthworks.

Legal Implications / Risks

28. There are a range of risks

associated with the Te Tumu project as set out in this report. Staff are

taking legal advice on these matters as appropriate.

Consultation / Engagement

29. Further engagement has occurred

with the Te Tumu landowner group ahead of this report being drafted and

engagement will continue moving forward.

30. TCC continues to inform its

SmartGrowth Partners on progress with the Te Tumu urban growth area including

impacts on work such as the Housing & Business Assessment, the SmartGrowth

Strategy Review & the Future Development Strategy.

Significance

31. The Local Government Act 2002

requires an assessment of the significance of matters, issues, proposals and

decisions in this report against Council’s Significance and Engagement

Policy. Council acknowledges that in some instances a matter, issue,

proposal or decision may have a high degree of importance to individuals,

groups, or agencies affected by the report.

32. In making this assessment,

consideration has been given to the likely impact, and likely consequences for:

(a) the current

and future social, economic, environmental, or cultural well-being of the

district or region

(b) any persons who are likely to be

particularly affected by, or interested in, the matter.

(c) the capacity of the local authority to

perform its role, and the financial and other costs of doing so.

33. This report provides an update

on the Te Tumu urban growth area project. In accordance with the

considerations above, criteria and thresholds in the policy, it is considered

that the decision is of medium significance.

ENGAGEMENT

34. Taking into consideration the

above assessment, that the matter is of medium significance, officers are of

the opinion that no further engagement is required prior to Council making a

decision.

Next Steps

35. The next steps involve

progressing key workstreams related to the Te Tumu plan change and reporting

progress through 2024.

Attachments

1. Te

Tumu Plan Change Timeline - A15371180 ⇩

|

Ordinary

Council meeting Agenda

|

11

December 2023

|

|

Ordinary

Council meeting Agenda

|

11

December 2023

|

11.3 Hull

Road Intersection increased unbudgeted expenditure.

File

Number: A15356949

Author: Rebecca

Rimmer, Senior Project Manager

Jenny Hill, Senior

Project Manager

Authoriser: Nic

Johansson, General Manager: Infrastructure

Purpose of the Report

1. The purpose of this

report is to approve an updated project budget of $765,250 for the Hull Road

level crossing upgrade.

|

Recommendations

That the Council:

(a) Receives the report

"Hull Road Intersection increased unbudgeted expenditure."

(b) Approves an updated project

budget for the construction of $765,250 (the current budget is $400,000).

|

Executive Summary

2. On the 21st

July 2023, the Chief Executive approved a request for an unbudgeted expenditure

of $400,000 to design and implement safety upgrades to the Hull Road level

crossing to enable the safe opening of the adjacent Destination Skate Park in

Autumn 2024.

3. The $400,000

requested was based on estimated costs. Now that the design has progressed and

provisional costings have been received for both the design and construction

works; the total required at completion is expected to be $765,250, including

contingency. This is an additional $365,250 on the previously approved

unbudgeted expenditure of $400,000.

4. It is proposed that

the additional $365,250 required to complete the project is approved from the

Transportation budget.

Background

5. Construction has commenced

on the Destination Skate Park at 1 Hull Road and is expected to be completed by

May 2024.

6. The original

$400,000 request was a rough order of cost as the extent of works were unknown.

As the design has progressed we are now in a position where the physical works

estimates are more detailed. There have also been additional design costs for

track improvements which are required to complete the project. We are

still waiting for costings for the physical track works and have therefore put

a 15% contingency in place to cover this work.

7. It is expected that

the works will most likely be able to be completed in line with a May 2024

opening of the Skate Park. Due to various design and approval iterations

required and the need for the works to be completed by specialist contractors

and line closures to be in place it is expected that the implementation of the

interim measures will likely form or be very close to forming the critical path

for the opening of the Skate Park.

8. Immediately adjacent

to the skate park on Hull Road is an existing level crossing. A Level

Crossing Safety Impact Assessment (LCSIA) was commissioned and completed by

Aurecon which highlighted a series of improvements that should be made to the

crossing to improve its safety.

9. In conjunction with

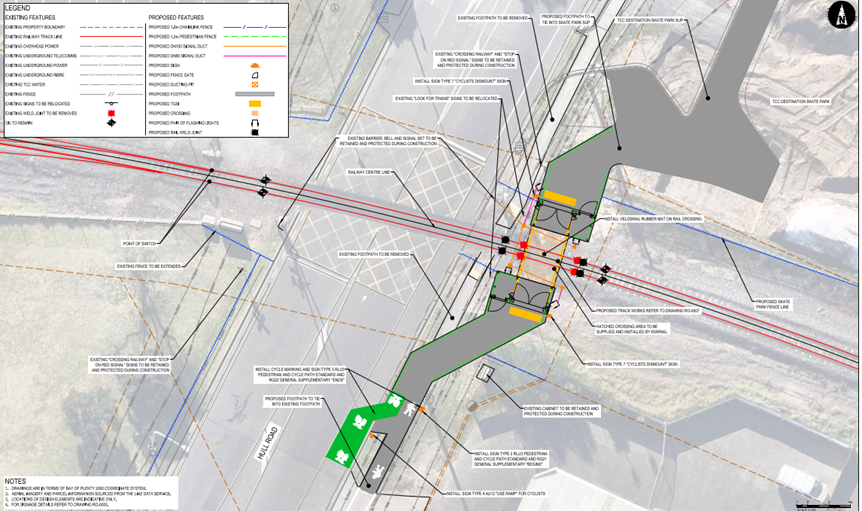

KiwiRail a series of interim measures have been identified that would allow the

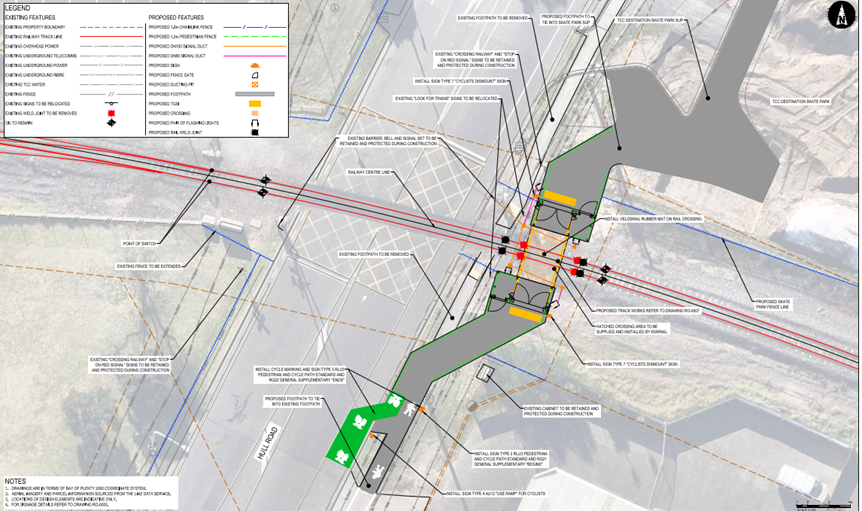

Skate Park to be opened safely (see detailed design below). These include a

wider shared path, maze gates, fencing, tactile paving signage and track

improvements. These will need to be followed by the signalisation of the

pedestrian/cycle gates.

10. It is currently proposed to

design the full scope of upgrade works as noted in the LCSIA and implement only

those that are required to allow the safe opening of the Skate Park.

11. Based on initial estimates it

was expected that the design effort and interim measures would cost in the

order of $400,000.

12. To date $150,000 has been spent

on these works.

13. As the design has developed in

conjunction with KiwiRail, it has highlighted the need for track improvements

and initial costings have now been refined in line with the detailed design

which has shown the expected cost to complete the project will be in the region

of $765,250.

14. The costs associated with track

works are to enable safe access to the skate park across the crossing.

This is a TCC cost due to current available KiwiRail funding. While

KiwiRail would ordinarily pay for this, at this time, KiwiRail have advised

that this needs to be at TCC cost due to the current schedule for delivery of

this project. The Skatepark and Mount programme requires this work

to be completed for the opening of the Skate Park, currently forecast for

Spring 2024. The project team are continuing to negotiate these costs with

KiwiRail.

A

breakdown of the $685,000 (excludes 15% contingency) is as follows:

Design

$141,000

KiwiRail

(track work) $246,000

Safety

audit $10,000

Construction

$260,000

Internal

costs $28,000

Total:

$685,000

Strategic / Statutory Context

15. The destination skatepark

project is a key initiative that will enable us to meet our community outcomes

of a city that is, “well-planned with a variety of successful and

thriving compact centres, resilient infrastructure, and community

amenities” and one that, “values our natural environment and

outdoor lifestyle, and actively works to protect and enhance it.

16. Due to the nature of the

Destination Skate Park it is expected that there will be significant trip

generation into the area, this is highly likely to increase pedestrian

movements across the Hull Road Level Crossing with the current state of this

crossing providing minimal safety controls for pedestrians. Encouraging this

increased pedestrian movement without increasing safety controls would present

a significant risk to user safety.

Options Analysis

17. The LCSIA report has clearly

identified the improvements required to the level crossing to make it safer for

the public. These measures are being implemented in a staged approach.

Financial Considerations

18. It is expected that the interim

measures will cost approximately $685,000 to design and implement. Of this

approximately $150,000 has been spent to date. Although cost forecasts have

been reviewed, given the remaining uncertainty relating to the Kiwirail costs

it is believed to be prudent to allow a contingency of 15% on the remaining

costs. Contingency value = ($685,000 - $150,000) x 15% = $80,250

19. Therefore the total required at

completion is expected to be $765,250. This is an additional $365,250 on the

previously approved unbudgeted expenditure of $400,000.

20. Consideration of costs

associated with the remaining improvements noted in the LCSIA would be

additional to this and funding is yet to be confirmed. These costs are not

included in this request.

Legal Implications / Risks

21. A Funding Agreement is required

to be put in place between KiwiRail and TCC to cover the track upgrade work as

KiwiRail undertake this work. TCC’s Legal team is working with

KiwiRail’s Legal team to agree the final format of this document.

Consultation / Engagement

22. No formal public consultation

has been undertaken to date. Once the design is finalised it will be circulated

to interested parties including being displayed at the Mount Hub.

Significance

23. The Local Government Act 2002

requires an assessment of the significance of matters, issues, proposals and

decisions in this report against Council’s Significance and Engagement

Policy. Council acknowledges that in some instances a matter, issue,

proposal or decision may have a high degree of importance to individuals,

groups, or agencies affected by the report.

24. In making this assessment,

consideration has been given to the likely impact, and likely consequences for:

(a) the current

and future social, economic, environmental, or cultural well-being of the

district or region

(b) any persons who are likely to be

particularly affected by, or interested in, the decision.

(c) the capacity of the local authority to

perform its role, and the financial and other costs of doing so.

25. In accordance with the

considerations above, criteria and thresholds in the policy, it is considered

that the decision is of low significance.

ENGAGEMENT

26. Taking into consideration the

above assessment, that the decision is of low significance, officers are of the

opinion that no further engagement is required prior to Council making a

decision.

Next Steps

27. Once the updated project budget

has been confirmed, the project team will continue preparation for construction

of the level crossing upgrade commencing in March/April 2024.

Attachments

Nil

|

Ordinary

Council meeting Agenda

|

11

December 2023

|

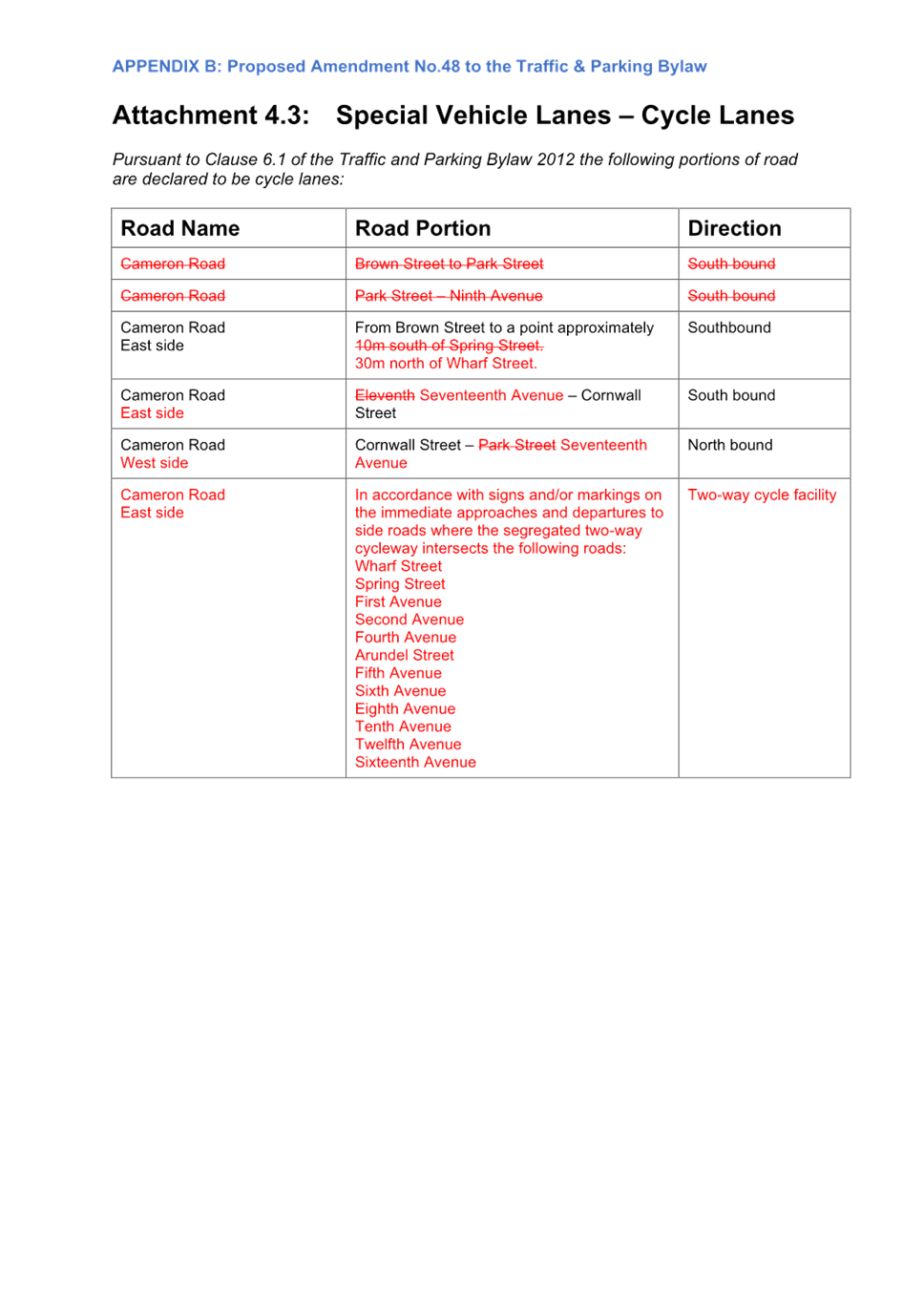

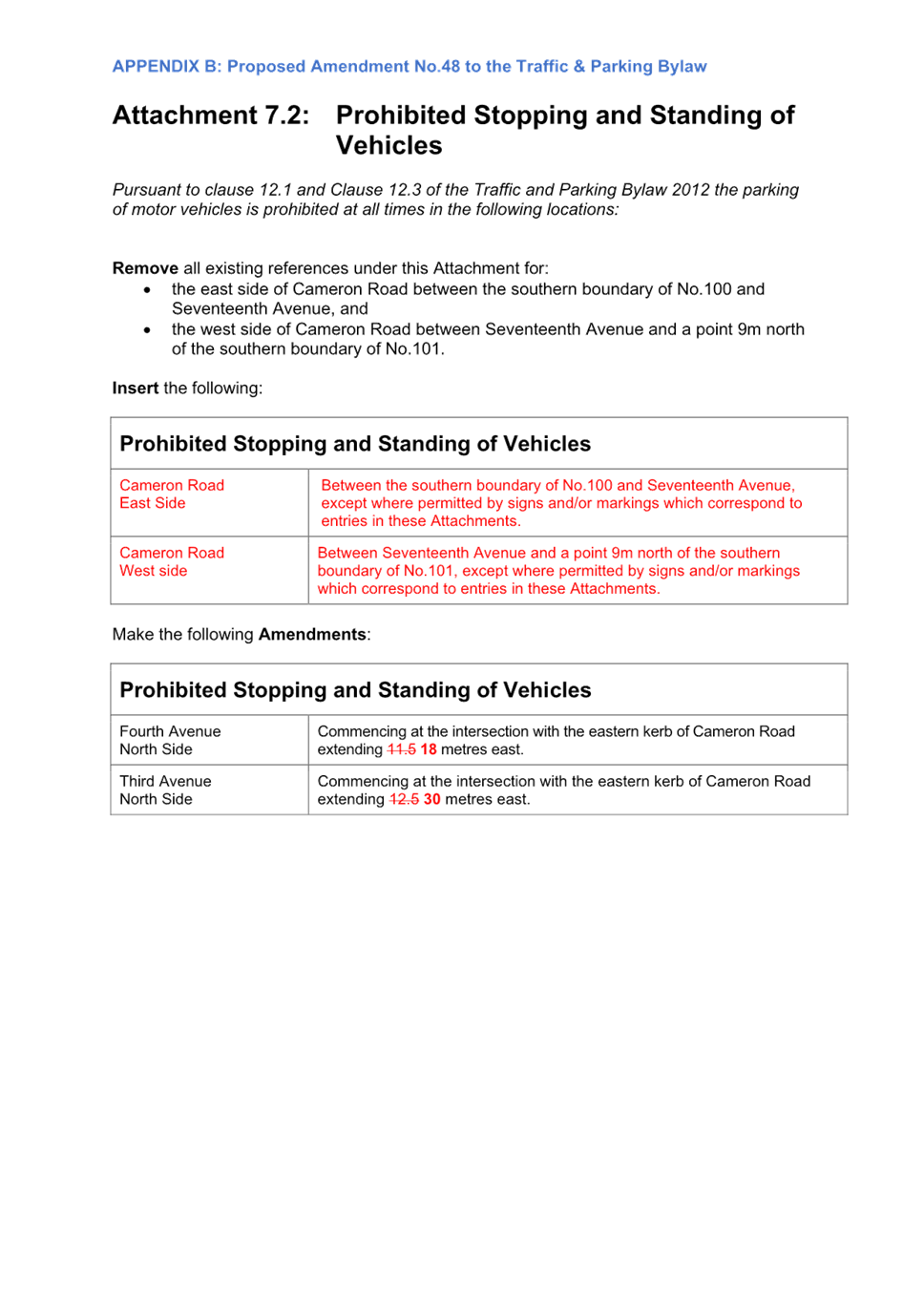

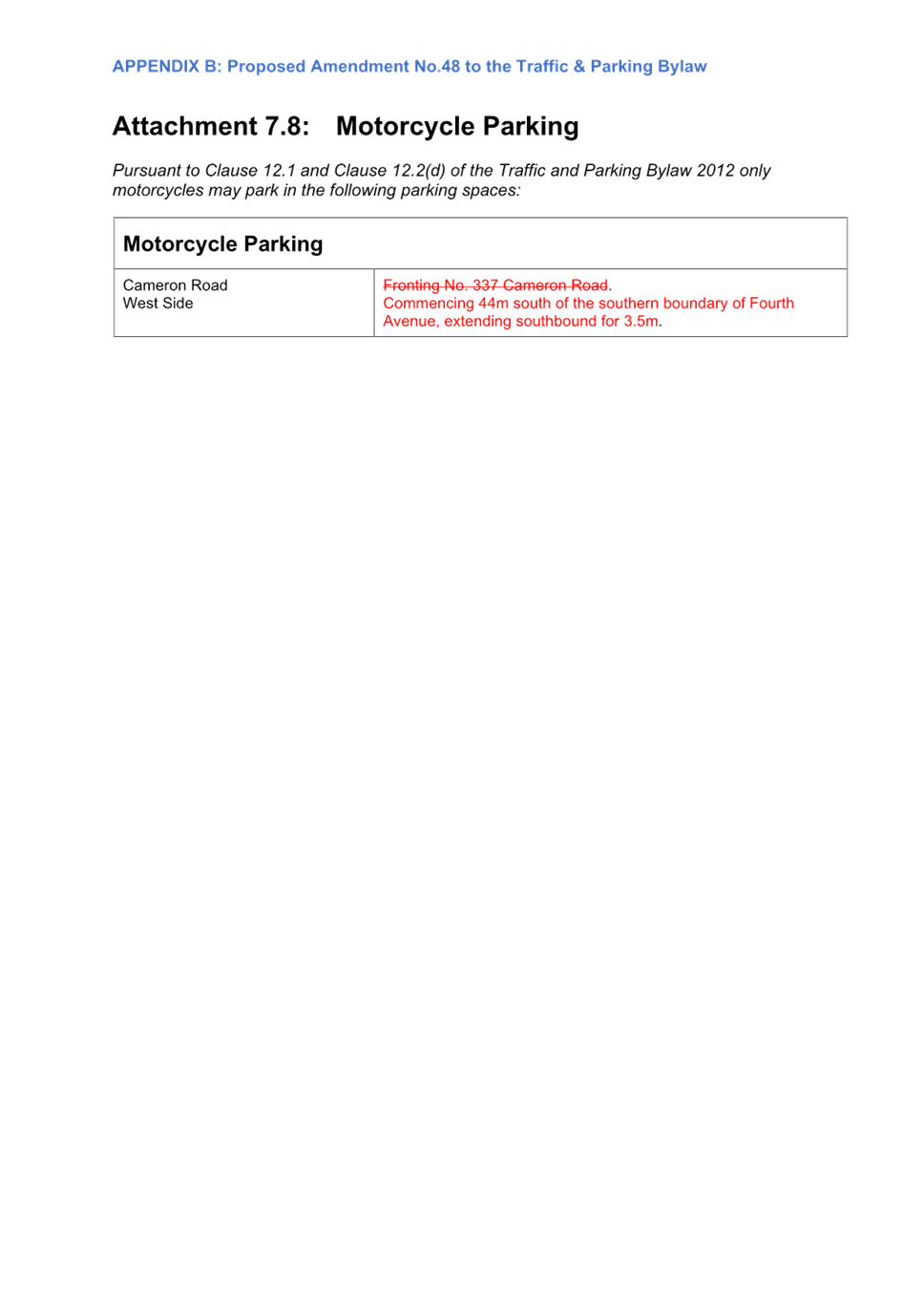

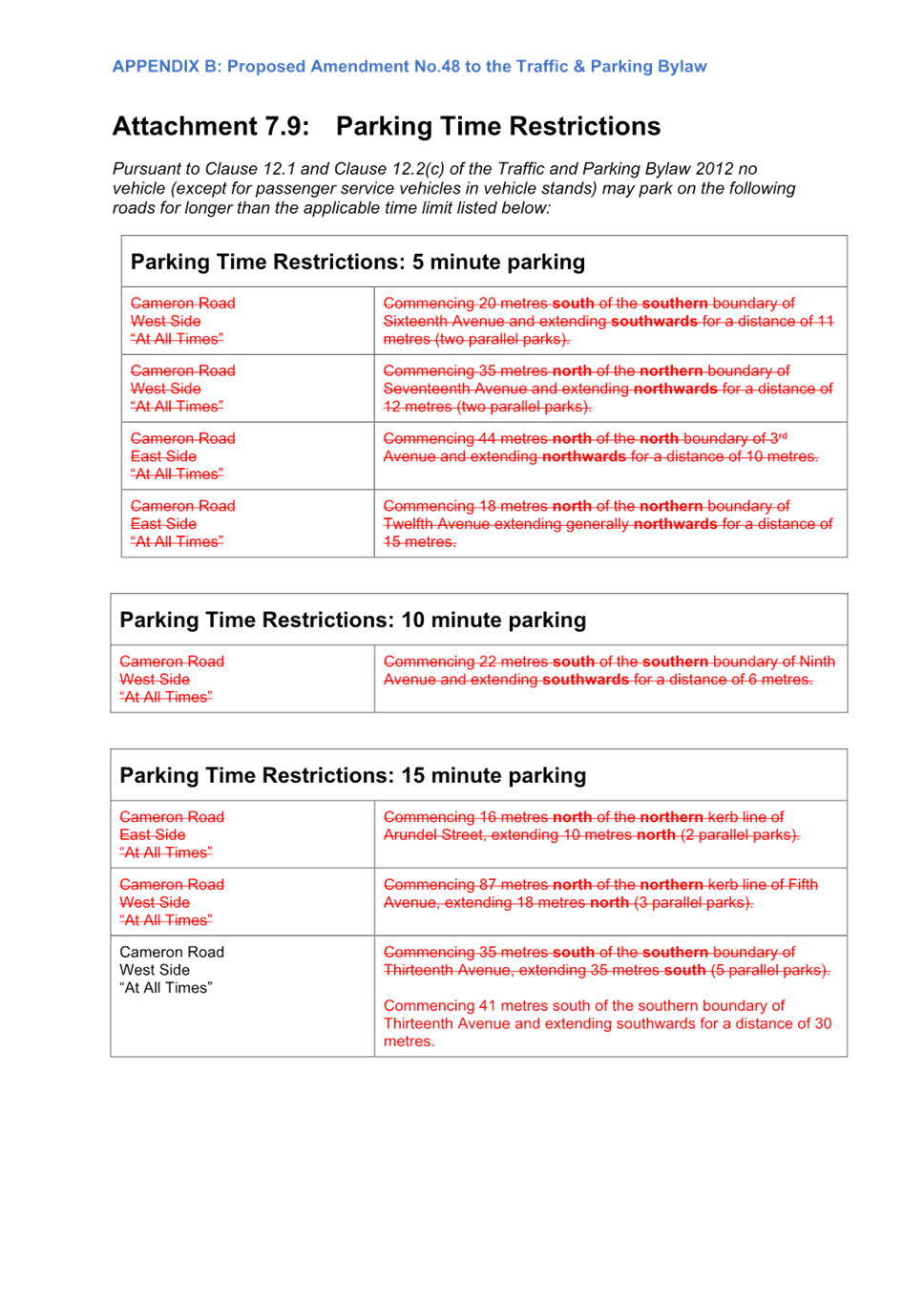

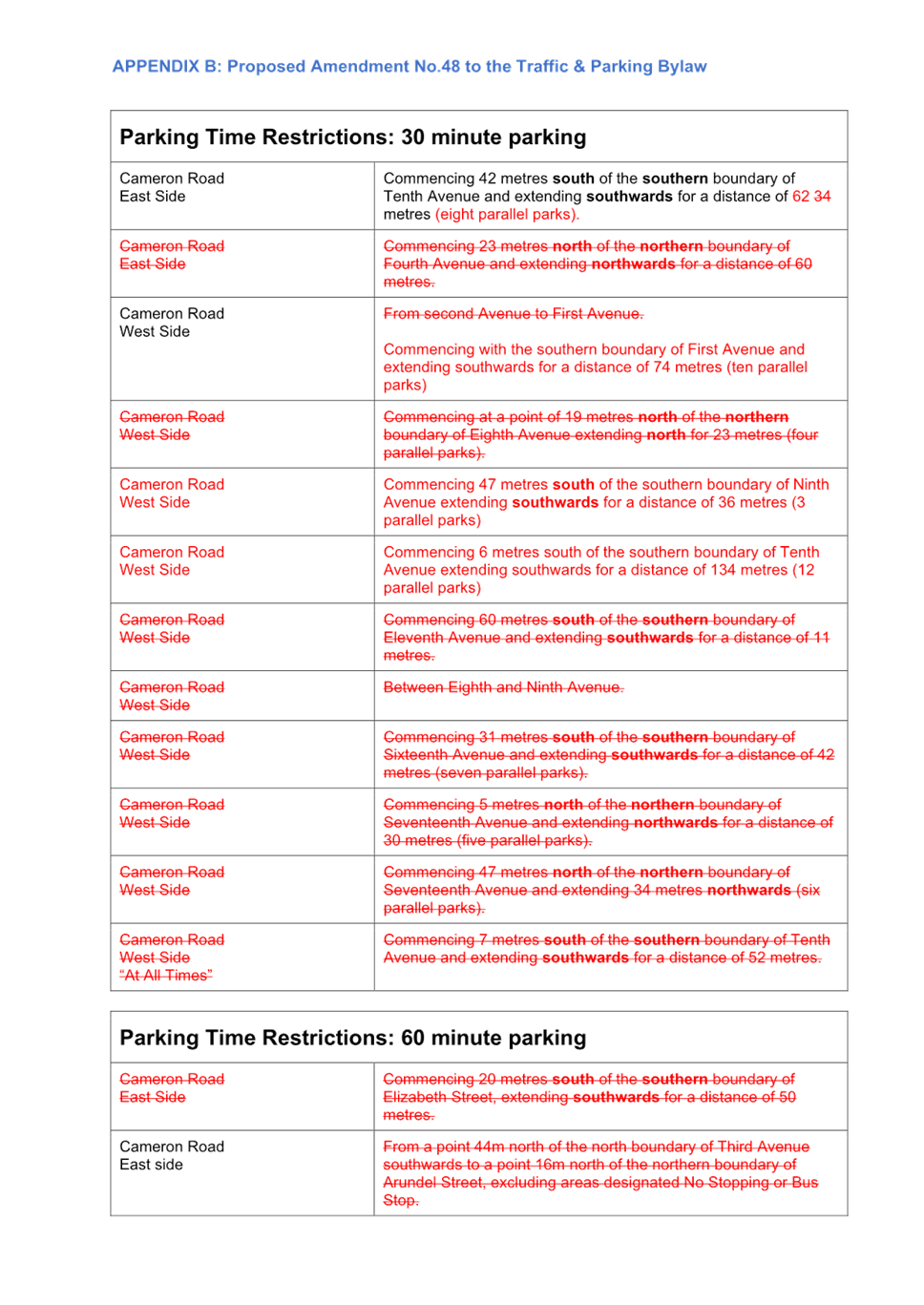

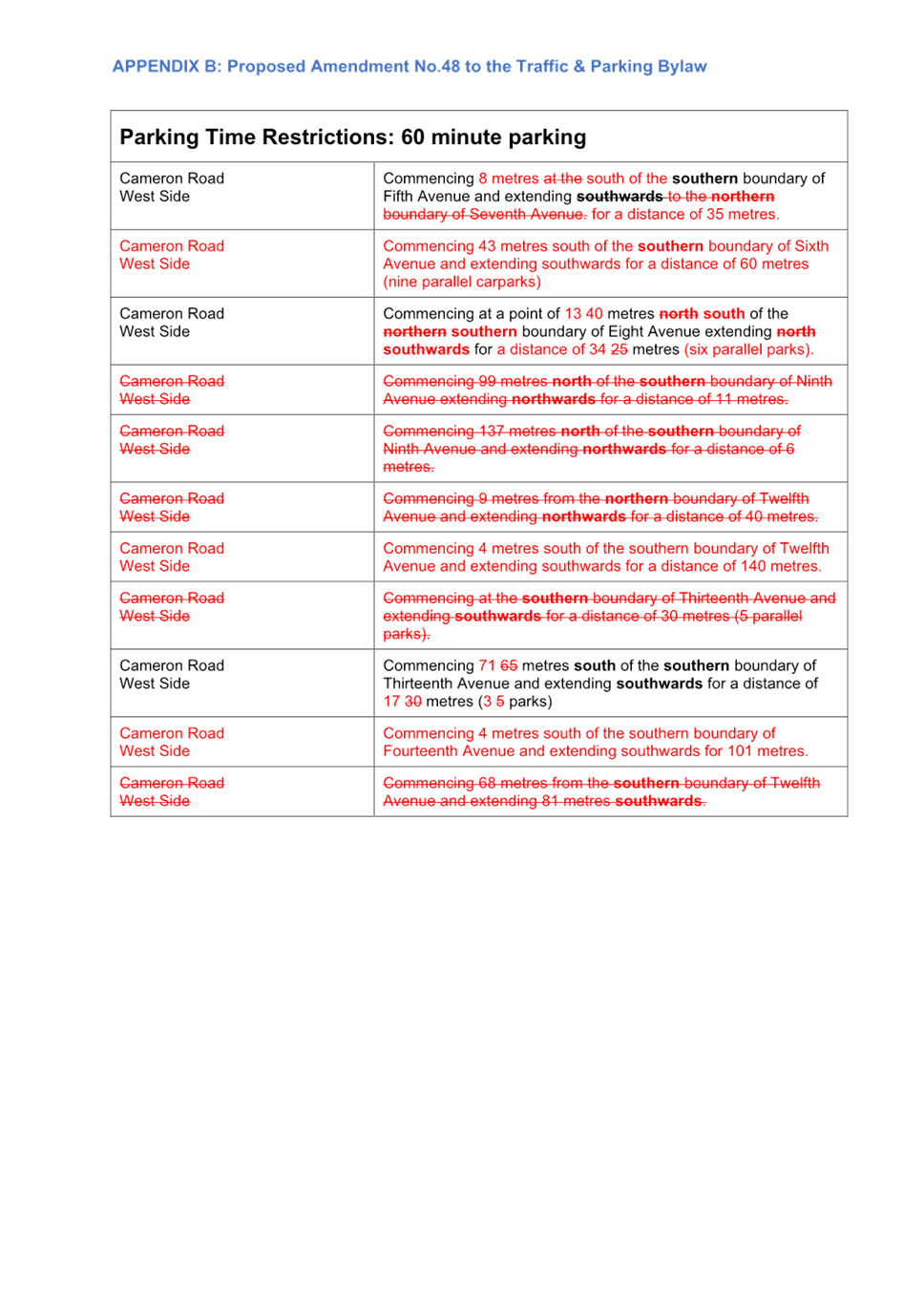

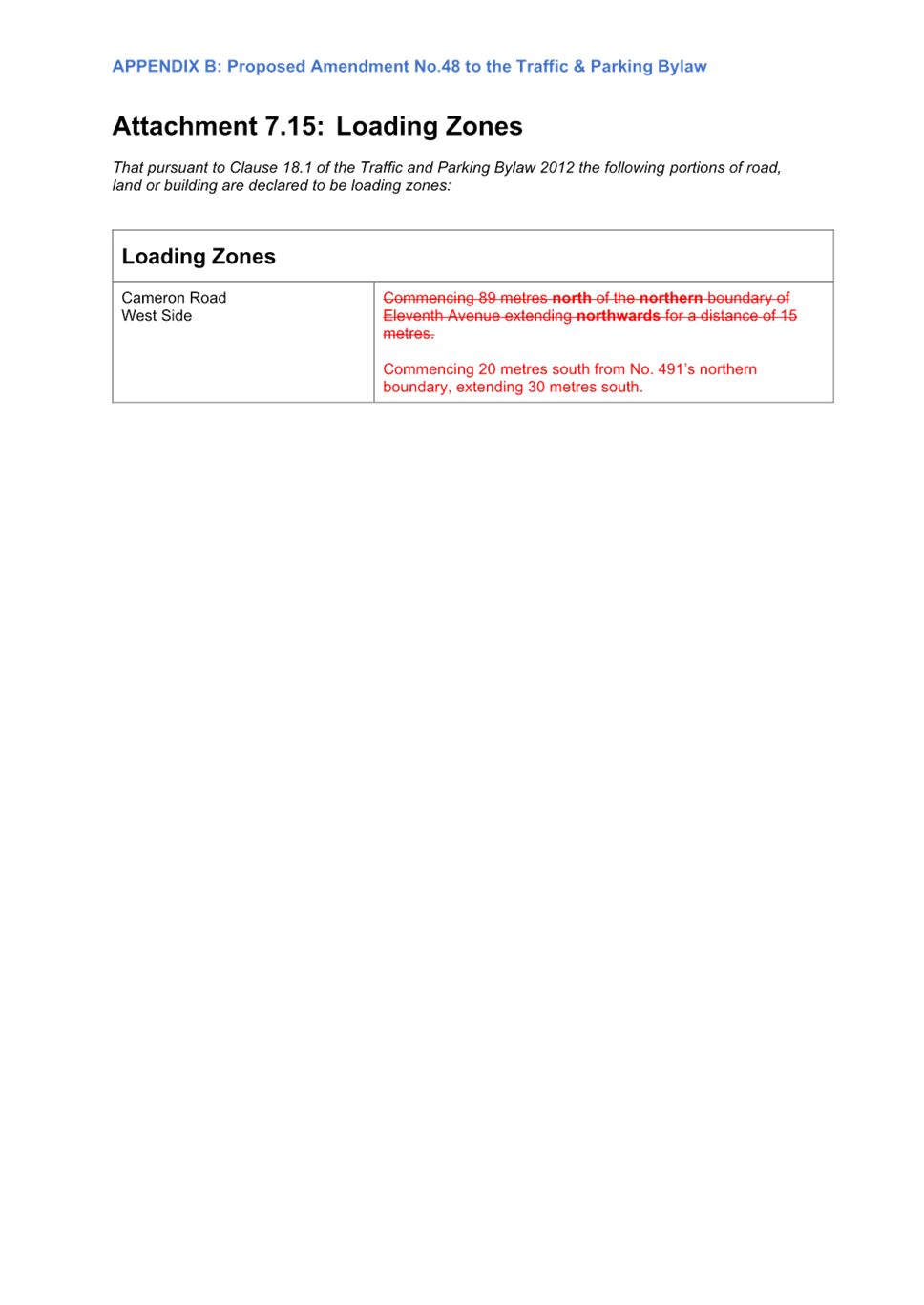

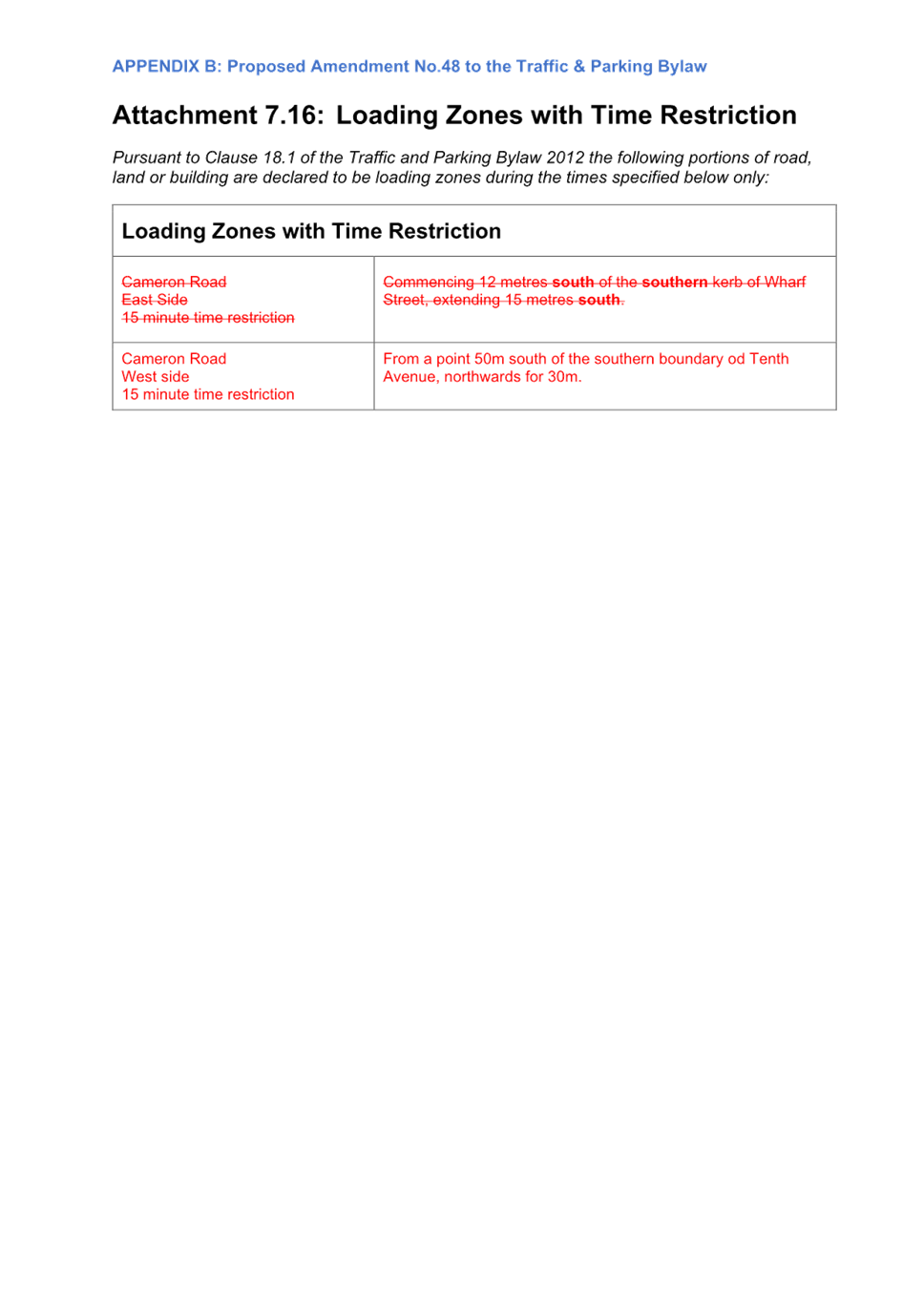

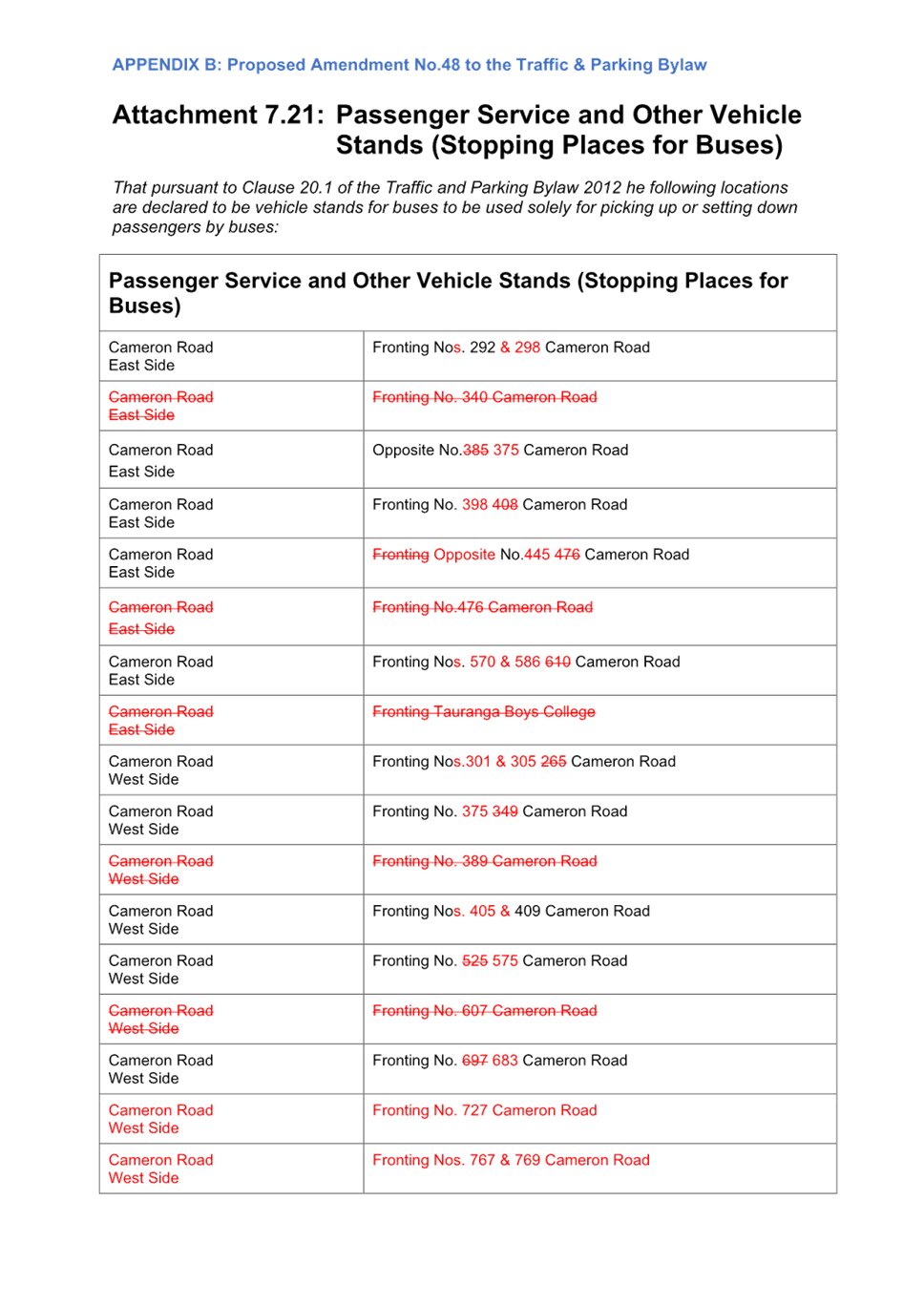

11.4 Cameron

Road Stage 2 Detailed Business Case

File

Number: A15275818

Author: Richard

O Kane, Senior Project Manager

Authoriser: Nic

Johansson, General Manager: Infrastructure

Purpose of the Report

1. To provide an overview of

the Cameron Road Stage 2 Detailed Business Case and to seek Council endorsement

for its submission to Waka Kotahi for their approval.

|

Recommendations

That the Council:

(a) Receives the report

"Cameron Road Stage 2 Detailed Business Case".

(b) Endorses the Detailed

Business Case for submission to Waka Kotahi Board for approval.

|

Executive Summary

2. The

purpose of the Cameron Road Stage 2 Detailed Business Case (CRS2 DBC) is to

outline the need for investment in a long-term transport solution, within the

Te Papa Peninsula of Tauranga. The study area for the CRS2 DBC is along Cameron

Road between 17th Avenue

and Cheyne Road.

3. Tauranga and Cameron

Road are on the cusp of significant changes in land use. The long-term ambition

is to accommodate future growth, manage congestion and enable the urban

transformation of the Te Papa Peninsula through providing:

(a) Greater housing choices;

(b) Safe and efficient transport

options;

(c) Local amenities; and

(d) The infrastructure needed to

support healthy and connected communities now and in the future.

4. In response, the

SmartGrowth endorsed Urban Form + Transport Initiative (UFTI) Connected Centres

Programme was developed in 2020. The UFTI Connected Centres Programme is based

on intensifying existing and enabling new growth areas, and having a transport

system that supports safe, frequent, and reliable multimodal access for people

and goods. The improvements investigated in this business case are a critical

step in achieving the UFTI Connected Centres Programme.

5. CRS2 is included and

aligns with the Western Bay of Plenty Transport Spatial Plan (TSP) endorsed by

the region by promoting alternative travel modes, increasing bus usage, and

reducing car congestion, supporting the plan's goals and enhancing freight

reliability. Integrated with increased housing density, the project offers

diverse transportation and living options, providing residents with improved

access to amenities, employment and links into vital public spaces with the aim

to foster vibrant and connected communities.

6. This DBC is a result

of collaborative efforts between Tauranga City Council, tangata whenua, Bay of

Plenty Regional Council, Waka Kotahi New Zealand Transport Agency (Waka

Kotahi), and stakeholders.

7. This Business Case

identifies a preferred way forward for investment with project partners and

stakeholders. This includes the provision of peak hour bus lanes, a two-way

cycleway and places that recognise the cultural significance of parts of the

corridor.

8. The investment is

proposed to be implemented from 2024 to 2027/28 and financed from a range of

funding sources including Crown Funding, the National Land Transport Fund and

local share from rates and developer contributions. The total project is

estimated to be $164M (P50 rounded) in investment, with a discounted

construction cost estimate of $143M, yielding an expected benefit of $103M (Net

Present Value), and overall BCR of 0.81 or 1.05 with wider economic benefits

included.

Background

9. The Te Papa

Peninsula and Cameron Road corridor constitute a vital hub for residential,

employment, and amenity growth in Tauranga, serving as a primary arterial

connection from the southern suburbs to the city centre. This area, home to

schools, businesses, public spaces, and the hospital, is undergoing a

transformative process outlined in strategic documents such as the Te Papa

Spatial Plan, UFTI, Plan Change 33, and the Tauranga Moana Cultural Framework.

10. The Business Case started in

2022 and aims to build upon Stage One, scheduled for completion in early 2024.

11. Cameron Road is identified as a

strategic public transport corridor and plays a key role in promoting increased

use of public transport and active modes within Te Papa, aligning with broader

urban growth plans. The significance of Cameron Road is further underscored by

its inclusion in the Public Transport Reference Case, connecting the CBD,

Greerton, and the Tauriko area, and its endorsement in the Tauriko Network

Connections DBC, emphasizing the need for upgrades to support high-quality

public transport services and accommodate urban growth in the Western Corridor.

12. A Lessons Learnt study has been

commissioned for the Stage One project, with findings being available in

advance of the next (detailed design) phase of the project. The ‘Lessons

Learnt’ will be considered as part of the detailed design process with

construction lessons learnt incorporated within the implementation phase of

CRS2.

13. A significant period of public

consultation on the Concept Design has been completed up to 12th

November ‘23, with valuable feedback now being assessed in advance of the

next, ‘detailed design’ stage of the project, which subject to

approval of the Detailed Business Case, will commence in January 2024.

14. A staged approach to detailed

design that integrates the associated Three Waters components, along with the

subsequent staged implementation process has been identified as part of the

concept design phase, thus avoiding the simultaneous construction across the

entire route as the city experienced during Stage 1 of the project.

Strategic / Statutory Context

15. The Business Case aligns with

the Urban Form and Transport Initiative (UFTI) and Te Papa Spatial Plan,

focusing on pedestrian and cyclist safety, bus priority measures, and key land

transport priorities, including climate change mitigation and safety. It

supports the Vision Zero principle and aims to reduce private vehicle trips in

line with the Climate Change Commission's advice.

16. Additionally, the project

aligns with the Western Bay of Plenty Transport Spatial Plan (TSP) by promoting

alternative travel modes, increasing public transport usage, and reducing car

congestion, supporting the plan's goals and enhancing freight reliability.

Integrated with increased housing density, the project offers diverse

transportation and living options, providing residents with improved access to

amenities and employment.

Options Analysis

17. An Investment Logic Mapping

(ILM) workshop was held in May 2022 with various stakeholders with the purpose

of understanding issues faced by users of Cameron Road and to justify the need

for improvements.The ILM workshop identified the benefits and an Opportunity

Statement centred on strengthening cultural identity, restoring the mauri of

land and water and ultimately managing and realising the anticipated benefits.

18. The long list options analysis

considered various methods to address the transport problem, providing

confidence to decision makers that suitable solutions were being explored.

19. Four options were identified

for progression: Do Minimum, and three Hybrid options with different focuses

(Safety and Active Modes, Public Transport, and People and Place) all

incorporating environmental enhancements.

20. Following assessments and

stakeholder consultation, none of the shortlisted options were deemed fully

satisfactory on their own. Therefore, a hybrid option is proposed, combining

high-value features of the shortlisted options to optimise project benefits

while minimising potential drawbacks.

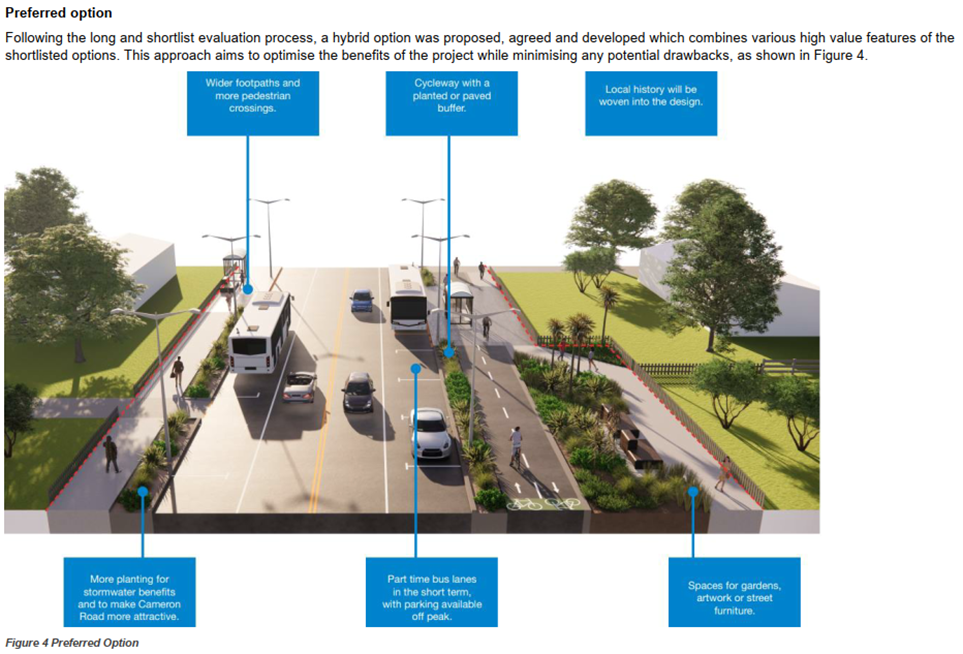

21. The emerging Preferred Option

for the corridor development proposes integrating the history and cultural

identity of Cameron Road and the peninsula into the design, emphasising

placemaking opportunities, including a two-way cycleway, 3.5m wide peak-hour

bus lanes, and a minimum 2.5m wide footpath on both sides. The plan features

signalised mid-block crossings, one lane for general traffic in each direction,

measures for speed reductions, and strategically positioned bus stops, along

with the use of raingardens for water quality treatment in appropriate areas,

all subject to further detailed design considerations.

22. The Business Case also covers a

range of other areas which includes:

(a) The Strategic Case which

outlines the options assessed, the outcomes and objectives of the project. The

primary outcome is to:

(i) Offer a safe, culturally

integrated, and vibrant environment that aligns with the Te Papa Spatial Plan's

vision for the next 30 years. The investment objectives include improving

safety for all users, supporting spatial plan goals through infrastructure

development, reducing reliance on private vehicles, and acknowledging the

historical significance of the area.

(b) The Management Case which

outlines the strategic approach to the next phases of the project, leveraging

past successes and lessons learned from Stage 1 to enhance future stages. The

focus is on effective governance, milestone planning, stakeholder engagement,

risk management, and ultimately realising the anticipated benefits.

(c) The Commercial Case which

outlines a phased implementation strategy, with construction services

procurement planned for 2024, incorporating a flexible approach that includes

negotiating the inclusion of the Detailed Design phase based on performance,

while noting the absence of significant consenting risks during the

Design-Build-Construct phase of the multi-modal improvements on Cameron Road.

(d) The Financial Case for

the Preferred Option underscores a diverse funding approach, with contributions

from Crown Funding, the National Land Transport Fund, and local sources. It

assures the project's affordability, emphasises ongoing alignment with broader

investments, and highlights the need for cost refinement during the detailed

design phase to ensure effective implementation.

(e) The Economic Case for

the project is considered economically feasible with a BCR of 0.81 (without

wider economic benefits) and 1.05 with wider economic benefits. The key benefits

associated with Business Case are:

(i) Integrate sustainable

urban planning and promote remote work to reduce emissions growth.

(ii) Facilitate

public-private partnerships and involve local communities to enable the

development of Stage 3.

(iii) Establish innovation hubs and

mixed-use zoning to grow access to goods and services.

(iv) Support business

diversification and develop an emergency preparedness plan to increase business

resilience.

Financial Considerations

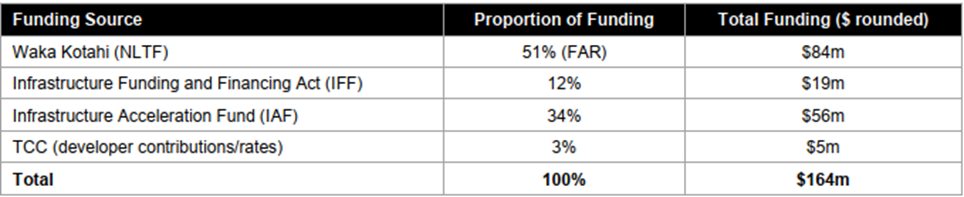

23. The

forecasted delivery costs for the project are expected to cost between $164M

(P50) to $198M (P95).

24. The proposed cost sharing

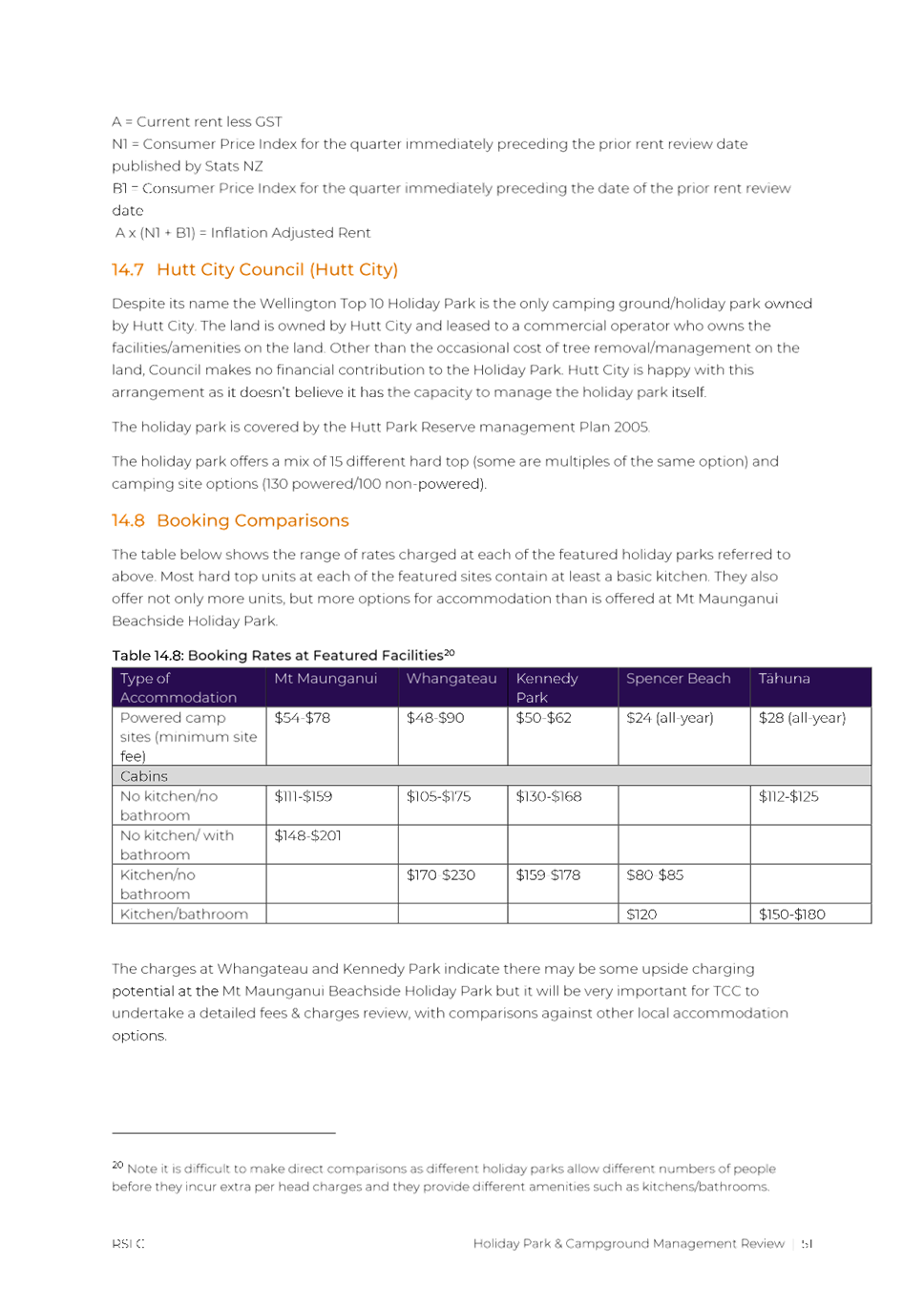

arrangement between Tauranga City Council, the Crown and Waka Kotahi is

tabulated below:

25. The cost and cashflow for the

implementation phase will be assessed through the detailed design phase and the

total project cost is considered to be affordable and within existing budget

forecasts. Ongoing alignment with broader transport and Three Waters investments

will be required to maximise the expected benefits, reduce disruption and to

provide cost efficiencies through the pre-implementation phase.

26. The project has been accounted

for in the draft LTP which is due to be adopted next year. We have budgeted for

the full cost of the project as part of the draft LTP which is based on current

cost estimates.

Legal Implications / Risks

27. Funding availability within the

National Land Transport Plan is a key uncertainty. This will be confirmed

through the Waka Kotahi decision-making process and assessed alongside other

projects nationally for funding assistance. To mitigate this uncertainty the

focus has been on supporting the development of a strong investment case which

tells a compelling story for investment and the benefits that would flow from

this.

28. Increasing costs over time

(pre-implementation and implementation phase) have been raised as occurring

across most transport projects in New Zealand. Contingencies have been added to

the physical woks, ongoing maintenance and operational costs.

29. Funding of parallel projects in

the vicinity or within Cameron Road including bus priority measures proposed by

BoPRC, the proposed grade separation of the SH29a intersection as noted in the

Tauriko Connections business case and water upgrades along, across and adjacent

to the corridor has noted financial risks. Mitigations include ongoing

coordination through the pre-implementation/detailed design to align with

parallel investments, reduce disruption and maximise the expected benefits.

30. There are a range of

project-level delivery risks for TCC to manage including maintaining the

relationship with BoPRC, potential financial challenges without Waka Kotahi

funding, political support changes due to the recent general election,

uncertainties in ground conditions, economic appraisal concerns, and the need

to maximise Stage 1 benefits. Mitigation strategies involve transparent

communication, early engagement with funders, demonstrating a strong case for

investment, detailed site investigations, careful economic appraisal, and

incorporating lessons learned from Stage 1 into subsequent phases. The risk

management approach adheres to Tauranga City Council guidelines, with the TCC

Project Manager responsible for maintaining a risk register and reporting

significant changes to the Project Control Group.

31. The project also relies upon

Waka Kotahi investing in the Tauriko Network Connections DBC, in particular

Barkes Corner. Whilst that business case is endorsed, funding is yet to be

confirmed.

Consultation / Engagement

32. There has been considerable

consultation and engagement over the 1.5-year development of the Business case.

GHD has led this consultation and engagement and in a number of situations this

has been supported by and with involvement of TCC staff.

33. Engagement involves a

comprehensive and multi-layered approach, including interactive workshops,

public exercises, and targeted engagement with various groups, employing a

robust and rigorous process that takes stakeholders and the community through a

phased journey, with messaging cantered on the importance of infrastructure

investment to support future land use, and providing technical overviews to

foster a strong sense of ownership and understanding of decision rationale.

The

development of this project prioritised community engagement, following a

four-stage process, guided by principles such as putting the community first,

maintaining consistent and transparent communication, using clear language, and

emphasizing the broader strategic benefits for the people of Tauranga.

34. Engagement with Mana Whenua was

a key objective of the business case and focused on establishing robust

partnerships with mana whenua, including recognising cultural relationships,

engaging with local Māori communities, incorporating Māori

aspirations through co-design, participating in consultations, facilitating

learning sessions, developing cultural narratives, ensuring transparency, and

carefully managing project risks in alignment with Māori values and the

Treaty of Waitangi. Additionally, the use of Tauranga Moana Design Principles

is highlighted to inform the assessment of interventions for the project. These

principles aim to guide culturally appropriate design processes and responses

that enhance appreciation of the natural, landscape, and built environment in

the Tauranga Moana area.

35. Initial Discovery Phase

community and stakeholder engagement took place between May- July 2022 with the

objective to understand the community’s sense of place and determine how

it can be incorporated into the Business Case. Overall, 225 respondents engaged

with TCC, a Vision Workshop was held on the 25 May 2022, over 90 business were

visited along the corridor and three walking tours with Schools were held.

Key

themes that emerged from the consultation included:

(a) The importance of connections

across the corridor;

(b) Recognition of the significant

cultural heritage;

(c) Future-proofing the corridor

for anticipated growth;

(d) Improving safety and amenity

within the corridor;

(e) Streetscape contributing to a

sense of place along the corridor;

(f) Supporting local

businesses;

Feedback

and technical study findings were taken into consideration to develop a

long-list of options for the corridor.

36. Long-list workshops to seek

feedback on the eight options were undertaken between August – September

2022 attended by key project partners, hapu, business and community

organisations with the aim to provide updates on key findings to date, present

and compare options against investment objectives and identify key features and

trade-offs. Discussion around the criteria for the Multi-Criteria Assessment

(MCA) was agreed with participants providing preliminary scores for each

option. The MCA criteria were Safety, Place, Access and Growth.

37. Following the long list MCA

assessment and stakeholder consultation, four short-list options were

identified for progression for the corridor:

(a) Do Minimum (included as a

comparator)

(b) Hybrid – Safety and

Active Modes focus with Street Greening (environmental enhancements)

(c) Hybrid – Public Transport

focus with Street Greening (environmental enhancements)

(d) Hybrid – People and Place

focus with Street Greening (environmental enhancements)

38. Short-list community and

stakeholder engagement took place between February – April 2023 and was

used to develop the preferred option. Over 400 respondents took part during

this time and activities included business drop-in sessions, open day stalls at

the Tauranga Farmers Market and Summer Market, three community drop-in

sessions, a virtual engagement room and online survey which saw 228 responses.

39. Key themes that emerged from

the short-list engagement were:

(a)

(a) Traffic

flow

(b) Parking availability

(c) The natural environment

(d) Cultural expression

(e) Attractive and vibrant spaces

(f) Public transport services

(g) Active transport

(h) Safety and security

(i) Economic impacts

(j) Supports infrastructure.

Taking all feedback into consideration a hybrid option was proposed, agreed and developed which

combines various high value features of the shortlisted options. This approach

aims to optimise the benefits of the project while minimising any potential

drawbacks.

40. Community engagement was

undertaken on the preferred option in November 2023 but this feedback has not

been incorporated in the Business Case and will be used for the Detailed Design

phase of the project.

Significance

41. The Local Government Act 2002

requires an assessment of the significance of matters, issues, proposals and

decisions in this report against Council’s Significance and Engagement

Policy. Council acknowledges that in some instances a matter, issue,

proposal or decision may have a high degree of importance to individuals,

groups, or agencies affected by the report.

42. In making this assessment,

consideration has been given to the likely impact, and likely consequences for:

(a) the current

and future social, economic, environmental, or cultural well-being of the

district or region

(b) any persons who are likely to be particularly

affected by, or interested in, the decision.

(c) the capacity of the local authority to

perform its role, and the financial and other costs of doing so.

(d) the impacts of construction on residents

and businesses and the staggered construction programme proposed along the

corridor.

43. In accordance with the

considerations above, criteria and thresholds in the policy, it is considered

that the decision is of high significance.

Next Steps

44. Subject to Council’s

decision to endorse the submission of the Business case to Waka Kotahi for

their decision-making the next steps for this project include:

(a) Waka Kotahi decision-making

including:

(i) Waka Kotahi full internal

investment decision-making review – programmed from January – March

2024. This will enable Waka Kotahi to finalise the current

‘Final-draft’ business case; and

(ii) Waka Kotahi Board

decision-making – programmed for March 2024

(b) The pre-implementation

activities including Detailed Design, Service Investigation and Pavement